Document

DESCRIPTION OF SECURITIES

REGISTERED UNDER SECTION 12 OF THE EXCHANGE ACT

As of June 30, 2025, DRDGOLD Limited (the Company, DRDGOLD, we, us, and our) had the following securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934 (the Exchange Act):

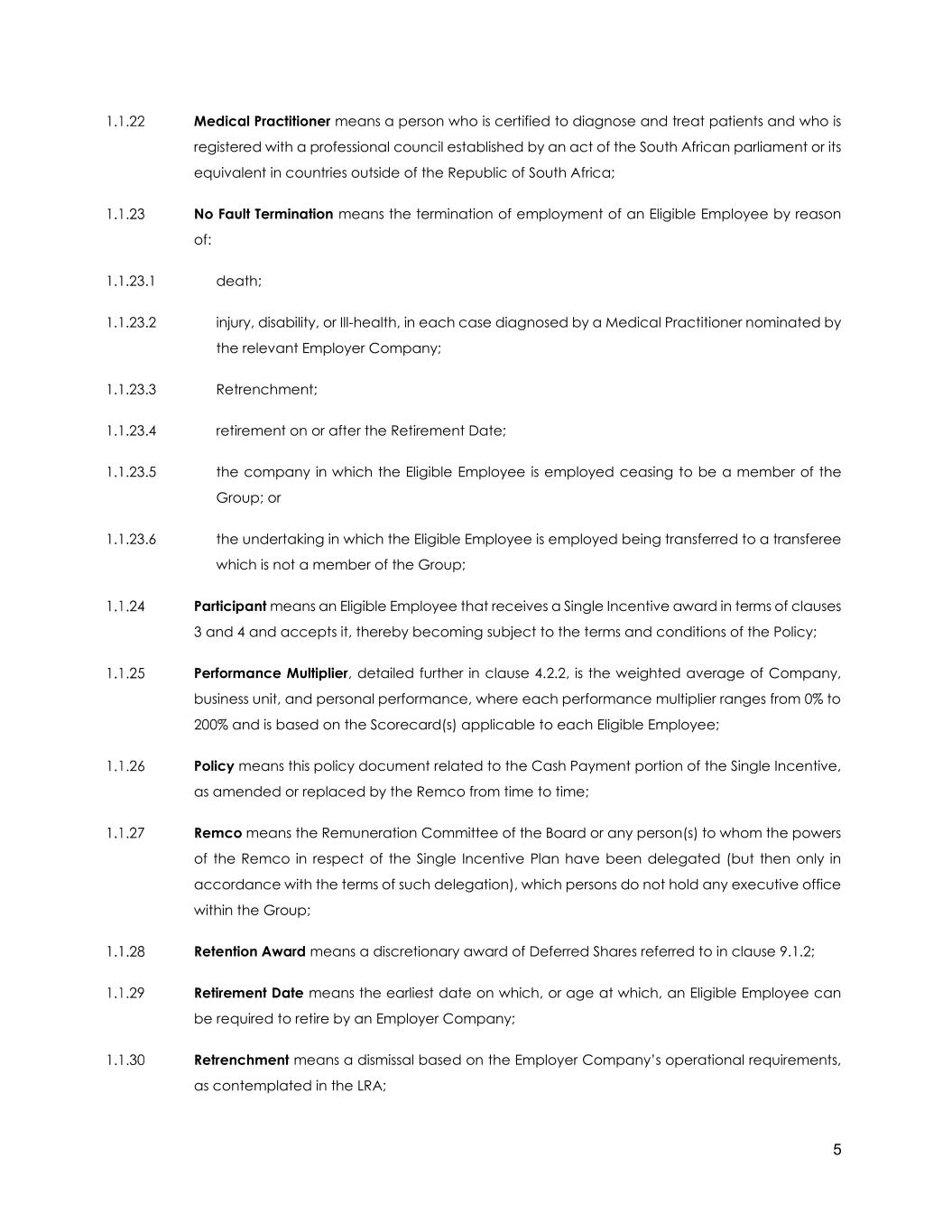

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

| American Depositary Shares, each representing ten ordinary shares |

DRD |

New York Stock Exchange |

| Ordinary shares |

|

New York Stock Exchange* |

* Not for trading, but only in connection with the registration of the American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission.

Capitalised terms used but not defined herein have the meanings given to them in DRDGOLD’s annual report on Form 20-F for the fiscal year ended June 30, 2025.

Ordinary shares

Item 9.A.3 Pre-emptive rights

Issue of additional shares

In accordance with the provisions of the JSE Listings Requirements and the DRDGOLD MOI, the Board shall not have the power to issue authorised shares other than:

•the issue of capitalisation shares or the offer of a cash payment in lieu of awarding capitalisation shares; and

•issues which do not require the approval of shareholders in terms of the Companies Act or the JSE Listings Requirements.

In accordance with the provisions of the Companies Act:

•an issue of shares must be approved by a special resolution of the shareholders of a company if the shares are issued to (i) a director, future director, prescribed officer or future prescribed officer of the company; (ii) any other person related or inter-related to the company or a director or prescribed officer of the company; or (iii) a nominee of a person contemplated in (i) or (ii); and

•an issue of shares in a transaction, or series of integrated transactions, requires approval of the shareholders by special resolution if the voting power of the shares that are issued as a result of the transaction will be equal to or exceed 30 per cent. of the voting power of all the shares held by shareholders immediately before the transaction or series of transactions.

Issues for Cash

In accordance with the provisions of the JSE Listings Requirements and the DRDGOLD MOI, shareholders may either convey a:

•special authority to issue shares for cash on terms that are specifically approved by shareholders in a shareholders meeting in respect of a particular issue (Specific Issue for Cash); or

•general authority to issue shares for cash on terms generally approved by shareholders in a shareholders meeting by granting the Board the authority to issue a specified number of securities for cash, which authority will be valid until the next annual general meeting or for 15 months from the date on which the resolution was passed, whichever period is shorter (General Issue for Cash).

In terms of the JSE Listings Requirements, a company may only undertake:

•a Specific Issue for Cash or a General Issue for Cash on the basis that a 75 per cent. majority of votes cast by shareholders at a shareholders meeting must approve the granting of such authority to the directors;

•a General Issue for Cash is subject to satisfactory compliance with certain requirements, including:

othe shares that are the subject of a General Issue for Cash may not exceed 5 per cent. of the company’s listed shares; and

othe maximum discount at which shares may be issued is 10 per cent. of the weighted average traded price of such shares measured over the 30 business days prior to the date that the price of the issue is agreed between the company and the party subscribing for the shares.

Pre-emptive rights

The Companies Act, the JSE Listings Requirements and the DRDGOLD MOI require that any new issue of shares by DRDGOLD must first be offered to existing shareholders in proportion to their shareholding in the Company, unless, among other things:

•the necessary shareholder approvals have been obtained;

•a capitalisation issue, an issue for an acquisition of assets (including another company) or an amalgamation or merger is to be undertaken; or

•the shares are to be issued in terms of option or conversion rights.

Repurchase of Shares

DRDGOLD or any subsidiary of DRDGOLD may, if authorised by special resolution by way of a general approval, acquire ordinary shares in the capital of DRDGOLD in accordance with the Companies Act and the JSE Listings Requirements, provided among other things that:

•the number of its own ordinary shares acquired by DRDGOLD in any one financial year shall not exceed 10 per cent. of the ordinary shares in issue at the date on which this resolution is passed;

•this authority shall lapse on the earlier of the date of the next annual general meeting or the date 15 months after the date on which the special resolution is passed;

•the Board has resolved to authorise the acquisition and that the Group will satisfy the solvency and liquidity test immediately after the acquisition and that since the test was done there have been no material changes to the financial position of the Group;

•the price paid per ordinary share may not be greater than 10 per cent. above the weighted average of the market value of the ordinary shares for the five business days immediately preceding the date on which an acquisition is made; and

•the number of shares acquired by subsidiaries of DRDGOLD shall not exceed 10 per cent. in the aggregate of the number of issued shares in DRDGOLD.

Item 9.A.5 Type and class of securities

DRDGOLD’s ordinary shares are listed on securities exchange operated by the JSE Limited (JSE). As of June 30, 2025, the total number of issued ordinary shares was 864,588,711. DRDGOLD’s ordinary shares are issued in registered (dematerialised) form. In addition, some of DRDGOLD’s shareholders hold a limited number of the shares in certificated form.

The transfer of any DRDGOLD certificated shares must be implemented in accordance with the provisions of the Companies Act, using the then common form of transfer. Dematerialised shares, which have been traded on the JSE, are transferred on the STRATE system and delivered five business days after each trade. The transferor of any share is deemed to remain the holder of that share until the name of the transferee is entered in DRDGOLD’s register for that share. Since DRDGOLD shares are traded through STRATE, only shares that have been dematerialised may be traded on the JSE. Accordingly, DRDGOLD shareholders who hold shares in certificated form must dematerialise their shares in order to trade on the JSE.

Item 9.A.6 Limitations or qualifications

Not applicable.

Item 9.A.7 Other rights

Not applicable.

Item 10.B.3 Shareholder rights

Dividends and payments to shareholders

DRDGOLD may make distributions (including the payment of dividends) from time to time in accordance with provisions of the Companies Act, the JSE Listings Requirements and the DRDGOLD MOI. In terms of the Companies Act, a company may only make a distribution (including the payment of any dividend) if:

•it reasonably appears that the company will satisfy the solvency and liquidity test immediately after completing the proposed distribution; and

•the board of the company, by resolution, has acknowledged that it has applied the solvency and liquidity test and reasonably concluded that the company will satisfy the solvency and liquidity test immediately after completing the proposed distribution.

In terms of the Companies Act, a company satisfies the solvency and liquidity test at a particular time if, considering all reasonably foreseeable financial circumstances of the company at that time:

•the assets of the company, as fairly valued, equal or exceed the liabilities of the company, as fairly valued; and

•it appears that the company will be able to pay its debts as they become due in the ordinary course of business for a period of:

o12 months after the date on which the test is considered; or

oin the case of a distribution (including the payment of dividends), 12 months following that distribution.

Subject to the above requirements, the directors of DRDGOLD may from time to time declare a dividend or any other distribution to shareholders in proportion to the number of shares held by them.

The Company must hold all monies due to the shareholders in trust indefinitely, subject to the laws of prescription. The Company shall be entitled at any time to delegate its obligations in respect of unclaimed dividends, or other unclaimed distributions, to any one of the Company’s bankers.

Voting Rights

Every shareholder of DRDGOLD, or representative of a shareholder, who is present at a shareholders meeting has one vote on a show of hands, irrespective of the number of shares he or she holds or represents, provided that a representative of a shareholder shall, irrespective of the number of shareholders he or she represents, have only one vote. Every DRDGOLD shareholder is, on a poll, entitled to one vote per ordinary share held. Neither the Companies Act nor the DRDGOLD MOI provide for cumulative voting.

A shareholder entitled to attend and vote at a shareholders meeting shall be entitled to appoint a proxy to attend, participate in, speak and vote at such shareholders meeting in the place of such shareholder. The proxy need not be a shareholder. However, the proxy may delegate the authority granted to him or her as a proxy as set out in the Companies Act.

Rights to share in the company’s profits

See “Dividends and payments to shareholders”.

Rights to share in any surplus in the event of liquidation

In the event of a voluntary or compulsory liquidation, dissolution or winding-up, the assets remaining after payment of all the debts and liabilities of DRDGOLD, including the costs of liquidation, shall be dealt with by a liquidator who may, among other things, divide among the shareholders any part of the assets of DRDGOLD, and may vest any part of the assets of DRDGOLD as the liquidator deems fit in trust for the benefit of shareholders. The division of assets is not required to be done in accordance with the legal rights of shareholders of DRDGOLD. In particular, any class may be given preferential or special rights or may be partly or fully excluded.

Redemption provisions

Not applicable.

Sinking fund provisions

Not applicable.

Liability to further capital calls by the Company

Not applicable.

Any provision discriminating against any existing or prospective holder of the ordinary shares as a result of such shareholder owning a substantial number of shares

Not applicable.

Item 10.B.4. Changes to shareholder rights

Amendments to DRDGOLD’s MOI

The DRDGOLD shareholders may, by the passing of a special resolution in accordance with the provisions of the Companies Act and the DRDGOLD MOI, or in compliance with a court order, and subject to the approval of the JSE, amend the DRDGOLD MOI, including:

•the creation of any class of shares;

•the variation of any preferences, rights, limitations and other terms attaching to any class of shares;

•the conversion of one class of shares into one or more other classes;

•an increase in DRDGOLD’s authorised share capital;

•a consolidation of DRDGOLD’s equity securities;

•a sub-division of DRDGOLD’s equity securities; and/or

•the change of DRDGOLD’s name.

Variation of Rights

All or any of the rights, privileges or conditions attached to DRDGOLD’s ordinary shares may be varied by a special resolution of DRDGOLD passed in accordance with the provisions of the Companies Act and the DRDGOLD MOI.

Item 10.B.6 Limitations

There are no limitations imposed by South African law or by the DRDGOLD MOI on the rights of non-South African shareholders to hold or vote DRDGOLD’s ordinary shares.

Item 10.B.7 Change in control

The DRDGOLD MOI does not contain any provisions that would have the effect of delaying, deferring or preventing a change in control of the company and that would operate only with respect to a merger, acquisition or corporate restructuring involving the company (or any of its subsidiaries).

Item 10.B.8 Disclosure of shareholdings

The Companies Act requires a registered holder of DRDGOLD shares who is not the beneficial owner of such shares to disclose to DRDGOLD, within five business days of the end of every month during which a change has occurred in the beneficial ownership, the identity of the beneficial owner and the number and class of securities held on behalf of the beneficial owner. Moreover, DRDGOLD may, by notice in writing, require a person who is a registered shareholder, or whom DRDGOLD knows or has reasonable cause to believe has a beneficial interest in DRDGOLD ordinary shares, to confirm or deny whether or not such person holds the ordinary shares or beneficial interest and, if the ordinary shares are held for another person, to disclose to DRDGOLD the identity of the person on whose behalf the ordinary shares are held. DRDGOLD may also require the person to give particulars of the extent of the beneficial interest held during the three years preceding the date of the notice. DRDGOLD is obliged to establish and maintain a register of the disclosures described above in accordance with the Companies Act and to publish in its annual financial statements a list of the persons who hold a beneficial interest equal to or in excess of 5 per cent. of the total number of ordinary shares issued by DRDGOLD, together with the extent of those beneficial interests.

Item 10.B.9 Differences in the law

With respect to Items 10.B.2-10.B.8, there are no significant differences between the South African law and U.S. federal law.

American Depositary Shares (12.D.1 and 12.D.2)

Deposit Agreement

DRDGOLD has an American Depositary Receipt facility. In connection with this facility, DRDGOLD is party to a Deposit Agreement, dated as of August 12, 1996, as amended and restated as of July 23, 2007, and as further amended and restated as of May 16, 2025, among DRDGOLD, JPMorgan Chase Bank, N.A. (JPMorgan), as Depositary, and all owners and holders from time to time of American Depositary Receipts issued thereunder.

This summary is subject to and qualified in its entirety by reference to the Deposit Agreement, including the form of ADRs attached thereto. Terms used in this section and not otherwise defined will have the meanings set forth in the Deposit Agreement. Copies of the Deposit Agreement are available for inspection at the Depositary Receipts Group of the Depositary, located at 383 Madison Avenue, Floor 11, New York, New York 10179. The Depositary’s principal executive office is also located at 383 Madison Avenue, Floor 11, New York, New York 10179.

American Depositary Shares

An American Depositary Receipt (ADR) is a receipt evidencing a specific number of American Depositary Shares (ADSs). The ADRs are issued by JPMorgan as Depositary. Each ADS represents an ownership interest in a designated number of shares which are deposited with the custodian, as agent of the Depositary, under the Deposit Agreement among ourselves, the Depositary, holders of ADRs, and all beneficial owners of an interest in the ADSs evidenced by ADRs from time to time.

Each DRDGOLD ADS represents ownership interests in ten DRDGOLD ordinary shares and the rights attributable to ten DRDGOLD ordinary shares that DRDGOLD will deposit with the custodian. The ADS to share ratio is subject to amendment as provided in the form of ADR (which may give rise to fees contemplated by the form of ADR). In the future, each ADS will also represent any securities, cash or other property deposited with the Depositary but which they have not distributed directly to you.

A beneficial owner is any person or entity having a beneficial ownership interest ADSs. A beneficial owner need not be the holder of the ADR evidencing such ADS. If a beneficial owner of ADSs is not an ADR holder, it must rely on the holder of the ADR(s) evidencing such ADSs in order to assert any rights or receive any benefits under the Deposit Agreement. A beneficial owner shall only be able to exercise any right or receive any benefit under the Deposit Agreement solely through the holder of the ADR(s) evidencing the ADSs owned by such beneficial owner. The arrangements between a beneficial owner of ADSs and the holder of the corresponding ADRs may affect the beneficial owner’s ability to exercise any rights it may have.

An ADR holder shall be deemed to have all requisite authority to act on behalf of any and all beneficial owners of the ADSs evidenced by the ADRs registered in such ADR holder’s name for all purposes under the Deposit Agreement and ADRs. The Depositary’s only notification obligations under the Deposit Agreement and the ADRs is to registered ADR holders. Notice to an ADR holder shall be deemed, for all purposes of the Deposit Agreement and the ADRs, to constitute notice to any and all beneficial owners of the ADSs evidenced by such ADR holder’s ADRs.

Unless certificated ADRs are specifically requested, all ADSs will be issued on the books of our Depositary in book-entry form and periodic statements will be mailed to you which reflect your ownership interest in such ADSs. In our description, references to American Depositary Receipts or ADRs shall include the statements you will receive which reflect your ownership of ADSs.

You may hold ADSs either directly or indirectly through your broker or other financial institution. If you hold ADSs directly, by having an ADS registered in your name on the books of the Depositary, you are an ADR holder. This description assumes you hold your ADSs directly. If you hold the ADSs through your broker or financial institution nominee, you must rely on the procedures of such broker or financial institution to assert the rights of an ADR holder described in this section. You should consult with your broker or financial institution to find out what those procedures are.

As an ADR holder or beneficial owner, DRDGOLD will not treat you as one of its shareholders and you will not have any shareholder rights. The law of the Republic of South Africa governs shareholder rights. Because the Depositary or its nominee will be the shareholder of record for the shares represented by all outstanding ADSs, shareholder rights rest with such record holder. Your rights are those of an ADR holder or of a beneficial owner. Such rights derive from the terms of the Deposit Agreement entered into among us, the Depositary and all holders and beneficial owners from time to time of ADRs issued under the Deposit Agreement and, in the case of a beneficial owner, from the arrangements between the beneficial owner and the holder of the corresponding ADRs. The obligations of the Depositary and its agents are also set out in the Deposit Agreement. Because the Depositary or its nominee will actually be the registered owner of the shares, you must rely on it to exercise the rights of a shareholder on your behalf.

The deposit agreement and the ADSs are governed by New York law. Under the Deposit Agreement, by holding an ADS or an interest therein, ADR holders and beneficial owners each irrevocably agree that any legal suit, action or proceeding against or involving us or the Depositary, arising out of or based upon the Deposit Agreement, the ADSs, the ADRs or the transactions contemplated thereby, may be instituted in a state or federal court in New York, New York, irrevocably waive any objection which you may have to the laying of venue of any such proceeding, and irrevocably submit to the exclusive jurisdiction of such courts in any such suit, action or proceeding.

The following is a summary of what we believe to be the material terms of the Deposit Agreement. Notwithstanding this, because it is a summary, it may not contain all the information that you may otherwise deem important. For more complete information, you should read the entire deposit agreement and the form of ADR which contains the terms of your ADSs. You can read a copy of the Deposit Agreement which is filed as an exhibit to the registration statement on Form F-6, which is available on the SEC’s website at http://www.sec.gov.

Share Dividends and Other Distributions

How will you receive dividends and other distributions on the shares underlying your ADSs?

We may make various types of distributions with respect to our securities. The Depositary has agreed that, to the extent practicable, it will pay to you the cash dividends or other distributions it or the custodian receives on shares or other deposited securities, after converting any cash received into U.S. dollars (if it determines such conversion may be made on a reasonable basis) and, in all cases, making any necessary deductions provided for in the Deposit Agreement. The Depositary may utilize a division, branch or affiliate of JPMorgan to direct, manage and/or execute any public and/or private sale of securities under the Deposit Agreement. Such division, branch and/or affiliate may charge the Depositary a fee in connection with such

sales, which fee is considered an expense of the Depositary. You will receive these distributions in proportion to the number of underlying securities that your ADSs represent.

Except as stated below, the Depositary will deliver such distributions to ADR holders in proportion to their interests in the following manner:

•Cash. The Depositary will distribute any U.S. dollars available to it resulting from a cash dividend or other cash distribution or the net proceeds of sales of any other distribution or portion thereof (to the extent applicable), on an averaged or other practicable basis, subject to (i) appropriate adjustments for taxes withheld, (ii) such distribution being impermissible or impracticable with respect to certain registered ADR holders, and (iii) deduction of the Depositary’s and/or its agents’ expenses in (1) converting any foreign currency to U.S. dollars to the extent that it determines that such conversion may be made on a reasonable basis, (2) transferring foreign currency or U.S. dollars to the United States by such means as the Depositary may determine to the extent that it determines that such transfer may be made on a reasonable basis, (3) obtaining any approval or license of any governmental authority required for such conversion or transfer, which is obtainable at a reasonable cost and within a reasonable time and (4) making any sale by public or private means in any commercially reasonable manner. If exchange rates fluctuate during a time when the Depositary cannot convert a foreign currency, you may lose some or all of the value of the distribution.

•Shares. In the case of a distribution in shares, the Depositary will issue additional ADRs to evidence the number of ADSs representing such shares. Only whole ADSs will be issued. Any shares which would result in fractional ADSs will be sold and the net proceeds will be distributed in the same manner as cash to the ADR holders entitled thereto.

•Rights to receive additional shares. In the case of a distribution of rights to subscribe for additional shares or other rights, if we timely provide evidence satisfactory to the Depositary that it may lawfully distribute such rights, the Depositary will distribute warrants or other instruments in the discretion of the Depositary representing such rights. However, if we do not timely furnish such evidence, the Depositary may:

osell such rights if practicable and distribute the net proceeds in the same manner as cash to the ADR holders entitled thereto; or

oif it is not practicable to sell such rights by reason of the non-transferability of the rights, limited markets therefor, their short duration or otherwise, do nothing and allow such rights to lapse, in which case ADR holders will receive nothing and the rights may lapse.

•Other Distributions. In the case of a distribution of securities or property other than those described above, the Depositary may either (i) distribute such securities or property in any manner it deems equitable and practicable or (ii) to the extent the Depositary deems distribution of such securities or property not to be equitable and practicable, sell such securities or property and distribute any net proceeds in the same way it distributes cash.

•Elective Distributions. In the case of a dividend payable at the election of our shareholders in cash or in additional shares whether or not we wish such elective distribution to be made available to ADR holders. The Depositary shall make such elective distribution available to ADR holders only if (i) we shall have timely requested that the elective distribution is available to ADR holders, (ii) the Depositary shall have determined that such distribution is reasonably practicable and (iii) the Depositary shall have received satisfactory documentation within the terms of the Deposit Agreement including any legal opinions of counsel that the Depositary in its reasonable discretion may request. If the above conditions are not satisfied, the Depositary shall, to the extent permitted by law, distribute to the ADR holders, on the basis of the same determination as is made in the local market in respect of the shares for which no election is made, either (x) cash or (y) additional ADSs representing such additional shares. If the above conditions are satisfied, the Depositary shall establish procedures to enable ADR holders to elect the receipt of the proposed dividend in cash or in additional ADSs. There can be no assurance that ADR holders generally, or any ADR holder in particular, will be given the opportunity to receive elective distributions on the same terms and conditions as the holders of shares.

If the Depositary determines in its discretion that any distribution described above is not practicable for the purpose of effecting such distribution with respect to any specific registered ADR holder entitled thereto, the

Depositary may choose any method of distribution that it deems practicable for such ADR holder, including the distribution of foreign currency, securities or property, or it may retain such items, without paying interest on or investing them, on behalf of the ADR holder as deposited securities, in which case the ADSs will also represent the retained items.

Any U.S. dollars will be distributed by checks drawn on a bank in the United States for whole dollars and cents. Fractional cents will be withheld without liability and dealt with by the Depositary in accordance with its then current practices.

The Depositary is not responsible if it fails to determine that any distribution or action is lawful or reasonably practicable.

There can be no assurance that the Depositary will be able to convert any currency at a specified exchange rate or sell any property, rights, shares or other securities at a specified price, nor that any of such transactions can be completed within a specified time period. All purchases and sales of securities will be handled by the Depositary in accordance with its then current policies, which are currently set forth in the “Depositary Receipt Sale and Purchase of Security” section of https://www.adr.com/Investors/FindOutAboutDRs, the location and contents of which the Depositary shall be solely responsible for.

Deposit, Withdrawal and Cancellation

How does the Depositary issue ADSs?

The Depositary will issue ADSs if you or your broker deposit shares or evidence of rights to receive shares with the custodian and pay the fees and expenses owing to the Depositary in connection with such issuance.

Shares deposited in the future with the custodian must be accompanied by certain delivery documentation and shall, at the time of such deposit, be registered in the name of JPMorgan Chase Bank, N.A., as Depositary for the benefit of holders of ADRs or in such other name as the Depositary shall direct.

The custodian will hold all deposited shares (including those being deposited by or on our behalf in connection with the offering to which this prospectus relates) for the account and to the order of the Depositary, in each case for the benefit of ADR holders. ADR holders and beneficial owners thus have no direct ownership interest in the shares and only have such rights as are contained in the Deposit Agreement. The custodian will also hold any additional securities, property and cash received on or in substitution for the deposited shares. The deposited shares and any such additional items are referred to as “deposited securities”.

Deposited securities are not intended to, and shall not, constitute proprietary assets of the Depositary, the custodian or their nominees. Beneficial ownership in deposited securities is intended to be, and shall at all times during the term of the Deposit Agreement continue to be, vested in the beneficial owners of the ADSs representing such deposited securities. Notwithstanding anything else contained herein, in the Deposit Agreement, in the form of ADR and/or in any outstanding ADSs, the Depositary, the custodian and their respective nominees are intended to be, and shall at all times during the term of the Deposit Agreement be, the record holder(s) only of the deposited securities represented by the ADSs for the benefit of the ADR holders. The Depositary, on its own behalf and on behalf of the custodian and their respective nominees, disclaims any beneficial ownership interest in the deposited securities held on behalf of the ADR holders.

Upon each deposit of shares, receipt of related delivery documentation and compliance with the other provisions of the Deposit Agreement, including the payment of the fees and charges of the Depositary and any taxes or other fees or charges owing, the Depositary will issue an ADR or ADRs in the name or upon the order of the person entitled thereto evidencing the number of ADSs to which such person is entitled. All of the ADSs issued will, unless specifically requested to the contrary, be part of the Depositary’s direct registration system, and a registered holder will receive periodic statements from the Depositary which will show the number of ADSs registered in such holder’s name. An ADR holder can request that the ADSs not be held through the Depositary’s direct registration system and that a certificated ADR be issued.

How do ADR holders cancel an ADS and obtain deposited securities?

When you turn in your ADR certificate at the Depositary’s office, or when you provide proper instructions and documentation in the case of direct registration ADSs, the Depositary will, upon payment of certain applicable fees, charges and taxes, deliver the underlying shares to you or upon your written order. Delivery of deposited securities in certificated form will be made at the custodian’s office. At your risk, expense and request, the Depositary may deliver deposited securities at such other place as you may request.

The Depositary may only restrict the withdrawal of deposited securities in connection with:

•temporary delays caused by closing our transfer books or those of the Depositary or the deposit of shares in connection with voting at a shareholders’ meeting, or the payment of dividends;

•the payment of fees, taxes and similar charges; or

•compliance with any U.S. or foreign laws or governmental regulations relating to the ADRs or to the withdrawal of deposited securities.

This right of withdrawal may not be limited by any other provision of the Deposit Agreement.

Record Dates

The Depositary may, after consultation with us if practicable, fix record dates (which, to the extent applicable, shall be as near as practicable to any corresponding record dates set by us) for the determination of the registered ADR holders who will be entitled (or obligated, as the case may be):

•to receive any distribution on or in respect of deposited securities,

•to give instructions for the exercise of voting rights at a meeting of holders of shares, or

•to pay the fee assessed by the Depositary for administration of the ADR program and for any expenses as provided for in the ADR,

•to receive any notice or to act or be obligated in respect of other matters, all subject to the provisions of the Deposit Agreement.

Voting Rights

How do you vote?

If you are an ADR holder and the Depositary asks you to provide it with voting instructions, you may instruct the Depositary how to exercise the voting rights for the shares which underlie your ADSs. Subject to the next sentence, as soon as practicable after receiving notice from us of any meeting at which the holders of shares are entitled to vote, or of our solicitation of consents or proxies from holders of shares, the Depositary shall fix the ADS record date in accordance with the provisions of the Deposit Agreement, provided that if the Depositary receives a written request from us and at least 30 days prior to the date of such vote or meeting, the Depositary shall, at our expense, distribute to the registered ADR holders a “voting notice” stating (i) final information particular to such vote and meeting and any solicitation materials, (ii) that each ADR holder on the record date set by the Depositary will, subject to any applicable provisions of South African law, be entitled to instruct the Depositary as to the exercise of the voting rights, if any, pertaining to the deposited securities represented by the ADSs evidenced by such ADR holder’s ADRs and (iii) the manner in which such instructions may be given, including instructions for giving a discretionary proxy to a person designated by us. Each ADR holder shall be solely responsible for the forwarding of voting notices to the beneficial owners of ADSs registered in such ADR holder’s name. There is no guarantee that ADR holders and beneficial owners generally or any holder or beneficial owner in particular will receive the notice described above with sufficient time to enable such ADR holder or beneficial owner to return any voting instructions to the Depositary in a timely manner.

Following actual receipt by the ADR department responsible for proxies and voting of ADR holders’ instructions (including, without limitation, instructions of any entity or entities acting on behalf of the nominee for DTC), the Depositary shall, in the manner and on or before the time established by the

Depositary for such purpose, endeavour to vote or cause to be voted the deposited securities represented by the ADSs evidenced by such ADR holders’ ADRs in accordance with such instructions insofar as practicable and permitted under the provisions of or governing deposited securities.

Holders are strongly encouraged to forward their voting instructions to the Depositary as soon as possible. Voting instructions will not be deemed received until such time as the ADR department responsible for proxies and voting has received such instructions, notwithstanding that such instructions may have been physically received by the Depositary prior to such time. The Depositary will not itself exercise any voting discretion in respect of deposited securities. The Depositary and its agents will not be responsible for any failure to carry out any instructions to vote any of the deposited securities, for the manner in which any such vote is cast, including, without limitation, any vote cast by a person to whom the Depositary is required to grant a discretionary proxy, or for the effect of any such vote. Notwithstanding anything contained in the Deposit Agreement or any ADR, the Depositary may, to the extent not prohibited by any law, rule or regulation or the rules and/or requirements of the stock exchange on which the ADSs are listed, in lieu of distribution of the materials provided to the Depositary in connection with any meeting of, or solicitation of consents or proxies from, holders of deposited securities, distribute to the registered holders of ADRs a notice that provides such holders with, or otherwise publicizes to such holders, instructions on how to retrieve such materials or receive such materials upon request (i.e., by reference to a website containing the materials for retrieval or a contact for requesting copies of the materials).

There is no guarantee that you will receive voting materials in time to instruct the Depositary to vote and it is possible that you, or persons who hold their ADSs through brokers, dealers or other third parties, will not have the opportunity to exercise a right to vote.

Reports and Other Communications

Will ADR holders be able to view our reports?

The Depositary will make available for inspection by ADR holders at the offices of the Depositary and the custodian the Deposit Agreement, the provisions of or governing deposited securities, and any written communications from us which are both received by the custodian or its nominee as a holder of deposited securities and made generally available to the holders of deposited securities.

Additionally, if we make any written communications generally available to holders of our shares, and we furnish copies thereof (or English translations or summaries) to the Depositary, it will distribute the same to registered ADR holders.

Fees and Expenses

What fees and expenses will you be responsible for paying?

The Depositary may charge each person to whom ADSs are issued, including, without limitation, issuances against deposits of shares, issuances in respect of share distributions, rights and other distributions, issuances pursuant to a stock dividend or stock split declared by us or issuances pursuant to a merger, exchange of securities or any other transaction or event affecting the ADSs or deposited securities, and each person surrendering ADSs for withdrawal of deposited securities or whose ADSs are cancelled or reduced for any other reason, $5.00 for each 100 ADSs (or any portion thereof) issued, delivered, reduced, cancelled or surrendered. The Depositary may sell (by public or private sale) sufficient securities and property received in respect of a share distribution, rights and/or other distribution prior to such deposit to pay such charge.

The following additional charges shall also be incurred by the ADR holders, the beneficial owners, by any party depositing or withdrawing shares or by any party surrendering ADSs and/or to whom ADSs are issued (including, without limitation, issuance pursuant to a stock dividend or stock split declared by us or an exchange of stock regarding the ADSs or the deposited securities or a distribution of ADSs), whichever is applicable:

•a fee of U.S.$0.05 or less per ADS held (i) upon which any cash distribution is made pursuant to the Deposit Agreement or (ii) in the case of an elective cash/stock dividend, upon which a cash distribution or an issuance of additional ADSs is made as a result of such elective dividend;

•an aggregate fee of U.S.$0.05 or less per ADS per calendar year (or portion thereof) for services performed by the Depositary in administering the ADRs (which fee may be charged on a periodic basis during each calendar year and shall be assessed against holders of ADRs as of the record date or record dates set by the Depositary during each calendar year and shall be payable in the manner described in the next succeeding provision);

•a fee for the reimbursement of such fees, charges and expenses as are incurred by the Depositary and/or any of its agents (including, without limitation, the custodian and expenses incurred on behalf of ADR holders in connection with compliance with foreign exchange control regulations or any law or regulation relating to foreign investment) in connection with the servicing of the shares or other deposited securities, the sale of securities (including, without limitation, deposited securities), the delivery of deposited securities or otherwise in connection with the Depositary’s or its custodian’s compliance with applicable law, rule or regulation (which fees and charges shall be assessed on a proportionate basis against ADR holders as of the record date or dates set by the Depositary and shall be payable at the sole discretion of the Depositary by billing such ADR holders or by deducting such charge from one or more cash dividends or other cash distributions);

•a fee for the distribution of securities (or the sale of securities in connection with a distribution), such fee being in an amount equal to the $0.05 per ADS issuance fee for the execution and delivery of ADSs which would have been charged as a result of the deposit of such securities (treating all such securities as if they were shares) but which securities or the net cash proceeds from the sale thereof are instead distributed by the Depositary to those ADR holders entitled thereto;

•stock transfer or other taxes and other governmental charges;

•SWIFT, cable, telex and facsimile transmission and delivery charges incurred at your request in connection with the deposit or delivery of shares, ADRs or deposited securities;

•transfer or registration fees for the registration of transfer of deposited securities on any applicable register in connection with the deposit or withdrawal of deposited securities;

•in connection with the conversion of foreign currency into U.S. dollars, JPMorgan Chase Bank, N.A. shall deduct out of such foreign currency the fees, expenses and other charges charged by it and/or its agent (which may be a division, branch or affiliate) so appointed in connection with such conversion; and

•fees of any division, branch or affiliate of the Depositary utilized by the Depositary to direct, manage and/or execute any public and/or private sale of securities under the Deposit Agreement.

JPMorgan Chase Bank, N.A. and/or its agent may act as principal for such conversion of foreign currency. For further details see https://www.adr.com.

We will pay all other charges and expenses of the Depositary and any agent of the Depositary (except the custodian) pursuant to agreements from time to time between us and the Depositary.

The right of the Depositary to receive payment of fees, charges and expenses survives the termination of the Deposit Agreement, and shall extend for those fees, charges and expenses incurred prior to the effectiveness of any resignation or removal of the Depositary.

The fees and charges described above may be amended from time to time by agreement between us and the Depositary.

The Depositary may make available to us a set amount or a portion of the depositary fees charged in respect of the ADR program or otherwise upon such terms and conditions as we and the Depositary may agree from time to time. The Depositary collects its fees for issuance and cancellation of ADSs directly from investors depositing shares or surrendering ADSs for the purpose of withdrawal or from intermediaries acting for them. The Depositary collects fees for making distributions to investors by deducting those fees from the amounts distributed or by selling a portion of distributable property to pay the fees. The Depositary may

collect its annual fee for depositary services by deduction from cash distributions, or by directly billing investors, or by charging the book-entry system accounts of participants acting for them. The Depositary will generally set off the amounts owing from distributions made to holders of ADSs. If, however, no distribution exists and payment owing is not timely received by the Depositary, the Depositary may refuse to provide any further services to ADR holders that have not paid those fees and expenses owing until such fees and expenses have been paid. At the discretion of the Depositary, all fees and charges owing under the Deposit Agreement are due in advance and/or when declared owing by the Depositary.

Payment of Taxes

ADR holders or beneficial owners must pay any tax or other governmental charge payable by the custodian or the Depositary on any ADS or ADR, deposited security or distribution. If any taxes or other governmental charges (including any penalties and/or interest) shall become payable by or on behalf of the custodian or the Depositary with respect to any ADR, any deposited securities represented by the ADSs evidenced thereby or any distribution thereon, such tax or other governmental charge shall be paid by the ADR holder thereof to the Depositary and by holding or having held an ADR or any ADSs evidenced thereby, the ADR holder and all beneficial owners thereof, and all prior ADR holders and beneficial owners thereof, jointly and severally, agree to indemnify, defend and save harmless each of the Depositary and its agents in respect of such tax or other governmental charge. Each ADR holder and beneficial owner of the ADSs evidenced thereby, and each prior ADR holder and beneficial owner thereof (collectively, the “Tax Indemnitors”), by holding or having held an ADR or an interest in ADSs, the ADR holder thereof (and prior ADR holder thereof) acknowledges and agrees that the Depositary shall have the right to seek payment of amounts owing from any one or more Tax Indemnitor(s) as determined by the Depositary in its sole discretion, without any obligation to seek payment from any other Tax Indemnitor(s). If an ADR holder owes any tax or other governmental charge, the Depositary may (i) deduct the amount thereof from any cash distributions, or (ii) sell deposited securities (by public or private sale) and deduct the amount owing from the net proceeds of such sale. In either case the ADR holder remains liable for any shortfall. If any tax or governmental charge is unpaid, the Depositary may also refuse to effect any registration, registration of transfer, split-up or combination of deposited securities or withdrawal of deposited securities until such payment is made. If any tax or governmental charge is required to be withheld on any cash distribution, the Depositary may deduct the amount required to be withheld from any cash distribution or, in the case of a non- cash distribution, sell the distributed property or securities (by public or private sale) in such amounts and in such manner as the Depositary deems necessary and practicable to pay such taxes and distribute any remaining net proceeds or the balance of any such property after deduction of such taxes to the ADR holders entitled thereto.

As an ADR holder or beneficial owner, you will be agreeing to indemnify us, the Depositary, its custodian and any of our or their respective officers, directors, employees, agents and affiliates against, and hold each of them harmless from, any claims by any governmental authority with respect to taxes, additions to tax, penalties or interest arising out of any refund of taxes, reduced rate of withholding at source or other tax benefit obtained.

Reclassifications, Recapitalizations and Mergers

If we take certain actions that affect the deposited securities, including (i) any change in par value, split-up, consolidation, cancellation or other reclassification of deposited securities or (ii) any distributions of shares or other property not made to holders of ADRs or (iii) any recapitalization, reorganization, merger, consolidation, liquidation, receivership, bankruptcy or sale of all or substantially all of our assets, then the Depositary may choose to, and shall if reasonably requested by us:

•amend the form of ADR;

•distribute additional or amended ADRs;

•distribute cash, securities or other property it has received in connection with such actions;

•sell any securities or property received and distribute the proceeds as cash; or

•none of the above.

If the Depositary does not choose any of the above options, any of the cash, securities or other property it receives will constitute part of the deposited securities and each ADS will then represent a proportionate interest in such property.

Amendment and Termination

How may the Deposit Agreement be amended?

We may agree with the Depositary to amend the Deposit Agreement and the ADSs without your consent for any reason. ADR holders must be given at least 30 days’ notice of any amendment that imposes or increases any fees or charges (other than stock transfer or other taxes and other governmental charges, transfer or registration fees, SWIFT, cable, telex or facsimile transmission costs, delivery costs or other such expenses), or otherwise prejudices any substantial existing right of ADR holders or beneficial owners. Such notice need not describe in detail the specific amendments effectuated thereby, but must identify to ADR holders and beneficial owners a means to access the text of such amendment. If an ADR holder continues to hold an ADR or ADRs after being so notified, such ADR holder and any beneficial owner are deemed to agree to such amendment and to be bound by the Deposit Agreement as so amended. No amendment, however, will impair your right to surrender your ADSs and receive the underlying securities, except in order to comply with mandatory provisions of applicable law.

Any amendments or supplements which (i) are reasonably necessary (as agreed by us and the Depositary) in order for (a) the ADSs to be registered on Form F-6 under the Securities Act of 1933 or (b) the ADSs or shares to be traded solely in electronic book-entry form and (ii) do not in either such case impose or increase any fees or charges to be borne by ADR holders, shall be deemed not to prejudice any substantial rights of ADR holders or beneficial owners. Notwithstanding the foregoing, if any governmental body or regulatory body should adopt new laws, rules or regulations which would require amendment or supplement of the Deposit Agreement or the form of ADR to ensure compliance therewith, we and the Depositary may amend or supplement the Deposit Agreement and the ADR at any time in accordance with such changed laws, rules or regulations. Such amendment or supplement to the Deposit Agreement in such circumstances may become effective before a notice of such amendment or supplement is given to ADR holders or within any other period of time as required for compliance.

Notice of any amendment to the Deposit Agreement or form of ADRs shall not need to describe in detail the specific amendments effectuated thereby, and failure to describe the specific amendments in any such notice shall not render such notice invalid, provided, however, that, in each such case, the notice given to the ADR holders identifies a means for ADR holders and beneficial owners to retrieve or receive the text of such amendment (i.e., upon retrieval from the SEC’s, the Depositary’s or our website or upon request from the Depositary).

How may the Deposit Agreement be terminated?

The Depositary may, and shall at our written direction, terminate the Deposit Agreement and the ADRs by mailing notice of such termination to the registered holders of ADRs at least 30 days prior to the date fixed in such notice for such termination; provided, however, if the Depositary shall have (i) resigned as Depositary under the Deposit Agreement, notice of such termination by the Depositary shall not be provided to registered ADR holders unless a successor Depositary shall not be operating under the Deposit Agreement within 60 days of the date of such resignation, and (ii) been removed as Depositary under the Deposit Agreement, notice of such termination by the Depositary shall not be provided to registered holders of ADRs unless a successor Depositary shall not be operating under the Deposit Agreement on the 60th day after our notice of removal was first provided to the Depositary.

After the date so fixed for termination, the Depositary and its agents will perform no further acts under the Deposit Agreement or the ADRs, except to receive and hold (or sell) distributions on deposited securities and deliver deposited securities being withdrawn. As soon as practicable after the date so fixed for termination, the Depositary shall use its reasonable efforts to sell the deposited securities and shall thereafter (as long as it may lawfully do so) hold in an account (which may be segregated or unsegregated account) the net proceeds of such sales, together with any other cash then held by it under the Deposit Agreement,

without liability for interest, in trust for the pro rata benefit of the holders of ADRs not theretofore surrendered. After making such sale, the Depositary shall be discharged from all obligations in respect of the Deposit Agreement and the ADR, except to account for such net proceeds and other cash.

Limitations on Obligations and Liability to ADR holders

Limits on our obligations and the obligations of the Depositary; limits on liability to ADR holders and holders of ADSs

Prior to the issue, registration, registration of transfer, split-up, combination, or cancellation of any ADRs, or the delivery of any distribution in respect thereof, and from time to time in the case of the production of proofs as described below, we or the Depositary or its custodian may require:

•payment with respect thereto of (i) any stock transfer or other tax or other governmental charge, (ii) any stock transfer or registration fees in effect for the registration of transfers of shares or other deposited securities upon any applicable register and (iii) any applicable fees and expenses described in the Deposit Agreement;

•the production of proof satisfactory to it of (i) the identity of any signatory and genuineness of any signature and (ii) such other information, including without limitation, information as to citizenship, residence, exchange control approval, beneficial or other ownership of any securities, compliance with applicable law, regulations, provisions of or governing deposited securities and terms of the Deposit Agreement and the ADRs, as it may deem necessary or proper; and

•compliance with such regulations as the Depositary may establish consistent with the Deposit Agreement.

The issuance of ADRs, the acceptance of deposits of shares, the registration, registration of transfer, split-up or combination of ADRs or the withdrawal of shares, may be suspended, generally or in particular instances, when the ADR register or any register for deposited securities is closed or when any such action is deemed advisable by the Depositary; provided that the ability to withdraw shares may only be limited under the following circumstances: (i) temporary delays caused by closing transfer books of the Depositary or our transfer books or the deposit of shares in connection with voting at a shareholders’ meeting, or the payment of dividends, (ii) the payment of fees, taxes, and similar charges, and (iii) compliance with any laws or governmental regulations relating to ADRs or to the withdrawal of deposited securities.

The deposit agreement expressly limits the obligations and liability of the Depositary, ourselves and our respective agents, provided, however, that no disclaimer of liability under the Securities Act of 1933 is intended by any of the limitations of liabilities provisions of the Deposit Agreement. The deposit agreement provides that each of us, the Depositary and our respective agents will:

•incur no liability to holders or beneficial owners of ADRs if any present or future law, rule, regulation, fiat, order or decree of the United States, the Republic of South Africa or any other country or jurisdiction, or of any governmental or regulatory authority or securities exchange or market or automated quotation system, the provisions of or governing any deposited securities, any present or future provision of our charter, any act of God, war, terrorism, nationalization, expropriation, currency restrictions, work stoppage, strike, civil unrest, revolutions, rebellions, explosions, computer failure or circumstance beyond our, the Depositary’s or our respective agents’ direct and immediate control shall prevent or delay, or shall cause any of them to be subject to any civil or criminal penalty in connection with, any act which the Deposit Agreement or the ADRs provide shall be done or performed by us, the Depositary or our respective agents (including, without limitation, voting);

•incur no liability to holders or beneficial owners of ADRs by reason of any non-performance or delay, caused as aforesaid, in the performance of any act or things which by the terms of the Deposit Agreement it is provided shall or may be done or performed or any exercise or failure to exercise discretion under the Deposit Agreement or the ADRs including, without limitation, any failure to determine that any distribution or action may be lawful or reasonably practicable;

•not incur or assume any liability to holders or beneficial owners of ADRs if it performs its obligations under the Deposit Agreement and ADRs without gross negligence or wilful misconduct and the Depositary shall not be a fiduciary or have any fiduciary duty to holders or beneficial owners of ADRs;

•in the case of the Depositary and its agents, be under no obligation to appear in, prosecute or defend any action, suit or other proceeding in respect of any deposited securities, the ADSs or the ADRs;

•in the case of us and our agents, be under no obligation to appear in, prosecute or defend any action, suit or other proceeding in respect of any deposited securities or the ADRs, which in our or our agents’ opinion, as the case may be, may involve it in expense or liability, unless indemnity satisfactory to us or our agent, as the case may be against all expense (including fees and disbursements of counsel) and liability be furnished as often as may be requested;

•not be liable to holders or beneficial owners of ADRs for any action or inaction by it in reliance upon the advice of or information from legal counsel, accountants, any person presenting shares for deposit, any registered holder of ADRs, any other person believed by it to be competent to give such advice or information, or in the case of the Depositary only, us; or

•may rely and shall be protected in acting upon any written notice, request, direction, instruction or document believed by it to be genuine and to have been signed, presented or given by the proper party or parties.

Neither the Depositary nor its agents have any obligation to appear in, prosecute or defend any action, suit or other proceeding in respect of any deposited securities, the ADSs or the ADRs. We and our agents shall only be obligated to appear in, prosecute or defend any action, suit or other proceeding in respect of any deposited securities, the ADSs or the ADRs, which in our opinion may involve us in expense or liability, if indemnity satisfactory to us against all expense (including fees and disbursements of counsel) and liability is furnished as often as may be required. The Depositary and its agents may fully respond to any and all demands or requests for information maintained by or on its behalf in connection with the Deposit Agreement, any registered holder or holders of ADRs, any ADRs or otherwise related to the Deposit Agreement or ADRs to the extent such information is requested or required by or pursuant to any lawful authority, including without limitation laws, rules, regulations, administrative or judicial process, banking, securities or other regulators. The Depositary shall not be liable for the acts or omissions made by, or the insolvency of, any securities depository, clearing agency or settlement system. Furthermore, the Depositary shall not be responsible for, and shall incur no liability in connection with or arising from, the insolvency of any custodian that is not a branch or affiliate of JPMorgan.

Notwithstanding anything to the contrary contained in the Deposit Agreement or any ADRs, the Depositary shall not be responsible for, and shall incur no liability in connection with or arising from, any act or omission to act on the part of the custodian except to the extent that any registered ADR holder has incurred liability directly as a result of the custodian having (i) committed fraud or wilful misconduct in the provision of custodial services to the Depositary or (ii) failed to use reasonable care in the provision of custodial services to the Depositary as determined in accordance with the standards prevailing in the jurisdiction in which the custodian is located. The Depositary and the custodian(s) may use third party delivery services and providers of information regarding matters such as pricing, proxy voting, corporate actions, class action litigation and other services in connection with the ADRs and the Deposit Agreement, and use local agents to provide extraordinary services such as attendance at annual meetings of issuers of securities. Although the Depositary and the custodian will use reasonable care (and cause their agents to use reasonable care) in the selection and retention of such third party providers and local agents, they will not be responsible for any errors or omissions made by them in providing the relevant information or services. The Depositary shall not have any liability for the price received in connection with any sale of securities, the timing thereof or any delay in action or omission to act nor shall it be responsible for any error or delay in action, omission to act, default or negligence on the part of the party so retained in connection with any such sale or proposed sale.

The Depositary has no obligation to inform ADR holders or beneficial owners about the requirements of the laws, rules or regulations or any changes therein or thereto of any country or jurisdiction or of any governmental or regulatory authority or any securities exchange or market or automated quotation system.

Additionally, none of us, the Depositary or the custodian shall be liable for the failure by any registered holder of ADRs or beneficial owner therein to obtain the benefits of credits or refunds of non-U.S. tax paid against such ADR holder’s or beneficial owner’s income tax liability. The Depositary is under no obligation to provide the ADR holders and beneficial owners, or any of them, with any information about our tax status. Neither we nor the Depositary shall incur any liability for any tax or tax consequences that may be incurred by registered ADR holders or beneficial owners on account of their ownership or disposition of ADRs or ADSs.

Neither the Depositary nor its agents will be responsible for any failure to carry out any instructions to vote any of the deposited securities, for the manner in which any such vote is cast, including, without limitation, any vote cast by a person to whom the Depositary is required to grant a discretionary proxy, or for the effect of any such vote. The Depositary may rely upon instructions from us or our counsel in respect of any approval or license required for any currency conversion, transfer or distribution. The Depositary shall not incur any liability for the content of any information submitted to it by us or on our behalf for distribution to ADR holders or for any inaccuracy of any translation thereof, for any investment risk associated with acquiring an interest in the deposited securities, for the validity or worth of the deposited securities, for the credit-worthiness of any third party, for allowing any rights to lapse upon the terms of the Deposit Agreement or for the failure or timeliness of any notice from us. The Depositary shall not be liable for any acts or omissions made by a successor depositary whether in connection with a previous act or omission of the Depositary or in connection with any matter arising wholly after the removal or resignation of the Depositary.

Neither us, the Depositary nor any of its agents shall be liable for any indirect, special, punitive or consequential damages (including, without limitation, legal fees and expenses) or lost profits, in each case of any form incurred by any person or entity (including, without limitation holders or beneficial owners of ADRs and ADSs), whether or not foreseeable and regardless of the type of action in which such a claim may be brought.

No provision of the Deposit Agreement or the ADRs is intended to constitute a waiver or limitation of any rights which an ADR holder or any beneficial owner may have under the Securities Act of 1933 or the Securities Exchange Act of 1934, to the extent applicable.

The Depositary and its agents may own and deal in any class of securities of our company and our affiliates and in ADRs.

Disclosure of Interest in ADSs

To the extent that the provisions of or governing any deposited securities may require disclosure of or impose limits on beneficial or other ownership of, or interests in, deposited securities, other shares and other securities and may provide for blocking transfer, voting or other rights to enforce such disclosure or limits, you as ADR holders or beneficial owners agree to comply with all such disclosure requirements and ownership limitations and to comply with any reasonable instructions we may provide in respect thereof.

Books of Depositary

The Depositary or its agent will maintain a register for the registration, registration of transfer, combination and split-up of ADRs, which register shall include the Depositary’s direct registration system. Registered holders of ADRs may inspect such records at the Depositary’s office at all reasonable times, but solely for the purpose of communicating with other ADR holders in the interest of the business of our company or a matter relating to the Deposit Agreement. Such register may be closed at any time or from time to time, when deemed expedient by the Depositary or, in the case of the issuance book portion of the ADR Register, when reasonably requested by the Company solely in order to enable the Company to comply with applicable law.

The Depositary will maintain facilities for the delivery and receipt of ADRs.

Appointment

In the Deposit Agreement, each registered holder of ADRs and each beneficial owner, upon acceptance of any ADSs or ADRs (or any interest in any of them) issued in accordance with the terms and conditions of the Deposit Agreement will be deemed for all purposes to:

•be a party to and bound by the terms of the Deposit Agreement and the applicable ADR or ADRs,

•appoint the Depositary its attorney-in-fact, with full power to delegate, to act on its behalf and to take any and all actions contemplated in the Deposit Agreement and the applicable ADR or ADRs, to adopt any and all procedures necessary to comply with applicable laws and to take such action as the Depositary in its sole discretion may deem necessary or appropriate to carry out the purposes of the Deposit Agreement and the applicable ADR and ADRs, the taking of such actions to be the conclusive determinant of the necessity and appropriateness thereof; and

•acknowledge and agree that (i) nothing in the Deposit Agreement or any ADR shall give rise to a partnership or joint venture among the parties thereto, nor establish a fiduciary or similar relationship among such parties, (ii) the Depositary, its divisions, branches and affiliates, and their respective agents, may from time to time be in the possession of non-public information about us, ADR holders, beneficial owners and/or their respective affiliates, (iii) the Depositary and its divisions, branches and affiliates may at any time have multiple banking relationships with us, ADR holders, beneficial owners and/or the affiliates of any of them, (iv) the Depositary and its divisions, branches and affiliates may, from time to time, be engaged in transactions in which parties adverse to us or ADR holders or beneficial owners may have interests, (v) nothing contained in the Deposit Agreement or any ADR(s) shall (A) preclude the Depositary or any of its divisions, branches or affiliates from engaging in such transactions or establishing or maintaining such relationships, or (B) obligate the Depositary or any of its divisions, branches or affiliates to disclose such transactions or relationships or to account for any profit made or payment received in such transactions or relationships, (vi) the Depositary shall not be deemed to have knowledge of any information held by any branch, division or affiliate of the Depositary and (vii) notice to an ADR holder shall be deemed, for all purposes of the Deposit Agreement and the ADRs, to constitute notice to any and all beneficial owners of the ADSs evidenced by such ADR holder’s ADRs. For all purposes under the Deposit Agreement and the ADRs, the ADR holders thereof shall be deemed to have all requisite authority to act on behalf of any and all beneficial owners of the ADSs evidenced by such ADRs.

Governing Law

The deposit agreement, the ADSs and the ADRs are governed by and construed in accordance with the internal laws of the State of New York. In the Deposit Agreement, we have submitted to the non-exclusive jurisdiction of the courts of the State of New York and appointed an agent for service of process on our behalf. Any action based on the Deposit Agreement, the ADSs, the ADRs or the transactions contemplated therein or thereby may be instituted by the Depositary against us in any competent court in the Republic of South Africa and/or the United States.

Under the Deposit Agreement, by holding an ADR or an interest therein, ADR holders and beneficial owners each irrevocably agree that any legal suit, action or proceeding against or involving us or the Depositary, arising out of or based upon the Deposit Agreement, the ADSs, the ADRs or the transactions contemplated thereby, may only be instituted in a state or federal court in New York, New York, and by holding an ADS or an interest therein each irrevocably waives any objection which it may now or hereafter have to the laying of venue of any such proceeding, and irrevocably submits to the exclusive jurisdiction of such courts in any such suit, action or proceeding.

Jury Trial Waiver

In the Deposit Agreement each party thereto (including, for avoidance of doubt, each holder and beneficial owner and/or holder of interests in ADSs and ADRs) irrevocably waives, to the fullest extent permitted by applicable law, any right it may have to a trial by jury in any suit, action or proceeding against the Depositary and/or us directly or indirectly arising out of or relating to the shares or other deposited securities, the ADSs or the ADRs, the Deposit Agreement or any transaction contemplated therein, or the

breach thereof (whether based on contract, tort, common law or any other theory), including any claim under the U.S. federal securities laws.

If we or the Depositary were to oppose a jury trial demand based on such waiver, the court would determine whether the waiver was enforceable in the facts and circumstances of that case in accordance with applicable state and federal law, including whether a party knowingly, intelligently and voluntarily waived the right to a jury trial. The waiver to right to a jury trial of the Deposit Agreement is not intended to be deemed a waiver by any holder or beneficial owner of ADSs of the Company’s or the Depositary’s compliance with the U.S. federal securities laws and the rules and regulations promulgated thereunder.