Document

Babcock & Wilcox Enterprises Reports Fourth Quarter and Full Year 2024 Results

•Revenue from Continuing Operations in Q4 2024 of $200.8 million increased 15% Year over Year

•Operating Income from Continuing Operations in Q4 2024 of $11.6 million increased $14.8 million compared to Q4 2023

•Announced Full Year 2024 Bookings from Continuing Operations of $889.6 million, a 39% increase compared to the same period of 2023

•Announced Continuing Operations Backlog of $540.1 million, a 47% increase compared to the same period of 2023

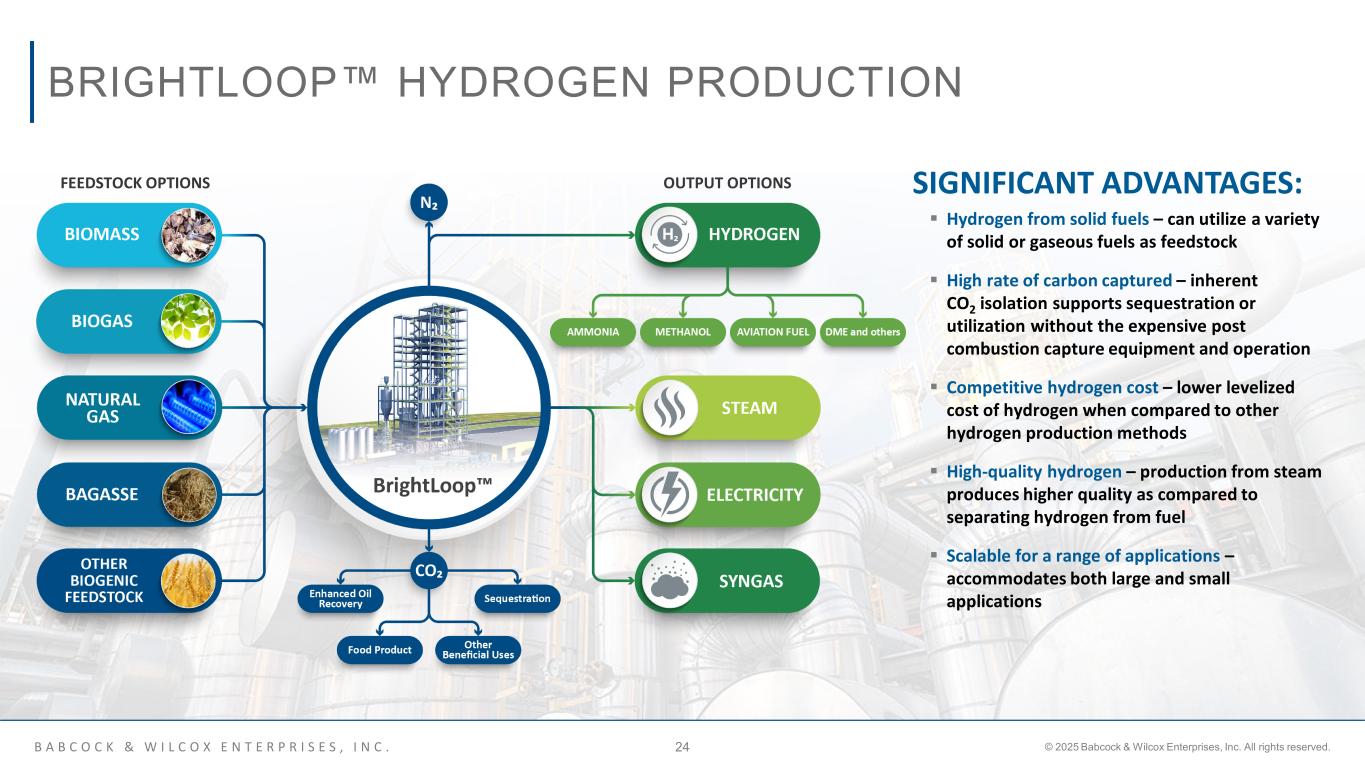

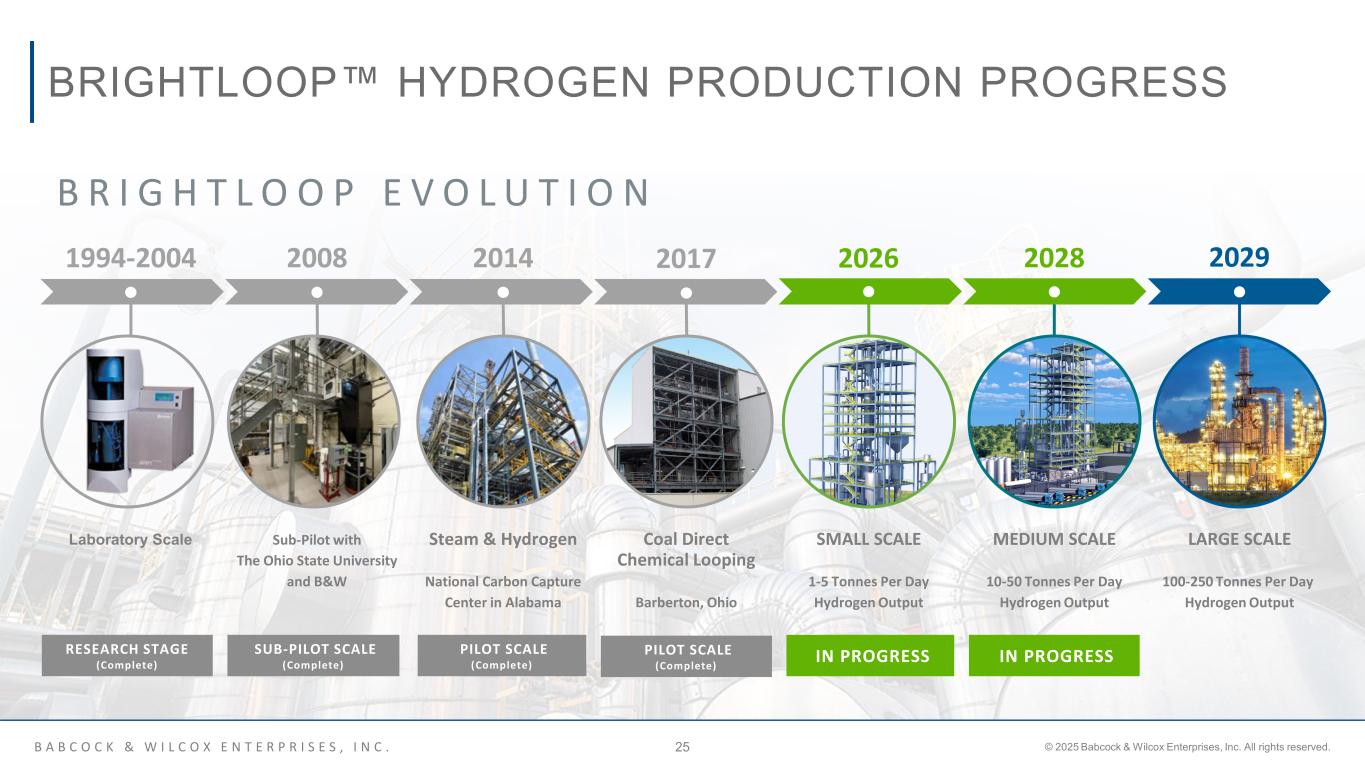

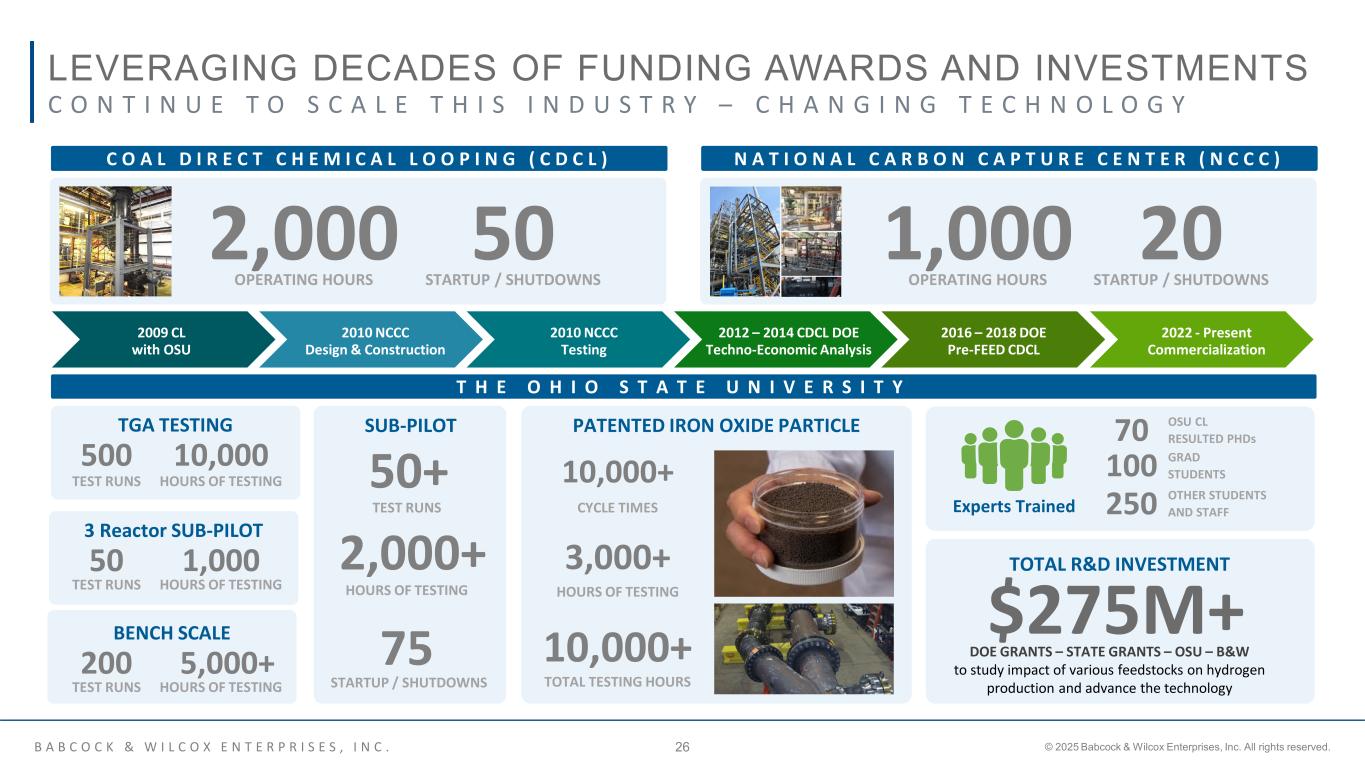

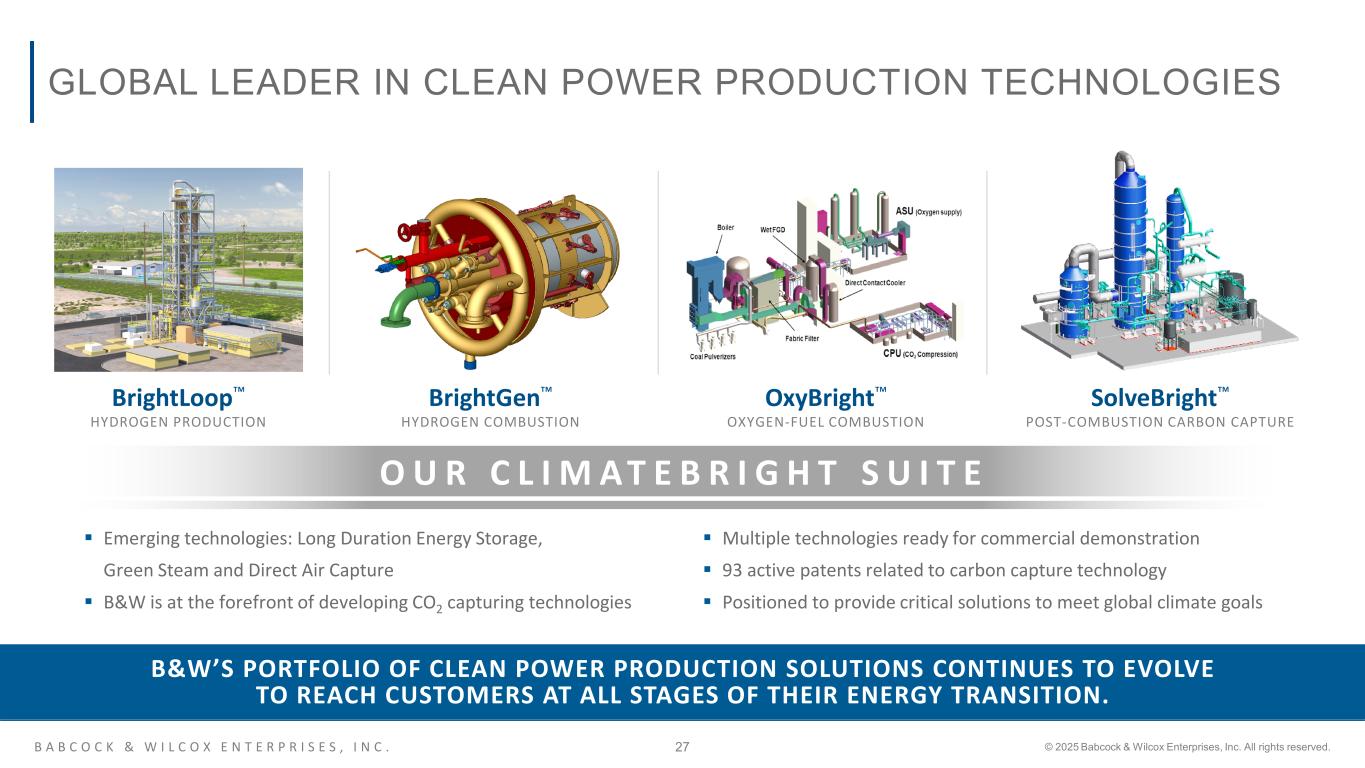

•Progressed BrightLoopTM project in Massillon, Ohio, and maintaining target to produce hydrogen and sequester CO2 by early 2026

•Anticipate positive net cash flow in 2025 excluding BrightLoop

•Awarded $10.0 million of support from state of West Virginia for development of BrightLoopTM hydrogen production and carbon capture facility project

•Continued negotiations regarding potential sale of assets and with certain bondholders to reduce overall debt

Q4 2024 Continuing Operations Financial Highlights

•Revenue increased to $200.8 million, compared to revenue of $174.7 million in the fourth quarter of 2023

•Operating income from Continuing Operations increased to $11.6 million, compared to operating loss from Continuing Operations of $3.3 million in the fourth quarter of 2023

•Net loss from Continuing Operations reduced to $45.0 million, compared to a net loss from Continuing Operations of $58.3 million in the fourth quarter of 2023

•Loss per share of $0.52, reduced compared to a loss per share of $0.70 in the fourth quarter of 2023

•Adjusted EBITDA from Continuing Operations of $23.9 million increased when compared to Adjusted EBITDA from Continuing Operations of $15.4 million in the fourth quarter of 2023. Adjusted EBITDA excluding BrightLoopTM and ClimateBrightTM expenses of $24.6 million in the fourth quarter of 2024

Full Year 2024 Continuing Operations Financial Highlights

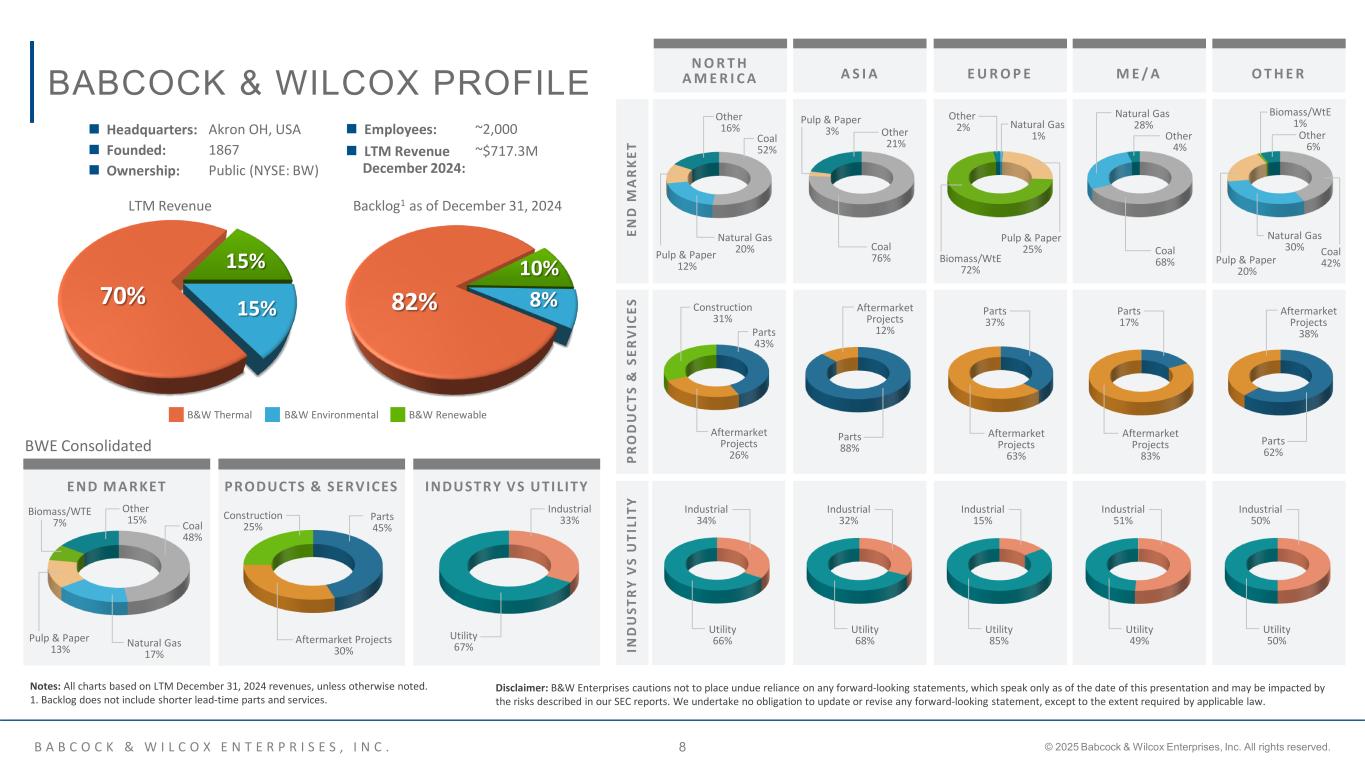

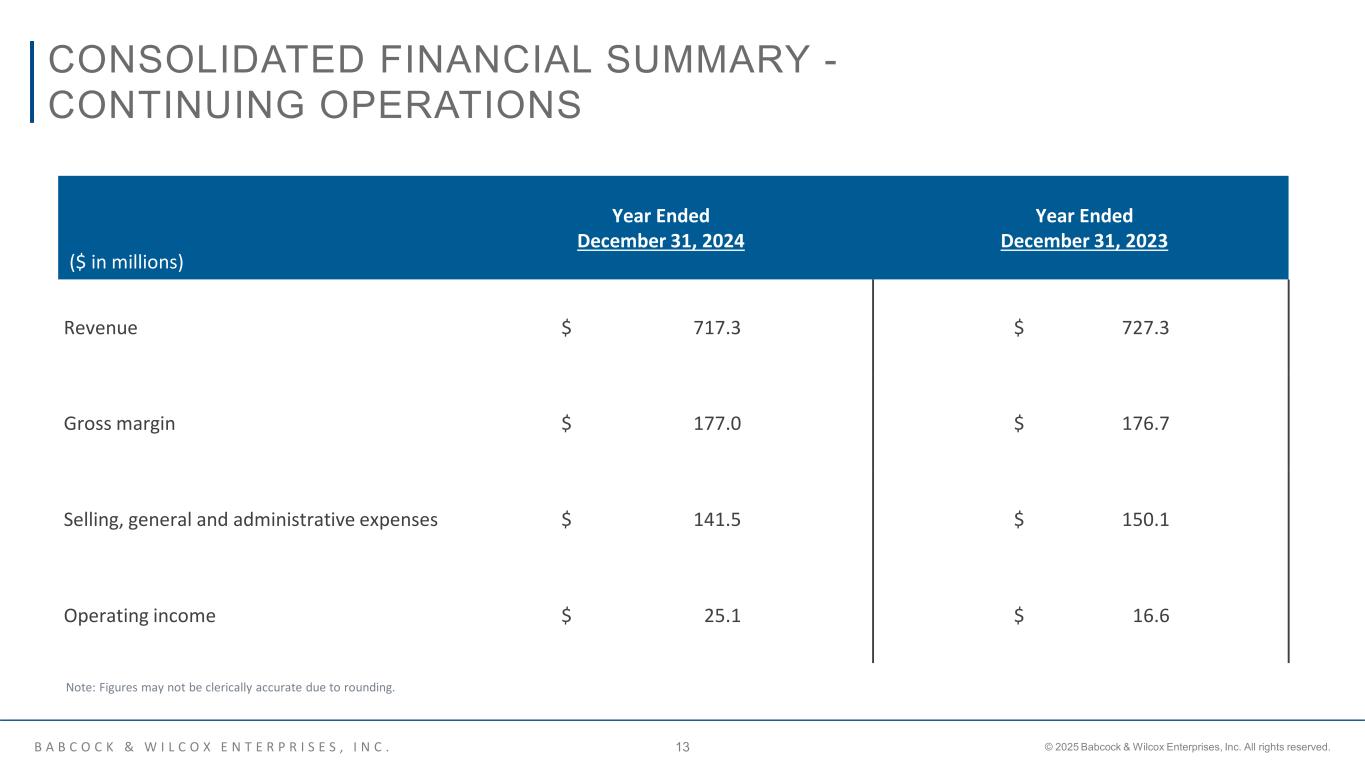

–Revenues of $717.3 million which remained stable compared to 2023

–Net loss from Continuing Operations of $73.0 million, compared to a net loss from Continuing Operations of $75.8 million in 2023

–Loss per share of $0.96, compared to a loss per share of $1.02 in 2023

–Adjusted EBITDA from Continuing Operations of $68.9 million, compared to $60.8 million in 2023

–Adjusted EBITDA from Continuing Operations excluding BrightLoopTM and ClimateBrightTM expenses, of $72.6 million, compared to $65.7 million in 2023

–Bookings of $889.6 million, an increase of 39% compared to full year 2023 bookings

–Ending backlog of $540.1 million, a 47% increase compared to the end of 2023

(AKRON, Ohio – March 31, 2025) – Babcock & Wilcox Enterprises, Inc. ("B&W", "Babcock & Wilcox" or the "Company") (NYSE: BW) announced results for the fourth quarter and full year 2024.

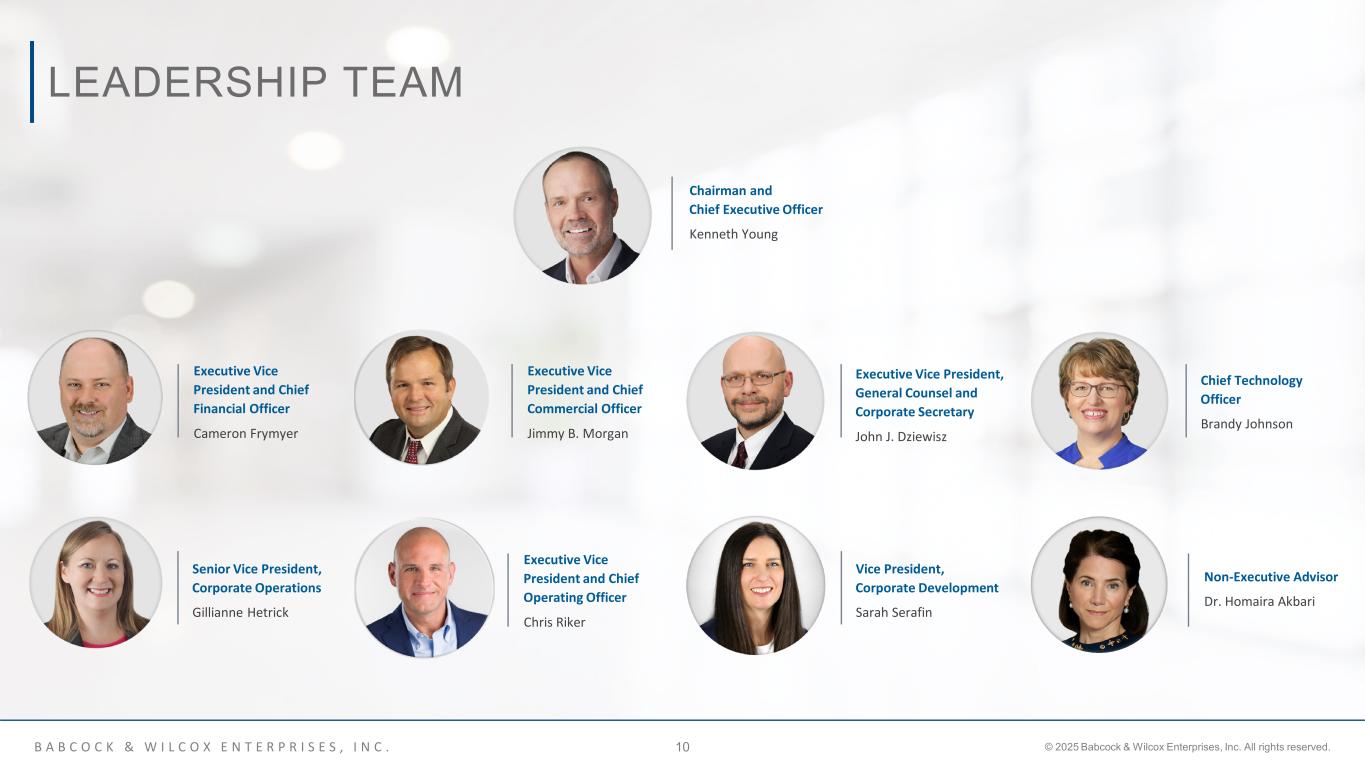

“During 2024, we successfully completed combined asset sales of $120.9 million and strategically reduced our exposure to new build projects internationally, while executing additional cost reductions across the business," said Kenneth Young, B&W's Chairman and Chief Executive Officer. "In the first few months of 2025, we have continued our restructuring efforts toward reducing our overall debt and we remain well positioned operationally from a demand perspective. In fact, our continuing operations going into 2025 have the largest backlog in recent company history as our Thermal segment continues to perform based on higher base load generation demand in North America. The company's core business continues to perform ahead of expectations and we anticipate returning to positive cash flow in 2025. We also remain focused on reducing our overall debt as we continue negotiations on certain asset sales and have entered in discussions with certain bond holders to potentially restructure some of our unsecured notes."

"Our full year results displayed continued year over year improvement in Adjusted EBITDA, excluding BrightLoop™ and ClimateBright™, achieving a 13% year over year increase,” Young said. “We continue to make progress in converting our global pipeline of identified project opportunities, as displayed by our increased bookings in 2024 on a continuing operations basis, which improved 39% compared to the previous year. We believe these results reflect a strong global demand for our technologies, underpinning our pipeline and outlook for sustained growth in 2025 and beyond.”

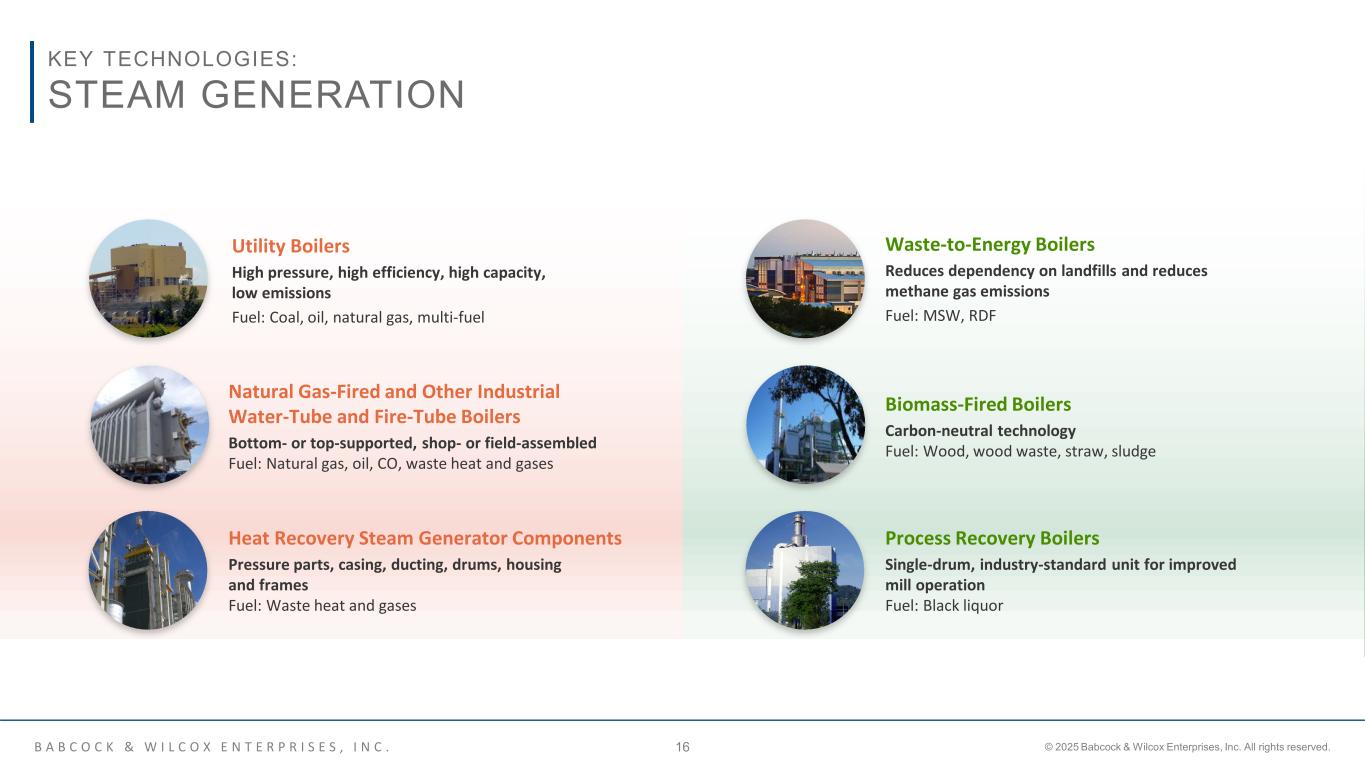

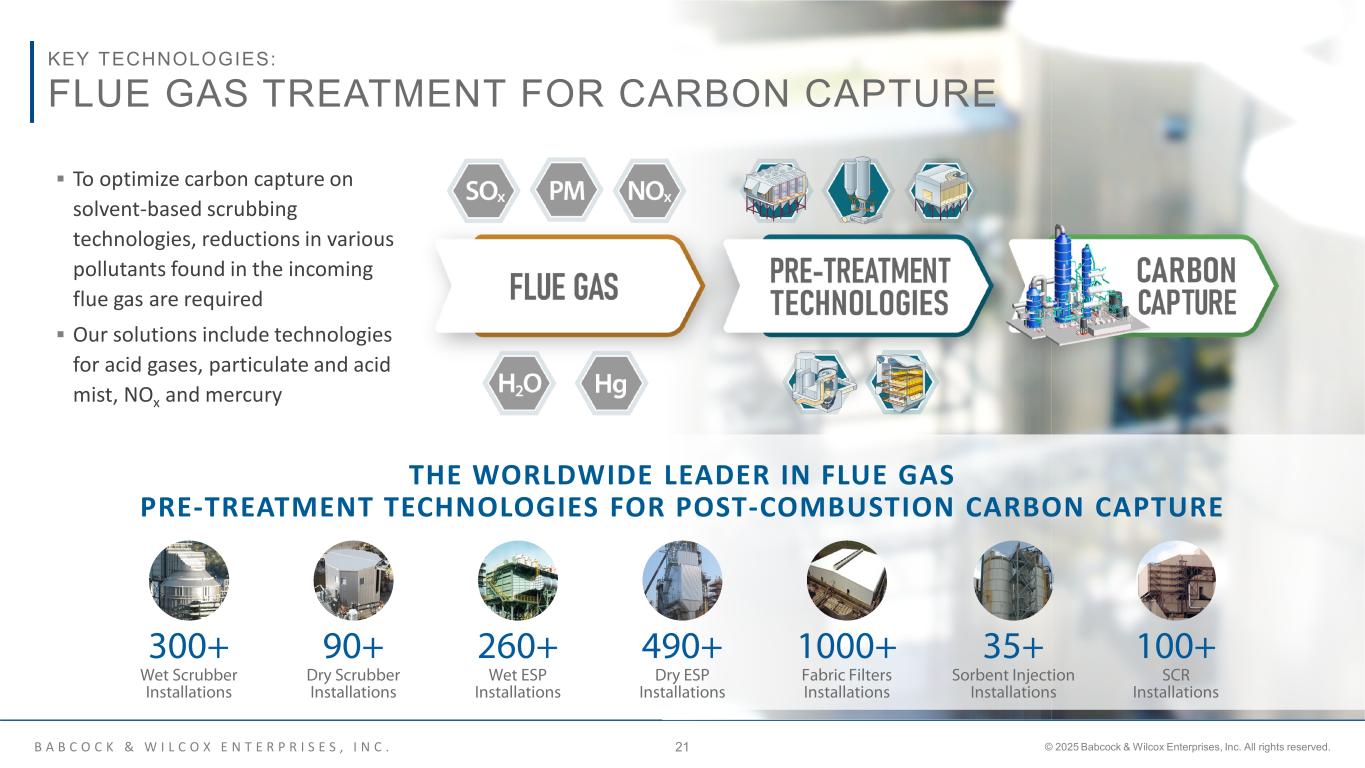

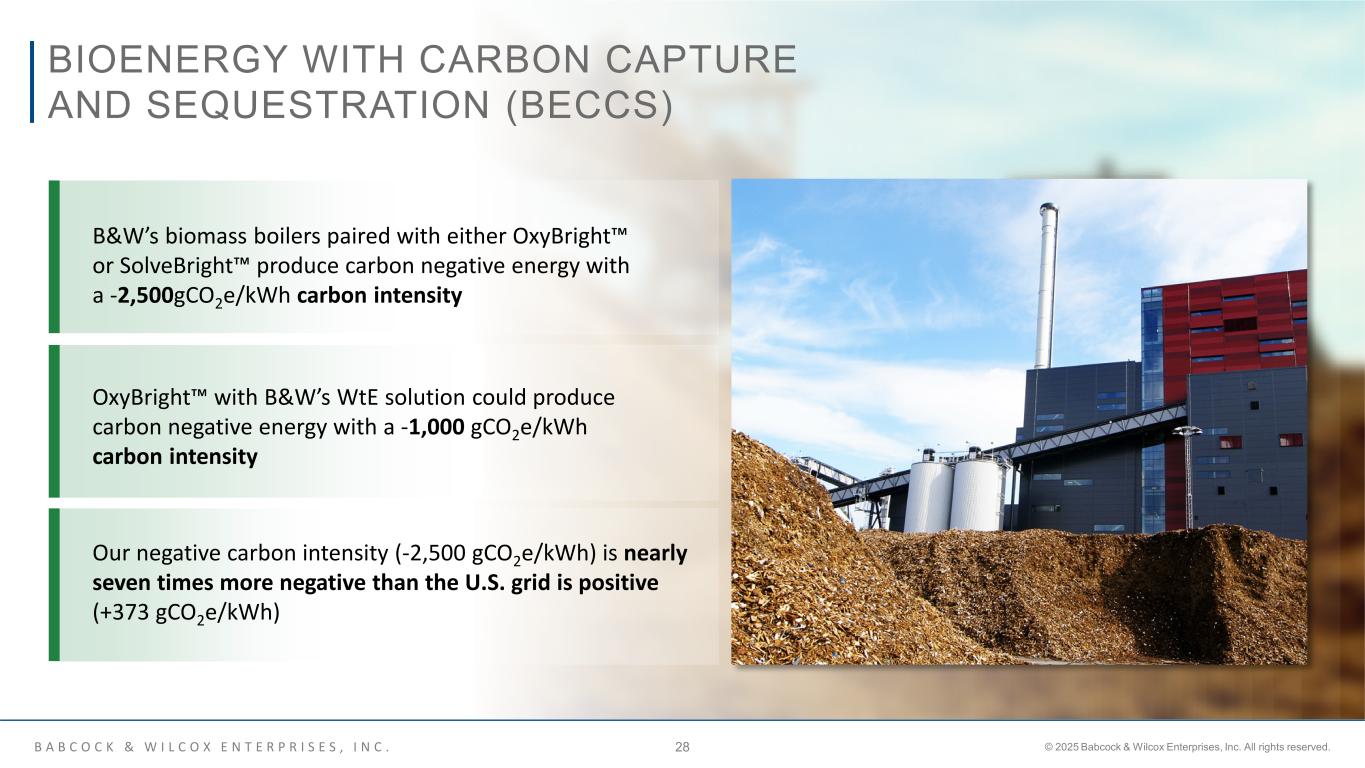

"We believe the increasing need for power and electricity fueled by demand from artificial intelligence data centers, electric vehicles and expanding economies will be key drivers for growth across our broad range of technologies, and we are seeing our utility and industrial clients, including in the oil and gas sector, continuing to increase capacity utilizing our core technologies while evaluating further power generation augmentation through biomass, hydrogen and natural gas," Young continued. "We expect these tailwinds to increase in the coming years, as the amount of front-end engineering design (FEED) opportunities have grown. Today we have 12 to 15 active FEED studies that represent potential projects of over $1 billion in revenues in our pipeline. We believe that these expected industry tailwinds provide a strong foundation for B&W to grow in 2025 and beyond as we continue to drive for higher margins and improved cash flows. Overall, we continue to see strong demand for our diverse portfolio of technologies, and we expect this will further drive increases to our backlog and bookings.”

“We also remain dedicated to our development, engineering and construction activities around our several BrightLoop projects and are intently focused on our strategic investments to enhance our ClimateBright decarbonization platform and BrightLoop hydrogen generation technology," Young added. "Notably, we continued to move forward on our BrightLoop project in Massillon, Ohio, with a target of producing hydrogen by early 2026, and we recently announced $10 million in funding for the development of a BrightLoop hydrogen production and carbon capture facility in Mason County, West Virginia. We are excited about the progress to date and about deploying our BrightLoop technology at commercial scale, and look forward to expanding our BrightLoop activities in the years ahead, with targeted bookings of approximately $1 billion by 2028, which represents less than 1% of the estimated global market for hydrogen production." “Looking forward, the refinancing of our current debt obligations remains one of our top priorities.

We are in discussions regarding the refinancing of the debt with key bondholders in addition to other potential asset sales. Finally in 2024, adjusted EBITDA from continuing operations was $68.9 million, and we anticipate continued growth in adjusted EBITDA from continuing operations in 2025, leading to our Full Year 2025 adjusted EBITDA target range of $70 million to $85 million."

Q4 2024 Continuing Operations Financial Summary

Revenues in the fourth quarter of 2024 were $200.8 million, an increase of $26.1 million, compared to revenues of $174.7 million in the fourth quarter of 2023. Operating income in the fourth quarter of 2024 was $11.6 million, compared to an operating loss of $3.3 million in the fourth quarter of 2023. Net loss in the fourth quarter of 2024 was $45.0 million, compared to a net loss of $58.3 million in the fourth quarter of 2023. Loss per share in the fourth quarter of 2024 was $0.52, compared to a loss per share of $0.70 in the fourth quarter of 2023. Adjusted EBITDA was $23.9 million, an increase compared to $15.4 million in the fourth quarter of 2023. All amounts referred to in this release are on a continuing operations basis, unless otherwise noted. Reconciliations of net income (loss), the most directly comparable GAAP measure, to Adjusted EBITDA and Adjusted EBITDA for the Company's segments, are provided in the exhibits to this release.

Babcock & Wilcox Renewable segment revenues were $33.6 million in the fourth quarter of 2024, an increase of 18% compared to $28.5 million in the fourth quarter of 2023. This is primarily due to the planned decision to reduce new build projects in Europe. Adjusted EBITDA in the fourth quarter of 2024 was $5.0 million, an increase compared to $3.1 million in the fourth quarter of 2023.

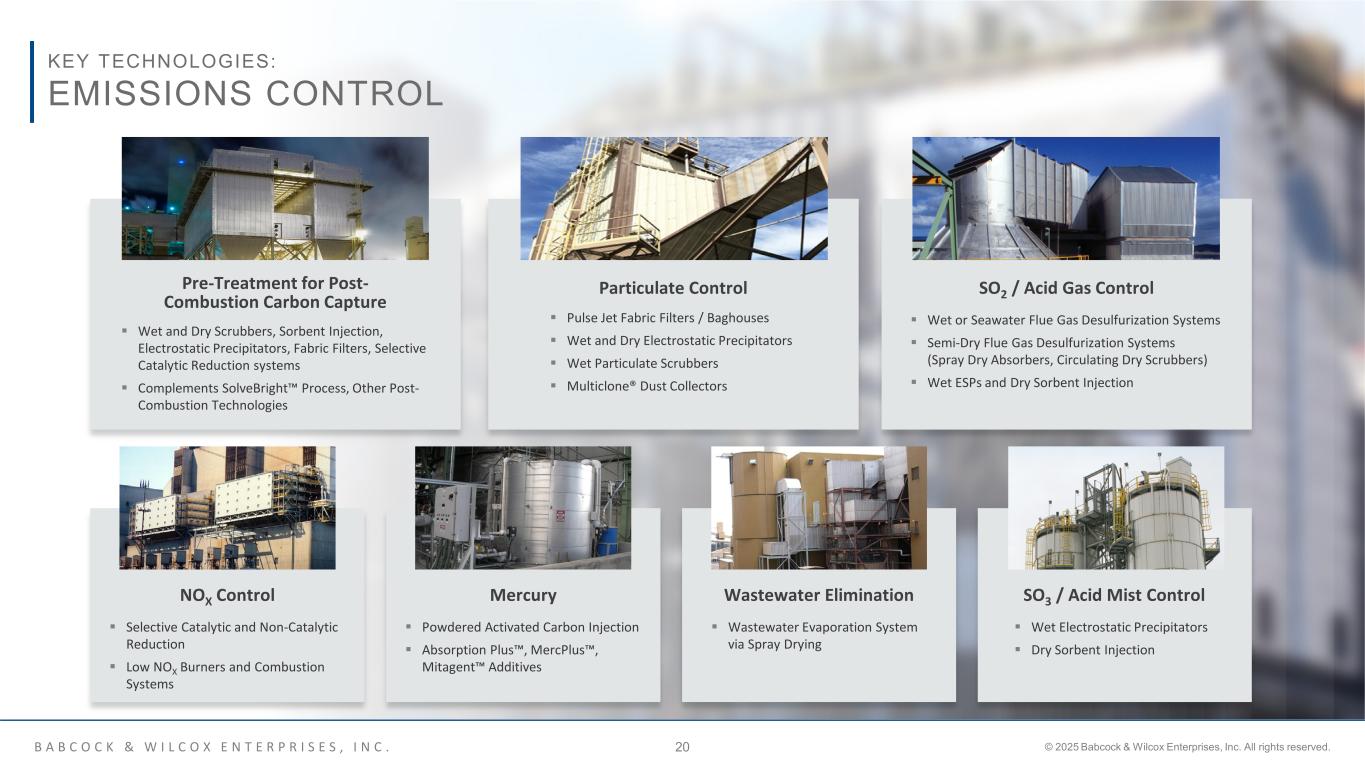

Babcock & Wilcox Environmental segment revenues were $19.0 million in the fourth quarter of 2024, a decrease of 39% compared to $31.3 million in the fourth quarter of 2023. This is primarily due to a large European project that had more volume and larger volume from our Allen-Sherman-Hoff® ash handling equipment and solutions in previous quarters. Adjusted EBITDA in the fourth quarter of 2024 was $4.0 million, compared to negative $1.2 million in the fourth quarter of 2023.

Babcock & Wilcox Thermal segment revenues were $148.2 million in the fourth quarter of 2024, an increase of 29% compared to $115.0 million in the fourth quarter of 2023. This is primarily due to a large natural gas conversion project as well as a large construction project being executed in Q4 2024. Adjusted EBITDA in the fourth quarter of 2024 was $17.9 million, an increase compared to $16.3 million in the fourth quarter of 2023.

Full Year 2024 Continuing Operations Financial Summary

Consolidated revenues in 2024 were $717.3 million, which remained stable compared to 2023. Net loss from continuing operations in 2024 was $73.0 million compared to a net loss from continuing operations of $75.8 million in 2023. Operating income in 2024 was $25.1 million, compared to operating income of $16.6 million in 2023 and consolidated Adjusted EBITDA was $68.9 million, an increase of 13% compared to $60.8 million in 2023. Total bookings in 2024 were $889.6 million, a 39% increase compared to full year 2023 bookings, and backlog at December 31, 2024 was $540.1 million, a 47% increase compared to December 31, 2023. Reconciliations of net income (loss), the most directly comparable GAAP measure to Adjusted EBITDA for the Company's segments, are provided in the exhibits to this release.

Babcock & Wilcox Renewable segment revenues were $110.1 million in 2024, a decrease of 22% compared to $140.8 million in 2023, primarily attributable to planned lower volume of certain European projects as well as projects that were nearing completion in 2023 and not fully replaced in 2024.

Adjusted EBITDA was $15.1 million, an increase of 136% compared to $6.4 million in 2023, primarily attributable to lower SG&A expenses due to lower allocation of costs associated with a lower percentage of revenue.

Babcock & Wilcox Environmental segment revenues were $109.4 million in 2024, an increase of 1% compared to $108.7 million in 2023, primarily attributable to growth in our electrostatic precipitator business. Adjusted EBITDA was $10.8 million, an increase of 161% compared to $4.1 million in 2023, primarily driven by growth and higher margins in our industrial electrostatic precipitator business.

Babcock & Wilcox Thermal segment revenues were $497.9 million in 2024, which was consistent with $499.2 million in 2023. The minor change is primarily due to project timing as a large construction project was completed in late 2023, and a new large natural gas conversion project did not begin until late 2024. The core Thermal parts and services business remains strong, inclusive of coal plant closures and natural gas conversions. Adjusted EBITDA in 2024 was $61.4 million, a decrease of 5% compared to $64.8 million in the prior year, primarily due to the large construction project timing described above as well as an increased share of allocated SG&A.

Liquidity and Balance Sheet

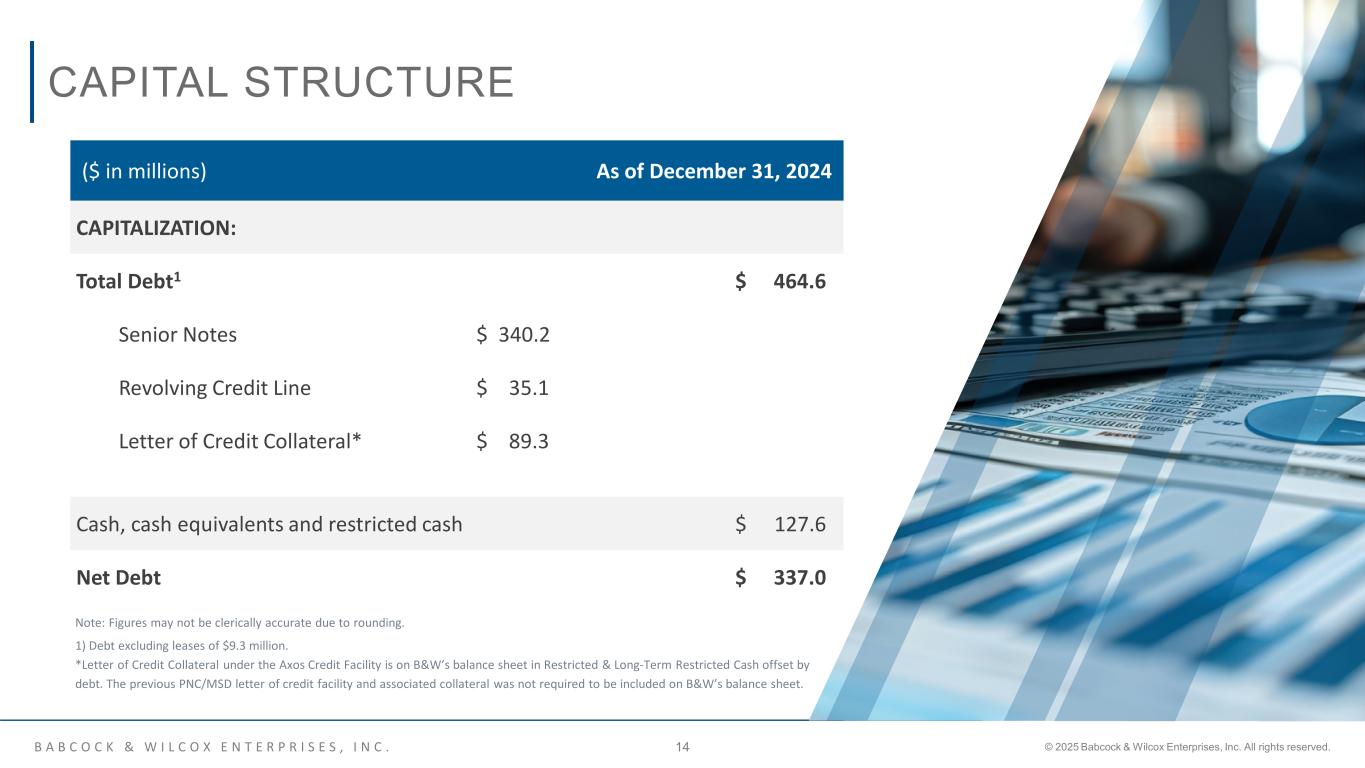

At December 31, 2024, the Company had total debt of $473.9 million and a cash, cash equivalents and restricted cash balance of $127.6 million.

The Company has a credit agreement that provides for an up to $150.0 million asset-based credit facility with an outstanding balance of $124.4 million, comprised of a $35.1 million revolver and $89.3 million in letters of credit as of December 31, 2024 that is now currently due in November 2025 and accordingly is classified as a current liability. In addition, the Company has senior notes with an aggregate principal amount of $193.0 million as of December 31, 2024 for which the maturity date is February 2026 and is within the 12 months following the issuance of these financial statements. As a result of the uncertainty regarding our demonstrated ability to repay the current debt, these conditions raise substantial doubt about the Company’s ability to continue as a going concern. Management believes it is taking all appropriate actions to address the current debt and alleviate our going concern; however, these plans have not been finalized and are subject to market conditions.

Earnings Call Information

B&W plans to host a conference call and webcast on Monday, March 31, 2025 at 5 p.m. ET to discuss the Company's fourth quarter 2024 results. The listen-only audio of the conference call will be broadcast live via the Internet on B&W’s Investor Relations site. The dial-in number for participants in the U.S. is (833) 470-1428; the dial-in number for participants in Canada is (833) 950-0062; the dial-in number for participants in all other locations is (929) 526-1599. The conference ID for all participants is 798073. A replay of this conference call will remain accessible in the investor relations section of the Company’s website for a limited time.

Non-GAAP Financial Measures

The Company uses non-GAAP financial measures internally, also referred to in this release as “adjusted” financial measures, to evaluate its performance and in making financial and operational decisions. When viewed in conjunction with GAAP results and the accompanying reconciliation, the Company believes that its presentation of these measures provides investors with greater transparency and a greater understanding of factors affecting its financial condition and results of operations than GAAP measures alone.

The presentation of non-GAAP financial measures should not be considered in isolation or as a substitute for the Company’s related financial results prepared in accordance with GAAP.

Adjusted EBITDA on a consolidated basis is a non-GAAP metric defined as the sum of the Adjusted EBITDA for each of the segments, further adjusted for corporate allocations and research and development costs. At a segment level, the Adjusted EBITDA presented is consistent with the way the Company's chief operating decision maker reviews the results of operations and makes strategic decisions about the business and is calculated as earnings before interest expense, tax, depreciation and amortization adjusted for items such as gains or losses arising from the sale of non-income producing assets, net pension benefits, restructuring costs, impairments, gains and losses on debt extinguishment, costs related to financial consulting, research and development costs and other costs that may not be directly controllable by segment management and are not allocated to the segment. The Company presents consolidated Adjusted EBITDA because it believes it is useful to investors to help facilitate comparisons of the ongoing, operating performance before corporate overhead and other expenses not attributable to the operating performance of the Company's revenue generating segments. In addition, the Company presents the non-GAAP financial measure of Adjusted EBITDA excluding BrightLoop and ClimateBright. Management believes this measure is useful to investors because of the increasing importance of BrightLoop and ClimateBright to the future growth of the Company. Management uses Adjusted EBITDA excluding BrightLoop and ClimateBright to assess the Company's performance independent of these technologies.

This release also presents certain targets for the Company's Adjusted EBITDA in the future; these targets are not intended as guidance regarding how the Company believes the business will perform. The Company is unable to reconcile these targets to their GAAP counterparts without unreasonable effort and expense. Prior period results have been revised to conform with the revised definition and present separate reconciling items in our reconciliation, including business transition costs.

Bookings and Backlog

Bookings and backlog are our measures of remaining performance obligations under our sales contracts. It is possible that our methodology for determining bookings and backlog may not be comparable to methods used by other companies.

We generally include expected revenue from contracts in our backlog when we receive written confirmation from our customers authorizing the performance of work and committing the customers to payment for work performed. Backlog may not be indicative of future operating results, and contracts in our backlog may be canceled, modified or otherwise altered by customers. Backlog can vary significantly from period to period, particularly when large new build projects or operations and maintenance contracts are booked because they may be fulfilled over multiple years. Because we operate globally, our backlog is also affected by changes in foreign currencies each period. We do not include orders of our unconsolidated joint ventures in backlog.

Bookings represent changes to the backlog. Bookings include additions from booking new business, subtractions from customer cancellations or modifications, changes in estimates of liquidated damages that affect selling price and revaluation of backlog denominated in foreign currency. We believe comparing bookings on a quarterly basis or for periods less than one year is less meaningful than for longer periods and that shorter-term changes in bookings may not necessarily indicate a material trend.

Impacts of Market Conditions

Management continues to adapt to macroeconomic conditions, including the impacts from inflation, changing interest rates and foreign exchange rate volatility, geopolitical conflicts (including the ongoing conflicts in Ukraine and the Middle East) and global shipping and supply chain disruptions that continued to have an impact across 2024. In certain instances, these situations have resulted in cost increases and delays or disruptions that have had, and could continue to have, an adverse impact on our ability to meet customers’ demands. We continue to actively monitor the impact of these market conditions on current and future periods and actively manage costs and our liquidity position to provide additional flexibility while still supporting our customers and their specific needs. The duration and scope of these conditions cannot be predicted, and therefore, any anticipated negative financial impact on our operating results cannot be reasonably estimated.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current fact included in this release are forward-looking statements. You should not place undue reliance on these statements. Forward-looking statements include words such as “expect,” “intend,” “plan,” “likely,” “seek,” “believe,” “project,” “forecast,” “target,” “goal,” “potential,” “estimate,” “may,” “might,” “will,” “would,” “should,” “could,” “can,” “have,” “due,” “anticipate,” “assume,” “contemplate,” “continue” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operational performance or other events.

The forward-looking statements included herein are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as required by law. These forward-looking statements are based on management’s current expectations and involve a number of risks and uncertainties, including, but not limited to: that our financial condition raises substantial doubt as to our ability to continue as a going concern and we have entered into a number of amendments and waivers to our Debt Facilities; our need of additional financing to continue as a going concern; any negative reactions to the substantial doubt about our ability to continue as a going concern by our customers, suppliers, vendors, employees and other third parties; risks associated with contractual pricing in our industry; our relationships with customers, subcontractors and other third parties; our ability to comply with our contractual obligations; disruptions at our manufacturing facilities or a third-party manufacturing facility that we have engaged; the actions or failures of our co-venturers; our ability to implement our growth strategy, including through strategic acquisitions, which we may not successfully consummate or integrate; our evaluation of strategic alternatives for certain businesses and non-core assets may not result in a successful transaction; the risks of unexpected adjustments and cancellations in our backlog; professional liability, product liability, warranty and other claims; our ability to compete successfully against current and future competitors; our ability to develop and successfully market new products; the impacts of macroeconomic downturns, industry conditions and public health crises; the cyclical nature of the industries in which we operate; changes in the legislative and regulatory environment in which we operate; supply chain issues, including shortages of adequate components; failure to properly estimate customer demand; our ability to comply with the covenants in our debt agreements; our ability to refinance our 8.125% Notes due 2026 and 6.50% Notes due 2026 prior to their maturity; our ability to maintain adequate bonding and letter of credit capacity; impairment of goodwill or other indefinite-lived intangible assets; credit risk; disruptions in, or failures of, our information systems; our ability to comply with privacy and information security laws; our ability to protect our intellectual property and use the intellectual property that we license from third parties; risks related to our international operations, including fluctuations in the value of foreign currencies, global tariffs, sanctions and export controls could harm our profitability; volatility in the price of our common stock; B. Riley’s significant influence over us; changes in tax rates or tax law; our ability to use NOL and certain tax credits; our ability to maintain effective internal control over financial reporting; our ability to attract and retain skilled personnel and senior management; labor problems, including negotiations with labor unions and possible work stoppages; risks associated with our retirement benefit plans; natural disasters or other events beyond our control, such as war, armed conflicts or terrorist attacks; and the risks and uncertainties described under the heading "Risk Factors" in Part I, Item 1A of this Annual Report, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the SEC.

The forward-looking statements included herein are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as required by law.

About B&W Enterprises, Inc.

Headquartered in Akron, Ohio, Babcock & Wilcox Enterprises, Inc. is a leader in energy and environmental products and services for power and industrial markets worldwide. Follow us on LinkedIn and learn more at babcock.com.

# # #

|

|

|

|

|

|

| Investor Contact: |

Media Contact: |

| Cameron Frymyer, Chief Financial Officer |

Ryan Cornell, Public Relations Lead |

Babcock & Wilcox Enterprises, Inc. |

Babcock & Wilcox Enterprises, Inc. |

330.860.6176 | investors@babcock.com |

330.860.1345 | rscornell@babcock.com |

Exhibit 1

Babcock & Wilcox Enterprises, Inc.

Condensed Consolidated Statements of Operations (1)

(In millions, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, |

Year ended December 31, |

|

2024 |

2023 |

2024 |

2023 |

| Revenues |

$ |

200.8 |

|

$ |

174.7 |

|

$ |

717.3 |

|

$ |

727.3 |

|

| Costs and expenses: |

|

|

|

|

| Cost of operations |

150.5 |

|

135.3 |

|

540.3 |

|

550.6 |

|

| Selling, general and administrative expenses |

32.6 |

|

37.2 |

|

141.5 |

|

150.1 |

|

|

|

|

|

|

|

|

|

|

|

| Restructuring activities |

0.2 |

|

0.4 |

|

1.3 |

|

2.6 |

|

Research and development costs |

2.6 |

|

5.0 |

|

5.8 |

|

7.2 |

|

|

|

|

|

|

| Impairment on long-lived assets |

3.7 |

|

— |

|

3.7 |

|

— |

|

(Gain) loss on asset disposals, net |

(0.4) |

|

0.1 |

|

(0.4) |

|

0.1 |

|

| Total costs and expenses |

189.3 |

|

178.0 |

|

692.2 |

|

710.7 |

|

Operating income (loss) |

11.5 |

|

(3.3) |

|

25.1 |

|

16.6 |

|

| Other (expense) income: |

|

|

|

|

| Interest expense |

(12.1) |

|

(11.1) |

|

(46.1) |

|

(42.6) |

|

| Interest income |

0.5 |

|

0.3 |

|

0.8 |

|

1.1 |

|

| Loss on debt extinguishment |

(0.5) |

|

— |

|

(7.3) |

|

— |

|

| Benefit plans, net |

(32.2) |

|

(37.2) |

|

(31.9) |

|

(37.5) |

|

| Foreign exchange |

(2.6) |

|

1.3 |

|

(0.1) |

|

(2.6) |

|

Other expense, net |

(0.9) |

|

(0.2) |

|

(1.2) |

|

(1.0) |

|

Total other expense, net |

(47.8) |

|

(46.8) |

|

(85.9) |

|

(82.6) |

|

Loss before income tax expense |

(36.2) |

|

(50.1) |

|

(60.8) |

|

(66.0) |

|

Income tax expense |

8.8 |

|

8.2 |

|

12.2 |

|

9.8 |

|

Loss from continuing operations |

(45.0) |

|

(58.3) |

|

(73.0) |

|

(75.8) |

|

(Loss) income from discontinued operations, net of tax |

(18.0) |

|

(3.9) |

|

13.2 |

|

(121.2) |

|

Net loss |

(63.0) |

|

(62.2) |

|

(59.8) |

|

(197.0) |

|

| Net loss attributable to non-controlling interest |

— |

|

— |

|

(0.1) |

|

(0.2) |

|

Net loss attributable to stockholders |

(63.1) |

|

(62.2) |

|

(59.9) |

|

(197.2) |

|

| Less: Dividend on Series A preferred stock |

3.7 |

|

3.7 |

|

14.9 |

|

14.9 |

|

Net loss attributable to stockholders of common stock |

$ |

(66.8) |

|

$ |

(66.0) |

|

$ |

(74.8) |

|

$ |

(212.1) |

|

|

|

|

|

|

Basic and diluted loss per share |

|

|

|

|

| Continuing operations |

$ |

(0.52) |

|

$ |

(0.70) |

|

$ |

(0.96) |

|

$ |

(1.02) |

|

| Discontinued operations |

(0.19) |

|

(0.04) |

|

0.14 |

|

(1.36) |

|

|

$ |

(0.71) |

|

$ |

(0.74) |

|

$ |

(0.82) |

|

$ |

(2.38) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in the computation of loss per share: |

|

|

|

|

| Basic and diluted |

94.1 |

|

89.4 |

|

91.7 |

|

89.0 |

|

|

|

|

|

|

(1) Figures may not be clerically accurate due to rounding

Exhibit 2

Babcock & Wilcox Enterprises, Inc.

Condensed Consolidated Balance Sheets (1)

|

|

|

|

|

|

|

|

|

|

| (In millions, except per share amount) |

December 31, 2024 |

December 31, 2023 |

|

| Cash and cash equivalents |

$ |

23.4 |

|

$ |

39.9 |

|

|

| Current restricted cash |

94.2 |

|

3.9 |

|

|

| Accounts receivable – trade, net |

112.7 |

|

101.4 |

|

|

|

|

|

|

| Contracts in progress |

82.4 |

|

50.3 |

|

|

| Inventories, net |

108.9 |

|

97.6 |

|

|

| Other current assets |

25.1 |

|

42.2 |

|

|

| Current assets held for sale |

43.6 |

|

162.3 |

|

|

| Total current assets |

490.2 |

|

497.6 |

|

|

| Net property, plant and equipment, and finance leases |

69.6 |

|

69.4 |

|

|

| Goodwill |

82.1 |

|

85.1 |

|

|

| Intangible assets, net |

19.1 |

|

23.6 |

|

|

| Right-of-use assets |

32.8 |

|

26.1 |

|

|

| Long-term restricted cash |

10.0 |

|

0.3 |

|

|

| Deferred tax assets |

— |

|

2.1 |

|

|

| Other assets |

23.1 |

|

20.8 |

|

|

| Noncurrent assets held for sale |

— |

|

50.8 |

|

|

| Total assets |

$ |

727.0 |

|

$ |

775.7 |

|

|

|

|

| Accounts payable |

$ |

101.0 |

|

$ |

83.2 |

|

|

| Accrued employee benefits |

4.9 |

|

3.8 |

|

|

| Advance billings on contracts |

58.5 |

|

59.1 |

|

|

| Accrued warranty expense |

3.4 |

|

4.4 |

|

|

| Financing lease liabilities |

1.6 |

|

1.4 |

|

|

| Operating lease liabilities |

3.6 |

|

3.3 |

|

|

| Other accrued liabilities |

36.0 |

|

51.1 |

|

|

| Current borrowings |

125.1 |

|

6.2 |

|

|

| Current liabilities held for sale |

54.4 |

|

137.9 |

|

|

| Total current liabilities |

388.5 |

|

350.2 |

|

|

| Senior notes |

340.2 |

|

337.9 |

|

|

| Borrowings, net of current portion |

8.6 |

|

35.4 |

|

|

| Pension and other postretirement benefit liabilities |

192.7 |

|

172.9 |

|

|

| Finance lease liabilities, net of current portion |

28.5 |

|

26.2 |

|

|

| Operating lease liabilities, net of current portion |

30.3 |

|

23.9 |

|

|

| Deferred tax liability |

11.0 |

|

10.2 |

|

|

| Other noncurrent liabilities |

10.4 |

|

13.9 |

|

|

| Non-current liabilities held for sale |

— |

|

5.4 |

|

|

| Total liabilities |

1,010.2 |

|

976.1 |

|

|

|

|

|

|

Stockholders' deficit: |

|

|

|

Preferred stock, par value $0.01 per share, authorized shares of 20,000; issued and outstanding shares 7,669 at both December 31, 2024 and December 31, 2023 |

0.1 |

|

0.1 |

|

|

Common stock, par value $0.01 per share, authorized shares of 500,000; outstanding shares of 95,138 and 89,449 at December 31, 2024 and December 31, 2023, respectively |

5.2 |

|

5.1 |

|

|

| Capital in excess of par value |

1,558.8 |

|

1,546.3 |

|

|

Treasury stock at cost, 2,379 and 2,139 shares at December 31, 2024 and December 31, 2023, respectively |

(115.5) |

|

(115.2) |

|

|

| Accumulated deficit |

(1,645.7) |

|

(1,570.9) |

|

|

| Accumulated other comprehensive loss |

(86.7) |

|

(66.4) |

|

|

Stockholders' deficit attributable to shareholders |

(283.8) |

|

(201.0) |

|

|

| Non-controlling interest |

0.6 |

|

0.6 |

|

|

Total stockholders' deficit |

(283.2) |

|

(200.4) |

|

|

Total liabilities and stockholders' deficit |

$ |

727.0 |

|

$ |

775.7 |

|

|

(1) Figures may not be clerically accurate due to rounding.

Exhibit 3

Babcock & Wilcox Enterprises, Inc.

Condensed Consolidated Statements of Cash Flows (1)

|

|

|

|

|

|

|

|

|

| (In millions) |

Year ended December 31, |

|

2024 |

2023 |

| Cash flows from operating activities: |

|

|

Net loss from continuing operations |

$ |

(73.0) |

|

$ |

(75.8) |

|

Net income (loss) from discontinued operations |

13.2 |

|

(121.2) |

|

Net loss |

(59.8) |

|

(197.0) |

|

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

| Depreciation and amortization of long-lived assets |

16.7 |

|

21.0 |

|

| Impairment of goodwill and long-lived assets |

9.6 |

|

56.6 |

|

| Amortization of deferred financing costs and debt discount |

5.8 |

|

5.7 |

|

| Amortization of guaranty fee |

2.9 |

|

0.9 |

|

| Non-cash operating lease expense |

7.4 |

|

6.8 |

|

|

|

|

| Loss on debt extinguishment |

7.3 |

|

— |

|

| Gain on sale of business |

(58.9) |

|

— |

|

|

|

|

Loss on asset disposals |

0.4 |

|

0.2 |

|

Provision for (benefit from) deferred income taxes, including valuation allowances |

7.1 |

|

(1.5) |

|

| Mark to market, prior service cost amortization for pension and postretirement plans |

34.9 |

|

38.9 |

|

| Stock-based compensation, net of associated income taxes |

4.7 |

|

8.7 |

|

| Foreign exchange |

3.1 |

|

2.5 |

|

| Changes in operating assets and liabilities: |

|

|

| Accounts receivable - trade, net and other |

(13.4) |

|

31.2 |

|

| Contracts in progress |

(41.6) |

|

40.2 |

|

| Advance billings on contracts |

(3.3) |

|

(47.3) |

|

| Inventories, net |

(6.4) |

|

(8.1) |

|

| Income taxes |

9.7 |

|

(6.3) |

|

| Accounts payable |

8.1 |

|

12.9 |

|

| Accrued and other current liabilities |

(28.5) |

|

(2.6) |

|

| Accrued contract loss |

(2.4) |

|

0.8 |

|

| Pension liabilities, accrued postretirement benefits and employee benefits |

(16.8) |

|

(5.0) |

|

| Other, net |

(5.3) |

|

(1.0) |

|

Net cash used in operating activities |

(118.7) |

|

(42.3) |

|

|

|

|

| Cash flows from investing activities: |

|

|

| Purchase of property, plant and equipment |

(11.2) |

|

(9.8) |

|

|

|

|

| Proceeds from sale of business and assets, net |

120.9 |

|

— |

|

| Purchases of available-for-sale securities |

(7.1) |

|

(6.1) |

|

| Sales and maturities of available-for-sale securities |

7.4 |

|

8.1 |

|

| Other, net |

— |

|

(0.1) |

|

Net cash provided by (used in) investing activities |

110.0 |

|

(7.9) |

|

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

| Borrowings on loan payable |

215.6 |

|

252.5 |

|

| Repayments on loan payable |

(121.9) |

|

(226.6) |

|

| Payment of holdback funds from acquisition |

(3.0) |

|

(2.8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Finance lease payments |

(1.4) |

|

(1.2) |

|

| Payment of preferred stock dividends |

(18.6) |

|

(11.1) |

|

| Shares of common stock returned to treasury stock |

(0.3) |

|

(1.4) |

|

| Issuance of common stock, net |

7.9 |

|

— |

|

| Debt issuance costs |

(8.5) |

|

(0.7) |

|

| Other, net |

(0.2) |

|

(0.2) |

|

Net cash provided by financing activities |

69.7 |

|

8.6 |

|

| Effects of exchange rate changes on cash |

(1.3) |

|

(0.4) |

|

Net increase (decrease) in cash, cash equivalents and restricted cash |

59.7 |

|

(42.1) |

|

| Cash, cash equivalents and restricted cash at beginning of period |

71.4 |

|

113.5 |

|

| Cash, cash equivalents and restricted cash at end of period |

$ |

131.1 |

|

$ |

71.4 |

|

(1) Figures may not be clerically accurate due to rounding.

Exhibit 4

Babcock & Wilcox Enterprises, Inc.

Segment Information (1)

(In millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SEGMENT RESULTS |

Three months ended December 31, |

Year ended December 31, |

|

2024 |

2023 |

2024 |

2023 |

| REVENUES: |

|

|

|

|

| Babcock & Wilcox Renewable |

$ |

33.6 |

|

$ |

28.5 |

|

$ |

110.1 |

|

$ |

140.8 |

|

| Babcock & Wilcox Environmental |

19.0 |

|

31.3 |

|

109.4 |

|

108.7 |

|

| Babcock & Wilcox Thermal |

148.2 |

|

115.0 |

|

497.9 |

|

499.2 |

|

| Other |

— |

|

(0.1) |

|

(0.1) |

|

(21.4) |

|

|

$ |

200.8 |

|

$ |

174.7 |

|

$ |

717.3 |

|

$ |

727.3 |

|

|

|

|

|

|

| ADJUSTED EBITDA: |

|

|

|

|

| Babcock & Wilcox Renewable |

$ |

5.0 |

|

$ |

3.1 |

|

$ |

15.1 |

|

$ |

6.4 |

|

| Babcock & Wilcox Environmental |

4.0 |

|

(1.2) |

|

10.8 |

|

4.1 |

|

| Babcock & Wilcox Thermal |

17.9 |

|

16.3 |

|

61.4 |

|

64.8 |

|

| Corporate |

(3.1) |

|

(2.7) |

|

(18.4) |

|

(14.5) |

|

|

|

|

|

|

|

$ |

23.9 |

|

$ |

15.4 |

|

$ |

68.9 |

|

$ |

60.8 |

|

|

|

|

|

|

| AMORTIZATION EXPENSE: |

|

|

|

|

| Babcock & Wilcox Renewable |

$ |

0.1 |

|

$ |

0.1 |

|

$ |

0.4 |

|

$ |

0.5 |

|

| Babcock & Wilcox Environmental |

0.1 |

|

0.1 |

|

0.4 |

|

0.6 |

|

| Babcock & Wilcox Thermal |

1.1 |

|

1.1 |

|

4.3 |

|

4.4 |

|

|

$ |

1.3 |

|

$ |

1.4 |

|

$ |

5.2 |

|

$ |

5.6 |

|

|

|

|

|

|

| DEPRECIATION EXPENSE: |

|

|

|

|

| Babcock & Wilcox Renewable |

$ |

— |

|

$ |

0.3 |

|

$ |

0.8 |

|

$ |

1.4 |

|

| Babcock & Wilcox Environmental |

— |

|

0.3 |

|

0.9 |

|

1.5 |

|

| Babcock & Wilcox Thermal |

0.4 |

|

1.5 |

|

4.3 |

|

5.9 |

|

|

$ |

0.4 |

|

$ |

2.2 |

|

$ |

6.0 |

|

$ |

8.7 |

|

|

|

|

|

|

| BOOKINGS AND BACKLOG |

Three months ended December 31, |

Year ended December 31, |

|

2024 |

2023 |

2024 |

2023 |

| BOOKINGS: |

|

|

|

|

| Babcock & Wilcox Renewable |

$ |

17 |

|

$ |

19 |

|

$ |

108 |

|

$ |

130 |

|

| Babcock & Wilcox Environmental |

11 |

|

15 |

|

65 |

|

108 |

|

| Babcock & Wilcox Thermal |

395 |

|

111 |

|

717 |

|

410 |

|

| Other/Eliminations |

3 |

|

(5) |

|

0 |

|

(10) |

|

|

$ |

426 |

|

$ |

140 |

|

$ |

890 |

|

$ |

638 |

|

|

|

|

|

|

|

BACKLOG |

|

|

|

As of December 31, |

|

|

|

2024 |

2023 |

|

|

| Babcock & Wilcox Renewable |

$ |

54 |

|

$ |

63 |

|

|

|

| Babcock & Wilcox Environmental |

42 |

|

88 |

|

|

|

| Babcock & Wilcox Thermal |

437 |

|

211 |

|

|

|

| Other/Eliminations |

7 |

|

7 |

|

|

|

|

$ |

540 |

|

$ |

369 |

|

|

|

(1) Figures may not be clerically accurate due to rounding.

Exhibit 5

Babcock & Wilcox Enterprises, Inc.

Reconciliation of Adjusted EBITDA (1)

(In millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, |

Year ended December 31, |

|

|

2024 |

2023 |

2024 |

2023 |

|

|

Net loss from continuing operations |

$ |

(45.0) |

|

$ |

(58.8) |

|

$ |

(73.0) |

|

$ |

(75.8) |

|

|

|

| Interest expense, net |

(11.7) |

|

(10.8) |

|

45.3 |

|

41.5 |

|

|

|

| Income tax expense |

(8.8) |

|

(8.2) |

|

12.2 |

|

9.8 |

|

|

|

| Depreciation & amortization |

0.4 |

|

2.2 |

|

11.1 |

|

14.3 |

|

|

|

| EBITDA |

(22.9) |

|

(36.2) |

|

(4.3) |

|

(10.2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Benefit plans, net |

32.2 |

|

37.2 |

|

31.9 |

|

37.5 |

|

|

|

Gain (loss) on asset sales, net |

(0.4) |

|

0.1 |

|

(0.4) |

|

0.1 |

|

|

|

| Impairment of goodwill and long-lived assets |

3.7 |

|

— |

|

3.7 |

|

— |

|

|

|

| Stock compensation |

0.5 |

|

1.2 |

|

4.5 |

|

7.1 |

|

|

|

| Restructuring activities and business services transition costs |

0.2 |

|

2.4 |

|

1.3 |

|

2.6 |

|

|

|

Settlement and related legal costs (recoveries) |

0.8 |

|

1.5 |

|

4.0 |

|

(1.5) |

|

|

|

Loss on debt extinguishment |

0.5 |

|

— |

|

7.3 |

|

— |

|

|

|

| Advisory fees for settlement costs and liquidity planning |

(0.1) |

|

0.6 |

|

1.2 |

|

1.1 |

|

|

|

| Acquisition pursuit and related costs |

0.4 |

|

0.2 |

|

0.6 |

|

0.8 |

|

|

|

Product development (2) |

3.1 |

|

5.7 |

|

8.2 |

|

9.0 |

|

|

|

| Foreign exchange |

2.6 |

|

(1.3) |

|

0.1 |

|

2.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Letter of credit fees |

1.3 |

|

2.1 |

|

7.0 |

|

7.7 |

|

|

|

| Other - net |

1.9 |

|

1.9 |

|

3.6 |

|

3.8 |

|

|

|

| Adjusted EBITDA |

$ |

23.9 |

|

$ |

15.4 |

|

$ |

68.9 |

|

$ |

60.8 |

|

|

|

Product development (2) |

(2.8) |

|

(5.3) |

|

(6.6) |

|

(7.1) |

|

|

|

BrightLoopTM and ClimateBrightTM expenses |

3.4 |

|

6.6 |

|

10.3 |

|

12.0 |

|

|

|

Adjusted EBITDA excluding BrightLoopTM and ClimateBrightTM expenses |

$ |

24.6 |

|

$ |

16.7 |

|

$ |

72.6 |

|

$ |

65.7 |

|

|

|

(1) Figures may not be clerically accurate due to rounding.

(2) Costs associated with development of commercially viable products that are ready to go to market. The elements of these costs associated with BrightLoopTM and ClimateBrightTM are included in the BrightLoopTM and ClimateBrightTM expenses line.