00015084782024FYFALSEhttp://fasb.org/us-gaap/2024#AccountsPayableCurrenthttp://fasb.org/us-gaap/2024#LongTermDebtNoncurrenthttp://fasb.org/us-gaap/2024#LongTermDebtNoncurrentxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:purearco:territoryarco:agreementarco:loanarco:periodarco:restaurantarco:divisionarco:sourcearco:votearco:installment00015084782024-01-012024-12-310001508478dei:BusinessContactMember2024-01-012024-12-310001508478us-gaap:CommonClassAMember2024-12-310001508478us-gaap:CommonClassBMember2024-12-310001508478us-gaap:ProductMember2024-01-012024-12-310001508478us-gaap:ProductMember2023-01-012023-12-310001508478us-gaap:ProductMember2022-01-012022-12-310001508478us-gaap:FranchiseMember2024-01-012024-12-310001508478us-gaap:FranchiseMember2023-01-012023-12-310001508478us-gaap:FranchiseMember2022-01-012022-12-3100015084782023-01-012023-12-3100015084782022-01-012022-12-3100015084782024-12-3100015084782023-12-310001508478us-gaap:CommonClassAMember2023-12-310001508478us-gaap:CommonClassBMember2023-12-310001508478arco:A2029NotesMember2024-01-012024-12-310001508478arco:A2029NotesMember2023-01-012023-12-310001508478arco:A2029NotesMember2022-01-012022-12-310001508478arco:A2027NotesMember2024-01-012024-12-310001508478arco:A2027NotesMember2023-01-012023-12-310001508478arco:A2027NotesMember2022-01-012022-12-310001508478arco:TwoThousandTwentyThreeNotesMember2024-01-012024-12-310001508478arco:TwoThousandTwentyThreeNotesMember2023-01-012023-12-310001508478arco:TwoThousandTwentyThreeNotesMember2022-01-012022-12-3100015084782022-12-3100015084782021-12-310001508478us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310001508478us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-12-310001508478us-gaap:AdditionalPaidInCapitalMember2021-12-310001508478us-gaap:RetainedEarningsMember2021-12-310001508478us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001508478us-gaap:TreasuryStockCommonMember2021-12-310001508478us-gaap:ParentMember2021-12-310001508478us-gaap:NoncontrollingInterestMember2021-12-310001508478us-gaap:RetainedEarningsMember2022-01-012022-12-310001508478us-gaap:ParentMember2022-01-012022-12-310001508478us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001508478us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001508478us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-01-012022-12-310001508478us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001508478us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001508478us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001508478us-gaap:AdditionalPaidInCapitalMember2022-12-310001508478us-gaap:RetainedEarningsMember2022-12-310001508478us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001508478us-gaap:TreasuryStockCommonMember2022-12-310001508478us-gaap:ParentMember2022-12-310001508478us-gaap:NoncontrollingInterestMember2022-12-310001508478us-gaap:RetainedEarningsMember2023-01-012023-12-310001508478us-gaap:ParentMember2023-01-012023-12-310001508478us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001508478us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001508478us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-12-310001508478us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001508478us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001508478us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310001508478us-gaap:AdditionalPaidInCapitalMember2023-12-310001508478us-gaap:RetainedEarningsMember2023-12-310001508478us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001508478us-gaap:TreasuryStockCommonMember2023-12-310001508478us-gaap:ParentMember2023-12-310001508478us-gaap:NoncontrollingInterestMember2023-12-310001508478us-gaap:RetainedEarningsMember2024-01-012024-12-310001508478us-gaap:ParentMember2024-01-012024-12-310001508478us-gaap:NoncontrollingInterestMember2024-01-012024-12-310001508478us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001508478us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-12-310001508478us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001508478us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-12-310001508478us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-12-310001508478us-gaap:AdditionalPaidInCapitalMember2024-12-310001508478us-gaap:RetainedEarningsMember2024-12-310001508478us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001508478us-gaap:TreasuryStockCommonMember2024-12-310001508478us-gaap:ParentMember2024-12-310001508478us-gaap:NoncontrollingInterestMember2024-12-310001508478arco:ArcosDoradosB.V.Member2024-12-310001508478arco:MartiniqueFrenchGuyanaGuadeloupeMember2007-08-032007-08-030001508478arco:MartiniqueFrenchGuyanaGuadeloupeMember2016-07-200001508478us-gaap:SubsequentEventMember2025-01-010001508478us-gaap:SubsequentEventMember2025-01-012025-01-010001508478country:AR2024-12-310001508478country:VE2024-12-310001508478srt:MaximumMemberus-gaap:BuildingMember2024-12-310001508478srt:MinimumMemberus-gaap:EquipmentMember2024-12-310001508478srt:MaximumMemberus-gaap:EquipmentMember2024-12-310001508478arco:InternalUseSoftwareMember2024-12-310001508478arco:CompanyOperatedFranchiseMember2024-01-012024-12-310001508478arco:CompanyOperatedFranchiseMember2023-01-012023-12-310001508478arco:CompanyOperatedFranchiseMember2022-01-012022-12-310001508478arco:FranchiseeMember2024-01-012024-12-310001508478arco:FranchiseeMember2023-01-012023-12-310001508478arco:FranchiseeMember2022-01-012022-12-310001508478srt:MinimumMember2024-12-310001508478srt:MaximumMember2024-12-310001508478arco:ThirdPartyFinancialInstitutionsMembersrt:MinimumMember2024-12-310001508478arco:ThirdPartyFinancialInstitutionsMembersrt:MaximumMember2024-12-310001508478arco:LatinAmericaAndCaribbeanMcdonaldSMember2007-08-0300015084782007-08-032007-08-030001508478arco:FirstTenYearsMember2007-08-032007-08-030001508478arco:NextFiveYearsMember2007-08-032007-08-030001508478arco:LastFiveYearsMember2007-08-032007-08-030001508478arco:FirstTenYearsMemberus-gaap:SubsequentEventMember2025-01-012025-01-010001508478arco:NextFiveYearsMemberus-gaap:SubsequentEventMember2025-01-012025-01-010001508478arco:LastFiveYearsMemberus-gaap:SubsequentEventMember2025-01-012025-01-010001508478arco:FranchisedRestaurantsMember2024-12-310001508478arco:FranchisedRestaurantsMember2023-12-310001508478arco:FranchisedRestaurantsMember2022-12-310001508478arco:FranchisedRestaurantsMember2024-01-012024-12-310001508478arco:FranchisedRestaurantsMember2023-01-012023-12-310001508478arco:FranchisedRestaurantsMember2022-01-012022-12-310001508478us-gaap:ComputerSoftwareIntangibleAssetMember2024-12-310001508478us-gaap:ComputerSoftwareIntangibleAssetMember2023-12-310001508478us-gaap:FranchiseRightsMember2024-12-310001508478us-gaap:FranchiseRightsMember2023-12-310001508478arco:ReacquiredFranchiseRightsMember2024-12-310001508478arco:ReacquiredFranchiseRightsMember2023-12-310001508478us-gaap:OtherIntangibleAssetsMember2024-12-310001508478us-gaap:OtherIntangibleAssetsMember2023-12-310001508478country:BR2024-12-310001508478country:BR2023-12-310001508478country:CL2024-12-310001508478country:CL2023-12-310001508478country:MX2024-12-310001508478country:MX2023-12-310001508478country:AR2023-12-310001508478country:CO2024-12-310001508478country:CO2023-12-310001508478arco:FranchiseInitialFeesMember2024-12-310001508478arco:FranchiseInitialFeesMember2023-12-310001508478arco:ExcludingFranchiseInitialFeesMember2024-12-310001508478arco:ExcludingFranchiseInitialFeesMember2023-12-310001508478us-gaap:BankOverdraftsMember2024-12-310001508478us-gaap:BankOverdraftsMember2023-12-310001508478us-gaap:NotesPayableToBanksMember2024-12-310001508478us-gaap:NotesPayableToBanksMember2023-12-310001508478us-gaap:LineOfCreditMember2024-12-310001508478us-gaap:LineOfCreditMember2023-12-310001508478arco:BancoItauChileNoteDueDecember2024Memberus-gaap:NotesPayableToBanksMember2024-12-310001508478arco:BancoDeChileNoteDueDecember2024Memberus-gaap:NotesPayableToBanksMember2023-12-310001508478country:PAarco:CitibankNoteDueFebruary2025Memberus-gaap:NotesPayableToBanksMember2024-12-310001508478country:PAarco:CitibankNoteDueFebruary2025Memberus-gaap:NotesPayableToBanksMember2023-12-310001508478country:PRarco:CitibankNoteDueFebruary2025Memberus-gaap:NotesPayableToBanksMember2024-12-310001508478country:PRarco:CitibankNoteDueFebruary2025Memberus-gaap:NotesPayableToBanksMember2023-12-310001508478country:CLarco:BancoDeChileNoteDueDecember2024Memberus-gaap:NotesPayableToBanksMember2024-12-310001508478country:CLarco:BancoDeChileNoteDueDecember2024Memberus-gaap:NotesPayableToBanksMember2023-12-310001508478country:CLarco:BancoItauChileNoteDueDecember2024Memberus-gaap:NotesPayableToBanksMember2024-12-310001508478country:CLarco:BancoItauChileNoteDueDecember2024Memberus-gaap:NotesPayableToBanksMember2023-12-310001508478country:CLarco:BancoChileNoteDueMarch2025Memberus-gaap:NotesPayableToBanksMember2024-12-310001508478country:CLarco:BancoChileNoteDueMarch2025Memberus-gaap:NotesPayableToBanksMember2023-12-310001508478country:CLarco:BancoItauChileNoteDueJune2025Memberus-gaap:NotesPayableToBanksMember2024-12-310001508478country:CLarco:BancoItauChileNoteDueJune2025Memberus-gaap:NotesPayableToBanksMember2023-12-310001508478country:UYarco:BancoItauUruguayNoteDueMay2025Memberus-gaap:NotesPayableToBanksMember2024-12-310001508478country:UYarco:BancoItauUruguayNoteDueMay2025Memberus-gaap:NotesPayableToBanksMember2023-12-310001508478country:UYarco:BancoBBVAUruguayNoteDueMay2025Memberus-gaap:NotesPayableToBanksMember2024-12-310001508478country:UYarco:BancoBBVAUruguayNoteDueMay2025Memberus-gaap:NotesPayableToBanksMember2023-12-310001508478arco:ItauUnibancoS.A.DueApril142025Membersrt:MinimumMemberus-gaap:LineOfCreditMember2024-12-310001508478arco:ItauUnibancoS.A.DueApril142025Membersrt:MaximumMemberus-gaap:LineOfCreditMember2024-12-310001508478arco:ItauUnibancoS.A.DueApril142025Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310001508478arco:JPMorganDueFebruary172026Memberus-gaap:LineOfCreditMember2024-12-310001508478arco:JPMorganDueFebruary172026Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310001508478arco:BancoSantanderBrasilDueOctober312026Membersrt:MinimumMemberus-gaap:LineOfCreditMember2024-12-310001508478arco:BancoSantanderBrasilDueOctober312026Membersrt:MaximumMemberus-gaap:LineOfCreditMember2024-12-310001508478arco:BancoSantanderBrasilDueOctober312026Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310001508478arco:BancoSantanderBrasilDueOctober312026Memberarco:ADBVSubsidiaryMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310001508478arco:JPMorganDueFebruary172026Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-01-012024-12-310001508478arco:TwoThousandTwentyNineNotesMember2024-12-310001508478arco:TwoThousandTwentyNineNotesMember2023-12-310001508478arco:TwoThousandTwentySevenNotesMember2024-12-310001508478arco:TwoThousandTwentySevenNotesMember2023-12-310001508478arco:TwoThousandTwentyNineNotesMember2024-01-012024-12-310001508478arco:TwoThousandTwentyNineNotesMember2023-01-012023-12-310001508478arco:TwoThousandTwentyNineNotesMember2022-01-012022-12-310001508478arco:TwoThousandTwentySevenNotesMember2024-01-012024-12-310001508478arco:TwoThousandTwentySevenNotesMember2023-01-012023-12-310001508478arco:TwoThousandTwentySevenNotesMember2022-01-012022-12-310001508478arco:TwoThousandTwentySevenNotesMember2017-04-040001508478arco:TwoThousandTwentySevenNotesMember2020-09-110001508478arco:TwoThousandTwentySevenNotesMember2020-09-112020-09-110001508478arco:TwoThousandTwentySevenNotesMember2020-10-130001508478arco:TwoThousandTwentySevenNotesMember2021-12-310001508478arco:TwoThousandTwentySevenNotesMember2021-01-012021-12-310001508478arco:TwoThousandTwentySevenNotesMember2022-05-130001508478arco:TwoThousandTwentySevenNotesMember2022-05-132022-05-130001508478arco:TwoThousandTwentySevenNotesMember2022-12-310001508478arco:A2029NotesMember2022-04-270001508478arco:A2029NotesMembersrt:MinimumMembersrt:ScenarioForecastMember2026-05-270001508478arco:A2029NotesMembersrt:MaximumMembersrt:ScenarioForecastMember2026-05-270001508478arco:RestaurantAndOfficeMemberarco:A2029NotesMember2022-04-272022-04-270001508478arco:SupplyChainMemberarco:A2029NotesMember2022-04-272022-04-270001508478arco:TwoThousandTwentyNineNotesMember2022-04-270001508478arco:TwoThousandTwentyNineNotesMember2022-12-310001508478arco:A2032NotesMemberus-gaap:SubsequentEventMember2025-01-240001508478arco:TwoThousandTwentySevenNotesMemberus-gaap:SubsequentEventMember2025-01-292025-01-290001508478arco:TwoThousandTwentySevenNotesMemberus-gaap:SubsequentEventMember2025-01-290001508478arco:TwoThousandTwentyNineNotesMember2024-12-310001508478arco:TwoThousandTwentySevenNotesMember2024-12-310001508478us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberarco:OtherReceivablesMember2024-12-310001508478us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberarco:OtherReceivablesMember2023-12-310001508478us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherLiabilitiesMember2024-12-310001508478us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherLiabilitiesMember2023-12-310001508478arco:CallSpreadAndCouponOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberarco:DerivativeInstrumentsMember2024-12-310001508478arco:CallSpreadAndCouponOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberarco:DerivativeInstrumentsMember2023-12-310001508478arco:ESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberarco:DerivativeInstrumentsMember2024-12-310001508478arco:ESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberarco:DerivativeInstrumentsMember2023-12-310001508478us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberarco:DerivativeInstrumentsMember2024-12-310001508478us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberarco:DerivativeInstrumentsMember2023-12-310001508478us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310001508478us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001508478us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMemberarco:OtherReceivablesMember2024-12-310001508478us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMemberarco:OtherReceivablesMember2023-12-310001508478us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMemberus-gaap:OtherLiabilitiesMember2024-12-310001508478us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMemberus-gaap:OtherLiabilitiesMember2023-12-310001508478arco:CallSpreadAndCouponOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMemberarco:DerivativeInstrumentsMember2024-12-310001508478arco:CallSpreadAndCouponOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMemberarco:DerivativeInstrumentsMember2023-12-310001508478us-gaap:CallOptionMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMemberarco:DerivativeInstrumentsMember2024-12-310001508478us-gaap:CallOptionMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMemberarco:DerivativeInstrumentsMember2023-12-310001508478us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMemberarco:DerivativeInstrumentsMember2024-12-310001508478us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMemberarco:DerivativeInstrumentsMember2023-12-310001508478us-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMember2024-12-310001508478us-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMember2023-12-310001508478us-gaap:CashFlowHedgingMember2024-12-310001508478us-gaap:CashFlowHedgingMember2023-12-310001508478arco:BrazilSegmentMember2024-01-012024-12-310001508478arco:BrazilSegmentMember2023-01-012023-12-310001508478us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310001508478us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001508478arco:CallSpreadAndCouponOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310001508478arco:CallSpreadAndCouponOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001508478arco:ESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310001508478arco:ESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001508478us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310001508478us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001508478us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMember2024-01-012024-12-310001508478us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMember2023-01-012023-12-310001508478us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMember2022-01-012022-12-310001508478us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:CashFlowHedgingMember2024-01-012024-12-310001508478us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:CashFlowHedgingMember2023-01-012023-12-310001508478us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:CashFlowHedgingMember2022-01-012022-12-310001508478us-gaap:CallOptionMemberus-gaap:CashFlowHedgingMember2024-01-012024-12-310001508478us-gaap:CallOptionMemberus-gaap:CashFlowHedgingMember2023-01-012023-12-310001508478us-gaap:CallOptionMemberus-gaap:CashFlowHedgingMember2022-01-012022-12-310001508478us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2024-01-012024-12-310001508478us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2023-01-012023-12-310001508478us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2022-01-012022-12-310001508478arco:ESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMember2024-01-012024-12-310001508478arco:ESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMember2023-01-012023-12-310001508478arco:ESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMember2022-01-012022-12-310001508478us-gaap:CashFlowHedgingMember2024-01-012024-12-310001508478us-gaap:CashFlowHedgingMember2023-01-012023-12-310001508478us-gaap:CashFlowHedgingMember2022-01-012022-12-310001508478arco:CrossCurrencyInterestRateContractAndESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestExpenseMember2024-01-012024-12-310001508478arco:CrossCurrencyInterestRateContractAndESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestExpenseMember2023-01-012023-12-310001508478arco:CrossCurrencyInterestRateContractAndESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestExpenseMember2022-01-012022-12-310001508478arco:CrossCurrencyInterestRateContractAndESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:GainLossOnDerivativeInstrumentsMember2024-01-012024-12-310001508478arco:CrossCurrencyInterestRateContractAndESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:GainLossOnDerivativeInstrumentsMember2023-01-012023-12-310001508478arco:CrossCurrencyInterestRateContractAndESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:GainLossOnDerivativeInstrumentsMember2022-01-012022-12-310001508478arco:CrossCurrencyInterestRateContractAndESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:ForeignCurrencyGainLossMember2024-01-012024-12-310001508478arco:CrossCurrencyInterestRateContractAndESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:ForeignCurrencyGainLossMember2023-01-012023-12-310001508478arco:CrossCurrencyInterestRateContractAndESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMemberus-gaap:ForeignCurrencyGainLossMember2022-01-012022-12-310001508478arco:CrossCurrencyInterestRateContractAndESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMember2024-01-012024-12-310001508478arco:CrossCurrencyInterestRateContractAndESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMember2023-01-012023-12-310001508478arco:CrossCurrencyInterestRateContractAndESGPrincipalOnlySwapMemberus-gaap:CashFlowHedgingMember2022-01-012022-12-310001508478us-gaap:NondesignatedMember2024-01-012024-12-310001508478us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:NondesignatedMember2024-12-310001508478us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:NondesignatedMember2023-12-310001508478arco:CallSpreadAndCouponOnlySwapMemberus-gaap:NondesignatedMember2024-12-310001508478arco:CallSpreadAndCouponOnlySwapMemberus-gaap:NondesignatedMember2023-12-310001508478us-gaap:CallOptionMemberus-gaap:NondesignatedMember2024-12-310001508478us-gaap:CallOptionMemberus-gaap:NondesignatedMember2023-12-310001508478us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2024-12-310001508478us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2023-12-310001508478arco:RestaurantsMember2024-12-310001508478us-gaap:PropertyPlantAndEquipmentOtherTypesMember2024-12-310001508478arco:OccupancyAndOtherOperatingExpensesMemberus-gaap:ProductMember2024-01-012024-12-310001508478arco:OccupancyAndOtherOperatingExpensesMemberus-gaap:ProductMember2023-01-012023-12-310001508478arco:OccupancyAndOtherOperatingExpensesMemberus-gaap:ProductMember2022-01-012022-12-310001508478us-gaap:CostOfSalesMemberus-gaap:FranchiseMember2024-01-012024-12-310001508478us-gaap:CostOfSalesMemberus-gaap:FranchiseMember2023-01-012023-12-310001508478us-gaap:CostOfSalesMemberus-gaap:FranchiseMember2022-01-012022-12-310001508478us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-12-310001508478us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001508478us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-3100015084782010-03-012010-03-3100015084782017-12-052017-12-0500015084782017-12-050001508478arco:InitialFranchiseFeeMember2024-12-310001508478arco:PropertyAndEquipmentUnderFranchiseArrangementsMember2024-12-310001508478arco:PropertyAndEquipmentUnderFranchiseArrangementsMember2023-12-310001508478arco:FranchiseRentalIncomeMember2024-01-012024-12-310001508478arco:FranchiseRentalIncomeMember2023-01-012023-12-310001508478arco:FranchiseRentalIncomeMember2022-01-012022-12-310001508478arco:FranchiseInitialFeesMember2024-01-012024-12-310001508478arco:FranchiseInitialFeesMember2023-01-012023-12-310001508478arco:FranchiseInitialFeesMember2022-01-012022-12-310001508478arco:FranchiseRoyaltyFeesMember2024-01-012024-12-310001508478arco:FranchiseRoyaltyFeesMember2023-01-012023-12-310001508478arco:FranchiseRoyaltyFeesMember2022-01-012022-12-310001508478arco:OwnedSitesMember2024-12-310001508478arco:LeasedSitesMember2024-12-310001508478country:VE2024-01-012024-12-310001508478country:VE2023-01-012023-12-310001508478country:VE2022-01-012022-12-310001508478arco:TaxYearRange1Member2024-12-310001508478arco:TaxYearRange2Member2024-12-310001508478arco:NoExpirationPeriodMember2024-12-310001508478arco:BrazilColombiaMexicoPanamaAndVenezuelaMember2024-12-310001508478arco:BrazilColombiaMexicoPanamaAndVenezuelaMember2023-12-310001508478arco:TaxYear2009To2017Member2024-01-012024-12-310001508478arco:TwoThousandElevenEquityIncentivePlanMember2011-03-012011-03-300001508478arco:TwoThousandElevenEquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMemberarco:SecondAnniversaryOfGrantDateMember2024-01-012024-12-310001508478arco:TwoThousandElevenEquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMemberarco:FourthAnniversaryofGrantDateMember2024-01-012024-12-310001508478arco:TwoThousandElevenEquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMemberarco:FifthAnniversaryofGrantDateMember2024-01-012024-12-310001508478arco:TwoThousandElevenEquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMemberarco:ThirdAnniversaryOfGrantDateMember2024-01-012024-12-310001508478us-gaap:RestrictedStockUnitsRSUMemberarco:TwoThousandElevenEquityIncentivePlanMember2024-01-012024-12-310001508478arco:TwoThousandElevenEquityIncentivePlanMember2023-01-012023-12-310001508478arco:TwoThousandElevenEquityIncentivePlanMember2022-01-012022-12-310001508478us-gaap:RestrictedStockUnitsRSUMemberarco:TwoThousandElevenEquityIncentivePlanMember2021-12-310001508478us-gaap:RestrictedStockUnitsRSUMemberarco:TwoThousandElevenEquityIncentivePlan2017GrantsMember2022-01-012022-12-310001508478us-gaap:RestrictedStockUnitsRSUMemberarco:TwoThousandElevenEquityIncentivePlan2018GrantsMember2022-01-012022-12-310001508478us-gaap:RestrictedStockUnitsRSUMemberarco:TwoThousandElevenEquityIncentivePlanMember2022-01-012022-12-310001508478us-gaap:RestrictedStockUnitsRSUMemberarco:TwoThousandElevenEquityIncentivePlanMember2022-12-310001508478us-gaap:RestrictedStockUnitsRSUMemberarco:TwoThousandElevenEquityIncentivePlan2018GrantsMember2023-01-012023-12-310001508478us-gaap:RestrictedStockUnitsRSUMemberarco:TwoThousandElevenEquityIncentivePlanMember2023-01-012023-12-310001508478us-gaap:RestrictedStockUnitsRSUMemberarco:TwoThousandElevenEquityIncentivePlanMember2023-12-310001508478us-gaap:RestrictedStockUnitsRSUMemberarco:TwoThousandElevenEquityIncentivePlanMember2024-12-310001508478us-gaap:CommonClassAMember2024-01-012024-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlan2022GrantsMember2023-01-012023-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlan2023GrantsMember2024-01-012024-12-310001508478arco:PhantomRSUAwardPlan2024GrantsMemberarco:PhantomRSUAwardMemberarco:April2025Member2024-01-012024-12-310001508478arco:PhantomRSUAwardPlan2024GrantsMemberarco:PhantomRSUAwardMemberarco:May2027Member2024-01-012024-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlanImplementedMay2019Member2024-01-012024-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlanImplementedMay2019Member2023-01-012023-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlanImplementedMay2019Member2022-01-012022-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlanImplementedMay2019Member2021-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlan2022GrantsMember2022-01-012022-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlan2019GrantsMember2022-01-012022-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlan2021GrantsMember2022-01-012022-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlanImplementedMay2019Member2022-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlan2023GrantsMember2023-01-012023-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlan2019GrantsMember2023-01-012023-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlanImplementedMay2019Member2023-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlan2024GrantsMember2024-01-012024-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlan2019GrantsMember2024-01-012024-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlan2021GrantsMember2024-01-012024-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlan2022GrantsMember2024-01-012024-12-310001508478arco:PhantomRSUAwardMemberarco:PhantomRSUAwardPlanImplementedMay2019Member2024-12-310001508478arco:TwoThousandElevenEquityIncentivePlanMember2024-01-012024-12-3100015084782022-01-012024-12-310001508478arco:DebtCovenantsMember2024-03-310001508478arco:DebtCovenantsMember2024-06-300001508478arco:DebtCovenantsMember2024-09-300001508478arco:DebtCovenantsMember2024-12-310001508478us-gaap:StandbyLettersOfCreditMember2024-12-310001508478arco:ItauUnibancoSAMember2024-12-310001508478arco:BancoBilbaoVizcayaArgentariaMember2024-12-310001508478arco:JPMorganS.A.Member2024-12-310001508478arco:BancoBilbaoVizcayaArgentariaMember2024-10-250001508478arco:CreditSuisseMember2024-10-280001508478arco:TaxContingenciesMember2023-12-310001508478arco:TaxContingenciesMember2024-01-012024-12-310001508478arco:TaxContingenciesMember2024-12-310001508478arco:LaborContingenciesMember2023-12-310001508478arco:LaborContingenciesMember2024-01-012024-12-310001508478arco:LaborContingenciesMember2024-12-310001508478arco:OtherLossContingenciesMember2023-12-310001508478arco:OtherLossContingenciesMember2024-01-012024-12-310001508478arco:OtherLossContingenciesMember2024-12-310001508478arco:TaxContingenciesMember2022-12-310001508478arco:TaxContingenciesMember2023-01-012023-12-310001508478arco:LaborContingenciesMember2022-12-310001508478arco:LaborContingenciesMember2023-01-012023-12-310001508478arco:OtherLossContingenciesMember2022-12-310001508478arco:OtherLossContingenciesMember2023-01-012023-12-310001508478arco:TaxContingenciesMember2021-12-310001508478arco:TaxContingenciesMember2022-01-012022-12-310001508478arco:LaborContingenciesMember2021-12-310001508478arco:LaborContingenciesMember2022-01-012022-12-310001508478arco:OtherLossContingenciesMember2021-12-310001508478arco:OtherLossContingenciesMember2022-01-012022-12-310001508478us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001508478us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001508478us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001508478us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001508478us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001508478us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001508478us-gaap:FairValueMeasurementsRecurringMember2024-12-310001508478us-gaap:FairValueMeasurementsRecurringMember2023-12-310001508478us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310001508478us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310001508478us-gaap:OperatingSegmentsMemberarco:BrazilSegmentMember2024-01-012024-12-310001508478us-gaap:OperatingSegmentsMemberarco:BrazilSegmentMember2023-01-012023-12-310001508478us-gaap:OperatingSegmentsMemberarco:BrazilSegmentMember2022-01-012022-12-310001508478us-gaap:OperatingSegmentsMemberarco:NorthLatinAmericaDivisionSegmentMember2024-01-012024-12-310001508478us-gaap:OperatingSegmentsMemberarco:NorthLatinAmericaDivisionSegmentMember2023-01-012023-12-310001508478us-gaap:OperatingSegmentsMemberarco:NorthLatinAmericaDivisionSegmentMember2022-01-012022-12-310001508478us-gaap:OperatingSegmentsMemberarco:SouthLatinAmericaDivisionSegmentMember2024-01-012024-12-310001508478us-gaap:OperatingSegmentsMemberarco:SouthLatinAmericaDivisionSegmentMember2023-01-012023-12-310001508478us-gaap:OperatingSegmentsMemberarco:SouthLatinAmericaDivisionSegmentMember2022-01-012022-12-310001508478us-gaap:OperatingSegmentsMember2024-01-012024-12-310001508478us-gaap:OperatingSegmentsMember2023-01-012023-12-310001508478us-gaap:OperatingSegmentsMember2022-01-012022-12-310001508478us-gaap:OperatingSegmentsMemberus-gaap:CorporateMember2024-01-012024-12-310001508478us-gaap:OperatingSegmentsMemberus-gaap:CorporateMember2023-01-012023-12-310001508478us-gaap:OperatingSegmentsMemberus-gaap:CorporateMember2022-01-012022-12-310001508478us-gaap:CorporateNonSegmentMember2024-01-012024-12-310001508478us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001508478us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001508478us-gaap:MaterialReconcilingItemsMember2024-01-012024-12-310001508478us-gaap:MaterialReconcilingItemsMember2023-01-012023-12-310001508478us-gaap:MaterialReconcilingItemsMember2022-01-012022-12-310001508478us-gaap:OperatingSegmentsMemberarco:BrazilSegmentMember2024-12-310001508478us-gaap:OperatingSegmentsMemberarco:BrazilSegmentMember2023-12-310001508478us-gaap:OperatingSegmentsMemberarco:NorthLatinAmericaDivisionSegmentMember2024-12-310001508478us-gaap:OperatingSegmentsMemberarco:NorthLatinAmericaDivisionSegmentMember2023-12-310001508478us-gaap:OperatingSegmentsMemberarco:SouthLatinAmericaDivisionSegmentMember2024-12-310001508478us-gaap:OperatingSegmentsMemberarco:SouthLatinAmericaDivisionSegmentMember2023-12-310001508478us-gaap:OperatingSegmentsMember2024-12-310001508478us-gaap:OperatingSegmentsMember2023-12-310001508478us-gaap:CorporateNonSegmentMember2024-12-310001508478us-gaap:CorporateNonSegmentMember2023-12-310001508478us-gaap:MaterialReconcilingItemsMember2024-12-310001508478us-gaap:MaterialReconcilingItemsMember2023-12-310001508478country:BR2024-01-012024-12-310001508478country:BR2023-01-012023-12-310001508478country:BR2022-01-012022-12-310001508478country:AR2024-01-012024-12-310001508478country:AR2023-01-012023-12-310001508478country:AR2022-01-012022-12-310001508478country:MX2024-01-012024-12-310001508478country:MX2023-01-012023-12-310001508478country:MX2022-01-012022-12-310001508478arco:OtherCountriesMember2024-01-012024-12-310001508478arco:OtherCountriesMember2023-01-012023-12-310001508478arco:OtherCountriesMember2022-01-012022-12-310001508478arco:OtherCountriesMember2024-12-310001508478arco:OtherCountriesMember2023-12-310001508478us-gaap:CommonClassAMember2021-12-310001508478us-gaap:CommonClassBMember2021-12-310001508478us-gaap:CommonClassAMember2023-01-012023-12-310001508478us-gaap:CommonClassAMember2022-01-012022-12-310001508478arco:TheRepurchaseProgramMemberus-gaap:CommonClassAMember2018-05-220001508478us-gaap:CommonClassAMember2022-12-310001508478us-gaap:CommonClassBMember2022-12-310001508478us-gaap:CommonClassBMember2024-01-012024-12-3100015084782024-03-122024-03-1200015084782024-04-012024-06-3000015084782024-10-012024-12-3100015084782024-01-012024-03-3100015084782024-07-012024-09-300001508478us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001508478us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001508478us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310001508478us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001508478us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310001508478us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-01-012022-12-310001508478us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001508478us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001508478us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001508478us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310001508478us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310001508478us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-12-310001508478us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001508478us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310001508478us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310001508478us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-12-310001508478us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-12-310001508478us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-01-012024-12-310001508478us-gaap:AccumulatedTranslationAdjustmentMember2024-12-310001508478us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-12-310001508478us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-12-310001508478us-gaap:RelatedPartyMemberarco:AxionlogDistributionB.V.Member2024-12-310001508478us-gaap:RelatedPartyMemberarco:AxionlogDistributionB.V.Member2023-12-310001508478us-gaap:RelatedPartyMemberarco:AxionlogDistributionB.V.Member2024-01-012024-12-310001508478us-gaap:RelatedPartyMemberarco:AxionlogDistributionB.V.Member2023-01-012023-12-310001508478us-gaap:RelatedPartyMemberarco:AxionlogDistributionB.V.Member2022-01-012022-12-310001508478us-gaap:RelatedPartyMemberarco:AxionlogDistributionB.V.Memberarco:DistributionFeesMember2024-01-012024-12-310001508478us-gaap:RelatedPartyMemberarco:AxionlogDistributionB.V.Memberarco:SupplierPurchasesMember2024-01-012024-12-310001508478us-gaap:RelatedPartyMemberarco:AxionlogDistributionB.V.Memberarco:DistributionFeesMember2023-01-012023-12-310001508478us-gaap:RelatedPartyMemberarco:AxionlogDistributionB.V.Memberarco:SupplierPurchasesMember2023-01-012023-12-310001508478us-gaap:RelatedPartyMemberarco:AxionlogDistributionB.V.Memberarco:DistributionFeesMember2022-01-012022-12-310001508478us-gaap:RelatedPartyMemberarco:AxionlogDistributionB.V.Memberarco:SupplierPurchasesMember2022-01-012022-12-310001508478us-gaap:EquityMethodInvestmentsMemberarco:LacoopIISCMember2024-12-310001508478us-gaap:EquityMethodInvestmentsMemberarco:SaileMember2024-12-310001508478us-gaap:EquityMethodInvestmentsMemberarco:LacoopIISCMember2023-12-310001508478us-gaap:EquityMethodInvestmentsMemberarco:SaileMember2023-12-310001508478us-gaap:AllowanceForCreditLossMember2023-12-310001508478us-gaap:AllowanceForCreditLossMember2024-01-012024-12-310001508478us-gaap:AllowanceForCreditLossMember2024-12-310001508478us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-310001508478us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-01-012024-12-310001508478us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-12-310001508478us-gaap:LegalReserveMember2023-12-310001508478us-gaap:LegalReserveMember2024-01-012024-12-310001508478us-gaap:LegalReserveMember2024-12-310001508478us-gaap:AllowanceForCreditLossMember2022-12-310001508478us-gaap:AllowanceForCreditLossMember2023-01-012023-12-310001508478us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310001508478us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310001508478us-gaap:LegalReserveMember2022-12-310001508478us-gaap:LegalReserveMember2023-01-012023-12-310001508478us-gaap:AllowanceForCreditLossMember2021-12-310001508478us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310001508478us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310001508478us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310001508478us-gaap:LegalReserveMember2021-12-310001508478us-gaap:LegalReserveMember2022-01-012022-12-310001508478us-gaap:AccountsReceivableMemberus-gaap:AllowanceForCreditLossMember2024-12-310001508478us-gaap:AccountsReceivableMemberus-gaap:AllowanceForCreditLossMember2023-12-310001508478us-gaap:AccountsReceivableMemberus-gaap:AllowanceForCreditLossMember2022-12-310001508478arco:OtherReceivablesMemberus-gaap:AllowanceForCreditLossMember2024-12-310001508478arco:OtherReceivablesMemberus-gaap:AllowanceForCreditLossMember2023-12-310001508478arco:OtherReceivablesMemberus-gaap:AllowanceForCreditLossMember2022-12-310001508478arco:TwoThousandTwentySevenNotesMemberus-gaap:SubsequentEventMember2025-01-150001508478arco:TwoThousandTwentySevenNotesMemberus-gaap:SubsequentEventMember2025-01-152025-01-230001508478arco:TwoThousandTwentySevenNotesMemberus-gaap:SubsequentEventMember2025-02-282025-02-280001508478us-gaap:SubsequentEventMember2025-02-012025-02-280001508478us-gaap:CommonClassBMemberus-gaap:SubsequentEventMember2025-03-112025-03-110001508478us-gaap:CommonClassAMemberus-gaap:SubsequentEventMember2025-03-112025-03-110001508478us-gaap:SubsequentEventMember2025-03-112025-03-110001508478srt:ScenarioForecastMember2025-09-260001508478srt:ScenarioForecastMember2025-03-270001508478srt:ScenarioForecastMember2025-06-270001508478srt:ScenarioForecastMember2025-12-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

For the transition period from ________________ to ________________

Commission file number: 001-35129

Arcos Dorados Holdings Inc.

(Exact name of Registrant as specified in its charter)

British Virgin Islands

(Jurisdiction of incorporation or organization)

Río Negro 1338, First Floor

Montevideo, Uruguay, 11100

(Address of principal executive offices)

Juan David Bastidas

Chief Legal Officer

Arcos Dorados Holdings Inc.

Río Negro 1338, First Floor

Montevideo, Uruguay 11100

Telephone: +598 2626-3000

Fax: +598 2626-3018

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Class A shares, no par value |

|

ARCO |

|

New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock or common stock as of the close of the period covered by the annual report.

Class A shares: 130,663,057

Class B shares: 80,000,000

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes o No x

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

x |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

Emerging growth company |

☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. o

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP |

x |

International Financial Reporting Standards as issued by the International Accounting Standards Board |

o |

Other |

o |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No x

ARCOS DORADOS HOLDINGS INC.

TABLE OF CONTENTS

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

All references to “U.S. dollars,” “dollars,” “U.S.$” or “$” are to the U.S. dollar. All references to “Argentine pesos” or “ARS$” are to the Argentine peso. All references to “Brazilian reais” or “R$” are to the Brazilian real. All references to “Mexican pesos” or “Ps.” are to the Mexican peso. All references to “Chilean pesos” or “CLPs.” are to the Chilean peso. All references to “Venezuelan bolívares” or “Bs.” are to the Venezuelan bolívar, the legal currency of Venezuela. See “Item 3. Key Information—A. Selected Financial Data—Exchange Rates and Exchange Controls” for information regarding exchange rates for the Argentine, Brazilian and Mexican currencies.

Definitions

In this annual report, unless the context otherwise requires, all references to “Arcos Dorados,” the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to Arcos Dorados Holdings Inc., together with its subsidiaries. All references to “systemwide” refer only to the system of McDonald’s-branded restaurants operated by us or our sub-franchisees in 20 countries and territories in Latin America and the Caribbean, including Argentina, Aruba, Brazil, Chile, Colombia, Costa Rica, Curaçao, Ecuador, French Guiana, Guadeloupe, Martinique, Mexico, Panama, Peru, Puerto Rico, Trinidad and Tobago, Uruguay, the U.S. Virgin Islands of St. Croix and St. Thomas, and Venezuela, which we refer to as the “Territories,” and do not refer to the system of McDonald’s-branded restaurants operated by McDonald’s Corporation, its affiliates or its franchisees (other than us).

We own our McDonald’s franchise rights pursuant to a Second Amended and Restated Master Franchise Agreement for all of the Territories, except Brazil, which we refer to as the “MFA,” and a separate, but substantially identical, Third Amended and Restated Master Franchise Agreement for Brazil, which we refer to as the “Brazilian MFA.” We refer to the MFA and the Brazilian MFA, as amended or otherwise modified to date, collectively as the “MFAs.” We commenced operations on August 3, 2007, as a result of our purchase of McDonald’s operations and real estate in the Territories (except for Trinidad and Tobago), which we refer to collectively as the “McDonald’s LatAm” business, and the acquisition of McDonald’s franchise rights pursuant to the MFAs, which together with the purchase of the McDonald’s LatAm business, we refer to as the “Acquisition.”

Financial Statements

We prepare our financial statements in accordance with accounting principles and standards generally accepted in the United States, or U.S. GAAP, and elect to report in U.S. dollars.

The financial information contained in this annual report includes our consolidated financial statements at December 31, 2024 and 2023 and for the years ended December 31, 2024, 2023 and 2022, which have been audited by Pistrelli, Henry Martin y Asociados S.A. (successor firm of Pistrelli, Henry Martin y Asociados S.R.L.), member Firm of Ernst & Young Global Limited, as stated in their report included elsewhere in this annual report.

Our fiscal year ends on December 31. References in this annual report to a fiscal year, such as “fiscal year 2024,” relate to our fiscal year ended on December 31 of that calendar year.

Operating Data

Our operations are comprised of three geographic divisions, as follows: (i) Brazil, (ii) the North Latin American division, or “NOLAD,” consisting of Costa Rica, Mexico, Panama, Puerto Rico, Martinique, Guadeloupe, French Guiana and the U.S. Virgin Islands of St. Croix and St. Thomas, and (iii) the South Latin American division, or “SLAD,” consisting of Argentina, Chile, Ecuador, Peru, Uruguay, Colombia, Venezuela, Trinidad and Tobago, Aruba and Curaçao. For more information see “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Segment Presentation.”

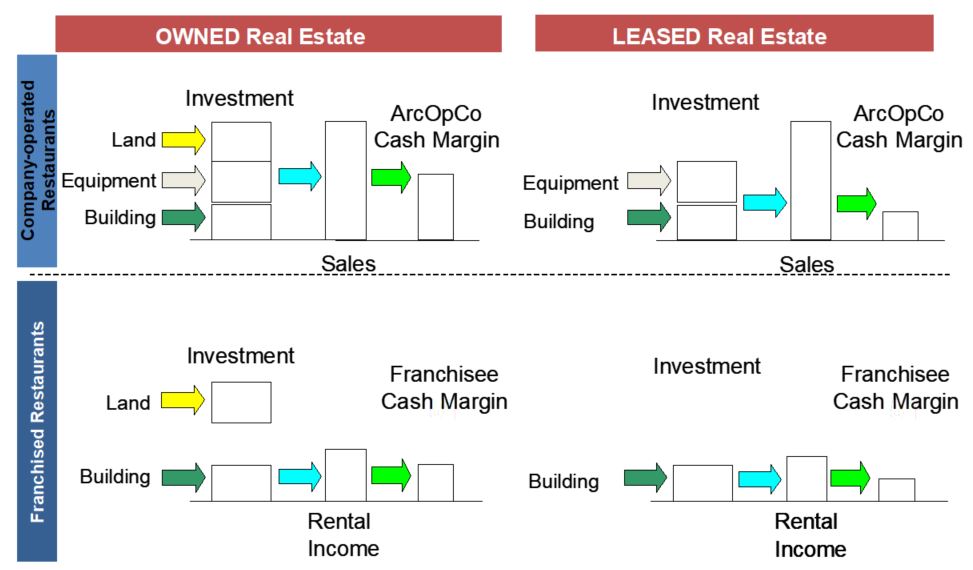

We operate McDonald’s-branded restaurants under two different operating formats: those directly operated by us, or “Company-operated” restaurants, and those operated by sub-franchisees, or “franchised” restaurants. All references to “restaurants” are to our freestanding, food court, in-store and mall store restaurants and do not refer to our McCafé locations or Dessert Centers. Systemwide data represents measures for both our Company-operated restaurants and our franchised restaurants.

We are the majority stakeholder in two joint ventures with third parties that collectively own 16 restaurants in Argentina and Chile. We consider these restaurants to be Company-operated restaurants. We also have granted developmental licenses to 6 restaurants. Developmental licensees own or lease the land and buildings on which their restaurants are located and pay a franchise fee to us in addition to the royalties due to McDonald’s. We consider these restaurants to be franchised restaurants and we refer to them as stand-alone restaurants. We are also a minority stakeholder in a joint venture formed with a Mexican sub-franchisee, which owns 44 restaurants. We consider these restaurants to be franchised restaurants. The Company’s joint ventures in Argentina, Chile and Mexico operate as a joint venture under the traditional definition used within the McDonald’s system for such business arrangements. For purposes of this annual report, a joint venture is an entity that operates certain restaurants in the Company’s territory in which the Company is a stakeholder together with a third party. This third party is always a sub-franchisee of the Company. Although in most joint ventures the Company exercises control or significant influence over the entity’s operating and financial policies, the third party is responsible for the day-to-day operation of the entity’s restaurants. Restaurants operated by entities in which the Company has a majority stake are considered to be Company-operated; whereas, restaurants operated by entities in which the Company holds a minority stake are considered to be franchised restaurants.

Market Share and Other Information

Market data and certain industry forecast data used in this annual report were obtained from internal reports and studies, where appropriate, as well as estimates, market research, publicly available information (including information available from the United States Securities and Exchange Commission, or the “SEC,” website) and industry publications, including the United Nations Economic Commission for Latin America and the Caribbean and the CIA World Factbook. Industry publications generally state that the information they include has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Similarly, internal reports and studies, estimates and market research, which we believe to be reliable and accurately extracted by us for use in this annual report, have not been independently verified. However, we believe such data is accurate and agree that we are responsible for the accurate extraction of such information from such sources and its correct reproduction in this annual report.

Basis of Consolidation

The accompanying consolidated financial statements have been prepared in accordance with U.S. GAAP on the accrual basis of accounting and include the accounts of the Company and its subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation.

Rounding

We have made rounding adjustments to some of the figures included in this annual report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

FORWARD-LOOKING STATEMENTS

This annual report contains statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Many of the forward-looking statements contained in this annual report can be identified by the use of forward-looking words such as “aim,” “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” among others.

Forward-looking statements appear in a number of places in this annual report and include, but are not limited to, statements regarding our intent, belief or current expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including, but not limited to, those identified in “Item 3. Key Information—D. Risk Factors” in this annual report. These risks and uncertainties include factors relating to:

•general economic, political, social, demographic and business conditions in Latin America and the Caribbean;

•fluctuations in inflation, interest rates and exchange rates in Latin America and the Caribbean;

•our ability to implement our growth strategy;

•the success of operating initiatives, including advertising and promotional efforts and new product and concept development by us and our competitors;

•our ability to compete and conduct our business in the future;

•unforeseen events, such as disruptions, natural disasters, adverse weather conditions, wars, pandemics and other catastrophic events, such as hurricanes and earthquakes;

•changes in consumer tastes and preferences, including changes resulting from concerns over nutritional or safety aspects of beef, poultry, french fries or other foods or the effects of pandemics or food-borne illnesses, bovine spongiform encephalopathy disease and avian influenza or “bird flu,” and changes in spending patterns and demographic trends, such as the extent to which consumers eat meals away from home;

•the availability, location and lease terms for restaurant development;

•our sub-franchisees, including their business and financial viability and the timely payment of our sub-franchisees’ obligations due to us and to McDonald’s;

•our ability to comply with the requirements of the MFAs, including McDonald’s standards;

•our decision to own and operate restaurants or to operate under franchise agreements;

•the availability of qualified restaurant personnel for us and for our sub-franchisees, and the ability to retain such personnel;

•changes in commodity costs, labor, supply, fuel, utilities, distribution and other operating costs;

•changes in labor laws;

•our ability, if necessary, to secure alternative distribution of supplies of food, equipment and other products to our restaurants at competitive rates and in adequate amounts, and the potential financial impact of any interruptions in such distribution;

•material changes in government regulation;

•material changes in tax legislation;

•climate change manifesting as physical or transition risks;

•climate-related conditions, regulations, targets and weather events;

•changes in our liquidity or the availability of lines of credit and other sources of financing;

•other factors that may affect our financial condition, liquidity and results of operations; and

•other risk factors discussed under “Item 3. Key Information—D. Risk Factors.”

Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

ENFORCEMENT OF JUDGMENTS

We are incorporated under the laws of the British Virgin Islands with limited liability. We are incorporated in the British Virgin Islands because of certain benefits associated with being a British Virgin Islands company, such as political and economic stability, an effective judicial system, a favorable tax system, the absence of exchange control or currency restrictions, and the availability of professional and support services. However, the British Virgin Islands has a less developed body of securities laws as compared to the United States and provides protections for investors to a significantly lesser extent. In addition, British Virgin Islands companies may not have standing to sue before the federal courts of the United States.

A majority of our directors and officers, as well as certain of the experts named herein, reside outside of the United States. A substantial portion of our assets and several of such directors, officers and experts are located principally in Argentina, Brazil and Uruguay. As a result, it may not be possible for investors to effect service of process outside Argentina, Brazil and Uruguay upon such directors or officers, or to enforce against us or such parties in courts outside Argentina, Brazil and Uruguay judgments predicated solely upon the civil liability provisions of the federal securities laws of the United States or other non-Argentine, Brazilian or Uruguayan regulations, as applicable. In addition, local counsel to the Company have advised that there is doubt as to whether the courts of Argentina, Brazil or Uruguay would enforce in all respects, to the same extent and in as timely a manner as a U.S. court or non-Argentine, Brazilian or Uruguayan court, an original action predicated solely upon the civil liability provisions of the U.S. federal securities laws or other non-Argentine, Brazilian or Uruguayan regulations, as applicable; and that the enforceability in Argentine, Brazilian or Uruguayan courts of judgments of U.S. courts or non-Argentine, Brazilian or Uruguayan courts predicated upon the civil liability provisions of the U.S. federal securities laws or other non-Argentine, Brazilian or Uruguayan regulations, as applicable, will be subject to compliance with certain requirements under Argentine, Brazilian or Uruguayan law, including the condition that any such judgment does not violate Argentine, Brazilian or Uruguayan public policy.

We have been advised by Maples and Calder, our counsel as to British Virgin Islands law, that the United States and the British Virgin Islands do not have a treaty providing for reciprocal recognition and enforcement of judgments of courts of the United States in civil and commercial matters and that a final judgment for the payment of money rendered by any general or state court in the United States based on civil liability, whether or not predicated solely upon the U.S. federal securities laws, would not be automatically enforceable in the British Virgin Islands. We have been advised by Maples and Calder that a final and conclusive judgment obtained in U.S. federal or state courts under which a sum of money is payable (i.e., not being a sum claimed by a revenue authority for taxes or other charges of a similar nature by a governmental authority, or in respect of a fine or penalty or multiple or punitive damages) may be the subject of an action on a debt in the court of the British Virgin Islands under British Virgin Islands common law.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

Not applicable.

B. Advisers

Not applicable.

C. Auditors

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

A. Offer Statistics

Not applicable.

B. Method and Expected Timetable

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The selected balance sheet data as of December 31, 2024 and 2023 and the income statement data for the years ended December 31, 2024, 2023 and 2022 of Arcos Dorados Holdings Inc. are derived from the consolidated financial statements included elsewhere in this annual report, which have been audited by Pistrelli, Henry Martin y Asociados S.A., member firm of Ernst & Young Global Limited.

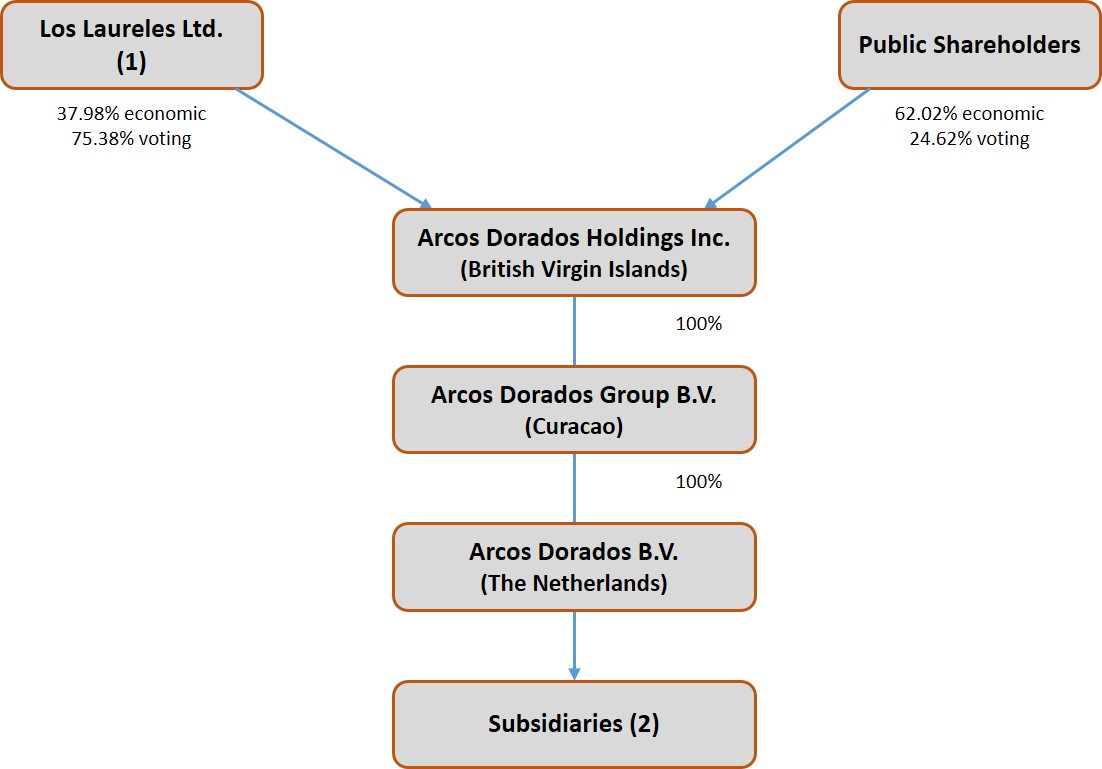

We were incorporated on December 9, 2010 as a direct, wholly-owned subsidiary of Arcos Dorados Limited, the prior holding company for the Arcos Dorados business. On December 13, 2010, Arcos Dorados Limited effected a downstream merger into and with us, with us as the surviving entity. The merger was accounted for as a reorganization of entities under common control in a manner similar to a pooling of interest and the consolidated financial statements reflect the historical consolidated operations of Arcos Dorados Limited as if the reorganization structure had existed since Arcos Dorados Limited was incorporated in July 2006. We did not commence operations until the Acquisition on August 3, 2007.

We prepare our financial statements in accordance with accounting principles and standards generally accepted in the United States, or U.S. GAAP, and elect to report in U.S. dollars. This financial information should be read in conjunction with “Presentation of Financial and Other Information,” “Item 5. Operating and Financial Review and Prospects” and our consolidated financial statements, including the notes thereto, included elsewhere in this annual report.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Years Ended December 31, |

|

|

2024 |

|

2023 |

|

2022 |

|

|

(in thousands of U.S. dollars, except for per share data) |

Income Statement Data: |

|

|

|

|

|

|

| Sales by Company-operated restaurants |

|

$ |

4,266,748 |

|

|

$ |

4,137,675 |

|

|

$ |

3,457,491 |

| Revenues from franchised restaurants |

|

203,414 |

|

|

|

194,203 |

|

|

|

161,411 |

| Total revenues |

|

4,470,162 |

|

|

|

4,331,878 |

|

|

|

3,618,902 |

|

| Company-operated restaurant expenses: |

|

|

|

|

|

|

Food and paper |

|

(1,498,853) |

|

|

|

(1,457,720) |

|

|

|

(1,227,293) |

|

Payroll and employee benefits |

|

(797,620) |

|

|

|

(790,042) |

|

|

|

(668,764) |

|

Occupancy and other operating expenses |

|

(1,238,220) |

|

|

|

(1,154,334) |

|

|

|

(967,690) |

|

Royalty fees |

|

(265,382) |

|

|

|

(249,278) |

|

|

|

(194,522) |

|

| Franchised restaurants—occupancy expenses |

|

(83,665) |

|

|

|

(83,359) |

|

|

|

(68,028) |

|

| General and administrative expenses |

|

(279,859) |

|

|

|

(285,000) |

|

|

|

(239,263) |

|

Other operating income, net |

|

17,952 |

|

|

|

1,894 |

|

|

|

11,080 |

|

| Total operating costs and expenses |

|

(4,145,647) |

|

|

|

(4,017,839) |

|

|

|

(3,354,480) |

|

Operating income |

|

324,515 |

|

|

314,039 |

|

|

|

264,422 |

|

| Net interest expense and other financing results |

|

(47,238) |

|

|

|

(32,275) |

|

|

|

(43,750) |

Gain (loss) from derivative instruments |

|

941 |

|

|

|

(13,183) |

|

|

|

(10,490) |

|

|

|

|

|

|

|

|

|

|

| Foreign currency exchange results |

|

(15,063) |

|

|

|

10,774 |

|

|

|

16,501 |

|

Other non-operating expenses, net |

|

(3,873) |

|

|

|

(1,238) |

|

|

|

(287) |

|

Income before income taxes |

|

259,282 |

|

|

|

278,117 |

|

|

|

226,396 |

|

Income tax expense, net |

|

(109,903) |

|

|

|

(95,702) |

|

|

|

(85,476) |

|

Net income |

|

149,379 |

|

|

|

182,415 |

|

|

|

140,920 |

|

| Less: Net income attributable to non-controlling interests |

|

(620) |

|

|

|

(1,141) |

|

|

|

(577) |

|

Net income attributable to Arcos Dorados Holdings Inc. |

|

$ |

148,759 |

|

|

|

$ |

181,274 |

|

|

|

$ |

140,343 |

|

| Earnings per share: |

|

|

|

|

|

|

Basic net income per common share attributable to Arcos Dorados |

|

$ |

0.71 |

|

|

|

$ |

0.86 |

|

|

|

$ |

0.67 |

|

Diluted net income per common share attributable to Arcos Dorados |

|

$ |

0.71 |

|

|

|

$ |

0.86 |

|

|

|

$ |

0.67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

|

2024 |

|

2023 |

|

2022 |

|

|

(in thousands of U.S. dollars, except for share data) |

| Balance Sheet Data: |

|

|

|

|

|

|

| Cash and cash equivalent |

|

$ |

135,064 |

|

|

$ |

196,661 |

|

|

$ |

266,937 |

| Total current assets |

|

468,403 |

|

|

605,278 |

|

|

684,363 |

| Property and equipment, net |

|

1,127,042 |

|

|

1,119,885 |

|

|

856,085 |

| Total non-current assets |

|

2,424,251 |

|

|

2,413,960 |

|

|

1,952,267 |

| Total assets |

|

2,892,654 |

|

|

3,019,238 |

|

|

2,636,630 |

| Accounts payable |

|

347,895 |

|

|

|

374,986 |

|

|

353,468 |

| Short-term debt and current portion of long-term debt |

|

62,875 |

|

|

31,336 |

|

|

19,351 |

| Total current liabilities |

|

765,924 |

|

|

841,670 |

|

|

759,412 |

| Long-term debt, excluding current portion |

|

715,974 |

|

|

713,038 |

|

|

711,671 |

| Total non-current liabilities |

|

1,617,301 |

|

|

1,660,729 |

|

|

1,552,791 |

| Total liabilities |

|

2,383,225 |

|

|

2,502,399 |

|

|

2,312,203 |

| Total common stock |

|

522,882 |

|

|

522,822 |

|

|

522,308 |

| Total equity |

|

509,429 |

|

|

516,839 |

|

|

324,427 |

| Total liabilities and equity |

|

2,892,654 |

|

|

3,019,238 |

|

|

2,636,630 |

| Shares outstanding |

|

210,663,057 |

|

|

210,654,969 |

|

|

210,594,545 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Years Ended December 31, |

|

|

2024 |

|

2023 |

|

2022 |

|

|

(in thousands of U.S. dollars, except percentages) |

Other Data: |

|

|

|

|

|

|

| Total Revenues |

|

|

|

|

|

|

| Brazil |

|

$ |

1,768,311 |

|

|

|

$ |

1,701,547 |

|

|

|

$ |

1,429,105 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NOLAD |

|

|

|

1,225,751 |

|

|

|

|

|

1,132,912 |

|

|

|

|

|

920,189 |

|

|

| SLAD |

|

|

|

1,476,100 |

|

|

|

|

|

1,497,419 |

|

|

|

|

|

1,269,608 |

|

|

| Total |

|

$ |

4,470,162 |

|

|

|

$ |

4,331,878 |

|

|

|

$ |

3,618,902 |

|

|

| Operating Income (Loss) |

|

|

|

|

|

|

| Brazil |

|

$ |

269,019 |

|

|

$ |

230,024 |

|

|

$ |

186,862 |

|

| NOLAD |

|

67,412 |

|

|

73,237 |

|

|

61,832 |

|

| SLAD |

|

87,406 |

|

|

121,683 |

|

|

107,520 |

|

| Corporate and others and purchase price allocation |

|

(99,322) |

|

|

(110,905) |

|

|

(91,792) |

|

| Total |

|

$ |

324,515 |

|

|

|

$ |

314,039 |

|

|

|

$ |

264,422 |

|

|

| Operating Margin(1) |

|

|

|

|

|

|

| Brazil |

|

15.2 |

% |

|

13.5 |

% |

|

13.1 |

% |

| NOLAD |

|

5.5 |

|

|

6.5 |

|

|

6.7 |

|

| SLAD |

|

5.9 |

|

|

8.1 |

|

|

8.5 |

|

| Corporate and others and purchase price allocation |

|

(2.2) |

|

|

(2.6) |

|

|

(2.5) |

|

| Total |

|

7.3 |

% |

|

7.2 |

% |

|

7.3 |

% |

| Adjusted EBITDA(2) |

|

|

|

|

|

|

| Brazil |

|

$ |

340,002 |

|

|

|

$ |

300,177 |

|

|

$ |

242,346 |

|

| NOLAD |

|

116,256 |

|

|

|

115,364 |

|

|

|

95,290 |

|

|

| SLAD |

|

133,692 |

|

|

|

160,380 |

|

|

|

134,253 |

|

|

| Corporate and others |

|

(89,850) |

|

|

|

(103,617) |

|

|

|

(85,325) |

|

|

| Total |

|

$ |

500,100 |

|

|

|

$ |

472,304 |

|

|

|

$ |

386,564 |

|

|

Net Income attributable to Arcos Dorados Holdings Inc. |

|

$ |

148,759 |

|

|

|

$ |

181,274 |

|

|

|

$ |

140,343 |

|

|

| Adjusted EBITDA Margin(3) |

|

|

|

|

|

|

| Brazil |

|

19.2 |

% |

|

17.6 |

% |

|

17.0 |

% |

| NOLAD |

|

9.5 |

|

|

10.2 |

|

|

10.4 |

|

| SLAD |

|

9.1 |

|

|

10.7 |

|

|

10.6 |

|

| Corporate and others |

|

(2.0) |

|

|

(2.4) |

|

|

(2.4) |

|

| Total |

|

11.2 |

% |

|

10.9 |

% |

|

10.7 |

% |

| Other Financial Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income attributable to Arcos Dorados Holdings Inc. Margin (4) |

|

3.3 |

% |

|

4.2 |

% |

|

3.9 |

% |

| Working capital(5) |

|

|

(297,521) |

|

|

|

|

(236,392) |

|

|

|

|

|

|

(75,049) |

|

|

|

|

| Capital expenditures(6) |

|

333,719 |

|

|

362,178 |

|

|

|

|

221,915 |

|

|

|

| Cash Dividends declared per common share |

|

$ |

0.24 |

|

|

$ |

0.19 |

|

|

|

|

$ |

0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

|

2024 |

|

2023 |

|

2022 |

| Number of systemwide restaurants(7) |

|

2,428 |

|

|

2,361 |

|

|

2,312 |

| Brazil |

|

1,173 |

|

|

1,130 |

|

|

1,084 |

| NOLAD |

|

654 |

|

|

647 |

|

|

638 |

| SLAD |

|

601 |

|

|

584 |

|

|

590 |

| Number of Company-operated restaurants |

|

1,725 |

|

|

1,678 |

|

|

1,633 |

| Brazil |

|

723 |

|

|

689 |

|

|

656 |

| NOLAD |

|

497 |

|

|

494 |

|

|

473 |

| SLAD |

|

505 |

|

|

495 |

|

|

504 |

| Number of franchised restaurants |

|

703 |

|

|

683 |

|

|

679 |

| Brazil |

|

450 |

|

|

441 |

|

|

428 |

| NOLAD |

|

157 |

|

|

153 |

|

|

165 |

| SLAD |

|

96 |

|

|

89 |

|

|

86 |

(1)Operating margin is operating income divided by revenues for each division, except for Corporate and others and purchase price allocation which is calculated as Operating loss divided by Total Revenues, since there are no revenues assigned to this segment, expressed as a percentage. Total Operating margin is calculated as Total Operating Income divided by Total Revenues, expressed as a percentage.