Document

Atkore Inc. Announces Fourth Quarter 2025 Results

Fourth-Quarter Highlights

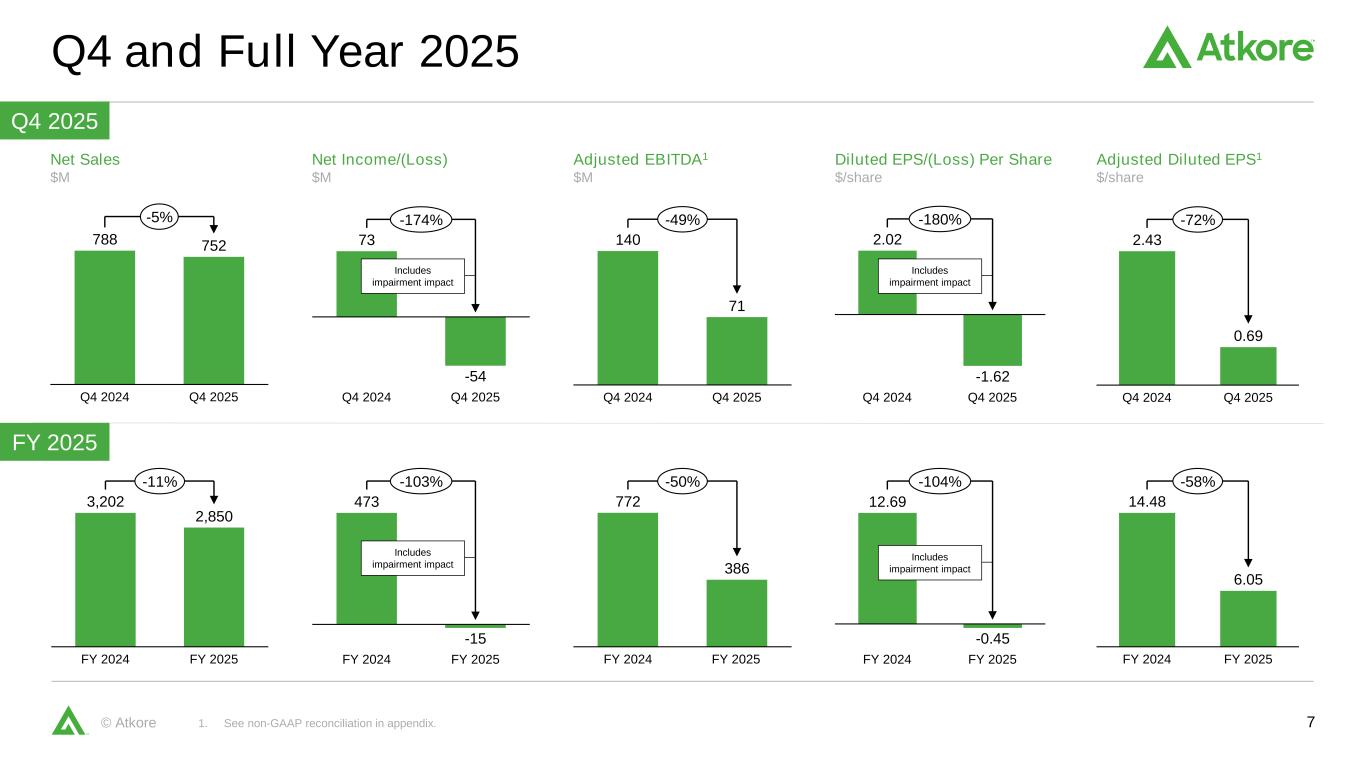

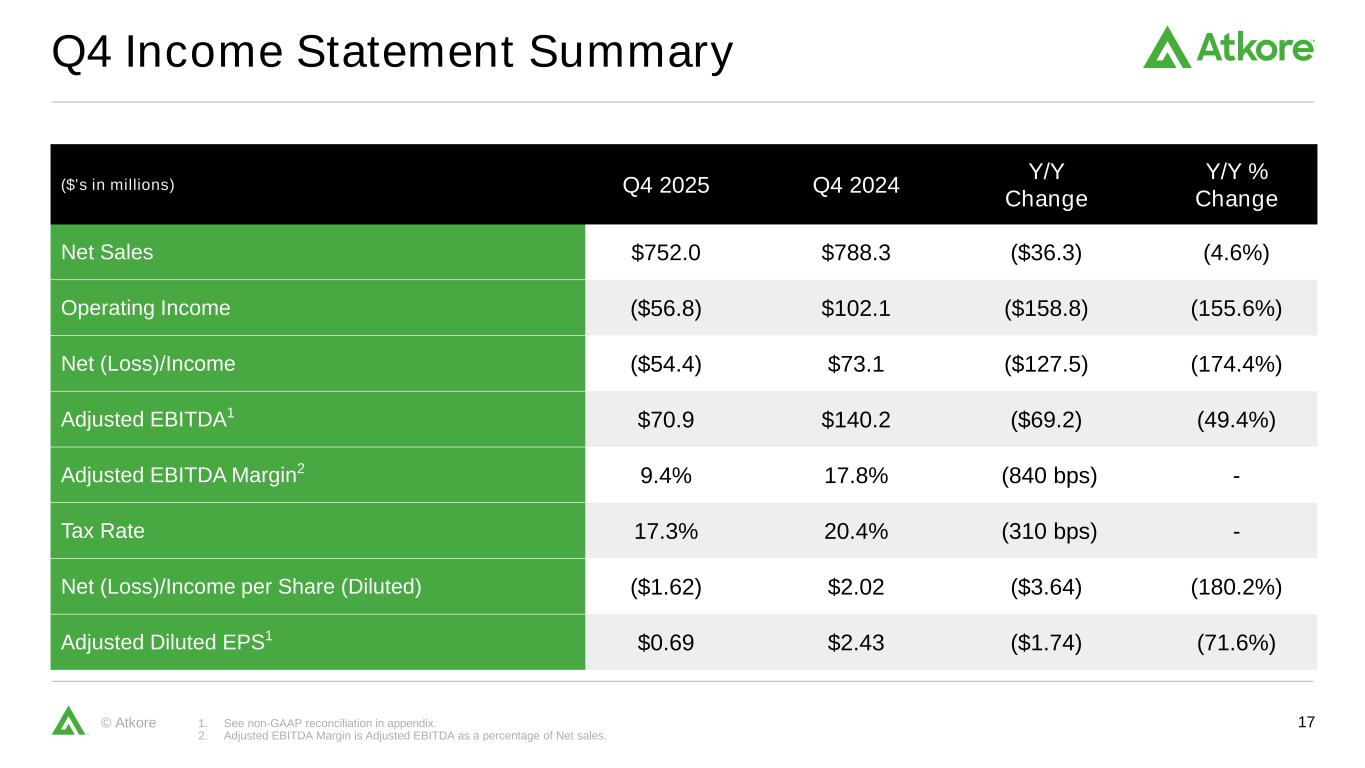

•Net sales of $752.0 million compared to $788.3 million in the prior year

•Net (loss) of $(54.4) million compared to net income of $73.1 million in the prior year

◦Net (loss) includes $66.7 million non-cash impairment of certain long-lived assets in our HDPE business

◦Net (loss) includes $18.9 million non-cash goodwill impairment related to the Mechanical reporting unit

•Adjusted EBITDA of $70.9 million compared to $140.1 million in the prior year

◦Fourth quarter includes $5.8 million one-time inventory adjustments and,

◦Non-routine advisory, financing & legal services for $5.4 million

◦Excluding both items, Adjusted EBITDA would have been $82 million

•Net (loss) income per diluted share decreased to $(1.62) from $2.02 in prior year period; Adjusted net income per diluted share decreased to $0.69 from $2.43 in prior year period

Fiscal 2025 Highlights

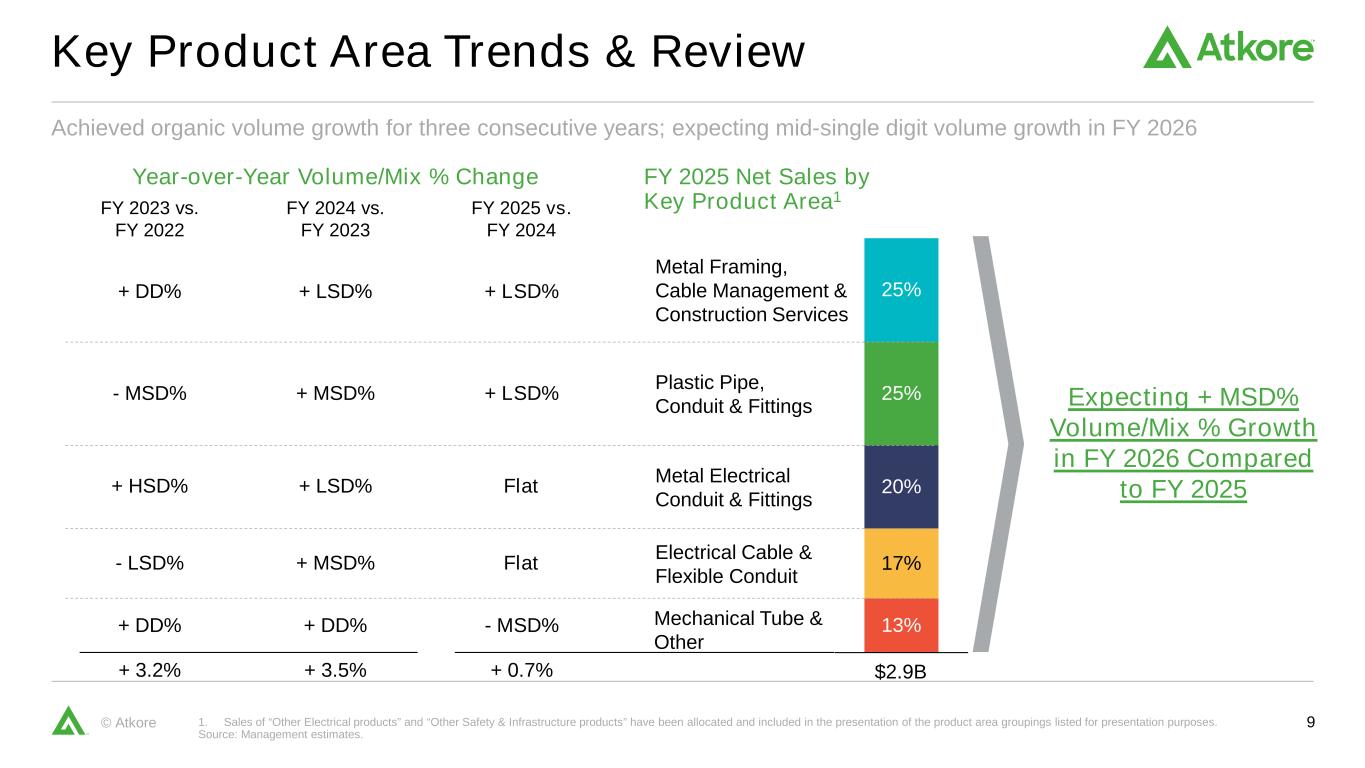

•Net sales of $2,850.4 million compared to $3,202.1 million in prior year

•Net (loss) of $(15.2) million compared to net income of $472.9 million in the prior year

• Adjusted EBITDA of $386.4 million compared to $771.7 million in prior year

◦Fourth quarter includes $5.8 million one-time inventory adjustments and,

◦Non-routine advisory, financing & legal services for $5.4 million

◦Excluding both items, Adjusted EBITDA would have been $397.3 million

•Net (loss) income per diluted share decreased to $(0.45) from $12.69 in prior year; Adjusted net income per diluted share decreased to $6.05 from $14.48 in prior year

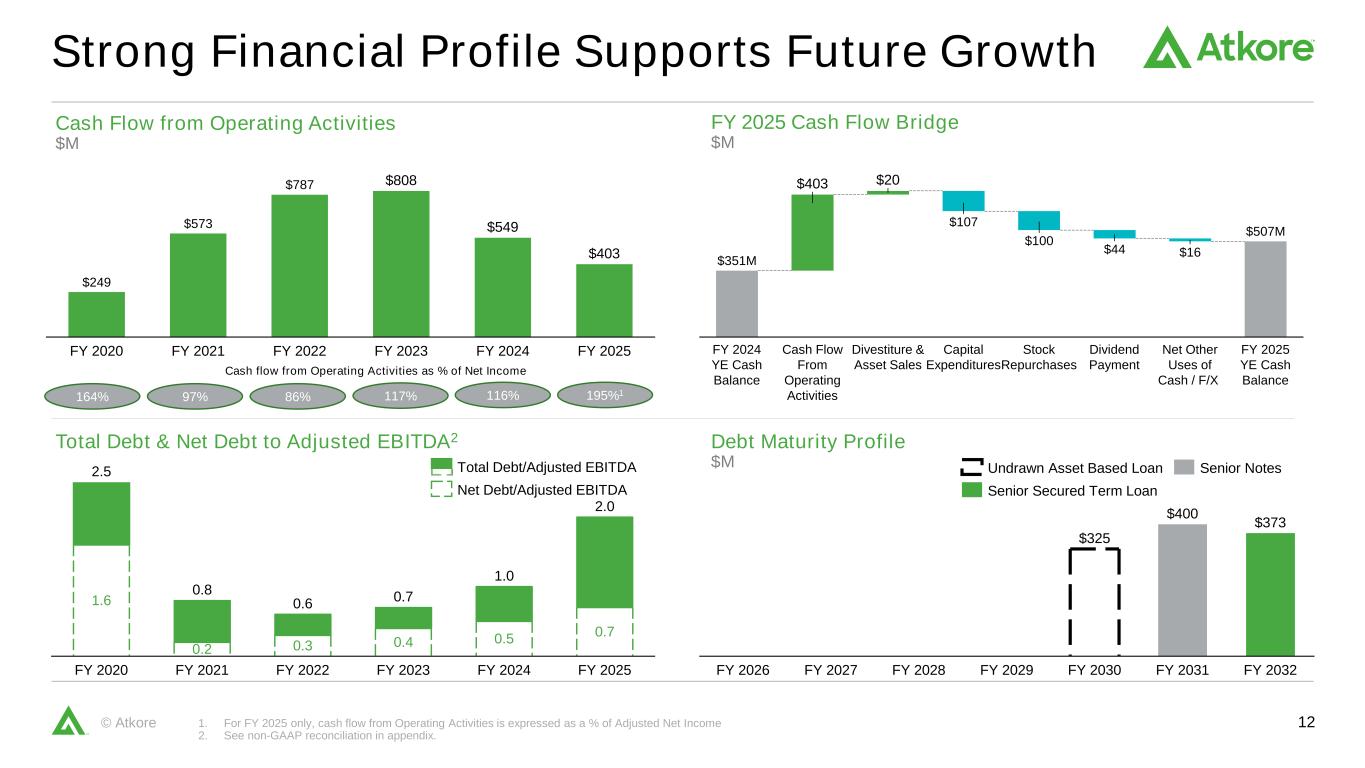

•Net cash provided by operating activities of $402.8 million; Free Cash Flow of $295.7 million

•Repurchased $100.0 million in outstanding shares and paid dividends totaling $44.2 million

Additional Highlights

•On November 18, 2025, Atkore’s Board of Directors declared a quarterly cash dividend of $0.33 per share of common stock payable on December 17, 2025, to stockholders of record on December 5, 2025

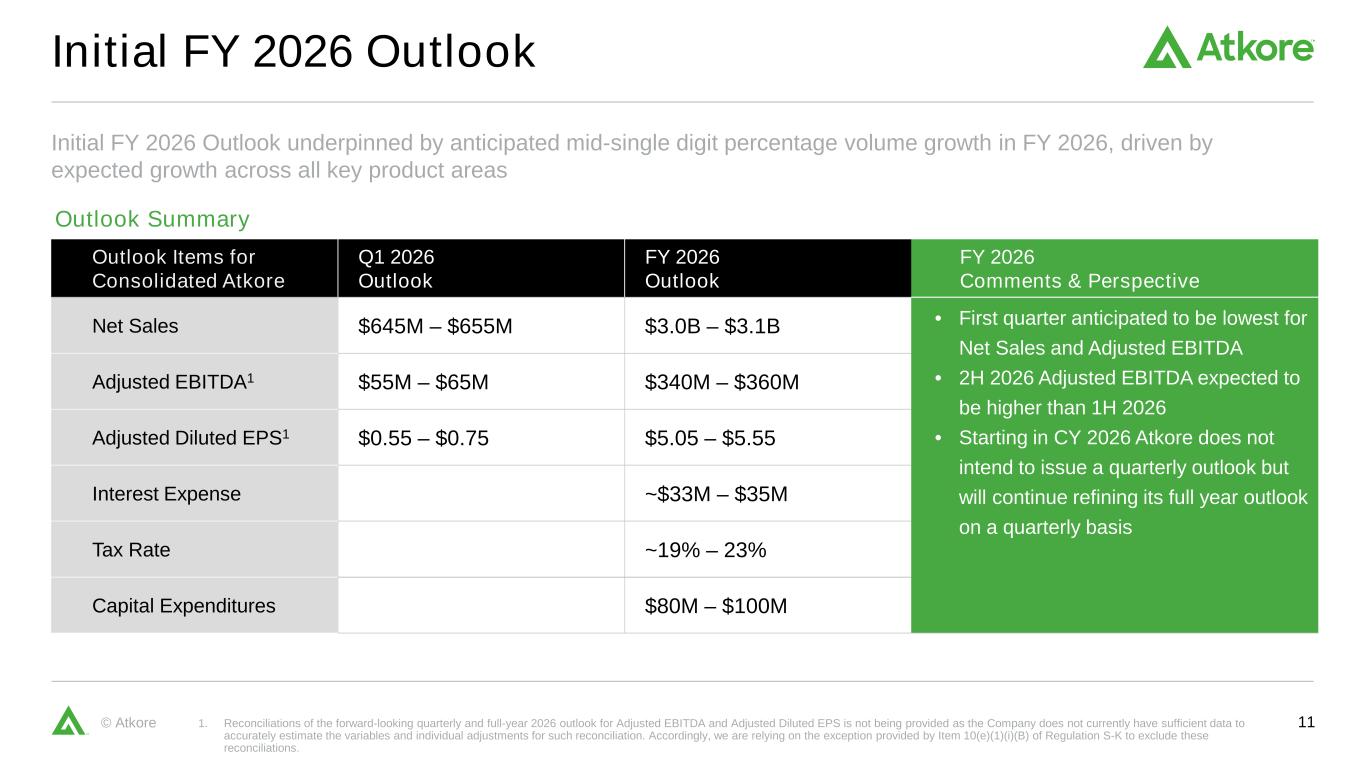

•Full-year 2026 Net sales expected to be in the range of $3.0 - $3.1 billion

•Full-year 2026 Adjusted EBITDA outlook of $340 - $360 million; Full-year Adjusted net income per diluted share outlook of $5.05 - $5.55

HARVEY, IL. — November 20, 2025 (BUSINESS WIRE) - Atkore Inc. (the “Company” or “Atkore”) (NYSE: ATKR) announced earnings for its fiscal 2025 full year and fourth quarter ended September 30, 2025 (“fourth quarter”).

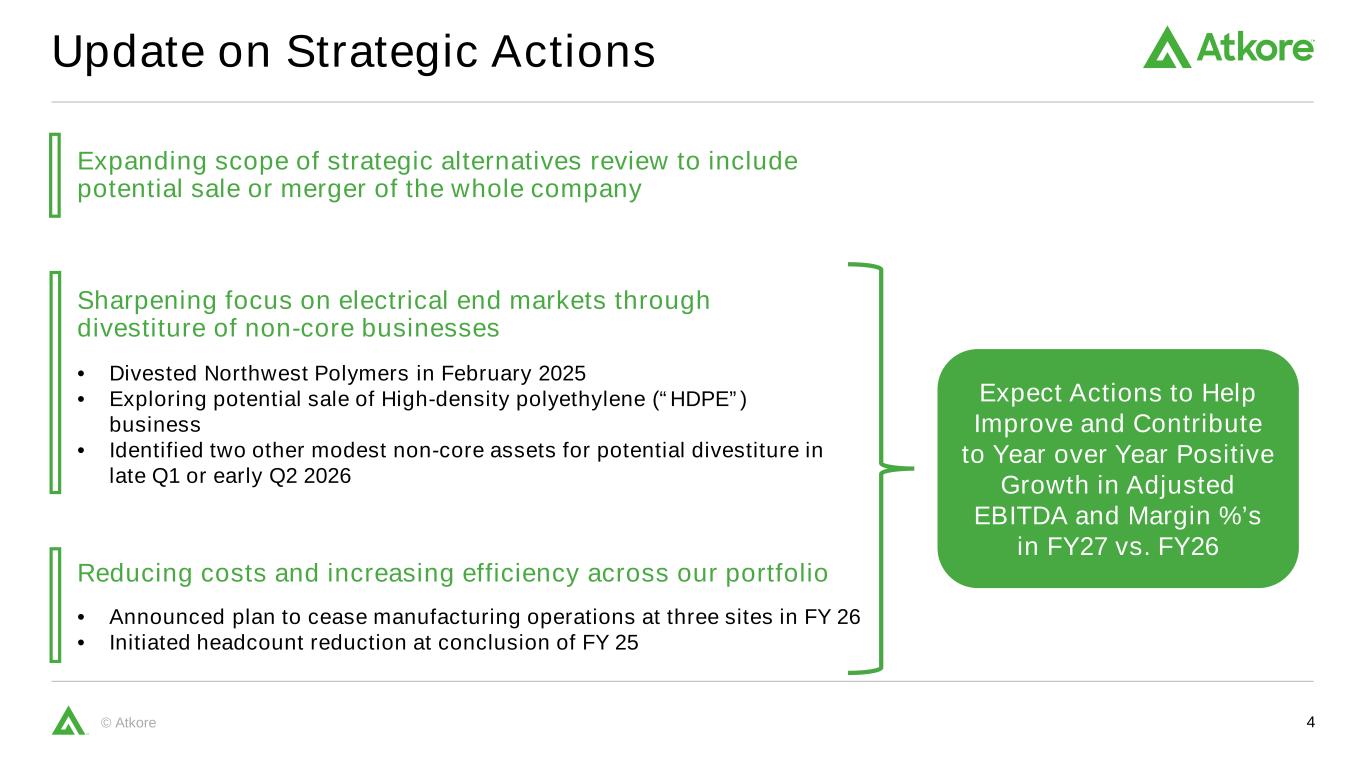

“Atkore achieved Net Sales of $2.9 billion in fiscal 2025 and grew organic volume for the third consecutive year,” said Bill Watlz, Atkore President and Chief Executive Officer. “We returned cash to shareholders by deploying $144 million towards share repurchases and dividend payments. We also took steps to preserve our financial flexibility by refinancing our existing asset-based lending agreement and our senior secured term loan, moving maturity dates beyond fiscal 2030.”

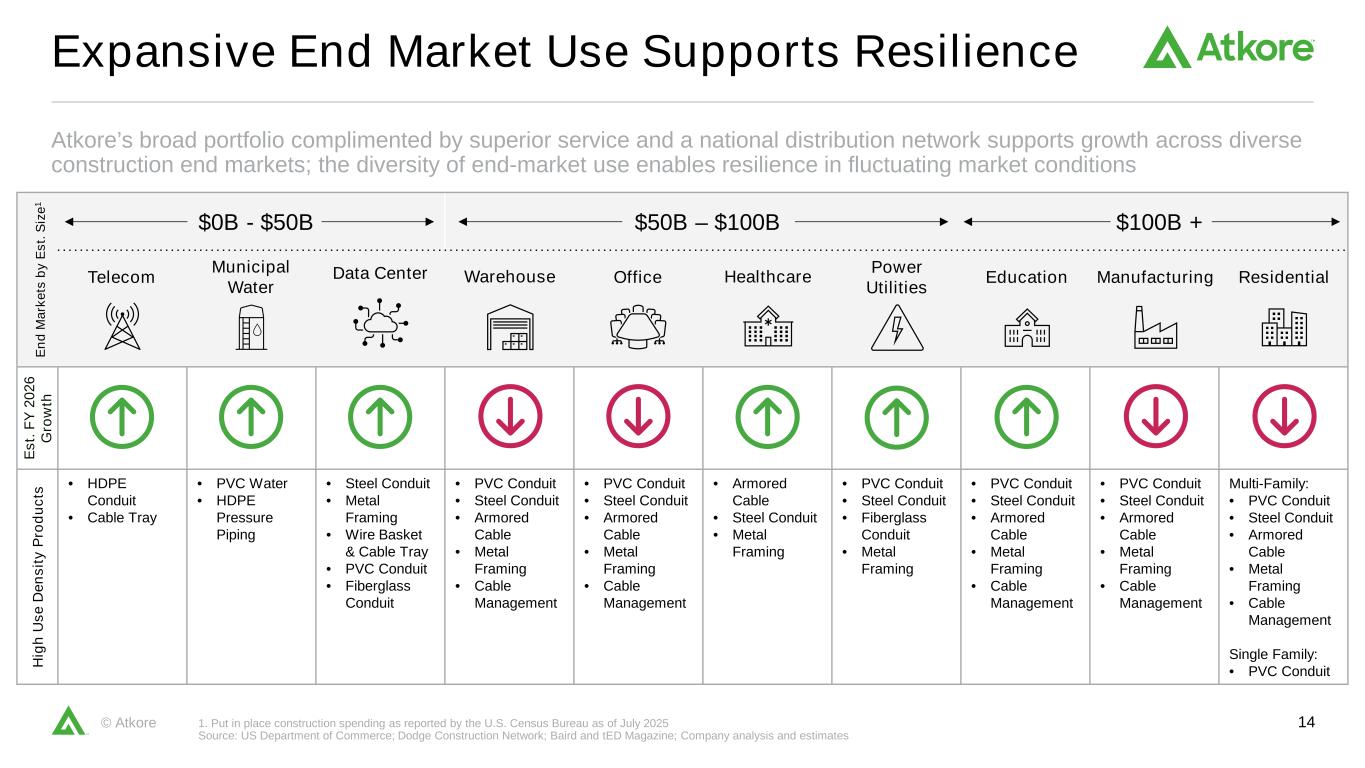

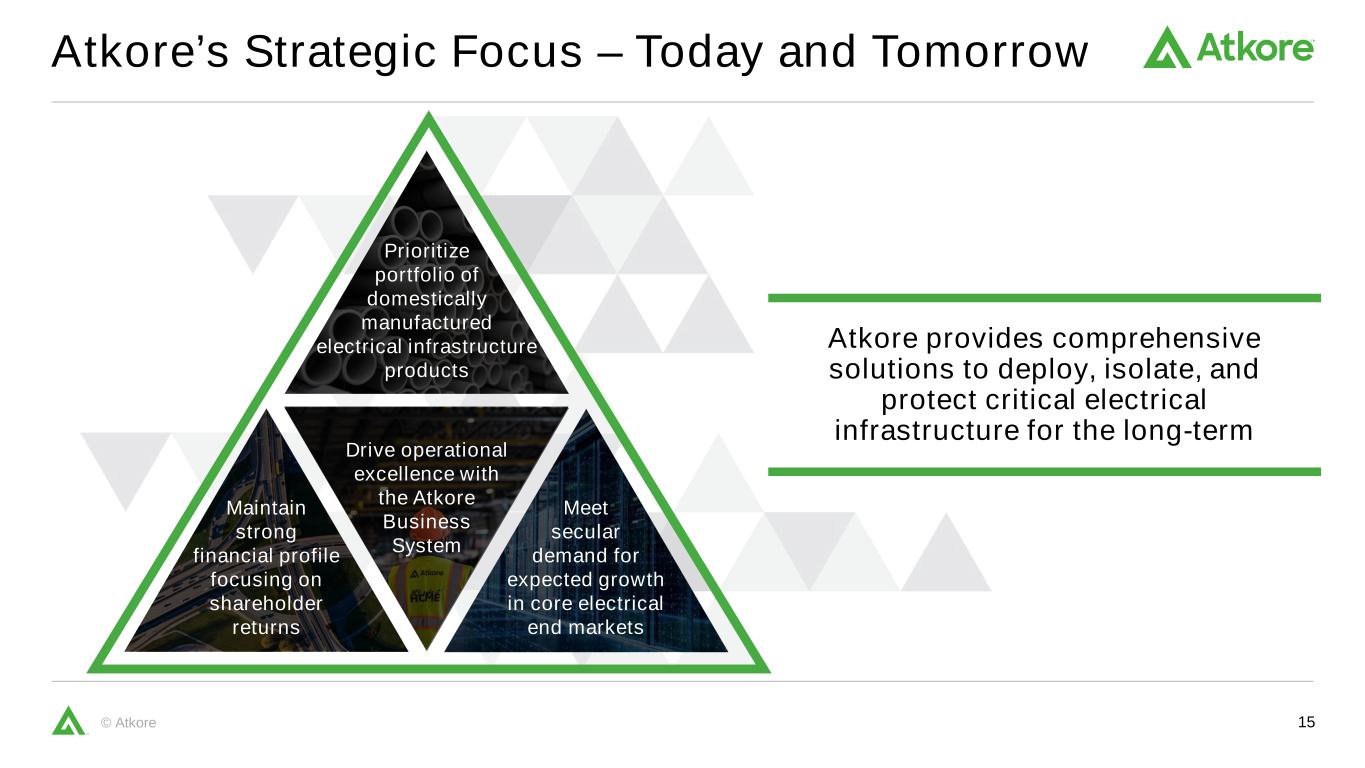

Waltz continued, “Earlier today we announced that the Board of Directors has expanded the scope of its previously announced review of strategic alternatives which is intended to maximize shareholder value. I have decided to stay in my role as Atkore’s President and CEO at least through the conclusion of the strategic review. Our product portfolio is well positioned to serve our customers with anticipated near-term market demand growth in several key electrical end markets, and the long-term demand outlook for electricity.”

2025 Fourth Quarter Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

| (in thousands) |

|

September 30, 2025 |

|

September 30, 2024 |

|

Change |

|

Change % |

| Net sales |

|

|

|

|

|

|

|

|

| Electrical |

|

$ |

518,880 |

|

|

$ |

564,535 |

|

|

$ |

(45,655) |

|

|

(8.1) |

% |

| Safety & Infrastructure |

|

233,409 |

|

|

224,507 |

|

|

8,902 |

|

|

4.0 |

% |

| Eliminations |

|

(278) |

|

|

(746) |

|

|

468 |

|

|

(62.7) |

% |

| Consolidated operations |

|

$ |

752,011 |

|

|

$ |

788,296 |

|

|

$ |

(36,285) |

|

|

(4.6) |

% |

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(54,420) |

|

|

$ |

73,119 |

|

|

$ |

(127,539) |

|

|

(174.4) |

% |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

|

|

|

|

|

|

| Electrical |

|

$ |

65,947 |

|

|

$ |

145,662 |

|

|

$ |

(79,715) |

|

|

(54.7) |

% |

| Safety & Infrastructure |

|

26,817 |

|

|

14,898 |

|

|

11,919 |

|

|

80.0 |

% |

| Unallocated |

|

(21,849) |

|

|

(20,410) |

|

|

(1,439) |

|

|

7.1 |

% |

| Consolidated operations |

|

$ |

70,915 |

|

|

$ |

140,150 |

|

|

$ |

(69,235) |

|

|

(49.4) |

% |

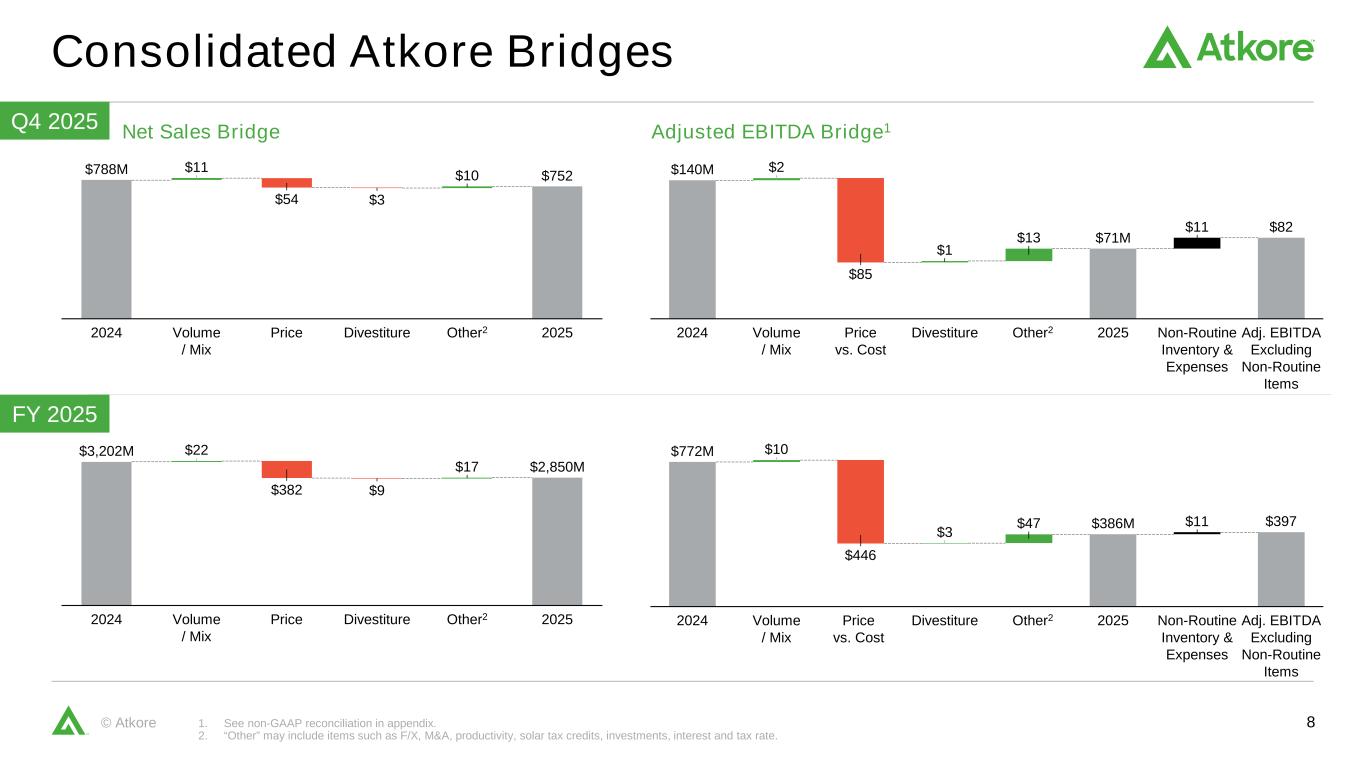

Net sales for the fourth quarter of 2025 decreased to $752.0 million, a decrease of 4.6% compared to $788.3 million for the prior-year period. The decrease was primarily due to lower average selling prices of $53.6 million as the result of expected pricing normalization. These decreases were partially offset by higher sales volume of $10.7 million and a decrease in the economic value of solar tax credits to be transferred to certain customers of $7.7 million.

Gross profit decreased by $68.2 million to $147.8 million for the fourth quarter of 2025, as compared to $216.1 million for the prior-year period. Gross margins decreased from 27.4% in the prior year period to 19.7%. Gross profit and gross profit margin decreased primarily due to declines in average selling prices of $53.6 million and higher raw material costs of $12.3 million.

Net income decreased $127.5 million to a net loss of $54.4 million for the fourth quarter of 2025, as compared to $73.1 million of net income for the prior-year period, due to lower operating income of $158.8 million, partially offset by decreased income taxes of $30.1 million. Adjusted net income decreased $63.3 million to $23.3 million compared to $86.6 million for the prior-year period.

Adjusted EBITDA decreased $69.2 million, or 49.4%, to $70.9 million for the fourth quarter of 2025, as compared to $140.1 million for the prior-year period. Net income margin decreased from 9.3% in the prior-year period to (7.2)% and Adjusted EBITDA Margin decreased 840 basis points from 17.8% to 9.4%.

Net loss per diluted share was $(1.62) for the fourth quarter of 2025, a decrease of $3.64 from the prior-year period. Adjusted net income per diluted share was $0.69 per share for the fourth quarter of 2025 compared to $2.43 for the prior-year period.

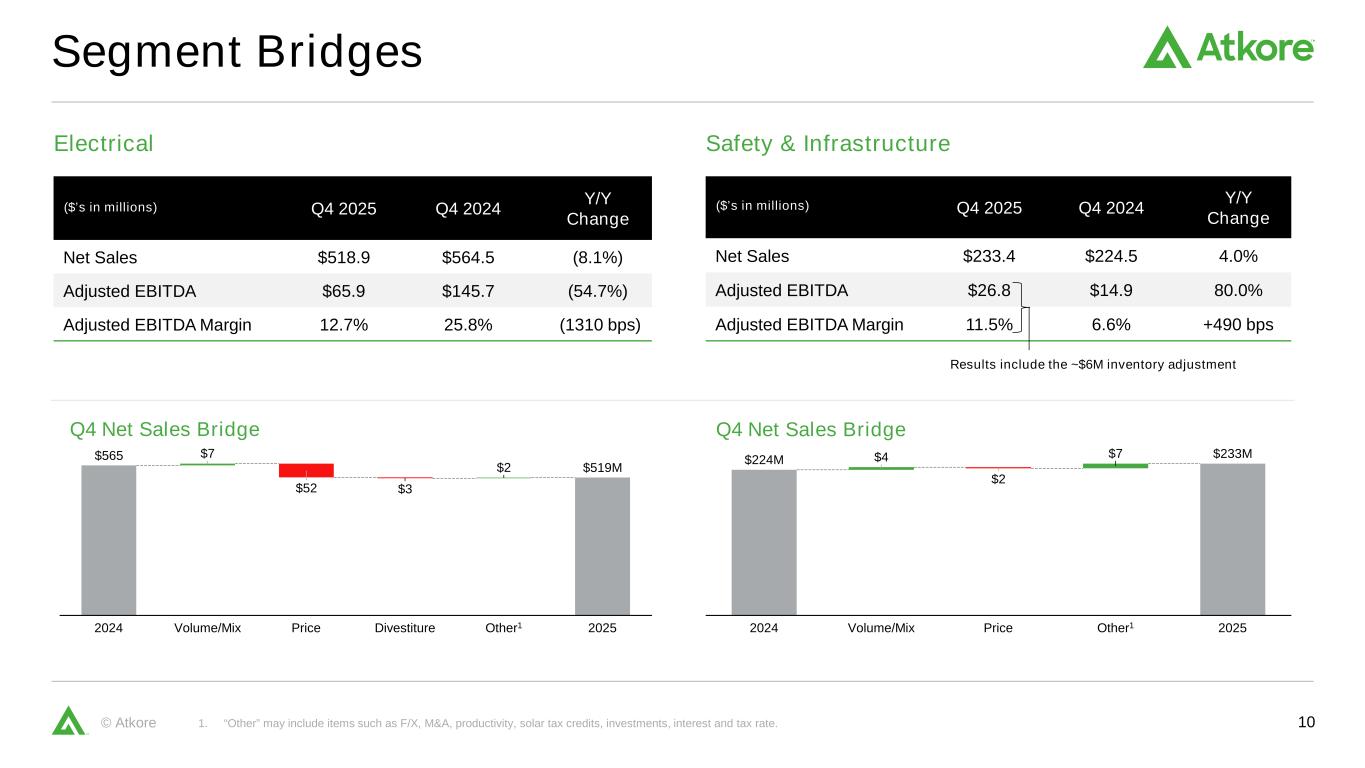

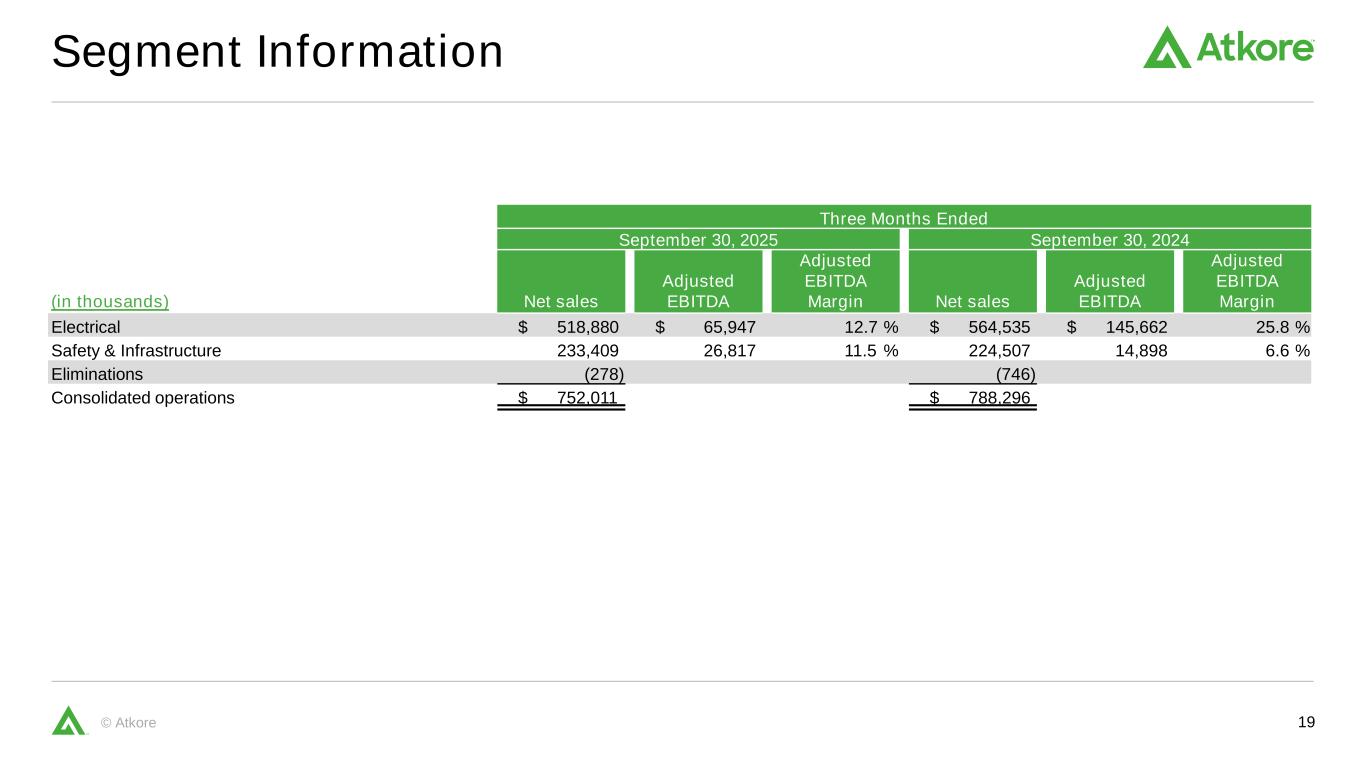

Segment Results

Electrical

Electrical net sales decreased $45.7 million, or 8.1%, to $518.9 million for the fourth quarter of 2025, as compared to $564.5 million for the prior-year period. The decrease in net sales is primarily attributed to decreased average selling prices of $51.8 million as a result of expected pricing normalization and divestitures of $3.1 million, partially offset by increased volume of $6.5 million.

Adjusted EBITDA decreased $79.7 million, or 54.7%, to $65.9 million for the fourth quarter of 2025, as compared to $145.7 million for the prior-year period, and Adjusted EBITDA Margin decreased from 25.8% to 12.7%. The decrease in Adjusted EBITDA was largely due to lower average selling prices and higher input costs.

Safety & Infrastructure

Safety & Infrastructure net sales increased $8.9 million, or 4.0%, to $233.4 million for the fourth quarter of 2025, as compared to $224.5 million for the prior-year period. The increase is attributed to higher volumes of $4.2 million and a decrease in the economic value of solar tax credits to be transferred to certain customers of $7.7 million, partially offset by lower average selling prices of $1.8 million.

Adjusted EBITDA increased $11.9 million, or 80.0%, to $26.8 million for the fourth quarter of 2025, as compared to $14.9 million for the prior-year period. Adjusted EBITDA Margin increased from 6.6% to 11.5%. The increase in Adjusted EBITDA and Adjusted EBITDA Margin was primarily driven by lower input costs.

Fiscal 2025 Full-Year Results

Net sales for fiscal 2025 decreased $351.7 million to $2,850.4 million, a decrease of 11.0% compared to $3,202.1 million for fiscal 2024. The decrease in net sales is primarily attributed to decreased average selling prices of $381.8 million and divestitures of $9.3 million. These decreases are partially offset by increased sales volume of $21.6 million across varying product categories within both the Electrical and the Safety & Infrastructure segments and a decrease in the economic value of solar tax credits to be transferred to certain customers of $15.7 million.

Gross profit for fiscal 2025 decreased $401.7 million to $676.1 million, a decrease of 37.3% compared to $1,077.8 million for fiscal 2024. Gross margin decreased to 23.7% in fiscal 2025 compared to 33.7% in fiscal 2024 due to declines in average selling prices of $381.8 million and a decrease in the net benefit of solar tax credits of $9.9 million.

Net income decreased $488.0 million to a net loss of $15.2 million for fiscal 2025, as compared to net income of $472.9 million for fiscal 2024. Adjusted net income decreased $327.1 million to $205.8 million for fiscal 2025 compared to $532.9 million for fiscal 2024. The decrease in both net income and adjusted net income was primarily driven by lower operating income of $601.6 million, partially offset by lower income tax of $117.8 million.

Adjusted EBITDA decreased $385.3 million or 49.9%, to $386.4 million for fiscal 2025, as compared to $771.7 million for fiscal 2024. The decrease was primarily due to lower operating income.

Net income per diluted share on a GAAP basis was $(0.45) for fiscal 2025, a decrease of $13.14 from fiscal 2024. Adjusted net income per diluted share was $6.05 for fiscal 2025 compared to $14.48 for fiscal 2024.

Liquidity & Capital Resources

During fiscal 2025, operating activities provided $402.8 million of cash, compared to $549.0 million during fiscal year 2024. Free cash flow decreased to $295.7 million for fiscal 2025 from $399.2 million in fiscal year 2024. The decrease in free cash flow during fiscal 2025 was driven primarily by lower operating income of $601.6 million, partially offset by non-cash asset impairments of $214.4 million, less cash used in working capital of $123.1 million, tax impacts of $105.5 million, decreased capital expenditures of $42.8 million, higher depreciation and amortization of $8.6 million and a non-cash loss on sale of a business of $6.2 million.

During fiscal 2025, the Company repurchased $100.0 million of its outstanding stock, leaving $328.1 million of authorization remaining on the current plan.

Outlook and Targets1

Fiscal 2026 First Quarter - The Company expects the first quarter of fiscal 2026 Adjusted EBITDA to be in the range of $55 - $65 million and Adjusted net income per diluted share to be in the range of $0.55 - $0.75.

Fiscal 2026 Full Year - The Company expects fiscal year 2026 Adjusted EBITDA to be in the range of $340 - $360 million and Adjusted net income per diluted share to be in the range of $5.05 - $5.55.

The Company notes that the outlook and target information provided may vary due to changes in assumptions or market conditions and other factors described under “Forward-Looking Statements.”

Conference Call Information

Atkore management will host a conference call today, November 20, 2025, at 8 a.m. Eastern time, to discuss the Company’s financial results, provide a business update and long-term financial targets. The conference call may be accessed by dialing (888) 330-2446 (domestic) or (240) 789-2732 (international). The call will be available for replay until December 4, 2025. The replay can be accessed by dialing (800) 770-2030, or for international callers, (609) 800-9909. The passcode for the live call and the replay is 5592214.

Interested investors and other parties can also listen to a webcast of the live conference call by logging onto the Investor Relations section of the Company's website at http://investors.atkore.com. The online replay will be available on the same website immediately following the call.

To learn more about the Company please visit the Company's website at http://investors.atkore.com.

1 Reconciliations of the forward-looking full-year and fiscal first quarter outlook and target for Adjusted EBITDA and Adjusted net income per diluted share are not being provided as the Company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such reconciliations. Accordingly, we are relying on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K to exclude these reconciliations.

About Atkore Inc.

Atkore is a leading manufacturer of electrical products for commercial, industrial, data center, telecommunications, and solar applications. With 5,400 employees and $2.9B in sales in fiscal year 2025, we deliver sustainable solutions to meet the growing demands of electrification and digital transformation. To learn more, please visit www.atkore.com.

Media Contact:

|

|

|

| Lisa Winter |

| Vice President - Communications |

| 708-225-2453 |

AtkoreCommunications@atkore.com |

Investor Contact:

|

|

|

Matthew Kline |

| Vice President - Treasury and Investor Relations |

708-225-2116 |

Investors@atkore.com |

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Federal Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements relating to financial outlook. Some of the forward-looking statements can be identified by the use of forward-looking terms such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” or other comparable terms. Forward-looking statements include, without limitation, all matters that are not historical facts. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond our control. We caution you that forward-looking statements are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of the market in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this press release. In addition, even if our results of operations, financial condition and cash flows, and the development of the market in which we operate, are consistent with the forward-looking statements contained in this press release, those results or developments may not be indicative of results or developments in subsequent periods.

A number of important factors, including, without limitation, the risks and uncertainties discussed or referenced under the caption “Risk Factors” in our Annual Report on Form 10-K, filed with the U.S. Securities and Exchange Commission (“SEC”) on November 20, 2025 could cause actual results and outcomes to differ materially from those reflected in the forward-looking statements.

Additional factors that could cause actual results and outcomes to differ from those reflected in forward-looking statements include, without limitation: declines in, and uncertainty regarding, the general business and economic conditions in the United States and international markets in which we operate; weakness or another downturn in the United States non-residential construction industry; changes in prices of raw materials; pricing pressure, reduced profitability, or loss of market share due to intense competition; availability and cost of third-party freight carriers and energy; security threats, attacks, or other disruptions to our information systems, or failure to comply with complex network security, data privacy and other legal obligations or the failure to protect sensitive information; high levels of imports of products similar to those manufactured by us; changes in federal, state, local and international governmental regulations and trade policies; adverse weather conditions; work stoppage or other interruptions of production at our facilities as a result of disputes under existing collective bargaining agreements with labor unions or in connection with negotiations of new collective bargaining agreements, as a result of supplier financial distress, or for other reasons; increased costs relating to future capital and operating expenditures to maintain compliance with environmental, health and safety laws; reduced spending by, deterioration in the financial condition of, or other adverse developments, including inability or unwillingness to pay our invoices on time, with respect to one or more of our top customers; increases in our working capital needs, which are substantial and fluctuate based on economic activity and the market prices for our main raw materials, including as a result of failure to collect, or delays in the collection of, cash from the sale of manufactured products; possible impairment of goodwill or other long-lived assets as a result of future triggering events, such as declines in our cash flow projections or customer demand and changes in our business and valuation assumptions; product liability, construction defect and warranty claims and litigation relating to our various products, as well as government inquiries and investigations, and consumer, employment, tort and other legal proceedings; widespread outbreak of diseases; changes in our financial obligations relating to pension plans that we maintain in the United States; reduced production or distribution capacity due to interruptions in the operations of our facilities or those of our key suppliers; loss of a substantial number of our third-party agents or distributors or a dramatic deviation from the amount of sales they generate; our inability to introduce new products effectively or implement our innovation strategies; safety and labor risks associated with the manufacture and in the testing of our products; our ability to protect our intellectual property and other material proprietary rights; risks inherent in doing business internationally; changes in foreign laws and legal systems; our inability to continue importing raw materials, component parts and/or finished goods; disruptions or impediments to the receipt of sufficient raw materials resulting from various anti-terrorism security measures; the incurrence of liabilities and the issuance of additional debt or equity in connection with acquisitions, joint ventures or divestitures and the failure of indemnification provisions in our acquisition agreements to fully protect us from unexpected liabilities; failure to manage acquisitions successfully, including identifying, evaluating, and valuing acquisition targets and integrating acquired companies, businesses or assets; the incurrence of additional expenses, increase in complexity of our supply chain and potential damage to our reputation with customers resulting from regulations related to "conflict minerals"; restrictions contained in our debt agreements; failure to generate cash sufficient to pay the principal of, interest on, or other amounts due on our debt; failure to generate the significant amount of cash needed to pay dividends; challenges attracting and retaining key personnel or high-quality employees; future changes to tax legislation; failure to generate sufficient cash flow from operations or to raise sufficient funds in the capital markets to satisfy existing obligations and support the development of our business; and other factors described from time to time in documents that we file with the SEC. The Company assumes no obligation to update the information contained herein, which speaks only as of the date hereof.

Non-GAAP Financial Information

This press release includes certain financial information, not prepared in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”). Because not all companies calculate non-GAAP financial information identically (or at all), the presentations herein may not be comparable to other similarly titled measures used by other companies. Further, these measures should not be considered substitutes for the performance measures derived in accordance with GAAP. See non-GAAP reconciliations below in this press release for a reconciliation of these measures to the most directly comparable GAAP financial measures.

Adjusted EBITDA and Adjusted EBITDA Margin

We use Adjusted EBITDA and Adjusted EBITDA Margin in evaluating the performance of our business and in the preparation of our annual operating budgets as indicators of business performance and profitability. We believe Adjusted EBITDA and Adjusted EBITDA Margin allow us to readily view operating trends, perform analytical comparisons and identify strategies to improve operating performance.

We define Adjusted EBITDA as net income (loss) before income taxes, adjusted to exclude unallocated expenses, depreciation and amortization, interest expense, net, stock-based compensation, loss on extinguishment of debt, gains and losses on the divestiture of a business, impairment of assets, certain legal matters, and other items, such as inventory reserves and adjustments, loss on disposal of property, plant and equipment, insurance recovery related to damages of property, plant and equipment, release of indemnified uncertain tax positions, realized or unrealized gain (loss) on foreign currency impacts of intercompany loans and related forward currency derivatives, gain on purchase of business, loss on assets held for sale, restructuring costs and transaction costs. We define Adjusted EBITDA margin as Adjusted EBITDA as a percentage of Net sales.

We believe Adjusted EBITDA and Adjusted EBITDA Margin, when presented in conjunction with comparable GAAP measures, are useful for investors because management uses Adjusted EBITDA and Adjusted EBITDA Margin in evaluating the performance of our business.

Adjusted Net Income and Adjusted Net Income per Share

We use Adjusted net income and Adjusted net income per share in evaluating the performance of our business and profitability. Management believes that these measures provide useful information to investors by offering additional ways of viewing the Company’s results that, when reconciled to the corresponding GAAP measure provide an indication of performance and profitability excluding the impact of unusual and certain non-cash items. We define Adjusted net income as net income before stock-based compensation, loss on extinguishment of debt, loss on assets held for sale, gains and losses on the divestiture of a business (including any additional tax adjustments related to those divestitures), insurance recoveries, asset impairment charges, intangible asset amortization, certain legal matters and other items, and the income tax expense or benefit on the foregoing adjustments that are subject to income tax. We define Adjusted net income per share as basic and diluted net income per share excluding the per share impact of stock-based compensation, intangible asset amortization, certain legal matters and other items, and the income tax expense or benefit on the foregoing adjustments that are subject to income tax.

Free Cash Flow

We define Free Cash Flow as net cash provided by operating activities less capital expenditures. We believe that Free Cash Flow provides meaningful information regarding the Company’s liquidity.

ATKORE INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Fiscal Year Ended |

| (in thousands, except per share data) |

September 30, 2025 |

|

September 30, 2024 |

|

September 30, 2025 |

|

September 30, 2024 |

| Net sales |

$ |

752,011 |

|

|

$ |

788,296 |

|

|

$ |

2,850,378 |

|

|

$ |

3,202,053 |

|

| Cost of sales |

604,185 |

|

|

572,227 |

|

|

2,174,286 |

|

|

2,124,214 |

|

| Gross profit |

147,826 |

|

|

216,069 |

|

|

676,092 |

|

|

1,077,839 |

|

| Gross Margin |

19.7 |

% |

|

27.4 |

% |

|

23.7 |

% |

|

33.7 |

% |

| Selling, general and administrative |

107,979 |

|

|

100,397 |

|

|

396,609 |

|

|

397,544 |

|

| Intangible asset amortization |

9,952 |

|

|

13,607 |

|

|

41,924 |

|

|

55,511 |

|

| Asset impairment charges |

86,654 |

|

|

— |

|

|

214,386 |

|

|

— |

|

| Operating income |

(56,759) |

|

|

102,065 |

|

|

23,173 |

|

|

624,784 |

|

| Interest expense, net |

7,926 |

|

|

9,526 |

|

|

33,269 |

|

|

35,584 |

|

| Loss on extinguishment of debt |

795 |

|

|

— |

|

|

795 |

|

|

— |

|

Other expense (income), net |

290 |

|

|

661 |

|

|

7,699 |

|

|

1,963 |

|

(Loss) Income before income taxes |

(65,770) |

|

|

91,878 |

|

|

(18,590) |

|

|

587,237 |

|

| Income tax expense |

(11,350) |

|

|

18,759 |

|

|

(3,415) |

|

|

114,365 |

|

Net (loss) income |

$ |

(54,420) |

|

|

$ |

73,119 |

|

|

$ |

(15,175) |

|

|

$ |

472,872 |

|

|

|

|

|

|

|

|

|

Net (loss) income per share |

|

|

|

|

|

|

|

| Basic |

$ |

(1.62) |

|

|

$ |

2.04 |

|

|

$ |

(0.45) |

|

|

$ |

12.83 |

|

| Diluted |

$ |

(1.62) |

|

|

$ |

2.02 |

|

|

$ |

(0.45) |

|

|

$ |

12.69 |

|

ATKORE INC.

CONSOLIDATED BALANCE SHEETS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands, except share and per share data) |

|

September 30, 2025 |

|

September 30, 2024 |

| Assets |

|

|

|

|

| Current Assets: |

|

|

|

|

| Cash and cash equivalents |

|

$ |

506,699 |

|

|

$ |

351,385 |

|

| Accounts receivable, less allowance for current and expected credit losses of $5,128 and $6,322, respectively |

|

447,035 |

|

|

489,926 |

|

| Inventories, net |

|

484,845 |

|

|

524,695 |

|

| Prepaid expenses and other current assets |

|

162,225 |

|

|

158,382 |

|

| Total current assets |

|

1,600,804 |

|

|

1,524,388 |

|

| Property, plant and equipment, net |

|

594,266 |

|

|

652,093 |

|

| Intangible assets, net |

|

160,758 |

|

|

340,431 |

|

| Goodwill |

|

294,485 |

|

|

314,000 |

|

| Right-of-use assets, net |

|

156,679 |

|

|

180,656 |

|

| Deferred income taxes |

|

35,863 |

|

|

554 |

|

| Other long-term assets |

|

9,067 |

|

|

9,281 |

|

| Total Assets |

|

$ |

2,851,922 |

|

|

$ |

3,021,403 |

|

| Liabilities and Equity |

|

|

|

|

| Current Liabilities: |

|

|

|

|

| Short-term debt and current maturities of long-term debt |

|

$ |

3,730 |

|

|

$ |

— |

|

| Accounts payable |

|

241,246 |

|

|

262,201 |

|

| Income tax payable |

|

720 |

|

|

2,000 |

|

| Accrued compensation and employee benefits |

|

49,192 |

|

|

44,723 |

|

| Customer liabilities |

|

128,538 |

|

|

108,782 |

|

| Lease obligations |

|

26,995 |

|

|

22,038 |

|

| Other current liabilities |

|

74,098 |

|

|

71,122 |

|

| Total current liabilities |

|

524,519 |

|

|

510,866 |

|

| Long-term debt |

|

756,802 |

|

|

764,838 |

|

| Long-term lease obligations |

|

144,293 |

|

|

164,328 |

|

| Deferred income taxes |

|

13,451 |

|

|

26,574 |

|

|

|

|

|

|

|

|

|

|

|

| Other long-term liabilities |

|

14,516 |

|

|

14,897 |

|

| Total Liabilities |

|

1,453,581 |

|

|

1,481,503 |

|

| Equity: |

|

|

|

|

| Common stock, $0.01 par value, 1,000,000,000 shares authorized, 33,665,258 and 34,859,033 shares issued and outstanding, respectively |

|

338 |

|

|

350 |

|

|

|

|

|

|

| Additional paid-in capital |

|

526,600 |

|

|

509,254 |

|

| Retained earnings |

|

889,391 |

|

|

1,049,390 |

|

| Accumulated other comprehensive loss |

|

(17,988) |

|

|

(19,094) |

|

| Total Equity |

|

1,398,341 |

|

|

1,539,900 |

|

| Total Liabilities and Equity |

|

$ |

2,851,922 |

|

|

$ |

3,021,403 |

|

ATKORE INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

|

September 30, 2025 |

|

September 30, 2024 |

| Operating activities |

|

|

|

|

| Net income |

|

$ |

(15,175) |

|

|

$ |

472,872 |

|

| Adjustments to reconcile net income to net cash provided by operating activities |

|

|

|

|

| Asset impairment charges |

|

214,386 |

|

|

— |

|

| Depreciation and amortization |

|

124,533 |

|

|

121,018 |

|

| Amortization of debt issuance costs and original issue discount |

|

2,092 |

|

|

2,151 |

|

| Deferred income taxes |

|

(48,038) |

|

|

3,369 |

|

| Loss on extinguishment of debt |

|

795 |

|

|

— |

|

| Provision for losses on accounts receivable and inventory |

|

2,140 |

|

|

5,096 |

|

| Stock-based compensation expense |

|

23,561 |

|

|

20,300 |

|

| Amortization of right of use asset |

|

35,309 |

|

|

30,194 |

|

|

|

|

|

|

| Loss on sale of business |

|

6,243 |

|

|

— |

|

| Other adjustments to net income |

|

(473) |

|

|

(1,076) |

|

| Changes in operating assets and liabilities, net of effects from acquisitions |

|

|

|

|

| Accounts receivable |

|

40,233 |

|

|

72,732 |

|

| Inventories |

|

37,355 |

|

|

(31,920) |

|

| Prepaid expenses and other current assets |

|

3,705 |

|

|

(18,610) |

|

| Accounts payable |

|

(8,420) |

|

|

(37,558) |

|

| Income taxes |

|

(6,987) |

|

|

(46,163) |

|

| Accrued and other liabilities |

|

29,534 |

|

|

(23,134) |

|

| Lease assets and liabilities |

|

(31,715) |

|

|

(25,557) |

|

| Other, net |

|

(6,316) |

|

|

5,319 |

|

| Net cash provided by operating activities |

|

402,762 |

|

|

549,033 |

|

| Investing activities |

|

|

|

|

| Capital expenditures |

|

(107,108) |

|

|

(149,861) |

|

|

|

|

|

|

| Proceeds from sale of properties, plant and equipment |

|

12,766 |

|

|

1,561 |

|

| Proceeds from insurance claims |

|

1,770 |

|

|

— |

|

| Proceeds from sale of a business |

|

7,021 |

|

|

— |

|

| Acquisitions of businesses, net of cash acquired |

|

— |

|

|

(6,036) |

|

|

|

|

|

|

| Net cash used for investing activities |

|

(85,551) |

|

|

(154,336) |

|

| Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common stock, net of taxes withheld |

|

(6,214) |

|

|

(17,824) |

|

| Repurchase of common stock |

|

(100,026) |

|

|

(381,040) |

|

| Payments for debt financing costs and fees |

|

(7,193) |

|

|

— |

|

| Dividends paid to shareholders |

|

(44,204) |

|

|

(34,461) |

|

| Finance lease payments |

|

(2,814) |

|

|

(1,957) |

|

|

|

|

|

|

| Net cash used for financing activities |

|

(160,451) |

|

|

(435,282) |

|

| Effects of foreign exchange rate changes on cash and cash equivalents |

|

(1,446) |

|

|

3,856 |

|

| Increase (decrease) in cash and cash equivalents |

|

155,314 |

|

|

(36,729) |

|

| Cash and cash equivalents at beginning of period |

|

351,385 |

|

|

388,114 |

|

| Cash and cash equivalents at end of period |

|

$ |

506,699 |

|

|

$ |

351,385 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

|

September 30, 2025 |

|

September 30, 2024 |

| Supplementary Cash Flow information |

|

|

|

|

| Interest paid |

|

$ |

37,286 |

|

|

47,099 |

|

| Income taxes paid, net of refunds |

|

(5,666) |

|

|

66,369 |

|

| Capital expenditures, not yet paid |

|

1,685 |

|

|

12,848 |

|

|

|

|

|

|

| Operating cash flows from cash paid on operating lease liabilities |

|

21,215 |

|

|

18,526 |

|

| Operating lease right-of-use assets obtained in exchange for lease liabilities |

|

11,135 |

|

|

73,294 |

|

|

|

|

|

|

| Free Cash Flow: |

|

|

|

|

| Net cash provided by operating activities |

|

$ |

402,762 |

|

|

$ |

549,033 |

|

| Capital expenditures |

|

(107,108) |

|

|

(149,861) |

|

| Free Cash Flow: |

|

$ |

295,654 |

|

|

$ |

399,172 |

|

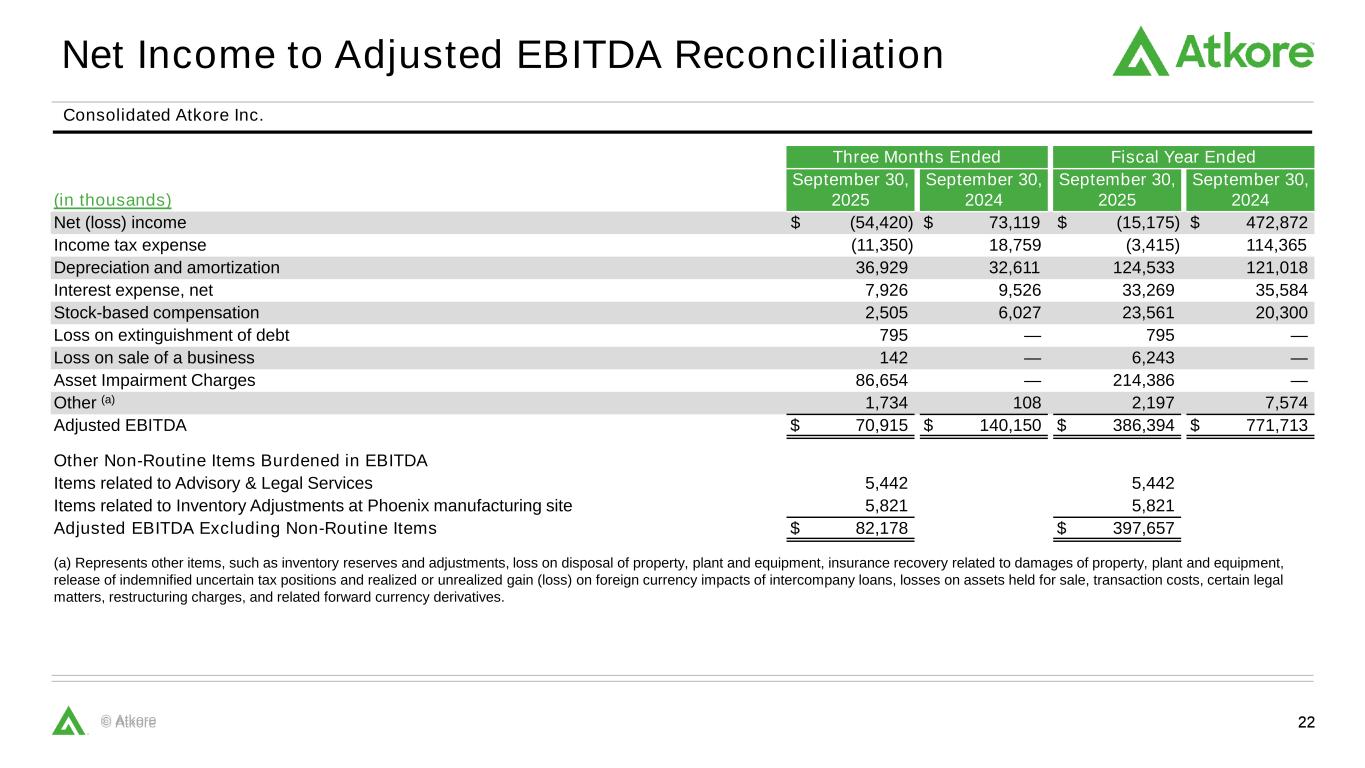

ATKORE INC.

ADJUSTED EBITDA

The following table presents reconciliations of Adjusted EBITDA to net income for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Fiscal Year Ended |

| (in thousands) |

|

September 30, 2025 |

|

September 30, 2024 |

|

September 30, 2025 |

|

September 30, 2024 |

| Net (loss) income |

|

$ |

(54,420) |

|

|

$ |

73,119 |

|

|

$ |

(15,175) |

|

|

$ |

472,872 |

|

| Income tax expense |

|

(11,350) |

|

|

18,759 |

|

|

(3,415) |

|

|

114,365 |

|

| Depreciation and amortization |

|

36,929 |

|

|

32,611 |

|

|

124,533 |

|

|

121,018 |

|

| Interest expense, net |

|

7,926 |

|

|

9,526 |

|

|

33,269 |

|

|

35,584 |

|

| Stock-based compensation |

|

2,505 |

|

|

6,027 |

|

|

23,561 |

|

|

20,300 |

|

| Loss on extinguishment of debt |

|

795 |

|

|

— |

|

|

795 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Loss on sale of a business |

|

142 |

|

|

— |

|

|

6,243 |

|

|

— |

|

| Asset impairment charges |

|

86,654 |

|

|

— |

|

|

214,386 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Other (a) |

|

1,734 |

|

|

108 |

|

|

2,197 |

|

|

7,574 |

|

| Adjusted EBITDA |

|

$ |

70,915 |

|

|

$ |

140,150 |

|

|

$ |

386,394 |

|

|

$ |

771,713 |

|

|

|

|

|

|

|

|

|

|

|

| (a) Represents other items, such as inventory reserves and adjustments, loss on disposal of property, plant and equipment, insurance recovery related to damages of property, plant and equipment, release of indemnified uncertain tax positions and realized or unrealized gain (loss) on foreign currency impacts of intercompany loans, losses on assets held for sale, transaction costs, certain legal matters, restructuring charges, and related forward currency derivatives. |

The following table presents calculations of Adjusted EBITDA Margin for Atkore Inc. for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Fiscal Year Ended |

| (in thousands) |

September 30, 2025 |

|

September 30, 2024 |

|

Change |

|

% Change |

|

September 30, 2025 |

|

September 30, 2024 |

|

Change |

|

% Change |

| Net sales |

$ |

752,011 |

|

|

$ |

788,296 |

|

|

$ |

(36,285) |

|

|

(4.6) |

% |

|

$ |

2,850,378 |

|

|

$ |

3,202,053 |

|

|

$ |

(351,675) |

|

|

(11.0) |

% |

| Adjusted EBITDA |

$ |

70,915 |

|

|

$ |

140,150 |

|

|

$ |

(69,235) |

|

|

(49.4) |

% |

|

$ |

386,394 |

|

|

$ |

771,713 |

|

|

$ |

(385,319) |

|

|

(49.9) |

% |

| Adjusted EBITDA Margin |

9.4 |

% |

|

17.8 |

% |

|

|

|

|

|

13.6 |

% |

|

24.1 |

% |

|

|

|

|

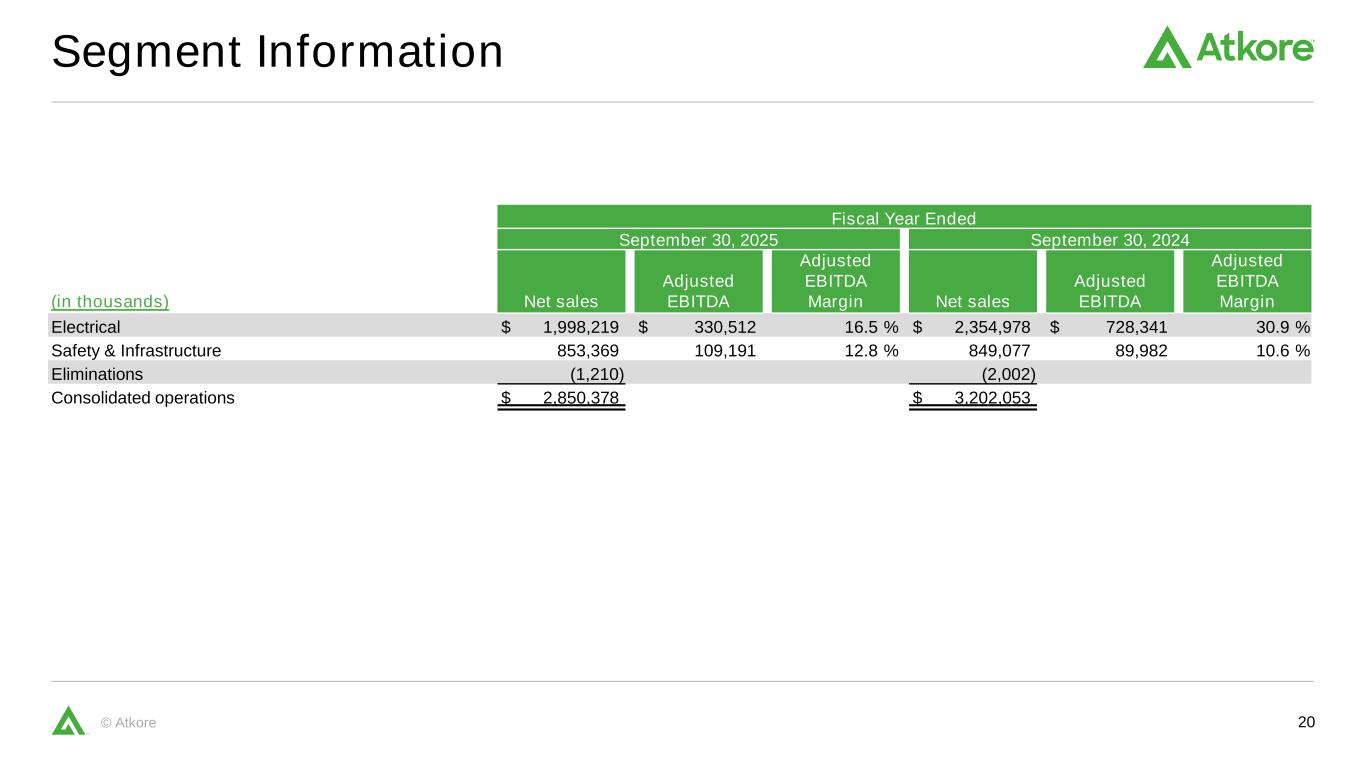

ATKORE INC.

SEGMENT INFORMATION

The following tables represent calculations of Adjusted EBITDA Margin by segment for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

| |

September 30, 2025 |

|

September 30, 2024 |

| (in thousands) |

Net sales |

|

Adjusted EBITDA |

|

Adjusted EBITDA Margin |

|

Net sales |

|

Adjusted EBITDA |

|

Adjusted EBITDA Margin |

| Electrical |

$ |

518,880 |

|

|

$ |

65,947 |

|

|

12.7 |

% |

|

$ |

564,535 |

|

|

$ |

145,662 |

|

|

25.8 |

% |

| Safety & Infrastructure |

233,409 |

|

|

$ |

26,817 |

|

|

11.5 |

% |

|

224,507 |

|

|

$ |

14,898 |

|

|

6.6 |

% |

| Eliminations |

(278) |

|

|

|

|

|

|

(746) |

|

|

|

|

|

| Consolidated operations |

$ |

752,011 |

|

|

|

|

|

|

$ |

788,296 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended |

| |

September 30, 2025 |

|

September 30, 2024 |

| (in thousands) |

Net sales |

|

Adjusted EBITDA |

|

Adjusted EBITDA Margin |

|

Net sales |

|

Adjusted EBITDA |

|

Adjusted EBITDA Margin |

| Electrical |

$ |

1,998,219 |

|

|

$ |

330,512 |

|

|

16.5 |

% |

|

$ |

2,354,978 |

|

|

$ |

728,341 |

|

|

30.9 |

% |

| Safety & Infrastructure |

853,369 |

|

|

$ |

109,191 |

|

|

12.8 |

% |

|

849,077 |

|

|

$ |

89,982 |

|

|

10.6 |

% |

| Eliminations |

(1,210) |

|

|

|

|

|

|

(2,002) |

|

|

|

|

|

| Consolidated operations |

$ |

2,850,378 |

|

|

|

|

|

|

$ |

3,202,053 |

|

|

|

|

|

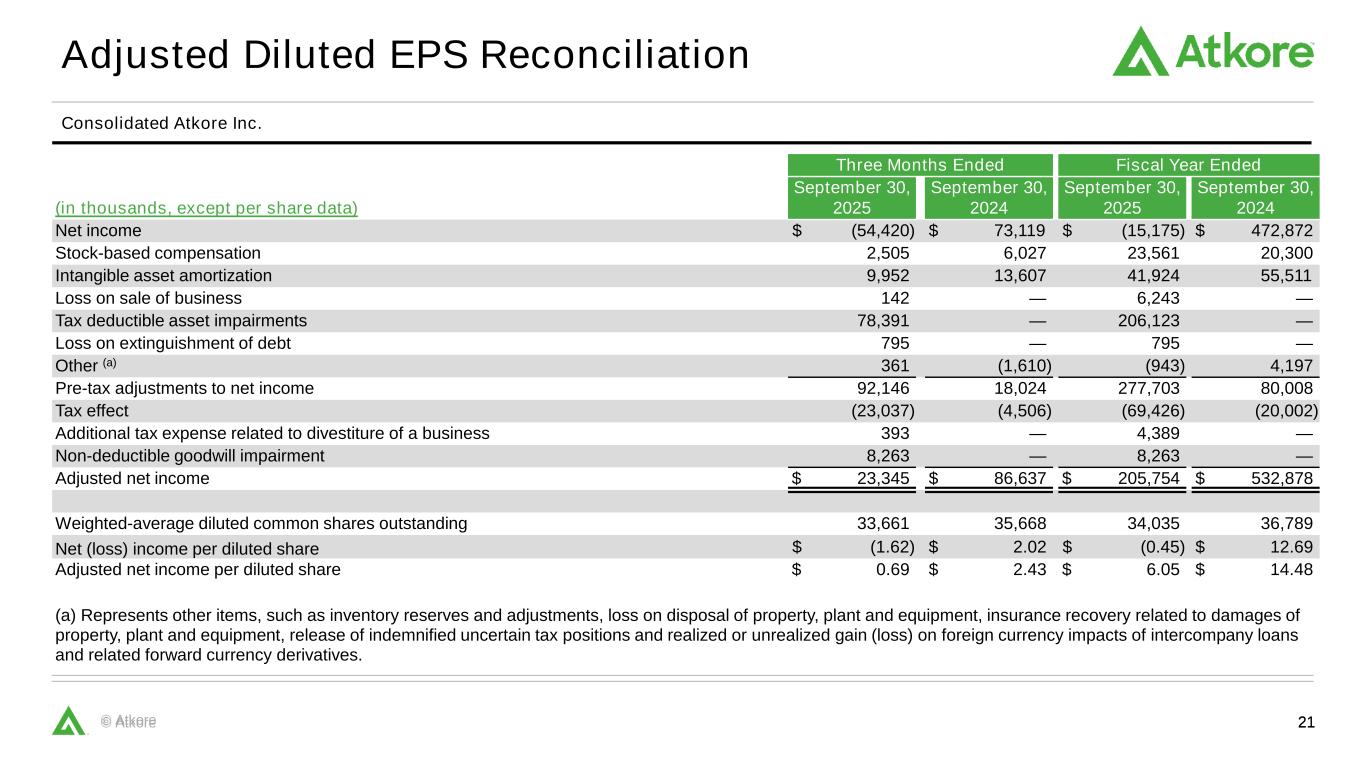

ATKORE INC.

ADJUSTED NET INCOME PER SHARE

The following table presents reconciliations of Adjusted net income to net income for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Fiscal Year Ended |

| (in thousands, except per share data) |

September 30, 2025 |

|

September 30, 2024 |

|

September 30, 2025 |

|

September 30, 2024 |

| Net (loss) income |

$ |

(54,420) |

|

|

$ |

73,119 |

|

|

$ |

(15,175) |

|

|

$ |

472,872 |

|

| Stock-based compensation |

2,505 |

|

|

6,027 |

|

|

23,561 |

|

|

20,300 |

|

| Intangible asset amortization |

9,952 |

|

|

13,607 |

|

|

41,924 |

|

|

55,511 |

|

| Loss on sale of business |

142 |

|

|

— |

|

|

6,243 |

|

|

— |

|

| Tax deductible asset impairments |

78,391 |

|

— |

|

|

206,123 |

|

|

— |

|

| Loss on extinguishment of debt |

795 |

|

|

— |

|

|

795 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (a) |

361 |

|

|

(1,610) |

|

|

(943) |

|

|

4,197 |

|

| Pre-tax adjustments to net income |

92,146 |

|

|

18,024 |

|

|

277,703 |

|

|

80,008 |

|

| Tax effect |

(23,037) |

|

|

(4,506) |

|

|

(69,426) |

|

|

(20,002) |

|

| Additional tax expense related to divestiture of a business |

393 |

|

|

— |

|

|

4,389 |

|

|

— |

|

| Non-deductible goodwill impairment |

8,263 |

|

|

— |

|

|

8,263 |

|

|

— |

|

| Adjusted net income |

$ |

23,345 |

|

|

$ |

86,637 |

|

|

$ |

205,754 |

|

|

$ |

532,878 |

|

|

|

|

|

|

|

|

|

| Weighted-Average Diluted Common Shares Outstanding |

33,661 |

|

|

35,668 |

|

|

34,035 |

|

|

36,789 |

|

| Net (loss) income per diluted share (b) |

$ |

(1.62) |

|

|

$ |

2.02 |

|

|

$ |

(0.45) |

|

|

$ |

12.69 |

|

| Adjusted net income per diluted share (c) |

$ |

0.69 |

|

|

$ |

2.43 |

|

|

$ |

6.05 |

|

|

$ |

14.48 |

|

|

| (a) Represents other items, such as inventory reserves and adjustments, loss on disposal of property, plant and equipment, insurance recovery related to damages of property, plant and equipment, release of indemnified uncertain tax positions and realized or unrealized gain (loss) on foreign currency impacts of intercompany loans and related forward currency derivatives. |

| (b) The Company calculates basic and diluted net income per common share using the two-class method. Under the two-class method, net earnings are allocated to each class of common stock and participating securities as if all the net earnings for the period had been distributed. The Company's participating securities consist of share-based payment awards that contain a non-forfeitable right to receive dividends and therefore are considered to participate in undistributed earnings with common stockholders. Included within the calculation of net income per diluted share is 0 and 6,135 of undistributed earnings allocated to participating securities for fiscal years ended 2025 and 2024. See Note 9, “Earnings Per Share” in our Annual Report on Form 10-K. |

| (c) Adjusted net income per diluted share is calculated by taking adjusted net income and divided by the weighted-average diluted common shares outstanding. |

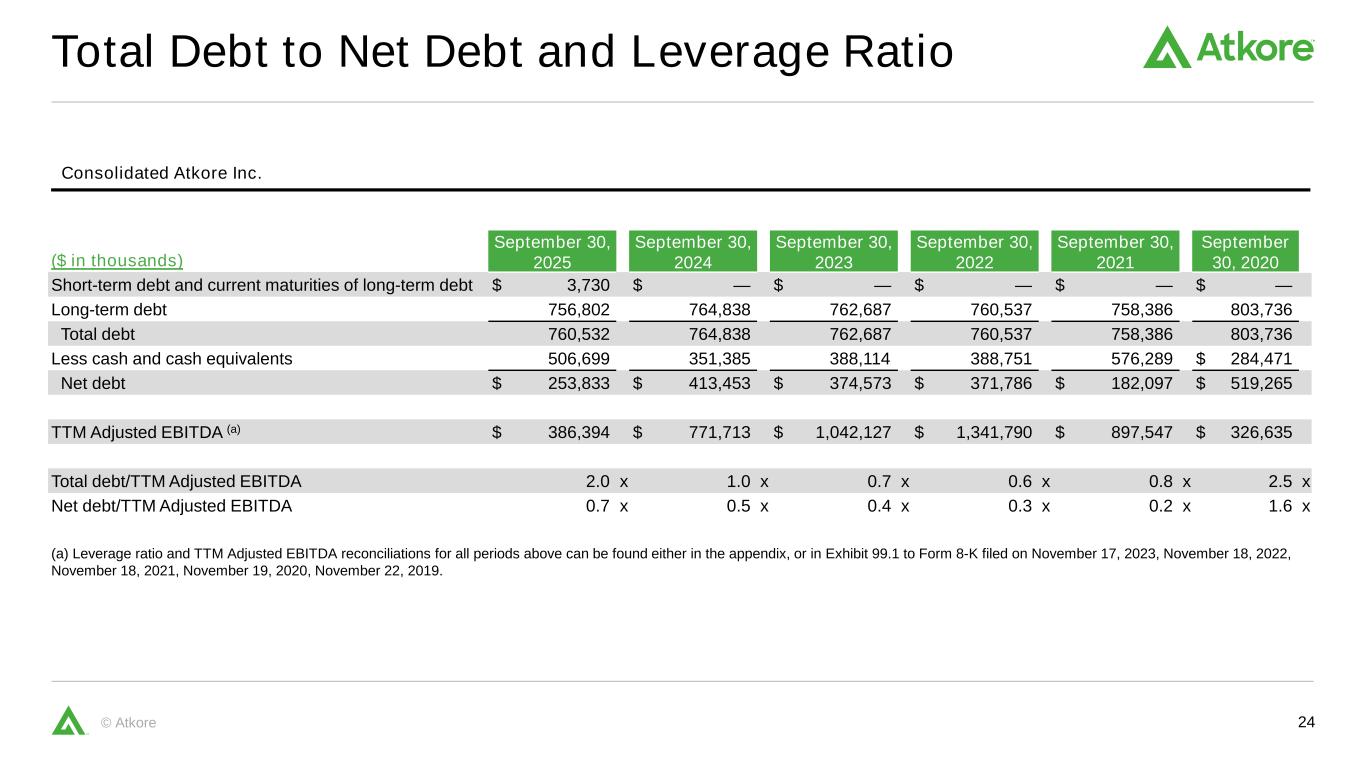

ATKORE INC.

NET DEBT

The following table presents reconciliations of Net Debt to Total Debt for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

September 30, 2025 |

|

September 30, 2024 |

|

September 30, 2023 |

| Short-term debt and current maturities of long-term debt |

$ |

3,730 |

|

|

$ |

— |

|

|

$ |

— |

|

| Long-term debt |

756,802 |

|

|

764,838 |

|

|

762,687 |

|

| Total Debt |

760,532 |

|

|

764,838 |

|

|

762,687 |

|

| Less cash and cash equivalents |

506,699 |

|

|

351,385 |

|

|

388,114 |

|

| Net Debt |

$ |

253,833 |

|

|

$ |

413,453 |

|

|

$ |

374,573 |

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

386,394 |

|

|

$ |

771,713 |

|

|

$ |

1,042,127 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|