INVESTOR PRESENTATION November 2025

Safe Harbor 2 This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of First Western Financial, Inc.’s (“First Western”) management with respect to, among other things, future events and First Western’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “position,” “project,” “future” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about First Western’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond First Western’s control. Accordingly, First Western cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although First Western believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. The following risks and uncertainties, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: the risk of geographic concentration in Colorado, Arizona, Wyoming, California, and Montana; the risk of changes in the economy affecting real estate values and liquidity; the risk in our ability to continue to originate residential real estate loans and sell such loans; risks specific to commercial loans and borrowers; the risk of claims and litigation pertaining to our fiduciary responsibilities; the risk of changes in interest rates could reduce our net interest margins and net interest income; increased credit risk, including as a result of deterioration in economic conditions, could require us to increase our allowance for credit losses and could have a material adverse effect on our results of operations and financial condition; the risk in our ability to maintain a strong core deposit base or other low-cost funding sources. Additional information regarding these and other risks and uncertainties to which our business and future financial performance are subject is contained in our Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) on March 7, 2025 and other documents we file with the SEC from time to time. All subsequent written and oral forward-looking statements attributable to First Western or persons acting on First Western’s behalf are expressly qualified in their entirety by this paragraph. Forward-looking statements speak only as of the date of this presentation. First Western undertakes no obligation to publicly update or otherwise revise any forward-looking statements, whether as a result of new information, future events or otherwise (except as required by law). Certain of the information contained herein may be derived from information provided by industry sources. The Company believes that such information is accurate and the sources from which it has been obtained are reliable; however, the Company cannot guaranty the accuracy of such information and has not independently verified such information. This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding. Our common stock is not a deposit or savings account. Our common stock is not insured by the Federal Deposit Insurance Corporation or any governmental agency or instrumentality. Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of the Company after the date hereof.

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 3 A Unique Financial Institution in Attractive Markets Overview • Niche-focused regional wealth manager built on a private trust bank platform • Headquartered in Denver, Colorado and positioned in desirable, affluent and high growth markets Target Market • Households of $1+ million liquid net worth • Focus on entrepreneurs and investors brings commercial bank and fee business • High net worth and high growth markets • Unique focus on attractive Rocky Mountain footprint Company Highlights Competitive Advantage (as of 9/30/2025) • Assets: $3.24 billion • Total Loans: $2.61 billion • Total Deposits: $2.85 billion • AUM: $7.43 billion • Operates as one integrated firm, not silos • Team approach benefits both clients and First Western • Local boutique private trust bank offices with central product experts • Named one of 16 U.S. banks with industry leading performance over the last decade

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 4 Investment Highlights Successful Execution on Growth Strategies Attractive Markets and Business Model Strong Earnings Momentum • Significant revenue growth driving improved operating leverage and higher profitability since pre-IPO • TBV/share(1) increased ~158% since the IPO • Continued scale expected to drive further leverage and generate returns consistent with a high performing institution over long term • Chairman and CEO has previously built and sold three banks for substantial gains for shareholders • COO has been instrumental in building the MYFW franchise over 18 years at the institution • Highly aligned with shareholder interests as insiders own ~15.5% of total shares outstanding(2) • Discounted valuation trading at 0.98x TBV/share(3) Proven Management Team, High Insider Ownership, and Discounted Valuation • Track record of combining organic growth and market expansion with accretive acquisitions to enhance franchise value • Total assets up 210% since the IPO with substantial increases in revenue and EPS • Strengthening commercial banking platform creating more diverse loan portfolio and lower-cost deposit base • Growing institution operating in high growth markets • Attractive, stable deposit base with noninterest-bearing and money market accounts comprising 83% of total deposits as of 9/30/2025 • Conservative underwriting and affluent client base results in minimal credit losses • Client relationships deepen over time with banking, planning, trust and investment services (1) See Non-GAAP reconciliation within the appendix. (2) Represents beneficial ownership as defined within the April 2025 Proxy Statement. (3) As of October 31, 2025.

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 5 Strong Operational and Financial Momentum • Robust organic balance sheet growth • Accretive acquisitions • Market expansion • Highly leverageable operating platform driving improved efficiencies • Minimal credit losses Drivers of Improved Performance (1) See Non-GAAP reconciliation within the appendix. TBV/Share(1) Up ~172% Since December 2017 (TCE $ in thousands)

Franchise Overview 6

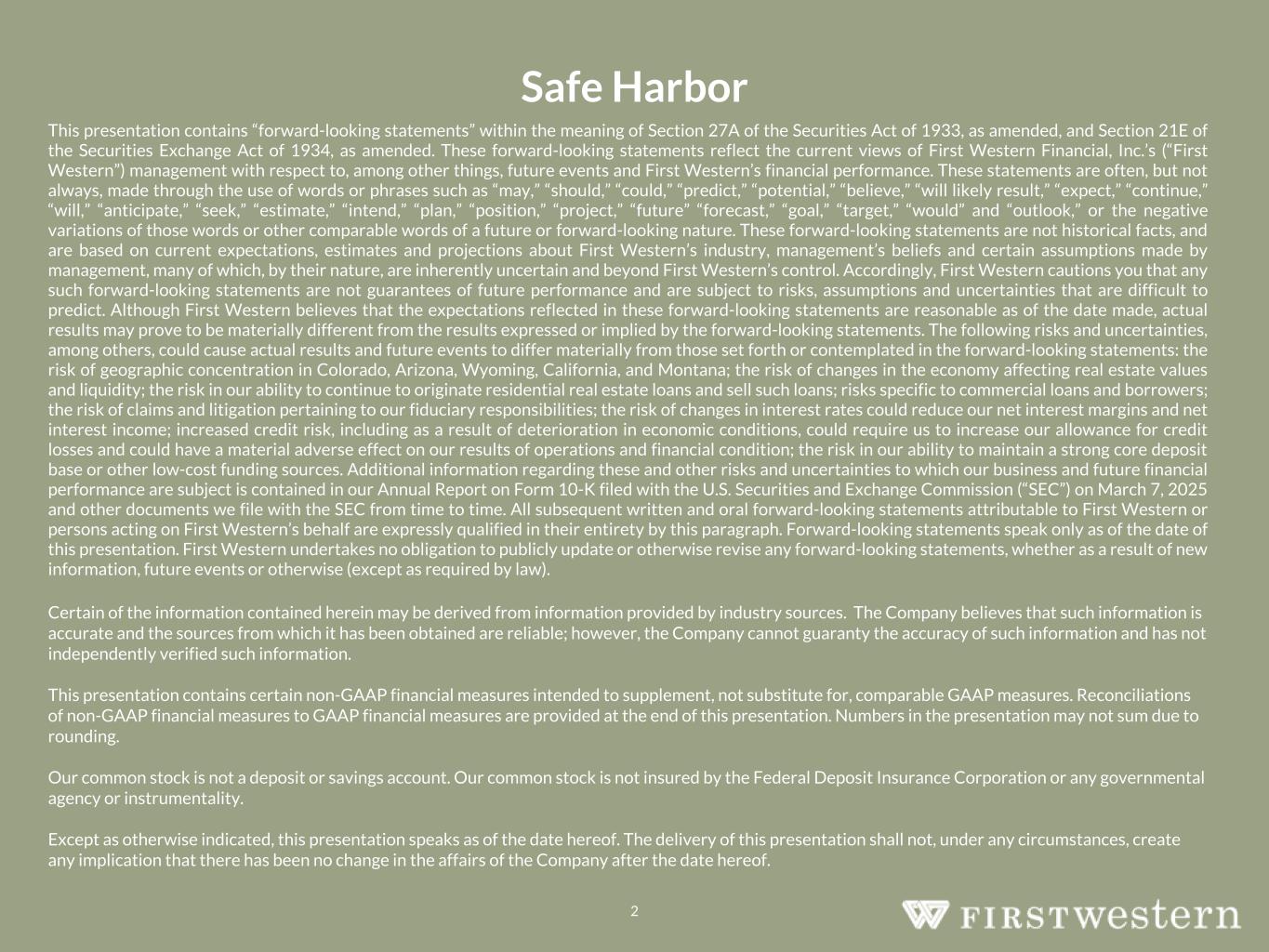

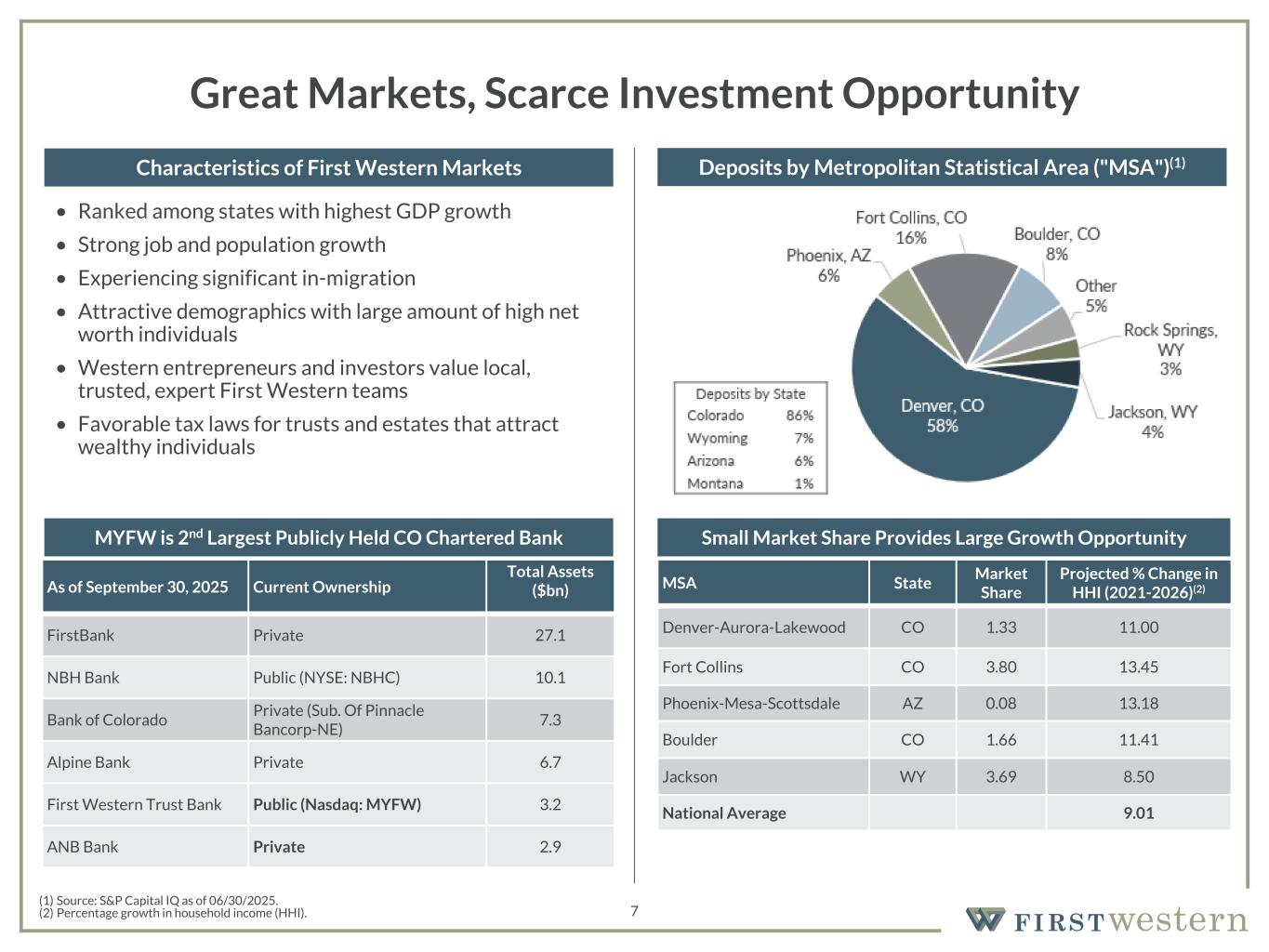

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 7 Great Markets, Scarce Investment Opportunity • Ranked among states with highest GDP growth • Strong job and population growth • Experiencing significant in-migration • Attractive demographics with large amount of high net worth individuals • Western entrepreneurs and investors value local, trusted, expert First Western teams • Favorable tax laws for trusts and estates that attract wealthy individuals MSA State Market Share Projected % Change in HHI (2021-2026)(2) Denver-Aurora-Lakewood CO 1.33 11.00 Fort Collins CO 3.80 13.45 Phoenix-Mesa-Scottsdale AZ 0.08 13.18 Boulder CO 1.66 11.41 Jackson WY 3.69 8.50 National Average 9.01 (1) Source: S&P Capital IQ as of 06/30/2025. (2) Percentage growth in household income (HHI). Characteristics of First Western Markets Deposits by Metropolitan Statistical Area ("MSA")(1) Small Market Share Provides Large Growth Opportunity As of September 30, 2025 Current Ownership Total Assets ($bn) FirstBank Private 27.1 NBH Bank Public (NYSE: NBHC) 10.1 Bank of Colorado Private (Sub. Of Pinnacle Bancorp-NE) 7.3 Alpine Bank Private 6.7 First Western Trust Bank Public (Nasdaq: MYFW) 3.2 ANB Bank Private 2.9 MYFW is 2nd Largest Publicly Held CO Chartered Bank

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 8 Success in Expansion and Acquisition Growth 2006 – 2010 (3) • Boulder, CO • Century City, CA • Scottsdale, AZ 2011 – 2015 (6) • Aspen, CO • DTC/Cherry Hills, CO • Fort Collins, CO • Jackson Hole, WY • Laramie, WY(4) • Phoenix, AZ 2016 – 2020 (4) • Broomfield, CO (2021) • Greenwood Village, CO • Lone Tree, CO(2) • Vail Valley, CO 2002 – 2005 (3) • Cherry Creek, CO • Denver, CO • Northern Colorado, CO 2002 – 2005 (5) • Westcor Insurance Group, Inc. • Poudre River Valley Trust Co. • Sprout & Associates, Inc. • Sterling Partners • Silversmith Financial Corp 2006 – 2010 (4) • Reber/Russell Company • Ryder, Stilwell Inc. • Asset Purchase – Financial Management Advisors, LLC • Asset Purchase – GKM Advisors, LLC 2011 – 2015 (1) • Trust Department Assets – First National Bank of Wyoming 2016 – 2020 (2) • Asset Purchase – EMC Holdings, Inc. • Branch Purchase & Assumption from Simmons Bank O ff ic e O p en in gs A cq u is it io n s 2002 2025 3 5 6 9 12 10 16 12 # #Total Acquisitions Total Offices 19 13 2021 - 2022 (1) • Teton Financial Services, Inc. 2021 - 2024 (7) • Jackson Hole, WY(1) • Pinedale, WY(1) • Rock Springs, WY(1) • Bozeman, MT(5) • Phoenix, AZ(3) • Cheyenne, WY(6) • Loveland, CO(6) (1) Added through the Teton Financial Services, Inc. acquisition. Jackson Hole offices were consolidated in 2Q22. (2) Lone Tree office closed in 2Q22. (3) Phoenix loan production office closed in 1Q25. (4) Laramie trust office closed 1Q23. (5) Bozeman office expanded from a loan production office to a full-service office in 3Q23. (6) Cheyenne and Loveland loan production offices opened in 3Q24.

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 9 Revenue Growth Strategies Expand commercial loan production platform • Upgraded C&I product and service capabilities • Building expertise in specific vertical markets • Capitalize on growing reputation to attract additional experienced commercial banking talent Expand into new markets with attractive demographics • Add infill and adjacent market locations • Built team and revenue base to open office in Broomfield, CO in 2021 • Full-service Bozeman, MT office opened in 2023 Execute on revenue initiatives in existing markets • Differentiate with local, expert, trusted teams • Cross-sell MYFW’s larger offering of planning, insurance, retirement, insurance, and investment products • Continue adding banking and B2B talent to further accelerate market share gains Execute on low- risk strategic transactions that add value to the MYFW franchise • Execute on minimally dilutive acquisitions • Leverage infrastructure through branch acquisition transactions • Proactive expansion, acquisition team

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 10 Representative M&A Transactions Branch Purchase and Assumption Whole Bank Acquisition • Closed on May 18, 2020 • Acquisition of all of the Denver locations of Simmons Bank (three branches and one loan production office) • Assumed $63 million in deposits and $120 million in loans related to the acquired locations • Added scale, an attractive client base, and commercial banking talent Transaction Overview Financial Impact • Mid-teens earnings accretion in 2021 Transaction Overview • Closed on December 31, 2021 • Acquisition of Teton Financial Services Inc., the holding company for Rocky Mountain Bank • Expanded First Western’s footprint and market share in Wyoming where favorable trust, estate and tax laws align well with private banking and investment management business model • Added $379 million in deposits and $252 million in loans • Added scale and improved operating efficiencies Financial Impact • High single-digit earnings accretion in 2022 • Immediately accretive to TBV/share upon closing • Added low-cost deposits and higher-yielding loans that positively impacted net interest margin

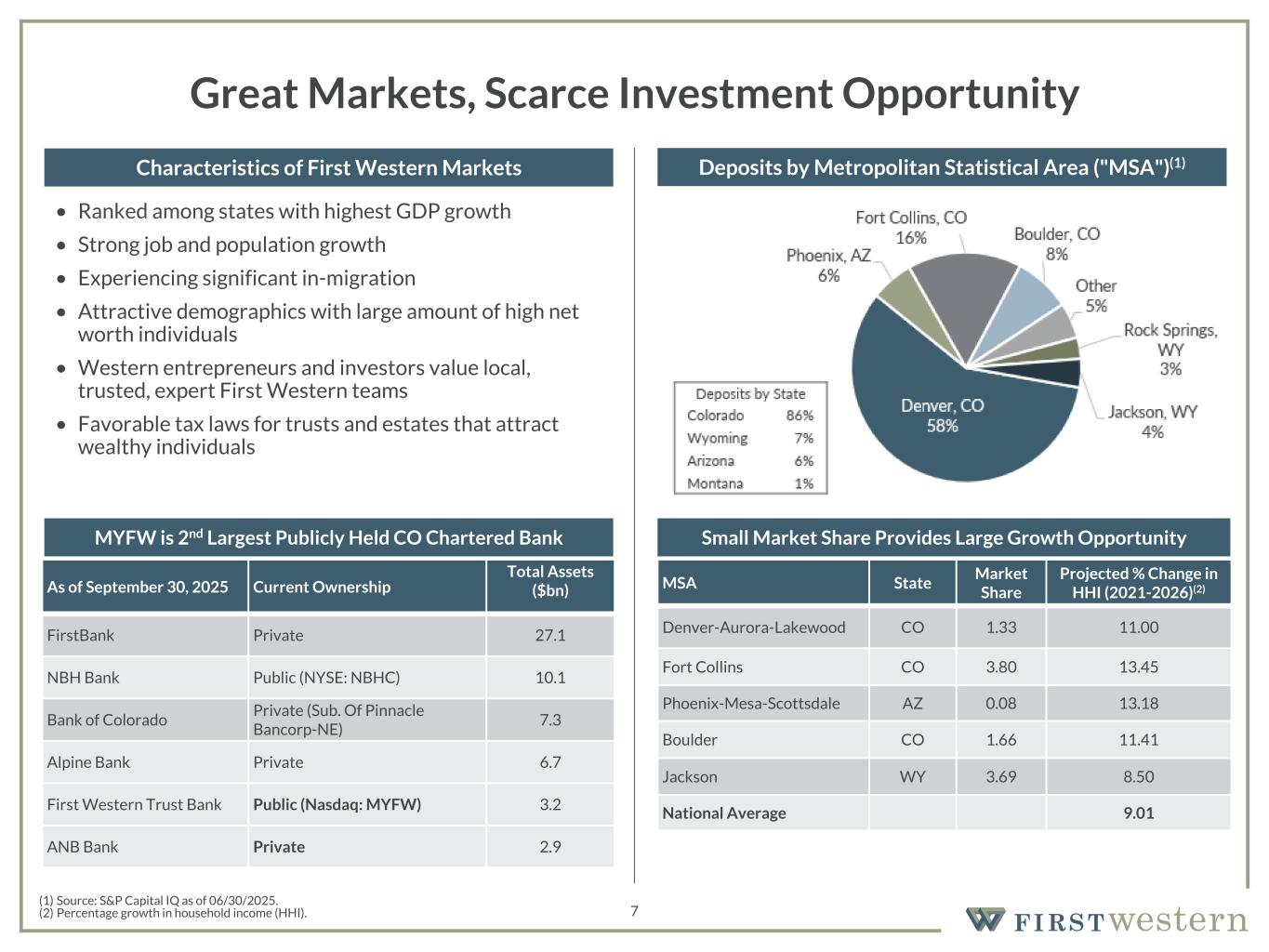

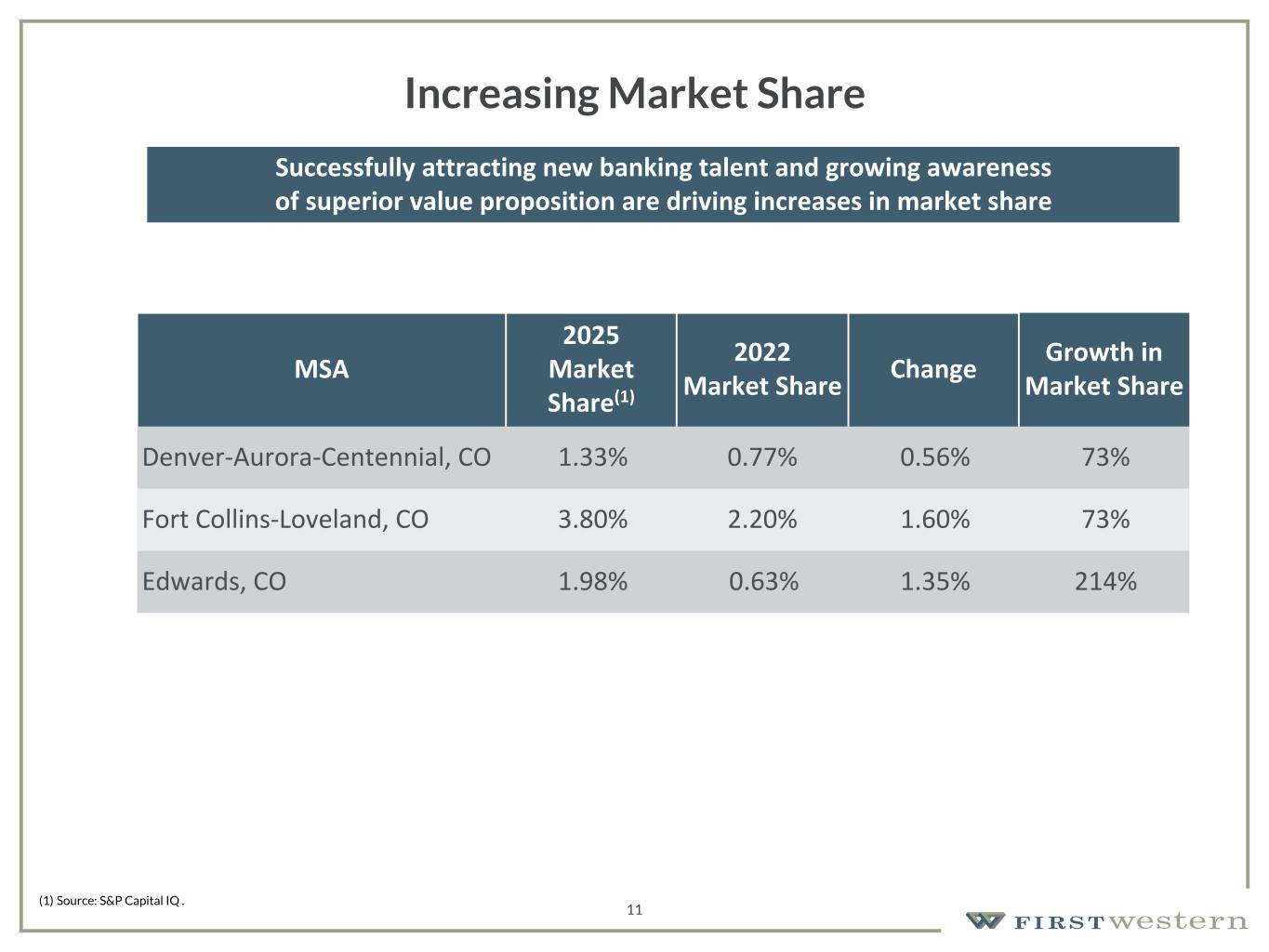

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 11 Increasing Market Share Successfully attracting new banking talent and growing awareness of superior value proposition are driving increases in market share MSA 2025 Market Share(1) 2022 Market Share Change Growth in Market Share Denver-Aurora-Centennial, CO 1.33% 0.77% 0.56% 73% Fort Collins-Loveland, CO 3.80% 2.20% 1.60% 73% Edwards, CO 1.98% 0.63% 1.35% 214% (1) Source: S&P Capital IQ .

Unique Business Model 12

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 13 Unique Market Position

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions • Corporate loans to match specific needs • Well-versed in working with complex cash flows and business models • Customized treasury management products and services 14 Cross-Selling a Diverse Set of Products and Services Commercial Banking • Fiduciary wealth management with expert review of client objectives, creating solutions • Irrevocable life insurance trust, conservatorship, successor trustee, directed custodial trusteeship • WY tax-exempt asset protection, special needs trusts, escrow services, family office services • Provide a broad range of asset and sub asset classes, with automated tax and basis management • Create unique solutions through internal research, proprietary and third-party investment options • Central team creates the platform for Portfolio Managers to service clients, manage accounts • Wealth planning with specialized services (e.g. tax management, philanthropic) • Proprietary ConnectView® approach, with access to CFPs, CPAs and estate planning attorneys • Charitable giving tax strategies, deferred-compensation plans, life insurance, key person insurance • Mortgage banking specializing in purchase money, high net worth lending • Underwritten to Fannie Mae and Freddie Mac guidelines • Targeted portfolio lending and secondary sales • Retirement plan consultants partnering with businesses to sponsor retirement plans • Creative corporate retirement plan design, analysis solutions, fiduciary liability management • ERISA compliance and education Retirement / 401(k) Plan Consulting Residential Mortgage Lending Wealth Planning Investment Management Trust Our local profit centers team with specialized product experts through ConnectView®, with many points of entry

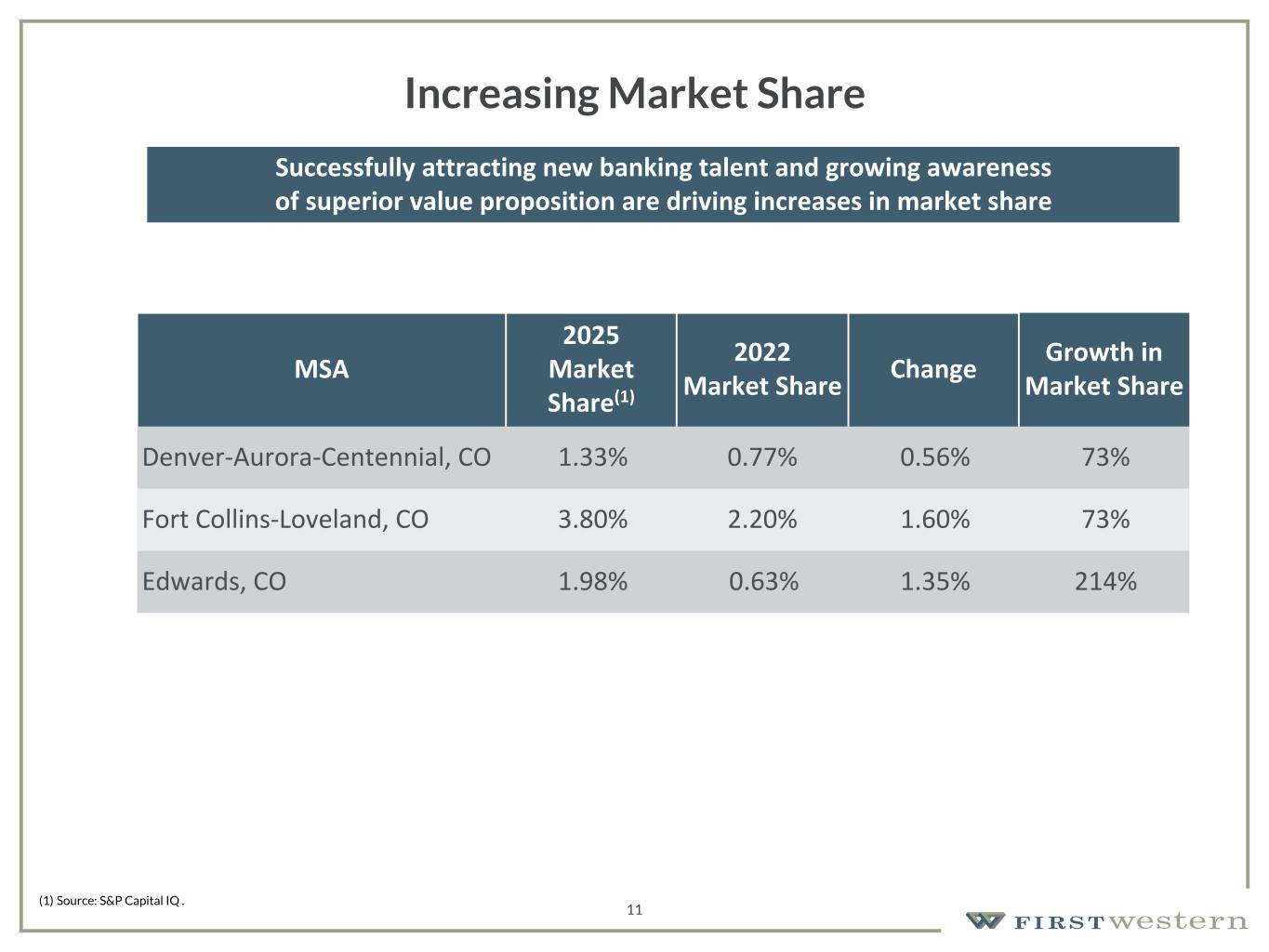

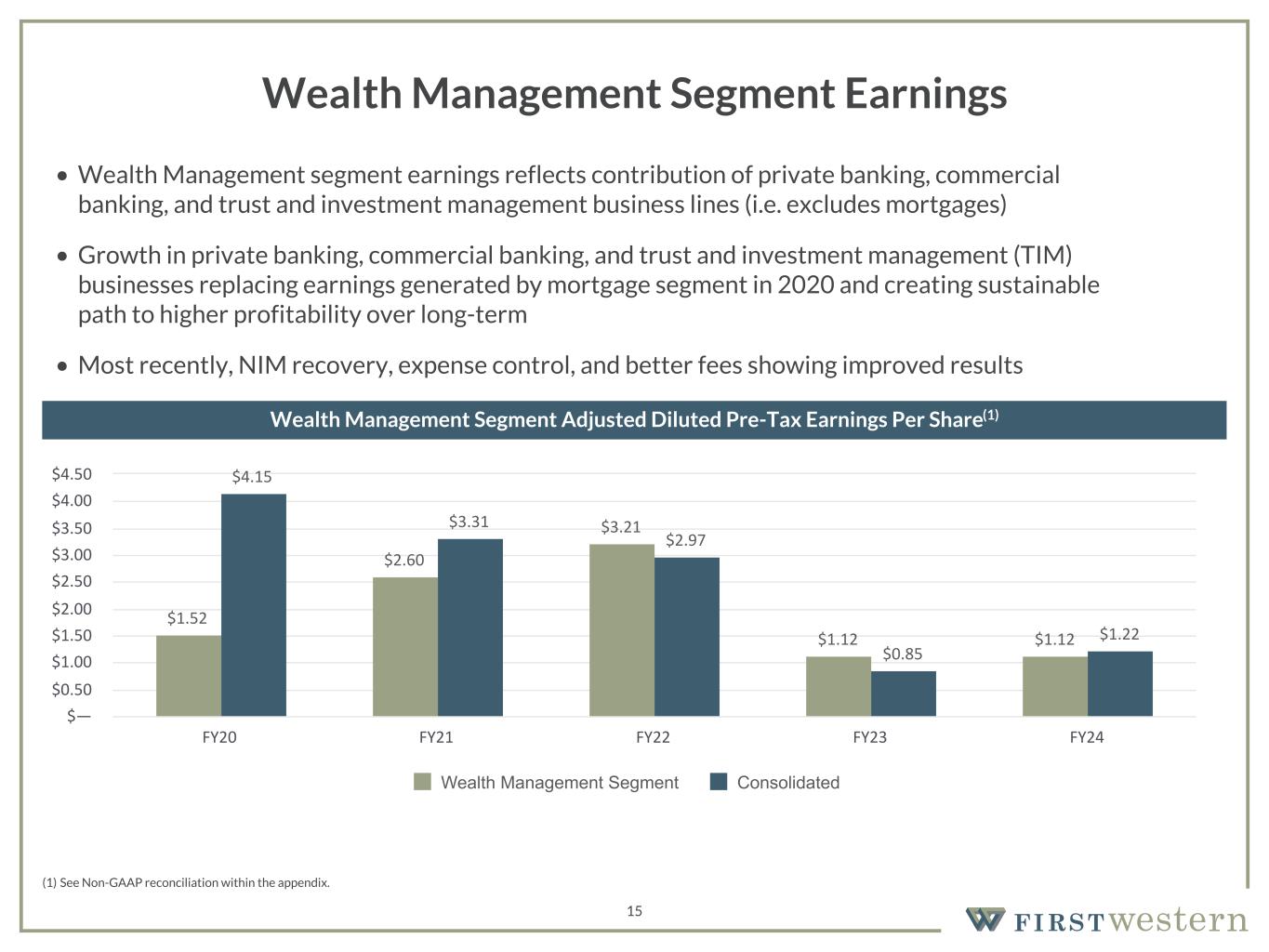

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 15 Wealth Management Segment Earnings (1) See Non-GAAP reconciliation within the appendix. • Wealth Management segment earnings reflects contribution of private banking, commercial banking, and trust and investment management business lines (i.e. excludes mortgages) • Growth in private banking, commercial banking, and trust and investment management (TIM) businesses replacing earnings generated by mortgage segment in 2020 and creating sustainable path to higher profitability over long-term • Most recently, NIM recovery, expense control, and better fees showing improved results Wealth Management Segment Adjusted Diluted Pre-Tax Earnings Per Share(1) $1.52 $2.60 $3.21 $1.12 $1.12 $4.15 $3.31 $2.97 $0.85 $1.22 Wealth Management Segment Consolidated FY20 FY21 FY22 FY23 FY24 $— $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 16 Long Track Record of Superior Credit Quality • Relationship-based approach, conservative underwriting criteria, and financial strength of clients have resulted in minimal credit losses over First Western’s history • Underwriting criteria includes three sources of repayment including personal guarantees • Low LTVs and high DSCRs • 67% of borrowers have deposit accounts at First Western • Average annual net charge-offs below 10 basis points over the last 10 years Net Charge-offs as a Percent to Average Loans (1) (1) As of September 30, 2025.

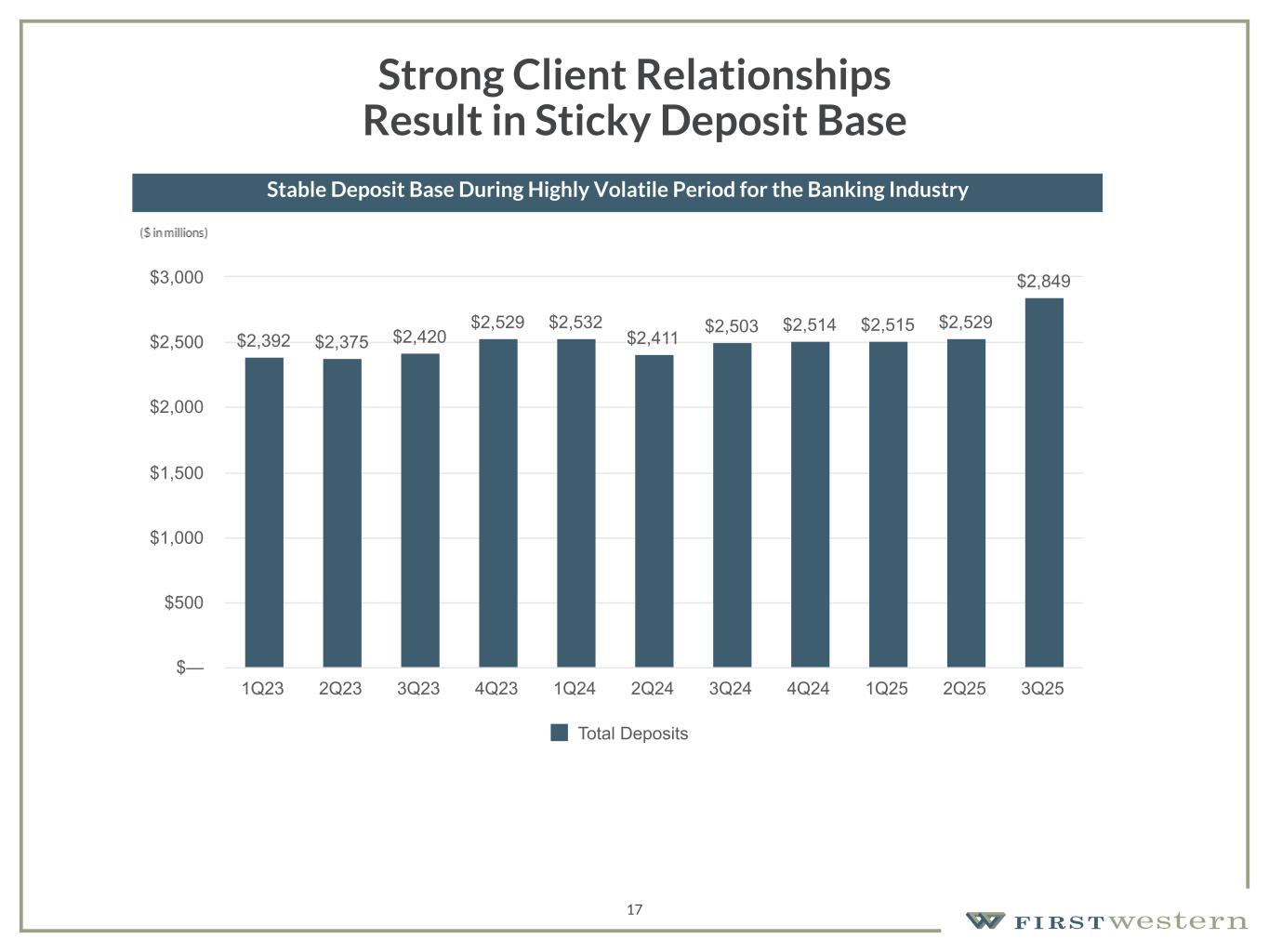

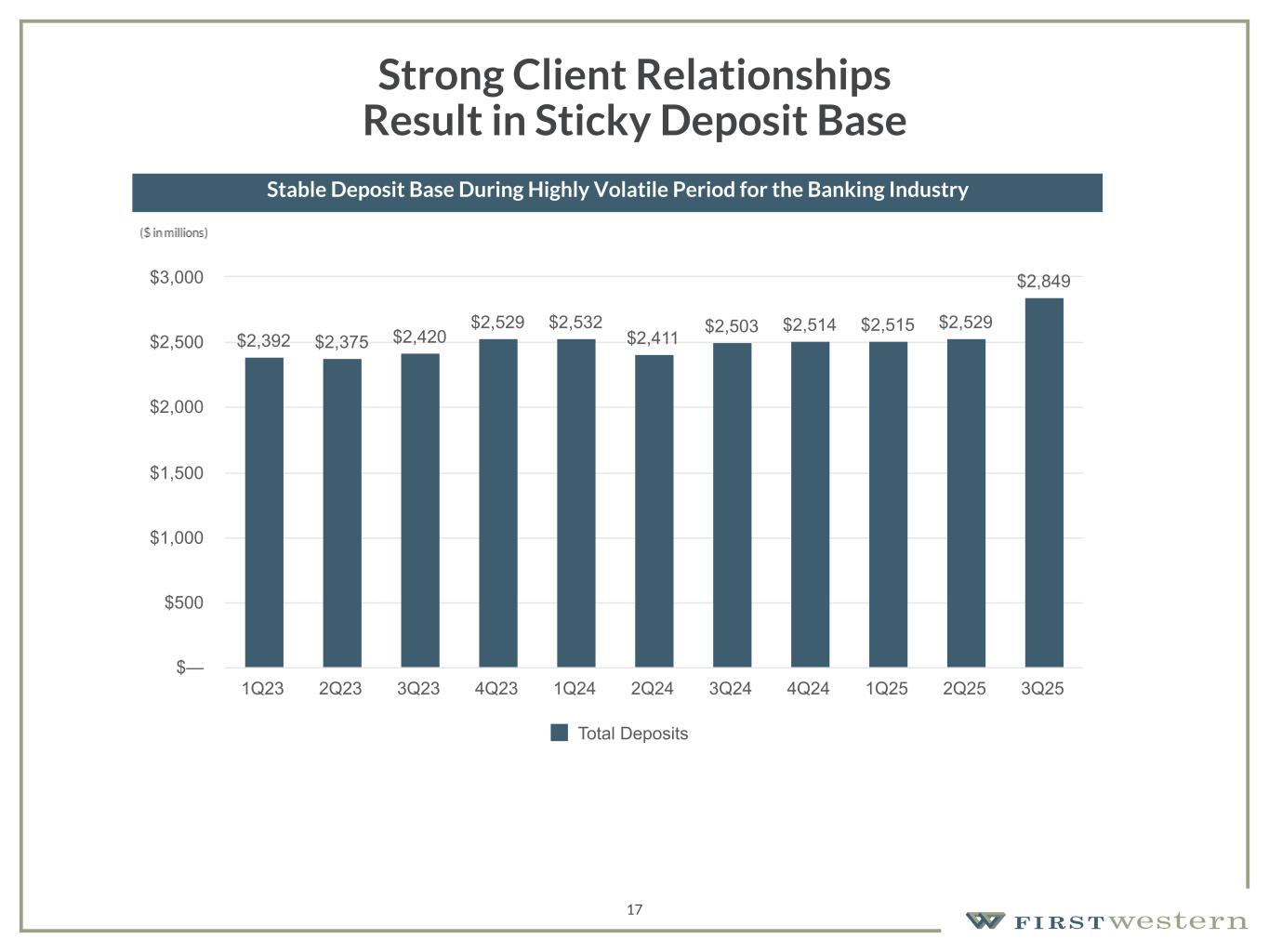

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 17 Strong Client Relationships Result in Sticky Deposit Base Stable Deposit Base During Highly Volatile Period for the Banking Industry $2,392 $2,375 $2,420 $2,529 $2,532 $2,411 $2,503 $2,514 $2,515 $2,529 $2,849 Total Deposits 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 $— $500 $1,000 $1,500 $2,000 $2,500 $3,000

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 18 Consistent Success in Adding New Deposit Relationships Unique Value Proposition, Addition of New Banking Talent, and Expansion into Attractive Growth Markets Resulting in Consistent Addition of New Deposit Relationships $32 $82 $226 $316 $464 $680 $828 189 393 893 1,141 1,518 1,765 1,992 New Deposits (cumulative) Number of New Deposits Accounts (cumulative) 2018 2019 2020 2021 2022 2023 2024 $— $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 — 500 1,000 1,500 2,000 2,500

Driving Profitable Growth 19

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 20 Strong Execution on Revenue Growth Strategies • Accelerating business development, office expansion and accretive acquisitions all contributing to the balance sheet growth driving improved operating leverage and higher profitability • M&A strategy continued with acquisition of Teton Financial Services • Office expansion continued with hiring of teams to focus on Bozeman, MT market and deepen presence in Colorado and Wyoming (in millions) Incremental Balance Sheet Growth (1/1/20 through 12/31/24) 143% Increase in Loans HFI 131% Increase in Total Deposits (1) Acquired growth represents remaining balances as of December 31, 2024 following payoffs/paydowns since the loans were acquired.

Recent Financial Trends 21

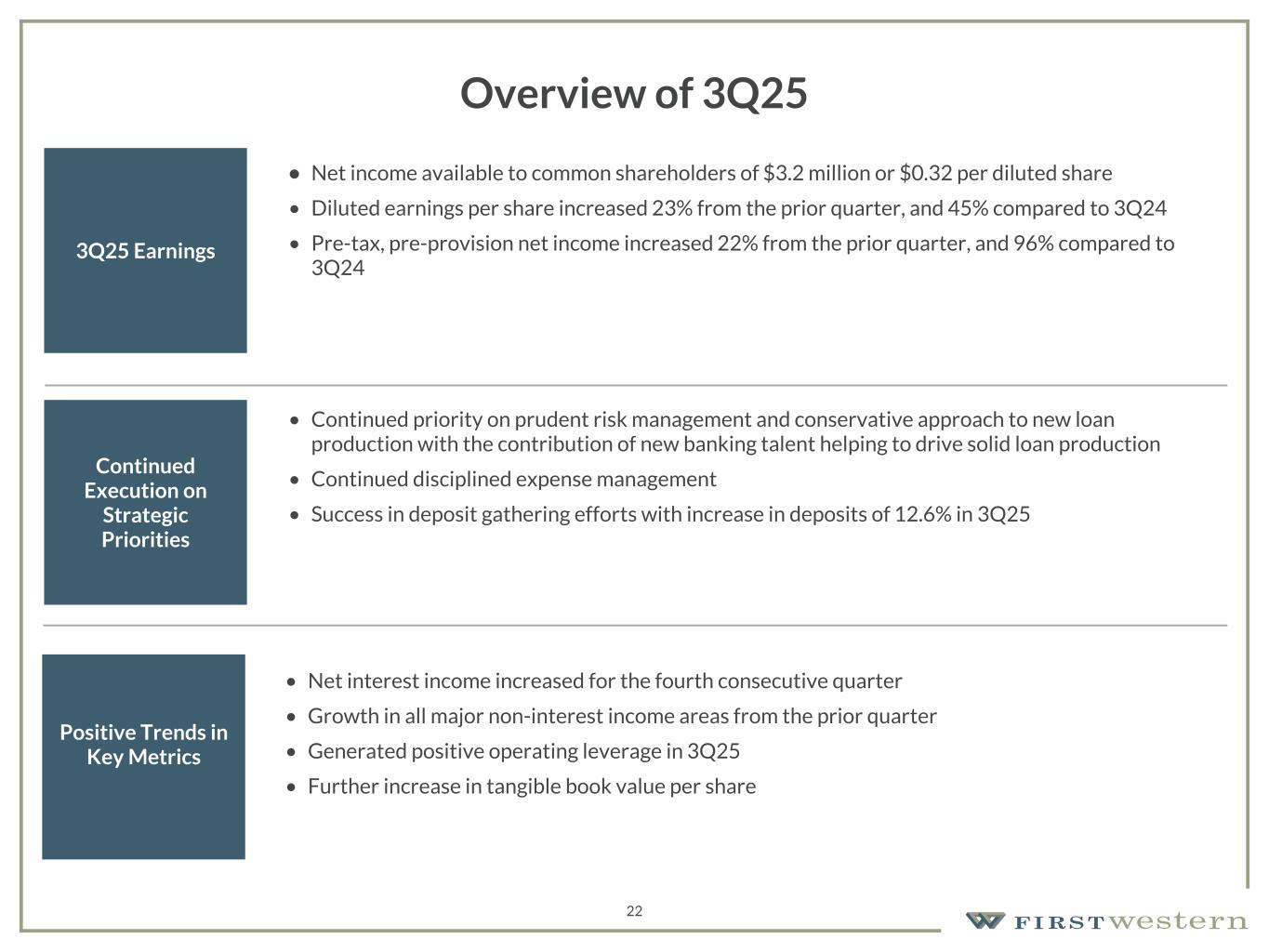

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions Overview of 3Q25 3Q25 Earnings • Net income available to common shareholders of $3.2 million or $0.32 per diluted share • Diluted earnings per share increased 23% from the prior quarter, and 45% compared to 3Q24 • Pre-tax, pre-provision net income increased 22% from the prior quarter, and 96% compared to 3Q24 Continued Execution on Strategic Priorities • Continued priority on prudent risk management and conservative approach to new loan production with the contribution of new banking talent helping to drive solid loan production • Continued disciplined expense management • Success in deposit gathering efforts with increase in deposits of 12.6% in 3Q25 Positive Trends in Key Metrics • Net interest income increased for the fourth consecutive quarter • Growth in all major non-interest income areas from the prior quarter • Generated positive operating leverage in 3Q25 • Further increase in tangible book value per share 22

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 23 Net Income Available to Common Shareholders and Earnings per Share • Net income of $3.2 million, or $0.32 diluted earnings per share, in 3Q25 • Tangible book value per share(1) increased 1.2% to $23.68 Net Income Available to Common Shareholders Diluted Earnings per Share $2,134 $2,748 $4,185 $2,503 $3,186 3Q24 4Q24 1Q25 2Q25 3Q25 $— $1,000 $2,000 $3,000 $4,000 $5,000 $0.22 $0.28 $0.43 $0.26 $0.32 3Q24 4Q24 1Q25 2Q25 3Q25 $— $0.10 $0.20 $0.30 $0.40 $0.50 (1) See Non-GAAP reconciliation within the appendix.

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 24 Loan Portfolio • Total loans held for investment increased $50.4 million from prior quarter due to strong loan production • New loan production well diversified across markets and loan types • New loan production in 3Q25 of $145.7 million with a focus on relationship-based lending • Average rate on new loan production was 6.38% 3Q24 2Q25 3Q25 Cash, Securities and Other $ 116,856 $ 161,725 $ 159,204 Consumer and Other 14,978 15,778 12,254 Construction and Development 301,542 255,870 230,600 1-4 Family Residential 920,709 1,012,662 1,041,990 Non-Owner Occupied CRE 608,494 655,954 728,039 Owner Occupied CRE 176,165 196,692 191,239 Commercial and Industrial 239,660 239,278 225,919 Total $ 2,378,404 $ 2,537,959 $ 2,589,245 Loans accounted for at fair value(2) 8,884 5,235 4,319 Total Loans HFI $ 2,387,288 $ 2,543,194 $ 2,593,564 Mortgage loans held for sale 12,324 24,151 21,806 Loans held for sale 473 — — Total Loans $ 2,400,085 $ 2,567,345 $ 2,615,370 (1) Represents unpaid principal balance. Excludes deferred (fees) costs and unamortized premium/ (unaccreted discount). (2) Excludes fair value adjustments on loans accounted for under the fair value option. ($ in thousands, as of quarter end) Loan Portfolio Composition(1) Loan Portfolio Details Loan Production & Loan Payoffs Total Loans(1) $2,458 $2,421 $2,428 $2,468 $2,594 $2,567 $2,615 3Q24 4Q24 1Q25 2Q25 3Q25 2Q25 3Q25 $1,000 $1,500 $2,000 $2,500 $3,000 Average Period End $82.8 $93.5 $70.8 $166.9 $145.7$153.8 $97.1 $71.6 $122.6 $110.1 Production Loan Payoffs 3Q24 4Q24 1Q25 2Q25 3Q25 $0 $50 $100 $150 $200 ($ in millions) ($ in millions)

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 25 Commercial Real Estate Portfolio • Average CRE loan balance was $2.8 million as of September 30, 2025 • Average loan-to-value ratio was 54.4% as of September 30, 2025 • Limited exposure to the office building sector in central business districts • 77% of CRE loans are located in Colorado • Deposit relationships are required • Ongoing monitoring procedures include loan reviews, stress tests, and sensitivity analyses Commercial Real Estate Portfolio (as of 9/30/2025) Owner Occupied Non-Owner Occupied Total Percent of Total CRE Multi-family $ — $ 212,905 $ 212,905 23.4 % Industrial and warehouse 57,471 146,210 203,681 22.3 Office 56,898 158,437 215,335 23.5 Retail 26,604 60,713 87,317 9.5 Hotel 3,153 58,889 62,042 6.8 Restaurant and entertainment 20,121 10,355 30,476 3.3 Land 2,178 — 2,178 0.2 Other commercial real estate 23,865 77,232 101,097 11.0 Total CRE loan portfolio $ 190,290 $ 724,741 $ 915,031 100.0 % ($ in thousands)

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 26 Total Deposits • Total deposits increased 12.6% from $2.53 billion in 2Q25 to $2.85 billion in 3Q25 • Interest-bearing deposits increased 13.8% from $2.17 billion in 2Q25 to $2.47 billion in 3Q25 primarily driven by growth in money market deposit accounts • Noninterest-bearing deposits increased 3.9% from $362 million in 2Q25 to $376 million in 3Q25 primarily due to operating account fluctuations 3Q24 2Q25 3Q25 Money market deposit accounts $ 1,350,619 $ 1,632,997 $ 1,988,336 Time deposits 533,452 397,006 349,533 Interest checking accounts 130,255 123,967 121,901 Savings accounts 15,152 13,503 13,433 Noninterest-bearing accounts 473,576 361,656 375,708 Total Deposits $ 2,503,054 $ 2,529,129 $ 2,848,911 Deposit Portfolio Composition Total Deposits $2,403 $2,499 $2,454 $2,400 $2,772 $2,529 $2,849 3Q24 4Q24 1Q25 2Q25 3Q25 2Q25 3Q25 $1,000 $1,500 $2,000 $2,500 $3,000 Average Period End ($ in millions)($ in thousands, as of quarter end)

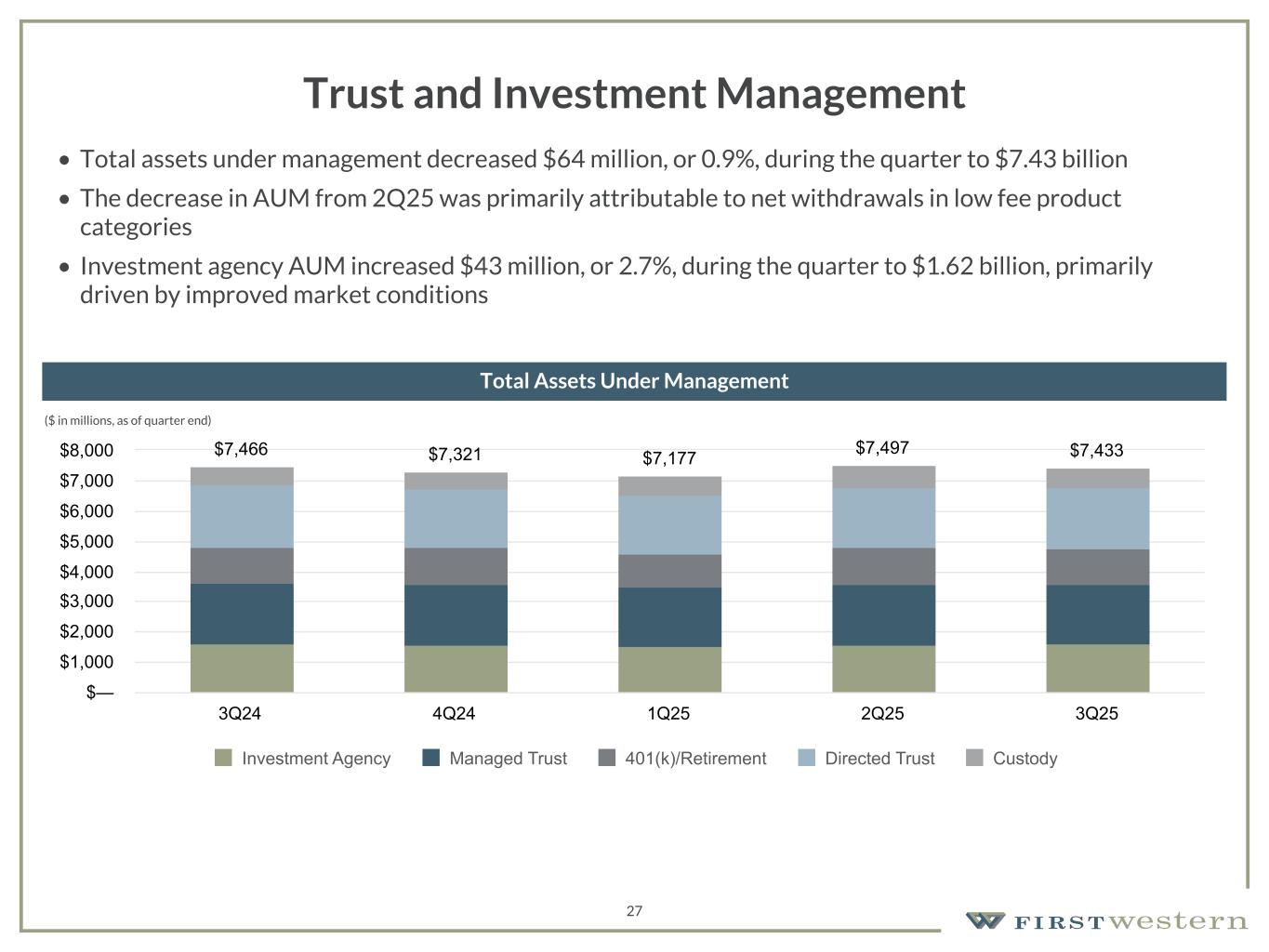

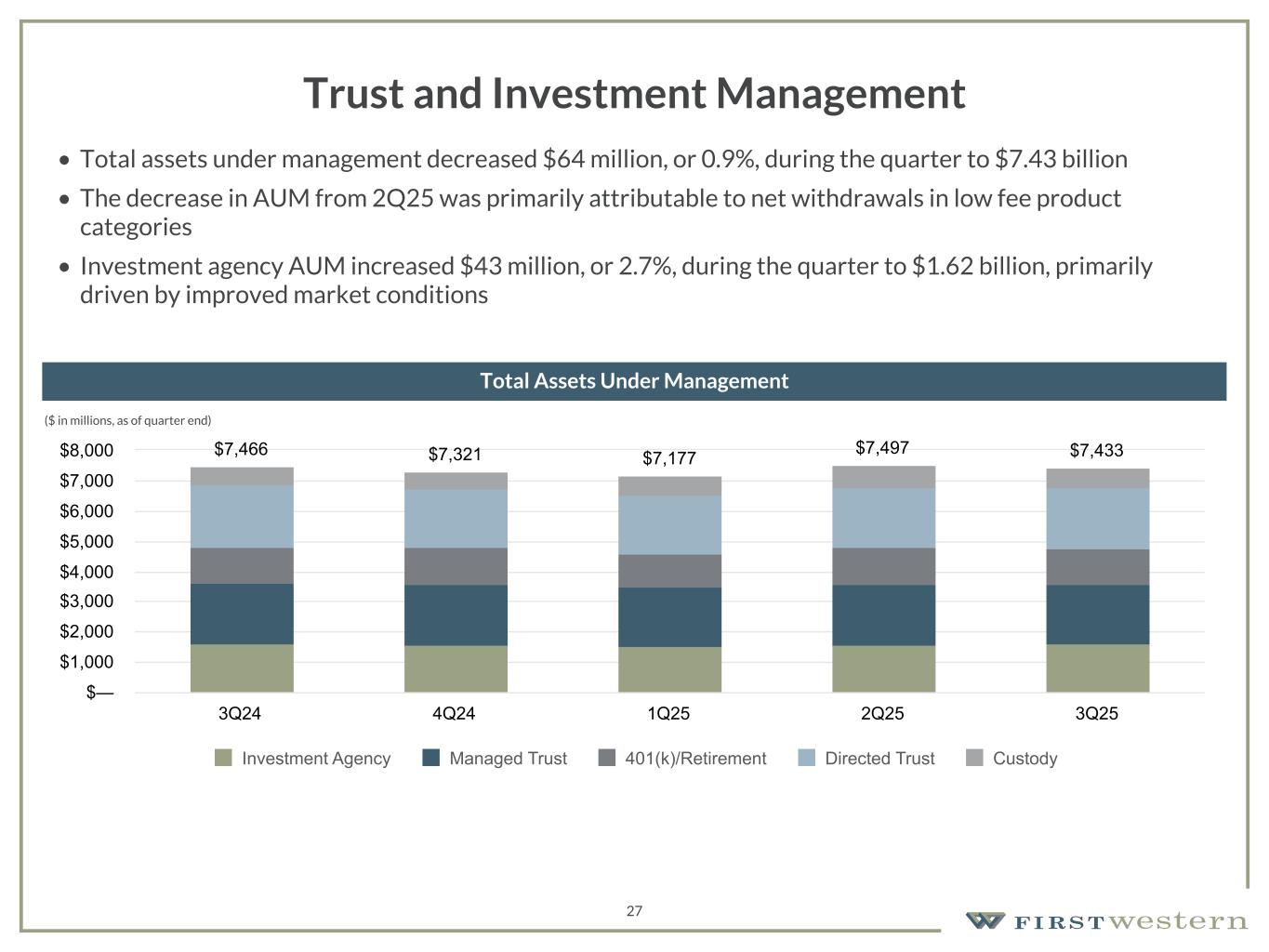

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 27 Trust and Investment Management • Total assets under management decreased $64 million, or 0.9%, during the quarter to $7.43 billion • The decrease in AUM from 2Q25 was primarily attributable to net withdrawals in low fee product categories • Investment agency AUM increased $43 million, or 2.7%, during the quarter to $1.62 billion, primarily driven by improved market conditions ($ in millions, as of quarter end) Total Assets Under Management $7,466 $7,321 $7,177 $7,497 $7,433 Investment Agency Managed Trust 401(k)/Retirement Directed Trust Custody 3Q24 4Q24 1Q25 2Q25 3Q25 $— $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions (1) See Non-GAAP reconciliation within the appendix. Gross Revenue Gross Revenue(1) Gross Revenue(1) 28 $22.7 $23.8 $24.6 $24.2 $26.3 Wealth Management Mortgage 3Q24 4Q24 1Q25 2Q25 3Q25 $— $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 • Gross revenue(1) increased 8.7% from $24.2 million in 2Q25 to $26.3 million in 3Q25 • Net interest income increased 8.9% from prior quarter primarily driven by an increase in average interest- earnings assets, partially offset by a 13 basis point decrease in net interest margin • Non-interest income increased $0.5 million from prior quarter primarily driven by increases in Net gain on mortgage loans, Risk management and insurance fees, and Trust and investment management fees Non-interest Income $6,842 26.0% Net Interest Income $19,454 74.0% ($ in thousands) ($ in millions)

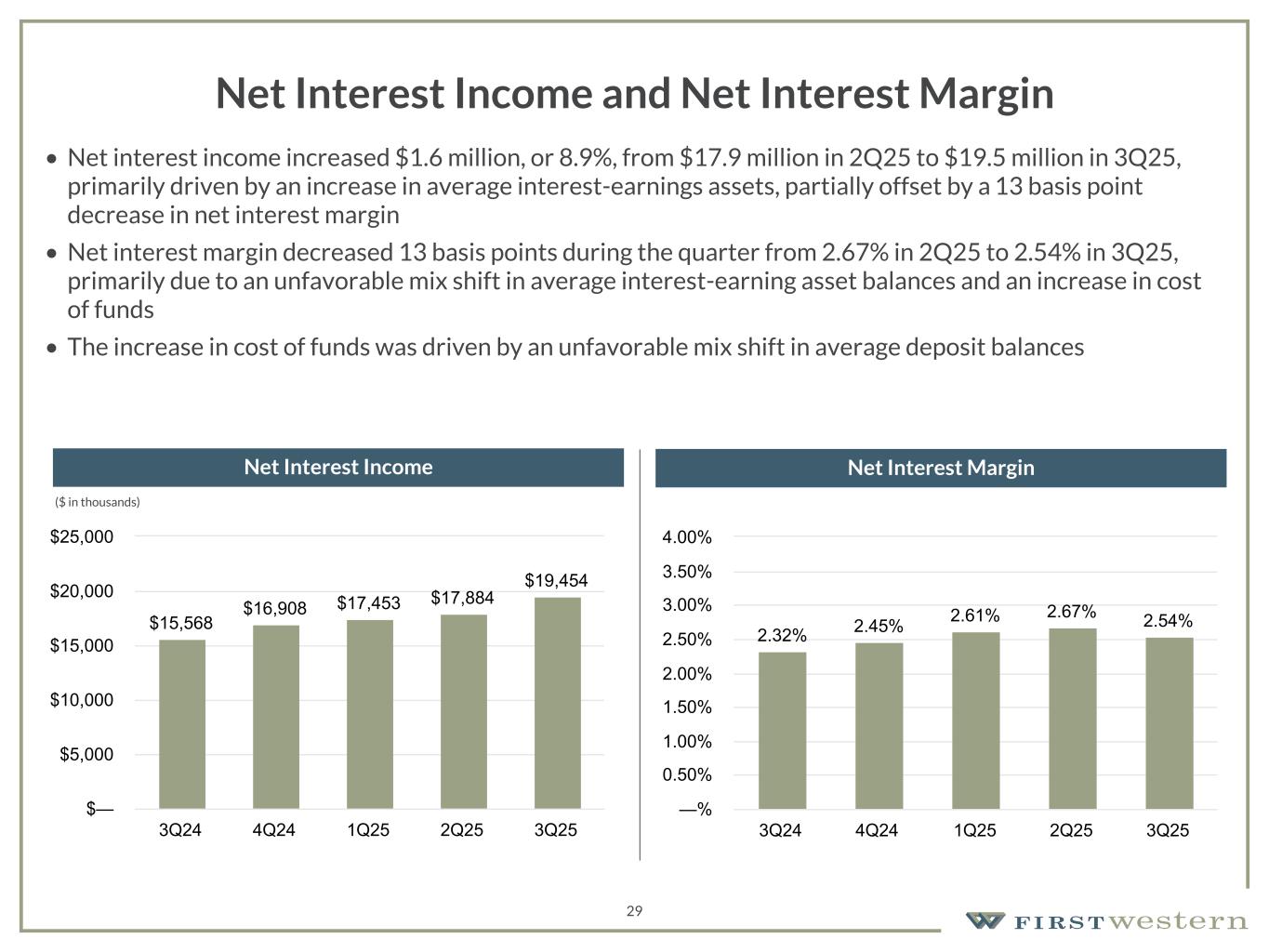

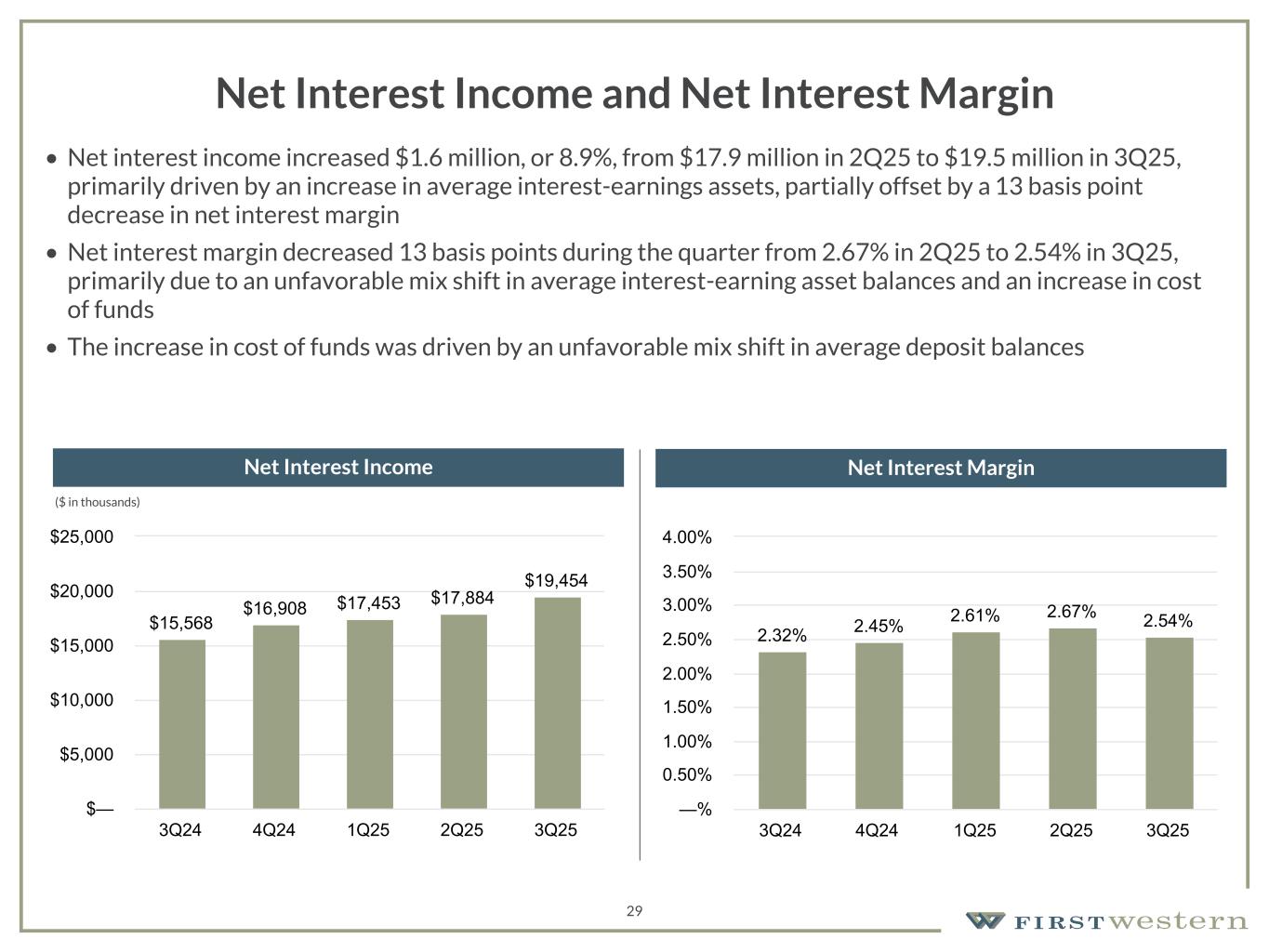

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 29 Net Interest Income and Net Interest Margin • Net interest income increased $1.6 million, or 8.9%, from $17.9 million in 2Q25 to $19.5 million in 3Q25, primarily driven by an increase in average interest-earnings assets, partially offset by a 13 basis point decrease in net interest margin • Net interest margin decreased 13 basis points during the quarter from 2.67% in 2Q25 to 2.54% in 3Q25, primarily due to an unfavorable mix shift in average interest-earning asset balances and an increase in cost of funds • The increase in cost of funds was driven by an unfavorable mix shift in average deposit balances Net Interest Income Net Interest Margin $15,568 $16,908 $17,453 $17,884 $19,454 3Q24 4Q24 1Q25 2Q25 3Q25 $— $5,000 $10,000 $15,000 $20,000 $25,000 2.32% 2.45% 2.61% 2.67% 2.54% 3Q24 4Q24 1Q25 2Q25 3Q25 —% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% ($ in thousands)

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 30 Non-Interest Income • Non-interest income increased $0.5 million to $6.8 million from prior quarter primarily driven by increases in Net gain on mortgage loans, Risk management and insurance fees, and Trust and investment management fees • Higher level of mortgage production contributed to an increase in Net gain on mortgage loans of $0.2 million in 3Q25 • Trust and investment management fees increased $0.1 million from the prior quarter primarily driven by an increase in investment agency AUM as a result of improving market conditions Total Non-Interest Income Trust and Investment Management Fees $6,972 $6,459 $7,345 $6,305 $6,842 Trust and Investment Management Fees Bank Fees Net Gain on Mortgage Loans Net gain on OREO Risk Management and Insurance Fees Other 3Q24 4Q24 1Q25 2Q25 3Q25 $(2,000) $— $2,000 $4,000 $6,000 $8,000 $10,000 $4,728 $4,660 $4,677 $4,512 $4,629 3Q24 4Q24 1Q25 2Q25 3Q25 $— $2,000 $4,000 $6,000 ($ in thousands) ($ in thousands)

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 31 Non-Interest Expense and Efficiency Ratio • Non-interest expense increased to $20.1 million from $19.1 million in the second quarter of 2025, primarily driven by an increase in Salaries and employee benefits, partially offset by a decrease in Occupancy and equipment • The increase in Salaries and employee benefits was primarily driven by an increase in bonus accruals as a result of the balance sheet growth and improved earnings during the quarter • The efficiency ratio improved from 78.83% as of 2Q25 and 84.98% as of 3Q24 to 76.38% as of 3Q25 (1) See Non-GAAP reconciliation within the appendix. Adjusted Non-Interest Expense(1) Operating Efficiency Ratio(1) (1) (1) (1) $19,333 $19,205 $19,441 $19,046 $20,066 3Q24 4Q24 1Q25 2Q25 3Q25 $— $5,000 $10,000 $15,000 $20,000 $25,000 84.98% 80.74% 79.16% 78.83% 76.38% 3Q24 4Q24 1Q25 2Q25 3Q25 —% 20.00% 40.00% 60.00% 80.00% 100.00% ($ in thousands)

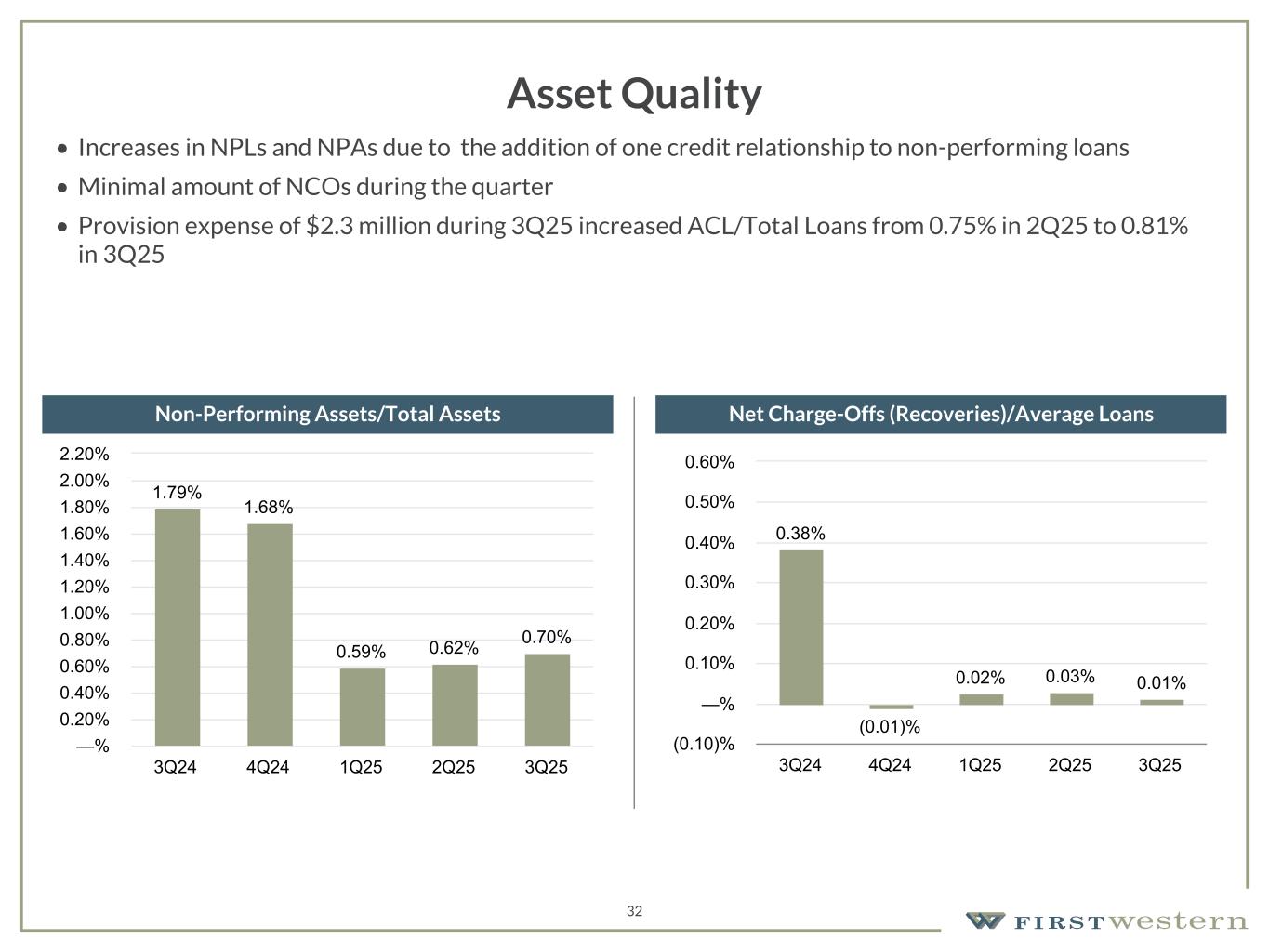

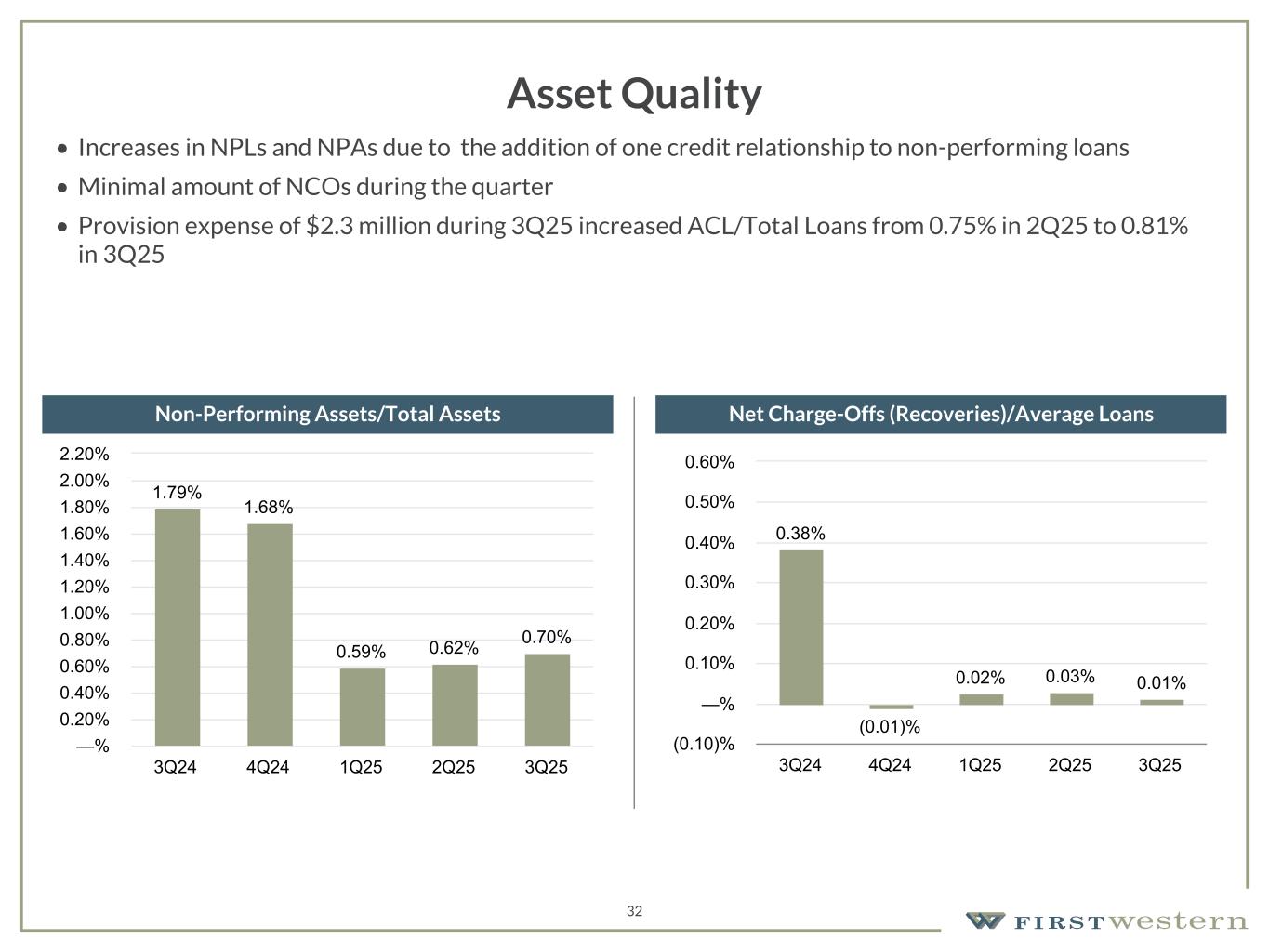

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 32 Asset Quality • Increases in NPLs and NPAs due to the addition of one credit relationship to non-performing loans • Minimal amount of NCOs during the quarter • Provision expense of $2.3 million during 3Q25 increased ACL/Total Loans from 0.75% in 2Q25 to 0.81% in 3Q25 Non-Performing Assets/Total Assets Net Charge-Offs (Recoveries)/Average Loans 1.79% 1.68% 0.59% 0.62% 0.70% 3Q24 4Q24 1Q25 2Q25 3Q25 —% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% 0.38% (0.01)% 0.02% 0.03% 0.01% 3Q24 4Q24 1Q25 2Q25 3Q25 (0.10)% —% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60%

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 33 Capital and Liquidity Overview Liquidity Funding Sources (as of 09/30/25) (1) See Non-GAAP reconciliation within the appendix. (2) Based on internal policy guidelines. Consolidated Capital Ratios (as of 09/30/25) Tangible Common Equity / TBV per Share(1) ($ in thousands) Liquidity Reserves: Total Available Cash $ 354,000 Unpledged Investment Securities 115,273 Borrowed Funds: Secured: FHLB Available 603,500 FRB Available 24,764 Other: Brokered Remaining Capacity 337,690 Unsecured: Credit Lines 29,000 Total Liquidity Funding Sources $ 1,464,227 Loan-to-Deposit Ratio 90.9 % 9.80% 9.80% 12.50% 7.51% Tier 1 Capital to Risk- Weighted Assets CET1 to Risk- Weighted Assets Total Capital to Risk- Weighted Assets Tier 1 Capital to Average Assets —% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% (2) (TCE $ in thousands) $130,704 $187,139 $208,760 $210,884 $213,731 $215,134 $217,147 $220,695 $224,979 $227,323 $230,022 $16.44 $19.87 $21.99 $22.01 $22.21 $22.27 $22.47 $22.83 $23.18 $23.39 $23.68 TCE TBV/Share 4Q20 4Q21 4Q22 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 $— $40,000 $80,000 $120,000 $160,000 $200,000 $240,000 $— $4 $8 $12 $16 $20 $24

Creating Additional Shareholder Value 34

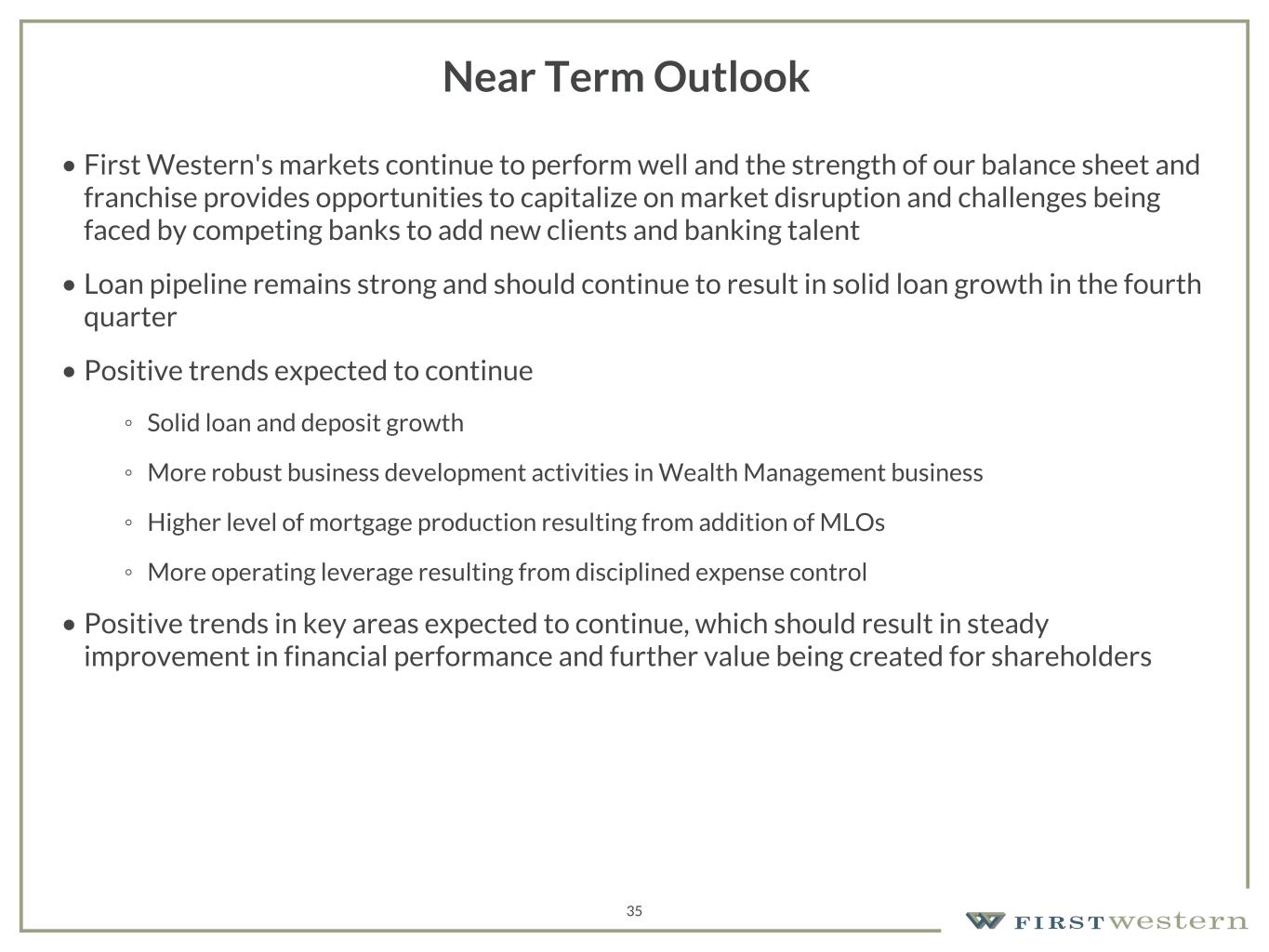

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 35 Near Term Outlook • First Western's markets continue to perform well and the strength of our balance sheet and franchise provides opportunities to capitalize on market disruption and challenges being faced by competing banks to add new clients and banking talent • Loan pipeline remains strong and should continue to result in solid loan growth in the fourth quarter • Positive trends expected to continue ◦ Solid loan and deposit growth ◦ More robust business development activities in Wealth Management business ◦ Higher level of mortgage production resulting from addition of MLOs ◦ More operating leverage resulting from disciplined expense control • Positive trends in key areas expected to continue, which should result in steady improvement in financial performance and further value being created for shareholders

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 36 Drivers of Long-Term Improved Financial Performance Efficiency Ratio Asset Quality ROA and ROE • Net interest margin expanding due to increase in average yield on loans and improving deposit mix • Disciplined balance sheet management and effective business development efforts expected to result in growth in high quality loans, lower cost of deposits, and fee income • Increased operating leverage through disciplined expense management • Realization of more operational efficiencies through streamlining of back-office support and process improvements throughout the organization • Organization shifting more towards revenue producers without adding to headcount • Investments in technology resulting in improved efficiencies, enhanced client service, and additional revenue generation opportunities • Continued resolution of non-performing loans with minimal loss content • Disciplined underwriting criteria continues to result in strong overall asset quality with low level of losses

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 37 MYFW: Our Five Core Strengths Differentiated, Proven in the Marketplace Built-in Operating Leverage Highly Desirable Recurring Fee Income Experienced, Tested Team Unique Opportunity for Investors • Niche-focused franchise headquartered in Denver, Colorado • Well-positioned in many attractive markets in Arizona, California, Colorado, Montana, and Wyoming • Specialized central expertise to compete with siloed national, regional firms • Delivered through local, boutique trust banking teams so clients “owned” by MYFW, not associates • Strong profit center margins at maturity, growth opportunities in current and new markets • Revenue growth over long-term in both fee income and net interest income, with neutral balance sheet • Scalable, leverageable high fixed cost, low variable cost Product and Support Centers • Operating expense investment already in place for growth and expansion • Primarily recurring trust and investment management (“TIM”) fees • Low risk, “sticky” wealth/trust business with comprehensive product offering • Multiple entry points with ConnectView® – proprietary review process to service, cross-sell • At critical mass but small market share, many current and new market opportunities • Proven ability to expand: (1) Organically, (2) By expansion and (3) By acquisition • Few large Colorado bank alternatives for investors and clients, creating lift-out opportunities • Attractive revenue and earnings growth story trading at discounted valuation • Executives are major bank/professional firm trained, with deep relationships in communities • Achieved growth through business and economic cycles, capital constraints • Healthy relationship with all regulators with strong risk management culture • CEO with proven track record for creating value in previous bank ownership

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 38 President Private Bankers Lenders Portfolio Managers Trust Officer Team-based incentives Relationship-based wealth management Many relationship managers to one client Product group specialists Holistic view of the client – ConnectView® Integrated Team Approach in Boutique Offices Working as a team to grow relationships

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 39 Organizational Structure Built for Scale Full Bank and Trust: ◦ Aspen, CO ◦ Boulder, CO ◦ Cherry Creek, CO ◦ Denver, CO ◦ DTC/Cherry Hills, CO ◦ Northern Colorado ◦ Jackson Hole, WY ◦ Rock Springs, WY ◦ Pinedale, WY ◦ Scottsdale, AZ ◦ Broomfield, CO ◦ Phoenix, AZ ◦ Vail Valley, Avon, CO ◦ Bozeman, MT Loan Production Offices: ◦ Ft. Collins, CO ◦ Greenwood Village, CO ◦ Loveland, CO ◦ Cheyenne, WY Trust Offices: ◦ Century City, CA ◦ Investment Management ◦ Fiduciary/ Trust ◦ Wealth Planning ◦ Retirement Services ◦ Insurance ◦ Mortgage Services ◦ Treasury Management First Western Profit Centers Product Groups Support Centers ◦ Finance & Accounting ◦ Risk & Compliance ◦ Enterprise Technology ◦ Human Capital ◦ Credit Analysis ◦ Bank & Trust/Investment Operations ◦ Marketing/Branding Big operating leverage from expert, high fixed cost teams Very profitable when mature

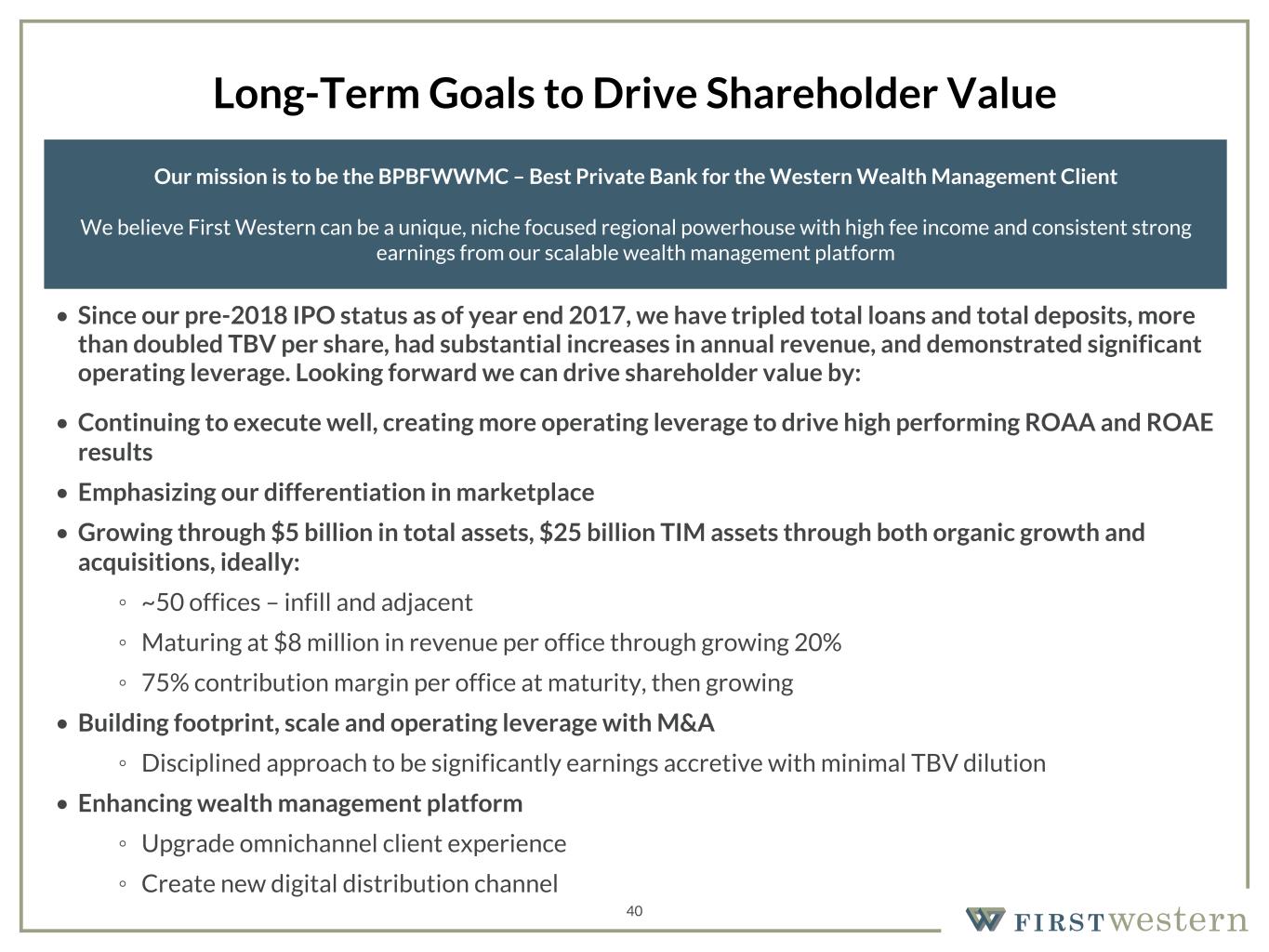

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 40 Long-Term Goals to Drive Shareholder Value • Since our pre-2018 IPO status as of year end 2017, we have tripled total loans and total deposits, more than doubled TBV per share, had substantial increases in annual revenue, and demonstrated significant operating leverage. Looking forward we can drive shareholder value by: • Continuing to execute well, creating more operating leverage to drive high performing ROAA and ROAE results • Emphasizing our differentiation in marketplace • Growing through $5 billion in total assets, $25 billion TIM assets through both organic growth and acquisitions, ideally: ◦ ~50 offices – infill and adjacent ◦ Maturing at $8 million in revenue per office through growing 20% ◦ 75% contribution margin per office at maturity, then growing • Building footprint, scale and operating leverage with M&A ◦ Disciplined approach to be significantly earnings accretive with minimal TBV dilution • Enhancing wealth management platform ◦ Upgrade omnichannel client experience ◦ Create new digital distribution channel Our mission is to be the BPBFWWMC – Best Private Bank for the Western Wealth Management Client We believe First Western can be a unique, niche focused regional powerhouse with high fee income and consistent strong earnings from our scalable wealth management platform

Appendix 41

Organizational Overview 42

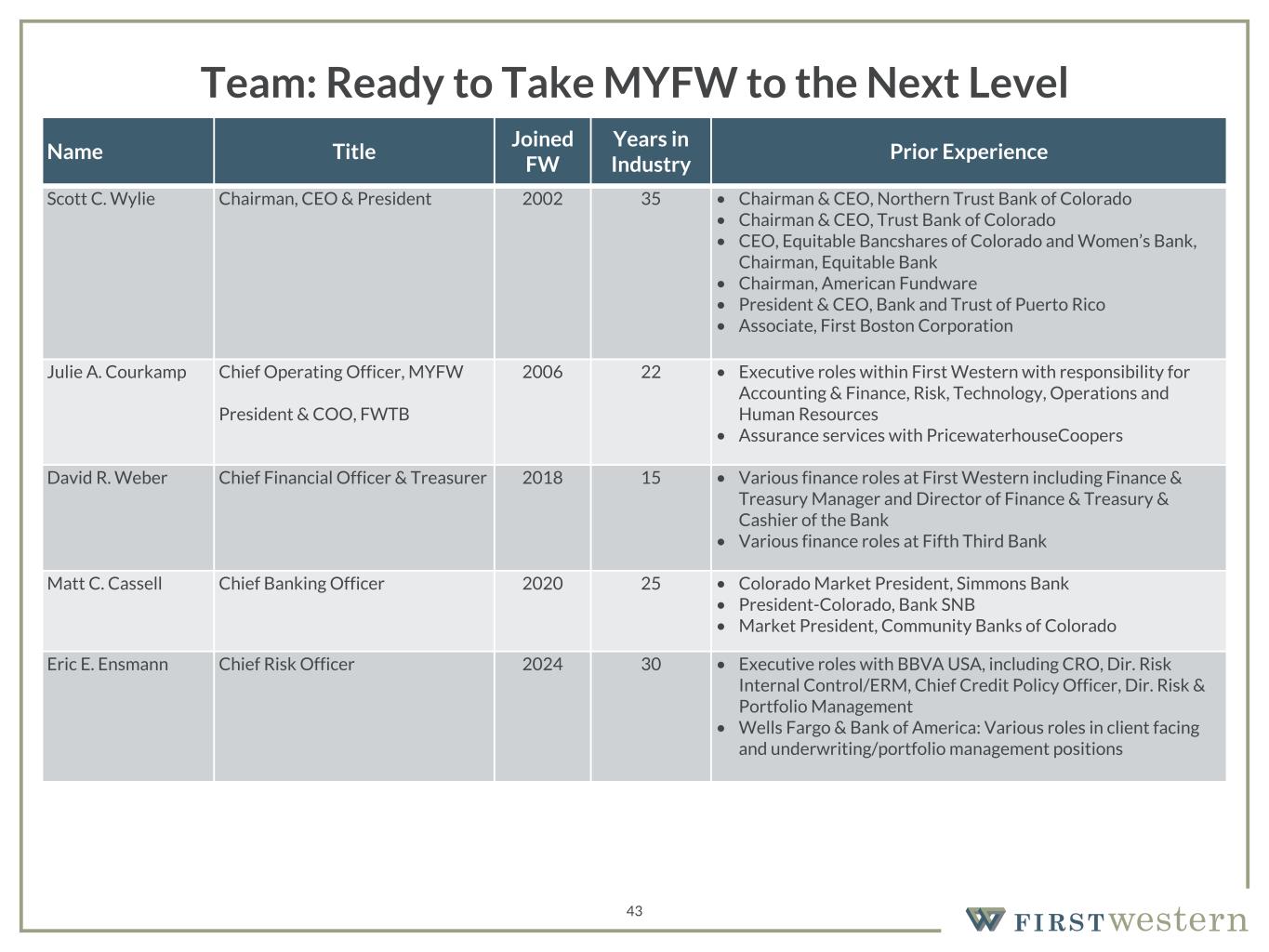

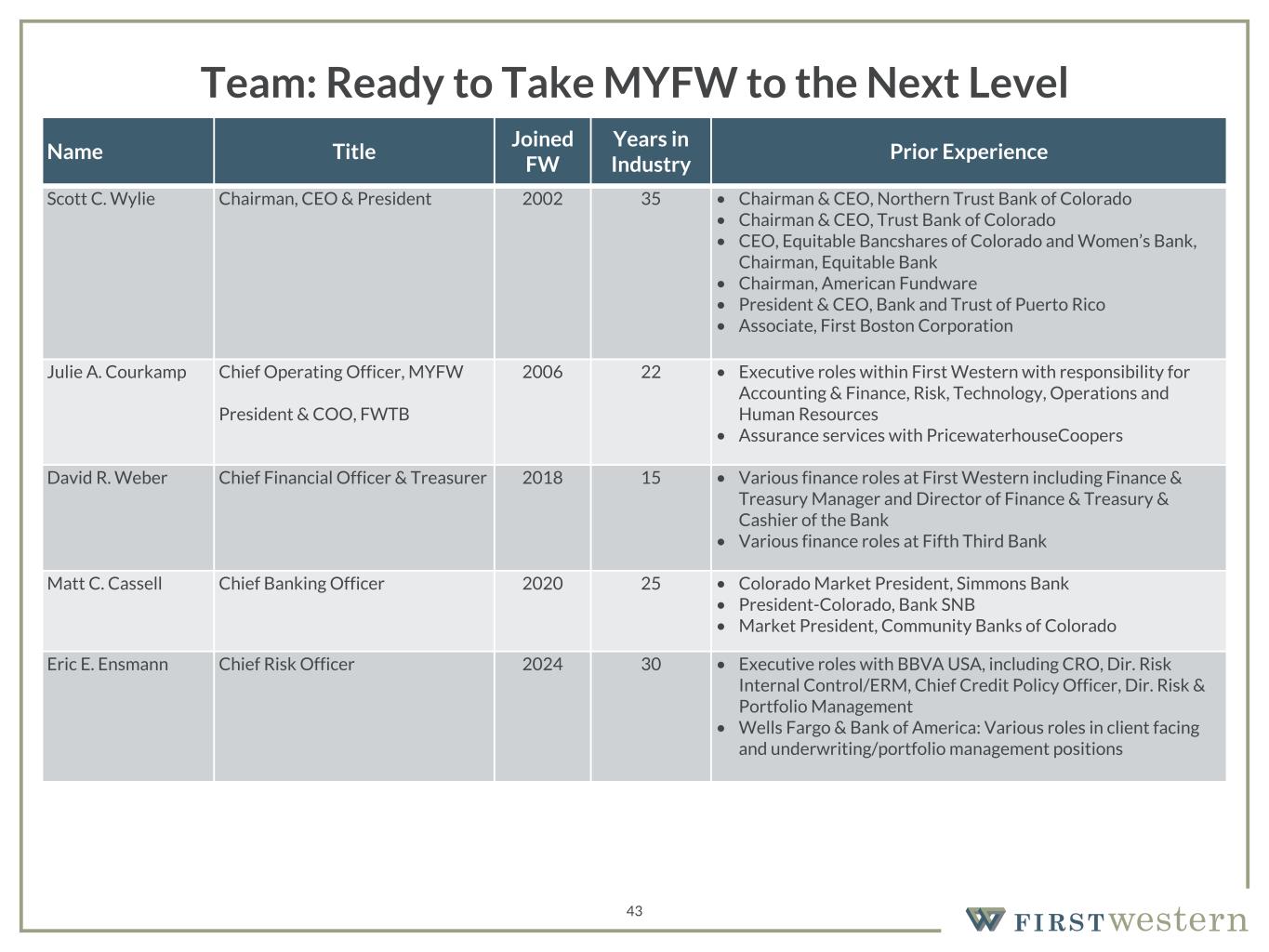

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions Name Title Joined FW Years in Industry Prior Experience Scott C. Wylie Chairman, CEO & President 2002 35 • Chairman & CEO, Northern Trust Bank of Colorado • Chairman & CEO, Trust Bank of Colorado • CEO, Equitable Bancshares of Colorado and Women’s Bank, Chairman, Equitable Bank • Chairman, American Fundware • President & CEO, Bank and Trust of Puerto Rico • Associate, First Boston Corporation Julie A. Courkamp Chief Operating Officer, MYFW President & COO, FWTB 2006 22 • Executive roles within First Western with responsibility for Accounting & Finance, Risk, Technology, Operations and Human Resources • Assurance services with PricewaterhouseCoopers David R. Weber Chief Financial Officer & Treasurer 2018 15 • Various finance roles at First Western including Finance & Treasury Manager and Director of Finance & Treasury & Cashier of the Bank • Various finance roles at Fifth Third Bank Matt C. Cassell Chief Banking Officer 2020 25 • Colorado Market President, Simmons Bank • President-Colorado, Bank SNB • Market President, Community Banks of Colorado Eric E. Ensmann Chief Risk Officer 2024 30 • Executive roles with BBVA USA, including CRO, Dir. Risk Internal Control/ERM, Chief Credit Policy Officer, Dir. Risk & Portfolio Management • Wells Fargo & Bank of America: Various roles in client facing and underwriting/portfolio management positions 43 Team: Ready to Take MYFW to the Next Level

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions Name Director Since Primary Business Scott C. Wylie 2002 • First Western Financial, Inc. Julie A. Caponi, CPA(1) 2017 • Former Finance Executive at Arconic, Inc. (fka Alcoa Inc.) • Former audit partner at Deloitte • Board member & Audit Committee chair for FCF (NYSE) Julie A. Courkamp 2021 • First Western Financial, Inc. David R. Duncan 2011 • Energy • Winery Executive, Silver Oak Cellars • Entrepreneur, board member, business leader Thomas A. Gart 2013 • Real Estate Developer • Specialty Retail Executive • Family business, PE investing across broad range of industries Patrick H. Hamill 2004 • Real Estate Developer • Home Builder Executive • Entrepreneur, business/community leader, real estate expertise Luke A. Latimer 2015 • Utility Maintenance • Construction Executive • Family business, public bank board Scott C. Mitchell 2021 • President, U.S. Engineering, Metalworks • President of several successful manufacturing companies • Six Sigma Master Black Belt Ellen S. Robinson 2024 • Principal and Founder of the Robinson Coaching Group, Inc • Leadership development and coaching • Professional Coach Certification Mark L. Smith 2002 • Real Estate Developer • Entrepreneur, community leadership, real estate expertise Joseph C. Zimlich, CPA 2004 • Former Family Office Executive • Corporate leadership, board, and investment management 44 MYFW’s Sophisticated Board of Directors (1) CPA license inactive.

Non-GAAP Reconciliations 45

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 46 Non-GAAP Reconciliation Consolidated Gross Revenue For the Years Ended, (Dollars in thousands) 2020 2021 2022 2023 2024 Total income before non-interest expense $ 92,615 $ 95,408 $ 107,934 $ 82,698 $ 90,071 Less: Unrealized (loss) gain recognized on equity securities 15 (21) 342 (22) (33) Less: Net loss on loans accounted for under the fair value option — — (891) (2,010) (999) Less: Net gain on equity interests — 489 7 — — Less: Net loss on loans held for sale — — (12) (178) (105) Plus: Provision for credit losses 4,682 1,230 3,682 10,355 1,933 Gross revenue $ 97,282 $ 96,170 $ 112,170 $ 95,263 $ 93,141 Consolidated Adjusted Pre-tax, Preprovision Income For the Years Ended, (Dollars in thousands) 2020 2021 2022 2023 2024 Net income before income tax, as reported $ 33,063 $ 27,280 $ 28,828 $ 7,061 $ 11,579 Plus: Provision for credit losses 4,682 1,230 3,682 10,355 1,933 Pre-tax, Pre-provision Income $ 37,745 $ 28,510 $ 32,510 $ 17,416 $ 13,512 Adjusted Diluted Pre-Tax Earnings Per Share For the Years Ended, (Dollars in thousands) 2020 2021 2022 2023 2024 Wealth Management income before income tax $ 12,086 $ 21,378 $ 31,139 $ 9,660 $ 10,629 Mortgage income (loss) before income tax 20,978 5,902 (2,311) (2,599) 950 Plus: Impairment of contingent consideration assets — — — 1,249 338 Less: Income tax expense 8,529 6,670 7,130 1,836 3,106 Adjusted net income available to common shareholders $ 24,535 $ 20,610 $ 21,698 $ 6,474 $ 8,811 Adjusted diluted weighted average shares 7,961,904 8,235,178 9,713,623 9,725,910 9,755,804 Wealth Management Segment Adjusted Diluted Pre-Tax Earnings Per Share $ 1.52 $ 2.60 $ 3.21 $ 1.12 $ 1.12 Consolidated Adjusted Diluted Pre-Tax Earnings Per Share $ 4.15 $ 3.31 $ 2.97 $ 0.85 $ 1.22

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 47 Non-GAAP Reconciliation (1) Represents the percentage of loans to total loans in the respective category. Consolidated Efficiency Ratio For the Years Ended, (Dollars in thousands) 2020 2021 2022 2023 2024 Non-interest expense $ 59,552 $ 68,128 $ 79,106 $ 75,637 $ 78,492 Less: OREO expenses and write-downs 190 — — — 1,285 Adjusted non-interest expense $ 59,362 $ 68,128 $ 79,106 $ 75,637 $ 77,207 Net interest income $ 46,102 $ 56,509 $ 83,204 $ 71,105 $ 64,324 Non-interest income 51,195 40,129 28,412 21,948 27,680 Less: Unrealized (loss)/gain recognized on equity securities 15 (21) 342 (22) (33) Less: Net loss on loans accounted for under the fair value option — — (891) (2,010) (999) Less: Net gain on equity interests — 489 7 — — Less: Net loss on loans held for sale — — (12) (178) (105) Adjusted non-interest income $ 51,180 $ 39,661 $ 28,966 $ 24,158 $ 28,817 Adjusted total income $ 97,282 $ 96,170 $ 112,170 $ 95,263 $ 93,141 Efficiency ratio 61.0 % 70.8 % 70.5 % 79.4 % 82.9 % Allocation of the Allowance for Credit Losses (ACL) As of December 31, 2024 2023 (Dollars in thousands) ACL Amount % of Loans % of ACL %(1) ACL Amount % of Loans % of ACL %(1) Commercial: Construction and Development $ 5,184 1.6 % 28.3 % 13.0 % $ 7,945 2.3 % 33.2 % 13.7 % Non-Owner Occupied CRE 4,340 0.7 % 23.7 % 25.3 % 2,325 0.4 % 9.7 % 21.6 % Owner Occupied CRE 654 0.4 % 3.6 % 7.1 % 1,034 0.5 % 4.3 % 7.8 % Commercial and Industrial 2,357 1.1 % 12.9 % 9.1 % 7,172 2.1 % 30.0 % 13.3 % Total Commercial $ 12,535 1.0 % 68.4 % 54.5 % $ 18,476 1.3 % 77.2 % 56.4 % Consumer: Cash, Securities and Other $ 410 0.3 % 2.2 % 5.0 % $ 961 0.7 % 4.0 % 5.6 % Consumer and Other 185 1.1 % 1.0 % 0.7 % 124 0.5 % 0.5 % 1.1 % 1-4 Family Residential 5,200 0.5 % 28.4 % 39.8 % 4,370 0.5 % 18.3 % 36.9 % Total Consumer $ 5,795 0.5 % 31.6 % 45.5 % $ 5,455 0.5 % 22.8 % 43.6 % Total allowance for credit losses $ 18,330 0.8 % 100 % 100 % $ 23,931 1.0 % 100 % 100 %

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 48 Non-GAAP Reconciliation Adjusted Diluted Pre-Tax Earnings Per Share For the Quarters Ended, (Dollars in thousands) 31-Dec-23 31-Mar-24 30-Jun-24 30-Sep-24 31-Dec-24 Wealth Management (loss) income before income tax $ (3,626) $ 3,397 $ 645 $ 2,218 $ 4,369 Mortgage (loss) income before income tax (731) 182 770 453 (455) Plus: Impairment of contingent consideration assets — 143 97 — 98 Less: Income tax (benefit) expense (1,138) 1,064 339 537 1,166 Adjusted net income available to common shareholders $ (3,219) $ 2,658 $ 1,173 $ 2,134 $ 2,846 Adjusted diluted weighted average shares 9,572,582 9,710,764 9,750,667 9,766,656 9,794,797 Wealth Management Segment Adjusted Diluted Pre-Tax Earnings Per Share $ (0.38) $ 0.36 $ 0.08 $ 0.23 $ 0.46 Consolidated Adjusted Diluted Pre-Tax Earnings Per Share $ (0.46) $ 0.38 $ 0.16 $ 0.27 $ 0.41

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 49 Non-GAAP Reconciliation Consolidated Tangible Common Book Value Per Share (Dollars in thousands) September 30, 2024 December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 Total shareholders' equity $ 248,831 $ 252,322 $ 256,555 $ 258,847 $ 261,495 Goodwill and other intangibles, net 31,684 31,627 31,576 31,524 31,473 Tangible common equity $ 217,147 $ 220,695 $ 224,979 $ 227,323 $ 230,022 Common shares outstanding, end of period 9,664,101 9,667,142 9,704,320 9,717,922 9,714,711 Tangible common book value per share $ 22.47 $ 22.83 $ 23.18 $ 23.39 $ 23.68 Net income available to common shareholders $ 3,186 Return on tangible common equity (annualized) 5.54 % Consolidated Efficiency Ratio For the Three Months Ended, (Dollars in thousands) September 30, 2024 December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 Non-interest expense $ 19,368 $ 20,427 $ 19,361 $ 19,099 $ 20,074 Less: OREO expenses and write-downs 35 1,222 (80) 53 8 Adjusted non-interest expense $ 19,333 $ 19,205 $ 19,441 $ 19,046 $ 20,066 Net interest income $ 15,568 $ 16,908 $ 17,453 $ 17,884 $ 19,454 Non-interest income 6,972 6,459 7,345 6,305 6,842 Less: unrealized gain (loss) recognized on equity securities 24 (49) 11 3 6 Less: net (loss) gain on loans accounted for under the fair value option (233) (149) 6 26 18 Less: net (loss) gain on loans held for sale — (222) 222 — — Adjusted non-interest income $ 7,181 $ 6,879 $ 7,106 $ 6,276 $ 6,818 Adjusted total income $ 22,749 $ 23,787 $ 24,559 $ 24,160 $ 26,272 Efficiency ratio 84.98 % 80.74 % 79.16 % 78.83 % 76.38 %

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 50 Non-GAAP Reconciliation Wealth Management Gross Revenue For the Three Months Ended, (Dollars in thousands) September 30, 2024 December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 Total income before non-interest expense $ 20,296 $ 23,540 $ 23,468 $ 20,919 $ 22,278 Less: unrealized gain (loss) recognized on equity securities 24 (49) 11 3 6 Less: net (loss) gain on loans accounted for under the fair value option (233) (149) 6 26 18 Less: net (loss) gain on loans held for sale at fair value — (222) 222 — — Plus: provision for (release of) credit losses 501 (974) 80 1,773 2,257 Gross revenue $ 21,006 $ 22,986 $ 23,309 $ 22,663 $ 24,511 Mortgage Gross Revenue For the Three Months Ended, (Dollars in thousands) September 30, 2024 December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 Total income before non-interest expense $ 1,743 $ 801 $ 1,250 $ 1,497 $ 1,761 Gross revenue $ 1,743 $ 801 $ 1,250 $ 1,497 $ 1,761 Consolidated Gross Revenue For the Three Months Ended, (Dollars in thousands) September 30, 2024 December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 Total income before non-interest expense $ 22,039 $ 24,341 $ 24,718 $ 22,416 $ 24,039 Less: unrealized gain (loss) recognized on equity securities 24 (49) 11 3 6 Less: net (loss) gain on loans accounted for under the fair value option (233) (149) 6 26 18 Less: net (loss) gain on loans held for sale at fair value — (222) 222 — — Plus: provision for (release of) credit losses 501 (974) 80 1,773 2,257 Gross revenue $ 22,749 $ 23,787 $ 24,559 $ 24,160 $ 26,272

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 51 Non-GAAP Reconciliation Pre-tax, Pre-Provision Net Income For the Three Months Ended, (Dollars in thousands) September 30, 2024 June 30, 2025 September 30, 2025 Income before income taxes $ 2,671 $ 3,317 $ 3,965 Plus: provision for credit losses 501 1,773 2,257 Pre-tax, pre-provision net income $ 3,172 $ 5,090 $ 6,222 Allocation of the Allowance for Credit Losses (ACL) As of September 30, 2025 December 31, 2024 (Dollars in thousands) ACL Amount % of Loans % of ACL %(1) ACL Amount % of Loans % of ACL %(1) Commercial: Construction and Development $ 2,164 0.9 % 10.3 % 8.9 % $ 5,184 1.7 % 28.3 % 13.0 % Non-Owner Occupied CRE 3,939 0.5 18.8 28.0 4,340 0.7 23.7 25.3 Owner Occupied CRE 725 0.4 3.5 7.4 654 0.4 3.5 7.1 Commercial and Industrial 7,012 3.1 33.4 8.7 2,357 1.1 12.9 9.1 Total Commercial 13,840 1.0 66.0 53.0 12,535 1.0 68.4 54.5 Consumer: Cash, Securities and Other 1,137 0.7 5.4 6.1 410 0.3 2.2 5.0 Consumer and Other 186 1.5 0.9 0.5 185 1.1 1.0 0.7 1-4 Family Residential 5,804 0.6 27.7 40.4 5,200 0.5 28.4 39.8 Total Consumer 7,127 0.6 34.0 47.0 5,795 0.5 31.6 45.5 Total allowance for credit losses $ 20,967 0.8 % 100 % 100 % $ 18,330 0.8 % 100 % 100 % (1) Represents the percentage of loans to total loans in the respective category.