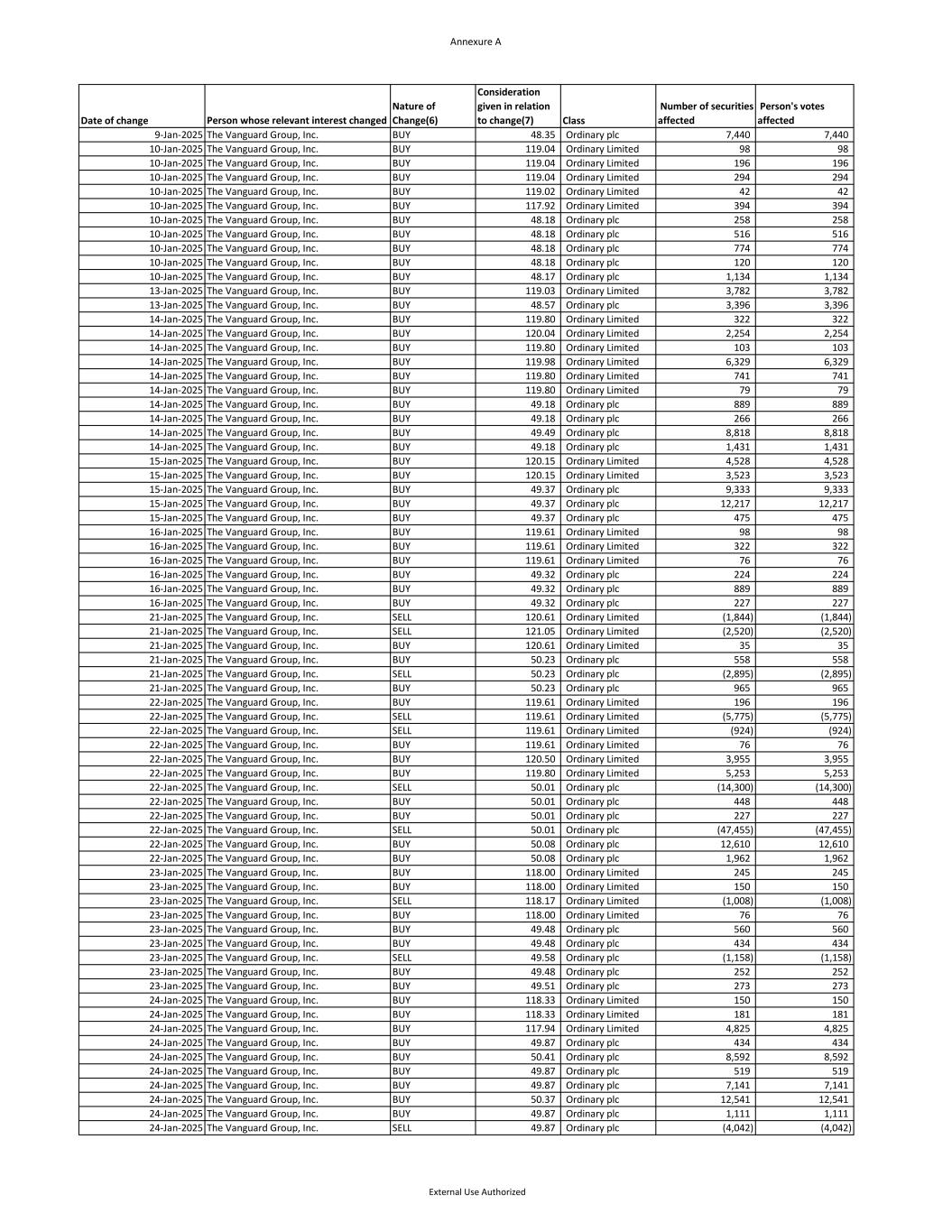

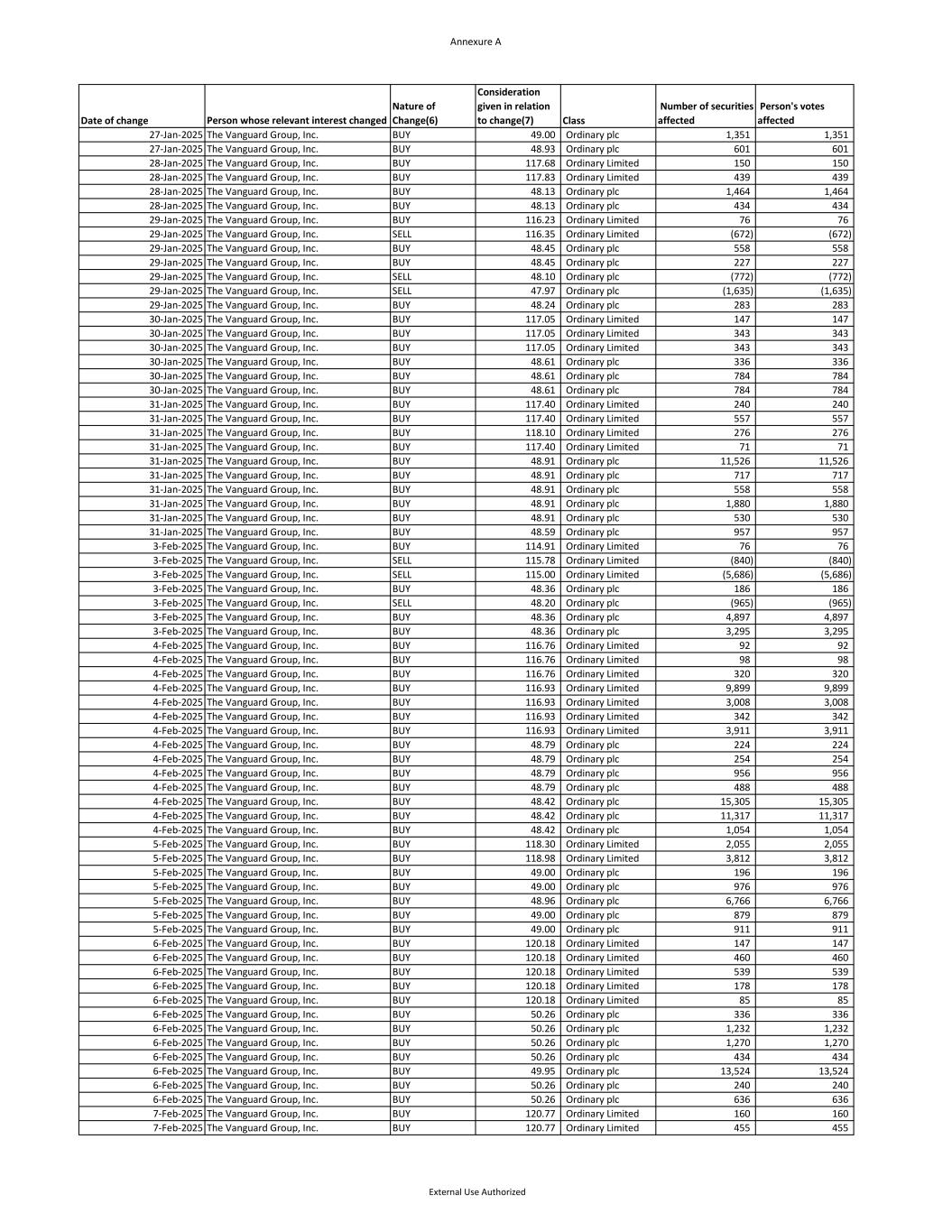

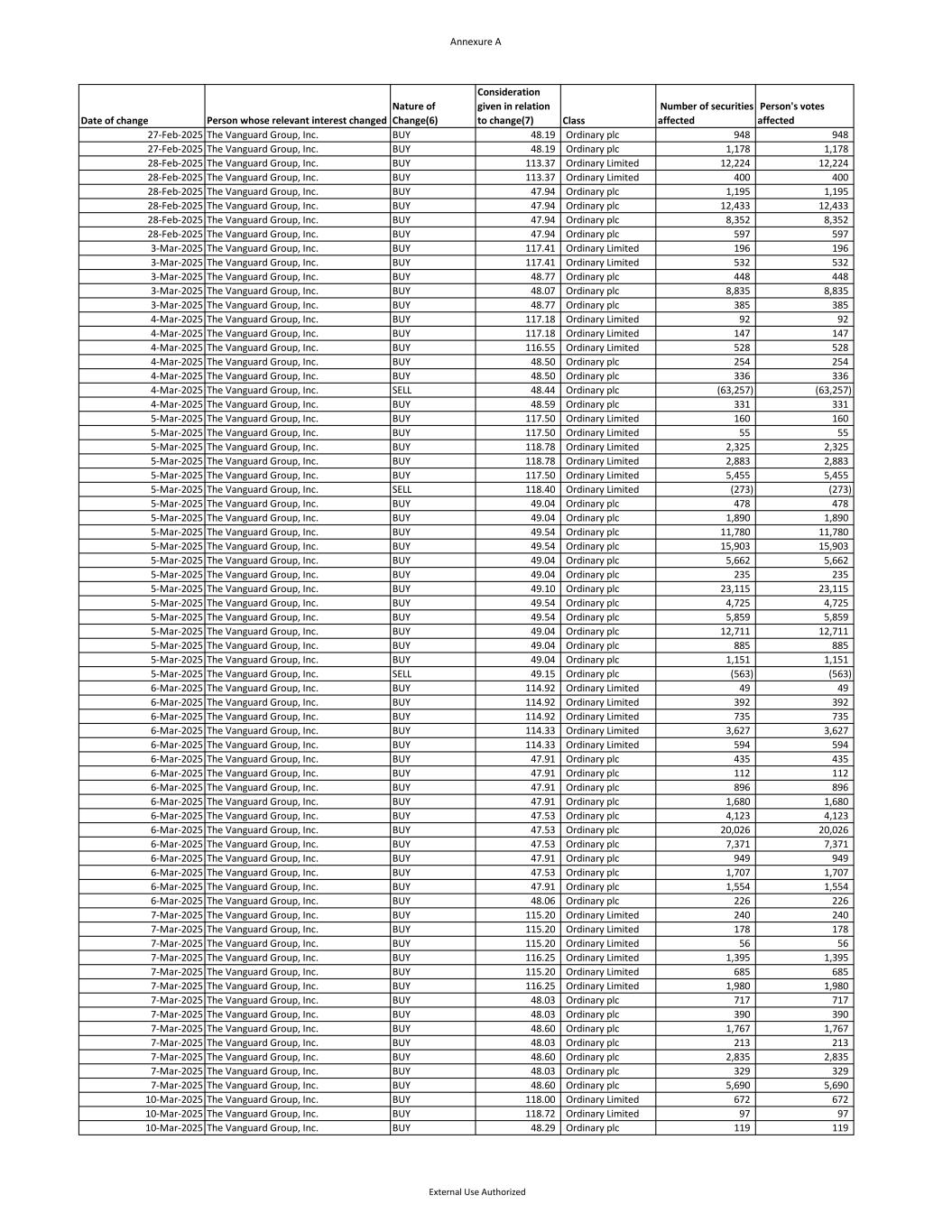

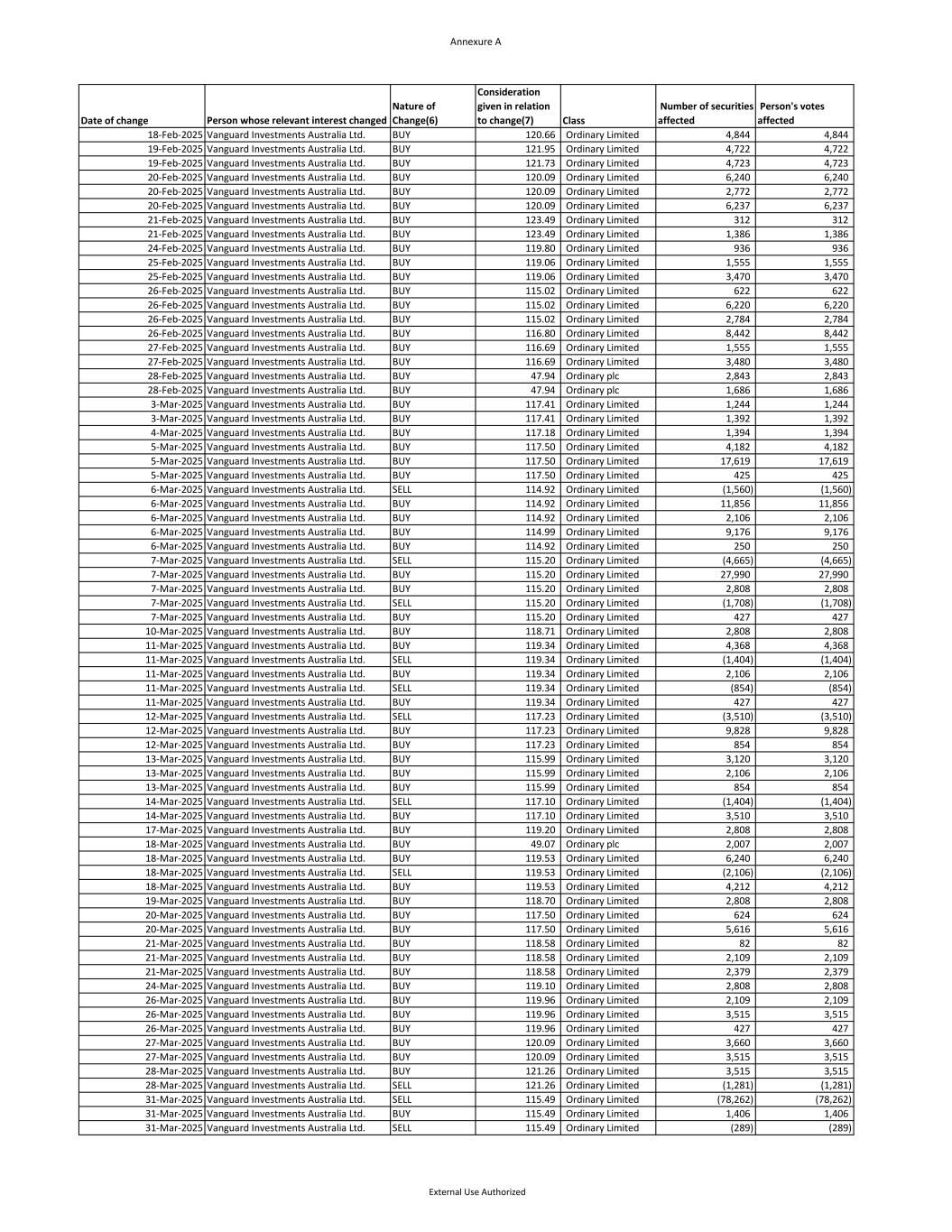

605 Page 1 of 4 Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder To Company Name/Scheme RIO TINTO LTD ACN/ARSN/ABN 96 004 458 404 1. Details of substantial holder (1) Name JPMorgan Chase & Co. and its affiliates ACN/ARSN (if applicable) NA 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest (2) of the substantial holder or an associate (3) in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose relevant interest changed Nature of change (4) Consideration given in relation to change (5) Class (6) and number of securities affected Person's votes affected See Appendix JPMORGAN CHASE BANK, N.A. Securities on Loan as Agent Lender See Appendix 1,074,857 (Ordinary) 1,074,857 (Ordinary) See Appendix J.P. MORGAN SECURITIES PLC Holder of securities subject to an obligation to return under a securities lending agreement See Appendix 559,376 (Ordinary) 559,376 (Ordinary) See Appendix J.P. MORGAN SECURITIES PLC Purchase and sales of securities in its capacity as Principal/Proprietary See Appendix 99,997 (Ordinary) 99,997 (Ordinary) See Appendix J.P. MORGAN SECURITIES LLC Holder of securities subject to an obligation to return under a securities lending agreement See Appendix 183,000 (Ordinary) 183,000 (Ordinary) The holder ceased to be a substantial holder on 22/April/2025 The previous notice was given to the company on 12/March/2025 The previous notice was dated 10/March/2025 EXHIBIT 99.11

605 Page 2 of 4 See Appendix J.P. MORGAN SECURITIES AUSTRALIA LIMITED Purchase and sales of securities in its capacity as Principal/Proprietary See Appendix 119,959 (Ordinary) 119,959 (Ordinary) See Appendix JPMORGAN CHASE BANK, N.A. In its capacity as investment manager or in various other related capacities See Appendix 30,725 (Ordinary) 30,725 (Ordinary) See Appendix JPMORGAN ASSET MANAGEMENT (UK) LIMITED In its capacity as investment manager or in various other related capacities See Appendix 17,910 (Ordinary) 17,910 (Ordinary) See Appendix JPMORGAN ASSET MANAGEMENT (JAPAN) LIMITED In its capacity as investment manager or in various other related capacities See Appendix 923 (Ordinary) 923 (Ordinary) See Appendix JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED In its capacity as investment manager or in various other related capacities See Appendix 80,545 (Ordinary) 80,545 (Ordinary) See Appendix J.P.M INSTL INVESTMENTS INC. In its capacity as investment manager or in various other related capacities See Appendix 376 (Ordinary) 376 (Ordinary) See Appendix J.P. MORGAN INVESTMENT MANAGEMENT INC. In its capacity as investment manager or in various other related capacities See Appendix 114,201 (Ordinary) 114,201 (Ordinary) 3. Changes in association The persons who have become associates (3) of, ceased to be associates of, or have changed the nature of their association (7) with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN/ARSN (if applicable) Nature of association J.P. MORGAN SECURITIES AUSTRALIA LIMITED Subsidiary of JPMorgan Chase & Co. J.P. MORGAN SECURITIES LLC Subsidiary of JPMorgan Chase & Co. J.P. MORGAN SECURITIES PLC Subsidiary of JPMorgan Chase & Co. JPMORGAN CHASE BANK, N.A. Subsidiary of JPMorgan Chase & Co.

605 Page 3 of 4 J.P. MORGAN INVESTMENT MANAGEMENT INC. Subsidiary of JPMorgan Chase & Co. JPMORGAN ASSET MANAGEMENT (UK) LIMITED Subsidiary of JPMorgan Chase & Co. JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Subsidiary of JPMorgan Chase & Co. JPMORGAN ASSET MANAGEMENT (JAPAN) LIMITED Subsidiary of JPMorgan Chase & Co. J.P.M INSTL INVESTMENTS INC. Subsidiary of JPMorgan Chase & Co. 4. Addresses The addresses of persons named in this form are as follows: Name Address JPMorgan Chase & Co. 383 Madison Avenue, New York, New York, NY, 10179, United States J.P. MORGAN SECURITIES AUSTRALIA LIMITED LEVEL 18, 83-85 CASTLEREAGH STREET, SYDNEY, NSW 2000, Australia J.P. MORGAN SECURITIES LLC 383 Madison Ave., New York, New York, NY, 10179, United States J.P. MORGAN SECURITIES PLC 25 Bank Street, Canary Wharf, London, E14 5JP, England JPMORGAN CHASE BANK, N.A. 1111 Polaris Parkway, Columbus, Delaware, OH, 43240, United States J.P. MORGAN INVESTMENT MANAGEMENT INC. 383 Madison Avenue, New York, New York, NY, 10179, United States JPMORGAN ASSET MANAGEMENT (UK) LIMITED 60 Victoria Embankment, London, EC4Y0JP, England JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED 19 & 20/F, Chater House, 8 Connaught Road Central, Hong Kong, Hong Kong JPMORGAN ASSET MANAGEMENT (JAPAN) LIMITED Tokyo Building, 7-3 Marunouchi 2 Chome,Chiyoda-ku, Tokyo, 100 6432, Japan J.P.M INSTL INVESTMENTS INC. 383 Madison Avenue, New York, New York, NY, 10179, United States Signature Print name Vasim Pathan Capacity Compliance Officer Sign here Date 25/April/2025

605 Page 4 of 4 DIRECTIONS (1) If there are a number of substantial holders with similar or related relevant interests (e.g. a corporation and its related corporations, or the manager and trustee of an equity trust), the names could be included in an annexure to the form. If the relevant interests of a group of persons are essentially similar, they may be referred to throughout the form as a specifically named group if the membership of each group, with the names and addresses of members is clearly set out in paragraph 4 of the form. (2) See the definition of "relevant interest" in sections 608 and 671B(7) of the Corporations Act 2001. (3) See the definition of "associate" in section 9 of the Corporations Act 2001. (4) Include details of: (a) any relevant agreement or other circumstances because of which the change in relevant interest occurred. If subsection 671B(4) applies, a copy of any document setting out the terms of any relevant agreement, and a statement by the person giving full and accurate details of any contract, scheme or arrangement, must accompany this form, together with a written statement certifying this contract, scheme or arrangement; and (b) any qualification of the power of a person to exercise, control the exercise of, or influence the exercise of, the voting powers or disposal of the securities to which the relevant interest relates (indicating clearly the particular securities to which the qualification applies). See the definition of "relevant agreement" in section 9 of the Corporations Act 2001. (5) Details of the consideration must include any and all benefits, money and other, that any person from whom a relevant interest was acquired has, or may, become entitled to receive in relation to that acquisition. Details must be included even if the benefit is conditional n the happening or not of a contingency. Details must be included of any benefit paid on behalf of the substantial holder or its associate in relation to the acquisitions, even if they are not paid directly to the person from whom the relevant interest was acquired. (6) T he voting shares of a company constitute one class unless divided into separate classes. (7) Give details, if appropriate, of the present association and any change in that association since the last substantial holding notice.

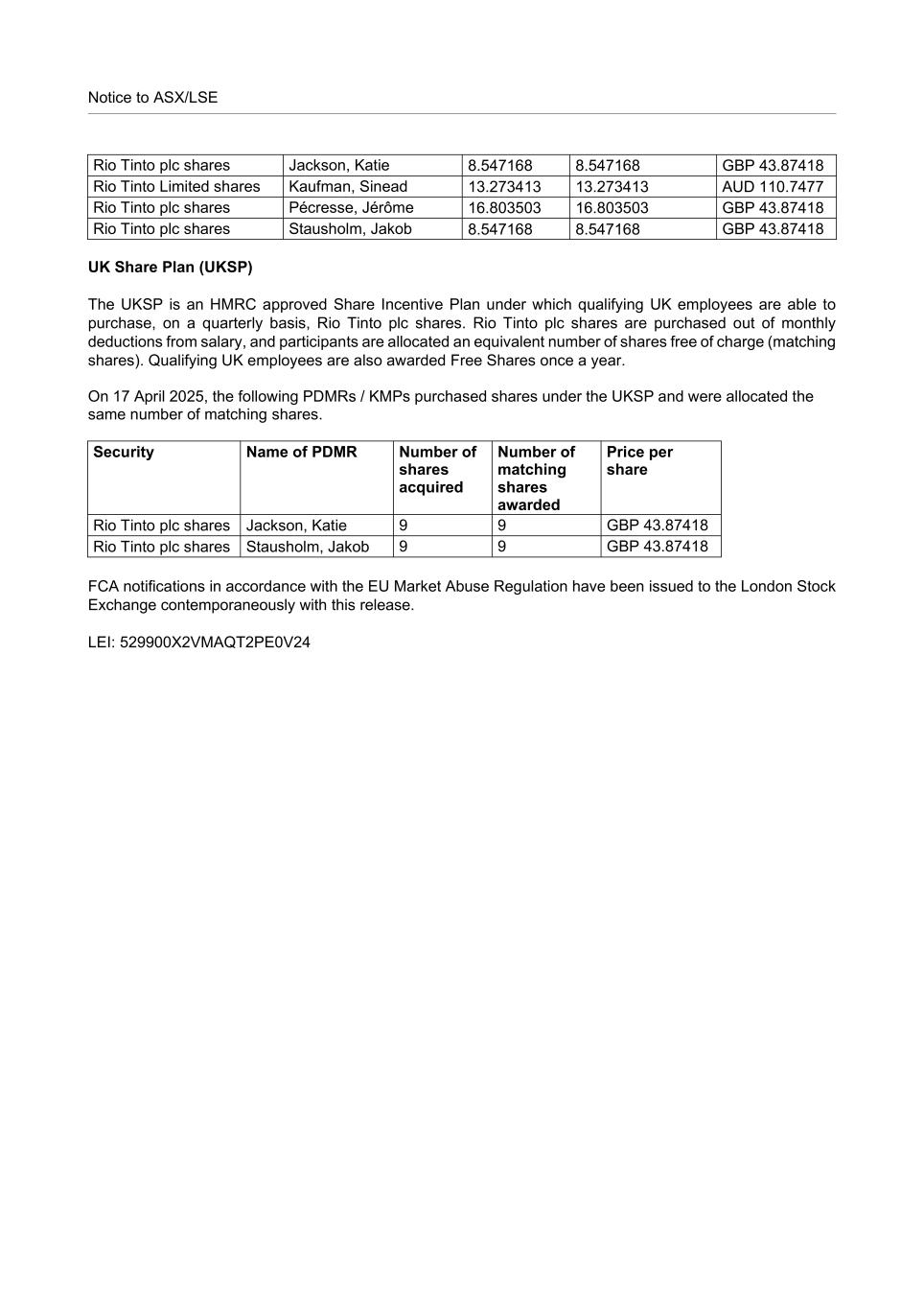

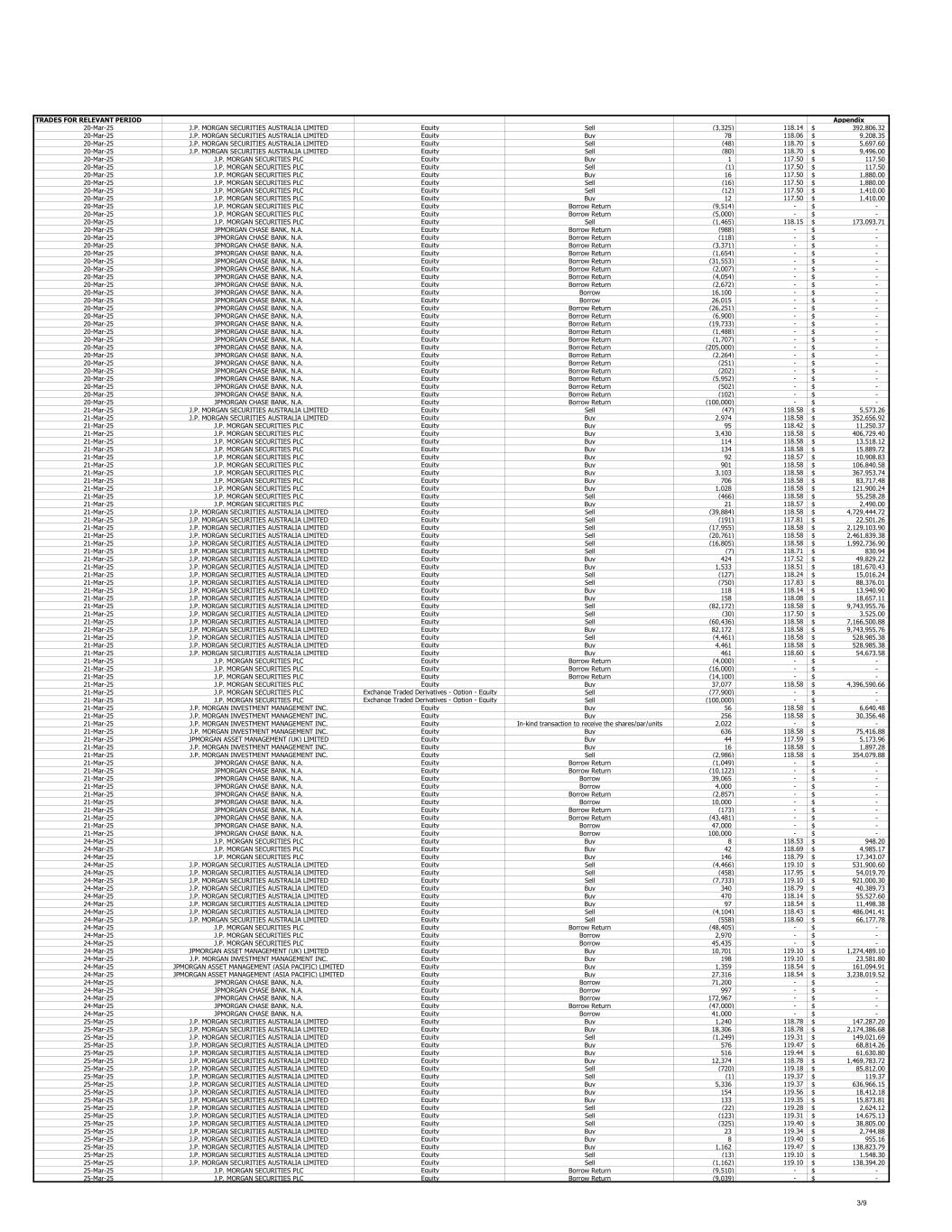

TRADES FOR RELEVANT PERIOD Appendix Transaction Date Entity Product Type Type of Transaction Quantity Price (AUD) Consideration Balance at start of relevant period 19,904,059.23 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (751) 119.34 89,624.34$ 11-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (15) 119.98 1,799.71$ 11-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (15) 119.44 1,791.54$ 11-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (109) 119.01 12,972.63$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2,517) 118.85 299,149.11$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (14,967) 119.65 1,790,769.12$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2,338) 119.34 279,016.92$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (30) 118.96 3,568.89$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (6,234) 119.34 743,965.56$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (216) 120.10 25,941.48$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (394) 119.21 46,970.15$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (270) 118.71 32,051.70$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (53) 118.71 6,291.63$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (360) 119.34 42,962.40$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,083) 118.71 128,562.93$ 11-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (11) 119.34 1,312.74$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 5,699 119.18 679,207.96$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 291 118.72 34,547.14$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 2,902 118.34 343,421.46$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 53 118.71 6,291.64$ 11-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,083 119.53 129,451.86$ 11-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 292 119.34 34,847.28$ 11-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 11 119.34 1,312.74$ 11-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 1,294 118.33 153,117.08$ 11-Mar-25 J.P. MORGAN SECURITIES PLC Equity Adjustment (1,474) - -$ 11-Mar-25 J.P. MORGAN SECURITIES PLC Equity Adjustment (444) - -$ 11-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (1,050) - -$ 11-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (189) - -$ 11-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (2,385) - -$ 11-Mar-25 J.P. MORGAN SECURITIES LLC Equity Borrow 25,000 - -$ 11-Mar-25 J.P. MORGAN SECURITIES LLC Equity Borrow 38,000 - -$ 11-Mar-25 J.P. MORGAN SECURITIES LLC Equity Borrow 32,000 - -$ 11-Mar-25 J.P. MORGAN SECURITIES LLC Equity Borrow 21,000 - -$ 11-Mar-25 J.P. MORGAN SECURITIES LLC Equity Borrow 67,000 - -$ 11-Mar-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Buy 2,762 119.99 331,399.12$ 11-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 133 119.34 15,872.22$ 11-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 6,626 - -$ 11-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (4,000) - -$ 11-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 10,000 - -$ 11-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 3,051 - -$ 11-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 398 - -$ 11-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 1,287 - -$ 11-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 2,998 - -$ 11-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 10,000 - -$ 11-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 12,129 - -$ 11-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 41,000 - -$ 11-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (8,076) - -$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,916) 117.23 224,612.68$ 12-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (4) 117.27 469.07$ 12-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (2) 116.90 233.79$ 12-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (46) 117.03 5,383.32$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 13,088 117.23 1,534,306.24$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1 117.23 117.23$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,659 117.23 194,484.57$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 379 116.98 44,337.01$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1) 118.02 118.02$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (7,035) 117.25 824,851.79$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (10,121) 117.11 1,185,221.84$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 4,083 117.23 478,650.09$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (18,866) 117.41 2,214,967.01$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 5,854 116.94 684,546.10$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (365) 116.86 42,653.38$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (180) 117.23 21,101.40$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (623) 117.53 73,221.19$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 22 116.66 2,566.56$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 254 117.23 29,776.42$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2,400) 119.34 286,416.00$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (22) 119.34 2,625.48$ 12-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (390) 119.34 46,542.60$ 12-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 2,965 117.23 347,576.57$ 12-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 42 117.53 4,936.26$ 12-Mar-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Sell (9,083) 116.64 1,059,455.65$ 12-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 265 117.23 31,065.95$ 12-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 46 117.53 5,406.38$ 12-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 47 117.53 5,523.91$ 12-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (27,260) - -$ 12-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (204,074) - -$ 12-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 652 - -$ 12-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 18,300 - -$ 12-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 520,000 - -$ 13-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,267) 116.32 147,377.44$ 13-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (133) 116.53 15,498.71$ 13-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 24 116.07 2,785.66$ 13-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 752 116.10 87,305.65$ 13-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 244 116.10 28,327.70$ 13-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (2) 116.18 232.36$ 13-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (55) 116.24 6,393.47$ 13-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (76) 115.97 8,813.47$ 13-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (490) 116.19 56,932.02$ 13-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (6,405) 116.09 743,545.04$ 13-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (45) 116.14 5,226.40$ 13-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 52 116.25 6,044.80$ 13-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (3,941) 116.54 459,277.83$ 13-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,594 116.59 185,843.15$ 13-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (3,494) 115.99 405,271.01$ 13-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (3,493) 115.99 405,153.07$ 13-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 476 116.49 55,450.81$ 13-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (11,717) 116.10 1,360,371.12$ 13-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (7) 117.23 820.61$ 13-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2,400) 117.23 281,352.00$ 13-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (1,053) - -$ 13-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity In-kind transaction to receive the shares/par/units 1,685 - -$ 13-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 59 116.32 6,862.88$ 13-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 69,000 - -$ 13-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 10,000 - -$ 13-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (400) - -$ 13-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 24,029 - -$ 13-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (46,032) - -$ 13-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 5,000 - -$ 13-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 1,227 - -$ 13-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (6,442) - -$ 13-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (42,200) - -$ 13-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (47,149) - -$ 13-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (603) - -$ 14-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 2,400 115.99 278,376.00$ 14-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (954) 117.10 111,713.40$ 14-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (32) 117.64 3,764.32$ 14-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (6,234) 117.10 730,001.40$ 14-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (98) 117.30 11,495.80$ 14-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (16) 117.61 1,881.76$ 14-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 374 117.79 44,051.79$ 14-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1 117.61 117.61$ 14-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (359) 117.15 42,058.62$ 14-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (5,746) 117.36 674,338.34$ 14-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (109) 117.57 12,815.62$ 14-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2,400) 115.99 278,376.00$ 14-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (10,723) - -$ 14-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Sell (1,506) 117.34 176,714.04$ 14-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Sell (20) 117.34 2,346.80$ 14-Mar-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Sell (18,580) 117.69 2,186,678.34$ 14-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 9,000 - -$ 14-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (8) - -$ 14-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 192,000 - -$ 1/9

TRADES FOR RELEVANT PERIOD Appendix 14-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 57 - -$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 2,400 117.10 281,040.00$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (222) 117.10 25,996.20$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,509) 119.20 179,872.80$ 17-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 356 119.71 42,617.25$ 17-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 79 119.68 9,454.67$ 17-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 104 119.59 12,437.44$ 17-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 1,504 119.54 179,782.83$ 17-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 163 119.53 19,482.80$ 17-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 10 119.47 1,194.70$ 17-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 180 119.24 21,463.84$ 17-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (2) 119.20 238.40$ 17-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 199 119.34 23,749.51$ 17-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 1,723 119.29 205,531.79$ 17-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 156 119.20 18,595.20$ 17-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 262 119.20 31,230.40$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (12,294) 119.36 1,467,452.37$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (270) 119.57 32,283.90$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (99) 119.65 11,845.21$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (18,704) 119.20 2,229,516.80$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (300) 119.63 35,888.11$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (226) 119.54 27,016.45$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 331 119.05 39,406.00$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (47) 119.93 5,636.52$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 3,374 118.65 400,336.22$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (15) 117.10 1,756.50$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2,400) 117.10 281,040.00$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 25 119.20 2,980.00$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (84) 119.20 10,012.80$ 17-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (11) 119.34 1,312.74$ 17-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (3,820) - -$ 17-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (2,263) 119.31 269,993.55$ 17-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity In-kind transaction to receive the shares/par/units 2,022 - -$ 17-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity In-kind transaction to receive the shares/par/units 6,403 - -$ 17-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 1,937 118.20 228,953.40$ 17-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 983 - -$ 17-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 17,895 - -$ 17-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (41,000) - -$ 17-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (5) - -$ 17-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 970 - -$ 17-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 198,100 - -$ 18-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 14 119.10 1,667.42$ 18-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 49 119.20 5,840.66$ 18-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 218 119.34 26,016.02$ 18-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (717) 119.30 85,541.39$ 18-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 2,510 119.50 299,945.00$ 18-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (11,365) 119.05 1,352,987.26$ 18-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (609) 119.13 72,552.25$ 18-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,870 119.20 222,904.00$ 18-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (15,588) 119.53 1,863,233.64$ 18-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 545 119.37 65,058.89$ 18-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (246) 119.16 29,314.10$ 18-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 518 119.53 61,916.54$ 18-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (2,590) - -$ 18-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (2,714) 119.07 323,143.50$ 18-Mar-25 JPMORGAN ASSET MANAGEMENT (JAPAN) LIMITED Equity Sell (923) 119.53 110,326.19$ 18-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity In-kind transaction to receive the shares/par/units 2,022 - -$ 18-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Sell (183) 119.20 21,813.60$ 18-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Sell (35) 119.20 4,172.00$ 18-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 1,000 - -$ 18-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 1,785 - -$ 18-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 489 - -$ 18-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (12,004) - -$ 18-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (24,029) - -$ 18-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 620 - -$ 18-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 10,000 - -$ 18-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 10,000 - -$ 18-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 300 - -$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 502 118.70 59,587.40$ 19-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 333 118.70 39,527.10$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 40,097 118.70 4,759,513.90$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (190) 119.08 22,624.66$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (405) 119.05 48,217.27$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 281 118.70 33,354.70$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (10,518) 118.89 1,250,504.28$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 80 119.26 9,540.59$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 3,460 118.70 410,702.00$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (336) 118.75 39,900.38$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (28,057) 118.70 3,330,365.90$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (11,545) 119.00 1,373,845.08$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 308 119.35 36,760.65$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 2,286 118.80 271,582.56$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 682 119.40 81,429.03$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (363) 118.82 43,132.78$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 2,400 118.70 284,880.00$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 2,400 118.70 284,880.00$ 19-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2,279) 118.27 269,537.33$ 19-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (400,000) - -$ 19-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 157 119.18 18,711.26$ 19-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity In-kind transaction to receive the shares/par/units 674 - -$ 19-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Sell (1,915) 119.18 228,229.70$ 19-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Sell (3,307) 119.18 394,128.26$ 19-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Sell (16) 119.18 1,906.88$ 19-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Sell (57) 119.18 6,793.26$ 19-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Sell (70) 119.18 8,342.60$ 19-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Sell (161) 119.18 19,187.98$ 19-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Sell (351) 119.18 41,832.18$ 19-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (17,169) - -$ 19-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (1,000) - -$ 19-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (407) - -$ 19-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (901) - -$ 19-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (164) - -$ 19-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (19,423) - -$ 19-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (42,019) - -$ 19-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 25,075 - -$ 19-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (10,000) - -$ 19-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (5,677) - -$ 19-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (45,962) - -$ 19-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 250,000 - -$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (12,723) 118.70 1,510,220.10$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 50,594 118.70 6,005,507.80$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (50,594) 118.70 6,005,507.80$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2) 118.31 236.61$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (5) 118.26 591.30$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 26,498 118.70 3,145,312.60$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (26,498) 118.70 3,145,312.60$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,258) 118.32 148,846.56$ 20-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 21 117.69 2,471.57$ 20-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 57 117.73 6,710.39$ 20-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 142 117.79 16,726.72$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (299) 118.20 35,341.75$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 46,137 118.32 5,458,929.84$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 124,695 118.32 14,753,912.40$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (12,469) 117.50 1,465,107.50$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (654) 118.17 77,284.56$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 373 117.65 43,883.11$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 2,746 117.85 323,614.91$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (4) 118.18 472.73$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,204) 117.50 141,470.00$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (3,113) 117.50 365,777.50$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (51) 117.94 6,014.70$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 102 117.89 12,024.75$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,718 117.81 202,401.31$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 156 118.32 18,457.92$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (4) 118.14 472.57$ 2/9

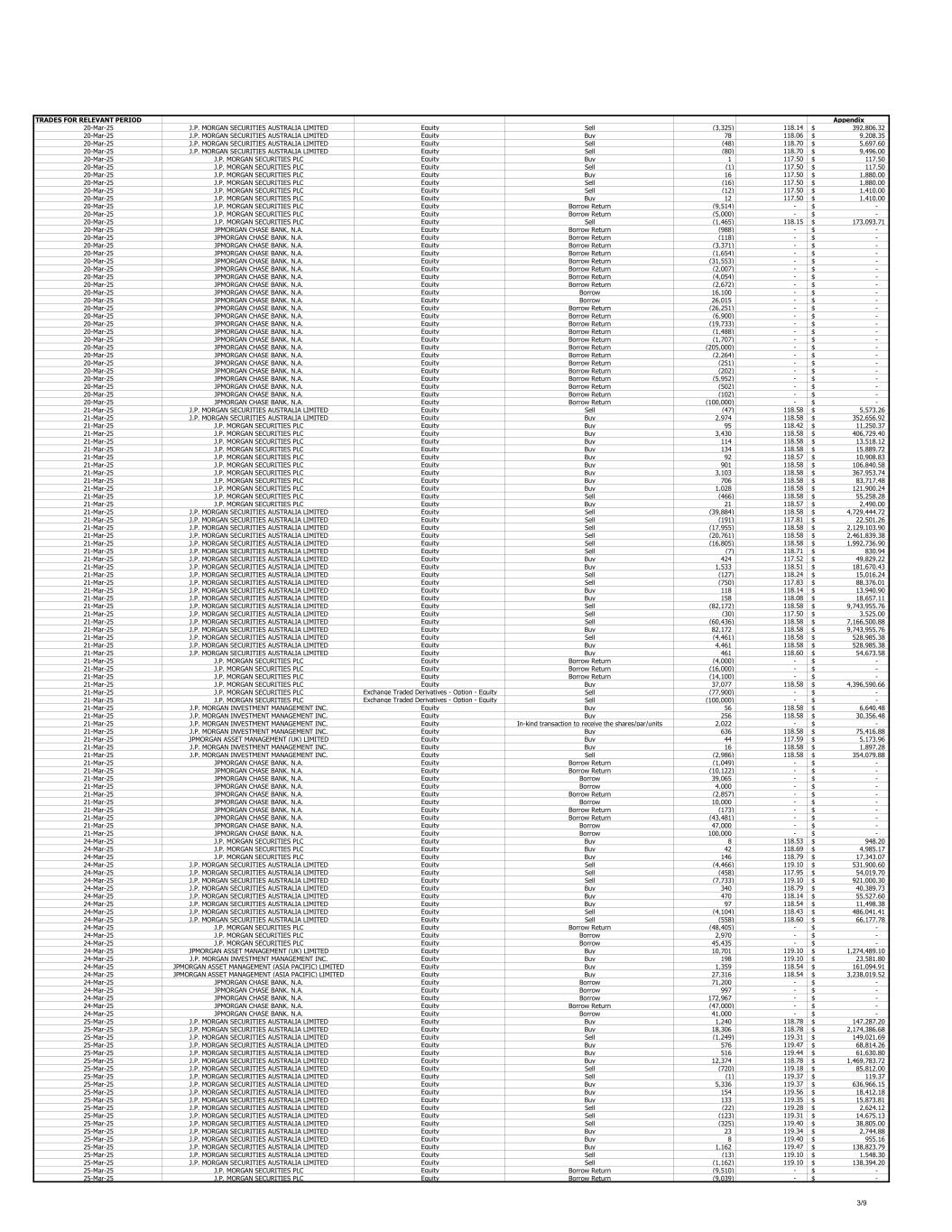

TRADES FOR RELEVANT PERIOD Appendix 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (3,325) 118.14 392,806.32$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 78 118.06 9,208.35$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (48) 118.70 5,697.60$ 20-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (80) 118.70 9,496.00$ 20-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 1 117.50 117.50$ 20-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (1) 117.50 117.50$ 20-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 16 117.50 1,880.00$ 20-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (16) 117.50 1,880.00$ 20-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (12) 117.50 1,410.00$ 20-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 12 117.50 1,410.00$ 20-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (9,514) - -$ 20-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (5,000) - -$ 20-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (1,465) 118.15 173,093.71$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (988) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (118) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (3,371) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (1,654) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (31,553) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (2,007) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (4,054) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (2,672) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 16,100 - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 26,015 - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (26,251) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (6,900) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (19,733) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (1,488) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (1,707) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (205,000) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (2,264) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (251) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (202) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (5,952) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (502) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (102) - -$ 20-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (100,000) - -$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (47) 118.58 5,573.26$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 2,974 118.58 352,656.92$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 95 118.42 11,250.37$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 3,430 118.58 406,729.40$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 114 118.58 13,518.12$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 134 118.58 15,889.72$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 92 118.57 10,908.83$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 901 118.58 106,840.58$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 3,103 118.58 367,953.74$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 706 118.58 83,717.48$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 1,028 118.58 121,900.24$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (466) 118.58 55,258.28$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 21 118.57 2,490.00$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (39,884) 118.58 4,729,444.72$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (191) 117.81 22,501.26$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (17,955) 118.58 2,129,103.90$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (20,761) 118.58 2,461,839.38$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (16,805) 118.58 1,992,736.90$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (7) 118.71 830.94$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 424 117.52 49,829.22$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,533 118.51 181,670.43$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (127) 118.24 15,016.24$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (750) 117.83 88,376.01$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 118 118.14 13,940.90$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 158 118.08 18,657.11$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (82,172) 118.58 9,743,955.76$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (30) 117.50 3,525.00$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (60,436) 118.58 7,166,500.88$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 82,172 118.58 9,743,955.76$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (4,461) 118.58 528,985.38$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 4,461 118.58 528,985.38$ 21-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 461 118.60 54,673.58$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (4,000) - -$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (16,000) - -$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (14,100) - -$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 37,077 118.58 4,396,590.66$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Exchange Traded Derivatives - Option - Equity Sell (77,900) - -$ 21-Mar-25 J.P. MORGAN SECURITIES PLC Exchange Traded Derivatives - Option - Equity Sell (100,000) - -$ 21-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 56 118.58 6,640.48$ 21-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 256 118.58 30,356.48$ 21-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity In-kind transaction to receive the shares/par/units 2,022 - -$ 21-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 636 118.58 75,416.88$ 21-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 44 117.59 5,173.96$ 21-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 16 118.58 1,897.28$ 21-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Sell (2,986) 118.58 354,079.88$ 21-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (1,049) - -$ 21-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (10,122) - -$ 21-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 39,065 - -$ 21-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 4,000 - -$ 21-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (2,857) - -$ 21-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 10,000 - -$ 21-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (173) - -$ 21-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (43,481) - -$ 21-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 47,000 - -$ 21-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 100,000 - -$ 24-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 8 118.53 948.20$ 24-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 42 118.69 4,985.17$ 24-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 146 118.79 17,343.07$ 24-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (4,466) 119.10 531,900.60$ 24-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (458) 117.95 54,019.70$ 24-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (7,733) 119.10 921,000.30$ 24-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 340 118.79 40,389.73$ 24-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 470 118.14 55,527.60$ 24-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 97 118.54 11,498.38$ 24-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (4,104) 118.43 486,041.41$ 24-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (558) 118.60 66,177.78$ 24-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (48,405) - -$ 24-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow 2,970 - -$ 24-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow 45,435 - -$ 24-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 10,701 119.10 1,274,489.10$ 24-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 198 119.10 23,581.80$ 24-Mar-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Buy 1,359 118.54 161,094.91$ 24-Mar-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Buy 27,316 118.54 3,238,019.52$ 24-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 71,200 - -$ 24-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 997 - -$ 24-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 172,967 - -$ 24-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (47,000) - -$ 24-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 41,000 - -$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,240 118.78 147,287.20$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 18,306 118.78 2,174,386.68$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,249) 119.31 149,021.69$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 576 119.47 68,814.26$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 516 119.44 61,630.80$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 12,374 118.78 1,469,783.72$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (720) 119.18 85,812.00$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1) 119.37 119.37$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 5,336 119.37 636,966.15$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 154 119.56 18,412.18$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 133 119.35 15,873.81$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (22) 119.28 2,624.12$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (123) 119.31 14,675.13$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (325) 119.40 38,805.00$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 23 119.34 2,744.88$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 8 119.40 955.16$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,162 119.47 138,823.79$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (13) 119.10 1,548.30$ 25-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,162) 119.10 138,394.20$ 25-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (9,510) - -$ 25-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (9,039) - -$ 3/9

TRADES FOR RELEVANT PERIOD Appendix 25-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 890 119.41 106,273.39$ 25-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (2,878) 118.78 341,848.84$ 25-Mar-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Buy 2,318 119.52 277,048.06$ 25-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity In-kind transaction to receive the shares/par/units 2,359 - -$ 25-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 264 118.78 31,357.92$ 25-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 5,000 - -$ 25-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (1,213) - -$ 25-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 4,000 - -$ 25-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (16,100) - -$ 25-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 6,509 - -$ 25-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (26,015) - -$ 25-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (49,511) - -$ 25-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 290,153 - -$ 25-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 1,252 - -$ 25-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (32,933) - -$ 25-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (3,585) - -$ 25-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (135,000) - -$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2,069) 118.78 245,755.82$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (246) 119.96 29,510.16$ 26-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (4) 120.09 480.36$ 26-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (567) 120.27 68,193.24$ 26-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (593) 120.20 71,280.37$ 26-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 4 121.00 484.00$ 26-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 3 120.23 360.68$ 26-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 51 120.56 6,148.43$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,388 119.96 166,504.48$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,216) 119.96 145,871.36$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (336) 120.56 40,508.31$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 312 121.10 37,784.41$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (9,280) 119.96 1,113,228.80$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (5,087) 121.01 615,586.50$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (18) 121.24 2,182.26$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (781) 120.79 94,338.27$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 10 120.22 1,202.20$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 4 120.09 480.36$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 11,106 120.84 1,342,013.08$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (183) 120.84 22,113.18$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 892 120.69 107,657.48$ 26-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (10) 118.78 1,187.80$ 26-Mar-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Buy 1,492 120.18 179,315.72$ 26-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 3,384 120.13 406,519.92$ 26-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (957) - -$ 26-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 500 - -$ 26-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (1,270) - -$ 26-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (39,096) - -$ 26-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (6,943) - -$ 26-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (3,850) - -$ 26-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (1,331) - -$ 26-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 43,561 - -$ 26-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (102,043) - -$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1 119.88 119.88$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 45 119.88 5,394.60$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 571 119.88 68,453.32$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (246) 120.09 29,542.14$ 27-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 5 120.16 600.78$ 27-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 6 120.23 721.36$ 27-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (61) 120.09 7,325.49$ 27-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 44 120.22 5,289.75$ 27-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (82) 120.09 9,847.38$ 27-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (18) 120.09 2,161.62$ 27-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 4 120.09 480.36$ 27-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (10) 120.09 1,200.90$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 15,470 120.09 1,857,792.30$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 2,785 120.09 334,450.65$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (430) 120.28 51,721.81$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 3,712 119.88 444,994.56$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 54 120.40 6,501.51$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (10) 120.31 1,203.10$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (537) 120.17 64,530.03$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (407) 120.26 48,947.46$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 92 120.20 11,058.45$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (3) 120.11 360.33$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2,246) 120.03 269,596.50$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 134 120.06 16,087.59$ 27-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (90) 119.96 10,796.40$ 27-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 2,898 120.09 348,020.82$ 27-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity In-kind transaction to receive the shares/par/units 4,381 - -$ 27-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Sell (487) 120.09 58,483.83$ 27-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (648,319) - -$ 27-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 649,835 - -$ 27-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (10,000) - -$ 27-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (10,000) - -$ 27-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (25,400) - -$ 27-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (70,900) - -$ 27-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (67,339) - -$ 27-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 61,811 - -$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,845) 121.26 223,724.70$ 28-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (16) 121.26 1,940.16$ 28-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (11) 121.26 1,333.86$ 28-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (1) 121.26 121.26$ 28-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (44) 121.26 5,335.44$ 28-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (92) 121.26 11,155.92$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 12,485 121.26 1,513,931.10$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (50) 121.26 6,063.00$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (501) 121.35 60,793.97$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (403) 120.89 48,716.79$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (20,109) 121.26 2,438,417.34$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (10,957) 121.26 1,328,661.65$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (32) 121.39 3,884.59$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (379) 120.95 45,839.14$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,022) 120.75 123,408.95$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (27) 120.92 3,264.88$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 195 121.29 23,651.89$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 45 120.36 5,416.02$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (17) 120.57 2,049.65$ 28-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (18) 120.09 2,161.62$ 28-Mar-25 J.P. MORGAN SECURITIES PLC Exchange Traded Derivatives - Option - Equity Buy 3,500 - -$ 28-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 107 119.76 12,814.32$ 28-Mar-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 1,111 119.76 133,053.36$ 28-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (75,668) - -$ 28-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (314) - -$ 28-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 251 - -$ 28-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (251) - -$ 28-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (4,000) - -$ 28-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 1,190 - -$ 28-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (3,445) - -$ 28-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (380) - -$ 28-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 380 - -$ 28-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 3,986 - -$ 28-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (3,986) - -$ 28-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (27,877) - -$ 28-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (7,000) - -$ 28-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (3,403) - -$ 31-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 2,999 115.49 346,354.51$ 31-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 3,823 115.49 441,518.27$ 31-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 162 115.49 18,709.38$ 31-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 795 116.74 92,808.77$ 31-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (6,378) 115.91 739,301.70$ 31-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (22,821) 115.64 2,638,949.56$ 31-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,093) 115.49 126,230.57$ 31-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (381) 117.14 44,629.33$ 31-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (85) 116.95 9,940.97$ 31-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (404) 116.39 47,022.69$ 31-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (4,317) 118.37 511,002.15$ 31-Mar-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (795) 121.26 96,401.70$ 4/9

TRADES FOR RELEVANT PERIOD Appendix 31-Mar-25 J.P. MORGAN SECURITIES PLC Equity Buy 92 115.49 10,625.08$ 31-Mar-25 J.P. MORGAN SECURITIES PLC Equity Sell (92) 115.49 10,625.08$ 31-Mar-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (6,846) - -$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Sell (8,731) 115.49 1,008,343.19$ 31-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 1,827 115.49 211,000.23$ 31-Mar-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Sell (146) 115.49 16,861.54$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (12,356) - -$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 20,299 - -$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (25,500) - -$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (2,114) - -$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (3,898) - -$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (57,910) - -$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (4,036) - -$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (29,283) - -$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (2,000) - -$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (31,014) - -$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (10,873) - -$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 2,190 - -$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 4,373 - -$ 31-Mar-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (6,563) - -$ 1-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 110 117.10 12,881.00$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,955 117.10 228,930.50$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (262) 117.50 30,784.63$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,857 117.10 217,454.70$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,318) 117.51 154,882.62$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (15,468) 117.10 1,811,302.80$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 209 116.35 24,318.14$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (6,368) 116.39 741,143.49$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2) 116.14 232.28$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (203) 116.31 23,611.81$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (10) 116.07 1,160.74$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (304) 116.27 35,346.85$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (5,005) 117.48 587,988.90$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 10,090 116.52 1,175,641.59$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 2,757 117.12 322,909.27$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,472 117.12 172,405.67$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (197) 115.49 22,751.53$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2,757) 115.49 318,405.93$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (5,085) 115.49 587,266.65$ 1-Apr-25 J.P. MORGAN SECURITIES PLC Equity Sell (1,014) 117.10 118,739.40$ 1-Apr-25 J.P. MORGAN SECURITIES PLC Equity Sell (59) 117.10 6,908.90$ 1-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 59 117.10 6,908.90$ 1-Apr-25 J.P. MORGAN SECURITIES PLC Equity Sell (73) 117.10 8,548.30$ 1-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 73 117.10 8,548.30$ 1-Apr-25 J.P. MORGAN SECURITIES PLC Equity Sell (433) 117.10 50,704.30$ 1-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 433 117.10 50,704.30$ 1-Apr-25 J.P. MORGAN SECURITIES PLC Equity Sell (43) 117.10 5,035.30$ 1-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 43 117.10 5,035.30$ 1-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (15,000) 115.49 1,732,350.00$ 1-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 3,312 116.32 385,259.79$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Sell (19,160) 116.16 2,225,671.58$ 1-Apr-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 264 117.10 30,914.40$ 1-Apr-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 91 116.03 10,558.73$ 1-Apr-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 38 116.03 4,409.14$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Sell (7,528) 116.16 874,470.55$ 1-Apr-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity In-kind transaction to deliver the shares/par/units (11,458) - -$ 1-Apr-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity In-kind transaction to receive the shares/par/units 674 - -$ 1-Apr-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 279 116.03 32,372.37$ 1-Apr-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 64 116.03 7,425.92$ 1-Apr-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 28 117.10 3,278.80$ 1-Apr-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity In-kind transaction to deliver the shares/par/units (2,421) - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 60,000 - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 4,000 - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 5,380 - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 1,000 - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (6,509) - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (11,237) - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 690 - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 2,836 - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (48,705) - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (40,468) - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (38,813) - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (3,692) - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (1) - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 4,612 - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 44,474 - -$ 1-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 9,790 - -$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 5 116.09 580.45$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (373) 115.08 42,924.84$ 2-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 637 115.85 73,795.08$ 2-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 23 115.75 2,662.25$ 2-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 762 115.77 88,215.16$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 21 114.96 2,414.14$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 376 116.17 43,678.14$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1) 115.40 115.40$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (10,667) 115.15 1,228,343.05$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,998) 115.08 229,929.84$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (7,593) 115.13 874,213.85$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (7,510) 115.14 864,710.85$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2,695) 115.08 310,140.60$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (14) 115.09 1,611.26$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (7,197) 115.08 828,230.76$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 182 115.26 20,977.92$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 34 115.46 3,925.48$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (85) 115.08 9,781.80$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 21,945 115.12 2,526,400.04$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (18) 115.08 2,071.44$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (183) 117.10 21,429.30$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (106) 117.10 12,412.60$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 5,800 115.39 669,236.48$ 2-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (666) 115.08 76,643.28$ 2-Apr-25 J.P. MORGAN SECURITIES PLC Equity Sell (1,532) 115.55 177,019.69$ 2-Apr-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Sell (239) 115.78 27,670.99$ 2-Apr-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 1,352 116.25 157,175.14$ 2-Apr-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Buy 126 115.08 14,500.08$ 2-Apr-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Sell (4,572) 115.78 529,337.93$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (280) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (8,664) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (26,925) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (2,527) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (22,918) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (24,000) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (3,051) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (746) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (398) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (7,587) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (3,238) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (6,006) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (29,122) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (3,000) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (9,972) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 29,000 - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 4,366 - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (4,366) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (650,215) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 191,326 - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 458,889 - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 59,819 - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 26,079 - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 99,474 - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 45,015 - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (54,811) - -$ 2-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 54,811 - -$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (668) 113.38 75,737.84$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 787 111.94 88,096.78$ 5/9

TRADES FOR RELEVANT PERIOD Appendix 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (4) 112.31 449.24$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 526 112.36 59,101.56$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (5,990) 112.36 673,060.89$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (331) 111.94 37,053.28$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 38 112.38 4,270.25$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 12 112.20 1,346.40$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,051 111.75 117,450.23$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 196 111.74 21,900.74$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 12,374 111.94 1,385,145.56$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 845 112.15 94,769.80$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,958) 111.93 219,163.85$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (619) 113.38 70,182.22$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 30 111.89 3,356.63$ 3-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (522) 115.08 60,071.76$ 3-Apr-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (1,865) - -$ 3-Apr-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Buy 5,111 113.38 579,485.18$ 3-Apr-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity In-kind transaction to receive the shares/par/units 674 - -$ 3-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (48,600) - -$ 3-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 690 - -$ 3-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (1,000) - -$ 3-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (100,000) - -$ 3-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (13,270) - -$ 3-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (5,481) - -$ 3-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (3,750) - -$ 3-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (75,518) - -$ 3-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (3,971) - -$ 3-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 58,742 - -$ 3-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 214,905 - -$ 3-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (1,090) - -$ 3-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 1,090 - -$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 2,278 112.70 256,730.60$ 4-Apr-25 J.P. MORGAN SECURITIES PLC Equity Sell (67) 112.70 7,550.90$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (28) 112.70 3,155.60$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,485 110.32 163,821.43$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (201) 111.89 22,490.21$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (28) 111.67 3,126.80$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 8 111.43 891.46$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (12,373) 112.70 1,394,437.10$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 180 111.99 20,157.60$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 1,215 108.92 132,333.80$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (10,494) 112.52 1,180,777.95$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (10,675) 111.44 1,189,602.08$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 8,939 109.06 974,928.59$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (738) 111.70 82,436.95$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (10,675) 111.73 1,192,727.18$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,490) 111.16 165,626.97$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,472) 111.94 164,775.68$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (3,722) 111.94 416,640.68$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,453) 111.94 162,648.82$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 703 111.48 78,367.48$ 4-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 151 112.70 17,017.70$ 4-Apr-25 J.P. MORGAN SECURITIES PLC Equity Sell (151) 112.70 17,017.70$ 4-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 32 112.70 3,606.40$ 4-Apr-25 J.P. MORGAN SECURITIES PLC Equity Sell (32) 112.70 3,606.40$ 4-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 15,000 112.55 1,688,250.00$ 4-Apr-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (9,161) - -$ 4-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 4,045 110.57 447,254.44$ 4-Apr-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Sell (6,955) 111.43 775,029.73$ 4-Apr-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Sell (3,604) 111.43 401,611.38$ 4-Apr-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Sell (10,450) 111.43 1,164,494.71$ 4-Apr-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Sell (1,796) 111.43 200,137.08$ 4-Apr-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Sell (902) 111.43 100,514.28$ 4-Apr-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Sell (2,407) 111.43 268,223.80$ 4-Apr-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Sell (4,243) 111.43 472,818.28$ 4-Apr-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Sell (2,991) 111.43 333,301.79$ 4-Apr-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Sell (28,039) 111.43 3,124,523.16$ 4-Apr-25 JPMORGAN ASSET MANAGEMENT (ASIA PACIFIC) LIMITED Equity Sell (46,714) 111.43 5,205,569.92$ 4-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (10,000) - -$ 4-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (434) - -$ 4-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (418,248) - -$ 4-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (2,567) - -$ 4-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 2,567 - -$ 4-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 45,968 - -$ 4-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 25,310 - -$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (703) 112.70 79,228.10$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 5,735 107.85 618,505.99$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (303) 108.07 32,744.04$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 694 106.90 74,191.50$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (372) 107.37 39,940.63$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 37 108.34 4,008.67$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (525) 107.96 56,679.36$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 20,334 107.43 2,184,579.98$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (38,516) 107.31 4,132,984.88$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 12,375 108.40 1,341,450.00$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (7) 105.00 735.00$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (7,875) 108.24 852,368.25$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (500) 108.06 54,032.01$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 5,777 107.94 623,545.00$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (906) 108.40 98,210.40$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (4,662) 105.00 489,510.00$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (281) 105.00 29,505.00$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 277 108.23 29,979.88$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2,577) 108.40 279,346.80$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 3,162 108.40 342,760.80$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (703) 112.70 79,228.10$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (326) 112.70 36,740.20$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (9,000) 112.70 1,014,300.00$ 7-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 459 108.40 49,755.60$ 7-Apr-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (1,742) - -$ 7-Apr-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (25,731) - -$ 7-Apr-25 J.P. MORGAN SECURITIES PLC Equity Borrow Return (100,000) - -$ 7-Apr-25 J.P. MORGAN SECURITIES PLC Equity Borrow 38 - -$ 7-Apr-25 J.P. MORGAN SECURITIES PLC Equity Borrow 98,118 - -$ 7-Apr-25 J.P. MORGAN SECURITIES PLC Equity Borrow 1,844 - -$ 7-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 8,106 108.45 879,129.75$ 7-Apr-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Sell (593) 108.40 64,281.20$ 7-Apr-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 95 105.00 9,975.00$ 7-Apr-25 J.P. MORGAN INVESTMENT MANAGEMENT INC. Equity Sell (260) 105.00 27,300.00$ 7-Apr-25 JPMORGAN ASSET MANAGEMENT (UK) LIMITED Equity Buy 22 105.00 2,310.00$ 7-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (983) - -$ 7-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (34,000) - -$ 7-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (489) - -$ 7-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 2,000 - -$ 7-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (44,895) - -$ 7-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (2,254) - -$ 7-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow 2,254 - -$ 7-Apr-25 JPMORGAN CHASE BANK, N.A. Equity Borrow Return (216,700) - -$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (37) 108.40 4,010.80$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2,197) 109.48 240,527.56$ 8-Apr-25 J.P. MORGAN SECURITIES PLC Equity Sell (191) 109.48 20,910.68$ 8-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 384 109.48 42,040.32$ 8-Apr-25 J.P. MORGAN SECURITIES PLC Equity Buy 33 109.48 3,612.84$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 4,707 109.48 515,322.36$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (92) 109.48 10,072.16$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (2,554) 109.72 280,219.90$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 100 110.00 11,000.10$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (1,286) 109.50 140,822.34$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (31) 109.73 3,401.77$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (163) 109.97 17,924.45$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 2,278 109.59 249,645.88$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 156 109.83 17,133.07$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (100) 108.40 10,840.00$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (8,446) 108.40 915,546.40$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Sell (125) 108.40 13,550.00$ 8-Apr-25 J.P. MORGAN SECURITIES AUSTRALIA LIMITED Equity Buy 3,033 109.48 332,052.84$ 6/9