EXECUTION VERSION FIRST SUPPLEMENTAL INDENTURE to the INDENTURE dated as of March 20, 2025 by and among CHURCHILL NCDLC CLO-I, LLC, as Issuer and U.S. BANK TRUST COMPANY, NATIONAL ASSOCIATION, as Trustee This FIRST SUPPLEMENTAL INDENTURE dated as of March 20, 2025 (this “Supplemental Indenture”) to the Indenture (the “Original Indenture” and, as amended by this Supplemental Indenture, the “Indenture”), dated as of May 20, 2022 (the “Closing Date”), is entered into by and among Churchill NCDLC CLO-I, LLC, a Delaware limited liability company (the “Issuer”) and U.S. Bank Trust Company, National Association, as trustee (together with its successors in such capacity, the “Trustee”). Capitalized terms used but not otherwise defined herein shall have the respective meanings set forth in the blackline Indenture attached hereto as Annex A. PRELIMINARY STATEMENT WHEREAS, pursuant to Section 8.1(xii)(B)(y) of the Original Indenture, without the consent of the Holders of any Debt but with the written consent of the Collateral Manager at any time and from time to time, subject to Section 8.3 of the Original Indenture, and without an Opinion of Counsel being provided to the Issuer or the Trustee or the Loan Agent, as applicable, as to whether any Class of Debt would be materially and adversely affected thereby, (x) the Issuer and the Trustee may enter into one or more indentures supplemental to the Indenture, in form satisfactory to the Trustee and/or (y) the Issuer and the Loan Agent may enter into one or more indentures supplemental to the Loan Agreement, in a form satisfactory to the Loan Agent, in each case, in order to, at the direction of the Collateral Manager and with the consent of the Retention Holder, permit the Issuer to issue replacement securities in connection with a Refinancing in accordance with the Indenture (including, in connection with a Refinancing of all Classes of Secured Debt in full, modifications to (a) effect an extension of the end of the Reinvestment Period, (b) establish a non-call period or prohibit a future Refinancing, (c) modify the Weighted Average Life Test, (d) provide for a stated maturity of the obligations or loans or other financial arrangements issued or entered into in connection with such Refinancing that is later than the Stated Maturity of the Secured Debt, (e) effect an extension of the Stated Maturity of the Subordinated Notes or (f) any other changes to the Transaction Documents, in the case of each of BUSINESS.32633450.5

- 2 - (a) through (f), as consented to by the Collateral Manager and a Majority of the Subordinated Notes; WHEREAS, the Issuer, the Collateral Manager and the Retention Holder wish to (A) amend the Original Indenture and amend and restate the Loan Agreement, among the Issuer, U.S. Bank Trust Company, National Association, as loan agent (in such capacity, the “Loan Agent”) and as Trustee, and each of the Class A-L Lenders party thereto, dated as of the Closing Date (the “Original Loan Agreement” and, as amended and restated on the Refinancing Date, the “Amended and Restated Loan Agreement”), in each case pursuant to Sections 8.1(xii)(B)(y) and 9.2(g) of the Original Indenture, and, in the case of the Original Loan Agreement, Section 7.02(b) thereof, to effect a Refinancing of the Class A-1 Notes, the Class A-1F Notes, the Class A-L Loans, the Class B Notes, the Class C Notes and the Class D Notes (collectively, the “Redeemed Debt”) through (x) the issuance by the Applicable Issuers of the Class X Notes, the Class A-R Notes, the Class B- R Notes and additional Subordinated Notes (collectively, the “Replacement Debt”) pursuant to this Supplemental Indenture pursuant to the amended and restated class A-L-R loan agreement entered into as of March 20, 2025, by and among the Issuer, as borrower, the Class A-L-R Lenders party thereto, the Trustee and the Loan Agent (the “Loan Agreement”) and (B) make the further changes to the Indenture as indicated in Annex A hereto; WHEREAS, pursuant to Section 8.1(xii)(B)(y) of the Original Indenture, in connection with the amendments to the Original Indenture as described herein, the parties hereto wish to (A) enter into (x) the Amended and Restated Collateral Management Agreement (the “Collateral Management Agreement”), dated as of the Refinancing Date, by and between the Issuer and the Collateral Manager, (y) the Amended and Restated Collateral Administration Agreement (the “Collateral Administration Agreement”), dated as of the Refinancing Date, by and among the Issuer, the Collateral Manager, and U.S. Bank Trust Company, National Association, as collateral administrator, (z) the Amended and Restated EU/UK Retention Agreement (the “EU/UK Retention Agreement”), dated as of the Closing Date, by and among the Issuer, the Retention Holder, the Trustee and the Initial Purchaser, and (B) make any other changes to the Transaction Documents in connection with the amendment of the Original Indenture, in each case, with the consent of the Collateral Manager and the Holder of all of the Subordinated Notes; WHEREAS, the conditions set forth for entry into a supplemental indenture pursuant to Sections 8.1 and 8.3 of the Original Indenture have been satisfied; WHEREAS, the conditions set forth in Section 9.2 of the Original Indenture to the redemption by Refinancing to be effected from the proceeds of the issuance and incurrence of the Replacement Debt have been satisfied; WHEREAS, pursuant to Section 8.1(xii)(B)(y) of the Original Indenture, the Holder of 100% of the Subordinated Notes has consented to this Supplemental Indenture; NOW, THEREFORE, in consideration of the mutual agreements herein set forth, the parties agree as follows: 1. Amendments. Effective as of the date hereof upon satisfaction of the conditions set forth in Section 2 below, the Original Indenture (including the Schedules and Exhibits thereto) is

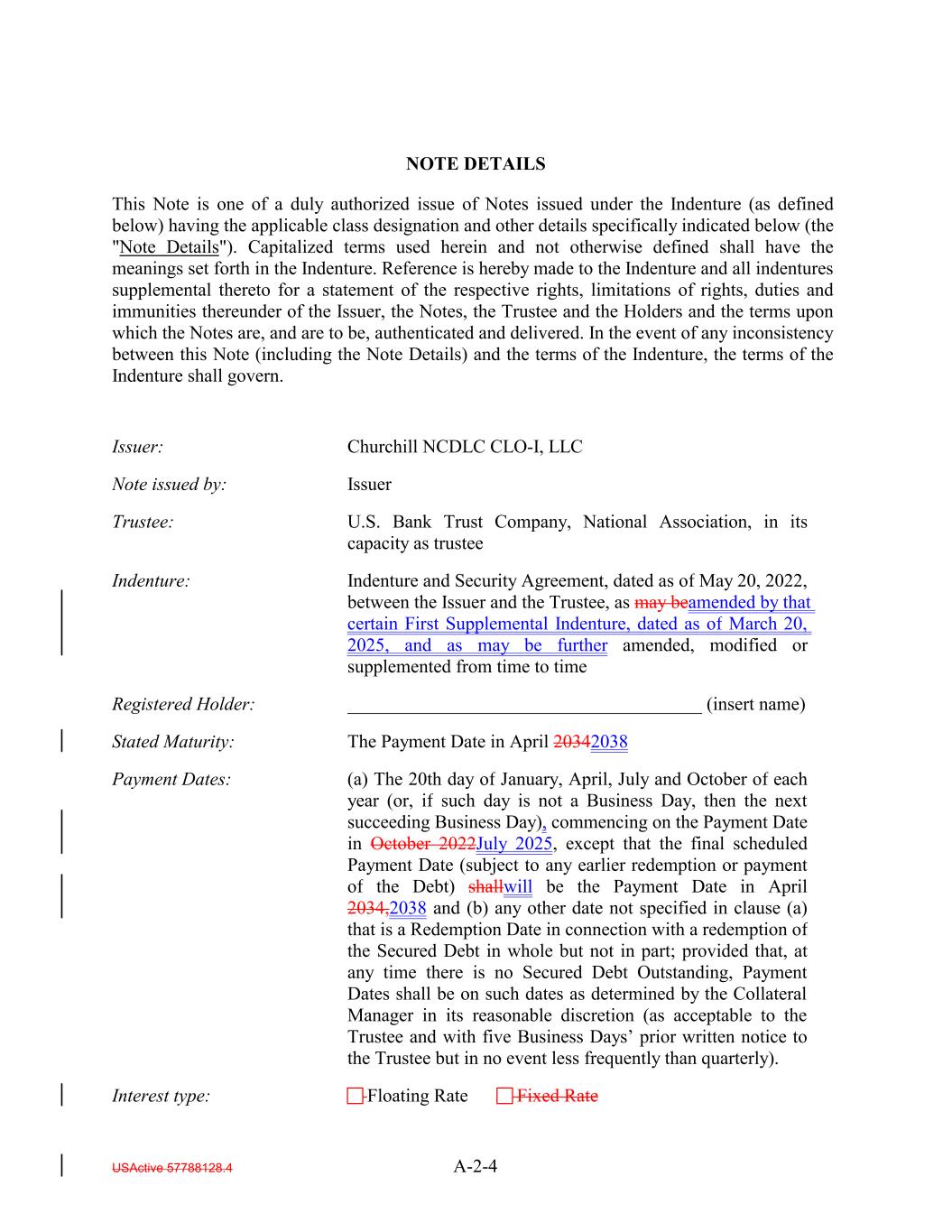

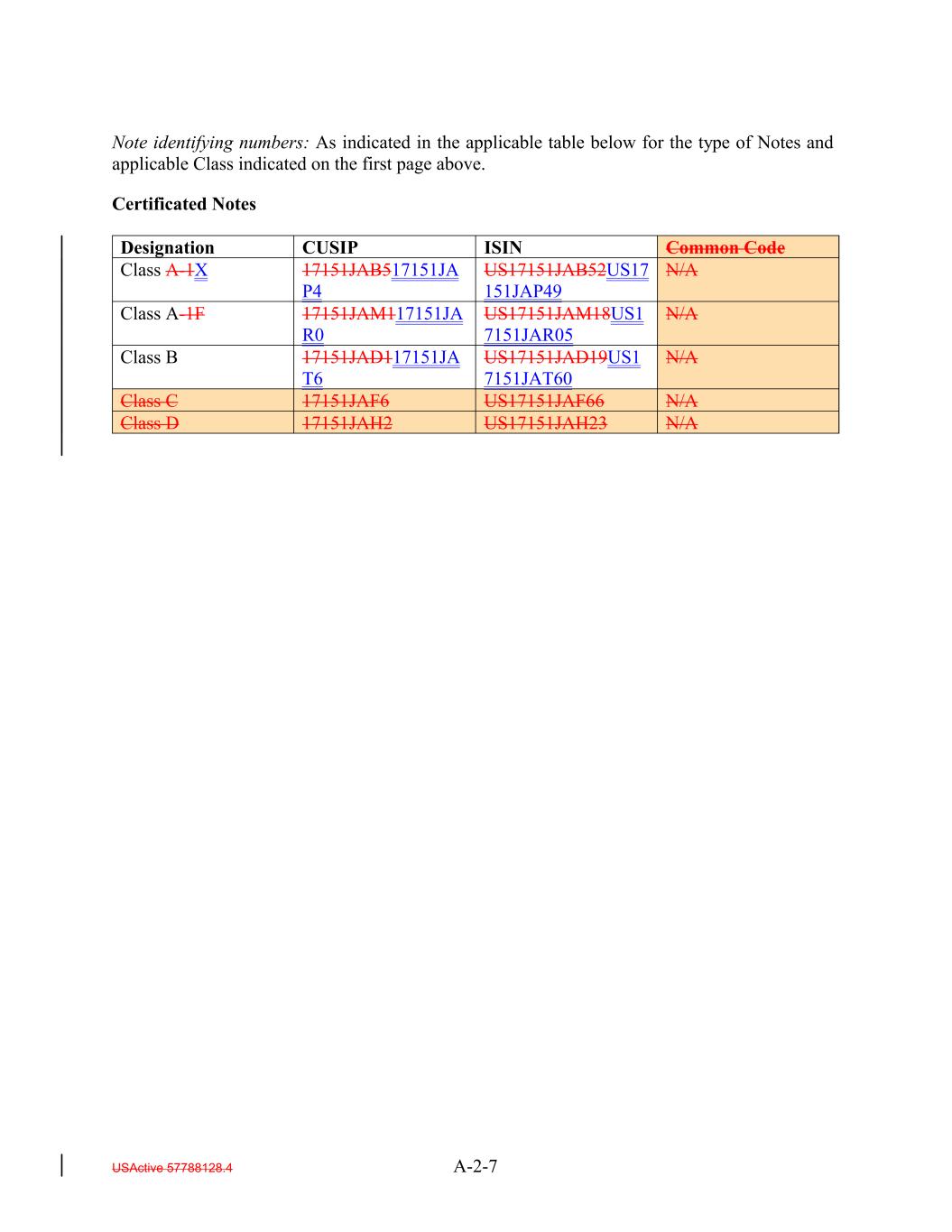

- 3 - amended pursuant to Sections 8.1(xii)(B)(y) and 9.2 of the Original Indenture, by deleting the stricken text (indicated in the same manner as the following example: stricken text) and adding the inserted text (indicated in the same manner as the following example: inserted text) as set forth on the pages of the draft Indenture attached as Annex A hereto. 2. Terms of the Replacement Debt. (a) The redemption and repayment of the Redeemed Debt and the issuance and incurrence of the Replacement Debt shall each occur on March 20, 2025 (the “Refinancing Date”). (b) The Subordinated Notes shall remain Outstanding following the Refinancing; provided that additional Subordinated Notes shall be issued in connection with the Refinancing and the Stated Maturity of the Subordinated Notes shall be extended as set forth on Annex A hereto. 3. Conditions Precedent. The modifications to be effected pursuant to Section 1 above shall become effective as of the date first written above upon receipt by the Trustee of each of the following: (i) a Responsible Officer’s certificate of the Issuer (A) evidencing the authorization by Issuer Resolution of the execution and delivery of this Supplemental Indenture, the Collateral Management Agreement, the Collateral Administration Agreement, the EU/UK Retention Agreement, the Loan Agreement, and the execution, authentication and delivery of the Replacement Debt applied for by it and specifying the Stated Maturity, principal amount and Interest Rate of each Class of Replacement Debt to be authenticated and delivered, and (B) certifying that (1) the attached copy of the Issuer Resolution is a true and complete copy thereof, (2) such Issuer Resolution has not been rescinded and is in full force and effect on and as of the Refinancing Date and (3) the Officers authorized to execute and deliver such documents hold the offices and have the signatures indicated thereon; (ii) from the Issuer either (A) a certificate of the Issuer or other official document evidencing the due authorization, approval or consent of any governmental body or bodies, at the time having jurisdiction in the premises, together with an Opinion of Counsel of the Issuer that no other authorization, approval or consent of any governmental body is required for the valid issuance or incurrence of the Replacement Debt, or (B) an Opinion of Counsel of the Issuer that no other authorization, approval or consent of any governmental body is required for the valid issuance or incurrence of such Replacement Debt except as have been given (provided that the opinions delivered pursuant to clause (iii) below may satisfy the requirement); (iii) opinions of (i) Dechert LLP, special U.S. counsel to the Issuer and the Collateral Manager, (ii) Nixon Peabody LLP, counsel to the Trustee, and (iii) Richards, Layton & Finger, P.A., Delaware counsel to the Issuer, in each case dated the Refinancing Date, in form and substance satisfactory to the Issuer; (iv) a Responsible Officer’s certificate of the Issuer stating that, to the best of the signing Responsible Officer’s knowledge, the Issuer is not in default under the Original Indenture and that the issuance and incurrence of the Replacement Debt applied for by it shall not result in a default or a breach of any of the terms, conditions or provisions of, or constitute a default under,

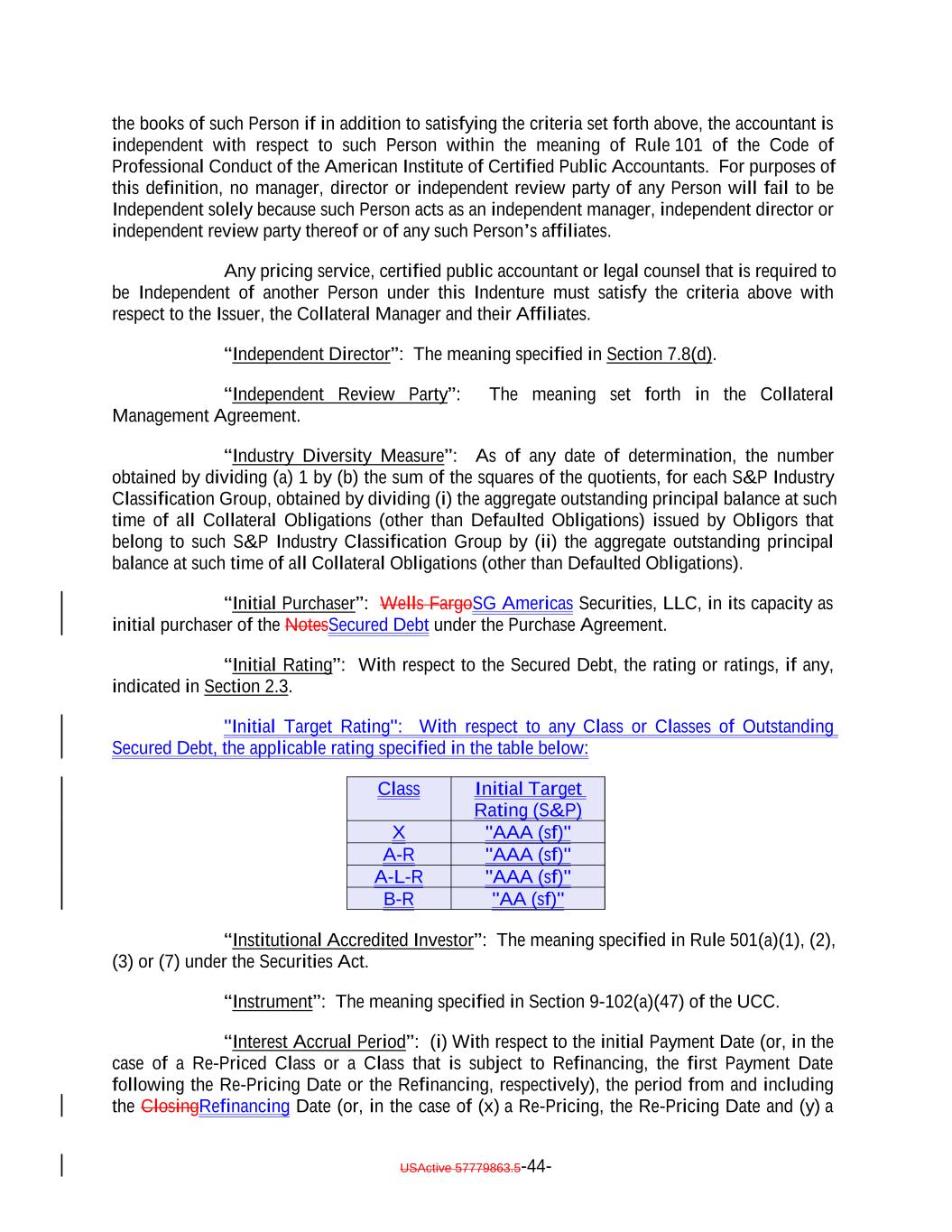

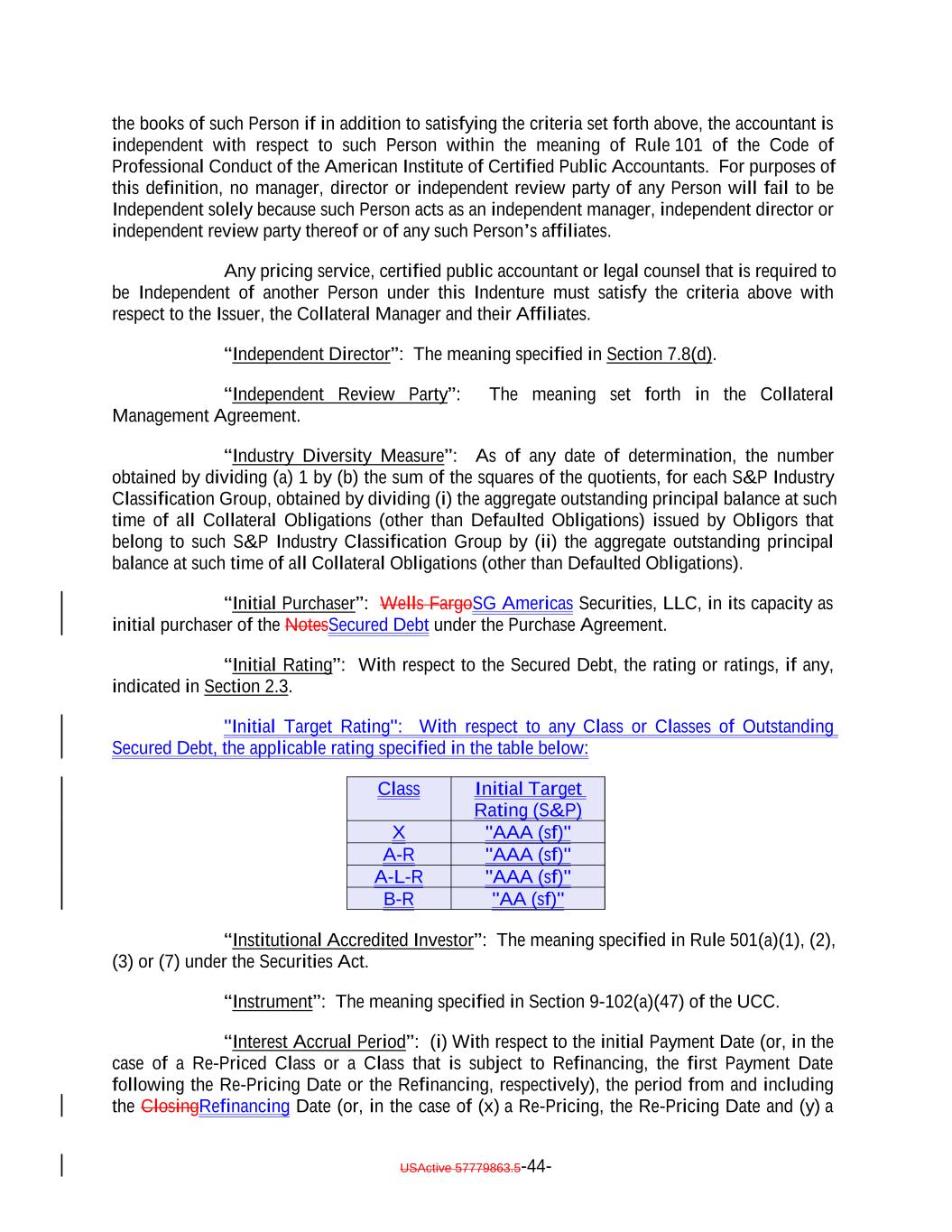

- 4 - its organizational documents, any indenture or other agreement or instrument to which it is a party or by which it is bound, or any order of any court or administrative agency entered in any Proceeding to which it is a party or by which it may be bound or to which it may be subject; that all conditions precedent provided in the Original Indenture and this Supplemental Indenture relating to the authentication and delivery of the Replacement Debt applied for by it have been complied with; that all expenses due or accrued with respect to the offering of the Replacement Debt or relating to actions taken on or in connection with the Refinancing Date have been paid or reserves therefor have been made; and, with respect to the Issuer, that all of its representations and warranties contained in the Original Indenture are true and correct as of the Refinancing Date. (v) a letter signed by each Rating Agency confirming that the Class X Notes are rated “AAA (sf)” by S&P, the Class A-R Notes are rated “AAA (sf)” by S&P, the Class A-L-R Loans are rated “AAA (sf)” by S&P and the Class B-R Notes are rated at least “AA (sf)” by S&P; and (vi) an Issuer Order by the Issuer directing the Trustee to authenticate the Replacement Debt in the amounts and names set forth therein and to apply the proceeds thereof to redeem the Redeemed Debt issued or incurred on the Closing Date at the applicable Redemption Prices therefor on the Refinancing Date. 4. Consents and Waivers. (a) Consent of the Holders of the Replacement Debt. Each Holder or beneficial owner of any Replacement Debt, by its acquisition thereof on the Refinancing Date, shall be deemed to agree to the terms of and the execution of the parties thereto, as applicable, of the Indenture including the amendments set forth in this Supplemental Indenture, the Loan Agreement, the Collateral Management Agreement, the Collateral Administration Agreement, the EU/UK Retention Agreement, and any other amendments to the Transaction Documents entered into on the Refinancing Date. (b) Consent of the Collateral Manager. The Collateral Manager hereby consents to the amendments set forth in this Supplemental Indenture, the Loan Agreement, the Collateral Management Agreement, the Collateral Administration Agreement, the EU/UK Retention Agreement, and any other amendments to the Transaction Documents entered into on the Refinancing Date. (c) Consent and Waiver of the Holder of the Subordinated Notes. The undersigned Holder of all of the Subordinated Notes hereby (i) consents to the amendments set forth in this Supplemental Indenture, the Loan Agreement, the Collateral Management Agreement, the Collateral Administration Agreement, the EU/UK Retention Agreement, and any other amendments to the Transaction Documents entered into on the Refinancing Date and (ii) waives any notice of supplemental indenture required pursuant to section 8.3(e) of the Original Indenture. (d) Consent of the Retention Holder. The Retention Holder hereby consents to the amendments set forth in this Supplemental Indenture.

- 5 - 5. Payments on the Refinancing Date. The Issuer hereby directs the Trustee to (1) first, apply the proceeds of the Refinancing Debt received on the Refinancing Date to pay the Redemption Price (without duplication of any payments received by the Holders of the Debt being redeemed pursuant to the Priority of Interest Proceeds or the Special Priority of Payments) of the Redeemed Debt in accordance with the Debt Payment Sequence; (2) second, apply any remaining proceeds of the Refinancing Debt received on the Refinancing Date to pay Administrative Expenses related to the Refinancing (regardless of the Administrative Expense Cap), including the reasonable fees, costs, charges and expenses incurred by the Trustee, the Loan Agent, the Collateral Administrator and the Collateral Manager (including reasonable attorneys’ fees and expenses) in accordance with Section 9.2(e) of the Indenture and (3) third, acquire additional Collateral Obligations from the Retention Holder pursuant to the Master Transfer Agreement, (4) fourth, deposit $15,835,104.45 in the Ramp-Up Account for use pursuant to Section 10.3(c) of the Indenture, (5) fifth, deposit $1,902,166.56 in the Expense Reserve Account for use pursuant to Section 10.3(d) of the Indenture, (6) sixth, deposit $0.00, in the Revolver Funding Account for use pursuant to Section 10.4 of the Indenture, (7) seventh, deposit in the Interest Collection Subaccount as Interest Proceeds or the Principal Collection Subaccount as Principal Proceeds, as directed by the Collateral Manager, any remaining proceeds of the Refinancing Debt received on the Refinancing Date, (8) eighth, apply available Interest Proceeds pursuant to Section 11.1(a)(i) of the Indenture and (9) ninth, apply all Principal Proceeds on deposit in the Principal Collection Subaccount pursuant to 11.1(a)(ii) of the Indenture. For purposes of the Distribution Report related to the Refinancing Date and the distribution of amounts on the Refinancing Date, the related Collection Period shall end on the seventh Business Day prior to the Refinancing Date (provided that, for the avoidance of doubt, the related Refinancing Proceeds shall be deemed to have been received in such Collection Period). 6. Governing Law. THIS SUPPLEMENTAL INDENTURE AND EACH NOTE AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED TO THIS AGREEMENT, THE RELATIONSHIP OF THE PARTIES, AND/OR THE INTERPRETATION AND ENFORCEMENT OF THE RIGHTS AND DUTIES OF THE PARTIES SHALL BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED IN ALL RESPECTS (WHETHER IN CONTRACT OR IN TORT) BY THE LAWS OF THE STATE OF NEW YORK WITHOUT REGARD TO CONFLICT OF LAWS. 7. Execution in Counterparts. This Supplemental Indenture may be executed in any number of counterparts, each of which so executed shall be deemed to be an original, but all such counterparts shall together constitute but one and the same instrument. Delivery of an executed counterpart of this Supplemental Indenture by electronic means (including email or telecopy) will be effective as delivery of a manually executed counterpart of this Supplemental Indenture. 8. Concerning the Trustee.

- 6 - The recitals contained in this Supplemental Indenture shall be taken as the statements of the Issuer, and the Trustee assumes no responsibility for their correctness. Except as provided in the Indenture, the Trustee shall not be responsible or accountable in any way whatsoever for or with respect to the validity, execution or sufficiency of this Supplemental Indenture and makes no representation with respect thereto. In entering into this Supplemental Indenture, the Trustee shall be entitled to the benefit of every provision of the Indenture relating to the conduct of or affecting the liability of or affording protection to the Trustee. 9. Non-Petition; Limited Recourse. The parties hereto agree to the provisions set forth in Sections 2.7(i), 5.4(d) and 13.1(c) of the Indenture, and such provisions are incorporated in this Supplemental Indenture, mutatis mutandis. 10. No Other Changes. Except as provided herein, including Annex A hereto, the Original Indenture shall remain unchanged and in full force and effect, and each reference to the Indenture and words of similar import in the Indenture, as amended hereby, shall be a reference to the Indenture as amended hereby and as the same may be further amended, supplemented and otherwise modified and in effect from time to time. This Supplemental Indenture may be used to create a conformed amended and restated Indenture for the convenience of administration by the parties hereto. 11. Execution, Delivery and Validity. The Issuer represents and warrants to the Trustee that this Supplemental Indenture has been duly and validly executed and delivered by it and constitutes its legal, valid and binding obligation, enforceable against it in accordance with its terms. 12. Binding Effect. This Supplemental Indenture shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns. 13. Direction to the Trustee. Each of the Issuer and the Collateral Manager hereby direct the Trustee to execute this Supplemental Indenture and acknowledge and agree that the Trustee will be fully protected in relying upon the foregoing direction.

[Signature Page to Supplemental Indenture] IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed and delivered by their respective proper and duly authorized officers as of the day and year first above written. CHURCHILL NCDLC CLO-I, LLC, as Issuer By: Nuveen Churchill Direct Lending Corp., its Designated Manager By: Name: Shai Vichness Title: Chief Financial Officer

[Signature Page to Supplemental Indenture] U.S. BANK TRUST COMPANY, NATIONAL ASSOCIATION, not in its individual capacity but solely as Trustee By: Name: Title: Scott DeRoss Senior Vice President

[Signature Page to Supplemental Indenture] Acknowledged and consented to: NUVEEN CHURCHILL DIRECT LENDING CORP., as Collateral Manager By: Name: Shai Vichness Title: Chief Financial Officer

[Signature Page to Supplemental Indenture] NUVEEN CHURCHILL DIRECT LENDING CORP., as Retention Holder By: Name: Shai Vichness Title: Chief Financial Officer

[Signature Page to Supplemental Indenture] NUVEEN CHURCHILL DIRECT LENDING CORP., as Holder of all of the Subordinated Notes By: Name: Shai Vichness Title: Chief Financial Officer

ANNEX A [Attached]

EXECUTION VERSION Conformed through First Supplemental Indenture, dated March 20, 2025 USActive 57779863.5 INDENTURE AND SECURITY AGREEMENT by and between CHURCHILL NCDLC CLO-I, LLC, Issuer and U.S. BANK TRUST COMPANY, NATIONAL ASSOCIATION, Trustee Dated as of May 20, 2022 BUSINESS.32619346.11

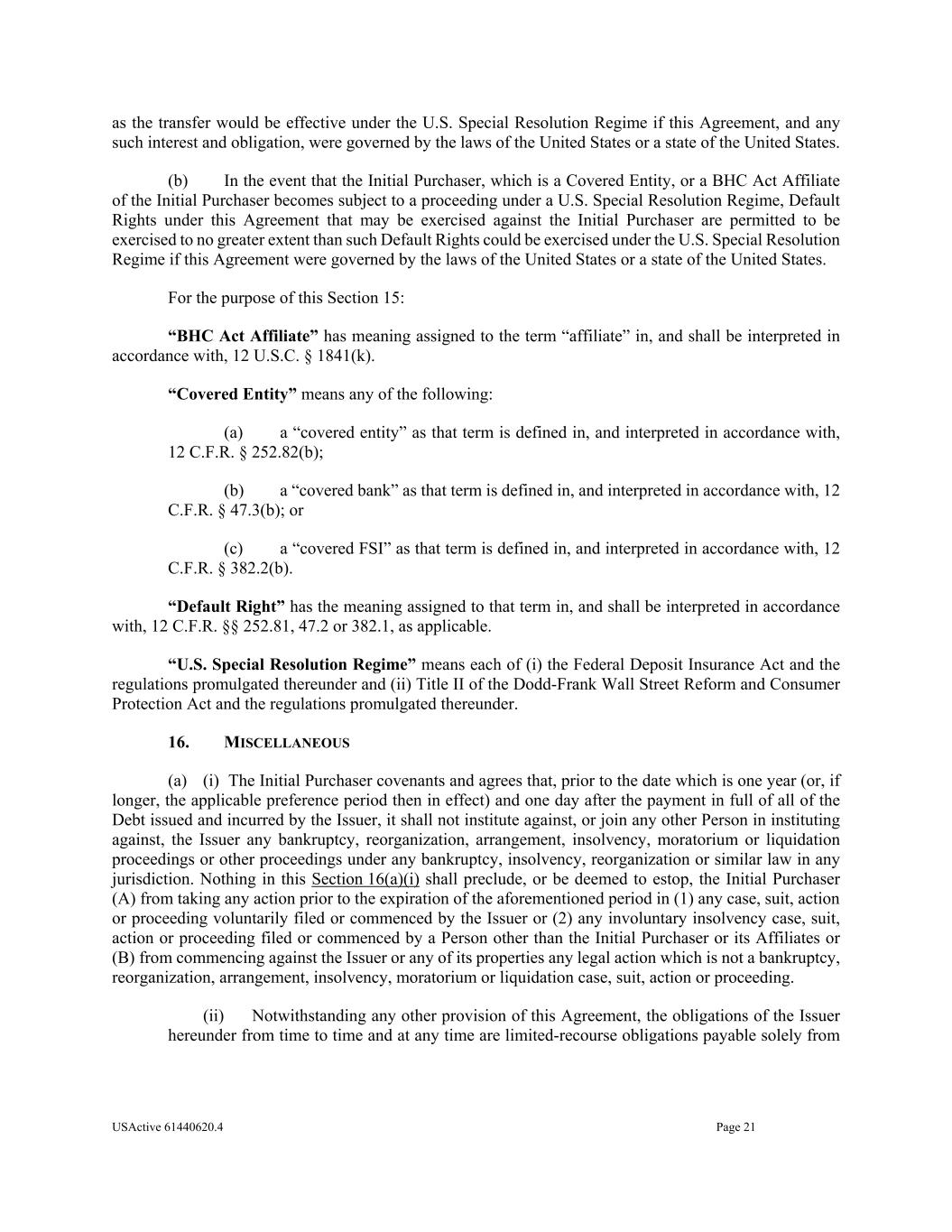

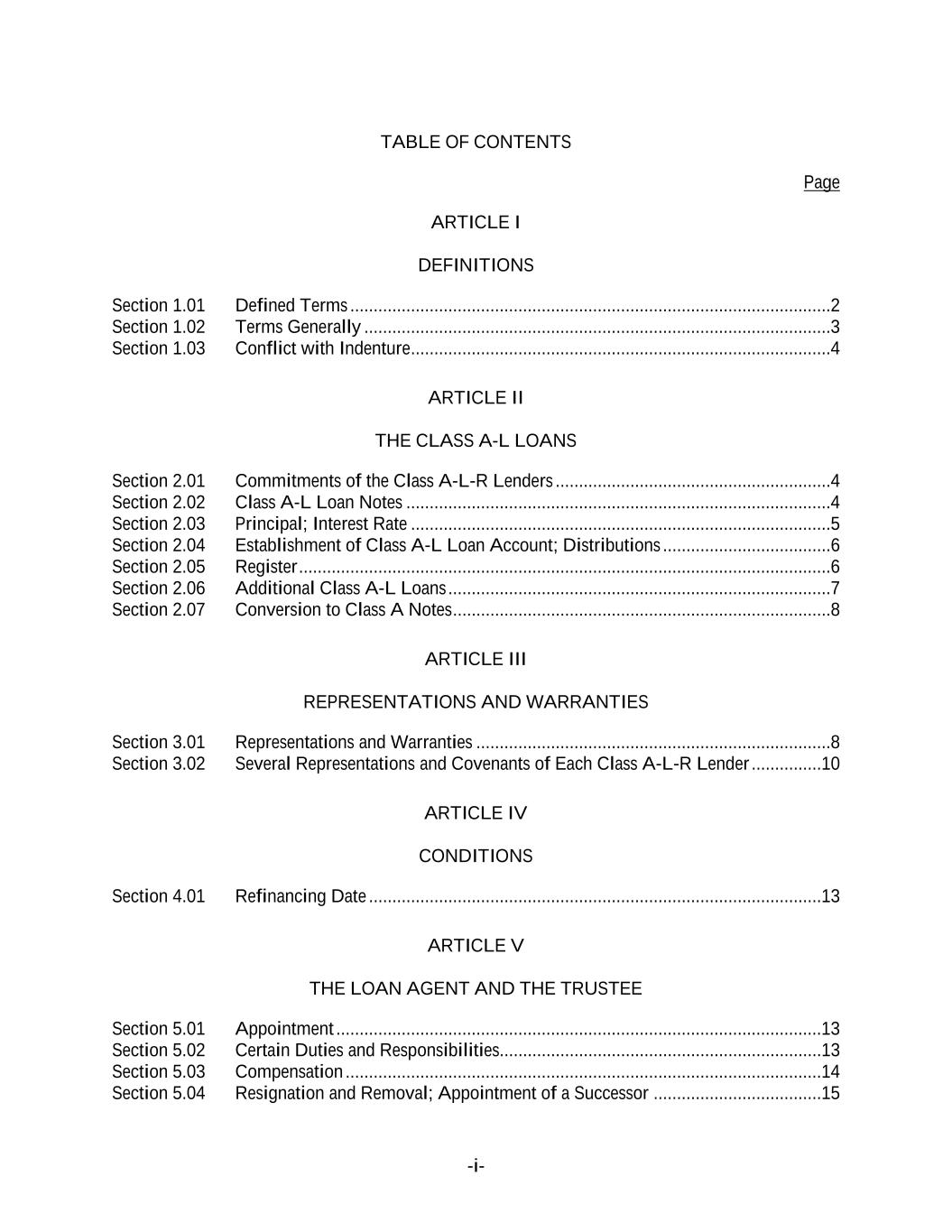

TABLE OF CONTENTS Page -i- TABLE OF CONTENTS Page ARTICLE I DEFINITIONS Section 1.1 Definitions 2 Section 1.2 Usage of Terms 7675 Section 1.3 Assumptions as to Assets 7675 ARTICLE II THE DEBT Section 2.1 Forms Generally 79 Section 2.2 Forms of Notes 79 Section 2.3 Authorized Amount; Stated Maturity; Denominations 81 Section 2.4 Execution, Authentication, Delivery and Dating. 82 Section 2.5 Registration, Registration of Transfer and Exchange. 8382 Section 2.6 Mutilated, Defaced, Destroyed, Lost or Stolen Note. 91 Section 2.7 Payment of Principal and Interest and Other Amounts; Principal and Interest Rights Preserved 92 Section 2.8 Persons Deemed Owners 95 Section 2.9 Cancellation 9695 Section 2.10 DTC Ceases to be Depository 9695 Section 2.11 Non-Permitted Holders 97. (a) 96 Section 2.12 Tax Treatment and Tax Certifications 9998 Section 2.13 Additional Issuance. 102101 Section 2.14 Conversion of Class A-L Loans to Class A-1 Notes. 104103 ARTICLE III CONDITIONS PRECEDENT Section 3.1 Conditions to Issuance of Debt on Closing Date 105[Reserved]. 104 Section 3.2 Conditions to Additional Issuance. 107104

TABLE OF CONTENTS (continued) Page -ii- Section 3.3 Custodianship; Delivery of Collateral Obligations and Eligible Investments. 109105 ARTICLE IV SATISFACTION AND DISCHARGE Section 4.1 Satisfaction and Discharge of Indenture. 110106 Section 4.2 Application of Deposited Money. 112108 Section 4.3 Repayment of Monies Held by Paying Agent. 112108 Section 4.4 Limitation on Obligation to Incur Administrative Expenses. 112108 ARTICLE V EVENTS OF DEFAULT; REMEDIES Section 5.1 Events of Default. 112109 Section 5.2 Acceleration of Maturity; Rescission and Annulment. 114110 Section 5.3 Collection of Indebtedness and Suits for Enforcement by Trustee. 116112 Section 5.4 Remedies. 117113 Section 5.5 Optional Preservation of Assets. 119115 Section 5.6 Trustee May Enforce Claims Without Possession of Debt. 121117 Section 5.7 Application of Money Collected. 121117 Section 5.8 Limitation on Suits. 121117 Section 5.9 Unconditional Rights of Secured Debtholders to Receive Principal and Interest. 122118 Section 5.10 Restoration of Rights and Remedies. 122118 Section 5.11 Rights and Remedies Cumulative. 122118 Section 5.12 Delay or Omission Not Waiver. 122118 Section 5.13 Control by Majority of Controlling Class. 122119 Section 5.14 Waiver of Past Defaults. 123119 Section 5.15 Undertaking for Costs. 123119 Section 5.16 Waiver of Stay or Extension Laws. 124120 Section 5.17 Sale of Assets. 124120 Section 5.18 Action on the Debt. 125121

TABLE OF CONTENTS (continued) Page -iii- ARTICLE VI THE TRUSTEE Section 6.1 Certain Duties and Responsibilities. 125121 Section 6.2 Notice of Event of Default. 127123 Section 6.3 Certain Rights of Trustee. 127123 Section 6.4 Not Responsible for Recitals or Issuance of Debt 131127 Section 6.5 May Hold Debt. 131127 Section 6.6 Money Held for the Benefit of the Secured Debtholders. 132128 Section 6.7 Compensation and Reimbursement. 132128 Section 6.8 Corporate Trustee Required; Eligibility. 133129 Section 6.9 Resignation and Removal; Appointment of Successor. 133129 Section 6.10 Acceptance of Appointment by Successor. 135131 Section 6.11 Merger, Conversion, Consolidation or Succession to Business of Trustee. 135131 Section 6.12 Co-Trustees. 136132 Section 6.13 Certain Duties of Trustee Related to Delayed Payment of Proceeds. 137133 Section 6.14 Authenticating Agents. 137133 Section 6.15 Withholding. 138134 Section 6.16 Representative for Debtholders Only; Agent for each other Secured Party. 138134 Section 6.17 Representations and Warranties of the Bank. 138135 ARTICLE VII COVENANTS Section 7.1 Payment of Principal and Interest. 139135 Section 7.2 Maintenance of Office or Agency. 140136 Section 7.3 Money for Debt Payments to be Held for the Benefit of the Holders. 140136 Section 7.4 Existence of the Issuer. 142138 Section 7.5 Protection of Assets. 143139 Section 7.6 Opinions as to Assets. 144140 Section 7.7 Performance of Obligations. 144140 Section 7.8 Negative Covenants. 144140

TABLE OF CONTENTS (continued) Page -iv- Section 7.9 Statement as to Compliance. 146142 Section 7.10 The Issuer May Consolidate, etc. 146142 Section 7.11 Successor Substituted. 148144 Section 7.12 No Other Business. 148144 Section 7.13 [Reserved]. 148144 Section 7.14 Annual Rating Review. 148144 Section 7.15 Reporting. 149145 Section 7.16 Calculation Agent. 149145 Section 7.17 Certain Tax Matters 151. (a) 147 Section 7.18 Effective Date; Purchase of Additional Collateral Obligations 155. (a) 151 Section 7.19 Representations Relating to Security Interests in the Assets. 157153 Section 7.20 Limitation on Certain Maturity Amendments. 159155 Section 7.21 Maintenance of Listing. 160156 ARTICLE VIII SUPPLEMENTAL INDENTURES Section 8.1 Supplemental Indentures Without Consent of Holders of Debt. 160156 Section 8.2 Supplemental Indentures With Consent of Holders of Debt. 165161 Section 8.3 Execution of Supplemental Indentures. 166162 Section 8.4 Effect of Supplemental Indentures or Amendments. 169165 Section 8.5 Reference in Debt to Supplemental Indentures. Debt 169165 ARTICLE IX REDEMPTION OF DEBT Section 9.1 Mandatory Redemption. 169165 Section 9.2 Optional Redemption. 169165 Section 9.3 Tax Redemption 173. (a) 169 Section 9.4 Redemption Procedures. 170 Section 9.5 Debt Payable on Redemption Date. 176172 Section 9.6 Special Redemption. 176172 Section 9.7 Optional Re-Pricing. 177173

TABLE OF CONTENTS (continued) Page -v- Section 9.8 Clean-Up Call Redemption. 180176 ARTICLE X ACCOUNTS, ACCOUNTINGS AND RELEASES Section 10.1 Collection of Money. 181177 Section 10.2 Collection Account. 181178 Section 10.3 Transaction Accounts. 183180 Section 10.4 The Revolver Funding Account. 185181 Section 10.5 The Interest Reserve Account 186[Reserved]. 182 Section 10.6 Contributions. 187182 Section 10.7 Reinvestment of Funds in Accounts; Reports by Trustee. 187183 Section 10.8 Accountings. 188184 Section 10.9 EU/UK Transparency Requirements. 192 Section 10.910.10 Release of Assets. 196193 Section 10.1010.11 Reports by Independent Accountants. 197194 Section 10.1110.12 Reports to Rating Agencies and Additional Recipients. 198196 Section 10.13 Procedures Relating to the Establishment of Accounts Controlled by the Trustee. 196 Section 10.1310.14 Section 3(c)(7) Procedures. 199196 ARTICLE XI APPLICATION OF MONIES Section 11.1 Disbursements of Monies from Payment Account. 202199 ARTICLE XII SALE OF COLLATERAL OBLIGATIONS; PURCHASE OF ADDITIONAL COLLATERAL OBLIGATIONS Section 12.1 Sales of Collateral Obligations. 209205 Section 12.2 Purchase of Additional Collateral Obligations. 211208 Section 12.3 Reserved. 214211 Section 12.4 Conditions Applicable to All Sale and Purchase Transactions. 214211 Section 12.5 Hedging. 215212

TABLE OF CONTENTS (continued) Page -vi- ARTICLE XIII NOTEHOLDERSDEBTHOLDERS’ RELATIONS Section 13.1 Subordination. 215212 Section 13.2 Standard of Conduct. 216213 ARTICLE XIV MISCELLANEOUS Section 14.1 Form of Documents Delivered to Trustee. 216213 Section 14.2 Acts of Holders. 217215 Section 14.3 Notices, etc. to Certain Parties. 218216 Section 14.4 Notices to Holders; Waiver. 220217 Section 14.5 Effect of Headings and Table of Contents. 218 Section 14.6 Successors and Assigns. 221218 Section 14.7 Severability. 222219 Section 14.8 Benefits of Indenture. 222219 Section 14.9 Reserved. 222219 Section 14.10 GOVERNING LAW. 222219 Section 14.11 Submission to Jurisdiction. 222219 Section 14.12 WAIVER OF JURY TRIAL. 222219 Section 14.13 Counterparts. 223220 Section 14.14 Acts of Issuer. 223220 Section 14.15 Confidential Information. 223220 Section 14.16 17g-5 Information. 225222 Section 14.17 [Reserved] 227 Section 14.18 [Reserved] 227 ARTICLE XV ASSIGNMENT OF CERTAIN AGREEMENTS Section 15.1 Assignment of Collateral Management Agreement. 227224

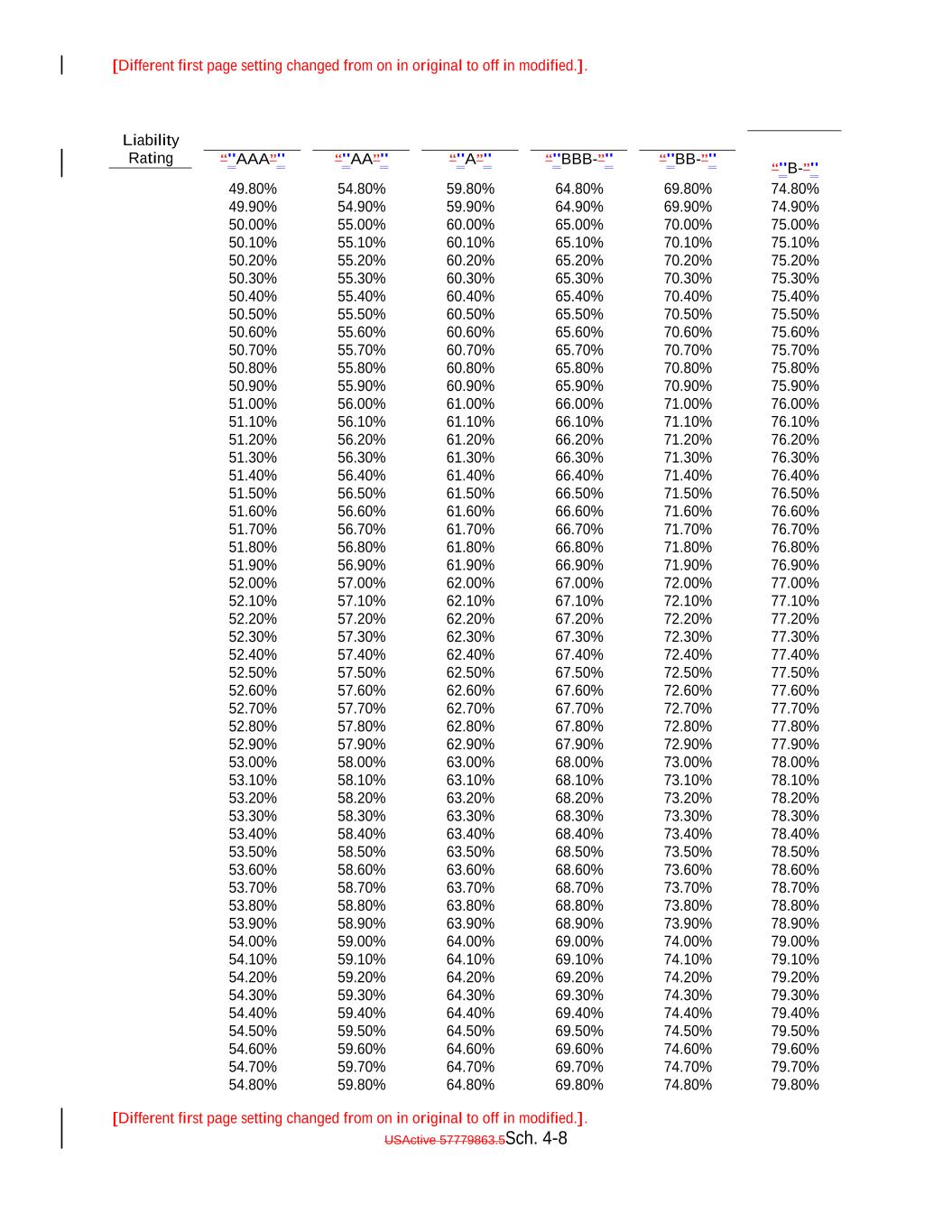

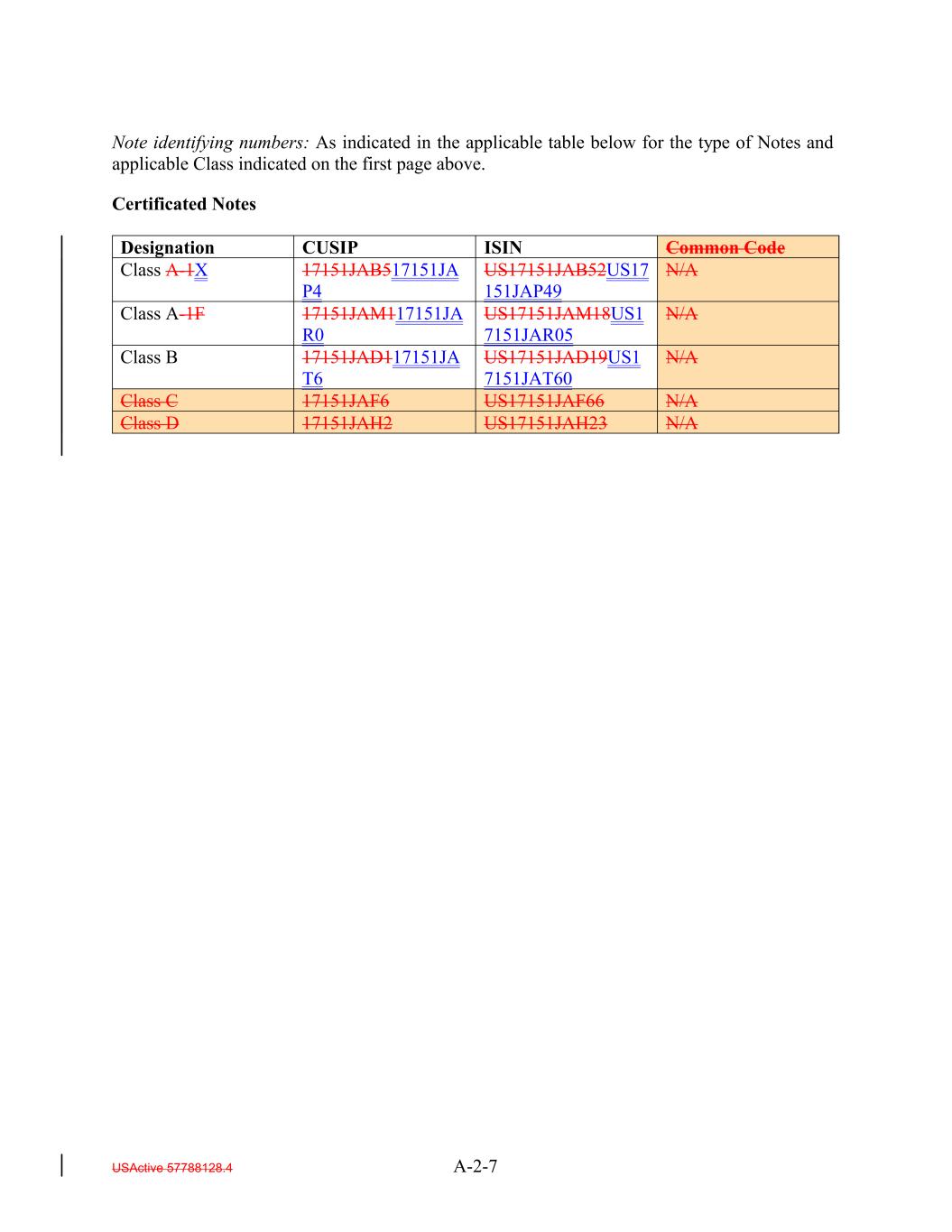

-i- USActive 57779863.5-i- Schedules and Exhibits Schedule 1 [Reserved] Schedule 2 S&P Industry Classifications Schedule 3 Moody’s Rating Definitions Schedule 4 S&P Recovery Rate Tables Exhibit A Forms of Notes A-1 Form of Global Secured Note A-2 Form of Certificated Secured Note A-3 Form of Global Subordinated Note A-4 Form of Certificated Subordinated Note Exhibit B Forms of Transfer and Exchange Certificates B-1 Form of Transferor Certificate for Transfer of Rule 144A Global Note or Certificated Note to Regulation S Global Note B-2 Form of Purchaser Representation Letter for the Class A-1X Notes, the Class A-1F Notes, and the Class B Notes, Class C Notes and Class D Notes issued in the form of Certificated Notes B-3 Form of Purchaser Representation Letter for Subordinated Notes issued in the form of Certificated Notes B-4 Form of Transferor Certificate for Transfer of Regulation S Global Note or Certificated Note to Rule 144A Global Note B-5 Form of ERISA Certificate B-6 Form of Transferee Certificate for Rule 144A Global Note B-7 Form of Transferee Certificate for Regulation S Global Note Exhibit C Contributions C-1 Form of Contribution Notice C-2 Form of Contribution Participation Notice C-3 Form of Trustee Notice of Contribution Exhibit D Form of Debt Owner Certificate Exhibit E Form of Conversion Certificate

INDENTURE AND SECURITY AGREEMENT, dated as of May 20, 2022, between CHURCHILL NCDLC CLO-ICLO-I, LLC, a Delaware limited liability company (together with its permitted successors and assigns, the “Issuer”) and U.S. BANK TRUST COMPANY, NATIONAL ASSOCIATION, as trustee (herein, together with its permitted successors and assigns in the trusts hereunder, the “Trustee”). PRELIMINARY STATEMENT The Issuer is duly authorized to execute and deliver this Indenture to provide for the Debt issuable as provided herein. The Issuer and the Trustee are entering into this Indenture for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged. All things necessary to make this Indenture a valid agreement of the Issuer in accordance with the agreement’s terms have been done. GRANTING CLAUSES The Issuer hereby Grants to the Trustee, for the benefit and security of the Holders of the Secured Debt, the Trustee, the Loan Agent, the Collateral Administrator, the Collateral Manager, the Bank, and U.S. Bank National Association and their respective Affiliates in each of their other capacities under the Transaction Documents (collectively, the “Secured Parties”), all of the Issuer’s right, title and interest in, to and under, in each case, whether now owned or existing on the Closing Date, or hereafterthereafter acquired or arising, (a) the Collateral Obligations, Workout Loans, Restructured Loans and Specified Equity Securities and all payments thereon or with respect thereto; (b) each of the Accounts, and any Eligible Investments on deposit in any of the Accounts, and all income from the investment of funds therein, (c) each Transaction Document, (d) all Cash or Money owned by the Issuer, (e) any Equity Securities received by the Issuer, (f) all accounts (including health-care-insurance receivables), chattel paper (whether tangible or electronic), commercial tort claims, deposit accounts, documents (including, if applicable, electronic documents), financial assets, general intangibles (including all payment intangibles), goods (including inventory and equipment), instruments, investment property, letters of credit, letter-of-credit rights (whether or not the letter of credit is evidenced by a writing), promissory notes and other supporting obligations relating to the foregoing (in each case as defined in the UCC), (g) any other property of the Issuer (whether or not constituting Collateral Obligations or Eligible Investments), and USActive 57779863.5

(h) all proceeds with respect to the foregoing (the assets referred to in (a) through (h) are collectively referred to as the “Assets”). The above Grant is made to secure the Secured Debt and certain other amounts payable by the Issuer as described herein. Except as set forth in the Priority of Payments and Article XIII of this Indenture, the Secured Debt is secured by the Grant equally and ratably without prejudice, priority or distinction between any Secured Debt and any other Secured Debt by reason of difference in time of issuance or otherwise. The Grant is made to secure, in accordance with the priorities set forth in the Priority of Payments and Article XIII of this Indenture, (i) the payment of all amounts due on the Secured Debt in accordance with its terms, (ii) the payment of all other sums (other than in respect of the Subordinated Notes) payable under this Indenture, (iii) the payment of amounts owing by the Issuer under the Class A-L Loan Agreement, the Collateral Management Agreement, the Securities Account Control Agreement, and the Collateral Administration Agreement and (iv) compliance with the provisions of this Indenture, all as provided herein. The foregoing Grant shall, for the purpose of determining the property subject to the lien of this Indenture, be deemed to include any securities and any investments granted to the Trustee by or on behalf of the Issuer, whether or not such securities or investments satisfy the criteria set forth in the definitions of “Collateral Obligation” or “Eligible Investments”, as the case may be. The Trustee acknowledges such Grant and agrees to perform the duties herein in accordance with the terms hereof. ARTICLE I DEFINITIONS Section 1.1 DefinitionsDefinitions. Except as otherwise specified herein or as the context may otherwise require, the following terms have the respective meanings set forth below for all purposes of this Indenture, and the definitions of such terms are equally applicable both to the singular and plural forms of such terms and to the masculine, feminine and neuter genders of such terms. The word “including” shall mean “including without limitation”. All references herein to designated “Articles”, “Sections”, “sub-sections” and other subdivisions are to the designated articles, sections, sub-sections and other subdivisions of this Indenture. The words “herein”, “hereof”, “hereunder” and other words of similar import refer to this Indenture as a whole and not to any particular article, section, sub-section or other subdivision. “17g-5 Information”: The meaning specified in Section 14.16. “17g-5 Website”: A password- protected website which shall initially be located at https://www.structuredfn.com. Any change of the 17g- 5 Website shall only occur after notice has been delivered by the Issuer to the Trustee, the Collateral Manager, the Collateral Administrator, the Initial Purchaser, the Co-Placement Agent and S&P setting the date of change and new location of the 17g- 5 Website. USActive 57779863.5-2-

“1940 Act”: The Investment Company Act of 1940, as amended from time to time. “25% Limitation”: The meaning specified in Section 2.5(cb). “Accountants’ Effective Date Comparison AUP Report”: The meaning specified in Section 7.18(c). “Accountants’ Effective Date Recalculation AUP Report”: The meaning specified in Section 7.18(c). “Accountants’ Report”: A certificate of the firm or firms appointed by the Issuer pursuant to Section 10.1010.11(a). “Accounts”: (i) The Payment Account, (ii) the Collection Account, (iii) the Ramp-UpRamp-Up Account, (iv) the Revolver Funding Account, (v) the Custodial Account, (vi) the Expense Reserve Account, (vii) the Interest Reserve Account, (viii) the Permitted Use Account and (ixviii) the Class A-L Loan Account. “Accredited Investor”: The meaning specified in Rule 501(a) under the Securities Act. “Act”: The meaning specified in Section 14.2. “Adjusted Class Break-even Default Rate”: The rate equal to (a)(i) the Class Break-even Default Rate multiplied by (ii)(x) the Target Initial Par Amount divided by (y) the S&P Collateral Principal Amount plus (b)(i)(x) the S&P Collateral Principal Amount minus (y) the Target Initial Par Amount, divided by (ii)(x) the S&P Collateral Principal Amount multiplied by (y) 1 minus the Weighted Average S&P Recovery Rate. “Adjusted Collateral Principal Amount”: As of any date of determination: (a) the Aggregate Principal Balance of the Collateral Obligations (other than Defaulted Obligations, Deferring Obligations (other than Permitted Deferrable Obligations),, Discount Obligations and Long Dated Obligations), plus (b) without duplication, the amounts on deposit in the Collection Account and the Ramp-UpRamp-Up Account (in each case, including Eligible Investments therein) representing Principal Proceeds, plus (c) the aggregate of the Defaulted Obligation Balances for each Defaulted Obligation (except for Deferring Obligations), plus (d) the aggregate of the purchase prices for each Discount Obligation, excluding accrued interest, expressed as a percentage of par and multiplied by the Principal Balance thereof, for such Discount Obligation, plus USActive 57779863.5-3-

(e) the sum of, with respect to each Deferring Obligation (other than a Permitted Deferrable Obligations), the S&P Collateral Value for such Deferring Obligation; plus (f) the sum of, with respect to each Long Dated Obligation, the lesser of (i) the product of 70% multiplied by the Principal Balance thereof, for and (ii) the Market Value of such Long Dated Obligation; provided that the Aggregate Principal Balance will be zero for any Long Dated Obligation that matures more than 24 months after the earliest Stated Maturity of the Debt; minus (g) the Excess CCC Adjustment Amount; provided that, with respect to any Collateral Obligation that satisfies more than one of the definitions of Defaulted Obligation, Deferring Obligation, Discount Obligation or Long Dated Obligation or any asset that falls into the Excess CCC Adjustment Amount, such Collateral Obligation shall, for the purposes of this definition, be treated as belonging to the category of Collateral Obligations which results in the lowest Adjusted Collateral Principal Amount on any date of determination. “Administrative Excess Amount”: An amount equal on any Payment Date to (i) the Administrative Expense Cap (disregarding the proviso in such definition) on such Payment Date minus (ii) the aggregate amount of any Administrative Expenses paid pursuant to clause (A)(2) of Section 11.1(a)(i) on such Payment Date. “Administrative Expense Cap”: An amount equal on any Payment Date (when taken together with any Administrative Expenses paid during the period since the preceding Payment Date or in the case of the first Payment Date following the Refinancing Date, the period since the ClosingRefinancing Date), to the sum of (a) 0.025% per annum (prorated for the related Interest Accrual Period on the basis of a 360-day year and the actual number of days elapsed) of the Fee Basis Amount on the Determination Date relating to the immediately preceding Payment Date (or, in the case of the first Payment Date following the Refinancing Date, the ClosingRefinancing Date) and (b) U.S.$200,000 per annum (prorated for the related Interest Accrual Period on the basis of a 360-day year consisting of twelve 30 day months); provided that (1) in respect of any Payment Date after the third Payment Date following the ClosingRefinancing Date, if the aggregate amount of Administrative Expenses paid pursuant to Section 11.1(a)(i)(A), Section 11.1(a)(ii)(A) and Section 11.1(a)(iii)(BA)(2) (including any excess applied in accordance with this proviso) on the three immediately preceding Payment Dates and during the related Collection Periods is less than the stated Administrative Expense Cap (without regard to any excess applied in accordance with this proviso) in the aggregate for such three preceding Payment Dates, then the excess may be applied to the Administrative Expense Cap with respect to the then-current Payment Date; and (2) in respect of the third Payment Date following the ClosingRefinancing Date, such excess amount shall be calculated based on the Payment Dates preceding such Payment Date. “Administrative Expenses”: The fees, expenses (including fees and costs of counsel and indemnities) and other amounts due or accrued with respect to any Payment Date USActive 57779863.5-4-

(including, with respect to any Payment Date, any such amounts that were due and not paid on any prior Payment Date in accordance with the Priority of Payments) and payable in the following order by the Issuer: first, to the Trustee pursuant to Section 6.7 and the other provisions of this Indenture, second, to the Bank, U.S. Bank National Association and any of their respective Affiliates in any of their respective other capacities under the Transaction Documents, third, on a pro rata basis, the following amounts (excluding indemnities) to the following parties: (i) the Independent Review Party, if any, Independent accountants (including tax accountants), agents (other than the Collateral Manager) and counsel of the Issuer for fees and expenses; (ii) S&P for fees and expenses (including any annual fee, amendment fees and surveillance fees) in connection with any rating of the Debt or in connection with the rating of (or provision of credit estimates in respect of) any Collateral Obligations; (iii) the Collateral Manager under this Indenture and the Collateral Management Agreement, including without limitation reasonable expenses of the Collateral Manager (including fees for its accountants, agents and counsel) incurred in connection with the purchase or sale of any Collateral Obligations, any other expenses incurred in connection with the Collateral Obligations and any other amounts payable pursuant to the Collateral Management Agreement but excluding the Aggregate Collateral Management Fees; (iv) the independent manager of the Issuer for fees and expenses; (v) any person in respect of any governmental fee, charge or tax; and (vi) any other Person in respect of any other fees or expenses permitted under this Indenture and the documents delivered pursuant to or in connection with this Indenture (including without limitation the payment of all legal and other fees and expenses incurred in connection with the purchase or sale of any Collateral Obligations and any other expenses incurred in connection with the Collateral Obligations) and the Debt, including but not limited to, amounts owed to the Issuer pursuant to this Indenture, any amounts due in respect of the listing of the Debt on any stock exchange or trading system, any Re-Pricing, redemption, Refinancing or additional issuance of Debt; fourth, on a pro rata basis to any Person (including the Collateral Manager) in connection with satisfying the EU/UK Risk Retention Requirements and the EU/UK Transparency Requirements in connection with the transaction contemplated hereunder, including any costs or fees related to additional due diligence or reporting requirements; and and fourthfifth, on a pro rata basis, indemnities payable to any Person pursuant to any Transaction Document or the Warehouse Agreement; provided that, for the avoidance of doubt, (x) amounts due in respect of actions taken on or before the ClosingRefinancing Date (other than indemnities payable under the Warehouseany amounts owing to the Bank or any Affiliate in any of their respective capacities under any Transaction Document or the Posting Agent Letter Agreement) shall not be payable as Administrative Expenses but shall be payable only from the USActive 57779863.5-5-

Expense Reserve Account pursuant to Section 10.3(d) and (y) amounts that are expressly payable to any Person under the Priority of Payments in respect of an amount that is stated to be payable as an amount other than as Administrative Expenses (including, without limitation, interest and principal in respect of the Debt) shall not constitute Administrative Expenses. “Affected Class”: Any Class of Debt that, as a result of the occurrence of a Tax Event, has not received or will not receive 100% of the aggregate amount of principal and interest that would otherwise be due and payable to such Class on any Payment Date. “Affiliate”: With respect to a Person, (i) any other Person who, directly or indirectly, is in control of, or controlled by, or is under common control with, such Person or (ii) any other Person who is a director, Officer, employee or general partner (a) of such Person, (b) of any subsidiary or parent company of such Person or (c) of any Person described in clause (i) above. For the purposes of this definition, “control” of a Person shall mean the power, direct or indirect, (x) to vote more than 50% (or, solely for purposes of determining control in connection with a Portfolio Company, 35%) of the securities or other interests having ordinary voting power for the election of directors of such Person or (y) other than for purposes of certain limits on the ability of the Issuer to sell Collateral Obligations to its Affiliates, to direct or cause the direction of the management and policies of such Person whether by contract or otherwise. For purposes of this definition, Obligors in respect of Collateral Obligations shall be deemed not to be Affiliates if they have distinct corporate family ratings and/or distinct issuer credit ratings. “Agent Members”: Members of, or participants in, DTC, Euroclear or Clearstream. “Aggregate Collateral Management Fee”: Without duplication, all accrued and unpaid Collateral Management Fees, Current Deferred Management Fees, Cumulative Deferred Management Fees and Collateral Management Fee Shortfall Amounts (including accrued interest). “Aggregate Coupon”: As of any Measurement Date, the sum of the products obtained by multiplying, in the case of each Fixed Rate Obligation (other than a Defaulted Obligation) (including, for any Permitted Deferrable Obligation, only the required current cash interest required by the Underlying Documents thereon and excluding the unfunded portion of any Delayed Drawdown Collateral Obligation and Revolving Collateral Obligation), (i) the stated coupon on such Collateral Obligation expressed as a percentage (provided that, for purposes of this definition, the stated coupon will be deemed to be, with respect to any Step-Up Obligation, the current interest coupon) and (ii) the principal balance of such Collateral Obligation. “Aggregate Funded Spread”: As of any Measurement Date, the sum of: (a) in the case of each Floating Rate Obligation (other than a Defaulted Obligation) that bears interest at a spread over a Reference Rate-based index (including, for any Permitted Deferrable Obligation, only the excess of the required current cash pay interest required by the Underlying Documents thereon over the applicable index and excluding the unfunded portion of any Delayed Drawdown Collateral Obligation and Revolving Collateral Obligation), (i) the stated interest rate spread on such Collateral Obligation above such index multiplied by (ii) the outstanding principal balance USActive 57779863.5-6-

of such Collateral Obligation; provided that, with respect to any Reference Rate Floor Obligation, the stated interest rate spread on such Collateral Obligation over the applicable index shall be deemed to be equal to the sum of (x) the stated interest rate spread over the applicable index and (y) the excess, if any, of the specified “floor” rate relating to such Collateral Obligation over the applicable Reference Rate; and (b) in the case of each Floating Rate Obligation (other than a Defaulted Obligation) (including, for any Permitted Deferrable Obligation, only the required current cash pay interest required by the Underlying Documents thereon and excluding the unfunded portion of any Delayed Drawdown Collateral Obligation and Revolving Collateral Obligation) that bears interest at a spread over an index other than a Reference Rate-based index, (i) the excess of the sum of such spread and such index over the Reference Rate as of the immediately preceding Interest Determination Date (which spread or excess may be expressed as a negative percentage) multiplied by (ii) the outstanding principal balance of each such Collateral Obligation; provided that, in each case, with respect to any Reference Rate Floor Obligation, the stated interest rate spread on such Collateral Obligation over the applicable index shall be deemed to be equal to the sum of (x)for purposes of clauses (a) and (b) of this definition, the stated interest rate spread over the applicable index and (y) the excess, if any, of the specified “floor” rate relating to such Collateral Obligation over the applicable Reference Rate.will be deemed to be, with respect to any Step-Up Obligation, the current interest rate spread. “Aggregate Outstanding Amount”: With respect to any of the Debt as of any date, the aggregate unpaid principal amount of such Debt Outstanding on such date. “Aggregate Principal Balance”: When used with respect to all or a portion of the Collateral Obligations or the Assets, the sum of the Principal Balances of all or of such portion of the Collateral Obligations or Assets, respectively. “Aggregate Unfunded Spread”: As of any Measurement Date, the sum of the products obtained by multiplying (i) for each Delayed Drawdown Collateral Obligation and Revolving Collateral Obligation (other than Defaulted Obligations), the related commitment fee rate then in effect as of such date and (ii) the undrawn commitments of each such Delayed Drawdown Collateral Obligation and Revolving Collateral Obligation as of such date. “Alternative Method”: The meaning specified in Section 7.17(m). “Alternative Rate”: The Fallback Rate or Benchmark Replacement Rate selected by the Collateral Manager to replace the then current Reference Rate pursuant to a Reference Rate Amendment. “ARRC”: The Alternative Reference Rates Committee. “Asset-backed Commercial Paper”: Commercial paper or other short-term obligations of a program that primarily issues externally rated commercial paper backed by assets or exposures held in a bankruptcy-remote, special purpose entity. “Assets”: The meaning specified in the Granting Clauses. USActive 57779863.5-7-

“Assumed Reinvestment Rate”: The Term SOFR Rate (as determined on the most recent Interest Determination Date relating to an Interest Accrual Period beginning on a Payment Date or the ClosingRefinancing Date) minus 0.25% per annum; provided that the Assumed Reinvestment Rate shall not be less than 0.00%. “Authenticating Agent”: With respect to the Debt or a Class of the Debt, the Person designated by the Trustee or the Loan Agent, as applicable, to authenticate such Debt on behalf of the Trustee pursuant to Section 6.14 hereof or on behalf of thesuch Loan Agent pursuant to the Class A-L Loan Agreement. “Average Life”: On any date of determination with respect to any Collateral Obligation, the quotient obtained by dividing (i) the sum of the products of (a) the number of years (rounded to the nearest one hundredth thereof) from such date of determination to the respective dates of each successive Scheduled Distribution of principal of such Collateral Obligation and (b) the respective amounts of principal of such Scheduled Distributions by (ii) the sum of all successive Scheduled Distributions of principal on such Collateral Obligation. “Balance”: On any date, with respect to Cash or Eligible Investments in any account, the aggregate of the (i) current balance of Cash, demand deposits, time deposits, certificates of deposit and federal funds; (ii) principal amount of interest-bearing corporate and government securities, money market accounts and repurchase obligations; and (iii) purchase price (but not greater than the face amount) of non-interest-bearing government and corporate securities and commercial paper. “Bank”: U.S. Bank Trust Company, National Association, in its individual capacity and not as Trustee, or any successor thereto. “Bankruptcy Code”: The federal Bankruptcy Code, Title 11 of the United States Code, as amended from time to time. “Benchmark Replacement Conforming Changes”: With respect to the implementation of any Benchmark Replacement Rate, any technical, administrative or operational changes (including, but not limited to, changes to the definition of “Interest Accrual Period”) that the Collateral Manager (on behalf of the Issuer) decides may be appropriate to reflect the adoption of such Benchmark Replacement Rate in a manner substantially consistent with market practice (or, if the Collateral Manager (on behalf of the Issuer) decides that adoption of any portion of such market practice is not administratively feasible or if the Collateral Manager (on behalf of the Issuer) determines that no market practice for use of the Benchmark Replacement Rate exists, in such other manner as the Collateral Manager (on behalf of the Issuer) determines is reasonably necessary). “Benchmark Replacement Date”: The earlier to occur of the following events with respect to the Reference Rate and each date thereafter designated by the Collateral Manager following the occurrence of any of the following events: (i) in the case of clause (a) or (b) of the definition of “Benchmark Transition Event,” the later of (x) the date of the public statement or publication of information USActive 57779863.5-8-

referenced therein and (y) the date on which the administrator of the Reference Rate permanently or indefinitely ceases to provide the Reference Rate; (ii) in the case of clause (c) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein; or (iii) in the case of clause (d) of the definition of “Benchmark Transition Event,” the date on which the Collateral Manager in its sole discretion has notified the Trustee and the Calculation Agent that a “Benchmark Replacement Date” has occurred. “Benchmark Replacement Rate”: The reference rate that the Collateral Manager determines in its sole discretion as a replacement for the base rate component applicable to the Floating RateSecured Debt as of the applicable Benchmark Replacement Date meets each of clauses (i) and (ii) below: (i) the first applicable alternative set forth in the order below that also meets clause (ii) below: (1) the sum of: (a) Daily Simple SOFR and (b) in the case of an Unadjusted Benchmark Replacement Rate, the Benchmark Replacement Rate Adjustment; (2) the sum of: (a) the alternate rate of interest that has been selected or recommended by the Relevant Governmental Body or the LSTA as the replacement for then current Reference Rate for the applicable Corresponding Tenor with respect to quarterly pay floating rate Loans of the type included in the Assets and (b) the Benchmark Replacement Rate Adjustment; and (3) the sum of: (a) the alternate rate of interest identified by the Collateral Manager as expected to be used in a majority of the quarterly pay Floating Rate Obligations included in the Assets or a majority of the new issue collateralized loan obligation transactions priced in the six months prior to the applicable Benchmark Replacement Date and (b) in the case of an Unadjusted Benchmark Replacement Rate, the Benchmark Replacement Rate Adjustment; and (ii) used in a majority of the quarterly pay Floating Rate Obligations included in the Assets or a majority of the new issue collateralized loan obligation transactions priced in the six months prior to the applicable Benchmark Replacement Date as determined by the Collateral Manager in its sole discretion. “Benchmark Replacement Rate Adjustment”: With respect to any replacement of the Reference Rate with an Unadjusted Benchmark Replacement Rate, the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected by the Collateral Manager in the following order: (i) any selection or recommendation of a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of the Reference Rate with the applicable Unadjusted Benchmark Replacement Rate by the Relevant Governmental Body or the LSTA or (ii) any evolving or then-prevailing market convention for determining a spread USActive 57779863.5-9-

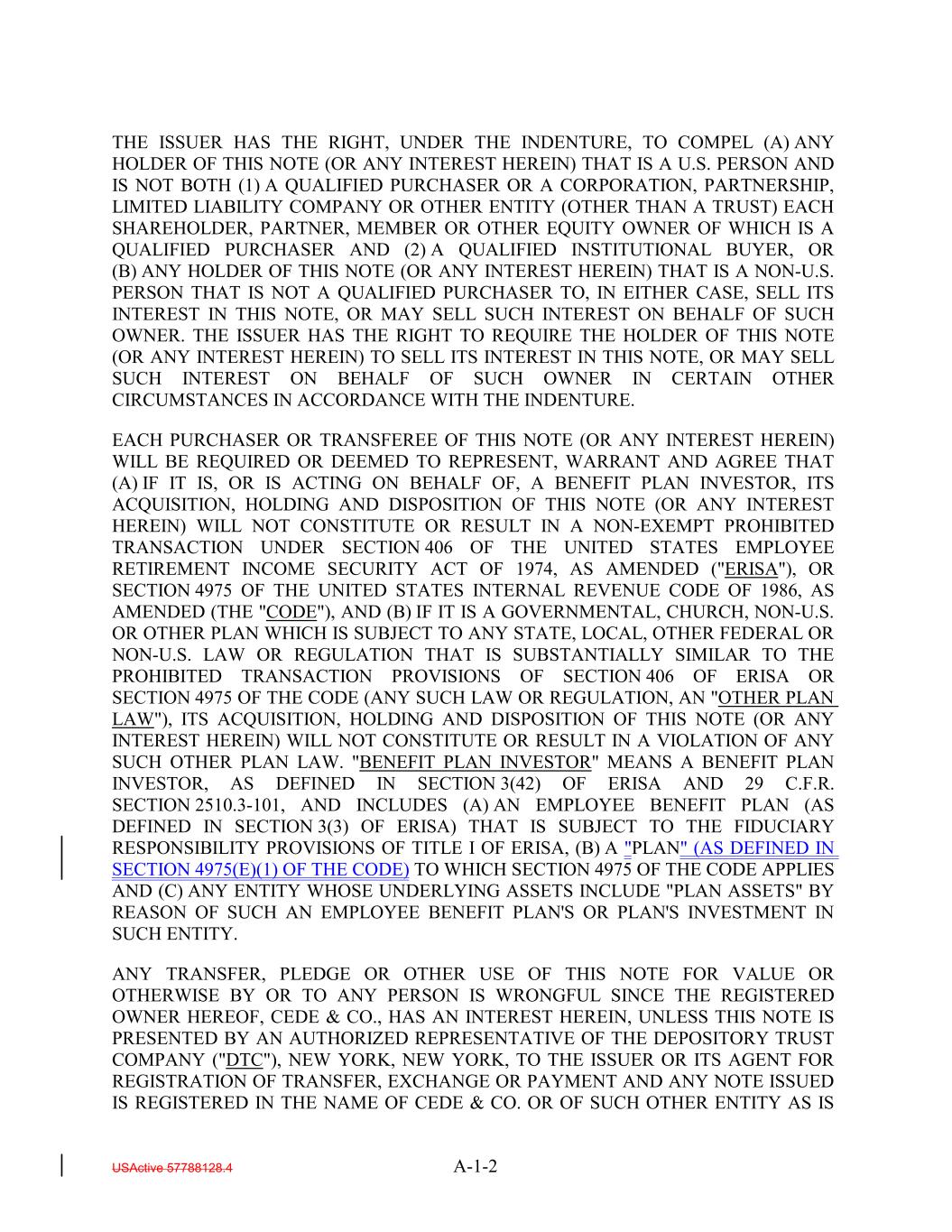

adjustment, or method for calculating or determining such spread adjustment, for the replacement of the Reference Rate with the applicable Unadjusted Benchmark Replacement Rate for Dollar-denominated collateralized loan obligation securitization transactions at such time. “Benchmark Transition Event”: The occurrence of one or more of the following events with respect to the Reference Rate, as determined by the Collateral Manager: (a) public statement or publication of information by or on behalf of the administrator of the Reference Rate announcing that such administrator has ceased or will cease to provide such Reference Rate, permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide such Reference Rate; (b) a public statement or publication of information by the regulatory supervisor for the administrator of the Reference Rate, the Federal Reserve System, an insolvency official with jurisdiction over the administrator for the Reference Rate, a resolution authority with jurisdiction over the administrator for the Reference Rate or a court or an entity with similar insolvency or resolution authority over the administrator for the Reference Rate, which states that the administrator of the Reference Rate has ceased or will cease to provide the Reference Rate permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Reference Rate; (c) a public statement or publication of information by the regulatory supervisor for the administrator of the Reference Rate announcing that the Reference Rate is no longer representative; or (d) if at any time after the occurrence of a Benchmark Transition Event set forth in clauses (a) – (c) the Reference Rate is a rate that does not satisfy clause (ii) of the definition of Benchmark Replacement Rate, the Collateral Manager determines in its sole discretion to replace the then current Reference Rate with a rate that satisfies clause (ii) of the definition of Benchmark Replacement Rate. “Beneficial Ownership Certificate”: The meaning specified in Section 14.2(e). “Benefit Plan Investor”: A “benefit plan investor” as defined in 29 C.F.R. Section 2510.3-101 and Section 3(42) of ERISA, which includes (a) any employee benefit plan (as defined in Section 3(3) of ERISA) that is subject to the fiduciary responsibility provisions of Title I of ERISA, (b) any plan (as defined in Section 4975(e)(1) of the Code) to which Section 4975 of the Code applies and (c) any entity whose underlying assets include “plan assets” by reason of such an employee benefit plan’s or plan’s investment in such entity. “Board Resolution”: A resolution of the managers of the Issuer. “Bond”: A debt security (that is not a Loan) that is issued by a partnership, trust or any other entity. USActive 57779863.5-10-

“Book Value”: “Book value” within the meaning of Treasury Regulations Section 1.704-1(b)(2)(iv), adjusted (to the extent permitted under Treasury Regulations Section 1.704-11.704-1(b)(2)(iv)(f)) as necessary to reflect the relative economic interests of the beneficial owners of the Subordinated Notes (as determined for U.S. federal income tax purposes). “Bridge Loan”: Any loan or other obligation that (i) is incurred in connection with a merger, acquisition, consolidation, or sale of all or substantially all of the assets of a Person or similar transaction and (ii) by its terms, is required to be repaid within one year of the incurrence thereof with proceeds from additional borrowings or other refinancings (it being understood that any such loan or debt security that has a nominal maturity date of one year or less from the incurrence thereof but has a term-out or other provision whereby (automatically or at the sole option of the Obligor thereof) the maturity of the indebtedness thereunder may be extended to a later date is not a Bridge Loan). “Business Day”: Any day other than (i) a Saturday or a Sunday or (ii) a day on which commercial banks are authorized or required by applicable law, regulation or executive order to close in New York, New York or in the city in which the Corporate Trust Office of the Trustee or the Loan Agent is located or, for any final payment of principal, in the relevant place of presentation. “Calculation Agent”: The meaning specified in Section 7.16. “Cash”: Such funds denominated in currency of the United States as at the time shall be legal tender for payment of all public and private debts, including funds standing to the credit of an Account. “CCC Collateral Obligation”: A Collateral Obligation (other than a Defaulted Obligation or a Deferring Obligation) with an S&P Rating of “CCC+” or lower. “CCC Excess”: An amount equal to the excess of the Principal Balance of all CCC Collateral Obligations over an amount equal to 17.5% of the Collateral Principal Amount as of such date of determination; provided that, in determining which of the CCC Collateral Obligations shall be included in the CCC Excess, the CCC Collateral Obligations with the lowest Market Value (expressed as a percentage of the outstanding Principal Balance of such Collateral Obligations as of such date of determination) shall be deemed to constitute such CCC Excess. “Certificate of Authentication”: The meaning specified in Section 2.1. “Certificate of Formation”: The certificate of formation the Issuer. “Certificated Note”: Any Certificated Secured Note or Certificated Subordinated Note. “Certificated Secured Note”: The meaning specified in Section 2.2(b)(iv). USActive 57779863.5-11-

“Certificated Security”: The meaning specified in Section 8-102(a)(4) of the UCC. “Certificated Subordinated Note”: A definitive, fully registered note without coupons substantially in the form attached as Exhibit A-4-3 hereto. “Class”: In the case of (i) the Secured Debt, all of the Secured Debt having the same Interest Rate, Stated Maturity and class designation and (ii) the Subordinated Notes, all of the Subordinated Notes; provided that, solely for purposes of calculating the Interest Coverage Ratio and the Overcollateralization Ratio, the Class A Debt and the Class B Notes shall be treated as a single Class; provided further that, (x) except as provided in clause (y) of this provisoprovision, the Class A-1 Notes, the Class A-1F Notes and the Class A-L Loans shall constitute, and vote together as, a single Class and (y) the Class A-1 Notes, the Class A-1F Notes and the Class A-L Loans shall be treated as separate Classes, and shall vote separately, solely for the purposes of (1) any determination as to whether a proposed supplemental indenture or amendment would have a material adverse effect on such Debt and (2) a Refinancing or a Re-Pricing. Notwithstanding the foregoing, the Class X Notes constitute a separate Class from the Class A Debt, including for purposes of exercising any rights to consent, give direction or otherwise vote (and any determination relating to whether a proposed supplemental indenture would have a material and adverse effect on a Class). “Class A Debt”: The Class A-1 Notes, the Class A-1F Notes and the Class A-L Loans, collectively. “Class A-1 Notes”: The Class A-1 Senior Secured Floating Rate Notes issued pursuant to this Indenture and having the characteristics specified in Section 2.3./B Coverage Tests”: The Overcollateralization Ratio Test and the Interest Coverage Test, each as applied with respect to the Class A Debt and the Class B Notes. “Class A-1F Notes”: TheOn and after the Refinancing Date, the Class A-1FA-R Senior Secured FixedFloating Rate Notes issued pursuant to this Indenture and having the characteristics specified in Section 2.3. “Class A-L Lender”: Each lender under the Class A-L Loan Agreement with respect to the Class A-L Loans. “Class A-L Loan Account”: The account established pursuant to the Class A-L Loan Agreement. “Class A-L Loan Agreement”: The loan agreement entered into as of the Closing Date by the Issuer, as borrower, the Class A-L Lenders party thereto and the Loan Agent. “Class A-L Loans”: The Class A-LA-L-R Senior Secured Floating Rate Loans incurred pursuant to the Class A-L Loan Agreement and having the characteristics specified in Section 2.3. USActive 57779863.5-12-

“Class A/B Coverage Tests”: The Overcollateralization Ratio Test and the Interest Coverage Test, each as applied with respect to the Class A Debt and the Class B Notes. “Class B Notes”: TheOn and after the Refinancing Date, the Class BB-R Senior Secured Floating Rate Notes issued pursuant to this Indenture and having the characteristics specified in Section 2.3. “Class Break-even Default Rate”: With respect to the Highest Ranking S&P Class: (a) prior to the S&P CDO Monitor Election Date, the rate equal to (a) 0.1027520.042904 plus (b) the product of (x) 3.3900243.433883 and (y) the Weighted Average Floating Spread plus (c) the product of (x) 1.2520601.365283 and (y) the Weighted Average S&P Recovery Rate; or (b) on and after the S&P CDO Monitor Election Date, the maximum percentage of defaults, at any time, that the Current Portfolio or the Proposed Portfolio, as applicable, can sustain, as determined through application of the applicable S&P CDO Monitor chosen by the Collateral Manager in accordance with this Indenture that is applicable to the portfolio of Collateral Obligations, which, after giving effect to the assumptions on recoveries, defaults and timing and to the Priority of Payments, will result in sufficient funds remaining for the payment of the Highest Ranking S&P Class in full. After the S&P CDO Monitor Election Date, S&P will provide the Collateral Manager with the Class Break-even Default Rates for each S&P CDO Monitor input file based upon the S&P Minimum Floating Spread and the S&P CDO Monitor Recovery Rate to be associated with such S&P CDO Monitor input file as selected by the Collateral Manager in accordance with the definition of “S&P CDO Monitor”. “Class C Coverage Tests”: The Overcollateralization Ratio Test and the Interest Coverage Test, each as applied with respect to the Class C Notes. “Class C Notes”: The Class C Secured Deferrable Floating Rate Notes issued pursuant to this Indenture and having the characteristics specified in Section 2.3. “Class D Coverage Tests”: The Overcollateralization Ratio Test and the Interest Coverage Test, each as applied with respect to the Class D Notes. “Class D Notes”: The Class D Secured Deferrable Floating Rate Notes issued pursuant to this Indenture and having the characteristics specified in Section 2.3. “Class Default Differential”: With respect to the Highest Ranking S&P Class, the rate calculated by subtracting the Class Scenario Default Rate at such time from (x) prior to the S&P CDO Monitor Election Date, the Adjusted Class Break-even Default Rate or (y) on and after the S&P CDO Monitor Election Date, the Class Break-even Default Rate, in each case, at such time. USActive 57779863.5-13-

“Class Scenario Default Rate”: With respect to the Highest Ranking S&P Class: (a) prior to the S&P CDO Monitor Election Date, the rate at such time equal to (ai) 0.247621 plus (bii) (x) the S&P Weighted Average Rating Factor divided by (y) 9162.65 minus (ciii) (x) the Default Rate Dispersion divided by (y) 16757.20 minus (div)(x) the Obligor Diversity Measure divided by (y) 7677.80 minus (ev)(x) the Industry Diversity Measure divided by (y) 2177.56 minus (fvi)(x) the Regional Diversity Measure divided by (y) 34.0948 plus (gvii)(x) the S&P Weighted Average Life divided by (y) 27.3896; or (b) on and after the S&P CDO Monitor Election Date, an estimate of the cumulative default rate for the Current Portfolio or the Proposed Portfolio, as applicable, consistent with S&P’s initial ratingthe Initial Rating of such Class or Classes of Debt, determined by application by the Collateral Manager and the Collateral Administrator of the S&P CDO Monitor at such time. “Class X Note Payment Amount”: An amount equal to (i) for each of the first through the twelfth Payment Dates after the Refinancing Date, $158,333.33, and (ii) for each Payment Date thereafter, the Aggregate Outstanding Amount, if any, of the Class X Notes as of such Payment Date. “Class X Notes”: On and after the Refinancing Date, the Class X Senior Secured Floating Rate Notes issued pursuant to this Indenture and having the characteristics specified in Section 2.3. “Clean-Up Call Purchase Price”: The meaning specified in Section 9.8(b). “Clean-Up Call Redemption”: The meaning specified in Section 9.8(a). “Clearing Agency”: An organization registered as a “clearing agency” pursuant to Section 17A of the Exchange Act. “Clearing Corporation”: (i) Clearstream, (ii) DTC, (iii) Euroclear and (iv) any entity included within the meaning of “clearing corporation” under Section 8-102(a)(5) of the UCC. “Clearing Corporation Security”: Securities which are in the custody of or maintained on the books of a Clearing Corporation or a nominee subject to the control of a Clearing Corporation and, if they are Certificated Securities in registered form, properly endorsed to or registered in the name of the Clearing Corporation or such nominee. “Clearstream”: Clearstream Banking, société anonyme, a corporation organized under the laws of the Duchy of Luxembourg (formerly known as Cedelbank, société anonyme). “Closing Date”: May 20, 2022. USActive 57779863.5-14-

“Closing Date Certificate”: The closing certificate of the Issuer and the Collateral Manager dated as of the Closing Date. “Code”: The United States Internal Revenue Code of 1986, as amended. “Collateral Administration Agreement”: AnThe amended and restated collateral administration agreement, dated as of the ClosingRefinancing Date, among the Issuer, the Collateral Manager and the Collateral Administrator, as amended from time to time, in accordance with the terms thereof. “Collateral Administrator”: U.S. Bank Trust Company, National Association, in its capacity as collateral administrator under the Collateral Administration Agreement, and any successor thereto. “Collateral Interest Amount”: As of any date of determination, without duplication, the aggregate amount of Interest Proceeds that has been received or that is expected to be received (other than Interest Proceeds expected to be received from Defaulted Obligations or the deferring portion of a Permitted Deferrable Obligation, but including Interest Proceeds actually received from Defaulted Obligations or the deferring portion of a Permitted Deferrable Obligation), in each case during the Collection Period in which such date of determination occurs (or after such Collection Period but on or prior to the related Payment Date if such Interest Proceeds would be treated as Interest Proceeds with respect to such Collection Period). “Collateral Management Agreement”: The amended and restated agreement dated as of the ClosingRefinancing Date, between the Issuer and the Collateral Manager relating to the management of the Collateral Obligations and the other Assets by the Collateral Manager on behalf of the Issuer, as amended from time to time in accordance with the terms thereof. “Collateral Management Fee”: The fee payable to the Collateral Manager in arrears on each Payment Date (prorated for the related Interest Accrual Period) pursuant to Section 8(a) of the Collateral Management Agreement and Section 11.1 of this Indenture, in an amount equal to 0.20% per annum (calculated on the basis of the actual number of days in the applicable Interest Accrual Period divided by 360) of the Fee Basis Amount at the beginning of the Collection Period relating to such Payment Date. “Collateral Management Fee Shortfall Amount”: To the extent the Collateral Management Fee is not paid on a Payment Date due to insufficient Interest Proceeds or Principal Proceeds (and such fee was not voluntarily deferred or waived by the Collateral Manager), the Collateral Management Fee due on such Payment Date (or the unpaid portion thereof, as applicable), which shall be automatically deferred for payment on the succeeding Payment Date, with interest at the rate specified in the Collateral Management Agreement, as certified to the Trustee by the Collateral Manager, in accordance with the Priority of Payments. “Collateral Manager”: Nuveen Churchill Direct Lending Corp., a Maryland corporation, until a successor Person shall have become the Collateral Manager pursuant to the provisions of the Collateral Management Agreement, and thereafter “Collateral Manager” shall mean such successor Person. USActive 57779863.5-15-

“Collateral Manager Standard”: The standard of care applicable to the Collateral Manager set forth in the Collateral Management Agreement. “Collateral Obligation”: A Senior Secured Loan (including, but not limited to, interests in middle market loans acquired by way of a purchase or assignment) or Participation Interest therein, a Second Lien Loan or Participation Interest therein, or a DIP Collateral Obligation or a Participation Interest therein, that as of the date of acquisition by the Issuer: (i) is U.S. Dollar denominated and is neither convertible by the Obligor thereof into, nor payable in, any other currency; (ii) is not (A) a Defaulted Obligation or (B) a Credit Risk Obligation; (iii) is not a lease; (iv) if it is a Deferrable Obligation, it is a Permitted Deferrable Obligation; (v) provides for a fixed amount of principal payable in Cash on scheduled payment dates and/or at maturity and does not by its terms provide for earlier amortization or prepayment at a price of less than par; (vi) does not constitute Margin Stock; (vii) gives rise only to payments that are not subject to withholding tax, other than withholding tax imposed on commitment fees and other similar fees, withholding imposed pursuant to FATCA and withholding tax as to which the Obligor must make additional payments so that the net amount received by the Issuer after satisfaction of such tax is the amount due to the Issuer before the imposition of any withholding tax; (viii) has an S&P Rating; (ix) is not a debt obligation whose repayment is subject to substantial non-credit related risk as determined by the Collateral Manager; (x) except for Delayed Drawdown Collateral Obligations and Revolving Collateral Obligations, is not an obligation pursuant to which any future advances or payments to the borrower or the Obligor thereof may be required to be made by the Issuer; provided that the Issuer may be required, as a lender under the underlying instrumentsUnderlying Documents, to make customary protective advances or provide customary indemnities to the agent of the Collateral Obligation (for which the Issuer may receive a participation interest or other right of repayment); (xi) is not a repurchase obligation, a Bond, a Zero Coupon Bond, an Unsecured Loan, a Bridge Loan, a Commercial Real Estate Loan, a Structured Finance Obligation, a Step-Down Obligation, a Step-Up Obligation or a note (other than a promissory note evidencing a loan); USActive 57779863.5-16-

(xii) will not require the Issuer or the pool of Assets to be registered as an investment company under the 1940 Act; (xiii) is not an Equity Security or by its terms convertible into or exchangeable for an Equity Security; (xiv) is not the subject of an Offer of exchange, or tender by its Obligor, for cash, securities or any other type of consideration other than a Permitted Offer; (xv) does not have an S&P Rating that is below “CCC-”; (xvi) does not have an “f,” “p,” “pi,” “sf” or “t” subscript assigned by S&P or an “sf” subscript assigned by any other NRSRO; (xvii) does not mature after the earliest Stated Maturity of the Debt; (xviii) other than in the case of a Fixed Rate Obligation, accrues interest at a floating rate determined by reference to (a) the Dollar prime rate, federal funds rate, LIBOR or SOFR or (b) a similar interbank offered rate, commercial deposit rate or any other index in respect of which the S&P Rating Condition is satisfied; (xix) if it is a “registration-required obligation” within the meaning of the Code, is Registered; (xx) is not a Synthetic Security; (xxi) does not pay interest less frequently than semi-annually; (xxii) is not a letter of credit and does not support a letter of credit; (xxiii) is not an interest in a grantor trust; (xxiv) is purchased at a price at least equal to 65% of its outstanding principal balance; (xxv) is not issued by an Obligor Domiciled in Cyprus, Greece, Iceland, Ireland, Italy, Liechtenstein, Portugal or, Russia, Spain or Ukraine; (xxvi) is issued by a Non-Emerging Market Obligor Domiciled in the United States, Canada, a Group I Country, a Group II Country, or a Group III Country; (xxvii) if it is a Participation Interest, the Third Party Credit Exposure Limits are satisfied with respect to the acquisition thereof; (xxviii) is not an obligation of a Portfolio Company; (xxix) does not have attached equity warrants; USActive 57779863.5-17-

(xxx) is not a commodity forward contract; (xxxi) is issued by an Obligor with a most-recently calculated (in accordance with the related Underlying Documents) EBITDA of at least $5,000,000; (xxxii) is not an ESG Collateral Obligation; and (xxxiii) (xxxii) is not an infrastructure or a project finance loan; and (xxxiii) is not an ESG Collateral Obligation; provided that, notwithstanding anything to the contrary contained in this Indenture, any Workout Loan designated as a Collateral Obligation by the Collateral Manager in accordance with the terms specified in the definition of “Workout Loan” shall constitute a Collateral Obligation (and not a Workout Loan) following such designation. “Collateral Principal Amount”: As of any date of determination, the sum of (a) the Aggregate Principal Balance of the Collateral Obligations (other than Defaulted Obligations except as otherwise expressly set forth herein), (b) without duplication, the amounts on deposit in the Collection Account and the Ramp-UpRamp-Up Account (in each case, including Eligible Investments therein) representing Principal Proceeds and (c) unpaid Principal Financed Accrued Interest (other than in respect of Defaulted Obligations); provided that for purposes of calculating the Concentration Limitations, Defaulted Obligations shall be included in the Collateral Principal Amount with a Principal Balance equal to the Defaulted Obligation Balance thereof. “Collateral Quality Test”: A test satisfied, as of the Effective Date and any other date thereafter on which such test is required to be determined hereunder if, in the aggregate, the Collateral Obligations owned (or in relation to a proposed purchase of a Collateral Obligation, proposed to be owned) by the Issuer satisfy each of the tests set forth below (or, after the Effective Date, if not in compliance at the time of reinvestment, the relevant requirements must be maintained or improved as described in the Investment Criteria): (i) the S&P CDO Monitor Test; (ii) at any time on or after the S&P CDO Monitor Election Date, the Minimum Weighted Average S&P Recovery Rate Test; (iii) the Minimum Floating Spread Test; (iv) the Minimum Weighted Average Coupon Test; and (v) the Weighted Average Life Test. “Collection Account”: The account established pursuant to Section 10.2 which consists of the Principal Collection Subaccount and the Interest Collection Subaccount. USActive 57779863.5-18-