00016803782024FYfalse0.08330.10.1000P3Miso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:puresnes:statesnes:territorysnes:yearsnes:segmentsnes:defendant00016803782024-01-012024-12-3100016803782024-06-3000016803782025-03-1100016803782024-12-3100016803782023-12-3100016803782023-01-012023-12-310001680378us-gaap:CommonStockMember2022-12-310001680378us-gaap:AdditionalPaidInCapitalMember2022-12-310001680378us-gaap:RetainedEarningsMember2022-12-3100016803782022-12-310001680378us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001680378us-gaap:CommonStockMember2023-01-012023-12-310001680378us-gaap:RetainedEarningsMember2023-01-012023-12-310001680378us-gaap:CommonStockMember2023-12-310001680378us-gaap:AdditionalPaidInCapitalMember2023-12-310001680378us-gaap:RetainedEarningsMember2023-12-310001680378us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001680378us-gaap:CommonStockMember2024-01-012024-12-310001680378us-gaap:RetainedEarningsMember2024-01-012024-12-310001680378us-gaap:CommonStockMember2024-12-310001680378us-gaap:AdditionalPaidInCapitalMember2024-12-310001680378us-gaap:RetainedEarningsMember2024-12-310001680378snes:EvolveMember2023-11-012023-12-310001680378snes:EvolveMouseMember2023-11-012024-09-3000016803782024-07-012024-07-310001680378snes:ResearchAndDevelopmentEquipmentMember2024-12-310001680378snes:OfficeAndComputerEquipmentMember2024-12-310001680378us-gaap:AutomobilesMember2024-12-310001680378us-gaap:FurnitureAndFixturesMember2024-12-310001680378snes:ResearchAndDevelopmentEquipmentMember2023-12-310001680378snes:OfficeAndComputerEquipmentMember2023-12-310001680378snes:AutosTrucksMember2024-12-310001680378snes:AutosTrucksMember2023-12-310001680378us-gaap:FurnitureAndFixturesMember2023-12-310001680378us-gaap:LeaseholdImprovementsMember2024-12-310001680378us-gaap:LeaseholdImprovementsMember2023-12-310001680378snes:DepreciablePropertyPlantAndEquipmentMember2024-12-310001680378snes:DepreciablePropertyPlantAndEquipmentMember2023-12-310001680378us-gaap:ConstructionInProgressMember2024-12-310001680378us-gaap:ConstructionInProgressMember2023-12-310001680378us-gaap:NotesPayableOtherPayablesMember2024-12-310001680378us-gaap:NotesPayableOtherPayablesMember2023-07-012023-12-310001680378snes:EquityIncentivePlan2018Member2023-06-230001680378snes:EquityIncentivePlan2018Memberus-gaap:EmployeeStockOptionMembersrt:MinimumMember2023-06-232023-06-230001680378snes:EquityIncentivePlan2018Memberus-gaap:EmployeeStockOptionMembersrt:MaximumMember2023-06-232023-06-230001680378us-gaap:EmployeeStockOptionMembersnes:EquityIncentivePlan2018Member2023-06-232023-06-230001680378snes:EquityIncentivePlan2018Member2024-12-310001680378us-gaap:EmployeeStockOptionMembersnes:EquityIncentivePlan2018Member2024-01-012024-12-310001680378us-gaap:EmployeeStockOptionMembersnes:EquityIncentivePlan2018Member2023-01-012023-12-3100016803782022-01-012022-12-310001680378snes:ShareBasedPaymentArrangementOptionInducementAwardMember2024-12-310001680378us-gaap:RestrictedStockMember2022-12-310001680378us-gaap:RestrictedStockMember2023-01-012023-12-310001680378us-gaap:RestrictedStockMember2023-12-310001680378us-gaap:RestrictedStockMember2024-01-012024-12-310001680378us-gaap:RestrictedStockMember2024-12-310001680378us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-12-310001680378us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001680378us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-12-310001680378us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-3100016803782023-04-012023-04-3000016803782023-04-300001680378snes:SeriesCWarrantsMembersrt:MaximumMember2023-04-300001680378snes:SeriesCWarrantsMember2023-04-300001680378snes:SeriesCWarrantsMember2023-04-012023-04-300001680378snes:SeriesCWarrantsMembersnes:HCWainwrightCoLLCMembersrt:MaximumMember2023-04-300001680378snes:SeriesCWarrantsMembersnes:HCWainwrightCoLLCMember2023-04-3000016803782023-11-012023-11-3000016803782023-11-300001680378snes:PreFundedWarrantsIssuedInNovember2023Membersrt:MaximumMember2023-11-300001680378snes:PreFundedWarrantsIssuedInNovember2023Member2023-11-300001680378snes:SeriesDWarrantsAndSeriesEWarrantsMembersrt:MaximumMember2023-11-300001680378snes:SeriesDWarrantsAndSeriesEWarrantsMember2023-11-300001680378snes:PreFundedWarrantsIssuedInNovember2023SeriesDWarrantsAndSeriesEWarrantsMember2023-11-012023-11-300001680378snes:PreFundedWarrantsIssuedInNovember2023SeriesDWarrantsAndSeriesEWarrantsMembersnes:HCWainwrightCoLLCMembersrt:MaximumMember2023-11-300001680378snes:PreFundedWarrantsIssuedInNovember2023SeriesDWarrantsAndSeriesEWarrantsMembersnes:HCWainwrightCoLLCMember2023-11-300001680378us-gaap:CommonStockMember2024-08-012024-08-310001680378snes:August2023OriginalWarrantsMember2023-08-242023-08-240001680378snes:August2023OriginalWarrantsMember2023-08-240001680378snes:November2023OriginalWarrantsMember2023-11-292023-11-290001680378snes:November2023OriginalWarrantsMember2023-11-290001680378snes:OriginalWarrantsMember2024-12-310001680378snes:OriginalWarrantsMember2024-01-012024-12-310001680378snes:August2023OriginalWarrantsMemberus-gaap:MeasurementInputSharePriceMember2024-08-310001680378snes:August2023OriginalWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2024-08-310001680378snes:August2023OriginalWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2024-08-310001680378snes:August2023OriginalWarrantsMemberus-gaap:MeasurementInputExpectedDividendRateMember2024-08-310001680378snes:August2023OriginalWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-08-310001680378snes:November2023OriginalWarrantsMemberus-gaap:MeasurementInputSharePriceMember2024-08-240001680378snes:November2023OriginalWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2024-08-310001680378snes:November2023OriginalWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2024-08-310001680378snes:November2023OriginalWarrantsMemberus-gaap:MeasurementInputExpectedDividendRateMember2024-08-310001680378snes:November2023OriginalWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-08-310001680378snes:SeriesF1SeriesF2AndDealerManagerWarrantsMember2024-01-012024-12-310001680378snes:WarrantReissueMember2024-01-012024-12-310001680378snes:WarrantReissueMember2024-12-310001680378snes:WarrantReissueMember2022-12-310001680378snes:WarrantReissueMember2023-01-012023-12-310001680378snes:WarrantReissueMember2023-12-310001680378snes:RightsOfferingWarrantsMember2024-01-012024-12-310001680378snes:RightsOfferingWarrantsMember2024-12-310001680378snes:RightsOfferingWarrantsMember2022-12-310001680378snes:RightsOfferingWarrantsMember2023-01-012023-12-310001680378snes:RightsOfferingWarrantsMember2023-12-310001680378snes:DealerManagerWarrants1Member2024-01-012024-12-310001680378snes:DealerManagerWarrants1Member2024-12-310001680378snes:DealerManagerWarrants1Member2022-12-310001680378snes:DealerManagerWarrants1Member2023-01-012023-12-310001680378snes:DealerManagerWarrants1Member2023-12-310001680378snes:DealerManagerWarrants2Member2024-01-012024-12-310001680378snes:DealerManagerWarrants2Member2024-12-310001680378snes:DealerManagerWarrants2Member2022-12-310001680378snes:DealerManagerWarrants2Member2023-01-012023-12-310001680378snes:DealerManagerWarrants2Member2023-12-310001680378snes:RegisteredDirectOfferingMember2024-01-012024-12-310001680378snes:RegisteredDirectOfferingMember2024-12-310001680378snes:RegisteredDirectOfferingMember2022-12-310001680378snes:RegisteredDirectOfferingMember2023-01-012023-12-310001680378snes:RegisteredDirectOfferingMember2023-12-310001680378snes:DealerManagerWarrants3Member2024-01-012024-12-310001680378snes:DealerManagerWarrants3Member2024-12-310001680378snes:DealerManagerWarrants3Member2022-12-310001680378snes:DealerManagerWarrants3Member2023-01-012023-12-310001680378snes:DealerManagerWarrants3Member2023-12-310001680378snes:DealerManagerWarrants4Member2024-01-012024-12-310001680378snes:DealerManagerWarrants4Member2024-12-310001680378snes:DealerManagerWarrants4Member2022-12-310001680378snes:DealerManagerWarrants4Member2023-01-012023-12-310001680378snes:DealerManagerWarrants4Member2023-12-310001680378snes:DealerManagerWarrants5Member2024-01-012024-12-310001680378snes:DealerManagerWarrants5Member2024-12-310001680378snes:DealerManagerWarrants5Member2022-12-310001680378snes:DealerManagerWarrants5Member2023-01-012023-12-310001680378snes:DealerManagerWarrants5Member2023-12-310001680378snes:RegisteredDirectOfferingTwoMember2024-01-012024-12-310001680378snes:RegisteredDirectOfferingTwoMember2024-12-310001680378snes:RegisteredDirectOfferingTwoMember2022-12-310001680378snes:RegisteredDirectOfferingTwoMember2023-01-012023-12-310001680378snes:RegisteredDirectOfferingTwoMember2023-12-310001680378snes:PrivateWarrantInducementTwoMember2024-01-012024-12-310001680378snes:PrivateWarrantInducementTwoMember2024-12-310001680378snes:PrivateWarrantInducementTwoMember2022-12-310001680378snes:PrivateWarrantInducementTwoMember2023-01-012023-12-310001680378snes:PrivateWarrantInducementTwoMember2023-12-310001680378snes:DealerManagerWarrants6Member2024-01-012024-12-310001680378snes:DealerManagerWarrants6Member2024-12-310001680378snes:DealerManagerWarrants6Member2022-12-310001680378snes:DealerManagerWarrants6Member2023-01-012023-12-310001680378snes:DealerManagerWarrants6Member2023-12-310001680378snes:PrivatePlacementAgreementOneMember2024-01-012024-12-310001680378snes:PrivatePlacementAgreementOneMember2024-12-310001680378snes:PrivatePlacementAgreementOneMember2022-12-310001680378snes:PrivatePlacementAgreementOneMember2023-01-012023-12-310001680378snes:PrivatePlacementAgreementOneMember2023-12-310001680378snes:PrivatePlacementAgreementTwoMember2024-01-012024-12-310001680378snes:PrivatePlacementAgreementTwoMember2024-12-310001680378snes:PrivatePlacementAgreementTwoMember2022-12-310001680378snes:PrivatePlacementAgreementTwoMember2023-01-012023-12-310001680378snes:PrivatePlacementAgreementTwoMember2023-12-310001680378snes:DealerManagerWarrants7Member2024-01-012024-12-310001680378snes:DealerManagerWarrants7Member2024-12-310001680378snes:DealerManagerWarrants7Member2022-12-310001680378snes:DealerManagerWarrants7Member2023-01-012023-12-310001680378snes:DealerManagerWarrants7Member2023-12-310001680378snes:DealerManagerWarrants8Member2024-01-012024-12-310001680378snes:DealerManagerWarrants8Member2024-12-310001680378snes:DealerManagerWarrants8Member2022-12-310001680378snes:DealerManagerWarrants8Member2023-01-012023-12-310001680378snes:DealerManagerWarrants8Member2023-12-310001680378snes:PreFundedWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2024-01-012024-12-310001680378snes:PreFundedWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2024-12-310001680378snes:PreFundedWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2022-12-310001680378snes:PreFundedWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2023-01-012023-12-310001680378snes:PreFundedWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2023-12-310001680378snes:SeriesAWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2024-01-012024-12-310001680378snes:SeriesAWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2024-12-310001680378snes:SeriesAWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2022-12-310001680378snes:SeriesAWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2023-01-012023-12-310001680378snes:SeriesAWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2023-12-310001680378snes:SeriesBWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2024-01-012024-12-310001680378snes:SeriesBWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2024-12-310001680378snes:SeriesBWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2022-12-310001680378snes:SeriesBWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2023-01-012023-12-310001680378snes:SeriesBWarrantsIssuedInNovember2022CommonStockRegisteredDirectOfferingMember2023-12-310001680378snes:DealerManagerWarrants9Member2024-01-012024-12-310001680378snes:DealerManagerWarrants9Member2024-12-310001680378snes:DealerManagerWarrants9Member2022-12-310001680378snes:DealerManagerWarrants9Member2023-01-012023-12-310001680378snes:DealerManagerWarrants9Member2023-12-310001680378snes:SeriesCWarrantsMember2024-01-012024-12-310001680378snes:SeriesCWarrantsMember2024-12-310001680378snes:SeriesCWarrantsMember2022-12-310001680378snes:SeriesCWarrantsMember2023-01-012023-12-310001680378snes:SeriesCWarrantsMember2023-12-310001680378snes:DealerManagerWarrants10Member2024-01-012024-12-310001680378snes:DealerManagerWarrants10Member2024-12-310001680378snes:DealerManagerWarrants10Member2022-12-310001680378snes:DealerManagerWarrants10Member2023-01-012023-12-310001680378snes:DealerManagerWarrants10Member2023-12-310001680378snes:PrivateWarrantInducement3Member2024-01-012024-12-310001680378snes:PrivateWarrantInducement3Member2024-12-310001680378snes:PrivateWarrantInducement3Member2022-12-310001680378snes:PrivateWarrantInducement3Member2023-01-012023-12-310001680378snes:PrivateWarrantInducement3Member2023-12-310001680378snes:PrivateWarrantInducement4Member2024-01-012024-12-310001680378snes:PrivateWarrantInducement4Member2024-12-310001680378snes:PrivateWarrantInducement4Member2022-12-310001680378snes:PrivateWarrantInducement4Member2023-01-012023-12-310001680378snes:PrivateWarrantInducement4Member2023-12-310001680378snes:DealerManagerWarrants11Member2024-01-012024-12-310001680378snes:DealerManagerWarrants11Member2024-12-310001680378snes:DealerManagerWarrants11Member2022-12-310001680378snes:DealerManagerWarrants11Member2023-01-012023-12-310001680378snes:DealerManagerWarrants11Member2023-12-310001680378snes:PreFundedWarrantsIssuedInNovember2023Member2024-01-012024-12-310001680378snes:PreFundedWarrantsIssuedInNovember2023Member2024-12-310001680378snes:PreFundedWarrantsIssuedInNovember2023Member2022-12-310001680378snes:PreFundedWarrantsIssuedInNovember2023Member2023-01-012023-12-310001680378snes:PreFundedWarrantsIssuedInNovember2023Member2023-12-310001680378snes:SeriesDWarrantsMember2024-01-012024-12-310001680378snes:SeriesDWarrantsMember2024-12-310001680378snes:SeriesDWarrantsMember2022-12-310001680378snes:SeriesDWarrantsMember2023-01-012023-12-310001680378snes:SeriesDWarrantsMember2023-12-310001680378snes:SeriesEWarrantsMember2024-01-012024-12-310001680378snes:SeriesEWarrantsMember2024-12-310001680378snes:SeriesEWarrantsMember2022-12-310001680378snes:SeriesEWarrantsMember2023-01-012023-12-310001680378snes:SeriesEWarrantsMember2023-12-310001680378snes:DealerManagerWarrants12Member2024-01-012024-12-310001680378snes:DealerManagerWarrants12Member2024-12-310001680378snes:DealerManagerWarrants12Member2022-12-310001680378snes:DealerManagerWarrants12Member2023-01-012023-12-310001680378snes:DealerManagerWarrants12Member2023-12-310001680378snes:SeriesF1WarrantsMember2024-01-012024-12-310001680378snes:SeriesF1WarrantsMember2024-12-310001680378snes:SeriesF1WarrantsMember2022-12-310001680378snes:SeriesF1WarrantsMember2023-01-012023-12-310001680378snes:SeriesF1WarrantsMember2023-12-310001680378snes:SeriesF2WarrantsMember2024-01-012024-12-310001680378snes:SeriesF2WarrantsMember2024-12-310001680378snes:SeriesF2WarrantsMember2022-12-310001680378snes:SeriesF2WarrantsMember2023-01-012023-12-310001680378snes:SeriesF2WarrantsMember2023-12-310001680378snes:DealerManagerWarrants13Member2024-01-012024-12-310001680378snes:DealerManagerWarrants13Member2024-12-310001680378snes:DealerManagerWarrants13Member2022-12-310001680378snes:DealerManagerWarrants13Member2023-01-012023-12-310001680378snes:DealerManagerWarrants13Member2023-12-310001680378snes:ClassOfWarrantOrRightExpirationPeriodYearOneMember2024-12-310001680378snes:ClassOfWarrantOrRightExpirationPeriodYearTwoMember2024-12-310001680378snes:ClassOfWarrantOrRightExpirationPeriodYearThreeMember2024-12-310001680378snes:ClassOfWarrantOrRightExpirationPeriodYearFourMember2024-12-310001680378snes:ClassOfWarrantOrRightExpirationPeriodYearFiveMember2024-12-310001680378snes:SeriesCWarrantsMemberus-gaap:MeasurementInputSharePriceMember2023-04-300001680378snes:SeriesCWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2023-04-300001680378snes:SeriesCWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-04-300001680378snes:SeriesCWarrantsMemberus-gaap:MeasurementInputExpectedDividendRateMember2023-04-300001680378snes:SeriesCWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-04-300001680378snes:DealerManagerWarrants10Membersnes:HCWainwrightCoLLCMembersrt:MaximumMember2023-04-300001680378snes:DealerManagerWarrants10Membersnes:HCWainwrightCoLLCMember2023-04-300001680378snes:DealerManagerWarrants10Memberus-gaap:MeasurementInputSharePriceMembersnes:HCWainwrightCoLLCMember2023-04-300001680378snes:DealerManagerWarrants10Memberus-gaap:MeasurementInputPriceVolatilityMembersnes:HCWainwrightCoLLCMember2023-04-300001680378snes:DealerManagerWarrants10Memberus-gaap:MeasurementInputExpectedTermMembersnes:HCWainwrightCoLLCMember2023-04-300001680378snes:DealerManagerWarrants10Memberus-gaap:MeasurementInputExpectedDividendRateMembersnes:HCWainwrightCoLLCMember2023-04-300001680378snes:DealerManagerWarrants10Memberus-gaap:MeasurementInputRiskFreeInterestRateMembersnes:HCWainwrightCoLLCMember2023-04-300001680378snes:PrivateWarrantInducement3AndPrivateWarrantInducement4Membersrt:MaximumMember2023-08-310001680378snes:PrivateWarrantInducement3AndPrivateWarrantInducement4Member2023-08-310001680378snes:PrivateWarrantInducement4Membersrt:MaximumMember2023-08-310001680378snes:PrivateWarrantInducement3Membersrt:MaximumMember2023-08-310001680378snes:PrivateWarrantInducement4Member2023-08-310001680378snes:PrivateWarrantInducement4Memberus-gaap:MeasurementInputSharePriceMember2023-08-310001680378snes:PrivateWarrantInducement4Memberus-gaap:MeasurementInputPriceVolatilityMember2023-08-310001680378snes:PrivateWarrantInducement4Memberus-gaap:MeasurementInputExpectedTermMember2023-08-310001680378snes:PrivateWarrantInducement4Memberus-gaap:MeasurementInputExpectedDividendRateMember2023-08-310001680378snes:PrivateWarrantInducement4Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-08-310001680378snes:PrivateWarrantInducement3Member2023-08-310001680378snes:PrivateWarrantInducement3Memberus-gaap:MeasurementInputSharePriceMember2023-08-310001680378snes:PrivateWarrantInducement3Memberus-gaap:MeasurementInputPriceVolatilityMembersnes:HCWainwrightCoLLCMember2023-08-310001680378snes:PrivateWarrantInducement3Memberus-gaap:MeasurementInputExpectedTermMembersnes:HCWainwrightCoLLCMember2023-08-310001680378snes:PrivateWarrantInducement3Memberus-gaap:MeasurementInputExpectedDividendRateMember2023-08-310001680378snes:PrivateWarrantInducement3Memberus-gaap:MeasurementInputRiskFreeInterestRateMembersnes:HCWainwrightCoLLCMember2023-08-310001680378snes:DealerManagerWarrants11Membersnes:HCWainwrightCoLLCMembersrt:MaximumMember2023-08-310001680378snes:DealerManagerWarrants11Membersnes:HCWainwrightCoLLCMember2023-08-310001680378snes:DealerManagerWarrants11Memberus-gaap:MeasurementInputSharePriceMembersnes:HCWainwrightCoLLCMember2023-08-310001680378snes:DealerManagerWarrants11Memberus-gaap:MeasurementInputPriceVolatilityMembersnes:HCWainwrightCoLLCMember2023-08-310001680378snes:DealerManagerWarrants11Memberus-gaap:MeasurementInputExpectedTermMembersnes:HCWainwrightCoLLCMember2023-08-310001680378snes:DealerManagerWarrants11Memberus-gaap:MeasurementInputExpectedDividendRateMembersnes:HCWainwrightCoLLCMember2023-08-310001680378snes:DealerManagerWarrants11Memberus-gaap:MeasurementInputRiskFreeInterestRateMembersnes:HCWainwrightCoLLCMember2023-08-310001680378snes:PreFundedWarrantsIssuedInNovember2023Memberus-gaap:MeasurementInputSharePriceMember2023-11-300001680378snes:PreFundedWarrantsIssuedInNovember2023Memberus-gaap:MeasurementInputPriceVolatilityMember2023-11-300001680378snes:PreFundedWarrantsIssuedInNovember2023Memberus-gaap:MeasurementInputExpectedDividendRateMember2023-11-300001680378snes:PreFundedWarrantsIssuedInNovember2023Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-11-300001680378snes:SeriesDWarrantsMembersrt:MaximumMember2023-11-300001680378snes:SeriesDWarrantsMember2023-11-300001680378snes:SeriesDWarrantsMemberus-gaap:MeasurementInputSharePriceMember2023-11-300001680378snes:SeriesDWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2023-11-300001680378snes:SeriesDWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-11-300001680378snes:SeriesDWarrantsMemberus-gaap:MeasurementInputExpectedDividendRateMember2023-11-300001680378snes:SeriesDWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-11-300001680378snes:SeriesEWarrantsMembersrt:MaximumMember2023-11-300001680378snes:SeriesEWarrantsMember2023-11-300001680378snes:SeriesEWarrantsMemberus-gaap:MeasurementInputSharePriceMember2023-11-300001680378snes:SeriesEWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2023-11-300001680378snes:SeriesEWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-11-300001680378snes:SeriesEWarrantsMemberus-gaap:MeasurementInputExpectedDividendRateMember2023-11-300001680378snes:SeriesEWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-11-300001680378snes:DealerManagerWarrants12Membersnes:HCWainwrightCoLLCMembersrt:MaximumMember2023-11-300001680378snes:DealerManagerWarrants12Membersnes:HCWainwrightCoLLCMember2023-11-300001680378snes:DealerManagerWarrants12Memberus-gaap:MeasurementInputSharePriceMembersnes:HCWainwrightCoLLCMember2023-11-300001680378snes:DealerManagerWarrants12Memberus-gaap:MeasurementInputPriceVolatilityMembersnes:HCWainwrightCoLLCMember2023-11-300001680378snes:DealerManagerWarrants12Memberus-gaap:MeasurementInputExpectedTermMembersnes:HCWainwrightCoLLCMember2023-11-300001680378snes:DealerManagerWarrants12Memberus-gaap:MeasurementInputExpectedDividendRateMembersnes:HCWainwrightCoLLCMember2023-11-300001680378snes:DealerManagerWarrants12Memberus-gaap:MeasurementInputRiskFreeInterestRateMembersnes:HCWainwrightCoLLCMember2023-11-300001680378snes:SeriesF1WarrantsAndSeriesF2WarrantsMembersrt:MaximumMember2024-08-310001680378snes:SeriesF1WarrantsAndSeriesF2WarrantsMember2024-08-310001680378snes:SeriesF1WarrantsMember2024-08-310001680378snes:SeriesF2WarrantsMember2024-08-310001680378snes:SeriesF1WarrantsMemberus-gaap:MeasurementInputSharePriceMember2024-08-310001680378snes:SeriesF1WarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2024-08-310001680378snes:SeriesF1WarrantsMemberus-gaap:MeasurementInputExpectedTermMember2024-08-310001680378snes:SeriesF1WarrantsMemberus-gaap:MeasurementInputExpectedDividendRateMember2024-08-310001680378snes:SeriesF1WarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-08-310001680378snes:SeriesF2WarrantsMemberus-gaap:MeasurementInputSharePriceMember2024-08-310001680378snes:SeriesF2WarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2024-08-310001680378snes:SeriesF2WarrantsMemberus-gaap:MeasurementInputExpectedTermMember2024-08-310001680378snes:SeriesF2WarrantsMemberus-gaap:MeasurementInputExpectedDividendRateMember2024-08-310001680378snes:SeriesF2WarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-08-310001680378snes:DealerManagerWarrants13Membersrt:MaximumMember2024-08-310001680378snes:DealerManagerWarrants13Member2024-08-310001680378snes:DealerManagerWarrants13Memberus-gaap:MeasurementInputSharePriceMember2024-08-310001680378snes:DealerManagerWarrants13Memberus-gaap:MeasurementInputPriceVolatilityMember2024-08-310001680378snes:DealerManagerWarrants13Memberus-gaap:MeasurementInputExpectedTermMember2024-08-310001680378snes:DealerManagerWarrants13Memberus-gaap:MeasurementInputExpectedDividendRateMember2024-08-310001680378snes:DealerManagerWarrants13Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-08-310001680378snes:AllOtherDistributorsMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001680378snes:AllOtherDistributorsMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001680378snes:DistributorAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001680378snes:DistributorAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001680378snes:DistributorBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001680378snes:DistributorBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001680378snes:DistributorAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2024-01-012024-12-310001680378snes:DistributorAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-01-012023-12-310001680378snes:DistributorBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2024-01-012024-12-310001680378snes:DistributorBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-01-012023-12-310001680378snes:EndCustomerAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2024-01-012024-12-310001680378snes:EndCustomerAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-01-012023-12-310001680378snes:EndCustomerBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2024-01-012024-12-310001680378snes:EndCustomerBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-01-012023-12-310001680378us-gaap:WarrantMember2024-01-012024-12-310001680378us-gaap:WarrantMember2023-01-012023-12-310001680378snes:CommonStockOptionsMember2024-01-012024-12-310001680378snes:CommonStockOptionsMember2023-01-012023-12-310001680378snes:SuperiorCourtOfTheStateOfCaliforniaKennanEKaedarLitigationMemberus-gaap:SettledLitigationMember2021-09-012021-09-300001680378snes:SuperiorCourtOfTheStateOfCaliforniaKennanEKaedarLitigationMemberus-gaap:SettledLitigationMember2023-11-012023-11-300001680378srt:AffiliatedEntityMembersnes:KitoImpactFoundationMember2023-12-310001680378srt:AffiliatedEntityMembersnes:KitoImpactFoundationMember2024-12-310001680378snes:ATMFinancingMemberus-gaap:SubsequentEventMember2025-03-060001680378snes:ATMFinancingMemberus-gaap:SubsequentEventMember2025-01-012025-03-060001680378us-gaap:SubsequentEventMember2025-03-112025-03-1100016803782024-08-230001680378us-gaap:SubsequentEventMember2025-03-110001680378us-gaap:MeasurementInputExpectedTermMemberus-gaap:SubsequentEventMember2025-03-110001680378snes:DealerManagerWarrants14Memberus-gaap:SubsequentEventMember2025-03-112025-03-110001680378snes:DealerManagerWarrants14Member2024-08-230001680378snes:DealerManagerWarrants14Memberus-gaap:MeasurementInputExpectedTermMemberus-gaap:SubsequentEventMember2025-03-1100016803782024-10-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-37941

SENESTECH, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Delaware |

|

20-2079805 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

|

777 W. Pinnacle Peak Road, Suite B104

Phoenix, AZ

|

|

85027 |

| (Address of principal executive offices) |

|

(Zip Code) |

(928) 779-4143

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading symbol |

|

Name of each exchange on

which registered |

| Common Stock, $0.001 par value |

|

SNES |

|

The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated

filer |

o |

|

Accelerated

filer |

o |

|

Non-accelerated filer |

x |

|

Smaller reporting

company |

x |

|

Emerging growth

company |

o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1b. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the registrant’s common stock held by non-affiliates on June 30, 2024 (the last business day of the registrant’s most recently completed second fiscal quarter) as reported by the Nasdaq Capital Market on such date was approximately $2,968,000. There were 515,340 shares of the registrant’s common stock outstanding on June 30, 2024.

As of March 11, 2025, there were 1,746,930 shares of common stock outstanding.

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement for the 2025 Annual Meeting of Stockholders

are incorporated by reference into Part III of this Form 10-K.

SENESTECH, INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2024

TABLE OF CONTENTS

Definitions

The abbreviations or acronym defined below are used throughout this Annual Report on Form 10-K:

|

|

|

|

|

|

| Abbreviation or Acronym |

Definition |

| ASC |

Accounting Standards Codification |

| EPA |

Environmental Protection Agency |

| ESA |

The Endangered Species Act of 1973 |

Exchange Act |

Securities Exchange Act of 1934, as amended |

| FIFRA |

Federal Insecticide Fungicide and Rodenticide Act |

| U.S. GAAP |

Generally accepted accounting principles in the United States |

| IPM |

Integrated pest management |

| Nasdaq |

The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

| PCAOB |

Public Company Accounting Oversight Board |

| PMP |

Pest Management Provider |

| ROU |

Right-of-use |

| RUP |

Restricted use product |

| SEC |

Securities and Exchange Commission |

| VCD |

Vinylcyclohexene diepoxide |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this Annual Report on Form 10-K that are not historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). All statements other than statements of historical facts contained or incorporated herein by reference in this Annual Report on Form 10-K, including statements regarding our future operating results, future financial position, business strategy, objectives, goals, plans, prospects, markets, and plans and objectives for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “suggests,” “targets,” “contemplates,” “projects,” “predicts,” “may,” “might,” “plan,” “would,” “should,” “could,” “can,” “potential,” “continue,” “objective,” or the negative of those terms, or similar expressions intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. Specific forward-looking statements in this Annual Report on Form 10-K include statements regarding:

•our belief the most effective, long-term way to manage rats is by using a combination of tools that work together to magnify the efficacy of the pest management protocol;

•our belief that our field research demonstrates more than 90% reduction in rat populations when added to an integrated pest management (“IPM”) with sustained population suppression;

•our belief that we can achieve our goal for fertility control to be standard tool utilized in pest management in IPM programs across all verticals;

•our belief that maintaining a fertility control program reduces the reproduction and therefore the risk of future population spikes of rodent populations, known as the rebound effect;

•our belief that the size of the rat control market is sufficient for our near-term focus;

•our belief that ContraPest® or EvolveTM are novel in the pest control industry;

•our belief that the use of Evolve can lead to sustained reductions of the rat populations;

•our belief that first and second generation anti-coagulant rodenticides will come under increased scrutiny for non-target exposure and bioaccumulation impacts on non-target species as they travel up the food chain and their use is being restricted or banned in select areas across the United States and globally;

•our belief that the pest industry in the United States has demonstrated a reluctance to adopt new technologies;

•our belief that Evolve qualifies for exemption from registration as a minimum risk pesticide under the United States Environmental Protection Agency’s (the “EPA’s”) Federal Insecticide, Fungicide, and Rodenticide Act (“FIFRA”), Section 25(b);

•our belief that our internal production capabilities allow us to meet our current and anticipated demand through 2025 and beyond;

•our belief that ContraPest or Evolve consumption should not cause rats to become ill or change their behavior, which reduces risks of non-target species exposure;

•our belief that non-registered products being sold online that claims to control rodent reproduction are not competitive products;

•our plan to continue to utilize various forms of stock-based awards to hire, retain and motivate talented employees, consultants and directors;

•our expectation that our expenses may continue and to increase in connection with our ongoing activities, particularly as we advance our commercialization activities;

•our ability to obtain and maintain regulatory approval for our product and product candidates;

•our ability to gain market acceptance, commercial viability and profitability of ContraPest, Evolve and other products;

•our ability to market our products and establish an effective sales force and marketing infrastructure to generate significant revenue;

•the success of our research and development;

•our belief that our technology can be applied to other mammalian species;

•our ability to retain and attract key personnel to develop, operate and grow our business;

•our ability to meet our working capital needs;

•our belief that our competitive position could be harmed if we fail to obtain or protect our intellectual property rights;

•our belief that our intellectual property rights may not adequately protect our business, or permit us to maintain our competitive advantage;

•our belief that our technology may be found to infringe third party intellectual property rights;

•our belief that product liability lawsuits against us could cause us to incur substantial liabilities and to limit commercialization of any products that we may develop;

•our belief that reverse stock splits may decrease the liquidity of the shares of our common stock;

•our belief that raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates;

•our belief that our share price is volatile, which could subject us to securities class action litigation and your investment in our securities could decline in value;

•our belief that if securities or industry analysts, or other sources of information, do not publish research, or publish inaccurate or unfavorable research or other information about our business, our stock price and trading volume could decline;

•our estimates or expectations related to our revenue, cash flow, expenses, capital requirements and need for additional financing;

•our plans for our business, including for research and development;

•our financial performance, including our ability to fund operations; and

•developments and projections relating to our projects, competitors and our industry, including legislative developments and impacts from those developments.

These forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and situations that are difficult to predict and that may cause our own, or our industry’s, actual results to be materially different from the future results that are expressed or implied by these statements. Accordingly, actual results may differ materially from those anticipated or expressed in such statements as a result of a variety of factors, including those discussed in Item 1A-“Risk Factors” of Part II of in this Annual Report on Form 10-K. A number of factors could cause our actual results to differ materially from those indicated by the forward-looking statements. Such factors include, among others, the following:

•the successful commercialization of our products;

•market acceptance of our products;

•our financial performance, including our ability to fund operations;

•our ability to regain and maintain compliance with Nasdaq Capital Market’s (“Nasdaq’s”) continued listing requirements;

•regulatory approval and regulation of our products; and

•other factors and risks identified from time to time in our filings with the Securities and Exchange Commission (the “SEC”), including this Annual Report on Form 10-K.

All forward-looking statements included herein are based on information available to us as of the date hereof and speak only as of such date. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. The forward-looking statements contained in or incorporated by reference into this Annual Report on Form 10-K reflect our views as of the date of this Annual Report on Form 10-K about future events and are subject to risks, uncertainties, assumptions, and changes in circumstances that may cause our actual results, performance, or achievements to differ significantly from those expressed or implied in any forward-looking statement. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future events, results, performance or achievements.

We are subject to the information requirements of the Exchange Act, and we file or furnish reports, proxy statements and other information with the SEC. Such reports and other information we file with the SEC are available free of charge at www.senestech.com as soon as practicable after such reports are available on the SEC’s website at www.sec.gov. The SEC’s website contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

PART I

ITEM 1. BUSINESS.

Overview

We have developed and are commercializing products for managing animal pest populations through fertility control. Our current products focus on rat and mouse populations, and are known as: ContraPest, Evolve Rat, and Evolve Mouse.

As far back as we can trace, rodents - and in particular rats - have been foes to mankind. Rodents pose threats to human and animal health, food security and infrastructure around the world, and we have spent centuries trying to mitigate the problems associated with these pests. Rodents are known to be reservoir hosts for at least 60 zoonotic diseases and the potential transmission of these diseases creates a global risk to public health and safety, as well as agriculture. Through consumption and contamination, rats destroy at least 20% of the global stored food supply every year. Additionally, rats cause over $27 billion in damage to public and private infrastructure annually in the United States alone by burrowing beneath foundations and gnawing on electrical wiring, insulation, fire-proofing systems and equipment.

Over the centuries, the most prevalent response to rodent infestations has been an attempt to eliminate them through the use of lethal tools such as traps and rodenticides. However, there are growing concerns about the environmental and ecological impact of rodenticides due to secondary exposure and bioaccumulation, including a push for safer and more humane products as consumer awareness increases. While some of these challenges are of recent concern, the efficacy of how rodent infestations respond has always been limited by their extraordinary reproductive rate.

CONTRAPEST. ContraPest, our initial product, is a liquid bait, containing the active ingredients 4-vinylcyclohexene diepoxide (“VCD”) and triptolide. ContraPest targets the reproductive systems of both male and female rats, is a highly palatable formulation, does not cause illness or changed behavior in rats, and leads to significant reductions in fertility and rat populations. Accordingly, ContraPest is an additional tool to use as part of an IPM program.

On August 2, 2016, the EPA granted an unconditional registration for ContraPest as a Restricted Use Product (“RUP”), requiring purchase or application oversight by a licensed professional. On October 18, 2018, the EPA approved the removal of the RUP designation and ContraPest was reclassified as a general-use pesticide. To date, ContraPest is registered in all 50 states (49 states and the District of Columbia have approved the RUP designation) and two major U.S. territories, Puerto Rico and the U.S. Virgin Islands. On March 10, 2022, the EPA granted a sub-label for ContraPest allowing for an alternative delivery system in a hanging bait station. This sub-label is marketed as Elevate Bait System™ and was designed to target roof rat habitats and infestations.

EVOLVE. The Evolve product line, which began in the form of Evolve Rat, launched in January 2024, and is currently our lead product. Evolve Rat is a soft bait product that is novel to the pest control industry and contains the active ingredient, cottonseed oil. Evolve Rat reduces fertility in both male and female rats. Additionally, its palatable formulation produces high acceptance for sustained consumption even when other sought-after food sources are present. , Evolve Rat does not cause illness in rats and, therefore, it does not change behavior or result in bait aversion. By targeting the reproductive systems of both male and female rats, and with palatability promoting continued consumption, the use of Evolve can lead to sustained reductions of the rat population.

Evolve Rat meets the EPA’s minimum risk pesticide conditions under FIFRA, Section 25(b). Due to its classification, Evolve is exempt from federal registration because it poses little to no risk to human health and the environment. Evolve is also made from food ingredients with tolerance exemptions for both food and nonfood applications, which allows it to be used in agricultural application. There are 10 states that accept the federal exemption for pesticide registration and require no additional determination or approval. In states that do not accept the federal exemption, we must obtain registration from the various state regulatory agencies. To date, we are authorized to sell Evolve in 48 states.

In May 2024, we launched Evolve Mouse, our latest iteration of the Evolve product line. Evolve Mouse is a modified version of our soft bait technology and contains the active ingredient, cottonseed oil. Evolve Mouse limits reproduction of male and female mice and is also considered a minimum risk pesticide under the EPA’s FIFRA, Section 25(b). To date, we are authorized to sell Evolve Mouse in 35 states.

We are continuously enhancing ContraPest and Evolve to align with the unique needs and environments of our customers in our target verticals while simultaneously pursuing regulatory approvals and amendments to our existing U.S. registration to broaden its use and marketability. When regulatory and financial conditions permit, we will seek regulatory approval for additional jurisdictions beyond the United States.

Current Challenges in Pest Control Methodologies

Under ideal conditions, a female rat can yield up to 15,000 descendants in approximately 12 months. Lethal control measures such as traps and rodenticides are often at the forefront of rat control programs. However, this reproduction rate, along with intelligence and genetic resistance to the active ingredients in rodenticides, can negatively impact results of traditional mitigation efforts.

Rodents reach sexual maturity between approximately six to nine weeks of age. Female rats can give birth to six litters per year with an average of five to ten offspring each. Female mice can produce up to ten litters per year with an average of five to six offspring. This prolific breeding can cause populations to rebound quickly even after implementing a lethal control program.

Rodent behavior, either learned or innate, can negatively affect pest control efforts. Neophobia, or the fear and avoidance of new objects, is an innate behavior that often impacts control efforts. Rats avoid bait stations, loose bait, or traps until they are confident that these new objects pose no danger. Rodents will sample new foods and baits to establish palatability and determine if there are any negative side effects, which reduces the likelihood of ingesting a lethal dose of rodenticide. If the rodenticide causes illness in rodents but they survive, they will develop conditioned aversion and avoid such substance in the future.

Resistance to traditional rodenticides creates challenges for rodent control programs. Rodents, like all animals, are hard-wired to survive. Further, some rats can be born with a genetic mutation making them resistant to certain rodenticides. Studies show that resistance is increasing in commensal rodents as resistance can be passed onto offspring who will then carry this resistant trait into future generations.

Because of these factors, traditional rodenticide producers are continually challenged to develop new, more lethal chemicals to control future rat populations.

Rodenticides do not just affect their intended target but can also directly impact other species or transfer through the food chain. Animals that prey or scavenge on poisoned rats such as raptors, large cats, foxes, and other mammals of concern have significant levels of rodenticide present in their bodies due to persistence of the rodenticide in the rat tissue. The Center for Biological Diversity highlights that rodenticides can be lethal to any bird or mammal and their non-selective toxicity endangers various wildlife species. The United States Geological Survey notes that despite regulatory efforts to limit certain rodenticides, exposure and adverse effects in non-target predatory wildlife persist, indicating ongoing environmental risks.

Additionally, there is growing concern about the rise in reported cases of adverse effects that rodenticides have on children and pets due to accidental, direct exposure. The American Society for the Prevention of Cruelty to Animals (“ASPCA”) reports that these substances are highly toxic to cats and dogs leading to severe health issues such as internal bleeding, kidney failure, seizures, or even death. Studies show that anticoagulant rodenticides are the most reported substance causing pet poisonings. The American Association of Poison Control Centers reported the number of human cases between 2011 and 2015 was a cumulative total of 44,095 and 1,029 for long-acting superwarfarin-type and warfarin-type drugs, respectively, and 88% of these involved children under the age of five.

In addition to direct exposure to humans, chemicals in rodenticides have also been found as contaminates in the food supply.

In November 2022, the EPA announced an update to its Endangered Species Act of 1973 (“ESA”) Workplan to expand the protection efforts for endangered species potentially affected by rodenticides. In November 2024, the EPA released its final Biological Evaluations for 11 rodenticide active ingredients, assessing their potential effects on approximately 90 endangered species and their critical habitats. These evaluations guide regulatory actions and implement mitigation measures to restrict or condition rodenticide use in areas where endangered species may be present to reduce exposure risks. Such measures include specifying distances between rodenticide application sites and critical habitat to create buffer zones, restricting application by limiting how and where rodenticides can be applied, and requiring training and certification for applicators that ensures safe and targeted use. In addition, they require rodenticide label updates to reflect new usage restrictions, mitigation measures and environmental protection guidelines, which can alter market preference to shift toward more attractive, non-lethal solutions.

Changes to the EPA’s review and registration policies could affect filings with the agency due to expanded test requirements for mammals, birds, reptiles, and critical habitats. ContraPest is not a traditional rodenticide and does not contain the active ingredients under this evaluation. While these requirements (or a subset) do not directly impact our registration, ContraPest is classified in the rodenticide category with the EPA, therefore, updates to ContraPest’s current registration or newly registered products with the agency in the future may be subject to stricter testing requirements or limitations on use. However, ContraPest, under its current registration, and the exemption status of Evolve as a 25b pesticide, offers a distinct competitive advantage in the rodent control market through its alternative non-lethal and environmentally benign products.

Integrated Pest Management and Fertility Control

The most effective, long-term way to manage rodents is by using a combination of tools that work together to magnify the efficacy of the pest management protocol; IPM is based upon this concept. The EPA defines IPM as an effective and environmentally sensitive approach to pest management that relies on a combination of common-sense practices through use of current, comprehensive information on the life cycles of pests and their interaction with the environment. This approach considers the least hazardous and most economical option to people, property, and the environment. An effective IPM program should reduce the existing rat population, while preventing recurrence of the problem thus limiting continual application of hazardous chemicals such as lethal rodenticides.

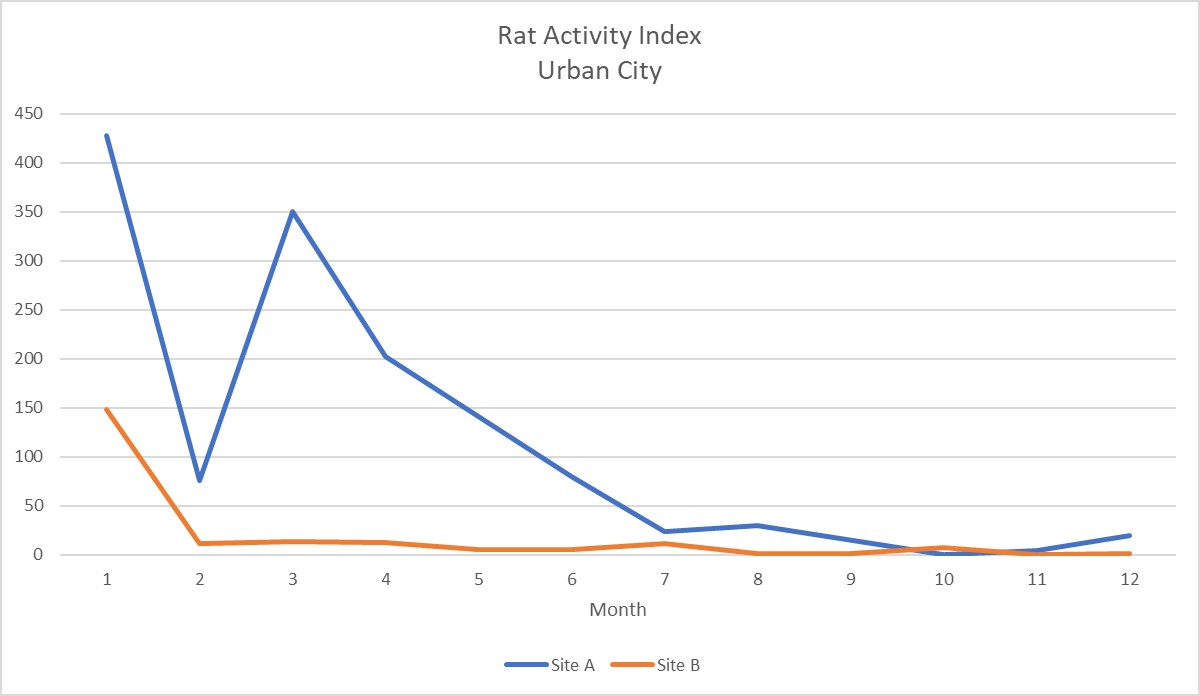

Based on company field research, the addition of a fertility control product to an IPM program has demonstrated improved efficacy of more than 90% with sustained population suppression. A fertility control program reduces the reproduction and therefore the risk of future population spikes, known in the industry as the rebound effect. Fertility control can also trigger the Allee Effect, which means that when a population becomes too small, it struggles to survive. This happens because it becomes harder for individuals to find mates and to reproduce. As a result, the population declines even faster, helping suppress or even eliminate it. Accordingly, fertility control can reduce the reliance on poisons or their frequency of use, allowing for a pest control program that focus on maintenance only.

Updates to the EPA’s ESA Workplan in November 2024 strongly encourage a shift towards IPM that promotes alternatives to rodenticides, including non-lethal and environmentally safer solutions. This shift aligns with our fertility control products, ContraPest and Evolve. The EPA has indicated a willingness to collaborate with manufacturers and stakeholders to ensure compliance and explore safer alternatives given the recent ESA changes. As the first and only EPA registered liquid contraceptive bait for use on Norway rat and roof rat populations, ContraPest was – and remains – a novel product among a catalog of lethal rodenticides that have dominated the market. The EPA granted us waivers for several studies typically required for new rodenticide products at the time ContraPest was initially registered because of its low risk profile and use characteristics. While there may be limitations to how and where ContraPest can be used, ContraPest’s product features align with the agency’s agenda to provide alternative IPM solutions and allows us the potential opportunity to further expand our partnerships.

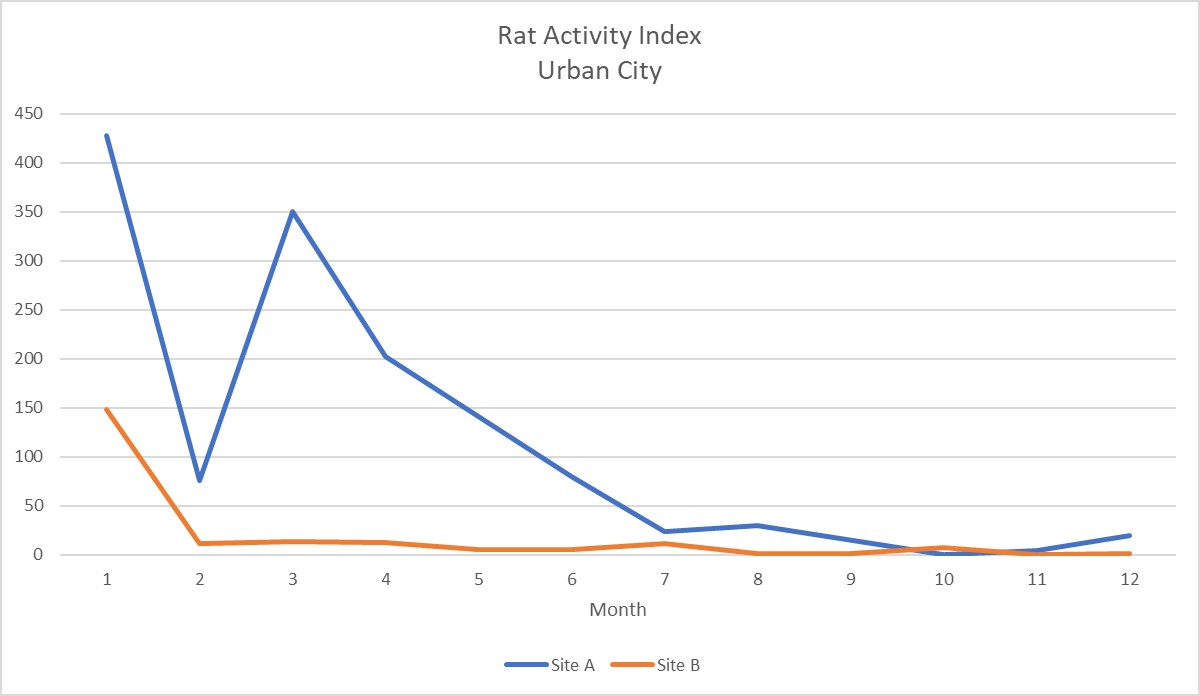

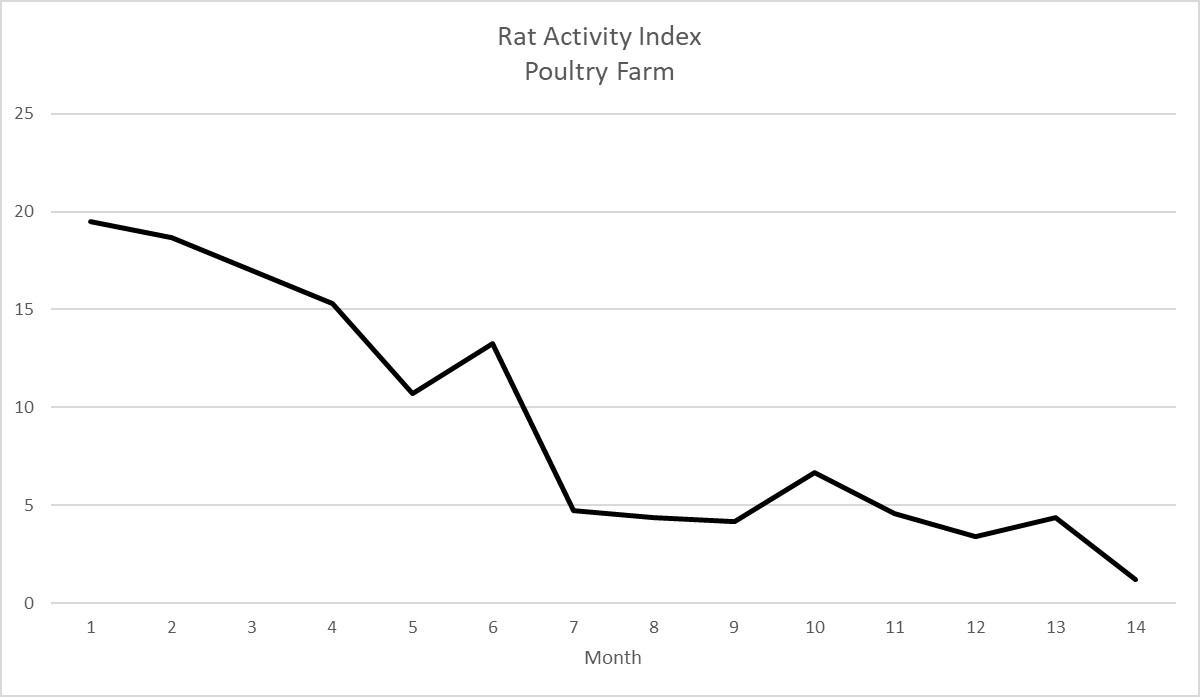

(source: company studies)

Other Applications

While our proprietary technology is effective on rat species, our technology can be applied to other mammalian species. We have explored and continue to evaluate fertility control in mice, feral dogs, and other species. This preliminary data indicates potential for the continued development of fertility control technology in general. We believe that the size of the rat control market is sufficient for our near-term focus. We remain open to potentially to licensing our technology for our strategic partners to explore its applicability to other mammalian species.

Business Strategy

Our goal is for fertility control to be a standard tool utilized in pest management in IPM programs across all verticals. We will achieve this through the following:

End User Awareness and Adoption.

Our focus is educating end users on the rapid reproduction rate of rodents, which draws attention to the complex issue of gaining control of an infestation when you do not have control of fertility. As more rodenticides come to market to address rat populations, attention will be drawn to the impact other rodenticides may have on other species due to bioaccumulation, and the benefit of ContraPest and Evolve having a low potential for bioaccumulation. Our fertility control products align with the EPA’s recent push for non-lethal alternatives and reduced environmental impact.

Tailored Value Propositions.

While the general desire to achieve and maintain control of rat populations is universal among end users, each vertical has a specific pain point which may be improved through the use of fertility control. By working with our existing customers and conducting field research, we are understanding and leveraging unique opportunities in our sales strategies across verticals. Our approaches include, but are not limited to the following:

•Product Development. The needs of customers in each vertical vary due to environment and limitations, requiring ongoing innovation, exploration of additional species and the pursuit of additional regulatory approvals for ContraPest and Evolve, both in the United States and globally.

•Strategic Partnerships. Alignment with industry leaders and organizations accelerate awareness, adoption, product innovation and development.

•Efficiencies. Through securing more reliable, affordable suppliers for our raw materials, and continuous development of our manufacturing process, we will be able to increase profits while scaling production to meet rising product demand and the production of additional registered products.

Marketing and Sales Approach

ContraPest and Evolve are differentiated in what is otherwise a very crowded pest control market. They are the only products registered with or exempt from registration by the EPA that restrict fertility in both male and female rats and are designed to be non-lethal. As first and second generation anti-coagulant rodenticides come under increased scrutiny for non-target exposure and bioaccumulation impacts on non-target species as they travel up the food chain, their use is being restricted or banned in select areas across the United States and globally. These increasing restrictions and bans create an opportunity to highlight the safety and efficacy of our products as industry professionals look for alternative tools to serve their customers and gain control of rat and mouse populations through nontraditional means.

Because the pest industry in the United States has demonstrated a reluctance to adopt new technologies, the marketing of fertility control has primarily been aimed at end-user and professional awareness, and penetration of the key verticals of agribusiness distribution, pest management distribution, industrial distribution, retail distribution, international distribution and e-commerce. While pain points and benefits are unique to each vertical, they have shared core value propositions.

•Fertility control is effective. Lab tests and field research demonstrate more than 90% reduction in rat populations when added to an IPM with sustained population suppression;

•Our proprietary formulations and feeding systems optimize consumption and provides targeted delivery for maximum efficacy;

•ContraPest and Evolve are specifically designed to minimize exposure hazard for handlers and non-targeted species such as wildlife, livestock, and pets, with Evolve being designated by the EPA as a minimum risk product; and

•Fertility control can be used as an anchor or enhancement for an IPM program, and as a solution to decrease reliance on poisons or other lethal control options.

Raw Materials and Manufacturing Process

The Evolve products contain one active ingredient, cottonseed oil, a plant-derived food product. Evolve also contains several other inactive food ingredients. Currently, we source cottonseed oil from standard food suppliers, and it is available from a variety of sources. Our manufacturing process for Evolve involves the incorporation of our active ingredient, in low concentration, into several inactive ingredients. Once incorporated, the entire product is packaged inside of a casing and cut to length for sale. This process allows Evolve to be delivered to rats and mice in a palatable, effective manner, and it is designed to be non-lethal.

ContraPest contains two active ingredients, VCD, an industrial chemical, and triptolide, a plant derived chemical. ContraPest also contains several other inactive, generally recognized as safe, ingredients. Currently, we source VCD from standard industrial chemical supply providers. Triptolide is derived from the Thunder god vine, Tripterygium wilfordii, which is commonly cultivated and harvested wild in southeastern China and other Asian countries. Triptolide is available from a variety of sources, but the process to purify triptolide for use in ContraPest is expensive. Thus, we are investigating other, less costly sources of triptolide.

Our manufacturing process involves the incorporation of our two active ingredients, in low concentrations, into several inactive ingredients. Once incorporated, the entire product goes through a proprietary process in order to stabilize the final formulation. This process allows ContraPest to be delivered to rats in a palatable, effective manner, and it is designed to be non-lethal.

Currently, we have production scale capability in our facilities in Arizona to manufacture ContraPest and Evolve. Our internal production capabilities allow us to meet our current and anticipated demand through 2025 and beyond.

Scientific Background Regarding our Product

Female rats are born with a finite number of eggs, or oocytes, and remain fertile until death. Within the ovary, eggs develop within structures called follicles. The non-regenerating and least mature follicles are called primordial. The primordial follicles mature through primary, secondary and antral stages and ultimately ovulate. Once the primordial follicles have become depleted, ovarian failure occurs, which terminates reproductive capability. The active ingredients in our products cause specific loss of small ovarian follicles (both primordial and primary) and growing follicles (secondary and antral). In males, the active ingredients in our products exert a significant suppression of male fertility by preventing sperm maturation and impairing the movement of sperm.

The safety and efficacy of our active ingredients and products are supported by considerable evidence. The active ingredients are rapidly metabolized by the rat, limiting the possibility of bioaccumulation or effect on non-target species. Further, based on laboratory and toxicology studies, ContraPest and Evolve should not cause rats to become ill or change their behavior.

Furthermore, ContraPest and Evolve are contraceptives, not sterilants, limiting fertility in male and female rats beginning with the first breeding cycle following consumption. The average duration of infertility post consumption ranges from 42 to over 180 days.

Other Potential Products

We continue to explore the application of ContraPest and Evolve on other species. We expect to continuously evaluate and evolve our current product offerings and, technology and market conditions permitting, introduce additional products.

Competition

Currently, we are unaware of any other non-lethal fertility control products targeting rats that are registered by the EPA. There are non-registered products being sold online that claim to control rodent reproduction. We do not believe these to be competitive products.

Our principal competition is large corporations with greater resources that offer a wider range of products. Generally, these are lethal pest control products largely consisting of rodenticide-based products and other tools that Pest Management Provider (“PMPs”) use in their IPM.

Government Regulation and Product Approval

Federal, state and local government authorities in the United States regulate, among other things, the testing, manufacturing, quality control, approval, labeling, packaging, storage, record-keeping, distribution and marketing of the products we develop. The process for obtaining regulatory approval and compliance with appropriate federal, state and local regulations is rigorous and requires the expenditure of substantial time and financial resources.

United States Review and Approval Processes

In the United States, the EPA regulates the sale, distribution and use of any pesticide under FIFRA. The EPA’s definition of a pesticide includes “any substance or mixture of substances intended for preventing, destroying, repelling, or mitigating any pest.” FIFRA defines a pest as “any insect, rodent, nematode, fungus, or weed.” To register a new product with the EPA, all active ingredients within the product must be registered with the EPA or meet specific exemptions.

The EPA has an exemption under FIFRA, Section 25(b) which exempts certain pesticides from federal registration based on six criteria for minimum risk. Evolve is exempt from registration as a minimum risk pesticide under FIFRA, Section 25(b). All applicable requirements for registration, manufacturing, selling, or distributing into designated sates and territories have been met. Evolve has not been registered by the EPA but is in the process of registering in all 50 states, the District of Columbia, and five major U.S. territories. There are 10 states that accept the federal exemption for pesticide registration within the respective state. For the states that do not accept the federal exemption, we began the registration process for pesticide registration in October 2023. To date, we are authorized to sell Evolve in 48 states.

The EPA granted registration for ContraPest effective August 2, 2016, and as of July 12, 2018, we have received registration for ContraPest in all 50 states, the District of Columbia, and five major U.S. territories. This initial EPA approval labeled ContraPest as a restricted-use product, due to the need for applicator expertise for deployment. On October 18, 2018, the EPA removed the Restricted Use designation, meaning that we can sell ContraPest to consumers who do not have applicator expertise.

ContraPest is currently limited by EPA requirements to indoor use and to use within one foot of manmade structures.

In addition to the EPA registration of ContraPest in the United States, we must obtain registration from the various state regulatory agencies prior to selling in each state. To date, we have received registration for ContraPest in all 50 states and the District of Columbia, 49 of which have approved the removal of the Restricted Use designation.

In addition to product registration, the EPA also approves all labeling (the container label, instructional inserts, and the Safety Data Sheet) of ContraPest. Generally, states accept the EPA approved label as is. ContraPest’s labeling was submitted to states at initial registration and is resubmitted during state scheduled reregistration or for any significant labeling change requiring EPA approval.

In certain cases, our EPA and state registrations require completion of testing and certifications even after we have received approval for the product or its labeling. We continue to seek compliance with these requirements.

International Review and Approval Processes

With the assistance of in-country distributors, we are pursuing potential international markets and evaluating the regulatory landscapes of each prospective market. Country-specific regulatory laws have provisions that include requirements for certain labeling, safety, efficacy and manufacturers’ quality control procedures to assure the consistency of the product, as well as company records and reports. Some specific in-country studies will be required for particular countries, but others will generally accept an EPA or EU compliant dossier.

Personnel

As of December 31, 2024, we had 23 full-time employees and no part-time employees. Within our workforce, 11 employees are engaged in manufacturing, quality assurance and research and development and 12 employees are engaged in sales, business development, finance, regulatory, human resources, facilities, information technology, and general management and administration.

None of our employees are represented by labor unions or covered by collective bargaining agreements.

Intellectual Property and Other Proprietary Rights

Maintaining a strong position in the rodenticide market requires constant innovation along with a healthy research program to evolve product lines in order to remain competitive and relevant to the needs of the changing global marketplace. We seek to protect our proprietary data and trade secrets with attention to data exchanges among employees, consultants, collaborators and research and trade partners.

Patent Filings

Our intellectual property portfolio supporting ContraPest consists of nine international patent filings (in the United States, Europe, Canada, Brazil, Russia, Japan, Mexico, South Korea and Australia) addressing the ContraPest compound. Claims directed toward the compound include composition-of-matter involving a diterpenoid epoxide or salts thereof in combination with an organic diepoxide, use claims for inducing follicle depletion and for reducing the reproductive capability of a mammalian animal or non-human mammalian population. Issued claims will have a patent term extending to 2033 or longer based on patent term determinations in each of the filing countries. The novelty of ContraPest extends to its method of field distribution and has required innovation to perfect the dosing of our product to rodents. We have filed U.S. and international patent applications covering our novel bait station device to effectively and efficiently deliver our rodent bait at individual bait sites that would, if issued, offer patent term protection through at least 2036.

Trade Secrets and Trademarks

Beyond our patent right holdings, we broaden our intellectual property position with trademark, trade secret, know-how and continuous scientific discovery to accompany our product development efforts. We protect these proprietary assets with a combination of confidentiality terms in all commercial agreements or stand-alone confidentiality agreements along with rights-ownership agreements and structured information transfer understandings prior to beginning any collaborative projects. We own and maintain the ContraPest trademark and have initiated registration for Evolve. We intend to register new trademarks for products from our evolving rodenticide product line and for products for mammalian species beyond rodentia.

Data Sets

We have exclusive use status with the EPA for the data sets we have developed and submitted to the EPA as part of our application for ContraPest. The exclusive use status applies to new active ingredients and the final formulation of the ContraPest product for a period of 10 years. For five years after the 10-year period of exclusivity, if another applicant or the EPA Administrator chooses to rely on one or more data sets that we submitted in support of an application submitted by another applicant, the new applicant must make a binding offer to compensate us and certify to the EPA that it has done so. If we and the offeror cannot reach agreement on the terms of the compensation for the use of such data sets, FIFRA requires resolution by binding arbitration. The EPA rules do not describe how the compensation should be determined, and there is publicly available information about some, but not all, binding arbitration decisions.

Incorporation and Capital Structure

We were originally incorporated in the State of Nevada in July 2004, and on November 12, 2015, we reincorporated in the State of Delaware. Our corporate headquarters and manufacturing site are in Phoenix, Arizona. On December 8, 2016, we went public and are currently traded on the Nasdaq under the symbol SNES.

In July 2024, we amended our Amended and Restated Certificate of Incorporation to effect a 1-for-10 reverse split of our issued and outstanding shares of common stock. The accompanying financial statements and notes thereto provide retrospective effect to the reverse stock split for all periods presented. All issued and outstanding common stock, options and warrants exercisable for common stock, restricted stock units, and per share amounts contained in our financial statements have been retrospectively adjusted.

Where You Can Find Additional Information

We electronically file with the SEC our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. We make available on our website at www.senestech.com, free of charge, copies of these reports, as soon as reasonably practicable after electronically filing such reports with, or furnishing them to, the SEC. The information contained in, or that can be accessed through, our website is not part of, and is not incorporated into, this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS.

As discussed immediately prior to Item 1 of Part I, “Business” under “Cautionary Note Regarding Forward-Looking Statements,” our actual results could differ materially from those expressed in our forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed below. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also impair our business operations. If any of the following risks occur, our business, financial condition, operating results, cash flows and the trading price of our common stock could be materially adversely affected.

Risks Related to our Business

Our success is dependent on the successful commercialization of ContraPest and Evolve.

The EPA granted registration approval for ContraPest effective August 2, 2016, and as of July 12, 2018, we have received registration for ContraPest in all 50 states, the District of Columbia, and two major U.S. territories, Puerto Rico and The U.S. Virgin Islands. Evolve, as a FIFRA 25(b) minimum risk pesticide, does not require federal registration with the EPA but is in the process of being registered in all 50 states, the District of Columbia, and five major U.S. territories. To date, we are authorized to sell Evolve in 48 states, and two major U.S. territories, Puerto Rico and The U.S. Virgin Islands. However, we have not yet had significant sales of ContraPest and Evolve, which are our only products to date that are available for commercialization and the generation of revenue.

ContraPest, Evolve, and our other product candidates may not achieve adequate market acceptance necessary for commercial success.

Market acceptance of any of our product candidates for which we receive approval depends on a number of factors, including the following:

•the potential and perceived advantages of product candidates over alternative or complementary products;

•the effectiveness of our sales and marketing efforts and those of our collaborators;

•the efficacy and safety of such product candidates as demonstrated in trials;

•the uses, indications or limitations for which the product candidate is approved;

•product labeling or product insert requirements of the EPA or other regulatory authorities;

•the timing of market introduction of our products as well as future competitive or alternative products;

•relative convenience and ease of use; and

•unfavorable publicity relating to the product.

If we cannot successfully commercialize our products, especially ContraPest and Evolve, we will not become profitable.

If any of our approved product candidates fail to achieve sufficient market acceptance, we will not be able to generate significant revenues or become profitable. The commercial success of ContraPest and Evolve will depend on a number of factors, including the following:

•the execution of our commercial strategy and the successful expansion of our commercial organization;

•our success in educating end users about the benefits, administration and use of ContraPest and/or Evolve;

•the effectiveness of our own or our potential strategic partners’ marketing, sales and distribution strategy and operations;

•convincing PMPs to deploy ContraPest and Evolve in quantity as an enhancement to, or replacement of, their current strategy of rodenticide use;

•continued refinement of our pricing strategy;

•our ability to manufacture quantities of ContraPest and Evolve using commercially acceptable processes and at a scale sufficient to meet anticipated demand and enable us to reduce our cost of manufacturing; and

•a continued acceptable safety profile of ContraPest.

Many of these factors are beyond our control. If we are unable to successfully commercialize ContraPest and Evolve, we may not be able to earn sufficient revenues or profits to continue our business.

We will require additional capital to fund our operations. Failure to obtain this necessary capital if needed may force us to delay, limit, or terminate our product development efforts or other operations.