FALSE2024FY00014176630.00270.00270.00270.0027P5D0.002712/31/202412/31/202512/31/2043iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:puresnwv:segmentsnwv:warrant00014176632024-01-012024-12-3100014176632024-06-2800014176632025-03-1800014176632024-12-3100014176632023-12-310001417663us-gaap:NonrelatedPartyMember2024-12-310001417663us-gaap:NonrelatedPartyMember2023-12-310001417663us-gaap:RelatedPartyMember2024-12-310001417663us-gaap:RelatedPartyMember2023-12-310001417663us-gaap:SeriesAPreferredStockMember2023-12-310001417663us-gaap:SeriesAPreferredStockMember2024-12-310001417663us-gaap:SeriesBPreferredStockMember2023-12-310001417663us-gaap:SeriesBPreferredStockMember2024-12-310001417663us-gaap:SeriesCPreferredStockMember2023-12-310001417663us-gaap:SeriesCPreferredStockMember2024-12-310001417663us-gaap:SeriesDPreferredStockMember2023-12-310001417663us-gaap:SeriesDPreferredStockMember2024-12-3100014176632024-10-182024-10-1800014176632023-01-012023-12-310001417663us-gaap:NonrelatedPartyMember2024-01-012024-12-310001417663us-gaap:NonrelatedPartyMember2023-01-012023-12-310001417663us-gaap:RelatedPartyMember2024-01-012024-12-310001417663us-gaap:RelatedPartyMember2023-01-012023-12-310001417663us-gaap:CommonStockMember2022-12-310001417663us-gaap:AdditionalPaidInCapitalMember2022-12-310001417663us-gaap:RetainedEarningsMember2022-12-310001417663us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100014176632022-12-310001417663us-gaap:CommonStockMember2023-01-012023-12-310001417663us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001417663us-gaap:CommonStockMembersnwv:ConversionOfDebtMember2023-01-012023-12-310001417663us-gaap:AdditionalPaidInCapitalMembersnwv:ConversionOfDebtMember2023-01-012023-12-310001417663snwv:ConversionOfDebtMember2023-01-012023-12-310001417663us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001417663us-gaap:RetainedEarningsMember2023-01-012023-12-310001417663us-gaap:CommonStockMember2023-12-310001417663us-gaap:AdditionalPaidInCapitalMember2023-12-310001417663us-gaap:RetainedEarningsMember2023-12-310001417663us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001417663us-gaap:CommonStockMember2024-01-012024-12-310001417663us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001417663us-gaap:CommonStockMembersnwv:ConversionOfWarrantsMember2024-01-012024-12-310001417663us-gaap:AdditionalPaidInCapitalMembersnwv:ConversionOfWarrantsMember2024-01-012024-12-310001417663snwv:ConversionOfWarrantsMember2024-01-012024-12-310001417663us-gaap:CommonStockMembersnwv:ConversionOfDebtMember2024-01-012024-12-310001417663us-gaap:AdditionalPaidInCapitalMembersnwv:ConversionOfDebtMember2024-01-012024-12-310001417663snwv:ConversionOfDebtMember2024-01-012024-12-310001417663us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001417663us-gaap:RetainedEarningsMember2024-01-012024-12-310001417663us-gaap:CommonStockMember2024-12-310001417663us-gaap:AdditionalPaidInCapitalMember2024-12-310001417663us-gaap:RetainedEarningsMember2024-12-310001417663us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001417663us-gaap:CustomerRelationshipsMember2024-01-012024-12-310001417663us-gaap:PatentsMember2024-01-012024-12-310001417663us-gaap:TradeNamesMember2024-01-012024-12-3100014176632024-06-012024-06-300001417663us-gaap:StockOptionMember2024-01-012024-12-310001417663us-gaap:StockOptionMember2023-01-012023-12-310001417663us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001417663us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001417663us-gaap:WarrantMember2024-01-012024-12-310001417663us-gaap:WarrantMember2023-01-012023-12-310001417663us-gaap:ConvertibleNotesPayableMember2024-01-012024-12-310001417663us-gaap:ConvertibleNotesPayableMember2023-01-012023-12-310001417663us-gaap:CustomerRelationshipsMember2024-12-310001417663us-gaap:CustomerRelationshipsMember2023-12-310001417663us-gaap:PatentsMember2024-12-310001417663us-gaap:PatentsMember2023-12-310001417663us-gaap:TrademarksMember2024-12-310001417663us-gaap:TrademarksMember2023-12-310001417663snwv:FactoringAgreementMember2021-06-012021-06-300001417663srt:MaximumMembersnwv:FactoringAgreementMember2021-06-300001417663snwv:FactoringAgreementMember2021-06-300001417663snwv:SeniorSecuredPromissoryNotesPayableMember2024-12-310001417663snwv:SeniorSecuredPromissoryNotesPayableMember2023-12-310001417663snwv:SeniorSecuredPromissoryNotesPayableMember2020-08-310001417663snwv:SeniorSecuredPromissoryNotesPayableMembersnwv:SecondAmendmentToNoteAndWarrantPurchaseAndSecurityAgreementMember2022-02-280001417663snwv:SeniorSecuredPromissoryNotesPayableMember2022-02-280001417663snwv:WarrantOneMembersnwv:SeniorSecuredPromissoryNotesPayableMembersnwv:SecondAmendmentToNoteAndWarrantPurchaseAndSecurityAgreementMember2022-02-012022-02-280001417663snwv:WarrantOneMembersnwv:SeniorSecuredPromissoryNotesPayableMembersnwv:SecondAmendmentToNoteAndWarrantPurchaseAndSecurityAgreementMember2022-02-280001417663snwv:WarrantTwoMembersnwv:SeniorSecuredPromissoryNotesPayableMembersnwv:SecondAmendmentToNoteAndWarrantPurchaseAndSecurityAgreementMember2022-02-012022-02-280001417663snwv:SeniorSecuredPromissoryNotesPayableMember2024-01-012024-12-310001417663snwv:SeniorSecuredPromissoryNotesPayableMember2023-06-012023-06-300001417663snwv:SeniorSecuredPromissoryNotesPayableMember2023-07-152023-07-150001417663snwv:NoteAndWarrantPurchaseAndSecurityAgreementMembersnwv:SeniorSecuredPromissoryNotesPayableMember2024-06-300001417663snwv:ConvertiblePromissoryNoteMemberus-gaap:ConvertibleDebtMember2020-08-060001417663us-gaap:PrivatePlacementMember2024-10-1700014176632024-10-170001417663snwv:ConversionOfWarrantsMember2024-10-182024-10-180001417663snwv:SeniorSecuredPromissoryNotesPayableMember2023-01-012023-12-310001417663us-gaap:NotesPayableOtherPayablesMember2023-12-310001417663snwv:ConvertiblePromissoryNotesPayableRelatedPartiesMember2023-12-310001417663us-gaap:ConvertibleNotesPayableMember2023-12-310001417663snwv:Two022ConvertibleNotesPayableRelatedPartiesMember2023-12-310001417663snwv:AssetBackedSecuredPromissoryNotesMembersnwv:SecuritiesPurchaseAgreementAndFutureAdvanceConvertiblePromissoryNotesMember2022-08-310001417663snwv:AssetBackedSecuredPromissoryNotesMembersnwv:SecuritiesPurchaseAgreementAndFutureAdvanceConvertiblePromissoryNotesMember2022-11-300001417663snwv:AssetBackedSecuredPromissoryNotesMembersnwv:SecuritiesPurchaseAgreementAndFutureAdvanceConvertiblePromissoryNotesMember2023-05-310001417663snwv:AssetBackedSecuredPromissoryNotesMembersnwv:SecuritiesPurchaseAgreementAndFutureAdvanceConvertiblePromissoryNotesMember2024-12-310001417663snwv:AssetBackedSecuredPromissoryNotesMembersnwv:SecuritiesPurchaseAgreementAndFutureAdvanceConvertiblePromissoryNotesMember2024-01-310001417663snwv:AssetBackedSecuredPromissoryNotesMembersnwv:SecuritiesPurchaseAgreementAndFutureAdvanceConvertiblePromissoryNotesMember2024-06-300001417663snwv:WarrantOneMembersnwv:SecuritiesPurchaseAgreementAndFutureAdvanceConvertiblePromissoryNotesMember2024-06-300001417663snwv:WarrantTwoMembersnwv:SecuritiesPurchaseAgreementAndFutureAdvanceConvertiblePromissoryNotesMember2024-06-300001417663snwv:SecuritiesPurchaseAgreementAndFutureAdvanceConvertiblePromissoryNotesMember2024-01-012024-12-310001417663snwv:SecuritiesPurchaseAgreementAndFutureAdvanceConvertiblePromissoryNotesMember2023-01-012023-12-310001417663snwv:SecuritiesPurchaseAgreementAndFutureAdvanceConvertiblePromissoryNotesMember2024-12-310001417663srt:MaximumMembersnwv:SecuritiesPurchaseAgreementAndFutureAdvanceConvertiblePromissoryNotesMember2024-12-310001417663snwv:AugustIssued2022ConvertiblePromissoryNotesMember2023-08-310001417663snwv:AugustIssued2022ConvertiblePromissoryNotesMember2023-08-012023-08-310001417663us-gaap:CommonStockMembersnwv:AugustIssued2022ConvertiblePromissoryNotesMember2023-08-012023-08-310001417663snwv:NovemberIssued2022ConvertiblePromissoryNotesMember2023-11-300001417663snwv:NovemberIssued2022ConvertiblePromissoryNotesMember2023-11-012023-11-300001417663us-gaap:CommonStockMembersnwv:NovemberIssued2022ConvertiblePromissoryNotesMember2023-11-012023-11-3000014176632024-05-3100014176632024-05-312024-05-310001417663us-gaap:CommonStockMember2024-10-182024-10-1800014176632024-10-180001417663us-gaap:RelatedPartyMemberus-gaap:NotesPayableOtherPayablesMember2024-06-300001417663snwv:CelularitySUltraMISTAssetsMemberus-gaap:NotesPayableOtherPayablesMember2020-08-012020-08-310001417663snwv:CelularitySUltraMISTAssetsMemberus-gaap:NotesPayableOtherPayablesMember2020-08-310001417663snwv:CelularitySUltraMISTAssetsMemberus-gaap:NotesPayableOtherPayablesMember2024-12-310001417663snwv:CelularitySUltraMISTAssetsMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001417663snwv:CelularitySUltraMISTAssetsMemberus-gaap:NotesPayableOtherPayablesMember2024-01-012024-12-310001417663snwv:ConvertiblePromissoryNotesPayableRelatedPartiesMember2020-08-310001417663snwv:ConvertiblePromissoryNotesPayableRelatedPartiesMember2024-12-310001417663snwv:ConvertiblePromissoryNotesPayableRelatedPartiesMember2024-01-012024-12-310001417663snwv:AssetBackedSecuredPromissoryNotesMember2023-07-310001417663snwv:AssetBackedSecuredPromissoryNotesMember2023-07-012023-07-310001417663snwv:AssetBackedSecuredPromissoryNotesMember2024-01-012024-12-310001417663snwv:AssetBackedSecuredPromissoryNotesMemberus-gaap:NonrelatedPartyMember2023-12-310001417663snwv:AssetBackedSecuredPromissoryNotesMemberus-gaap:RelatedPartyMember2023-12-310001417663snwv:AssetBackedSecuredPromissoryNotesMember2023-12-310001417663us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2024-12-310001417663us-gaap:FairValueInputsLevel1Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001417663us-gaap:FairValueInputsLevel2Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001417663us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001417663us-gaap:FairValueMeasurementsRecurringMember2024-12-310001417663us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001417663us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001417663us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001417663us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2023-12-310001417663us-gaap:FairValueInputsLevel1Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001417663us-gaap:FairValueInputsLevel2Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001417663us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001417663us-gaap:FairValueMeasurementsRecurringMembersnwv:EmbeddedConversionOptionMember2023-12-310001417663us-gaap:FairValueInputsLevel1Membersnwv:EmbeddedConversionOptionMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001417663us-gaap:FairValueInputsLevel2Membersnwv:EmbeddedConversionOptionMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001417663us-gaap:FairValueInputsLevel3Membersnwv:EmbeddedConversionOptionMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001417663us-gaap:FairValueMeasurementsRecurringMember2023-12-310001417663us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001417663us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001417663us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001417663snwv:A0.04WarrantsMembersnwv:MeasurementInputExchangeRatioMember2024-12-310001417663snwv:A0.04WarrantsMember2024-12-310001417663snwv:A0.067WarrantsMembersnwv:MeasurementInputExchangeRatioMember2024-12-310001417663snwv:A0.067WarrantsMember2024-12-310001417663snwv:MeasurementInputExchangeRatioMember2023-12-310001417663us-gaap:MeasurementInputExpectedTermMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2024-12-310001417663us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2024-12-310001417663us-gaap:MeasurementInputSharePriceMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2024-12-310001417663us-gaap:MeasurementInputRiskFreeInterestRateMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2024-12-310001417663us-gaap:MeasurementInputExpectedDividendRateMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2024-12-310001417663us-gaap:FairValueInputsLevel3Member2022-12-310001417663us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-12-310001417663us-gaap:FairValueInputsLevel3Member2023-01-012023-12-310001417663us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2023-01-012023-12-310001417663us-gaap:FairValueInputsLevel3Member2023-12-310001417663us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2023-12-310001417663us-gaap:FairValueInputsLevel3Member2024-01-012024-12-310001417663us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2024-01-012024-12-310001417663us-gaap:FairValueInputsLevel3Member2024-12-310001417663us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2024-12-310001417663us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2023-12-310001417663snwv:EmbeddedConversionOptionMember2022-12-310001417663snwv:EmbeddedConversionOptionMember2023-01-012023-12-310001417663snwv:EmbeddedConversionOptionMember2023-12-310001417663snwv:EmbeddedConversionOptionMember2024-01-012024-12-310001417663snwv:EmbeddedConversionOptionMember2024-12-3100014176632022-01-012022-12-3100014176632022-11-300001417663us-gaap:PrivatePlacementMember2024-10-182024-10-180001417663snwv:VendorAMemberus-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMember2024-01-012024-12-310001417663snwv:VendorAMemberus-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMember2023-01-012023-12-310001417663snwv:VendorBMemberus-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMember2024-01-012024-12-310001417663snwv:VendorBMemberus-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMember2023-01-012023-12-310001417663country:USsnwv:ConsumablesAndPartsMember2024-01-012024-12-310001417663us-gaap:NonUsMembersnwv:ConsumablesAndPartsMember2024-01-012024-12-310001417663snwv:ConsumablesAndPartsMember2024-01-012024-12-310001417663country:USsnwv:ConsumablesAndPartsMember2023-01-012023-12-310001417663us-gaap:NonUsMembersnwv:ConsumablesAndPartsMember2023-01-012023-12-310001417663snwv:ConsumablesAndPartsMember2023-01-012023-12-310001417663country:USsnwv:SystemRevenueMember2024-01-012024-12-310001417663us-gaap:NonUsMembersnwv:SystemRevenueMember2024-01-012024-12-310001417663snwv:SystemRevenueMember2024-01-012024-12-310001417663country:USsnwv:SystemRevenueMember2023-01-012023-12-310001417663us-gaap:NonUsMembersnwv:SystemRevenueMember2023-01-012023-12-310001417663snwv:SystemRevenueMember2023-01-012023-12-310001417663country:USsnwv:LicenseFeesAndOtherMember2024-01-012024-12-310001417663us-gaap:NonUsMembersnwv:LicenseFeesAndOtherMember2024-01-012024-12-310001417663snwv:LicenseFeesAndOtherMember2024-01-012024-12-310001417663country:USsnwv:LicenseFeesAndOtherMember2023-01-012023-12-310001417663us-gaap:NonUsMembersnwv:LicenseFeesAndOtherMember2023-01-012023-12-310001417663snwv:LicenseFeesAndOtherMember2023-01-012023-12-310001417663country:US2024-01-012024-12-310001417663us-gaap:NonUsMember2024-01-012024-12-310001417663country:US2023-01-012023-12-310001417663us-gaap:NonUsMember2023-01-012023-12-310001417663us-gaap:EmployeeStockOptionMembersnwv:A2024EquityIncentivePlanMember2024-10-220001417663us-gaap:EmployeeStockOptionMembersnwv:A2024EquityIncentivePlanMember2024-01-012024-12-310001417663us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-12-310001417663us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001417663us-gaap:RestrictedStockUnitsRSUMember2023-12-310001417663us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001417663us-gaap:RestrictedStockUnitsRSUMember2024-12-310001417663us-gaap:DomesticCountryMember2024-01-012024-12-310001417663us-gaap:ForeignCountryMember2024-01-012024-12-310001417663snwv:A2005Through2017Member2024-12-310001417663snwv:A2018Through2024Member2024-12-310001417663snwv:A2005Through2044Member2024-12-310001417663us-gaap:EarliestTaxYearMember2024-01-012024-12-310001417663us-gaap:LatestTaxYearMember2024-01-012024-12-310001417663snwv:SEPAcquisitionCorpMember2024-02-280001417663snwv:CelularityMember2024-06-012024-06-300001417663snwv:ReportableSegmentMember2024-01-012024-12-310001417663snwv:ReportableSegmentMember2023-01-012023-12-310001417663snwv:LicenseAndOptionAgreementMember2024-01-012024-09-300001417663snwv:LicenseAndOptionAgreementMember2024-03-3100014176632024-10-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

|

|

|

|

|

|

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

or

|

|

|

|

|

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________________to____________________.

Commission File Number: 000-52985

SANUWAVE Health, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

| Nevada |

|

20-1176000 |

| (State or Other Jurisdiction of Incorporation) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

|

|

|

11495 Valley View Road

Eden Prairie, MN

|

|

55344 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(952) 656-1029

Registrant’s Telephone Number, Including Area Code

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

SNWV |

The Nasdaq Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such file). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large accelerated filer o |

Accelerated filer o |

|

|

Non-accelerated filer x |

Smaller reporting company x |

|

|

|

Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrants’ executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). YES o NO x

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant (assuming, for purposes of this calculation only, that the registrant’s directors, executive officers and greater than 10% stockholders are affiliates of the registrant), based upon the closing sale price of the registrant’s common stock on June 28, 2024, the last business day of the registrant’s most recently completed second fiscal quarter, was $13.6 million.

As of March 18, 2025, there were issued and outstanding 8,548,473 shares of the registrant’s common stock.

SANUWAVE Health, Inc.

Table of Contents

PART I

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K of SANUWAVE Health, Inc. and its subsidiaries (“Sanuwave” or the “Company”) contains forward-looking statements. All statements in this Annual Report on Form 10-K, including those made by the management of the Company, other than statements of historical fact, are forward-looking statements. Examples of forward-looking statements include statements regarding: results of operations, liquidity, and operations, restrictions and new regulations on our operations and processes, including the execution of clinical trials; the Company’s future financial results, operating results, and projected costs; market acceptance of and demand for UltraMIST® and PACE®; success of future business development and acquisition activities; management’s plans and objectives for future operations; industry trends; regulatory actions that could adversely affect the price of or demand for our approved products; our intellectual property portfolio; our business, marketing and manufacturing capacity and strategy; estimates regarding our capital requirements, the anticipated timing of the need for additional funds, and our expectations regarding future capital-raising transactions, including through investments by strategic partners for market opportunities, which may include strategic partnerships or licensing agreements, or raising capital through the conversion of outstanding warrants or issuances of securities; product liability claims; economic conditions that could adversely affect the level of demand for or the cost of our products; timing of clinical studies and any eventual U.S. Food and Drug Administration ("FDA") approval of new products and new uses of our current products; financial markets; the competitive environment; supplier and customer disputes; and our plans to remediate our material weaknesses in our disclosure controls and procedures and our internal control over financial reporting. These forward-looking statements are based on management’s estimates, projections and assumptions as of the date hereof and include the assumptions that underlie such statements. Forward-looking statements may contain words such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” and “continue,” the negative of these terms, or other comparable terminology. Any expectations based on these forward-looking statements are subject to risks and uncertainties and other important factors, including those discussed in this report, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Other risks and uncertainties are and will be disclosed in the Company’s subsequent filings with the U.S. Securities and Exchange Commission (the “SEC”). These and many other factors could affect the Company’s future financial condition and operating results and cause actual results to differ materially from expectations based on forward-looking statements made in this document or elsewhere by the Company or on its behalf. Except to the extent required by law, the Company does not undertake, and expressly disclaims, any duty, or obligation to revise or update any forward-looking statements whether as a result of new information, future events, changes in assumptions or otherwise.

Except as otherwise indicated by the context, references in this Annual Report on Form 10-K to “we,” “us” and “our” are to the consolidated business of the Company.

Item 1. BUSINESS

Overview

Sanuwave is a medical device company providing directed energy products into the wound care space. Our mission is to improve patient lives and outcomes by developing and marketing effective, easy to use products to decrease wound burden, lessen healing times, and reduce patient pain.

Our focus is regenerative medicine utilizing noninvasive ultrasound or shockwaves to produce a biological response promoting the repair and regeneration of tissue, musculoskeletal, and vascular structures. The Company’s patented and FDA cleared products include the UltraMIST® system (UM) and the PACE® family of products, both of which are used to treat a variety of acute and chronic wounds. These products are backed by an intellectual property (“IP”) portfolio of over 165 patents.

In the year ended December 31, 2024, we had total revenues of $32.6 million, a 60% increase from revenues of $20.4 million in the year ended December 31, 2023. UltraMIST systems and consumables represented approximately 98% of 2024 revenues versus 90% of revenues in 2023.

Our Products and Services:

The Company currently markets directed energy products using both ultrasound and high energy acoustic shockwaves.

UltraMIST

The UltraMIST system delivers low frequency, non-thermal ultrasound to target tissues using a fluid mist to transmit energy in a non-contact and pain free fashion. This energy penetrates deep into wound beds to promote healing while reducing inflammation, killing bacteria and biofilms, and increasing the growth of blood vessels in the wound and peri-wound.

This proprietary technology has been shown to speed healing and reduce reported pain, and it has been cleared by the FDA for wound healing and debridement for a variety of acute and chronic wounds including:

•diabetic foot ulcers,

•venous leg ulcers,

•split thickness wounds/skin grafts,

•deep tissue pressure injuries,

•surgical wounds, and

•many more wound types.

The UltraMIST System is cleared for marketing in the U.S. by the FDA (K140782) and has CMS schedule one reimbursement under code 97610. The UltraMIST system treatment must be administered by a healthcare professional.

The UltraMIST system is highly portable and is used in hospitals, physician’s offices, wound centers, nursing homes, and skilled nursing facilities, and by mobile wound care providers serving patient homes. Treatment may be provided by a doctor, nurse, nurse practitioner, or physical therapist.

Treating chronic wounds is a difficult and time-consuming process. Current modalities for wound management typically involve the use of ointments and liquid solutions, specialized bandages, topical skin substitutes, negative pressure, or hyperbaric oxygen. Despite this, many patients are left with chronic wounds resistant to healing.

Sanuwave’s Energy First™ protocol is at the forefront of improving the standard of care for advanced and chronic wounds. Our solutions help expedite the healing process at a cellular level, a better and simpler alternative that can lead to improved patient outcomes and enhanced quality of life.

As the UltraMIST device never touches the wound, the treatment is painless and patients report a significant reduction in pain post treatment. Significant clinical research demonstrates reductions in healing time, patient pain, and other indicators of patient healing (for more clinical information, please visit our website: https://sanuwave.com/clinical). The UltraMIST system is in use with many top hospitals and wound care providers across the United States. Typical treatment time is 6 minutes (and ranges from 3 to 20 minutes).

UltraMIST is sold using a simple “razor/razor blade” model. Customers purchase an UltraMIST system and then each treatment utilizes a sterile, single use applicator sold in cases of 12. UM consumables revenues constitute the majority of Sanuwave revenue amounting to approximately 61% of total revenues in 2024 and are expected to remain the largest revenue stream for the Company. Over 1,000 UM systems were in the field as of December 31, 2024.

PACE

The PACE systems use acoustic pressure shockwaves generated by the Company’s Pulsed Acoustic Cellular Expression (PACE) technology to converge at precise selected targets to produce an extremely short duration compression burst and are used in both wound and orthopedic applications under the brand names dermaPACE, Profile, and orthoPACE.

The PACE systems are marketed in the U.S., and the European Union (CE Mark).

Market

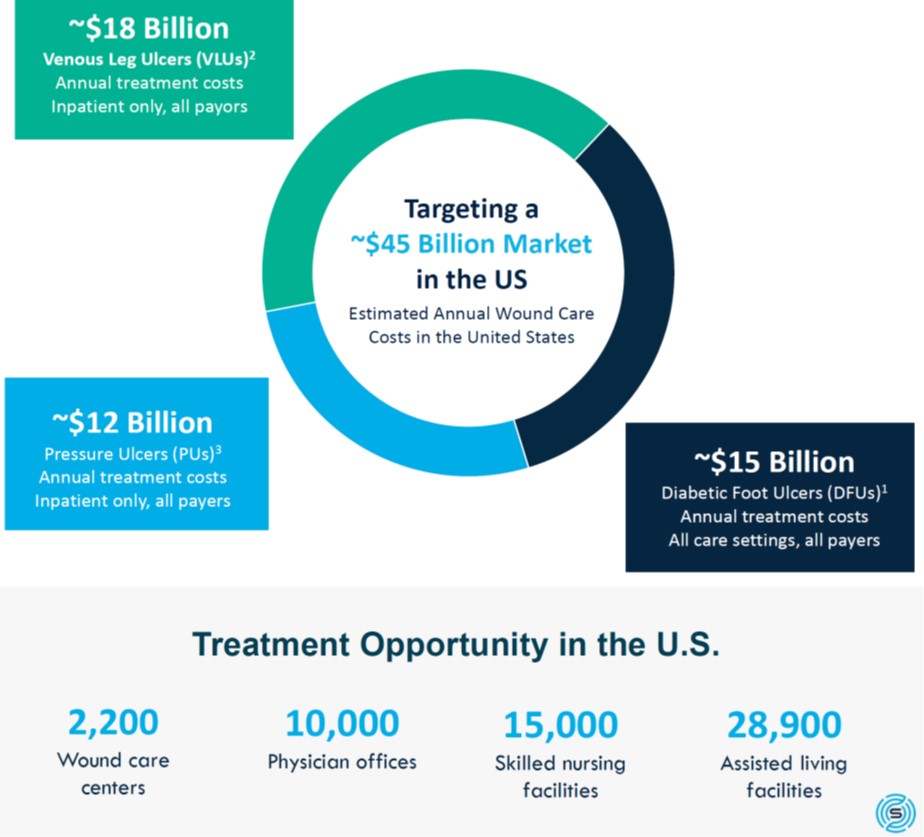

The wound care market exceeds $45 billion per year in the United States and is spread among a number of key categories:

1) Rice et al. Diabetes Care 2014;37:651-658.

2) Rice et al. J Med Econ. 2014;17-(5): 347-356.

3) National Pressure Ulcer Advisory Panel (NPUAP).

The Centers for Medicare and Medicaid Services (the "CMS") have increasingly classified regenerative technology as medically necessary. With an aging population and high incidence of obesity, diabetes, cancers, and autoimmune disorders, the Company believes this market is likely to continue to expand.

Strategy

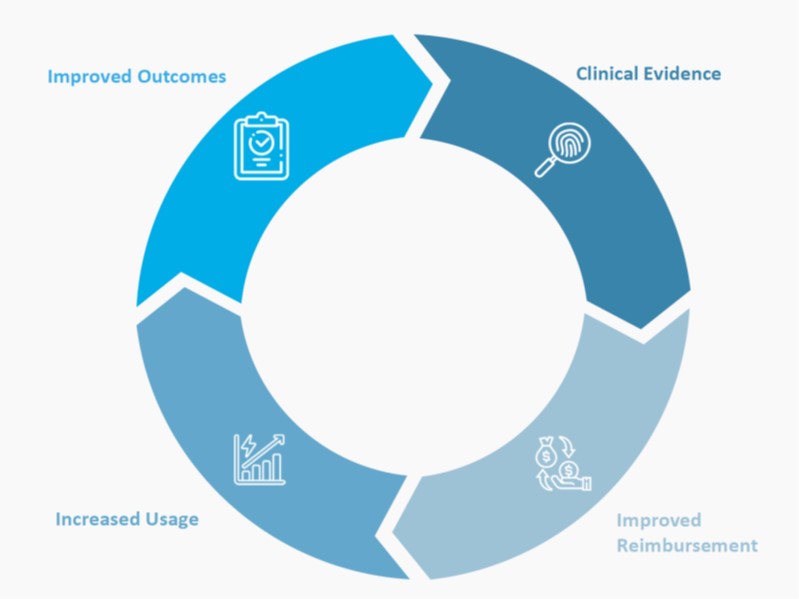

The Company plans to focus on building a direct sales force and distribution network to market the UltraMIST product in the United States and to assess potential expansion abroad. The Company sees two broad trends favoring UM adoption:

transition to evidence-based medicine in wound care and “care to the edge”, as care is being directed away from hospital settings in an effort to treat patients where they are to increase ease of care and to reduce risks of nosocomial infection.

Reimbursement is being restructured around efficacy and cost effectiveness as payors, physicians, and patients seek better outcomes for less money.

The Company believes that both trends are favorable to Sanuwave.

We aim to change the wound care space by bringing cost effective, easy to use technology to market, and putting it into the hands of providers who can easily adopt it as well as integrate it into their workflow and patient treatment plans. To generate broad adoption, a technology needs to be more than just effective, it needs to be both user and patient friendly.

Traditionally, many patients have been resistant to seek wound care because treatments are long in duration, difficult, involve cumbersome medical devices that must be worn long term, and are frequently painful. The Company seeks to overcome such patient and provider objections in order to expand access to high quality, modern wound care and to get more patients seen and seen earlier. By lowering the bar of “willing to seek treatment”, Sanuwave seeks to engage with patients and wounds before they become severe.

By providing an effective, pain free system with short treatment times that practitioners can learn to use via video conference and for which nationwide CMS reimbursement is already available, the Company seeks to appeal to the “three P’s.”

•Patients want to get better sooner and to experience less pain.

•Physicians want patients to get better but also need to be able to integrate care into their practice flow and economic models.

•Payors want to see patients get better faster and to receive early treatment often outside of hospital settings as such treatments save money.

When the needs of Patients, Physicians, and Payors are aligned, markets are ready adopters of products and markets are ready for change.

The Company seeks to move wound care from a more “transactional” mindset to a consultative one, helping practitioners work effective wound treatment into the practice flows and patients' lives. No one wants to live with chronic wounds. We do not believe they should have to.

Sales, Marketing and Distribution

The Company sells systems through a combination of direct sales representatives and independent distributors. The systems are used in hospitals, clinics, and alternate care facilities. Our primary sales are in the Unites States.

Manufacturing

The Company has developed a network of suppliers, manufacturers, and contract service providers to provide sufficient quantities of our products.

The Company is party to a manufacturing supply agreement with Nortech in Wayzata, MN and Biomerics in Salt Lake City UT, covering the generator and treatment wand components of our products. Our generators and treatment wands are manufactured in accordance with applicable quality standards and applicable industry and regulatory standards. In addition, the Company performs the final product testing for generators and treatment wands internally.

The Company is party to a manufacturing supply agreement with Dynamic Group in Ramsey, MN, covering the applicator component of our products. Our applicators are manufactured in accordance with applicable quality standards and applicable industry and regulatory standards. Dynamic Group produces the applicators and applicator kits for our products.

Our facility in Eden Prairie, MN consists of 8,199 square feet and provides office, product development, quality control, and warehouse space. It is an FDA-registered facility and is International Organization for Standardization (ISO) 13485:2016 certified.

Intellectual Property

Our success depends in part on our ability to obtain and maintain proprietary protection for our products, technology, and know-how, to operate without infringing on the proprietary rights of others and to prevent others from infringing upon our proprietary rights. The Company seeks to protect our proprietary position by, among other methods, filing United States and selected foreign patent applications and United States and selected foreign trademark applications related to our proprietary technology, inventions, products, and improvements that are important to the development of our business. Effective trademark, service mark, copyright, patent, and trade secret protection may not be available in every country in which our products are made available. The protection of our intellectual property may require the expenditure of significant financial and managerial resources.

Patents

The Company considers the protection afforded by patents important to our business. The Company intends to seek and maintain patent protection in the United States and select foreign countries, where deemed appropriate for products that the Company develops. As of December 31, 2024, Sanuwave held more than 140 issued or pending patents worldwide that cover various aspects of the Company’s technology. In general, our patents are effective, ranging from 6 months to 16 years. There are no assurances that any patents will result from our patent applications, or that any patents that may be issued will protect our intellectual property, or that any issued patents or pending applications will not be successfully challenged, including as to ownership and/or validity, by third parties. In addition, if the Company does not avoid infringement of the intellectual property rights of others, the Company may have to seek a license to sell our products, defend an infringement action or challenge the validity of intellectual property in court. Any current or future challenges to our patent rights, or challenges by us to the patent rights of others, could be expensive and time consuming.

The Company believes that our owned and licensed patent rights provide a competitive advantage with respect to others that might seek to utilize certain of our apparatuses and methods incorporating low frequency and non-contact ultrasound and extracorporeal acoustic pressure shockwave technologies that the Company has patented. However, the Company does not hold patent rights that cover all of our products, product components, or methods that utilize our products. The Company also has not conducted a competitive analysis or valuation with respect to our issued and pending patent portfolio in relation to our current products and/or competitor products.

In August 2005, we entered into a license agreement with HealthTronics Inc. (“HealthTronics”) in connection with our acquisition of certain assets and intellectual property relating to orthopedic, tendinopathy, skin wounds, cardiac, dental, neural medical conditions and to all conditions in animals (the “Ortho Field”) from HealthTronics. The majority of the intellectual property licensed from HealthTronics was associated with the construction of shockwave devices, indications for orthopedic treatments, and wound care. These patents and patent applications have either expired or were not pursued in our portfolio.

Under our license to HealthTronics, Inc., we reserved exclusive rights in our purchased portfolio as to the Ortho Field. HealthTronics received field-exclusive and sublicensable rights under the purchased portfolio as to (1) certain HealthTronics lithotripsy devices in all fields other than the Ortho Field, and (2) all products in the treatment of renal, ureteral, gall stones and other urological conditions (the “Litho Field”).

HealthTronics also received non-exclusive and non-sublicensable rights in the purchased portfolio as to any products in all fields other than the Ortho Field and Litho Field.

Pursuant to mutual amendment and other assignment-back rights under the patent license agreement with HealthTronics, we are also a licensee of certain patents and patent applications that have been assigned to HealthTronics. We received a perpetual, non-exclusive and royalty-free license to nine issued foreign patents. Our non-exclusive license is subject to HealthTronics’ sole discretion to further maintain any of the patents and pending applications assigned back to HealthTronics.

In August 2020, we entered into an asset purchase agreement with Celularity Inc. (“Celularity”), pursuant to which we acquired all of Celularity’s assets related to the MIST Therapy System and UltraMIST System, including all intellectual property and trademarks related to MIST and UltraMIST. These assets are for use in low frequency and non-contact ultrasound to treat wounds.

In August 2020, we also entered into a License and Marketing Agreement with Celularity, pursuant to which we were granted an exclusive, royalty-bearing license to commercialize Biovance, a minimally processed human amniotic membrane, and Interfyl, a human connective tissue matrix, for the care and treatment of acute and chronic wounds performed in an operating room setting for worldwide commercialization, excluding the Asia Pacific region.

Under the terms of the agreement, Celularity was to provide Biovance and Interfyl product to us for commercialization in exchange for a quarterly license fee payment. In May 2021, we received notification of non-compliance with the terms of the agreement due to alleged non-payment of the quarterly license fee. Pursuant to the notification, we ceased commercialization of the licensed products and have not resumed commercialization.

Trademarks

Since other products on the market compete with our products, the Company believes that our product brand names are an important factor in establishing and maintaining brand recognition.

The Company has the following trademark registrations: SANUWAVE® (United States, European Community, Canada, Japan, Switzerland, United Kingdom, Taiwan and under the Madrid Protocol), dermaPACE® (United States, European Community, Japan, South Korea, Switzerland, Taiwan, Canada, China, Brazil, and under the Madrid Protocol), angioPACE® (European Community and United Kingdom), PACE® - Pulsed Acoustic Cellular Expression (United States, European Community, China, Hong Kong, Singapore, Switzerland, United Kingdom Taiwan, and Canada), orthoPACE® (United States, United Kingdom, and European Community), DAP® - Diffused Acoustic Pressure (United States, United Kingdom, and European Community), Profile® (United States, European Community, and United Kingdom), Energy First® (United States), Healing Today, Curing Tomorrow® (United States), and UltraMIST® (United States).

Through the acquisition of UltraMIST®/MIST assets from Celularity Inc., the Company is the owner of the Celleration® (United States, Australia, Europe Community, and Japan), Proven Healing® (Madrid Protocol, European Community, and United Kingdom), MIST Ultrasound Healing Therapy & Design® (United States), MIST® (United States), MIST Therapy® (United States), and MIST & Design® (United States) registered trademarks.

The Company also maintains trademark registrations for: OssaTron® (United States), evoPACE® (United Kingdom), Evotron® (Switzerland), and Orthotripsy® (United States). The Company phased out the OssaTrode® (United States, Germany and Switzerland), Equitron® (United States and Switzerland), Reflectron® (Germany and Switzerland), Reflectrode® (Germany and Switzerland), OSWT® (Switzerland), Evotrode® (United States, Germany and Switzerland), and evoPACE® (Canada, Australia, European Community and Switzerland) trademarks, due to the fact that OssaTrode®, Equitron®, Reflectron®, Reflectrode®, OSWT®, Evotrode®, products are no longer available for sale in any market and evoPACE® is a product that is not commercialized.

Competition

The Company believes the advanced wound care market can benefit from our technology which up-regulates the biological factors that promote wound healing. Current medical technologies developed by Acelity L.P. Inc, (formerly Kinetic Concepts, Inc., now owned by 3M), Organogenesis, Inc., Smith & Nephew plc, Derma Sciences, Inc., MiMedx Group, Inc., Osiris Therapeutics, Inc. (now owned by Smith & Nephew), Molnlycke Health Care, Systagenix Wound Management (US), Inc. (now owned by Scapa Group Ltd) and SoftWave Tissue Regeneration Technologies manage wounds, but, in our opinion, do not provide the value proposition to the patients and care givers like our PACE technology has the potential to do. The leading medical device serving this market is the Vacuum Assisted Closure (“V.A.C.”) System marketed by Kinetic Concepts Inc. The V.A.C. is a negative pressure wound therapy device that applies suction to debride and manage wounds.

There are also several companies that market extracorporeal shockwave device products targeting lithotripsy and orthopedic markets, including Dornier MedTech, Storz Medical AG, Electro Medical Systems (EMS) S.A., SoftWave Tissue Regeneration Technologies, and CellSonic Medical, which could ultimately pursue the wound care market. Nevertheless, the Company believes that the PACE systems have a competitive advantage over all of these existing technologies by achieving wound closure by means of a minimally invasive process through innate biological response to PACE technology.

Regarding the companies that use low frequency ultrasound that creates a pressure wave producing micro-strains due to mechanical forces that deform cell membrane and therefore promote healing, there are technologies developed by Arobella Medical LLC, NanoVibronix, Chattanooga, and EDAP TMS to manage wound care. However, these treatment devices or medical systems are different in design and mode of application of the ultrasound when compared to Sanuwave’s UltraMIST. The Company believes that UltraMIST has a competitive advantage over all of these existing technologies, due to broad medical indications, simplicity of use, wound healing results and the tolerability of the treatment by the patients, especially for painful wounds.

Regulatory Matters

Food and Drug Administration (FDA) Regulation

Each of our products must be approved or cleared by the FDA before it is marketed in the United States. Before and after approval or clearance in the United States, our products are subject to extensive regulation by the FDA under the Federal Food, Drug, and Cosmetic Act and/or the Public Health Service Act, as well as by other regulatory bodies. FDA regulations govern, among other things, the development, testing, manufacturing, labeling, safety, storage, record-keeping, market clearance or approval, advertising and promotion, import and export, marketing and sales, and distribution of medical devices and pharmaceutical products.

In the United States, the FDA subjects medical products to rigorous review. If the Company does not comply with applicable requirements, the Company may be fined, the government may refuse to approve our marketing applications or to allow us to manufacture or market our products, and the Company may be criminally prosecuted. Failure to comply with the law could result in, among other things, warning letters, civil penalties, delays in approving or refusal to approve a product candidate, product recall, product seizure, interruption of production, operating restrictions, suspension or withdrawal of product approval, injunctions, or criminal prosecution.

The FDA has determined that our technology and products constitute “medical devices.” The FDA determines what center or centers within the FDA will review the product and its indication for use and determines under what legal authority the product will be reviewed. For the current indications, our products are being reviewed by the Center for Devices and Radiological Health. However, the Company cannot be sure that the FDA will not select a different center and/or legal authority for one or more of our other product candidates, in which case the governmental review requirements could vary in some respects.

FDA Approval or Clearance of Medical Devices

In the United States, medical devices are subject to varying degrees of regulatory control and are classified in one of three classes depending on the extent of controls the FDA determines are necessary to reasonably ensure their safety and efficacy:

•Class I: general controls, such as labeling and adherence to quality system regulations;

•Class II: special controls, pre-market notification (510(k)), specific controls such as performance standards, patient registries, and post market surveillance, and additional controls such as labeling and adherence to quality system regulations; and

•Class III: special controls and approval of a pre-market approval (PMA) application.

Each of our products require FDA authorization prior to marketing, by means of either a 510(k) clearance or a PMA approval. To request marketing authorization by means of a 510(k) clearance, the Company must submit a pre-market notification demonstrating that the proposed device is substantially equivalent to another legally marketed medical device, has the same intended use, and is as safe and effective as a legally marketed device and does not raise different questions of safety and effectiveness than does a legally marketed device. 510(k) submissions generally include, among other things, a description of the device and its manufacturing, device labeling, medical devices to which the device is substantially equivalent, safety and biocompatibility information, and the results of performance testing. In some cases, a 510(k) submission must include data from human clinical studies. Marketing may commence only when the FDA issues a clearance letter finding substantial equivalence. After a device receives 510(k) clearance, any product modification that could significantly affect the safety or effectiveness of the product, or that would constitute a significant change in intended use, requires a new 510(k) clearance or, if the device would no longer be substantially equivalent, would require a PMA. If the FDA determines that the product does not qualify for 510(k) clearance, then a company must submit, and the FDA must approve, a PMA before marketing can begin.

A PMA application must provide a demonstration of safety and effectiveness, which generally requires extensive pre-clinical and clinical trial data. Information about the device and its components, device design, manufacturing, and labeling, among other information, must also be included in the PMA. As part of the PMA review, the FDA will inspect the manufacturer’s facilities for compliance with quality system regulation requirements, which govern testing, control, documentation, and other aspects of quality assurance with respect to manufacturing. The PMA approval can include post-approval conditions, including, among other things, restrictions on labeling, promotion, sale and distribution, or requirements to do additional clinical studies post-approval. Even after approval of a PMA, a new PMA or PMA supplement is required to authorize certain modifications to the device, its labeling, or its manufacturing process. Supplements to a PMA often require the submission of the same type of information required for an original PMA, except that the supplement is generally limited to that information needed to support the proposed change from the product covered by the original PMA.

Obtaining medical device clearance, approval, or licensing in the United States or abroad can be an expensive process. International fee structures vary from minimal to substantial, depending on the country. In addition, the Company is subject to annual establishment registration fees in the United States and abroad. Device licenses require periodic renewal with associated fees as well. Currently, the Company is registered as a Small Business Manufacturer with the FDA and as such is subject to reduced fees. If, in the future, our revenues exceed a certain annual threshold limit, the Company may not qualify for the Small Business Manufacturer reduced fee amounts and will be required to pay full fee amounts.

Post-Approval Regulation of Medical Devices

After a device is cleared or approved for marketing, numerous and pervasive regulatory requirements continue to apply. These include:

•the FDA quality systems regulation, which governs, among other things, how manufacturers design, test, manufacture, exercise quality control over, and document manufacturing of their products;

•labeling and claims regulations, which prohibit the promotion of products for unapproved or “off-label” uses and impose other restrictions on labeling;

•the Medical Device Reporting regulation, which requires reporting to the FDA of certain adverse experiences associated with use of the product; and

•post market surveillance, including documentation of clinical experience and follow-on, confirmatory studies.

The Company continues to be subject to inspection by the FDA to determine our compliance with regulatory requirements, as are our suppliers, contract manufacturers, and contract testing laboratories.

International sales of medical devices manufactured in the United States that are not approved or cleared by the FDA are subject to FDA export requirements. Exported devices are subject to the regulatory requirements of each country to which the device is exported. Exported devices may also fall under the jurisdiction of the United States Department of Commerce/Bureau of Industry and Security and compliance with export regulations may be required for certain countries.

Manufacturing Certifications

The Medical Device Single Audit Program (MDSAP)

MDSAP allows a single regulatory audit of a medical device manufacturer’s quality management system to satisfy the requirements of multiple regulatory authorities (RAs). Five RAs including: The Australian Therapeutic Goods Administration (TGA), Brazil’s Agência Nacional de Vigilância Sanitária (ANVISA), Health Canada, MHLW/PMDA (Japan), and the FDA participated in a three-year MDSAP Pilot which concluded in December 2016. These RAs have continued to participate in MDSAP since the program moved into its operational phase starting January 2017, with Health Canada making a full transition from the Canadian Medical Devices Conformity Assessment System (CMDCAS) to MDSAP in January of 2019.

MDSAP uses recognized third-party auditors – auditing organizations (AOs) – to conduct a single quality management system audit that satisfies the requirements of multiple regulatory authorities. Manufacturers only needed to comply with the regulations from the jurisdictions where they sell their products. The MDSAP certificate indicates that a manufacturer complies with the regulatory requirements for the markets defined in the certificate. The certificate does not represent marketing authorization, nor does it require any regulatory authority to issue a marketing authorization or endorsement to the device manufacturer.

The Company has been certified to the MDSAP requirements for the U.S., most recently successfully completing a MDSAP surveillance audit in September 2024. Audit to additional countries will be conducted if expansion to those markets is considered. This certificate is valid for three years. Annual surveillance audits are required to maintain this certification. A full recertification will be conducted in 2025.

Manufacturing cGMP Requirements

Manufacturers of medical devices are required to comply with FDA manufacturing requirements contained in the FDA’s current Good Manufacturing Practices (cGMP) set forth in the quality system regulations promulgated under section 520 of the Federal Food, Drug and Cosmetic Act. cGMP regulations require, among other things, quality control and quality assurance as well as the corresponding maintenance of records and documentation. The manufacturing facility for our products must meet cGMP requirements to the satisfaction of the FDA pursuant to a pre-PMA approval inspection before the Company can use it. The Company and some of our third-party service providers are also subject to periodic inspections of facilities by the FDA and other authorities, including procedures and operations used in the testing and manufacture of our products to assess our compliance with applicable regulations. Failure to comply with statutory and regulatory requirements subjects a manufacturer to possible legal or regulatory action, including the seizure or recall of products, injunctions, consent decrees placing significant restrictions on or suspending manufacturing operations, and civil and criminal penalties. Adverse experiences with the product must be reported to the FDA and could result in the imposition of marketing restrictions through labeling changes or in product withdrawal. Product approvals may be withdrawn if compliance with regulatory requirements is not maintained or if problems concerning safety or efficacy of the product occur following the approval.

International Regulation

We are subject to regulations and product registration requirements in many foreign countries in which we may sell our products, including in the areas of product standards, packaging requirements, labeling requirements, import and export restrictions and tariff regulations, duties and tax requirements. The time required to obtain clearance required by foreign countries may be longer or shorter than that required for FDA clearance, and requirements for licensing a product in a foreign country may differ significantly from FDA requirements.

United States Anti-Kickback and False Claims Laws

In the United States, there are Federal and state anti-kickback laws that prohibit the payment or receipt of kickbacks, bribes or other remuneration intended to induce the purchase or recommendation of healthcare products and services. Violations of these laws can lead to civil and criminal penalties, including exclusion from participation in Federal healthcare programs. These laws are potentially applicable to manufacturers of products regulated by the FDA as medical devices, such as us, and hospitals, physicians, and other potential purchasers of such products. Other provisions of Federal and state laws provide civil and criminal penalties for presenting, or causing to be presented, to third-party payors for reimbursement, claims that are false or fraudulent, or which are for items or services that were not provided as claimed. In addition, certain states have implemented regulations requiring medical device and pharmaceutical companies to report all gifts and payments over $50 to medical practitioners. Although we intend to structure our future business relationships with clinical investigators and purchasers of our products to comply with these and other applicable laws, it is possible that some of our business practices in the future could be subject to scrutiny and challenge by Federal or state enforcement officials under these laws.

Third Party Reimbursement

We anticipate that sales volumes and prices of the products we commercialize will depend in large part on the availability of coverage and reimbursement from third party payors. Third party payors include governmental programs such as Medicare and Medicaid, private insurance plans, and workers’ compensation plans. Even though a new product may have been approved or cleared by the FDA for commercial distribution, we may find limited demand for the device until adequate history of reimbursement has been obtained from governmental and private third-party payors.

The CPT code for UltraMIST is 97610. This Category 1 code describes a system used in wound care that uses low frequency ultrasonic energy to atomize a liquid and deliver continuous low frequency ultrasound to the wound bed. The CPT codes for the dermaPACE System using extracorporeal shock wave technology to treat diabetic foot ulcers are 0512T and 0513T. The codes 0512T and 0513T are for extracorporeal shock wave for integumentary wound healing, including topical application and dressing and high energy extracorporeal shockwave therapy for integumentary wound healing. While these are Category 3 codes because the dermaPACE System is considered experimental by the CMS, this designation does not preclude billing and obtaining payment. Instead, claims are reviewed on an individual basis.

In international markets, reimbursement and healthcare payment systems vary significantly by country, and many countries have instituted price ceilings on specific product lines and procedures. There can be no assurance that procedures using our products will be considered medically reasonable and necessary for a specific indication, that our products will be considered cost-effective by third-party payors, that an adequate level of reimbursement will be available or that the third-party payors’ reimbursement policies will not adversely affect our ability to sell our products profitably.

We believe that the overall escalating costs of medical products and services has led to, and will continue to lead to, increased pressures on the healthcare industry to reduce the costs of products and services. In addition, recent healthcare reform measures, as well as legislative and regulatory initiatives at the Federal and state levels, create significant additional uncertainties. There can be no assurance that third party coverage and reimbursement will be available or adequate, or that future legislation, regulation, or reimbursement policies of third-party payors will not adversely affect the demand for our products or our ability to sell these products on a profitable basis. The unavailability or inadequacy of third-party payor coverage or reimbursement would have a material adverse effect on our business, operating results and financial condition.

Confidentiality and Security of Personal Health Information and Sensitive Personal Information

The Health Insurance Portability and Accountability Act of 1996, as amended by the Health Information Technology for Economic and Clinical Health Act ("HITECH"), and their implementing regulations (collectively referred to as "HIPAA"), contains provisions that protect individually identifiable health information from unauthorized use or disclosure by covered entities and their business associates. The Office for Civil Rights of the U.S. Department of Health and Human Services ("HHS"), the agency responsible for enforcing HIPAA, has published regulations to address the privacy (the “Privacy Rule”) and security (the “Security Rule”) of protected health information ("PHI"). HIPAA also requires that all providers who transmit claims for health care goods or services electronically utilize standard transaction and data sets and to standardize national provider identification codes. In addition, the American Recovery and Reinvestment Act enacted the HITECH Act, which extends the scope of HIPAA to permit enforcement against business associates for a violation, establishes new requirements to notify the Office for Civil Rights of HHS of a breach of HIPAA, and allows the Attorneys General of the states to bring actions to enforce violations of HIPAA.

We anticipate that, as we expand our business, we may in the future be a covered entity under HIPAA. We have adopted policies and procedures to comply with the Privacy Rule, the Security Rule and the HIPAA statute as such regulations become applicable to our business. We currently don’t capture patient data through our PACE system.

In addition to HIPAA, many states have laws that govern the processing, collection, use, disclosure, transfer, storage, disposal and protection of health-related and other sensitive and personal information. These state law protections are different and, in some cases, may be more stringent, broader in scope, or offer greater individual rights with respect to sensitive health information than HIPAA. These laws are evolving rapidly and may differ from each other in significant ways and may not have the same effect, thus complicating compliance efforts. Such laws and regulations will be subject to interpretation by various courts and other governmental authorities, thus creating potentially complex compliance issues for us and our future customers and strategic partners. Failure to comply with these laws, where applicable, can result in the imposition of significant civil and/or criminal penalties and private litigation. By way of example, the California Consumer Privacy Act, as amended by the California Privacy Rights Act, (“CCPA”) gives California residents individual privacy rights to access and delete their personal information, opt out of certain personal information sharing, limit the use of their sensitive personal information, and receive detailed information about how their personal information is used. The CCPA provides for civil penalties for violations, as well as a private right of action for data breaches. The CCPA also established a new California agency, the California Privacy Protection Agency, which is authorized to issue new substantive regulations and has independent enforcement power alongside the California Attorney General. These additional rights and the establishment of an agency with independent enforcement powers are expected to increase data breach litigation and government enforcement activity in California. Comprehensive privacy legislation similar to the CCPA has been adopted in other U.S. states including Colorado, Connecticut, Kentucky, Maryland, Minnesota, Montana, New Jersey, New Hampshire, Nevada, Oregon, Rhode Island, Tennessee, Texas, Utah, and Virginia. In the event that we are subject to or affected by HIPAA, the CCPA, or other domestic privacy and data protection laws, any liability from failure to comply with the requirements of these laws could adversely affect our financial condition.

In addition to the state comprehensive data privacy laws, recent years have brought substantial changes to the federal and state treatment of non-HIPAA consumer health information. At the federal level, the FTC brought three enforcement actions in 2023 against a range of companies that handle electronic health information relating to collection and disclosure of non-HIPAA covered consume health information under Section 5 of the FTC Act, two of which included allegations made under the FTC’s Health Breach Notification Rule (“HBNR”). The FTC’s focus on health information continued in 2024 with changes to the HBNR that clarified its scope and emphasized applicability to non-HIPAA health care providers as well as three additional enforcement actions against companies for their use of health information for advertising purposes. On the state level, Washington and Nevada have adopted significant new legislation addressing businesses treatment of consumer health information and Connecticut added more stringent protections for health information to its existing comprehensive state privacy law. In both Washington and Nevada’s laws, there are restrictive provisions limiting collection and disclosure of consumer health information, and Washington’s law provides a separate private right of action for violations.

We intend to adopt policies and procedures to ensure material compliance with state laws regarding the confidentiality of health information as such laws become applicable to us and to monitor and comply with new or changing state laws on an ongoing basis.

Environmental and Occupational Safety and Health Regulations

Our operations are subject to extensive Federal, state, provincial and municipal environmental statutes, regulations and policies, including those promulgated by the Occupational Safety and Health Administration, the United States Environmental Protection Agency, Environment and Climate Change Canada, Alberta Environment and Protected Areas, the Department of Health Services, and the Air Quality Management District, that govern activities and operations that may have adverse environmental effects such as discharges into air and water, as well as handling and disposal practices for solid and hazardous wastes. Some of these statutes and regulations impose strict liability for the costs of cleaning up, and for damages resulting from, sites of spills, disposals, or other releases of contaminants, hazardous substances and other materials and for the investigation and remediation of environmental contamination at properties leased or operated by us and at off-site locations where we have arranged for the disposal of hazardous substances. In addition, we may be subject to claims and lawsuits brought by private parties seeking damages and other remedies with respect to similar matters. We have not to date needed to make material expenditures to comply with current environmental statutes, regulations and policies. However, we cannot predict the impact and costs those possible future statutes, regulations and policies will have on our business.

Employees

As of December 31, 2024, we had a total of 46 full time employees in the United States. Of these, seven were engaged in research and development which also includes clinical, regulatory, and quality. None of our employees are represented by a labor union or covered by a collective bargaining agreement. We believe our relationship with our employees is good.

Corporate Information

We were formed as a Nevada corporation in 2004. Our corporate headquarters address is 11495 Valley View Road, Eden Prairie, MN 55344, and our main telephone number is (800) 545-8810 or (952) 656-1029.

Available Information

We maintain a website at www.sanuwave.com. We make available on our website, free of charge, our periodic reports and registration statements filed with the SEC, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We make these reports available through our website as soon as reasonably practicable after we electronically file such reports with, or furnish such reports to, the SEC. Our internet site and the information contained on or connected to that site are not incorporated by reference into this Annual Report on Form 10-K. The SEC also maintains a website at www.sec.gov that contains reports, proxy statements and other information regarding issuers that file electronically with the SEC.

Item 1A. RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors and all other information contained in this Annual Report on Form 10-K, including the consolidated financial statements and the related notes, before purchasing our common stock. If any of the following risks actually occur, they may materially harm our business and our financial condition and results of operations. In any such event, the market price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to our Business

Our recurring losses from operations and dependency upon future issuances of equity or other financing to fund ongoing operations have raised substantial doubt as to our ability to continue as a going concern. We will be required to raise additional funds to finance our operations and remain a going concern; we may not be able to do so, and/or the terms of any financings may not be advantageous to us.

The continuation of our business is dependent upon raising additional capital. We expect to devote substantial resources for the commercialization of UltraMIST which will require additional capital resources. We incurred a net loss of $31.4 million and $25.8 million for the years ended December 31, 2024, and 2023, respectively. The operating losses and the current portion of our Senior Secured Debt indicate substantial doubt about the Company’s ability to continue as a going concern for a period of at least twelve months from the filing of this Annual Report on Form 10-K.

Management’s plans are to obtain additional capital in 2025. The Company could obtain additional capital through the issuance of common or preferred stock, securities convertible into common stock, or secured or unsecured debt. These possibilities, to the extent available, may be on terms that result in significant dilution to the Company’s existing stockholders. In addition, there can be no assurances that the Company’s plans to obtain additional capital will be successful on the terms or timeline it expects, or at all. If these efforts are unsuccessful, the Company may be required to significantly curtail or discontinue operations or, if available, obtain funds through financing transactions with unfavorable terms.

The accompanying consolidated financial statements have been prepared in conformity with U.S. GAAP, which contemplate continuation of the Company as a going concern and the realization of assets and satisfaction of liabilities in the normal course of business. The carrying amounts of assets and liabilities presented in the consolidated financial statements do not necessarily purport to represent realizable or settlement values. The consolidated financial statements do not include any adjustment that might result from the outcome of this uncertainty. The Company’s consolidated financial statements do not include any adjustments relating to the recoverability of assets and classification of assets and liabilities that might be necessary should the Company be unable to continue as a going concern.

We have identified material weaknesses in our internal control over financial reporting. If we are unable to remediate these material weaknesses, or if we identify additional material weaknesses in the future or otherwise fail to maintain effective internal control over financial reporting or disclosure controls and procedures, it may result in material misstatements of our consolidated financial statements or cause us to fail to meet our periodic reporting obligations, which may adversely affect our business, financial condition, and results of operations.

We have identified material weaknesses in our internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis. These material weaknesses are as follows:

•The Company lacked expertise and resources to analyze and properly apply U.S. GAAP to complex and non-routine transactions such as complex financial instruments and derivatives and complex sales distributing agreements with select vendors.

•A lack of internal resources to analyze and properly apply U.S. GAAP to account for financial instruments included in service agreements with select vendors.

•Failure to implement controls around the following accounting processes: Equity, Financial Reporting, Accounts Payable, Expenses, Revenue, Accounts Receivable, Tax, Cash, Debt, Fixed Assets, Inventory, Commissions, Entity-Level, Human Resources/Payroll, and IT processes: change management, operations, and access security. As such, we believe that accounting and IT processes and procedures need to be tested for operating effectiveness.

We are taking certain measures to remediate these material weaknesses described above as discussed further in Part II, Item 9A of this Annual Report on Form 10-K; however, such material weaknesses had not been remediated as of December 31, 2024. In addition, due to the material weaknesses in internal control over financial reporting, we have also determined that our disclosure controls and procedures were ineffective as of December 31, 2024. The material weaknesses will not be considered remediated until management completes the design and implementation of the measures described above and the controls operate for a sufficient period of time and management has concluded, through testing, that these controls are effective.

There can be no assurance as to when the material weaknesses will be remediated. At this time, we cannot provide an estimate of costs expected to be incurred in connection with implementing this remediation plan; however, these remediation measures will be time consuming, will result in us incurring significant costs, and will place significant demands on our financial and operational resources.

We cannot assure that the measures we have taken to date and may take in the future will be sufficient to remediate the control deficiencies that led to our material weaknesses in internal control over financial reporting or that they will prevent or avoid potential future material weaknesses to be identified in the future. The effectiveness of our internal control over financial reporting is subject to various inherent limitations, including cost limitations, judgments used in decision making, assumptions about the likelihood of future events, the possibility of human error and the risk of fraud. Any failure to design, implement and maintain effective internal control over financial reporting and effective disclosure controls and procedures, or any difficulties encountered in their implementation or improvement, may result in additional material misstatements of our consolidated financial statements, or cause us to fail to meet our periodic reporting obligations, which may adversely affect our business, financial condition and results of operations.

If we are unable to successfully raise additional capital, our viability may be threatened; however, if we do raise additional capital, your percentage ownership as a stockholder could decrease and constraints could be placed on the operations of our business.

We have experienced negative operating cash flows since our inception and have funded our operations primarily from proceeds received from sales of our capital stock, the issuance of promissory notes and convertible promissory notes, the issuance of notes payable to related parties, and product sales. We will seek to obtain additional funds in the future either through equity or debt financings or through strategic alliances with third parties, either alone or in combination with equity financings. These financings could result in substantial dilution to the holders of our common stock or require contractual or other restrictions on our operations or on alternative business opportunities that may be available to us. If we can raise additional funds by issuing debt securities, these debt securities could impose significant additional restrictions on our operations. Any such required financing may not be available in amounts or on terms acceptable to us, and the failure to procure such required financing could have a material adverse effect on our business, financial condition, and results of operations, or threaten our ability to continue as a going concern.

A variety of factors could impact our need to raise additional capital, the timing of any required financing and the amount of such financings. Factors that may cause our future capital requirements to be greater than anticipated or could accelerate our need for funds include, without limitation:

•unanticipated expenditures in research and development or manufacturing activities;

•unanticipated expenditures in the acquisition and defense of intellectual property rights;

•the failure to develop strategic alliances for the marketing of some of our products;

•unforeseen changes in healthcare reimbursement for procedures using any of our approved products;

•inability to train a sufficient number of physicians to create a demand for any of our approved products;