FALSE000105335200010533522026-01-222026-01-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 22, 2026

HERITAGE COMMERCE CORP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| California |

|

000-23877 |

|

77-0469558 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

|

|

|

|

|

|

|

224 Airport Parkway, San Jose, California |

|

95110 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (408) 947-6900

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, No Par Value |

|

HTBK |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the

Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On January 22, 2026, Heritage Commerce Corp (the “Company”), the holding company for Heritage Bank of Commerce (the “Bank”), issued a press release announcing its preliminary unaudited financial results for the fourth quarter and year ended December 31, 2025. Copies of the press release and the Investor Presentation for the Fourth Quarter of 2025 are attached as Exhibit 99.1 and Exhibit 99.2 to this Current Report and are incorporated herein by reference.

The information in this report set forth under this Item 2.02 and in Exhibits 99.1 and 99.2 is being furnished pursuant to Item 2.02 of Form 8-K and shall not be treated as “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration statement or other filing pursuant to the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as expressly stated by specific reference in such filing.

ITEM 7.01 REGULATION FD DISCLOSURE

A copy of the Company’s press release announcing the quarterly dividend described below is attached as Exhibit 99.3 to this Current Report on Form 8-K. In accordance with General Instruction B.2 of Form 8-K, this press release is deemed to be “furnished” and shall not be deemed “filed” for the purpose of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration statement or other filing pursuant to the Securities Act or the Exchange Act.

ITEM 8.01 OTHER EVENTS

QUARTERLY DIVIDEND

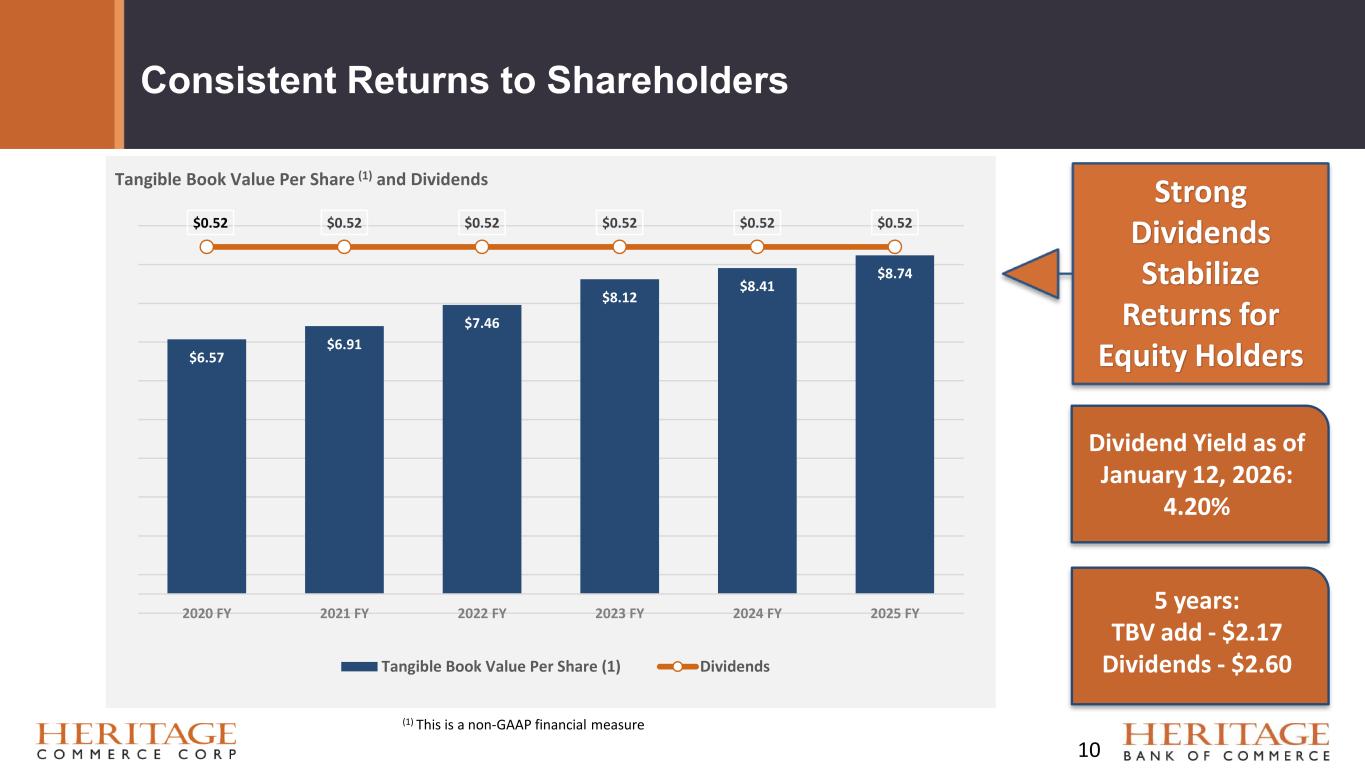

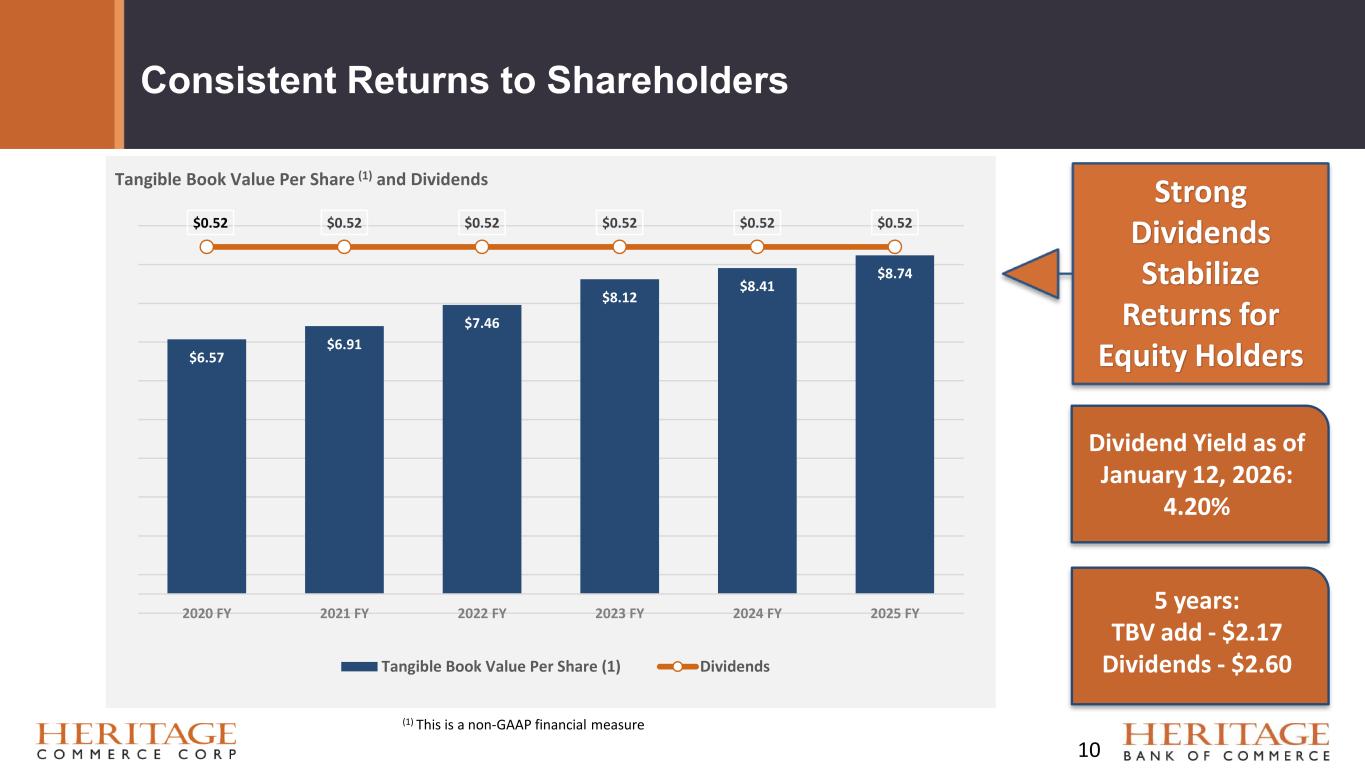

On January 22, 2026, the Company announced that its Board of Directors (the "Board") declared a $0.13 per share quarterly cash dividend to holders of its common stock. The dividend will be paid on February 19, 2026, to shareholders of record at the close of the business day on February 5, 2026.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This communication may contain certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements about the benefits of the proposed transaction (including statements about the future financial and operating results and impact on Heritage Commerce Corp’s (“Heritage”) earnings and tangible book value per share), the plans, objectives, expectations and intentions of CVB Financial Corp. (“Citizens”) and Heritage, the expected timing of completion of the transaction, and other statements that are not historical facts. Such statements are subject to numerous assumptions, risks, estimates, uncertainties and other important factors that change over time and could cause actual results to differ materially from any results, performance, or events expressed or implied by such forward-looking statements, including as a result of the factors referenced below. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, continue, believe, intend, estimate, plan, trend, objective, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995.

Although there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements or historical performance: difficulties and delays in integrating Heritage’s business, key personnel and customers into Citizens’ business and operations, and achieving anticipated synergies, cost savings and other benefits from the transaction; higher than anticipated transaction costs; deposit attrition, operating costs, customer loss and other business disruption following the merger, including difficulties in maintaining relationships with employees; supply and demand for commercial or residential real estate and periodic deterioration in real estate prices and/or values in California or other states where Citizens and Heritage lend; a sharp or prolonged slowdown or decline in real estate construction, sales

or leasing activities; Citizens’ or Heritage’s ability to retain and increase market share, to retain and grow customers and to control expenses; the costs or effects of mergers, acquisitions or dispositions Citizens may make, whether Citizens and Heritage are able to obtain any required governmental approvals in connection with any such mergers, acquisitions or dispositions, and/or Citizens’ ability to realize the contemplated financial or business benefits associated with any such mergers, acquisitions or dispositions; Citizens’ or Heritage’s relationships with and reliance upon outside vendors with respect to certain of Citizens’ or Heritage’s key internal and external systems, applications and controls; the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the Agreement and Plan of Reorganization and Merger to which Citizens and Heritage are parties; changes in the financial performance and/or condition of Citizens’ or Heritage’s borrowers or depositors; fluctuations in Citizens’ or Heritage’s share price before closing, and the resulting impact on Citizens’ ability to raise capital or to make acquisitions, including as a result of the financial performance of the other party prior to closing, or more generally due to broader stock market movements, and the performance of financial companies and peer group companies; Citizens’ ability to recruit and retain key executives, board members and other employees; the failure of Citizens or Heritage to obtain regulatory or shareholder approvals, as applicable, or to satisfy any of the other conditions to the closing of the proposed merger on a timely basis or at all, and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company after the closing of the proposed transaction or adversely affect the expected benefits of the proposed transaction; the dilution caused by the issuance of shares of CVBF’s common stock in the transaction; possible impairment charges to goodwill, including any impairment that may result from increased volatility in Citizens’ or Heritage’s stock price; possible credit-related impairments or declines in the fair value of loans and securities held by CVBF or Heritage; volatility in the credit and equity markets and its effect on the general economy, and local, regional, national and international economic and market conditions, political events and public health developments and the impact they may have on CVBF or Heritage, their customers and their capital, deposits, assets and liabilities; Citizens’ or Heritage’s ability to attract deposits and other sources of funding or liquidity; changes in general economic, political, or industry conditions, and in conditions impacting the banking industry specifically; catastrophic events or natural disasters, including earthquakes, drought, climate change or extreme weather events that may affect our assets, communications or computer services, customers, employees or third-party vendors; public health crises and pandemics, and their effects on the economic and business environments in which Citizens and Heritage operate; the strength of the United States economy and the strength of the local economies in which we conduct business; the effects of, and changes in, immigration, trade, tariff, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; the impact of changes in financial services policies, laws, regulations, and ongoing or unanticipated regulatory or legal proceedings or outcomes, including those concerning banking, taxes, securities, and insurance, and the application thereof by regulatory agencies; the effectiveness of Citizens’ or Heritage’s risk management framework and quantitative models and our ability to manage the risks involved in regulatory, legal or policy changes; the risks associated with Citizens’ or Heritage’s loan portfolio, including the risks of any geographic and industry concentrations; the impact of systemic or non-systemic failures, crisis or adverse developments at other banks on general investor sentiment regarding the stability and liquidity of banks; regulatory or other governmental inquiries or investigations, and/or the results of regulatory examinations or reviews; our ongoing relations with various federal and state regulators, including, but not limited to, the SEC, Federal Reserve Board, FDIC, Office of the Comptroller of the Currency, and California DFPI; and other factors that may affect the future results of Citizens and Heritage.

Additional factors that could cause results to differ materially from those described above can be found in CVBF’s Annual Report on Form 10-K for the year ended December 31, 2024 (available here) and subsequently filed Quarterly Reports on Form 10-Q, which are on file with the SEC and available on CVBF’s website at http://www.cbbank.com under the “Investors” tab, and in other documents CVBF files with the SEC, and in Heritage’s Annual Report on Form 10-K for the year ended December 31, 2024 (available here) and subsequently filed Quarterly Reports on Form 10-Q, which are on file with the SEC and available on Heritage’s website, www.heritagecommercecorp.com, under the “Investor Relations” tab and in other documents Heritage files with the SEC, and in each case, in particular, the discussion of “Risk Factors” set forth in such filings.

All forward-looking statements are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither CVBF nor Heritage assumes any obligation to update forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in circumstances or other factors affecting forward-looking statements that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. If CVBF or Heritage updates one or more forward-looking statements, no inference should be drawn that CVBF or Heritage will make additional updates with respect to

those or other forward-looking statements. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

Additional Information About the Proposed Merger and Where to Find It

In connection with the proposed merger, CVBF will file with the SEC a Registration Statement on Form S-4 that will include a Joint Proxy Statement of Citizens and Heritage and a Prospectus of CVBF (the “Joint Proxy Statement/Prospectus”), as well as other relevant documents concerning the proposed merger. Certain matters in respect of the proposed merger involving Citizens and Heritage will be submitted to CVBF’s shareholders or Heritage’s shareholders, as applicable, for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Before making any voting or investment decision, investors and security holders of CVBF and security holders of Heritage are urged to carefully read the entire registration statement and the Joint Proxy Statement/Prospectus, when they become available, as well as any amendments or supplements to these documents, because they will contain important information about the proposed merger. The documents filed by CVBF and Heritage with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by CVBF may be obtained free of charge at Citizens’ website at www.cbbank.com under the “Investors” tab or at Heritage’s website at ww.heritagecommercecorp.com under the “Investor Relations” tab. Alternatively, these documents, when available, can be obtained free of charge by directing a written request to Citizens, Attention: Investor Relations, 701 North Haven Avenue, Ontario, CA 91764, or by calling (909) 980-4030, or to Heritage Commerce Corp, Attention: Investor Relations, 224 Airport Parkway, San Jose, CA 95110 or by calling (408) 947-6900.

Participants in the Solicitation

Citizens, Heritage, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from CVBF shareholders or Heritage shareholders in connection with the proposed merger transaction under the rules of the SEC.

Information regarding Citizens’ directors and executive officers is available in the sections entitled “Directors, Executive Officers and Corporate Governance” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” in CVBF’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed with the SEC on February 28, 2025 (available here); in the sections entitled “Board Oversight and Structure,” “Our Executive Officers,” “The Nominees” “Certain Relationships and Related Person Transactions,” “Director Compensation,” “Compensation Arrangements with our President and Chief Executive Officer,” “Compensation Arrangements with our Other Named Executive Officers,” “Summary of Compensation Table” and “How Much Stock Do CVB Financial Corp.’s Directors and Executive Officers Own” in CVBF’s definitive proxy statement relating to its 2025 Annual Meeting of Shareholders, which was filed with the SEC on April 8, 2025 (available here); the Form 8-K filed with the SEC on October 23, 2025 regarding the election of a new director (available here); and other documents filed by CVBF with the SEC. Information regarding Heritage’s directors and executive officers is available in the sections entitled “Directors, Executive Officers and Corporate Governance” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” in Heritage’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed with the SEC on March 10, 2025 (available here); in the sections entitled “The Board and Corporate Governance,” “Director Compensation,” “Our Executive Officers,” “Executive Compensation,” “Beneficial Ownership of Common Stock,” and “Transactions with Management” in Heritage’s definitive proxy statement relating to its 2025 Annual Meeting of Shareholders, which was filed with the SEC on April 7, 2025 (available here); and other documents filed by Heritage with the SEC.

To the extent holdings of CVBF’s common stock by the CVBF directors and executive officers, or holdings of Heritage’s common stock by the Heritage directors and executive officers, have changed from the amounts held by such persons as reflected in the documents described above, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC (available at https://www.sec.gov/edgar/browse/?CIK=354647&owner=exclude, in the case of CVBF, and available at https://www.sec.gov/edgar/browse/?CIK=1053352&owner=exclude, in the case of Heritage). Other information regarding the participants in the proxy

solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Joint Proxy Statement/Prospectus relating to the proposed merger. Free copies of this document and the above-mentioned Joint Proxy Statement/Prospectus when it becomes available, may be obtained as described in the preceding section titled “Additional Information About the Proposed Merger and Where to Find It.”

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

|

|

|

|

|

|

|

|

| 99.1 |

|

|

|

| 99.2 |

|

|

|

| 99.3 |

|

|

|

| 104 |

Cover Page Interactive Data File (embedded within XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: January 22, 2026

Heritage Commerce Corp

|

|

|

|

|

|

| By: /s/ Seth Fonti |

|

| Seth Fonti |

|

| Executive Vice President and Chief Financial Officer |

|

EX-99.1

2

htbkearningsrelease.htm

EX-99.1

HTBK Earnings Release

Exhibit 99.1

Heritage Commerce Corp

224 Airport Parkway

San Jose, CA 95110

www.heritagecommercecorp.com

Heritage Commerce Corp Reports Fourth Quarter and Full Year 2025 Financial Results

Adjusted 4th quarter earnings increased 62% year over year due to sustained balance‑sheet growth, NIM expansion and positive operating leverage.

Announced strategic merger to expand market presence and enhance long‑term growth opportunities.

San Jose, CA – January 22, 2026 – Heritage Commerce Corp (Nasdaq: HTBK), (the “Company”), the holding company for Heritage Bank of Commerce

(the “Bank”) today announced its financial results for the fourth quarter and year ended December 31, 2025. All data are unaudited.

|

|

|

|

|

|

|

|

|

|

FOURTH QUARTER AND FULL YEAR 2025 HIGHLIGHTS: |

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings Per Share ("EPS") |

|

|

|

|

|

Return on Average Assets ("ROAA") |

|

|

|

|

|

Return on Average Tangible Common Equity ("ROATCE")(1)

|

|

|

|

|

|

|

|

|

|

|

|

Pre-Provision Net Revenue ("PPNR")(1)

|

|

|

|

|

|

Fully Tax Equivalent ("FTE") Net Interest Margin(1)

|

|

|

|

|

|

|

|

|

|

|

|

CEO COMMENTARY:

“The year 2025, and the fourth quarter in particular, was a consequential time for Heritage, and we are proud of the way our team worked to deliver solid

growth and results, driven by steady performance across the business, sustained client momentum and strong credit quality. This quarter reflects strong

execution across the organization. We delivered meaningful balance‑sheet growth, expanded operating leverage through disciplined expense management,

and increased adjusted full year earnings by 39%. Our focus on consistent performance and prudent growth continues to strengthen our foundation,” said Clay

Jones, President and Chief Executive Officer.

“The recently announced merger with Citizens Business Bank represents an exciting next step in Heritage’s journey, building on the strength of our franchise

and the consistent performance we delivered throughout 2025. As we work toward the completion of the transaction, we remain fully focused on executing

our strategy and continuing to support our clients, colleagues, and communities.”

|

|

|

|

|

|

|

|

FINANCIAL HIGHLIGHTS / KEY PERFORMANCE METRICS: |

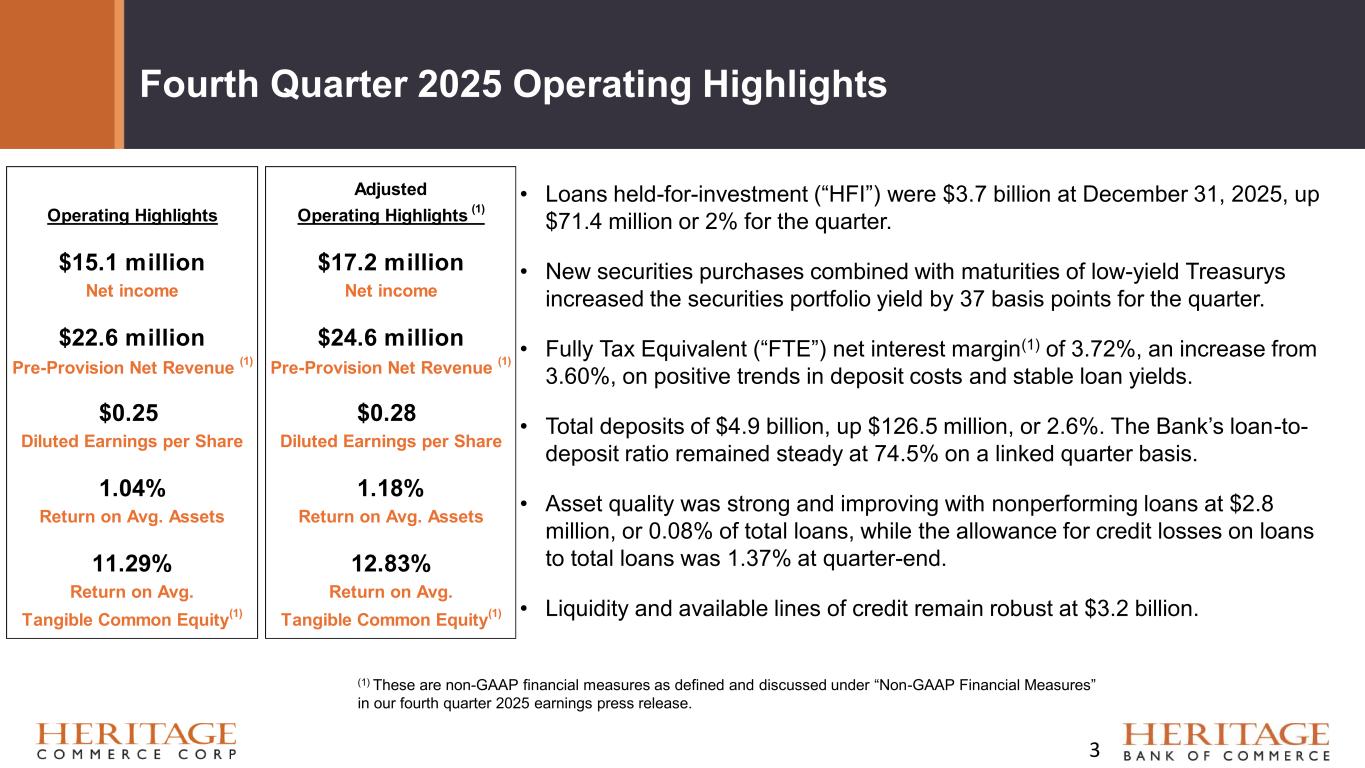

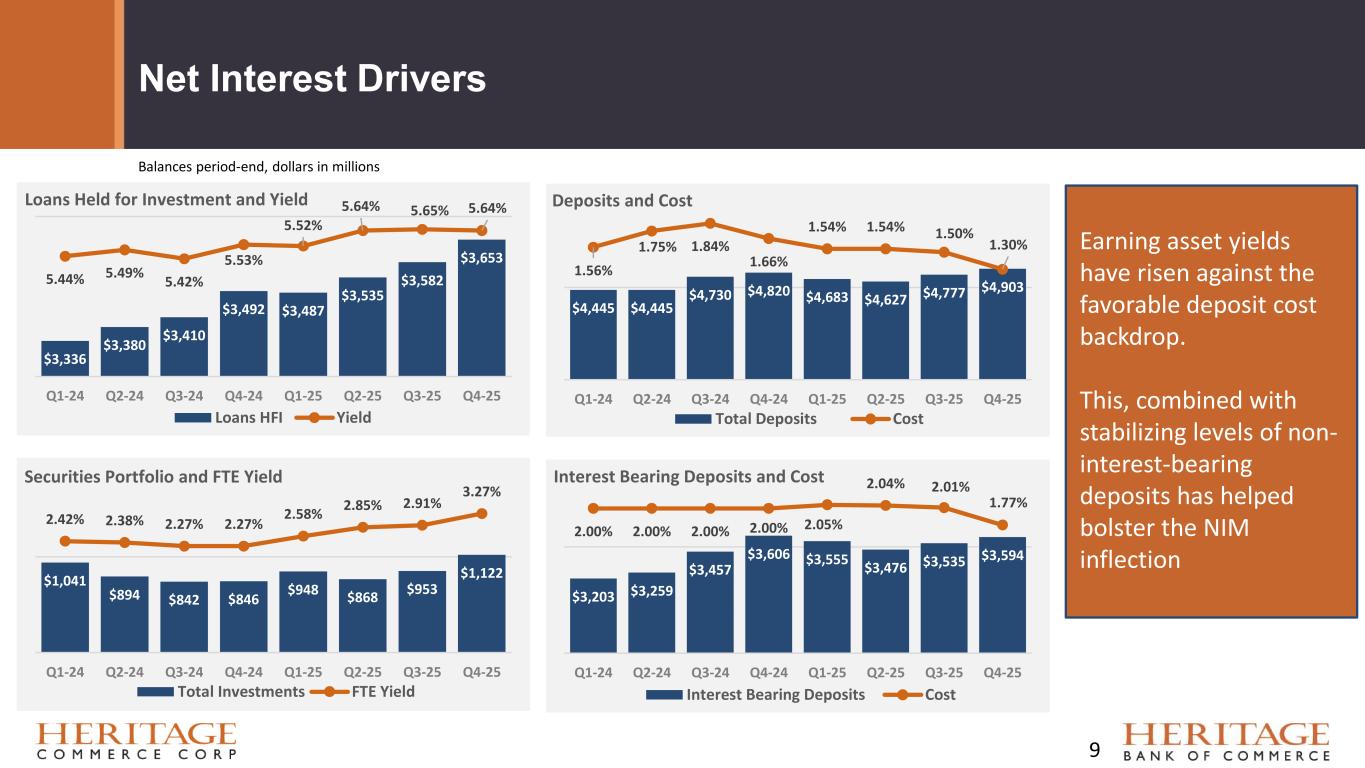

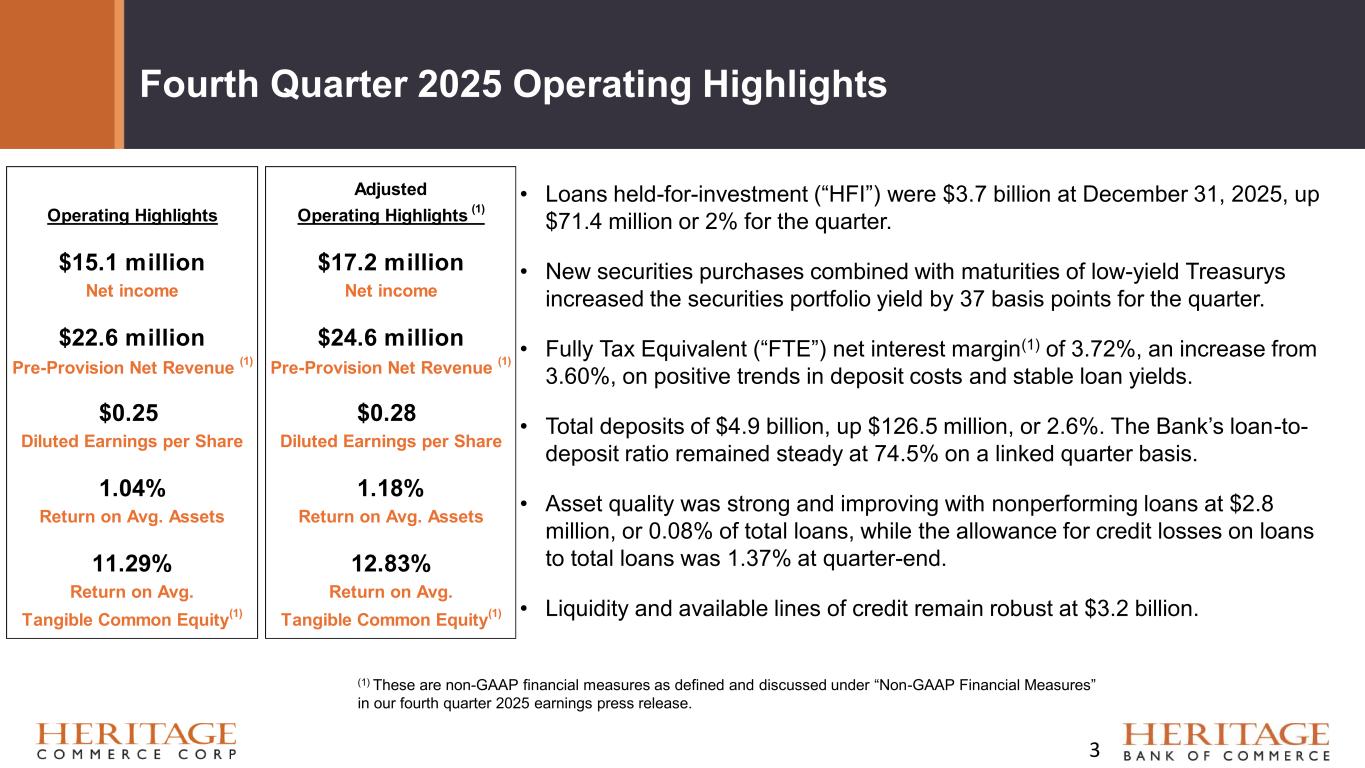

•Total revenue of $53.6 million, an increase of 7%, or $3.6 million

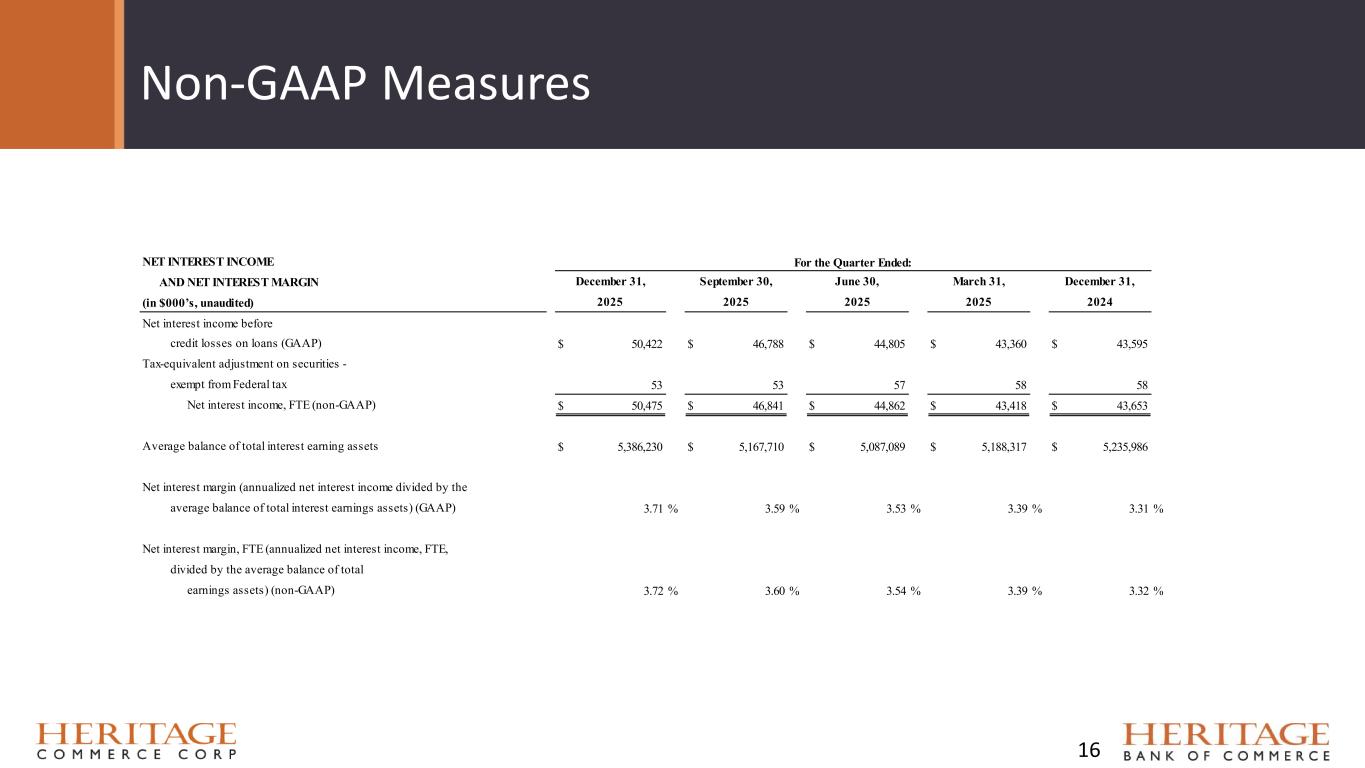

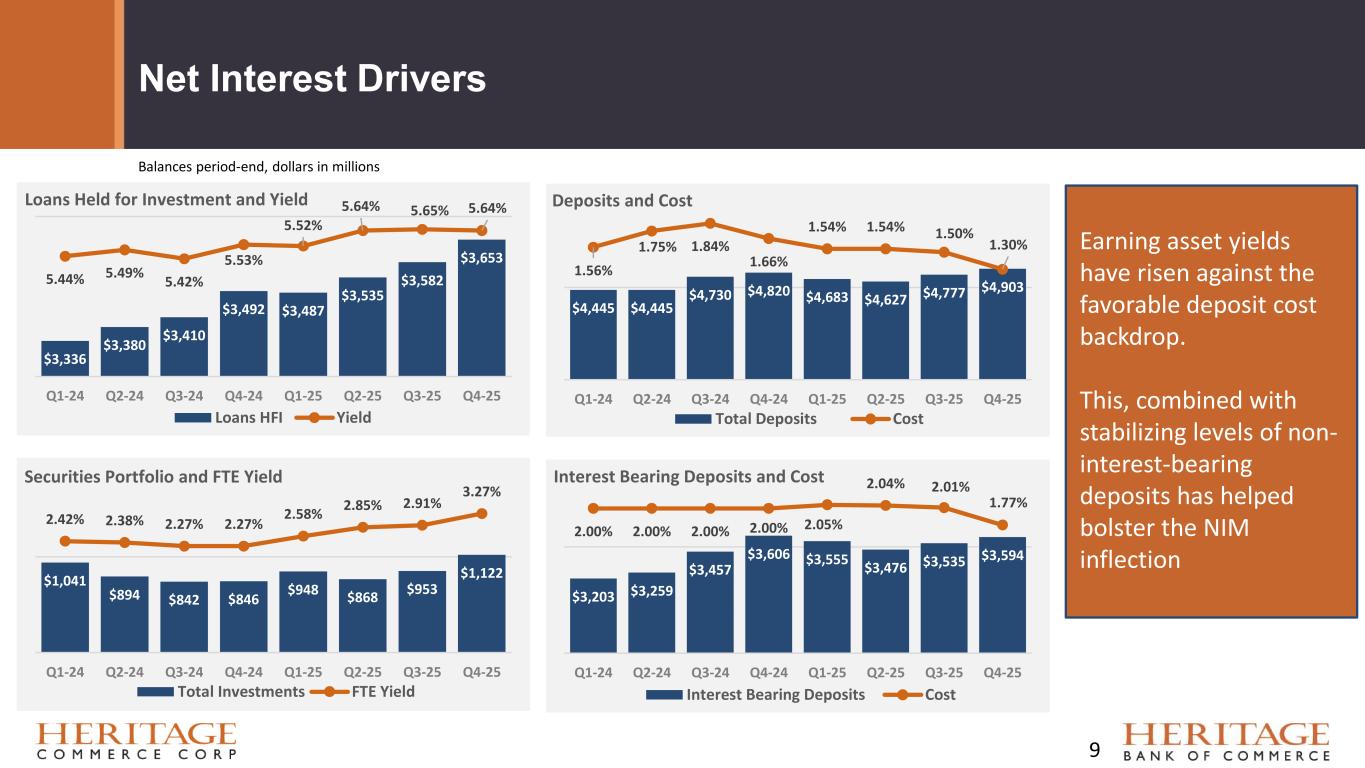

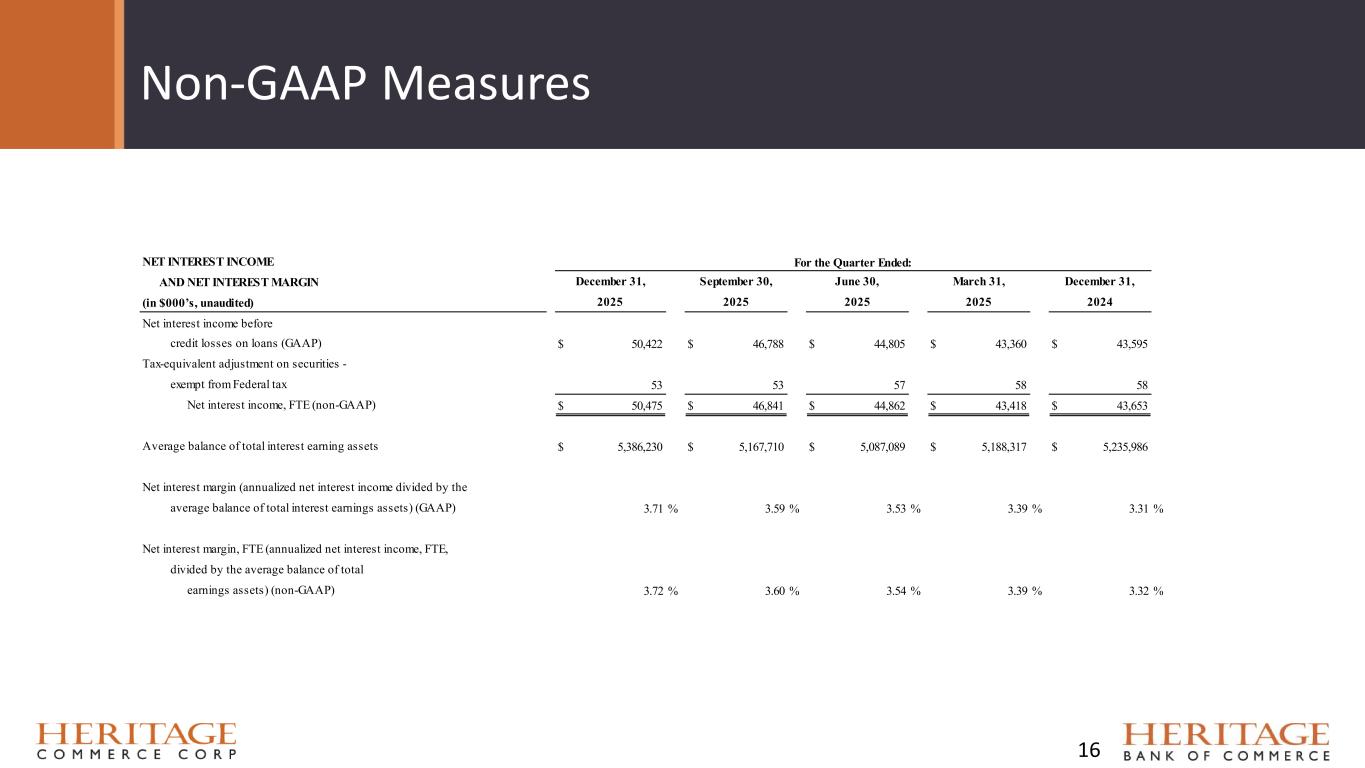

•FTE net interest margin(1) of 3.72%, an increase of 12 basis points from 3.60%

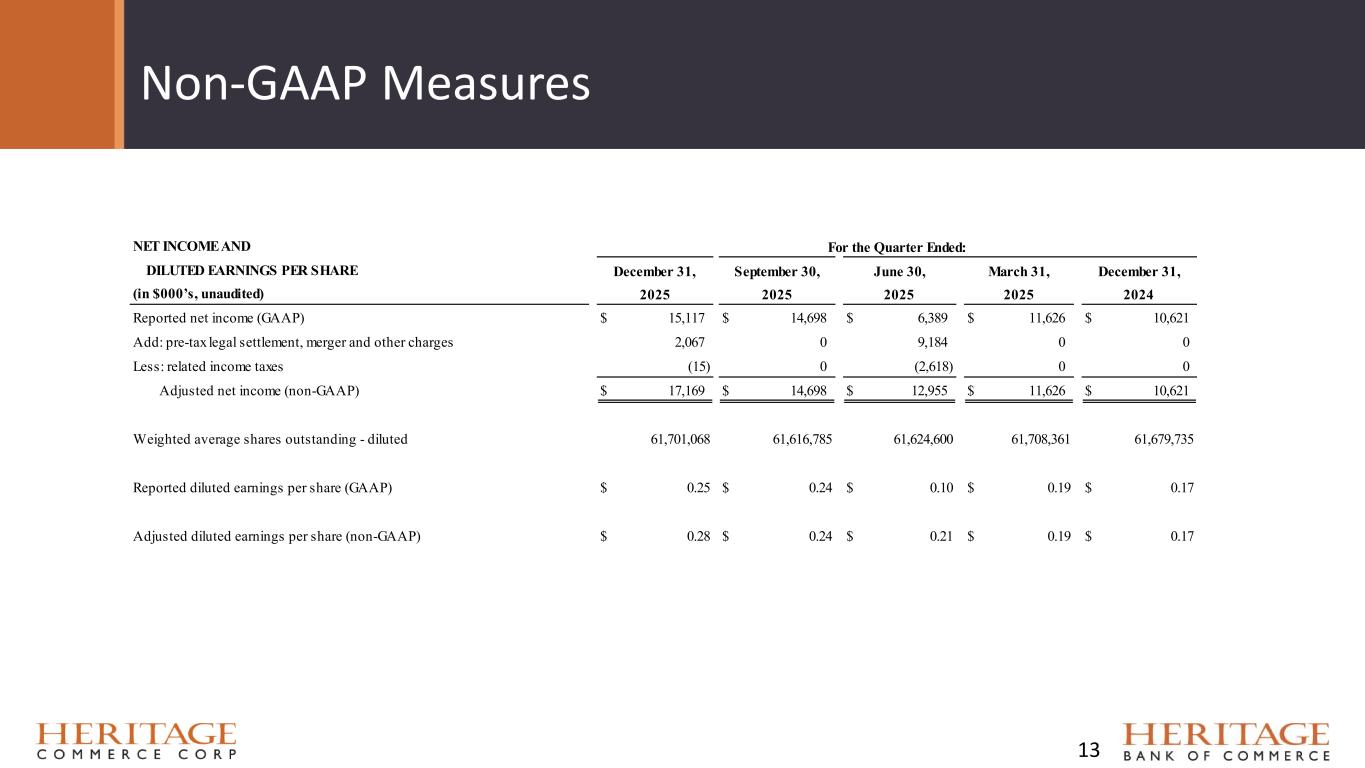

•Reported net income of $15.1 million and reported EPS of $0.25, up 3% and 4%,

from $14.7 million and $0.24, respectively

•Adjusted net income(1) of $17.2 million and adjusted EPS(1) of $0.28, both up 17%

from $14.7 million and $0.24, respectively

|

•Total revenue of $197.5 million, an increase of 15%, or $25.1 million

•FTE net interest margin(1) of 3.56%, an increase of 31 basis points from

3.25%

•Reported net income of $47.8 million and reported EPS of $0.78, both up

18%, from $40.5 million and $0.66, respectively

•Adjusted net income(1) of $56.4 million and adjusted EPS(1) of $0.91, up

39% and 38%, from $40.5 million and $0.66, respectively

|

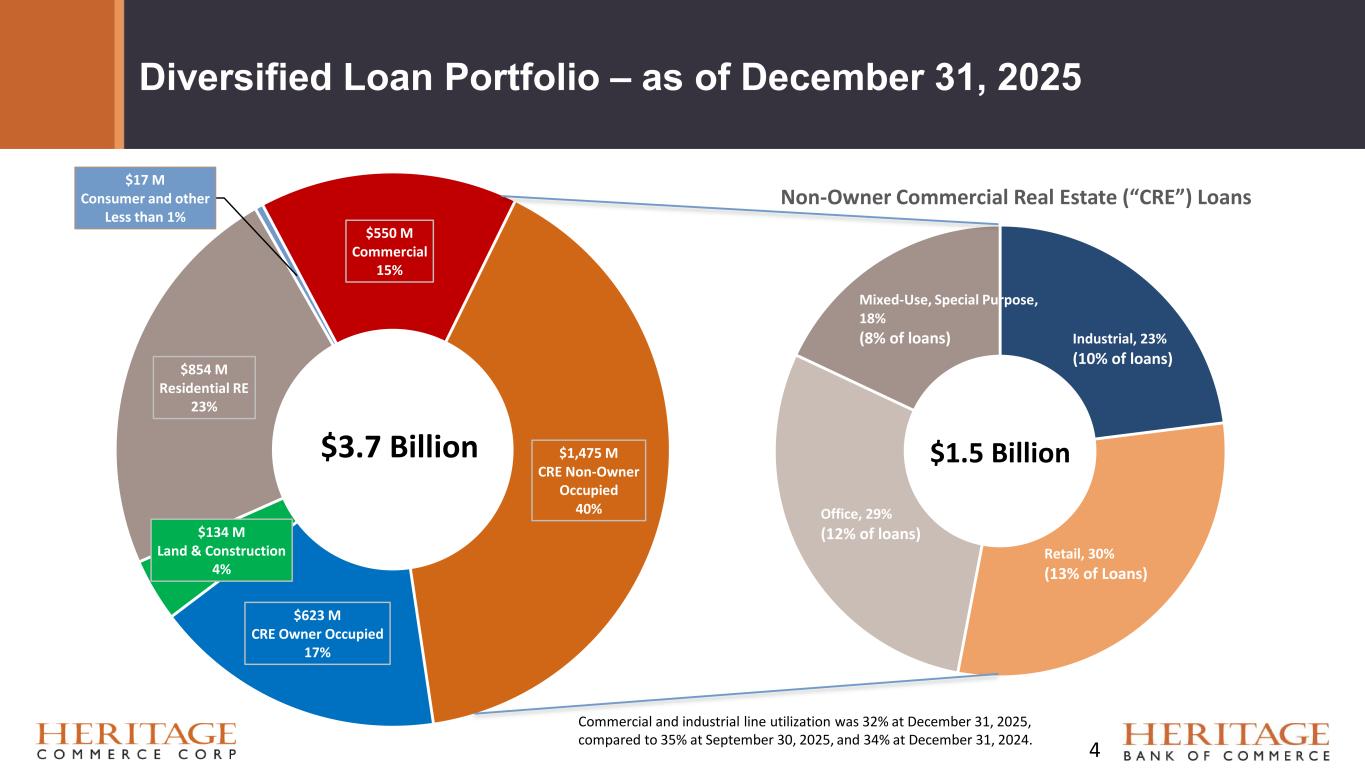

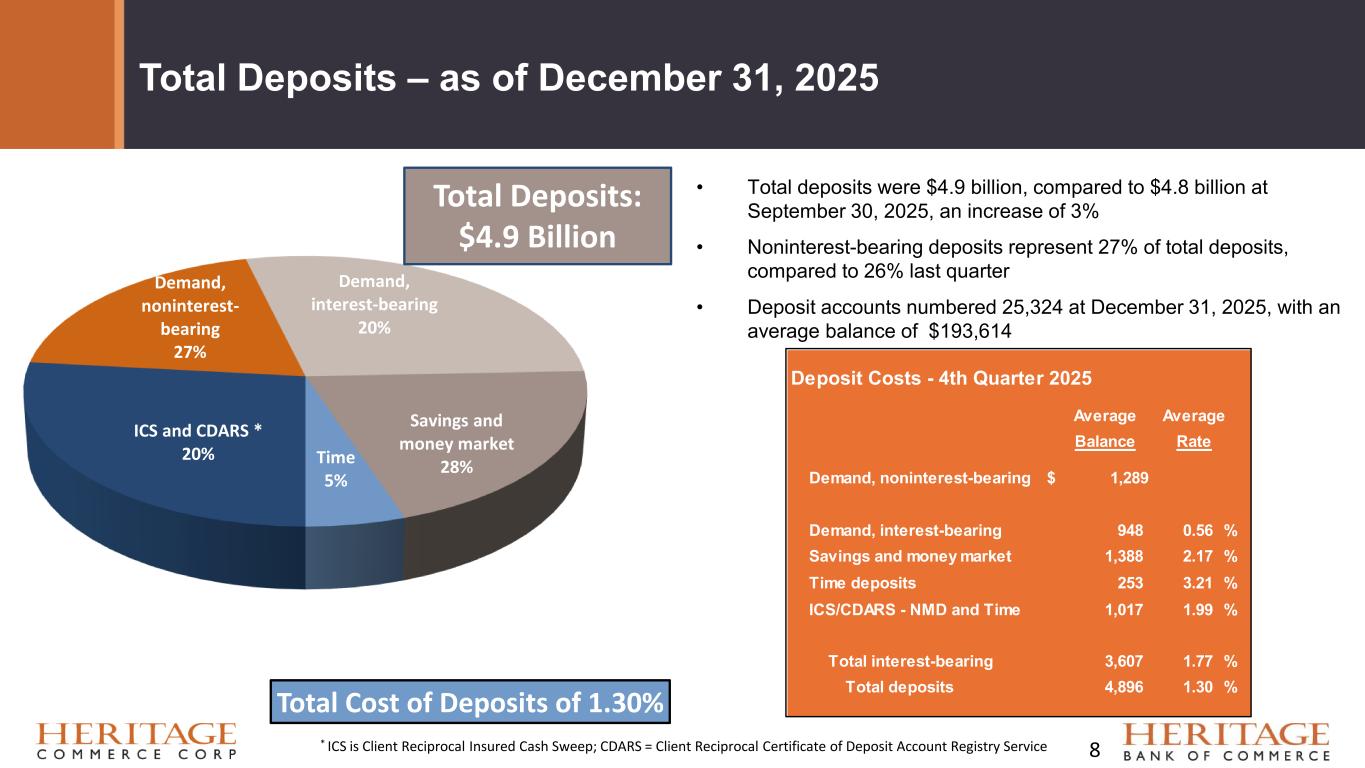

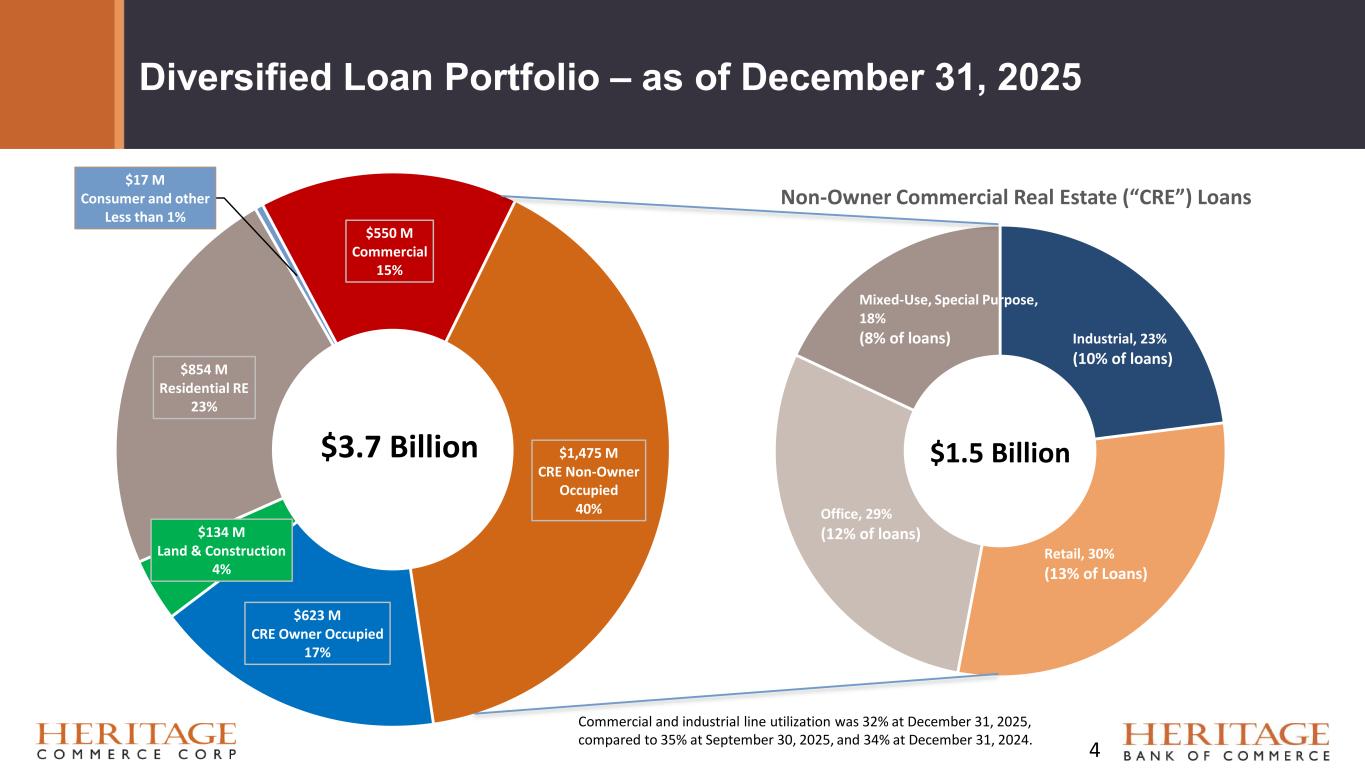

•Loans held-for-investment (“HFI”) of $3.7 billion, up $71.4 million, or 2%

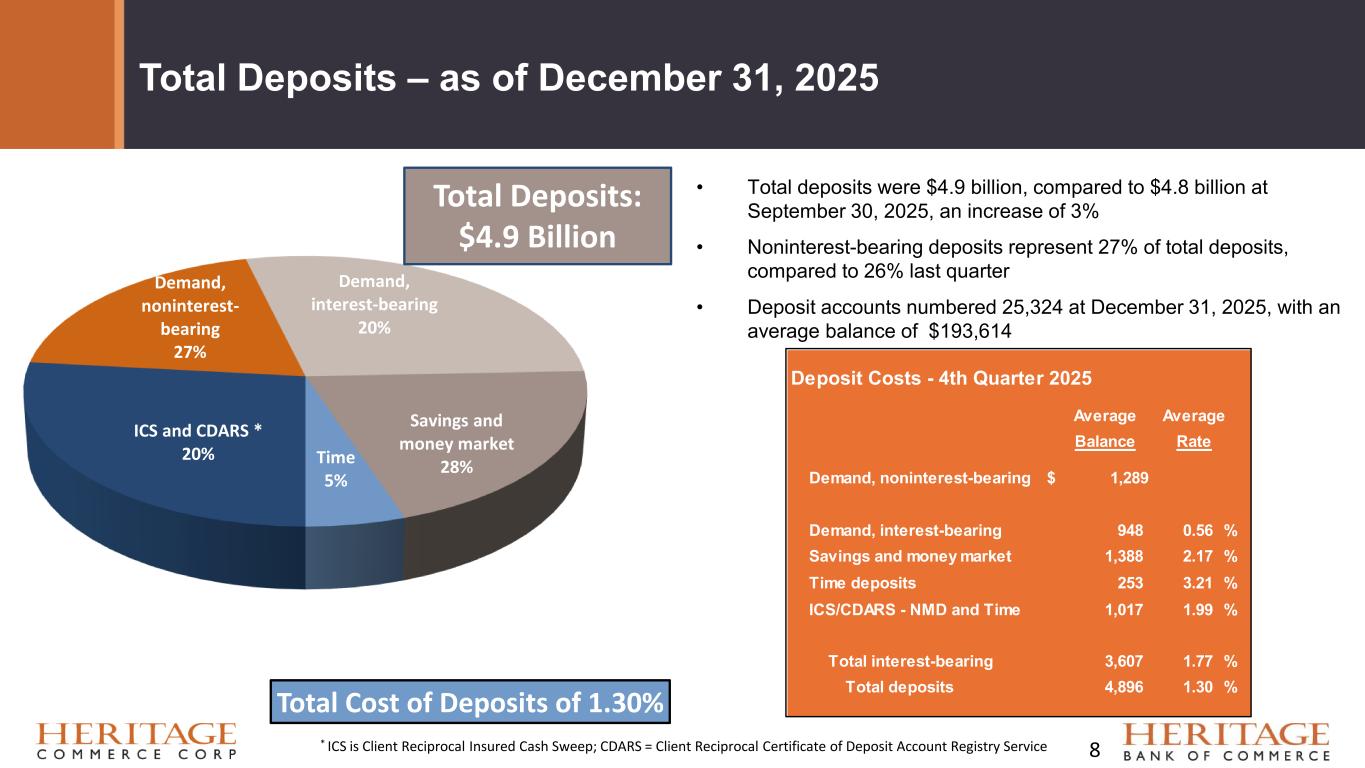

•Total deposits of $4.9 billion, up $126.5 million, or 3%

|

•Loans HFI of $3.7 billion, up $161.1 million, or 5%

•Total deposits of $4.9 billion, up $83.1 million, or 2%

|

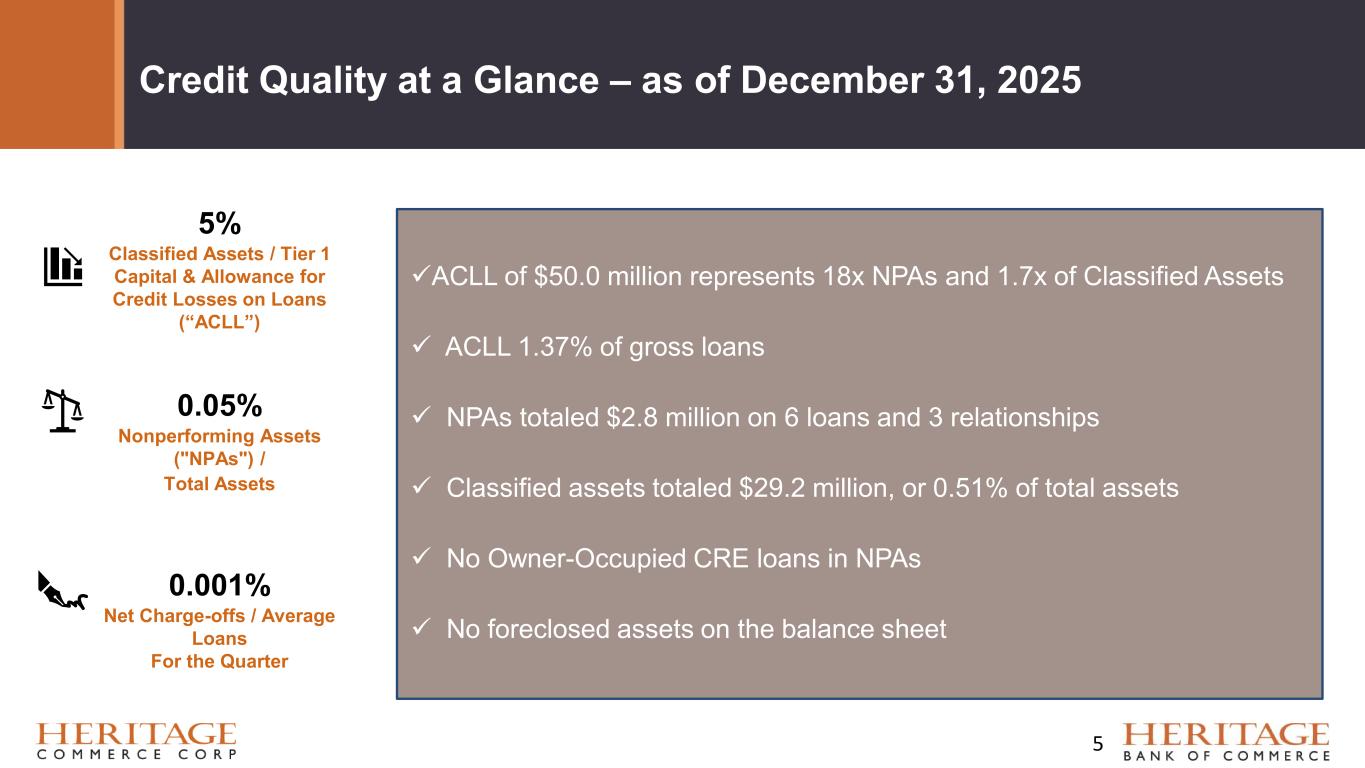

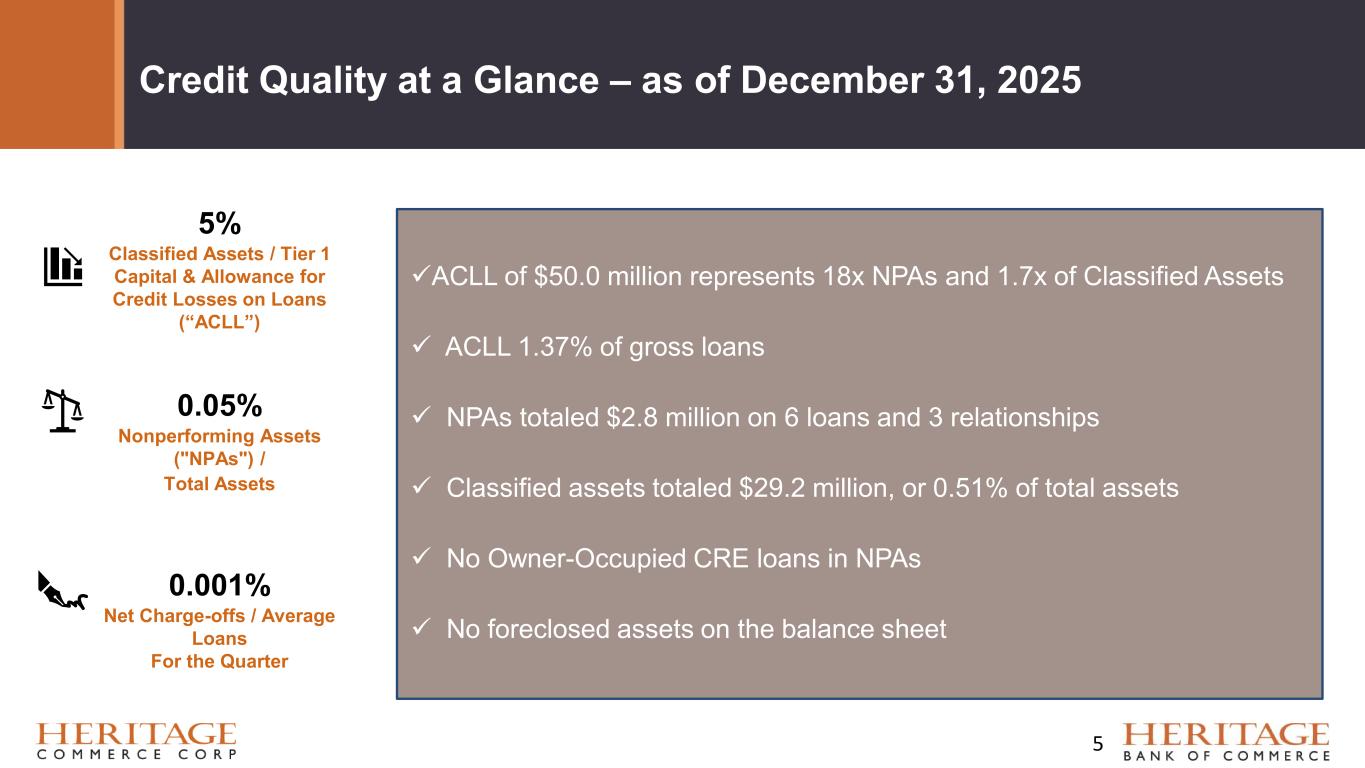

•Nonperforming assets (“NPAs”) to total assets of 0.05%, compared to 0.07%

|

•NPAs to total assets of 0.05%, compared to 0.14%

|

•Adjusted efficiency ratio(1) of 54.04%, a decrease of 7% from efficiency ratio of

58.05%

•Adjusted ROAA(1) of 1.18%, an increase of 12% over ROAA of 1.05%

•Adjusted ROATCE(1) of 12.83%, an increase of 15% over ROATCE(1) of 11.14%

|

•Adjusted efficiency ratio(1) of 59.05%, a decrease of 10% from efficiency

ratio of 65.88%

•Adjusted ROAA(1) of 1.01%, an increase of 33% over ROAA of 0.76%

•Adjusted ROATCE(1) of 10.77%, an increase of 34% over ROATCE(1) of

8.05%

|

(1)This is a non-GAAP financial measure as defined and discussed under “Non-GAAP Financial Measures” in this press release. All references to “adjusted” operating metrics exclude the $9.2

million of pre-tax charges primarily related to a legal settlement in the second quarter of 2025 and $2.1 million of pre-tax merger-related costs in the fourth quarter of 2025 as presented in the

reconciliation of non-GAAP financial measures at the end of this press release.

About Heritage Commerce Corp

Heritage Commerce Corp, a bank holding company established in October 1997, is the parent company of Heritage Bank of

Commerce, established in 1994 and headquartered in San Jose, CA with full-service branches in Danville, Fremont, Hollister,

Livermore, Los Altos, Los Gatos, Morgan Hill, Oakland, Palo Alto, Pleasanton, Redwood City, San Francisco, San Jose, San Mateo,

San Rafael, and Walnut Creek. Heritage Bank of Commerce is an SBA Preferred Lender. Bay View Funding, a subsidiary of Heritage

Bank of Commerce, is based in San Jose, CA and provides business-essential working capital factoring financing to various industries

throughout the United States. For more information, please visit www.heritagecommercecorp.com. The contents of our website are

not incorporated into, and do not form a part of, this release or of our filings with the Securities and Exchange Commission.

Recent Merger Announcement

On December 17, 2025, CVB Financial Corp. (Nasdaq: CVBF; together with Citizens Business Bank, National Association,

“Citizens”) and Heritage Commerce Corp (Nasdaq: HTBK; together with Heritage Bank of Commerce, “Heritage”), jointly

announced that they have entered into a definitive merger agreement. Under the terms of the agreement, Heritage will merge with and

into Citizens in an all-stock transaction valued at approximately $811 million, or $13.00 per HTBK share, based on CVBF’s closing

stock price on December 16, 2025. The value of the transaction is based on a specified closing price and is subject to CVBF stock

price fluctuations. Upon completion, the combination is expected to create a top-performing California business bank with

approximately $22 billion in assets, more than 75 offices and branches, and a deeply rooted presence in the State’s key economic

centers. The proposed merger has been unanimously approved by the respective Boards of Directors of both companies and is

expected to close in the second quarter of 2026, subject to customary regulatory approvals, Heritage and Citizens shareholder

approvals, and other closing conditions. For more information, please refer to the Company’s Current Report on Form 8-K filed with

the Securities and Exchange Commission on December 17, 2025.

Reclassifications

During the first quarter of 2025, we reclassified Federal Home Loan Bank (“FHLB”) and Federal Reserve Bank (“FRB”) stock

dividends from interest income to noninterest income and the related average asset balances were reclassified from interest earning

assets to other assets on the “Net Interest Income and Net Interest Margin” tables. The amounts for the prior periods were reclassified

to conform to the current presentation. These reclassifications did not affect previously reported net income or shareholders’ equity.

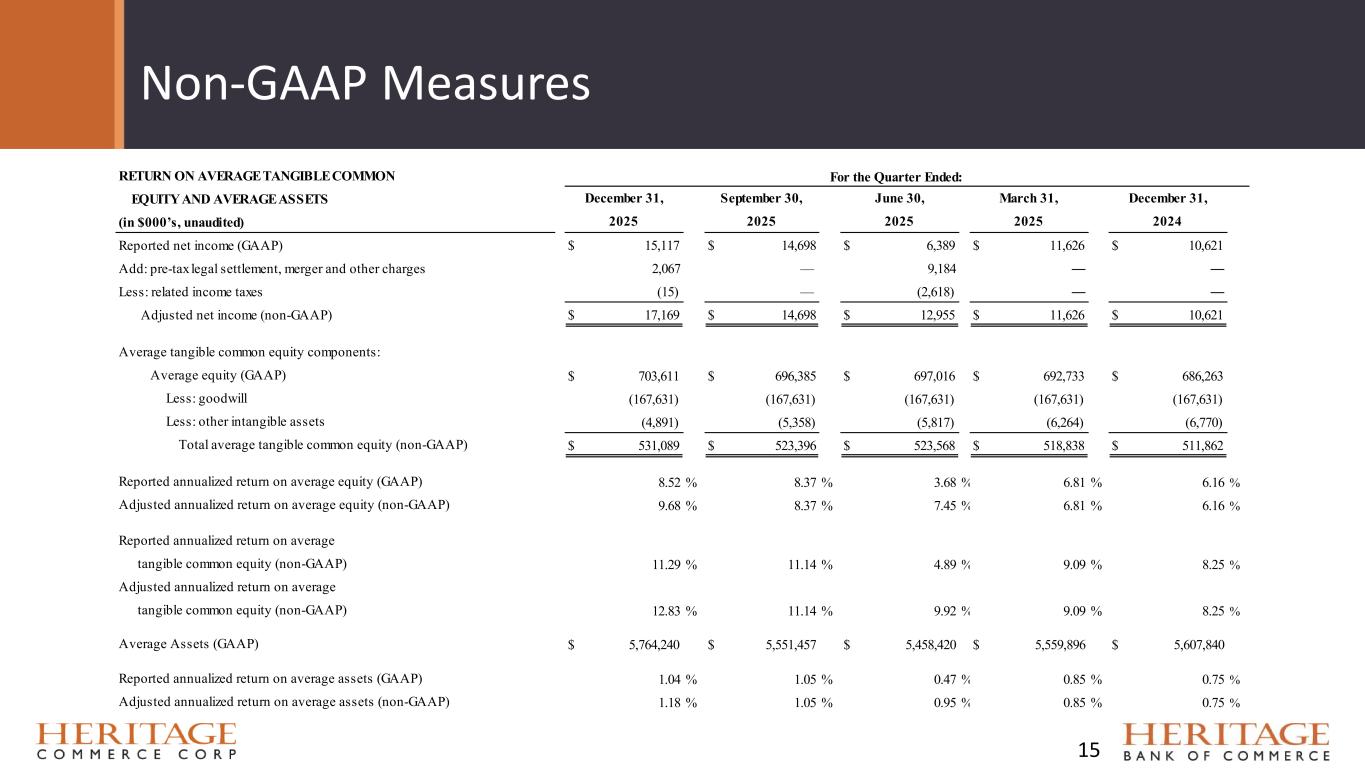

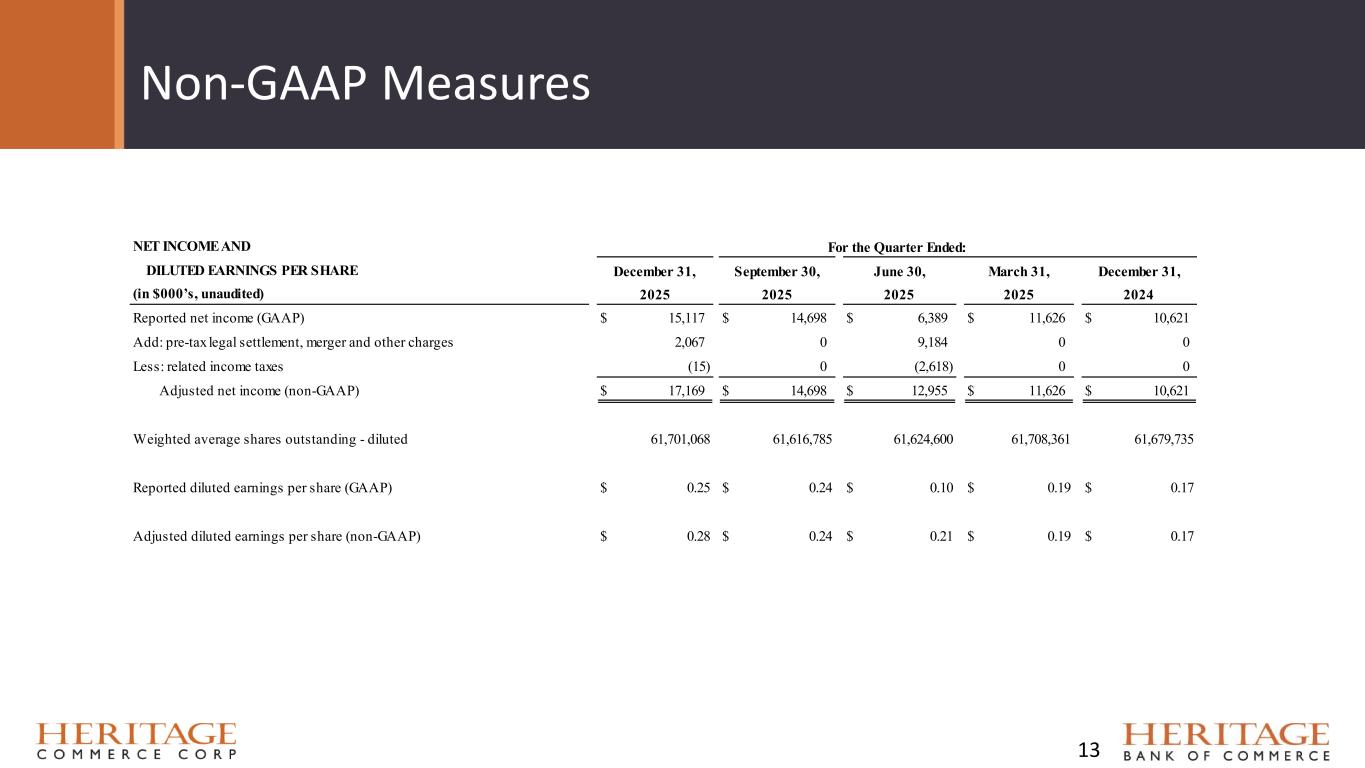

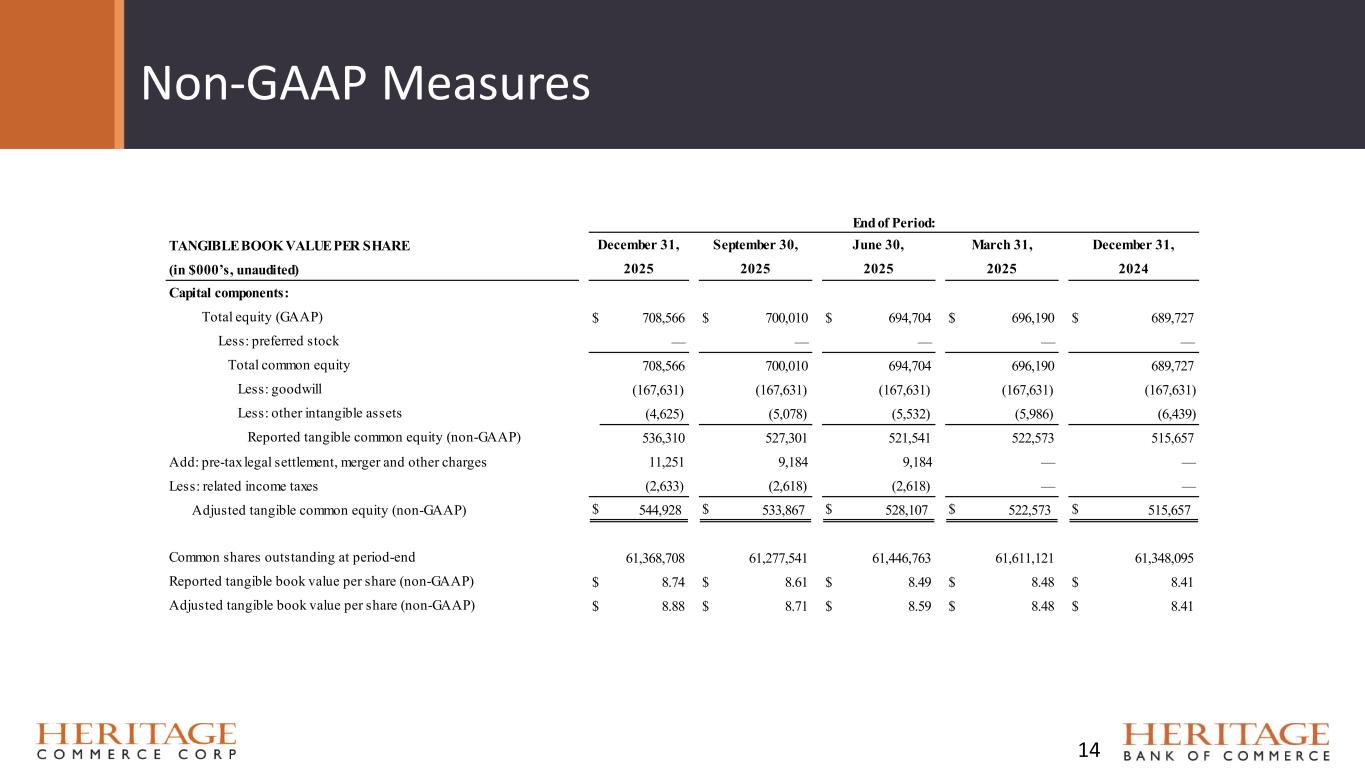

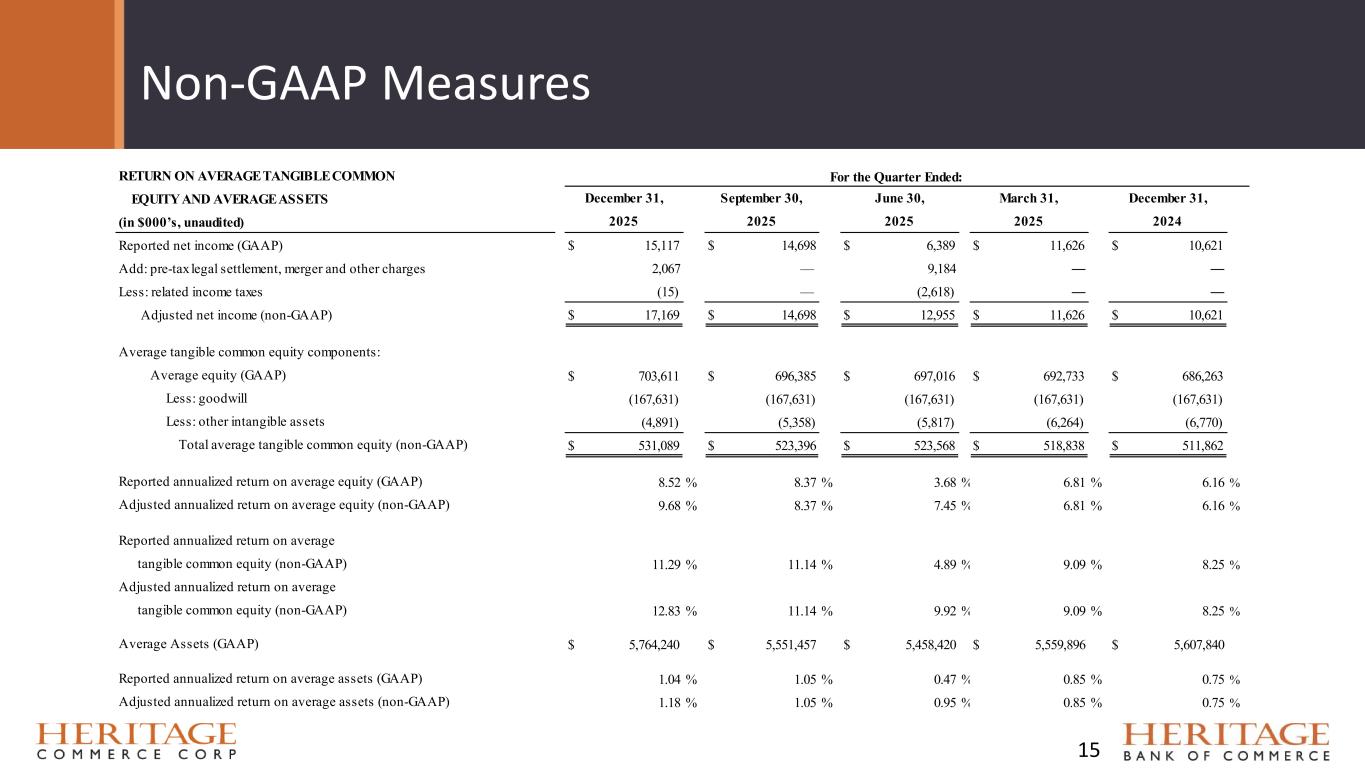

Non-GAAP Financial Measures

Financial results are presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”)

and prevailing practices in the banking industry. However, certain non-GAAP performance measures and ratios are used by

management to evaluate and measure the Company’s performance. These measures include “adjusted” operating metrics that have

been adjusted to exclude notable expenses incurred in the second and fourth quarters of 2025 as well as other performance measures

and ratios adjusted for notable items. Management believes these non-GAAP financial measures enhance comparability between

periods and in some instances are common in the banking industry. These non-GAAP financial measures should be supplemental to

primary GAAP financial measures and should not be read in isolation or relied upon as a substitute for primary GAAP financial

measures. A reconciliation of GAAP to non-GAAP financial measures is presented in the tables at the end of this press release under

“Reconciliation of Non-GAAP Financial Measures.”

Forward-Looking Statement Disclaimer

Certain matters discussed in this press release constitute forward-looking statements within the meaning of Section 21E of the

Securities Exchange Act of 1934, as amended. Such forward-looking statements are inherently uncertain in that they reflect plans and

expectations for future events. These statements may include, among other things, those relating to the Company’s future financial

performance, plans and objectives regarding future events, expectations regarding changes in interest rates and market conditions,

projected cash flows of our investment securities portfolio, the performance of our loan portfolio, loan growth, expenses, net interest

margin, estimated net interest income resulting from a shift in interest rates, expectation of high credit quality issuers ability to repay,

as well as statements relating to the anticipated effects on the Company’s financial condition and results of operations from expected

developments or events. Any statements that reflect our belief about, confidence in, or expectations for future events, performance or

condition should be considered forward-looking statements. Readers should not construe these statements as assurances of a given

level of performance, nor as promises that we will take actions that we currently expect to take. All statements are subject to various

risks and uncertainties, many of which are outside our control and some of which may fall outside our ability to predict or anticipate.

Accordingly, our actual results may differ materially from our projected results, and we may take actions or experience events that we

do not currently expect. Risks and uncertainties that could cause our financial performance to differ materially from our goals, plans,

expectations and projections expressed in forward-looking statements include those set forth in our filings with the Securities and

Exchange Commission, Item 1A of the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, and

include: (i) cybersecurity risks that may affect us directly or may impact us indirectly by virtue of their effects on our clients, markets

or vendors, including our ability to identify and address cybersecurity risks, including those posed by the increasing use of artificial

intelligence (such as, but not limited to, ransomware, data security breaches, “denial of service” attacks, “hacking” and identity theft)

affecting us, our clients, and our third-party vendors and service providers; (ii) events that affect our ability to attract, recruit, and

retain qualified officers and other personnel to implement our strategic plan, and that enable current and future personnel to protect

and develop our relationships with clients, and to promote our business, results of operations and growth prospects; (iii) media items

and consumer confidence as those factors affect our clients’ confidence in the banking system generally and in our bank specifically;

(iv) adequacy of our risk management framework, disclosure controls and procedures and internal control over financial reporting;

(v) market, geographic and sociopolitical factors that arise by virtue of the fact that we operate primarily in the general San Francisco

Bay Area of Northern California; (vi) risks of geographic concentration of our client base, our loans, and the collateral securing our

loans, as those clients and assets may be particularly subject to natural disasters and to events and conditions that directly or indirectly

affect those regions, including the particular risks of natural disasters (including earthquakes, fires, and flooding) and other events that

disproportionately affect that region; (vii) political events that have accompanied or that may in the future accompany or result from

recent political changes, particularly including the imposition of tariffs, sociopolitical events and conditions that result from political

conflicts and law enforcement activities that may adversely affect our markets or our clients; (viii) our ability to estimate accurately,

and to establish adequate reserves against, the risk of loss associated with our loan and lease portfolios and our factoring business;

(ix) inflationary pressures and changes in the interest rate environment that reduce our margins and yields, the fair value of financial

instruments or our level of loan originations, or increase the level of defaults, losses and prepayments on loans to clients, whether held

in the portfolio or in the secondary market; (x) factors that affect the value and liquidity of our investment portfolios, particularly the

values of securities available-for-sale; (xi) factors that affect our liquidity and our ability to meet client demands for withdrawals from

deposit accounts and undrawn lines of credit, including our cash on hand and the availability of funds from our own lines of credit;

(xii) increased capital requirements for our continual growth or as imposed by banking regulators, which may require us to raise

capital at a time when capital is not available on favorable terms or at all; (xiii) the expense and uncertain resolution of litigation

matters whether occurring in the ordinary course of business or otherwise, particularly including but not limited to the effects of recent

and ongoing developments in California labor and employment laws, regulations and court decisions; (xiv) operational issues

stemming from, and/or capital spending necessitated by, the potential need to adapt to industry changes in information technology

systems, on which we are highly dependent; and (xv) our success in managing the risks involved in the foregoing factors. In addition,

statements regarding the timing and impact of the closing of the proposed merger with Citizens are subject to risks and uncertainties.

For more information on factors that could cause our expectations regarding the proposed merger with Citizens to differ, potentially

materially, please refer to our Current Report on Form 8-K filed with the Securities and Exchange Commission on December 17,

2025.

Member FDIC

For additional information, email:

InvestorRelations@herbank.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED INCOME STATEMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income before provision |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for credit losses on loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for credit losses on loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income after provision |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for credit losses on loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service charges and fees on deposit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FHLB and FRB stock dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase in cash surrender value of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sales of SBA loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on proceeds from company-owned |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total noninterest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares outstanding at period-end |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

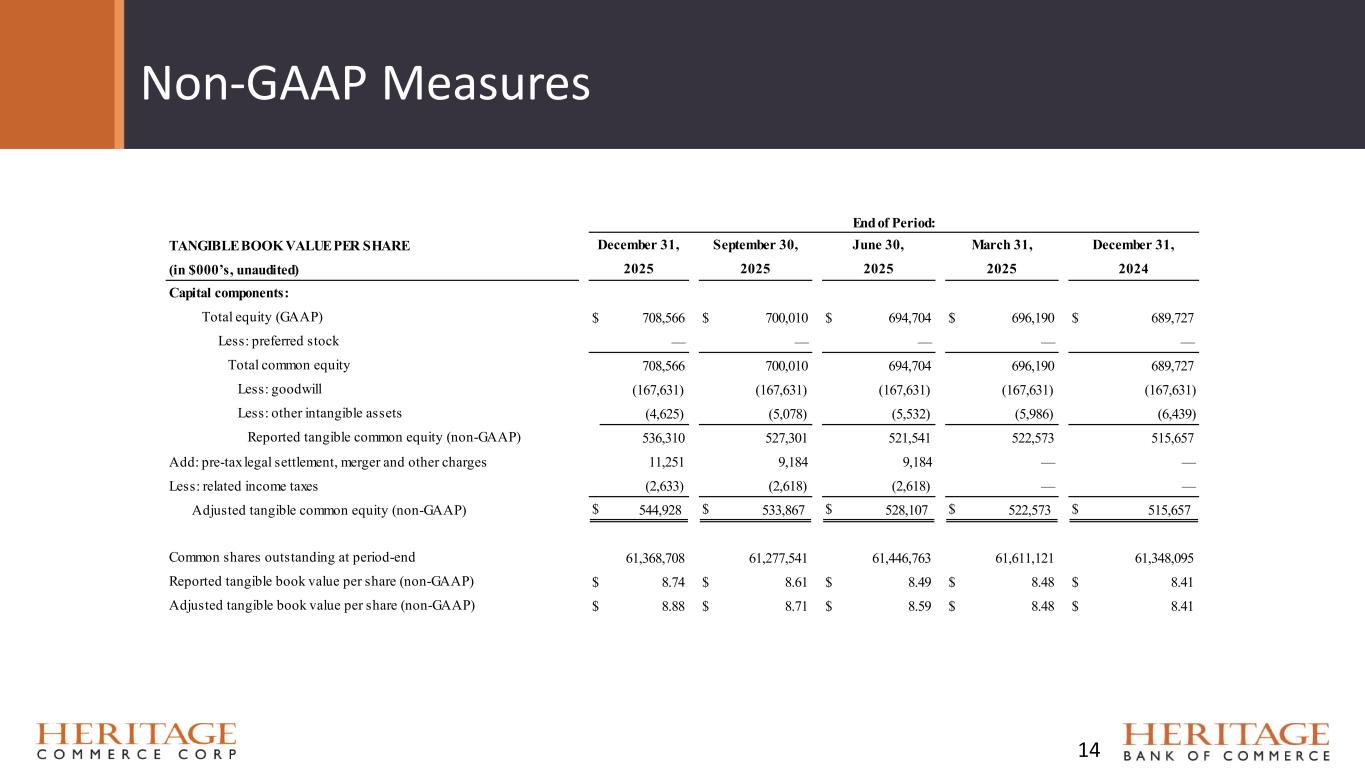

Tangible book value per share(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized return on average equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized return on average tangible |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized return on average assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized return on average tangible assets(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest margin (FTE)(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-provision net revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average tangible assets(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average loans held-for-sale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average loans held-for-investment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average demand deposits - noninterest-bearing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average interest-bearing deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average interest-bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average tangible common equity(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)This is a non-GAAP financial measure as defined and discussed under “Non-GAAP Financial Measures” in this press release.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED INCOME STATEMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income before provision |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for credit losses on loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for credit losses on loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income after provision |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for credit losses on loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service charges and fees on deposit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FHLB and FRB stock dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase in cash surrender value of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sales of SBA loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total noninterest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares outstanding at period-end |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible book value per share(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized return on average equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized return on average tangible |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized return on average assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized return on average tangible assets(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest margin (FTE)(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-provision net revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average tangible assets(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average loans held-for-sale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average loans held-for-investment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average demand deposits - noninterest-bearing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average interest-bearing deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average interest-bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average tangible common equity(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)This is a non-GAAP financial measure as defined and discussed under “Non-GAAP Financial Measures” in this press release.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other investments and interest-bearing deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

in other financial institutions |

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities available-for-sale, at fair value |

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities held-to-maturity, at amortized cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans - held-for-sale - SBA, including deferred costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans - held-for-investment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total loans - held-for-investment, net of deferred fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses on loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company-owned life insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

Premises and equipment, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accrued interest receivable and other assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand, noninterest-bearing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time deposits - under $250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Time deposits - $250 and over |

|

|

|

|

|

|

|

|

|

|

|

|

|

Insured Cash Sweep ("ICS")/Certificates of Deposit Account Registry |

|

|

|

|

|

|

|

|

|

|

|

|

|

Service ("CDARS") - interest-bearing demand, money market and time deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subordinated debt, net of issuance costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accrued interest payable and other liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated other comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shareholders' equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other investments and interest-bearing deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in other financial institutions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities available-for-sale, at fair value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities held-to-maturity, at amortized cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans - held-for-sale - SBA, including deferred costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans - held-for-investment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total loans - held-for-investment, net of deferred fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses on loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company-owned life insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Premises and equipment, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accrued interest receivable and other assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand, noninterest-bearing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time deposits - under $250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time deposits - $250 and over |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ICS/CDARS - interest-bearing demand, money market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subordinated debt, net of issuance costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accrued interest payable and other liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated other comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shareholders' equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or For the Quarter Ended: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

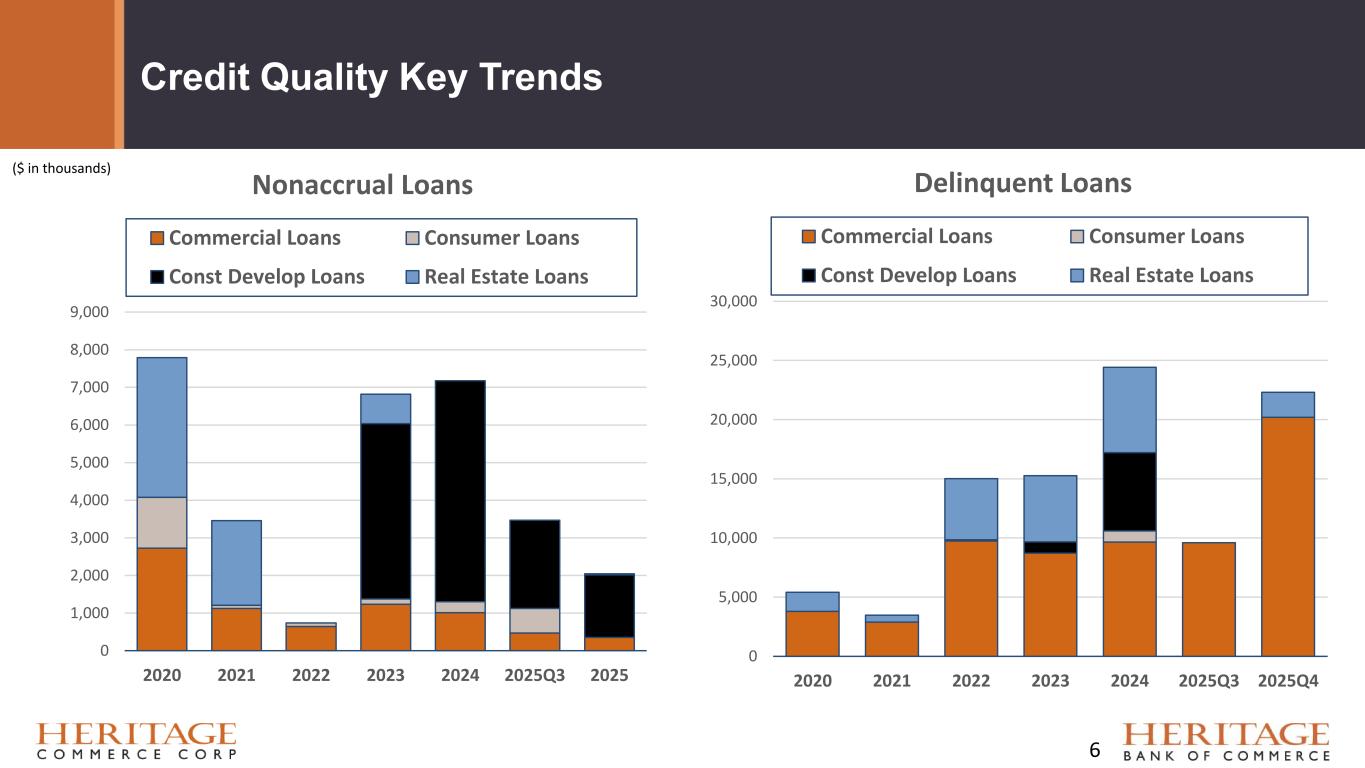

Nonaccrual loans - held-for-investment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Land and construction loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial real estate ("CRE") |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total nonaccrual loans - held-for-investment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans over 90 days past due and still accruing |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total nonperforming loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total nonperforming assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

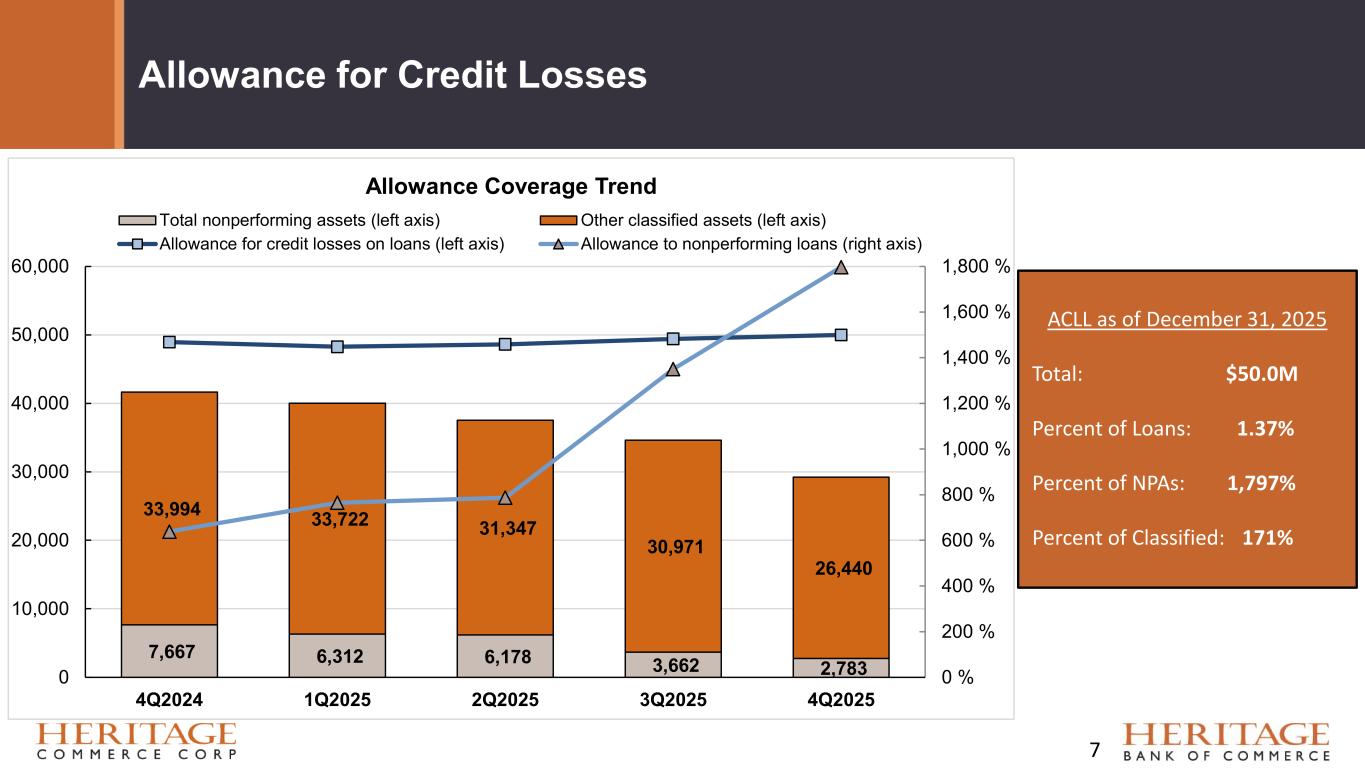

Net charge-offs (recoveries) during the quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for credit losses on loans during the quarter |

|

|

|

|

|

|

|