| 1-13395 | 56-2010790 | |||||||

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|||||||

4401 Colwick Road |

||||||||||||||||||||

| Charlotte, | North Carolina | 28211 | ||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Class A Common Stock, par value $0.01 per share | SAH | New York Stock Exchange | ||||||

|

Exhibit

No.

|

Description |

|||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |||||||

| SONIC AUTOMOTIVE, INC. | ||||||||

| October 23, 2025 | By: | /s/ STEPHEN K. COSS | ||||||

| Stephen K. Coss | ||||||||

| Senior Vice President and General Counsel | ||||||||

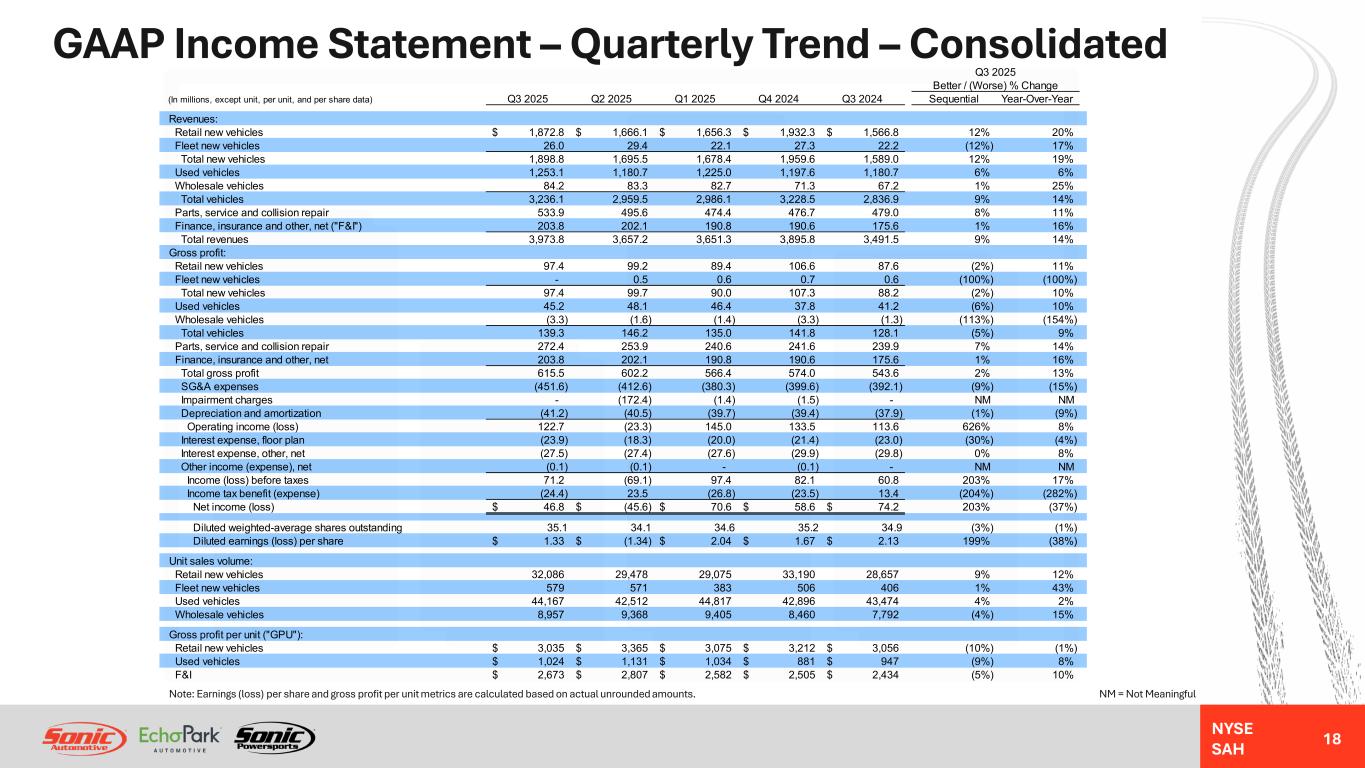

| Three Months Ended September 30, | Better / (Worse) | Nine Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | % Change | 2025 | 2024 | % Change | ||||||||||||||||||||||||||||||

| (In millions, except per share amounts) | |||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 1,872.8 | $ | 1,566.8 | 20 | % | $ | 5,195.2 | $ | 4,575.2 | 14 | % | |||||||||||||||||||||||

| Fleet new vehicles | 26.0 | 22.2 | 17 | % | 77.4 | 68.0 | 14 | % | |||||||||||||||||||||||||||

| Total new vehicles | 1,898.8 | 1,589.0 | 19 | % | 5,272.6 | 4,643.2 | 14 | % | |||||||||||||||||||||||||||

| Used vehicles | 1,253.1 | 1,180.7 | 6 | % | 3,658.8 | 3,582.5 | 2 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 84.2 | 67.2 | 25 | % | 250.5 | 215.8 | 16 | % | |||||||||||||||||||||||||||

| Total vehicles | 3,236.1 | 2,836.9 | 14 | % | 9,181.9 | 8,441.5 | 9 | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | 533.9 | 479.0 | 11 | % | 1,503.8 | 1,369.8 | 10 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 203.8 | 175.6 | 16 | % | 596.6 | 517.2 | 15 | % | |||||||||||||||||||||||||||

| Total revenues | 3,973.8 | 3,491.5 | 14 | % | 11,282.3 | 10,328.5 | 9 | % | |||||||||||||||||||||||||||

| Cost of sales: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | (1,775.4) | (1,479.2) | (20) | % | (4,909.2) | (4,293.4) | (14) | % | |||||||||||||||||||||||||||

| Fleet new vehicles | (26.0) | (21.6) | (20) | % | (76.3) | (65.7) | (16) | % | |||||||||||||||||||||||||||

| Total new vehicles | (1,801.4) | (1,500.8) | (20) | % | (4,985.5) | (4,359.1) | (14) | % | |||||||||||||||||||||||||||

| Used vehicles | (1,207.9) | (1,139.5) | (6) | % | (3,519.1) | (3,449.6) | (2) | % | |||||||||||||||||||||||||||

| Wholesale vehicles | (87.5) | (68.5) | (28) | % | (256.6) | (218.5) | (17) | % | |||||||||||||||||||||||||||

| Total vehicles | (3,096.8) | (2,708.8) | (14) | % | (8,761.2) | (8,027.2) | (9) | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | (261.5) | (239.1) | (9) | % | (736.9) | (682.4) | (8) | % | |||||||||||||||||||||||||||

| Total cost of sales | (3,358.3) | (2,947.9) | (14) | % | (9,498.1) | (8,709.6) | (9) | % | |||||||||||||||||||||||||||

| Gross profit | 615.5 | 543.6 | 13 | % | 1,784.2 | 1,618.9 | 10 | % | |||||||||||||||||||||||||||

| Selling, general and administrative expenses | (451.6) | (392.1) | (15) | % | (1,244.5) | (1,177.4) | (6) | % | |||||||||||||||||||||||||||

| Impairment charges | — | — | NM | (173.8) | (2.4) | NM | |||||||||||||||||||||||||||||

| Depreciation and amortization | (41.2) | (37.9) | (9) | % | (121.6) | (111.1) | (9) | % | |||||||||||||||||||||||||||

| Operating income (loss) | 122.7 | 113.6 | 8 | % | 244.3 | 328.0 | (26) | % | |||||||||||||||||||||||||||

| Other income (expense): | |||||||||||||||||||||||||||||||||||

| Interest expense, floor plan | (23.9) | (23.0) | (4) | % | (62.2) | (65.4) | 5 | % | |||||||||||||||||||||||||||

| Interest expense, other, net | (27.5) | (29.8) | 8 | % | (82.5) | (88.1) | 6 | % | |||||||||||||||||||||||||||

| Other income (expense), net | (0.1) | — | NM | — | (0.5) | NM | |||||||||||||||||||||||||||||

| Total other income (expense) | (51.5) | (52.8) | 2 | % | (144.7) | (154.0) | 6 | % | |||||||||||||||||||||||||||

| Income (loss) before taxes | 71.2 | 60.8 | 17 | % | 99.6 | 174.0 | (43) | % | |||||||||||||||||||||||||||

| Provision for income taxes - benefit (expense) | (24.4) | 13.4 | (282) | % | (27.8) | (16.6) | (67) | % | |||||||||||||||||||||||||||

| Net income (loss) | $ | 46.8 | $ | 74.2 | (37) | % | $ | 71.8 | $ | 157.4 | (54) | % | |||||||||||||||||||||||

| Basic earnings (loss) per common share | $ | 1.37 | $ | 2.18 | (37) | % | $ | 2.11 | $ | 4.63 | (54) | % | |||||||||||||||||||||||

| Basic weighted-average common shares outstanding | 34.2 | 34.0 | (1) | % | 34.0 | 34.0 | — | % | |||||||||||||||||||||||||||

| Diluted earnings (loss) per common share | $ | 1.33 | $ | 2.13 | (38) | % | $ | 2.06 | $ | 4.52 | (54) | % | |||||||||||||||||||||||

| Diluted weighted-average common shares outstanding | 35.1 | 34.9 | (1) | % | 34.8 | 34.8 | — | % | |||||||||||||||||||||||||||

| Dividends declared per common share | $ | 0.38 | $ | 0.30 | 27 | % | $ | 1.08 | $ | 0.90 | 20 | % | |||||||||||||||||||||||

| Three Months Ended September 30, | Better / (Worse) | Nine Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | % Change | 2025 | 2024 | % Change | ||||||||||||||||||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||||||||||||||||||||

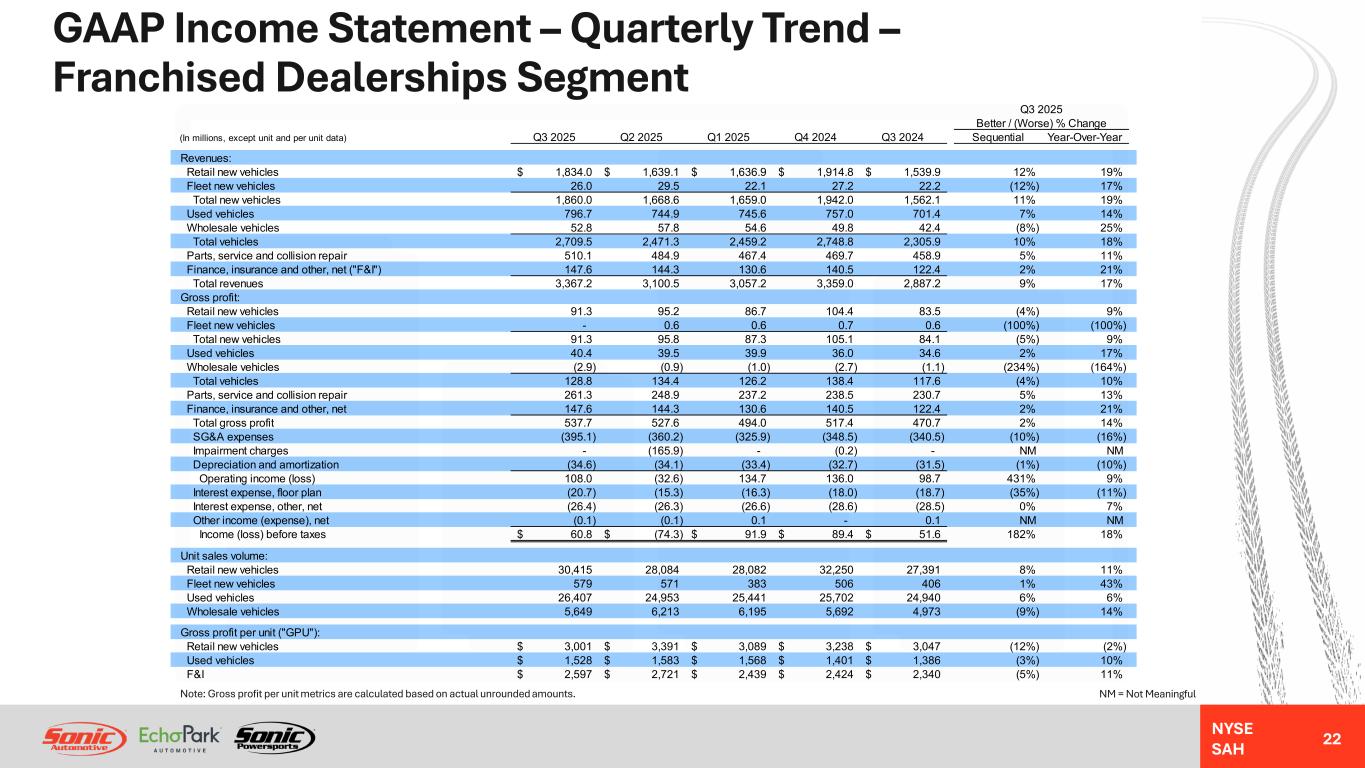

| Revenues: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 1,834.0 | $ | 1,539.9 | 19 | % | $ | 5,110.1 | $ | 4,510.8 | 13 | % | |||||||||||||||||||||||

| Fleet new vehicles | 26.0 | 22.2 | 17 | % | 77.4 | 68.0 | 14 | % | |||||||||||||||||||||||||||

| Total new vehicles | 1,860.0 | 1,562.1 | 19 | % | 5,187.5 | 4,578.8 | 13 | % | |||||||||||||||||||||||||||

| Used vehicles | 796.7 | 701.4 | 14 | % | 2,287.3 | 2,162.8 | 6 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 52.8 | 42.4 | 25 | % | 165.1 | 139.1 | 19 | % | |||||||||||||||||||||||||||

| Total vehicles | 2,709.5 | 2,305.9 | 18 | % | 7,639.9 | 6,880.7 | 11 | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | 510.1 | 458.9 | 11 | % | 1,462.5 | 1,333.2 | 10 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 147.6 | 122.4 | 21 | % | 422.5 | 366.3 | 15 | % | |||||||||||||||||||||||||||

| Total revenues | 3,367.2 | 2,887.2 | 17 | % | 9,524.9 | 8,580.2 | 11 | % | |||||||||||||||||||||||||||

| Gross Profit: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 91.3 | 83.5 | 9 | % | 273.3 | 272.5 | — | % | |||||||||||||||||||||||||||

| Fleet new vehicles | — | 0.6 | (100) | % | 1.1 | 2.3 | (52) | % | |||||||||||||||||||||||||||

| Total new vehicles | 91.3 | 84.1 | 9 | % | 274.4 | 274.8 | — | % | |||||||||||||||||||||||||||

| Used vehicles | 40.4 | 34.6 | 17 | % | 119.8 | 114.1 | 5 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | (2.9) | (1.1) | (164) | % | (4.7) | (1.8) | (161) | % | |||||||||||||||||||||||||||

| Total vehicles | 128.8 | 117.6 | 10 | % | 389.5 | 387.1 | 1 | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | 261.3 | 230.7 | 13 | % | 747.4 | 670.4 | 11 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 147.6 | 122.4 | 21 | % | 422.5 | 366.3 | 15 | % | |||||||||||||||||||||||||||

| Total gross profit | 537.7 | 470.7 | 14 | % | 1,559.4 | 1,423.8 | 10 | % | |||||||||||||||||||||||||||

| Selling, general and administrative expenses | (395.1) | (340.5) | (16) | % | (1,081.2) | (1,027.0) | (5) | % | |||||||||||||||||||||||||||

| Impairment charges | — | — | NM | (165.9) | (1.0) | NM | |||||||||||||||||||||||||||||

| Depreciation and amortization | (34.6) | (31.5) | (10) | % | (102.2) | (91.6) | (12) | % | |||||||||||||||||||||||||||

| Operating income (loss) | 108.0 | 98.7 | 9 | % | 210.1 | 304.2 | (31) | % | |||||||||||||||||||||||||||

| Other income (expense): | |||||||||||||||||||||||||||||||||||

| Interest expense, floor plan | (20.7) | (18.7) | (11) | % | (52.3) | (52.5) | — | % | |||||||||||||||||||||||||||

| Interest expense, other, net | (26.4) | (28.5) | 7 | % | (79.3) | (84.1) | 6 | % | |||||||||||||||||||||||||||

| Other income (expense), net | (0.1) | 0.1 | NM | — | (0.6) | NM | |||||||||||||||||||||||||||||

| Total other income (expense) | (47.2) | (47.1) | — | % | (131.6) | (137.2) | 4 | % | |||||||||||||||||||||||||||

| Income (loss) before taxes | 60.8 | 51.6 | 18 | % | 78.5 | 167.0 | (53) | % | |||||||||||||||||||||||||||

| Add: Impairment charges | — | — | NM | 165.9 | 1.0 | NM | |||||||||||||||||||||||||||||

| Segment income (loss) | $ | 60.8 | $ | 51.6 | 18 | % | $ | 244.4 | $ | 168.0 | 45 | % | |||||||||||||||||||||||

| Unit Sales Volume: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 30,415 | 27,391 | 11 | % | 86,581 | 79,200 | 9 | % | |||||||||||||||||||||||||||

| Fleet new vehicles | 579 | 406 | 43 | % | 1,533 | 1,299 | 18 | % | |||||||||||||||||||||||||||

| Total new vehicles | 30,994 | 27,797 | 12 | % | 88,114 | 80,499 | 9 | % | |||||||||||||||||||||||||||

| Used vehicles | 26,407 | 24,940 | 6 | % | 76,801 | 76,274 | 1 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 5,649 | 4,973 | 14 | % | 18,057 | 15,326 | 18 | % | |||||||||||||||||||||||||||

| Retail new & used vehicles | 56,822 | 52,331 | 9 | % | 163,382 | 155,474 | 5 | % | |||||||||||||||||||||||||||

| Used-to-New Ratio | 0.87 | 0.91 | (4) | % | 0.89 | 0.96 | (7) | % | |||||||||||||||||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 3,001 | $ | 3,047 | (2) | % | $ | 3,156 | $ | 3,441 | (8) | % | |||||||||||||||||||||||

| Fleet new vehicles | $ | 23 | $ | 1,596 | (99) | % | $ | 711 | $ | 1,743 | (59) | % | |||||||||||||||||||||||

| New vehicles | $ | 2,945 | $ | 3,026 | (3) | % | $ | 3,114 | $ | 3,413 | (9) | % | |||||||||||||||||||||||

| Used vehicles | $ | 1,528 | $ | 1,386 | 10 | % | $ | 1,559 | $ | 1,497 | 4 | % | |||||||||||||||||||||||

| Finance, insurance and other, net | $ | 2,597 | $ | 2,340 | 11 | % | $ | 2,586 | $ | 2,356 | 10 | % | |||||||||||||||||||||||

| Three Months Ended September 30, | Better / (Worse) | Nine Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | % Change | 2025 | 2024 | % Change | ||||||||||||||||||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 1,725.7 | $ | 1,533.9 | 13 | % | $ | 4,964.6 | $ | 4,491.1 | 11 | % | |||||||||||||||||||||||

| Fleet new vehicles | 24.0 | 21.8 | 10 | % | 75.5 | 67.6 | 12 | % | |||||||||||||||||||||||||||

| Total new vehicles | 1,749.7 | 1,555.7 | 12 | % | 5,040.1 | 4,558.7 | 11 | % | |||||||||||||||||||||||||||

| Used vehicles | 767.4 | 698.6 | 10 | % | 2,225.2 | 2,149.7 | 4 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 48.8 | 42.1 | 16 | % | 159.1 | 138.1 | 15 | % | |||||||||||||||||||||||||||

| Total vehicles | 2,565.9 | 2,296.4 | 12 | % | 7,424.4 | 6,846.5 | 8 | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | 484.9 | 457.4 | 6 | % | 1,422.1 | 1,327.3 | 7 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 137.2 | 121.9 | 13 | % | 407.7 | 364.1 | 12 | % | |||||||||||||||||||||||||||

| Total revenues | 3,188.0 | 2,875.7 | 11 | % | 9,254.2 | 8,537.9 | 8 | % | |||||||||||||||||||||||||||

| Gross Profit: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 83.5 | 83.5 | — | % | 263.9 | 272.8 | (3) | % | |||||||||||||||||||||||||||

| Fleet new vehicles | — | 0.7 | (100) | % | 1.2 | 2.3 | (48) | % | |||||||||||||||||||||||||||

| Total new vehicles | 83.5 | 84.2 | (1) | % | 265.1 | 275.1 | (4) | % | |||||||||||||||||||||||||||

| Used vehicles | 39.2 | 34.6 | 13 | % | 117.2 | 114.9 | 2 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | (2.6) | (1.2) | (117) | % | (4.3) | (1.6) | (169) | % | |||||||||||||||||||||||||||

| Total vehicles | 120.1 | 117.6 | 2 | % | 378.0 | 388.4 | (3) | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | 248.3 | 229.8 | 8 | % | 726.8 | 666.8 | 9 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 137.2 | 121.9 | 13 | % | 407.7 | 364.1 | 12 | % | |||||||||||||||||||||||||||

| Total gross profit | $ | 505.6 | $ | 469.3 | 8 | % | $ | 1,512.5 | $ | 1,419.3 | 7 | % | |||||||||||||||||||||||

| Unit Sales Volume: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 29,269 | 27,236 | 7 | % | 84,746 | 78,703 | 8 | % | |||||||||||||||||||||||||||

| Fleet new vehicles | 560 | 398 | 41 | % | 1,514 | 1,291 | 17 | % | |||||||||||||||||||||||||||

| Total new vehicles | 29,829 | 27,634 | 8 | % | 86,260 | 79,994 | 8 | % | |||||||||||||||||||||||||||

| Used vehicles | 25,628 | 24,802 | 3 | % | 74,900 | 75,692 | (1) | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 5,433 | 4,940 | 10 | % | 17,566 | 15,161 | 16 | % | |||||||||||||||||||||||||||

| Retail new & used vehicles | 54,897 | 52,038 | 5 | % | 159,646 | 154,395 | 3 | % | |||||||||||||||||||||||||||

| Used-to-New Ratio | 0.88 | 0.91 | (3) | % | 0.88 | 0.96 | (8) | % | |||||||||||||||||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 2,852 | $ | 3,067 | (7) | % | $ | 3,114 | $ | 3,466 | (10) | % | |||||||||||||||||||||||

| Fleet new vehicles | $ | 133 | $ | 1,639 | (92) | % | $ | 760 | $ | 1,757 | (57) | % | |||||||||||||||||||||||

| New vehicles | $ | 2,801 | $ | 3,047 | (8) | % | $ | 3,073 | $ | 3,439 | (11) | % | |||||||||||||||||||||||

| Used vehicles | $ | 1,530 | $ | 1,394 | 10 | % | $ | 1,565 | $ | 1,518 | 3 | % | |||||||||||||||||||||||

| Finance, insurance and other, net | $ | 2,500 | $ | 2,342 | 7 | % | $ | 2,554 | $ | 2,359 | 8 | % | |||||||||||||||||||||||

| Three Months Ended September 30, | Better / (Worse) | Nine Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | % Change | 2025 | 2024 | % Change | ||||||||||||||||||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||

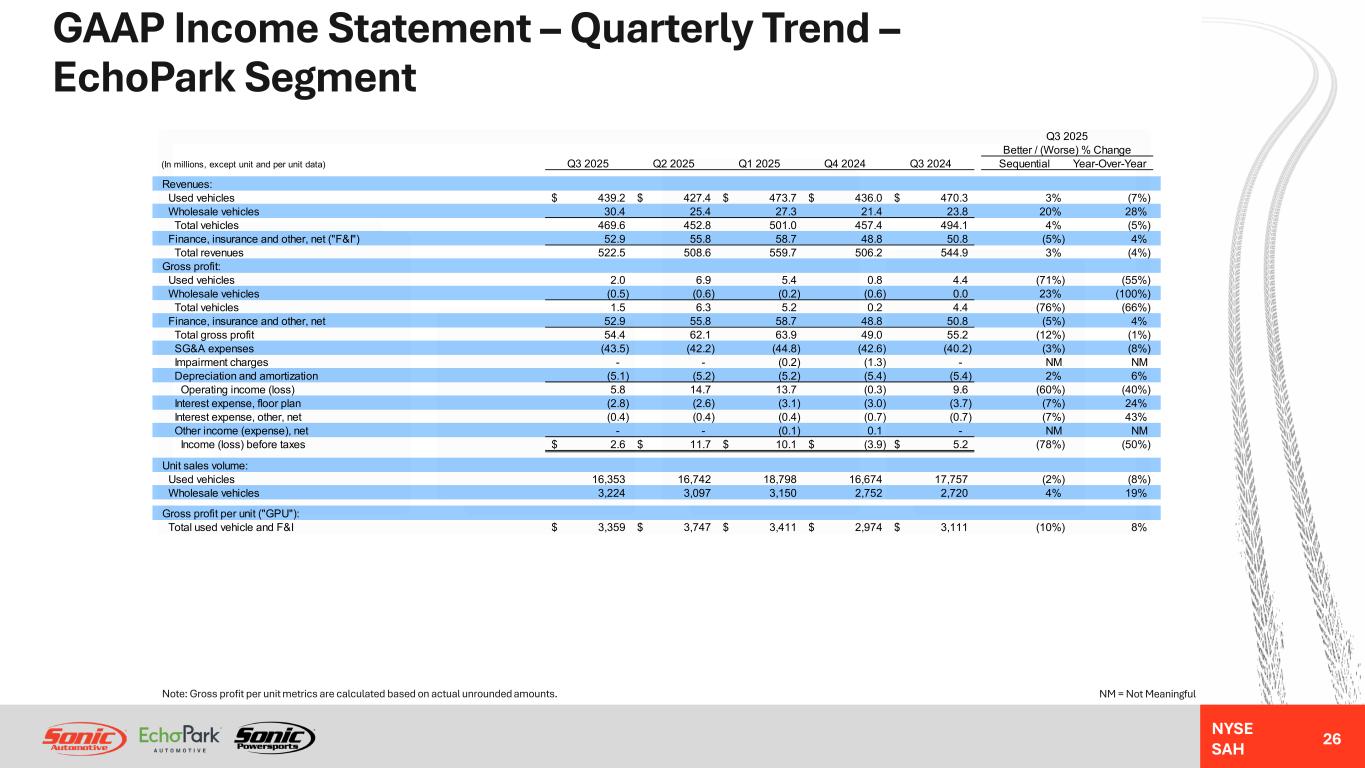

| Used vehicles | $ | 439.2 | $ | 470.3 | (7) | % | $ | 1,340.3 | $ | 1,402.0 | (4) | % | |||||||||||||||||||||||

| Wholesale vehicles | 30.4 | 23.8 | 28 | % | 83.2 | 74.4 | 12 | % | |||||||||||||||||||||||||||

| Total vehicles | 469.6 | 494.1 | (5) | % | 1,423.5 | 1,476.4 | (4) | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 52.9 | 50.8 | 4 | % | 167.4 | 145.2 | 15 | % | |||||||||||||||||||||||||||

| Total revenues | 522.5 | 544.9 | (4) | % | 1,590.9 | 1,621.6 | (2) | % | |||||||||||||||||||||||||||

| Gross Profit: | |||||||||||||||||||||||||||||||||||

| Used vehicles | 2.0 | 4.4 | (55) | % | 14.3 | 14.4 | (1) | % | |||||||||||||||||||||||||||

| Wholesale vehicles | (0.5) | — | (100) | % | (1.3) | (0.7) | (86) | % | |||||||||||||||||||||||||||

| Total vehicles | 1.5 | 4.4 | (66) | % | 13.0 | 13.7 | (5) | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 52.9 | 50.8 | 4 | % | 167.4 | 145.2 | 15 | % | |||||||||||||||||||||||||||

| Total gross profit | 54.4 | 55.2 | (1) | % | 180.4 | 158.9 | 14 | % | |||||||||||||||||||||||||||

| Selling, general and administrative expenses | (43.5) | (40.2) | (8) | % | (130.6) | (123.1) | (6) | % | |||||||||||||||||||||||||||

| Impairment charges | — | — | NM | (0.2) | (1.4) | NM | |||||||||||||||||||||||||||||

| Depreciation and amortization | (5.1) | (5.4) | 6 | % | (15.5) | (16.4) | 5 | % | |||||||||||||||||||||||||||

| Operating income (loss) | 5.8 | 9.6 | (40) | % | 34.1 | 18.0 | 89 | % | |||||||||||||||||||||||||||

| Other income (expense): | |||||||||||||||||||||||||||||||||||

| Interest expense, floor plan | (2.8) | (3.7) | 24 | % | (8.6) | (11.3) | 24 | % | |||||||||||||||||||||||||||

| Interest expense, other, net | (0.4) | (0.7) | 43 | % | (1.1) | (2.0) | 45 | % | |||||||||||||||||||||||||||

| Other income (expense), net | — | — | NM | — | — | NM | |||||||||||||||||||||||||||||

| Total other income (expense) | 3.2 | (4.4) | 173 | % | (9.7) | (13.3) | 27 | % | |||||||||||||||||||||||||||

| Income (loss) before taxes | 2.6 | 5.2 | (50) | % | 24.4 | 4.7 | 419 | % | |||||||||||||||||||||||||||

| Add: Impairment charges | — | — | NM | 0.2 | 1.4 | NM | |||||||||||||||||||||||||||||

| Segment income (loss) | $ | 2.6 | $ | 5.2 | (50) | % | $ | 24.6 | $ | 6.1 | 303 | % | |||||||||||||||||||||||

| Unit Sales Volume: | |||||||||||||||||||||||||||||||||||

| Used vehicles | 16,353 | 17,757 | (8) | % | 51,893 | 52,379 | (1) | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 3,224 | 2,720 | 19 | % | 9,471 | 8,307 | 14 | % | |||||||||||||||||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||||||||||||||||||||

| Total used vehicle and F&I | $ | 3,359 | $ | 3,111 | 8 | % | $ | 3,503 | $ | 3,047 | 15 | % | |||||||||||||||||||||||

| Three Months Ended September 30, | Better / (Worse) | Nine Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | % Change | 2025 | 2024 | % Change | ||||||||||||||||||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||

| Used vehicles | $ | 439.2 | $ | 470.3 | (7) | % | $ | 1,340.3 | $ | 1,392.4 | (4) | % | |||||||||||||||||||||||

| Wholesale vehicles | 30.4 | 23.8 | 28 | % | 83.2 | 71.2 | 17 | % | |||||||||||||||||||||||||||

| Total vehicles | 469.6 | 494.1 | (5) | % | 1,423.5 | 1,463.6 | (3) | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 53.2 | 51.4 | 4 | % | 168.4 | 146.2 | 15 | % | |||||||||||||||||||||||||||

| Total revenues | 522.8 | 545.5 | (4) | % | 1,591.9 | 1,609.8 | (1) | % | |||||||||||||||||||||||||||

| Gross Profit: | |||||||||||||||||||||||||||||||||||

| Used vehicles | 1.1 | 4.4 | (75) | % | 11.5 | 14.8 | (22) | % | |||||||||||||||||||||||||||

| Wholesale vehicles | (0.5) | — | (100) | % | (1.4) | — | (100) | % | |||||||||||||||||||||||||||

| Total vehicles | 0.6 | 4.4 | (86) | % | 10.1 | 14.8 | (32) | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 53.2 | 51.4 | 4 | % | 168.4 | 146.2 | 15 | % | |||||||||||||||||||||||||||

| Total gross profit | $ | 53.8 | $ | 55.8 | (4) | % | $ | 178.5 | $ | 161.0 | 11 | % | |||||||||||||||||||||||

| Unit Sales Volume: | |||||||||||||||||||||||||||||||||||

| Used vehicles | 16,353 | 17,757 | (8) | % | 51,893 | 52,016 | — | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 3,224 | 2,720 | 19 | % | 9,471 | 8,098 | 17 | % | |||||||||||||||||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||||||||||||||||||||

| Total used vehicle and F&I | $ | 3,317 | $ | 3,145 | 5 | % | $ | 3,466 | $ | 3,096 | 12 | % | |||||||||||||||||||||||

| Three Months Ended September 30, | Better / (Worse) | Nine Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | % Change | 2025 | 2024 | % Change | ||||||||||||||||||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||||||||||||||||||||

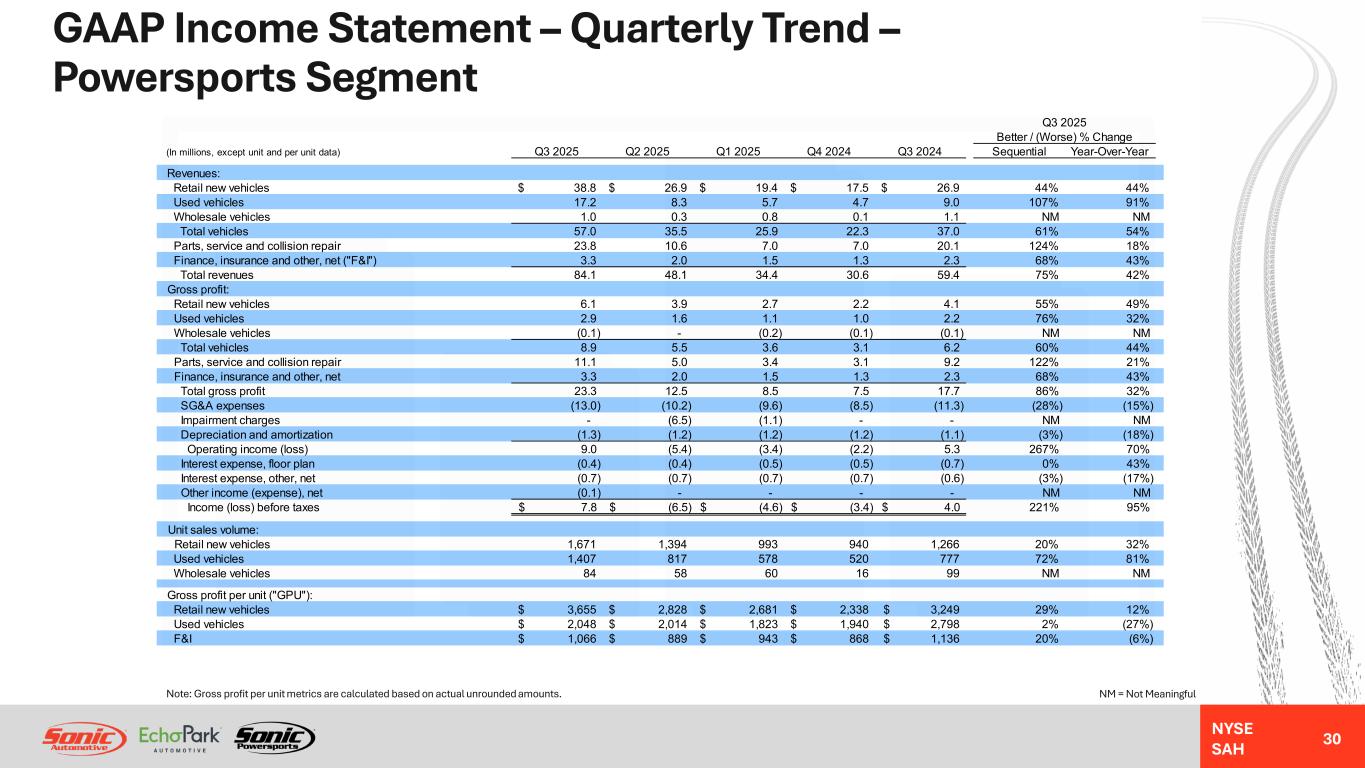

| Revenues: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 38.8 | $ | 26.9 | 44 | % | $ | 85.1 | $ | 64.4 | 32 | % | |||||||||||||||||||||||

| Used vehicles | 17.2 | 9.0 | 91 | % | 31.2 | 17.6 | 77 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 1.0 | 1.1 | (9) | % | 2.1 | 2.3 | (9) | % | |||||||||||||||||||||||||||

| Total vehicles | 57.0 | 37.0 | 54 | % | 118.4 | 84.3 | 40 | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | 23.8 | 20.1 | 18 | % | 41.4 | 36.6 | 13 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 3.3 | 2.3 | 43 | % | 6.7 | 5.8 | 16 | % | |||||||||||||||||||||||||||

| Total revenues | 84.1 | 59.4 | 42 | % | 166.5 | 126.7 | 31 | % | |||||||||||||||||||||||||||

| Gross Profit: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 6.1 | 4.1 | 49 | % | 12.7 | 9.3 | 37 | % | |||||||||||||||||||||||||||

| Used vehicles | 2.9 | 2.2 | 32 | % | 5.6 | 4.3 | 30 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | (0.1) | (0.1) | — | % | (0.1) | (0.2) | 50 | % | |||||||||||||||||||||||||||

| Total vehicles | 8.9 | 6.2 | 44 | % | 18.2 | 13.4 | 36 | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | 11.1 | 9.2 | 21 | % | 19.5 | 17.0 | 15 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 3.3 | 2.3 | 43 | % | 6.7 | 5.8 | 16 | % | |||||||||||||||||||||||||||

| Total gross profit | 23.3 | 17.7 | 32 | % | 44.4 | 36.2 | 23 | % | |||||||||||||||||||||||||||

| Selling, general and administrative expenses | (13.0) | (11.3) | (15) | % | (32.8) | (27.3) | (20) | % | |||||||||||||||||||||||||||

| Impairment charges | — | — | NM | (7.6) | — | NM | |||||||||||||||||||||||||||||

| Depreciation and amortization | (1.3) | (1.1) | (18) | % | (3.9) | (3.1) | (26) | % | |||||||||||||||||||||||||||

| Operating income (loss) | 9.0 | 5.3 | 70 | % | 0.1 | 5.8 | (98) | % | |||||||||||||||||||||||||||

| Other income (expense): | |||||||||||||||||||||||||||||||||||

| Interest expense, floor plan | (0.4) | (0.7) | 43 | % | (1.4) | (1.6) | 13 | % | |||||||||||||||||||||||||||

| Interest expense, other, net | (0.7) | (0.6) | (17) | % | (2.1) | (1.9) | (11) | % | |||||||||||||||||||||||||||

| Other income (expense), net | (0.1) | — | NM | 0.1 | — | NM | |||||||||||||||||||||||||||||

| Total other income (expense) | (1.2) | (1.3) | 8 | % | (3.4) | (3.5) | 3 | % | |||||||||||||||||||||||||||

| Income (loss) before taxes | 7.8 | 4.0 | 95 | % | (3.3) | 2.3 | (243) | % | |||||||||||||||||||||||||||

| Add: Impairment charges | — | — | NM | 7.6 | — | NM | |||||||||||||||||||||||||||||

| Segment income (loss) | $ | 7.8 | $ | 4.0 | 95 | % | $ | 4.3 | $ | 2.3 | 87 | % | |||||||||||||||||||||||

| Unit Sales Volume: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 1,671 | 1,266 | 32 | % | 4,058 | 3,304 | 23 | % | |||||||||||||||||||||||||||

| Used vehicles | 1,407 | 777 | 81 | % | 2,802 | 1,708 | 64 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 84 | 99 | (15) | % | 202 | 130 | 55 | % | |||||||||||||||||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 3,655 | $ | 3,249 | 12 | % | $ | 3,133 | $ | 2,820 | 11 | % | |||||||||||||||||||||||

| Used vehicles | $ | 2,048 | $ | 2,798 | (27) | % | $ | 1,992 | $ | 2,537 | (21) | % | |||||||||||||||||||||||

| Finance, insurance and other, net | $ | 1,066 | $ | 1,136 | (6) | % | $ | 981 | $ | 1,157 | (15) | % | |||||||||||||||||||||||

| Three Months Ended September 30, | Better / (Worse) | Nine Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | % Change | 2025 | 2024 | % Change | ||||||||||||||||||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 35.2 | $ | 26.4 | 33 | % | $ | 75.0 | $ | 62.3 | 20 | % | |||||||||||||||||||||||

| Used vehicles | 16.2 | 8.7 | 86 | % | 27.8 | 16.7 | 66 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 1.0 | 0.9 | 11 | % | 2.1 | 2.0 | 5 | % | |||||||||||||||||||||||||||

| Total vehicles | 52.4 | 36.0 | 46 | % | 104.9 | 81.0 | 30 | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | 22.7 | 19.7 | 15 | % | 37.9 | 35.2 | 8 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 3.2 | 2.3 | 39 | % | 6.4 | 5.5 | 16 | % | |||||||||||||||||||||||||||

| Total revenues | 78.3 | 58.0 | 35 | % | 149.2 | 121.7 | 23 | % | |||||||||||||||||||||||||||

| Gross Profit: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 5.5 | 4.0 | 38 | % | 11.2 | 9.1 | 23 | % | |||||||||||||||||||||||||||

| Used vehicles | 2.7 | 2.1 | 29 | % | 5.0 | 4.1 | 22 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | — | (0.2) | 100 | % | (0.2) | (0.2) | — | % | |||||||||||||||||||||||||||

| Total vehicles | 8.2 | 5.9 | 39 | % | 16.0 | 13.0 | 23 | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | 10.6 | 9.1 | 16 | % | 18.1 | 16.4 | 10 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 3.2 | 2.3 | 39 | % | 6.4 | 5.5 | 16 | % | |||||||||||||||||||||||||||

| Total gross profit | $ | 22.0 | $ | 17.3 | 27 | % | $ | 40.5 | $ | 34.9 | 16 | % | |||||||||||||||||||||||

| Unit Sales Volume: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 1,497 | 1,240 | 21 | % | 3,584 | 3,215 | 11 | % | |||||||||||||||||||||||||||

| Used vehicles | 1,325 | 748 | 77 | % | 2,516 | 1,617 | 56 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 84 | 99 | (15) | % | 199 | 130 | 53 | % | |||||||||||||||||||||||||||

| Retail new & used vehicles | 2,822 | 1,988 | 42 | % | 6,100 | 4,832 | 26 | % | |||||||||||||||||||||||||||

| Used-to-New Ratio | 0.89 | 0.60 | 48 | % | 0.70 | 0.50 | 40 | % | |||||||||||||||||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 3,693 | $ | 3,263 | 13 | % | $ | 3,112 | $ | 2,834 | 10 | % | |||||||||||||||||||||||

| Used vehicles | $ | 2,041 | $ | 2,812 | (27) | % | $ | 1,993 | $ | 2,551 | (22) | % | |||||||||||||||||||||||

| Finance, insurance and other, net | $ | 1,125 | $ | 1,133 | (1) | % | $ | 1,049 | $ | 1,128 | (7) | % | |||||||||||||||||||||||

| Three Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||

| 2025 | 2024 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Compensation | $ | 283.5 | $ | 252.2 | $ | (31.3) | (12) | % | |||||||||||||||

| Advertising | 26.4 | 21.5 | (4.9) | (23) | % | ||||||||||||||||||

| Rent | 13.3 | 8.9 | (4.4) | (49) | % | ||||||||||||||||||

| Other | 128.4 | 109.5 | (18.9) | (17) | % | ||||||||||||||||||

| Total SG&A expenses | $ | 451.6 | $ | 392.1 | $ | (59.5) | (15) | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | $ | (3.0) | $ | 2.3 | |||||||||||||||||||

| Excess compensation related to CDK outage | — | (1.8) | |||||||||||||||||||||

| Storm damage charges | — | (1.5) | |||||||||||||||||||||

Legal settlements |

(0.7) | — | |||||||||||||||||||||

| Total SG&A adjustments | $ | (3.7) | $ | (1.0) | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses | $ | 447.9 | $ | 391.1 | $ | (56.8) | (15) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 46.1 | % | 46.4 | % | 30 | bps | |||||||||||||||||

| Advertising | 4.3 | % | 4.0 | % | (30) | bps | |||||||||||||||||

| Rent | 2.2 | % | 1.6 | % | (60) | bps | |||||||||||||||||

| Other | 20.8 | % | 20.1 | % | (70) | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 73.4 | % | 72.1 | % | (130) | bps | |||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | (0.5) | % | 0.5 | % | |||||||||||||||||||

| Excess compensation related to CDK outage | — | % | (0.4) | % | |||||||||||||||||||

| Storm damage charges | — | % | (0.3) | % | |||||||||||||||||||

Legal settlements |

(0.1) | % | — | % | |||||||||||||||||||

| Total effect of adjustments | (0.6) | % | (0.2) | % | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses as a % of gross profit | 72.8 | % | 71.9 | % | (90) | bps | |||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Total gross profit | $ | 615.5 | $ | 543.6 | $ | 71.9 | 13 | % | |||||||||||||||

| Nine Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||

| 2025 | 2024 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Compensation | $ | 806.8 | $ | 750.3 | $ | (56.5) | (8) | % | |||||||||||||||

| Advertising | 74.6 | 65.5 | (9.1) | (14) | % | ||||||||||||||||||

| Rent | 33.4 | 25.9 | (7.5) | (29) | % | ||||||||||||||||||

| Other | 329.7 | 335.7 | 6.0 | 2 | % | ||||||||||||||||||

| Total SG&A expenses | $ | 1,244.5 | $ | 1,177.4 | $ | (67.1) | (6) | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | $ | (5.6) | $ | 2.9 | |||||||||||||||||||

| Closed store accrued expenses | — | (2.1) | |||||||||||||||||||||

| Cyber insurance proceeds | 40.0 | — | |||||||||||||||||||||

| Excess compensation related to CDK outage | — | (11.4) | |||||||||||||||||||||

| Storm damage charges | (5.0) | (5.1) | |||||||||||||||||||||

| Gain (loss) on exit of leased dealerships | — | 3.0 | |||||||||||||||||||||

| Severance and long-term compensation charges | — | (5.0) | |||||||||||||||||||||

Legal settlements |

(0.7) | — | |||||||||||||||||||||

| Total SG&A adjustments | $ | 28.7 | $ | (17.7) | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses | $ | 1,273.2 | $ | 1,159.7 | $ | (113.5) | (10) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 45.2 | % | 46.3 | % | 110 | bps | |||||||||||||||||

| Advertising | 4.2 | % | 4.0 | % | (20) | bps | |||||||||||||||||

| Rent | 1.9 | % | 1.6 | % | (30) | bps | |||||||||||||||||

| Other | 18.5 | % | 20.8 | % | 230 | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 69.8 | % | 72.7 | % | 290 | bps | |||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | (0.3) | % | 0.2 | % | |||||||||||||||||||

| Closed store accrued expenses | — | % | (0.1) | % | |||||||||||||||||||

| Cyber insurance proceeds | 2.2 | % | — | % | |||||||||||||||||||

| Excess compensation related to CDK outage | — | % | (0.8) | % | |||||||||||||||||||

| Storm damage charges | (0.3) | % | (0.3) | % | |||||||||||||||||||

| Gain (loss) on exit of leased dealerships | — | % | 0.2 | % | |||||||||||||||||||

| Severance and long-term compensation charges | — | % | (0.3) | % | |||||||||||||||||||

Legal settlements |

— | % | — | % | |||||||||||||||||||

| Total effect of adjustments | 1.6 | % | (1.2) | % | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses as a % of gross profit | 71.4 | % | 71.5 | % | 10 | bps | |||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Total gross profit | $ | 1,784.2 | $ | 1,618.9 | $ | 165.3 | 10 | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Excess compensation related to CDK outage | $ | — | $ | 2.0 | |||||||||||||||||||

| Total adjustments | $ | — | $ | 2.0 | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted gross profit | $ | 1,784.2 | $ | 1,620.9 | $ | 163.3 | 10 | % | |||||||||||||||

| Three Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||

| 2025 | 2024 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

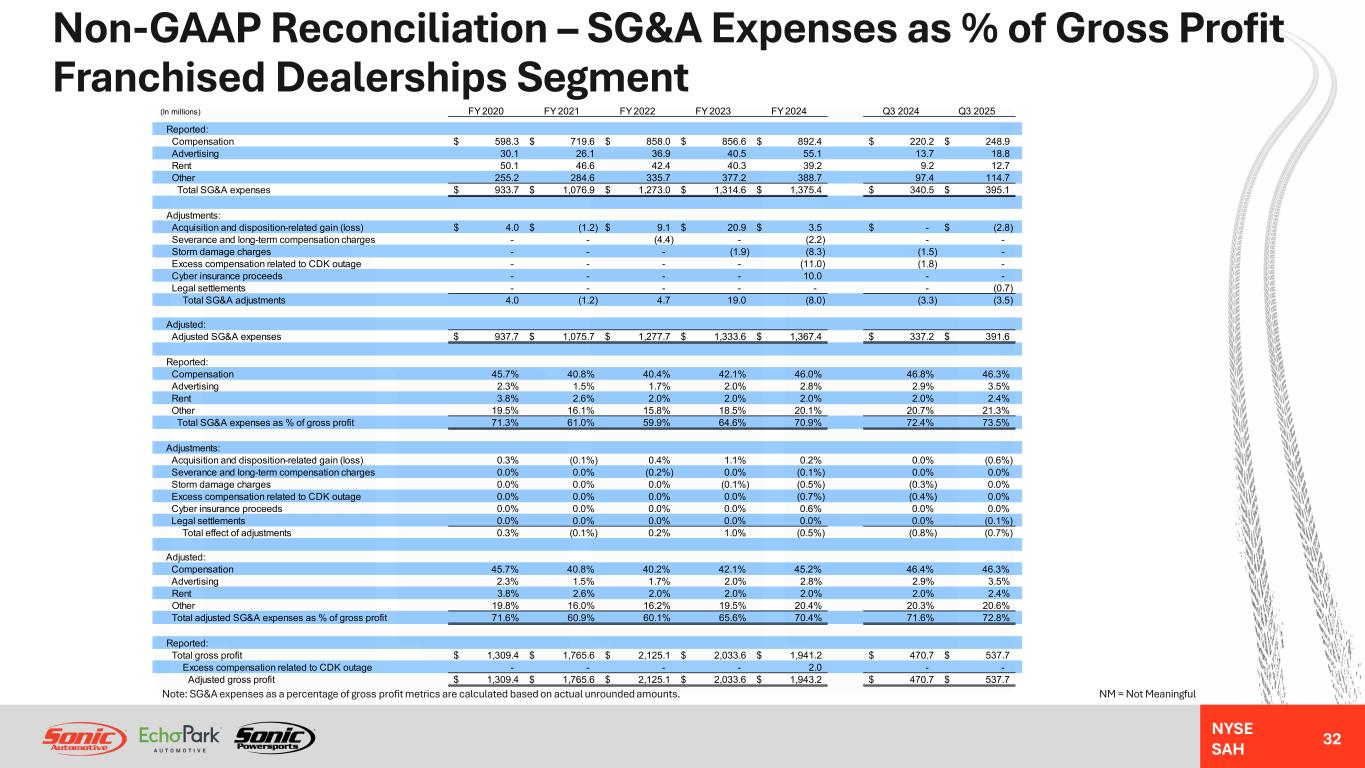

| Compensation | $ | 248.9 | $ | 220.2 | $ | (28.7) | (13) | % | |||||||||||||||

| Advertising | 18.8 | 13.7 | (5.1) | (37) | % | ||||||||||||||||||

| Rent | 12.7 | 9.2 | (3.5) | (38) | % | ||||||||||||||||||

| Other | 114.7 | 97.4 | (17.3) | (18) | % | ||||||||||||||||||

| Total SG&A expenses | $ | 395.1 | $ | 340.5 | $ | (54.6) | (16) | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | $ | (2.8) | $ | — | |||||||||||||||||||

| Excess compensation related to CDK outage | — | (1.8) | |||||||||||||||||||||

| Storm damage charges | — | (1.5) | |||||||||||||||||||||

Legal settlements |

(0.7) | — | |||||||||||||||||||||

| Total SG&A adjustments | $ | (3.5) | $ | (3.3) | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses | $ | 391.6 | $ | 337.2 | $ | (54.4) | (16) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 46.3 | % | 46.8 | % | 50 | bps | |||||||||||||||||

| Advertising | 3.5 | % | 2.9 | % | (60) | bps | |||||||||||||||||

| Rent | 2.4 | % | 2.0 | % | (40) | bps | |||||||||||||||||

| Other | 21.3 | % | 20.7 | % | (60) | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 73.5 | % | 72.4 | % | (110) | bps | |||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | (0.6) | % | — | % | |||||||||||||||||||

| Excess compensation related to CDK outage | — | % | (0.4) | % | |||||||||||||||||||

| Storm damage charges | — | % | (0.4) | % | |||||||||||||||||||

Legal settlements |

(0.1) | % | — | % | |||||||||||||||||||

| Total effect of adjustments | (0.7) | % | (0.8) | % | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses as a % of gross profit | 72.8 | % | 71.6 | % | (120) | bps | |||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Total gross profit | $ | 537.7 | $ | 470.7 | $ | 67.0 | 14 | % | |||||||||||||||

| Nine Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||

| 2025 | 2024 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Compensation | $ | 707.5 | $ | 658.5 | $ | (49.0) | (7) | % | |||||||||||||||

| Advertising | 51.4 | 43.2 | (8.2) | (19) | % | ||||||||||||||||||

| Rent | 31.8 | 29.6 | (2.2) | (7) | % | ||||||||||||||||||

| Other | 290.5 | 295.7 | 5.2 | 2 | % | ||||||||||||||||||

| Total SG&A expenses | $ | 1,081.2 | $ | 1,027.0 | $ | (54.2) | (5) | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | $ | (5.5) | $ | — | |||||||||||||||||||

| Cyber insurance proceeds | 40.0 | — | |||||||||||||||||||||

| Excess compensation related to CDK outage | — | (11.0) | |||||||||||||||||||||

| Storm damage charges | (5.0) | (5.1) | |||||||||||||||||||||

| Severance and long-term compensation charges | — | (2.2) | |||||||||||||||||||||

Legal settlements |

(0.7) | — | |||||||||||||||||||||

| Total SG&A adjustments | $ | 28.8 | $ | (18.3) | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses | $ | 1,110.0 | $ | 1,008.7 | $ | (101.3) | (10) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 45.4 | % | 46.3 | % | 90 | bps | |||||||||||||||||

| Advertising | 3.3 | % | 3.0 | % | (30) | bps | |||||||||||||||||

| Rent | 2.0 | % | 2.1 | % | 10 | bps | |||||||||||||||||

| Other | 18.6 | % | 20.7 | % | 210 | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 69.3 | % | 72.1 | % | 280 | bps | |||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | (0.4) | % | — | % | |||||||||||||||||||

| Cyber insurance proceeds | 2.6 | % | — | % | |||||||||||||||||||

| Excess compensation related to CDK outage | — | % | (0.8) | % | |||||||||||||||||||

| Storm damage charges | (0.3) | % | (0.4) | % | |||||||||||||||||||

| Severance and long-term compensation charges | — | % | (0.2) | % | |||||||||||||||||||

Legal settlements |

— | % | — | % | |||||||||||||||||||

| Total effect of adjustments | 1.9 | % | (1.4) | % | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses as a % of gross profit | 71.2 | % | 70.7 | % | (50) | bps | |||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Total gross profit | $ | 1,559.4 | $ | 1,423.8 | $ | 135.6 | 10 | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Excess compensation related to CDK outage | $ | — | $ | 2.0 | |||||||||||||||||||

| Total adjustments | $ | — | $ | 2.0 | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted gross profit | $ | 1,559.4 | $ | 1,425.8 | $ | 133.6 | 9 | % | |||||||||||||||

| Three Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||

| 2025 | 2024 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Compensation | $ | 25.0 | $ | 23.5 | $ | (1.5) | (6) | % | |||||||||||||||

| Advertising | 7.4 | 7.4 | — | — | % | ||||||||||||||||||

| Rent | 0.8 | 0.7 | (0.1) | (14) | % | ||||||||||||||||||

| Other | 10.3 | 8.6 | (1.7) | (20) | % | ||||||||||||||||||

| Total SG&A expenses | $ | 43.5 | $ | 40.2 | $ | (3.3) | (8) | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | $ | (0.1) | $ | 2.3 | |||||||||||||||||||

| Total SG&A adjustments | $ | (0.1) | $ | 2.3 | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses | $ | 43.4 | $ | 42.5 | $ | (0.9) | (2) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 46.0 | % | 42.6 | % | (340) | bps | |||||||||||||||||

| Advertising | 13.6 | % | 13.5 | % | (10) | bps | |||||||||||||||||

| Rent | 1.5 | % | 1.3 | % | (20) | bps | |||||||||||||||||

| Other | 18.9 | % | 15.5 | % | (340) | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 80.0 | % | 72.9 | % | (710) | bps | |||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | (0.2) | % | 4.2 | % | |||||||||||||||||||

| Total effect of adjustments | (0.2) | % | 4.2 | % | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses as a % of gross profit | 79.8 | % | 77.1 | % | (270) | bps | |||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Total gross profit | $ | 54.4 | $ | 55.2 | $ | (0.8) | (1) | % | |||||||||||||||

| Nine Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||

| 2025 | 2024 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Compensation | $ | 76.1 | $ | 72.0 | $ | (4.1) | (6) | % | |||||||||||||||

| Advertising | 22.4 | 21.0 | (1.4) | (7) | % | ||||||||||||||||||

| Rent | 2.3 | (2.7) | (5.0) | (185) | % | ||||||||||||||||||

| Other | 29.8 | 32.8 | 3.0 | 9 | % | ||||||||||||||||||

| Total SG&A expenses | $ | 130.6 | $ | 123.1 | $ | (7.5) | (6) | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | $ | 0.9 | $ | 2.9 | |||||||||||||||||||

| Closed store accrued expenses | — | (2.1) | |||||||||||||||||||||

| Excess compensation related to CDK outage | — | (0.4) | |||||||||||||||||||||

| Gain (loss) on exit of leased dealerships | — | 3.0 | |||||||||||||||||||||

| Severance and long-term compensation charges | — | (2.8) | |||||||||||||||||||||

| Total SG&A adjustments | $ | 0.9 | $ | 0.6 | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses | $ | 131.5 | $ | 123.7 | $ | (7.8) | (6) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 42.2 | % | 45.3 | % | 310 | bps | |||||||||||||||||

| Advertising | 12.4 | % | 13.2 | % | 80 | bps | |||||||||||||||||

| Rent | 1.3 | % | (1.7) | % | (300) | bps | |||||||||||||||||

| Other | 16.5 | % | 20.6 | % | 410 | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 72.4 | % | 77.4 | % | 500 | bps | |||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | 0.5 | % | 1.9 | % | |||||||||||||||||||

| Closed store accrued expenses | — | % | (1.4) | % | |||||||||||||||||||

| Excess compensation related to CDK outage | — | % | (0.3) | % | |||||||||||||||||||

| Gain (loss) on exit of leased dealerships | — | % | 2.0 | % | |||||||||||||||||||

| Severance and long-term compensation charges | — | % | (1.9) | % | |||||||||||||||||||

| Total effect of adjustments | 0.5 | % | 0.4 | % | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses as a % of gross profit | 72.9 | % | 77.8 | % | 490 | bps | |||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Total gross profit | $ | 180.4 | $ | 158.9 | $ | 21.5 | 14 | % | |||||||||||||||

| Three Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||

| 2025 | 2024 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Compensation | $ | 9.7 | $ | 8.4 | $ | (1.3) | (15) | % | |||||||||||||||

| Advertising | 0.3 | 0.4 | 0.1 | 25 | % | ||||||||||||||||||

| Rent | (0.2) | (1.1) | (0.9) | 82 | % | ||||||||||||||||||

| Other | 3.2 | 3.6 | 0.4 | 11 | % | ||||||||||||||||||

| Total SG&A expenses | $ | 13.0 | $ | 11.3 | $ | (1.7) | (15) | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | $ | (0.2) | $ | — | |||||||||||||||||||

| Total SG&A adjustments | $ | (0.2) | $ | — | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses | $ | 12.8 | $ | 11.3 | $ | (1.5) | (13.3) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 41.6 | % | 47.8 | % | 620 | bps | |||||||||||||||||

| Advertising | 1.3 | % | 2.5 | % | 120 | bps | |||||||||||||||||

| Rent | (0.9) | % | (6.4) | % | (550) | bps | |||||||||||||||||

| Other | 13.8 | % | 19.8 | % | 600 | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 55.8 | % | 63.7 | % | 790 | bps | |||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | (0.7) | % | — | % | |||||||||||||||||||

| Total effect of adjustments | (0.7) | % | — | % | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses as a % of gross profit | 55.1 | % | 63.7 | % | 860 | bps | |||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Total gross profit | $ | 23.3 | $ | 17.7 | $ | 5.6 | 32 | % | |||||||||||||||

| Nine Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||

| 2025 | 2024 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Compensation | $ | 23.1 | $ | 19.8 | $ | (3.3) | (17) | % | |||||||||||||||

| Advertising | 0.8 | 1.2 | 0.4 | 33 | % | ||||||||||||||||||

| Rent | (0.7) | (1.0) | (0.3) | 30 | % | ||||||||||||||||||

| Other | 9.6 | 7.3 | (2.3) | (32) | % | ||||||||||||||||||

| Total SG&A expenses | $ | 32.8 | $ | 27.3 | $ | (5.5) | (20) | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | $ | (1.1) | $ | — | |||||||||||||||||||

| Total SG&A adjustments | $ | (1.1) | $ | — | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses | $ | 31.7 | $ | 27.3 | |||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 52.0 | % | 54.7 | % | 270 | bps | |||||||||||||||||

| Advertising | 1.8 | % | 3.4 | % | 160 | bps | |||||||||||||||||

| Rent | (1.6) | % | (2.8) | % | (120) | bps | |||||||||||||||||

| Other | 21.6 | % | 20.2 | % | (140) | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 73.8 | % | 75.5 | % | 170 | bps | |||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Acquisition and disposition-related gain (loss) | (2.4) | % | — | % | |||||||||||||||||||

| Total effect of adjustments | (2.4) | % | — | % | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses as a % of gross profit | 71.4 | % | 75.5 | % | 410 | bps | |||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Total gross profit | $ | 44.4 | $ | 36.2 | $ | 8.2 | 23 | % | |||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2025 | 2024 | % Change | 2025 | 2024 | % Change | ||||||||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||||||||||||||

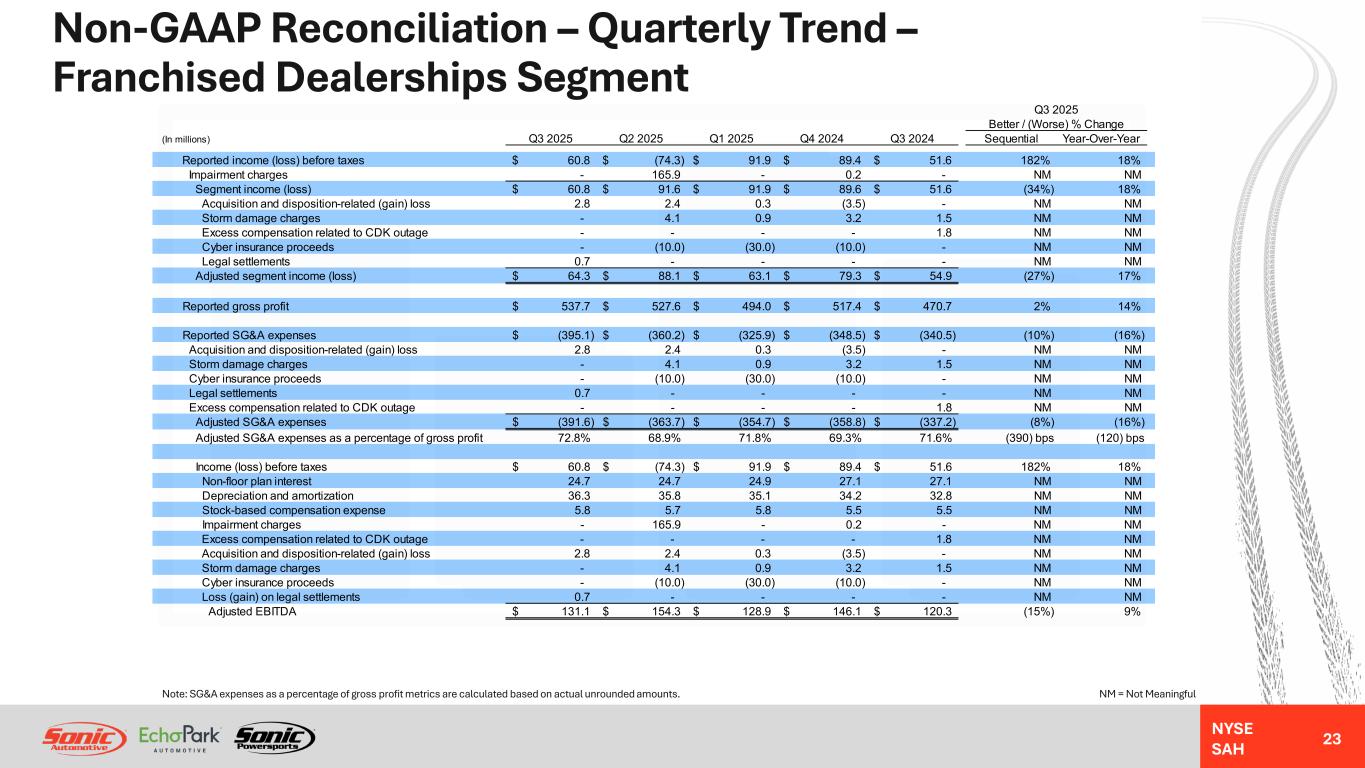

| Income (loss) before taxes | $ | 60.8 | $ | 51.6 | 18 | % | $ | 78.5 | $ | 167.0 | (53) | % | |||||||||||||||||||||||

| Add: Impairment charges | — | — | 165.9 | 1.0 | |||||||||||||||||||||||||||||||

| Segment income (loss) | $ | 60.8 | $ | 51.6 | 18 | % | $ | 244.4 | $ | 168.0 | 45 | % | |||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||||||

| Acquisition and disposition-related (gain) loss | $ | 2.8 | $ | — | $ | 5.5 | $ | — | |||||||||||||||||||||||||||

| Cyber insurance proceeds | — | — | (40.0) | — | |||||||||||||||||||||||||||||||

| Excess compensation related to CDK outage | — | 1.8 | — | 13.0 | |||||||||||||||||||||||||||||||

Legal settlements |

0.7 | — | 0.7 | — | |||||||||||||||||||||||||||||||

| Storm damage charges | — | 1.5 | 5.0 | 5.1 | |||||||||||||||||||||||||||||||

| Severance and long-term compensation charges | — | — | — | 2.2 | |||||||||||||||||||||||||||||||

| Total pre-tax adjustments | $ | 3.5 | $ | 3.3 | $ | (28.8) | $ | 20.3 | |||||||||||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||||||||||||||

| Segment income (loss) | $ | 64.3 | $ | 54.9 | 17 | % | $ | 215.6 | $ | 188.3 | 14 | % | |||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2025 | 2024 | % Change | 2025 | 2024 | % Change | ||||||||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||||||||||||||

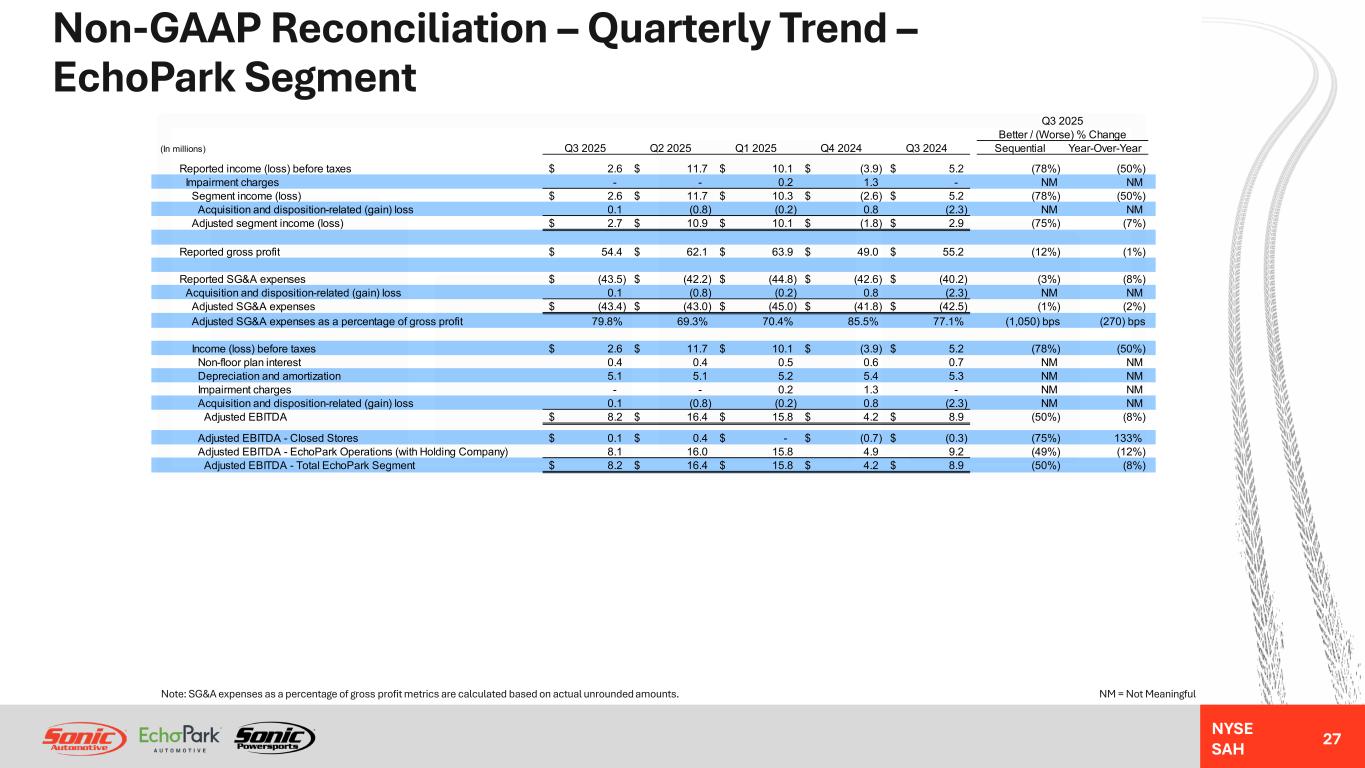

| Income (loss) before taxes | $ | 2.6 | $ | 5.2 | 50 | % | $ | 24.4 | $ | 4.7 | (419) | % | |||||||||||||||||||||||

| Add: Impairment charges | — | — | 0.2 | 1.4 | |||||||||||||||||||||||||||||||

| Segment income (loss) | $ | 2.6 | $ | 5.2 | 50 | % | $ | 24.6 | $ | 6.1 | (303) | % | |||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||||||

| Acquisition and disposition-related (gain) loss | $ | 0.1 | $ | (2.3) | $ | (0.9) | $ | (2.9) | |||||||||||||||||||||||||||

| Closed store accrued expenses | — | — | — | 2.1 | |||||||||||||||||||||||||||||||

| Excess compensation related to CDK outage | — | — | — | 0.4 | |||||||||||||||||||||||||||||||

| Loss (gain) on exit of leased dealerships | — | — | — | (3.0) | |||||||||||||||||||||||||||||||

| Severance and long-term compensation charges | — | — | — | 2.8 | |||||||||||||||||||||||||||||||

| Total pre-tax adjustments | $ | 0.1 | $ | (2.3) | $ | (0.9) | $ | (0.6) | |||||||||||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||||||||||||||

| Segment income (loss) | $ | 2.7 | $ | 2.9 | 7 | % | $ | 23.7 | $ | 5.5 | 331 | % | |||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2025 | 2024 | % Change | 2025 | 2024 | % Change | ||||||||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||||||||||||||

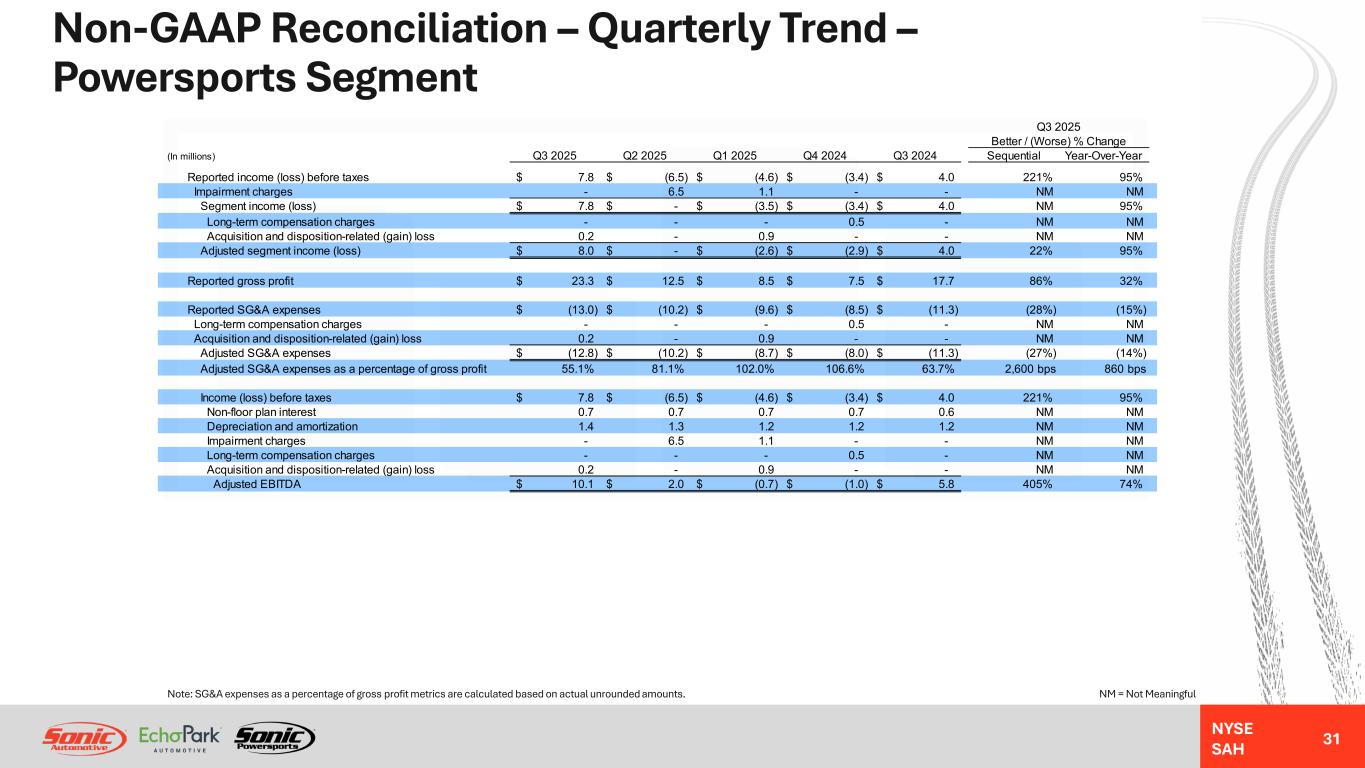

| Income (loss) before taxes | $ | 7.8 | $ | 4.0 | 95 | % | $ | (3.3) | $ | 2.3 | 243 | % | |||||||||||||||||||||||

| Add: Impairment charges | — | — | 7.6 | — | |||||||||||||||||||||||||||||||

| Segment income (loss) | $ | 7.8 | $ | 4.0 | 95 | % | $ | 4.3 | $ | 2.3 | (87) | % | |||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||||||

| Acquisition and disposition-related (gain) loss | $ | 0.2 | $ | — | $ | 1.1 | $ | — | |||||||||||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||||||||||||||

| Adjusted segment income (loss) | $ | 8.0 | $ | 4.0 | 100.0 | % | $ | 5.4 | $ | 2.3 | (135) | % | |||||||||||||||||||||||

| Three Months Ended September 30, 2025 | Three Months Ended September 30, 2024 | ||||||||||||||||||||||||||||||||||

| Weighted- Average Shares |

Amount | Per Share Amount |

Weighted- Average Shares |

Amount | Per Share Amount |

||||||||||||||||||||||||||||||

| (In millions, except per share amounts) | |||||||||||||||||||||||||||||||||||

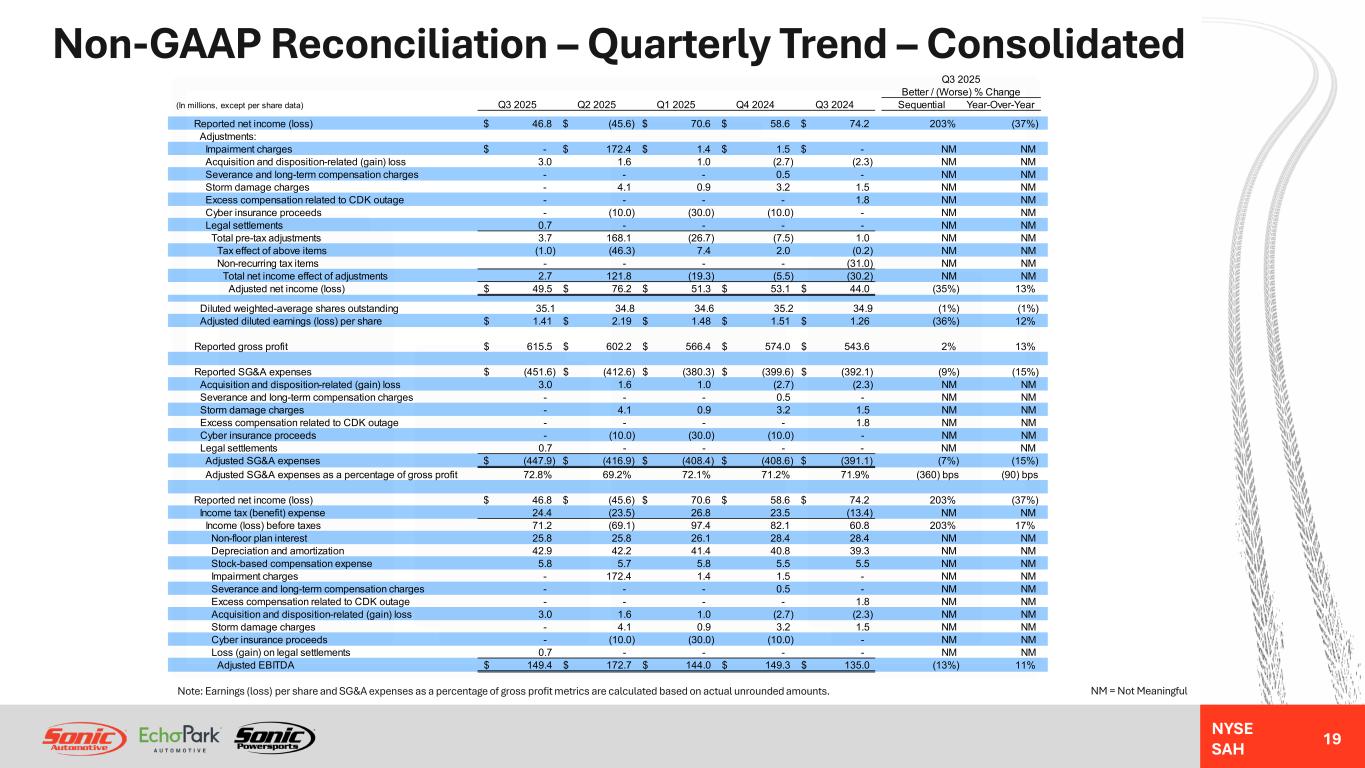

Reported net income (loss), diluted shares, and diluted earnings (loss) per share |

35.1 | $ | 46.8 | $ | 1.33 | 34.9 | $ | 74.2 | $ | 2.13 | |||||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||||||

| Acquisition and disposition-related (gain) loss | $ | 3.0 | $ | (2.3) | |||||||||||||||||||||||||||||||

Legal settlements |

0.7 | — | |||||||||||||||||||||||||||||||||

| Excess compensation related to CDK outage | — | 1.8 | |||||||||||||||||||||||||||||||||

| Storm damage charges | — | 1.5 | |||||||||||||||||||||||||||||||||

| Total pre-tax adjustments | $ | 3.7 | $ | 1.0 | |||||||||||||||||||||||||||||||

| Tax effect of above items | (1.0) | (0.2) | |||||||||||||||||||||||||||||||||

| Non-recurring tax items | $ | — | $ | (31.0) | |||||||||||||||||||||||||||||||

| Adjusted net income (loss), diluted shares, and diluted earnings (loss) per share | 35.1 | $ | 49.5 | $ | 1.41 | 34.9 | $ | 44.0 | $ | 1.26 | |||||||||||||||||||||||||

| Nine Months Ended September 30, 2025 | Nine Months Ended September 30, 2024 | ||||||||||||||||||||||||||||||||||

| Weighted- Average Shares |

Net Income (Loss) | Per Share Amount |

Weighted- Average Shares |

Net Income (Loss) | Per Share Amount |

||||||||||||||||||||||||||||||

| (In millions, except per share amounts) | |||||||||||||||||||||||||||||||||||

| Reported net income (loss), diluted shares, and diluted earnings (loss) per share | 34.8 | $ | 71.8 | $ | 2.06 | 34.8 | $ | 157.4 | $ | 4.52 | |||||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||||||

| Acquisition and disposition-related (gain) loss | $ | 5.6 | $ | (2.9) | |||||||||||||||||||||||||||||||

Legal settlements |

0.7 | — | |||||||||||||||||||||||||||||||||

| Closed store accrued expenses | — | 2.1 | |||||||||||||||||||||||||||||||||

| Cyber insurance proceeds | (40.0) | — | |||||||||||||||||||||||||||||||||

| Excess compensation related to CDK outage | — | 13.4 | |||||||||||||||||||||||||||||||||

| Storm damage charges | 5.0 | 5.1 | |||||||||||||||||||||||||||||||||

| Impairment charges | 173.8 | 2.4 | |||||||||||||||||||||||||||||||||

| Loss (gain) on exit of leased dealerships | — | (3.0) | |||||||||||||||||||||||||||||||||

| Severance and long-term compensation charges | — | 5.0 | |||||||||||||||||||||||||||||||||

| Total pre-tax adjustments | $ | 145.1 | $ | 22.1 | |||||||||||||||||||||||||||||||

| Tax effect of above items | (39.9) | (5.8) | |||||||||||||||||||||||||||||||||

| Non-recurring tax items | $ | — | $ | (31.0) | |||||||||||||||||||||||||||||||

| Adjusted net income (loss), diluted shares, and diluted earnings (loss) per share | 34.8 | $ | 177.0 | $ | 5.08 | 34.8 | $ | 142.7 | $ | 4.10 | |||||||||||||||||||||||||

| Three Months Ended September 30, 2025 | Three Months Ended September 30, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||

| Franchised Dealerships Segment | EchoPark Segment | Powersports Segment | Total | Franchised Dealerships Segment | EchoPark Segment | Powersports Segment | Total | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 46.8 | $ | 74.2 | |||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 24.4 | (13.4) | |||||||||||||||||||||||||||||||||||||||||||||

| Income (loss) before taxes | $ | 60.8 | $ | 2.6 | $ | 7.8 | $ | 71.2 | $ | 51.6 | $ | 5.2 | $ | 4.0 | $ | 60.8 | |||||||||||||||||||||||||||||||

| Non-floor plan interest (1) | 24.7 | 0.4 | 0.7 | 25.8 | 27.1 | 0.7 | 0.6 | 28.4 | |||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization (2) | 36.3 | 5.1 | 1.4 | 42.9 | 32.8 | 5.3 | 1.2 | 39.3 | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense | 5.8 | — | — | 5.8 | 5.5 | — | — | 5.5 | |||||||||||||||||||||||||||||||||||||||

| Excess compensation related to CDK outage | — | — | — | — | 1.8 | — | — | 1.8 | |||||||||||||||||||||||||||||||||||||||

| Acquisition and disposition related (gain) loss | 2.8 | 0.1 | 0.2 | 3.0 | — | (2.3) | — | (2.3) | |||||||||||||||||||||||||||||||||||||||

| Storm damage charges | — | — | — | — | 1.5 | — | — | 1.5 | |||||||||||||||||||||||||||||||||||||||

| Loss (gain) on legal settlements | 0.7 | — | — | 0.7 | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 131.1 | $ | 8.2 | $ | 10.1 | $ | 149.4 | $ | 120.3 | $ | 8.9 | $ | 5.8 | $ | 135.0 | |||||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2025 | Nine Months Ended September 30, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||

| Franchised Dealerships Segment | EchoPark Segment | Powersports Segment | Total | Franchised Dealerships Segment | EchoPark Segment | Powersports Segment | Total | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 71.8 | $ | 157.4 | |||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 27.8 | 16.6 | |||||||||||||||||||||||||||||||||||||||||||||

| Income (loss) before taxes | $ | 78.5 | $ | 24.4 | $ | (3.3) | $ | 99.6 | $ | 167.0 | $ | 4.7 | $ | 2.3 | $ | 174.0 | |||||||||||||||||||||||||||||||

| Non-floor plan interest (1) | 74.3 | 1.3 | 2.1 | 77.7 | 79.8 | 2.0 | 1.9 | 83.7 | |||||||||||||||||||||||||||||||||||||||

| Depreciation & amortization (2) | 107.1 | 15.4 | 3.9 | 126.4 | 95.8 | 16.3 | 3.1 | 115.2 | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense | 17.3 | — | — | 17.3 | 15.8 | — | — | 15.8 | |||||||||||||||||||||||||||||||||||||||

| Loss (gain) on exit of leased dealerships | — | — | — | — | — | (3.0) | — | (3.0) | |||||||||||||||||||||||||||||||||||||||

| Impairment charges | 165.9 | 0.2 | 7.6 | 173.8 | 1.0 | 1.4 | — | 2.4 | |||||||||||||||||||||||||||||||||||||||

| Loss on debt extinguishment | — | — | — | — | 0.6 | — | — | 0.6 | |||||||||||||||||||||||||||||||||||||||

| Severance and long-term compensation charges | — | — | — | — | 2.2 | 2.9 | — | 5.1 | |||||||||||||||||||||||||||||||||||||||

| Excess compensation related to CDK outage | — | — | — | — | 13.0 | 0.4 | — | 13.4 | |||||||||||||||||||||||||||||||||||||||

| Cyber insurance proceeds | (40.0) | — | — | (40.0) | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Acquisition and disposition related (gain) loss | 5.5 | (0.9) | 1.1 | 5.6 | (0.3) | (3.3) | — | (3.6) | |||||||||||||||||||||||||||||||||||||||

| Storm damage charges | 5.0 | — | — | 5.0 | 5.1 | — | — | 5.1 | |||||||||||||||||||||||||||||||||||||||

| Closed store accrued expenses | — | — | — | — | — | 2.1 | — | 2.1 | |||||||||||||||||||||||||||||||||||||||

| Loss (gain) on legal settlements | 0.7 | — | — | 0.7 | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 414.3 | $ | 40.4 | $ | 11.4 | $ | 466.1 | $ | 380.0 | $ | 23.5 | $ | 7.3 | $ | 410.8 | |||||||||||||||||||||||||||||||