| Commission file number: 001-10533 | Commission file number: 001-34121 | ||||

| Rio Tinto plc | Rio Tinto Limited | ||||

| ABN 96 004 458 404 | |||||

(Translation of registrant’s name into English) |

(Translation of registrant’s name into English) |

||||

| 6 St. James’s Square | Level 43, 120 Collins Street | ||||

| London, SW1Y 4AD, United Kingdom | Melbourne, Victoria 3000, Australia |

||||

(Address of principal executive offices) |

(Address of principal executive offices) |

||||

| Rio Tinto plc | Rio Tinto Limited | ||||||||||

| (Registrant) | (Registrant) | ||||||||||

By |

/s/ Andrew Hodges |

By |

/s/ Tim Paine |

||||||||

Name |

Andrew Hodges |

Name |

Tim Paine |

||||||||

| Title | Company Secretary | Title | Company Secretary | ||||||||

| Date | 2 June 2025 | Date | 2 June 2025 | ||||||||

|

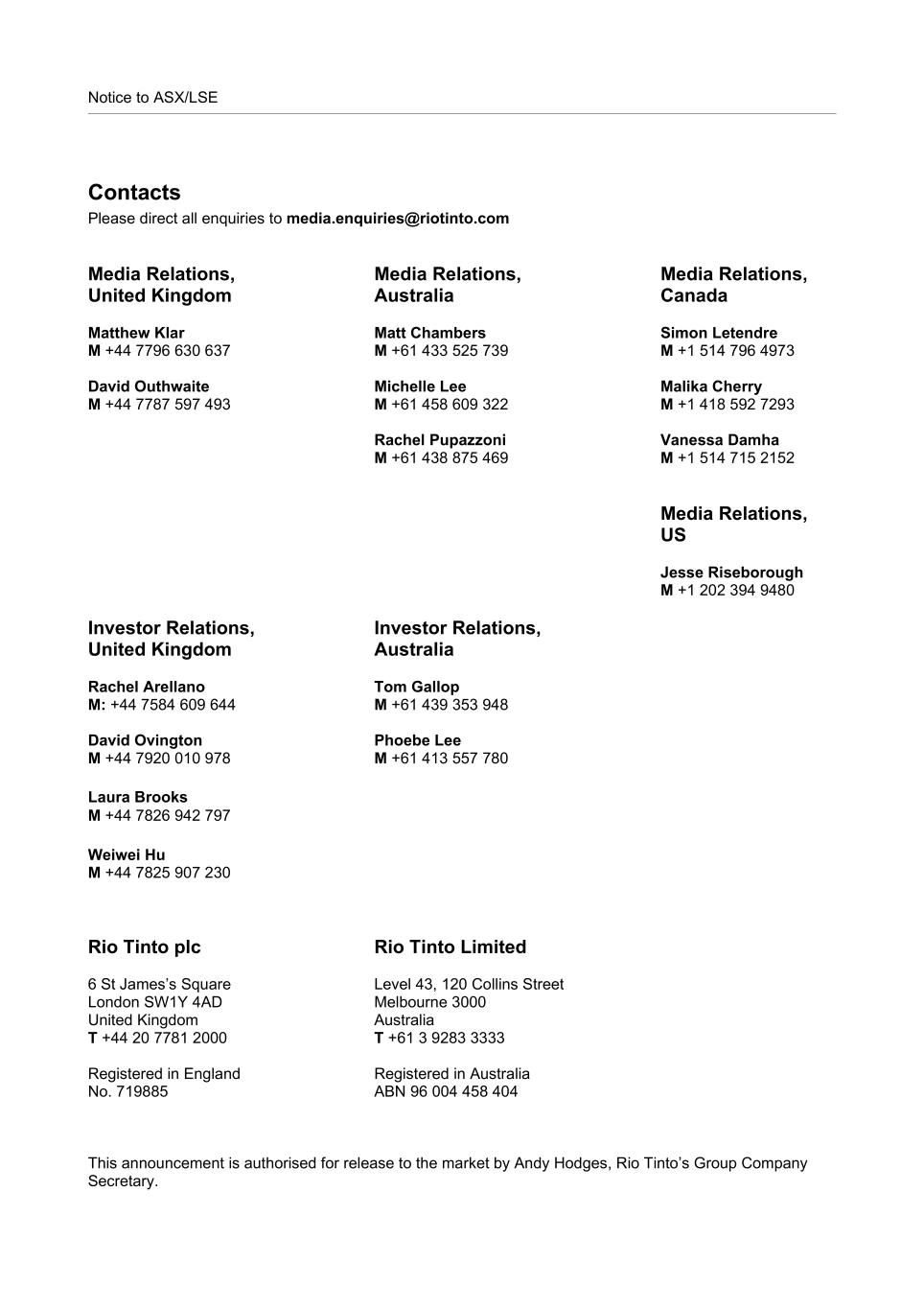

Media Relations,

United Kingdom

Matthew Klar

M +44 7796 630 637

David Outhwaite

M +44 7787 597 493

|

Media Relations,

Australia

Matt Chambers

M +61 433 525 739

Michelle Lee

M +61 458 609 322

Rachel Pupazzoni

M +61 438 875 469

|

Media Relations,

Canada

Simon Letendre

M +1 514 796 4973

Malika Cherry

M +1 418 592 7293

Vanessa Damha

M +1 514 715 2152

Media Relations,

US

Jesse Riseborough

M +1 202 394 9480

|

||||||

|

Investor Relations,

United Kingdom

Rachel Arellano

M: +44 7584 609 644 David Ovington

M +44 7920 010 978

Laura Brooks

M +44 7826 942 797

Weiwei Hu

M +44 7825 907 230

|

Investor Relations,

Australia

Tom Gallop

M +61 439 353 948

Phoebe Lee

M +61 413 557 780

|

|||||||

|

Rio Tinto plc

6 St James’s Square

London SW1Y 4AD

United Kingdom

T +44 20 7781 2000

Registered in England

No. 719885

|

Rio Tinto Limited

Level 43, 120 Collins Street

Melbourne 3000

Australia

T +61 3 9283 3333

Registered in Australia

ABN 96 004 458 404

|

|||||||

|

Media Relations,

United Kingdom

Matthew Klar

M +44 7796 630 637

David Outhwaite

M +44 7787 597 493

|

Media Relations,

Australia

Matt Chambers

M +61 433 525 739

Michelle Lee

M +61 458 609 322

Rachel Pupazzoni

M +61 438 875 469

|

Media Relations,

Canada

Simon Letendre

M +1 514 796 4973

Malika Cherry

M +1 418 592 7293

Vanessa Damha

M +1 514 715 2152

Media Relations,

US

Jesse Riseborough

M +1 202 394 9480

|

||||||

|

Investor Relations,

United Kingdom

Rachel Arellano

M: +44 7584 609 644 David Ovington

M +44 7920 010 978

Laura Brooks

M +44 7826 942 797

Weiwei Hu

M +44 7825 907 230

|

Investor Relations,

Australia

Tom Gallop

M +61 439 353 948

Phoebe Lee

M +61 413 557 780

|

|||||||

|

Rio Tinto plc

6 St James’s Square

London SW1Y 4AD

United Kingdom

T +44 20 7781 2000

Registered in England

No. 719885

|

Rio Tinto Limited

Level 43, 120 Collins Street

Melbourne 3000

Australia

T +61 3 9283 3333

Registered in Australia

ABN 96 004 458 404

|

|||||||

|

Media Relations,

United Kingdom

Matthew Klar

M +44 7796 630 637

David Outhwaite

M +44 7787 597 493

|

Media Relations,

Australia

Matt Chambers

M +61 433 525 739

Michelle Lee

M +61 458 609 322

Rachel Pupazzoni

M +61 438 875 469

|

Media Relations,

Canada

Simon Letendre

M +1 514 796 4973

Malika Cherry

M +1 418 592 7293

Vanessa Damha

M +1 514 715 2152

Media Relations,

US

Jesse Riseborough

M +1 202 394 9480

|

||||||

|

Investor Relations,

United Kingdom

Rachel Arellano

M: +44 7584 609 644 David Ovington

M +44 7920 010 978

Laura Brooks

M +44 7826 942 797

Weiwei Hu

M +44 7825 907 230

|

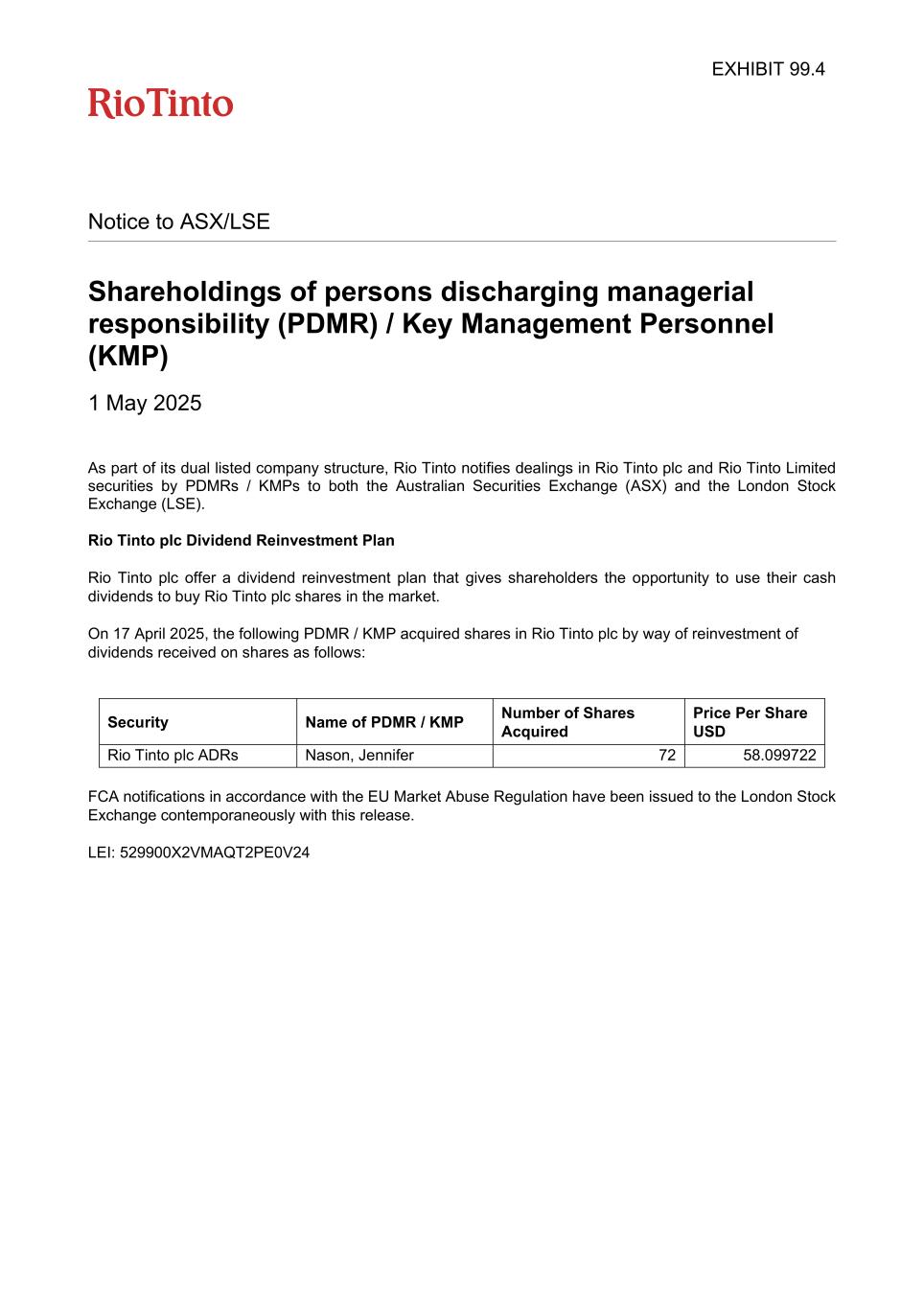

Investor Relations,

Australia

Tom Gallop

M +61 439 353 948

Amar Jambaa

M +61 472 865 948

|

|||||||

|

Rio Tinto plc

6 St James’s Square

London SW1Y 4AD

United Kingdom

T +44 20 7781 2000

Registered in England

No. 719885

|

Rio Tinto Limited

Level 43, 120 Collins Street

Melbourne 3000

Australia

T +61 3 9283 3333

Registered in Australia

ABN 96 004 458 404

|

|||||||

|

Media Relations,

United Kingdom

Matthew Klar

M +44 7796 630 637

David Outhwaite

M +44 7787 597 493

|

Media Relations,

Australia

Matt Chambers

M +61 433 525 739

Michelle Lee

M +61 458 609 322

Rachel Pupazzoni

M +61 438 875 469

|

Media Relations,

Canada

Simon Letendre

M +1 514 796 4973

Malika Cherry

M +1 418 592 7293

Vanessa Damha

M +1 514 715 2152

Media Relations,

US

Jesse Riseborough

M +1 202 394 9480

|

||||||

|

Investor Relations,

United Kingdom

Rachel Arellano

M: +44 7584 609 644 David Ovington

M +44 7920 010 978

Laura Brooks

M +44 7826 942 797

Weiwei Hu

M +44 7825 907 230

|

Investor Relations,

Australia

Tom Gallop

M +61 439 353 948

Phoebe Lee

M +61 413 557 780

|

|||||||

|

Rio Tinto plc

6 St James’s Square

London SW1Y 4AD

United Kingdom

T +44 20 7781 2000

Registered in England

No. 719885

|

Rio Tinto Limited

Level 43, 120 Collins Street

Melbourne 3000

Australia

T +61 3 9283 3333

Registered in Australia

ABN 96 004 458 404

|

|||||||

Project |

Total capital cost |

Status/Milestones |

||||||

|

Project: Rincon expansion

Location: Salta province, Argentina

Ownership: Rio Tinto (100%)

Capacity: total of 60kt per year (battery grade lithium carbonate)

Approval: Dec 2024

Planned first production: 2028 with three-year ramp-up to full capacity

To note: Project consists of the 3kt starter plant and 57kt expansion plant. The mine is expected to have a 40-year life and operate in the first quartile of the cost curve.

|

$2.5bn |

Starter plant - construction reached substantial completion, with final system testing and commissioning planned in Q2

Expansion project - construction is scheduled to begin in mid-2025, subject to permitting

NEW: Incentive Regime for Large Investments (RIGI) approval received (20.05.25)

|

||||||

|

Project: Fenix expansion

Location: Catamarca province, Argentina

Ownership: Rio Tinto (100%)

Capacity: 10ktpa LCE (Battery Grade Lithium Carbonate)

Planned first production: 2027

To note: product is carbonate, chloride

|

$0.7bn |

Project work progresses |

||||||

|

Project: Sal de Vida

Location: Catamarca province, Argentina

Ownership: Rio Tinto (100%)

Capacity: 15ktpa

Planned first production: 2027

To note: product is carbonate

|

$0.7bn |

Project work progresses |

||||||

|

Project: Nemaska Lithium

Location: Quebec, Canada

Ownership: Rio Tinto (50%), Investissement Québec (50%)

Capacity: 28kpta LCE (100%)

Planned first production: 2028

To note: product is integrated lithium hydroxide

|

$1.1bn

(Rio Tinto share)

|

Project work progresses |

||||||

Project |

Status/Milestones |

||||

|

Previously Arcadium assets

Location: Canada and Argentina

|

Canada: work in progress at Galaxy

Argentina: work in progress at Cauchari, Fenix and Sal de Vida next phases

|

||||

|

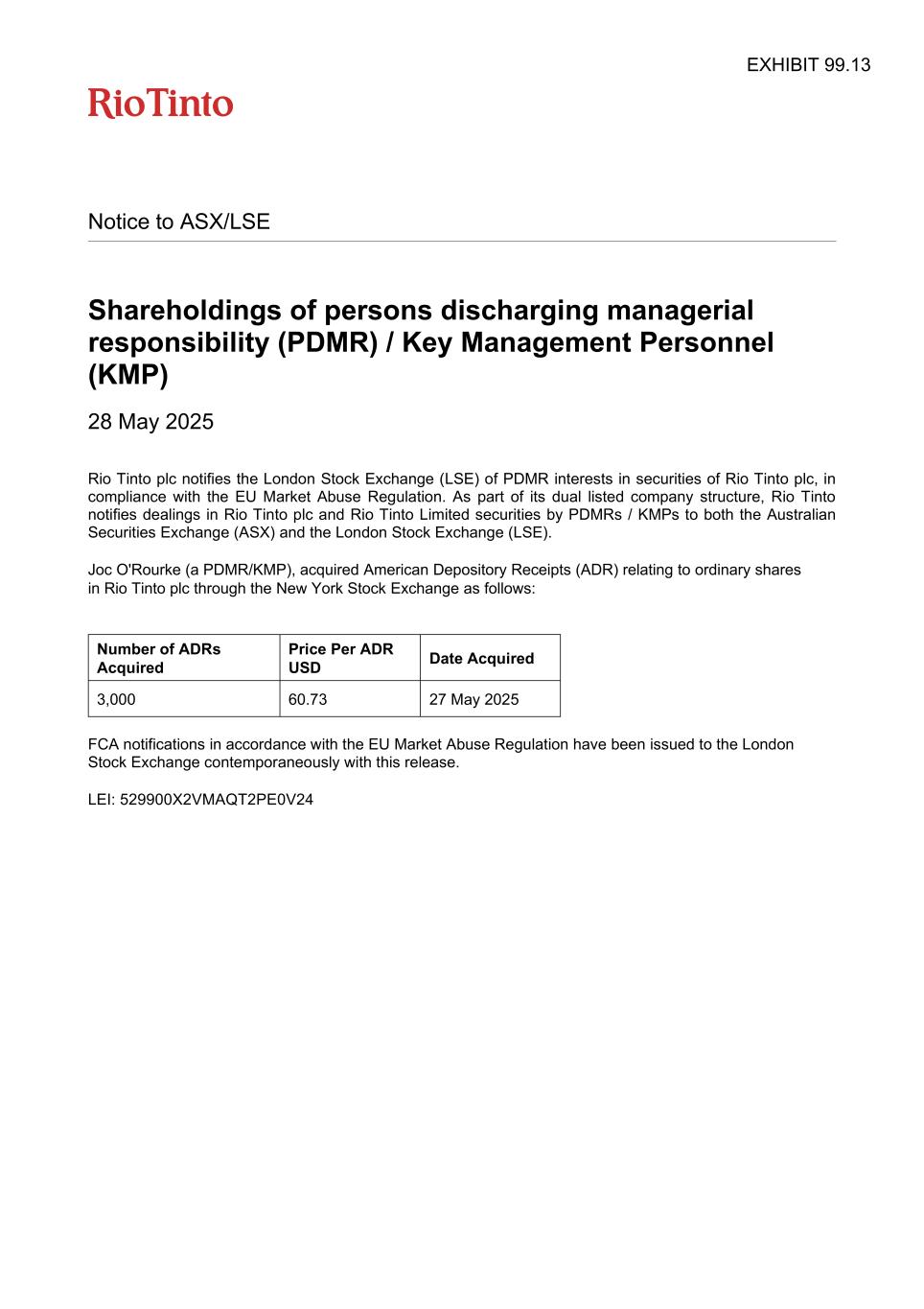

Salar de Maricunga - NEW

Location: Chile

Ownership: Rio Tinto (49.99%), Codelco (50.01%)

To note: Signed a binding agreement with Codelco to form a joint venture to develop and operate a high-grade lithium project in the Salar de Maricunga in Chile. Salar de Maricunga is a large lithium-containing resource based in the Atacama region with the potential for scalable, long-life and low-cost production. Its brine has one of the highest average grades of lithium content in the world.

|

Transaction to form the joint venture is expected to close by the end of the first quarter of 2026, subject to receipt of all applicable regulatory approvals and the satisfaction of other customary closing conditions.

Rio Tinto will invest:

•$350 million1,2 of initial funding into the Company towards additional studies and resource analysis to progress the project through to a final investment decision.

•$500 million1 into the Company once a decision is made to proceed with the project, towards construction costs. These milestones, subject to further studies, are targeted to occur before the end of the decade.

•$50 million into the Company if the joint venture achieves its aim of delivering first lithium by the end of 2030.

The partners will fund further capital requirements in line with their share of ownership of the joint venture.

1 This payment includes Rio Tinto’s 49.99% share of costs.

2 Subject to customary closing adjustments.

|

||||

|

Salares Altoandinos - NEW

Location: Chile

Ownership: Rio Tinto (51%), ENAMI (49%)

To note: Rio Tinto has been chosen as the preferred bidder to partner with ENAMI to develop the Salares Altoandinos Lithium Project.

|

Rio Tinto is focused on advancing towards binding agreements as quickly as possible.

It will progress the pre-feasibility and feasibility studies enabling a final investment decision.

Rio Tinto will provide estimated $425m in cash and non-cash contributions including its Direct Lithium Extraction (DLE) Technology. The cash contributions will include staged spending to sole fund the pre-feasibility study and further studies.

|

||||

|

Jadar

Location: Serbia

Ownership: Rio Tinto (100%)

To note: Development of the greenfield Jadar lithium-borates project in Serbia will include an underground mine with associated infrastructure and equipment, as well as a beneficiation chemical processing plant.

|

Continued the application process for obtaining the Exploitation Field Licence (EFL) (the EFL is essential for commencing fieldwork, including detailed geotechnical investigations)

Rio Tinto remains focused on consultation with all key stakeholders, including providing comprehensive factual information about the project

|

||||

|

Media Relations,

United Kingdom

Matthew Klar

M +44 7796 630 637

David Outhwaite

M +44 7787 597 493

|

Media Relations,

Australia

Matt Chambers

M +61 433 525 739

Michelle Lee

M +61 458 609 322

Rachel Pupazzoni

M +61 438 875 469

|

Media Relations,

Canada

Simon Letendre

M +1 514 796 4973

Malika Cherry

M +1 418 592 7293

Vanessa Damha

M +1 514 715 2152

Media Relations,

US

Jesse Riseborough

M +1 202 394 9480

|

||||||

|

Investor Relations,

United Kingdom

Rachel Arellano

M: +44 7584 609 644 David Ovington

M +44 7920 010 978

Laura Brooks

M +44 7826 942 797

Weiwei Hu

M +44 7825 907 230

|

Investor Relations,

Australia

Tom Gallop

M +61 439 353 948

Phoebe Lee

M +61 413 557 780

|

|||||||

|

Rio Tinto plc

6 St James’s Square

London SW1Y 4AD

United Kingdom

T +44 20 7781 2000

Registered in England

No. 719885

|

Rio Tinto Limited

Level 43, 120 Collins Street

Melbourne 3000

Australia

T +61 3 9283 3333

Registered in Australia

ABN 96 004 458 404

|

|||||||

GOVERNMENT PAYMENTS BY TYPE | ||||||||||||||||||||||||||||||||

Company Name |

RIO TINTO PLC |

|||||||||||||||||||||||||||||||

Company Number |

00719885 |

|||||||||||||||||||||||||||||||

Report Name |

Extractive Industry Reporting |

|||||||||||||||||||||||||||||||

Report End Date |

31-Dec-24 |

|||||||||||||||||||||||||||||||

Currency |

USD |

|||||||||||||||||||||||||||||||

Country Code |

Tax Authority Name |

Payment Type |

Unit Measure |

Volume |

Valuation Method |

Amount |

Notes |

Version |

Filing Date |

|||||||||||||||||||||||

ARG |

ADMINISTRACION FEDERAL DE INGRESOS PUBLICOS |

Tax |

0 |

16,880,594 |

1 |

29-May-25 |

||||||||||||||||||||||||||

AUS |

AUSTRALIAN TAXATION OFFICE |

Tax |

0 |

3,654,271,678 |

1 |

29-May-25 |

||||||||||||||||||||||||||

AUS |

NORTHERN TERRITORY REVENUE OFFICE |

Royalties |

0 |

50,293,231 |

1 |

29-May-25 |

||||||||||||||||||||||||||

AUS |

STATE OF QUEENSLAND |

Royalties |

0 |

126,389,229 |

1 |

29-May-25 |

||||||||||||||||||||||||||

AUS |

STATE OF WESTERN AUSTRALIA |

Royalties |

0 |

2,099,400,355 |

1 |

29-May-25 |

||||||||||||||||||||||||||

AUS |

NORTHERN TERRITORY REVENUE OFFICE |

Fees |

0 |

6,565,732 |

1 |

29-May-25 |

||||||||||||||||||||||||||

AUS |

STATE OF QUEENSLAND |

Fees |

0 |

1,965,268 |

1 |

29-May-25 |

||||||||||||||||||||||||||

AUS |

STATE OF WESTERN AUSTRALIA |

Fees |

0 |

15,003,832 |

1 |

29-May-25 |

||||||||||||||||||||||||||

CAN |

CANADA REVENUE AGENCY |

Tax |

0 |

92,897,412 |

A |

1 |

29-May-25 |

|||||||||||||||||||||||||

CAN |

GOVERNMENT OF NEWFOUNDLAND AND LABRADOR |

Tax |

0 |

31,347,823 |

1 |

29-May-25 |

||||||||||||||||||||||||||

CAN |

REVENUE QUEBEC |

Tax |

0 |

5,649,148 |

1 |

29-May-25 |

||||||||||||||||||||||||||

CAN |

CONSEIL DES INNUS DE EKUANITSHIT |

Fees |

0 |

783,172 |

1 |

29-May-25 |

||||||||||||||||||||||||||

CAN |

GOVERNMENT OF NEWFOUNDLAND AND LABRADOR |

Fees |

0 |

255,672 |

1 |

29-May-25 |

||||||||||||||||||||||||||

CAN |

GOVERNMENT OF NORTHWEST TERRITORIES |

Fees |

0 |

7,052,583 |

1 |

29-May-25 |

||||||||||||||||||||||||||

CAN |

INNU NATION (Labrador) |

Fees |

0 |

2,643,193 |

1 |

29-May-25 |

||||||||||||||||||||||||||

CAN |

LES INNUS DE UASHAT MAK MANI-UTENAM AND LES INNUS DE MATIMEKUSH-LAC JOHN |

Fees |

0 |

4,318,350 |

1 |

29-May-25 |

||||||||||||||||||||||||||

CAN |

LUTSEL K'E DENE FIRST NATION |

Fees |

0 |

299,946 |

1 |

29-May-25 |

||||||||||||||||||||||||||

CAN |

NASKAPI NATION OF KAWAWACHIKAMACH |

Fees |

0 |

1,122,746 |

1 |

29-May-25 |

||||||||||||||||||||||||||

CAN |

TLICHO GOVERNMENT |

Fees |

0 |

1,218,962 |

1 |

29-May-25 |

||||||||||||||||||||||||||

CAN |

YELLOWKNIVES DENE FIRST NATION |

Fees |

0 |

841,941 |

1 |

29-May-25 |

||||||||||||||||||||||||||

CHL |

SERVICIO DE IMPUESTOS INTERNOS |

Tax |

0 |

160,608 |

1 |

29-May-25 |

||||||||||||||||||||||||||

KAZ |

STATE REVENUE COMMITTEE |

Fees |

0 |

701,773 |

1 |

29-May-25 |

||||||||||||||||||||||||||

MDG |

MADAGASCAR - GENERAL DIRECTION OF TAXES |

Tax |

0 |

1,181,895 |

1 |

29-May-25 |

||||||||||||||||||||||||||

MDG |

TRESORERIE GENERALE DE FORT DAUPHIN |

Royalties |

0 |

5,768,606 |

1 |

29-May-25 |

||||||||||||||||||||||||||

MNG |

MONGOLIA - GENERAL DEPARTMENT OF TAXATION |

Tax |

0 |

13,061,197 |

1 |

29-May-25 |

||||||||||||||||||||||||||

MNG |

MONGOLIA - GENERAL DEPARTMENT OF TAXATION |

Royalties |

0 |

126,246,003 |

1 |

29-May-25 |

||||||||||||||||||||||||||

MNG |

MINERAL RESOURCES AND PETROLEUM AUTHORITY OF MONGOLIA |

Fees |

0 |

221,763 |

1 |

29-May-25 |

||||||||||||||||||||||||||

MNG |

ULAANBAATAR CITY |

Fees |

0 |

779,934 |

1 |

29-May-25 |

||||||||||||||||||||||||||

MNG |

UMNUGOVI PROVINCE |

Fees |

0 |

59,669,676 |

1 |

29-May-25 |

||||||||||||||||||||||||||

MNG |

WATER AGENCY GOVERNMENT ORGANIZATION |

Fees |

0 |

113,200 |

1 |

29-May-25 |

||||||||||||||||||||||||||

MNG |

GOBI OYU DEVELOPMENT SUPPORT FUND |

Bonuses |

0 |

1,593,947 |

B |

1 |

29-May-25 |

|||||||||||||||||||||||||

MNG |

OYU TOLGOI CATALYST FUND FOR KHANBOGD DEVELOPMENT |

Bonuses |

0 |

12,282,647 |

C |

1 |

29-May-25 |

|||||||||||||||||||||||||

PER |

PERU - THE NATIONAL SUPERINTENDENCY OF CUSTOMS AND TAX ADMINISTRATION |

Fees |

0 |

798,385 |

1 |

29-May-25 |

||||||||||||||||||||||||||

USA |

USA - INTERNAL REVENUE SERVICE |

Tax |

0 |

(28,438,780) |

1 |

29-May-25 |

||||||||||||||||||||||||||

USA |

UTAH STATE TAX COMMISSION |

Royalties |

0 |

16,423,992 |

1 |

29-May-25 |

||||||||||||||||||||||||||

USA |

ARIZONA DEPARTMENT OF REVENUE |

Fees |

0 |

106,889 |

1 |

29-May-25 |

||||||||||||||||||||||||||

USA |

CALIFORNIA FRANCHISE TAX BOARD |

Fees |

0 |

129,423 |

1 |

29-May-25 |

||||||||||||||||||||||||||

USA |

KERN COUNTY TREASURER AND TAX COLLECTOR (CA) |

Fees |

0 |

5,594,339 |

1 |

29-May-25 |

||||||||||||||||||||||||||

USA |

PINAL COUNTY TREASURER (AZ) |

Fees |

0 |

1,361,968 |

1 |

29-May-25 |

||||||||||||||||||||||||||

USA |

SALT LAKE COUNTY (UT) |

Fees |

0 |

55,068,829 |

1 |

29-May-25 |

||||||||||||||||||||||||||

ZAF |

SOUTH AFRICAN REVENUE SERVICE |

Tax |

0 |

65,591,414 |

1 |

29-May-25 |

||||||||||||||||||||||||||

ZAF |

SOUTH AFRICAN REVENUE SERVICE |

Royalties |

0 |

11,888,544 |

1 |

29-May-25 |

||||||||||||||||||||||||||

TOTAL |

6,469,507,119 |

|||||||||||||||||||||||||||||||

Note A: Payments reported are net of a cash refund of $867,618 in respect of Diavik. | ||||||||||||||||||||||||||||||||

Note B: Bonuses include contributions under the Oyu Tolgoi LLC's Communities Co-operation Agreement. | ||||||||||||||||||||||||||||||||

Note C: Bonuses include contributions under the Khanbodg Soum Centre Development Partnership Agreement. | ||||||||||||||||||||||||||||||||

GOVERNMENT PAYMENT TOTALS | ||||||||||||||||||||

Company Name |

RIO TINTO PLC |

|||||||||||||||||||

Company Number |

00719885 |

|||||||||||||||||||

Report Name |

Extractive Industry Reporting |

|||||||||||||||||||

Report End Date |

31-Dec-24 |

|||||||||||||||||||

Currency |

USD |

|||||||||||||||||||

Government |

Country Code |

Amount |

Version |

Notes |

Filing Date |

|||||||||||||||

ADMINISTRACION FEDERAL DE INGRESOS PUBLICOS |

ARG |

16,880,594 |

1 |

D |

29-May-25 |

|||||||||||||||

NORTHERN TERRITORY REVENUE OFFICE |

AUS |

56,858,964 |

1 |

D |

29-May-25 |

|||||||||||||||

STATE OF QUEENSLAND |

AUS |

128,354,496 |

1 |

D |

29-May-25 |

|||||||||||||||

STATE OF WESTERN AUSTRALIA |

AUS |

2,114,404,187 |

1 |

D |

29-May-25 |

|||||||||||||||

AUSTRALIAN TAXATION OFFICE |

AUS |

3,654,271,678 |

1 |

D |

29-May-25 |

|||||||||||||||

CONSEIL DES INNUS DE EKUANITSHIT |

CAN |

783,172 |

1 |

D |

29-May-25 |

|||||||||||||||

GOVERNMENT OF NEWFOUNDLAND AND LABRADOR |

CAN |

31,603,496 |

1 |

D |

29-May-25 |

|||||||||||||||

GOVERNMENT OF NORTHWEST TERRITORIES |

CAN |

7,052,583 |

1 |

D |

29-May-25 |

|||||||||||||||

INNU NATION (Labrador) |

CAN |

2,643,193 |

1 |

D |

29-May-25 |

|||||||||||||||

LES INNUS DE UASHAT MAK MANI-UTENAM AND LES INNUS DE MATIMEKUSH-LAC JOHN |

CAN |

4,318,350 |

1 |

D |

29-May-25 |

|||||||||||||||

LUTSEL K'E DENE FIRST NATION |

CAN |

299,946 |

1 |

D |

29-May-25 |

|||||||||||||||

NASKAPI NATION OF KAWAWACHIKAMACH |

CAN |

1,122,746 |

1 |

D |

29-May-25 |

|||||||||||||||

TLICHO GOVERNMENT |

CAN |

1,218,962 |

1 |

D |

29-May-25 |

|||||||||||||||

YELLOWKNIVES DENE FIRST NATION |

CAN |

841,941 |

1 |

D |

29-May-25 |

|||||||||||||||

CANADA REVENUE AGENCY |

CAN |

92,897,412 |

1 |

A,D |

29-May-25 |

|||||||||||||||

REVENUE QUEBEC |

CAN |

5,649,148 |

1 |

D |

29-May-25 |

|||||||||||||||

SERVICIO DE IMPUESTOS INTERNOS |

CHL |

160,608 |

1 |

D |

29-May-25 |

|||||||||||||||

STATE REVENUE COMMITTEE |

KAZ |

701,773 |

1 |

D |

29-May-25 |

|||||||||||||||

TRESORERIE GENERALE DE FORT DAUPHIN |

MDG |

5,768,606 |

1 |

D |

29-May-25 |

|||||||||||||||

MADAGASCAR - GENERAL DIRECTION OF TAXES |

MDG |

1,181,895 |

1 |

D |

29-May-25 |

|||||||||||||||

GOBI OYU DEVELOPMENT SUPPORT FUND |

MNG |

1,593,947 |

1 |

E |

29-May-25 |

|||||||||||||||

OYU TOLGOI CATALYST FUND FOR KHANBOGD DEVELOPMENT |

MNG |

12,282,647 |

1 |

E |

29-May-25 |

|||||||||||||||

MINERAL RESOURCES AND PETROLEUM AUTHORITY OF MONGOLIA |

MNG |

221,763 |

1 |

E |

29-May-25 |

|||||||||||||||

ULAANBAATAR CITY |

MNG |

779,934 |

1 |

E |

29-May-25 |

|||||||||||||||

UMNUGOVI PROVINCE |

MNG |

59,669,676 |

1 |

E |

29-May-25 |

|||||||||||||||

WATER AGENCY GOVERNMENT ORGANIZATION |

MNG |

113,200 |

1 |

E |

29-May-25 |

|||||||||||||||

MONGOLIA - GENERAL DEPARTMENT OF TAXATION |

MNG |

139,307,200 |

1 |

E |

29-May-25 |

|||||||||||||||

PERU - THE NATIONAL SUPERINTENDENCY OF CUSTOMS AND TAX ADMINISTRATION |

PER |

798,385 |

1 |

D |

29-May-25 |

|||||||||||||||

ARIZONA DEPARTMENT OF REVENUE |

USA |

106,889 |

1 |

29-May-25 |

||||||||||||||||

CALIFORNIA FRANCHISE TAX BOARD |

USA |

129,423 |

1 |

29-May-25 |

||||||||||||||||

KERN COUNTY TREASURER AND TAX COLLECTOR (CA) |

USA |

5,594,339 |

1 |

29-May-25 |

||||||||||||||||

PINAL COUNTY TREASURER (AZ) |

USA |

1,361,968 |

1 |

29-May-25 |

||||||||||||||||

SALT LAKE COUNTY (UT) |

USA |

55,068,829 |

1 |

29-May-25 |

||||||||||||||||

USA - INTERNAL REVENUE SERVICE |

USA |

(28,438,780) |

1 |

29-May-25 |

||||||||||||||||

UTAH STATE TAX COMMISSION |

USA |

16,423,992 |

1 |

29-May-25 |

||||||||||||||||

SOUTH AFRICAN REVENUE SERVICE |

ZAF |

77,479,957 |

1 |

D |

29-May-25 |

|||||||||||||||

TOTAL |

6,469,507,119 |

|||||||||||||||||||

Note D: Amounts in local currency are converted to US$ at the average exchange rate for the year. | ||||||||||||||||||||

Note E: Amounts in local currency are converted to US$ at the exchange rate at the time the payments were made. | ||||||||||||||||||||

PROJECT PAYMENTS BY TYPE | |||||||||||||||||||||||||||||||||||

Company Name |

RIO TINTO PLC |

||||||||||||||||||||||||||||||||||

Company Number |

00719885 |

||||||||||||||||||||||||||||||||||

Report Name |

Extractive Industry Reporting |

||||||||||||||||||||||||||||||||||

Report End Date |

31-Dec-24 |

||||||||||||||||||||||||||||||||||

Currency |

USD |

||||||||||||||||||||||||||||||||||

Project Code |

Project Name |

Country Code |

Payment Type |

Unit Measure |

Volume |

Valuation Method |

Amount |

Notes |

Version |

Filing Date |

|||||||||||||||||||||||||

ARG01 |

RINCON - ARGENTINA |

ARG |

Tax |

0 |

35,464,395 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

AUS01 |

PILBARA - WESTERN AUSTRALIA |

AUS |

Tax |

0 |

3,952,931,118 |

F |

1 |

29-May-25 |

|||||||||||||||||||||||||||

AUS01 |

PILBARA - WESTERN AUSTRALIA |

AUS |

Royalties |

0 |

2,096,460,438 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

AUS01 |

PILBARA - WESTERN AUSTRALIA |

AUS |

Fees |

0 |

14,860,403 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

AUS05 |

DAMPIER SALT - AUSTRALIA |

AUS |

Tax |

0 |

35,367,429 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

AUS05 |

DAMPIER SALT - AUSTRALIA |

AUS |

Royalties |

0 |

2,939,918 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

AUS05 |

DAMPIER SALT - AUSTRALIA |

AUS |

Fees |

0 |

143,429 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

AUS06 |

GOVE - AUSTRALIA |

AUS |

Royalties |

0 |

50,293,231 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

AUS06 |

GOVE - AUSTRALIA |

AUS |

Fees |

0 |

6,565,732 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

AUS07 |

WEIPA INCLUDING AMRUN - AUSTRALIA |

AUS |

Tax |

0 |

(79,752,159) |

G |

1 |

29-May-25 |

|||||||||||||||||||||||||||

AUS07 |

WEIPA INCLUDING AMRUN - AUSTRALIA |

AUS |

Royalties |

0 |

126,389,228 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

AUS07 |

WEIPA INCLUDING AMRUN - AUSTRALIA |

AUS |

Fees |

0 |

1,965,268 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

AUS08 |

WINU - AUSTRALIA |

AUS |

Tax |

0 |

(20,429,763) |

G |

1 |

29-May-25 |

|||||||||||||||||||||||||||

AUSEXP01 |

EXPLORATION - AUSTRALIA |

AUS |

Tax |

0 |

(22,232,782) |

G |

1 |

29-May-25 |

|||||||||||||||||||||||||||

AUSOTH01 |

HEAD OFFICE / NON-EXTRACTIVE AUSTRALIA |

AUS |

Tax |

0 |

(230,195,965) |

G |

1 |

29-May-25 |

|||||||||||||||||||||||||||

CAN01 |

IRON ORE COMPANY OF CANADA |

CAN |

Tax |

0 |

129,264,702 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

CAN01 |

IRON ORE COMPANY OF CANADA |

CAN |

Fees |

0 |

8,339,961 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

CAN02 |

DIAVIK - CANADA |

CAN |

Tax |

0 |

(867,618) |

1 |

29-May-25 |

||||||||||||||||||||||||||||

CAN02 |

DIAVIK - CANADA |

CAN |

Fees |

0 |

9,413,432 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

CAN03 |

RIO TINTO FER ET TITANE - CANADA |

CAN |

Tax |

0 |

1,497,300 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

CAN03 |

RIO TINTO FER ET TITANE - CANADA |

CAN |

Fees |

0 |

783,172 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

CHLEXP01 |

EXPLORATION - CHILE |

CHL |

Tax |

0 |

160,608 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

KAZEXP01 |

EXPLORATION - KAZAKHSTAN |

KAZ |

Fees |

0 |

701,773 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

MDG01 |

QIT MADAGASCAR MINERALS |

MDG |

Tax |

0 |

1,181,895 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

MDG01 |

QIT MADAGASCAR MINERALS |

MDG |

Royalties |

0 |

5,768,605 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

MNG01 |

OYU TOLGOI - MONGOLIA |

MNG |

Tax |

0 |

13,061,197 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

MNG01 |

OYU TOLGOI - MONGOLIA |

MNG |

Royalties |

0 |

126,246,003 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

MNG01 |

OYU TOLGOI - MONGOLIA |

MNG |

Fees |

0 |

60,784,574 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

MNG01 |

OYU TOLGOI - MONGOLIA |

MNG |

Bonuses |

0 |

13,876,594 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

PEREXP01 |

EXPLORATION - PERU |

PER |

Fees |

0 |

798,385 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

USA01 |

KENNECOTT UTAH COPPER - US |

USA |

Tax |

0 |

6,925,310 |

H |

1 |

29-May-25 |

|||||||||||||||||||||||||||

USA01 |

KENNECOTT UTAH COPPER - US |

USA |

Royalties |

0 |

16,423,992 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

USA01 |

KENNECOTT UTAH COPPER - US |

USA |

Fees |

0 |

55,068,829 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

USA02 |

RESOLUTION COPPER - US |

USA |

Tax |

0 |

(36,933,176) |

H |

1 |

29-May-25 |

|||||||||||||||||||||||||||

USA02 |

RESOLUTION COPPER - US |

USA |

Fees |

0 |

1,361,968 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

USA03 |

US BORAX |

USA |

Tax |

0 |

14,627,122 |

H |

1 |

29-May-25 |

|||||||||||||||||||||||||||

USA03 |

US BORAX |

USA |

Fees |

0 |

5,723,761 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

USAEXP01 |

EXPLORATION - US |

USA |

Tax |

0 |

(13,058,036) |

H |

1 |

29-May-25 |

|||||||||||||||||||||||||||

USAEXP01 |

EXPLORATION - US |

USA |

Fees |

0 |

106,889 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

ZAF01 |

RICHARDS BAY MINERALS - SOUTH AFRICA |

ZAF |

Tax |

0 |

65,591,414 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

ZAF01 |

RICHARDS BAY MINERALS - SOUTH AFRICA |

ZAF |

Royalties |

0 |

11,888,543 |

1 |

29-May-25 |

||||||||||||||||||||||||||||

TOTAL |

6,469,507,119 |

||||||||||||||||||||||||||||||||||

Note F: Project amount includes payments / refunds between entities within tax groups where final payments to government are paid by the head / representative entity on behalf of the tax group. | |||||||||||||||||||||||||||||||||||

Note G: Project amount includes payments / refunds between entities within tax groups where final payments to government are paid by the head / representative entity on behalf of the tax group. This does not represent an actual refund from the Australian Tax Office. | |||||||||||||||||||||||||||||||||||

Note H: Project amount includes payments / refunds between entities within tax groups where final payments to government are paid by the head / representative entity on behalf of the tax group. Overall there was a net refund from the IRS in the year. | |||||||||||||||||||||||||||||||||||

PROJECT PAYMENT TOTALS | ||||||||||||||||||||

Company Name |

RIO TINTO PLC |

|||||||||||||||||||

Company Number |

00719885 |

|||||||||||||||||||

Report Name |

Extractive Industry Reporting |

|||||||||||||||||||

Report End Date |

31-Dec-24 |

|||||||||||||||||||

Currency |

USD |

|||||||||||||||||||

Project Name |

Project Code |

Amount |

Version |

Notes |

Filing Date |

|||||||||||||||

RINCON - ARGENTINA |

ARG01 |

35,464,395 |

1 |

29-May-25 |

||||||||||||||||

PILBARA - WESTERN AUSTRALIA |

AUS01 |

6,064,251,959 |

1 |

29-May-25 |

||||||||||||||||

DAMPIER SALT - AUSTRALIA |

AUS05 |

38,450,776 |

1 |

29-May-25 |

||||||||||||||||

GOVE - AUSTRALIA |

AUS06 |

56,858,964 |

1 |

29-May-25 |

||||||||||||||||

WEIPA INCLUDING AMRUN - AUSTRALIA |

AUS07 |

48,602,337 |

1 |

29-May-25 |

||||||||||||||||

WINU - AUSTRALIA |

AUS08 |

(20,429,763) |

1 |

29-May-25 |

||||||||||||||||

EXPLORATION - AUSTRALIA |

AUSEXP01 |

(22,232,782) |

1 |

29-May-25 |

||||||||||||||||

HEAD OFFICE / NON-EXTRACTIVE AUSTRALIA |

AUSOTH01 |

(230,195,965) |

1 |

29-May-25 |

||||||||||||||||

IRON ORE COMPANY OF CANADA |

CAN01 |

137,604,663 |

1 |

29-May-25 |

||||||||||||||||

DIAVIK - CANADA |

CAN02 |

8,545,814 |

1 |

A |

29-May-25 |

|||||||||||||||

RIO TINTO FER ET TITANE - CANADA |

CAN03 |

2,280,471 |

1 |

29-May-25 |

||||||||||||||||

EXPLORATION - CHILE |

CHLEXP01 |

160,608 |

1 |

29-May-25 |

||||||||||||||||

EXPLORATION - KAZAKHSTAN |

KAZEXP01 |

701,773 |

1 |

29-May-25 |

||||||||||||||||

QIT MADAGASCAR MINERALS |

MDG01 |

6,950,501 |

1 |

29-May-25 |

||||||||||||||||

OYU TOLGOI - MONGOLIA |

MNG01 |

213,968,367 |

1 |

29-May-25 |

||||||||||||||||

EXPLORATION - PERU |

PEREXP01 |

798,385 |

1 |

29-May-25 |

||||||||||||||||

KENNECOTT UTAH COPPER - US |

USA01 |

78,418,131 |

1 |

29-May-25 |

||||||||||||||||

RESOLUTION COPPER - US |

USA02 |

(35,571,208) |

1 |

29-May-25 |

||||||||||||||||

US BORAX |

USA03 |

20,350,883 |

1 |

29-May-25 |

||||||||||||||||

EXPLORATION - US |

USAEXP01 |

(12,951,147) |

1 |

29-May-25 |

||||||||||||||||

RICHARDS BAY MINERALS - SOUTH AFRICA |

ZAF01 |

77,479,957 |

1 |

29-May-25 |

||||||||||||||||

TOTAL |

6,469,507,119 |

|||||||||||||||||||

|

Media Relations,

United Kingdom

Matthew Klar

M +44 7796 630 637

David Outhwaite

M +44 7787 597 493

|

Media Relations,

Australia

Matt Chambers

M +61 433 525 739

Michelle Lee

M +61 458 609 322

Rachel Pupazzoni

M +61 438 875 469

|

Media Relations,

Canada

Simon Letendre

M +1 514 796 4973

Malika Cherry

M +1 418 592 7293

Vanessa Damha

M +1 514 715 2152

Media Relations,

US

Jesse Riseborough

M +1 202 394 9480

|

||||||

|

Investor Relations,

United Kingdom

Rachel Arellano

M: +44 7584 609 644 David Ovington

M +44 7920 010 978

Laura Brooks

M +44 7826 942 797

Weiwei Hu

M +44 7825 907 230

|

Investor Relations,

Australia

Tom Gallop

M +61 439 353 948

Phoebe Lee

M +61 413 557 780

|

|||||||

|

Rio Tinto plc

6 St James’s Square

London SW1Y 4AD

United Kingdom

T +44 20 7781 2000

Registered in England

No. 719885

|

Rio Tinto Limited

Level 43, 120 Collins Street

Melbourne 3000

Australia

T +61 3 9283 3333

Registered in Australia

ABN 96 004 458 404

|

|||||||