Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2025

Commission File Number 1-11414

BANCO LATINOAMERICANO DE COMERCIO EXTERIOR, S.A.

(Exact name of Registrant as specified in its Charter)

FOREIGN TRADE BANK OF LATIN AMERICA, INC.

(Translation of Registrant’s name into English)

Business Park Torre V, Ave. La Rotonda, Costa del Este

P.O. Box 0819-08730

Panama City, Republic of Panama

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

| |

|

FOREIGN TRADE BANK OF LATIN AMERICA, INC. |

| |

|

(Registrant) |

| |

|

|

| Date: October 30, 2025 |

By: |

/s/ Annette van Hoorde de Solís |

|

Name: |

Annette van Hoorde de Solís |

|

Title: |

Chief Financial Officer |

BLADEX ANNOUNCES NET PROFITS OF $55.0 MILLION OR $1.48 PER SHARE IN 3Q25 AND $170.9 MILLION OR $4.60 PER SHARE IN 9M25

PANAMA CITY, REPUBLIC OF PANAMA, OCTOBER 28, 2025

Banco Latinoamericano de Comercio Exterior, S.A. (NYSE: BLX, “Bladex”, or “the Bank”), a Panama-based multinational bank originally established by the central banks of 23 Latin-American and Caribbean countries to promote foreign trade and economic integration in the Region, announced today its results for the Third Quarter (“3Q25”) and nine months (“9M25”) ended September 30, 2025.

The consolidated financial information in this document has been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

FINANCIAL & BUSINESS HIGHLIGHTS

•Solid profitability, with Net Profits reaching $55.0 million in 3Q25 (+4% YoY) and $170.9 million in 9M25 (+11% YoY), fostered by a diversified and recurring earnings base delivering strong top-line revenues, overcompensating higher provisions for credit losses.

•Annualized Return on Equity (“ROE”) totaled 14.9% in 3Q25 (-143bps YoY) and 16.2% in 9M25 (-20bps YoY), as the Bank steadily improved its earnings while further strengthening its capital position, most recently on the back of the successful launch of its inaugural $200 million Additional Tier 1 (“AT1”) issuance registered as other equity instruments. Excluding the overall effects of the AT1 issuance, the adjusted ROE stood at 15.1% for the 3Q25 and 16.3% for the 9M25.

•Net Interest Income (“NII”) totaled $67.4 million in 3Q25 (+1% YoY) and $200.4 million in 9M25 (+4% YoY), mainly driven by higher average business volumes. Net Interest Margin (“NIM”) stood at 2.32% for 3Q25 (-23bps YoY) and 2.35% for 9M25 (-14bps YoY), in the face of the gradual impact of lower market-based rates and increased USD market liquidity driving competitive pricing and margin compression.

•Strong Fee Income at $14.1 million for 3Q25 (+34% YoY) and $44.5 million for 9M25 (+37% YoY), driven by solid performance in all business lines, highlighted by strong growth on letters of credit and credit commitments.

•Well-managed Efficiency Ratio of 25.8% for 3Q25 and 25.2% in 9M25, as revenue growth overcompensated ongoing investments in technology, modernization and other business initiatives related to the Bank’s strategy execution.

•Credit Portfolio reached new all-time high at $12,286 million as of September 30, 2025 (+13% YoY), resulting from:

◦Commercial Portfolio EoP balances reaching an historic peak of $10,872 million at the end of 3Q25 (+12% YoY), supported by steady credit demand across all business products.

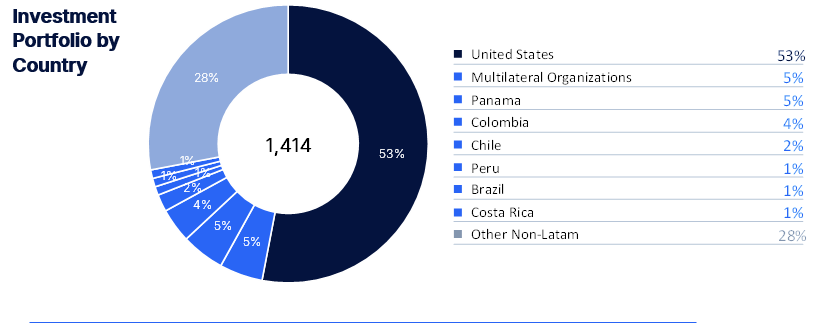

◦Investment Portfolio amounted to $1,414 million (+18% YoY), mostly consisting of investment-grade securities outside of Latin America held at amortized cost, further enhancing country and credit-risk diversification and providing contingent liquidity funding.

•Healthy asset quality, with most of the credit portfolio (97.2%) remaining low risk or Stage 1 at the end of 3Q25. Impaired credits or Stage 3 principal balance totaled $19 million or 0.2% of total Credit Portfolio, with a robust reserve coverage of 5.4x.

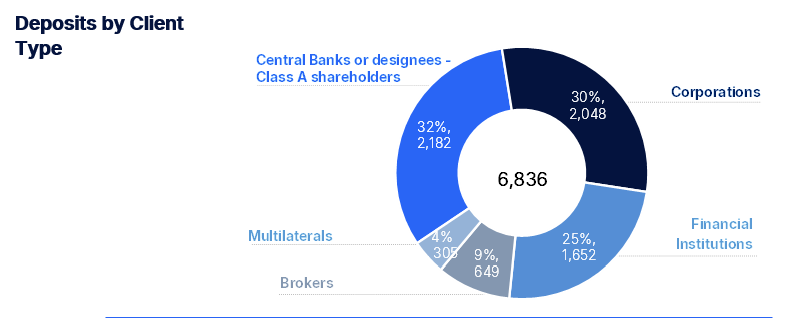

•Steady growth and diversified deposit base, reaching $6,836 million at the end of 3Q25 (+21% YoY), representing a new all-time high, and 66% of the Bank’s total funding sources (+7pp YoY). The Bank also counts on ample and constant access to interbank and debt capital markets, denoted by the $4 billion MXN bond issued in July in the Mexican capital market.

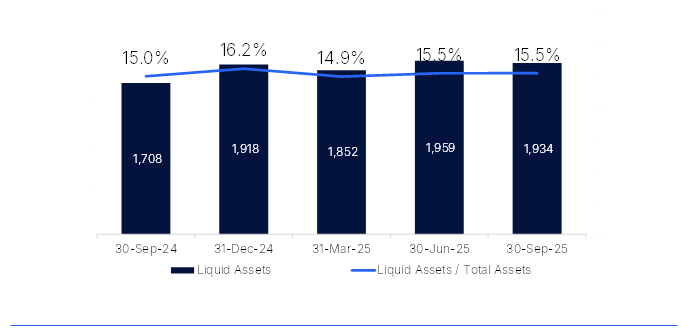

•Strong Liquidity position at $1,934 million, or 15.5% of total assets as of September 30, 2025, mostly consisting of deposits placed with the Federal Reserve Bank of New York (95%).

•The Bank´s Tier 1 Basel III Capital and Regulatory Capital Adequacy Ratios improved to 18.1% and 15.8% at the end of 3Q25, respectively, both well above internal targets and regulatory minimum, enhanced by strong earnings generation and the successful execution of its inaugural AT1 issuance.

FINANCIAL SNAPSHOT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US$ million, except percentages and per share amounts) |

|

3Q25 |

|

2Q25 |

|

3Q24 |

|

9M25 |

|

9M24 |

| Key Income Statement Highlights |

|

|

|

|

|

|

|

|

|

|

| Net Interest Income ("NII") |

|

$ |

67.4 |

|

|

$ |

67.7 |

|

|

$ |

66.6 |

|

|

$ |

200.4 |

|

|

$ |

192.3 |

|

| Fees and commissions, net |

|

$ |

14.1 |

|

|

$ |

19.9 |

|

|

$ |

10.5 |

|

|

$ |

44.5 |

|

|

$ |

32.5 |

|

| Gain on financial instruments, net |

|

$ |

0.9 |

|

|

$ |

2.2 |

|

|

$ |

0.3 |

|

|

$ |

5.0 |

|

|

$ |

0.1 |

|

| Other income, net |

|

$ |

0.4 |

|

|

$ |

0.2 |

|

|

$ |

0.1 |

|

|

$ |

0.8 |

|

|

$ |

0.3 |

|

| Total revenues |

|

$ |

82.8 |

|

|

$ |

90.0 |

|

|

$ |

77.6 |

|

|

$ |

250.8 |

|

|

$ |

225.2 |

|

| Provision for credit losses |

|

$ |

(6.5) |

|

|

$ |

(5.0) |

|

|

$ |

(3.5) |

|

|

$ |

(16.7) |

|

|

$ |

(13.3) |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

$ |

(21.3) |

|

|

$ |

(20.8) |

|

|

$ |

(21.0) |

|

|

$ |

(63.2) |

|

|

$ |

(57.6) |

|

| Profit for the period |

|

$ |

55.0 |

|

|

$ |

64.2 |

|

|

$ |

53.0 |

|

|

$ |

170.9 |

|

|

$ |

154.4 |

|

| Profitability Ratios |

|

|

|

|

|

|

|

|

|

|

Earnings per Share ("EPS") (1) |

|

$ |

1.48 |

|

|

$ |

1.73 |

|

|

$ |

1.44 |

|

|

$ |

4.60 |

|

|

$ |

4.20 |

|

Return on Average Equity (“ROE”) (2) |

|

14.9 |

% |

|

18.5 |

% |

|

16.4 |

% |

|

16.2 |

% |

|

16.4 |

% |

Adjusted ROE excluding other equity instruments (3) |

|

15.1 |

% |

|

18.5 |

% |

|

16.4 |

% |

|

16.3 |

% |

|

16.4 |

% |

Return on Average Assets (ROA) (4) |

|

1.8 |

% |

|

2.1 |

% |

|

1.9 |

% |

|

1.9 |

% |

|

1.9 |

% |

Net Interest Margin ("NIM") (5) |

|

2.32 |

% |

|

2.36 |

% |

|

2.55 |

% |

|

2.35 |

% |

|

2.49 |

% |

Net Interest Spread ("NIS") (6) |

|

1.64 |

% |

|

1.70 |

% |

|

1.78 |

% |

|

1.66 |

% |

|

1.77 |

% |

Efficiency Ratio (7) |

|

25.8 |

% |

|

23.1 |

% |

|

27.1 |

% |

|

25.2 |

% |

|

25.6 |

% |

| Assets, Capital, Liquidity & Credit Quality |

|

|

|

|

|

|

|

|

|

|

Credit Portfolio (8) |

|

$ |

12,286 |

|

|

$ |

12,182 |

|

|

$ |

10,875 |

|

|

$ |

12,286 |

|

|

$ |

10,875 |

|

Commercial Portfolio (9) |

|

$ |

10,872 |

|

|

$ |

10,819 |

|

|

$ |

9,673 |

|

|

$ |

10,872 |

|

|

$ |

9,673 |

|

| Investment Portfolio |

|

$ |

1,414 |

|

|

$ |

1,363 |

|

|

$ |

1,202 |

|

|

$ |

1,414 |

|

|

$ |

1,202 |

|

| Total assets |

|

$ |

12,498 |

|

|

$ |

12,674 |

|

|

$ |

11,412 |

|

|

$ |

12,498 |

|

|

$ |

11,412 |

|

| Total equity |

|

$ |

1,646 |

|

|

$ |

1,415 |

|

|

$ |

1,310 |

|

|

$ |

1,646 |

|

|

$ |

1,310 |

|

Market capitalization (10) |

|

$ |

1,712 |

|

|

$ |

1,500 |

|

|

$ |

1,195 |

|

|

$ |

1,712 |

|

|

$ |

1,195 |

|

Tier 1 Capital to Risk-Weighted Assets (Basel III – IRB) (11) |

|

18.1 |

% |

|

15.0 |

% |

|

16.0 |

% |

|

18.1 |

% |

|

16.0 |

% |

Capital Adequacy Ratio (Regulatory) (12) |

|

15.8 |

% |

|

13.9 |

% |

|

13.7 |

% |

|

15.8 |

% |

|

13.7 |

% |

| Total Assets / Total Equity (times) |

|

7.6 |

|

9.0 |

|

8.7 |

|

7.6 |

|

8.7 |

Liquid Assets / Total Assets (13) |

|

15.5 |

% |

|

15.5 |

% |

|

15.0 |

% |

|

15.5 |

% |

|

15.0 |

% |

Credit-impaired loans to Loan Portfolio (14) |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

Impaired credits (15) to Credit Portfolio |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

Total Allowance for Losses to Credit Portfolio (16) |

|

0.8 |

% |

|

0.8 |

% |

|

0.7 |

% |

|

0.8 |

% |

|

0.7 |

% |

Total Allowance for Losses to Impaired credits (times) (16) |

|

5.4 |

|

5.1 |

|

4.7 |

|

5.4 |

|

4.7 |

RESULTS BY BUSINESS SEGMENT

Bladex’s activities are comprised of two business segments, Commercial and Treasury. Information related to each segment is set out below. Business segment reporting is based on the Bank’s managerial accounting process, which assigns assets, liabilities, revenue, and expense items to each business segment on a systemic basis.

COMMERCIAL BUSINESS SEGMENT

The Commercial Business Segment encompasses the Bank’s core business of financial intermediation and fee generation activities developed to cater to corporations, financial institutions, and investors in Latin America. These activities include the origination of bilateral short-term and medium-term loans, structured and syndicated credits, loan commitments, and financial guarantee contracts such as issued and confirmed letters of credit, stand-by letters of credit, guarantees covering commercial risk, and other assets consisting of customers’ liabilities under acceptances.

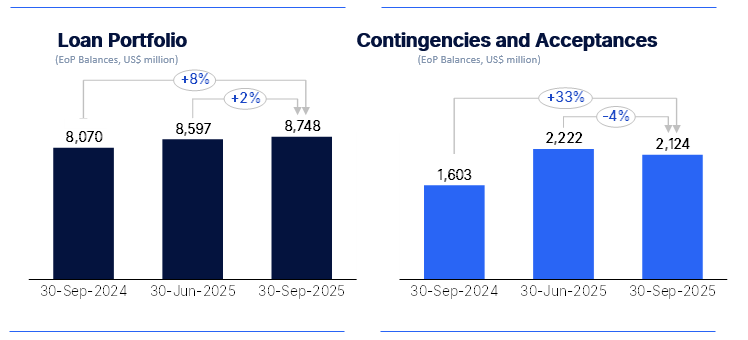

The majority of the Bank’s core financial intermediation business, consisting of loans – principal balance (or the “Loan Portfolio”), amounted to $8,748 million at the end of 3Q25, representing an increase of 2% QoQ and 8% YoY, as the Bank experienced steady credit demand, even in the context of ample market liquidity and tighter spreads. In addition, contingencies and acceptances amounted to $2,124 million at the end of 3Q25 (-4% QoQ; +33% YoY), reflecting sustained commercial activity across the Region and solid demand in letters of credit, guarantees and credit commitments.

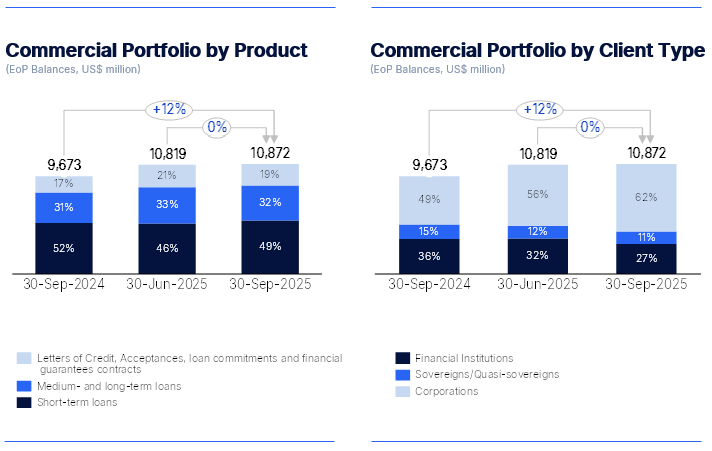

Consequently, the Bank’s Commercial Portfolio reached an all-time high of $10,872 million at the end of 3Q25, a slight increase from $10,819 million in the prior quarter and increasing 12% from $9,673 million a year ago. In addition, the average Commercial Portfolio balance totaled $10,596 million in 3Q25 (stable QoQ and +16% YoY) and $10,469 million in 9M25 (+18% YoY).

As of September 30, 2025, 68% of the Commercial Portfolio was scheduled to mature within a year and trade finance transactions accounted for 63% of the Bank’s short-term original book.

Weighted average lending rates stood at 7.34% in 3Q25 (-8bps QoQ; -110bps YoY) and 7.43% in 9M25 (-106bps YoY), reflecting the continued effect of lower USD market-based interest rates and ample market liquidity driving competitive pricing.

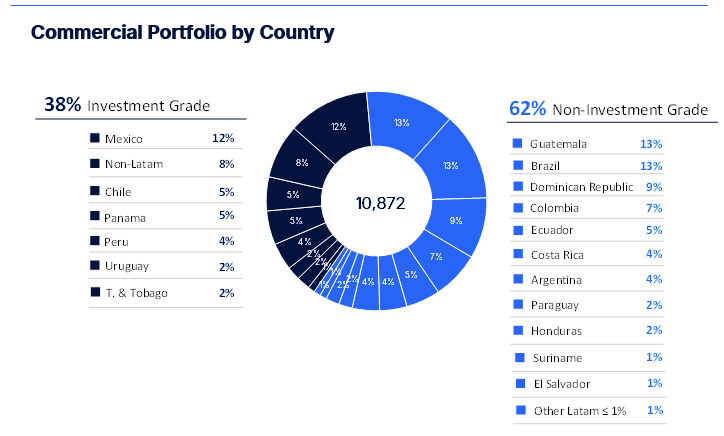

Bladex maintains well-diversified exposures across countries and industries. At the end of 3Q25, Guatemala and Brazil represent the largest country-risk exposure of the total Commercial Portfolio at 13% each, followed by Mexico at 12%, Dominican Republic at 9% and exposure to top-rated countries outside of Latin America at 8%, which relates to transactions carried out in the Region. As of September 30, 2025, 38% of the Commercial Portfolio was geographically distributed in investment grade countries.

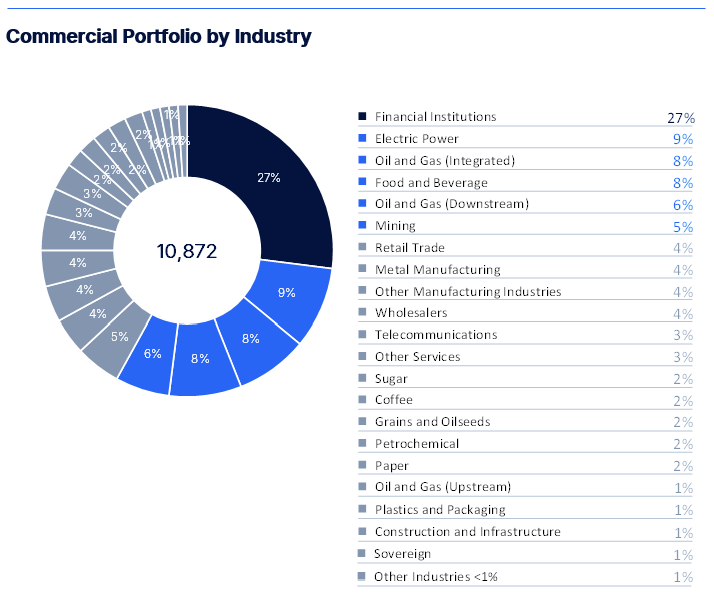

Exposure to the Bank’s traditional client base comprising financial institutions represented 27% of the total, while sovereign and state-owned corporations accounted for another 11%. Exposure to corporates accounted for the remainder 62% of the Commercial Portfolio, comprised of top-tier clients well diversified across sectors, with the most significant exposures in Electric Power at 9%, Oil & Gas (Integrated) and Food and Beverage at 8% each, Oil & Gas (Downstream) at 6% and Mining at 5% of the Commercial Portfolio at the end of 3Q25.

Refer to Exhibit IX for additional information related to the Bank’s Commercial Portfolio distribution by country.

Commercial Segment Profitability

Profits from the Commercial Business Segment include: (i) net interest income from loans; (ii) fees and commissions from the issuance, confirmation and negotiation of letters of credit, guarantees and loan commitments, as well as through loan structuring and syndication activities; (iii) gain on sale of loans generated through loan intermediation activities, such as sales and distribution in the primary market; (iv) gain (loss) on sale of loans measured at FVTPL; (v) reversal (provision) for credit losses; and (vi) direct and allocated operating expenses.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US$ million) |

|

3Q25 |

|

2Q25 |

|

3Q24 |

|

QoQ (%) |

|

YoY (%) |

|

9M25 |

|

9M24 |

|

YoY (%) |

| Commercial Business Segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

$ |

60.0 |

|

|

$ |

59.7 |

|

|

$ |

59.2 |

|

|

1 |

% |

|

1 |

% |

|

$ |

178.7 |

|

|

$ |

171.5 |

|

|

4 |

% |

| Other income |

|

15.3 |

|

21.5 |

|

10.8 |

|

-29 |

% |

|

41 |

% |

|

47.7 |

|

33.3 |

|

43 |

% |

| Total revenues |

|

75.3 |

|

81.2 |

|

70.1 |

|

-7 |

% |

|

7 |

% |

|

226.4 |

|

204.8 |

|

11 |

% |

| Provision for credit losses |

|

(6.5) |

|

(5.2) |

|

(3.4) |

|

-25 |

% |

|

-93 |

% |

|

(16.8) |

|

(13.7) |

|

-22 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

(16.8) |

|

(16.3) |

|

(16.9) |

|

-3 |

% |

|

1 |

% |

|

(50.0) |

|

(46.2) |

|

-8 |

% |

| Profit for the segment |

|

$ |

52.0 |

|

|

$ |

59.7 |

|

|

$ |

49.8 |

|

|

-13 |

% |

|

4 |

% |

|

$ |

159.6 |

|

|

$ |

145.0 |

|

|

10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial Segment Profit totaled $52.0 million in 3Q25 (-13% QoQ and +4% YoY) and $159.6 million in 9M25 (+10% YoY). The YoY increases were mostly driven by increased top line performance in NII coupled with strengthened fee income generation, offsetting the effects of higher provision for credit losses and operating expenses. The 13% QoQ decrease was mainly due to the record-level fee income highlighted by the Bank’s largest ever structured transaction accounted in the second quarter 2025.

TREASURY BUSINESS SEGMENT

The Treasury Business Segment manages the Bank’s investment portfolio and overall asset and liability structure to enhance funding efficiency and liquidity, mitigating the traditional financial risks associated with the balance sheet, such as interest rate, liquidity, price, and currency risks. Interest-earning assets managed by the Treasury Business Segment include liquidity positions in cash and cash equivalents, as well as highly liquid corporate debt securities rated ‘A-‘ or above, and financial instruments related to investment management activities, consisting of the principal balances of securities at fair value through other comprehensive income (“FVOCI”) and securities at amortized cost (the “Investment Portfolio”). The Treasury Business Segment also manages the Bank’s interest-bearing liabilities, consisting of deposits, securities sold under repurchased agreements, borrowed funds and floating and fixed rate debt placements.

Liquidity

The Bank’s liquid assets, mostly consisting of cash and due from banks, totaled $1,934 million as of September 30, 2025, compared to $1,959 million as of June 30, 2025, and $1,708 million as of September 30, 2024, highlighting the Bank’s proactive and prudent liquidity management approach in response to higher interest-bearing assets, also conforming with Basel methodology’s liquidity coverage ratio, as required by Panamanian banking regulator. At the end of those periods, liquidity balances to total assets represented 15.5%, 15.5% and 15.0%, respectively, while the liquidity balances to total deposits ratio was 28%, 30% and 30%, respectively. As of September 30, 2025, 95% of total liquid assets represented deposits placed with the Federal Reserve Bank of New York (“FED”), and 2% of total liquid assets represented deposits placed with highly rated U.S. banks.

Investment Portfolio

The Investment Portfolio, focused on further diversifying credit-risk exposures and providing contingent liquidity funding, amounted to $1,414 million in principal amount as of September 30, 2025, up 4% from the previous quarter and up 18% from a year ago. As of September 30, 2025, 88% of the Investment Portfolio consists of investment-grade credit securities eligible for the FED discount window, and $49 million consists of highly rated corporate debt securities (‘A-‘ or above) classified as high quality liquid assets (“HQLA”) in accordance with the specifications of the Basel Committee. Refer to Exhibit X for a per-country risk distribution of the Investment Portfolio.

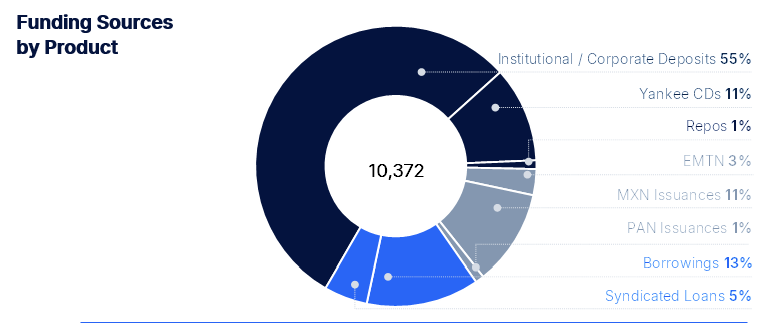

Funding

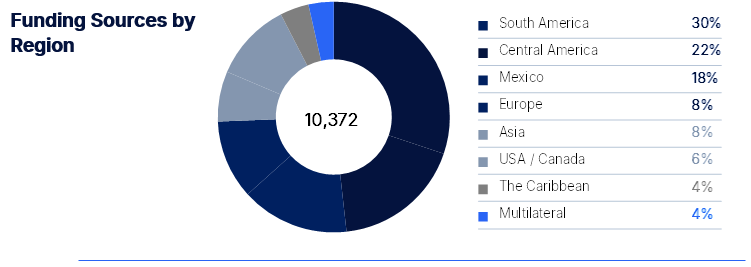

The Bank’s principal sources of funds are deposits, borrowed funds and floating and fixed rate debt placements. As of September 30, 2025, total net funding amounted to $10,372 million, a 0.5% decrease compared to $10,423 million a quarter ago, and a 9% increase compared to $9,556 million a year ago, as the Bank continues to expand its deposit base and diversify its funding base aligned with the ongoing commercial strategic initiatives.

The Bank obtains deposits from central banks, as well as from multilaterals, commercial banks and corporations primarily located in the Region. Total deposits amounted to $6,836 million at the end of 3Q25 (+6% QoQ and +21% YoY), representing a new all-time high, and 66% of total funding sources, compared to 62% and 59% a quarter and year ago, respectively, supported by effective cross-selling efforts, highlighting the change in the funding structure towards increased reliance in deposits.

As of September 30, 2025, the Bank’s Yankee CD program totaled $1,171 million, or 11% of total funding sources, providing granularity and complementing the short-term funding structure and long-standing support from the Bank’s Class A shareholders (i.e.: central banks and their designees), which represented 32% of total deposits at the end of 3Q25.

Funding through short and medium-term borrowings and debt, net decreased 10% QoQ and 5% YoY to $3,397 million at the end of 3Q25. The Bank’s ample and constant access to interbank and debt capital markets is clearly evidenced through public debt issuances in Mexico and Panama, coupled with private debt issuances placed in different markets primarily in Asia, Europe, the United States and Latin America. Funding through securities sold under repurchase agreements (“Repos”) reached $139 million at the end of 3Q25 (-29% QoQ; -60% YoY).

The Bank's funding sources are well diversified across geographies and currencies. In addition, the Bank has no significant foreign exchange risk, nor does it hold material open foreign exchange positions. Funding obtained in other currencies is hedged with derivatives to avoid any currency mismatch.

Weighted average funding costs resulted in 4.94% in 3Q25 (-5bps QoQ; -77bps YoY) and 5.01% in 9M25 (-69bps YoY), reflecting the effect of lower USD market-based interest rates.

Treasury Segment Profitability

Profits from the Treasury Business Segment include net interest income derived from the above-mentioned Treasury assets and liabilities, and related net other income (net results from derivative financial instruments and foreign currency exchange, gain (loss) per financial instruments at fair value through profit or loss (“FVTPL”), gain (loss) on sale of securities at FVOCI, and other income), recovery or impairment loss on financial instruments, and direct and allocated operating expenses.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US$ million) |

|

3Q25 |

|

2Q25 |

|

3Q24 |

|

QoQ (%) |

|

YoY (%) |

|

9M25 |

|

9M24 |

|

YoY (%) |

| Treasury Business Segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

$ |

7.4 |

|

|

$ |

8.1 |

|

|

$ |

7.4 |

|

|

-8 |

% |

|

1 |

% |

|

$ |

21.7 |

|

|

$ |

20.7 |

|

|

5 |

% |

| Other income (expense) |

|

0.1 |

|

0.8 |

|

0.1 |

|

-91 |

% |

|

-46 |

% |

|

2.7 |

|

(0.3) |

|

907 |

% |

| Total revenues |

|

7.5 |

|

8.9 |

|

7.5 |

|

-15 |

% |

|

0 |

% |

|

24.4 |

|

20.4 |

|

20 |

% |

| Reversal of (provision for) credit losses |

|

0.0 |

|

0.2 |

|

(0.2) |

|

-92 |

% |

|

107 |

% |

|

0.0 |

|

0.4 |

|

-92 |

% |

| Operating expenses |

|

(4.5) |

|

(4.6) |

|

(4.1) |

|

1 |

% |

|

-11 |

% |

|

(13.2) |

|

(11.4) |

|

-16 |

% |

| Profit for the segment |

|

$ |

3.0 |

|

|

$ |

4.5 |

|

|

$ |

3.2 |

|

|

-33 |

% |

|

-8 |

% |

|

$ |

11.3 |

|

|

$ |

9.4 |

|

|

20 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Treasury Business Segment recorded a $3.0 million profit for 3Q25 and $11.3 million profit for 9M25. The 33% quarterly decrease was mainly associated with lower NII and other income from the effectiveness of the derivatives positions. The year-to-date 20% YoY increase was primarily driven by the efficient cost of funds and liquidity management, coupled with positive other income results in 9M25, offsetting increased operating expenses.

NET INTEREST INCOME AND MARGINS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US$ million, except percentages) |

|

3Q25 |

|

2Q25 |

|

3Q24 |

|

QoQ (%) |

|

YoY (%) |

|

9M25 |

|

9M24 |

|

YoY (%) |

| Net Interest Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

$ |

193.7 |

|

|

$ |

194.4 |

|

|

$ |

198.7 |

|

|

0 |

% |

|

-3 |

% |

|

$ |

577.5 |

|

|

$ |

587.6 |

|

|

-2 |

% |

| Interest expense |

|

(126.3) |

|

|

(126.7) |

|

|

(132.1) |

|

|

0 |

% |

|

-4 |

% |

|

(377.1) |

|

|

(395.4) |

|

|

-5 |

% |

| Net Interest Income ("NII") |

|

$ |

67.4 |

|

|

$ |

67.7 |

|

|

$ |

66.6 |

|

|

0 |

% |

|

1 |

% |

|

$ |

200.4 |

|

|

$ |

192.3 |

|

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Interest Spread ("NIS") |

|

1.64 |

% |

|

1.70 |

% |

|

1.78 |

% |

|

|

|

|

|

1.66 |

% |

|

1.77 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Interest Margin ("NIM") |

|

2.32 |

% |

|

2.36 |

% |

|

2.55 |

% |

|

|

|

|

|

2.35 |

% |

|

2.49 |

% |

|

|

NII remained stable QoQ and increased 1% YoY to $67.4 million in 3Q25. For the nine months ended September 30, 2025, NII increased 4% to $200.4 million. Solid NII levels continue to be supported by a steady increase in average business volumes and disciplined pricing, together with a higher deposit base allowing for an efficient cost of funds, partly offset by the impact of margin compression from high USD market liquidity and the gradual impact of lower reference rates. As a result, NIM stood at 2.32% in 3Q25 and at 2.35% for 9M25.

FEES AND COMMISSIONS

Fees and Commissions, net, include revenues associated with the letter of credit business and guarantees, credit commitments, loan structuring and syndication, loan intermediation and distribution in the primary market, and other commissions, net of fee and commission expenses.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US$ million) |

|

3Q25 |

|

2Q25 |

|

3Q24 |

|

QoQ (%) |

|

YoY (%) |

|

9M25 |

|

9M24 |

|

YoY (%) |

| Letters of credit and guarantees |

|

8.9 |

|

7.8 |

|

7.1 |

|

13 |

% |

|

25 |

% |

|

23.4 |

|

19.6 |

|

19 |

% |

| Structuring services |

|

1.9 |

|

10.0 |

|

1.5 |

|

-81 |

% |

|

29 |

% |

|

14.3 |

|

6.5 |

|

120 |

% |

| Credit commitments |

|

4.0 |

|

2.8 |

|

2.1 |

|

41 |

% |

|

85 |

% |

|

8.2 |

|

6.1 |

|

33 |

% |

| Other fees and commissions income |

|

0.2 |

|

|

0.1 |

|

|

0.1 |

|

|

149 |

% |

|

175 |

% |

|

0.8 |

|

|

1.0 |

|

|

-20 |

% |

| Total fee and commission income |

|

15.0 |

|

|

20.7 |

|

|

10.8 |

|

|

-28 |

% |

|

39 |

% |

|

46.6 |

|

|

33.2 |

|

|

40 |

% |

| Fees and commission expenses |

|

(0.9) |

|

|

(0.8) |

|

|

(0.3) |

|

|

-13 |

% |

|

-217 |

% |

|

-2.1 |

|

|

-0.7 |

|

|

-201 |

% |

| Fees and Commissions, net |

|

$ |

14.1 |

|

|

$ |

19.9 |

|

|

$ |

10.5 |

|

|

-29 |

% |

|

34 |

% |

|

$ |

44.5 |

|

|

$ |

32.5 |

|

|

37 |

% |

Fees and Commissions, net, reached $14.1 million in 3Q25 (-29% QoQ; +34% YoY), and totaled $44.5 million in 9M25 (+37% YoY). The YoY increases were driven by solid performance in all business lines, highlighted by strong growth in the Bank’s off-balance sheet business (letters of credit and commitments) driven by the effective strategic execution,

increased transactionality and strong cross-selling initiatives. The 29% QoQ decrease was mainly due to the record-level fee income highlighted by the Bank’s largest ever structured transaction accounted in the second quarter 2025.

PORTFOLIO QUALITY AND TOTAL ALLOWANCE FOR CREDIT LOSSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US$ million, except percentages) |

|

3Q25 |

|

2Q25 |

|

1Q25 |

|

4Q24 |

|

3Q24 |

|

9M25 |

|

9M24 |

| Allowance for loan losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at beginning of the period |

|

$ |

81.9 |

|

|

$ |

77.3 |

|

|

$ |

78.2 |

|

|

$ |

71.9 |

|

|

$ |

63.3 |

|

|

$ |

78.2 |

|

|

$ |

59.4 |

|

| Provisions (reversals) |

|

$ |

5.1 |

|

|

$ |

4.6 |

|

|

$ |

(0.9) |

|

|

$ |

6.3 |

|

|

$ |

7.5 |

|

|

$ |

8.8 |

|

|

$ |

11.3 |

|

| Recoveries (write-offs) |

|

$ |

0.0 |

|

|

$ |

0.0 |

|

|

$ |

0.0 |

|

|

$ |

0.0 |

|

|

$ |

1.1 |

|

|

$ |

0.0 |

|

|

$ |

1.1 |

|

| End of period balance |

|

$ |

87.0 |

|

|

$ |

81.9 |

|

|

$ |

77.3 |

|

|

$ |

78.2 |

|

|

$ |

71.9 |

|

|

$ |

87.0 |

|

|

$ |

71.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for loan commitments and financial guarantee contract losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at beginning of the period |

|

$ |

11.9 |

|

|

$ |

11.3 |

|

|

$ |

5.4 |

|

|

$ |

7.4 |

|

|

$ |

11.5 |

|

|

$ |

5.4 |

|

|

$ |

5.1 |

|

| Provisions (reversals) |

|

$ |

1.4 |

|

|

$ |

0.5 |

|

|

$ |

6.0 |

|

|

$ |

(2.0) |

|

|

$ |

(4.1) |

|

|

$ |

7.9 |

|

|

$ |

2.3 |

|

| End of period balance |

|

$ |

13.3 |

|

|

$ |

11.9 |

|

|

$ |

11.3 |

|

|

$ |

5.4 |

|

|

$ |

7.4 |

|

|

$ |

13.3 |

|

|

$ |

7.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for Investment Portfolio losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at beginning of the period |

|

$ |

1.2 |

|

|

$ |

1.2 |

|

|

$ |

1.3 |

|

|

$ |

1.5 |

|

|

$ |

1.4 |

|

|

$ |

1.3 |

|

|

$ |

1.6 |

|

| Provisions (reversals) |

|

$ |

0.0 |

|

|

$ |

0.0 |

|

|

$ |

(0.1) |

|

|

$ |

(0.2) |

|

|

$ |

0.2 |

|

|

$ |

(0.1) |

|

|

$ |

(0.4) |

|

| Recoveries (write-offs) |

|

0.0 |

|

$ |

0.0 |

|

|

$ |

0.0 |

|

|

$ |

0.0 |

|

|

$ |

0.0 |

|

|

$ |

0.0 |

|

|

$ |

0.3 |

|

| End of period balance |

|

$ |

1.2 |

|

|

$ |

1.2 |

|

|

$ |

1.2 |

|

|

$ |

1.3 |

|

|

$ |

1.5 |

|

|

$ |

1.2 |

|

|

$ |

1.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total allowance for Credit Portfolio losses |

|

$ |

101.5 |

|

|

$ |

95.0 |

|

|

$ |

89.8 |

|

|

$ |

84.9 |

|

|

$ |

80.8 |

|

|

$ |

101.5 |

|

|

$ |

80.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for cash and due from banks losses |

|

$ |

0.1 |

|

|

$ |

0.0 |

|

|

$ |

0.2 |

|

|

$ |

0.0 |

|

|

$ |

0.0 |

|

|

$ |

0.1 |

|

|

$ |

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total allowance for losses |

|

$ |

101.5 |

|

|

$ |

95.1 |

|

|

$ |

90.0 |

|

|

$ |

84.9 |

|

|

$ |

80.8 |

|

|

$ |

101.5 |

|

|

$ |

80.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (at the end of each period) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total allowance for losses to Credit Portfolio |

|

0.8 |

% |

|

0.8 |

% |

|

0.8 |

% |

|

0.8 |

% |

|

0.7 |

% |

|

0.8 |

% |

|

0.7 |

% |

| Credit-impaired loans to Loan Portfolio |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

| Impaired Credits to Credit Portfolio |

|

0.2 |

% |

|

0.2 |

% |

|

0.1 |

% |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

| Total allowance for losses to impaired credits (times) |

|

5.4 |

|

5.1 |

|

5.3 |

|

5.0 |

|

4.7 |

|

5.4 |

|

4.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stage 1 Exposure (low risk) to Total Credit Portfolio |

|

97.2 |

% |

|

97.9 |

% |

|

97.9 |

% |

|

96.4 |

% |

|

95.7 |

% |

|

97.2 |

% |

|

95.7 |

% |

| Stage 2 Exposure (increased risk) to Total Credit Portfolio |

|

2.6 |

% |

|

2.0 |

% |

|

2.0 |

% |

|

3.5 |

% |

|

4.1 |

% |

|

2.6 |

% |

|

4.1 |

% |

| Stage 3 Exposure (credit impaired) to Total Credit Portfolio |

|

0.2 |

% |

|

0.2 |

% |

|

0.1 |

% |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

|

0.2 |

% |

As of September 30, 2025, the total allowance for losses stood at $101.5 million, compared to $95.1 million the previous quarter, and $80.8 million a year ago. The $6.5 million provision for credit losses in 3Q25 was mainly associated with a single client exposure classified at Stage 2 with increased risk since origination. Allowances for losses associated with the Credit Portfolio represented a coverage ratio of 0.8% at the end of 3Q25.

As of September 30, 2025, the principal balance of impaired credits (Stage 3) remained unchanged at $18.7 million, or 0.2% of total Credit Portfolio, with ample reserve coverage, compared to $18.7 million in the previous quarter and $17.0 million a year ago. Total allowance for credit losses to impaired credits resulted in 5.4 times. Credits categorized as Stage 1 or low-risk credits under IFRS 9 accounted for 97.2% of total credits, while Stage 2 credits represented 2.6% of total credits.

OPERATING EXPENSES AND EFFICIENCY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US$ million, except percentages) |

|

3Q25 |

|

2Q25 |

|

3Q24 |

|

QoQ (%) |

|

YoY (%) |

|

9M25 |

|

9M24 |

|

YoY (%) |

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and other employee expenses |

|

13.2 |

|

|

12.4 |

|

|

14.2 |

|

|

7 |

% |

|

-7 |

% |

|

39.5 |

|

|

37.6 |

|

|

5 |

% |

| Depreciation and amortization of equipment, leases and leasehold improvements |

|

0.7 |

|

|

0.7 |

|

|

0.6 |

|

|

-3 |

% |

|

14 |

% |

|

2.1 |

|

|

1.8 |

|

|

17 |

% |

| Amortization of intangible assets |

|

0.4 |

|

|

0.3 |

|

|

0.3 |

|

|

2 |

% |

|

27 |

% |

|

1.0 |

|

|

0.8 |

|

|

37 |

% |

| Other expenses |

|

7.1 |

|

|

7.4 |

|

|

6.0 |

|

|

-4 |

% |

|

19 |

% |

|

20.5 |

|

|

17.4 |

|

|

18 |

% |

| Total Operating Expenses |

|

$ |

21.3 |

|

|

$ |

20.8 |

|

|

$ |

21.0 |

|

|

2 |

% |

|

1 |

% |

|

$ |

63.2 |

|

|

$ |

57.6 |

|

|

10 |

% |

| Efficiency Ratio |

|

25.8 |

% |

|

23.1 |

% |

|

27.1 |

% |

|

|

|

|

|

25.2 |

% |

|

25.6 |

% |

|

|

Operating expenses totaled $21.3 million in 3Q25 (+2% QoQ; +1% YoY) and $63.2 million in 9M25 (+10% YoY). The increases continue to be related to higher personnel expenses stemming from compensation adjustments, new hires supporting strategic projects and other expenses aimed at enhancing business volumes, modernization and strengthening the Bank’s strategy execution capabilities.

The Efficiency Ratio totaled 25.8% in 3Q25, compared to 23.1% in 2Q25 and 27.1% in 3Q24, on the back of total revenues overcompensating higher operating expenses. For the nine months ended September 30, 2025, the Efficiency Ratio slightly improved to 25.2%, compared to 25.6% a year ago, reflecting the consistent disciplined approach to cost management.

CAPITAL RATIOS AND CAPITAL MANAGEMENT

The following table shows capital amounts and ratios as of the dates indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (US$ million, except percentages and shares outstanding) |

|

30-Sep-25 |

|

30-Jun-25 |

|

30-Sep-24 |

|

QoQ (%) |

|

YoY (%) |

| Total equity |

|

$ |

1,646 |

|

|

$ |

1,415 |

|

|

$ |

1,310 |

|

|

16 |

% |

|

26 |

% |

| Total assets / Total equity (times) |

|

7.6 |

|

9.0 |

|

8.7 |

|

-15 |

% |

|

-13 |

% |

| Shares outstanding (in thousand) |

|

37,231 |

|

37,231 |

|

36,787 |

|

0 |

% |

|

1 |

% |

|

|

|

|

|

|

|

|

|

|

|

Basel III International Framework (11) |

|

|

|

|

|

|

|

|

|

|

| Risk-Weighted Assets (Basel III – IRB) |

|

$ |

9,078 |

|

|

$ |

9,433 |

|

|

$ |

8,193 |

|

|

-4 |

% |

|

11 |

% |

| Tier 1 capital to risk weighted assets (Basel III – IRB) |

|

18.1 |

% |

|

15.0 |

% |

|

16.0 |

% |

|

21 |

% |

|

13 |

% |

|

|

|

|

|

|

|

|

|

|

|

Panama's Banking Regulation (12) |

|

|

|

|

|

|

|

|

|

|

| Risk-Weighted Assets |

|

$ |

10,387 |

|

|

$ |

10,156 |

|

|

$ |

9,572 |

|

|

2 |

% |

|

9 |

% |

| Ordinary Common Tier 1 Capital Ratio |

|

12.5 |

% |

|

12.5 |

% |

|

12.2 |

% |

|

0 |

% |

|

2 |

% |

| Total Common Tier 1 Capital Ratio |

|

14.4 |

% |

|

12.5 |

% |

|

12.2 |

% |

|

15 |

% |

|

18 |

% |

| Capital Adequacy Ratio |

|

15.8 |

% |

|

13.9 |

% |

|

13.7 |

% |

|

13 |

% |

|

15 |

% |

The Bank’s equity mainly consists of issued and fully paid ordinary common stock, with 37.2 million common shares outstanding as of September 30, 2025. In addition, the Bank’s capital position considers the US$200 million inaugural Additional Tier 1 (AT1) capital executed at the end of September 2025, registered in the Bank’s statement of financial position as other equity instruments, net of transaction costs.

As of September 30, 2025, the Tier 1 Basel III Capital Ratio, in which risk-weighted assets are calculated under the advanced internal ratings-based approach (IRB) for credit risk, resulted in 18.1%. Similarly, the Bank’s Capital Adequacy Ratio, as defined by Panama’s banking regulator under Basel’s standardized approach, was 15.8% as of September 30, 2025, well above the regulatory minimum of 9.25%. Additionally, the Bank’s Ordinary Common Tier 1 Capital Ratio, as defined by the Panama’s banking regulator, was 12.5% as of September 30, 2025, well above the regulatory minimum of 5.75%.

Recent Events:

•Quarterly dividend payment: The Board of Directors approved a quarterly common dividend of $0.625 per share corresponding to 3Q25. The cash dividend will be paid on November 25, 2025, to shareholders registered as of November 10, 2025.

•AT1 issuance: On September 12, 2025, the Bank announced the successful pricing of its inaugural Additional Tier 1 (AT1) capital offering of US$200 million in the international markets. The perpetual, non-cumulative instruments, with an initial call date set for seven years, were priced at a 7.50% coupon. The transaction was more than three times oversubscribed, reflecting robust market confidence in the Bank.

Notes:

•Numbers and percentages set forth in this earnings release have been rounded and accordingly may not total exactly.

•QoQ and YoY refer to quarter-on-quarter and year-on-year variations, respectively.

Footnotes:

1.Earnings per Share (“EPS”) calculation is based on the average number of shares outstanding during each period.

2.ROE refers to return on average stockholders’ equity which is calculated based on unaudited daily average balances.

3.ROE excluding other equity instruments refers to the adjusted net profit after AT1 distributions over average stockholders’ equity excluding other equity instruments, which is calculated based on unaudited daily average balances.

4.ROA refers to return on average assets which is calculated based on unaudited daily average balances.

5.NIM refers to net interest margin which constitutes to Net Interest Income (“NII”) divided by the average balance of interest-earning assets.

6.NIS refers to net interest spread which constitutes the average yield earned on interest-earning assets, minus the average yield paid on interest-bearing liabilities.

7.Efficiency Ratio refers to consolidated operating expenses as a percentage of total revenues.

8.The Bank’s “Credit Portfolio” includes (i) loans – principal balance, which excludes interest receivable, allowance for loan losses, and unearned interest and deferred fees (or the “Loan Portfolio”); (ii) principal balance of securities at FVOCI and at amortized cost, which excludes interest receivable and allowance for expected credit losses (or the “Investment Portfolio”); and (iii) loan commitments and financial guarantee contracts, such as confirmed and stand-by letters of credit and guarantees covering commercial risk and other assets consisting of customers’ liabilities under acceptances.

9.The Bank’s “Commercial Portfolio” includes loans – principal balance (or the “Loan Portfolio”), loan commitments and financial guarantee contracts, such as issued and confirmed letters of credit, stand-by letters of credit, guarantees covering commercial risk and other assets consisting of customers’ liabilities under acceptances.

10.Market capitalization corresponds to total outstanding common shares multiplied by market close price at the end of each corresponding period.

11.Tier 1 Capital ratio is calculated according to Basel III capital adequacy guidelines, and as a percentage of risk-weighted assets. Risk-weighted assets are estimated based on Basel III capital adequacy guidelines, utilizing internal-ratings based approach or “IRB” for credit risk and standardized approach for operational risk.

12.As defined by the Superintendency of Banks of Panama (“SBP”) through Rules No. 01-2015, 03-2016 and 05-2023, based on Basel III standardized approach. The capital adequacy ratio is defined as the ratio of capital funds to risk-weighted assets, rated according to the asset’s categories for credit risk. In addition, risk-weighted assets consider calculations for market risk and operating risk.

13.Liquid assets consist of total cash and due from banks, excluding time deposits with original maturity over 90 days and other restricted deposits, as well as corporate debt securities rated A- or above. Liquidity ratio refers to liquid assets as a percentage of total assets.

14.Loan Portfolio refers to loans – principal balance, which excludes interest receivable, allowance for loan losses, and unearned interest and deferred fees. Credit-impaired loans are also commonly referred to as Non-Performing Loans or NPLs.

15.Impaired Credits refers to the principal balance of Non-Performing Loans or NPLs and non-performing securities at FVOCI and at amortized cost.

16.Total allowance for losses refers to allowance for loan losses plus allowance for loan commitments and financial guarantee contract losses, allowance for investment securities losses and allowance for cash and due from banks losses.

SAFE HARBOR STATEMENT

This press release contains forward-looking statements of expected future developments within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by words such as: “anticipate”, “intend”, “plan”, “goal”, “seek”, “believe”, “project”, “estimate”, “expect”, “strategy”, “future”, “likely”, “may”, “should”, “will” and similar references to future periods. The forward-looking statements in this press release include the Bank’s financial position, asset quality and profitability, among

others. These forward-looking statements reflect the expectations of the Bank’s management and are based on currently available data; however, actual performance and results are subject to future events and uncertainties, which could materially impact the Bank’s expectations. Among the factors that can cause actual performance and results to differ materially are as follows: the coronavirus (COVID-19) pandemic and geopolitical events; the anticipated changes in the Bank’s credit portfolio; the continuation of the Bank’s preferred creditor status; the impact of increasing/decreasing interest rates and of the macroeconomic environment in the Region on the Bank’s financial condition; the execution of the Bank’s strategies and initiatives, including its revenue diversification strategy; the adequacy of the Bank’s allowance for expected credit losses; the need for additional allowance for expected credit losses; the Bank’s ability to achieve future growth, to reduce its liquidity levels and increase its leverage; the Bank’s ability to maintain its investment-grade credit ratings; the availability and mix of future sources of funding for the Bank’s lending operations; potential trading losses; the possibility of fraud; and the adequacy of the Bank’s sources of liquidity to replace deposit withdrawals. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

ABOUT BLADEX

Bladex, a multinational bank originally established by the central banks of Latin-American and Caribbean countries, began operations in 1979 to promote foreign trade and economic integration in the Region. The Bank, headquartered in Panama, also has offices in Argentina, Brazil, Colombia, Mexico, and the United States of America, and a Representative License in Peru, supporting the regional expansion and servicing its customer base, which includes financial institutions and corporations.

Bladex is listed on the NYSE in the United States of America (NYSE: BLX), since 1992, and its shareholders include: central banks and state-owned banks and entities representing 23 Latin American countries; commercial banks and financial institutions; and institutional and retail investors through its public listing.

CONFERENCE CALL INFORMATION

There will be a conference call to discuss the Bank’s quarterly results on Wednesday, October 29, 2025, at 11:00 a.m. New York City time (Eastern Time). For those interested in participating, please click here to pre-register to our conference call or visit our website at http://www.bladex.com. Participants should register five minutes before the call is set to begin. The webcast presentation will be available for viewing and downloads on http://www.bladex.com. The conference call will become available for review one hour after its conclusion.

For more information, please access http://www.bladex.com or contact:

|

|

|

|

|

|

|

Mr. Carlos Daniel Raad

Chief Investor Relations Officer

Tel: +507 366-4925 ext. 7925

E-mail: craad@bladex.com / ir@bladex.com

|

EXHIBIT I

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AT THE END OF, |

|

|

|

|

|

|

|

|

|

(A) |

|

(B) |

|

(C) |

|

(A) - (B) |

|

|

|

(A) - (C) |

|

|

|

September 30, 2025 |

|

June 30, 2025 |

|

September 30, 2024 |

|

CHANGE |

|

% |

|

CHANGE |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In US$ thousand) |

|

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

$ |

1,959,783 |

|

|

$ |

1,997,581 |

|

|

$ |

1,711,425 |

|

|

$ |

(37,798) |

|

|

(2) |

% |

|

$ |

248,358 |

|

|

15 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment securities |

1,426,520 |

|

|

1,377,813 |

|

|

1,213,329 |

|

|

48,707 |

|

|

4 |

|

213,191 |

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans |

8,726,282 |

|

|

8,583,899 |

|

|

8,090,061 |

|

|

142,383 |

|

|

2 |

|

636,221 |

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Customers' liabilities under acceptances |

260,173 |

|

|

602,232 |

|

|

292,542 |

|

|

(342,059) |

|

|

(57) |

|

(32,369) |

|

|

(11) |

| Trading derivative financial instruments - assets |

1,079 |

|

|

2,189 |

|

|

0 |

|

|

(1,110) |

|

|

(51) |

|

1,079 |

|

|

n.m. |

| Hedging derivative financial instruments - assets |

64,810 |

|

|

63,713 |

|

|

71,487 |

|

|

1,097 |

|

|

2 |

|

(6,677) |

|

|

(9) |

| Equipment, leases and leasehold improvements, net |

18,888 |

|

|

19,417 |

|

|

15,985 |

|

|

(529) |

|

|

(3) |

|

2,903 |

|

|

18 |

| Intangible assets |

11,553 |

|

|

3,462 |

|

|

3,086 |

|

|

8,091 |

|

|

234 |

|

8,467 |

|

|

274 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other assets |

28,714 |

|

|

23,901 |

|

|

14,228 |

|

|

4,813 |

|

|

20 |

|

14,486 |

|

|

102 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

12,497,802 |

|

|

$ |

12,674,207 |

|

|

$ |

11,412,143 |

|

|

$ |

(176,405) |

|

|

(1) |

% |

|

$ |

1,085,659 |

|

|

10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Customer deposits |

$ |

6,879,709 |

|

|

$ |

6,491,382 |

|

|

$ |

5,691,892 |

|

|

$ |

388,327 |

|

|

598 |

% |

|

$ |

1,187,817 |

|

|

2,087 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities sold under repurchase agreements |

139,401 |

|

|

196,562 |

|

|

346,299 |

|

|

(57,161) |

|

|

(29) |

|

(206,898) |

|

|

(60) |

| Borrowings and debt, net |

3,397,299 |

|

|

3,779,353 |

|

|

3,571,404 |

|

|

(382,054) |

|

|

(10) |

|

(174,105) |

|

|

(5) |

| Interest payable |

36,342 |

|

|

44,581 |

|

|

40,040 |

|

|

(8,239) |

|

|

(18) |

|

(3,698) |

|

|

(9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lease Liabilities |

18,377 |

|

|

18,713 |

|

|

15,867 |

|

|

(336) |

|

|

(2) |

|

2,510 |

|

|

16 |

| Acceptance outstanding |

260,173 |

|

|

602,232 |

|

|

292,542 |

|

|

(342,059) |

|

|

(57) |

|

(32,369) |

|

|

(11) |

| Trading derivative financial instruments - liabilities |

406 |

|

|

191 |

|

|

0 |

|

|

215 |

|

|

113 |

|

406 |

|

|

n.m. |

| Hedging derivative financial instruments - liabilities |

57,708 |

|

|

69,217 |

|

|

90,837 |

|

|

(11,509) |

|

|

(17) |

|

(33,129) |

|

|

(36) |

| Allowance for losses on loan commitments and financial guarantee contract losses |

13,311 |

|

|

11,877 |

|

|

7,403 |

|

|

1,434 |

|

|

12 |

|

5,908 |

|

|

80 |

| Other liabilities |

48,603 |

|

|

44,619 |

|

|

46,039 |

|

|

3,984 |

|

|

9 |

|

2,564 |

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

$ |

10,851,329 |

|

|

$ |

11,258,727 |

|

|

$ |

10,102,323 |

|

|

$ |

(407,398) |

|

|

(4) |

% |

|

$ |

749,006 |

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock |

$ |

279,980 |

|

|

$ |

279,980 |

|

|

$ |

279,980 |

|

|

$ |

0 |

|

|

0 |

% |

|

$ |

0 |

|

|

0 |

% |

| Treasury stock |

(97,581) |

|

|

(97,578) |

|

|

(105,672) |

|

|

(3) |

|

|

0 |

|

8,091 |

|

|

8 |

| Additional paid-in capital in excess of value assigned to common stock |

122,994 |

|

|

120,854 |

|

|

122,472 |

|

|

2,140 |

|

|

2 |

|

522 |

|

|

0 |

| Other equity instrument, net |

197,976 |

|

|

0 |

|

|

0 |

|

|

197,976 |

|

|

n.m. |

|

197,976 |

|

|

n.m. |

| Capital reserves |

95,210 |

|

|

95,210 |

|

|

95,210 |

|

|

0 |

|

|

0 |

|

0 |

|

|

0 |

| Regulatory reserves |

151,469 |

|

|

149,665 |

|

|

145,117 |

|

|

1,804 |

|

|

1 |

|

6,352 |

|

|

4 |

| Retained earnings |

891,325 |

|

|

861,430 |

|

|

763,460 |

|

|

29,895 |

|

|

3 |

|

127,865 |

|

|

17 |

| Other comprehensive income |

5,100 |

|

|

5,919 |

|

|

9,253 |

|

|

(819) |

|

|

(14) |

|

(4,153) |

|

|

(45) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

$ |

1,646,473 |

|

|

$ |

1,415,480 |

|

|

$ |

1,309,820 |

|

|

$ |

230,993 |

|

|

16 |

% |

|

$ |

336,653 |

|

|

26 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

$ |

12,497,802 |

|

|

$ |

12,674,207 |

|

|

$ |

11,412,143 |

|

|

$ |

(176,405) |

|

|

(1) |

% |

|

$ |

1,085,659 |

|

|

10 |

% |

(*) "n.m."means not meaningful. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXHIBIT II

CONSOLIDATED STATEMENTS OF PROFIT OR LOSS

(In US$ thousand, except per share amounts and ratios)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

FOR THE THREE MONTHS ENDED |

|

|

|

|

|

|

|

|

| |

(A) |

|

(B) |

|

(C) |

|

(A) - (B) |

|

|

|

(A) - (C) |

|

|

| |

September 30, 2025 |

|

June 30, 2025 |

|

September 30, 2024 |

|

CHANGE |

|

% |

|

CHANGE |

|

% |

| Net Interest Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

$ |

193,680 |

|

|

$ |

194,431 |

|

|

$ |

198,682 |

|

|

$ |

(751) |

|

|

0 |

% |

|

$ |

(5,002) |

|

|

(3) |

% |

| Interest expense |

(126,253) |

|

|

(126,692) |

|

|

(132,052) |

|

|

439 |

|

|

0 |

|

5,799 |

|

|

4 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Interest Income |

67,427 |

|

|

67,739 |

|

|

66,630 |

|

|

(312) |

|

|

0 |

|

797 |

|

|

1 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fees and commissions, net |

14,052 |

|

|

19,912 |

|

|

10,490 |

|

|

(5,860) |

|

|

(29) |

|

3,562 |

|

|

34 |

| Gain on financial instruments, net |

882 |

|

|

2,161 |

|

|

328 |

|

|

(1,279) |

|

|

(59) |

|

554 |

|

|

169 |

| Other income, net |

416 |

|

|

230 |

|

|

135 |

|

|

186 |

|

|

81 |

|

281 |

|

|

208 |

| Total other income, net |

15,350 |

|

|

22,303 |

|

|

10,953 |

|

|

(6,953) |

|

|

(31) |

|

4,397 |

|

|

40 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

82,777 |

|

|

90,042 |

|

|

77,583 |

|

|

(7,265) |

|

|

(8) |

|

5,194 |

|

|

7 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for credit losses |

(6,482) |

|

|

(5,019) |

|

|

(3,548) |

|

|

(1,463) |

|

|

(29) |

|

(2,934) |

|

|

(83) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and other employee expenses |

(13,196) |

|

|

(12,384) |

|

|

(14,177) |

|

|

(812) |

|

|

(7) |

|

981 |

|

|

7 |

| Depreciation and amortization of equipment, leases and leasehold improvements |

(697) |

|

|

(721) |

|

|

(614) |

|

|

24 |

|

|

3 |

|

(83) |

|

|

(14) |

| Amortization of intangible assets |

(355) |

|

|

(348) |

|

|

(279) |

|

|

(7) |

|

|

(2) |

|

(76) |

|

|

(27) |

| Other expenses |

(7,079) |

|

|

(7,386) |

|

|

(5,972) |

|

|

307 |

|

|

4 |

|

(1,107) |

|

|

(19) |

| Total operating expenses |

(21,327) |

|

|

(20,839) |

|

|

(21,042) |

|

|

(488) |