TROPICANA ANALYST VISIT 2025

DISCLAIMER│ANGLOGOLD ASHANTI T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 2 Certain statements contained in this document, other than statements of historical fact, including, without limitation, those concerning the economic outlook for the gold mining industry, expectations regarding gold prices, production, total cash costs, cost savings and other operating results, return on equity, productivity improvements, growth prospects and outlook of AngloGold Ashanti plc’s (the “Company”, “AngloGold Ashanti” or “AGA”) operations, individually or in the aggregate, including the achievement of project milestones, commencement and completion of commercial operations of certain of AngloGold Ashanti’s exploration and production projects and the completion of acquisitions, dispositions or joint venture transactions, AngloGold Ashanti’s liquidity and capital resources and capital expenditures, the consequences of the COVID-19 pandemic and the outcome and consequences of any potential or pending litigation or regulatory proceedings or environmental, health and safety issues, are forward-looking statements regarding AngloGold Ashanti’s financial reports, operations, economic performance and financial condition. These forward-looking statements or forecasts are not based on historical facts, but rather reflect our current beliefs and expectations concerning future events and generally may be identified by the use of forward-looking words, phrases and expressions such as “believe”, “expect”, “aim”, “anticipate”, “intend”, “foresee”, “forecast”, “predict”, “project”, “estimate”, “likely”, “may”, “might”, “could”, “should”, “would”, “seek”, “plan”, “scheduled”, “possible”, “continue”, “potential”, “outlook”, “target” or other similar words, phrases, and expressions; provided that the absence thereof does not mean that a statement is not forward-looking. Similarly, statements that describe our objectives, plans or goals are or may be forward-looking statements. These forward-looking statements or forecasts involve known and unknown risks, uncertainties and other factors that may cause AngloGold Ashanti’s actual results, performance, actions or achievements to differ materially from the anticipated results, performance, actions or achievements expressed or implied in these forward-looking statements. Although AngloGold Ashanti believes that the expectations reflected in such forward-looking statements and forecasts are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results, performance, actions or achievements could differ materially from those set out in the forward-looking statements as a result of, among other factors, changes in economic, social, political and market conditions, including related to inflation or international conflicts, the success of business and operating initiatives, changes in the regulatory environment and other government actions, including environmental approvals, fluctuations in gold prices and exchange rates, the outcome of pending or future litigation proceedings, any supply chain disruptions, any public health crises, pandemics or epidemics (including the COVID-19 pandemic), the failure to maintain effective internal control over financial reporting or effective disclosure controls and procedures, the inability to remediate one or more material weaknesses, or the discovery of additional material weaknesses, in the Company's internal control over financial reporting, and other business and operational risks and challenges and other factors, including mining accidents. For a discussion of such risk factors, refer to AngloGold Ashanti’s annual report on Form 20-F for the financial year ended 31 December 2024 filed with the United States Securities and Exchange Commission (“SEC”). These factors are not necessarily all of the important factors that could cause AngloGold Ashanti’s actual results, performance, actions or achievements to differ materially from those expressed in any forward-looking statements. Other unknown or unpredictable factors could also have material adverse effects on AngloGold Ashanti’s future results, performance, actions or achievements. Consequently, readers are cautioned not to place undue reliance on forward-looking statements. AngloGold Ashanti undertakes no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except to the extent required by applicable law. All subsequent written or oral forward-looking statements attributable to AngloGold Ashanti or any person acting on its behalf are qualified by the cautionary statements herein. The information included in this presentation has not been reviewed or reported on by AngloGold Ashanti’s external auditors. Non-GAAP financial measures This communication may contain certain “Non-GAAP” financial measures, including, for example, “total cash costs”, “total cash costs per ounce”, “all-in sustaining costs”, “all-in sustaining costs per ounce”, “average gold price received per ounce”, “sustaining capital expenditure”, “non-sustaining capital expenditure”, “Adjusted EBITDA”, “Adjusted net debt” and “free cash flow”. AngloGold Ashanti utilises certain Non-GAAP performance measures and ratios in managing its business. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the reported operating results or cash flow from operations or any other measures of performance prepared in accordance with IFRS. In addition, the presentation of these measures may not be comparable to similarly titled measures other companies may use. Reconciliations from IFRS to Non-GAAP financial measures can be found in the appendices to this presentation or in AngloGold Ashanti’s Earnings Release for the three months ended 31 March 2025, which is available on its website. Website: w w w . a n g l o g o l d a s h a n t i . c o m

MINERAL RESOURCE & MINERAL RESERVE INFORMATION│ANGLOGOLD ASHANTI T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 3 The Mineral Resource and Mineral Reserve stated herein were prepared in compliance with Subpart 1300 of Regulation S-K (17 CFR § 229.1300) (“Regulation S-K 1300”). Refer to Item 1300 (Definitions) of Regulation S-K for the meaning of the terms used in AngloGold Ashanti’s Mineral Resource and Mineral Reserve reporting. The Mineral Resource and Mineral Reserve represent the amount of gold, copper, silver, sulphur and molybdenum estimated at 31 December 2024 and are based on information available at the time of estimation. Such estimates are, or will be, to a large extent, based on the prices of the respective commodities and interpretations of geologic data obtained from drill holes and other exploration techniques, which data may not necessarily be indicative of future results. The Mineral Resource and Mineral Reserve estimates are published at 31 December 2024, taking into account economic assumptions, changes to future production and capital costs, depletion, additions as well as any acquisitions or disposals during 2024. The legal tenure of each material property has been verified to the satisfaction of the accountable Qualified Person and all of the Mineral Reserve has been confirmed to be covered by the required mining permits or there exists a realistic expectation, based on applicable laws and regulations, that issuance of permits or resolution of legal issues necessary for mining and processing at a particular deposit will be accomplished in the ordinary course and in a timeframe consistent with AngloGold Ashanti’s (or its joint venture partners’) current mine plans. For the Mineral Reserve, the term “economically viable” means that profitable extraction or production has been established or analytically demonstrated in, at a minimum, a pre-feasibility study, to be economically viable under reasonable investment and market assumptions. Mineral Reserve is subdivided and reported, in order of increasing geoscientific knowledge and confidence, into Probable and Proven Mineral Reserve categories. Mineral Reserve is aggregated from the Probable and Proven Mineral Reserve categories. Ounces of gold or silver or pounds of copper or sulphur included in the Probable and Proven Mineral Reserve are estimated and reported as delivered to plant (i.e., the point where material is delivered to the processing facility) and exclude losses during metallurgical treatment. In compliance with Regulation S-K 1300, the Mineral Resource herein is reported as exclusive of the Mineral Reserve before dilution and other factors are applied, unless otherwise stated. Mineral Resource is subdivided and reported, in order of increasing geoscientific knowledge and confidence, into Inferred, Indicated and Measured Mineral Resource categories. Ounces of gold or silver or pounds of copper, sulphur or molybdenum included in the Inferred, Indicated and Measured Mineral Resource are those contained in situ prior to losses during metallurgical treatment. While it would be reasonable to expect that the majority of Inferred Mineral Resource would upgrade to Indicated Mineral Resource with continued exploration, due to the uncertainty of Inferred Mineral Resource, it should not be assumed that such upgrading will always occur. If estimations are required to be revised using significantly lower commodity prices, increases in operating costs, reductions in metallurgical recovery or other modifying factors, this could result in the Mineral Resource or Mineral Reserve not being mined or processed profitably, material write-downs of AngloGold Ashanti’s investment in mining properties, goodwill and increased amortisation, reclamation and closure charges. If AngloGold Ashanti determines that certain of its Mineral Resource or Mineral Reserve have become uneconomic, this may ultimately lead to a reduction in its aggregate reported Mineral Resource or Mineral Reserve, respectively. Consequently, if AngloGold Ashanti’s actual Mineral Resource and Mineral Reserve is less than current estimates, its business, prospects, results of operations and financial position may be materially impaired. The pre-feasibility and feasibility studies for undeveloped ore bodies derive estimates of capital expenditure and operating costs based upon anticipated tonnage and grades of ore to be mined and processed, the predicted configuration of the ore body, expected recovery rates of metals from the ore, the costs of comparable facilities, the costs of operating and processing equipment and other factors. Actual operating and capital expenditure cost and economic returns on projects may differ significantly from original estimates. Further, it may take many years from the initial phases of exploration until commencement of production, during which time, the economic feasibility of production may change. The Mineral Resource is subject to further exploration and development, and is subject to additional risks, and no assurance can be given that they will eventually convert to future Mineral Reserve. For additional information, refer to Table 1 (Summary Mineral Resource) and Table 2 (Summary Mineral Reserve) to Paragraph (b) of Item 1303 (Summary disclosure) of Regulation S-K, which can be found on pages 14 to 19 of AngloGold Ashanti’s Mineral Resource and Mineral Reserve Report for the year ended 31 December 2024. These summary tables are also presented in AngloGold Ashanti’s annual report on Form 20-F for the financial year ended 31 December 2024 filed with the United States Securities and Exchange Commission (“SEC”). These summary tables include each class of Mineral Resource (Inferred, Indicated and Measured) together with total Measured and Indicated Mineral Resource, and each class of Mineral Reserve (Probable and Proven) together with total Mineral Reserve. The Mineral Resource at the end of the financial year ended 31 December 2024 was estimated using a gold price of $1,900/oz (2023: $1,750/oz), a copper price of $3.50/lb (2023: $3.50/lb), a silver price of $23.00/oz (2023: $21.64/oz) and a molybdenum price of $12.00/lb (2023: $12.00/lb), unless otherwise stated. The Mineral Reserve at the end of the financial year ended 31 December 2024 was estimated using a gold price of $1,600/oz (2023: $1,400/oz), a copper price of $2.90/lb (2023: $2.90/lb) and a silver price of $19.50/oz (2023: $19.58/oz), unless otherwise stated. The scientific and technical information in respect of AngloGold Ashanti’s Mineral Resource and Mineral Reserve for the financial year ended 31 December 2024, contained in this document has been reviewed and approved for release by Mrs. TM Flitton, Chairperson of AngloGold Ashanti’s Mineral Resource and Mineral Reserve Leadership Team, Vice President Resource and Reserve, Master of Engineering (Mining), Bachelor of Science (Honours, Geology), SME RM, Pr.Sci.Nat (SACNASP), FGSSA. Mrs. TM Flitton assumes responsibility for the Mineral Resource and Mineral Reserve processes for AngloGold Ashanti. Mrs. TM Flitton has 23 years’ experience in mining with 12 years directly leading and managing Mineral Resource and Mineral Reserve reporting. She is employed full-time by AngloGold Ashanti and can be contacted at the following address: 6363 S. Fiddlers Green Circle, Suite 1000, Greenwood Village, CO 80111, United States. Mrs. TM Flitton consents to the inclusion of the Mineral Resource and Mineral Reserve information in this document, in the form and context in which it appears in the narrative disclosure.

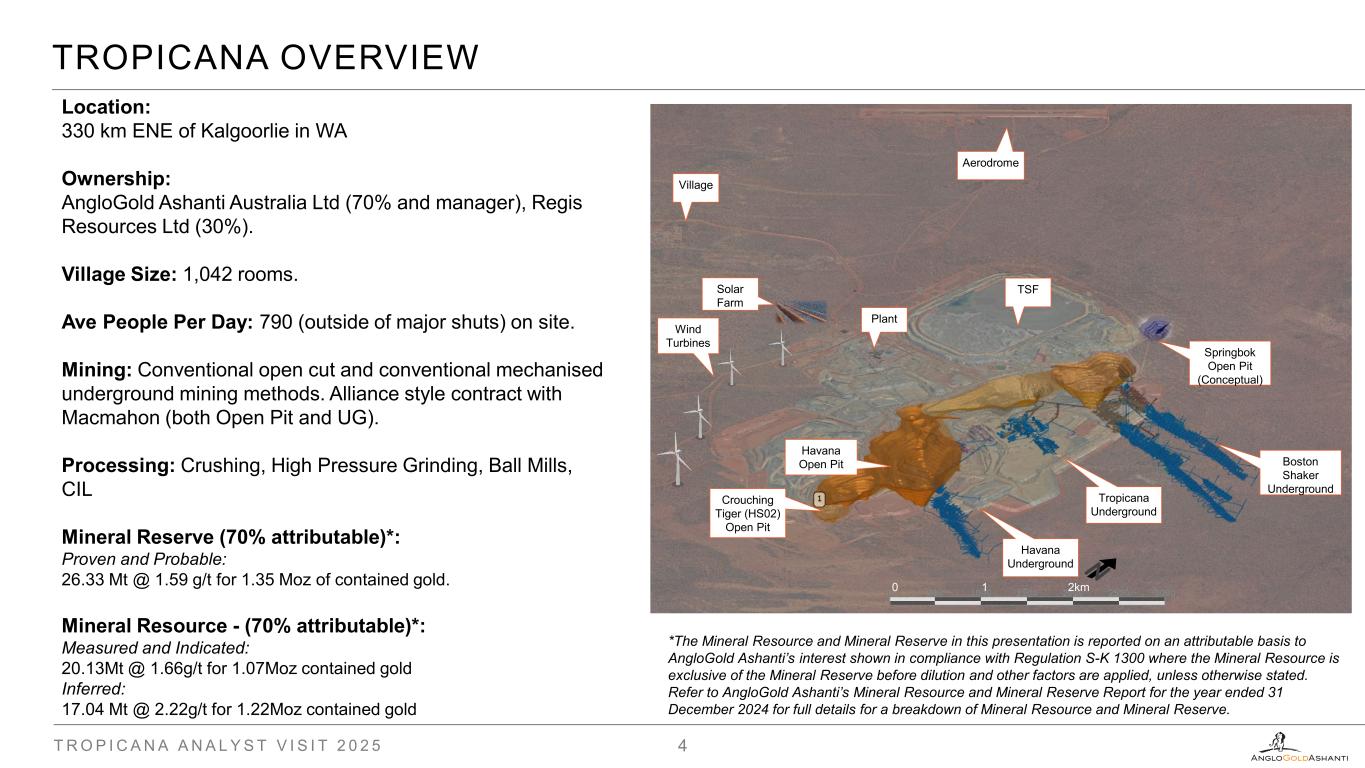

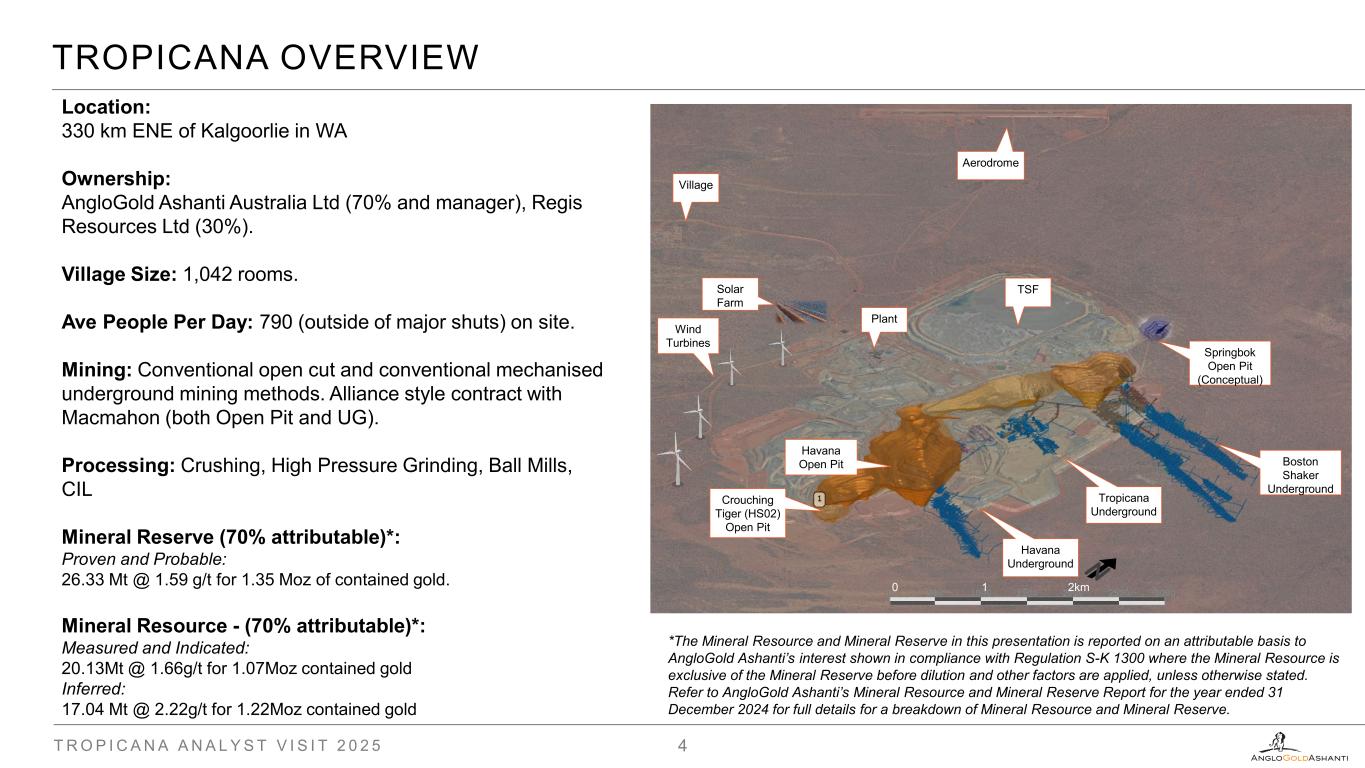

0 1 2km Boston Shaker Underground Tropicana Underground Havana Open Pit Village Aerodrome Plant TSF Havana Underground Wind Turbines Solar Farm Springbok Open Pit (Conceptual) Crouching Tiger (HS02) Open Pit TROPICANA OVERVIEW T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 4 Location: 330 km ENE of Kalgoorlie in WA Ownership: AngloGold Ashanti Australia Ltd (70% and manager), Regis Resources Ltd (30%). Village Size: 1,042 rooms. Ave People Per Day: 790 (outside of major shuts) on site. Mining: Conventional open cut and conventional mechanised underground mining methods. Alliance style contract with Macmahon (both Open Pit and UG). Processing: Crushing, High Pressure Grinding, Ball Mills, CIL Mineral Reserve (70% attributable)*: Proven and Probable: 26.33 Mt @ 1.59 g/t for 1.35 Moz of contained gold. Mineral Resource - (70% attributable)*: Measured and Indicated: 20.13Mt @ 1.66g/t for 1.07Moz contained gold Inferred: 17.04 Mt @ 2.22g/t for 1.22Moz contained gold *The Mineral Resource and Mineral Reserve in this presentation is reported on an attributable basis to AngloGold Ashanti’s interest shown in compliance with Regulation S-K 1300 where the Mineral Resource is exclusive of the Mineral Reserve before dilution and other factors are applied, unless otherwise stated. Refer to AngloGold Ashanti’s Mineral Resource and Mineral Reserve Report for the year ended 31 December 2024 for full details for a breakdown of Mineral Resource and Mineral Reserve.

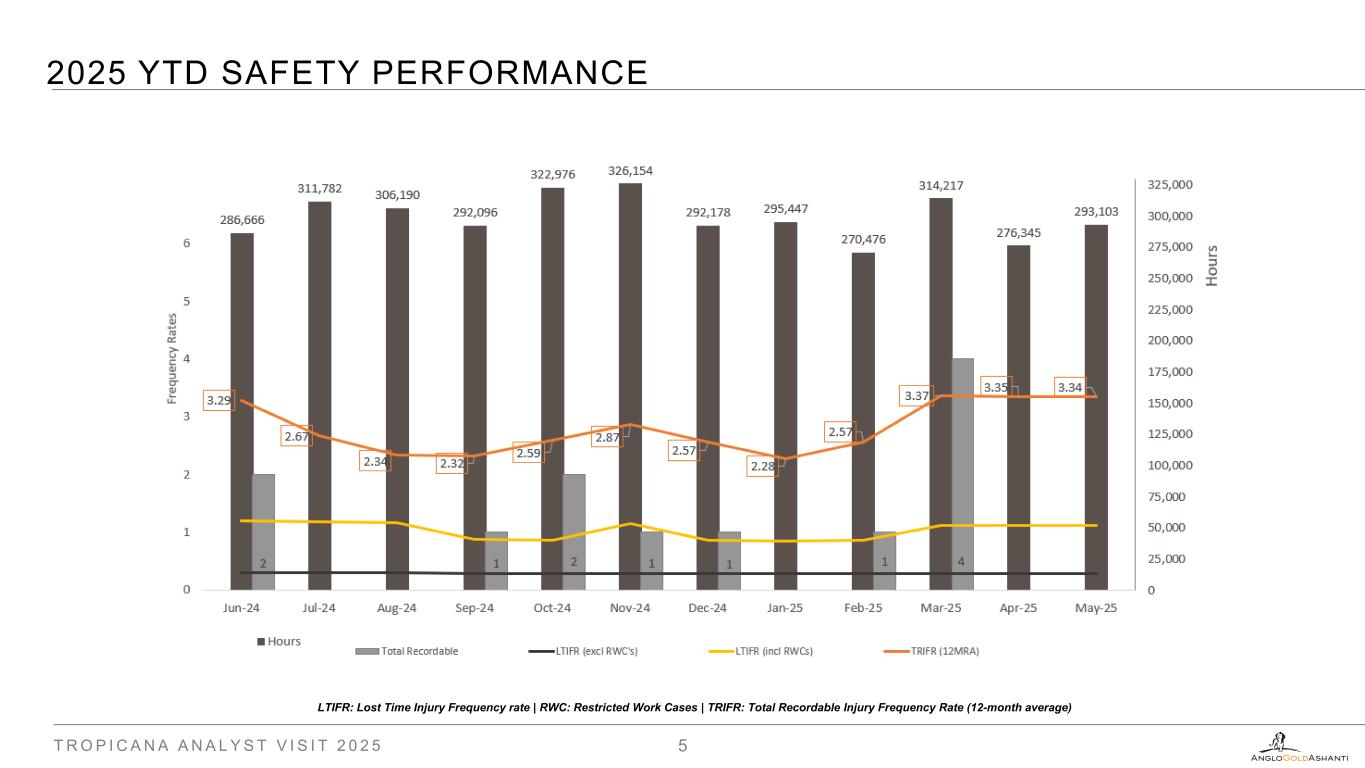

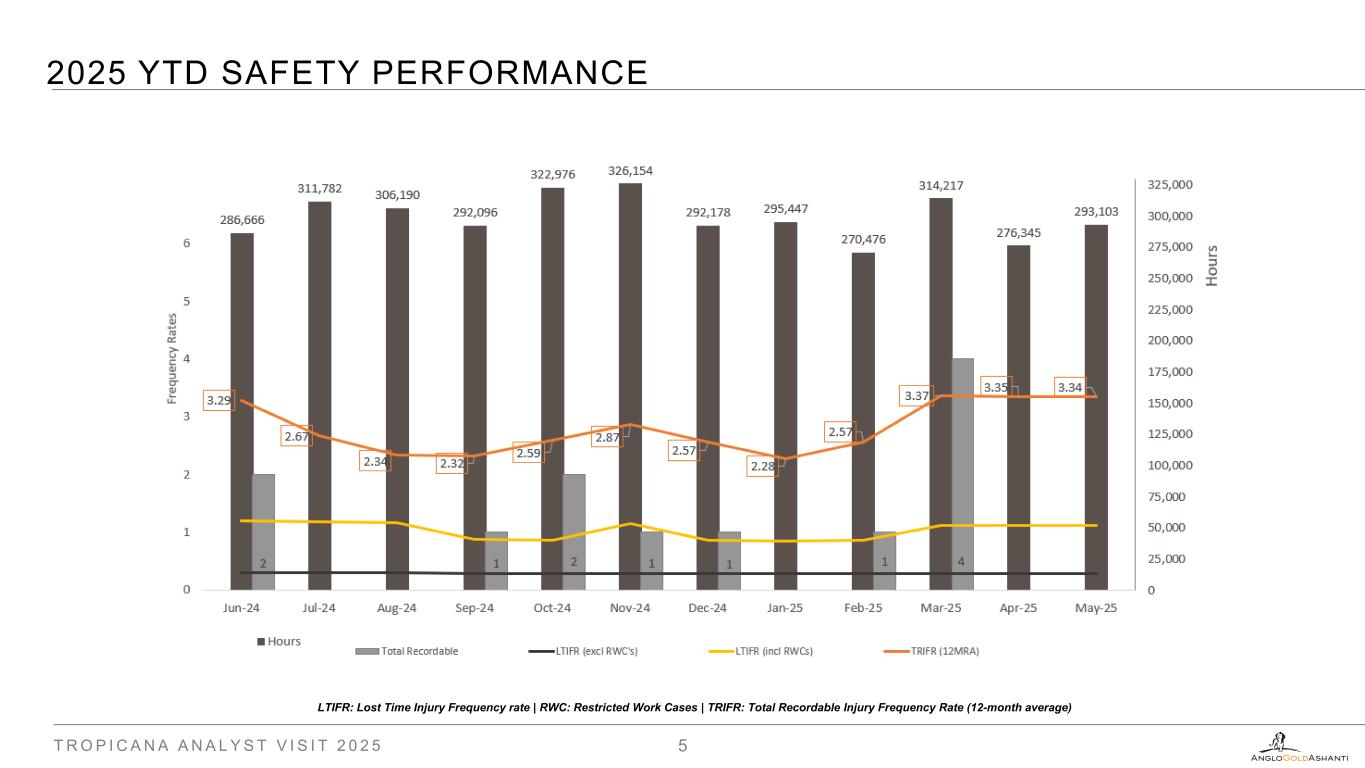

T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 5 2025 YTD SAFETY PERFORMANCE LTIFR: Lost Time Injury Frequency rate | RWC: Restricted Work Cases | TRIFR: Total Recordable Injury Frequency Rate (12-month average)

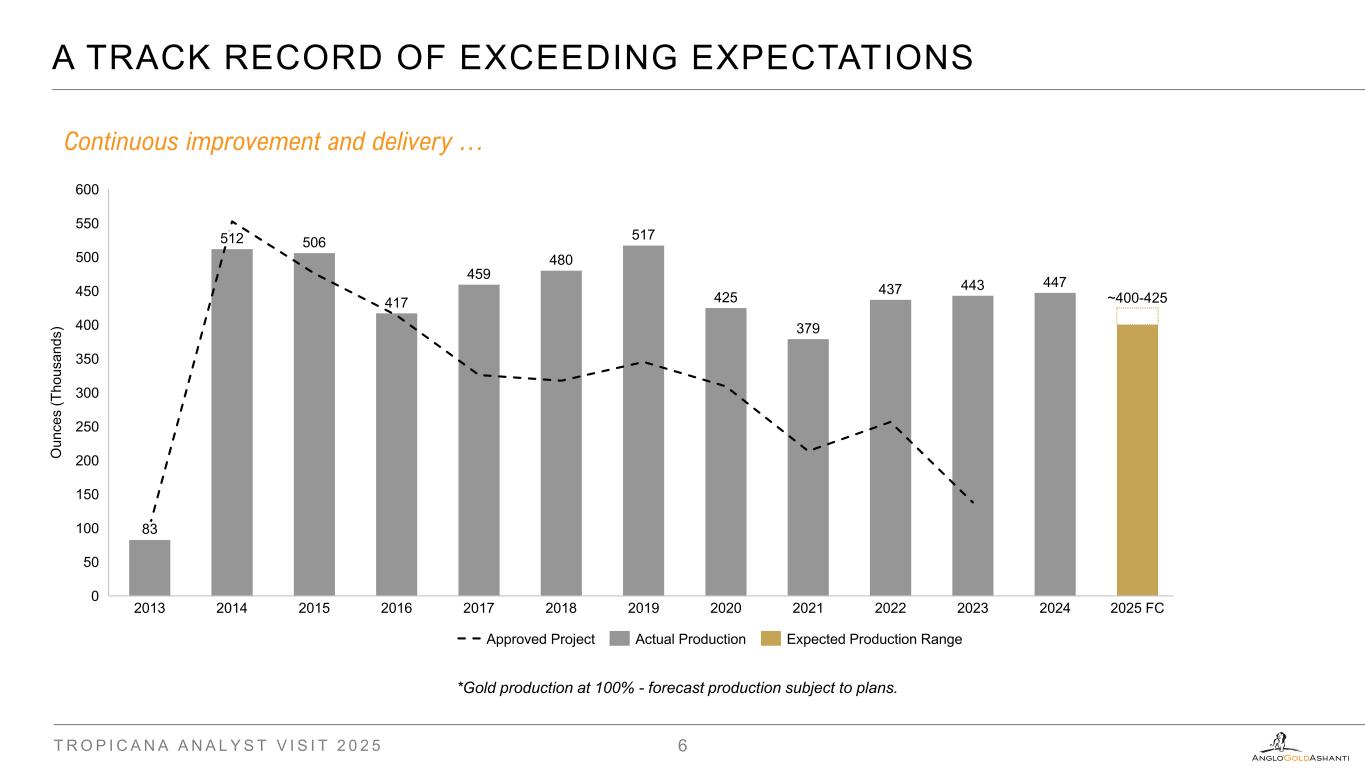

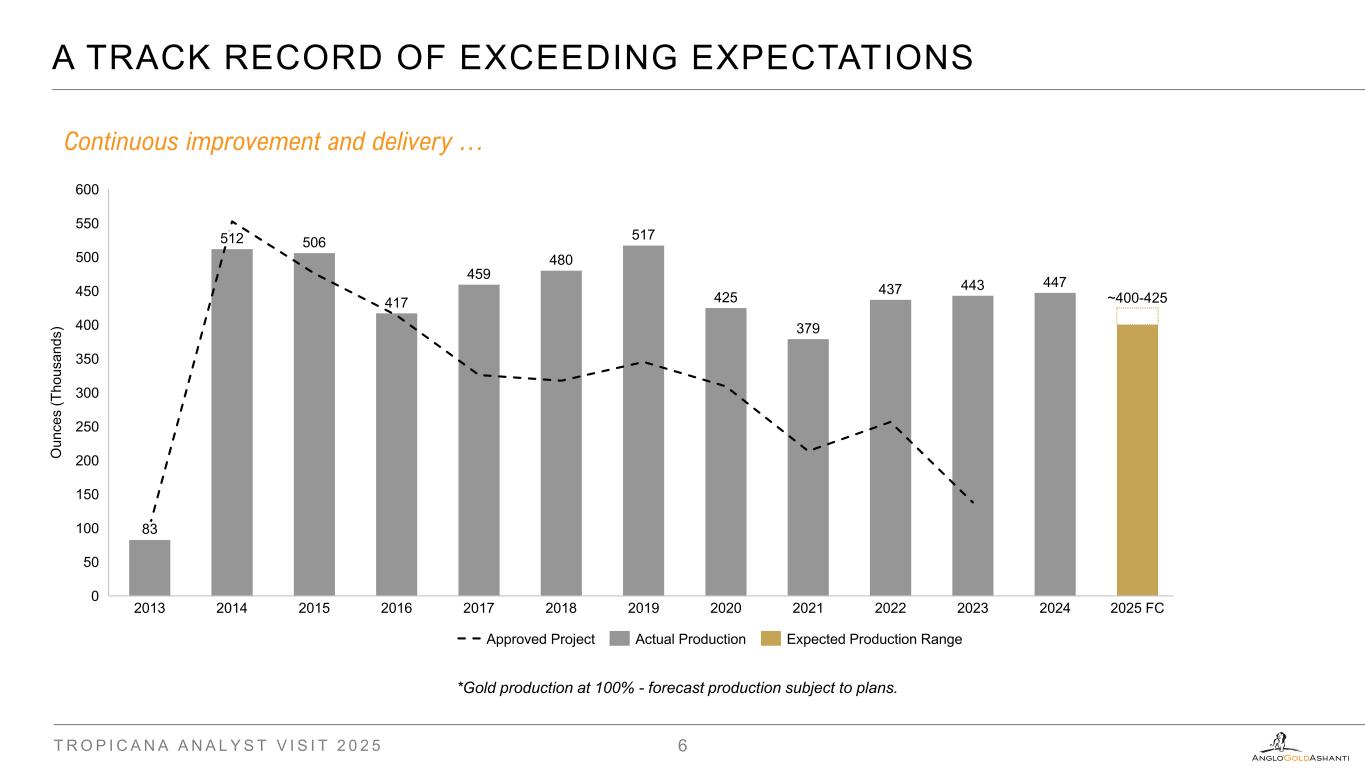

A TRACK RECORD OF EXCEEDING EXPECTATIONS T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 6 Continuous improvement and delivery … *Gold production at 100% - forecast production subject to plans. 506 417 459 480 517 425 379 437 443 447 ~400-425 ~400-425 0 50 100 150 200 250 300 350 400 450 500 550 600 O un ce s (T ho us an ds ) 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 FC 83 512 2026 FC Approved Project Actual Production Expected Production Range

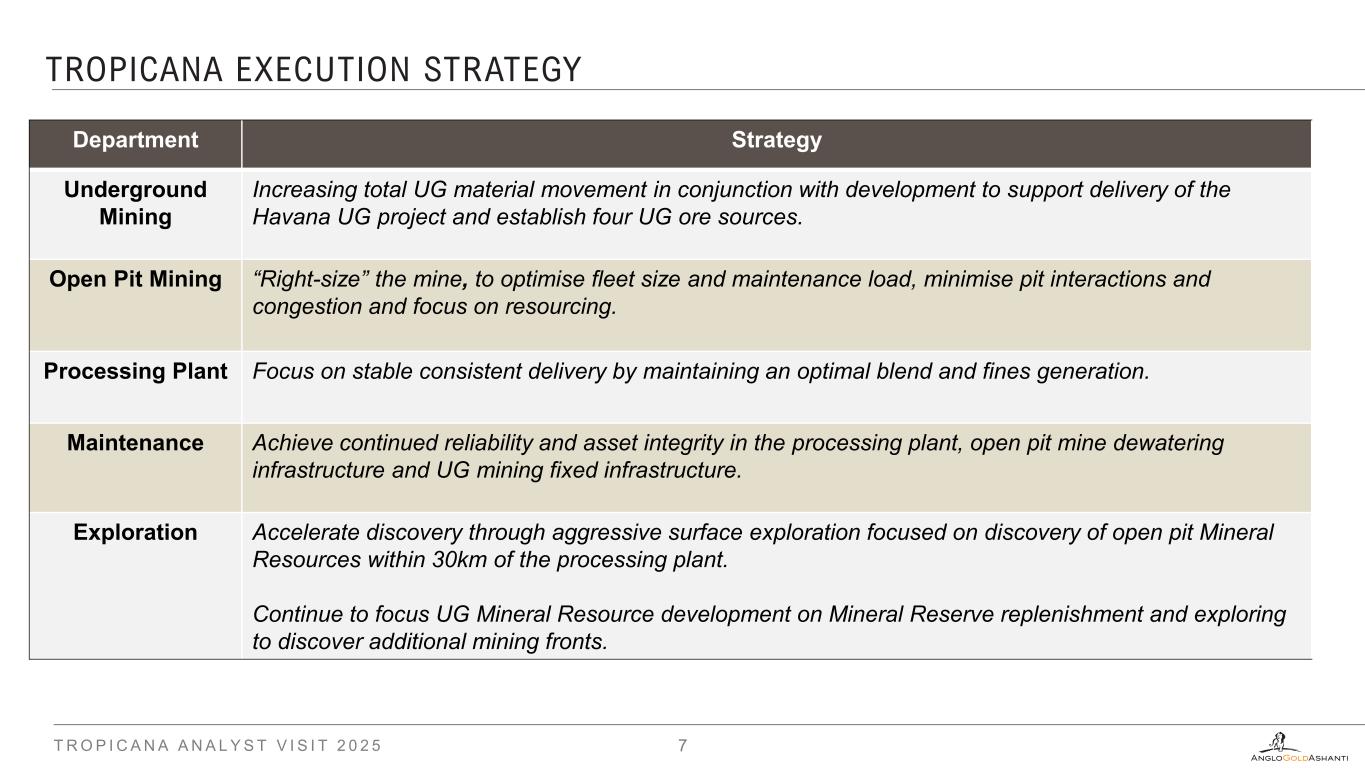

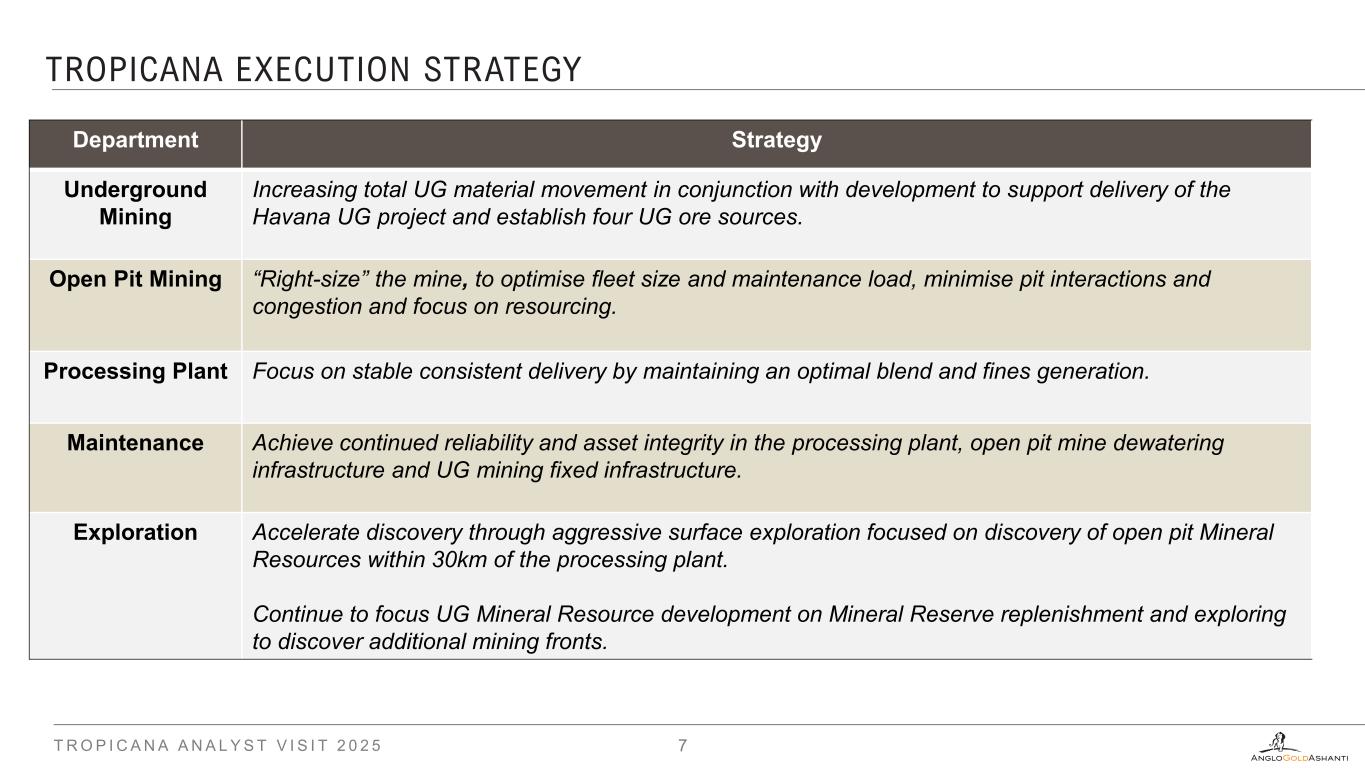

T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 7 Department Strategy Underground Mining Increasing total UG material movement in conjunction with development to support delivery of the Havana UG project and establish four UG ore sources. Open Pit Mining “Right-size” the mine, to optimise fleet size and maintenance load, minimise pit interactions and congestion and focus on resourcing. Processing Plant Focus on stable consistent delivery by maintaining an optimal blend and fines generation. Maintenance Achieve continued reliability and asset integrity in the processing plant, open pit mine dewatering infrastructure and UG mining fixed infrastructure. Exploration Accelerate discovery through aggressive surface exploration focused on discovery of open pit Mineral Resources within 30km of the processing plant. Continue to focus UG Mineral Resource development on Mineral Reserve replenishment and exploring to discover additional mining fronts. TROPICANA EXECUTION STRATEGY

Full Asset Potential

FULL ASSET POTENTIAL PROCESS T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 9 Weeks 1-4 Weeks 4-8 Weeks 9-12 Weeks 12-13 Beyond Identify Diagnose (Validate & prioritise) Design Identify solutions Plan & mobilise Deliver Deliver Wave 1 initiatives Establish repeatable model Facilitate PMO Finalise and select detailed design Develop PMO/workbooks Finalise workbooks/action plan Solution prioritization Action plans/ workbooks Mobilise – Launch no-regret or quick win actions Solution generation Opportunity prioritization “bubble chart” Opportunity deep dives & root cause analysis Build fact base Benchmark Valuation fundamentalsBuild opportunity long list Data request & collection follow up Site interviews Working team mobilization

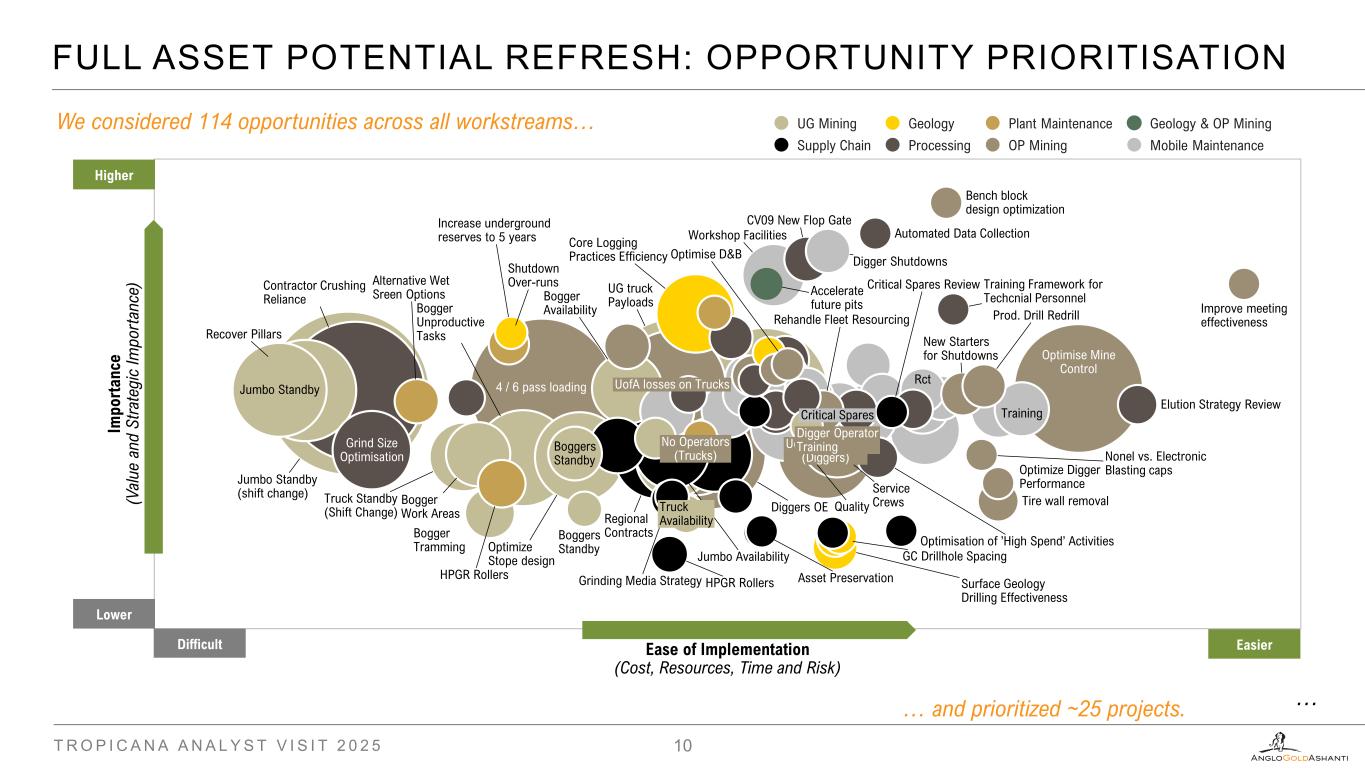

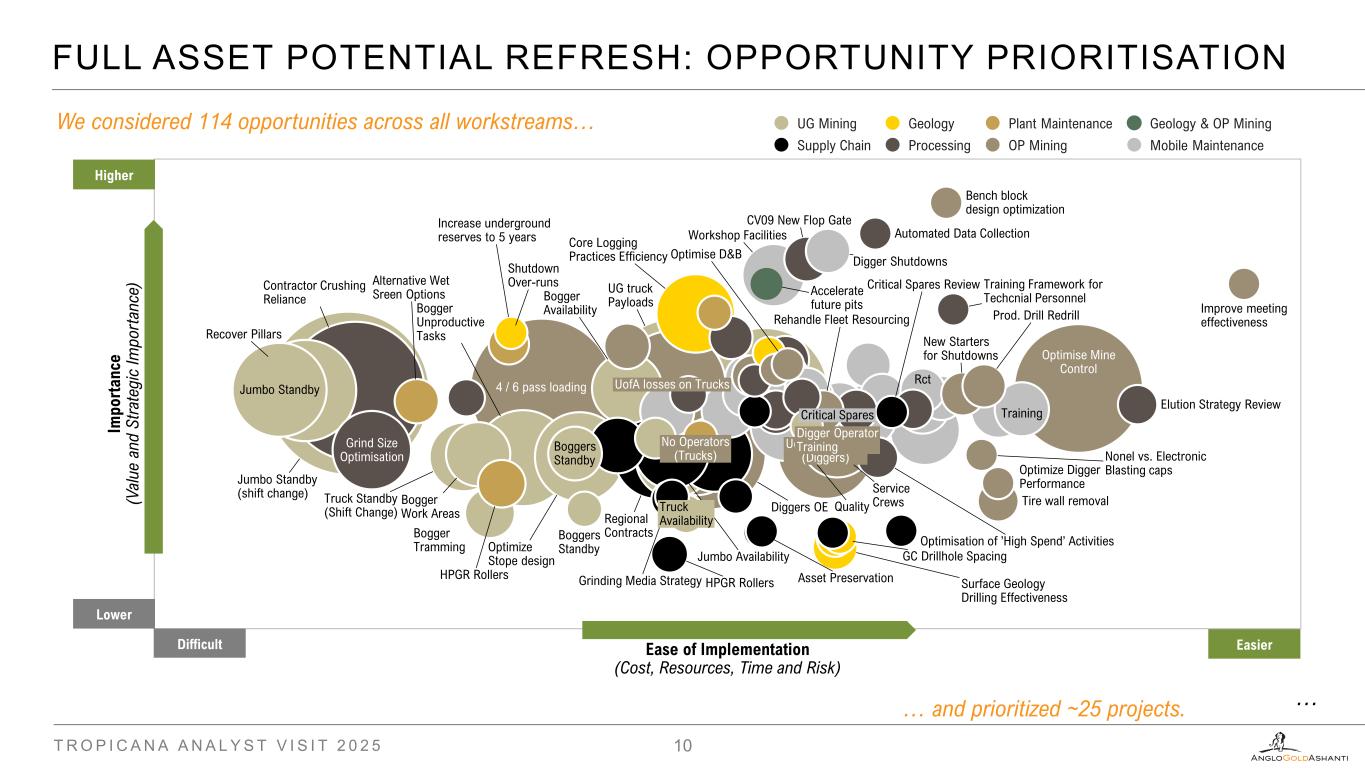

FULL ASSET POTENTIAL REFRESH: OPPORTUNITY PRIORITISATION T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 10 We considered 114 opportunities across all workstreams… HPGR Rollers Regional Contracts Grinding Media Strategy Critical Spares Review Asset Preservation GC Drillhole Spacing Increase underground reserves to 5 years Surface Geology Drilling Effectiveness Core Logging Practices Efficiency Contractor Crushing Reliance Grind Size Optimisation Elution Strategy Review Automated Data Collection Optimisation of ’High Spend’ Activities Im po rt an ce (V al ue a nd S tr at eg ic Im po rt an ce ) CV09 New Flop Gate Truck Availability Training Framework for Techcnial Personnel Truck Standby (Shift Change) Shutdown Over-runs UG truck Payloads Alternative Wet Sreen Options Boggers Standby HPGR Rollers Bogger Availability No Operators (Trucks) Rehandle Fleet Resourcing Boggers Standby New Starters for Shutdowns Bogger Tramming Optimise Mine Control UofA / Standby (Diggers) Diggers OE Ease of Implementation (Cost, Resources, Time and Risk) Bogger Unproductive Tasks Optimize Stope design 4 / 6 pass loading Digger Operator Training Prod. Drill Redrill Jumbo Standby Nonel vs. Electronic Blasting caps Jumbo Availability Optimize Digger Performance UofA losses on Trucks Tire wall removal Improve meeting effectiveness Optimise D&B Accelerate future pits Jumbo Standby (shift change) Digger Shutdowns Service Crews Workshop Facilities Bogger Work Areas TrainingCritical Spares Quality Recover Pillars Rct Bench block design optimization UG Mining Supply Chain Geology Processing Plant Maintenance OP Mining Geology & OP Mining Mobile Maintenance Lower Higher EasierDifficult …… and prioritized ~25 projects.

Processing Plant

PROCESSING OVERVIEW T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 12 2025 Anticipated Performance Throughput: 9.3 - 9.5 Mt Head grade: 1.51 - 1.56 g/t Plant availability: 96% Metallurgical recovery: 89% - 90% Residence time: +24 hrs

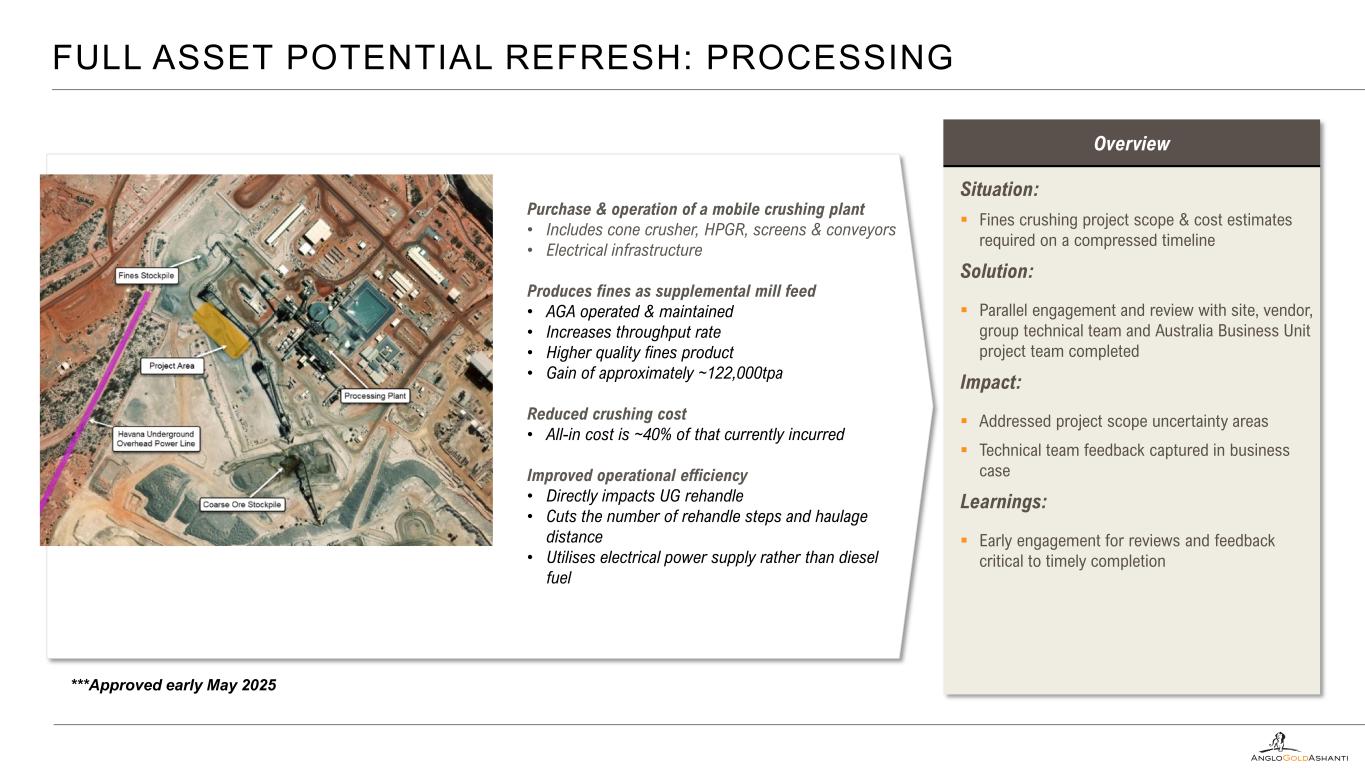

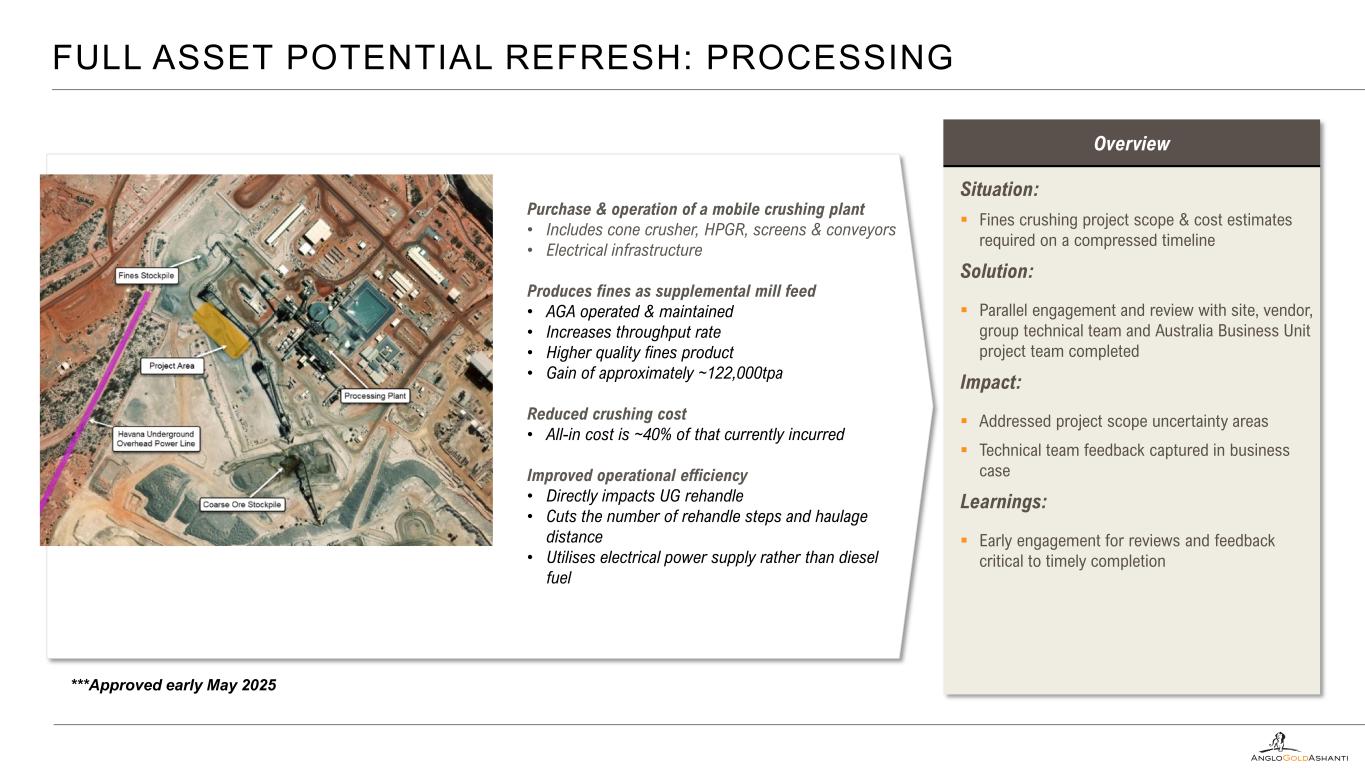

FULL ASSET POTENTIAL REFRESH: PROCESSING ***Approved early May 2025 Overview Situation: Fines crushing project scope & cost estimates required on a compressed timeline Solution: Parallel engagement and review with site, vendor, group technical team and Australia Business Unit project team completed Impact: Addressed project scope uncertainty areas Technical team feedback captured in business case Learnings: Early engagement for reviews and feedback critical to timely completion Purchase & operation of a mobile crushing plant • Includes cone crusher, HPGR, screens & conveyors • Electrical infrastructure Produces fines as supplemental mill feed • AGA operated & maintained • Increases throughput rate • Higher quality fines product • Gain of approximately ~122,000tpa Reduced crushing cost • All-in cost is ~40% of that currently incurred Improved operational efficiency • Directly impacts UG rehandle • Cuts the number of rehandle steps and haulage distance • Utilises electrical power supply rather than diesel fuel

Renewables

RENEWABLE POWER FACILITY T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 15

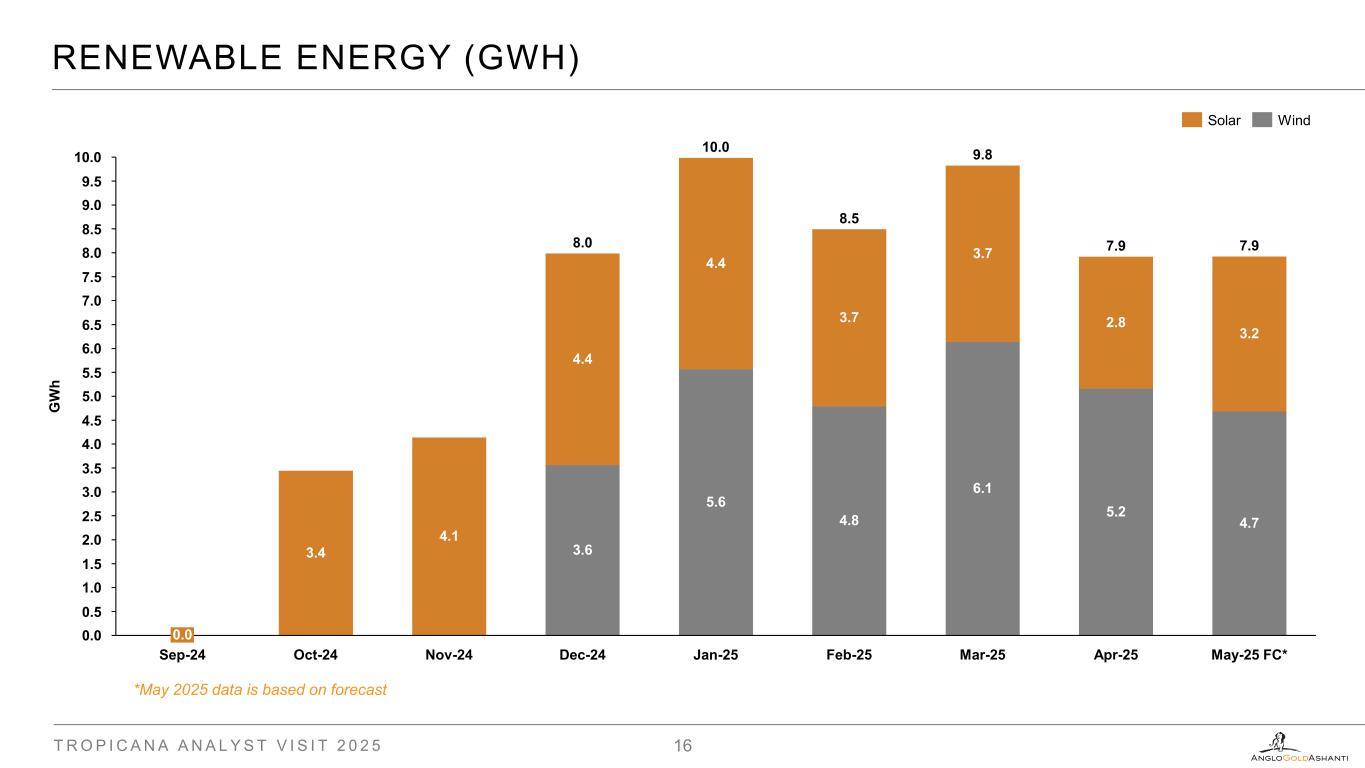

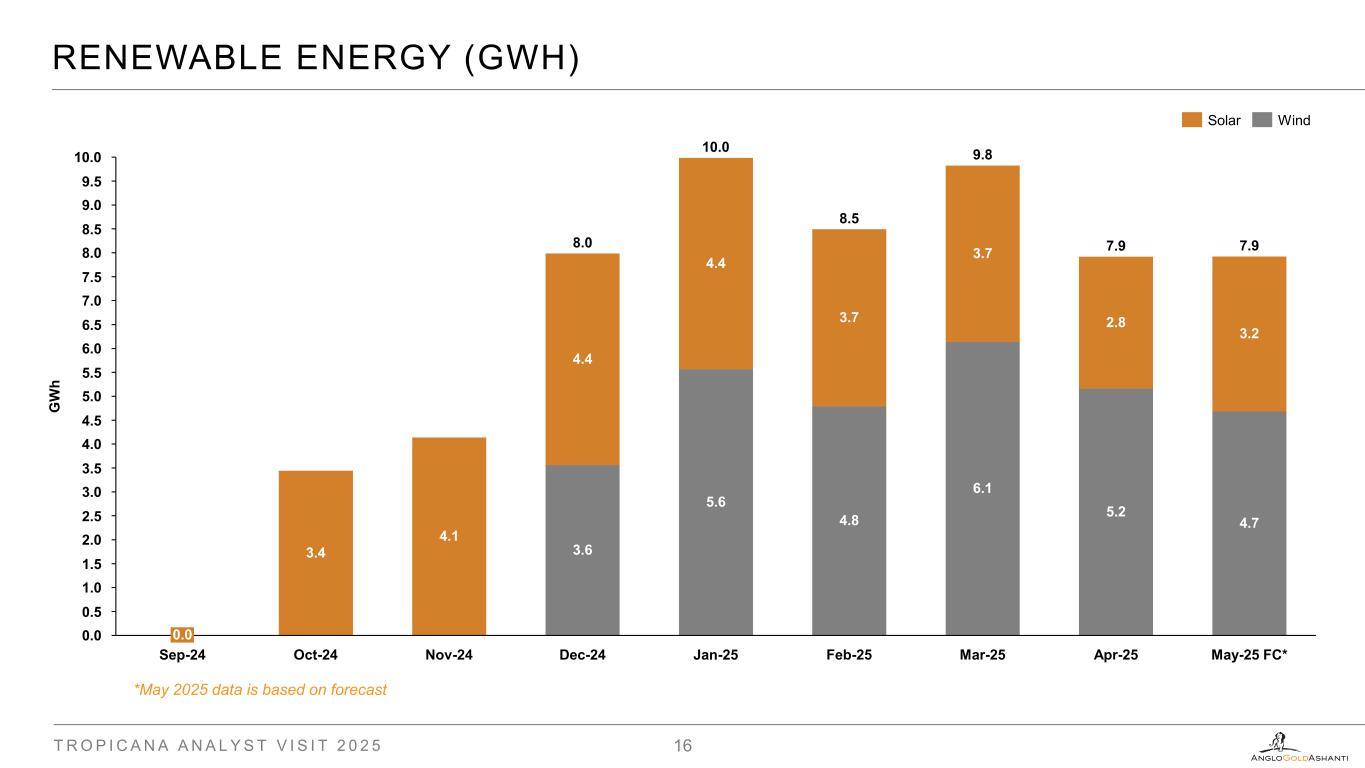

RENEWABLE ENERGY (GWH) T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 16 *May 2025 data is based on forecast 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 6.5 7.5 8.5 9.5 4.5 0.5 1.5 2.5 3.5 5.5 G W h 0.0 Sep-24 3.4 Oct-24 4.1 Nov-24 4.4 3.6 Dec-24 4.4 5.6 Jan-25 3.7 8.0 10.0 8.5 9.8 4.8 7.93.7 6.1 Mar-25 2.8 Feb-25 5.2 Apr-25 3.2 4.7 May-25 FC* 7.9 Solar Wind

Open Pit Mining

OPEN PIT MINING; OVERVIEW T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 18 • Conventional drill & blast, load and haul open pit mining • Most material mined is hard rock and requires drilling and blasting • Mining is carried out on blasting benches of up to 12m in height then mined in flitches (~4m in height) • Grade control is completed with a dedicated RC rig. • Ore is loaded by excavators in backhoe configuration and is hauled to the ROM pad in 226t trucks where it is fed to the crusher or stored on long-term stockpiles • Waste rock is hauled to nearby waste rock dumps alongside the pits or in-pit dumped • Haul roads are three times the width of a Caterpillar 793 truck to minimise congestion • Road conditions are good with fresh waste rock used as road base for sheeting haul roads HA06 HA04

OPEN PIT MINING FLEET T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 19 Drill rigs Haul trucks Excavators Other • 1 x Hitachi 5600 hydraulic excavator • 1 x Caterpillar 6060 hydraulic excavator • 2 x Caterpillar 6040 hydraulic excavators • 1 x Hitachi EX2500 & 1 x Hitachi EX1200 hydraulic excavator • 24 x Caterpillar 793F haul trucks – 226-t capacity • 4 x Caterpillar 785C & • 2 x Caterpillar 789C haulage trucks for re-handle material • 5 x Caterpillar MD6250 production drill rigs (229/241 mm) • 1X Ausdrill AC DML (229/241 mm) • 1X Sandvik DR410 (229 mm) • 4 x Sandvik DR560/580 drill rigs • 1 x Ausdrill Rock Commander • 2 x Caterpillar 992 front-end loaders • 1 x Caterpillar 993 front-end loader • 5 x Caterpillar D10T dozers • 1 x Caterpillar D11T dozer • 1 x Caterpillar 854K wheel dozer • 2 x Caterpillar M16/M18 graders • 3 x Komatsu HD785-7 Water Carts • Macmahon is the alliance mining contractor, providing operators and maintaining the mining equipment • There is a four-bay OP workshop to service and repair mine vehicles, along with a separate boilermaker’s workshop for major weld repairs. It is equipped with an overhead crane large enough to remove trays from the trucks • An on-site tyre repair facility significantly reduces tyre repair costs and time lost during transportation

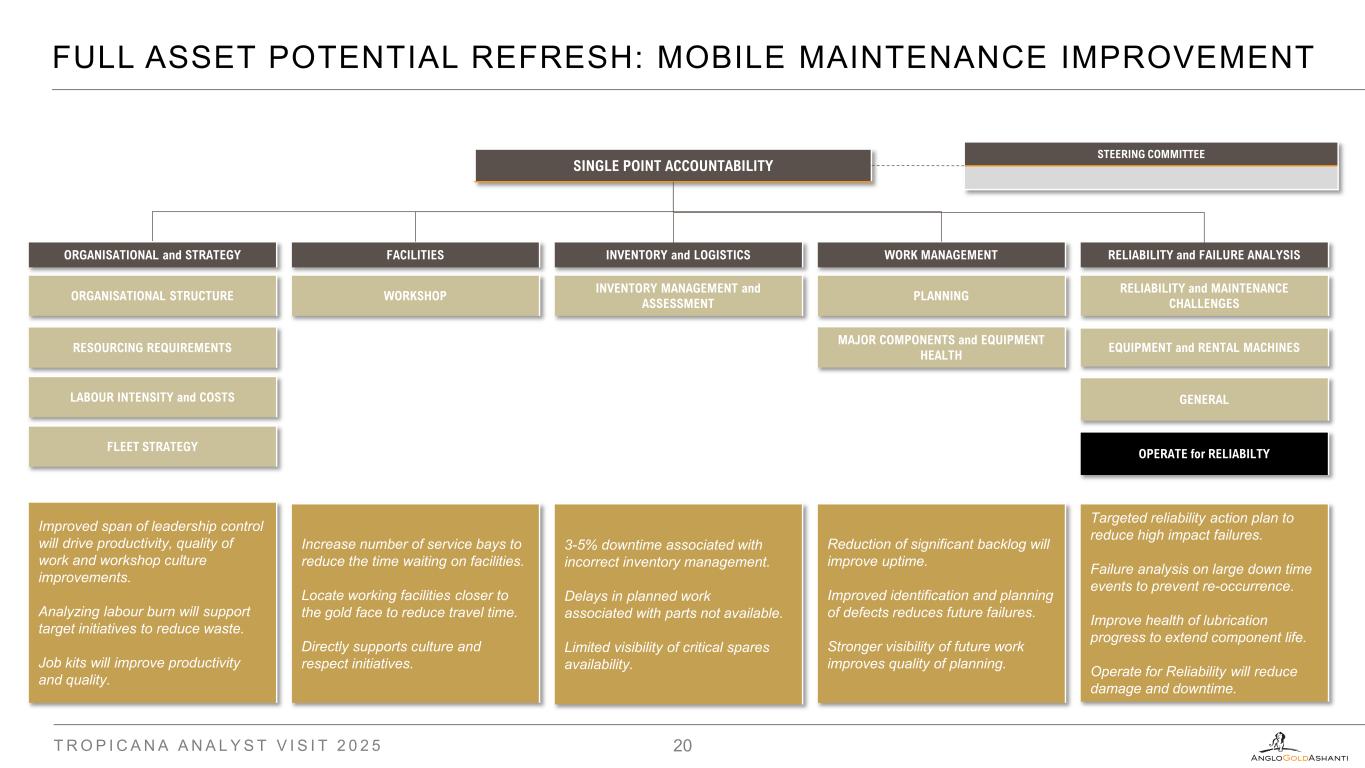

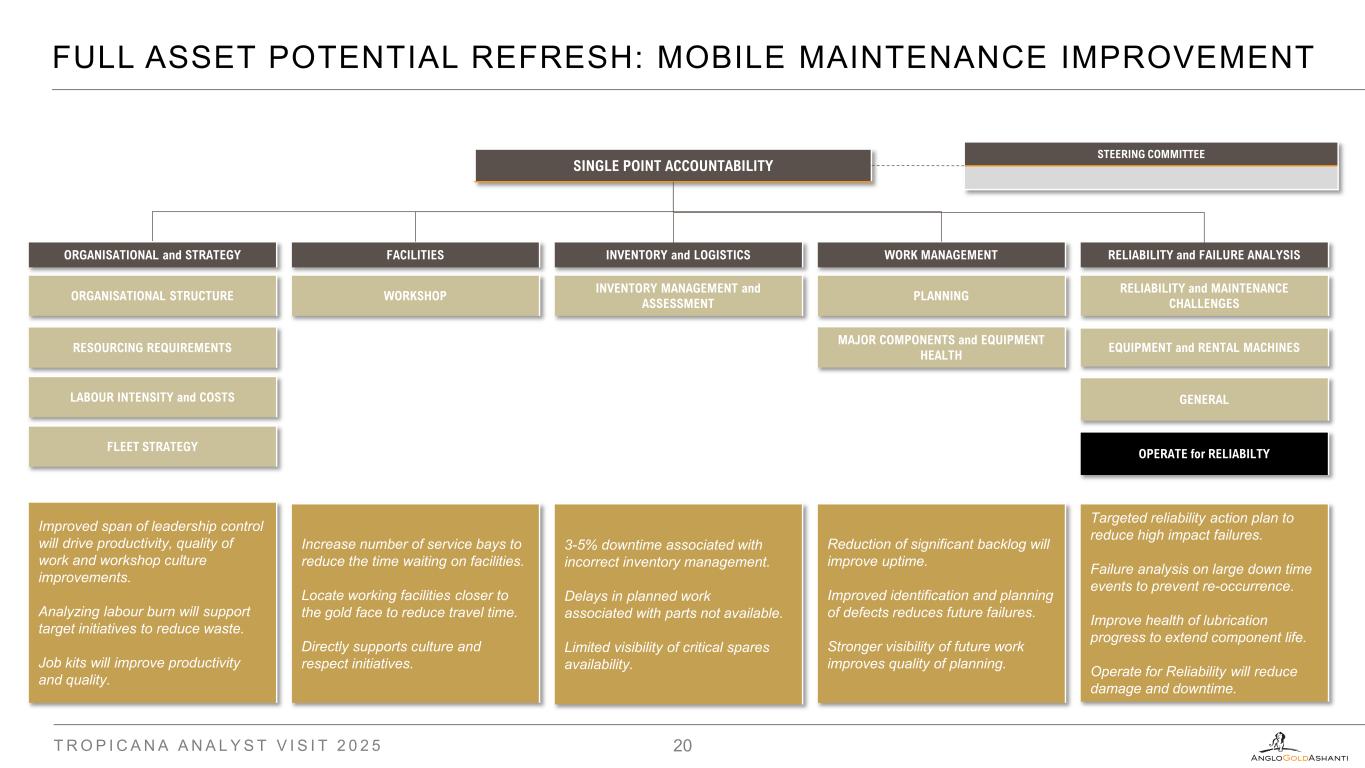

T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 20 FULL ASSET POTENTIAL REFRESH: MOBILE MAINTENANCE IMPROVEMENT ORGANISATIONAL STRUCTURE STEERING COMMITTEE SINGLE POINT ACCOUNTABILITY ORGANISATIONAL and STRATEGY RESOURCING REQUIREMENTS LABOUR INTENSITY and COSTS FLEET STRATEGY WORKSHOP FACILITIES INVENTORY MANAGEMENT and ASSESSMENT INVENTORY and LOGISTICS PLANNING WORK MANAGEMENT MAJOR COMPONENTS and EQUIPMENT HEALTH RELIABILITY and MAINTENANCE CHALLENGES RELIABILITY and FAILURE ANALYSIS EQUIPMENT and RENTAL MACHINES GENERAL Reduction of significant backlog will improve uptime. Improved identification and planning of defects reduces future failures. Stronger visibility of future work improves quality of planning. Improved span of leadership control will drive productivity, quality of work and workshop culture improvements. Analyzing labour burn will support target initiatives to reduce waste. Job kits will improve productivity and quality. 3-5% downtime associated with incorrect inventory management. Delays in planned work associated with parts not available. Limited visibility of critical spares availability. Targeted reliability action plan to reduce high impact failures. Failure analysis on large down time events to prevent re-occurrence. Improve health of lubrication progress to extend component life. Operate for Reliability will reduce damage and downtime. Increase number of service bays to reduce the time waiting on facilities. Locate working facilities closer to the gold face to reduce travel time. Directly supports culture and respect initiatives. OPERATE for RELIABILTY

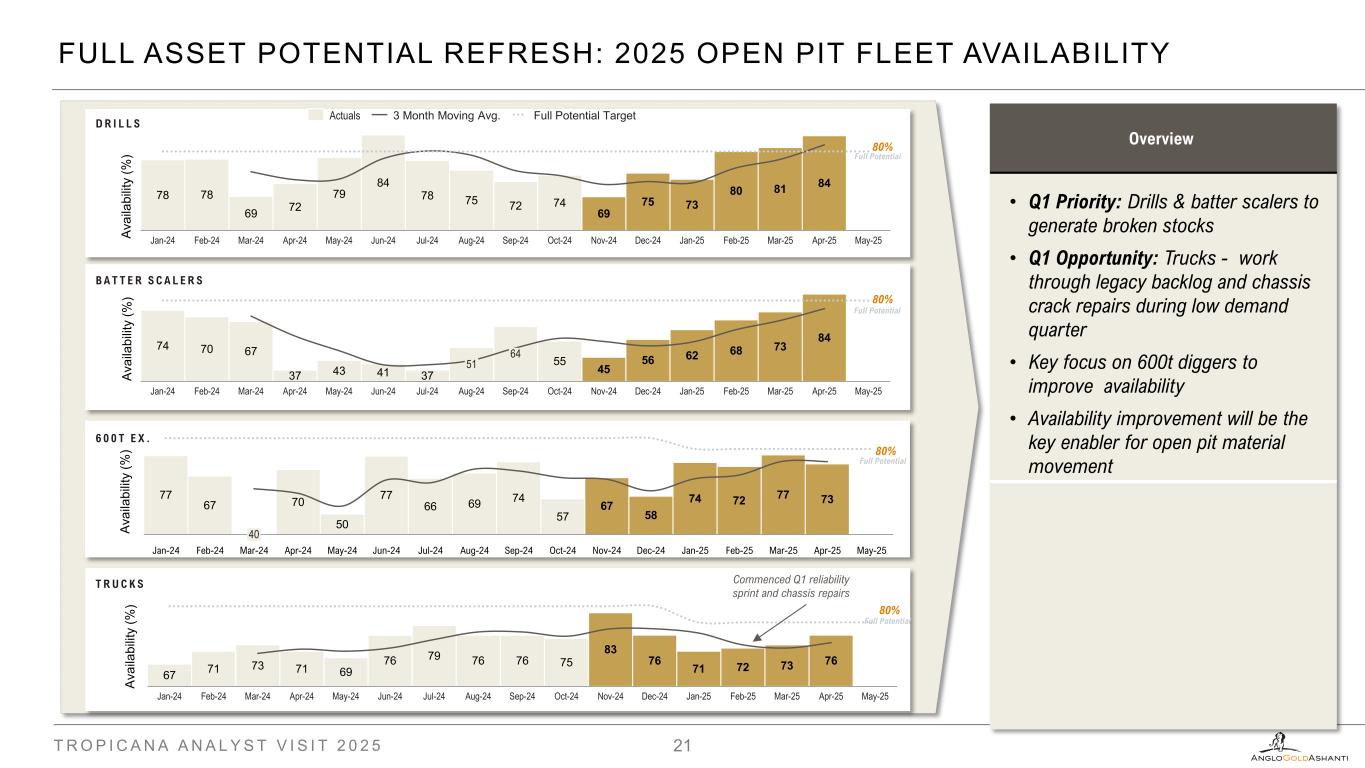

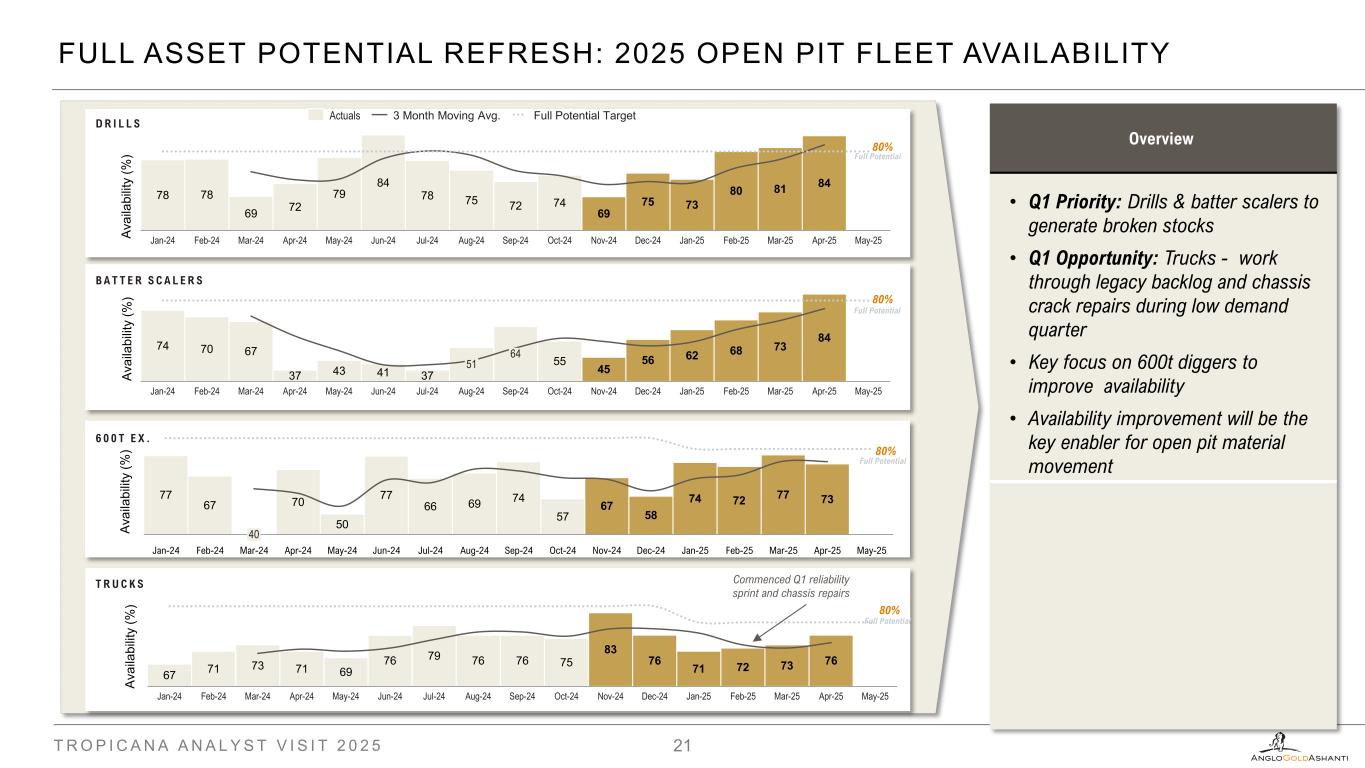

T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 21 Overview • Q1 Priority: Drills & batter scalers to generate broken stocks • Q1 Opportunity: Trucks - work through legacy backlog and chassis crack repairs during low demand quarter • Key focus on 600t diggers to improve availability • Availability improvement will be the key enabler for open pit material movement FULL ASSET POTENTIAL REFRESH: 2025 OPEN PIT FLEET AVAILABILITY 78 78 69 72 79 84 78 75 72 74 69 75 73 80 81 84 60 65 70 75 80 85 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 Jan-25 Feb-25 Mar-25 Apr-25 May-25 74 70 67 37 43 41 37 55 45 56 62 68 73 84 30 40 50 60 70 80 90 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 51 Aug-24 64 Sep-24 Oct-24 Nov-24 Dec-24 Jan-25 Feb-25 Mar-25 Apr-25 May-25 67 71 73 71 69 76 79 76 76 75 83 76 71 72 73 76 60 65 70 75 80 85 90 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 Jan-25 Feb-25 Mar-25 Apr-25 May-25 77 67 70 50 77 66 69 74 57 67 58 74 72 77 73 40 50 60 70 80 Jan-24 Feb-24 40 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 Jan-25 Feb-25 Mar-25 Apr-25 May-25 Actuals 3 Month Moving Avg. Full Potential Target 80% 80% 80% 80% Commenced Q1 reliability sprint and chassis repairs Full Potential Full Potential Full Potential Full Potential D R I L L S B A T T E R S C A L E R S T R U C K S 6 0 0 T E X . Av ai la bi lit y (% ) Av ai la bi lit y (% ) Av ai la bi lit y (% ) Av ai la bi lit y (% )

Underground Mining

UNDERGROUND MINING - OVERVIEW T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 23 • Development of the first underground mine began in May 2019 via a portal in the Tropicana pit to access Boston Shaker, which started production in Sep 2020. • In Sep 2022 the Tropicana underground mine commenced production. A second access portal was established in Jan 2023 in the Boston Shaker pit. • The Havana portal was established in Sep 2024, and development is underway to access the Havana mine. Mining from the first stope is scheduled by March 2027. Havana South Havana Tropicana Boston Shaker Boston Shaker UG Mine Tropicana UG Mine Havana Link Drive Havana UG

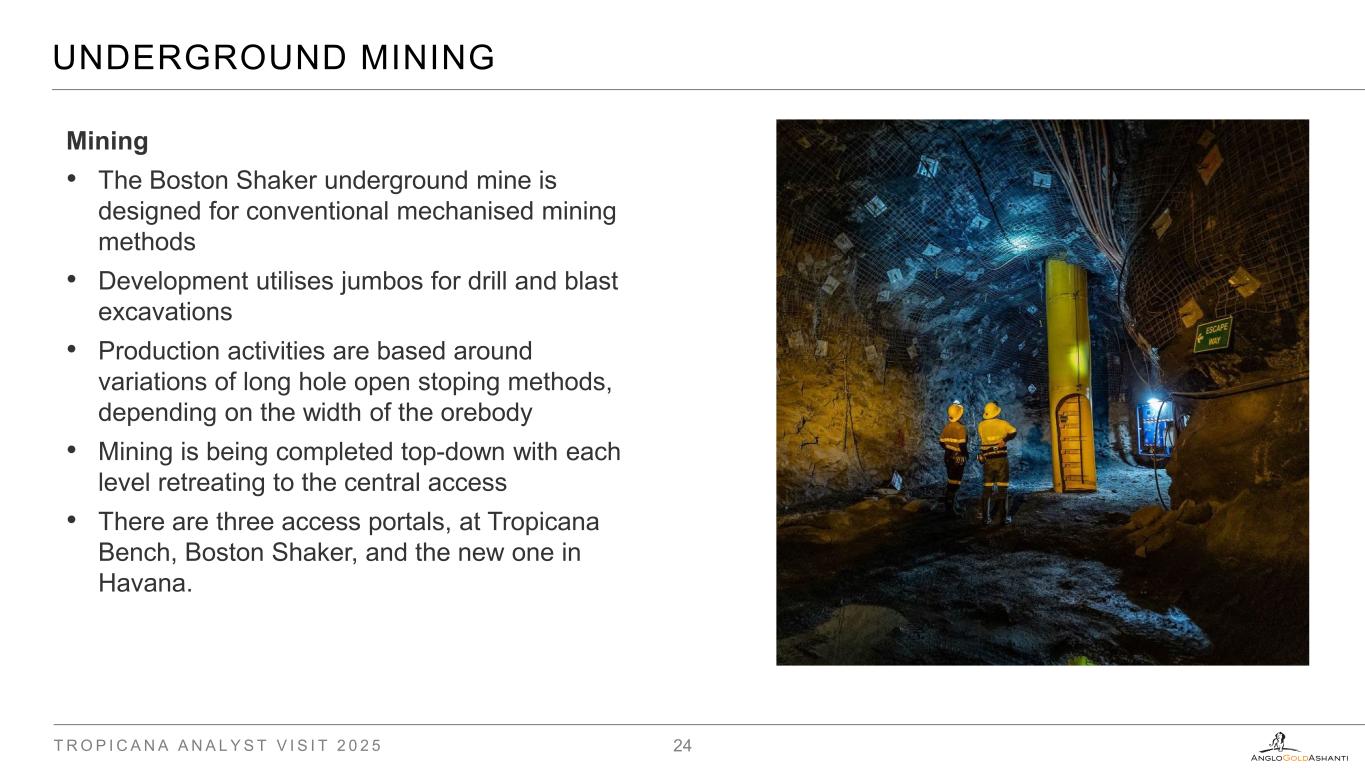

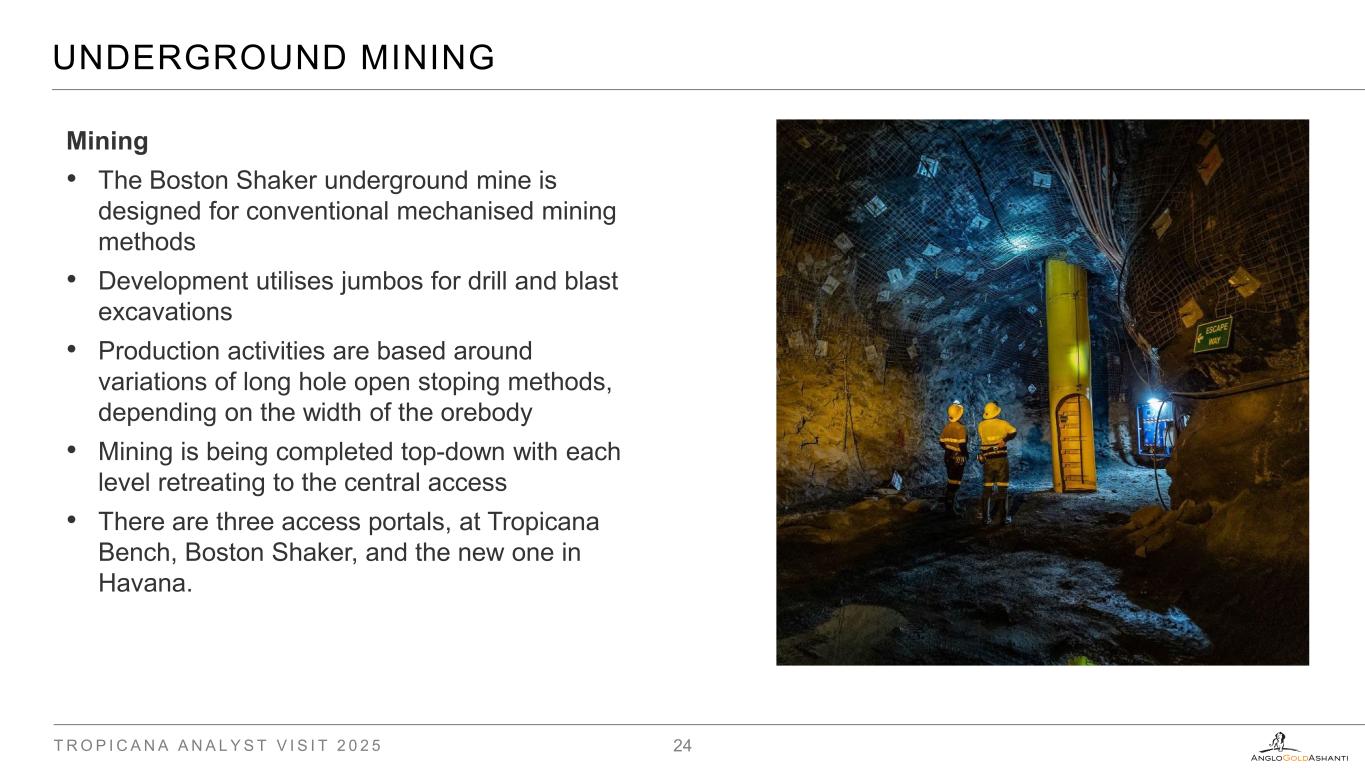

UNDERGROUND MINING T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 24 Mining • The Boston Shaker underground mine is designed for conventional mechanised mining methods • Development utilises jumbos for drill and blast excavations • Production activities are based around variations of long hole open stoping methods, depending on the width of the orebody • Mining is being completed top-down with each level retreating to the central access • There are three access portals, at Tropicana Bench, Boston Shaker, and the new one in Havana.

UNDERGROUND MINING T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 25 Grade Control • Underground grade control is completed in advance of stope final designs by underground RC or Diamond drilling - predominantly from dedicated drill drives above the orebody • Drill drives are designed parallel to the strike of the lodes in the hanging wall via an extension of the level access drive Ore • Ore from Stopping and Development is trucked to the Tropicana and Boston Shaker benches. Waste • Waste from development activities from Tropicana and Boston Shaker mine are unloaded at the end of Boston Shaker bench, and at a satellite waste tip at Tropicana, whilst the Havana material is trucked to the surface area.

UNDERGROUND FLEET T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 26 Development • 5 x Sandvik DD421 Production Drilling • 2 x Sandvik DL432i (boom rig) • 1 x Sandvik DL421 (horseshoe) Boggers • 7 X Sandvik LH621 • 1 X Sandvik LH517 • 3 X CAT 2900 Trucks • 11 X Sandvik TH663 • Macmahon is the alliance mining contractor, providing operators and maintaining the mining equipment • There is a three-bay UG workshop next to the OP one, and a workshop at the Tropicana bench for small service & daily inspections.

FULL ASSET POTENTIAL REFRESH | DEVELOPMENT VALUE DRIVER T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 27 100 200 600 0 700 800 900 1,000 1,100 1,200 1,300 Ja n- 24 77 6 Fe b- 24 75 2 M ar -2 4 80 9 Ap r- 24 1, 02 4 M ay -2 4 96 7 Ju n- 24 87 9 Ju l-2 4 92 9 Au g- 24 94 4 Se p- 24 97 4 O ct -2 4 1, 02 3 N ov -2 4 1, 01 9D ev el op m en t ( m ) 1, 01 7 909 1,250 Ja n- 25 98 3 Fe b- 25 D ec -2 4 M ar -2 5 1, 03 4 Ap r- 25 1, 10 7 M ay -2 5 81 0 1, 16 9 2024 Actuals Baseline Full Potential TargetDevelopment Advance

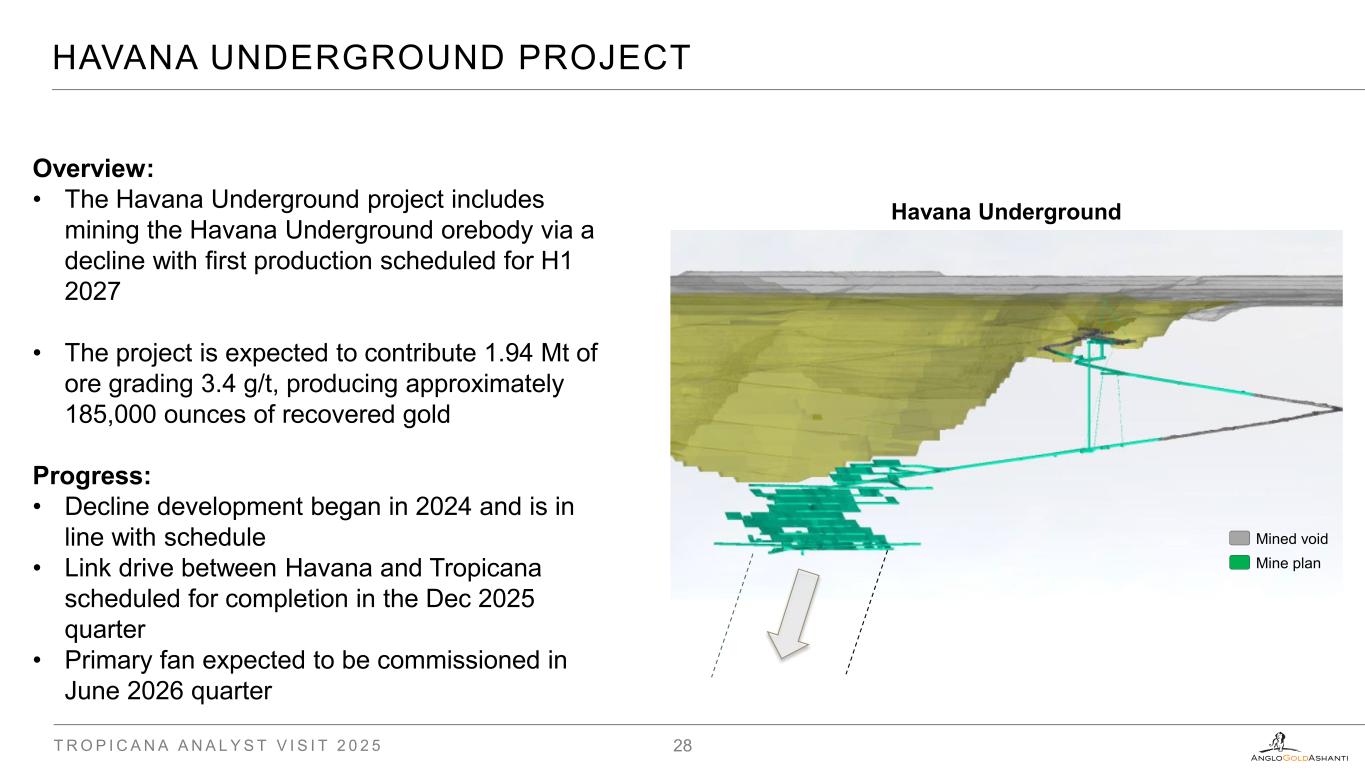

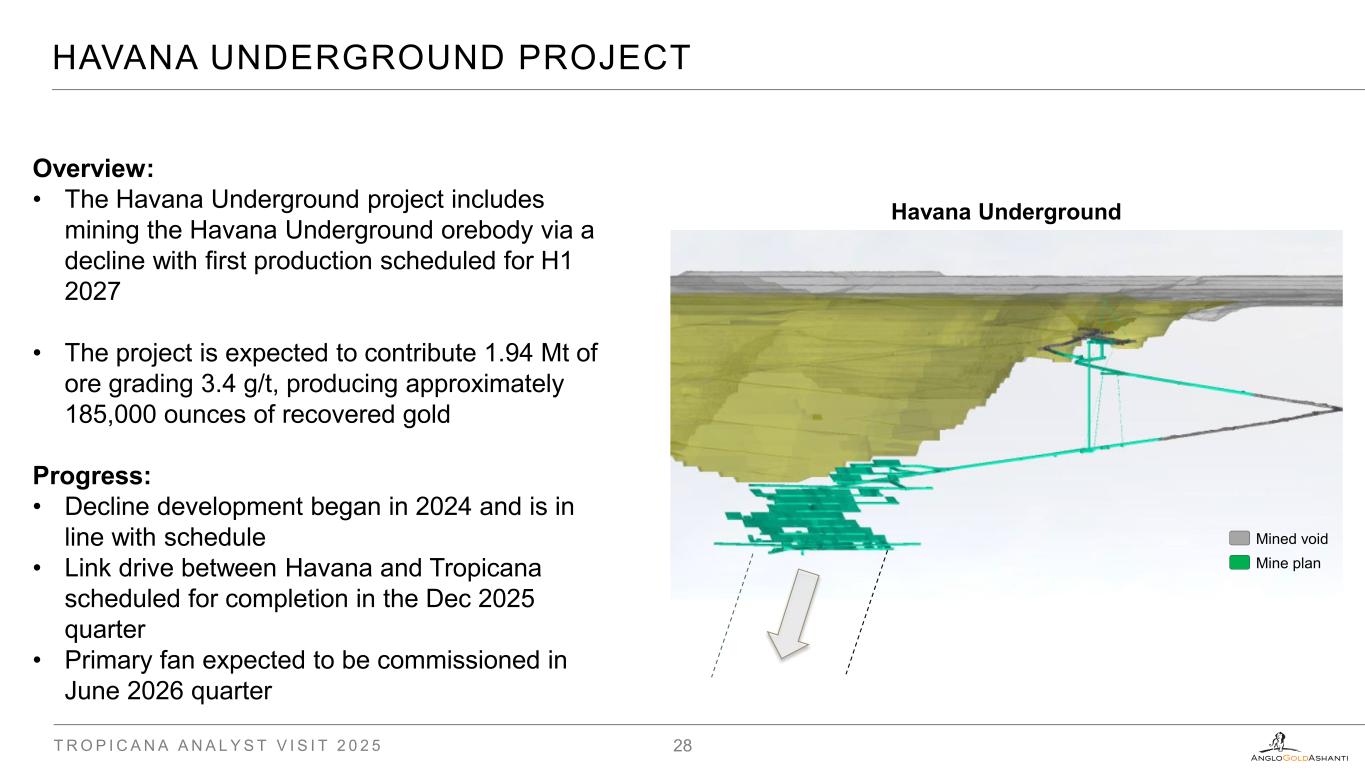

HAVANA UNDERGROUND PROJECT T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 28 Overview: • The Havana Underground project includes mining the Havana Underground orebody via a decline with first production scheduled for H1 2027 • The project is expected to contribute 1.94 Mt of ore grading 3.4 g/t, producing approximately 185,000 ounces of recovered gold Progress: • Decline development began in 2024 and is in line with schedule • Link drive between Havana and Tropicana scheduled for completion in the Dec 2025 quarter • Primary fan expected to be commissioned in June 2026 quarter Havana Underground Mined void Mine plan

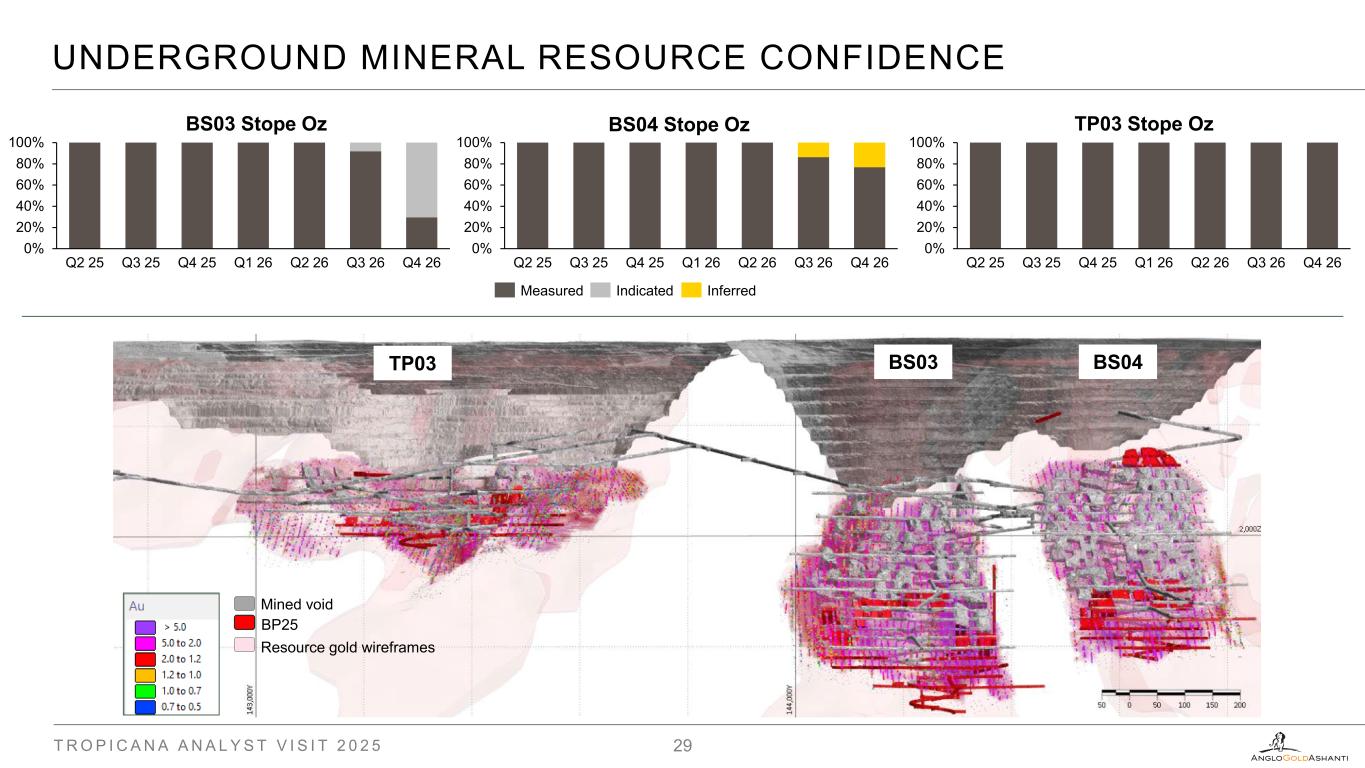

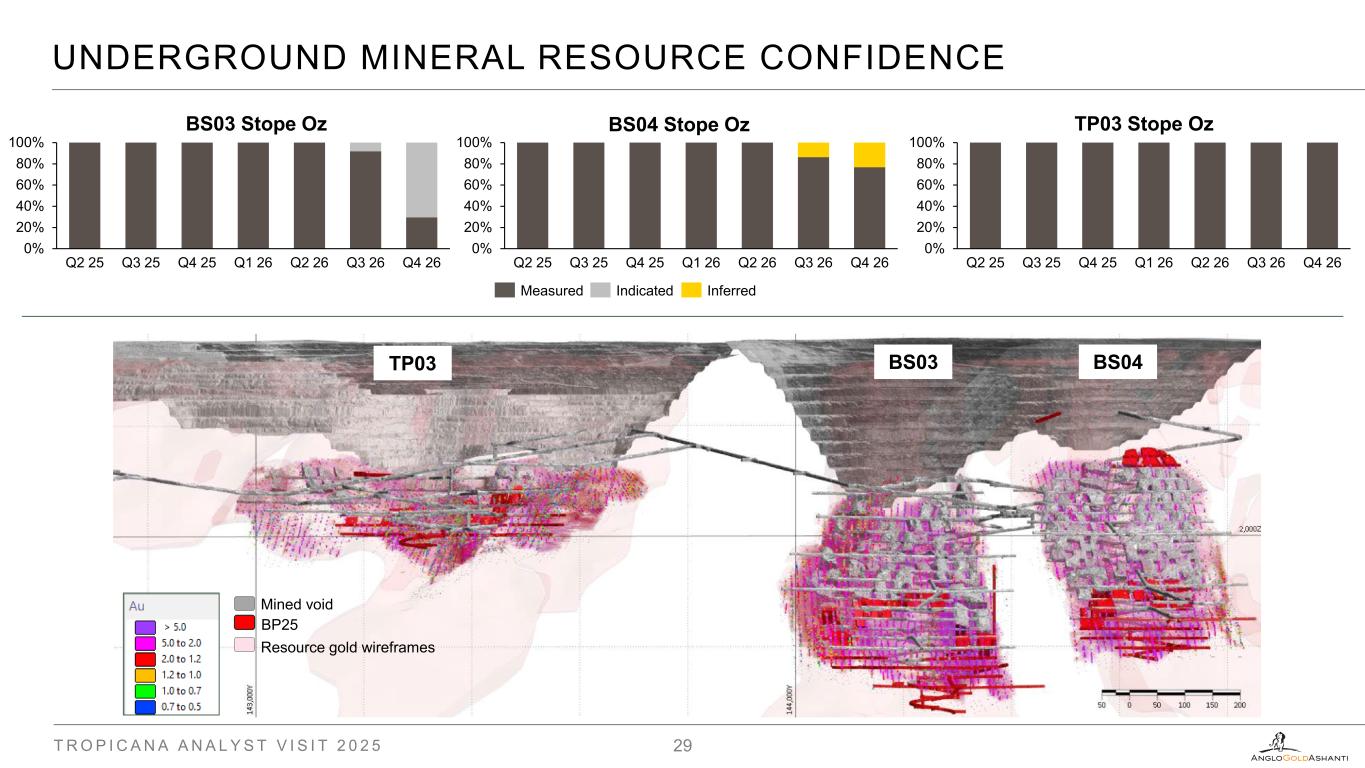

UNDERGROUND MINERAL RESOURCE CONFIDENCE T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 29 TP03 BS03 BS04 Mined void BP25 Resource gold wireframes IndicatedMeasured Inferred BS03 Stope Oz BS04 Stope Oz TP03 Stope Oz 0% 20% 40% 60% 80% 100% Q2 25 Q3 25 Q4 25 Q1 26 Q2 26 Q3 26 Q4 26 0% 20% 40% 60% 80% 100% Q2 25 Q3 25 Q4 25 Q1 26 Q2 26 Q3 26 Q4 26 0% 20% 40% 60% 80% 100% Q2 25 Q3 25 Q4 25 Q1 26 Q2 26 Q3 26 Q4 26

Geology

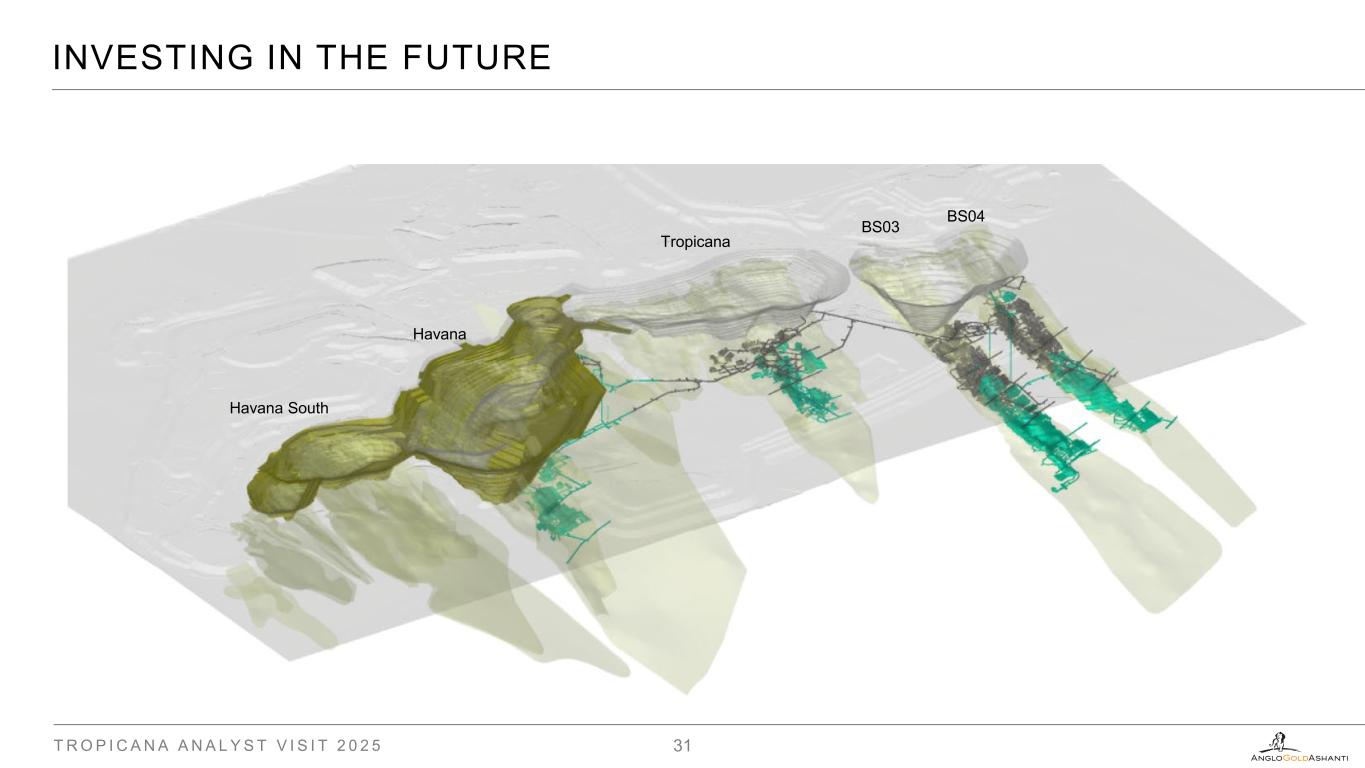

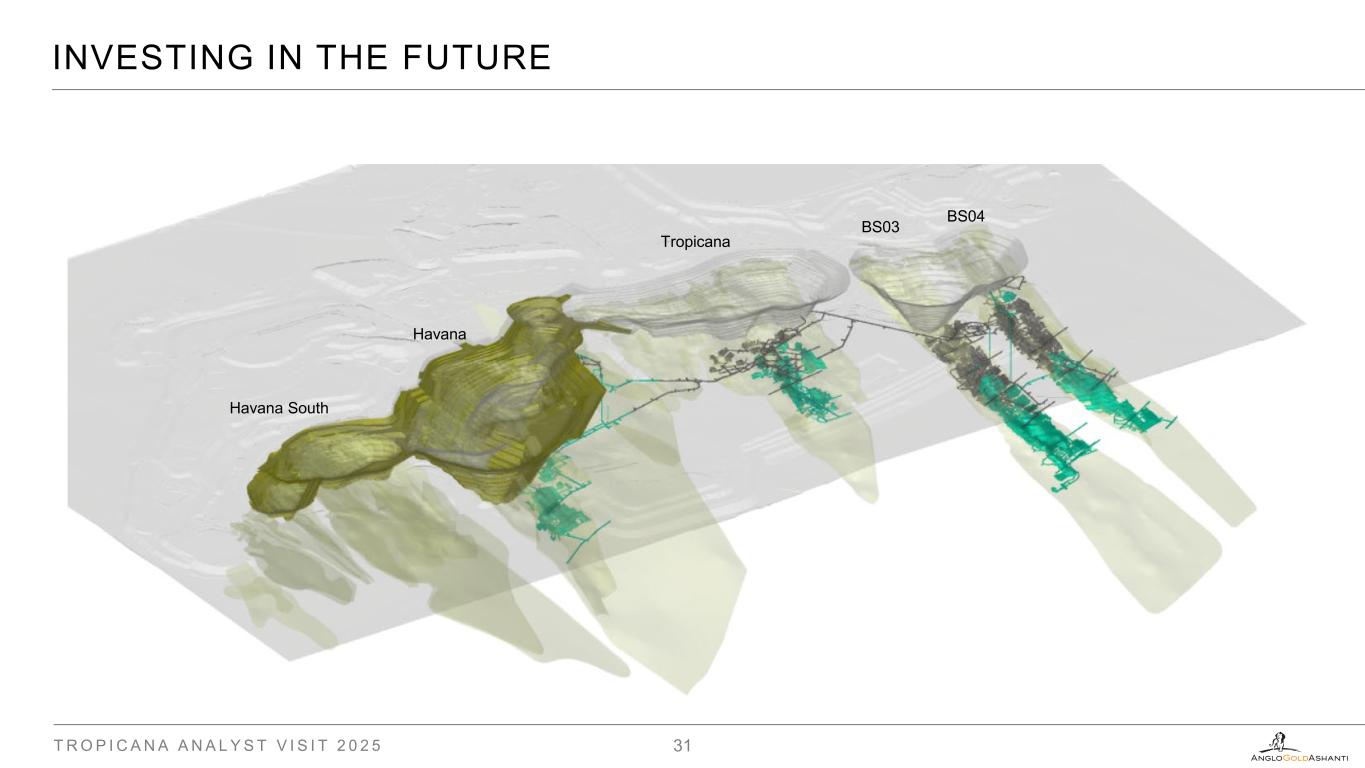

INVESTING IN THE FUTURE T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 31 BS04 BS03 Tropicana Havana Havana South

INVESTING IN THE FUTURE T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 32 32 >10.0 5.0 – 10.0 1.5 – 5.0 1.0 – 1.5 0.5 -1.0 5m @ 0.81 g/t Au from 1239m 2m @ 28.85 g/t Au from 1257m 11m @ 2.19g/t Au from 1131m 26m @ 2.71g/t Au from 1282m Boston Fault Shadow 12m @ 5.94g/t Au from 565m BS04BS03Tropicana Havana Havana South 19m @ 2.31g/t Au from 1184m 21m @ 3.44g/t Au from 1236m Grade legend (g/t) 4m @ 9.98g/t Au 262m (UGD) 3m @ 5.7g/t Au from 1088m 35m @ 1.59g/t Au from 1178m 6m @ 6.15g/t Au 176m (UGD)

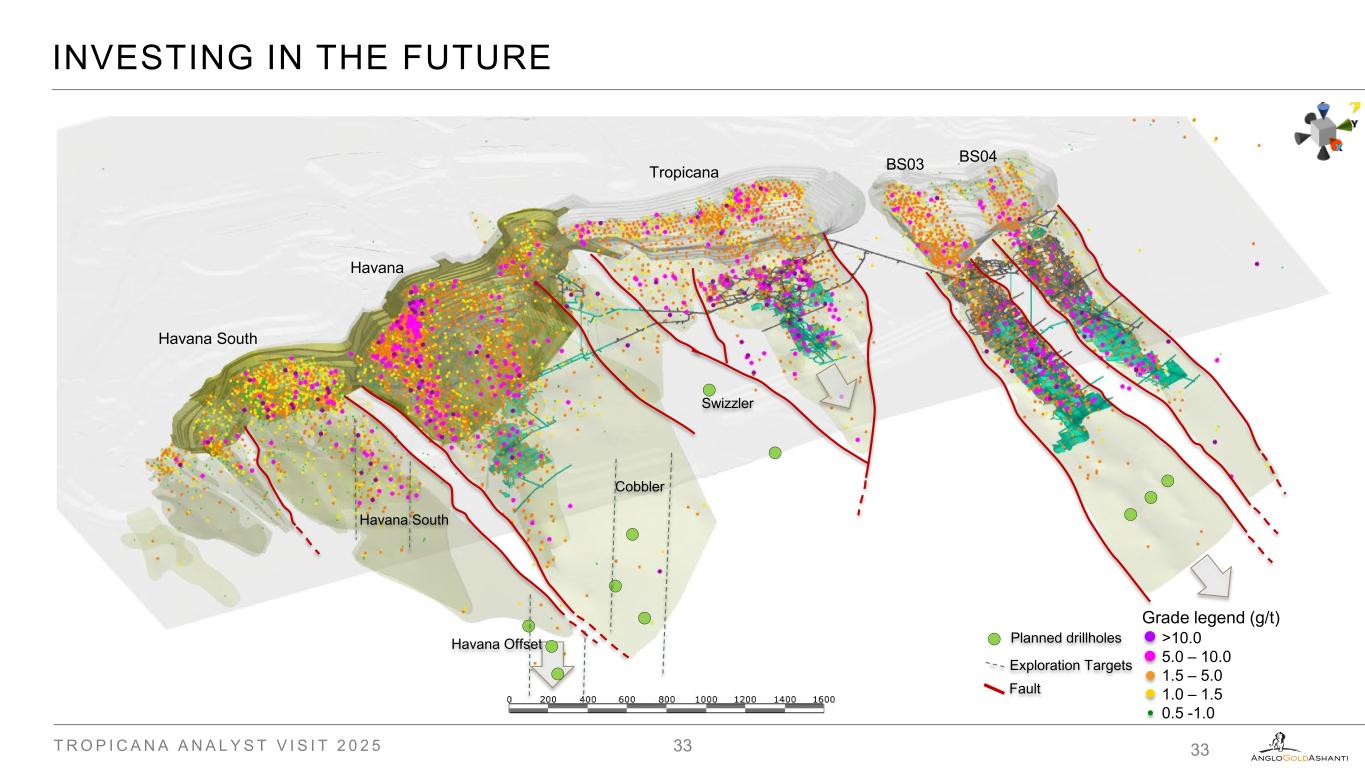

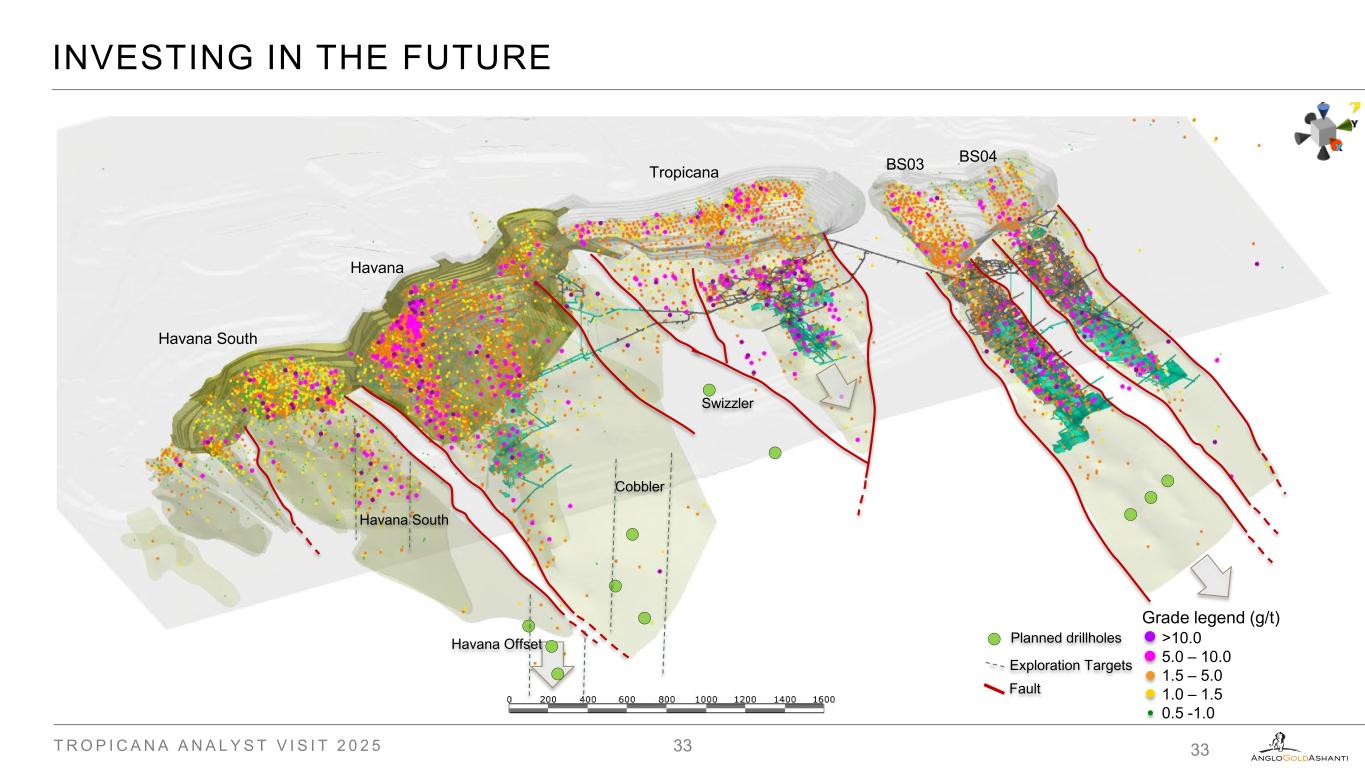

INVESTING IN THE FUTURE T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 33 33 >10.0 5.0 – 10.0 1.5 – 5.0 1.0 – 1.5 0.5 -1.0 BS04BS03Tropicana Havana Havana South Grade legend (g/t) Cobbler Havana Offset Planned drillholes Exploration Targets Swizzler Fault Havana South

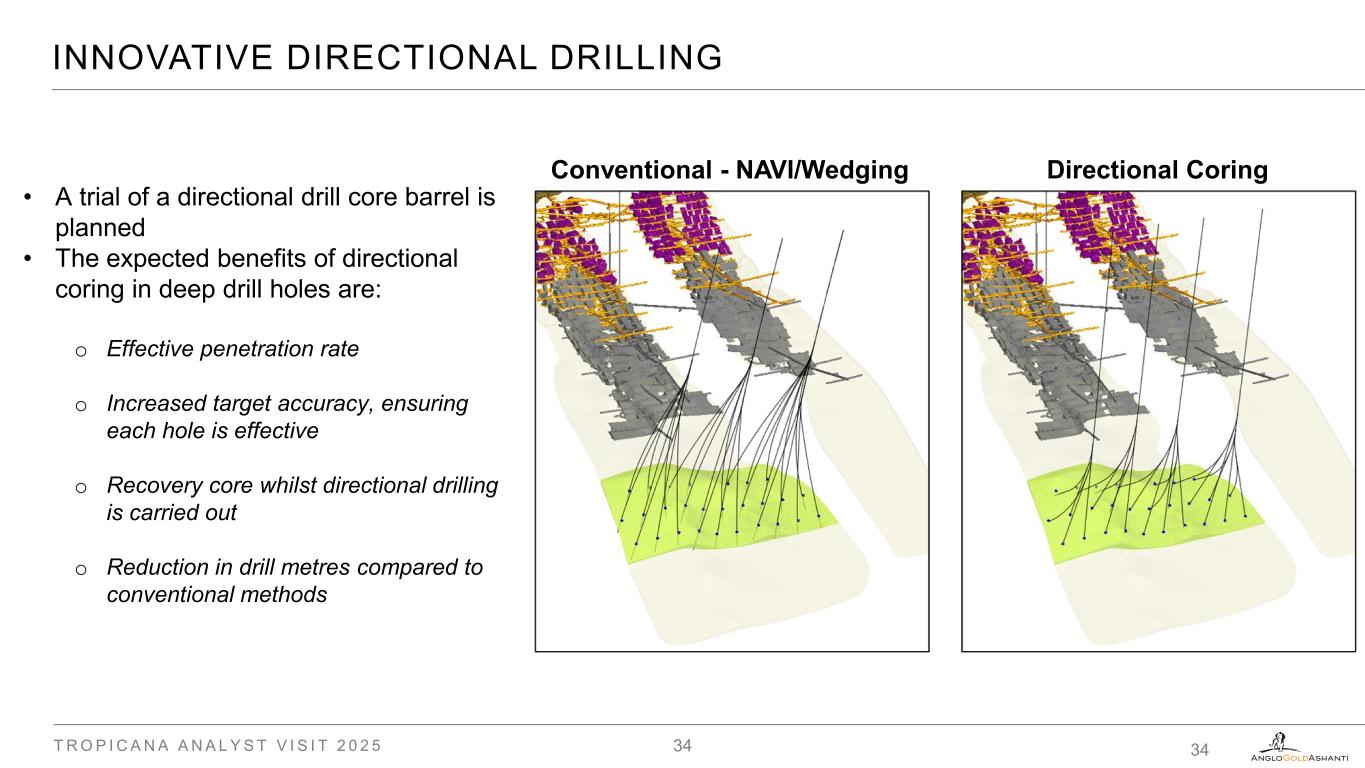

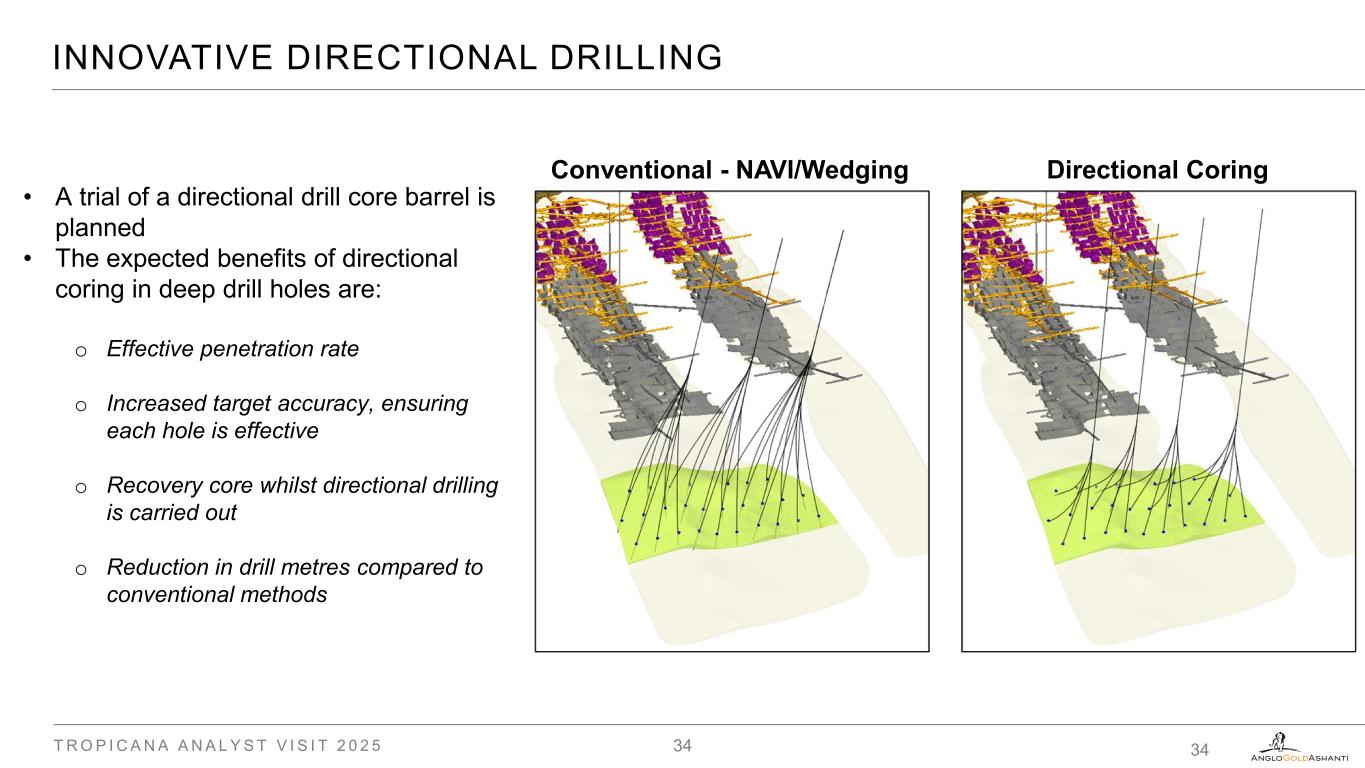

INNOVATIVE DIRECTIONAL DRILLING T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 34 34 • A trial of a directional drill core barrel is planned • The expected benefits of directional coring in deep drill holes are: o Effective penetration rate o Increased target accuracy, ensuring each hole is effective o Recovery core whilst directional drilling is carried out o Reduction in drill metres compared to conventional methods Conventional - NAVI/Wedging Directional Coring

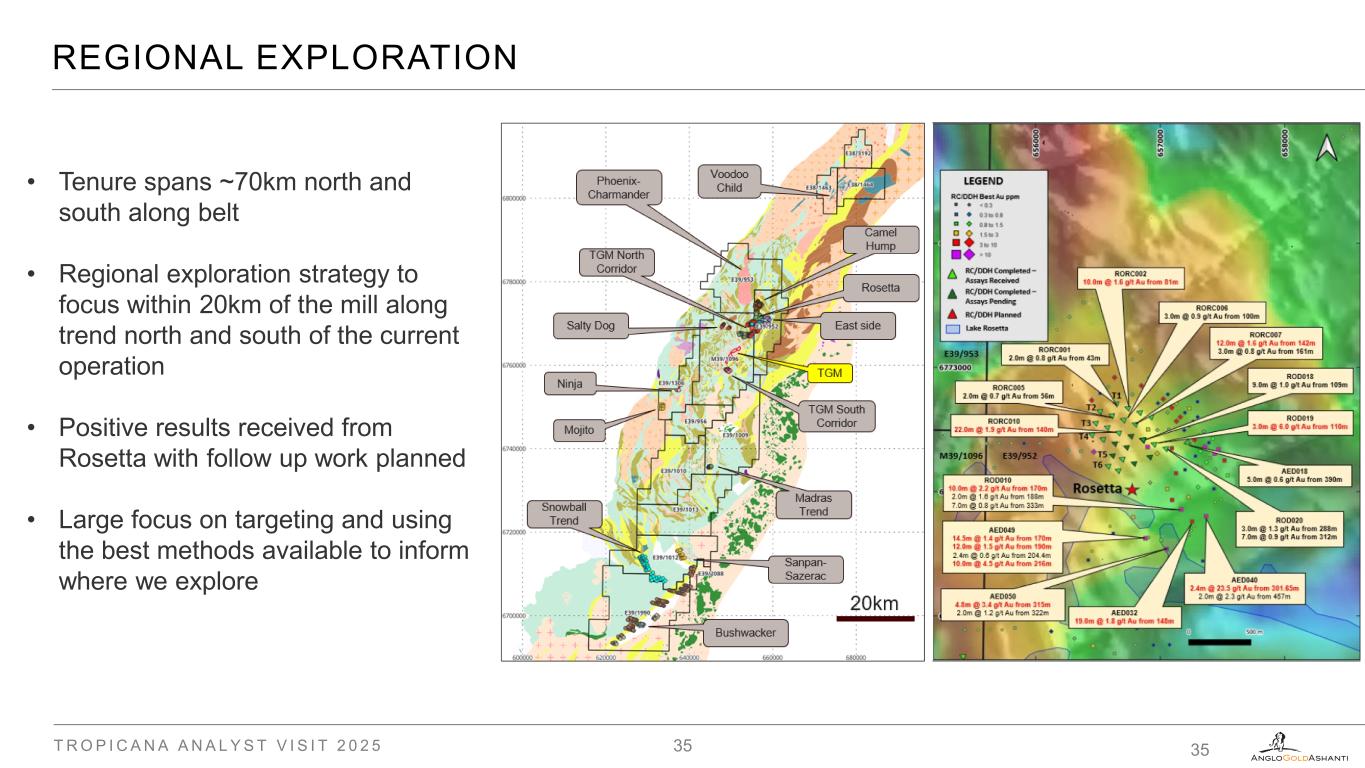

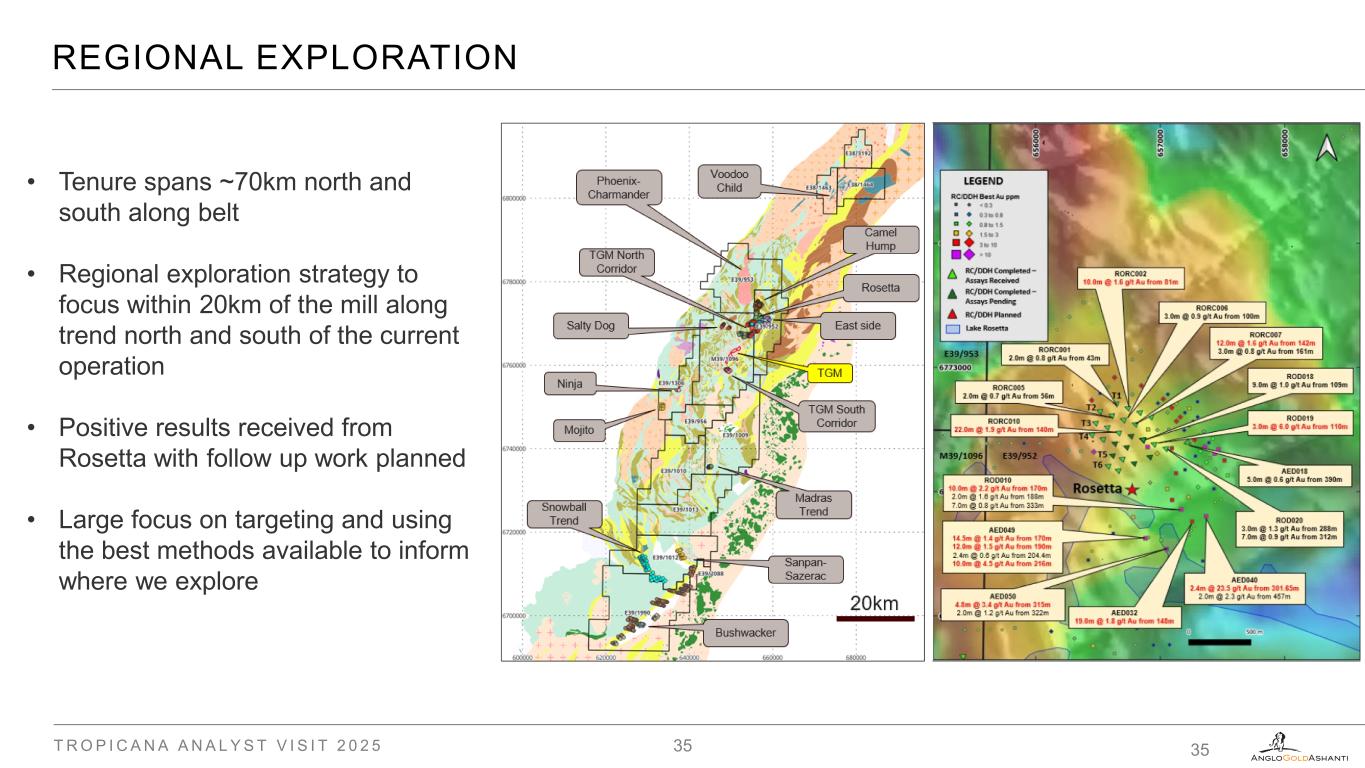

T R O P I C A N A A N A L Y S T V I S I T 2 0 2 5 35 35 • Tenure spans ~70km north and south along belt • Regional exploration strategy to focus within 20km of the mill along trend north and south of the current operation • Positive results received from Rosetta with follow up work planned • Large focus on targeting and using the best methods available to inform where we explore REGIONAL EXPLORATION

w w w . a n g l o g o l d a s h a n t i . c o m