Document

Wealthfront Reports Fiscal Third Quarter 2026 Results

with Record Total Revenue of $93.2 Million and Net Income of $30.9 Million

Revenue up 16% to a record $93.2 million

Net income of $30.9 million with a Net income margin of 33%

Total Platform Assets up 21% to a record $92.8 billion

Adjusted EBITDA1 up 24% to $43.8 million with an Adjusted EBITDA margin1 of 47%

Palo Alto, CA - January 12, 2026 - Wealthfront Corporation (Nasdaq: WLTH), a tech-driven financial platform helping digital natives turn their savings into wealth, announced financial results for its fiscal third quarter ended October 31, 2025.

***

David Fortunato - CEO, President & Director: “We continued to execute in our core business driving Platform Assets to a record at quarter-end amidst a dynamic macro environment. This included the best quarter in net cross account transfers from Cash Management to Investment Advisory in the company’s history. We achieved this while accelerating the pace of product innovation including the launch of Nasdaq-100 Direct and the origination of our first home mortgage.”

Alan Imberman - CFO & Treasurer: “Our fiscal third quarter results highlighted the purposeful balance of the business model between Cash Management and Investment Advisory. We drove profitable growth and another quarter of strong free cash flow generation, while also improving our liquidity profile by increasing the capacity on our revolving credit facility from $50 million to $250 million.”

***

Fiscal Third Quarter 2026 Results Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended October 31, |

|

|

|

Nine Months Ended October 31, |

|

|

| ($ in thousands, except per share amounts) |

2025 |

|

2024 |

|

% change |

|

2025 |

|

2024 |

|

% change |

| GAAP |

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

$ |

93,220 |

|

|

$ |

80,309 |

|

|

16 |

% |

|

$ |

268,857 |

|

|

$ |

226,179 |

|

|

19 |

% |

| Net income |

30,901 |

|

|

30,046 |

|

|

3 |

% |

|

91,589 |

|

|

162,355 |

|

|

(44) |

% |

| Net income margin (%) |

33 |

% |

|

37 |

% |

|

|

|

34 |

% |

|

72 |

% |

|

|

| Diluted earnings per common share |

$ |

0.21 |

|

|

$ |

0.22 |

|

|

(5) |

% |

|

$ |

0.64 |

|

|

$ |

1.08 |

|

|

(41) |

% |

| Net cash provided by operating activities |

41,479 |

|

|

35,158 |

|

|

18 |

% |

|

118,884 |

|

|

103,235 |

|

|

15 |

% |

| Operating cash flow conversion (%) |

134 |

% |

|

117 |

% |

|

|

|

130 |

% |

|

64 |

% |

|

|

Non-GAAP1 |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

43,813 |

|

|

$ |

35,273 |

|

|

24 |

% |

|

$ |

126,479 |

|

|

$ |

106,486 |

|

|

19 |

% |

| Adjusted EBITDA margin (%) |

47 |

% |

|

44 |

% |

|

|

|

47 |

% |

|

47 |

% |

|

|

Free cash flow |

41,280 |

|

|

34,071 |

|

|

21 |

% |

|

118,053 |

|

|

98,338 |

|

|

20 |

% |

| Free cash flow conversion (%) |

94 |

% |

|

97 |

% |

|

|

|

93 |

% |

|

92 |

% |

|

|

1 Non-GAAP measure. Wealthfront’s reasons for use of the non-GAAP measure and a detailed reconciliation between the non-GAAP measure and the comparable GAAP amount are included at the end of this document in the section labeled ‘Non-GAAP Reconciliations’.

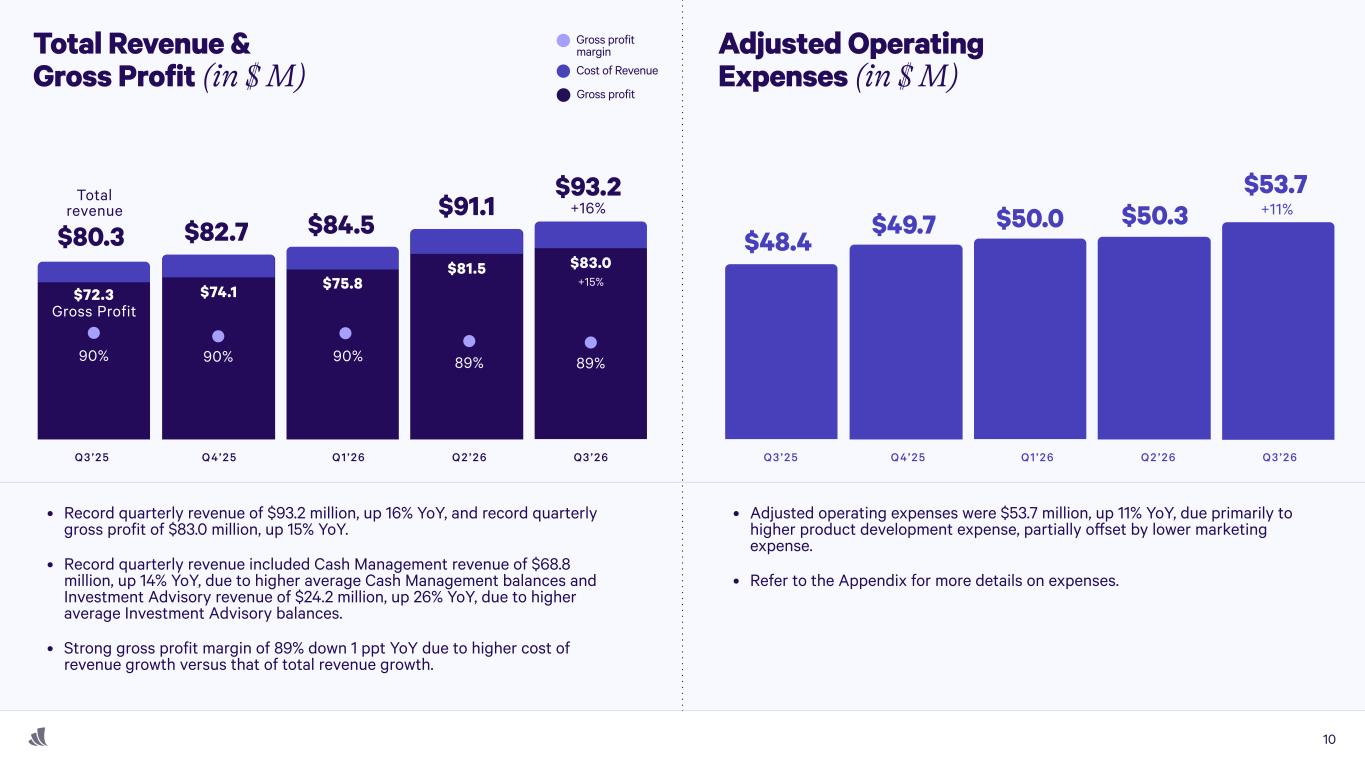

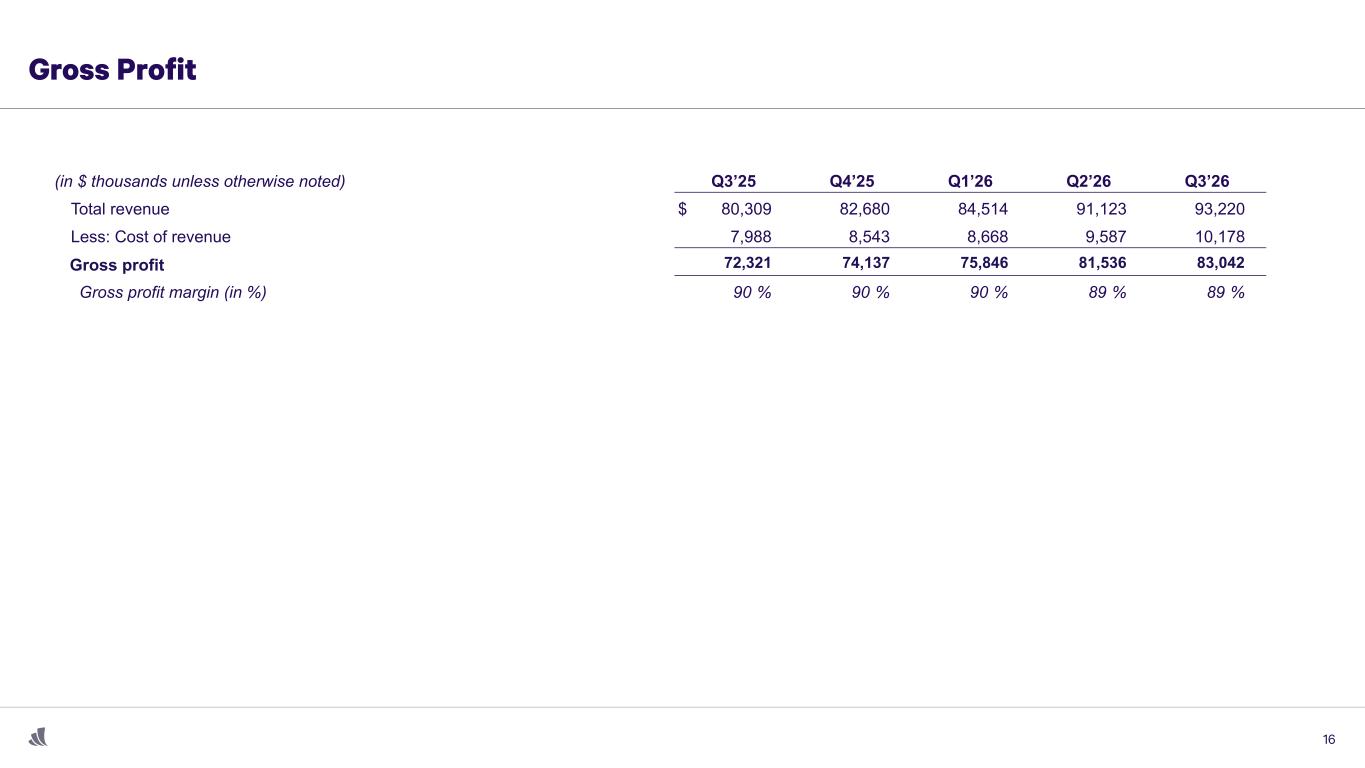

F3Q26 Financial Highlights

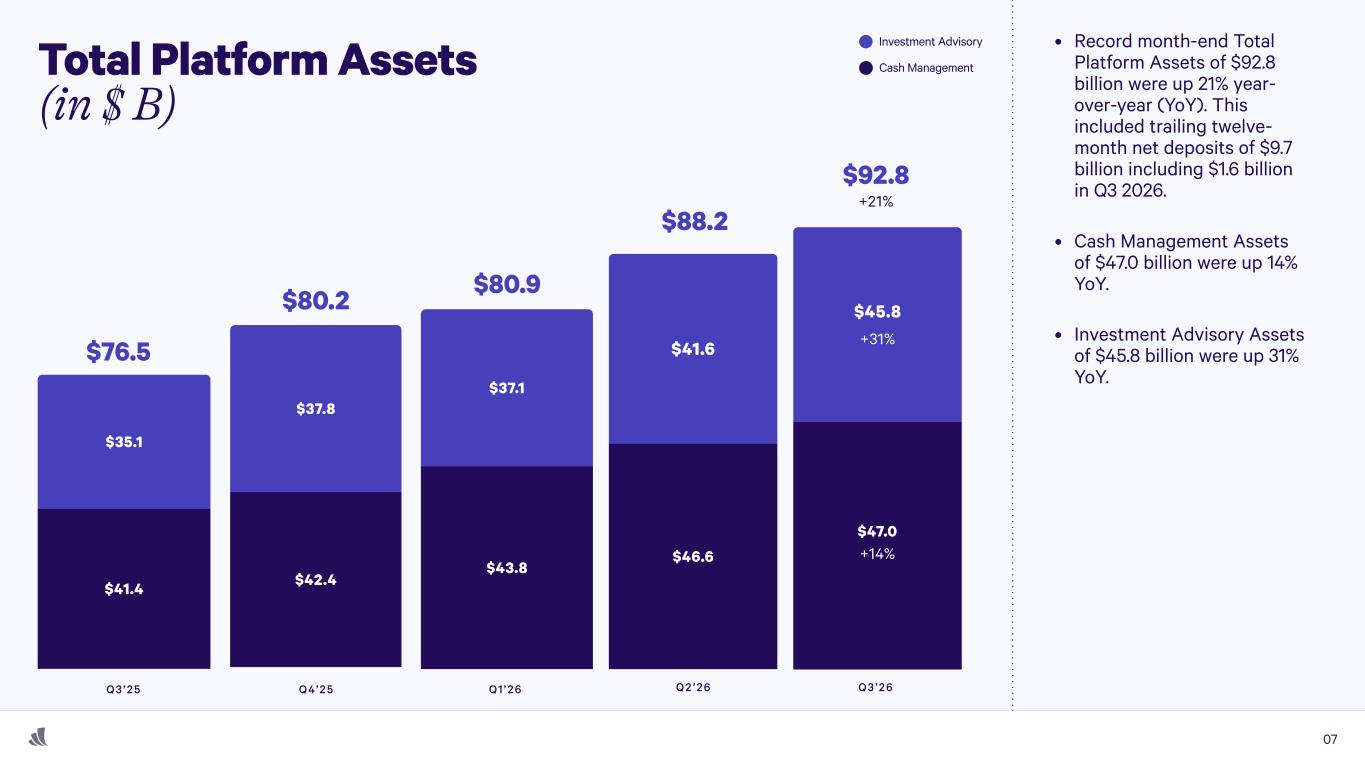

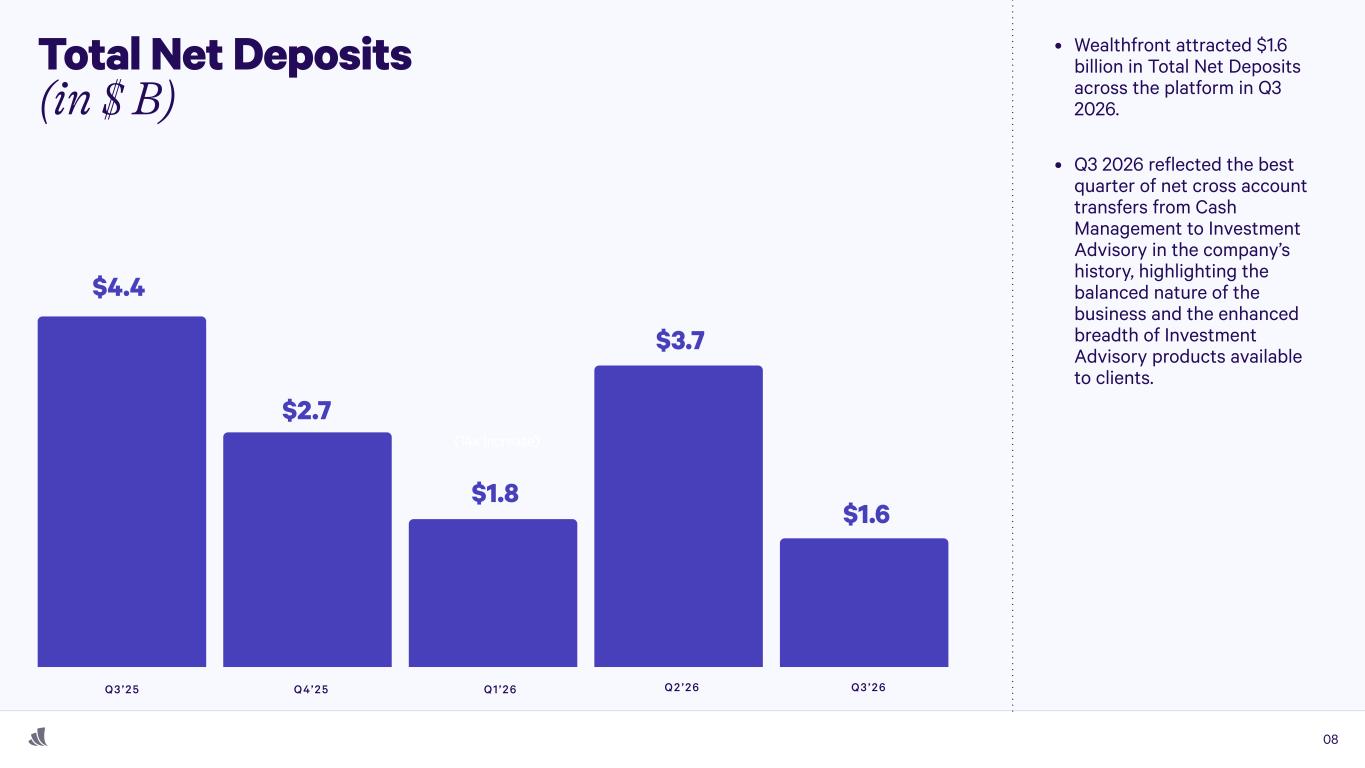

•Quarterly total revenue of $93.2 million increased 16% year-over year primarily driven by Total Platform Assets of $92.8 billion, which were up 21% year-over-year. This includes Cash Management Assets of $47.0 billion, which were up 14% year-over-year, and Investment Advisory Assets of $45.8 billion, which were up 31% year-over-year. Total Platform Asset growth included Total Net Deposits of $1.6 billion in the quarter.

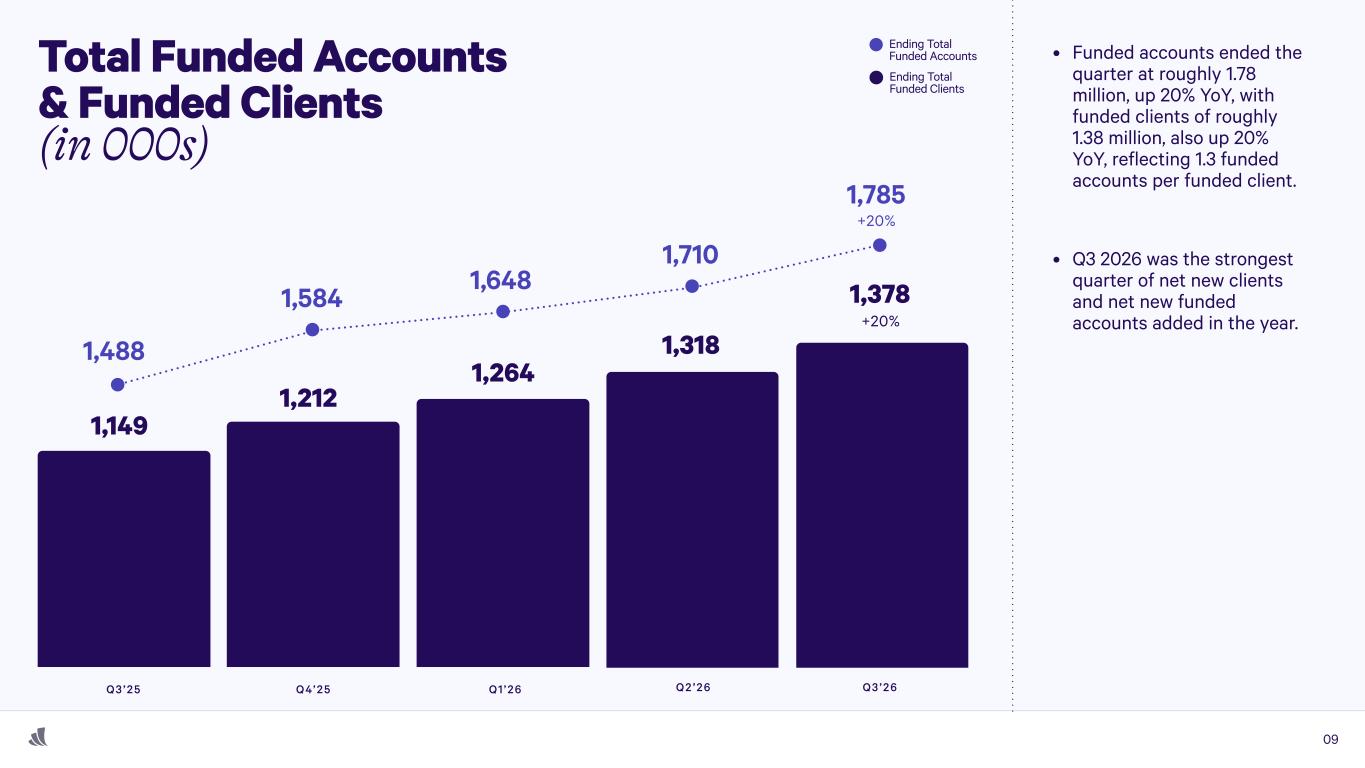

•Funded Clients of 1.38 million grew 20% year-over-year.

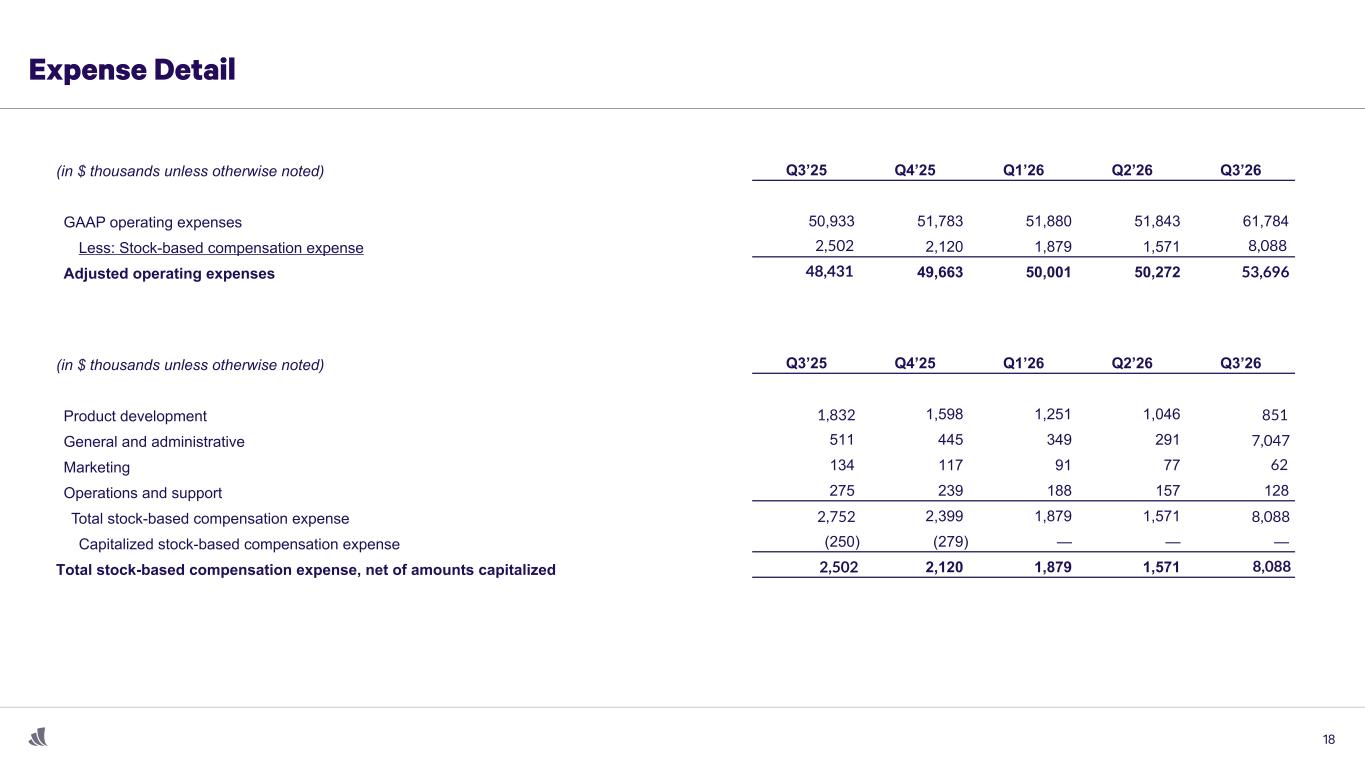

•GAAP expenses of $61.8 million increased 21% year-over-year primarily due to higher share-based compensation and product development expense, partially offset by lower marketing expense. Adjusted operating expenses of $53.7 million increased 11% year-over-year due to higher product development expense, partially offset by lower marketing expense.

•GAAP net income of $30.9 million increased 3% year-over-year. GAAP net income margin was 33%, compared to 37% for the three months ended October 31, 2024, with the decrease driven in part by a GAAP tax benefit realized in the prior year quarter.

•GAAP diluted EPS for the three months ended October 31, 2025 was $0.21, down year-over-year compared to $0.22 for the three months ended October 31, 2024 as higher GAAP net income was more than offset by a higher average diluted sharecount.

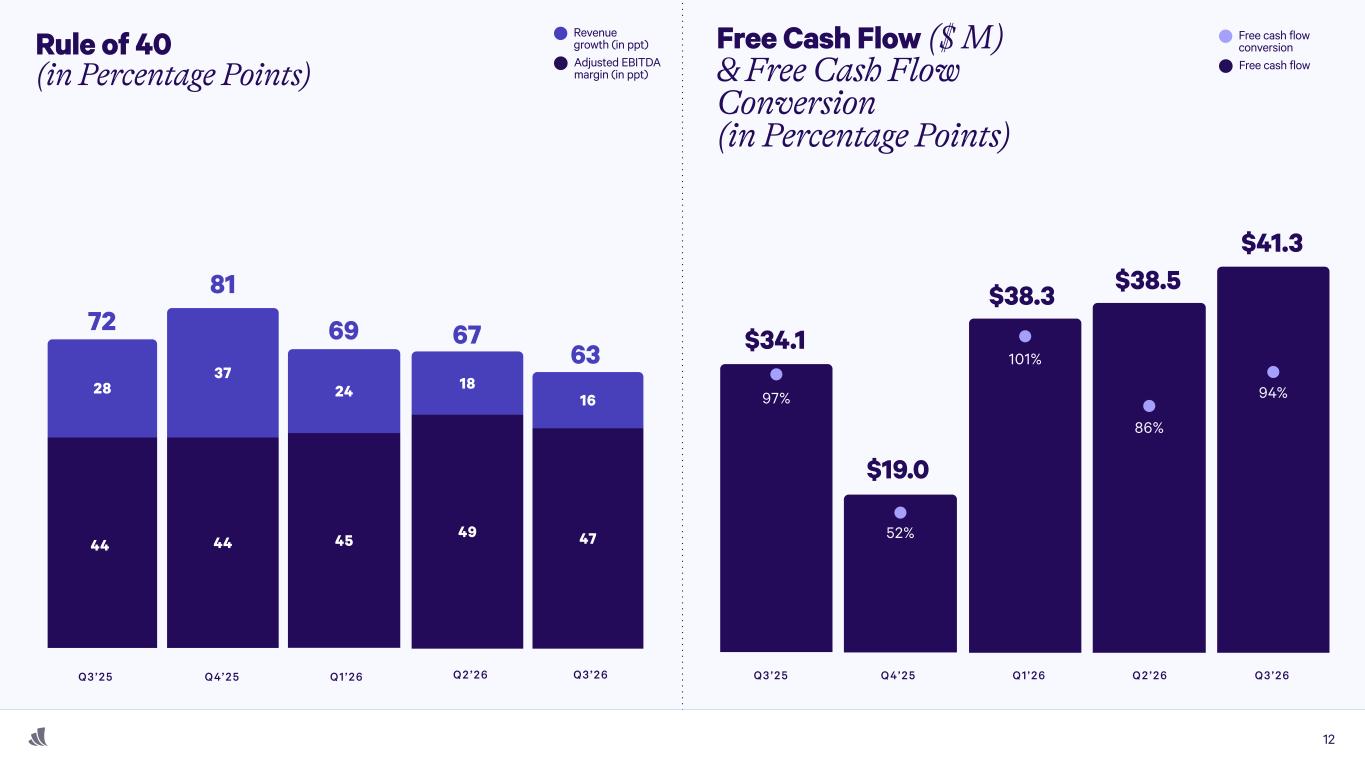

•Adjusted EBITDA1 of $43.8 million grew 24% year-over-year. Adjusted EBITDA margin1 was 47%, compared to 44% for the three months ended October 31, 2024.

•Net cash provided by operating activities was $41.5 millon and Free cash flow1 was $41.3 million. Free cash flow conversion ratio1 was 94% for the three months ended October 31, 2025 and 93% in the nine months ended October 31, 2025.

F3Q26 Business Highlights

•Originated the company’s first home mortgage in the quarter with a broader intention to offer clients access to low, transparent rates and no hidden fees. Wealthfront now has state licenses that cover the states of residence for the majority of its clients and began a measured rollout in the fiscal fourth quarter, initially to clients in Colorado.

•Launched Nasdaq-100 Direct, the first-ever product to offer retail investors tax savings from tax-loss harvesting in combination with tracking the Nasdaq-100 Index®. Nasdaq-100 Direct allows investors to turn market volatility into a tax-saving opportunity and is currently available for a 0.12% annual advisory fee.

•Generated the best quarter of net cross account transfers from Cash Management to Investment Advisory in the company’s history, highlighting the balanced nature of the business and the enhanced breadth of Investment Advisory products available to clients.

•Introduced free instant wire transfers, further bolstering the attractiveness of the Cash Management account that already provides an industry-leading annual percentage yield (APY) on as little as $1 and with $0 in account fees, up to $8 million in FDIC insurance for individual accounts and up to $16 million for joint accounts through our program banks, free instant withdrawals, and paycheck access up to two days early, among other features.

1 Non-GAAP measure. Wealthfront’s reasons for use of the non-GAAP measure and a detailed reconciliation between the non-GAAP measure and the comparable GAAP amount are included at the end of this document in the section labeled ‘Non-GAAP Reconciliations’.

Conference Call

Wealthfront’s executive management team will host a live audio webcast beginning at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) today to discuss the quarter’s financial results and business highlights. The live webcast as well as the earnings press release and earnings presentation can be found at https://ir.wealthfront.com. Following the call, a replay of the webcast will be available on the Wealthfront Investor Relations website.

About Wealthfront

Wealthfront is a tech-driven financial platform helping digital natives turn their savings into wealth. Since pioneering the automated investing category in 2011, the company has grown into a leading consumer fintech that helps clients achieve their financial goals with innovative saving, investing, borrowing, and lending products. Wealthfront’s expanding suite of high-quality, low-cost offerings helps digital natives earn more on their savings, borrow at lower rates, and keep more of their returns. To learn more and get started, visit www.wealthfront.com or download the Wealthfront app.

Contacts

Investors: ir@wealthfront.com

Press: press@wealthfront.com

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements that involve substantial risks and uncertainties. All statements contained in this press release other than statements of historical fact, including statements regarding Wealthfront’s future operating results and financial condition, its business strategy and plans, market growth, and its objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “target,” “plan,” “expect,” and similar expressions are intended to identify forward-looking statements.

These forward-looking statements are made as of the date they were first issued and are based on information available to Wealthfront together with Wealthfront’s expectations, estimates, forecasts, projections, beliefs, and assumptions as of such date. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Wealthfront’s control. Wealthfront’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors. Further information on potential risks that could affect actual results is included in Wealthfront’s most recent filings with the Securities and Exchange Commission (the “SEC”), including in the final prospectus Wealthfront filed with the SEC pursuant to Rule 424(b), dated December 11, 2025, copies of which may be obtained by visiting Wealthfront’s Investor Relations website at https://ir.wealthfront.com or the SEC's website at https://www.sec.gov. Past performance is not necessarily indicative of future results. Wealthfront undertakes no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Forward-looking statements should not be relied upon as representing Wealthfront’s views as of any date subsequent to the date of this press release.

Non-GAAP Financial Measures

We collect and analyze operating and financial data to evaluate the health of our business, allocate our resources, and assess our performance. In addition to total revenue, net income and other results under GAAP, we utilize non-GAAP calculations of adjusted earnings before interest, taxes, depreciation, and amortization (“Adjusted EBITDA”). Adjusted EBITDA is defined as net income, excluding: (i) interest expenses, (ii) provision for (benefit from) income taxes, (iii) depreciation and amortization, (iv) stock-based compensation expense, (v) change in fair value of the convertible note, warrant liabilities, and SAFEs, and (vi) nonrecurring expenses, if any. The above items are excluded from our Adjusted EBITDA measure because these items are non-cash in nature, or because the amount and timing of these items is unpredictable, are not driven by core results of operations and render comparisons with prior periods and competitors less meaningful. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by revenue. We define Incremental Adjusted EBITDA margin as the year-over-year change in Adjusted EBITDA divided by the year-over-year change in revenue over the comparable prior year period. We believe Adjusted EBITDA, Adjusted EBITDA Margin, and Incremental Adjusted EBITDA margin provide useful information to investors and others in understanding and evaluating our results of operations, as well as providing a useful measure for period-to-period comparisons of our business performance. Moreover, we have included Adjusted EBITDA, Adjusted EBITDA Margin, and Incremental Adjusted EBITDA margin in this press release because it is a key measurement used by our management internally to make operating decisions, including those related to operating expenses, evaluate performance, identify trends affecting our business and perform strategic planning and annual budgeting.

Free Cash Flow reflects net cash provided from operating activities, less (i) purchases of property, software, and equipment and (ii) capitalized internally developed software. We believe Free Cash Flow allows investors to evaluate the cash generated from our underlying operations in a manner similar to the method used by management. However, the utility of Free Cash Flow as a measure of our liquidity is limited as it does not represent the total increase or decrease in our cash balance for a given period. Free Cash Flow Conversion reflects 1) Free Cash Flow divided by 2) Adjusted EBITDA. Adjusted Operating Expenses reflect GAAP expenses, less (i) stock-based compensation expense and (ii) nonrecurring expenses, if any. The above items are excluded from our Adjusted Operating Expenses because these items are non-cash in nature, or because the amount and timing of these items is unpredictable, are not driven by core results of operations and render comparisons with prior periods and competitors less meaningful. Please refer to the Appendix for a reconciliation of each non-GAAP financial measure presented herein to the most directly comparable financial measure stated in accordance with GAAP.

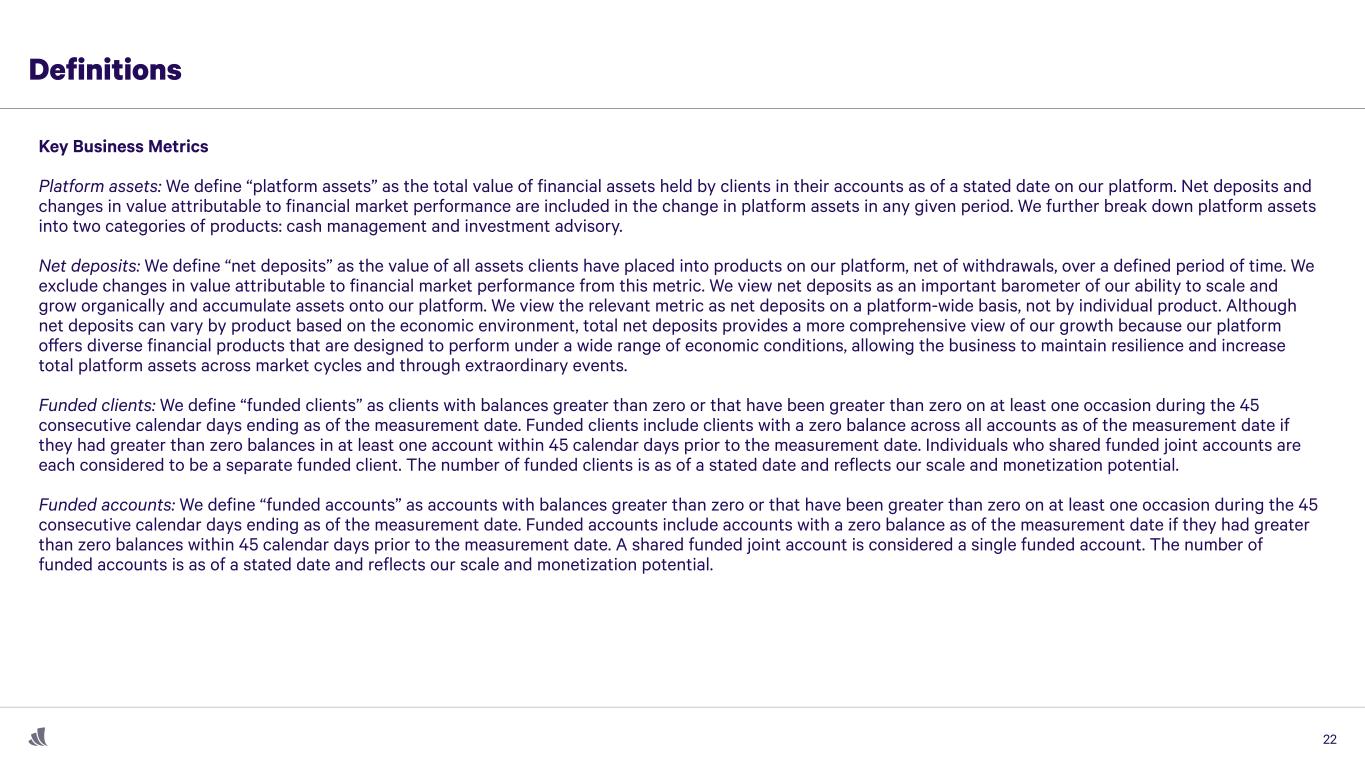

Key Business Metrics

Platform assets: We define “platform assets” as the total value of financial assets held by clients in their accounts as of a stated date on our platform. Net deposits and changes in value attributable to financial market performance are included in the change in platform assets in any given period. We further break down platform assets into two categories of products: cash management and investment advisory.

Net deposits: We define “net deposits” as the value of all assets clients have placed into products on our platform, net of withdrawals, over a defined period of time. We exclude changes in value attributable to financial market performance from this metric. We view net deposits as an important barometer of our ability to scale and grow organically and accumulate assets onto our platform. We view the relevant metric as net deposits on a platform-wide basis, not by individual product. Although net deposits can vary by product based on the economic environment, total net deposits provides a more comprehensive view of our growth because our platform offers diverse financial products that are designed to perform under a wide range of economic conditions, allowing the business to maintain resilience and increase total platform assets across market cycles and through extraordinary events.

Funded clients: We define “funded clients” as clients with balances greater than zero or that have been greater than zero on at least one occasion during the 45 consecutive calendar days ending as of the measurement date. Funded clients include clients with a zero balance across all accounts as of the measurement date if they had greater than zero balances in at least one account within 45 calendar days prior to the measurement date. Individuals who shared funded joint accounts are each considered to be a separate funded client. The number of funded clients is as of a stated date and reflects our scale and monetization potential.

Funded accounts: We define “funded accounts” as accounts with balances greater than zero or that have been greater than zero on at least one occasion during the 45 consecutive calendar days ending as of the measurement date.

Funded accounts include accounts with a zero balance as of the measurement date if they had greater than zero balances within 45 calendar days prior to the measurement date. A shared funded joint account is considered a single funded account. The number of funded accounts is as of a stated date and reflects our scale and monetization potential.

WEALTHFRONT CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

($ in thousands) |

October 31, 2025 |

|

January 31, 2025 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

266,191 |

|

|

$ |

142,860 |

|

| Cash segregated and on deposit for regulatory purposes |

10,701 |

|

|

9,083 |

|

| Due from clients |

191,070 |

|

|

118,518 |

|

| Accounts receivable |

32,071 |

|

|

29,127 |

|

| Client-held fractional shares |

211,299 |

|

|

28,057 |

|

| Other current assets |

31,447 |

|

|

18,805 |

|

| Total current assets |

742,779 |

|

|

346,450 |

|

| Deferred tax assets, net |

45,700 |

|

|

60,194 |

|

| Operating lease right-of-use asset |

9,545 |

|

|

11,229 |

|

| Property, software, and equipment, net |

9,276 |

|

|

14,723 |

|

| Other noncurrent assets |

3,341 |

|

|

2,610 |

|

| Total assets |

$ |

810,641 |

|

|

$ |

435,206 |

|

| Liabilities, redeemable convertible preferred stock, and stockholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

9,593 |

|

|

6,467 |

|

| Accrued liabilities |

12,377 |

|

|

7,517 |

|

| Due to clients |

12,413 |

|

|

9,452 |

|

| Payable to clearing broker |

191,126 |

|

|

118,174 |

|

| Current portion of operating lease liabilities |

4,035 |

|

|

3,556 |

|

| Fractional shares repurchase obligation |

211,299 |

|

|

28,057 |

|

| Total current liabilities |

440,843 |

|

|

173,223 |

|

| Operating lease liabilities, net of current portion |

7,329 |

|

|

9,796 |

|

| Other noncurrent liabilities |

9,912 |

|

|

9,651 |

|

| Total liabilities |

$ |

458,084 |

|

|

$ |

192,670 |

|

Commitments and contingencies |

|

|

|

Redeemable convertible preferred stock, $0.0001 par value per share; 85,490,483 shares authorized as of October 31, 2025 and January 31, 2025; 69,852,421 and 69,914,359 shares issued and outstanding as of October 31, 2025 and January 31, 2025, respectively; aggregate liquidation preference of $229,393 and $229,543 as of October 31, 2025 and January 31, 2025, respectively |

227,198 |

|

|

227,198 |

|

| Stockholders’ equity: |

|

|

|

Common stock, $0.0001 par value per share; 214,611,134 shares authorized as of October 31, 2025 and January 31, 2025; 44,871,567 and 41,532,599 shares issued as of October 31, 2025 and January 31, 2025; 43,419,298 and 40,110,106 shares outstanding as of October 31, 2025 and January 31, 2025, respectively |

4 |

|

|

4 |

|

Treasury stock, at cost; 1,452,269 and 1,422,493 shares held as of October 31, 2025 and January 31, 2025, respectively |

(12,858) |

|

|

(12,593) |

|

| Additional paid-in capital |

146,559 |

|

|

127,862 |

|

| Accumulated deficit |

(8,346) |

|

|

(99,935) |

|

| Total stockholders’ equity |

$ |

125,359 |

|

|

$ |

15,338 |

|

| Total liabilities, redeemable convertible preferred stock, and stockholders’ equity |

$ |

810,641 |

|

|

$ |

435,206 |

|

WEALTHFRONT CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

October 31, |

|

Nine Months Ended

October 31, |

($ in thousands) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenue: |

|

|

|

|

|

|

|

| Cash management |

$ |

68,812 |

|

|

$ |

60,157 |

|

|

$ |

201,951 |

|

|

$ |

168,890 |

|

| Investment advisory |

24,182 |

|

|

19,141 |

|

|

66,096 |

|

|

53,413 |

|

| Other revenue |

226 |

|

|

1,011 |

|

|

810 |

|

|

3,876 |

|

| Total revenue |

93,220 |

|

|

80,309 |

|

|

268,857 |

|

|

226,179 |

|

| Costs and operating expenses: |

|

|

|

|

|

|

|

| Cost of revenue |

10,178 |

|

|

7,988 |

|

|

28,433 |

|

|

22,421 |

|

| Product development |

20,922 |

|

|

17,063 |

|

|

62,381 |

|

|

46,430 |

|

| General and administrative |

15,404 |

|

|

7,365 |

|

|

34,144 |

|

|

21,251 |

|

| Marketing |

12,234 |

|

|

15,812 |

|

|

31,515 |

|

|

37,721 |

|

| Operations and support |

3,046 |

|

|

2,705 |

|

|

9,034 |

|

|

7,780 |

|

| Total costs and operating expenses |

61,784 |

|

|

50,933 |

|

|

165,507 |

|

|

135,603 |

|

| Interest expense |

217 |

|

|

1,031 |

|

|

383 |

|

|

2,557 |

|

| Other income, net |

(3,526) |

|

|

(1,182) |

|

|

(5,760) |

|

|

(19,754) |

|

| Income before income taxes |

34,745 |

|

|

29,527 |

|

|

108,727 |

|

|

107,773 |

|

| Provision for (benefit from) income taxes |

3,844 |

|

|

(519) |

|

|

17,138 |

|

|

(54,582) |

|

| Net income |

$ |

30,901 |

|

|

$ |

30,046 |

|

|

$ |

91,589 |

|

|

$ |

162,355 |

|

|

|

|

|

|

|

|

|

| Earnings per share (EPS): |

|

|

|

|

|

|

|

| Basic |

$ |

0.72 |

|

|

$ |

0.77 |

|

|

$ |

2.22 |

|

|

$ |

4.17 |

|

| Diluted |

$ |

0.21 |

|

|

$ |

0.22 |

|

|

$ |

0.64 |

|

|

$ |

1.08 |

|

| Weighted-average shares outstanding used in computing EPS: |

|

|

|

|

|

|

|

| Basic |

42,872,653 |

|

|

38,856,370 |

|

|

41,224,226 |

|

|

38,951,008 |

|

| Diluted |

142,510,293 |

|

|

138,336,934 |

|

|

142,434,669 |

|

|

138,890,885 |

|

Stock-Based Compensation by Type

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

October 31, |

|

Nine Months Ended

October 31, |

($ in thousands) |

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

| Product development |

$ |

851 |

|

|

$ |

1,832 |

|

|

$ |

3,148 |

|

|

$ |

5,693 |

|

| General and administrative |

7,047 |

|

|

511 |

|

|

7,687 |

|

|

1,622 |

|

| Marketing |

62 |

|

|

134 |

|

|

230 |

|

|

427 |

|

Operations and support |

128 |

|

|

275 |

|

|

473 |

|

|

860 |

|

| Stock-based compensation expense, net of amounts capitalized |

8,088 |

|

|

2,752 |

|

|

11,538 |

|

|

8,602 |

|

| Capitalized stock-based compensation expense |

— |

|

|

(250) |

|

|

— |

|

|

(1,358) |

|

| Total stock-based compensation expense |

$ |

8,088 |

|

|

$ |

2,502 |

|

|

$ |

11,538 |

|

|

$ |

7,244 |

|

WEALTHFRONT CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

October 31, |

|

Nine Months Ended

October 31, |

($ in thousands) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Operating activities |

|

|

|

|

|

|

|

| Net income |

$ |

30,901 |

|

|

$ |

30,046 |

|

|

$ |

91,589 |

|

|

$ |

162,355 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

| Depreciation and amortization of property, software, and equipment, net |

1,862 |

|

|

1,649 |

|

|

5,568 |

|

|

4,457 |

|

| Non-cash lease expense |

813 |

|

|

771 |

|

|

2,421 |

|

|

2,283 |

|

| Cash interest paid on convertible note |

— |

|

|

— |

|

|

— |

|

|

(904) |

|

| Non-cash interest expense on related-party long-term debt |

— |

|

|

765 |

|

|

— |

|

|

2,101 |

|

| Deferred income taxes |

4,767 |

|

|

6 |

|

|

14,494 |

|

|

(59,534) |

|

| Stock-based compensation expense |

8,086 |

|

|

2,503 |

|

|

11,536 |

|

|

7,244 |

|

| Impairment of internally developed software |

— |

|

|

— |

|

|

709 |

|

|

— |

|

| Change in fair value of convertible note |

— |

|

|

— |

|

|

— |

|

|

(16,927) |

|

| Change in fair value of warrant liabilities |

(437) |

|

|

189 |

|

|

(23) |

|

|

458 |

|

| Change in fair value of simple agreement for future equity |

(660) |

|

|

375 |

|

|

285 |

|

|

924 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

| Due from clients |

(33,291) |

|

|

(16,867) |

|

|

(72,552) |

|

|

(25,842) |

|

| Accounts receivable |

(1,126) |

|

|

(1,736) |

|

|

(2,944) |

|

|

(7,299) |

|

| Other current and noncurrent assets |

(2,291) |

|

|

(3,430) |

|

|

(13,373) |

|

|

(4,304) |

|

| Accounts payable |

3,161 |

|

|

409 |

|

|

3,126 |

|

|

3,258 |

|

| Accrued liabilities |

(4,173) |

|

|

1,408 |

|

|

4,860 |

|

|

5,459 |

|

| Due to clients |

1,498 |

|

|

3,195 |

|

|

2,961 |

|

|

6,304 |

|

| Payable to clearing broker |

33,293 |

|

|

16,727 |

|

|

72,952 |

|

|

25,724 |

|

| Lease liabilities |

(924) |

|

|

(852) |

|

|

(2,725) |

|

|

(2,522) |

|

| Net cash provided by operating activities |

$ |

41,478 |

|

|

$ |

35,158 |

|

|

$ |

118,883 |

|

|

$ |

103,235 |

|

| Investing activities |

|

|

|

|

|

|

|

| Purchases of property, software, and equipment |

(198) |

|

|

(272) |

|

|

(830) |

|

|

(502) |

|

| Capitalized internally developed software |

— |

|

|

(815) |

|

|

— |

|

|

(4,395) |

|

| Net cash used in investing activities |

$ |

(198) |

|

|

$ |

(1,087) |

|

|

$ |

(830) |

|

|

$ |

(4,897) |

|

| Financing activities |

|

|

|

|

|

|

|

| Repayment of convertible note |

— |

|

|

— |

|

|

— |

|

|

(29,122) |

|

| Proceeds from exercise of stock options, including early exercises |

2,040 |

|

|

2,159 |

|

|

7,161 |

|

|

2,293 |

|

| Repurchase of common stock |

(27) |

|

|

(23,482) |

|

|

(265) |

|

|

(23,482) |

|

| Net cash provided by (used in) financing activities |

$ |

2,013 |

|

|

$ |

(21,323) |

|

|

$ |

6,896 |

|

|

$ |

(50,311) |

|

| Net increase in cash and cash equivalents, cash segregated and on deposit for regulatory purposes, and restricted cash |

43,293 |

|

|

12,748 |

|

|

124,949 |

|

|

48,027 |

|

| Cash and cash equivalents, cash segregated and on deposit for regulatory purposes, and restricted cash at the beginning of the period |

236,209 |

|

|

131,071 |

|

|

154,553 |

|

|

95,792 |

|

| Cash and cash equivalents, cash segregated and on deposit for regulatory purposes, and restricted cash at the end of the period |

$ |

279,502 |

|

|

$ |

143,819 |

|

|

$ |

279,502 |

|

|

$ |

143,819 |

|

WEALTHFRONT CORPORATION

KEY BUSINESS METRICS

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL |

As of or for the

Three Months Ended

October 31, |

| (in $ millions unless otherwise noted) |

2025 |

|

2024 |

| Platform assets |

$ |

92,821 |

|

|

$ |

76,496 |

|

| Cash management |

47,011 |

|

41,400 |

| Investment advisory |

45,810 |

|

35,096 |

|

|

|

|

| Net deposits |

$ |

1,568 |

|

|

$ |

4,394 |

|

|

|

|

|

| Funded clients (# in thousands) |

1,378 |

|

1,149 |

Funded accounts (# in thousands) |

1,785 |

|

1,488 |

|

|

|

|

|

|

|

|

|

|

|

|

| CASH MANAGEMENT |

As of or for the

Three Months Ended

October 31, |

| (in $ millions unless otherwise noted) |

2025 |

|

2024 |

| Cash management assets (off-balance sheet), beginning of the period |

$ |

46,579 |

|

|

$ |

38,085 |

|

| Cash management assets (off-balance sheet), end of the period |

47,011 |

|

|

41,400 |

|

Average1 |

46,795 |

|

|

39,743 |

|

|

|

|

|

| Cash management revenue |

$ |

68.8 |

|

|

$ |

60.2 |

|

|

|

|

|

Annualized cash management fee rate (in %) 2 |

0.58 |

% |

|

0.60 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| INVESTMENT ADVISORY |

As of or for the

Three Months Ended

October 31, |

| (in $ millions unless otherwise noted) |

2025 |

|

2024 |

| Investment advisory assets (off-balance sheet), beginning of the period |

$ |

41,596 |

|

|

$ |

33,275 |

|

| Investment advisory assets (off-balance sheet), end of the period |

45,811 |

|

|

35,096 |

|

Average1 |

43,704 |

|

|

34,186 |

|

|

|

|

|

| Investment advisory revenue |

$ |

24.2 |

|

|

$ |

19.1 |

|

|

|

|

|

Annualized investment advisory fee rate (in %) 2 |

0.22 |

% |

|

0.22 |

% |

1 Average balance rows represent the average of the beginning of period and end of period balances.

2 Annualized cash management fee rate and Annualized investment advisory fee rate is calculated by annualizing revenue for the given period and dividing by the simple average asset balance presented.

WEALTHFRONT CORPORATION

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

(UNAUDITED)

The following tables present reconciliations of GAAP to non-GAAP measures disclosed within this document.

Adjusted Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

October 31, |

|

Nine Months Ended

October 31, |

($ in thousands) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP operating expenses |

$ |

61,784 |

|

|

$ |

50,933 |

|

|

$ |

165,507 |

|

|

$ |

135,603 |

|

Less: Stock-based compensation expense |

8,088 |

|

|

2,502 |

|

|

11,539 |

|

|

7,244 |

|

Adjusted operating expenses |

$ |

53,696 |

|

|

$ |

48,431 |

|

|

$ |

153,968 |

|

|

$ |

128,359 |

|

Adjusted EBITDA & Adjusted EBITDA Margin

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

October 31, |

|

Nine Months Ended

October 31, |

($ in thousands) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income |

$ |

30,901 |

|

|

$ |

30,046 |

|

|

$ |

91,589 |

|

|

$ |

162,355 |

|

Net income margin |

33 |

% |

|

37 |

% |

|

34 |

% |

|

72 |

% |

| Add: |

|

|

|

|

|

|

|

| Interest expense |

217 |

|

|

1,031 |

|

|

383 |

|

|

2,557 |

|

| Provision for (benefit from) income taxes |

3,844 |

|

|

(519) |

|

|

17,138 |

|

|

(54,582) |

|

| Depreciation and amortization of property, software, and equipment, net |

1,860 |

|

|

1,649 |

|

|

5,568 |

|

|

4,457 |

|

| EBITDA (non-GAAP) |

$ |

36,822 |

|

|

$ |

32,207 |

|

|

$ |

114,678 |

|

|

$ |

114,787 |

|

| Stock-based compensation expense |

8,088 |

|

|

2,502 |

|

|

11,539 |

|

|

7,244 |

|

| Change in fair value of convertible note, warrant liabilities, and SAFEs |

(1,097) |

|

|

564 |

|

|

262 |

|

|

(15,545) |

|

| Adjusted EBITDA (non-GAAP) |

$ |

43,813 |

|

|

$ |

35,273 |

|

|

$ |

126,479 |

|

|

$ |

106,486 |

|

| Adjusted EBITDA Margin (non-GAAP) |

47 |

% |

|

44 |

% |

|

47 |

% |

|

47 |

% |

Incremental Adjusted EBITDA Margin

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

October 31, |

|

Nine Months Ended

October 31, |

($ in thousands) |

2025 |

|

2024 |

|

2025 |

|

2024 |

Total revenue |

$ |

93,220 |

|

|

$ |

80,309 |

|

|

$ |

268,857 |

|

|

$ |

226,179 |

|

(a) 2025 change versus prior year period |

12,911 |

|

|

NA |

|

42,678 |

|

|

NA |

| Adjusted EBITDA (non-GAAP) |

$ |

43,813 |

|

|

$ |

35,273 |

|

|

$ |

126,479 |

|

|

$ |

106,486 |

|

(b) 2025 change versus prior year period |

8,540 |

|

|

NA |

|

19,993 |

|

|

NA |

Incremental adjusted EBITDA margin (b/a) |

66 |

% |

|

|

|

47 |

% |

|

|

WEALTHFRONT CORPORATION

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

(UNAUDITED)

Free Cash Flow & Free Cash Flow Conversion

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

October 31, |

|

Nine Months Ended

October 31, |

| (in thousands) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net cash provided by operating activities |

$ |

41,478 |

|

|

$ |

35,158 |

|

|

$ |

118,883 |

|

|

$ |

103,235 |

|

Divided by: Net income |

30,901 |

|

|

30,046 |

|

|

91,589 |

|

|

162,355 |

|

Operating cash flow conversion |

134 |

% |

|

117 |

% |

|

130 |

% |

|

64 |

% |

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

$ |

41,478 |

|

|

$ |

35,158 |

|

|

$ |

118,883 |

|

|

$ |

103,235 |

|

| Less: Capital expenditures |

(198) |

|

|

(1,087) |

|

|

(830) |

|

|

(4,897) |

|

Free cash flow |

$ |

41,280 |

|

|

$ |

34,071 |

|

|

$ |

118,053 |

|

|

$ |

98,338 |

|

Divided by: Adjusted EBITDA (non-GAAP) |

43,813 |

|

|

35,273 |

|

|

126,479 |

|

|

106,486 |

|

Free cash flow conversion |

94 |

% |

|

97 |

% |

|

93 |

% |

|

92 |

% |