Third Quarter 2025 Results 1

Third Quarter 2025 Results 850k Merchants ↑38% Q3’25 YoY 114m Active Klarna consumers ↑32% Q3’25 YoY $32.7b GMV ↑23% Q3’25 LfL $903m Total revenue ↑26% Q3’25 LfL $281m Transaction margin dollars Q3’25 $(14)m Adjusted operating loss Q3’25 Transaction margin dollars, adjusted operating loss and like-for-like ("LfL") changes are non-IFRS measures. See "Non-IFRS measures and reconciliations" for more information. 2

Letter from the CEO Dear fellow shareholders, The malfunctioning markets that built modern finance are ending. For decades, banks and tech companies thrived on customer lock-in, hidden fees, and information asymmetry. AI is now dismantling those barriers — and Klarna is leading the way. Q3 proved it. This was our strongest quarter ever. Revenue hit $903 million, up 51% in the U.S. and 28% globally in Q3, while GMV reached $32.7 billion, with 3.4 million transactions every day. The Klarna Card has exploded since its July launch — over four million signups, already 15% of all global transactions1. Consumers are voting with their wallets for transparency and control. Our Fair Financing offering grew 244% in the U.S., taking massive share in fixed-term lending — Fair Financing has a transaction margin over twice the group average2. While accounting rules recognize provisions upfront, the long-term economics are powerful. We expect over $100 million in transaction margin uplift in Q4 as compounding revenue kicks in. On a realized loss basis, transaction margin dollars already grew 25% in Q33. Even as we grow, our discipline strengthens. Realized losses fell 1 basis point to 0.44% of GMV year- on year — proof our underwriting works at scale. More consumers are paying early, not late. That’s what responsible finance looks like. And we’re just getting started. The Klarna Card and our new membership program — already over one million members — are redefining everyday banking for the post-AI era: debit-first, transparent, empowering. We’re not asking customers to adapt to us; we’re building products that adapt to them. To our shareholders, old and new: thank you for backing this mission. We’ve entered a new chapter — not just as a listed company on the New York Stock Exchange, but as the first truly global digital bank built for the world after AI. Sebastian Siemiatkowski CEO and co-founder, Klarna 3 1 Card transactions as a percentage of total transactions in October 2025. 2The expected lifetime transaction margin for Q1 2025 Fair Financing GMV cohort. 3 Transaction margin dollars (TMD) is a non-IFRS measure. Please refer to “Non-IFRS Measures and Reconciliations” for reconciliation to the most directly comparable IFRS measure. TMD based on realised losses is calculated as revenue minus processing and servicing costs, realised losses and funding costs before the Klarna Checkout (KCO) disposal. It excludes upfront provisions.

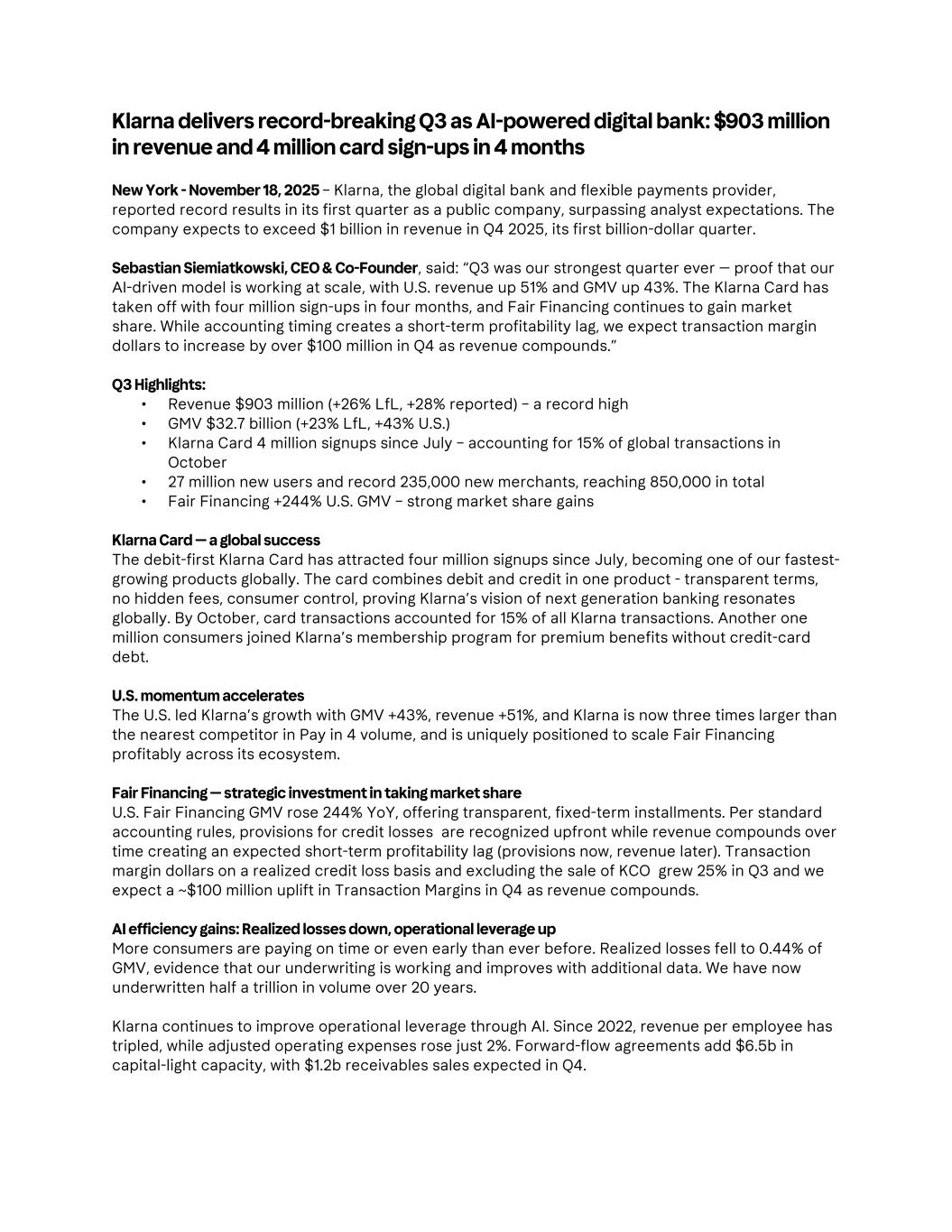

Letter from the CFO Dear fellow shareholders, In the third quarter of 2025, Klarna delivered accelerated growth and record GMV and Revenues. Growth was broad-based Like-for-like GMV rose 23% (up from 19% in Q2), including the U.S. up +43% LfL, Southern Europe +73% LfL and Sweden +18% LfL. Revenue reached $903 million, up 26% like-for-like compared to Q3’24, our highest quarter ever, with take rate expanding to 2.76% supported by the U.S. and Fair Financing mix. Expanding global reach Our merchant network added 235,000 new partners year-over-year, now totaling 850,000. Stripe continues to be a key contributor, while partnerships with Worldpay, Nexi, and JPMorgan Payments will extend distribution further. We also expanded with leading global brands — including OnePay Later Powered by Klarna at Walmart, eBay (now in eight markets), and Qatar Airways — strengthening Klarna’s position as the preferred partner for digital commerce. The Klarna Card continued its surge, with GMV up 92% year-over-year in the quarter and four million signups since launch in July. The card’s rapid adoption demonstrates consumers’ appetite for debit- first flexibility and Klarna’s global product scalability. Scaling Fair financing Fair Financing continued to scale rapidly, with U.S. GMV up 244% year-over-year and globally by 139%. Fair financing is now available at 151 thousand merchants, 18% of our merchants, up from 10% two years ago. The accounting treatment of upfront provisions for Fair Financing means the underlying economics are not fully captured in the quarter of origination, as credit loss provisions are recognized immediately while revenues accrue over the life of the loan. For example, this quarter we delivered 139% growth in Fair Financing GMV but only 48% growth in interest income. The rest will flow through in subsequent quarters as customers make repayments over the life of the loan. Margins for Fair Financing over the life of the loan are over twice the group average, and transaction margin dollars on a realized loss basis grew 25% in Q3 excluding KCO. We expect >$100 million uplift in Transaction margin dollars in Q4 compared to Q3 as revenue compounds. 4 Months Illustrative example (Fair Financing) Cumulative revenue Provision for credit losses 1 2 3 4 5 6

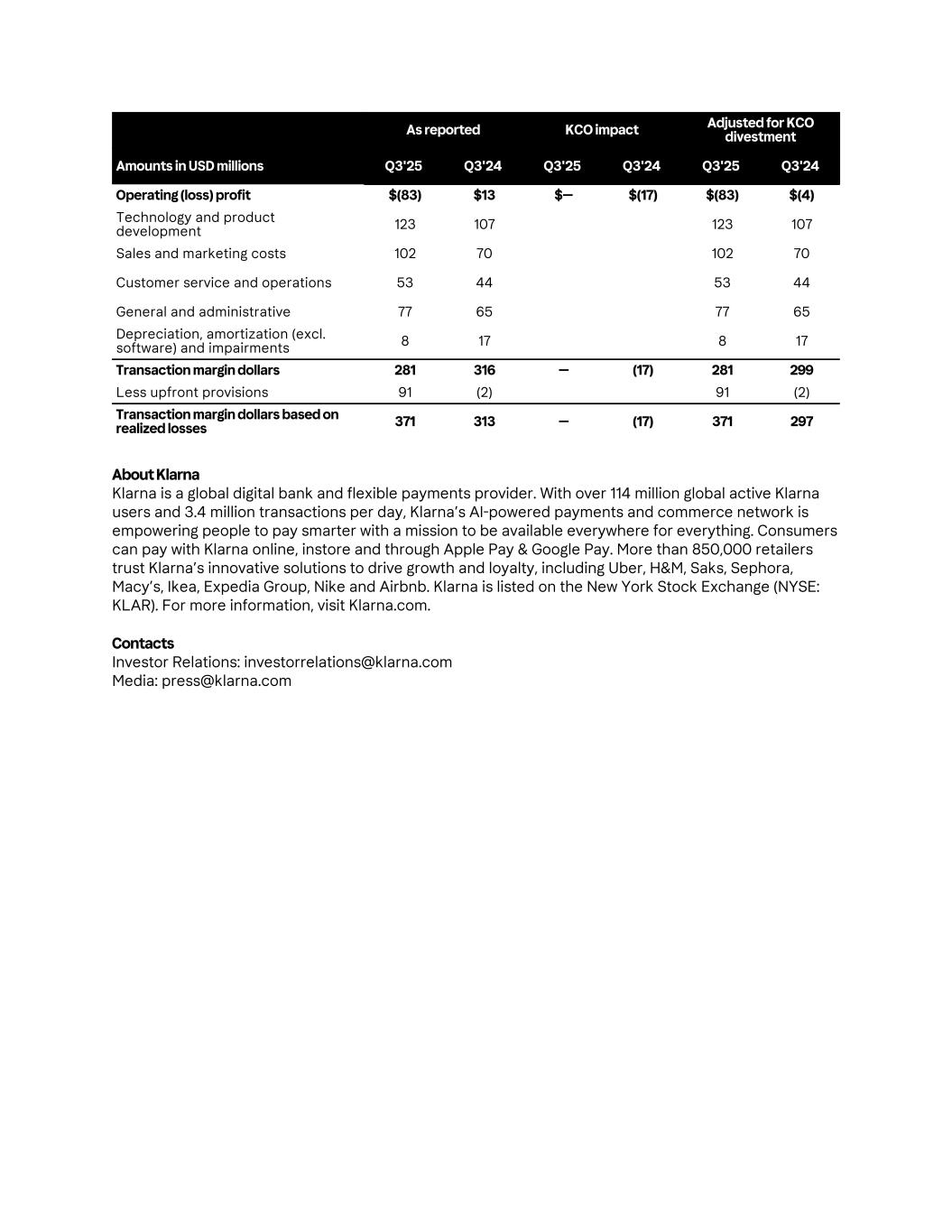

Credit quality remains strong Realized losses fell to 1 basis point YoY to 0.44% of GMV. Fair Financing delinquencies improved 5% YoY, the increase in provisions for credit losses (0.72% of GMV) simply reflecting the accelerated growth of the Fair Financing portfolio. Note: “Upfront provisions” primarily reflect potential losses at origination as well as changes in credit risk of on-book loans. Through the new forward flow agreements, Klarna has secured additional capacity for $6.5 billion of Fair Financing growth, with $1.2 billion in receivables sales expected in Q4, improving liquidity and accelerating revenue recognition. 5 Provision for credit losses (% of GMV) 0.44% 0.53% 0.53% 0.55% 0.72% 0.45% 0.39% 0.48% 0.45% 0.44% (0.01)% 0.14% 0.05% 0.10% 0.28% Realized losses Upfront provisions Q3’24 Q4'24 Q1'25 Q2'25 Q3’25 Provision for credit losses as a % of GMV increased, driven by the upfront provisions we’re required to book when growing the Fair Financing portfolio Quarter of origination Fair Financing 60+ days past due delinquency rates U.S. Group Q1'22 Q1'23 Q1'24 Q1’25 0.0% 2.0% 4.0% 6.0% Months since origination U.S. Fair Financing charge-offs 2022 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4’24 6 8 10 12 14 16 18 20 22 24 0.0% 2.0% 4.0% 6.0% Realized losses as a percentage of GMV were one basis point lower compared to last year

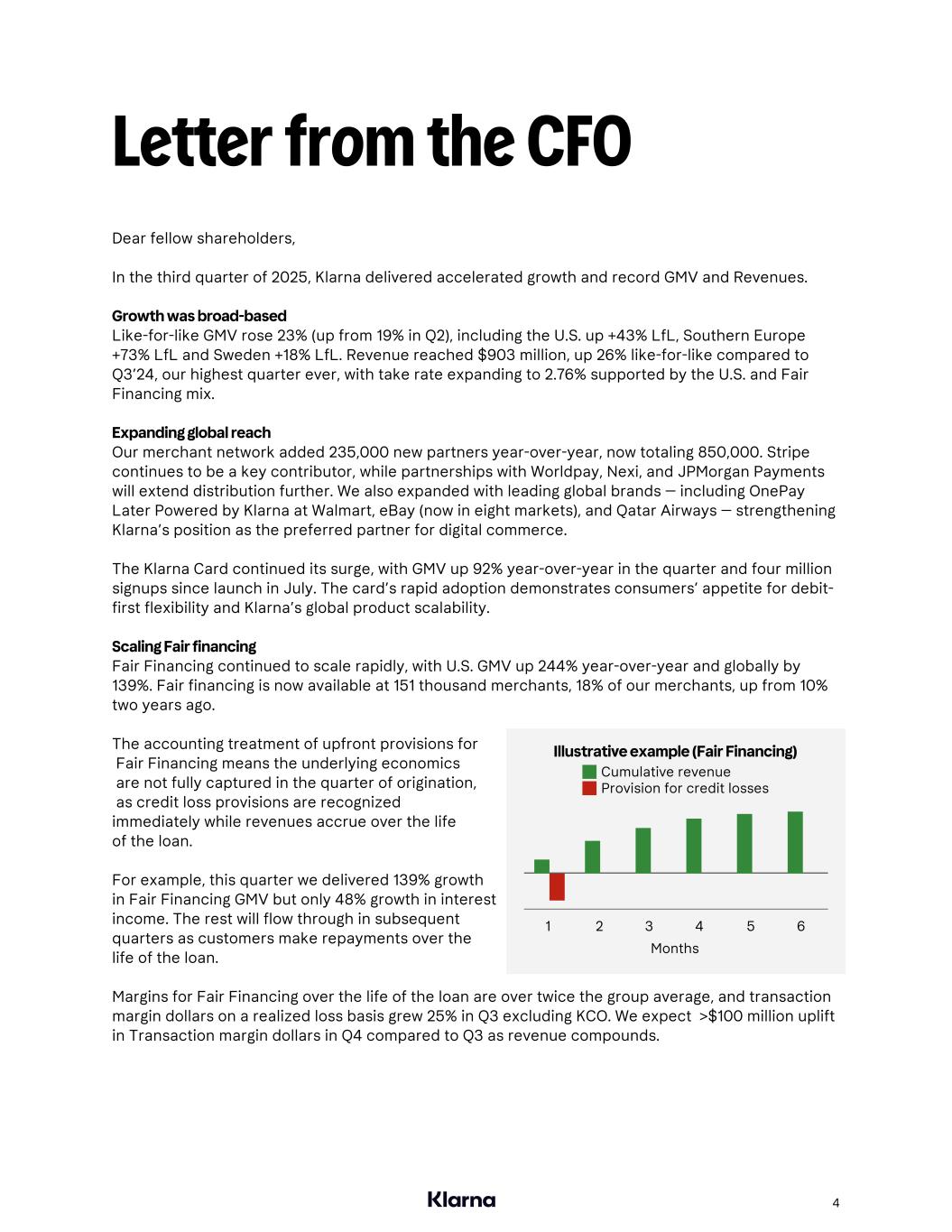

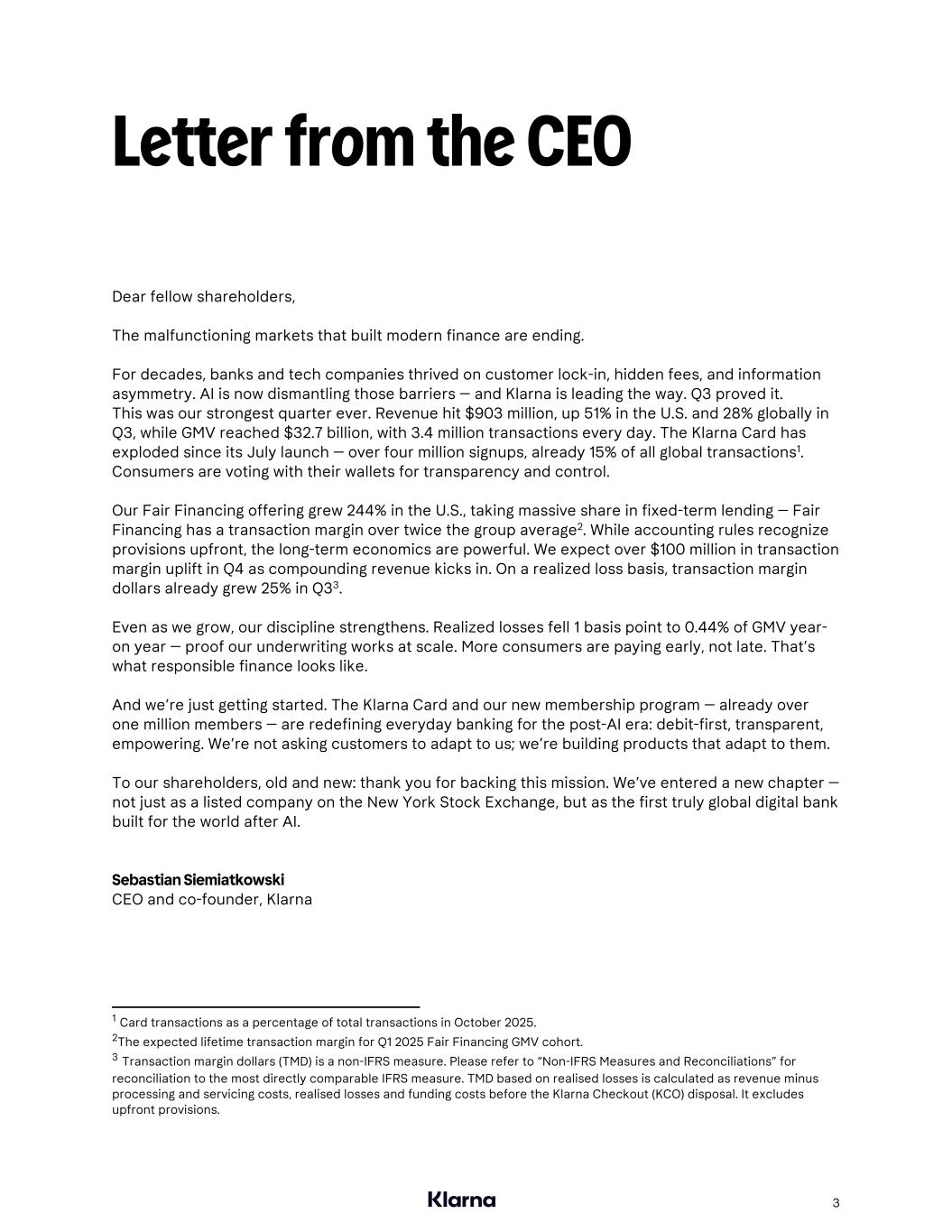

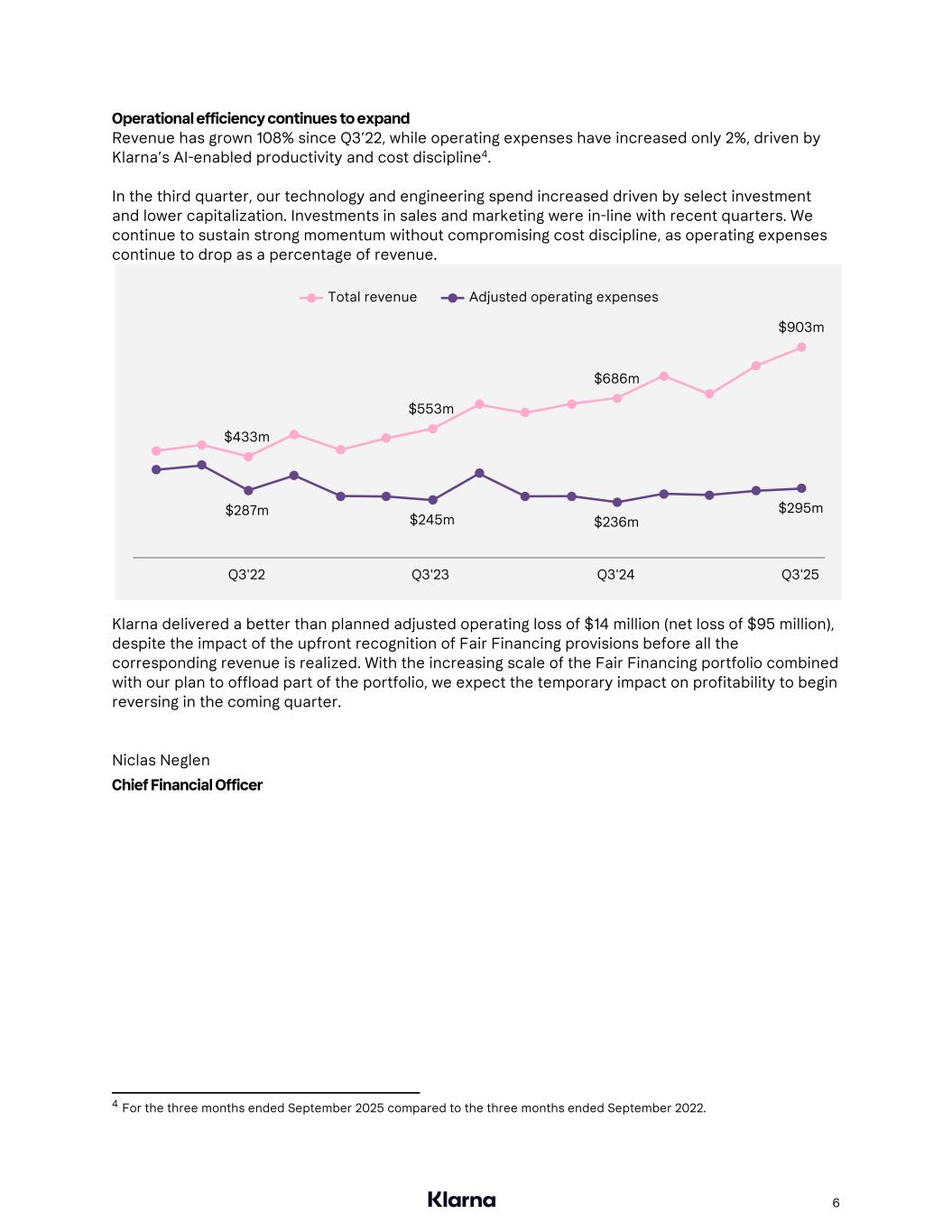

Operational efficiency continues to expand Revenue has grown 108% since Q3’22, while operating expenses have increased only 2%, driven by Klarna’s AI-enabled productivity and cost discipline4. In the third quarter, our technology and engineering spend increased driven by select investment and lower capitalization. Investments in sales and marketing were in-line with recent quarters. We continue to sustain strong momentum without compromising cost discipline, as operating expenses continue to drop as a percentage of revenue. Klarna delivered a better than planned adjusted operating loss of $14 million (net loss of $95 million), despite the impact of the upfront recognition of Fair Financing provisions before all the corresponding revenue is realized. With the increasing scale of the Fair Financing portfolio combined with our plan to offload part of the portfolio, we expect the temporary impact on profitability to begin reversing in the coming quarter. Niclas Neglen Chief Financial Officer 6 4 For the three months ended September 2025 compared to the three months ended September 2022. $433m $553m $686m $903m $287m $245m $236m $295m Total revenue Adjusted operating expenses Q3'22 Q3'23 Q3'24 Q3'25

Financial outlook Klarna remains on a clear and steady path to profitability, reflected in our 2025 financial outlook, which anticipates continued expansion across GMV, revenue, and transaction margin dollars. Outlook for Q4’25 • GMV: $37.5–38.5 billion • Revenue: $1,065–1,080 million • TMD: $390–400 million The following USD foreign exchange rates are assumed for the guidance period: • EUR: 1.17 • SEK: 0.107 • GBP: 1.35 Klarna’s growth remains disciplined, data-driven, and scalable. With AI enhancing efficiency and our network expanding globally, we are well positioned for sustained, profitable growth. We do not attempt to provide reconciliations of forward-looking Transaction margin dollars to the comparable IFRS measure because the impact and timing of potential charges or gains excluded from the calculation of our Transaction margin dollars are inherently uncertain and difficult to predict and are unavailable without unreasonable efforts. In addition, we believe such reconciliations would imply a degree of precision and certainty that could be confusing to investors. Such items could have a material impact on our financial performance. The financial outlook is only effective as of the date given and will not be updated or affirmed unless and until we publicly announce updated or affirmed guidance. Distribution or reference of this earnings release following the date hereof does not constitute Klarna re-affirming guidance. Conference call Klarna will host a conference call and webcast to discuss its third quarter 2025 financial results on November 18, 2025, at 8:30 am ET. Participating on the call will be: • Sebastian Siemiatkowski, Chief Executive Officer, • Niclas Neglen, Chief Financial Officer, and • Andrea Ferraz, Head of Investor Relations and Corporate Development The conference call will be webcast live on Klarna’s investor relations website at investors.klarna.com. A replay will be available on the same website following the call. 7

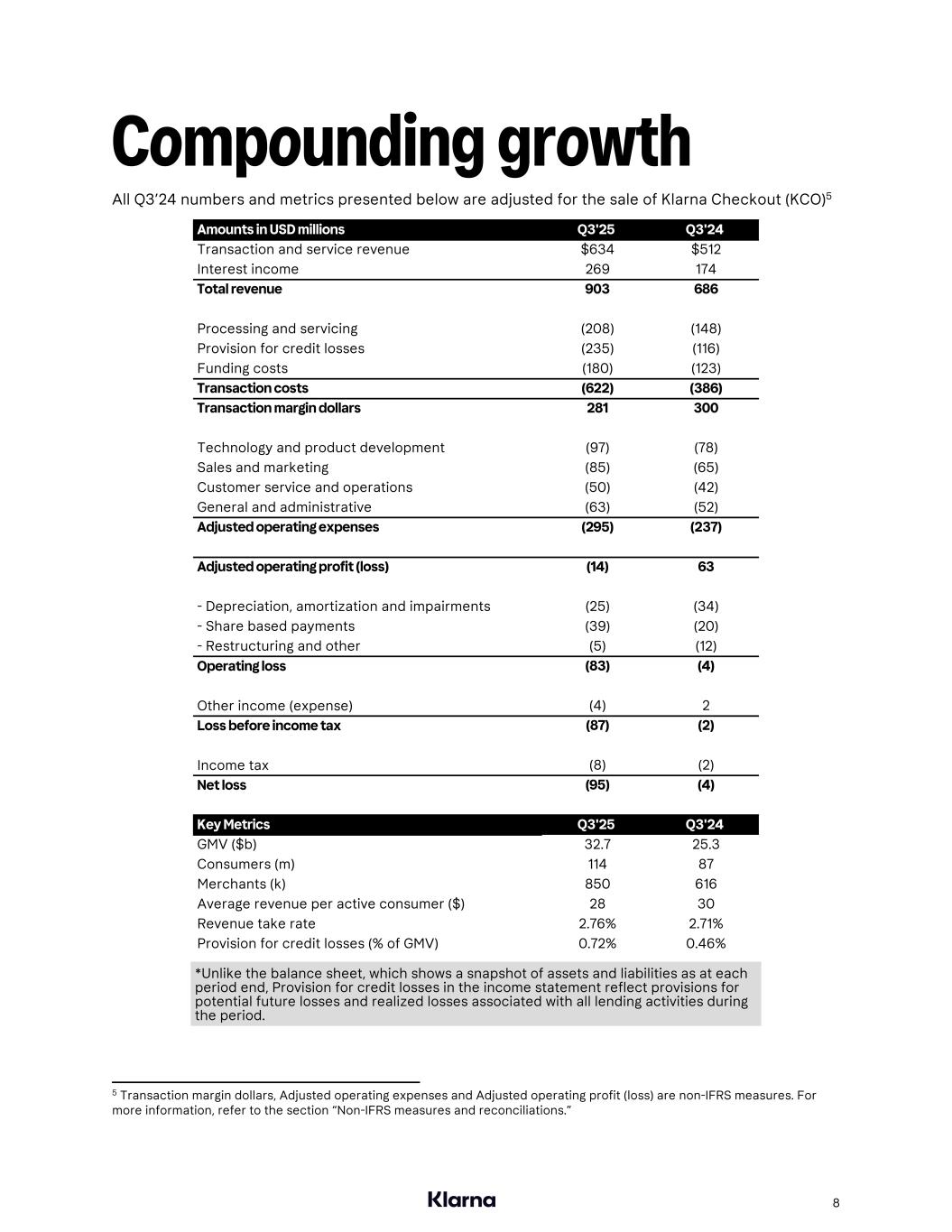

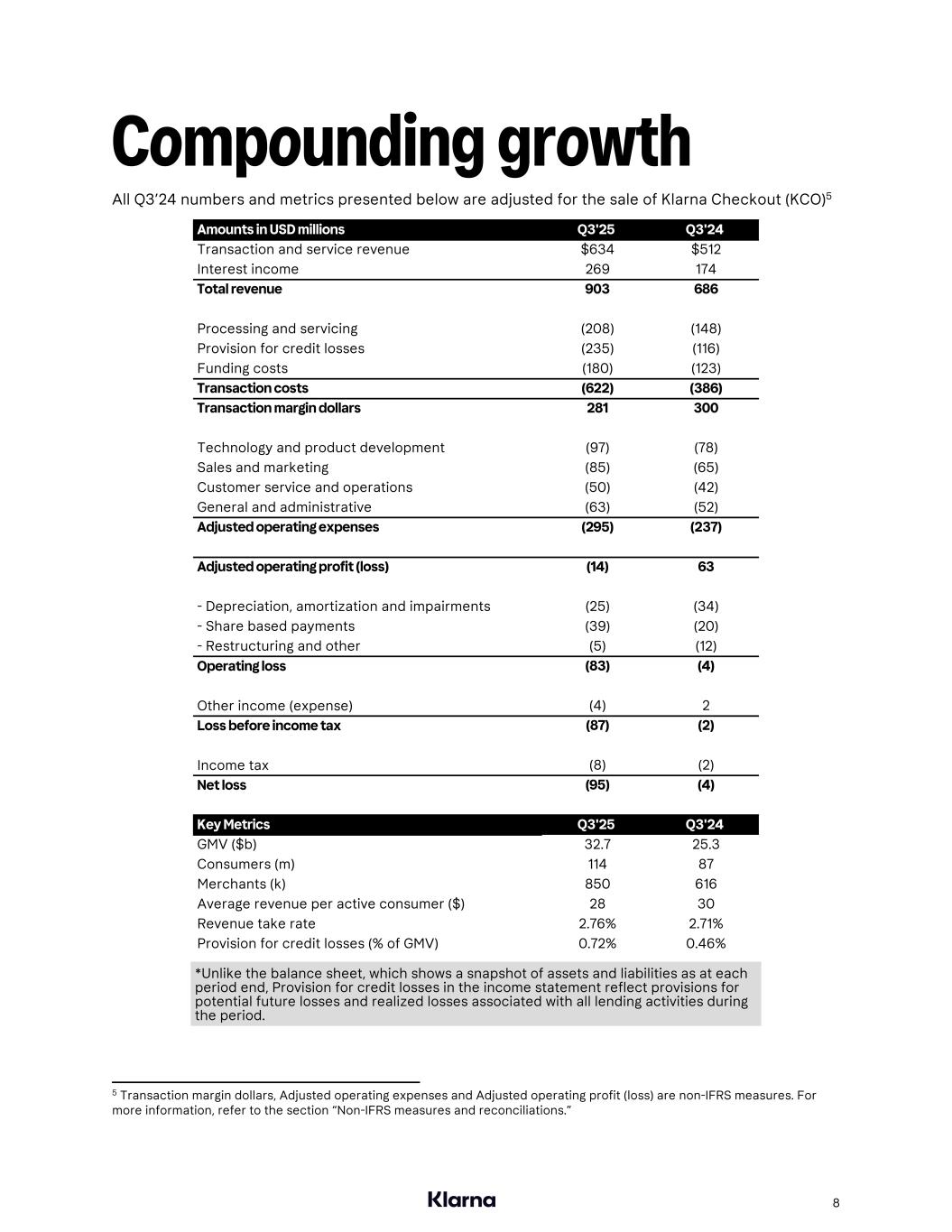

Compounding growth All Q3’24 numbers and metrics presented below are adjusted for the sale of Klarna Checkout (KCO)5 Amounts in USD millions Q3'25 Q3'24 Transaction and service revenue $634 $512 Interest income 269 174 Total revenue 903 686 Processing and servicing (208) (148) Provision for credit losses (235) (116) Funding costs (180) (123) Transaction costs (622) (386) Transaction margin dollars 281 300 Technology and product development (97) (78) Sales and marketing (85) (65) Customer service and operations (50) (42) General and administrative (63) (52) Adjusted operating expenses (295) (237) Adjusted operating profit (loss) (14) 63 - Depreciation, amortization and impairments (25) (34) - Share based payments (39) (20) - Restructuring and other (5) (12) Operating loss (83) (4) Other income (expense) (4) 2 Loss before income tax (87) (2) Income tax (8) (2) Net loss (95) (4) Key Metrics Q3'25 Q3'24 GMV ($b) 32.7 25.3 Consumers (m) 114 87 Merchants (k) 850 616 Average revenue per active consumer ($) 28 30 Revenue take rate 2.76% 2.71% Provision for credit losses (% of GMV) 0.72% 0.46% *Unlike the balance sheet, which shows a snapshot of assets and liabilities as at each period end, Provision for credit losses in the income statement reflect provisions for potential future losses and realized losses associated with all lending activities during the period. 8 5 Transaction margin dollars, Adjusted operating expenses and Adjusted operating profit (loss) are non-IFRS measures. For more information, refer to the section “Non-IFRS measures and reconciliations.”

Definitions Like-for-like (LfL) growth Year-over-year change on a like-for-like basis is calculated by adjusting the relevant metric for (1) the sale of Klarna Checkout (KCO) and (2) the impact of foreign currency fluctuations. The impact of foreign currency fluctuations is calculated by translating the reported amounts in the current period using the exchange rates in use during the comparative prior period. Active Klarna consumers Consumers who have made a purchase or a payment using a Klarna-branded product or logged into the Klarna app within the past 12 months, calculated as of the end of that 12-month period. New merchants Refers to the net new number of merchants onboarded year-over-year. Merchants means the businesses that offer their goods and services to consumers on our network. The number of merchants presented refers to the number of unique combinations of brands (e.g., H&M) available on our network and the markets where such brands are available (e.g., Sweden). Gross merchandise volume (GMV) The total monetary value of all completed purchases on our network in that period, excluding any additional fees and any subsequent actions (such as returns, settlements and disputes). Take rate Total revenue as a percentage of GMV. Average revenue per active consumer (ARPAC) Our total revenue for the trailing twelve months, divided by the number of active Klarna consumers over that period. Transaction margin dollars Transaction margin dollars as total revenue less total transaction costs, which consist of processing and servicing costs, provision for credit losses and funding costs. Transaction margin dollars before Provision for credit losses Transaction margin dollars as total revenue less processing and servicing costs and funding costs. Provision for credit losses (% of GMV) Provision for credit losses divided by GMV. Realized losses (% of GMV) Actual loan losses incurred during the period divided by GMV. Upfront provisions (% of GMV) Upfront provisions which primarily reflect expected losses at origination as well as changes in credit risk of on-book loans, divided by GMV. Adjusted operating profit (loss) Adjusted operating profit (loss) is defined as operating profit (loss) excluding (i) depreciation, amortization and impairments, (ii) share-based payments expense, (iii) restructuring costs and expenses related to preparation for an initial public offering. 9

Non-IFRS measures and reconciliations We use certain non-IFRS financial measures to supplement our consolidated financial statements, which are presented in accordance with IFRS. These non-IFRS financial measures include Transaction margin dollars, Transaction margin, Adjusted operating profit (loss), Adjusted operating expenses and Adjusted operating margin. We use these non-IFRS financial measures to facilitate the review of our operational performance and as a basis for strategic planning. We also present period-over-period changes in certain metrics on like-for-like (LfL) basis, which is calculated by adjusting the metric for (1) the sale of KCO and (2) the impact of foreign currency fluctuations. The impact of foreign currency fluctuations is calculated by translating the reported amounts in the current period using the exchange rates in use during the comparative prior period. Transaction margin dollars and Transaction margin are key performance measures used by our management to measure our ability to attain efficiency and scale and to grow these metrics over time. They measure our success in growing revenue while effectively managing our processing and servicing costs, provision for credit losses and funding costs. In addition, by excluding certain items that are nonrecurring or not reflective of the performance of our normal course of business, we believe that Adjusted operating expenses, Adjusted operating profit (loss) and Adjusted operating margin provide meaningful supplemental information regarding our performance. Accordingly, we believe that these non-IFRS financial measures are useful to investors and others because they allow investors to supplement their understanding of our financial trends and evaluate our ongoing and future performance in the same manner as management. However, there are several limitations related to the use of non-IFRS financial measures as they reflect the exercise of judgment by our management about which expenses are excluded or included in determining these non-IFRS measures. These non-IFRS measures should be considered in addition to, not as a substitute for or in isolation from, our financial results prepared in accordance with IFRS. Other companies, including companies in our industry, may calculate these non-IFRS (or similar non-GAAP) financial measures differently or not at all, which reduces their usefulness as comparative measures. Transaction margin dollars is defined as total revenue less total transaction costs, consisting of processing and servicing, provision for credit losses and funding costs. Transaction margin is calculated by dividing Transaction margin dollars by our total revenue. Adjusted operating profit (loss) is defined as operating profit (loss) excluding (i) depreciation, amortization and impairments, (ii) share-based payments expense, (iii) severance-related restructuring costs and (iv) expenses related to the preparation of the initial public offering (IPO). Adjusted operating expenses are defined as operating expenses excluding (i) depreciation, amortization and impairments, (ii) share-based payments expense and (iii) severance-related restructuring costs. Adjusted operating margin is defined as Adjusted operating profit (loss) divided by our total revenue. Depreciation, amortization and impairments below include amounts recorded within Technology and product development expenses in our consolidated statements of profit and loss. We consider the exclusion of certain nonrecurring or noncash items in calculating Adjusted operating profit (loss), Adjusted operating margin and Adjusted non-transaction-related operating expenses to provide a useful measure for investors and others to evaluate our operating results and expenses in the same manner as management. Revenue, Transaction costs and adjusted operating expenses for the three months ended 30 September 2025 have been adjusted to reflect the divestment of KCO completed October 1, 2024. 10

Forward-looking statements This earnings release contains forward-looking statements within the meaning of applicable securities laws. These statements include, but are not limited to, statements regarding our future financial performance, business strategy, growth objectives, market opportunities, and operational plans. Words such as "believe," "expect," "anticipate," "intend," "plan," "will," "may," "could," "estimate," and similar expressions identify forward- looking statements. These forward-looking statements are subject to risks, uncertainties, and assumptions that could cause actual results to differ materially from those expressed or implied, including risks related to: • Our ability to retain and grow consumer and merchant relationships; • Competition and technological developments; • Regulatory compliance and licensing requirements; • Credit risk management and funding availability; • General economic conditions and market volatility; and • Our ability to expand into new markets and products. Forward-looking statements reflect our views as of the date of this release and are based on information currently available to us. We undertake no obligation to update any forward-looking statements, except as required by law. Actual results may differ materially from those anticipated. Investors should not place undue reliance on these forward-looking statements and should review the risk factors in our filings with the SEC for a more complete discussion of risks. 11

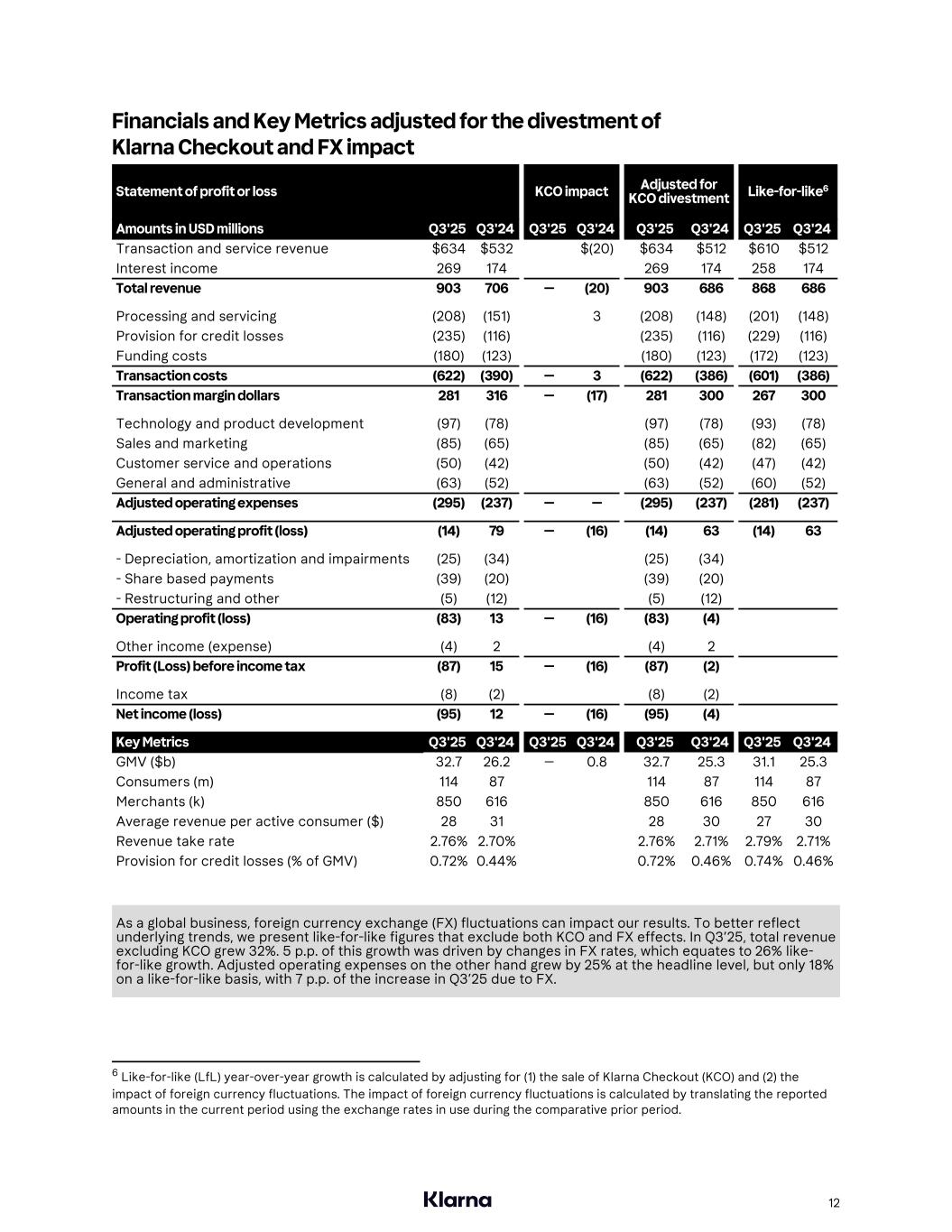

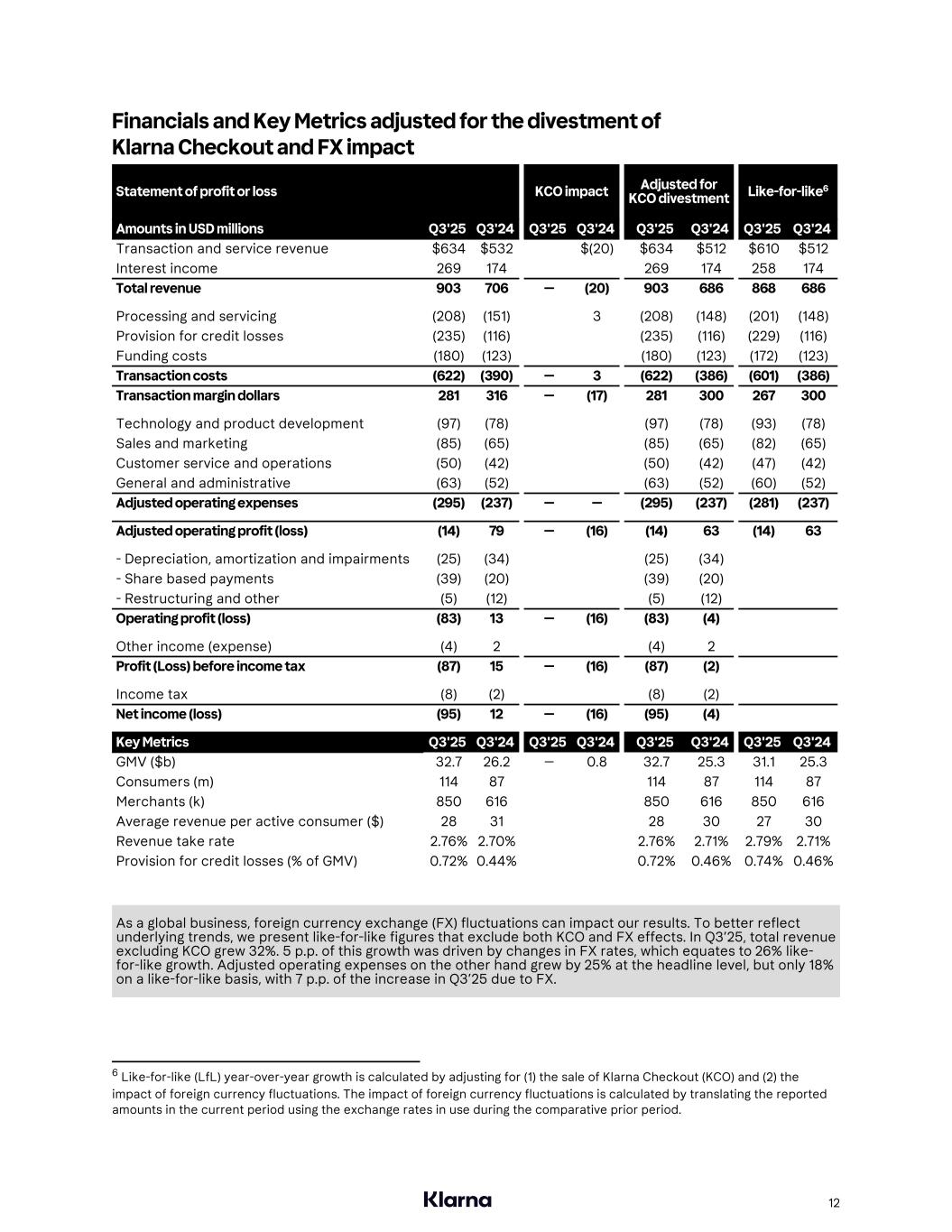

Financials and Key Metrics adjusted for the divestment of Klarna Checkout and FX impact Statement of profit or loss KCO impact Adjusted for KCO divestment Like-for-like6 Amounts in USD millions Q3'25 Q3'24 Q3'25 Q3'24 Q3'25 Q3'24 Q3'25 Q3'24 Transaction and service revenue $634 $532 $(20) $634 $512 $610 $512 Interest income 269 174 269 174 258 174 Total revenue 903 706 — (20) 903 686 868 686 Processing and servicing (208) (151) 3 (208) (148) (201) (148) Provision for credit losses (235) (116) (235) (116) (229) (116) Funding costs (180) (123) (180) (123) (172) (123) Transaction costs (622) (390) — 3 (622) (386) (601) (386) Transaction margin dollars 281 316 — (17) 281 300 267 300 Technology and product development (97) (78) (97) (78) (93) (78) Sales and marketing (85) (65) (85) (65) (82) (65) Customer service and operations (50) (42) (50) (42) (47) (42) General and administrative (63) (52) (63) (52) (60) (52) Adjusted operating expenses (295) (237) — — (295) (237) (281) (237) Adjusted operating profit (loss) (14) 79 — (16) (14) 63 (14) 63 - Depreciation, amortization and impairments (25) (34) (25) (34) - Share based payments (39) (20) (39) (20) - Restructuring and other (5) (12) (5) (12) Operating profit (loss) (83) 13 — (16) (83) (4) Other income (expense) (4) 2 (4) 2 Profit (Loss) before income tax (87) 15 — (16) (87) (2) Income tax (8) (2) (8) (2) Net income (loss) (95) 12 — (16) (95) (4) Key Metrics Q3'25 Q3'24 Q3'25 Q3'24 Q3'25 Q3'24 Q3'25 Q3'24 GMV ($b) 32.7 26.2 — 0.8 32.7 25.3 31.1 25.3 Consumers (m) 114 87 114 87 114 87 Merchants (k) 850 616 850 616 850 616 Average revenue per active consumer ($) 28 31 28 30 27 30 Revenue take rate 2.76% 2.70% 2.76% 2.71% 2.79% 2.71% Provision for credit losses (% of GMV) 0.72% 0.44% 0.72% 0.46% 0.74% 0.46% As a global business, foreign currency exchange (FX) fluctuations can impact our results. To better reflect underlying trends, we present like-for-like figures that exclude both KCO and FX effects. In Q3’25, total revenue excluding KCO grew 32%. 5 p.p. of this growth was driven by changes in FX rates, which equates to 26% like- for-like growth. Adjusted operating expenses on the other hand grew by 25% at the headline level, but only 18% on a like-for-like basis, with 7 p.p. of the increase in Q3’25 due to FX. 12 6 Like-for-like (LfL) year-over-year growth is calculated by adjusting for (1) the sale of Klarna Checkout (KCO) and (2) the impact of foreign currency fluctuations. The impact of foreign currency fluctuations is calculated by translating the reported amounts in the current period using the exchange rates in use during the comparative prior period.

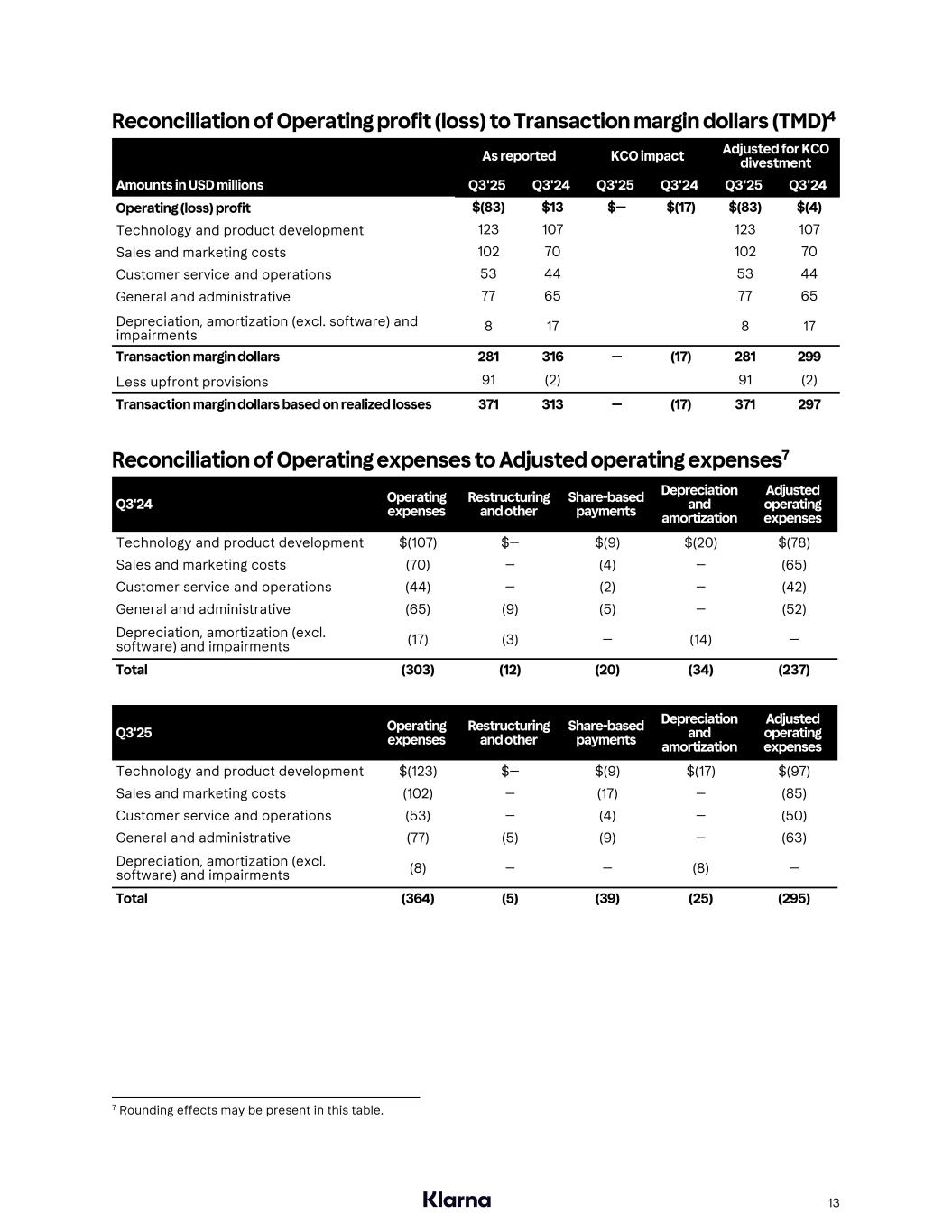

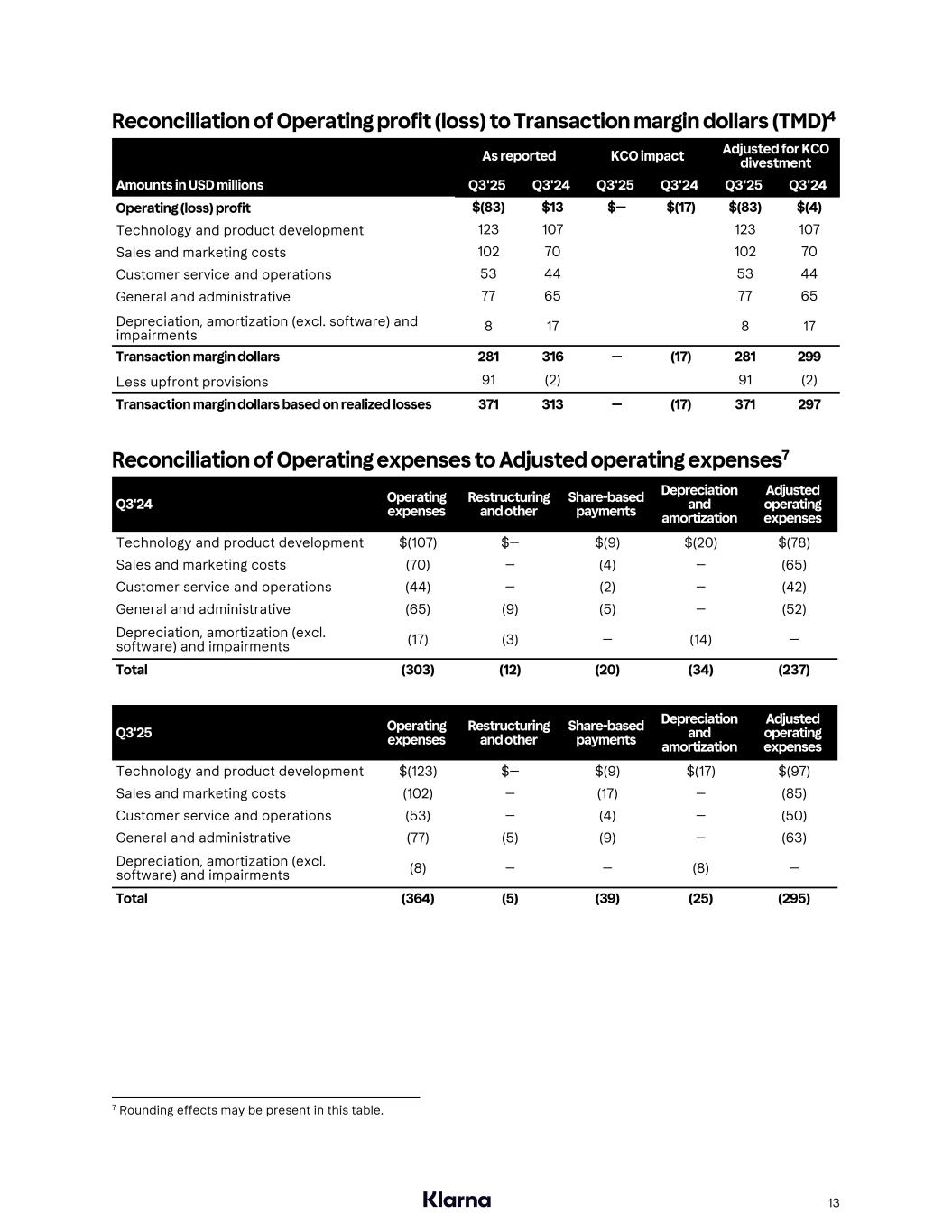

Reconciliation of Operating profit (loss) to Transaction margin dollars (TMD)4 As reported KCO impact Adjusted for KCO divestment Amounts in USD millions Q3'25 Q3'24 Q3'25 Q3'24 Q3'25 Q3'24 Operating (loss) profit $(83) $13 $— $(17) $(83) $(4) Technology and product development 123 107 123 107 Sales and marketing costs 102 70 102 70 Customer service and operations 53 44 53 44 General and administrative 77 65 77 65 Depreciation, amortization (excl. software) and impairments 8 17 8 17 Transaction margin dollars 281 316 — (17) 281 299 Less upfront provisions 91 (2) 91 (2) Transaction margin dollars based on realized losses 371 313 — (17) 371 297 Reconciliation of Operating expenses to Adjusted operating expenses7 Q3'24 Operating expenses Restructuring and other Share-based payments Depreciation and amortization Adjusted operating expenses Technology and product development $(107) $— $(9) $(20) $(78) Sales and marketing costs (70) — (4) — (65) Customer service and operations (44) — (2) — (42) General and administrative (65) (9) (5) — (52) Depreciation, amortization (excl. software) and impairments (17) (3) — (14) — Total (303) (12) (20) (34) (237) Q3'25 Operating expenses Restructuring and other Share-based payments Depreciation and amortization Adjusted operating expenses Technology and product development $(123) $— $(9) $(17) $(97) Sales and marketing costs (102) — (17) — (85) Customer service and operations (53) — (4) — (50) General and administrative (77) (5) (9) — (63) Depreciation, amortization (excl. software) and impairments (8) — — (8) — Total (364) (5) (39) (25) (295) 13 7 Rounding effects may be present in this table.

Interim Consolidated Statements of Profit or Loss for the Three and Nine Months Ended September 30, 2025 and 2024 (Unaudited) Three Months Ended Nine Months Ended Amounts in USD millions, except share and per share amounts September 30, 2025 September 30, 2024 September 30, 2025 September 30, 2024 Transaction and service revenue ................................ 634 532 $ 1,757 $ 1,535 Interest income ................................................................ 269 174 670 494 Total revenue ................................................................... 903 706 2,427 2,029 Processing and servicing costs .................................... (208) (151) (559) (435) Provision for credit losses ............................................. (235) (116) (545) (339) Funding costs ................................................................... (180) (123) (457) (356) Technology and product development ...................... (123) (107) (358) (309) Sales and marketing ........................................................ (102) (70) (286) (227) Customer service and operations ................................ (53) (44) (155) (148) General and administrative ........................................... (77) (65) (235) (180) Depreciation, amortization and impairments ............ (8) (17) (50) (55) Operating expenses ........................................................ (986) (693) (2,645) (2,049) Operating Profit (loss) ...................................................... (83) 13 (218) (20) Other income (expense) ................................................. (4) 2 (6) 7 Profit (Loss) before taxes .............................................. (87) 15 (224) (13) Tax expense ...................................................................... (8) (2) (22) (6) Net Profit (loss) ................................................................. (95) 12 (246) (19) Whereof attributable to: Shareholders of Klarna Group plc ................................ (95) 18 (247) (20) Non-controlling interests ............................................... — (5) 1 (5) Other equity holders ....................................................... — 0 — 6 Total .................................................................................. (95) 12 (246) (19) Net loss per share attributable to shareholders of Klarna Group plc Basic ................................................................................... $ (0.25) $ 0.05 $ (0.67) $ (0.06) Diluted ................................................................................ $ (0.25) $ 0.05 $ (0.67) $ (0.06) Unlike the balance sheet, which shows a snapshot of assets and liabilities as at each period end, Provision for credit losses in the income statement reflect provisions for future losses and realized losses associated with all lending activities during the period. 14

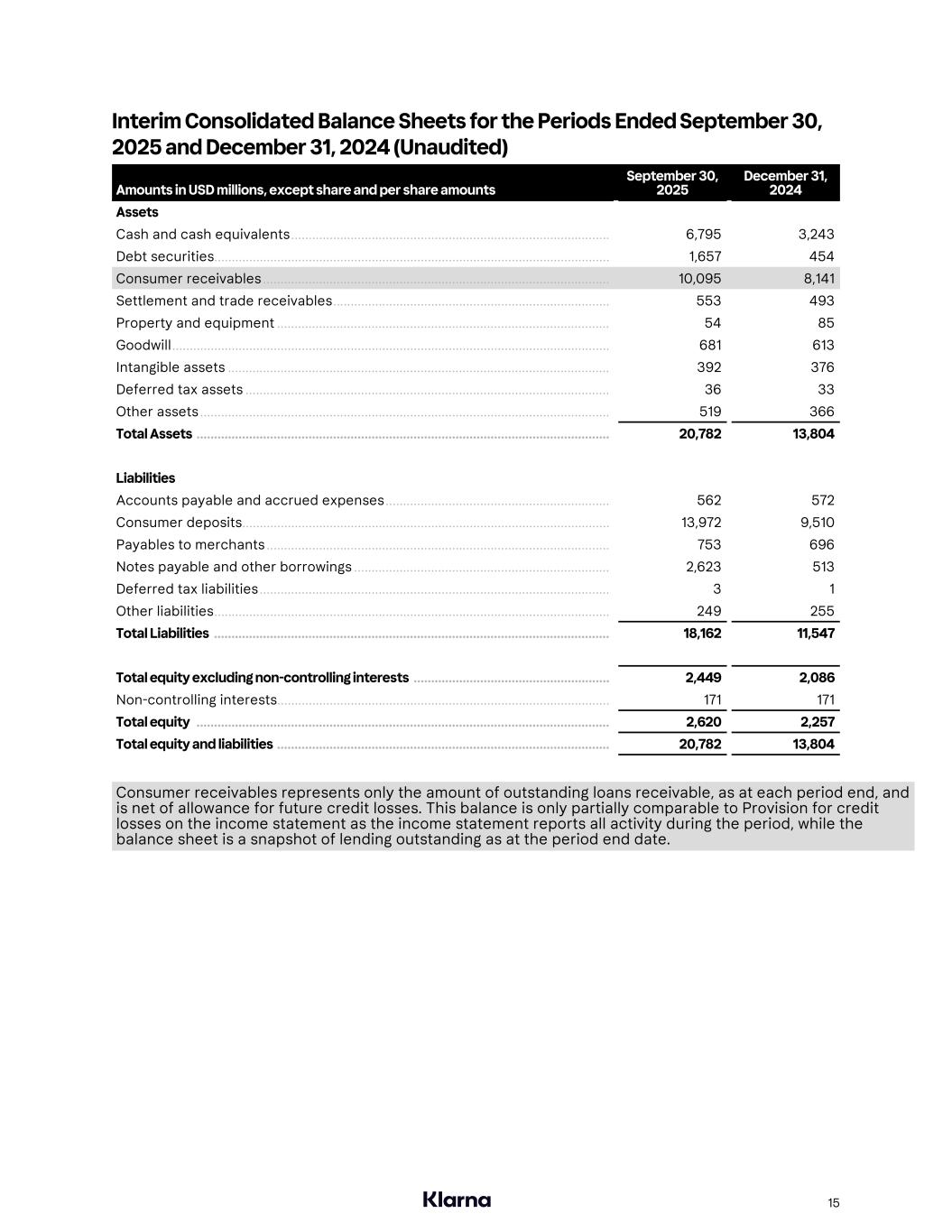

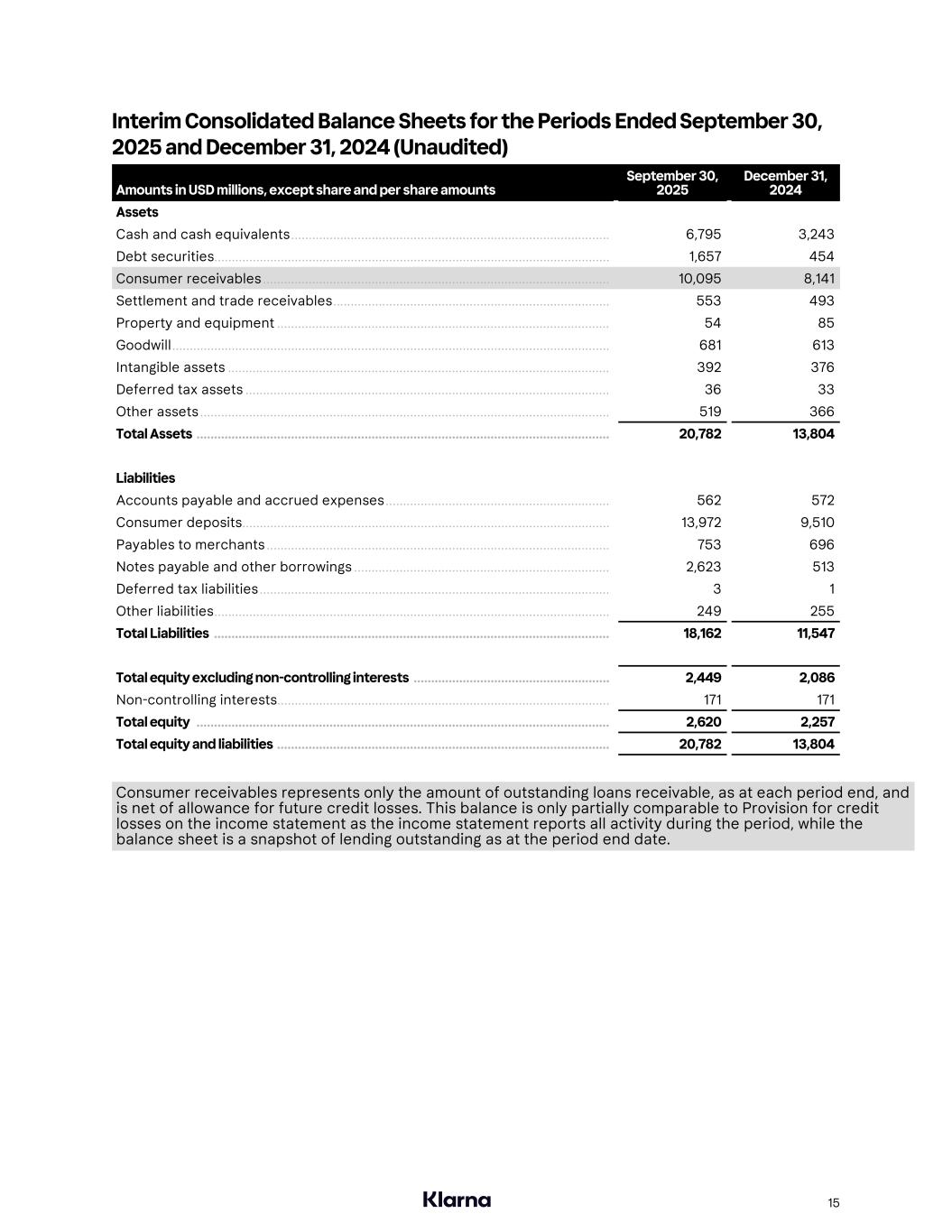

Interim Consolidated Balance Sheets for the Periods Ended September 30, 2025 and December 31, 2024 (Unaudited) Amounts in USD millions, except share and per share amounts September 30, 2025 December 31, 2024 Assets Cash and cash equivalents ........................................................................................... 6,795 3,243 Debt securities ................................................................................................................. 1,657 454 Consumer receivables ................................................................................................... 10,095 8,141 Settlement and trade receivables ............................................................................... 553 493 Property and equipment ............................................................................................... 54 85 Goodwill ............................................................................................................................. 681 613 Intangible assets ............................................................................................................. 392 376 Deferred tax assets ........................................................................................................ 36 33 Other assets ..................................................................................................................... 519 366 Total Assets ...................................................................................................................... 20,782 13,804 Liabilities Accounts payable and accrued expenses ................................................................ 562 572 Consumer deposits ......................................................................................................... 13,972 9,510 Payables to merchants .................................................................................................. 753 696 Notes payable and other borrowings ......................................................................... 2,623 513 Deferred tax liabilities .................................................................................................... 3 1 Other liabilities ................................................................................................................. 249 255 Total Liabilities ................................................................................................................. 18,162 11,547 Total equity excluding non-controlling interests ........................................................ 2,449 2,086 Non-controlling interests ............................................................................................... 171 171 Total equity ...................................................................................................................... 2,620 2,257 Total equity and liabilities ............................................................................................... 20,782 13,804 Consumer receivables represents only the amount of outstanding loans receivable, as at each period end, and is net of allowance for future credit losses. This balance is only partially comparable to Provision for credit losses on the income statement as the income statement reports all activity during the period, while the balance sheet is a snapshot of lending outstanding as at the period end date. 15

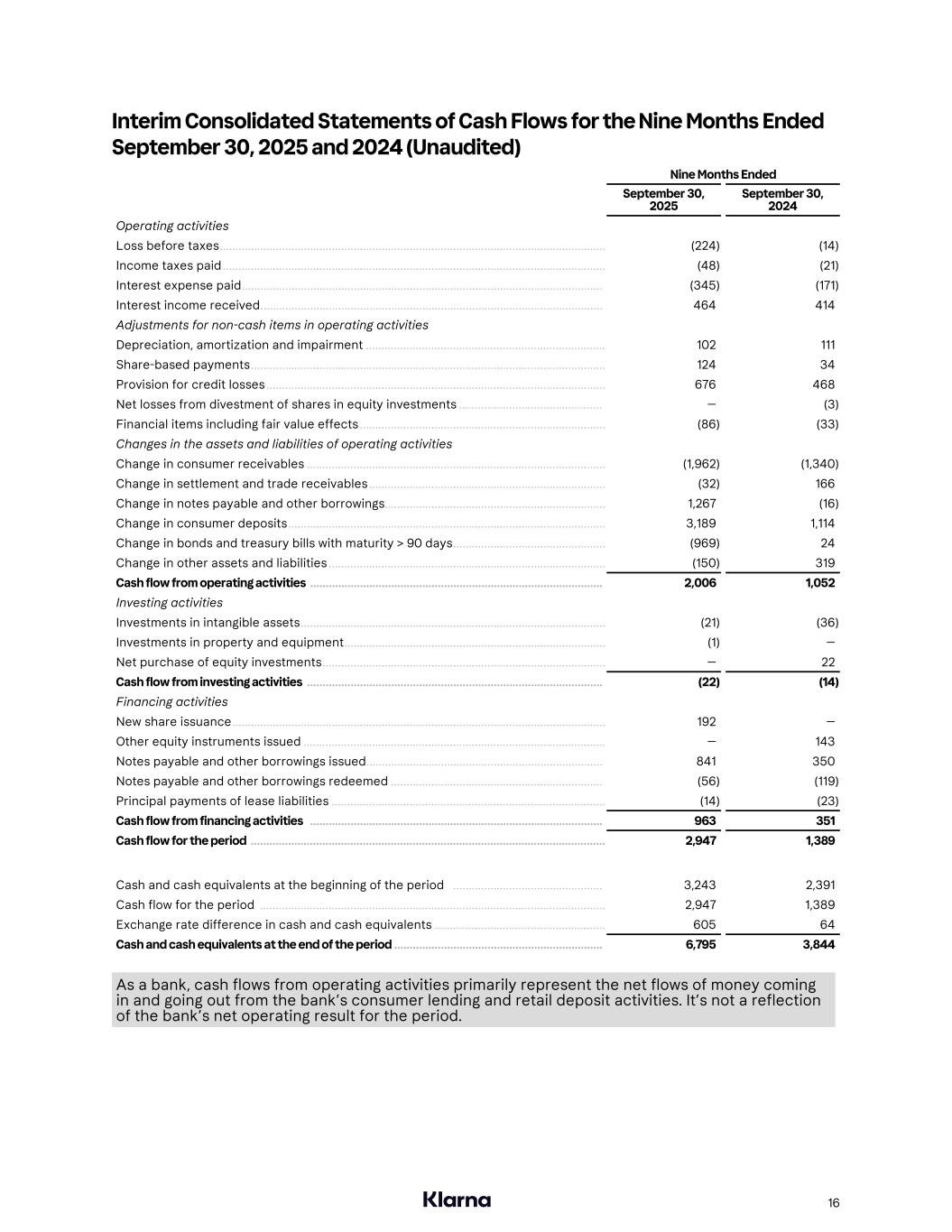

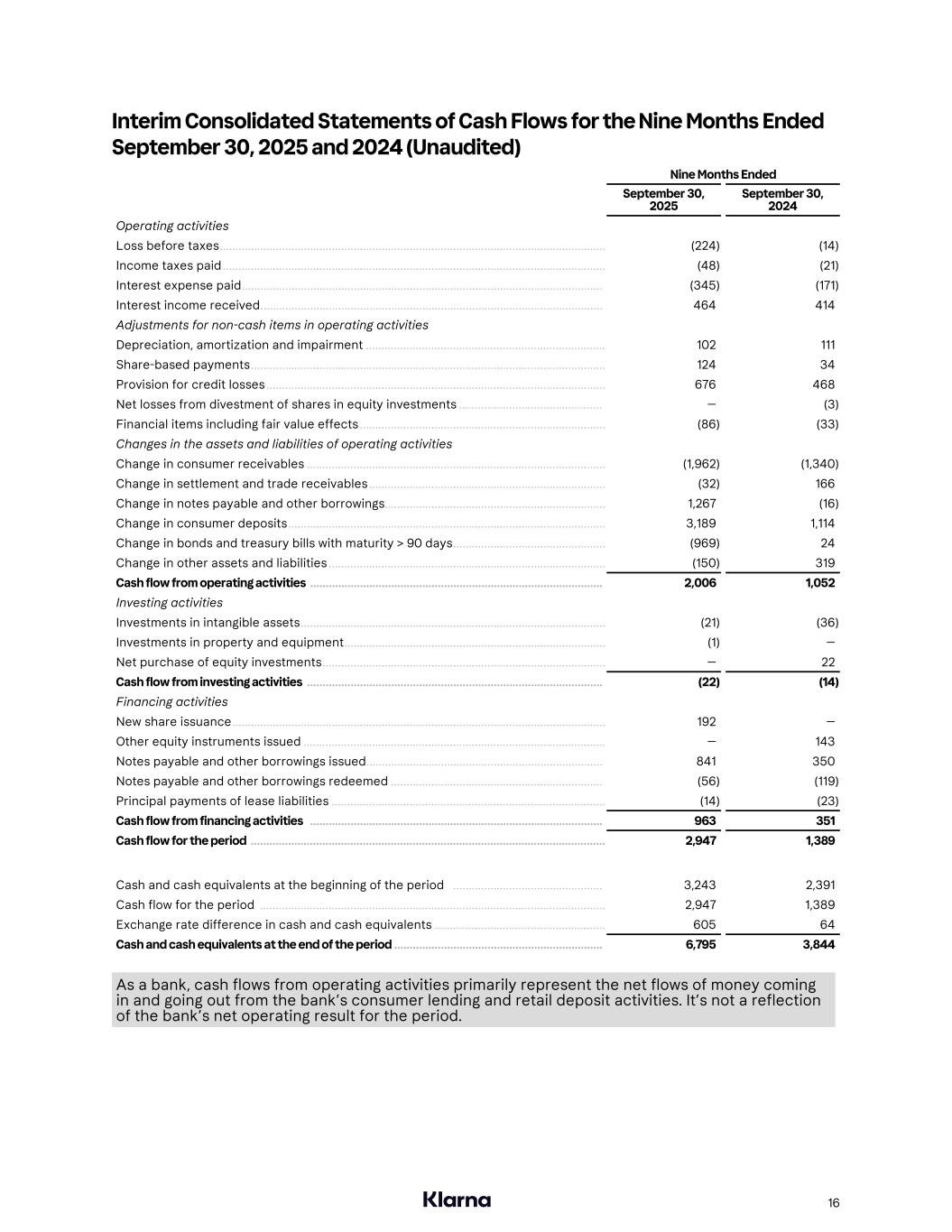

Interim Consolidated Statements of Cash Flows for the Nine Months Ended September 30, 2025 and 2024 (Unaudited) Nine Months Ended September 30, 2025 September 30, 2024 Operating activities Loss before taxes ............................................................................................................................ (224) (14) Income taxes paid ........................................................................................................................... (48) (21) Interest expense paid .................................................................................................................... (345) (171) Interest income received .............................................................................................................. 464 414 Adjustments for non-cash items in operating activities Depreciation, amortization and impairment ............................................................................. 102 111 Share-based payments .................................................................................................................. 124 34 Provision for credit losses ............................................................................................................. 676 468 Net losses from divestment of shares in equity investments .............................................. — (3) Financial items including fair value effects ............................................................................... (86) (33) Changes in the assets and liabilities of operating activities Change in consumer receivables ................................................................................................ (1,962) (1,340) Change in settlement and trade receivables ............................................................................ (32) 166 Change in notes payable and other borrowings ....................................................................... 1,267 (16) Change in consumer deposits ...................................................................................................... 3,189 1,114 Change in bonds and treasury bills with maturity > 90 days ................................................. (969) 24 Change in other assets and liabilities ......................................................................................... (150) 319 Cash flow from operating activities .............................................................................................. 2,006 1,052 Investing activities Investments in intangible assets .................................................................................................. (21) (36) Investments in property and equipment .................................................................................... (1) — Net purchase of equity investments ........................................................................................... — 22 Cash flow from investing activities ............................................................................................... (22) (14) Financing activities New share issuance ........................................................................................................................ 192 — Other equity instruments issued ................................................................................................. — 143 Notes payable and other borrowings issued ............................................................................ 841 350 Notes payable and other borrowings redeemed .................................................................... (56) (119) Principal payments of lease liabilities ........................................................................................ (14) (23) Cash flow from financing activities .............................................................................................. 963 351 Cash flow for the period .................................................................................................................. 2,947 1,389 Cash and cash equivalents at the beginning of the period ................................................ 3,243 2,391 Cash flow for the period ............................................................................................................... 2,947 1,389 Exchange rate difference in cash and cash equivalents ....................................................... 605 64 Cash and cash equivalents at the end of the period ................................................................... 6,795 3,844 As a bank, cash flows from operating activities primarily represent the net flows of money coming in and going out from the bank’s consumer lending and retail deposit activities. It’s not a reflection of the bank’s net operating result for the period. 16