Q4’24 Business Update March 20, 2025

Creating advanced LiDAR and software[1] to enable the world’s safest and smartest vehicles. © 2025 Luminar Technologies, Inc. All rights reserved. | 2Please refer to Footnotes on slide 4 for more detail.

Forward-looking statements This presentation of Luminar Technologies, Inc. (“Luminar” or the “company”) includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private securities litigation reform act of 1995. Forward-looking statements may be identified by the use of words such as “future,” “growth,” “opportunity,” "will," “well-positioned,” "forecast," "intend," "seek," "target," “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding whether next generation sensors and software will be developed successfully or will accelerate automaker adoption, whether new automaker agreements will develop successfully into product launches, whether cost reduction efforts will continue to result in improved operational and financial efficiency, including projected free cash flow generation, expected achievement and timing of manufacturing scale up, OEM production readiness, next-gen LiDAR prototype development, continued software and AI development and performance, program milestones, expected milestones, market size estimates, product efficacy, near-term priorities, including plans to ramp production and ramp down costs, operating expenses and cost of sales, and the financial guidance for fiscal 2025. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of Luminar’s management and are not guarantees of actual performance. You are cautioned not to place undue reliance upon any forward-looking statements, including the projections, which speak only as of the date made. Luminar does not undertake any commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Accordingly, forward-looking statements, including any projections or analysis, should not be viewed as factual and should not be relied upon as an accurate prediction of future results. The forward-looking statements contained in this presentation are based on the company’s current expectations and beliefs concerning future developments and their potential effects on Luminar. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements, including the risks discussed in the “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Luminar’s most recently filed periodic reports on Form 10-K and Form 10-Q, and other documents Luminar files with the SEC in the future, including Luminar's Annual Report on Form 10-K for the year ended December 31, 2024. Should one or more of these risks or uncertainties materialize, or should any of management’s assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Luminar does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Accordingly, you should not put undue reliance on these statements. Trademarks and trade names Luminar owns or has rights to various trademarks, service marks and trade names that it uses in connection with the operation of its business. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended in, and does not imply, a relationship with Luminar, or an endorsement or sponsorship by or of Luminar. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that Luminar will not assert, to the fullest extent under applicable law, its rights or the right of the applicable licensor in these trademarks, service marks and trade names. Industry and market data In this presentation, Luminar relies on and refers to information and statistics regarding the sectors in which Luminar competes and other industry data. Luminar obtained this information and statistics from third-party sources, including reports by market research firms. Although Luminar believes these sources are reliable, the company has not independently verified the information and does not guarantee its accuracy and completeness. Luminar has supplemented this information where necessary with information from discussions with Luminar customers and Luminar’s own internal estimates, taking into account publicly available information about other industry participants and Luminar’s management’s best view as to information that is not publicly available. Disclaimer & Cautionary Note © 2025 Luminar Technologies, Inc. All rights reserved. | 3

Use of Non-GAAP financial measures The financial information and data contained in this presentation is unaudited and does not conform to regulation S-X promulgated under the securities act of 1933, as amended. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any filing Luminar makes with the SEC. Luminar has not filed its Form 10-K for the year ended December 31, 2024. As a result, all financial results described in this presentation should be considered preliminary and are subject to change to reflect any necessary adjustments or changes in accounting estimates that are identified prior to the time that Luminar files its Form 10-K. In addition to disclosing financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), this presentation contains certain non-GAAP financial measures and certain other metrics. Non-GAAP financial measures and these other metrics do not have any standardized meaning and are therefore unlikely to be comparable to similarly titled measures and metrics presented by other companies. Luminar considers these non-GAAP financial measures and metrics to be important because they provide useful measures of the operating performance of the Company, exclusive of factors that do not directly affect what we consider to be our core operating performance, as well as unusual events. The Company’s management uses these measures and metrics to (i) illustrate underlying trends in the Company’s business that could otherwise be masked by the effect of income or expenses that are excluded from non-GAAP measures, and (ii) establish budgets and operational goals for managing the Company’s business and evaluating its performance. In addition, investors often use similar measures to evaluate the operating performance of a company. Non-GAAP financial measures and metrics are presented only as supplemental information for purposes of understanding the Company’s operating results. The non-GAAP financial measures and metrics should not be considered a substitute for financial information presented in accordance with GAAP. This presentation includes non-GAAP financial measures, including non-GAAP cost of sales, gross loss/gross profit, operating expenses, net loss, and Free Cash Flow. Non-GAAP cost of sales is defined as GAAP cost of sales adjusted for stock-based compensation expense and amortization of intangible assets. Non-GAAP gross loss/gross profit is defined as GAAP gross loss/gross profit adjusted for stock-based compensation expense and amortization of intangible assets. Non- GAAP operating expenses is defined as GAAP operating expenses adjusted for stock-based compensation expense, amortization of intangible assets, impairment of goodwill and intangible assets, and transaction costs relating to acquisition activities. Non-GAAP net loss is defined as GAAP net loss adjusted for stock-based compensation expense, amortization of intangible assets, accelerated depreciation related to certain property, plant, and equipment items, impairment of goodwill and intangible assets, gain on extinguishment of debt, impairment of investments, restructuring costs, gain from certain acquisitions, transaction costs relating to acquisition activities, change in fair value of embedded derivative, and change in fair value of warrant liabilities. Free Cash Flow is defined as operating cash flow less capital expenditures. Footnotes 1 Software: Various Luminar software capabilities are still in development and have not achieved “technology feasibility” or “production ready” status. 2 Non-GAAP metrics: Please refer to Reconciliation of GAAP to Non-GAAP financial measures on slides 36-38. 3 Cash & Liquidity: Includes Cash, cash equivalents, and marketable securities, as well as applicable lines of credit and other facilities. 4 Free Cash Flow: Free cash flow is a non-GAAP measure and is defined as Operating cash flow less Capital expenditures. 5 Change in Cash: Refers to change in cash, cash equivalents, and marketable securities, and excludes incremental liquidity from undrawn line of credit. 6 Capital expenditures: Excludes Vendor stock-in-lieu of cash program - purchases and advances for capital projects and equipment of $1.1M for the Three Months Ended December 30, 2023 and $8.6M for the Twelve Months Ended December 30, 2023. Disclaimer & Cautionary Note © 2025 Luminar Technologies, Inc. All rights reserved. | 4

Luminar Overview © 2025 Luminar Technologies, Inc. All rights reserved. | 5

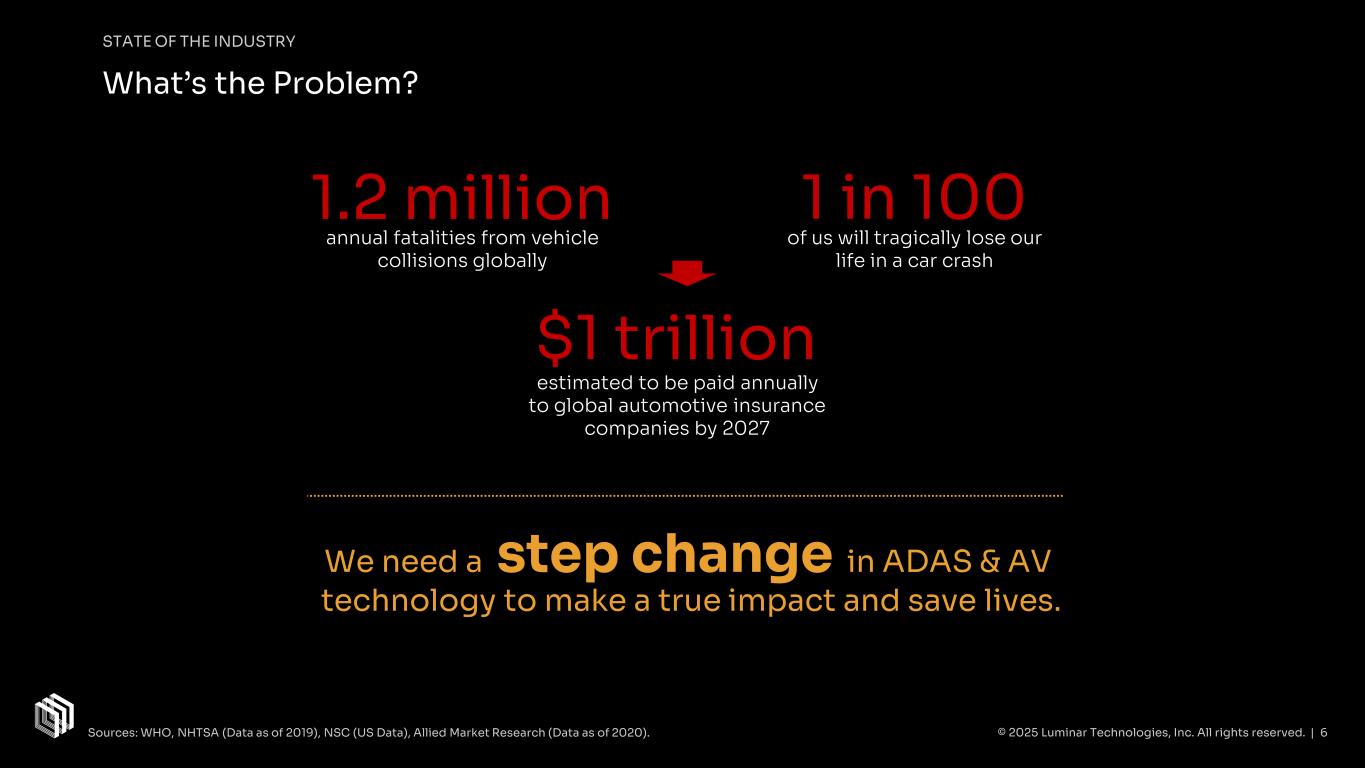

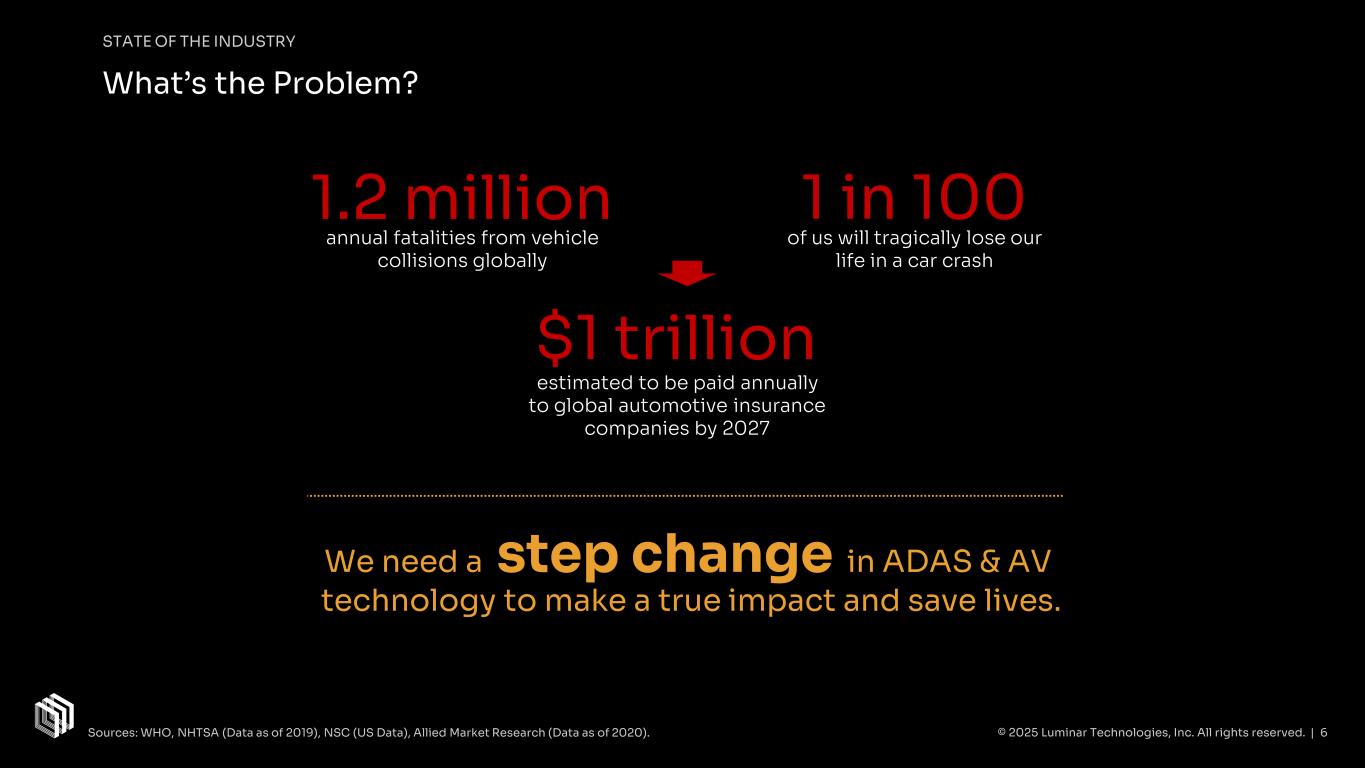

annual fatalities from vehicle collisions globally 1.2 million of us will tragically lose our life in a car crash 1 in 100 STATE OF THE INDUSTRY What’s the Problem? We need a step change in ADAS & AV technology to make a true impact and save lives. estimated to be paid annually to global automotive insurance companies by 2027 $1 trillion © 2025 Luminar Technologies, Inc. All rights reserved. | 6Sources: WHO, NHTSA (Data as of 2019), NSC (US Data), Allied Market Research (Data as of 2020).

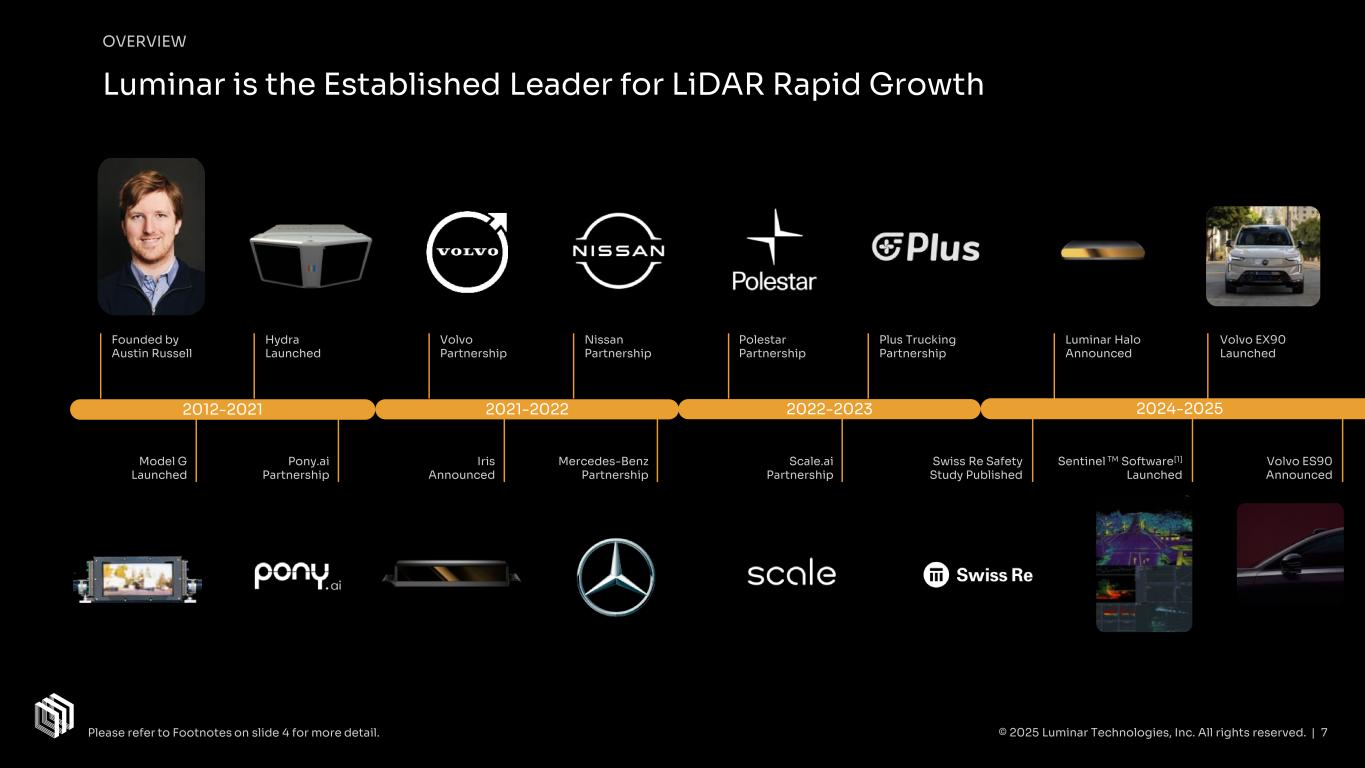

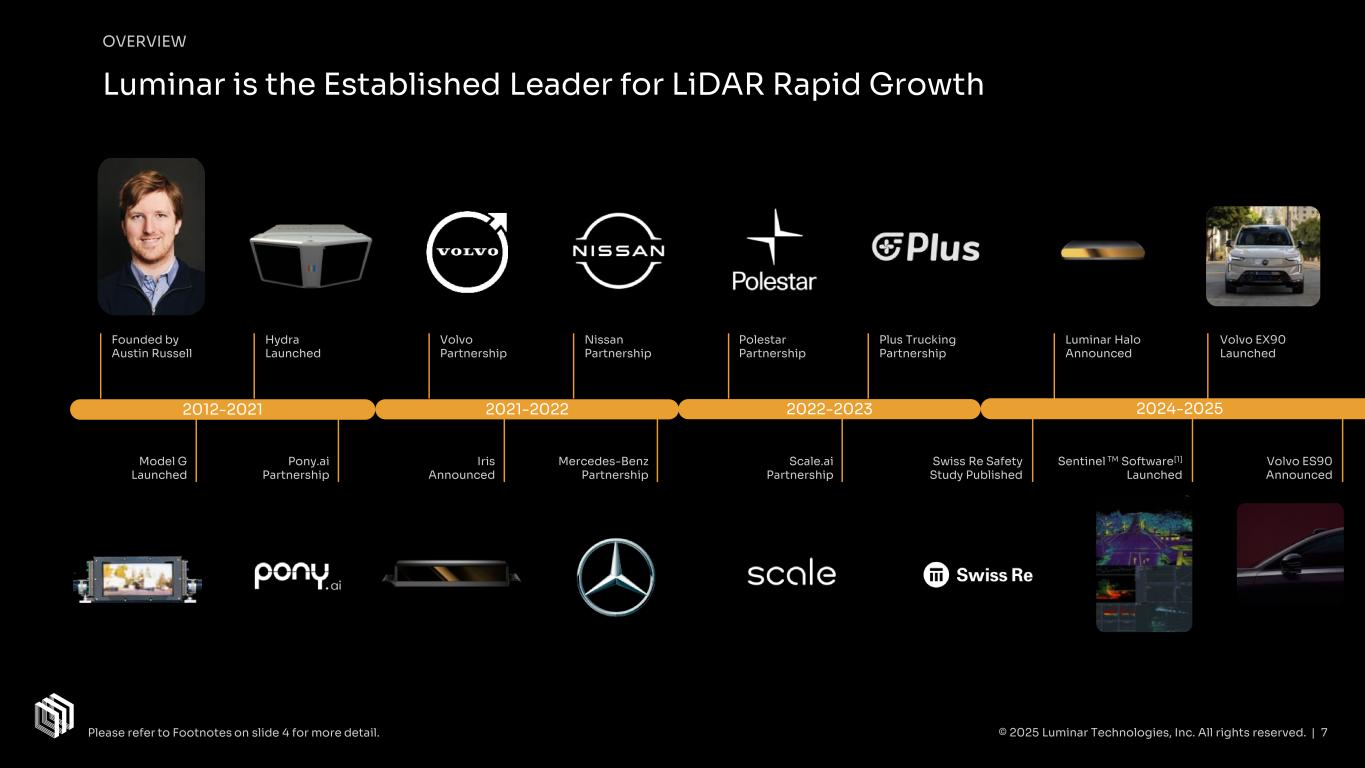

OVERVIEW Luminar is the Established Leader for LiDAR Rapid Growth 2012-2021 2021-2022 2022-2023 2024-2025 Swiss Re Safety Study Published Luminar Halo Announced Volvo EX90 Launched Plus Trucking Partnership Founded by Austin Russell Pony.ai Partnership Hydra Launched Volvo Partnership Nissan Partnership Model G Launched Scale.ai Partnership Sentinel TM Software[1] Launched Mercedes-Benz Partnership Iris Announced © 2025 Luminar Technologies, Inc. All rights reserved. | 7 Polestar Partnership Volvo ES90 Announced Please refer to Footnotes on slide 4 for more detail.

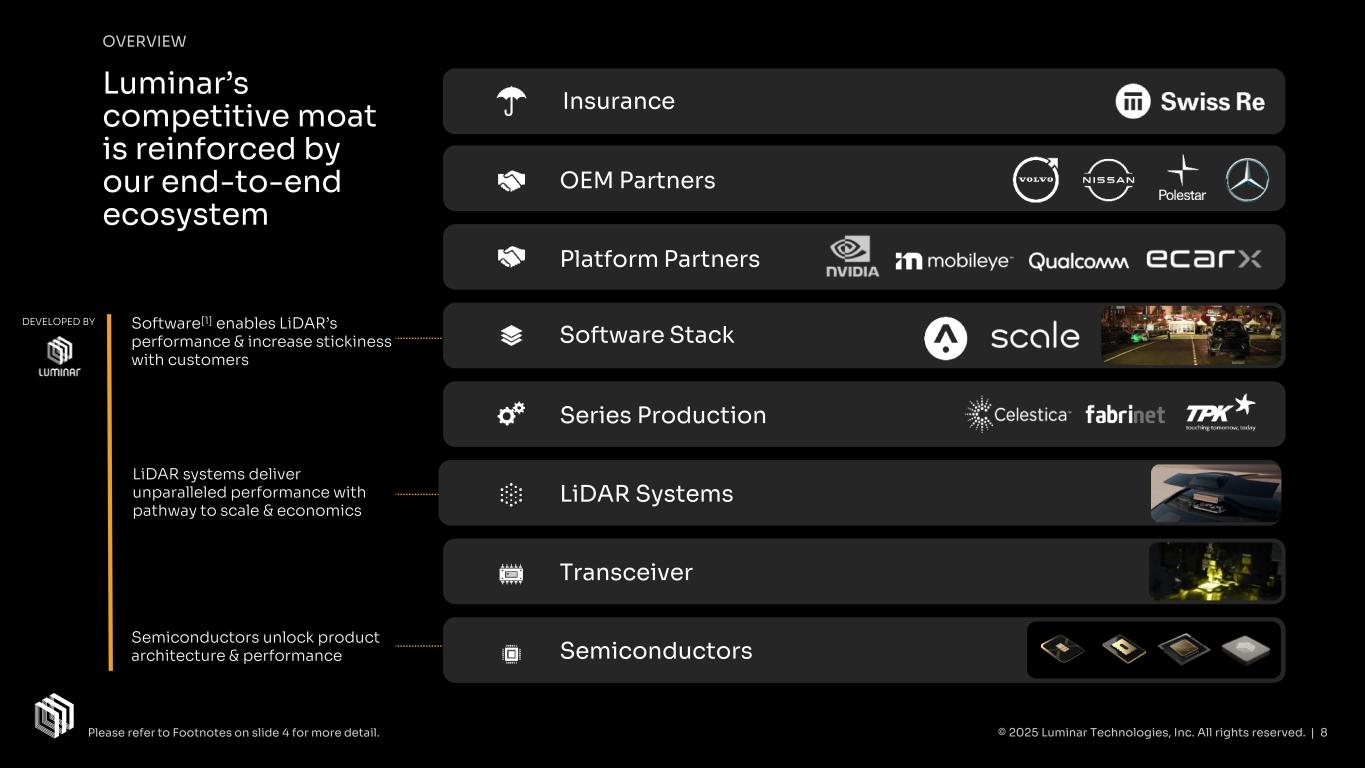

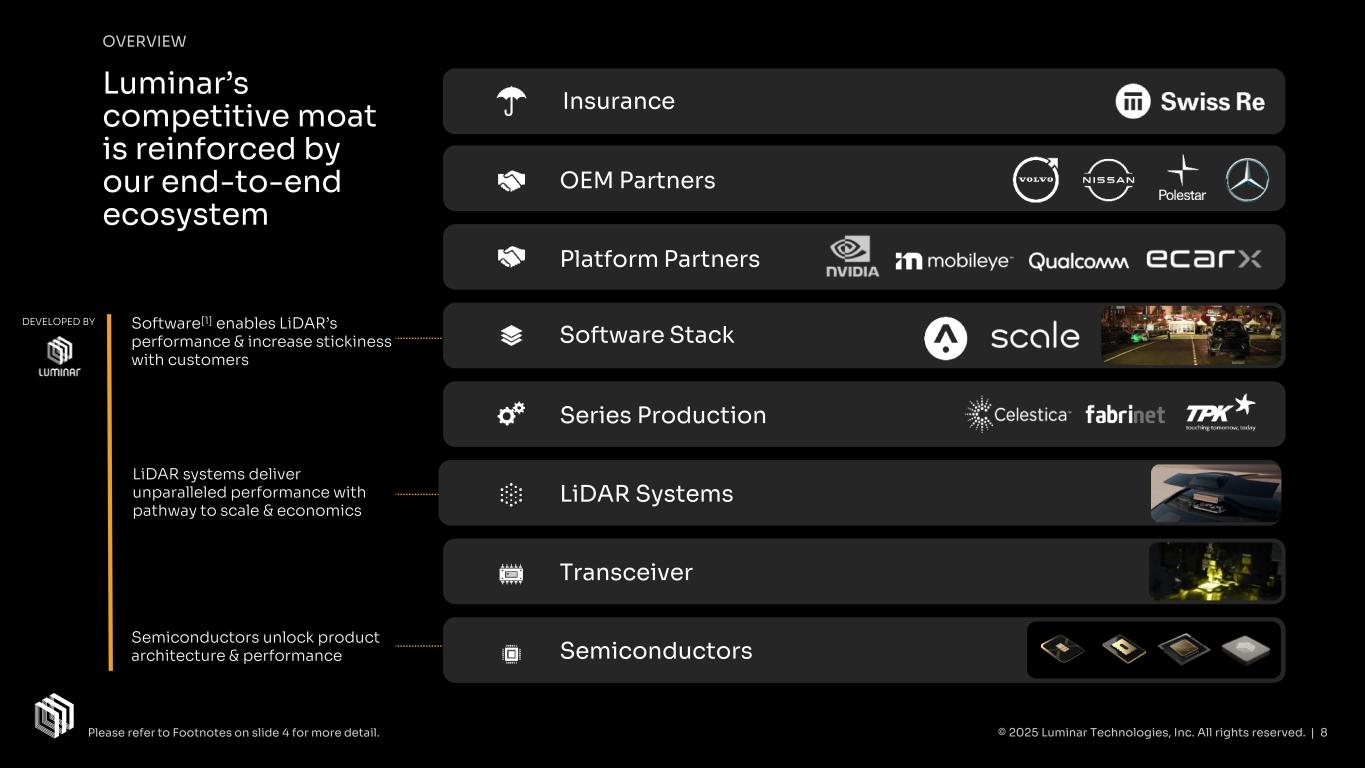

Transceiver LiDAR Systems Semiconductors Series Production Platform Partners OEM Partners Insurance Software Stack Luminar’s competitive moat is reinforced by our end-to-end ecosystem OVERVIEW Software[1] enables LiDAR’s performance & increase stickiness with customers LiDAR systems deliver unparalleled performance with pathway to scale & economics Semiconductors unlock product architecture & performance DEVELOPED BY © 2025 Luminar Technologies, Inc. All rights reserved. | 8Please refer to Footnotes on slide 4 for more detail.

Next-Gen ADAS & AV is Coming L2+ L3 & Beyond To improve safety performance versus Camera/RADAR LiDAR useful for L2+ Estimated ADAS & AV LiDAR TAM* in 2030 ~197M Unit TAM LIDAR’S ADVANTAGE What’s the LiDAR Opportunity? To provide reliable 3-D context & object detection for safe autonomy, along with upgrade optionality from L2+ LiDAR required for L3 & Beyond © 2025 Luminar Technologies, Inc. All rights reserved. | 9Note: * Estimated TAM of LiDAR in ADAS Applications by 2030 according to Frost & Sullivan.

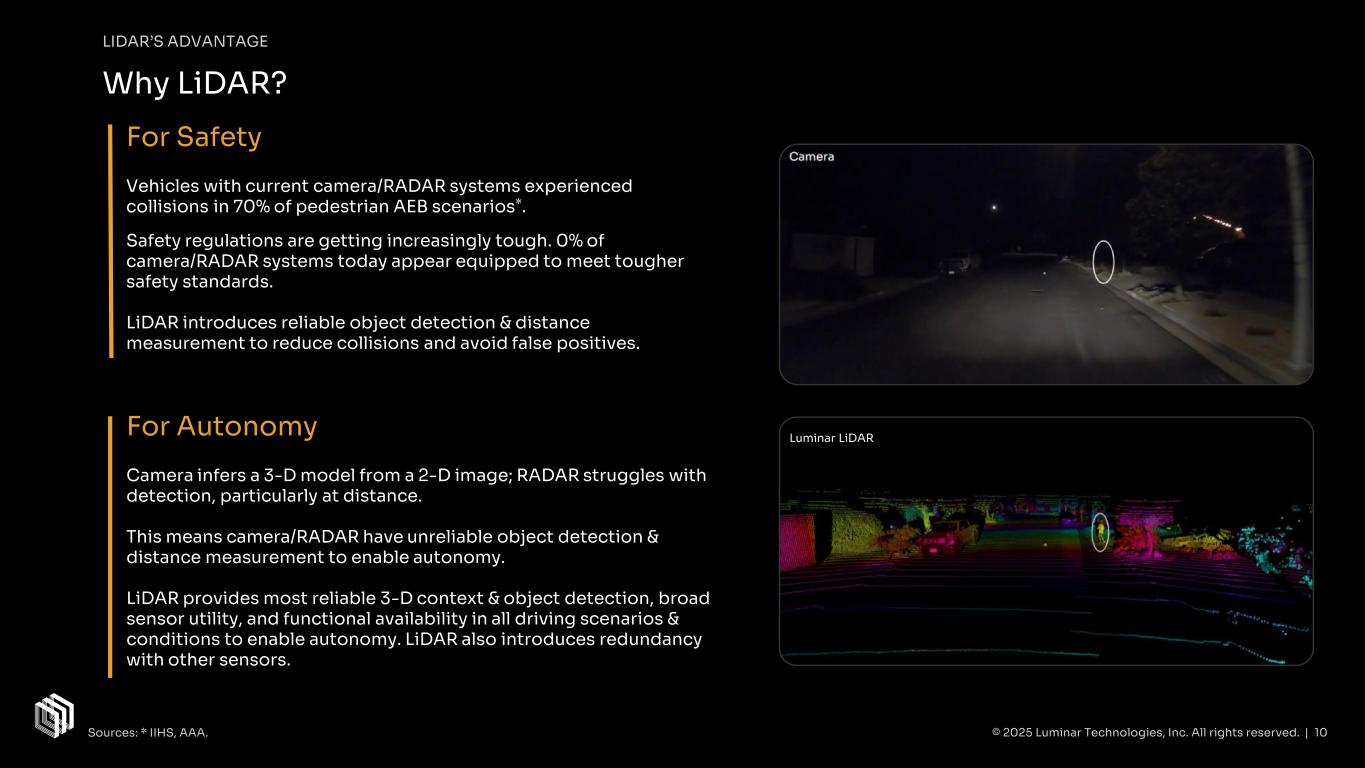

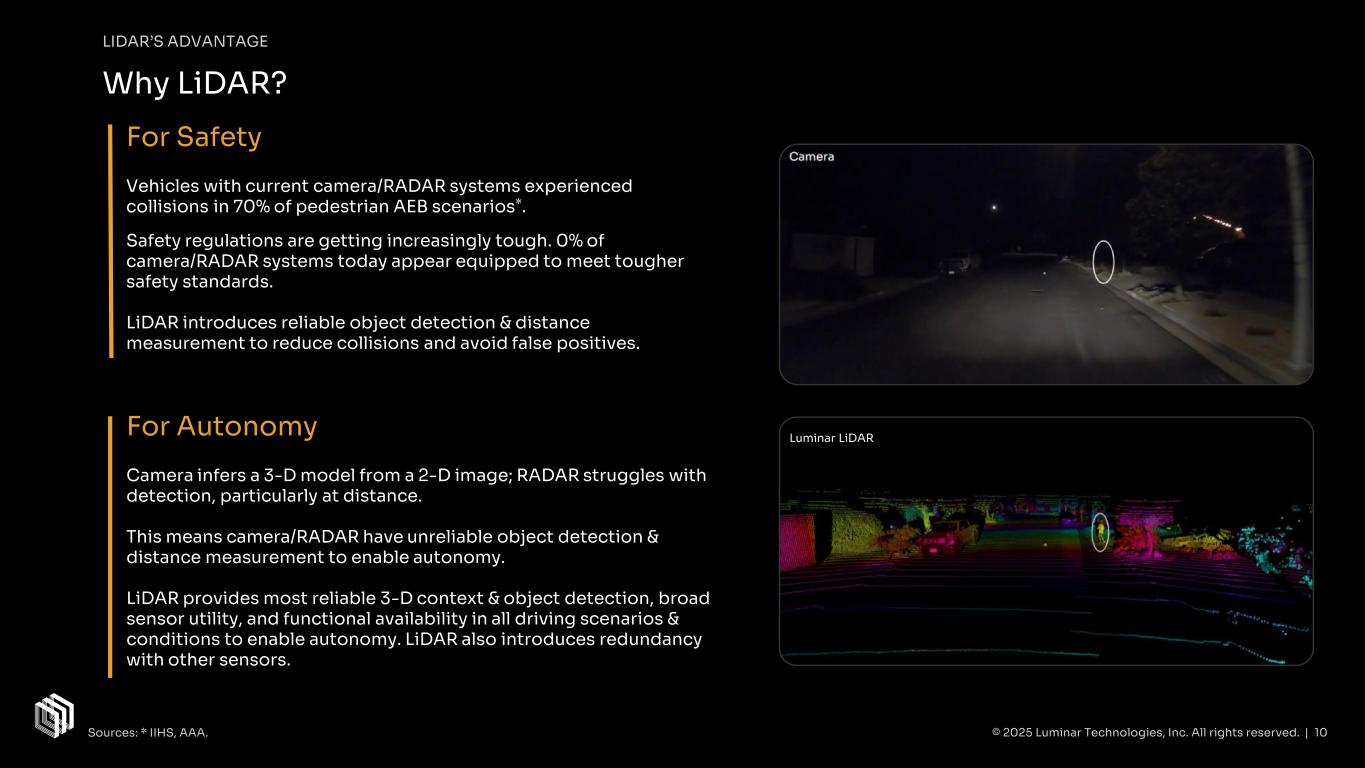

For Autonomy Camera infers a 3-D model from a 2-D image; RADAR struggles with detection, particularly at distance. This means camera/RADAR have unreliable object detection & distance measurement to enable autonomy. LiDAR provides most reliable 3-D context & object detection, broad sensor utility, and functional availability in all driving scenarios & conditions to enable autonomy. LiDAR also introduces redundancy with other sensors. For Safety Vehicles with current camera/RADAR systems experienced collisions in 70% of pedestrian AEB scenarios*. Safety regulations are getting increasingly tough. 0% of camera/RADAR systems today appear equipped to meet tougher safety standards. LiDAR introduces reliable object detection & distance measurement to reduce collisions and avoid false positives. LIDAR’S ADVANTAGE Why LiDAR? Luminar LiDAR © 2025 Luminar Technologies, Inc. All rights reserved. | 10Sources: * IIHS, AAA.

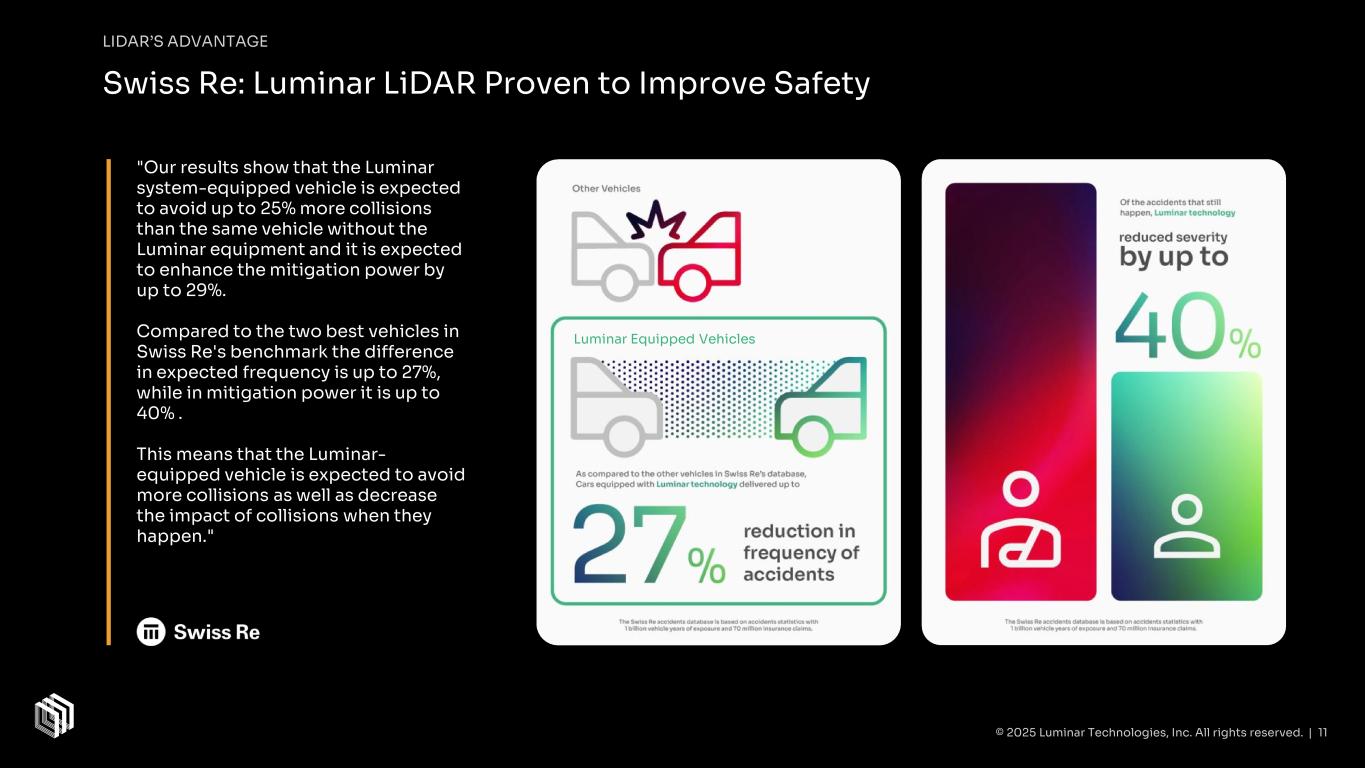

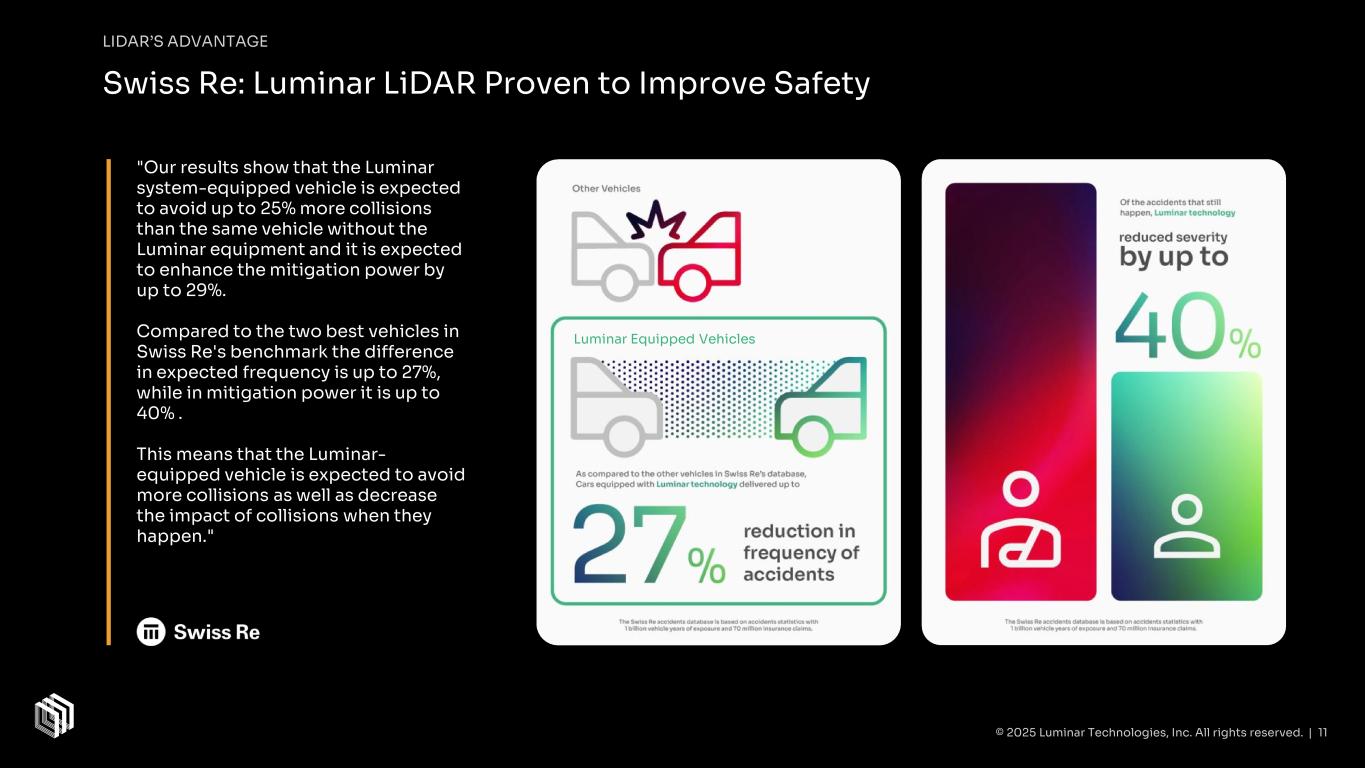

LIDAR’S ADVANTAGE Swiss Re: Luminar LiDAR Proven to Improve Safety "Our results show that the Luminar system-equipped vehicle is expected to avoid up to 25% more collisions than the same vehicle without the Luminar equipment and it is expected to enhance the mitigation power by up to 29%. Compared to the two best vehicles in Swiss Re's benchmark the difference in expected frequency is up to 27%, while in mitigation power it is up to 40% . This means that the Luminar- equipped vehicle is expected to avoid more collisions as well as decrease the impact of collisions when they happen." Luminar Equipped Vehicles © 2025 Luminar Technologies, Inc. All rights reserved. | 11

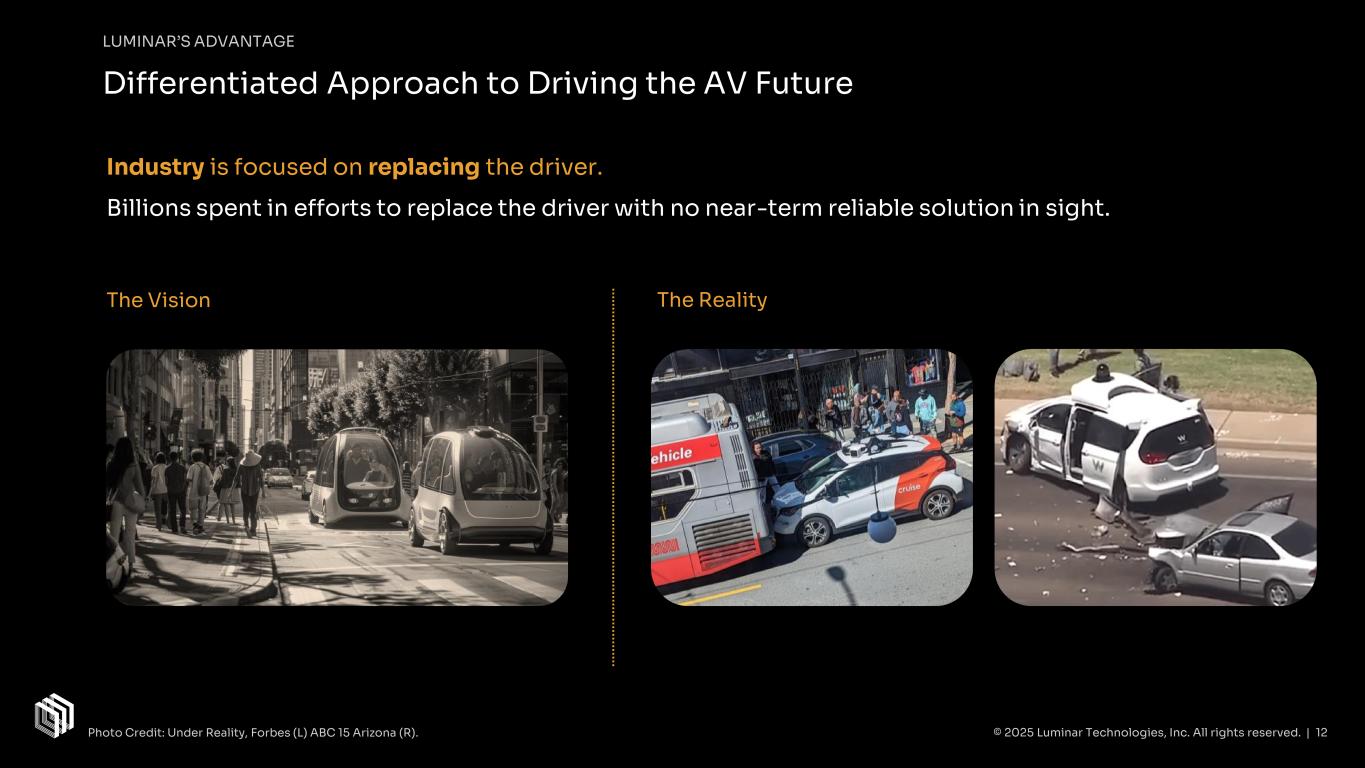

Industry is focused on replacing the driver. Billions spent in efforts to replace the driver with no near-term reliable solution in sight. The Vision The Reality Differentiated Approach to Driving the AV Future LUMINAR’S ADVANTAGE © 2025 Luminar Technologies, Inc. All rights reserved. | 12Photo Credit: Under Reality, Forbes (L) ABC 15 Arizona (R).

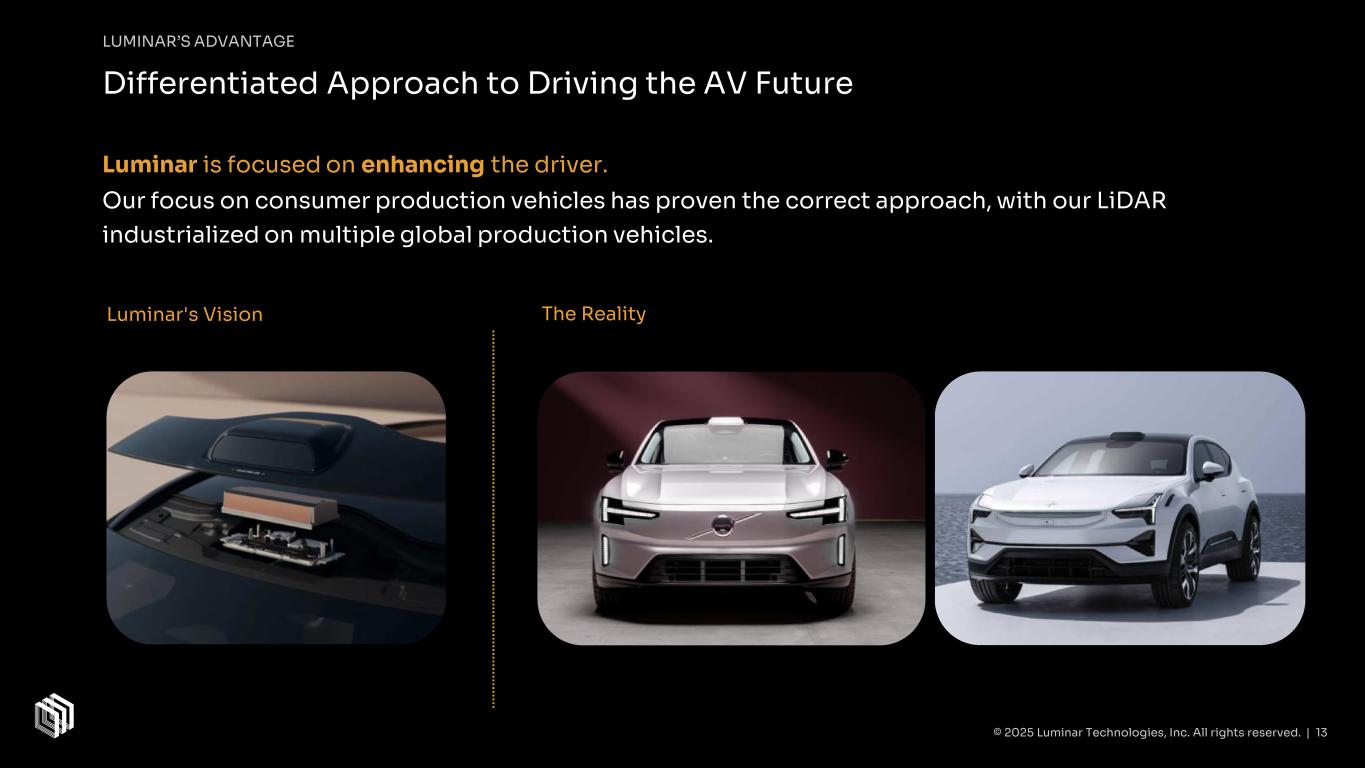

Differentiated Approach to Driving the AV Future LUMINAR’S ADVANTAGE © 2025 Luminar Technologies, Inc. All rights reserved. | 13 Luminar's Vision The Reality Luminar is focused on enhancing the driver. Our focus on consumer production vehicles has proven the correct approach, with our LiDAR industrialized on multiple global production vehicles.

Hybrid VehicleInternal Combustion Electric Vehicle Luminar is currently being planned into Programs Across All Major Powertrains LUMINAR’S ADVANTAGE Luminar & LiDAR are Powertrain Agnostic © 2025 Luminar Technologies, Inc. All rights reserved. | 14

LUMINAR’S ADVANTAGE Why Luminar? Others Path of Least Resistance Product decisions were made to 1. Get to market as fast as possible 2. Use off-the-shelf components Standard technology is not developed to meet the long-term application of safe autonomy. Luminar Path of Most Performance Product decisions were made to meet the needs of highway speed autonomy and maximum safety. These needs required custom component development from the chip-level up and supply chain development to achieve performance, scale, and economics. © 2025 Luminar Technologies, Inc. All rights reserved. | 15

LUMINAR’S ADVANTAGE Why 1550nm? To deliver safe highway speed autonomy, Range x Resolution is required. 905nm wavelength operates closer to that visible by human eye & can cause eye damage. 1550nm can output more power than 905nm while remaining eye safe. 1550nm emits on average 17x more photons into environment than 905nm. 17x photon budget = Better Range x Resolution 1550nm has more robust performance across solar & weather conditions. 200m 100m 50m 905nm Peer A 905nm Peer B 1550nm Luminar Birds Eye Point Cloud Illustration of Luminar versus 905nm Peers Points/Frame @ >50m 1.6K Points/Frame @ >50m 5.6K Points/Frame @ >50m 21.4K © 2025 Luminar Technologies, Inc. All rights reserved. | 16

Our Foundational Technology Moat LUMINAR’S ADVANTAGE Laser & Laser Chip ASIC Receiver & Packaging 79 Engineers 44 PhDs & M.Engs Gen 4 laser chip (InP) 5th gen receiver chip (InGaAs) Laser driver chip (Si) Custom developed components from Luminar Semiconductor, Inc. 5th gen signal processing chip (Si) Luminar’s LiDAR leverages highly specialized components developed by Luminar Semiconductor Inc to: Enable performance and lower supply chain cost Enhance competitive moat Accelerate pace of innovation © 2025 Luminar Technologies, Inc. All rights reserved. | 17

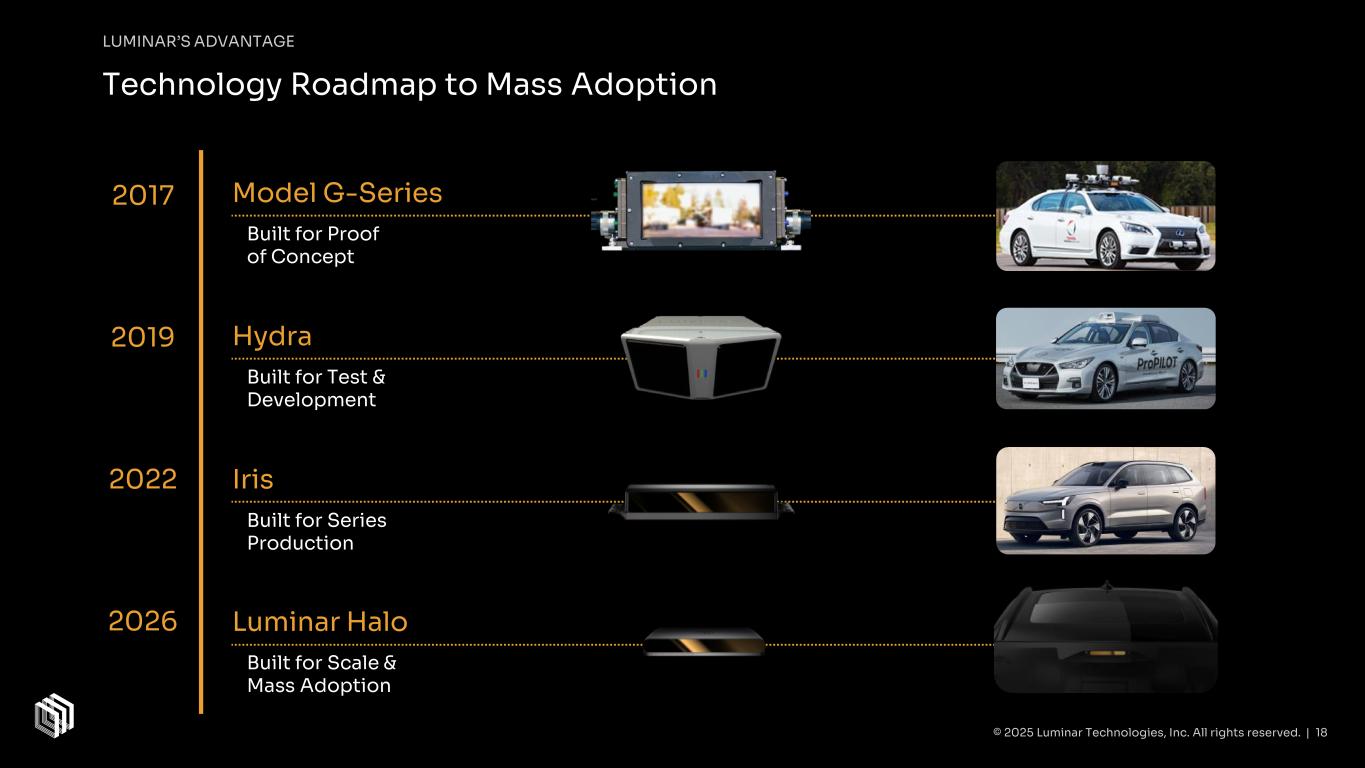

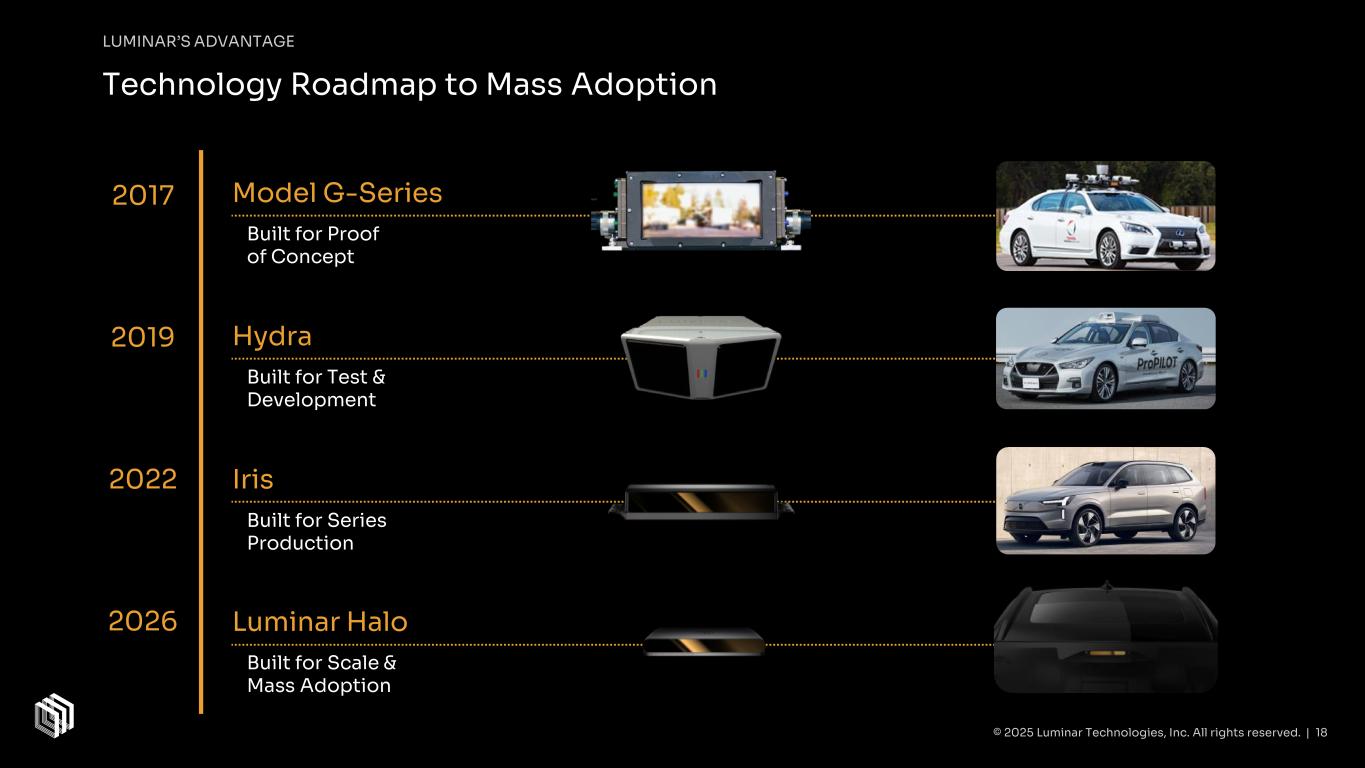

Iris Built for Series Production 2022 Luminar Halo Built for Scale & Mass Adoption 2026 Model G-Series Built for Proof of Concept 2017 Hydra Built for Test & Development 2019 Technology Roadmap to Mass Adoption LUMINAR’S ADVANTAGE © 2025 Luminar Technologies, Inc. All rights reserved. | 18

2020 Estimated number of LiDAR efforts >100 Now LiDAR companies that successfully developed and industrialized product <10 LiDAR industrialized, launched & standard on global production vehicle 1 Luminar has Separated from the Pack LOOKING BACK © 2025 Luminar Technologies, Inc. All rights reserved. | 19 Note: IDTechEx estimated 106 3D LiDAR players as of 2020. Sources: IDTechEx, Forbes.

Near-Term Priorities LOOKING AHEAD 1 2 3 4 Ramp Production for Volvo & Others Post SOP Ramp Down Costs Post SOP OpEx & COGS Launch Additional Vehicle Programs Accelerate Luminar Halo to Market 5 Sufficiently Capitalize for Future Growth © 2025 Luminar Technologies, Inc. All rights reserved. | 20

Q4’24 Business Update © 2025 Luminar Technologies, Inc. All rights reserved. | 21

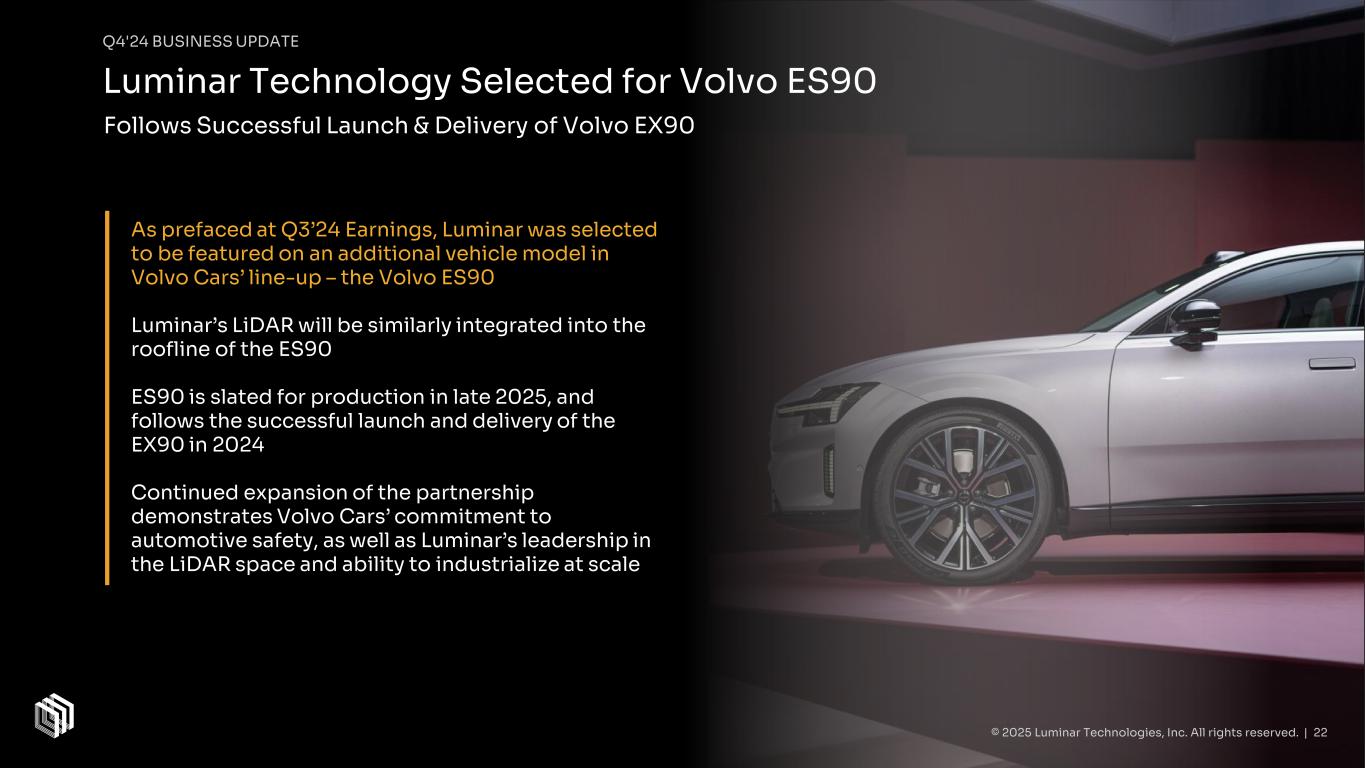

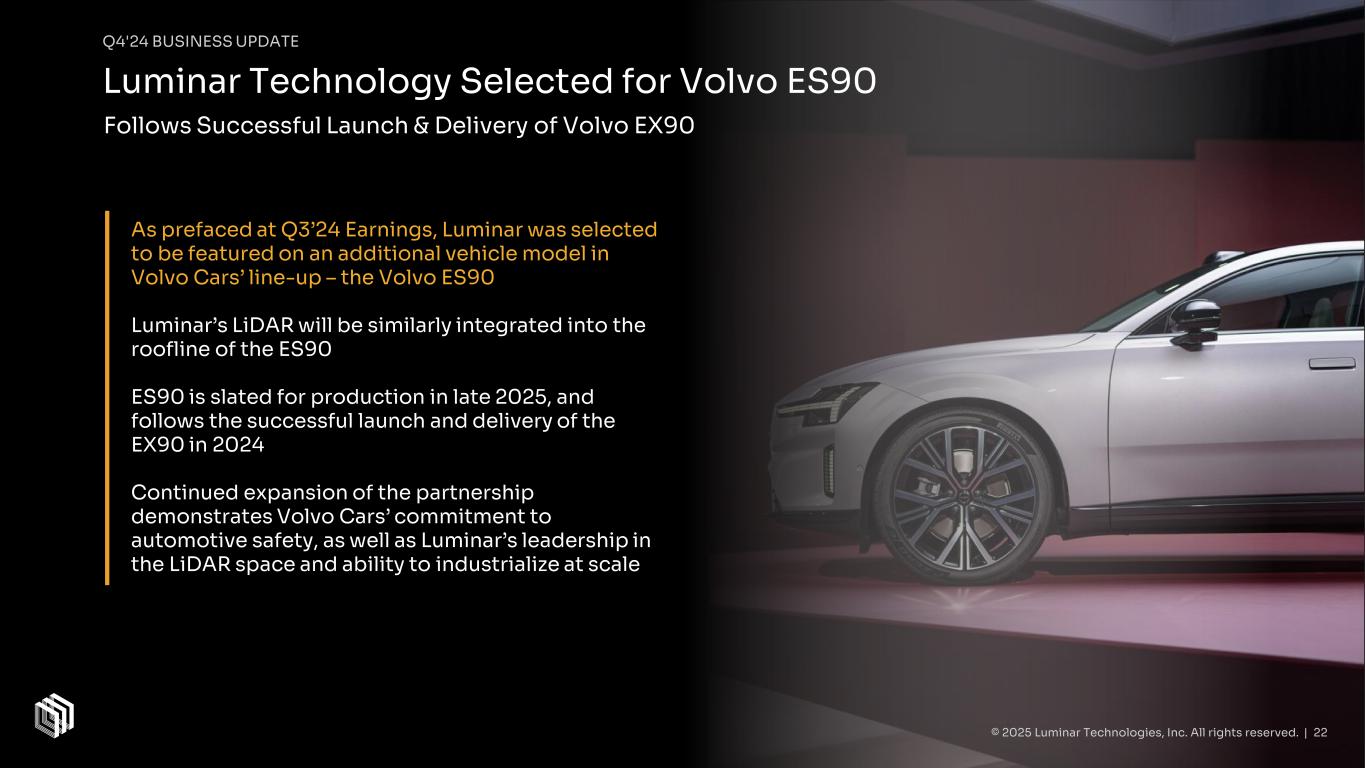

Q4'24 BUSINESS UPDATE As prefaced at Q3’24 Earnings, Luminar was selected to be featured on an additional vehicle model in Volvo Cars’ line-up – the Volvo ES90 Luminar’s LiDAR will be similarly integrated into the roofline of the ES90 ES90 is slated for production in late 2025, and follows the successful launch and delivery of the EX90 in 2024 Continued expansion of the partnership demonstrates Volvo Cars’ commitment to automotive safety, as well as Luminar’s leadership in the LiDAR space and ability to industrialize at scale © 2025 Luminar Technologies, Inc. All rights reserved. | 22 Luminar Technology Selected for Volvo ES90 Follows Successful Launch & Delivery of Volvo EX90

Q4'24 BUSINESS UPDATE Momentum with New & Existing Customers OEM will integrate Luminar’s technology into its industrial automation platform Start of production for initial vehicle platform targeted for 2026 Program reinforces Luminar’s applications beyond automotive markets to the industrial sector, with a common objective of improving safety & unlocking automated driving capabilities OEM and Luminar decided to transition development work from customized Iris+ product to unified Luminar Halo platform Converting key customers to Luminar Halo platform, aligning on specifications across OEMs, while maintaining backwards-compatibility with Iris family Unified product architecture supports focused development, leveraging previous work from Iris family for reduced costs and faster time to market Partnership with a New Major Industrial Equipment OEM Development Contract for Luminar Halo with Auto OEM © 2025 Luminar Technologies, Inc. All rights reserved. | 23

© 2025 Luminar Technologies, Inc. All rights reserved. | 24 Q4'24 BUSINESS UPDATE Converting Customers from Iris Family to Luminar Halo Transitioning from investing & developing multiple products and variants simultaneously to meet different customers' needs to a singular technology platform (Luminar Halo) that can meet all customer requirements. Essentially all engineering & development efforts with customers are now shifting to Luminar Halo. Iris+ eliminated from Luminar product family and will no longer serve as bridge product from Iris to Luminar Halo. Narrowing of product scope will further enable streamlining of Luminar’s business model, reducing costs, and accelerating path to profitability. Iris Iris+ Automotive | Industrial Luminar Halo Historical Product Development: Customer-Centric Go-Forward Plan: Unified LiDAR Platform Automotive | Industrial

Q4'24 BUSINESS UPDATE Continued Progress with Luminar Halo Luminar has successfully developed and produced fully integrated samples of Luminar Halo, demonstrating its breakthrough capabilities in a small, low cost package Luminar Halo was uniquely designed for efficient manufacturability at high-volume production Luminar-TPK Partnership (LTEC) has allowed Luminar to already begin industrialization after the first samples were produced, in a parallelized and integrated capacity As a result, samples have already integrated multiple production-intent subassemblies © 2025 Luminar Technologies, Inc. All rights reserved. | 25 Accelerated Industrialization Supported by LTEC

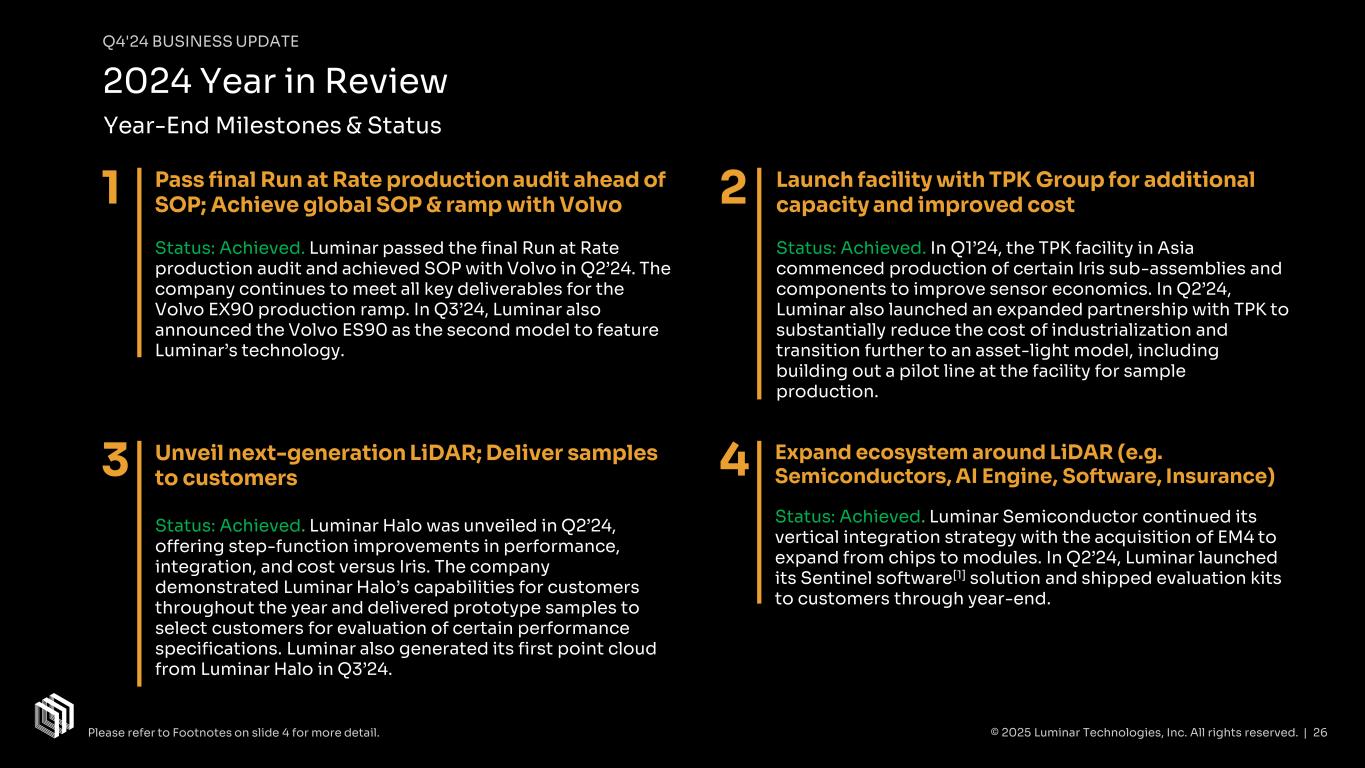

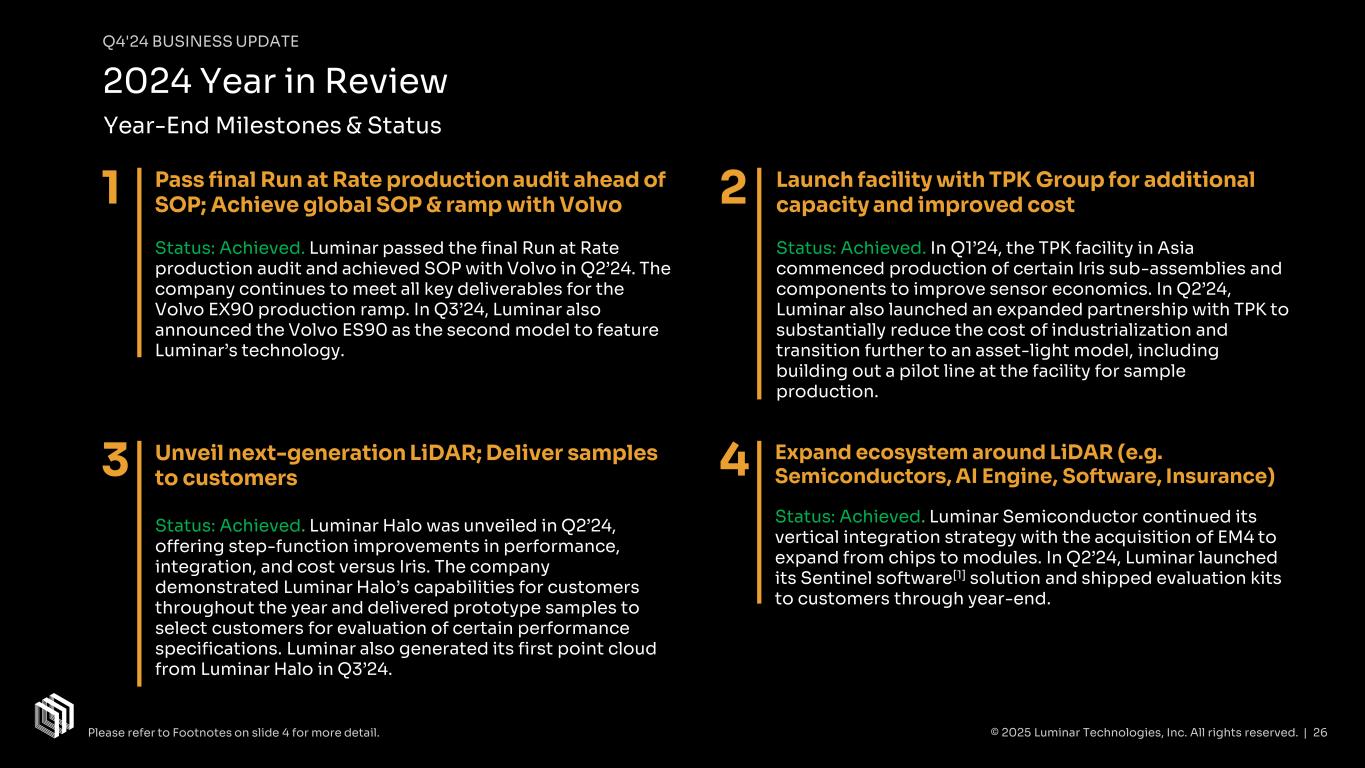

Q4'24 BUSINESS UPDATE 2024 Year in Review Pass final Run at Rate production audit ahead of SOP; Achieve global SOP & ramp with Volvo Status: Achieved. Luminar passed the final Run at Rate production audit and achieved SOP with Volvo in Q2’24. The company continues to meet all key deliverables for the Volvo EX90 production ramp. In Q3’24, Luminar also announced the Volvo ES90 as the second model to feature Luminar’s technology. Launch facility with TPK Group for additional capacity and improved cost Status: Achieved. In Q1’24, the TPK facility in Asia commenced production of certain Iris sub-assemblies and components to improve sensor economics. In Q2’24, Luminar also launched an expanded partnership with TPK to substantially reduce the cost of industrialization and transition further to an asset-light model, including building out a pilot line at the facility for sample production. Unveil next-generation LiDAR; Deliver samples to customers Status: Achieved. Luminar Halo was unveiled in Q2’24, offering step-function improvements in performance, integration, and cost versus Iris. The company demonstrated Luminar Halo’s capabilities for customers throughout the year and delivered prototype samples to select customers for evaluation of certain performance specifications. Luminar also generated its first point cloud from Luminar Halo in Q3’24. Expand ecosystem around LiDAR (e.g. Semiconductors, AI Engine, Software, Insurance) Status: Achieved. Luminar Semiconductor continued its vertical integration strategy with the acquisition of EM4 to expand from chips to modules. In Q2’24, Luminar launched its Sentinel software[1] solution and shipped evaluation kits to customers through year-end. 1 2 3 4 © 2025 Luminar Technologies, Inc. All rights reserved. | 26 Year-End Milestones & Status Please refer to Footnotes on slide 4 for more detail.

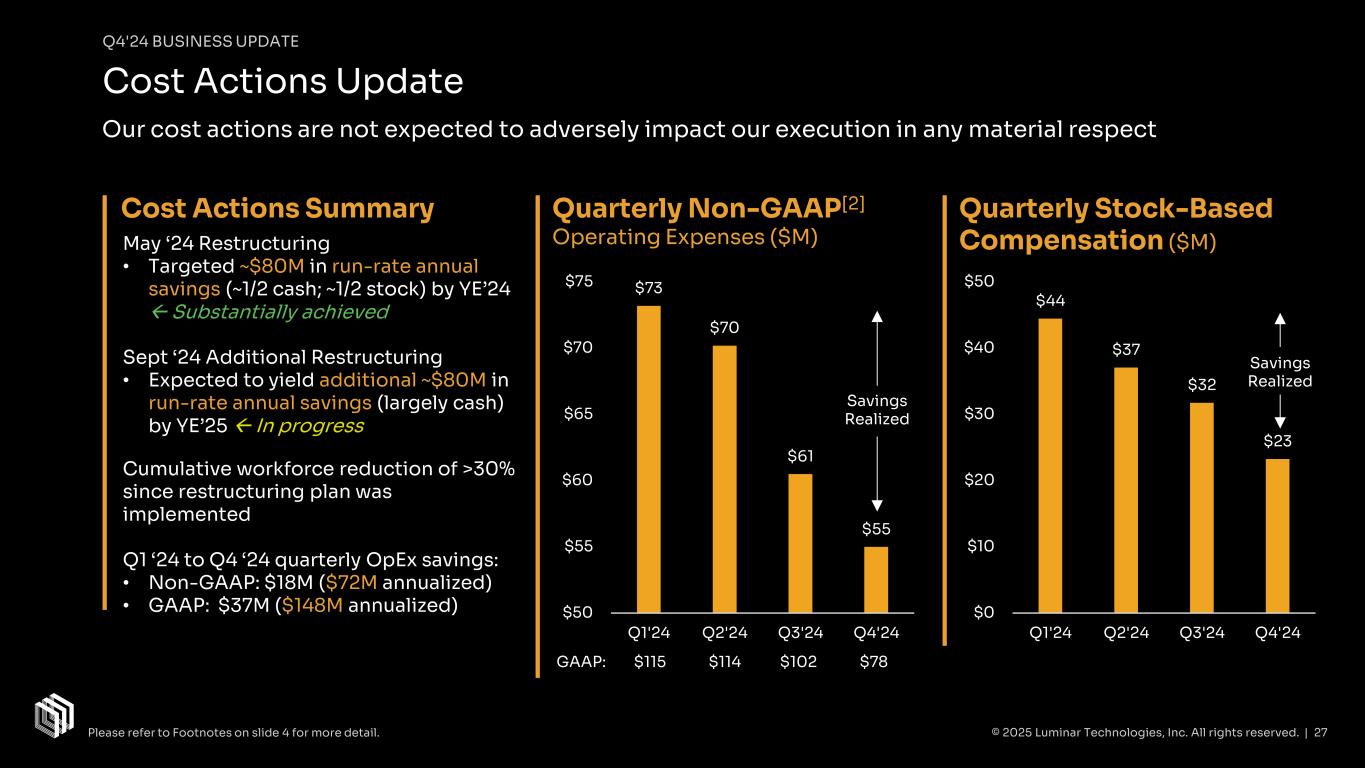

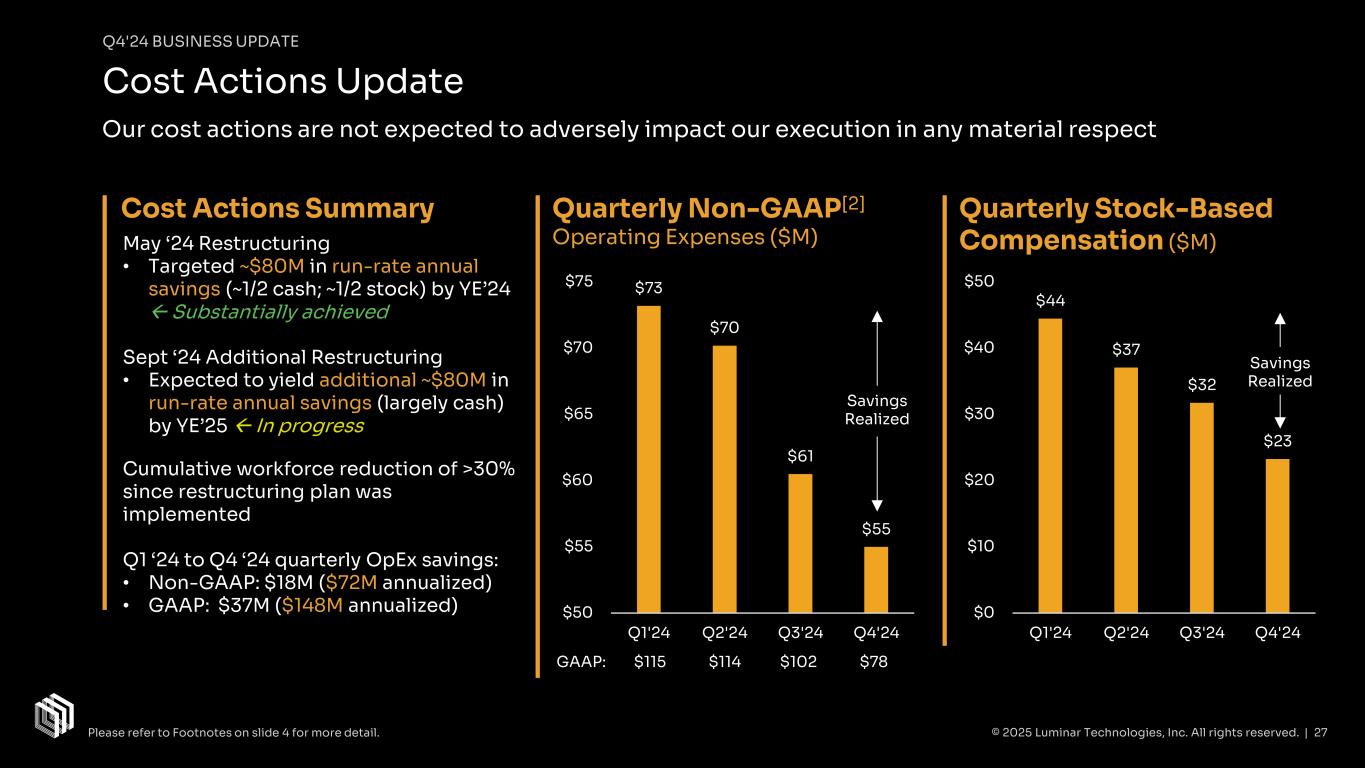

$73 $70 $61 $55 $50 $55 $60 $65 $70 $75 Q1'24 Q2'24 Q3'24 Q4'24 Q4'24 BUSINESS UPDATE Cost Actions Update May ‘24 Restructuring • Targeted ~$80M in run-rate annual savings (~1/2 cash; ~1/2 stock) by YE’24 Substantially achieved Sept ‘24 Additional Restructuring • Expected to yield additional ~$80M in run-rate annual savings (largely cash) by YE’25 In progress Cumulative workforce reduction of >30% since restructuring plan was implemented Q1 ‘24 to Q4 ‘24 quarterly OpEx savings: • Non-GAAP: $18M ($72M annualized) • GAAP: $37M ($148M annualized) Cost Actions Summary Our cost actions are not expected to adversely impact our execution in any material respect Quarterly Non-GAAP[2] Operating Expenses ($M) Quarterly Stock-Based Compensation ($M) Savings Realized © 2025 Luminar Technologies, Inc. All rights reserved. | 27 GAAP: $115 $114 $102 $78 $44 $37 $32 $23 $0 $10 $20 $30 $40 $50 Q1'24 Q2'24 Q3'24 Q4'24 Savings Realized Please refer to Footnotes on slide 4 for more detail.

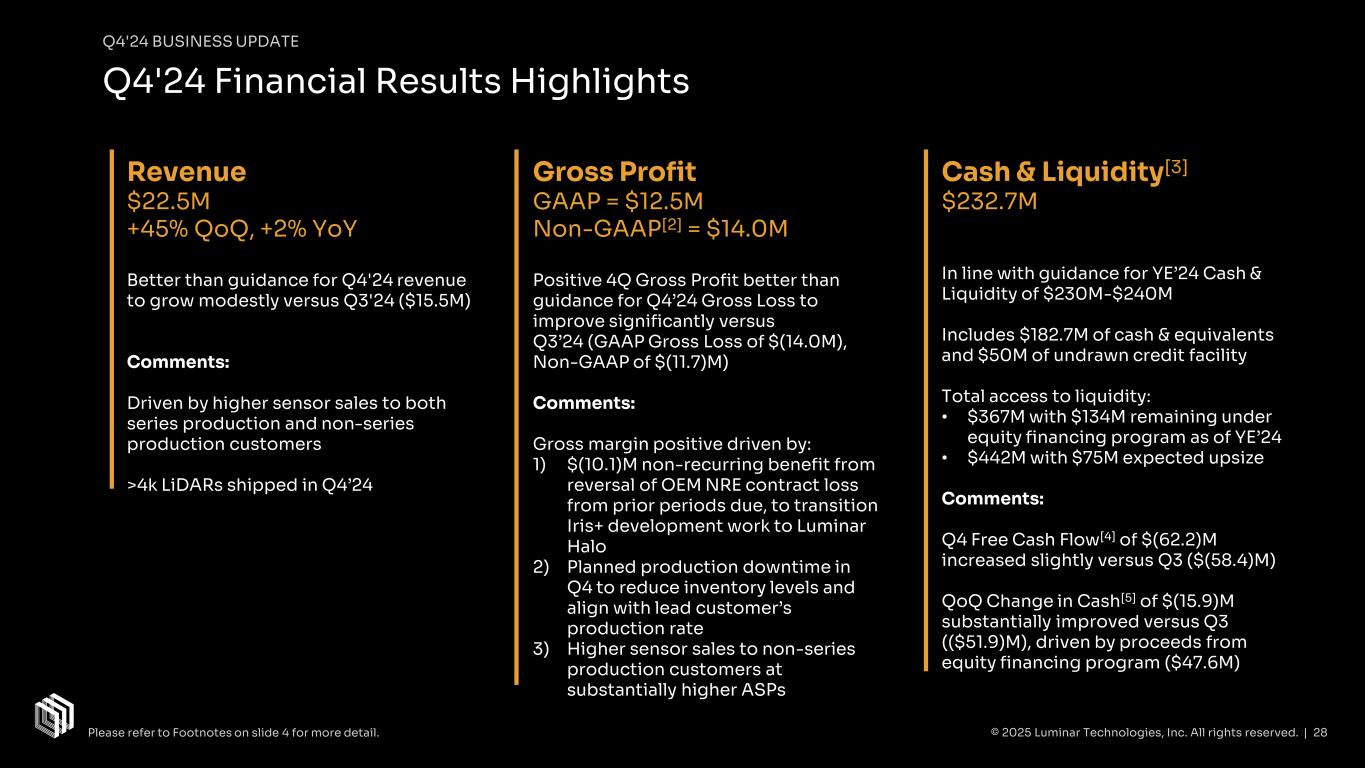

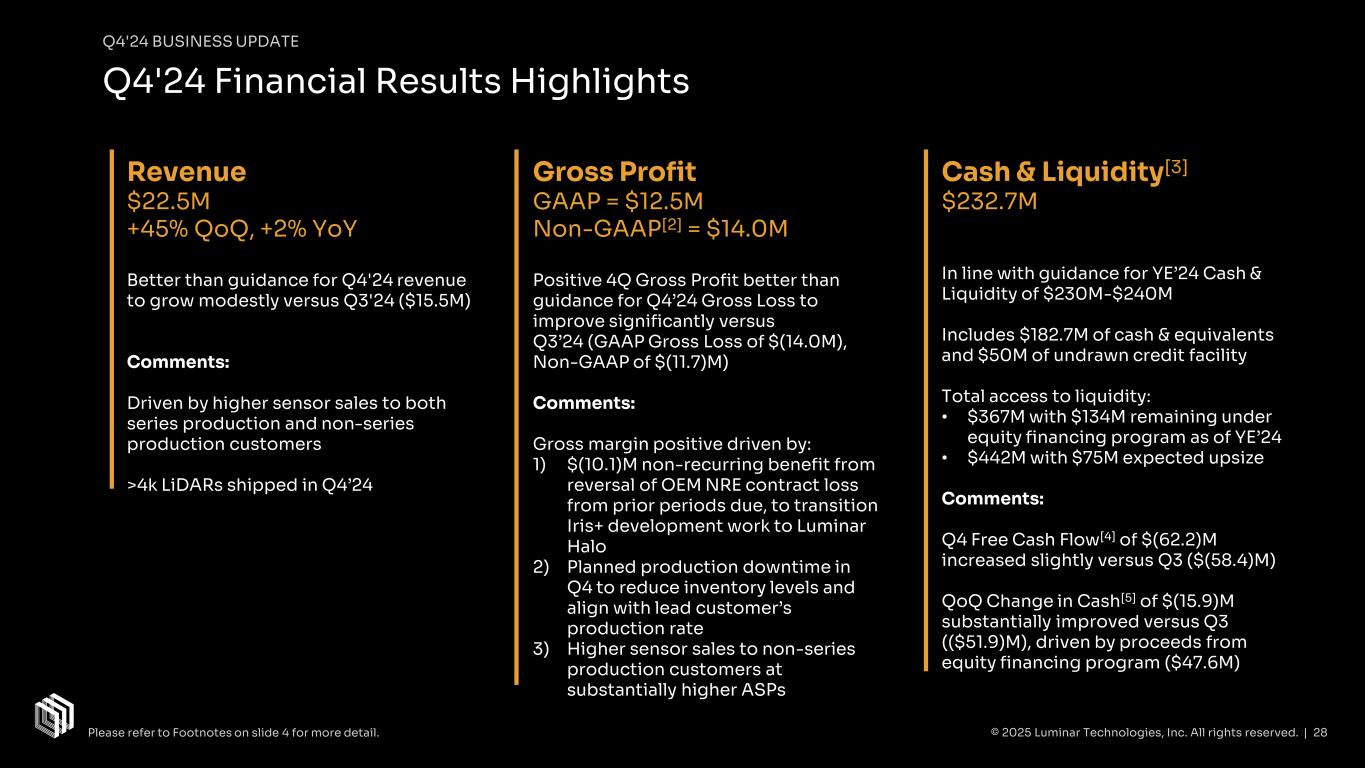

Revenue $22.5M +45% QoQ, +2% YoY Better than guidance for Q4'24 revenue to grow modestly versus Q3'24 ($15.5M) Comments: Driven by higher sensor sales to both series production and non-series production customers >4k LiDARs shipped in Q4’24 Gross Profit GAAP = $12.5M Non-GAAP[2] = $14.0M Positive 4Q Gross Profit better than guidance for Q4’24 Gross Loss to improve significantly versus Q3’24 (GAAP Gross Loss of $(14.0M), Non-GAAP of $(11.7)M) Comments: Gross margin positive driven by: 1) $(10.1)M non-recurring benefit from reversal of OEM NRE contract loss from prior periods due, to transition Iris+ development work to Luminar Halo 2) Planned production downtime in Q4 to reduce inventory levels and align with lead customer’s production rate 3) Higher sensor sales to non-series production customers at substantially higher ASPs Cash & Liquidity[3] $232.7M In line with guidance for YE’24 Cash & Liquidity of $230M-$240M Includes $182.7M of cash & equivalents and $50M of undrawn credit facility Total access to liquidity: • $367M with $134M remaining under equity financing program as of YE’24 • $442M with $75M expected upsize Comments: Q4 Free Cash Flow[4] of $(62.2)M increased slightly versus Q3 ($(58.4)M) QoQ Change in Cash[5] of $(15.9)M substantially improved versus Q3 (($51.9)M), driven by proceeds from equity financing program ($47.6M) Q4'24 BUSINESS UPDATE Q4'24 Financial Results Highlights © 2025 Luminar Technologies, Inc. All rights reserved. | 28Please refer to Footnotes on slide 4 for more detail.

FY’25 Guidance © 2025 Luminar Technologies, Inc. All rights reserved. | 29

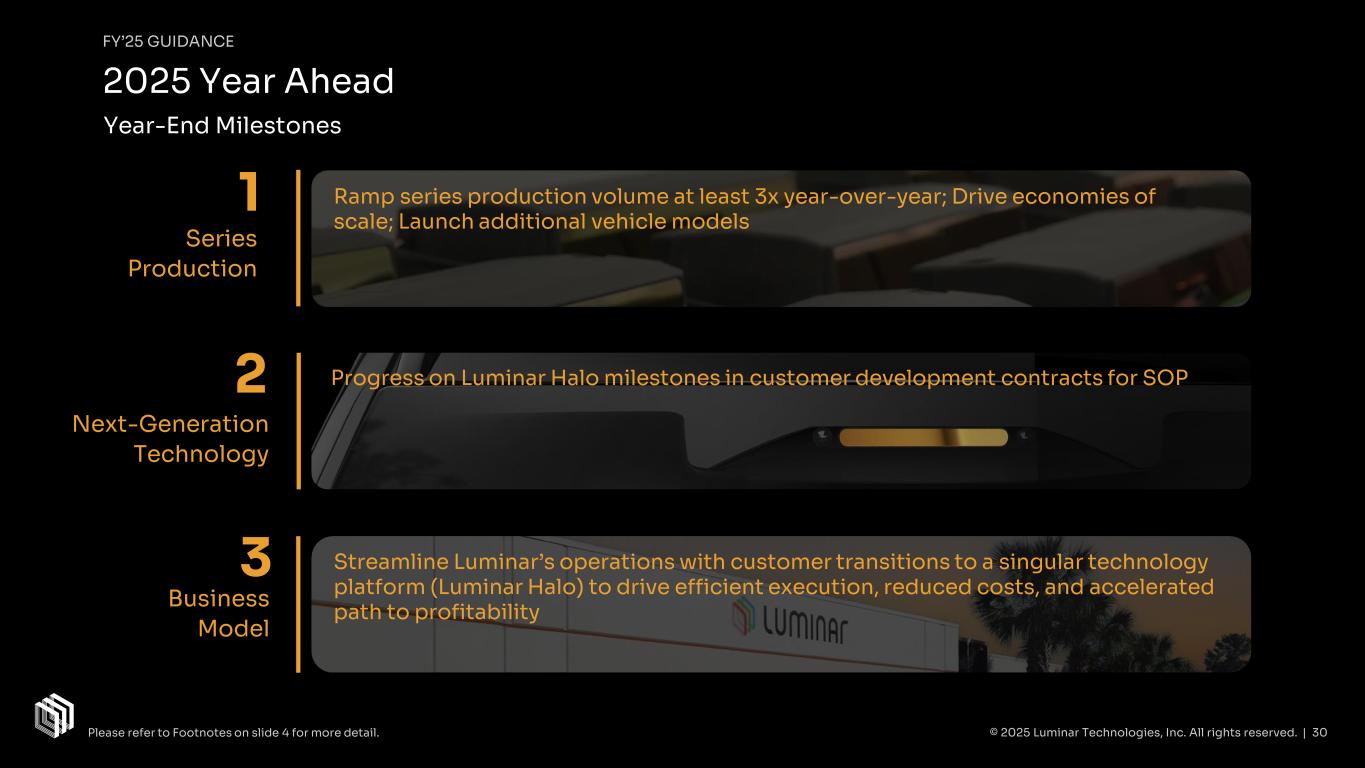

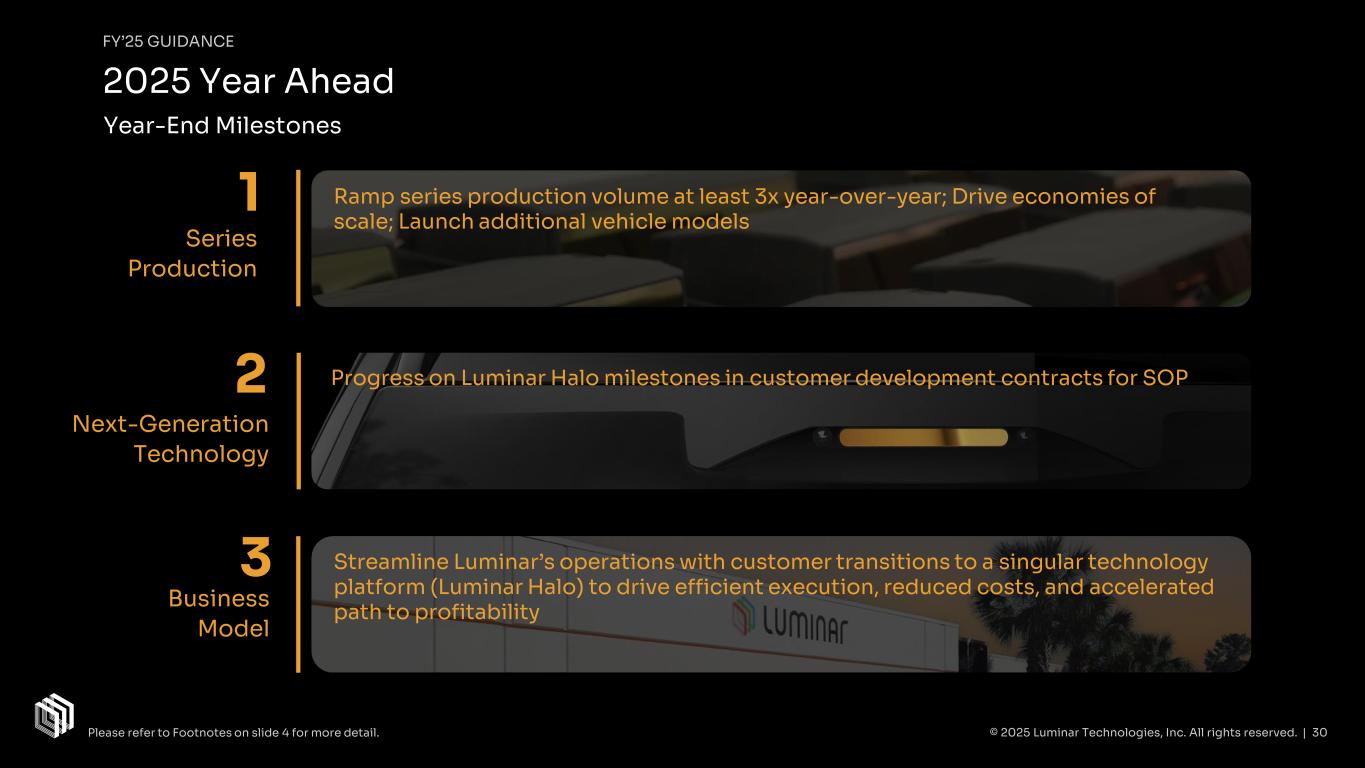

FY’25 GUIDANCE 2025 Year Ahead Ramp series production volume at least 3x year-over-year; Drive economies of scale; Launch additional vehicle models Progress on Luminar Halo milestones in customer development contracts for SOP Streamline Luminar’s operations with customer transitions to a singular technology platform (Luminar Halo) to drive efficient execution, reduced costs, and accelerated path to profitability Series Production Next-Generation Technology Business Model © 2025 Luminar Technologies, Inc. All rights reserved. | 30 Year-End Milestones Please refer to Footnotes on slide 4 for more detail. 1 2 3

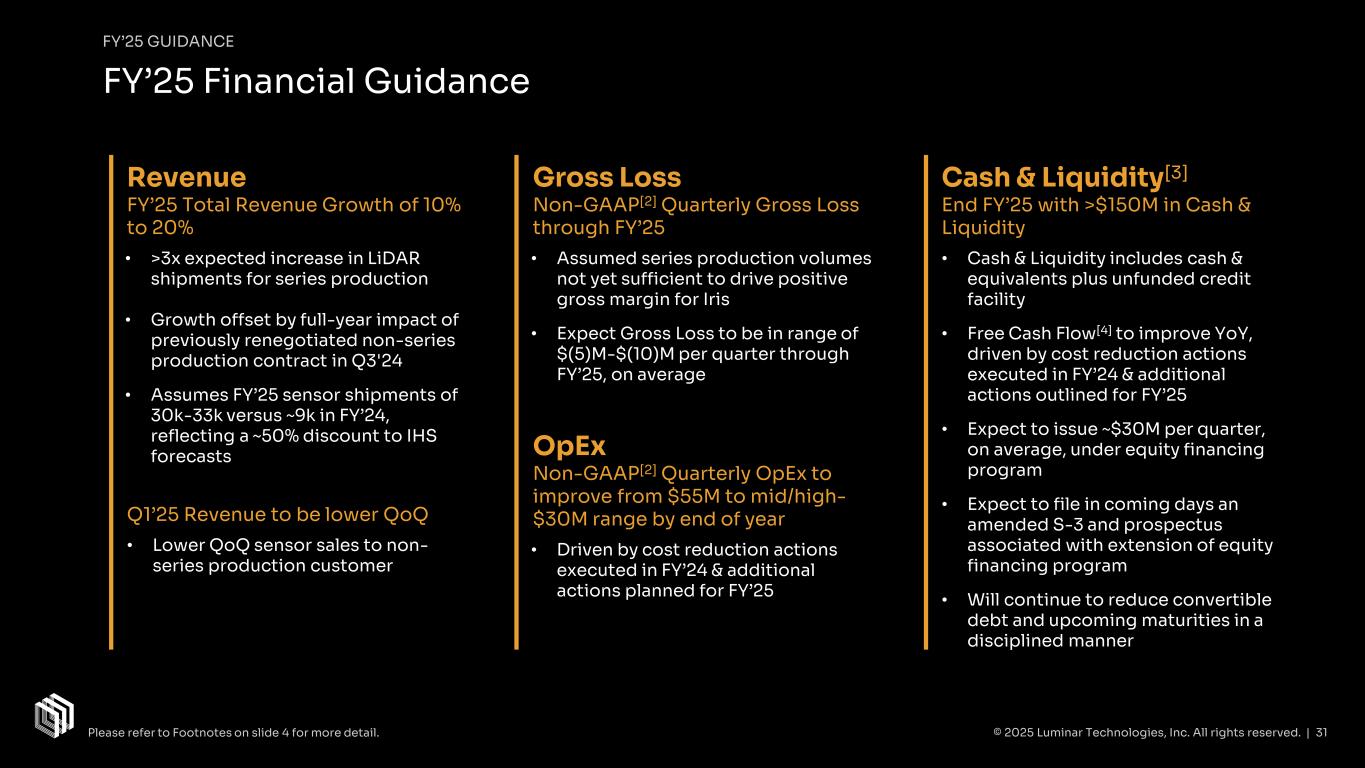

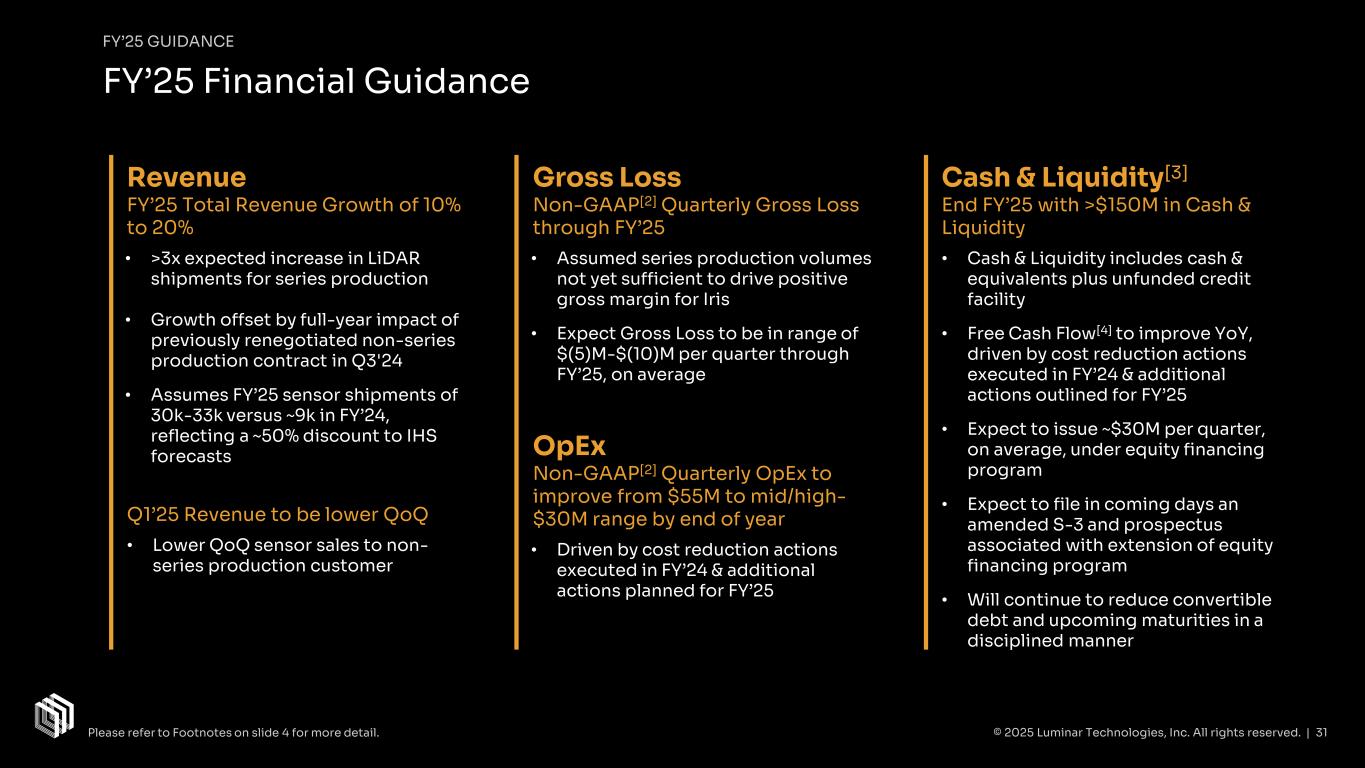

FY’25 GUIDANCE FY’25 Financial Guidance Revenue FY’25 Total Revenue Growth of 10% to 20% • >3x expected increase in LiDAR shipments for series production • Growth offset by full-year impact of previously renegotiated non-series production contract in Q3'24 • Assumes FY’25 sensor shipments of 30k-33k versus ~9k in FY’24, reflecting a ~50% discount to IHS forecasts Q1’25 Revenue to be lower QoQ • Lower QoQ sensor sales to non- series production customer Gross Loss Non-GAAP[2] Quarterly Gross Loss through FY’25 • Assumed series production volumes not yet sufficient to drive positive gross margin for Iris • Expect Gross Loss to be in range of $(5)M-$(10)M per quarter through FY’25, on average OpEx Non-GAAP[2] Quarterly OpEx to improve from $55M to mid/high- $30M range by end of year • Driven by cost reduction actions executed in FY’24 & additional actions planned for FY’25 Cash & Liquidity[3] End FY’25 with >$150M in Cash & Liquidity • Cash & Liquidity includes cash & equivalents plus unfunded credit facility • Free Cash Flow[4] to improve YoY, driven by cost reduction actions executed in FY’24 & additional actions outlined for FY’25 • Expect to issue ~$30M per quarter, on average, under equity financing program • Expect to file in coming days an amended S-3 and prospectus associated with extension of equity financing program • Will continue to reduce convertible debt and upcoming maturities in a disciplined manner © 2025 Luminar Technologies, Inc. All rights reserved. | 31Please refer to Footnotes on slide 4 for more detail.

Appendix © 2025 Luminar Technologies, Inc. All rights reserved. | 32

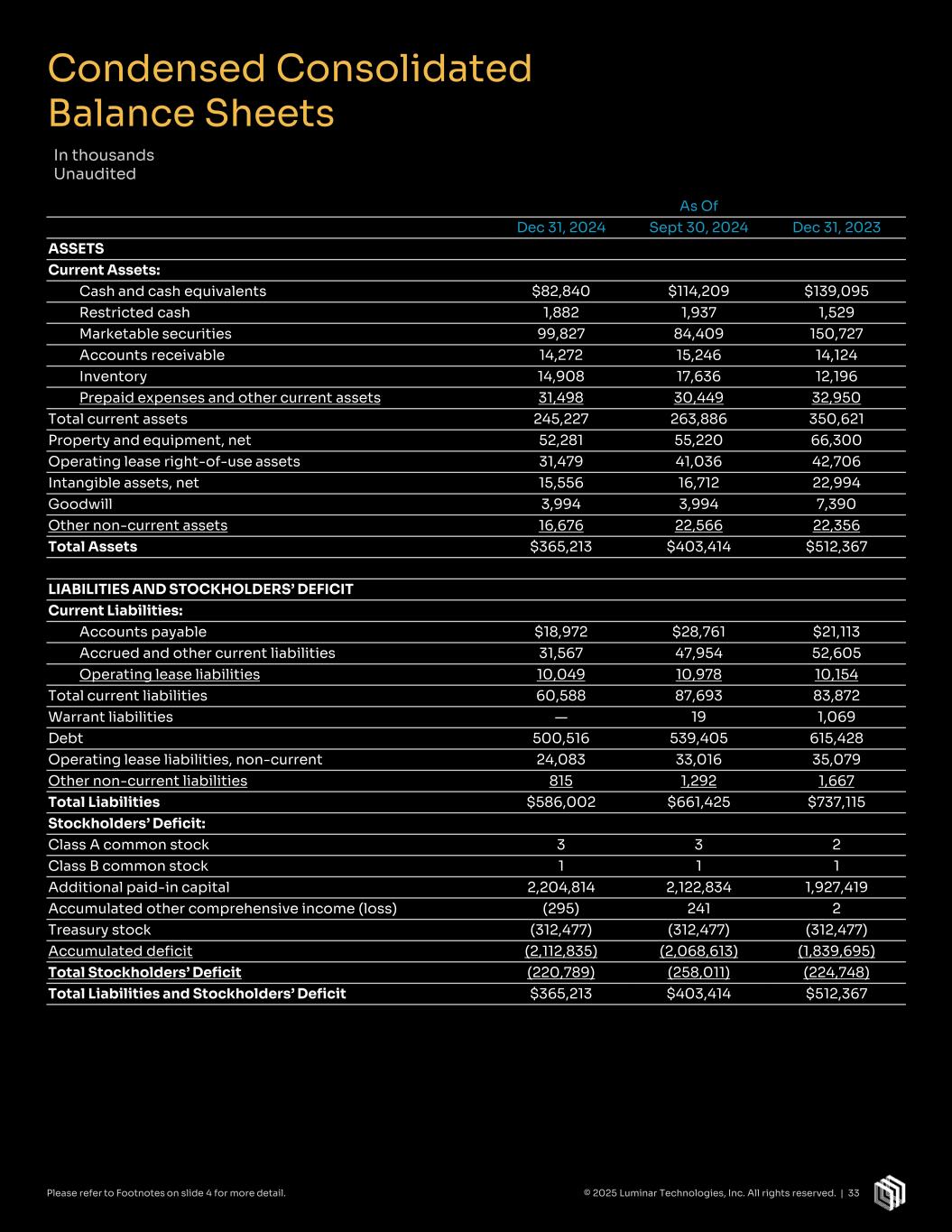

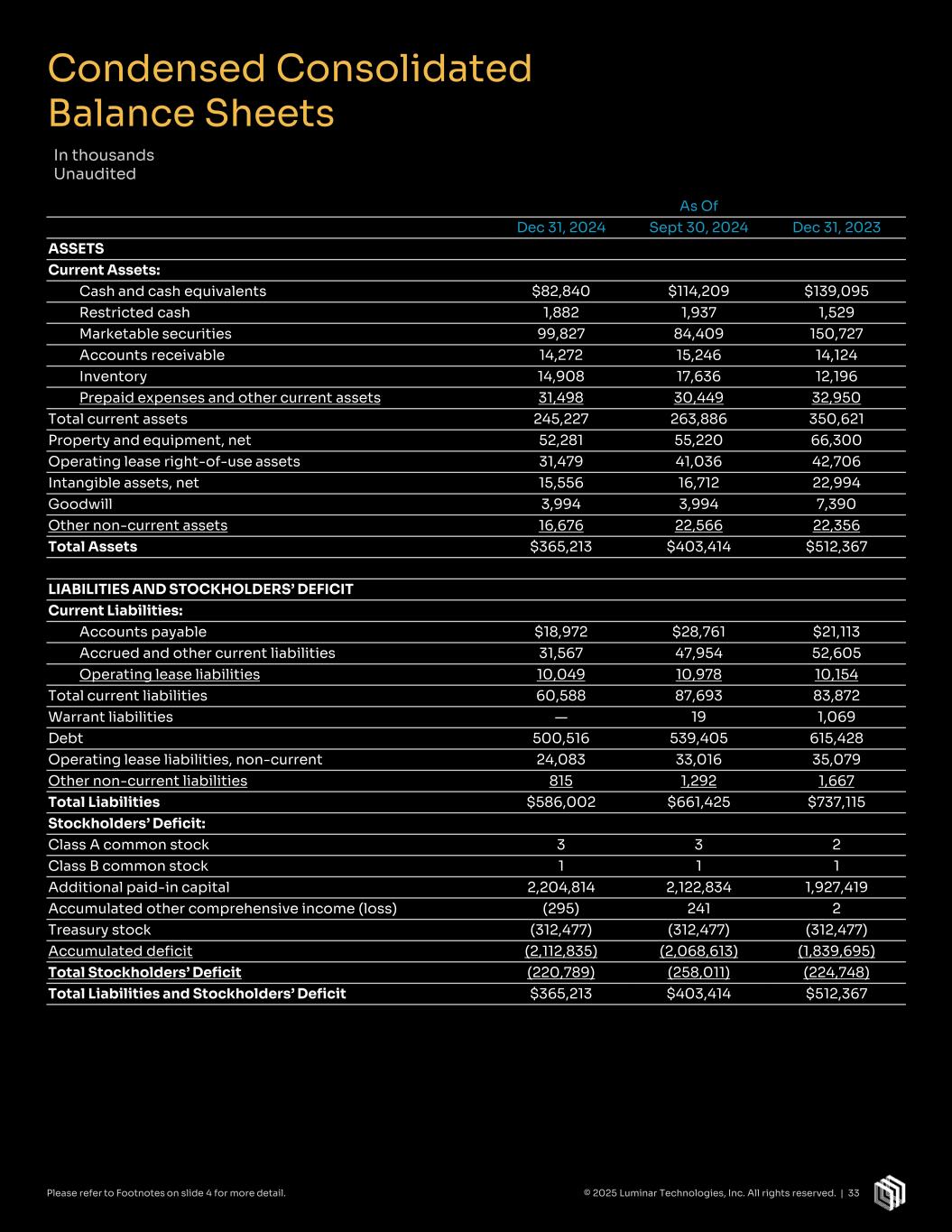

As Of Dec 31, 2024 Sept 30, 2024 Dec 31, 2023 ASSETS Current Assets: Cash and cash equivalents $82,840 $114,209 $139,095 Restricted cash 1,882 1,937 1,529 Marketable securities 99,827 84,409 150,727 Accounts receivable 14,272 15,246 14,124 Inventory 14,908 17,636 12,196 Prepaid expenses and other current assets 31,498 30,449 32,950 Total current assets 245,227 263,886 350,621 Property and equipment, net 52,281 55,220 66,300 Operating lease right-of-use assets 31,479 41,036 42,706 Intangible assets, net 15,556 16,712 22,994 Goodwill 3,994 3,994 7,390 Other non-current assets 16,676 22,566 22,356 Total Assets $365,213 $403,414 $512,367 LIABILITIES AND STOCKHOLDERS’ DEFICIT Current Liabilities: Accounts payable $18,972 $28,761 $21,113 Accrued and other current liabilities 31,567 47,954 52,605 Operating lease liabilities 10,049 10,978 10,154 Total current liabilities 60,588 87,693 83,872 Warrant liabilities — 19 1,069 Debt 500,516 539,405 615,428 Operating lease liabilities, non-current 24,083 33,016 35,079 Other non-current liabilities 815 1,292 1,667 Total Liabilities $586,002 $661,425 $737,115 Stockholders’ Deficit: Class A common stock 3 3 2 Class B common stock 1 1 1 Additional paid-in capital 2,204,814 2,122,834 1,927,419 Accumulated other comprehensive income (loss) (295) 241 2 Treasury stock (312,477) (312,477) (312,477) Accumulated deficit (2,112,835) (2,068,613) (1,839,695) Total Stockholders’ Deficit (220,789) (258,011) (224,748) Total Liabilities and Stockholders’ Deficit $365,213 $403,414 $512,367 Condensed Consolidated Balance Sheets In thousands Unaudited © 2025 Luminar Technologies, Inc. All rights reserved. | 33Please refer to Footnotes on slide 4 for more detail.

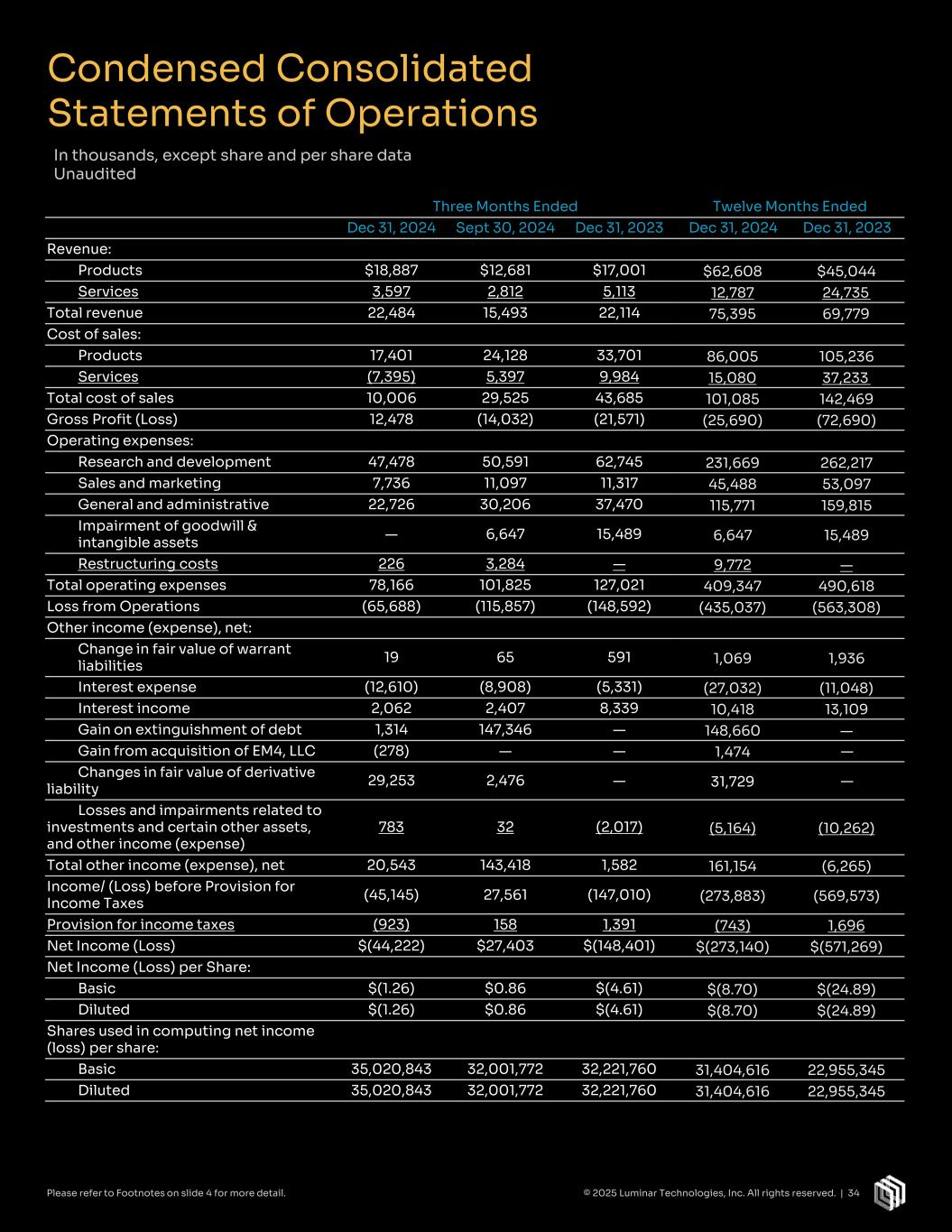

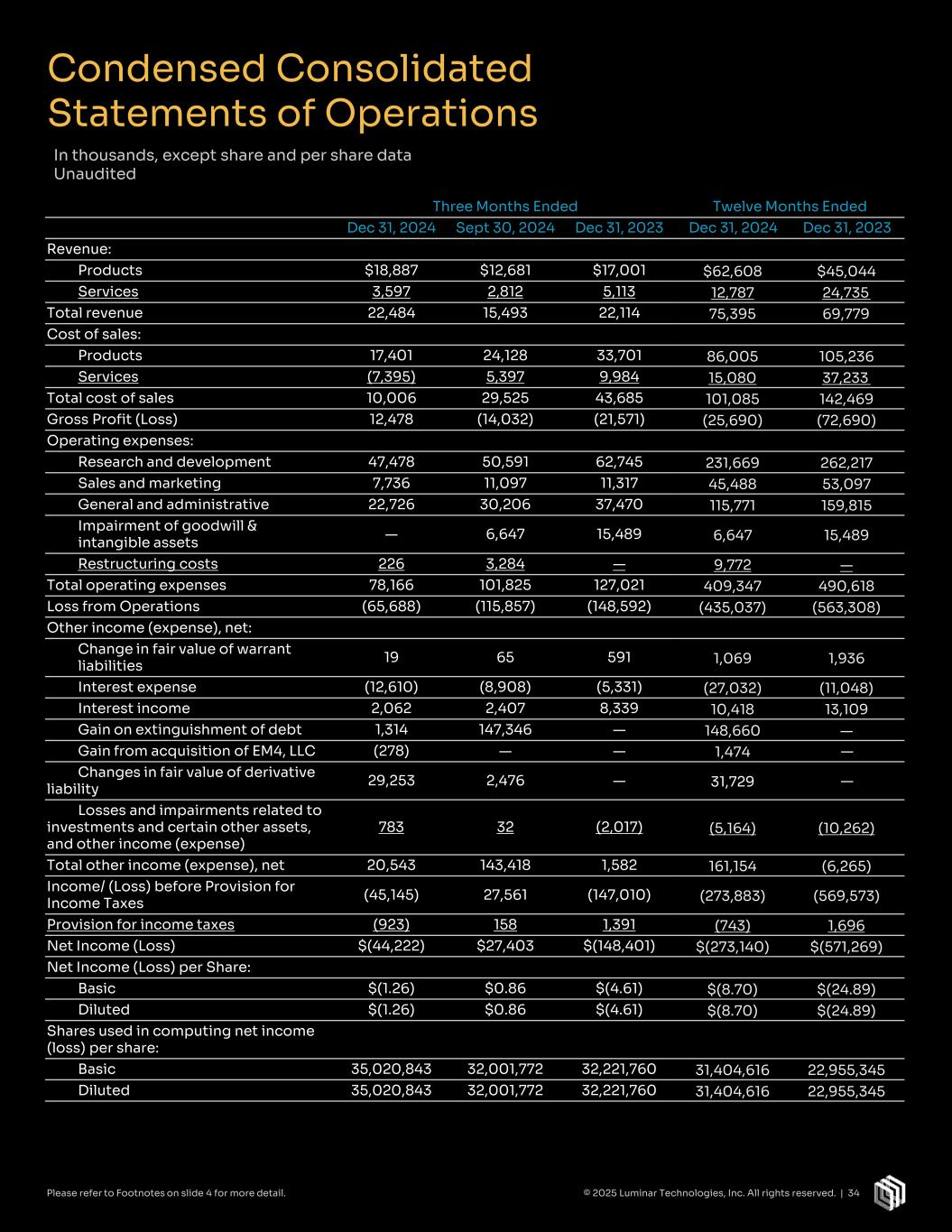

Condensed Consolidated Statements of Operations In thousands, except share and per share data Unaudited Three Months Ended Twelve Months Ended Dec 31, 2024 Sept 30, 2024 Dec 31, 2023 Dec 31, 2024 Dec 31, 2023 Revenue: Products $18,887 $12,681 $17,001 $62,608 $45,044 Services 3,597 2,812 5,113 12,787 24,735 Total revenue 22,484 15,493 22,114 75,395 69,779 Cost of sales: Products 17,401 24,128 33,701 86,005 105,236 Services (7,395) 5,397 9,984 15,080 37,233 Total cost of sales 10,006 29,525 43,685 101,085 142,469 Gross Profit (Loss) 12,478 (14,032) (21,571) (25,690) (72,690) Operating expenses: Research and development 47,478 50,591 62,745 231,669 262,217 Sales and marketing 7,736 11,097 11,317 45,488 53,097 General and administrative 22,726 30,206 37,470 115,771 159,815 Impairment of goodwill & intangible assets — 6,647 15,489 6,647 15,489 Restructuring costs 226 3,284 — 9,772 — Total operating expenses 78,166 101,825 127,021 409,347 490,618 Loss from Operations (65,688) (115,857) (148,592) (435,037) (563,308) Other income (expense), net: Change in fair value of warrant liabilities 19 65 591 1,069 1,936 Interest expense (12,610) (8,908) (5,331) (27,032) (11,048) Interest income 2,062 2,407 8,339 10,418 13,109 Gain on extinguishment of debt 1,314 147,346 — 148,660 — Gain from acquisition of EM4, LLC (278) — — 1,474 — Changes in fair value of derivative liability 29,253 2,476 — 31,729 — Losses and impairments related to investments and certain other assets, and other income (expense) 783 32 (2,017) (5,164) (10,262) Total other income (expense), net 20,543 143,418 1,582 161,154 (6,265) Income/ (Loss) before Provision for Income Taxes (45,145) 27,561 (147,010) (273,883) (569,573) Provision for income taxes (923) 158 1,391 (743) 1,696 Net Income (Loss) $(44,222) $27,403 $(148,401) $(273,140) $(571,269) Net Income (Loss) per Share: Basic $(1.26) $0.86 $(4.61) $(8.70) $(24.89) Diluted $(1.26) $0.86 $(4.61) $(8.70) $(24.89) Shares used in computing net income (loss) per share: Basic 35,020,843 32,001,772 32,221,760 31,404,616 22,955,345 Diluted 35,020,843 32,001,772 32,221,760 31,404,616 22,955,345 © 2025 Luminar Technologies, Inc. All rights reserved. | 34Please refer to Footnotes on slide 4 for more detail.

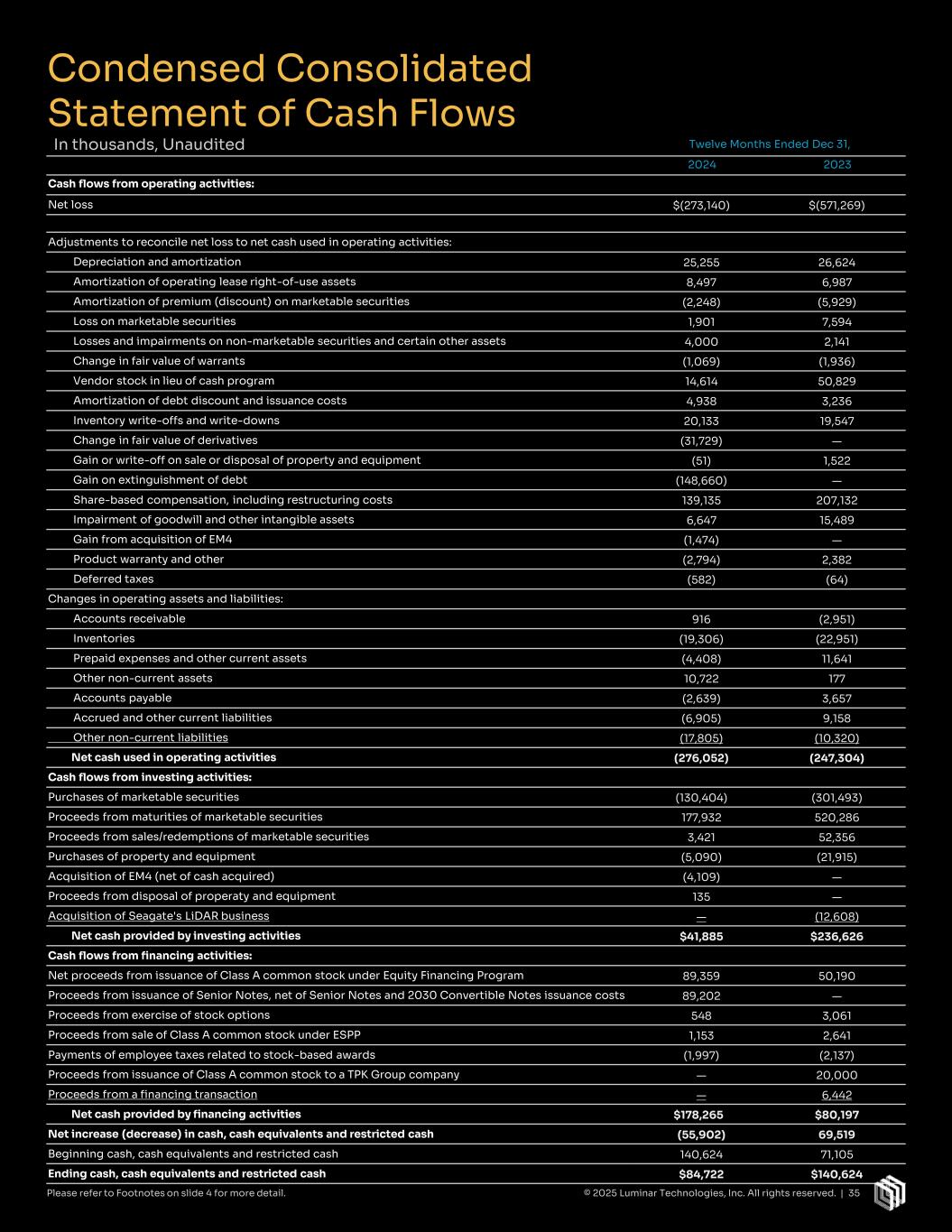

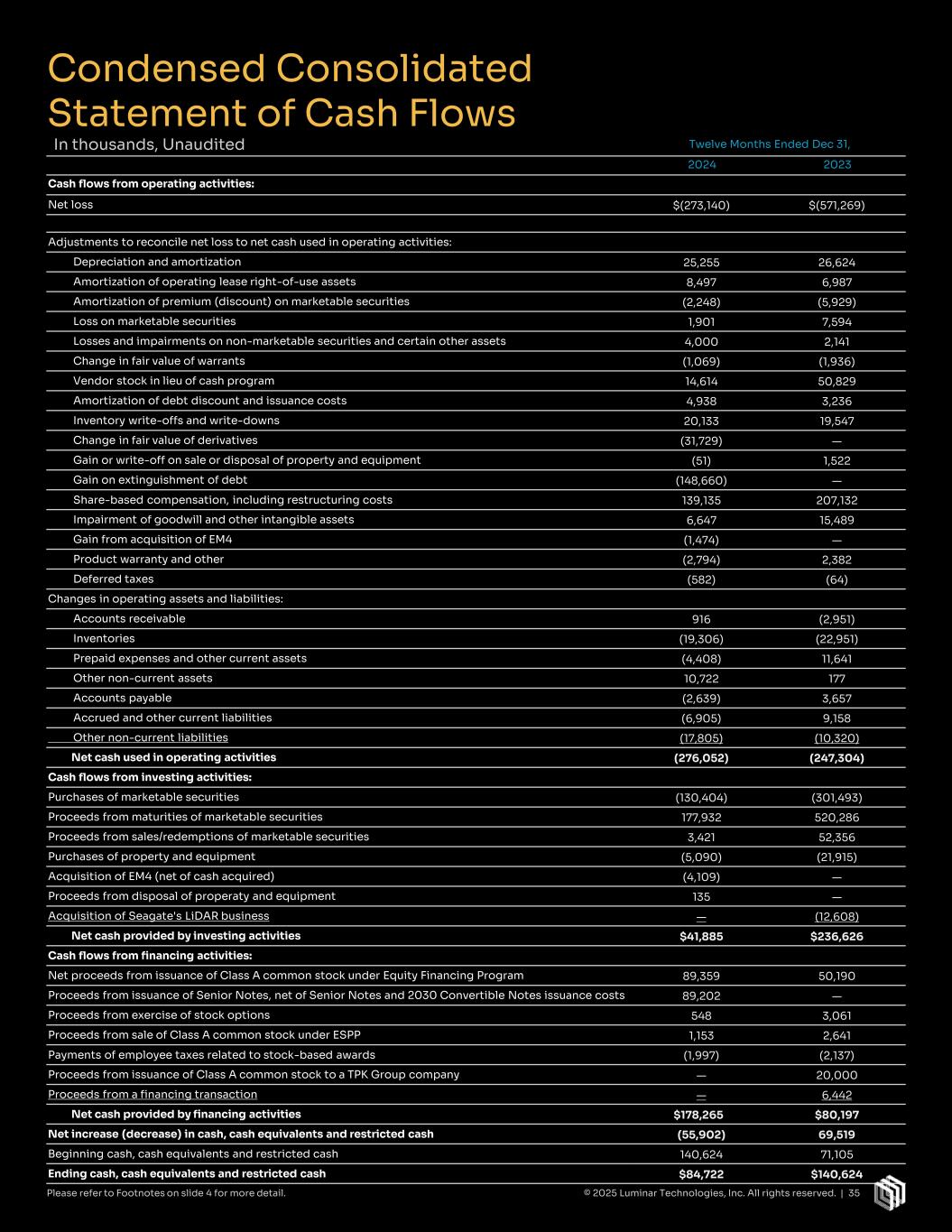

Twelve Months Ended Dec 31, 2024 2023 Cash flows from operating activities: Net loss $(273,140) $(571,269) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 25,255 26,624 Amortization of operating lease right-of-use assets 8,497 6,987 Amortization of premium (discount) on marketable securities (2,248) (5,929) Loss on marketable securities 1,901 7,594 Losses and impairments on non-marketable securities and certain other assets 4,000 2,141 Change in fair value of warrants (1,069) (1,936) Vendor stock in lieu of cash program 14,614 50,829 Amortization of debt discount and issuance costs 4,938 3,236 Inventory write-offs and write-downs 20,133 19,547 Change in fair value of derivatives (31,729) — Gain or write-off on sale or disposal of property and equipment (51) 1,522 Gain on extinguishment of debt (148,660) — Share-based compensation, including restructuring costs 139,135 207,132 Impairment of goodwill and other intangible assets 6,647 15,489 Gain from acquisition of EM4 (1,474) — Product warranty and other (2,794) 2,382 Deferred taxes (582) (64) Changes in operating assets and liabilities: Accounts receivable 916 (2,951) Inventories (19,306) (22,951) Prepaid expenses and other current assets (4,408) 11,641 Other non-current assets 10,722 177 Accounts payable (2,639) 3,657 Accrued and other current liabilities (6,905) 9,158 Other non-current liabilities (17,805) (10,320) Net cash used in operating activities (276,052) (247,304) Cash flows from investing activities: Purchases of marketable securities (130,404) (301,493) Proceeds from maturities of marketable securities 177,932 520,286 Proceeds from sales/redemptions of marketable securities 3,421 52,356 Purchases of property and equipment (5,090) (21,915) Acquisition of EM4 (net of cash acquired) (4,109) — Proceeds from disposal of properaty and equipment 135 — Acquisition of Seagate's LiDAR business — (12,608) Net cash provided by investing activities $41,885 $236,626 Cash flows from financing activities: Net proceeds from issuance of Class A common stock under Equity Financing Program 89,359 50,190 Proceeds from issuance of Senior Notes, net of Senior Notes and 2030 Convertible Notes issuance costs 89,202 — Proceeds from exercise of stock options 548 3,061 Proceeds from sale of Class A common stock under ESPP 1,153 2,641 Payments of employee taxes related to stock-based awards (1,997) (2,137) Proceeds from issuance of Class A common stock to a TPK Group company — 20,000 Proceeds from a financing transaction — 6,442 Net cash provided by financing activities $178,265 $80,197 Net increase (decrease) in cash, cash equivalents and restricted cash (55,902) 69,519 Beginning cash, cash equivalents and restricted cash 140,624 71,105 Ending cash, cash equivalents and restricted cash $84,722 $140,624 Condensed Consolidated Statement of Cash Flows In thousands, Unaudited © 2025 Luminar Technologies, Inc. All rights reserved. | 35Please refer to Footnotes on slide 4 for more detail.

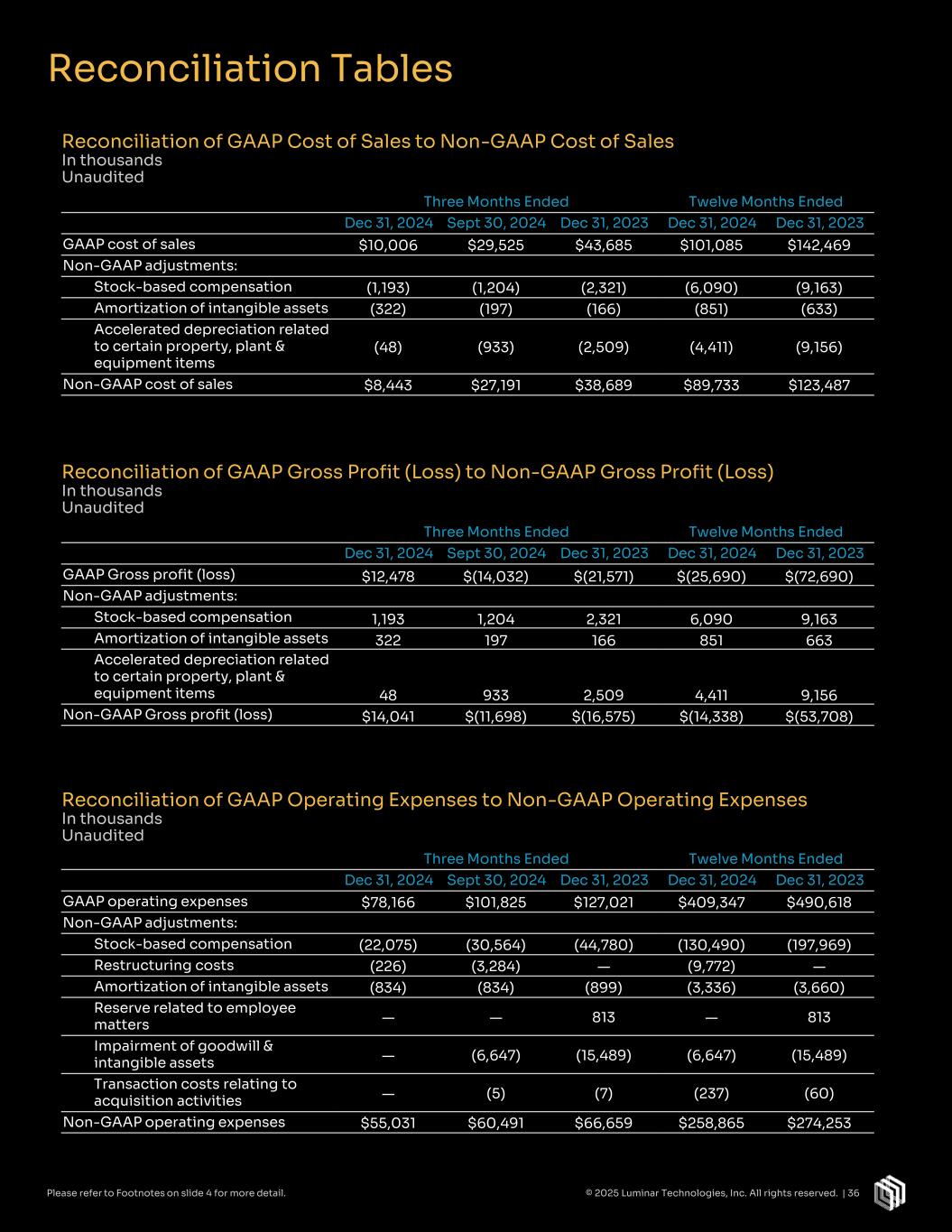

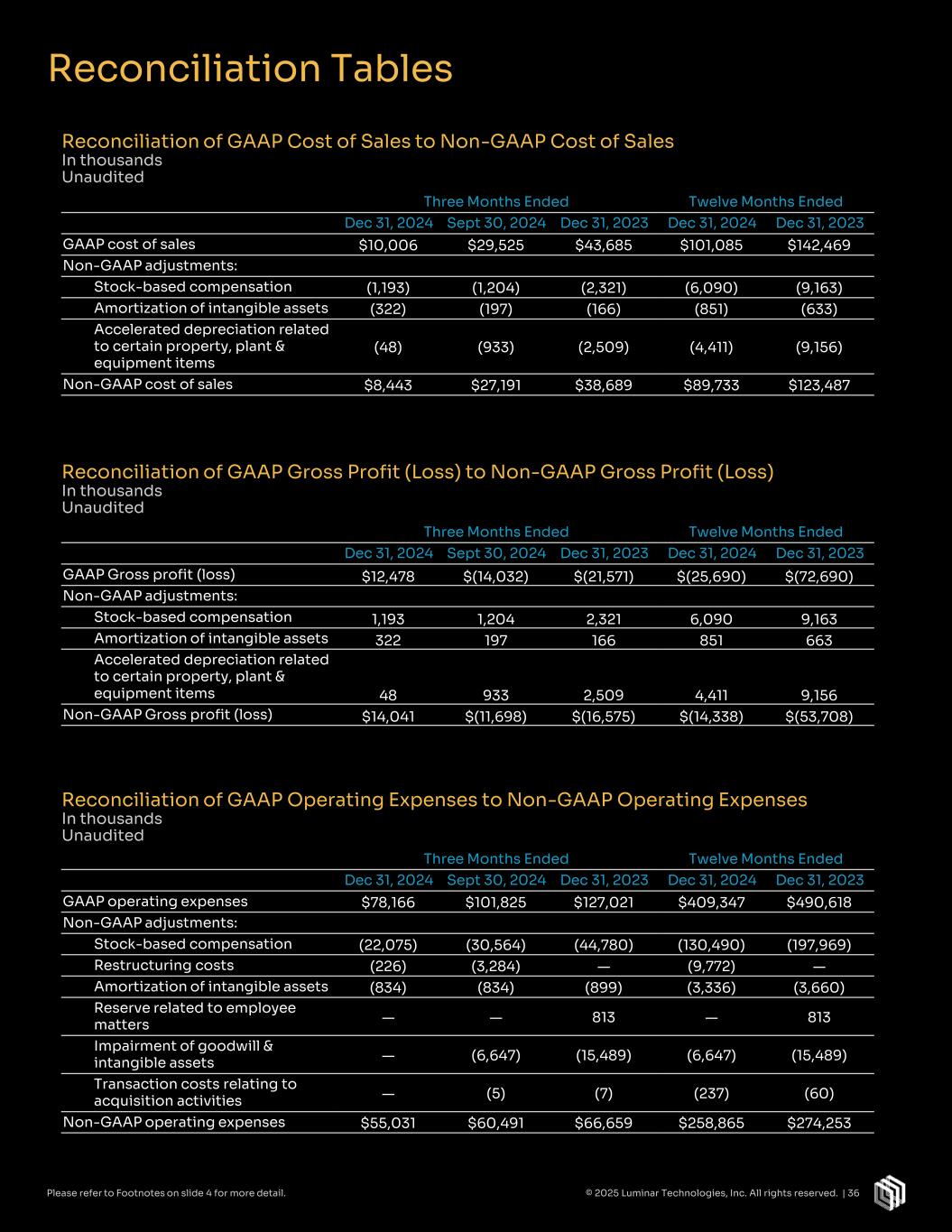

Reconciliation Tables Three Months Ended Twelve Months Ended Dec 31, 2024 Sept 30, 2024 Dec 31, 2023 Dec 31, 2024 Dec 31, 2023 GAAP Gross profit (loss) $12,478 $(14,032) $(21,571) $(25,690) $(72,690) Non-GAAP adjustments: Stock-based compensation 1,193 1,204 2,321 6,090 9,163 Amortization of intangible assets 322 197 166 851 663 Accelerated depreciation related to certain property, plant & equipment items 48 933 2,509 4,411 9,156 Non-GAAP Gross profit (loss) $14,041 $(11,698) $(16,575) $(14,338) $(53,708) Reconciliation of GAAP Cost of Sales to Non-GAAP Cost of Sales In thousands Unaudited Reconciliation of GAAP Gross Profit (Loss) to Non-GAAP Gross Profit (Loss) In thousands Unaudited Three Months Ended Twelve Months Ended Dec 31, 2024 Sept 30, 2024 Dec 31, 2023 Dec 31, 2024 Dec 31, 2023 GAAP operating expenses $78,166 $101,825 $127,021 $409,347 $490,618 Non-GAAP adjustments: Stock-based compensation (22,075) (30,564) (44,780) (130,490) (197,969) Restructuring costs (226) (3,284) — (9,772) — Amortization of intangible assets (834) (834) (899) (3,336) (3,660) Reserve related to employee matters — — 813 — 813 Impairment of goodwill & intangible assets — (6,647) (15,489) (6,647) (15,489) Transaction costs relating to acquisition activities — (5) (7) (237) (60) Non-GAAP operating expenses $55,031 $60,491 $66,659 $258,865 $274,253 Reconciliation of GAAP Operating Expenses to Non-GAAP Operating Expenses In thousands Unaudited Three Months Ended Twelve Months Ended Dec 31, 2024 Sept 30, 2024 Dec 31, 2023 Dec 31, 2024 Dec 31, 2023 GAAP cost of sales $10,006 $29,525 $43,685 $101,085 $142,469 Non-GAAP adjustments: Stock-based compensation (1,193) (1,204) (2,321) (6,090) (9,163) Amortization of intangible assets (322) (197) (166) (851) (633) Accelerated depreciation related to certain property, plant & equipment items (48) (933) (2,509) (4,411) (9,156) Non-GAAP cost of sales $8,443 $27,191 $38,689 $89,733 $123,487 © 2025 Luminar Technologies, Inc. All rights reserved. | 36Please refer to Footnotes on slide 4 for more detail.

Reconciliation Tables Three Months Ended Twelve Months Ended Dec 31, 2024 Sept 30, 2024 Dec 31, 2023 Dec 31, 2024 Dec 31, 2023 GAAP Net income (loss) $(44,222) $27,403 $(148,401) $(273,140) $(571,269) Non-GAAP adjustments: Stock-based compensation 23,268 31,768 47,101 136,580 207,132 Amortization of intangible assets 1,156 1,031 1,065 4,187 4,323 Accelerated depreciation related to certain property, plant and equipment items 48 933 2,509 4,411 9,156 Impairment of goodwill and intangible assets — 6,647 15,489 6,647 15,489 Gain on extinguishment of debt (1,314) (147,346) — (148,660) — Impairment of investments and certain other assets — — — 4,000 — Restructuring costs, including stock-based compensation 226 3,284 — 9,772 — Gain from acquisition of EM4 278 — — (1,474) — Legal reserves related to employee matters — — (813) — (813) Transaction costs relating to acquisition activities — 5 7 237 60 Change in fair value of embedded derivative (29,253) (2,476) — (31,729) — Change in fair value of warrant liabilities (18) (65) (591) (1,068) (1,936) Provision for income taxes — — — — — Non-GAAP Net Loss $(49,831) $(78,816) $(83,634) $(290,237) $(337,858) GAAP Net Income (Loss) per Share: Basic and Diluted $(1.26) $0.86 $(4.61) $(8,70) $(24.89) Non-GAAP Net Income (Loss) per Share Basic and Diluted $(1.42) $(2.46) $(2.60) $(9.24) $(14.72) Shares used in computing GAAP Net income (loss) per share Basic and Diluted 35,020,843 32,001,772 32,221,760 31,404,616 22,955,345 Shares used in computing Non- GAAP Net income (loss) per share Basic and Diluted 35,020,843 32,001,772 32,221,760 31,404,616 22,955,345 Reconciliation of GAAP Net Loss to Non-GAAP Net Loss In thousands, except share and per share data Unaudited © 2025 Luminar Technologies, Inc. All rights reserved. | 37Please refer to Footnotes on slide 4 for more detail.

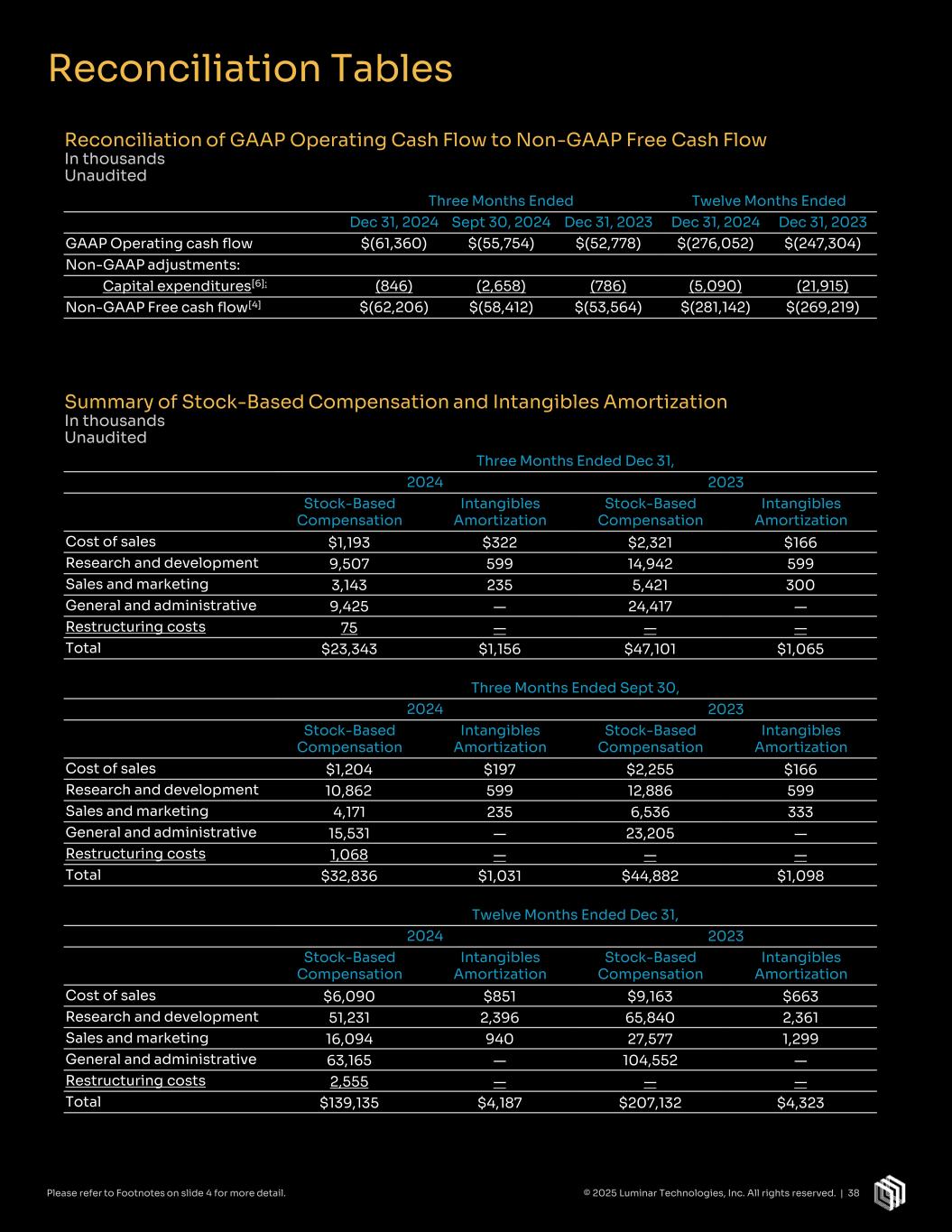

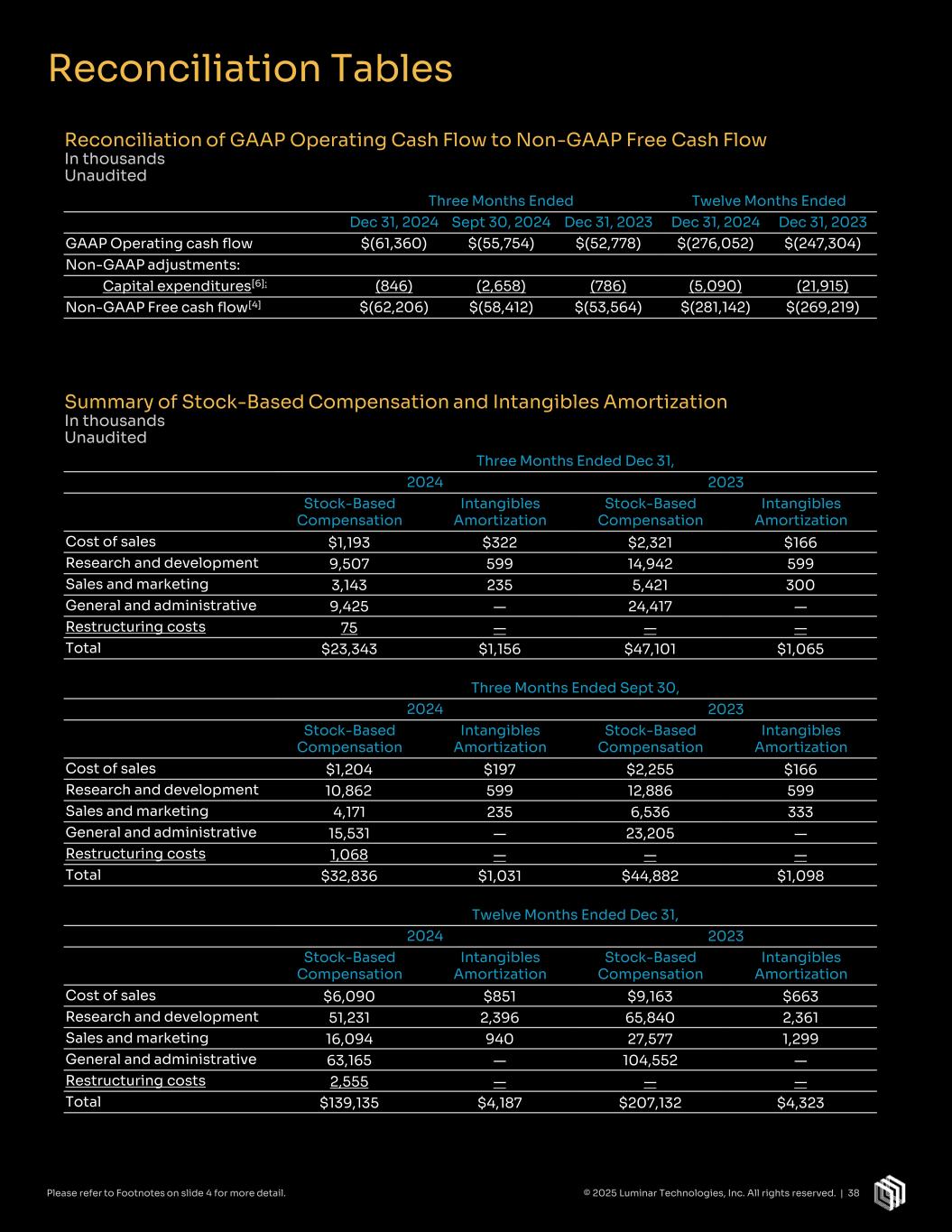

Reconciliation Tables Reconciliation of GAAP Operating Cash Flow to Non-GAAP Free Cash Flow In thousands Unaudited Summary of Stock-Based Compensation and Intangibles Amortization In thousands Unaudited Three Months Ended Twelve Months Ended Dec 31, 2024 Sept 30, 2024 Dec 31, 2023 Dec 31, 2024 Dec 31, 2023 GAAP Operating cash flow $(61,360) $(55,754) $(52,778) $(276,052) $(247,304) Non-GAAP adjustments: Capital expenditures[6]: (846) (2,658) (786) (5,090) (21,915) Non-GAAP Free cash flow[4] $(62,206) $(58,412) $(53,564) $(281,142) $(269,219) Three Months Ended Dec 31, 2024 2023 Stock-Based Compensation Intangibles Amortization Stock-Based Compensation Intangibles Amortization Cost of sales $1,193 $322 $2,321 $166 Research and development 9,507 599 14,942 599 Sales and marketing 3,143 235 5,421 300 General and administrative 9,425 — 24,417 — Restructuring costs 75 — — — Total $23,343 $1,156 $47,101 $1,065 Three Months Ended Sept 30, 2024 2023 Stock-Based Compensation Intangibles Amortization Stock-Based Compensation Intangibles Amortization Cost of sales $1,204 $197 $2,255 $166 Research and development 10,862 599 12,886 599 Sales and marketing 4,171 235 6,536 333 General and administrative 15,531 — 23,205 — Restructuring costs 1,068 — — — Total $32,836 $1,031 $44,882 $1,098 Twelve Months Ended Dec 31, 2024 2023 Stock-Based Compensation Intangibles Amortization Stock-Based Compensation Intangibles Amortization Cost of sales $6,090 $851 $9,163 $663 Research and development 51,231 2,396 65,840 2,361 Sales and marketing 16,094 940 27,577 1,299 General and administrative 63,165 — 104,552 — Restructuring costs 2,555 — — — Total $139,135 $4,187 $207,132 $4,323 Please refer to Footnotes on slide 4 for more detail. © 2025 Luminar Technologies, Inc. All rights reserved. | 38