UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________to_________

Commission file number 001-31361

MIRA Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| Florida | 85-3354547 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

| 1200 Brickell Avenue, Suite 1950 #1183, Miami, Florida | 33131 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 786-432-9792

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of exchange on which registered | ||

| Common stock, par value $0.0001 | MIRA | The Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2024, was $2,440,211 based on the closing sale price of the company’s common stock on such date of $0.64 per share, as reported by the NASDAQ Capital Market.

As of March 28, 2025, there were 16,813,654 shares of common stock, par value $0.0001, issued and outstanding.

MIRA Pharmaceuticals, Inc.

Annual Report on Form 10-K

For the fiscal year ended December 31, 2024

TABLE OF CONTENTS

Unless we have indicated otherwise, or the context otherwise requires, references in this Report to “MIRA,” the “Company,” “we,” “us” and “our” or similar terms refer to MIRA Pharmaceuticals, Inc., a Florida corporation.

From time to time, we may use our website, our Facebook page at https://www.facebook.com/people/MIRA-Pharmaceuticals-Inc/100087641460083, our Twitter at https://twitter.com/PharmaMIRA and on our LinkedIn account at www.linkedin.com/company/mira-pharmaceuticals-inc to distribute material information. Our financial and other material information is routinely posted to and accessible on the Investors section of our website, available at www.mirapharmaceuticals.com. Investors are encouraged to review the Investors section of our website because we may post material information on that site that is not otherwise disseminated by us. However, information that is contained in and can be accessed through our website, our Facebook page, our Twitter posts and our LinkedIn posts are not incorporated into, and does not form a part of, this Report.

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains forward-looking statements (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act) that reflect our current expectations and views of future events. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential”, or “continue” or the negative of these terms or other similar expressions. In particular, statements about our pre-clinical and clinical trials and expectations regarding such trials, the markets in which we operate, including growth of such markets, and our expectations, beliefs, plans, strategies, objectives, prospects, assumptions, or future events or performance contained in this Report generally under the headings “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” are forward-looking statements.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates, and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors, including those discussed in this Report under the headings “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” may cause our actual results, performance, or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements, or could affect our share price. Important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements include, but are not limited to, the following

| ● | our ability to obtain and maintain regulatory approval of our product candidates; | |

| ● | our ability to contract with third-party suppliers, manufacturers and other service providers and their ability to perform adequately; | |

| ● | our ability to successfully complete our potential acquisition of SKNY Pharmaceuticals Inc.; | |

| ● | the implementation of our business model and strategic plans for our business, product candidates, and technology; | |

| ● | the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and technology; | |

| ● | the initiation, timing, progress and results of our pre-clinical studies and clinical trials, and our research and development programs; | |

| ● | the timing of anticipated regulatory filings; | |

| ● | the timing and availability of data from our clinical trials; | |

| ● | the timing or likelihood of the accomplishment of various scientific, clinical, regulatory, and other product development objectives; | |

| ● | our ability to retain the continued service of our key professionals and to identify, hire and retain additional qualified professionals; | |

| ● | our ability to advance product candidates into, and successfully complete, clinical trials; | |

| ● | our ability to recruit and enroll suitable patients in our clinical trials; | |

| ● | our future expenses, capital requirements, need for additional financing, and the period over which we believe that our existing cash and cash equivalents will be sufficient to fund our operating expenses and capital expenditure requirements; | |

| ● | our ability to obtain additional funding for our operations and development activities; | |

| ● | the accuracy of our estimates regarding expenses, capital requirements and needs for additional financing; | |

| ● | the pricing and reimbursement of our product candidates, if approved; | |

| ● | the rate and degree of market acceptance of our product candidates, if approved; | |

| ● | developments relating to our competitors and our industry; | |

| ● | our ability to successfully commercialize and market our product candidates, if approved; | |

| ● | the potential market size, opportunity, and growth potential for our product candidates if approved. | |

| ● | the development of major public health concerns and the future impact of such concerns on our clinical trials, business operations and funding requirements; and | |

| ● | other risks and factors listed under “Risk Factors” and elsewhere in this Report. |

|

|

Given the risks and uncertainties set forth in this Report, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements contained in this Report are not guarantees of future performance and our actual results of operations, financial condition, and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in this Report. In addition, even if our results of operations, financial condition and liquidity, and events in the industry in which we operate, are consistent with the forward-looking statements contained in this Report, they may not be predictive of results or developments in future periods.

Any forward-looking statement that we make in this Report speaks only as of the date of such statement. Except as required by federal securities laws, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this Report.

Summary of Principal Risks

Our business is subject to numerous risks and uncertainties that represent challenges that we face in connection with the implementation of our strategy and the growth of our business. In particular, the following are the principal risks which could cause a decline in the price of shares of our common stock:

| ● | We are a development-stage, pre-clinical biotechnology company that has no revenues and has incurred losses since our inception. We expect to incur losses for the foreseeable future and may never be able to generate revenues or achieve or maintain profitability. | |

| ● | Our limited operating history may make it difficult for you to evaluate the success of our business to date and to assess our future viability. | |

| ● | Our losses from operations and negative cash flows during the year ended December 31, 2024 raise substantial doubt about our ability to continue as a going concern absent obtaining adequate new debt or equity financings. | |

| ● | The report of our independent registered accounting firm on our audited financial statements for the fiscal year ended December 31, 2024 contains an explanatory paragraph relating to our ability to continue as a going concern. | |

| ● | We are dependent on the success of our product candidates, some of which may not receive regulatory approval or be successfully commercialized. | |

| ● | We will need additional funds to complete the further development of our business plan, and there is no assurance that additional financing will be available or will be available on terms acceptable to us. | |

| ● | Certain of our executive officers will not be employed by us on a full-time basis. | |

| ● | We face risks related to health, pandemics, epidemics, and outbreaks could significantly disrupt our pre-clinical studies and clinical trials, commercialization efforts, supply chain, regulatory and clinical development activities, and other business operations, in addition to the impact of a global economic slowdown. | |

| ● | We plan to conduct clinical trials at sites outside the United States. There could be interruptions or delays in our trials resulting from geopolitical events, such as war or terrorism. | |

| ● | Results of pre-clinical studies and future early clinical trials are not necessarily predictive indicators of future results. | |

| ● | We may fail to expand our anticipated outsourced manufacturing capability in time to meet market demand for our products and product candidates, and the FDA may refuse to accept the facilities of our contract manufacturers as being suitable to produce our products and product candidates. Any problems in our manufacturing process could have a material adverse effect on our business, results of operations and financial condition. | |

| ● | Our future success will largely depend on the success of our product candidates, which development will require significant capital resources and years of clinical development effort. | |

| ● | There is a high rate of failure for drug candidates proceeding through clinical trials | |

| ● | We rely on, and expect to continue to rely on, third parties to conduct clinical trials for our product candidates. If these third parties do not successfully carry out their contractual duties, comply with regulatory requirements or meet expected deadlines, we may not be able to obtain marketing approval for or commercialize our product candidates, and our business could be substantially harmed. | |

| ● | We rely on third parties to manufacture our clinical product supplies, and we intend to rely on third parties for at least a portion of the manufacturing process of our product candidates, if approved. Our business could be harmed if those third parties fail to provide us with sufficient quantities of product or fail to do so at acceptable quality levels or prices or fail to maintain or achieve satisfactory regulatory compliance. | |

| ● | Even if any of our product candidates receives marketing approval, it may fail to achieve the degree of market acceptance by physicians, patients, third-party payors, and others in the medical community necessary for commercial success. | |

| ● | If we are unable to obtain and maintain intellectual property protection for our technology and products, or if the scope of the intellectual property protection obtained is not sufficiently broad, our competitors could commercialize technology and products similar or identical to ours, and our ability to successfully commercialize our technology and products may be impaired. | |

| ● | Certain recent initial public offerings of companies with relatively small public floats comparable to our anticipated public float have experienced extreme volatility that was seemingly unrelated to the underlying performance of the respective company, and our securities may potentially experience rapid and substantial price volatility, which may make it difficult for prospective investors to assess the value of our securities. |

|

|

PART I

ITEM 1. Description of Business

Overview

MIRA Pharmaceuticals, Inc. (NASDAQ: MIRA) is a clinical-stage pharmaceutical development company advancing two neuroscience programs targeting neurologic and neuropsychiatric disorders. The company holds exclusive rights in the U.S., Canada, and Mexico for Ketamir-2 and MIRA-55, two novel drug candidates designed to address unmet medical needs in pain management, depression, PTSD and cognitive function.

Ketamir-2: A Novel Oral Ketamine Analog

Ketamir-2 is a patent-pending, oral ketamine analog currently being evaluated for the treatment of diabetic neuropathy and is in an ongoing Phase I clinical trial. The compound is designed to overcome the limitations of existing ketamine-based treatments, offering the potential for enhanced safety, improved tolerability, and better oral bioavailability. If approved, Ketamir-2 could provide a safer, more effective option for patients suffering from neuropathic pain, treatment-resistant depression (TRD), major depressive disorder with suicidal ideation (MDD-SI), and post-traumatic stress disorder (PTSD), with the possibility of additional Phase I studies exploring these indications.

Neuropathic pain is a complex, chronic condition resulting from damage or dysfunction in the nervous system, leading to abnormal sensations or pain responses. Common symptoms include burning, coldness, “pins and needles” sensations, numbness, itching, and sudden electric shock-like pain. Neuropathic pain can arise from metabolic disorders (such as diabetic neuropathy), viral infections (like post-herpetic neuralgia), autoimmune diseases, chemotherapy-induced neuropathy, traumatic nerve injury, stroke, or spinal cord injury.

Existing treatment options include antidepressants (tricyclic antidepressants and serotonin-norepinephrine reuptake inhibitors), anticonvulsants (gabapentin and pregabalin), topical agents (lidocaine patches and capsaicin), and opioids. However, these therapies often provide incomplete relief, have significant side effects, and, in the case of opioids, carry a high risk of addiction. Ketamine has demonstrated efficacy for neuropathic pain, but its poor oral bioavailability and high risk of side effects have limited its widespread use. Ketamir-2 aims to address these challenges, offering a treatment with fewer side effects, lower abuse potential, and more convenient oral dosing.

MIRA-55: A Novel Oral Pharmaceutical Marijuana Analog

MIRA-55 is a preclinical-stage investigational drug designed to support cognitive function and enhance memory. It is currently being evaluated in preclinical studies for its potential benefits in neuropsychiatric, inflammatory, and neurologic disorders. If approved, MIRA-55 could provide a breakthrough treatment for patients experiencing cognitive decline, including those with early neurodegenerative conditions.

Regulatory and DEA Classification

The U.S. Drug Enforcement Administration (DEA) has completed its scientific review of both Ketamir-2 and MIRA-55, determining that neither compound will be classified as a controlled substance or listed chemical under the Controlled Substances Act and its governing regulations. This regulatory distinction significantly enhances their commercial and clinical viability, removing potential barriers associated with controlled substances and positioning both compounds for streamlined clinical development and commercialization.

MIRA Pharmaceuticals remains committed to advancing Ketamir-2 and MIRA-55 through clinical development with a focus on addressing major unmet medical needs and improving patient outcomes.

|

|

Preclinical Studies and Pharmacology of Ketamir-2

MIRA has conducted extensive preclinical studies to characterize the pharmacological profile, safety, and therapeutic potential of Ketamir-2, an investigational compound targeting neuropathic pain, treatment-resistant depression (TRD), major depressive disorder with suicidal ideation (MDD-SI), and post-traumatic stress disorder (PTSD). These studies, performed in accordance with ICH and FDA regulatory guidelines, include in vitro and in vivo assessments to evaluate receptor binding, efficacy, selectivity, pharmacokinetics, metabolism, general pharmacology and toxicology.

Mechanism of Action and Receptor Selectivity

Ketamir-2 has been identified as a low-affinity NMDA receptor antagonist, selectively binding to the PCP-site with an IC50 of approximately 100 µM. Its primary metabolite, Nor-Ketamir, also binds to the PCP-site and also does not exhibit affinity for NMDA site, with an IC50 of approximately 300 µM. This targeted receptor interaction differentiates Ketamir-2 from ketamine, which exhibits broader receptor binding, including opioid and monoaminergic receptors, and binds to NMDA receptors with significantly higher affinity (0.5–1 µM).

Efficacy in Animal Models

The therapeutic potential of Ketamir-2 was evaluated in preclinical neuropathic pain and depression models, demonstrating significant effects:

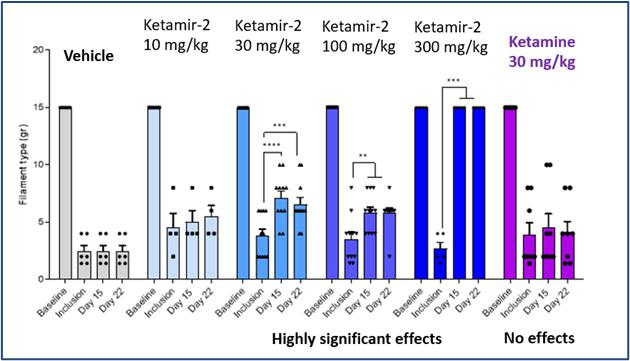

| ● | In neuropathic pain models (Chung model), animals treated with 30–300 mg/kg Ketamir-2 exhibited improved pain thresholds, with the most notable effects observed at 100 and 300 mg/kg at 15- and 22- days post treatment . | |

| ● | Behavioral assessments such as the open-field test, elevated plus maze, and forced swim test showed anti-anxiolytic and antidepressant properties | |

| ● | These improvements occurred without off-target receptor interactions, supporting the compound’s high specificity and potential safety advantages over ketamine. |

Recent Developments

Executive Incentive Compensation Program

On March 26, 2025, the compensation committee (the “Committee”) of MIRA Pharmaceuticals, Inc. (the “Company”) adopted the Company’s Executive Incentive Compensation Plan (the “EICP”) for Erez Aminov, its Chairman and Chief Executive Officer. The EICP was approved by the Committee following greater presentation of the EICP to the board of directors of the Company (the “Board”). The specific terms of the EICP were prepared by the Board’s independent compensation consultant.

Under the EICP, Mr. Aminov is eligible to receive an annual target bonus of $242,500, with a maximum bonus of up to $485,000 (the “Annual Target Bonus”). The Annual Target Bonus is equally weighted (though as adjusted as appropriate) based on the following three components: (i) achievement of clinical milestones for the Company’s drug candidates, (ii) entering into certain strategic partnerships, and (iii) achieving capital raise milestones. Each component under the 2025 Program may be achieved and a corresponding payout made independent of the other components, but only after such component meets the minimum threshold of $40,017 is reached before any bonus payments will be made.

Under the EICP, Mr. Aminov will be eligible for certain long-term awards of up to 500,000 performance-based units of the Company’s common stock, par value $0.001 upon the Company achieving specified milestones based upon the Company reaching certain market capitalization values and the progress of the Company’s drug candidates.

Mr. Aminov will also be entitled to an amount equal to 3% of the total value of any mergers and acquisition or strategic transaction completed by the Company.

All awards under the EICP are subject to the approval of the Board and the Committee. Furthermore, the Board and the Committee, each in its sole discretion, generally retain the right to amend, supplement, supersede or cancel any awards under the EICP for any reason, and reserve the right to determine whether and when to pay out any bonus amounts pursuant to or outside of the EICP, regardless of the achievement of the performance targets.

In addition, the Committee approved an increase of Mr. Aminov’s salary to $485,000 effective April 1st.

Binding Letter of Intent with SKNY Pharmaceuticals Inc.

On March 19, 2025, the Company entered into a binding letter of intent (the “LOI”) with SKNY Pharmaceuticals, Inc. (“SKNY”), a privately held Delaware corporation, to acquire SKNY through a stock exchange transaction (the “SKNY Acquisition”). The acquisition will bring SKNY-1, a novel oral drug candidate targeting weight loss and smoking cessation—two of the leading causes of preventable death—into MIRA’s development pipeline. As part of the agreement, SKNY will provide a $5 million capital infusion in cash or cash equivalents, further strengthening MIRA’s financial position and supporting future growth initiatives.

SKNY holds exclusive rights to its compounds in the United States, Canada, and Mexico. Under the terms of the LOI, SKNY will merge into the Company through a stock exchange, with each outstanding share of SKNY’s common stock being exchanged for shares of MIRA’s common stock. The exact exchange ratio will be determined by an independent third-party valuation firm (the “Independent Valuator”) based on the relative values of both companies. The completion of the SKNY Acquisition is contingent upon the Independent Valuator determining that SKNY’s valuation is at least equal to or greater than that of the Company. The SKNY Acquisition will be subject to shareholder approval of both companies.

Safety and Toxicology Studies

Cardiovascular, CNS, and Respiratory Safety

A GLP-compliant safety pharmacology program evaluated the effects of Ketamir-2 on the cardiovascular, central nervous system (CNS), and respiratory function using standard nonclinical models.

| ● | The hERG assay assessed cardiac ion channel inhibition, while CNS functional observational battery (FOB) studies measured motor function, coordination, and behavioral changes. | |

| ● | Mild, reversible changes in blood pressure and heart rate were observed at higher doses, with no significant adverse effects on CNS function or respiratory parameters. |

Toxicology and Dose Tolerability

Comprehensive toxicology studies were conducted in Sprague Dawley rats and Beagle dogs to assess systemic exposure, metabolism, and dose tolerability.

| ● | Systemic exposure was dose-proportional in females but increased more than dose-proportionally in males at certain doses. | |

| ● | The No Observed Adverse Effect Level (NOAEL) was determined at 300 mg/kg/day in rats and 200 mg/kg/day in dogs, with a safety margin of 67–156 times the intended initial human dose. | |

| ● | Genotoxicity assessments, including the Ames test, micronucleus assay, and COMET assay, confirmed no mutagenic or genotoxic risk associated with Ketamir-2. |

|

|

Pharmacokinetics and Metabolism

A series of in vivo pharmacokinetics (PK) and toxicokinetic (TK) studies assessed the absorption, metabolism, and systemic exposure of Ketamir-2.

| ● | Ketamir-2 crosses the blood-brain barrier, with higher CNS exposure relative to plasma levels. | |

| ● | It exhibits rapid absorption, a short half-life, and high clearance following oral administration. | |

| ● | Metabolism studies confirmed that Ketamir-2 is not a substrate for P-glycoprotein (P-gp), suggesting improved oral bioavailability compared to ketamine. | |

| ● | Metabolism is primarily mediated by CYP2B6 and CYP3A4, with N-demethylation identified as the primary metabolic pathway. | |

| ● | High-affinity NMDA receptor antagonists, such as MK-801, PCP, ketamine, and tiletamine, have been associated with Olney Lesions, typically binding to the PCP-site in the nanomolar range. | |

| ● | Low-affinity NMDA receptor antagonists, such as memantine, amantadine, and hydroxy-nor-ketamine, have not demonstrated this effect. | |

| ● | Ketamir-2, with an IC50 of ~100 µM for the PCP-site, has significantly lower receptor affinity than ketamine (0.5–1 µM), reducing the likelihood of neurotoxicity. |

Ketamir-2 Clinical Development Program

The clinical development program for Ketamir-2 follows a structured, multi-phase approach, beginning with IND-enabling studies and progressing through Phase I and Phase IIa clinical trials. The objective is to evaluate the safety, efficacy, and optimal use of Ketamir-2 for the treatment of diabetic neuropathy, with a focus on patient safety and regulatory compliance. If successful, Ketamir-2 could provide a novel treatment option that addresses the limitations of existing therapies for neuropathic pain management.

IND-Enabling Studies and Regulatory Progress

The development pathway began with the completion of IND-enabling studies, including pharmacokinetics, pharmacodynamics, toxicology, and safety pharmacology assessments in compliance with FDA regulatory standards. Following the submission of an Investigational New Drug (IND) application for diabetic neuropathy to the FDA in December 2024, the agency provided feedback requiring the completion of a neurotoxicity study before proceeding with human dosing in the United States. This study is currently ongoing, and we expect it to be completed by May 2025.

While awaiting the completion of the neurotoxicity study, we have received approval from the Israeli Ministry of Health and Institutional Review Board (IRB) to initiate our Phase I studies. The study will be conducted at the Clinical Pharmacology Unit, Hadassah Medical Center in Jerusalem, Israel. We plan to begin Phase I clinical trials in Israel in the first quarter of 2025, followed by Phase IIa studies in diabetic neuropathy patients to be initiated in the fourth quarter of 2025.

Phase I: Safety and Dosage Determination in Healthy Volunteers

Study Design

| ● | Randomized, double-blind, placebo-controlled trial. | |

| ● | Primary objective: Assess safety and tolerability of Ketamir-2. | |

| ● | Secondary objectives: Evaluate pharmacokinetics (PK) and pharmacodynamics (PD). |

Participant Selection

| ● | Healthy adult volunteers representing a diverse demographic population. |

|

|

| ● | Exclusion criteria: Individuals with a history of psychiatric illness, substance abuse, or significant medical conditions. |

Dosing and Administration

| ● | Dose-escalation strategy starting with low doses, gradually increasing based on safety data. Subsequently moving to a Multiple Ascending dose phase of the trial. | |

| ● | Continuous monitoring for adverse effects. |

Outcome Measures

| ● | Safety assessments: Vital signs, laboratory tests, ECG, and adverse event monitoring. | |

| ● | PK/PD assessments: Blood sampling for drug levels; potential brain imaging for receptor binding (if feasible). |

Phase IIa: Dose, Tolerability, and Early Efficacy in Diabetic Neuropathy

Following the completion of Phase I, Phase IIa clinical trials will focus on diabetic neuropathy patients. This phase will evaluate the optimal dose and tolerability while also collecting preliminary efficacy data.

Study Design

| ● | Randomized, controlled trial in patients with diabetic neuropathy. | |

| ● | Primary objective: Identify optimal dose and tolerability. | |

| ● | Secondary objective: Assess early efficacy outcomes. |

Participant Selection

| ● | Patients diagnosed with diabetic neuropathy, using standardized diagnostic criteria and severity scales. |

Dosing Regimen

| ● | Dose range based on Phase I findings. | |

| ● | Flexible or fixed-dose regimens, depending on safety and tolerability data. |

Outcome Measures

| ● | Tolerability assessments: Adverse event monitoring, patient-reported outcomes, and psychiatric evaluations. | |

| ● | Efficacy assessments: Several standardized pain measures. |

Clinical Manufacturing and Drug Supply

Recipharm Israel Ltd., a leading global contract development and manufacturing organization (CDMO), has successfully completed the upscaling, development, and GMP manufacturing for clinical and preclinical supplies of Ketamir-2.

|

|

MIRA-55: A Novel Oral THC Analog

Our objective is to develop and commercialize new treatment options for neuropsychiatric, inflammatory, and neurologic diseases and disorders. Cannabinoids are a class of chemical compounds that are naturally occurring and are primarily found in cannabis plant extracts. The two major cannabinoids found in cannabis plant extracts include tetrahydrocannabinol, a compound that is the main psychoactive ingredient of cannabis (or THC) and cannabidiol, the second most prevalent active ingredient in cannabis which does not have psychoactive properties (or CBD). These compounds bind to CB1 and CB2 cannabinoid receptors, which are found throughout the body. Specifically, CB1 receptors are concentrated in the central nervous system (or CNS), while CB2 receptors are found mostly in peripheral organs and are associated with the immune system. When the chemical compounds bind to these cannabinoid receptors, the process elicits certain physiological responses. Physiological responses to cannabinoids may vary among individuals. Some of the effects of cannabinoids have been shown to impact nervous system functions, immune responses, muscular motor functions, gastrointestinal maintenance, blood sugar management, and the integrity of ocular functions. Based on pre-clinical testing, our product candidate, MIRA-55, appears to have a strong selectivity for CB2 versus CB1, and is designed to minimize the risk of psychoactive adverse events associated with CB1 activation.

Mechanism of Action of MIRA-55

We believe that the effects of MIRA-55 at the cannabinoid receptors CB1 and CB2 is predicted to account for most of its potential therapeutic effects, especially as it relates to its anti-inflammatory properties. For example, the difference in the dose-response effects of MIRA-55 compared with THC on CB1 receptors appears to coincide with its improved therapeutic profile. If approved by the FDA, MIRA-55 may potentially provide therapeutic effects and enhanced cognition and memory.

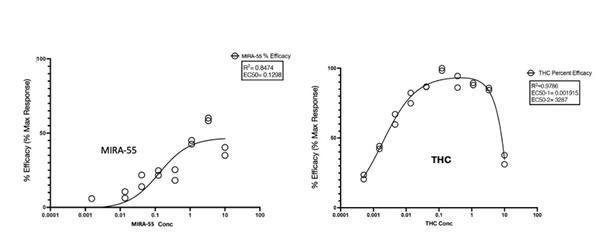

THC has been demonstrated to have biphasic physiological effects (meaning effects in two phases), which have been described for over 40 years: at low levels THC has positive effects while high doses cause the opposite, undesirable symptoms. Examples of biphasic effects at low versus high levels of THC include the anti-anxiety versus pro-anxiety effects, respectively. Through pre-clinical test, we obtained the following dose-response effects for MIRA-55 and THC at the CB1 receptor (see below). In contrast to THC, which displays an initial maximally stimulatory and then inhibitory response at CB1, MIRA-55 appears to act as a monophasic partial agonist (meaning it has a lower intrinsic activity than full agonists) in that it creates a stimulation throughout its dose range, achieving a moderate activation of the CB1 even at high doses. We believe that this accounts for the potential broad therapeutic efficacy of MIRA-55 and the observed absence of negative symptoms even at maximal doses of the drug.

Figure 1: Compound activity with the selected GPCR Biosensor Assays: THC vs MIRA-55 agonist activity at the CB1 Receptor.

In pharmacology, “efficacy” or “Emax” refers to the maximum response that can be achieved with a drug or agent. It represents the extent or magnitude of the response produced by the drug once it has bound to its target, typically referred to as a receptor. The binding between a drug and its receptor is characterized by affinity, which quantifies the strength of their interaction. Efficacy, however, assesses the action or effect of the drug following binding to the receptor.

|

|

The dose-response curve is a commonly used graph in pharmacology that depicts the relationship between the effect of a drug and its dosage. The X-axis represents the increasing doses of the drug, while the Y-axis represents the response produced by the drug. In the case of the figure above, the term “% Efficacy” on the Y-axis refers to the maximum response that can be achieved with the agonist (MIRA-55 or THC) in relation to its ability to activate GPCR receptors (specifically CB1 receptors). GPCRs are G-protein-coupled receptors that form a large group of proteins which are expressed on the cell surface of eukaryotic cells to detect molecules outside the cell and activate cellular response.

The data presented in the figure above has been normalized to the maximal and minimal responses observed in the presence of a control compound and vehicle, respectively. This normalization allows for a standardized comparison of the agonist’s efficacy.

MIRA-55 Preclinical Developments and Studies

As of the date of this report, we have completed several preclinical studies of MIRA-55, including, but not limited to, radio-ligand binding assays, the elevated plus maze (EPM) model of anxiety, and hot plate model thermal sensitivity testing.

We have studied the effects of acute administration of MIRA-55 on anxiety-related phenotypes in mice to model human conditions. An intraperitoneal injection of placebo (e.g., saline) or MIRA-55 (50 mg/kg treatment) was administered to C57Bl/6 mice (n=5/group) that were 8-12 weeks old. Thirty minutes following injection, mice were tested in anxiety-related measures using the Elevated Plus Maze (EPM). The EPM is a widely used preclinical behavioral assay for rodents and has been validated to assess the anti-anxiety effects of pharmacological agents. If determined and approved by the FDA or other regulatory agencies, MIRA-55 appears to have anti-anxiety effects at doses that lacked side effects of sedation or intoxication in mice. The EPM measures anxiety in rodents as a screening test for putative anxiolytic compounds and as a general research tool in neurobiological anxiety research, such as Generalized Anxiety Disorder (GAD) or Post-Traumatic Stress Disorder (PTSD). The model is based on the animal’s aversion to open spaces, which are present in the open arms of the maze. Anti-anxiety effects of test agents are demonstrated by an increase in the percentage of time spent in the open arms with treatment compared to placebo. The total distance traveled is a measure of the overall level of arousal and mobility of the mice undergoing testing on the EPM and is used to rule out any sedating or intoxicating effects of the test agent.

Preclinical studies have also shown the potential of MIRA-55 for relieving pain. Several clinically approved pharmacological agents used to treat pain, including opioids, have been demonstrated to delay or ameliorate the onset of heat sensitivity upon paw exposure of mice to heat. Thirty minutes after treatment with either a placebo (control) or MIRA-55, mice were placed on a heated plate to measure the time it took for each mouse to lift its paw in response to the mild pain they felt from the heat. Mice treated with pain-alleviating drugs took significantly longer to become bothered by the heat and to lift their paws. Similarly, mice treated with MIRA-55 statistically took significantly more time to lift their legs, indicating MIRA-55’s potential effectiveness as a possible treatment for pain in this model. If approved by the FDA, MIRA-55 may potentially provide therapeutic effects for pain control.

MIRA-55 is a CB2 agonist, which may also be an optimal treatment for neurodegenerative diseases associated with neuroinflammation caused by microglial activation. CB2 agonism has been shown in preclinical studies to regulate neuroinflammatory processes, reducing the neuronal damage characteristic of degeneration. We believe there may be a strong rationale for CB2 agonism in neurodegenerative diseases, given increased CB2 expression in patients with these diseases as well as preliminary results from animal models. We see potential for a potent CB2 agonist to treat a range of neurodegenerative diseases. MIRA-55, through its robust activity at CB2 compared to CB1, was designed to minimize the risk of psychotropic adverse events associated with CB1 activation. If approved by the FDA, MIRA-55 may potentially provide therapeutic effects for neurodegenerative and neuroinflammatory illnesses.

Our preclinical development program for MIRA-55 has included a variety of testing. Summarized below are the tests we have completed. Our interpretation of results derived from preclinical data, or our conclusions based on preclinical data, may prove inaccurate and are not necessarily predictive indicators of future results. See the section below titled “Research and Testing to Date - MIRA-55” for more information.

|

|

In addition to the studies completed, we have ongoing preclinical studies evaluating the effects of MIRA-55 on memory and cognition in animal models. These studies aim to further assess MIRA-55’s potential for enhancing cognitive function and addressing deficits associated with neurodegenerative and neuropsychiatric disorders.

Our MIRA-55 Clinical Development Program

Following the preclinical development plan outlined above, we intend to advance MIRA-55 toward an Investigational New Drug (IND) application submission to the FDA for the treatment of cognitive decline in elderly patients. This patient population represents a significant unmet medical need, and we believe MIRA-55 has the potential to provide therapeutic benefits in this area.

The timing of our IND submission will be based on the completion of ongoing preclinical studies, regulatory discussions, and overall development progress. If the FDA allows the program to proceed, a Phase I trial would be expected to begin following the standard regulatory review period post-IND submission.

All development plans are subject to FDA review and acceptance. As discussions with the FDA progress, we may refine our timeline for clinical trials and regulatory submissions as appropriate. Given the inherent uncertainties in drug development, there is no guarantee that our clinical development activities will align with anticipated timelines.

Market Opportunity and Competitive Advantage of Ketamir-2 in Neuropathic Pain Treatment

Market Opportunity

Neuropathic pain is a significant and growing health concern in the United States, affecting approximately 10% of adults (PMC5677393). The North American neuropathic pain market was valued at approximately $2.60 billion in 2022 and is projected to reach $5.20 billion by 2030, growing at a 9.0% compound annual growth rate (CAGR) during this period (Data Bridge Market Research). This growth is driven by an aging population, increasing prevalence of diabetes, chemotherapy-induced neuropathy, and post-surgical nerve injuries.

Despite the high prevalence and economic burden, current treatment options remain limited, often ineffective, or associated with significant side effects and safety concerns. Standard treatments include antidepressants (tricyclic antidepressants, serotonin-norepinephrine reuptake inhibitors), anticonvulsants (gabapentin, pregabalin), opioids, and topical agents. However, these medications often provide incomplete pain relief, require long-term use, and come with risks such as sedation, cognitive impairment, addiction, and withdrawal symptoms.

The strong demand for innovative, effective, and safer neuropathic pain treatments presents a major market opportunity for Ketamir-2, a novel investigational therapy designed to address these critical treatment gaps.

Competitive Advantage of Ketamir-2

Ketamir-2 has the potential to transform neuropathic pain management by offering a more effective, safer, and accessible treatment compared to existing therapies, including currently approved medications.

| ● | Oral Bioavailability – Unlike IV or intranasal ketamine, Ketamir-2 is designed for oral administration, improving patient accessibility, convenience, and compliance while eliminating the need for clinic-based administration. |

|

|

| ● | Improved Safety and Tolerability – Traditional ketamine treatments are associated with dissociation, sedation, and cardiovascular effects. Preclinical studies suggest that Ketamir-2 may provide therapeutic benefits without these side effects, making it a more tolerable alternative for long-term pain management. | |

| ● | Selective Receptor Binding Profile – Unlike ketamine, which interacts with opioid and monoaminergic receptors, Ketamir-2 selectively targets the NMDA receptor PCP-site, potentially reducing off-target effects, addiction risks, and misuse potential. | |

| ● | Lower Abuse Liability – Ketamir-2’s receptor profile suggests a lower potential for abuse and addiction compared to ketamine and opioids, addressing a critical safety concern in chronic pain management. | |

| ● | Potential Advantages Over Current FDA-Approved Neuropathic Pain Treatments: |

| ○ | Compared to Gabapentinoids (Gabapentin, Pregabalin): These drugs are commonly prescribed for neuropathic pain but often cause dizziness, drowsiness, weight gain, and cognitive impairment. Ketamir-2 may provide effective pain relief with a reduced risk of sedation and cognitive side effects. | |

| ○ | Compared to Antidepressants (Duloxetine, Amitriptyline, Venlafaxine): While widely used, these drugs take weeks to show efficacy, may have inconsistent pain relief, and can cause sexual dysfunction, nausea, and sleep disturbances. Ketamir-2 has the potential for a faster onset of action and improved tolerability. | |

| ○ | Compared to Opioids: Due to their high risk of addiction and overdose, opioids are used cautiously for neuropathic pain. Ketamir-2, with its non-opioid mechanism of action, may provide a safer alternative without addiction concerns. | |

| ○ | Compared to Capsaicin Patches and Lidocaine Patches: These topical agents provide localized relief but may be ineffective for widespread or severe neuropathic pain. As an oral systemic therapy, Ketamir-2 could offer broader and more consistent pain relief. |

| ● | Broad Market Potential – With the North American neuropathic pain market projected to exceed $5 billion by 2030, Ketamir-2 could serve millions of patients suffering from conditions such as diabetic neuropathy, chemotherapy-induced neuropathy, and post-surgical nerve pain. |

By offering oral bioavailability, improved safety, reduced abuse potential, and a potential advantage over currently approved neuropathic pain treatments, Ketamir-2 is positioned to become a leading treatment option in the rapidly growing neuropathic pain market, addressing an urgent need for more effective and accessible pain management solutions.

Ketamir-2 Development Strategy

The goal is to advance the development of Ketamir-2 as an orally administered medication with the potential for fewer side effects and greater accessibility, free from the restrictions imposed by ketamine’s REMS. Ketamir-2 aims to address the urgent clinical need for a rapid-acting treatment for diabetic neuropathy and treatment-resistant depression (TRD) in patients who can take the medication at home.

The strategic focus is to establish proof of concept in human patients, demonstrating Ketamir-2’s safety, efficacy, and differentiation from existing therapies. In parallel, the company will actively explore effective exit strategies, including strategic partnerships, licensing opportunities, or potential acquisition pathways to maximize value and commercial potential.

|

|

| ● | IND-Enabling Research. For IND submission, we have conducted comprehensive IND-enabling research, which was mainly undertake through Frontage and Wuxi . This includes pharmacokinetics/pharmacodynamics (PK/PD) studies to understand how Ketamir-2 is absorbed, distributed, metabolized, and excreted, along with its mechanism of action. Toxicology and tolerability studies, encompassing both acute and chronic toxicology assessments in relevant animal models, including 7 and 14-day studies in rats and dogs have been accomplished with excellent results. Additionally, the development of a stable and effective formulation for Ketamir-2’s oral administration has been done and capsules ready for the clinical studies have been manufactured. |

| ● | IND Submission for Diabetic Neuropathy Indication. An IND was submitted to the FDA in December 2024. This submission included all preclinical data and a proposed plan for clinical trials. A well-thought-out regulatory strategy is essential to address potential queries and concerns from regulatory bodies. We are awaiting the completion of the requested Neurotoxicity study for the obtaining of the IND by the FDA. |

| ● | Clinical Trials - Phase I and IIa. Phase-I clinical development, focusing on assessing the safety, tolerability, and optimal dosing in a small group of healthy volunteers is in the process of initiation at the Hadassah Medical Center in Israel.. This will be followed by Phase IIa trials, where the efficacy of Ketamir-2 will be evaluated in a group of diabetic neuropathy patients, along with further safety assessments. |

| ● | Potential Collaborations. We are actively exploring partnerships with a larger pharmaceutical company for further clinical development and commercialization of Ketamir-2 or a potential exit strategy through acquisition. Such a collaboration could help accelerate development while reducing financial and operational burdens. |

MIRA-55 Development strategy

Our goal is to develop therapeutics targeting well-characterized CB1 and CB2 receptors with optimized pharmacological properties to transform the lives of patients with neurological diseases. Key elements of our strategy to achieve this goal include:

| ● | Advance our MIRA-55 through clinical development and approval. Our product candidate, MIRA-55, is in pre-clinical studies. Existing treatment options for neuropsychiatric disorders and neurological diseases have significant limitations, and, if approved, we believe MIRA-55 would represent a major therapeutic advancement for patients. |

| ● | Continue pre-clinical development of MIRA-55 across a range of CNS diseases associated with neurodegeneration and progress into clinical development. MIRA-55 is currently in IND-enabling studies for neurobehavioral disorders such as cognitive decline, as well as neurodegenerative diseases. We believe MIRA-55 may have potential in several diseases associated with neuroinflammation. |

| ● | Identify additional product candidates and expand current candidates into additional neurological diseases. We see potential for our current product candidate to be evaluated in clinical trials outside of its initial indications and will evaluate additional indications to maximize the potential of our drug development program. Our current product focus is on targets that are well characterized in neurological diseases but for which there are limitations with currently available therapies. We also plan to continue to identify and develop additional novel product candidates that align with our focus. |

| ● | Explore strategic collaborations to maximize the value of our product candidates. We plan to explore collaborations opportunistically to maximize the value of our product candidates. We intend to retain significant economic and commercial rights to our programs in key geographic areas that are core to our long-term strategy. |

|

|

Ketamir-2

Preclinical Research Findings

In Silico Analysis of Targets of Ketamir-2 vs Ketamine

In silico analysis, referring to computer-based techniques, has become an integral part of pharmaceutical research and development.7 This approach utilizes computational methods to analyze and predict the properties and behaviors of pharmaceutical compounds. The use of in silico analysis is especially crucial in the early stages of drug development, as it aids in identifying potential drug targets and elucidating differences between a new drug and its parent compound. By analyzing large datasets, such as genomic, proteomic, and metabolomic data, researchers can predict how different compounds might interact with various biological targets. This approach helps in understanding the mechanism of action of new drugs and can significantly reduce the time and cost associated with experimental screening. InSilico Trials was contracted to provide a comparison between targets of Ketamir-2 vs ketamine employing their target identification protocol. The following characterize some of the unique targets that are predicted to interact with either Ketamir-2 or ketamine, thereby differentiating one drug from the next.

Studies evaluating the mechanism of action of the investigational product indicate that Ketamir-2 exhibits a highly selective receptor binding profile. Specifically, Ketamir-2 was found to be a low affinity NMDA receptor antagonist, that selectively binds to the phencyclidine (PCP)-site with an IC50 on this receptor site of ~100 µM. In contrast, ketamine primarily works as an NMDA receptor antagonist with affinities in the range of 0.5-1 µM.

Ketamir-2 selective target:

Additionally, while ketamine has a broader receptor binding profile which includes opioid receptors and receptors associated with monoaminergic systems, the receptor binding profile of Ketamir-2 and the primary metabolite of Ketamir-2 is specific to the NMDA receptor PCP-site.

Pharmacology:

Primary pharmacology studies (in vitro and in vivo) conducted to support the advancement of Ketamir-2 are summarized in the table below. In vivo pharmacology assessments include evaluation of Ketamir-2 using endpoint assessments post-dose administration that are traditionally utilized to evaluate behavioral indices such as spontaneous horizontal locomotor activity, anxiety, and depression in addition to evaluation of the therapeutic efficacy in a rodent model of neuropathic pain. While endpoint assessments pertaining to depression, anxiety, and general locomotion are not direct evidence of an improvement in indices of neuropathic pain, discordant neuropharmacological signaling through the NMDA receptor is a commonality within neuropsychiatric disorders such as depression and anxiety. Specifically, overactivation of the NMDA receptor has been suggested to play a role in major depressive disorders for which anxiety is comorbid. Moreover, signaling through the NMDA receptor plays a role in the pain transmission pathway and is thus associated with neuropathic pain. Thus, data derived from assessments traditionally used in the evaluation of potential antidepressant therapeutics such as the forced swim test, elevated plus maze, and open field test are directly linked to the mechanism of action of Ketamir-2.

MIRA Pharmaceuticals has completed a series of nonclinical pharmacology studies characterizing Ketamir-2 efficacy in vitro and in vivo in animal models. Results of in vitro assessments which evaluated the pharmacological activity of Ketamir-2 indicate that Ketamir is a low affinity NMDA receptor antagonist that selectively binds to the PCP-site with an IC50 of ~100 µM on this receptor site. Nor-Ketamir, the primary metabolite of Ketamir-2, selectively binds to the PCP-site with no affinity for NMDA. The IC50 is ~300 µM. Evaluation of therapeutic efficacy of Ketamir-2 in animal models of depression, anxiety and neuropathic pain (i.e., Chung model) indicate that treatment with Ketamir-2 results in anti-anxiolytic and anti-depressive behavior in behavioral assessments such as the open-field test, elevated plus maze, and the forced swim test. Moreover, animals administered 30 – 300 mg/kg Ketamir-2 exhibited significant increases in mean withdrawal threshold on Day 15 and 22 (100 and 300 mg/kg only) when compared to Day 14 post-surgery values. These ameliorative effects are observed in the absence of off-target binding/signaling from both Ketamir-2 and the primary metabolite Nor-Ketamir.

Figure 2: Effect of Ketamir-2 on neuropathic pain in male rats. Study represents the sensitivity to von-Frey filaments at 15 (blue) and 22 days (purple) after induction of neuropathy.

|

|

Bioavailability:

MIRA has conducted a series of informational ADME assessments typical for a novel therapeutic classified as a small molecule. The data indicate that Ketamir-2 is permeable at a dose of 10 µM (A-B and B-A) and is not highly bound to plasma proteins in mouse, rat, dog, cynomolgus monkey, or human plasma. Substrate interaction and metabolism studies indicate that Ketamir-2 is not a substrate of P-glycoprotein and is metabolized in mice, rats, dogs, cynomolgus monkey, and human hepatocytes with half-lives between 3.26 – 18.3 min. This biotransformation, as evaluated in human hepatic microsomes, is primarily the result of N-demethylation with metabolism being mediated primarily by CYP2B6 and CYP3A4

In addition to these data, the pharmacokinetics of Ketamir-2 have been characterized in a series of in vivo PK/TK studies conducted in Sprague Dawley rats and Beagle dogs. General PK data indicate that Ketamir-2 does cross the blood brain barrier with longer exposure times and greater levels of nor-Ketamir present in the brain. Moreover, the PK profile of Ketamir-2 following oral administration is characterized by rapid absorption, a short half-life, high clearance, and lower oral bioavailability.

Within the definitive toxicology studies, in general, females had higher systemic exposure than males of both Ketamir-2 and nor-Ketamir at 100 and 300 mg/kg/day (Days 1 and 14) and at 1000 mg/kg/day (Day 1) in rats and at 100 mg/kg/day (Days 1 and 14) and at 50 mg/kg/day (Day 1) in canines. Within rats, systemic exposure increased dose proportionally in females on Day 1 and in both sexes on Day 14 but increased more than dose proportionally in males on Day 1. In contrast, systemic exposure in canines increased in a more than dose proportional manner in both sexes on Days 1 and 14. The metabolite to parent (nor-Ketamir/Ketamir-2) ratios in AUC0-24h ranged from 2.2 – 22 and 4.5 – 44 in rats and canines, respectively.

MIRA-55

Eurofins DiscoverX has developed a panel of cell lines stably expressing non-tagged GPCRs that signal through cyclic adenosine monophosphate, a messenger used for intracellular signal transduction in many different organisms (or cAMP). Hit Hunter® cAMP assays are specialized tests that track the activation of a type of cell receptor known as GPCR. GPCRs play a crucial role in how cells respond to external signals, and they are activated through two pathways: Gi and Gs secondary messenger signaling. These pathways are like internal communication systems in cells that relay signals from the outside to trigger specific responses inside the cell. The assay is conducted in a straightforward, uniform manner without the need for image-based analysis. This method uses a technology developed by DiscoverX called Enzyme Fragment Complementation (or EFC). In EFC, fragments of an enzyme, specifically β-galactosidase (β-Gal), are brought together to become functional only when the GPCR is activated. β-Galactosidase, the enzyme used as a functional reporter in this assay, is typically inactive in fragmented form and becomes active when the fragments reassemble, indicating the activation of the GPCR. In this case, the GPCR target was CB1 receptor. Compounds were tested in agonist and antagonist mode with the requested GPCR Biosensor Assays. For agonist assays, data was normalized to the maximal and minimal response observed in the presence of control ligand and vehicle. This Eurofins DiscoverX system was used to test THC vs MIRA-55 agonist activity at the CB1 receptor.

Unlike CB1 receptors that mediate many of the psychotropic effects of cannabinoids on the CNS, CB2 receptors are predominantly present on cells of the immune system. Based on preliminary results of our GPCR biosensor assays, the CB2 receptor agonistic effects of MIRA-55 are 8-fold more potent than THC and 30-fold more potent than CBD.

The study regarding the ability of MIRA-55 vs THC vs CBD to activate CB2Receptors and alter intracellular cAMP levels was performed by the CRO Eurofins DiscoverX.

As can be seen in the table below, the EC50 (i.e. concentration required to induce a half maximal response) for MIRA-55 was 8 times more potent than THC and at least 30 times more potent that CBD-i.e. it only took 1 uM of MIRA-55 to induce the same response that required 8 uM of THC and >30 uM of CBD.

| Compound Name | Assay Name | Assay Format | Assay Target | Result Type | EC50 | Unit | ||||||

| MIRA-55 | cAMP | Agonist | CNR2/CB2 | EC50 | 1.008462 | uM | ||||||

| THC | cAMP | Agonist | CNR2/CB2 | EC50 | 8.209884 | uM | ||||||

| CBD | cAMP | Agonist | CNR2/CB2 | EC50 | >30 | uM |

Table: The foregoing measurements were performed as follows:

DiscoverX has developed a panel of cell lines that stably express non-tagged GPCRs (G-protein coupled receptors) capable of signaling through cAMP. The Hit Hunter® assay platform is used to investigate the functionality and response of these GPCRs.

In the case of the CB2 receptor, which is a GPCR involved in various physiological processes and has potential therapeutic implications, the Hit Hunter® assay can be employed to study the effects of drug agonists on CB2 receptor activity.

To measure the half maximal response (EC50) of CB2 receptor activation by a drug agonist that leads to a decrease in cAMP levels, an alternative approach may be required. One common method involves using forskolin, an activator of adenylate cyclase, to stimulate cAMP production. Forskolin bypasses the GPCR signaling and directly activates adenylate cyclase, resulting in increased cAMP levels.

In the presence of forskolin, the drug agonist at the CB2 receptor can then be tested at various concentrations to determine its ability to inhibit the forskolin-induced cAMP production. The drug’s concentration that leads to a 50% reduction in forskolin-stimulated cAMP levels can be considered the half maximal response or EC50.

|

|

Completed Pre-Clinical Tests

EPM Model of Anxiety Test

EPM is a widely used behavioral test to assess anxiety-like behavior in rodents. Typically, rodents tend to avoid open spaces due to their natural aversion to potentially dangerous areas. Therefore, spending more time in the open arms of the maze indicates decreased anxiety-like behavior. Similarly, the total distance travelled can reflect general locomotor activity and exploratory behavior, which can be influenced by the state of anxiety and the effect of drugs.

The EPM apparatus consists of two open arms and two enclosed arms elevated above the floor. Blue Bars represent the percentage of time spent in the open arms by mice in the placebo and drug-treated groups. Green Bars show the total distance travelled by mice in both groups during the EPM test

| ● | Method: We studied the effect of acute administration of MIRA-55 on anxiety-related phenotypes in mice to model human conditions. |

| ■ | An intraperitoneal (i.p.) injection of Placebo (e.g. saline) or MIRA-55 (e.g. 50mg/kg = Treatment) was administered to C57Bl/6 mice (n=5/group) that were 8-12 weeks old. | |

| ■ | 30 minutes following injection, mice were tested in anxiety related measures using EPM |

| ● | Outcome: We have found a significant MIRA-55’s anti-anxiety effects as the animals spent significantly more time at the open arm, compared to vehicle control. |

The issue of how to test the effect of MIRA-55 on cognition was complicated by the following:1) MIRA-55 has anti-anxiety (i.e. anxiolytic) effects, 2) anxiolytics can potentially improve cognitive assessment outcomes by reducing anxiety levels that may otherwise hinder cognitive functioning. Thus, in commonly performed tests of cognition in mice, such as novel object recognition and Morris water maze, anxiolytic medications can indirectly result in improved performance by decreasing anxiety rather than by directly improving cognition. To separate assessments of the impact of MIRA-55 on cognitive performance from its demonstrated anti-anxiety effects, we employed a model of context fear conditioning wherein we dosed the mice after training. Context fear conditioning in mice is a behavioral paradigm used to measure cognitive processes related to associative learning and memory. Associative learning, where an individual learns to associate specific stimuli or contexts with outcomes, in this case the mice associate being in a specific chamber with receiving a mild foot shock that occurs during training the day before testing. This process of forming associations between stimuli, actions, and consequences is involved in numerous skills and behaviors in everyday life: it underlies learning new skills, developing habits, and acquiring knowledge through experiences and conditioning. The use of associating the chamber with the foot shock on day one, means that when the mice are returned to the chamber on day 2 a measure of how much freezing they do corresponds to a read out of how well they can recall the experiences they had during training on day 1 (i.e. the greater the freezing, the better the recollection of the association between the chamber and food shock). Since the mice are given MIRA-55 AFTER training that takes place on day 1, and only before testing on day 2, there is no concern about the anxiolytic effects of MIRA-55 on learning during training, but rather this model tests MIRA-55’s effects on performance only-which in this case represents memory (i.e. the ability to recognize and recall the chamber where they had previously been shocked) and to translate that into an associated behavior (i.e. freezing). As published in the Journal of Neuropharmacology in 2023, THC and cannabis impair context fear conditioning, both when given prior to training (because of its anti-anxiety effects) and when given prior to testing (because of its cognitive impairing effects). MIRA-55 resulted a dramatic effect on cognitive performance in the context fear conditioning model, the percentage of time spent freezing-that is a demonstration of their memory and association-in the mice who received MIRA-55 at a dose of 75 mg/kg was more than twice that of those who received 0 mg/kg=placebo (i.e. 55% vs 25%, p<0.0001). Thus, MIRA-55 doubled the cognitive performance of the mice compared to placebo. This degree of improvement in cognitive performance in healthy mice dosed just prior to testing and after learning has not been demonstrated with any cannabinoid compound previously.

|

|

Because MIRA-55 is an anxiolytic, we decided to test whether it could impair cognitive function. We therefore sought to determine if MIRA-55 could impair attention-a different aspect of cognition than memory, recall and associative learning, and one that is affected negatively by sedating compounds (e.g. THC, Cannabis, benzodiazepine, etc.) and positively by stimulants (e.g. caffeine, nicotine, amphetamine) In order to assess whether MIRA-55 affected attention as compared to THC required a different testing model-Psychomotor Vigilance Test (PVT). The rat Psychomotor Vigilance Test (rPVT) is a widely used method to measure sustained attention in rodents. In the rPVT model, rats are trained to respond to a visual stimulus by pressing a lever, with shorter reaction times indicative of better attentional performance. Mice with longer reaction times or higher variability in response times may be considered to have attention deficits or altered vigilance. Data is shown as percentage accuracy at pressing the lever within the allowed reaction time vs dose of drug used. We have found that at doses of THC that impair attention, MIRA-55 had no negative effects on attention (i.e. their accuracy at pressing a lever at the right amount of time after receiving a trained cue was not impaired at all).

| Status | Planned Activity | |

| Drug Substance Preparation | Analytical Development and qualification | |

| NonGMP Production Refinement and optimization | ||

| GLP/GMP Production Refinement | ||

| Testing | Acute toxicity study mice | |

| Genotoxicity studies | ||

| MTD/7D DRF Dog | ||

| MTD/7D DRF Rat | ||

| Dog 28-day Toxicology | ||

| Rat 28-day Toxicology | ||

| Cardiovascular Study Dog (Telemetry) | ||

| Respiratory Study Rat | ||

| hERG (Manual Patch-Clamp) | ||

| Neurobehavioral Evaluation Rats | ||

| Neurobehavioral Evaluation Mice |

We plan to conduct further neurobehavioral evaluations of orally administered MIRA-55 in rats and mice, along with a respiratory evaluation of orally administered MIRA-55 in rats. Additionally, in vitro testing is planned to assess the effects of MIRA-55 on hERG (the human Ether-à-go-go-Related Gene) channel currents, an early FDA-required assay that helps identify potential cardiac abnormalities before advancing to human dose studies.

hERG encodes a potassium ion channel that plays a critical role in the electrical activity of the heart. The hERG channel mediates the repolarizing current in the cardiac action potential, ensuring proper heart rhythm. If the function of this channel is inhibited—whether by drug interaction or rare genetic mutations—it can lead to long QT syndrome, a potentially life-threatening condition.

In addition to these studies, we are planning a 28-day toxicology analysis in dogs and rats as part of the broader safety evaluation of MIRA-55.

We have also initiated analytical development and manufacturing for MIRA-55. Our suppliers are working toward scaling production under GLP/cGMP conditions, building upon previous non-GMP batches used in initial testing. We are collaborating closely with our suppliers to generate sufficient cGMP-grade MIRA-55 materials for planned preclinical toxicity programs, expanded animal testing, and potential human trials, which will be conducted pending regulatory approval.

|

|

Regulation

The FDA and comparable regulatory authorities in state and local jurisdictions impose substantial and burdensome requirements upon companies involved in the clinical development, manufacture, marketing, and distribution of drugs. These agencies and other federal, state, and local entities regulate, among other things, the research and development, testing, manufacture, quality control, safety, effectiveness, labeling, storage, record keeping, approval, advertising and promotion, distribution, post-approval monitoring and reporting, sampling and export and import of our drug candidates.

U.S. Government Regulation

In the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act, or FDCA, and its implementing regulations. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations requires the expenditure of substantial time and financial resources. Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process or after approval, may subject an applicant to a variety of administrative or judicial sanctions, such as the FDA’s refusal to approve pending New Drug Applications (or NDAs), withdrawal of an approval, imposition of a clinical hold, issuance of warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement or civil or criminal penalties.

The process required by the FDA before a drug may be marketed in the United States generally involves the following:

| ● | completion of pre-clinical laboratory tests, animal studies and formulation studies in compliance with the FDA’s good laboratory practice (“GLP”) regulations; |

| ● | submission to the FDA of an IND application, which must become effective before human clinical trials may begin; |

| ● | approval by an independent Institutional Review Board (“IRB”), at each clinical site before each trial may be initiated; |

| ● | performance of adequate and well-controlled human clinical trials in accordance with good clinical practices (“GCP”) requirements to establish the safety and efficacy of the proposed drug product for each indication; |

| ● | demonstration that the API and finished product are manufactured under well controlled (eventually cGMP) conditions and meet all applicable standards of identity, strength, quality, and purity; |

| ● | submission to the FDA of an NDA; |

| ● | satisfactory completion of an FDA advisory committee review, if applicable; |

| ● | satisfactory completion of an FDA inspection of the manufacturing facility or facilities at which the product is produced to assess compliance with cGMP requirements and to assure that the facilities, methods, and controls are adequate to preserve the drug’s identity, strength, quality, and purity; |

| ● | FDA review and approval of the NDA, including consideration of the views of any FDA advisory committee, prior to commercial marketing or sale of the drug in the United States; and |

| ● | compliance with any post-approval requirements, including the potential requirement to implement a Risk Evaluation and Mitigation Strategy (“REMS”) or to conduct a post-approval study. |

Pre-clinical studies

Before testing any drug or biological product candidate in humans, the product candidate must undergo rigorous pre-clinical testing. The pre-clinical developmental stage generally involves laboratory evaluations of drug chemistry, formulation, and stability, as well as studies to evaluate toxicity in animals, to assess the potential for adverse events (“AEs”) and, in some cases, to establish a rationale for therapeutic use. The conduct of pre-clinical studies is subject to federal regulations and requirements, including GLP regulations for safety/toxicology studies. An IND sponsor must submit the results of the pre-clinical studies, together with manufacturing information, analytical data, any available clinical data or literature and a proposed clinical protocol, to the FDA as part of the IND.

|

|

An IND is a request for authorization from the FDA to ship an investigation product and then administer it to humans and must be allowed to proceed by the FDA before human clinical trials may begin. Some long-term pre-clinical testing, such as animal tests of reproductive AEs and carcinogenicity, may continue after the IND is submitted. An IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA raises concerns or questions before that time related to one or more proposed clinical trials and places the trial on clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. As a result, submission of an IND may not result in the FDA allowing clinical trials to commence.

Clinical trials

The clinical stage of development involves the administration of the investigational product to healthy volunteers or patients under the supervision of qualified investigators, generally physicians not employed by, or under control of, the trial sponsor, in accordance with GCPs, which include the requirement that all research patients provide their informed consent for their participation in any clinical trial. Clinical trials are conducted under protocols detailing, among other things, the objectives of the clinical trial, dosing procedures, subject selection and exclusion criteria and the parameters to be used to monitor subject safety and assess efficacy. Each protocol, and any subsequent amendments to the protocol, must be submitted to the FDA as part of the IND. Furthermore, each clinical trial must be reviewed and approved by an IRB for each institution at which the clinical trial will be conducted to ensure that the risks to individuals participating in the clinical trials are minimized and are reasonable in relation to anticipated benefits. The IRB also approves the informed consent form that must be provided to each clinical trial subject or his or her legal representative and must monitor the clinical trial until completed. There also are requirements governing the reporting of ongoing clinical trials and completed clinical trial results to public registries. Information about most clinical trials must be submitted within specific timeframes for publication on the www.clinicaltrials.gov website. Information related to the product, patient population, phase of investigation, study sites and investigators and other aspects of the clinical trial is made public as part of the registration of the clinical trial. Sponsors are also obligated to disclose the results of their clinical trials after completion. Disclosure of the results of these trials can be delayed in some cases for up to two years after the date of completion of the trial. Competitors may use this publicly available information to gain knowledge regarding the progress of development programs.

Human clinical trials are typically conducted in three sequential phases, which may overlap or be combined:

| ● | Phase I clinical trials generally involve a small number of healthy volunteers or disease-affected patients who are initially exposed to a single dose and then multiple doses of the product candidate. The primary purpose of these clinical trials is to assess the metabolism, pharmacologic action, side effect tolerability and safety of the drug. |

| ● | Phase II clinical trials involve studies in disease-affected patients to determine the dose required to produce the desired benefits. At the same time, safety and further pharmacokinetic and pharmacodynamic information is collected, possible adverse effects and safety risks are identified, and a preliminary evaluation of efficacy is conducted. |

| ● | Phase III clinical trials generally involve a larger number of patients at multiple sites and are designed to provide the data necessary to demonstrate the effectiveness of the product for its intended use, its safety in use and to establish the overall benefit/risk relationship of the product and provide an adequate basis for product approval. These trials may include comparisons with placebo and/or other comparator treatments. The duration of treatment is often extended to mimic the actual use of a product during marketing. |