Document

Talen Energy Expands Nuclear Energy Relationship with Amazon

Talen enters power purchase agreement for 1,920 megawatts of carbon-free electricity at full quantity to support Amazon operations, and explore SMR technology

HOUSTON, June 11, 2025 – Talen Energy Corporation (“Talen,” “we,” or “our”) (NASDAQ: TLN), an independent power producer dedicated to powering the future, announced today that it has expanded its existing nuclear energy relationship with Amazon to provide carbon-free energy from Talen’s Susquehanna nuclear power plant to Amazon Web Services (“AWS”) data centers in the region.

Under the terms of a new power purchase agreement (“PPA”), Talen will supply electricity to Amazon for operations that support AI and other cloud technologies at Amazon’s data center campus adjacent to Susquehanna, with the ability to deliver to other sites throughout Pennsylvania. Talen and Amazon will also explore building new Small Modular Reactors (“SMRs”) within Talen’s Pennsylvania footprint and pursue expanding the nuclear plant’s energy output through uprates, with the intent to add net-new energy to the PJM grid.

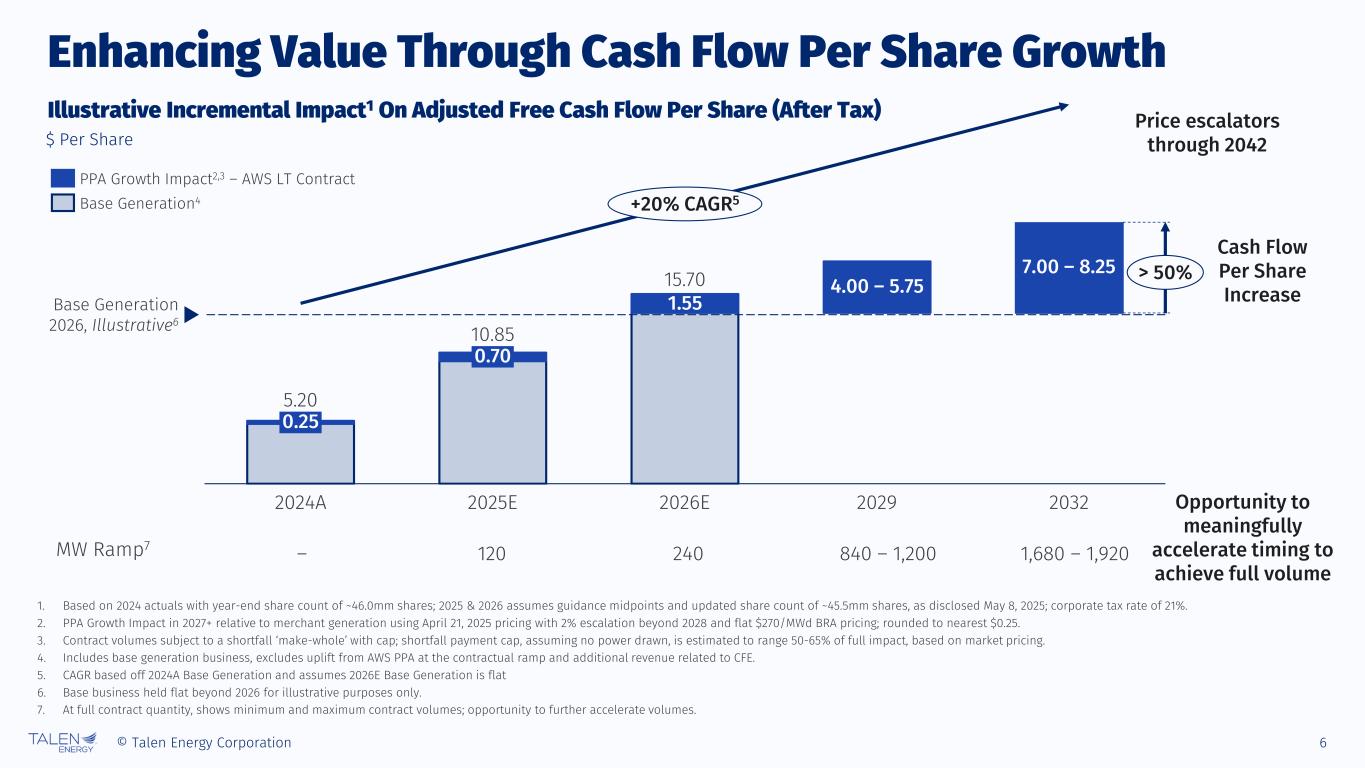

Under the expanded PPA, at the full contract quantity, Talen will provide Amazon with 1,920 megawatts of carbon-free nuclear power through 2042, with options to further extend its duration. The power delivery schedule will ramp over time, expecting to achieve the full volume no later than 2032, with the potential to meaningfully accelerate. This long-term transaction will significantly decrease Talen’s market risk and minimize its reliance on the Federal nuclear production tax credit.

“Our agreement with Amazon is designed to provide us with a long-term, steady source of revenue and greater balance sheet flexibility through contracted revenues. We remain a first mover in this space and intend to continue to execute on our data center strategy,” said Talen President and Chief Executive Officer Mac McFarland. “Talen is well-positioned to support Amazon’s energy needs as it invests further in the Commonwealth of Pennsylvania.”

“Amazon is proud to help Pennsylvania advance AI innovation through investments in the Commonwealth’s economic and energy future,” said AWS Vice President of Global Data Centers Kevin Miller. “That’s why we’re making the largest private sector investment in state history – $20B – to bring 1,250 high-skilled jobs and economic benefits to the state, while also collaborating with Talen Energy to help power our infrastructure with carbon-free energy.”

The existing Susquehanna co-located load arrangement between Talen and Amazon will transition to a “front-of-the-meter” arrangement after the completion of transmission reconfigurations expected in the Spring of 2026, concurrent with Susquehanna’s refueling outage. Under the terms of the new agreement, Susquehanna will provide its carbon-free power to the PJM grid, Talen will act as the retail electric generation supplier to Amazon, and PPL Electric Utilities (“PPL”) will be responsible for transmission and delivery.

“PPL Electric Utilities is investing in the resiliency of its transmission system so we can better serve our customers, meet growing energy demands, and ensure power is delivered reliably,” said Christine Martin, president of PPL Electric Utilities. “Connecting large load customers like data centers to our transmission system helps lower the transmission component of energy bills for all customers, as large load customers pay significant transmission charges on our network. We’re excited to be part of Amazon’s broader investment in Pennsylvania and look forward to the positive effects it can have for our customers and the local economy.”

Strengthening Pennsylvania’s Energy Future

The Talen and Amazon relationship will help safe, reliable nuclear energy continue to be generated at Susquehanna for years to come, maintaining its contributions to the local community and supporting Pennsylvania’s energy future while also helping to power Amazon’s AI innovation investments in the Commonwealth. Talen is a major employer and significant local taxpayer, and the agreement supports the jobs of more than 900 employees currently working at the Susquehanna facility, as well as new construction jobs.

While Pennsylvania maintains a position as a net energy exporter, producing more power than the Commonwealth requires, Talen’s strategic partnership with Amazon will help send the necessary market signals to spur new investment in additional generation and grid modernization within the Commonwealth.

Pennsylvania Policy and Stakeholder Support

The following key policymakers and stakeholders expressed their support for the transaction.

“This partnership between Talen Energy and Amazon taps into Pennsylvania’s strengths as a national energy leader and will power the largest economic development project in Commonwealth history – creating good-paying jobs, growing our economy, and ultimately adding more power to the PJM energy grid,” said Governor Josh Shapiro. “I am an all-of-the-above energy governor, and as part of my economic development plan, my Administration is working to generate even more power in the Commonwealth – with more power comes more national security, more independence, and more economic freedom. My Administration is going to continue to bring people together to attract new investment to Pennsylvania, and we stand ready to work with Talen Energy and its partners to review permits for this project as efficiently as possible.” – Pennsylvania Governor Josh Shapiro (D)

“Talen and Amazon’s expanded nuclear energy relationship not only strengthens the future of the Susquehanna plant and maintains its contributions to the community, but also helps to support the development of AI technology in Pennsylvania. Adding data centers that support AI strengthens American national security, provides a wide variety of economic opportunities, and positions the Commonwealth, and the U.S., as a leader in AI innovation.” – U.S. Senator Dave McCormick (R-PA)

“I’m pleased about the economic development opportunities the Commonwealth and the Ninth District will receive thanks to Talen and Amazon’s long-term arrangement. Our communities will not only benefit from the economic development that will occur, but also from the contributions that the Susquehanna plant provides as a large employer within the district. Thank you, Talen, Amazon and PPL for working together to bring these benefits to Pennsylvania.” – U.S. Representative Dan Meuser (R-PA), who represents Pennsylvania’s 9th U.S. Congressional District

“IBEW Local 1600 strongly supports the new transaction. Our members, friends, and families all benefit from the jobs and community growth this investment in Susquehanna will bring. This sets up a great career path for young students coming out of high school or college who are looking for a career in the electrical industry.” – John “Rusty” Clausius, President, IBEW Local 1600

Investor Call

Talen will host an investor call at 8:00 a.m. EDT today, Wednesday, June 11, 2025. To participate in the call, please register for the webcast via the page linked here. Participants can also join by phone by registering via the form linked here prior to the start time of the call to receive a conference call dial-in number. For those unable to participate in the live event, a digital replay will be archived for approximately one year and available on the Events page of Talen's Investor Relations website linked here.

About Talen

Talen Energy (NASDAQ: TLN) is a leading independent power producer and energy infrastructure company dedicated to powering the future. We own and operate approximately 10.7 gigawatts of power infrastructure in the United States, including 2.2 gigawatts of nuclear power and a significant dispatchable fossil fleet. We produce and sell electricity, capacity, and ancillary services into wholesale U.S. power markets, with our generation fleet principally located in the Mid-Atlantic and Montana. Our team is committed to generating power safely and reliably and delivering the most value per megawatt produced. Talen is also powering the digital infrastructure revolution. We are well-positioned to capture this significant growth opportunity, as data centers serving artificial intelligence increasingly demand more reliable, clean power. Talen is headquartered in Houston, Texas. For more information, visit https://www.talenenergy.com/.

Investor Relations:

Sergio Castro

Vice President & Treasurer

InvestorRelations@talenenergy.com

Media:

Taryne Williams

Director, Corporate Communications

Taryne.Williams@talenenergy.com

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the federal securities laws, which statements are subject to substantial risks and uncertainties. These forward-looking statements are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this communication, or incorporated by reference into this communication, are forward-looking statements. Throughout this communication, we have attempted to identify forward-looking statements by using words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecasts,” “goal,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will,” or other forms of these words or similar words or expressions or the negative thereof, although not all forward-looking statements contain these terms. Forward-looking statements address future events and conditions concerning, among other things, capital expenditures, earnings, litigation, regulatory matters, hedging, liquidity and capital resources and accounting matters. Forward-looking statements are subject to substantial risks and uncertainties that could cause our future business, financial condition, results of operations or performance to differ materially from our historical results or those expressed or implied in any forward-looking statement contained in this communication. All of our forward-looking statements include assumptions underlying or relating to such statements that may cause actual results to differ materially from expectations, and are subject to numerous factors that present considerable risks and uncertainties.