FALSE000162253600016225362025-07-172025-07-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported): July 17, 2025

Talen Energy Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

001-37388 |

|

47-1197305 |

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number) |

|

(IRS Employer

Identification No.)

|

2929 Allen Pkwy, Suite 2200

Houston, TX 77019

(Address of principal executive offices) (Zip Code)

(888) 211-6011

(Registrant’s telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.001 per share |

|

TLN |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry Into a Material Definitive Agreement.

Moxie Purchase Agreement

On July 17, 2025, Talen Generation, LLC (“Talen Generation”), an indirect wholly-owned subsidiary of Talen Energy Corporation (the “Company”), entered into a purchase and sale agreement (the “Moxie Purchase Agreement”) with Caithness Energy, L.L.C. (the “Seller”), pursuant to which Talen Generation agreed to purchase from the Seller the indirect ownership interests in the Luzerne Project (as defined below) through the sale, transfer, conveyance and assignment of all of the issued and outstanding interests in Moxie Freedom LLC, a Delaware limited liability company (the “Moxie Interests”), directly or indirectly (pursuant to the conditions of the Moxie Purchase Agreement). Seller, through certain of its subsidiaries, owns and controls a 1,105 MW natural gas fired combined cycle generation project located in Luzerne County, Pennsylvania (the “Luzerne Project”).

As consideration for the transfer of the Moxie Interests (and, indirectly, the Luzerne Project) and the transactions contemplated by the Moxie Purchase Agreement (collectively, the “Moxie Acquisition”), the purchase price shall be $1.46 billion in cash, as adjusted in accordance with the Moxie Purchase Agreement.

The obligations of the parties to complete the Moxie Acquisition are subject to the satisfaction or waiver of customary closing conditions set forth in the Moxie Purchase Agreement. At the closing of the Moxie Acquisition, the Company shall deposit, or cause to be deposited, with an escrow agent a cash deposit equal to 1% of the enterprise value of the Moxie Acquisition to secure the post-closing purchase price adjustments, pursuant to an escrow agreement among the Company, the Seller, and the escrow agent.

Guernsey Purchase Agreement

On July 17, 2025, Talen Generation entered into a purchase and sale agreement (the “Guernsey Purchase Agreement,” and together with the Moxie Purchase Agreement, the “Purchase Agreements”) with Seller and Caithness Apex Guernsey, LLC (“Caithness Apex Guernsey,” and together with Seller, the “Guernsey Sellers”), pursuant to which Talen Generation agreed to purchase from the Guernsey Sellers all of the issued and outstanding interests in Guernsey Power Holdings, LLC, a Delaware limited liability company (such subsidiary, the “Project Holding Company,” and such interests in the Project Holding Company, the “Project Holding Company Interests”). Seller, through its subsidiaries, owns and controls a 1,875 MW natural gas fired combined cycle generation project located in Guernsey County, Ohio (the “Guernsey Project,” and together with the Luzerne Project, the “Generation Projects”).

As consideration for the transfer of the Project Holding Company Interests (and indirectly, the Guernsey Project) and the transactions contemplated by the Guernsey Purchase Agreement (collectively, the “Guernsey Acquisition” and, together with the Moxie Acquisition, the “Acquisitions”), the purchase price shall be $2.33 billion in cash, as adjusted in accordance with the Guernsey Purchase Agreement.

The obligations of the parties to complete the Guernsey Acquisition are subject to the satisfaction or waiver of customary closing conditions set forth in the Guernsey Purchase Agreement. At the closing of the Guernsey Acquisition, the Company shall deposit, or cause to be deposited, with an escrow agent a cash deposit equal to1% of the enterprise value of the Guernsey Acquisition to secure the post-closing purchase price adjustments, pursuant to an escrow agreement among the Company, the Guernsey Sellers, and the escrow agent.

Debt Commitment Letters

In connection with the Acquisitions, Talen Energy Supply, LLC (“TES”), a wholly-owned subsidiary of the Company, entered into debt commitment letters, dated July 17, 2025 (the “Debt Commitment Letters”) with Citigroup Global Markets Inc. and RBC Capital Markets (collectively, the “Commitment Parties”), pursuant to which the Commitment Parties have agreed to provide TES with: (i) senior secured bridge facilities in an aggregate principal amount of up to $1.2 billion; and (ii) senior unsecured bridge facilities in an aggregate principal amount of up to $2.57 billion (collectively, the “Debt Commitment Financing”). The funding of the Debt Commitment Financing is contingent upon the satisfaction of certain conditions set forth in the Debt Commitment Letters.

The foregoing descriptions of the Moxie Purchase Agreement and Guernsey Purchase Agreement and the transactions contemplated thereby are not complete and are qualified in their entirety by reference to the full text of each of the Moxie Purchase Agreement and Guernsey Purchase Agreement, which will be filed as exhibits to a subsequent report of the Company with the U.S. Securities and Exchange Commission (the “SEC”).

Item 7.01. Regulation FD Disclosure.

On July 17, 2025, the Company issued a press release announcing the Acquisitions. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Report”) and is incorporated herein by reference.

Also on July 17, 2025, as announced in the press release, the Company will be hosting an investor call beginning at 4:30 p.m. Eastern time to discuss the Acquisitions. A copy of the investor call presentation is furnished as Exhibit 99.2 to this Report and is incorporated herein by reference. The investor call webcast and presentation will be available both live and for subsequent replay via the Events page of Talen’s investor relations website at https://ir.talenenergy.com. Information contained on or accessible from Talen’s website is not, and shall not be deemed to be, incorporated by reference into this Report.

The information provided under this Item 7.01 and in Exhibit 99.1 and Exhibit 99.2 to this Report is being furnished and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. Such information shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act.

Forward-Looking Statements

This Report, including Exhibit 99.1 and Exhibit 99.2, may contain forward-looking statements within the meaning of the federal securities laws, which statements are subject to substantial risks and uncertainties. These forward-looking statements are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this communication, or incorporated by reference into this communication, are forward-looking statements. Throughout this Report, we have attempted to identify forward-looking statements by using words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecasts,” “goal,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will,” or other forms of these words or similar words or expressions or the negative thereof, although not all forward-looking statements contain these terms. Forward-looking statements address future events and conditions concerning, among other things, statements regarding the proposed Moxie and Guernsey acquisitions, the expected closing of the proposed transactions and the timing thereof, the financing of the proposed transactions, capital expenditures, earnings, litigation, regulatory matters, hedging, liquidity and capital resources and accounting matters. Forward-looking statements are subject to substantial risks and uncertainties that could cause our future business, financial condition, results of operations or performance to differ materially from our historical results or those expressed or implied in any forward-looking statement contained in this communication. All of our forward-looking statements include assumptions underlying or relating to such statements that may cause actual results to differ materially from expectations and are subject to numerous factors that present considerable risks and uncertainties.

Forward-looking statements are neither historical facts nor assurance of future performance. Instead, the statements are based on current beliefs, expectations and assumptions regarding the future of the Company’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s control, and actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not unduly rely on any of these forward-looking statements. Any forward-looking statement is based only on information currently available and speaks only as of the date when made. The Company undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

A discussion of certain risks and uncertainties affecting the Company, and some of the factors that could cause the Company’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, Quarterly Report on Form 10-Q for the quarter ended March 31, 2025 and other current and periodic reports, which have been, or will be, filed with the SEC and are, or will be, available in the Investor Relations section of the Company’s website (www.talenenergy.com) and on the SEC’s website (www.sec.gov). Information contained on or accessible from the Company’s website is not, and shall not be deemed to be, incorporated by reference into this Report or any other filings with the SEC.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

|

|

|

|

|

|

| Exhibit No. |

Description. |

| 99.1 |

|

| 99.2 |

|

| 104 |

Cover Page Interactive Data File (cover page XBRL tags embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TALEN ENERGY CORPORATION |

| Date: |

July 17, 2025 |

By: |

/s/ Terry L. Nutt |

|

|

Name: |

Terry L. Nutt |

|

|

Title: |

Chief Financial Officer |

EX-99.1

2

a20250717pressreleasetalen.htm

EX-99.1

Document

Talen Energy Expands and Enhances Portfolio with Best-in-Class CCGT Acquisitions in PJM

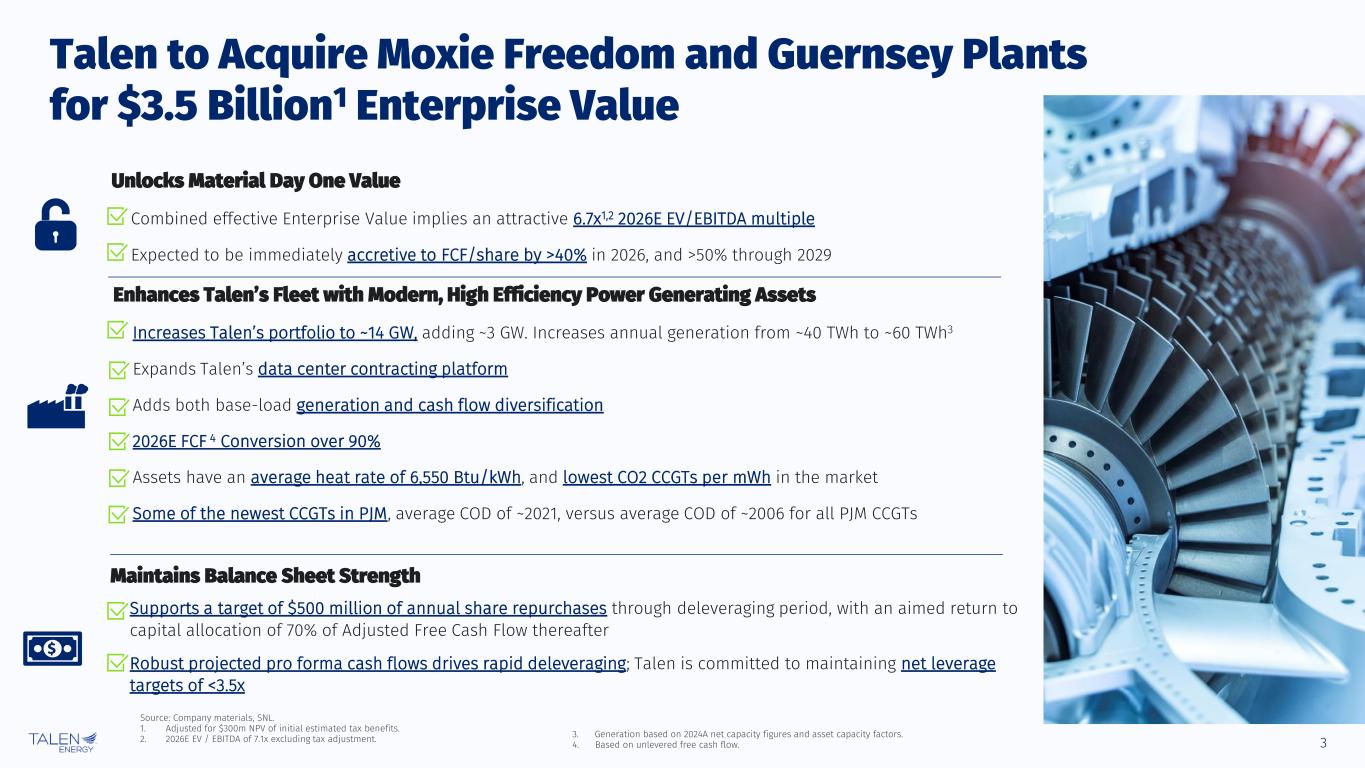

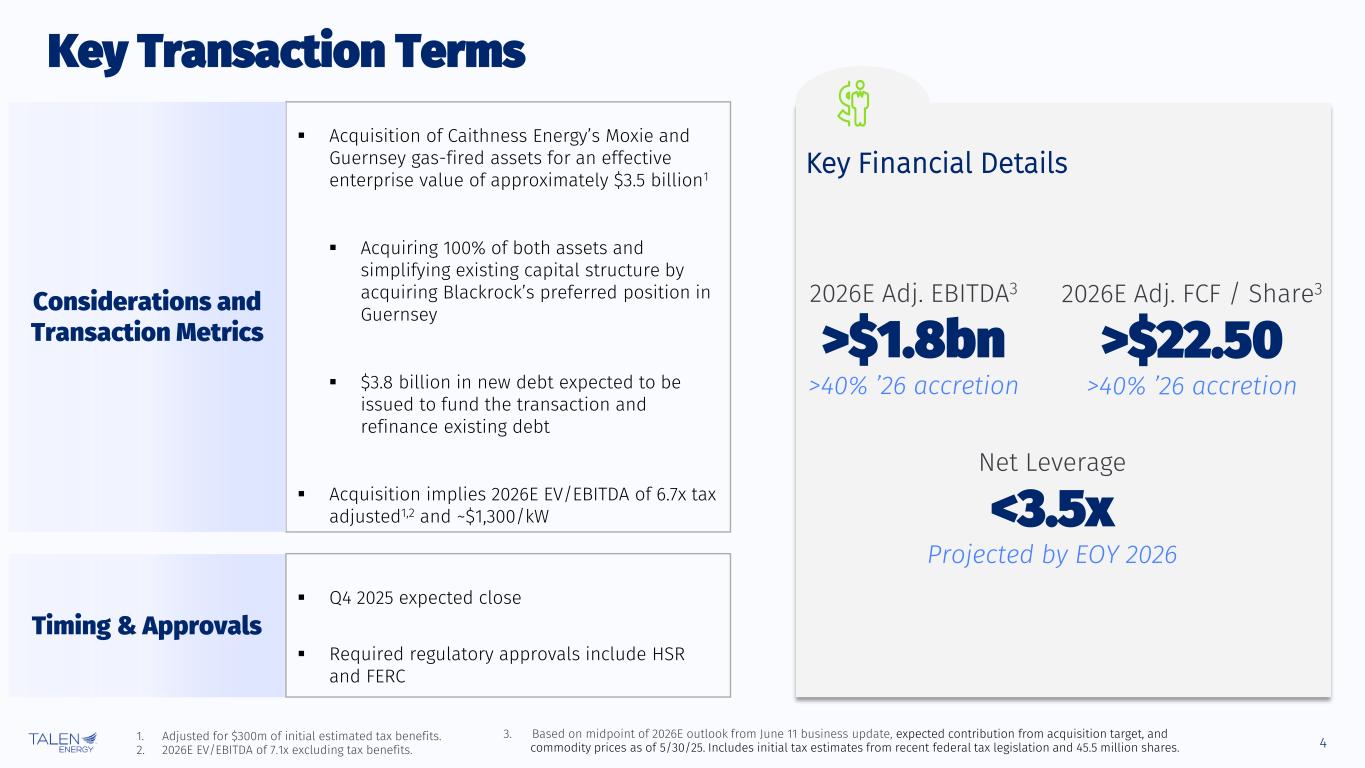

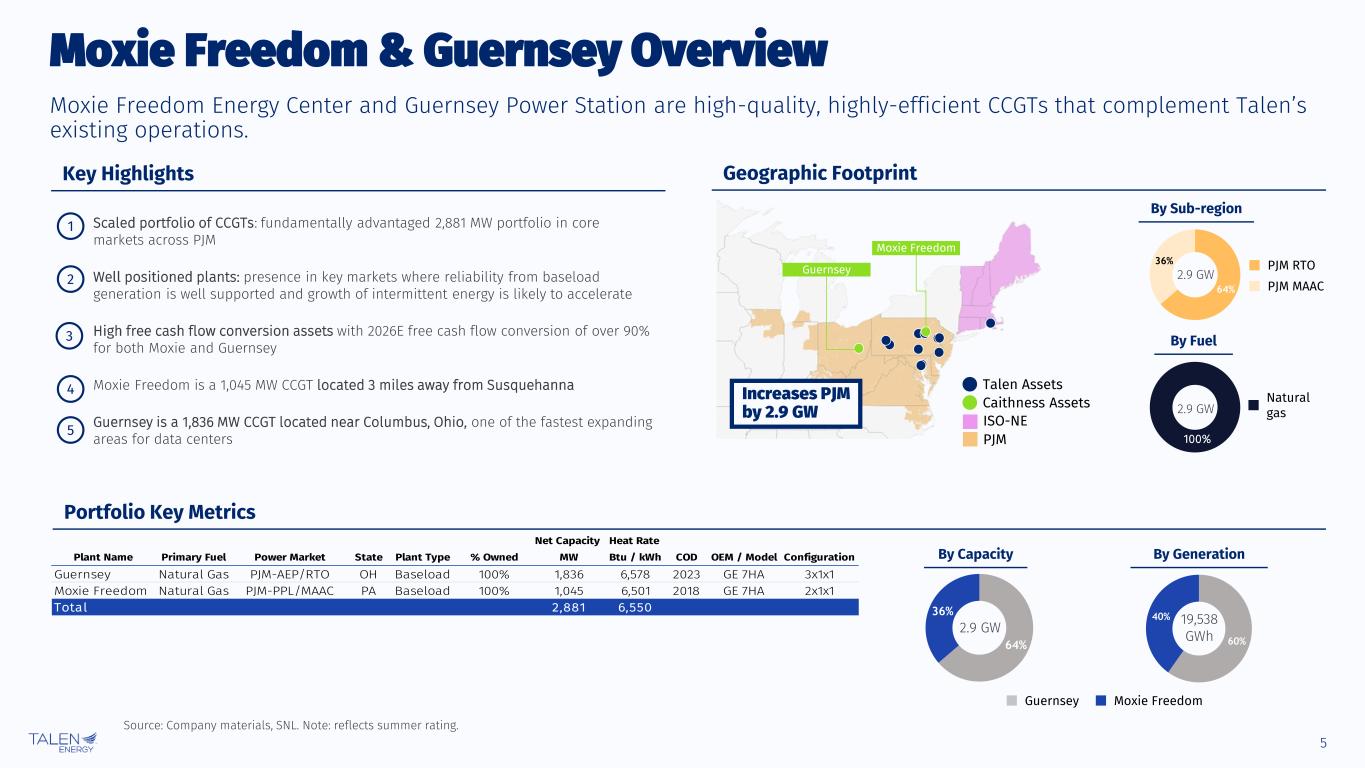

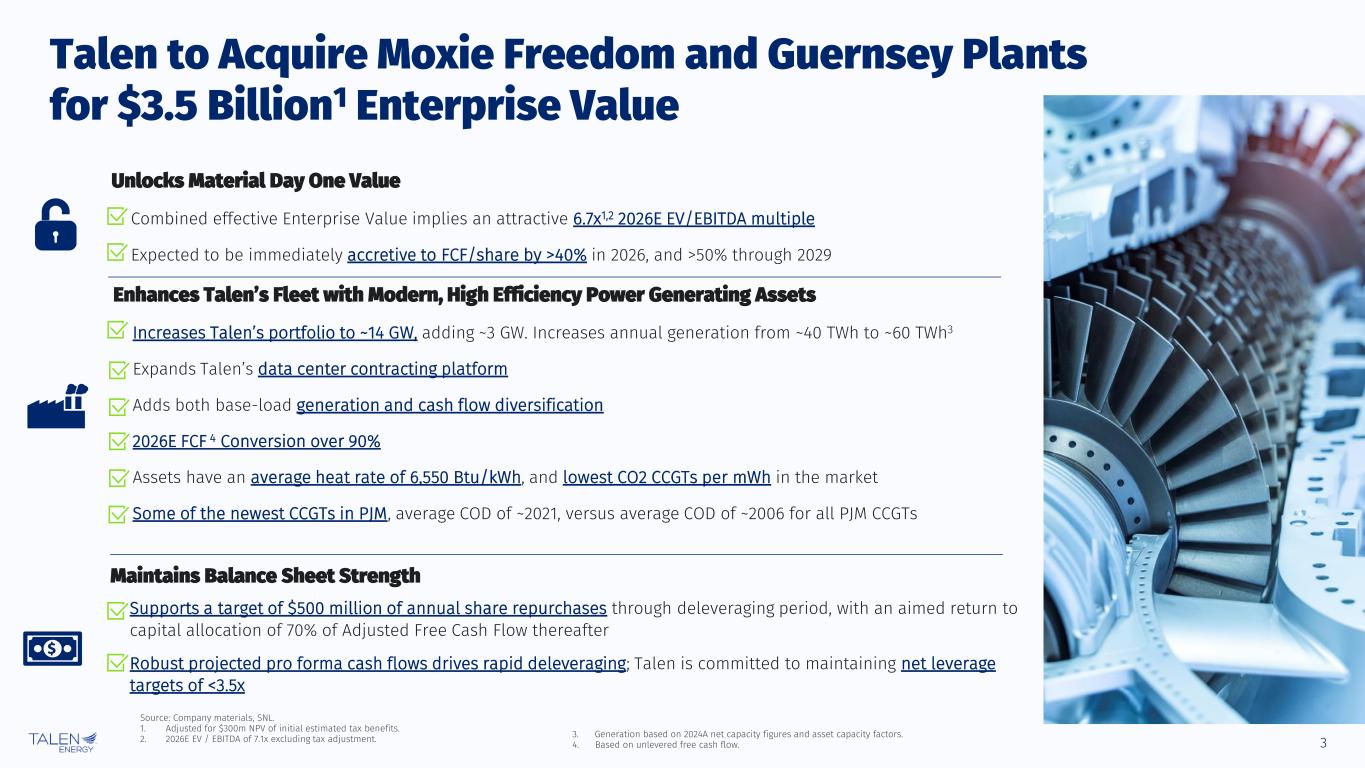

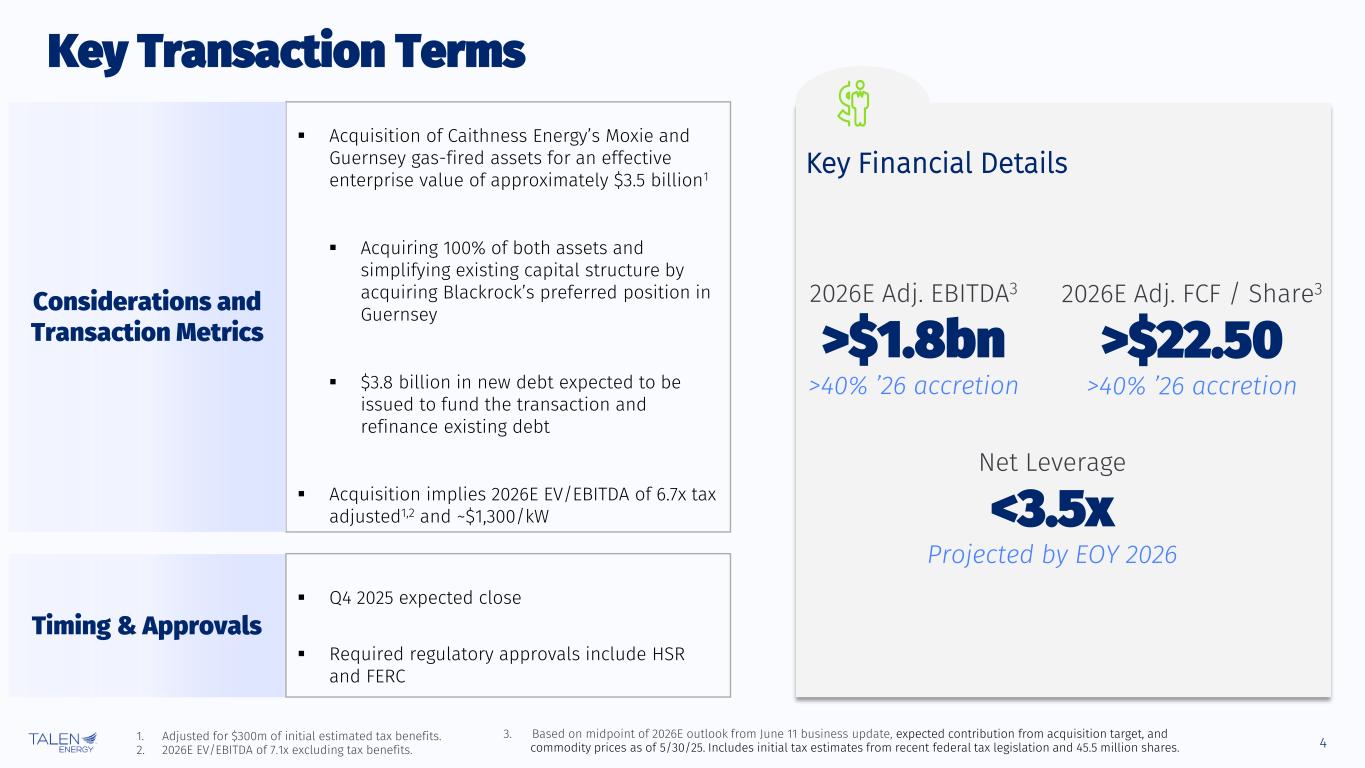

HOUSTON, July 17, 2025 – Talen Energy Corporation (“Talen,” “we,” or “our”) (NASDAQ: TLN), a leading independent power producer, announced it has signed definitive agreements to acquire Caithness Energy’s Moxie Freedom Energy Center (“Moxie”) in Pennsylvania and Caithness Energy and BlackRock’s Guernsey Power Station (“Guernsey”) in Ohio, both combined-cycle gas-fired plants located within the PJM power market.

The net acquisition price is $3.5 billion after adjusting for estimated tax benefits, or approximately $3.8 billion gross. The net purchase price reflects an attractive acquisition multiple of 6.7x 2026 EV/EBITDA for two of the most efficient natural gas plants in PJM, at a material discount to current new-build CCGT costs. The transaction is expected to be immediately accretive to free cash flow per share by over 40% in 2026, and over 50% through 2029.

“This acquisition enhances Talen’s fleet by selectively adding modern, highly efficient baseload H-class CCGTs in Talen’s key markets, where we are an innovator in data center contracting,” said Mac McFarland, Talen President and Chief Executive Officer. “The transaction is immediately and highly accretive, maintains our balance sheet discipline, and adds more than the equivalent of another Susquehanna nuclear plant to our platform, further enabling large load service.”

“Caithness has built an extensive portfolio of leading-edge power generation facilities to support our valued customers,” said James D. Bishop, Jr., Chairman and CEO of Caithness Energy. “We are proud of what we have accomplished and this sale to Talen positions the assets for continued success under a strong and successful management team.”

⸻

Key Strategic and Acquisition Highlights

▪Expands Talen’s Fleet with Modern, High Efficiency, H-Class CCGTs: These highly efficient plants add both baseload generation and cash flow diversification. The plants have an average heat rate of 6,550 Btu/kWh. Their highly efficient dispatch profile results in significant energy margin and strong cash flow conversion and increases our annual generation by 50% from approximately 40 TWh to 60 TWh.

The plants benefit from an advantaged location and reliable access to gas pipeline infrastructure from the Marcellus and Utica shale formations, with their rich natural gas reserves and interconnects to primary natural gas pipelines.

▪Enhances Platform for Data Center and Large-load Contracting: The addition of the facilities to Talen’s portfolio enhances Talen’s ability to offer reliable, scalable, grid-supported and regionally diverse low-carbon capacity to hyperscale data centers and large commercial off-takers. With greater operational flexibility, proximity to key load pockets, and proven track record in bilateral contracting, the proforma company will be well positioned to meet the evolving needs of high-growth, 24/7 power demand sectors.

▪Unlocks Material Value Day One: Immediately accretive to free cash flow per share by over 40% in 2026, and over 50% through 2029.

▪Maintains Balance Sheet Strength: Talen expects robust pro forma cash flows to drive rapid deleveraging and is committed to maintaining a leverage target of 3.5x or lower, anticipated by year-end 2026.

▪Capital Allocation Discipline: The acquisition supports a target of approximately $500 million of annual share repurchases through the 2026 deleveraging period with an aimed return to capital allocation of 70% of adjusted free cash flow thereafter.

Additional Transaction Details

Talen expects to issue approximately $3.8 billion in new debt to fund the acquisitions and refinance target debt, using both secured and unsecured instruments.

The Moxie and Guernsey transactions are both expected to close in Q4 2025. Each transaction is subject to the satisfaction of customary closing conditions, including the expiration or termination of the waiting period pursuant to the Hart-Scott-Rodino act, and regulatory approvals from the Federal Energy Regulatory Commission and other regulatory agencies.

As part of the transaction, Talen is also acquiring the equity interests in Guernsey owned by the mid-market infrastructure funds managed by Global Infrastructure Partners (GIP), a part of BlackRock.

⸻

Advisors

RBC Capital Markets and Citi are co-lead financial advisors to Talen. Kirkland & Ellis LLP and White & Case LLP are legal counsel to Talen. Cahill Gordon & Reindel LLP is legal counsel to RBC Capital Markets and Citi.

Lazard is lead financial advisor to Caithness. Paul Hastings LLP is legal counsel to Caithness. Morgan Stanley & Co. LLC served as lead financial advisor and Simpson Thacher & Bartlett LLP is legal counsel to Global Infrastructure Partners, a part of BlackRock.

⸻

Investor Call

Talen will host an investor call at 4:30 p.m. EDT today, Thursday, July 17, 2025. To participate in the call, please register for the webcast via the page linked here. Participants can also join by phone by registering via the form linked here prior to the start time of the call to receive a conference call dial-in number. For those unable to participate in the live event, a digital replay will be archived for approximately one year and available on the Events page of Talen’s Investor Relations website linked here.

⸻

About Talen

Talen Energy (NASDAQ: TLN) is a leading independent power producer and energy infrastructure company dedicated to powering the future. We own and operate approximately 10.7 gigawatts of power infrastructure in the United States, including 2.2 gigawatts of nuclear power and a significant dispatchable fossil fleet. We produce and sell electricity, capacity, and ancillary services into wholesale U.S. power markets, with our generation fleet principally located in the Mid-Atlantic and Montana. Our team is committed to generating power safely and reliably and delivering the most value per megawatt produced. Talen is also powering the digital infrastructure revolution. We are well-positioned to serve this growing industry, as artificial intelligence data centers increasingly demand more reliable, clean power. Talen is headquartered in Houston, Texas. For more information, visit https://www.talenenergy.com/.

⸻

About Caithness

Caithness Energy, LLC is a privately held independent power producer with over 30 years of experience developing, managing, and operating innovative power generation projects. Headquartered in New York, Caithness focuses on clean, efficient natural gas and renewable energy assets, including the Moxie and Guernsey facilities—some of the most advanced combined-cycle gas plants in the U.S. The company is known for its leadership in developing state-of-the-art, low-carbon generation solutions that support reliable power delivery and environmental stewardship.

⸻

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the federal securities laws, which statements are subject to substantial risks and uncertainties. These forward-looking statements are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this communication, or incorporated by reference into this communication, are forward-looking statements. Throughout this communication, we have attempted to identify forward-looking statements by using words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecasts,” “goal,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will,” or other forms of these words or similar words or expressions or the negative thereof, although not all forward-looking statements contain these terms. Forward-looking statements address future events and conditions concerning, among other things statements regarding the proposed Moxie and Guernsey acquisitions, the expected closing of the proposed transactions and the timing thereof, the financing of the proposed transactions, capital expenditures, earnings, litigation, regulatory matters, hedging, liquidity and capital resources, accounting matters, expectations, beliefs, plans, objectives, goals, strategies, future events or performance, shareholder returns and underlying assumptions. Forward-looking statements are subject to substantial risks and uncertainties that could cause our future business, financial condition, results of operations or performance to differ materially from our historical results or those expressed or implied in any forward-looking statement contained in this communication. All of our forward-looking statements include assumptions underlying or relating to such statements that may cause actual results to differ materially from expectations and are subject to numerous factors that present considerable risks and uncertainties.

⸻

Talen Contact Information

Investor Relations

Sergio Castro, Talen Energy

Vice President & Treasurer

(281) 203-5315

InvestorRelations@talenenergy.com

Media Contact

Taryne Williams, Talen Energy

Director, Corporate Communications

Taryne.Williams@talenenergy.com

EX-99.2

3

a20250717investorrelatio.htm

EX-99.2

a20250717investorrelatio

Talen Energy Corporation | July 17, 2025 Acquisition of Moxie Freedom and Guernsey Guernsey Moxie Freedom

2 The information contained herein, as well as any information that has been supplied orally in connection herewith, speaks only as of the date of this presentation. Talen Energy Corporation (“Talen,” “TEC,” the “Company,” “we,” “our,” or “us”) and our affiliates and representatives expressly disclaim any obligation to update any information contained herein, whether as a result of new information or circumstances, future events or otherwise. The information contained herein is summary. For additional information, see the Company’s historical financial statements and other information included in its periodic reports and other filings with the Securities and Exchange Commission (the “SEC”) (available at www.sec.gov/edgar). Nothing contained herein should be construed as legal, business, tax, accounting or other professional advice, and you should consult your own advisors regarding such matters. These materials should not be relied upon for the maintenance of your books and records for any tax, accounting, legal or other procedures. Non-GAAP Financial Measures We include in this presentation Adjusted EBITDA and Adjusted Free Cash Flow, which we use as measures of our performance and liquidity, and which are not financial measures prepared under U.S. Generally Accepted Accounting Principles (“GAAP”). Non-GAAP financial measures, such as Adjusted EBITDA and Adjusted Free Cash Flow, do not have definitions under GAAP and may be defined differently by, and not be comparable to, similarly titled measures used by other companies or used in our credit facilities, the indentures governing our notes or any of our other debt agreements. Generally, a non-GAAP financial measure is a numerical measure of financial performance, financial position or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. Management cautions investors not to place undue reliance on such non-GAAP measures, but to consider them along with their most directly comparable GAAP measures. Adjusted EBITDA and Adjusted Free Cash Flow have limitations as analytical tools and should not be considered in isolation or as a substitute for analyzing our results as reported under GAAP. Due to the difficulty in predicting certain components of Adjusted EBITDA and Adjusted Free Cash Flow for Moxie Freedom and Guernsey with a reasonable degree of certainty, we are unable to reconcile these non-GAAP financial measures to the comparable GAAP measures without unreasonable efforts. Market and Industry Data This presentation includes market data and other information from independent industry publications, as well as surveys and our own research and knowledge of the industry. Some data is also based on management’s estimates, which are derived from our review of internal sources, as well as the independent sources described above. Although we believe these sources are reliable, the third-party information contained in this presentation has not been independently investigated, verified or audited and, therefore, we cannot guarantee the accuracy or completeness of such information. As a result, you should be aware that market share, ranking and other similar data set forth in this presentation, and estimates and beliefs based on such data, may not be reliable. Forward Looking Statements Statements contained in this presentation concerning expectations, beliefs, plans, objectives, goals, strategies, future events or performance, shareholder returns and underlying assumptions, and other statements that are not statements of historical fact are “forward-looking statements,” and should be considered estimates, assumptions or projections. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would” “goal”, “predict”, “continue”, “potential” or similar expressions. Any such forward-looking statements reflect various estimates and assumptions. Although we believe that the expectations and assumptions reflected in these statements are reasonable, there can be no assurance that they will prove to be correct. No representations or warranties are made by Talen or any of its affiliates, shareholders, directors, officers, employees, agents, partners or professional advisors as to the accuracy or achievability of any such forward-looking statements. Except as otherwise required by law, Talen undertakes no obligation to update any forward-looking statement to reflect new information or circumstances, future events or otherwise after the date on which such statement is made. Forward-looking statements are subject to many risks and uncertainties, and actual results may differ materially due to many factors. New factors emerge from time to time, and it is not possible for us to predict all of these factors. In addition to the specific factors discussed in the sections entitled “Cautionary Note Regarding Forward-Looking Information” and “Risk Factors” in our periodic reports and other filings with the SEC, the following are among the important factors that could cause actual results to differ materially from forward-looking statements: Talen’s or its subsidiaries’ levels of indebtedness; the terms and conditions of debt instruments that may restrict Talen’s ability to operate its business; operational, price and credit risks in the wholesale and retail electricity markets (including as a result of increases in the supply of electricity generally due to new power or intermittent renewable power generation); the effectiveness of Talen’s risk management techniques, including hedging, with respect to electricity and fuel prices, interest rates and counterparty and joint venture partner credit and non-performance risks; methods of accounting and developments in or interpretations of accounting requirements that may impact reported results, including with respect to, but not limited to, hedging activity; Talen’s ability to forecast and provide the actual load needed to perform sales contracts; the effects of transmission congestion due to line maintenance outages and the performance of transmission facilities and any changes in the structure and operation of, or the pricing limitations imposed by, the Regional Transmission Organizations and Independent System Operators that operate those facilities; blackouts due to disruptions in neighboring interconnected systems; the impacts of federal, state, local and market legislation, regulation, proceedings and other actions, including but not limited to those related to energy, the environment and tax, the outcomes thereof and the costs of compliance therewith; the impacts of new or revised United States and/or international trade tariffs, treaties, policies, and regulations; the costs of complying with environmental, social and related worker health and safety laws and regulations; the impacts of climate change, including changes in regulation or their enforcement; the availability and cost of emission allowances; the performance of Talen’s subsidiaries and affiliates, on which our ability to meet our debt obligations largely depend; the risks inherent with variable rate indebtedness; disruption in or adverse developments of financial markets; acquisition or divestiture activities, including Talen’s ability to realize expected synergies and other benefits from such business transactions; Talen’s ability to achieve anticipated cost savings; the execution and development of proposed future enterprises, including the ability to permit, develop, construct and operate proposed renewable energy, energy storage and/or data center facilities, realization of assumptions underlying the statements regarding future enterprises, and realization of estimates of valuations of future enterprises; Talen’s ability to optimize its competitive power generation operations and the costs associated with any capital expenditures; the proposed Moxie Freedom and Guernsey acquisitions, the expected closing of the proposed transactions and the timing thereof, the financing of the proposed transactions; significant increases in operation and maintenance expenses, such as health care, and pension costs, including as a result of changes in interest rates; the loss of key personnel, the ability to hire and retain qualified employees, and the possibility of union strikes or work stoppages; war (including supply chain disruptions as a result of war, and including the effects of the Ukraine/Russia and Middle East conflicts, attendant sanctions and related disruptions in oil and natural gas production and the supply of nuclear fuel), armed conflicts or terrorist attacks, including cyber-based attacks; and pandemics, including COVID-19. Recipients are cautioned to not place undue reliance on such forward-looking statements. Disclaimer

3 Enhances Talen’s Fleet with Modern, High Efficiency Power Generating Assets ▪ Increases Talen’s portfolio to ~14 GW, adding ~3 GW. Increases annual generation from ~40 TWh to ~60 TWh3 ▪ Expands Talen’s data center contracting platform ▪ Adds both base-load generation and cash flow diversification ▪ 2026E FCF 4 Conversion over 90% ▪ Assets have an average heat rate of 6,550 Btu/kWh, and lowest CO2 CCGTs per mWh in the market ▪ Some of the newest CCGTs in PJM, average COD of ~2021, versus average COD of ~2006 for all PJM CCGTs Maintains Balance Sheet Strength • Supports a target of $500 million of annual share repurchases through deleveraging period, with an aimed return to capital allocation of 70% of Adjusted Free Cash Flow thereafter • Robust projected pro forma cash flows drives rapid deleveraging; Talen is committed to maintaining net leverage targets of <3.5x 12 Talen to Acquire Moxie Freedom and Guernsey Plants for $3.5 Billion1 Enterprise Value Source: Company materials, SNL. 1. Adjusted for $300m NPV of initial estimated tax benefits. 2. 2026E EV / EBITDA of 7.1x excluding tax adjustment. Unlocks Material Day One Value ▪ Combined effective Enterprise Value implies an attractive 6.7x1,2 2026E EV/EBITDA multiple ▪ Expected to be immediately accretive to FCF/share by >40% in 2026, and >50% through 2029 3. Generation based on 2024A net capacity figures and asset capacity factors. 4. Based on unlevered free cash flow.

4 Key Transaction Terms Considerations and Transaction Metrics ▪ Acquisition of Caithness Energy’s Moxie and Guernsey gas-fired assets for an effective enterprise value of approximately $3.5 billion1 ▪ Acquiring 100% of both assets and simplifying existing capital structure by acquiring Blackrock’s preferred position in Guernsey ▪ $3.8 billion in new debt expected to be issued to fund the transaction and refinance existing debt ▪ Acquisition implies 2026E EV/EBITDA of 6.7x tax adjusted1,2 and ~$1,300/kW ▪ Q4 2025 expected close ▪ Required regulatory approvals include HSR and FERC Timing & Approvals 1. Adjusted for $300m of initial estimated tax benefits. 2. 2026E EV/EBITDA of 7.1x excluding tax benefits. Key Financial Details 2026E Adj. EBITDA3 >$1.8bn >40% ’26 accretion 2026E Adj. FCF / Share3 >$22.50 >40% ’26 accretion Net Leverage <3.5x Projected by EOY 2026 3. Based on midpoint of 2026E outlook from June 11 business update, expected contribution from acquisition target, and commodity prices as of 5/30/25. Includes initial tax estimates from recent federal tax legislation and 45.5 million shares.

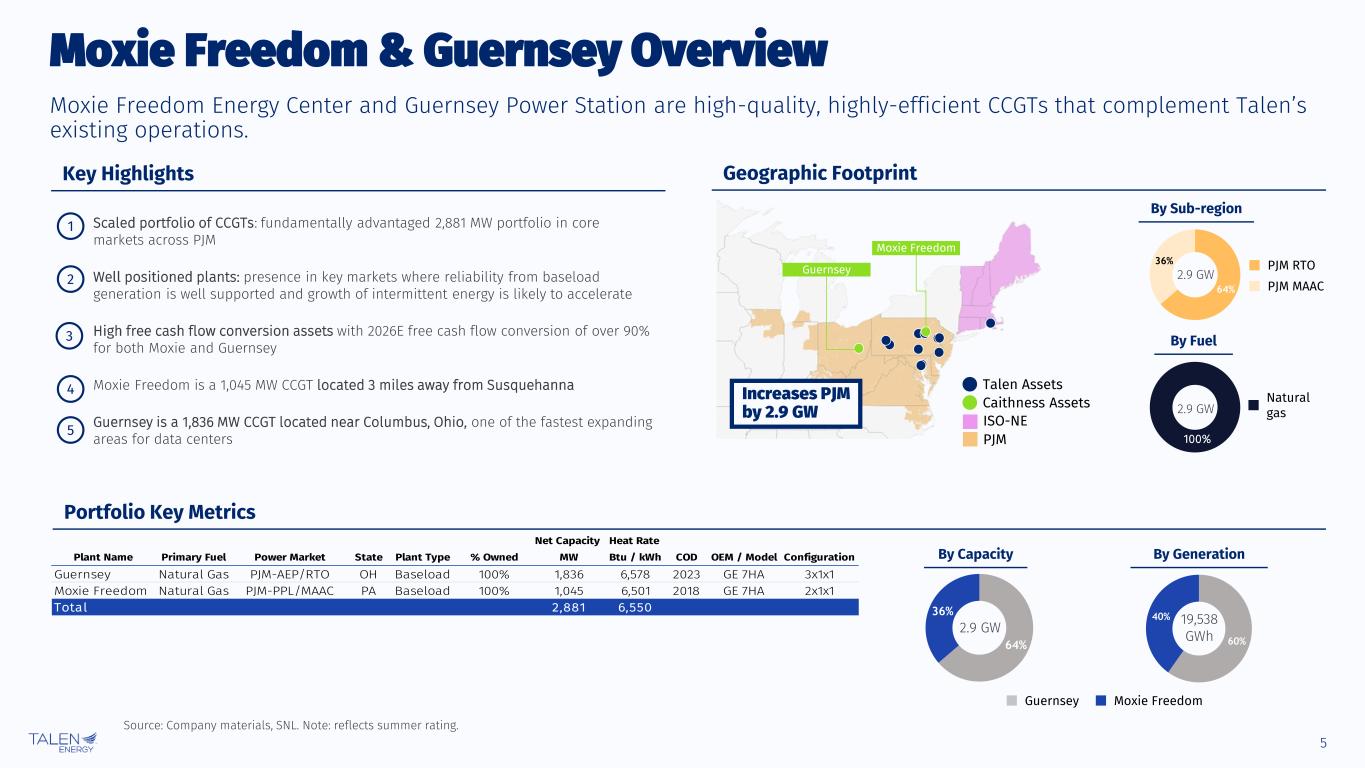

5 Net Capacity Heat Rate Plant Name Primary Fuel Power Market State Plant Type % Owned MW Btu / kWh COD OEM / Model Configuration Guernsey Natural Gas PJM-AEP/RTO OH Baseload 100% 1,836 6,578 2023 GE 7HA 3x1x1 Moxie Freedom Natural Gas PJM-PPL/MAAC PA Baseload 100% 1,045 6,501 2018 GE 7HA 2x1x1 Total 2,881 6,550 Scaled portfolio of CCGTs: fundamentally advantaged 2,881 MW portfolio in core markets across PJM Well positioned plants: presence in key markets where reliability from baseload generation is well supported and growth of intermittent energy is likely to accelerate High free cash flow conversion assets with 2026E free cash flow conversion of over 90% for both Moxie and Guernsey Moxie Freedom is a 1,045 MW CCGT located 3 miles away from Susquehanna Guernsey is a 1,836 MW CCGT located near Columbus, Ohio, one of the fastest expanding areas for data centers Moxie Freedom Energy Center and Guernsey Power Station are high-quality, highly-efficient CCGTs that complement Talen’s existing operations. Key Highlights Geographic Footprint Portfolio Key Metrics 64% 36% By Fuel 100%1 Natural gas 3 2.9 GW 2.9 GW PJM RTO By Sub-region 2 1 2 3 4 By Capacity By Generation 64% 36% Guernsey Moxie Freedom 19,538 GWh 2.9 GW PJM MAAC Moxie Freedom & Guernsey Overview Source: Company materials, SNL. Note: reflects summer rating. PJM ISO-NE Talen Assets Caithness AssetsIncreases PJM by 2.9 GW Moxie Freedom Guernsey 5 60% 40%

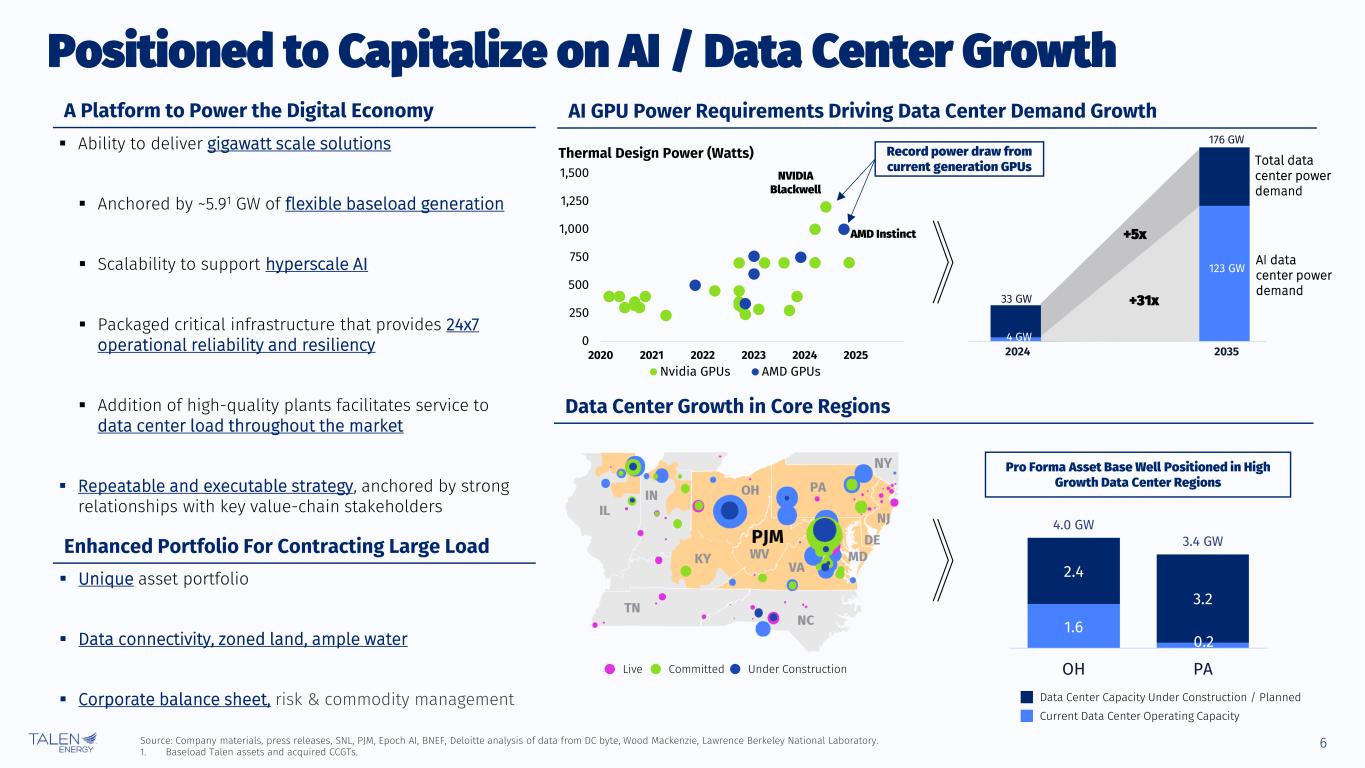

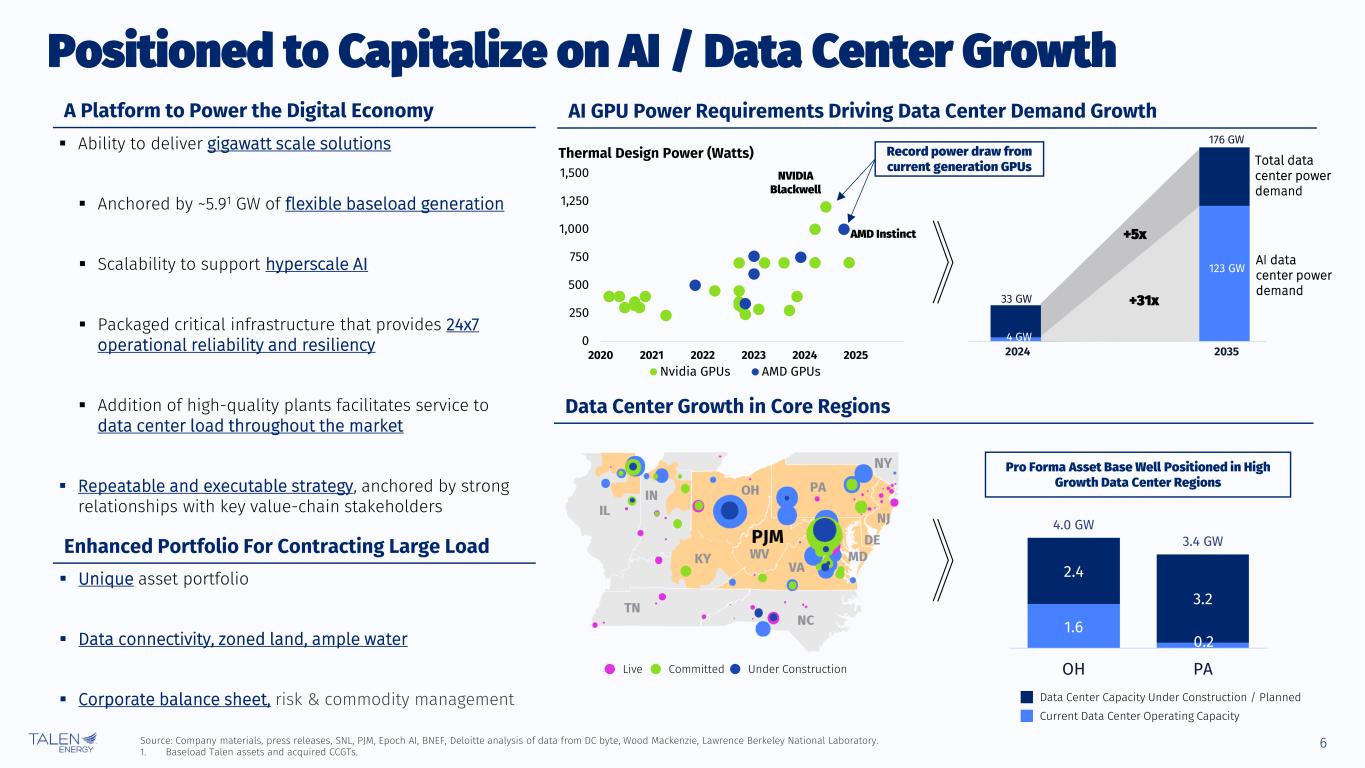

6 1.6 0.2 2.4 3.2 4.0 GW 3.4 GW OH PA A Platform to Power the Digital Economy AI GPU Power Requirements Driving Data Center Demand Growth Positioned to Capitalize on AI / Data Center Growth Source: Company materials, press releases, SNL, PJM, Epoch AI, BNEF, Deloitte analysis of data from DC byte, Wood Mackenzie, Lawrence Berkeley National Laboratory. 1. Baseload Talen assets and acquired CCGTs. +5x +31x Total data center power demand AI data center power demand 4 GW 123 GW 33 GW 176 GW 2024 2035 Data Center Capacity Under Construction / Planned Current Data Center Operating Capacity Record power draw from current generation GPUs Pro Forma Asset Base Well Positioned in High Growth Data Center Regions NVIDIA Blackwell AMD Instinct 0 250 500 750 1,000 1,250 1,500 2020 2021 2022 2023 2024 2025 Thermal Design Power (Watts) Nvidia GPUs AMD GPUs Live Under ConstructionCommitted Data Center Growth in Core Regions ▪ Ability to deliver gigawatt scale solutions ▪ Anchored by ~5.91 GW of flexible baseload generation ▪ Scalability to support hyperscale AI ▪ Packaged critical infrastructure that provides 24x7 operational reliability and resiliency ▪ Addition of high-quality plants facilitates service to data center load throughout the market ▪ Repeatable and executable strategy, anchored by strong relationships with key value-chain stakeholders NY Enhanced Portfolio For Contracting Large Load ▪ Unique asset portfolio ▪ Data connectivity, zoned land, ample water ▪ Corporate balance sheet, risk & commodity management

7 Maintains Balance Sheet Strength ▪ Utilizes balance sheet to acquire accretive highly strategic assets ▪ Focused deleveraging plan with capital allocation commitments supporting a target net leverage of below 3.5x by year end 2026 ▪ Supports a target of $500 million of annual share repurchases through deleveraging period; aim to return to 70% of adjusted free cash flow allocated to share repurchases thereafter ▪ Healthy balance sheet underpinned by predictable cash flow (including the new AWS contract) for allocation offers long-term strategic flexibility ▪ Maintains appropriate liquidity necessary to serve wholesale and large load customer base ▪ Ability to unlock cash flow generated by assets with a corporate financing structure ▪ Enhanced credit for hedging / optimizing assets Balance Sheet Stability and Capital Markets Access High quality cash flows with disciplined capital allocation Innovatively serving growing customer needs Flexible fleet to capture capacity & energy upside

8 Upcoming Investor Events: ▪ Q2 Earnings Call: August 7 at 8am ET (7am CT) ▪ Seaport Virtual Conference: August 20th ▪ Barclays CEO Energy and Power Conference: September 3rd in New York ▪ Wells Fargo Texas Power and Gas Tour: September 18th in Houston ▪ Wolfe Research Utilities, Midstream & Clean Energy Conference: September 30th in New York Powering the Future: Upcoming Events Investor Update in NYC: September 9th Click to submit aregis ration request Click to submit a registration request Agenda includes: ▪ 2026 guidance and 2027 - 2028 outlook ▪ Long-term growth drivers In-person attendance will be capacity-limited, but the event will also be available via Zoom webinar and recorded

9 Appendix

10 Regulatory Approvals and Timing ▪ FERC approval required prior to the close of the transaction ▪ FERC has 180 days to act but can extend for another 180 days Federal Energy Regulatory Commission (“FERC”) Hart-Scott- Rodino (“HSR”) ▪ Hart-Scott-Rodino review: initial 30-day waiting period Other Filings ▪ Other FERC filings to address discrete regulatory and administrative matters ▪ Federal Communications Commission Moxie Freedom Guernsey

11 Asset State Primary Fuel Plant Type Ownership Owned Capacity (MW) Commercial Operations Date Region Caithness Guernsey OH Natural Gas Baseload 100% 1,836 2023 PJM-AEP/RTO Moxie Freedom PA Natural Gas Baseload 100% 1,045 2018 PJM-PPL/MAAC Caithness 2,881 Susquehanna Nuclear Facility Susquehanna2 PA Nuclear Baseload 90% 2,228 1983 – 1985 PJM-PPL/MAAC PJM Gas Assets Brunner Island3, 4 PA Coal / Natural Gas Intermediate 100% 1,429 1961 – 1969 PJM-PPL Camden NJ Natural Gas Peaker 100% 145 1993 PJM-PSEG Lower Mt. Bethel PA Natural Gas Baseload 100% 608 2004 PJM-PPL Martins Creek PA Natural Gas Peaker 100% 1,705 1975 – 1977 PJM-PPL Montour PA Natural Gas Peaker 100% 1,528 1972 – 1973 PJM-PPL Reliability Assets Brandon Shores5 MD Coal Peaker 100% 1,289 1984 – 1991 PJM-BGE H.A. Wagner5 MD Oil Peaker 100% 843 1956 – 1972 PJM-BGE Colstrip2 MT Coal Baseload 15% 222 1984 – 1986 WECC Other Conemaugh2, 4 PA Coal Intermediate 22% 386 1970 – 1971 PJM-MAAC Keystone2, 4 PA Coal Intermediate 12% 213 1967 – 1968 PJM-MAAC Dartmouth MA Natural Gas Peaker 100% 80 1992 – 2009 ISO-NE Talen 10,676 Caithness + Talen 13,557 Talen Pro Forma Generation Portfolio 4. Coal-fired electric generation is required to cease at Brunner Island, Keystone, and Conemaugh by December 2028. 5. See Note 8 to the Q1 2025 Financial Statements for additional information on the Brandon Shores and H.A. Wagner RMR arrangements. 6. Currently being held for sale. Source: Company materials. Note: As of March 31, 2025. 1. Generation capacity (summer rating) is based on factors, among others, such as operating experience and physical conditions, which may be subject to revision. 2. See Note 10 to the FY 2024 Financial Statements for additional information on jointly owned facilities. 3. Coal-fired electric generation is restricted during the EPA Ozone Season, which is May 1 to September 30 of each year. 1 1 6 6