FIDELIS INSURANCE HOLDINGS LIMITED Information Circular and Request for Proxy 2024

Dear Shareholders, In 2023, Fidelis Insurance Group achieved several significant milestones, marking a pivotal year for our Company, and I couldn’t be more pleased with our performance. We completed our IPO, successfully listing on the New York Stock Exchange on July 3. We executed against all aspects of our strategy. And we delivered excellent financial performance and compelling returns. I am incredibly proud of everything our teams accomplished in 2023. In our first year as a public company, we delivered strong results, including 18.6% growth in gross premiums written, an 82.1% combined ratio, and operating return on average common equity (“Operating ROAE”)(1) of 18.8%. Our results demonstrate the benefits of our scale, capital strength, and lead positioning across a high-quality, mature, and diversified portfolio focused on three segments – Specialty, Bespoke, and Reinsurance. They also demonstrate our ability to make nimble, thoughtful, and efficient underwriting decisions which is a key driver of profitability alongside active capital management and seizing market opportunities positioning us to deliver consistent returns and sustained value to our shareholders. Our underwriting strategy and structure is working exactly as intended, and we enter 2024 well positioned for continued growth, profitability, and efficiency as a global specialty insurance platform, leveraging strategic partnerships to offer innovative and tailored solutions to clients. We have the strategy, the financial strength, and the expertise to execute our vision and seize upon the opportunities we see in what remains the best market environment in twenty years. 2023: A Year of Strong Performance The benefits of our structure and strategy are evidenced by our strong financial results in 2023 – including broad-based underwriting gains, increased net investment income, and an industry leading combined ratio. Highlights from the year include: n $3.6 billion in gross premiums written, a year-over-year increase of 18.6%; n 82.1% combined ratio; n 18.8% operating ROAE; n $10.0 billion in total assets at year-end; n $4.3 billion in cash and invested assets at year-end; and n $398.9 million in operating net income, or $3.49 per diluted common share. (1) Operating ROAE is a non-US GAAP financial measure and is calculated as operating net income divided by adjusted average common shareholders’ equity. This Letter also includes forward-looking statements. See our Form 20-F for reconciliation and risk factors which would cause actual results to differ materially. i.

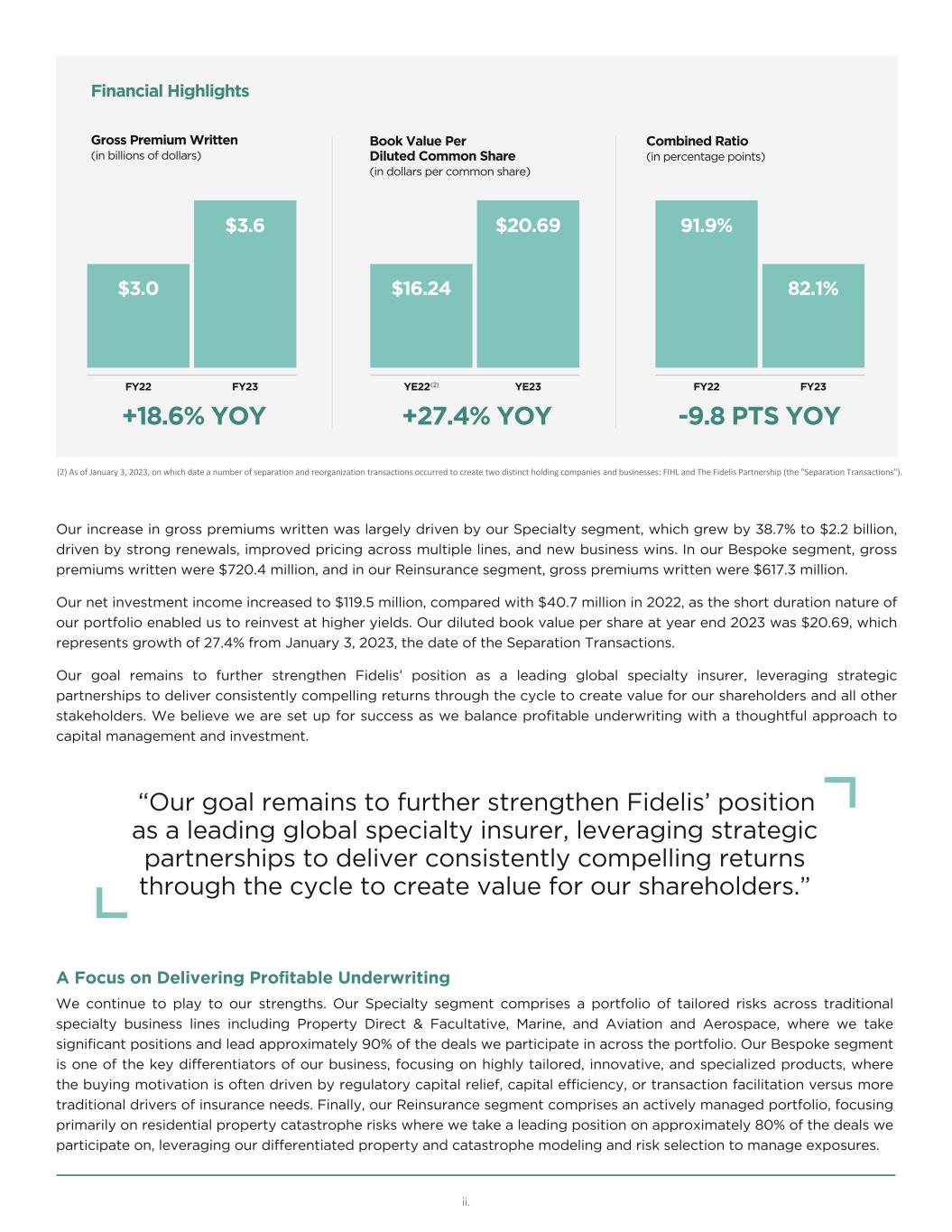

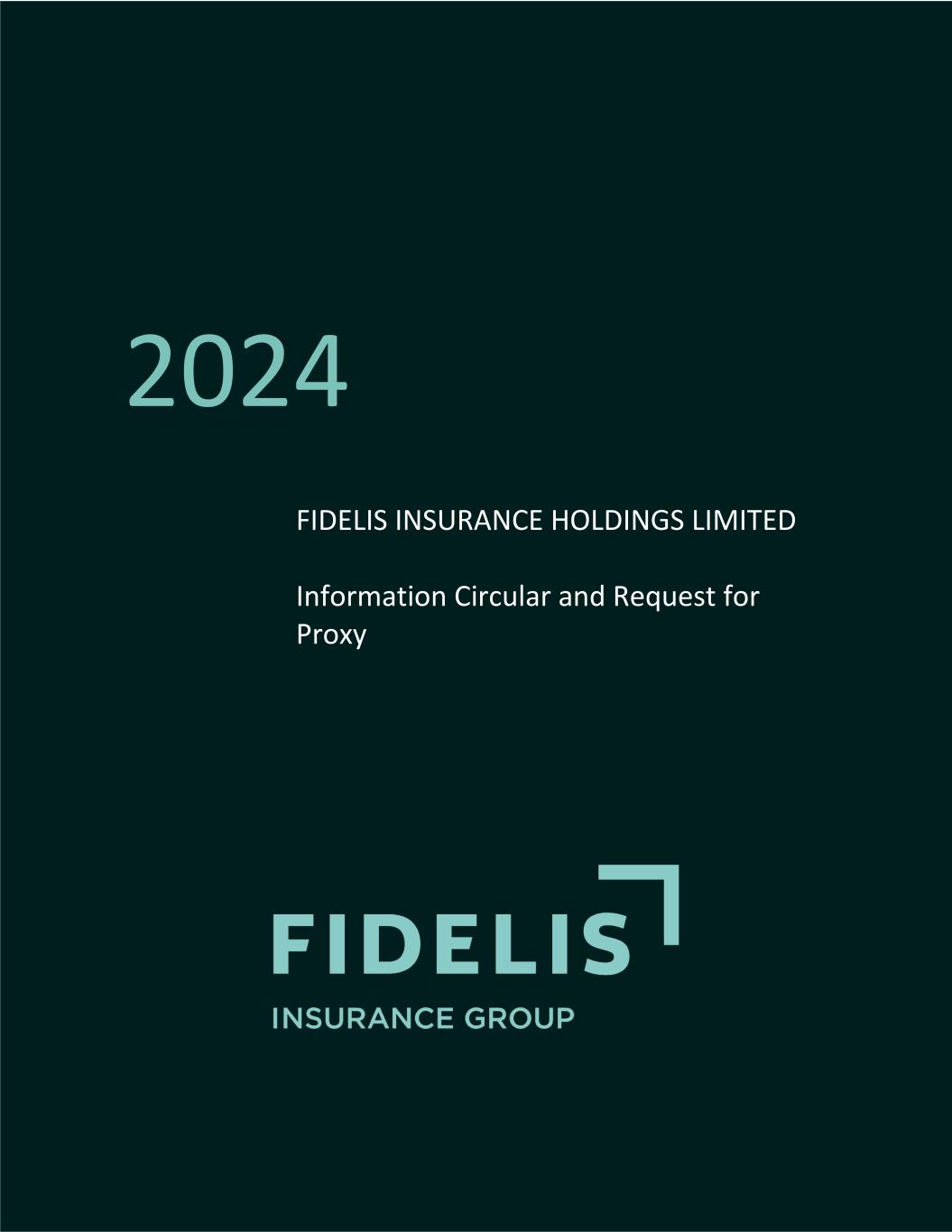

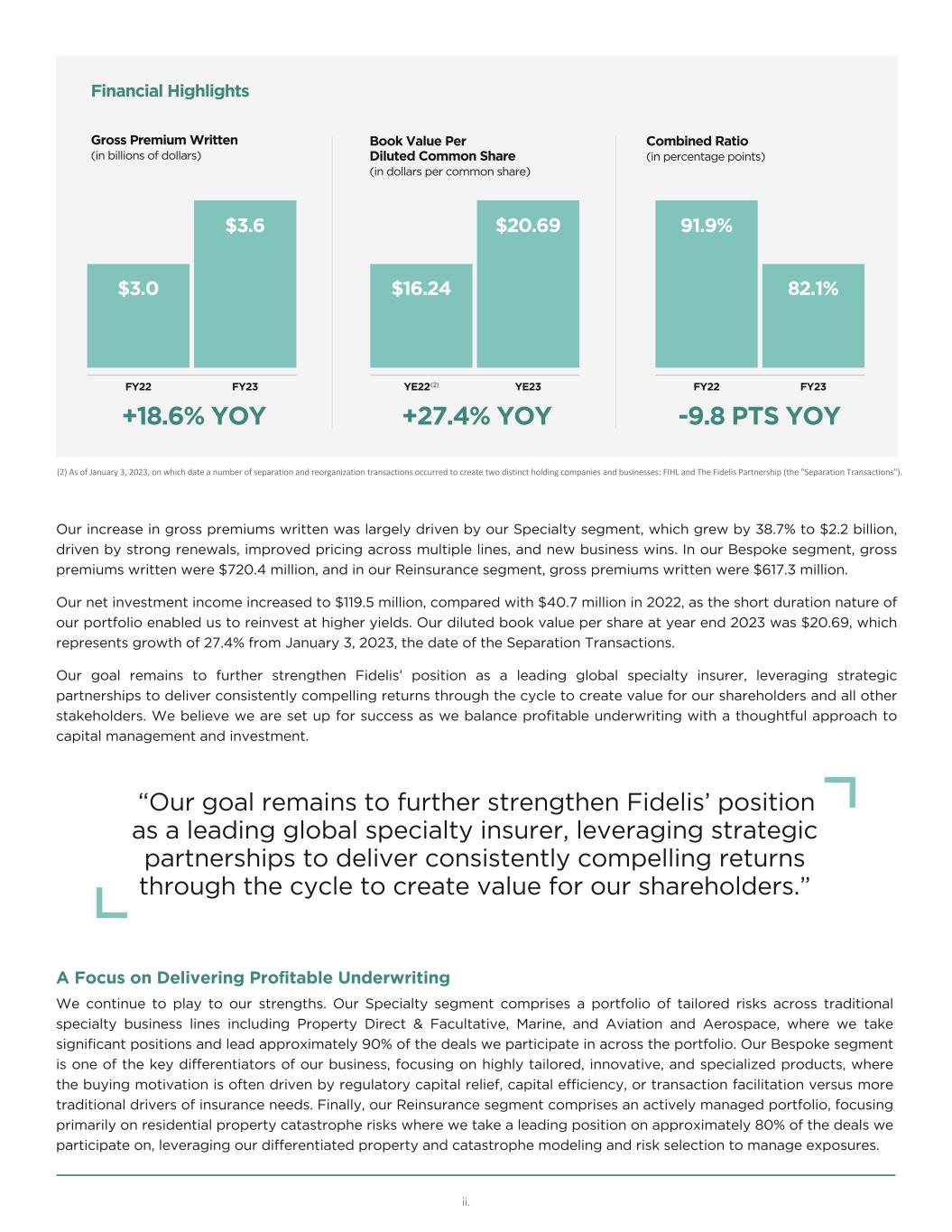

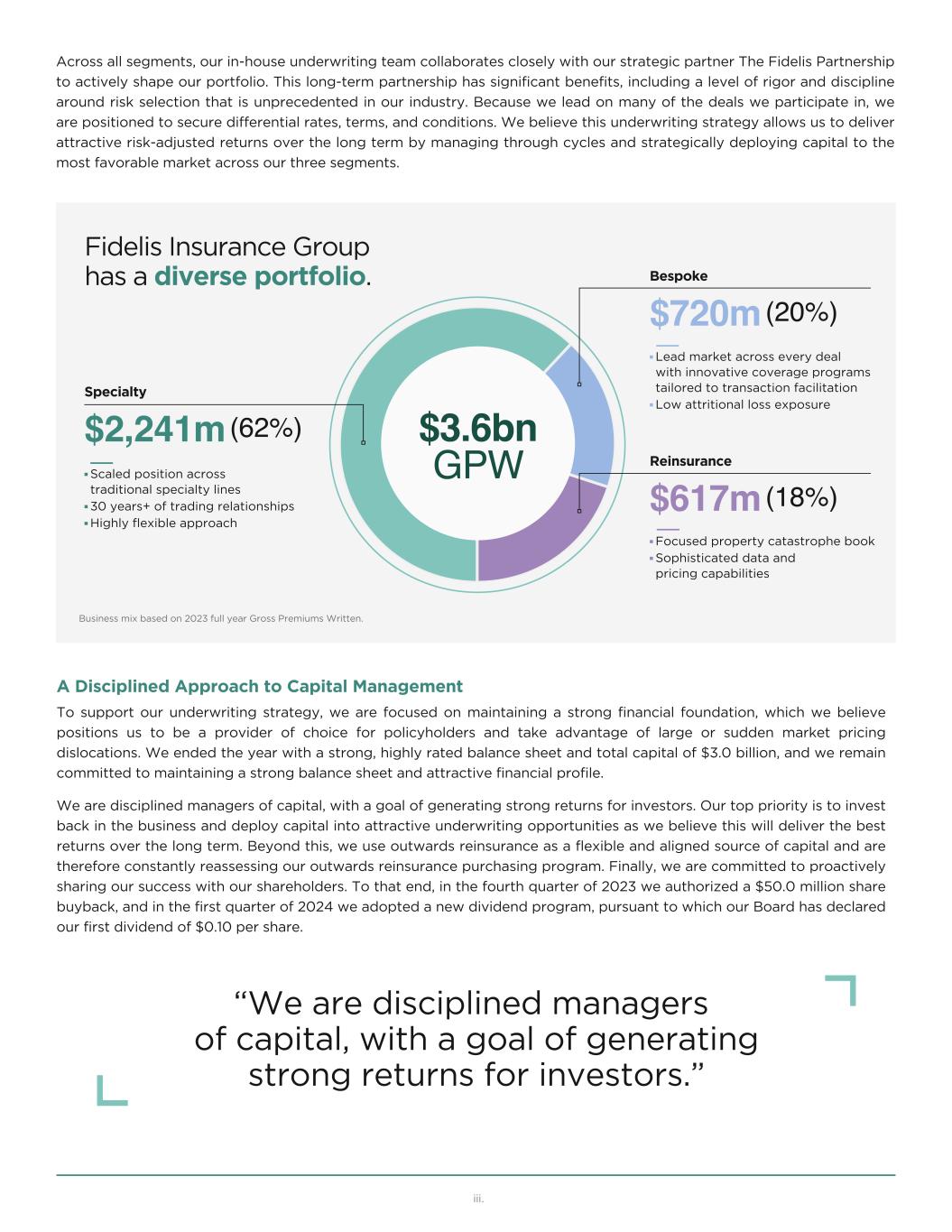

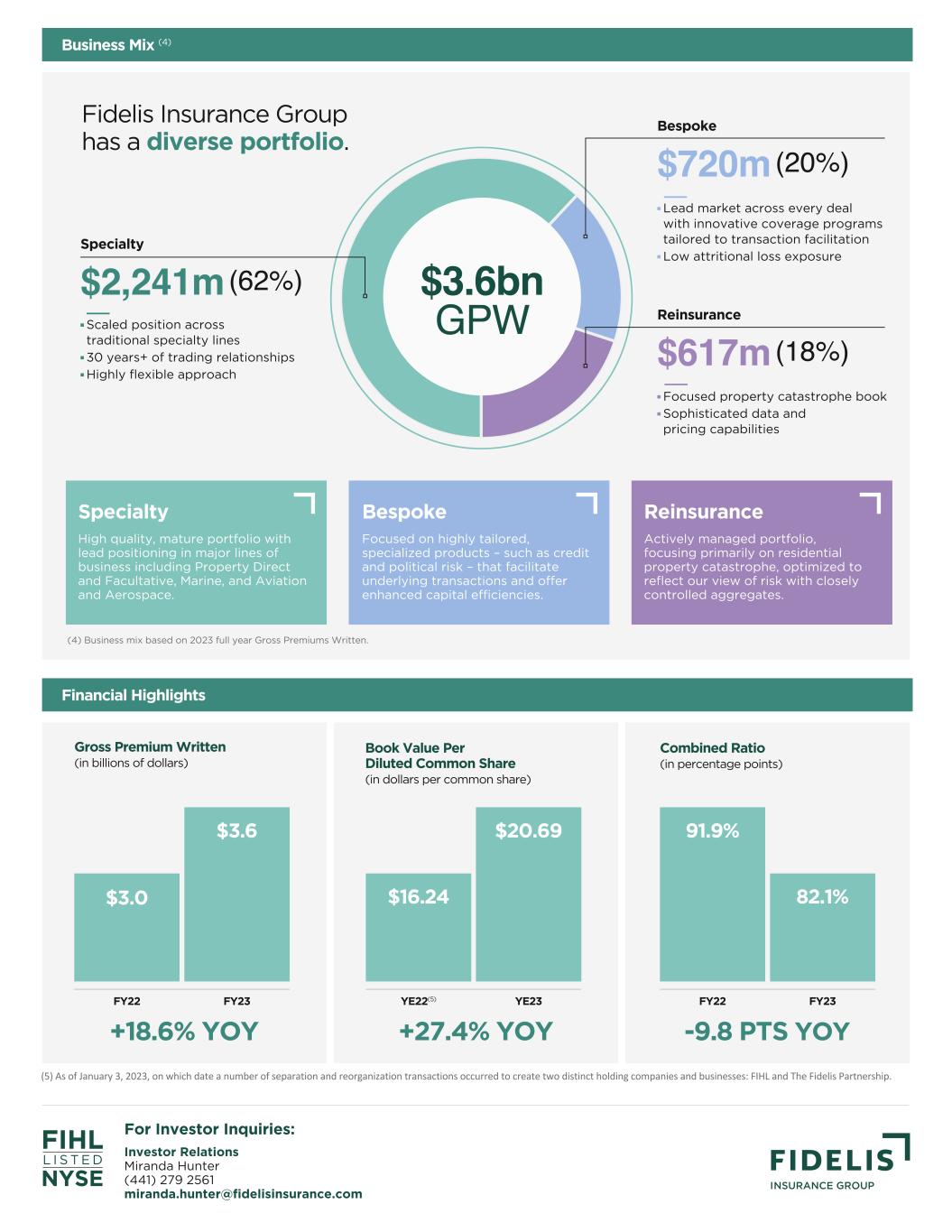

Financial Highlights Book Value Per Diluted Common Share (in dollars per common share) Combined Ratio (in percentage points) Gross Premium Written (in billions of dollars) FY22 FY23 $3.0 +18.6% YOY $3.6 YE22(2) FY22YE23 FY23 $16.24 91.9% +27.4% YOY -9.8 PTS YOY $20.69 82.1% A Focus on Delivering Profitable Underwriting We continue to play to our strengths. Our Specialty segment comprises a portfolio of tailored risks across traditional specialty business lines including Property Direct & Facultative, Marine, and Aviation and Aerospace, where we take significant positions and lead approximately 90% of the deals we participate in across the portfolio. Our Bespoke segment is one of the key differentiators of our business, focusing on highly tailored, innovative, and specialized products, where the buying motivation is often driven by regulatory capital relief, capital efficiency, or transaction facilitation versus more traditional drivers of insurance needs. Finally, our Reinsurance segment comprises an actively managed portfolio, focusing primarily on residential property catastrophe risks where we take a leading position on approximately 80% of the deals we participate on, leveraging our differentiated property and catastrophe modeling and risk selection to manage exposures. (2) As of January 3, 2023, on which date a number of separation and reorganization transactions occurred to create two distinct holding companies and businesses: FIHL and The Fidelis Partnership (the "Separation Transactions"). Our increase in gross premiums written was largely driven by our Specialty segment, which grew by 38.7% to $2.2 billion, driven by strong renewals, improved pricing across multiple lines, and new business wins. In our Bespoke segment, gross premiums written were $720.4 million, and in our Reinsurance segment, gross premiums written were $617.3 million. Our net investment income increased to $119.5 million, compared with $40.7 million in 2022, as the short duration nature of our portfolio enabled us to reinvest at higher yields. Our diluted book value per share at year end 2023 was $20.69, which represents growth of 27.4% from January 3, 2023, the date of the Separation Transactions. Our goal remains to further strengthen Fidelis’ position as a leading global specialty insurer, leveraging strategic partnerships to deliver consistently compelling returns through the cycle to create value for our shareholders and all other stakeholders. We believe we are set up for success as we balance profitable underwriting with a thoughtful approach to capital management and investment. “Our goal remains to further strengthen Fidelis’ position as a leading global specialty insurer, leveraging strategic partnerships to deliver consistently compelling returns through the cycle to create value for our shareholders.” ii.

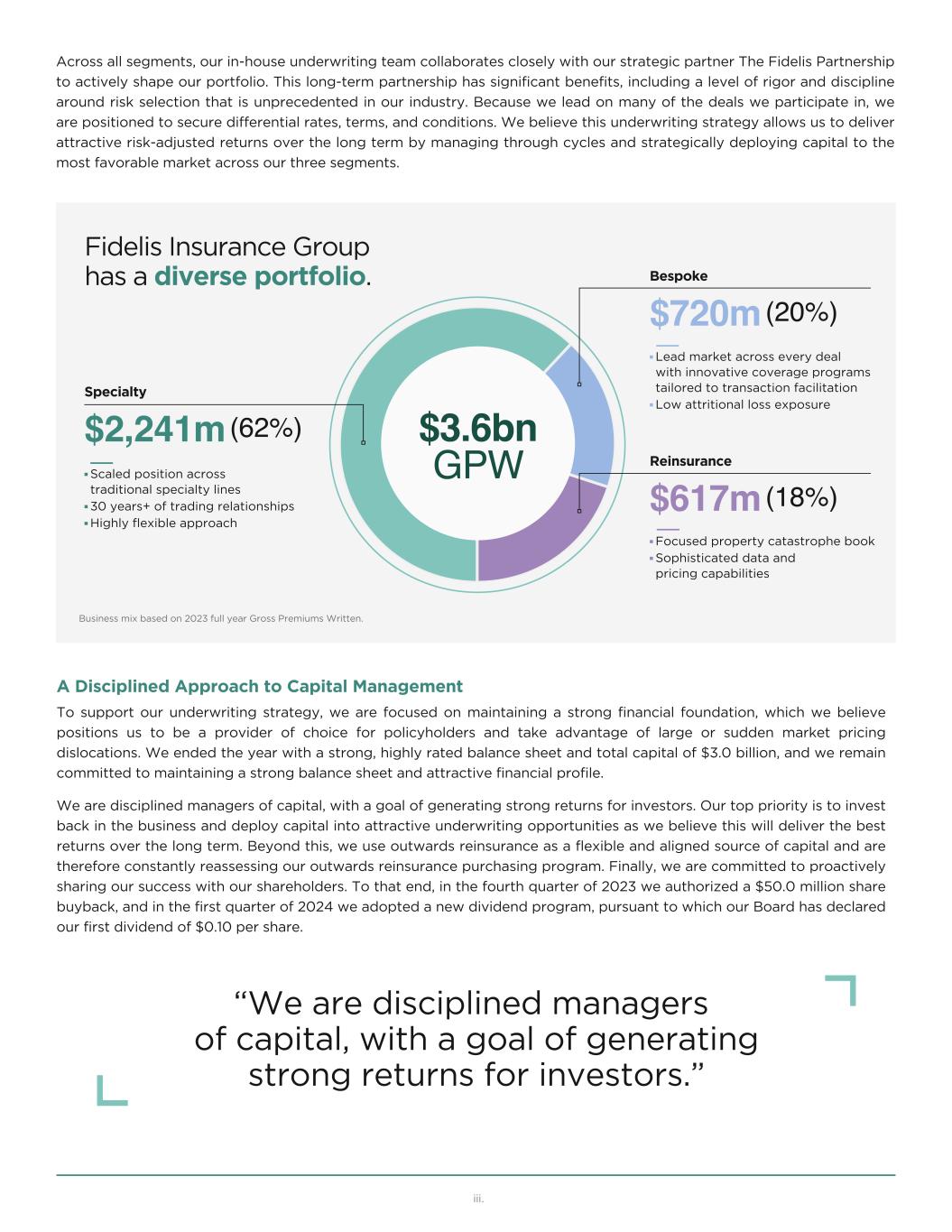

Across all segments, our in-house underwriting team collaborates closely with our strategic partner The Fidelis Partnership to actively shape our portfolio. This long-term partnership has significant benefits, including a level of rigor and discipline around risk selection that is unprecedented in our industry. Because we lead on many of the deals we participate in, we are positioned to secure differential rates, terms, and conditions. We believe this underwriting strategy allows us to deliver attractive risk-adjusted returns over the long term by managing through cycles and strategically deploying capital to the most favorable market across our three segments. A Disciplined Approach to Capital Management To support our underwriting strategy, we are focused on maintaining a strong financial foundation, which we believe positions us to be a provider of choice for policyholders and take advantage of large or sudden market pricing dislocations. We ended the year with a strong, highly rated balance sheet and total capital of $3.0 billion, and we remain committed to maintaining a strong balance sheet and attractive financial profile. We are disciplined managers of capital, with a goal of generating strong returns for investors. Our top priority is to invest back in the business and deploy capital into attractive underwriting opportunities as we believe this will deliver the best returns over the long term. Beyond this, we use outwards reinsurance as a flexible and aligned source of capital and are therefore constantly reassessing our outwards reinsurance purchasing program. Finally, we are committed to proactively sharing our success with our shareholders. To that end, in the fourth quarter of 2023 we authorized a $50.0 million share buyback, and in the first quarter of 2024 we adopted a new dividend program, pursuant to which our Board has declared our first dividend of $0.10 per share. “We are disciplined managers of capital, with a goal of generating strong returns for investors.” Specialty Reinsurance $2,241m (62%) $617m (18%) n Scaled position across traditional specialty lines n 30 years+ of trading relationships n Highly flexible approach n Focused property catastrophe book n Sophisticated data and pricing capabilities Bespoke $720m (20%) n Lead market across every deal with innovative coverage programs tailored to transaction facilitation n Low attritional loss exposure $3.6bn GPW Business mix based on 2023 full year Gross Premiums Written. Fidelis Insurance Group has a diverse portfolio. iii.

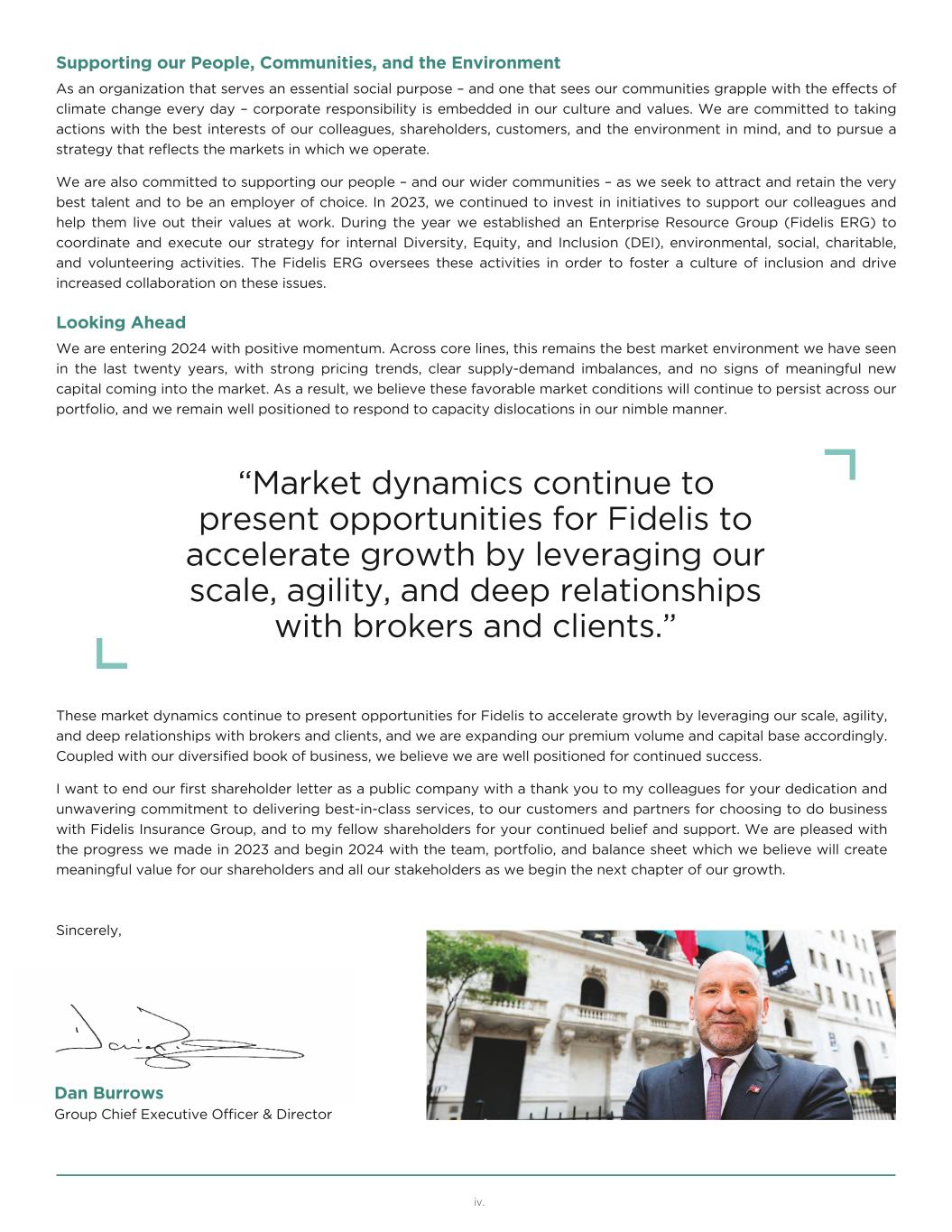

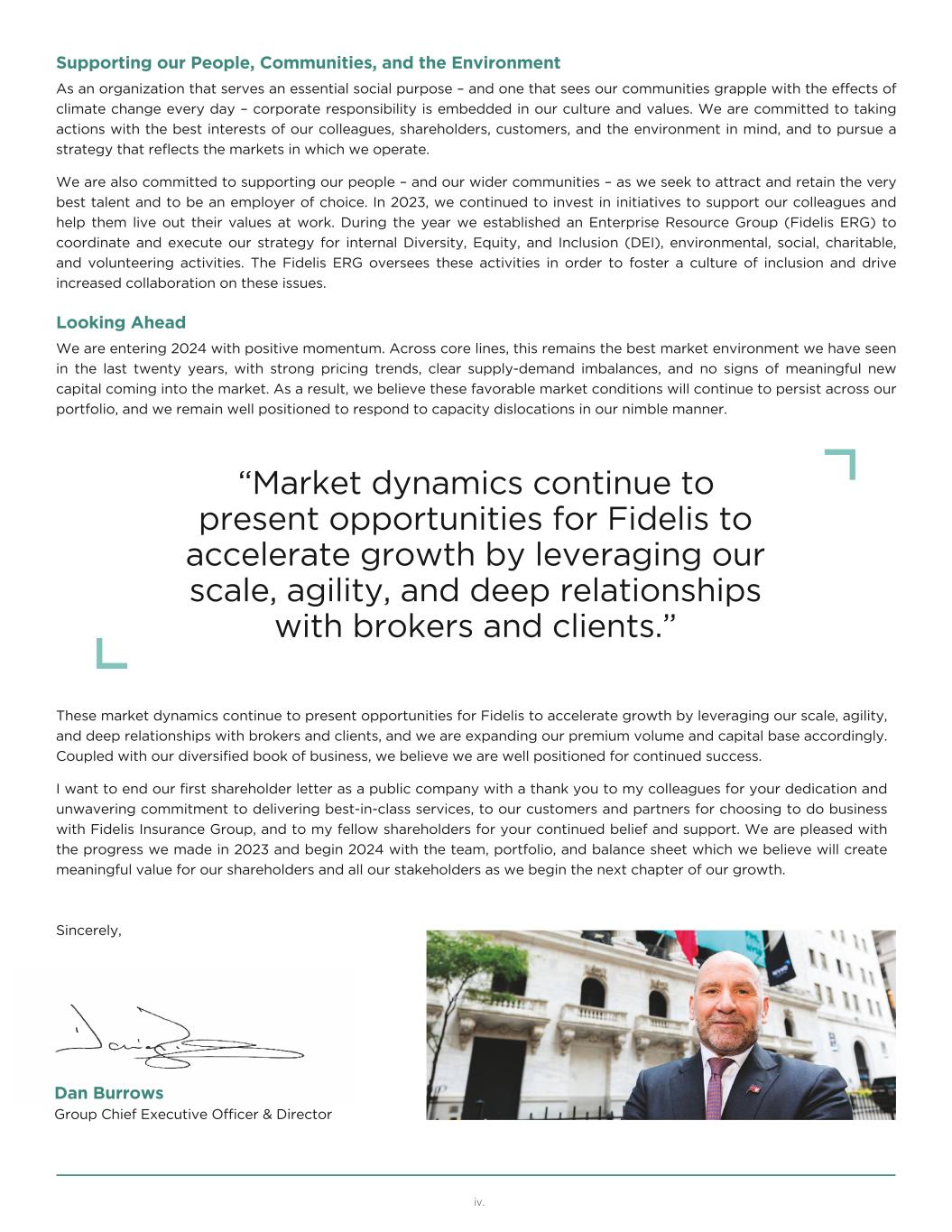

These market dynamics continue to present opportunities for Fidelis to accelerate growth by leveraging our scale, agility, and deep relationships with brokers and clients, and we are expanding our premium volume and capital base accordingly. Coupled with our diversified book of business, we believe we are well positioned for continued success. I want to end our first shareholder letter as a public company with a thank you to my colleagues for your dedication and unwavering commitment to delivering best-in-class services, to our customers and partners for choosing to do business with Fidelis Insurance Group, and to my fellow shareholders for your continued belief and support. We are pleased with the progress we made in 2023 and begin 2024 with the team, portfolio, and balance sheet which we believe will create meaningful value for our shareholders and all our stakeholders as we begin the next chapter of our growth. Sincerely, Dan Burrows Group Chief Executive Officer & Director Supporting our People, Communities, and the Environment As an organization that serves an essential social purpose – and one that sees our communities grapple with the effects of climate change every day – corporate responsibility is embedded in our culture and values. We are committed to taking actions with the best interests of our colleagues, shareholders, customers, and the environment in mind, and to pursue a strategy that reflects the markets in which we operate. We are also committed to supporting our people – and our wider communities – as we seek to attract and retain the very best talent and to be an employer of choice. In 2023, we continued to invest in initiatives to support our colleagues and help them live out their values at work. During the year we established an Enterprise Resource Group (Fidelis ERG) to coordinate and execute our strategy for internal Diversity, Equity, and Inclusion (DEI), environmental, social, charitable, and volunteering activities. The Fidelis ERG oversees these activities in order to foster a culture of inclusion and drive increased collaboration on these issues. Looking Ahead We are entering 2024 with positive momentum. Across core lines, this remains the best market environment we have seen in the last twenty years, with strong pricing trends, clear supply-demand imbalances, and no signs of meaningful new capital coming into the market. As a result, we believe these favorable market conditions will continue to persist across our portfolio, and we remain well positioned to respond to capacity dislocations in our nimble manner. “Market dynamics continue to present opportunities for Fidelis to accelerate growth by leveraging our scale, agility, and deep relationships with brokers and clients.” iv.

v. Notice of Annual General Meeting of Shareholders To our shareholders: Notice is hereby given that the 2024 Annual General Meeting of Shareholders of Fidelis Insurance Holdings Limited (NYSE: FIHL) will be held in Pembroke, Bermuda on Wednesday, May 8, 2024. The following are details for the meeting: Meeting Details DATE TIME PLACE Wednesday, May 8, 2024 12.00 p.m. Atlantic Daylight Time Tea Rose Room, Hamilton Princess & Beach Club Hotel 76 Pitts Bay Rd, Pembroke HM 08, Bermuda Matters to Be Voted On The principal items of business of the Annual General Meeting will be: 1 Election of Class I Directors for a three-year term; 2 Ratification of Appointment of KPMG Audit Limited, an independent registered public accounting firm, as the Company’s auditor and authorization for our Board to fix the independent auditor’s remuneration; and 3 To transact any other business as may properly come before the meeting or any adjournment or postponement thereof. Record Date The record date for the Annual General Meeting is March 15, 2024. Only shareholders of record at the close of business on that date will be entitled to notice of, and to vote at, the Annual General Meeting or any adjournment or postponement of that meeting. Voting Your vote is important. Whether or not you plan to attend the Annual General Meeting, we urge you to vote and submit your proxy in advance of the meeting. In order to ensure that your shares will be voted in accordance with your wishes and that the presence of a quorum at the 2024 Annual General Meeting may be assured, please promptly complete, sign, date and submit your proxy card which will be available by requesting a paper copy of the proxy materials as provided in the instructions set forth on the Notice of Annual General Meeting and Internet Availability of Proxy Materials (“Proxy Materials Notice”) or your proxy card. The proxy card must be properly dated, signed and submitted in order to be counted. You can submit your proxy to vote your shares via the Internet, by telephone, via a mobile device or by mail as provided in the instructions set forth on the Proxy

vi. Materials Notice or proxy card. Following submission of your signed proxy, you may revoke your signed proxy at any time before it is voted by following the procedures specified in the Information Circular. By Order of the Board of Directors, _____________________________ Janice R. Weidenborner Group Chief Legal Officer and Company Secretary Fidelis Insurance Holdings Limited Pembroke HM 08, Bermuda March 28, 2024 Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting of Shareholders to be held on May 8, 2024: The Notice of Annual General Meeting, this Information Circular and Request for Proxy and our 2023 Annual Report to Shareholders are available electronically at www.proxyvote.com.

vii. Table of Contents Questions and Answers about the Annual General Meeting 1 Proposal One - Election of Class I Directors for Three-Year Term 6 Director Biographies 7 Proposal Two - Ratification of Appointment of Independent Registered Public Accounting Firm 13 Statement of Corporate Governance Practices 14 Overview 14 Code of Conduct 14 Director Independence 14 Risk Oversight 14 Meetings of the Board and Director Attendance 15 Insider Trading Policies 15 Board Leadership Structure 16 Board Committees 16 Board and Committee Performance Evaluations 19 Summary of Director Qualifications and Experience 19 Diversity of the Board 19 Compensation Framework 20 Other Business 21 Investor 2023 Fact Sheet 22

1 Questions and Answers about the Annual General Meeting The following are some questions that you, as a shareholder of Fidelis Insurance Holdings Limited (“FIHL”, “Fidelis”, “we” or the “Company”), may have regarding FIHL’s 2024 Annual General Meeting and brief answers to those questions. You are urged to carefully read this Information Circular in its entirety. Who is soliciting my vote? The Board of Directors of FIHL (the “Board”) is soliciting proxies to vote common shares, par value $0.01 per share (the “Common Shares”), at FIHL’s Annual General Meeting of Shareholders, which will take place on Wednesday, May 8, 2024. In connection with this solicitation, we distributed a Proxy Materials Notice to registered holders of our Common Shares on or about March 28, 2024. You may access the materials online by following the instructions in the Proxy Materials Notice. What items of business will be voted on at the Annual General Meeting? The items of business scheduled to be voted on at the Annual General Meeting are: • The election of Class I directors to FIHL’s Board for a term of three years; • The ratification of the appointment of KPMG Audit Limited as our independent auditor for the fiscal year ending December 31, 2024, and authorization for our Board to fix the independent auditor’s remuneration; and • Such other business as may properly come before the meeting. How does the Board of Directors recommend I vote? The Board recommends that you vote ‘FOR’ each of the director nominees and ‘FOR’ the ratification of the appointment of KPMG Audit Limited, an independent registered public accounting firm, to act as the Company’s independent auditor for the fiscal year ending December 31, 2024 and the authorization for our Board, acting through our Audit Committee, to fix the remuneration of the Company’s independent auditor for the fiscal year ending December 31, 2024. What shares can I vote? Each of FIHL’s Common Shares issued and outstanding as of the close of business on March 15, 2024 (the “Record Date”) for the Annual General Meeting is entitled to be voted on all items being voted upon at the Annual General Meeting. The record date for the Annual General Meeting is the date used to determine both the number of FIHL’s Common Shares that are entitled to be voted at the Annual General Meeting and the identity of the shareholders of record and beneficial owners of those Common Shares who are entitled to vote those shares at the Annual General Meeting. On the Record Date for the Annual General Meeting, we had 117,559,939 Common Shares issued and outstanding. You may vote all shares owned by you as of the Record Date for the Annual General Meeting, including (1) shares held directly in your name as the shareholder of record, and (2) shares held for you as the beneficial owner through a broker, trustee or other nominee such as a bank.

2 What is the difference between holding shares as a shareholder of record and as a beneficial owner? Voting procedures vary between record holders of shares and beneficial owners of shares. Shareholder of Record If your shares are registered directly in your name with FIHL’s transfer agent, Computershare, Inc., you are considered, with respect to those shares, the shareholder of record, and a Proxy Materials Notice is being sent directly to you by FIHL. As the shareholder of record, you have the right to grant your voting proxy directly to FIHL management or to vote in person at the Annual General Meeting. A proxy card will be available for your use by requesting a copy of proxy materials. Beneficial Owner If your shares are held in a brokerage account or by another nominee, you are considered the beneficial owner of shares held in street name, and a Proxy Materials Notice is being forwarded to you together with voting instructions. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to vote and are also invited to attend the Annual General Meeting. Since a beneficial owner is not the shareholder of record, you may not vote these shares at the Annual General Meeting unless you obtain a ‘legal proxy’ from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the meeting. Your broker, trustee or nominee should have provided voting instructions for you to use in directing the broker, trustee or nominee how to vote your shares. How can I attend the Annual General Meeting? You are entitled to attend the Annual General Meeting only if you were an FIHL shareholder as of the close of business on March 15, 2024, or you hold a valid proxy for the Annual General Meeting. The Annual General Meeting will be held on May 8, 2024, at 12:00 p.m. Atlantic Daylight Time, at the Hamilton Princess & Beach Club Hotel in Bermuda. How can I vote my shares? For each of the proposals you may vote ‘For’ or ‘Against’ or abstain from voting. Shareholder of Record: Shares Registered in Your Name If you are a shareholder of record as of March 15, 2024, you may vote at the Annual General Meeting by proxy using your proxy card, over the telephone, through the Internet or via a mobile device. Whether or not you plan to attend the Annual General Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy. To vote using the proxy card, simply complete, sign and date the proxy card and submit it promptly in accordance with the instructions therein. If you submit your signed proxy card to us before the Annual General Meeting, we will vote your shares as you direct. Your proxy card must be received by 11:59 p.m., Eastern Time on May 7, 2024. To vote over the telephone, please dial 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the control number from your Proxy Materials Notice or your proxy card. Your telephone vote must be received by 11:59 p.m., Eastern Time on May 7, 2024, to be counted. To vote through the Internet before the Annual General Meeting, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the control number from your Proxy Materials Notice or your proxy card. Your internet vote must be received by 11:59 p.m., Eastern Time on May 7, 2024, to be counted.

Questions and Answers 3 To vote via a mobile device, on your smartphone/tablet, open the QR Reader and scan the image in the Proxy Materials Notice or the proxy card. Once the voting site is displayed, enter the 12-digit control number included on your Proxy Materials Notice or your proxy card and vote your shares. Your mobile vote must be received by 11:59 p.m., Eastern Time on May 7, 2024, to be counted. Beneficial Owner: Shares Registered in the Name of Broker or Bank If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received the Proxy Materials Notice from that organization rather than from the Company. Simply follow the instructions in the Proxy Materials Notice to ensure that your vote is counted. Alternatively, you may vote by telephone as instructed by your broker or bank. Can I change my vote? You may change your vote at any time prior to the vote at the Annual General Meeting. If you are the shareholder of record, you may change your vote by granting a new proxy bearing a later date (which automatically revokes the earlier proxy) by providing a written notice of revocation to FIHL’s Group Chief Legal Officer and Company Secretary by mail, which must be received by 11:59 p.m., Eastern Time on May 7, 2024 prior to your shares being voted in accordance with the earlier proxy, or by attending the Annual General Meeting in person and voting. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically so request. For shares you hold beneficially in street name, you may change your vote by submitting new voting instructions to your broker, trustee or nominee, or, if you have obtained a legal proxy from your broker or nominee giving you the right to vote your shares, by attending the meeting in person and voting. How many shares must be present or represented to conduct business at the Annual General Meeting? A quorum of shareholders is necessary to hold a valid meeting. A quorum will be present if two or more shareholders holding at least a majority of the voting power of the issued and outstanding shares entitled to vote are present at the meeting in person or represented by proxy. On the record date, there were 117,559,939 Common Shares issued and outstanding and entitled to vote. Thus, Common Shares representing at least 58,779,970 votes must be present in person or represented by proxy at the meeting to have a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. How are votes counted? For each item of business, you may vote ‘FOR,’ ‘AGAINST’ or ‘ABSTAIN.’ If you ‘ABSTAIN,’ your abstention is not considered a vote for the purposes of the proposals and therefore has no effect on the adoption of any of the proposals. If you provide specific instructions for a given item, your shares will be voted as you instruct on such item. If you sign your proxy card or voting instruction card without giving specific instructions, your shares will be voted in accordance with the recommendations of the Board (‘FOR’ each of FIHL’s nominees to the Board, ‘FOR’ the appointment of our independent auditor and authorization for the Board to fix their remuneration, and in the discretion of the proxyholders on any other matters that properly come before the meeting). If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute ‘broker non-votes.’ Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, broker non-votes will not

4 affect the outcome of any matter being voted on at the meeting, assuming that a quorum is obtained. Shares represented by such broker non-votes will be counted in determining whether there is a quorum. What is the voting requirement to approve each of the proposals? Proposals 1 and 2 require the affirmative ‘FOR’ vote of shareholders holding more than 50% of the total votes attributable to all issued and outstanding company securities entitled to vote. Is cumulative voting permitted for the election of directors? No. FIHL does not allow you to cumulate your vote in the election of directors. For all matters proposed for shareholder action at the Annual General Meeting, each Common Share issued and outstanding as of the close of business on the record date is entitled to one vote. What happens if additional matters are presented at the Annual General Meeting? Other than the items of business described in this Information Circular, we are not aware of any business to be acted upon at the Annual General Meeting. If you grant a proxy, Janice Weidenborner, or her duly appointed substitute, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If for any unforeseen reason any of our nominees are not available as a candidate for director, Janice Weidenborner, or her duly appointed substitute, will vote your proxy for such candidate or candidates as may be nominated by the Board, unless the Board chooses to reduce the number of directors serving on the Board pursuant to the Amended and Restated Bye-laws. Why did I receive a Proxy Materials Notice in the mail regarding notice of the Annual General Meeting and the Internet availability of proxy materials instead of a full set of proxy materials? As permitted under Bermuda law and our Amended and Restated Bye-laws, we are able to provide information to our shareholders by publication of an electronic record of such information on our website so long as the notice requirements in Bye- law 31 are met. We have provided notice to our shareholders of the Annual General Meeting and the availability of such related information by mailing them the Proxy Materials Notice. This saves time and costs to the Company and is in line with our environmental commitments to reduce wastage. If you would like to receive a paper copy of the proxy materials, you must request one. There is no charge for such documents to be mailed to you. Please make your request for a paper copy as instructed below on or before April 24, 2024, to facilitate a timely delivery. You may also request that you receive electronic copies of all future proxy materials at www.proxyvote.com. By telephone, please call 1-800-579-1639, or By logging on to www.proxyvote.com, or By email at: sendmaterial@proxyvote.com Please include the company name and your control number in the subject line. The Company shall provide paper copies of the requested documents to you within seven (7) days of receipt of your request.

Questions and Answers 5 Who will bear the cost of soliciting votes for the Annual General Meeting? FIHL is making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing the Proxy Materials Notice and soliciting votes. In addition to the mailing of the Proxy Materials Notice, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. Upon request, we will reimburse brokerage houses and other custodians, nominees and fiduciaries for forwarding proxy and solicitation materials to shareholders. Where can I find the voting results of the Annual General Meeting? We intend to publish final voting results in a report on Form 6-K filed with the U.S. Securities and Exchange Commission (the “SEC”). How can I communicate with the Board of Directors? Any interested parties desiring to communicate with the Board or any of the independent directors regarding the Company may directly contact such director(s) by delivering correspondence to the relevant director(s) (or the entire Board) by e-mail to FidelisBoard@FidelisInsurance.com or by mail at the following address: c/o Group Chief Legal Officer and Company Secretary, Attn: Janice Weidenborner, Wellesley House South, 90 Pitts Bay Road, Pembroke, Bermuda, HM 08. The Group Chief Legal Officer and Company Secretary (or her designee) opens all communications and forwards them to the appropriate recipient. However, at the discretion of the Group Chief Legal Officer, items unrelated to the directors’ duties and responsibilities as members of the Board may not be forwarded, including unsolicited marketing or advertising material, mass mailings, junk mail and “spam”; unsolicited newsletters, newspapers, magazines, books and publications; and other materials deemed to be trivial, irrelevant, inappropriate and/or harassing. More specific details as to how to contact Management, the Audit Committee, the Independent Directors and/or the Board of Directors can be found on our website, www.fidelisinsurance.com.

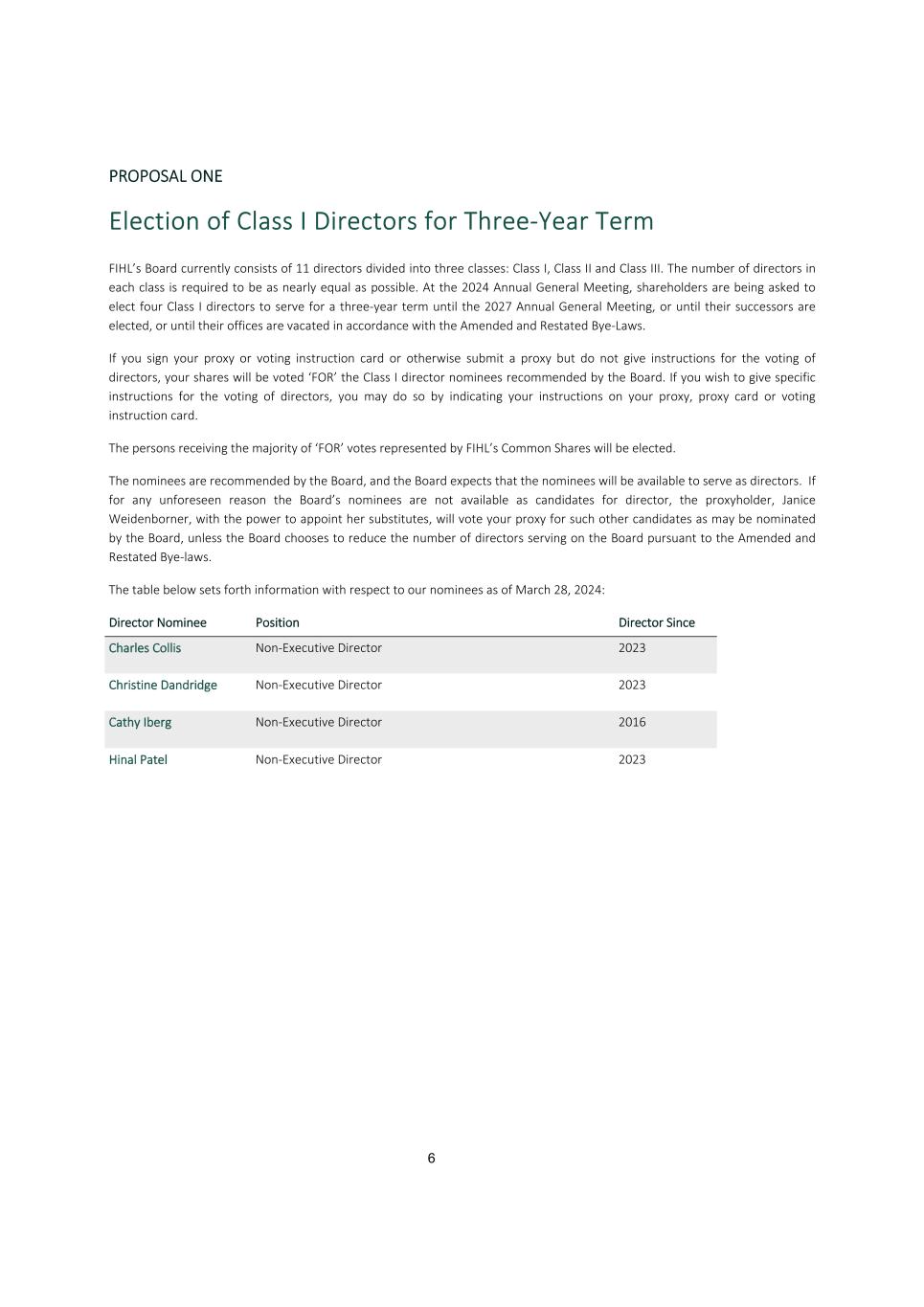

6 PROPOSAL ONE Election of Class I Directors for Three-Year Term FIHL’s Board currently consists of 11 directors divided into three classes: Class I, Class II and Class III. The number of directors in each class is required to be as nearly equal as possible. At the 2024 Annual General Meeting, shareholders are being asked to elect four Class I directors to serve for a three-year term until the 2027 Annual General Meeting, or until their successors are elected, or until their offices are vacated in accordance with the Amended and Restated Bye-Laws. If you sign your proxy or voting instruction card or otherwise submit a proxy but do not give instructions for the voting of directors, your shares will be voted ‘FOR’ the Class I director nominees recommended by the Board. If you wish to give specific instructions for the voting of directors, you may do so by indicating your instructions on your proxy, proxy card or voting instruction card. The persons receiving the majority of ‘FOR’ votes represented by FIHL’s Common Shares will be elected. The nominees are recommended by the Board, and the Board expects that the nominees will be available to serve as directors. If for any unforeseen reason the Board’s nominees are not available as candidates for director, the proxyholder, Janice Weidenborner, with the power to appoint her substitutes, will vote your proxy for such other candidates as may be nominated by the Board, unless the Board chooses to reduce the number of directors serving on the Board pursuant to the Amended and Restated Bye-laws. The table below sets forth information with respect to our nominees as of March 28, 2024: Director Nominee Position Director Since Charles Collis Non-Executive Director 2023 Christine Dandridge Non-Executive Director 2023 Cathy Iberg Non-Executive Director 2016 Hinal Patel Non-Executive Director 2023

Proposal One 7 CLASS I DIRECTORS STANDING FOR ELECTION Director Biographies The following is a brief biographical summary of the experience of each of the Class I director nominees: Charles Collis DIRECTOR SINCE: 2023 Mr. Collis has held the position of non-executive director of FIHL since May 15, 2023. Mr. Collis is a director of Conyers Dill & Pearman (“Conyers”). Mr. Collis works in the corporate department of the Bermuda office of Conyers and headed up the Bermuda Insurance Practice for more than fifteen years. Mr. Collis joined Conyers in 1990 and became a partner in 1998. Mr. Collis specializes in insurance and reinsurance, advising on corporate and regulatory matters. Mr. Collis holds a Bachelor of Laws from University College London and a Bachelor of Arts from the University of Toronto. We believe Mr. Collis is qualified to serve as a member of our Board based on our review of his experience, qualifications, attributes, and skills, including his extensive legal background and experience in the insurance industry. Christine Dandridge DIRECTOR SINCE: 2023 Ms. Dandridge has held the position of non-executive director of FIHL since October 25, 2023.Ms. Dandridge is a veteran of the specialty insurance market, with experience spanning more than four decades. Ms. Dandridge began her career in 1978 as a broker at Stewart Wrightson, before joining the underwriting team at Posgate and Denby Syndicate in 1980 and becoming one of the first female underwriters at Lloyd’s. Ms. Dandridge was one of the founding members of Atrium Underwriting. She served as active underwriter of Syndicate 609 from 1997 to 2007, was part of numerous Lloyd’s market committees and was a member of the Council of Lloyd’s from 2004 to 2007. Since then, she has held several non-executive directorships and currently acts as non- executive director on the boards of Equitas Limited, Hive Underwriting Limited, Managing Agency Partners Limited and Track My Risks Ltd. She graduated from University College, London with a BSc (Hon) in Anthropology and is an associate of the Chartered Insurance Institute. Ms. Dandridge will serve on the Board’s Risk Committee. We believe Ms. Dandridge is qualified to serve as a member of our Board based on our review of her experience, qualifications, attributes, and skills, including her extensive underwriting background and executive leadership and directorial experience in the insurance sector.

8 Cathy Iberg DIRECTOR SINCE: 2016 Ms. Iberg has held the position of non-executive director of FIHL since November 2, 2016. Ms. Iberg is Vice President of Investments at the St David’s Foundation, a charitable foundation dedicated to providing and supporting nonprofit health-related programs in the US, including the largest scholarship program in Texas for aspiring health professionals, and the largest mobile dental program in the country. Ms. Iberg joined the St David’s Foundation in December 2015. Prior to her role at the Foundation, Ms. Iberg was UTIMCO’s (University of Texas Investment Management Company) President and Deputy CIO and retired in August 2014. At UTIMCO she was responsible for investment oversight of $30 billion in investment assets in addition to the management of public equity, fixed income and hedge fund investments. Her employment with the organization dates back to April of 1991 when she joined the U.T. System Office of Asset Management, the predecessor to UTIMCO. Previous to joining U.T. System, Ms. Iberg practiced in the area of public accounting for 15 years. She has a B.Sc. degree in accounting from the Southern Illinois University and was a Certified Public Accountant. We believe Ms. Iberg is qualified to serve as a member of our Board based on our review of her experience, qualifications, attributes, and skills, including her financial accounting background and executive leadership experience in the investments sector. Hinal Patel DIRECTOR SINCE: 2023 Mr. Patel is The Fidelis Partnership director nominee. Mr. Patel acted as Group Chief Actuary of Fidelis from September 2015 to July 2017 and as Group Chief Financial Officer of Fidelis from July 2017 until January 3, 2023, following which Mr. Patel left Fidelis to become the Chief Financial Officer of The Fidelis Partnership. Mr. Patel has held the position of non-executive director of FIHL since January 3, 2023. During his time as Group Chief Financial Officer of Fidelis, Mr. Patel was responsible for the finance, investment, actuarial and corporate finance functions. Prior to joining Fidelis, Mr. Patel spent 12 years at Catlin, where he served in a variety of positions, including Bermuda Chief Actuary overseeing actuarial, catastrophe modelling and capital functions for the Bermuda entity. Prior to joining Catlin, Mr. Patel worked at a number of actuarial consultancies and has over 20 years of experience. Mr. Patel graduated from the London School of Economics and is also Fellow of the Institute of Actuaries. We believe Mr. Patel is qualified to serve as a member of our Board based on our review of his experience, qualifications, attributes, and skills, including his extensive financial accounting background, corporate governance and executive leadership experience in the insurance industry The Board recommends a vote ‘FOR’ the election of the director nominees.

Proposal One 9 INFORMATION ABOUT DIRECTORS CONTINUING IN OFFICE Director Biographies The following is a brief biographical summary of the experience of each of our directors continuing in office: Class II Directors (terms expire 2025) Matthew Adams DIRECTOR SINCE: 2023 Mr. Adams has held the position of non-executive director of FIHL since October 25, 2023. Mr. Adams built a long-standing practice with PricewaterhouseCoopers ("PwC"), largely concentrated in the insurance industry. He served as a lead account partner for PwC, auditing and advising many of PwC’s largest and most complex global insurance clients. From 2015-2021, he led PwC’s U.S. Insurance Practice and was a member of PwC’s global insurance practice leadership team. Mr. Adams retired from PwC in June 2023, following a 38-year career with the firm. Mr. Adams’ leadership of PwC’s U.S. Insurance Practice has exposed him to many diverse aspects of the insurance sector, and he has significant experience managing the strategic, operational, profitability and human capital challenges of leading a large, quickly growing business. Mr. Adams has participated in numerous audit and other board committee meetings during his career, providing broad perspectives on board governance priorities. Mr. Adams earned a B.S. in Economics and an M.B.A. from the Wharton School of the University of Pennsylvania and is a certified public accountant in New York. Mr. Adams will serve on the Board’s Audit Committee. We believe Mr. Adams is qualified to serve as a member of our Board based on our review of his experience, qualifications, attributes, and skills, including his extensive financial accounting, audit and corporate governance background in the insurance sector. Daniel Brand DIRECTOR SINCE: 2021 Mr. Brand is the CVC non-executive director nominee of FIHL and was appointed to this position on 26 July 2021. Mr. Brand joined CVC in 2009 and is a partner leading CVC’s U.S. private equity activities in financial services and co-leading CVC’s U.S. private equity activities in business services. Mr. Brand also represents CVC on the boards of directors of CFGI, Medrisk, Republic, Teneo and Worldwide Express. Prior to joining CVC, Mr. Brand worked at DLJ Merchant Banking Partners and Credit Suisse in the investment banking division covering financial institutions. Mr. Brand holds a B.A. in Economics with a Certificate in Finance from Princeton University, and an M.B.A. from Harvard Business School. We believe Mr. Brand is qualified to serve as a member of our Board based on our review of his experience, qualifications, attributes, and skills, including his extensive financial background and directorial experience.

10 Allan Decleir DIRECTOR SINCE: 2023 Mr. Decleir has held the position of Group Chief Financial Officer of FIHL since January 3, 2023. Mr. Decleir is also Chief Executive Officer of FIBL and an executive director of FIBL. Prior to assuming these executive positions, Mr. Decleir was a consultant to FIBL from June 1, 2022. He has over 27 years of experience in the (re)insurance industry. From June 2015 to December 2022, Mr. Decleir was an independent consultant for ThreeSeas Consulting Ltd, providing management consulting services in the Bermuda (re)insurance market. Mr. Decleir was also a Listings Manager at the Canadian Securities Exchange from February 2019 until March 2022. Prior to this, he was Executive Vice President & Chief Financial Officer of Platinum Underwriters Holdings, Ltd. (“Platinum”) from June 2010 until March 2015, overseeing SEC, financial and regulatory reporting. He first joined Platinum’s Class 4 reinsurance subsidiary, Platinum Underwriters Bermuda, Ltd. (“Platinum Bermuda”), in 2003, and, from 2005 until his promotion to Platinum’s Group CFO, served as Senior Vice President and Chief Financial Officer. Prior to joining Platinum Bermuda, Mr. Decleir was the Chief Financial Officer of Stockton Reinsurance Limited from June 1996 to May 2003. He began his career at Ernst & Young in 1988, taking on various positions in Canada and Bermuda. Mr. Decleir was granted a National Association of Corporate Directors governance fellowship in 2017 and achieved the ‘Directorship Certified’ designation in 2022, and earned the Associate in Reinsurance designation from the Insurance Institute of America in 2000. Mr. Decleir holds a Bachelor of Business Administration from Wilfrid Laurier University and is a Chartered Professional Accountant (Chartered Accountant). We believe Mr. Decleir is qualified to serve as a member of our Board based on our review of his experience, qualifications, attributes, and skills, including his extensive financial accounting background, corporate governance and executive leadership experience in the financial and insurance industries. Daniel Kilpatrick DIRECTOR SINCE: 2022 Mr. Kilpatrick is the Crestview director nominee and has held this position since November 15, 2022. Mr. Kilpatrick joined Crestview in August 2009 and is a partner and member of the Crestview Investment Committee. He is also the head of the financial services strategy. Mr. Kilpatrick also is on the boards of directors of AutoLenders, Congruex, DARAG Group, Modern Wealth Management, WildOpenWest, LLC and Venerable Holdings. He was previously on the boards of Accuride Corporation, Camping World Holdings, ICM Partners, Industrial Media, NYDJ Apparel, Protect My Car and Symbion. Prior to joining Crestview, Mr. Kilpatrick worked at the Yale Investments Office. Mr. Kilpatrick received an M.B.A. from Stanford Graduate School of Business and a B.A. from Yale University. We believe Mr. Kilpatrick is qualified to serve as a member of our Board based on our review of his experience, qualifications, attributes, and skills, including his extensive financial background and directorial experience.

Proposal One 11 Class III Directors (terms expire 2026) Daniel Burrows DIRECTOR SINCE: 2022 Mr. Burrows has been a director of FIHL since April 2022 and has held the position of Group Chief Executive Officer of FIHL since January 3, 2023. He is also Chief Underwriting Officer of FIBL and an executive director of FIBL. Mr. Burrows joined Fidelis in 2015. Prior to joining Fidelis, Mr. Burrows was co-CEO of Aon Benfield’s Global Re Specialty (“GRS”) division from 2013 to 2015. Specializing in non-marine retrocession and the aviation, marine and energy sectors, among others, Mr. Burrows supported Aon Benfield’s business hubs across North America, Europe, the Middle East, Africa and Asia Pacific. Prior to this, he was Deputy CEO of the GRS division from 2008 until 2013. Mr. Burrows began his career as a non-marine property broker at Greig Fester in the 1980s, later joining the retrocession team and then leading that team following a merger with Benfield in 1997. We believe Mr. Burrows is qualified to serve as a member of our Board based on our review of his experience, qualifications, attributes, and skills, including his extensive insurance background and executive leadership experience Dana LaForge DIRECTOR SINCE: 2021 Mr. LaForge is the Pine Brook director nominee and has held this position since March 19, 2021. Mr. LaForge joined Pine Brook in June 2020 and is a partner on the financial services investment team and a member of Pine Brook’s Investment Committee. Mr. LaForge also represents Pine Brook on the boards of directors of Amedeo Capital Limited, Belmont Green Limited, Syndicate Holding Corp., and Clear Blue Financial Holdings. He also serves as a director of a venture philanthropy fund, the Myeloma Investment Fund. Prior to joining Pine Brook, he was the founder and managing director of Colonnade Financial Group from 2002-2020, a spin-out from Deutsche Bank created to manage a private equity portfolio. Prior to Colonnade, from 1985-2002 Mr. LaForge served in numerous senior executive roles at Deutsche Bank and its predecessor companies, Bankers Trust and BT Alex. Brown, also serving as the head of the North American financial institutions group in investment banking. Mr. LaForge holds a Bachelor of Science in Commerce and Accounting from Washington & Lee University and a Master of Business Administration from Harvard Business School. We believe Mr. LaForge is qualified to serve as a member of our Board based on our review of his experience, qualifications, attributes, and skills, including his extensive financial background and directorial experience.

12 Helena Morrissey DIRECTOR SINCE: 2023 Baroness Morrissey has held the position of Chair of the Board since January 3, 2023. She has over three decades of experience in the financial services sector and has served in several leadership roles throughout her career. In addition to acting as chair of the Board of Fidelis, Baroness Morrissey currently holds the position of director on the boards of a number of other organizations. Since February 2023, Baroness Morrissey has acted as chair of the board of Altum Group. She also serves as an advisory board member of All Perspectives Ltd, Edelman Communications, Anthemis and UK Fintech Growth Fund and is chair of the Nominations and Governance Committee of McKinsey Investment Office. Prior to her current positions, Baroness Morrissey was lead non- executive director at the Foreign & Commonwealth Office between July 2020 and September 2020, transferring to lead non-executive director of the Foreign, Commonwealth & Development Office until June 2022. Between January 2020 and May 2021, Baroness Morrissey was a non-executive director of St James’ Place. Prior to this, she was head of personal investing at Legal & General Investment Management between May 2017 and December 2019. From 2001 to 2016, she was CEO of Newton Investment Management. Baroness Morrissey began her career as a global bond analyst at Schroders in the 1980s, later becoming a global bond fund manager. Baroness Morrissey holds a Master of Arts in Philosophy from Cambridge University. Other prior experience includes: chair of the Investment Association from July 2013 to May 2017; founder of the 30% Club campaign; non-executive director of Green Park Limited from August 2020 to March 2023; and non-executive director of the board of AJ Bell plc from July 2021 to April 2023, acting as chair of the board from January 2022 to April 2023. Baroness Morrissey is chair of the Diversity Project, a trustee of the Lady Garden Foundation and a fellow and Chair of the Endowment Committee of Eton College. Baroness Morrissey has served as a director of Helena Morrissey Ltd since February 2017. We believe Baroness Morrissey is qualified to serve as a member of our Board based on our review of her experience, qualifications, attributes and skills, including her executive leadership experience in the financial sector.

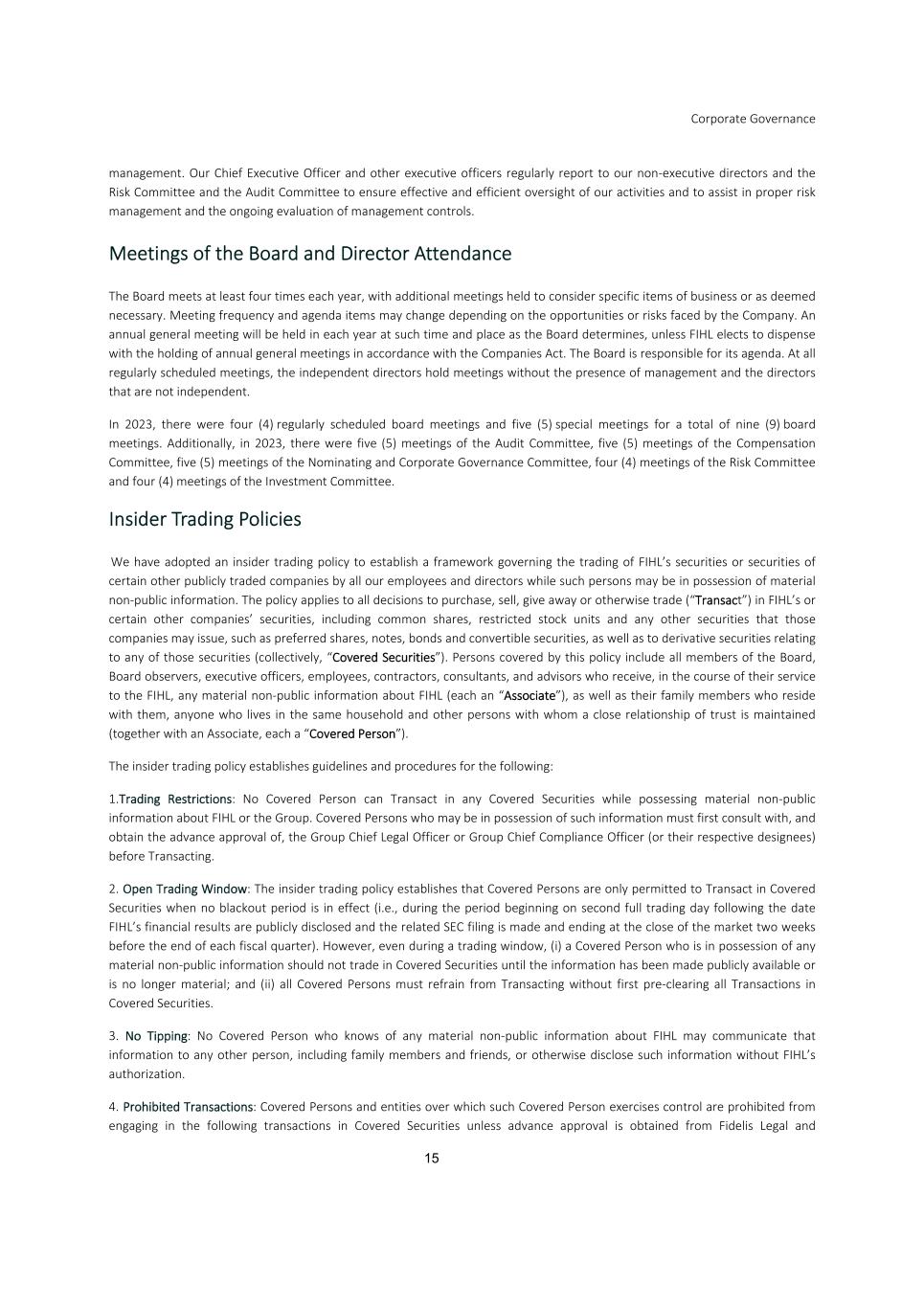

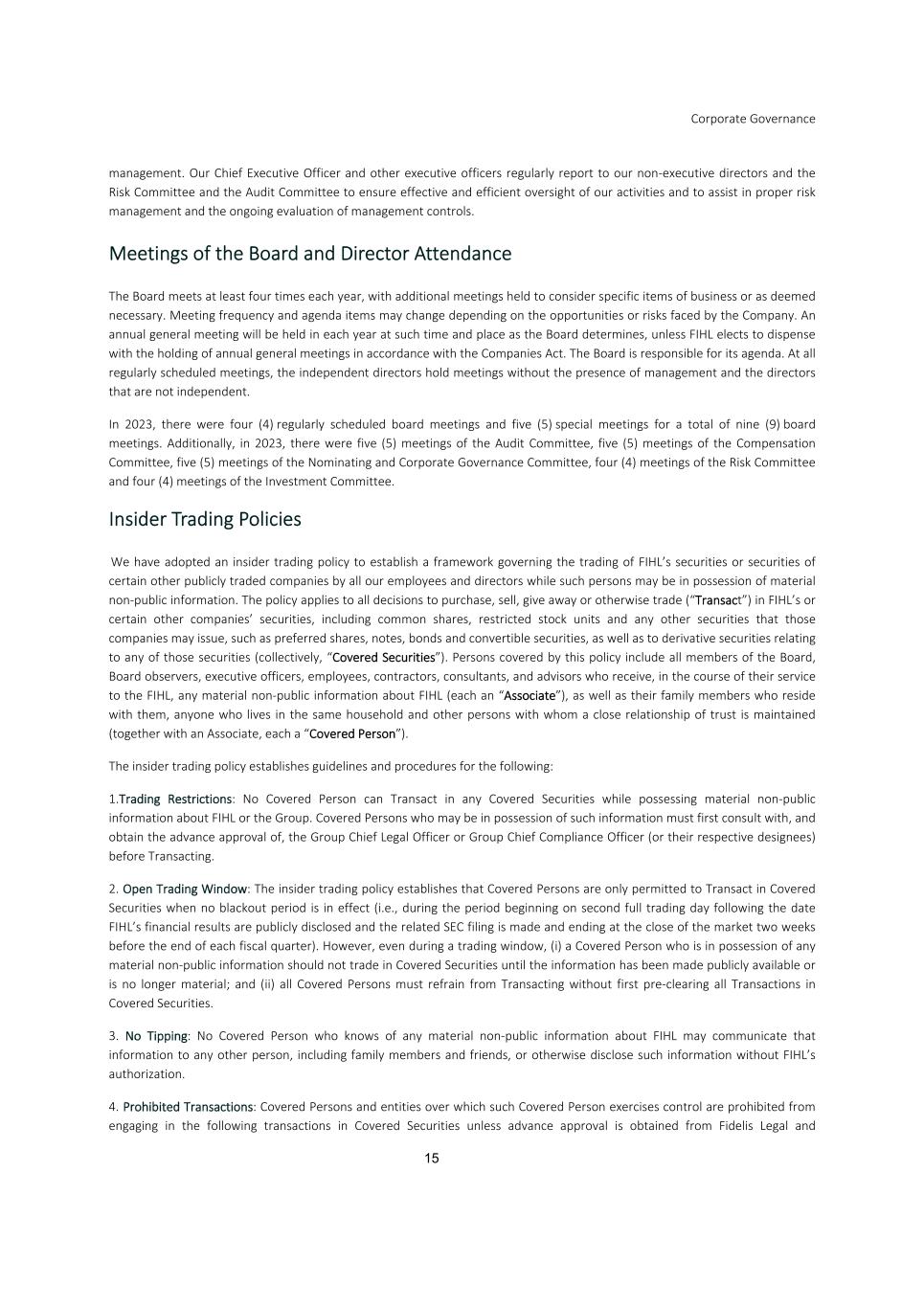

13 Proposal 2 Ratification of Appointment of Independent Registered Public Accounting Firm At the Annual General Meeting, shareholders will be asked to approve the appointment of KPMG Audit Limited, an independent registered public accounting firm, to act as the Company’s independent auditor for the fiscal year ending December 31, 2024 and the authorization for the Board, acting through our Audit Committee, to fix the remuneration of the Company’s independent auditor for the fiscal year ending December 31, 2024. The following table summarizes the fees for professional services rendered by KPMG Audit Limited to the Company for fiscal years ended December 31, 2023 and 2022 (in millions of dollars): 2023 2022 Audit Fees (1) 5.8 4.8 Audit-Related Fees (2) 0.5 -- Total Fees 6.3 4.8 (1) Audit fees consist of fees paid to KPMG Audit Limited for the audit of the Group’s annual consolidated financial statements, reviews of quarterly consolidated financial statements, audit of annual statutory statements, and comfort letters and consent letters issued in connection with documents filed with the SEC. (2) Audit-related fees consist of fees paid to KPMG Audit Limited for reviewing management’s initial assessment of the design and operating effectiveness of internal controls over financial reporting. Pre-Approval Policies and Procedures The policy of the Audit Committee is to pre-approve all audit and permissible non-audit services to be provided by the independent registered public accounting firm during the year. The fees are budgeted, and the Audit Committee requires the independent registered public accounting firm and management to report actual fees compared to the budget. During the year, circumstances may arise when it may become necessary to engage the independent registered public accounting firm for additional services not contemplated in the original pre-approval. In those circumstances, the Chair of the Audit Committee has been delegated the Authority to pre-approve such services and must report those fees to the Audit Committee at its next scheduled meeting. For the years ended December 31, 2023, and 2022, 100% of the audit fees and audit-related fees were pre- approved. The Board recommends a vote ‘FOR’ the ratification of the appointment of KPMG Audit Limited, an independent registered public accounting firm, to act as the Company’s independent auditor for the fiscal year ending December 31, 2024 and the authorization for our Board, acting through our Audit Committee, to fix the remuneration of the Company’s independent auditor for the fiscal year ending December 31, 2024 as set forth in Proposal No. 2.

Corporate Governance 14 Statement of Corporate Governance Practices Overview The Company’s corporate governance policies and practices are comprehensive and consistent with the guidelines with the requirements of the SEC, the listing standards of the New York Stock Exchange (“NYSE”) and the applicable provisions under the U.S. Sarbanes-Oxley Act of 2002, as amended. The structure, practices and committees of the Board, including matters relating to the size, independence and composition of the Board, the election and removal of directors, requirements relating to Board action and the powers delegated to the Board committees are governed by our memorandum of association, Bye-laws and policies adopted by the Board. The Board is responsible for exercising the management, control, power and authority of the Company except as required by applicable law, the memorandum of association or the Company’s Bye-laws. The following is a summary of certain provisions of the memorandum of association, Bye-laws and policies that affect the Company’s governance. Code of Conduct The Company’s policy is that all its activities be conducted with the utmost honesty, integrity, fairness and respect and in compliance with all legal and regulatory requirements. We have adopted a Code of Ethics and Conduct (the “Code of Conduct”) that is applicable to all of our employees (including our executive officers) and our directors. The Code of Ethics and Conduct is available, free of charge, on our website at www.fidelisinsurance.com. The Board is responsible for overseeing the Code of Conduct and is required to approve any waivers of the Code of Conduct applicable to any director or executive officer. Director Independence As a foreign private issuer, under the listing requirements and rules of NYSE we are not required to have independent directors on our Board of Directors, except to the extent that our Audit Committee is required to consist fully of independent directors under U.S. securities laws, subject to certain phase-in schedules. However, at least a majority of the directors holding office are independent of management of the Company, as determined by the full Board using the standards for independence established by the NYSE and, in the case of the Audit Committee, the U.S. securities laws. The Board has made these determinations based primarily on an annual review of each director’s responses to questions regarding employment and compensation history, family relationships and affiliations and discussions with the directors. The Board decides which directors are considered to be independent based on the recommendation of the Nominating and Corporate Governance Committee, which evaluates director independence based on the guidelines set forth under applicable stock exchange guidelines and securities laws. Our Board currently consists of eleven (11) directors, eight (8) of whom are independent. For a director to be deemed independent, the Board must affirmatively determine that he or she does not have a direct or indirect material relationship with the Company. The Board has affirmatively determined that each of Matthew Adams, Daniel Brand, Charles Collis, Christine Dandridge, Cathy Iberg, Daniel Kilpatrick, Dana LaForge and Helena Morrissey meet the definition of ‘independent director’ under the applicable rules of the NYSE Listed Company Manual. In making this determination, the Board considered the relationships that each such non-employee director has with FIHL and all other facts and circumstances that the Board deemed relevant in determining such director’s independence, including beneficial ownership of Common Shares. Risk Oversight The Board is responsible for overseeing our risk management process. The Board focuses on our general risk management strategy and the most significant risks facing us, as well as oversees the implementation of risk mitigation strategies by

Corporate Governance 15 management. Our Chief Executive Officer and other executive officers regularly report to our non-executive directors and the Risk Committee and the Audit Committee to ensure effective and efficient oversight of our activities and to assist in proper risk management and the ongoing evaluation of management controls. Meetings of the Board and Director Attendance The Board meets at least four times each year, with additional meetings held to consider specific items of business or as deemed necessary. Meeting frequency and agenda items may change depending on the opportunities or risks faced by the Company. An annual general meeting will be held in each year at such time and place as the Board determines, unless FIHL elects to dispense with the holding of annual general meetings in accordance with the Companies Act. The Board is responsible for its agenda. At all regularly scheduled meetings, the independent directors hold meetings without the presence of management and the directors that are not independent. In 2023, there were four (4) regularly scheduled board meetings and five (5) special meetings for a total of nine (9) board meetings. Additionally, in 2023, there were five (5) meetings of the Audit Committee, five (5) meetings of the Compensation Committee, five (5) meetings of the Nominating and Corporate Governance Committee, four (4) meetings of the Risk Committee and four (4) meetings of the Investment Committee. Insider Trading Policies We have adopted an insider trading policy to establish a framework governing the trading of FIHL’s securities or securities of certain other publicly traded companies by all our employees and directors while such persons may be in possession of material non-public information. The policy applies to all decisions to purchase, sell, give away or otherwise trade (“Transact”) in FIHL’s or certain other companies’ securities, including common shares, restricted stock units and any other securities that those companies may issue, such as preferred shares, notes, bonds and convertible securities, as well as to derivative securities relating to any of those securities (collectively, “Covered Securities”). Persons covered by this policy include all members of the Board, Board observers, executive officers, employees, contractors, consultants, and advisors who receive, in the course of their service to the FIHL, any material non-public information about FIHL (each an “Associate”), as well as their family members who reside with them, anyone who lives in the same household and other persons with whom a close relationship of trust is maintained (together with an Associate, each a “Covered Person”). The insider trading policy establishes guidelines and procedures for the following: 1.Trading Restrictions: No Covered Person can Transact in any Covered Securities while possessing material non-public information about FIHL or the Group. Covered Persons who may be in possession of such information must first consult with, and obtain the advance approval of, the Group Chief Legal Officer or Group Chief Compliance Officer (or their respective designees) before Transacting. 2. Open Trading Window: The insider trading policy establishes that Covered Persons are only permitted to Transact in Covered Securities when no blackout period is in effect (i.e., during the period beginning on second full trading day following the date FIHL’s financial results are publicly disclosed and the related SEC filing is made and ending at the close of the market two weeks before the end of each fiscal quarter). However, even during a trading window, (i) a Covered Person who is in possession of any material non-public information should not trade in Covered Securities until the information has been made publicly available or is no longer material; and (ii) all Covered Persons must refrain from Transacting without first pre-clearing all Transactions in Covered Securities. 3. No Tipping: No Covered Person who knows of any material non-public information about FIHL may communicate that information to any other person, including family members and friends, or otherwise disclose such information without FIHL’s authorization. 4. Prohibited Transactions: Covered Persons and entities over which such Covered Person exercises control are prohibited from engaging in the following transactions in Covered Securities unless advance approval is obtained from Fidelis Legal and

Corporate Governance 16 Compliance: (i) Short-term trading – Associates who purchase Company securities may not sell any Company securities of the same class for at least six months after the purchase; (ii) Short Sales – Covered Persons may not sell Company securities short; (iii) Options trading – Covered Persons may not buy or sell puts or calls or other derivative securities on Company Securities; (iv) Trading on margin or pledging – Covered Persons may not hold Company securities in a margin account or pledge Company securities as collateral for a loan; and (v) Hedging – Covered Persons may not enter into hedging or monetization transactions or similar arrangements with respect to Company securities. We are committed to maintaining the highest standards of ethical conduct and have implemented the insider trading policy and procedures to ensure compliance with applicable securities laws and to protect the interests of our shareholders. Board Leadership Structure Our Board is divided into three classes, which are designated as Class I, Class II and Class III. The term for each Class I director expires at this year’s Annual General Meeting to be held on May 8, 2024; the term for each Class II director will expire at the Annual General Meeting in 2025; and the term for each Class III director will expire at the Annual General Meeting in 2026. At each annual general meeting of the Company, the successors of the class of directors whose term expires at that meeting will be elected for a term expiring at the annual general meeting to be held in the third year following the year of their election. Four Class I directors are to be elected at the annual general meeting to serve until the Company’s Annual General Meeting in 2027. All of the nominees are currently directors. Our Nominating and Corporate Governance Committee recommended all of the nominees to our Board for election at the meeting and all nominees have consented to serve on our Board. We do not expect that any of the nominees will become unavailable for election as a director, but if any nominee should become unavailable prior to the Annual General Meeting, proxy cards authorizing the proxy to vote for the nominees will instead be voted for substitute nominees recommended by our Board, unless the Board chooses to reduce the number of directors serving on the Board pursuant to the Amended and Restated Bye-laws. Our Board has reviewed its classified board structure and believes that this structure provides greater stability and continuity in the Board’s membership and in the direction and guidance that it provides to the Company’s management. As compared to an annual election process, this approach promotes a long-term perspective in relation to our strategic objectives and is beneficial to our CEO and executive management in establishing the Company’s short- and long-term priorities. The classified board structure also ensures that at any given time, a majority of the directors serving on the Board will have substantial knowledge of the Company and its business, competitive environment, risks, culture and strategic goals. We believe directors who have experience with the Company are better positioned to make decisions that are best for the Company and its shareholders, particularly given the complexity of the specialty insurance industry. In addition, three-year terms assist in recruiting highly qualified directors who are willing to commit the time and resources to develop a deep understanding of the Company and its business and encourage a longer-term view. After carefully considering the arguments for and against a classified board structure, we believe that a classified election process is in the best interests of the Company and our shareholders at this time. As noted in our final prospectus filed pursuant to Rule 424(b)(4) (Registration No. 333-271270) with the SEC on June 30, 2023, available electronically at www.sec.gov, the classified Board will be in place until the Annual General Meeting in 2030, following which all of the directors shall be one class. Board Committees The standing committees of the Board include the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, Investment Committee and Risk Committee. The Board may have such other committees as it shall determine from time to time. Each of the standing committees of the Board has the composition and responsibilities described below. The committee charters are reviewed at least annually, and each Committee recommends any proposed changes to the Board for approval. Copies of the Audit Committee’s, the Compensation Committee’s and the Nominating and Corporate Governance Committee’s charters are publicly available on our website, www.fidelisinsurance.com/investors. The reference to our website address does not constitute incorporation by reference of the information contained at or available through our website.

Corporate Governance 17 Audit Committee The Audit Committee includes the following directors: Matthew Adams (Chair with effect from February 2024), Cathy Iberg, Dana LaForge and Helena Morrissey, each of whom is independent for purposes of the NYSE rules and Rule 10A-3 under the Exchange Act. Pursuant to its terms of reference, the Audit Committee’s role is one of oversight. Its responsibilities include appointing and evaluating the performance and independence of the Company’s independent auditor. Additionally, the Audit Committee also reviews the financial statements and annual audits of the Company, oversees the internal audit function, reviewing and discussing with the Board earnings press releases, reviewing procedures for handling complaints in relation to accounting, internal accounting controls or auditing matters and assisting the Board in assessing and providing oversight regarding the Company’s internal controls and risk management systems. The Audit Committee is responsible for reviewing its terms of reference on an annual basis and shall review its own performance at least once per year. The Board determined that each of the members of the Audit Committee is financially literate as such term is defined by applicable NYSE and SEC requirements. In addition, the Board has determined that Mr. Matthew Adams qualifies as having accounting or related financial management expertise pursuant to NYSE requirements and is an ‘audit committee financial expert’ pursuant to the rules and regulations of the SEC. Compensation Committee The Compensation Committee includes of the following directors: Helena Morrissey (Chair), Daniel Brand, Charles Collis, Christine Dandridge, Daniel Kilpatrick and Dana LaForge, each of whom is independent for purposes of the NYSE rules. Pursuant to its terms of reference, the Compensation Committee is responsible for reviewing, assessing, and making recommendations to the Board regarding the Company’s incentive-based and equity-based compensation plans (including long- term incentive plans) and the Company’s processes and procedures for considering and determining the compensation of its directors and senior executives. The Compensation Committee is also responsible for developing and recommending to the Board one or more policies for the recovery or clawback of erroneously paid compensation and is additionally responsible for monitoring compliance with such policies and making any necessary revisions to such policies as may be required from time to time. The Compensation Committee is responsible for reviewing its terms of reference on an annual basis and shall review its own performance at least once per year. Nominating and Corporate Governance Committee The Nominating and Corporate Governance Committee includes the following directors: Helena Morrissey (Chair), Matthew Adams, Daniel Brand, Charles Collis, Christine Dandridge, Cathy Iberg and Daniel Kilpatrick, each of whom is independent for purposes of the NYSE rules. Pursuant to its terms of reference, the Nominating and Corporate Governance Committee is responsible for overseeing FIHL’s corporate governance and procedures by developing a set of guidelines and making recommendations to the Board to ensure compliance with laws and regulations. The Nominating and Corporate Governance Committee also reviews the Group’s leadership needs by preparing and recommending nominees it considers necessary based on vacancies and plans for succession in respect of directorship and management, using recommended selection criteria. Additionally, the Nominating and Corporate Governance Committee develops, recommends and oversees the process of annual self-evaluation for the Board as well as its own performance on an annual basis, subject to approval by the Board. Risk Committee The Board has established a risk committee, which consists of Daniel Kilpatrick (Chair), Matthew Adams, Daniel Burrows, Christine Dandridge, Allan Decleir and Hinal Patel. Pursuant to its written charter, the risk committee is responsible for, among other things: (i) evaluating FIHL’s risk appetite and tolerances; (ii) overseeing risk management and related policies and guidelines;

Corporate Governance 18 (iii) reviewing FIHL’s internal controls framework and risk management systems to ensure integrity of financial and regulatory reporting; and (iv) overseeing the Board’s responsibilities related to risk management exposure. Investment Committee The Board has established an investment committee, which consists of Cathy Iberg (Chair), Daniel Brand, Daniel Burrows, Allan Decleir, Dana LaForge and Hinal Patel. Pursuant to its written charter, the investment committee is responsible for, among other things: (i) overseeing investment strategy, investment risk appetite and investment risk limits to the FIHL Board; (ii) reviewing and approving material changes to the investment policy or investment managers; (iii) overseeing and reviewing investment policies, guidelines and benchmarks; (iv) delegation of investment related authorities and responsibilities to sub-committees and management; and (v) monitoring investment risk, compliance, portfolio composition, investment performance and activity.

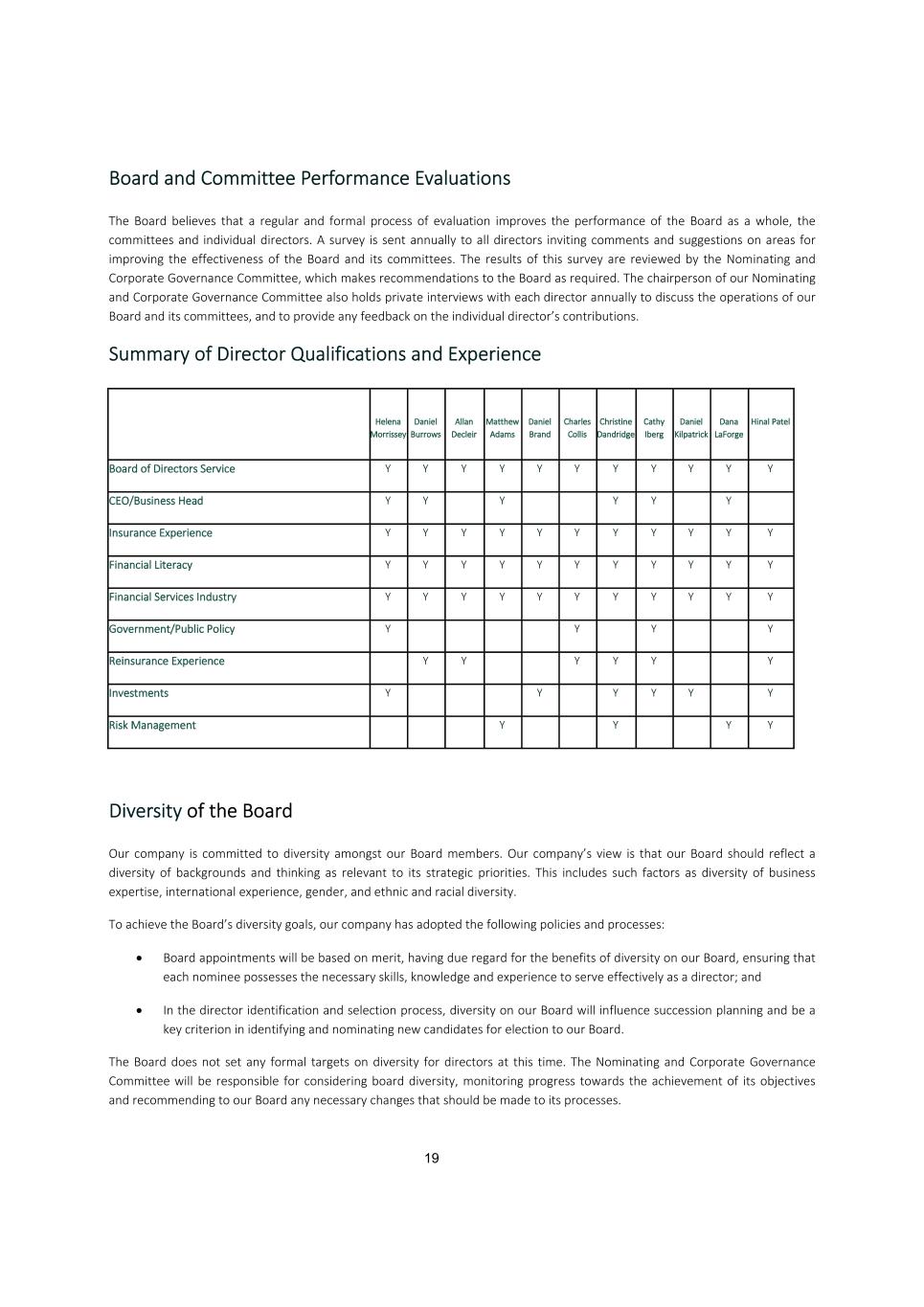

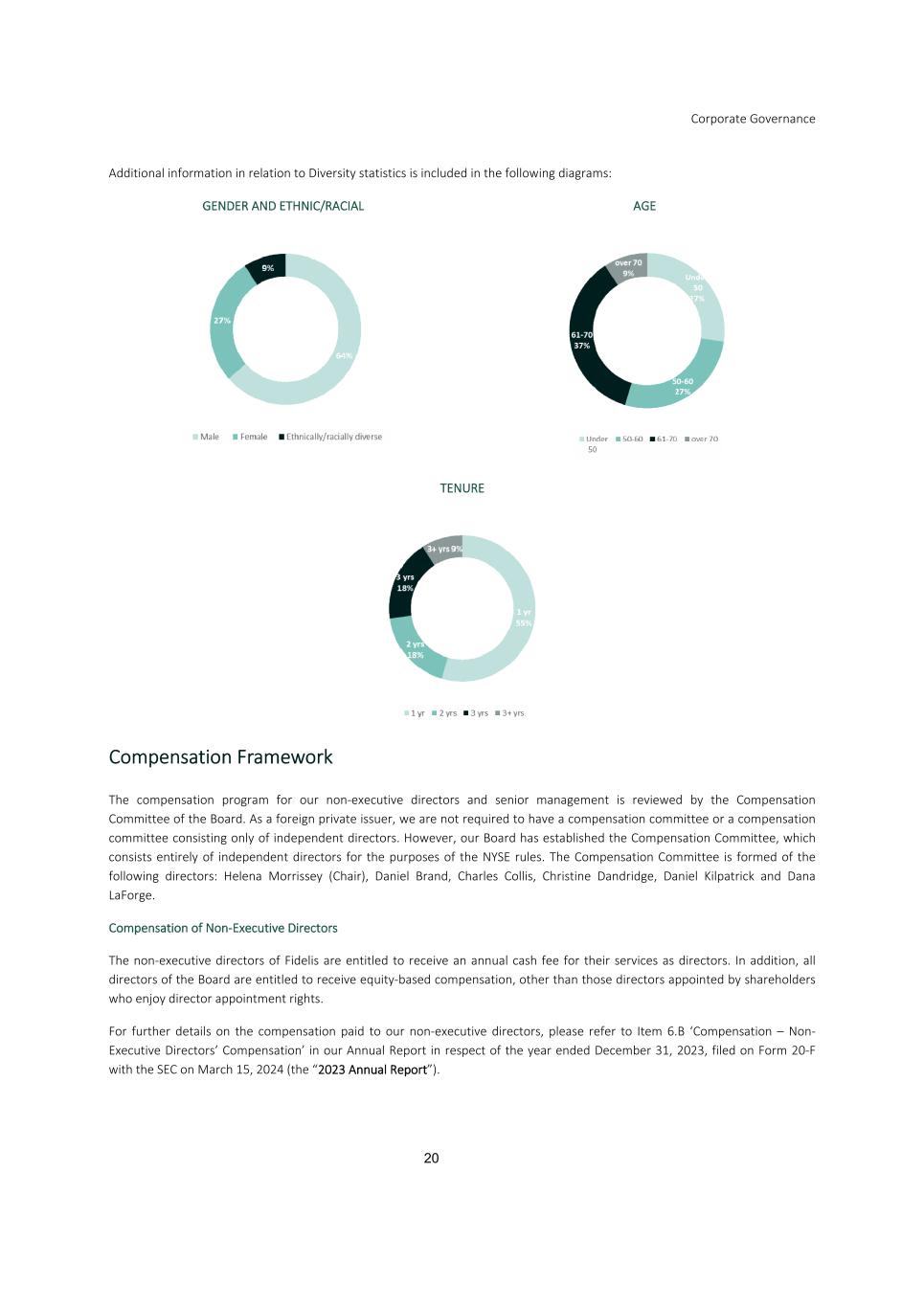

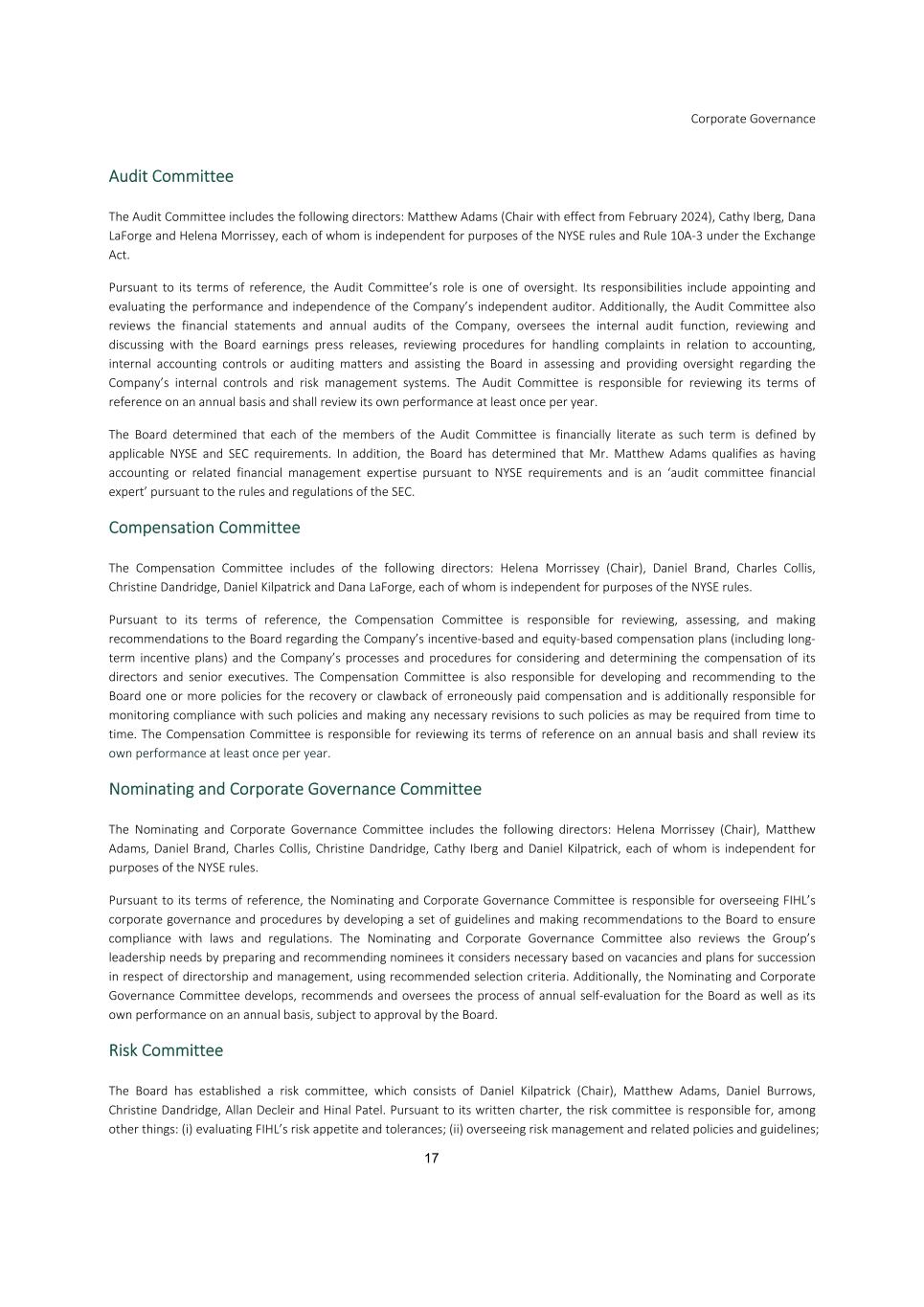

19 Board and Committee Performance Evaluations The Board believes that a regular and formal process of evaluation improves the performance of the Board as a whole, the committees and individual directors. A survey is sent annually to all directors inviting comments and suggestions on areas for improving the effectiveness of the Board and its committees. The results of this survey are reviewed by the Nominating and Corporate Governance Committee, which makes recommendations to the Board as required. The chairperson of our Nominating and Corporate Governance Committee also holds private interviews with each director annually to discuss the operations of our Board and its committees, and to provide any feedback on the individual director’s contributions. Summary of Director Qualifications and Experience Helena Morrissey Daniel Burrows Allan Decleir Matthew Adams Daniel Brand Charles Collis Christine Dandridge Cathy Iberg Daniel Kilpatrick Dana LaForge Hinal Patel Board of Directors Service Y Y Y Y Y Y Y Y Y Y Y CEO/Business Head Y Y Y Y Y Y Insurance Experience Y Y Y Y Y Y Y Y Y Y Y Financial Literacy Y Y Y Y Y Y Y Y Y Y Y Financial Services Industry Y Y Y Y Y Y Y Y Y Y Y Government/Public Policy Y Y Y Y Reinsurance Experience Y Y Y Y Y Y Investments Y Y Y Y Y Y Risk Management Y Y Y Y Diversity of the Board Our company is committed to diversity amongst our Board members. Our company’s view is that our Board should reflect a diversity of backgrounds and thinking as relevant to its strategic priorities. This includes such factors as diversity of business expertise, international experience, gender, and ethnic and racial diversity. To achieve the Board’s diversity goals, our company has adopted the following policies and processes: Board appointments will be based on merit, having due regard for the benefits of diversity on our Board, ensuring that each nominee possesses the necessary skills, knowledge and experience to serve effectively as a director; and In the director identification and selection process, diversity on our Board will influence succession planning and be a key criterion in identifying and nominating new candidates for election to our Board. The Board does not set any formal targets on diversity for directors at this time. The Nominating and Corporate Governance Committee will be responsible for considering board diversity, monitoring progress towards the achievement of its objectives and recommending to our Board any necessary changes that should be made to its processes.

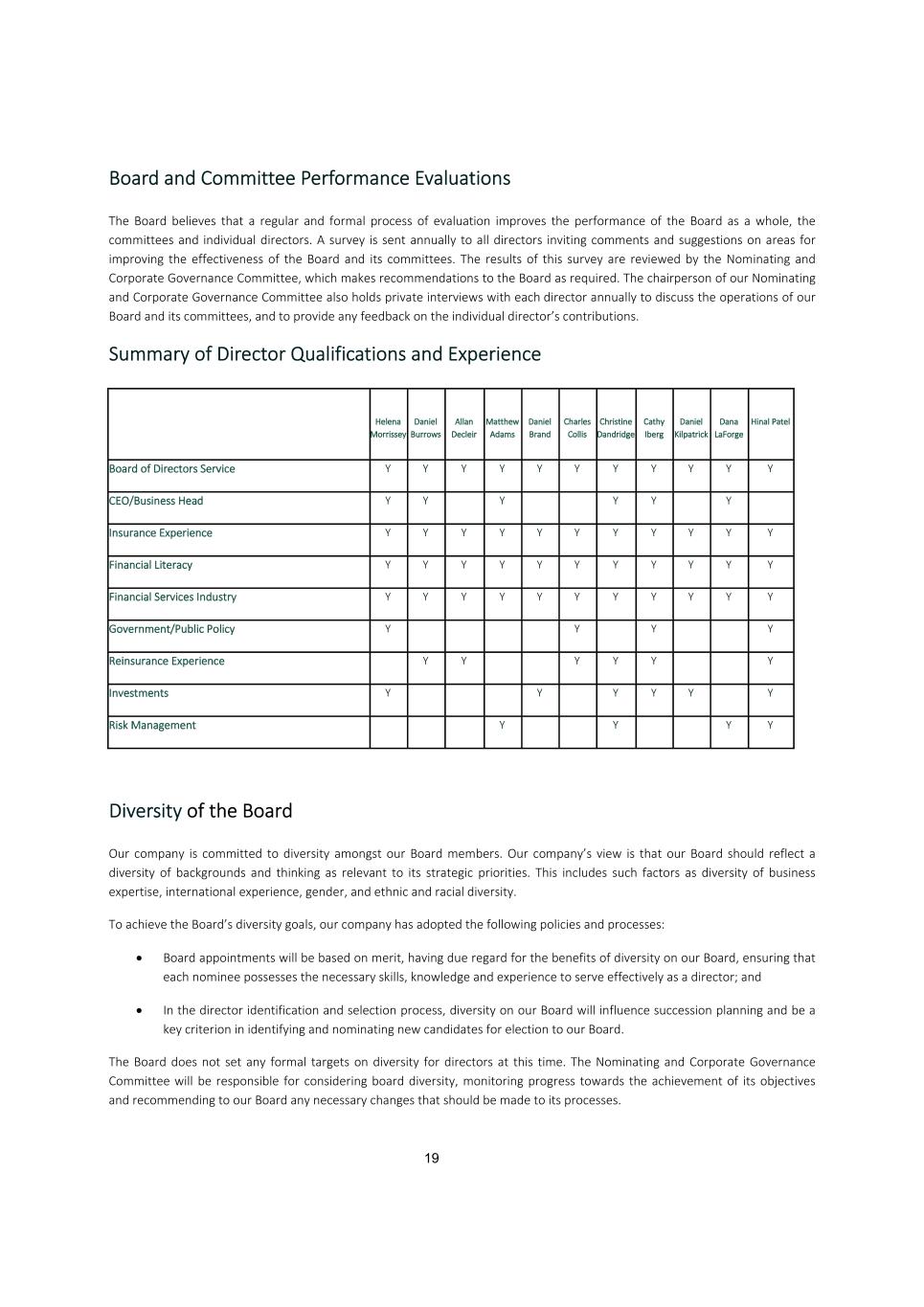

Corporate Governance 20 Additional information in relation to Diversity statistics is included in the following diagrams: GENDER AND ETHNIC/RACIAL AGE TENURE Compensation Framework The compensation program for our non-executive directors and senior management is reviewed by the Compensation Committee of the Board. As a foreign private issuer, we are not required to have a compensation committee or a compensation committee consisting only of independent directors. However, our Board has established the Compensation Committee, which consists entirely of independent directors for the purposes of the NYSE rules. The Compensation Committee is formed of the following directors: Helena Morrissey (Chair), Daniel Brand, Charles Collis, Christine Dandridge, Daniel Kilpatrick and Dana LaForge. Compensation of Non-Executive Directors The non-executive directors of Fidelis are entitled to receive an annual cash fee for their services as directors. In addition, all directors of the Board are entitled to receive equity-based compensation, other than those directors appointed by shareholders who enjoy director appointment rights. For further details on the compensation paid to our non-executive directors, please refer to Item 6.B ‘Compensation – Non- Executive Directors’ Compensation’ in our Annual Report in respect of the year ended December 31, 2023, filed on Form 20-F with the SEC on March 15, 2024 (the “2023 Annual Report”).

Corporate Governance 21 Compensation of Senior Management Our compensation philosophy for our senior management is that total compensation should have the potential to deliver above- market levels of reward for outstanding individual and financial performance, while aligning the interests of our senior management with those of our shareholders. The primary elements of the total compensation package for our senior management include base salary, annual cash bonus awards under our annual cash bonus program and equity awards granted pursuant to our 2023 Share Incentive Plan. For further details on the compensation paid to our senior management, please refer to Item 6.B ‘Compensation – Senior Management Compensation’ in our 2023 Annual Report. Other Business The company knows of no other matter to come before the meeting other than the matters referred to in the Notice of Annual General Meeting dated March 28, 2024. Shareholder Nominations for the 2025 Annual General Meeting Proposals to nominate directors intended for inclusion in next year’s Proxy Statement should be sent to the registered office of Fidelis by mail at the following address: c/o Group Chief Legal Officer and Company Secretary, Attn: Janice Weidenborner, Wellesley House South, 90 Pitts Bay Road, Pembroke, Bermuda, HM 08, and must be received by February 7, 2025. The Bye-laws permit a shareholder, owning not less than ten percent or more of our outstanding shares of Fidelis at the time to deliver a written notice of nomination to the registered office of Fidelis to nominate and include in Fidelis’s annual general meeting proxy materials director nominees, provided that the shareholder(s) and the nominee(s) satisfy the requirements specified in the Bye-laws. The presiding person of the meeting may refuse to acknowledge or introduce any proposal or nomination of director if it was not timely submitted or does not comply with the Bye-laws.

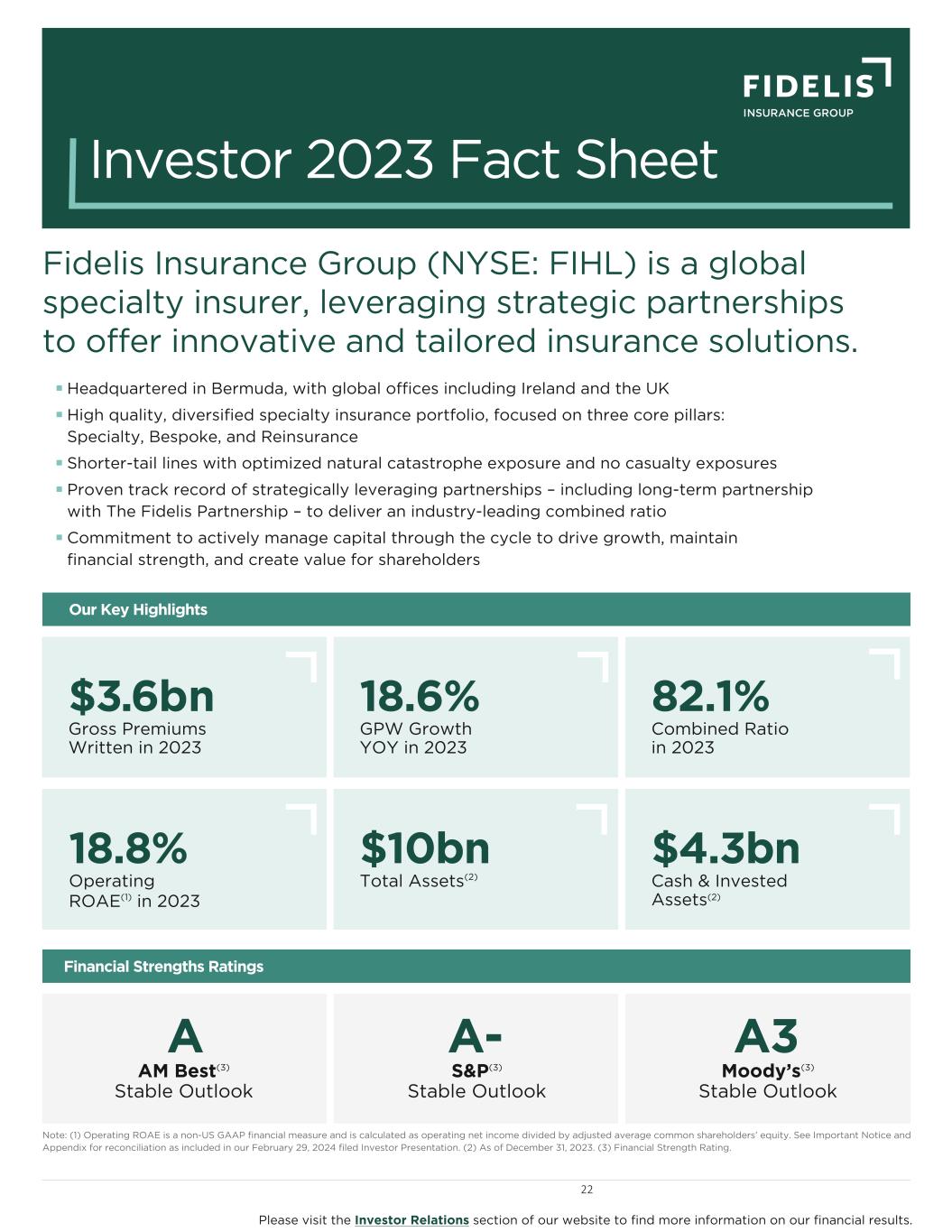

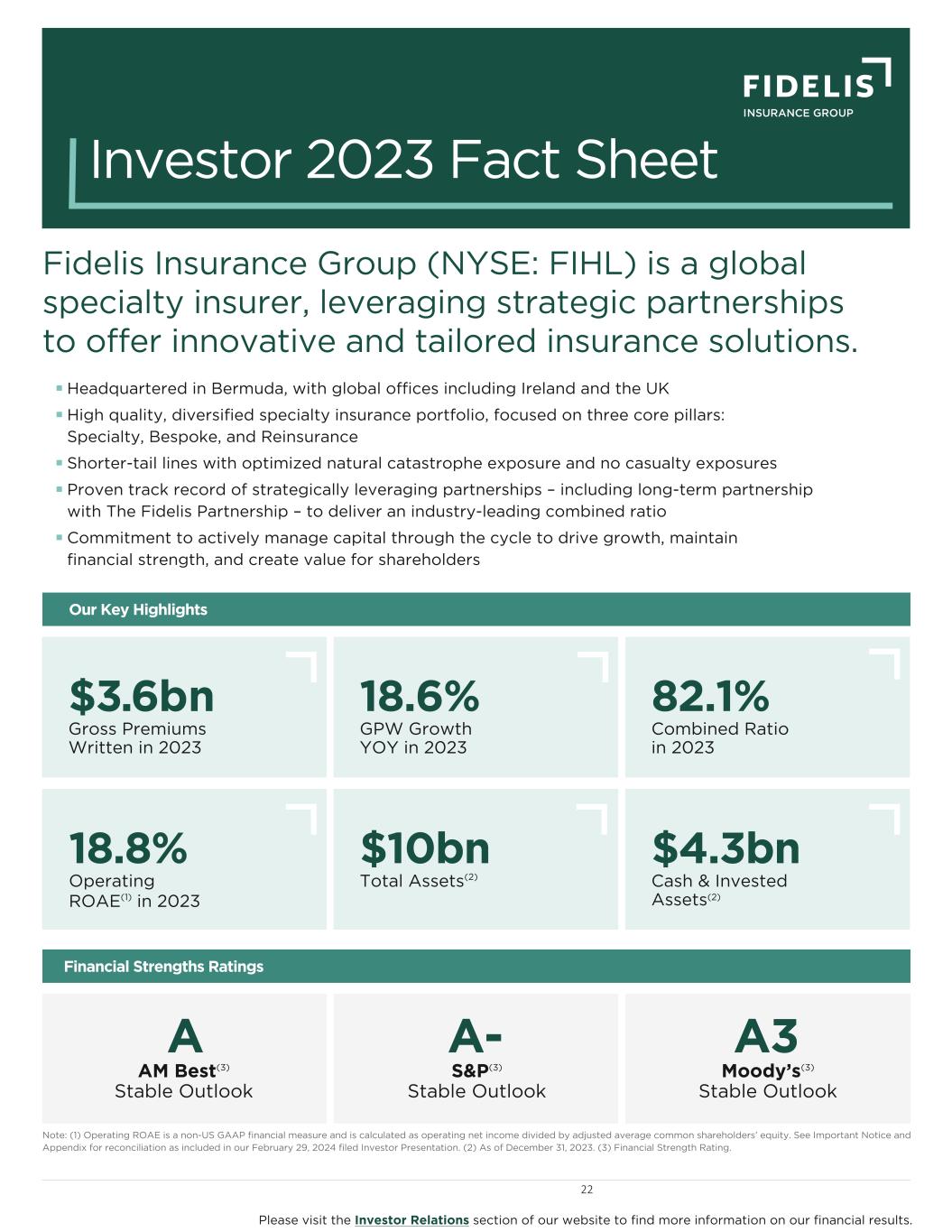

Investor 2023 Fact Sheet Fidelis Insurance Group (NYSE: FIHL) is a global specialty insurer, leveraging strategic partnerships to offer innovative and tailored insurance solutions. Note: (1) Operating ROAE is a non-US GAAP financial measure and is calculated as operating net income divided by adjusted average common shareholders’ equity. See Important Notice and Appendix for reconciliation as included in our February 29, 2024 filed Investor Presentation. (2) As of December 31, 2023. (3) Financial Strength Rating. n Headquartered in Bermuda, with global offices including Ireland and the UK n High quality, diversified specialty insurance portfolio, focused on three core pillars: Specialty, Bespoke, and Reinsurance n Shorter-tail lines with optimized natural catastrophe exposure and no casualty exposures n Proven track record of strategically leveraging partnerships – including long-term partnership with The Fidelis Partnership – to deliver an industry-leading combined ratio n Commitment to actively manage capital through the cycle to drive growth, maintain financial strength, and create value for shareholders $3.6bn A A- A3 $10bn 82.1% 18.6% $4.3bn 18.8% Gross Premiums Written in 2023 AM Best(3) Stable Outlook S&P(3) Stable Outlook Moody’s(3) Stable Outlook Total Assets(2) Combined Ratio in 2023 GPW Growth YOY in 2023 Cash & Invested Assets(2) Operating ROAE(1) in 2023 Financial Strengths Ratings Our Key Highlights 22 Please visit the Investor Relations section of our website to find more information on our financial results.

Business Mix (4) Financial Highlights Specialty Bespoke Reinsurance High quality, mature portfolio with lead positioning in major lines of business including Property Direct and Facultative, Marine, and Aviation and Aerospace. Focused on highly tailored, specialized products – such as credit and political risk – that facilitate underlying transactions and offer enhanced capital efficiencies. For Investor Inquiries: Investor Relations Miranda Hunter (441) 279 2561 miranda.hunter@fidelisinsurance.com Actively managed portfolio, focusing primarily on residential property catastrophe, optimized to reflect our view of risk with closely controlled aggregates. Specialty Reinsurance $2,241m (62%) $617m (18%) n Scaled position across traditional specialty lines n 30 years+ of trading relationships n Highly flexible approach n Focused property catastrophe book n Sophisticated data and pricing capabilities Bespoke $720m (20%) n Lead market across every deal with innovative coverage programs tailored to transaction facilitation n Low attritional loss exposure $3.6bn GPW Book Value Per Diluted Common Share (in dollars per common share) Combined Ratio (in percentage points) Gross Premium Written (in billions of dollars) FY22 FY23 $3.0 +18.6% YOY $3.6 YE22(5) FY22YE23 FY23 $16.24 91.9% +27.4% YOY -9.8 PTS YOY $20.69 82.1% (4) Business mix based on 2023 full year Gross Premiums Written. (5) As of January 3, 2023, on which date a number of separation and reorganization transactions occurred to create two distinct holding companies and businesses: FIHL and The Fidelis Partnership. FIHL L I S T E D NYSE Fidelis Insurance Group has a diverse portfolio.