Results of Operations:

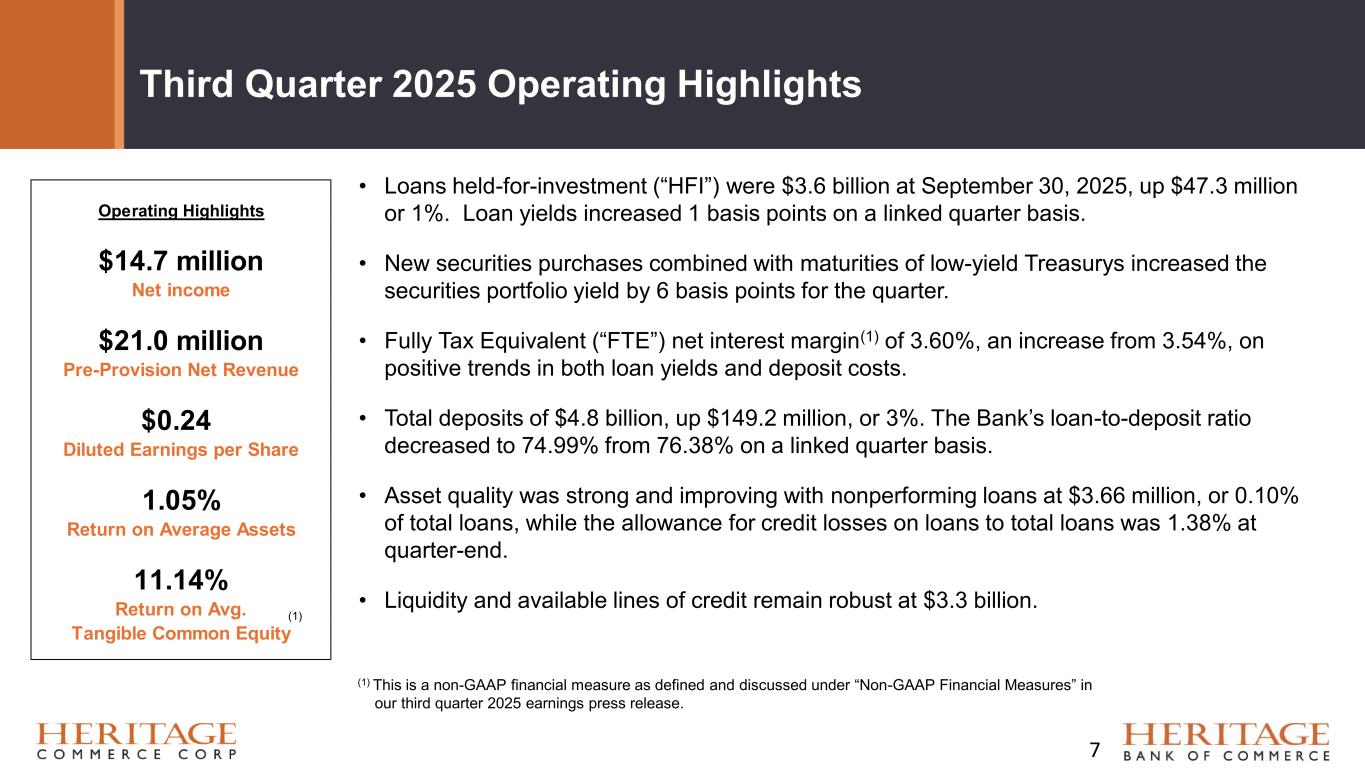

Net income was $14.7 million, or $0.24 per average diluted common share, for the third quarter of 2025, compared to $6.4 million, or

$0.10 for the second quarter of 2025, and $10.5 million, or $0.17 per average diluted common share for the third quarter of 2024.

Adjusted net income(2) was $13.0 million, or $0.21 per average diluted common share, for the second quarter of 2025. The annualized

return on average assets was 1.05%, the annualized return on average equity was 8.37%, and the annualized return on average tangible

common equity(2) was 11.14% for the third quarter of 2025, compared to 0.47%, 3.68%, and 4.89%, respectively, for the second

quarter of 2025, and 0.78%, 6.14%, and 8.27%, respectively, for the third quarter of 2024. The adjusted annualized return on average

assets(2) was 0.95%, the adjusted annualized return on average equity(2) was 7.45%, and the adjusted annualized return on average

tangible common equity(2) was 9.92%, for the second quarter of 2025.

Net income was $32.7 million, or $0.53 per average diluted common share, for the first nine months of 2025. Adjusted net income(2)

was $39.3 million, or $0.64 per average diluted common share, for the first nine months of 2025, compared to $29.9 million, or $0.49

per average diluted common share, for the first nine months of 2024. EPS increased 8% and adjusted EPS(2) increased 31% for the first

nine months of 2025, compared to the first nine months of 2024. The annualized return on average assets was 0.79%, the annualized

return on average equity was 6.29%, and the annualized return on average tangible common equity(2) was 8.38% for the nine months

ended September 30, 2025, compared to 0.76%, 5.91%, and 7.98%, respectively, for the nine months ended September 30, 2024. The

adjusted annualized return on average assets(2) was 0.95%, the adjusted annualized return on average equity(2) was 7.55%, and the

adjusted annualized return on average tangible common equity(2) was 10.06%, for the nine months ended September 30, 2025.

Total revenue, which is defined as net interest income before provision for credit losses on loans plus noninterest income, increased

$2.2 million, or 5%, to $50.0 million for the third quarter of 2025, compared to $47.8 million for the second quarter of 2025, and

increased $7.9 million, or 19%, from $42.2 million for the third quarter of 2024. Total revenue increased $17.8 million, or 14%, to

$143.8 million for the first nine months of 2025, compared to $126.0 million for the first nine months of 2024.

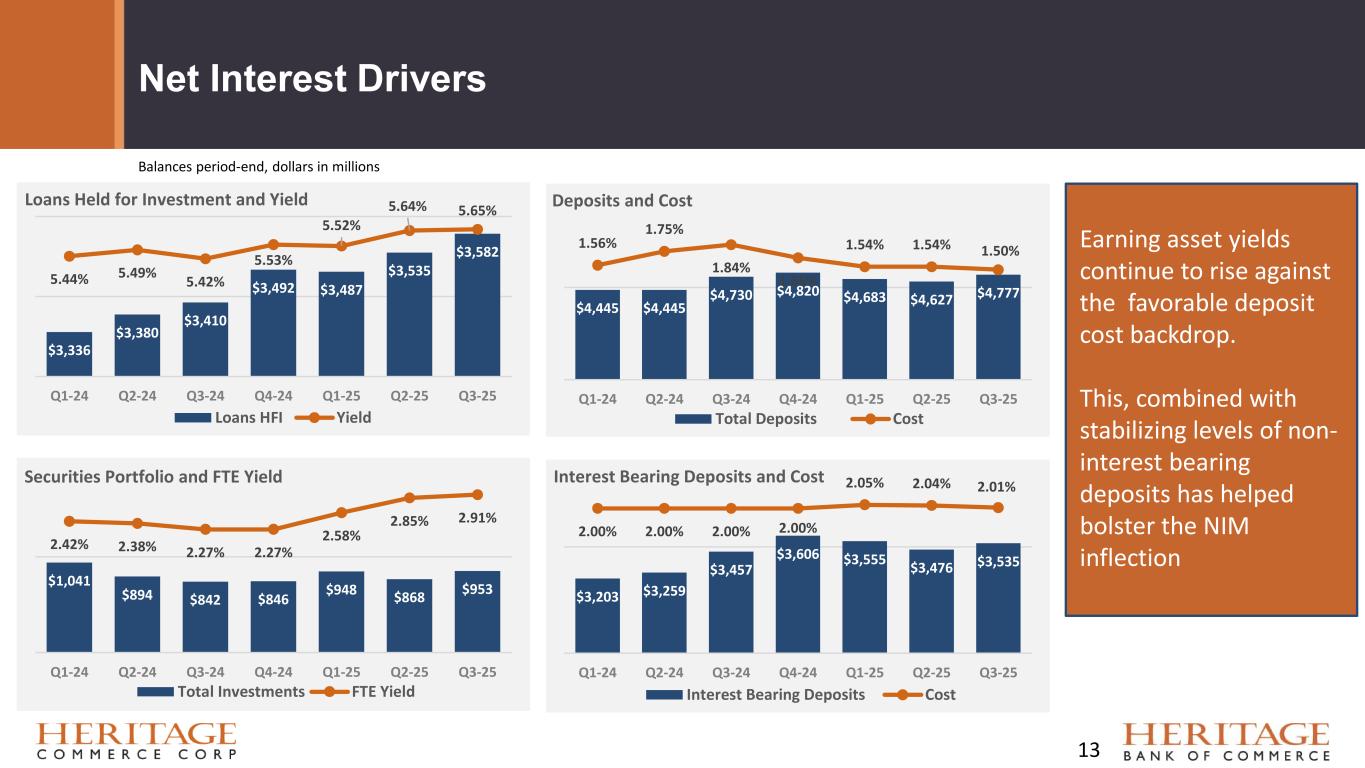

Net interest income totaled $46.8 million for the third quarter of 2025, representing an increase of $2.0 million, or 4%, compared to

$44.8 million for the second quarter of 2025. The FTE net interest margin(2) was 3.60% for the third quarter of 2025, compared to

3.54% for the second quarter of 2025. The increase in the net interest margin is primarily attributable to higher average balances of

loans and overnight funds, a higher average yield on securities, and a decrease in the average cost of deposits. The cost of deposits was

down 4 basis points, driven by proactive management of exception based deposit pricing and favorable noninterest-bearing deposit

mix shift. These factors were partially offset by a decrease in the average balances of securities due to maturities and paydowns.

Net interest income increased $7.5 million, or 19%, to $46.8 million, compared to $39.3 million for the third quarter of 2024. The FTE

net interest margin(2) increased from 3.15% for the third quarter of 2024 primarily due to lower rates paid on customer deposits, an

increase in the average yields on loans and securities, a higher average balance of loans, and an increase in the average balance of

deposits resulting in a higher average balance of overnight funds, partially offset by a lower average yield on overnight funds.

For the first nine months of 2025, net interest income increased $17.3 million, or 15% to $135.0 million, compared to $117.7 million

for the first nine months of 2024. The FTE net interest margin(2) increased 28 basis points to 3.51% for the first nine months of 2025,

from 3.23% for the first nine months of 2024, primarily due to decrease in rates paid on client deposits, an increase in the average

balances of average interest earning assets, and an increase in the average yields on loans and securities, partially offset by a lower

yield on overnight funds.

Total noninterest income increased 8% to $3.2 million for the third quarter of 2025, compared to $3.0 million for the second quarter of

2025, and increased 14% from $2.8 million for the third quarter of 2024. Total noninterest income increased 7% to $8.9 million for the

first nine months of 2025, compared to $8.3 million for the first nine months of 2024. The increase in noninterest income for the third

quarter and first nine months of 2025 was primarily driven by a $386,000 recovery on an acquired loan that had been previously

charged off and by higher facility fees. For the first nine months of 2025, the increase was partially offset by a $219,000 gain on

proceeds from company-owned life insurance recorded in the same period of 2024.

(2)This is a non-GAAP financial measure as defined and discussed under “Non-GAAP Financial Measures” in this press release.