NASDAQ: CHCI COMSTOCK HOLDING COMPANIES, INC. | NASDAQ: CHCI Q3 2025 INVESTOR PRESENTATION Exhibit 99.2

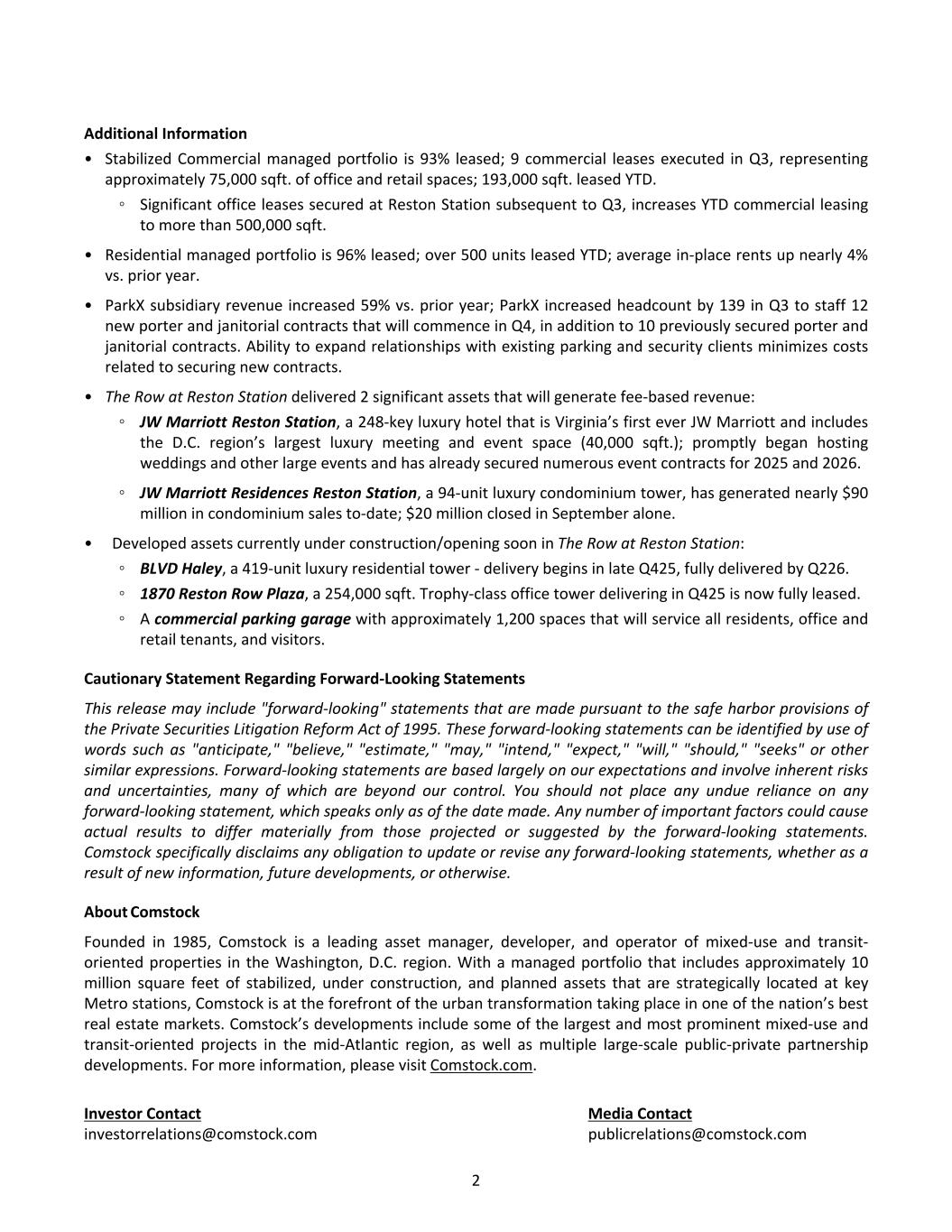

NASDAQ: CHCI 2 Disclosures This presentation may include “forward -looking” statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward -looking statements can be identified by use of words such as “anticipate,” “believe,” “estimate,” “may,” “intend,” “expect,” “will,” “should,” “seeks” or other similar expressions. Forward -looking statements are based largely on our expectations and involve inherent risks and uncertainties, many of which are beyond our control. You should not place undue reliance on any forward - looking statement, which speaks only as of the date made. Any number of important factors could cause actual results to differ materially from those projected or suggested by the forward -looking statements. Comstock specifically disclaims any obligation to update or revise any forward -looking statements, whether as a result of new information, future developments, or otherwise. While every attempt has been made to ensure the accuracy of included measurements, all future development measurements are based on available information at the time of production of this Investor Presentation and therefore all square foot measurements are subject to change without notice.

NASDAQ: CHCI 3 Table of Contents Comstock Overview 4 Visionary Leadership 5 Why Comstock 6-8 Q3 2025 Update 9 Recent Highlights 10 Our Managed Portfolio 11-16 ESG: Creating Positive Impacts 17 Supplemental Information Leadership and Board 20 -21 Corporate Structure Overview 22 Our Services 23 Reconciliation of Non -GAAP Financial Measures 24

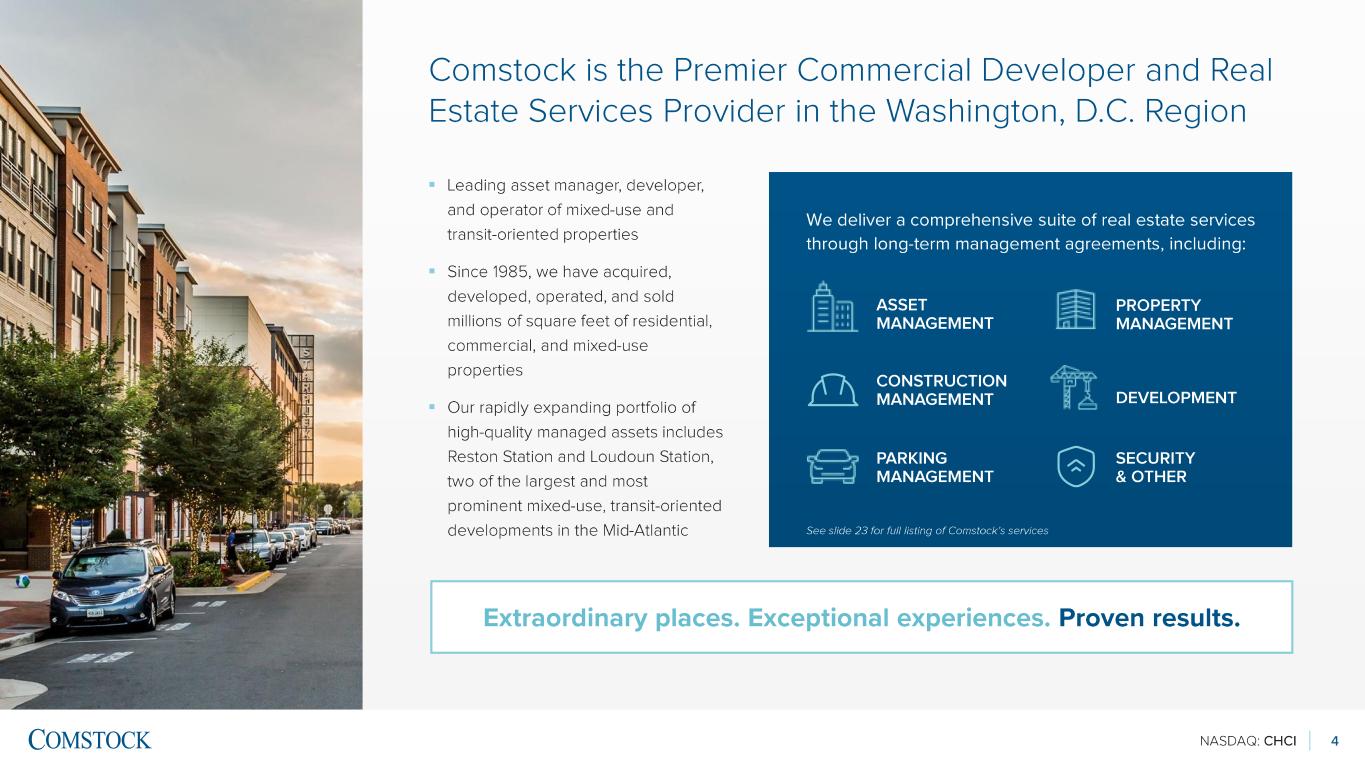

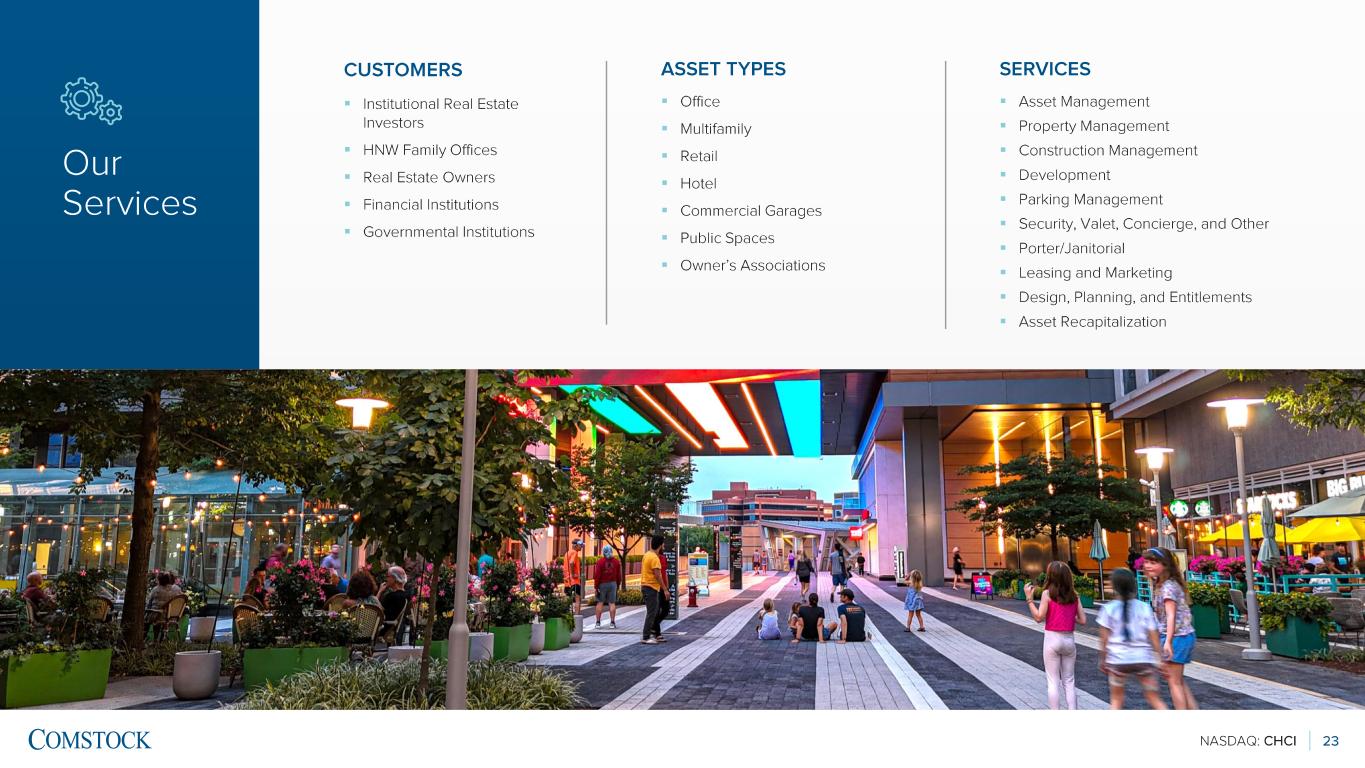

NASDAQ: CHCI 4 Comstock is the Premier Commercial Developer and Real Estate Services Provider in the Washington, D.C. Region ▪ Leading asset manager, developer, and operator of mixed -use and transit-oriented properties ▪ Since 1985, we have acquired, developed, operated, and sold millions of square feet of residential, commercial, and mixed -use properties ▪ Our rapidly expanding portfolio of high-quality managed assets includes Reston Station and Loudoun Station, two of the largest and most prominent mixed -use, transit -oriented developments in the Mid -Atlantic Extraordinary places. Exceptional experiences. Proven results. We deliver a comprehensive suite of real estate services through long -term management agreements, including: ASSET MANAGEMENT DEVELOPMENT CONSTRUCTION MANAGEMENT PROPERTY MANAGEMENT PARKING MANAGEMENT SECURITY & OTHER See slide 23 for full listing of Comstock’s services

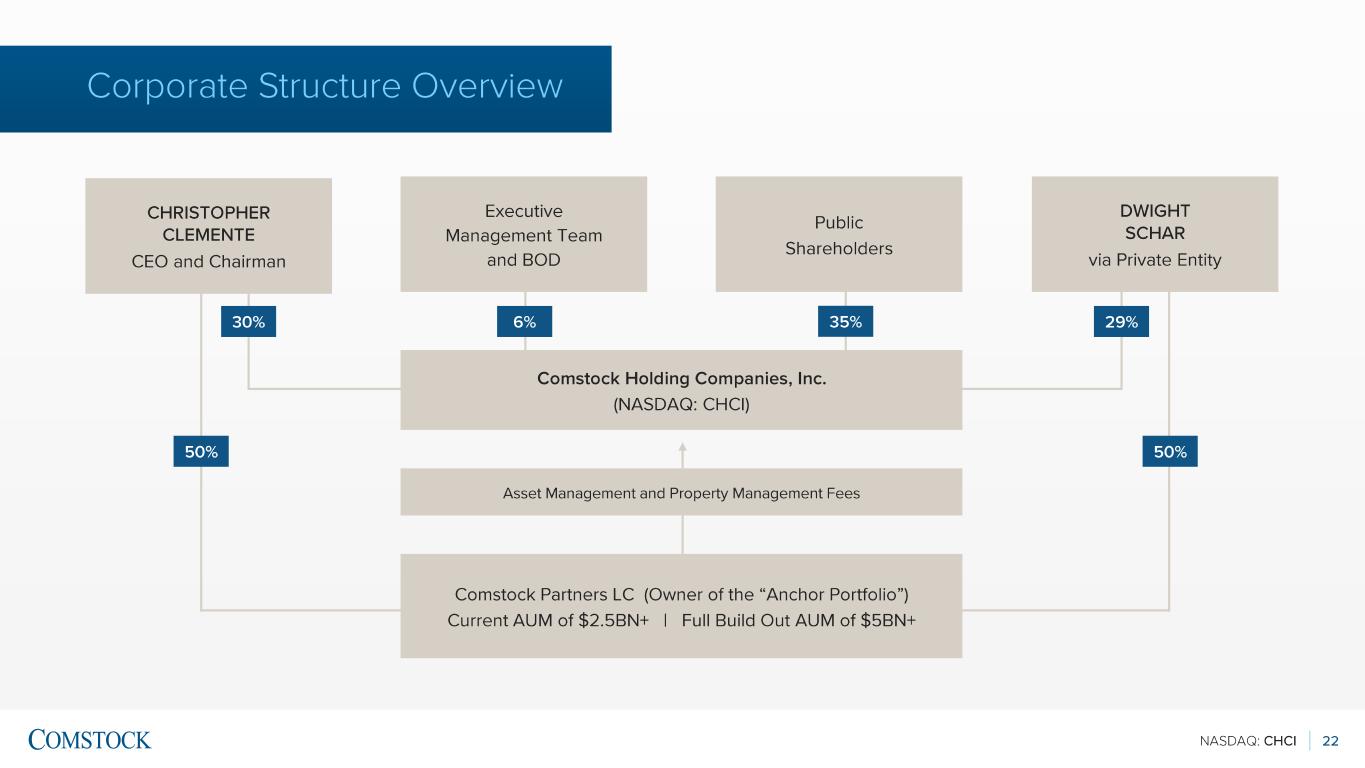

NASDAQ: CHCI 5 Visionary Leadership Chris Clemente – Chairman and CEO ▪ Founded Comstock (Nasdaq: CHCI) in 1985 ▪ Led acquisition, development, operation, and sale of millions of square feet of residential, commercial, and mixed -use properties ▪ Guided Comstock’s successful transformation from homebuilder to leading commercial developer and real estate services provider ▪ Controlling CHCI shareholder and Managing Partner of Comstock Partners, LC (Anchor Portfolio owner) See slides 20 -21 for full listing of Comstock’s leadership team and Board of Directors See slide 22 for additional details on the relationship between Comstock Partners, LC and Comstock Holding Companies, Inc. (C HCI ) Dwight Schar – Strategic Advisor & Principal, Comstock Partners, LC ▪ Founder and former Chairman & CEO of NVR, Inc. (NYSE: NVR), a Fortune 500 homebuilder ▪ Led NVR in developing hundreds of thousands of homes across multiple states, generating billions in annual revenue ▪ Strategic Advisor to CHCI; Instrumental in its business transformation and the visionary behind its fee -based, asset -light, debt -free business model that is based on the successful model he implemented at NVR ▪ Significant CHCI shareholder and Principal of Comstock Partners, LC (Anchor Portfolio owner)

NASDAQ: CHCI 6 Why Comstock DYNAMIC & RESILIENT BUSINESS MODEL PROVEN EXPERTISE ▪ Fee -based, asset -light, and debt -free platform that mitigates risk and drives consistent revenue growth ▪ Long -term asset management agreements generate reliable fee -based and supplemental revenue and include cost -plus downside protection for its most significant assets ▪ Vertically integrated operating subsidiaries provide property management services that generate multiple recurring fee revenue streams ▪ Four decades of experience delivering thousands of residential units and millions of square feet of mixed -use ▪ Leadership team with institutional experience and deep local market knowledge ▪ Strong track record in developing, entitling, and managing complex real estate projects across multiple states in the Mid -Atlantic and Southeastern U.S. region ▪ Predictable revenue streams provide visibility into future earnings and foundation for stable growth ▪ Expanding managed portfolio, development pipeline, and strategic investments further drive scalability and profitability ▪ Focus on premier real estate assets in supply -constrained markets fuels ongoing “flight-to-quality” demand SCALABLE GROWTH PLATFORM We Show Up every day to make a difference — for our customers, our stakeholders, and in the communities that we serve

NASDAQ: CHCI $3.4 $5.8 $9.0 $10.4 $11.6 $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $- $10 $20 $30 $40 $50 $60 2020 2021 2022 2023 2024 Q3 2025 YTD Cost Plus Property Management and Other Supplemental Fees Incentive Fees Adjusted EBITDA 7 By the Numbers: A Proven Model That Delivers Our platform drives consistent growth, preserves flexibility, and generates cash – all with minimal risk ▪ Long -term 2022 Asset Management Agreement (2022 AMA) that covers our most significant properties (the Anchor Portfolio) generates consistent asset management fee revenue and provides cost -plus protection ▪ 3 vertically -integrated operating subsidiaries (CHCI Commercial, CHCI Residential, ParkX Management) perform contract real estate services that generate recurring, fee - based property management and other revenue streams ▪ S upplemental fee income provides additional upside : ▪ Leasing, financing, development, and construction management fees ▪ FY 2022 -24 avg/year =$3.0 million ▪ Incentive fees on stabilized assets ▪ FY 2022 -24 total = $10.1 million ▪ Predictable cash flow generation and streamlined balance sheet provide enhanced agility when pursuing strategic growth opportunities (capital re -investment, acquisitions, etc.) See slide 24 for reconciliation of Adjusted EBITDA to more directly comparable GAAP financial measure REVENUE = 23% CAGR | ADJUSTED EBITDA 35% CAGR $5.3 ($ in M) Revenue ($ in M) Adjusted EBITDA Projected Q425 Revenue

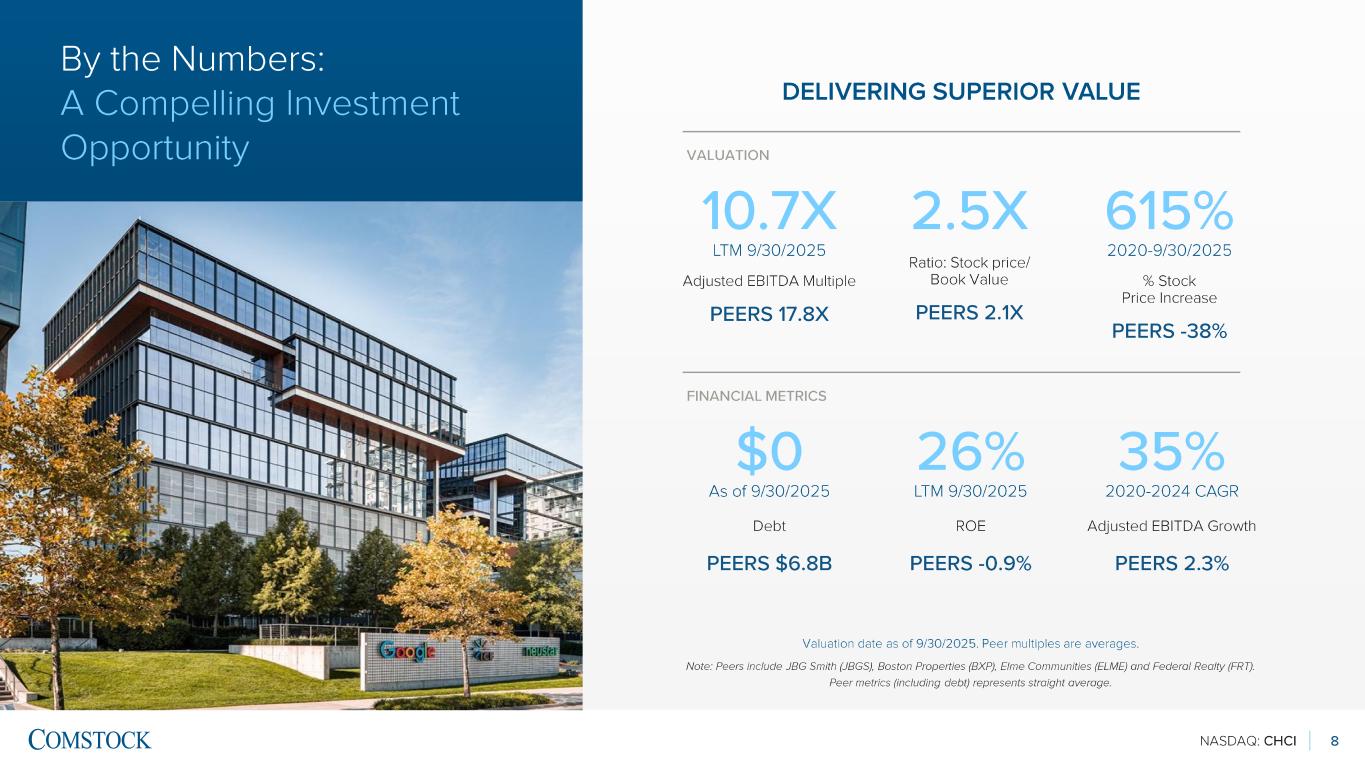

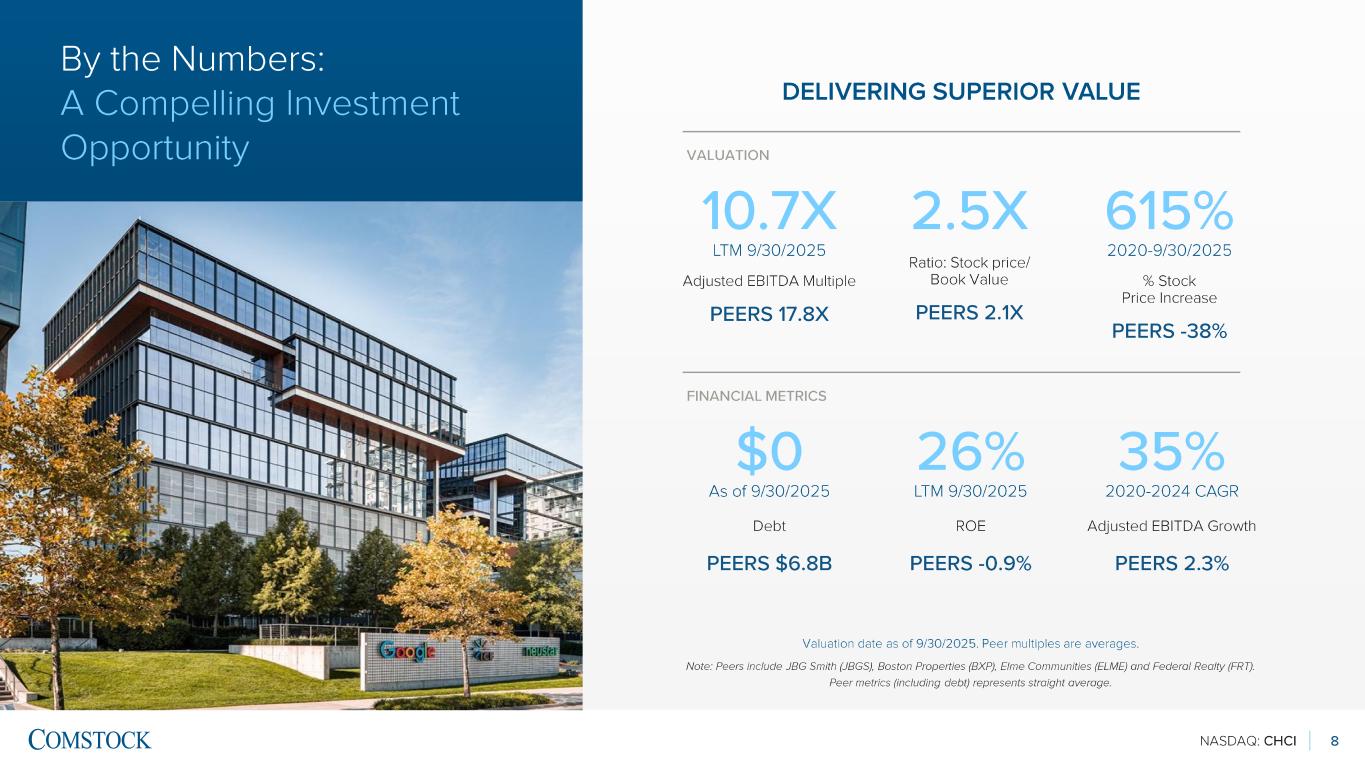

NASDAQ: CHCI 8 DELIVERING SUPERIOR VALUE Note: Peers include JBG Smith (JBGS), Boston Properties (BXP), Elme Communities (ELME) and Federal Realty (FRT). Peer metrics (including debt) represents straight average. Valuation date as of 9/30/2025. Peer multiples are averages. 10.7X LTM 9/30/2025 Adjusted EBITDA Multiple PEERS 17.8X 2.5X Ratio: Stock price/ Book Value PEERS 2.1X 615% 2020 -9/30/2025 % Stock Price Increase PEERS -38% VALUATION $0 As of 9/30/2025 Debt PEERS $6.8B FINANCIAL METRICS 26% LTM 9/30/2025 ROE PEERS -0.9% 35% 2020 -2024 CAGR Adjusted EBITDA Growth PEERS 2.3% By the Numbers: A Compelling Investment Opportunity

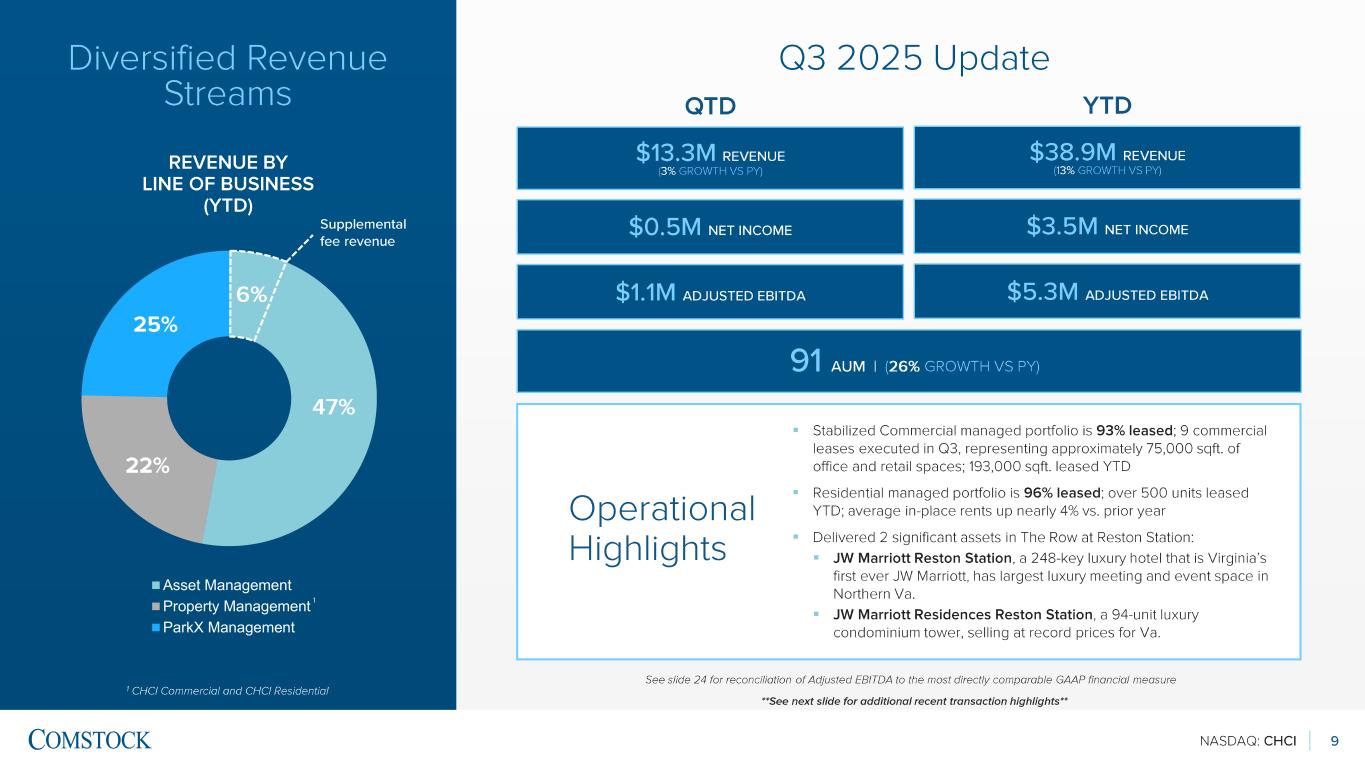

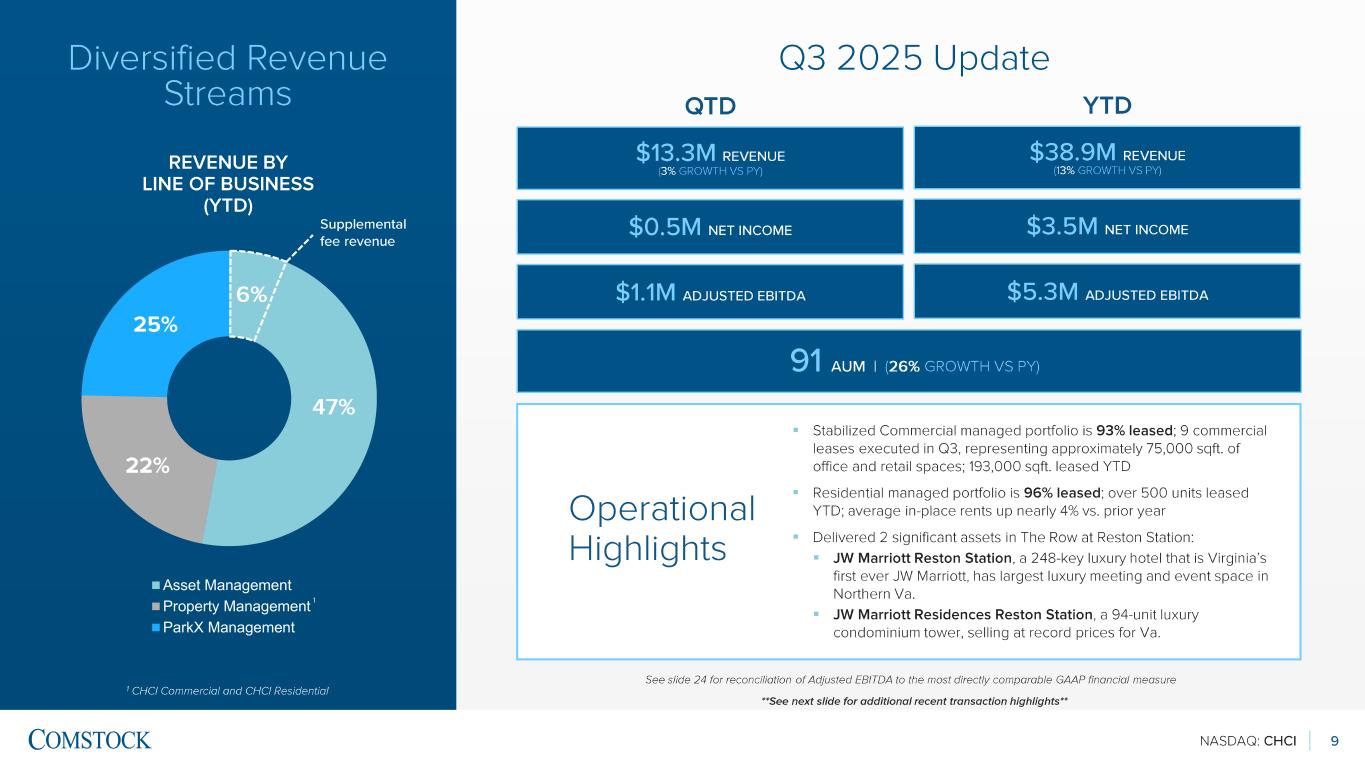

NASDAQ: CHCI 9 Diversified Revenue Streams 1 CHCI Commercial and CHCI Residential 22% 25% Asset Management Property Management ParkX Management REVENUE BY LINE OF BUSINESS (YTD) ▪ Stabilized Commercial managed portfolio is 93% leased ; 9 commercial leases executed in Q3, representing approximately 75,000 sqft. of office and retail spaces; 193,000 sqft. leased YTD ▪ Residential managed portfolio is 96% leased ; over 500 units leased YTD; average in -place rents up nearly 4% vs. prior year ▪ Delivered 2 significant assets in The Row at Reston Station: ▪ JW Marriott Reston Station , a 248 -key luxury hotel that is Virginia’s first ever JW Marriott, has largest luxury meeting and event space in Northern Va. ▪ JW Marriott Residences Reston Station , a 94 -unit luxury condominium tower, selling at record prices for Va. Operational Highlights See slide 24 for reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure Q3 2025 Update 1 $13.3M REVENUE (3% GROWTH VS PY) $1.1M ADJUSTED EBITDA QTD $0.5M NET INCOME 91 AUM | (26% GROWTH VS PY) $38.9M REVENUE (13% GROWTH VS PY) $5.3M ADJUSTED EBITDA YTD $3.5M NET INCOME 6% Supplemental fee revenue 47% **See next slide for additional recent transaction highlights**

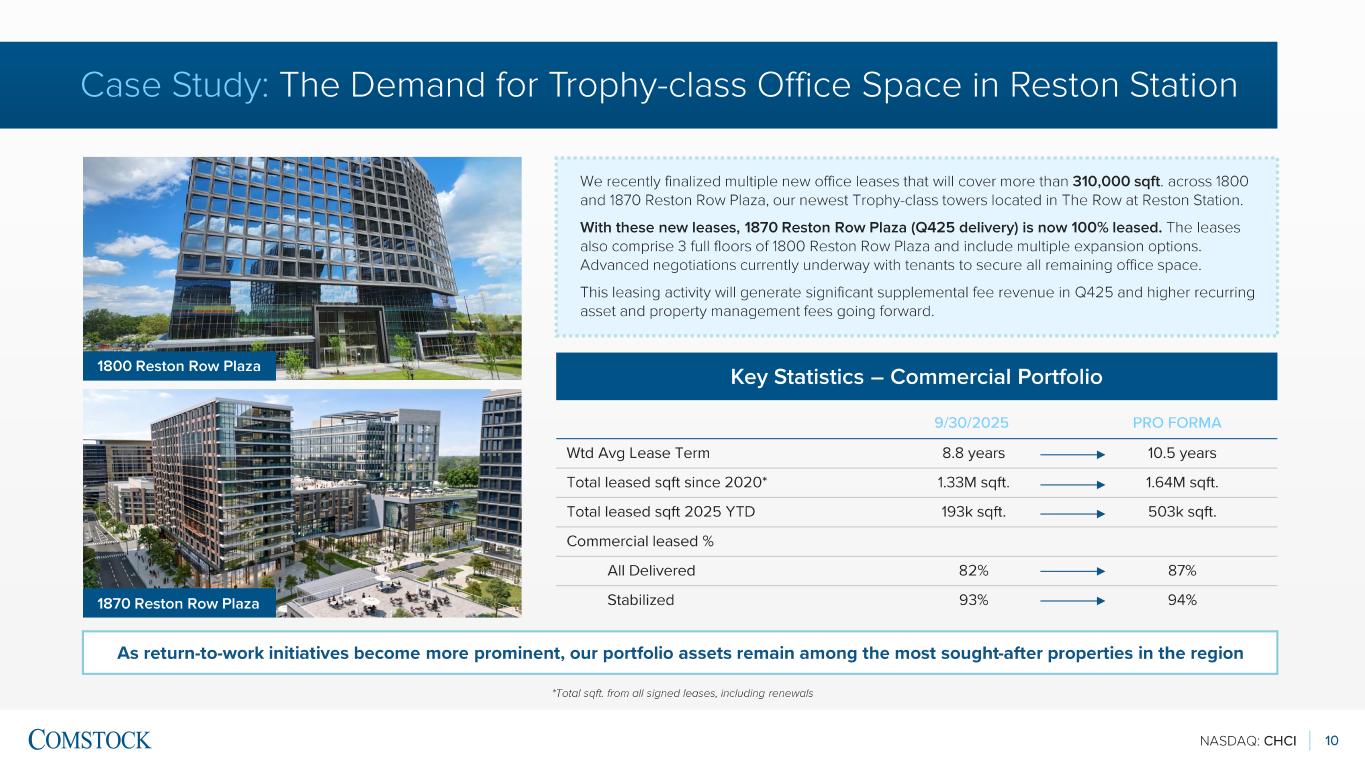

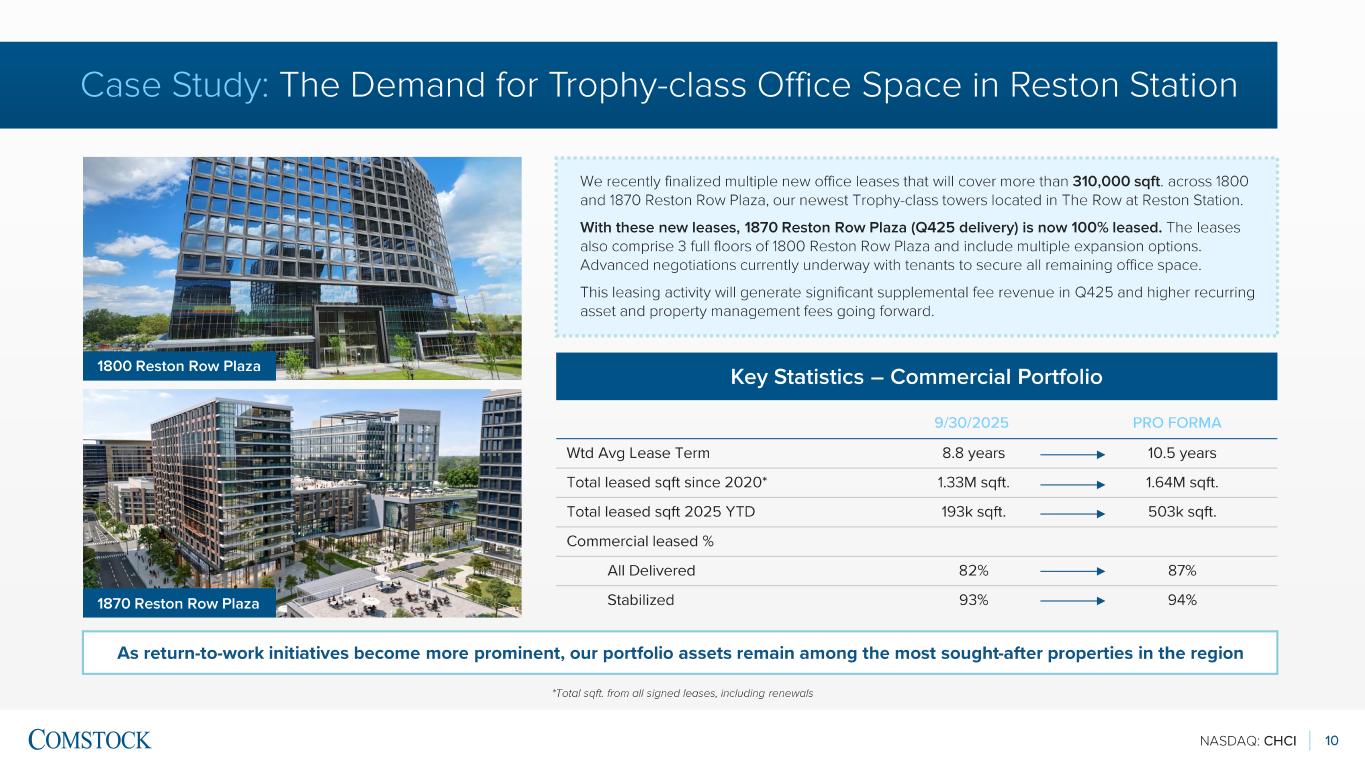

NASDAQ: CHCI 10 Case Study: The Demand for Trophy -class Office Space in Reston Station As return -to-work initiatives become more prominent, our portfolio assets remain among the most sought -after properties in the region We recently f inalized multiple new office leases that will cover more than 310,000 sqft. across 1800 and 1870 Reston Row Plaza, our newest Trophy -class towers located in The Row at Reston Station. With these new leases, 1870 Reston Row Plaza (Q425 delivery) is now 100% leased. The leases also comprise 3 full floors of 1800 Reston Row Plaza and include multiple expansion options. Advanced negotiations currently underway with tenants to secure all remaining office space. This leasing activity will generate significant supplemental fee revenue in Q425 and higher recurring asset and property management fees going forward. PRO FORMA9/30/2025 Wtd Avg Lease Term 8.8 years 10.5 years Total leased sqft since 2020* 1.33M sqft. 1.64M sqft. Total leased sqft 2025 YTD 193k sqft. 503k sqft. Commercial leased % All Delivered 82% 87% Stabilized 93% 94% Key Statistics – Commercial Portfolio *Total sqft. from all signed leases, including renewals 1800 Reston Row Plaza 1870 Reston Row Plaza

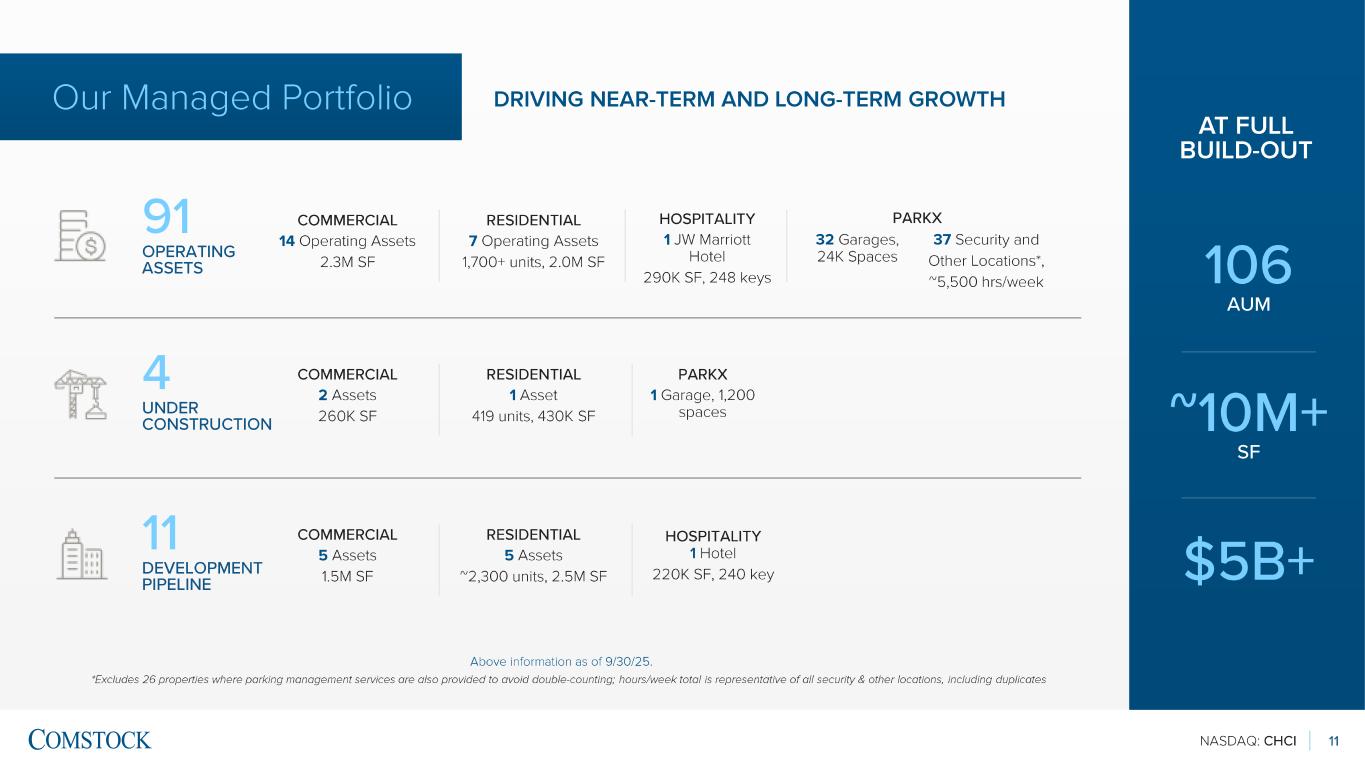

NASDAQ: CHCI 11 Above information as of 9/30/25. *Excludes 26 properties where parking management services are also provided to avoid double -counting ; hours/week total is representative of all security & other locations, including duplicates COMMERCIAL 14 Operating Assets 2.3M SF RESIDENTIAL 7 Operating Assets 1,700+ units, 2.0M SF 32 Garages, 24K Spaces 37 Security and Other Locations*, ~5,500 hrs/week COMMERCIAL 2 Assets 260K SF RESIDENTIAL 1 Asset 419 units, 430K SF PARKX 1 Garage, 1,200 spaces HOSPITALITY 1 JW Marriott Hotel 290K SF, 248 keys COMMERCIAL 5 Assets 1.5M SF RESIDENTIAL 5 Assets ~2,300 units, 2.5M SF HOSPITALITY 1 Hotel 220K SF, 240 key 91 OPERATING ASSETS 4 UNDER CONSTRUCTION 11 DEVELOPMENT PIPELINE Our Managed Portfolio DRIVING NEAR -TERM AND LONG -TERM GROWTH 106 AUM ~10M+ SF $5B+ AT FULL BUILD -OUT PARKX

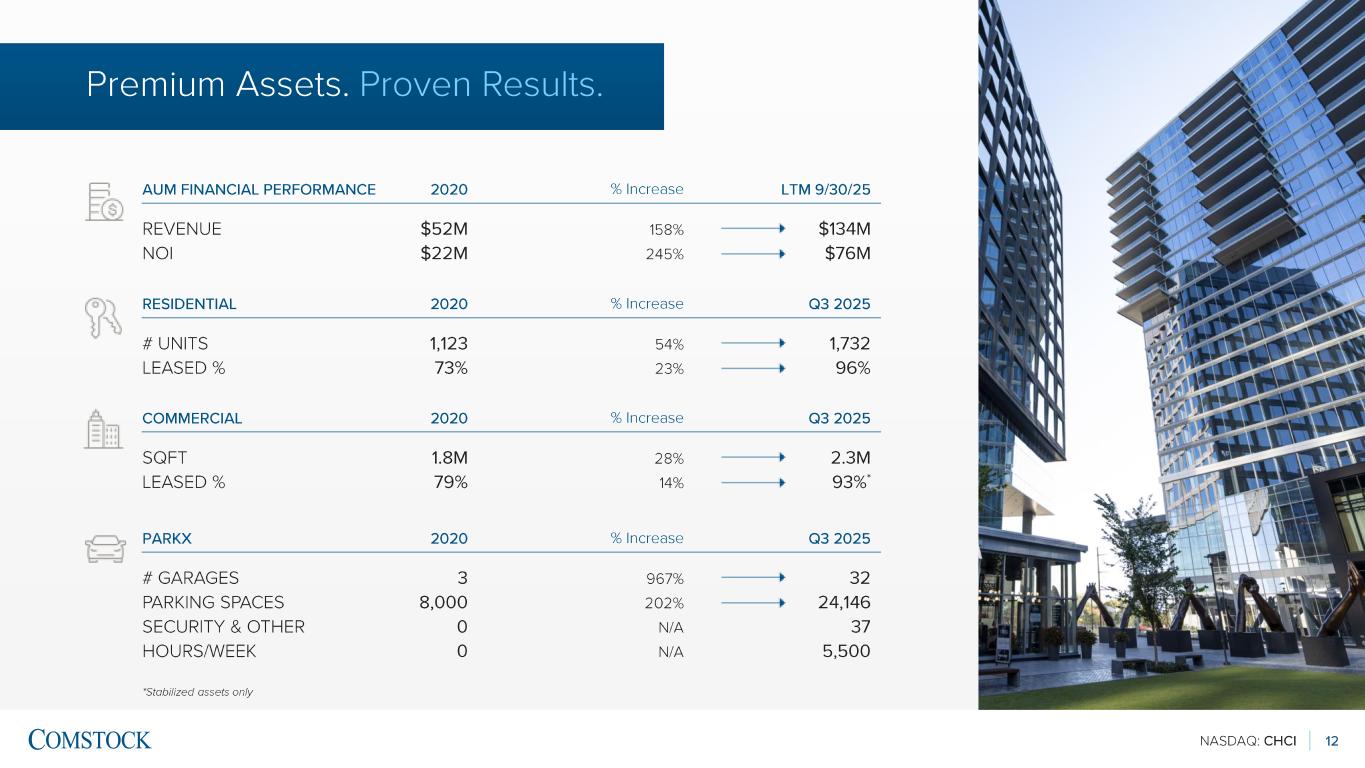

NASDAQ: CHCI 12 Premium Assets. Proven Results. AUM FINANCIAL PERFORMANCE 2020 LTM 9/30/25% Increase REVENUE NOI $52M $22M $134M $76M 158% 245% RESIDENTIAL 2020 Q3 2025% Increase # UNITS LEASED % 1,123 73% 1,732 96% 54% 23% COMMERCIAL 2020 Q3 2025% Increase SQFT LEASED % 1.8M 79% 2.3M 93% * 28% 14% PARKX 2020 Q3 2025% Increase # GARAGES PARKING SPACES SECURITY & OTHER HOURS/WEEK 3 8,000 0 0 32 24,146 37 5,500 967% 202% N/A N/A *Stabilized assets only

NASDAQ: CHCI 13 Flight-to-Quality Attracting Premier Tenants and Partners MAJOR OFFICE TENANTS MAJOR RETAIL LEASES STRATEGIC PARTNERS 0

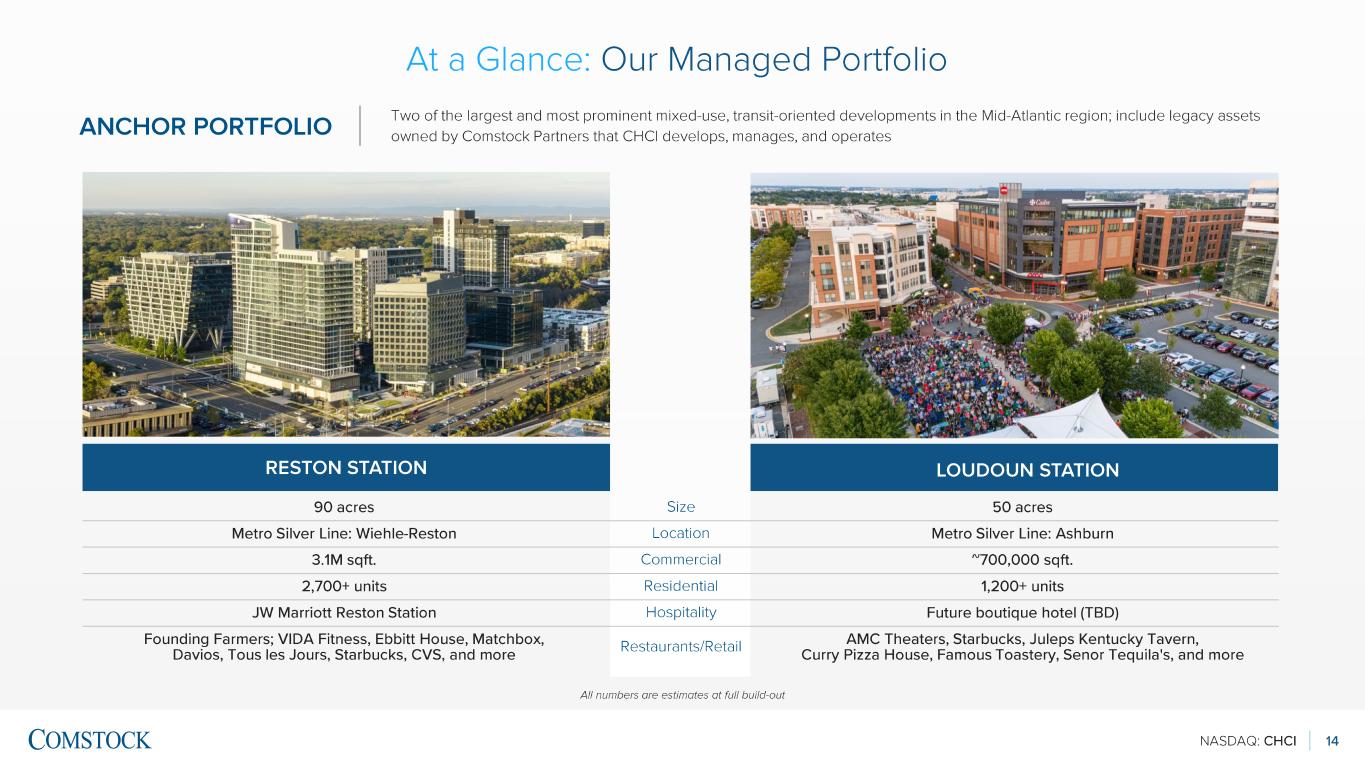

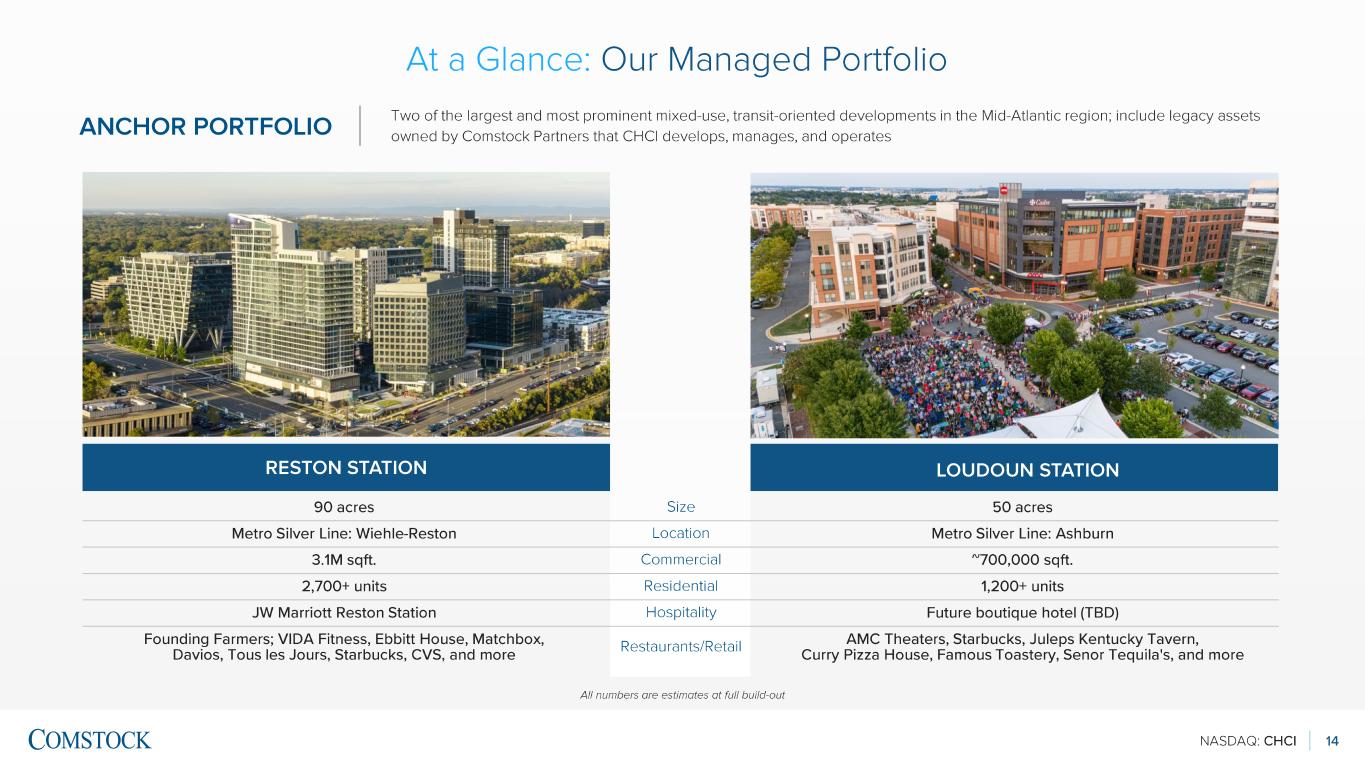

NASDAQ: CHCI 14 ANCHOR PORTFOLIO Two of the largest and most prominent mixed -use, transit-oriented developments in the Mid -Atlantic region; include legacy assets owned by Comstock Partners that CHCI develops, manages, and operates RESTON STATION LOUDOUN STATION 90 acres Size 50 acres Metro Silver Line: Wiehle -Reston Location Metro Silver Line: Ashburn 3.1M sqft. Commercial ~700,000 sqft. 2,700+ units Residential 1,200+ units JW Marriott Reston Station Hospitality Future boutique hotel (TBD) Founding Farmers; VIDA Fitness, Ebbitt House, Matchbox, Davios, Tous les Jours, Starbucks, CVS, and more Restaurants/Retail AMC Theaters, Starbucks, Juleps Kentucky Tavern, Curry Pizza House, Famous Toastery , Senor Tequila's, and more All numbers are estimates at full build -out At a Glance : Our Managed Portfolio

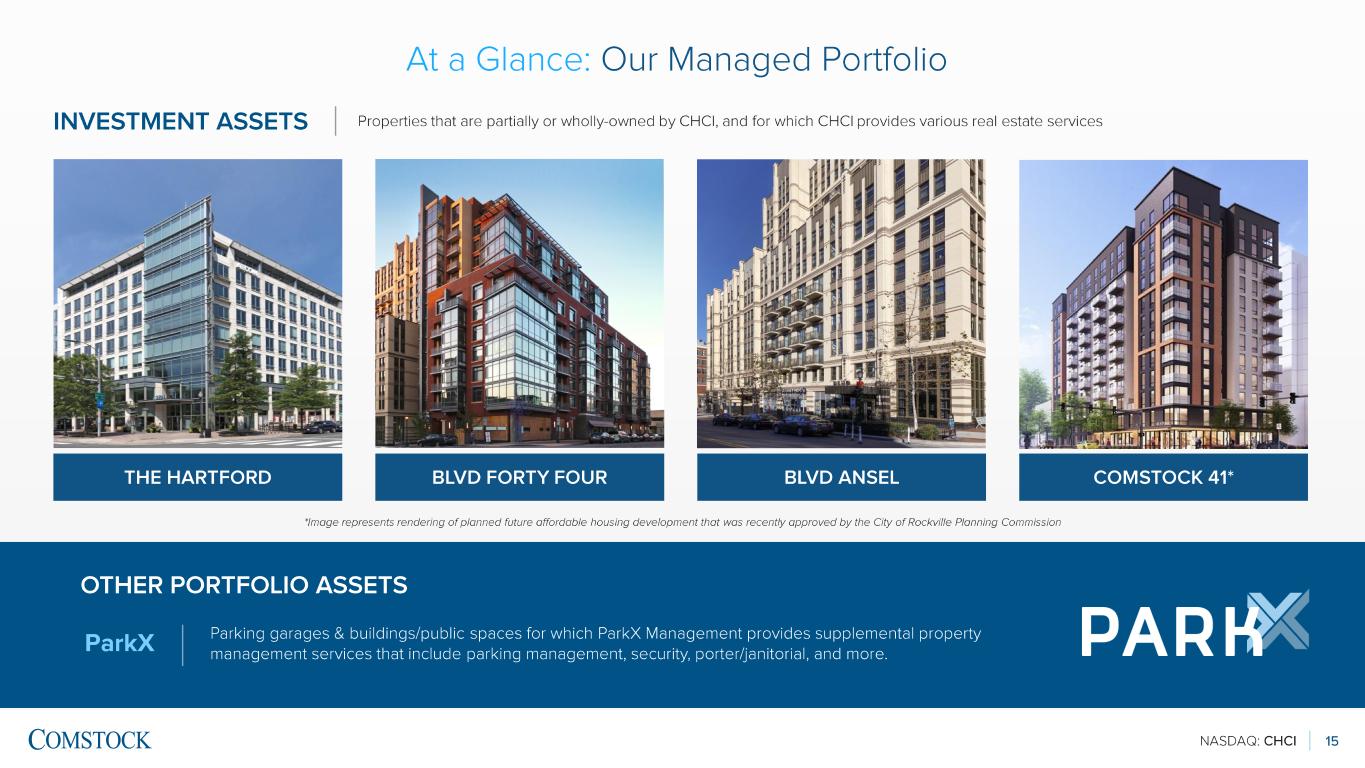

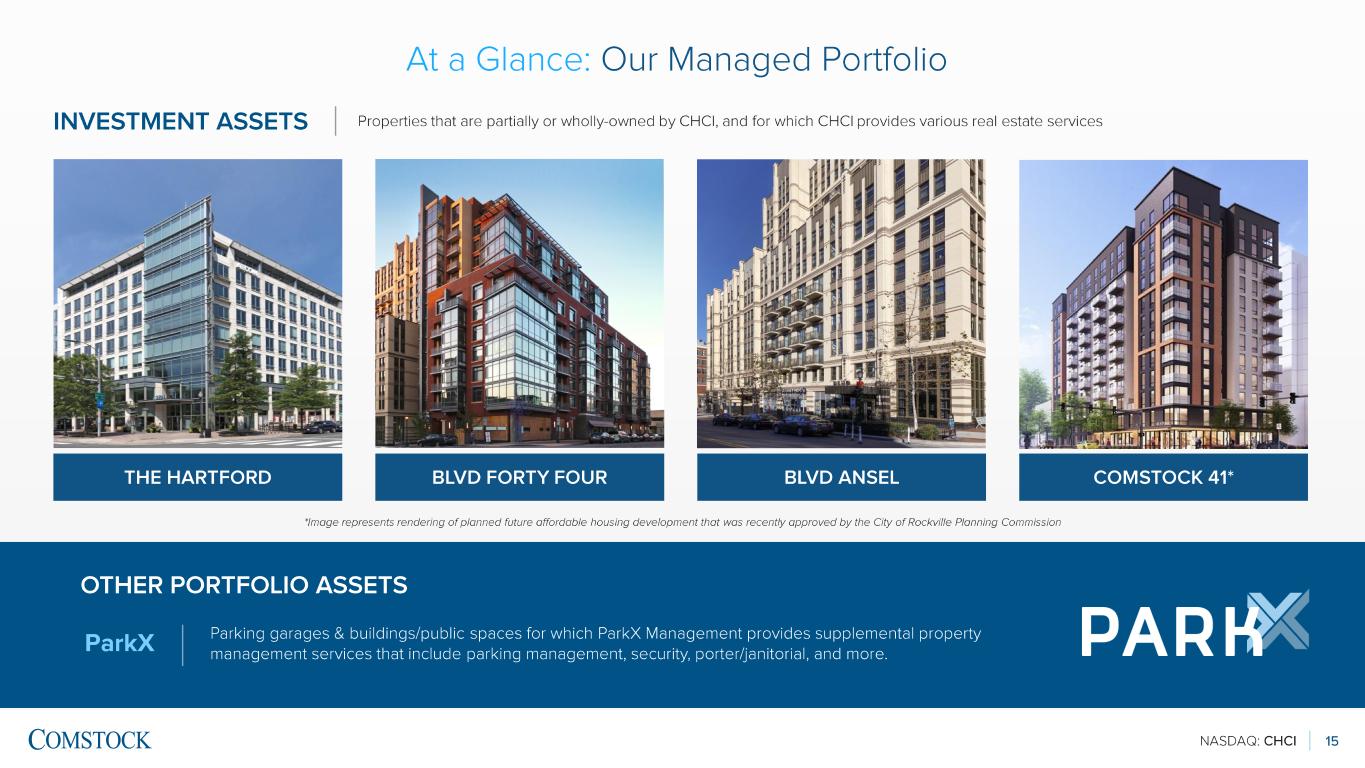

NASDAQ: CHCI INVESTMENT ASSETS 15 THE HARTFORD BLVD FORTY FOUR COMSTOCK 41*BLVD ANSEL Parking garages & buildings/public spaces for which ParkX Management provides supplemental property management services that include parking management, security, porter/janitorial, and more. ParkX OTHER PORTFOLIO ASSETS Properties that are partially or wholly -owned by CHCI, and for which CHCI provides various real estate services At a Glance : Our Managed Portfolio *Image represents rendering of planned future affordable housing development that was recently approved by the City of Rockville Planning Commission

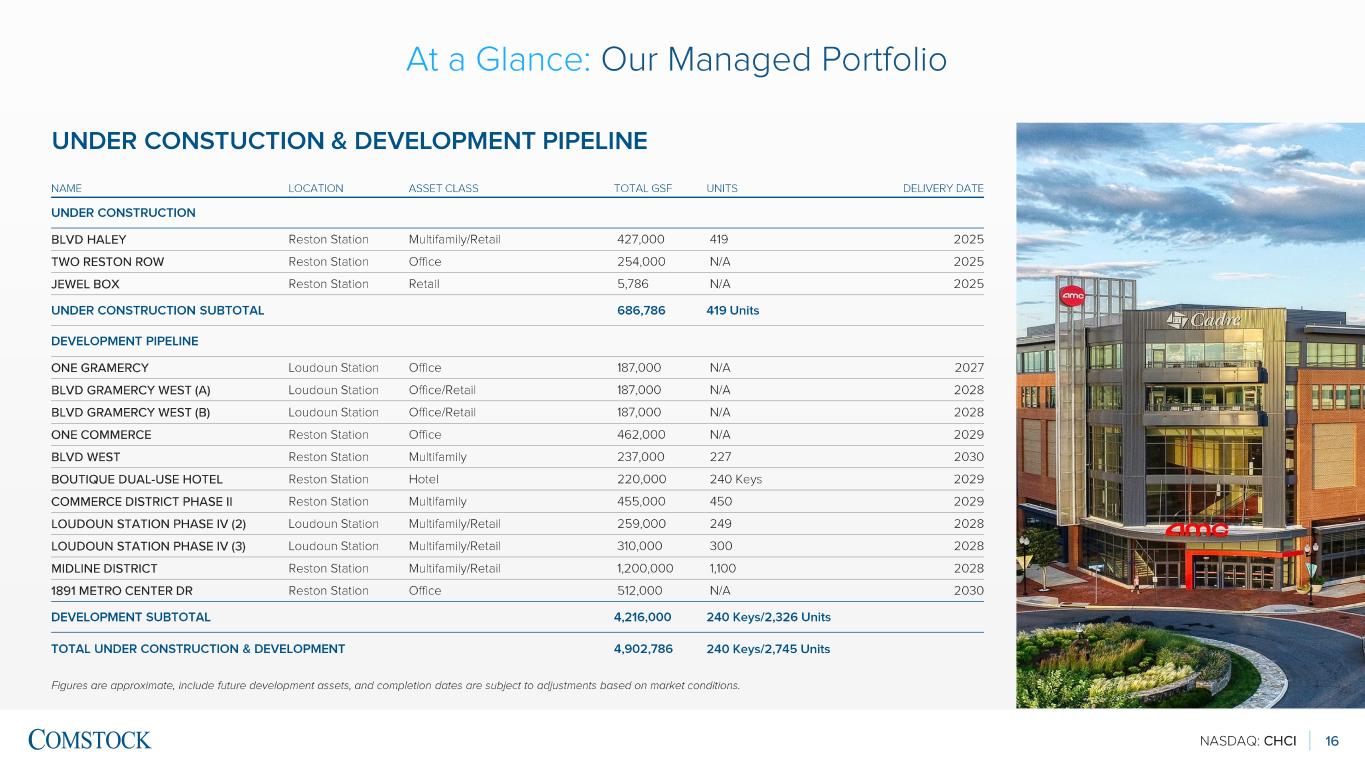

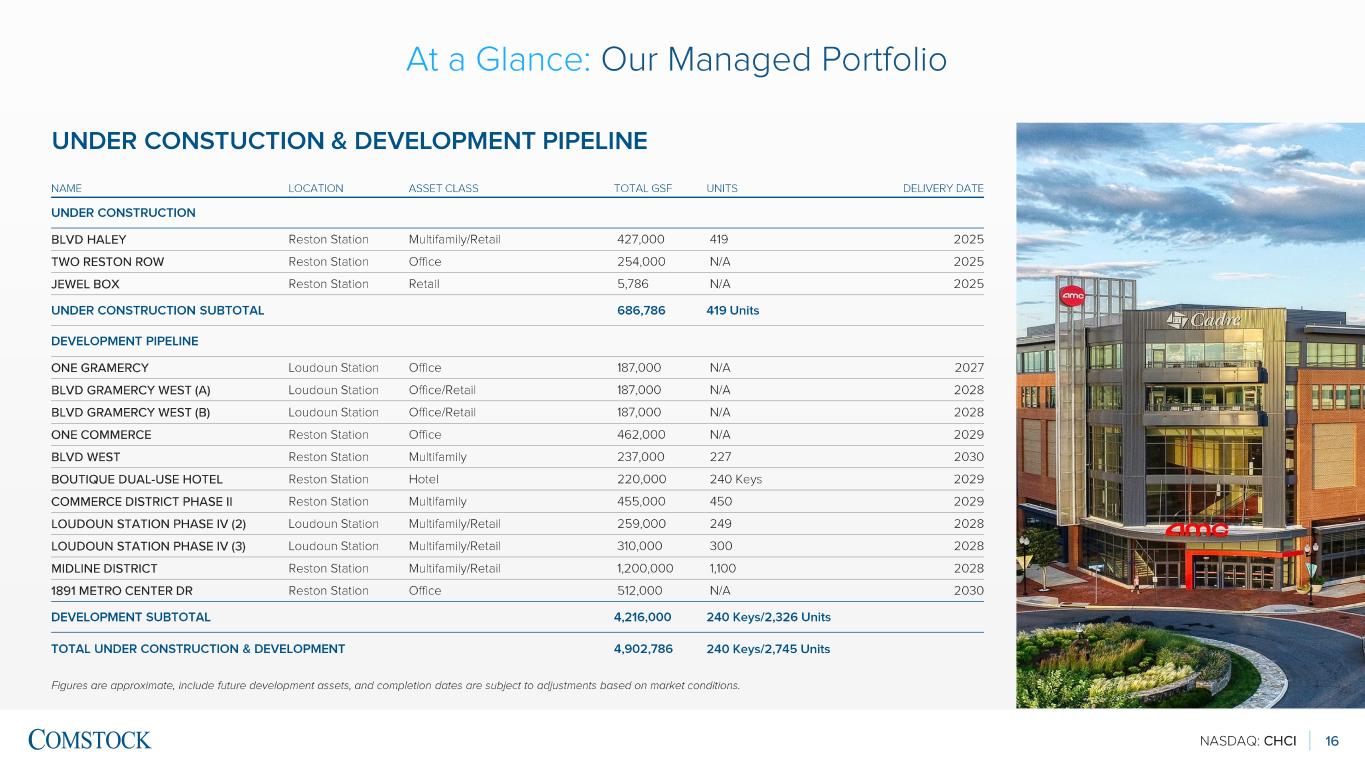

NASDAQ: CHCI 16 UNDER CONSTUCTION & DEVELOPMENT PIPELINE Figures are approximate, include future development assets, and completion dates are subject to adjustments based on market c ond itions. NAME LOCATION ASSET CLASS TOTAL GSF UNITS DELIVERY DATE UNDER CONSTRUCTION BLVD HALEY Reston Station Multifamily/Retail 427,000 419 2025 TWO RESTON ROW Reston Station Office 254,000 N/A 2025 JEWEL BOX Reston Station Retail 5,786 N/A 2025 UNDER CONSTRUCTION SUBTOTAL 686,786 419 Units DEVELOPMENT PIPELINE ONE GRAMERCY Loudoun Station Office 187,000 N/A 2027 BLVD GRAMERCY WEST (A) Loudoun Station Office/Retail 187,000 N/A 2028 BLVD GRAMERCY WEST (B) Loudoun Station Office/Retail 187,000 N/A 2028 ONE COMMERCE Reston Station Office 462,000 N/A 2029 BLVD WEST Reston Station Multifamily 237,000 227 2030 BOUTIQUE DUAL -USE HOTEL Reston Station Hotel 220,000 240 Keys 2029 COMMERCE DISTRICT PHASE II Reston Station Multifamily 455,000 450 2029 LOUDOUN STATION PHASE IV (2) Loudoun Station Multifamily/Retail 259,000 249 2028 LOUDOUN STATION PHASE IV (3) Loudoun Station Multifamily/Retail 310,000 300 2028 MIDLINE DISTRICT Reston Station Multifamily/Retail 1,200,000 1,100 2028 1891 METRO CENTER DR Reston Station Office 512,000 N/A 2030 DEVELOPMENT SUBTOTAL 4,216,000 240 Keys/2,326 Units TOTAL UNDER CONSTRUCTION & DEVELOPMENT 4,902,786 240 Keys/2,745 Units At a Glance : Our Managed Portfolio

NASDAQ: CHCI 17 We recognize that development of real estate can have significant impact, positive or negative, for the surrounding community , the region, and the environment that we all share. Supporting and fostering these initiatives in a rational way is instrumental in making our co mmunities better places to live, work, and play while simultaneously bolstering asset value, reducing risk, and positively impacting all stakeholders. All buildings at Reston Metro Plaza LEED silver or above Green Cleaning: use environmentally -friendly practices and low toxicity cleaning products Electric Charging Stations The Hartford Building in Arlington LEED gold certified CarbonCure Concrete Bike Racks, Bike Repair Rooms, Bike to Work Events and Bike Share Program The Hartford Building is Energy Star certified in addition to buildings at Reston Metro Plaza and Commerce Districts Smoke Free Buildings Community Involvement Annual Summerbration , Arts Program, Community Donations, Sponsored Community Events, Habitat for Humanity Transit -oriented projects encourages use of and promotes public transportation to reduce the carbon footprint Non Corrosive and Non Toxic Ice Melt 2024 Best Places to Work & Best Workplaces for Commuters ESG: Creating Positive Impacts

NASDAQ: CHCI 18 1900 Reston Metro Plaza, Reston, VA 20190 703.230.1985 comstock.com | investorrelations@comstock.com NASDAQ: CHCI

NASDAQ: CHCI 19 SUPPLEMENTAL INFORMATION

NASDAQ: CHCI 20 Leadership Team EX EC U TI V E C O M M IT TE E SE N IO R L EA D ER SH IP TIMOTHY STEFFAN Chief Operating Officer CHRISTOPHER GUTHRIE CFO & EVP ROBERT DEMCHAK General Counsel & Corporate Secretary TRACY SCHAR SVP of Marketing & Design Management JOHN HARRISON EVP of Development PAUL SCHWARTZ SVP of Human Resources MICHAEL GUALTIERI Chief Accounting Officer RUBEN MERCADO VP & Head of Information Technology JIMMY MANDICH VP & Controller KRIS GREEN SVP, Property & Asset Management CHRIS FACAS Senior Managing Director, Asset Management DYLAN CLEMENTE President, ParkX Management CHRIS CLEMENTE CEO & Chairman of CHCI Significant Shareholder of CHCI Managing Partner of Comstock Partners, LC (Owner of Anchor Portfolio) DWIGHT SCHAR Former CEO & Chairman of NVR (NYSE: NVR) Significant Shareholder of CHCI Principal of Comstock Partners, LC (Owner of Anchor Portfolio) COMBINING LOCAL EXPERTISE WITH INDUSTRY EXPERIENCE

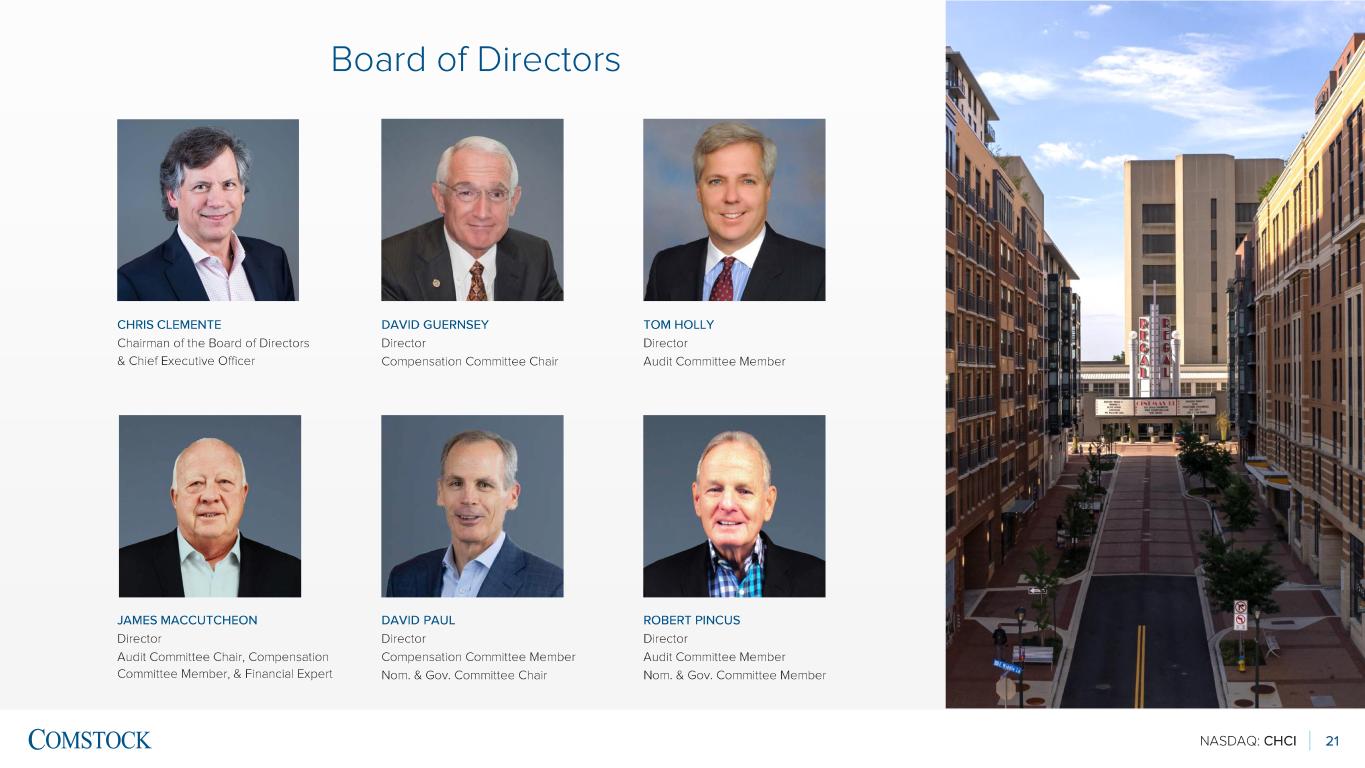

NASDAQ: CHCI 21 Board of Directors CHRIS CLEMENTE Chairman of the Board of Directors & Chief Executive Officer DAVID GUERNSEY Director Compensation Committee Chair TOM HOLLY Director Audit Committee Member JAMES MACCUTCHEON Director Audit Committee Chair, Compensation Committee Member, & Financial Expert DAVID PAUL Director Compensation Committee Member Nom. & Gov. Committee Chair ROBERT PINCUS Director Audit Committee Member Nom. & Gov. Committee Member

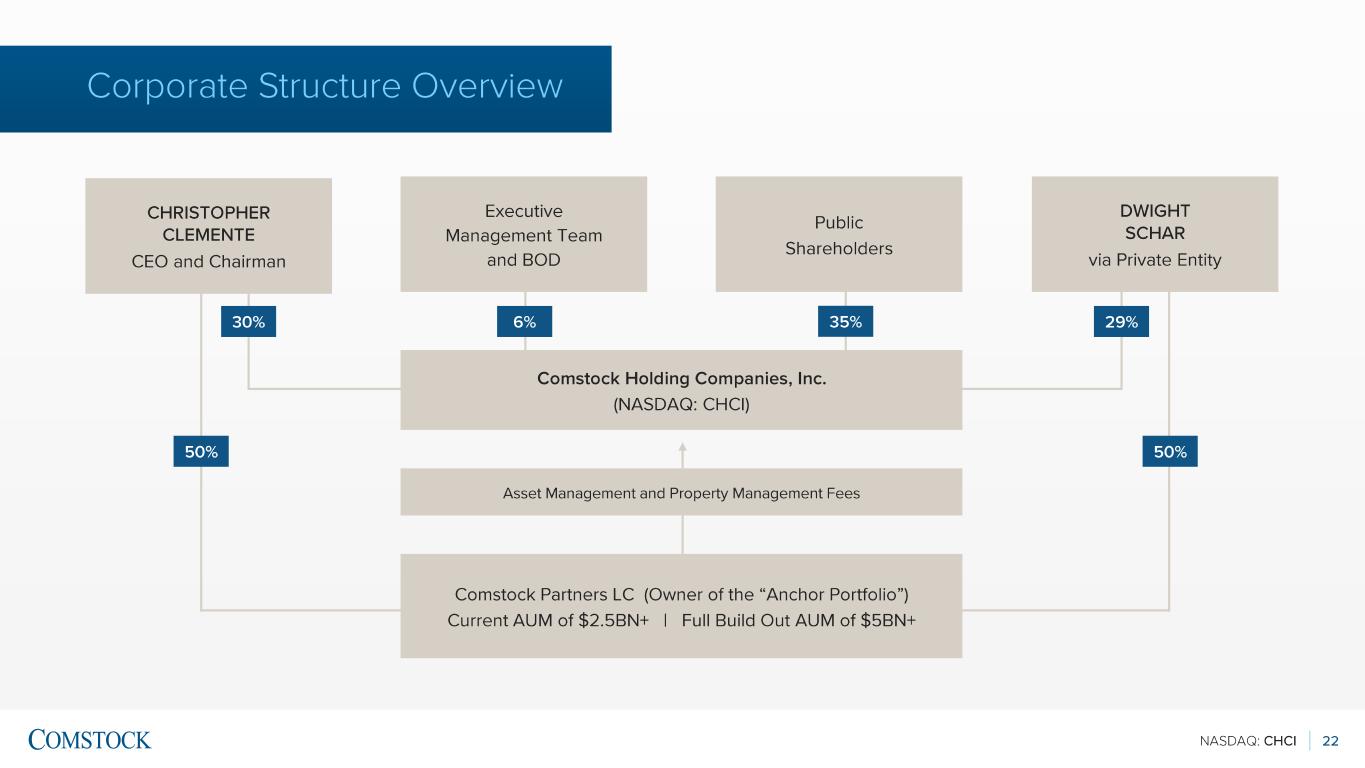

NASDAQ: CHCI 22 Corporate Structure Overview CHRISTOPHER CLEMENTE CEO and Chairman Executive Management Team and BOD Public Shareholders DWIGHT SCHAR via Private Entity Comstock Holding Companies, Inc. (NASDAQ: CHCI ) Asset Management and Property Management Fees Comstock Partners LC (Owner of the “Anchor Portfolio”) Current AUM of $2.5BN+ | Full Build Out AUM of $5BN+ 30% 6% 29% 50%50% 35%

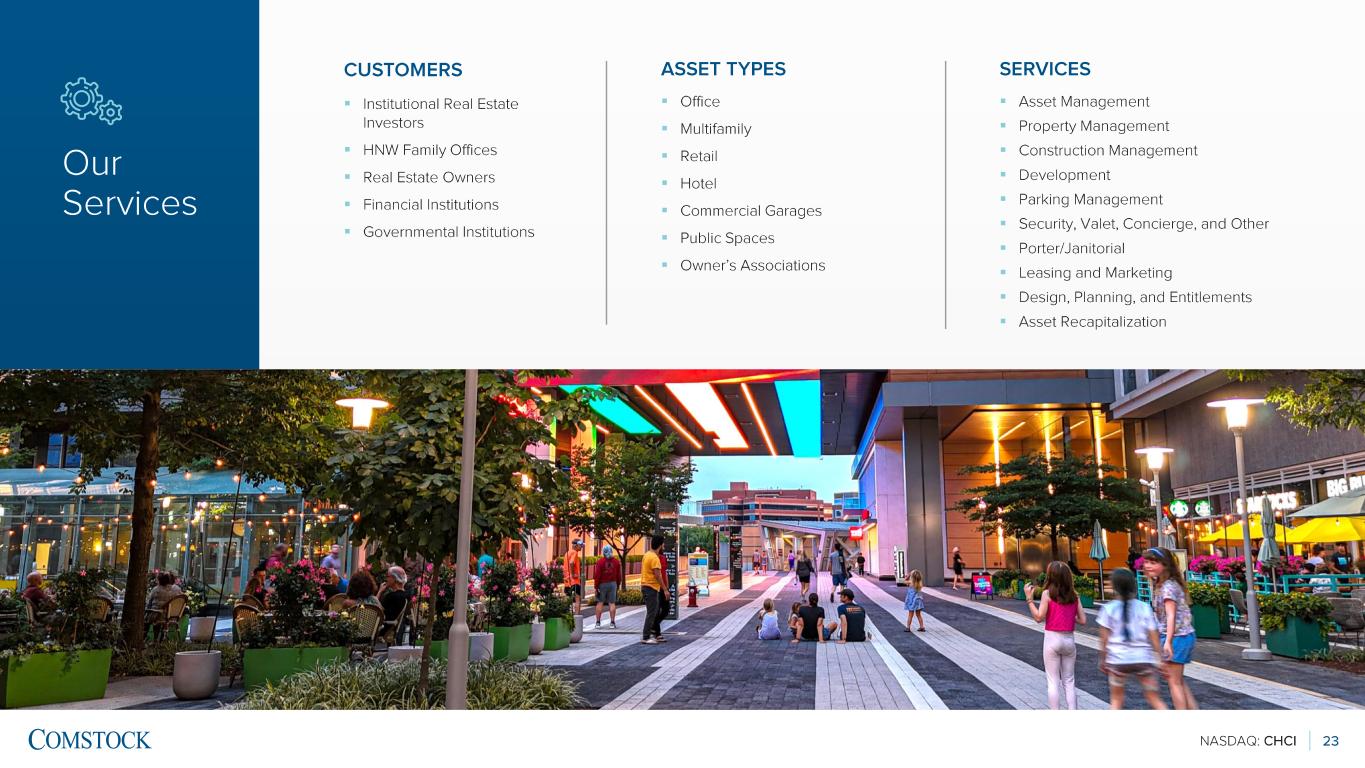

NASDAQ: CHCI 23 CUSTOMERS ▪ Institutional Real Estate Investors ▪ HNW Family Offices ▪ Real Estate Owners ▪ Financial Institutions ▪ Governmental Institutions ASSET TYPES ▪ Office ▪ Multifamily ▪ Retail ▪ Hotel ▪ Commercial Garages ▪ Public Spaces ▪ Owner’s Associations SERVICES ▪ Asset Management ▪ Property Management ▪ Construction Management ▪ Development ▪ Parking Management ▪ Security, Valet, Concierge, and Other ▪ Porter/Janitorial ▪ Leasing and Marketing ▪ Design, Planning, and Entitlements ▪ Asset Recapitalization Our Services

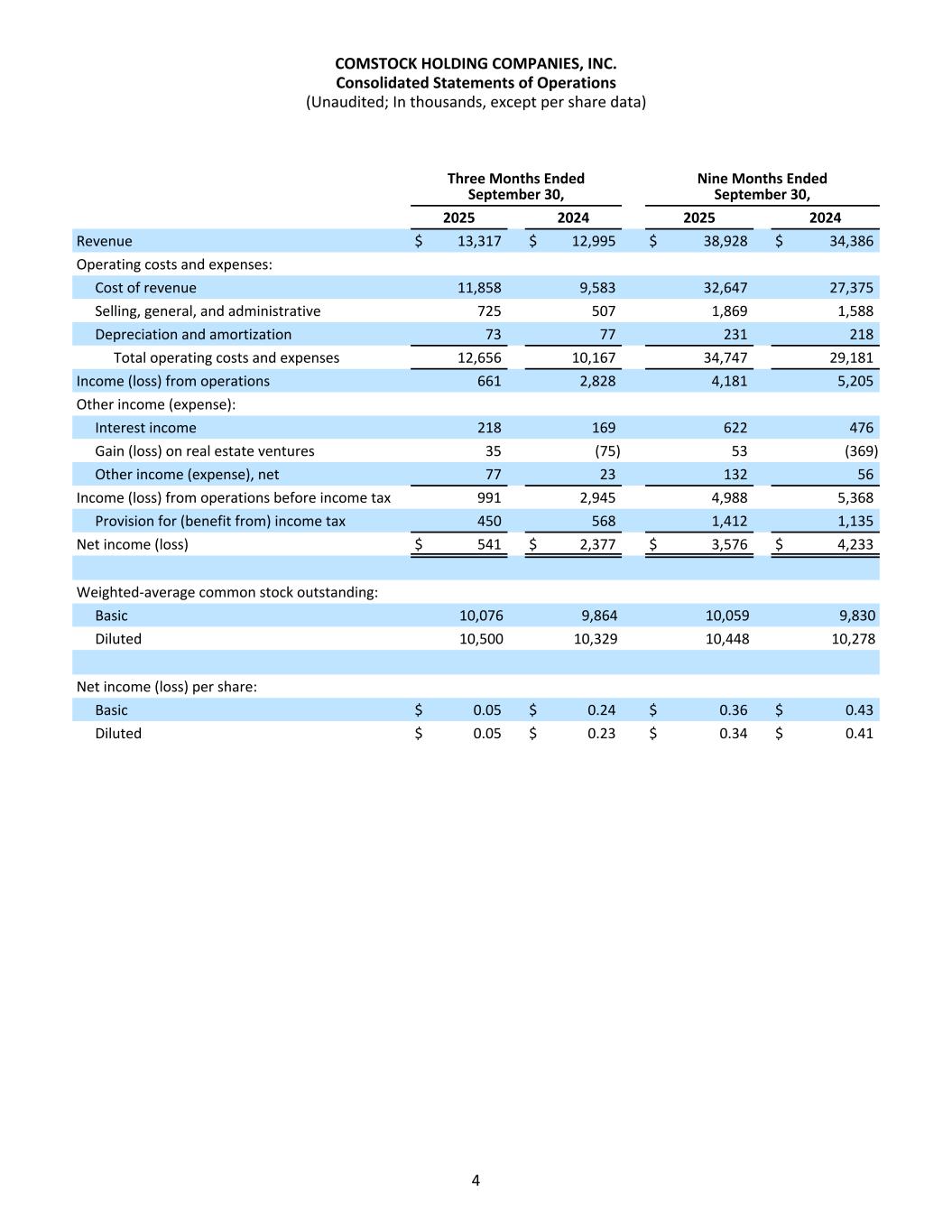

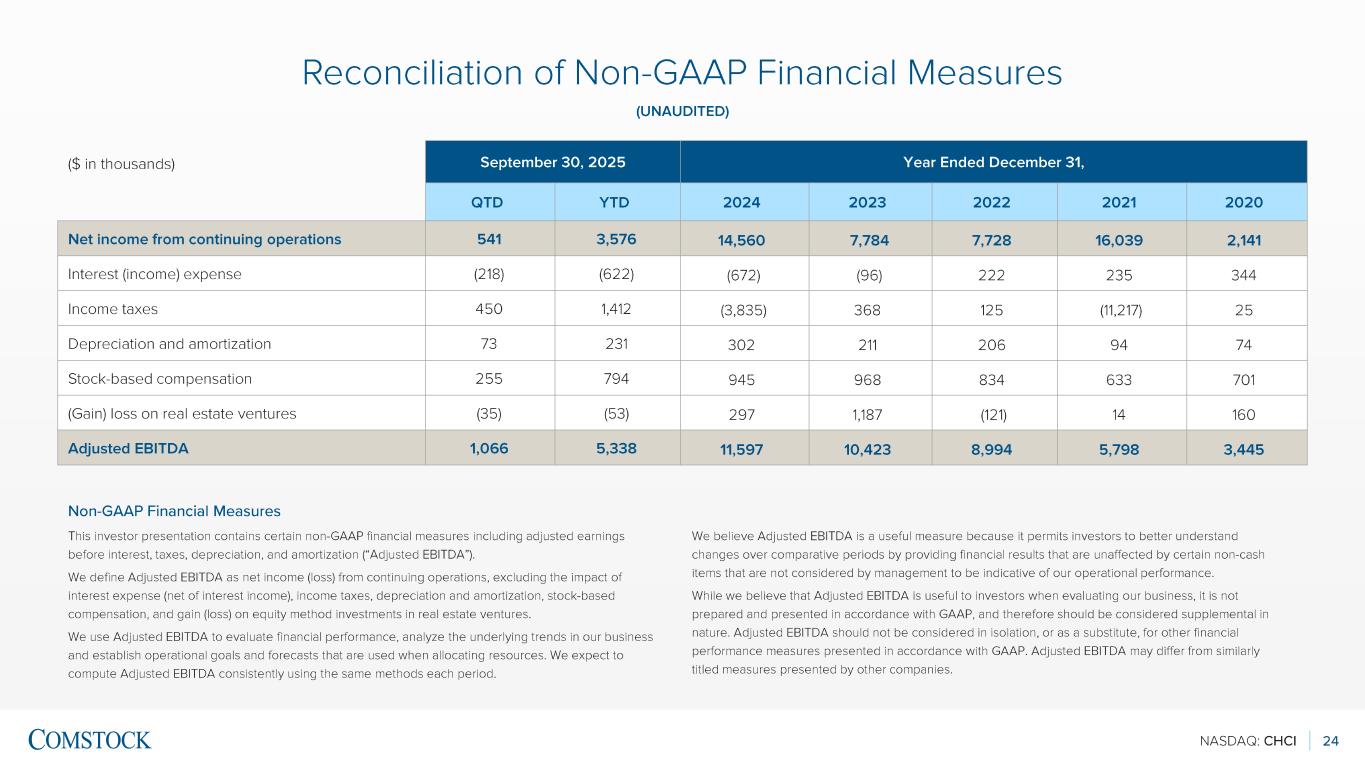

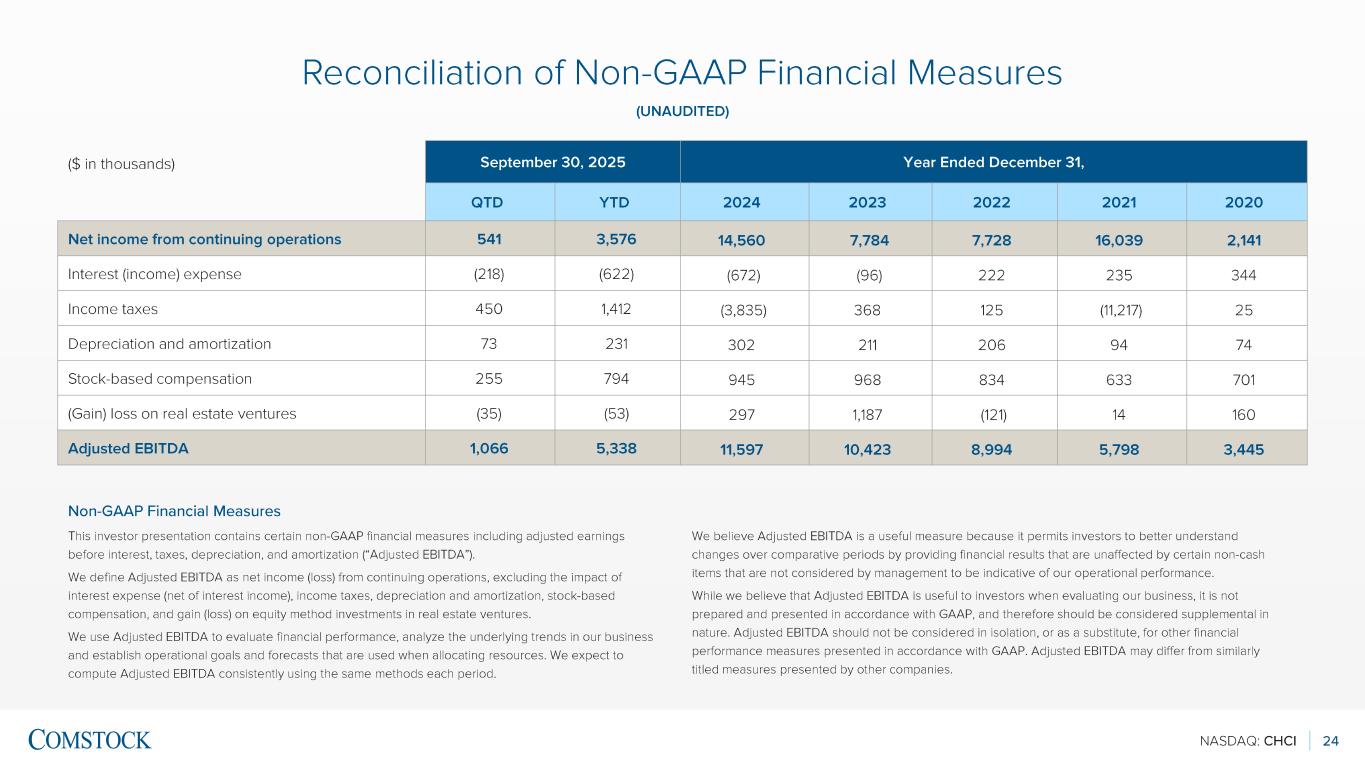

NASDAQ: CHCI 24 This investor presentation contains certain non -GAAP financial measures including adjusted earnings before interest, taxes, depreciation, and amortization (“Adjusted EBITDA”). We define Adjusted EBITDA as net income (loss) from continuing operations, excluding the impact of interest expense (net of interest income), income taxes, depreciation and amortization, stock -based compensation, and gain (loss) on equity method investments in real estate ventures. We use Adjusted EBITDA to evaluate financial performance, analyze the underlying trends in our business and establish operational goals and forecasts that are used when allocating resources. We expect to compute Adjusted EBITDA consistently using the same methods each period. We believe Adjusted EBITDA is a useful measure because it permits investors to better understand changes over comparative periods by providing financial results that are unaffected by certain non -cash items that are not considered by management to be indicative of our operational performance. While we believe that Adjusted EBITDA is useful to investors when evaluating our business, it is not prepared and presented in accordance with GAAP, and therefore should be considered supplemental in nature. Adjusted EBITDA should not be considered in isolation, or as a substitute, for other financial performance measures presented in accordance with GAAP. Adjusted EBITDA may differ from similarly titled measures presented by other companies. Reconciliation of Non -GAAP Financial Measures (UNAUDITED) Non -GAAP Financial Measures ($ in thousands) September 30, 2025 Year Ended December 31, QTD YTD 2024 2023 2022 2021 2020 Net income from continuing operations 541 3,576 14,560 7,784 7,728 16,039 2,141 Interest (income) expense (218) (622) (672) (96) 222 235 344 Income taxes 450 1,412 (3,835) 368 125 (11,217) 25 Depreciation and amortization 73 231 302 211 206 94 74 Stock -based compensation 255 794 945 968 834 633 701 (Gain) loss on real estate ventures (35) (53) 297 1,187 (121) 14 160 Adjusted EBITDA 1,066 5,338 11,597 10,423 8,994 5,798 3,445