C O N F I D E N T I A L 1 Preliminary Fiscal Year 2024

C O N F I D E N T I A L 2 Legal Disclaimer This disclaimer applies to this document and the verbal comments of any person presenting it. This presentation, together with any such written comments, is referred to herein as the "Presentation." Forward Looking Statements This Presentation may contain forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue,” the negative of these terms and other comparable terminology. You should not rely upon forward-looking statements as predictions of future events. All statements other than statements of historical facts contained in this Presentation, including information concerning our possible or assumed future results of operations and expenses, business strategies and plans, competitive position, business and industry environment and potential growth opportunities, are forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Given these uncertainties, you should not place undue reliance on any forward-looking statements in this Presentation. Except as required by law, we disclaim any obligation to update any forward-looking statements for any reason after the date of this Presentation, or to update the reasons why actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. Further information on potential factors that could affect the financial results of TWFG Insurance are included in our Registration Statement on Form S-1, as amended (Registration No. 333-280439) and in our other filings with the Securities and Exchange Commission ("SEC"). These documents and others containing important disclosures are available on the SEC Filings section of the Investor Information section of our Web site. Industry and Market Information This Presentation includes industry and market data that we obtained from periodic industry publications, third-party studies and surveys, including from Independent Insurance Agents & Brokers of America, Inc. (“Independent Insurance Agents & Brokers of America”) and S&P Global Market Intelligence Inc. (“S&P Global Market Intelligence”), as well as from filings of public companies in our industry, insurance carrier-provided information and internal company surveys. These sources include industry sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this Presentation, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein. Unless otherwise indicated, throughout this Presentation we reference our relative market positioning and performance as compared to the U.S. property and casualty insurance industry. The industry group metrics are based on the latest date for which complete financial data are publicly available such as a 2022 Future One Agency Universe Case Study containing 2022 industry data conducted by the Independent Insurance Agents & Brokers of America (the “Agency Universe Study”). The information contained in this Presentation is provided as at the date of this Presentation and is subject to change without notice. Financial Information This Presentation contains preliminary unaudited financial highlights for the fourth quarter and full year ended December 31, 2024. These results are preliminary, unaudited estimates and are subject to change. The Company is currently finalizing its fourth quarter and year end 2024 results, and as a result, these preliminary estimates are based solely on information available to management as of the date of this press release. The Company’s actual results may differ from these estimates due to the completion of its closing procedures, final adjustments and developments that may arise or information that may become available between now and the time the Company’s financial results are finalized. Non-GAAP Financial Measures In addition to providing financial information based on accounting principles generally accepted in the United States ("GAAP"), this Presentation includes certain financial measures prepared other than in accordance with GAAP, or non-GAAP financial measures, including Organic Revenue, Organic Revenue Growth, Adjusted Net Income, Adjusted Net Income Margin, Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted Free Cash Flow. Accordingly, these non-GAAP financial measures should not be considered as a substitute for data prepared and presented in accordance with GAAP and should not be construed as being more important than comparable GAAP measures. TWFG’s management believes these non-GAAP financial measures provide users of our financial statements with additional and useful comparisons of current results of operations with past and future periods. Although we use or have used these non-GAAP financial measures to assess the performance of our business and for other purposes, the use of these non-GAAP financial measures as an analytical tool has limitations, and you should not consider them in isolation, or as a substitute for analysis of our results of operations as reported in accordance with GAAP. In addition, because not all companies use identical calculations, the non-GAAP financial measures included in this Presentation may not be comparable to similarly titled measures disclosed by other companies, including our peers or other companies in our industry. Please see “KPI Information and Non-GAAP Reconciliations” and “Additional Reconciliations” within the Presentation for reconciliations of the non-GAAP financial measures included in the Presentation to our most directly comparable financial measures calculated and presented in accordance with GAAP.

C O N F I D E N T I A L 3 520+ TWFG Branches (2) 23 Years Of Operating History TWFG At a Glance: 20+ Year Track Record of Independence, Innovation, and Growth In Personal and Commercial Insurance Who We Are What We Do How We Do It Why We Are Different We are a founder-led, publicly traded (Nasdaq: TWFG), high-growth, independent distribution platform for personal and commercial insurance in the U.S. We pioneered a distribution and ownership model that is geared towards flexibility, efficiency, and alignment. We exist to serve our agents and agency principals through our retail and wholesale operations. We provide resources, technology, training, carrier access, and M&A opportunities to grow and succeed in an increasingly complex market. Developed and led by agents, for agents – we offer a distinctive level of autonomy and entrepreneurial opportunity to our agencies regardless of whether they started with us from scratch or joined us through acquisition. Notes: 1. Rankings based on revenue per Insurance Journal’s 2024 Top 100 Property / Casualty Agencies 2. As of Dec 31, 2024 3. YTD Dec 31, 2024 - Results are preliminary unaudited estimates and are subject to change 8th Largest U.S. Personal Lines Agency (1) $1.5Bn+ Total Written Premium (3) 2,000+ TWFG MGA Agencies in 40+ States (2) Market Leader with Rich Heritage and Scaled, National Platform 27th Largest Agency Across All Lines (1) Multi-Line – Retail – Wholesale – Admitted – Non-Admitted

C O N F I D E N T I A L 4 Independent Agencies 38% Captive Agencies 35% Direct Distribution ("DTC") 26% TWFG’s Business Model Was Built to Capture a Shift Away from Captive Distribution Source: Independent Insurance Agents & Brokers of America Homeowners Premium Mix by Distribution (%) 33 33 48 35 17 32 2011 2021 Auto Premium Mix by Distribution (%) Independent Agencies Captive Agencies DTC • Accelerating momentum toward the independent channel • Carriers looking to consolidate points of distribution • DTC carriers increasingly utilizing independent channel to reach consumers (16 ppts) Large Share of Personal Lines Distribution Is Captured by the Independent Channel … … Reflecting a Decade-Long Shift Away from Captive Distribution (13 ppts) 41 49 51 35 5 15 2011 2021

C O N F I D E N T I A L 5 Top Challenges Faced by Agencies TWFG Addresses Key Pain Points Experienced By Captive and Independent Agencies To p Is su es TW FG S ol ut io ns Perpetuation planning Opportunity to sell or transfer existing books of business enabling a smooth handover of client relationships and a rewarding exit for retiring agents Back-office inefficiencies Agency-in-a-Box turnkey solution delivers tools and technology that streamline back- office services and allow agents to focus on sales Limited product choice Access to a comprehensive suite of products; high degree of autonomy over the direction of business to best address client needs Changing commission structures Compelling revenue and work share model; no sales quotas, no forced cross-selling Access to carriers Access to 300+ insurance carriers, MGAs and programs across admitted and non- admitted markets

C O N F I D E N T I A L 6 272 284 292 296 305 321 342 357 404 451 479 268 281 293 310 330 350 363 365 386 417 477 540 565 586 607 635 671 705 722 790 868 956 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Commercial Personal TWFG Operates in a Large and Growing Addressable Market P&C Insurance Market Exhibits Consistent Growth Premium CAGR (2013-23): 5.9% Total P&C 5.9% Personal Lines 5.8% Commercial Source: S&P Global Market Intelligence P&C Insurance Direct Written Premium Over Time ($Bn)

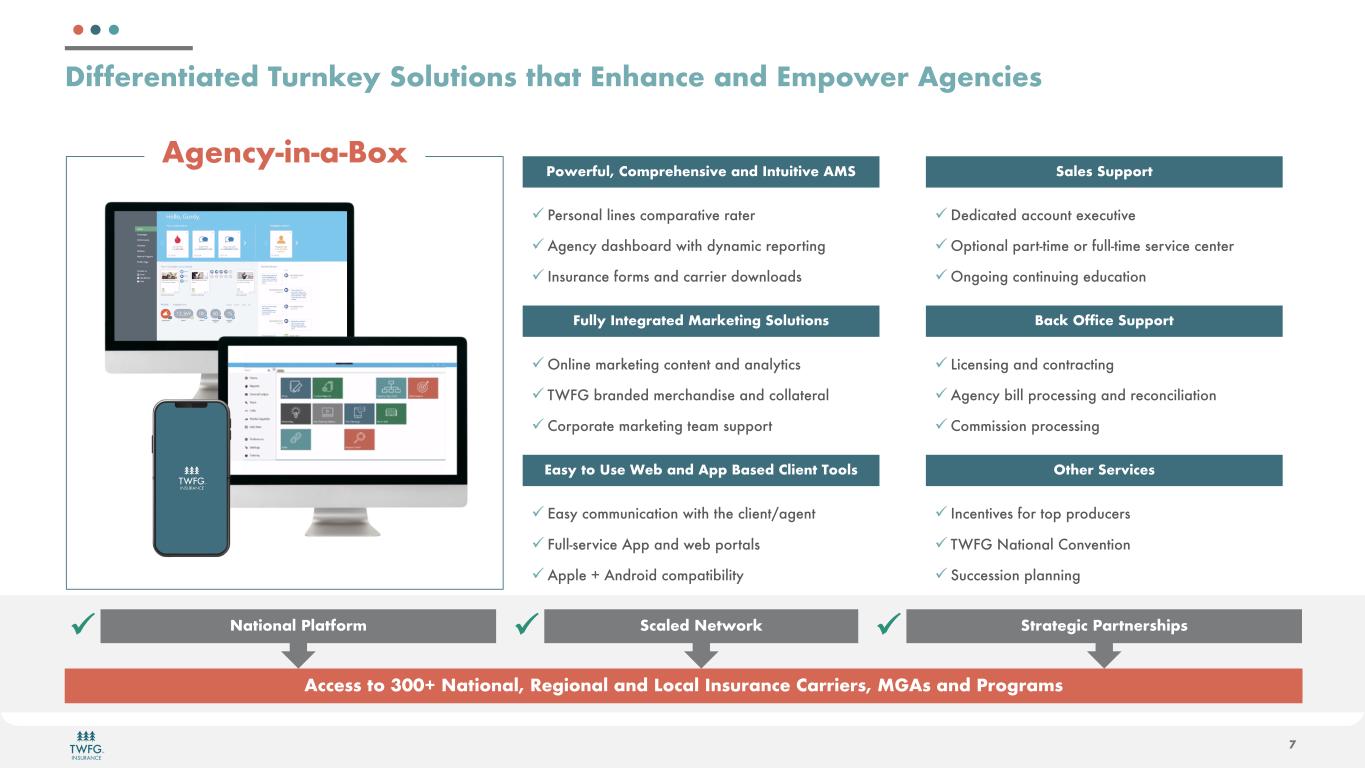

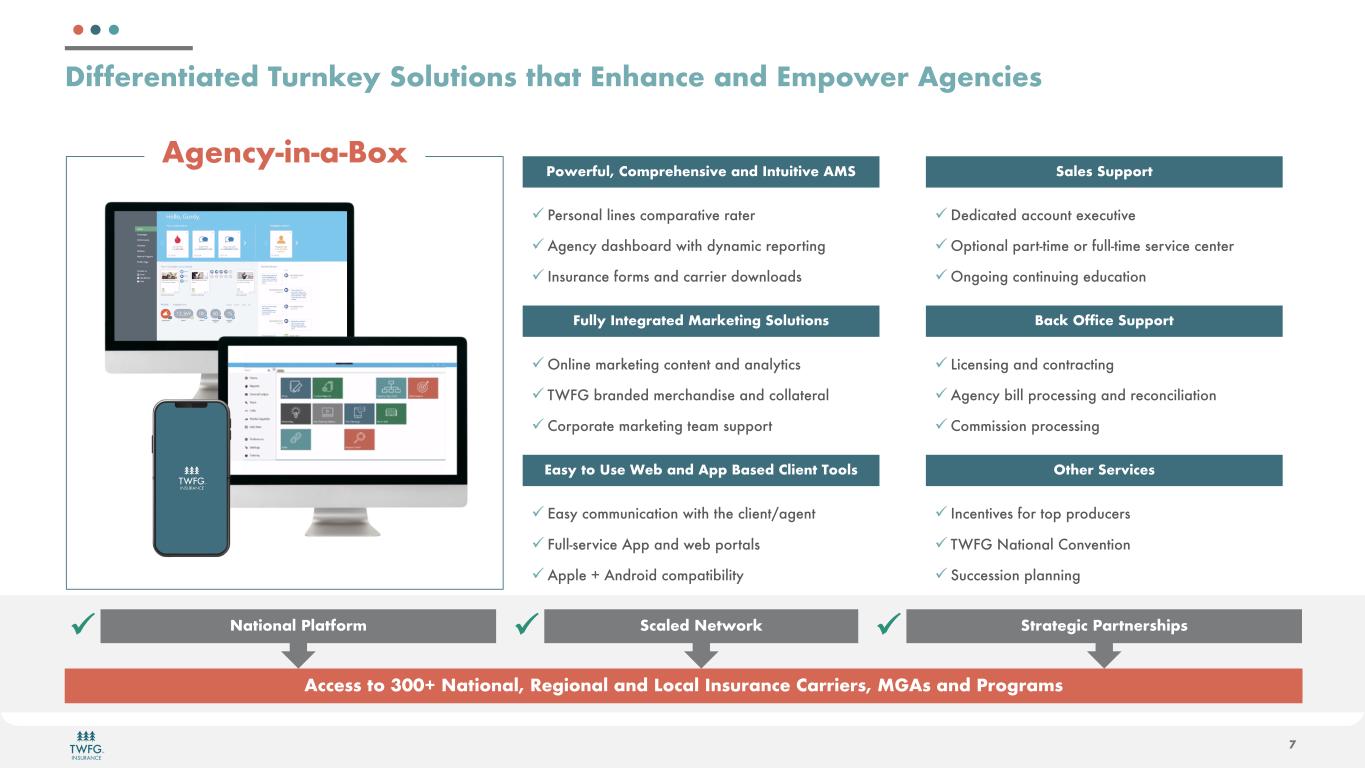

C O N F I D E N T I A L 7 Differentiated Turnkey Solutions that Enhance and Empower Agencies Access to 300+ National, Regional and Local Insurance Carriers, MGAs and Programs National Platform Scaled Network Strategic Partnershipsü ü ü ü Personal lines comparative rater üAgency dashboard with dynamic reporting ü Insurance forms and carrier downloads Powerful, Comprehensive and Intuitive AMS üOnline marketing content and analytics ü TWFG branded merchandise and collateral üCorporate marketing team support Fully Integrated Marketing Solutions ü Easy communication with the client/agent ü Full-service App and web portals üApple + Android compatibility Easy to Use Web and App Based Client Tools üDedicated account executive üOptional part-time or full-time service center üOngoing continuing education Sales Support ü Licensing and contracting üAgency bill processing and reconciliation üCommission processing Back Office Support ü Incentives for top producers ü TWFG National Convention ü Succession planning Other Services Agency-in-a-Box

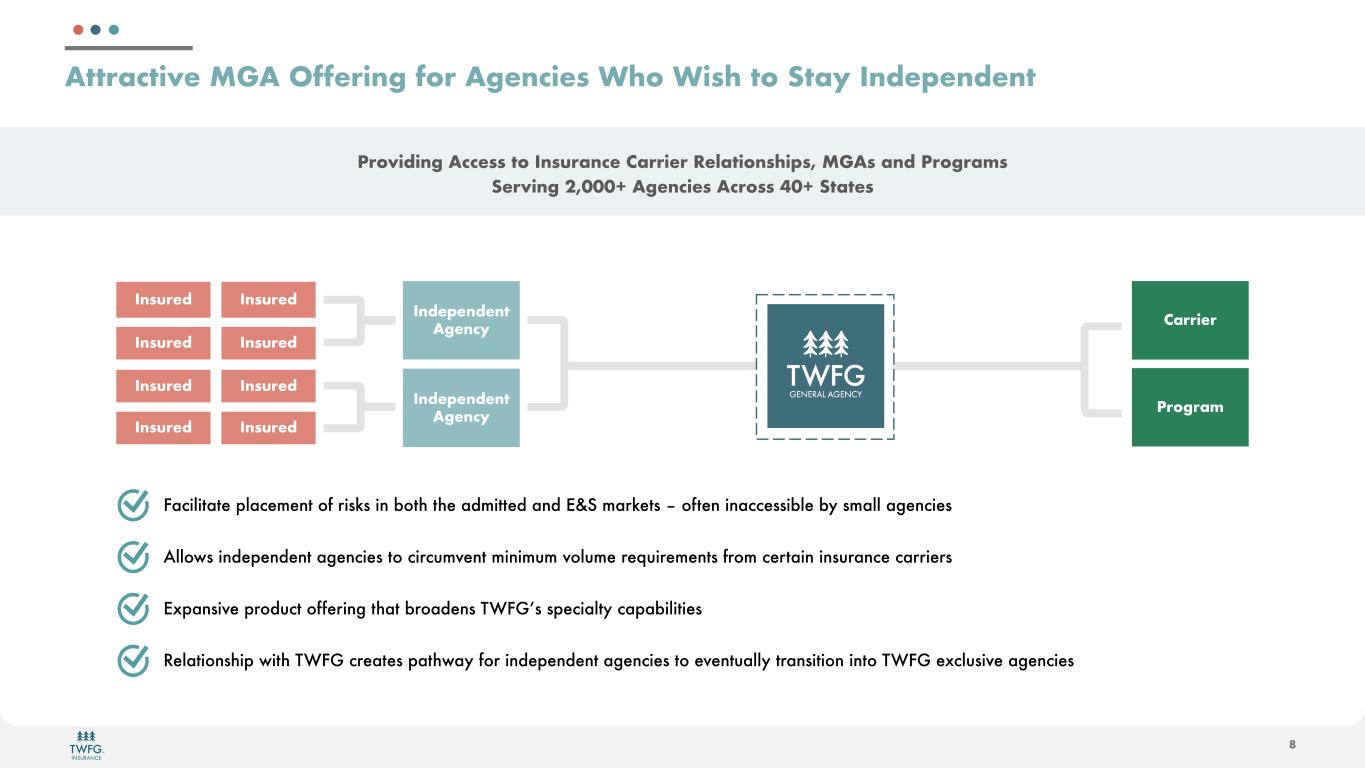

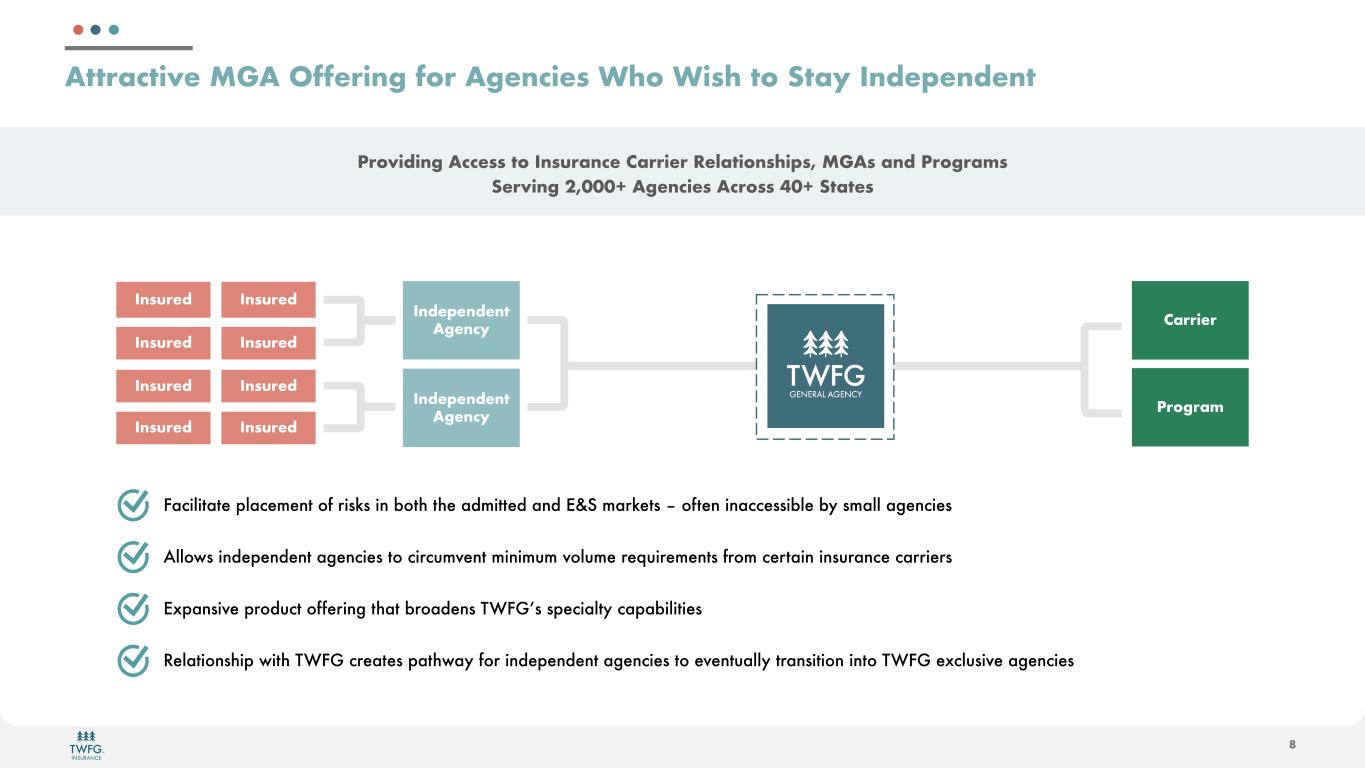

C O N F I D E N T I A L 8 Attractive MGA Offering for Agencies Who Wish to Stay Independent Providing Access to Insurance Carrier Relationships, MGAs and Programs Serving 2,000+ Agencies Across 40+ States Insured Insured CarrierIndependent Agency Insured Insured Insured Insured Insured Insured Independent Agency Program Facilitate placement of risks in both the admitted and E&S markets – often inaccessible by small agencies Allows independent agencies to circumvent minimum volume requirements from certain insurance carriers Expansive product offering that broadens TWFG’s specialty capabilities Relationship with TWFG creates pathway for independent agencies to eventually transition into TWFG exclusive agencies

C O N F I D E N T I A L 9 Umbrella Our Product Mix is a Function of Our Opportunistic Approach To Adding Talent. We Do Business In Personal, Commercial, Retail, Wholesale, Programs, Admitted, & Non-Admitted Markets Personal Lines Commercial Lines General Liability Workers’ Comp Commercial Property Commercial Bonds Business Owner Policy Business Auto Professional Liability Group Benefits Personal Auto Flood Motorcycle Life/Health RV Boat WindHome/Renters Luxury ItemsEvent Commercial Lines 20% Other Personal Lines 12% Personal Auto 32% Homeowners 36% Consolidated Written Premium Mix Commercial Lines 22% Other Personal Lines 13% Personal Auto 32% Homeowners 33% Commercial Lines 11% Other Personal Lines 8% Personal Auto 30% Homeowners 51% • Broad product set enabling TWFG agencies to deliver comprehensive coverage for client risks • Ability to offer in-demand, exclusive programs in certain niches (e.g., catastrophe- exposed property and high value homes) • Access to admitted and E&S insurance markets through TWFG MGA • Favorable characteristics of TWFG’s personal and small commercial client base: ‒ High demand for insurance protection across all economic cycles ‒ Relationships built on long-term trust, resulting in stickiness ‒ Evolving risks and increasing complexity require expert guidance Business mix comprises ~78% Personal Lines and ~22% Commercial Lines (As of 12/31/23) Insurance Services Premium Mix TWFG MGA Premium Mix Personal Lines 89%Personal Lines 78%Personal Lines 80% By Line of Business (2023) By Line of Business (2023) By Line of Business (2023)

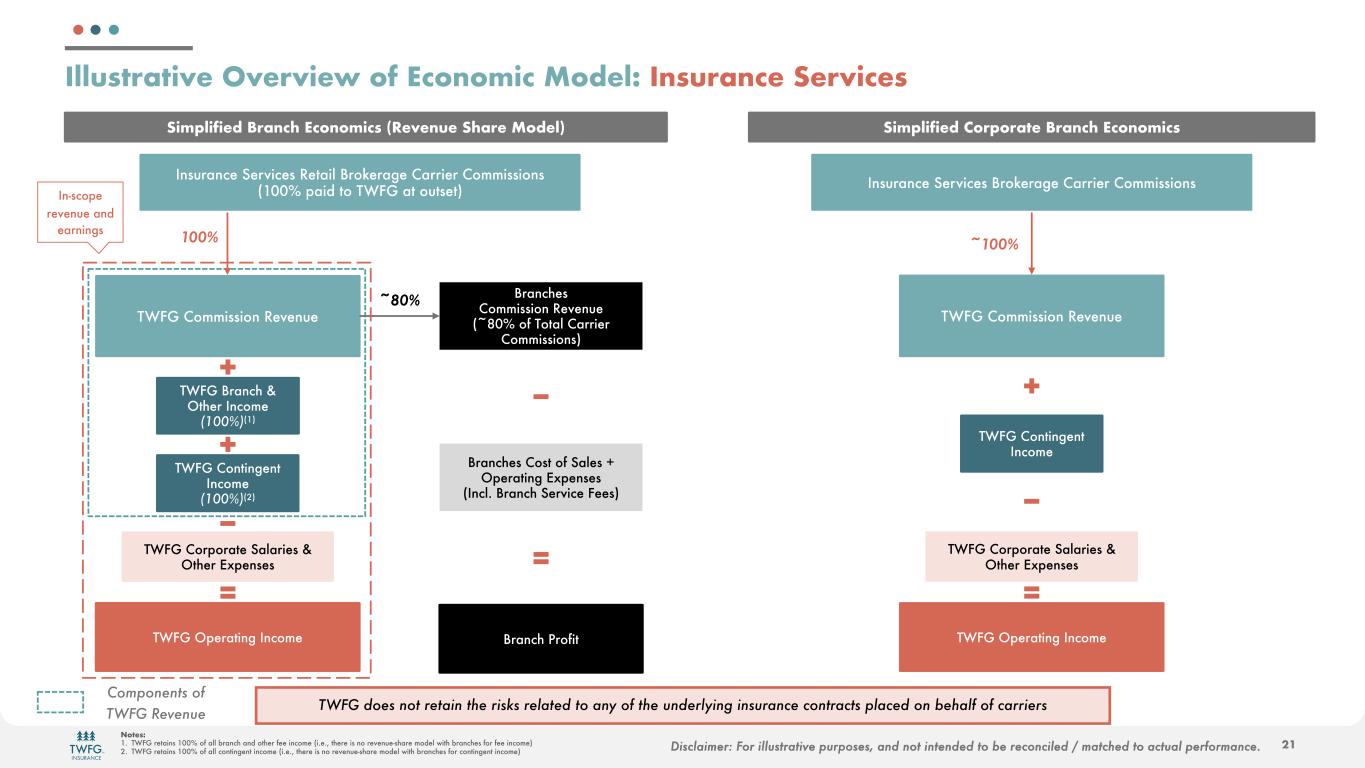

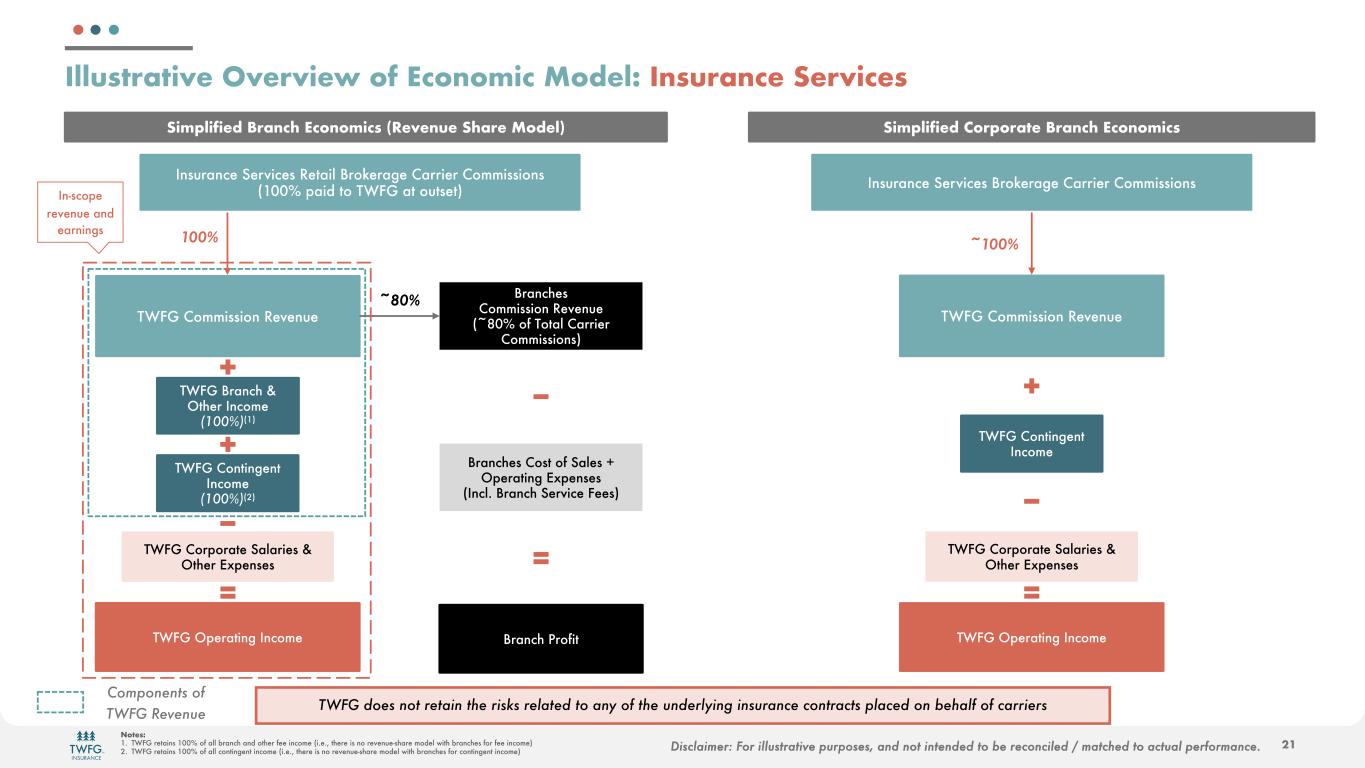

C O N F I D E N T I A L 10 Illustrative Overview of Economic Model Insurance Services ~80% of total TWFG Revenue MGA ~20% of total TWFG Revenue Branches Commission Revenue (~80% of Total Carrier Commissions) Agency-in-a-Box Commission Revenue (~20% of Total Carrier Commissions) Branch & Other Income Contingent Income MGA Other Fees Two primary service offerings: Insurance Services l TWFG recognizes 100% of the commission paid by insurance carriers and remits 80% of the commission revenue to the Branches (retaining 20%) l Branches are responsible for 100% of their operating expenses and pay a fee to TWFG to cover the costs of technology, E&O coverage and other services provided by TWFG l TWFG insurance services revenue also includes contingent income and other income (all 100% retained by TWFG) l For Corporate Branches, TWFG retains 100% of commission revenue and is responsible for 100% of expenses Managing General Agency (MGA) l TWFG receives 100% of commission revenue and contingent income earned from wholesale & brokerage and underwriting businesses l TWFG also receives other fees for providing third-party administration (TPA) and brokerage services including policy and software licensing to carriers l Depending on the terms of an individual MGA agency agreement, MGA may also include outbound commission expense to MGA Agencies Contingent Income + + + + Corporate Branches Commission Revenue Contingent Income + Corporate Salaries & Other Expenses (Corp. S&E) - Branches & Corp. S&E - Corporate Expenses - TWFG Operating Income = TWFG Operating Income = TWFG Operating Income = TWFG does not retain the risks related to any of the underlying insurance contracts placed on behalf of carriers Outbound Commission (variable % of Total Carrier Commissions) MGA Commission Revenue

C O N F I D E N T I A L 11 Compelling Financial Profile with Strong Growth and Profitability A Growth Story Compelling Financial Profile Diversified & recurring revenue Above-market growth rates Balance sheet flexibility Asset-light, FCF generative Notes: 1. Please see “KPI Information and Non-GAAP Reconciliations” for reconciliations of Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted Free Cash Flow to their most comparable GAAP measures 2. Results are preliminary unaudited estimates and are subject to change Strong annual results and trends $11.7MM Adj. EBITDA (Q324) (1) 21.5% Adj. EBITDA Margin (Q324) (1) $11.5MM Adj. Free Cash Flow (Q324) (1) $4.5MM Long Term Debt (Q324) 14.5% Total Revenue Growth (Q324) 16.5% - 18.2%(2) Total Revenue Growth (FY24) $102 $125 $154 $172 2020 2021 2022 2023 2024 Total Revenue ($MM) $696 $886 $1,054 $1,248 $1,476 2020 2021 2022 2023 2024 Total Written Premium ($MM) $201-$203 (2) (2)

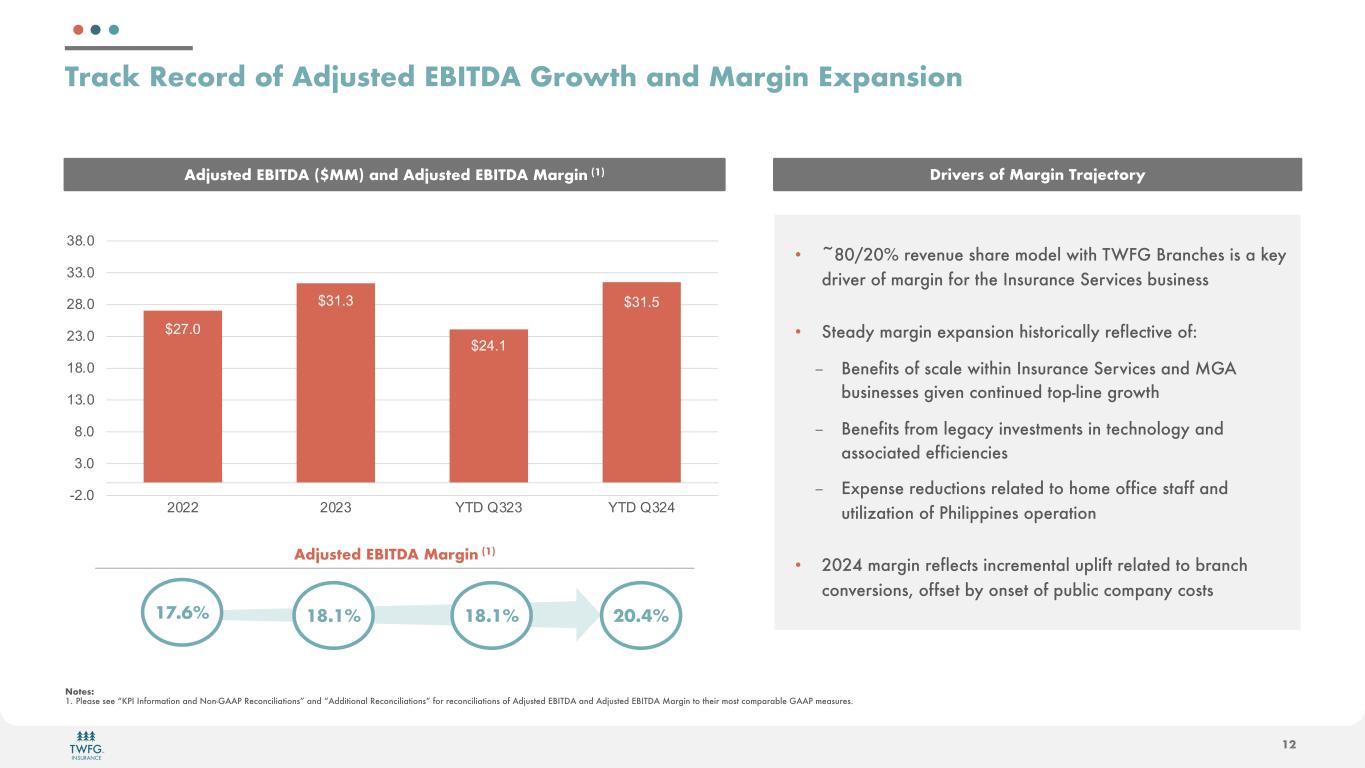

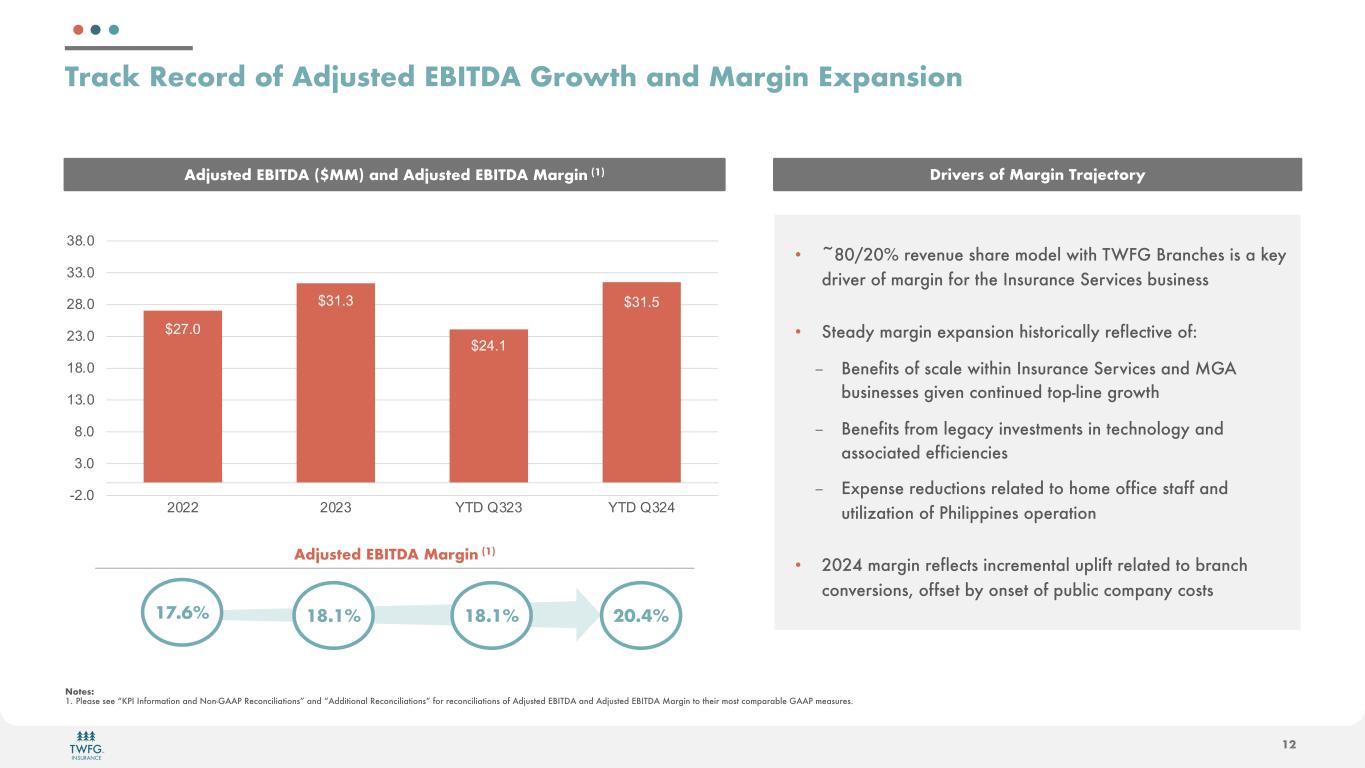

C O N F I D E N T I A L 12 $27.0 $31.3 $24.1 $31.5 -2.0 3.0 8.0 13.0 18.0 23.0 28.0 33.0 38.0 2022 2023 YTD Q323 YTD Q324 Track Record of Adjusted EBITDA Growth and Margin Expansion Adjusted EBITDA Margin (1) 17.6% 18.1% Notes: 1. Please see “KPI Information and Non-GAAP Reconciliations” and “Additional Reconciliations” for reconciliations of Adjusted EBITDA and Adjusted EBITDA Margin to their most comparable GAAP measures. 20.4% Adjusted EBITDA ($MM) and Adjusted EBITDA Margin (1) Drivers of Margin Trajectory • ~80/20% revenue share model with TWFG Branches is a key driver of margin for the Insurance Services business • Steady margin expansion historically reflective of: − Benefits of scale within Insurance Services and MGA businesses given continued top-line growth − Benefits from legacy investments in technology and associated efficiencies − Expense reductions related to home office staff and utilization of Philippines operation • 2024 margin reflects incremental uplift related to branch conversions, offset by onset of public company costs 18.1%

C O N F I D E N T I A L 13 Consistent Double-Digit Organic Growth over Time 23.2% 11.2% 14.5% 16.9% 14.5% 14.5% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 2022 2023 2024 As Reported Current Methodology Organic revenue growth definition based on commission income (including renewal and new business) Shift away from captive distribution Client service model led by experienced agents Diversified product offering Agency-in-a-box Tools and technology Differentiated access to carriers Ability to leverage TWFG MGA Innovative carrier partnerships Track record of hiring top industry talent Notes: 1. Please see “KPI Information and Non-GAAP Reconciliations” and “Additional Reconciliations” for reconciliations of Organic Revenue and Organic Revenue Growth to their most comparable GAAP measures 2. Reflects the application of enhanced data collected from external sources throughout the periods presented, which improved our assumptions for estimating revenues starting in 2022 3. Results are preliminary unaudited estimates and are subject to change (2) Organic Revenue Growth (1) Drivers of Sustained, Double-Digit Organic Growth Culminating in strong and consistent performance across retention and new business 14.1% - 14.8% 14.1% - 14.8% (3)

C O N F I D E N T I A L 14 5% < 1 year 10% 1-3 years 20% 3-5 years 66% 5+ years ~35% of 40,000 U.S. agencies expected to be sold over the next 5 years SIGNIFICANT PORTION OF U.S. AGENCIES COMING TO MARKET • Highly fragmented market with ~40,000 independent agencies and brokerages in the U.S. as of 2022 • Demographic tailwinds accelerate deal flow • Excessive leverage in the system creates opportunities for strong balance sheet acquirers Acquisition Opportunity by Revenue Size "Jumbo“ $10MM+ 2% Large $2.5-$10MM 7% Medium-Large $1.25MM-$2.5MM 7% Medium $500K-$1.25MM 22% Medium-Small $150K-$500K 24% Small <$150K 38% Fragmented Market Creates Additional Growth Opportunities Going Forward Source: Big I Agency Universe Study 2022 Industry Maintains a Robust Acquisition Pipeline that is Constantly Replenishing

C O N F I D E N T I A L 15 TWFG’s Scale, Balance Sheet and Disciplined Approach to Acquisitions Positions Us Well for Future Growth Backed By a Strong Balance Sheet and Repeatable Playbook • Disciplined and selective approach to M&A: ‒ Cultural compatibility ‒ Attractive loss ratios ‒ Organic growth ‒ EBITDA margin ‒ Enhances capabilities ‒ Geographic diversification • Focus on post-acquisition integration and synergies • Ability to leverage TWFG Agency network as a source of referrals • Future opportunity to convert additional TWFG Agencies into Corporate Branches TWFG Has a Proven Acquisition Track Record • Successful acquisitions across a range of specialties and geographies since inception: ‒ Agencies ‒ Books of business ‒ MGAs ‒ Insurance networks ‒ Renewal rights • Robust acquisition pipeline with preliminary dialogue across several agencies and potential partners • 2022 acquisitions (2): $7.9 million of capital deployed • 2023 acquisitions (2): $19.4 million of capital deployed • 2024 YTD acquisitions: $40.8 million of capital deployed (3) Notes: 1. Refers to acquisitions in excess of $0.5 million in annual revenue 2. Figure excludes $5.2MM purchase of remaining interests in assets of partially owned Corporate Branches in January 2024 3. As of 9/30/24

C O N F I D E N T I A L 16 Unique Value Proposition to Agency Owners Looking for a Partner LONG TERM STABILITY AND INDEPENDENCE ENTREPRENEURIAL OPPORTUNITIES SCALED SERVICES PLATFORM ü Founder led and controlled, yet publicly listed ü Think in decades, not 3-year “flips” ü Fiercely independent ü Low financial leverage ü Flexible Deal Structures ü Access to and preferred relationships with 7 of the top 10 US personal lines carriers that write with IA1 ü Access to and preferred relationships with the 9 of the top 10 US commercial lines carriers ü Access to over 100 MGAs on the TWFG platform ü Strong alignment – potential for revenue share, referral fees, and further M&A promotes agency performance ü Support branch owners’ and branch managers’ growth aspirations ü Back-office support allows agent to focus on new sales and customer service ü Comprehensive training and cross-training available to agents and teams ACCESS TO CARRIERS AND MGAS REPUTATION FOR FAIR DEALING Notes: 1. Excludes captive only carriers

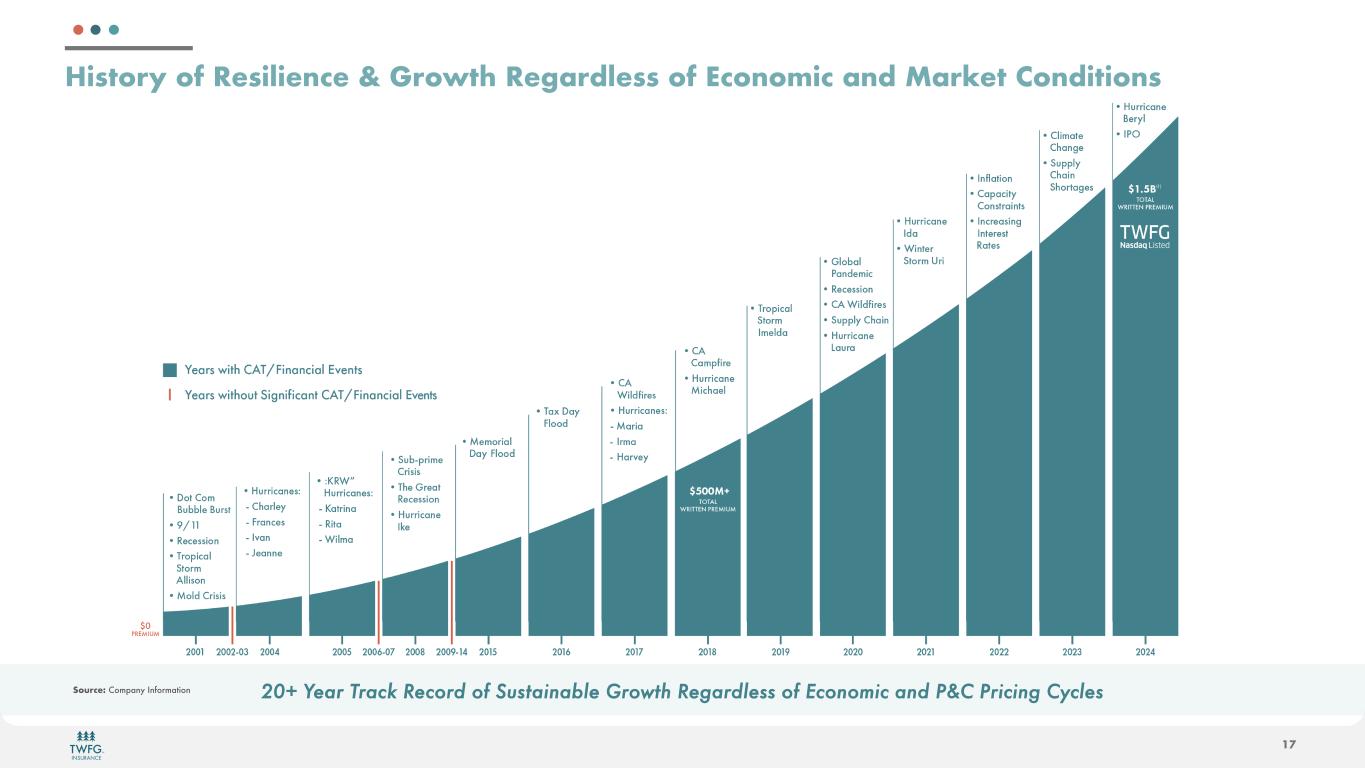

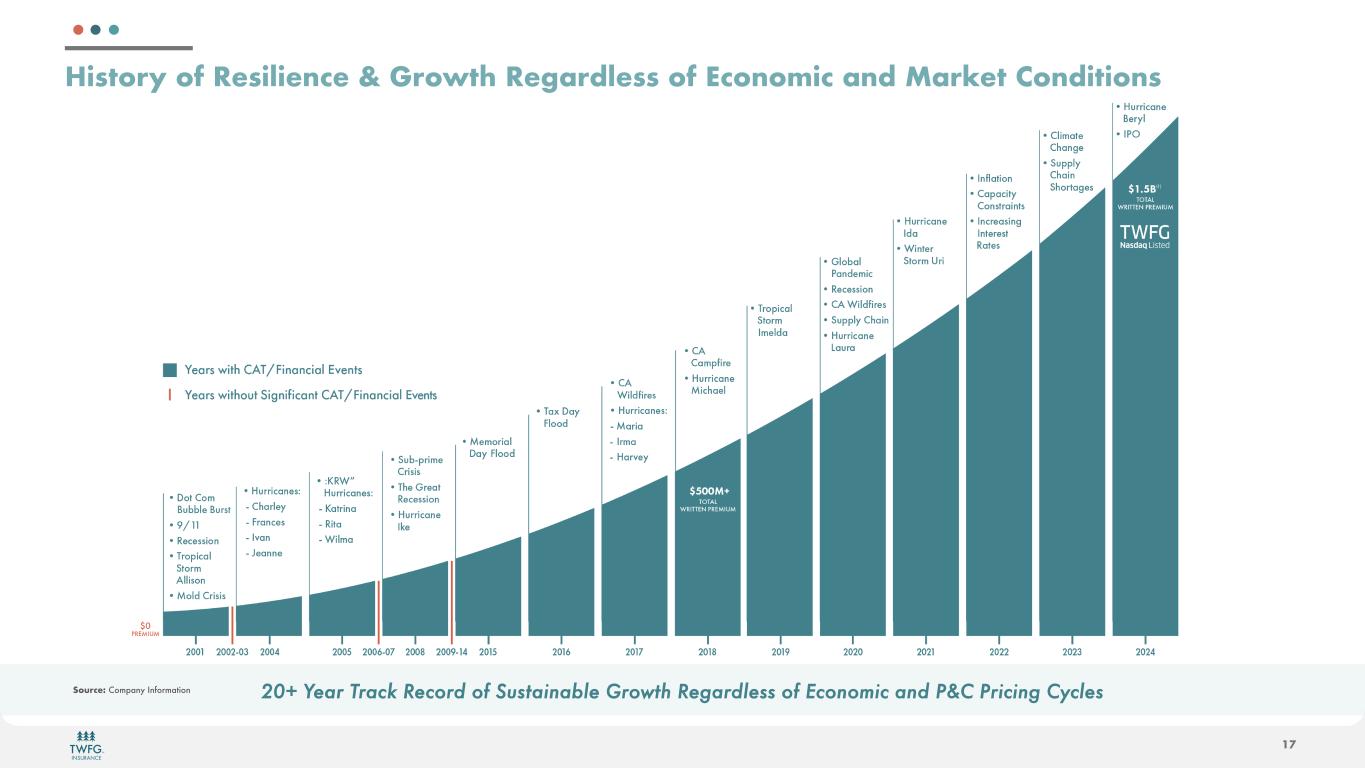

C O N F I D E N T I A L 17 History of Resilience & Growth Regardless of Economic and Market Conditions 20+ Year Track Record of Sustainable Growth Regardless of Economic and P&C Pricing CyclesSource: Company Information

C O N F I D E N T I A L 18 Proven Management Team Well Positioned to Execute on Growth 20+ Year Track Record of Sustainable Growth Regardless of Economic and Property and Casualty Insurance Pricing Cycles Proven Ability to Execute on Growth Strategy Backed by a deep bench of seasoned operatorsü Collaborative culture focused on teamwork, innovation and driving the best result for clientsü Executive management team with an average of 25+ years of insurance industry experienceü Janice E. Zwinggi, CPA Chief Financial Officer Richard F. (“Gordy”) Bunch III Founder and CEO Julie E. Benes General Counsel Katherine C. Nolan Chief Operating Officer Charles Alexander Bunch Chief Creative and Marketing Officer Mark Alberto SVP of Technology

C O N F I D E N T I A L 19 Independent Agencies 38% Captive Agencies 35% Direct Distribution ("DTC")… Key Investment Highlights 1 Trusted Distribution Partner with Track Record of Innovative Solutions2 3 4 National Footprint and Scaled Platform Delivering Sustainable Growth 5 Compelling Financial Profile with Strong Growth and Profitability Attractive Product Mix with Personal Lines Focus 6 Proven Management Team Well-Positioned to Execute on Growth Business Snapshot Differentiated Solutions that Enhance and Empower Agencies TWFG’s Business Model Was Built to Capture a Secular Shift from Captive Distribution 520+ TWFG Branches in 34 States (1) 2,000+ TWFG MGA Agencies in 40+ States(1) 8th Largest U.S. Personal Lines Agency (2) 27th Largest U.S. Agency (2) $201-203MM Revenue (2024)(3) National Footprint and Scaled Platform Delivering Sustainable Growth Insurance Services ~80% of Total TWFG Rev. (2023) Managing General Agency ~20% of Total TWFG Rev.(2023) Revenue Share Model Commission & Fee Income • Turnkey solution for Branches (“Agency-in-a-Box”) that promotes growth and facilitates the administrative work of operating an agency • Facilitates the placement of traditional and hard-to-place personal and commercial insurance risks for agencies across the country Source: Independent Insurance Agents & Brokers of America Notes: 1. As of Dec 31, 2024 2. Rankings based on revenue per Insurance Journal’s 2024 Top 100 Property / Casualty Agencies 3. Results are preliminary unaudited estimates and are subject to change 19.5% Revenue CAGR (2019-23)

C O N F I D E N T I A L 20 APPENDIX

C O N F I D E N T I A L 21 Illustrative Overview of Economic Model: Insurance Services Simplified Branch Economics (Revenue Share Model) Notes: 1. TWFG retains 100% of all branch and other fee income (i.e., there is no revenue-share model with branches for fee income) 2. TWFG retains 100% of all contingent income (i.e., there is no revenue-share model with branches for contingent income) Disclaimer: For illustrative purposes, and not intended to be reconciled / matched to actual performance. TWFG does not retain the risks related to any of the underlying insurance contracts placed on behalf of carriers Components of TWFG Revenue Insurance Services Retail Brokerage Carrier Commissions (100% paid to TWFG at outset) TWFG Commission Revenue Branches Commission Revenue (~80% of Total Carrier Commissions) Branches Cost of Sales + Operating Expenses (Incl. Branch Service Fees) Branch Profit 100% TWFG Operating Income TWFG Branch & Other Income (100%)(1) TWFG Contingent Income (100%)(2) In-scope revenue and earnings TWFG Corporate Salaries & Other Expenses ~80% Simplified Corporate Branch Economics ~100% TWFG Operating Income TWFG Contingent Income TWFG Corporate Salaries & Other Expenses TWFG Commission Revenue Insurance Services Brokerage Carrier Commissions

C O N F I D E N T I A L 22 Illustrative Overview of Economic Model: MGA Simplified Wholesale and Brokering Economics Simplified Underwriting Economics MGA Carrier Commissions and Fees TWFG Commission Revenue TWFG Operating Income TWFG Contingent Income TWFG Corporate Expenses ~100% Outbound Commission Expense Carrier Commissions and Fees TPA, Policy and Software Licensing Fees TWFG Operating Income ~100% Disclaimer: For illustrative purposes, and not intended to be reconciled / matched to actual performance. TWFG does not retain the risks related to any of the underlying insurance contracts placed on behalf of carriers TWFG Operating Expenses TWFG Commission Revenue TWFG Contingent Income

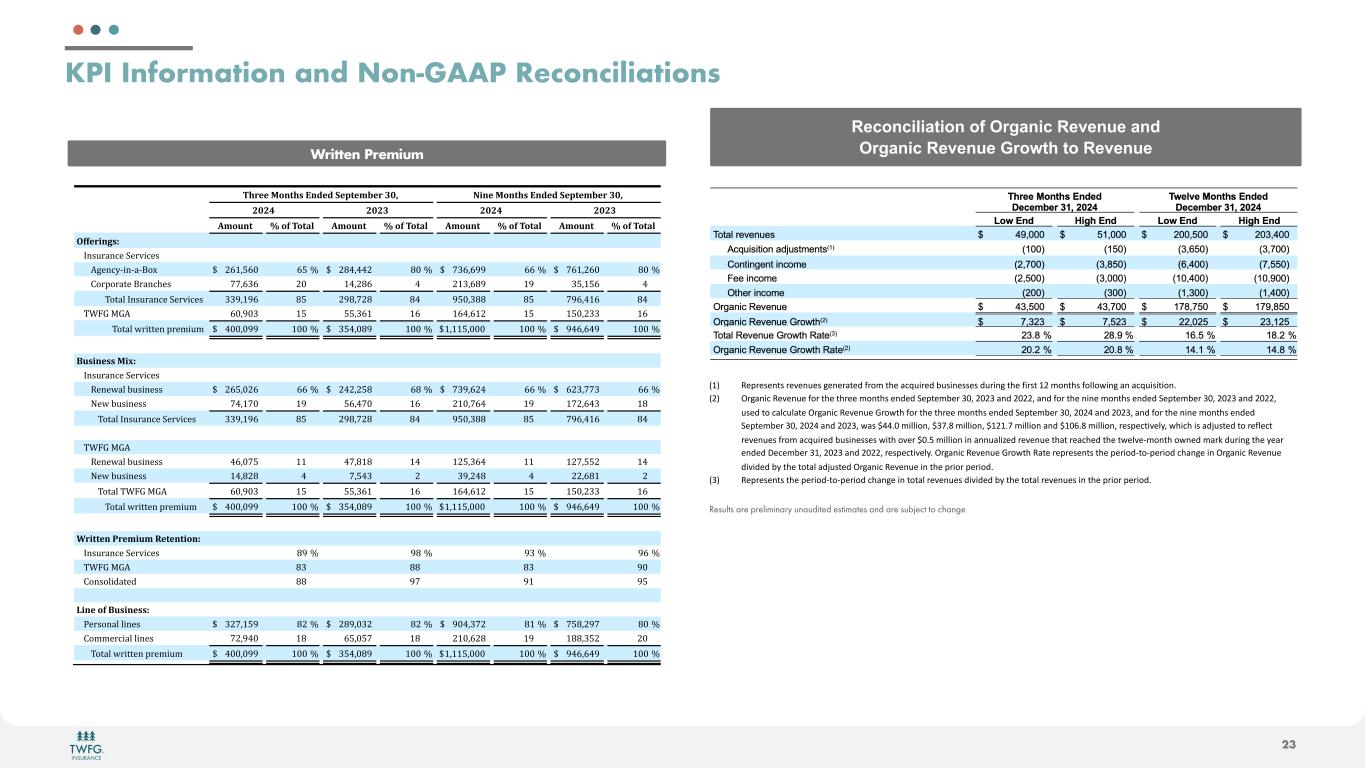

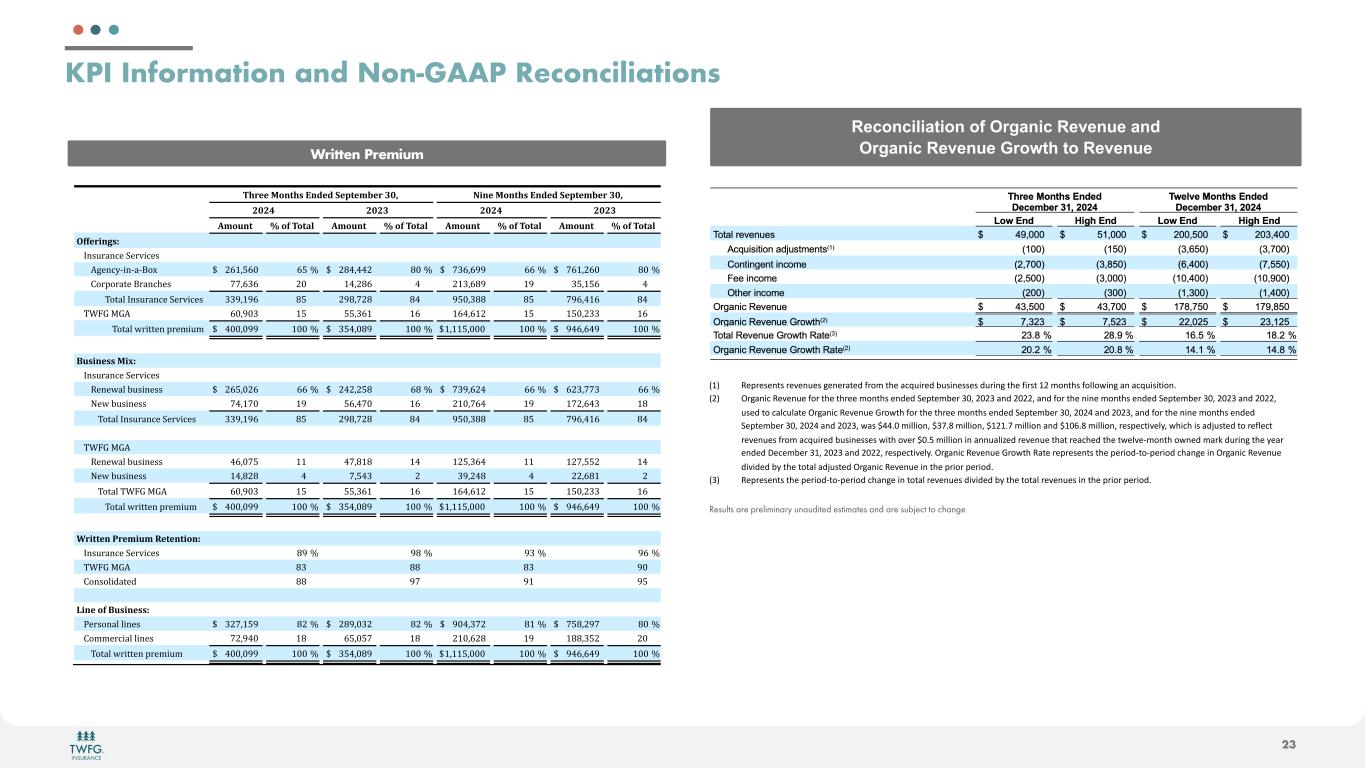

C O N F I D E N T I A L 23 KPI Information and Non-GAAP Reconciliations Written Premium Reconciliation of Organic Revenue and Organic Revenue Growth to Revenue Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Amount % of Total Amount % of Total Amount % of Total Amount % of Total Offerings: Insurance Services Agency-in-a-Box $ 261,560 65 % $ 284,442 80 % $ 736,699 66 % $ 761,260 80 % Corporate Branches 77,636 20 14,286 4 213,689 19 35,156 4 Total Insurance Services 339,196 85 298,728 84 950,388 85 796,416 84 TWFG MGA 60,903 15 55,361 16 164,612 15 150,233 16 Total written premium $ 400,099 100 % $ 354,089 100 % $ 1,115,000 100 % $ 946,649 100 % Business Mix: Insurance Services Renewal business $ 265,026 66 % $ 242,258 68 % $ 739,624 66 % $ 623,773 66 % New business 74,170 19 56,470 16 210,764 19 172,643 18 Total Insurance Services 339,196 85 298,728 84 950,388 85 796,416 84 TWFG MGA Renewal business 46,075 11 47,818 14 125,364 11 127,552 14 New business 14,828 4 7,543 2 39,248 4 22,681 2 Total TWFG MGA 60,903 15 55,361 16 164,612 15 150,233 16 Total written premium $ 400,099 100 % $ 354,089 100 % $ 1,115,000 100 % $ 946,649 100 % Written Premium Retention: Insurance Services 89 % 98 % 93 % 96 % TWFG MGA 83 88 83 90 Consolidated 88 97 91 95 Line of Business: Personal lines $ 327,159 82 % $ 289,032 82 % $ 904,372 81 % $ 758,297 80 % Commercial lines 72,940 18 65,057 18 210,628 19 188,352 20 Total written premium $ 400,099 100 % $ 354,089 100 % $ 1,115,000 100 % $ 946,649 100 % (1) Represents revenues generated from the acquired businesses during the first 12 months following an acquisition. (2) Organic Revenue for the three months ended September 30, 2023 and 2022, and for the nine months ended September 30, 2023 and 2022, used to calculate Organic Revenue Growth for the three months ended September 30, 2024 and 2023, and for the nine months ended September 30, 2024 and 2023, was $44.0 million, $37.8 million, $121.7 million and $106.8 million, respectively, which is adjusted to reflect revenues from acquired businesses with over $0.5 million in annualized revenue that reached the twelve-month owned mark during the year ended December 31, 2023 and 2022, respectively. Organic Revenue Growth Rate represents the period-to-period change in Organic Revenue divided by the total adjusted Organic Revenue in the prior period. (3) Represents the period-to-period change in total revenues divided by the total revenues in the prior period. Results are preliminary unaudited estimates and are subject to change

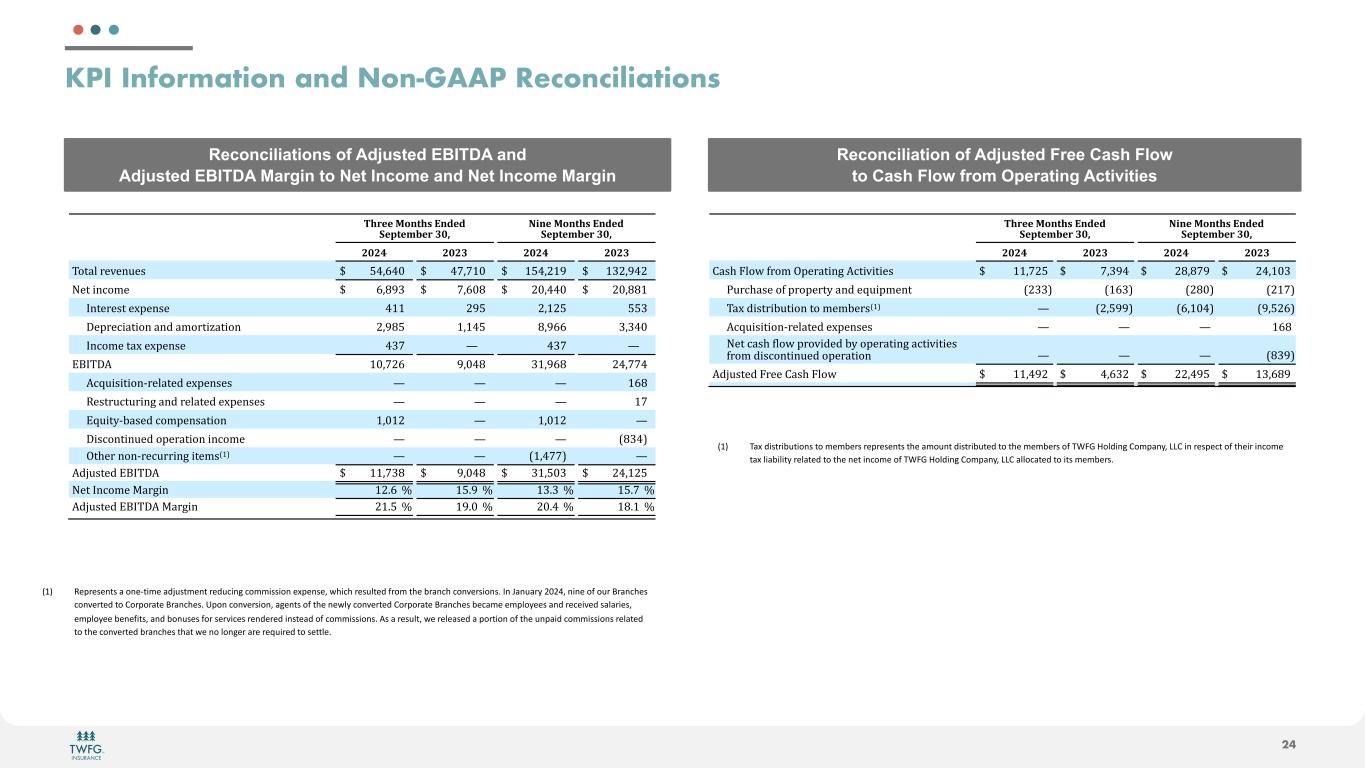

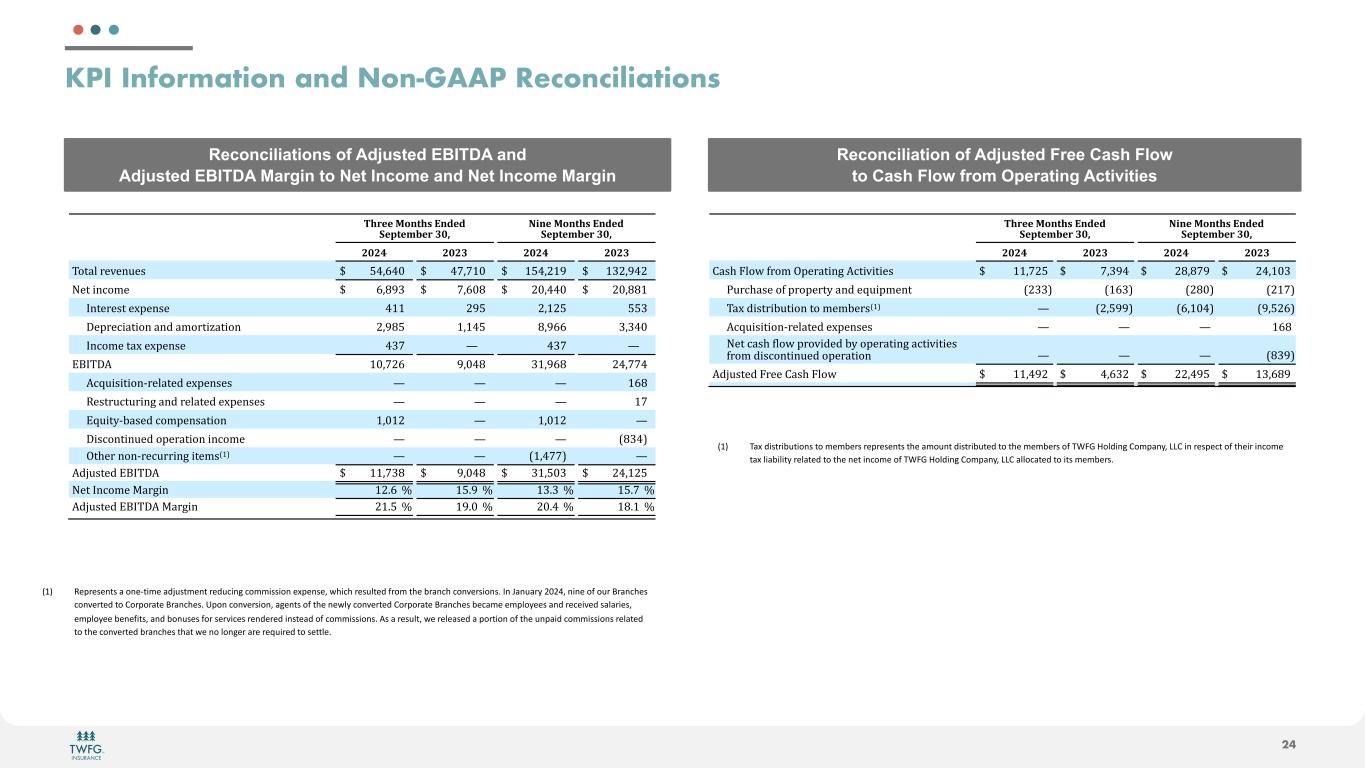

C O N F I D E N T I A L 24 KPI Information and Non-GAAP Reconciliations Reconciliations of Adjusted EBITDA and Adjusted EBITDA Margin to Net Income and Net Income Margin Reconciliation of Adjusted Free Cash Flow to Cash Flow from Operating Activities ! !"#$$%&'()"*%+(,$,! -$.)$/0$#%123! ! 45($%&'()"*%+(,$,! -$.)$/0$#%123! ! 6267! ! 6261! ! 6267! ! 6261! !"#$%&'()(*+(,! -& ./01/2! ! -& /30342! ! -& 4./0546! ! -& 47506/5! 8(#&9*:";(! -& 10<67! ! -& 3012<! ! -& 520//2! ! -& 520<<4! =*#('(,#&(>?(*,(! & /44! ! & 56.! ! & 5045.! ! & ..7! @(?'(:9$#9"*&$*A&$;"'#9B$#9"*! & 506<.! ! & 404/.! ! & <0611! ! & 707/2! =*:";(&#$>&(>?(*,(! & /73! ! & C& !! & /73! ! & C& ! DE=!@F! & 420351! ! & 602/<! ! & 74061<! ! & 5/033/! F:G+9,9#9"*H'(%$#(A&(>?(*,(,! & C! ! & C! ! & C! ! & 41<! I(,#'+:#+'9*J&$*A&'(%$#(A&(>?(*,(,! & C! ! & C! ! & C! ! & 43! DG+9#KHL$,(A&:";?(*,$#9"*! & 40245! ! & C! ! & 40245! ! & C! @9,:"*#9*+(A&"?('$#9"*&9*:";(! & C! ! & C! ! & C! ! & M<7/N! O#P('&*"*H'(:+''9*J&9#(;,M4N& & C! ! & C! ! & M40/33N! ! & C! FAQ+,#(A&DE=!@F! -& 44037<! ! -& 602/<! ! -& 740.27! ! -& 5/045.! 8(#&=*:";(&R$'J9*! 45S1&T!! 4.S6&T!! 47S7&T!! 4.S3&T! FAQ+,#(A&DE=!@F&R$'J9*! 54S.&T!! 46S2&T!! 52S/&T!! 4<S4&T! ! ! !! !! !!! ! !"#$$%&'()"*%+(,$,! -$.)$/0$#%123! ! 45($%&'()"*%+(,$,! -$.)$/0$#%123! ! 6267! ! 6261! ! 6267! ! 6261! !"#$%&'()%*+(,%-./+"0123%45016101/#! 7% 889:;<% !! 7% :9=>?% !! 7% ;@9@:>% !! 7% ;?98A=% ! BC+5$"#/%(*%.+(./+0D%"2E%/FC1.,/20! % G;==H!! % G8I=H!! % G;@AH!! % G;8:H! J"K%E1#0+1LC01(2%0(%,/,L/+#G8H% % M%!! % G;9<>>H!! % GI98A?H!! % G>9<;IH! 45FC1#101(2N+/'"0/E%/K./2#/#! % M%!! % M%!! % M%!! % 8I@%! O/0%5"#$%*'()%.+(61E/E%LD%(./+"0123%"5016101/#% *+(,%E1#5(2012C/E%(./+"01(2! % M%!! % M%!! % M%!! % G@=>H! 4EPC#0/E%&+//%!"#$%&'()! 7% 889?>;% !! 7% ?9I=;% !! 7% ;;9?><% !! 7% 8=9I@>% ! ! (1) Represents a one-time adjustment reducing commission expense, which resulted from the branch conversions. In January 2024, nine of our Branches converted to Corporate Branches. Upon conversion, agents of the newly converted Corporate Branches became employees and received salaries, employee benefits, and bonuses for services rendered instead of commissions. As a result, we released a portion of the unpaid commissions related to the converted branches that we no longer are required to settle. (1) Tax distributions to members represents the amount distributed to the members of TWFG Holding Company, LLC in respect of their income tax liability related to the net income of TWFG Holding Company, LLC allocated to its members.

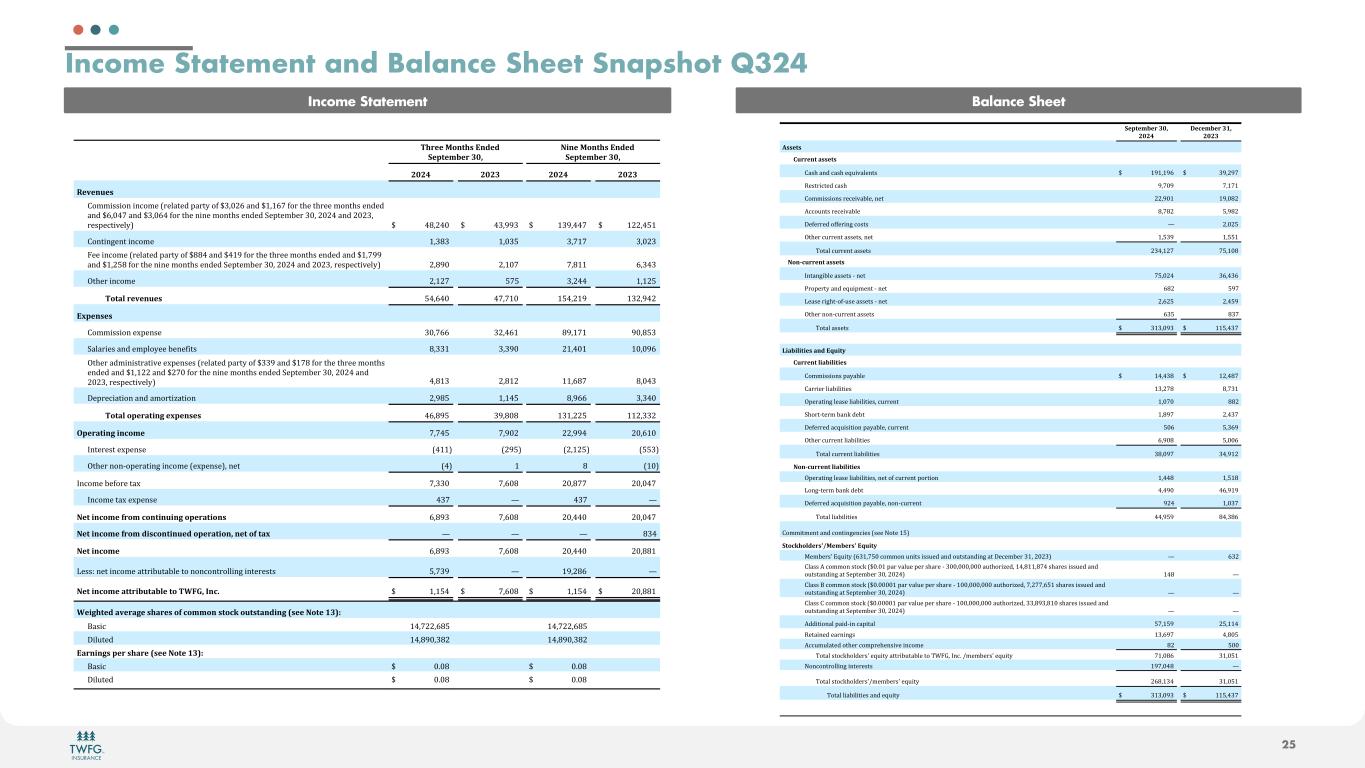

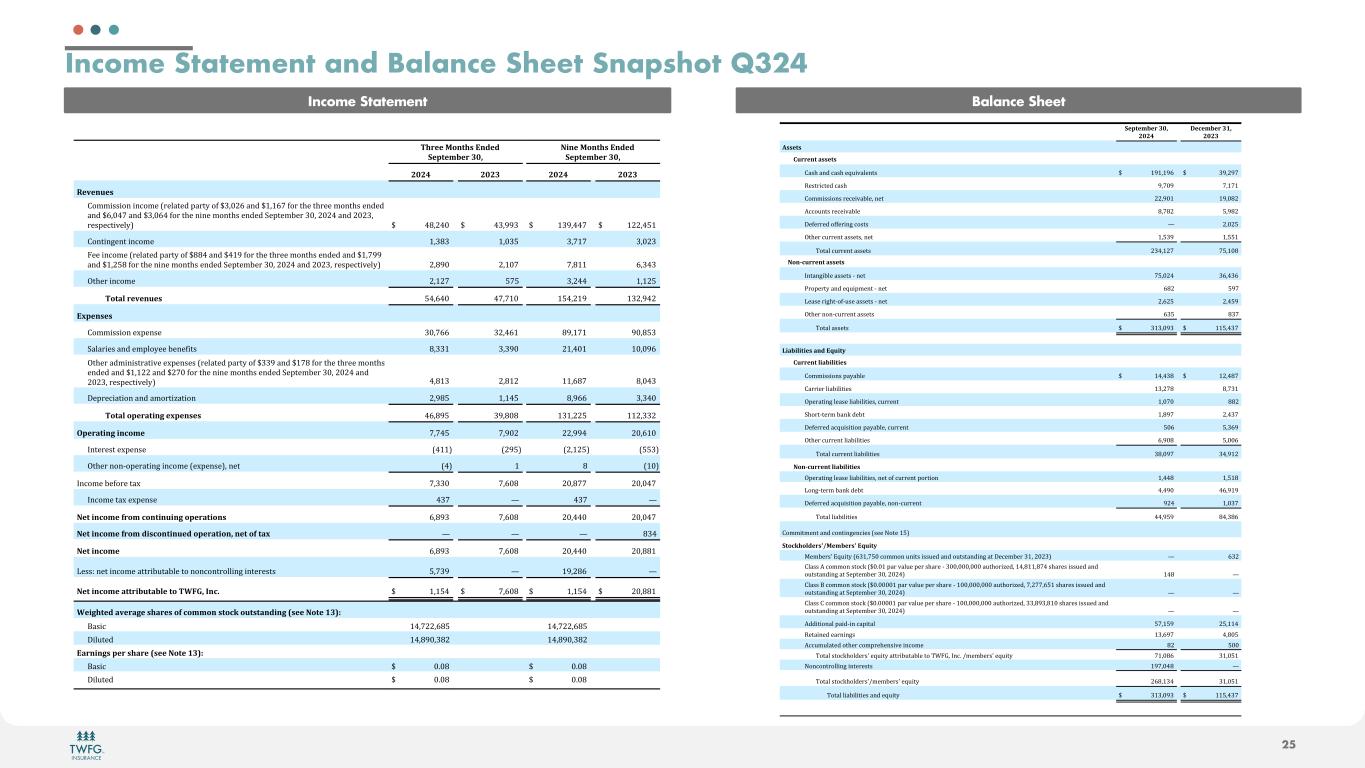

C O N F I D E N T I A L 25 Income Statement and Balance Sheet Snapshot Q324 Income Statement Balance Sheet ! !!!!!"#$%%!&'()#*!+(,%,! -%.)%/0%$!123! ! !!!!!45(%!&'()#*!+(,%,! -%.)%/0%$!123! ! 6267! ! 6261! ! 6267! ! 6261! 8%9%(:%*! ! ! ! !! ! ! !"##$%%$"&'$&("#)'*+),-.)/'0-+.1'"2'345678'-&/'39598:'2"+'.;)'.;+))'#"&.;%')&/)/' -&/'3856<:'-&/'34568<'2"+'.;)'&$&)'#"&.;%')&/)/'=)0.)#>)+'465'767<'-&/'76745' +)%0)(.$?),1@' 3' <A57<6' ! 3' <45BB4' ! 3' 94B5<<:'! 3' 9775<C9'! !"&.$&D)&.'$&("#)! ' 954A4'! ' 9564C'! ' 45:9:'! ' 45674'! E))'$&("#)'*+),-.)/'0-+.1'"2'3AA<'-&/'3<9B'2"+'.;)'.;+))'#"&.;%')&/)/'-&/'395:BB' -&/'3957CA'2"+'.;)'&$&)'#"&.;%')&/)/'=)0.)#>)+'465'767<'-&/'76745'+)%0)(.$?),1@' ' 75AB6'! ' 7596:'! ' :5A99'! ' 854<4'! F.;)+'$&("#)! ' 7597:'! ' C:C'! ' 457<<'! ' 9597C'! "');<!$%9%(:%*'' ' C<58<6' ! ' <:5:96' ! ' 9C<579B'! ' 9475B<7'! +=.%(*%*! ! ! ! !! ! ! !"##$%%$"&')G0)&%)! ' 465:88' ! ' 475<89' ! ' AB59:9' ! ' B65AC4' ! =-,-+$)%'-&/')#0,"1))'>)&)2$.%! ' A5449'! ' 454B6'! ' 795<69' ! ' 9656B8' ! F.;)+'-/#$&$%.+-.$?)')G0)&%)%'*+),-.)/'0-+.1'"2'344B'-&/'39:A'2"+'.;)'.;+))'#"&.;%' )&/)/'-&/'395977'-&/'37:6'2"+'.;)'&$&)'#"&.;%')&/)/'=)0.)#>)+'465'767<'-&/' 76745'+)%0)(.$?),1@' ' <5A94'! ' 75A97'! ' 9958A:' ! ' A56<4'! H)0+)($-.$"&'-&/'-#"+.$I-.$"&! ' 75BAC'! ' 959<C'! ' A5B88'! ' 454<6'! "');<!'.%$;)5(>!%=.%(*%*'' ' <85ABC' ! ' 4B5A6A' ! ' 949577C'! ' 9975447'! ?.%$;)5(>!5(@'/%'' ' :5:<C'! ' :5B67'! ' 775BB<' ! ' 765896' ! J&.)+)%.')G0)&%)! ' *<99@! ' *7BC@! ' *7597C@! ' *CC4@! F.;)+'&"&K"0)+-.$&D'$&("#)'*)G0)&%)@5'&).! ' *<@! ' 9'! ' A'! ' *96@! J&("#)'>)2"+)'.-G! ' :5446'! ' :586A'! ' 765A::' ! ' 7656<:' ! J&("#)'.-G')G0)&%)! ' <4:'! ' L'! ' <4:'! ' L'! 4%)!5(@'/%!A$'/!@'()5(:5(>!'.%$;)5'(*'' ' 85AB4'! ' :586A'! ' 765<<6' ! ' 7656<:' ! 4%)!5(@'/%!A$'/!,5*@'()5(:%,!'.%$;)5'(3!(%)!'A!);='' ' L'! ' L'! ' L'! ' A4<'! 4%)!5(@'/%'' ' 85AB4'! ' :586A'! ' 765<<6' ! ' 765AA9' ! M)%%N'&).'$&("#)'-..+$>O.->,)'."'&"&("&.+",,$&D'$&.)+)%.%' ' C5:4B'!! ' L'!!' 9B57A8' !! ' L'! 4%)!5(@'/%!;))$50:);0<%!)'!"BCD3!E(@F! 3' 959C<'!! 3' :586A'!!3' 959C<'!! 3' 765AA9' ! B%5>#)%,!;9%$;>%!*#;$%*!'A!@'//'(!*)'@G!':)*);(,5(>!H*%%!4')%!I1JK! ! ! ! !! ! ! P-%$(! 9<5:7758AC!! !! 9<5:7758AC!! ! H$,O.)/! 9<5AB654A7!! !! 9<5AB654A7!! ! +;$(5(>*!.%$!*#;$%!H*%%!4')%!I1JK! ! ! ! !! ! ! P-%$(' 3' 6Q6A'!! !! 3' 6Q6A'!! ! H$,O.)/' 3' 6Q6A'!! !! 3' 6Q6A'!! ! ! ! ! ! !! ! !! ! !"#$"%&"'()*+( ,*,-! ! ."/"%&"'()0+( ,*,)! 122"$2! ! ! ! 34''"5$(622"$2! ! ! ! !"#$%"&'%("#$%)*+,-".)&/#! 0% 1213124%! 0% 523627%! 8)#/9,(/)'%("#$! % 237:2%! % 73171%! !;<<,##,;&#%9)(),-"=.)3%&)/! % 6632:1%! % 123:>6%! ?((;+&/#%9)(),-"=.)! % >37>6%! % @32>6%! A)B)99)'%;BB)9,&C%(;#/#! % D%! % 63:6@%! E/$)9%(+99)&/%"##)/#3%&)/! % 13@52%! % 13@@1%! F;/".%(+99)&/%"##)/#%! % 65G3167%! % 7@31:>%! 7859/4''"5$(622"$2! ! ! ! H&/"&C,=.)%"##)/#%I%&)/! % 7@3:6G%! % 543G54%! J9;K)9/L%"&'%)*+,K<)&/%I%&)/! % 4>6%! % @27%! M)"#)%9,C$/I;BI+#)%"##)/#%I%&)/! % 6346@%! % 63G@2%! E/$)9%&;&I(+99)&/%"##)/#! % 45@%! % >57%! F;/".%"##)/#%! 0% 5153:25%! 0% 11@3G57%! ! ! ! ! :;6&;<;$;"2(65=(>?4;$@! ! ! ! 34''"5$(<;6&;<;$;"2! ! ! ! !;<<,##,;&#%K"L"=.)! 0% 1G3G5>%! 0% 163G>7%! !"99,)9%.,"=,.,/,)#! % 15367>%! % >3751%! EK)9"/,&C%.)"#)%.,"=,.,/,)#3%(+99)&/! % 13:7:%! % >>6%! N$;9/I/)9<%="&O%')=/! % 13>27%! % 63G57%! A)B)99)'%"(*+,#,/,;&%K"L"=.)3%(+99)&/! % @:4%! % @3542%! E/$)9%(+99)&/%.,"=,.,/,)#! % 432:>%! % @3::4%! F;/".%(+99)&/%.,"=,.,/,)#%! % 5>3:27%! % 5G3216%! 7859/4''"5$(<;6&;<;$;"2! ! ! ! EK)9"/,&C%.)"#)%.,"=,.,/,)#3%&)/%;B%(+99)&/%K;9/,;&! % 13GG>%!! % 13@1>%! M;&CI/)9<%="&O%')=/! % G3G2:%! % G43212%! A)B)99)'%"(*+,#,/,;&%K"L"=.)3%&;&I(+99)&/! % 26G%! % 13:57%! F;/".%.,"=,.,/,)#%! % GG32@2%! % >G35>4%! !;<<,/<)&/%"&'%(;&/,&C)&(,)#%P#))%Q;/)%1@R! ! ! ! !$8/AB8<="'2CDE"%&"'2C(>?4;$@! ! ! ! S)<=)9#T%U*+,/L%P45137@:%(;<<;&%+&,/#%,##+)'%"&'%;+/#/"&',&C%"/%A)()<=)9%513%6:65R% % D%!! % 456%! !."##%?%(;<<;&%#/;(O%P0:V:1%K"9%-".+)%K)9%#$"9)%I%5::3:::3:::%"+/$;9,W)'3%1G3>113>7G%#$"9)#%,##+)'%"&'% ;+/#/"&',&C%"/%N)K/)<=)9%5:3%6:6GR% % 1G>%!! % D%! !."##%X%(;<<;&%#/;(O%P0:V::::1%K"9%-".+)%K)9%#$"9)%I%1::3:::3:::%"+/$;9,W)'3%7367734@1%#$"9)#%,##+)'%"&'% ;+/#/"&',&C%"/%N)K/)<=)9%5:3%6:6GR% % D%!! % D%! !."##%!%(;<<;&%#/;(O%P0:V::::1%K"9%-".+)%K)9%#$"9)%I%1::3:::3:::%"+/$;9,W)'3%553>253>1:%#$"9)#%,##+)'%"&'% ;+/#/"&',&C%"/%N)K/)<=)9%5:3%6:6GR% % D%!! % D%! ?'',/,;&".%K",'I,&%("K,/".! % @731@2%! % 6@311G%! 8)/",&)'%)"9&,&C#! % 153427%!! % G3>:@%! ?((+<+."/)'%;/$)9%(;<K9)$)&#,-)%,&(;<)! % >6%!! % @::%! F;/".%#/;(O$;.')9#Y%)*+,/L%"//9,=+/"=.)%/;%FZ[\3%H&(V%]<)<=)9#T%)*+,/L% % 713:>4%!! % 513:@1%! Q;&(;&/9;..,&C%,&/)9)#/#% % 1273:G>%!! % D%! F;/".%#/;(O$;.')9#Y]<)<=)9#Y%)*+,/L% % 64>315G%!! % 513:@1%! F;/".%.,"=,.,/,)#%"&'%)*+,/L% 0% 5153:25%! 0% 11@3G57%! ! ! ! ! !