0001633978false00016339782025-06-032025-06-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 3, 2025

Lumentum Holdings Inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

001-36861 |

|

47-3108385 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

1001 Ridder Park Drive, San Jose, California 95131

(Address of Principal Executive Offices including Zip code)

(408) 546-5483

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value of $0.001 per share |

LITE |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

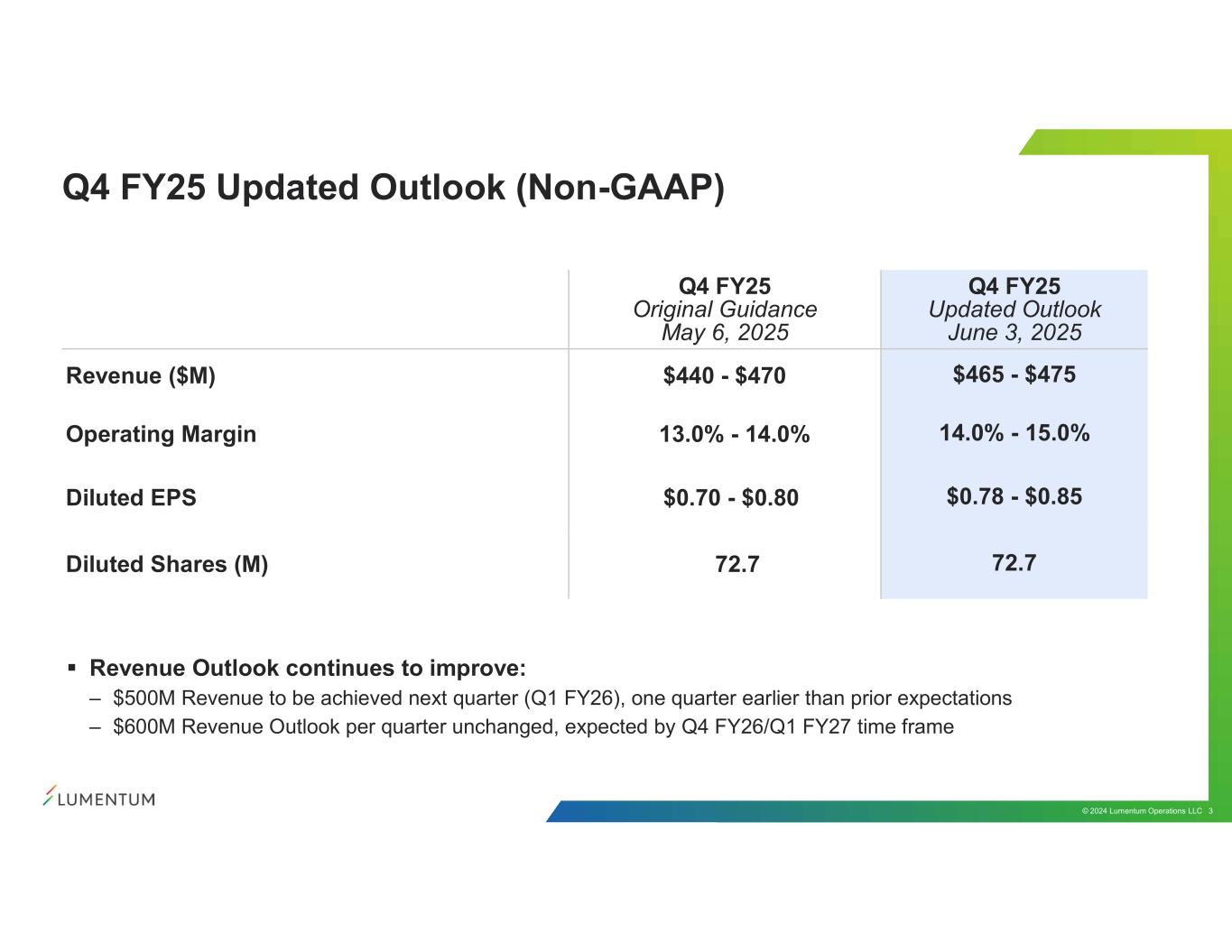

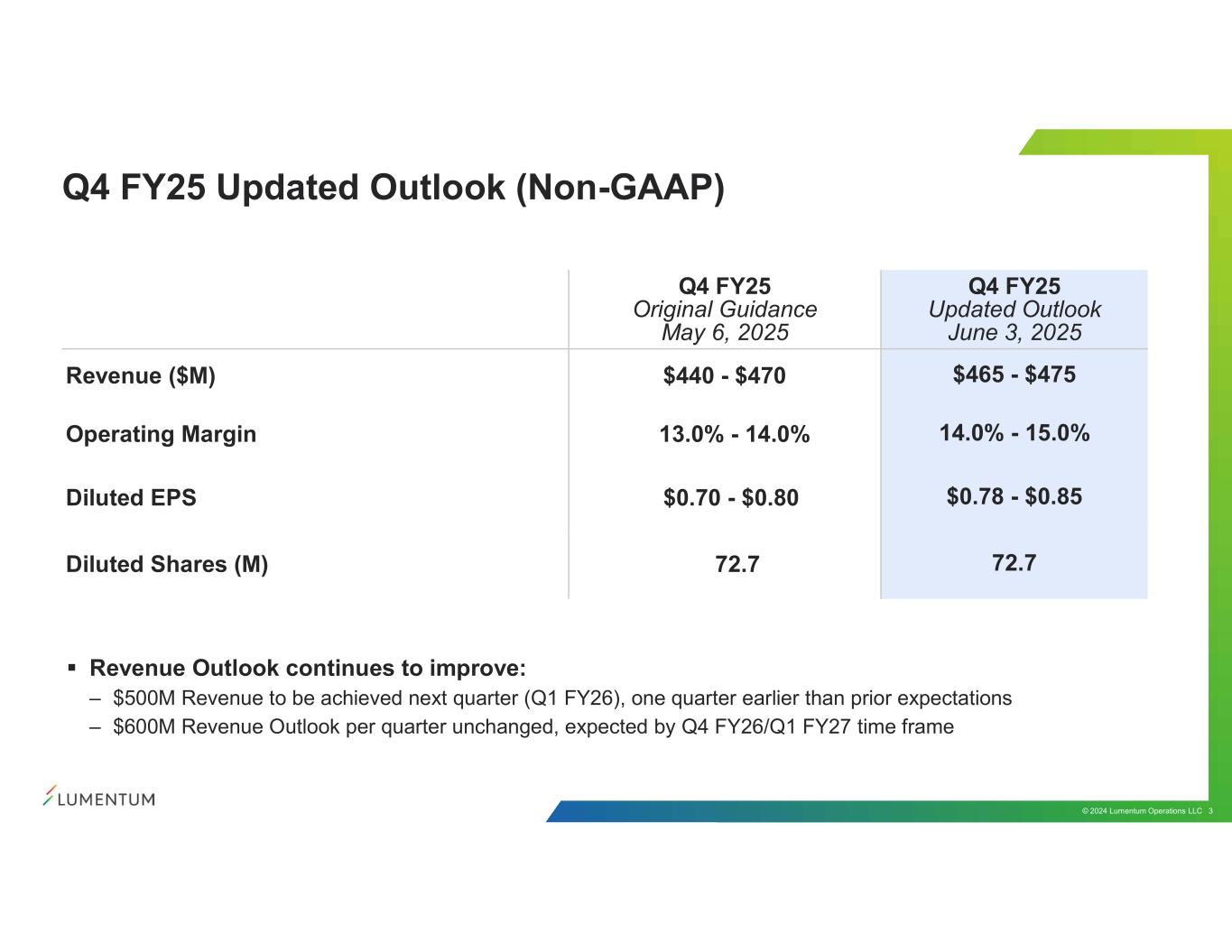

On June 3, 2025, Lumentum Holdings Inc. announced updated guidance for the quarter ending June 28, 2025 and certain additional updates to its revenue outlook. A presentation setting forth the updated guidance and outlook is attached as Exhibit 99.1 hereto.

Lumentum management will discuss the updated outlook at the BofA Securities 2025 Global Technology Conference in San Francisco, California on June 4, 2025, including at a fireside chat scheduled to take place at 2:00 p.m. Pacific. The live webcast and subsequent replay of the event can be accessed from Lumentum’s Investor Relations website at https://investor.lumentum.com.

The information in this Current Report on Form 8-K, including Exhibit 99.1, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

|

| 104 |

|

Cover Page Interactive Data File (formatted as Inline XBRL) |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LUMENTUM HOLDINGS INC. |

|

|

|

|

|

By: |

|

/s/ Jae Kim |

|

|

Name: |

|

Jae Kim |

|

|

Title: |

|

Senior Vice President, General Counsel and Secretary |

|

|

|

| June 3, 2025 |

|

|

|

|

EX-99.1

2

q4updatedoutlook.htm

EX-99.1

q4updatedoutlook

Q4 FY25 Updated Outlook June 3, 2025

© 2024 Lumentum Operations LLC 2 Forward Looking Statements and Financial Presentation This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These include statements regarding our guidance with respect to future net revenue, non-GAAP diluted earnings per share, and non-GAAP operating margins, and related assumptions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected. Among the factors that could cause actual results to differ from those contemplated are: (a) uncertainty and volatility in the global markets, including uncertainty and volatility in the macroeconomic environment, volatility and uncertainty with respect to economic growth, inflationary pressures, changes in the political or economic environment, such as geopolitical conflicts, war, trade and export restrictions, including for certain rare earth minerals, and the imposition of tariffs or other duties, and the effect of such market disruptions on demand for our products, technology spending by our customers, our costs and expenses and our ability to obtain components for our products; (b) quarter-over-quarter product mix fluctuations, which can materially impact profitability measures due to the broad gross margin ranges across our portfolio; (c) decline of average selling prices across our businesses or increase in costs, either of which will also decrease our margins; (d) effects of seasonality; (e) the ability of our suppliers and contract manufacturers to meet production, quality, and delivery requirements for our forecasted demand; (f) changes in customer demand, including due to changes in inventory practices and end-customer demand; (g) our ability to attract and retain new customers, particularly in the cloud photonics and imaging and sensing markets; (h) the risk that our markets will not grow or develop as expected or that our strategies and ability to compete in those markets are not successful, (i) the risk that Lumentum’s financing or operating strategies will not be successful; (j) risks related to our restructuring initiatives and changes to our operations, and (k) failure to successfully integrate Cloud Light into our business or that we will not achieve the expected benefits. For more information on these and other risks, please refer to the "Risk Factors" section included in the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 29, 2025, filed with the Securities and Exchange Commission (the “SEC”). The forward-looking statements contained in this presentation are made as of the date hereof and the Company assumes no obligation to update such statements, except as required by applicable law. Unless otherwise stated, all financial results and projections are on a non-GAAP basis. Our GAAP results, details about our non-GAAP financial measures, and a reconciliation between GAAP and non-GAAP results can be found in our fiscal third quarter of 2025 earnings press release which is available on our web site, www.lumentum.com, under the investors section. We have not provided reconciliations from GAAP to non-GAAP measures for our outlook. A large portion of non-GAAP adjustments, such as stock-based compensation, acquisition related costs, amortization of acquired intangibles, amortization of acquired inventory fair value, restructuring and related charges, foreign exchange gains and losses, net, non-cash interest expense on convertible notes, intangible assets write-off, integration related costs, non-GAAP income tax reconciling adjustments, and other costs and contingencies unrelated to current and future cash flows, are by their nature highly volatile and we have low visibility as to the range that may be incurred in the future.

© 2024 Lumentum Operations LLC 3 Q4 FY25 Updated Outlook (Non-GAAP) Q4 FY25 Updated Outlook June 3, 2025 Q4 FY25 Original Guidance May 6, 2025 $465 - $475$440 - $470Revenue ($M) 14.0% - 15.0%13.0% - 14.0%Operating Margin $0.78 - $0.85$0.70 - $0.80Diluted EPS 72.772.7Diluted Shares (M) Revenue Outlook continues to improve: – $500M Revenue to be achieved next quarter (Q1 FY26), one quarter earlier than prior expectations – $600M Revenue Outlook per quarter unchanged, expected by Q4 FY26/Q1 FY27 time frame

Thank You