Unaudited Interim Condensed Consolidated Financial Statements For the three and nine-month periods ended September 30, 2025

INDEX TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS Page Unaudited Interim Condensed Consolidated Statements of Profit or Loss ...................................................... 3 Unaudited Interim Condensed Consolidated Statements of Comprehensive Income (Loss) ....................... 4 Unaudited Interim Condensed Consolidated Balance Sheets ............................................................................. 5 Unaudited Interim Condensed Consolidated Statements of Shareholders’ Equity .......................................... 6 Unaudited Interim Condensed Consolidated Statements of Cash Flows .......................................................... 8 Notes to the Unaudited Interim Condensed Consolidated Financial Statements ............................................ 9 2 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

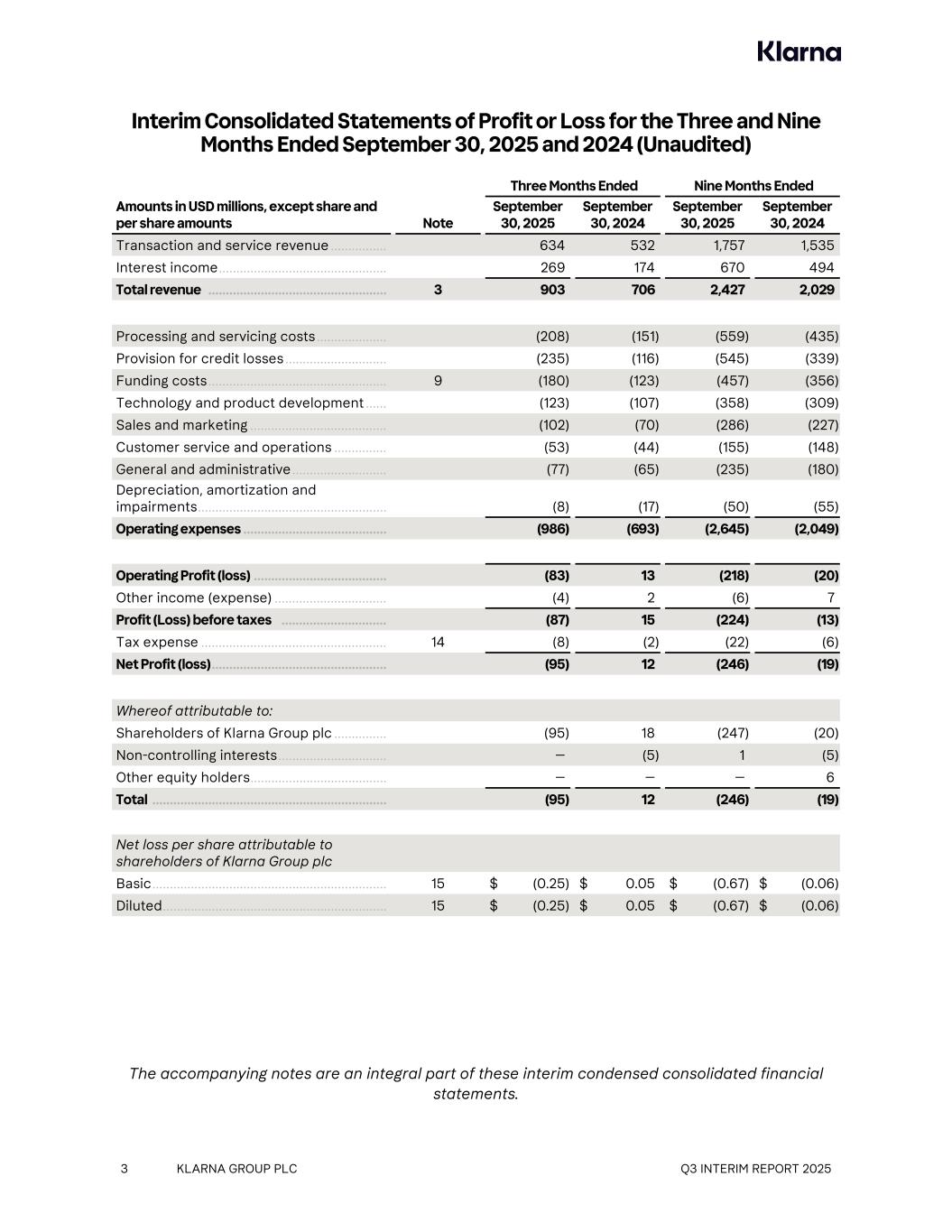

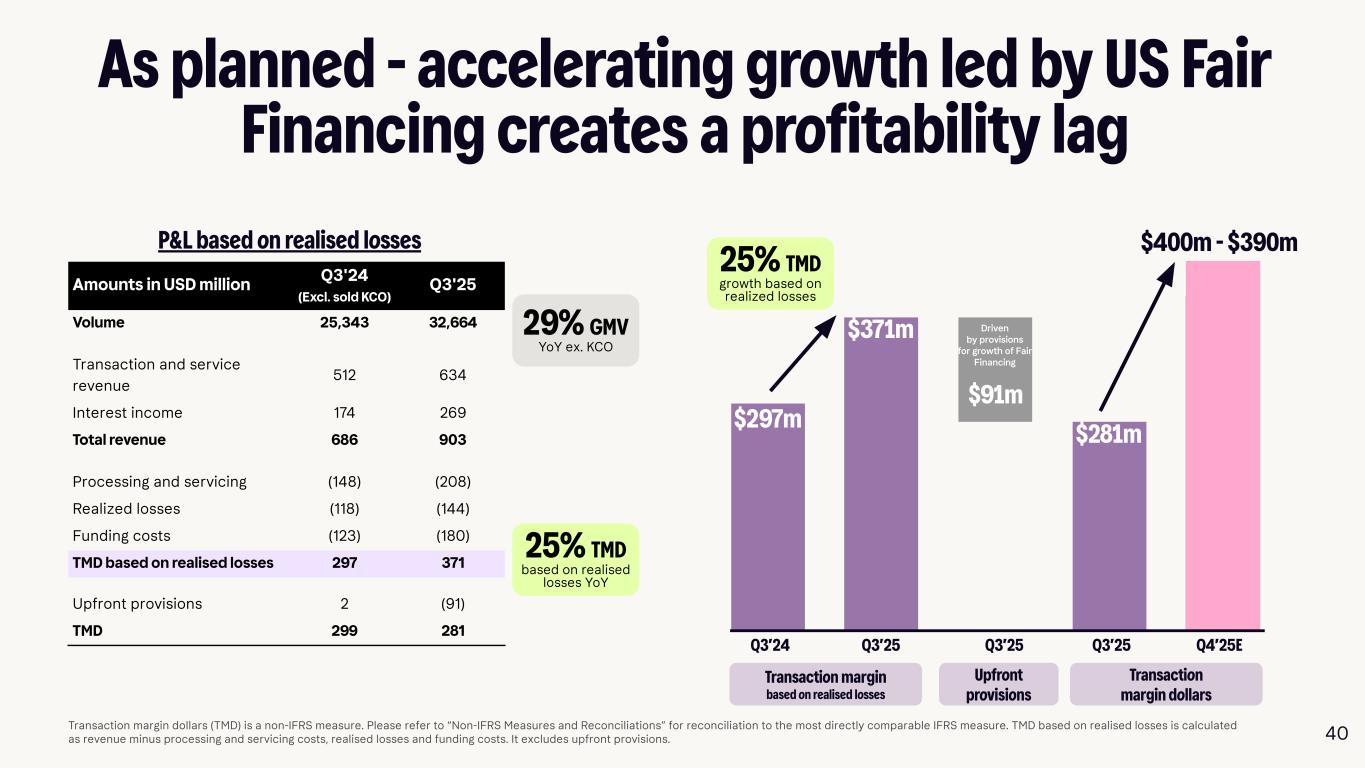

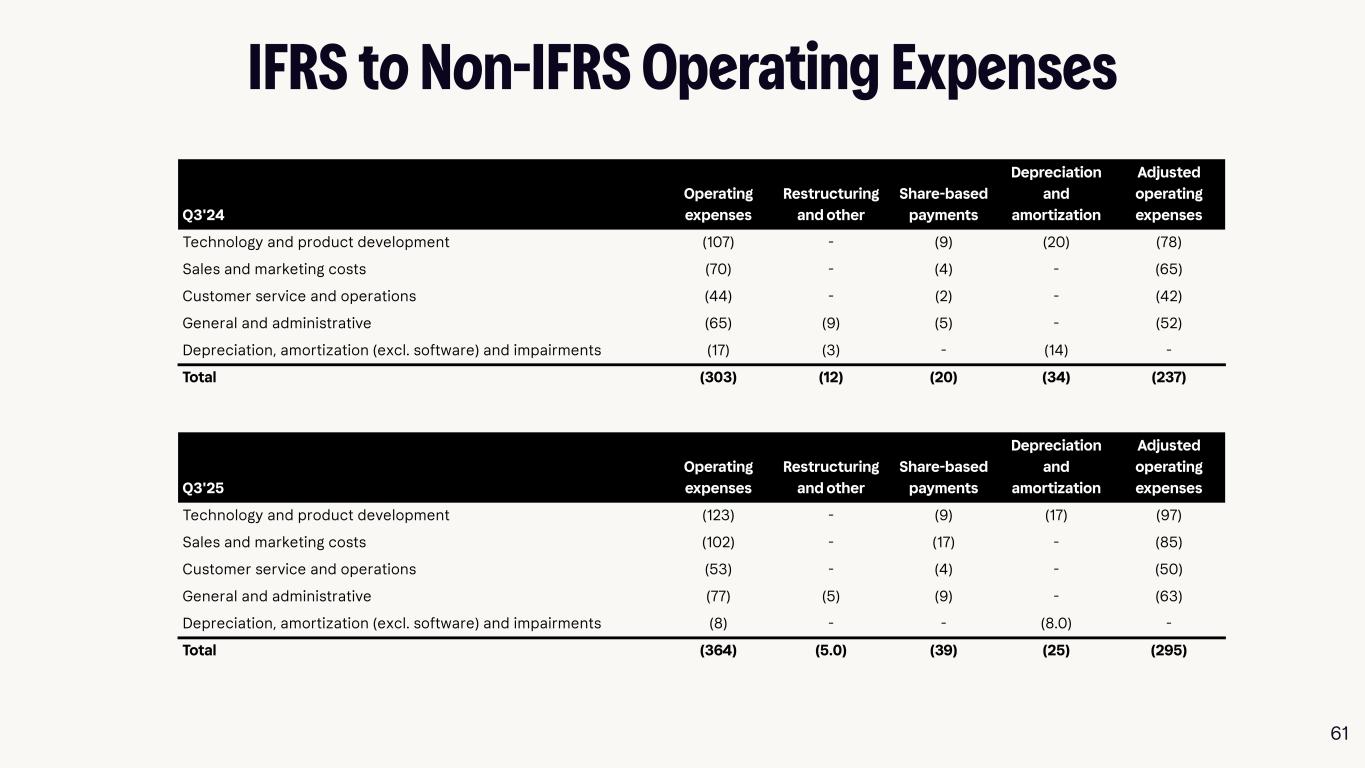

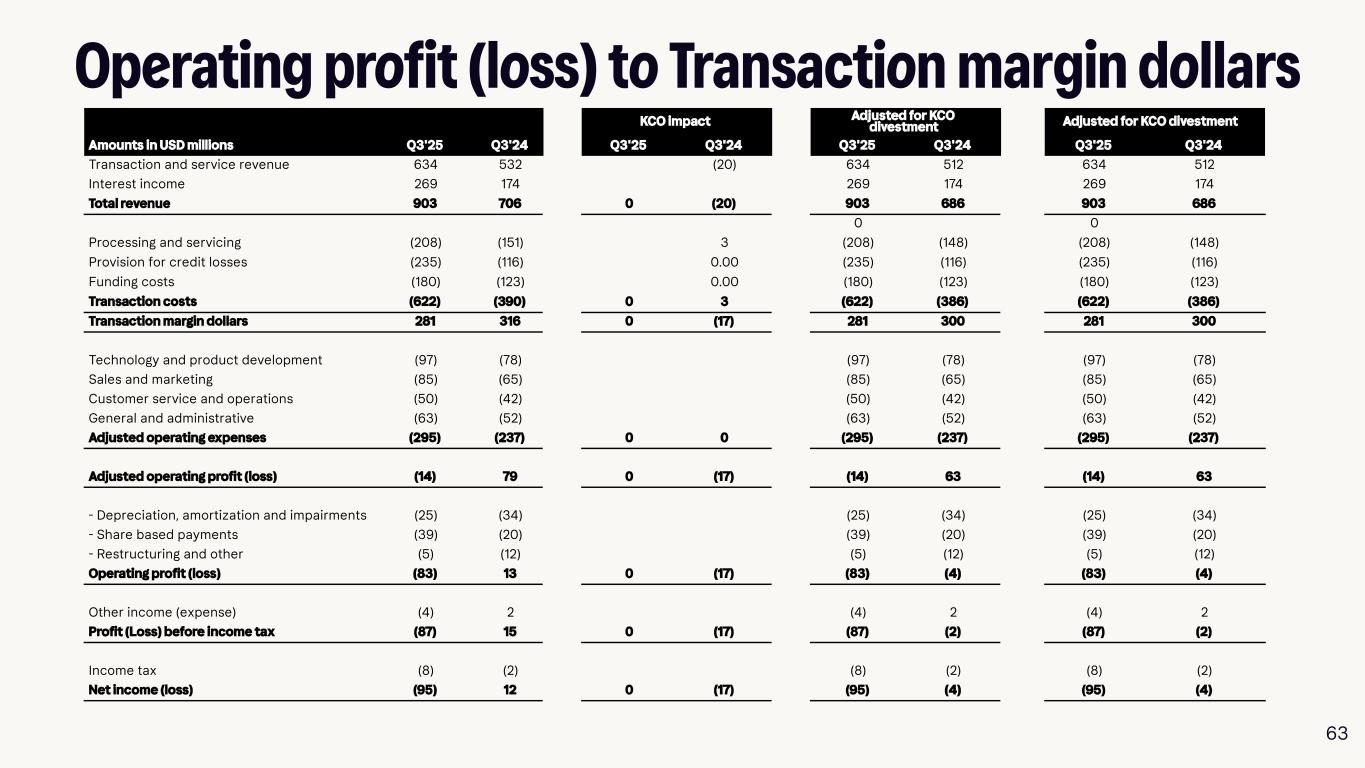

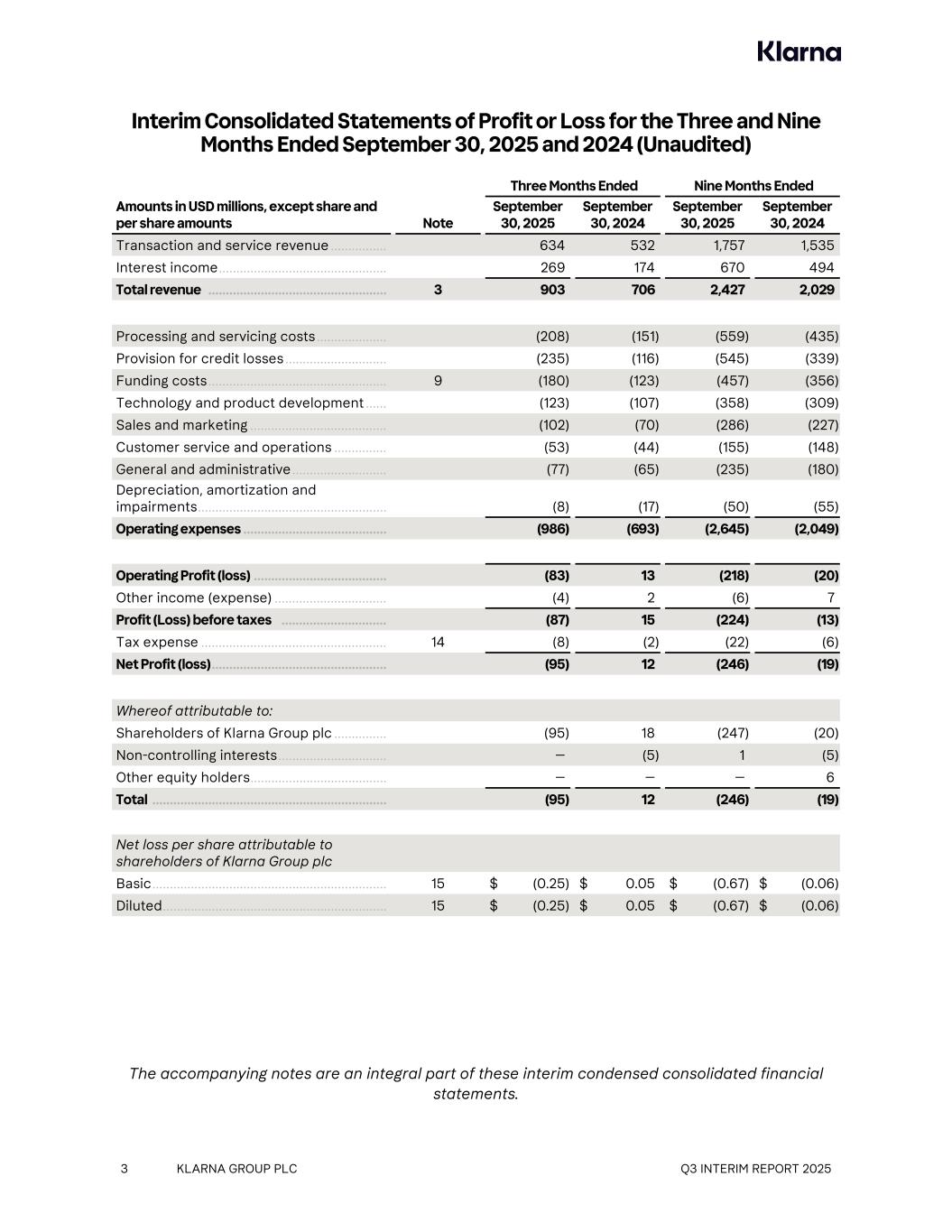

Interim Consolidated Statements of Profit or Loss for the Three and Nine Months Ended September 30, 2025 and 2024 (Unaudited) Three Months Ended Nine Months Ended Amounts in USD millions, except share and per share amounts Note September 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Transaction and service revenue ................ 634 532 1,757 1,535 Interest income ................................................ 269 174 670 494 Total revenue ................................................... 3 903 706 2,427 2,029 Processing and servicing costs .................... (208) (151) (559) (435) Provision for credit losses ............................. (235) (116) (545) (339) Funding costs ................................................... 9 (180) (123) (457) (356) Technology and product development ...... (123) (107) (358) (309) Sales and marketing ....................................... (102) (70) (286) (227) Customer service and operations ............... (53) (44) (155) (148) General and administrative ........................... (77) (65) (235) (180) Depreciation, amortization and impairments ...................................................... (8) (17) (50) (55) Operating expenses ......................................... (986) (693) (2,645) (2,049) Operating Profit (loss) ...................................... (83) 13 (218) (20) Other income (expense) ................................ (4) 2 (6) 7 Profit (Loss) before taxes .............................. (87) 15 (224) (13) Tax expense ..................................................... 14 (8) (2) (22) (6) Net Profit (loss) .................................................. (95) 12 (246) (19) Whereof attributable to: Shareholders of Klarna Group plc ............... (95) 18 (247) (20) Non-controlling interests ............................... — (5) 1 (5) Other equity holders ....................................... — — — 6 Total ................................................................... (95) 12 (246) (19) Net loss per share attributable to shareholders of Klarna Group plc Basic ................................................................... 15 $ (0.25) $ 0.05 $ (0.67) $ (0.06) Diluted ................................................................ 15 $ (0.25) $ 0.05 $ (0.67) $ (0.06) The accompanying notes are an integral part of these interim condensed consolidated financial statements. 3 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

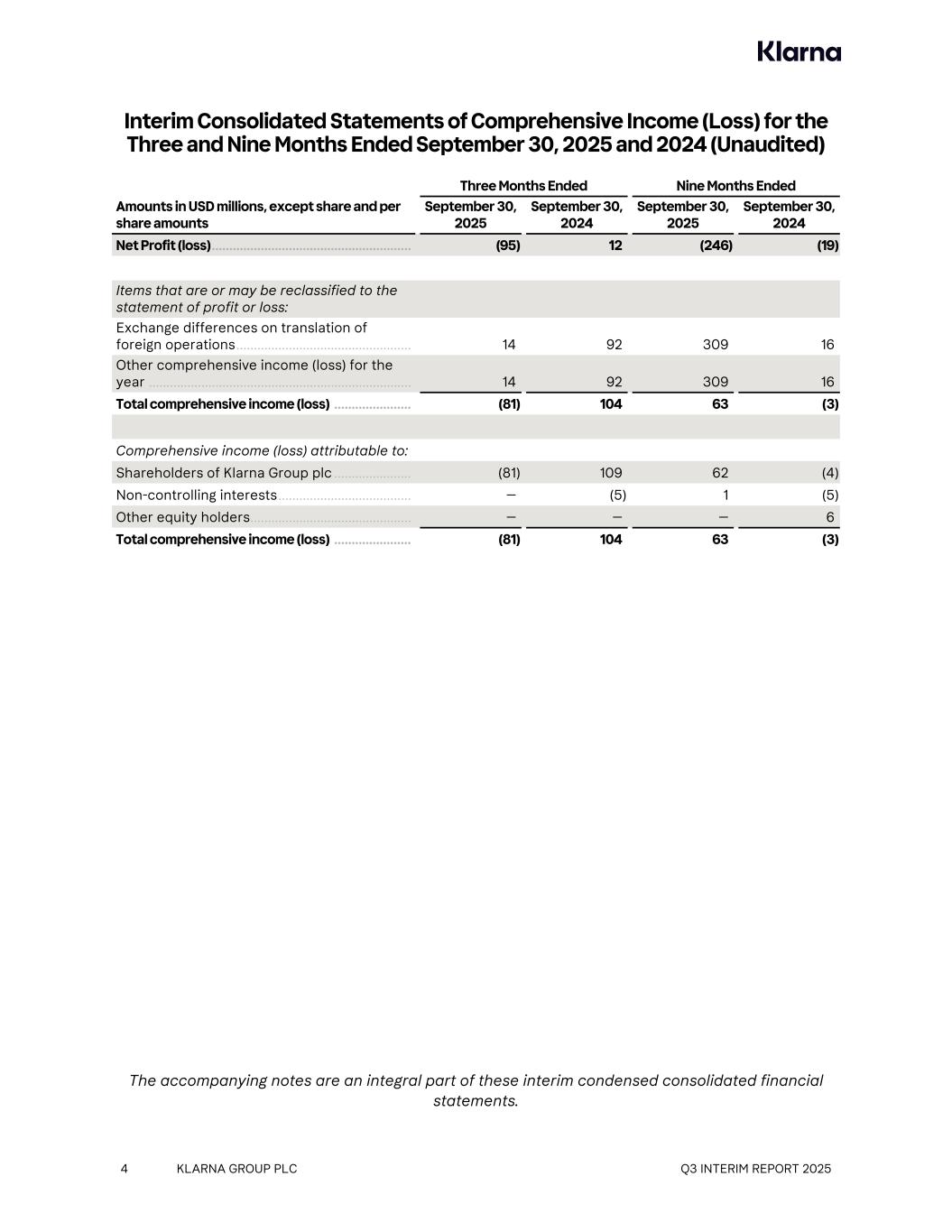

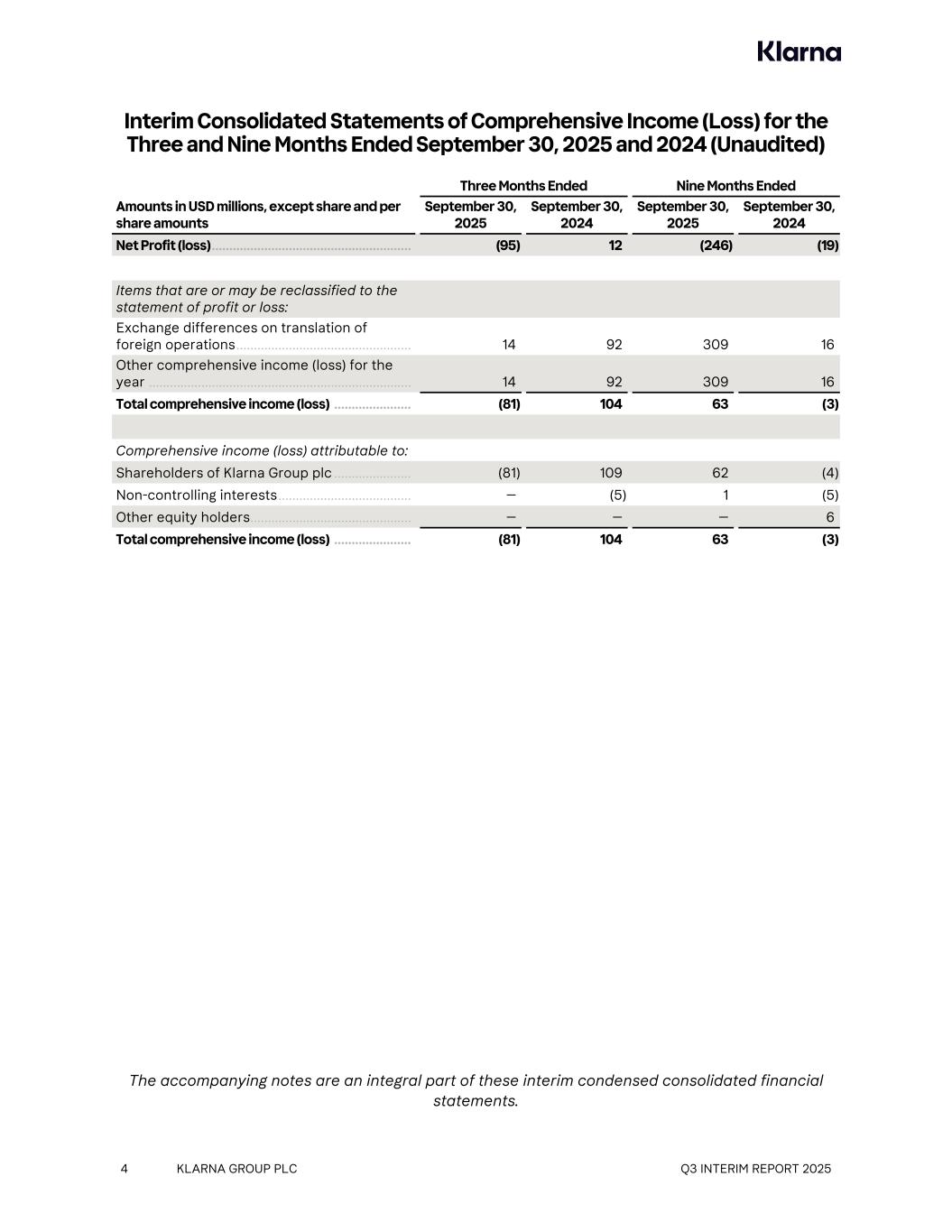

Interim Consolidated Statements of Comprehensive Income (Loss) for the Three and Nine Months Ended September 30, 2025 and 2024 (Unaudited) Three Months Ended Nine Months Ended Amounts in USD millions, except share and per share amounts September 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Net Profit (loss) ......................................................... (95) 12 (246) (19) Items that are or may be reclassified to the statement of profit or loss: Exchange differences on translation of foreign operations .................................................. 14 92 309 16 Other comprehensive income (loss) for the year ........................................................................... 14 92 309 16 Total comprehensive income (loss) ...................... (81) 104 63 (3) Comprehensive income (loss) attributable to: Shareholders of Klarna Group plc ...................... (81) 109 62 (4) Non-controlling interests ...................................... — (5) 1 (5) Other equity holders .............................................. — — — 6 Total comprehensive income (loss) ...................... (81) 104 63 (3) The accompanying notes are an integral part of these interim condensed consolidated financial statements. 4 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

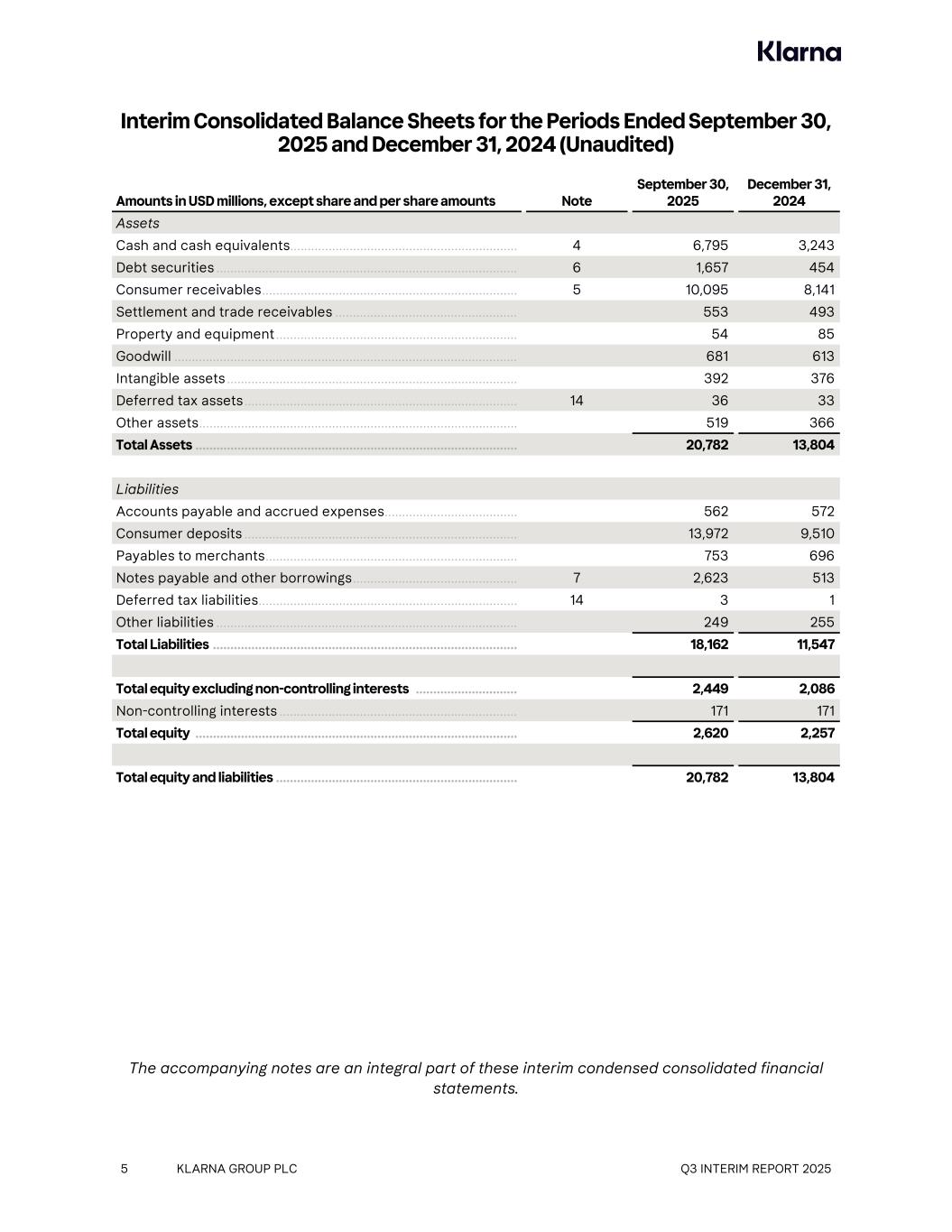

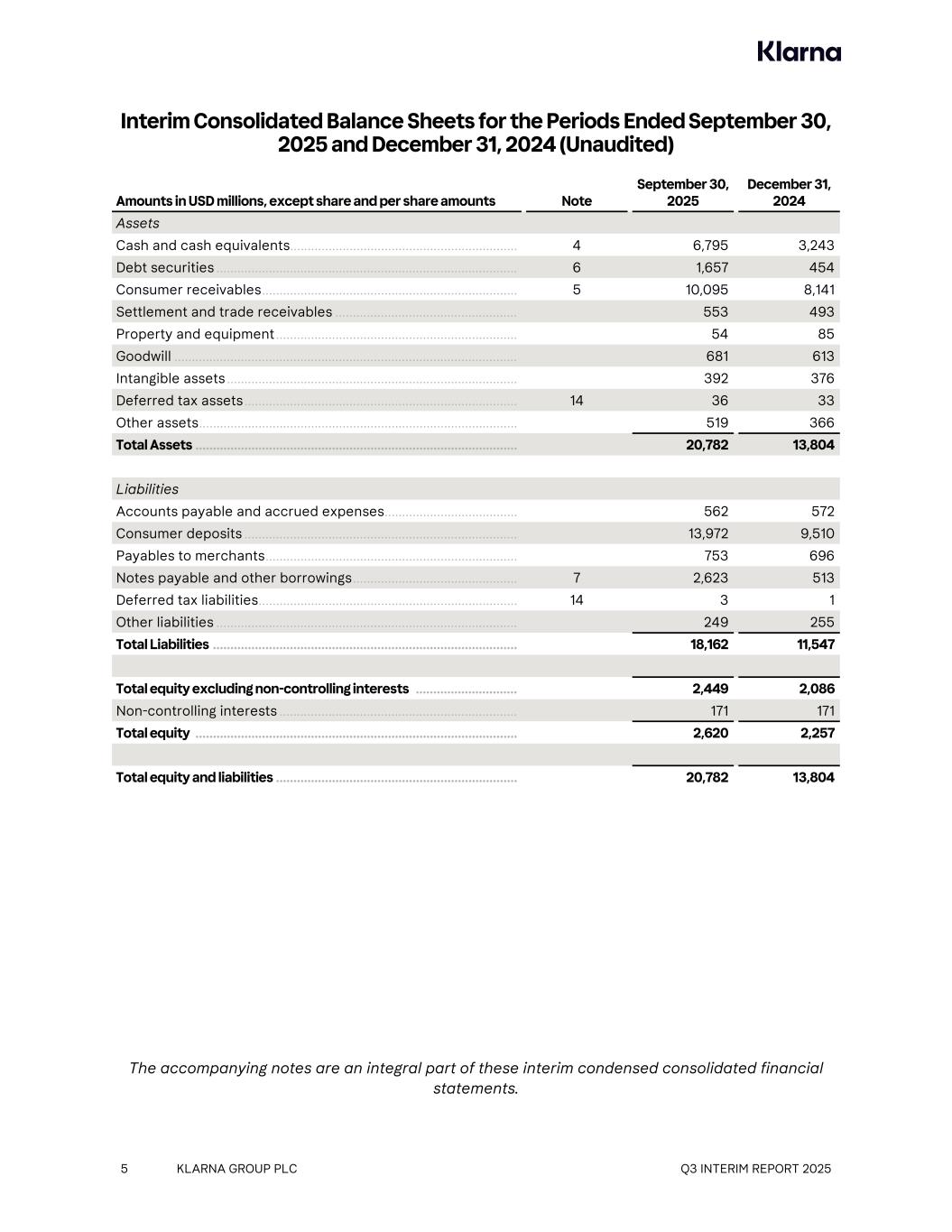

Interim Consolidated Balance Sheets for the Periods Ended September 30, 2025 and December 31, 2024 (Unaudited) Amounts in USD millions, except share and per share amounts Note September 30, 2025 December 31, 2024 Assets Cash and cash equivalents ................................................................. 4 6,795 3,243 Debt securities ...................................................................................... 6 1,657 454 Consumer receivables ......................................................................... 5 10,095 8,141 Settlement and trade receivables .................................................... 553 493 Property and equipment ..................................................................... 54 85 Goodwill .................................................................................................. 681 613 Intangible assets ................................................................................... 392 376 Deferred tax assets .............................................................................. 14 36 33 Other assets ........................................................................................... 519 366 Total Assets ............................................................................................ 20,782 13,804 Liabilities Accounts payable and accrued expenses ...................................... 562 572 Consumer deposits .............................................................................. 13,972 9,510 Payables to merchants ........................................................................ 753 696 Notes payable and other borrowings ............................................... 7 2,623 513 Deferred tax liabilities .......................................................................... 14 3 1 Other liabilities ...................................................................................... 249 255 Total Liabilities ....................................................................................... 18,162 11,547 Total equity excluding non-controlling interests ............................. 2,449 2,086 Non-controlling interests .................................................................... 171 171 Total equity ............................................................................................ 2,620 2,257 Total equity and liabilities ..................................................................... 20,782 13,804 The accompanying notes are an integral part of these interim condensed consolidated financial statements. 5 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

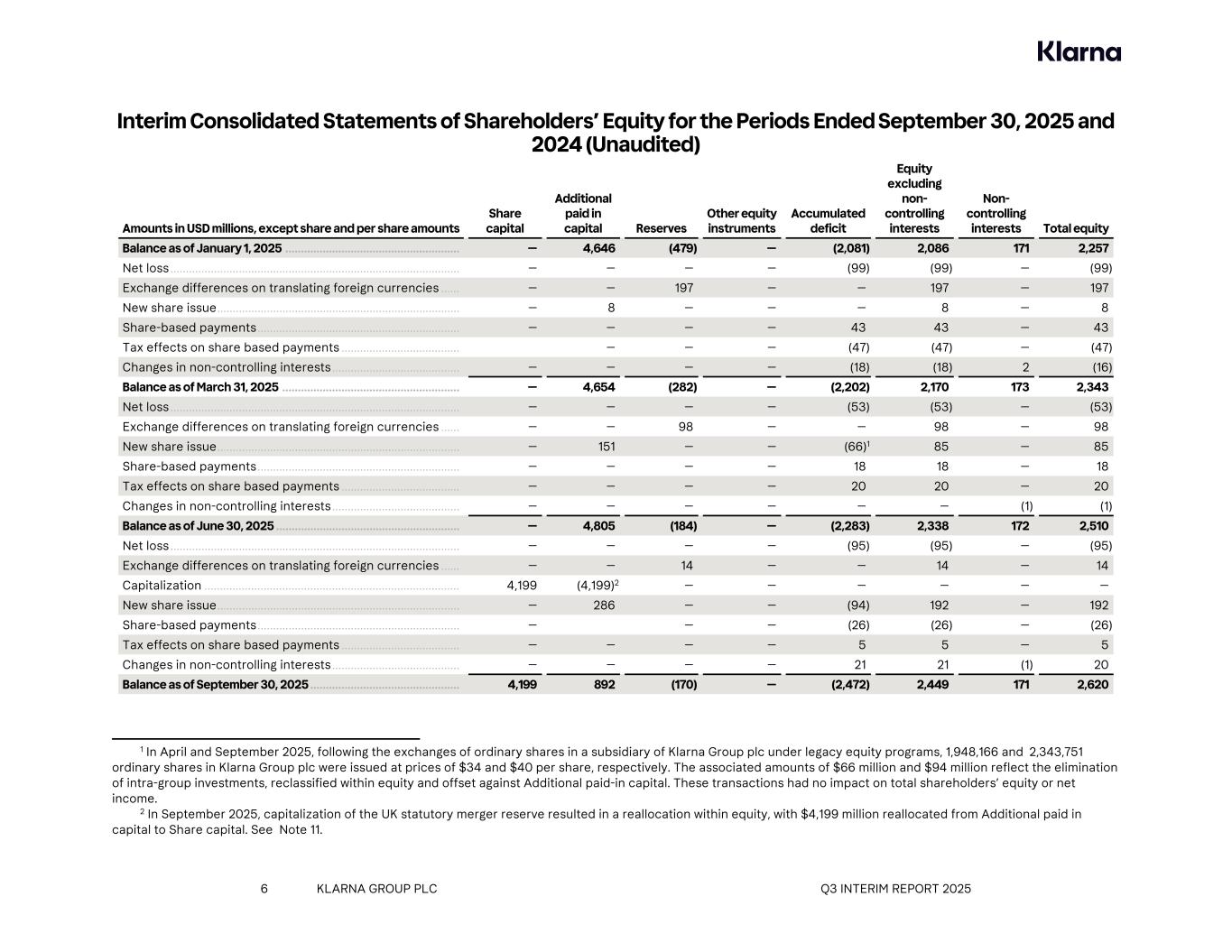

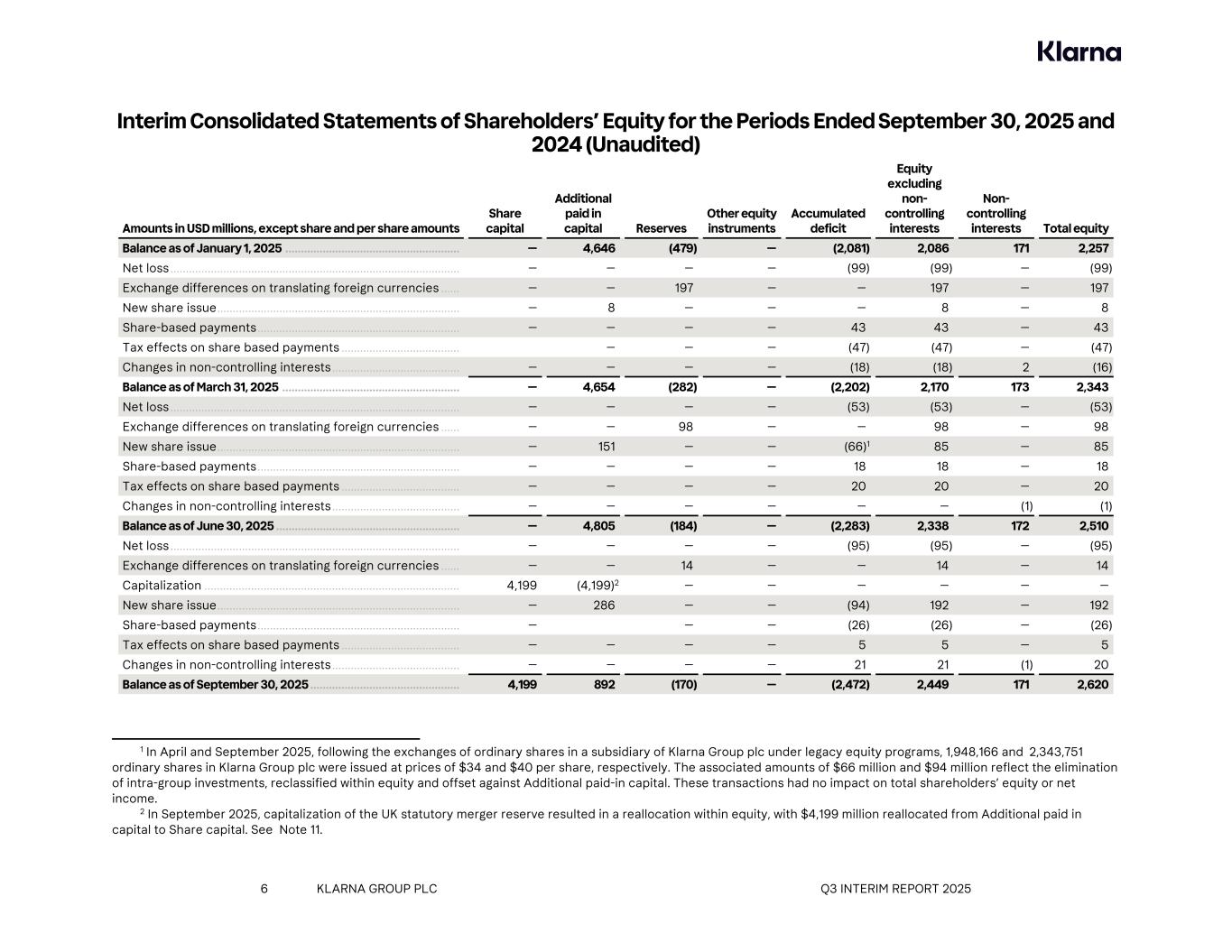

Interim Consolidated Statements of Shareholders’ Equity for the Periods Ended September 30, 2025 and 2024 (Unaudited) Amounts in USD millions, except share and per share amounts Share capital Additional paid in capital Reserves Other equity instruments Accumulated deficit Equity excluding non- controlling interests Non- controlling interests Total equity Balance as of January 1, 2025 ........................................................ — 4,646 (479) — (2,081) 2,086 171 2,257 Net loss ............................................................................................. — — — — (99) (99) — (99) Exchange differences on translating foreign currencies ...... — — 197 — — 197 — 197 New share issue .............................................................................. — 8 — — — 8 — 8 Share-based payments ................................................................. — — — — 43 43 — 43 Tax effects on share based payments ...................................... — — — (47) (47) — (47) Changes in non-controlling interests ......................................... — — — — (18) (18) 2 (16) Balance as of March 31, 2025 ......................................................... — 4,654 (282) — (2,202) 2,170 173 2,343 Net loss ............................................................................................. — — — — (53) (53) — (53) Exchange differences on translating foreign currencies ...... — — 98 — — 98 — 98 New share issue .............................................................................. — 151 — — (66) 1 85 — 85 Share-based payments ................................................................. — — — — 18 18 — 18 Tax effects on share based payments ...................................... — — — — 20 20 — 20 Changes in non-controlling interests ......................................... — — — — — — (1) (1) Balance as of June 30, 2025 ........................................................... — 4,805 (184) — (2,283) 2,338 172 2,510 Net loss ............................................................................................. — — — — (95) (95) — (95) Exchange differences on translating foreign currencies ...... — — 14 — — 14 — 14 Capitalization .................................................................................. 4,199 (4,199) 2 — — — — — — New share issue .............................................................................. — 286 — — (94) 192 — 192 Share-based payments ................................................................. — — — (26) (26) — (26) Tax effects on share based payments ...................................... — — — — 5 5 — 5 Changes in non-controlling interests ......................................... — — — — 21 21 (1) 20 Balance as of September 30, 2025 ................................................ 4,199 892 (170) — (2,472) 2,449 171 2,620 6 KLARNA GROUP PLC Q3 INTERIM REPORT 2025 1 In April and September 2025, following the exchanges of ordinary shares in a subsidiary of Klarna Group plc under legacy equity programs, 1,948,166 and 2,343,751 ordinary shares in Klarna Group plc were issued at prices of $34 and $40 per share, respectively. The associated amounts of $66 million and $94 million reflect the elimination of intra-group investments, reclassified within equity and offset against Additional paid-in capital. These transactions had no impact on total shareholders’ equity or net income. 2 In September 2025, capitalization of the UK statutory merger reserve resulted in a reallocation within equity, with $4,199 million reallocated from Additional paid in capital to Share capital. See Note 11.

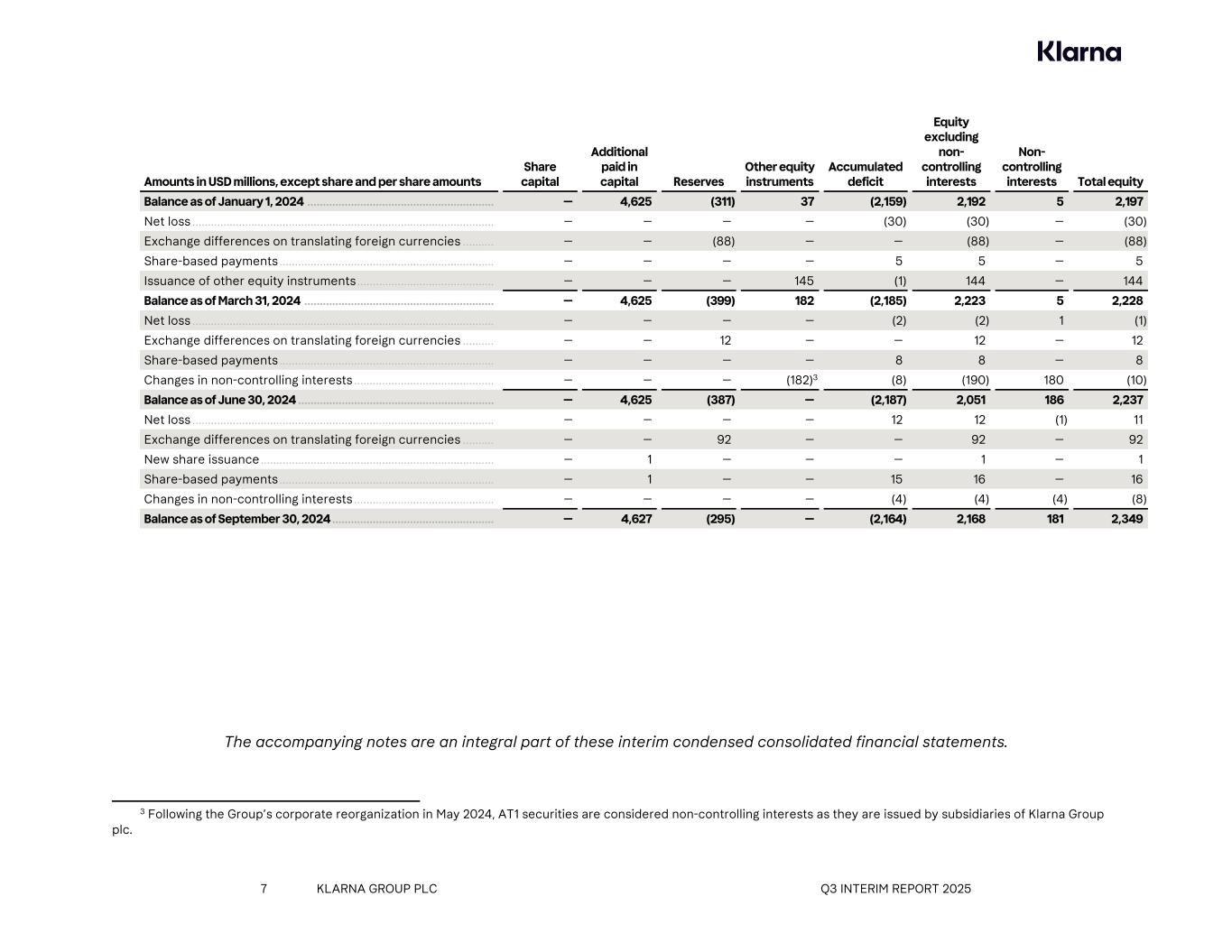

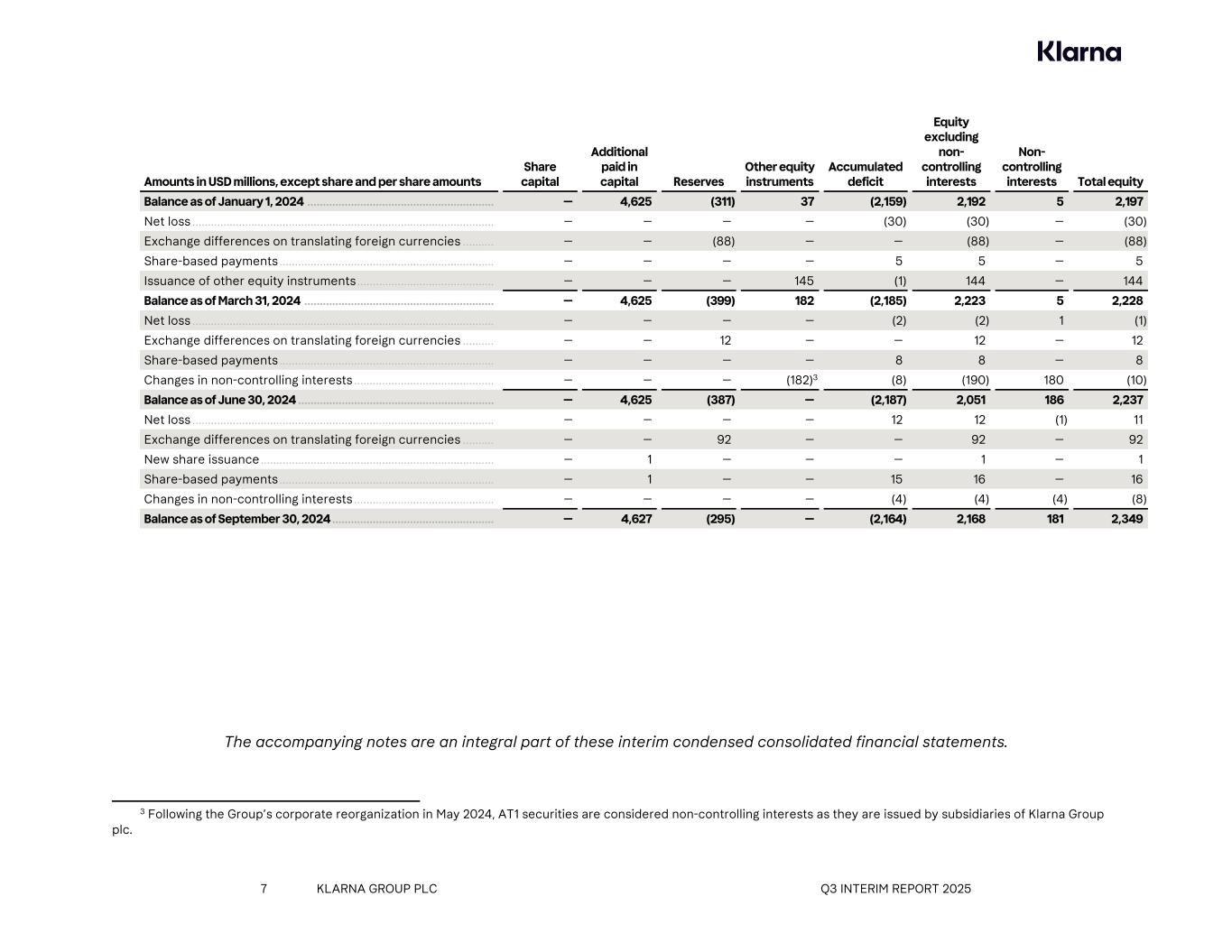

Amounts in USD millions, except share and per share amounts Share capital Additional paid in capital Reserves Other equity instruments Accumulated deficit Equity excluding non- controlling interests Non- controlling interests Total equity Balance as of January 1, 2024 ............................................................ — 4,625 (311) 37 (2,159) 2,192 5 2,197 Net loss ................................................................................................. — — — — (30) (30) — (30) Exchange differences on translating foreign currencies .......... — — (88) — — (88) — (88) Share-based payments ..................................................................... — — — — 5 5 — 5 Issuance of other equity instruments ............................................ — — — 145 (1) 144 — 144 Balance as of March 31, 2024 ............................................................. — 4,625 (399) 182 (2,185) 2,223 5 2,228 Net loss ................................................................................................. — — — — (2) (2) 1 (1) Exchange differences on translating foreign currencies .......... — — 12 — — 12 — 12 Share-based payments ..................................................................... — — — — 8 8 — 8 Changes in non-controlling interests ............................................. — — — (182) 3 (8) (190) 180 (10) Balance as of June 30, 2024 ............................................................... — 4,625 (387) — (2,187) 2,051 186 2,237 Net loss ................................................................................................. — — — — 12 12 (1) 11 Exchange differences on translating foreign currencies .......... — — 92 — — 92 — 92 New share issuance ........................................................................... — 1 — — — 1 — 1 Share-based payments ..................................................................... — 1 — — 15 16 — 16 Changes in non-controlling interests ............................................. — — — — (4) (4) (4) (8) Balance as of September 30, 2024 .................................................... — 4,627 (295) — (2,164) 2,168 181 2,349 The accompanying notes are an integral part of these interim condensed consolidated financial statements. 7 KLARNA GROUP PLC Q3 INTERIM REPORT 2025 3 Following the Group’s corporate reorganization in May 2024, AT1 securities are considered non-controlling interests as they are issued by subsidiaries of Klarna Group plc.

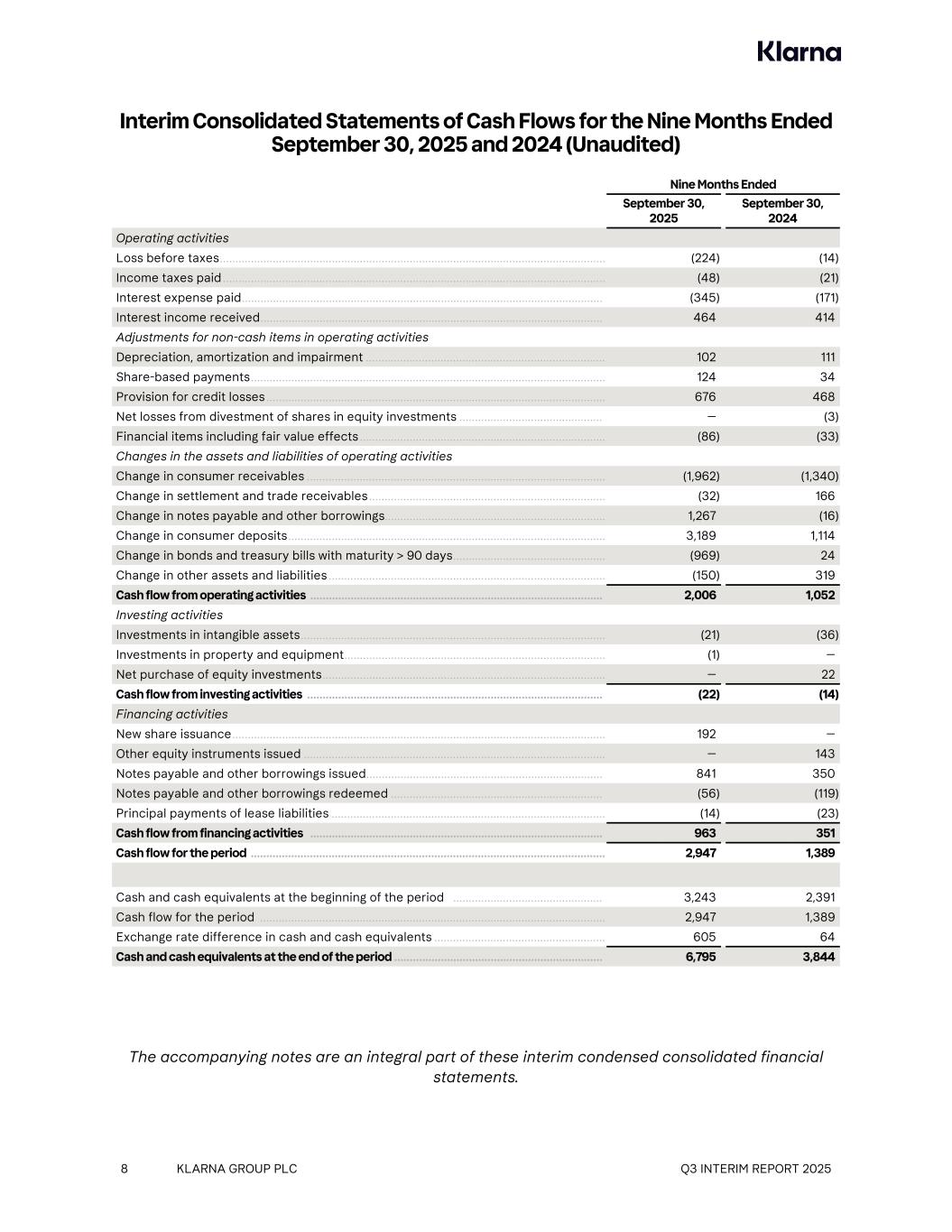

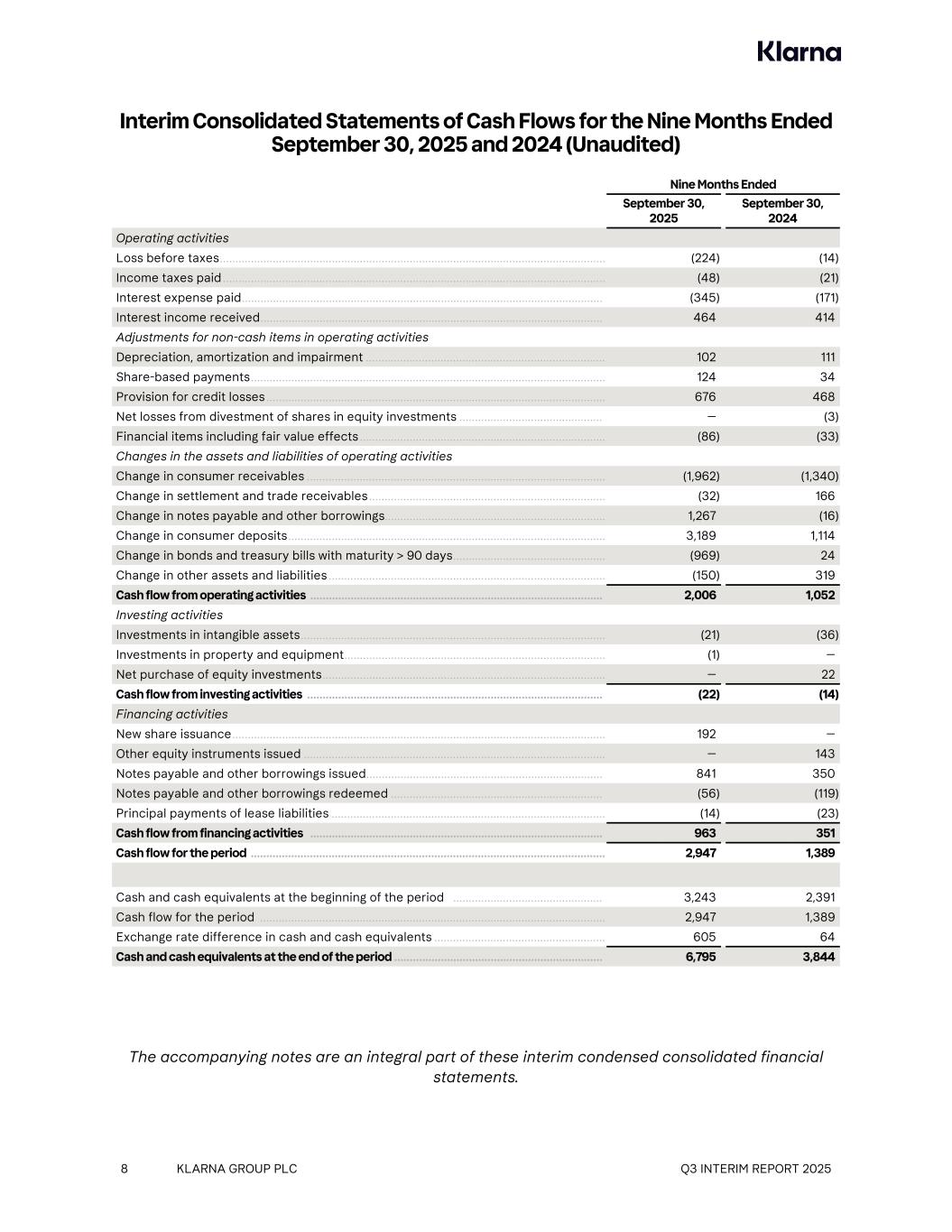

Interim Consolidated Statements of Cash Flows for the Nine Months Ended September 30, 2025 and 2024 (Unaudited) Nine Months Ended September 30, 2025 September 30, 2024 Operating activities Loss before taxes ............................................................................................................................ (224) (14) Income taxes paid ........................................................................................................................... (48) (21) Interest expense paid .................................................................................................................... (345) (171) Interest income received .............................................................................................................. 464 414 Adjustments for non-cash items in operating activities Depreciation, amortization and impairment ............................................................................. 102 111 Share-based payments .................................................................................................................. 124 34 Provision for credit losses ............................................................................................................. 676 468 Net losses from divestment of shares in equity investments .............................................. — (3) Financial items including fair value effects ............................................................................... (86) (33) Changes in the assets and liabilities of operating activities Change in consumer receivables ................................................................................................ (1,962) (1,340) Change in settlement and trade receivables ............................................................................ (32) 166 Change in notes payable and other borrowings ....................................................................... 1,267 (16) Change in consumer deposits ...................................................................................................... 3,189 1,114 Change in bonds and treasury bills with maturity > 90 days ................................................. (969) 24 Change in other assets and liabilities ......................................................................................... (150) 319 Cash flow from operating activities .............................................................................................. 2,006 1,052 Investing activities Investments in intangible assets .................................................................................................. (21) (36) Investments in property and equipment .................................................................................... (1) — Net purchase of equity investments ........................................................................................... — 22 Cash flow from investing activities ............................................................................................... (22) (14) Financing activities New share issuance ........................................................................................................................ 192 — Other equity instruments issued ................................................................................................. — 143 Notes payable and other borrowings issued ............................................................................ 841 350 Notes payable and other borrowings redeemed .................................................................... (56) (119) Principal payments of lease liabilities ........................................................................................ (14) (23) Cash flow from financing activities .............................................................................................. 963 351 Cash flow for the period .................................................................................................................. 2,947 1,389 Cash and cash equivalents at the beginning of the period ................................................ 3,243 2,391 Cash flow for the period ............................................................................................................... 2,947 1,389 Exchange rate difference in cash and cash equivalents ....................................................... 605 64 Cash and cash equivalents at the end of the period ................................................................... 6,795 3,844 The accompanying notes are an integral part of these interim condensed consolidated financial statements. 8 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

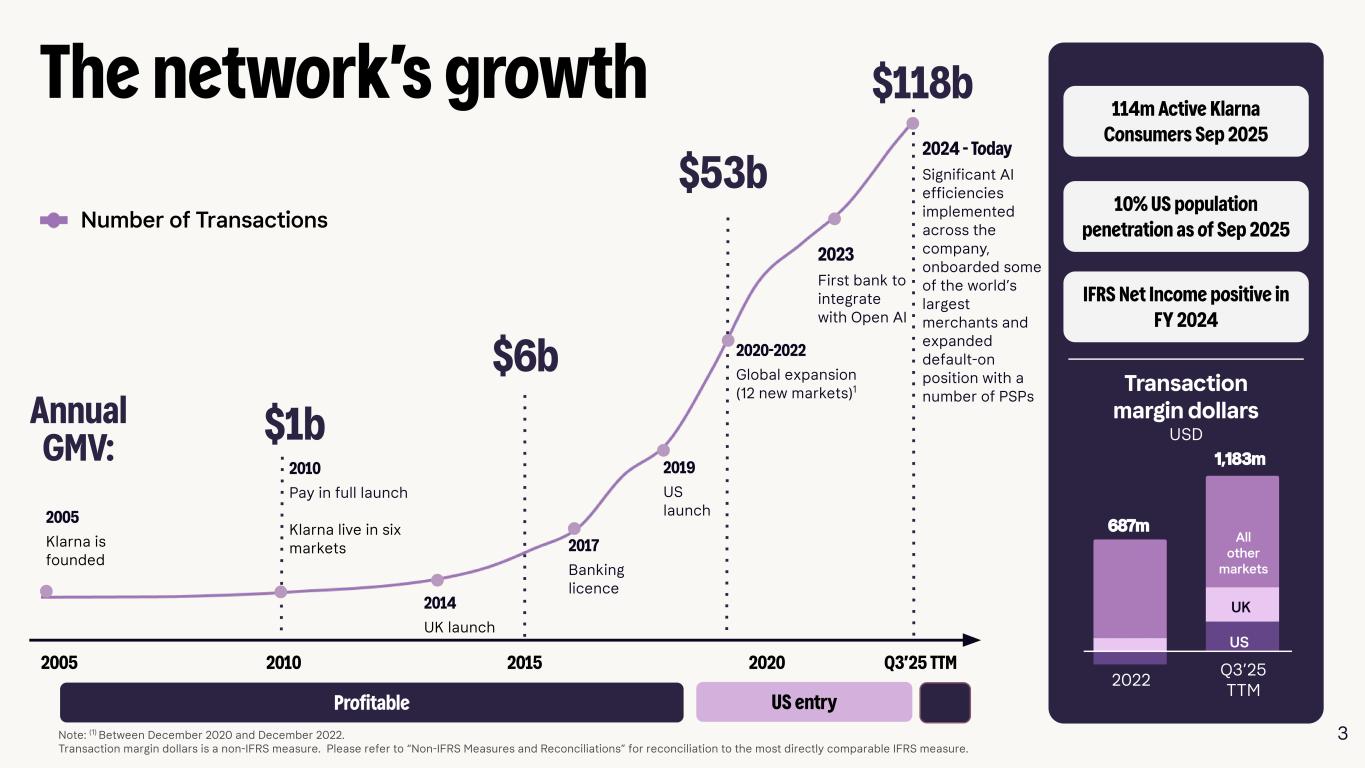

Note 1 Corporate information Klarna Group plc is a public company with limited liability incorporated under the laws of England and Wales. The interim condensed consolidated financial statements consist of Klarna Group plc and its direct and indirect subsidiaries (collectively, “Klarna,” the “Company,” the “Group,” “we,” “us,” or “our”). Klarna is a technology-driven payments company, with operations spanning multiple countries. We connect consumers and merchants with comprehensive payment solutions and tailored advertising solutions, both online and offline. Our payment solutions provide consumers with more control and flexibility over their payments. On September 10, 2025, the Company completed its initial public offering (“IPO”) of 5,000,000 ordinary shares, completed the sale of additional 29,311,274 ordinary shares from “selling shareholders” and on September 22, 2025, completed the sale of 5,146,691 of additional ordinary shares to the underwriters pursuant to their option to purchase additional shares, at an offering price of $40.00 per share. The Company raised net proceeds of $169 million through the IPO, net of underwriting discounts and other offering costs of $22.41 million. Directly attributable transaction costs related to the issuance of new ordinary shares of $8.5 million were deducted from equity. These costs, primarily underwriting fees, were offset against the gross proceeds recognized in Additional paid in capital. The Company’s registration statement on Form S-8 (File No. 333-285826) registering shares under its employee equity plans, was declared effective by the Securities and Exchange Commission (“SEC”) on September 10, 2025. Note 2 Accounting principles 1. Basis of preparation and consolidation The interim condensed consolidated financial statements are prepared in accordance with IAS 34, Interim Financial Reporting, as issued by the International Accounting Standards Board (“IASB”) and have been prepared on a historical cost basis, except for equity investments, derivatives, and consumer receivables held for trading which have been measured at fair value, and lease liabilities, which are measured at present value. These interim condensed consolidated financial statements are prepared on a going concern basis. All amounts in the notes to the interim condensed consolidated financial statements are stated in millions of United States dollars (“USD”), unless otherwise stated. The interim condensed consolidated financial statements should be read in conjunction with the Group’s consolidated financial statements for the year ended December 31, 2024, as filed with the SEC as part of the Company's Registration Statement on Form F-1, as they do not include all the information and disclosures required in the annual consolidated financial statements. Accounting principles and calculation methods applied in these interim condensed consolidated financial statements are consistent with those in the Group’s consolidated financial statements for the year ended December 31, 2024. The results of operations for the interim periods are not necessarily indicative of the results that may be expected for the full year or any other interim period. 9 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

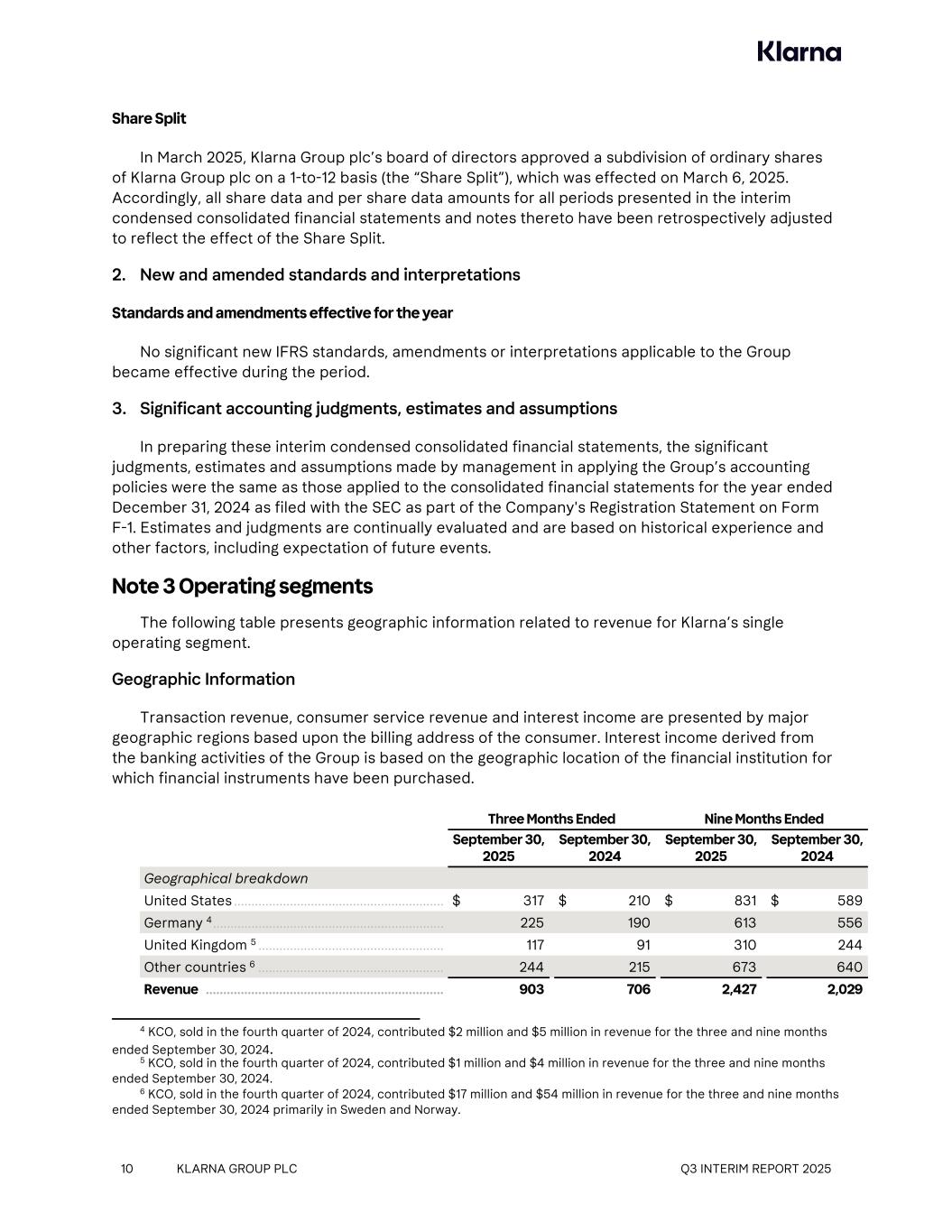

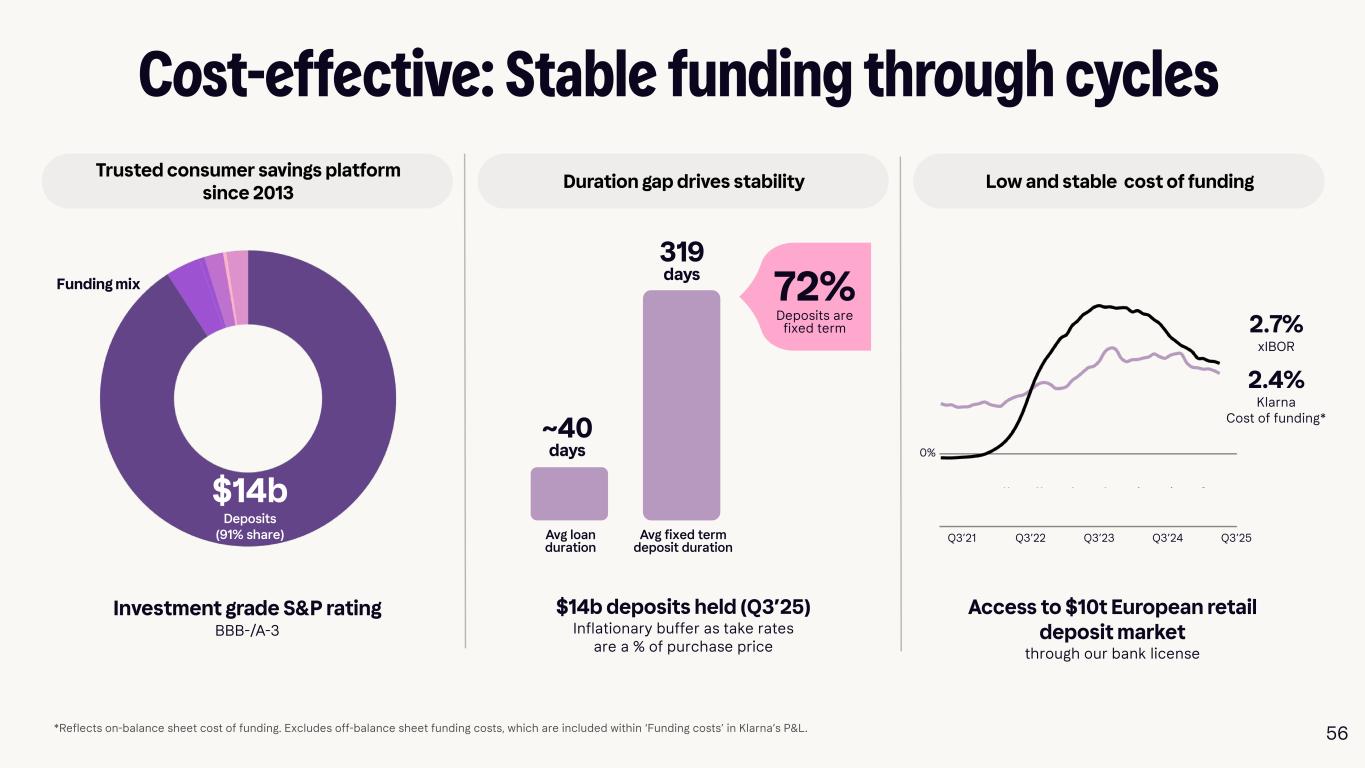

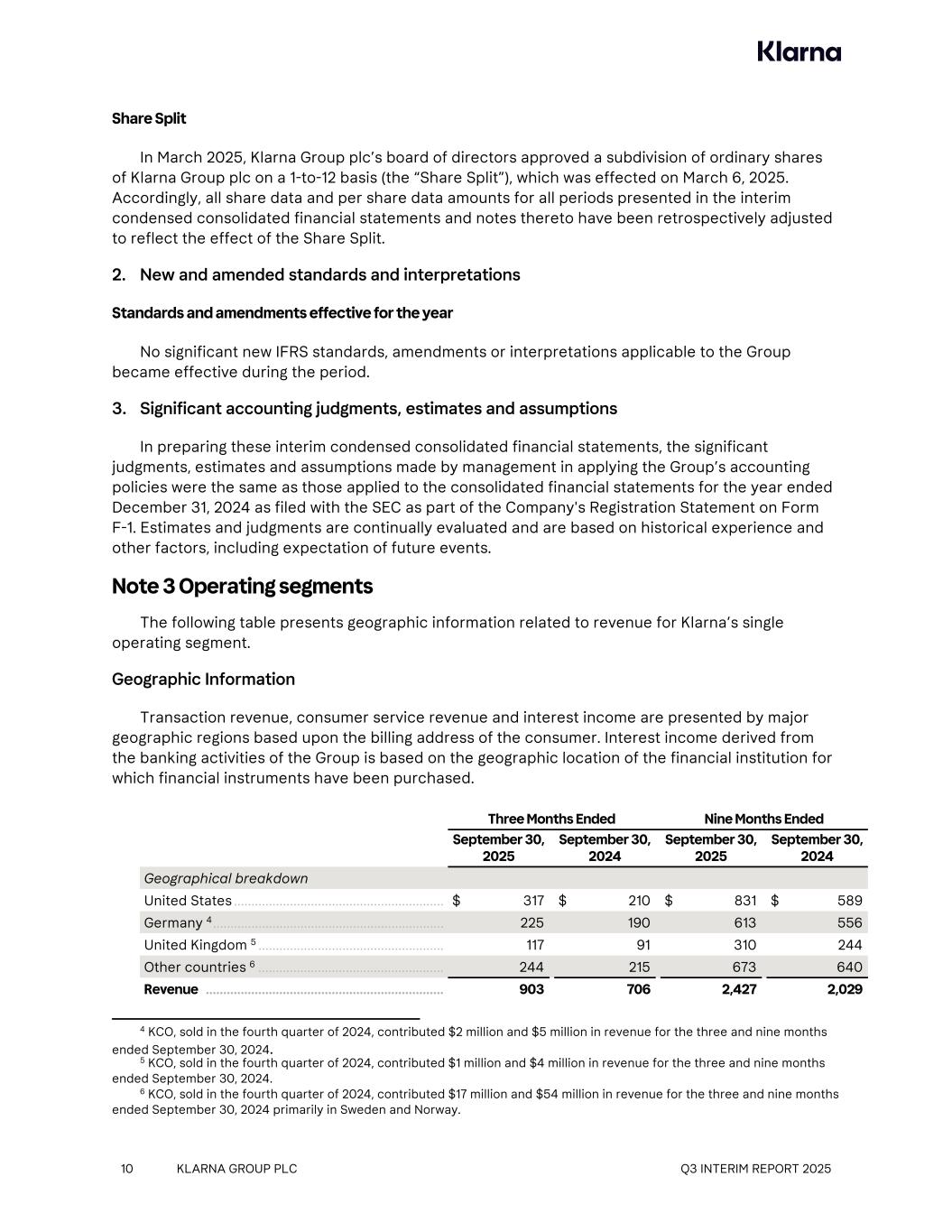

Share Split In March 2025, Klarna Group plc’s board of directors approved a subdivision of ordinary shares of Klarna Group plc on a 1-to-12 basis (the “Share Split”), which was effected on March 6, 2025. Accordingly, all share data and per share data amounts for all periods presented in the interim condensed consolidated financial statements and notes thereto have been retrospectively adjusted to reflect the effect of the Share Split. 2. New and amended standards and interpretations Standards and amendments effective for the year No significant new IFRS standards, amendments or interpretations applicable to the Group became effective during the period. 3. Significant accounting judgments, estimates and assumptions In preparing these interim condensed consolidated financial statements, the significant judgments, estimates and assumptions made by management in applying the Group’s accounting policies were the same as those applied to the consolidated financial statements for the year ended December 31, 2024 as filed with the SEC as part of the Company's Registration Statement on Form F-1. Estimates and judgments are continually evaluated and are based on historical experience and other factors, including expectation of future events. Note 3 Operating segments The following table presents geographic information related to revenue for Klarna’s single operating segment. Geographic Information Transaction revenue, consumer service revenue and interest income are presented by major geographic regions based upon the billing address of the consumer. Interest income derived from the banking activities of the Group is based on the geographic location of the financial institution for which financial instruments have been purchased. Three Months Ended Nine Months Ended September 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Geographical breakdown United States ............................................................ $ 317 $ 210 $ 831 $ 589 Germany 4 .................................................................. 225 190 613 556 United Kingdom 5 ..................................................... 117 91 310 244 Other countries 6 ..................................................... 244 215 673 640 Revenue .................................................................... 903 706 2,427 2,029 10 KLARNA GROUP PLC Q3 INTERIM REPORT 2025 4 KCO, sold in the fourth quarter of 2024, contributed $2 million and $5 million in revenue for the three and nine months ended September 30, 2024. 5 KCO, sold in the fourth quarter of 2024, contributed $1 million and $4 million in revenue for the three and nine months ended September 30, 2024. 6 KCO, sold in the fourth quarter of 2024, contributed $17 million and $54 million in revenue for the three and nine months ended September 30, 2024 primarily in Sweden and Norway.

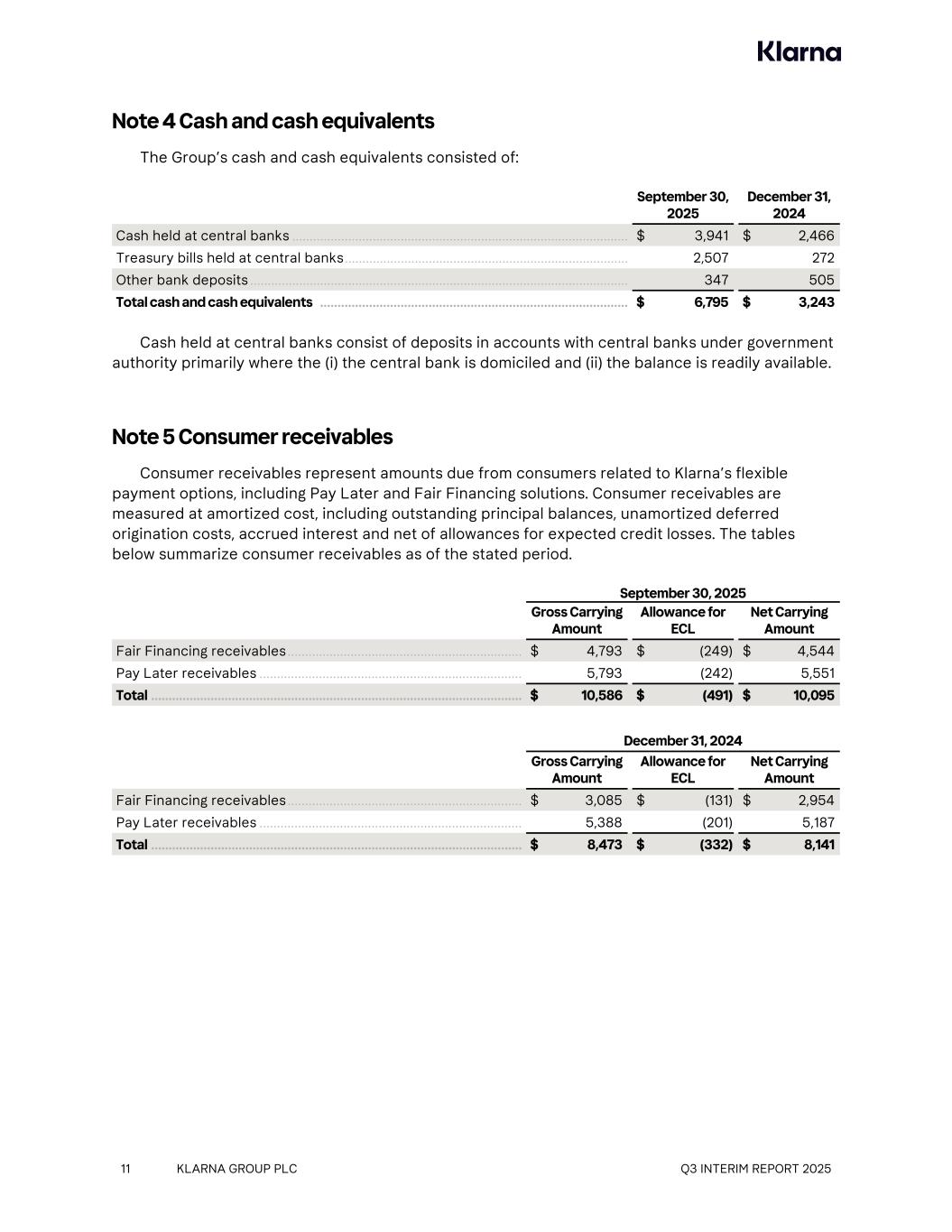

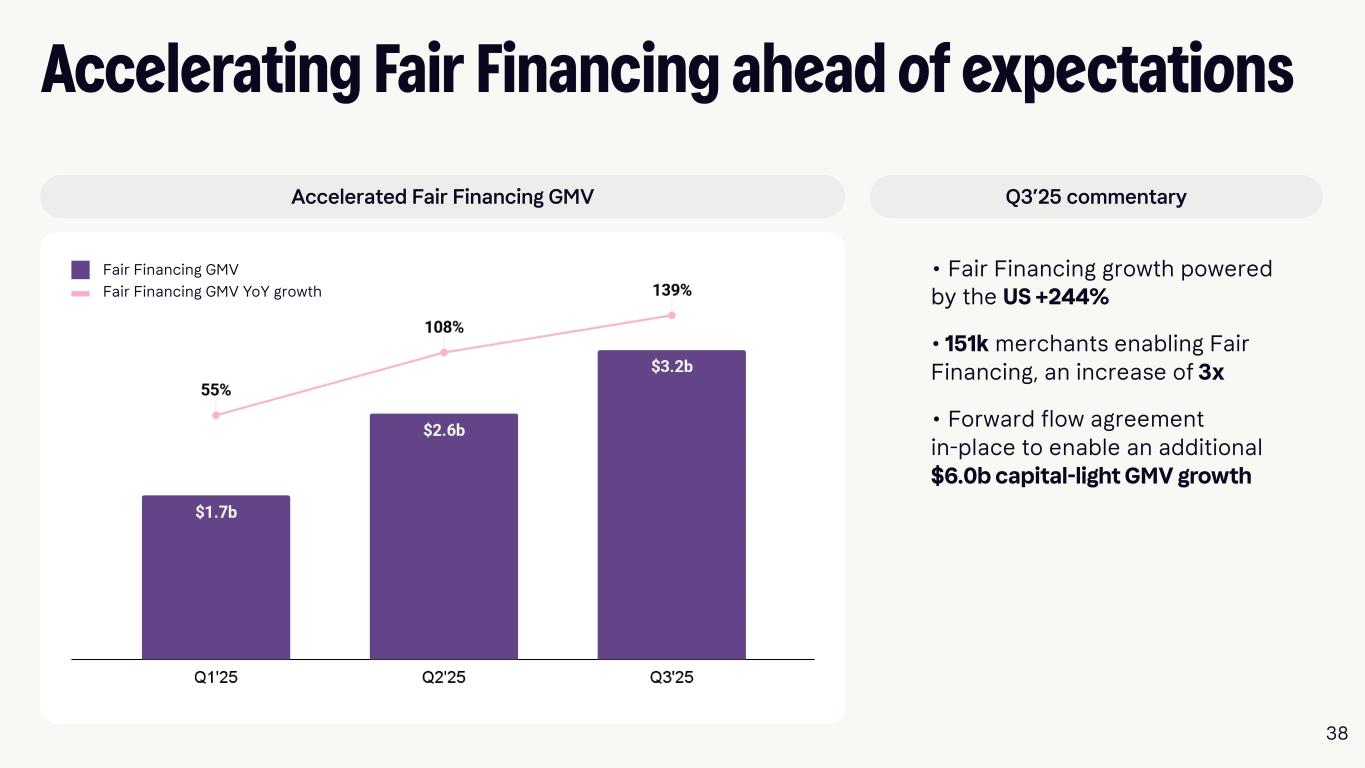

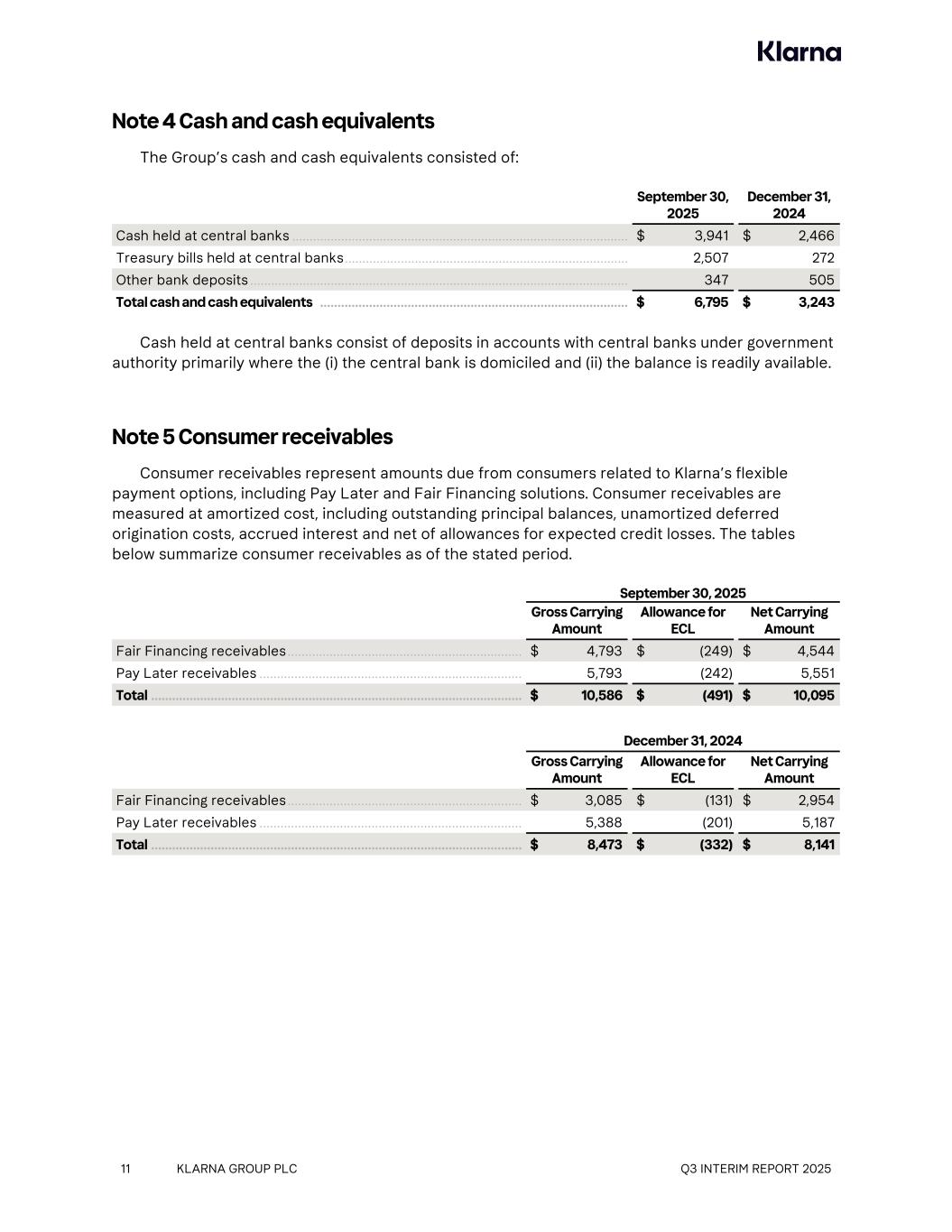

Note 4 Cash and cash equivalents The Group’s cash and cash equivalents consisted of: September 30, 2025 December 31, 2024 Cash held at central banks ................................................................................................ $ 3,941 $ 2,466 Treasury bills held at central banks ................................................................................. 2,507 272 Other bank deposits ............................................................................................................ 347 505 Total cash and cash equivalents ........................................................................................ $ 6,795 $ 3,243 Cash held at central banks consist of deposits in accounts with central banks under government authority primarily where the (i) the central bank is domiciled and (ii) the balance is readily available. Note 5 Consumer receivables Consumer receivables represent amounts due from consumers related to Klarna’s flexible payment options, including Pay Later and Fair Financing solutions. Consumer receivables are measured at amortized cost, including outstanding principal balances, unamortized deferred origination costs, accrued interest and net of allowances for expected credit losses. The tables below summarize consumer receivables as of the stated period. September 30, 2025 Gross Carrying Amount Allowance for ECL Net Carrying Amount Fair Financing receivables ................................................................... $ 4,793 $ (249) $ 4,544 Pay Later receivables ........................................................................... 5,793 (242) 5,551 Total .......................................................................................................... $ 10,586 $ (491) $ 10,095 December 31, 2024 Gross Carrying Amount Allowance for ECL Net Carrying Amount Fair Financing receivables ................................................................... $ 3,085 $ (131) $ 2,954 Pay Later receivables ........................................................................... 5,388 (201) 5,187 Total .......................................................................................................... $ 8,473 $ (332) $ 8,141 11 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

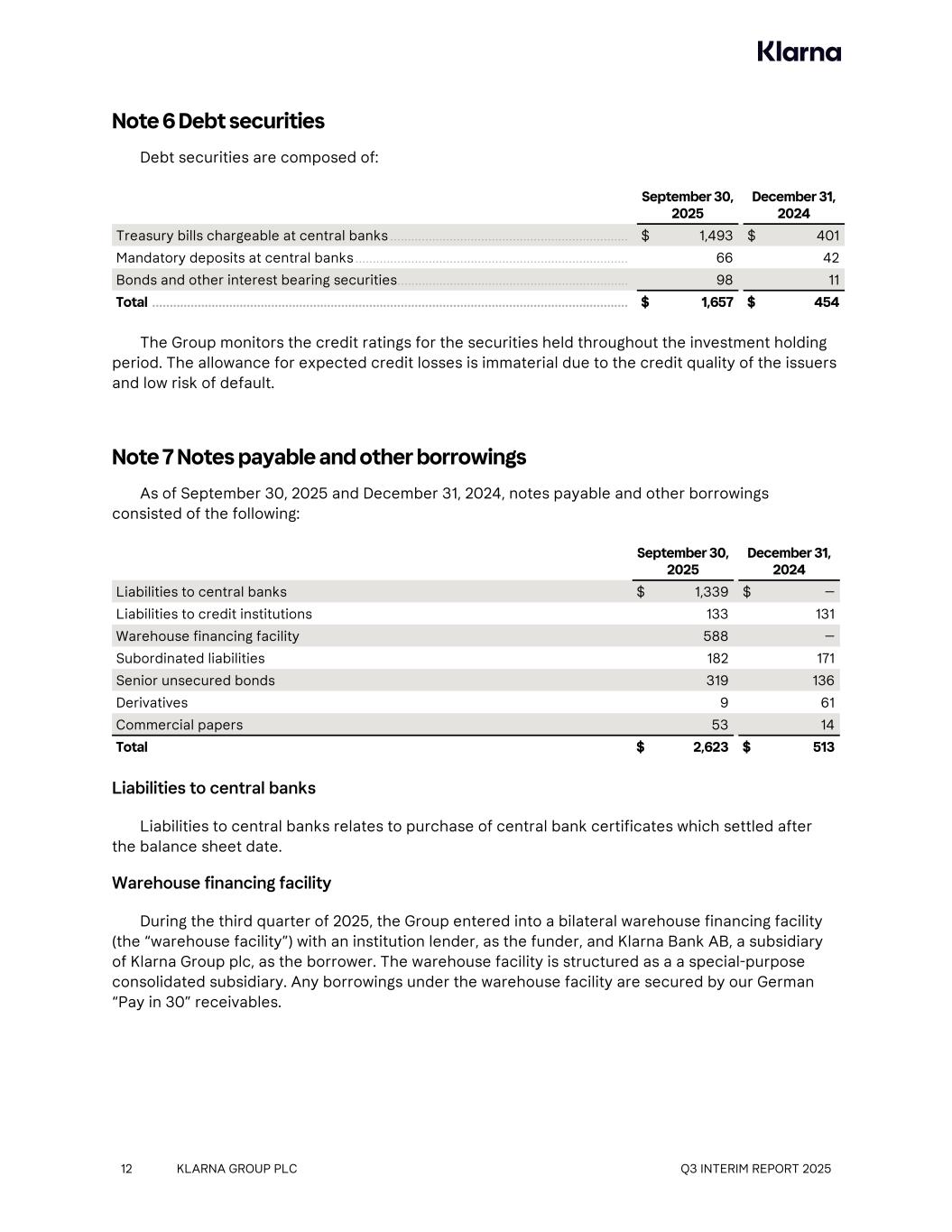

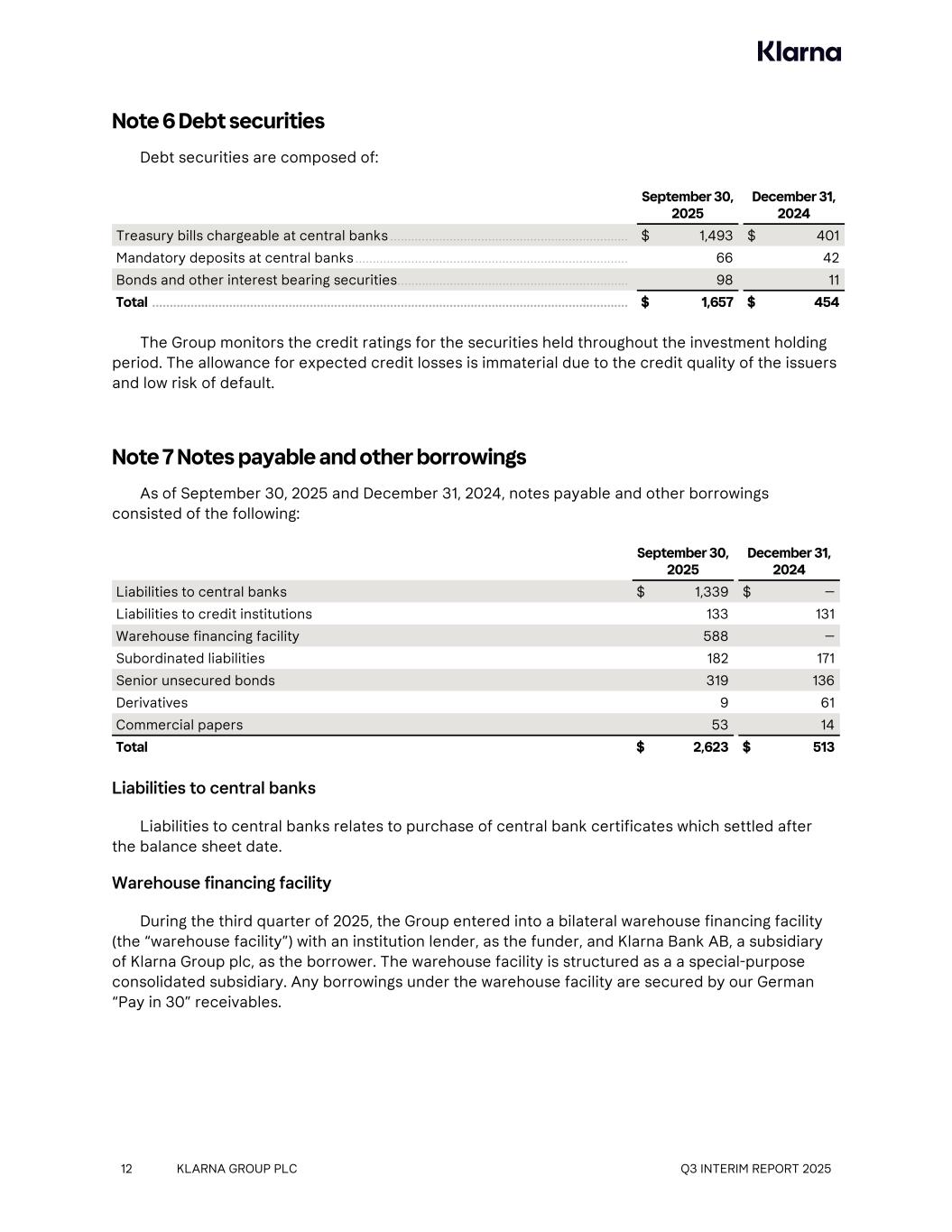

Note 6 Debt securities Debt securities are composed of: September 30, 2025 December 31, 2024 Treasury bills chargeable at central banks .................................................................... $ 1,493 $ 401 Mandatory deposits at central banks .............................................................................. 66 42 Bonds and other interest bearing securities .................................................................. 98 11 Total ........................................................................................................................................ $ 1,657 $ 454 The Group monitors the credit ratings for the securities held throughout the investment holding period. The allowance for expected credit losses is immaterial due to the credit quality of the issuers and low risk of default. Note 7 Notes payable and other borrowings As of September 30, 2025 and December 31, 2024, notes payable and other borrowings consisted of the following: September 30, 2025 December 31, 2024 Liabilities to central banks $ 1,339 $ — Liabilities to credit institutions 133 131 Warehouse financing facility 588 — Subordinated liabilities 182 171 Senior unsecured bonds 319 136 Derivatives 9 61 Commercial papers 53 14 Total $ 2,623 $ 513 Liabilities to central banks Liabilities to central banks relates to purchase of central bank certificates which settled after the balance sheet date. Warehouse financing facility During the third quarter of 2025, the Group entered into a bilateral warehouse financing facility (the “warehouse facility”) with an institution lender, as the funder, and Klarna Bank AB, a subsidiary of Klarna Group plc, as the borrower. The warehouse facility is structured as a a special-purpose consolidated subsidiary. Any borrowings under the warehouse facility are secured by our German “Pay in 30” receivables. 12 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

Note 8 Unconsolidated structured entities The Group have entered into securitization arrangements with unconsolidated securitization vehicles (the “SPVs”) whereby specified pools of consumer receivables (“eligible receivables”) were transferred to the SPVs. Klarna derecognizes these receivables upon transferring the contractual rights to the cash flows and substantially all associated risks and rewards. This includes; the sale of U.K. Pay Later receivables to an external securitization vehicle financed by the issuance of senior and junior notes to third parties. As of the nine months ended September 30, 2025, the Group has sold $8.4 billion of receivables under this securitization program. In addition, during the three months ended June 30, 2025, the Group entered into a forward flow arrangement for the sale of U.S. Pay Later receivables to a securitization vehicle, with a maximum program size of $777 million.The sale of receivables under this arrangement commenced during the three months ended September 30, 2025.As of the three months ended September 30, 2025, the Group has sold $1.3 billion of receivables under this securitization program. The following table shows the carrying amount of Klarna’s recorded interest in its consolidated balance sheet and represents the maximum exposure to risk due to the exposures in the unconsolidated structured entities. September 30, 2025 December 31, 2024 Receivables held for trading 1 ............................................................................................ $ 111 $ 2 SPV Pledged assets2 ............................................................................................................ — 2 Total assets ......................................................................................................................... $ 111 $ 4 Payable to SPV3 .................................................................................................................... 33 15 Total liabilities ....................................................................................................................... $ 33 $ 15 Note 9 Funding costs The Group’s funding costs for the three and nine months ended September 30, 2025 and 2024 were as follows: Three Months Ended Nine Months Ended September 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Consumer deposits ................................................ $ (89) $ (86) $ (248) $ (260) Cost of securitizations .......................................... (51) (10) (110) (26) Interest-bearing securities ................................... (4) (5) (14) (15) Liabilities to credit institutions ............................ (9) (5) (19) (13) Subordinated liabilities ......................................... (5) (5) (14) (12) Other funding costs ............................................... (22) (12) (52) (30) Total .......................................................................... $ (180) $ (123) $ (457) $ (356) 13 KLARNA GROUP PLC Q3 INTERIM REPORT 2025 1 Receivables held for trading are included in other assets. 2 The pledged assets are included within debt securities. 3 The Company’s payable to SPV are included within other liabilities.

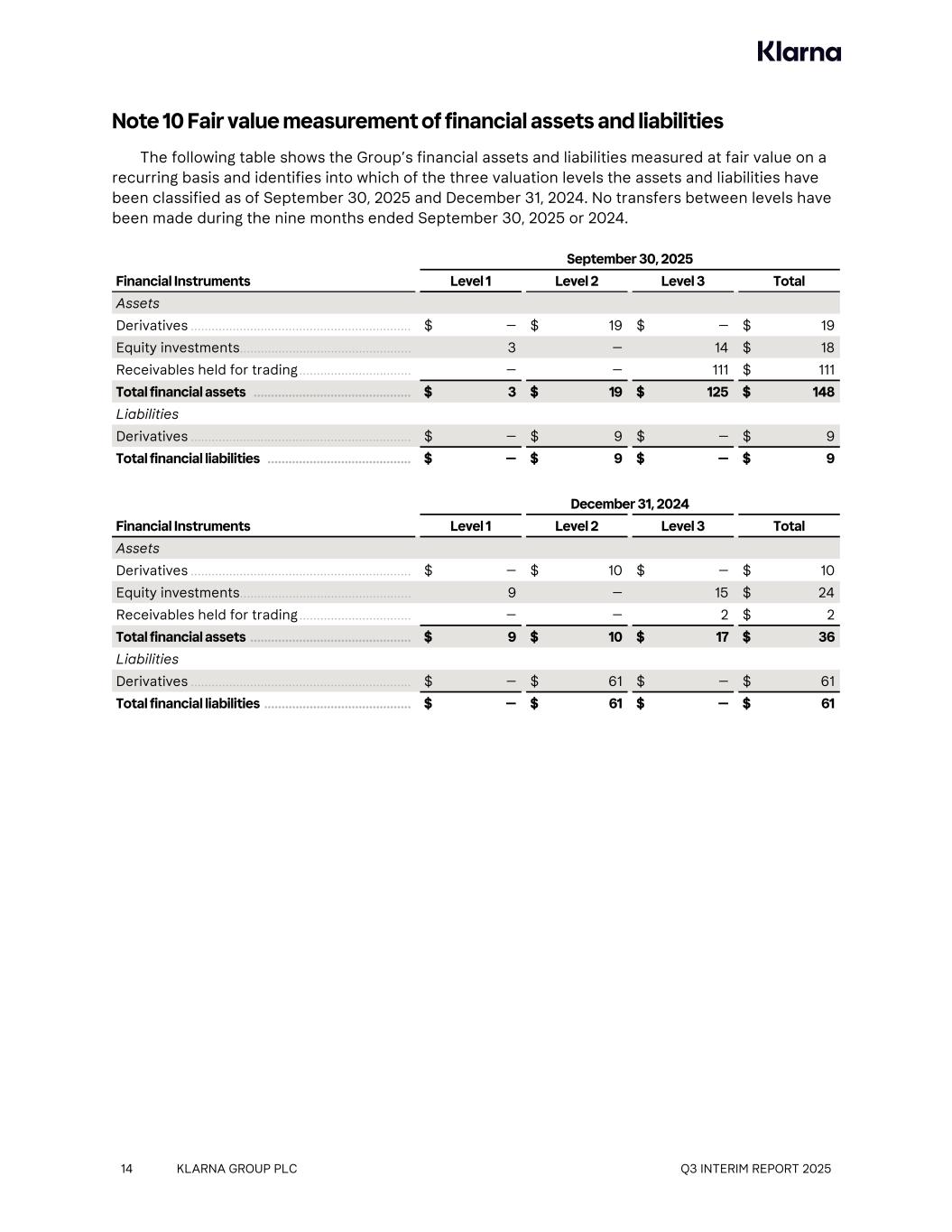

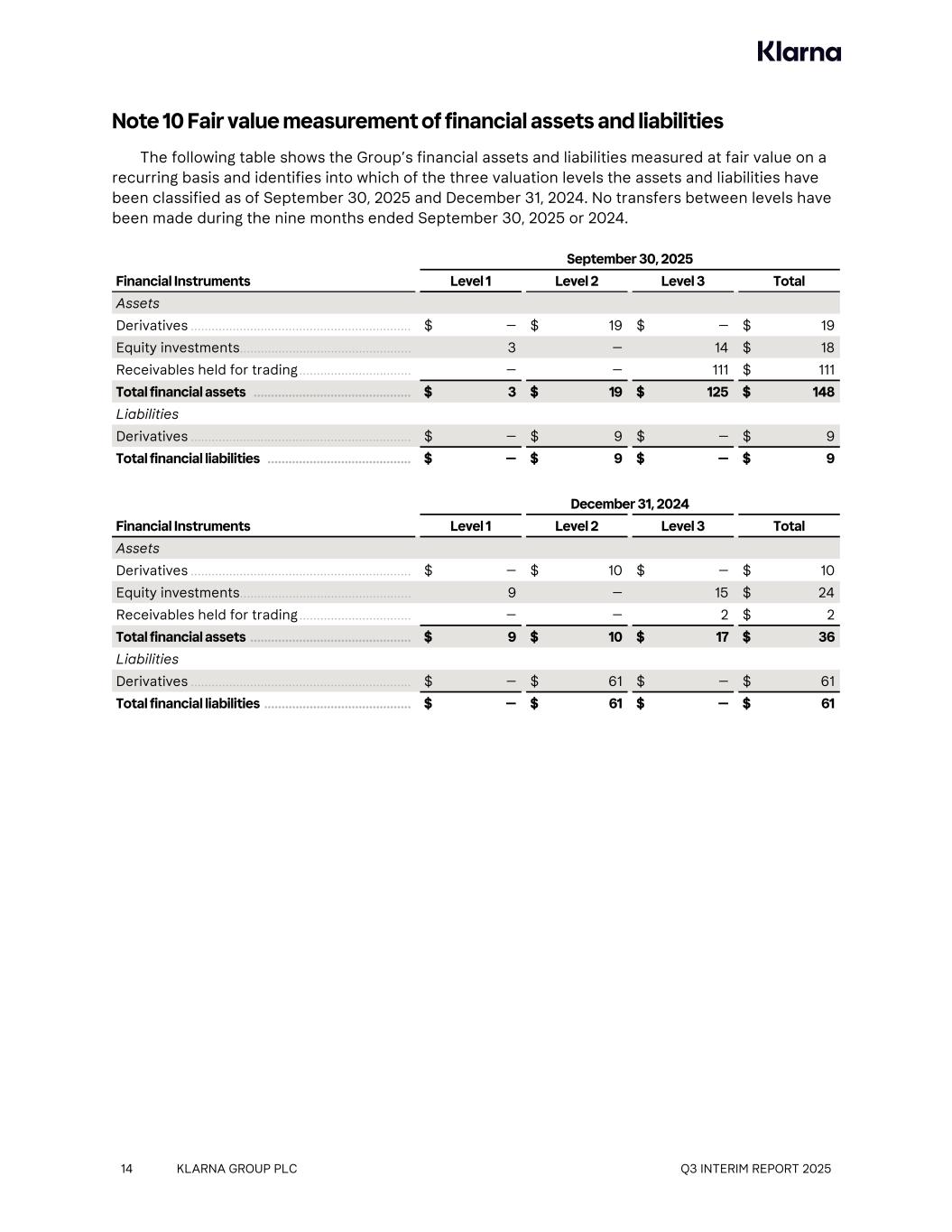

Note 10 Fair value measurement of financial assets and liabilities The following table shows the Group’s financial assets and liabilities measured at fair value on a recurring basis and identifies into which of the three valuation levels the assets and liabilities have been classified as of September 30, 2025 and December 31, 2024. No transfers between levels have been made during the nine months ended September 30, 2025 or 2024. September 30, 2025 Financial Instruments Level 1 Level 2 Level 3 Total Assets Derivatives ............................................................... $ — $ 19 $ — $ 19 Equity investments ................................................. 3 — 14 $ 18 Receivables held for trading ................................ — — 111 $ 111 Total financial assets ............................................. $ 3 $ 19 $ 125 $ 148 Liabilities Derivatives ............................................................... $ — $ 9 $ — $ 9 Total financial liabilities ......................................... $ — $ 9 $ — $ 9 December 31, 2024 Financial Instruments Level 1 Level 2 Level 3 Total Assets Derivatives ............................................................... $ — $ 10 $ — $ 10 Equity investments ................................................. 9 — 15 $ 24 Receivables held for trading ................................ — — 2 $ 2 Total financial assets .............................................. $ 9 $ 10 $ 17 $ 36 Liabilities Derivatives ............................................................... $ — $ 61 $ — $ 61 Total financial liabilities .......................................... $ — $ 61 $ — $ 61 14 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

The following tables show a reconciliation of the opening and closing balances of Level 3 financial assets which are recorded at fair value. Equity investments Receivables held for trading Balance as at December 31, 2023 ...................................................................................... $ 26 $ — Gain/(loss) in income statement4 .................................................................................... (11) (30) of which: unrealized gain/loss .......................................................................................... (11) — of which: realized gain/loss .............................................................................................. — (30) Receivables originated as held for trading .................................................................... — 3,261 Receivables held for trading sold to third parties ....................................................... — (3,259) Impact of foreign exchange movements ....................................................................... — — Balance as at December 31, 2024 ...................................................................................... $ 15 $ 2 Gain/(loss) in income statement ...................................................................................... (1) (82) of which: unrealized gain/loss .......................................................................................... (1) — of which: realized gain/loss .............................................................................................. — (82) Receivables originated as held for trading .................................................................... — 9,807 Receivables held for trading sold to third parties ....................................................... — (9,707) Impact of foreign exchange movements ....................................................................... — 9 Balance as at September 30, 2025 .................................................................................... $ 14 $ 111 Receivables held for trading Receivables held for trading refers to receivables intended for offloading as part of the Company’s forward flow transactions. Fair value is estimated using a discounted cash flow model. Significant assumptions used in the valuation of the receivables held for trading include repayment rates, discount rates and loss rates. Financial assets and liabilities measured at amortized cost The following tables show the fair value of financial instruments carried at amortized cost. They do not include financial assets and financial liabilities not measured at fair value if the carrying amount approximates fair value, which includes: cash and cash equivalents, consumer receivables, settlement and trade receivables, payables to merchants, repurchase agreement liabilities (included in notes payable and other borrowings) and other liabilities. 15 KLARNA GROUP PLC Q3 INTERIM REPORT 2025 4 Fair value gains and losses recognized in the statement of profit or loss are included in other income (loss).

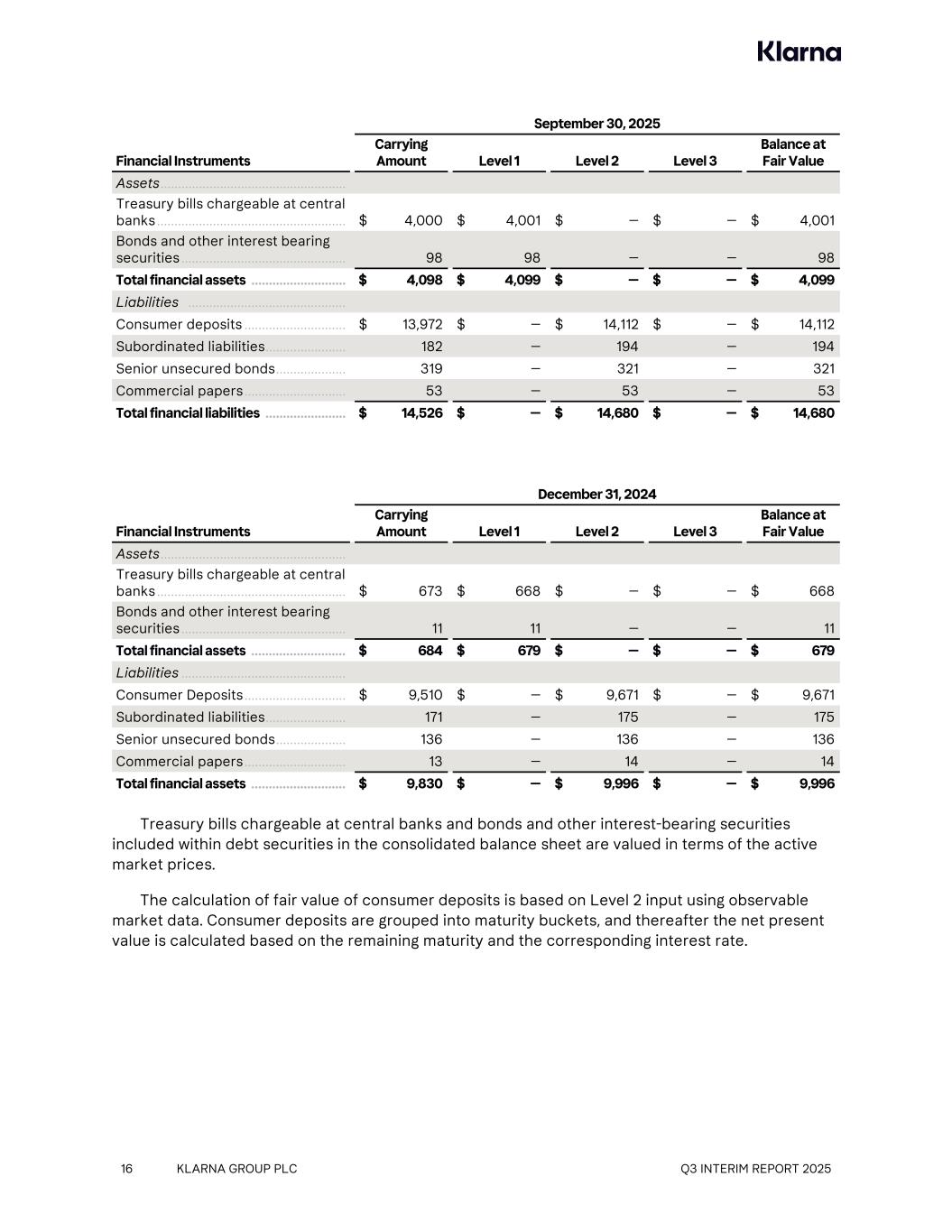

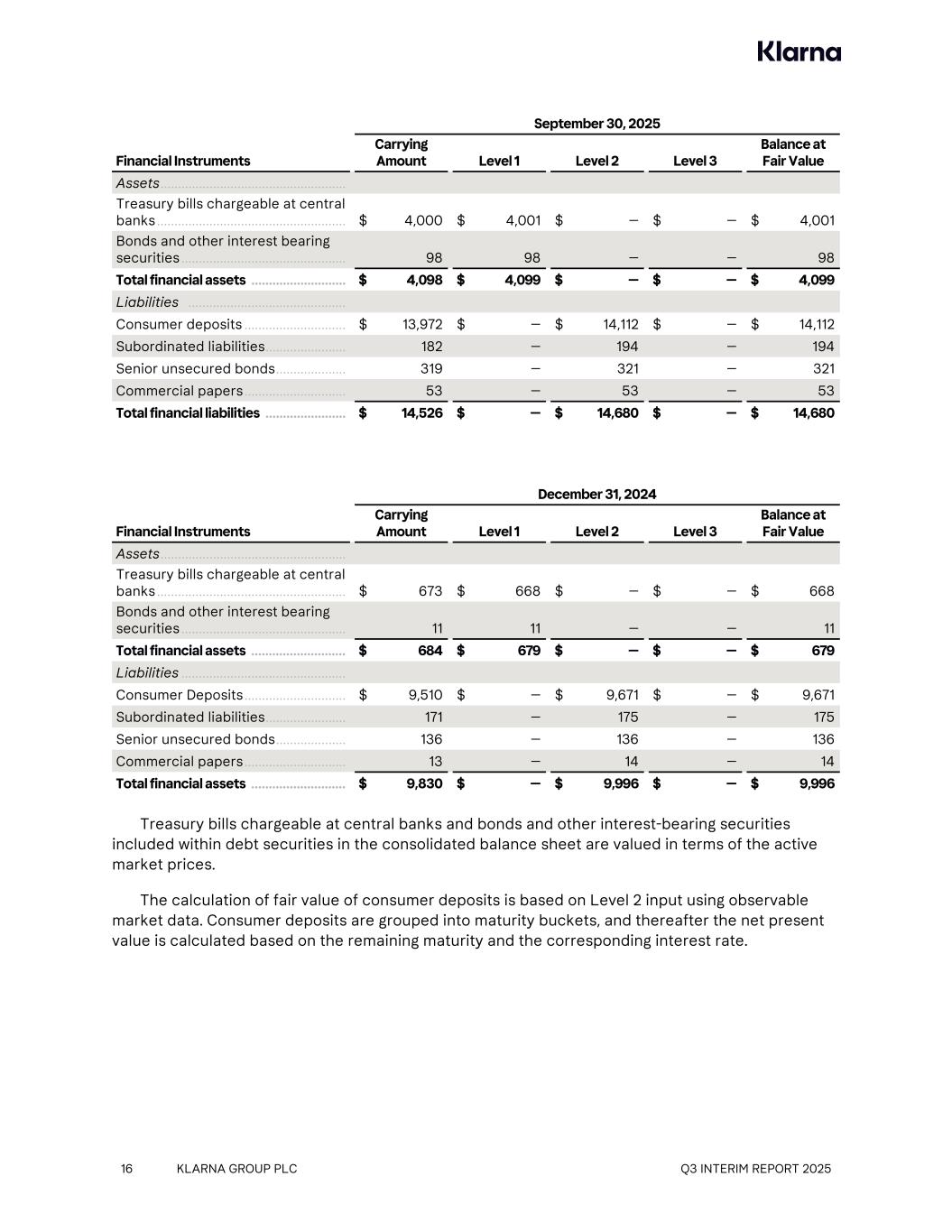

September 30, 2025 Financial Instruments Carrying Amount Level 1 Level 2 Level 3 Balance at Fair Value Assets ..................................................... Treasury bills chargeable at central banks ...................................................... $ 4,000 $ 4,001 $ — $ — $ 4,001 Bonds and other interest bearing securities ............................................... 98 98 — — 98 Total financial assets ........................... $ 4,098 $ 4,099 $ — $ — $ 4,099 Liabilities ............................................. Consumer deposits ............................. $ 13,972 $ — $ 14,112 $ — $ 14,112 Subordinated liabilities ....................... 182 — 194 — 194 Senior unsecured bonds .................... 319 — 321 — 321 Commercial papers ............................. 53 — 53 — 53 Total financial liabilities ....................... $ 14,526 $ — $ 14,680 $ — $ 14,680 December 31, 2024 Financial Instruments Carrying Amount Level 1 Level 2 Level 3 Balance at Fair Value Assets ..................................................... Treasury bills chargeable at central banks ...................................................... $ 673 $ 668 $ — $ — $ 668 Bonds and other interest bearing securities ............................................... 11 11 — — 11 Total financial assets ........................... $ 684 $ 679 $ — $ — $ 679 Liabilities ............................................... Consumer Deposits ............................. $ 9,510 $ — $ 9,671 $ — $ 9,671 Subordinated liabilities ....................... 171 — 175 — 175 Senior unsecured bonds .................... 136 — 136 — 136 Commercial papers ............................. 13 — 14 — 14 Total financial assets ........................... $ 9,830 $ — $ 9,996 $ — $ 9,996 Treasury bills chargeable at central banks and bonds and other interest-bearing securities included within debt securities in the consolidated balance sheet are valued in terms of the active market prices. The calculation of fair value of consumer deposits is based on Level 2 input using observable market data. Consumer deposits are grouped into maturity buckets, and thereafter the net present value is calculated based on the remaining maturity and the corresponding interest rate. 16 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

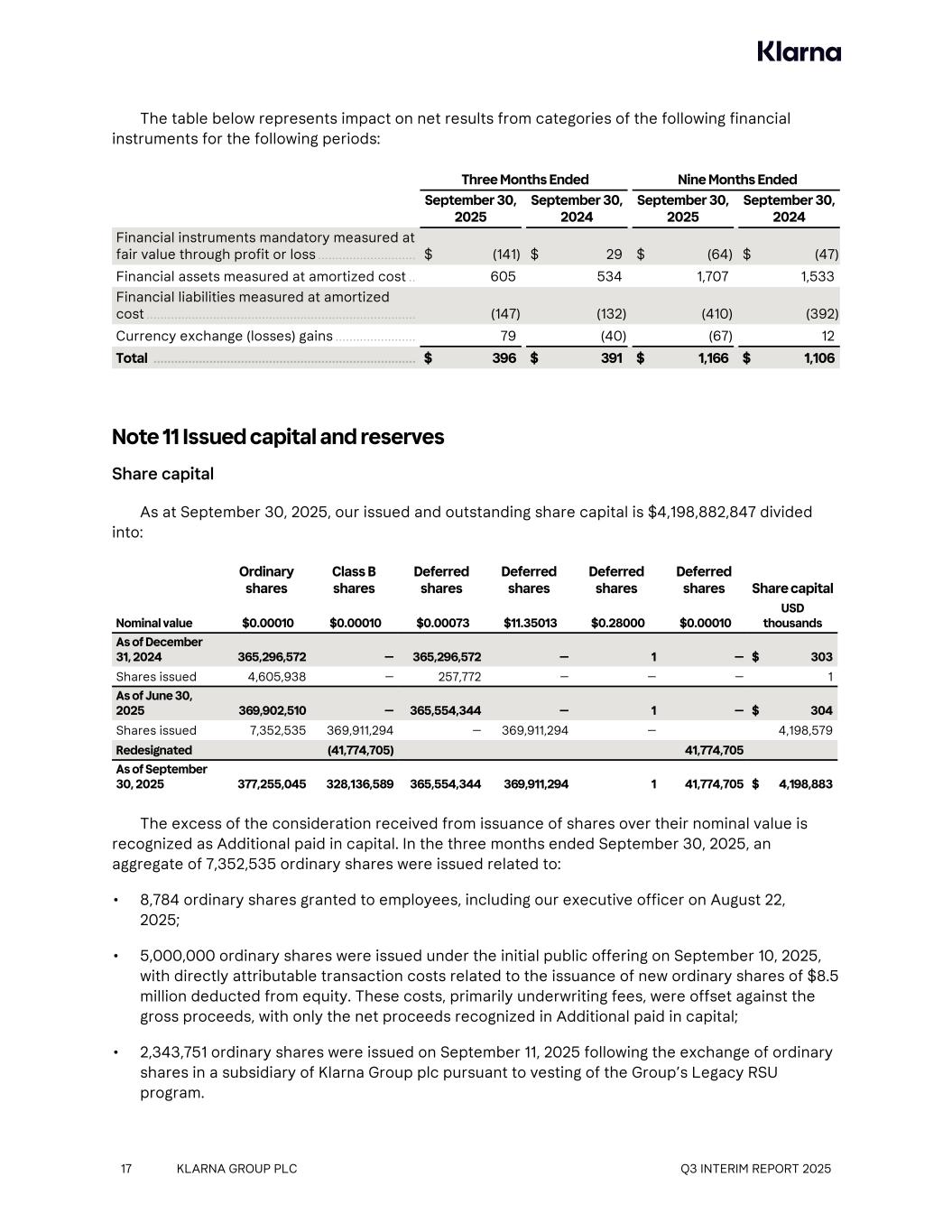

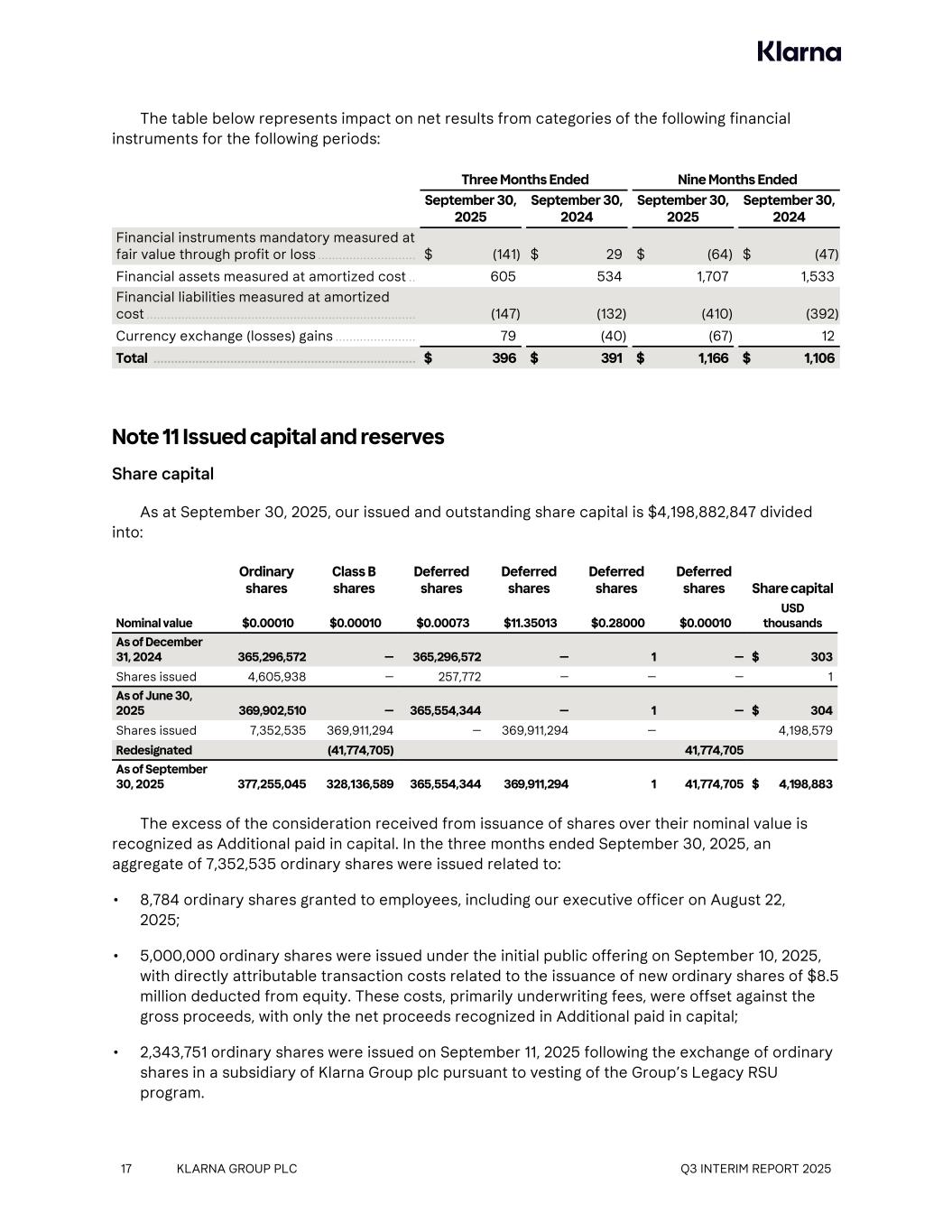

The table below represents impact on net results from categories of the following financial instruments for the following periods: Three Months Ended Nine Months Ended September 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Financial instruments mandatory measured at fair value through profit or loss ............................ $ (141) $ 29 $ (64) $ (47) Financial assets measured at amortized cost .. 605 534 1,707 1,533 Financial liabilities measured at amortized cost ............................................................................. (147) (132) (410) (392) Currency exchange (losses) gains ....................... 79 (40) (67) 12 Total ........................................................................... $ 396 $ 391 $ 1,166 $ 1,106 Note 11 Issued capital and reserves Share capital As at September 30, 2025, our issued and outstanding share capital is $4,198,882,847 divided into: Ordinary shares Class B shares Deferred shares Deferred shares Deferred shares Deferred shares Share capital Nominal value $0.00010 $0.00010 $0.00073 $11.35013 $0.28000 $0.00010 USD thousands As of December 31, 2024 365,296,572 — 365,296,572 — 1 — $ 303 Shares issued 4,605,938 — 257,772 — — — 1 As of June 30, 2025 369,902,510 — 365,554,344 — 1 — $ 304 Shares issued 7,352,535 369,911,294 — 369,911,294 — 4,198,579 Redesignated (41,774,705) 41,774,705 As of September 30, 2025 377,255,045 328,136,589 365,554,344 369,911,294 1 41,774,705 $ 4,198,883 The excess of the consideration received from issuance of shares over their nominal value is recognized as Additional paid in capital. In the three months ended September 30, 2025, an aggregate of 7,352,535 ordinary shares were issued related to: • 8,784 ordinary shares granted to employees, including our executive officer on August 22, 2025; • 5,000,000 ordinary shares were issued under the initial public offering on September 10, 2025, with directly attributable transaction costs related to the issuance of new ordinary shares of $8.5 million deducted from equity. These costs, primarily underwriting fees, were offset against the gross proceeds, with only the net proceeds recognized in Additional paid in capital; • 2,343,751 ordinary shares were issued on September 11, 2025 following the exchange of ordinary shares in a subsidiary of Klarna Group plc pursuant to vesting of the Group’s Legacy RSU program. 17 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

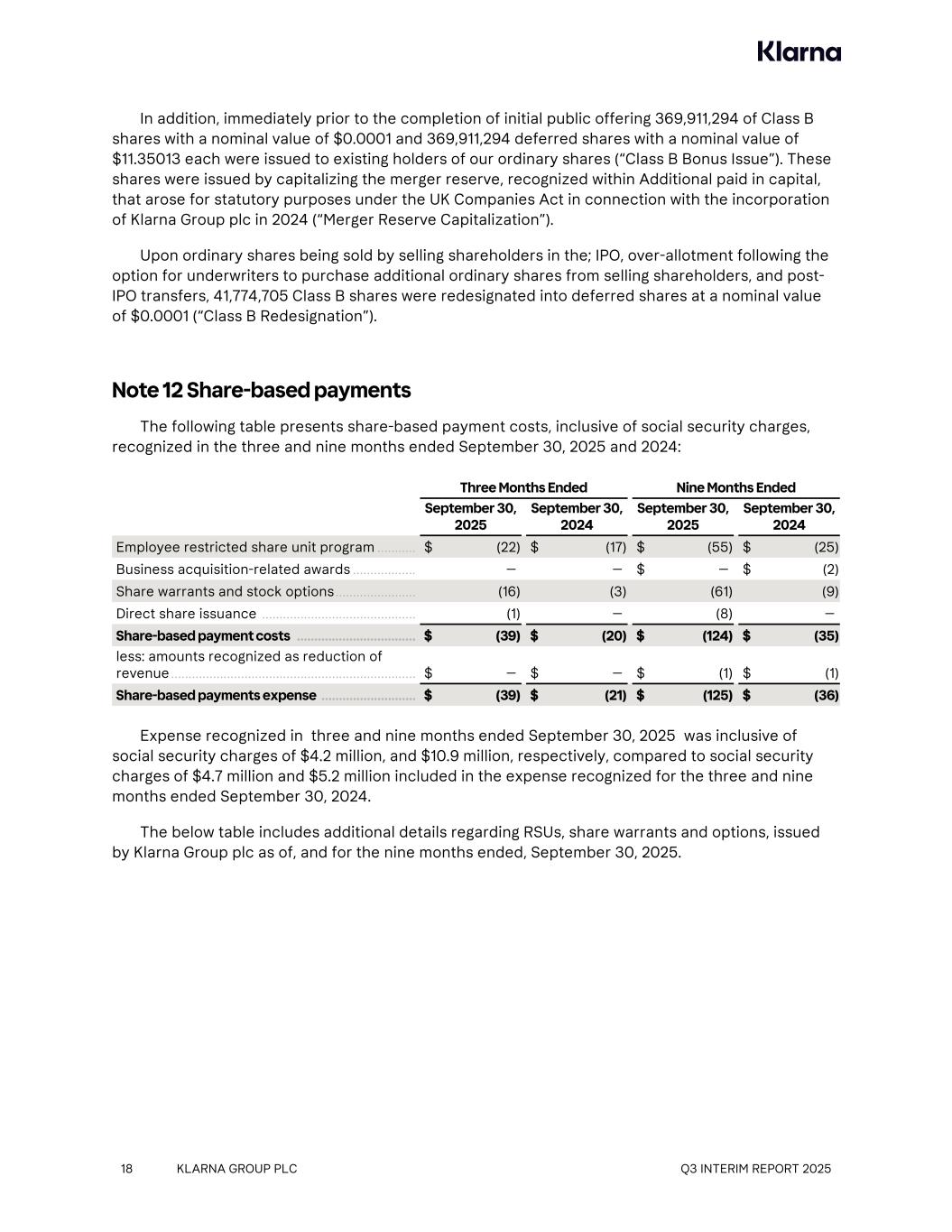

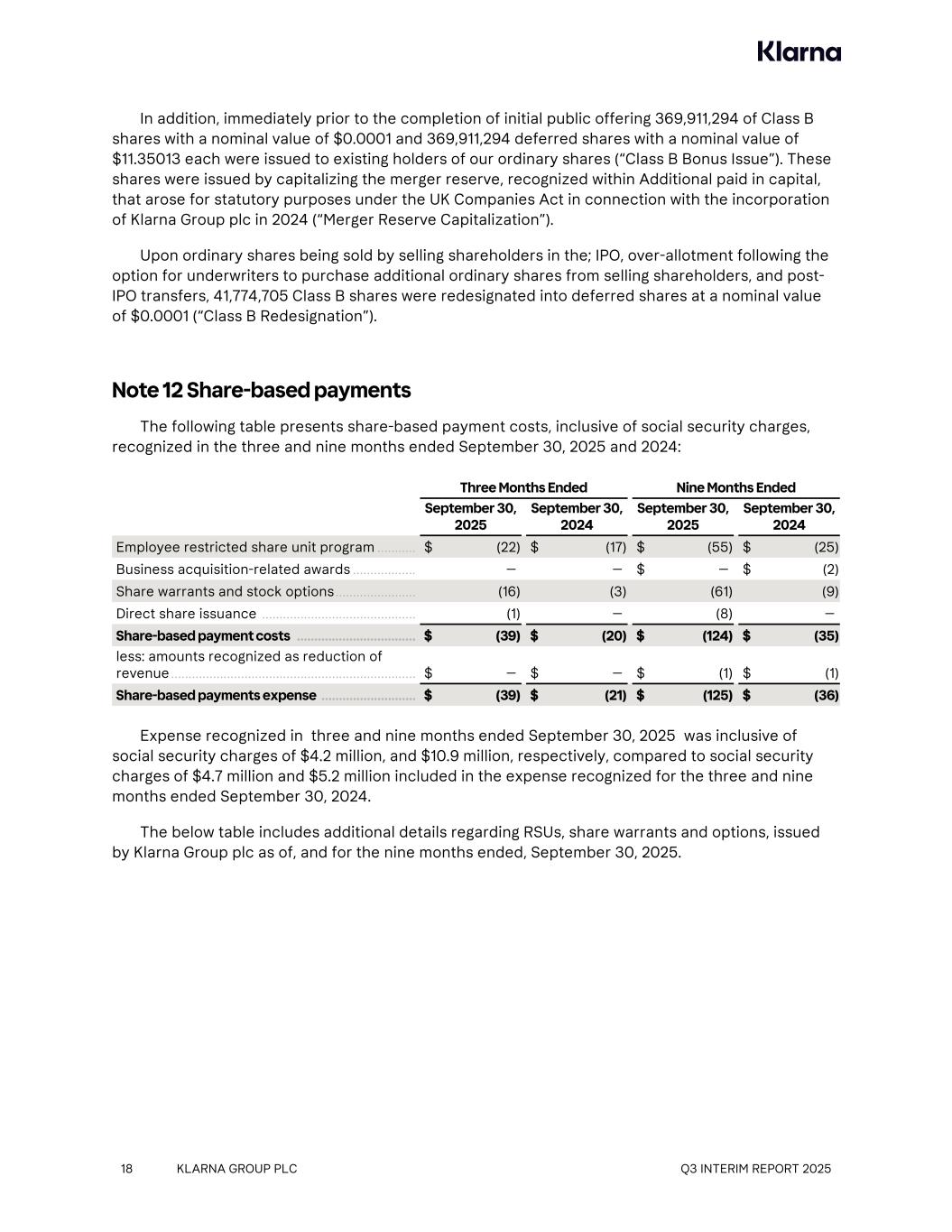

In addition, immediately prior to the completion of initial public offering 369,911,294 of Class B shares with a nominal value of $0.0001 and 369,911,294 deferred shares with a nominal value of $11.35013 each were issued to existing holders of our ordinary shares (“Class B Bonus Issue”). These shares were issued by capitalizing the merger reserve, recognized within Additional paid in capital, that arose for statutory purposes under the UK Companies Act in connection with the incorporation of Klarna Group plc in 2024 (“Merger Reserve Capitalization”). Upon ordinary shares being sold by selling shareholders in the; IPO, over-allotment following the option for underwriters to purchase additional ordinary shares from selling shareholders, and post- IPO transfers, 41,774,705 Class B shares were redesignated into deferred shares at a nominal value of $0.0001 (“Class B Redesignation”). Note 12 Share-based payments The following table presents share-based payment costs, inclusive of social security charges, recognized in the three and nine months ended September 30, 2025 and 2024: Three Months Ended Nine Months Ended September 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Employee restricted share unit program ........... $ (22) $ (17) $ (55) $ (25) Business acquisition-related awards .................. — — $ — $ (2) Share warrants and stock options ....................... (16) (3) (61) (9) Direct share issuance ............................................ (1) — (8) — Share-based payment costs .................................. $ (39) $ (20) $ (124) $ (35) less: amounts recognized as reduction of revenue ...................................................................... $ — $ — $ (1) $ (1) Share-based payments expense ........................... $ (39) $ (21) $ (125) $ (36) Expense recognized in three and nine months ended September 30, 2025 was inclusive of social security charges of $4.2 million, and $10.9 million, respectively, compared to social security charges of $4.7 million and $5.2 million included in the expense recognized for the three and nine months ended September 30, 2024. The below table includes additional details regarding RSUs, share warrants and options, issued by Klarna Group plc as of, and for the nine months ended, September 30, 2025. 18 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

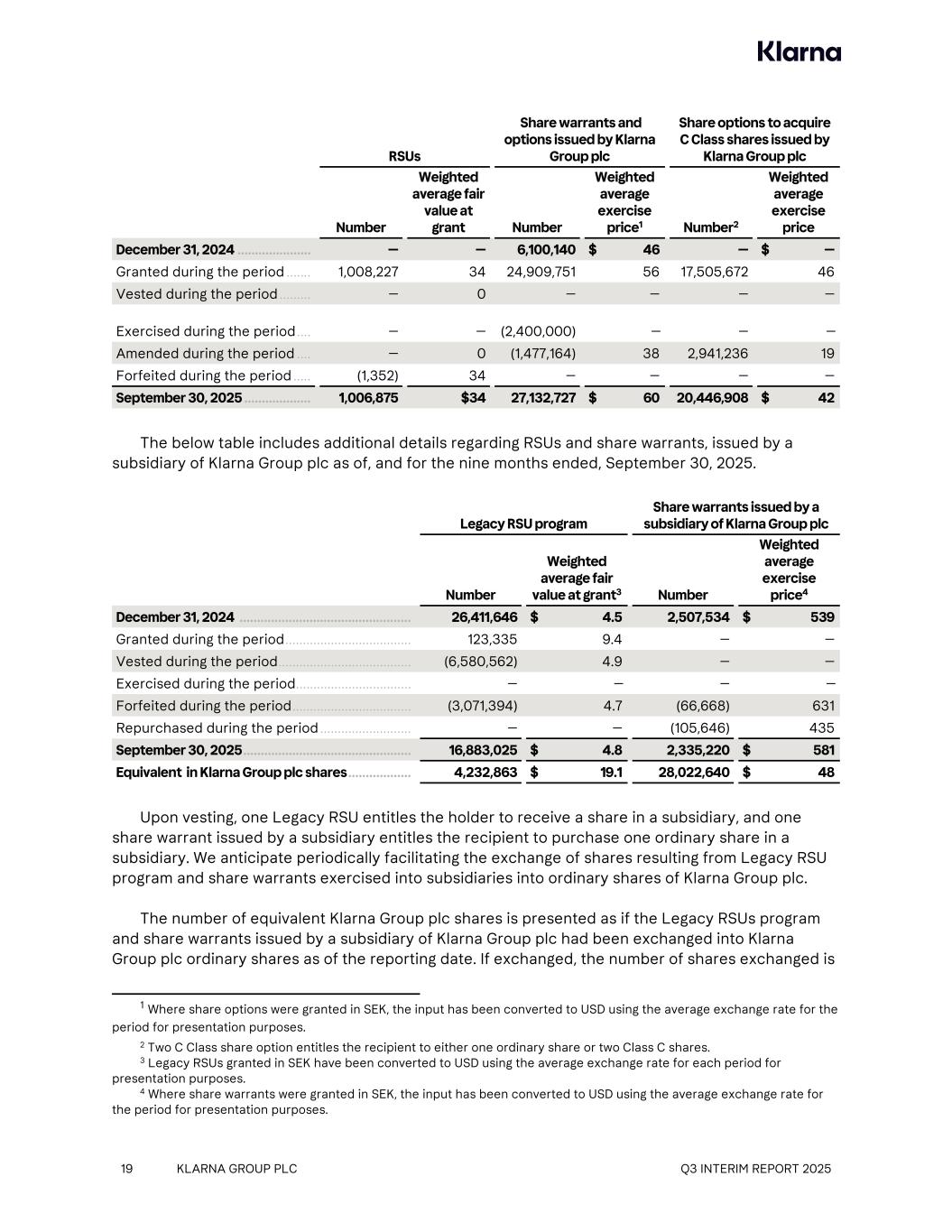

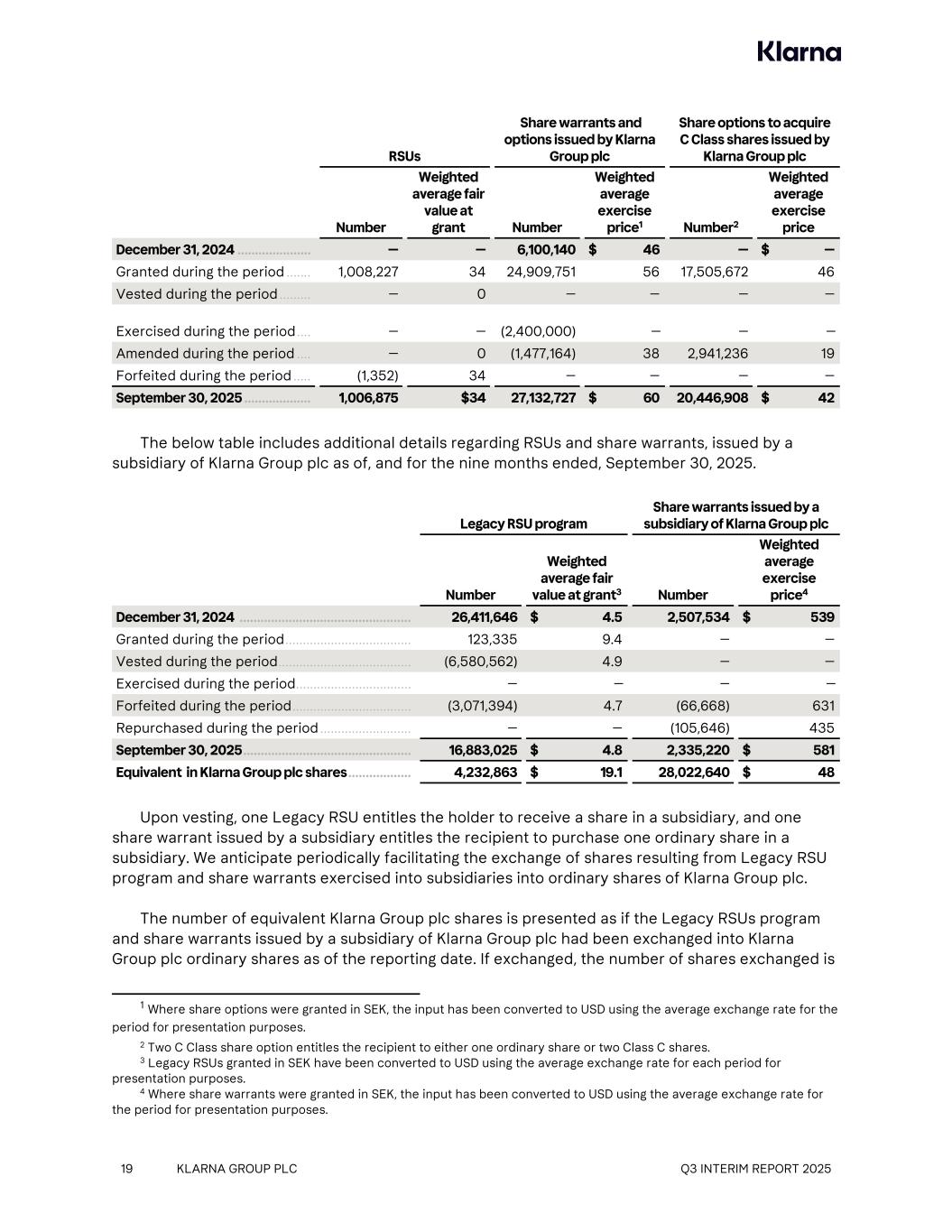

RSUs Share warrants and options issued by Klarna Group plc Share options to acquire C Class shares issued by Klarna Group plc Number Weighted average fair value at grant Number Weighted average exercise price1 Number2 Weighted average exercise price December 31, 2024 ..................... — — 6,100,140 $ 46 — $ — Granted during the period ....... 1,008,227 34 24,909,751 56 17,505,672 46 Vested during the period ......... — 0 — — — — Exercised during the period .... — — (2,400,000) — — — Amended during the period .... — 0 (1,477,164) 38 2,941,236 19 Forfeited during the period ..... (1,352) 34 — — — — September 30, 2025 ................... 1,006,875 $34 27,132,727 $ 60 20,446,908 $ 42 The below table includes additional details regarding RSUs and share warrants, issued by a subsidiary of Klarna Group plc as of, and for the nine months ended, September 30, 2025. Legacy RSU program Share warrants issued by a subsidiary of Klarna Group plc Number Weighted average fair value at grant3 Number Weighted average exercise price4 December 31, 2024 ................................................. 26,411,646 $ 4.5 2,507,534 $ 539 Granted during the period .................................... 123,335 9.4 — — Vested during the period ...................................... (6,580,562) 4.9 — — Exercised during the period ................................. — — — — Forfeited during the period .................................. (3,071,394) 4.7 (66,668) 631 Repurchased during the period .......................... — — (105,646) 435 September 30, 2025 ................................................ 16,883,025 $ 4.8 2,335,220 $ 581 Equivalent in Klarna Group plc shares .................. 4,232,863 $ 19.1 28,022,640 $ 48 Upon vesting, one Legacy RSU entitles the holder to receive a share in a subsidiary, and one share warrant issued by a subsidiary entitles the recipient to purchase one ordinary share in a subsidiary. We anticipate periodically facilitating the exchange of shares resulting from Legacy RSU program and share warrants exercised into subsidiaries into ordinary shares of Klarna Group plc. The number of equivalent Klarna Group plc shares is presented as if the Legacy RSUs program and share warrants issued by a subsidiary of Klarna Group plc had been exchanged into Klarna Group plc ordinary shares as of the reporting date. If exchanged, the number of shares exchanged is 19 KLARNA GROUP PLC Q3 INTERIM REPORT 2025 1 Where share options were granted in SEK, the input has been converted to USD using the average exchange rate for the period for presentation purposes. 2 Two C Class share option entitles the recipient to either one ordinary share or two Class C shares. 3 Legacy RSUs granted in SEK have been converted to USD using the average exchange rate for each period for presentation purposes. 4 Where share warrants were granted in SEK, the input has been converted to USD using the average exchange rate for the period for presentation purposes.

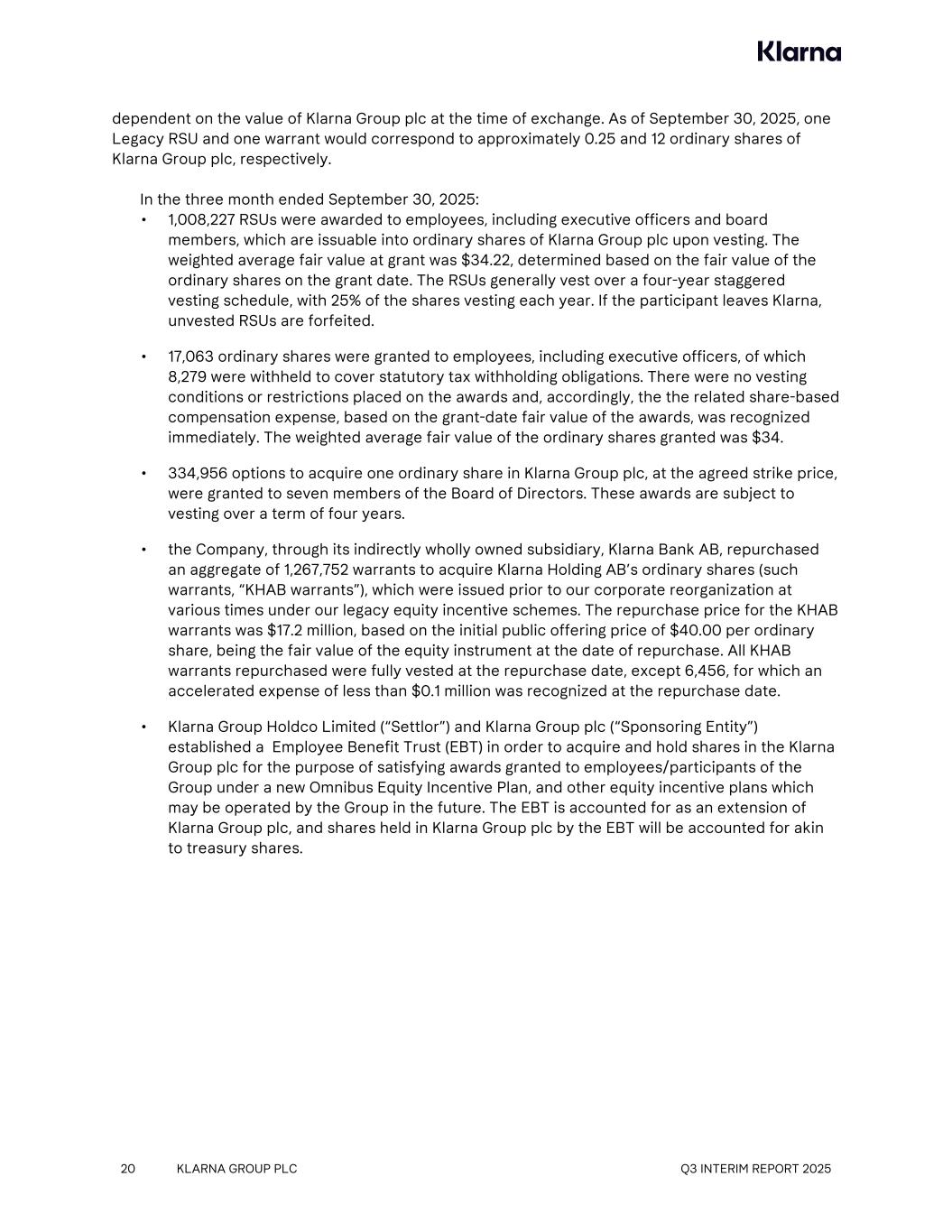

dependent on the value of Klarna Group plc at the time of exchange. As of September 30, 2025, one Legacy RSU and one warrant would correspond to approximately 0.25 and 12 ordinary shares of Klarna Group plc, respectively. In the three month ended September 30, 2025: • 1,008,227 RSUs were awarded to employees, including executive officers and board members, which are issuable into ordinary shares of Klarna Group plc upon vesting. The weighted average fair value at grant was $34.22, determined based on the fair value of the ordinary shares on the grant date. The RSUs generally vest over a four-year staggered vesting schedule, with 25% of the shares vesting each year. If the participant leaves Klarna, unvested RSUs are forfeited. • 17,063 ordinary shares were granted to employees, including executive officers, of which 8,279 were withheld to cover statutory tax withholding obligations. There were no vesting conditions or restrictions placed on the awards and, accordingly, the the related share-based compensation expense, based on the grant-date fair value of the awards, was recognized immediately. The weighted average fair value of the ordinary shares granted was $34. • 334,956 options to acquire one ordinary share in Klarna Group plc, at the agreed strike price, were granted to seven members of the Board of Directors. These awards are subject to vesting over a term of four years. • the Company, through its indirectly wholly owned subsidiary, Klarna Bank AB, repurchased an aggregate of 1,267,752 warrants to acquire Klarna Holding AB’s ordinary shares (such warrants, “KHAB warrants”), which were issued prior to our corporate reorganization at various times under our legacy equity incentive schemes. The repurchase price for the KHAB warrants was $17.2 million, based on the initial public offering price of $40.00 per ordinary share, being the fair value of the equity instrument at the date of repurchase. All KHAB warrants repurchased were fully vested at the repurchase date, except 6,456, for which an accelerated expense of less than $0.1 million was recognized at the repurchase date. • Klarna Group Holdco Limited (“Settlor”) and Klarna Group plc (“Sponsoring Entity”) established a Employee Benefit Trust (EBT) in order to acquire and hold shares in the Klarna Group plc for the purpose of satisfying awards granted to employees/participants of the Group under a new Omnibus Equity Incentive Plan, and other equity incentive plans which may be operated by the Group in the future. The EBT is accounted for as an extension of Klarna Group plc, and shares held in Klarna Group plc by the EBT will be accounted for akin to treasury shares. 20 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

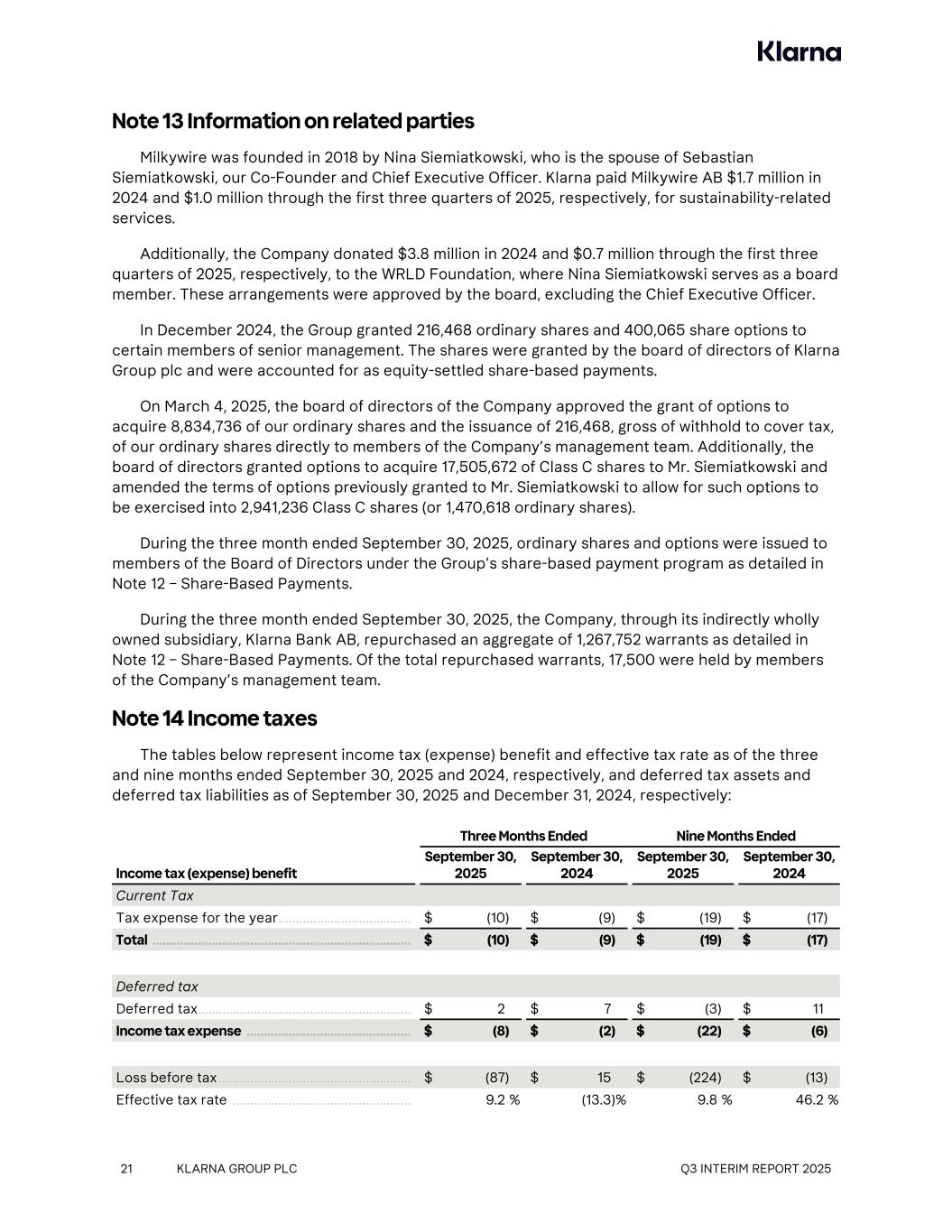

Note 13 Information on related parties Milkywire was founded in 2018 by Nina Siemiatkowski, who is the spouse of Sebastian Siemiatkowski, our Co-Founder and Chief Executive Officer. Klarna paid Milkywire AB $1.7 million in 2024 and $1.0 million through the first three quarters of 2025, respectively, for sustainability-related services. Additionally, the Company donated $3.8 million in 2024 and $0.7 million through the first three quarters of 2025, respectively, to the WRLD Foundation, where Nina Siemiatkowski serves as a board member. These arrangements were approved by the board, excluding the Chief Executive Officer. In December 2024, the Group granted 216,468 ordinary shares and 400,065 share options to certain members of senior management. The shares were granted by the board of directors of Klarna Group plc and were accounted for as equity-settled share-based payments. On March 4, 2025, the board of directors of the Company approved the grant of options to acquire 8,834,736 of our ordinary shares and the issuance of 216,468, gross of withhold to cover tax, of our ordinary shares directly to members of the Company’s management team. Additionally, the board of directors granted options to acquire 17,505,672 of Class C shares to Mr. Siemiatkowski and amended the terms of options previously granted to Mr. Siemiatkowski to allow for such options to be exercised into 2,941,236 Class C shares (or 1,470,618 ordinary shares). During the three month ended September 30, 2025, ordinary shares and options were issued to members of the Board of Directors under the Group’s share-based payment program as detailed in Note 12 – Share-Based Payments. During the three month ended September 30, 2025, the Company, through its indirectly wholly owned subsidiary, Klarna Bank AB, repurchased an aggregate of 1,267,752 warrants as detailed in Note 12 – Share-Based Payments. Of the total repurchased warrants, 17,500 were held by members of the Company’s management team. Note 14 Income taxes The tables below represent income tax (expense) benefit and effective tax rate as of the three and nine months ended September 30, 2025 and 2024, respectively, and deferred tax assets and deferred tax liabilities as of September 30, 2025 and December 31, 2024, respectively: Three Months Ended Nine Months Ended Income tax (expense) benefit September 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Current Tax Tax expense for the year ...................................... $ (10) $ (9) $ (19) $ (17) Total .......................................................................... $ (10) $ (9) $ (19) $ (17) Deferred tax Deferred tax ............................................................. $ 2 $ 7 $ (3) $ 11 Income tax expense ............................................... $ (8) $ (2) $ (22) $ (6) Loss before tax ....................................................... $ (87) $ 15 $ (224) $ (13) Effective tax rate ................................................... 9.2 % (13.3) % 9.8 % 46.2 % 21 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

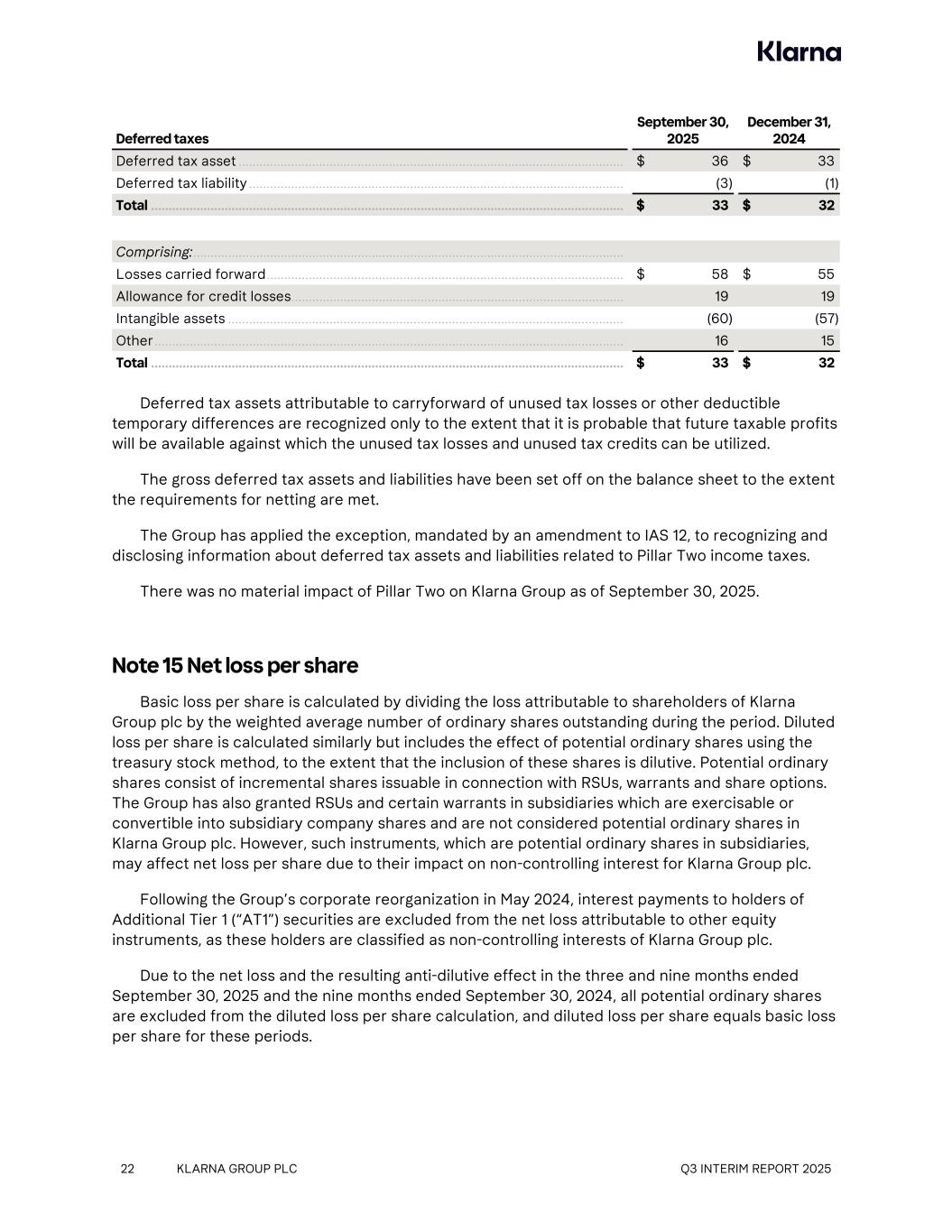

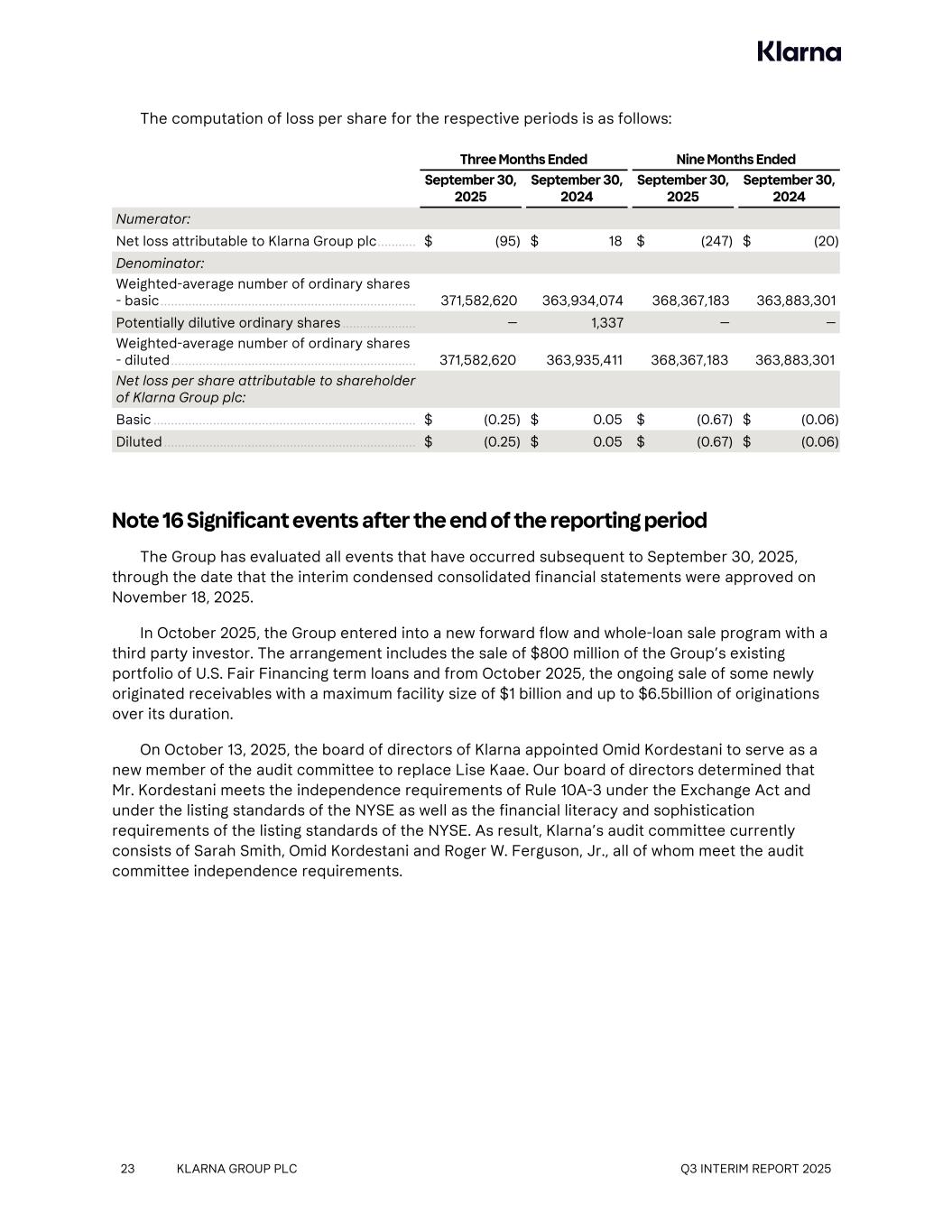

Deferred taxes September 30, 2025 December 31, 2024 Deferred tax asset .............................................................................................................. $ 36 $ 33 Deferred tax liability ........................................................................................................... (3) (1) Total ....................................................................................................................................... $ 33 $ 32 Comprising: ........................................................................................................................... Losses carried forward ...................................................................................................... $ 58 $ 55 Allowance for credit losses ............................................................................................... 19 19 Intangible assets ................................................................................................................. (60) (57) Other ...................................................................................................................................... 16 15 Total ....................................................................................................................................... $ 33 $ 32 Deferred tax assets attributable to carryforward of unused tax losses or other deductible temporary differences are recognized only to the extent that it is probable that future taxable profits will be available against which the unused tax losses and unused tax credits can be utilized. The gross deferred tax assets and liabilities have been set off on the balance sheet to the extent the requirements for netting are met. The Group has applied the exception, mandated by an amendment to IAS 12, to recognizing and disclosing information about deferred tax assets and liabilities related to Pillar Two income taxes. There was no material impact of Pillar Two on Klarna Group as of September 30, 2025. Note 15 Net loss per share Basic loss per share is calculated by dividing the loss attributable to shareholders of Klarna Group plc by the weighted average number of ordinary shares outstanding during the period. Diluted loss per share is calculated similarly but includes the effect of potential ordinary shares using the treasury stock method, to the extent that the inclusion of these shares is dilutive. Potential ordinary shares consist of incremental shares issuable in connection with RSUs, warrants and share options. The Group has also granted RSUs and certain warrants in subsidiaries which are exercisable or convertible into subsidiary company shares and are not considered potential ordinary shares in Klarna Group plc. However, such instruments, which are potential ordinary shares in subsidiaries, may affect net loss per share due to their impact on non-controlling interest for Klarna Group plc. Following the Group’s corporate reorganization in May 2024, interest payments to holders of Additional Tier 1 (“AT1”) securities are excluded from the net loss attributable to other equity instruments, as these holders are classified as non-controlling interests of Klarna Group plc. Due to the net loss and the resulting anti-dilutive effect in the three and nine months ended September 30, 2025 and the nine months ended September 30, 2024, all potential ordinary shares are excluded from the diluted loss per share calculation, and diluted loss per share equals basic loss per share for these periods. 22 KLARNA GROUP PLC Q3 INTERIM REPORT 2025

The computation of loss per share for the respective periods is as follows: Three Months Ended Nine Months Ended September 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Numerator: Net loss attributable to Klarna Group plc ........... $ (95) $ 18 $ (247) $ (20) Denominator: Weighted-average number of ordinary shares - basic ......................................................................... 371,582,620 363,934,074 368,367,183 363,883,301 Potentially dilutive ordinary shares ..................... — 1,337 — — Weighted-average number of ordinary shares - diluted ...................................................................... 371,582,620 363,935,411 368,367,183 363,883,301 Net loss per share attributable to shareholder of Klarna Group plc: Basic ........................................................................... $ (0.25) $ 0.05 $ (0.67) $ (0.06) Diluted ........................................................................ $ (0.25) $ 0.05 $ (0.67) $ (0.06) Note 16 Significant events after the end of the reporting period The Group has evaluated all events that have occurred subsequent to September 30, 2025, through the date that the interim condensed consolidated financial statements were approved on November 18, 2025. In October 2025, the Group entered into a new forward flow and whole-loan sale program with a third party investor. The arrangement includes the sale of $800 million of the Group’s existing portfolio of U.S. Fair Financing term loans and from October 2025, the ongoing sale of some newly originated receivables with a maximum facility size of $1 billion and up to $6.5billion of originations over its duration. On October 13, 2025, the board of directors of Klarna appointed Omid Kordestani to serve as a new member of the audit committee to replace Lise Kaae. Our board of directors determined that Mr. Kordestani meets the independence requirements of Rule 10A-3 under the Exchange Act and under the listing standards of the NYSE as well as the financial literacy and sophistication requirements of the listing standards of the NYSE. As result, Klarna’s audit committee currently consists of Sarah Smith, Omid Kordestani and Roger W. Ferguson, Jr., all of whom meet the audit committee independence requirements. 23 KLARNA GROUP PLC Q3 INTERIM REPORT 2025