WASHINGTON, D.C. 20549

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

☒ ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

ORGANIGRAM GLOBAL INC.

Securities registered or to be registered pursuant to Section 12(b) of the Securities Exchange Act of 1934 (the "Exchange Act"):

Securities registered or to be registered pursuant to Section 12(g) of the Exchange Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Exchange Act: None

Indicate the number of outstanding shares of the Registrant’s classes of capital or common stock as of the close of the period covered by the annual report: 134,461,029

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Organigram Global Inc. (the "Company" or "Organigram") is a "foreign private issuer" as defined in Rule 3b-4 under the Exchange Act, and is a Canadian issuer eligible to file its annual report ("Annual Report") pursuant to Section 13 of the Exchange Act on Form 40-F pursuant to the multi-jurisdictional disclosure system (the "MJDS") adopted by the United States Securities and Exchange Commission (the "SEC"). The Company's common shares are listed on the Toronto Stock Exchange (the "TSX") and the Nasdaq Global Select Market ("NASDAQ") under the trading symbol "OGI".

In this annual report, references to "we", "our", "us", the "Company" or "Organigram", mean Organigram Global Inc. and our wholly-owned subsidiaries, unless the context suggests otherwise.

Unless otherwise indicated, all amounts in this annual report are in Canadian dollars and all references to "$" or "Cdn.$" mean Canadian dollar and references to "U.S. dollars" or "US$" are to United States dollars.

The following principal documents are filed as exhibits to, and incorporated by reference into this Annual Report:

This Annual Report (including the documents incorporated by reference herein) includes or incorporates by reference certain statements that constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this Annual Report and include statements regarding our intent, belief or current expectation and that of our officers and directors.

Such statements can be identified by the use of forward-looking terminology such as "outlook", "objective", "may", "will," "could", "would", "might", "expect", "intend", "estimate", "anticipate", "believe", "plan", "continue", "budget", "schedule" or "forecast" or similar expressions suggesting future outcomes or events. They include, but are not limited to, statements with respect to expectations, forecasts or other characterizations of future events or circumstances, and the Company's objectives, goals, strategies, beliefs, intentions, plans, estimates, projections and outlook, including statements relating to the Company's plans and objectives, or estimates or predictions of actions of customers, suppliers, partners, distributors, competitors or regulatory authorities; and, statements regarding the Company's future economic performance. These statements are not historical facts but instead represent management beliefs regarding future events, many of which by their nature are inherently uncertain and beyond management control. Forward-looking information has been based on the Company's current expectations about future events.

Forward-looking statements in this Annual Report include, but are not limited to, statements with respect to:

•Expectations regarding production capacity, facility size, THC (as defined in the AIF) content, costs and yields;

•Expectations regarding the prospects of the Company's collaboration and ongoing investment from BT DE Investments Inc., a wholly-owned subsidiary of British American Tobacco p.l.c. (referred to in the AIF and MD&A as "BAT");

•Expectations regarding the prospects for the Company's principal operating subsidiary Organigram Inc. (formerly, Organigram, EIC and LAU (as defined in the AIF));

•Expectations around demand for cannabis and related products, future opportunities and sales including the relative mix of medical versus adult-use recreational products, the relative mix of products within the adult-use recreational category including wholesale, the Company's financial position, future liquidity and other financial results;

•Changes in legislation related to permitted cannabis types, forms and potency and legislation of additional cannabis types and forms for adult-use recreational cannabis in Canada, including regulation relating thereto, the timing and the implementation thereof, and our future product forms;

•Expectations around branded products and derivative-based products with respect to timing, launch, product attributes, composition and consumer demand;

•Expectation to create sustainable competitive advantage through relevant and differentiated consumer products and medical trade engagement materials;

•Expectations around the Company's ability to develop current and future vapour hardware, and the Company's ability to expand its share of the vapour market;

•The expectation that the technical arrangement between Organigram and Phylos Bioscience Inc. will permit Organigram to continue to transition a portion of its garden to seed-based cultivation over time, and the anticipated benefits of seed-based production;

•The expectations regarding the Company's investments in Green Tank Technologies Corp., Steady State LLC doing business as Open Book Extracts, and Sanity Group GmbH;

•The expectations regarding the Company's acquisition and integration of Motif Labs Ltd. and Collective Project Limited;

•Expectations regarding the resolution of litigation and other legal proceedings;

•The general continuance of current, or where applicable, assumed industry conditions;

•Changes in laws, regulations and guidelines, including those relating to the recreational market, the medical cannabis markets domestically and internationally, and in particular, with respect to changes in hemp and marijuana in the U.S.;

•Changes in laws, regulations, guidelines and policies, including those related to minor cannabinoids;

•The impact of the Company's cash flow and financial performance on third parties, including its supply partners;

•Fluctuations in the price of the Common Shares and the market for the Common Shares;

•The treatment of the Company's business under international regulatory regimes and impacts on changes thereto to the Company's international sales;

•The Company's growth strategy, targets for future growth and forecasts of the results of such growth;

•Expectations concerning access to capital and liquidity, and the Company's ability to access the public markets to fund operational activities and growth;

•The Company's ability to remain listed on the TSX and NASDAQ, and the impact of any actions it may be required to take to remain listed;

•The ability of the Company to generate cash flow from operations and from financing activities;

•The competitive conditions of the industry, including the Company's ability to maintain or grow its market share; and

•Expectations concerning Fiscal 2026 performance.

Certain of the forward-looking statements and other information contained herein are based on estimates prepared by the Company using data from publicly available governmental sources as well as from market research and industry analysis, and on assumptions based on data and knowledge of the medical cannabis industry, industrial hemp industry and the adult-use recreational cannabis industry which the Company believes to be reasonable.

However, although generally indicative of relative market positions, market shares and performance characteristics, such data is inherently imprecise. While the Company is not aware of any misstatement regarding any industry or government data presented herein, the medical cannabis industry, industrial hemp industry, and the adult-use recreational cannabis industry involve risks and uncertainties that are subject to change based on various factors.

Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. The Company’s forward-looking statements are expressly qualified in their entirety by this cautionary statement. A number of factors could cause actual events, performance or results to differ materially from what is projected in the forward-looking statements. These factors include, but are not limited to, risks related to competition, changes in the Canadian cannabis industry and market, governmental regulation, changes in laws, regulations and guidelines, reliance primarily on a single cultivation facility, reliance on key inputs and volatility in the wholesale and retail prices of cannabis, the Company’s success in developing new products and finding a market for the sale of new products, licence renewal risks, risk inherent in the agricultural business, rising energy costs, negative cash flows from operations, dividends, competition from illicit markets, acquisition and integration risk, volatility in the market for the Company’s securities, history of losses, product liability, sufficiency of insurance, management of growth, financing risks, risks relating to developing and maintaining effective internal controls for reliable financial reporting and for fraud prevention, reliance on key personnel, risks relating to the resurgence of pandemic and catastrophic events, product recalls, risks relating to litigation and securities class actions, difficulties with forecasts, uninsured and uninsurable events risks, risks relating to inflation, unknown health impacts of the use of cannabis and cannabis-derivatives, reliance on third-party transportation, ability to meet target production capacity, scale of operations, supply chain and distribution disruptions, facility and technological risks, packaging and shipping logistics, changes to government laws, regulations or policy, including the amendment of the definition of hemp in the 2018 Farm Bill (U.S.) to effectively eliminate hemp-derived THC products, potential time frame for the implementation of legislation to legalize cannabis internationally, risks relating to the ability of the Company to obtain and/or maintain their status as a licensed producer, the potential size of the regulated adult-use recreational cannabis market, demand for and changes to products, the development of the vapour market, political conditions, market opportunities, timing of final implementation of the Company’s enterprise resource planning system, contracts or other arrangements with provincial governments are not guaranteed, TSX and NASDAQ listing requirements and the ability to continue to meet listing standards for the TSX and the NASDAQ, risks relating to the Company’s designation as a “large accelerated filer”, differing shareholder protections across jurisdictions, increased volatility for dual-listed shares, market liquidity risks, investment risk, risks relating to the Company’s status as a foreign private issuer in the U.S., risks relating to expansion into new markets, foreign investment risk, risk of corruption and fraud in emerging markets and relating to ownership of real property; risks relating to the Company’s IP, credit risk, liquidity risk, concentration risk, risks associated with significant shareholders, dividends, publicity or consumer perception, cyber security and privacy, product security, environmental and employee health and safety regulations, regulatory proceedings, investigations and audits, fraudulent or illegal activity by employees, restrictions on foreign investors, regulatory and operational risks associated with expansion into foreign jurisdictions, reliance on international advisers and consultants, anti-money laundering laws and regulation risks, anti-corruption and anti-bribery laws, global economic risks, future acquisitions, general business risks and liabilities, dilution, constraints on marketing products, provincial legislative controls, suppliers and skilled labour, conflicts of interest, risks associated with the Company’s status as a holding company and the other risks described in AIF. Material factors and assumptions used in establishing forward-looking information include that construction and production activities will proceed as planned and regulatory conditions will advance in the manner expected by management. The purpose of forward-looking statements is only to provide the reader with a description of management’s expectations relating to future periods, and, as such, forward-looking statements are not appropriate for any other purpose. You should not place undue reliance on forward-looking statements contained in this Annual Report.

All forward-looking information is provided as of the date of this Annual Report. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as and to the extent required by applicable law, including applicable United States federal securities laws.

See also "Risk Factors" in the MD&A and the AIF.

The Company is permitted to prepare this Annual Report in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company prepares its consolidated financial statements in accordance with International Financial Reporting Standards ("IFRS"), as issued by the International Accounting Standards Board (the "IASB"), which differ in certain respects from United States generally accepted accounting principles ("US GAAP") and from certain practices prescribed by the SEC. Therefore, the Company's financial statements incorporated by reference in this Annual Report may not be comparable to financial statements prepared in accordance with US GAAP.

Unless otherwise indicated, all dollar amounts in this Annual Report are in Canadian dollars. The exchange rate of Canadian dollars into United States dollars, on October 1, 2025, based upon the daily exchange rate as quoted by the Bank of Canada was U.S.$1.00 = Cdn. $1.394.

Purchasing, holding, or disposing of the Company's securities may have tax consequences under the laws of the United States and Canada that are not described in this Annual Report.

Disclosure controls and procedures are defined in Rule 13a-15(e) and 15d-15(e) under the Exchange Act to mean controls and other procedures of an issuer that are designed to ensure that information required to be disclosed by the issuer in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms and includes, without limitation, controls and procedures designed to ensure that such information is accumulated and communicated to the issuer's management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure.

As of the end of the period covered by this report, our management carried out an evaluation, with the participation of Beena Goldenberg, our Chief Executive Officer until November 30, 2025, and Peter Amirault, our Executive Chair acting in the capacity of interim Chief Executive Officer effective December 1, 2025 ("CEO"), and our Chief Financial Officer ("CFO"), of the effectiveness of our disclosure controls and procedures. Based upon that evaluation, our CEO and CFO concluded that, as of the end of the period covered by this report, our disclosure controls and procedures, as defined in Rule 13a-15(e), were not effective because of the material weaknesses in our internal control over financial reporting noted below and described in the MD&A.

Internal control over financial reporting, as defined by Rule 13a-15(f) and 15d-15(f) of the Exchange Act ("ICFR"), is a process designed by, or under the supervision of, the Company's principal executive and principal financial officers or persons performing similar functions and effected by the Board of Directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS as issued by the IASB. ICFR includes policies and procedures that:

•pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company;

•provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with IFRS, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and

•provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements.

In connection with the Company's reporting obligations in Canada and its obligations under Rule 13a-15(c) under the Exchange Act, management, under the supervision and with the participation of its CEO and CFO, conducted an evaluation of the effectiveness of the Company's ICFR as of September 30, 2025, using the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) Internal Control - Integrated Framework (2013). Based on this evaluation management concluded that a material weakness existed as of September 30, 2025, as described at page 21 of the MD&A under the heading "Management's Evaluation of Internal Control over Financial Reporting", filed as Exhibit 99.5 to this Annual Report.

PKF O’Connor Davies, LLP, an Independent Registered Public Accounting Firm, has audited the Company's consolidated annual financial statements for the year ended September 30, 2025, and has issued an adverse report on the effectiveness of ICFR which is addressed to the Board of Directors of the Company and is included in the Company's audited consolidated annual financial statements filed as Exhibit 99.4 to this Annual Report.

There has been a change to the Company’s ICFR during the three months ended September 30, 2025 ("Q4 Fiscal 2025") that has materially affected, or is likely to materially affect, the Company’s ICFR.

During Q4 Fiscal 2025, staff turnover among personnel responsible for preparing and reviewing complex spreadsheets related to biological assets and inventory impacted management's ability to maintain effective operation of applicable controls.

With respect to the material weakness related to the information process during Fiscal 2025, the following remedial activities were completed and the material weakness assessed was remediated in Q4 Fiscal 2025:

•Engaged internal control specialists that assisted management in evaluating internal controls and in designing remediation plans;

•Hired a VP, Information Technology, to oversee and enhance the IT department and support the remediation of deficiencies in general IT controls;

•Hired and trained a dedicated resource to review the third-party service organization control reports and assess their impact in relation to the Company's control environment; and

•Remediated certain IT general controls.

The Board of Directors is responsible for the Company’s corporate governance and has the following separately designated standing committees: the Governance, Nominating and Sustainability Committee, the Compensation Committee, the Investment Committee, and the Audit Committee. The respective charters of the Governance, Nominating and Sustainability Committee, the Compensation Committee, the Investment Committee, and the Audit Committee can be viewed on the Company’s corporate website at www.organigram.ca. In addition, the Company’s Audit Committee Charter is attached as Appendix “A” to the AIF, which is filed as Exhibit 99.6 to this Annual Report.

The Governance, Nominating and Sustainability Committee is responsible for reviewing, overseeing and evaluating the governance, nominating and sustainability policies of the Company, and the Compensation Committee is responsible for reviewing, overseeing and evaluating the compensation policies of the Company.

The mandate of the Governance, Nominating and Sustainability Committee includes: (a) assessing the effectiveness of the Board of Directors, each of its committees and individual directors; (b) overseeing the recruitment and selection of candidates to be nominated for election as directors; (c) organizing an orientation and education program for new directors; (d) considering and approving proposals by the directors to engage outside advisors on behalf of the Board of Directors as a whole or on behalf of the independent directors; (e) reviewing and making recommendations to the Board of Directors concerning the size, composition and structure of the Board of Directors and its committees; and (f) overseeing management succession.

The Compensation Committee is responsible for: (a) administering any securities-based compensation plans of the Company; (b) assessing the performance of the Company's management; (c) reviewing and approving the compensation paid by the Company, if any, to the Company's officers; and (d) reviewing and making recommendations to the Board of Directors concerning the level and nature of the compensation payable to Company's directors and officers. The Compensation Committee is also responsible for administering the Company's Policy for the Recovery of Erroneously Awarded Incentive-Based Compensation (the "Recovery Policy"), which has been adopted by the Board of Directors pursuant to Rule 5608 of the NASDAQ Marketplace Rules. A copy of the Recovery Policy is filed as Exhibit 97.1 to this Annual Report, and is also available on the Company's corporate website at www.organigram.ca.

The Compensation Committee also reviews and makes recommendations to the Board of Directors at least annually with respect to the compensation of the Chief Executive Officer and other senior executive officers of the Company, including incentive compensation plans, equity-based plans, the terms of any employment agreements, severance arrangements, and change of control arrangements or provisions, and any special or supplemental benefits. In considering compensation matters, the Compensation Committee is required under its Charter to be guided by the following principles: (a) offering competitive compensation to attract, retain and motivate the very best qualified individuals in order for the Company to meet its goals; and (b) acting in the interests of the Company by being fiscally responsible.

The Company's Governance, Nominating and Sustainability Committee and the Company's Compensation Committee are required under their respective Charters to meet at least semi-annually and more frequently as circumstances require.

The Governance, Nominating and Sustainability Committee is comprised of Geoffrey Machum (Chair), Sherry Porter, Dexter John and Craig Harris. The Compensation Committee is comprised of Sherry Porter (Chair), Geoffrey Machum and Karina Gehring. The Board of Directors has determined that all members of each of the Governance, Nominating and Sustainability Committee and the Compensation Committee are independent, based on the criteria for independence prescribed by Rule 5605(a)(2) of the NASDAQ Marketplace Rules.

The Investment Committee's mandate is to assist the Board of Directors in discharging the Board of Directors' oversight responsibilities relating to proposed acquisitions, dispositions, major capital investments and financing arrangements. The Investment Committee is responsible for: (a) reviewing at least quarterly with management the Company's strategic business objectives, including potential acquisitions, dispositions, transaction opportunities and financing arrangements; (b) convening with management as needed to discuss and assess such opportunities, and reviewing and evaluating such opportunities with management on a regular basis; (c) monitoring the performance of the Company's completed transactions and investments by conducting periodic reviews for the purposes of evaluating the degree of success achieved, assessing the accuracy of projections and other assumptions relied upon in approving transactions, identifying the factors that differentiate more successful transactions from less successful ones, and evaluating the strategic contributions resulting from transactions; (d) considering, in conjunction with the Audit Committee as appropriate, the accounting treatment and impact of proposed investments; (e) when appropriate, making recommendations to the Board of Directors in respect of a proposed acquisition, disposition, financing or other arrangement (provided, however, that management may approve, without the requirement for further Committee or Board of Directors action, corporate development, business development, acquisitions and divestiture transactions in the normal course of business involving consideration up to $5,000,000); and (f) considering conformance with applicable law and compliance elements of proposed investments.

The Investment Committee is comprised of Dexter John (Chair), Stephen Smith, Marni Wieshofer, Simon Ashton and Craig Harris. The Board of Directors has determined that all five members of the Investment Committee are independent, based on the criteria for independence prescribed by Rule 5605(a)(2) of the NASDAQ Marketplace Rules.

Our Board of Directors has established the Audit Committee in accordance with section 3(a)(58)(A) of the Exchange Act and Rule 5605(c) of the NASDAQ Marketplace Rules for the purpose of overseeing our accounting and financial reporting processes and the audits of our annual financial statements and effectiveness of internal control over financial reporting.

The Audit Committee is comprised of Stephen Smith (Chair), Marni Wieshofer, Dexter John and Simon Ashton. Our Board of Directors has determined that the Audit Committee meets the composition requirements set forth by Section 5605(c)(2) of the NASDAQ Marketplace Rules, and that each of the members of the Audit Committee is independent as determined under Rule 10A-3 of the Exchange Act and Rule 5605(a)(2) of the NASDAQ Marketplace Rules. All four members of the Audit Committee are financially literate, meaning they are able to read and understand the Company's financial statements and to understand the breadth and level of complexity of the issues that can reasonably be expected to be raised by the Company's financial statements.

•qualifies as an "audit committee financial expert" (as defined in paragraph (8)(b) of General Instruction B to Form 40-F),

•has past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in his financial sophistication (pursuant to Rule 5605(c)(2)(A) of the NASDAQ Marketplace Rules), and

•is independent (as determined under Exchange Act Rule 10A-3 and Rule 5605(a)(2) of the NASDAQ Marketplace Rules).

The Audit Committee Charter sets out responsibilities regarding the provision of non-audit services by the Company's external auditors and requires the Audit Committee to pre-approve all permitted non-audit services to be provided by the Company's external auditors, in accordance with applicable law.

As of June 28, 2024, our independent registered public accounting firm is PKF O’Connor Davies, LLP, New York, NY, Auditor Firm ID: 127. Prior to June 28, 2024, our independent registered public accounting firm was KPMG LLP, Vaughan, ON, Canada, Auditor Firm ID: 85. Tabular disclosure of the amounts billed to us by our independent auditors for each of our last fiscal years ended September 30, 2024 ("Fiscal 2024") and September 30, 2025 ("Fiscal 2025") as Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees, is made on page 78 of the AIF, filed as Exhibit 99.6 to this Annual Report.

Audit Fees include fees necessary to perform the annual audit including the audit of internal controls over financial reporting and quarterly reviews of the Company’s financial statements. Audit Fees include fees for review of tax provisions and for accounting consultations on matters reflected in the financial statements. Audit Fees also include audit or other attest services required by legislation or regulation, such as comfort letters, consents, reviews of securities filings and statutory audits. For Fiscal 2024 audit fees were comprised of quarterly reviews and the annual audit (including the audit of internal controls over financial reporting) . For Fiscal 2025 audit fees were comprised of quarterly reviews and the annual audit (including the audit of internal controls over financial reporting).

Audit-related Fees include fees related to Public Company Accounting Oversight Board and Canadian Public Accountability in Fiscal 2025.

Tax Fees include fees for all tax services other than those included in "Audit Fees" and "Audit-Related Fees". This category includes fees for tax compliance and advisory in Fiscal 2024. Tax advice includes advice related to mergers and acquisitions and a captive insurance structure.

From time to time, management of the Company recommends to and requests approval from the Audit Committee for audit and non-audit services to be provided by the Company's external auditor.

The Audit Committee may delegate to one or more of its members the authority to pre-approve non-audit services to be provided to the Company or its subsidiaries by the Company's external auditor. The pre-approval of non-audit services must be presented to the Audit Committee at its first scheduled meeting following such pre-approval.

The Audit Committee may satisfy its duty to pre-approve non-audit services by adopting specific policies and procedures for the engagement of the non-audit services, provided the policies and procedures are detailed as to the particular service, the Audit Committee is informed of each non-audit service and the procedures do not include delegation of the Audit Committee's responsibilities to management.

There were no off-balance sheet arrangements during Q4 Fiscal 2025 and Fiscal 2025.

Disclosure of contractual obligations can be found under "Risk Factors - (ii) Liquidity Risk" beginning on page 23 of our MD&A, filed as Exhibit 99.5 to this Annual Report, which section is incorporated by reference.

We have adopted a Code of Business Conduct and Ethics (the "Code") that applies to our officers (including without limitation, the CEO and CFO), employees and directors of the Company and its subsidiaries and promotes, among other things, honest and ethical conduct. The Code meets the requirements for a "code of ethics" within the meaning of that term in Form 40-F.

The Code was reviewed and approved by the Board of Directors on September 26, 2025. The Code is available on the Company's corporate website at www.organigram.ca and under the Company's SEDAR+ profile on www.sedarplus.ca and is filed as Exhibit 99.7 to this Annual Report.

During Fiscal 2025, no material amendment was made to the Code which would be required to be disclosed pursuant to Paragraph 9 of General Instruction B, and no waivers of the Code were granted to any principal officer of the Company or any person performing similar functions.

There were no notices required by Rule 104 of Regulation BTR that the Company sent during Fiscal 2025, concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

The Company complies with corporate governance requirements of the TSX. As a foreign private issuer, the Company is required to comply with some, but not all, of the corporate governance requirements of NASDAQ. Notwithstanding certain accommodations available to foreign private issuers under NASDAQ's corporate governance standards, the Company adopts best practices consistent with domestic NASDAQ listed companies when appropriate to its circumstances.

The Company has reviewed the NASDAQ corporate governance requirements and confirms that the Company is in compliance with the NASDAQ corporate governance standards that apply to the Company (taking into account the accommodations available for foreign private issuers) in all significant respects:

Executive Sessions: Under Rule 5605(b)(2) of the NASDAQ Marketplace Rules, a listed company must have regularly scheduled meetings at which only independent directors are present ("executive sessions"). The rule contemplates that executive sessions will occur at least twice a year, and perhaps more frequently, in conjunction with regularly scheduled board meetings. Under applicable Canadian rules, customs and practice, the Company's independent directors are not required to hold executive sessions. However, the Company is subject to certain disclosure requirements prescribed in Canadian Form 58-101F1 - Corporate Governance Disclosure ("Form 58-101F1"). In particular, the Company must disclose whether the independent directors hold executive sessions and, if such executive sessions are held, how many of these meetings have been held since the beginning of the Company's most recently completed financial year. If the Company does not hold executive sessions, the Company must describe what the Board of Directors does to facilitate open and candid discussion among its independent directors.

Contents of Audit Committee Charter: Under Rule 5605(c)(1) of the NASDAQ Marketplace Rules, a listed company must adopt a formal written charter that specifies the scope of its responsibilities and the means by which it carries out those responsibilities; the external auditor's accountability to the audit committee; and the audit committee's responsibility to ensure the independence of the outside auditor. In accordance with section 2.3(1) of Canadian National Instrument 52-110 - Audit Committees, the Company has adopted an Audit Committee Charter that sets out its mandate and responsibilities, and substantially complies with Rule 5605(c)(1) of the NASDAQ Marketplace Rules.

However, the Audit Committee Charter does not strictly comply with the requirement under Rule 5605(c)(1)(B) that an audit committee charter must specify the committee's responsibility for ensuring its receipt from the outside auditors of a formal written statement delineating all relationships between the auditor and the company, with the view to confirming the objectivity and independence of the external auditor. Instead, consistent with the laws, customs and practices in Canada, the Company's Audit Committee Charter provides that: (a) the Committee shall satisfy itself, on behalf of the Board of Directors, that the external auditor is independent of management; and (b) in assessing such independence, the Committee shall discuss with the external auditor, and may require a letter from the external auditor outlining, any relationships between the external auditor and the Company or its affiliates.

Composition of Compensation Committee: Under Rule 5605(d)(1) of the NASDAQ Marketplace Rules, a listed company must adopt a formal written compensation committee charter that specifies the scope of its responsibilities and the means by which it carries out those responsibilities, including structure, processes and membership requirements. Rule 5605(d)(2)(A) requires that, subject to a limited exception, the compensation committee must be composed of at least two members, each of whom must be an independent director as defined in Rule 5605(a)(2). Under applicable Canadian rules, the Company's compensation committee is not required to include a prescribed number of independent directors. However, pursuant to Form 58-101F1, the Company must disclose what steps its board of directors takes to ensure an objective process for determining the compensation of the directors and officers of the Company, if its compensation committee is not comprised entirely of independent directors.

Independent Director Oversight of Director Nominations: Rule 5605(e)(1) of the NASDAQ Marketplace Rules prescribes that, subject to a limited exception, director nominees must either be selected, or recommended for the Board of Directors' selection, either by: (a) independent directors (as defined in Rule 5605(a)(2)) constituting a majority of the Board of Directors' independent directors in a vote in which only independent directors participate, or (b) a nominations committee comprised solely of independent directors. Rule 5605(e)(2) requires a listed company to adopt a formal written charter or board resolution, as applicable, addressing the nominations process and such related matters as may be required under United States federal securities laws. Under applicable Canadian rules, the Company's nominating committee is not required to include a prescribed number of independent directors. However, pursuant to Form 58-101F1, the Company must disclose what steps its board of directors takes to ensure an objective process for encouraging an objective nomination process for new directors of the Company, if its nominating committee is not comprised entirely of independent directors.

The Company's Governance, Nominating and Sustainability Committee and Compensation Committee: The Company has adopted a Governance, Nominating and Sustainability Committee Charter and a Compensation Committee Charter (the "Charters") that substantially comply with Rules 5605(d)(1) and Rule 5605(e)(2) of the NASDAQ Marketplace Rules. However, in contrast to the requirements of Rules 5605(d)(2)(A) and 5605(e)(1), the Charters prescribe that only a majority of the Committee (which should be comprised of a minimum of three directors) must be independent as defined in Canadian National Instrument 58 101 - Disclosure of Corporate Governance Practices, and free from any relationship that, in the view of the Board of Directors, could be reasonably expected to interfere with the exercise of his or her independent judgment as a member of the Committee. This is consistent with the laws, customs and practices in Canada. As disclosed elsewhere in this Annual Report, the Company's Governance, Nominating and Sustainability Committee is currently comprised of Geoff Machum (Chair), Sherry Porter, Dexter John and Craig Harris, and the Compensation Committee is currently comprised of Sherry Porter (Chair), Geoff Machum and Karina Gehring, each of whom has been determined by the Board of Directors to be independent based on the criteria for independence prescribed by Rule 5605(a)(2) of the NASDAQ Marketplace Rules. In the event that the Governance, Nominating and Sustainability Committee or the Compensation Committee ceases to comprised of only independent directors, the Company will disclose the steps its Board of Directors takes to ensure an objective process for the nomination of new directors of the Company or the determination of the compensation of the Company's directors and officers, as the case may be.

Shareholder Meeting Quorum Requirement: Under Rule 5620(c) of the NASDAQ Marketplace Rules, a listed company that is not a limited partnership must provide in its by-laws for a quorum of not less than 33 1/3% of the outstanding shares of the company's common voting stock in respect of all meetings of the holders of its common stock. The Company's Bylaws provide that a quorum for a meeting of shareholders of the Company is present if two persons who are, or who represent by proxy, one or more shareholders who, in the aggregate, hold at least five percent of the issued shares. This quorum requirement is consistent with the laws, customs and practices in Canada.

Proxy Delivery Requirement: Under Rule 5620(b) of the NASDAQ Marketplace Rules, a listed company that is not a limited partnership must solicit proxies and provide proxy statements for all meetings of shareholders, and also provide copies of such proxy solicitation materials to NASDAQ. The Company is a "foreign private issuer" as defined in Rule 3b-4 under the Exchange Act, and the equity securities of the Company are accordingly exempt from the proxy rules set forth in Sections 14(a), 14(b), 14(c) and 14(f) of the Exchange Act. The Company solicits proxies in accordance with applicable rules and regulations in Canada.

Distribution of Annual Reports: NASDAQ Marketplace Rule 5250(d) requires a NASDAQ-listed Company to make available to shareholders an annual report containing audited financial statements of the Company and its subsidiaries (which, for example, may be on 40-F under the Exchange Act) within a reasonable period of time following the filing of the annual report with the SEC. The Company may comply with this requirement either:

•by mailing the report to shareholders (as opposed to electronic or notice-and-access delivery);

•by satisfying the requirements for furnishing an annual report contained in Rule 14a-16 under the Exchange Act; or

•by posting the annual report to shareholders on or through the Company's website, along with a prominent undertaking in the English language to provide shareholders, upon request, a hard copy of the annual report free of charge. A Company that chooses to satisfy this requirement pursuant in this manner must, simultaneous with this posting, issue a press release stating that its annual report has been filed with the Commission. The press release must also state that: (a) the annual report is available on the Company's website and include the website address, and (b) shareholders may receive a hard copy free of charge upon request.

As indicated above, the Company is exempt from the proxy rules set forth in Sections 14(a), 14(b), 14(c) and 14(f) of the Exchange Act (as well as Rule 14a-16 promulgated under the Exchange Act), and solicits proxies in accordance with applicable rules and regulations in Canada.

Section 437 of the TSX Company Manual requires that: (a) every TSX-listed company must forward annually to each shareholder who has requested them its annual financial statements and its related management's discussion and analysis in accordance with Canadian National Instrument 51-102 - Continuous Disclosure Obligations ("NI 51-102"); and (b) if a listed company produces an annual report, it must be filed publicly through SEDAR+, available at www.sedarplus.ca.

Pursuant to NI 51-102, the Company is required to send annually a request form to the registered holders and beneficial owners of its securities, other than debt instruments, that registered holders and beneficial owners may use to request a copy of the Company's annual financial statements and related management's discussion and analysis, the interim financial statements and related management's discussion and analysis, or both. If a registered holder or beneficial owner of securities, other than debt instruments, of the Company requests the Company's annual or interim financial statements, the Company must send a copy of the requested financial statements to the person or company that made the request, without charge, by the later of: (a) 10 days after the filing deadline for the financial statements, or (b) 10 calendar days after the Company receives the request.

If the Company sends financial statements it must also send, at the same time, the annual or interim management's discussion and analysis relating to the financial statements.

Shareholder Approval Requirements: Section 5635 of the NASDAQ Marketplace Rules requires shareholder approval for issuances of common shares, or any securities convertible or exercisable into common shares:

(i)where, due to the present or potential issuance of common shares (including shares issued pursuant to an earn-out or similar type of provision, or securities convertible into or exercisable for common shares) other than a public offering for cash:

(A)the common shares constitute or will upon issuance constitute at least 20% of the voting power outstanding before the issuance of the common shares (or, if applicable before the issuance of the securities convertible into or exercisable for common shares); or

(B)the common shares constitute or will upon issuance constitute at least 20% of the number of common shares outstanding before the issuance; or

(ii)if any director, officer or Substantial Shareholder (as defined by Rule 5635(e)(3) of the NASDAQ Marketplace Rules) of the listed company has a 5% or greater interest (or such persons collectively have a 10% or greater interest), directly or indirectly, in the target company or assets to be acquired, or in the consideration to be paid in the transaction or series of related transactions, and the present or potential issuance of common shares, or securities convertible into or exercisable for common shares, could result in an increase of 5% or more in the outstanding common shares or voting power of the listed company;

(b)where the common shares sold (or the number of common shares into which the securities sold are convertible or exercisable), either alone or together with sales by officers, directors or Substantial Shareholders of the listed company, constitute at least

(ii)20% of the voting power of the outstanding common shares before the issuance,

in either case except for (A) public offerings of common shares for cash, and (B) transactions involving the sale, issuance or potential issuance of common shares at a price, or securities convertible or exercisable into common shares with a conversion or exercise price, that is greater than or equal to the lesser of (1) the last closing price immediately preceding the signing of a binding agreement, and (2) the average closing price of the common shares on NASDAQ for the five trading days immediately preceding the signing of the binding agreement; and

(c)where the issuance would result in a change of control of the listed company.

The Company intends to follow TSX rules for shareholder approval of new issuances of its common shares. Following TSX rules, shareholder approval is required for certain issuances of shares that: (i) materially affect control of the listed issuer; or (ii) provide consideration to insiders in aggregate of 10% or greater of the market capitalization of the listed issuer, during any six-month period, and has not been negotiated at arm's length. Shareholder approval is also required, pursuant to TSX rules, in the case of private placements: (a) for an aggregate number of listed securities issuable greater than 25% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of closing of the transaction if the price per security is less than the market price; or (b) that during any six month period are to insiders for listed securities or options, rights or other entitlements to listed securities greater than 10% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of the closing of the first private placement to an insider during the six month period. The rules of the TSX also require shareholder approval in connection with an acquisition by a listed issuer where the number of securities issued or issuable in payment of the purchase price for the acquisition exceeds 25% of the number of securities of the listed issuer that are outstanding, on a non-diluted basis.

Equity Compensation Plans: Section 5635(c) of the NASDAQ Marketplace Rules also requires shareholder approval of all stock option or purchase plans or other arrangements that provide for equity securities as compensation to officers, directors, employees or consultants, and any material amendments to such plans or arrangements, except for certain plans and arrangements, including:

(a)stock purchase plans available on equal terms to all security holders of the listed company (such as a typical dividend reinvestment plan);

(b)tax qualified, non-discriminatory employee benefit plans (e.g., plans that meet the requirements of section 401(a) or 423 of the Internal Revenue Code) or parallel nonqualified plans, provided that such plans are approved by the listed company's independent compensation committee or a majority of the company's independent directors;

(c)those plans or arrangements allowing employees, directors or service providers to buy such securities on the open market or from the listed company for current fair market value;

(d)grants of options or other equity-based compensation as a material inducement to the grantee's entering into employment with the listed company, provided that such grants are approved by the listed company's independent compensation committee or a majority of the company's independent directors; and

(e)conversions, replacements or adjustments of outstanding options or other equity compensation awards to reflect a merger or acquisition.

The Company intends to follow TSX rules in respect of its security-based compensation arrangements. The TSX requires shareholder approval of all security-based compensation arrangements, and any material amendments to such arrangements, except for arrangements used as an inducement to persons or companies not previously employed by and not previously an insider of the listed issuer, provided that: (i) such persons or companies enter into a contract of full time employment as an officer of the listed issuer; and (ii) the number of securities made issuable to such persons or companies during any twelve month period does not exceed in aggregate 2% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date the exemption is first used during such twelve month period. Such shareholder approval is required when the security-based arrangement is instituted and every three years thereafter if the arrangement does not have a fixed maximum aggregate of securities issuable. The TSX considers a security-based compensation arrangement to be any compensation or incentive mechanism involving the issuance from treasury or potential issuance from treasury of securities of a listed issuer.

Insiders of a listed issuer that are entitled to receive a benefit under a security-based compensation arrangement are not eligible to vote their securities in respect of the shareholder approval required by the TSX unless such security based compensation arrangement contains an "insider participation limit". An "insider participation limit" is a provision typically found in security-based compensation arrangements which limits the number of a listed issuer's securities: (i) issued to insiders of the listed issuer, within any one year period; and (ii) issuable to insiders of the listed issuer at any time, to 10% of the listed issuer's total issued and outstanding securities.

For the purposes of security-based compensation arrangements, the definition of "insider" would include the CEO, CFO, all directors of the listed issuer and its major subsidiaries, any person responsible for a principal business unit, division or function, and any shareholder that has beneficial ownership or control or direction over, more than 10% of the issued and outstanding common shares of the listed issuer. The Company obtains shareholder approval of its equity compensation plans in accordance with applicable rules and regulations of the TSX.

The foregoing are consistent with the laws, customs and practices in Canada.

Not applicable.

Not applicable.

Not applicable.

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

The Company has previously filed with the SEC a written consent to service of process on Form F-X. Any change to the name or address of the Company's agent for service shall be communicated promptly to the SEC by amendment to the Form F-X referencing the file number of the Company.

Pursuant to the requirements of the Exchange Act, the Company certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 16, 2025 Organigram Global Inc.

|

|

|

|

|

|

|

|

|

|

|

|

| TABLE OF CONTENTS |

|

|

|

| Management’s Responsibility for the Financial Statements |

|

|

|

Independent Auditor's Reports |

2 |

– |

8 |

Consolidated Statements of Financial Position |

|

|

9 |

Consolidated Statements of Operations and Comprehensive Loss |

|

|

|

Consolidated Statements of Changes in Equity |

|

|

|

Consolidated Statements of Cash Flows |

|

|

|

Notes to the Consolidated Financial Statements |

|

– |

|

|

|

|

|

|

|

|

|

December 11, 2025

Management’s Responsibility for the Financial Statements

The accompanying consolidated financial statements of Organigram Global Inc. (the “Company”) have been prepared by the Company’s management in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board and contain estimates based on management’s judgment. Internal control systems are maintained by management to provide reasonable assurance that assets are safe-guarded and financial information is reliable.

The Board of Directors of the Company is responsible for ensuring that management fulfills its responsibilities for financial reporting and is ultimately responsible for reviewing and approving the financial statements and the accompanying management discussion and analysis. The Board of Directors carries out this responsibility principally through its Audit Committee.

The Audit Committee is appointed by the Board of Directors. It meets with the Company’s management and auditors, and reviews internal controls and financial reporting matters to ensure that management is properly discharging its responsibilities before submitting the financial statements to the Board of Directors for approval.

|

|

|

|

|

|

| (signed) ‘Peter Amirault’ |

(signed) ‘Greg Guyatt’ |

Executive Chair |

Chief Financial Officer |

| Toronto, Ontario |

Toronto, Ontario |

CONSOLIDATED FINANCIAL STATEMENTS | FOR THE YEAR ENDED SEPTEMBER 30, 2025 AND 2024 1

CONSOLIDATED FINANCIAL STATEMENTS | FOR THE YEAR ENDED SEPTEMBER 30, 2025 AND 2024 2

CONSOLIDATED FINANCIAL STATEMENTS | FOR THE YEAR ENDED SEPTEMBER 30, 2025 AND 2024 3

CONSOLIDATED FINANCIAL STATEMENTS | FOR THE YEAR ENDED SEPTEMBER 30, 2025 AND 2024 4

CONSOLIDATED FINANCIAL STATEMENTS | FOR THE YEAR ENDED SEPTEMBER 30, 2025 AND 2024 5

CONSOLIDATED FINANCIAL STATEMENTS | FOR THE YEAR ENDED SEPTEMBER 30, 2025 AND 2024 6

CONSOLIDATED FINANCIAL STATEMENTS | FOR THE YEAR ENDED SEPTEMBER 30, 2025 AND 2024 7

CONSOLIDATED FINANCIAL STATEMENTS | FOR THE YEAR ENDED SEPTEMBER 30, 2025 AND 2024 8

ORGANIGRAM GLOBAL INC.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

As at September 30, 2025 and September 30, 2024

(Expressed in CDN $000’s except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

SEPTEMBER 30, 2025 |

|

SEPTEMBER 30,

2024 |

| ASSETS |

|

|

|

| Current assets |

|

|

|

Cash |

$ |

28,200 |

|

|

$ |

106,745 |

|

Restricted cash (Note 4) |

55,394 |

|

|

25,860 |

|

Short-term investments |

826 |

|

|

821 |

|

Accounts and other receivables (Note 5) |

64,859 |

|

|

37,153 |

|

Biological assets (Note 6) |

17,931 |

|

|

15,173 |

|

Inventories (Note 7) |

106,023 |

|

|

67,351 |

|

| Prepaid expenses and deposits |

11,664 |

|

|

9,116 |

|

|

284,897 |

|

|

262,219 |

|

|

|

|

|

|

|

|

|

Property, plant and equipment (Note 8) |

122,977 |

|

|

96,231 |

|

Intangible assets (Note 9) |

48,511 |

|

|

8,092 |

|

Goodwill (Note 10) |

52,524 |

|

|

— |

|

Deferred charges and deposits |

3,754 |

|

|

591 |

|

Other financial assets (Note 11) |

49,548 |

|

|

40,727 |

|

|

|

|

|

|

|

|

|

|

$ |

562,211 |

|

|

$ |

407,860 |

|

|

|

|

|

| LIABILITIES |

|

|

|

| Current liabilities |

|

|

|

| Accounts payable and accrued liabilities |

$ |

89,247 |

|

|

$ |

47,097 |

|

Other liabilities (Note 15) |

8,080 |

|

|

1,086 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative liabilities (Note 12) |

28,832 |

|

|

5,139 |

|

|

126,159 |

|

|

53,322 |

|

|

|

|

|

|

|

|

|

Derivative liabilities (Note 12) |

5,506 |

|

|

14,110 |

|

Preferred shares (Note 13 and 14) |

68,653 |

|

|

31,070 |

|

Other long-term liabilities (Note 15) |

12,763 |

|

|

3,369 |

|

|

|

|

|

|

213,081 |

|

|

101,871 |

|

|

|

|

|

| SHAREHOLDERS' EQUITY |

|

|

|

Share capital (Note 14) |

919,908 |

|

|

852,891 |

|

Equity reserves (Note 14) |

37,346 |

|

|

37,129 |

|

Accumulated other comprehensive income (loss) (Note 11) |

603 |

|

|

(63) |

|

Accumulated deficit |

(608,727) |

|

|

(583,968) |

|

|

349,130 |

|

|

305,989 |

|

|

$ |

562,211 |

|

|

$ |

407,860 |

|

On behalf of the Board:

/s/Peter Amirault, Director

/s/Stephen Smith, Director

The accompanying notes are an integral part of these Consolidated Financial Statements.

CONSOLIDATED FINANCIAL STATEMENTS | FOR THE YEAR ENDED SEPTEMBER 30, 2025 AND 2024 9

ORGANIGRAM GLOBAL INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

For the year ended September 30, 2025 and 2024

(Expressed in CDN $000’s except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR ENDED |

|

|

SEPTEMBER 30, 2025 |

|

SEPTEMBER 30,

2024 |

| REVENUE |

|

|

|

|

Gross revenue (Note 20) |

|

$ |

403,024 |

|

|

$ |

247,177 |

|

| Excise taxes |

|

(143,841) |

|

|

(87,336) |

|

| Net revenue |

|

259,183 |

|

|

159,841 |

|

Cost of sales (Note 7 and 21) |

|

174,850 |

|

|

111,390 |

|

| Gross margin before fair value adjustments |

|

84,333 |

|

|

48,451 |

|

Realized fair value on inventories sold and other inventory charges (Note 7) |

|

(67,125) |

|

|

(52,078) |

|

Unrealized gain on changes in fair value of biological assets (Note 6) |

|

73,008 |

|

|

51,151 |

|

| Gross margin |

|

90,216 |

|

|

47,524 |

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

General and administrative (Note 23) |

|

59,499 |

|

|

44,955 |

|

| Sales and marketing |

|

31,097 |

|

|

19,851 |

|

| Research and development |

|

10,945 |

|

|

11,200 |

|

Share-based compensation (Note 14 (iv)) |

|

3,975 |

|

|

6,274 |

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

105,516 |

|

|

82,280 |

|

|

|

|

|

|

LOSS FROM OPERATIONS |

|

(15,300) |

|

|

(34,756) |

|

|

|

|

|

|

Investment income, net of financing costs |

|

(1,150) |

|

|

(3,311) |

|

| Acquisition and transaction costs |

|

6,580 |

|

|

915 |

|

|

|

|

|

|

|

|

|

|

|

Share of loss from investments in associates |

|

— |

|

|

5,284 |

|

|

|

|

|

|

Loss (gain) on disposal of property, plant and equipment and intangible assets |

|

9 |

|

|

(633) |

|

Change in fair value of contingent consideration (Note 26) |

|

(9,743) |

|

|

(50) |

|

Change in fair value of derivative liabilities, preferred shares and other financial assets (Note 11, 12 and 13) |

|

27,505 |

|

|

7,718 |

|

|

|

|

|

|

Share issuance costs allocated to derivative liabilities and preferred shares (Note 14) |

|

170 |

|

|

937 |

|

Other non-operating income |

|

(142) |

|

|

(176) |

|

Loss before tax |

|

(38,529) |

|

|

(45,440) |

|

|

|

|

|

|

Income tax recovery (Note 24) |

|

|

|

|

|

|

|

|

|

| Deferred, net |

|

(13,770) |

|

|

— |

|

|

|

|

|

|

NET LOSS |

|

$ |

(24,759) |

|

|

$ |

(45,440) |

|

|

|

|

|

|

OTHER COMPREHENSIVE INCOME |

|

|

|

|

Change in fair value of investments at fair value through other comprehensive income (Note 11) |

|

666 |

|

|

96 |

|

|

|

|

|

|

COMPREHENSIVE LOSS |

|

$ |

(24,093) |

|

|

$ |

(45,344) |

|

Net loss per common share, basic and diluted (Note 14 (v)) |

|

$ |

(0.194) |

|

|

$ |

(0.477) |

|

|

|

|

|

|

The accompanying notes are an integral part of these Consolidated Financial Statements.

CONSOLIDATED FINANCIAL STATEMENTS | FOR THE YEAR ENDED SEPTEMBER 30, 2025 AND 2024 10

ORGANIGRAM GLOBAL INC.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

For the year ended September 30, 2025 and 2024

(Expressed in CDN $000’s except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER OF SHARES |

|

SHARE CAPITAL |

|

EQUITY RESERVES |

|

ACCUMULATED OTHER COMPREHENSIVE (LOSS) INCOME |

|

ACCUMULATED DEFICIT |

|

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

$ |

— |

|

Balance - October 1, 2023 |

81,161,630 |

|

$776,906 |

|

$33,404 |

|

$(159) |

|

$ |

(538,528) |

|

|

$271,623 |

|

|

|

|

|

|

|

|

|

|

|

|

Unit financing, net of issuance costs (Note 14 (iii)) |

8,901,000 |

|

|

19,157 |

|

|

— |

|

|

— |

|

|

— |

|

|

19,157 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Private placement (Note 14 (iii)) |

17,322,915 |

|

|

53,365 |

|

|

— |

|

|

— |

|

|

— |

|

|

53,365 |

|

Share-based compensation (Note 14 (iv)) |

— |

|

|

— |

|

|

7,182 |

|

|

— |

|

|

— |

|

|

7,182 |

|

Exercise of stock options (Note 14 (iii)) |

3,942 |

|

|

11 |

|

|

(5) |

|

|

— |

|

|

— |

|

|

6 |

|

Exercise of restricted share units (Note 14 (iii)) |

1,193,789 |

|

|

3,430 |

|

|

(3,430) |

|

|

— |

|

|

— |

|

|

— |

|

Exercise of performance share units (Note 14 (iii)) |

2,216 |

|

|

22 |

|

|

(22) |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(45,440) |

|

|

(45,440) |

|

| Other comprehensive loss |

|

|

|

|

|

|

96 |

|

|

— |

|

|

96 |

|

Balance - September 30, 2024 |

108,585,492 |

|

|

$ |

852,891 |

|

|

$ |

37,129 |

|

|

$ |

(63) |

|

|

$ |

(583,968) |

|

|

$ |

305,989 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - October 1, 2024 |

108,585,492 |

|

|

$ |

852,891 |

|

|

$ |

37,129 |

|

|

$ |

(63) |

|

|

$ |

(583,968) |

|

|

$ |

305,989 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares issued related to business combination, net of issue costs of $71 (Note 14 (iii) and Note 26) |

17,233,950 |

|

|

39,050 |

|

|

— |

|

|

— |

|

|

— |

|

|

39,050 |

|

Private placement (Note 14 (iii)) |

7,562,447 |

|

|

23,963 |

|

|

— |

|

|

— |

|

|

— |

|

|

23,963 |

|

Share-based compensation (Note 14 (iv)) |

— |

|

|

— |

|

|

4,217 |

|

|

— |

|

|

— |

|

|

4,217 |

|

Exercise of stock options (Note 14 (iii)) |

2,500 |

|

|

11 |

|

|

(7) |

|

|

— |

|

|

— |

|

|

4 |

|

Exercise of restricted share units (Note 14 (iii)) |

1,063,473 |

|

|

3,841 |

|

|

(3,841) |

|

|

— |

|

|

— |

|

|

— |

|

Exercise of performance share units (Note 14 (iii)) |

13,167 |

|

|

152 |

|

|

(152) |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

|

|

(24,759) |

|

|

(24,759) |

|

| Other comprehensive loss |

— |

|

|

— |

|

|

— |

|

|

666 |

|

|

— |

|

|

666 |

|

Balance - September 30, 2025 |

134,461,029 |

|

|

$ |

919,908 |

|

|

$ |

37,346 |

|

|

$ |

603 |

|

|

$ |

(608,727) |

|

|

$ |

349,130 |

|

The accompanying notes are an integral part of these Consolidated Financial Statements.

CONSOLIDATED FINANCIAL STATEMENTS | FOR THE YEAR ENDED SEPTEMBER 30, 2025 AND 2024 11

ORGANIGRAM GLOBAL INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the year ended September 30, 2025 and 2024

(Expressed in CDN $000’s except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR ENDED |

|

|

|

|

|

SEPTEMBER 30, 2025 |

|

SEPTEMBER 30,

2024 |

CASH PROVIDED BY (USED IN) |

|

|

|

|

|

|

|

| OPERATING ACTIVITIES |

|

|

|

|

|

|

|

Net loss |

|

|

|

|

$ |

(24,759) |

|

|

$ |

(45,440) |

|

| Items not affecting operating cash: |

|

|

|

|

|

|

|

Share-based compensation (Note 14 (iv)) |

|

|

|

|

4,217 |

|

|

7,182 |

|

Depreciation and amortization (Note 8 and 9) |

|

|

|

|

17,975 |

|

|

12,079 |

|

Loss (gain) on disposal of property, plant and equipment and intangible assets |

|

|

|

|

9 |

|

|

(633) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized fair value on inventories sold and other inventory charges (Note 7) |

|

|

|

|

67,125 |

|

|

52,078 |

|

Unrealized gain on changes in fair value of biological assets (Note 6) |

|

|

|

|

(73,008) |

|

|

(51,151) |

|

|

|

|

|

|

|

|

|

Investment income, net of financing costs |

|

|

|

|

(1,150) |

|

|

(3,311) |

|

Share of loss from investments in associates (Note 16) |

|

|

|

|

— |

|

|

5,284 |

|

Change in fair value of contingent consideration (Note 26) |

|

|

|

|

(9,743) |

|

|

(50) |

|

|

|

|

|

|

|

|

|

Bad debts and provision for expected credit losses (Note 5) |

|

|

|

|

274 |

|

|

4,222 |

|

| Change in fair value of derivative liabilities, preferred shares and other financial assets (Note 11, 12 and 13) |

|

|

|

|

27,505 |

|

|

7,718 |

|

| Share issuance costs allocated to derivative liabilities and preferred shares (Note 14) |

|

|

|

|

170 |

|

|

937 |

|

| Unrealized foreign exchange gain |

|

|

|

|

(313) |

|

|

— |

|

Income tax recovery (Note 24) |

|

|

|

|

(13,770) |

|

|

— |

|

| Cash used in operating activities before working capital changes |

|

|

|

|

(5,468) |

|

|

(11,085) |

|

| Changes in non-cash working capital: |

|

|

|

|

|

|

|

| Net change in accounts and other receivables, biological assets, inventories, prepaid expenses and deposits |

|

|

|

|

(15,287) |

|

|

(12,059) |

|

| Net change in accounts payable and accrued liabilities, provisions and other liabilities |

|

|

|

|

13,164 |

|

|

27,016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash (used in) provided by operating activities |

|

|

|

|

(7,591) |

|

|

3,872 |

|

|

|

|

|

|

|

|

|

| FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from unit financing, net of issuance costs (Note 14 (iii)) |

|

|

|

|

— |

|

|

26,018 |

|

Private placement, net of share issuance costs (Note 14 (iii)) |

|

|

|

|

41,181 |

|

|

82,541 |

|

Payment of lease liabilities, net of sublease receipts (Note 15) |

|

|

|

|

(1,792) |

|

|

(710) |

|

| Payment of long-term debt |

|

|

|

|

(60) |

|

|

(76) |

|

|

|

|

|

|

|

|

|

Stock options exercised (Note 14 (iii)) |

|

|

|

|

4 |

|

|

6 |

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities |

|

|

|

|

39,333 |

|

|

107,779 |

|

|

|

|

|

|

|

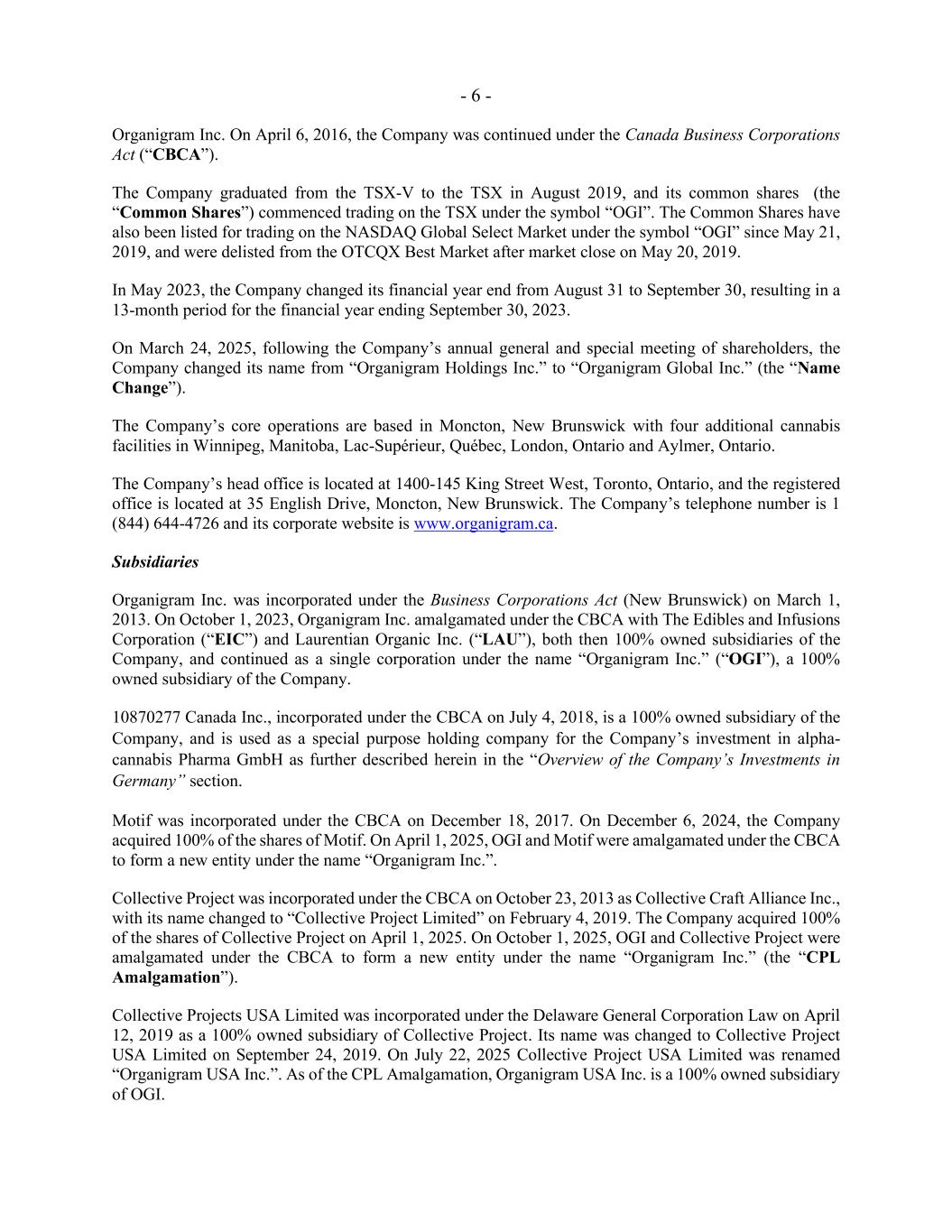

|