| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, par value $0.001 per share | EWBC | The Nasdaq Global Select Market | ||||||||||||

| Press Release, dated April 22, 2025. | |||||

| Presentation Materials, dated April 22, 2025. | |||||

| 104 | Cover Page Interactive Data (formatted in Inline XBRL). | ||||

| EAST WEST BANCORP, INC. | |||||||||||

| Date: April 22, 2025 | By: | /s/ Christopher J. Del Moral-Niles | |||||||||

| Christopher J. Del Moral-Niles | |||||||||||

| Executive Vice President and Chief Financial Officer | |||||||||||

|

East West Bancorp, Inc. | ||||

| 135 N. Los Robles Ave., 7th Fl. | |||||

| Pasadena, CA 91101 | |||||

| Tel. 626.768.6000 | |||||

NEWS RELEASE |

|||||||||||

Three Months Ended |

Quarter-over-Quarter Change |

||||||||||||||||||||||||||||

| ($ in millions, except per share data) | March 31, 2025 | December 31, 2024 | $ | % | |||||||||||||||||||||||||

Total Revenue (FTE) |

$693 | $677 | $16 | 2 | % | ||||||||||||||||||||||||

Pre-tax, Pre-provision Income2 |

441 | 427 | 14 | 3 | |||||||||||||||||||||||||

| Net Income | 290 | 293 | (3) | (1) | |||||||||||||||||||||||||

| Diluted Earnings per Share | $2.08 | $2.10 | $(0.02) | (1) | |||||||||||||||||||||||||

| Book Value per Share | $57.54 | $55.79 | $1.75 | 3 | |||||||||||||||||||||||||

Tangible Book Value per Share1 |

$54.13 | $52.39 | $1.74 | 3 | % | ||||||||||||||||||||||||

Return on Average Assets |

1.56% | 1.55% | — | 1 bp |

|||||||||||||||||||||||||

| Return on Average Common Equity | 14.96% | 15.08% | — | -12 bps | |||||||||||||||||||||||||

Return on Average Tangible Common Equity1 |

15.92% | 16.07% | — | -15 bps | |||||||||||||||||||||||||

Total Stockholders’ Equity to Assets Ratio |

10.41% | 10.17% | — | 24 bps | |||||||||||||||||||||||||

Tangible Common Equity Ratio1 |

9.85% | 9.60% | — | 25 bps | |||||||||||||||||||||||||

| Total Assets | $76,165 | $75,976 | $189 | 0 | % | ||||||||||||||||||||||||

1 Return on average tangible common equity, tangible book value per share, and tangible common equity ratio are non-GAAP financial measures. See reconciliation of GAAP to non-GAAP measures in Table 11. | |||||||||||

|

2 Pre-tax, pre-provision income is a non-GAAP financial measure. See reconciliation of GAAP to non-GAAP financial measures in Table 10.

| |||||||||||

| EWBC Capital | |||||||||||||||||||||||||||||

| ($ in millions) | March 31, 2025 (a)(b) |

December 31, 2024 (b) |

March 31, 2024 (b) |

||||||||||||||||||||||||||

Risk-Weighted Assets (“RWA”) (c) |

$55,366 | $54,942 | $53,448 | ||||||||||||||||||||||||||

| Risk-based capital ratios: | |||||||||||||||||||||||||||||

| Total capital ratio | 15.63% | 15.58% | 14.84% | ||||||||||||||||||||||||||

| CET1 capital ratio | 14.32% | 14.27% | 13.53% | ||||||||||||||||||||||||||

| Tier 1 capital ratio | 14.32% | 14.27% | 13.53% | ||||||||||||||||||||||||||

| Leverage ratio | 10.46% | 10.42% | 10.05% | ||||||||||||||||||||||||||

| Total stockholders’ equity to assets ratio | 10.41% | 10.17% | 9.91% | ||||||||||||||||||||||||||

Tangible common equity ratio (d) |

9.85% | 9.60% | 9.31% | ||||||||||||||||||||||||||

3 Tangible book value per share is a non-GAAP financial measure. See reconciliation of GAAP to non-GAAP measures in Table 11. | ||||||||||||||

4 Pre-tax, pre-provision income is a non-GAAP financial measure. See reconciliation of GAAP to non-GAAP financial measures in Table 10. | |||||||||||

5 Fee income includes commercial and consumer deposit-related fees, lending fees, foreign exchange income, wealth management fees, and customer derivative income. Refer to Table 3 for additional fee and noninterest income information. | |||||||||||

Adrienne Atkinson | ||

Director of Investor Relations | ||

T: (626) 788-7536 | ||

E: adrienne.atkinson@eastwestbank.com | ||

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||||||||

| CONDENSED CONSOLIDATED BALANCE SHEET | ||||||||||||||||||||||||||||||||||||||

| ($ and shares in thousands, except per share data) | ||||||||||||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||||||||||||

| Table 1 | ||||||||||||||||||||||||||||||||||||||

|

March 31, 2025

% or Basis Point Change

|

||||||||||||||||||||||||||||||||||||||

| March 31, 2025 | December 31, 2024 | March 31, 2024 | Qtr-o-Qtr | Yr-o-Yr | ||||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||

Cash and cash equivalents, and deposits with banks |

$ | 3,481,072 | $ | 5,298,940 | $ | 4,235,394 | (34.3) | % | (17.8) | % | ||||||||||||||||||||||||||||

| Securities purchased under resale agreements (“resale agreements”) | 425,000 | 425,000 | 485,000 | — | (12.4) | |||||||||||||||||||||||||||||||||

Available-for-sale (“AFS”) debt securities (amortized cost of $12,962,469, $11,505,775 and $9,131,953) |

12,384,912 | 10,846,811 | 8,400,468 | 14.2 | 47.4 | |||||||||||||||||||||||||||||||||

Held-to-maturity (“HTM”) debt securities, at amortized cost (fair value of $2,435,292, $2,387,754 and $2,414,478) |

2,905,341 | 2,917,413 | 2,948,642 | (0.4) | (1.5) | |||||||||||||||||||||||||||||||||

| Total cash, resale agreements and debt securities | 19,196,325 | 19,488,164 | 16,069,504 | (1.5) | 19.5 | |||||||||||||||||||||||||||||||||

| Loans held-for-sale (“HFS”) | — | — | 13,280 | — | (100.0) | |||||||||||||||||||||||||||||||||

Loans held-for-investment (“HFI”) (net of allowance for loan losses of $734,856, $702,052 and $670,280) |

53,517,878 | 53,024,585 | 51,322,224 | 0.9 | 4.3 | |||||||||||||||||||||||||||||||||

| Affordable housing partnership, tax credit and Community Reinvestment Act (“CRA”) investments, net | 930,058 | 926,640 | 933,187 | 0.4 | (0.3) | |||||||||||||||||||||||||||||||||

| Goodwill | 465,697 | 465,697 | 465,697 | — | — | |||||||||||||||||||||||||||||||||

| Operating lease right-of-use assets | 80,239 | 81,967 | 87,535 | (2.1) | (8.3) | |||||||||||||||||||||||||||||||||

| Other assets | 1,974,816 | 1,989,422 | 1,984,243 | (0.7) | (0.5) | |||||||||||||||||||||||||||||||||

| Total assets | $ | 76,165,013 | $ | 75,976,475 | $ | 70,875,670 | 0.2 | % | 7.5 | % | ||||||||||||||||||||||||||||

| Liabilities and Stockholders’ Equity | ||||||||||||||||||||||||||||||||||||||

| Deposits | $ | 63,052,105 | $ | 63,175,023 | $ | 58,560,624 | (0.2) | % | 7.7 | % | ||||||||||||||||||||||||||||

| Short-term borrowings | — | — | 19,173 | — | (100.0) | |||||||||||||||||||||||||||||||||

| Federal Home Loan Bank (“FHLB”) advances | 3,500,000 | 3,500,000 | 3,500,000 | — | — | |||||||||||||||||||||||||||||||||

Securities sold under repurchase agreements (“repurchase agreements”) |

270,111 | — | — | 100.0 | 100.0 | |||||||||||||||||||||||||||||||||

| Long-term debt and finance lease liabilities | 35,880 | 35,974 | 36,428 | (0.3) | (1.5) | |||||||||||||||||||||||||||||||||

| Operating lease liabilities | 87,157 | 89,263 | 95,643 | (2.4) | (8.9) | |||||||||||||||||||||||||||||||||

| Accrued expenses and other liabilities | 1,290,295 | 1,453,161 | 1,640,570 | (11.2) | (21.4) | |||||||||||||||||||||||||||||||||

| Total liabilities | 68,235,548 | 68,253,421 | 63,852,438 | 0.0 | 6.9 | |||||||||||||||||||||||||||||||||

| Stockholders’ equity | 7,929,465 | 7,723,054 | 7,023,232 | 2.7 | 12.9 | |||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 76,165,013 | $ | 75,976,475 | $ | 70,875,670 | 0.2 | % | 7.5 | % | ||||||||||||||||||||||||||||

Total cash, resale agreements and debt securities/total assets |

25.20 | % | 25.65 | % | 22.67 | % | (45) | bps | 253 | bps | ||||||||||||||||||||||||||||

| Total stockholders’ equity to assets ratio | 10.41 | % | 10.17 | % | 9.91 | % | 24 | 50 | ||||||||||||||||||||||||||||||

Tangible common equity (“TCE”) ratio (1) |

9.85 | % | 9.60 | % | 9.31 | % | 25 | bps | 54 | bps | ||||||||||||||||||||||||||||

| Book value per share | $ | 57.54 | $ | 55.79 | $ | 50.48 | 3.1 | % | 14.0 | % | ||||||||||||||||||||||||||||

Tangible book value (1) per share |

$ | 54.13 | $ | 52.39 | $ | 47.09 | 3.3 | 14.9 | ||||||||||||||||||||||||||||||

| Number of common shares at period-end | 137,802 | 138,437 | 139,121 | (0.5) | % | (0.9) | % | |||||||||||||||||||||||||||||||

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||

| TOTAL LOANS AND DEPOSITS DETAIL | |||||||||||||||||||||||||||||||||||

| ($ in thousands) | |||||||||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||||||||

| Table 2 | |||||||||||||||||||||||||||||||||||

|

March 31, 2025

% Change

|

|||||||||||||||||||||||||||||||||||

| March 31, 2025 | December 31, 2024 | March 31, 2024 | Qtr-o-Qtr | Yr-o-Yr | |||||||||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||||||||

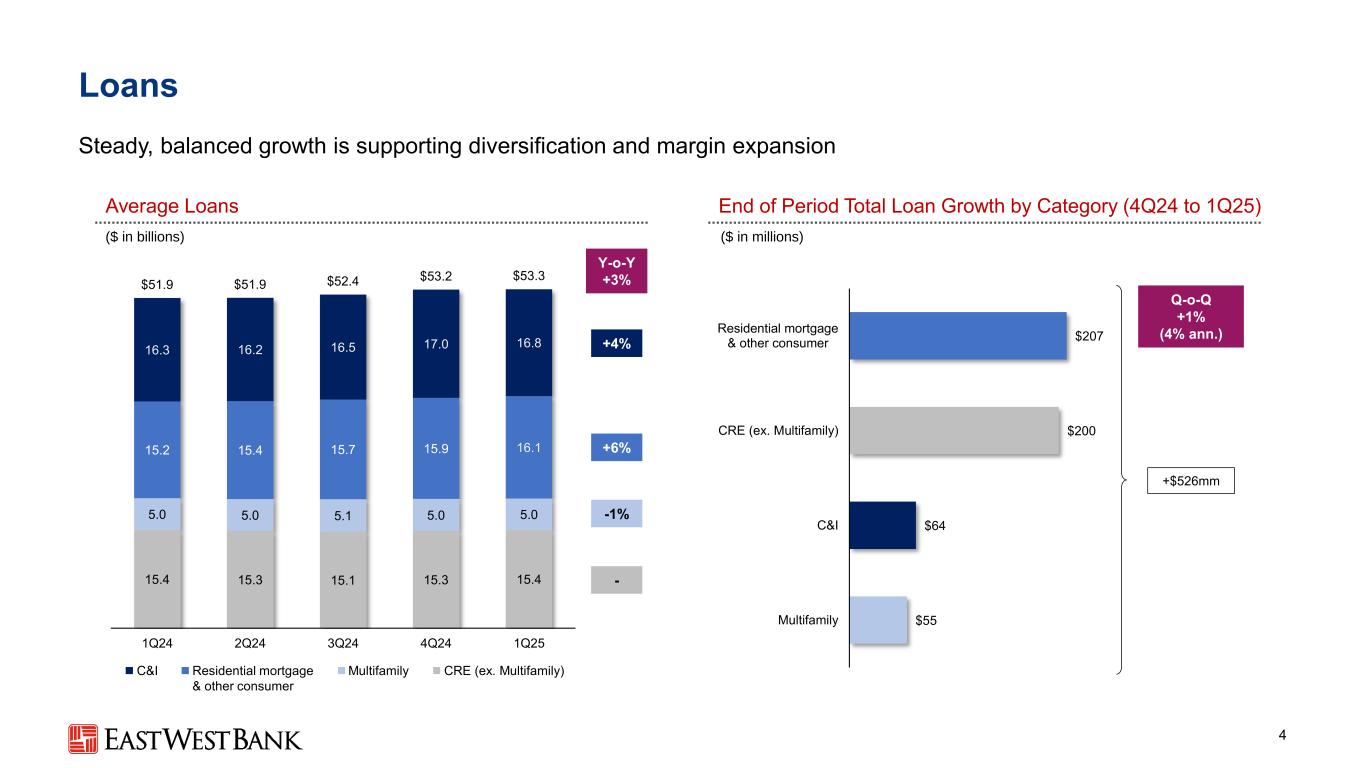

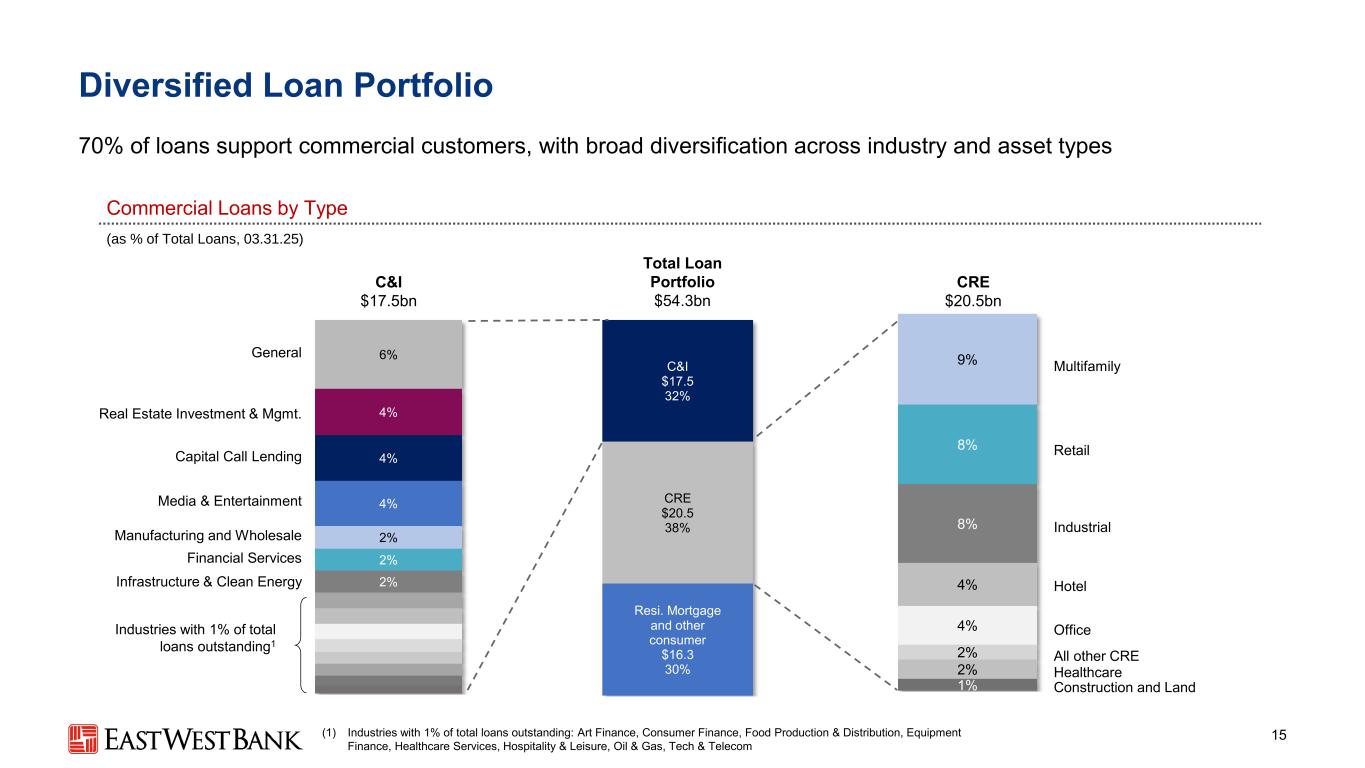

| Commercial and industrial (“C&I”) | $ | 17,460,744 | $ | 17,397,158 | $ | 16,350,191 | 0.4 | % | 6.8 | % | |||||||||||||||||||||||||

| Commercial real estate (“CRE”): | |||||||||||||||||||||||||||||||||||

| CRE | 14,868,361 | 14,655,340 | 14,609,655 | 1.5 | 1.8 | ||||||||||||||||||||||||||||||

| Multifamily residential | 5,007,969 | 4,953,442 | 5,010,245 | 1.1 | 0.0 | ||||||||||||||||||||||||||||||

| Construction and land | 653,630 | 666,162 | 673,939 | (1.9) | (3.0) | ||||||||||||||||||||||||||||||

| Total CRE | 20,529,960 | 20,274,944 | 20,293,839 | 1.3 | 1.2 | ||||||||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||||||||

| Residential mortgage: | |||||||||||||||||||||||||||||||||||

| Single-family residential | 14,383,562 | 14,175,446 | 13,563,738 | 1.5 | 6.0 | ||||||||||||||||||||||||||||||

| Home equity lines of credit (“HELOCs”) | 1,827,837 | 1,811,628 | 1,731,233 | 0.9 | 5.6 | ||||||||||||||||||||||||||||||

| Total residential mortgage | 16,211,399 | 15,987,074 | 15,294,971 | 1.4 | 6.0 | ||||||||||||||||||||||||||||||

| Other consumer | 50,631 | 67,461 | 53,503 | (24.9) | (5.4) | ||||||||||||||||||||||||||||||

Total loans HFI (1) |

54,252,734 | 53,726,637 | 51,992,504 | 1.0 | 4.3 | ||||||||||||||||||||||||||||||

| Loans HFS | — | — | 13,280 | — | (100.0) | ||||||||||||||||||||||||||||||

Total loans (1) |

54,252,734 | 53,726,637 | 52,005,784 | 1.0 | 4.3 | ||||||||||||||||||||||||||||||

| Allowance for loan losses | (734,856) | (702,052) | (670,280) | 4.7 | 9.6 | ||||||||||||||||||||||||||||||

Net loans (1) |

$ | 53,517,878 | $ | 53,024,585 | $ | 51,335,504 | 0.9 | % | 4.3 | % | |||||||||||||||||||||||||

Deposits by product: |

|||||||||||||||||||||||||||||||||||

| Noninterest-bearing demand | $ | 15,169,775 | $ | 15,450,428 | $ | 14,798,927 | (1.8) | % | 2.5 | % | |||||||||||||||||||||||||

| Interest-bearing checking | 7,591,847 | 7,940,692 | 7,570,427 | (4.4) | 0.3 | ||||||||||||||||||||||||||||||

| Money market | 14,885,732 | 14,816,511 | 13,585,597 | 0.5 | 9.6 | ||||||||||||||||||||||||||||||

| Savings | 1,740,044 | 1,751,620 | 1,834,393 | (0.7) | (5.1) | ||||||||||||||||||||||||||||||

| Time deposits | 23,664,707 | 23,215,772 | 20,771,280 | 1.9 | 13.9 | ||||||||||||||||||||||||||||||

| Total deposits | $ | 63,052,105 | $ | 63,175,023 | $ | 58,560,624 | (0.2) | % | 7.7 | % | |||||||||||||||||||||||||

Deposits by segment/region: |

|||||||||||||||||||||||||||||||||||

Consumer and Business Banking - U.S. (2) |

$ | 33,023,739 | $ | 32,832,926 | $ | 30,251,355 | 0.6 | % | 9.2 | % | |||||||||||||||||||||||||

Commercial Banking - U.S. (2) |

22,571,582 | 23,405,769 | 22,464,774 | (3.6) | 0.5 | ||||||||||||||||||||||||||||||

International Branches (3) |

3,524,223 | 3,412,262 | 3,282,218 | 3.3 | 7.4 | ||||||||||||||||||||||||||||||

Treasury and Other - U.S. (4) |

3,932,561 | 3,524,066 | 2,562,277 | 11.6 | 53.5 | ||||||||||||||||||||||||||||||

| Total deposits | $ | 63,052,105 | $ | 63,175,023 | $ | 58,560,624 | (0.2) | % | 7.7 | % | |||||||||||||||||||||||||

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||

| CONDENSED CONSOLIDATED STATEMENT OF INCOME | |||||||||||||||||||||||||||||||||||

| ($ and shares in thousands, except per share data) | |||||||||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||||||||

| Table 3 | |||||||||||||||||||||||||||||||||||

| Three Months Ended |

March 31, 2025

% Change

|

||||||||||||||||||||||||||||||||||

| March 31, 2025 | December 31, 2024 | March 31, 2024 | Qtr-o-Qtr | Yr-o-Yr | |||||||||||||||||||||||||||||||

| Interest and dividend income | $ | 1,031,802 | $ | 1,059,266 | $ | 1,023,617 | (2.6)% | 0.8% | |||||||||||||||||||||||||||

| Interest expense | 431,601 | 471,640 | 458,478 | (8.5) | (5.9) | ||||||||||||||||||||||||||||||

| Net interest income before provision for credit losses | 600,201 | 587,626 | 565,139 | 2.1 | 6.2 | ||||||||||||||||||||||||||||||

| Provision for credit losses | 49,000 | 70,000 | 25,000 | (30.0) | 96.0 | ||||||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 551,201 | 517,626 | 540,139 | 6.5% | 2.0% | ||||||||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||||||||

Commercial and consumer deposit-related fees |

27,075 | 26,468 | 24,948 | 2.3 | 8.5 | ||||||||||||||||||||||||||||||

| Lending fees | 26,230 | 24,737 | 22,925 | 6.0 | 14.4 | ||||||||||||||||||||||||||||||

| Foreign exchange income | 15,837 | 16,643 | 11,469 | (4.8) | 38.1 | ||||||||||||||||||||||||||||||

| Wealth management fees | 13,679 | 9,829 | 8,637 | 39.2 | 58.4 | ||||||||||||||||||||||||||||||

Customer derivative income |

5,539 | 3,782 | 3,137 | 46.5 | 76.6 | ||||||||||||||||||||||||||||||

| Total fee income | 88,360 | 81,459 | 71,116 | 8.5 | 24.2 | ||||||||||||||||||||||||||||||

Derivative mark-to-market and credit valuation adjustments |

(1,470) | 3,811 | 613 | NM | NM | ||||||||||||||||||||||||||||||

| Net gains on AFS debt securities | 131 | 90 | 49 | 45.6 | 167.3 | ||||||||||||||||||||||||||||||

Other investment income (loss) |

2,262 | (590) | 2,815 | NM | (19.6) | ||||||||||||||||||||||||||||||

| Other income | 2,819 | 3,396 | 3,894 | (17.0) | (27.6) | ||||||||||||||||||||||||||||||

| Total noninterest income | 92,102 | 88,166 | 78,487 | 4.5% | 17.3% | ||||||||||||||||||||||||||||||

| Noninterest expense: | |||||||||||||||||||||||||||||||||||

| Compensation and employee benefits | 146,435 | 139,870 | 141,812 | 4.7% | 3.3% | ||||||||||||||||||||||||||||||

| Occupancy and equipment expense | 15,689 | 16,384 | 15,716 | (4.2) | (0.2) | ||||||||||||||||||||||||||||||

| Deposit account expense | 9,042 | 10,923 | 12,188 | (17.2) | (25.8) | ||||||||||||||||||||||||||||||

| Computer and software related expenses | 13,314 | 13,099 | 11,344 | 1.6 | 17.4 | ||||||||||||||||||||||||||||||

Deposit insurance premiums and regulatory assessments (1) |

10,385 | 6,201 | 19,649 | 67.5 | (47.1) | ||||||||||||||||||||||||||||||

| Other operating expense | 41,541 | 44,108 | 32,458 | (5.8) | 28.0 | ||||||||||||||||||||||||||||||

Total operating noninterest expense |

236,406 | 230,585 | 233,167 | 2.5 | 1.4 | ||||||||||||||||||||||||||||||

Amortization of tax credit and CRA investments (2) |

15,742 | 19,383 | 13,207 | (18.8) | 19.2 | ||||||||||||||||||||||||||||||

| Total noninterest expense | 252,148 | 249,968 | 246,374 | 0.9 | 2.3 | ||||||||||||||||||||||||||||||

| Income before income taxes | 391,155 | 355,824 | 372,252 | 9.9 | 5.1 | ||||||||||||||||||||||||||||||

| Income tax expense | 100,885 | 62,709 | 87,177 | 60.9 | 15.7 | ||||||||||||||||||||||||||||||

| Net income | $ | 290,270 | $ | 293,115 | $ | 285,075 | (1.0)% | 1.8% | |||||||||||||||||||||||||||

| Earnings per share (“EPS”) | |||||||||||||||||||||||||||||||||||

| - Basic | $ | 2.10 | $ | 2.11 | $ | 2.04 | (0.7)% | 2.7% | |||||||||||||||||||||||||||

| - Diluted | $ | 2.08 | $ | 2.10 | $ | 2.03 | (0.5) | 2.5 | |||||||||||||||||||||||||||

| Weighted-average number of shares outstanding | |||||||||||||||||||||||||||||||||||

| - Basic | 138,201 | 138,604 | 139,409 | (0.3)% | (0.9)% | ||||||||||||||||||||||||||||||

| - Diluted | 139,291 | 139,883 | 140,261 | (0.4) | (0.7) | ||||||||||||||||||||||||||||||

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||||||||

| SELECTED AVERAGE BALANCES | ||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||||||||||||

| Table 4 | ||||||||||||||||||||||||||||||||||||||

| Three Months Ended | March 31, 2025 % Change |

|||||||||||||||||||||||||||||||||||||

| March 31, 2025 | December 31, 2024 | March 31, 2024 | Qtr-o-Qtr | Yr-o-Yr | ||||||||||||||||||||||||||||||||||

| Loans: | ||||||||||||||||||||||||||||||||||||||

| Commercial: | ||||||||||||||||||||||||||||||||||||||

| C&I | $ | 16,865,399 | $ | 17,010,327 | $ | 16,251,622 | (0.9)% | 3.8% | ||||||||||||||||||||||||||||||

| CRE: | ||||||||||||||||||||||||||||||||||||||

| CRE | 14,731,881 | 14,580,509 | 14,725,440 | 1.0 | 0.0 | |||||||||||||||||||||||||||||||||

| Multifamily residential | 4,965,448 | 5,046,676 | 5,033,143 | (1.6) | (1.3) | |||||||||||||||||||||||||||||||||

| Construction and land | 675,686 | 680,374 | 655,001 | (0.7) | 3.2 | |||||||||||||||||||||||||||||||||

| Total CRE | 20,373,015 | 20,307,559 | 20,413,584 | 0.3 | (0.2) | |||||||||||||||||||||||||||||||||

| Consumer: | ||||||||||||||||||||||||||||||||||||||

| Residential mortgage: | ||||||||||||||||||||||||||||||||||||||

| Single-family residential | 14,238,697 | 14,048,515 | 13,477,057 | 1.4 | 5.7 | |||||||||||||||||||||||||||||||||

| HELOCs | 1,811,022 | 1,775,587 | 1,725,288 | 2.0 | 5.0 | |||||||||||||||||||||||||||||||||

| Total residential mortgage | 16,049,719 | 15,824,102 | 15,202,345 | 1.4 | 5.6 | |||||||||||||||||||||||||||||||||

| Other consumer | 49,578 | 59,273 | 57,289 | (16.4) | (13.5) | |||||||||||||||||||||||||||||||||

Total loans (1) |

$ | 53,337,711 | $ | 53,201,261 | $ | 51,924,840 | 0.3% | 2.7% | ||||||||||||||||||||||||||||||

| Interest-earning assets | $ | 72,690,586 | $ | 72,150,099 | $ | 68,122,045 | 0.7% | 6.7% | ||||||||||||||||||||||||||||||

| Total assets | $ | 75,624,952 | $ | 75,121,440 | $ | 71,678,396 | 0.7% | 5.5% | ||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing demand | $ | 15,104,028 | $ | 14,973,805 | $ | 14,954,953 | 0.9% | 1.0% | ||||||||||||||||||||||||||||||

| Interest-bearing checking | 7,749,665 | 7,998,098 | 7,695,429 | (3.1) | 0.7 | |||||||||||||||||||||||||||||||||

| Money market | 14,833,615 | 14,313,494 | 13,636,210 | 3.6 | 8.8 | |||||||||||||||||||||||||||||||||

| Savings | 1,752,946 | 1,731,414 | 1,809,568 | 1.2 | (3.1) | |||||||||||||||||||||||||||||||||

| Time deposits | 23,197,328 | 22,931,856 | 19,346,243 | 1.2 | 19.9 | |||||||||||||||||||||||||||||||||

| Total deposits | $ | 62,637,582 | $ | 61,948,667 | $ | 57,442,403 | 1.1% | 9.0% | ||||||||||||||||||||||||||||||

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||

| QUARTER-TO-DATE AVERAGE BALANCES, YIELDS AND RATES | |||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | |||||||||||||||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||||||||||||||

| Table 5 | |||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||

| March 31, 2025 | December 31, 2024 | ||||||||||||||||||||||||||||||||||||||||

Average Balance |

Interest | Average Yield/Rate (1) |

Average Balance |

Interest | Average Yield/Rate (1) |

||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||

| Interest-bearing cash and deposits with banks | $ | 4,087,664 | $ | 39,137 | 3.88 | % | $ | 4,585,135 | $ | 47,946 | 4.16 | % | |||||||||||||||||||||||||||||

| Resale agreements | 425,000 | 1,610 | 1.54 | % | 425,000 | 1,591 | 1.49 | % | |||||||||||||||||||||||||||||||||

| Debt securities: | |||||||||||||||||||||||||||||||||||||||||

| AFS | 11,766,446 | 135,519 | 4.67 | % | 10,852,569 | 125,628 | 4.61 | % | |||||||||||||||||||||||||||||||||

| HTM | 2,908,402 | 12,265 | 1.71 | % | 2,921,096 | 12,330 | 1.68 | % | |||||||||||||||||||||||||||||||||

| Total debt securities | 14,674,848 | 147,784 | 4.08 | % | 13,773,665 | 137,958 | 3.98 | % | |||||||||||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||||||||||||||

| C&I | 16,865,399 | 293,414 | 7.06 | % | 17,010,327 | 317,374 | 7.42 | % | |||||||||||||||||||||||||||||||||

| CRE | 20,373,015 | 311,386 | 6.20 | % | 20,307,559 | 317,526 | 6.22 | % | |||||||||||||||||||||||||||||||||

| Residential mortgage | 16,049,719 | 234,891 | 5.94 | % | 15,824,102 | 233,147 | 5.86 | % | |||||||||||||||||||||||||||||||||

| Other consumer | 49,578 | 721 | 5.90 | % | 59,273 | 749 | 5.03 | % | |||||||||||||||||||||||||||||||||

Total loans (2) |

53,337,711 | 840,412 | 6.39 | % | 53,201,261 | 868,796 | 6.50 | % | |||||||||||||||||||||||||||||||||

| FHLB and FRB stock | 165,363 | 2,859 | 7.01 | % | 165,038 | 2,975 | 7.17 | % | |||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 72,690,586 | $ | 1,031,802 | 5.76 | % | $ | 72,150,099 | $ | 1,059,266 | 5.84 | % | |||||||||||||||||||||||||||||

| Noninterest-earning assets: | |||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 373,827 | 381,012 | |||||||||||||||||||||||||||||||||||||||

| Allowance for loan losses | (716,255) | (707,689) | |||||||||||||||||||||||||||||||||||||||

| Other assets | 3,276,794 | 3,298,018 | |||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 75,624,952 | $ | 75,121,440 | |||||||||||||||||||||||||||||||||||||

| Liabilities and Stockholders’ Equity | |||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||||||||

| Checking deposits | $ | 7,749,665 | $ | 47,911 | 2.51 | % | $ | 7,998,098 | $ | 56,640 | 2.82 | % | |||||||||||||||||||||||||||||

| Money market deposits | 14,833,615 | 116,018 | 3.17 | % | 14,313,494 | 119,420 | 3.32 | % | |||||||||||||||||||||||||||||||||

| Savings deposits | 1,752,946 | 3,447 | 0.80 | % | 1,731,414 | 3,829 | 0.88 | % | |||||||||||||||||||||||||||||||||

| Time deposits | 23,197,328 | 224,605 | 3.93 | % | 22,931,856 | 248,533 | 4.31 | % | |||||||||||||||||||||||||||||||||

Total interest-bearing deposits |

47,533,554 | 391,981 | 3.34 | % | 46,974,862 | 428,422 | 3.63 | % | |||||||||||||||||||||||||||||||||

Short-term borrowings and federal funds purchased |

428 | 6 | 5.69 | % | 783 | 9 | 4.57 | % | |||||||||||||||||||||||||||||||||

| FHLB advances | 3,500,001 | 38,866 | 4.50 | % | 3,500,001 | 42,429 | 4.82 | % | |||||||||||||||||||||||||||||||||

Repurchase agreements |

6,684 | 77 | 4.67 | % | 4,337 | 55 | 5.05 | % | |||||||||||||||||||||||||||||||||

| Long-term debt and finance lease liabilities | 35,919 | 671 | 7.58 | % | 36,123 | 725 | 7.98 | % | |||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 51,076,586 | $ | 431,601 | 3.43 | % | $ | 50,516,106 | $ | 471,640 | 3.71 | % | |||||||||||||||||||||||||||||

| Noninterest-bearing liabilities and stockholders’ equity: | |||||||||||||||||||||||||||||||||||||||||

| Demand deposits | 15,104,028 | 14,973,805 | |||||||||||||||||||||||||||||||||||||||

| Accrued expenses and other liabilities | 1,575,264 | 1,900,205 | |||||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 7,869,074 | 7,731,324 | |||||||||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 75,624,952 | $ | 75,121,440 | |||||||||||||||||||||||||||||||||||||

Total deposits |

$ | 62,637,582 | $ | 391,981 | 2.54 | % | $ | 61,948,667 | $ | 428,422 | 2.75 | % | |||||||||||||||||||||||||||||

| Interest rate spread | 2.33 | % | 2.13 | % | |||||||||||||||||||||||||||||||||||||

| Net interest income and net interest margin | $ | 600,201 | 3.35 | % | $ | 587,626 | 3.24 | % | |||||||||||||||||||||||||||||||||

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||

| QUARTER-TO-DATE AVERAGE BALANCES, YIELDS AND RATES | |||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | |||||||||||||||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||||||||||||||

| Table 6 | |||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||

| March 31, 2025 | March 31, 2024 | ||||||||||||||||||||||||||||||||||||||||

Average Balance |

Interest | Average Yield/Rate (1) |

Average Balance |

Interest | Average Yield/Rate (1) |

||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||

| Interest-bearing cash and deposits with banks | $ | 4,087,664 | $ | 39,137 | 3.88 | % | $ | 5,861,517 | $ | 74,382 | 5.10 | % | |||||||||||||||||||||||||||||

Resale agreements |

425,000 | 1,610 | 1.54 | % | 725,659 | 6,115 | 3.39 | % | |||||||||||||||||||||||||||||||||

| Debt securities: | |||||||||||||||||||||||||||||||||||||||||

| AFS | 11,766,446 | 135,519 | 4.67 | % | 6,566,368 | 62,858 | 3.85 | % | |||||||||||||||||||||||||||||||||

| HTM | 2,908,402 | 12,265 | 1.71 | % | 2,950,686 | 12,534 | 1.71 | % | |||||||||||||||||||||||||||||||||

| Total debt securities | 14,674,848 | 147,784 | 4.08 | % | 9,517,054 | 75,392 | 3.19 | % | |||||||||||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||||||||||||||

| C&I | 16,865,399 | 293,414 | 7.06 | % | 16,251,622 | 325,810 | 8.06 | % | |||||||||||||||||||||||||||||||||

| CRE | 20,373,015 | 311,386 | 6.20 | % | 20,413,584 | 324,087 | 6.39 | % | |||||||||||||||||||||||||||||||||

| Residential mortgage | 16,049,719 | 234,891 | 5.94 | % | 15,202,345 | 215,674 | 5.71 | % | |||||||||||||||||||||||||||||||||

| Other consumer | 49,578 | 721 | 5.90 | % | 57,289 | 818 | 5.74 | % | |||||||||||||||||||||||||||||||||

Total loans (2) |

53,337,711 | 840,412 | 6.39 | % | 51,924,840 | 866,389 | 6.71 | % | |||||||||||||||||||||||||||||||||

| FHLB and FRB stock | 165,363 | 2,859 | 7.01 | % | 92,975 | 1,339 | 5.79 | % | |||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 72,690,586 | $ | 1,031,802 | 5.76 | % | $ | 68,122,045 | $ | 1,023,617 | 6.04 | % | |||||||||||||||||||||||||||||

| Noninterest-earning assets: | |||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 373,827 | 445,767 | |||||||||||||||||||||||||||||||||||||||

| Allowance for loan losses | (716,255) | (679,116) | |||||||||||||||||||||||||||||||||||||||

| Other assets | 3,276,794 | 3,789,700 | |||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 75,624,952 | $ | 71,678,396 | |||||||||||||||||||||||||||||||||||||

| Liabilities and Stockholders’ Equity | |||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||||||||

| Checking deposits | $ | 7,749,665 | $ | 47,911 | 2.51 | % | $ | 7,695,429 | $ | 53,821 | 2.81 | % | |||||||||||||||||||||||||||||

| Money market deposits | 14,833,615 | 116,018 | 3.17 | % | 13,636,210 | 134,661 | 3.97 | % | |||||||||||||||||||||||||||||||||

| Savings deposits | 1,752,946 | 3,447 | 0.80 | % | 1,809,568 | 4,120 | 0.92 | % | |||||||||||||||||||||||||||||||||

| Time deposits | 23,197,328 | 224,605 | 3.93 | % | 19,346,243 | 213,597 | 4.44 | % | |||||||||||||||||||||||||||||||||

Total interest-bearing deposits |

47,533,554 | 391,981 | 3.34 | % | 42,487,450 | 406,199 | 3.85 | % | |||||||||||||||||||||||||||||||||

| BTFP, short-term borrowings and federal funds purchased | 428 | 6 | 5.69 | % | 3,864,525 | 42,106 | 4.38 | % | |||||||||||||||||||||||||||||||||

| FHLB advances | 3,500,001 | 38,866 | 4.50 | % | 554,946 | 7,739 | 5.61 | % | |||||||||||||||||||||||||||||||||

| Repurchase agreements | 6,684 | 77 | 4.67 | % | 2,549 | 35 | 5.52 | % | |||||||||||||||||||||||||||||||||

| Long-term debt and finance lease liabilities | 35,919 | 671 | 7.58 | % | 125,818 | 2,399 | 7.67 | % | |||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 51,076,586 | $ | 431,601 | 3.43 | % | $ | 47,035,288 | $ | 458,478 | 3.92 | % | |||||||||||||||||||||||||||||

| Noninterest-bearing liabilities and stockholders’ equity: | |||||||||||||||||||||||||||||||||||||||||

| Demand deposits | 15,104,028 | 14,954,953 | |||||||||||||||||||||||||||||||||||||||

| Accrued expenses and other liabilities | 1,575,264 | 2,695,597 | |||||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 7,869,074 | 6,992,558 | |||||||||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 75,624,952 | $ | 71,678,396 | |||||||||||||||||||||||||||||||||||||

Total deposits |

$ | 62,637,582 | $ | 391,981 | 2.54 | % | $ | 57,442,403 | $ | 406,199 | 2.84 | % | |||||||||||||||||||||||||||||

| Interest rate spread | 2.33 | % | 2.12 | % | |||||||||||||||||||||||||||||||||||||

| Net interest income and net interest margin | $ | 600,201 | 3.35 | % | $ | 565,139 | 3.34 | % | |||||||||||||||||||||||||||||||||

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||||||||

| SELECTED RATIOS | ||||||||||||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||||||||||||

| Table 7 | ||||||||||||||||||||||||||||||||||||||

Three Months Ended (1) |

March 31, 2025

Basis Point Change

|

|||||||||||||||||||||||||||||||||||||

| March 31, 2025 |

December 31, 2024 |

March 31, 2024 |

Qtr-o-Qtr | Yr-o-Yr | ||||||||||||||||||||||||||||||||||

| Return on average assets | 1.56 | % | 1.55 | % | 1.60 | % | 1 | bps | (4) | bps | ||||||||||||||||||||||||||||

| Return on average common equity | 14.96 | % | 15.08 | % | 16.40 | % | (12) | (144) | ||||||||||||||||||||||||||||||

Return on average TCE (2) |

15.92 | % | 16.07 | % | 17.60 | % | (15) | (168) | ||||||||||||||||||||||||||||||

| Interest rate spread | 2.33 | % | 2.13 | % | 2.12 | % | 20 | 21 | ||||||||||||||||||||||||||||||

| Net interest margin | 3.35 | % | 3.24 | % | 3.34 | % | 11 | 1 | ||||||||||||||||||||||||||||||

| Average loan yield | 6.39 | % | 6.50 | % | 6.71 | % | (11) | (32) | ||||||||||||||||||||||||||||||

| Yield on average interest-earning assets | 5.76 | % | 5.84 | % | 6.04 | % | (8) | (28) | ||||||||||||||||||||||||||||||

| Average cost of interest-bearing deposits | 3.34 | % | 3.63 | % | 3.85 | % | (29) | (51) | ||||||||||||||||||||||||||||||

| Average cost of deposits | 2.54 | % | 2.75 | % | 2.84 | % | (21) | (30) | ||||||||||||||||||||||||||||||

| Average cost of funds | 2.64 | % | 2.87 | % | 2.97 | % | (23) | (33) | ||||||||||||||||||||||||||||||

Operating noninterest expense/average assets |

1.27 | % | 1.22 | % | 1.31 | % | 5 | (4) | ||||||||||||||||||||||||||||||

Efficiency ratio |

36.42 | % | 36.99 | % | 38.28 | % | (57) | (186) | ||||||||||||||||||||||||||||||

Efficiency ratio (fully taxable equivalent) (“FTE”) (3) |

36.36 | % | 36.92 | % | 38.19 | % | (56) | (183) | ||||||||||||||||||||||||||||||

Effective tax rate |

25.79 | % | 17.62 | % | 23.42 | % | 817 | bps | 237 | bps |

||||||||||||||||||||||||||||

|

March 31, 2025

Basis Point Change

|

||||||||||||||||||||||||||||||||||||||

| March 31, 2025 |

December 31, 2024 |

March 31, 2024 |

Qtr-o-Qtr | Yr-o-Yr | ||||||||||||||||||||||||||||||||||

Loan-to-deposit ratio |

86.04 | % | 85.04 | % | 88.81 | % | 100 | (277) | ||||||||||||||||||||||||||||||

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| ALLOWANCE FOR LOAN LOSSES & OFF-BALANCE SHEET CREDIT EXPOSURES | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Table 8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial | Consumer | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| CRE | Residential Mortgage | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | C&I | CRE | Multifamily Residential | Construction and Land | Single-Family Residential | HELOCs | Other Consumer | Total | |||||||||||||||||||||||||||||||||||||||||||||

|

Allowance for loan losses,

December 31, 2024

|

$ | 384,319 | $ | 218,677 | $ | 32,117 | $ | 17,497 | $ | 44,816 | $ | 3,132 | $ | 1,494 | $ | 702,052 | |||||||||||||||||||||||||||||||||||||

| Provision for (reversal of) credit losses on loans | (a) | 36,370 | 8,105 | 201 | (305) | 2,072 | 1,739 | (120) | 48,062 | ||||||||||||||||||||||||||||||||||||||||||||

| Gross charge-offs | (988) | (13,937) | (4) | (1,996) | (9) | — | (49) | (16,983) | |||||||||||||||||||||||||||||||||||||||||||||

| Gross recoveries | 1,564 | 54 | 10 | 3 | 50 | 8 | 13 | 1,702 | |||||||||||||||||||||||||||||||||||||||||||||

Total net recoveries (charge-offs) |

576 | (13,883) | 6 | (1,993) | 41 | 8 | (36) | (15,281) | |||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | 23 | — | — | — | — | — | — | 23 | |||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan losses, March 31, 2025 | $ | 421,288 | $ | 212,899 | $ | 32,324 | $ | 15,199 | $ | 46,929 | $ | 4,879 | $ | 1,338 | $ | 734,856 | |||||||||||||||||||||||||||||||||||||

| Three Months Ended December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial | Consumer | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| CRE | Residential Mortgage | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | C&I | CRE | Multifamily Residential | Construction and Land | Single-Family Residential | HELOCs | Other Consumer | Total | |||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan losses, September 30, 2024 | $ | 378,315 | $ | 221,244 | $ | 31,782 | $ | 12,208 | $ | 48,231 | $ | 3,210 | $ | 1,495 | $ | 696,485 | |||||||||||||||||||||||||||||||||||||

| Provision for (reversal of) credit losses on loans | (a) | 66,318 | (2,634) | 149 | 5,286 | (3,416) | (81) | 3,921 | 69,543 | ||||||||||||||||||||||||||||||||||||||||||||

| Gross charge-offs | (62,021) | (1) | (4) | — | — | (5) | (3,922) | (65,953) | |||||||||||||||||||||||||||||||||||||||||||||

| Gross recoveries | 2,140 | 68 | 190 | 3 | 1 | 8 | — | 2,410 | |||||||||||||||||||||||||||||||||||||||||||||

| Total net (charge-offs) recoveries | (59,881) | 67 | 186 | 3 | 1 | 3 | (3,922) | (63,543) | |||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | (433) | — | — | — | — | — | — | (433) | |||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan losses, December 31, 2024 | $ | 384,319 | $ | 218,677 | $ | 32,117 | $ | 17,497 | $ | 44,816 | $ | 3,132 | $ | 1,494 | $ | 702,052 | |||||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial | Consumer | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| CRE | Residential Mortgage | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | C&I | CRE | Multifamily Residential | Construction and Land | Single-Family Residential | HELOCs | Other Consumer | Total | |||||||||||||||||||||||||||||||||||||||||||||

|

Allowance for loan losses,

December 31, 2023

|

$ | 392,685 | $ | 170,592 | $ | 34,375 | $ | 10,469 | $ | 55,018 | $ | 3,947 | $ | 1,657 | $ | 668,743 | |||||||||||||||||||||||||||||||||||||

| Provision for (reversal of) credit losses on loans | (a) | 275 | 19,132 | 3,032 | 1,381 | 899 | (432) | (132) | 24,155 | ||||||||||||||||||||||||||||||||||||||||||||

| Gross charge-offs | (20,998) | (2,398) | (6) | (1,224) | — | — | (58) | (24,684) | |||||||||||||||||||||||||||||||||||||||||||||

| Gross recoveries | 1,710 | 134 | 17 | 193 | 5 | 48 | — | 2,107 | |||||||||||||||||||||||||||||||||||||||||||||

| Total net (charge-offs) recoveries | (19,288) | (2,264) | 11 | (1,031) | 5 | 48 | (58) | (22,577) | |||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | (41) | — | — | — | — | — | — | (41) | |||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan losses, March 31, 2024 | $ | 373,631 | $ | 187,460 | $ | 37,418 | $ | 10,819 | $ | 55,922 | $ | 3,563 | $ | 1,467 | $ | 670,280 | |||||||||||||||||||||||||||||||||||||

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| ALLOWANCE FOR LOAN LOSSES & OFF-BALANCE-SHEET CREDIT EXPOSURES | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Table 8 (continued) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||

| March 31, 2025 | December 31, 2024 | March 31, 2024 | |||||||||||||||||||||

| Unfunded Credit Facilities | |||||||||||||||||||||||

Allowance for unfunded credit commitments, beginning of period (1) |

$ | 39,526 | $ | 39,062 | $ | 37,699 | |||||||||||||||||

| Provision for credit losses on unfunded credit commitments | (b) | 938 | 457 | 845 | |||||||||||||||||||

| Foreign currency translation adjustment | — | 7 | — | ||||||||||||||||||||

Allowance for unfunded credit commitments, end of period (1) |

$ | 40,464 | $ | 39,526 | $ | 38,544 | |||||||||||||||||

| Provision for credit losses | (a)+(b) | $ | 49,000 | $ | 70,000 | $ | 25,000 | ||||||||||||||||

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||

CRITICIZED LOANS, NONPERFORMING ASSETS, CREDIT QUALITY RATIOS AND |

|||||||||||||||||||||||

| COMPOSITION OF ALLOWANCE BY PORTFOLIO | |||||||||||||||||||||||

| ($ in thousands) | |||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||

| Table 9 | |||||||||||||||||||||||

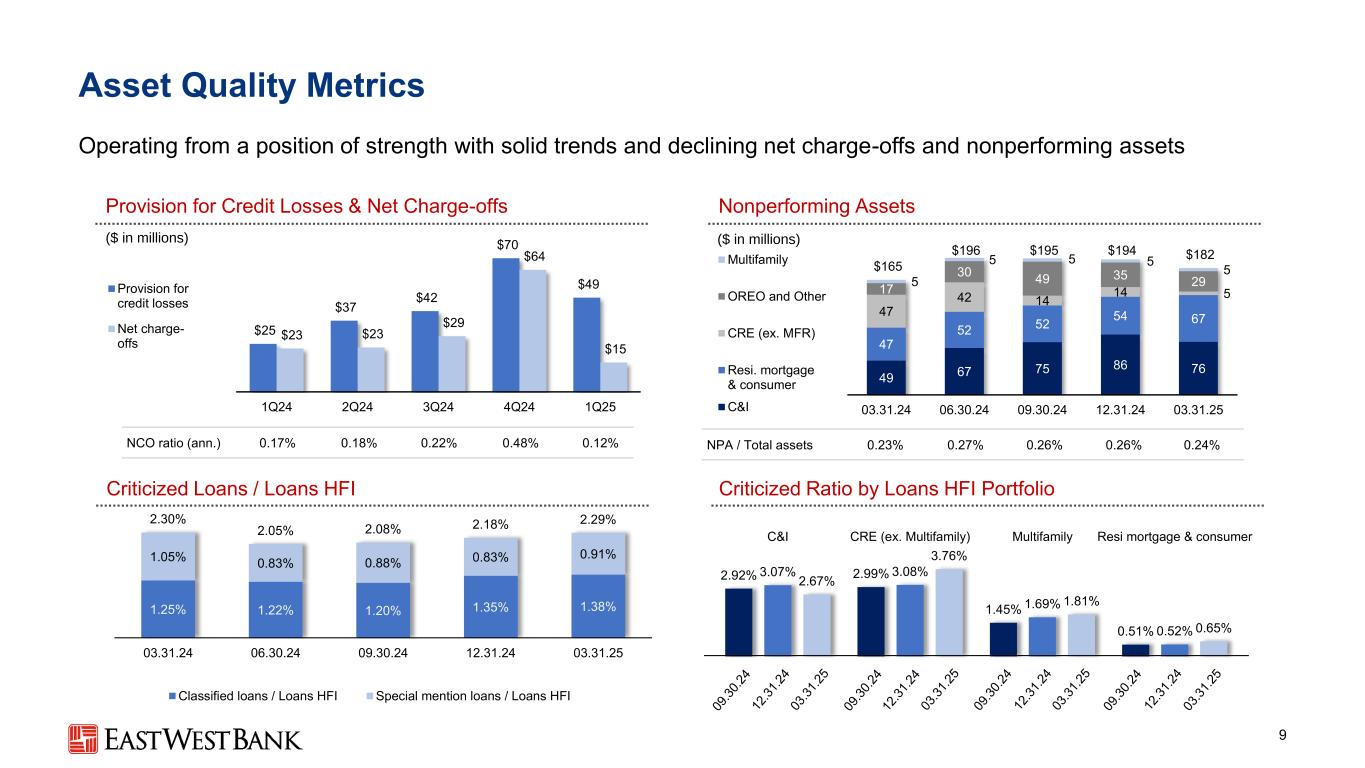

| Criticized Loans | March 31, 2025 | December 31, 2024 | March 31, 2024 | ||||||||||||||||||||

| Special mention loans | $ | 494,444 | $ | 447,290 | $ | 543,573 | |||||||||||||||||

| Classified loans | 750,570 | 725,863 | 651,485 | ||||||||||||||||||||

Total criticized loans (1) |

$ | 1,245,014 | $ | 1,173,153 | $ | 1,195,058 | |||||||||||||||||

Nonperforming Assets |

March 31, 2025 | December 31, 2024 | March 31, 2024 | ||||||||||||||||||||

| Nonaccrual loans: | |||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||

| C&I | $ | 75,579 | $ | 86,165 | $ | 48,962 | |||||||||||||||||

| Total CRE | 10,108 | 18,318 | 51,888 | ||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||

| Total residential mortgage | 67,416 | 54,469 | 47,167 | ||||||||||||||||||||

| Other consumer | 97 | 66 | 162 | ||||||||||||||||||||

| Total nonaccrual loans | 153,200 | 159,018 | 148,179 | ||||||||||||||||||||

| Other real estate owned, net | 29,003 | 35,077 | 16,692 | ||||||||||||||||||||

| Total nonperforming assets | $ | 182,203 | $ | 194,095 | $ | 164,871 | |||||||||||||||||

| Credit Quality Ratios | March 31, 2025 | December 31, 2024 | March 31, 2024 | ||||||||||||||||||||

| Annualized quarterly net charge-offs to average loans HFI | 0.12 | % | 0.48 | % | 0.17 | % | |||||||||||||||||

| Special mention loans to loans HFI | 0.91 | % | 0.83 | % | 1.05 | % | |||||||||||||||||

| Classified loans to loans HFI | 1.38 | % | 1.35 | % | 1.25 | % | |||||||||||||||||

| Criticized loans to loans HFI | 2.29 | % | 2.18 | % | 2.30 | % | |||||||||||||||||

| Nonperforming assets to total assets | 0.24 | % | 0.26 | % | 0.23 | % | |||||||||||||||||

| Nonaccrual loans to loans HFI | 0.28 | % | 0.30 | % | 0.29 | % | |||||||||||||||||

| Allowance for loan losses to loans HFI | 1.35 | % | 1.31 | % | 1.29 | % | |||||||||||||||||

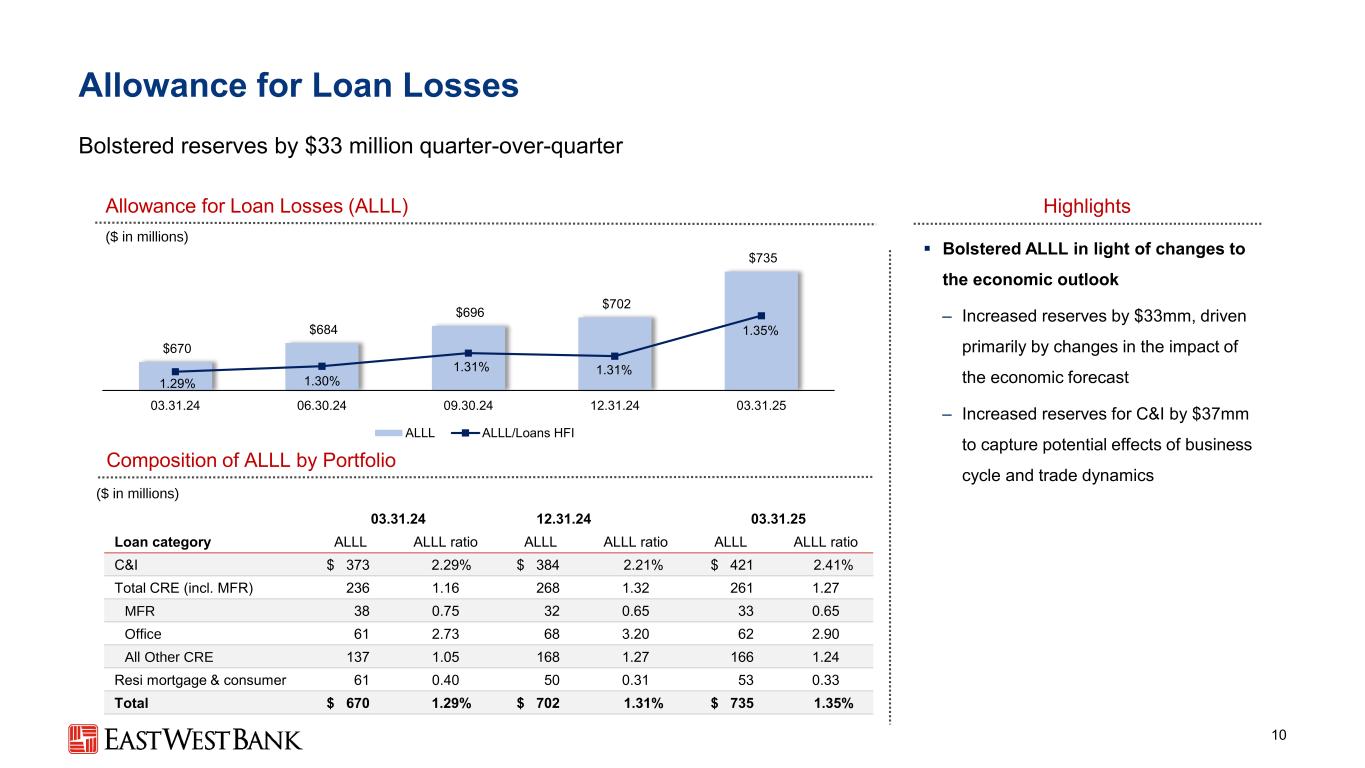

| Composition of Allowance (“ALLL”) by Portfolio | March 31, 2025 | December 31, 2024 | March 31, 2024 | ||||||||||||||||||||||||||||||||||||||

| Loan Category | ALLL | ALLL/ Loans HFI |

ALLL | ALLL/ Loans HFI |

ALLL | ALLL/ Loans HFI |

|||||||||||||||||||||||||||||||||||

| C&I | $ | 421,288 | 2.41 | % | $ | 384,319 | 2.21 | % | $ | 373,631 | 2.29 | % | |||||||||||||||||||||||||||||

| Total CRE | 260,422 | 1.27 | 268,291 | 1.32 | 235,697 | 1.16 | |||||||||||||||||||||||||||||||||||

| Multifamily | 32,324 | 0.65 | 32,117 | 0.65 | 37,418 | 0.75 | |||||||||||||||||||||||||||||||||||

| Office | 62,265 | 2.90 | 68,015 | 3.20 | 61,271 | 2.73 | |||||||||||||||||||||||||||||||||||

| All other CRE | 165,833 | 1.24 | 168,159 | 1.27 | 137,008 | 1.05 | |||||||||||||||||||||||||||||||||||

| Residential mortgage & consumer | 53,146 | 0.33 | 49,442 | 0.31 | 60,952 | 0.40 | |||||||||||||||||||||||||||||||||||

| Total loans | $ | 734,856 | 1.35 | % | $ | 702,052 | 1.31 | % | $ | 670,280 | 1.29 | % | |||||||||||||||||||||||||||||

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

| GAAP TO NON-GAAP RECONCILIATION | |||||||||||||||||||||||||||||

| ($ in thousands) | |||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||

| Table 10 | |||||||||||||||||||||||||||||

The Company uses certain non-GAAP financial measures to provide supplemental information regarding the Company’s performance. Non-GAAP measures used consist of FTE net interest income and total revenue. The FTE adjustment relates to tax exempt interest on certain investment securities and loans. Efficiency ratio represents noninterest expenses divided by total revenue (FTE). Pre-tax, pre-provision income represents total revenue (FTE) less noninterest expense. | |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2025 | December 31, 2024 | March 31, 2024 | |||||||||||||||||||||||||||

| Net interest income before provision for credit losses | (a) | $ | 600,201 | $ | 587,626 | $ | 565,139 | ||||||||||||||||||||||

FTE adjustment |

(b) | 1,146 | 1,276 | 1,576 | |||||||||||||||||||||||||

FTE net interest income before provision for credit losses |

(c)=(a)+(b) | 601,347 | 588,902 | 566,715 | |||||||||||||||||||||||||

| Total noninterest income | (d) | 92,102 | 88,166 | 78,487 | |||||||||||||||||||||||||

| Total revenue | (e)=(a)+(d) | 692,303 | 675,792 | 643,626 | |||||||||||||||||||||||||

Total revenue (FTE) |

(f)=(c)+(d) | $ | 693,449 | $ | 677,068 | $ | 645,202 | ||||||||||||||||||||||

| Total noninterest expense | (g) | $ | 252,148 | $ | 249,968 | $ | 246,374 | ||||||||||||||||||||||

Efficiency ratio |

(g)/(e) |

36.42 | % | 36.99 | % | 38.28 | % | ||||||||||||||||||||||

Efficiency ratio (FTE) |

(g)/(f) | 36.36 | % | 36.92 | % | 38.19 | % | ||||||||||||||||||||||

| Pre-tax, pre-provision income | (f)-(g) | $ | 441,301 | $ | 427,100 | $ | 398,828 | ||||||||||||||||||||||

|

Adjusted net income represents net income adjusted for the tax-effected adjustments below. Adjusted diluted EPS represents diluted EPS adjusted for the tax-effected adjustments below. Management believes that the measures and ratios presented below provide clarity to financial statement users regarding the ongoing performance of the Company and allow comparability to prior periods.

▪During the first quarters of 2025 and 2024, the Company recorded $833 thousand and $10 million, respectively, of pre-tax FDIC special assessment charges. The Company recorded a $3 million FDIC special assessment reversal during the fourth quarter of 2024. Pre-tax FDIC special assessment charges/reversals are included in Deposit insurance premiums and regulatory assessments on the Condensed Consolidated Statement of Income.

▪During the fourth quarter of 2024, the Company recorded $343 thousand in pre-tax DC Solar recoveries (included in Amortization of Tax Credit and CRA Investments on the Condensed Consolidated Statement of Income) related to the Company’s investment in DC Solar.

| ||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, 2025 | December 31, 2024 | March 31, 2024 | ||||||||||||||||||

| Net income | $ | 290,270 | $ | 293,115 | $ | 285,075 | ||||||||||||||

Less/Add: FDIC special assessment charge (reversal) |

833 | (3,385) | 10,305 | |||||||||||||||||

Less: DC Solar recovery |

— | (343) | — | |||||||||||||||||

Tax effect of adjustments (1) |

(248) | 1,109 | (3,046) | |||||||||||||||||

| Adjusted net income | $ | 290,855 | $ | 290,496 | $ | 292,334 | ||||||||||||||

| Diluted weighted-average number of shares outstanding | 139,291 | 139,883 | 140,261 | |||||||||||||||||

| Diluted EPS | $ | 2.08 | $ | 2.10 | $ | 2.03 | ||||||||||||||

Less/Add: FDIC special assessment charge (reversal) |

0.01 | (0.03) | 0.07 | |||||||||||||||||

Less: DC Solar recovery |

— | — | — | |||||||||||||||||

Tax effect of adjustments (1) |

— | 0.01 | (0.02) | |||||||||||||||||

| Adjusted diluted EPS | $ | 2.09 | $ | 2.08 | $ | 2.08 | ||||||||||||||

| EAST WEST BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||

| GAAP TO NON-GAAP RECONCILIATION | ||||||||||||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||

| Table 11 | ||||||||||||||||||||||||||

The Company uses certain non-GAAP financial measures to provide supplemental information regarding the Company’s performance. Tangible book value, tangible book value per share and TCE ratio are non-GAAP financial measures. Tangible book value and tangible assets represent stockholders’ equity and total assets, respectively, which have been reduced by goodwill and other intangible assets. Given that the use of such measures and ratios is more prevalent in the banking industry, and are used by banking regulators and analysts, the Company has included them below for discussion. | ||||||||||||||||||||||||||

| March 31, 2025 | December 31, 2024 | March 31, 2024 | ||||||||||||||||||||||||

Common Stock |

170 | 170 | 170 | |||||||||||||||||||||||

Additional paid-in capital |

2,043,898 | 2,030,712 | 1,993,806 | |||||||||||||||||||||||

Retained earnings |

7,517,711 | 7,311,542 | 6,662,919 | |||||||||||||||||||||||

Treasury stock |

(1,137,299) | (1,034,110) | (970,930) | |||||||||||||||||||||||

Accumulated other comprehensive income: |

||||||||||||||||||||||||||

AFS debt securities net unrealized losses |

(482,175) | (542,152) | (601,511) | |||||||||||||||||||||||

Cash flow hedges net unrealized (losses) gains |

10,493 | (20,787) | (43,705) | |||||||||||||||||||||||

Foreign currency translation adjustments |

(23,333) | (22,321) | (17,517) | |||||||||||||||||||||||

Total accumulated other comprehensive loss |

(495,015) | (585,260) | (662,733) | |||||||||||||||||||||||

| Stockholders’ equity | (a) | $ | 7,929,465 | $ | 7,723,054 | $ | 7,023,232 | |||||||||||||||||||

| Less: Goodwill | (465,697) | (465,697) | (465,697) | |||||||||||||||||||||||

| Mortgage servicing assets | (4,940) | (5,234) | (6,234) | |||||||||||||||||||||||

| Tangible book value | (b) | $ | 7,458,828 | $ | 7,252,123 | $ | 6,551,301 | |||||||||||||||||||

| Number of common shares at period-end | (c) | 137,802 | 138,437 | 139,121 | ||||||||||||||||||||||

| Book value per share | (a)/(c) | $ | 57.54 | $ | 55.79 | $ | 50.48 | |||||||||||||||||||

| Tangible book value per share | (b)/(c) | $ | 54.13 | $ | 52.39 | $ | 47.09 | |||||||||||||||||||

| Total assets | (d) | $ | 76,165,013 | $ | 75,976,475 | $ | 70,875,670 | |||||||||||||||||||

| Less: Goodwill | (465,697) | (465,697) | (465,697) | |||||||||||||||||||||||

| Mortgage servicing assets | (4,940) | (5,234) | (6,234) | |||||||||||||||||||||||

| Tangible assets | (e) | $ | 75,694,376 | $ | 75,505,544 | $ | 70,403,739 | |||||||||||||||||||

| Total stockholders’ equity to assets ratio | (a)/(d) | 10.41 | % | 10.17 | % | 9.91 | % | |||||||||||||||||||

| TCE ratio | (b)/(e) | 9.85 | % | 9.60 | % | 9.31 | % | |||||||||||||||||||

Return on average TCE represents tangible net income divided by average tangible book value. Tangible net income excludes the after-tax impacts of the amortization of core deposit intangibles and mortgage servicing assets. Given that the use of such measures and ratios is more prevalent in the banking industry, and are used by banking regulators and analysts, the Company has included them below for discussion. | ||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||

| March 31, 2025 | December 31, 2024 | March 31, 2024 | ||||||||||||||||||||||||

| Net income | (f) |

$ | 290,270 | $ | 293,115 | $ | 285,075 | |||||||||||||||||||

| Add: Amortization of mortgage servicing assets | 293 | 334 | 308 | |||||||||||||||||||||||

Tax effect of amortization adjustments (1) |

(87) | (99) | (91) | |||||||||||||||||||||||

| Tangible net income | (g) |

$ | 290,476 | $ | 293,350 | $ | 285,292 | |||||||||||||||||||

| Average stockholders’ equity | (h) |

$ | 7,869,074 | $ | 7,731,324 | $ | 6,992,558 | |||||||||||||||||||

| Less: Average goodwill | (465,697) | (465,697) | (465,697) | |||||||||||||||||||||||

| Average mortgage servicing assets | (5,120) | (5,445) | (6,473) | |||||||||||||||||||||||

| Average tangible book value | (i) |

$ | 7,398,257 | $ | 7,260,182 | $ | 6,520,388 | |||||||||||||||||||

Return on average common equity (2) |

(f)/(h) | 14.96 | % | 15.08 | % | 16.40 | % | |||||||||||||||||||

Return on average TCE (2) |

(g)/(i) | 15.92 | % | 16.07 | % | 17.60 | % | |||||||||||||||||||