May 2025 Investor Day Meeting with Management

Forward-Looking Statements This presentation contains forward-looking statements that are subject to risks and uncertainties including, but not limited to, statements regarding our intent, belief or current expectations with respect to (i) our strategic plans and future financial results; (ii) trends in the demand for our services and products; (iii) trends in the industries that consume our services and products; (iv) market and company-specific impacts of NHP supply and demand matters; (v) compliance with the Resolution Agreement and Plea Agreement and the expected impacts on the Company related to the compliance plan and compliance monitor, and the expected amounts, timing and expense treatment of cash payments and other investments thereunder; (vi) our ability to service our outstanding indebtedness and to comply or regain compliance with financial covenants, including those established by the Seventh Amendment to our Credit Agreement; (vii) our current and forecasted cash position; (viii) our ability to make capital expenditures, fund our operations and satisfy our obligations; (ix) our ability to manage recurring and unusual costs; (x) our ability to execute on and realize the expected benefits related to our restructuring and site optimization plans; (xi) our expectations regarding the volume of new bookings, pre-sales, pricing, cost savings initiatives, expansion of services, operating income or losses and liquidity; (xii) our ability to effectively fill the recent expanded capacity or any future expansion or acquisition initiatives undertaken by us; (xiii) our ability to develop and build infrastructure and teams to manage growth and projects; (xiv) our ability to continue to retain and hire key talent; (xv) our ability to market our services and products under our corporate name and relevant brand names; (xvi) our ability to develop new services and products; (xvii) our ability to negotiate amendments to the Credit Agreement or obtain waivers related to the financial covenants defined within the Credit Agreement; and (xviii) the impact of macroeconomic factors, including but not limited to tariffs; (xix) the impact of potential government consolidation efforts or funding cuts; and (xx) the anticipated use and impact of new approach methodologies. Further discussion of these risks, uncertainties, and other matters can be found in the Risk Factors detailed in our Annual Report on Form 10-K as filed on December 4, 2024, as well as other filings we make with the Securities and Exchange Commission. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Any forward-looking statement made by us is based only on information currently available to us and speaks only as of the date on which it is made. In light of the uncertainties inherent in any forward-looking statement, the inclusion of a forward-looking statement herein should not be regarded as a representation by us that our plans and objectives will be achieved. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. Tradenames, trademarks and service marks of other companies appearing in this presentation are the property of their respective owners. Solely for convenience, the trademarks, trade names and service marks referred to in this presentation may appear without the Ⓡ, or SM symbols, but such references are not intended to indicate, in any way, that the Company will not assert, to the fullest extent under applicable law, its rights, or the right of the applicable licensor, to these trademarks, trade names and service marks. The Company does not intend its use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties. 2

Opening Remarks Bob Leasure CEO, President and Director

Company Overview • Inotiv, Inc. is a leading contract research organization (“CRO”) dedicated to providing drug discovery and development services primarily to the pharmaceutical and medical device industries • We provide a comprehensive suite of high research-quality science, models, diets and services, participating with our clients in the discovery and development of novel therapeutics • Our full spectrum solutions span two segments: > Discovery and Safety Assessment (“DSA”) > Research Models and Services (“RMS”) • Founded in 1974, company was reinvented in 2017 when current leadership launched a new strategic plan and vision for the company Headquarters West Lafayette, IN Year Formed 1974 Employees ~2,100 Clients ~2,200 Exchange:Ticker Nasdaq:NOTV Recent Price (5/27/25) $2.55 Market Cap. (5/27/25)1 ~$88 million 1 Market Cap. is based on shares outstanding as of 4/30/25. 4

The Evolving Preclinical Industry and Current Challenges Adrian Hardy, Chief Commercial Officer & John Sagartz, Chief Strategy Officer

Evolving Preclinical Industry and Current Challenges • Tariffs • NIH funding • New approach methodologies (NAMs) 6

Trade Tariffs • Uncertainty as to whether US-imposed trade tariffs, and any retaliatory actions from trade partners, could impact pricing and supply chain – likely to become clear over time on a country-by-country basis • Potential impacts for Inotiv are both direct and indirect • Direct impacts – cost inflation on cross-border finished goods sold or sourced > Inotiv naturally hedged with majority of revenue and costs incurred in same geographies > Major exception is non-human primates – we anticipate any additional costs will be shared with suppliers and/or to be passed on whole, or in part, to clients for this critical resource • Indirect impacts – cost inflation of source components used in the production of finished goods and services > Potential for challenges over time in cost inflation and supply chain disruption, primarily for plant and equipment needed for routine maintenance and facility expansions > Proactive sourcing strategies to help mitigate worst-case scenarios > Will continually reassess as clarity around progress of the country-by-country negotiations evolves 7

NIH Funding • NIH is the largest public funder of biomedical research globally, with a current annual budget of ~$48 billion • The US administration has proposed a cut to the NIH 2026 budget of ~40%, approximately a quarter of which would be anticipated to come from capping grant funding for indirect costs at 15% (down from an average of ~27% currently) • Proposed consolidation of 27 agencies down to 5, potential to further reduce overhead • Too early to determine how much may flow directly to reduced research funding 8

FDA Recent Announcement • April 10, 2025, the FDA announced efforts to reduce, refine and replace certain animal testing • FDA will consider, that with certain well-characterized therapeutic candidates such as monoclonal antibodies (mABs), fast track review may be given to products characterized using new approach methodologies (NAMS) • Inotiv strongly supports, has long invested in, and applies the use of new approach methodologies toward the development of efficacious and safe therapies; our clients require them 9

Inotiv and NAMs • “NAMs” > New Approach Methodologies > “Non-Animal Methodologies” • Inotiv’s NAMs capabilities > Computational toxicology > Genetic toxicology in bacteria and mammalian cells > Cell culture techniques (primary and cell lines) > Access to procured and curated healthy and diseased human tissues > Proteomic pathway profiling in human and animal tissues > Multiple collaborations to validate new methods, including 2D and 3D cell culture > Laboratory flexibility to develop bespoke models to support project-specific issues 10 The pathologist and toxicologist in pharmaceutical product discovery C L Alden 1, J E Sagartz, P F Smith, A G Wilson, R T Bunch, D L Morris, 1999 The application of discovery toxicology and pathology towards the design of safer pharmaceutical lead candidates Jeffrey A Kramer 1, John E Sagartz, Dale L Morris, 2007

NAMs Example in Supporting 3R’s (Reduce and Refine) • ILSI-HESI alternatives to carcinogenicity > Initiated in 1996 with the widespread capability of generating knock-out and transgenic mice > Industry consortium consisting of regulators, pharmaceutical companies, CROs and animal suppliers > Goal: Determine the ability of several genetically-modified mice or in vitro assays to replace carcinogenicity studies, initially directed at mice • Carcinogenicity assessment > Lifetime (i.e., 2 years) studies typically in BOTH mice and rats > Mice poorly predictive of human cancer risk, and studies employed thousands of animals to evaluate both cancer risk and systemic exposure to the candidate drug 11

Reduce and Refine: Mouse Carcinogenicity • Studies conducted over several years by numerous sponsors, evaluating several mechanisms of cancer risk assessment • p53+/-, TG.AC, Tg.rasH2, neonatal mouse assay • Outcome > Regulatory acceptance of alternative models, especially p53+/- and Tg.rasH2 > With the advent of these models, animal use is a fraction of that in traditional 2 year assays > Time taken to assess safety reduced from >2.5 years to ~8-10 months 12 The Utility of Genetically Modified Mouse Assays for Identifying Human Carcinogens: A Basic Understanding and Path Forward James MacDonald , John E. French , Ronald J. Gerson , Jay Goodman , Tohru Inoue , Abigail Jacobs , Peter Kasper , Douglas Keller , Amy Lavin , Gerald Long , Bruce McCullough , Frank D. Sistare , Richard Storer , Jan Willem van der Laan Toxicological Sciences, Volume 77, Issue 2, February 2004, Pages 188–194

Refine and/or Replace: Skin Sensitization Assay • Historically, relied on animal models, especially guinea pigs, to evaluate immune-mediated skin responses • The local lymph node assay, a mouse-based test, became a dominant method for assessing skin sensitization. Involves injecting the test chemical into the skin and monitoring the lymph nodes for a sensitized immune response. The LLNA is considered a refinement of the guinea pig tests and is less painful and uses fewer animals • Driven by the desire to replace animal testing and gain a deeper understanding of the mechanisms of skin sensitization, in vitro and in silico assays emerged • In vitro assays, such as the Direct Peptide Reactivity Assay (DPRA) and the Human Cell Line Activation Test (h-CLAT), focus on specific key events in the adverse outcome pathway (AOP) of skin sensitization, such as the interaction of the chemical with skin proteins or the activation of keratinocytes • In silico models use computational methods to predict skin sensitization based on chemical structure and other information 13

Skin Sensitization Assays • Integrated Testing Strategies and Defined Approaches • To improve the accuracy and reliability of skin sensitization assessments, integrated testing strategies that combine multiple assays, including in vivo and in vitro methods, are now in use • Defined Approaches (DAs) are specific combinations of information sources, such as in silico predictions, in chemico and in vitro data, used in a fixed data interpretation procedure to assess the risk of skin sensitization • These DAs are designed to be more predictive than single-test methods and can be used for both regulatory submissions and internal screenings Current Status • While animal tests like the LLNA are still used, there is a clear trend towards replacing them with non- animal methods • The focus is on developing and validating in vitro and in silico assays that can accurately predict skin sensitization and provide insights into the mechanisms involved 14

Vision of a Possible NAMs Future • Industry has been developing NAMs technologies for decades • Already made substantial progress in supplementing the science, and refining and reducing the use of animals, in drug development • It took over twenty years to almost completely replace the use of animals in a “simple” test for skin sensitization • It is our belief that developing new medicines for complex diseases, that could affect multiple organ systems, for 8 billion humans is beyond the capabilities of current alternatives • Inotiv is committed to working with the science, and the regulators, in advancing the use of NAMs where they are appropriate to help develop safer new medicines 15

Building Inotiv for the Future Bob Leasure, CEO, President and Director

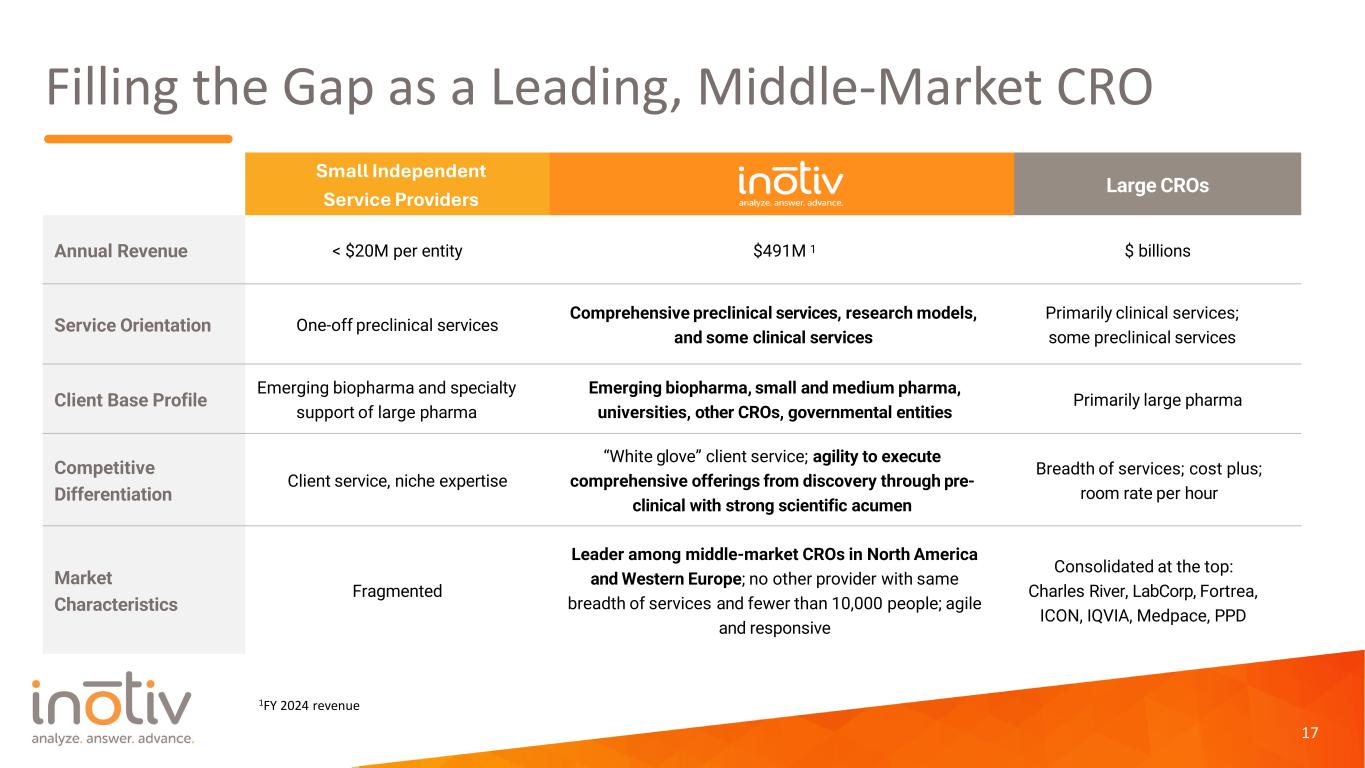

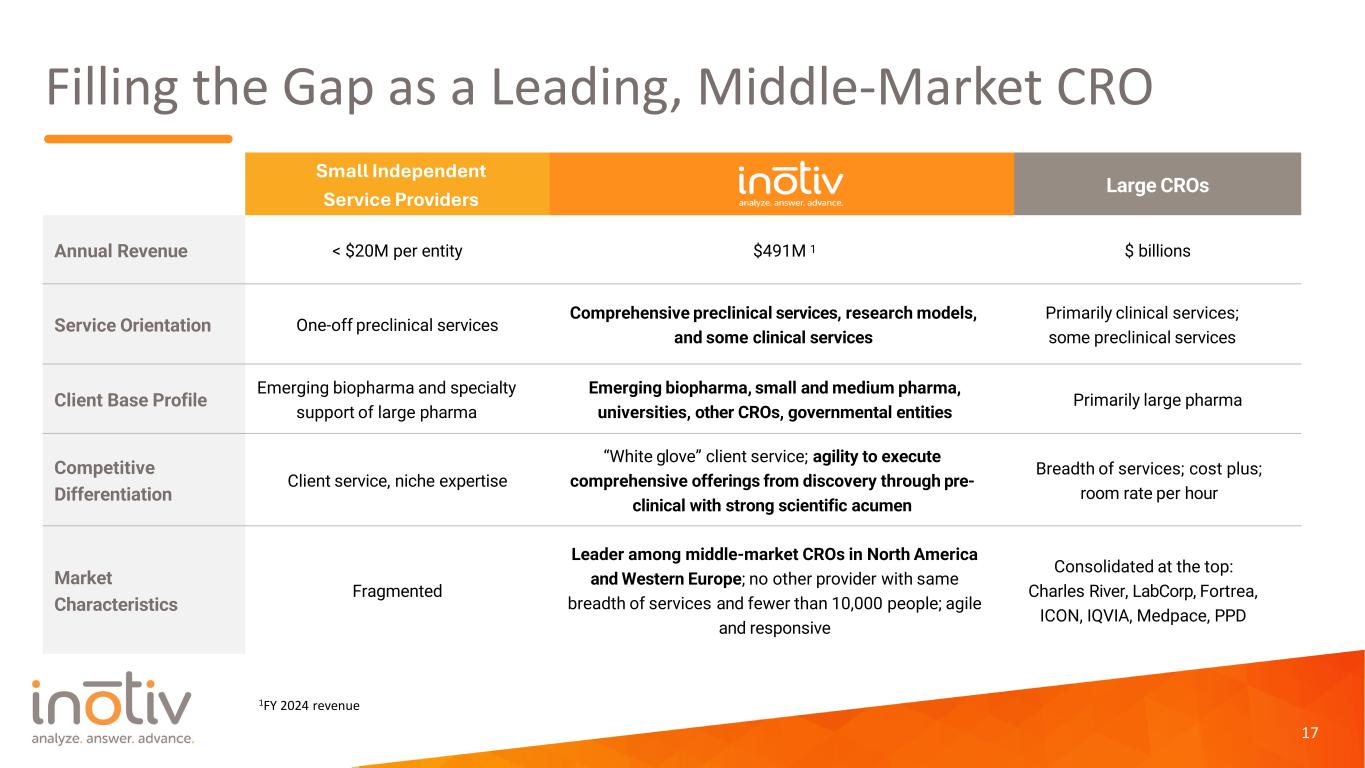

Filling the Gap as a Leading, Middle-Market CRO 17 Large CROs Annual Revenue < $20M per entity $491M 1 $ billions Service Orientation One-off preclinical services Comprehensive preclinical services, research models, and some clinical services Primarily clinical services; some preclinical services Client Base Profile Emerging biopharma and specialty support of large pharma Emerging biopharma, small and medium pharma, universities, other CROs, governmental entities Primarily large pharma Competitive Differentiation Client service, niche expertise “White glove” client service; agility to execute comprehensive offerings from discovery through pre- clinical with strong scientific acumen Breadth of services; cost plus; room rate per hour Market Characteristics Fragmented Leader among middle-market CROs in North America and Western Europe; no other provider with same breadth of services and fewer than 10,000 people; agile and responsive Consolidated at the top: Charles River, LabCorp, Fortrea, ICON, IQVIA, Medpace, PPD Small Independent Service Providers 1FY 2024 revenue

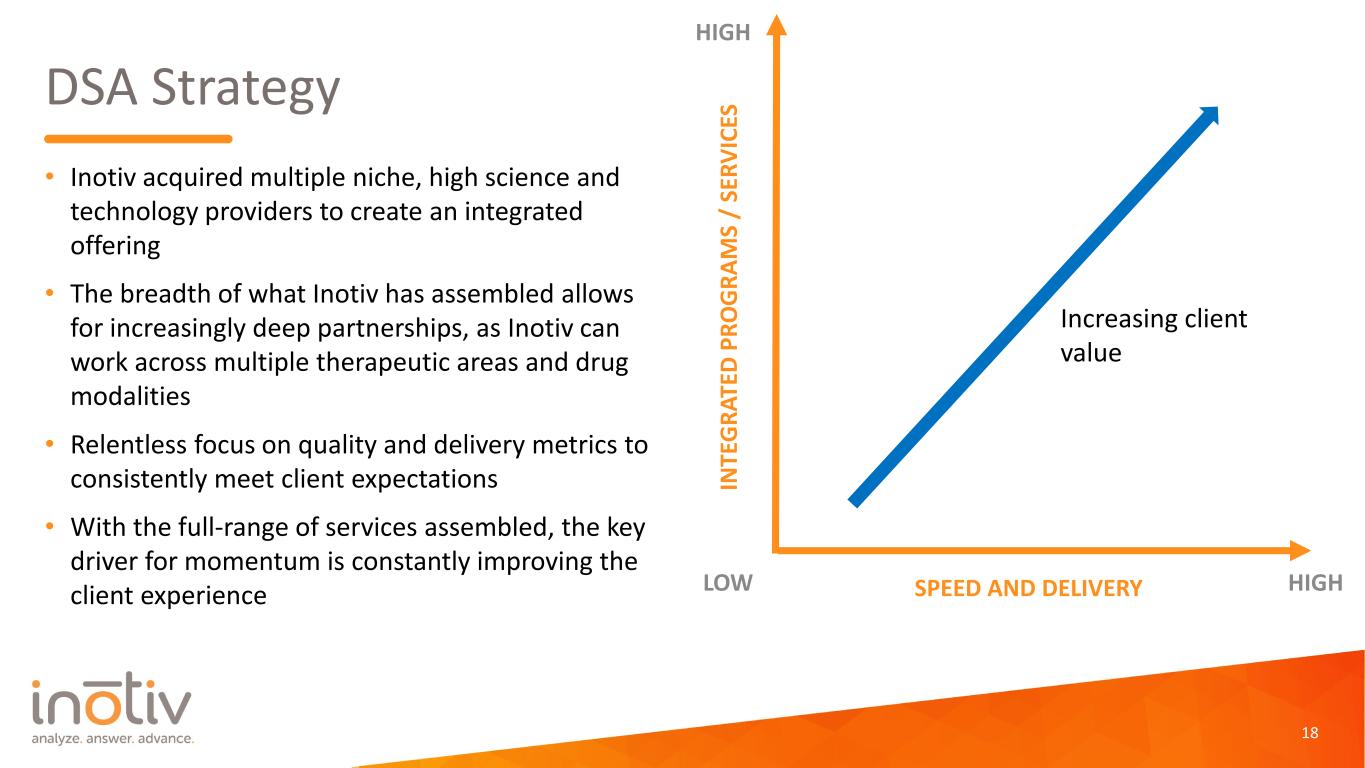

DSA Strategy • Inotiv acquired multiple niche, high science and technology providers to create an integrated offering • The breadth of what Inotiv has assembled allows for increasingly deep partnerships, as Inotiv can work across multiple therapeutic areas and drug modalities • Relentless focus on quality and delivery metrics to consistently meet client expectations • With the full-range of services assembled, the key driver for momentum is constantly improving the client experience 18 IN TE G RA TE D P RO G RA M S / SE RV IC ES SPEED AND DELIVERYLOW HIGH HIGH Increasing client value

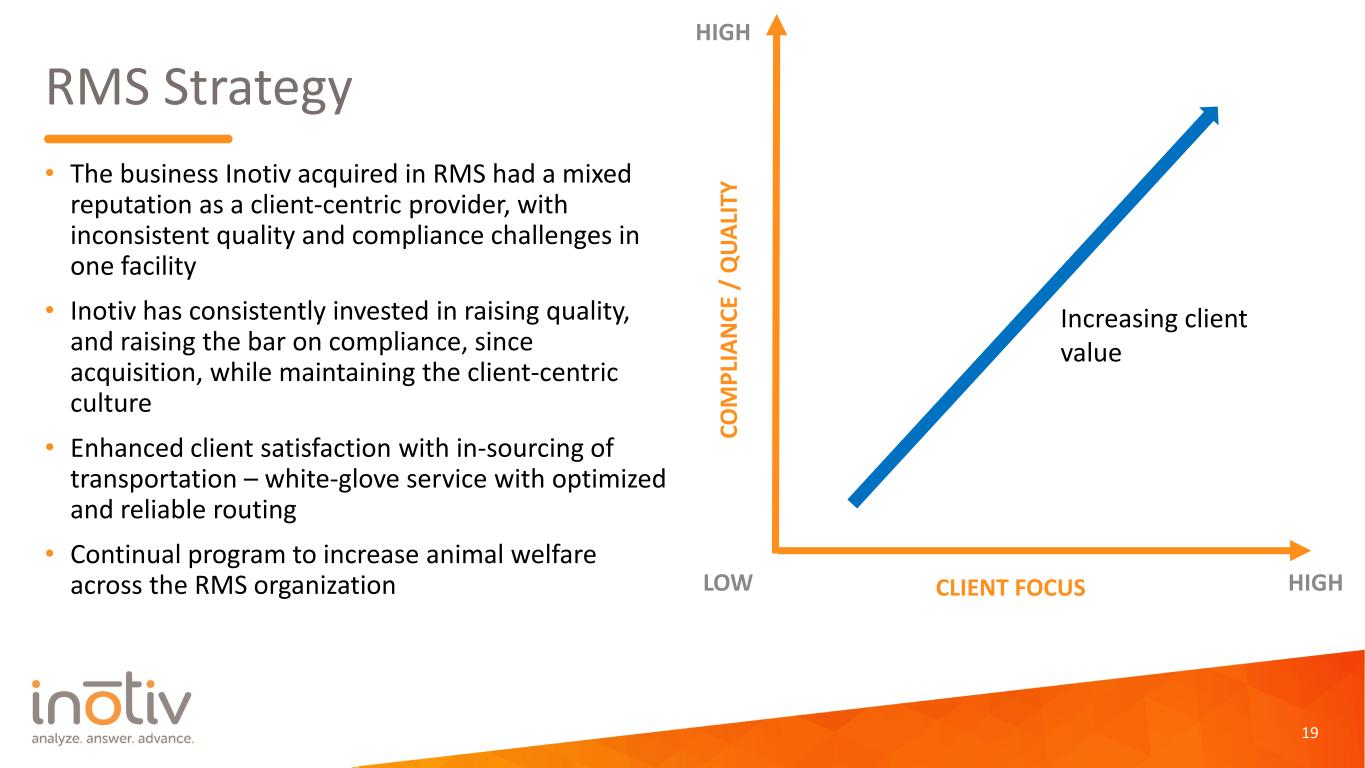

RMS Strategy • The business Inotiv acquired in RMS had a mixed reputation as a client-centric provider, with inconsistent quality and compliance challenges in one facility • Inotiv has consistently invested in raising quality, and raising the bar on compliance, since acquisition, while maintaining the client-centric culture • Enhanced client satisfaction with in-sourcing of transportation – white-glove service with optimized and reliable routing • Continual program to increase animal welfare across the RMS organization 19 CO M PL IA N CE / Q UA LI TY CLIENT FOCUSLOW HIGH HIGH Increasing client value

Strategic Evolution of Inotiv • Phase I: Acquisition and Growth (2018-2023) > M&A activity drove development of a full-service drug discovery and development CRO, and secured critical supply chains > Initiated organic investments to create capacity for growth • Phase II: Optimization & Integration (2023-2025) > Integrate acquired entities to present a unified One Inotiv experience to market > Consolidate operating footprint to drive efficiencies > Enhance client satisfaction • Phase III: Expansion (2025 →) > Margin expansion through operating leverage and cost management > Continued organic growth and opportunistic M&A strategy 20 Phase I: Acquisition and Growth Building a Full-Service CRO Phase II: Optimization & Integration Building One Inotiv Phase III: Expansion Building on the Platform

Phase I: Acquisition and Growth Building a Full-Service CRO

Acquisition & Growth: Building a Full-Service CRO • Strengthen management team • Accretive, client-driven acquisitions • Organic growth • Comprehensive breadth of services 22

Robert Leasure, Jr. Chief Executive Officer, President and Director Beth Taylor Executive Vice President, Chief Financial Officer Past Experience John Sagartz, DVM, PHD Chief Strategy Officer and Director Jeff Krupp Chief Human Resources Officer Greg Beattie Chief Operating Officer, DSA Lizanne Muller President, RMS Adrian Hardy, PhD Chief Commercial Officer Andrea Castetter Senior Vice President, General Counsel & Corporate Secretary, Chief Compliance Officer Experienced Management Team David Roll Chief Operating Officer, NHP 23

Successful Acquisition Strategy (14 in 5 years) $26.3 $43.6 $60.5 $89.6 $547.7 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 Capabilities Added: • Medical Device Assessment • Surgical Specialty Revenue ($millions) Capabilities Added: • Genetic Toxicology • Specialty Histology and Pathology • Drug Discovery Pharmacology – Rheumatoid Arthritis, Osteoarthritis, IBD, CNS, Inflammation, Pain, Cardiovascular, Renal Capabilities Added: • Research Models & Services • Proteomics • Specialty Histology and Pathology • Drug Discovery Pharmacology – Cardiovascular, Renal, Pulmonary, Hepatic • Genetic Toxicology • Computational Toxicology • In Vitro Toxicology BioReliance® Inotiv has a strong track record integrating accretive acquisitions to enhance revenue growth Capabilities Added: • In vivo Toxicology and Pharmacology • GLP in vivo Services • GLP and non-GLP Bioanalysis • Histopathology / Histochemistry Capabilities Added: • Reproductive Toxicology

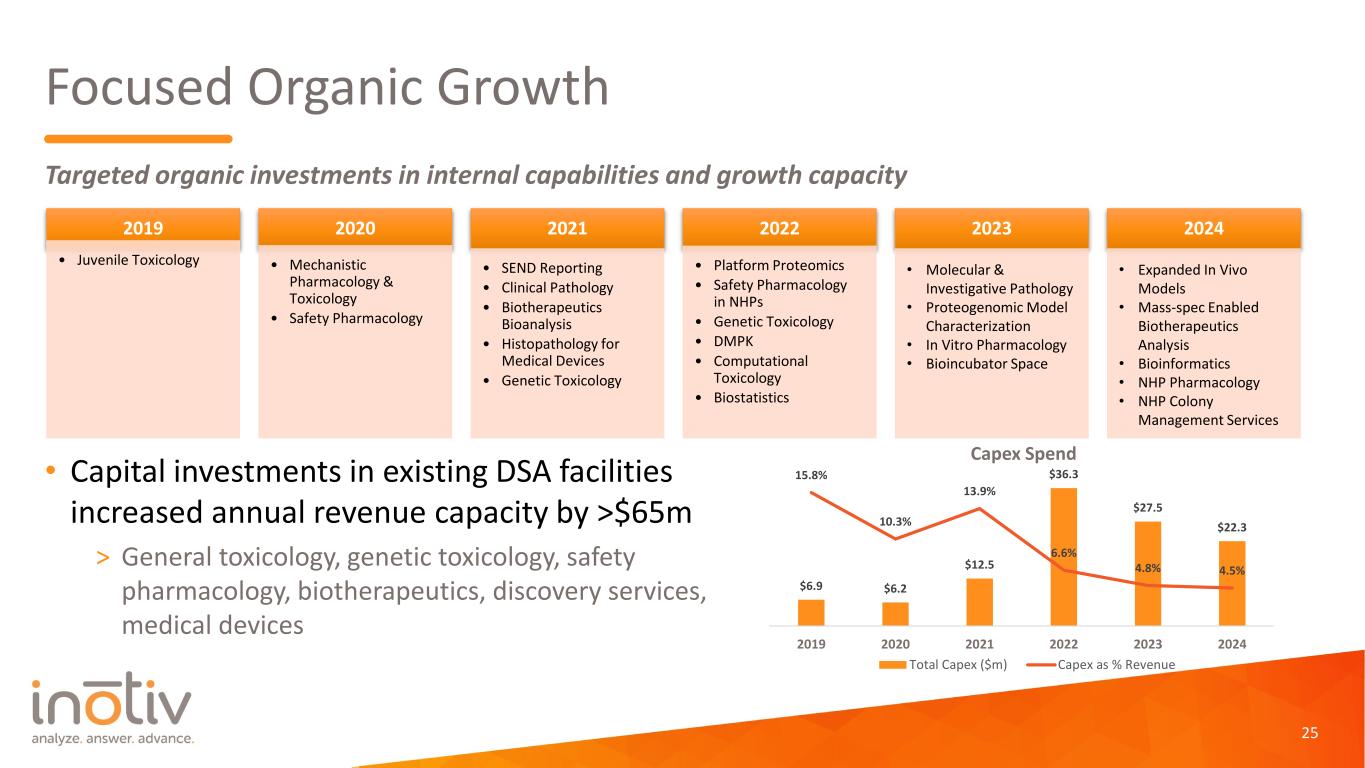

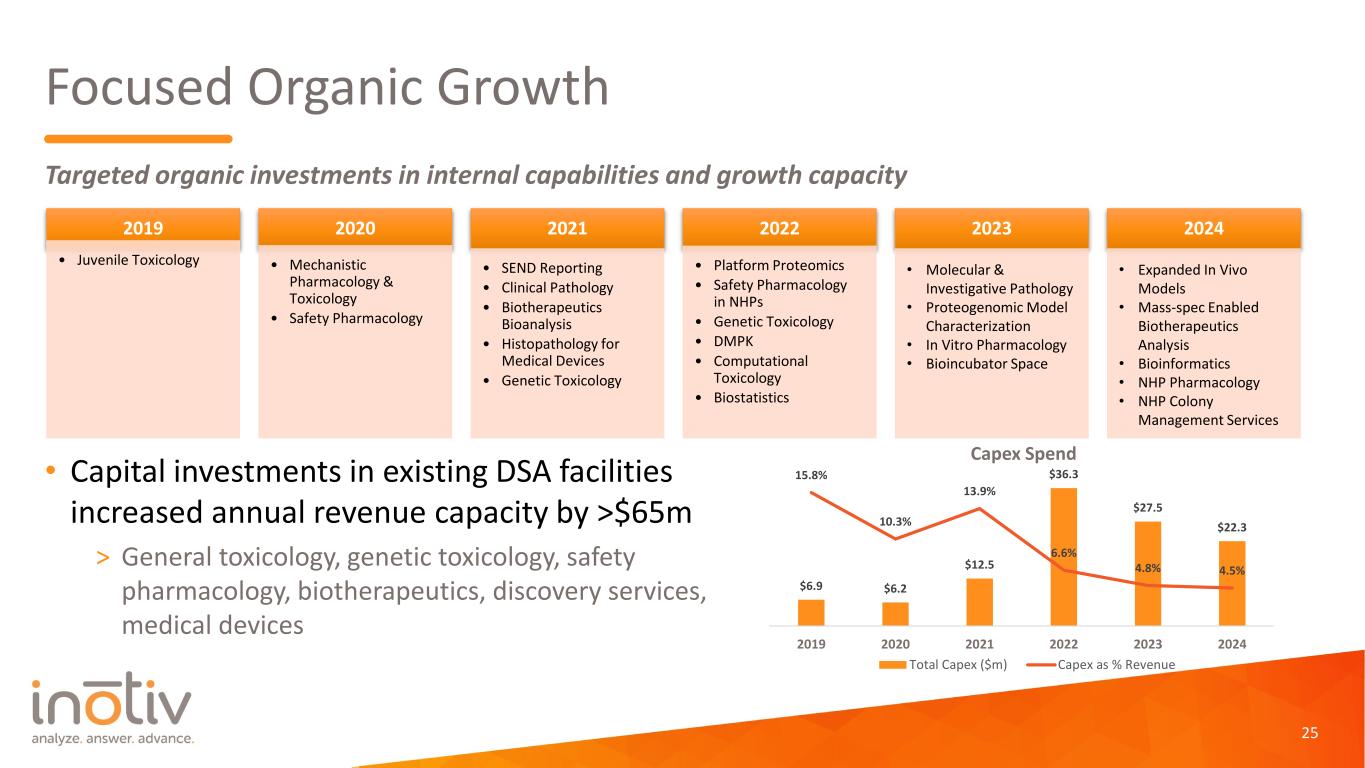

Focused Organic Growth • Capital investments in existing DSA facilities increased annual revenue capacity by >$65m > General toxicology, genetic toxicology, safety pharmacology, biotherapeutics, discovery services, medical devices Targeted organic investments in internal capabilities and growth capacity $6.9 $6.2 $12.5 $36.3 $27.5 $22.3 15.8% 10.3% 13.9% 6.6% 4.8% 4.5% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 0 5 10 15 20 25 30 35 40 2019 2020 2021 2022 2023 2024 Capex Spend Total Capex ($m) Capex as % Revenue 2019 • Juvenile Toxicology 2020 • Mechanistic Pharmacology & Toxicology • Safety Pharmacology 2021 • SEND Reporting • Clinical Pathology • Biotherapeutics Bioanalysis • Histopathology for Medical Devices • Genetic Toxicology 2022 • Platform Proteomics • Safety Pharmacology in NHPs • Genetic Toxicology • DMPK • Computational Toxicology • Biostatistics 2023 • Molecular & Investigative Pathology • Proteogenomic Model Characterization • In Vitro Pharmacology • Bioincubator Space 2024 • Expanded In Vivo Models • Mass-spec Enabled Biotherapeutics Analysis • Bioinformatics • NHP Pharmacology • NHP Colony Management Services 25

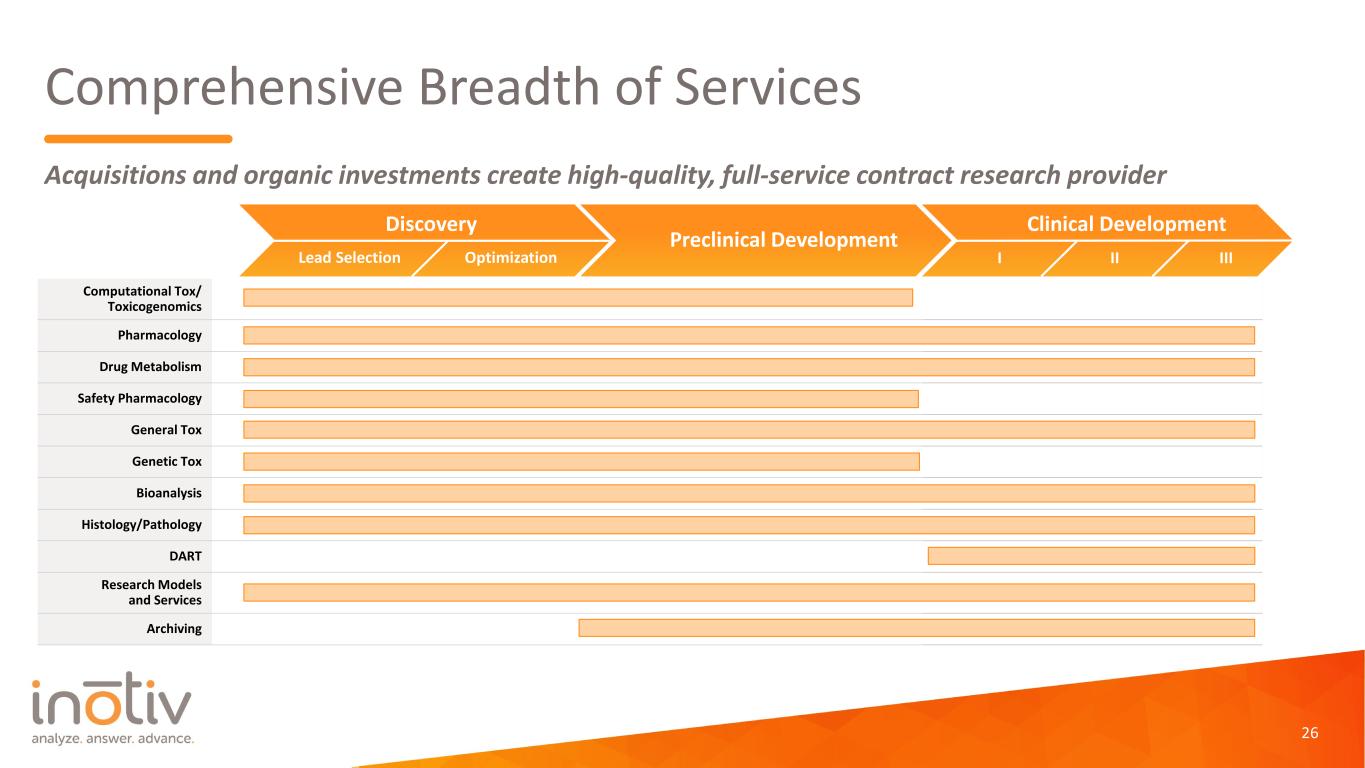

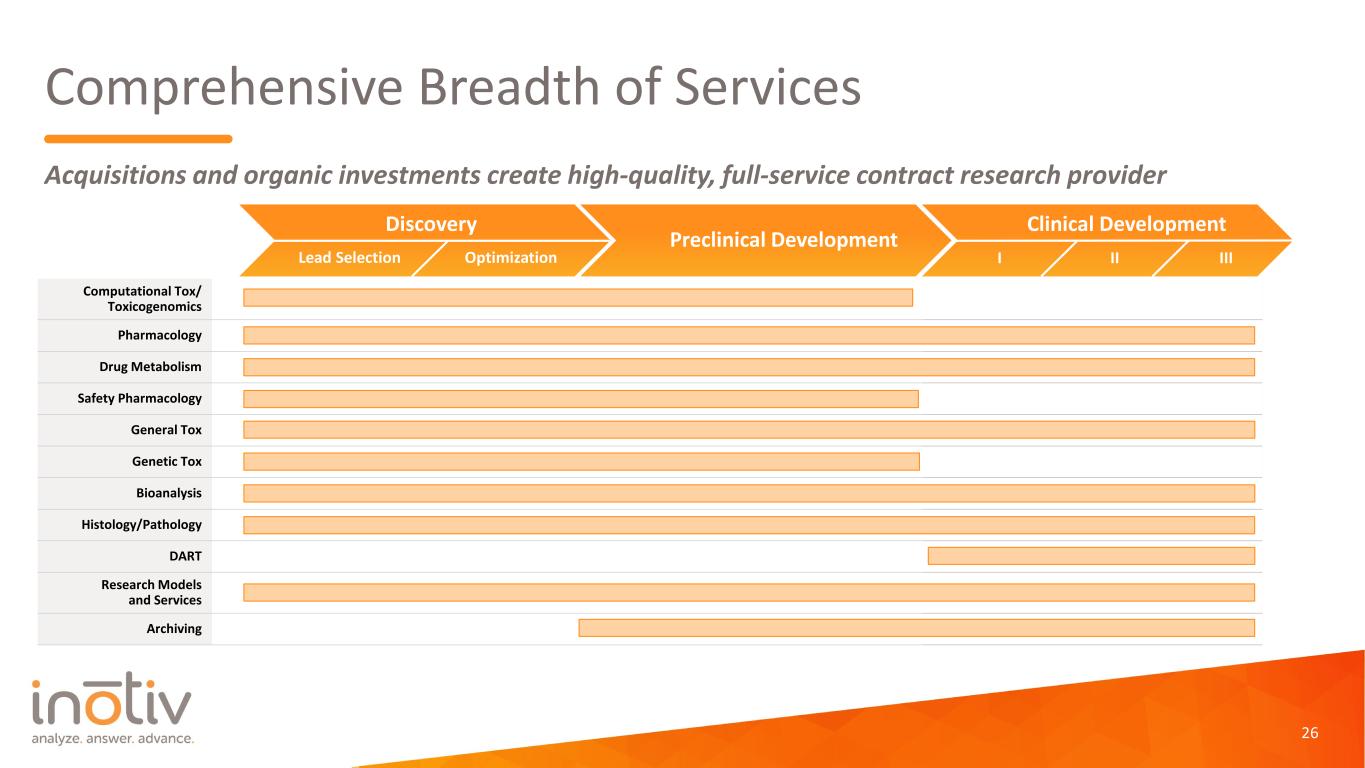

Comprehensive Breadth of Services Computational Tox/ Toxicogenomics Pharmacology Drug Metabolism Safety Pharmacology General Tox Genetic Tox Bioanalysis Histology/Pathology DART Research Models and Services Archiving Clinical DevelopmentDiscovery Preclinical Development Lead Selection Optimization I II III Acquisitions and organic investments create high-quality, full-service contract research provider 26

Phase II: Optimization & Integration Building One Inotiv

Optimization & Integration: Building One Inotiv • Site optimization & capacity utilization • In-sourcing transportation • Reduction of DSA outsourced 3rd party spend • Evolution of the NHP business • Enterprise study management • Strengthening commercial organization • Investments in strategic IT integration & “back office” optimization • Compliance enhancements 28

RMS Animal Facility Footprint Optimization 29 • Multi-year program to consolidate the number of RMS small animal production facilities • Increase operating efficiency and drive higher revenues per facility • Optimize capital expenditures to enhance quality and animal welfare in reduced number of facilities North America EMEA Previous Locations Future Locations Future LocationsPrevious Locations

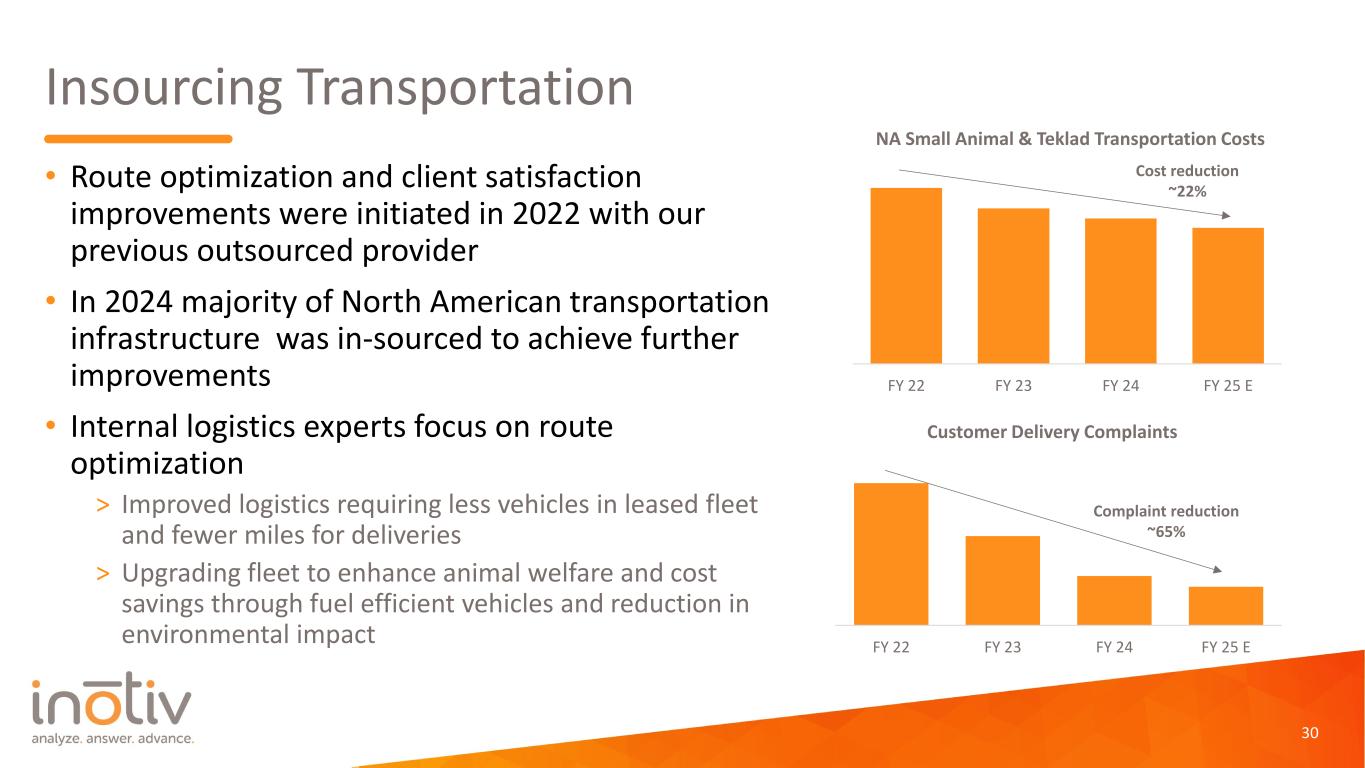

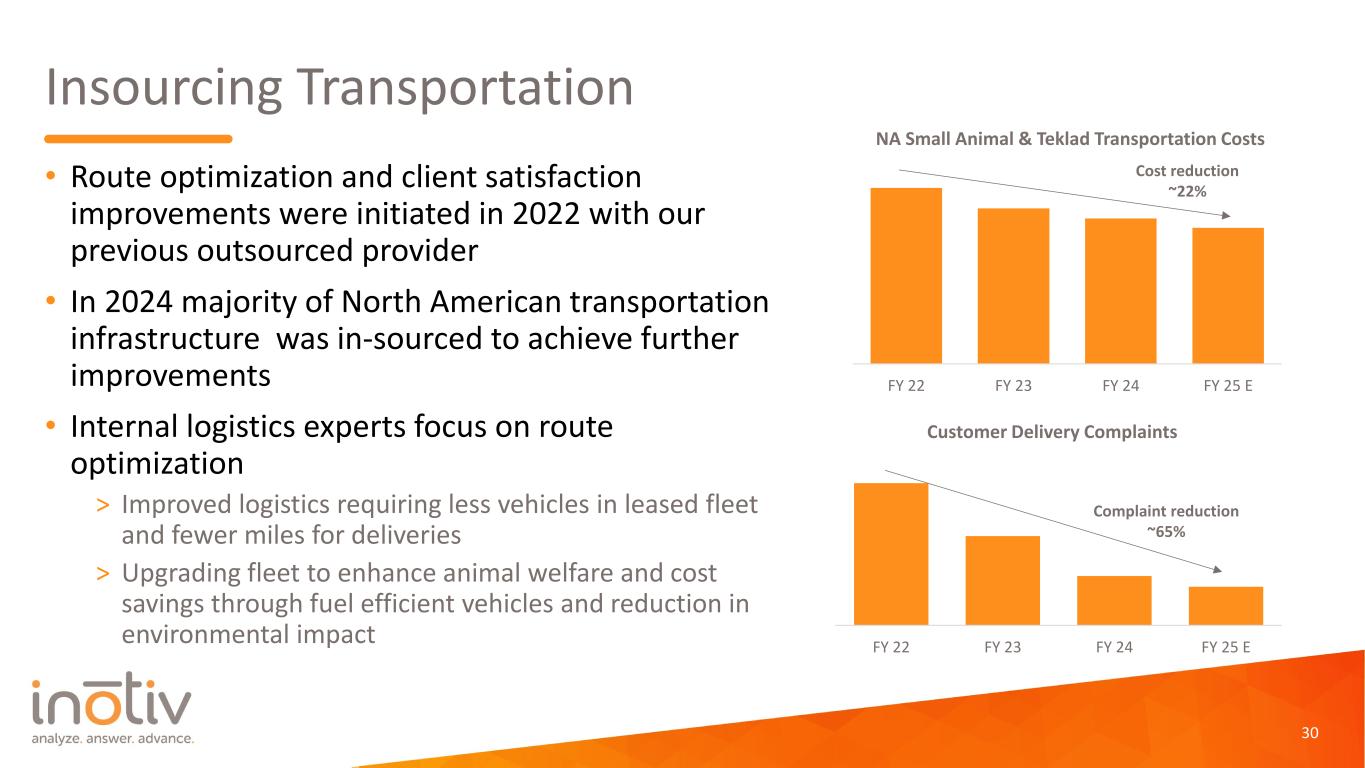

Insourcing Transportation • Route optimization and client satisfaction improvements were initiated in 2022 with our previous outsourced provider • In 2024 majority of North American transportation infrastructure was in-sourced to achieve further improvements • Internal logistics experts focus on route optimization > Improved logistics requiring less vehicles in leased fleet and fewer miles for deliveries > Upgrading fleet to enhance animal welfare and cost savings through fuel efficient vehicles and reduction in environmental impact 30 0 5000 10000 15000 20000 25000 30000 35000 40000 FY 22 FY 23 FY 24 FY 25 E NA Small Animal & Teklad Transportation Costs Cost reduction ~22% 0 100 200 300 400 500 600 FY 22 FY 23 FY 24 FY 25 E Customer Delivery Complaints Complaint reduction ~65%

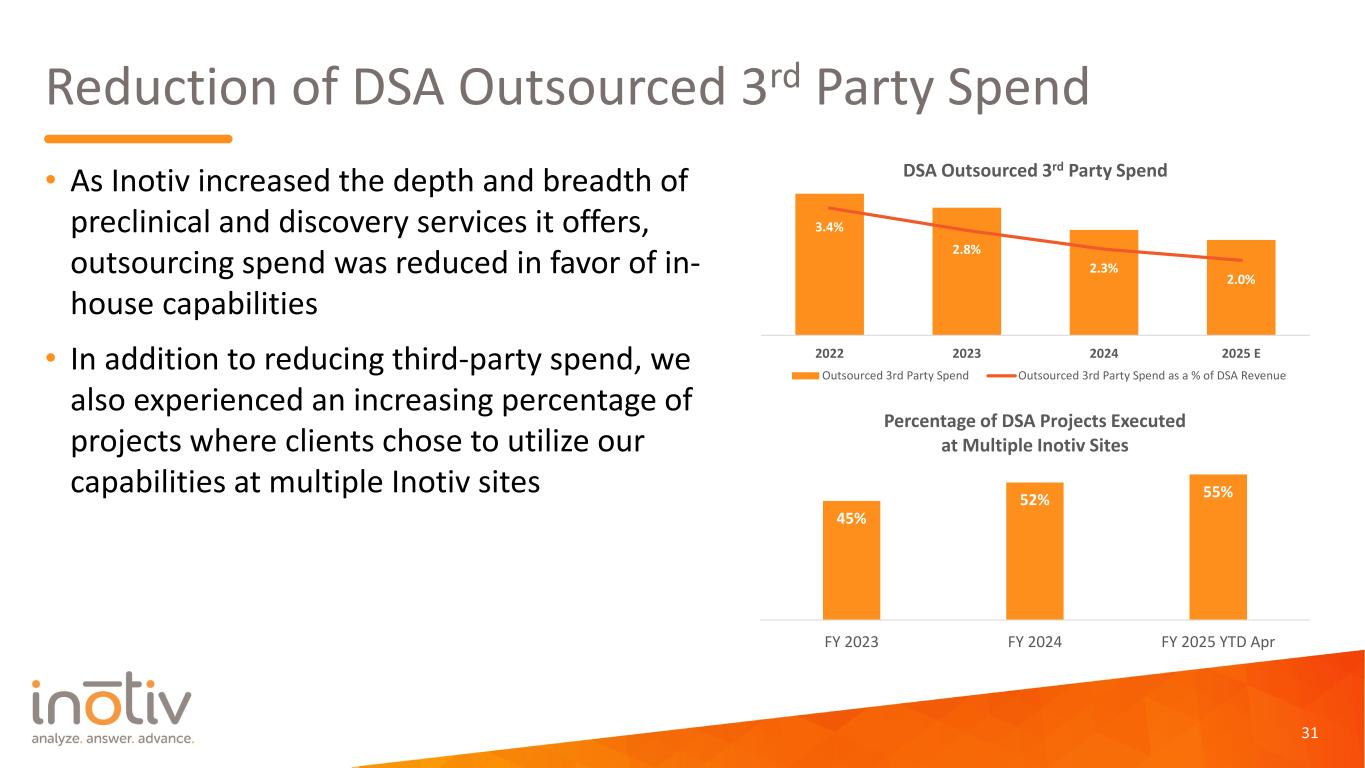

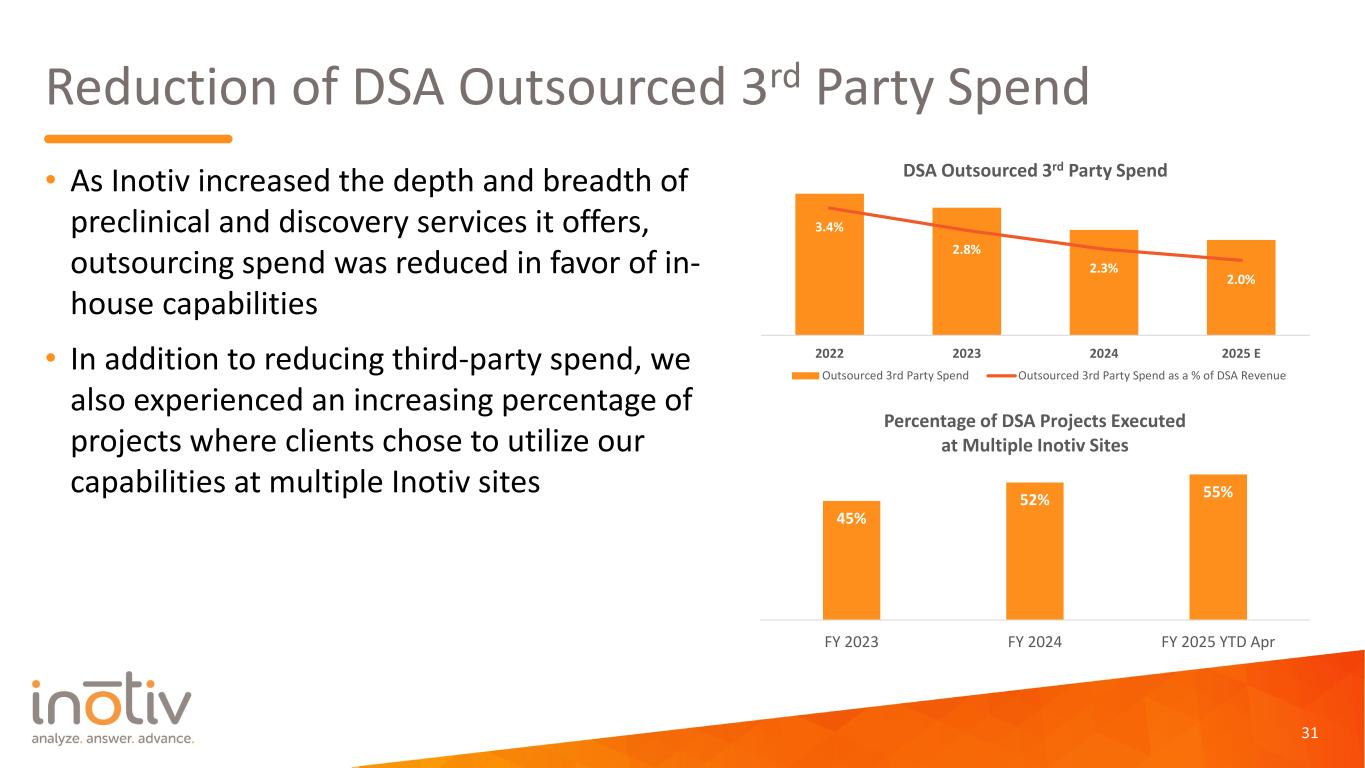

Reduction of DSA Outsourced 3rd Party Spend • As Inotiv increased the depth and breadth of preclinical and discovery services it offers, outsourcing spend was reduced in favor of in- house capabilities • In addition to reducing third-party spend, we also experienced an increasing percentage of projects where clients chose to utilize our capabilities at multiple Inotiv sites 31 3.4% 2.8% 2.3% 2.0% 2022 2023 2024 2025 E DSA Outsourced 3rd Party Spend Outsourced 3rd Party Spend Outsourced 3rd Party Spend as a % of DSA Revenue 45% 52% 55% FY 2023 FY 2024 FY 2025 YTD Apr Percentage of DSA Projects Executed at Multiple Inotiv Sites

Evolution of NHP Business FY 2022 – FY 2025 0 5 10 15 20 25 30 35 FY 2022 FY 2023 FY 2024 FY 2025 E NA NHP Colony Management Revenue • Increasing service revenue/colony management (boarding and breeding) • Diversification of client base • Diversification of supplier base • Increasing long-term reoccurring client contracts • Improving infrastructure and enhancing animal welfare > Added new IT / colony management systems > Enhanced veterinary team and support > New sewer and water treatment facility > Increased electrical capacity to the site > Continue to improve and add boarding and breeding facilities 32 Revenue CAGR 18% (22-25E) Largest NHP Customer Revenue as Percent of Overall NHP Revenue Down 40% from 2022 Ownership of NHPs at Inotiv Sites Client-Owned Inotiv-owned 2020 2021 2022 2023 2024 2025

Managing Complex Drug Development Programs • Assembled and integrated the people, processes and systems to deliver a seamless Inotiv experience for clients • Professional program management team providing oversight for complex projects through entire development lifecycle • Sophisticated project management tools developed to provide a common platform and visibility for integrated study management across disciplines and locations • Industry-standard tools for collection and reporting of data to regulatory requirements 33

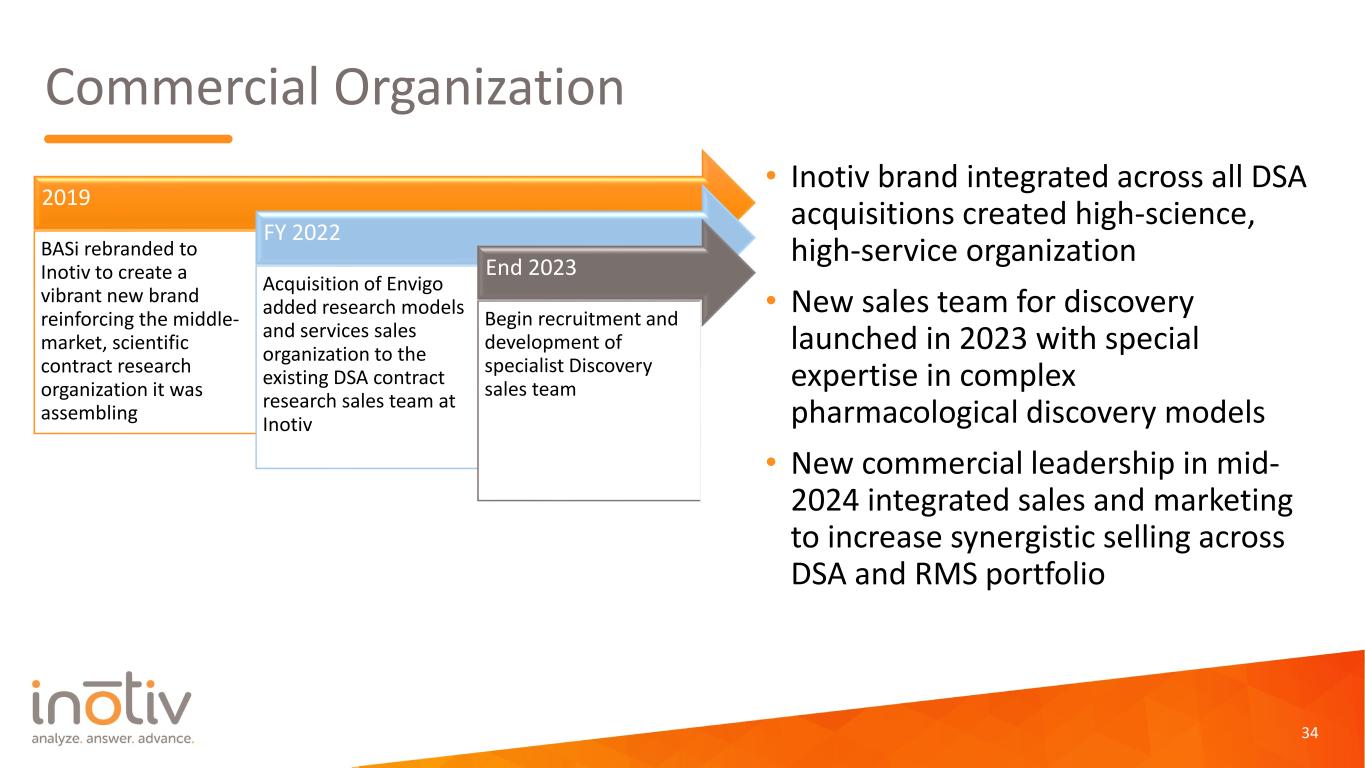

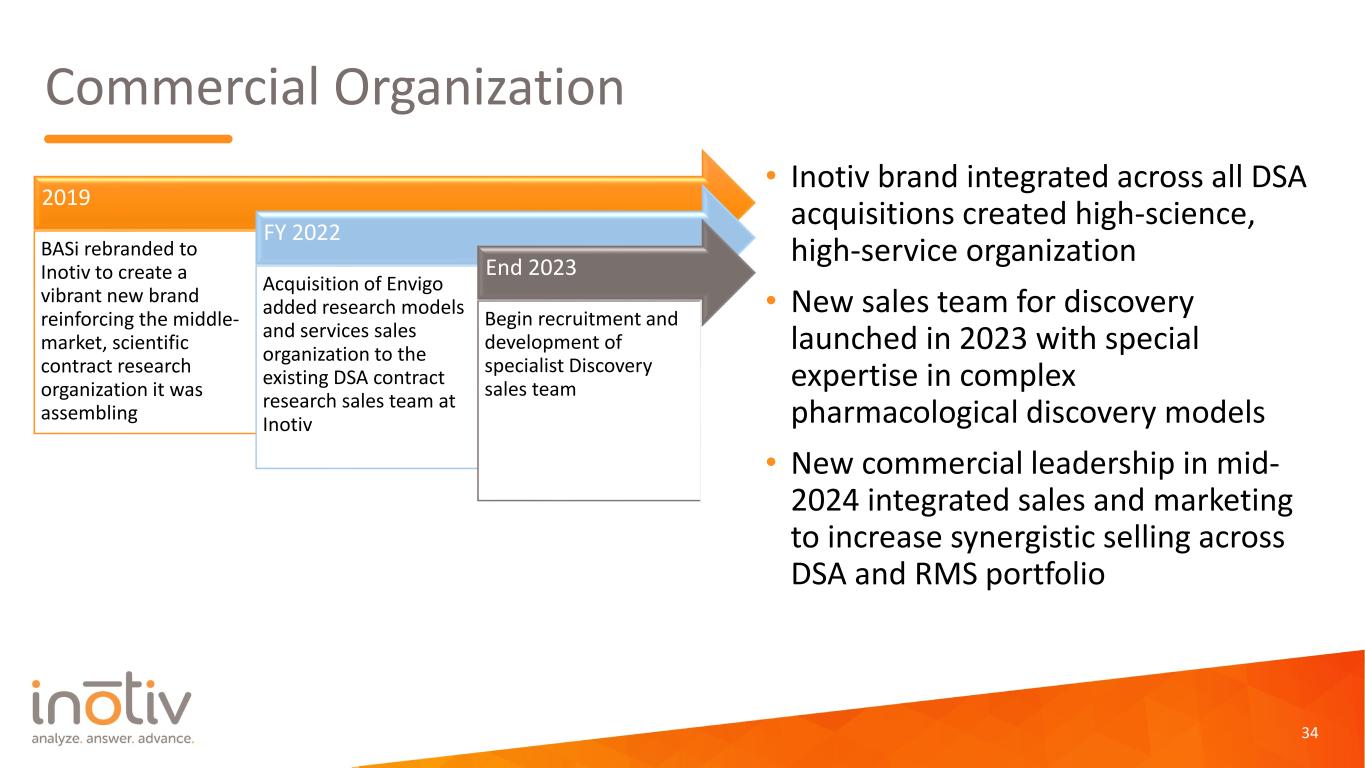

Commercial Organization • Inotiv brand integrated across all DSA acquisitions created high-science, high-service organization • New sales team for discovery launched in 2023 with special expertise in complex pharmacological discovery models • New commercial leadership in mid- 2024 integrated sales and marketing to increase synergistic selling across DSA and RMS portfolio 34 2019 BASi rebranded to Inotiv to create a vibrant new brand reinforcing the middle- market, scientific contract research organization it was assembling FY 2022 Acquisition of Envigo added research models and services sales organization to the existing DSA contract research sales team at Inotiv End 2023 Begin recruitment and development of specialist Discovery sales team

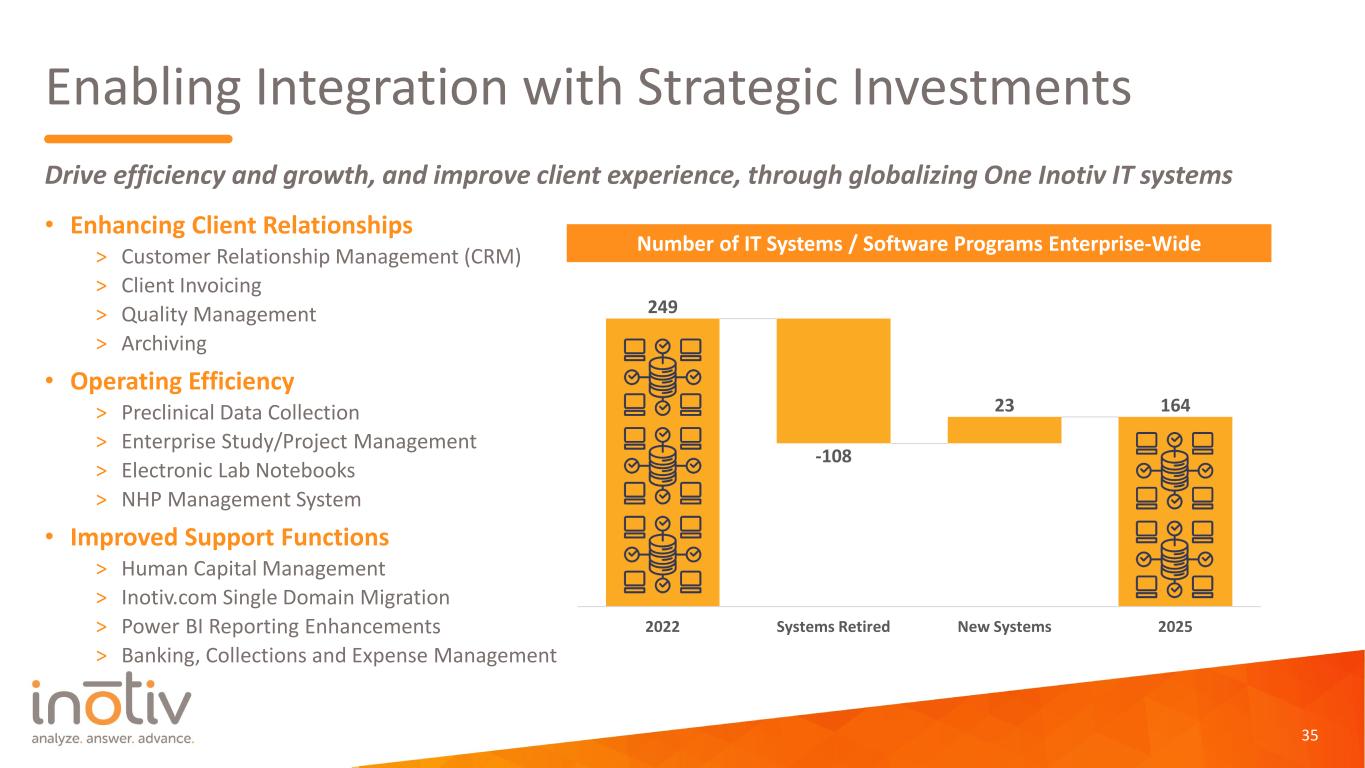

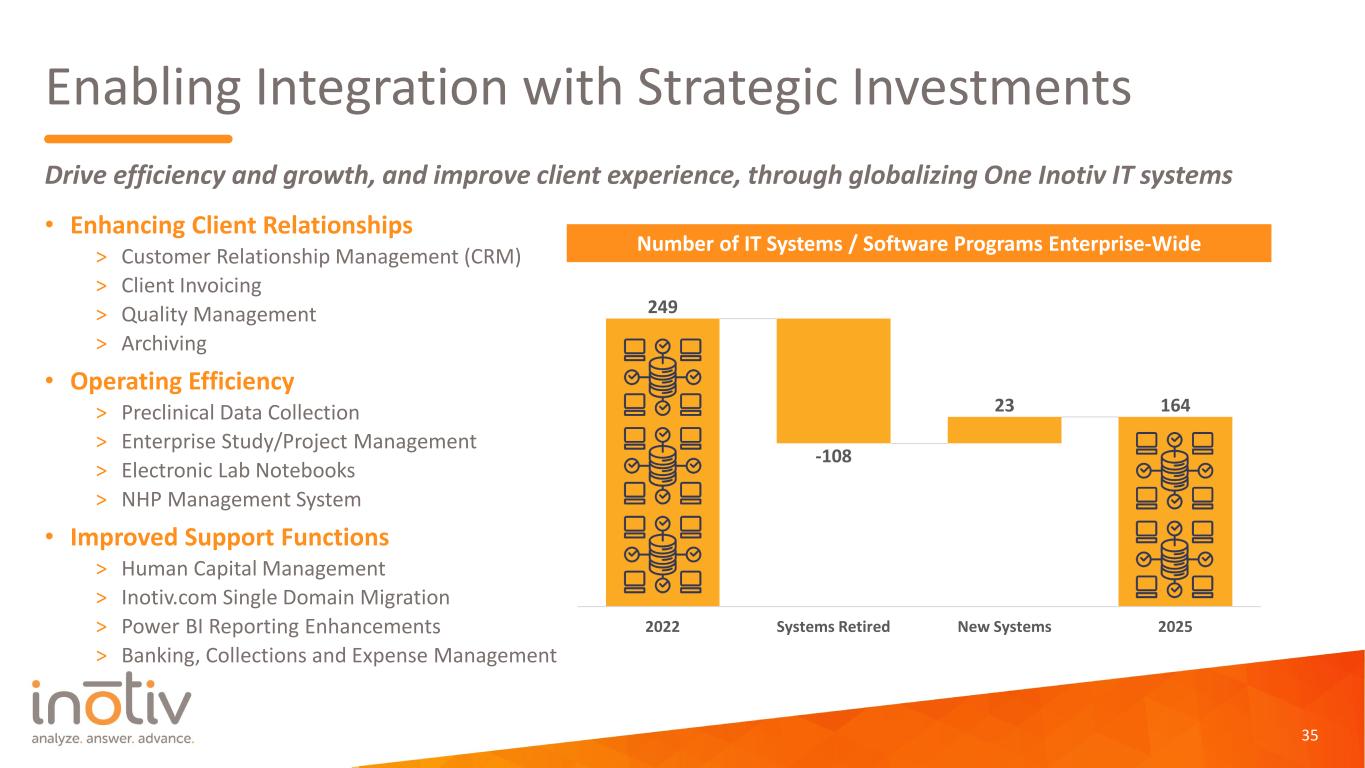

Enabling Integration with Strategic Investments • Enhancing Client Relationships > Customer Relationship Management (CRM) > Client Invoicing > Quality Management > Archiving • Operating Efficiency > Preclinical Data Collection > Enterprise Study/Project Management > Electronic Lab Notebooks > NHP Management System • Improved Support Functions > Human Capital Management > Inotiv.com Single Domain Migration > Power BI Reporting Enhancements > Banking, Collections and Expense Management 35 Drive efficiency and growth, and improve client experience, through globalizing One Inotiv IT systems Number of IT Systems / Software Programs Enterprise-Wide 249 -108 23 164 2022 Systems Retired New Systems 2025

Enhanced Compliance Program Continuous Improvement • Appointed a Chief Compliance Officer and Compliance Committee responsible for overseeing the Company’s compliance, particularly with respect to animal welfare and environmental requirements • Developed and implemented a Nationwide Compliance Plan to reinforce Inotiv’s commitment to complying with animal welfare and environmental laws, regulations, and policy requirements and standards applicable to its U.S. business operations • Created and/or revised policies and procedures governing speaking up, investigations, and specific subject areas including animal welfare, environmental, health and safety, among others • Developing with a third-party expert a detailed guidebook to better memorialize and unify IACUC procedures across the Company • Modernizing and automating certain data, such as health, medical, management, and breeding, to provide real time care and trend analysis for NHPs and small animals 36

Phase III: Expansion Building on the Platform

Expansion: Building on the Platform • Strategic focus to drive value • Expanding margins • DSA strategy • RMS strategy • Opportunistic M&A > Client driven > Accretive > Additional shareholder value 38

Strategic Focus to Drive Value Drive organic revenue growth with enhancements in commercial execution and client satisfaction Exceed client expectations with high scientific touch and speed of project execution creating up/cross-selling opportunities to expand share of wallet Increase margins through operating efficiency, leveraging capacity, pricing opportunity and cost management Reduce corporate overhead (as a % of revenue) through proactive reductions in operating & third party expenses Evaluate opportunities to improve balance sheet Client-driven mergers and acquisitions strategy to evaluate opportunities 39

DSA Strategy • Inotiv acquired multiple niche, high science and technology providers to create an integrated offering • The breadth of what Inotiv has assembled allows for increasingly deep partnerships, as Inotiv can work across multiple therapeutic areas and drug modalities • Relentless focus on quality and delivery metrics to consistently meet client expectations • With the full-range of services assembled, the key driver for momentum is constantly improving the client experience 40 IN TE G RA TE D P RO G RA M S / SE RV IC ES SPEED AND DELIVERYLOW HIGH HIGH Increasing client value

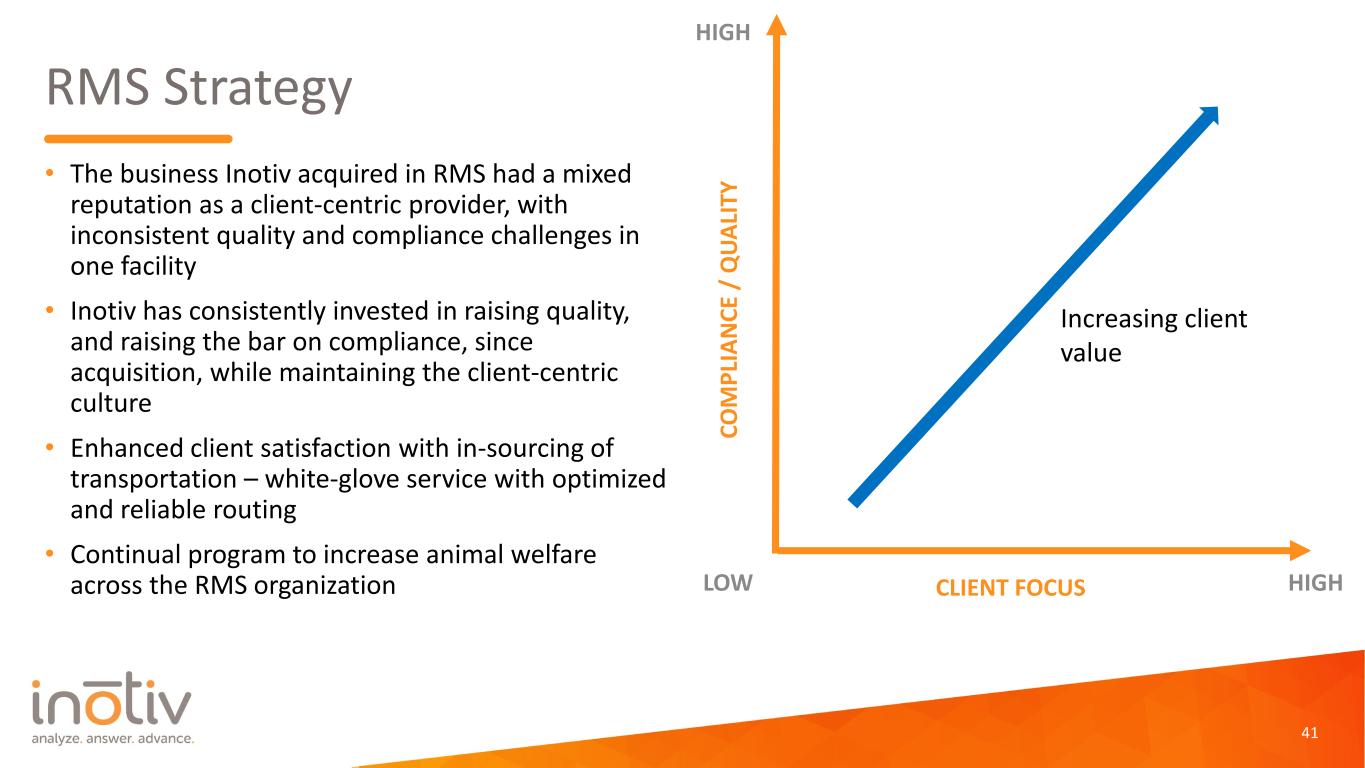

RMS Strategy • The business Inotiv acquired in RMS had a mixed reputation as a client-centric provider, with inconsistent quality and compliance challenges in one facility • Inotiv has consistently invested in raising quality, and raising the bar on compliance, since acquisition, while maintaining the client-centric culture • Enhanced client satisfaction with in-sourcing of transportation – white-glove service with optimized and reliable routing • Continual program to increase animal welfare across the RMS organization 41 CO M PL IA N CE / Q UA LI TY CLIENT FOCUSLOW HIGH HIGH Increasing client value

Financial Metrics & Trends Beth Taylor Executive Vice President and Chief Financial Officer

Agenda • FY Q2 2025 financial results • Margin bridge • Current capital structure 43

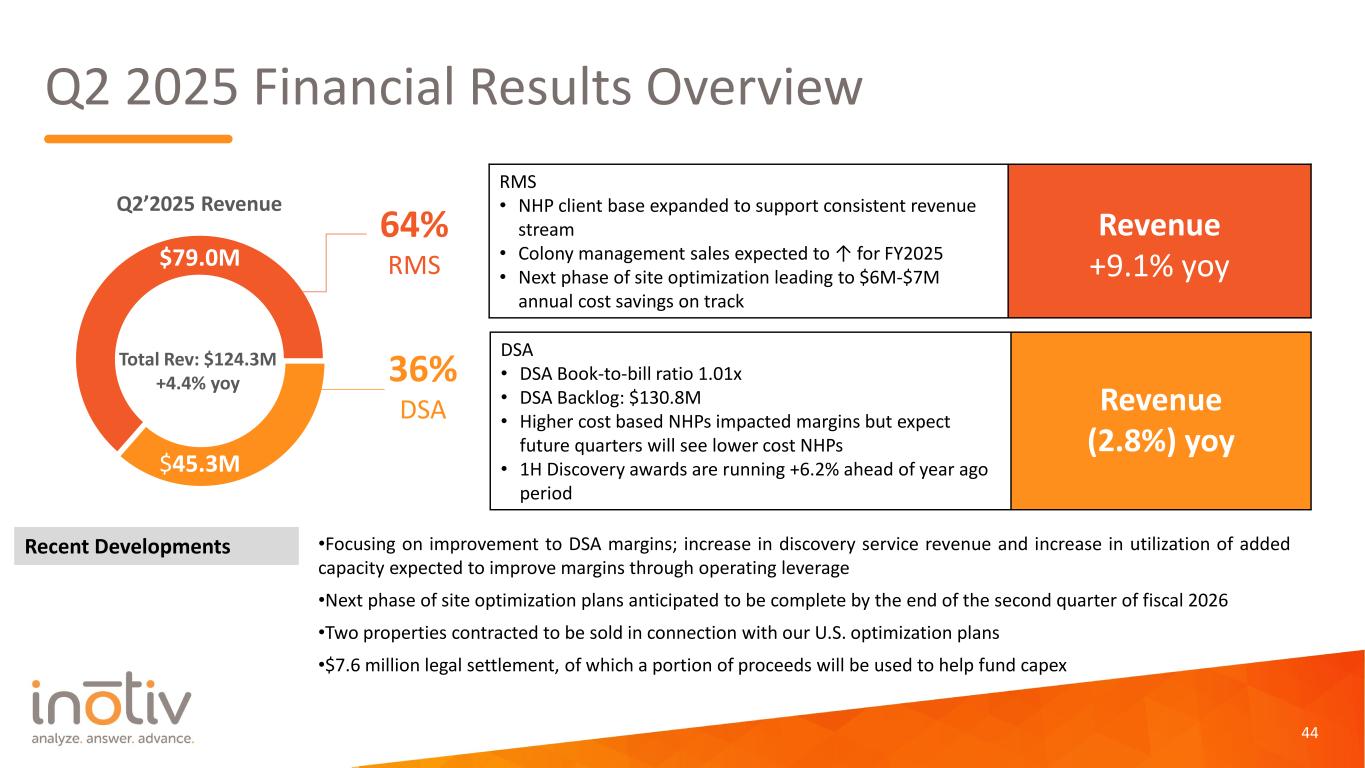

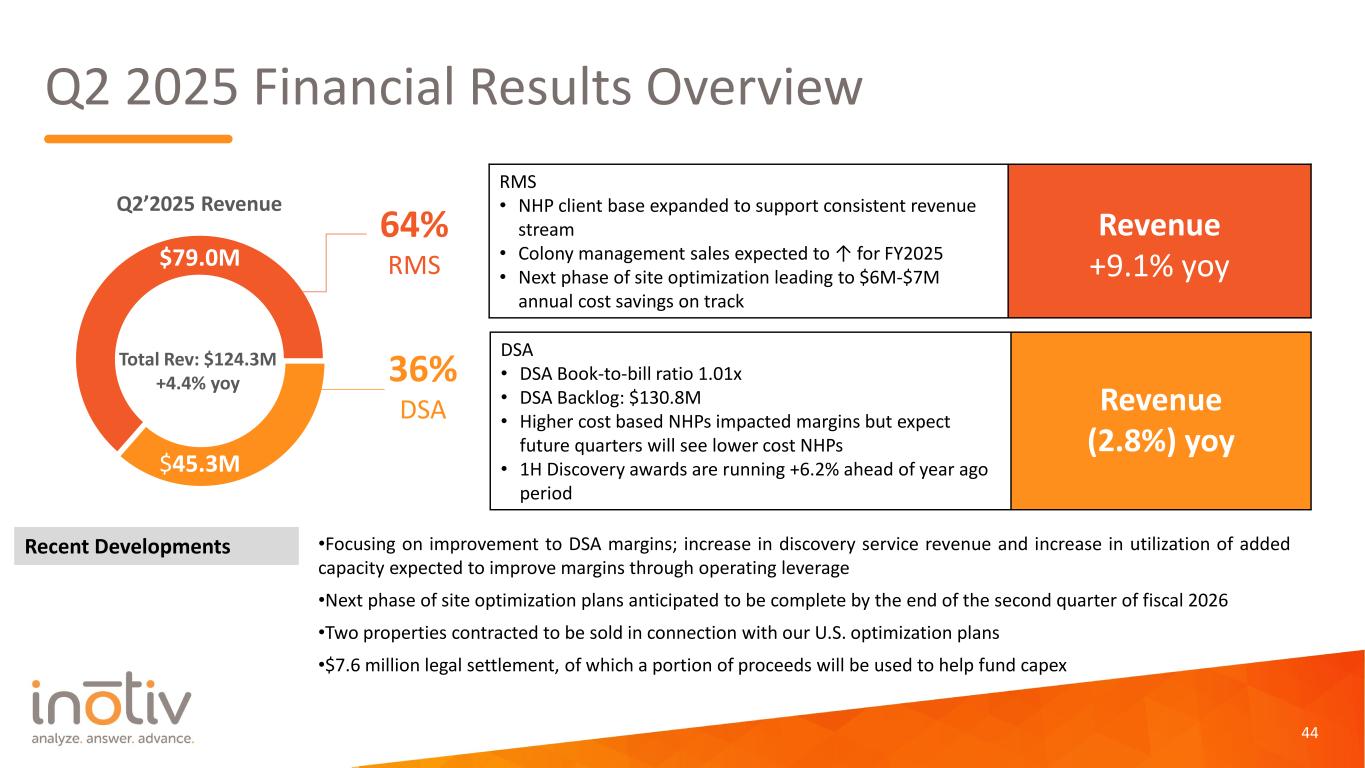

Q2 2025 Financial Results Overview 44 Q2’2025 Revenue 64% RMS 36% DSA Total Rev: $124.3M +4.4% yoy RMS • NHP client base expanded to support consistent revenue stream • Colony management sales expected to ↑ for FY2025 • Next phase of site optimization leading to $6M-$7M annual cost savings on track Revenue +9.1% yoy DSA • DSA Book-to-bill ratio 1.01x • DSA Backlog: $130.8M • Higher cost based NHPs impacted margins but expect future quarters will see lower cost NHPs • 1H Discovery awards are running +6.2% ahead of year ago period Revenue (2.8%) yoy Recent Developments $45.3M $79.0M •Focusing on improvement to DSA margins; increase in discovery service revenue and increase in utilization of added capacity expected to improve margins through operating leverage •Next phase of site optimization plans anticipated to be complete by the end of the second quarter of fiscal 2026 •Two properties contracted to be sold in connection with our U.S. optimization plans •$7.6 million legal settlement, of which a portion of proceeds will be used to help fund capex

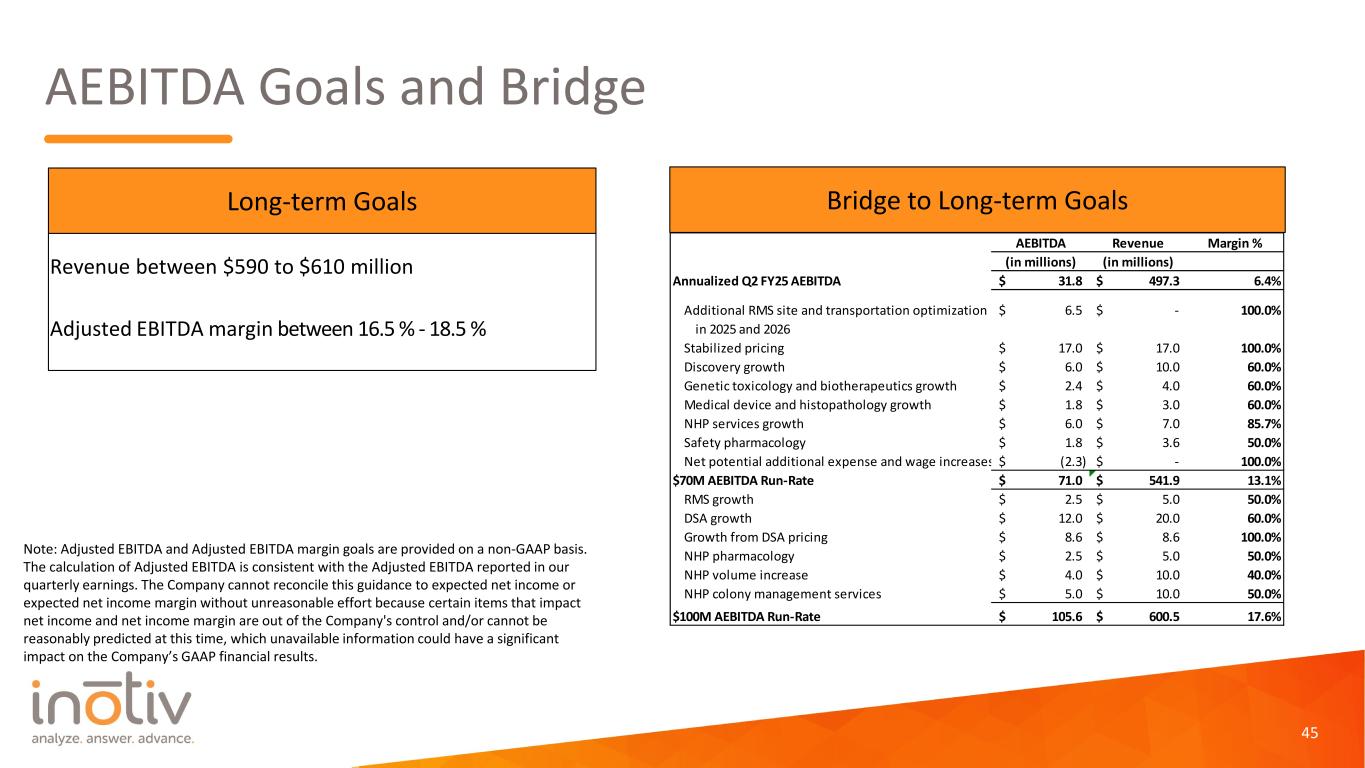

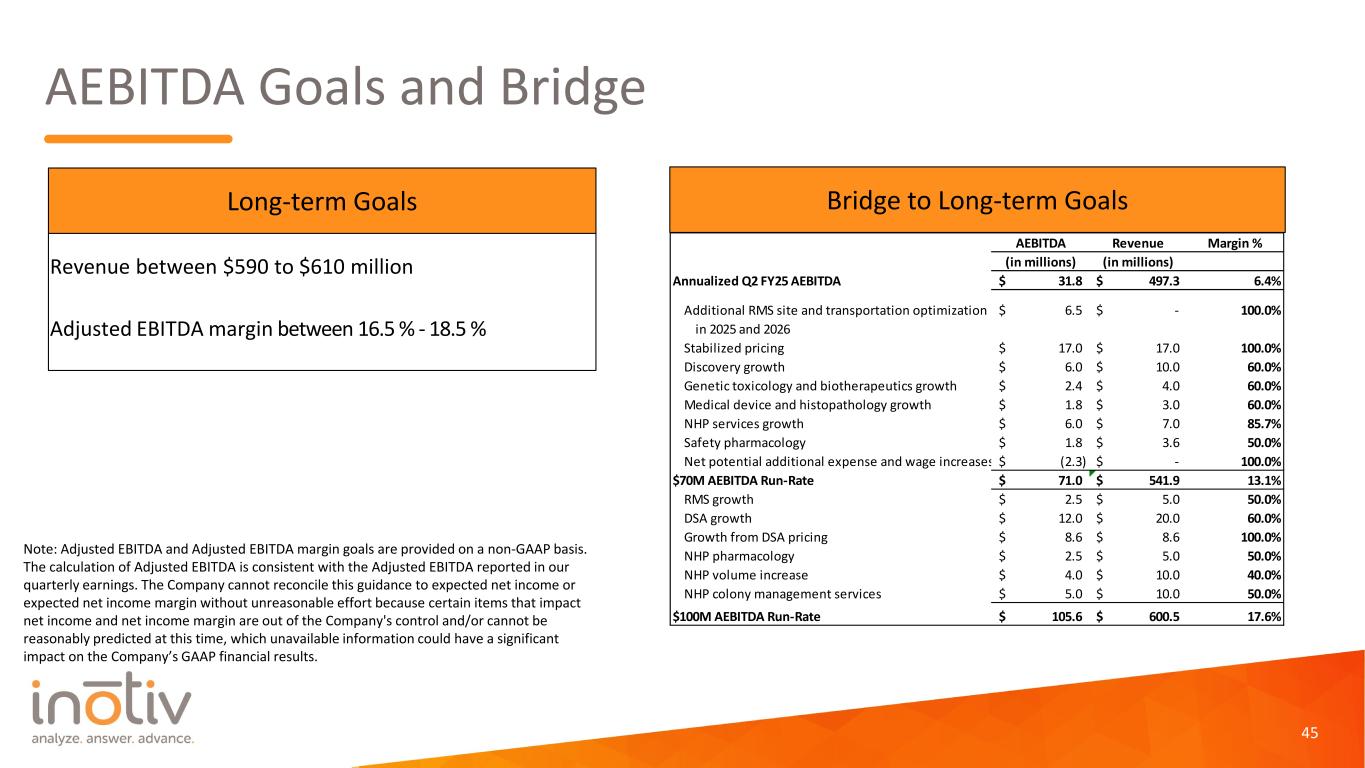

AEBITDA Goals and Bridge 45 Note: Adjusted EBITDA and Adjusted EBITDA margin goals are provided on a non-GAAP basis. The calculation of Adjusted EBITDA is consistent with the Adjusted EBITDA reported in our quarterly earnings. The Company cannot reconcile this guidance to expected net income or expected net income margin without unreasonable effort because certain items that impact net income and net income margin are out of the Company's control and/or cannot be reasonably predicted at this time, which unavailable information could have a significant impact on the Company’s GAAP financial results. Revenue between $590 to $610 million Adjusted EBITDA margin between 16.5 % - 18.5 % Long-term Goals Bridge to Long-term Goals AEBITDA Revenue Margin % (in millions) (in millions) Annualized Q2 FY25 AEBITDA 31.8$ 497.3$ 6.4% Additional RMS site and transportation optimization 6.5$ -$ 100.0% in 2025 and 2026 Stabilized pricing 17.0$ 17.0$ 100.0% Discovery growth 6.0$ 10.0$ 60.0% Genetic toxicology and biotherapeutics growth 2.4$ 4.0$ 60.0% Medical device and histopathology growth 1.8$ 3.0$ 60.0% NHP services growth 6.0$ 7.0$ 85.7% Safety pharmacology 1.8$ 3.6$ 50.0% Net potential additional expense and wage increases (2.3)$ -$ 100.0% $70M AEBITDA Run-Rate 71.0$ 541.9$ 13.1% RMS growth 2.5$ 5.0$ 50.0% DSA growth 12.0$ 20.0$ 60.0% Growth from DSA pricing 8.6$ 8.6$ 100.0% NHP pharmacology 2.5$ 5.0$ 50.0% NHP volume increase 4.0$ 10.0$ 40.0% NHP colony management services 5.0$ 10.0$ 50.0% $100M AEBITDA Run-Rate 105.6$ 600.5$ 17.6%

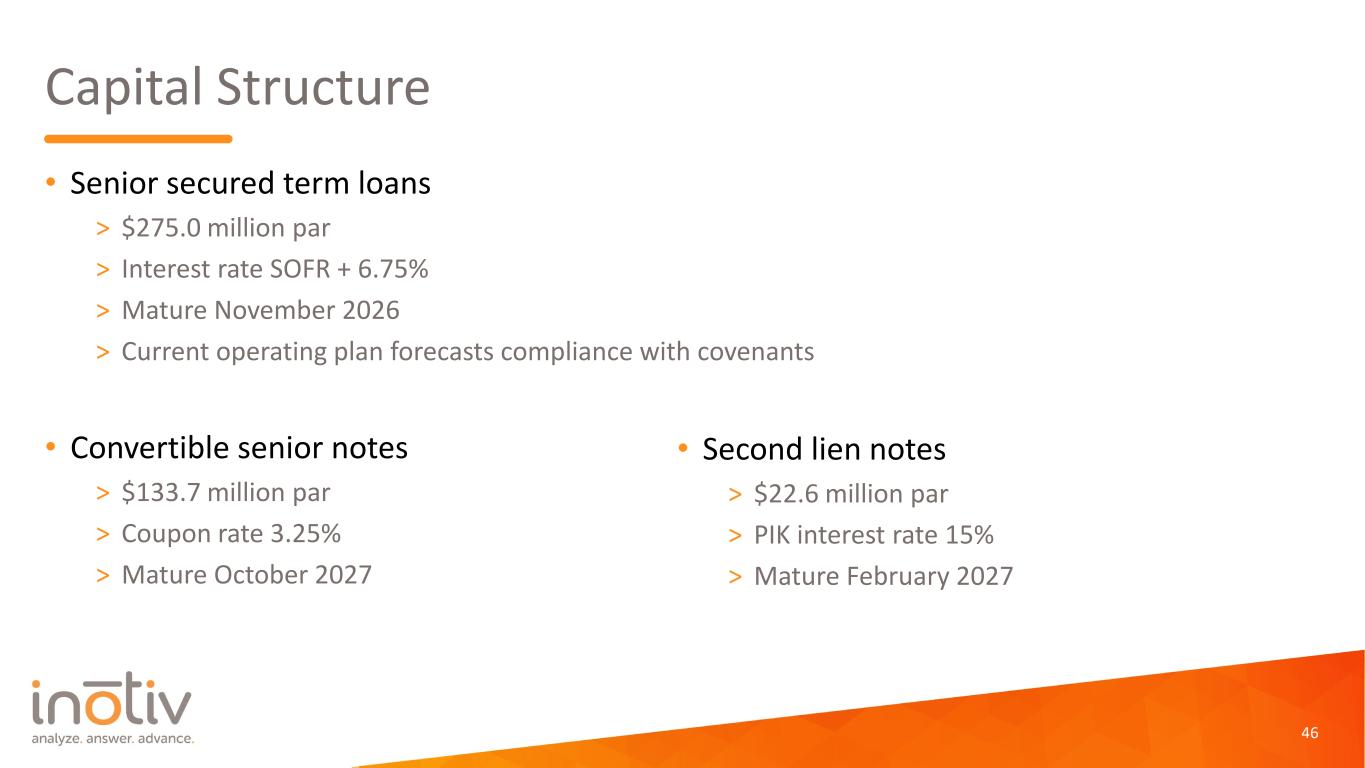

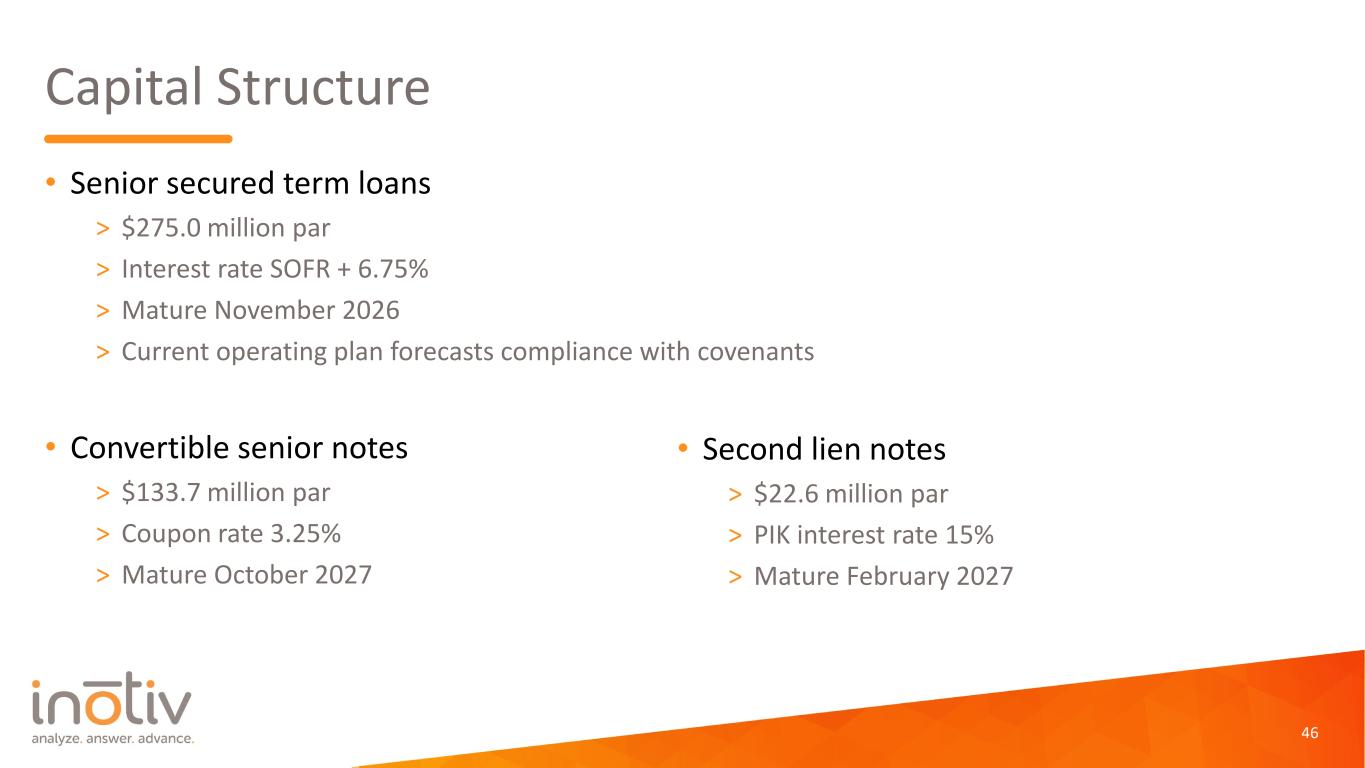

Capital Structure • Senior secured term loans > $275.0 million par > Interest rate SOFR + 6.75% > Mature November 2026 > Current operating plan forecasts compliance with covenants • Convertible senior notes > $133.7 million par > Coupon rate 3.25% > Mature October 2027 46 • Second lien notes > $22.6 million par > PIK interest rate 15% > Mature February 2027

Company Contact: Inotiv, Inc. Beth A. Taylor, CFO investors@inotiv.com Investor Contact: LifeSci Advisors Steven Halper 646-876-6455 SHalper@lifesciadvisors.com For more information, please visit us at https://www.inotiv.com/