false2024FY0001771910P5Yhttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrentP16M22DP28M22Dhttp://fasb.org/us-gaap/2024#CostsAndExpenseshttp://fasb.org/us-gaap/2024#CostsAndExpensesP2Yiso4217:USDxbrli:sharesiso4217:CHFxbrli:sharesiso4217:USDxbrli:sharesadc:subsidiaryadc:customerxbrli:pureadc:productadc:ageadc:participantiso4217:CHFadc:segment00017719102024-01-012024-12-3100017719102024-06-3000017719102025-03-0100017719102024-12-3100017719102023-12-310001771910us-gaap:ProductMember2024-01-012024-12-310001771910us-gaap:ProductMember2023-01-012023-12-310001771910adc:RoyaltyRevenueMember2024-01-012024-12-310001771910adc:RoyaltyRevenueMember2023-01-012023-12-3100017719102023-01-012023-12-310001771910us-gaap:CommonStockMember2022-12-310001771910us-gaap:AdditionalPaidInCapitalMember2022-12-310001771910us-gaap:TreasuryStockCommonMember2022-12-310001771910us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001771910us-gaap:RetainedEarningsMember2022-12-3100017719102022-12-310001771910us-gaap:RetainedEarningsMember2023-01-012023-12-310001771910us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001771910us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001771910us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001771910us-gaap:CommonStockMember2023-12-310001771910us-gaap:AdditionalPaidInCapitalMember2023-12-310001771910us-gaap:TreasuryStockCommonMember2023-12-310001771910us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001771910us-gaap:RetainedEarningsMember2023-12-310001771910us-gaap:RetainedEarningsMember2024-01-012024-12-310001771910us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001771910us-gaap:CommonStockMember2024-01-012024-12-310001771910us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001771910us-gaap:TreasuryStockCommonMember2024-01-012024-12-310001771910us-gaap:CommonStockMember2024-12-310001771910us-gaap:AdditionalPaidInCapitalMember2024-12-310001771910us-gaap:TreasuryStockCommonMember2024-12-310001771910us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001771910us-gaap:RetainedEarningsMember2024-12-310001771910adc:SeniorSecuredTermLoanMember2024-01-012024-12-310001771910adc:SeniorSecuredTermLoanMember2023-01-012023-12-310001771910adc:TopFourCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:FinanceReceivablesMember2024-01-012024-12-310001771910adc:TopFourCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:FinanceReceivablesMember2023-01-012023-12-310001771910currency:GBP2024-12-310001771910currency:GBP2023-12-310001771910currency:GBP2024-01-012024-12-310001771910currency:GBP2023-01-012023-12-310001771910srt:MinimumMember2024-01-012024-12-310001771910srt:MaximumMember2024-01-012024-12-310001771910srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2024-12-310001771910srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2024-12-310001771910adc:LaboratoryEquipmentMember2024-12-310001771910us-gaap:OfficeEquipmentMember2024-12-310001771910adc:HardwareAndSoftwareMember2024-12-310001771910country:CH2024-12-310001771910country:CH2023-12-310001771910country:GB2024-12-310001771910country:GB2023-12-310001771910country:US2024-12-310001771910country:US2023-12-310001771910us-gaap:FairValueInputsLevel1Member2024-12-310001771910us-gaap:FairValueInputsLevel2Member2024-12-310001771910us-gaap:FairValueInputsLevel3Member2024-12-310001771910us-gaap:FairValueInputsLevel1Member2023-12-310001771910us-gaap:FairValueInputsLevel2Member2023-12-310001771910us-gaap:FairValueInputsLevel3Member2023-12-310001771910us-gaap:LeaseholdImprovementsMember2024-12-310001771910us-gaap:LeaseholdImprovementsMember2023-12-310001771910adc:LaboratoryEquipmentMember2023-12-310001771910us-gaap:OfficeEquipmentMember2023-12-310001771910adc:HardwareAndSoftwareMember2023-12-310001771910country:CH2023-09-010001771910country:GB2023-01-300001771910adc:OverlandADCTBioPharmaCYLimitedMember2020-12-142020-12-140001771910adc:OverlandPharmaceuticalsMember2020-12-142020-12-140001771910adc:OverlandADCTBioPharmaMemberadc:OverlandPharmaceuticalsMember2020-12-140001771910adc:OverlandADCTBioPharmaMember2020-12-140001771910adc:OverlandADCTBioPharmaMember2020-12-140001771910adc:OverlandADCTBioPharmaCYLimitedMember2022-12-310001771910adc:OverlandADCTBioPharmaCYLimitedMember2023-01-012023-12-310001771910adc:OverlandADCTBioPharmaCYLimitedMember2023-12-310001771910adc:OverlandADCTBioPharmaCYLimitedMember2024-01-012024-12-310001771910adc:OverlandADCTBioPharmaCYLimitedMember2024-12-310001771910us-gaap:DomesticCountryMember2024-12-310001771910us-gaap:DomesticCountryMember2023-12-310001771910us-gaap:StateAndLocalJurisdictionMember2024-12-310001771910us-gaap:StateAndLocalJurisdictionMember2023-12-310001771910us-gaap:ResearchMember2024-12-310001771910us-gaap:ForeignCountryMember2024-12-310001771910adc:LoanAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-08-150001771910adc:LoanAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-08-152022-08-150001771910adc:LoanAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMemberadc:InterestRatePeriodOneMember2022-08-152022-08-150001771910adc:LoanAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMemberadc:InterestRatePeriodOneMember2022-08-152022-08-150001771910adc:LoanAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMemberadc:InterestRatePeriodTwoMember2022-08-152022-08-150001771910adc:LoanAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMemberadc:InterestRatePeriodTwoMember2022-08-152022-08-150001771910adc:LoanAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMember2022-08-150001771910adc:LoanAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMembersrt:MinimumMember2022-08-152022-08-150001771910adc:LoanAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMembersrt:MaximumMember2022-08-152022-08-150001771910adc:LoanAgreementWarrantsMember2022-08-1500017719102022-08-152022-08-1500017719102022-08-150001771910adc:LoanAgreementMember2024-01-012024-12-310001771910adc:LoanAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2023-01-012023-12-310001771910adc:LoanAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2024-12-310001771910adc:LoanAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2024-01-012024-12-310001771910adc:LoanAgreementMember2024-12-310001771910adc:DeerfieldWarrantsMember2022-08-152022-08-150001771910adc:WarrantsTrancheOneMemberadc:DeerfieldWarrantsMember2022-08-152022-08-150001771910adc:WarrantsTrancheOneMemberadc:DeerfieldWarrantsMember2022-08-150001771910adc:WarrantsTrancheTwoMemberadc:DeerfieldWarrantsMember2022-08-152022-08-150001771910adc:WarrantsTrancheTwoMemberadc:DeerfieldWarrantsMember2022-08-150001771910adc:DeerfieldWarrantsMember2022-08-150001771910adc:DeerfieldWarrantsMember2024-01-012024-12-310001771910adc:DeerfieldWarrantsMember2023-01-012023-12-310001771910adc:DeerfieldWarrantsMember2024-12-310001771910adc:DeerfieldWarrantsMember2023-12-310001771910adc:DeerfieldWarrantsMemberus-gaap:MeasurementInputExercisePriceMembersrt:MinimumMember2024-12-310001771910adc:DeerfieldWarrantsMemberus-gaap:MeasurementInputExercisePriceMembersrt:MaximumMember2024-12-310001771910adc:DeerfieldWarrantsMemberus-gaap:MeasurementInputExercisePriceMembersrt:MinimumMember2023-12-310001771910adc:DeerfieldWarrantsMemberus-gaap:MeasurementInputExercisePriceMembersrt:MaximumMember2023-12-310001771910adc:DeerfieldWarrantsMemberus-gaap:MeasurementInputSharePriceMember2024-12-310001771910adc:DeerfieldWarrantsMemberus-gaap:MeasurementInputSharePriceMember2023-12-310001771910adc:DeerfieldWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-12-310001771910adc:DeerfieldWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-310001771910adc:DeerfieldWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2024-12-310001771910adc:DeerfieldWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2023-12-310001771910us-gaap:MeasurementInputExpectedTermMember2024-12-310001771910us-gaap:MeasurementInputExpectedTermMember2023-12-310001771910adc:DeerfieldWarrantsMemberadc:MeasurementInputDividendYieldMember2024-12-310001771910adc:DeerfieldWarrantsMemberadc:MeasurementInputDividendYieldMember2023-12-310001771910adc:DeerfieldWarrantsMemberadc:MeasurementInputValueMembersrt:MinimumMember2024-12-310001771910adc:DeerfieldWarrantsMemberadc:MeasurementInputValueMembersrt:MaximumMember2024-12-310001771910adc:DeerfieldWarrantsMemberadc:MeasurementInputValueMembersrt:MinimumMember2023-12-310001771910adc:DeerfieldWarrantsMemberadc:MeasurementInputValueMembersrt:MaximumMember2023-12-310001771910adc:DeerfieldWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2024-12-310001771910adc:DeerfieldWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-12-3100017719102021-08-252021-08-250001771910adc:ZYNLONTAMember2021-08-252021-08-250001771910adc:CamiMember2021-08-252021-08-250001771910srt:MaximumMember2021-08-252021-08-250001771910srt:MaximumMember2023-01-012023-12-310001771910srt:MinimumMember2021-08-252021-08-250001771910srt:MinimumMember2023-01-012023-12-310001771910srt:MinimumMember2024-12-310001771910srt:MaximumMember2024-12-310001771910srt:MinimumMember2023-12-310001771910srt:MaximumMember2023-12-3100017719102022-01-012022-12-3100017719102021-01-012021-12-3100017719102021-08-250001771910country:US2024-01-012024-12-310001771910country:US2023-01-012023-12-310001771910us-gaap:ForeignPlanMember2024-01-012024-12-310001771910us-gaap:ForeignPlanMember2023-01-012023-12-310001771910srt:MedianMember2024-01-012024-12-310001771910adc:A2024EquityOfferingMember2024-05-012024-05-310001771910us-gaap:CommonStockMemberadc:A2024EquityOfferingMember2024-05-310001771910adc:A2024PreFundedWarrantMemberadc:A2024EquityOfferingMember2024-05-012024-05-310001771910adc:A2024EquityOfferingMember2024-05-3100017719102024-05-310001771910adc:A2024PreFundedWarrantMember2024-05-310001771910srt:MinimumMember2024-05-012024-05-310001771910srt:MaximumMember2024-05-012024-05-3100017719102024-05-012024-05-310001771910adc:PublicStockOfferingMember2024-01-012024-12-310001771910country:US2024-01-012024-12-310001771910country:US2023-01-012023-12-310001771910us-gaap:EMEAMember2024-01-012024-12-310001771910us-gaap:EMEAMember2023-01-012023-12-310001771910adc:DiscardedDrugRebateMember2022-12-310001771910adc:OtherAdjustmentsMember2022-12-310001771910adc:DiscardedDrugRebateMember2023-01-012023-12-310001771910adc:OtherAdjustmentsMember2023-01-012023-12-310001771910adc:DiscardedDrugRebateMember2023-12-310001771910adc:OtherAdjustmentsMember2023-12-310001771910adc:DiscardedDrugRebateMember2024-01-012024-12-310001771910adc:OtherAdjustmentsMember2024-01-012024-12-310001771910adc:DiscardedDrugRebateMember2024-12-310001771910adc:OtherAdjustmentsMember2024-12-310001771910adc:McKessonMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001771910adc:McKessonMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001771910adc:AmerisourceBergenCorporationMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001771910adc:AmerisourceBergenCorporationMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001771910adc:CardinalHealthMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001771910adc:CardinalHealthMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001771910adc:A2019EquityIncentivePlanMember2019-11-300001771910us-gaap:StockCompensationPlanMemberadc:A2019EquityIncentivePlanMember2024-12-310001771910adc:A2019EquityIncentivePlanMember2024-01-012024-12-310001771910adc:A2019EquityIncentivePlanMember2023-01-012023-12-310001771910adc:ConditionalShareCapitalPlanMember2019-11-300001771910us-gaap:RestrictedStockUnitsRSUMemberadc:ConditionalShareCapitalPlanMember2023-12-062023-12-060001771910us-gaap:StockCompensationPlanMemberadc:ConditionalShareCapitalPlanMember2023-12-062023-12-060001771910adc:ConditionalShareCapitalPlanMember2024-12-310001771910adc:ConditionalShareCapitalPlanMember2024-01-012024-12-310001771910adc:ConditionalShareCapitalPlanMember2023-01-012023-12-310001771910adc:InducementPlanMember2024-12-310001771910adc:InducementPlanMember2023-12-310001771910adc:InducementPlanMember2024-01-012024-12-310001771910adc:EquityExchangeProgramMember2023-03-062023-03-060001771910adc:EquityExchangeProgramMembersrt:MinimumMember2023-03-062023-03-060001771910adc:EquityExchangeProgramMembersrt:MaximumMember2023-03-062023-03-060001771910adc:EmployeeStockOptionExchangeMemberadc:EquityExchangeProgramMember2024-01-012024-12-310001771910adc:EmployeeStockOptionExchangeMemberadc:EquityExchangeProgramMember2023-03-062023-03-060001771910us-gaap:EmployeeStockOptionMember2019-11-012019-11-300001771910us-gaap:StockCompensationPlanMember2024-01-012024-12-310001771910us-gaap:StockCompensationPlanMember2023-01-012023-12-310001771910us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001771910us-gaap:EmployeeStockOptionMembersrt:MinimumMember2024-12-310001771910us-gaap:EmployeeStockOptionMembersrt:MaximumMember2024-12-310001771910us-gaap:EmployeeStockOptionMembersrt:MinimumMember2023-12-310001771910us-gaap:EmployeeStockOptionMembersrt:MaximumMember2023-12-310001771910us-gaap:EmployeeStockOptionMembersrt:MinimumMember2024-01-012024-12-310001771910us-gaap:EmployeeStockOptionMembersrt:MaximumMember2024-01-012024-12-310001771910us-gaap:EmployeeStockOptionMembersrt:MinimumMember2023-01-012023-12-310001771910us-gaap:EmployeeStockOptionMembersrt:MaximumMember2023-01-012023-12-310001771910us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001771910adc:EmployeeStockOptionExchangeMembersrt:MinimumMember2024-01-012024-12-310001771910adc:EmployeeStockOptionExchangeMembersrt:MaximumMember2024-01-012024-12-310001771910adc:EmployeeStockOptionExchangeMember2024-01-012024-12-310001771910adc:A2019EquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2019-11-012019-11-300001771910adc:A2019EquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMembersrt:MaximumMember2019-11-012019-11-300001771910us-gaap:RestrictedStockUnitsRSUMemberadc:A2019EquityIncentivePlanMember2024-01-012024-12-310001771910us-gaap:RestrictedStockUnitsRSUMemberadc:A2019EquityIncentivePlanMember2023-01-012023-12-310001771910us-gaap:RestrictedStockUnitsRSUMember2022-12-310001771910us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001771910us-gaap:RestrictedStockUnitsRSUMember2023-12-310001771910us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001771910us-gaap:RestrictedStockUnitsRSUMember2024-12-310001771910us-gaap:EmployeeStockMemberadc:A2022EmployeeStockPurchasePlanMember2022-06-012022-06-300001771910adc:A2022EmployeeStockPurchasePlanMember2024-01-012024-12-310001771910adc:A2022EmployeeStockPurchasePlanMember2023-01-012023-12-310001771910us-gaap:EmployeeStockOptionMemberadc:A2019EquityIncentivePlanMember2024-01-012024-12-310001771910us-gaap:EmployeeStockOptionMemberadc:A2019EquityIncentivePlanMember2023-01-012023-12-310001771910adc:InducementPlanMember2024-01-012024-12-310001771910adc:InducementPlanMember2023-01-012023-12-310001771910us-gaap:RestrictedStockUnitsRSUMemberadc:A2019EquityIncentivePlanMember2024-01-012024-12-310001771910us-gaap:RestrictedStockUnitsRSUMemberadc:A2019EquityIncentivePlanMember2023-01-012023-12-310001771910adc:ConditionalShareCapitalPlanMember2024-01-012024-12-310001771910adc:ConditionalShareCapitalPlanMember2023-01-012023-12-310001771910us-gaap:WarrantMember2024-01-012024-12-310001771910us-gaap:WarrantMember2023-01-012023-12-310001771910adc:A2022EmployeeStockPurchasePlanMember2024-01-012024-12-310001771910adc:A2022EmployeeStockPurchasePlanMember2023-01-012023-12-310001771910adc:ReportableSegmentMember2024-01-012024-12-310001771910adc:ReportableSegmentMember2023-01-012023-12-3100017719102024-10-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

|

|

|

|

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2024 |

|

OR |

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

Commission File Number: 001-39071

ADC Therapeutics SA

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

| Switzerland |

Not Applicable |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

Biopôle

Route de la Corniche 3B

1066 Epalinges

Switzerland

(Address of principal executive offices) (Zip code)

|

+41 21 653 02 00

(Registrant’s telephone number)

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Shares, par value CHF 0.08 per share |

|

ADCT |

|

The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

| Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates, based on the closing price of the common shares on The New York Stock Exchange, as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $173.4 million.

As of March 17, 2025, the number of common shares outstanding was 99,083,838.

DOCUMENTS INCORPORATED BY REFERENCE:

ADC Therapeutics SA intends to file a definitive proxy statement pursuant to Regulation 14A relating to its 2025 Annual General Meeting within 120 days of the end of its fiscal year ended December 31, 2024. Portions of such definitive proxy statement are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent stated herein.

Table of Contents

Unless otherwise indicated or the context otherwise requires, all references in this Annual Report to “ADC Therapeutics,” “ADCT,” the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to ADC Therapeutics SA and its consolidated subsidiaries.

Trademarks

We own various trademark registrations and applications, and unregistered trademarks, including ADC Therapeutics, ADCT, ZYNLONTA and our corporate logo. All other trade names, trademarks and service marks of other companies appearing in this Annual Report are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Annual Report may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend to use or display other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Market and Industry Data

This Annual Report contains industry, market and competitive position data that are based on general and industry publications, surveys and studies conducted by third parties, some of which may not be publicly available, and our own internal estimates and research. Third-party publications, surveys and studies generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. These data involve a number of assumptions and limitations and contain projections and estimates of the future performance of the industries in which we operate that are subject to a high degree of uncertainty.

FORWARD-LOOKING STATEMENTS

This Annual Report contains statements that constitute forward-looking statements. All statements other than statements of historical facts contained in this Annual Report, including statements regarding our future catalysts, results of operations and financial position, business and commercial strategy, market opportunities, products and product candidates, research pipeline, ongoing and planned preclinical studies and clinical trials, regulatory submissions and approvals, research and development costs, projected revenues and expenses and the timing of revenues and expenses, timing and likelihood of success, as well as plans and objectives of management for future operations are forward-looking statements. Many of the forward-looking statements contained in this Annual Report can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate,” “will” and “potential,” among others.

Forward-looking statements are based on our management’s beliefs and assumptions and on information available to our management at the time such statements are made. Such statements are subject to known and unknown risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including, but not limited to:

•the substantial net losses that we have incurred since our inception, our expectation to continue to incur losses for the foreseeable future and our need to raise additional capital to fund our operations and execute our business plan;

•our indebtedness under the loan agreement and guaranty (the “Loan Agreement”) with certain affiliates and/or funds managed by each of Oaktree Capital Management, L.P. and Owl Rock Capital Advisors LLC, as lenders, and Blue Owl Opportunistic Master Fund I, L.P., as administrative agent, and the associated restrictive covenants thereunder;

•the purchase and sale agreement (the “HCR Agreement”) with certain entities managed by HealthCare Royalty Management, LLC (“HCR”) and its negative effect on the amount of cash that we are able to generate from sales of, and licensing agreements involving, ZYNLONTA and on our attractiveness as an acquisition target;

•our ability to complete clinical trials on expected timelines, if at all;

•the timing, outcome and results of ongoing or planned clinical trials and the sufficiency of such results;

•undesirable side effects or adverse events of our products and product candidates;

•our and our partners’ ability to obtain and maintain regulatory approval for our product and product candidates;

•our and our partners’ ability to successfully commercialize our products;

•the availability and scope of coverage and reimbursement for our products;

•the complexity and difficulty of manufacturing our products and product candidates;

•the substantial competition in our industry, including new technologies and therapies;

•our ability to continue to fund, or enter into collaborative or partnership arrangements for our research programs, and the timing, results and future clinical outcomes of such research programs;

•our reliance on third parties for preclinical studies and clinical trials and for the manufacture, production, storage and distribution of our products and product candidates and certain commercialization activities for our products;

•our ability to obtain, maintain and protect our intellectual property rights and our ability to operate our business without infringing on the intellectual property rights of others;

•our estimates regarding future revenue, expenses, liquidity, capital resources and needs for additional financing;

•the size and growth potential of the markets for our products and product candidates

•potential product liability lawsuits and product recalls for our products;

•and those identified in the “Item 1A. Risk Factors” section of this Annual Report and in our other reports filed with the U.S. Securities and Exchange Commission (the “SEC”), from time to time hereafter

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements, whether as a result of any new information, future events, changed circumstances or otherwise.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

PART I

Item 1. Business

Overview

ADC Therapeutics is a commercial-stage global pioneer in the field of antibody drug conjugates (“ADCs”). The Company is advancing its proprietary ADC technology with the goal of transforming the cancer treatment paradigm for patients with hematologic malignancies and solid tumors. We have a validated and differentiated technology platform with multiple payloads, linkers and conjugation chemistry, enabling the design of next-generation potent ADCs with an enhanced therapeutic index. We are seeking to expand the label for our FDA-approved and marketed product, ZYNLONTA® (loncastuximab tesirine) into new indications and earlier lines of therapy while pursuing our early-stage solid tumor programs. We leverage our scientific and technical expertise and apply a disciplined approach to target selection to expand and advance our pipeline. Our portfolio of ADCs utilizes our highly potent pyrrolobenzodiazepine (“PBD”) payload, a differentiated exatecan-based payload with a novel hydrophilic linker and a next generation ADC toolbox.

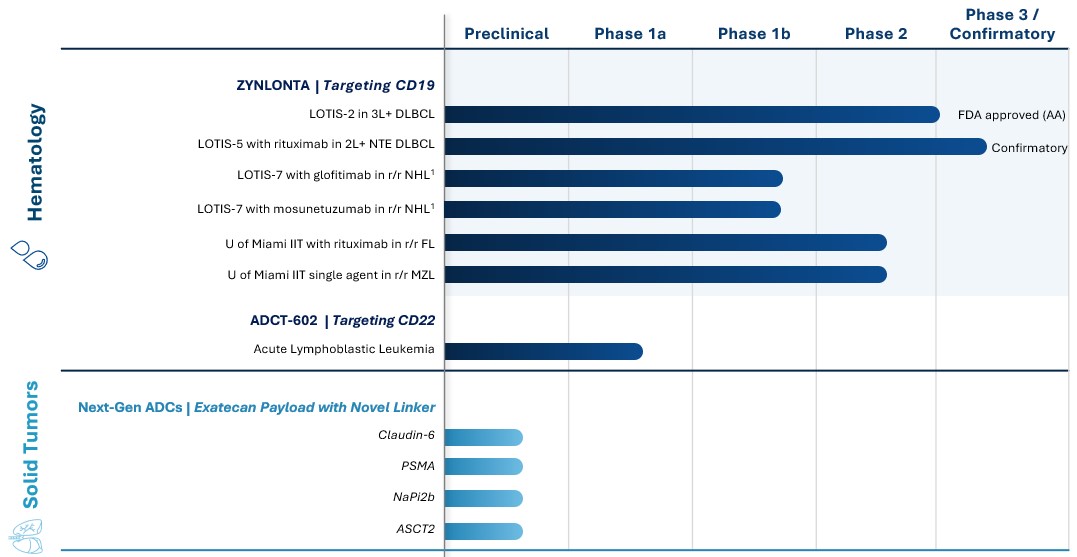

In our hematology program, our flagship product, ZYNLONTA, a CD19-directed ADC, received accelerated approval from the U.S. Food and Drug Administration (“FDA”), conditional approval from the European Commission and conditional approval from the China National Medical Products Administration (“NMPA”) for the treatment of relapsed or refractory diffuse large B-cell lymphoma (“DLBCL”) after two or more lines of systemic therapy. We are seeking to continue expanding ZYNLONTA internationally, and into earlier lines of DLBCL and indolent lymphomas, including marginal zone lymphoma (“MZL”) and follicular lymphoma (“FL”), as a single agent and in combination through our LOTIS-5 confirmatory Phase 3 clinical trial and LOTIS-7 Phase 1b clinical trial as well as through investigator-initiated trials (“IITs”) at leading institutions. In addition, we are investigating a CD-22 targeted compound, ADCT-602, in collaboration with the MD Anderson Cancer Center in a Phase 1/2 IIT in relapsed or refractory B-cell acute lymphoblastic leukemia.

In solid tumors, we have early-stage preclinical research programs, including a portfolio of next-generation investigational ADCs targeting Claudin-6, PSMA, NaPi2b, and ASCT2, the most advanced of which are PSMA and Claudin-6. In addition, we are advancing research with a range of payloads, linkers and conjugation technologies against undisclosed targets. The Company is seeking strategic partnerships, collaborations or license arrangements to continue to fund these and other programs.

Strategy

Our goal is to be a leading ADC company that transforms the lives of those impacted by cancer. To achieve this, we are focused on unlocking the potential value of our robust ADC portfolio across two pillars of growth: maximizing the ZYNLONTA opportunity in hematology and pursuing our early-stage research portfolio in solid tumors.

We aim to expand our portfolio and accelerate the development of our pipeline through targeted investments and in collaboration with strategic partners. In this way, we plan to pursue multiple targets in parallel, enabling us to prioritize and ensure disciplined capital allocation strategy while advancing the most promising candidates in both hematology and solid tumors.

Hematology

In our hematology program, our strategy is to maximize and expand the ZYNLONTA opportunity in several ways:

•Maximize ZYNLONTA in third-line plus (“3L+”) DLBCL. We are driving utilization of ZYNLONTA in the 3L+ setting of DLBCL through increased awareness of ZYNLONTA’s efficacy and manageable safety profile and its suitability for use across treatment settings.

•Seek to expand ZYNLONTA into earlier lines of DLBCL and indolent lymphomas as a single agent and in combination with other therapies. We are studying the potential to move ZYNLONTA into earlier lines of therapy in combination with rituximab (LOTIS-5), glofitamab (LOTIS-7) and other novel combinations through our clinical trials and IITs. We believe these development efforts, if successful, will enable ZYNLONTA to move into earlier lines of treatment and potentially become a combination agent of choice in the 2L+ setting, increasing ZYNLONTA’s overall market opportunity.

•Continue to advance the development and commercialization of ZYNLONTA outside of the United States through strategic partnerships. We are committed to providing global access to ZYNLONTA for patients who may benefit from this treatment. In Europe, ZYNLONTA has received conditional approval from the European Commission for the treatment of relapsed or refractory DLBCL after two or more lines of systemic therapy. In China, we have received conditional approval for relapsed or refractory DLBCL after two or more lines of systemic therapy. We have entered into strategic agreements to maximize the commercial potential of ZYNLONTA, including an exclusive license agreement with Mitsubishi Tanabe Corporation (“MTPC”) in Japan, and a joint venture with Overland Pharmaceuticals in China (including Hong Kong and Macau), Singapore, and Taiwan, and an exclusive license agreement with Sobi for all other regions, excluding the U.S. In China, we and the joint venture are exploring commercialization options for ZYNLONTA. In Japan, MTPC is undertaking a Phase 1/2 bridging study and joined the LOTIS-5 confirmatory Phase 3 clinical trial.

We are also developing ADCT-602 targeting CD22 in collaboration with the MD Anderson Cancer Center for patients with relapsed or refractory acute lymphoblastic leukemia. We are currently in dose escalation with ADCT-602 and evaluating the 75 µg/kg dose.

Solid Tumors

In solid tumors, our strategy is to pursue multiple exatecan-based ADC pre-clinical candidates in parallel. We seek to maximize the value of our solid tumor program through strategic partnerships, collaborations and licenses for one or more research programs. Specifically, we seek to:

•Broaden and advance our ADC platform. We are advancing a portfolio of investigational ADCs including those targeting Claudin-6, PSMA, NaPi2b, and ASCT2, the most advanced of which are PSMA and Claudin-6. These candidates are based on an innovative proprietary approach that utilizes exatecan with a novel hydrophilic linker as a highly potent and differentiated payload. We are leveraging our decade-long expertise in the ADC field with multiple INDs and a proven track record of success to continue building this toolbox with new antibody formats, linkers and toxins while advancing a range of payloads, linkers and conjugation technologies against multiple targets to develop differentiated next-generation assets.

Our Competitive Capabilities

We are a pioneer and leader in the ADC field with specialized end-to-end capabilities for developing optimized ADCs. This includes a strong, integrated research & development organization and a validated technology platform with clinical-stage product candidates currently in the pipeline, multiple next-generation ADCs being developed and a proven executional track record that includes ZYNLONTA, the first PBD-based ADC receiving accelerated approval from the FDA, conditional approval from the European Commission and conditional approval from the NMPA in China for the treatment of relapsed or refractory DLBCL after two or more lines of systemic therapy.

Our executive leadership team is comprised of seasoned industry veterans with a history of proven expertise in biopharma from preclinical research and development to drug approval and commercialization.

Since the company was founded in 2011, ADC Therapeutics has significantly invested in all the core capabilities required for the design, preclinical and clinical development and manufacturing of novel ADCs. In the discovery stage, we utilize cutting-edge research to select optimal targeting moiety, linker and payload. The intersection of our technical capabilities, integrated organization and depth of experience allows us to move efficiently through preclinical development into the clinic in pursuit of therapeutic window, if needed in biomarker enriched patient populations. Further, our robust in-house chemistry, manufacturing and controls (“CMC”) capabilities utilize a highly experienced workforce to manage a top-tier external manufacturing network through third-party contract manufacturing organizations (“CMOs”) capable of manufacturing highly potent molecules and complex biologics.

Our Technology Platform and Key Strengths of ADCs

ADCs are an established therapeutic approach in oncology. ADCs selectively deliver potent cytotoxins directly to tumor cells, with the goal of maximizing activity in tumor cells while minimizing toxicity to healthy cells. ADCs are an important part of the cancer treatment paradigm for the following reasons:

•Selective Targeting. Traditional chemotherapies are unable to distinguish between healthy cells and tumor cells and therefore have a narrow therapeutic window (i.e., the dose range that can treat disease effectively without causing unacceptable toxic side effects). In contrast, ADCs, through their use of tumor-specific antibodies, target tumor cells with greater selectivity than chemotherapies. This selective targeting allows ADCs to use potent cytotoxins at dose levels that otherwise would not be tolerated and ADCs therefore represent a highly effective treatment approach while maintaining manageable side effects.

•Wide Addressable Patient Population. ADCs represent a treatment approach that expands the treatment options available to cancer patients. Many therapies are not appropriate for certain patient populations. For example, chemotherapy may not be appropriate when the patient is too sick to tolerate or does not respond to available chemotherapeutics, stem cell transplant may not be appropriate when the patient is frail, and some novel targeted therapies such as CAR-T (i.e., a type of treatment in which a patient’s T cells are modified in the laboratory so they will attack cancer cells) may not be appropriate when there is significant comorbidity. As a result of these limitations, there remains a significant unmet medical need for patients for whom other treatment options are inappropriate or ineffective.

•Potential in Relapsed or Refractory Patients. Traditional therapies typically have limited effectiveness for patients who exhibit relapsed (i.e., the cancer returns after an initial positive response to treatment) or refractory (i.e., the cancer is resistant to treatment) disease. In contrast, some ADCs have proven efficacious in such patient populations while maintaining a manageable safety profile. Therefore, ADCs represent an important part of the cancer treatment paradigm, expanding the treatment options available to patients suffering from relapsed or refractory disease.

ADC Design

An ADC consists of three components: (i) an antibody that selectively targets a distinct antigen preferentially expressed on tumor cells; (ii) a cytotoxic molecule, often referred to as the toxin or the warhead, that kills the target cell; and (iii) a chemical linker that joins together the antibody and the warhead. The warhead and the linker are together referred to as the payload. The figure below shows the three components of an ADC.

_______________

Schematic representation of an ADC, showing its three components.

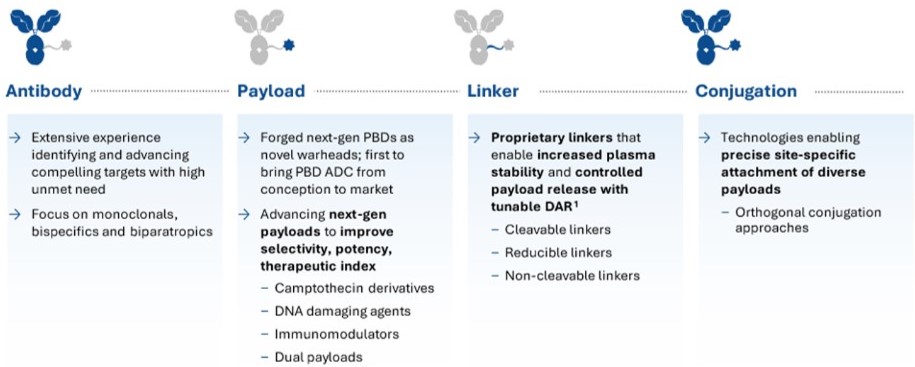

Within ADC Therapeutics, we have a strong focus on technology development with the goal of developing best-in-class ADC candidates with an optimal therapeutic window for any given tumor target. We have an expanding toolbox with a range of payloads, linkers and conjugation technologies.

Note: 1 DAR: Drug antibody ratio

Antibody

Different antibody technologies can be used to optimize targeting of the ADC to the tumor and/or to enhance uptake of the ADC into the tumor once it is bound to the target on the membrane of the tumor. Currently, while most of the ADCs in development are based on monoclonal antibody targeting, we are also exploring the use of bispecific and/or biparatopic antibodies in our ADC selection to enhance the uptake of the ADC into the tumor. We are also exploring the use of novel antibody formats in ADC design such conditionally binding antibodies. Conditionally binding antibodies bind stronger to target expressed in the more acidic local tumor environment and bind less strong to target expressed on healthy tissue which has neutral pH.

Toxins

Our current pipeline consists of multiple programs targeting hematological and solid tumor targets for which we have selected ADC candidates employing our proprietary exatecan platform or PBD dimer technology (under license from AstraZeneca). Exatecans belong to the family of camptothecins, which are naturally occurring pentacyclic quinoline alkaloids that bind to DNA topoisomerase I, inhibiting DNA relegation and finally causing apoptosis. Campothecins such as exatecan therefore possesses high cytotoxic activity against a variety of tumors. The potency of exatecan is slightly higher than DXd, the topoisomerase I inhibitor used in Enhertu® and other ADCs in clinical development such as ifinatamab deruxtecan, patritumab deruxtecan and raludotatug deruxtecan.

PBD dimers are highly potent and bind irreversibly to two guanines from opposite DNA strands in minor groove of DNA without distorting the double helix, potentially evading DNA repair mechanisms. The interstrand cross-links block DNA strand separation, disrupting essential DNA metabolic processes such as replication, and ultimately result in cell death. These interstrand cross-links persist in target cells and can lie dormant, potentially for weeks, which may contribute to the frequency and durability of responses in heavily pre-treated and primary refractory patients that we have observed in our clinical trials with PBD-based ADCs.

Both exatecans and PBD dimers cause a bystander effect, which occurs when a released warhead (from a target positive cells which has internalized and processed the ADC) is able to diffuse into and kill neighboring cells in the tumor microenvironment, irrespective of those cells’ antigen expression. Since exatecan and PBD dimers are cell-permeable, they may be able to diffuse into adjacent cells and kill them in an antigen-independent manner. Importantly, the bystander effect of exatecan has been observed to be considerably stronger than the other topoisomerase 1 inhibitor DXd. Both exatecan and PBD dimers also cause immunogenic cell death (ICD), whereby a cancer cell’s death expresses certain stress signals that induce the body’s anti-tumor immune response through the activation of T cells and antigen-presenting cells. This opens up the potential for combining our ADCs with other therapies, particularly with immuno-oncology therapies such as checkpoint inhibitors, that are specifically designed to activate the patient’s own immune system to combat cancer.

In addition to our proprietary exatecan platform and PBD dimer technology, we have access to another DNA alkylating cytotoxin which we can access under a license agreement. We are furthermore developing payloads based on immune modulators to develop immune stimulating antibody conjugates (ISACs) based on TLR7 agonists. Our ultimate objective is to have a variety of different toxins with orthogonal Mode of Action which can be used to design dual conjugate ADCs (i.e., an ADC to which two different toxins are conjugated).

Linkers

Our linker design focuses on different aspects. First, we focus on the spacer in the linker. Our proprietary exatecan platform is based on a novel hydrophilic spacer which allows conjugation of exatecan to antibodies at high drug to antibody ratio (“DAR”). Secondly, we have cleavable versus non-cleavable linker configurations. While cleavable linkers are the preferred choice if a bystander effect of the ADC is desired, in certain cases bystander activity should be avoided, which can be achieved using non-cleavable linkers. Finally, we have developed a set of branched linkers that allows us to increase the DAR or to generate ADCs with multiple toxins on a single conjugation site.

Conjugation Technologies

Depending on the desired DAR and other criteria such as the need for Fc gamma receptor binding, we can design the optimal ADC using a selection of different site-specific conjugation technologies, either enzymatic or non-enzymatic. We also have access to multiple conjugation chemistries such as classical maleimide and bio-orthogonal click chemistry and we are implementing additional proprietary approaches. We also have a variety of tools that allows us to design dual conjugate ADCs (i.e., an ADC to which two different toxins are conjugated).

Our Portfolio and Pipeline

The following table provides an overview of our current product portfolio and research pipeline:

NTE: Non-Transplant Eligible. * The ADCT-602 trial is being led by the University of Texas MD Anderson Cancer Center.

Our Market Opportunity

Hematology

ZYNLONTA (loncastuximab tesirine): ADC Targeting CD19

The Lymphoma Disease Setting

We have and continue to develop ZYNLONTA for the treatment of B-cell lymphomas, including:

•DLBCL, the most common type of lymphoma. It is an aggressive form of non-Hodgkin lymphoma (“NHL”) and accounts for 30% of all NHL cases. Approximately 32,000 people in the United States are diagnosed with DLBCL each year and the five-year prevalence for DLBCL is an estimated 113,000 patients, with approximately 70% in the first-line setting, approximately 21% in the 2L setting and approximately 9% in the 3L setting.

•Marginal zone lymphoma (“MZL”) is a rare, indolent form of NHL. MZL is the third most common NHL subtype. In the United States, the five-year prevalence for MZL is an estimated 40,000 patients, with approximately 61% in the first-line setting, approximately 27% in the 2L setting and approximately 12% in the 3L setting.

•Follicular lymphoma (“FL”), is an indolent type of NHL. In the United States, the five-year prevalence for FL is an estimated 62,000 patients, with approximately 65% in the first-line setting, approximately 24% in the 2L setting and approximately 11% in the 3L setting.

Currently, ZYNLONTA is approved for the treatment of DLBCL in the 3L+ setting. We believe that our LOTIS-5 confirmatory Phase 3 clinical trial evaluating the efficacy of ZYNLONTA and rituximab, if successful, could allow this combination to be approved for use in the 2L setting for the treatment of DLBCL. In addition, our LOTIS-7 Phase 1b clinical trial is currently evaluating ZYNLONTA in combination with glofitamab in r/r DLBCL, which could provide initial data for the safety and efficacy of this novel combination in the 2L setting and support for future development of this combination.

Advancing ZYNLONTA Development

Our flagship product, ZYNLONTA (loncastuximab tesirine) is an ADC targeting CD19-expressing cancers. It received accelerated approval from the FDA, conditional approval from the European Commission and conditional approval from the NMPA in China for the treatment of relapsed or refractory DLBCL after two or more lines of systemic therapy. We are seeking to expand ZYNLONTA into international markets throughout the world, and into earlier lines of DLBCL and other indolent lymphomas as a single agent and in combination through our LOTIS-5 and LOTIS-7 clinical trials, as well as through IITs at leading institutions. ZYNLONTA as a monotherapy has a differentiated profile. Based on data from our LOTIS-2 trial, ZYNLONTA provides rapid responses with the median time to response of 1.5 months. Responses were durable for patients with a complete response and the median duration of complete response had not yet been reached at the 2-year follow-up. ZYNLONTA has a manageable safety profile with no cytokine release syndrome (“CRS”), no Risk Evaluation and Mitigation Strategies (“REMS”) or recommendation for in-patient stay. We believe ZYNLONTA’s profile is well-positioned for patients who do not have access to more complex therapies like CAR-T and bi-specific antibodies and for patients who have progressed post CAR-T and or bi-specific antibodies.

Structure and Mechanism of Action

ZYNLONTA is composed of a humanized monoclonal antibody (RB4v1.2) directed against human CD19 and conjugated through a cathepsin-cleavable linker to SG3199, a PBD dimer cytotoxin. Once bound to a CD19-expressing cell, it is internalized by the cell, following which the warhead is released. The warhead is designed to bind irreversibly to DNA to create highly potent interstrand cross-links that block DNA strand separation, thus disrupting essential DNA metabolic processes such as replication and ultimately resulting in cell death.

The human CD19 antigen is involved in the recognition, binding and adhesion processes of cells, mediating direct interactions between surfaces of different cell types and pathogen recognition. CD19 is expressed only on B cells (i.e., a type of white blood cell that plays a significant role in protecting the body from infection by producing antibodies) throughout all stages of B cell development and differentiation. Its expression is maintained at high levels in hematologic B cell malignancies, including NHL and certain types of leukemia.

Regulatory Approval

On April 23, 2021, ZYNLONTA received accelerated approval from the FDA for the treatment of adult patients with relapsed or refractory large B-cell lymphoma after two or more lines of systemic therapy, including DLBCL not otherwise specified, DLBCL arising from low-grade lymphoma and high-grade B-cell lymphoma. Continued approval for this indication is contingent upon verification and description of clinical benefit in a confirmatory trial, which we intend to satisfy through our LOTIS-5 confirmatory Phase 3 clinical trial.

On December 20, 2022, the European Commission granted conditional marketing authorization for the use of ZYNLONTA for the treatment of relapsed or refractory DLBCL. The decision is valid in all European Union Member States, Iceland, Norway, and Liechtenstein. Continued approval for this indication is contingent upon verification of clinical benefit in a confirmatory trial, which we intend to satisfy through our LOTIS-5 confirmatory Phase 3 clinical trial.

On December 06, 2024, ZYNLONTA received conditional approval in China from the NMPA for the treatment of adult patients with relapsed or refractory large B-cell lymphoma after two or more lines of systemic therapy. This conditional approval is based on overall response rate and duration of response results from a single-arm clinical trial. The full approval for this indication will be contingent upon the results of the subsequent confirmatory randomized controlled trial. We intend to satisfy this requirement through our LOTIS-5 Phase 3 clinical trial.

Commercialization

We continue to directly commercialize ZYNLONTA in the United States through a commercial organization comprised of cross-functional employees, including marketing, sales, market access, insights and analytics, and commercial operations functions. Our field sales team calls on healthcare providers across both the academic and community settings and has the potential to cover more than 90% of the DLBCL opportunity.

Outside of the United States, we have entered into strategic agreements to maximize the commercial potential of ZYNLONTA, including an exclusive license agreement with MTPC in Japan, and a joint venture with Overland Pharmaceuticals in China (including Hong Kong and Macau), Singapore, and Taiwan, and an exclusive license agreement with Sobi for all other regions, excluding the U.S. and Japan. In Europe, ZYNLONTA has received conditional approval from the European Commission for the treatment of relapsed or refractory DLBCL after two or more lines of systemic therapy. In China, we have received conditional approval from the NMPA for relapsed or refractory DLBCL after two or more lines of systemic therapy. In China, we and the joint venture are exploring commercialization options for ZYNLONTA. In Japan, MTPC is undertaking a Phase 1/2 bridging study and joined the LOTIS-5 confirmatory Phase 3 clinical trial.

Confirmatory Phase 3 Clinical Trial (LOTIS-5)

LOTIS-5 is a Phase 3, randomized, open-label, two-part, two-arm, multi-center clinical trial of ZYNLONTA combined with rituximab compared to immunochemotherapy in patients with relapsed or refractory DLBCL. We believe that this clinical trial, if successful, will support a supplemental biologics license application (“sBLA”) for ZYNLONTA to be used as a 2L therapy for the treatment of relapsed or refractory DLBCL in transplant-ineligible patients.

Clinical Trial Design

The primary objective of the clinical trial is to evaluate the efficacy of ZYNLONTA combined with rituximab compared to standard immunochemotherapy, as measured by progression-free survival (“PFS”). The secondary endpoints of the clinical trial are overall survival (“OS”), overall response rate (“ORR”), complete response (“CR”) rate and duration of response (“DoR”) as well as frequency and severity of adverse events as well as: (i) characterize the safety profile of ZYNLONTA combined with rituximab, (ii) characterize the pharmacokinetic profile of ZYNLONTA combined with rituximab, (iii) evaluate the immunogenicity of ZYNLONTA combined with rituximab and (iv) evaluate the impact of ZYNLONTA combined with rituximab treatment on treatment-related and disease-related symptoms, patient-reported functions and overall health status.

The clinical trial enrolled patients with pathologically confirmed relapsed or refractory DLBCL who are not considered by the investigator to be a candidate for stem cell transplantation (“SCT”) and who had failed at least one multi-agent systemic treatment regimen. Enrollment was completed in 2024.

The clinical trial is being conducted in two parts: In the safety run-in, the first 20 patients were non-randomly assigned to receive ZYNLONTA in combination with rituximab to compare the combination’s toxicity against historical safety data from monotherapy clinical trials of ZYNLONTA. The randomized part of the clinical trial was initiated after the last patient in the safety run-in completed the first treatment cycle and it was observed that there were no significant increases in toxicity of the combination as compared to historical safety data of ZYNLONTA used as a monotherapy.

Patients are randomly assigned 1:1 to receive either ZYNLONTA in combination with rituximab or rituximab in combination with gemcitabine and oxaliplatin.

In August 2023, we announced updated safety run-in results from the clinical trial. The 20 patients in the safety run-in were a median age of 74.5 years and had previously received a median of five cycles of ZYNLONTA in combination with rituximab and one previous therapy. As of the April 10, 2023, data cutoff:

•Seven patients completed treatment and five continue in follow-up.

•The ORR by central review was 16/20 (80%). A total of 10/20 (50%) and 6/20 (30%) patients attained complete and partial response, respectively.

•The median DoR was 8.0 months and the median PFS was 8.3 months.

•A total of 11 (55%) patients had Grade ≥3 TEAEs. The most common Grade ≥3 TEAEs were increased gamma-glutamyltransferase (five patients (25%) and neutropenia (three patients (15%)).

Pivotal Phase 2 Clinical Trial in Relapsed or Refractory Diffuse Large B-Cell Lymphoma (LOTIS-2)

We conducted a 145-patient Phase 2, multi-center, open-label, single-arm clinical trial to evaluate the safety and efficacy of ZYNLONTA in patients with relapsed or refractory DLBCL. This trial was used as the basis to obtain accelerated approval in the U.S. and conditional approvals in Europe and China.

Clinical Trial Design

The primary objective of the clinical trial was to evaluate the efficacy of ZYNLONTA in patients with relapsed or refractory DLBCL, measured by ORR based on the 2014 Lugano Classification Criteria. The secondary objectives were to (i) further evaluate the efficacy of ZYNLONTA measured by DoR, CR rate, PFS, relapse-free survival (“RFS”) and OS, (ii) characterize the safety profile of ZYNLONTA, (iii) characterize the pharmacokinetic profile of ZYNLONTA, (iv) evaluate the immunogenicity of ZYNLONTA and (v) evaluate the impact of ZYNLONTA treatment on health-related quality of life (“HRQoL”).

The clinical trial enrolled patients with pathologically confirmed relapsed or refractory DLBCL who have previously received two or more multi-agent systemic treatment regimens. The table below presents information about the patients’ characteristics.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Patient Characteristics |

|

|

|

n=145 |

|

|

| Age, median (minimum, maximum) |

|

|

|

66 |

|

(23, 94) |

| Histology, n (%) |

|

DLBCL Not otherwise specified |

|

128 |

|

(88.3) |

| |

|

HGBCL* |

|

10 |

|

(6.9) |

| |

|

PMBCL** |

|

7 |

|

(4.8) |

| Cancer characteristic, n (%) |

|

Double-hit or triple-hit disease*** |

|

15 |

|

(10.3) |

| |

|

Double/triple expressor |

|

20 |

|

(13.8) |

| |

|

Transformed disease**** |

|

29 |

|

(20.0) |

| Disease stage*****, n (%) |

|

I-II |

|

33 |

|

(22.8) |

| |

|

III-IV |

|

112 |

|

(77.2) |

| Number of previous systemic therapies received, median (minimum, maximum) |

|

|

|

3 |

|

(2, 7) |

| Response to first-line prior systemic therapy, n (%) |

|

Relapsed |

|

99 |

|

(68.3) |

| |

|

Refractory |

|

29 |

|

(20.0) |

| Response to most recent prior systemic therapy, n (%) |

|

Relapsed |

|

44 |

|

(30.3) |

| |

|

Refractory |

|

88 |

|

(60.7) |

| Refractory to all prior systemic therapies, n (%) |

|

Yes |

|

24 |

|

(16.6) |

| |

|

No |

|

115 |

|

(79.3) |

| Prior stem cell transplant, n (%) |

|

Autologous stem cell transplant |

|

21 |

|

(14.5) |

| |

|

Allogeneic stem cell transplant |

|

2 |

|

(1.4) |

| |

|

Both autologous and allogeneic stem cell transplant |

|

1 |

|

(0.7) |

| |

|

No |

|

121 |

|

(83.4) |

_______________

Information about the patients’ characteristics. *High-grade diffuse large B-cell lymphoma. **Primary mediastinal large B-cell lymphoma. ***Double-hit or triple-hit DLBCL are rare subtypes of DLBCL characterized by two or three recurrent chromosome translocations and are generally associated with poor prognosis. ****Transformed disease is recorded for patients who had another type of lymphoma that transformed to DLBCL. *****Disease stage is determined by the location of the tumor: Stage I means that the cancer is located in a single region, usually one lymph node and the surrounding area. Stage II means that the cancer is located in two separate regions, an affected lymph node or lymphatic organ and a second affected area, and that both affected areas are confined to one side of the diaphragm; Stage III means that the cancer has spread to both sides of the diaphragm, including one organ or area near the lymph nodes or the spleen; Stage IV means diffuse or disseminated involvement of one or more extralymphatic organs, including any involvement of the liver, bone marrow, or nodular involvement of the lungs.

Clinical Trial Results

The mean number of treatment cycles received was 4.6 and the maximum number of treatment cycles received was 26.

As of March 1, 2021, the main observed safety and tolerability findings were as follows:

•Grade ≥3 TEAEs were reported in 107 patients, or 73.8% of patients. The most common Grade ≥3 TEAEs that were reported in more than 10% of patients included neutropenia (reported in 26.2% of patients), thrombocytopenia (reported in 17.9% of patients), gamma-glutamyltransferase increased (reported in 17.2% of patients) and anemia (reported in 10.3% of patients).

•Treatment-related adverse events in 27 patients, or 18.6% of patients, led to treatment discontinuation. The most common of such adverse events that led to treatment discontinuation in more than 2% of patients included gamma-glutamyltransferase increased (led to treatment discontinuation in 11.7% of patients), peripheral edema (led to treatment discontinuation in 2.8% of patients) and localized edema (led to treatment discontinuation in 2.1% of patients).

•No increase in adverse events was observed in patients aged ≥65 years compared to younger patients.

The main observed efficacy findings were as follows:

•Thirty-six patients, or 24.8% of patients, achieved a complete response and another 34 patients, or 23.4% of patients, achieved a partial response, resulting in a 48.3% ORR. The median time to first response was 41.0 days.

•ZYNLONTA’s favorable clinical activity was observed across a broad patient population in this clinical trial, including transplant eligible and ineligible patients, patients who have not responded to first-line therapy or any prior therapy, double-hit and triple-hit disease and transformed disease and patients who had received prior CD19 therapies or SCT.

•The median DoR was 13.37 months for patients who achieved a response. The median DoR was not reached for patients who achieved a complete response and was 5.68 months for patients who achieved a partial response. The median DoR observed in subgroups at high risk of poor prognosis was comparable to that observed in the overall study population.

•Sixteen patients received CD-19 directed CAR-T after receiving treatment with ZYNLONTA, with an investigator-assessed ORR of 56.3% (eight complete response and one partial response). Eleven patients received SCT as consolidation after responding to treatment with ZYNLONTA.

•The median progression free survival was 4.93 months.

•The median overall survival was 9.53 months.

Other ZYNLONTA Clinical Trials

LOTIS-7

Clinical Trial Design

LOTIS-7 is a Phase 1b global multicenter, multi-arm study in patients with relapsed or refractory B-cell non-Hodgkin lymphoma (B-NHL), including Part 1 (dose escalation) and Part 2 (dose expansion). The three dosing arms include ZYNLONTA plus polatuzumab vedotin, ZYNLONTA plus glofitamab, and ZYNLONTA plus mosunetuzumab. Part 1 of the study uses a 3+3 dose escalation in third-line(“3L”)/3L+ heavily pre-treated patients with ZYNLONTA doses starting at 90 µg/kg and then proceeding to 120 µg/kg and 150 µg/kg. Part 2 currently includes dose expansion in second-line (“2L”)/second-line plus (“2L+”) large B-cell lymphoma in the ZYNLONTA plus glofitamab arm at dose levels determined from Part 1 (120 µg/kg and 150 µg/kg of ZYNLONTA plus the approved dosing of glofitamab). Primary endpoints of the study include safety and tolerability. Secondary efficacy endpoints include ORR, DOR, CRR, PFS, RFS, and OS as well as pharmacokinetics and immunogenicity.

The primary objective of the clinical trial is to characterize the safety and tolerability of loncastuximab tesirine in combination with polatuzumab vedotin, glofitamab, or mosunetuzumab, and to identify the maximum tolerated dose (“MTD”) and/or recommended dose for expansion (“RDE”) for any of the combinations.

The secondary objectives of the clinical trial are to evaluate the anti-cancer effect of loncastuximab tesirine in combination with polatuzumab vedotin, glofitamab, or mosunetuzumab, to characterize the pharmacokinetics (“PK”) profile of loncastuximab tesirine in combination with polatuzumab vedotin, glofitamab, or mosunetuzumab, and to evaluate the immunogenicity of loncastuximab tesirine, glofitamab, and mosunetuzumab, respectively.

The clinical trial is enrolling patients with relapsed or refractory B-cell NHL who have previously received two or more multi-agent systemic treatment regimens (in the dose escalation part) or who have previously received one or more multi-agent systemic treatment regimens (in the dose expansion part). The clinical trial is expected to enroll up to approximately 200 patients.

LOTIS-7 Initial Data

On December 11, 2024, we announced preliminary data from LOTIS-7, the ongoing Phase 1b global multicenter, multi-arm study in patients with relapsed or refractory B-NHL that includes Part 1 (dose escalation) and Part 2 (dose expansion). As of the November 20, 2024 cutoff date, a total of 29 B-NHL patients from Part 1 and Part 2 across all dose levels were treated and evaluated for safety and a total of 18 2L or later DLBCL patients who received dose levels of 120 μg/kg (n=9) or 150 μg/kg (n=9) of ZYNLONTA plus the bispecific antibody glofitamab (Arm E) were evaluated for efficacy. Patients had a median of two prior lines of systemic therapy.

Safety Data. No dose-limiting toxicities (“DLTs”) and no Grade 5 TEAEs were observed. The most common Grade ≥3 TEAEs occurring in 5% or more of patients were neutropenia (24% of patients), lymphopenia (7% of patients) and hypokalemia (7% of patients). No Grade ≥3 cytokine release syndrome CRS or Grade ≥3 immune effector cell-associated neurotoxicity syndrome (“ICANS”) were observed, although low-grade CRS was observed in 34.5% of patients and resolved with standard treatment and low-grade ICANS was observed in 7% of patients and fully resolved.

Efficacy Data. The ORR was 94% (17/18 patients), with 72% of patients (13/18 patients) achieving a CR and 22% of patients (4/18 patients) achieving a PR. Five patients with initial assessment of stable disease (“SD”) or partial response (“PR”) achieved CRs over time.

Of the patients who achieved a CR, 92% (12/13 patients) remained in CR as of the cutoff date. Of the patients who were treated with ZYNLONTA at the 150μg/kg dose — the FDA-approved dose for ZYNLONTA as a monotherapy for 3L or later DLBCL patients — the ORR was 100% (9/9 patients), with 78% (7/9 patients) achieving a CR and 22% (2/9 patients) achieving a PR. The encouraging anti-tumor activity was observed across patients with different numbers of lines and types of prior treatments and across different histologies.

For the LOTIS-7 clinical trial, we plan to fully enroll 20 patients per dosing arm in Part 2 of Arm E (dose levels of 120μg/kg (n=9) or 150 μg/kg (n=9) of ZYNLONTA plus glofitamab) in the first half of 2025.

Phase 2 Investor Initiated Trials (IITs)

On December 9, 2024, we announced updated data from a Phase 2 investigator-initiated clinical trial IIT evaluating ZYNLONTA in combination with rituximab for relapsed or refractory FL and data from a Phase 2 IIT evaluating ZYNLONTA for relapsed or refractory MZL were presented at the 66th American Society of Hematology (“ASH”) Annual Meeting and Exposition. Both IITs were conducted at the Sylvester Comprehensive Cancer Center at the University of Miami Miller School of Medicine.

Marginal Zone Lymphoma

The IIT evaluated ZYNLONTA as monotherapy in patients with relapsed or refractory MZL. As of the October 15, 2024 data cutoff, 23 patients were evaluated for safety and efficacy. Patients had a median of two prior lines of systemic therapy. According to the poster presentations at ASH:

Safety Data. No Grade 5 TEAEs were observed. The most common Grade ≥3 TEAEs occurring in 5% or more of patients were neutropenia (17% of patients), increased alkaline phosphatase (13% of patients) and increased alanine minotransferase (13% of patients).

Efficacy Data. The ORR was 91% (21/23 patients), with 70% of patients (16/23 patients) achieving a CR and 22% of patients (5/23 patients) achieving a PR. Of POD24 patients, 64% of such patients (7/11 patients) achieved a CR, including one patient who progressed after CAR-T. The 18-month duration of response DOR was 61%, and the estimated 12-month PFS was 92%. With a median follow-up duration of 11.5 months, of the patients who received a CR, all but one patient maintained a CR as of the cutoff date, and the median 18-month DOR was 67%.

Follicular Lymphoma

The IIT evaluated ZYNLONTA in combination with rituximab in patients with relapsed or refractory FL presenting high-disease burden as defined by GELF criteria or disease progression within 24 months (“POD24”) at enrollment. As of the September 13, 2024 data cutoff, the trial enrolled 39 patients, all of whom were evaluated for safety and 35 of whom were evaluated for efficacy. Patients had a median of one prior line of systemic therapy. According to the presentation at ASH:

Safety Data. No Grade 5 TEAEs were observed. The most common Grade ≥3 TEAEs occurring in 5% or more of patients were lymphopenia (21% of patients) and neutropenia (13% of patients). Four patients experienced treatment-related serious adverse events.

Efficacy Data. The ORR was 97% (38/39 patients), with 77% of patients (30/39 patients) achieving a complete response (“CR”) and 24% of patients (8/39 patients) achieving a PR. Of POD24 patients, 85% of such patients (17/20 patients) achieved a CR. After a median follow-up duration of 15.6 months, the median PFS was not reached and the 12-month PFS was 95%.

The data were selected for an oral presentation at ASH and simultaneously published in the December issue of The Lancet Haematology.

LOTIS-10

LOTIS-10 is a Phase 1b open-label, multi-center study to evaluate the safety, pharmacokinetics and anti-cancer activity of ZYNLONTA in patients with relapsed or refractory DLBCL or high-grade B-cell lymphoma (“HGBCL”) with hepatic impairment. The primary objective of the clinical trial is to determine the recommended dosing regimen of loncastuximab

tesirine in DLBCL or HGBCL patients with moderate and severe hepatic impairment. The secondary objectives of the clinical trial are to characterize the PK profile, safety and tolerability of loncastuximab tesirine in patients with hepatic impairment, and to evaluate the antitumor activity and the immunogenicity of loncastuximab tesirine in patients with hepatic impairment.

The clinical trial is enrolling patients with relapsed or refractory DLBCL or HGBCL with hepatic impairment. The clinical trial is expected to enroll approximately 56 patients.

Pediatric Trial

‘Glo-BNHL’ is an international multi-center, adaptive, platform trial of novel agents in pediatric and adolescent relapsed or refractory B-cell NHL. The primary objective of the clinical trial is to estimate the clinical efficacy of the specific treatment in patients with r/r B-NHL in either first relapse or subsequent relapse. The secondary objectives of the clinical trial are to assess the safety profile of the novel agent in children, adolescents, and young adults and to confirm the pharmacokinetics of the novel agent at the recommended trial dose in children, adolescents, and young adults, where relevant. The clinical trial is enrolling children, adolescents and young adults with relapsed or refractory B-cell NHL. The initial target sample size is 15 evaluable patients in each treatment arm or relevant sub-group, with additional patients to be added pending results from the no/no go decision from the initial 15 patients results.

The clinical trial consists of three arms: bispecific antibody (Arm A); ADC with standard chemotherapy (Arm B); and CAR-T (Arm C). Novel agents are selected for inclusion in the platform according to an overarching prioritization list and a robust systematic scientific assessment of each proposed asset. ZYNLONTA was selected for study in Arm B in combination with modified R-ICE (rituximab, ifosfamide, carboplatin and etoposide) chemotherapy to estimate the clinical efficacy of the combination in patients with relapsed or refractory B-cell NHL in first (only one prior line of therapy) or subsequent relapse (more than one prior line of therapy).

ADCT-602: PBD-Based ADC Targeting CD22

The Acute Lymphoblastic Leukemia Disease Setting

Acute lymphoblastic leukemia (“ALL”) is a rare form of blood cancer with an annual incidence of ~6,000. Adults make-up ~50% of ALL patients. The five-year survival rate is 71%; however, it declines significantly with age. Allogeneic transplant is the standard of care for patients who are relapsed or refractory to induction therapy. Achieving a response without toxicities which can prevent a patient’s ability to get to an allogeneic transplant is an area of unmet need. We are developing ADCT-602 (CD22) in this area of high unmet medical need.

Structure and Mechanism of Action

ADCT-602 (CD22) is composed of a humanized monoclonal antibody (hLL2-C220) directed against human CD22 and conjugated through a cathepsin-cleavable linker to SG3199, a PBD dimer cytotoxin. Once bound to a CD22-expressing cell, it is internalized by the cell, following which the warhead is released. The warhead is designed to bind irreversibly to DNA to create highly potent interstrand cross-links that block DNA strand separation, thus disrupting essential DNA metabolic processes such as replication and ultimately resulting in cell death. The human CD22 antigen plays a pivotal role in the recognition, binding and adhesion processes of cells. CD22 is only expressed on B cells throughout all stages of B cell development and differentiation. Its expression is maintained in high levels in hematological B cell malignancies, including in NHL and certain types of leukemia, including B-cell ALL.

Phase 1/2 Clinical Trial in Relapsed or Refractory Acute Lymphoblastic Leukemia

Pursuant to our collaboration agreement with MD Anderson Cancer Center, a Phase 1/2, open-label, dose escalation and dose expansion clinical trial of the safety and anti-tumor activity of ADCT-602 (CD22), used as monotherapy, in patients with relapsed or refractory ALL is progressing and additional clinical trial sites are being added to accelerate enrollment.

The primary objectives of the dose escalation stage are to (i) evaluate the safety and tolerability, and determine, as appropriate, the MTD of ADCT-602 (CD22) in patients with relapsed or refractory ALL and (ii) determine the recommended dose(s) of ADCT-602 (CD22) for the dose expansion stage. The primary objective of the dose expansion stage is to evaluate the efficacy of ADCT-602 (CD22) at the dose level(s) recommended from the results of the dose escalation stage. The secondary objectives of the clinical trial are to (i) evaluate the clinical activity of ADCT-602 (CD22), as measured by ORR, DoR, OS and PFS, (ii) characterize the pharmacokinetic profile of ADCT-602 and the free warhead SG3199, (iii) evaluate the immunogenicity of ADCT-602 (CD22) and (iv) characterize the effect of ADCT-602 (CD22) exposure on the QT interval.

The clinical trial is enrolling patients with pathologically confirmed relapsed or refractory B-ALL and patients with pathologically confirmed relapsed or refractory Ph+ ALL who have failed either first- or second-generation tyrosine kinase inhibitor. The clinical trial is expected to enroll approximately 65 patients.

As presented at ASH 2022 (data cutoff July 2022), 21 patients have been treated with ADCT-602 (CD22). We observed that ADCT-602 (CD22) was well tolerated with one DLT of prolonged myelosuppression. Four patients achieved MRD-negative remission, including two of six patients at the 50 µg/kg weekly dose level. One additional patient at 50 µg/kg weekly dose level had marrow blast clearance without count recovery.

Solid Tumors:

The Solid Tumor Disease Setting

There are many different types of solid tumors and they account for the majority of cancers. Some of the most commonly diagnosed solid tumor cancers include lung cancer and prostate cancer. There were an estimated ~200,000 new cases of non-small cell lung cancer and ~274,000 new cases of prostate cancer in the United States. The prognosis and treatment of solid tumor cancers vary based on the type of cancer.

Despite recent significant advances in the treatment of some solid tumor cancers, there remains a high medical need for novel therapies.

Research Strategy, Platform and Pipeline

Our solid tumor research strategy is focused on three key elements. First, we have identified areas of high unmet need that currently feature high use of chemotherapy. Second, we are pursuing targets within these tumor types that are amenable to an ADC approach. And third, we are utilizing our deep knowledge and broad toolkit to optimize the design of ADCs that fit with our first two criteria.

We have developed four lead candidates with differentiated profiles based on a novel, proprietary linker approach to tracelessly release exatecan and a high therapeutic index, which reflects the proprietary design of our ADCs: Claudin-6, PSMA, NaPi2b, and ASCT2, the most advanced of which are PSMA and Claudin-6. Details include:

Claudin-6 and NaPi2b: Preclinical studies demonstrated the Company’s novel, exatecan-based ADCs, targeting Claudin-6 and NaPi2b, were well tolerated with potent and specific in vitro and in vivo anti-tumor activity. Based on these results, we believe a Claudin-6 directed ADC and a NaPi2b directed ADC have the potential for high impact in platinum-resistant ovarian cancer and non-small cell lung cancer.

PSMA: With PSMA-PL2202, we are developing an optimized ADC directed against a validated target with high potential impact in metastatic castrate resistant prostate cancer.

ASCT2: And with ASCT2-PL2202, we are designing an optimized ADC directed against a novel target with high potential impact in many indications including - but not limited to - colorectal cancer and non-small cell lung cancer.