Document

Angel Oak Mortgage REIT, Inc. Reports Third Quarter 2025 Financial Results

ATLANTA – November 6, 2025 -- Angel Oak Mortgage REIT, Inc. (NYSE: AOMR) (the “Company,” “we,” and “our”), a leading real estate finance company focused on acquiring and investing in first lien non-QM loans and other mortgage-related assets in the U.S. mortgage market, today reported financial results for the quarter ended September 30, 2025.

Third Quarter 2025 and Year-to-Date Highlights

•Q3 2025 GAAP net income of $11.4 million, or $0.46 per diluted share of common stock.

•Q3 2025 net interest income of $10.2 million demonstrates an increase of 12.9% versus Q3 2024 net interest income of $9.0 million and an increase of 2.4% compared to Q2 2025 net interest income of $9.9 million.

•Net interest income of $30.2 million for the nine months ended September 30, 2025, an increase of 11.6% compared to net interest income of $27.1 million for the nine months ended September 30, 2024.

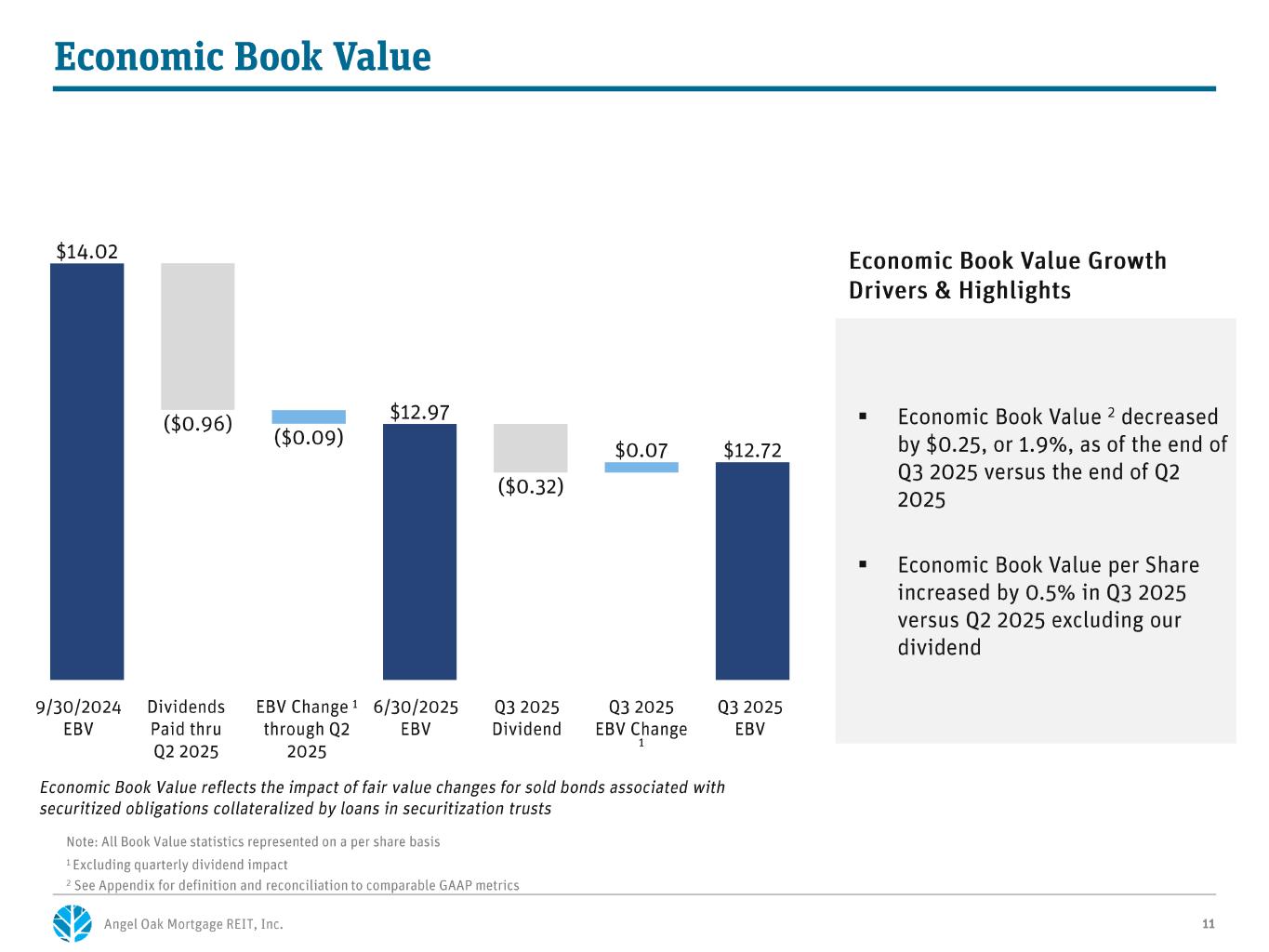

•GAAP book value of $10.60 per share of common stock and economic book value of $12.72 per share of common stock as of September 30, 2025, an increase of 2.2% and decrease of 1.9%, respectively, from June 30, 2025 GAAP and economic book value per share of $10.37 and $12.97, respectively.

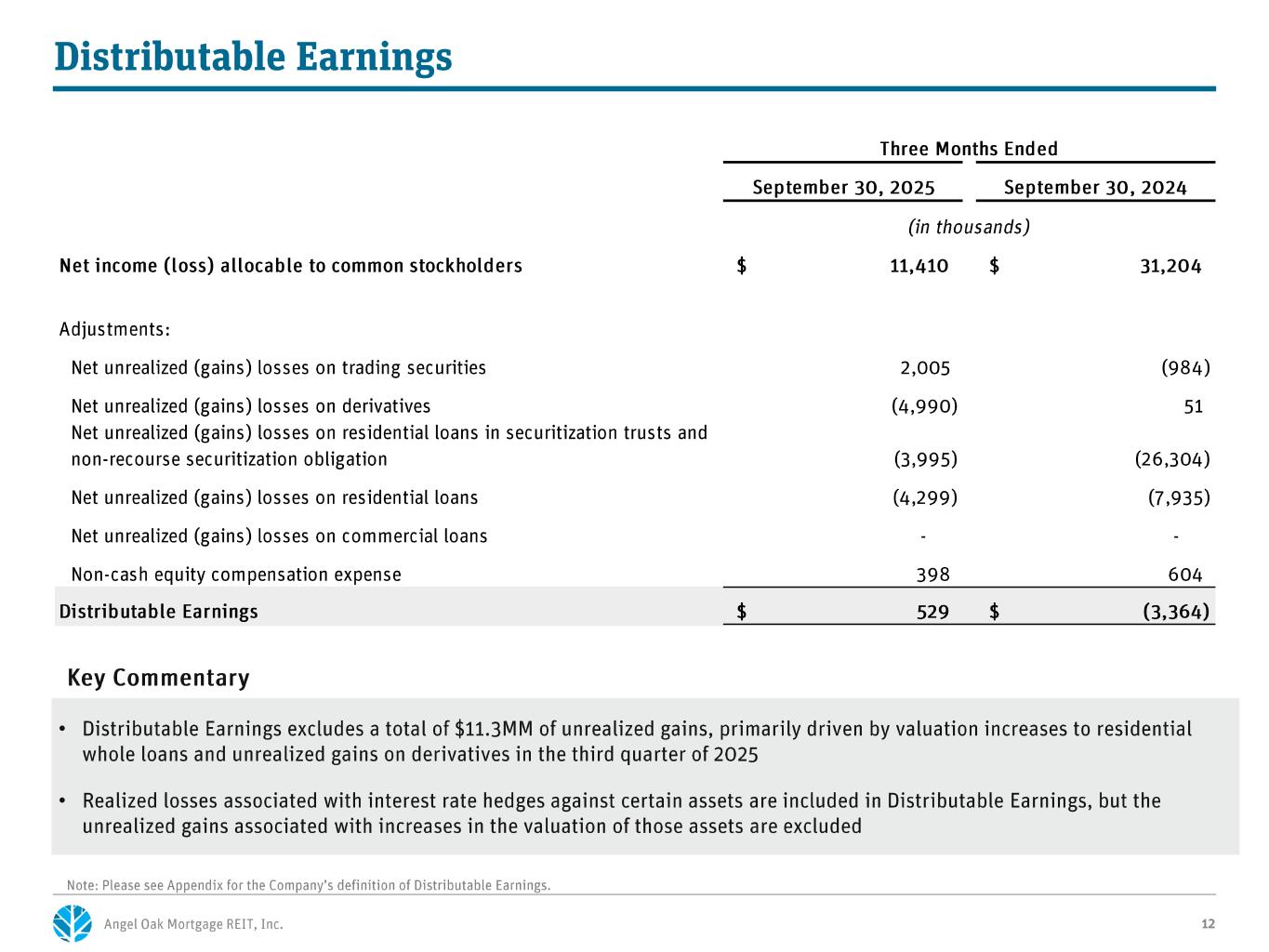

•Q3 2025 Distributable Earnings of $0.5 million, or $0.02 per diluted share of common stock.

•Declared a dividend of $0.32 per share of common stock, which will be paid on November 26, 2025, to common stockholders of record as of November 18, 2025.

Sreeni Prabhu, Chief Executive Officer and President of Angel Oak Mortgage REIT, Inc., said "The third quarter of 2025 presented a constructive environment for AOMR's business in which we demonstrated our ability to capitalize on opportunities to drive accretive growth in our portfolio. Of note, we called and retired two legacy securitizations and re-allocated that capital toward higher-yielding investments. Additionally, following the end of the quarter, we established a new credit facility at attractive rates, diversifying our creditor base and driving reduced interest expense." He continued, "Our financial results were strong; we resumed quarterly sequential net income growth following May's senior unsecured debt issuance, maintained operating expense levels, and observed increases in valuations across the portfolio compared to the second quarter of 2025. Additionally, following the end of the quarter, we executed the AOMT 2025-10 securitization with favorable terms. We remain committed to leveraging our competitive advantages and building upon our proven track record to drive continued income and earnings growth for our stakeholders."

Portfolio and Investment Activity

•During the quarter ended September 30, 2025, we purchased $237.6 million of newly-originated, current market coupon non-QM residential mortgage loans, second lien mortgage loans (residential mortgage loans that are subordinate to the primary or first lien mortgage loans on a residential property, and home equity lines of credit, with a weighted average coupon of 7.74%, weighted average combined loan-to-value ratio of 69.4% and weighted average non-zero credit score of 759.

•In September 2025, the Company, in conjunction with the Company’s affiliates, exercised its call rights on the AOMT 2019-2 and AOMT 2019-4 securitizations and subsequently re-securitized the underlying loans in AOMT 2025-R1. This transaction resulted in $19.4 million of cash which was used for repayment of outstanding repurchase debt and operational purposes.

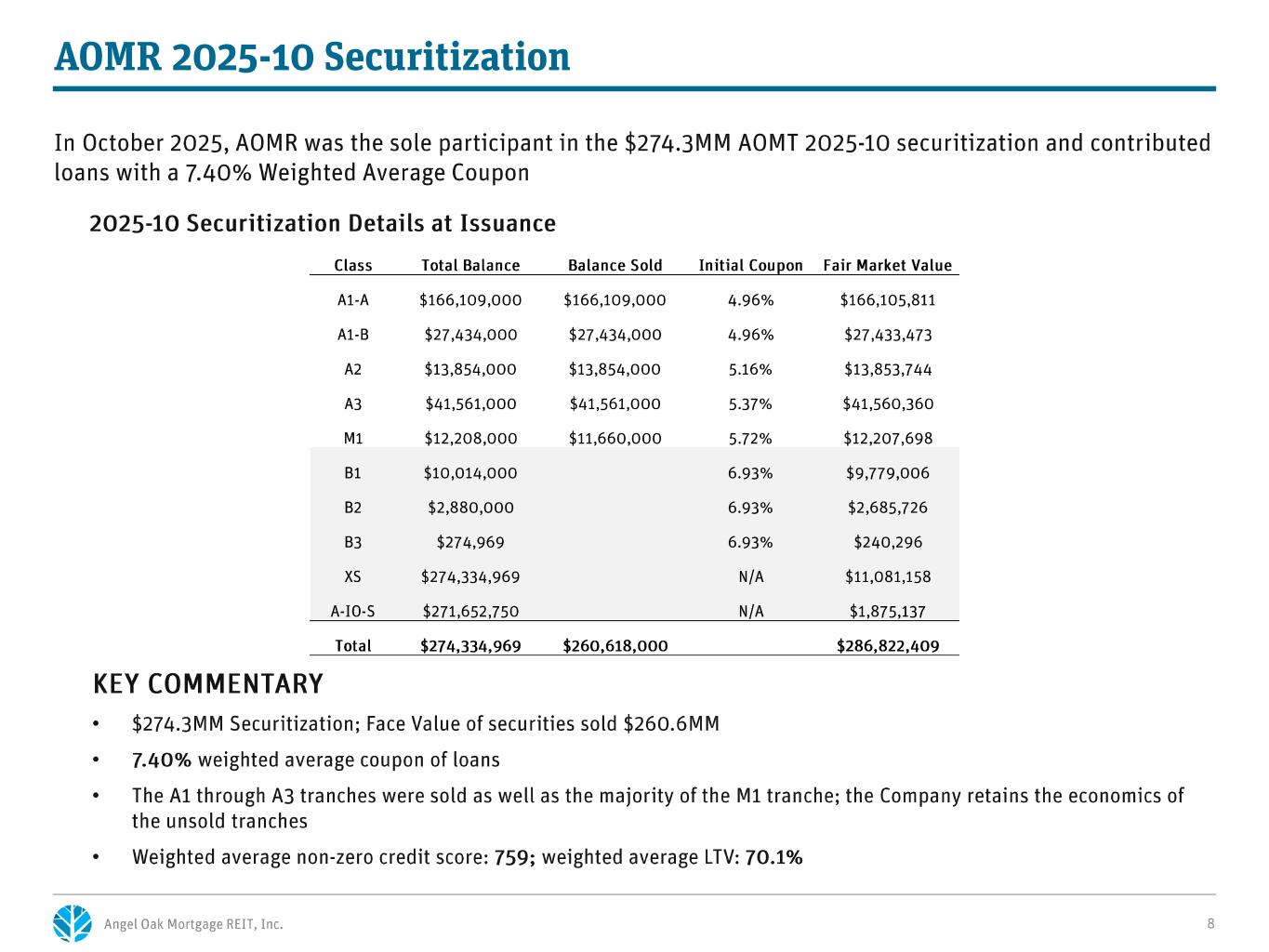

•Subsequent to the quarter ended September 30, 2025, in October 2025, we issued AOMT 2025-10, an approximately $274.3 million scheduled unpaid principal balance securitization backed by a pool of residential mortgage loans. We issued AOMT 2025-10 as the sole contributor of loans in the securitization. We used the proceeds to repay outstanding debt of approximately $237.4 million, and the $22.1 million of cash released is planned to be used for new loan purchases and operational purposes.

•As of September 30, 2025, the weighted average interest rate of our residential whole loans portfolio was 7.98%.

Capital Markets Activity

•As of September 30, 2025, the Company was a party to three loan financing lines which permit borrowings in an aggregate amount of up to $1.1 billion, of which approximately $342.6 million is drawn, leaving capacity of approximately $707.4 million for new loan purchases.

•On October 6, 2025, the Company and one of its subsidiaries entered into a $200.0 million repurchase facility with a global investment bank (“Global Investment Bank 4”) through the execution of a Master Repurchase Agreement and Securities Contract. The amount expected to be advanced by Global Investment Bank 4 is generally in line with other similar agreements that the Company has entered into. The interest rate is equal to the sum of (1) a spread of 1.60%, and (2) Term SOFR.

Balance Sheet

•Target assets totaled $2.5 billion as of September 30, 2025.

•The Company held residential mortgage whole loans with fair value of $425.8 million as of September 30, 2025.

•As of September 30, 2025, the Company's recourse debt to equity ratio was approximately 1.9x.

Dividend

On November 6, 2025, the Company declared a dividend of $0.32 per share of common stock, which will be paid on November 26, 2025, to common stockholders of record as of November 18, 2025.

Conference Call and Webcast Information

The Company will host a live conference call and webcast today, November 6, 2025 at 8:30 a.m. Eastern time. To listen to the live webcast, go to the Investors section of the Company’s website at www.angeloakreit.com at least 15 minutes prior to the scheduled start time in order to register and install any necessary audio software.

To Participate in the Telephone Conference Call:

Dial in at least 15 minutes prior to start time.

Domestic: 1-844-826-3033

International: 1-412-317-5185

For the conference call playback (which can be accessed through November 20, 2025), dial one of the following numbers:

Domestic: 1-844-512-2921

International: 1-412-317-6671

Pass code: 10202739

Non-GAAP Metrics

Distributable Earnings is a non‑GAAP measure and is defined as net income (loss) allocable to common stockholders as calculated in accordance with generally accepted accounting principles in the United States of America (“GAAP”), excluding (1) unrealized gains and losses on our aggregate portfolio, (2) impairment losses, (3) extinguishment of debt, (4) non-cash equity compensation expense, (5) the incentive fee earned by Falcons I, LLC, our external manager (our “Manager”), (6) realized gains or losses on swap terminations and (7) certain other nonrecurring gains or losses. We believe that the presentation of Distributable Earnings provides investors with a useful measure to facilitate comparisons of financial performance among our real estate investment trust (“REIT”) peers, but has important limitations. We believe Distributable Earnings as described above helps evaluate our financial performance without the impact of certain transactions but is of limited usefulness as an analytical tool. Therefore, Distributable Earnings should not be viewed in isolation and is not a substitute for net income computed in accordance with GAAP. Our methodology for calculating Distributable Earnings may differ from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and as a result, our Distributable Earnings may not be comparable to similar measures presented by other REITs.

Distributable Earnings Return on Average Equity is a non-GAAP measure and is defined as annual or annualized Distributable Earnings divided by average total stockholders’ equity. We believe that the presentation of Distributable Earnings Return on Average Equity provides investors with a useful measure to facilitate comparisons of financial performance among our REIT peers, but has important limitations. Additionally, we believe Distributable Earnings Return on Average Equity provides investors with additional detail on the Distributable Earnings generated by our invested equity capital. We believe Distributable Earnings Return on Average Equity as described above helps evaluate our financial performance without the impact of certain transactions but is of limited usefulness as an analytical tool. Therefore, Distributable Earnings Return on Average Equity should not be viewed in isolation and is not a substitute for net income computed in accordance with GAAP. Our methodology for calculating Distributable Earnings Return on Average Equity may differ from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and as a result, our Distributable Earnings Return on Average Equity may not be comparable to similar measures presented by other REITs.

Economic book value is a non-GAAP financial measure of our financial position. To calculate our economic book value, the portions of our non-recourse financing obligation held at amortized cost are adjusted to fair value. These adjustments are also reflected in our end of period total stockholders’ equity. Management considers economic book value to provide investors with a useful supplemental measure to evaluate our financial position as it reflects the impact of fair value changes for our legally held retained bonds, irrespective of the accounting model applied for GAAP reporting purposes. Economic book value does not represent and should not be considered as a substitute for book value per share of common stock or stockholders’ equity, as determined in accordance with GAAP, and our calculation of this measure may not be comparable to similarly titled measures reported by other companies.

Forward-Looking Statements

This press release contains certain forward-looking statements that are subject to various risks and uncertainties, including, without limitation, statements relating to the performance of the Company’s investments. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue,” or by the negative of these words and phrases or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe existing or future plans and strategies, contain projections of results of operations, liquidity and/or financial condition, or state other forward-looking information. The Company’s ability to predict future events or conditions or their impact or the actual effect of existing or future plans or strategies is inherently uncertain. Although the Company believes that such forward-looking statements are based on reasonable assumptions, actual results and performance in the future could differ materially from those set forth in or implied by such forward-looking statements. You are cautioned not to place undue reliance on these forward‐looking statements, which reflect the Company’s views only as of the date of this press release. Additional information concerning factors that could cause actual results and performance to differ materially from these forward-looking statements is contained from time to time in the Company’s filings with the Securities and Exchange Commission. Except as required by applicable law, neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward‐looking statements. The Company does not undertake any obligation to update any forward-looking statements contained in this press release as a result of new information, future events or otherwise.

About Angel Oak Mortgage REIT, Inc.

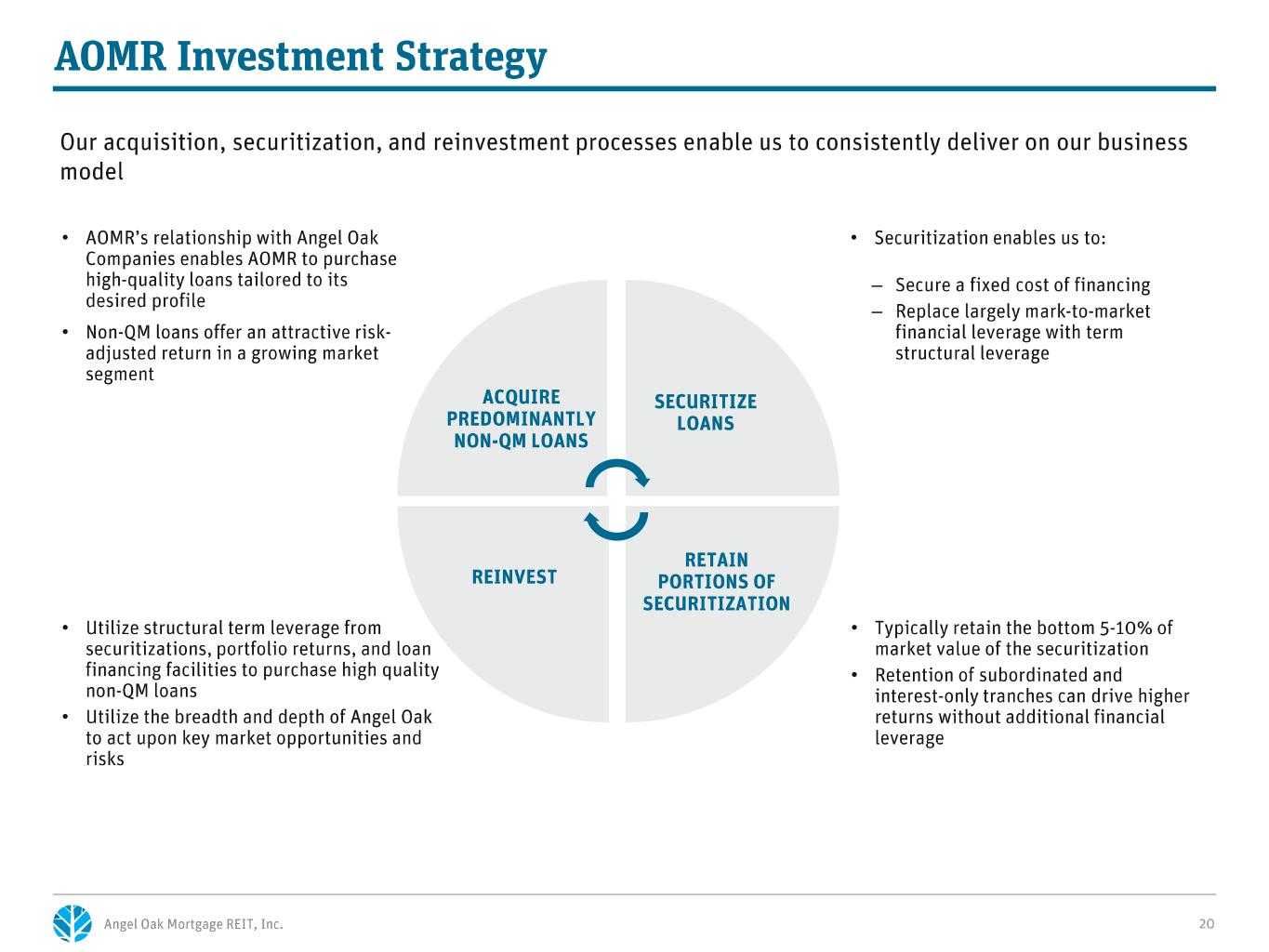

Angel Oak Mortgage REIT, Inc. is a real estate finance company focused on acquiring and investing in first lien non-QM loans and other mortgage-related assets in the U.S. mortgage market. The Company’s objective is to generate attractive risk-adjusted returns for its stockholders through cash distributions and capital appreciation across interest rate and credit cycles. The Company is externally managed and advised by an affiliate of Angel Oak Capital Advisors, LLC, which, collectively with its affiliates, is a leading alternative credit manager with market leadership in mortgage credit that includes asset management, lending, and capital markets. Additional information about the Company is available at www.angeloakreit.com

Angel Oak Mortgage REIT, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(Unaudited)

(in thousands, except for share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, 2025 |

|

September 30, 2024 |

|

September 30, 2025 |

|

September 30, 2024 |

| INTEREST INCOME, NET |

|

|

|

|

|

|

|

| Interest income |

$ |

36,659 |

|

|

$ |

27,444 |

|

|

$ |

104,620 |

|

|

$ |

78,558 |

|

| Interest expense |

26,479 |

|

|

18,424 |

|

|

74,414 |

|

|

51,495 |

|

| NET INTEREST INCOME |

$ |

10,180 |

|

|

$ |

9,020 |

|

|

$ |

30,206 |

|

|

$ |

27,063 |

|

|

|

|

|

|

|

|

|

| REALIZED AND UNREALIZED GAINS (LOSSES), NET |

|

|

|

|

|

|

|

| Net realized gain (loss) on mortgage loans, derivative contracts, RMBS, and CMBS |

$ |

(6,557) |

|

|

$ |

(6,335) |

|

|

$ |

(12,238) |

|

|

$ |

(14,527) |

|

| Net unrealized gain (loss) on trading securities, mortgage loans, portion of debt at fair value option, and derivative contracts |

11,280 |

|

|

35,172 |

|

|

26,329 |

|

|

48,514 |

|

| TOTAL REALIZED AND UNREALIZED GAINS (LOSSES), NET |

$ |

4,723 |

|

|

$ |

28,837 |

|

|

$ |

14,091 |

|

|

$ |

33,987 |

|

|

|

|

|

|

|

|

|

| EXPENSES |

|

|

|

|

|

|

|

| Operating expenses |

$ |

1,117 |

|

|

$ |

1,541 |

|

|

$ |

3,653 |

|

|

$ |

5,282 |

|

| Operating expenses incurred with affiliate |

510 |

|

|

472 |

|

|

1,379 |

|

|

1,444 |

|

|

|

|

|

|

|

|

|

| Stock compensation |

398 |

|

|

604 |

|

|

930 |

|

|

1,864 |

|

| Securitization costs |

— |

|

|

— |

|

|

1,866 |

|

|

1,583 |

|

| Management fee incurred with affiliate |

1,161 |

|

|

1,204 |

|

|

3,454 |

|

|

3,810 |

|

| Total operating expenses |

$ |

3,186 |

|

|

$ |

3,821 |

|

|

$ |

11,282 |

|

|

$ |

13,983 |

|

|

|

|

|

|

|

|

|

| INCOME (LOSS) BEFORE INCOME TAXES |

$ |

11,717 |

|

|

$ |

34,036 |

|

|

$ |

33,015 |

|

|

$ |

47,067 |

|

| Income tax expense (benefit) |

307 |

|

|

2,832 |

|

|

307 |

|

|

3,261 |

|

| NET INCOME (LOSS) ALLOCABLE TO COMMON STOCKHOLDERS |

$ |

11,410 |

|

|

$ |

31,204 |

|

|

$ |

32,708 |

|

|

$ |

43,806 |

|

| Other comprehensive income (loss) |

3,665 |

|

|

2,706 |

|

|

2,479 |

|

|

4,534 |

|

| TOTAL COMPREHENSIVE INCOME (LOSS) |

$ |

15,075 |

|

|

$ |

33,910 |

|

|

$ |

35,187 |

|

|

$ |

48,340 |

|

|

|

|

|

|

|

|

|

| Basic earnings (loss) per common share |

$ |

0.49 |

|

|

$ |

1.31 |

|

|

$ |

1.40 |

|

|

$ |

1.79 |

|

| Diluted earnings (loss) per common share |

$ |

0.46 |

|

|

$ |

1.29 |

|

|

$ |

1.36 |

|

|

$ |

1.76 |

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

| Basic |

23,043,587 |

|

23,757,039 |

|

23,320,200 |

|

24,445,105 |

| Diluted |

24,560,881 |

|

24,079,247 |

|

24,014,840 |

|

24,778,465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Angel Oak Mortgage REIT, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

(in thousands, except for share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

As of: |

|

September 30, 2025 |

|

December 31, 2024 |

| ASSETS |

|

|

|

| Residential mortgage loans - at fair value |

$ |

425,775 |

|

|

$ |

183,064 |

|

| Residential mortgage loans in securitization trusts - at fair value |

1,862,330 |

|

|

1,696,995 |

|

| RMBS - at fair value |

235,024 |

|

|

300,243 |

|

|

|

|

|

| Cash and cash equivalents |

51,598 |

|

|

40,762 |

|

| Restricted cash |

1,833 |

|

|

2,131 |

|

| Principal and interest receivable |

14,781 |

|

|

8,141 |

|

| TBA securities and interest rate futures contracts - at fair value |

1,944 |

|

|

1,515 |

|

| Other assets |

44,825 |

|

|

36,918 |

|

| Total assets |

$ |

2,638,110 |

|

|

$ |

2,269,769 |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| LIABILITIES |

|

|

|

| Notes payable |

$ |

342,608 |

|

|

$ |

129,459 |

|

| Non-recourse securitization obligation, collateralized by residential mortgage loans in securitization trusts |

1,726,657 |

|

|

1,593,612 |

|

| Securities sold under agreements to repurchase |

54,041 |

|

|

50,555 |

|

| Senior unsecured notes |

88,795 |

|

|

47,740 |

|

| TBA securities and interest rate futures contracts - at fair value |

1,309 |

|

|

— |

|

| Due to broker |

153,819 |

|

|

201,994 |

|

|

|

|

|

| Accrued expenses |

1,952 |

|

|

2,291 |

|

| Accrued expenses payable to affiliate |

588 |

|

|

766 |

|

| Interest payable |

2,173 |

|

|

934 |

|

| Income taxes payable |

163 |

|

|

2,785 |

|

| Management fee payable to affiliate |

1,840 |

|

|

666 |

|

| Total liabilities |

$ |

2,373,945 |

|

|

$ |

2,030,802 |

|

|

|

|

|

| Commitments and contingencies |

|

|

|

|

|

|

|

| STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

Common stock, $0.01 par value. As of September 30, 2025: 350,000,000 shares authorized, 24,914,035 shares issued and outstanding. As of December 31, 2024: 350,000,000 shares authorized, 23,500,175 shares issued and outstanding. |

$ |

249 |

|

|

$ |

234 |

|

| Additional paid-in capital |

474,154 |

|

|

461,057 |

|

| Accumulated other comprehensive income (loss) |

(996) |

|

|

(3,475) |

|

| Retained earnings (deficit) |

(209,242) |

|

|

(218,849) |

|

| Total stockholders' equity |

$ |

264,165 |

|

|

$ |

238,967 |

|

| Total liabilities and stockholders' equity |

$ |

2,638,110 |

|

|

$ |

2,269,769 |

|

Angel Oak Mortgage REIT, Inc.

Reconciliation of Net Income (Loss) to Distributable Earnings

and Distributable Earnings Return on Average Equity

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, 2025 |

|

September 30, 2024 |

|

September 30, 2025 |

|

September 30, 2024 |

|

(in thousands) |

| Net income (loss) allocable to common stockholders |

$ |

11,410 |

|

|

$ |

31,204 |

|

|

$ |

32,708 |

|

|

$ |

43,806 |

|

| Adjustments: |

|

|

|

|

|

|

|

| Net unrealized (gains) losses on trading securities |

2,005 |

|

|

(984) |

|

|

(1,861) |

|

|

829 |

|

| Net unrealized (gains) losses on derivatives |

(4,990) |

|

|

51 |

|

|

881 |

|

|

(2,985) |

|

| Net unrealized (gains) losses on residential loans in securitization trusts and non-recourse securitization obligation |

(3,995) |

|

|

(26,304) |

|

|

(20,199) |

|

|

(28,871) |

|

| Net unrealized (gains) losses on residential loans |

(4,299) |

|

|

(7,935) |

|

|

(5,149) |

|

|

(17,438) |

|

| Net unrealized (gains) losses on commercial loans |

— |

|

|

— |

|

|

— |

|

|

(49) |

|

| Stock compensation expense |

398 |

|

|

604 |

|

|

930 |

|

|

1,864 |

|

| Distributable Earnings |

$ |

529 |

|

|

$ |

(3,364) |

|

|

$ |

7,310 |

|

|

$ |

(2,844) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, 2025 |

|

September 30, 2024 |

|

September 30, 2025 |

|

September 30, 2024 |

|

|

($ in thousands) |

| Annualized Distributable Earnings |

|

$ |

2,116 |

|

|

$ |

(13,460) |

|

|

$ |

9,747 |

|

|

$ |

(3,793) |

|

| Average total stockholders’ equity |

|

$ |

255,276 |

|

|

$ |

260,452 |

|

|

$ |

250,250 |

|

|

$ |

260,083 |

|

| Distributable Earnings Return on Average Equity |

|

0.8 |

% |

|

(5.2) |

% |

|

3.9 |

% |

|

(1.5) |

% |

Angel Oak Mortgage REIT, Inc.

Reconciliation of Stockholders’ Equity to Stockholders’ Equity Including Economic Book Value Adjustments

and Economic Book Value per Share of Common Stock

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

|

|

|

(in thousands, except for share and per share data) |

|

|

| GAAP total stockholders’ equity |

$ |

264,165 |

|

$ |

246,389 |

|

$ |

251,480 |

|

$ |

238,967 |

|

$ |

265,098 |

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

| Fair value adjustment for securitized debt held at amortized cost |

52,770 |

|

61,846 |

|

63,593 |

|

68,784 |

|

64,522 |

|

|

|

| Stockholders’ equity including economic book value adjustments |

$ |

316,935 |

|

$ |

308,235 |

|

$ |

315,073 |

|

$ |

307,751 |

|

$ |

329,620 |

|

|

|

|

|

|

|

|

|

|

|

| Number of shares of common stock outstanding at period end |

24,914,035 |

|

23,765,202 |

|

23,500,175 |

|

23,500,175 |

|

23,511,272 |

|

|

|

| Book value per share of common stock |

$ |

10.60 |

|

$ |

10.37 |

|

$ |

10.70 |

|

$ |

10.17 |

|

$ |

11.28 |

|

|

|

| Economic book value per share of common stock |

$ |

12.72 |

|

$ |

12.97 |

|

$ |

13.41 |

|

$ |

13.10 |

|

$ |

14.02 |

|

|

|

Contacts

Investors:

investorrelations@angeloakreit.com

855-502-3920

IR Agency Contact:

Nick Teves or Joseph Caminiti, Alpha IR Group

312-445-2870

AOMR@alpha-ir.com

Company Contact:

KC Kelleher, Head of Corporate Finance & Investor Relations

404-528-2684

kc.kelleher@angeloakcapital.com