Document

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE QUARTER ENDED JUNE 30, 2025

|

|

|

|

|

|

|

|

|

|

925 West Georgia Street, Suite 1800, Vancouver, B.C., Canada V6C 3L2

Phone: 604.688.3033 | Fax: 604.639.8873| Toll Free: 1.866.529.2807 | Email: info@firstmajestic.com

www.firstmajestic.com |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OVERVIEW OF OPERATING RESULTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OVERVIEW OF FINANCIAL PERFORMANCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER DISCLOSURES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First Majestic Silver Corp. 2025 Second Quarter Report |

Page 2 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION

This Management’s Discussion and Analysis of Results of Operations and Financial Condition (“MD&A”) should be read in conjunction with the unaudited consolidated financial statements of First Majestic Silver Corp. (“First Majestic” or the "Company”) for the three and six months ended June 30, 2025 which are prepared in accordance with International Accounting Standard ("IAS") 34, "Interim Financial Reporting", and the audited consolidated financial statements of the Company as at and for the year ended December 31, 2024, as some disclosures from the annual consolidated financial statements have been condensed or omitted. All dollar amounts are expressed in United States (“US”) dollars and tabular amounts are expressed in thousands of US dollars, unless otherwise indicated. Certain amounts shown in this MD&A may not add exactly to total amounts due to rounding differences. Production and certain metrics as specified in each table throughout the MD&A with respect to the Los Gatos Silver Mine are presented on an attributable basis calculated on the basis of the Company’s 70% interest in the Los Gatos joint venture and reflect results from January 16, 2025 which is the date of the acquisition by the Company of its interest in the Los Gatos Silver Mine.

This MD&A contains “forward-looking statements” that are subject to risk factors set out in a cautionary note contained at the end of this MD&A. All information contained in this MD&A is current and has been approved by the Board of Directors of the Company as of August 13, 2025 unless otherwise stated.

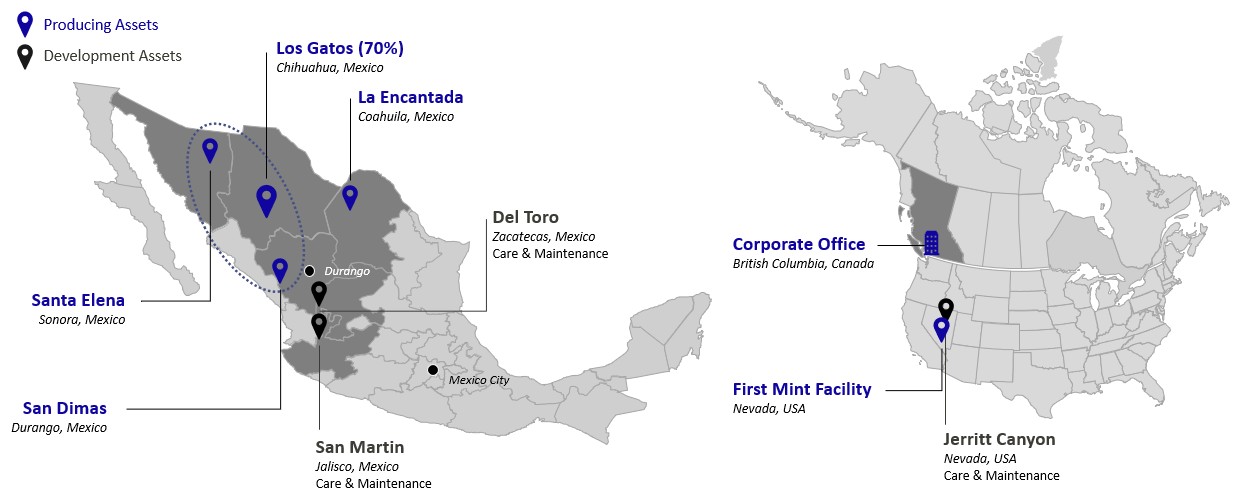

First Majestic is in the business of production, development, exploration, and acquisition of mineral properties with a focus on silver and gold production in North America. The Company owns four producing mines in Mexico consisting of the Santa Elena Silver/Gold Mine, the newly acquired Los Gatos Silver Mine (“Los Gatos”) (through the Company’s 70% interest in the Los Gatos joint venture), the San Dimas Silver/Gold Mine, and the La Encantada Silver Mine. The Company also owns the Jerritt Canyon Gold Mine in Nevada, USA which the Company placed on temporary suspension on March 20, 2023 to focus on exploration, definition, and expansion of the mineral resources and optimization of mine planning and plant operations. The Company owns two additional mines currently in care and maintenance in Mexico: the San Martin Silver Mine and the Del Toro Silver Mine, as well as several exploration projects. In addition, the Company is the 100% owner and operator of its own minting facility, First Mint, LLC (“First Mint”).

First Majestic is publicly listed on the New York Stock Exchange (“NYSE”) and the Toronto Stock Exchange (“TSX”) under the symbol “AG”, and on the Frankfurt Stock Exchange under the symbol “FMV”.

|

|

|

|

|

|

|

|

|

|

| First Majestic Silver Corp. 2025 Second Quarter Report |

Page 3 |

|

|

|

|

|

|

2025 SECOND QUARTER HIGHLIGHTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Key Performance Metrics |

|

2025-Q2 |

|

2025-Q1 |

Change

Q2 vs Q1 |

|

2024-Q2 |

Change

Q2 vs Q2 |

|

2025-YTD |

|

2024-YTD |

|

Change

YTD |

Operational(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ore Processed / Tonnes Milled |

|

1,003,804 |

|

944,373 |

|

6 |

% |

|

674,570 |

|

49 |

% |

|

1,948,177 |

|

1,263,221 |

|

|

54 |

% |

| Silver Ounces Produced |

|

3,701,995 |

|

3,704,503 |

|

0 |

% |

|

2,104,181 |

|

76 |

% |

|

7,406,498 |

|

4,079,358 |

|

|

82 |

% |

| Gold Ounces Produced |

|

33,865 |

|

36,469 |

|

(7 |

%) |

|

39,339 |

|

(14 |

%) |

|

70,333 |

|

75,275 |

|

|

(7 |

%) |

| Silver Equivalent ("AgEq") Ounces Produced |

|

7,852,311 |

|

7,711,709 |

|

2 |

% |

|

5,289,439 |

|

48 |

% |

|

15,564,020 |

|

10,451,724 |

|

|

49 |

% |

Cash Costs per Silver Equivalent Ounce(1) |

|

$15.08 |

|

$13.68 |

|

10 |

% |

|

$15.29 |

|

(1 |

%) |

|

$14.39 |

|

$15.14 |

|

|

(5 |

%) |

All-in Sustaining Cost per Silver Equivalent Ounce ("AISC")(1) |

|

$21.02 |

|

$19.24 |

|

9 |

% |

|

$21.64 |

|

(3 |

%) |

|

$20.14 |

|

$21.58 |

|

|

(7 |

%) |

Total Production Cost per Tonne(1) |

|

$104.45 |

|

$97.71 |

|

7 |

% |

|

$113.16 |

|

(8 |

%) |

|

$101.19 |

|

$120.18 |

|

|

(16 |

%) |

Average Realized Silver Price per Silver Equivalent Ounce(1) |

|

$34.62 |

|

$32.50 |

|

7 |

% |

|

$27.81 |

|

24 |

% |

|

$33.57 |

|

$25.88 |

|

|

30 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial (in $millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$264.2 |

|

$243.9 |

|

8 |

% |

|

$136.2 |

|

94 |

% |

|

$508.2 |

|

$242.2 |

|

|

110 |

% |

| Mine Operating Earnings |

|

$49.4 |

|

$63.8 |

|

(23 |

%) |

|

$15.5 |

|

NM |

|

$113.2 |

|

$15.1 |

|

|

NM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Earnings (Loss) |

|

$56.6 |

|

$6.2 |

|

NM |

|

($48.3) |

|

NM |

|

$62.8 |

|

($61.8) |

|

|

NM |

Operating Cash Flows before Non-Cash Working Capital and Taxes |

|

$114.9 |

|

$110.0 |

|

4 |

% |

|

$23.8 |

|

NM |

|

$225.0 |

|

$36.4 |

|

|

NM |

| Capital Expenditures |

|

$56.0 |

|

$51.0 |

|

10 |

% |

|

$28.3 |

|

98 |

% |

|

$107.0 |

|

$56.5 |

|

|

89 |

% |

| Cash and Cash Equivalents |

|

$384.8 |

|

$351.3 |

|

10 |

% |

|

$152.2 |

|

153 |

% |

|

$384.8 |

|

$152.2 |

|

|

153 |

% |

| Total Assets |

|

$4,094.0 |

|

$4,033.7 |

|

1 |

% |

|

$1,987.0 |

|

106 |

% |

|

$4,094.0 |

|

$1,987.0 |

|

|

106 |

% |

| Total Non-Current Financial Liabilities |

|

$995.6 |

|

$1,015.3 |

|

(2 |

%) |

|

$501.1 |

|

99 |

% |

|

$995.6 |

|

$501.1 |

|

|

99 |

% |

Working Capital(1) |

|

$444.1 |

|

$404.8 |

|

10 |

% |

|

$229.9 |

|

93 |

% |

|

$444.1 |

|

$229.9 |

|

|

93 |

% |

Earnings before Interest, Tax, Depreciation and Amortization ("EBITDA")(1) |

|

$119.9 |

|

$98.8 |

|

21 |

% |

|

$21.2 |

|

NM |

|

$218.7 |

|

$27.5 |

|

|

NM |

Adjusted EBITDA(1) |

|

$125.3 |

|

$109.7 |

|

14 |

% |

|

$26.4 |

|

NM |

|

$235.0 |

|

$38.5 |

|

|

NM |

Free Cash Flow(1) |

|

$77.9 |

|

$43.5 |

|

79 |

% |

|

$6.4 |

|

NM |

|

$121.4 |

|

$7.4 |

|

|

NM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) per Share ("EPS") – Basic & Diluted |

|

$0.11 |

|

$0.01 |

|

NM |

|

($0.17) |

|

165 |

% |

|

$0.12 |

|

($0.21) |

|

|

157 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EPS(1) |

|

$0.04 |

|

$0.05 |

|

(20 |

%) |

|

($0.07) |

|

157 |

% |

|

$0.08 |

|

($0.13) |

|

|

162 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM - Not meaningful.

(1)These measures do not have a standardized meaning under the Company's financial reporting framework and the methods used by the Company to calculate these measures may differ from methods used by other companies with similar descriptions. See “Non-GAAP Measures” on pages 52 to 62 for further details on these measures and a reconciliation of non-GAAP to GAAP measures.

(2) Operational metrics shown in the table above are reported on an attributable basis to account for the Company’s 70% ownership of the Los Gatos Silver Mine.

|

|

|

|

|

|

|

|

|

|

| First Majestic Silver Corp. 2025 Second Quarter Report |

Page 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Second Quarter Production Summary |

Los Gatos (1) |

Santa Elena |

San Dimas |

|

La Encantada |

|

|

|

|

|

Consolidated |

| Ore Processed / Tonnes Milled |

233,480 |

|

269,830 |

|

219,198 |

|

|

281,296 |

|

|

|

|

|

|

1,003,804 |

|

| Silver Ounces Produced |

1,524,949 |

|

306,224 |

|

1,242,717 |

|

|

628,105 |

|

|

|

|

|

|

3,701,995 |

|

| Gold Ounces Produced |

706 |

|

20,637 |

|

12,472 |

|

|

49 |

|

|

|

|

|

|

33,865 |

|

| Silver Equivalent Ounces Produced |

2,436,722 |

|

2,318,618 |

|

2,464,029 |

|

|

632,942 |

|

|

|

|

|

|

7,852,311 |

|

Cash Costs per Silver Equivalent Ounce (2) |

$12.44 |

|

$13.57 |

|

$15.66 |

|

|

$27.19 |

|

|

|

|

|

|

$15.08 |

|

All-in Sustaining Cost per Silver Equivalent Ounce (2) |

$13.70 |

|

$18.58 |

|

$20.10 |

|

|

$31.94 |

|

|

|

|

|

|

$21.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Production Cost per Tonne (2) |

$91.65 |

|

$107.02 |

|

$173.88 |

|

|

$58.53 |

|

|

|

|

|

|

$104.45 |

|

(1) All production and non-GAAP results shown in the table above are reported on an attributable basis to account for the Company’s 70% ownership of the Los Gatos Silver Mine.

(2) These measures do not have a standardized meaning under the Company's financial reporting framework and the methods used the Company to calculate these measures may differ from methods used by other companies with similar descriptions. See “Non-GAAP Measures” on pages 52 to 62 for further details on these measures and a reconciliation of non-GAAP to GAAP measures.

Second Quarter Operational Highlights

•Strong Quarterly Silver Production: The Company produced 3.7 million silver ounces in Q2 2025 representing a 76% increase when compared to 2.1 million silver ounces produced in Q2 2024. Total silver production in the quarter included 1.5 million ounces of attributable silver production from Los Gatos. The Company had strong results despite weather-related disruptions and power outages in the final days of June that impacted production at Los Gatos, San Dimas and La Encantada.

•Robust Silver Equivalent Production: The Company produced 7.9 million AgEq ounces in Q2 2025 representing a 48% increase compared to 5.3 million AgEq ounces produced in Q2 2024. This growth was primarily driven by a 76% increase in attributable consolidated silver production, including contributions from Los Gatos, as well as a 17% production increase at San Dimas.

•Inventory: The Company held 424,272 silver ounces in finished goods inventory as at June 30, 2025, inclusive of coins and bullion. The fair value of this inventory at June 30, 2025 was $15.3 million, which was not included in revenue during the second quarter.

•Continued Active Exploration Program: During the second quarter, the Company completed a total of 66,360 metres (“m”) of drilling across its mines in Mexico. During the quarter, up to 28 drill rigs were active consisting of 12 rigs at San Dimas, nine rigs at Santa Elena, five rigs at Los Gatos, and two rigs at La Encantada.

•High-Grade Gold and Silver Discovery: The Company announced the discovery of a new, gold and silver vein hosted system - Santo Niño - at the Santa Elena property (see news release dated May 28, 2025). The Santo Niño discovery is 900 m south of the Santa Elena plant and is the second discovery made by the Company in the past 12 months.

•Strong Safety Performance Continues: The consolidated Q2 2025 Total Reportable Incident Frequency Rate (“TRIFR”) was 0.52, below the Company’s 2025 target KPI of 0.70. The Lost Time Incident Frequency Rate (“LTIFR”) was 0.11 compared to 0.12 from the same period last year.

•Cash Costs: Cash costs per attributable payable AgEq ounce for the quarter were $15.08, an improvement when compared with $15.29 per ounce in the second quarter of 2024. The decrease in cash costs was due to a 48% increase in AgEq ounces, primarily driven by the attributable production increase of 2.4 million AgEq ounces from Los Gatos, along with a 17% increase in AgEq production at San Dimas as a result of operational efficiencies and increased plant throughput rates. This decrease was partially offset by higher contractor and energy costs at San Dimas that helped improve and support production, as well as higher maintenance costs as a result of weather-related power outages at San Dimas, La Encantada and Los Gatos in June.

•AISC: AISC per attributable payable AgEq ounce in the second quarter was $21.02, representing a 3% decrease compared to $21.64 per ounce in the second quarter of 2024. This was primarily attributable to the decrease in cash costs. This decrease was partially offset by an increase in profit sharing per AgEq ounce relating to the prior year, which was paid in the second quarter.

|

|

|

|

|

|

|

|

|

|

| First Majestic Silver Corp. 2025 Second Quarter Report |

Page 5 |

Second Quarter Financial Highlights

•Record Treasury and Working Capital Position: The Company ended the quarter with a record $510.1 million cash in treasury, representing a 65% increase compared to $308.3 million at December 31, 2024, and the highest in the Company’s history. Cash in treasury includes $125.3 million that is held in restricted cash, representing an 18% increase when compared to $106.1 million at December 31, 2024. The increase in restricted cash was mostly driven by the strengthening of the Mexican Peso at June 30, 2025. Further, working capital reached a record high of $444.1 million, representing a 98% increase compared to $224.5 million at December 31, 2024. The increase in cash was partially offset by income tax installments of $30.6 million paid during the second quarter primarily related to the true-up of tax payments made for the strong performance in the prior year and the first quarter along with payments related to the annual bonus for 2024. Refer to the “Liquidity, Capital Resources and Contractual Obligations” section below for further details.

•Record Quarterly Revenue: In the second quarter, the Company generated a second consecutive quarterly revenue record of $264.2 million, representing a 94% increase compared to $136.2 million in the second quarter of 2024. This significant growth was primarily attributable to a 42% increase in payable AgEq ounces sold, mainly driven by the addition of the Los Gatos Silver Mine, which contributed $103.1 million in revenue. Additional contributions came from continued strong performance at Santa Elena, which contributed $74.5 million in revenue, and improved production at San Dimas, which contributed $65.1 million in revenue. Further, the average realized silver price per AgEq ounce increased to $34.62 per ounce, representing a 24% increase compared to the second quarter of 2024.

•Improved Mine Operating Earnings: The Company achieved mine operating earnings of $49.4 million, representing a significant increase of $33.9 million compared to mine operating earnings of $15.5 million in the second quarter of 2024. The increase was mainly driven by the addition of the Los Gatos Silver Mine, which contributed $20.6 million in mine operating earnings during the quarter. Additionally, the improvement in performance at San Dimas and La Encantada increased mine operating earnings by $6.7 million and $4.4 million, respectively, compared to the second quarter of 2024. The increase in mine operating earnings was partially offset by higher contractor and energy costs at San Dimas that supported improvements in production. Additionally, maintenance costs were higher as a result of weather-related power outages at San Dimas, La Encantada and Los Gatos in late June. Mine operating earnings were further impacted by a higher non-cash depletion expense, primarily driven by the addition of Los Gatos and increased overall production. The Company's operating earnings are inclusive of $51.6 million in non-cash depletion expense.

•Increased Cash Flow from Operations: Operating cash flow before changes in working capital and taxes paid in the quarter was $114.9 million, representing a significant increase compared to $23.8 million in the second quarter of 2024. This increase was achieved despite incurring higher production bonuses and profit-sharing costs related to the annual bonus for 2024. This improvement was primarily driven by an increase in mine operating earnings, excluding depletion, depreciation and amortization, of $76.0 million resulting from strong performance at San Dimas and Los Gatos.

•Increased EBITDA: EBITDA for the quarter was $119.9 million, representing a significant increase compared to $21.2 million in the second quarter of 2024. The increase in EBITDA was primarily attributable to the above-mentioned increase in mine operating earnings.

•Increased Adjusted EBITDA: Adjusted EBITDA normalized for non-cash or non-recurring items such as share-based payments, unrealized gains on marketable securities, and abnormal costs for the quarter was $125.3 million, representing a significant increase compared to $26.4 million in the second quarter of 2024.

•Net Earnings: Net earnings for the quarter were $56.6 million (EPS of $0.11) representing a significant increase compared to a net loss of $48.3 million (EPS of ($0.17)) in the second quarter of 2024. The increase in net earnings was primarily attributed to higher mine operating earnings compared to the second quarter of 2024. This was partially offset by a non-cash depletion and depreciation expense of $73.7 million (EPS of (0.15)), compared to $31.6 million (EPS of (0.11)) in the second quarter of 2024 driven by higher production and the addition of Los Gatos, and a non-cash deferred income tax recovery of $39.6 million (EPS of $0.08), compared to a non-cash deferred income tax expense of $22.6 million (EPS ($0.08)) in the second quarter of 2024. Additionally, the Company incurred higher general and administrative costs related to the integration of Los Gatos, including costs associated with insurance, travel, legal fees, systems implementation and consulting services. The Company expects to realize significant synergies and cost reductions after the integration of Los Gatos is complete.

•Increased Adjusted Net Earnings: Adjusted net earnings excluding non-cash or non-recurring items such as share-based payments, unrealized gains on marketable securities, abnormal costs, and deferred income tax for the quarter was $18.4 million (Adjusted EPS of $0.04), representing a significant increase compared to an adjusted net loss of $20.4 million (Adjusted EPS of ($0.07)) in the second quarter of 2024.

|

|

|

|

|

|

|

|

|

|

| First Majestic Silver Corp. 2025 Second Quarter Report |

Page 6 |

•Capital Expenditures: The Company’s total capital expenditures in the second quarter were $56.0 million, representing a 98% increase compared to $28.3 million in total capital expenditures in the second quarter of 2024 as the Company continues to focus on growth and mine development in line with the 2025 guidance. Total capital expenditures consisted of $17.3 million in underground development (2024 - $13.5 million), $19.6 million in property, plant and equipment (2024 - $5.4 million), and $19.1 million in exploration (2024 - $9.4 million).

|

|

|

|

|

|

|

|

|

|

| First Majestic Silver Corp. 2025 Second Quarter Report |

Page 7 |

|

|

|

|

|

|

| ACQUISITION OF GATOS SILVER INC. |

On January 16, 2025, the Company completed its acquisition of Gatos Silver, Inc. (“Gatos”) pursuant to a merger agreement that was entered into between the parties on September 4, 2024 (the "Merger Agreement"), and as a result of such acquisition, Gatos became a wholly-owned subsidiary of the Company. The Company issued an aggregate of 177,433,006 common shares of the Company to acquire all of the issued and outstanding shares of common stock of Gatos (in addition to a nominal amount of cash in lieu of fractional First Majestic common shares), resulting in former Gatos shareholders holding approximately 38% of the issued and outstanding common shares of the Company post-closing on a fully diluted basis at the closing of the transaction. In addition, the Merger Agreement provided for the issuance by First Majestic of options to purchase an aggregate of 8,242,244 First Majestic options in exchange for all existing Gatos options at exercise prices adjusted by the exchange ratio of 2.55 ("the Exchange Ratio"). All existing RSUs and DSUs of Gatos were settled for an aggregate of 2,207,762 First Majestic common shares.

Gatos a 70% interest in the Los Gatos Joint Venture (“LGJV”), which owns the producing Los Gatos underground silver mine in Chihuahua, Mexico. The Los Gatos mine consists of approximately 103,000 hectares (“ha”) of mineral rights, representing a highly prospective and under-explored district with numerous silver-zinc-lead epithermal mineralized zones identified as priority targets. The acquisition was completed in order to support the Company's growth strategy by adding another cornerstone asset within a world-class mining jurisdiction to the Company's portfolio.

Management has concluded that Gatos constitutes a business and, therefore, the acquisition is accounted for in accordance with IFRS 3 - Business Combinations. Given the delivery of the consideration and the fulfillment of the covenants as per the Merger Agreement, the transaction was deemed to be completed with First Majestic identified as the acquirer. Based on the opening market price of the Company’s common shares on January 16, 2025 (“Acquisition Date”), the total consideration of the Gatos acquisition is $1.05 billion. The Company began consolidating the operating results, cash flows and net assets of Gatos from January 16, 2025 onwards

The determination of the fair value of assets acquired and liabilities assumed is based on a detailed valuation of Gatos' net assets, utilizing income, market, and cost valuation methods conducted with the assistance of an independent third party. The determination of the fair value of assets acquired and liabilities assumed was previously reported based on preliminary estimates at the Acquisition Date. The Company has since finalized the full and detailed valuation of the fair value of the net assets of Gatos acquired using income, market, and cost valuation methods with the assistance of an independent third party.

|

|

|

|

|

|

|

|

|

|

| First Majestic Silver Corp. 2025 Second Quarter Report |

Page 8 |

Consideration and Purchase Price Allocation

Total consideration for the acquisition was valued at $1.05 billion on the Acquisition Date. The following table summarizes the consideration paid as part of the purchase price:

|

|

|

|

|

|

|

|

|

| Total Consideration |

|

|

|

|

|

177,433,066 Consideration Shares issued to Los Gatos shareholders with an accounting fair value of $5.68 per share(1) |

|

$1,007,819 |

|

2,207,762 Consideration DSUs and RSUs of Los Gatos converted to First Majestic common shares with an accounting fair value of $5.68 per share(1) |

|

12,540 |

|

8,242,244 Consideration Options of Los Gatos converted to First Majestic Options with an accounting fair value of $3.51 per option(3) |

|

26,023 |

|

Other consideration(2) |

|

7,841 |

|

|

|

|

| Total consideration |

|

$1,054,223 |

|

(1)Fair value of Consideration Shares was estimated at $5.68 per share based on the opening price of First Majestic’s common share on the New York Stock Exchange on January 16, 2025.

(2)Other consideration is made up of cash payments for withholding taxes and payments made for fractional shares.

(3)The fair value of Consideration Options was estimated using the Black-Scholes method as at the Acquisition Date, using the following assumptions:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk-free interest rate (%) |

|

2.94% - 3.05% |

|

Expected life (years) |

|

3.99 |

|

Expected Volatility (%) |

|

58 |

% |

|

Expected dividend yield (%) |

|

0.28 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First Majestic Silver Corp. 2025 Second Quarter Report |

Page 9 |

The following table summarizes the purchase price allocated to the identifiable assets and liabilities based on their estimated fair values on the Acquisition Date:

|

|

|

|

|

|

|

|

|

| Allocation of Purchase Price |

|

|

|

|

|

Cash and cash equivalents(2) |

|

$167,401 |

|

| Inventories |

|

19,107 |

|

Trade and other receivables(1) |

|

19,644 |

|

| VAT receivables |

|

2,026 |

|

| Prepaid expenses and other |

|

6,505 |

|

| Mining interest |

|

1,658,689 |

|

| Property, plant and equipment |

|

185,261 |

|

| Right-of-use assets |

|

281 |

|

| Trade and other payables |

|

(65,037) |

|

| Income taxes payable |

|

(12,717) |

|

| Lease obligations |

|

(415) |

|

| Decommissioning liabilities |

|

(8,112) |

|

| Deferred tax liabilities |

|

(511,314) |

|

| Net assets acquired |

|

$1,461,319 |

|

| Non-controlling interests |

|

(407,096) |

|

| Net assets attributable to the Company |

|

$1,054,223 |

|

(1) Trade and other receivables are expected to be fully recoverable.

(2) Cash acquired by the Company on the Acquisition Date was $159.6 million net of withholding taxes on RSU settlements amounting to $7.8

Financial and operating results of Gatos are included in the Company’s consolidated financial statements effective January 16, 2025. During the three and six months ended June 30, 2025, the acquisition of Gatos contributed $103.1 and $193.6 million of revenues, respectively, and $11.9 million and $24.1 million of net earnings, respectively, to the Company’s financial results since January 16, 2025.

Had the business combination been effective at January 1, 2025, the Company's pro forma revenues and net earnings for the three and six months ended June 30, 2025 would have been $264.2 million and $56.6 million, and $525.7 million and $66.0 million, respectively. Total transaction costs of $5.6 million related to the acquisition were expensed in Q1 2025.

|

|

|

|

|

|

|

|

|

|

| First Majestic Silver Corp. 2025 Second Quarter Report |

Page 10 |

The Company used discounted cash flow models to determine the fair value of the depletable mining interest. The expected future cash flows are based on estimates of future silver, gold, lead, zinc and copper prices, estimated quantities of mineral reserves and mineral resources, expected future production costs and capital expenditures based on the life of mine plans at the Acquisition Date. The discounted future cash flow models used a 6.00% discount rate based on the Company’s assessment of country risk, project risk and other potential risks specific to the acquired mining interest.

The significant assumptions used in the determination of the fair value of the mining interests were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average prices: |

|

|

| Silver |

|

$28.50 |

| Gold |

|

$2,200 |

| Zinc |

|

$1.25 |

| Lead |

|

$1.10 |

| Copper |

|

$4.50 |

| Discount rate |

|

6.0% |

| Average grades over life of mine: |

|

|

| Silver |

|

150 g/t |

| Gold |

|

0.21 g/t |

| Zinc |

|

3.84% |

| Lead |

|

2.01% |

| Copper |

|

0.20% |

| Average recovery rate: |

|

|

| Silver |

|

88.20% |

| Gold |

|

54.20% |

| Zinc |

|

63.10% |

| Lead |

|

88.10% |

| Copper |

|

74.00% |

| Discount rate |

|

6.00% |

| Mine life (years) |

|

10 |

The Company used a market approach to determine the fair value of exploration potential by comparing the costs of other precedent market transactions on a dollar per hectare basis. Those amounts were used to determine the range of area-based resources multiples implied within the value of transactions by other market participants. Additionally, the Company completed a secondary valuation by comparing the costs of other precedent transactions within the industry on a dollar per in situ ounce basis and selected a multiple within this range for additional ounces identified outside of the life of mine. Management made a significant assumption in the determination of the fair value of exploration potential by using an implied multiple of $5,208 per hectare or $3.16 per silver equivalent ounce for a total of $536.4 million. The Company accounted for exploration potential through inclusion within non-depletable mineral interest.

|

|

|

|

|

|

|

|

|

|

| First Majestic Silver Corp. 2025 Second Quarter Report |

Page 11 |

|

|

|

|

|

|

| 2025 PRODUCTION OUTLOOK AND COST GUIDANCE UPDATE |

This section provides management’s updated production outlook and cost guidance for 2025. These are forward-looking estimates and are subject to the cautionary note at the end of this MD&A regarding the risks associated with relying on forward-looking statements. Actual results may vary based on production throughputs, grades, recoveries and changes in economic circumstances.

The Company is updating its full year 2025 guidance, primarily to reflect the following changes:

1.Improved metal price environment: The silver and gold price assumptions for the second half of 2025 have been revised to $30.00 and $2,800 per ounce, respectively.

2.Los Gatos: Management is increasing the Los Gatos attributable production forecast to 9.1 – 9.7 million AgEq ounces, an increase of 6% (midpoint) compared to the original guidance. The revision is primarily driven by higher throughput rates and slightly improved silver grades, with a long-term objective of achieving and sustaining a throughput level of 4,000 tpd.

3.Santa Elena: Management is increasing the Santa Elena production forecast to 8.8 – 9.4 million AgEq ounces, an increase of 12% (midpoint) compared to the original guidance, primarily due to higher gold grades and slightly increased gold recoveries.

4.San Dimas: Management is increasing the San Dimas production forecast to 9.9 – 10.5 million AgEq ounces, an increase of 7% (midpoint) compared to the original guidance, primarily due to higher throughput rates.

5.Capital Investments: Management has increased the 2025 capital budget by 7% to $193 million to support key growth initiatives, including the plant expansion at Santa Elena, early-stage development at the Navidad discovery, and the acquisition of additional equipment to enhance and sustain higher throughput rates at Los Gatos.

As a result of the Company's strong production results in H1 2025 and continued operating efficiencies, the 2025 attributable consolidated production guidance has increased to 30.6 – 32.6 (midpoint: 31.6) million AgEq ounces, representing a 7% increase compared to the original guidance of 27.8 – 31.2 (midpoint: 29.5) million AgEq ounces, with a 6% and 2% increase in silver and gold production (midpoints), respectively, along with 11% and 8% increases in lead and zinc production (mid-points), respectively.

A mine-by-mine breakdown of the Company's revised 2025 production and cost guidance is included in the table below. The Company reports cost guidance to reflect cash costs and AISC on a per AgEq attributable payable ounce basis. The metal price and foreign currency assumptions that were used to calculate the numbers below were: silver: $30.00/oz, gold: $2,800/oz, lead: $0.95/lb., zinc: $1.25/lb. and MXN:USD 19.5:1.

GUIDANCE FOR FULL YEAR 2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operation: |

Silver Oz

(M) |

Gold Oz

(k) |

Lead Lbs

(M) |

Zinc Lbs

(M) |

|

Silver Eqv Oz

(M) |

Cash Cost

($ per AgEq Oz)* |

AISC

($ per AgEq Oz)* |

| Los Gatos (70%), Mexico |

5.6 – 6.0 |

3 |

33 – 35 |

52 – 56 |

|

9.1 – 9.7 |

11.14 – 11.46 |

14.62 – 15.13 |

| Santa Elena, Mexico |

1.5 – 1.6 |

79 – 84 |

— |

— |

|

8.8 – 9.4 |

13.56 – 13.95 |

17.39 – 18.02 |

| San Dimas, Mexico |

4.9 – 5.2 |

53 – 57 |

— |

— |

|

9.9 – 10.5 |

14.11 – 14.56 |

18.38 – 19.10 |

| La Encantada, Mexico |

2.8 – 3.0 |

— |

— |

— |

|

2.8 – 3.0 |

22.29 – 23.15 |

28.16 – 29.42 |

| Operations Total |

14.8 – 15.8 |

135 – 144 |

33 – 35 |

52 – 56 |

|

30.6 – 32.6 |

$13.94 – $14.37 |

$18.11 – $18.79 |

|

|

|

|

|

|

|

|

|

| Corporate: |

|

|

|

|

|

|

|

|

| Corp. G&A and Services |

— |

— |

— |

— |

|

— |

— |

1.91 – 2.03 |

| Total: |

|

|

|

|

|

|

|

|

| Total Consolidated |

14.8 – 15.8 |

135 – 144 |

33 – 35 |

52 – 56 |

|

30.6 – 32.6 |

$13.94 – $14.37 |

$20.02 – $20.82 |

*Certain amounts shown in the above table may not add exactly to the total amount due to rounding differences

*These measures do not have a standardized meaning under the Company's financial reporting framework and the methods used by the Company to calculate these measures may differ from methods used by other companies with similar descriptions. The Company calculates cash costs and consolidated AISC in the manner set out in the table below. These measures have been calculated on a basis consistent with historical periods. See “Non-GAAP Measures” at the end of this MD&A for further details regarding these measures and a reconciliation of non-GAAP to GAAP measures.

|

|

|

|

|

|

|

|

|

|

| First Majestic Silver Corp. 2025 Second Quarter Report |

Page 12 |

For the full year of 2025, the Company now estimates silver production will range between 14.8 to 15.8 million ounces compared to the prior guidance of 13.6 to 15.3 million ounces, a 6% increase at the midpoint. Additionally, gold production is estimated to range between 135,000 to 144,000 ounces compared to the prior guidance of 129,000 to 144,000, a 2% increase at the midpoint.

Annual cash costs are now expected to be within the range of $13.94 to $14.37 per ounce, an improvement from the previous guidance of $14.10 to $14.86 per ounce, primarily due to higher production.

The Company is projecting its consolidated 2025 AISC to be within the range of $20.02 to $20.82 on a per consolidated payable AgEq ounce basis, in line with the original guidance range of $19.89 to $21.27 with a 1% improvement on the midpoint average. Excluding non-cash items, the Company anticipates its 2025 AISC to be within a range of $19.41 to $20.17 per payable AgEq ounce. An itemized AISC cost table is provided below:

|

|

|

|

|

|

| All-In Sustaining Cost Calculation |

FY 2025 ($ per AgEq oz) |

|

|

| Total Cash Costs per Payable Equivalent Silver Ounce |

13.94 – 14.37 |

| General and Administrative Costs |

1.46 – 1.56 |

| Sustaining Development Costs |

0.68 – 0.71 |

| Sustaining Property, Plant and Equipment Costs |

1.77 – 1.88 |

| Profit Sharing |

1.03 – 1.09 |

| Lease Payments |

0.53 – 0.56 |

| Share-based Payments (non-cash) |

0.45 – 0.48 |

| Accretion and Reclamation Costs (non-cash) |

0.16 – 0.17 |

| All-In Sustaining Costs (AgEq Oz) |

20.02 – 20.82 |

| All-In Sustaining Costs: (AgEq Oz excluding non-cash items) |

19.41 – 20.17 |

1.Certain amounts shown may not add exactly to the total amount due to rounding differences.

2.AISC does not have a standardized meaning under the Company's financial reporting framework and the methods used by the Company to calculate AISC may differ from methods used by other companies with similar descriptions. See “Non-GAAP Measures” at the end of this MD&A for further details regarding these measures and a reconciliation of non-GAAP to GAAP measures.

3.Consolidated AISC includes general and administrative cost estimates and non-cash costs of $2.07 to $2.21 per AgEq ounce.

UPDATED CAPITAL INVESTMENTS IN 2025

The Company now plans to invest approximately $193 million in capital expenditures in 2025 consisting of $76 million for sustaining activities and $117 million for expansionary projects. This represents a 7% increase over the original 2025 guidance, primarily driven by higher investments in Property, Plant and Equipment to support increased production forecasts for 2025 and beyond. Key initiatives include plant upgrades at Santa Elena to gradually increase throughput to 3,500 tonnes per day ("tpd"), ongoing studies and early-stage mine development at the Navidad discovery, and the acquisition of additional equipment to support higher mining and processing rates at Los Gatos. These investments are fully aligned with the Company’s long-term growth strategy.

|

|

|

|

|

|

|

|

|

|

|

|

| Area |

Sustaining ($M) |

Expansionary ($M) |

Total ($M) |

| Underground Development |

$21 |

$61 |

$82 |

| Exploration |

$— |

$43 |

$43 |

| Property, Plant and Equipment |

$54 |

$13 |

$67 |

| Corporate Projects |

$1 |

$— |

$1 |

| Total |

$76 |

$117 |

$193 |

The updated 2025 guidance includes total capital investments of $82 million for underground development; $43 million in exploration; $67 million towards property, plant and equipment; and $1 million towards corporate innovation projects.

Under the updated 2025 budget, the Company is planning to complete a total of approximately 44,000 m of lateral underground development drilling, representing a 24% increase to what was set out in the original guidance. In addition,

|

|

|

|

|

|

|

|

|

|

| First Majestic Silver Corp. 2025 Second Quarter Report |

Page 13 |

the Company is now planning to complete a total of approximately 255,000 m of exploration drilling in 2025, representing a 6% decrease compared to the original guidance. The decrease in exploration spend and metres is mostly at Los Gatos reflecting forecasted improved cost per metre guidance as a result of takeover synergies and a program rationalization where the Company will defer some drilling in the South East Deep zone to prioritize Central and North West Deep drilling for an overall cost and total metre reduction.

In the first half of 2025, the Company completed 23,100 m of underground development drilling and 128,141 m of exploration drilling.

Management may revise the Company's guidance during the year to reflect actual and anticipated changes in metal prices or to the business. There can be no assurance that cost estimates related to the Company's 2025 guidance will prove to be accurate. For further details regarding relevant risks, including those related to the allocation of capital by the Company, see the section entitled "Risk Factors" in the Company’s most recently filed Annual Information Form (“AIF”).

|

|

|

|

|

|

|

|

|

|

| First Majestic Silver Corp. 2025 Second Quarter Report |

Page 14 |

|

|

|

|

|

|

| OVERVIEW OF OPERATING RESULTS |

Selected Production Results for the Past Eight Quarters:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025 |

|

2024 |

|

2023 |

|

|

|

|

|

| PRODUCTION HIGHLIGHTS |

|

Q2 |

Q1(3) |

|

Q4 |

Q3 |

Q2 |

Q1 |

|

Q4 |

Q3 |

|

|

|

|

|

|

|

|

| Ore processed/tonnes milled |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Los Gatos (70%)(2) |

|

233,480 |

|

193,825 |

|

|

— |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

|

|

|

|

|

|

|

|

| Santa Elena |

|

269,830 |

|

270,203 |

|

|

271,783 |

|

259,919 |

|

256,427 |

|

224,394 |

|

|

233,601 |

|

226,292 |

|

|

|

|

|

|

|

|

|

| San Dimas |

|

219,198 |

|

231,190 |

|

|

219,388 |

|

195,279 |

|

183,188 |

|

178,957 |

|

|

215,232 |

|

213,681 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| La Encantada |

|

281,296 |

|

249,155 |

|

|

253,953 |

|

223,200 |

|

234,955 |

|

185,298 |

|

|

203,898 |

|

230,230 |

|

|

|

|

|

|

|

|

|

| Jerritt Canyon |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated |

|

1,003,804 |

|

944,373 |

|

|

745,124 |

|

678,397 |

|

674,570 |

|

588,651 |

|

|

652,731 |

|

670,203 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Silver equivalent ounces produced |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Los Gatos (70%)(2) |

|

2,436,722 |

|

2,252,258 |

|

|

— |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

|

|

|

|

|

|

|

|

| Santa Elena |

|

2,318,618 |

|

2,259,772 |

|

|

2,719,702 |

|

2,685,375 |

|

2,580,497 |

|

2,280,739 |

|

|

3,008,449 |

|

2,669,411 |

|

|

|

|

|

|

|

|

|

| San Dimas |

|

2,464,029 |

|

2,636,689 |

|

|

2,235,407 |

|

2,110,905 |

|

2,114,072 |

|

2,364,875 |

|

|

3,110,677 |

|

3,010,458 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| La Encantada |

|

632,942 |

|

562,990 |

|

|

758,181 |

|

550,042 |

|

589,060 |

|

459,110 |

|

|

521,424 |

|

573,458 |

|

|

|

|

|

|

|

|

|

| Jerritt Canyon |

|

— |

|

— |

|

|

— |

|

144,093 |

|

5,811 |

|

57,559 |

|

|

— |

|

32,463 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated |

|

7,852,311 |

|

7,711,709 |

|

|

5,713,289 |

|

5,490,416 |

|

5,289,439 |

|

5,162,283 |

|

|

6,640,550 |

|

6,285,790 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Silver ounces produced |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Los Gatos (70%)(2) |

|

1,524,949 |

|

1,444,719 |

|

|

— |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

|

|

|

|

|

|

|

|

| Santa Elena |

|

306,224 |

|

339,784 |

|

|

406,009 |

|

376,203 |

|

376,947 |

|

355,205 |

|

|

582,484 |

|

347,941 |

|

|

|

|

|

|

|

|

|

| San Dimas |

|

1,242,717 |

|

1,359,378 |

|

|

1,191,893 |

|

1,046,340 |

|

1,141,906 |

|

1,163,792 |

|

|

1,513,791 |

|

1,548,203 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| La Encantada |

|

628,105 |

|

560,622 |

|

|

755,963 |

|

545,031 |

|

585,329 |

|

456,179 |

|

|

516,141 |

|

565,724 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated |

|

3,701,995 |

|

3,704,503 |

|

|

2,353,865 |

|

1,967,574 |

|

2,104,181 |

|

1,975,176 |

|

|

2,612,416 |

|

2,461,868 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gold ounces produced |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Los Gatos (70%)(2) |

|

706 |

|

794 |

|

|

— |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

|

|

|

|

|

|

|

|

| Santa Elena |

|

20,637 |

|

21,408 |

|

|

27,216 |

|

27,435 |

|

27,176 |

|

21,713 |

|

|

28,056 |

|

28,367 |

|

|

|

|

|

|

|

|

|

| San Dimas |

|

12,472 |

|

14,241 |

|

|

12,264 |

|

12,582 |

|

12,043 |

|

13,543 |

|

|

18,468 |

|

17,863 |

|

|

|

|

|

|

|

|

|

| La Encantada |

|

49 |

|

26 |

|

|

26 |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

|

|

|

|

|

|

|

|

| Jerritt Canyon |

|

— |

|

— |

|

|

— |

|

1,684 |

|

74 |

|

647 |

|

|

— |

|

396 |

|

|

|

|

|

|

|

|

|

| Consolidated |

|

33,864 |

|

36,469 |

|

|

39,506 |

|

41,701 |

|

39,293 |

|

35,903 |

|

|

46,524 |

|

46,626 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash cost per Ounce(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Los Gatos (per AgEq Ounce)(2) |

|

$ |

12.44 |

|

$ |

10.82 |

|

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

$ |

— |

|

$ |

— |

|

|

|

|

|

|

|

|

|

| Santa Elena (per AgEq Ounce) |

|

$ |

13.57 |

|

$ |

12.92 |

|

|

$ |

10.99 |

|

$ |

11.96 |

|

$ |

12.25 |

|

$ |

12.13 |

|

|

$ |

10.42 |

|

$ |

11.72 |

|

|

|

|

|

|

|

|

|

| San Dimas (per AgEq Ounce) |

|

$ |

15.66 |

|

$ |

13.82 |

|

|

$ |

15.14 |

|

$ |

16.50 |

|

$ |

16.66 |

|

$ |

15.81 |

|

|

$ |

13.21 |

|

$ |

14.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| La Encantada (per AgEq Ounce) |

|

$ |

27.19 |

|

$ |

26.03 |

|

|

$ |

20.01 |

|

$ |

25.24 |

|

$ |

23.69 |

|

$ |

25.22 |

|

|

$ |

26.19 |

|

$ |

25.63 |

|

|

|

|

|

|

|

|

|

| Jerritt Canyon (per Au Ounce) |

|

$ |

— |

|

$ |

— |

|

|

$ |

— |

|

$ |

1,491 |

|

$ |

1,186 |

|

$ |

1,260 |

|

|

$ |

— |

|

$ |

1,478 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated (per AgEq Ounce) |

|

$ |

15.08 |

|

$ |

13.68 |

|

|

$ |

13.82 |

|

$ |

15.17 |

|

$ |

15.29 |

|

$ |

15.00 |

|

|

$ |

13.01 |

|

$ |

14.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All-in sustaining cost per Ounce(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Los Gatos (per AgEq Ounce)(2) |

|

$ |

13.70 |

|

$ |

13.07 |

|

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

$ |

— |

|

$ |

— |

|

|

|

|

|

|

|

|

|

| Santa Elena (per AgEq Ounce) |

|

$ |

18.58 |

|

$ |

15.46 |

|

|

$ |

13.54 |

|

$ |

14.38 |

|

$ |

15.07 |

|

$ |

14.70 |

|

|

$ |

12.82 |

|

$ |

14.68 |

|

|

|

|

|

|

|

|

|

| San Dimas (per AgEq Ounce) |

|

$ |

20.10 |

|

$ |

17.57 |

|

|

$ |

20.63 |

|

$ |

21.44 |

|

$ |

21.78 |

|

$ |

20.49 |

|

|

$ |

17.80 |

|

$ |

17.76 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| La Encantada (per AgEq Ounce) |

|

$ |

31.94 |

|

$ |

31.68 |

|

|

$ |

25.34 |

|

$ |

30.10 |

|

$ |

27.87 |

|

$ |

31.64 |

|

|

$ |

34.14 |

|

$ |

29.86 |

|

|

|

|

|

|

|

|

|

| Jerritt Canyon (per Au Ounce) |

|

$ |

— |

|

$ |

— |

|

|

$ |

— |

|

$ |

1,491 |

|

$ |

1,186 |

|

$ |

1,260 |

|

|

$ |

— |

|

$ |

1,730 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated (per AgEq Ounce) |

|

$ |

21.02 |

|

$ |

19.24 |

|

|

$ |

20.34 |

|

$ |

21.03 |

|

$ |

21.64 |

|

$ |

21.53 |

|

|

$ |

18.50 |

|

$ |

19.74 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Production cost per tonne |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Los Gatos(2) |

|

$ |

91.65 |

|

$ |

84.46 |

|

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

$ |

— |

|

$ |

— |

|

|

|

|

|

|

|

|

|

| Santa Elena |

|

$ |

107.02 |

|

$ |

94.28 |

|

|

$ |

91.11 |

|

$ |

107.80 |

|

$ |

107.47 |

|

$ |

120.22 |

|

|

$ |

117.36 |

|

$ |

125.05 |

|

|

|

|

|

|

|

|

|

| San Dimas |

|

$ |

173.88 |

|

$ |

156.10 |

|

|

$ |

149.49 |

|

$ |

168.45 |

|

$ |

193.02 |

|

$ |

200.72 |

|

|

$ |

183.61 |

|

$ |

193.41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| La Encantada |

|

$ |

58.53 |

|

$ |

57.56 |

|

|

$ |

56.88 |

|

$ |

60.86 |

|

$ |

57.11 |

|

$ |

67.80 |

|

|

$ |

64.70 |

|

$ |

61.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated |

|

$ |

104.45 |

|

$ |

97.71 |

|

|

$ |

96.63 |

|

$ |

109.81 |

|

$ |

113.16 |

|

$ |

128.23 |

|

|

$ |

122.76 |

|

$ |

125.81 |

|

|

|

|

|

|

|

|

|

(1) These measures do not have a standardized meaning under the Company's financial reporting framework and the methods used by the Company to calculate these measures may differ from methods used by other companies with similar descriptions. See “Non-GAAP Measures” on pages 52 to 62 for further details on these measures and a reconciliation of non-GAAP to GAAP measures.

(2) All production and non-GAAP results shown in the table above are reported on an attributable basis to account for the 70% ownership of the Los Gatos Silver Mine.

(3) Los Gatos production during Q1 2025 was from January 16, 2025 to March 31, 2025 or 74 days.

|

|

|

|

|

|

|

|

|

|

| First Majestic Silver Corp. 2025 Second Quarter Report |

Page 15 |

Operating Results – Consolidated Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED |

|

2025-Q2 |

2025-Q1 |

|

|

2024-Q2 |

2025-YTD |

|

2024-YTD |

|

Change

Q2 vs Q2 |

|

Change

'25 vs '24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ore processed/tonnes milled |

|

1,003,804 |

944,373 |

|

|

674,570 |

1,948,177 |

|

1,263,221 |

|

49 |

% |

|

54 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Production |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Silver ounces produced |

|

3,701,995 |

3,704,503 |

|

|

2,104,181 |

7,406,498 |

|

4,079,358 |

|

76 |

% |

|

82 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gold ounces produced |

|

33,865 |

36,469 |

|

|

39,339 |

70,333 |

|

75,275 |

|

(14 |

%) |

|

(7 |

%) |

| Pounds of lead produced |

|

9,014,545 |

7,487,065 |

|

|

— |

16,501,610 |

|

— |

|

100 |

% |

|

100 |

% |

| Pounds of zinc produced |

|

16,063,947 |

12,492,869 |

|

|

— |

28,556,816 |

|

— |

|

100 |

% |

|

100 |

% |

| Silver equivalent ounces produced |

|

7,852,311 |

7,711,709 |

|

|

5,289,439 |

15,564,020 |

|

10,451,724 |

|

48 |

% |

|

49 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash cost per AgEq Ounce(1) |

|

$15.08 |

$13.68 |

|

|

$15.29 |

$14.39 |

|

$15.14 |

|

(1 |

%) |

|

(5 |

%) |

All-in sustaining costs per AgEq Ounce(1) |

|

$21.02 |

$19.24 |

|

|

$21.64 |

$20.14 |

|

$21.58 |

|

(3 |

%) |

|

(7 |

%) |

Total production cost per tonne(1) |

|

$104.45 |

$97.71 |

|

|

$113.16 |

$101.19 |

|

$120.18 |

|

(8 |

%) |

|

(16 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Underground development (m) |

|

11,403 |

11,664 |

|

|

8,135 |

23,066 |

|

14,836 |

|

40 |

% |

|

55 |

% |

| Exploration drilling (m) |

|

66,360 |

61,218 |

|

|

47,447 |

127,579 |

|

83,721 |

|

40 |

% |

|

52 |

% |

(1) These measures do not have a standardized meaning under the Company's financial reporting framework and the methods used by the Company to calculate these measures may differ from methods used by other companies with similar descriptions. See “Non-GAAP Measures” on pages 52 to 62 for further details on these measures and a reconciliation of non-GAAP to GAAP measures.

Production

Total attributable production in the second quarter of 2025 was 7.9 million AgEq ounces, consisting of 3.7 million ounces of silver, and 33,865 ounces of gold, representing a 48% increase, a 76% increase, and a 14% decrease, respectively, compared to 5.3 million AgEq ounces, 2.1 million ounces of silver and 39,339 ounces of gold in the second quarter of 2024. Additionally, the Company produced 9.0 million pounds of lead and 16.1 million pounds of zinc during the quarter. This growth was driven by a 76% increase in silver production when compared to 2.1 million ounces in the same period last year. Total silver production in the quarter included 1.5 million ounces of attributable silver production from Los Gatos. Production at San Dimas increased by 17% compared to the second quarter of 2024 due to operational improvements that increased ore tonnes processed during the quarter. Finally, there was a 7% increase in silver production at La Encantada compared to the second quarter of 2024, primarily due to improved water availability, increases in ore processed and higher silver recoveries. Although production increased, weather-related power outages at the end of June 2025 slightly reduced production at Los Gatos, San Dimas, and La Encantada.