Document

Exhibit 99.1

ANNUAL INFORMATION FORM

For the Year Ended December 31, 2024

March 5, 2025

South Bow Corporation 2024 Annual Information Form | 1

TABLE OF CONTENTS

South Bow Corporation 2024 Annual Information Form | 2

PRESENTATION OF INFORMATION

Throughout this Annual Information Form ("AIF"), the terms the "Company" and "South Bow" mean South Bow Corporation and its subsidiaries. Effective October 1, 2024, South Bow completed its spinoff from TC Energy Corporation ("TC Energy") by way of plan of arrangement ("Plan of Arrangement") and began operating as an independent, publicly traded entity (the "Spinoff"). South Bow is an energy infrastructure company that owns and operates critical liquids pipelines and facilities extending across Canada and the U.S., safely and reliably connecting robust crude oil supplies to key refining and demand markets in the U.S. Midwest and Gulf Coast.

Unless otherwise noted, the information contained in this AIF is given as of December 31, 2024. Amounts are expressed in U.S. dollars, unless otherwise indicated. The Glossary found at the end of this AIF contains certain terms defined throughout this AIF and abbreviations and acronyms that may not otherwise be defined in this AIF.

Certain portions of South Bow's management's discussion and analysis dated March 5, 2025 ("MD&A") are incorporated by reference into this AIF as stated below and elsewhere in this AIF. The MD&A can be found on South Bow's website at www.southbow.com, on SEDAR+ at www.sedarplus.ca, and filed with the U.S. Securities and Exchange Commission ("SEC") at www.sec.gov.

Unless otherwise indicated, all financial information has been prepared in accordance with U.S. generally accepted accounting principles ("GAAP").

FORWARD-LOOKING INFORMATION

This AIF, including the MD&A disclosure incorporated by reference herein, includes forward-looking information or forward-looking statements (collectively, "forward-looking information") within the meaning of applicable Canadian securities laws and applicable U.S. securities laws. The words "anticipate," "expect," "believe," "may," "will," "should," "estimate," "project," "outlook," "forecast," "intend," "target," "plan" or other similar words are often used to identify such forward-looking information. Forward-looking information and future-oriented financial information in this AIF are intended to provide South Bow security holders and potential investors with information regarding South Bow, including their respective future plans and financial outlook.

Forward-looking information in this AIF includes, but is not limited to, statements regarding:

•South Bow's future objectives and strategies and the methods it expects to employ to achieve those objectives and to implement such strategies and the outcomes thereof;

•expectations with respect to the development, costs, schedules and outcomes for planned projects, including those relating to the Blackrod Connection Project (defined below);

•the future prospects and growth opportunities of South Bow, including the timing thereof and their expected impact on South Bow;

•the programs and policies of South Bow, including the systems used to implement such policies and the effectiveness thereof;

•South Bow's dividend policy, including the declaration or payment of future dividends and the sustainability thereof;

•the business environment in which South Bow operates, including expected crude oil supply and demand levels and the sources thereof generally, and in relation to the WCSB (as defined herein);

•expected industry, market and economic conditions, including their expected impact on South Bow and on its customers and suppliers;

•South Bow's competitive position and business prospects;

•expected earnings and future cash flows of South Bow, including the stability and sufficiency thereof;

South Bow Corporation 2024 Annual Information Form | 3

•factors affecting South Bow's financial results;

•treatment under current and future regulatory regimes, including those relating to taxes, tariffs and the environment;

•the timing and outcome of court and regulatory filings, proceedings and decisions, as well as their impact on South Bow;

•expectations regarding South Bow's pipeline integrity spending;

•expected sources of environmental risks;

•South Bow's contract profile; and

•South Bow's intentions with respect to future issuances of first preferred shares of South Bow and second preferred shares of South Bow.

This forward-looking information reflects South Bow's beliefs and assumptions based on information available to South Bow at the time the statements were made and, as such, is not a guarantee of future performance. By its nature, forward-looking information is subject to various assumptions, risks and uncertainties which could cause actual results and achievements to differ materially from the anticipated results or expectations expressed or implied in such forward-looking information. These assumptions, risks and uncertainties include, but are not limited to:

•realization of expected benefits from acquisitions, divestitures and energy transition;

•South Bow's ability to successfully implement its strategic priorities, and whether they will yield the expected benefits;

•South Bow's ability to implement a capital allocation strategy aligned with maximizing shareholder value;

•the operating performance and integrity of South Bow's assets;

•the amount of capacity sold and the tolls and rates achieved;

•the supply and demand for crude oil;

•energy industry exploration and development activities and production levels within supply basins;

•South Bow's reputation with key stakeholders;

•the performance of key officers, employees and consultants;

•South Bow maintaining its status as a foreign private issuer and its current credit ratings;

•construction and completion of capital projects in a manner consistent with management's expectations;

•cost, availability of and inflationary pressures on labour, equipment and materials;

•the availability and market prices of commodities;

•access to capital markets on competitive terms;

•interest, tax and foreign exchange rates;

•performance and credit risk of South Bow's counterparties;

•regulatory decisions and outcomes of legal proceedings, including arbitration and insurance claims;

•outcomes related to the Milepost 14 incident (defined below) and certain existing variable toll disputes on Keystone (defined below);

South Bow Corporation 2024 Annual Information Form | 4

•performance by TC Energy, South Bow, South Bow Pipelines Ltd., as applicable, and the other parties thereto, of their respective obligations under the Separation Agreement (defined below) and the Transition Services Agreement (defined below);

•South Bow's ability to effectively anticipate and assess changes to government policies and regulations, including those related to tariffs, trade and the environment;

•competition in the businesses in which South Bow operates;

•unexpected or unusual weather;

•acts of civil disobedience;

•cyber security and technological developments;

•sustainability-related risks;

•the impact of the energy transition on South Bow's business and results of operations;

•economic conditions in North America as well as globally;

•global health crises, such as pandemics and epidemics and the impacts related thereto; and

•other risks, uncertainties and factors, many of which are beyond the control of South Bow, and some of which are discussed under Risk Factors in this AIF.

You can read more about these factors and others in the MD&A and in other reports we have filed with Canadian securities regulators and the SEC. As actual results could vary significantly from the forward-looking information, you should not put undue reliance on forward-looking information. South Bow does not update its forward-looking statements due to new information or future events, unless it is required to by law.

NON-GAAP MEASURES

This AIF references certain non-GAAP financial measures and non-GAAP ratios which do not have any standardized meaning as prescribed by GAAP and therefore may not be comparable to similar measures presented by other entities. These non-GAAP measures include or exclude adjustments to the composition of the most directly comparable GAAP measures. South Bow considers these non-GAAP financial measures and non-GAAP ratios to be important in evaluating and understanding the operating performance and liquidity of South Bow. These non-GAAP measures should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP.

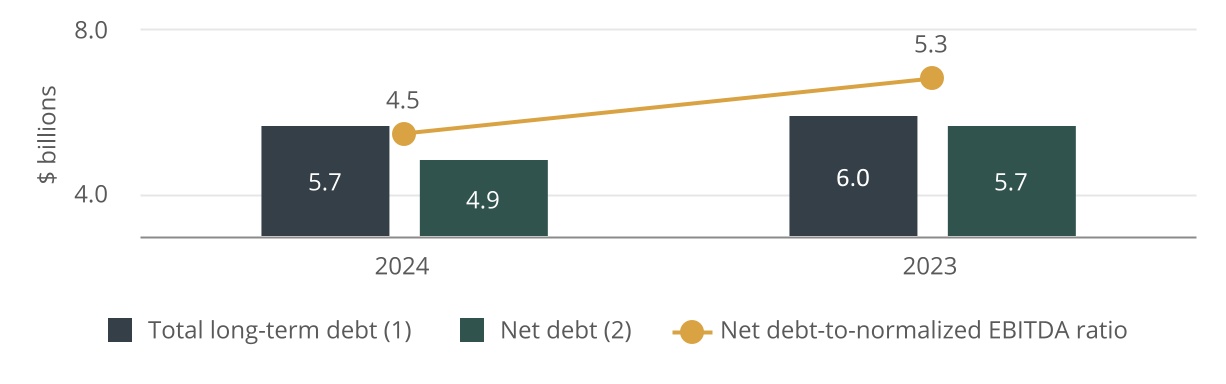

South Bow's non-GAAP financial measures and non-GAAP ratios include normalized EBITDA, normalized net income, normalized net income per share, distributable cash flow, net debt, and net debt-to-normalized EBITDA. These measures and ratios are further described with a reconciliation to their most directly comparable GAAP measure in the "Non-GAAP Financial Measures" section of the MD&A, which is incorporated by reference into this AIF and can be found on South Bow's website at www.southbow.com, on SEDAR+ at www.sedarplus.ca, and filed with the SEC at www.sec.gov.

South Bow Corporation 2024 Annual Information Form | 5

MARKET DATA AND INDUSTRY DATA

This AIF contains statistical data, market research, and industry forecasts that were obtained from third-party sources, industry publications, and publicly available information. South Bow believes that the market and industry data presented throughout this AIF are accurate and, with respect to data prepared by South Bow or on its behalf, that its estimates and assumptions are reasonable; however, there can be no assurance as to the accuracy or completeness thereof. The accuracy and completeness of the market and industry data presented throughout this AIF is not guaranteed and South Bow makes no representation as to the accuracy of such information. Although South Bow believes it to be reliable, it has not independently verified any of the data from third-party sources referred to in this AIF, or analyzed or verified the underlying studies or surveys relied upon or referred to by such sources, or ascertained the underlying economic and other assumptions relied upon by such sources or makes any representation as to the accuracy of such data. Actual outcomes may vary materially from those forecast in such reports or publications, and the prospect for material variation can be expected to increase as the length of the forecast period increases. Market and industry data are subject to variations and cannot be verified due to limits on the availability and reliability of data inputs, the voluntary nature of the data gathering process, and other limitations and uncertainties inherent in any statistical survey.

CORPORATE STRUCTURE

Incorporation

South Bow Corporation was incorporated on December 15, 2023 under the Canada Business Corporations Act ("CBCA") in order to carry out the Spinoff. South Bow did not carry on any active business prior to the completion of the Spinoff and, at all times prior to the completion of the Spinoff, South Bow did not have any assets or liabilities, did not conduct operations, and did not issue any shares. South Bow's head and registered office is currently located at 707 – 5 Street S.W., Calgary, Alberta, Canada, T2P 1V8. On October 1, 2024, following completion of the Spinoff, South Bow restated its articles of incorporation and by-laws to reflect the amendments thereto contemplated in the Plan of Arrangement.

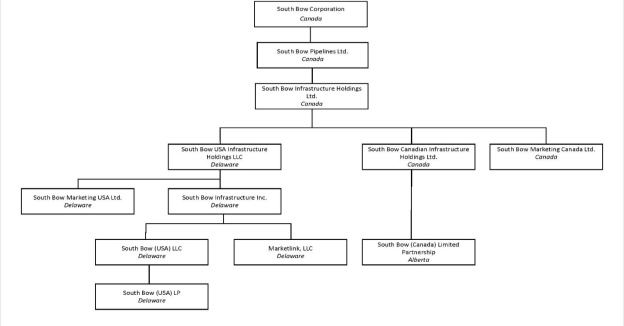

Inter-corporate Relationships

The following diagram presents the name and jurisdiction of incorporation, continuance or formation of the principal subsidiaries of South Bow. Each of the subsidiaries shown have total assets that exceed 10 per cent of the consolidated assets of South Bow or revenues that exceed 10 per cent of the consolidated revenues of South Bow. South Bow beneficially owns, controls, or directs, directly or indirectly, 100 per cent of the voting shares or units in each of these subsidiaries.

South Bow Corporation 2024 Annual Information Form | 6

GENERAL DEVELOPMENT OF THE BUSINESS

The following is a summary of significant developments in South Bow following and Spinoff and in the Liquids Pipelines business of TC Energy prior to the Spinoff, over the past three years:

Spinoff Transaction

On June 4, 2024, the shareholders of TC Energy and the Alberta Court of King's Bench approved the Spinoff. The Spinoff and the related transactions resulted in two separate, independent, investment-grade, publicly listed companies: (a) TC Energy; and (b) South Bow. South Bow is an energy infrastructure company that owns and operates critical liquids pipelines and facilities extending across Canada and the U.S., safely and reliably connecting robust crude oil supplies to key refining and demand markets in the U.S. Midwest and Gulf Coast. Pursuant to the Spinoff: (a) all of the assets and liabilities comprising the Liquids Pipelines business were transferred from TC Energy to South Bow; and (b) all of the common shares of South Bow were distributed to TC Energy shareholders on a pro rata basis.

On June 23, 2023, each of South Bow Infrastructure Holdings Ltd. ("HoldCo"), South Bow USA Infrastructure Holdings LLC ("U.S. LiquidsCo"), and South Bow Canadian Infrastructure Holdings Ltd. ("Canadian LiquidsCo") were formed as indirect wholly owned subsidiaries of TC Energy. In August 2023, the assets of the Liquids Pipelines business of TC Energy were consolidated under these newly formed entities to facilitate the Spinoff. HoldCo, U.S. LiquidsCo, and Canadian LiquidsCo are wholly owned subsidiaries of South Bow.

On August 28, 2024, U.S. LiquidsCo and Canadian LiquidsCo closed notes offerings of approximately $5.8 billion U.S.-dollar equivalent (C$7.9 billion Canadian-dollar equivalent) in aggregate principal amount (the "Notes Offering") related to the Spinoff. The net proceeds of the Notes Offering were released to South Bow upon completion of the Spinoff and used to repay indebtedness owed by South Bow and its subsidiaries to TC Energy and its subsidiaries. Separately, South Bow established a C$2.0 billion four-year senior unsecured revolving credit facility (the "Revolving Credit Facility") in the third quarter of 2024, which became available upon completion of the Spinoff.

Effective October 1, 2024, the Spinoff was implemented by way of the Plan of Arrangement pursuant to the terms of the Arrangement Agreement.

At closing of the Spinoff:

•TC Energy and South Bow entered into a separation agreement (the "Separation Agreement"), which sets forth the agreement between TC Energy and South Bow with respect to the separation of the Liquids Pipelines business from the business of TC Energy in connection with the Spinoff, including the transfer of certain assets related to the Liquids Pipelines business from TC Energy to South Bow and the allocation of certain liabilities and obligations related to the Liquids Pipelines business between TC Energy and South Bow, including responsibility and liability for certain legal actions existing at the time of completion of the Spinoff. In particular, TC Energy agreed to indemnify South Bow for 86 per cent of remaining total net liabilities and costs associated with the Milepost 14 incident and the existing variable toll disputes on Keystone (excluding any future impacts to the variable toll) subject to a maximum liability for South Bow of C$30 million for those two matters (collectively, the "TC Energy Indemnified Liquids Liabilities"). Any amounts that may ultimately be payable in respect of these liabilities and costs above the current accrued amount are indeterminable at this time. See Separation Agreement.

•TC Energy and South Bow provide certain services to one another pursuant to a transition services agreement (the "Transition Services Agreement"), which services are limited to those matters which, for practical reasons, TC Energy or South Bow, as applicable, cannot feasibly self-perform or outsource to third parties as of the time of completion of the Spinoff. Such services are primarily provided by TC Energy to South Bow. South Bow provides limited transitional services to TC Energy.

South Bow Corporation 2024 Annual Information Form | 7

•TC Energy and South Bow entered into a tax matters agreement (the "Tax Matters Agreement"), which governs the parties' respective rights, responsibilities, and obligations with respect to taxes (including taxes arising in the ordinary course of business and taxes, if any, incurred as a result of any failure of the Spinoff and certain related transactions to qualify as tax-free for Canadian or U.S. federal income tax purposes), tax attributes, the preparation and filing of tax returns, tax elections, the control of audits and other tax proceedings, and assistance and cooperation in respect of tax matters.

•TC Energy assigned employees and transferred certain employee benefit plan assets and liabilities to South Bow, and both South Bow and South Bow USA Services, Inc. have established benefit plans and arrangements for the transferred employees pursuant to an employee matters agreement (the "Employee Matters Agreement") that was entered into between, among others, TC Energy and South Bow.

Separation Agreement

The Separation Agreement, which was entered into at closing of the Spinoff, sets forth the agreement between TC Energy and South Bow with respect to the separation of the Liquids Pipelines business from the business of TC Energy in connection with the Spinoff, including the transfer of certain assets related to the Liquids Pipelines business from TC Energy to South Bow and the allocation of certain liabilities and obligations related to the Liquids Pipelines business between TC Energy and South Bow, including responsibility and liability for certain legal actions existing at the time of completion of the Spinoff.

Under the terms of the Separation Agreement, South Bow agreed to indemnify TC Energy and its affiliates from and against any liabilities that are primarily attributed to the Liquids Pipelines business, whether arising or accruing at, prior to or after the time of completion of the Spinoff and whether the facts on which such liability are based occurred at, prior to or after the time of completion of the Spinoff. This arrangement is subject to two primary exceptions, as TC Energy agreed to indemnify South Bow for the TC Energy Indemnified Liquids Liabilities, the effect of which is to limit South Bow's liability for the TC Energy Indemnified Liquids Liabilities to C$30 million in the aggregate. The variable toll disputes on Keystone are currently before applicable regulatory bodies and, while South Bow believes that it has strong arguments that the variable tolls in dispute were properly calculated and applied, any amounts above the current accrued amounts that may ultimately be payable in respect of these disputes are indeterminable at this time, however such amounts may be material. The arrangements with respect to the TC Energy Indemnified Liquids Liabilities will not apply to any impact the resolution of the variable toll disputes has on tolls following completion of the Spinoff or South Bow revenues.

The Separation Agreement also contains an indemnity under which TC Energy agreed to indemnify South Bow and its affiliates from and against any liabilities relating to the businesses and assets retained by TC Energy. TC Energy and South Bow also agreed to indemnify each other with respect to non-performance of their respective obligations under the Separation Agreement.

It is agreed that any amounts ultimately recoverable in respect of the claim to recover economic damages under the United States-Mexico-Canada Agreement ("USMCA") relating to the legacy North American Free Trade Agreement ("NAFTA") and the revocation of the Keystone XL Presidential Permit in early 2021, will be attributable to TC Energy and South Bow on a 90 / 10 split, respectively.

The separation of the Liquids Pipelines business was completed in accordance with the Separation Agreement, the Tax Matters Agreement, the Employee Matters Agreement, and the Plan of Arrangement. However, to the extent that certain legal documentation necessary to evidence any of the transactions contemplated by the Separation Agreement was not completed on or prior to the closing of the Spinoff, South Bow and TC Energy agreed under the Separation Agreement to cooperate to complete such legal documentation following the time of completion of the Spinoff. In addition, each of TC Energy and South Bow agreed under the Separation Agreement to cooperate with each other and use reasonable commercial efforts to take or to cause to be taken all actions, and to do, or to cause to be done, all things reasonably necessary under applicable law or contractual obligations to consummate and make effective the transactions contemplated by the Separation Agreement and the ancillary agreements.

South Bow Corporation 2024 Annual Information Form | 8

Other matters provided for by the Separation Agreement include, among other things, access to books and records, confidentiality, and dispute resolution.

Following the Spinoff, TC Energy and South Bow became independent of each other to the greatest extent practicable. While the owners of both companies were initially the shareholders of TC Energy prior to the Spinoff, other than Mary Pat Salomone, who was elected to the board of directors of each of TC Energy and South Bow, there is no overlap in the directors, management, or employees of TC Energy and South Bow. However, for a limited transition period, TC Energy and South Bow are subject to certain contractual arrangements, which are intended to facilitate the orderly transition of each entity into a fully independent public company. Such arrangements are limited to those contained in the Separation Agreement, the Transition Services Agreement, the Tax Matters Agreement, and the Employee Matters Agreement.

Blackrod Connection Project

South Bow is developing the Blackrod Connection Project, which will consist of a 25‑km (16-miles) crude oil pipeline and a 25‑km (16-miles) natural gas lateral and associated facilities to provide crude oil transportation from International Petroleum Corporation's ("IPC") Blackrod Steam Assisted Gravity Drainage ("SAGD") facility to South Bow's Grand Rapids Pipeline System. The total expected capital cost of the project is approximately $180 million, targeted to be ready for in-service in early 2026. The Blackrod Connection Project is supported by long term committed contracts. See Description of the Business—Blackrod Connection Project.

Keystone

The Keystone pipeline system ("Keystone") is currently operating at a historically high operating performance, with an operational reliability, or System Operating Factor, of 95 per cent in 2024. Operational reliability represents availability over a period of time. Through an acute focus on operational excellence, investments in integrity and reliability projects, as well as sustainable improvements, the system has been able to safely transport higher system throughput and increase its toll competitiveness. South Bow will continue to focus on enhancing system operations and continuing to optimize system reliability and performance.

On December 7, 2022, TC Energy responded to a release of 12,937 barrels of crude oil from Keystone into a creek in Washington County, Kansas at Milepost 14 of the pipeline (the "Milepost 14 incident"). By June 2023, the recovery of all released volumes was completed, and by October 2023, creek restoration was finished, restoring natural flows to it. South Bow will maintain its commitment to long-term reclamation and environmental monitoring activities.

A Corrective Action Order was issued by the PHMSA in December 2022 and later amended in March 2023. The pipeline is operating subject to the Amended Corrective Action Order, which includes certain operating pressure restrictions. Under the Amended Corrective Action Order, South Bow continues to fulfill its Keystone contract commitments. Subsequent to December 31, 2024, the Company received PHMSA approval of the remedial work plan, satisfying the conditions imposed by the Amended Corrective Action Order relating to the Milepost 14 Incident.

A Root Cause Failure Analysis ("RCFA") of the Milepost 14 incident was conducted by an independent third party and was submitted to PHMSA in April 2023. The RCFA revealed that a unique set of circumstances occurred at the rupture location, which likely originated during construction, with the primary cause of the rupture being a fatigue crack. A comprehensive remedial work plan has been implemented, including the RCFA's recommendations, to enhance pipeline integrity and safety performance of the system.

South Bow Corporation 2024 Annual Information Form | 9

In 2019 and 2020, certain Keystone customers initiated complaints before the FERC and the CER regarding certain costs within the variable toll calculation. In December 2022, the CER issued a decision which resulted in a one-time adjustment related to previously charged tolls of C$38 million. The CER has established a proceeding to consider Keystone's compliance filing required by the decision regarding the allocation of certain drag reducing agent costs in the variable toll. In February 2023, the FERC Administrative Law Judge released their initial decision in respect of the complaint and as a result, an adjustment of $42 million related to tolls previously charged between 2018 and 2022, which was accrued by the Company in 2023. A final order from the commission of the FERC was issued in July 2024, which resulted in a further adjustment of $8 million related to tolls previously charged between 2018 and 2022. South Bow appealed before the District of Columbia Court of Appeals in August 2024. A decision is expected in 2025.

Keystone XL

Following the revocation of the 2019 Presidential Permit for Keystone XL in January 2021, and after a comprehensive review of options in consultation with its partner, the Government of Alberta, in June 2021, TC Energy terminated the Keystone XL pipeline project. After the 2019 Presidential Permit was revoked, construction activities ceased except for certain activities required to clean up and reclaim worksites in adherence with TC Energy's commitment to safety, the environment, and its regulatory requirements. Right-of-way clean up and restoration is substantially complete while termination activities continued through the first half of 2024. TC Energy and South Bow, as applicable, will continue to coordinate with regulators, stakeholders, landowners, and Indigenous groups to meet their respective environmental and regulatory commitments.

In November 2021, TC Energy filed a Request for Arbitration to formally initiate a legacy NAFTA claim to recover more than $15 billion in economic damages resulting from the revocation of the Presidential Permit for the Keystone XL pipeline project. The U.S. government objected on the basis that the provisions under the USMCA that protect investments made while NAFTA was in force apply only in connection with actions taken before July 1, 2020, when USMCA replaced NAFTA. The Tribunal agreed with the U.S. government and therefore concluded that it did not have jurisdiction over TC Energy's claim. In April 2023, the Government of Alberta filed its own request for arbitration, which is proceeding separately from TC Energy's claim.

DESCRIPTION OF THE BUSINESS

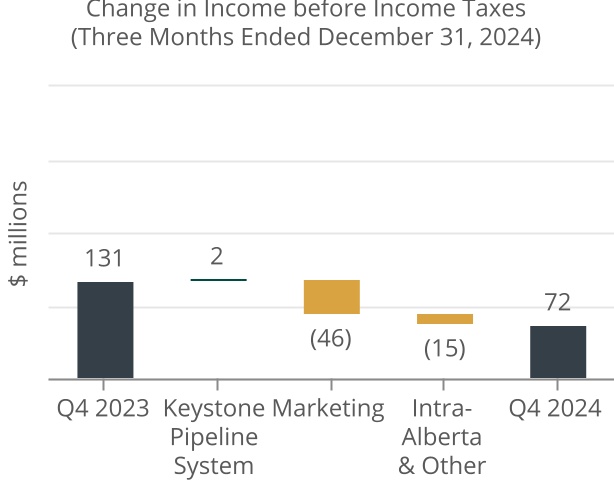

South Bow's business consists of crude oil pipeline and terminal assets that safely transport crude oil primarily from the WCSB and Cushing market hub to the U.S. Midwest and Gulf Coast. South Bow also offers ancillary services, including storage at terminals, which provides customers with increased receipt and delivery optionality. In addition to its crude oil pipeline and terminal assets, South Bow conducts marketing activities through a non-regulated marketing entity. South Bow has three reporting segments: (a) Keystone Pipeline System; (b) Marketing; and (c) Intra-Alberta & Other.

For information regarding South Bow's Keystone Pipeline System business, refer to the "Segment Results – Keystone Pipeline System" section of the MD&A, which section is incorporated by reference herein.

For information regarding the Company's Marketing business, refer to the "Segment Results – Marketing" section of the MD&A, which section is incorporated by reference herein.

For information regarding South Bow's Intra-Alberta & Other business, refer to the "Segment Results – Intra-Alberta & Other" section of the MD&A, which section is incorporated by reference herein.

Refer to the "Financial Highlights" section of the MD&A for the Company's revenues from operations, by segment, for the years ended December 31, 2024 and 2023, which section is incorporated by reference herein.

South Bow Corporation 2024 Annual Information Form | 10

South Bow Corporation 2024 Annual Information Form | 11

Liquids Pipelines

Spanning 4,900-km (3,045-miles), South Bow's network of pipelines is uniquely and strategically positioned, connecting stable oil production in the WCSB to world-class refineries in the U.S. Midwest ("PADD 2") and Gulf Coast ("PADD 3") markets.

South Bow's pipeline assets provide pipeline transportation services to customers predominantly supported by long-term contracts with fixed monthly payments that are linked to contracted throughput volumes, providing certainty and generating stable earnings over the contract term.

These long-term contracts provide for the recovery of development costs, with operating and maintenance costs primarily recovered through a variable flow-through toll. This contracting profile generally insulates South Bow's business against market fluctuations and commodity price volatility and is expected to provide South Bow with a stable source of cash flow to support its dividend and capital growth initiatives, and allocation priorities.

Revenues from South Bow's pipelines are generated mainly from providing customers with firm capacity arrangements to transport crude oil. The performance obligation in these contracts is the reservation of a specified amount of transportation capacity of crude oil on a monthly basis. Revenues earned from these arrangements are recognized ratably over the term of the contract regardless of the actual amount of crude oil that is transported. With the exception of South Bow's Marketing business, South Bow does not take ownership of the crude oil that it transports under these transportation contracts.

Uncontracted pipeline capacity is offered to the market on a monthly uncommitted basis and also through periodic open seasons, in accordance with regulatory requirements, which provides opportunities for South Bow to generate incremental earnings.

South Bow has an interest in the following pipelines:

|

|

|

|

|

|

|

|

|

|

|

|

| Pipeline |

Length |

Description |

Ownership |

| Keystone |

4,327 km

(2,689 mi) |

Transports crude oil from Hardisty, Alberta to U.S. markets at Wood River and Patoka, Illinois, Cushing, Oklahoma, and the U.S. Gulf Coast. |

100.0% |

| Marketlink |

— |

Transports crude oil from Cushing, Oklahoma to the U.S. Gulf Coast on facilities that form part of Keystone. |

100.0% |

| Grand Rapids |

460 km

(286 mi) |

Transports crude oil from the producing area northwest of Fort McMurray, Alberta to the Edmonton/Heartland, Alberta market region. |

50.0% |

| White Spruce |

72 km

(45 mi) |

Transports crude oil from Canadian Natural Resources Limited's Horizon facility in northeast Alberta to the Grand Rapids Pipeline System. |

100.0% |

| HoustonLink |

15 km

(9 mi) |

Connects Keystone and Marketlink to ONEOK, Inc.'s ("ONEOK") East Houston terminal. ONEOK operates the HoustonLink Pipeline. |

50.0% |

| Port Neches |

6 km

(4 mi) |

Transports crude oil from Keystone and other liquids terminals in the Port Arthur, Texas area to the Motiva terminal in Port Neches, Texas. |

74.9% |

|

|

|

|

|

|

|

|

|

|

|

|

| Pipeline |

Length |

Description |

Ownership |

| In Development |

|

|

| Blackrod Connection |

25 km

(16 mi) |

Upon completion, will provide a connection from IPC's proposed Blackrod SAGD facility to transport crude oil to the Grand Rapids Pipeline System and a 25 km (16-miles) natural gas supply pipeline connecting to TC Energy's NGTL system (the "Blackrod Connection Project"). |

100.0% |

Keystone Pipeline System

Keystone

Keystone is a 4,327‑km (2,689‑miles), 30 to 36‑inch crude oil pipeline system, traversing three Canadian provinces and eight U.S. states. Keystone safely transports crude oil exported from western Canada to various delivery points in the U.S. Midwest and Gulf Coast. In 2024, Keystone delivered approximately 626,000 bbl/d of crude oil from Alberta, Canada to U.S. markets. Keystone operates in Canada and the U.S. and is therefore subject to the common carrier obligations imposed by the CER and the FERC, respectively.

South Bow Corporation 2024 Annual Information Form | 12

Keystone has negotiated a fixed/variable rate toll structure with its shippers, providing South Bow with long-term certainty of cash flow. Recovery of the initial capital investment was fixed on a long-term committed basis, while actual operating and maintenance costs are recovered through the variable toll. Keystone is required through its common carrier obligations to make six per cent of its capacity readily available to uncommitted spot shippers. Spot tolls are adjusted based on market indicators to maintain competitiveness and are offered on a monthly basis.

Keystone was built out over four phases as follows and as shown on the map below:

Phase 1 (2007): 2,988‑km (1,857-miles) section from Hardisty, Alberta, to Steele City, Nebraska, and onward to Wood River and Patoka, Illinois (Wood River / Patoka Leg) where it delivers to Mid-Continent refineries and the Patoka trading hub. Phase 1 commenced operations in June 2010.

Phase 2 (2011) (Cushing Extension): 479‑km (298-miles) section from Steele City, Nebraska, to Cushing, Oklahoma, for delivery into the Cushing trading hub. Phase 2 commenced operations in 2011.

Phase 3 (2014) (Gulf Coast Extension): 782‑km (486-miles) section from Cushing, Oklahoma, to Nederland, Port Arthur, and Sour Lake, Texas, providing access to the U.S. Gulf Coast refining market. Phase 3 commenced operations in 2014.

Phase 4 (2016) (Houston Lateral): 78‑km (48-miles) Houston Lateral to Houston, Texas, enabling deliveries to the Houston Tank Terminal, refineries, trading hubs, and export terminals. Phase 4 commenced operations in 2016.

South Bow Corporation 2024 Annual Information Form | 13

Keystone's competitive rates, premium service offering, connectivity, and long-term supply source resilience has positioned the asset as the premier egress pipe for shippers over the long term.

Keystone Transportation Service Agreements ("Keystone TSAs")

Keystone is supported by 585,000 bbl/d of committed contracts and 540,000 bbl/d of those commitments are with shippers who are either rated investment grade by at least one of S&P or Moody's or whose parent entity is rated investment grade by at least one of S&P or Moody's.

South Bow Corporation 2024 Annual Information Form | 14

|

|

|

|

|

|

|

|

|

| Credit Profile |

Volume-weighted Term Remaining

(years)

|

Contract Volume

(bbl/d)

|

| Investment Grade |

7 |

540,000 |

| Non-investment Grade / Not Rated / Unrated |

6 |

45,000 |

| Total Contracted Volumes |

7 |

585,000 |

With a volume-weighted remaining contract term of approximately seven years,1 South Bow expects earnings stability through the medium term. In addition, Keystone TSAs include renewal provisions, which provides customers with an option to extend their contract term. Contract terms may be extended by up to 10 years at rates established at the time of re-contracting. Force majeure clauses within the Keystone TSAs require customers to continue payment of fixed tolls for an initial three-month period during which volumes are not shipped, which time period is within the response times demonstrated during the Milepost 14 incident. Customers recuperate transportation services for unshipped volumes through make-up rights.

South Bow is positioned to execute on a high-quality set of growth opportunities, which is expected to further strengthen its competitive position in advance of re-contracting for the long term. Keystone has the most direct path with the shortest transit times from Hardisty, Alberta, to the U.S. Gulf Coast, providing it with an existing competitive advantage. South Bow will take a focused and diligent approach to identifying, progressing, and executing on growth opportunities, which include leveraging existing infrastructure to expand or extend its premium corridor to add incremental market connections. For these reasons, South Bow believes it will be able to successfully compete for contracts over the long term.

Marketlink

The Marketlink pipeline system ("Marketlink") provides crude oil transportation services from Cushing, Oklahoma to the U.S. Gulf Coast, through its lease of capacity on the U.S. Gulf Coast segment of Keystone2, which represents approximately 40 per cent of the pipeline take-away capacity between Cushing and the U.S. Gulf Coast. Marketlink's lease payments are calculated in accordance with the lease and based on its proportional share of U.S. Gulf Coast capacity.

Marketlink is complementary to Keystone as it enables increased utilization of U.S. Gulf Coast segment capacity while ensuring Keystone customers maintain their right to capacity, and through the lease, reduces the operating costs for all Keystone customers, enabling South Bow to offer its customers a more competitive toll. Marketlink is regulated by FERC and operates as a common carrier pipeline, requiring South Bow to make 10 per cent of capacity available to new shippers if nominations exceed capacity. Marketlink has been granted approval by FERC to charge market-based rates.

Through its use of U.S. Gulf Coast segment capacity, Marketlink provides a connection to multiple terminals, refineries and marine export facilities in both Houston and Port Arthur, Texas markets.

Port Neches Link

South Bow owns a 74.9 per cent interest in Port Neches Link, a joint venture with Motiva. The 6‑km (4-miles), 36-inch, Port Neches Link pipeline is strategically located in a heavily congested area of energy infrastructure, enabling last-mile connectivity for Keystone and Marketlink shippers to Motiva's 630,000 bbl/d Port Arthur refinery—North America's largest refinery. The Port Neches pipeline also includes facilities that connect additional liquids terminals in the Port Arthur area to Motiva's refinery. The Port Neches Link pipeline is a common carrier pipeline regulated by the Railroad Commission of Texas.

HoustonLink

South Bow owns a 50 per cent interest in HoustonLink, a joint venture with Magellan Midstream Partners L.P., an affiliate of ONEOK. The 15‑km (9-miles), 24-inch, HoustonLink pipeline provides a connection between Keystone, Marketlink, and ONEOK's East Houston terminal. HoustonLink is a common carrier pipeline regulated by the Railroad Commission of Texas. ONEOK is the operator of HoustonLink.

1 As of December 31, 2024.

2 The U.S. Gulf Coast segment of Keystone includes the Gulf Coast Extension and Houston Lateral.

South Bow Corporation 2024 Annual Information Form | 15

Terminal Assets

To facilitate the delivery of its customers' products to key markets, South Bow owns and operates approximately 7.6 MMbbl of crude oil storage at facilities located in Alberta, Oklahoma, and Texas. These assets play an important role in the operations and competitiveness of South Bow's liquids pipelines network and provide South Bow with the opportunity to generate incremental revenue by leasing tank space to customers, providing them with market optionality. Contractual arrangements associated with storage are typically fixed-fee, term contracts.

|

|

|

|

|

|

|

|

|

| Tank Terminal |

Capacity

(MMbbl)

|

Type of Storage |

| Hardisty |

2.2 |

Operational / Contract |

| Cushing |

3.3 |

Operational / Contract |

| Houston |

1.4 |

Operational / Contract |

| MacKay & Heartland |

0.7 |

Operational |

| Total Capacity |

7.6 |

|

Marketing

South Bow's Marketing business provides customers with a variety of crude oil marketing services, including transportation, storage, and logistics, primarily through the purchase and sale of physical crude oil. This business contracts for capacity on South Bow's assets as well as third-party owned pipelines and tank terminals. The Marketing business periodically engages in hedging activities to minimize commodity risk exposure by utilizing financial instruments and derivative contracts.

Intra-Alberta & Other

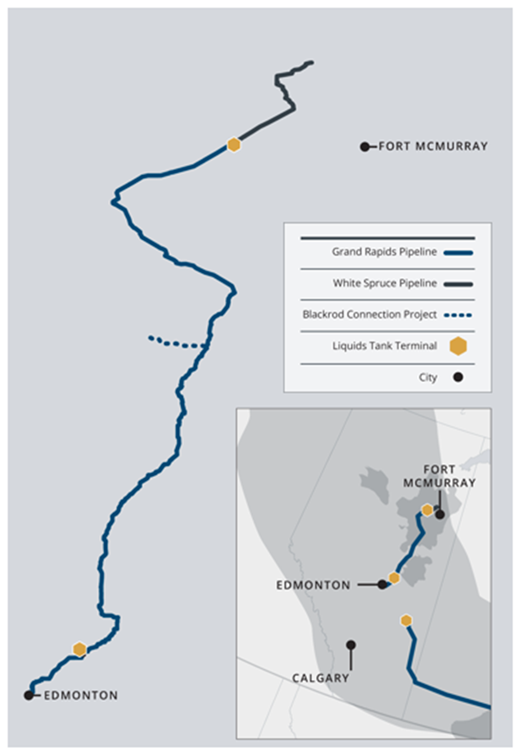

South Bow currently owns and operates two intra-Alberta pipelines as shown on the map below. South Bow's intra-Alberta pipelines are regulated by the Alberta Energy Regulator ("AER").

Grand Rapids Pipeline System

Jointly owned by South Bow and PetroChina Canada Ltd., with a 50 per cent interest each, the 460‑km (286-miles), 20-inch Grand Rapids Pipeline System plays a key role in connecting oil sands production to terminals in the Edmonton and Heartland refining and marketing region. Grand Rapids was brought into service in August 2017, supported by a 25-year committed contract. Grand Rapids provides connectivity to westbound and eastbound ex-Alberta pipelines.

White Spruce Pipeline System

The 72‑km (45-miles), 20-inch White Spruce Pipeline System provides transportation and market access for growing volumes of crude oil produced in Alberta's oil sands region. White Spruce is designed to transport crude oil produced at Canadian Natural Resources Limited's Horizon Oil Sands Facility in northeast Alberta to the Grand Rapids Pipeline System. White Spruce was brought into service in May 2019, supported by a 25-year committed contract.

South Bow Corporation 2024 Annual Information Form | 16

Blackrod Connection Project

South Bow is developing the Blackrod Connection Project, which is designed to provide both liquids and natural gas transportation infrastructure to support IPC's Blackrod SAGD facility. The Blackrod Connection Project will consist of a 25‑km (16‑miles), 12‑inch crude oil pipeline, a 25‑km (16‑miles), 16‑inch natural gas pipeline, and associated facilities, providing a connection from IPC's Blackrod SAGD facility to the existing Grand Rapids Pipeline System.

Project Status and Expected Timeline

|

|

|

|

|

|

| Date |

Action |

| Q3 2023 |

Engagement completed |

| Q2 2024 |

Regulatory and environmental approvals received |

| Q3 2024 |

Facility construction commenced |

| Q4 2024 |

Pipeline construction commenced |

| Early 2026 |

Anticipated to be ready for in-service |

Regulation of South Bow

Canada

The CER regulates the terms and conditions of service, including rates, construction, and operation of the Canadian portion of Keystone. The CER also subjects liquids pipelines to common carrier obligations. The rates for transportation service on Keystone are calculated in accordance with a methodology agreed to in transportation service agreements between Keystone and its customers, as approved by the CER.

South Bow Corporation 2024 Annual Information Form | 17

The AER regulates South Bow's White Spruce and Grand Rapids pipelines and matters related to rates and services by the Alberta Utilities Commission. Rates and services are regulated on a complaint basis.

Rate-regulated accounting is not applicable to South Bow's regulators' decisions regarding operations and tolls on South Bow's pipeline systems generally do not have an impact on timing of recognition of revenues and expenses.

United States

In the U.S., regulated interstate liquids pipelines are subject to the federal authority of the FERC, PHMSA and various U.S. state authorities. These entities regulate the construction, operation, and abandonment of pipeline infrastructure.

The FERC regulates the transportation service of South Bow's liquids pipeline systems and oversees the reasonableness of its tolls. The siting and construction of pipeline facilities are regulated by the specific state regulator in which the pipeline facilities are located.

PHMSA, an agency of the U.S. Department of Transportation, oversees safety for pipeline construction, operation, and maintenance including the U.S. portion of Keystone.

Liquids pipeline projects that cross federal lands or waters of the U.S. require additional federal permits.

Cross-border Regulation

Liquids pipelines that cross the international border between Canada and the U.S., such as Keystone, are subject to cross-border regulation. South Bow's cross border activities subject it to regulatory matters, including import and export licenses, tariffs, Canadian and U.S. customs and tax issues and toxic substance certifications. Such regulations include the Short Supply Controls of the Export Administration Act, the USMCA, and the Toxic Substances Control Act. Keystone obtained a Presidential Permit for the construction and operations of Keystone.

Business Environment

Dynamic shifts in geopolitical events, government policy changes, and various macroeconomic factors continue to impact global crude oil supply and demand fundamentals. While the upstream sector remains focused on balancing capital discipline and growth, South Bow still expects crude oil demand to increase this decade. Over the next 30 years, South Bow expects global demand to grow, driven by world population growth and economic expansion. South Bow believes that North America's crude oil supply, inclusive of the WCSB, is critical to supporting this future demand and that North American crude oil production will remain a robust and important part of the energy mix for decades to come.

Strategic Priorities

South Bow believes that its liquids pipelines are strategically positioned to provide secure and competitive transportation solutions for growing supplies of WCSB and U.S. crude oil to the U.S. Midwest and Gulf Coast. Supported by long-term contracts generating stable earnings, South Bow believes that its assets will be able to endure the impact of short-term commodity price fluctuations and supply and demand responses.

Within established risk preferences, South Bow will remain committed to:

•optimizing the operational performance and commercial value of existing assets;

•expanding and leveraging existing infrastructure for growth expansions; and

•progressing system operational improvements.

South Bow will examine opportunities to expand its transportation services and extend its pipeline platform to increase last-mile delivery connectivity to refineries and terminals with storage and marine export capabilities. South Bow will also focus on leveraging its existing assets and developing projects to provide increased optionality for its customers.

South Bow Corporation 2024 Annual Information Form | 18

A significant aspect of South Bow's strategy is employing a strengthened, customer-centric approach to position its business to remain competitive in a dynamic market. As part of this strategy and its commitment to maintaining customer trust, South Bow carefully scrutinizes variable toll costs and has enacted consistent, frequent, and transparent communications with its customers through targeted events and customer meetings.

Over the long term, South Bow believes it has a high-quality set of growth opportunities to unlock the full potential of its premium footprint. South Bow will closely monitor the marketplace for strategic asset acquisitions as well as joint venture or joint tolling opportunities to enhance system connectivity or expand its footprint within North America. South Bow will remain disciplined in its approach and will position its business development activities strategically to pursue opportunities within its risk preferences.

Customer Profile

South Bow's customers consist of vertically integrated companies, refiners, producers, and marketers with single customer exposure representing less than 30 per cent of annual contracted revenue.3 Customers are highly creditworthy counterparties with 96 per cent of South Bow's commercial contracts underpinned by investment-grade counterparties. The long life of South Bow's liquids infrastructure aligns with the nature of the producers and refineries South Bow serves and is a key driver of the long-term contract profile that is unique to the Company's business. With a volume-weighted remaining contract term of approximately seven years,3 South Bow expects earnings stability through the medium term.

The following table provides a breakdown of South Bow's revenue by customer type for the periods indicated.

|

|

|

|

|

|

|

|

|

| Customer Type |

Proportion as a Percentage of Total Revenues for the Year Ended December 31, 20241 |

Proportion as a Percentage of Total Revenues for the Year Ended December 31, 20231 |

Vertically Integrated (Producer & Refiner) |

44% |

43% |

| Refiner |

45% |

49% |

| Producer |

6% |

6% |

| Marketer |

5% |

2% |

1.Excludes "Other revenues".

Supply Outlook

Canada

Canada has the world's third-largest crude oil reserves with over 160 billion barrels of proven and economically recoverable oil.4 Canada's crude oil reserves are made up of conventional, unconventional and oil sands reserves, with the predominance of the reserves attributable to the oil sands within the WCSB, which has a reserves life index of greater than 50 years. Production from the WCSB, which is the main supply source for South Bow's assets, was approximately 4.9 MMbbl/d in 2024 and is expected to grow by over 500,000 bbl/d by 2030.5 The oil sands makeup the majority of Canadian crude oil production with 3.4 MMbbl/d in 2023.5 The oil sands are considered a world-class supply source given their decades-long reserve life, low base production decline, and continuously improving cost and environmental performance. South Bow believes that its assets are well-positioned to capture such production growth from the WCSB.

3 As of December 31, 2024.

4 Canadian Association of Petroleum Producers (2025).

5 S&P North American Crude Oil Markets Canadian Fundamentals Data (Q3 2024).

South Bow Corporation 2024 Annual Information Form | 19

United States

The U.S. is one of the largest crude oil producing countries in the world, with production exceeding 13 MMbbl/d in 2024.6 The majority of continental U.S. crude oil production is in the form of light tight oil from the Permian, Williston, Eagle Ford, and Niobrara plays/basins.7 U.S. refineries have been optimized through significant capital investments to refine a mix of light and heavy crude oils to produce an optimized refined products slate. With Keystone's connection to key refining and export markets, South Bow believes its assets are well-positioned to continue to attract barrels that aggregate at the Cushing, Oklahoma supply hub and utilize Marketlink to reach the U.S. Gulf Coast.

Demand Outlook

Global energy demand is forecasted to increase over the next 30 years,8 driven by global population and economic growth; and South Bow expects that crude oil will play a vital role in helping the world meet its energy needs for decades to come.

The U.S. is the primary source of crude oil demand in North America, with refining capacity of 18 MMbbl/d.6 Canada's heavy crude oil production is of strategic importance to the U.S. refining industry. South Bow's assets serve the U.S. Midwest and Gulf Coast refining markets, PADD 2 and PADD 3, respectively. PADD 2 represents 23 per cent (4 MMbbl/d) and PADD 3 represents 54 per cent (10 MMbbl/d) or, in aggregate, 77 per cent (14 MMbbl/d), of U.S. refining capacity.6 Many PADD 2 and PADD 3 refineries are large-scale, complex facilities, with deep conversion capacity for heavy crude oil reached through significant capital investments. These markets are expected to increase their domestic market share6 and remain globally competitive for decades to come due to their access to low-cost Canadian heavy and U.S. light crude oil, as well as their proximity to abundant low-cost natural gas supply, positioning them to be among the most profitable refineries in the world.

While domestic consumption makes up the predominance of current North American crude oil demand, exports are expected to grow, increasing their proportion of North American crude oil demand out past the end of the decade, driven by growth in emerging markets. Crude oil export from the U.S. Gulf Coast, a market served by South Bow's pipelines, is expected to grow through 2030.6

Given the unique and critical nature of its pipeline network, South Bow believes that its advantageous infrastructure corridor will be useful through even the most aggressive energy transition scenarios. South Bow will seek to augment its connectivity to resilient supply and premium markets to ensure that its business remains stable and is positioned for future growth, even through volatile markets. In particular, South Bow will examine opportunities to expand its transportation services and extend its pipeline platform to include last-mile delivery connectivity to refineries and terminals with storage and marine export capabilities. South Bow will also focus on leveraging its existing assets and developing new projects to provide optionality for its customers. See Strategic Priorities.

Competitive Conditions

Competition among liquids pipelines is based primarily on transportation charges, access to producing regions and demand for crude oil by end users. Existing third-party owned pipelines in the vicinity of South Bow's operations expose South Bow to competition based on their ability to provide crude oil transportation into similar or different markets. In areas where new infrastructure is being built or has been built to accommodate new or increased production or changing product flows, South Bow faces competition, as well as risk that egress capacity may be unconstrained until production grows sufficiently or pipelines are retired. Further delays in production growth, higher than anticipated production declines, or lower than expected demand for crude oil could exacerbate these risks, but South Bow believes that its contract terms, tenor and structure of its integrated business model, combined with expected crude oil supply and demand fundamentals, should partially help mitigate these risks.

6 S&P North American Crude Oil Markets Annual Strategic Workbook (2024).

7 S&P Global Commodity Insights (January 2025).

8 U.S. Energy Information Administration, International Energy Outlook 2021.

South Bow Corporation 2024 Annual Information Form | 20

Marketlink serves markets with heightened competition and, as a result, has been granted market-based rate authority by the commission of the FERC. South Bow is able to use Marketlink's market-based rates authority as a tool to compete to attract volumes.

Pipelines, which generally offer the lowest cost of transportation, may also face competition from other forms of transportation, such as truck, rail, and barge. Although these alternative forms of transportation typically have higher costs and are more carbon intensive, they may be able to provide access to alternative markets whereby a higher price may be realized justifying the increased transportation cost.

South Bow also faces competition with respect to its ancillary services, such as storage at terminals. South Bow's ability to offer competitive rates and attractive service attributes are necessary to compete in these markets.

Companies that compete with South Bow include Enbridge Inc., Gibson Energy Inc., Keyera Corp., Pembina Pipeline Corporation, Plains All American Pipeline, L.P., Energy Transfer LP, and Enterprise Products Partners L.P, among others.

Economic Cycles/Seasonality

South Bow's annual revenues are based on contracted and uncontracted transportation service, ancillary services, as well as marketing activities. Quarter-over-quarter revenues and earnings may be affected by a number of factors, which include but are not limited to:

•regulatory and government policy decisions;

•newly constructed assets being placed in service;

•acquisitions and divestitures;

•demand for uncontracted transportation services;

•marketing activities and commodity prices;

•developments outside of the normal course of operations;

•certain fair value adjustments;

•weather; and

•planned and unplanned outages.

The long-term contract profile supporting South Bow's business model provides stable tolls for customers and stable revenues for South Bow. The cyclical nature of commodity prices may influence the pace at which customers expand their operations. This can impact the rate of project growth in the liquids industry, the value of services as contracts expire, and the timing for the demand of transportation services and/or new liquids infrastructure.

Economic Dependence

For the year ended December 31, 2024, three major customers accounted for $630 million, $322 million, and $175 million, respectively, in revenues, each representing more than 10 per cent of total revenues from contracts with customers (2023 – four major customers: $635 million, $308 million, $174 million, and $167 million, respectively; 2022 – four major customers: $573 million, $237 million, $166 million, and $151 million, respectively), or in aggregate, $1.127 billion or approximately fifty-three per cent of total revenues from contracts with customers (2023 – four customers: $1.284 billion or approximately sixty-four per cent; 2022 – four customers: $1.127 billion or approximately fifty-five per cent). For further information, see Note 6 of the 2024 Annual Financial Statements.

South Bow Corporation 2024 Annual Information Form | 21

Changes to Contracts

The markets served by Marketlink are competitive, requiring South Bow to develop and offer services with attractive attributes at cost competitive levels. South Bow has been recently successful in attracting and retaining customers on Marketlink; however, adverse changes in market circumstances may result in customers with renewal options electing not to renew. Marketlink has contracts that are set to expire in 2025.

Health, Safety, Sustainability, Environmental Protection, and Social Policies

Safety, Environment and Operations Committee

South Bow established the Safety, Environment and Operations Committee of the board of directors (the "Board") of South Bow to oversee operational risk, major project execution risk, occupational and process safety, sustainability, security of personnel and electronic data, environmental and climate change-related risks, as well as monitoring the development and implementation of systems, programs and policies relating to HSSE matters through regular reporting from Management. The committee reviews, monitors, and reports on:

•Performance and activities of South Bow on HSSE matters including compliance with applicable and proposed legislation, regulations and orders; conformance with industry standards; people health, safety and security; process safety; asset reliability; operational risk management and asset integrity plans and programs; and emergency response plans and programs.

•Execution of major projects with significant cost, first-of-a kind technology to South Bow, or significant stakeholder complexity.

•Whether the systems, programs and policies are being appropriately developed and effectively implemented.

•Actions and initiatives undertaken by South Bow to prevent, mitigate and manage risks, including climate change-related risks and cyber security-related risks, which may have the potential to adversely impact South Bow's assets, operations, activities, plans, strategies, or reputation or prevent loss or injury to South Bow's employees and its assets or operations from malicious acts, natural disasters, or other crises situations.

•Critical incidents respecting South Bow's assets or operations involving: a fatality or a life-threatening injury to a person; any pipeline ruptures resulting in significant property damage or loss of product; whistleblower events; or any incidents involving personnel and public safety, property damage, environmental damage, or physical security that have the potential to severely and adversely impact South Bow's reputation or business continuity.

•Regulatory audits, findings, orders, reports and/or recommendations issued by or to South Bow together with Management's response.

•Sustainability matters, including social, environmental and climate change related risks and opportunities, as well as related public disclosure.

The Safety, Environment and Operations Committee also maintains oversight of significant and complex capital and system improvement projects, including the monitoring of prescribed performance criteria. The Safety, Environment and Operations Committee hosts regular sessions, as part of its formal committee meetings, with members of senior Management to receive status, cost and notable updates on certain of these capital projects. Management also provides periodic written updates to the Safety, Environment and Operations Committee throughout the year.

The Safety, Environment and Operations Committee also receives updates on any specific areas of operational and construction risk management review being conducted by Management and the results and corrective action plans flowing from internal and third-party audits. Generally, each year the Safety, Environment and Operations Committee or the Chair of the Safety, Environment and Operations Committee tours one of South Bow's existing assets or projects under development as part of its responsibility to monitor and review its HSSE practices. All South Bow board members are invited to attend site tours.

South Bow Corporation 2024 Annual Information Form | 22

Health, Safety, and Asset Integrity

Operational Management System

South Bow uses an integrated operational management system ("OMS") that establishes a framework for managing risks and is used to capture, organize, document, monitor, and improve its related policies, standards, and procedures. South Bow's OMS leverages industry consensus standards and incorporates applicable regulatory requirements. The OMS governs health, safety, environment, and operational integrity matters for all South Bow's assets across Canada and the U.S. throughout their lifecycle. The OMS is assessed through periodic audits and evaluations and continually improved through a structured and systematic process.

Safety Management Program

The safety of South Bow's employees, contractors, and the public and the integrity of its assets are an enduring core value. All assets were and will continue to be designed, constructed, commissioned, operated, and maintained with full consideration given to safety and integrity, and will be placed into service only after all necessary requirements, both regulatory and internal, have been satisfied.

In furtherance of its commitment to protecting the health and safety of all individuals involved in its activities, South Bow consistently seeks to deliver effective programs that:

•reduce the human and financial impact of illness and injury;

•ensure fitness for work;

•strengthen worker resiliency;

•build organizational capacity by focusing on individual well-being, health education, leader support, and improved working conditions to sustain a productive workforce;

•increase mental well-being awareness;

•provide various health and wellness supports and training to employees and leaders;

•measure the success of programs; and

•foster a positive safety culture by embracing human and organizational performance, which emphasizes understanding the systemic factors contributing to workplace incidents unlike traditional models that often pinpoint human error as the primary cause of such events.

Emergency Management Program

South Bow has implemented an Emergency Management Program to provide a consistent and comprehensive approach to emergency preparedness, business continuity, and emergency response within South Bow. South Bow has also implemented standard emergency response protocols which align to the Incident Command System. To maintain a high level of readiness, South Bow utilizes a common organizational framework for emergency response and provides initial and ongoing response training for all relevant personnel. South Bow believes it has the physical resources required to manage a response of any size or scope and works closely with industry-leading response contractors and maintains a fleet of company-owned response equipment located in strategic caches along its system footprint. South Bow's business maintains multi-layer response plans that support site-specific planning and industry best practices to support a coordinated and effective response. South Bow routinely exercises these plans and holds realistic drills, often in collaboration with local response agencies and communities, to hone the skills of its personnel and test its protocols to ensure it is prepared for an incident. If South Bow responds to an actual incident, it hosts meaningful after-action assessments to support a culture of learning and continuous improvement.

South Bow Corporation 2024 Annual Information Form | 23

Internal Root Cause Analysis

South Bow also has an internal root cause analysis process to collect learnings from minor events that would not receive a formal investigation as part of the Emergency Management Program and incorporate the learnings into procedures and work practices. Process safety events are classified based on the potential to escalate from a minor incident to something more severe or a repetitive pattern of small-scale incidents. High-potential process safety events are reviewed by leadership, driving actions and innovative solutions that go beyond repair and replacement to permanent improvements.

Pipeline and Facility Integrity

An integral component of South Bow's safety culture is its focus on pipeline and facility integrity, which is critical to managing the loss of containment risk that can have drastic consequences on life, property, and the environment. South Bow maintains a core pipeline integrity team with subject matter expertise to ensure that it is positioned to proactively respond to emerging integrity threats along its pipelines and at pump stations and terminals. South Bow also fosters a culture of continuous learning and improvement, which seeks to develop new technologies, while reviewing, adjusting, and implementing program advancements.

South Bow expects pipeline integrity spending to fluctuate based on the results of ongoing risk assessments conducted on its pipeline systems and evaluations of information obtained from recent inspections, incidents, and maintenance activities. Pipeline and facility integrity expenditures are primarily recovered through a flow-through tolling mechanism. Spending associated with process safety and integrity will be used to minimize risk to employees, contractors, the public, equipment, and the surrounding environment, and also prevent disruptions to serving the energy needs of South Bow's customers.

Environmental Risk, Compliance, and Liabilities

Through the implementation of OMS, South Bow proactively and systematically manages environmental hazards and risks throughout the lifecycle of its assets. South Bow's primary sources of risk related to the environment include:

•changing regulations and requirements coupled with increased costs related to impacts on the environment;

•product releases, including crude oil and diluent, which may cause harm to the environment (land, water, and air);

•use, storage and disposal of chemicals and hazardous materials; and

•natural disasters and other catastrophic events that may impact South Bow's operations.

South Bow's assets are subject to federal, state, provincial, and local environmental statutes and regulations governing environmental protection, including air and GHG emissions, water quality, species at risk, wastewater discharges, and waste management. Monitoring and reporting programs for environmental performance in day-to-day operations and project development, as well as inspections and assessments, are designed to provide assurance that environmental and regulatory standards are met.

Operating South Bow's assets requires obtaining and complying with a wide variety of environmental regulations, licenses, permits, and other approvals and requirements. Failure to comply could result in administrative, civil, or criminal penalties, remedial requirements, or orders affecting future operations. The OMS includes requirements for South Bow to continually monitor its facilities for compliance with all material legal and regulatory environmental requirements across all jurisdictions where it operates. South Bow complies with all material legal and regulatory permitting requirements in its project routing and development. South Bow routinely monitors proposed changes to environmental policy, legislation, and regulation. Where the risks are uncertain or have the potential to affect South Bow's ability to effectively operate its business, South Bow comments on proposals independently or through industry associations.

South Bow Corporation 2024 Annual Information Form | 24

Other than orders and claims relating to the Milepost 14 incident, South Bow is not aware of any material outstanding orders, claims, or lawsuits against it related to releasing or discharging any material into the environment or in connection with environmental protection. The Separation Agreement contains an indemnity under which TC Energy agreed to indemnify South Bow from certain liabilities associated with the Milepost 14 incident.

Compliance obligations can result in significant costs associated with installing and maintaining pollution controls, fines, and administrative, civil, or criminal penalties resulting from any failure to comply and potential limitations on operations. Remediation obligations can result in significant costs associated with the investigation and remediation of contaminated properties, and with damage claims arising from the contamination of properties. The timing and complete extent of future expenditures related to environmental matters is difficult to estimate accurately because:

•environmental laws and regulations and their interpretations and enforcement change;

•new claims can be brought against South Bow's existing or discontinued assets;

•South Bow's pollution control and clean-up cost estimates may change, especially when its current estimates are based on preliminary site investigations or agreements;

•new contaminated sites may be found or what South Bow knows about existing sites could change; and

•where there is potentially more than one responsible party involved in litigation, South Bow cannot estimate its joint and several liability with certainty.

Social Policies

South Bow's governance practices comply with the NYSE standards for U.S. companies in all significant respects. As a non-U.S. company, South Bow is not required to comply with most of the governance listing standards of the NYSE. As a foreign private issuer, however, South Bow must disclose how its governance practices differ from those followed by U.S. companies that are subject to the NYSE standards. South Bow's governance practices do not significantly differ from those required to be followed by U.S. domestic issuers under the NYSE's listing standards. A summary of South Bow's governance practices compared to U.S. standards can be found on its website at www.southbow.com.

Code of Business Ethics

South Bow has adopted a Code of Business Ethics ("COBE"), which applies to all employees, officers and directors, and contractors of South Bow and its wholly owned subsidiaries and operated entities in countries where it conducts business, with the exception of independently operated entities whose corporate governance documents meet or exceed South Bow's requirements. Annual online COBE training is provided to all employees and contractors, and all employees (including executive officers), directors, and contractors are required to certify their compliance with COBE annually.

Avoiding Bribery and Corruption Program

South Bow has also adopted an Avoiding Bribery and Corruption Program, which includes an Avoiding Bribery and Corruption Policy, annual online training included as part of annual online COBE training, instructor-led training provided to personnel in higher risk areas of its business, a supplier and contractor due diligence review process, and auditing of certain types of transactions.

Stakeholder Engagement

South Bow is proud of the relationships it has built with stakeholders and rightsholders across Canada and the U.S. and believes that these relationships are critical to its success. South Bow's approach to engagement with Indigenous groups, landowners, and other stakeholders who may be affected by South Bow's activities is guided by a principled approach that considers the foundations of respect, trust, and transparency. South Bow strives to listen, provide accurate information, and respond to interests in a prompt and consistent manner.

South Bow Corporation 2024 Annual Information Form | 25

South Bow acknowledges the unique rights of Indigenous Peoples and seeks to listen and understand in order to incorporate their traditional and local knowledge in project design and planning. South Bow seeks to establish partnerships and collaborate by supporting community-driven development and initiatives that contribute to the well-being and sustainability of Indigenous communities.

South Bow also employs programs that direct how it engages with other stakeholders including landowners, communities, and governments. South Bow works to understand and mitigate the complexity of sustainability issues and the interconnectivity of these issues as they relate to its business. These matters are of great importance to Indigenous groups and stakeholders and have an impact on South Bow's ability to build and operate energy infrastructure.

Specialized Skill and Knowledge

All aspects of South Bow's business require specialized skills and knowledge. Such skills and knowledge include the areas of pipeline and facility design, engineering, construction, and operations; energy market fundamentals; law and regulation; and commercial operations and negotiations. South Bow relies upon Management, employees and various consultants for such expertise in addition to new hires as they are required for the operation and management of South Bow's business. South Bow is committed to enabling opportunities for employees to develop and maintain the necessary skills and knowledge required to effectively perform their roles with South Bow.

Employees

As of December 31, 2024, South Bow and its subsidiaries have a total of approximately 600 employees. The Board evaluates the leadership expertise and skills required to meet South Bow's goals on an ongoing basis.

DESCRIPTION OF CAPITAL STRUCTURE

Share Capital

As of December 31, 2024, South Bow is authorized to issue: (a) an unlimited number of common shares; and (b) first preferred shares and second preferred shares in an amount not to exceed, in aggregate, 20 per cent of the number of issued and outstanding common shares of South Bow. As of December 31, 2024, 208,041,109 common shares of South Bow were issued and outstanding.

Common Shares

The common shares of South Bow entitle the holders thereof to one vote per share at all meetings of South Bow's shareholders, except meetings at which only holders of another specified class of shares are entitled to vote, and, subject to the rights, privileges, restrictions, and conditions attaching to the first preferred shares and the second preferred shares, whether as a class or a series, and to any other class or series of shares of South Bow which rank prior to the common shares, entitle the holders thereof to receive: (a) dividends if, as and when declared by the Board out of the assets of South Bow properly applicable to the payment of the dividends in such amount and payable at such times and at such place or places as the Board may from time to time determine; and (b) the remaining property of South Bow upon a liquidation, dissolution, or winding up of South Bow.

First Preferred Shares

Subject to certain limitations, the Board may, from time to time, issue first preferred shares of South Bow in one or more series and determine for any such series, its designation, number of shares (subject to the limit described below), and respective rights, privileges, restrictions, and conditions. The first preferred shares as a class have, among others, the provisions described below.