Document

Genworth Financial Announces Third Quarter 2025 Results

Strategic Highlights

•Delivered 950 matches1 with home care providers in the CareScout Quality Network in the quarter with over 95% home care coverage of the aged 65-plus census population in the United States

•Acquired Seniorly in October, accelerating the expansion of CareScout into senior living communities

•Launched Care Assurance in October, CareScout’s inaugural standalone LTC2 product

•Announced new $350M share repurchase program; executed $76M in share repurchases in the quarter

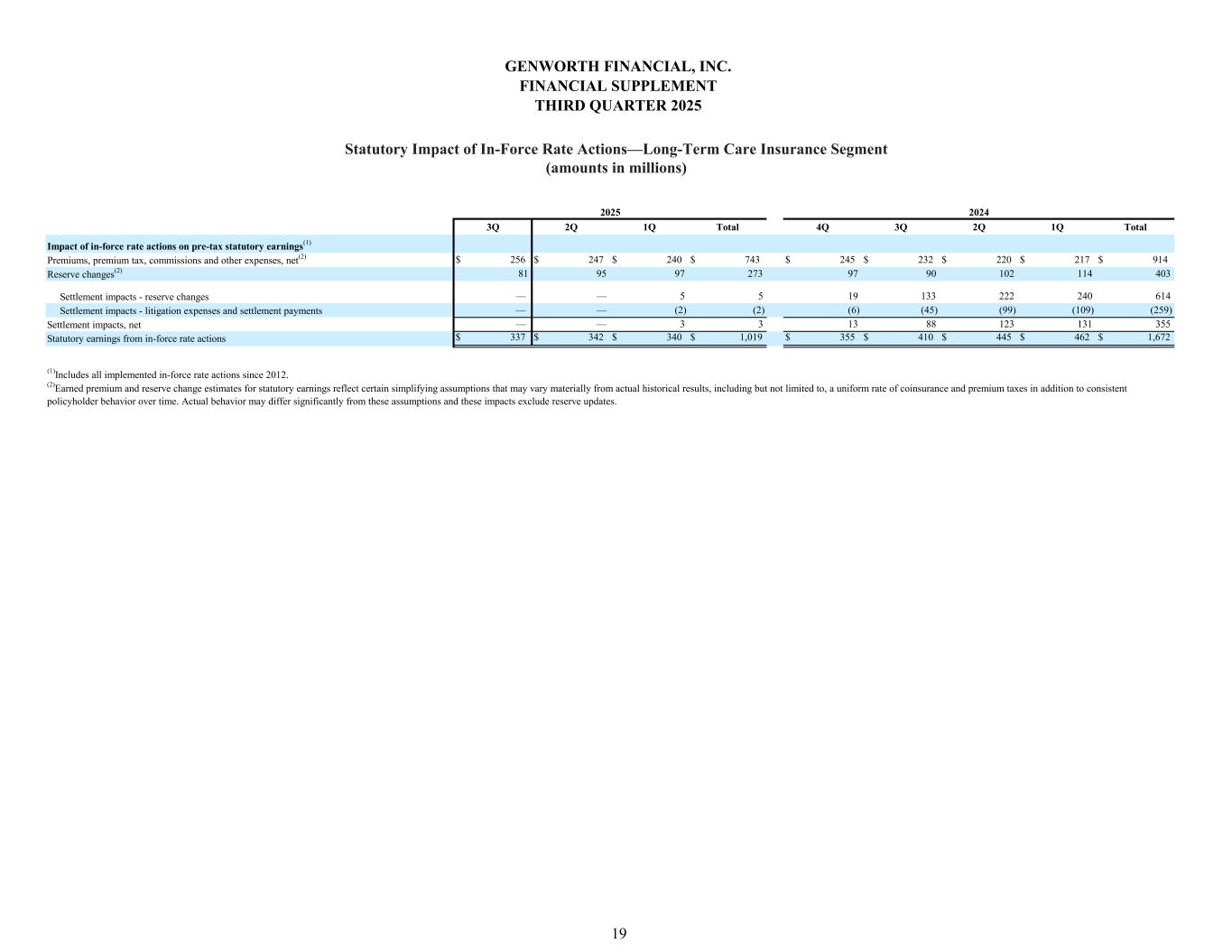

•Continued progress on the LTC MYRAP3 with $44M of gross incremental premium approvals in the quarter; approximately $31.8B estimated net present value achieved since 2012 from IFAs4

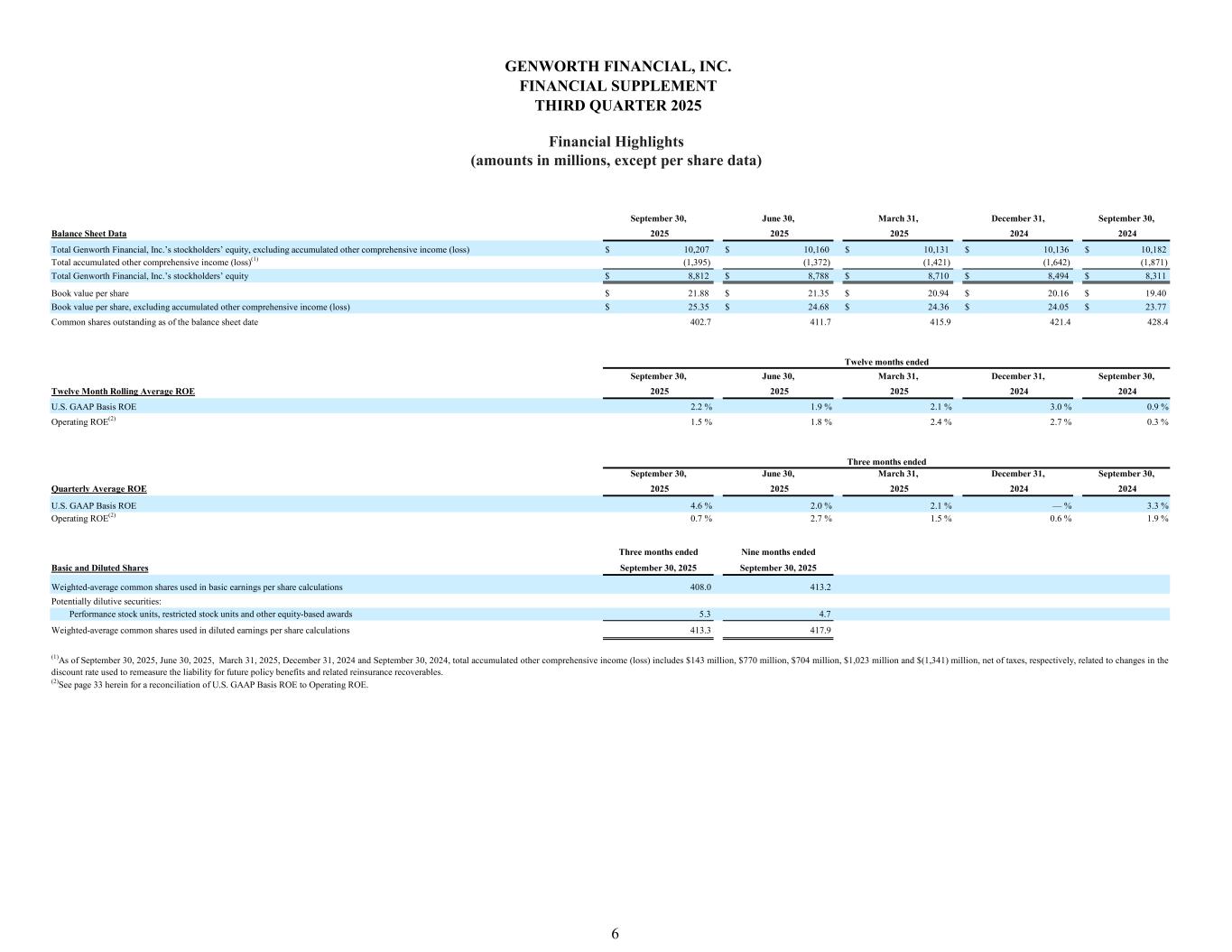

Financial Highlights

•Net income5 of $116M, or $0.28 per diluted share, and adjusted operating income5,6 of $17M, or $0.046 per diluted share

•Enact reported adjusted operating income of $134M5; distributed $110M in capital returns to Genworth

•U.S. life insurance companies’ RBC7 ratio of 303%8, down slightly from the prior quarter

•Genworth holding company cash and liquid assets of $254M9 at quarter-end

Richmond, VA (November 5, 2025) – Genworth Financial, Inc. (NYSE: GNW) today reported results for the quarter ended September 30, 2025.

|

|

|

|

|

|

|

“I’m proud of the significant progress we’ve made advancing Genworth’s strategic priorities,” said Tom McInerney, President & CEO. “We advanced the buildout of our CareScout growth platform with the launch of CareScout’s inaugural stand-alone long term care insurance product and the acquisition of Seniorly, helping more families understand, find and fund quality care. In addition, the Genworth Board authorized a new $350 million share repurchase program, reaffirming our commitment to returning capital to shareholders. Supported by Enact’s strong cash flows, we remain focused on delivering value to our shareholders and to the millions of families we serve.” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

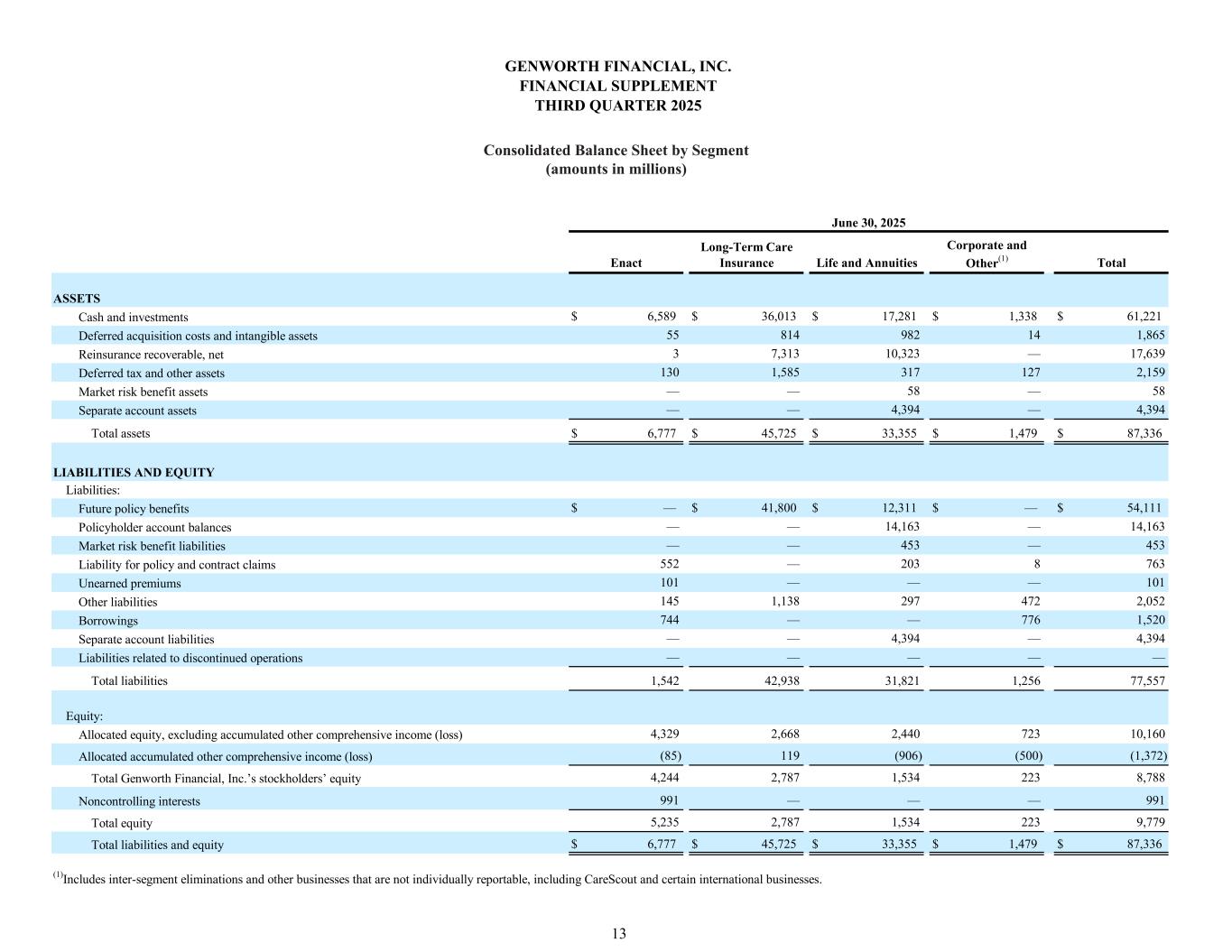

Consolidated Metrics

(Amounts in millions, except per share data)

|

|

Q3 2025 |

|

Q2 2025 |

|

Q3 2024 |

Net income5 |

|

$ |

116 |

|

|

$ |

51 |

|

|

$ |

85 |

|

Net income per diluted share5 |

|

$ |

0.28 |

|

|

$ |

0.12 |

|

|

$ |

0.19 |

|

Adjusted operating income5,6 |

|

$ |

17 |

|

|

$ |

68 |

|

|

$ |

48 |

|

Adjusted operating income per diluted share5,6 |

|

$ |

0.04 |

|

|

$ |

0.16 |

|

|

$ |

0.11 |

|

| Weighted-average diluted shares |

|

413.3 |

|

417.5 |

|

435.8 |

Consolidated GAAP Financial Highlights

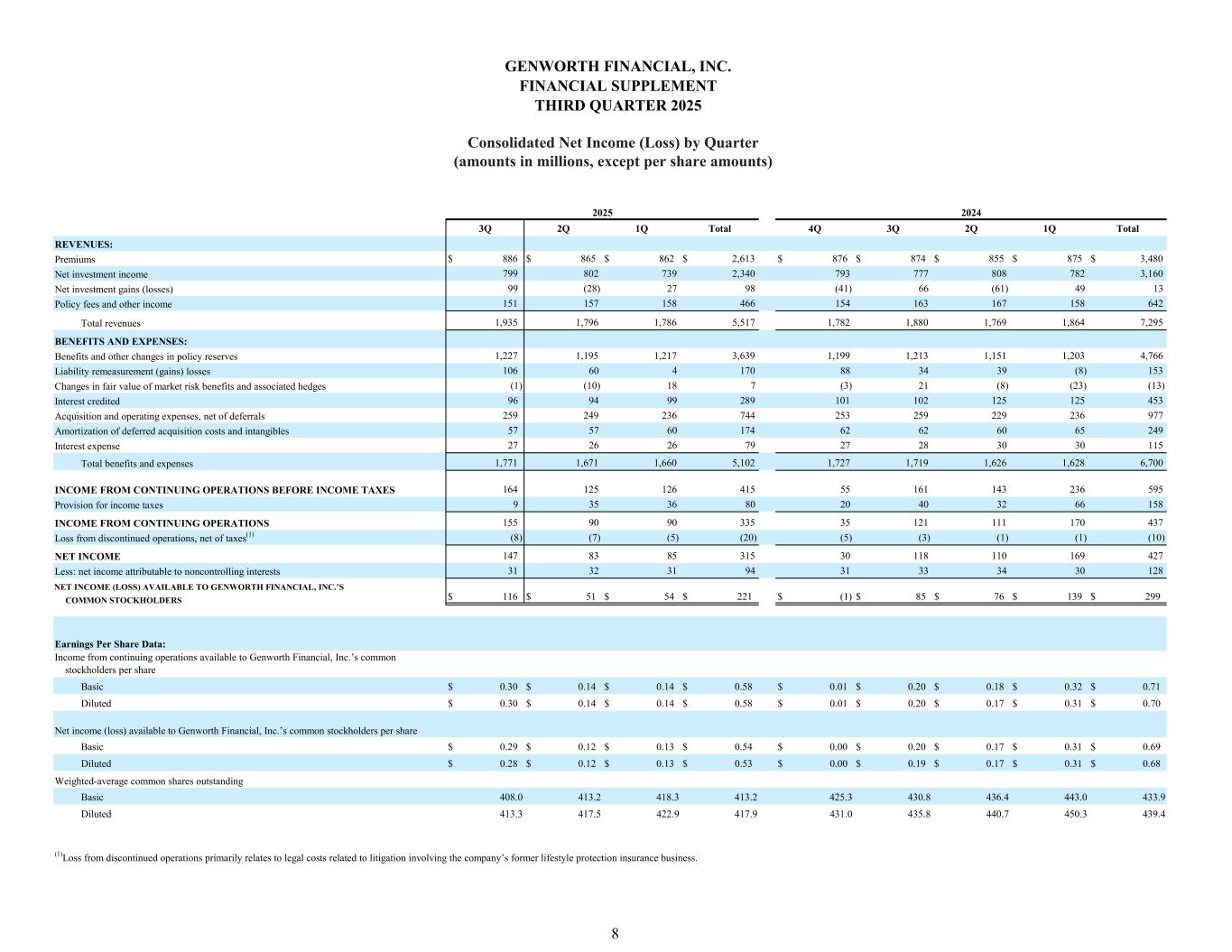

•Net income was driven by Enact, which had strong operating performance

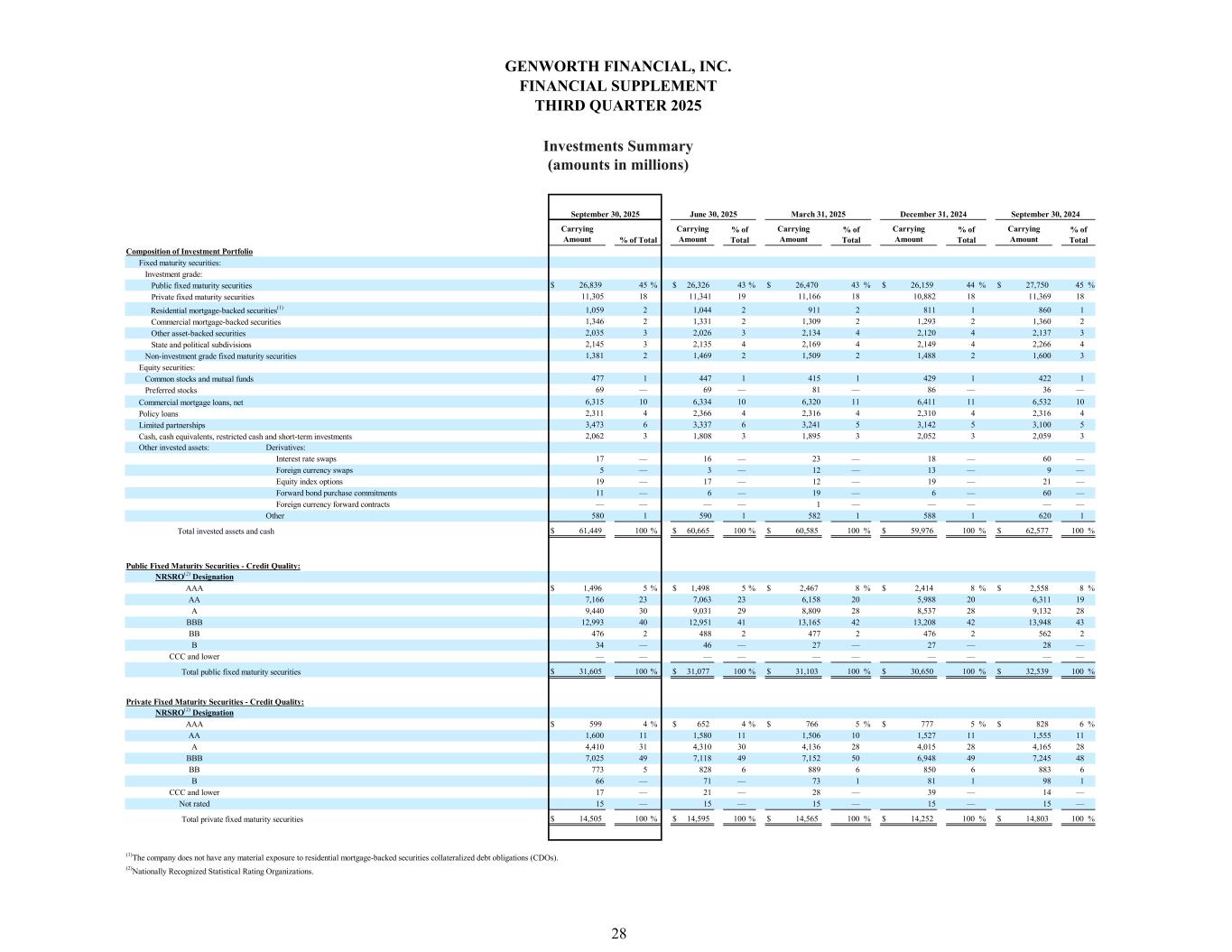

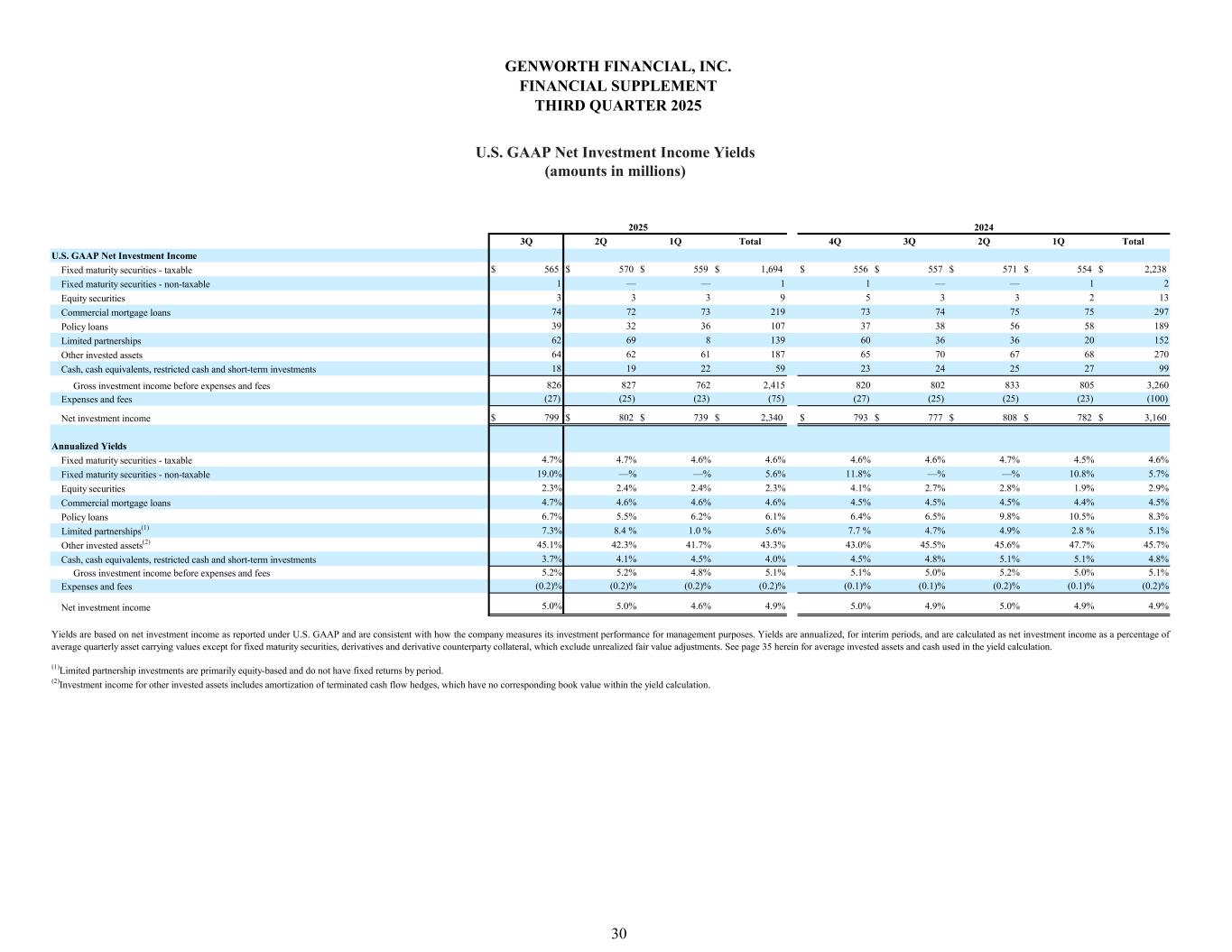

•Net investment income, net of taxes, was $631 million in the quarter, down from $634 million in the prior quarter and up from $614 million in the prior year from higher income from limited partnerships

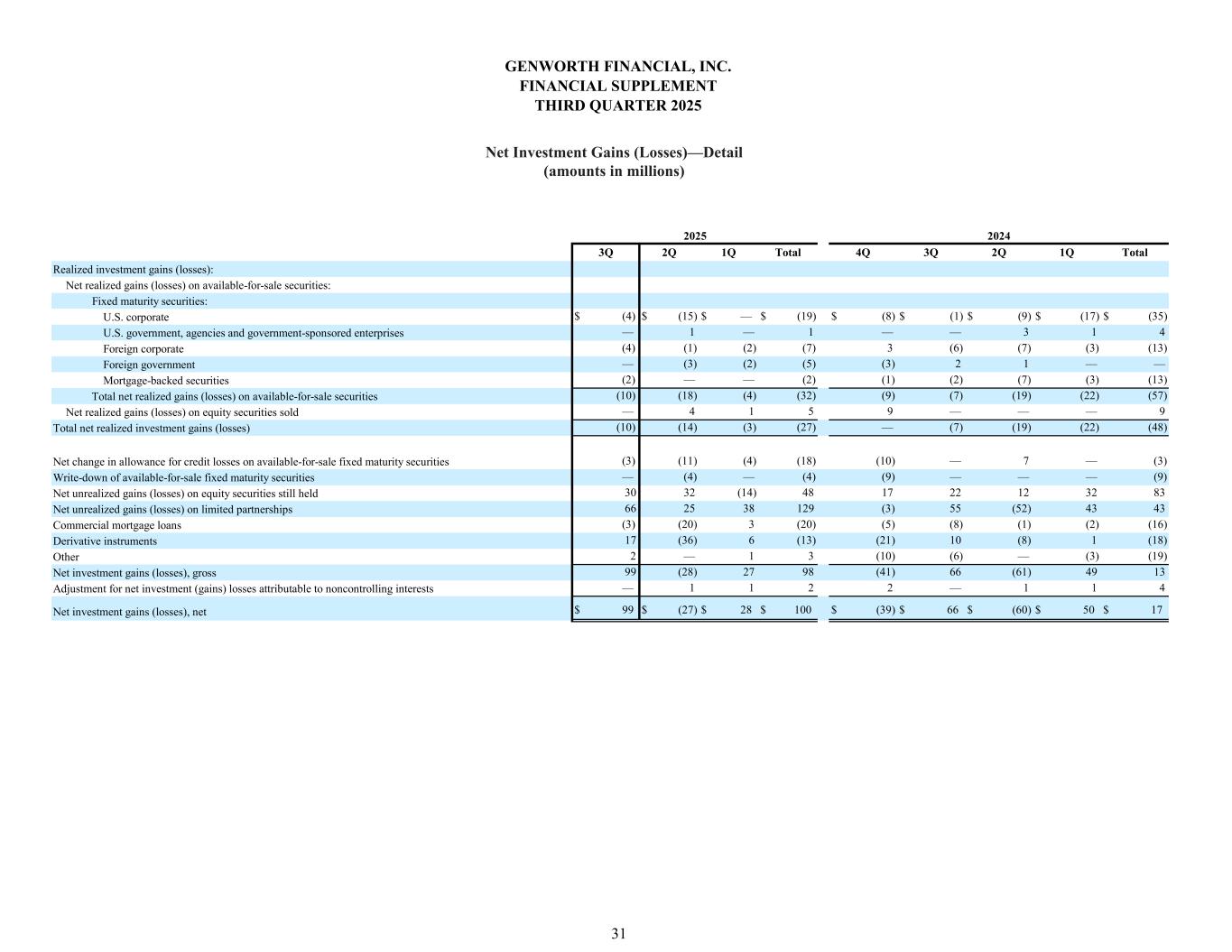

•Net investment gains, net of taxes, increased net income by $78 million in the quarter, compared with net investment losses of $22 million in the prior quarter and net investment gains of $52 million in the prior year. The investment gains in the current quarter were driven primarily by mark-to-market adjustments on limited partnerships and equity securities

•Current quarter net income included a $34 million tax benefit related to a release of a portion of the valuation allowance on certain deferred tax assets

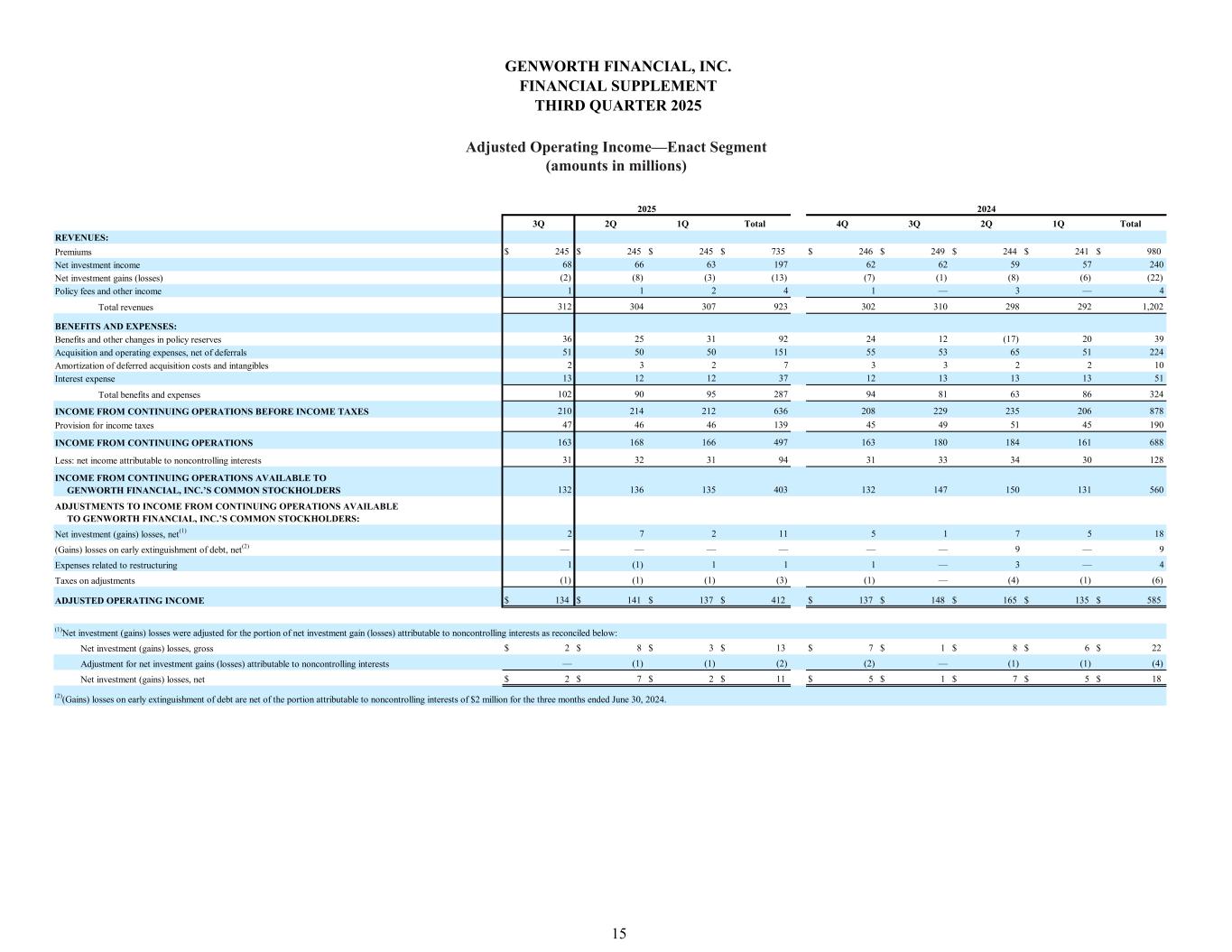

Enact

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Operating Metrics

(Dollar amounts in millions)

|

|

Q3 2025 |

|

Q2 2025 |

|

Q3 2024 |

Adjusted operating income5 |

|

$ |

134 |

|

|

$ |

141 |

|

|

$ |

148 |

|

| Primary new insurance written |

|

$ |

14,048 |

|

|

$ |

13,254 |

|

|

$ |

13,591 |

|

| Loss ratio |

|

15 |

% |

|

10 |

% |

|

5 |

% |

Equity10 |

|

$ |

4,320 |

|

|

$ |

4,244 |

|

|

$ |

4,097 |

|

•Results reflected a pre-tax reserve release of $45 million from favorable cure performance. The prior quarter and prior year included pre-tax reserve releases of $48 million and $65 million, respectively

•Net investment income of $68 million was up from $62 million in the prior year from higher yields and higher invested assets

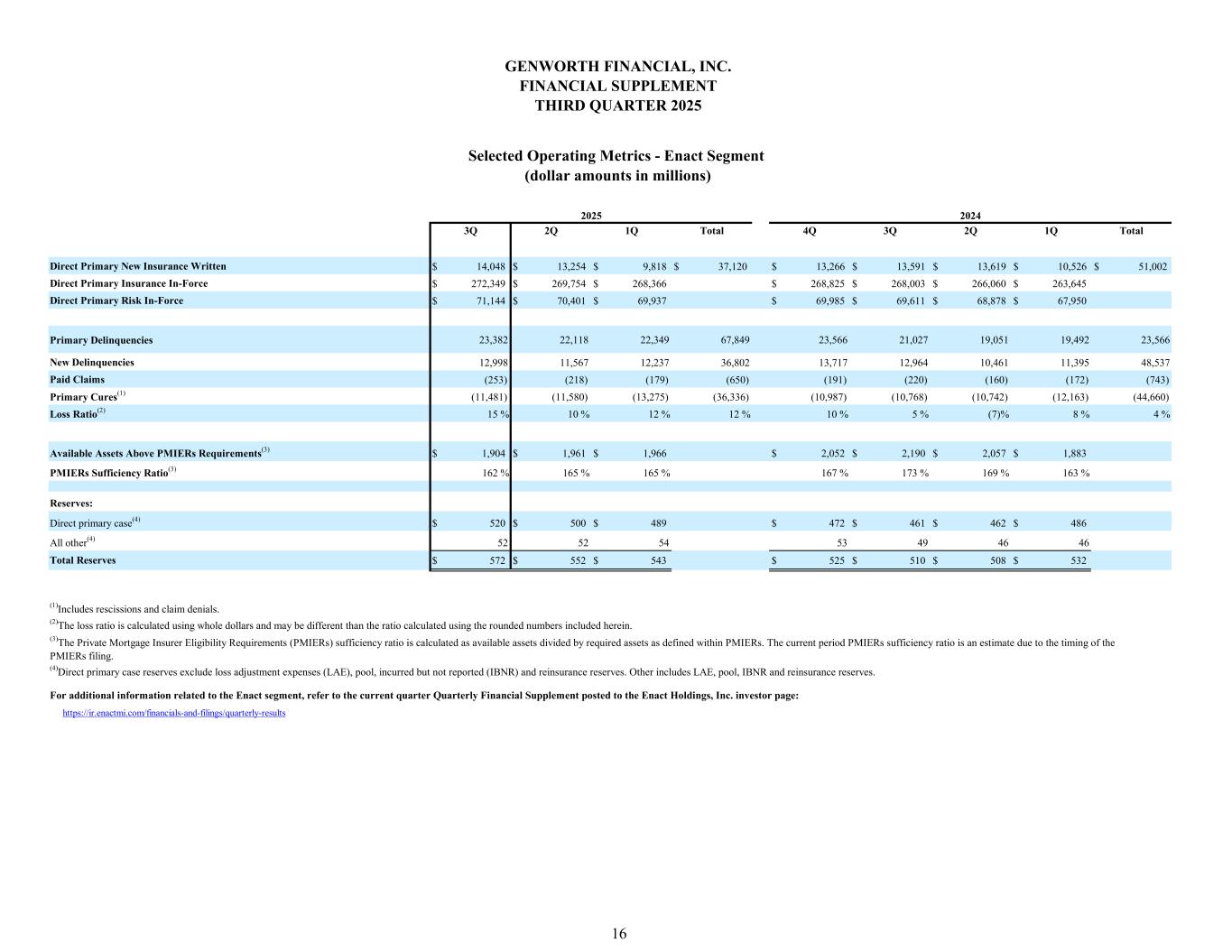

•Primary insurance in-force increased 2% versus the prior year to $272.3 billion driven by new insurance written (NIW) and continued elevated persistency

•Primary NIW was up 6% from the prior quarter primarily from seasonal trends and up 3% from the prior year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital Metric |

|

Q3 2025 |

|

Q2 2025 |

|

Q3 2024 |

PMIERs Sufficiency Ratio8,11 |

|

162 |

% |

|

165 |

% |

|

173 |

% |

•Enact entered into a quota share reinsurance agreement and in October announced an excess of loss reinsurance agreement, both covering the 2027 book year

•Enact closed a new $435 million revolving credit facility

•Enact paid a quarterly dividend of $0.21 per share

•Estimated PMIERs sufficiency ratio of 162%, $1,904 million above requirements

Long-Term Care Insurance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Operating Metrics

(Amounts in millions)

|

|

Q3 2025 |

|

Q2 2025 |

|

Q3 2024 |

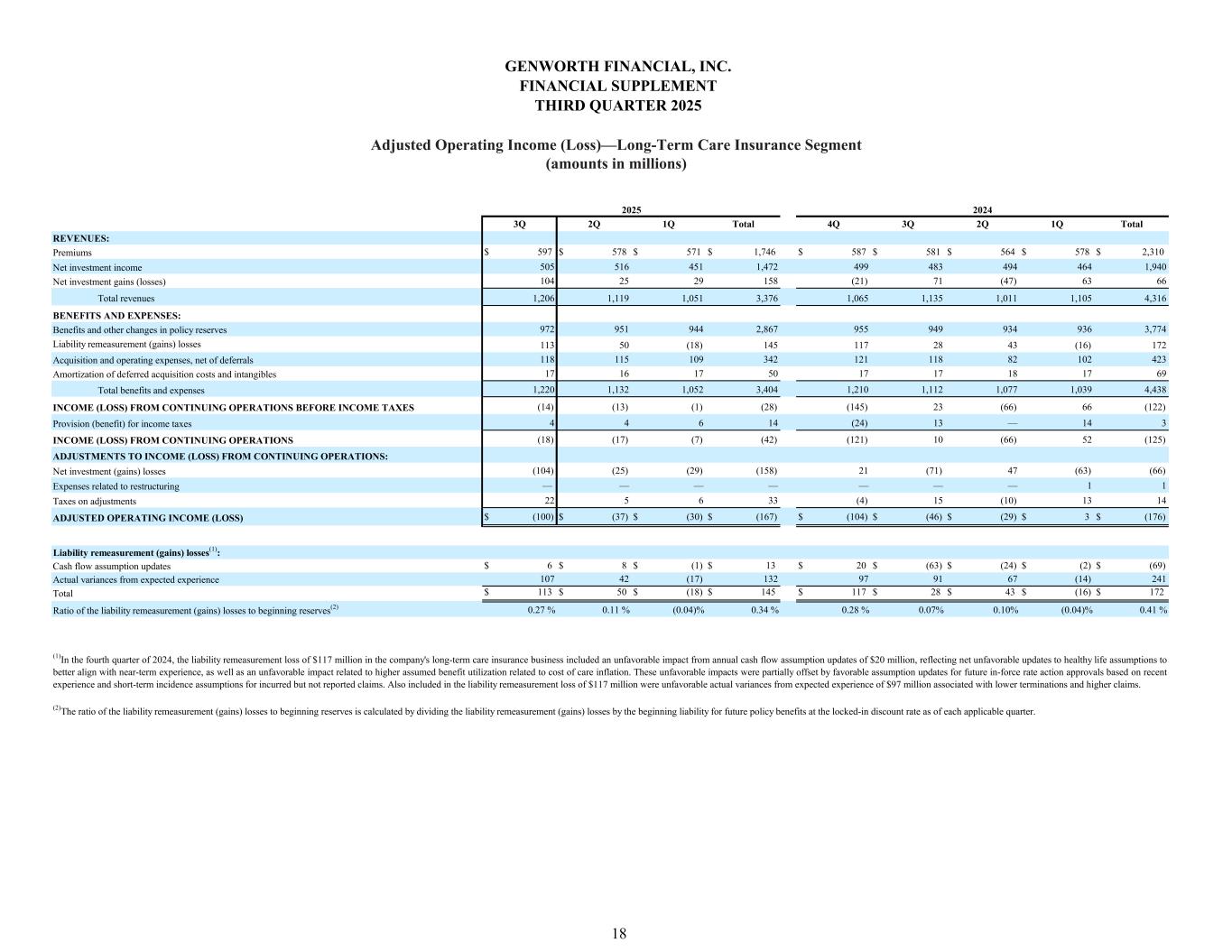

| Adjusted operating loss |

|

$ |

(100) |

|

|

$ |

(37) |

|

|

$ |

(46) |

|

| Premiums |

|

$ |

597 |

|

|

$ |

578 |

|

|

$ |

581 |

|

| Net investment income |

|

$ |

505 |

|

|

$ |

516 |

|

|

$ |

483 |

|

| Liability remeasurement gains (losses) |

|

$ |

(113) |

|

|

$ |

(50) |

|

|

$ |

(28) |

|

| Cash flow assumption updates |

|

(6) |

|

|

(8) |

|

|

63 |

|

| Actual variances from expected experience |

|

(107) |

|

|

(42) |

|

|

(91) |

|

•Premiums increased primarily driven by IFAs, partially offset by policy terminations

•Net investment income increased versus the prior year and decreased versus the prior quarter from limited partnership income

•The liability remeasurement loss in all periods included unfavorable actual variances from expected experience primarily from lower terminations and higher benefit utilization

•Prior quarter liability remeasurement loss also included a $26 million pre-tax gain from a third-party reinsurance recapture of a block of LTC policies previously assumed by Genworth

•Prior year liability remeasurement loss included a favorable cash flow assumption update largely related to higher approval amounts of certain IFAs

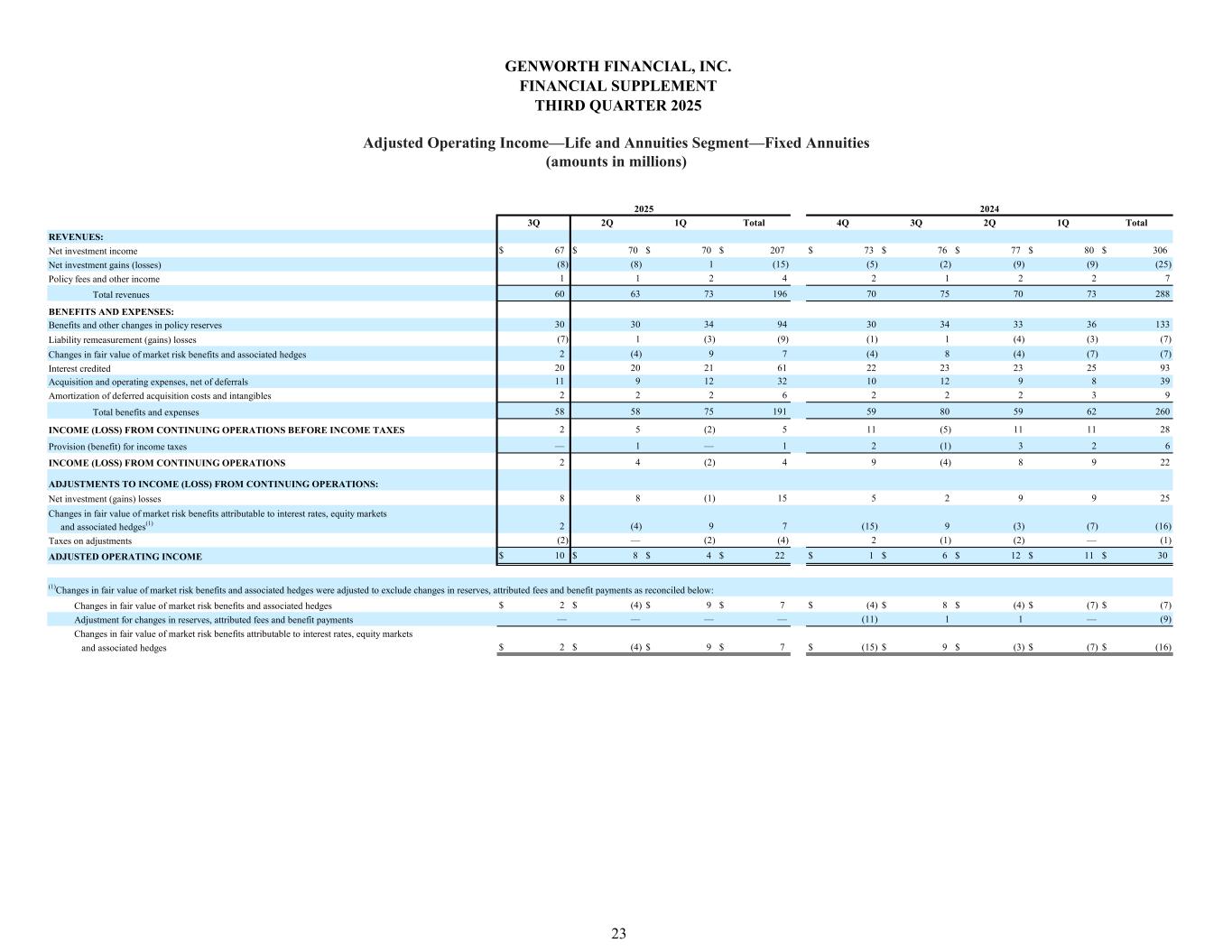

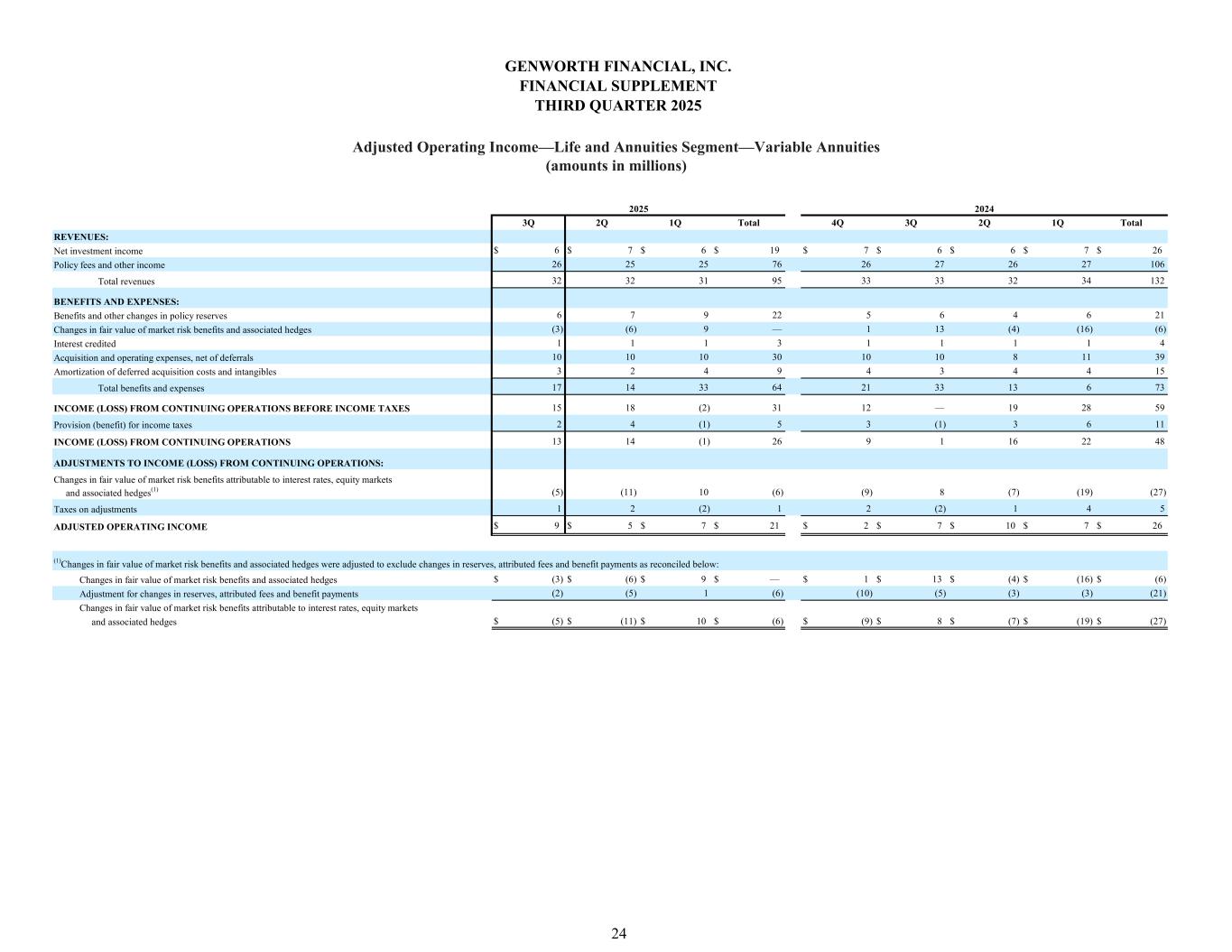

Life and Annuities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Adjusted Operating Income (Loss)

(Amounts in millions)

|

|

Q3 2025 |

|

Q2 2025 |

|

Q3 2024 |

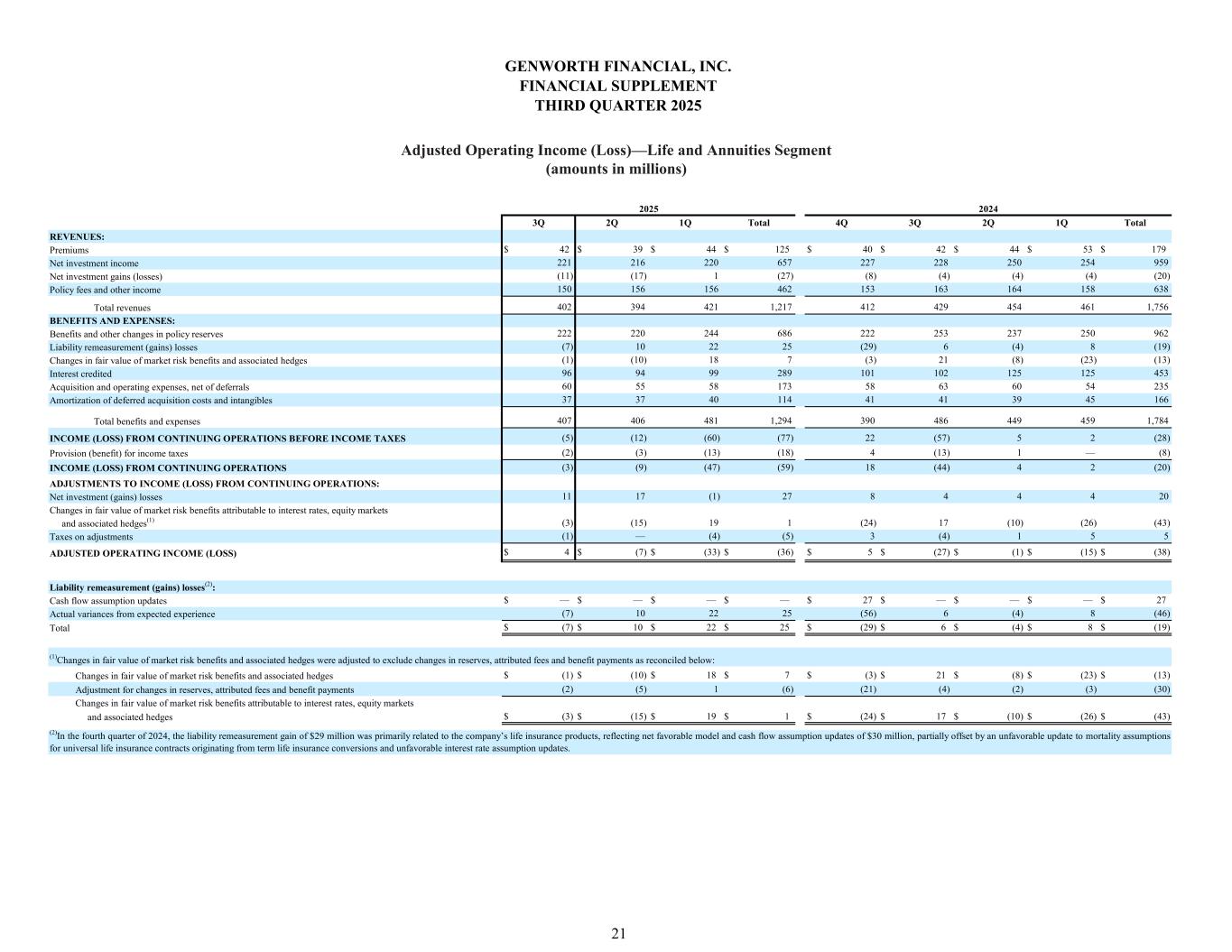

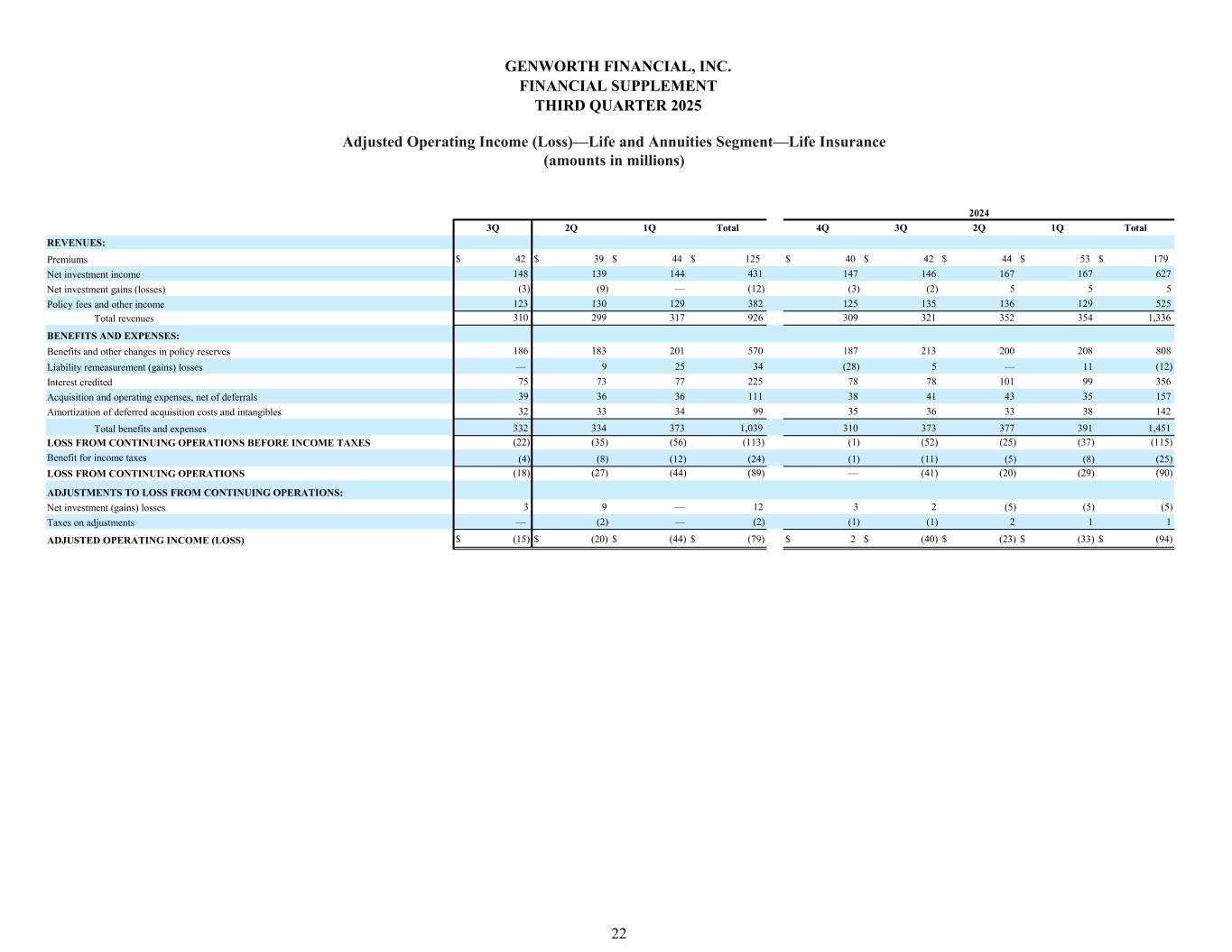

| Life Insurance |

|

$ |

(15) |

|

|

$ |

(20) |

|

|

$ |

(40) |

|

| Annuities |

|

19 |

|

|

13 |

|

|

13 |

|

| Total Life and Annuities |

|

$ |

4 |

|

|

$ |

(7) |

|

|

$ |

(27) |

|

Life Insurance

•Results reflected mortality experience that was favorable versus the prior quarter and prior year

Annuities

•Results included favorable mortality, partially offset by lower spread income from block runoff

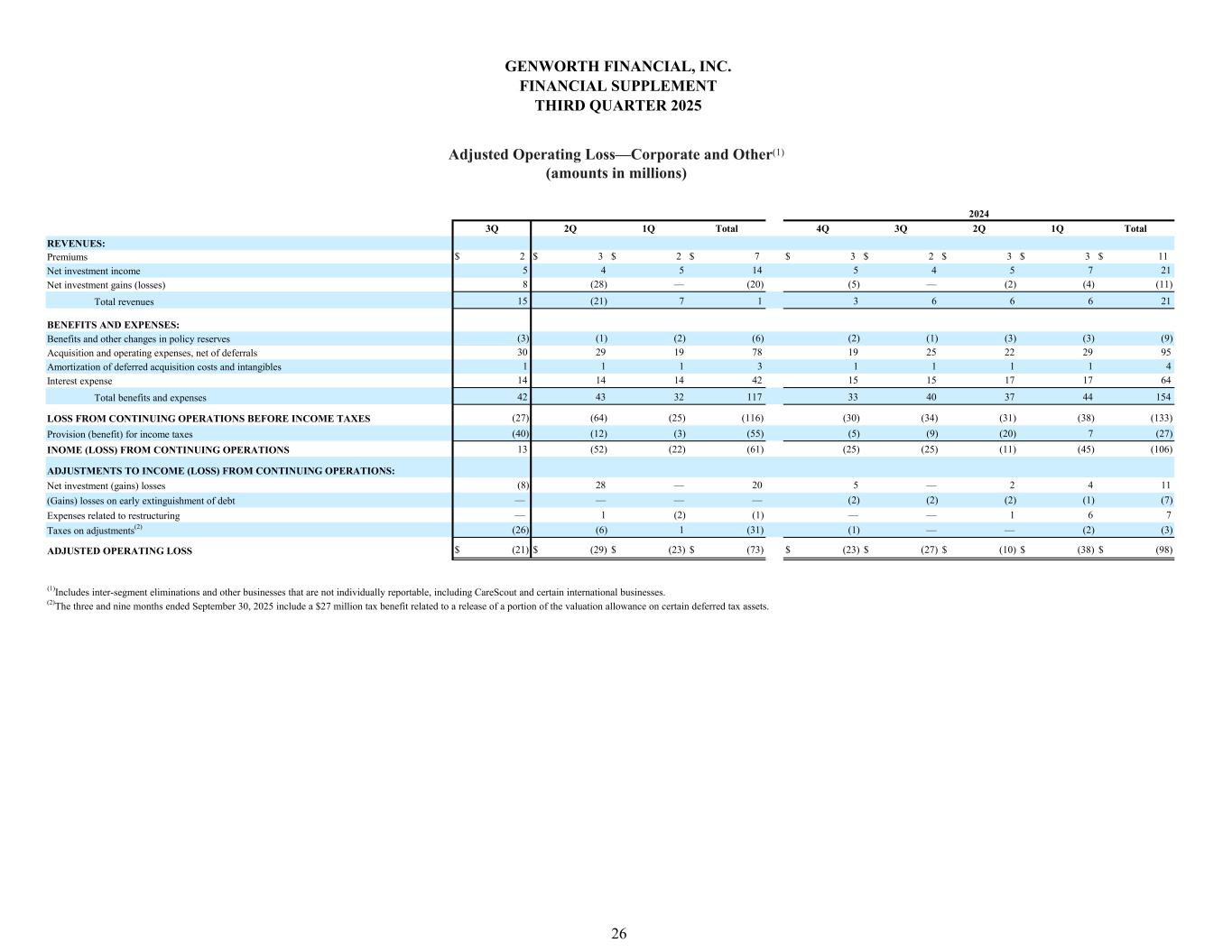

Corporate and Other

•The current quarter adjusted operating loss was $21 million, down from $29 million in the prior quarter and $27 million in the prior year primarily driven by a $7 million tax benefit related to a release of a portion of the valuation allowance on certain deferred tax assets in the current quarter

U.S. Life Insurance Companies12 Statutory Results8 and RBC8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollar amounts in millions) |

|

Q3 2025 |

|

Q2 2025 |

|

Q3 2024 |

Statutory pre-tax income (loss)8,13 |

|

$ |

(12) |

|

|

$ |

81 |

|

|

$ |

(18) |

|

| Long-Term Care Insurance |

|

(75) |

|

|

(26) |

|

|

(9) |

|

| Life Insurance |

|

(2) |

|

|

18 |

|

|

(29) |

|

| Annuities |

|

65 |

|

|

89 |

|

|

20 |

|

GLIC Consolidated RBC Ratio7,8 |

|

303 |

% |

|

304 |

% |

|

317 |

% |

•Statutory pre-tax loss was $12 million in the current quarter

•LTC continued to benefit from premium increases and benefit reductions from IFAs, though lower than the prior year as the Choice II legal settlement is complete, which provided a benefit of $88 million. Results reflected lower income from limited partnerships and higher claims, partially offset by higher claim terminations than the prior quarter. The prior quarter also included a pre-tax gain of $11 million from a third-party reinsurance recapture

•Life insurance results included unfavorable seasonal impacts versus the prior quarter, though improved from the prior year with favorable mortality experience and the net favorable impacts from block runoff

•Annuity results reflected favorable net equity market and interest rate impacts and mortality

•Current quarter estimated GLIC consolidated RBC ratio was 303%, down slightly from the prior quarter driven by the pre-tax loss, mostly offset by unrealized investment gains

Holding Company Cash and Liquid Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in millions) |

|

Q3 2025 |

|

Q2 2025 |

|

Q3 2024 |

Holding Company Cash and Liquid Assets9,14 |

|

$ |

254 |

|

|

$ |

248 |

|

|

$ |

369 |

|

•Cash and liquid assets were $254 million at the end of the current quarter, including approximately $145 million of cash held for future obligations, including advance cash payments from the company’s subsidiaries

•Cash inflows during the current quarter included $110 million from Enact capital returns and $58 million from net intercompany tax payments

•Current quarter cash outflows included $81 million capital investment for CareScout Insurance to support the launch of its inaugural LTC product, $74 million15 in share repurchases and $7 million related to debt servicing costs

Capital Allocation and Shareholder Returns

•Announced new $350 million share repurchase authorization and executed $76 million in share repurchases in the quarter at an average price of $8.44 per share

•Executed $696 million in share repurchases since the program’s inception through September 30, 2025 at an average price of $5.98 per share

About Genworth Financial

Genworth Financial, Inc. (NYSE: GNW) is a publicly traded holding company headquartered in Richmond, Virginia. Through its family of brands—including CareScout, Genworth, and Enact—Genworth uses its more than 150 years of experience to help families navigate the aging journey with clarity and confidence, offering guidance, products, and services that support caregiving decisions, long-term care planning, and the financial challenges of aging. Genworth is the majority owner of Enact Holdings, Inc. (Nasdaq: ACT), a leading U.S. mortgage insurance provider. For more information, visit https://www.genworth.com.

Conference Call Information

Investors are encouraged to read this press release, summary presentation and financial supplement which are now posted on the company’s website, https://investor.genworth.com.

Genworth will conduct a conference call on November 6, 2025 at 10:00 a.m. (ET) to discuss its third quarter results, which will be accessible via:

•Telephone: 800-330-6710 or 213-279-1505 (outside the U.S.); conference ID # 2260685; or

•Webcast: https://investor.genworth.com/news-events/ir-calendar

Allow at least 15 minutes prior to the call time to register for the call. A replay of the webcast will be available on the company’s website for one year.

Prior to Genworth’s conference call, Enact will hold a conference call on November 6, 2025 at 8:00 a.m. (ET) to discuss its third quarter results, which will be accessible via:

•Telephone: Click here to obtain a dial-in number and unique PIN for Enact’s live question and answer session; or

•Webcast: https://ir.enactmi.com/news-and-events/events

Allow at least 15 minutes prior to the call time to register for the call.

Contact Information:

|

|

|

|

|

|

|

|

|

| Investors: |

|

Christine Jewell |

|

|

InvestorInfo@genworth.com |

|

|

|

| Media: |

|

Evans Mandes |

|

|

Evans.Mandes@genworth.com |

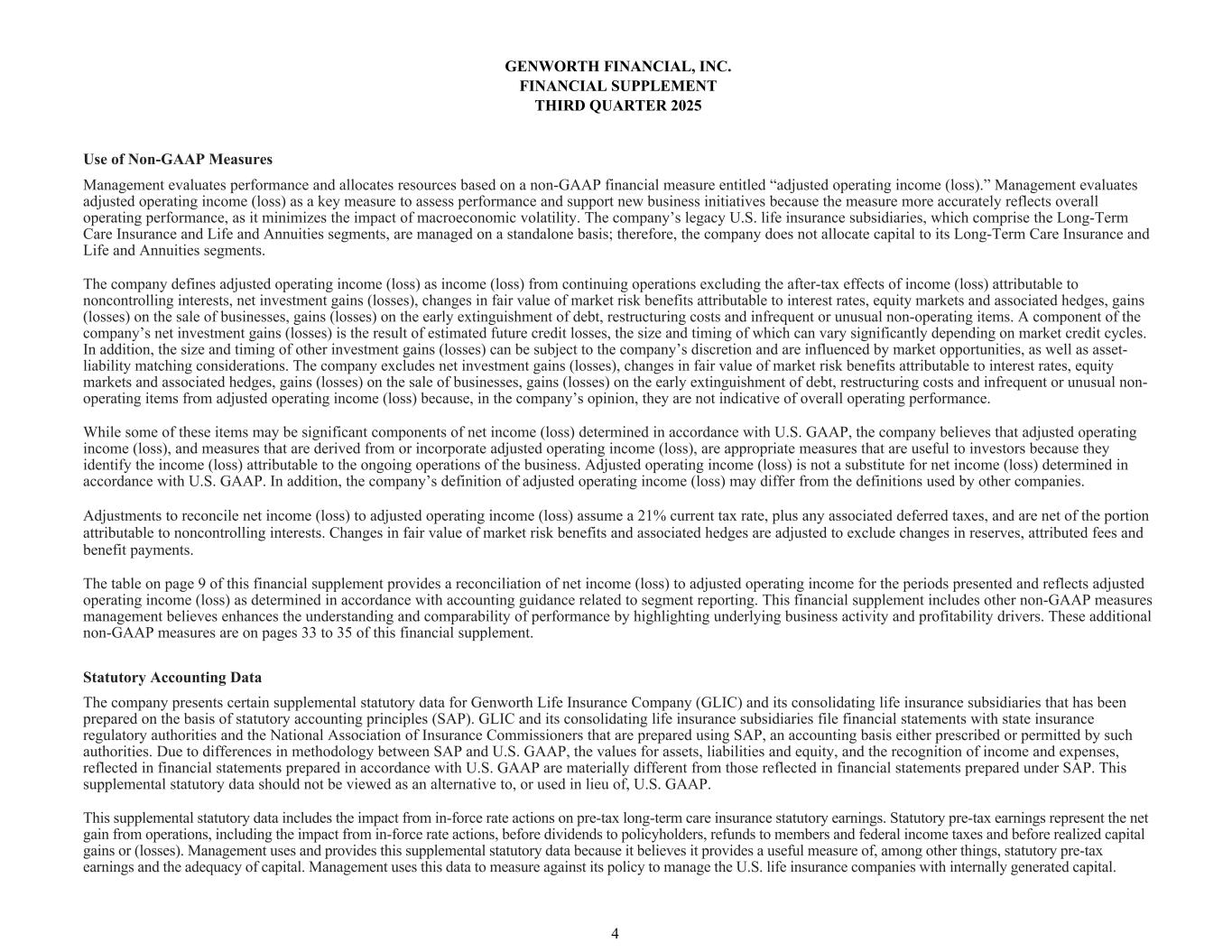

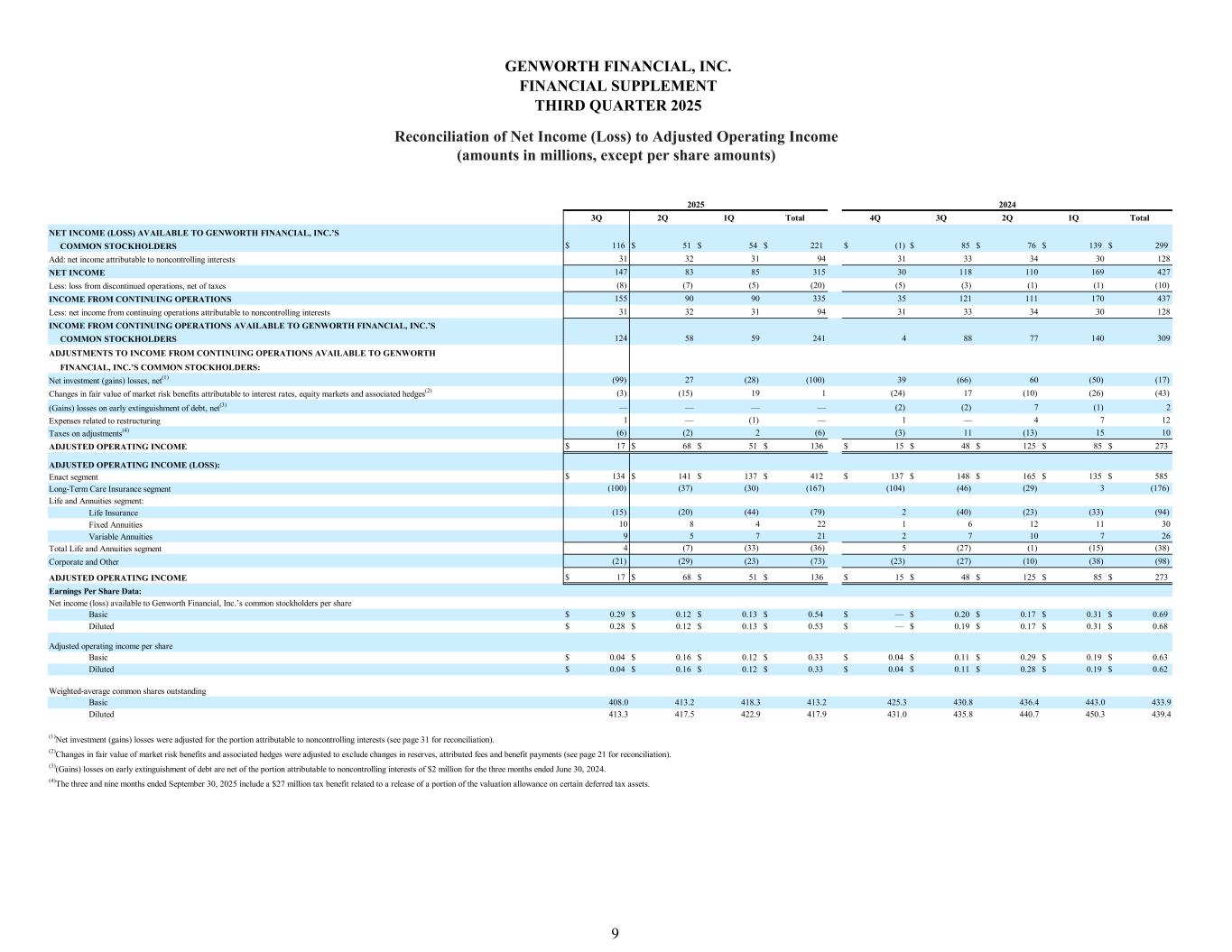

Use of Non-GAAP Measures

Management evaluates performance and allocates resources based on a non-GAAP financial measure entitled “adjusted operating income (loss).” Management evaluates adjusted operating income (loss) as a key measure to assess performance and support new business initiatives because the measure more accurately reflects overall operating performance, as it minimizes the impact of macroeconomic volatility. The company’s legacy U.S. life insurance subsidiaries, which comprise the Long-Term Care Insurance and Life and Annuities segments, are managed on a standalone basis; therefore, the company does not allocate capital to its Long-Term Care Insurance and Life and Annuities segments.

The company defines adjusted operating income (loss) as income (loss) from continuing operations excluding the after-tax effects of income (loss) attributable to noncontrolling interests, net investment gains (losses), changes in fair value of market risk benefits attributable to interest rates, equity markets and associated hedges, gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt, restructuring costs and infrequent or unusual non-operating items. A component of the company’s net investment gains (losses) is the result of estimated future credit losses, the size and timing of which can vary significantly depending on market credit cycles. In addition, the size and timing of other investment gains (losses) can be subject to the company’s discretion and are influenced by market opportunities, as well as asset-liability matching considerations. The company excludes net investment gains (losses), changes in fair value of market risk benefits attributable to interest rates, equity markets and associated hedges, gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt, restructuring costs and infrequent or unusual non-operating items from adjusted operating income (loss) because, in the company’s opinion, they are not indicative of overall operating performance.

While some of these items may be significant components of net income (loss) determined in accordance with GAAP, the company believes that adjusted operating income (loss), and measures that are derived from or incorporate adjusted operating income (loss), are appropriate measures that are useful to investors because they identify the income (loss) attributable to the ongoing operations of the business. Adjusted operating income (loss) is not a substitute for net income (loss) determined in accordance with GAAP. In addition, the company’s definition of adjusted operating income (loss) may differ from the definitions used by other companies.

Adjustments to reconcile net income (loss) to adjusted operating income (loss) assume a 21% current tax rate, plus any associated deferred taxes, and are net of the portion attributable to noncontrolling interests. Changes in fair value of market risk benefits and associated hedges are adjusted to exclude changes in reserves, attributed fees and benefit payments.

The table at the end of this press release provides a reconciliation of net income available to Genworth Financial, Inc.’s common stockholders to adjusted operating income for the three months ended September 30, 2025 and 2024, as well as the three months ended June 30, 2025 and reflect adjusted operating income (loss) as determined in accordance with accounting guidance related to segment reporting.

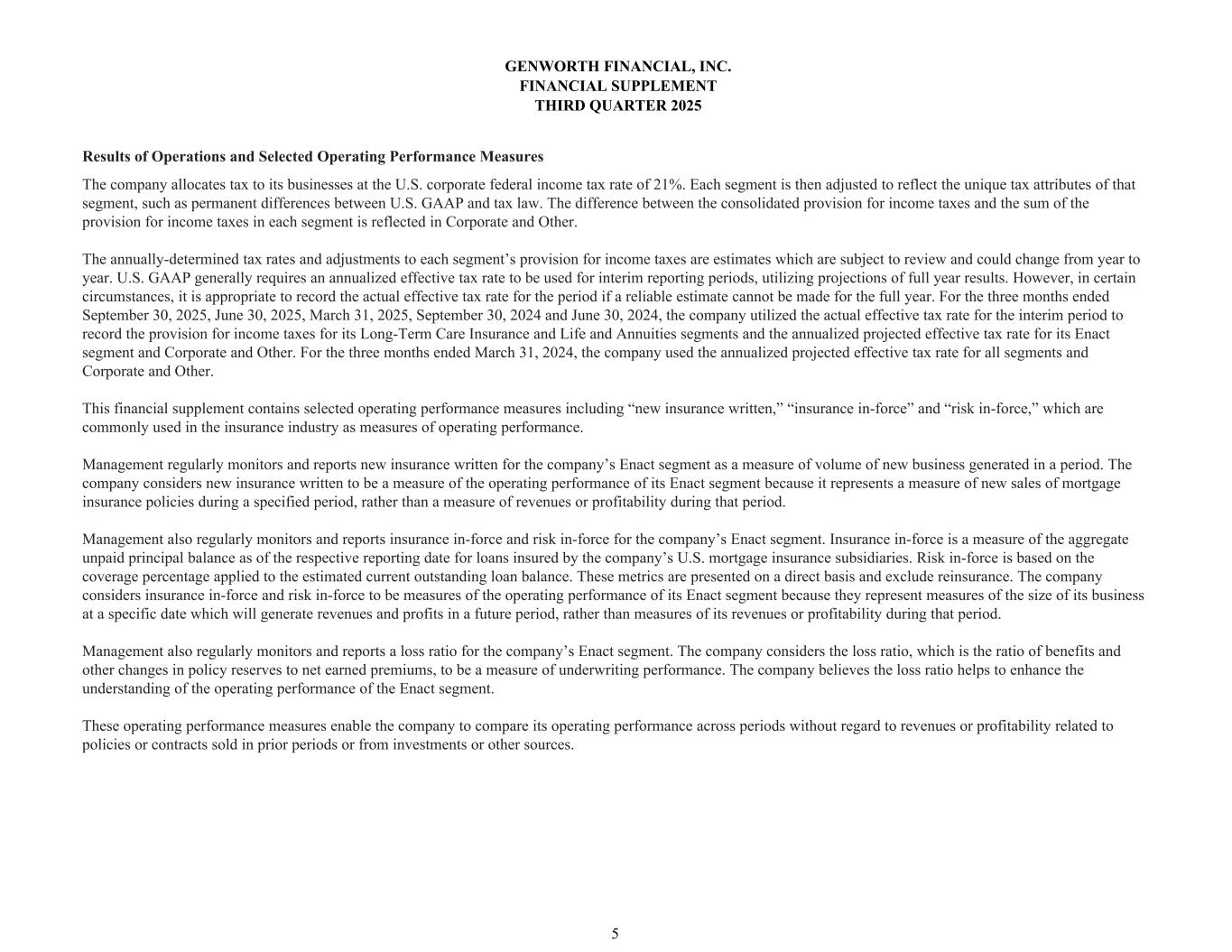

Statutory Accounting Data

The company presents certain supplemental statutory data for GLIC and its consolidating life insurance subsidiaries that has been prepared on the basis of statutory accounting principles (SAP). GLIC and its consolidating life insurance subsidiaries file financial statements with state insurance regulatory authorities and the National Association of Insurance Commissioners that are prepared using SAP, an accounting basis either prescribed or permitted by such authorities. Due to differences in methodology between SAP and GAAP, the values for assets, liabilities and equity, and the recognition of income and expenses, reflected in financial statements prepared in accordance with GAAP are materially different from those reflected in financial statements prepared under SAP. This supplemental statutory data should not be viewed as an alternative to, or used in lieu of, GAAP.

This supplemental statutory data includes the company action level RBC ratio for GLIC and its consolidating life insurance subsidiaries as well as combined statutory pre-tax earnings from the principal U.S. life insurance companies, GLIC, GLAIC and GLICNY. Statutory pre-tax earnings represent the net gain from operations, including the impact from in-force rate actions, before dividends to policyholders, refunds to members and federal income taxes and before realized capital gains or (losses). The combined product level statutory pre-tax earnings are grouped on a consistent basis as those provided on page six of the statutory Annual Statements. Management uses and provides this supplemental statutory data because it believes it provides a useful measure of, among other things, statutory pre-tax earnings and the adequacy of capital. Management uses this data to measure against its policy to manage the U.S. life insurance companies with internally generated capital.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will,” “may” or words of similar meaning and include, but are not limited to, statements regarding the outlook for the company’s future business and financial performance. Examples of forward-looking statements include statements the company makes relating to potential dividends or share repurchases; future return of capital by Enact Holdings, Inc. (Enact Holdings), including share repurchases, and quarterly and special dividends; the cumulative economic benefit of approved and future rate actions included in the company’s long-term care insurance multi-year in-force rate action plan; planned investments in and the company’s outlook for new lines of business or new insurance and other products and services, such as those it is pursuing with its CareScout business (CareScout), including through its CareScout services business (CareScout Services) and its CareScout insurance business (CareScout Insurance); the expected benefits and/or synergies of the Seniorly, Inc. (Seniorly) acquisition; future insurance offerings through CareScout Insurance; future financial performance, including the expectation that quarterly adverse variances between actual and expected experience could persist resulting in future remeasurement losses in the company’s long-term care insurance business; the resolution of the appeal or any potential litigation recovery amounts in connection with the AXA S.A. (AXA) and Santander Cards UK Limited (Santander) litigation, and Genworth’s planned use of proceeds from any recovery in connection with the litigation, including share repurchases, debt repurchases and investments in new businesses; future financial condition and liquidity of the company’s businesses; and statements the company makes regarding the outlook of the U.S. economy.

Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially from those in the forward-looking statements due to global political, economic, inflation, business, competitive, market, regulatory and other factors and risks, including but not limited to, the following:

•the inability to successfully launch new lines of business, including long-term care insurance and other products and services the company is pursuing with CareScout;

•the company’s failure to maintain the self-sustainability of its legacy U.S. life insurance subsidiaries, including as a result of the inability to achieve desired levels of in-force rate actions and/or the timing of future premium rate increases and associated benefit reductions taking longer to achieve than originally assumed; other regulatory actions negatively impacting the company’s life insurance businesses;

•inaccuracies or changes in estimates, assumptions, methodologies, valuations, projections and/or models, which result in inadequate reserves or other adverse results (including as a result of any changes in connection with quarterly, annual or other reviews, including reviews the company expects to complete in the fourth quarter of 2025);

•the impact on holding company liquidity caused by an inability to receive dividends or any other returns of capital from Enact Holdings, and limited sources of capital and financing and the need to seek additional capital on unfavorable terms;

•the impact on any potential recovery in the AXA and Santander litigation resulting from a successful appeal, significant delays or any other adverse development in the litigation;

•adverse changes to the structure or requirements of Federal National Mortgage Association (Fannie Mae), Federal Home Loan Mortgage Corporation (Freddie Mac) or the U.S. mortgage insurance market; an increase in the number of loans insured through federal government mortgage insurance programs, including those offered by the Federal Housing Administration; the inability of Enact Holdings and/or its U.S. mortgage insurance subsidiaries to continue to meet the requirements mandated by PMIERs (or any adverse changes thereto), the inability to meet minimum statutory capital requirements of applicable regulators or the mortgage insurer eligibility requirements of Fannie Mae or Freddie Mac;

•changes in economic, market and political conditions, labor shortages and fluctuating interest rates; unanticipated financial events, which could lead to market-wide liquidity problems and other significant market disruption resulting in losses, defaults or credit rating downgrades of other financial institutions; deterioration in economic conditions, a recession or a decline in home prices, all of which could be driven by many potential factors, including the U.S. government shutdown; an increase in the cost of care impacting the company’s long-term care insurance business; changes in international trade policy, including the potential impact of new or increased tariffs, retaliatory policies or actions from other countries, and trade wars or other events that lead to political and economic instability; changes in government or monetary policies, including U.S. federal tax laws, such as the One Big Beautiful Bill Act that was signed into law on July 4, 2025, tax rates or interest rates; changes within regulatory agencies as a result of the change in the U.S. Administration in January 2025; changes in immigration policy; and fluctuations in international securities markets;

•downgrades in financial strength and credit ratings and potential adverse impacts to liquidity; counterparty credit risks; defaults by counterparties to reinsurance arrangements or derivative instruments; defaults or other events impacting the value of invested assets;

•changes in tax rates or tax laws, or changes in accounting and reporting standards;

•litigation and regulatory investigations or other actions, including commercial and contractual disputes with counterparties;

•the inability to retain, attract and motivate qualified employees or senior management;

•changes in the composition of Enact Holdings’ business or undue concentration by customer or geographic region;

•the impact from deficiencies in the company’s disclosure controls and procedures or internal control over financial reporting;

•the occurrence of natural or man-made disasters, including geopolitical tensions and war (including the Russian invasion of Ukraine, the Israel-Hamas conflict and economic competition between the United States and China), a public health emergency, including pandemics, or climate change;

•the inability to effectively manage information technology systems (including artificial intelligence), cyber incidents or other failures, disruptions or security breaches of the company or its third-party vendors, as well as unknown risks and uncertainties associated with artificial intelligence;

•the inability of third-party vendors to meet their obligations to the company;

•the lack of availability, affordability or adequacy of reinsurance to protect the company against losses;

•a decrease in the volume of high loan-to-value home mortgage originations or an increase in the volume of mortgage insurance cancellations;

•unanticipated claims against Enact Holdings’ delegated underwriting and loss mitigation programs;

•the impact of medical advances such as genetic research and diagnostic imaging, emerging new technology, including artificial intelligence and related legislation; and

•other factors described in the risk factors contained in Item 1A of the company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission on February 28, 2025.

The company provides additional information regarding these risks and uncertainties in its Annual Report on Form 10-K. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Accordingly, for the foregoing reasons, the company cautions the reader against relying on any forward-looking statements. The company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required under applicable securities laws.

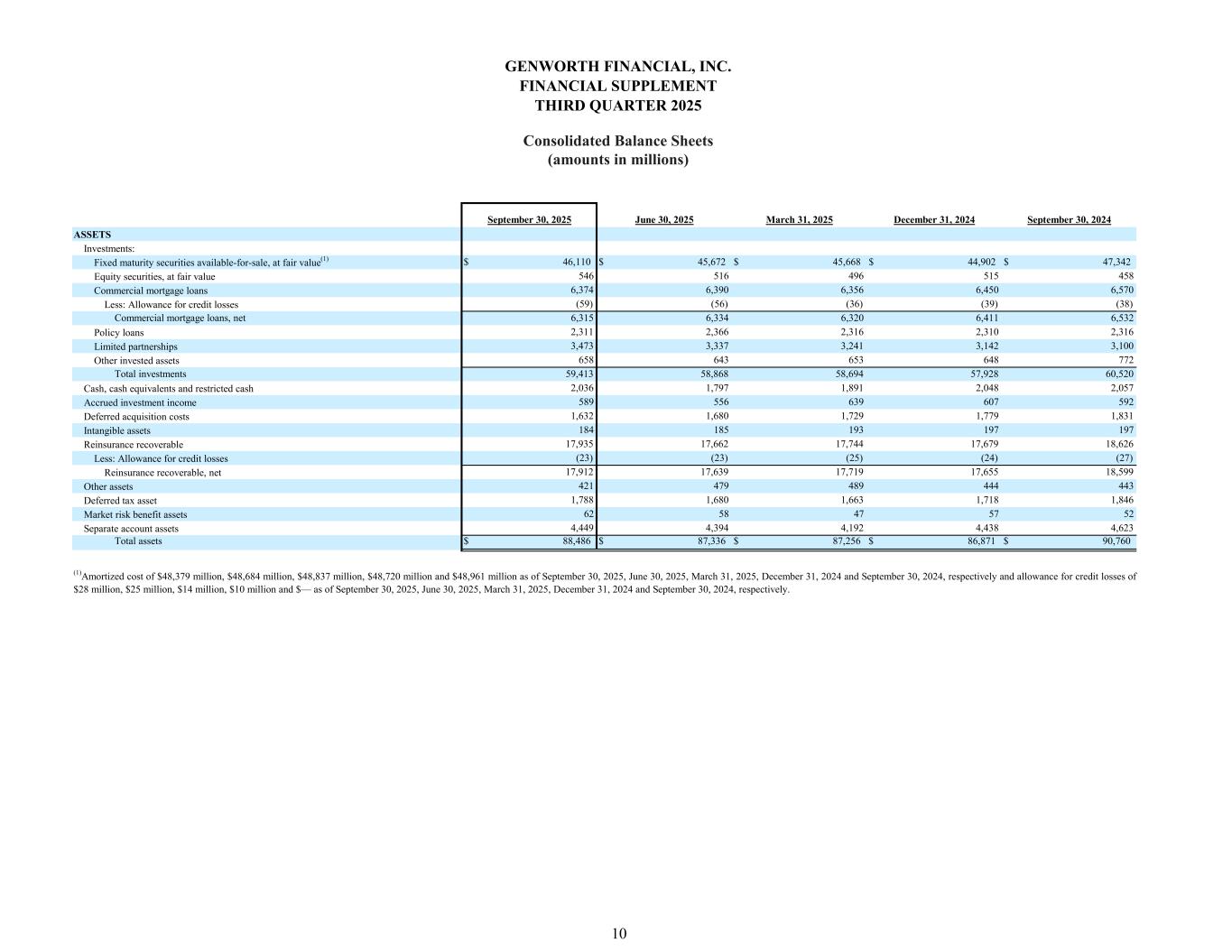

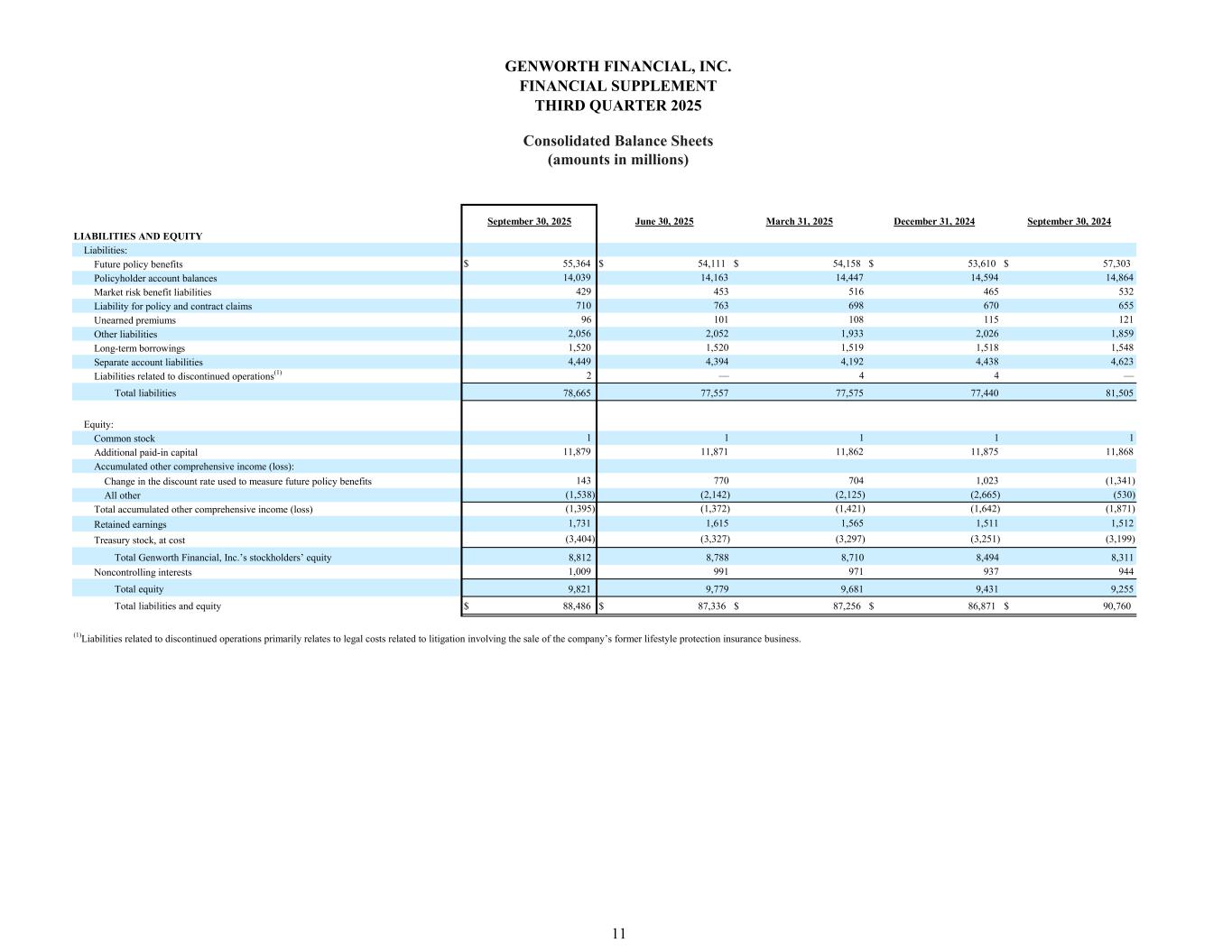

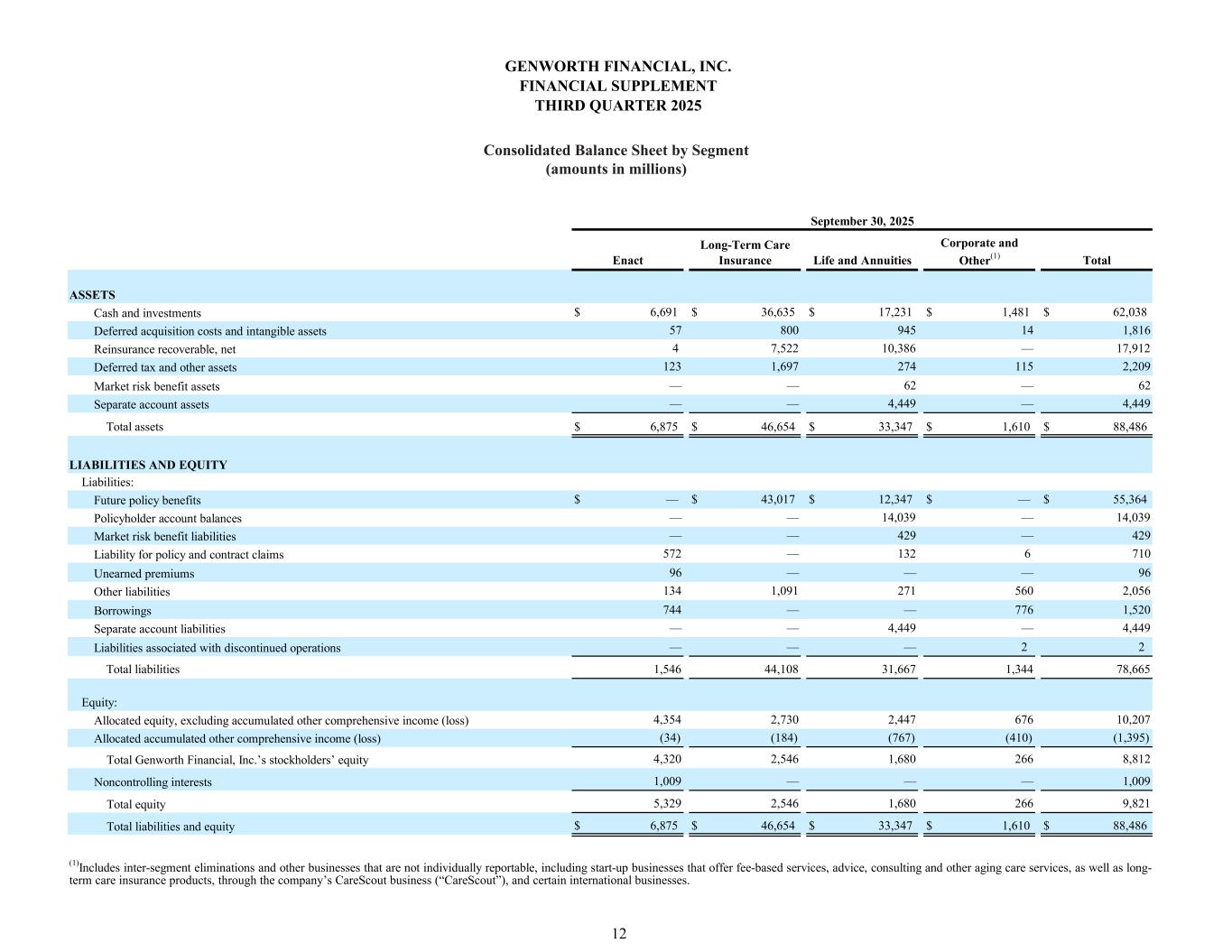

Condensed Consolidated Statements of Income

(Amounts in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

Three months ended June 30, 2025 |

|

2025 |

|

2024 |

|

| Revenues: |

|

|

|

|

|

| Premiums |

$ |

886 |

|

|

$ |

874 |

|

|

$ |

865 |

|

| Net investment income |

799 |

|

|

777 |

|

|

802 |

|

| Net investment gains (losses) |

99 |

|

|

66 |

|

|

(28) |

|

| Policy fees and other income |

151 |

|

|

163 |

|

|

157 |

|

| Total revenues |

1,935 |

|

|

1,880 |

|

|

1,796 |

|

| Benefits and expenses: |

|

|

|

|

|

| Benefits and other changes in policy reserves |

1,227 |

|

|

1,213 |

|

|

1,195 |

|

| Liability remeasurement (gains) losses |

106 |

|

|

34 |

|

|

60 |

|

| Changes in fair value of market risk benefits and associated hedges |

(1) |

|

|

21 |

|

|

(10) |

|

| Interest credited |

96 |

|

|

102 |

|

|

94 |

|

| Acquisition and operating expenses, net of deferrals |

259 |

|

|

259 |

|

|

249 |

|

| Amortization of deferred acquisition costs and intangibles |

57 |

|

|

62 |

|

|

57 |

|

| Interest expense |

27 |

|

|

28 |

|

|

26 |

|

| Total benefits and expenses |

1,771 |

|

|

1,719 |

|

|

1,671 |

|

| Income from continuing operations before income taxes |

164 |

|

|

161 |

|

|

125 |

|

| Provision for income taxes |

9 |

|

|

40 |

|

|

35 |

|

| Income from continuing operations |

155 |

|

|

121 |

|

|

90 |

|

| Loss from discontinued operations, net of taxes |

(8) |

|

|

(3) |

|

|

(7) |

|

| Net income |

147 |

|

|

118 |

|

|

83 |

|

| Less: net income attributable to noncontrolling interests |

31 |

|

|

33 |

|

|

32 |

|

| Net income available to Genworth Financial, Inc.’s common stockholders |

$ |

116 |

|

|

$ |

85 |

|

|

$ |

51 |

|

| Income from continuing operations available to Genworth Financial, Inc.’s common stockholders per share: |

|

|

|

|

|

| Basic |

$ |

0.30 |

|

|

$ |

0.20 |

|

|

$ |

0.14 |

|

| Diluted |

$ |

0.30 |

|

|

$ |

0.20 |

|

|

$ |

0.14 |

|

| Net income available to Genworth Financial, Inc.’s common stockholders per share: |

|

|

|

|

|

| Basic |

$ |

0.29 |

|

|

$ |

0.20 |

|

|

$ |

0.12 |

|

| Diluted |

$ |

0.28 |

|

|

$ |

0.19 |

|

|

$ |

0.12 |

|

| Weighted-average common shares outstanding: |

|

|

|

|

|

| Basic |

408.0 |

|

430.8 |

|

413.2 |

| Diluted |

413.3 |

|

435.8 |

|

417.5 |

Reconciliation of Net Income to Adjusted Operating Income

(Amounts in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

Three months ended June 30, 2025 |

|

2025 |

|

2024 |

|

| Net income available to Genworth Financial, Inc.’s common stockholders |

$ |

116 |

|

|

$ |

85 |

|

|

$ |

51 |

|

| Add: net income attributable to noncontrolling interests |

31 |

|

|

33 |

|

|

32 |

|

| Net income |

147 |

|

|

118 |

|

|

83 |

|

| Less: loss from discontinued operations, net of taxes |

(8) |

|

|

(3) |

|

|

(7) |

|

| Income from continuing operations |

155 |

|

|

121 |

|

|

90 |

|

| Less: net income from continuing operations attributable to noncontrolling interests |

31 |

|

|

33 |

|

|

32 |

|

| Income from continuing operations available to Genworth Financial, Inc.’s common stockholders |

124 |

|

|

88 |

|

|

58 |

|

| Adjustments to income from continuing operations available to Genworth Financial, Inc.’s common stockholders: |

|

|

|

|

|

Net investment (gains) losses, net16 |

(99) |

|

|

(66) |

|

|

27 |

|

Changes in fair value of market risk benefits attributable to interest rates, equity markets and associated hedges17 |

(3) |

|

|

17 |

|

|

(15) |

|

| (Gains) losses on early extinguishment of debt, net |

— |

|

|

(2) |

|

|

— |

|

| Expenses related to restructuring |

1 |

|

|

— |

|

|

— |

|

Taxes on adjustments18 |

(6) |

|

|

11 |

|

|

(2) |

|

| Adjusted operating income |

$ |

17 |

|

|

$ |

48 |

|

|

$ |

68 |

|

| Adjusted operating income (loss): |

|

|

|

|

|

| Enact segment |

$ |

134 |

|

|

$ |

148 |

|

|

$ |

141 |

|

| Long-Term Care Insurance segment |

(100) |

|

|

(46) |

|

|

(37) |

|

| Life and Annuities segment: |

|

|

|

|

|

| Life Insurance |

(15) |

|

|

(40) |

|

|

(20) |

|

| Fixed Annuities |

10 |

|

|

6 |

|

|

8 |

|

| Variable Annuities |

9 |

|

|

7 |

|

|

5 |

|

| Total Life and Annuities segment |

4 |

|

|

(27) |

|

|

(7) |

|

| Corporate and Other |

(21) |

|

|

(27) |

|

|

(29) |

|

| Adjusted operating income |

$ |

17 |

|

|

$ |

48 |

|

|

$ |

68 |

|

| Net income available to Genworth Financial, Inc.’s common stockholders per share: |

|

|

|

|

|

| Basic |

$ |

0.29 |

|

|

$ |

0.20 |

|

|

$ |

0.12 |

|

| Diluted |

$ |

0.28 |

|

|

$ |

0.19 |

|

|

$ |

0.12 |

|

| Adjusted operating income per share: |

|

|

|

|

|

| Basic |

$ |

0.04 |

|

|

$ |

0.11 |

|

|

$ |

0.16 |

|

| Diluted |

$ |

0.04 |

|

|

$ |

0.11 |

|

|

$ |

0.16 |

|

| Weighted-average common shares outstanding: |

|

|

|

|

|

| Basic |

408.0 |

|

430.8 |

|

413.2 |

| Diluted |

413.3 |

|

435.8 |

|

417.5 |

Footnote Definitions

1A match is identified when CareScout validates and approves an invoice from a CareScout Quality Network provider that demonstrates a CareScout member has received services for the first time, and the appropriate discount was applied.

2Long-term care insurance.

3Multi-year rate action plan.

4In-force rate actions.

5All references reflect amounts available to Genworth’s common stockholders.

6This is a financial measure that is not calculated based on U.S. Generally Accepted Accounting Principles (GAAP). See the Use of Non-GAAP Measures section of this press release for additional information.

7Risk-based capital ratio based on company action level for Genworth Life Insurance Company (GLIC) consolidated.

8Company estimate for the third quarter of 2025 due to timing of the preparation and filing of the statutory financial statement(s).

9Includes approximately $145 million, $128 million and $162 million of cash held for future obligations, including advance cash payments from the company’s subsidiaries as of September 30, 2025, June 30, 2025 and September 30, 2024, respectively.

10Reflects Genworth’s ownership of equity including accumulated other comprehensive income (loss) and excluding noncontrolling interests of $1,009 million, $991 million and $944 million as of September 30, 2025, June 30, 2025 and September 30, 2024, respectively.

11The Private Mortgage Insurer Eligibility Requirements (PMIERs) sufficiency ratio is calculated as available assets divided by required assets as defined within PMIERs.

12Genworth’s principal U.S. life insurance companies: GLIC, Genworth Life and Annuity Insurance Company (GLAIC) and Genworth Life Insurance Company of New York (GLICNY).

13Net gain (loss) from operations before dividends to policyholders, refunds to members and federal income taxes for GLIC, GLAIC and GLICNY, and before realized capital gains or (losses).

14Holding company cash and liquid assets comprises assets held in Genworth Holdings, Inc. (the issuer of outstanding public debt) which is a wholly-owned subsidiary of Genworth Financial, Inc.

15Excludes $2 million of share repurchases settled subsequent to the third quarter of 2025.

16Net investment (gains) losses were adjusted for the portion attributable to noncontrolling interests of $1 million for the three months ended June 30, 2025.

17Changes in fair value of market risk benefits and associated hedges were adjusted to exclude changes in reserves, attributed fees and benefit payments of $(2) million and $(4) million for the three months ended September 30, 2025 and 2024, respectively, and $(5) million for the three months ended June 30, 2025.

18The three months ended September 30, 2025 included a $27 million tax benefit related to a release of a portion of the valuation allowance on certain deferred tax assets.