UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of April 2025

Commission File Number: 333-280739

BELIVE HOLDINGS

(Translation of registrant’s name into English)

26A Ann Siang Road

#03-00

Singapore 069706

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Entry into a Material Definitive Agreement.

Entry into Underwriting Agreement and Closing of Offering

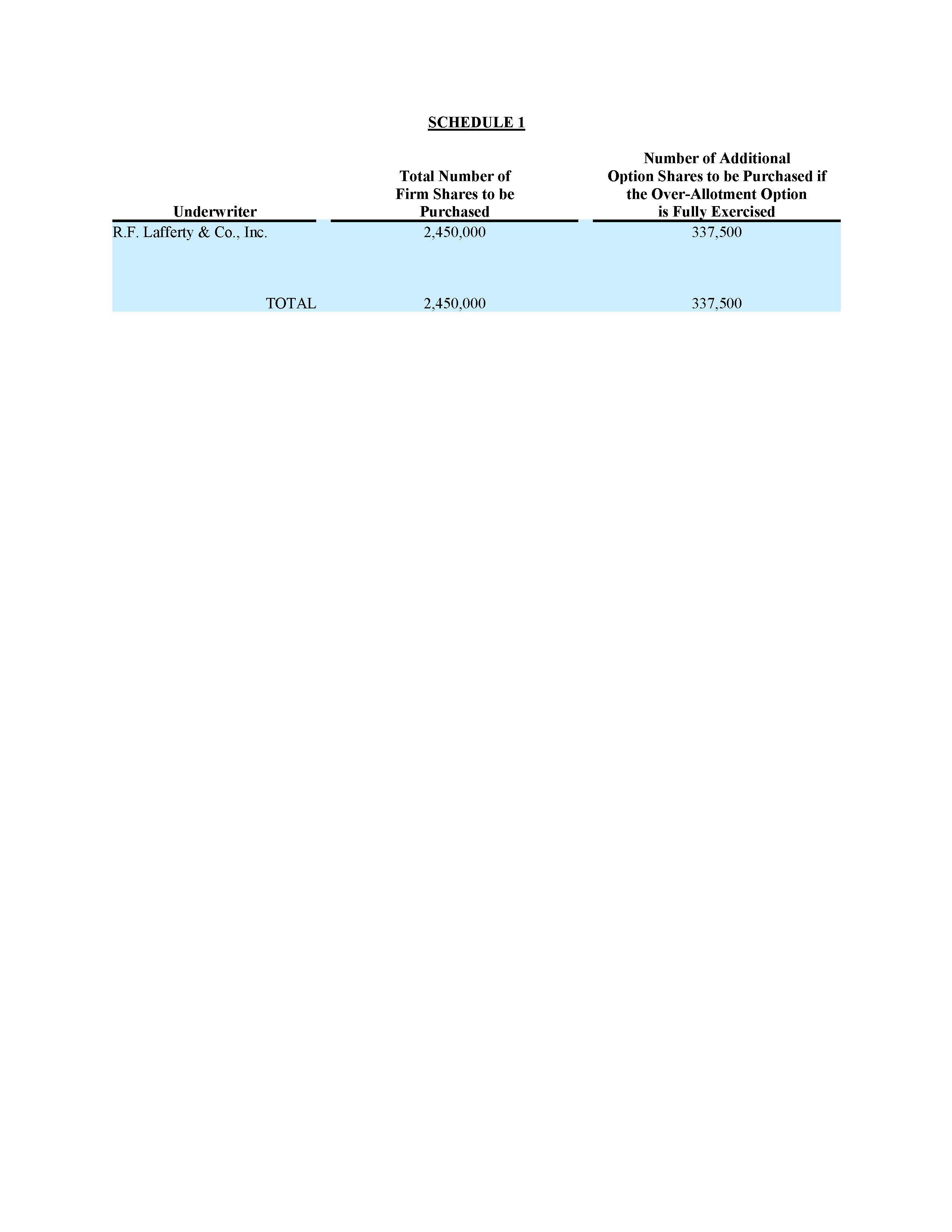

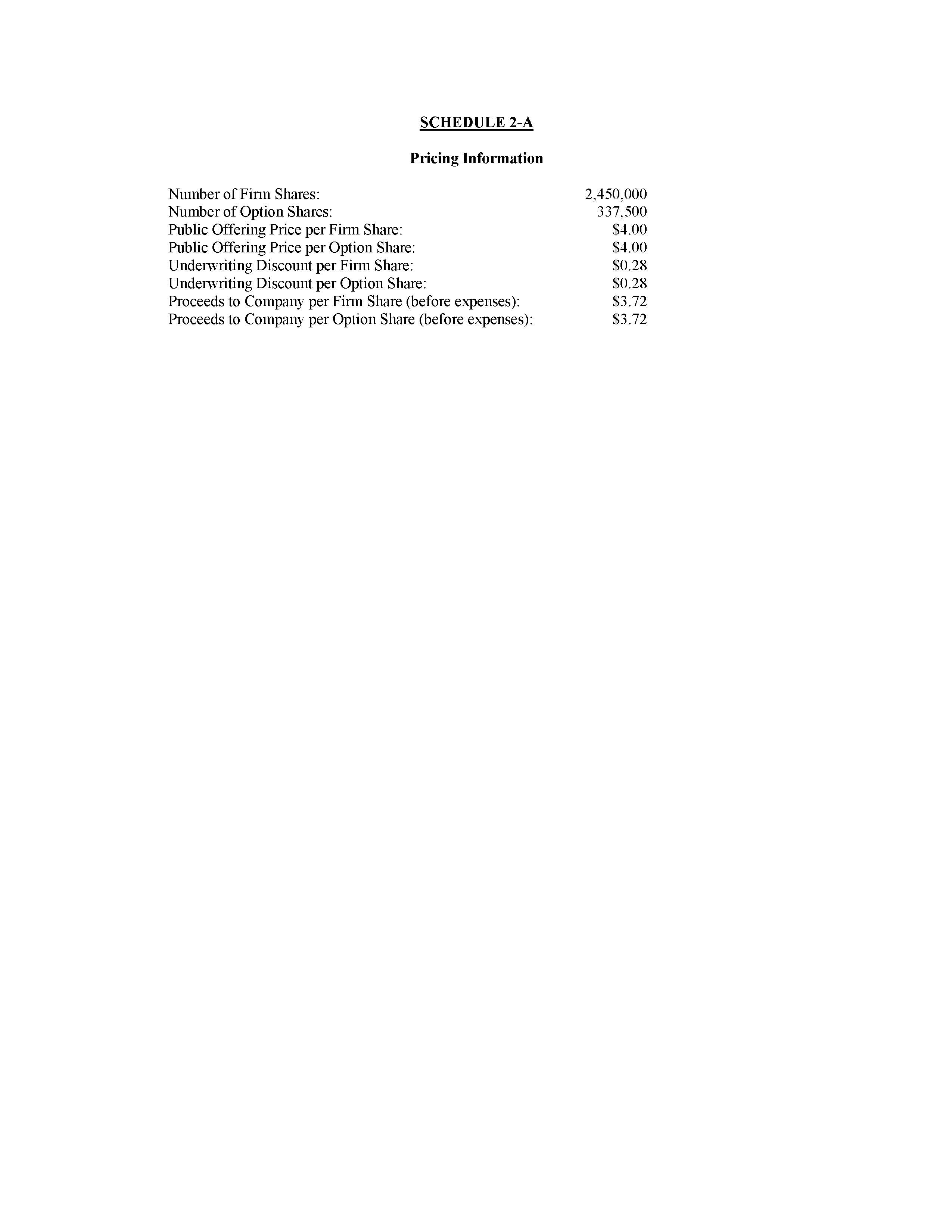

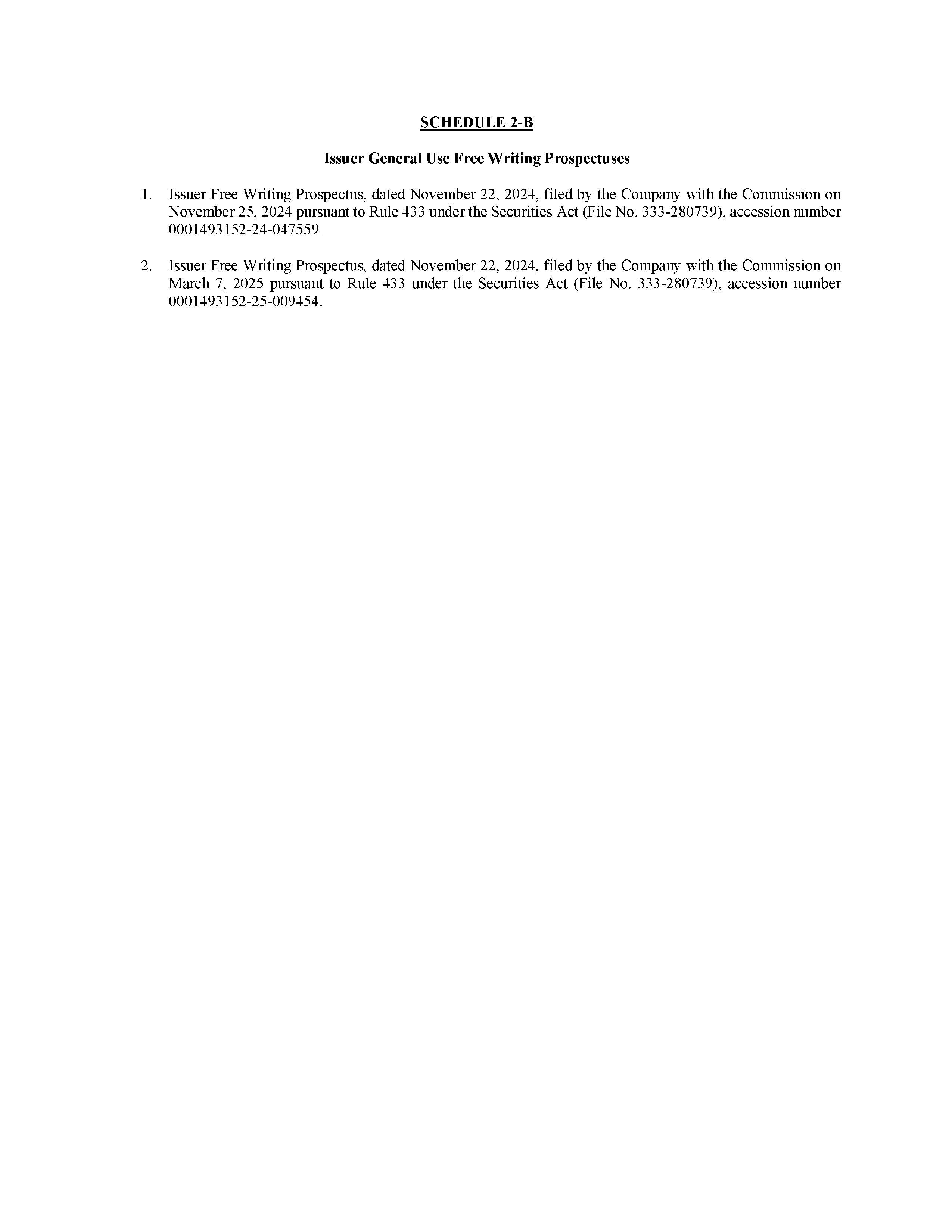

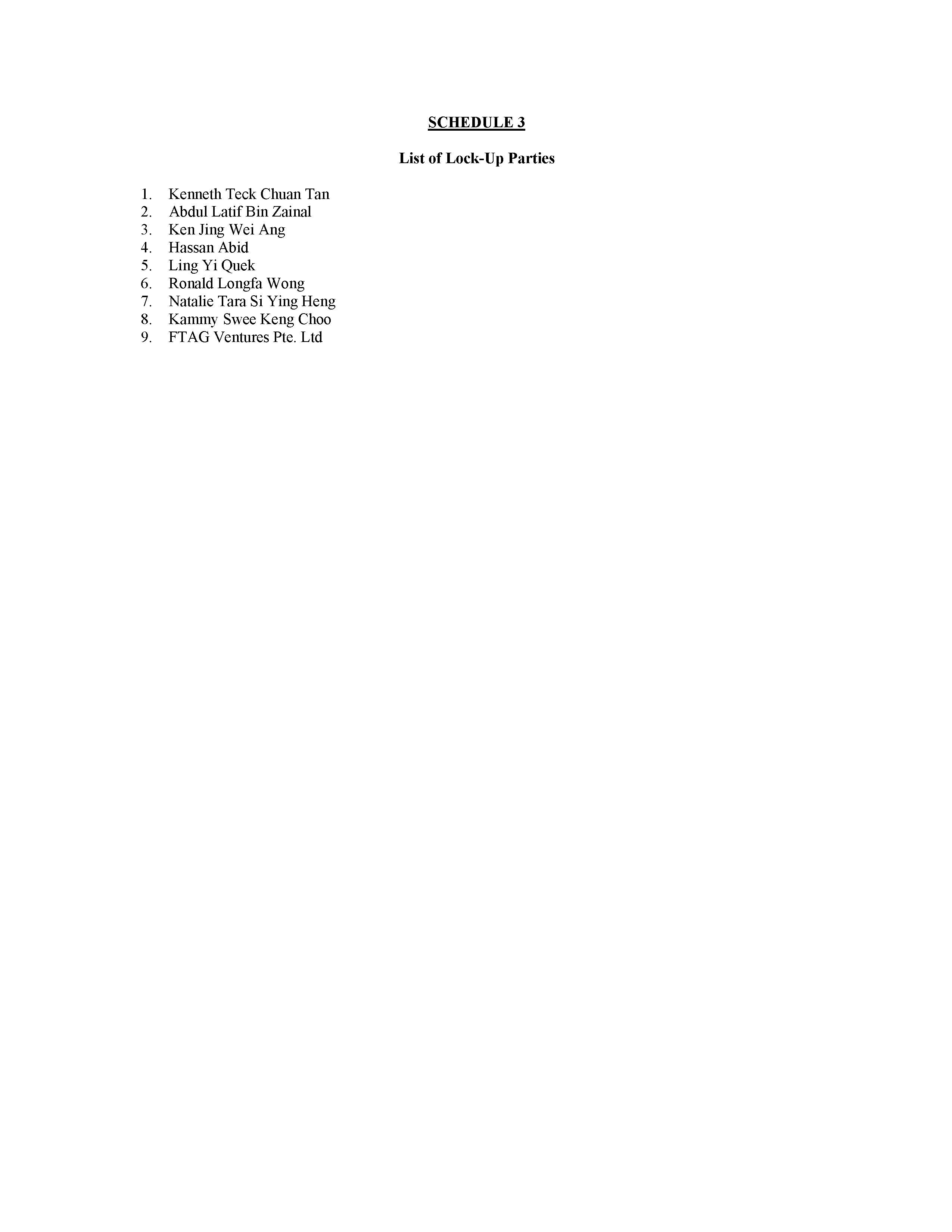

On April 3, 2025, BeLive Holdings (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”), with R.F. Lafferty & Co., Inc. as representative (the “Representative”) of the underwriters listed on Schedule 1 thereto (the “Underwriters”). The Underwriting Agreement relates to a firm commitment underwritten public offering (the “Offering”) of 2,450,000 ordinary shares of the Company being sold by the Company. The offering price to the public is US$4.00 per share. In addition, the Company granted the Underwriters a 45-day option to purchase up to an additional 367,500 ordinary shares at the public offering price, less underwriting discounts, and commissions.

On April 7, 2025 the Company closed the Offering. The Offering was conducted pursuant to the Company’s registration statement on Form F-1 (File No. 333-280739) (the “Registration Statement”) initially filed with the Securities and Exchange Commission on July 10, 2024 and declared effective on March 31, 2025. The ordinary shares of the Company were previously approved for listing on The Nasdaq Capital Market and commenced trading under the ticker symbol “BLIV.”

The foregoing description of the Underwriting Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Underwriting Agreement, which is furnished herewith as Exhibit 1.1, and is incorporated herein by reference.

Other Events.

Issuance of Press Releases

On April 4, 2025, the Company issued a press release announcing the pricing of the Offering.

On April 7, 2025, the Company issued a press release announcing the closing of the Offering.

Forward-Looking Statements

Matters discussed in this report may constitute forward-looking statements. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, other than statements of historical facts. The words “believe,” “anticipate,” “intends,” “estimate,” “potential,” “may,” “should,” “expect” “pending” and similar expressions identify forward-looking statements. The forward-looking statements in this report are based upon various assumptions. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: April 9, 2025 | BELIVE HOLDINGS |

| /s/ Kenneth Teck Chuan Tan | |

| Kenneth Teck Chuan Tan | |

| Chief Executive Officer, Chairman and Director |

Exhibit 1.1

Exhibit 99.1

BeLive Holdings Announces Pricing of Approximately $10,000,000 Initial Public Offering

Singapore, April 4, 2025 – BeLive Holdings (the “Company” or “BeLive”), a provider of live commerce and shoppable short videos solutions (“BeLive Solutions”) to international retail companies and e-commerce marketplaces, today announced the pricing of its initial public offering (the “Offering”) of 2,450,000 ordinary shares (the “Ordinary Shares”) at a public offering price of US$4.00 per share. The Company has granted the underwriters a 45-day overallotment option to purchase up to an additional 367,500 Ordinary Shares from the Company at the initial public offering price, less underwriting discounts and commissions. The Ordinary Shares have been approved for listing on the Nasdaq Capital Market and are expected to commence trading on April 4, 2025, under the ticker symbol “BLIV”.

The Company expects to receive aggregate gross proceeds of US$9.8 million from the Offering, before deducting underwriting discounts and other related expenses. In addition, the Company has granted the underwriters a 45-day option to purchase up to an additional 367,500 ordinary shares at the public offering price, less underwriting discounts. The Offering is expected to close on or about April 7, 2025, subject to the satisfaction of customary closing conditions.

The Company intends to use the net proceeds from this Offering for (i) advancing its video and live streaming technologies, artificial intelligence (“AI”) and big data capabilities; (ii) solution development to expand and enhance its current solution offerings, as well as to develop new features and functionalities to continue to provide innovative value propositions to its customers; (iii) marketing and branding, including marketing and promotional activities to further expand its customer base and strengthen its brand; and (iv) general corporate purposes that are beneficial in developing the business and its strategic direction.

R.F. Lafferty & Co., Inc. (“R.F. Lafferty”) acted as sole book-running manager for the Offering. Schlueter & Associates, P.C. acted as U.S. counsel to the Company, and Lucosky Brookman LLP acted as U.S. counsel to R.F. Lafferty, in connection with the Offering.

A registration statement on Form F-1 (File No. 333-280739) relating to the Offering, as amended, has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and was declared effective by the SEC on March 31, 2025. The Offering was made only by means of a prospectus. Copies of the final prospectus related to the Offering may be obtained from R.F. Lafferty by email at offerings@rflafferty.com or via standard mail to R.F. Lafferty & Co., Inc, 40 Wall Street, 27th Floor, New York, NY10005. In addition, a copy of the final prospectus can also be obtained via the SEC’s website at www.sec.gov.

Before you invest, you should read the prospectus and other documents the Company has filed or will file with the SEC for more information about the Company and the Offering. This press release shall not constitute an offer to sell or the solicitation of an offer to buy the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About BeLive Holdings Limited

Headquartered in Singapore, BeLive provides live commerce and shoppable short videos solutions (“BeLive Solutions”) to international retail companies and e-commerce marketplaces. Our BeLive Solutions enable our customers to leverage the power of interactive and immersive live and video commerce to their online business and enable our customers to curate unique videos that may also be aired real-time as they are simultaneously being recorded, for anytime instant replay. We categorize our BeLive Solutions into (i) an enterprise-grade BeLive White Label Solution which is customized to meet a customer’s unique requirements, and which can be integrated into their existing internal system and (ii) a cloud-based software-as-a-service (SaaS) solution (“BeLive SaaS Solution”) for customers who are looking for a quick and cost-effective live commerce and shoppable short video solution without the necessity of building their own infrastructure and technology stack. For more information, please visit: http://www.belive.technology.

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts. When the Company uses words such as “may, “will, “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. These forward-looking statements include, without limitation, the Company’s statements regarding the expected trading of its Ordinary Shares on the Nasdaq Capital Market and the closing of the Offering. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the uncertainties related to market conditions and the completion of the initial public offering on the anticipated terms or at all, and other factors discussed in the “Risk Factors” section of the registration statement filed with the SEC. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

For more information, please contact: ir@belive.sg

Exhibit 99.2

BeLive Holdings Announces Closing of Approximately $10,000,000 Initial Public Offering

Singapore, April 7, 2025 – BeLive Holdings (the “Company” or “BeLive”), a provider of live commerce and shoppable short videos solutions (“BeLive Solutions”) to international retail companies and e-commerce marketplaces, today announced the closing of its initial public offering (the “Offering”) of 2,450,000 ordinary shares (the “Ordinary Shares”) at a public offering price of US$4.00 per share for total gross proceeds of US$9.8 million, before deducting underwriting discounts and other offering expenses. The Offering closed on April 7, 2025 and the Ordinary Shares began trading on Nasdaq Capital Market on April 4, 2025, under the ticker symbol “BLIV”.

The Company has granted the underwriters an option, within 45 days from the date of the prospectus, to purchase up to an additional 367,500 Ordinary Shares at the public offering price, less underwriting discounts, to cover the over-allotment option, if any.

The Company intends to use the proceeds from this Offering for (i) advancing its video and live streaming technologies, artificial intelligence (“AI”) and big data capabilities; (ii) solution development to expand and enhance its current solution offerings, as well as to develop new features and functionalities to continue to provide innovative value propositions to its customers; (iii) marketing and branding, including marketing and promotional activities to further expand its customer base and strengthen its brand; and (iv) general corporate purposes that are beneficial in developing the business and its strategic direction.

R.F. Lafferty & Co., Inc. (“R. F. Lafferty”), acted as sole book-running manager for the Offering. Schlueter & Associates, P.C. acted as U.S. counsel to the Company, and Lucosky Brookman LLP acted as U.S. counsel to R.F. Lafferty, in connection with the Offering.

A registration statement on Form F-1 (File No. 333-280739) relating to the Offering, as amended, has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and was declared effective by the SEC on March 31, 2025. The Offering was made only by means of a prospectus. Copies of the final prospectus related to the Offering may be obtained, from R.F. Lafferty, Attn: offerings@rflafferty.com or via standard mail to R. F. Lafferty & Co., Inc., 40 Wall Street, 27th Floor, New York, NY 10005. In addition, a copy of the final prospectus can also be obtained via the SEC’s website at www.sec.gov.

Before you invest, you should read the prospectus and other documents the Company has filed or will file with the SEC for more information about the Company and the Offering. This press release shall not constitute an offer to sell or the solicitation of an offer to buy the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About BeLive Holdings Limited

Headquartered in Singapore, BeLive provides live commerce and shoppable short videos solutions (“BeLive Solutions”) to international retail companies and e-commerce marketplaces. Our BeLive Solutions enable our customers to leverage the power of interactive and immersive live and video commerce to their online business and enable our customers to curate unique videos that may also be aired real-time as they are simultaneously being recorded, for anytime instant replay. We categorize our BeLive Solutions into (i) an enterprise-grade BeLive White Label Solution which is customized to meet a customer’s unique requirements, and which can be integrated into their existing internal system and (ii) a cloud-based software-as-a-service (SaaS) solution (“BeLive SaaS Solution”) for customers who are looking for a quick and cost-effective live commerce and shoppable short video solution without the necessity of building their own infrastructure and technology stack. For more information, please visit: http://www.belive.technology.

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts. When the Company uses words such as “may, “will, “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. These forward-looking statements include, without limitation, the Company’s statements regarding the expected trading of its Ordinary Shares on the Nasdaq Capital Market and the closing of the Offering. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the uncertainties related to market conditions and the completion of the initial public offering on the anticipated terms or at all, and other factors discussed in the “Risk Factors” section of the registration statement filed with the SEC. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

For more information, please contact: ir@belive.sg