UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended: December 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 001-42497

ODYSIGHT.AI INC.

(Exact name of registrant as specified in its charter)

| Nevada | 47-4257143 | |

| State

or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) |

Suite 7A, Industrial Park, P.O. Box 3030

Omer, Israel 8496500

(Address of principal executive offices) (Zip Code)

Tel: +972 73 370-4690

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common stock, par value $0.001 per share | ODYS | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

N/A

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant as of June 28, 2024 based on the price at which the common equity was last sold on the OTCQB Market on such date, was $21.1 million. For purposes of this computation only, all officers, directors and 10% or greater stockholders of the registrant are deemed to be affiliates.

As of March 20, 2025, there were 16,307,321 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements concerning our business, operations and financial performance and condition, as well as our plans, objectives and expectations for our business operations and financial performance and condition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would,” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

| ● | our ability to scale up upon our operations, including market acceptance of our vision-based sensor products; | |

| ● | the amount and timing of future sales; | |

| ● | our ability to meet technical and quality specifications; | |

| ● | our ability to accurately estimate the future supply and demand for the Odysight TruVision solution and changes to various factors in our supply chain; | |

| ● | the market for adoption of vision-based sensor technologies; | |

| ● | existing regulations and regulatory developments in the United States and other jurisdictions; | |

| ● | our plans and ability to obtain or protect intellectual property rights, including extensions of patent terms where available and our ability to avoid infringing the intellectual property rights of others; | |

| ● | the need to hire additional personnel and our ability to attract and retain such personnel; | |

| ● | our estimates regarding expenses, backlog, future revenue, capital requirements and need for additional financing; | |

| ● | our dependence on third parties; | |

| ● | our financial performance; | |

| ● | the growth of regulatory requirements and incentives; | |

| ● | risks related to product liability claims or product recalls; | |

| ● | the overall global economic environment; | |

| ● | the impact of competition and new technologies; | |

| ● | our plans to continue to invest in research and develop technology for new products; | |

| ● | our plans to potentially acquire complementary businesses; | |

| ● | the impact of any resurgence of COVID-19 or any of its variants or any other pandemic on our business and on the business of our customers; | |

| ● | security, political and economic instability in the Middle East that could harm our business, including due to the current war in Israel; and | |

| ● | the increased expenses associated with being a listed public company on the Nasdaq Capital Market, or Nasdaq. |

Forward-looking statements are based on our management’s current expectations, estimates, forecasts and projections about our business and the industry in which we operate and our management’s beliefs and assumptions, are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this Annual Report may turn out to be inaccurate. Important factors that may cause actual results to differ materially from current expectations including, among other things, those listed under “Risk Factors” and elsewhere in this Annual Report. Readers are urged to consider these factors carefully in evaluating the forward-looking statements. You should read this Annual Report, and the documents that we reference in and have filed as exhibits to this Annual Report, completely and with the understanding that our actual future results may be materially different from what we expect.

Forward-looking statements included in this Annual Report speak only as of the date of this Annual Report. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future. You should, however, review the factors and risks we describe in the reports we will file from time to time with the SEC after the date of this Annual Report. We qualify all of our forward-looking statements by these cautionary statements.

|

|

PART I

ITEM 1. BUSINESS

Our Mission

We aim to become the industry standard for real time, visual based, health monitoring using AI/ML data analytics.

Our Company

We are a pioneer in the development, production and marketing of an innovative visualization AI solution that deploys small cameras to monitor critical safety components in hard-to-reach locations and harsh environments, across various PdM, and CBM use cases. We aim to be the industry benchmark for real-time, visual-based machine and infrastructure health monitoring through AI and machine learning data analytics.

The Odysight TruVision solution streams visual information to our processing unit, an in-platform, high-performance AI/machine learning computer, allowing maintenance and operations teams, on the ground and during operations, visibility into areas that are inaccessible under normal operating conditions or where conditions are not suitable for continuous real-time monitoring. The rich and informative data, continuously collected and analyzed by our solution on our secured cloud, provides customers with real-time failure / anomaly detection, events and data recordings, interfacing with platform mission systems and providing real-time alerts and streaming video or images, all while training our algorithms for ongoing improved accuracy and prediction capabilities. Our customers benefit from increased safety, a reduction in downtime, a more efficient data driven operation, increased mission readiness and lower maintenance costs for their monitored platforms, using the prediction capabilities of our solution to efficiently plan maintenance work on monitored components.

Our solution enhances safety and minimizes downtime by enabling real-time visual analysis of any failure occurrences. Additionally, we leverage advanced big data analytics to offer predictive insights throughout the entire system lifecycle. This includes efficient spare parts management and intelligent performance predictions, ensuring optimal system reliability and efficiency.

The Odysight TruVision solution is successfully used by NASA, as we seek to reshape the aerospace, Industry 4.0, transportation and energy markets with a vison-based technology leveraging AI and machine learning to deliver innovative solutions that transform maintenance practices. As used in this Annual Report, Industry 4.0, or I4.0, refers to the integration of advanced technologies into manufacturing and industrial processes to create smart, interconnected systems for improved efficiency and productivity.

Odysight solutions are already deployed in the aviation and medical sectors. Our customers include the Israeli Air Force, the Israeli Ministry of Defense, France-based Safran Aircraft Engines, a global international defense contractor, a leading Fortune 500 medical company as well as NASA, who came back to us for a repeat order. Historically, our revenue stream has been derived mainly from the medical sector. Our 2024 financial results reflect orders and agreements from both the medical and aerospace sectors. We have recently secured several contracts for our PdM and CBM systems with major government clients and defense and aviation companies and our backlog as of December 31, 2024 of approximately $15 million (compared to approximately $2.6 million as of December 31, 2023) reflects mostly those contracts.

|

|

Our vision-based sensor technology

Initially used in medical devices, our video-based sensor solution (comprising image acquisition, data collection and storage and image processing, including PdM and CBM) have contributed significantly to visual aids for medical teams in an FDA-cleared minimally invasive surgical device. Over time, our technology has proven essential in industries such as aerospace, where visual assessments are crucial for maintaining performance rates, maintenance, and safety standards for various mechanical systems.

We specialize in predictive maintenance and condition-based monitoring, utilizing advanced AI-driven sensor visualization solutions, using video analytics and algorithms. Human perception relies significantly on visual sensing, and our technology enables our clients to accurately observe phenomena that were previously only approximated or conjectured.

Our core technologies include:

| ● | Vision-Based Sensor Technology: This innovative approach uses micro cameras and specialized AI models to monitor and analyze system health in real-time, even in hard-to-reach and harsh environments. | |

| ● | AI and Machine Learning: We employ sophisticated proprietary AI algorithms to predict potential hazards, optimize maintenance schedules and enhance operational efficiency. | |

| ● | High-Resolution Visualization: Our solution provides detailed visual data, enabling accurate detection and monitoring of issues such as liquid leaks and bearing malfunctions. | |

| ● | Cloud-Based Analytics: The collected data is continuously analyzed on a secure cloud platform, offering customers both raw data and processed insights for improved decision-making. |

Our vision-based sensing technology provides solutions across diverse PdM and CBM markets, and in harsh conditions as demonstrated in a variety of environments, including outer space during NASA’s Robotic Refueling Mission, or RRM3, the Israeli Air Force, the Israeli Ministry of Defense, a global international defense contractor and a leading Fortune 500 medical company.

AH-64 “Apache” Use Case

In 2016, a Boeing AH-64 Apache helicopter crashed when a hidden and rarely inspected safety nut became undone, causing the rotor blades to dis-attach in-flight and caused a Class A (major) accident with casualties. We developed a solution that uses vision-based sensors and trained AI algorithms to monitor and measure the size and number of threads in a bolt in real-time and automatically warn of out-of-synch events, preventing such critical future events.

Our solution was further developed to monitor safety critical and other components on the aircraft and today the solution has been procured for the SH-60 Seahawk helicopter and deployed on the AH-64 Apache and other operational platforms in Israel and globally.

Odysight TruVision System Architecture

Our specialized software collects, processes, detects, and records real time information from multiple sensors. The data is available in real-time through a user application or via our technician ground tool. Our modular integrated solution is comprised of a processing unit and multiple vision-based sensors that are integrated into hard-to-reach areas and monitoring safety critical components in real time. The solution is designed as an open architecture that supports both a full solution by the Odysight TruVision or integration with existing systems.

|

|

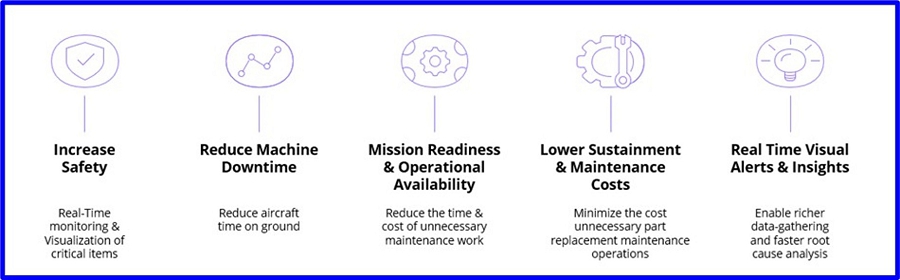

Our Business Model and Value Proposition

Our unique video-based sensors, embedded software and AI algorithms are currently being deployed in hard-to-reach locations and harsh environments across a variety of PdM and CBM use cases. Our value proposition is based on providing actual condition of a platform in real-time, offering significant value through enhanced safety, efficiency and cost savings. Our big data analytics provide predictive insights regarding an entire system life cycle, spare parts management and smart prediction of system performance. The operational, financial and quality benefits of using the Odysight TruVision solution include the following:

Enhanced Safety. The Odysight TruVision solution enhances worker safety without sacrificing productivity and while minimizing planned and unexpected downtime. This is made possible by early detection of potential failures, which can prevent accidents and help to ensure the aircraft operates within safe parameters. In addition, our technology can endure extreme environments and has wireless capability, features that allow maintenance teams to conduct monitoring and visual inspection remotely, with such continuous monitoring and real-time analysis on the ground and in-flight operations reducing the risk of unexpected malfunctions. Our smarter approach collects data by placing multiple cameras on or near the moving parts of machines, allowing workers to conduct remote monitoring to assess the condition of a component or machine without having to touch the mechanical parts themselves, eliminating potential hazards of being exposed to those parts, including extreme environmental conditions, rotating equipment and accidents while climbing ladders, among others.

Increased Efficiency and Mission Capability. On average, organizations are estimated to lower their machine failure rates by 70 percent using a predictive maintenance program. Conducting condition-based monitoring using technologies that can gather and distribute sensor data enables maintenance teams to obtain real-time data on the health of a mechanical system, providing automated and precise detection of issues that minimizes the time needed for manual and human visual inspections and increases the mission capability of the platform. This provides enough forewarning to apply the appropriate maintenance tasks that will prevent failure. For example, our vision-based sensor reduces or replaces a significant part of the visual inspections required by maintenance teams in the aviation or transportation industries (i.e., checks for completeness, checks for existence, checks for proper installation, etc.), allowing technicians that oversee rotating and other equipment to conduct real-time monitoring of bearing malfunctions and deformations while the machine is in operation. Our technology can detect minuscule deformations that will eventually leave the bearings vulnerable to surface fatigue. AI algorithms can then forecast the time of failure. This not only helps ensure that the bearings are replaced, when necessary, but also prevents collateral damage to nearby components, machines or systems that would occur should the bearings fail.

Cost Savings. Predictive maintenance is estimated to cut maintenance costs by 5 to 10 percent. This is savings on costs related to inventory management, the personnel needed to install replacement components and more. Under conventional maintenance programs, in cases of emergencies and unexpected machine breakdown, these costs can multiply. With the foresight predictive maintenance provides into the health of a machine, organizations can reduce the frequency of unexpected machine breakdowns and optimized maintenance schedules, extending the lifespan of aircraft components and lowering replacement costs. Using predictive maintenance in lieu of other maintenance approaches that rely on rigid maintenance scheduling also means that costs are saved on servicing and replacing machine components that are still in good working order.

Improved Accuracy and Reliability. As physical assets, machines are vulnerable to deterioration. Our vision-based system and analysis ensures consistent and objective detection of issues, reducing human error and enhancing the reliability of maintenance predictions and interventions. The data analytics we provide offer maintenance teams with insights that help machines perform optimally as long as possible. The analysis of machine data from our vision-based sensing solution and analytics will highlight the situations in which components fail or breakdown frequently. Maintenance teams can use this information to minimize breakdowns.

Reduced Downtime. Unexpected downtime is expensive, and can be one of the largest money drains in Industry 4.0 organizations. For example, the unplanned downtime of machines is estimated to cost industrial manufacturers as much as $50 billion annually. The Odysight TruVision solution has been designed to eliminate unplanned downtime and allows maintenance teams to keep necessary, planned downtime to a minimum and at a more convenient, less disruptive schedule. This is a stark difference from other maintenance approaches, such as preventive maintenance, that can increase downtime by implementing either insufficient or excessive maintenance.

Advanced Training and Support. Real-time and historical visual information serve as powerful training tools for technicians, improving their skills and preparedness. Visual remote access capabilities allow for expert support and collaboration, even across different locations.

|

|

Our current business model is to identify customers interested in adding real-time visualization and analytics to their existing or new products. This model includes the initial kit sale including vision-based sensors, processing unit with embedded software and basic set of algorithms. This strategy allows for immediate revenue generation from system sales, and also set the base to create a steady stream of recurring revenue from multi-year software subscriptions services.

Our solution provides upsell opportunities including expanding algorithmic functionalities, additional applications, fleet management solutions and improved cloud management.

We have commercial agreements and purchase orders for hundreds of airborne systems of various original equipment manufacturers, or OEMs, in aerospace and have completed successful demonstration projects for various industrial users. We are in the process of developing additional applications for our vision-based sensing portfolio, which are anticipated to provide significant benefits to our customers.

Market Opportunity

We believe the Odysight TruVision solution has potential application across diverse industry verticals as it is a core technology. As the benefits of vision-based sensor technology become more widely accepted, we believe there are significant market opportunities available for our product offerings.

Based on industry reports and our estimates, the global predictive maintenance market was approximately $8 billion in 2024 and is projected to grow to approximately $34 billion by 2030, at a compound annual growth rate of approximately 30%. In the aerospace market alone, which constitutes commercial aviation, military rotorcraft, fixed wing aircraft and UAVs, we believe that our Aerospace TAM is currently more than $10 billion. We based our Aerospace TAM calculations on data from third-party industry and governmental sources regarding the total number of units that could utilize our vision-based sensor technology and on our estimates of an average selling price and extent of our market penetration. We believe the TAM for other verticals we are targeting such as Industry 4.0, transportation and energy eclipse that of aerospace.

In addition, the U.S. Department of Defense has mandated the use of predictive maintenance as a pro-active maintenance strategy to improve mission readiness and availability.

Our Competitive Strengths

We believe the following strengths have been instrumental to our success. We intend to continue to build on these strengths to position us for future growth and drive our profitability:

Predictive maintenance algorithmics using AI and machine learning. Our vision-based platforms use AI and machine learning engines, video analytics and proprietary algorithms. Our AI platforms enable our customers to detect anomalies and anticipate maintenance trends in real-time, improving planning and forecasting.

Vision-based specialized sensors. The Odysight TruVision solution utilizes high end device sensor technology coupled with software-defined products. With this combination, we develop new solutions for industry-specific requirements, constantly expanding our product offerings.

Compelling value proposition. We designed the Odysight TruVision solution to provide improved operating efficiency and safety, minimize maintenance costs, reduce downtime and extend operational life. In addition, our solution may be installed at the design stage as well as retrofit. Due to these advantages, we believe that our vision-based sensor solutions are appealing to customers seeking the benefits of condition based monitoring and predictive maintenance solutions in hard-to-reach locations and harsh environments.

Potential long-term growth due to recurring subscription-based model. Currently, our revenues are derived mostly from sales of the Odysight TruVision solution. As we expand the installed base of our solutions, we expect subscriptions for the continued support of our technology to become the foundation of our recurring revenue for sustainable growth over time.

|

|

Unique research and development capabilities and a robust intellectual property portfolio. We have invested in establishing strong research and development capabilities, including integrating hardware, software and algorithms to create an exceptional solution in a single optimized system. Our deep knowledge and intellectual property is protected by a broad patent portfolio, including 17 issued patents, seven of which are in the U.S., and 55 pending patent applications, 19 of which are in the U.S. (including provisional patent applications), as of the date of this Annual Report. We believe our intellectual property and know-how present a significant barrier to entry for our competitors.

Experienced management team. We are led by a highly experienced management team with a successful track record in predictive maintenance, condition-based monitoring, aerospace, software, algorithms, video analytics, optics and system engineering. Our team, under the leadership of our CEO Yehu Ofer, who has decades of industry experience, has effectively managed dynamic growth phases in organizations and commercialized products in various markets. Our senior management team brings a wealth of industry expertise, with decades of experience in leading both public and private companies. Additionally, our board of directors consists of exceptional leaders with a proven track record of building and managing businesses.

Our Growth Strategy

We believe we are well-positioned as a pioneer of PdM and CBM vision-based sensor technology. Our significant growth opportunities are focused on the aerospace vertical where we have achieved sales to leading clientele, as well as expansion into new verticals.

Acquire New Customers. We believe there is significant potential to attract new customers in the aerospace vertical, where we already have leading clients. Our products, which meet aerospace standards, combined with our management expertise, knowledge, and professional relationships, provide a strong foundation to engage with prospective clients. We plan to continue focusing on efficient growth by expanding our sales and marketing efforts to secure new customers.

Execute On Our Product Roadmap We continue to place a priority on innovation and product development to be competitive in our target markets over time to win new and expanded business opportunities. We believe the performance of the Odysight TruVision solution, in conjunction with the flexibility of our software, will allow us to continue providing new solutions to our customers and further develop the use cases for our systems across various vertical markets.

Extend Our Technology Leadership. We believe our ability to enable our customers to optimize their maintenance and leverage applied-AI solutions will contribute to our continued success. To support these efforts, we intend to make substantial investments in research and development, including in the areas of applied machine learning and AI technologies, to expand and strengthen our offerings and develop next generation products.

Position Ourselves as Leading PdM and CBM Solution Provider in Aerospace and Expand to New Verticals. We continue to sign new commercial agreements in the aerospace vertical and believe our solution is highly relevant and a value add in many aerospace platforms. In addition, we are working to develop new vertical opportunities, including transportation, energy and other industries.

Partner with Global Market Leading Corporations to Leverage their Commercial Position. We aim to leverage the global market position of leading corporations that we partner with to maximize our reach and impact. By partnering with these industry leaders, we believe that we will expand our market presence, strengthen brand credibility, accelerate growth, and optimize resources through their established networks, extensive distribution channels, and operational capabilities.

Sales and Marketing

We are focused on the aerospace vertical while we target Industry 4.0, transportation and energy markets where there is a growing need for our vision-based sensor technology. In the aerospace market we are already generating commercial revenues, in Industry 4.0, we are executing on proof of concept projects, in transportation, we received our first purchase order in December 2024 and in the energy market we are conducting initial discussions with potential customers.

|

|

Currently our main marketing efforts are focused on the Israeli and U.S. markets, with some efforts invested in pursuing opportunities in European and other top tier markets.

We are implementing a comprehensive sales and marketing approach that encourages widespread adoption of our products. Our aim is to sell the Odysight TruVision solution by targeting the Israeli home market, utilizing global platforms available in the U.S. and internationally. This involves addressing operators, OEMs, maintenance and repair organizations, and forming strategic partnerships with entities holding strong market positions that can benefit from our solution, providing them immediate value and a technological edge, thereby accelerating our sales and global expansion. Our direct interaction with OEMs, enables us to work with them from the design phase, providing for seamless integration of our solutions into their products. Our sales cycles vary from a few months to a few years, depending on the type and scale of engagement. Once a system is deployed, it may be utilized for several years.

To engage new customers, we employ various sales and marketing strategies. We employ several professional experienced sales managers in relevant fields of expertise, in addition to a team of consultants who analyze global trends and designated geographical territories to assist us in targeting potential customers.

Our marketing efforts include, but are not limited to, the following:

| ● | engaging third-party companies and local consultants as territorial representatives in key markets to target leading companies in relevant industries; | |

| ● | initiating business engagements based on leads received through our marketing efforts or through active interaction with key industry influencers, | |

| ● | conducting proof of concept demonstrations in order to evaluate the feasibility of integration of the Odysight TruVision solution for monitoring their systems and to demonstrate the significant value proposition of our technology to customers; | |

| ● | networking through personal contacts in the aerospace, defense, transportation, maritime, energy and medical industries; and | |

| ● | participating in major aerospace, defense, vision technology and other exhibitions as well as Industry 4.0 specific events. |

Currently, we have four major customers that are expected to generate a substantial portion of our forecasted revenue in the near term.

In June 2022 we announced that we completed the verification and validation stage of our endoscopic camera solution with our Fortune 500 client, in January 2023 we announced the receipt of a $1.45 million order from this client, and in October 2023 we announced a solidified purchase order with this client and that formal commitments under the purchase order amount to a total of $3.3 million for fiscal year 2024. As of the date of this Annual Report, we have not received a purchase order from the Fortune 500 medical company customer with respect to 2025, and we do not expect to receive such purchase order for 2025, or if we do, it may be substantially lower in quantity than our 2024 purchase order from this customer. As this customer has accounted for the vast majority of our revenues to date, a lack of a sufficient order may lead to a significant decrease in our revenues in the near term, which in turn could result in us engaging in certain cost-cutting measures.

In February 2023, we announced the completion of a major development stage in equipping Elbit Systems Ltd.’s leading defense UAS aerial platforms with our real time video monitoring system. Through the program, our unique video-based sensors, embedded software, machine vision and algorithms support a variety of predictive maintenance and condition-based monitoring use cases for unmanned aerial vehicles. Since our technology features a modular open system architecture, it enables seamless integration with advanced unmanned aerial platforms.

|

|

In July 2023, we announced a collaboration with the Israel Aerospace Industries, or IAI, through which the IAI will utilize our advanced vision-based sensing and video analytics technology in a vision-based “health monitoring system” for UH-60 (Blackhawk) helicopters. By harnessing our multiple highly resilient video-based sensors, embedded software, video analytics and AI algorithms specifically designed for the UH-60 helicopter, this solution will provide real-time insights into the health of UH-60 helicopters, improving safety measures, minimizing downtime, optimizing spare parts management and enabling the implementation of predictive maintenance strategies.

In December 2023, we announced a strategic partnership to develop advanced applications for aerospace and industrial markets worldwide with SIPAL S.P.A., a leading company in Italy in the engineering sector. The goal of the collaboration is a next generation maintenance solution that will allow maintenance crews the ability to obtain and review real time visual inspection of an aircraft’s internal systems without the need to remove a single panel or a hatch.

In February 2024, we announced the receipt of a purchase order for our PdM system for an Israel Air Force Boeing AH-64 Apache attack helicopter prototype. The partnership marks a significant milestone, integrating our autonomous, vision-based monitoring and predictive maintenance technology into a leading attack helicopter. There are approximately 2,700 Boeing AH-64 Apache attack helicopters deployed worldwide.

In March 2024, we announced the receipt of a purchase order exceeding $1 million from a major international defense contractor for our vision-based sensor and AI analytics solution. The system will be installed in upgraded Lockheed Martin (Sikorsky) SH-60 Seahawk Maritime Rotary Wing Aircraft of the Israel Air Force. More than 4,000 UH-60 Black Hawk aircraft, and its variants such as the SH-60 Seahawk, are in service worldwide today.

In May 2024, we announced the receipt of a purchase order from Tel Aviv University for the Israeli Ministry of Defense for a bespoke system based on our proprietary vision-based sensors. In addition, in the same month, we announced the receipt of a purchase order for an engine guide vane monitoring system from France-based Safran Aircraft Engines.

In September 2024, we announced a purchase order exceeding $10 million with a leading international defense contractor for the integration of our vision-based sensor technology into a new UAV configuration as well as an existing UAV line. In the same month, we announced the receipt of a new repeat purchase order from NASA to support its high-speed aeronautical flight testing on aerospace vehicles.

In January 2025, we announced a collaboration with Israel Railways to develop an advanced monitoring and predictive maintenance system designed to prevent derailments and improve the safety and efficiency of the country’s rail network. This innovative solution, powered by artificial intelligence, aims to revolutionize Israel’s railway infrastructure by enhancing the performance, reliability, and safety of critical track switches.

Our purchase orders and collaborations generate revenue over a period ranging from a few months to several years. The variability in project durations and the potential for delays or changes in client needs further complicate our ability to forecast revenue with precision. As a result, there is an inherent uncertainty in predicting the exact timing and amount of revenue that will be generated from these activities.

In addition to our business development efforts that are mainly based on currently existing or future customer needs, we aim to identify new market opportunities. These efforts include systematic analysis of various industrial fields and procedures to identify where visualization solutions, including image analysis, might add value. When a potential opportunity is identified, we seek to protect our rights by establishing relevant intellectual property safeguards and developing prototypes for the required application.

Manufacturing and Supply

We rely on both in-house manufacturing together with outsourced manufacturing for a portion of the assembly of our vision-based sensor products. We manufacture the miniature cameras used in our vision-based sensor solution at our Omer location, while the manufacture of the processing units and handheld devices is outsourced to third parties. The camera is then assembled in our facilities into a finished system that is calibrated and tested by us for quality control.

|

|

Most of the components and parts we use in our manufacturing operations are available from more than one source. However, we obtain certain components from single source suppliers. For example, the number of suppliers engaged in the provision of miniature video sensors which are suitable for our CMOS technology mainly in the medical domain is very limited. As we do not have a direct general contract in place with these suppliers, there is no contractual commitment on the part of such suppliers for any set quantity of such sensors. In the event of an extended failure of a supplier or suppliers in this area, it is possible that we could experience an interruption in supply until we established new sources or, in some cases, implemented alternative processes. Any inability or delay in finding a suitable replacement supplier or suppliers could negatively affect our business, financial condition, results of operations and reputation.

Our facility in Omer holds the following certifications: AS9100, ISO13485, IPC-A-610, and IPC-7711/7721. We have completed the process of implementing the ISO14001 Standard to comply with environmental management systems.

Research and Development

Our research and development activities are conducted internally by a team of 32 research and development staff based in Israel. Our development strategy is to identify features and products for the hardware and software that enhance and improve the performance of our solutions for our customers. The focus of our R&D team is to provide technological innovation and associated intellectual property that expands the value proposition of our vision-based sensor solutions.

Our research and development efforts focus on two main areas:

| ● | Multi-Camera Solutions: We are advancing our multi-camera technology, which utilizes advanced vision-based sensing and AI/ML processing focusing on sensing, computing and prediction. | |

| ● | Industrial Cloud-Based Products: We leverage our existing cloud environment to develop proof of concept and innovative industrial solutions. |

Competition

Competition among providers of sensing solutions is characterized by extensive research efforts and rapid technological progress. There are currently several companies that develop and provide monitoring solutions for PdM and CBM. These monitoring solutions include the sensor itself, data collection and storage, AI processing, or a combination of these capabilities. CBM and PdM solutions are usually based on traditional sensing solutions such as vibration, temperature and acoustic sensors. Based on our research and discussions with customers, we believe these traditional sensing methods are limited in their ability to provide an in-depth view of the condition of the monitored components and usually alert on the occurrence of an anomaly when component failure has already occurred, which is too late in some cases. From an AI perspective, there are several vendors providing off-the-shelf AI capabilities which then require customization per market, use case, and/or data source. We believe that our more holistic approach and reliance on vision-based solutions creates richer and more informative data, leveraged by AI and machine learning algorithms, enabling our customers to more effectively deploy predictive maintenance programs.

We believe that our ability to compete successfully depends primarily on the following factors:

| ● | continuing to advance our vision-based sensor solution; | |

| ● | leveraging our data and AI capabilities; | |

| ● | maintaining and attracting customers; | |

| ● | developing and launching new products and transformative brands; | |

| ● | responding to changing customer demands in a timely manner; | |

| ● | maintaining the value and reputation of our brand; |

|

|

| ● | attracting and retaining a team committed to innovation; | |

| ● | effectiveness of our products; | |

| ● | accessible pricing; | |

| ● | customer service; and | |

| ● | effectiveness of our marketing strategies. |

Additional competitors may enter the market, and we are likely to encounter increased competition in the future. Any business combinations or mergers among our competitors that result in larger competitors with greater resources or distribution networks, or the acquisition of a competitor by a major technology corporation seeking to enter this business could further result in increased competition. Other companies, academic and research institutions or others may develop new technologies for products that are more effective than our vision-based sensor technology. Our technologies could be rendered obsolete by such developments.

Intellectual Property

Intellectual property is an important aspect of our business and we seek protection for our intellectual property rights as we deem appropriate. To establish and protect our proprietary rights, we rely on a combination of patent, copyright, trade secret and trademark laws, and contractual restrictions such as confidentiality agreements, licenses and intellectual property assignment agreements. We strive to protect the proprietary technologies that we believe are important to our business, including seeking and maintaining patent protection intended to cover our current and future products and technologies.

As of March 20, 2025, our patent portfolio included 17 issued patents, seven of which are in the U.S., and 55 pending patent applications, 19 of which are in the U.S. (including provisional patent applications). The issued U.S. patents are expected to expire between 2030 and 2042, in each case taking into account awarded patent term adjustments and extensions, and assuming payment of all appropriate maintenance, renewal, annuity or other governmental fees. We have a total of 19 patent families, 12 of which are in the predictive maintenance field and seven are related to imaging technology.

In January 2022, we entered into a patent cross-licensing arrangement with Japan-based Sumita Optical Glass, Inc. (Sumita), a specialty optical fiber technology company, pursuant to which we granted a non-exclusive license to Sumita to one of our imaging patent families in return for payment of royalties and a grant-back license to Odysight.ai of Sumita’s patents and patent applications related to fiber optics illumination. To date, only an immaterial amount of royalties has accrued.

We often initially submit applications to the USPTO as provisional patent applications. We sometimes continue by filing non-provisional patent applications under the Patent Cooperation Treaty, or the PCT, which is an international patent law treaty that provides a unified procedure for filing a single initial patent application to later seek patent protection for an invention in any number of the member states of the PCT. Although a PCT application does not itself issue as a patent, it acts as a placeholder allowing the applicant to seek protection in any of the member states through national-phase applications. In other cases, we file national applications claiming priority under the Paris Convention from the provisional patent applications.

We have trademark rights in our trade name and other brand elements in certain jurisdictions, including trademark applications and registrations in various jurisdictions around the world, including the U.S., Europe, Israel, Australia, Brazil, Canada, Japan and Korea.

We pursue the registration of domain names for websites that we use and that we consider material to the marketing of our products, including the odysight.ai domain.

|

|

We generally seek to enter into confidentiality agreements and proprietary rights agreements with our employees, consultants, contractors and suppliers and to control access to, and distribution of, our proprietary information and source code. However, we cannot guarantee that all applicable parties have executed such agreements. Such agreements can also be breached, and we may not have adequate remedies for any such breach.

Intellectual property laws, procedures and restrictions provide only limited protection, and any of our intellectual property rights may be challenged, invalidated, circumvented, infringed, misappropriated or otherwise violated (see “Item 3 — Legal Proceedings”). Furthermore, the laws of certain countries do not protect intellectual property and proprietary rights to the same extent as the laws of the United States, and we therefore may be unable to protect our proprietary technology in certain jurisdictions.

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or obtain and use our technology to develop products and services with the same functionality as our products. Policing unauthorized use of our technology is difficult. Our competitors could also independently develop technologies like ours, and our intellectual property rights may not be broad enough for us to prevent competitors from selling products and services incorporating those technologies. For more information regarding the risks relating to intellectual property, see “Item 1.A — Risk Factors — Risks Related to our Intellectual Property.”

Government Regulation

We are subject to a variety of laws, regulations and licensing requirements of U.S. federal, state and local authorities, including Israel. We are also required to obtain various licenses and permits from state, local and Israeli authorities in connection with the operation of our business.

Given that we do not manufacture or distribute end-user products and instead service businesses pursuant to a business-to-business model, we are subject to fewer regulatory standards commonly associated with manufacturers or distributors.

We manufacture and sell the Odysight TruVision solution that contains electronic components, and such components may contain materials that are subject to government regulation in both the locations where we develop, manufacture and assemble our products, as well as the locations where we sell our products. Among other things, certain applicable laws and regulations require or may in the future require the submission of annual reports to certain governmental agencies certifying that such products comply with applicable performance standards, the maintenance of manufacturing, testing and distribution records, and the reporting of certain product defects to such regulatory agency or consumers. If our products fail to comply with applicable regulations, we and/or our products could be subjected to a variety of enforcement actions or sanctions, such as product recalls, repairs or replacements, warning letters, untitled letters, safety alerts, injunctions, import alerts, administrative product detentions or seizures or civil penalties. The occurrence of any of the foregoing could harm our business, results of operations and financial condition.

Since we plan to operate on a global basis, we will be required to continually monitor applicable laws and regulations and engage in an ongoing compliance process to ensure that we and our suppliers are in compliance with existing laws and regulations, even as they change over time. If there is an unanticipated or onerous new law or regulation that significantly impacts our use of various components or requires more expensive components, such law or regulation could materially adversely affect our business, results of operations and financial condition.

In addition, some of our customers may require that we comply with unique requirements specific to their operations. For example, there exist U.S. Federal Aviation Administration and International Civil Aviation Organization requirements for certain airplane models to be subject to CE certification, a regulatory standard that verifies certain products are safe for sale and use in much of Europe. These and other requirements are applicable for the Odysight TruVision solution in various jurisdictions across the globe.

In our engagements with customers operating in the biomedical sector, we comply with the medical device standards in the corresponding territory, such as the FDA or ISO, among others. Compliance with these regulations is achieved through our QA department and the support we receive from highly experienced quality assurance and regulatory affairs consultants. In addition, we are audited annually by MEDCERT GmbH, a German Notified Body.

|

|

We are subject to a number of laws and regulations that involve matters central to our business. These laws and regulations involve privacy, data protection, intellectual property, competition and other subjects. Many of the laws and regulations to which we are subject are still evolving and being tested in courts and could be interpreted in ways that could harm our business. In addition, the application and interpretation of these laws and regulations are often uncertain, particularly in the new and rapidly evolving industry in which we operate. Because global laws and regulations have continued to develop and evolve rapidly, it is possible that we may not be, or may not have been, compliant with each such applicable law or regulation.

As we expand our operations internationally, we expect to be subject to other laws and regulations governing our international operations, including regulations administered by the governments of Israel, the U.S. and the European Union, including applicable export control regulations, economic sanctions and embargoes on certain countries and persons, anti-money laundering laws, import and customs requirements and currency exchange regulations, collectively referred to as trade control laws. Failure to comply with anti-corruption laws and trade control laws could subject us to criminal and civil penalties, disgorgement and other sanctions and remedial measures, and legal expenses.

Grants from the Israel Innovation Authority

On May 21, 2023, we were awarded a grant by the IIA. The purpose of this grant is to support and our production capabilities. Subject to our successfully achieving all predetermined milestones, the maximum grant amount that can be received is NIS 1 million (approximately US$ 277,777).

As of December 31, 2024, we received IIA royalty-bearing grants totaling approximately NIS 515,000 (approximately US$130,000).

We are committed to paying royalties to the IIA at a rate of approximately 1.0% to 3.5% on sales proceeds from our products (and related know-how and services) that were developed, in whole or in part, in connection with the IIA royalty-bearing grants we received under IIA programs, up to the total amount of royalty-bearing grants received, linked to the U.S. dollar and bearing annual interest at rates prescribed by the IIA’s rules and guidelines.

We may in the future apply to receive additional grants from the IIA. However, we cannot predict whether we will receive any future grants, or the amounts or the terms and conditions of any such grants.

In addition, as a result of certain agreements between Xylo Technologies Ltd. (formerly Medigus Ltd.), an Israeli company traded on Nasdaq, or Xylo Technologies and Odysight.ai Ltd., the IIA approved a transfer of IIA know-how developed by Xylo Technologies in the framework of the Bio Medical Photonic Consortium, or the Xylo Technologies Consortium. Accordingly, all rights and obligations with regard to the IIA under the Innovation Law, in connection with such know-how, now apply to us. The rights and obligations within the framework of our activity in the Xylo Technologies Consortium continue to apply to us notwithstanding the termination of the Xylo Technologies Consortium and include, among other things, the following:

| (i) | The property rights to information which has been developed belongs to the Xylo Technologies Consortium member that developed it. However, the developing entity is obligated to provide the other members in the Xylo Technologies Consortium a license for the use of the new information, without consideration, provided that the other members do not transfer such information to any entity which is not a member of the Xylo Technologies Consortium. The provision of a license or of the right to use the new information to a third-party is subject to approval by the administration of the MAGNET Program at the IIA; |

| (ii) | The Xylo Technologies Consortium member is entitled to register a patent for the new information which has been developed by it within the framework of its activity in the Xylo Technologies Consortium. The foregoing registration does not require approval from the administration of the MAGNET Program at the IIA; and |

| (iii) | The know-how and technology developed under the program is subject to the restrictions set forth under the Innovation Law, including restrictions on the transfer of such know-how and any manufacturing rights with respect thereto, without first obtaining the approval of the IIA. Such approval may entail additional payments to the IIA, as determined under the Innovation Law and regulations. |

|

|

In general, with regard to any IIA-funding, the Innovation Law requires, among other things, that the products developed as part of the programs under which the grants were given be manufactured in Israel, and restricts the ability to transfer know-how directly or indirectly funded by the IIA outside of Israel. A transfer for the purpose of the Innovation Law is generally interpreted very broadly and includes, among other things, any sale of the IIA-funded know-how, any license to develop the IIA-funded know-how or the products resulting from such IIA-funded know-how, grant of access to such knowhow, or any other transaction, which, in essence, involves a transfer of IIA-funded know-how. The transfer of IIA-funded know-how outside of Israel requires prior approval and may be subject to payment of a redemption fee to the IIA, calculated in accordance with a formula provided under the Innovation Law (which is subject to a cap of six times the total amount of the IIA grants received, plus interest). These restrictions may impair our ability to sell, license or otherwise transfer IIA-funded know-how outside of Israel.

In general, manufacturing of products developed with IIA-funded know-how outside of Israel also requires prior approval from the IIA. Even if we do receive approval to manufacture products developed with IIA-funded know-how outside of Israel, such transfer of manufacturing capacity outside of Israel may be subject to an increase in the amount of royalties payable, depending on the manufacturing volume that is performed outside of Israel, and to an increase in the rate of royalties. This restriction may impair our ability to outsource manufacturing or engage in our own manufacturing operations for those products or technologies.

The restrictions under the Innovation Law (including with respect to the restriction of the transfer of IIA-funded know-how and manufacturing outside of Israel) continue to apply even after payment of the full amount of royalties payable to the IIA in respect of grants. However, upon payment of the redemption fee on a transfer of IIA-funded know-how outside Israel, the obligations towards the IIA (including the obligation to pay royalties) and restrictions under the Innovation Law cease to apply.

We cannot be certain that any approval of the IIA will be obtained on terms that are acceptable to us, or at all. We may not receive the required approvals should we wish to transfer IIA-funded know-how and/or manufacture products developed with IIA-funded know-how outside of Israel in the future. Furthermore, in the event that we undertake a transaction involving the transfer to a non-Israeli entity of IIA-funded know-how pursuant to a merger or similar transaction, the consideration available to our shareholders may be reduced by the amounts we are required to pay to the IIA. If we fail to satisfy the conditions of the Innovation Law, we may be required to refund the amounts of the grants previously received, together with interest and penalties, and may become subject to criminal charges.

Subject to prior approval of the IIA, we may transfer the IIA-funded know-how to another Israeli company. If the IIA-funded know-how is transferred to another Israeli entity, the transfer would still require IIA approval but will not be subject to the payment of the redemption fee (however, there may be an obligation to pay royalties to the IIA from the income of such sale transaction as part of the royalty payment obligation). In such case, the acquiring company would have to assume all of the applicable restrictions and obligations towards the IIA (including the restrictions on the transfer of know-how and manufacturing outside of Israel) as a condition to the IIA’s approval.

Investment by a foreign entity in an IIA-funded company, following which the non-Israeli entity becomes an “interested party” in the company (e.g., holds, directly or indirectly, at least 5% of the shares of the funded company or has a right to appoint a director), including an acquisition of 100% of the shares of an IIA-funded company, requires notification to the IIA of the transaction and an undertaking signed by the non-Israeli investor to comply with the Innovation Law.

Human Capital Resources

Our key human capital management objectives are to attract, retain and develop the highest quality talent throughout our company. To support these objectives, we strive to provide our employees good working conditions and competitive pay, as well as a wide range of benefits programs to eligible employees. We regularly evaluate our benefits programs and policies to meet present and future employee needs and desires. Programs and policies applicable to our employees generally include, but are not limited to, benefits programs, equity compensation plans, flexible work schedules, diversity and inclusion initiatives, professional development opportunities, paid time-off policies and recognition and rewards programs.

|

|

As of the date of this Annual Report, we have four officers which consists of a Chief Executive Officer, Chief Financial Officer, Chief Technology Officer and Senior VP of Product Portfolio, all of whom are engaged on a full-time basis. As of the date of this Annual Report, we had 61 employees in full- or part-time capacities. Our employees are all located in Israel.

None of our employees are represented by labor unions or covered by collective bargaining agreements. We believe that we maintain good relations with all our employees.

All of our employment agreements include customary provisions with respect to non-competition, assignment to us of intellectual property rights developed in the course of employment and confidentiality. Our consulting agreements with our agents and partners include provisions with respect to assignment to us of intellectual property rights developed in the course of their engagement as well as confidentiality. The enforceability of such provisions may be limited under applicable law.

Organizational History

We were incorporated under the laws of the State of Nevada on March 22, 2013 under the name Intellisense Solutions Inc., or Intellisense. We were initially engaged in the business of developing web portals to allow companies and individuals to engage in the purchase and sale of vegetarian food products over the internet. However, we were unable to execute our original business plan, develop significant operations or achieve commercial sales.

On January 10, 2019, we formed Canna Patch Ltd., or Canna Patch, an Israeli corporation. Canna Patch did not have any operations and, on December 4, 2019, we sold 100% of our holdings in Canna Patch.

On September 16, 2019, Intellisense and Xylo Technologies entered into an exchange agreement pursuant to which, on December 30, 2019, we acquired from Xylo Technologies all of the issued and outstanding share capital of ScoutCam Ltd. On December 31, 2019, we changed our name to ScoutCam Inc. Following this acquisition, we integrated and fully adopted the acquired miniaturized imaging business into the company as our primary business activity.

On December 1, 2019, Xylo Technologies and Odysight.ai Ltd. consummated a certain Amended and Restated Asset Transfer Agreement, which transferred and assigned certain assets and intellectual property rights related to its miniaturized imaging business. On May 18, 2020, we and Xylo Technologies entered into a certain Side Letter Agreement, whereby the parties agreed to amend certain terms of the Amended and Restated Asset Transfer Agreement and related documents.

On April 20, 2020, Odysight.ai Ltd. entered into an Amended and Restated Intercompany Services Agreement with Xylo Technologies, which effectively amended and restated an intercompany services agreement dated May 30, 2019.

On June 5, 2023, we changed our name to Odysight.ai Inc. In addition, our trading symbol on the OTCQB was changed from “SCTC” to “ODYS”, effective as of February 13, 2024.

On February 28, 2024, we formed D. VIEW Ltd., a private company organized under the laws of the State of Israel and a wholly owned subsidiary of Odysight.ai Inc., to act as a local agent for the defense market in Israel.

On January 9, 2025, we formed an additional wholly-owned subsidiary, Odysight.Ai Eu S.r.l., a private company organized under the laws of Italy.

On February 11, 2025, our common stock began trading on the Nasdaq Capital Market under the symbol “ODYS”.

|

|

ITEM 1A. RISK FACTORS

Risk Factor Summary

Investing in our securities involves substantial risk. The risks described under the heading “Risk Factors” immediately following this summary may cause us to not realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the more significant challenges include the following:

| ● | We have a limited operating history and may not be able to successfully operate our business or execute our business plan. | |

| ● | We have a history of losses and anticipate that we will continue to incur significant losses for the foreseeable future. | |

| ● | We may need to raise additional capital before we can expect to become profitable from sales of our solutions. This additional capital may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations. | |

| ● | It is difficult to forecast our future performance, which may cause our financial results to fluctuate unpredictably. | |

| ● | Backlog may not be realized or may not result in revenue or profit. | |

| ● | Our sales cycles are long and unpredictable and require considerable time and expense before executing a customer agreement, which may make it difficult to predict when, if at all, we will obtain new customers and when we will generate revenue from those customers. | |

| ● | Our future growth and success are highly dependent upon large-scale adoption of the Odysight TruVision solution in the markets in which we compete. | |

● |

If we are unable to establish sales, marketing and distribution capabilities or enter into successful relationships with business targets and third parties to perform these services, we may not be successful in commercializing our products and technology. | |

| ● | Sales to government entities and highly regulated organizations are subject to a number of challenges and risks. | |

| ● | An agreement with one of our customers includes exclusivity provisions, and other agreements include limitations on our ability to sell products to other customers, and restrictions on the use of intellectual property. Such limitations may prevent us from selling certain products to third parties without the prior consent of the customers, and may limit our ability to use certain elements of intellectual property developed by funds received under these agreements. | |

| ● | If we are unable to ensure that the Odysight TruVision solution interoperates with a variety of hardware and software platforms that are developed by others, including our partners, we may become less competitive and our business may be harmed. | |

| ● | If we fail to scale our business operations or otherwise manage our future growth effectively as we attempt to grow our company, we may not be able to produce, market, service and sell the Odysight TruVision solution successfully. | |

| ● | We incorporate artificial intelligence, or AI, and machine learning, or ML, into some of our products. This technology is new and developing and may present both compliance and reputational risks. | |

| ● | Failure to make competitive technological advances will put us at a disadvantage and may lead to negative operational and financial outcomes. | |

| ● | We have four customers that account for a substantial portion of our revenues, and our result of our operation could be harmed were we to lose these customers or receive lower than expected purchase orders. |

|

|

| ● | Our reliance on third-party suppliers for most of the components of our products could harm our ability to meet demand for our products in a timely and cost-effective manner. | |

| ● | We may not be able to manage our strategic partners effectively. | |

| ● | We face competition from providers of sensing solutions. If we cannot successfully compete with new or existing technologies or future developed products, our marketing and sales will suffer, and we may never be profitable. | |

| ● | Our inability to retain key members of our senior management could impair our future success. | |

| ● | The estimates and forecasts of market opportunity and market growth included in this Annual Report may prove to be inaccurate, and we cannot assure you our business will grow at similar rates, or at all, or that we will be able to address, fully or at all, the markets we believe represent our market opportunity. | |

| ● | Adverse conditions in the aerospace, industrial, transportation, energy and medical markets or the global economy more generally could have adverse effects on our results of operations. | |

| ● | Our business could be adversely affected if we fail to maintain product quality and product performance at an acceptable cost or if we incur significant losses, increased costs or harm to our reputation or brand as a result of product liability claims or product recalls. | |

| ● | We are subject to, and must remain in compliance with, numerous laws and governmental regulations across various countries concerning the manufacturing, use, distribution and sale of our vision-based sensor products. Some of our customers also require that we comply with other unique requirements relating to these matters. | |

| ● | We and our third-party vendors face cybersecurity risks and may incur increasing costs in an effort to mitigate those risks, and if we fail to prevent data security breaches, there may be damage to our reputation, material financial penalties and legal liability, which would materially adversely affect our business, results of operations and financial condition. |

|

| ● | If we are unable to obtain, maintain and protect effective intellectual property rights for our products, we may not be able to compete effectively in our markets. | |

| ● | Intellectual property rights of third parties could adversely affect our ability to commercialize our products, and we might be required to litigate or obtain licenses from third parties in order to develop or market our products. Such litigation or licenses could be costly or not available on commercially reasonable terms. | |

| ● | The market price of our shares of common stock may be volatile or may decline steeply or suddenly regardless of our operating performance, and we may not be able to meet investor or analyst expectations. You may not be able to resell your shares at or above the price you paid and may lose all or part of your investment. | |

| ● | Sales of a substantial number of our shares of common stock in the public market by our existing shareholders could cause our share price to fall. | |

| ● | If the ownership of our common stock continues to be highly concentrated, it may prevent you and other minority stockholders from influencing significant corporate decisions and may result in conflicts of interest. | |

| ● | There can be no assurances that our common stock will not be subject to delisting if we do not continue to maintain the listing requirements of Nasdaq. | |

| ● | Our headquarters and other significant operations are located in Israel and therefore, our business, results of operation and financial condition may be adversely affected by political, economic and military instability in Israel. |

Investing in our shares of common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, in addition to the other information included elsewhere in this Annual Report, including the consolidated financial statements and the related notes, before purchasing our shares of common stock. If any of the following risks actually occurs, our business, financial condition, cash flows and results of operations could be negatively impacted. In that case, the trading price of our shares of common stock would likely decline and you might lose all or part of your investment. Additional risks and uncertainties that we are unaware of or that we deem immaterial may also become important factors that adversely affect our business, financial condition, cash flows and results of operations.

|

|

Risks Related to Our Business and Financial Condition

We have a limited operating history and may not be able to successfully operate our business or execute our business plan.

Although we were incorporated in 2013, we have only been pursuing our current business that is focused on the PdM and CBM markets only since 2021. Given our limited operating history, it is hard to evaluate our proposed business and prospects. Our proposed business operations will be subject to numerous risks, uncertainties, expenses, and difficulties associated with early-stage enterprises. Such risks include, but are not limited to, the following:

| ● | the absence of a lengthy operating history in our current business; | |

| ● | potential for ongoing operating losses; | |

| ● | our ability to anticipate and adapt to a developing market(s); | |

| ● | acceptance of our products in the markets we are targeting; | |

| ● | introducing innovation to industries that are slow to adopt change; | |

| ● | development risks and implementation of new software and algorithm for AI and cloud utilization; | |

| ● | insufficient capital to fully realize our operating plan; | |

| ● | a competitive environment; | |

| ● | the ability to identify, attract, and retain qualified personnel; and | |

| ● | operating in an environment that is highly regulated by a number of agencies. |

Because we are subject to these risks, evaluating our business may be difficult, our business strategy may be unsuccessful and we may be unable to address such risks in a cost-effective manner, if at all. We have not earned a profit in any full fiscal year since our inception, and we cannot be certain as to when or if we will achieve or maintain profitability. If we are unable to successfully address these risks our business could be harmed.

We have a history of losses and anticipate that we will continue to incur significant losses for the foreseeable future.

We have incurred net losses nearly every year since our inception and every year since 2021, when we began pursuing our current business that is focused on the PdM and CBM markets. We have incurred an accumulated deficit of approximately $46 million as of December 31, 2024. For the years ended December 31, 2024 and 2023, we had net losses of $11.8 million and $9.4 million, respectively.

We have devoted substantially all of our financial resources to the Odysight TruVision solution. We have financed our operations primarily through the issuance of equity securities. We do not expect to be profitable for the foreseeable future as we invest in our business, build capacity and ramp up operations, and we cannot assure you that we will ever achieve or be able to maintain profitability in the future. Failure to become profitable would materially and adversely affect the value of your investment. The amount of our future net losses will depend, in part, on the rate of penetration in the markets we are targeting, the rate of our future expenditures and our continued ability to obtain funding through the issuance of our securities, strategic collaborations or grants. We anticipate that our expenses will increase substantially if and as we:

| ● | continue the development of our products for a wider portfolio of products; | |

| ● | establish a sales, marketing, distribution and technical support infrastructure to support the ramp up of our operations; | |

| ● | seek to maintain, protect and expand our intellectual property portfolio; | |

| ● | seek to attract and retain skilled personnel; and | |

| ● | create additional infrastructure to support our operations as a public company and our product development. |

|

|

We may need to raise additional capital before we can expect to become profitable from sales of Odysight solutions. This additional capital may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

Based on our current business plan, we believe our current cash and cash equivalents and anticipated cash flow from operations, will be sufficient to meet our anticipated cash requirements over at least the next 12 months from the date of this Annual Report. We may need to raise additional capital before we can expect to become profitable from sales of Odysight solutions and may raise additional capital to expand our business, to pursue strategic investments, to take advantage of financing opportunities or for other reasons. In addition, our operating plans may change as a result of many factors that may currently be unknown to us, and we may need to seek additional funds sooner than planned. Any additional fundraising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our products. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of our stockholders and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our shares of common stock to decline.