UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

|

FORM 6-K |

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

February 15, 2024

Commission File Number 1-14712

ORANGE

(Translation of registrant’s name into English)

111 quai du Président Roosevelt

92130 Issy-les-Moulineaux, France

(Address of principal executive offices)

Indicate by check mark whether the Registrant files or will file

annual reports under cover Form 20-F or Form 40-F

|

Form 20-F |

|

Form 40- F |

|

Indicate by check mark if the Registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

|

Yes |

|

No |

|

Indicate by check mark if the Registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

|

Yes |

|

No |

|

Indicate by check mark whether the Registrant, by furnishing the

information contained in this Form, is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934

|

Yes |

|

No |

|

Consolidated Financial Statements

Year ended December 31, 2023

This document is a free translation into English of the yearly financial report prepared in French and is provided solely for the convenience of English speaking readers.

Warning

The audit procedures are being finalized and the audit report will be issued in March 2024.

Significant events 2023

|

Takeover of VOO in Belgium |

French pension reform |

Restructuring programs |

||

|

Following the approval of the European Commission, Orange Belgium has finalized on June 2nd, 2023, the acquisition of 75% of the capital minus one share of VOO for 1,369 million euros from Nethys. The Group has granted Nethys a put option on its remaining stake, exercisable for three years. |

In France, the pension reform enacted on April 14, 2023 led to the recognition of an additional provision of 241 million euros in respect of the French part-time for seniors plans (Temps Partiel Senior - TPS), which provided for the extension of measures for employees affected by the reform, and to the recognition of a provision reversal of 22 million euros for post-employment benefits. |

In 2023, the Group launched transformation programs in France and abroad. These programs notably involve the implementation of departure plans for Orange Business and Orange Bank activities, for which discussions with employee representative bodies in France are in progress at December 31, 2023. In view of the progress of discussions, costs and provisions

were recognized for a total of |

||

|

Note 3.2 |

Note 6 |

Note 5.3 |

Table of contents

Financial statements

Consolidated statement of comprehensive income

Consolidated statement of financial position

Consolidated statement of changes in shareholders' equity

Analysis of changes in shareholders' equity related to components of the other comprehensive income

Consolidated statement of cash flows

Notes to the Consolidated Financial Statements

1.1 Basis of preparation of segment information

1.3 Segment revenue to consolidated net income in 2023

1.4 Segment revenue to consolidated net income in 2022

1.5 Segment revenue to consolidated net income in 2021

1.8 Segment equity and liabilities

1.9 Simplified statement of cash flows on telecommunication and Mobile Financial Services activities

1.10 Definition of operating segments and performance indicators

Note 2 Description of business and basis of preparation of the Consolidated Financial Statements

2.2 Basis of preparation of the financial statements

2.3 New standards and interpretations applied from January 1, 2023

2.4 Standards and interpretations compulsory after December 31, 2023 with no early adoption

2.5 Accounting policies, use of judgment and estimates

Note 3 Gains and losses on disposal and main changes in scope of consolidation

3.1 Gains (losses) on disposal of fixed assets, investments and activities

3.2 Main changes in the scope of consolidation

4.4 Customer contract net assets and liabilities

Note 5 Purchases and other expenses

5.4 Broadcasting rights and equipment inventories

5.6 Trade payables (goods and services)

Note 7 Impairment losses and goodwill

7.3 Key assumptions used to determine recoverable amounts

7.4 Sensitivity of recoverable amounts

8.1 Gains (losses) on disposal of fixed assets

8.2 Depreciation and amortization

8.3 Impairment of fixed assets

8.5 Property, plant and equipment

10.1 Operating taxes and levies

10.3 Developments in tax disputes and audits

10.4 International tax reform - Pillar Two

Note 11 Interests in associates and joint ventures

11.1 Change in interests in associates and joint ventures

11.2 Key figures from associates and joint ventures

11.3 Contractual commitments on interests in associates and joint ventures

Note 12 Related party transactions

Note 13 Financial assets, liabilities and financial results (telecom activities)

13.1 Financial assets and liabilities of telecom activities

13.2 Profits and losses related to financial assets and liabilities

13.6 Loans from development organizations and multilateral lending institutions

14.1 Interest rate risk management

14.2 Foreign exchange risk management

14.3 Liquidity risk management

14.4 Financial ratios and commitments to sustainability targets

14.5 Credit risk and counterparty risk management

14.6 Commodity risk management (energy contracts)

14.9 Fair value of financial assets and liabilities

15.6 Non-controlling interests

Note 16 Unrecognized contractual commitments (telecom activities)

16.1 Operating activities commitments

16.2 Consolidation scope commitments

Note 17 Mobile Financial Services activities

17.1 Financial assets and liabilities of Mobile Financial Services

17.2 Information on market risk management with respect to Orange Bank activities

17.3 Orange Bank’s unrecognized contractual commitments

The accompanying notes form an integral part of the Consolidated Financial Statements. The accounting policies are set out in the shaded areas of each note.

Consolidated income statement

|

(in millions of euros, except for per share data) |

Note |

2023 |

2022 |

2021 |

||

|

Revenue |

4.1 |

44,122 |

43,471 |

42,522 |

||

|

External purchases |

5.1 |

(19,322) |

(18,732) |

(17,973) |

||

|

Other operating income |

4.2 |

894 |

747 |

783 |

||

|

Other operating expenses |

5.2 |

(452) |

(413) |

(700) |

||

|

Labor expenses |

6.1 |

(9,018) |

(8,920) |

(9,917) |

||

|

Operating taxes and levies |

10.1.1 |

(1,794) |

(1,882) |

(1,926) |

||

|

Gains (losses) on disposal of fixed assets, investments and activities |

3.1 |

90 |

233 |

2,507 |

||

|

Restructuring costs |

5.3 |

(456) |

(125) |

(331) |

||

|

Depreciation and amortization of fixed assets |

8.2 |

(7,312) |

(7,035) |

(7,074) |

||

|

Depreciation and amortization of financed assets |

8.5 |

(129) |

(107) |

(84) |

||

|

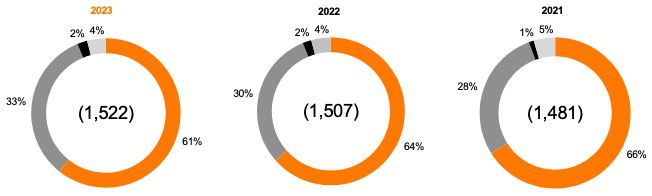

Depreciation and amortization of right-of-use assets |

9.1 |

(1,522) |

(1,507) |

(1,481) |

||

|

Effects resulting from business combinations |

11 |

- |

- |

|||

|

Impairment of goodwill |

7.1 |

- |

(817) |

(3,702) |

||

|

Impairment of fixed assets |

8.3 |

(47) |

(56) |

(17) |

||

|

Impairment of right-of-use assets |

9.1 |

(69) |

(54) |

(91) |

||

|

Share of profits (losses) of associates and joint ventures |

11.1 |

(29) |

(2) |

3 |

||

|

Operating income |

4,969 |

4,801 |

2,521 |

|||

|

Cost of gross financial debt excluding financed assets |

(1,073) |

(775) |

(829) |

|||

|

Interests on debts related to financed assets |

(14) |

(3) |

(1) |

|||

|

Gains (losses) on assets contributing to net financial debt |

283 |

48 |

(3) |

|||

|

Foreign exchange gain (loss) |

(32) |

(97) |

65 |

|||

|

Interests on lease liabilities |

(258) |

(145) |

(120) |

|||

|

Other net financial expenses |

(112) |

52 |

106 |

|||

|

Finance costs, net |

13.2 |

(1,206) |

(920) |

(782) |

||

|

Income taxes |

10.2.1 |

(871) |

(1,265) |

(962) |

||

|

Consolidated net income |

2,892 |

2,617 |

778 |

|||

|

Net income attributable to owners of the parent company |

2,440 |

2,146 |

233 |

|||

|

Non-controlling interests |

15.6 |

451 |

471 |

545 |

||

|

Earnings per share (in euros) attributable to parent company |

15.7 |

|||||

|

Net income |

||||||

|

- |

basic |

0.85 |

0.73 |

0.00 |

||

|

- |

diluted |

0.85 |

0.73 |

0.00 |

||

Consolidated statement of comprehensive income

|

(in millions of euros) |

Note |

2023 |

2022 |

2021 |

|

Consolidated net income |

2,892 |

2,617 |

778 |

|

|

Remeasurements of the net defined benefit liability |

6.2 |

(96) |

176 |

59 |

|

Assets at fair value |

13.7-17.1 |

3 |

(116) |

9 |

|

Income tax relating to items that will not be reclassified |

10.2.2 |

20 |

(47) |

(14) |

|

Share of other comprehensive income in associates and joint ventures that will not be reclassified |

14 |

0 |

(4) |

|

|

Items that will not be reclassified to profit or loss (a) |

(59) |

13 |

51 |

|

|

Assets at fair value |

13.7-17.1 |

2 |

4 |

1 |

|

Cash flow hedges |

13.8.2 |

(269) |

295 |

317 |

|

Translation adjustment gains and losses |

15.5 |

(28) |

(374) |

200 |

|

Income tax relating to items that are or may be reclassified |

10.2.2 |

66 |

(70) |

(84) |

|

Share of other comprehensive income in associates and joint ventures that are or may be reclassified |

(26) |

51 |

5 |

|

|

Items that are or may be reclassified subsequently to profit or loss (b) |

(255) |

(93) |

439 |

|

|

Other consolidated comprehensive income (a) + (b) |

(314) |

(80) |

490 |

|

|

Consolidated comprehensive income |

2,578 |

2,537 |

1,267 |

|

|

Comprehensive income attributable to the owners of the parent company |

2,108 |

2,050 |

687 |

|

|

Comprehensive income attributable to non-controlling interests |

470 |

487 |

580 |

|

Consolidated statement of financial position

|

(in millions of euros) |

Note |

December 31, 2023 |

December 31, 2022 |

December 31, 2021 |

|

Assets |

||||

|

Goodwill |

7.2 |

23,775 |

23,113 |

24,192 |

|

Other intangible assets |

8.4 |

15,098 |

14,946 |

14,940 |

|

Property, plant and equipment |

8.5 |

33,193 |

31,640 |

30,484 |

|

Right-of-use assets |

9.1 |

8,175 |

7,936 |

7,702 |

|

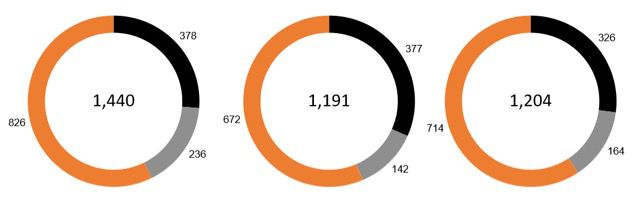

Interests in associates and joint ventures |

11 |

1,491 |

1,486 |

1,440 |

|

Non-current financial assets related to Mobile Financial Services activities |

17.1 |

297 |

656 |

900 |

|

Non-current financial assets |

13.1 |

1,036 |

977 |

950 |

|

Non-current derivatives assets |

13.1 |

956 |

1,458 |

683 |

|

Other non-current assets |

4.5 |

192 |

216 |

254 |

|

Deferred tax assets |

10.2.3 |

598 |

421 |

692 |

|

Total non-current assets |

84,811 |

82,847 |

82,236 |

|

|

Inventories |

5.4 |

1,152 |

1,048 |

952 |

|

Trade receivables |

4.3 |

6,013 |

6,305 |

6,029 |

|

Other customer contract assets |

4.4 |

1,795 |

1,570 |

1,460 |

|

Current financial assets related to Mobile Financial Services activities |

17.1 |

3,184 |

2,742 |

2,381 |

|

Current financial assets |

13.1 |

2,713 |

4,541 |

2,313 |

|

Current derivatives assets |

13.1 |

37 |

112 |

7 |

|

Other current assets |

4.5 |

2,388 |

2,217 |

1,875 |

|

Operating taxes and levies receivables |

10.1.2 |

1,233 |

1,265 |

1,163 |

|

Current taxes assets |

10.2.3 |

240 |

149 |

181 |

|

Prepaid expenses |

5.5 |

868 |

851 |

851 |

|

Cash and cash equivalents |

13.1 |

5,618 |

6,004 |

8,621 |

|

Total current assets |

25,241 |

26,803 |

25,834 |

|

|

Total assets |

110,052 |

109,650 |

108,071 |

|

|

(in millions of euros) |

Note |

December 31, 2023 |

December 31, 2022 |

December 31, 2021 |

|

Equity and liabilities |

||||

|

Share capital |

10,640 |

10,640 |

10,640 |

|

|

Share premiums and statutory reserve |

16,859 |

16,859 |

16,859 |

|

|

Subordinated notes |

4,950 |

4,950 |

5,497 |

|

|

Retained earnings |

(625) |

(666) |

(656) |

|

|

Equity attributable to the owners of the parent company |

31,825 |

31,784 |

32,341 |

|

|

Non-controlling interests |

3,274 |

3,172 |

3,020 |

|

|

Total equity |

15 |

35,098 |

34,956 |

35,361 |

|

Non-current financial liabilities |

13.1 |

30,535 |

31,930 |

31,922 |

|

Non-current derivatives liabilities |

13.1 |

225 |

397 |

220 |

|

Non-current lease liabilities |

9.2 |

7,099 |

6,901 |

6,696 |

|

Non-current fixed assets payables |

8.6 |

1,608 |

1,480 |

1,370 |

|

Non-current financial liabilities related to Mobile Financial Services activities |

17.1 |

73 |

82 |

0 |

|

Non-current employee benefits |

6.2 |

2,551 |

2,567 |

2,798 |

|

Non-current dismantling provisions |

8.7 |

698 |

670 |

876 |

|

Non-current restructuring provisions |

5.3 |

196 |

43 |

61 |

|

Other non-current liabilities |

5.7 |

299 |

276 |

306 |

|

Deferred tax liabilities |

10.2.3 |

1,143 |

1,124 |

1,185 |

|

Total non-current liabilities |

44,427 |

45,471 |

45,434 |

|

|

Current financial liabilities |

13.1 |

5,451 |

4,702 |

3,421 |

|

Current derivatives liabilities |

13.1 |

40 |

51 |

124 |

|

Current lease liabilities |

9.2 |

1,469 |

1,509 |

1,369 |

|

Current fixed assets payables |

8.6 |

2,926 |

3,101 |

3,111 |

|

Trade payables |

5.6 |

7,042 |

7,067 |

6,738 |

|

Customer contract liabilities |

4.4 |

2,717 |

2,579 |

2,512 |

|

Current financial liabilities related to Mobile Financial Services activities |

17.1 |

3,073 |

3,034 |

3,161 |

|

Current employee benefits |

6.2 |

2,632 |

2,418 |

2,316 |

|

Current dismantling provisions |

8.7 |

40 |

26 |

21 |

|

Current restructuring provisions |

5.3 |

281 |

119 |

124 |

|

Other current liabilities |

5.7 |

2,779 |

2,526 |

2,338 |

|

Operating taxes and levies payables |

10.1.2 |

1,483 |

1,405 |

1,436 |

|

Current taxes payables |

10.2.3 |

460 |

538 |

425 |

|

Deferred income |

135 |

149 |

180 |

|

|

Total current liabilities |

30,526 |

29,223 |

27,276 |

|

|

Total equity and liabilities |

110,052 |

109,650 |

108,071 |

|

Consolidated statement of changes in shareholders' equity

|

(in millions of euros) |

Attributable to owners of the parent company |

Attributable to non-controlling interests |

Total equity |

|||||||||||

|

Number of issued shares |

Share capital |

Share premiums and statutory reserve |

Subor-dinated notes |

Reserves |

Other compre- hensive income |

Total |

Reserves |

Other compre- hensive income |

Total |

|||||

|

Balance as of January 1, 2021 |

2,660,056,599 |

10,640 |

16,859 |

5,803 |

1,966 |

(711) |

34,557 |

2,484 |

159 |

2,643 |

37,200 |

|||

|

Consolidated comprehensive income |

- |

- |

- |

- |

233 |

454 |

687 |

545 |

36 |

580 |

1,267 |

|||

|

Share-based compensation |

6.3 |

- |

- |

- |

- |

165 |

- |

165 |

6 |

- |

6 |

171 |

||

|

Purchase of treasury shares |

15.2 |

- |

- |

- |

- |

(179) |

- |

(179) |

- |

- |

- |

(179) |

||

|

Dividends |

15.3 |

- |

- |

- |

- |

(2,127) |

- |

(2,127) |

(218) |

- |

(218) |

(2,345) |

||

|

Issues and purchases of subordinated notes |

15.4 |

- |

- |

- |

(306) |

(6) |

- |

(311) |

- |

- |

- |

(311) |

||

|

Subordinated notes remuneration |

15.4 |

- |

- |

- |

- |

(238) |

- |

(238) |

- |

- |

- |

(238) |

||

|

Changes in ownership interests with no gain/loss of control |

3.2 |

- |

- |

- |

- |

(185) |

- |

(185) |

(213) |

- |

(213) |

(398) |

||

|

Changes in ownership interests with gain/loss of control(1) |

3.2 |

- |

- |

- |

- |

- |

- |

- |

249 |

- |

249 |

249 |

||

|

Other movements |

- |

- |

- |

- |

(28) |

- |

(28) |

(28) |

- |

(28) |

(55) |

|||

|

Balance as of December 31, 2021 |

2,660,056,599 |

10,640 |

16,859 |

5,497 |

(399) |

(257) |

32,341 |

2,825 |

195 |

3,020 |

35,361 |

|||

|

Consolidated comprehensive income |

- |

- |

- |

- |

2,146 |

(96) |

2,050 |

471 |

16 |

487 |

2,537 |

|||

|

Share-based compensation |

6.3 |

- |

- |

- |

- |

11 |

- |

11 |

3 |

- |

3 |

14 |

||

|

Purchase of treasury shares |

15.2 |

- |

- |

- |

- |

(7) |

- |

(7) |

- |

- |

- |

(7) |

||

|

Dividends |

15.3 |

- |

- |

- |

- |

(1,861) |

- |

(1,861) |

(328) |

- |

(328) |

(2,189) |

||

|

Issues and purchases of subordinated notes |

15.4 |

- |

- |

- |

(547) |

51 |

- |

(496) |

- |

- |

- |

(496) |

||

|

Subordinated notes remuneration |

15.4 |

- |

- |

- |

- |

(215) |

- |

(215) |

- |

- |

- |

(215) |

||

|

Changes in ownership interests with no gain/loss of control |

3.2 |

- |

- |

- |

- |

(10) |

- |

(10) |

0 |

- |

0 |

(10) |

||

|

Changes in ownership interests with gain/loss of control |

3.2 |

- |

- |

- |

- |

(0) |

- |

(0) |

0 |

- |

0 |

(0) |

||

|

Other movements |

- |

- |

- |

- |

(29) |

- |

(29) |

(10) |

- |

(10) |

(39) |

|||

|

Balance as of December 31, 2022 |

2,660,056,599 |

10,640 |

16,859 |

4,950 |

(313) |

(353) |

31,784 |

2,960 |

211 |

3,172 |

34,956 |

|||

|

Consolidated comprehensive income |

- |

- |

- |

- |

2,440 |

(332) |

2,108 |

451 |

19 |

470 |

2,578 |

|||

|

Share-based compensation |

6.3 |

- |

- |

- |

- |

13 |

- |

13 |

3 |

- |

3 |

16 |

||

|

Purchase of treasury shares |

15.2 |

- |

- |

- |

- |

(15) |

- |

(15) |

- |

- |

- |

(15) |

||

|

Dividends |

15.3 |

- |

- |

- |

- |

(1,862) |

- |

(1,862) |

(381) |

- |

(381) |

(2,242) |

||

|

Issues and purchases of subordinated notes |

15.4 |

- |

- |

- |

- |

(22) |

- |

(22) |

- |

- |

- |

(22) |

||

|

Subordinated notes remuneration |

15.4 |

- |

- |

- |

- |

(185) |

- |

(185) |

- |

- |

- |

(185) |

||

|

Changes in ownership interests with no gain/loss of control |

3.2 |

- |

- |

- |

- |

(6) |

- |

(6) |

(2) |

- |

(2) |

(8) |

||

|

Changes in ownership interests with gain/loss of control(2) |

3.2 |

- |

- |

- |

- |

- |

- |

- |

0 |

- |

0 |

0 |

||

|

Other movements |

- |

- |

- |

- |

10 |

- |

10 |

11 |

- |

11 |

21 |

|||

|

Balance as of December 31, 2023 |

2,660,056,599 |

10,640 |

16,859 |

4,950 |

61 |

(686) |

31,825 |

3,043 |

230 |

3,274 |

35,098 |

|||

|

(1) Related to the takeover of Telekom Romania Communications (see Note 3.2). |

||||||||||||||

|

(2) Includes the fair value of the minority interests in VOO’s equity at the acquisition date, offset by the effect of the initial recognition of the financial liability related to the put option granted to Nethys by Orange (see Note 3.2). |

||||||||||||||

Analysis of changes in shareholders' equity related to components of the other comprehensive income

|

(in millions of euros) |

Attributable to owners of the parent company |

Attributable to non-controlling interests |

Total other compre- hensive income |

|||||||||||||

|

Assets at fair value |

Hedging instruments |

Translation adjustment |

Actuarial gains and losses |

Deferred tax |

Other compre- hensive income of associates and joint ventures |

Total |

Assets at fair value |

Hedging instruments |

Translation adjustment |

Actuarial gains and losses |

Deferred tax |

Other compre- hensive income of associates and joint ventures |

Total |

|||

|

Balance as of January 1, 2021 |

68 |

(98) |

(256) |

(579) |

195 |

(40) |

(711) |

(3) |

(2) |

171 |

(8) |

0 |

- |

159 |

(552) |

|

|

Variation(1) |

11 |

318 |

160 |

63 |

(98) |

1 |

454 |

0 |

(1) |

40 |

(4) |

(0) |

- |

36 |

490 |

|

|

Balance as of December 31, 2021 |

78 |

220 |

(96) |

(516) |

97 |

(39) |

(257) |

(3) |

(3) |

212 |

(11) |

1 |

- |

195 |

(62) |

|

|

Variation(1) |

(111) |

267 |

(360) |

179 |

(112) |

42 |

(96) |

(0) |

28 |

(14) |

(3) |

(4) |

9 |

16 |

(80) |

|

|

Balance as of December 31, 2022 |

(33) |

487 |

(455) |

(337) |

(16) |

3 |

(353) |

(4) |

25 |

198 |

(14) |

(4) |

9 |

211 |

(142) |

|

|

Variation(1) |

5 |

(254) |

(71) |

(89) |

81 |

(6) |

(332) |

(0) |

(15) |

43 |

(7) |

4 |

(6) |

19 |

(314) |

|

|

Balance as of December 31, 2023 |

(28) |

233 |

(526) |

(426) |

65 |

(3) |

(686) |

(4) |

10 |

240 |

(21) |

1 |

3 |

230 |

(456) |

|

|

(1) Including in 2023 a variation of (269) million euros related to hedging instruments (of which (236) million euros of hedging in American dollar and pound sterling held by Orange SA), an actuarial loss of (80) million euros mainly related to the decrease in discount rates and translation adjustments of (28) million euros mainly due to the depreciation of the Egyptian pound. Including in 2022 a variation of 295 million euros related to hedging instruments (of which 187 million euros of hedging in American dollar and pound sterling held by Orange SA), an actuarial gain of 176 million euros mainly related to the increase in discount rates and translation adjustments of (374) million euros mainly due to the depreciation of the Egyptian pound. Including in 2021 a variation of 317 million euros related to hedging instruments (of which 319 million euros of hedging in American dollar and pound sterling held by Orange SA) and a variation of 200 million euros related to translation adjustments (impact spread on multiple currencies). |

||||||||||||||||

|

Associates and joint ventures: entities accounted for using the equity method; amount before currency translation adjustments. |

||||||||||||||||

Consolidated statement of cash flows

|

(in millions of euros) |

Note |

2023 |

2022 |

2021 |

|

|

Operating activities |

|||||

|

Consolidated net income |

2,892 |

2,617 |

778 |

||

|

Non-monetary items and reclassified items for presentation |

12,971 |

13,298 |

14,592 |

||

|

Operating taxes and levies |

10.1.1 |

1,794 |

1,882 |

1,926 |

|

|

Gains (losses) on disposal of fixed assets, investments and activities |

3.1 |

(90) |

(233) |

(2,507) |

|

|

Other gains and losses |

(44) |

(22) |

(28) |

||

|

Depreciation and amortization of fixed assets |

8.2 |

7,312 |

7,035 |

7,074 |

|

|

Depreciation and amortization of financed assets |

8.5 |

129 |

107 |

84 |

|

|

Depreciation and amortization of right-of-use assets |

9.1 |

1,522 |

1,507 |

1,481 |

|

|

Changes in provisions |

4-5-6-8 |

117 |

(133) |

803 |

|

|

Effects resulting from business combinations |

(11) |

- |

- |

||

|

Impairment of goodwill |

7.1 |

- |

817 |

3,702 |

|

|

Impairment of fixed assets |

8.3 |

47 |

56 |

17 |

|

|

Impairment of right-of-use assets |

9.1 |

69 |

54 |

91 |

|

|

Share of profits (losses) of associates and joint ventures |

11 |

29 |

2 |

(3) |

|

|

Operational net foreign exchange and derivatives |

5 |

28 |

30 |

||

|

Finance costs, net |

13.2 |

1,206 |

920 |

782 |

|

|

Income tax |

10.2.1 |

871 |

1,265 |

962 |

|

|

Share-based compensation |

16 |

14 |

179 |

||

|

Changes in working capital and operating banking activities(1) |

(8) |

(792) |

(177) |

||

|

Decrease (increase) in inventories, gross |

(84) |

(108) |

(126) |

||

|

Decrease (increase) in trade receivables, gross |

441 |

(289) |

64 |

||

|

Increase (decrease) in trade payables |

(100) |

297 |

36 |

||

|

Changes in other customer contract assets and liabilities |

(103) |

(26) |

140 |

||

|

Changes in other assets and liabilities(2) |

(163) |

(666) |

(292) |

||

|

Other net cash out |

(3,801) |

(3,888) |

(3,956) |

||

|

Operating taxes and levies paid |

(1,680) |

(1,906) |

(1,880) |

||

|

Dividends received |

44 |

13 |

12 |

||

|

Interest paid and interest rates effects on derivatives, net(3) |

(1,035) |

(963) |

(1,134) |

||

|

Income tax paid |

(1,129) |

(1,033) |

(954) |

||

|

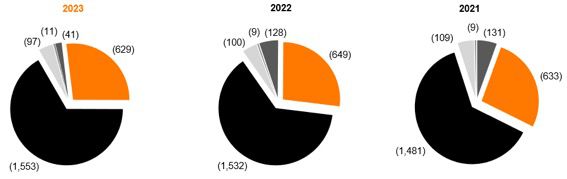

Net cash provided by operating activities (a) |

12,054 |

11,235 |

11,236 |

||

|

Investing activities |

|||||

|

Purchases and sales of property, plant and equipment and intangible assets |

(7,630) |

(8,282) |

(8,580) |

||

|

Purchases of property, plant and equipment and intangible assets(4) |

8.4-8.5 |

(7,829) |

(8,777) |

(8,749) |

|

|

Increase (decrease) in fixed assets payables |

(133) |

170 |

(72) |

||

|

Investing donations received in advance |

16 |

1 |

24 |

||

|

Sales of property, plant and equipment and intangible assets |

316 |

324 |

217 |

||

|

Cash paid for investment securities, net of cash acquired |

3.2 |

(1,416) |

(58) |

(211) |

|

|

VOO |

(1,373) |

- |

- |

||

|

Telekom Romania Communications |

- |

11 |

(206) |

||

|

Other |

(43) |

(68) |

(5) |

||

|

Investments in associates and joint ventures |

(38) |

(10) |

(3) |

||

|

Purchases of investment securities measured at fair value |

(46) |

(34) |

(76) |

||

|

Proceeds from sales of investment securities, net of cash transferred |

3.2 |

34 |

12 |

891 |

|

|

Swiatlowod Inwestycje Sp. z o.o (FiberCo in Poland) |

25 |

18 |

132 |

||

|

Orange Concessions |

- |

(8) |

758 |

||

|

Other |

9 |

2 |

- |

||

|

Other proceeds from sales of investment securities at fair value |

3 |

5 |

95 |

||

|

Decrease (increase) in securities and other financial assets |

2,085 |

(2,081) |

1,908 |

||

|

Investments at fair value, excluding cash equivalents |

1,831 |

(2,256) |

936 |

||

|

Other(5) |

254 |

175 |

972 |

||

|

Net cash used in investing activities (b) |

(7,008) |

(10,448) |

(5,976) |

||

|

(in millions of euros) |

Note |

2023 |

2022 |

2021 |

|

|

Financing activities |

|||||

|

Medium and long-term debt issuances |

13.5-13.6 |

1,442 |

1,809 |

2,523 |

|

|

Medium and long-term debt redemptions and repayments |

13.5-13.6 |

(2,595) |

(1,088) |

(4,572) |

|

|

Increase (decrease) of bank overdrafts and short-term borrowings |

56 |

(400) |

1,143 |

||

|

Decrease (increase) of cash collateral deposits |

(466) |

771 |

988 |

||

|

Exchange rates effects on derivatives, net |

5 |

(91) |

201 |

||

|

Repayments of lease liabilities |

9.2 |

(1,657) |

(1,519) |

(1,625) |

|

|

Subordinated notes issuances (purchases) and other related fees |

15.4 |

177 |

(451) |

(311) |

|

|

Coupon on subordinated notes |

15.4 |

(177) |

(213) |

(238) |

|

|

Proceeds (purchases) treasury shares |

15.2 |

(15) |

14 |

(199) |

|

|

o/w employee share offering (Orange Together 2021) |

6.3 |

- |

20 |

(188) |

|

|

Capital increase (decrease) - non-controlling interests |

2 |

0 |

5 |

||

|

Changes in ownership interests with no gain / loss of control |

3.2 |

(9) |

(11) |

(403) |

|

|

Dividends paid to owners of the parent company |

15.3 |

(1,862) |

(1,861) |

(2,127) |

|

|

Dividends paid to non-controlling interests |

15.6 |

(368) |

(304) |

(218) |

|

|

Net cash used in financing activities (c) |

(5,465) |

(3,343) |

(4,834) |

||

|

Cash change in cash and cash equivalents (a) + (b) + (c) |

(419) |

(2,556) |

427 |

||

|

Net change in cash and cash equivalents |

|||||

|

Cash and cash equivalents in the opening balance |

6,004 |

8,621 |

8,145 |

||

|

Cash change in cash and cash equivalents |

(419) |

(2,556) |

427 |

||

|

Non-cash change in cash and cash equivalents(6) |

32 |

(61) |

50 |

||

|

Cash and cash equivalents in the closing balance |

5,618 |

6,004 |

8,621 |

||

|

(1) Operating banking activities mainly include transactions with customers and credit institutions. They are presented in changes in other assets and liabilities. |

|||||

|

(2) Excluding operating tax receivables and payables. |

|||||

|

(3) Including interests paid on lease liabilities for (247) million euros in 2023, (141) million euros in 2022 and (120) million euros in 2021 and interests paid on debt related to financed assets for (14) million euros in 2023, (3) million euros in 2022 and (1) million euros in 2021. |

|||||

|

(4) Acquisitions of financed assets for 233 million euros in 2023, 229 million euros in 2022 and 40 million euros in 2021 have no effect on the net cash used in investing activities. |

|||||

|

(5) Includes the reimbursement in 2021 of loans granted to Orange Concessions and its subsidiaries for approximately 663 million euros, of which 620 million euros reimbursed by Orange Concessions and 43 million euros by the HIN consortium (see Note 3.2). |

|||||

|

(6) Of which effect of exchange rates changes and other non-monetary effects. |

|||||

Note 1 Segment information

1.1 Basis of preparation of segment information

Changes in segment information

The Orange group has announced its intention to transform its business model in the Enterprise business segment and to strengthen its position in cybersecurity. In line with these announcements, the Enterprise segment is changing its name to Orange Business.

The segment information presented herein takes into account the following changes in organization and scope:

− In 2023, the Other European countries segment includes the contribution of VOO from June 2, 2023 (see Note 3.2);

− Since January 1, 2022, Totem’s figures have been presented in a distinct operating segment. In 2021, these figures were included in the France, Spain and International Carriers & Shared Services segments;

− In 2021, the Other European countries segment included the contribution of Telekom Romania Communications from September 30, 2021 (see Note 3.2).

Definition of Group operating performance indicators

The key operating performance indicators used by the Group are described in Note 1.10.

The description of different sources of revenue is presented in Note 4.1.

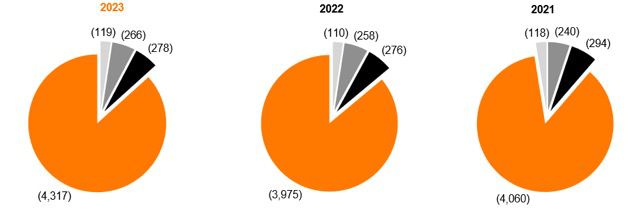

1.2 Segment revenue

|

(in millions of euros) |

France |

Europe |

|||

|

Spain |

Other European countries |

Eliminations Europe |

Total |

||

|

December 31, 2023 |

|||||

|

Revenue |

17,730 |

4,698 |

6,889 |

(12) |

11,574 |

|

Convergence services |

5,065 |

1,894 |

1,194 |

- |

3,088 |

|

Mobile services only |

2,364 |

782 |

2,150 |

- |

2,932 |

|

Fixed services only |

3,725(4) |

457 |

904 |

- |

1,361 |

|

IT & integration services |

- |

58 |

507 |

- |

565 |

|

Wholesale |

4,514 |

793 |

919 |

(12) |

1,700 |

|

Equipment sales |

1,394 |

711 |

1,047 |

- |

1,757 |

|

Other revenues |

668 |

2 |

168 |

- |

170 |

|

External |

17,007 |

4,643 |

6,795 |

- |

11,438 |

|

Inter-operating segments |

723 |

55 |

93 |

(12) |

136 |

|

December 31, 2022 |

|||||

|

Revenue |

17,983 |

4,647 |

6,329 |

(14) |

10,962 |

|

Convergence services |

4,857 |

1,870 |

959 |

- |

2,830 |

|

Mobile services only |

2,332 |

790 |

2,079 |

- |

2,869 |

|

Fixed services only |

3,787(4) |

436 |

783 |

- |

1,219 |

|

IT & integration services |

- |

41 |

430 |

- |

471 |

|

Wholesale |

4,938 |

878 |

964 |

(14) |

1,828 |

|

Equipment sales |

1,323 |

632 |

927 |

- |

1,559 |

|

Other revenues |

746 |

1 |

185 |

- |

187 |

|

External |

17,238 |

4,586 |

6,219 |

- |

10,805 |

|

Inter-operating segments |

745 |

61 |

109 |

(14) |

157 |

|

December 31, 2021 |

|||||

|

Revenue |

18,092 |

4,720 |

5,870 |

(11) |

10,579 |

|

Convergence services |

4,697 |

1,870 |

850 |

- |

2,720 |

|

Mobile services only |

2,276 |

880 |

2,007 |

- |

2,887 |

|

Fixed services only |

3,872(4) |

435 |

652 |

- |

1,087 |

|

IT & integration services |

- |

14 |

338 |

- |

352 |

|

Wholesale |

5,313 |

900 |

998 |

(11) |

1,886 |

|

Equipment sales |

1,226 |

621 |

869 |

- |

1,490 |

|

Other revenues |

708 |

1 |

155 |

0 |

157 |

|

External |

17,489 |

4,672 |

5,776 |

- |

10,449 |

|

Inter-operating segments |

603 |

48 |

94 |

(11) |

131 |

|

(1) Including, in 2023, revenue of 5,126 million euros in France, 19 million euros in Spain, 1,703 million euros in other European countries and 1,079 million euros in other countries. Including, in 2022, revenue of 5,126 million euros in France, 19 million euros in Spain, 1,762 million euros in other European countries and 1,023 million euros in other countries. Including, in 2021, revenue of 5,118 million euros in France, 13 million euros in Spain, 1,294 million euros in other European countries and 1,331 million euros in other countries. |

|||||

|

(2) Including, in 2023, revenue of 492 million euros in France and 195 million euros in Spain. Including, in 2022, revenue of 473 million euros in France and 212 million euros in Spain. |

|||||

|

(3) Including revenue of 1,283 million euros in France in 2023, 1,361 million euros in 2022 and 1,353 million euros in 2021. |

|||||

|

(4) Including, in 2023, fixed-only broadband revenue of 3,018 million euros and fixed-only narrowband revenue of 707 million euros. Including, in 2022, fixed-only broadband revenue of 2,955 million euros and fixed-only narrowband revenue of 831 million euros. Including, in 2021, fixed-only broadband revenue of 2,862 million euros and fixed-only narrowband revenue of 1,010 million euros. |

|||||

|

(5) Including, in 2023, revenue of 890 million euros from voice services and revenue of 2,330 million euros from data services. Including, in 2022, revenue of 1,018 million euros from voice services and revenue of 2,448 million euros from data services. Including, in 2021, revenue of 1,106 million euros from voice services and revenue of 2,527 million euros from data services. |

|||||

|

Africa & Middle East |

Orange Business(1) |

Totem(2) |

International Carriers & Shared Services(3) |

Eliminations |

Total telecom activities |

Mobile Financial Services |

Eliminations telecom activities / mobile financial services |

Orange Consoli- dated Financial Statements |

|

7,152 |

7,927 |

686 |

1,478 |

(2,416) |

44,132 |

- |

(9) |

44,122 |

|

- |

- |

- |

- |

- |

8,153 |

- |

- |

8,153 |

|

5,456 |

693 |

- |

- |

(37) |

11,408 |

- |

(2) |

11,406 |

|

847 |

3,220(5) |

- |

- |

(124) |

9,030 |

- |

(1) |

9,029 |

|

53 |

3,706 |

- |

- |

(177) |

4,146 |

- |

(5) |

4,141 |

|

666 |

41 |

686 |

982 |

(1,759) |

6,830 |

- |

- |

6,830 |

|

90 |

267 |

- |

- |

(6) |

3,503 |

- |

(0) |

3,503 |

|

40 |

- |

- |

496 |

(313) |

1,061 |

- |

(1) |

1,060 |

|

6,988 |

7,579 |

137 |

973 |

- |

44,122 |

- |

- |

44,122 |

|

164 |

347 |

549 |

505 |

(2,416) |

9 |

- |

(9) |

- |

|

6,918 |

7,930 |

685 |

1,540 |

(2,538) |

43,480 |

- |

(9) |

43,471 |

|

- |

- |

- |

- |

- |

7,687 |

- |

- |

7,687 |

|

5,272 |

659 |

- |

- |

(38) |

11,093 |

- |

(0) |

11,093 |

|

800 |

3,466(5) |

- |

- |

(150) |

9,121 |

- |

(1) |

9,120 |

|

40 |

3,489 |

- |

- |

(184) |

3,817 |

- |

(6) |

3,811 |

|

663 |

41 |

685 |

1,060 |

(1,859) |

7,356 |

- |

- |

7,356 |

|

104 |

275 |

- |

- |

(7) |

3,255 |

- |

(0) |

3,254 |

|

39 |

- |

- |

480 |

(299) |

1,152 |

- |

(2) |

1,150 |

|

6,750 |

7,548 |

113 |

1,017 |

- |

43,471 |

- |

- |

43,471 |

|

168 |

383 |

572 |

523 |

(2,538) |

9 |

- |

(9) |

- |

|

6,381 |

7,757 |

n/a |

1,515 |

(1,795) |

42,530 |

- |

(7) |

42,522 |

|

- |

- |

n/a |

- |

- |

7,417 |

- |

- |

7,417 |

|

4,884 |

636 |

n/a |

- |

(31) |

10,652 |

- |

(0) |

10,652 |

|

664 |

3,633(5) |

n/a |

- |

(168) |

9,089 |

- |

(1) |

9,088 |

|

31 |

3,195 |

n/a |

- |

(167) |

3,411 |

- |

(4) |

3,407 |

|

654 |

42 |

n/a |

1,056 |

(1,249) |

7,702 |

- |

- |

7,702 |

|

112 |

250 |

n/a |

- |

(8) |

3,070 |

- |

(0) |

3,070 |

|

36 |

- |

n/a |

460 |

(172) |

1,188 |

- |

(2) |

1,186 |

|

6,216 |

7,371 |

n/a |

998 |

- |

42,522 |

- |

- |

42,522 |

|

165 |

386 |

n/a |

517 |

(1,795) |

7 |

- |

(7) |

- |

1.3 Segment revenue to consolidated net income in 2023

|

(in millions of euros) |

France |

Europe |

Africa & Middle East |

|||

|

Spain |

Other European countries |

Elimina- tions Europe |

Total |

|||

|

Revenue |

17,730 |

4,698 |

6,889 |

(12) |

11,574 |

7,152 |

|

External purchases |

(7,518) |

(2,814) |

(4,046) |

12 |

(6,848) |

(2,754) |

|

Other operating income |

1,214 |

125 |

302 |

(2) |

426 |

101 |

|

Other operating expenses |

(535) |

(150) |

(170) |

2 |

(318) |

(247) |

|

Labor expenses |

(3,280) |

(275) |

(830) |

- |

(1,106) |

(584) |

|

Operating taxes and levies |

(765) |

(125) |

(100) |

- |

(225) |

(678) |

|

Gains (losses) on disposal of fixed assets, investments and activities |

- |

- |

- |

- |

- |

- |

|

Restructuring costs |

- |

- |

- |

- |

- |

- |

|

Depreciation and amortization of financed assets |

(129) |

- |

- |

- |

- |

- |

|

Depreciation and amortization of right-of-use assets |

(273) |

(175) |

(208) |

- |

(384) |

(199) |

|

Impairment of right-of-use assets |

- |

- |

(0) |

- |

(0) |

- |

|

Interests on debts related to financed assets(2) |

(14) |

- |

- |

- |

- |

- |

|

Interests on lease liabilities(2) |

(66) |

(37) |

(46) |

- |

(83) |

(58) |

|

EBITDAaL |

6,364 |

1,246 |

1,791 |

- |

3,037 |

2,734 |

|

Significant litigation |

68 |

- |

- |

- |

- |

(38) |

|

Specific labour expenses |

(349) |

- |

- |

- |

- |

- |

|

Fixed assets, investments and businesses portfolio review |

(1) |

- |

32 |

- |

32 |

28 |

|

Restructuring programs costs |

(4) |

- |

(63) |

- |

(63) |

(4) |

|

Acquisition and integration costs |

1 |

(6) |

(33) |

- |

(39) |

- |

|

Depreciation and amortization of fixed assets |

(3,154) |

(1,040) |

(1,223) |

- |

(2,263) |

(1,041) |

|

Effects resulting from business combinations |

- |

- |

- |

- |

- |

- |

|

Impairment of goodwill |

- |

- |

- |

- |

- |

- |

|

Impairment of fixed assets |

(1) |

- |

(10) |

- |

(10) |

(3) |

|

Share of profits (losses) of associates and joint ventures |

(36) |

- |

(8) |

- |

(8) |

22 |

|

Elimination of interests on debts related to financed assets(2) |

14 |

- |

- |

- |

- |

- |

|

Elimination of interests on lease liabilities(2) |

66 |

37 |

46 |

- |

83 |

58 |

|

Operating Income |

2,967 |

238 |

533 |

- |

770 |

1,755 |

|

Cost of gross financial debt except financed assets |

||||||

|

Interests on debts related to financed assets(2) |

||||||

|

Gains (losses) on assets contributing to net financial debt |

||||||

|

Foreign exchange gain (loss) |

||||||

|

Interests on lease liabilities(2) |

||||||

|

Other net financial expenses |

||||||

|

Finance costs, net |

||||||

|

Income Tax |

||||||

|

Consolidated net income |

||||||

|

(1) Mobile Financial Services’ net banking income is recognized in other operating income and amounts to 149 million euros in 2023. The cost of risk is included in other operating expenses and amounts to (63) million euros in 2023. |

||||||

|

(2) Presentation adjustments allow the reallocation of the lines of specific items identified in the segment information to the operating revenue and expense lines presented in the consolidated income statement. Interests on debts related to financed assets and interests on lease liabilities are included in segment EBITDAaL. They are excluded from segment operating income and included in net finance costs presented in the consolidated income statement. |

||||||

|

Orange Business |

Totem |

Interna- tional Carriers & Shared Services |

Elimination telecom activities |

Total telecom activities |

Mobile Financial Services(1) |

Elimina- tions telecom activities / mobile financial services |

Total |

Presenta- tion adjust- ments(2) |

Orange Consoli- dated Financial Statements |

|

|

7,927 |

686 |

1,478 |

(2,416) |

44,132 |

- |

(9) |

44,122 |

- |

44,122 |

|

|

(4,383) |

(116) |

(1,943) |

4,379 |

(19,183) |

(125) |

13 |

(19,295) |

(26) |

(19,322) |

|

|

201 |

0 |

2,111 |

(3,307) |

746 |

151 |

(4) |

894 |

- |

894 |

|

|

(601) |

(1) |

(29) |

1,345 |

(388) |

(60) |

1 |

(447) |

(5) |

(452) |

|

|

(2,229) |

(17) |

(1,231) |

- |

(8,446) |

(77) |

- |

(8,523) |

(495) |

(9,018) |

|

|

(65) |

(7) |

(51) |

- |

(1,790) |

(7) |

- |

(1,797) |

3 |

(1,794) |

|

|

- |

- |

- |

- |

- |

- |

- |

- |

90 |

90 |

|

|

- |

- |

- |

- |

- |

- |

- |

- |

(456) |

(456) |

|

|

- |

- |

- |

- |

(129) |

- |

- |

(129) |

- |

(129) |

|

|

(158) |

(163) |

(337) |

- |

(1,514) |

(4) |

- |

(1,518) |

(4) |

(1,522) |

|

|

(1) |

- |

0 |

- |

(1) |

- |

- |

(1) |

(67) |

(69) |

|

|

- |

- |

- |

- |

(14) |

- |

- |

(14) |

14 |

n/a |

|

|

(10) |

(11) |

(29) |

- |

(258) |

(0) |

- |

(258) |

258 |

n/a |

|

|

679 |

372 |

(30) |

1 |

13,157 |

(122) |

1 |

13,035 |

(690) |

n/a |

|

|

- |

- |

- |

- |

30 |

- |

- |

30 |

(30) |

n/a |

|

|

(61) |

(0) |

(92) |

- |

(502) |

(1) |

- |

(503) |

503 |

n/a |

|

|

16 |

- |

15 |

- |

90 |

- |

- |

90 |

(90) |

n/a |

|

|

(210) |

(4) |

(119) |

- |

(405) |

(121) |

- |

(526) |

526 |

n/a |

|

|

(1) |

(0) |

(14) |

- |

(53) |

- |

- |

(53) |

53 |

n/a |

|

|

(361) |

(127) |

(345) |

- |

(7,291) |

(21) |

- |

(7,312) |

- |

(7,312) |

|

|

11 |

- |

- |

- |

11 |

- |

- |

11 |

- |

11 |

|

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

8 |

- |

1 |

- |

(5) |

(42) |

- |

(47) |

- |

(47) |

|

|

0 |

- |

(8) |

- |

(29) |

- |

- |

(29) |

- |

(29) |

|

|

- |

- |

- |

- |

14 |

- |

- |

14 |

(14) |

n/a |

|

|

10 |

11 |

29 |

- |

258 |

0 |

- |

258 |

(258) |

n/a |

|

|

92 |

251 |

(563) |

1 |

5,274 |

(306) |

1 |

4,969 |

- |

4,969 |

|

|

(1,073) |

- |

(1,073) |

||||||||

|

(14) |

- |

(14) |

||||||||

|

283 |

- |

283 |

||||||||

|

(32) |

- |

(32) |

||||||||

|

(112) |

- |

(258) |

||||||||

|

(258) |

- |

(112) |

||||||||

|

(1,205) |

(0) |

(1) |

(1,206) |

- |

(1,206) |

|||||

|

(871) |

(0) |

- |

(871) |

- |

(871) |

|||||

|

3,198 |

(307) |

0 |

2,892 |

- |

2,892 |

|||||

1.4 Segment revenue to consolidated net income in 2022

|

(in millions of euros) |

France |

Europe |

Africa & Middle East |

|||

|

Spain |

Other European countries |

Elimina- tions Europe |

Total |

|||

|

Revenue |

17,983 |

4,647 |

6,329 |

(14) |

10,962 |

6,918 |

|

External purchases |

(7,429) |

(2,879) |

(3,684) |

14 |

(6,550) |

(2,740) |

|

Other operating income |

1,229 |

97 |

270 |

(0) |

367 |

69 |

|

Other operating expenses |

(486) |

(162) |

(187) |

0 |

(350) |

(171) |

|

Labor expenses |

(3,435) |

(266) |

(736) |

- |

(1,002) |

(575) |

|

Operating taxes and levies |

(834) |

(140) |

(101) |

- |

(241) |

(660) |

|

Gains (losses) on disposal of fixed assets, investments and activities |

- |

- |

- |

- |

- |

- |

|

Restructuring costs |

- |

- |

- |

- |

- |

- |

|

Depreciation and amortization of financed assets |

(107) |

- |

- |

- |

- |

- |

|

Depreciation and amortization of right-of-use assets |

(254) |

(169) |

(201) |

- |

(371) |

(194) |

|

Impairment of right-of-use assets |

- |

- |

- |

- |

- |

- |

|

Interests on debts related to financed assets(2) |

(3) |

- |

- |

- |

- |

- |

|

Interests on lease liabilities(2) |

(18) |

(17) |

(27) |

- |

(44) |

(64) |

|

EBITDAaL |

6,645 |

1,111 |

1,662 |

- |

2,772 |

2,584 |

|

Significant litigation |

(3) |

- |

- |

- |

- |

- |

|

Specific labour expenses |

(330) |

- |

0 |

- |

0 |

- |

|

Fixed assets, investments and businesses portfolio review |

(0) |

- |

29 |

- |

29 |

76 |

|

Restructuring programs costs |

(18) |

(8) |

(14) |

- |

(22) |

(8) |

|

Acquisition and integration costs |

- |

- |

(41) |

- |

(41) |

- |

|

Depreciation and amortization of fixed assets |

(2,922) |

(1,107) |

(1,057) |

- |

(2,164) |

(1,075) |

|

Impairment of goodwill |

- |

- |

(789) |

- |

(789) |

- |

|

Impairment of fixed assets |

(15) |

- |

(3) |

- |

(3) |

2 |

|

Share of profits (losses) of associates and joint ventures |

(18) |

- |

(3) |

- |

(3) |

22 |

|

Elimination of interests on debts related to financed assets(2) |

3 |

- |

- |

- |

- |

- |

|

Elimination of interests on lease liabilities(2) |

18 |

17 |

27 |

- |

44 |

64 |

|

Operating Income |

3,361 |

12 |

(190) |

- |

(177) |

1,665 |

|

Cost of gross financial debt except financed assets |

||||||

|

Interests on debts related to financed assets(2) |

||||||

|

Gains (losses) on assets contributing to net financial debt |

||||||

|

Foreign exchange gain (loss) |

||||||

|

Interests on lease liabilities(2) |

||||||

|

Other net financial expenses |

||||||

|

Finance costs, net |

||||||

|

Income Taxes |

||||||

|

Consolidated net income |

||||||

|

(1) Mobile Financial Services’ net banking income is recognized in other operating income and amounted to 116 million euros in 2022. The cost of risk is included in other operating expenses and amounted to (45) million euros in 2022. |

||||||

|

(2) Presentation adjustments allow the reallocation of the lines of specific items identified in the segment information to the operating revenue and expense lines presented in the consolidated income statement. Interests on debts related to financed assets and interests on lease liabilities are included in segment EBITDAaL. They are excluded from segment operating income and included in net finance costs presented in the consolidated income statement. |

||||||

|

Orange Business |

Totem |

Interna- tional Carriers & Shared Services |

Elimina- tion telecom activities |

Total telecom activities |

Mobile Financial Services(1) |

Elimina- tions telecom activities/ mobile financial services |

Total |

Presenta- tion adjust- ments(2) |

Orange Consoli- dated Financial Statements |

|

|

7,930 |

685 |

1,540 |

(2,538) |

43,480 |

- |

(9) |

43,471 |

- |

43,471 |

|

|

(4,240) |

(131) |

(1,997) |

4,491 |

(18,594) |

(129) |

15 |

(18,707) |

(24) |

(18,732) |

|

|

191 |

0 |

2,101 |

(3,331) |

627 |

128 |

(10) |

745 |

2 |

747 |

|

|

(657) |

(0) |

(49) |

1,377 |

(335) |

(36) |

4 |

(367) |

(47) |

(413) |

|

|

(2,179) |

(14) |

(1,255) |

- |

(8,461) |

(76) |

- |

(8,537) |

(383) |

(8,920) |

|

|

(82) |

(5) |

(55) |

- |

(1,877) |

(2) |

- |

(1,879) |

(3) |

(1,882) |

|

|

- |

- |

- |

- |

- |

- |

- |

- |

233 |

233 |

|

|

- |

- |

- |

- |

- |

- |

- |

- |

(125) |

(125) |

|

|

- |

- |

- |

- |

(107) |

- |

- |

(107) |

- |

(107) |

|

|

(154) |

(159) |

(372) |

- |

(1,504) |

(3) |

- |

(1,507) |

- |

(1,507) |

|

|

(1) |

- |

0 |

- |

(1) |

- |

- |

(1) |

(52) |

(54) |

|

|

- |

- |

- |

- |

(3) |

- |

- |

(3) |

3 |

n/a |

|

|

(6) |

(4) |

(10) |

- |

(144) |

(0) |

- |

(145) |

145 |

n/a |

|

|

804 |

371 |

(96) |

- |

13,080 |

(118) |

1 |

12,963 |

(251) |

n/a |

|

|

- |

- |

(6) |

- |

(9) |

- |

- |

(9) |

9 |

n/a |

|

|

(35) |

- |

(9) |

- |

(373) |

1 |

- |

(372) |

372 |

n/a |

|

|

8 |

- |

120 |

- |

233 |

- |

- |

233 |

(233) |

n/a |

|

|

(47) |

- |

(89) |

- |

(184) |

7 |

- |

(177) |

177 |

n/a |

|

|

(1) |

(1) |

(33) |

- |

(76) |

2 |

- |

(74) |

74 |

n/a |

|

|

(398) |

(122) |

(311) |

- |

(6,992) |

(44) |

- |

(7,035) |

- |

(7,035) |

|

|

- |

- |

- |

- |

(789) |

(28) |

- |

(817) |

- |

(817) |

|

|

(20) |

0 |

0 |

- |

(36) |

(21) |

- |

(56) |

- |

(56) |

|

|

1 |

- |

(3) |

- |

(2) |

- |

- |

(2) |

- |

(2) |

|

|

- |

- |

- |

- |

3 |

- |

- |

3 |

(3) |

n/a |

|

|

6 |

4 |

10 |

- |

144 |

0 |

- |

145 |

(145) |

n/a |

|

|

317 |

252 |

(417) |

- |

5,000 |

(200) |

1 |

4,801 |

- |

4,801 |

|

|

(775) |

- |

(775) |

||||||||

|

(3) |

- |

(3) |

||||||||

|

48 |

- |

48 |

||||||||

|

(97) |

- |

(97) |

||||||||

|

(145) |

- |

(145) |

||||||||

|

52 |

- |

52 |

||||||||

|

(920) |

1 |

(1) |

(920) |

- |

(920) |

|||||

|

(1,270) |

5 |

- |

(1,265) |

- |

(1,265) |

|||||

|

2,810 |

(194) |

0 |

2,617 |

- |

2,617 |

|||||

1.5 Segment revenue to consolidated net income in 2021

|

(in millions of euros) |

France |

Europe |

Africa & Middle East |

|||

|

Spain |

Other European countries |

Elimina- tions Europe |

Total |

|||

|

Revenue |

18,092 |

4,720 |

5,870 |

(11) |

10,579 |

6,381 |

|

External purchases |

(7,081) |

(2,768) |

(3,330) |

11 |

(6,087) |

(2,502) |

|

Other operating income |

1,274 |

161 |

192 |

(0) |

353 |

52 |

|

Other operating expenses |

(526) |

(171) |

(179) |

0 |

(350) |

(243) |

|

Labor expenses |

(3,657) |

(268) |

(665) |

- |

(932) |

(535) |

|

Operating taxes and levies |

(838) |

(163) |

(96) |

- |

(259) |

(644) |

|

Gains (losses) on disposal of fixed assets, investments and activities |

- |

- |

- |

- |

- |

- |

|

Restructuring costs |

- |

- |

- |

- |

- |

- |

|

Depreciation and amortization of financed assets |

(84) |

- |

- |

- |

- |

- |

|

Depreciation and amortization of right-of-use assets |

(304) |

(248) |

(198) |

- |

(446) |

(176) |

|

Impairment of right-of-use assets |

- |

- |

- |

- |

- |

- |

|

Interests on debts related to financed assets(2) |

(1) |

- |

- |

- |

- |

- |

|

Interests on lease liabilities(2) |

(8) |

(14) |

(15) |

- |

(29) |

(67) |

|

EBITDAaL |

6,867 |

1,251 |

1,579 |

- |

2,830 |

2,265 |

|

Significant litigation |

(128) |

- |

- |

- |

- |

- |

|

Specific labour expenses |

(959) |

- |

(2) |

- |

(2) |

- |

|

Fixed assets, investments and businesses portfolio review |

(2) |

- |

359 |

- |

359 |

2 |

|

Restructuring programs costs |

(10) |

(180) |

(31) |

- |

(211) |

(41) |

|

Acquisition and integration costs |

(7) |

- |

(25) |

- |

(25) |

- |

|

Depreciation and amortization of fixed assets |

(3,108) |

(1,107) |

(1,097) |

- |

(2,204) |

(1,012) |

|

Impairment of goodwill |

- |

(3,702) |

- |

- |

(3,702) |

- |

|

Impairment of fixed assets |

(1) |

- |

(13) |

- |

(13) |

(1) |

|

Share of profits (losses) of associates and joint ventures |

(8) |

- |

5 |

- |

5 |

10 |

|

Elimination of interests on debts related to financed assets(2) |

1 |

- |

- |

- |

- |

- |

|

Elimination of interests on lease liabilities(2) |

8 |

14 |

15 |

- |

29 |

67 |

|

Operating Income |

2,653 |

(3,724) |

791 |

- |

(2,933) |

1,291 |

|

Cost of gross financial debt except financed assets |

||||||

|

Interests on debts related to financed assets(2) |

||||||

|

Gains (losses) on assets contributing to net financial debt |

||||||

|

Foreign exchange gain (loss) |

||||||

|

Interests on lease liabilities(2) |

||||||

|

Other net financial expenses |

||||||

|

Finance costs, net |

||||||

|

Income Taxes |

||||||

|

Consolidated net income |

||||||

|

(1) Mobile Financial Services’ net banking income is recognized in other operating income and amounted to 109 million euros in 2021. The cost of risk is included in other operating expenses and amounted to (46) million euros in 2021. |

||||||

|

(2) Presentation adjustments allow the reallocation of the lines of specific items identified in the segment information to the operating revenue and expense lines presented in the consolidated income statement. Interests on debts related to financed assets and interests on lease liabilities are included in segment EBITDAaL. They are excluded from segment operating income and included in net finance costs presented in the consolidated income statement. |

||||||

|

Orange Business |

Interna- tional Carriers & Shared Services |

Elimina- tion telecom activities |

Total telecom activities |

Mobile Financial Services(1) |

Elimina- tions telecom activities/ mobile financial services |

Total |

Presenta- tion adjust- ments(2) |

Orange Consoli- dated Financial Statements |

|

|

7,757 |

1,515 |

(1,795) |

42,530 |

- |

(7) |

42,522 |

- |

42,522 |

|

|

(3,967) |

(2,000) |

3,786 |

(17,849) |

(112) |

10 |

(17,950) |

(23) |

(17,973) |

|

|

173 |

2,096 |

(3,328) |

620 |

114 |

(4) |

730 |

53 |

783 |

|

|

(640) |

(71) |

1,336 |

(493) |

(44) |

2 |

(535) |

(165) |

(700) |

|

|

(2,119) |

(1,298) |

- |

(8,542) |

(84) |

- |

(8,626) |

(1,291) |

(9,917) |

|

|

(80) |

(66) |

- |

(1,887) |

(3) |

- |

(1,890) |

(36) |

(1,926) |

|

|

- |

- |

- |

- |

- |

- |

- |

2,507 |

2,507 |

|

|

- |

- |

- |

- |

- |

- |

- |

(331) |

(331) |

|

|

- |

- |

- |

(84) |

- |

- |

(84) |

- |

(84) |

|

|

(147) |

(407) |

- |

(1,478) |

(3) |

- |

(1,481) |

- |

(1,481) |

|

|

- |

0 |

- |

0 |

- |

- |

0 |

(91) |

(91) |

|

|

- |

- |

- |

(1) |

- |

- |

(1) |

1 |

n/a |

|

|

(7) |

(8) |

- |

(119) |

(0) |

- |

(120) |

120 |

n/a |

|

|

970 |

(237) |

- |

12,696 |

(131) |

1 |

12,566 |

744 |

n/a |

|

|

- |

(6) |

- |

(134) |

- |

- |

(134) |

134 |

n/a |

|

|

(123) |

(190) |

- |

(1,274) |

(3) |

- |

(1,276) |

1,276 |

n/a |

|

|

3 |

2,146 |

- |

2,507 |

- |

- |

2,507 |

(2,507) |

n/a |

|

|

(5) |

(145) |

- |

(412) |

(11) |

- |

(422) |

422 |

n/a |

|

|

(1) |

(16) |

- |

(49) |

(2) |

- |

(51) |

51 |

n/a |

|

|

(378) |

(335) |

- |

(7,038) |

(36) |

- |

(7,074) |

- |

(7,074) |

|

|

- |

- |

- |

(3,702) |

- |

- |

(3,702) |

- |

(3,702) |

|

|

0 |

(2) |

- |

(17) |

- |

- |

(17) |

- |

(17) |

|

|

1 |

(5) |

- |

3 |

- |

- |

3 |

- |

3 |

|

|

- |

- |

- |

1 |

- |

- |

1 |

(1) |

n/a |

|

|

7 |

8 |

- |

119 |

0 |

- |

120 |

(120) |

n/a |

|

|

474 |

1,217 |

- |

2,702 |

(182) |

1 |

2,521 |

- |

2,521 |

|

|

(829) |

- |

(829) |

|||||||

|

- |

- |

(1) |

|||||||

|

(3) |

- |

(3) |

|||||||

|

65 |

- |

65 |

|||||||

|

- |

- |

(120) |

|||||||

|

106 |

- |

106 |

|||||||

|

(781) |

1 |

(1) |

(782) |

- |

(782) |

||||

|

(963) |

0 |

- |

(962) |

- |

(962) |

||||

|

958 |

(181) |

0 |

778 |

- |

778 |

||||

1.6 Segment investments

|

(in millions of euros) |

France |

Europe |

||||

|

Spain |

Other European countries |

Elimina- tions Europe |

Total |

|||

|

December 31, 2023 |