P LA YB O Y PLAYBOY Investor Presentation Playboy, Inc. NASDAQ: PLBY Prepared : NOVEMBER 2025

P LA YB O Y Legal Disclaimer This presentation (this “Presentation”) is provided for information purposes only and has been prepared to assist interested par ties in making their own evaluation of Playboy, Inc. and its Playboy business (collectively, “Playboy” or the “Company”) and for no other purpose. No representations or warranties, express or implied are given in, or in respect of, this Presentation. To the fullest extent permitted by law in no circumstances will Playboy or any of its subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be resp ons ible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in re lat ion thereto or otherwise arising in connection therewith. INDUSTRY & MARKET DATA Industry and market data used in this Presentation have been obtained from third party industry publications and sources as w ell as from research reports prepared for other purposes or the Company's internal data and estimates. Independent research reports, industry publications and other published industry sources generally indicate that the informat ion therein was obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. The Company has not independently verified the data obtained from these sources and cannot ass ure you of the data’s accuracy or completeness. This data is subject to change and the Company undertakes no obligation to update such data, except as required by law. FORWARD - LOOKING STATEMENTS Certain statements included in this Presentation that are not historical facts are forward - looking statements for purposes of th e safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticip ate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “model,” “target,” “goal,” and similar expressions that predict or indicate future events or trends or that are no t statements of historical matters. These forward - looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics and projections of market opportunity. Thes e statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Playboy’s management and are not predictions of actual performance. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actua l events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Playboy. These forward - looking statements involve significant risks an d uncertainties that could cause the actual results to differ materially from those discussed in the forward - looking statements. Most of these factors are outside Playboy’s control and are difficult to predict. Factors that may cause such differences inc lude, but are not limited to: (1) the inability to maintain the listing of the Company’s shares of common stock on Nasdaq; (2) the risk that the Company’s completed or proposed transactions disrupt the Company’s current plans and/o r operations, including the risk that the Company does not complete any such proposed transactions or achieve the expected benefits from any transactions; (3) the ability to recognize the anticipated benefits of co rporate transactions, commercial collaborations, commercialization of digital assets, cost reduction initiatives and proposed transactions, which may be affected by, among other things, competition, the ability of the Company to grow and manage growth profitably, and the Company’s ability to retain its key employees; (4) costs related to being a public company, corporate transactions, commercial collaborations and proposed transactions; (5) changes i n applicable laws or regulations; (6) the possibility that the Company may be adversely affected by global hostilities, supply chain delays, inflation, interest rates, foreign currency exchange rates or other economic, busine ss, and/or competitive factors; (7) risks relating to the uncertainty of the projected financial information of the Company, including changes in the Company’s estimates of cash flows and the fair value of certain of its intangible asset s, including goodwill; (8) risks related to the organic and inorganic growth of the Company’s businesses, and the timing of expected business milestones; (9) changing demand or shopping patterns for the Company’s products and servi ces ; (10) failure of licensees, suppliers or other third - parties to fulfill their obligations to the Company; (11) the Company’s ability to comply with the terms of its indebtedness and other obligations; (12) changes in finan cin g markets or the inability of the Company to obtain financing on attractive terms; and (13) other risks and uncertainties indicated from time to time in the Company’s annual report on Form 10 - K and quarterly reports on Form 10 - Q, including those under “Risk Factors” therein, and in the Company’s other filings with the Securities and Exchange Commission (“SEC”). If any of these risks materialize or the Company’s assumptions prove incorrect, actual resul ts could differ materially from the results implied by these forward - looking statements. There may be additional risks that Playboy does not presently know or that Playboy currently believes are immaterial that could also cause ac tual results to differ from those contained in the forward - looking statements. In addition, forward - looking statements reflect Playboy’s expectations, plans or forecasts of future events and views as of the date of this Presentation. Playboy anticipates that subsequent events and developments will cause Playboy’s assessments to change. However, while Playboy may elect to update these forward - looking statements at some point in th e future, Playboy specifically disclaims any obligation to do so. These forward - looking statements should not be relied upon as representing Playboy’s assessments as of any date subsequent to the date of this Pres ent ation. Accordingly, undue reliance should not be placed upon the forward - looking statements. NO OFFER OR SOLICITATION This Presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall ther e be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities will be made exce pt by means of a prospectus meeting the requirements of Securities Act of 1933, as amended, or an exemption therefrom. 2

P LA YB O Y Legal Disclaimer USE OF PROJECTIONS This Presentation contains projected (or ‘pro forma’) financial information with respect to the Company. Such projected finan cia l information constitutes forward - looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information or pro forma financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties. See “Forward - Looking Statements” above . Actual results may differ materially from the results contemplated by the projected financial information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. FINANCIAL INFORMATION; NON - GAAP FINANCIAL MEASURES The financial information, data and projections contained in this Presentation do not conform to Regulation S - X. Accordingly, su ch information and data may not be included in, may be adjusted in or may be presented differently in, any flings made by the Company with the SEC or any amendments thereto, and such differences may be material. Unless the conte xt otherwise requires, all references in this Presentation to the “Company,” “we,” “us” or “our” refer to Playboy, Inc. and its consolidated subsidiaries, including Playboy Enterprises, Inc. Some of the financial informati on and data contained in this Presentation has not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). The Company believes that the use of these non - GAAP financial measures provides an addi tional tool for investors to use in evaluating historical or projected operating results and trends in and in comparing the Company’s financial measures with other similar companies, some of which present similar non - GAAP financ ial measures to investors. Management does not consider these non - GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non - GAAP financ ial measures is that they may exclude significant expenses or revenue that are required by GAAP to be recorded in the Company’s financial statements. In addition, they are subject to inherent limitations as they reflect the exe rcise of judgments by management about which expense and revenue items are excluded or included in determining these non - GAAP financial measures. In order to compensate for these limitations, management typically presents non - GAAP financial measures in connection with GAAP results. You should review the Company’s audited financial statements and any reconciliations of non - GAAP measures to the closest GAAP measure, which may be included in this Presentation and/or the Company’s filings with t he SEC. TRADEMARKS This Presentation contains trademarks, service marks, trade names, copyrights and other information owned by the Company and oth er companies, which are the property of their respective owners. The use of third - party intellectual property or other information by the Company in this Presentation is used to describe past or current collaborat ions or press or social media mentions or depictions of the Company and its products and does not constitute an active affiliation with or endorsement by such third - party. 3

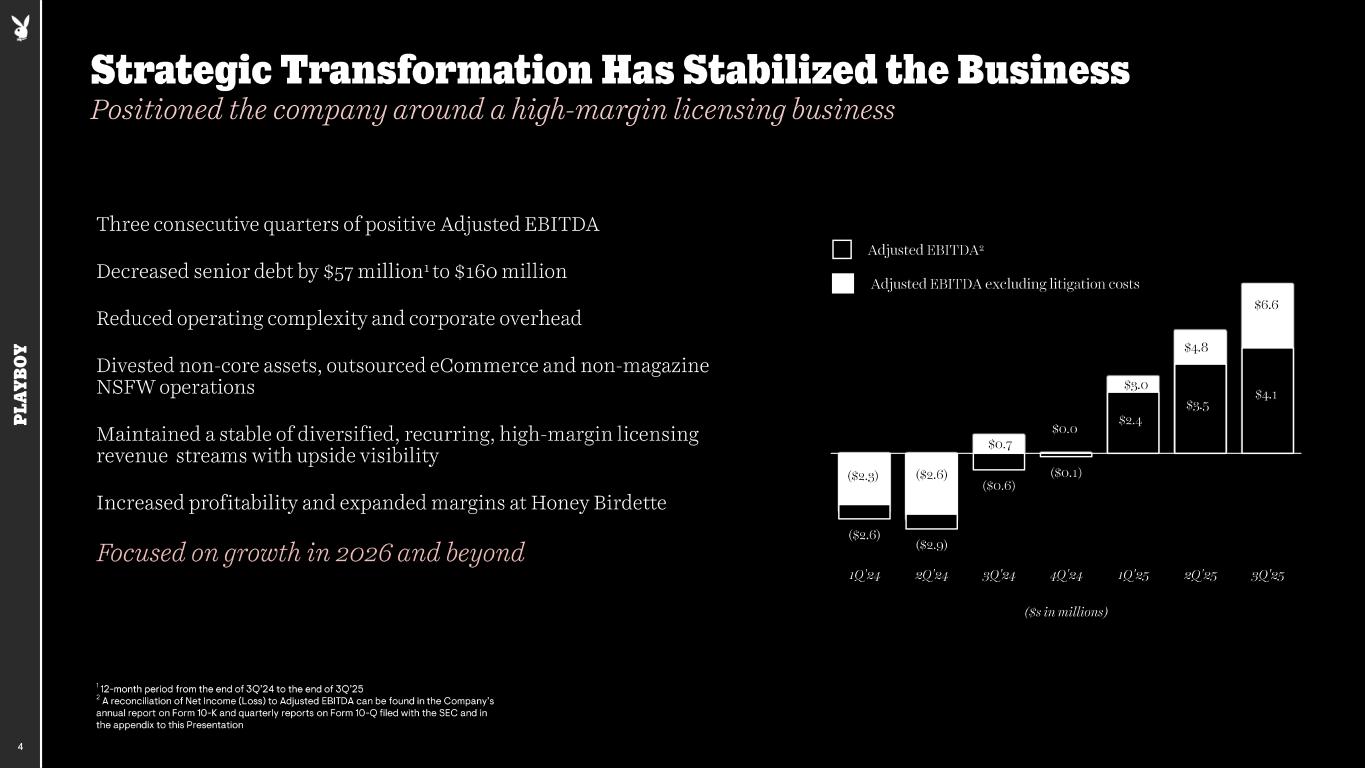

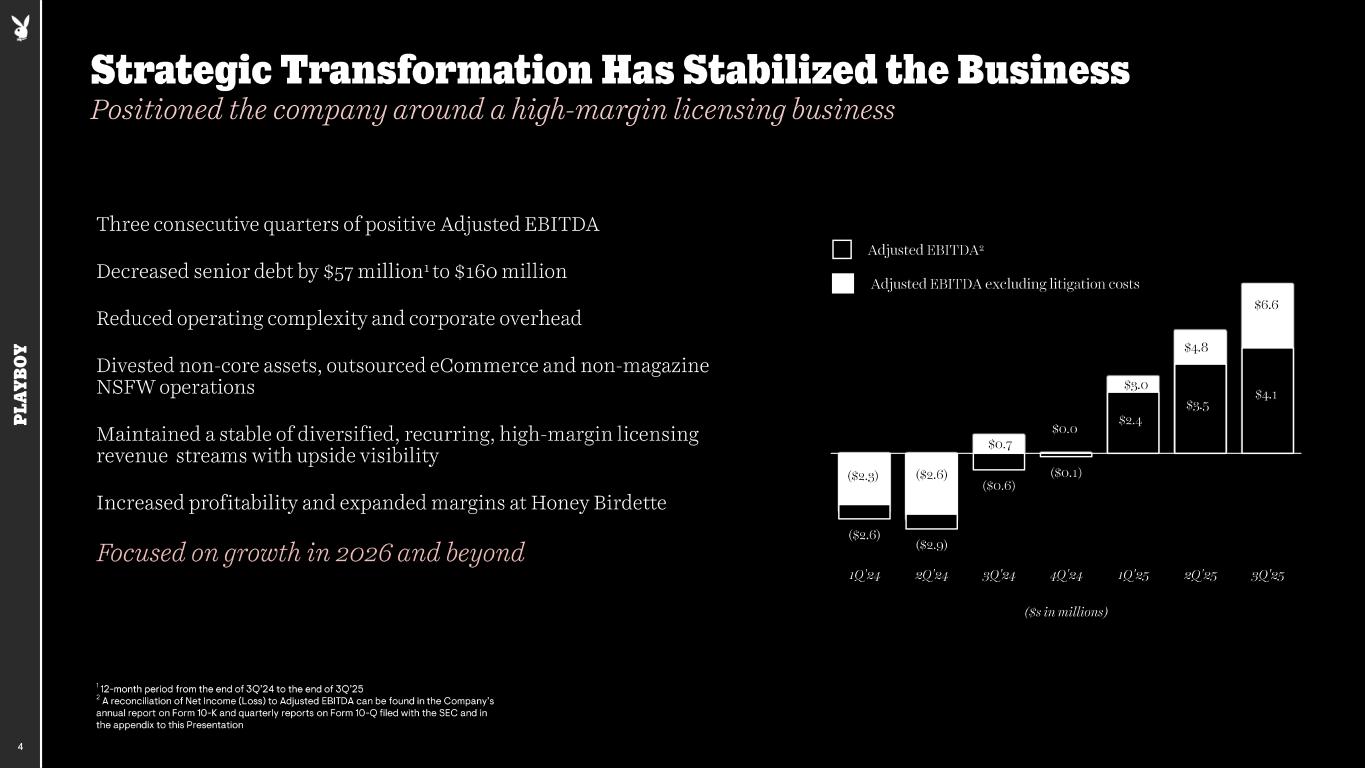

P LA YB O Y ($2.3) ($2.6) $0.7 $0.0 $3.0 $4.8 $6.6 ($2.6) ($2.9) ($0.6) ($0.1) $2.4 $3.5 $4.1 1Q'24 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 3Q'25 ($s in millions) ($2.3) ($2.6) Strategic Transformation Has Stabilized the Business 4 Positioned the company around a high -margin licensing business Three consecutive quarters of positive Adjusted EBITDA Decreased senior debt by $57 million 1 to $160 million Reduced operating complexity and corporate overhead Divested non -core assets, outsourced eCommerce and non -magazine NSFW operations Maintained a stable of diversified, recurring, high -margin licensing revenue streams with upside visibility Increased profitability and expanded margins at Honey Birdette Focused on growth in 2026 and beyond Adjusted EBITDA 2 Adjusted EBITDA excluding litigation costs $0.0 1 12- month period from the end of 3Q’24 to the end of 3Q’25 2 A reconciliation of Net Income (Loss) to Adjusted EBITDA can be found in the Company’s annual report on Form 10 - K and quarterly reports on Form 10 - Q filed with the SEC and in the appendix to this Presentation

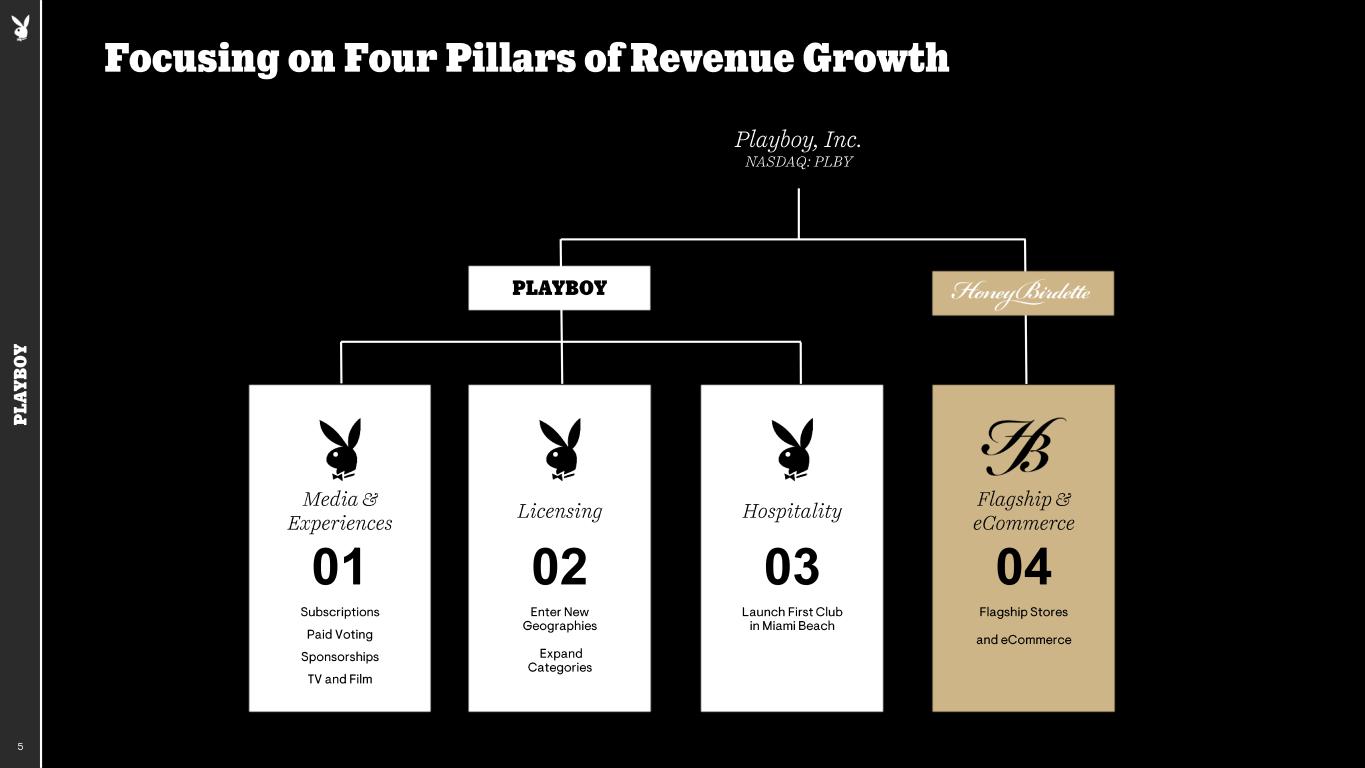

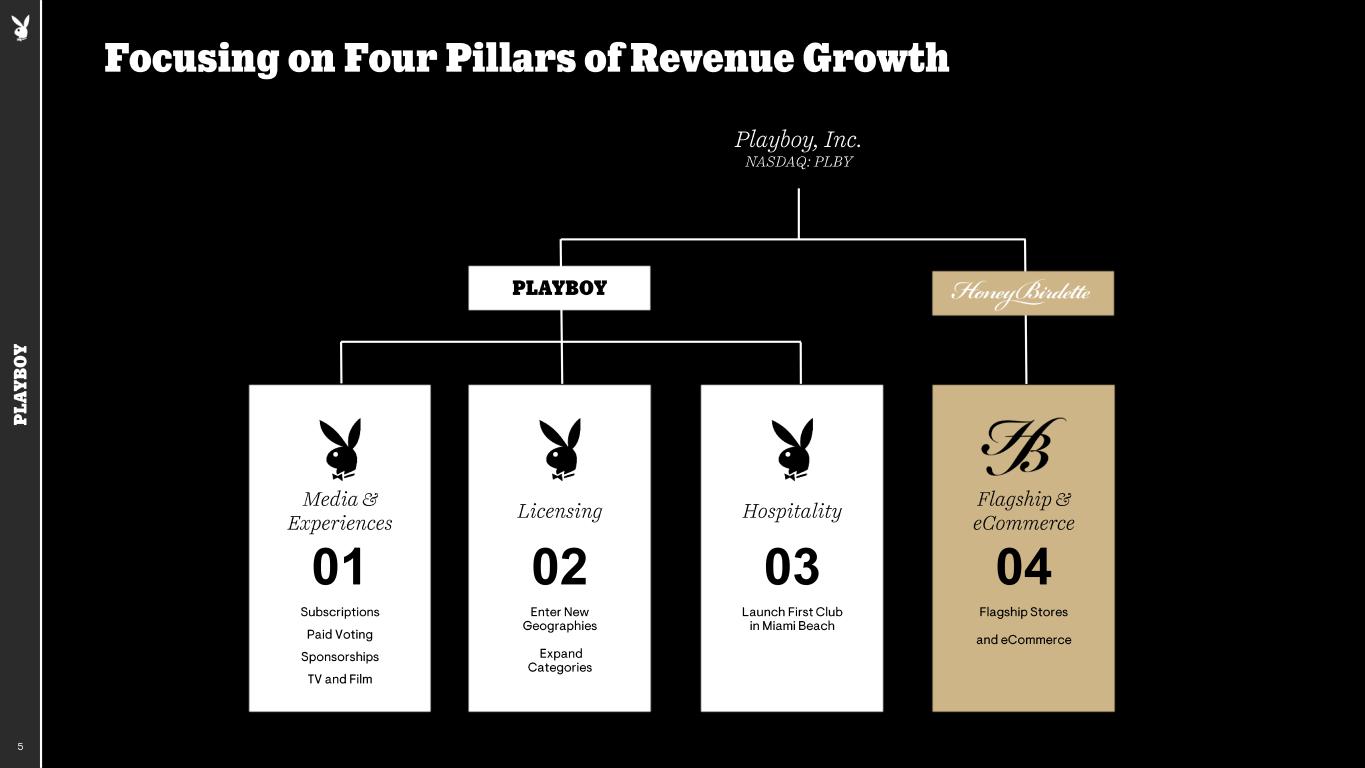

P LA YB O Y 5 Focusing on Four Pillars of Revenue Growth Playboy, Inc. NASDAQ: PLBY Subscriptions Paid Voting Sponsorships TV and Film Media & Experiences 01 Enter New Geographies Expand Categories Licensing 02 Launch First Club in Miami Beach Hospitality 03 Flagship Stores and eCommerce Flagship & eCommerce 04 PLAYBOY

P LA YB O Y PLAYBOY: PILLARS 1 -3 6

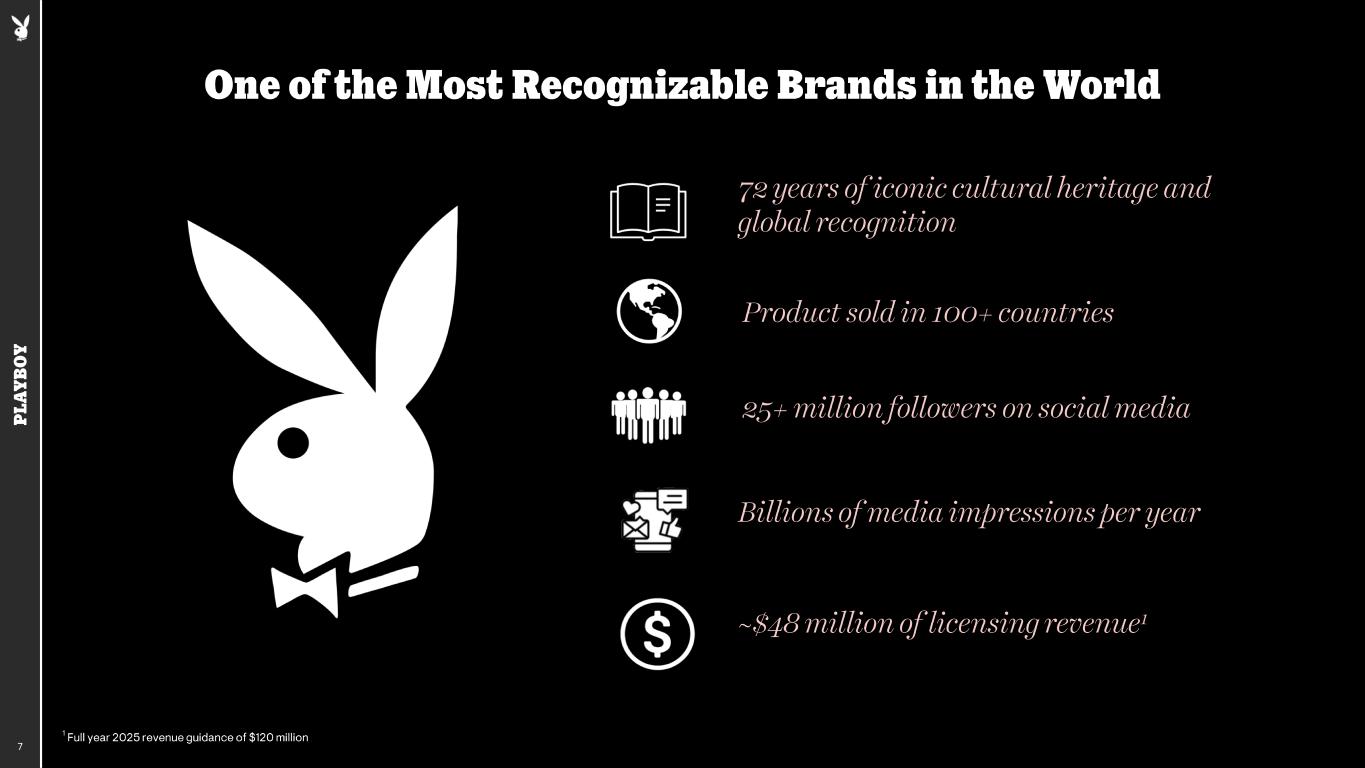

P LA YB O Y One of the Most Recognizable Brands in the World 7 72 years of iconic cultural heritage and global recognition Billions of media impressions per year ~$48 million of licensing revenue 1 25+ million followers on social media Product sold in 100+ countries 1 Full year 2025 revenue guidance of $120 million

P LA YB O Y 8 Content Is Key to Our Strategy Content is our brand marketing Drives brand relevancy and engagement Expands our audience Reaches our audience that now lives on social media Creates new IP we can use across the ecosystem The Company was built on content

P LA YB O Y • High -quality journalism, photography, and design - our historical differentiator • Editorial focus where Playboy has the experience to lead: • Sex, sexuality, relationships, dating, intimacy, and modern masculinity • Revival of legacy formats: • Playboy Advisor, longform essays, Playmate storytelling, lifestyle columns • Expansion into broader cultural verticals: • Celebrity, entertainment, sports, gaming, grooming, fashion, and art • Print as the prestige anchor; digital, newsletters, and social video as daily engagement drivers • Multi -platform distribution designed to scale: YouTube, YT Shorts, IG Reels, TikTok, podcasts, newsletters 9 Reclaiming the Core of What Made Playboy Iconic Create content that speaks directly to the modern man, while elevating the women who define Playboy

P LA YB O Y Young men are consuming content in record volume - sports, dating commentary, lifestyle podcasts - but are underserved by trusted, sophisticated voices The world is more disconnected, polarized, and anxious than ever; conversations around relationships, intimacy, and identity are happening everywhere, but without leadership or nuance The “men’s advice” ecosystem today is dominated by extremes - either hyper -niche experts or algorithms pushing harmful, misogynistic content The generational conversation around sex, dating, masculinity, and connection is wide open - and starving for a brand with credibility, heritage, and cultural fluency No competitor can match Playboy’s 72 -year legacy of talking honestly about intimacy, relationships, and desire Because women are at the center of our universe, our content speaks to men through women - not in opposition to them 10 A Cultural Moment Built for Playboy’s Comeback Whitespace where Playboy has a clear advantage

P LA YB O Y • Seek identity, confidence, connection, and guidance in dating, relationships, style, and lifestyle • Underserved by existing men’s media, which is fragmented, hyper - niche, or misaligned with modern male experiences • Buy the magazine • Consume our digital, social, and video content • Engage with Playmates, contests, and the culture of Playboy 11 Our Core Audience Is Men 18 to 44 Years Old They are the engine for membership, video views, and platform growth

P LA YB O Y Participate as creators, Playmates, contestants, and cultural voices - powering discovery and visibility across social media Aesthetic and style preferences shape the brand’s global fashion identity Inspire and attract male engagement Generate content that fuels the brand Add credibility, aspiration, and social proof Become brand ambassadors and creators Keep the brand culturally relevant Dramatically increase the value of Playboy 12 Our Halo Audience Is Women 18 to 34 Years Old They influence the core audience and amplify the brand while buying licensed products

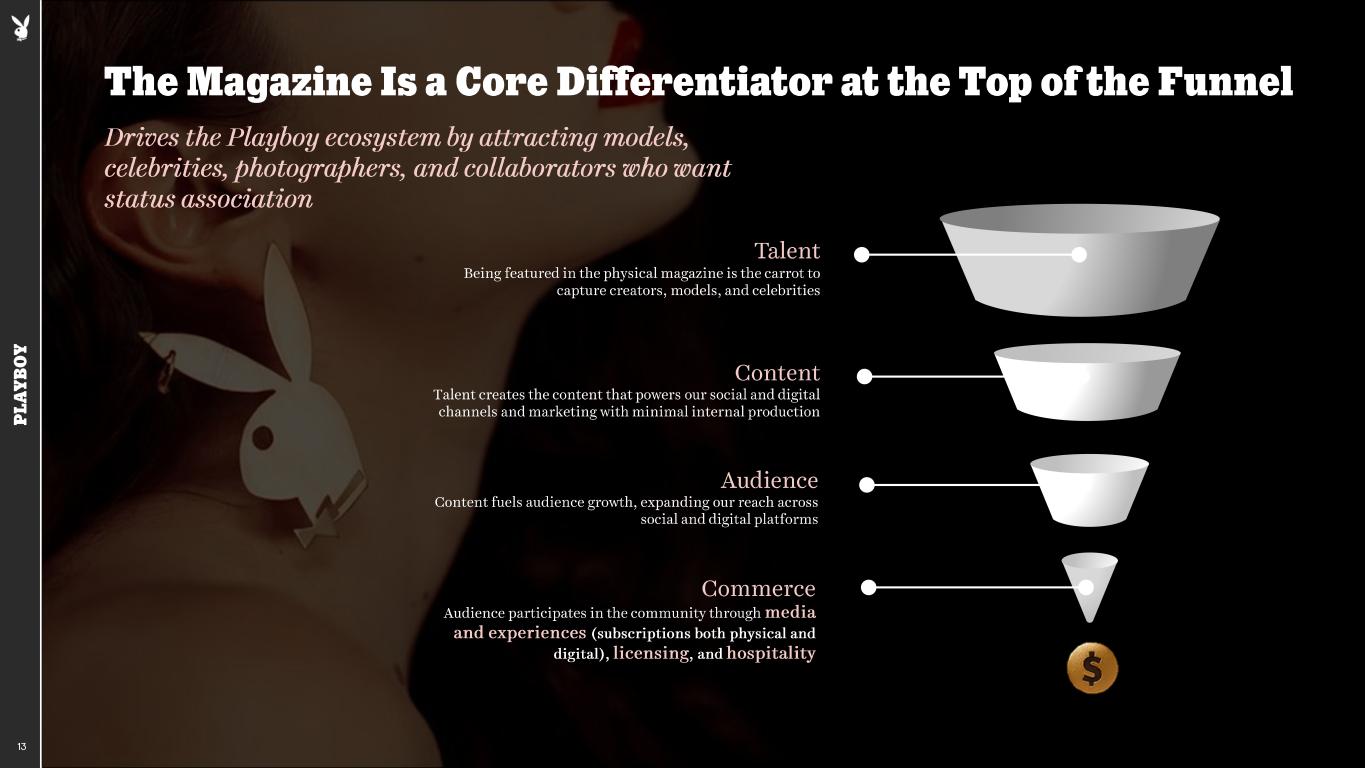

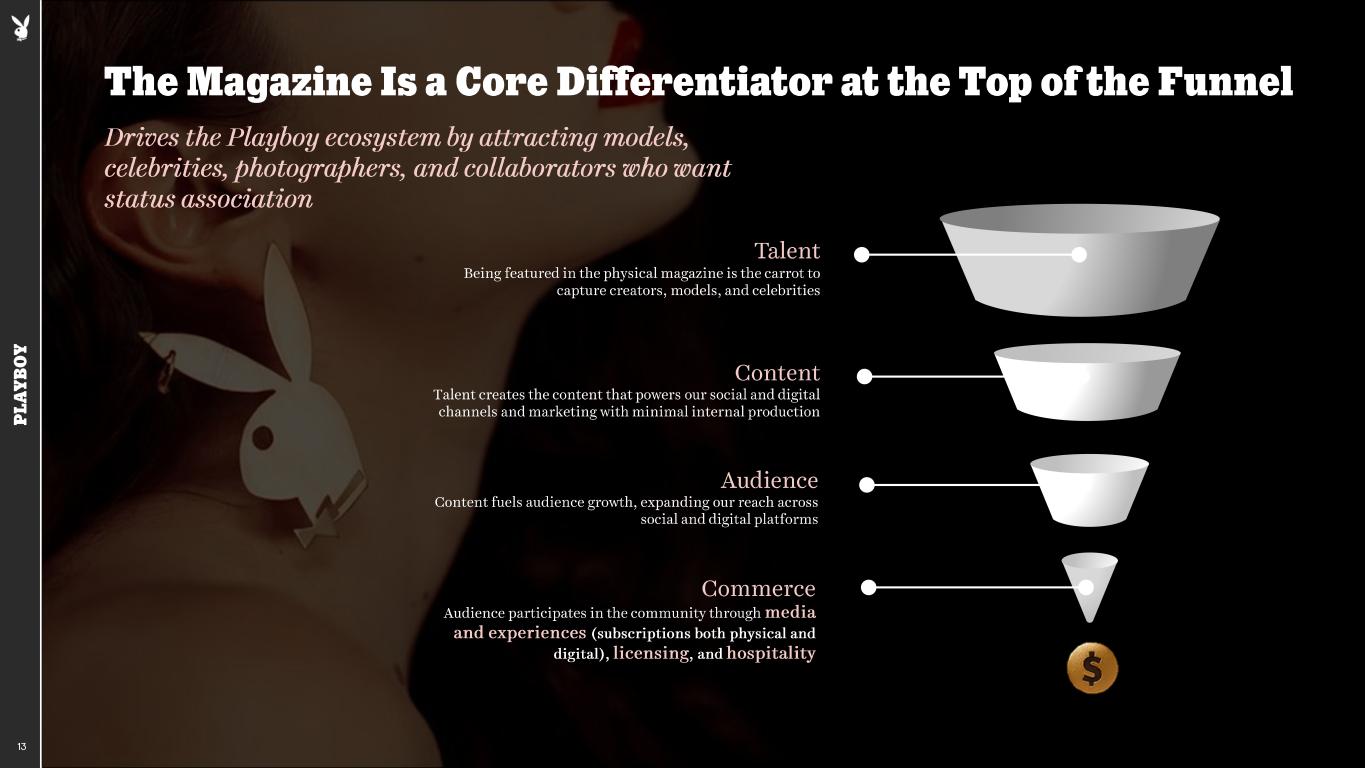

P LA YB O Y The Magazine Is a Core Differentiator at the Top of the Funnel 13 Talent Being featured in the physical magazine is the carrot to capture creators, models, and celebrities Content Talent creates the content that powers our social and digital channels and marketing with minimal internal production Audience Content fuels audience growth, expanding our reach across social and digital platforms Commerce Audience participates in the community through media and experiences (subscriptions both physical and digital), licensing , and hospitality Drives the Playboy ecosystem by attracting models, celebrities, photographers, and collaborators who want status association

P LA YB O Y PILLAR 1: MEDIA & EXPERIENCES 14

P LA YB O Y • From clubs and events to print subscriptions - subscriptions will be core to the Playboy experience • Paywall content spans digital archives, magazine, and behind -the - scenes creator media • Integrates physical and digital experiences • Digital: magazine, podcasts, archives, contests, and creator content • Physical: limited -edition print, event access, and product drops • Converts audience and creator participation into recurring revenue • Membership monetizes engagement at every stage of the funnel 15 Reimagining Subscriptions Playboy sells access to and participation in a lifestyle

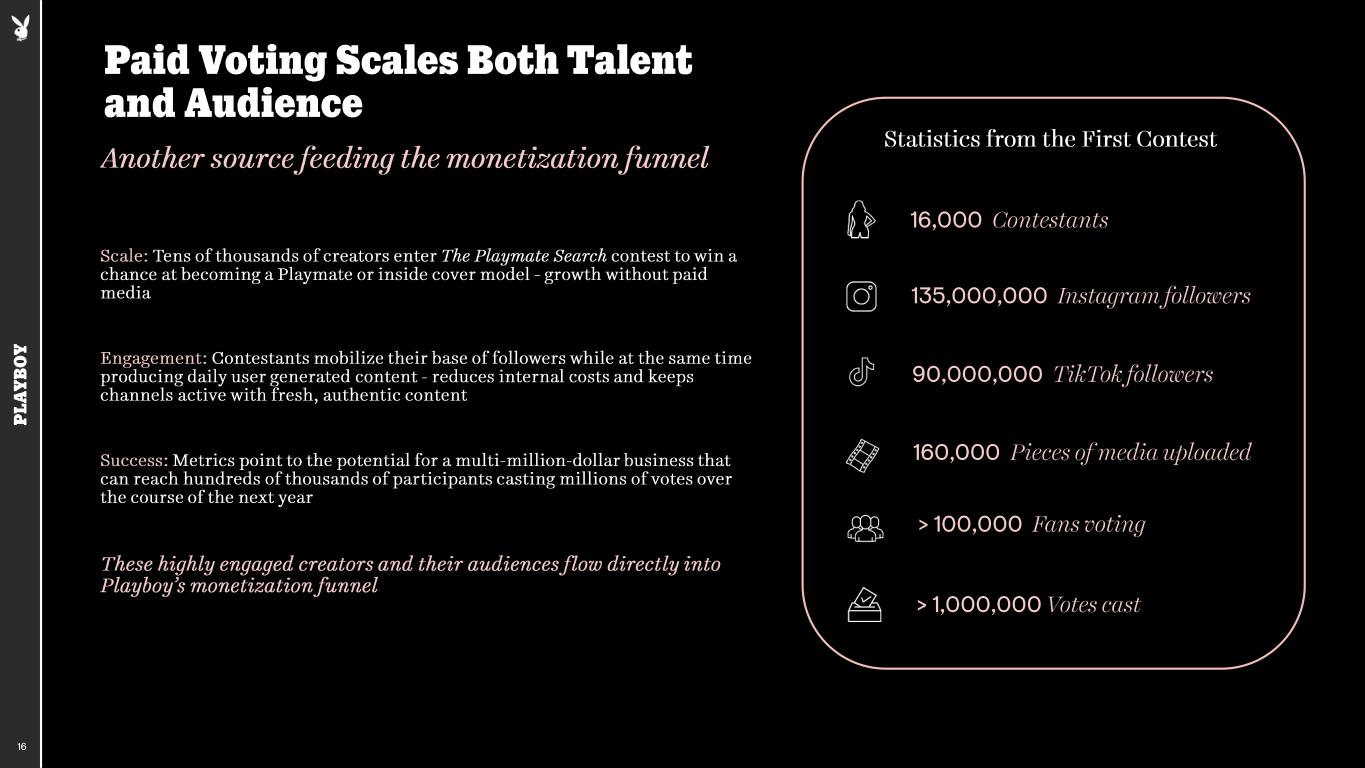

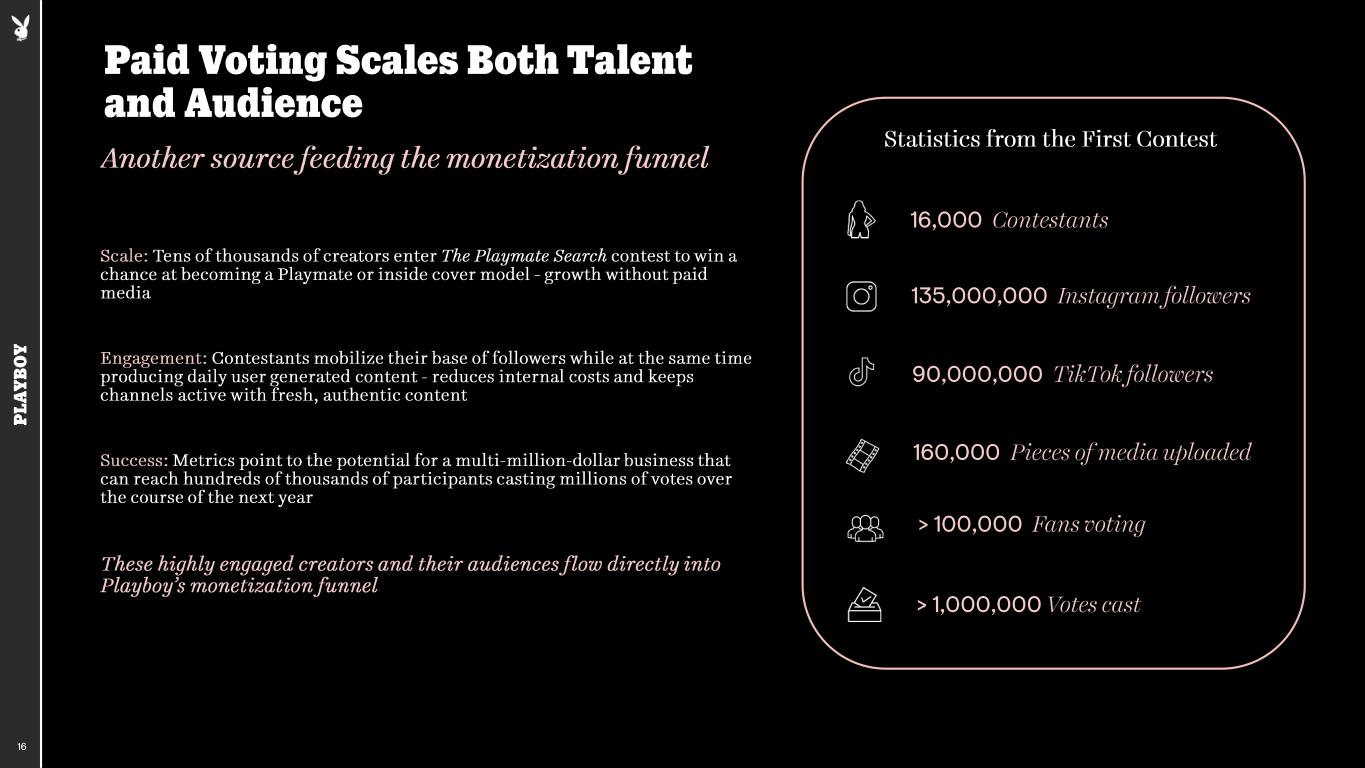

P LA YB O Y Paid Voting Scales Both Talent and Audience 16 Another source feeding the monetization funnel Scale: Tens of thousands of creators enter The Playmate Search contest to win a chance at becoming a Playmate or inside cover model - growth without paid media Engagement: Contestants mobilize their base of followers while at the same time producing daily user generated content - reduces internal costs and keeps channels active with fresh, authentic content Success: Metrics point to the potential for a multi -million -dollar business that can reach hundreds of thousands of participants casting millions of votes over the course of the next year These highly engaged creators and their audiences flow directly into Playboy’s monetization funnel > 1,000,000 Votes cast 135,000,000 Instagram followers 90,000,000 TikTok followers > 100,000 Fans voting 160,000 Pieces of media uploaded 16,000 Contestants Statistics from the First Contest

P LA YB O Y Re -establishing Playboy’s content studio, leveraging 70+ years of cultural IP and media assets Developing original programming inspired by historic franchises like The Playboy Interview and Playboy After Dark Strategic partnerships in development, including a feature film with Hefner Capital and The Great Playmate Search television adaptation Strengthens monetization flywheel: drives audience engagement, expands brand awareness, and enhances licensing value Business model: licensing revenue and profit share 17 Opportunities in TV and Film Tapping into heritage and developing new content

P LA YB O Y A scalable model built on exclusive experiences, community engagement, and premium access tiers By reintroducing curated events and experiences, we invite people back into that world Fans don’t just consume Playboy; they want to belong to it Access to the brand becomes a form of modern cultural currency 18 Converting Lifestyle Aspiration into Participation Revenue Bringing back Playboy’s signature experiences

P LA YB O Y PILLAR 2: LICENSING 19

P LA YB O Y Licensing Is the Foundation of Today’s Cash Flow 20 40% Expected Licensing Revenue as a Percent of Total in 2025 Focusing on our brand licensing business 91% 2024 Licensing Gross Margin Highly profitable 86% Percent of Total Licensing Revenue Guaranteed in 2025 Predictable and recurring Licensing gets stronger with increased brand awareness 83% Revenue from Top 20 Licensees LTM Unlocking growth with best -in -class partners

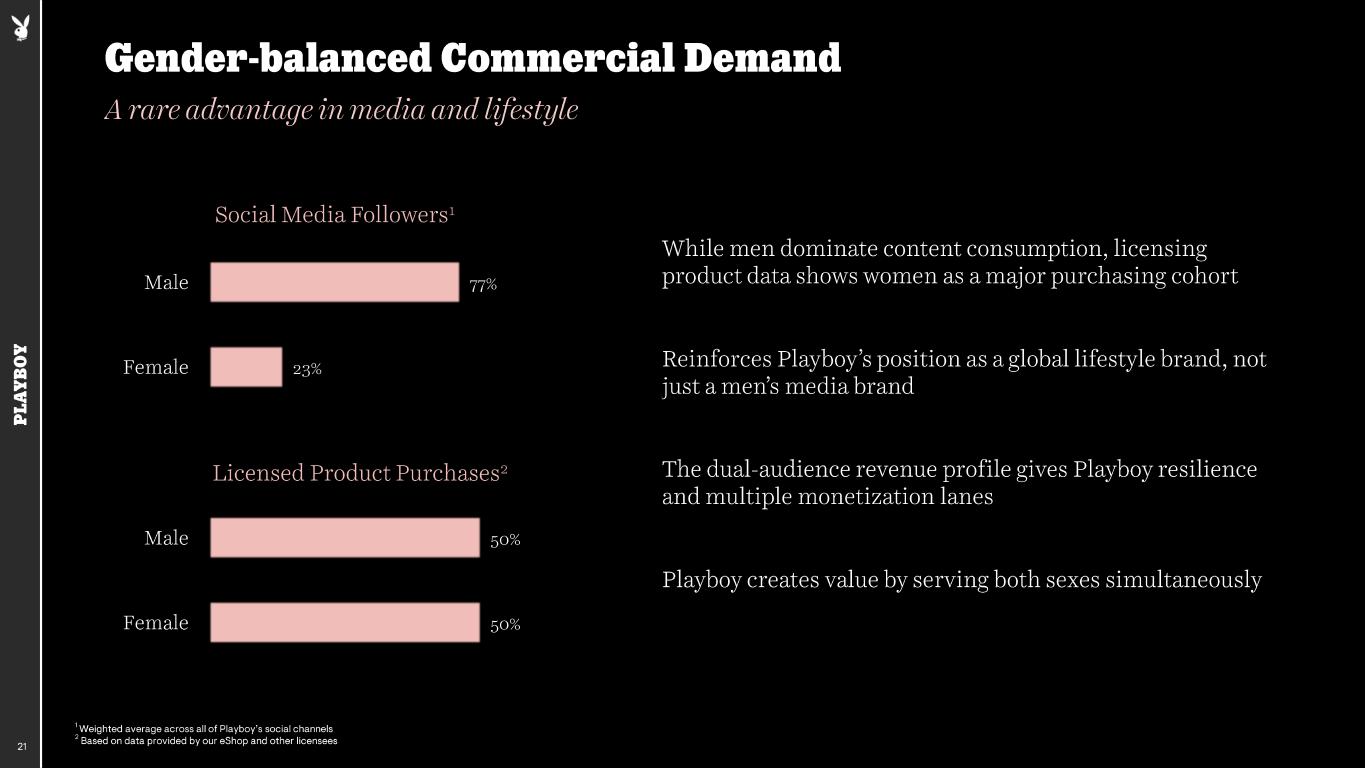

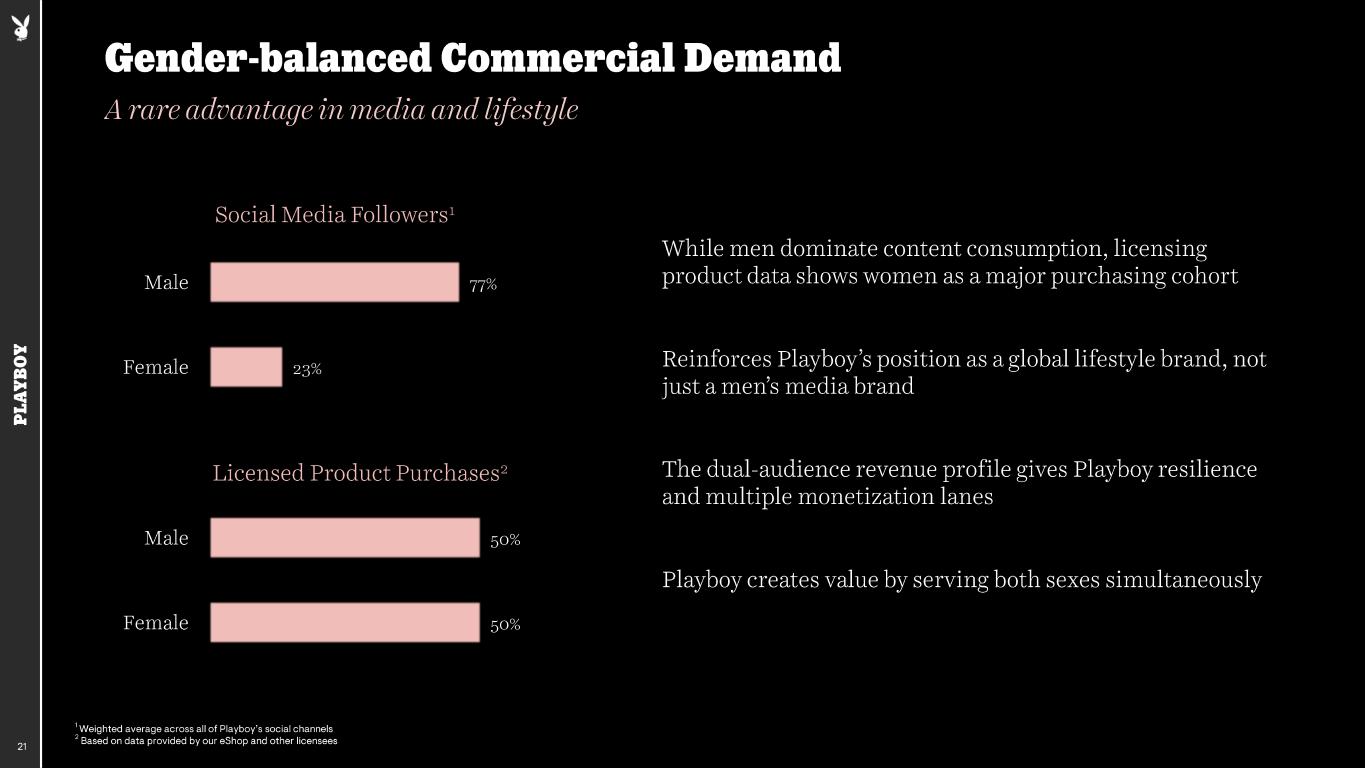

P LA YB O Y 21 Gender -balanced Commercial Demand A rare advantage in media and lifestyle While men dominate content consumption, licensing product data shows women as a major purchasing cohort Reinforces Playboy’s position as a global lifestyle brand, not just a men’s media brand The dual -audience revenue profile gives Playboy resilience and multiple monetization lanes Playboy creates value by serving both sexes simultaneously 23% 77% Female Male 50% 50% Female Male Social Media Followers 1 Licensed Product Purchases 2 1 Weighted average across all of Playboy’s social channels 2 Based on data provided by our eShop and other licensees

P LA YB O Y Expanding Playboy’s Global Reach 22 $11.0 China U.S. & Canada$7.5 2024 Revenue ($ in millions) 0.9 China + U.S. & Canada represented 70% of licensing revenue in 2024 Restructured our China partnership with Li & Fung and bought out CAA’s financial interest Significant white space in EMEA, Latin America & APAC Licensed adult content will contribute an incremental $20 million of licensing revenue in 2025 Playboy’s global recognition exceeds its global penetration = a large untapped addressable market open for growth $6.1 Rest of World

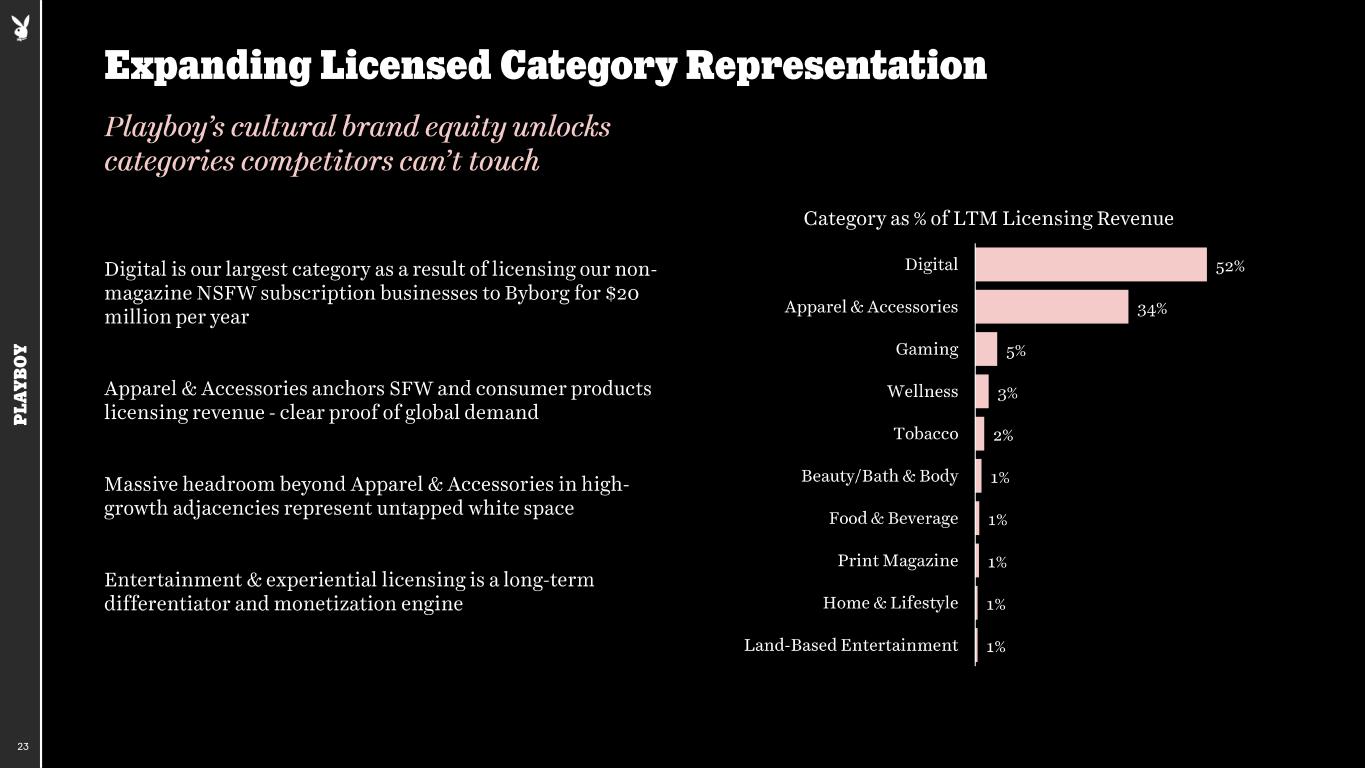

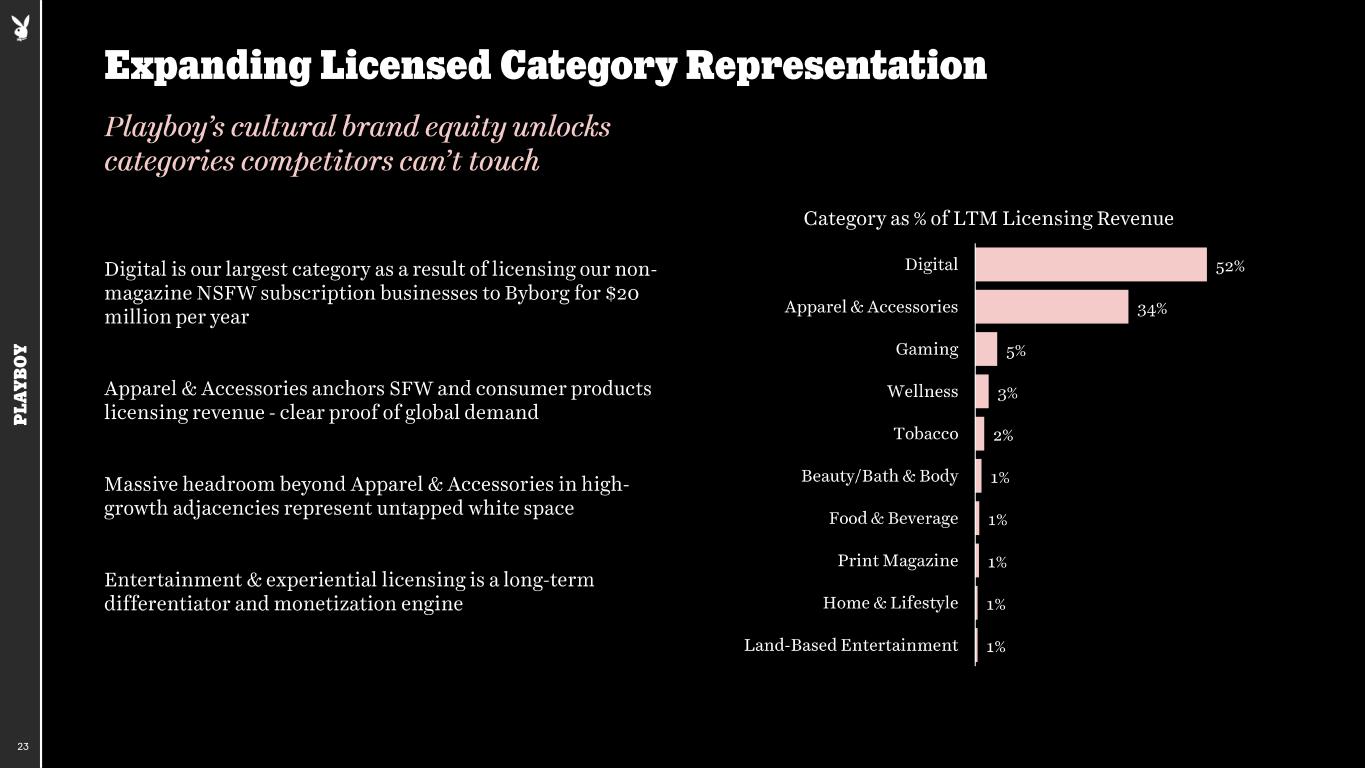

P LA YB O Y Digital is our largest category as a result of licensing our non - magazine NSFW subscription businesses to Byborg for $20 million per year Apparel & Accessories anchors SFW and consumer products licensing revenue - clear proof of global demand Massive headroom beyond Apparel & Accessories in high - growth adjacencies represent untapped white space Entertainment & experiential licensing is a long -term differentiator and monetization engine 1% 1% 1% 1% 1% 2% 3% 5% 34% 52% Land-Based Entertainment Home & Lifestyle Print Magazine Food & Beverage Beauty/Bath & Body Tobacco Wellness Gaming Apparel & Accessories Digital Category as % of LTM Licensing Revenue 23 Expanding Licensed Category Representation Playboy’s cultural brand equity unlocks categories competitors can’t touch

P LA YB O Y PILLAR 3: HOSPITALITY 24

P LA YB O Y Relaunching membership clubs as an outward extension of the brand Anticipate launching the first club in Miami Beach as the new “mansion” Signed a non -binding LOI to raise money from 3 rd parties to fund building and operating of clubs Expect to work with world -class hospitality partner to operate the club Limited capital risk for Playboy 25 Playboy Has a Rich History in Hospitality Over its 72 -year history, Playboy has owned/licensed 45 clubs across nine countries

P LA YB O Y PILLAR 4 (HONEY BIRDETTE) : FLAGSHIP & ECOMMERCE 26

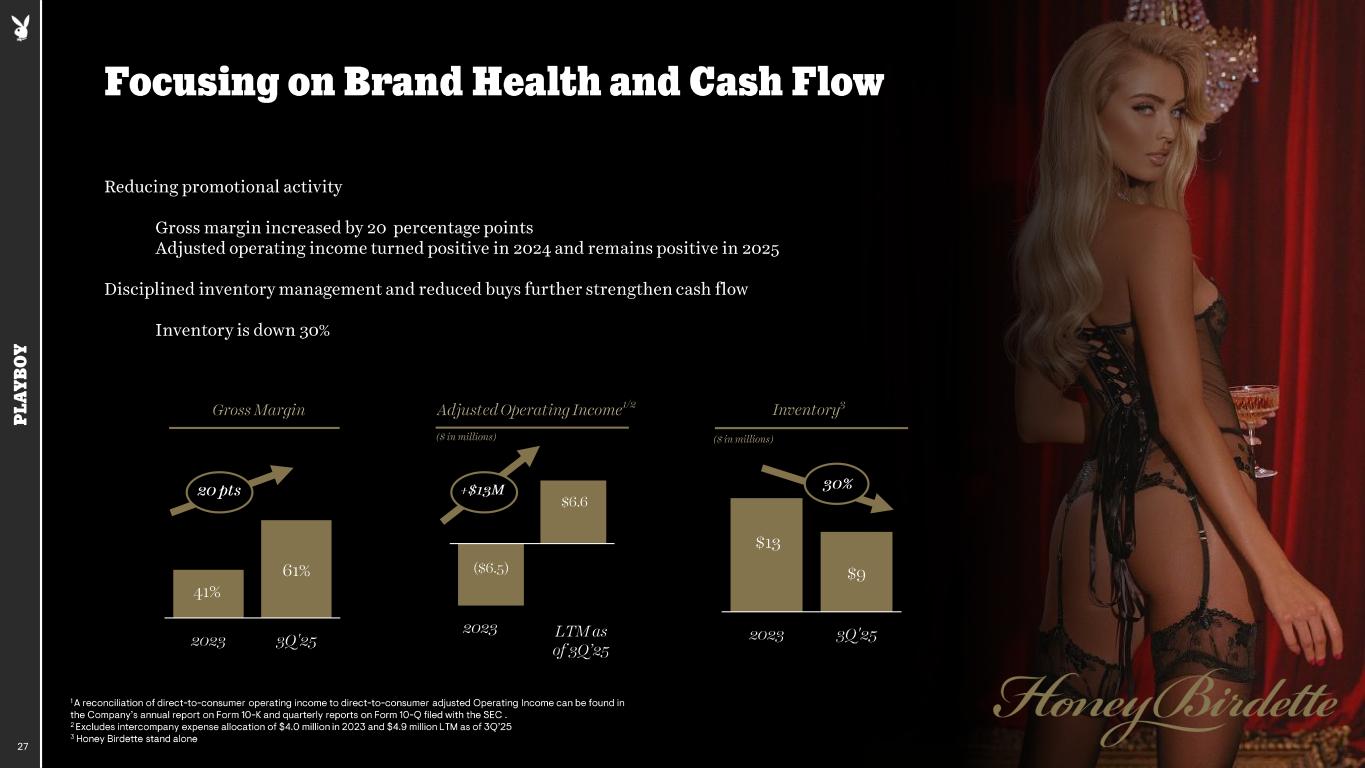

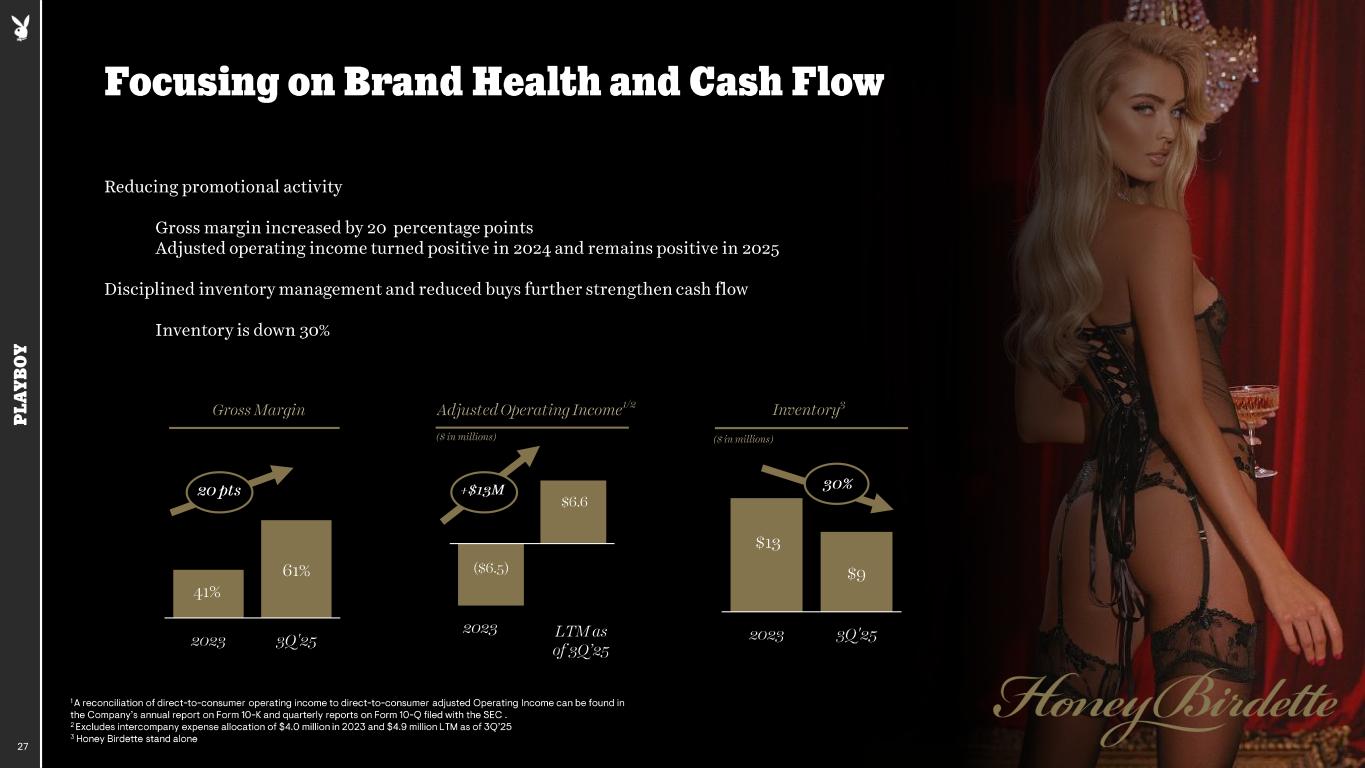

P LA YB O Y 27 Focusing on Brand Health and Cash Flow 1 A reconciliation of direct - to- consumer operating income to direct - to- consumer adjusted Operating Income can be found in the Company’s annual report on Form 10 - K and quarterly reports on Form 10 - Q filed with the SEC . 2 Excludes intercompany expense allocation of $4.0 million in 2023 and $4.9 million LTM as of 3Q’25 3 Honey Birdette stand alone Adjusted Operating Income 1/2 Inventory 3 $13 $9 2023 3Q'25 30% 41% 61% 2023 3Q'25 20 pts Gross Margin Reducing promotional activity Gross margin increased by 20 percentage points Adjusted operating income turned positive in 2024 and remains positive in 2025 Disciplined inventory management and reduced buys further strengthen cash flow Inventory is down 30% ($6.5) $6.6 LTM as of 3Q’25 2023 +$13M ($ in millions) ($ in millions)

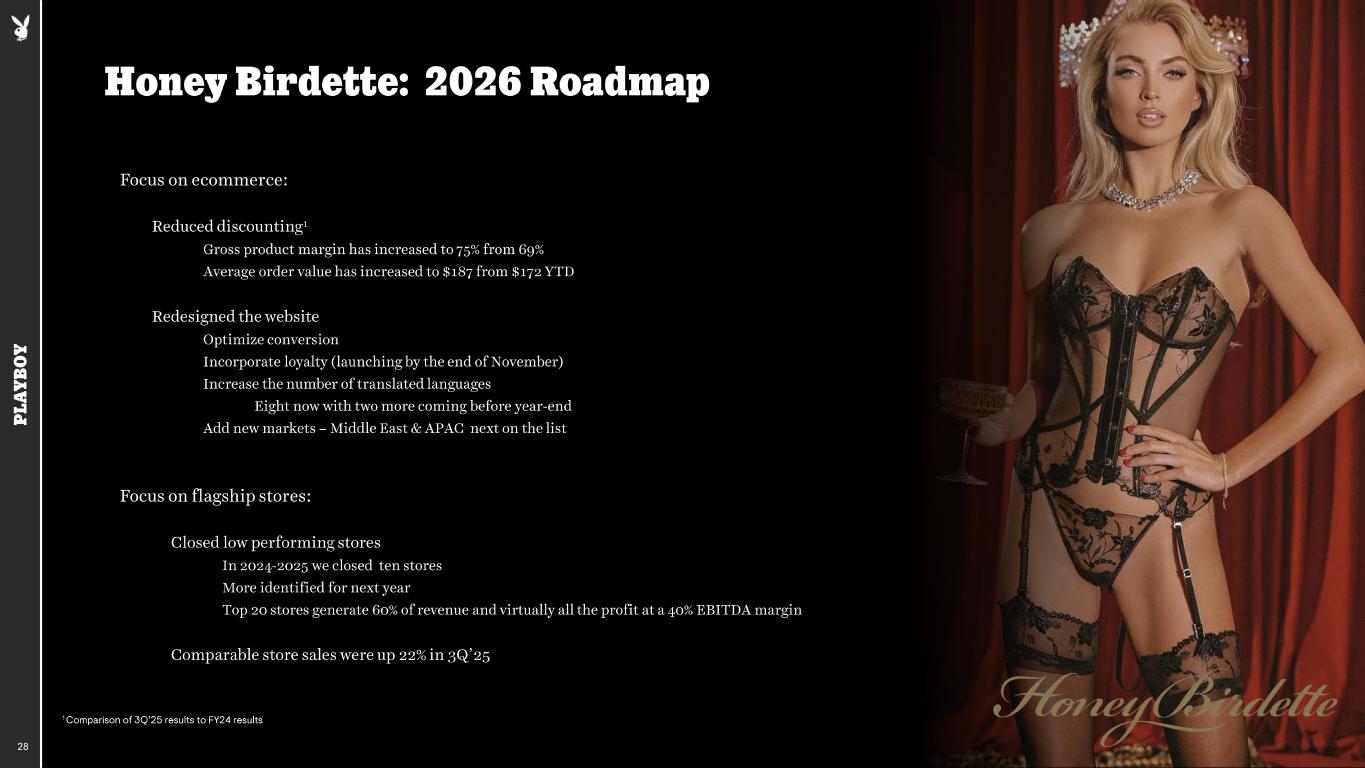

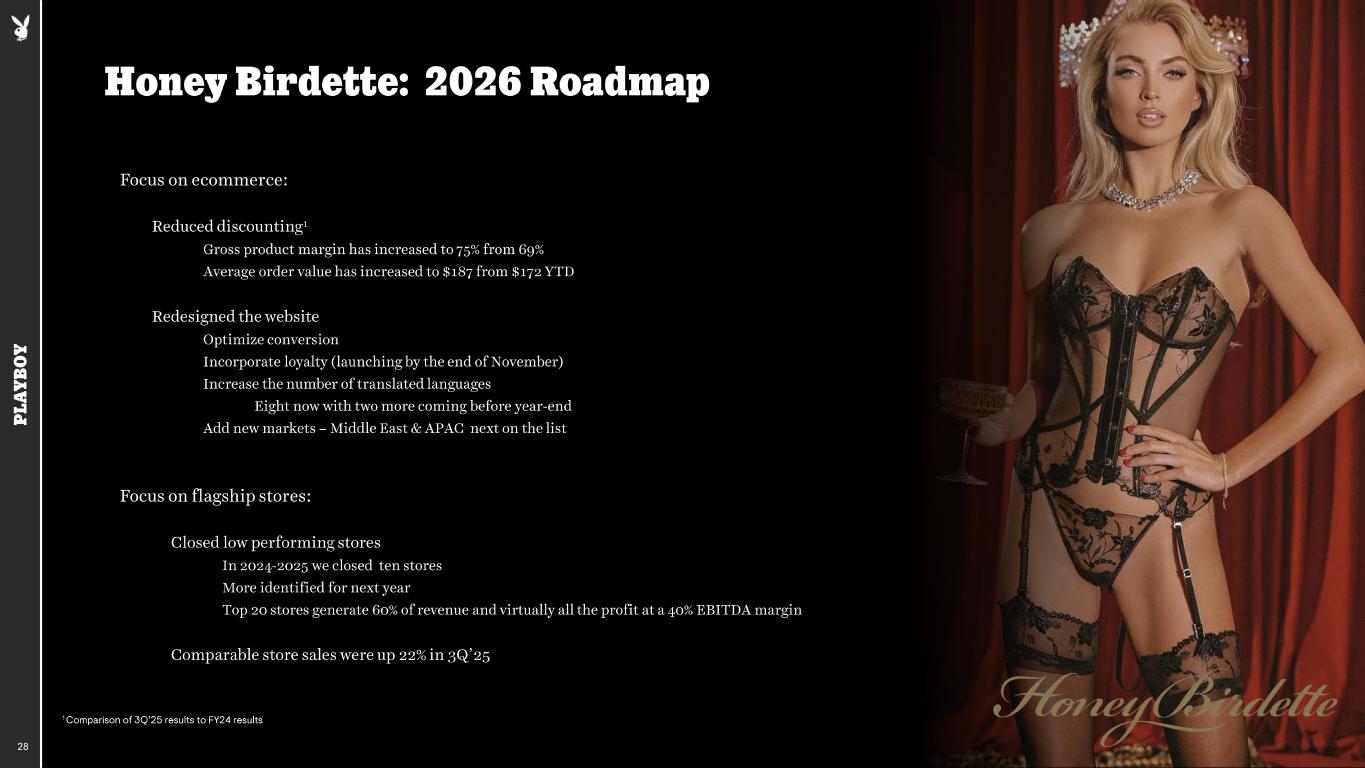

P LA YB O Y 28 Honey Birdette: 2026 Roadmap Focus on ecommerce: • Reduced discounting 1 • Gross product margin has increased to 75% from 69% • Average order value has increased to $187 from $172 YTD • Redesigned the website • Optimize conversion • Incorporate loyalty (launching by the end of November) • Increase the number of translated languages • Eight now with two more coming before year -end • Add new markets – Middle East & APAC next on the list Focus on flagship stores: Closed low performing stores In 2024 -2025 we closed ten stores More identified for next year Top 20 stores generate 60% of revenue and virtually all the profit at a 40% EBITDA margin Comparable store sales were up 22% in 3Q’25 1 Comparison of 3Q’25 results to FY24 results

P LA YB O Y Priceless IP that is nearly impossible to replicate today Diversified business model for future growth Growing base of high -margin, recurring licensing revenue, 86% in the form of guarantees 1 Sizeable long -term value with over $340 million in total contractual licensing guarantees Expanding margins and profitability at Honey Birdette with an eye for future monetization Continuing to maintain financial discipline with positive and growing quarter over quarter Adj. EBITDA Investment Highlights 29 1 2 3 4 1 Based on estimated fiscal year 2025 licensing revenue 5 6

P LA YB O Y 30 THANK YOU Investor Relations Contact: investors@playboy.com Instagram icon - Free download on Iconfinder Facebook Logo PNG With Transparent Background Download Tiktok, Logo, Brand. Royalty-Free Stock Illustration Image - Pixabay Hilarious brand kit confirms the X logo is here to stay ...

P LA YB O Y APPENDIX: FINANCIALS 31

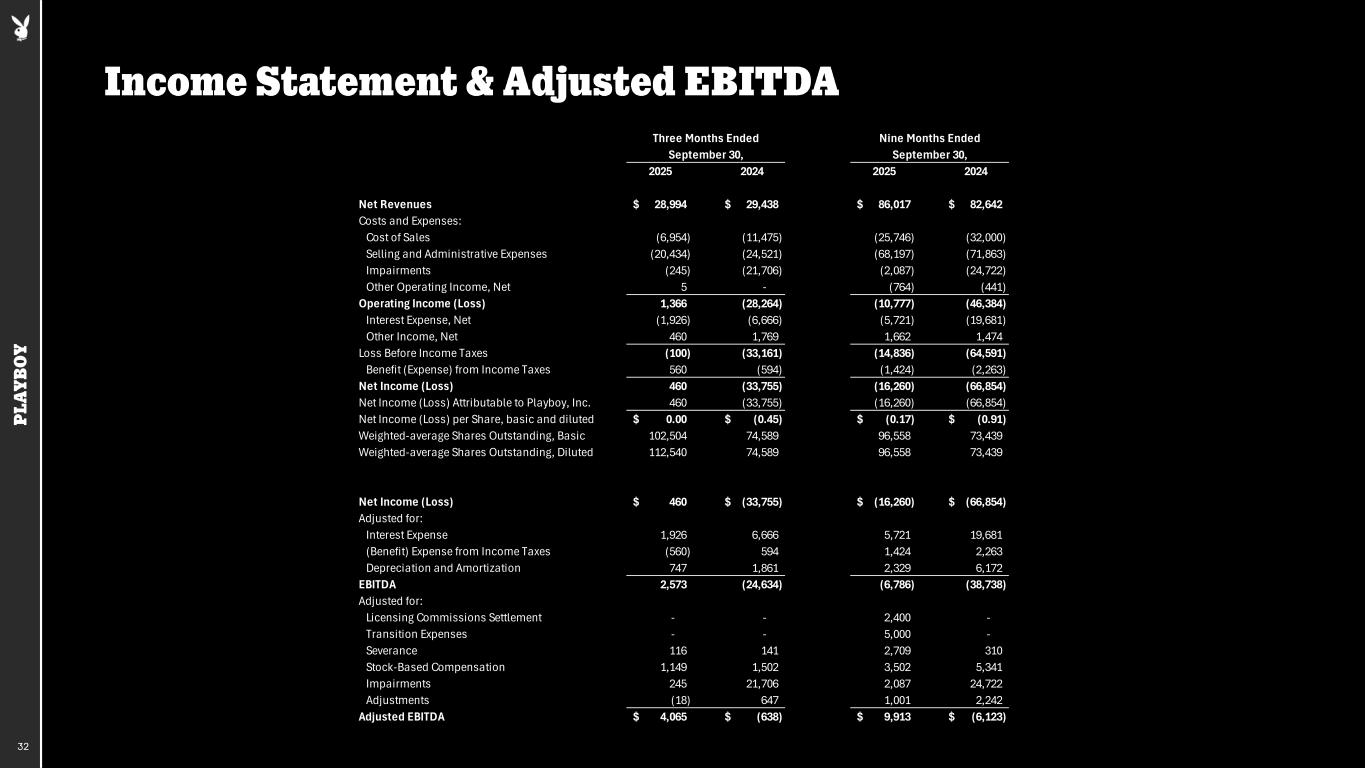

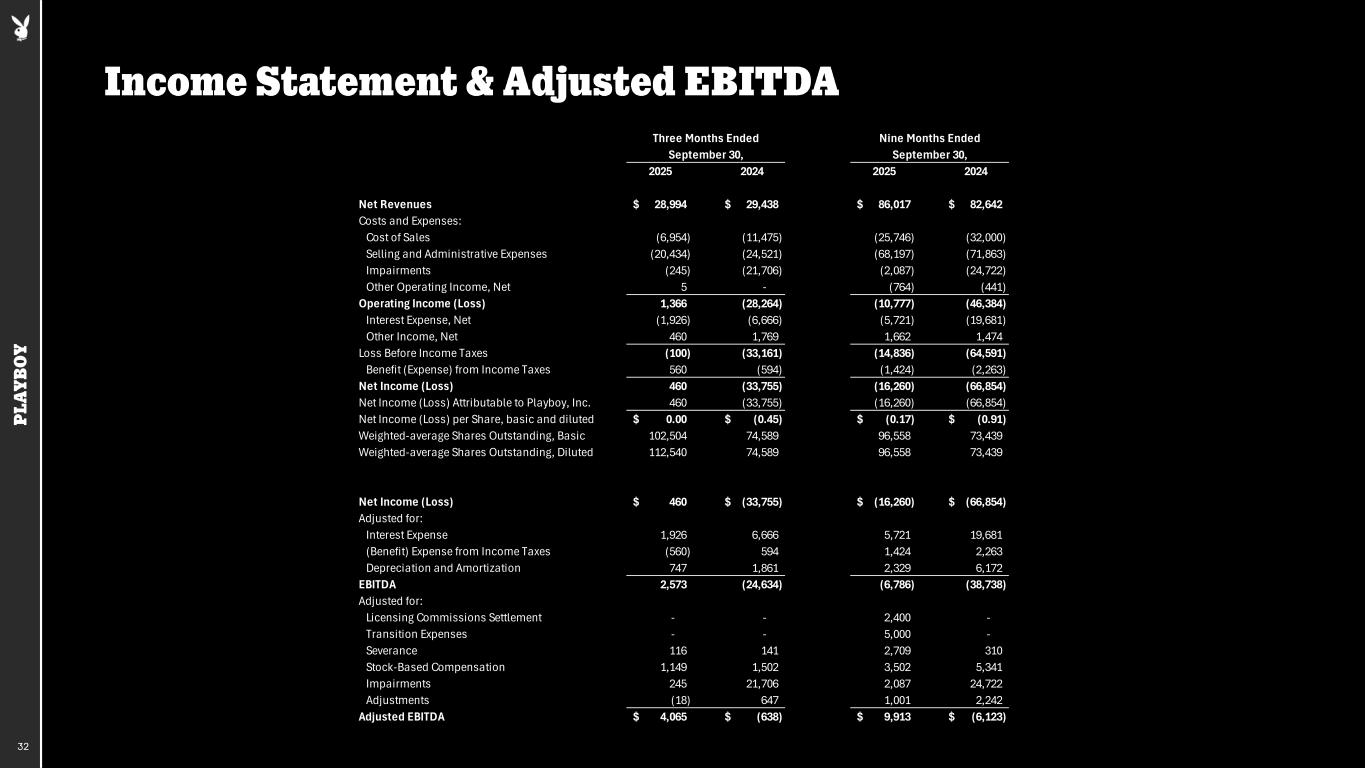

P LA YB O Y Income Statement & Adjusted EBITDA 32 2025 2024 2025 2024 Net Revenues 28,994$ 29,438$ 86,017$ 82,642$ Costs and Expenses: Cost of Sales (6,954) (11,475) (25,746) (32,000) Selling and Administrative Expenses (20,434) (24,521) (68,197) (71,863) Impairments (245) (21,706) (2,087) (24,722) Other Operating Income, Net 5 - (764) (441) Operating Income (Loss) 1,366 (28,264) (10,777) (46,384) Interest Expense, Net (1,926) (6,666) (5,721) (19,681) Other Income, Net 460 1,769 1,662 1,474 Loss Before Income Taxes (100) (33,161) (14,836) (64,591) Benefit (Expense) from Income Taxes 560 (594) (1,424) (2,263) Net Income (Loss) 460 (33,755) (16,260) (66,854) Net Income (Loss) Attributable to Playboy, Inc. 460 (33,755) (16,260) (66,854) Net Income (Loss) per Share, basic and diluted 0.00$ (0.45)$ (0.17)$ (0.91)$ Weighted-average Shares Outstanding, Basic 102,504 74,589 96,558 73,439 Weighted-average Shares Outstanding, Diluted 112,540 74,589 96,558 73,439 Net Income (Loss) 460$ (33,755)$ (16,260)$ (66,854)$ Adjusted for: Interest Expense 1,926 6,666 5,721 19,681 (Benefit) Expense from Income Taxes (560) 594 1,424 2,263 Depreciation and Amortization 747 1,861 2,329 6,172 EBITDA 2,573 (24,634) (6,786) (38,738) Adjusted for: Licensing Commissions Settlement - - 2,400 - Transition Expenses - - 5,000 - Severance 116 141 2,709 310 Stock-Based Compensation 1,149 1,502 3,502 5,341 Impairments 245 21,706 2,087 24,722 Adjustments (18) 647 1,001 2,242 Adjusted EBITDA 4,065$ (638)$ 9,913$ (6,123)$ September 30, Three Months Ended September 30, Nine Months Ended

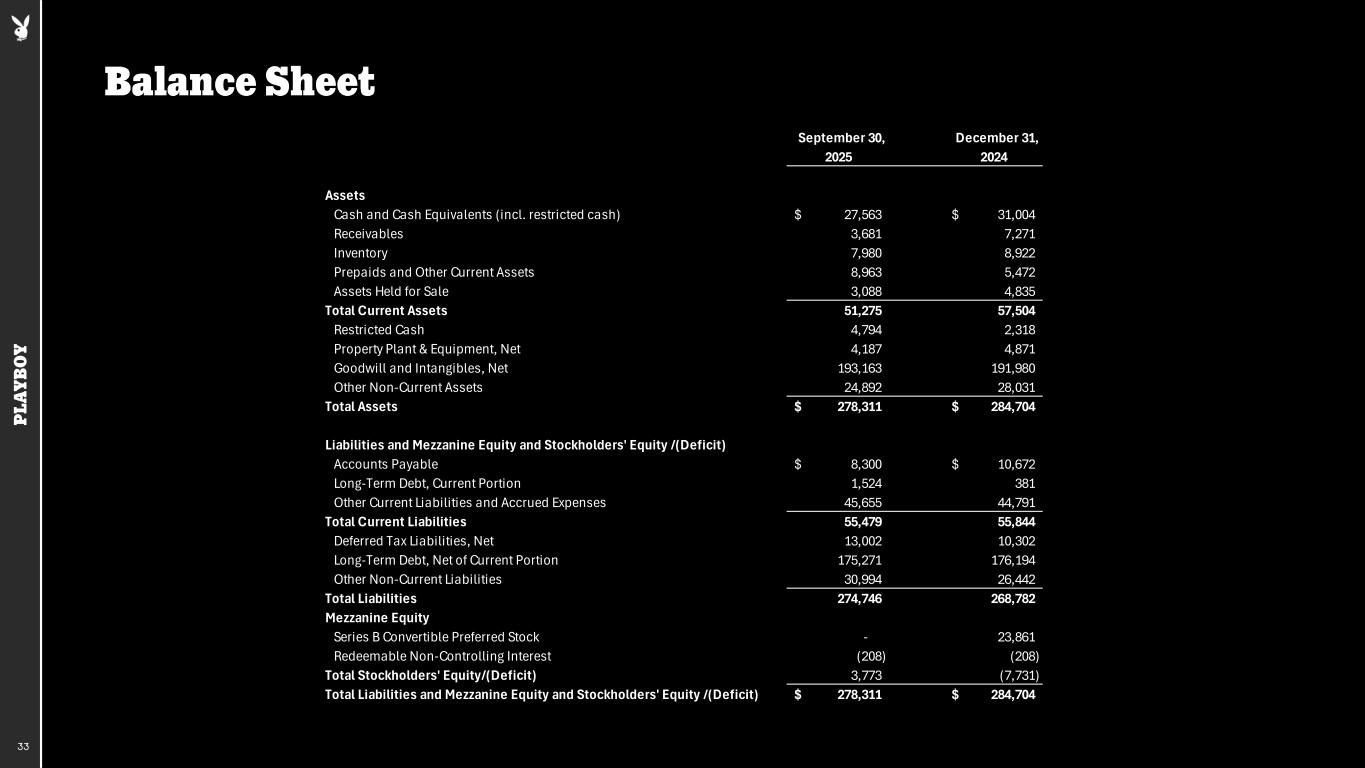

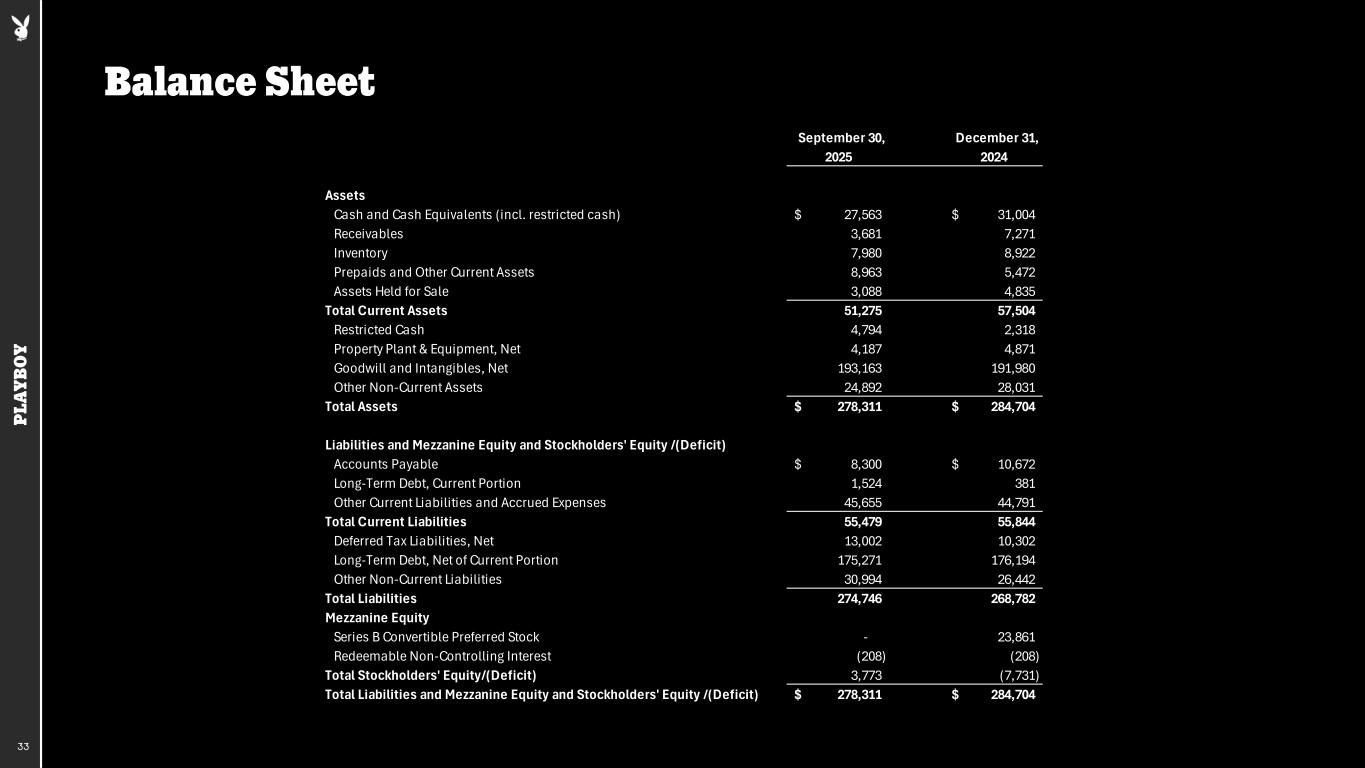

P LA YB O Y Balance Sheet 33 `September 30, `December 31, 2025 2024 Assets Cash and Cash Equivalents (incl. restricted cash) 27,563$ 31,004$ Receivables 3,681 7,271 Inventory 7,980 8,922 Prepaids and Other Current Assets 8,963 5,472 Assets Held for Sale 3,088 4,835 Total Current Assets 51,275 57,504 Restricted Cash 4,794 2,318 Property Plant & Equipment, Net 4,187 4,871 Goodwill and Intangibles, Net 193,163 191,980 Other Non-Current Assets 24,892 28,031 Total Assets 278,311$ 284,704$ Liabilities and Mezzanine Equity and Stockholders' Equity /(Deficit) Accounts Payable 8,300$ 10,672$ Long-Term Debt, Current Portion 1,524 381 Other Current Liabilities and Accrued Expenses 45,655 44,791 Total Current Liabilities 55,479 55,844 Deferred Tax Liabilities, Net 13,002 10,302 Long-Term Debt, Net of Current Portion 175,271 176,194 Other Non-Current Liabilities 30,994 26,442 Total Liabilities 274,746 268,782 Mezzanine Equity Series B Convertible Preferred Stock - 23,861 Redeemable Non-Controlling Interest (208) (208) Total Stockholders' Equity/(Deficit) 3,773 (7,731) Total Liabilities and Mezzanine Equity and Stockholders' Equity /(Deficit) 278,311$ 284,704$