MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2025 As used in this management’s discussion and analysis of financial condition and results of operations (“MD&A”), unless the context indicates or requires otherwise, all references to the “Company”, “Docebo”, “we”, “us” or “our” refer to Docebo Inc., together with our subsidiaries, on a consolidated basis as constituted on September 30, 2025. This MD&A for the three and nine months ended September 30, 2025 and 2024 should be read in conjunction with the Company’s unaudited condensed consolidated interim financial statements and accompanying notes thereto for the three and nine months ended September 30, 2025 and 2024, and the Company’s audited annual consolidated financial statements and accompanying notes thereto for the year ended December 31, 2024. The financial information presented in this MD&A is derived from the Company’s unaudited condensed consolidated interim financial statements for the nine months ended September 30, 2025 and 2024 which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). All amounts are in thousands of United States dollars except where otherwise indicated. This MD&A is dated as of November 6, 2025. Forward-looking Information This MD&A contains “forward-looking information” and “forward-looking statements” (collectively, “forward- looking information”) within the meaning of applicable securities laws. Forward-looking information may relate to our future financial outlook and anticipated events or results and may include information regarding our financial position, business strategy, macroeconomic conditions and global economic uncertainty, war and inflation, including actions of Central banks to contain it, on our business, growth strategies, addressable markets, budgets, operations, financial results, taxes, dividend policy, plans and objectives. Particularly, information regarding our expectations of future results, performance, achievements, prospects or opportunities or the markets in which we operate is forward-looking information. In some cases, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects”, “is expected”, “an opportunity exists”, “budget”, “scheduled”, “estimates”, “outlook”, “forecasts”, “projection”, “prospects”, “strategy”, “intends”, “anticipates”, “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or, “will”, “occur” or “be achieved”, and similar words or the negative of these terms and similar terminology. In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events or circumstances. This forward-looking information includes, but is not limited to, statements regarding the Company’s business; future financial position and business strategy; the learning management industry; our growth rates and growth strategies; addressable markets for our solutions; the achievement of advances in and expansion of our platform; expectations regarding our revenue and the revenue generation potential of our platform and other products; our business plans and strategies; use of artificial intelligence (“AI”) in our platform and its impact on the Company’s business; expectations regarding our future expenses; our competitive position in our industry; and our expectations regarding a key OEM customer’s intentions to reduce subscriptions for our solution. This forward-looking information is based on our opinions, estimates and assumptions in light of our experience and perception of historical trends, current conditions and expected future developments, as well as other factors that we currently believe are appropriate and reasonable in the circumstances. Despite a careful process to prepare and review the forward-looking information, there can be no assurance that the underlying opinions, estimates and assumptions will prove to be correct. Certain assumptions include: our ability to build our market share and enter new markets and industry verticals; our ability to attract and retain key personnel; our ability to maintain and expand geographic scope; our ability to execute on our expansion plans, including the continued incorporation of AI into our platform; our ability to continue investing in infrastructure to support our growth; our ability to obtain and 1

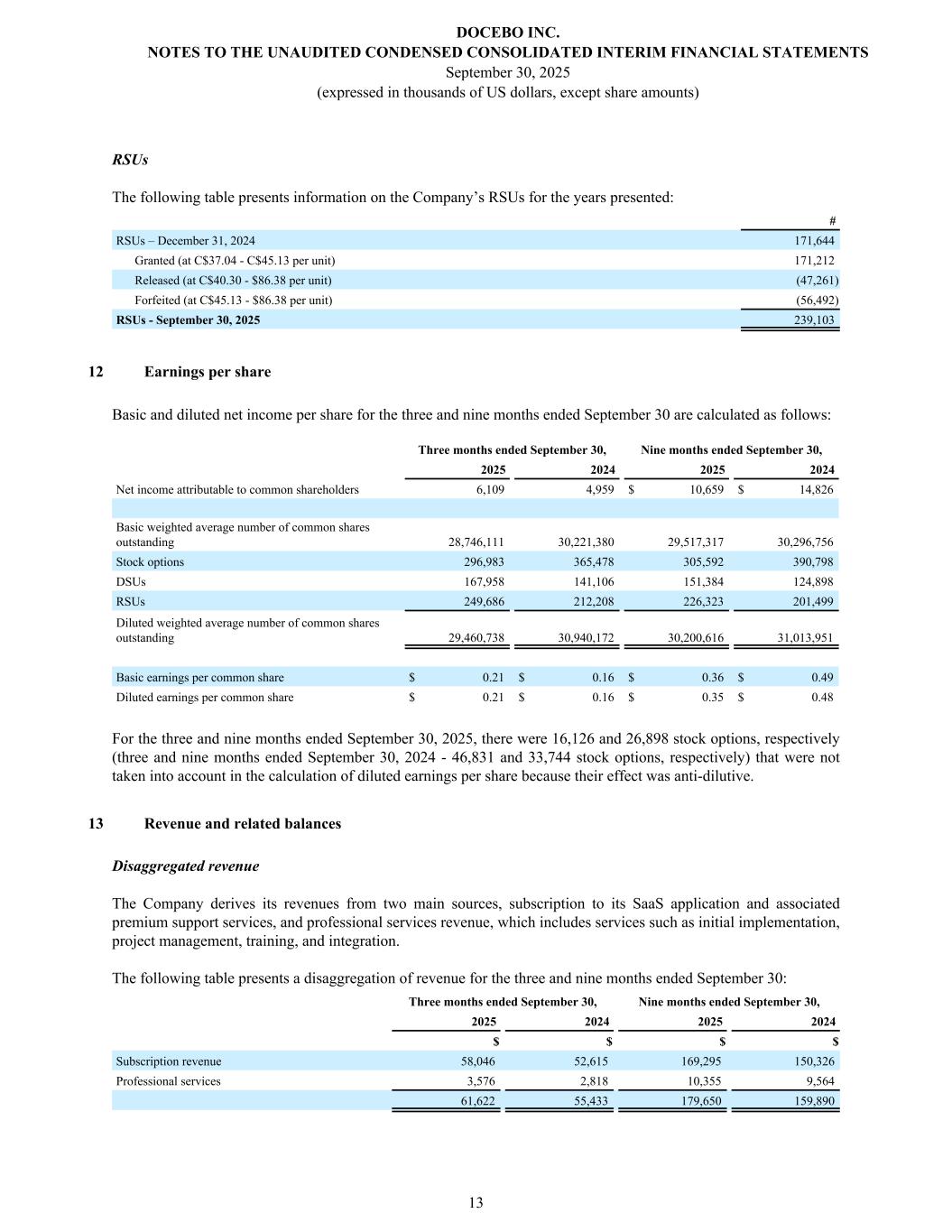

maintain existing financing on acceptable terms; our ability to execute on profitability initiatives; our ability to successfully integrate the companies we have acquired and to derive the benefits we expect from the acquisition thereof; currency exchange and interest rates; the impact of inflation and global macroeconomic conditions; the impact of competition; our ability to respond to the changes and trends in our industry or the global economy; and the changes in laws, rules, regulations, and global standards are material factors made in preparing forward- looking information and management’s expectations. Forward-looking information is necessarily based on a number of opinions, estimates and assumptions that, while considered by the Company to be appropriate and reasonable as of the date of this MD&A, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including but not limited to: • the Company’s ability to execute its growth strategies; • the impact of changing conditions in the global corporate e-learning market; • increasing competition in the global corporate e-learning market in which the Company operates; • fluctuations in currency exchange rates and volatility in financial markets; • the Company’s ability to operate its business and effectively manage its growth under evolving macroeconomic conditions, such as high inflation and recessionary environments; • fluctuations in the length and complexity of the sales cycle for our platform, especially for sales to larger enterprises; • issues in the use of AI in our platform and potential resulting reputational harm or liability; • changes in the attitudes, financial condition and demand of our target market; • developments and changes in applicable laws and regulations; • such other factors discussed in greater detail under the “Risk Factors” section of our Annual Information Form dated February 27, 2025 (“AIF”), which is available under our profile on SEDAR+ at www.sedarplus.ca. If any of these risks or uncertainties materialize, or if the opinions, estimates or assumptions underlying the forward-looking information prove incorrect, actual results or future events might vary materially from those anticipated in the forward-looking information. The opinions, estimates or assumptions referred to above and described in greater detail in “Summary of Factors Affecting our Performance” and in the “Risk Factors” section of our AIF, should be considered carefully by prospective investors. Although we have attempted to identify important risk factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other risk factors not presently known to us or that we presently believe are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking information. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. No forward-looking statement is a guarantee of future results. Accordingly, you should not place undue reliance on forward-looking information, which speaks only as of the date made. The forward-looking information contained in this MD&A represents our expectations as of the date specified herein, and are subject to change after such date. However, we disclaim any intention or obligation or undertaking to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required under applicable securities laws. All of the forward-looking information contained in this MD&A is expressly qualified by the foregoing cautionary statements. Additional information relating to Docebo, including our AIF, can be found on SEDAR+ at www.sedarplus.ca. Overview At Docebo, our mission is to redefine the way enterprises, including their internal and external workforces, partners and customers, learn by applying new technologies to the traditional corporate learning management system 2

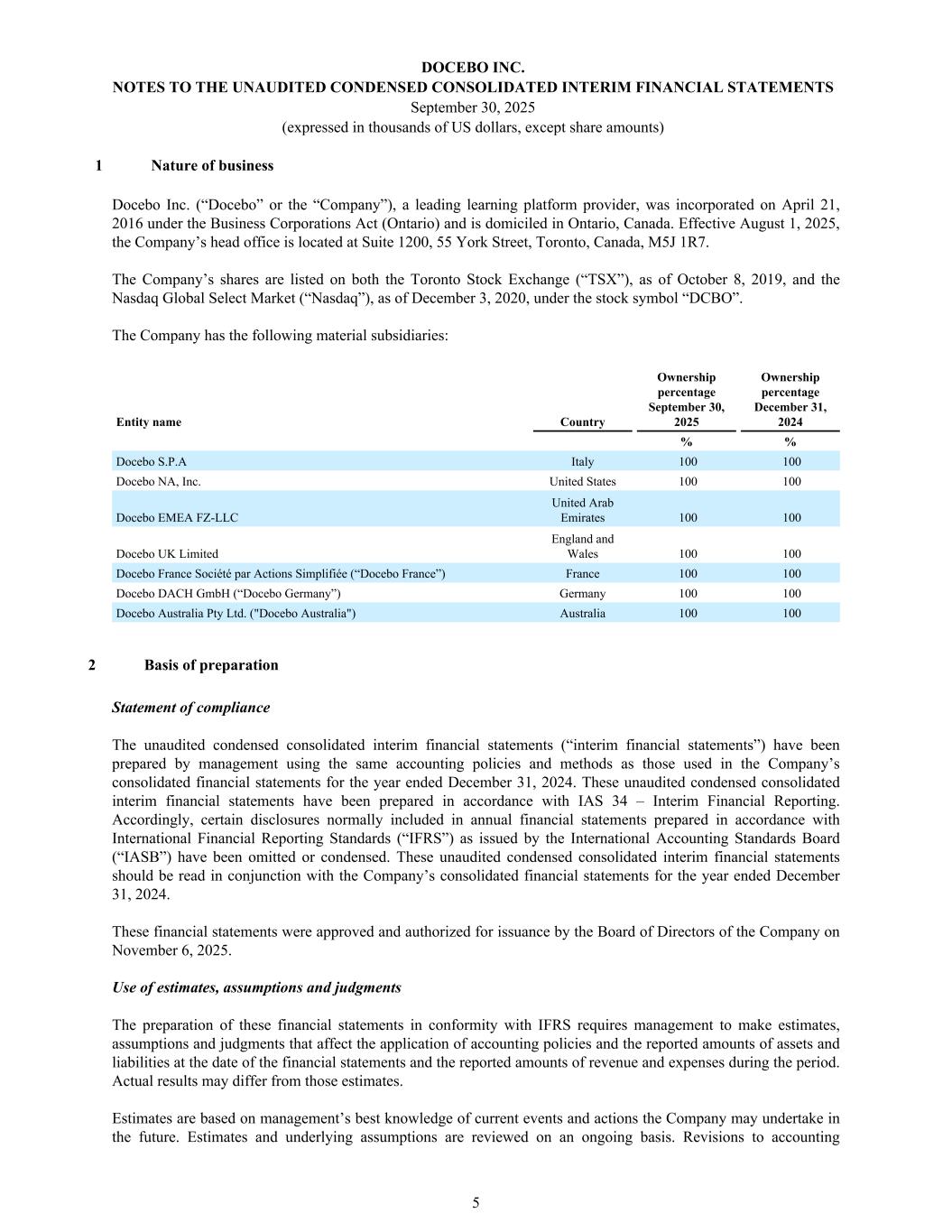

(“LMS”) market. Founded in 2005, Docebo is a powerful learning platform, built for the business of learning. Docebo helps organizations around the world deliver scalable, personalized learning to customers, partners, and employees, driving productivity, engagement, revenue, and growth. The Docebo Platform is stable and intuitive, with innovative technology for content generation, automation, and analytics, along with the advanced AI capabilities. This enables businesses to create and manage content, effectively train diverse audiences, and measure the impact of their learning programs, all from a single platform. Our platform is used by companies of all sizes, providing access to learners situated around the world in a variety of languages. Our customers range from Small and Medium Sized Businesses (SMBs) to large globally distributed enterprises in a wide variety of industries. We have registered offices in Toronto, Canada, Athens, Georgia (USA), Wilmington, Delaware (USA), Biassono, Italy, Dubai, United Arab Emirates, London, England, Paris, France, Frankfurt, Germany, Melbourne, Australia, and Dublin, Ireland. Our platform is sold primarily through a direct sales force located in several of these offices. We also have relationships with channel, service, technology and systems integrator partners around the world. The Docebo Learning Platform currently includes the following capabilities: (i) “Learning Management and Delivery”, (ii) “Content Marketplace”, (iii) “Learning Insights”, (iv) “Learning Evaluation”, (v) “Advanced Analytics”, (vi) “Communities”, (vii) “eCommerce”, (viii) “Integrations”, (ix) “Headless Learning”, and (x) “Creator”. The Docebo Learning Platform is a cloud-based solution that allows learning administrators to deliver scalable and flexible personalized learning experiences, from formal training to social learning, to multiple internal, external and blended audiences. Docebo’s Content Marketplace allows learning administrators to access the industry’s best off-the-shelf learning content and provide their learners with high-quality, predeveloped learning content. Learning administrators can partner with a Docebo Content specialist to help curate the right resources from our library of 40,000+ courses. The Insights module allows organizations to understand the results of their learning programs with data visualizations that are straightforward and actionable. With features like modern interactive dashboards for Super Admins and Power Users, it offers a centralized source for all learning analytics needs. Customers can swiftly build, discover, and share meaningful insights, enabling quick and impactful decision-making on learning performance based on a single, reliable source of truth. The Learning Evaluation module empowers learning administrators to incorporate the learner’s perspective into their analyses by facilitating the collection of feedback. This feedback enables organizations to demonstrate and enhance the effectiveness of their training programs while validating their investment in learning. Admins can gain insights into how learning influences employee experience and performance through a combination of pre-built and custom questionnaires, tailored evaluation processes, and relevant learning benchmarks and metrics. The Advanced Analytics Pack combines two essential tools for organizations ready to elevate their learning data and analytics. It offers seamless integration of learning data into any data ecosystem and Business Intelligence (BI) tool, allowing organizations to incorporate their learning and development data into a central repository. This integration helps them understand how learning impacts their business and contributes to their goals. Additionally, it unlocks a powerful BI tool within the Docebo platform, equipping Learning and Development teams with the resources they need to create customized metrics tailored to their specific needs. With advanced features at their fingertips, teams can confidently make data-driven decisions whenever necessary. The Communities module seamlessly integrates a dynamic hub into the learning environment, enabling interactive learner communities to become a central part of the learning experience. With features like Q&A functionality, forums, spaces, personalized member profiles, rich moderation tools, and 1:1 messaging, the Communities module fosters a collaborative and engaging learning atmosphere. Designed to enhance both knowledge sharing and community interaction, it enriches the overall learning journey by driving collaboration and creating a strong sense of belonging among users. 3

The eCommerce module allows administrators to monetize from digital training content, seamlessly managing and selling training offerings—whether it is courses, subscriptions, or content licensing—all from a single platform. With centralized control over pricing, catalog management, and discounts, admins can create public landing pages to boost content visibility and customize learning by branch or group. Learners benefit from flexible purchasing options, including Training Credits, coupons, and discounts, ensuring a smooth, personalized buying experience through secure transactions across multiple payment gateways. Docebo Integrations allow organizations to integrate Docebo with other business systems across their tech stack to improve the learner experience, drive efficiencies and scale learning programs. Connect with SSO, webinar tools, HR systems and more with off-the-shelf options or build and customize your own integrations and workflows for more unique requirements. Headless Learning allows businesses to build learning experiences outside of the Docebo learning environment in their own products or web environments so people can access learning where and when they need it, without having to switch between tools. Docebo Creator enables organizations to design and scale high-quality learning content directly within the Docebo Learning Platform. Powered by generative AI, it streamlines content development and personalization, while AI Virtual Coaching enhances learning impact through interactive simulations that strengthen learner confidence and performance. Creator continues to evolve rapidly as part of Docebo’s ongoing advancement in AI-driven learning innovation. Additional modules can also be purchased for specific use cases and needs, including, but not limited to: “Docebo for Salesforce”, “Docebo Embed (OEM)”, “Docebo Branded Mobile App”, and “Docebo for Microsoft Teams”. Docebo for Salesforce is a native integration that leverages Salesforce’s API and technology architecture to produce a learning experience that remains uniform no matter the use-case. Docebo Embed (OEM) eliminates disjointed learner experiences, long development cycles and ineffective partner models by allowing original equipment manufacturers (“OEMs”) to embed and re-sell the Docebo learning platform as a part of their software, including human capital management, risk management and retail/hospitality software-as-a-service (“SaaS”) products. Docebo’s Branded Mobile App product allows companies to create their own branded version of the award-winning “Docebo Go.Learn” mobile learning application and publish it as their own in Apple’s App Store, the Google Play Store or in their own Apple Store for Enterprise. Docebo Extended Enterprise breeds customer education, partner enablement, and retention by allowing customers to train multiple external audiences with a single LMS solution. Lastly, Docebo for Microsoft Teams is designed to remove barriers to learning, drive adoption and increase productivity by bringing learning directly into Microsoft Teams, where people at organizations who use this as their collaboration tool, already spend a large part of their time. We generate revenue primarily from the provision of access to our platform, which is typically provided on the basis of an annual subscription fee and prepaid on a quarterly, semi-annual, or annual basis. We offer our customers the flexibility to choose annual or multi-year contract terms, with the majority of our enterprise customers choosing multi-year terms. This results in a relatively smooth revenue curve with good visibility into near-term revenue growth. We typically enter into subscription agreements with our customers, with pricing based on the number of active or registered users, with minimum user commitment levels, in a measured time period, and the number of modules requested by the customer. Our goal is to continue to grow revenues arising from our existing customer base as well as adding new subscription customers to our platform. Our business does not have significant seasonal attributes, although historically sales in the fourth quarter have tended to be slightly stronger than the first three. The Company operates on a global basis and for this reason has decided to report its consolidated financial results in U.S. dollars notwithstanding that the Company’s functional currency is the Canadian dollar. The Company does not currently hedge its exposure to currencies different than its functional currency. The Company’s shares are listed under the symbol “DCBO” on both the Toronto Stock Exchange (the “TSX”), as of October 8, 2019, following the completion of its initial public offering in Canada and the Nasdaq Global Select Market, as of December 3, 2020, following the completion of its initial public offering in the United States. 4

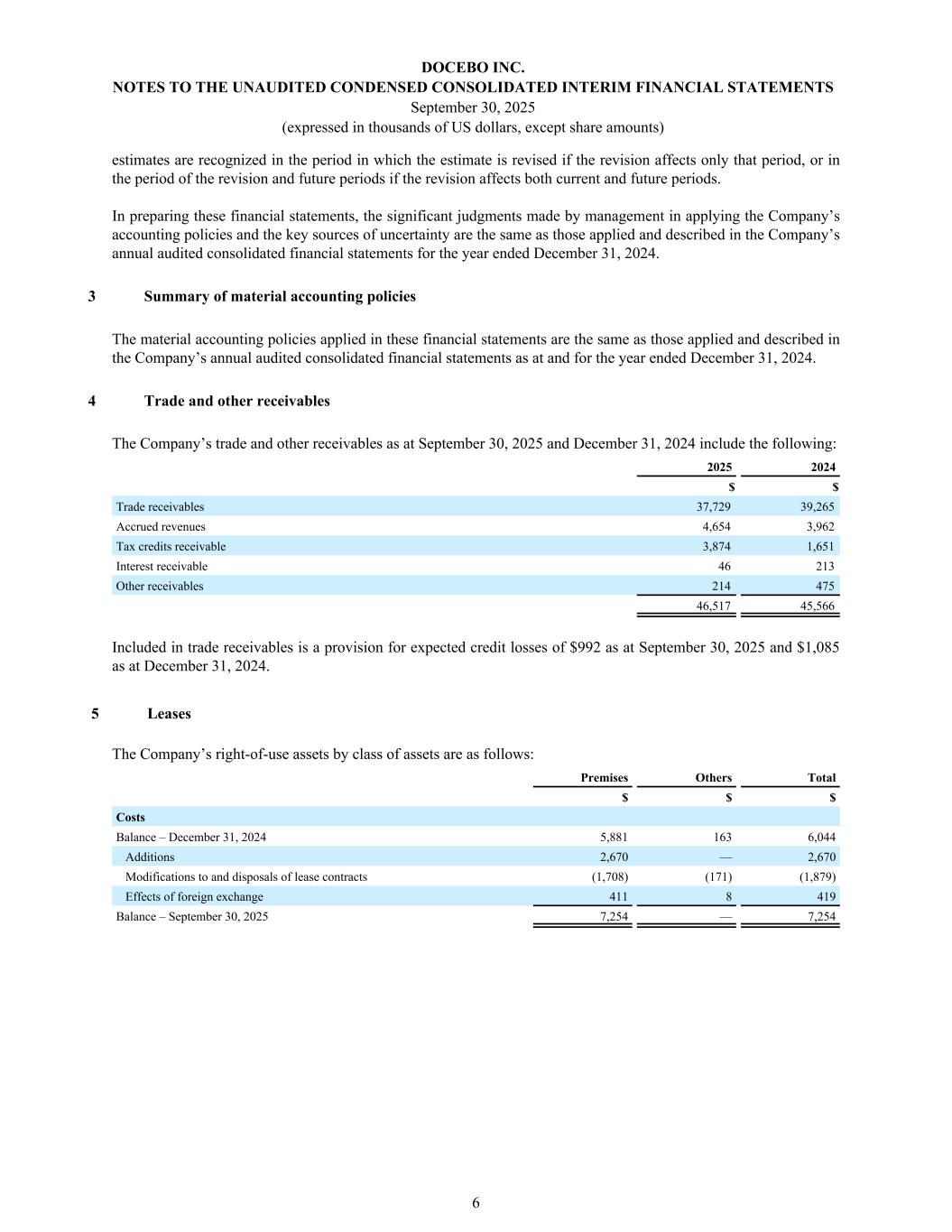

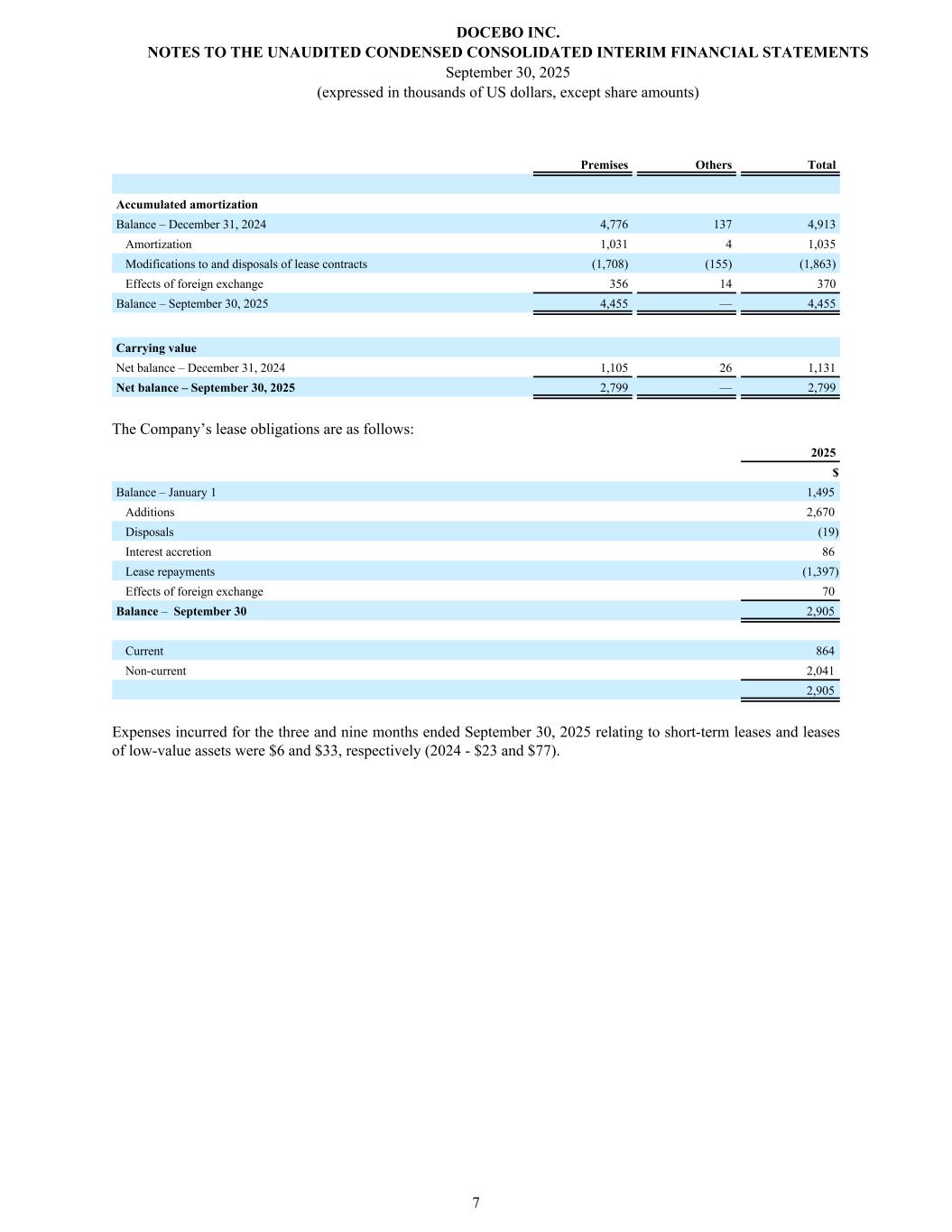

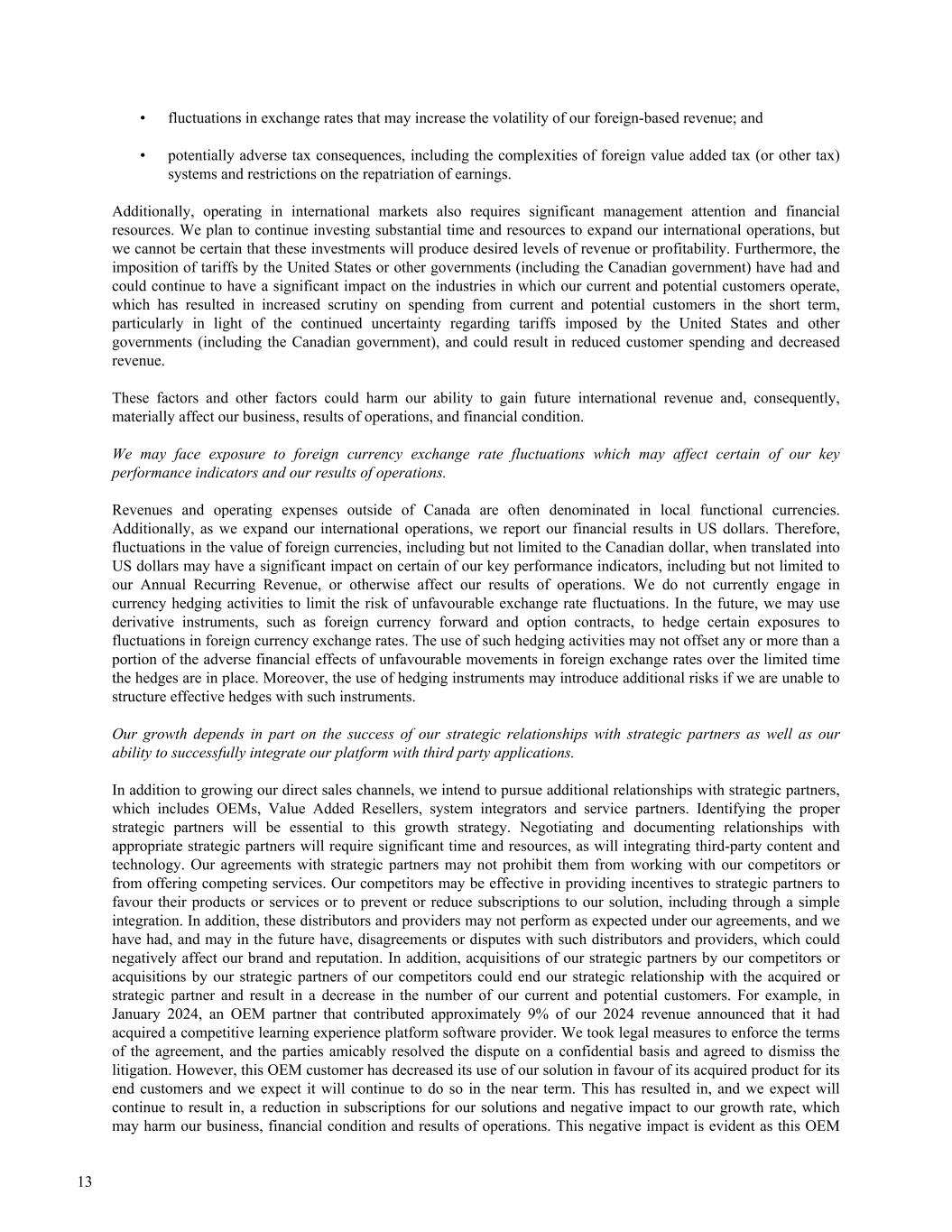

Non-IFRS Measures and Reconciliation of Non-IFRS Measures This MD&A makes reference to certain non-IFRS measures including key performance indicators used by management and typically used by our competitors in the SaaS industry. These measures are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS and are therefore not necessarily comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management’s perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS. These non-IFRS measures are used to provide investors with alternative measures of our operating performance and liquidity and thus highlight trends in our business that may not otherwise be apparent when relying solely on IFRS measures. We also believe that securities analysts, investors and other interested parties frequently use non-IFRS measures, including SaaS industry metrics, in the evaluation of companies in the SaaS industry. Management also uses non-IFRS measures to facilitate operating performance comparisons from period to period, the preparation of annual operating budgets and forecasts and to determine components of executive compensation. The non-IFRS measures referred to in this MD&A include “Annual Recurring Revenue”, “Average Contract Value”, “Adjusted EBITDA”, “Adjusted Net Income”, “Adjusted Earnings per Share - Basic and Diluted”, “Working Capital” and “Free Cash Flow”. Key Performance Indicators We recognize subscription revenues ratably over the term of the subscription period under the provisions of our agreements with customers. The terms of our agreements, combined with high customer retention rates, provides us with a significant degree of visibility into our near-term revenues. Management uses a number of metrics, including the ones identified below, to measure the Company’s performance and customer trends, which are used to prepare financial plans and shape future strategy. Our key performance indicators may be calculated in a manner different than similar key performance indicators used by other companies. Annual Recurring Revenue. We define Annual Recurring Revenue as the annualized equivalent value of the subscription revenue of all existing contracts (including OEM contracts) as at the date being measured, excluding non-recurring revenues from implementation, support and maintenance fees. Our customers generally enter into annual or multi-year contracts which are non-cancellable or cancellable with penalty. Accordingly, our calculation of Annual Recurring Revenue assumes that customers will renew the contractual commitments on a periodic basis as those commitments come up for renewal. Subscription agreements may be subject to price increases upon renewal reflecting both inflationary increases and the additional value provided by our solutions. In addition to the expected increase in subscription revenue from price increases over time, existing customers may subscribe for additional features, learners or services during the term. We believe that this measure provides a fair real-time measure of performance in a subscription-based environment. Annual Recurring Revenue provides us with visibility for consistent and predictable growth to our cash flows. Our strong total revenue growth coupled with increasing Annual Recurring Revenue indicates the continued strength in the expansion of our business and will continue to be our focus on a go-forward basis. Average Contract Value. Average Contract Value is calculated as total Annual Recurring Revenue divided by the number of active customers. Annual Recurring Revenue and Average Contract Value as at September 30 were as follows: 2025 2024 Change Change % Annual Recurring Revenue (in millions of US dollars) 235.6 214.1 21.5 10.1% Average Contract Value (in thousands of US dollars) 62.8 54.3 8.5 15.7% Adjusted EBITDA Adjusted EBITDA is defined as net income excluding net finance income, depreciation and amortization, income taxes, share-based compensation and related payroll taxes, other income, foreign exchange gains and losses, acquisition related compensation, transaction related expenses and restructuring costs, if any. 5

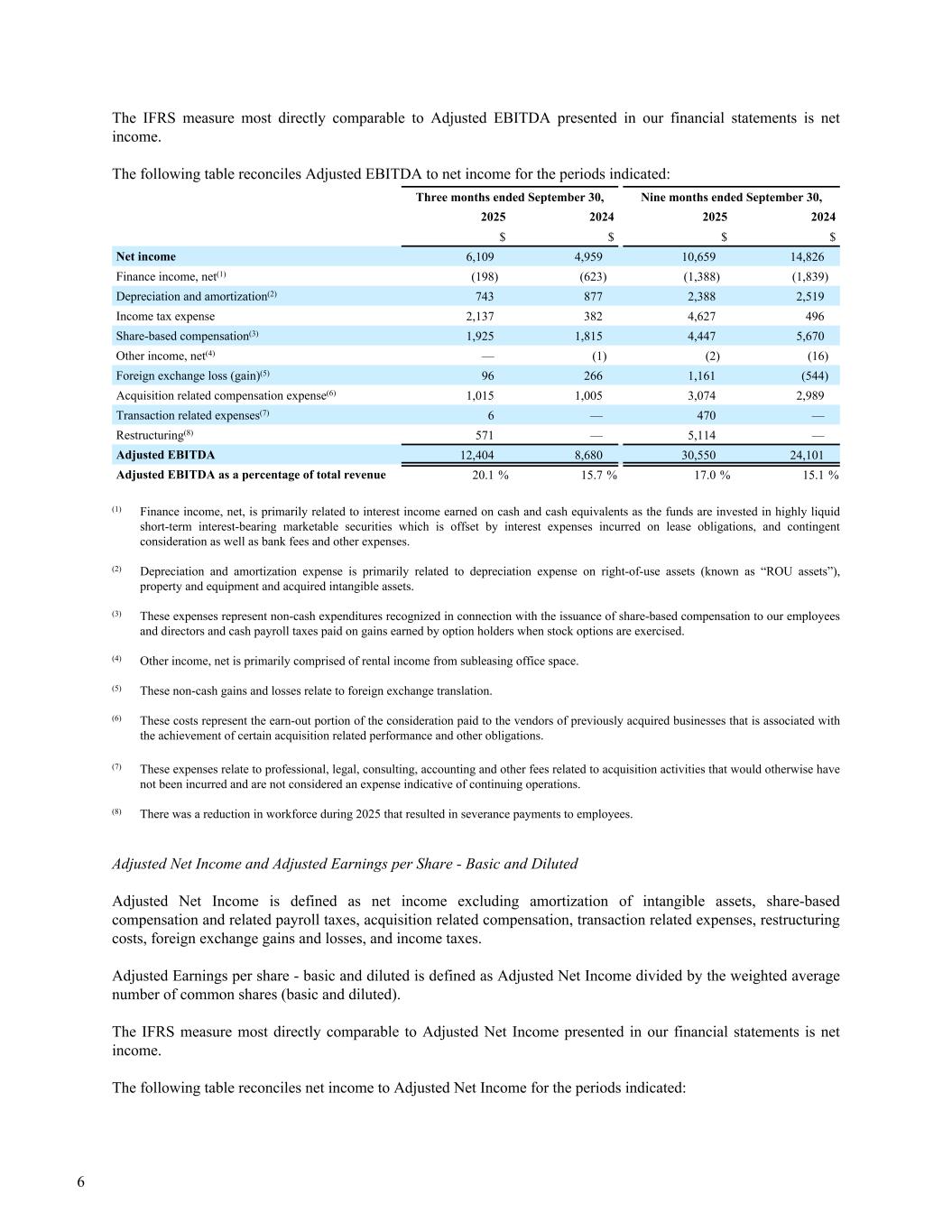

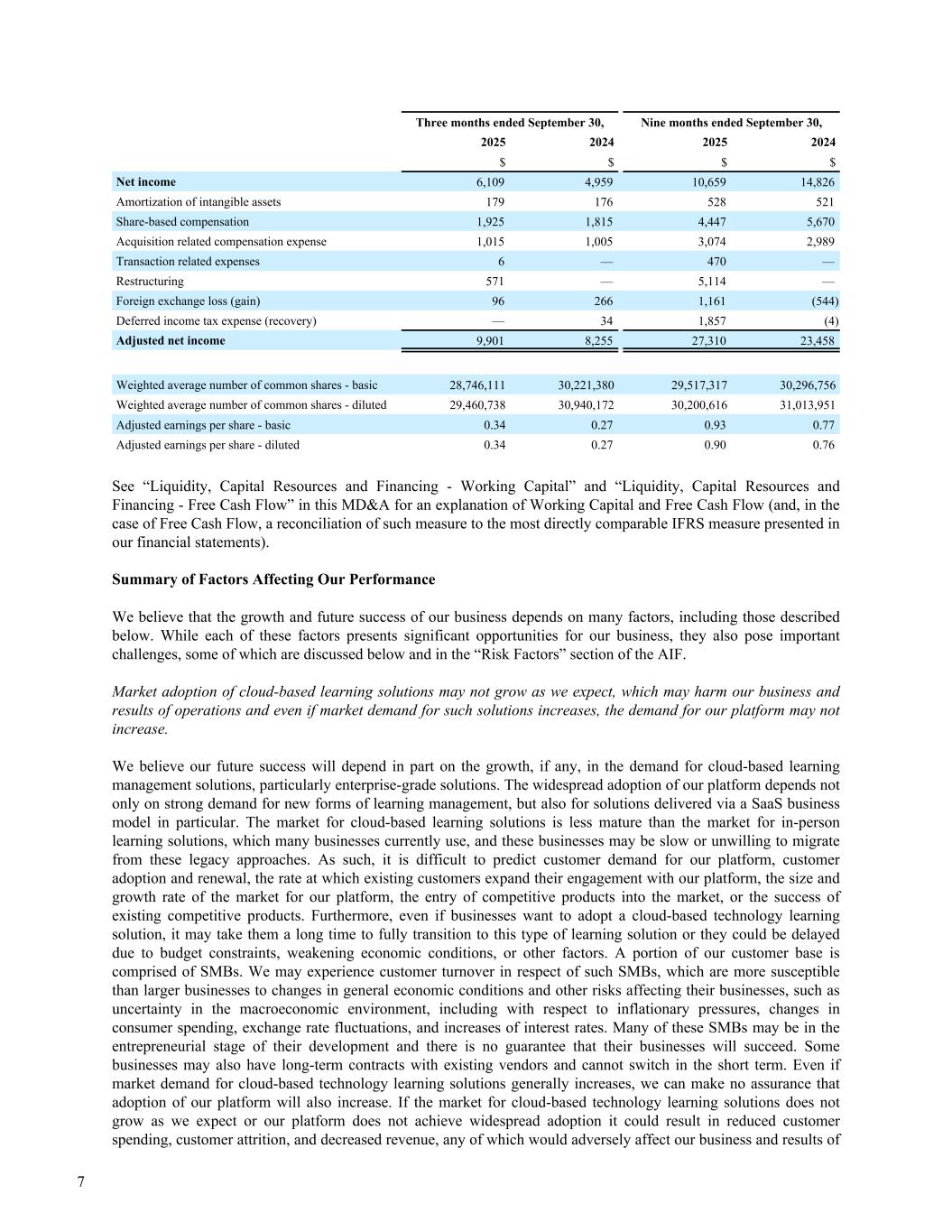

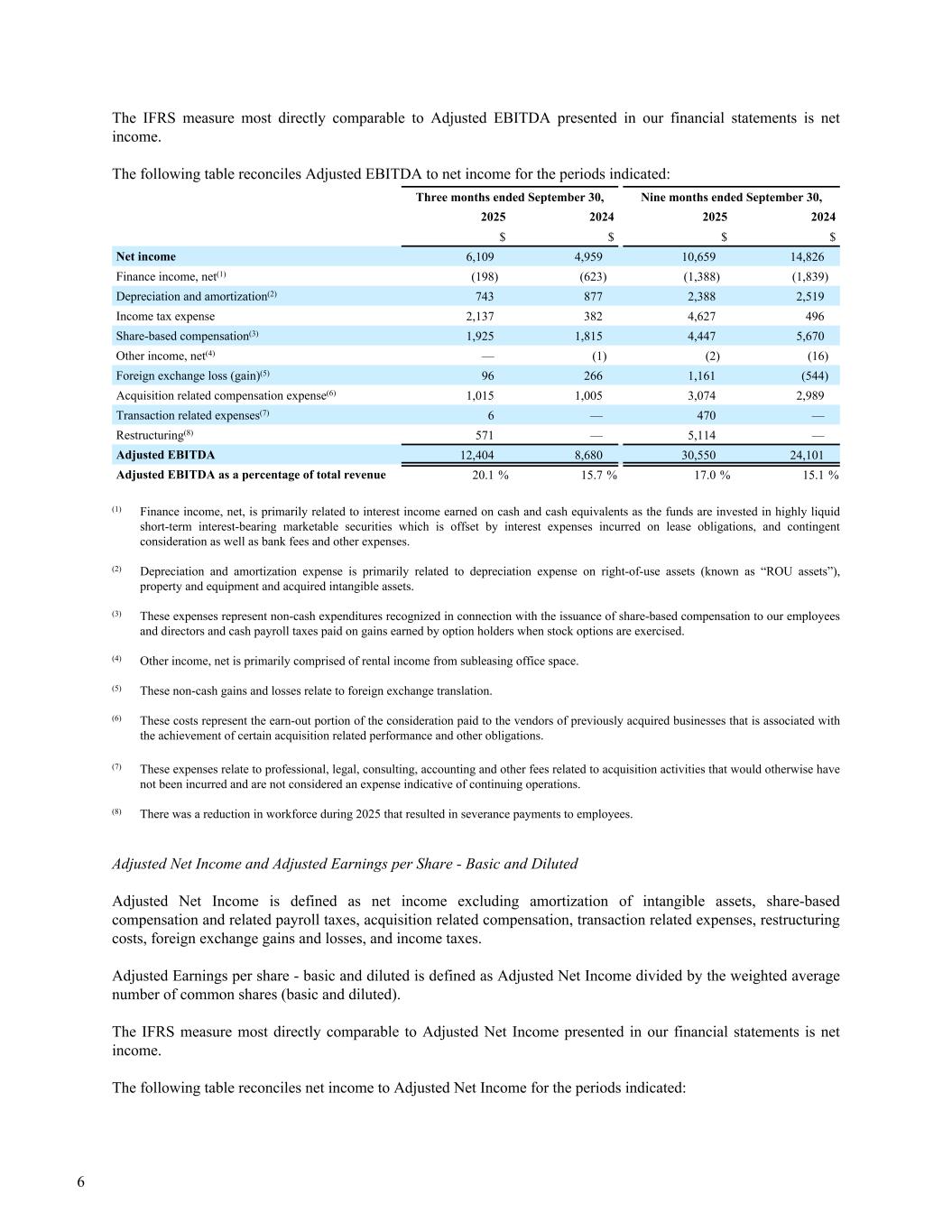

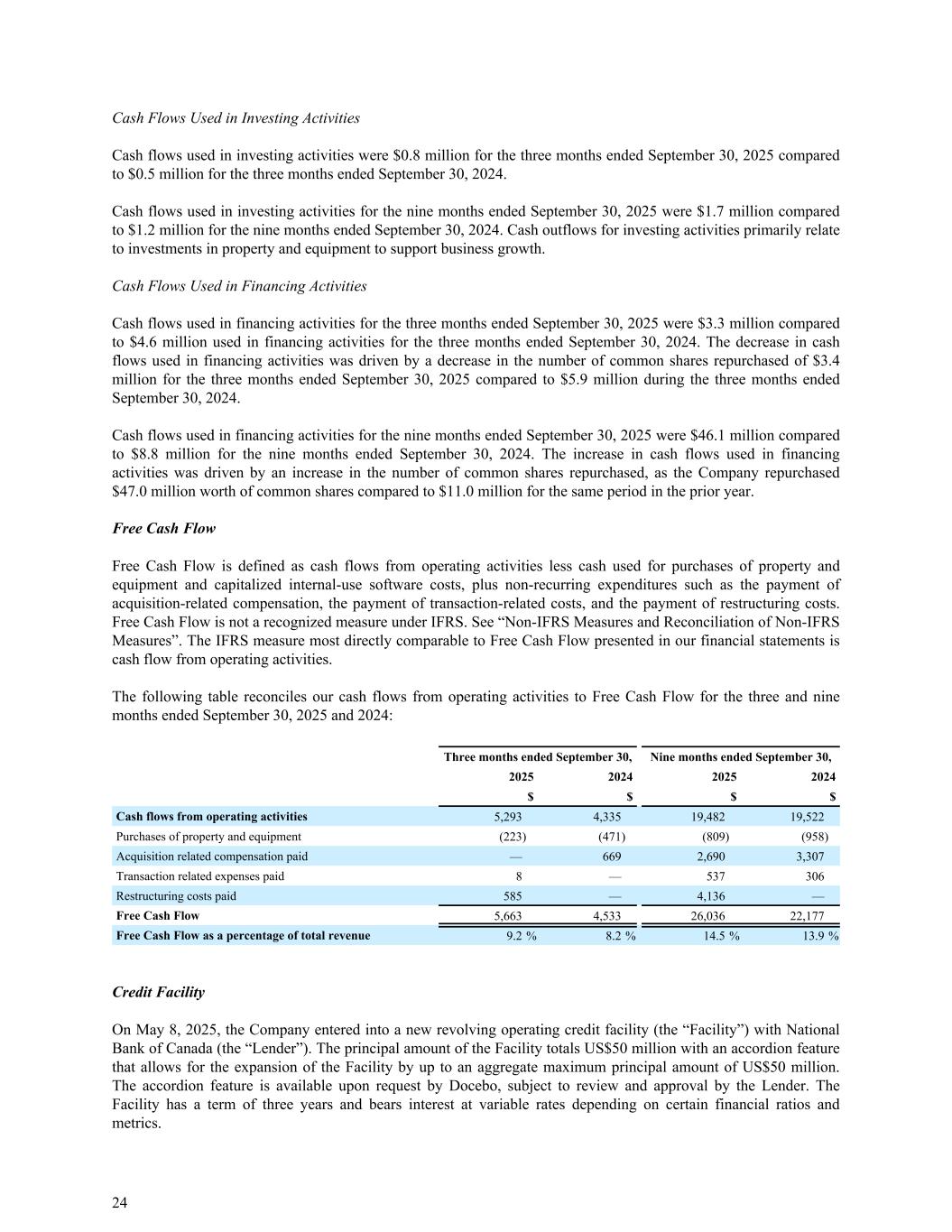

The IFRS measure most directly comparable to Adjusted EBITDA presented in our financial statements is net income. The following table reconciles Adjusted EBITDA to net income for the periods indicated: Three months ended September 30, Nine months ended September 30, 2025 2024 2025 2024 $ $ $ $ Net income 6,109 4,959 10,659 14,826 Finance income, net(1) (198) (623) (1,388) (1,839) Depreciation and amortization(2) 743 877 2,388 2,519 Income tax expense 2,137 382 4,627 496 Share-based compensation(3) 1,925 1,815 4,447 5,670 Other income, net(4) — (1) (2) (16) Foreign exchange loss (gain)(5) 96 266 1,161 (544) Acquisition related compensation expense(6) 1,015 1,005 3,074 2,989 Transaction related expenses(7) 6 — 470 — Restructuring(8) 571 — 5,114 — Adjusted EBITDA 12,404 8,680 30,550 24,101 Adjusted EBITDA as a percentage of total revenue 20.1 % 15.7 % 17.0 % 15.1 % (1) Finance income, net, is primarily related to interest income earned on cash and cash equivalents as the funds are invested in highly liquid short-term interest-bearing marketable securities which is offset by interest expenses incurred on lease obligations, and contingent consideration as well as bank fees and other expenses. (2) Depreciation and amortization expense is primarily related to depreciation expense on right-of-use assets (known as “ROU assets”), property and equipment and acquired intangible assets. (3) These expenses represent non-cash expenditures recognized in connection with the issuance of share-based compensation to our employees and directors and cash payroll taxes paid on gains earned by option holders when stock options are exercised. (4) Other income, net is primarily comprised of rental income from subleasing office space. (5) These non-cash gains and losses relate to foreign exchange translation. (6) These costs represent the earn-out portion of the consideration paid to the vendors of previously acquired businesses that is associated with the achievement of certain acquisition related performance and other obligations. (7) These expenses relate to professional, legal, consulting, accounting and other fees related to acquisition activities that would otherwise have not been incurred and are not considered an expense indicative of continuing operations. (8) There was a reduction in workforce during 2025 that resulted in severance payments to employees. Adjusted Net Income and Adjusted Earnings per Share - Basic and Diluted Adjusted Net Income is defined as net income excluding amortization of intangible assets, share-based compensation and related payroll taxes, acquisition related compensation, transaction related expenses, restructuring costs, foreign exchange gains and losses, and income taxes. Adjusted Earnings per share - basic and diluted is defined as Adjusted Net Income divided by the weighted average number of common shares (basic and diluted). The IFRS measure most directly comparable to Adjusted Net Income presented in our financial statements is net income. The following table reconciles net income to Adjusted Net Income for the periods indicated: 6

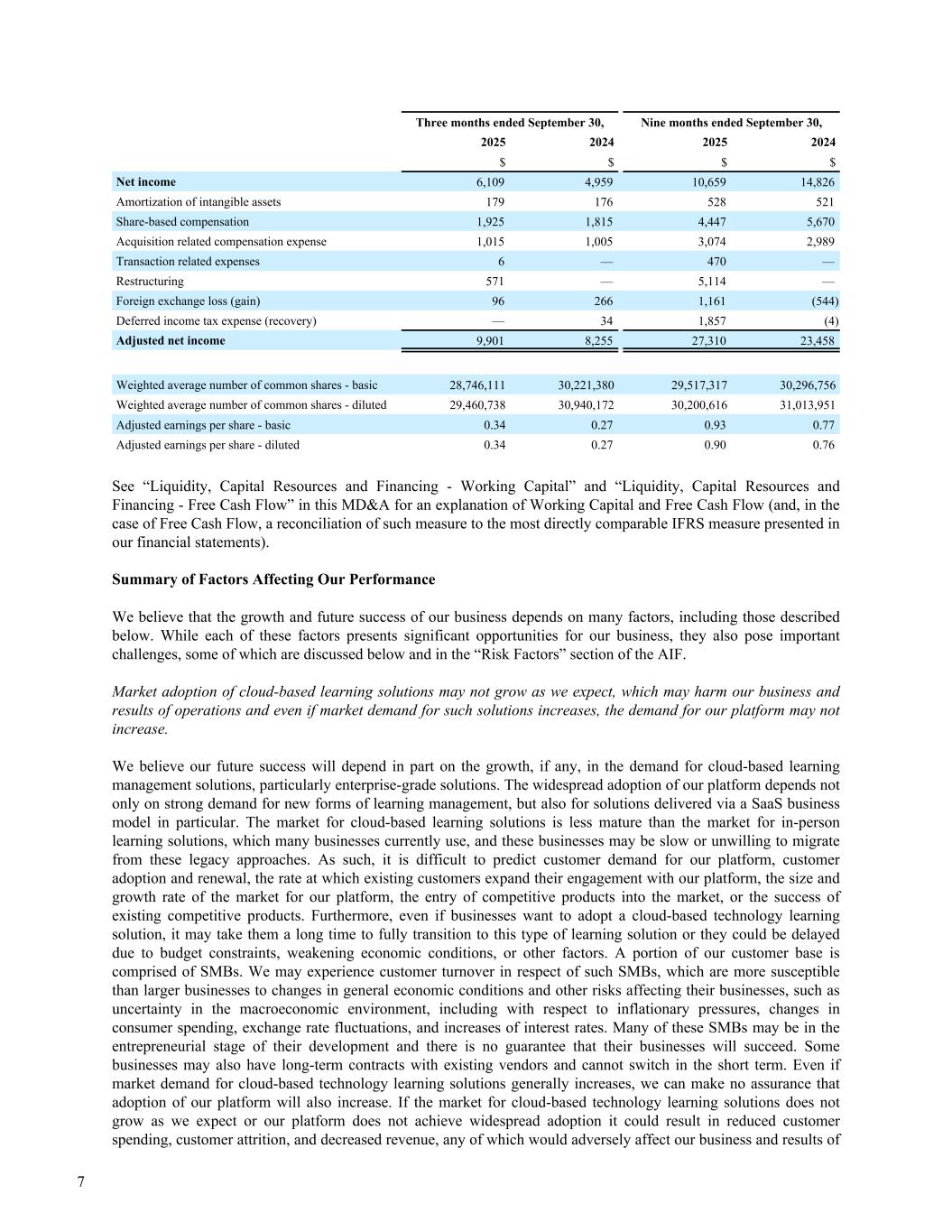

Three months ended September 30, Nine months ended September 30, 2025 2024 2025 2024 $ $ $ $ Net income 6,109 4,959 10,659 14,826 Amortization of intangible assets 179 176 528 521 Share-based compensation 1,925 1,815 4,447 5,670 Acquisition related compensation expense 1,015 1,005 3,074 2,989 Transaction related expenses 6 — 470 — Restructuring 571 — 5,114 — Foreign exchange loss (gain) 96 266 1,161 (544) Deferred income tax expense (recovery) — 34 1,857 (4) Adjusted net income 9,901 8,255 27,310 23,458 Weighted average number of common shares - basic 28,746,111 30,221,380 29,517,317 30,296,756 Weighted average number of common shares - diluted 29,460,738 30,940,172 30,200,616 31,013,951 Adjusted earnings per share - basic 0.34 0.27 0.93 0.77 Adjusted earnings per share - diluted 0.34 0.27 0.90 0.76 See “Liquidity, Capital Resources and Financing - Working Capital” and “Liquidity, Capital Resources and Financing - Free Cash Flow” in this MD&A for an explanation of Working Capital and Free Cash Flow (and, in the case of Free Cash Flow, a reconciliation of such measure to the most directly comparable IFRS measure presented in our financial statements). Summary of Factors Affecting Our Performance We believe that the growth and future success of our business depends on many factors, including those described below. While each of these factors presents significant opportunities for our business, they also pose important challenges, some of which are discussed below and in the “Risk Factors” section of the AIF. Market adoption of cloud-based learning solutions may not grow as we expect, which may harm our business and results of operations and even if market demand for such solutions increases, the demand for our platform may not increase. We believe our future success will depend in part on the growth, if any, in the demand for cloud-based learning management solutions, particularly enterprise-grade solutions. The widespread adoption of our platform depends not only on strong demand for new forms of learning management, but also for solutions delivered via a SaaS business model in particular. The market for cloud-based learning solutions is less mature than the market for in-person learning solutions, which many businesses currently use, and these businesses may be slow or unwilling to migrate from these legacy approaches. As such, it is difficult to predict customer demand for our platform, customer adoption and renewal, the rate at which existing customers expand their engagement with our platform, the size and growth rate of the market for our platform, the entry of competitive products into the market, or the success of existing competitive products. Furthermore, even if businesses want to adopt a cloud-based technology learning solution, it may take them a long time to fully transition to this type of learning solution or they could be delayed due to budget constraints, weakening economic conditions, or other factors. A portion of our customer base is comprised of SMBs. We may experience customer turnover in respect of such SMBs, which are more susceptible than larger businesses to changes in general economic conditions and other risks affecting their businesses, such as uncertainty in the macroeconomic environment, including with respect to inflationary pressures, changes in consumer spending, exchange rate fluctuations, and increases of interest rates. Many of these SMBs may be in the entrepreneurial stage of their development and there is no guarantee that their businesses will succeed. Some businesses may also have long-term contracts with existing vendors and cannot switch in the short term. Even if market demand for cloud-based technology learning solutions generally increases, we can make no assurance that adoption of our platform will also increase. If the market for cloud-based technology learning solutions does not grow as we expect or our platform does not achieve widespread adoption it could result in reduced customer spending, customer attrition, and decreased revenue, any of which would adversely affect our business and results of 7

operations. We further believe that a significant portion of our market capitalization is based on our revenue growth rate. If we are unable to continue growing our revenues, or if new revenues are offset by the rate at which existing customers cancel, do not renew or downgrade their recurring subscriptions (known in the industry as “churn”), our market capitalization may be negatively impacted, which could limit our access to capital, deter potential new investors, and harm our overall business and operations. Natural disasters, public health crises, political crises, or other catastrophic or adverse events, including adverse and uncertain macroeconomic conditions may adversely affect our business, operating results or financial position. Natural disasters, such as earthquakes, hurricanes, tornadoes, floods, and other adverse weather and climate conditions; unforeseen public health crises, and other pandemics and epidemics; political crises, such as terrorist attacks, war, and other political instability; or other catastrophic events, have and could in the future disrupt our operations or the operations of one or more of our third-party providers and vendors. Additionally, our business and results of operations have been, and may continue to be, impacted by recent adverse and uncertain macroeconomic conditions, including higher inflation, higher interest rates, and fluctuations or volatility in capital markets or foreign currency exchange rates, the collapse of financial institutions and related uncertainty regarding geopolitical events such as the ongoing conflict between Russia and Ukraine as well as Israel and the surrounding area. In particular, we have experienced in certain instances, and may continue to experience, longer sales cycles or generally increased scrutiny on spending from existing and potential customers due to macroeconomic uncertainty, including the uncertainty resulting from tariffs imposed or threatened to be imposed by the United States or other governments (including the Canadian government). We cannot be certain how long these uncertain macroeconomic conditions and the resulting effects on our industry, our business strategy, and customers will persist. If we fail to retain key employees or to recruit qualified technical and sales personnel, our business could be harmed. We believe that our success depends on the continued employment of our senior management and other key employees. In addition, because our future success is dependent on our ability to continue to enhance and introduce new platform features, we are heavily dependent on our ability to attract and retain qualified personnel with the requisite education, background, and industry experience. As we expand our business, our continued success will also depend, in part, on our ability to attract and retain qualified sales, marketing, and operational personnel capable of supporting a larger and more diverse customer base. We and our competitors continue to face significant turnover in our employee base. Qualified individuals are in high demand in our industry, and we may incur significant costs to attract and retain them. The loss of the services of a significant number of our technology or sales personnel could be disruptive to our business development efforts or customer relationships. In addition, if any of our key employees join a competitor or decides to otherwise compete with us, we may experience a material disruption of our operations and business strategy, which may cause us to lose customers or increase operating expenses and may divert our attention as we seek to recruit replacements for the departed employees. Further, changes we make to our current and future work environments may not meet the needs or expectations of our employees or may be perceived as less favourable compared to other companies’ policies, which could negatively impact our ability to hire and retain qualified personnel. Our future work strategy and continued efforts related to employee onboarding, training and development and retention may not be successful. Further, our future work strategy is continuing to evolve and may not meet the needs of our existing and potential future employees and they may prefer work models offered by other companies. If our customers do not expand their use of our platform beyond their current organizational engagements or renew their existing contracts with us, terminate their existing contracts with us or downgrade or scale back the scope of services under their existing contracts with us, our ability to grow our business and improve our results of operations may be adversely affected. Our future success depends, in part, on our ability to increase the adoption of our platform by our existing customers and future customers. Many of our customers initially use our platform in specific groups or departments within their organization. In addition, our customers may initially use our platform for a specific use case. Our ability to 8

grow our business depends in part on our ability to persuade customers to expand their use of our platform to address additional use cases. Further, to continue to grow our business, it is important that our customers renew their subscriptions when existing contracts expire and that we expand our relationships with our existing customers. Our customers have no obligation to renew their subscriptions, and our customers may decide not to renew their subscriptions with a similar contract period, at the same prices and terms, with the same or a greater number of learners, or at all. In the past, some of our customers, including certain key customers, have elected not to renew or terminate their agreements with us or downgrade the scope of their services under their agreements with us, and it is difficult to accurately predict whether we will have future success in retaining customers or expanding our relationships with them. We offer our customers the flexibility to choose annual or multi-year contract terms. Although our contracts often contain cancellation penalties, the difficulty and costs associated with switching to a competitor may not be significant for certain customers. New customers joining our platform may also decide not to continue or renew their subscription for reasons outside of our control. We have experienced significant growth in the number of learners of our platform, but we do not know whether we will continue to achieve similar learner growth in the future, or whether learner growth could be offset by increased churn. Our ability to retain our customers and expand our deployments with them may decline or fluctuate as a result of a number of factors, including our customers’ satisfaction with our platform, our customer support, our prices, the prices and features of competing solutions, reductions in our customers’ spending levels, insufficient learner adoption of our platform, and new feature releases. If our customers do not purchase additional subscriptions, do not renew, or terminate their existing subscriptions, renew on less favorable terms, or fail to continue to expand their engagement with our platform, our revenue may decline or grow less quickly than anticipated, which would harm our results of operations. Regulatory requirements placed on our software and services could impose increased costs on us, delay or prevent our introduction of new products and services and impair the function or value of our existing products and services. Our products and services are currently subject to various regulatory requirements, including laws, regulations and policies that govern the amount and type of taxes we are required to collect and remit, including with respect to internet transactions with customers in jurisdictions in which we do not have a physical presence. New income, sales, use or other tax laws, statutes, rules, regulations, or ordinances applicable to solutions provided over the internet could be enacted at any time by any local, regional, or national governmental authority, possibly with retroactive effect. Recent jurisprudence of the U.S. Supreme Court requires that online retailers collect sales and use taxes imposed by various U.S. states, even if the retailer has no physical presence in that state. We may also be subject to anti-spam laws, regulations, and policies. In Canada, the regulatory authority responsible for enforcement of Canada’s Anti-Spam Legislation (“CASL”) has issued a bulletin that signals broad potential liability for electronic intermediaries (such as hosting providers and SaaS providers) for failing to take sufficient steps to stop third parties from using intermediary services and facilities to violate CASL, including prohibitions on sending electronic marketing messages or installing computer programs without consent. Our business may become subject to increasing regulatory requirements, and as these requirements proliferate, we may be required to change or adapt our products and services to comply. Changing regulatory requirements might render our products and services obsolete or might block us from developing new products and services. This might in turn impose additional costs upon us to comply or to further develop our products and services. It might also make introduction of new products and services more costly or more time-consuming than we currently anticipate and could even prevent introduction by us of new products or services or cause the continuation of our existing products or services to become more costly. Accordingly, such regulatory requirements could have a material adverse effect on our business, financial condition, and results of operations. For example, the EU’s Regulation (EU) 2023/2854 (also known as the EU Data Act), which entered into force on September 12, 2025, imposes certain data and cloud service compatibility requirements to enable customer-initiated switching between service providers and a phased prohibition on charges for switching, with a complete prohibition becoming effective January 12, 2027. Additionally, in the EU, the Network and Information Security Directive regulates resilience and incident response capabilities of entities operating in a number of sectors, including the digital infrastructure sector (such as SaaS providers). Depending on how these frameworks are implemented and interpreted, we may have to adjust our business practices, service operations, and contractual arrangements to 9

comply with such obligations, and we could incur incremental compliance costs or be subject to supervisory actions or penalties for non-compliance. Additionally, as with many innovations, machine learning and AI present additional risks and challenges that could affect their adoption and therefore our business. For example, the development of machine learning and AI present emerging governance and transparency issues, including with respect to ethics and human rights, and if we enable or offer solutions on this front that are controversial, due to their impact, or perceived impact, we may experience brand or reputational harm, competitive harm, or legal liability. New regulations or standards have been or may be adopted in the space of AI such as the Draft Bill C-27 (Canada), which includes the Artificial Intelligence and Data Act in Canada (June 2022), the Colorado Senate Bill 24-205, which will go into effect on February 1, 2026, and the EU Regulation 2024/1689, which came into force on August 1, 2024 and includes a transitional period to be compliant with the law up to 24 months after its official publication. In the U.S., the National Institute for Standards and Technology released, on January 26, 2023, the non-binding AI Risk Management Framework in the design, development, use and evaluation of AI products, services, and systems. In addition, the Federal Trade Commission issued several publications to set forth ground rules for AI development and can use its existing authority under various existing consumer protection laws to expand AI enforcement. The growing focus on AI regulations and guidelines may increase the burden and cost of research and development in this area, including by causing us to incur significant costs in order to adapt certain components of our platform to the requirements for the use of AI systems, subjecting us to brand or reputational harm, competitive harm, legal liability, or regulatory penalties. It may also restrict our or our customers’ ability to fully utilize AI and machine learning technologies as a result of legal and regulatory restrictions on data governance, including data collection and processing. Also, our positions on social and ethical issues may impact our ability to attract or retain employees, customers, other users and overall affect our public perception. In particular, our brand and reputation are associated with our public commitments to sustainability, equality, inclusivity, accessibility, and ethical use, and any perceived changes in our dedication to these commitments could impact our relationships with potential and current customers and other users. We cannot determine the impact these emerging and future laws, regulations, and standards may have on our business. Such laws, regulations and standards are often subject to differing interpretations and may be inconsistent among jurisdictions, leading to uncertainty about how government or regulatory authorities will assess our AI practices. Our sales to government entities are subject to a number of challenges and risks, which could negatively impact our business. We sell to U.S. and Canadian government customers. Sales to such entities, whether direct or indirect, are subject to a number of challenges and risks. Selling to such entities can be highly competitive, expensive, and time-consuming, often requiring significant upfront time and expense without any assurance that these efforts will generate a sale. Contracting with certain federal government entities (or higher-tier contractors to such entities) requires additional compliance from us and our offerings, including with contractual requirements, regulations, and executive orders; compliance with such requirements may require us to change certain of our operations and involve significant effort and expense, which could harm our margins, business, financial condition, and results of operations. If we fail to achieve compliance with these standards and requirements, we may be disqualified from selling our offerings to such governmental entities, or be at a competitive disadvantage, which would harm our business, operating results, and financial condition. Government contracting requirements may also change and in doing so restrict our ability to sell into the government sector until we have complied with such requirements. Further, achieving and maintaining certain government certifications, such as U.S. Federal Risk and Authorization Management Program (“FedRAMP”) authorization for certain of our product offerings, has and may continue to require significant upfront cost, time, and resources. FedRAMP is a U.S. government-wide program providing a standardized approach to security assessment, authorization and continuous monitoring for cloud products and services. As of May 22, 2025, our LearnGov platform achieved FedRAMP Moderate Authorization and listing on the FedRAMP Marketplace, which authorizes its use across U.S. federal agencies. Although we have achieved FedRAMP authorization, there can be no assurance that we will enter into contracts or secure commitment with a U.S. government agency sponsor or other agencies. If we are unable to do so or we fail to adhere to the rigorous security and privacy controls required to maintain FedRAMP authorization, we will not be able to sell our products, directly or indirectly, to certain federal government and other public sector customers as well as private sector customers that require such certification for their intended use cases and we may lose our FedRAMP authorization and position on the FedRAMP Marketplace, which could harm our margins, growth, business, financial condition, and results of operations. This may also harm 10

our competitive position against larger enterprises whose competitive offerings are FedRAMP authorized. Government demand and payment for our offerings have been and may in the future be negatively impacted by public sector budgetary cycles and funding authorizations, such as federal government shutdowns, in the United States or elsewhere, including the duration thereof, with funding reductions or delays adversely affecting public sector demand for our offering. Further, governmental entities or their contractors may demand contract terms that differ from our standard arrangements and are less favorable than terms agreed with private sector customers. Such entities may have statutory, contractual or other legal rights to terminate contracts with us or our partners for convenience or for other reasons, some of which may be outside our control. Any termination for default/cause may adversely affect our ability to contract with other government customers as well as our reputation, business, financial condition, and results of operations. Governments and whistleblowers routinely investigate and audit government contractors’ administrative processes and compliance with applicable legal requirements. An unfavorable investigation or audit could result in the government refusing to continue buying our subscriptions, a reduction of revenue, suspension or debarment from government contracting, or fines or civil or criminal liability if the audit uncovers improper or illegal activities, including under the False Claims Act, which could adversely affect our results of operations and reputation. Additionally, we generally contract with government customers through the indirect sales channel (i.e., resellers and distributors). Accordingly, a large majority of our revenue from public sector customers comes from a small number of distribution and resale partners. This concentration presents a risk of lost revenue in the case of a partner’s bankruptcy, a dispute, nonpayment, or other business disruptions, as well as a risk of loss of access to certain public sector customers if a partner shuts down for any reason, or is suspended or debarred from government contracting in the event of their noncompliance with their own contractual and regulatory requirements. The loss of a reseller with which we do a substantial amount of business, together with our inability to replace them, could negatively impact our business, growth, financial condition and results of operations. Our sales cycles can be unpredictable, and our sales efforts require considerable time and expense. As a result, the timing of our billings and revenue are difficult to predict and may vary substantially from period to period, which may cause our results of operations to fluctuate significantly. Our results of operations may fluctuate, in part, because of the resource intensive nature of our sales efforts, the length and variability of our sales cycle, and difficulty in adjusting our operating expenses in the short term. The length of our sales cycle, from identification of the opportunity to delivery of access to our platform, can vary from customer to customer, with sales to larger businesses typically taking longer to complete. In addition, as we increase our sales to larger businesses, we face longer more complex customer requirements, and substantial upfront sales costs. With larger businesses, the decision to subscribe to our platform frequently requires the approvals of multiple management personnel and more technical personnel than would be typical of a smaller organization and, accordingly, sales to larger businesses may require us to invest more time educating these potential customers. Purchases by larger businesses are also frequently subject to budget constraints and unplanned administrative, processing, and other delays, which means we may not be able to come to agreement on the terms of the sale to larger businesses. If there is a reduction in information technology spending, due to weak economic conditions or otherwise, it may take several months, or even several quarters, for marketing opportunities to materialize. To the extent our competitors develop products that our prospective customers view as equivalent or superior to our platform, our average sales cycle may increase. Additionally, if a key sales member leaves our employment or if our primary point of contact at a customer or potential customers leaves his or her employment, our sales cycle may be further extended or customer opportunities may be lost. As a result of the buying behavior of enterprises and the efforts of our sales force and partners to meet or exceed their sales objectives by the end of each fiscal quarter, we may generate a substantial portion of billings towards the end of each fiscal quarter. If a customer’s decision to purchase our platform is delayed or if the implementation of our platform takes longer than originally anticipated, the date on which we may recognize revenues from these transactions may be delayed. The unpredictability of the timing of customer purchases, particularly large purchases, could cause our billings and revenue to vary from period to period or to fall below expected levels for a given period, which will adversely affect our business, results of operations, and financial condition. 11

We may not receive significant revenue as a result of our current research and development efforts. We reinvest a large percentage of our revenue in research and development, including AI. Our investment in our current research and development efforts may not provide a sufficient, timely return. We make and will continue to make significant investments in software research and development and related product opportunities. Investments in new technology and processes are inherently speculative. Commercial success depends on many factors including the degree of innovation of the products developed through our research and development efforts, sufficient support from our strategic partners, and effective distribution and marketing. Accelerated product introductions and short product life cycles require high levels of expenditures for research and development. These expenditures may materially adversely affect our operating results if they are not offset by revenue increases. We believe that we must continue to dedicate a significant amount of resources to our research and development efforts in order to maintain our competitive position. However, significant revenue from new product and service investments may not be achieved for a number of years, if at all. Moreover, new products and services may not be profitable. We believe our long-term success depends in part on continuing to expand our international sales and operations and we are therefore subject to a number of risks associated with international sales and operations. We intend to continue expanding our international operations. In order to maintain and expand our sales internationally, we need to hire and train experienced personnel to staff and manage our foreign operations. To the extent that we experience difficulties in recruiting, training, managing, and retaining international staff, and specifically sales and marketing personnel, we may experience difficulties in growing our international sales. Additionally, our international sales are subject to a number of risks, including, but not limited to, the following: • unexpected costs and errors in tailoring our products for individual markets, including translation into foreign languages and adaptation for local practices; • difficulties in adapting to customer desires due to language and cultural differences; • new and different sources of competition; • increased financial accounting and reporting burdens and complexities; • increased expenses associated with international sales and operations, including establishing and maintaining office space and equipment for our international operations; • lack of familiarity and burdens of complying with foreign laws, legal standards, privacy standards, regulatory requirements, tariffs, and other barriers; • greater difficulty in enforcing contracts and accounts receivable collection and longer collection periods; • practical difficulties of enforcing intellectual property rights in countries with fluctuating laws and standards and reduced or varied protection for intellectual property rights in some countries; • unexpected changes in regulatory requirements, taxes, trade laws, tariffs, export quotas, custom duties, or other trade restrictions, including the possibility of tariffs imposed by the U.S. federal government on the sale of Canadian software, which could have a direct or indirect impact on our international sales; • limitations on technology infrastructure, which could limit our ability to migrate international operations to our existing systems, which could result in increased costs; • difficulties in managing and staffing international operations and differing employer/employee relationships and local employment laws; 12

• fluctuations in exchange rates that may increase the volatility of our foreign-based revenue; and • potentially adverse tax consequences, including the complexities of foreign value added tax (or other tax) systems and restrictions on the repatriation of earnings. Additionally, operating in international markets also requires significant management attention and financial resources. We plan to continue investing substantial time and resources to expand our international operations, but we cannot be certain that these investments will produce desired levels of revenue or profitability. Furthermore, the imposition of tariffs by the United States or other governments (including the Canadian government) have had and could continue to have a significant impact on the industries in which our current and potential customers operate, which has resulted in increased scrutiny on spending from current and potential customers in the short term, particularly in light of the continued uncertainty regarding tariffs imposed by the United States and other governments (including the Canadian government), and could result in reduced customer spending and decreased revenue. These factors and other factors could harm our ability to gain future international revenue and, consequently, materially affect our business, results of operations, and financial condition. We may face exposure to foreign currency exchange rate fluctuations which may affect certain of our key performance indicators and our results of operations. Revenues and operating expenses outside of Canada are often denominated in local functional currencies. Additionally, as we expand our international operations, we report our financial results in US dollars. Therefore, fluctuations in the value of foreign currencies, including but not limited to the Canadian dollar, when translated into US dollars may have a significant impact on certain of our key performance indicators, including but not limited to our Annual Recurring Revenue, or otherwise affect our results of operations. We do not currently engage in currency hedging activities to limit the risk of unfavourable exchange rate fluctuations. In the future, we may use derivative instruments, such as foreign currency forward and option contracts, to hedge certain exposures to fluctuations in foreign currency exchange rates. The use of such hedging activities may not offset any or more than a portion of the adverse financial effects of unfavourable movements in foreign exchange rates over the limited time the hedges are in place. Moreover, the use of hedging instruments may introduce additional risks if we are unable to structure effective hedges with such instruments. Our growth depends in part on the success of our strategic relationships with strategic partners as well as our ability to successfully integrate our platform with third party applications. In addition to growing our direct sales channels, we intend to pursue additional relationships with strategic partners, which includes OEMs, Value Added Resellers, system integrators and service partners. Identifying the proper strategic partners will be essential to this growth strategy. Negotiating and documenting relationships with appropriate strategic partners will require significant time and resources, as will integrating third-party content and technology. Our agreements with strategic partners may not prohibit them from working with our competitors or from offering competing services. Our competitors may be effective in providing incentives to strategic partners to favour their products or services or to prevent or reduce subscriptions to our solution, including through a simple integration. In addition, these distributors and providers may not perform as expected under our agreements, and we have had, and may in the future have, disagreements or disputes with such distributors and providers, which could negatively affect our brand and reputation. In addition, acquisitions of our strategic partners by our competitors or acquisitions by our strategic partners of our competitors could end our strategic relationship with the acquired or strategic partner and result in a decrease in the number of our current and potential customers. For example, in January 2024, an OEM partner that contributed approximately 9% of our 2024 revenue announced that it had acquired a competitive learning experience platform software provider. We took legal measures to enforce the terms of the agreement, and the parties amicably resolved the dispute on a confidential basis and agreed to dismiss the litigation. However, this OEM customer has decreased its use of our solution in favour of its acquired product for its end customers and we expect it will continue to do so in the near term. This has resulted in, and we expect will continue to result in, a reduction in subscriptions for our solutions and negative impact to our growth rate, which may harm our business, financial condition and results of operations. This negative impact is evident as this OEM 13

partner represented 6.2% of Annual Recurring Revenue as at September 30, 2025, compared to 9.4% as at September 30, 2024. If we are unsuccessful in establishing or maintaining our strategic partnerships, our ability to compete in the marketplace or to grow our revenue could be impaired and our operating results could suffer. Even if we are successful, there can be no assurance that these relationships will result in improved operating results. A global economic slowdown and other factors could also adversely affect the businesses of our strategic partners, and it is possible that they may not be able to devote the resources we expect to the relationship. Risks and challenges with the use of AI in our platform, including flawed algorithms, insufficient data sets and biased information, may result in reputational harm or liability. Our platform uses AI, and we expect to continue building AI into our platform in the future. We envision a future in which AI operates within our cloud-based platform to offer an efficient and effective e-learning solution for our customers. As with many disruptive innovations, AI presents risks and challenges that could affect its adoption, and therefore our business. AI algorithms may be flawed. Datasets may be insufficient or contain biased information. Inappropriate or controversial data practices by us or others could impair the acceptance, utility and effectiveness of AI solutions. Our management aims to mitigate these risks through the development, implementation and ongoing review of an AI governance policy that aligns with our values, adheres to legal and regulatory standards and promotes the safety and well-being of various internal and external stakeholders. Our Board oversees these efforts, taking into account ethical considerations, mitigating exposure to any related material risks and participating in relevant Board education. Nonetheless, these deficiencies could undermine the decisions, predictions, or analysis AI applications produce, subjecting us to competitive harm, legal liability, and brand or reputational harm. If we enable or offer AI solutions that are controversial because of their impact on human rights, privacy, employment, equity, accessibility or other social issues, we may experience brand or reputational harm. Also, decisions by our current suppliers of AI infrastructure, whether made voluntarily or compelled by external factors or regulatory requirements, to limit the provision of their services may result in our inability to procure alternatives from other suppliers in a timely and efficient manner or at all, and could adversely affect our ability to develop and operate AI systems for our customers. Key Components of Results of Operations Docebo has always been operated and managed as a single economic entity, notwithstanding the fact that it has operations in several different countries. There is one management team that directs the activities of all aspects of the Company and it is managed globally through global department heads. As a result, we believe that we have one operating segment, being the consolidated company. Over time, this may change as the Company grows and when this occurs we will reflect the change in our reporting practice. Revenue We generate revenue from the following two primary sources: • Recurring Subscriptions to Our Learning Platform and Related Products. Our customers enter into agreements that provide for recurring subscription fees. The majority of the customer agreements currently being entered into have a term of one to three years and are non-cancellable or cancellable with penalty. Subscription revenue per contract will vary depending upon the particular products that each customer subscribes for, the number and type of learners intended to utilize the platform and the term of the agreement. Subscription revenue is typically recognized evenly over the enforceable term of a contract, commencing on the in-service date. • Professional Services. Our customers generally require support in implementing our product and training their learners. This support can include system integration, application integration, learner training and any required process-change analysis. Normally, these services are purchased at the same time as the original customer agreement is completed and while they are usually delivered during the 60-180 days immediately following the effective date of the customer agreement, timing can vary. As a result, unlike the recognition of recurring subscription revenue, the recognition of professional service revenue can be recorded unevenly from period to period. When customer agreements are renewed, there is not typically a need for additional 14

professional services so as overall revenue increases over time, the percentage of revenue that is generated from professional services will decrease. Revenues derived from professional services are recognized over the term that the service is provided. Our agreements generally do not contain any cancellation or refund provisions without penalty, other than in the case of our default. Cost of Revenue Cost of revenue is comprised of costs related to provisioning and hosting our learning platform and related products, the delivery of professional services, and customer support. Significant expenses included in cost of revenue include employee salaries and benefits expenses, web hosting fees, third party service fees, and software costs. Operating Expenses Our primary operating expenses are as follows: • General and Administrative. General and administrative expenses consist of employee salaries and benefits expenses for our finance, legal, administrative, human resources, and information technology and security teams. These costs also include consulting and professional service fees, transaction costs related to our acquisitions, software, travel, general office and administrative expenses, credit impairment losses, as well as public company costs including directors and officers liability insurance. • Sales and Marketing. Sales and marketing expenses are comprised primarily of employee salaries and benefits expenses for our sales and marketing teams, amortization of contract acquisition costs, software, travel and advertising and marketing event costs. We intend to continue to grow our sales and marketing teams to support our growth strategy. • Research and Development. Research and development expenses are comprised primarily of employee salaries and benefits for our product and innovation-related functions (net of tax credits), consulting and professional service fees, software, travel and web hosting fees, along with acquisition compensation related payments. Our research and development team is focused on both continuous improvement of our existing learning platform, as well as developing new product modules and features. As Docebo’s growth continues, we expect our research and development costs to increase. • Share-based Compensation. Share-based compensation expenses are comprised of the value of stock options granted to employees expensed over the vesting period of the options, deferred share units (“DSUs”), restricted share units (“RSUs”) and shares issued pursuant to the Employee Share Purchase Plan. In addition, the Company’s board of directors may fix, from time to time, a portion of the total compensation (including an annual retainer) paid by the Company to a director in a calendar year for service on the Board and directors may elect to receive a portion of their total compensation (including cash retainer) in the form of DSUs. • Foreign Exchange. Foreign exchange primarily relates to translation of monetary assets and liabilities denominated in foreign currencies into functional currencies at the foreign exchange rate applicable at the end of each period. • Depreciation and Amortization. Depreciation and amortization expense primarily relates to depreciation on property and equipment, and amortization of ROU assets and intangible assets. Property and equipment are comprised of furniture and office equipment, leasehold improvements and land and building. ROU assets are comprised of capitalized leases. Intangible assets are comprised of acquired intangible assets. Other Expenses • Finance Income, net. This includes costs related to interest income less interest on lease obligations, accretion of interest on contingent consideration and acquisition holdback payables, and bank fees and other expenses. 15

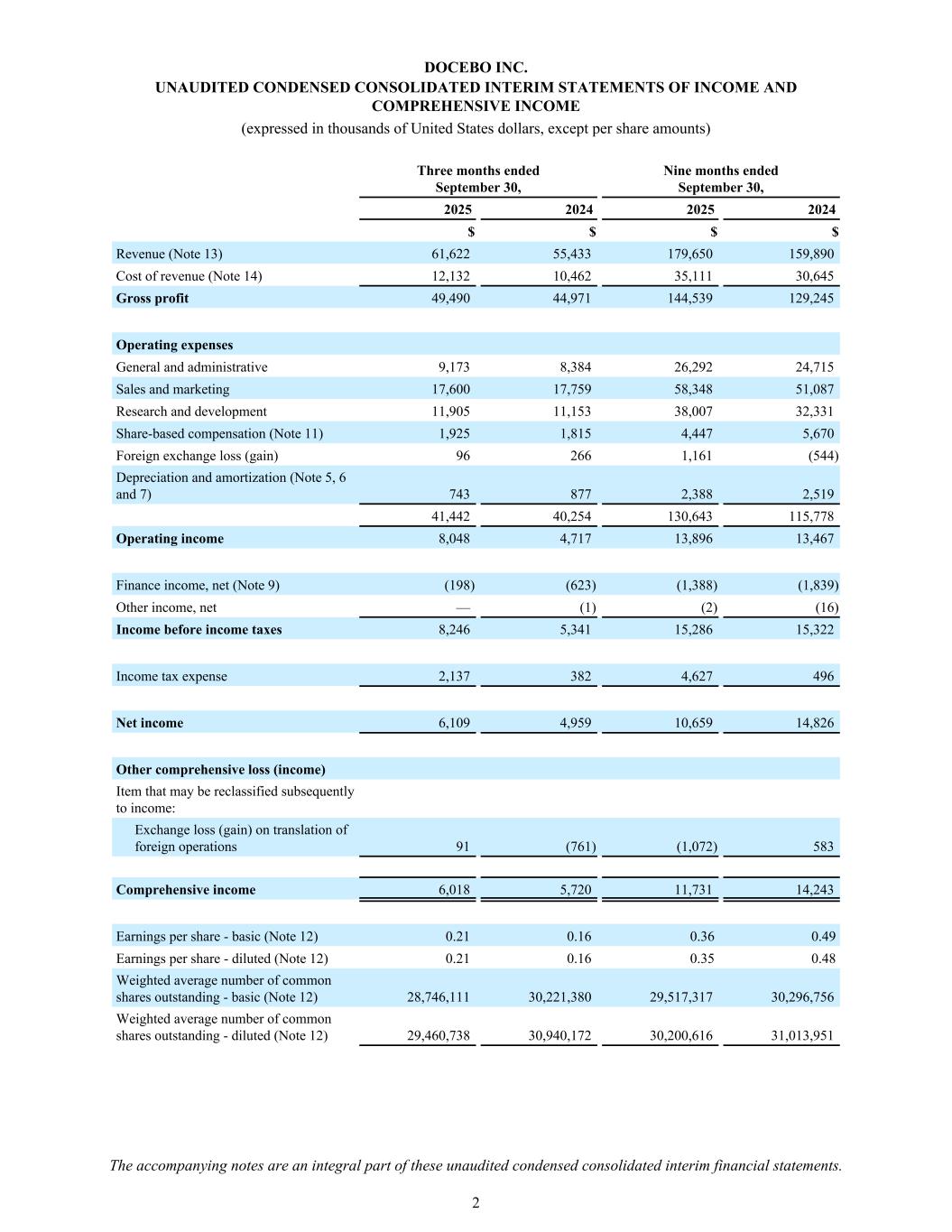

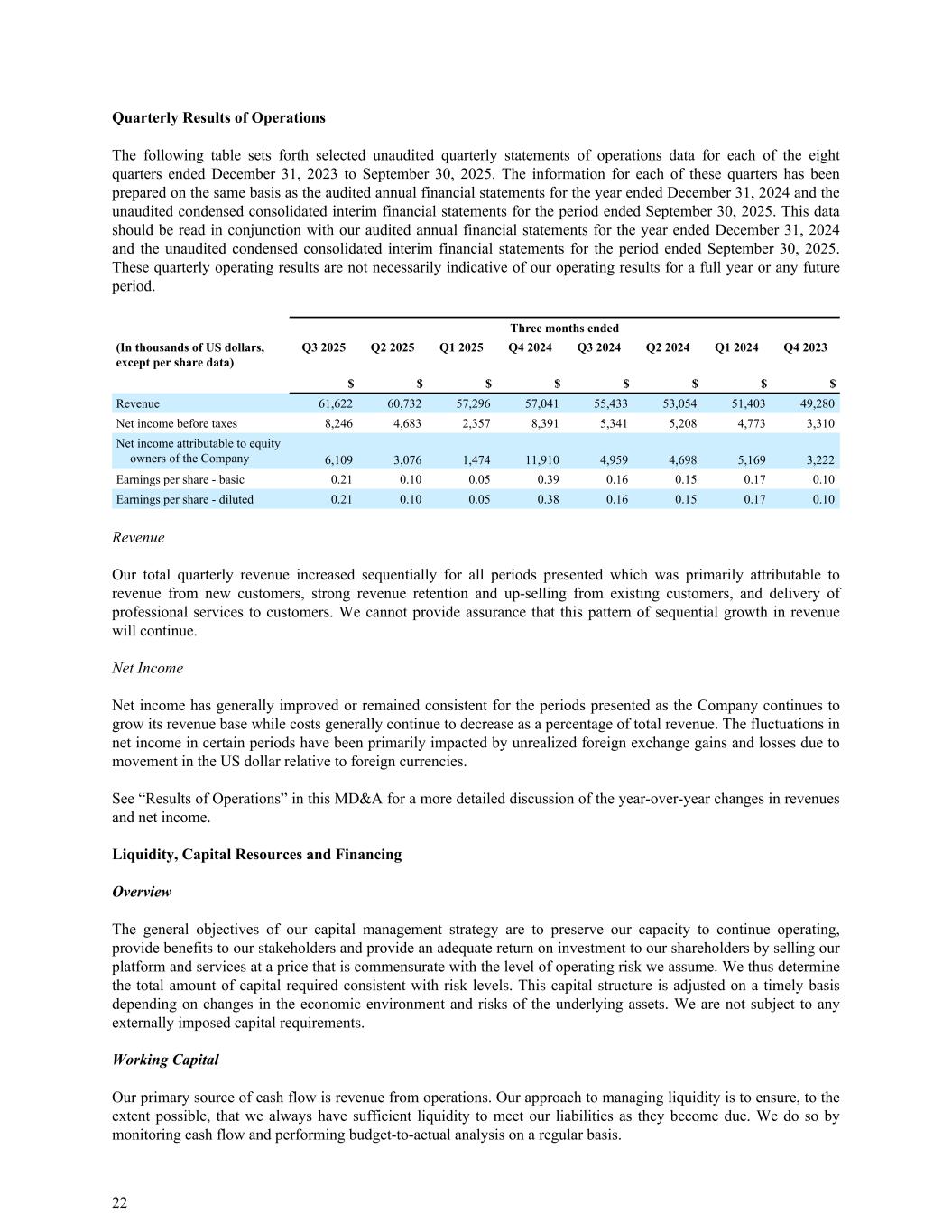

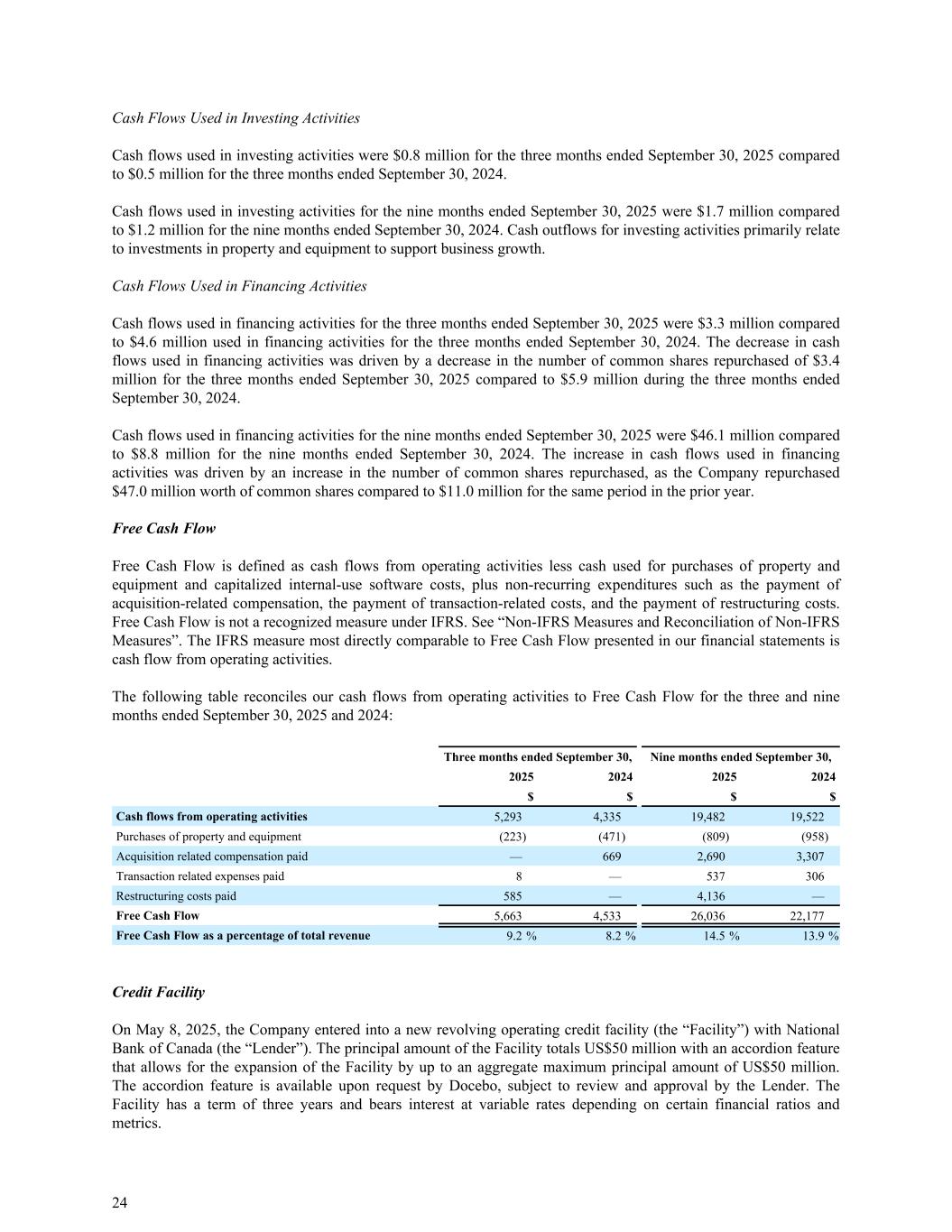

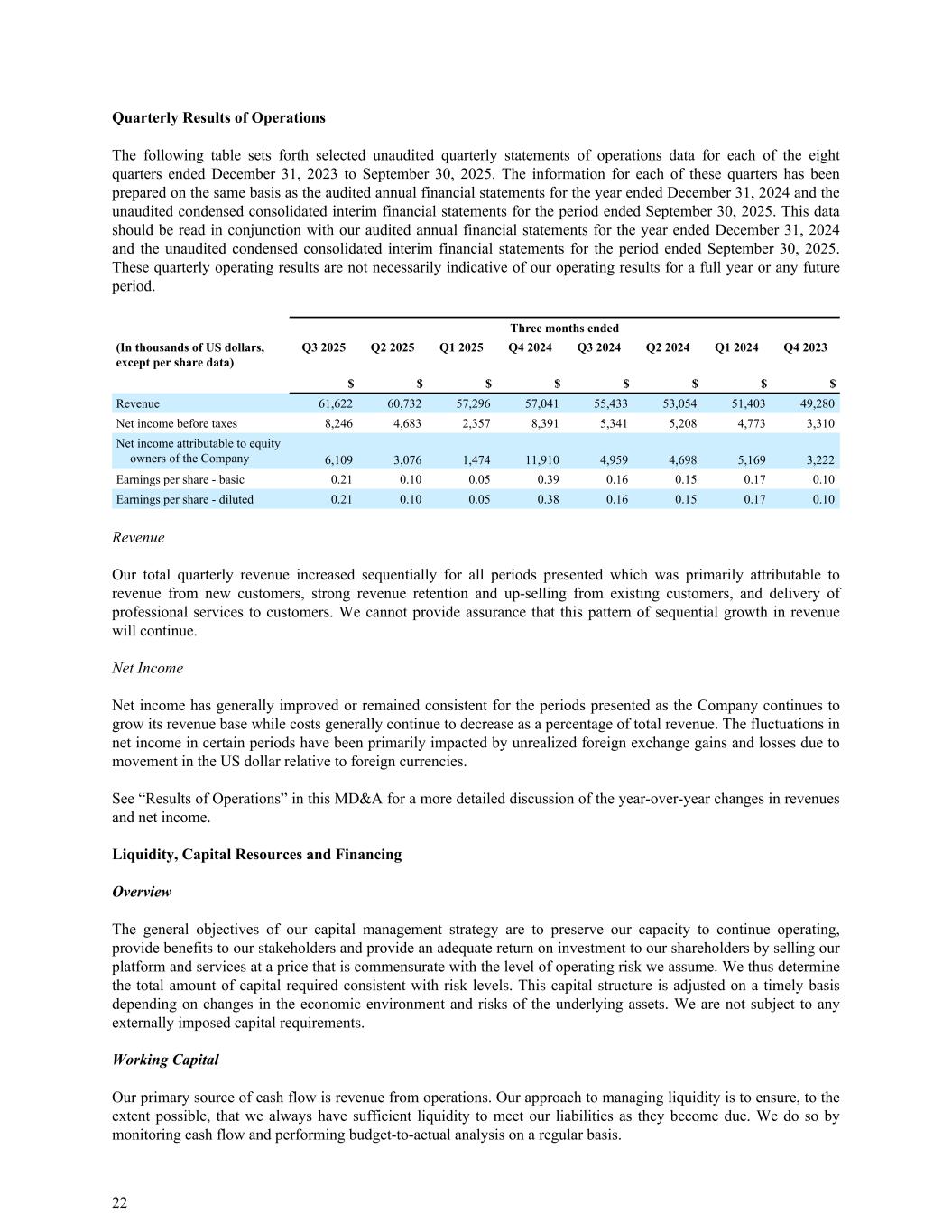

• Other Income, net. These costs are comprised of rental income from subleasing office space. Results of Operations The following table outlines our consolidated statements of income and comprehensive income for the periods indicated: Three months ended September 30, Nine months ended September 30, 2025 2024 2025 2024 $ $ $ $ Revenue 61,622 55,433 179,650 159,890 Cost of revenue 12,132 10,462 35,111 30,645 Gross profit 49,490 44,971 144,539 129,245 Operating expenses General and administrative 9,173 8,384 26,292 24,715 Sales and marketing 17,600 17,759 58,348 51,087 Research and development 11,905 11,153 38,007 32,331 Share-based compensation 1,925 1,815 4,447 5,670 Foreign exchange loss (gain) 96 266 1,161 (544) Depreciation and amortization 743 877 2,388 2,519 41,442 40,254 130,643 115,778 Operating income 8,048 4,717 13,896 13,467 Finance income, net (198) (623) (1,388) (1,839) Other income, net — (1) (2) (16) Income before income taxes 8,246 5,341 15,286 15,322 Income tax expense 2,137 382 4,627 496 Net income 6,109 4,959 10,659 14,826 Other comprehensive loss (income) Item that may be reclassified subsequently to income: Exchange loss (gain) on translation of foreign operations 91 (761) (1,072) 583 Comprehensive income 6,018 5,720 11,731 14,243 Earnings per share - basic 0.21 0.16 0.36 0.49 Earnings per share - diluted 0.21 0.16 0.35 0.48 Weighted average number of common shares outstanding - basic 28,746,111 30,221,380 29,517,317 30,296,756 Weighted average number of common shares outstanding - diluted 29,460,738 30,940,172 30,200,616 31,013,951 16

Review of Operations for the three and nine months ended September 30, 2025 Revenue Three months ended September 30, Nine months ended September 30, 2025 2024 Change Change 2025 2024 Change Change $ $ $ % $ $ $ % Subscription revenue 58,046 52,615 5,431 10 % 169,295 150,326 18,969 13 % Professional services 3,576 2,818 758 27 % 10,355 9,564 791 8 % Total revenue 61,622 55,433 6,189 11 % 179,650 159,890 19,760 12 % Total revenue increased by $6.2 million or 11% for the three months ended September 30, 2025 compared to the three months ended September 30, 2024 and increased by $19.8 million or 12% for the nine months ended September 30, 2025 compared to the nine months ended September 30, 2024. The increase in both periods was driven by revenue recognized from new customers, as well as up-selling to existing customers. Subscription revenue increased by $5.4 million or 10% for the three months ended September 30, 2025 compared to the three months ended September 30, 2024 and increased by $19.0 million or 13% for the nine months ended September 30, 2025 compared to the nine months ended September 30, 2024. The increase in both periods was driven by revenue recognized from net new customers, and growth from existing customers. Professional services revenue increased by $0.8 million or 27% for the three months ended September 30, 2025 compared to the three months ended September 30, 2024 and increased by $0.8 million or 8.3% for the nine months ended September 30, 2025 compared to the nine months ended September 30, 2024. The increase in both periods was driven by revenue recognized from new customers, and growth from existing customers. Cost of Revenue Three months ended September 30, Nine months ended September 30, 2025 2024 Change Change 2025 2024 Change Change $ $ $ % $ $ $ % Cost of revenue 12,132 10,462 1,670 16 % 35,111 30,645 4,466 15 % Percentage of total revenue 19.7 % 18.9 % 19.5 % 19.2 % Cost of revenue increased by $1.7 million or 16% for the three months ended September 30, 2025 compared to the three months ended September 30, 2024 and increased by $4.5 million or 15% for the nine months ended September 30, 2025 compared to the nine months ended September 30, 2024. The increase in both periods was primarily driven by the increase in revenues, as well as increased fees related to provisioning and hosting our learning platform as well as third party service fees. 17

Gross Profit Three months ended September 30, Nine months ended September 30, 2025 2024 Change Change 2025 2024 Change Change $ $ $ % $ $ $ % Gross profit 49,490 44,971 4,519 10 % 144,539 129,245 15,294 12 % Percentage of total revenue 80.3 % 81.1 % 80.5 % 80.8 % Gross profit for the three months ended September 30, 2025 increased by $4.5 million or 10% and decreased to 80.3% of revenue for the three months ended September 30, 2025 compared to 81.1% for the three months ended September 30, 2024. Gross profit for the nine months ended September 30, 2025 increased by $15.3 million or 12% and decreased to 80.5% of revenue for the nine months ended September 30, 2025 compared to 80.8% for the nine months ended September 30, 2024. Operating Expenses Three months ended September 30, Nine months ended September 30, 2025 2024 Change Change 2025 2024 Change Change $ $ $ % $ $ $ % General and administrative 9,173 8,384 789 9 % 26,292 24,715 1,577 6 % Sales and marketing 17,600 17,759 (159) (1) % 58,348 51,087 7,261 14 % Research and development 11,905 11,153 752 7 % 38,007 32,331 5,676 18 % Share-based compensation 1,925 1,815 110 6 % 4,447 5,670 (1,223) (22) % Foreign exchange loss (gain) 96 266 (170) (64) % 1,161 (544) 1,705 313 % Depreciation and amortization 743 877 (134) (15) % 2,388 2,519 (131) (5) % Total operating expenses 41,442 40,254 1,188 3 % 130,643 115,778 14,865 13 % General and Administrative Expenses Three months ended September 30, Nine months ended September 30, 2025 2024 Change Change 2025 2024 Change Change $ $ $ % $ $ $ % General and administrative 9,173 8,384 789 9 % 26,292 24,715 1,577 6 % Percentage of total revenue 14.9 % 15.1 % 14.6 % 15.5 % General and administrative expenses increased by $0.8 million or 9% for the three months ended September 30, 2025 compared to the three months ended September 30, 2024. The increase was driven by higher software spend to support the Company’s AI-first vision. General and administrative expenses increased by $1.6 million or 6% for the nine months ended September 30, 2025 compared to the nine months ended September 30, 2024. A significant portion of this increase was attributable to non-recurring transaction expenses and restructuring costs. Excluding the impact of these transaction and restructuring charges, general and administrative expenses rose by 2% for the nine months ended September 30, 2025. Our general and administrative expenses as a percentage of total revenue decreased from 15.1% to 14.9% for the three months ended September 30, 2024 and September 30, 2025, respectively, and decreased from 15.5% to 14.6% for the nine months ended September 30, 2024 and September 30, 2025, respectively. 18