UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _________

Commission File Number: 001-41254

| HWH INTERNATIONAL INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 87-3296100 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

|

4800 Montgomery Lane, Suite 210 Bethesda, MD 20814 |

301-971-3955 | |

|

(Address of Principal Executive Offices) |

Registrant’s telephone number, including area code |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| Common Stock, par value $0.0001 per share | HWH | The Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☐ Large accelerated filer | ☐ Accelerated filer | |

| ☒ Non-accelerated filer | ☒ Smaller reporting company | |

| ☒ Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statement of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

Aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of July 1, 2024 based upon the closing price of the common stock as reported by the Nasdaq Global Select Market on such date, was approximately $22,702,995.

As of March 31, 2025, there were 6,476,400 shares of Common Stock, par value $0.0001 per share of the Company issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

HWH International Inc.

Form 10-K

For the Year Ended December 31, 2024

Table of Contents

|

|

Throughout this Report on Form 10-K, the terms the “Company,” “HWH,” “we,” “us,” and “our” refer to HWH International Inc., and “our board of directors” refers to the board of directors of HWH International Inc.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains forward-looking statements regarding, among other things, our future operating results and financial position, our business strategy, and other objectives for our future operations. The words “anticipate,” “believe,” “intend,” “expect,” “may,” “estimate,” “predict,” “project,” “potential” and similar expression are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. There are a number of important risks and uncertainties that could cause our actual results to differ materially from those indicated by forward-looking statements. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments that we may make.

You should read this Report on Form 10-K and the documents that we have filed as exhibits to this Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. The forward-looking statements contained in this Report on Form 10-K are made as of the date of this Report on Form 10-K, and we do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

|

|

PART I

Item 1. Business.

General

The Company was incorporated in Delaware on October 20, 2021 under the name Alset Capital Acquisition Corp. The Company was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses (the “Business Combination”). On February 3, 2022, the Company completed its Initial Public Offering. The Company consummated the Business Combination on January 9, 2024 and changed its name from “Alset Capital Acquisition Corp.” to “HWH International Inc.”

The business we acquired in January of 2024 started in South Korea with a single-level membership marketing model with limited products for sale. We registered the business on April 1, 2019, and we started selling founders packages on July 1, 2019. While we had been profitable and growing, the COVID-19 pandemic had a material adverse effect on such growth and profits. We created a new corporate structure, with subsidiaries in the United States, Hong Kong and Singapore, that would allow for quick geographical expansion and turning our focus to the Hapi Café development.

We have 9,811 individuals with founding member status. This is a privileged class that will be able to enjoy continuous membership benefits given that they have trusted the Company and joined at an early stage. Such benefits include the ability to purchase new future memberships, in the model described below, at a favorable rate to be determined by the Company. They will also continue to be able to earn affiliate commissions as they sell our products in the marketplace and enjoy discounted rates when visiting Hapi Cafés until further notice. The total number of founding members was capped at 10,000. The Company is in the midst of implementing a new membership model. While we are not currently selling memberships, we intend to resume membership sales under this new model.

Members will get exclusive discounts on Hapi Marketplace products, priority invites to product launch events and other parties, and look to earn passive income through affiliate commissions at Hapi Marketplace.

Our operations include:

Hapi Marketplace, which offers certain products at a discounted price to our members. Hapi Marketplace, HWH’s online consumer marketplace, went live in September of 2024, and now offers over 6,500 products from manufacturers and wholesalers, including a wide range of items such as bathroom supplies, fashion products, accessories, cosmetics, and health supplements.

Hapi Cafés, which are, and will be, in-person, location-based social experiences, offer members the opportunity to build a sense of community with like-minded customers who share a potential interest in our products. The cafes expose our members to and educate them about the products and services of our affiliates, providing us with the chance to significantly increase our membership base as well as increase the amounts spent by our members on our affiliates’ products and services. Each of our cafés is a “Hapi Café.” We opened proof-of-concept Hapi Café locations in Seoul, South Korea and Singapore in May 2022, July 2022 and April 2024, respectively, and plan to open additional Hapi Cafés as we beta test and further improve our business concept. We intend to grow our memberships as we grow the number of Hapi Cafés around the world. Hapi Cafe is positioned to be an integral part of HWH’s business model.

Our travel business is in the planning stage as we are working with our affiliates to determine the market-by-market services. Through our travel business, we plan to offer exclusive access to unpublished rates and discounts on air travel, cruises, car rentals, hotels, and resorts for members. We have made a minority investment into a travel agency with a HK, China and Malaysia presence. The focus is primarily on educational tours for China’s primary and secondary school students visiting attractions and tours in China and overseas. We also conduct business for hotel booking offers to a hotel booking platform as well as organizing tour conferences for groups and communities. The Company shall continue develop consumer traveling services and hotel booking services in Asia.

|

|

Hapi Wealth Builder is in the planning stage as we are exploring the options of providing services to our members through financial informational materials aimed at various types of investing opportunities. The team has been diligently producing digital content for Hapi Wealth Builder and working to collaborate with the right partners to launch the program and make it available to members. We have completed a soft launch with Hapi Cafe China to build the credibility and reputation of the Company and its Hapi Wealth Builder business, which we intend to launch later in 2025.

Market Opportunity

Following the COVID-19 pandemic, we believe people are looking for in-person communities. By offering a social and business centric atmosphere at our Hapi Cafés, we plan to leverage this deeply-rooted desire and build a membership organization, increase their familiarity with and educate them about the products and services of our affiliates and how those products and services can help them in their own individual pursuits of health, wealth and happiness.

Growth Strategy

Our strategy is to continuously grow our membership base, while displaying to our members the added benefits of the higher tiers of membership. We will look to accomplish this by providing a comfortable in person setting of a Hapi Café for our customers in many more locations. We also plan to continually expand our product offerings and the services our affiliate companies can provide in the belief that this can serve to grow our membership base and have our members increasingly opt to avail themselves of membership options that offer them larger discounts and other benefits on the products and services of our affiliates.

Nasdaq Deficiency

On March 7, 2024, we received notice from Nasdaq Stock Market, LLC (“Nasdaq”) indicating that, because the market value of our common stock had been below $50,000,000 for the prior 37 consecutive business days, we no longer complied with the minimum market value of listed securities (the “MVLS”) requirement for continued listing on the Nasdaq Global Market under Rule 5450(b)(2)(A) of Nasdaq Listing Rules.

Nasdaq’s notice had no immediate effect on the listing of our common stock on the Nasdaq Global Market. Pursuant to Nasdaq Marketplace Rule 5810(c)(3)(C), we had been provided an initial compliance period of 180 calendar days, or until September 3, 2024, to regain compliance with the MVLS requirement. To regain compliance, the Company’s MVLS was required to be at least $50,000,000 or more for a minimum of ten consecutive business days prior to September 3, 2024. In that regard, on September 9, 2024, the Company received a notice from the Staff that the matter of the MVLS deficiency was to be considered at the Company’s upcoming appeal with the Nasdaq Hearings Panel.

|

|

On February 22, 2024, the Nasdaq Staff (the “Staff”) notified the Company that for the previous 30 consecutive trading days, the MVPHS had been below the minimum $15,000,000 required for continued listing as set forth in Listing Rule 5450(b)(2)(C) (the “Rule”). Therefore, in accordance with Marketplace Rule 5810(c)(3)(D), the Company was provided 180 calendar days, or until August 20, 2024, to regain compliance with the Rule. In that regard, on August 27, 2024, the Company received a notice from the Staff that the Company will be delisted from the Nasdaq Global Market, unless the Company requested an appeal of this determination by September 3, 2024.

The Company presented its compliance plan to the Panel at a hearing on October 15, 2024. On October 21, 2024, the Company received a notice from the Panel granting the Company an extension to phase down its securities to the Nasdaq Capital Market and demonstrate compliance with the market value of its publicly held shares (the “MVPHS”) and Stockholders’ Equity requirements as set forth in Nasdaq Listing Rules 5550(a)(5) and 5550(b)(1).

On September 4, 2024, the Company received written notice (the “Notice”) from the Listing Qualifications Staff of Nasdaq notifying the Company that for the prior 30 consecutive business days prior to the date of the Notice, the Company’s bid price was below the minimum $1 required for continued listing on the Nasdaq Global Market pursuant to Nasdaq Listing Rule 5450(a)(1) (the “Bid Price Requirement”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), Nasdaq provided the Company with 180 calendar days, or until March 3, 2025, (the “Compliance Date”), to regain compliance with the Bid Price Requirement.

On March 10, 2025, the Company received written notice (the “Compliance Notice”) from Nasdaq informing the Company that it has regained compliance with Nasdaq Listing Rule 5550(a)(2), which requires that companies listed on the Nasdaq Capital Market maintain a minimum bid price of $1.00 per share. Nasdaq notified the Company in the Compliance Notice that, from February 24, 2025 to March 7, 2025, the closing bid price of the Company’s common stock had been $1.00 per share or greater and, accordingly, the Company had regained compliance with Nasdaq Listing Rule 5550(a)(2) and that the matter was now closed. The Company is currently listed on the Nasdaq Capital Market.

On February 18, 2025, the Company filed a Certificate of Amendment to the Company’s Amended and Restated Certificate of Incorporation with the Delaware Secretary of State to effect a 1-for-5 reverse stock split (the “Reverse Stock Split”). The Reverse Stock Split became effective as of market open on February 24, 2025. The par value of the common stock following the reverse stock split remains at $0.001 per share. The reverse stock split has been retroactively applied to all financial statements presented.

As of December 31, 2024 and 2023, the total outstanding common shares of the Company were 5,593,920 and 2,000, respectively; the total outstanding class A common shares of the Company were 0 and 94,750, respectively; the total outstanding class B common shares of the Company were 0 and 431,250, respectively.

Credit Facility

On April 24, 2024, we entered into a Credit Facility Agreement (the “Credit Agreement”) with Alset Inc., a Texas corporation and the Company’s indirect, majority stockholder, pursuant to which Alset Inc. has provided the Company a line of credit facility (the “Credit Facility”), which provides a maximum, aggregate credit line of up to $1,000,000. As of December 31, 2024, $300,000 credit was used and $700,000 is available to use in the future.

Pursuant to the Credit Agreement, the Company may request an advance (each, an “Advance”) on the Credit Facility. Each Advance shall bear a simple interest rate of three percent (3%) per annum. Each Advance and all accrued but unpaid interest shall be due and payable at the first (1st) anniversary of the effective date of the Credit Agreement. HWH may at any time during the term of the Credit Agreement prepay a portion or all amounts of its indebtedness without penalty. Each advance shall not be secured by a lien or other encumbrance on any HWH assets, but shall be solely a general unsecured debt obligation of HWH.

|

|

Debt Conversion Agreements

On September 24, 2024, HWH International Inc. entered into two debt conversion agreements with creditors (each an “Agreement,” or collectively, the “Agreements”): (i) Alset International Limited (the Company’s majority stockholder); and (ii) Alset Inc. (which is Alset International Limited’s majority stockholder). Each Agreement converts debt owed by the Company to the respective creditor into shares of the Company’s common stock. The Agreements are substantially the same with the exception of the amount of debt to be converted under each.

Under the terms of their respective agreements, Alset Inc. converted $300,000 of the Company’s debt into 476,190 shares of the Company’s common stock, and Alset International Limited converted $3,501,759 of the Company’s debt into 5,558,347 shares of the Company’s common stock. Under the Agreements, the debt conversions resulted in the issuance of newly issued shares of the Company’s common stock. The debt conversion price was set at $0.63 per share. Cumulatively, the newly issued shares contemplated by the Agreements represent 6,034,537 new shares of the Company’s common stock, constituting an increase to the total issued and outstanding shares of the Company’s common stock of 37.2% over the amount immediately preceding the effectiveness of the Agreements. The shares contemplated by the Agreements are restricted securities under the Securities Act of 1933, and shall be issued in reliance upon the safe harbor provided by Rule 506 of Regulation D.

Stock Purchase Agreements

On November 25, 2024, the Company entered into a stock purchase agreement with Alset Inc. (“AEI”), pursuant to which Alset Inc. agreed to purchase 4,411,764 shares of the Company’s common stock for a purchase price of $0.68 per share. AEI is the majority shareholder of the Company, and immediately prior to the effectiveness of the stock purchase agreement, AEI directly and through its subsidiaries owned 86.6% of the issued and outstanding shares of HWH common stock.

On December 24, 2024, the Company entered into a Stock Purchase Agreement with AEI, pursuant to which AEI agreed to purchase 1,300,000 shares of the Company’s common stock (the “Shares”) for a total of $585,000, representing a purchase price of $0.45 per share. AEI is the majority shareholder of the Company.

AEI’s investments are intended to support the growth and development of HWH. The Company believes that these investments of additional funds into HWH are in the best interests of each of AEI and the Company.

Going Concern and Management’s Plan

On January 9, 2024, the Company consummated the Business Combination (the “Closing”) contemplated by the previously announced Agreement and Plan of Merger, dated as of September 9, 2022 (the “Merger Agreement”). The Company’s common stock commenced trading on the Nasdaq Global Market LLC under the ticker symbol “HWH” on January 9, 2024, and the Company’s warrants are expected to commence trading at a later date.

The Company has incurred continuing losses from its operations and has a working capital deficit of $2,163,723 as of December 31, 2024. There are no assurances the Company will be able to raise capital on acceptable terms or that cash flows generated from its operations will be sufficient to meet its current operating costs. If the Company is unable to obtain sufficient amounts of additional capital, it may be required to reduce the scope of its business, which could harm its financial condition and operating results.

These conditions raise substantial doubt about the Company’s ability to continue ongoing operations. However, the Company believes that the available cash in the Company’s bank accounts, anticipated cash from operations, and financing availability from related parties are sufficient to fund our operations for at least the next 12 months.

On April 24, 2024, the Company entered into a Credit Facility Agreement (the “Agreement”) with Alset Inc., a Texas corporation and the Company’s indirect, majority stockholder, pursuant to which Alset Inc. has provided the Company a line of credit facility (the “Credit Facility”) which provides a maximum, aggregate credit line of up to $1,000,000. As of December 31, 2024, there are no outstanding amounts related to the Credit Facility, as the debt with Alset Inc. was converted to equity on September 24, 2024. The remaining credit of $700,000 is available for draw as on December 31, 2024.

Pursuant to the Agreement, the Company may request an advance (each, an “Advance”) on the Credit Facility. Each advance shall bear a simple interest rate of three percent (3%) per annum. Each Advance and all accrued but unpaid interest shall be due and payable at the first (1st) anniversary of the effective date of the Agreement. HWH may at any time during the term of the Agreement prepay a portion or all amounts of its indebtedness without penalty. Each Advance shall not be secured by a lien or other encumbrance on any HWH assets, but shall be solely a general unsecured debt obligation of the Company.

The Company has obtained letters of financial support from Alset International Limited and Alset Inc., an indirect and direct owner of the Company, respectively. Alset International Limited and Alset Inc. committed to provide any additional funding required by the Company and would not demand repayment through twelve months from the issuance of these consolidated financial statements.

|

|

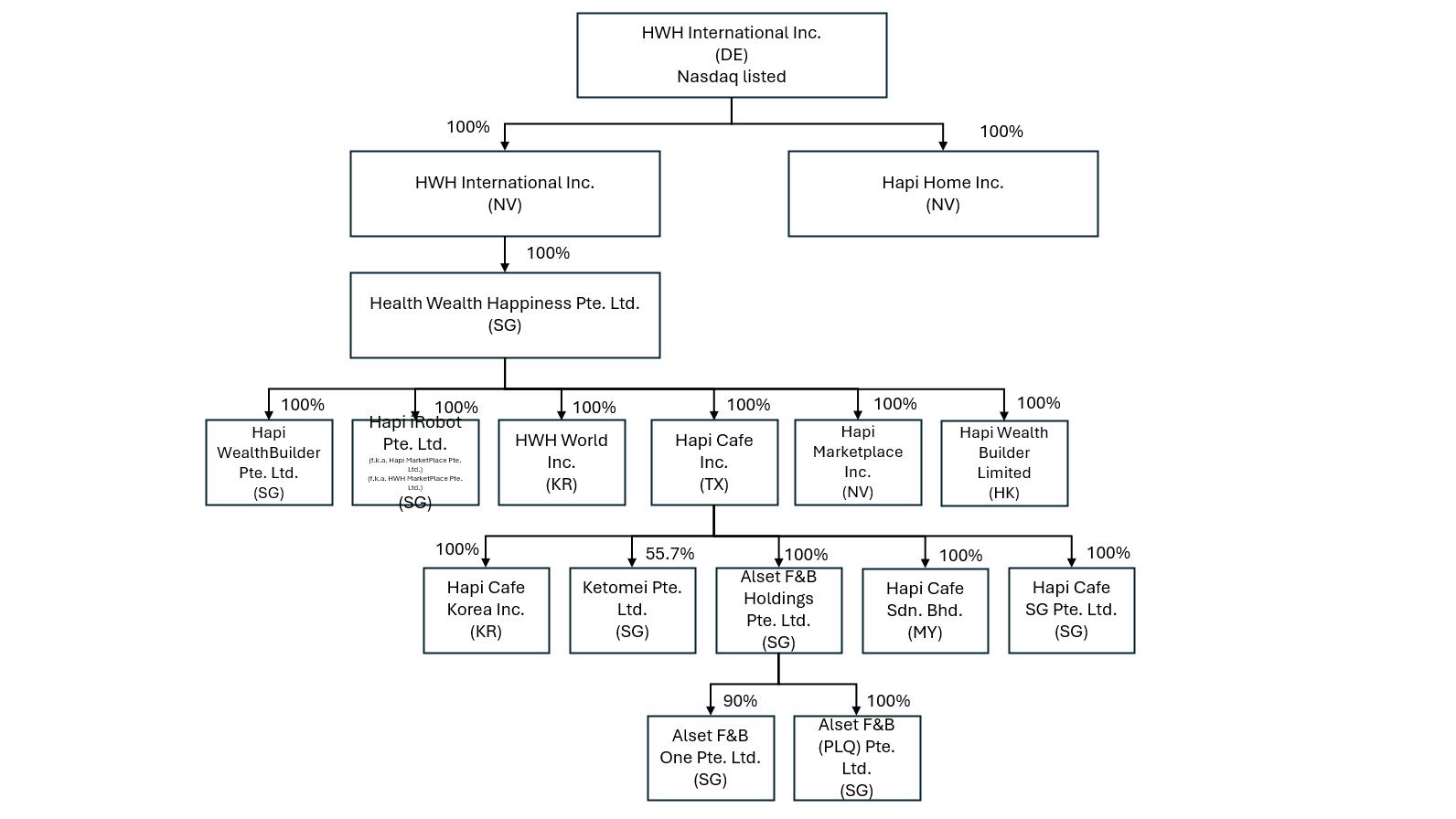

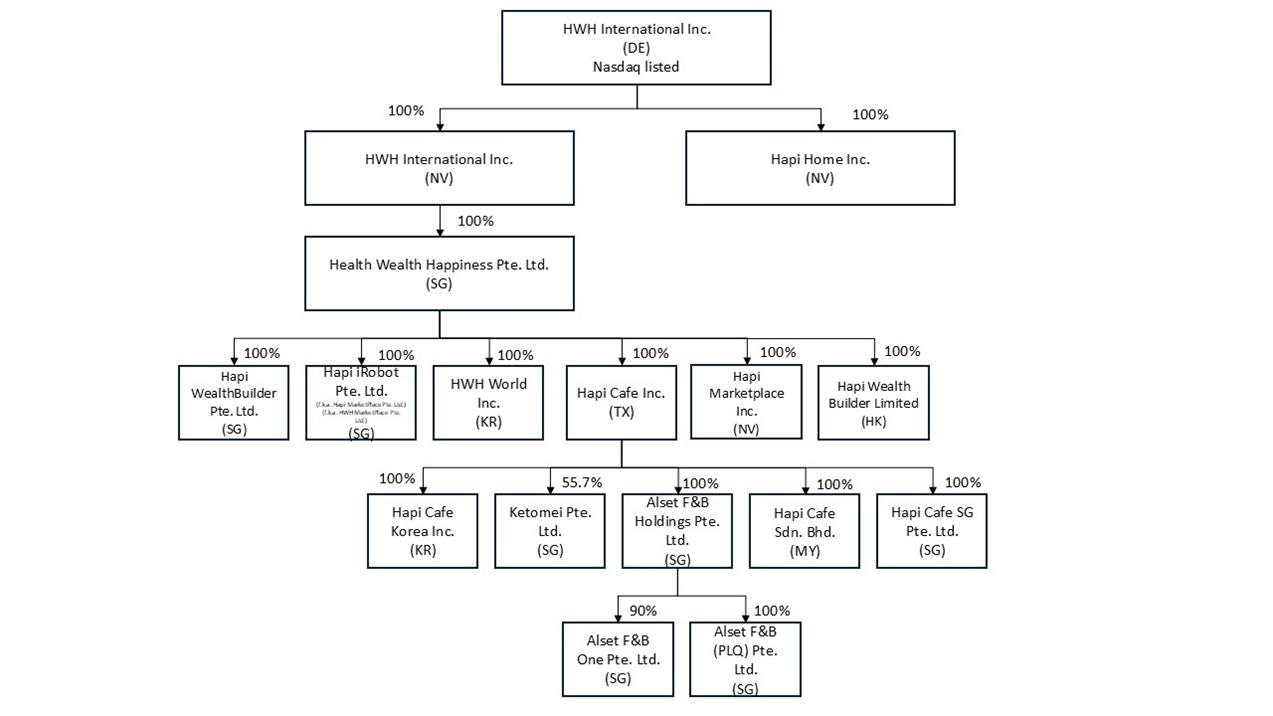

Our Organizational Chart:

Employees

At the present time, the Company has 16 employees. The Company had an agreement with Alset Management Group, Inc., pursuant to which, for a fee, Alset Management Group, Inc. provided the Company with secretarial and administrative services. This agreement expired at the time of closing of Business Combination.

Intellectual Property

We anticipate filing additional trademark applications as we expand into new areas of business.

Corporate Information

Our mailing address is 4800 Montgomery Lane, Suite 210, Bethesda, MD, 20814. We were incorporated in Delaware on October 20, 2021 under the name Alset Capital Acquisition Corp. The Company is an early stage and emerging growth company and, as such, the Company is subject to all of the risks associated with early stage and emerging growth companies.

Additional Information

The Company is subject to the information requirements of the Exchange Act, and, in accordance therewith, files annual, quarterly, and special reports, proxy statements and other information with the Securities and Exchange Commission (the “Commission”). The Commission maintains an internet website at http://www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the Commission. The periodic reports, proxy statements and other information that the Company files with the Commission are available for inspection on the Commission’s website free of charge as soon as reasonably practicable after they are electronically filed with or furnished to the Commission.

The Company maintains a website at https://www.hwhintl.com where you may also access these materials free of charge. We have included our website address as an inactive textual reference only and the information contained in, and that can be accessed through, our website is not incorporated into and is not part of this report on Form 10-K.

|

|

Item 1A. Risk Factors.

Not applicable to smaller reporting companies.

Item 1B. Unresolved Staff Comments.

Not applicable to smaller reporting companies.

Item 1C. Cybersecurity.

Risk Management and Strategy

We recognize the critical importance of developing, implementing, and maintaining robust cybersecurity measures to safeguard our information systems and protect the confidentiality, integrity, and availability of our data.

Managing Material Risks and Integrated Overall Risk Management

We have strategically integrated cybersecurity risk management into our broader risk management framework to promote a company-wide culture of cybersecurity risk management. This integration ensures that cybersecurity considerations are an integral part of our decision-making processes at every level. Our management continuously evaluate and addresses cybersecurity risks in alignment with our business objectives and operational needs.

Risks from Cybersecurity Threats

We have not encountered cybersecurity challenges that have materially impaired our operations or financial standing.

Cybersecurity Governance

Our Board considers cybersecurity risk as part of its risk oversight function and has delegated to the Audit Committee (the “Committee”) oversight of cybersecurity, data privacy and other information technology risks. The Committee oversees management’s implementation of our cybersecurity risk management program and cybersecurity risk exposures, and the steps taken by management to monitor and mitigate cybersecurity risks. The Committee is composed of members of our board of directors with diverse expertise, which has prepared them to oversee our cybersecurity risks.

The Committee receives periodic reports from management on our cybersecurity risks. In addition, management updates the Committee, as necessary, regarding any material cybersecurity incidents, as well as any incidents with lesser impact potential.

The Committee reports to the Board regarding its activities, including those related to cybersecurity. The Board also receives briefings from management on our cybersecurity risk management program.

Our management team, including our Chief Executive Officer, are responsible for assessing and managing our material risks from cybersecurity threats. The team has primary responsibility for our overall cybersecurity risk management program and supervises efforts to prevent, detect, mitigate and remediate cybersecurity risks and incidents through various means, which may include briefings from internal security consultants; threat intelligence and other information obtained from governmental, public or private sources, including external consultants which may be engaged by us; and alerts and reports produced by security tools deployed in the information technology environment. Our management team’s experience includes monitoring the cybersecurity landscape for new risks and best practices, developing and executing cybersecurity strategies, overseeing related governance policies, testing compliance with applicable technical standards, remediating known risks and leading employee training programs.

Item 2. Properties

Our executive offices are located at 4800 Montgomery Lane, Suite 210, Bethesda, MD 20814, and our telephone number is (301) 971-3955. The cost for our use of this space was included in the $10,000 per month fee we paid to Alset Management Group Inc. for office space, administrative and shared personnel support services. Upon completion of the Business Combination, the Company ceased paying these monthly fees. At the present time, our majority stockholder is temporarily providing us office space at no cost. We consider our current office space adequate for our current operations.

Item 3. Legal Proceedings.

The Company is not a party to any material pending legal proceedings.

There are no material proceedings to which any director, officer or affiliate of the Company, or any owner of record or beneficially of more than five percent of any class of voting securities of the Company, or any associate of any such director, officer, affiliate of the Company, or security holder is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

Item 4. Mine Safety Disclosures

Not applicable.

|

|

PART II

Item 5. Market for Company’s Common Equity, Related Stockholder Matters and Small Business Issuer Purchases of Equity Securities

Market Information

Our common stock is currently listed on the Nasdaq Capital Market under the symbol “HWH”. As of December 31, 2024, we had approximately 5,593,920 shares of common stock issued and outstanding.

Prior to our initial listing on the Nasdaq Global Market there was no public trading market for our securities. We subsequently moved to the Nasdaq Capital Market.

Holders

As of December 31, 2024, the Company had eight stockholders of record. The number of holders of record does not include a substantially greater number of “street name” holders or beneficial holders whose shares of the Company’s common stock are held of record by banks, brokers and other financial institutions.

Dividends

We have never declared or paid cash dividends on our capital stock. We intend to retain all available funds and any future earnings for use in the operation of our business and do not anticipate paying any cash dividends on our capital stock in the foreseeable future. Notwithstanding the foregoing, any determination to pay cash dividends will be at the discretion of our board of directors and will depend upon a number of factors, including our results of operations, financial condition, future prospects, contractual restrictions, restrictions imposed by applicable law and other factors our board of directors deems relevant.

Securities authorized for issuance under equity compensation plans.

The Company does not have securities authorized for issuance under any equity compensation plans.

Performance graph

Not applicable to smaller reporting companies.

Recent sales of unregistered securities; use of proceeds from registered securities

On November 8, 2021, our Sponsor purchased 2,156,250 founder shares for an aggregate purchase price of $25,000, or approximately $0.012 per share. Such securities were issued pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act. Prior to the initial investment in the Company of $25,000 by our Sponsor, the Company had no assets, tangible or intangible. The per share purchase price of the founder shares was determined by dividing the amount of cash contributed to the Company by the aggregate number of founder shares issued. The number of founder shares issued was determined based on the expectation that the founder shares would represent 20% of the outstanding shares after the Initial Public Offering (excluding the placement units and underlying securities).

On February 3, 2022, we consummated our Initial Public Offering (the “Offering”) of an aggregate of 8,625,000 units (“Units”) including the issuance of 1,125,000 Units as a result of the underwriter’s full exercise of its over-allotment option. The Units were sold at an offering price of $10.00 per Unit, generating gross proceeds of $86,250,000.

|

|

Simultaneously with the consummation of the Offering, the Company consummated the private placement of 473,750 units (the “Private Placement Units”) to the Sponsor, including the issuance of 33,750 Private Placement Units in connection with the underwriter’s full exercise of its over-allotment option, at a price of $10.00 per Private Placement Unit, generating total gross proceeds of $4,735,500 (the “Private Placement”). The Private Placement was conducted as a non-public transaction and, as a transaction by an issuer not involving a public offering, was exempt from registration under the Securities Act in reliance upon Section 4(a)(2) of the Securities Act.

Of the gross proceeds received from the Offering, including the full exercise of the over-allotment option, and the Private Placement Units, $86.25 million and $4.7 million was placed in the Trust Account, respectively.

On February 3, 2022, the Company paid a cash underwriting discount of $0.20 per Unit, or $1,725,000. In addition, the underwriters were entitled to a deferred fee of $0.35 per Unit, or $3,018,750 in the aggregate. The deferred fee was payable to the underwriters from the amounts held in the Trust Account solely in the event that the Company completes a Business Combination, subject to the terms of the underwriting agreement.

On December 18, 2023, the Company entered into a Satisfaction and Discharge of Indebtedness Agreement (the “Satisfaction Agreement”) in connection with the Underwriting Agreement, dated January 31, 2022 (the “Underwriting Agreement”), with EF Hutton, LLC (“EF Hutton”) (now known as D. Boral Capital LLC), in which, pursuant to that certain Underwriting Agreement, the Company was due to pay $3,018,750 to EF Hutton as deferred underwriting commission (the “Deferred Underwriting Commission”) upon the closing of the Business Combination. In lieu of the Company tendering the full amount of Deferred Underwriting Commission, the Company and EF Hutton entered into the Satisfaction Agreement, pursuant to which EF Hutton accepted a combination of $325,000 in cash (the “Cash Payment”) paid upon the closing of the Business Combination, 149,443 shares of the Company’s common stock (the “Shares”) and a $1,184,375 promissory note (the “Promissory Note”) as full satisfaction of the Deferred Underwriting Commission. Satisfaction and discharge of the Deferred Underwriting Commission depended on the Company’s delivery of the Cash Payment, the Shares and the Promissory Note under the terms of the Satisfaction Agreement. Additionally, the Company has granted EF Hutton an irrevocable right of first refusal (the “ROFR”) to act as the sole investment banker, sole book-runner, and/or sole placement agent, at EF Hutton’s sole discretion, for each and every future public and private equity and debt offering, including all equity linked financing for a period commencing on the date of the satisfaction and ending twenty-four months after the closing of the business combination.

On January 3, 2025, the Company announced the pricing of its public offering of 3,162,500 shares of common stock, par value $0.0001 per share and 1,250,000 pre-funded warrants to purchase shares of common stock (the “Pre-Funded Warrants”). These shares and the Pre-Funded Warrants were offered at a public offering price of $0.40 per share and $0.3999 per the Pre-Funded Warrant. The Pre-Funded Warrants are exercisable immediately upon issuance and have an exercise price of $0.0001 per share. The gross proceeds to the Company from the offering were approximately $1.76 million, before deducting placement agent fees and other offering expenses of approximately $355,017.

The offering was conducted pursuant to the Company’s registration statement on Form S-1, which was initially filed with the Commission on October 10, 2024, subsequently amended on October 23, 2024, December 4, 2024, and December 10, 2024, and declared effective on December 19, 2024. The offering closed on January 6, 2025.

D. Boral Capital LLC (“D. Boral Capital”) was acting as the exclusive placement agent for the offering. Pursuant to the Placement Agency Agreement, the Company has agreed to pay D. Boral Capital a cash fee equal to 7.5% of the gross proceeds from the offering, a non-accountable expense allowance equal to 1.0% of the gross proceeds, and reimbursement for legal and out-of-pocket expenses up to $75,000.

Purchases of Equity Securities by the issuer and affiliated purchasers

The Company did not repurchase any shares of the Company’s common stock during 2024 and 2023.

Item 6. [RESERVED]

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

References to the “Company,” “HWH International Inc.,” “HWH,” “our,” “us” or “we” refer to HWH International Inc. and its subsidiaries. The following discussion and analysis of the Company’s financial condition and results of operations should be read in conjunction with the unaudited interim financial statements and the notes thereto contained elsewhere in this report. Certain information contained in the discussion and analysis set forth below includes forward-looking statements that involve risks and uncertainties.

This Form 10-K contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For this purpose, any statements contained in this Form 10-K that are not statements of historical fact including, without limitation, statements under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding the Company’s financial position, business strategy and the plans and objectives of management for future operations, may be deemed to be forward-looking statements. Without limiting the foregoing, words such as “may”, “will”, “expect”, “believe”, “anticipate”, “estimate” or “continue” or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, and actual results may differ materially depending on a variety of factors, many of which are not within our control. These factors include by are not limited to economic conditions generally and in the industries in which we may participate; competition within our chosen industry, including competition from much larger competitors; technological advances and failure to successfully develop business relationships. Such forward-looking statements are based on the beliefs of management, as well as assumptions made by, and information currently available to, the Company’s management. Actual results could differ materially from those contemplated by the forward-looking statements as a result of certain factors detailed in our filings with the SEC.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the consolidated financial statements and the notes thereto contained elsewhere in this Report. Certain information contained in the discussion and analysis set forth below includes forward-looking statements that involve risks and uncertainties.

Overview

HWH International Inc. and its consolidated subsidiaries (collectively, the “Company” or “HWH”) operate a food and beverage (“F&B”) business in Singapore and South Korea. The F&B business operates four cafés, two of which are located in South Korea and two in Singapore, as well as an online healthy food store, serving customers in Singapore. The Company previously operated a membership model in which individuals paid an upfront membership fee to become members. As members, these individuals received discounted access to products and services offered by the Company’s affiliates. The Company had approximately 9,811 members, primarily in South Korea. Currently, this membership business has been temporarily suspended, however the Company intends to resume this business following the ongoing restructuring of the membership model.

HWH International Inc. was originally incorporated in Delaware on October 20, 2021 under the name Alset Capital Acquisition Corp. The Company was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses (the “Business Combination”). The Company consummated the Business Combination on January 9, 2024 and changed its name from “Alset Capital Acquisition Corp.” to “HWH International Inc.” The Company is an early stage and emerging growth company and, as such, the Company is subject to all of the risks associated with early stage and emerging growth companies.

On September 9, 2022, the Company entered into an agreement and plan of merger (the “Merger Agreement”) by and among the Company, HWH International Inc., a Nevada corporation (the “HWH Nevada” or “Target”) and HWH Merger Sub Inc., a Nevada corporation and a wholly owned subsidiary of the Company (“Merger Sub”). The Company and Merger Sub are sometimes referred to collectively as the “ACAX Parties.” Pursuant to the Merger Agreement, a Business Combination between the Company and the Target was effected through the merger of Merger Sub with and into HWH Nevada, with the Target surviving the merger as a wholly owned subsidiary of the Company (the “Merger”). Upon the closing of the Merger (the “Closing”) on January 9, 2024, the Company changed its name to “HWH International Inc.” The board of directors of the Company (i) approved and declared advisable the Merger Agreement, the Ancillary Agreements (as defined in the Merger Agreement) and the transactions contemplated thereby and (ii) resolved to recommend approval of the Merger Agreement and related transactions by the stockholders of the Company.

|

|

The Target was owned and controlled by certain member officers and directors of the Company and its Sponsor. The Merger was consummated following the receipt of the required approval by the stockholders of the Company and the shareholders of the Target and the satisfaction of certain other customary closing conditions.

The total consideration paid at the Closing (the “Merger Consideration”) by the Company to the Target’s shareholders was $125,000,000, and was payable in shares of the common stock, par value $0.0001 per share, of the Company (“Company Common Stock”). The number of shares of the Company Common Stock paid to the shareholders of the Target as Merger Consideration was 12,500,000, with each share being valued at $10.00.

Our newly acquired business started in South Korea with a single-level membership marketing model with limited products for sale. We registered the business on April 1, 2019, and we started selling founders package on July 1, 2019. While we had been profitable and growing, the COVID-19 pandemic had a material adverse effect on such growth and profits. Due to the decline in membership and revenue starting in 2020, we reorganized our internal staff by adding a broader team in each of the United States, Hong Kong and Singapore with direct selling and business development experience to head up and expand our operations across various geographies and revised our business plan to a tiered membership model in 2022, with more products and services to be made available to our members. We created a new corporate structure, with subsidiaries in the U.S., Hong Kong and Singapore, that would allow for quick geographical expansion and turned our focus to the Hapi Café development.

We have 9,811 individuals with founding member status. This is a privileged class that will be able to enjoy continuous membership benefits in time to come, given that they have trusted the Company and joined at an early stage. Such benefits include the ability to purchase new memberships, in the model described below, at a favorable rate to be determined by the Company. They will also continue to be able to earn affiliate commissions as they sell our products in the marketplace and enjoy discounted rates when visiting Hapi Cafés until further notice. The total number of founding members was capped at 10,000. The Company is in the midst of implementing a new membership model that operates on a yearly subscription basis. While we are not currently selling memberships, we intend to resume membership sales under this new model.

Members will get exclusive discounts on Hapi Marketplace products, priority invites to product launch events and other parties, and can earn passive income when a member’s referral signs up for membership or makes an initial purchase of Hapi Marketplace products through them.

Our operations include:

Hapi Marketplace. On November 4, 2024, the Company announced the launch of its business-to-consumer marketplace, Hapi Marketplace. Hapi Marketplace features a selection of over forty-seven product categories including wellness, elderly care, auto accessories and more. Launching first in the United States, we intend for Hapi Marketplace to expand in the near future to South Korea and Hong Kong, followed by further expansion across Asia.

The various aspects of the Hapi Marketplace will be launched in phases in different regions, each with their own timeline, depending on the completion of logistical aspects for implementation (i.e., payment gateway systems, business licenses, banking set up, import licenses, managerial resources, etc.) We are expanding the product range into robotics for consumer and commercial markets.

Hapi Cafés, which are, and will be, in-person, location-based social experiences, offer members the opportunity to build a sense of community with like-minded customers who share a potential interest in our products. The cafes are designed to operate sustainably as standalone businesses. The cafes also seek to be an avenue to create awareness to and educate potential and existing members about the products and services of HWH, providing us with the chance to significantly increase our membership base as well as increase the amounts spent by our members on our affiliates’ products and services. Each of our cafés is a “Hapi Café.” We opened proof-of-concept Hapi Café locations in Seoul, the Republic of Korea and Singapore in May and July 2022, respectively, one more opened in Seoul, the Republic of Korea in May 2024. We plan to open additional Hapi Cafés as we beta test and further improve our business concept. We intend to grow our memberships as we grow the number of Hapi Cafés around the world. Hapi Cafes are positioned to be integral parts of HWH’s business model. In June 2024, the Company’s decision to close the café under Alset F&B (PLQ) Pte. Ltd. (“F&BPLQ”) was driven by the unsustainable revenue it generated. We believe it is more strategic to refocus our efforts and resources on other business ventures that have greater growth potential.

Our travel business is in the planning stage as we are working with our affiliates to determine the market-by-market services. Through our travel business, we plan to offer exclusive access to unpublished rates and discounts on air travel, cruises, car rentals, hotels, and resorts for members.

|

|

Hapi Wealth Builder seeks to provide participants the opportunity to attend courses, workshops, and coaching sessions in person, fostering a collaborative learning environment for those dedicated to learning investment in equities and wealth-building strategies. The team has been diligently producing digital content for Hapi Wealth Builder and working to collaborate with the right partners to launch the program and make it available to members. Hapi Wealth Builder will leverage the wealth of knowledge and experience of its leaders to make wealth building accessible and effective for its members. Our unique community-centric approach will offer members tools for making informed financial decisions while creating pathways for sustained growth.

On October 31, 2024, we announced that the Company scheduled the launch of Hapi Wealth, a program dedicated to providing comprehensive education in equity investment and wealth-building strategies. We are targeting a rollout in selected regions later in 2025 as well.

To further support its mission, Hapi Wealth is opening its China headquarters, designed as a conducive environment for individuals to participate in tutorials and workshops. The hub will offer participants the opportunity to attend courses, workshops, and coaching sessions in person, fostering a collaborative learning environment for those dedicated to learning investment in equities and wealth-building strategies.

Our Revenue Model

Our total revenue for the years ended December 31, 2024 and 2023 was $1,253,577 and $830,519, respectively. Our net loss for the years ended December 31, 2024 and 2023 was $2,606,504 and $1,076,662, respectively.

We currently recognize revenue from food and beverage sales, sale of products, and memberships to customers. Sales of food and beverage accounted for approximately 100% and 98% of revenue in the years ended December 31, 2024, and 2023, respectively. Sales of memberships accounted for approximately 0% of revenue in the year ended December 31, 2024, and 2% of revenue in the year ended December 31, 2023.

From a geographical perspective, we recognized 6% and 94% of our total revenue in the year ended on December 31, 2024, in South Korea and Singapore, respectively, and 8% and 92% in the year ended December 31, 2023, in South Korea and Singapore, respectively.

Matters that May or Are Currently Affecting Our Business

In addition to the matters described above, the primary challenges and trends that could affect or are affecting our financial results include:

● Our ability to improve our revenue through cross-selling and revenue-sharing arrangements among our group of companies;

● Our ability to identify complementary businesses for acquisition, obtain additional financing for these acquisitions, if and when needed, and profitably integrate them into our existing operation;

● Our ability to attract competent and skilled technical and sales personnel for each of our businesses at acceptable compensation levels to manage our overhead; and

● Our ability to control our operating expenses as we expand each of our businesses and product and service offerings.

|

|

Summary of Significant Accounting Policies

Basis of Presentation and Principles of Consolidation

The Company’s consolidated financial statements and related notes include all the accounts of the Company and its wholly owned subsidiaries. They have been prepared in accordance with the accounting principles generally accepted in the United States of America (“U.S. GAAP”). All intercompany transactions have been eliminated in consolidation.

Use of Estimates and Critical Accounting Estimates and Assumptions

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Significant estimates made by management include, but are not limited to, allowance for credit losses, recoverability and useful lives of property, plant and equipment, the valuation allowance of deferred taxes, contingencies, and equity compensation. Actual results could differ from those estimates.

Revenue Recognition and Cost of Sales

Product Sales: The Company’s performance obligation is to transfer ownership of its products to its members. The Company generally recognizes revenue when a product is delivered to its member. Revenue is recorded net of applicable taxes, allowances, refund or returns. The Company receives the net sales price in cash or through credit card payments at the point of sale.

If any member returns a product to the Company on a timely basis, they may obtain a replacement product from the Company for such returned product. Allowances for product and membership returns are provided at the time the sale is recorded. This accrual is based upon historical return rates for each country and the relevant return pattern, which reflects anticipated returns to be received over a period of up to 12 months following the original sale. Product and membership returns for the years ended December 31, 2024, and 2023 were approximately $0 and $1,184, respectively.

Membership Fee: The Company collects an annual membership fee from its members. The fee is fixed, paid in full at the time of joining the membership and is not refundable. The Company’s performance obligation is to provide its members with the right to (a) purchase products from the Company, (b) access to certain back-office services, (c) receive commissions and (d) attend corporate events. The associated performance obligation is satisfied over time, generally over the term of the membership agreement, which is for a one-year period. The Company recognizes revenue from membership fee over the one-year period of membership.

Food and Beverage: The revenue received from food and beverage business in the years ended December 31, 2024, and 2023 was $1,253,577 and $817,761, respectively.

Cost of Revenue: Cost of revenue consists of cost of procuring finished goods from suppliers and related shipping and handling fees.

Results of Operations

Summary of Statements of Operations for the Years Ended December 31, 2024 and 2023

|

Years Ended December 31, |

||||||||

| 2024 | 2023 | |||||||

| Revenue | $ | 1,253,577 | $ | 830,519 | ||||

| Cost of revenue | 651,721 | 334,825 | ||||||

| Operating expenses | 3,027,024 | 3,402,793 | ||||||

| Other expenses / (income) | 181,336 | (2,245,820 | ) | |||||

| Provision for income taxes | - | 415,383 | ||||||

| Net loss | $ | 2,606,504 | $ | 1,076,662 | ||||

|

|

Revenue

Revenue was $1,253,577 and $830,519 for the years ended December 31, 2024 and 2023, respectively. Word of mouth, a social media presence, and the availability of meeting spaces are significant drivers of our revenue and revenue potential. Our revenue increased in 2024 due to increased customer base from the acquisition of Ketomei Pte. Limited in Singapore and new café under Hapi Café Korea Inc. in South Korea.

For the years ended December 31, 2024 and 2023, our revenue was generated as per the following:

|

Years Ended December 31, |

||||||||

| 2024 | 2023 | |||||||

| Membership Fee | $ | - | $ | 12,293 | ||||

| Product Sales | - | 465 | ||||||

| Food and Beverage | 1,253,577 | 817,761 | ||||||

| Total | $ | 1,253,577 | $ | 830,519 | ||||

Cost of revenue

Cost of revenue increased from $334,825 in the year ended December 31, 2023 to $651,721 in the year ended December 31, 2024. The increase is a result of the increase in sales of F&B business.

Sales commissions decreased from $13,827 to $0 in the years ended December 31, 2023 and 2024, respectively, due to decrease in sale of memberships.

The gross margin increased from $495,694 to $601,856 in the years ended December 31, 2023 and 2024, respectively. The increase of gross margin was caused by the increase of customer base in F&B revenue.

Operating expenses

Operating expenses decreased from $3,402,793 to $3,027,024 in the years ended December 31, 2023 and 2024, respectively, due to general and administrative expenses decreased from $2,908,895 to $2,646,627 in the years ended December 31, 2023 and 2024, respectively. The decrease of general and administrative expenses in 2024 compared with 2023 was mostly caused by the decrease in professional fees paid in relation to pursuing Business Combination by the Company.

Other income (expense)

In the year ended December 31, 2024, the Company had other expenses of $181,336, compared to the other income of $2,245,820 in the year ended December 31, 2023. This decrease is due to the decrease in interest income from $2,029,414 to $64,407, and unrealized loss on convertible note receivable – related party from unrealized profit of $0 to unrealized loss of $379,887 in the years ended December 31, 2023 and 2024, respectively.

Net loss

In the year ended December 31, 2024 the Company had a net loss of $2,606,504, compared to $1,076,662 in the year ended December 31, 2023.

|

|

Liquidity and Capital Resources

Our cash has increased from $1,159,201 as of December 31, 2023 to $4,341,746 as of December 31, 2024. Our liabilities decreased from $6,207,178 at December 31, 2023 to $3,531,523 at December 31, 2024. Our total assets have decreased from $23,710,684 as of December 31, 2023 to $6,408,722 as of December 31, 2024.

The Company believes that the available cash in the Company’s bank accounts, anticipated cash from operations, and financing availability from related parties are sufficient to fund our operations for at least the next 12 months. The Company’s capital requirements for the planned expansion are based on, among other items, geographical specific property costs, team requirements, and marketing steps needed. Our expansion consists of plans to take over leases of existing Hapi Cafes we currently do not own, as we look to add more Hapi Cafes over the next two (2) years. There is no guarantee that we will be able to execute on our plans as laid out above.

On April 24, 2024, the Company entered into a Credit Facility Agreement (the “Agreement”) with Alset Inc., a Texas corporation and the Company’s indirect, majority stockholder, pursuant to which Alset Inc. has provided the Company a line of credit facility (the “Credit Facility”) which provides a maximum, aggregate credit line of up to $1,000,000. As of December 31, 2024, there are no outstanding amounts related to the Credit Facility, as the debt with Alset Inc. was converted to equity on September 24, 2024. This conversion is reflected under Advances from Related Parties in the cash flow statement. The remaining credit of $700,000 is available for draw as on December 31, 2024.

Pursuant to the Agreement, the Company may request an advance (each, an “Advance”) on the Credit Facility. Each advance shall bear a simple interest rate of three percent (3%) per annum. Each Advance and all accrued but unpaid interest shall be due and payable at the first (1st) anniversary of the effective date of the Agreement. HWH may at any time during the term of the Agreement prepay a portion or all amounts of its indebtedness without penalty. Each Advance shall not be secured by a lien or other encumbrance on any HWH assets, but shall be solely a general unsecured debt obligation of the Company.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern and do not contain any adjustments that might be required should the Company be unable to continue as a going concern.

The Company has obtained letters of financial support from Alset International Limited and Alset Inc., an indirect and direct owner of the Company, respectively. Alset International Limited and Alset Inc. committed to provide any additional funding required by the Company and would not demand repayment through twelve months from the issuance of these consolidated financial statements.

Summary of Cash Flows for the Years Ended December 31, 2024 and 2023

| Years Ended December 31, | ||||||||

| 2024 | 2023 | |||||||

| Net cash used in operating activities | $ | (1,659,999 | ) | $ | (2,600,370 | ) | ||

| Net cash provided by investing activities | $ | 20,452,029 | $ | 68,431,427 | ||||

| Net cash used in financing activities | $ | (15,756,940 | ) | $ | (67,463,957 | ) | ||

Cash Flows from Operating Activities

Net cash used in operating activities was $1,659,999 in the year ended of December 31, 2024, as compared to net cash used in operating activities of $2,600,370 in the same period of 2023. The increase of impairment loss on goodwill and unrealized loss on convertible note receivable – related party, which reflects the change in the value of the convertible note and was deducted from the net income, led to the decrease of cash used in operating activities in the year ended December 31, 2024.

Cash Flows from Investing Activities

Net cash provided by investing activities was $20,452,029 in the year of December 31, 2024, as compared to net cash provided by investing activities of $68,431,427 in the same period of 2023. In the year ended December 31, 2024 we paid $30,394 for purchases of property and equipment, $850,000 for convertible note receivable – related party, $14,345 for investment in joint venture, $21,102,871 cash was withdrawn from Trust Account for redemptions and $243,897 cash withdrawn from Trust Account was available to the Company. In the year ended December 31, 2023 we paid $14,574 for purchases of property and equipment, $68,351,348 cash withdrawn was from Trust Account for redemptions, $299,958 cash withdrawn from Trust Account was available to the Company and $205,305 cash was deposited into Trust Account.

Cash Flows from Financing Activities

Net cash used in financing activities was $15,756,940 in the year ended December 31, 2024, compared to net cash used in financing activities of $67,463,957 in the same period of 2023. In the year ended December 31, 2024 we received $2,170,993 from a related party, and repaid $21,102,872 of class A common stock. In the year ended December 31, 2023 we received $526,323 from a related party, received $205,305 from proceeds from extension loan and paid $68,351,348 for repayment of class A common stock.

|

|

Nasdaq Compliance

On March 7, 2024, we received notice from Nasdaq Stock Market, LLC (“Nasdaq”) indicating that, because the market value of our common stock had been below $50,000,000 for the prior 37 consecutive business days, we no longer complied with the minimum market value of listed securities (the “MVLS”) requirement for continued listing on the Nasdaq Global Market under Rule 5450(b)(2)(A) of Nasdaq Listing Rules.

Nasdaq’s notice had no immediate effect on the listing of our common stock on the Nasdaq Global Market. Pursuant to Nasdaq Marketplace Rule 5810(c)(3)(C), we had been provided an initial compliance period of 180 calendar days, or until September 3, 2024, to regain compliance with the MVLS requirement. To regain compliance, the Company’s MVLS was required to be at least $50,000,000 or more for a minimum of ten consecutive business days prior to September 3, 2024. In that regard, on September 9, 2024, the Company received a notice from the Staff that the matter of the MVLS deficiency was to be considered at the Company’s upcoming appeal with the Nasdaq Hearings Panel.

On February 22, 2024, the Nasdaq Staff (the “Staff”) notified the Company that for the previous 30 consecutive trading days, the MVPHS had been below the minimum $15,000,000 required for continued listing as set forth in Listing Rule 5450(b)(2)(C) (the “Rule”). Therefore, in accordance with Marketplace Rule 5810(c)(3)(D), the Company was provided 180 calendar days, or until August 20, 2024, to regain compliance with the Rule. In that regard, on August 27, 2024, the Company received a notice from the Staff that the Company will be delisted from the Nasdaq Global Market, unless the Company requested an appeal of this determination by September 3, 2024.

The Company presented its compliance plan to the Panel at a hearing on October 15, 2024. On October 21, 2024, the Company received a notice from the Panel granting the Company an extension to phase down its securities to the Nasdaq Capital Market and demonstrate compliance with the market value of its publicly held shares (the “MVPHS”) and Stockholders’ Equity requirements as set forth in Nasdaq Listing Rules 5550(a)(5) and 5550(b)(1).

On September 4, 2024, the Company received written notice (the “Notice”) from the Listing Qualifications Staff of Nasdaq notifying the Company that for the prior 30 consecutive business days prior to the date of the Notice, the Company’s bid price was below the minimum $1 required for continued listing on the Nasdaq Global Market pursuant to Nasdaq Listing Rule 5450(a)(1) (the “Bid Price Requirement”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), Nasdaq provided the Company with 180 calendar days, or until March 3, 2025, (the “Compliance Date”), to regain compliance with the Bid Price Requirement.

On March 10, 2025, the Company received written notice (the “Compliance Notice”) from Nasdaq informing the Company that it has regained compliance with Nasdaq Listing Rule 5550(a)(2), which requires that companies listed on the Nasdaq Capital Market maintain a minimum bid price of $1.00 per share. Nasdaq notified the Company in the Compliance Notice that, from February 24, 2025 to March 7, 2025, the closing bid price of the Company’s common stock had been $1.00 per share or greater and, accordingly, the Company had regained compliance with Nasdaq Listing Rule 5550(a)(2) and that the matter was now closed. The Company is currently listed on the Nasdaq Capital Market.

On February 18, 2025, the Company filed a Certificate of Amendment to the Company’s Amended and Restated Certificate of Incorporation with the Delaware Secretary of State to effect a 1-for-5 reverse stock split (the “Reverse Stock Split”). The Reverse Stock Split became effective as of market open on February 24, 2025.

Contractual Obligations

As of December 31, 2024, we did not have any long-term debt obligations, capital lease obligations, operating lease obligations, purchase obligations or long-term liabilities.

Administrative Services Agreement

We agreed to pay Alset Management Group Inc. $10,000 per month for office space, utilities and secretarial and administrative support services commencing on the date that our securities were first listed on the Nasdaq. Upon completion of the initial Business Combination, we ceased paying these monthly fees.

Underwriting Agreement

On February 3, 2022, the Company paid a cash underwriting discount of $0.20 per Unit, or $1,725,000.

|

|

In addition, the underwriters, EF Hutton, LLC (“EF Hutton”) (now known as D. Boral Capital LLC), were entitled to a deferred fee of $0.35 per Unit, or $3,018,750 in the aggregate, however, on December 18, 2023, the Company entered into a Satisfaction and Discharge of Indebtedness Agreement in connection with the Underwriting Agreement, under which in lieu of the Company tendering the full amount, the underwriters accepted a combination of $325,000 in cash paid upon the closing of the Business Combination, 149,443 shares of the Company’s common stock and a $1,184,375 promissory note as full satisfaction. This agreement was effective at the closing of Business Combination on January 9, 2024. Additionally, the Company has granted EF Hutton an irrevocable right of first refusal (the “ROFR”) to act as the sole investment banker, sole book-runner, and/or sole placement agent, at EF Hutton’s sole discretion, for each and every future public and private equity and debt offering, including all equity linked financing for a period commencing on the date of the satisfaction and ending twenty-four (24) months after the closing of the Business Combination.

Merger Agreement

As previously disclosed, on August 1, 2023, the Company held the Special Meeting, at which the Company’s stockholders considered and adopted, among other matters, a proposal to approve the Business Combination. On the Closing Date, the parties consummated the Business Combination pursuant to the terms of that certain Agreement and Plan of Merger, dated September 9, 2022 (the “Merger Agreement”), by and among the Company, Merger Sub, and HWH Nevada.

Pursuant to the terms of the Merger Agreement, (and upon all other conditions pursuant to the Merger Agreement being satisfied or waived), on the Closing Date, (i) the Merger Agreement provided for the combination of HWH Nevada and Merger Sub under the Company, with HWH Nevada surviving as the Surviving Corporation (collectively, the “Merger”). At the consummation of the Merger, HWH Nevada survived as a direct, wholly-owned subsidiary of the Company; and (ii) the Company changed its name to “HWH International Inc.”

The transaction has closed, as all closing conditions referenced in the Merger Agreement have either been met or waived by the parties. Certain closing conditions that have been waived by the parties, pursuant to the Merger Agreement include Section 8.1(i), which states “the aggregate cash available to the Company at the Closing from the Trust Account (after giving effect to the redemption of any shares of the Company’s Class A Common Stock in connection with the Company’s Proposals, but before giving effect to (i) the payment of the Outstanding Alset Transaction Expenses, and (ii) the payment of the Outstanding Company Transaction Expenses), shall equal or exceed Thirty Million dollars ($30,000,000); and 8.1(j), which states “upon the closing, the Company shall not have redeemed shares of the Company’s Class A Common Stock in the Offer in an amount that would cause the Company to have less than $5,000,001 of net tangible assets (as determined in accordance with Rule 3a51-1(g)(1) under the Exchange Act).”

Registration Rights Agreement

On January 31, 2022 the Company, the Sponsor, and certain persons and entities holding securities of the Company entered into a Registration Rights Agreement (the “Registration Rights Agreement”). Pursuant to the Registration Rights Agreement, the Company is obligated to register certain securities, including (i) all of the shares of the Company’s common stock and warrants held by the Sponsor, and the Company’s common stock issuable upon exercise of such warrants, and (ii) the shares of the Company’s common stock and the Company’s common stock underlying warrants that were issued in the Private Placement on January 31, 2022. The Company is obligated to (a) file a resale registration statement to register such securities within 15 business days after the closing of the Business Combination, and (b) use reasonable best efforts to cause such registration statement to be declared effective by the SEC within 60 business days after the closing of the Business Combination.

|

|

Lock-Up Agreements

In connection with the execution of the Merger Agreement, at the closing, each of the HWH Holders holding more than 5% of the HWH Common Stock and certain members of HWH’s management team entered into a Lock-Up Agreement with the Company in substantially the form attached to the letter Agreement dated January 31, 2022 (the “Letter Agreement”) (each, a “Lock-Up Agreement”). Under the Lock-Up Agreement, each such holder agreed not to, during the period commencing from the Closing and with respect to the shares of the Company’s Common Stock to be received as part of the Merger Consideration by the HWH Holder (together with any securities paid as dividends or distributions with respect to such securities or into which such securities are exchanged or converted, the “Restricted Securities”), (A) ending on the earlier of nine months after the date of the Closing, the date on which the closing sale price of shares of the Company’s Common Stock equals or exceeds $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any 20 trading days within any 30 trading day period commencing at least 150 days after the Closing or (y) the date after the Closing on which the Company consummates a liquidation, merger, share exchange or other similar transaction with an unaffiliated third party that results in all of the Company’s stockholders having the right to exchange their equity holdings in the Company for cash, securities or other property.

Termination of Subscription Agreement

On July 30, 2023, the Company entered into a Subscription Agreement (the “Subscription Agreement”) with Meteora Special Opportunity Fund I, LP (“MSOF”), Meteora Capital Partners, LP (“MCP”), Meteora Select Trading Opportunities Master, LP (“MSTO”) and Meteora Strategic Capital, LLC, (“MSC”, and together with MSOF, MCP and MSTO, are referred to herein collectively as “Meteora”). The Subscription Agreement was subsequently terminated. The Company and Meteora entered into a Settlement Agreement as of April 11, 2024 (the “Settlement Agreement”). Pursuant to the Settlement Agreement, the Company paid Meteora $200,000, and agreed that Meteora could retain $100,000 already paid to Meteora.

Impact of Inflation

We believe that inflation has not had a material impact on our results of operations for the years ended December 31, 2024 or December 31, 2023. We cannot assure you that future inflation will not have an adverse impact on our operating results and financial condition.

Impact of Foreign Exchange Rates

The effects of foreign exchange rate changes on the intercompany loans (under ASC 830), which mostly consist of loans from Singapore to South Korea and which were approximately $0.9 million and $2.1 million on December 31, 2024 and December 31, 2023, respectively, are the reason for the fluctuation in foreign currency transaction gains or losses which are included in the Consolidated Statements of Operations and Other Comprehensive Income. Because the intercompany loan balances between Singapore and South Korea will remain at approximately $1 million over the next year, we expect this fluctuation of foreign exchange rates to still impact the results of operations in 2025, especially given that the foreign exchange rate may and is expected to be volatile. If the amount of intercompany loan is lowered in the future, the effect will also be reduced. However, at this moment, we do not expect to repay the intercompany loans in the short term.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies.” Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of these exemptions until we are no longer an emerging growth company or until we affirmatively and irrevocably opt out of this exemption.

|

|

Controls and Procedures

We are not currently required to maintain an effective system of internal controls as defined by Section 404 of the Sarbanes-Oxley Act. Only in the event that we are deemed to be a large accelerated filer or an accelerated filer would we be required to comply with the independent registered public accounting firm attestation requirement. Further, for as long as we remain an emerging growth company as defined in the JOBS Act, we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies including, but not limited to, not being required to comply with the independent registered public accounting firm attestation requirement.

Management is responsible for the preparation and fair presentation of the financial statements included in this prospectus. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America and reflect management’s judgment and estimates concerning effects of events and transactions that are accounted for or disclosed.

Management is also responsible for establishing and maintaining adequate internal control over financial reporting. Our internal control over financial reporting includes those policies and procedures that pertain to our ability to record, process, summarize and report reliable data. Management recognizes that there are inherent limitations in the effectiveness of any internal control over financial reporting, including the possibility of human error and the circumvention or overriding of internal control. Accordingly, even effective internal control over financial reporting can provide only reasonable assurance with respect to financial statement presentation. Further, because of changes in conditions, the effectiveness of internal control over financial reporting may vary over time.

In order to ensure that our internal control over financial reporting is effective, management regularly assesses controls and did so most recently for its financial reporting as of December 31, 2024. This assessment was based on criteria for effective internal control over financial reporting described in the Internal Control Integrated Framework issued by the Committee of Sponsoring Organizations (COSO) of the Treadway Commission. In connection with management’s evaluation of the effectiveness of our Company’s internal control over financial reporting as of December 31, 2024, management determined that our Company did not maintain effective controls over financial reporting due to having a limited staff with U.S. GAAP and SEC reporting experience. Management determined that the ineffective controls over financial reporting constitute a material weakness. To remediate such weaknesses, we plan to appoint additional qualified personnel with financial accounting, U.S. GAAP and SEC experience.