| Commission file number: 001-10533 | Commission file number: 001-34121 | ||||

| Rio Tinto plc | Rio Tinto Limited | ||||

| ABN 96 004 458 404 | |||||

(Translation of registrant’s name into English) |

(Translation of registrant’s name into English) |

||||

| 6 St. James’s Square | Level 43, 120 Collins Street | ||||

| London, SW1Y 4AD, United Kingdom | Melbourne, Victoria 3000, Australia |

||||

(Address of principal executive offices) |

(Address of principal executive offices) |

||||

| Rio Tinto plc | Rio Tinto Limited | ||||||||||

| (Registrant) | (Registrant) | ||||||||||

By |

/s/ Andrew Hodges |

By |

/s/ Tim Paine |

||||||||

Name |

Andrew Hodges |

Name |

Tim Paine |

||||||||

| Title | Company Secretary | Title | Company Secretary | ||||||||

| Date | 1 July 2025 | Date | 1 July 2025 | ||||||||

|

Media Relations,

United Kingdom

Matthew Klar

M +44 7796 630 637

David Outhwaite

M +44 7787 597 493

|

Media Relations,

Australia

Matt Chambers

M +61 433 525 739

Michelle Lee

M +61 458 609 322

Rachel Pupazzoni

M +61 438 875 469

|

Media Relations,

Canada

Simon Letendre

M +1 514 796 4973

Malika Cherry

M +1 418 592 7293

Vanessa Damha

M +1 514 715 2152

Media Relations,

US

Jesse Riseborough

M +1 202 394 9480

|

||||||

|

Investor Relations,

United Kingdom

Rachel Arellano

M: +44 7584 609 644 David Ovington

M +44 7920 010 978

Laura Brooks

M +44 7826 942 797

Weiwei Hu

M +44 7825 907 230

|

Investor Relations,

Australia

Tom Gallop

M +61 439 353 948

Phoebe Lee

M +61 413 557 780

|

|||||||

|

Rio Tinto plc

6 St James’s Square

London SW1Y 4AD

United Kingdom

T +44 20 7781 2000

Registered in England

No. 719885

|

Rio Tinto Limited

Level 43, 120 Collins Street

Melbourne 3000

Australia

T +61 3 9283 3333

Registered in Australia

ABN 96 004 458 404

|

|||||||

|

Media Relations,

United Kingdom

Matthew Klar

M +44 7796 630 637

David Outhwaite

M +44 7787 597 493

|

Media Relations,

Australia

Matt Chambers

M +61 433 525 739

Michelle Lee

M +61 458 609 322

Rachel Pupazzoni

M +61 438 875 469

|

Media Relations,

Canada

Simon Letendre

M +1 514 796 4973

Malika Cherry

M +1 418 592 7293

Vanessa Damha

M +1 514 715 2152

Media Relations,

US

Jesse Riseborough

M +1 202 394 9480

|

||||||

|

Investor Relations,

United Kingdom

Rachel Arellano

M: +44 7584 609 644 David Ovington

M +44 7920 010 978

Laura Brooks

M +44 7826 942 797

Weiwei Hu

M +44 7825 907 230

|

Investor Relations,

Australia

Tom Gallop

M +61 439 353 948

Phoebe Lee

M +61 413 557 780

|

|

||||||

|

Rio Tinto plc

6 St James’s Square

London SW1Y 4AD

United Kingdom

T +44 20 7781 2000

Registered in England

No. 719885

|

Rio Tinto Limited

Level 43, 120 Collins Street

Melbourne 3000

Australia

T +61 3 9283 3333

Registered in Australia

ABN 96 004 458 404

|

|||||||

|

Media Relations,

United Kingdom

Matthew Klar

M +44 7796 630 637

David Outhwaite

M +44 7787 597 493

|

Media Relations,

Australia

Matt Chambers

M +61 433 525 739

Michelle Lee

M +61 458 609 322

Rachel Pupazzoni

M +61 438 875 469

|

Media Relations,

Canada

Simon Letendre

M +1 514 796 4973

Malika Cherry

M +1 418 592 7293

Vanessa Damha

M +1 514 715 2152

Media Relations,

US

Jesse Riseborough

M +1 202 394 9480

|

||||||

|

Investor Relations,

United Kingdom

Rachel Arellano

M: +44 7584 609 644 David Ovington

M +44 7920 010 978

Laura Brooks

M +44 7826 942 797

Weiwei Hu

M +44 7825 907 230

|

Investor Relations,

Australia

Tom Gallop

M +61 439 353 948

Phoebe Lee

M +61 413 557 780

|

|

||||||

|

Rio Tinto plc

6 St James’s Square

London SW1Y 4AD

United Kingdom

T +44 20 7781 2000

Registered in England

No. 719885

|

Rio Tinto Limited

Level 43, 120 Collins Street

Melbourne 3000

Australia

T +61 3 9283 3333

Registered in Australia

ABN 96 004 458 404

|

|||||||

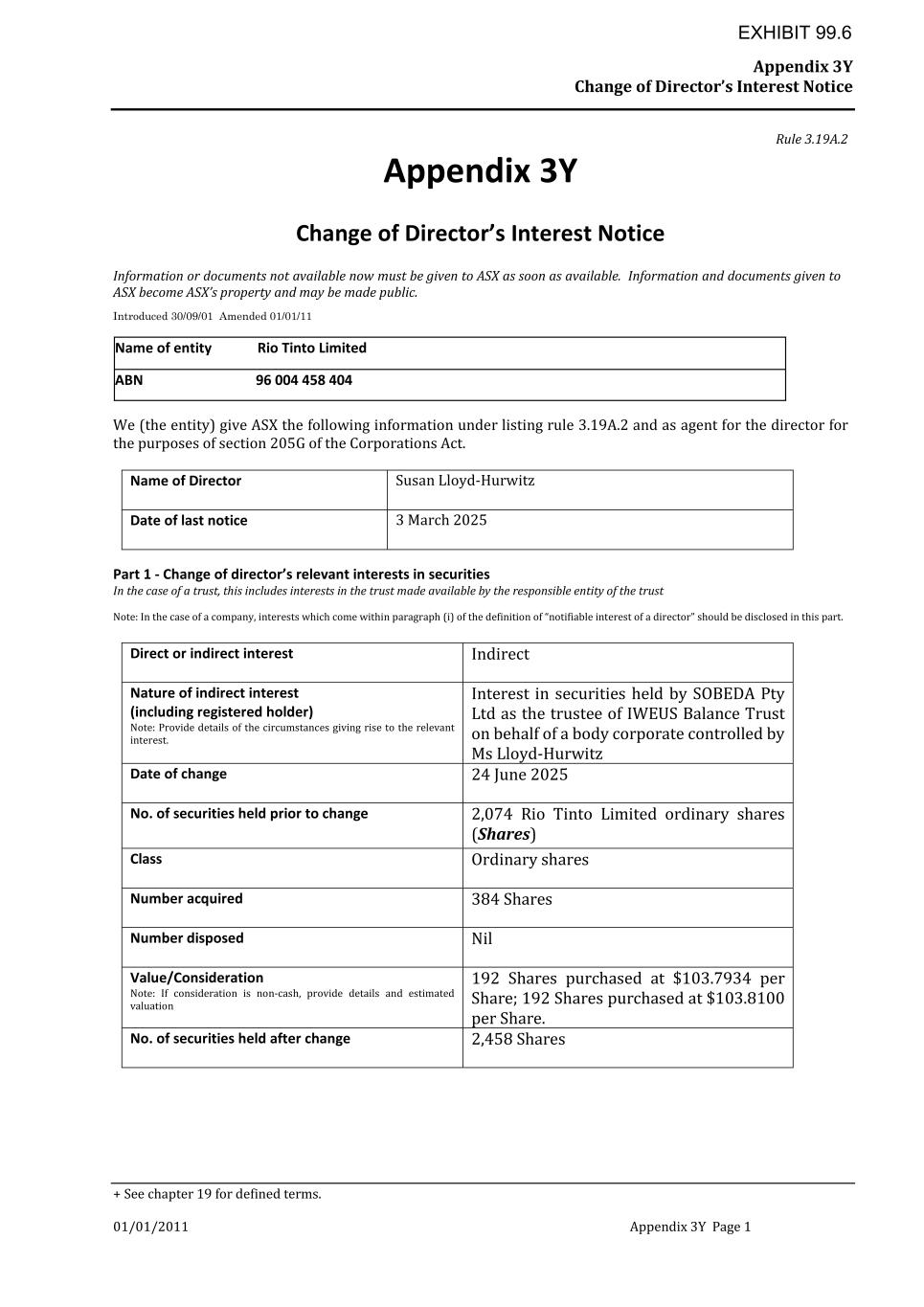

Date Acquired |

Number of Shares Acquired |

Price Per Share AUD |

||||||

24 June 2025 |

192 |

103.7934 |

||||||

192 |

103.8100 |

|||||||

|

Media Relations,

United Kingdom

Matthew Klar

M +44 7796 630 637

David Outhwaite

M +44 7787 597 493

|

Media Relations,

Australia

Matt Chambers

M +61 433 525 739

Michelle Lee

M +61 458 609 322

Rachel Pupazzoni

M +61 438 875 469

|

Media Relations,

Canada

Simon Letendre

M +1 514 796 4973

Malika Cherry

M +1 418 592 7293

Vanessa Damha

M +1 514 715 2152

Media Relations,

US

Jesse Riseborough

M +1 202 394 9480

|

||||||

|

Investor Relations,

United Kingdom

Rachel Arellano

M: +44 7584 609 644 David Ovington

M +44 7920 010 978

Laura Brooks

M +44 7826 942 797

Weiwei Hu

M +44 7825 907 230

|

Investor Relations,

Australia

Tom Gallop

M +61 439 353 948

Amar Jambaa

M +61 472 865 948

|

|||||||

|

Rio Tinto plc

6 St James’s Square

London SW1Y 4AD

United Kingdom

T +44 20 7781 2000

Registered in England

No. 719885

|

Rio Tinto Limited

Level 43, 120 Collins Street

Melbourne 3000

Australia

T +61 3 9283 3333

Registered in Australia

ABN 96 004 458 404

|

|||||||