1 Notice to ASX Mineral Resources and Ore Reserves updates: supporting information and Table 1 checklists 19 February 2025 Rio Tinto today announces changes in Mineral Resources and Ore Reserves to support its 2024 annual reporting, including: • Increased Proved Ore Reserves and decreased Mineral Resources at the Rio Tinto Aluminium (RTA) Pacific Operations Amrun deposit in Queensland, Australia. • Increased Indicated Mineral Resources at the Rio Tinto Copper Winu project in Western Australia, Australia. • Increased Mineral Resources at the Rio Tinto Iron and Titanium Quebec Operations (RTITQO) in Quebec, Canada. • Increased Ore Reserves and decreased Mineral Resources at the RTA Atlantic Operations Porto Trombetas deposit in Brazil. Porto Trombetas is operated by the Mineração Rio do Norte (MRN) joint venture. The changes in Mineral Resources and Ore Reserves are reported in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, 2012 Edition (JORC Code) and the ASX Listing Rules. Supporting information relating to the changes of Mineral Resources and Ore Reserves is set out in this release and its appendices. Mineral Resources and Ore Reserves are quoted in this release on a 100 percent basis. Mineral Resources are reported in addition to Ore Reserves. The figures used to calculate Mineral Resources and Ore Reserves are often more precise than the rounded numbers shown in the tables, hence small differences may result if the calculations are repeated using the tabulated figures. These changes will be included in Rio Tinto’s 2024 Annual Report, to be released to the market on 19 February 2025 (London time), which will set out in full Rio Tinto’s Mineral Resources and Ore Reserves position as at 31 December 2024, and Rio Tinto’s interests. Rio Tinto Aluminium Pacific Operations – Amrun Mineral Resources and Ore Reserves for the RTA Pacific Operations, including the Amrun deposit, are presented in Table A and Table B. The updated Ore Reserves at Amrun reflect a material change in classification. Proved Ore Reserves have increased by 203 million tonnes (Mt) (77%), while Probable Ore Reserves have decreased by 176 Mt (26%). The change in Ore Reserves classification reflects a higher level of confidence in the modifying factors resulting from completion of an access study, and increased confidence in the underlying Mineral Resources as a result of updated orebody knowledge. There has been no material change to other modifying factors, including governmental, tenure, environmental, cultural heritage or community factors. Mineral Resources exclusive of Ore Reserves have decreased by 41 Mt (5%) at Amrun due to the conversion of Mineral Resources to Ore Reserves, and updated orebody knowledge. EXHIBIT 99.5

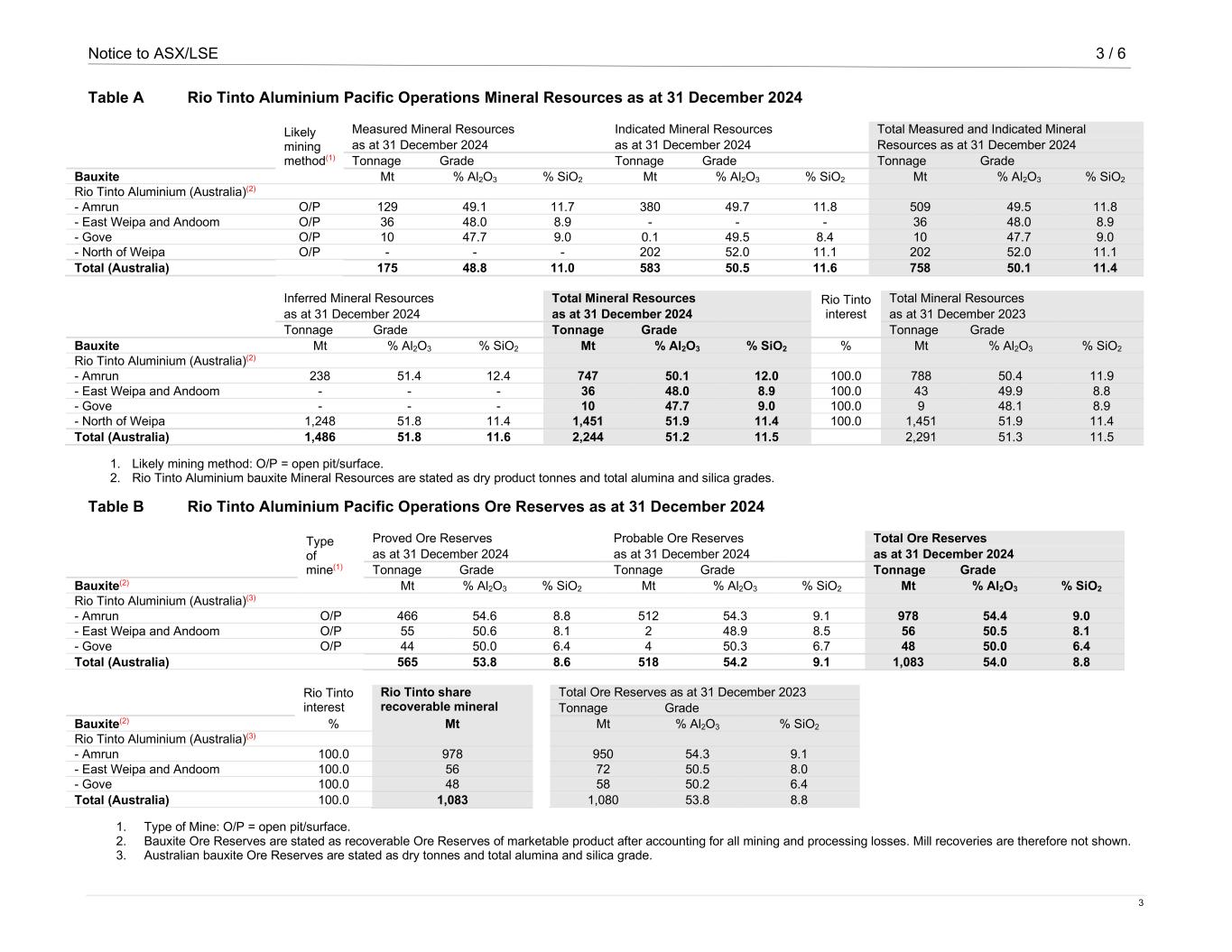

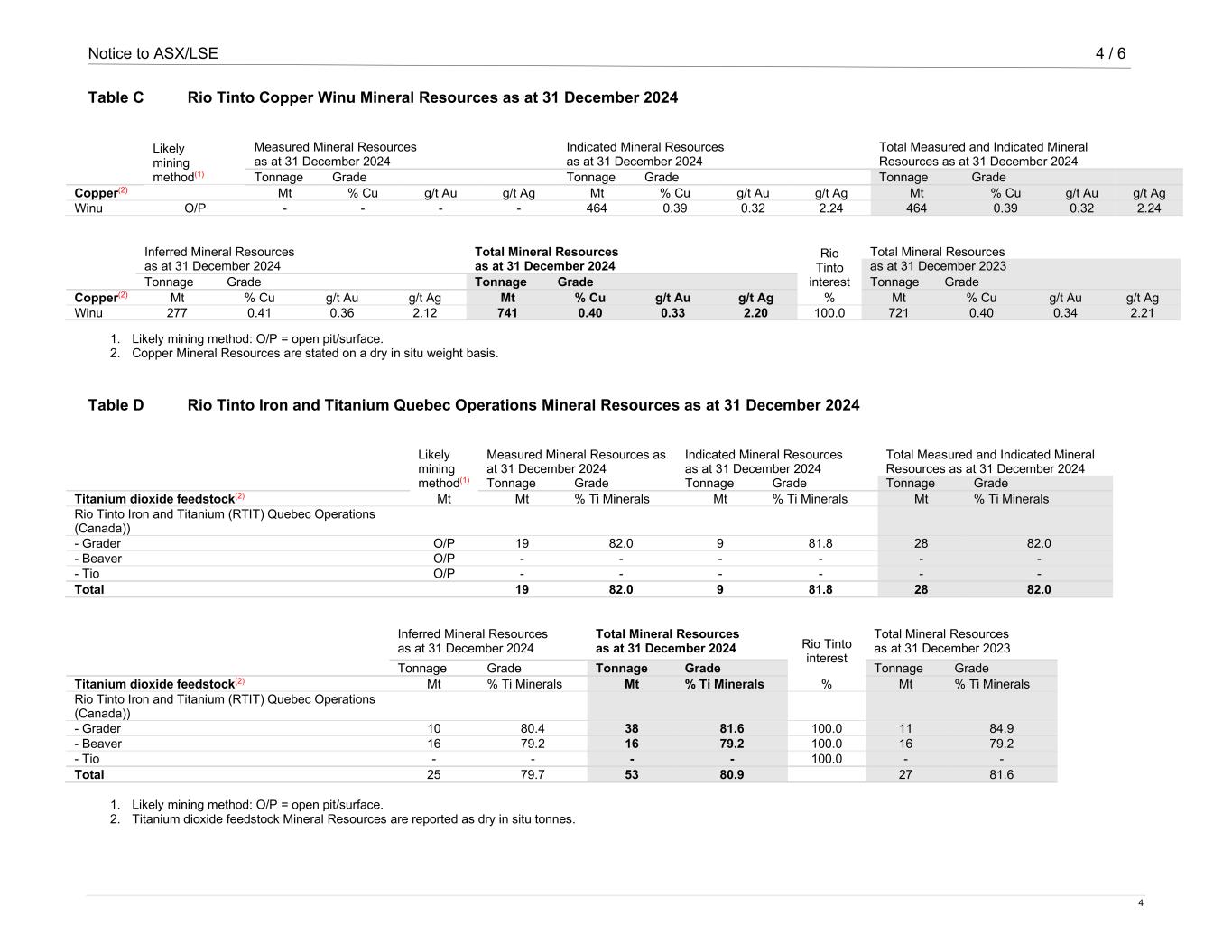

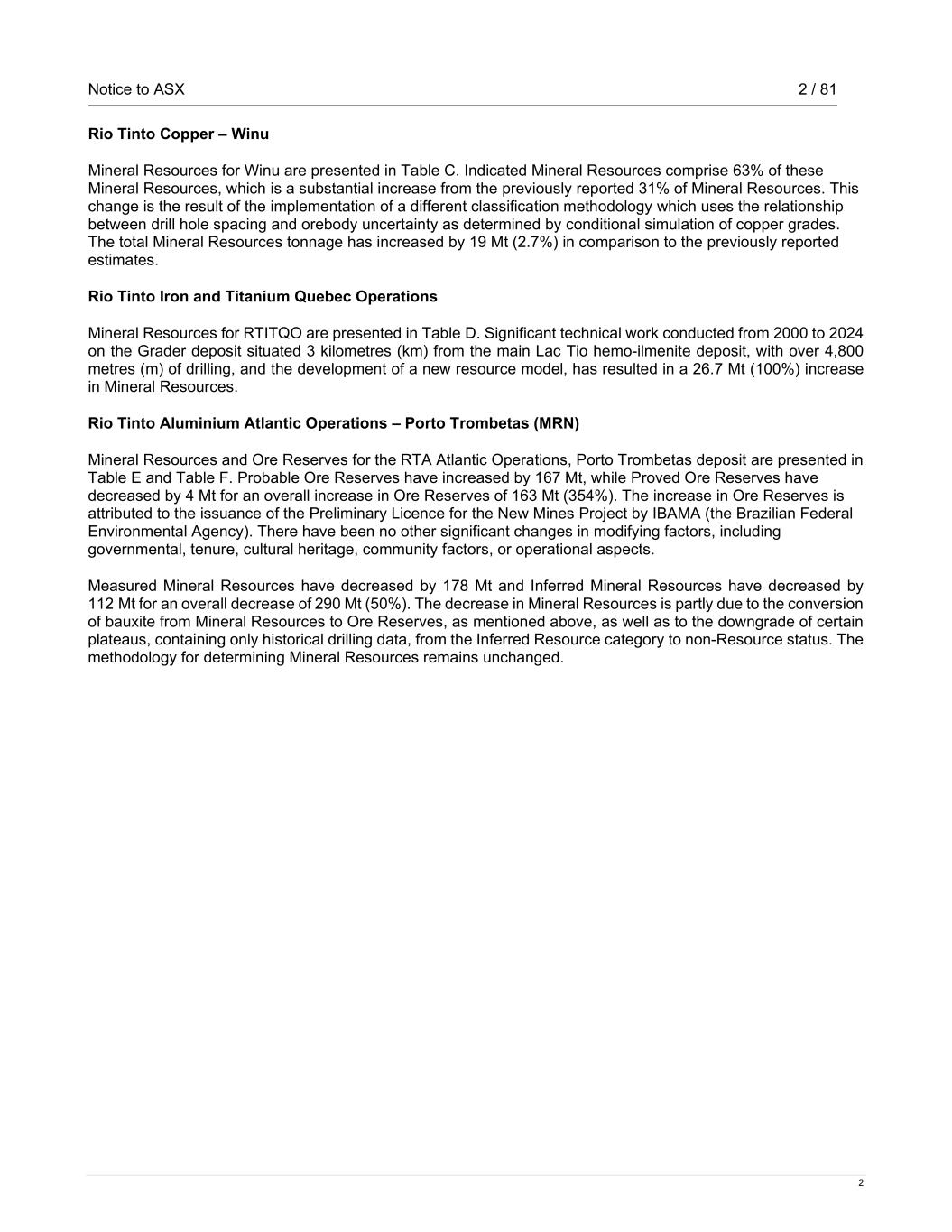

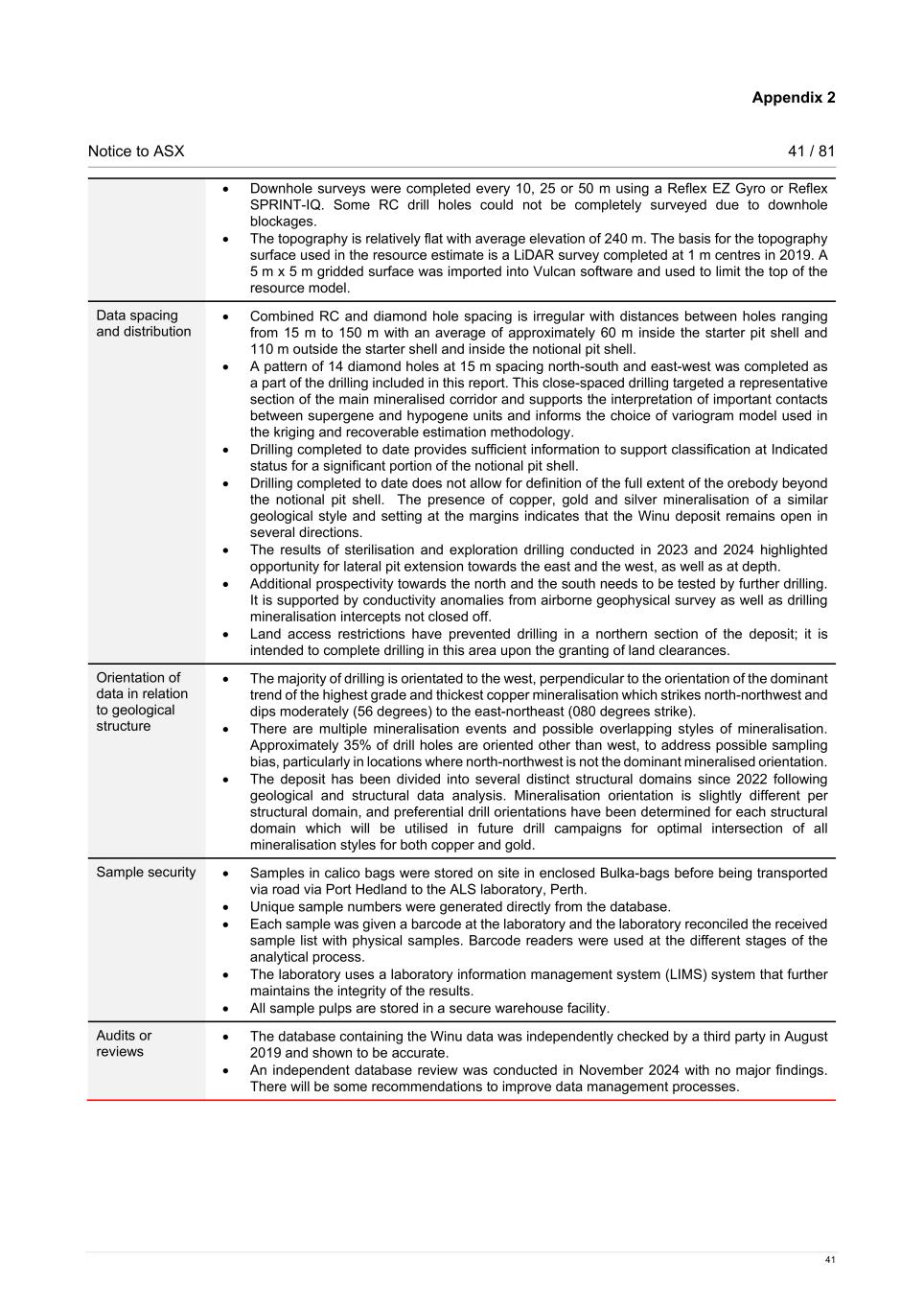

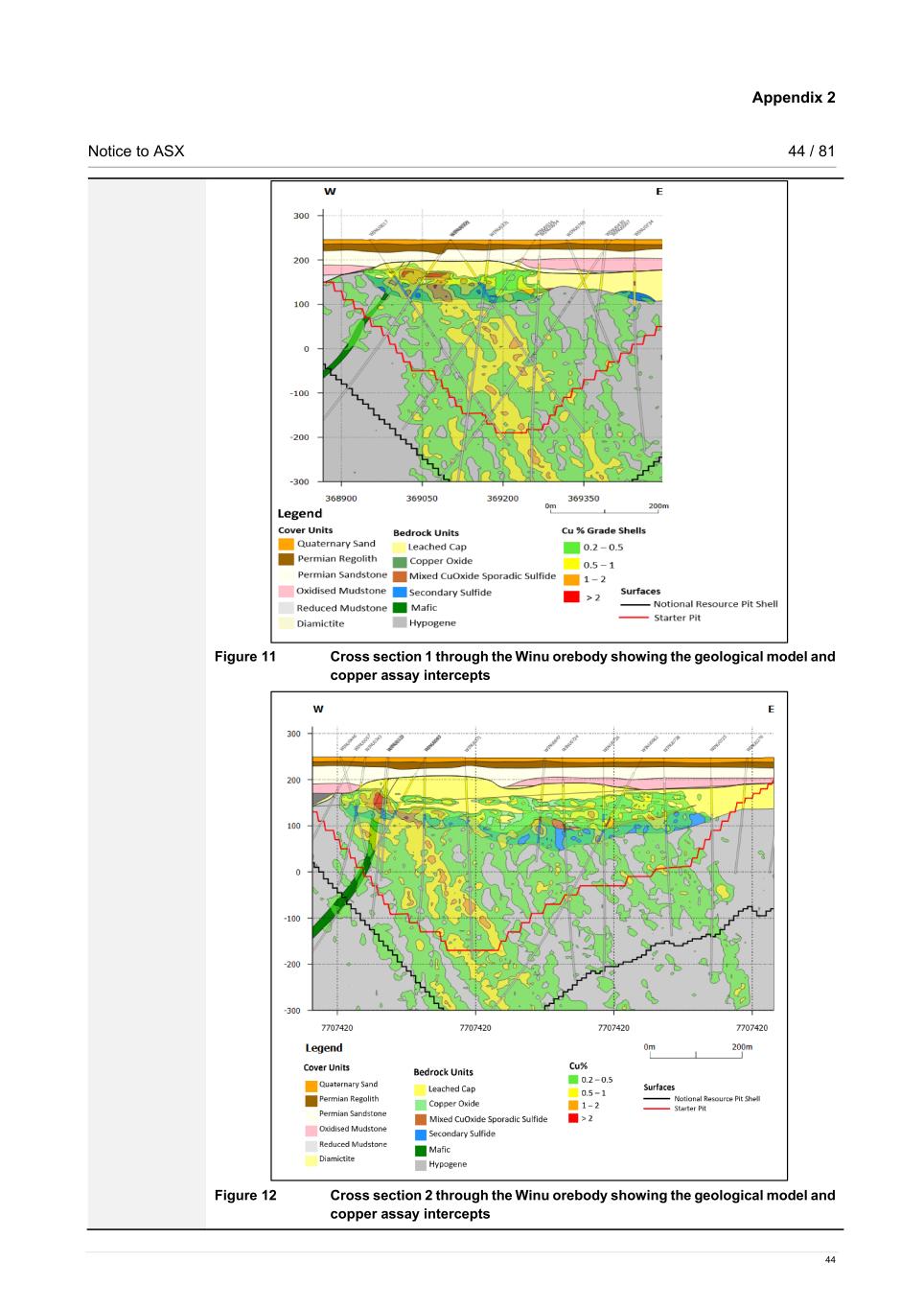

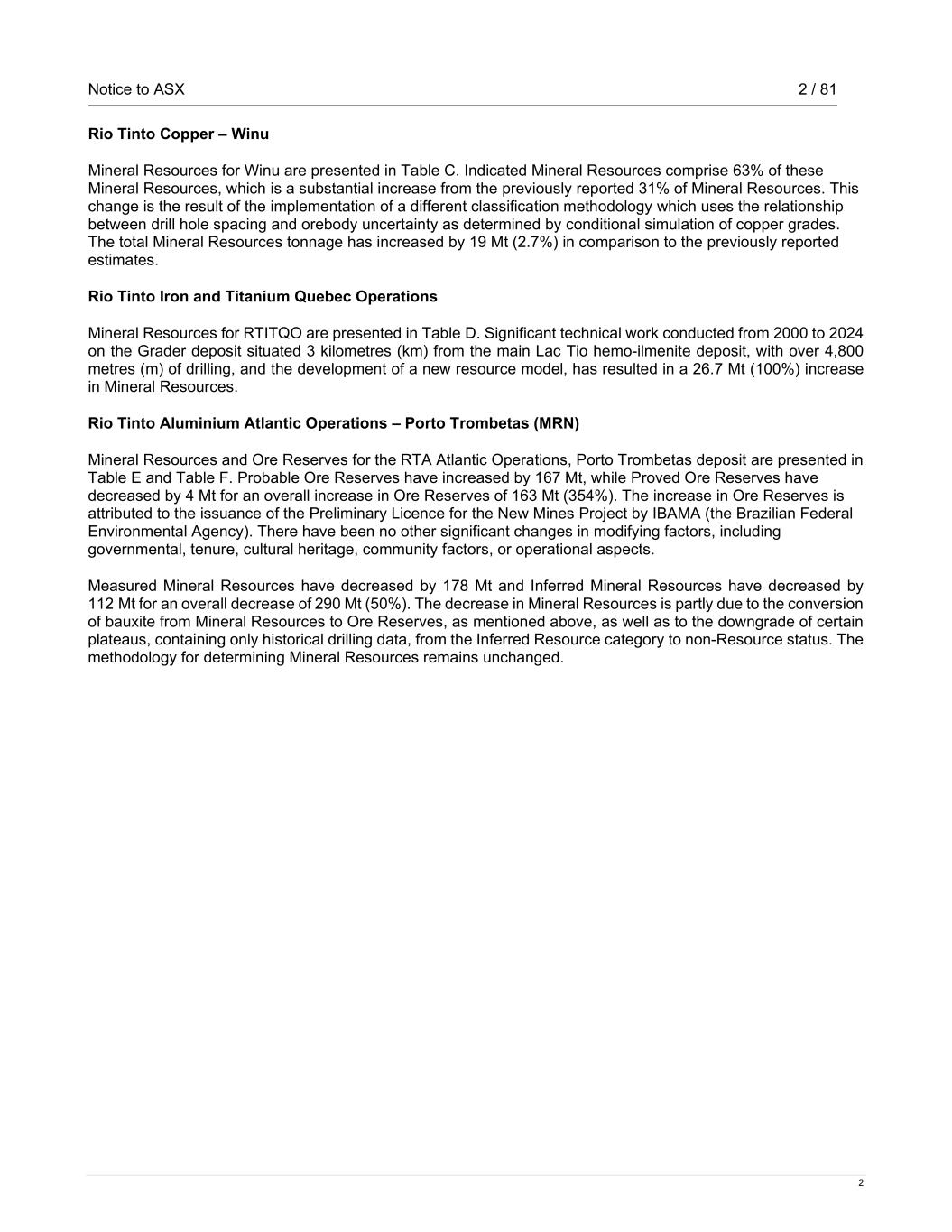

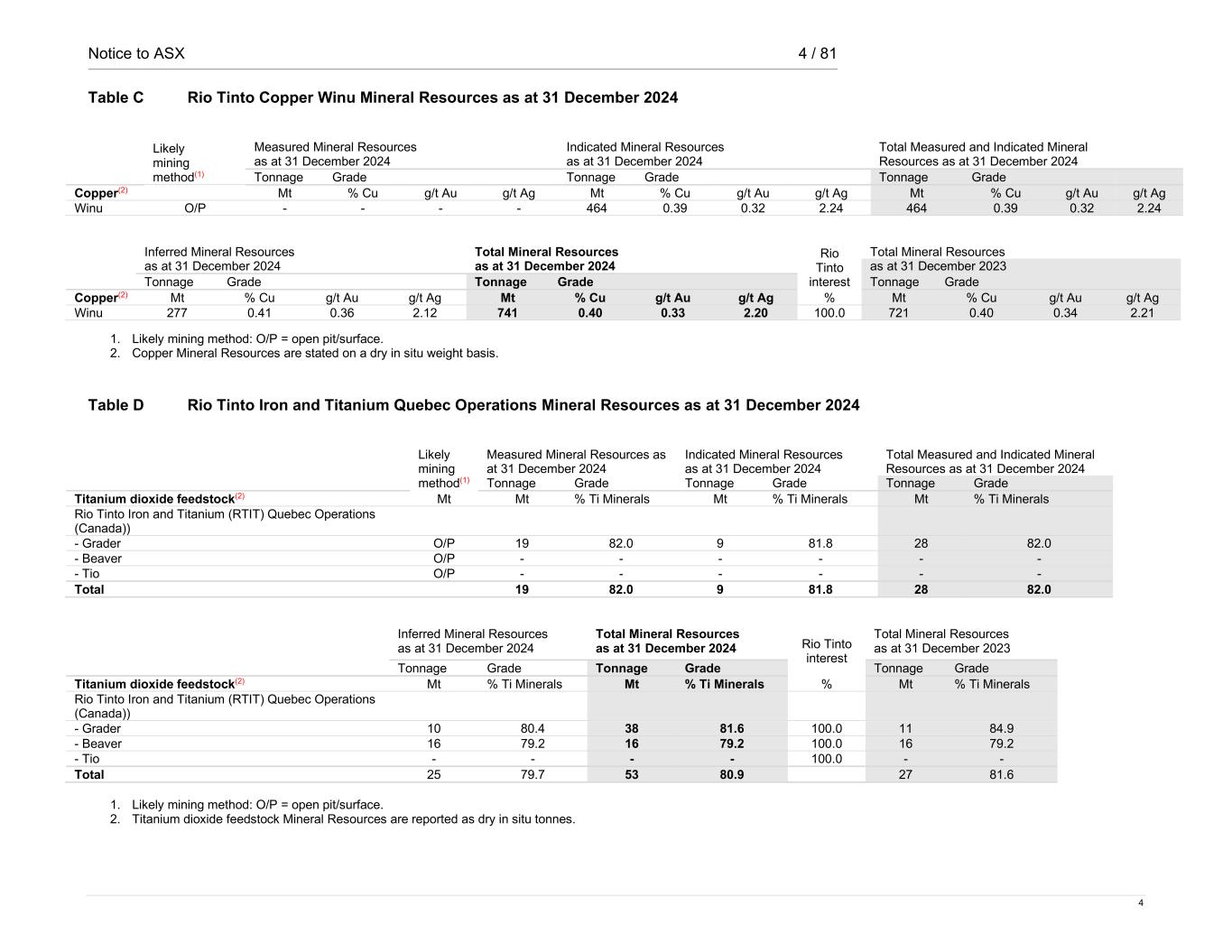

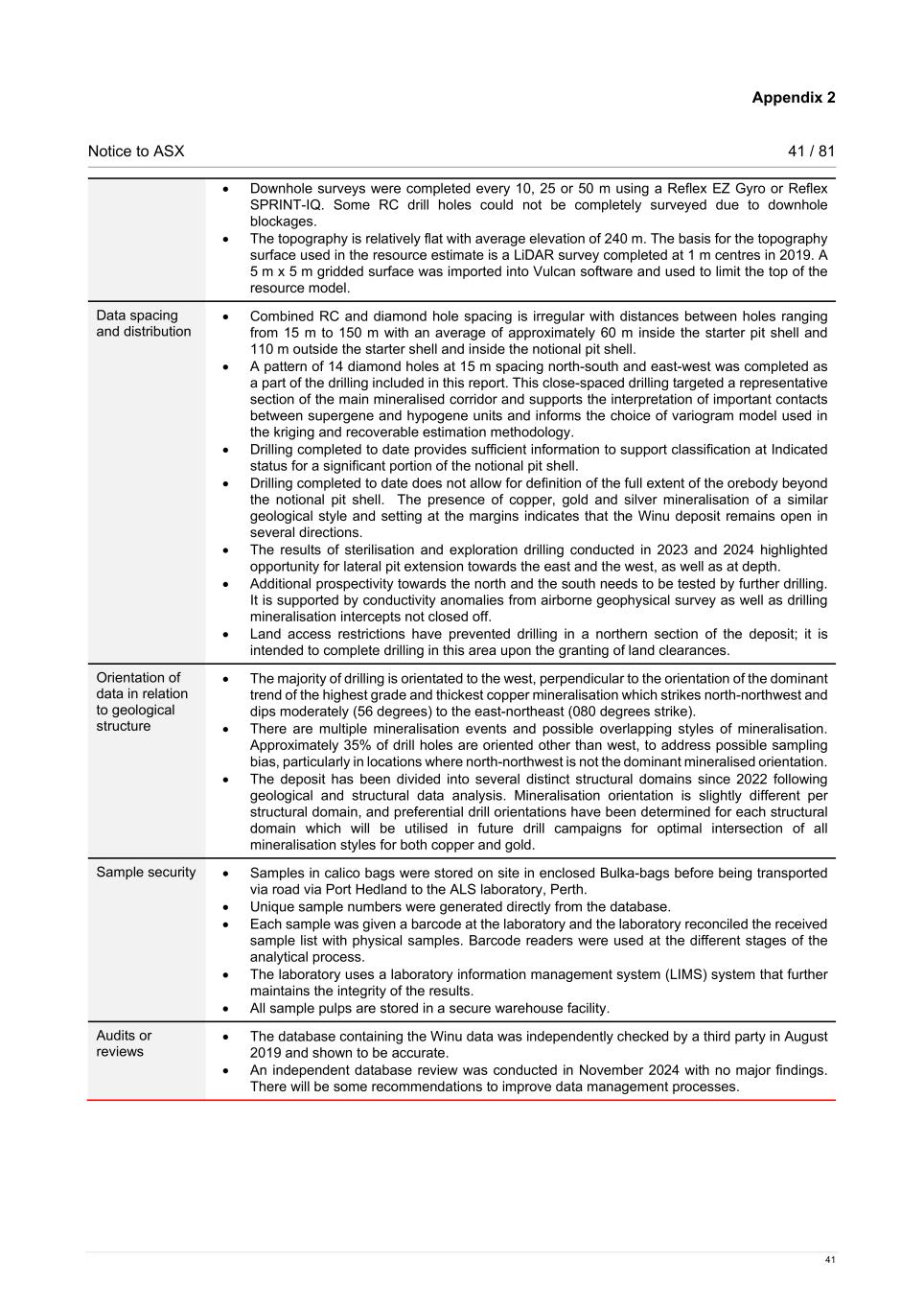

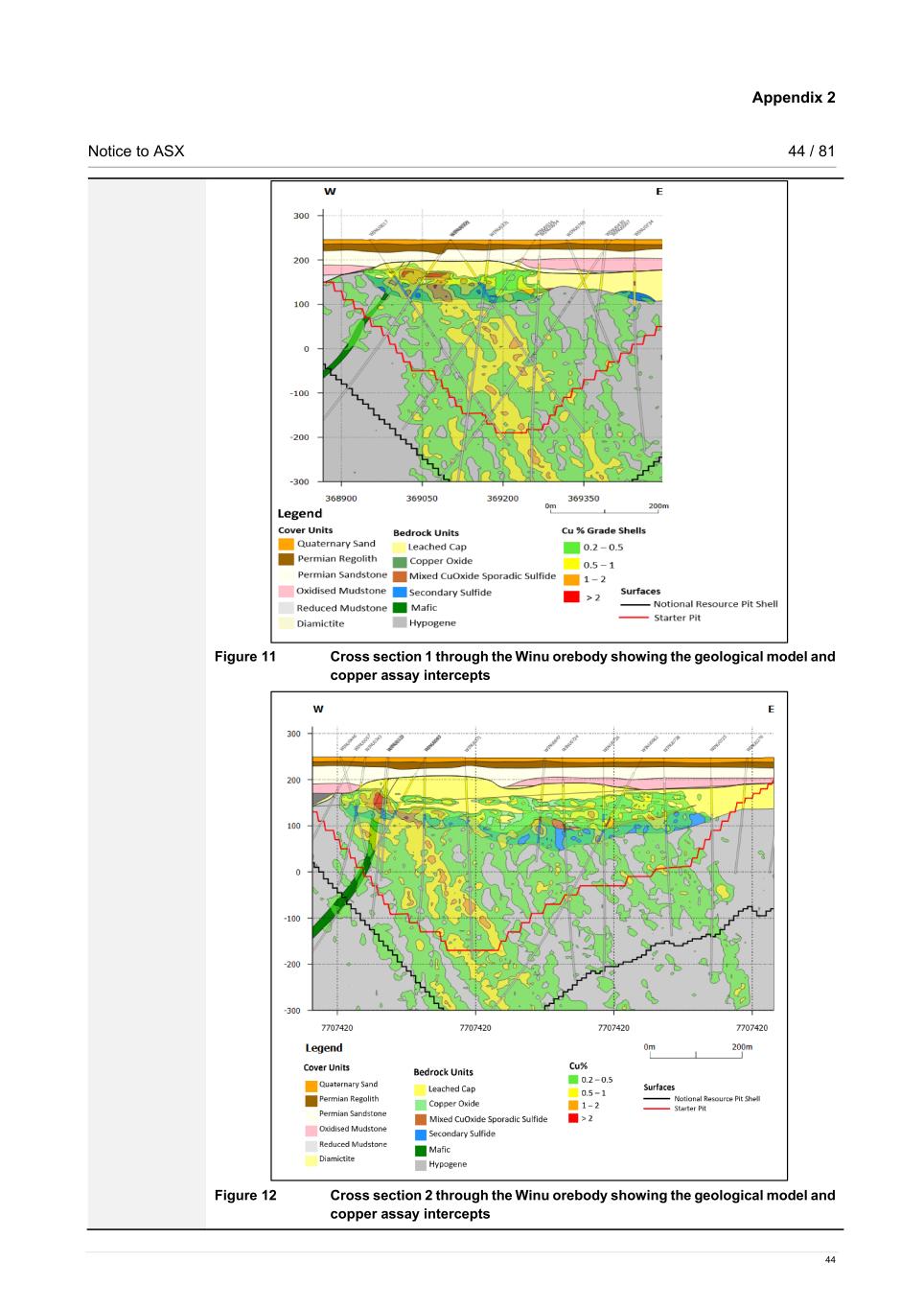

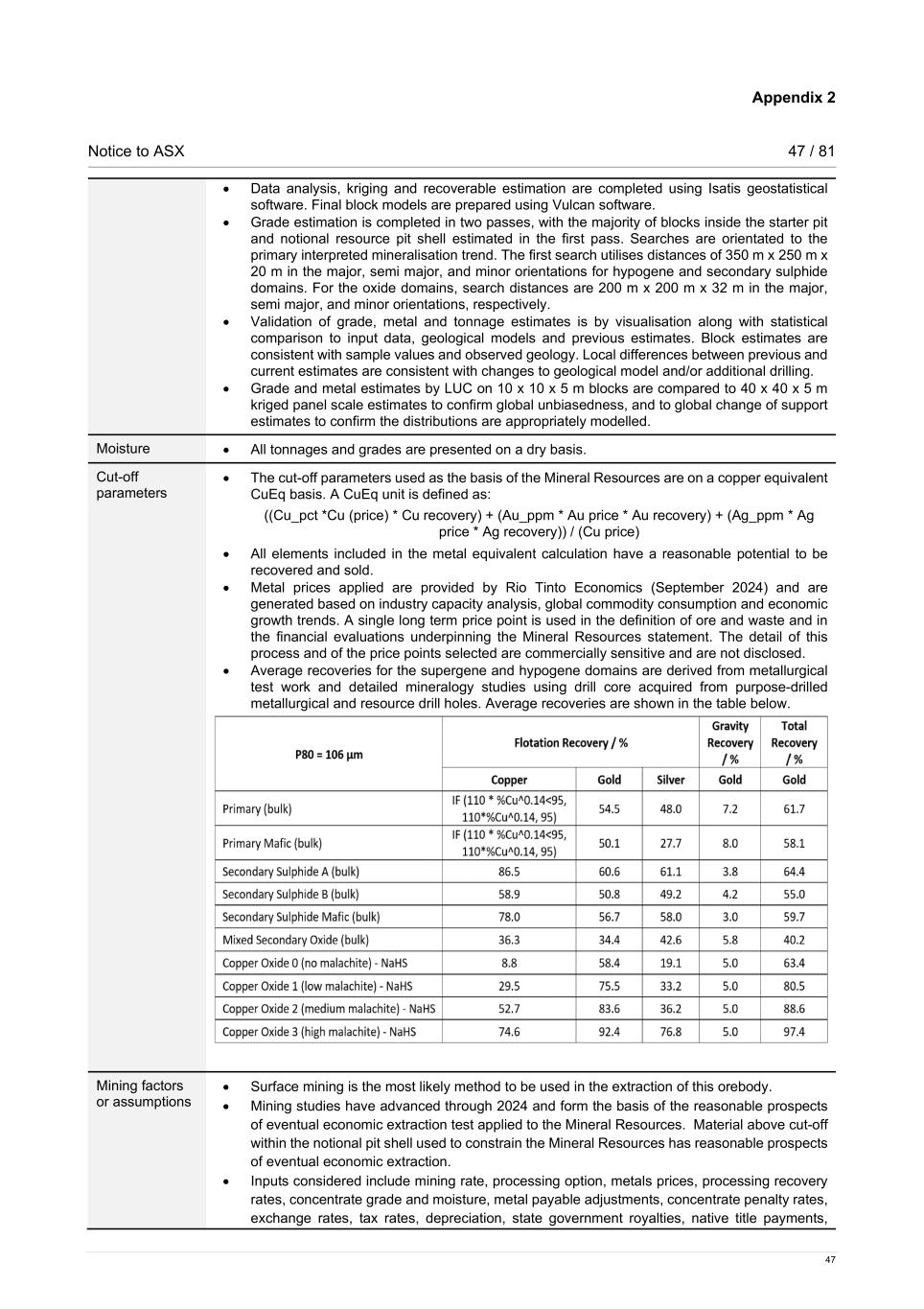

Notice to ASX 2 / 81 2 Rio Tinto Copper – Winu Mineral Resources for Winu are presented in Table C. Indicated Mineral Resources comprise 63% of these Mineral Resources, which is a substantial increase from the previously reported 31% of Mineral Resources. This change is the result of the implementation of a different classification methodology which uses the relationship between drill hole spacing and orebody uncertainty as determined by conditional simulation of copper grades. The total Mineral Resources tonnage has increased by 19 Mt (2.7%) in comparison to the previously reported estimates. Rio Tinto Iron and Titanium Quebec Operations Mineral Resources for RTITQO are presented in Table D. Significant technical work conducted from 2000 to 2024 on the Grader deposit situated 3 kilometres (km) from the main Lac Tio hemo-ilmenite deposit, with over 4,800 metres (m) of drilling, and the development of a new resource model, has resulted in a 26.7 Mt (100%) increase in Mineral Resources. Rio Tinto Aluminium Atlantic Operations – Porto Trombetas (MRN) Mineral Resources and Ore Reserves for the RTA Atlantic Operations, Porto Trombetas deposit are presented in Table E and Table F. Probable Ore Reserves have increased by 167 Mt, while Proved Ore Reserves have decreased by 4 Mt for an overall increase in Ore Reserves of 163 Mt (354%). The increase in Ore Reserves is attributed to the issuance of the Preliminary Licence for the New Mines Project by IBAMA (the Brazilian Federal Environmental Agency). There have been no other significant changes in modifying factors, including governmental, tenure, cultural heritage, community factors, or operational aspects. Measured Mineral Resources have decreased by 178 Mt and Inferred Mineral Resources have decreased by 112 Mt for an overall decrease of 290 Mt (50%). The decrease in Mineral Resources is partly due to the conversion of bauxite from Mineral Resources to Ore Reserves, as mentioned above, as well as to the downgrade of certain plateaus, containing only historical drilling data, from the Inferred Resource category to non-Resource status. The methodology for determining Mineral Resources remains unchanged.

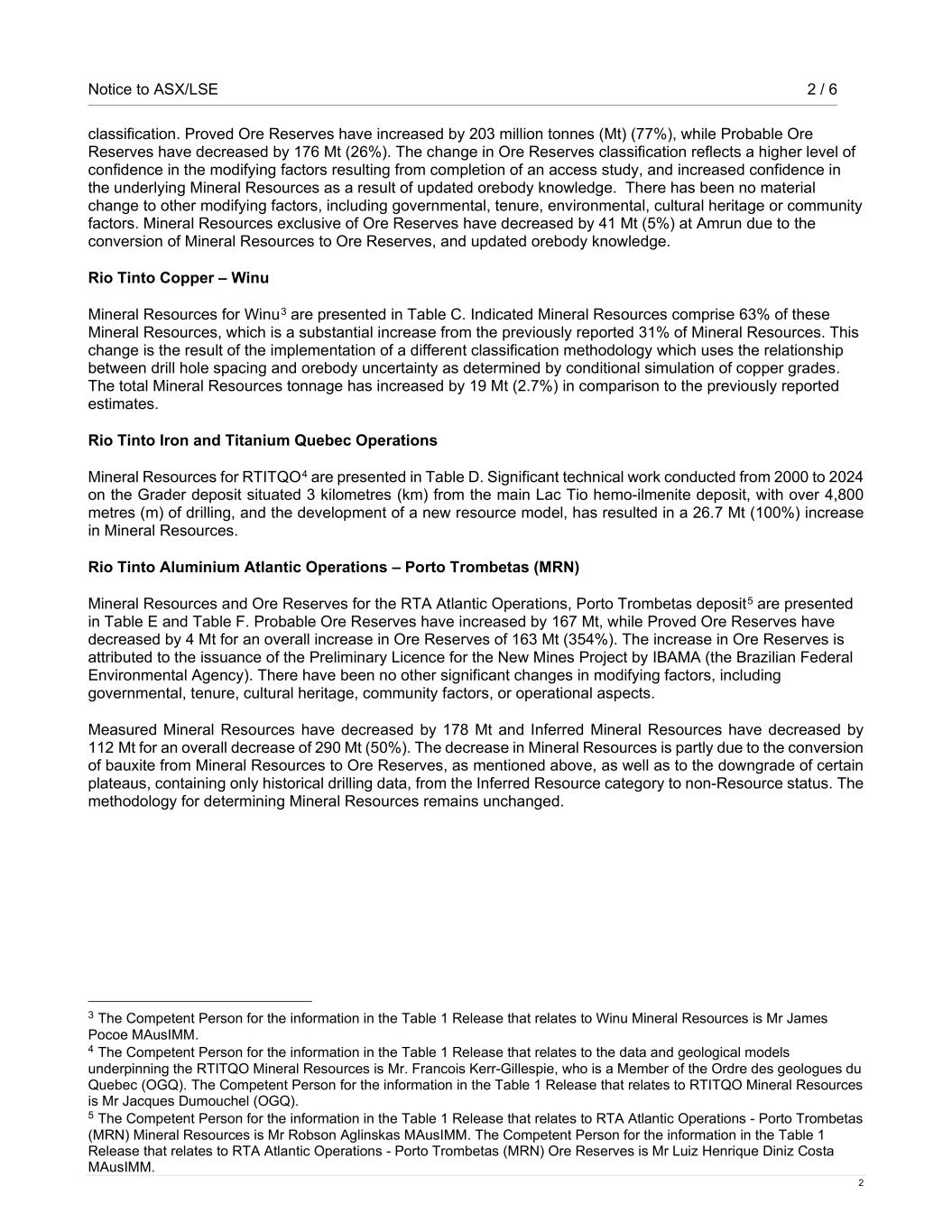

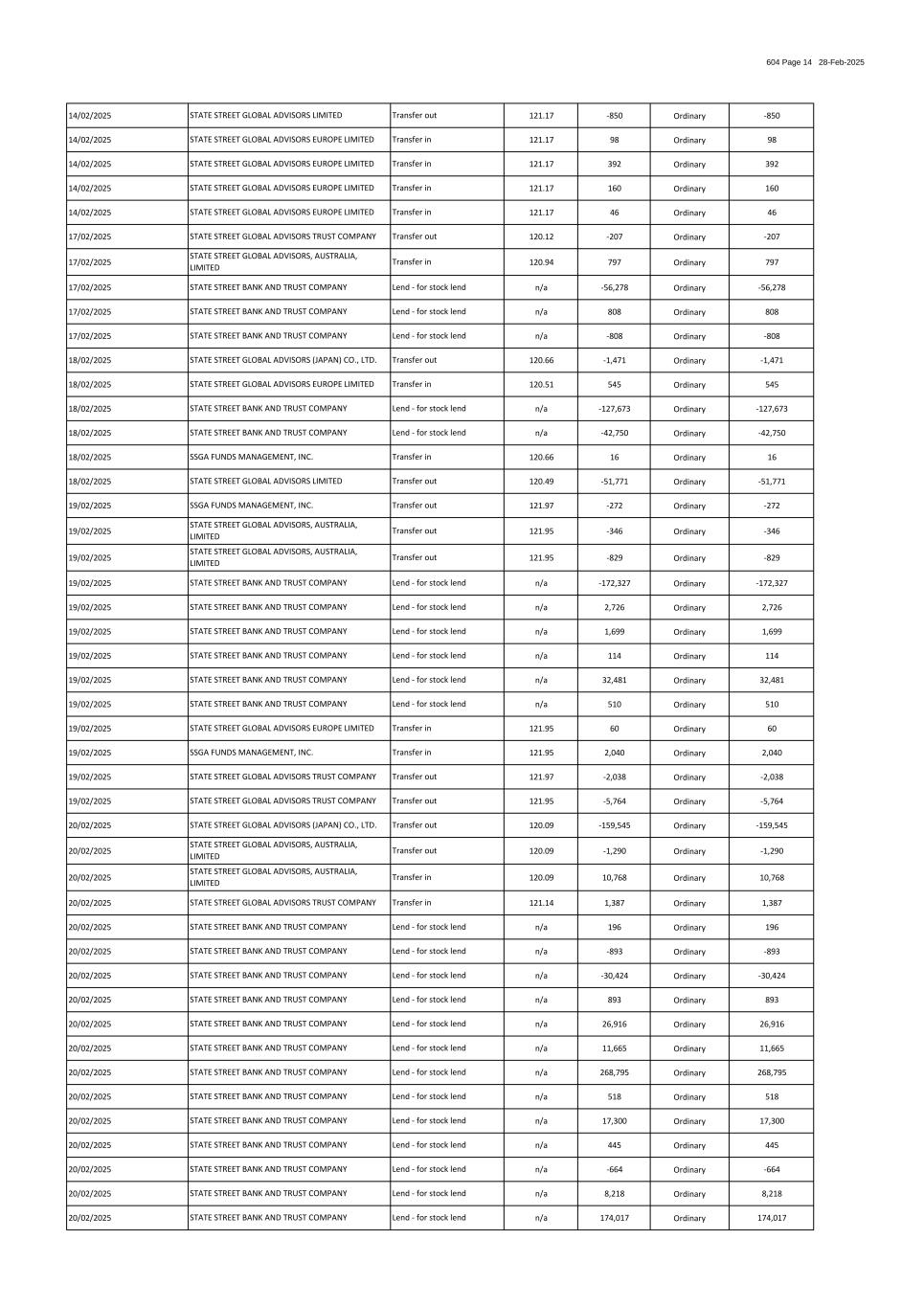

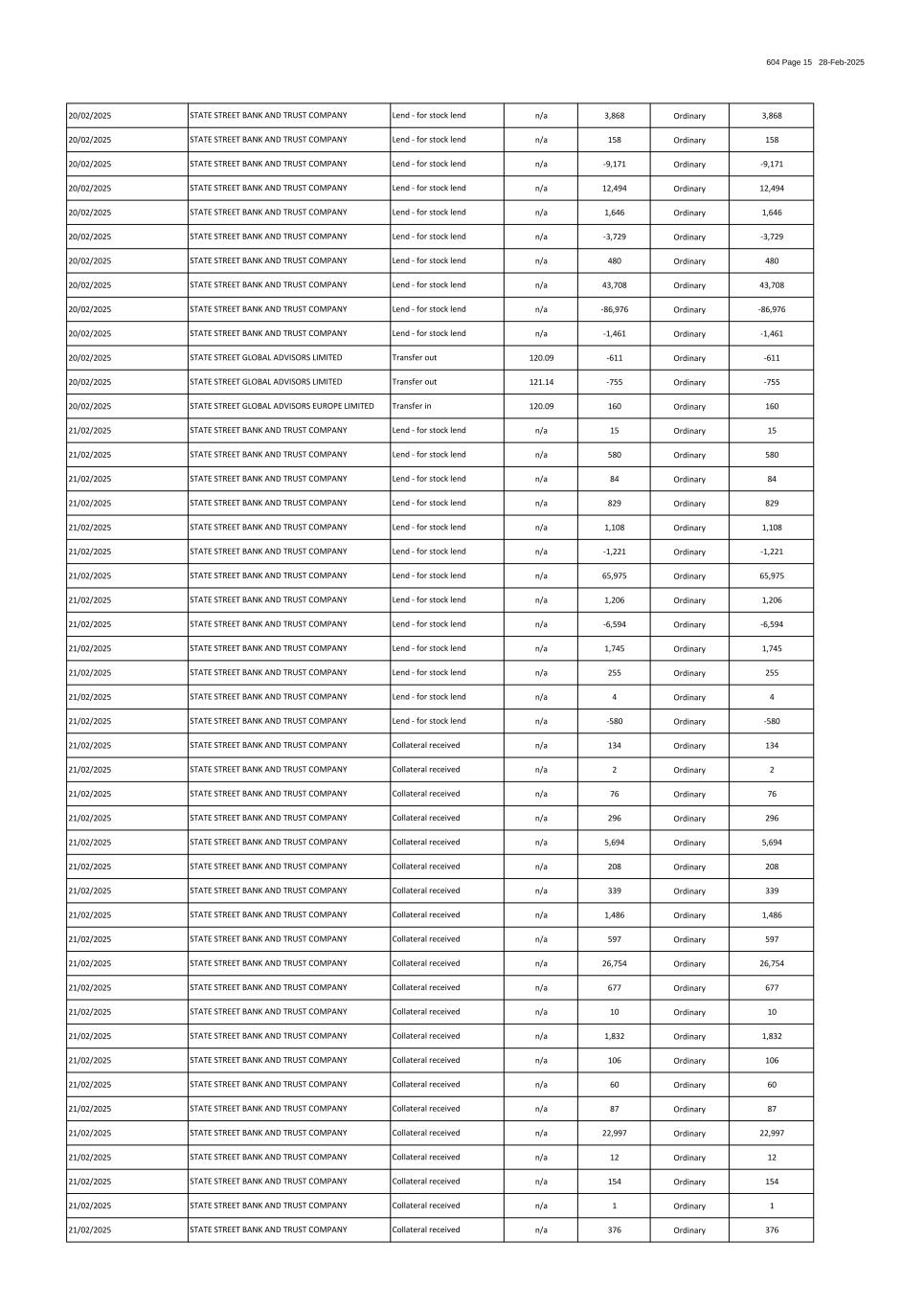

Notice to ASX 3 / 81 3 Table A Rio Tinto Aluminium Pacific Operations Mineral Resources as at 31 December 2024 Likely mining method(1) Measured Mineral Resources Indicated Mineral Resources Total Measured and Indicated Mineral as at 31 December 2024 as at 31 December 2024 Resources as at 31 December 2024 Tonnage Grade Tonnage Grade Tonnage Grade Bauxite Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Rio Tinto Aluminium (Australia)(2) - Amrun O/P 129 49.1 11.7 380 49.7 11.8 509 49.5 11.8 - East Weipa and Andoom O/P 36 48.0 8.9 - - - 36 48.0 8.9 - Gove O/P 10 47.7 9.0 0.1 49.5 8.4 10 47.7 9.0 - North of Weipa O/P - - - 202 52.0 11.1 202 52.0 11.1 Total (Australia) 175 48.8 11.0 583 50.5 11.6 758 50.1 11.4 Inferred Mineral Resources Total Mineral Resources Rio Tinto interest Total Mineral Resources as at 31 December 2024 as at 31 December 2024 as at 31 December 2023 Tonnage Grade Tonnage Grade Tonnage Grade Bauxite Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 % Mt % Al2O3 % SiO2 Rio Tinto Aluminium (Australia)(2) - Amrun 238 51.4 12.4 747 50.1 12.0 100.0 788 50.4 11.9 - East Weipa and Andoom - - - 36 48.0 8.9 100.0 43 49.9 8.8 - Gove - - - 10 47.7 9.0 100.0 9 48.1 8.9 - North of Weipa 1,248 51.8 11.4 1,451 51.9 11.4 100.0 1,451 51.9 11.4 Total (Australia) 1,486 51.8 11.6 2,244 51.2 11.5 2,291 51.3 11.5 1. Likely mining method: O/P = open pit/surface. 2. Rio Tinto Aluminium bauxite Mineral Resources are stated as dry product tonnes and total alumina and silica grades. Table B Rio Tinto Aluminium Pacific Operations Ore Reserves as at 31 December 2024 Type of mine(1) Proved Ore Reserves Probable Ore Reserves Total Ore Reserves as at 31 December 2024 as at 31 December 2024 as at 31 December 2024 Tonnage Grade Tonnage Grade Tonnage Grade Bauxite(2) Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Rio Tinto Aluminium (Australia)(3) - Amrun O/P 466 54.6 8.8 512 54.3 9.1 978 54.4 9.0 - East Weipa and Andoom O/P 55 50.6 8.1 2 48.9 8.5 56 50.5 8.1 - Gove O/P 44 50.0 6.4 4 50.3 6.7 48 50.0 6.4 Total (Australia) 565 53.8 8.6 518 54.2 9.1 1,083 54.0 8.8 Rio Tinto interest Rio Tinto share recoverable mineral Total Ore Reserves as at 31 December 2023 Tonnage Grade Bauxite(2) % Mt Mt % Al2O3 % SiO2 Rio Tinto Aluminium (Australia)(3) - Amrun 100.0 978 950 54.3 9.1 - East Weipa and Andoom 100.0 56 72 50.5 8.0 - Gove 100.0 48 58 50.2 6.4 Total (Australia) 100.0 1,083 1,080 53.8 8.8 1. Type of Mine: O/P = open pit/surface. 2. Bauxite Ore Reserves are stated as recoverable Ore Reserves of marketable product after accounting for all mining and processing losses. Mill recoveries are therefore not shown. 3. Australian bauxite Ore Reserves are stated as dry tonnes and total alumina and silica grade.

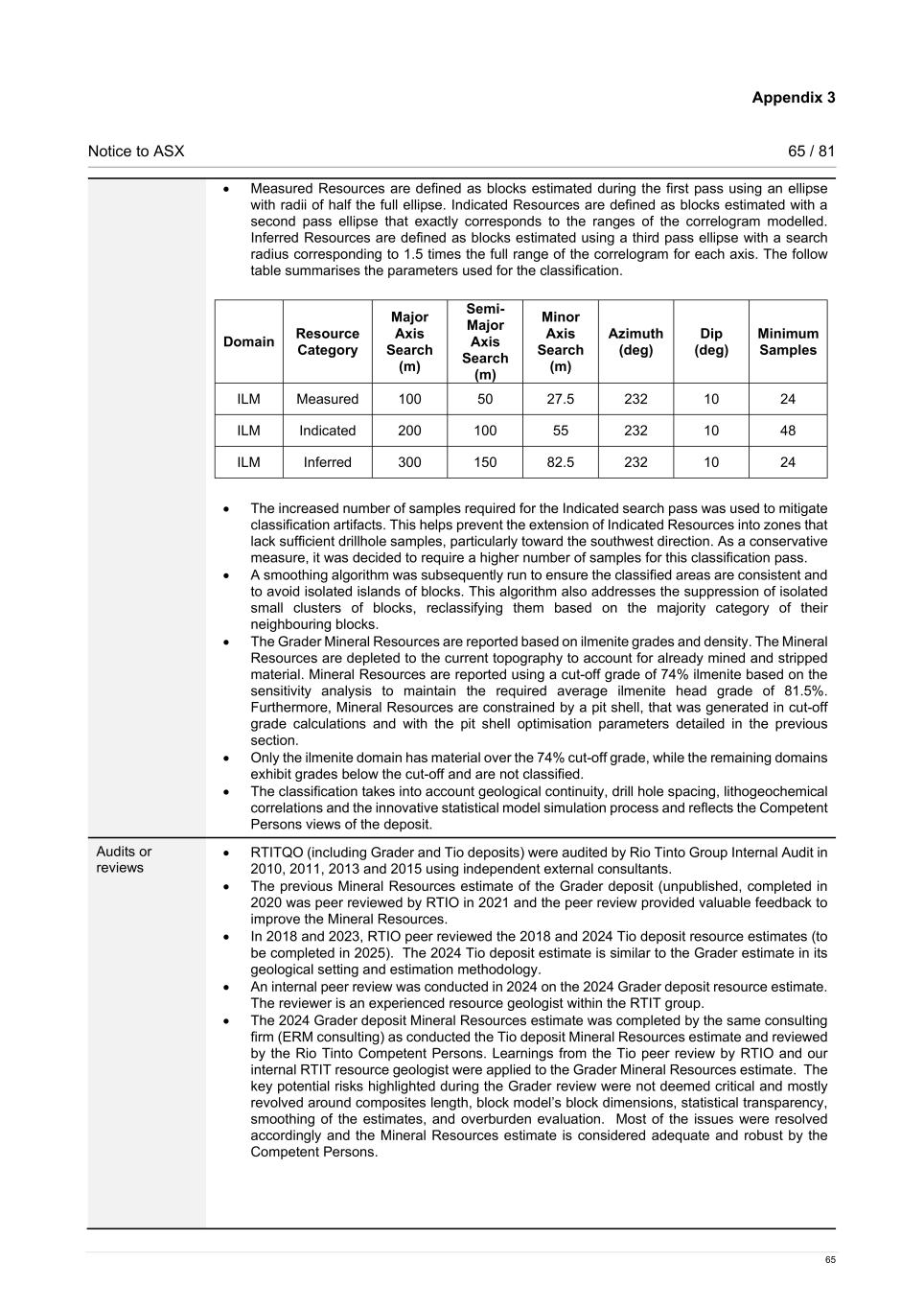

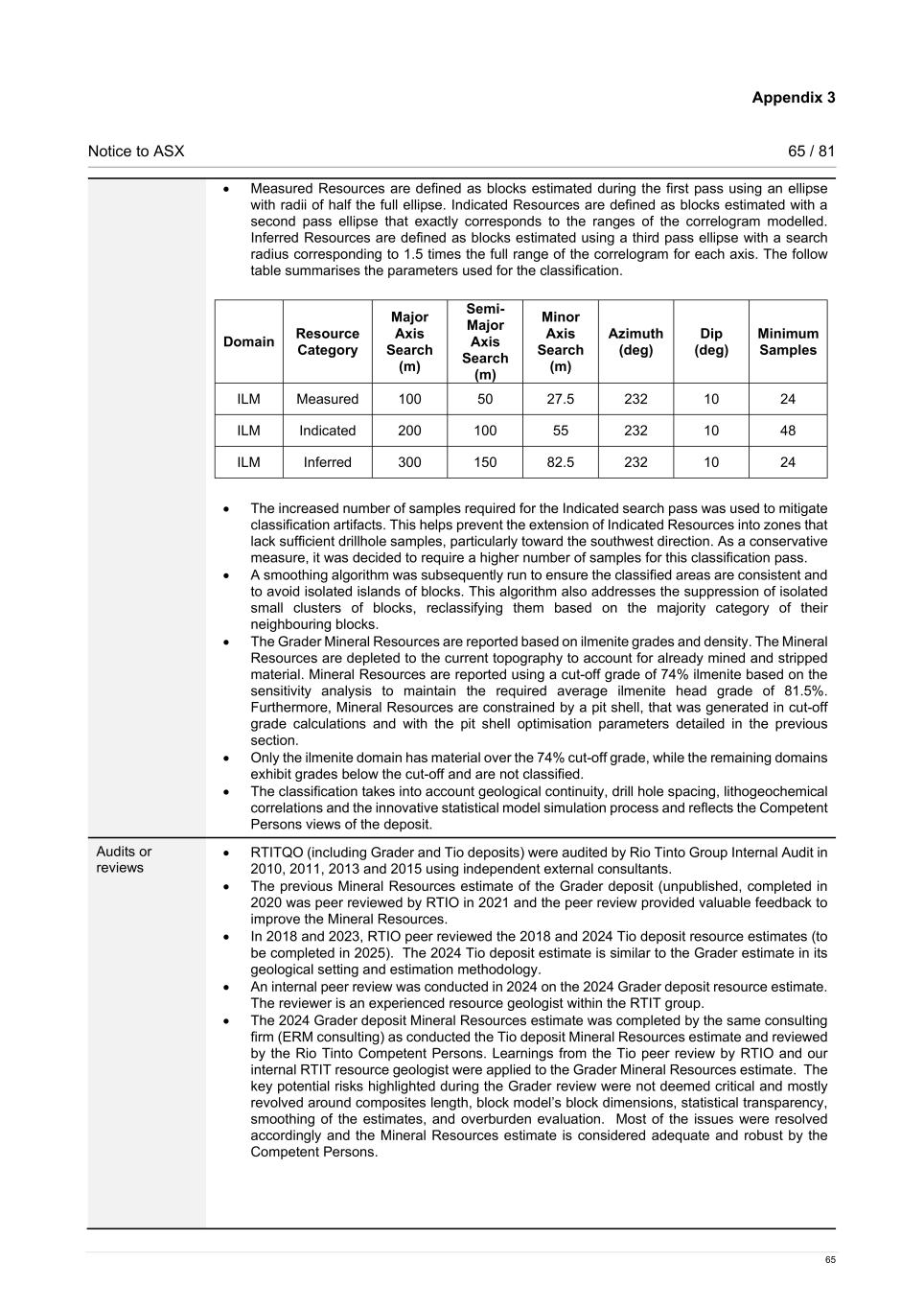

Notice to ASX 4 / 81 4 Table C Rio Tinto Copper Winu Mineral Resources as at 31 December 2024 Likely mining method(1) Measured Mineral Resources Indicated Mineral Resources Total Measured and Indicated Mineral as at 31 December 2024 as at 31 December 2024 Resources as at 31 December 2024 Tonnage Grade Tonnage Grade Tonnage Grade Copper(2) Mt % Cu g/t Au g/t Ag Mt % Cu g/t Au g/t Ag Mt % Cu g/t Au g/t Ag Winu O/P - - - - 464 0.39 0.32 2.24 464 0.39 0.32 2.24 Inferred Mineral Resources Total Mineral Resources Rio Tinto interest Total Mineral Resources as at 31 December 2024 as at 31 December 2024 as at 31 December 2023 Tonnage Grade Tonnage Grade Tonnage Grade Copper(2) Mt % Cu g/t Au g/t Ag Mt % Cu g/t Au g/t Ag % Mt % Cu g/t Au g/t Ag Winu 277 0.41 0.36 2.12 741 0.40 0.33 2.20 100.0 721 0.40 0.34 2.21 1. Likely mining method: O/P = open pit/surface. 2. Copper Mineral Resources are stated on a dry in situ weight basis. Table D Rio Tinto Iron and Titanium Quebec Operations Mineral Resources as at 31 December 2024 Likely mining method(1) Measured Mineral Resources as at 31 December 2024 Indicated Mineral Resources as at 31 December 2024 Total Measured and Indicated Mineral Resources as at 31 December 2024 Tonnage Grade Tonnage Grade Tonnage Grade Titanium dioxide feedstock(2) Mt Mt % Ti Minerals Mt % Ti Minerals Mt % Ti Minerals Rio Tinto Iron and Titanium (RTIT) Quebec Operations (Canada)) - Grader O/P 19 82.0 9 81.8 28 82.0 - Beaver O/P - - - - - - - Tio O/P - - - - - - Total 19 82.0 9 81.8 28 82.0 Inferred Mineral Resources as at 31 December 2024 Total Mineral Resources as at 31 December 2024 Rio Tinto interest Total Mineral Resources as at 31 December 2023 Tonnage Grade Tonnage Grade Tonnage Grade Titanium dioxide feedstock(2) Mt % Ti Minerals Mt % Ti Minerals % Mt % Ti Minerals Rio Tinto Iron and Titanium (RTIT) Quebec Operations (Canada)) - Grader 10 80.4 38 81.6 100.0 11 84.9 - Beaver 16 79.2 16 79.2 100.0 16 79.2 - Tio - - - - 100.0 - - Total 25 79.7 53 80.9 27 81.6 1. Likely mining method: O/P = open pit/surface. 2. Titanium dioxide feedstock Mineral Resources are reported as dry in situ tonnes.

Notice to ASX 5 / 81 5 Table E Rio Tinto Aluminium Atlantic Operations Porto Trombetas (MRN) Mineral Resources as at 31 December 2024 Likely mining method(1) Measured Mineral Resources Indicated Mineral Resources Total Measured and Indicated Mineral as at 31 December 2024 as at 31 December 2024 Resources as at 31 December 2024 Tonnage Grade Tonnage Grade Tonnage Grade Bauxite Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Porto Trombetas (MRN) (Brazil)(2) O/P 244 46.8 5.9 3 49.1 2.5 247 46.8 5.9 Inferred Mineral Resources Total Mineral Resources Rio Tinto interest Total Mineral Resources as at 31 December 2024 as at 31 December 2024 as at 31 December 2023 Tonnage Grade Tonnage Grade Tonnage Grade Bauxite Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 % Mt % Al2O3 % SiO2 Porto Trombetas (MRN) (Brazil)(2) 34 47.3 5.2 282 46.9 5.8 22.0 571 47.9 5.0 1. Likely mining method: O/P = open pit/surface. 2. Porto Trombetas (MRN) Mineral Resources are stated as dry in situ tonnes, available alumina grade and total reactive silica grade. Table F Rio Tinto Aluminium Atlantic Operations Porto Trombetas (MRN) Ore Reserves as at 31 December 2024 Type of mine(1) Proved Ore Reserves Probable Ore Reserves Total Ore Reserves as at 31 December 2024 as at 31 December 2024 as at 31 December 2024 Tonnage Grade Tonnage Grade Tonnage Grade Bauxite(2) Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Porto Trombetas (MRN) (Brazil)(3) O/P 39 48.0 5.2 170 49.1 4.6 209 48.9 4.7 Rio Tinto interest Rio Tinto share recoverable mineral Total Ore Reserves as at 31 December 2023 Tonnage Grade Bauxite(2) % Mt Mt % Al2O3 % SiO2 Porto Trombetas (MRN) (Brazil)(3) 22.0 46 46 48.9 4.9 1. Type of Mine: O/P = open pit/surface. 2. Bauxite Ore Reserves are stated as recoverable Ore Reserves of marketable product after accounting for all mining and processing losses. Mill recoveries are therefore not shown. 3. Porto Trombetas (MRN) Ore Reserves are stated as dry tonnes, available alumina grade and reactive silica grade.

Notice to ASX 6 / 81 6 Rio Tinto Aluminium Pacific Operations - Amrun RTA Pacific Operations Mineral Resources and Ore Reserves are contained within two bauxite deposits, one at Gove (North Territory, Australia) and one at Weipa (Queensland, Australia; Figure 1). The Weipa deposit consist of three primary areas: Amrun, East Weipa/Andoom and North of Weipa. The change in Ore Reserves classification reflects a higher level of confidence in the modifying factors resulting from completion of an access study, and increased confidence in the underlying Mineral Resources as a result of updated orebody knowledge. There has been no material change to other modifying factors, including governmental, tenure, environmental, cultural heritage or community. The decrease in Amrun Mineral Resources coincides with the uptake of bauxite ore from Mineral Resources into Ore Reserves, due to an increase in orebody knowledge. The methodology of determining Mineral Resources has not changed. The bauxite assets have been in operation for more than fifty years and are well understood. Resource work is currently more focussed on asset evaluation rather than exploration, systematically bringing the bauxite classification to higher levels of confidence. Table G and Table H summarise the changes to the Mineral Resources and Ore Reserves. Figure 1 Property location map – Weipa operations

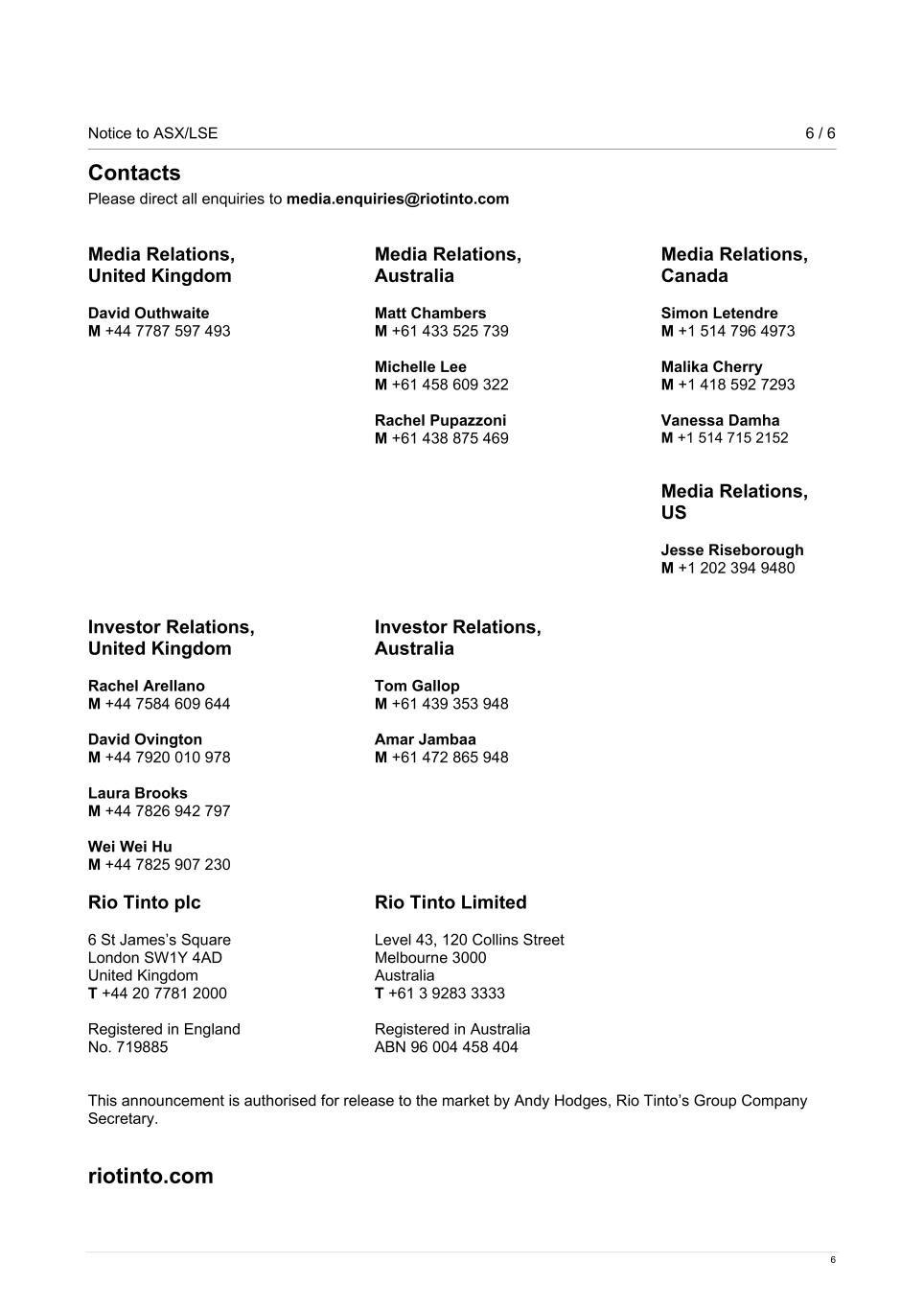

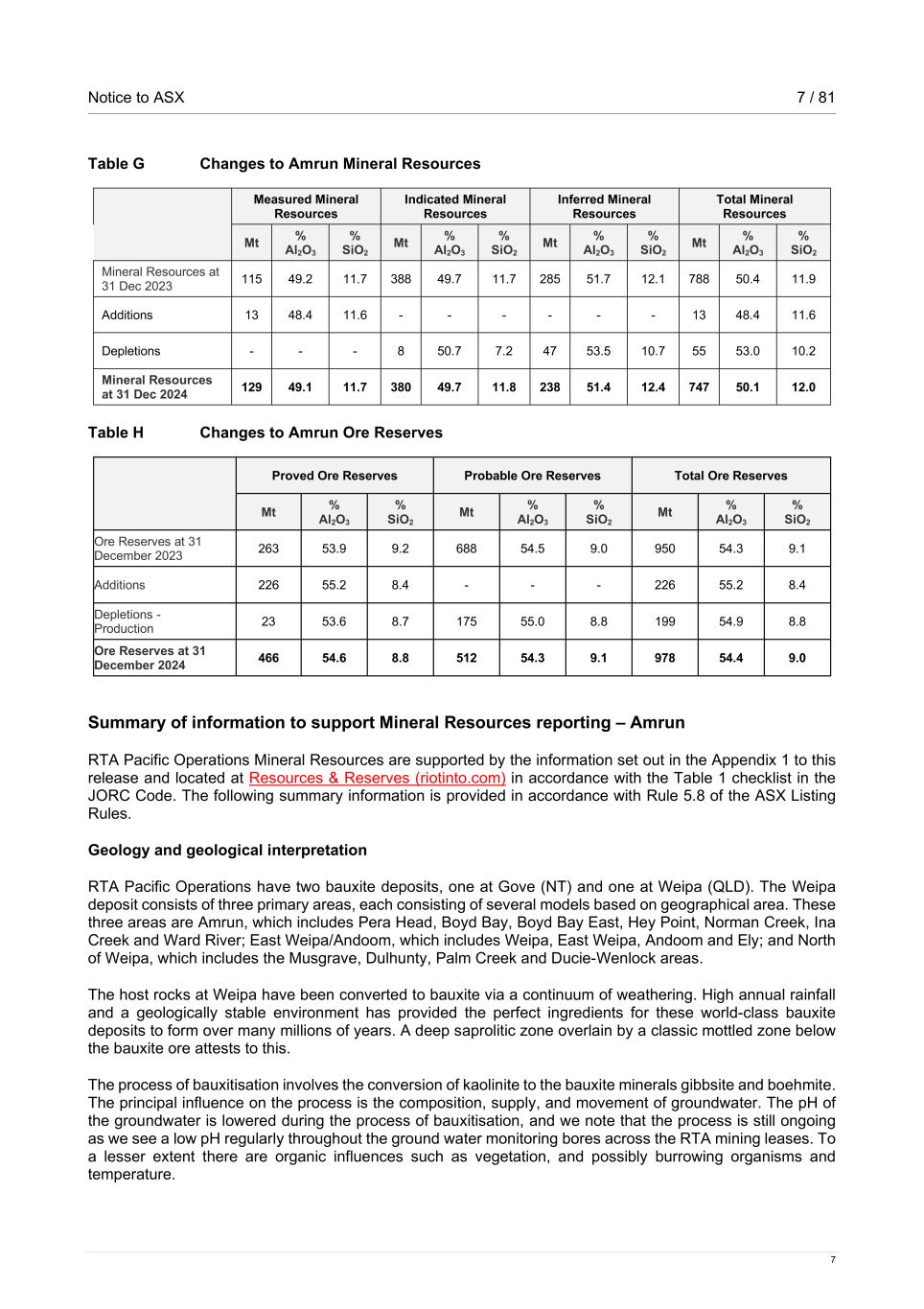

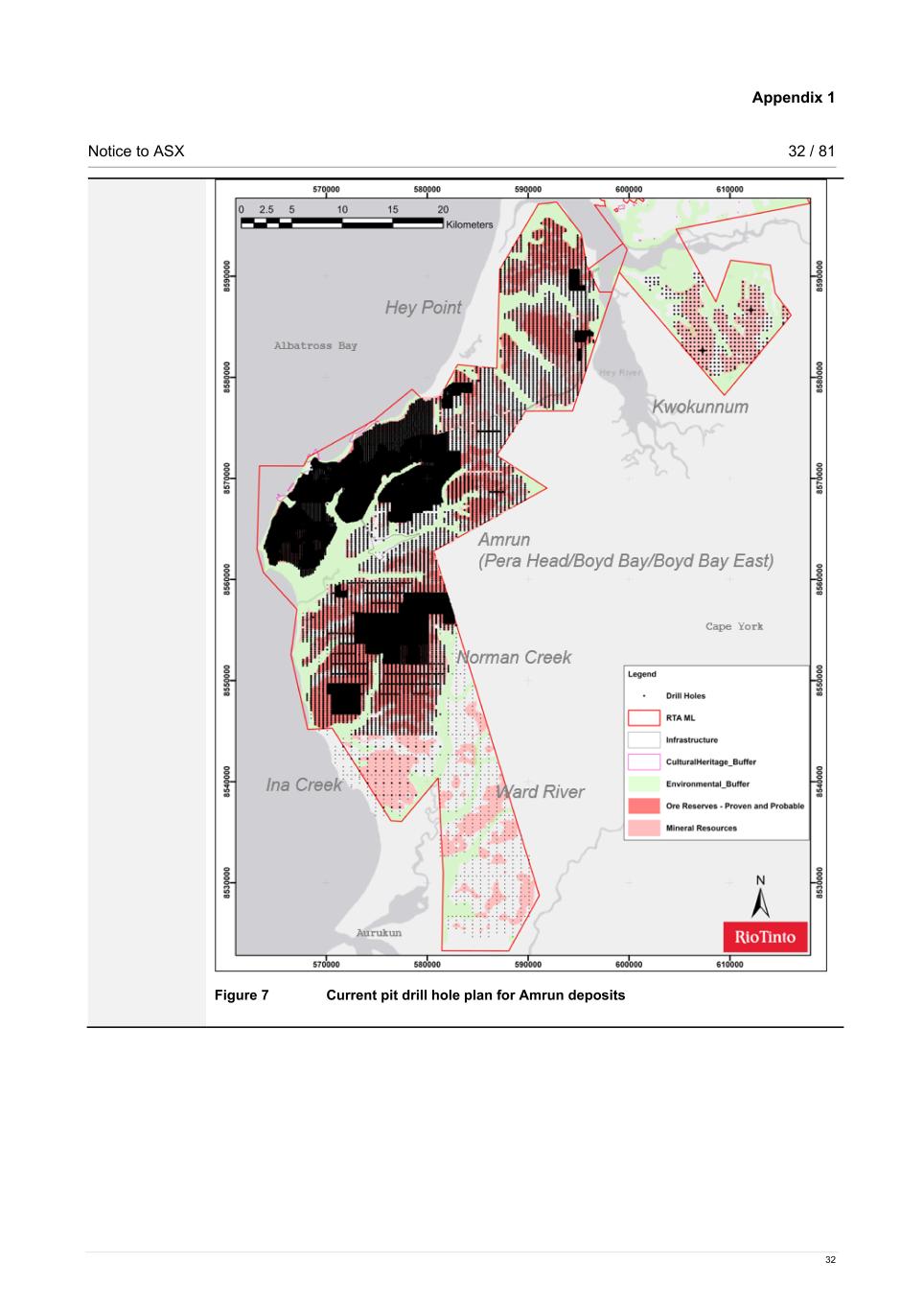

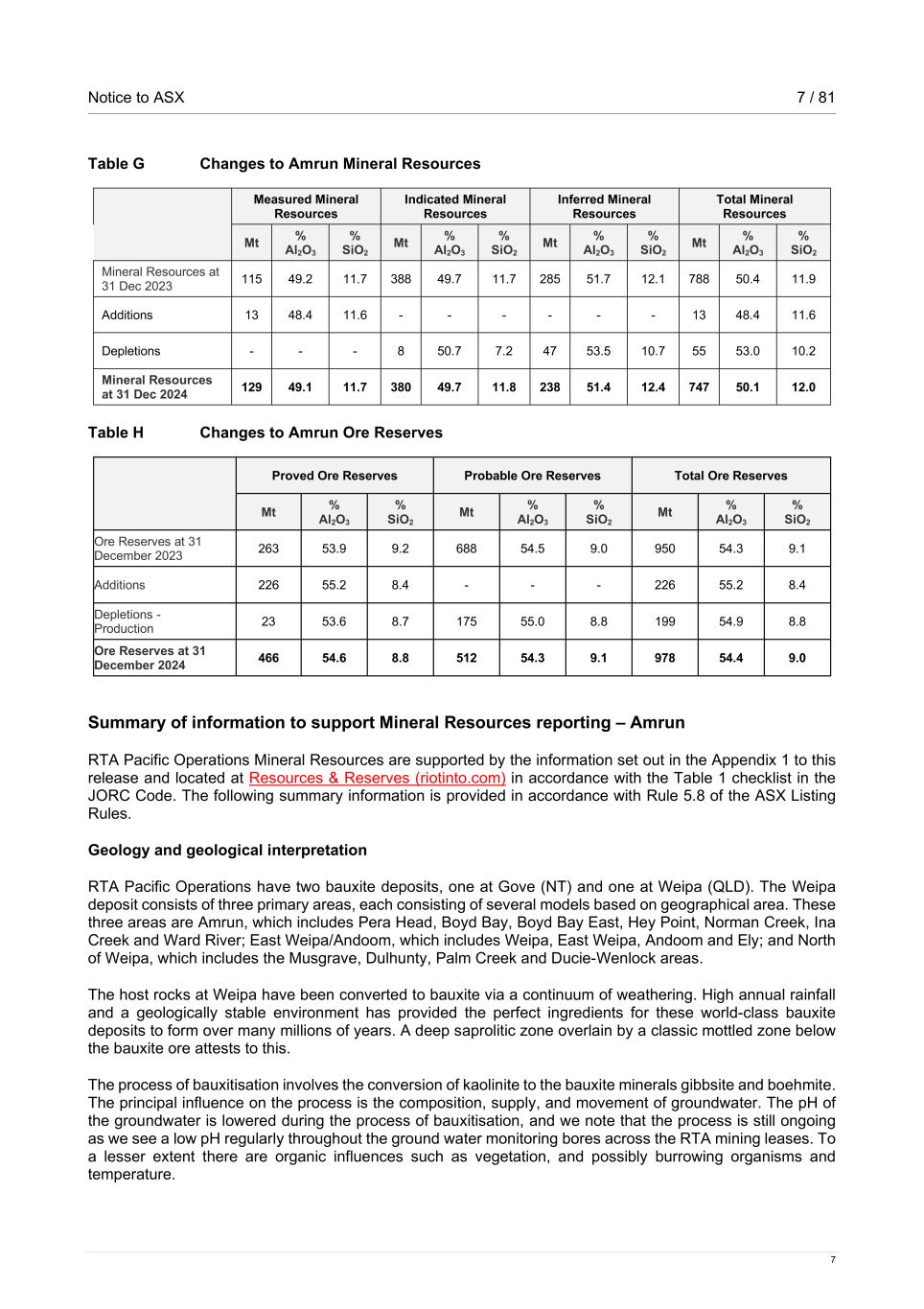

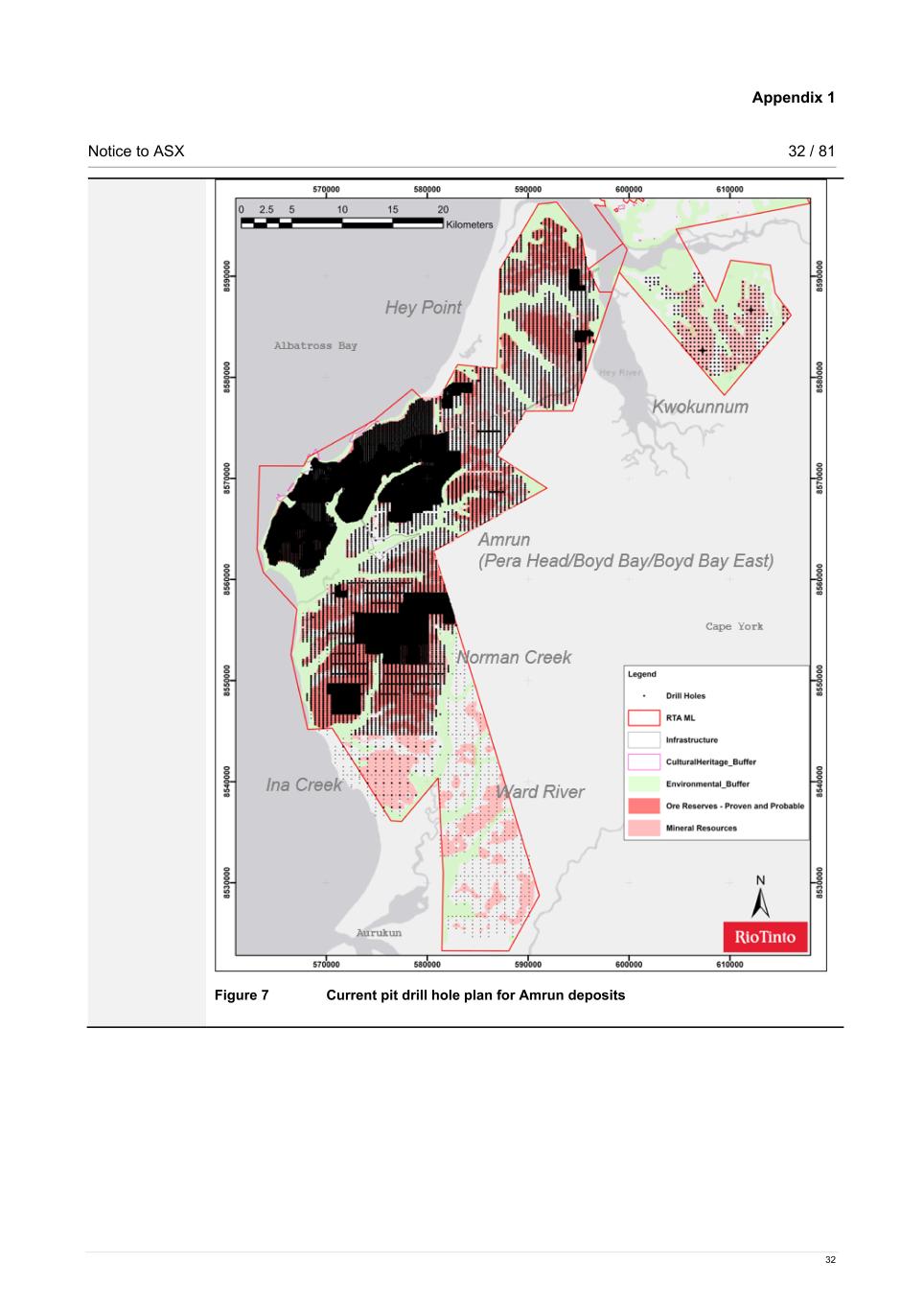

Notice to ASX 7 / 81 7 Table G Changes to Amrun Mineral Resources Measured Mineral Resources Indicated Mineral Resources Inferred Mineral Resources Total Mineral Resources Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Mineral Resources at 31 Dec 2023 115 49.2 11.7 388 49.7 11.7 285 51.7 12.1 788 50.4 11.9 Additions 13 48.4 11.6 - - - - - - 13 48.4 11.6 Depletions - - - 8 50.7 7.2 47 53.5 10.7 55 53.0 10.2 Mineral Resources at 31 Dec 2024 129 49.1 11.7 380 49.7 11.8 238 51.4 12.4 747 50.1 12.0 Table H Changes to Amrun Ore Reserves Proved Ore Reserves Probable Ore Reserves Total Ore Reserves Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Ore Reserves at 31 December 2023 263 53.9 9.2 688 54.5 9.0 950 54.3 9.1 Additions 226 55.2 8.4 - - - 226 55.2 8.4 Depletions - Production 23 53.6 8.7 175 55.0 8.8 199 54.9 8.8 Ore Reserves at 31 December 2024 466 54.6 8.8 512 54.3 9.1 978 54.4 9.0 Summary of information to support Mineral Resources reporting – Amrun RTA Pacific Operations Mineral Resources are supported by the information set out in the Appendix 1 to this release and located at Resources & Reserves (riotinto.com) in accordance with the Table 1 checklist in the JORC Code. The following summary information is provided in accordance with Rule 5.8 of the ASX Listing Rules. Geology and geological interpretation RTA Pacific Operations have two bauxite deposits, one at Gove (NT) and one at Weipa (QLD). The Weipa deposit consists of three primary areas, each consisting of several models based on geographical area. These three areas are Amrun, which includes Pera Head, Boyd Bay, Boyd Bay East, Hey Point, Norman Creek, Ina Creek and Ward River; East Weipa/Andoom, which includes Weipa, East Weipa, Andoom and Ely; and North of Weipa, which includes the Musgrave, Dulhunty, Palm Creek and Ducie-Wenlock areas. The host rocks at Weipa have been converted to bauxite via a continuum of weathering. High annual rainfall and a geologically stable environment has provided the perfect ingredients for these world-class bauxite deposits to form over many millions of years. A deep saprolitic zone overlain by a classic mottled zone below the bauxite ore attests to this. The process of bauxitisation involves the conversion of kaolinite to the bauxite minerals gibbsite and boehmite. The principal influence on the process is the composition, supply, and movement of groundwater. The pH of the groundwater is lowered during the process of bauxitisation, and we note that the process is still ongoing as we see a low pH regularly throughout the ground water monitoring bores across the RTA mining leases. To a lesser extent there are organic influences such as vegetation, and possibly burrowing organisms and temperature.

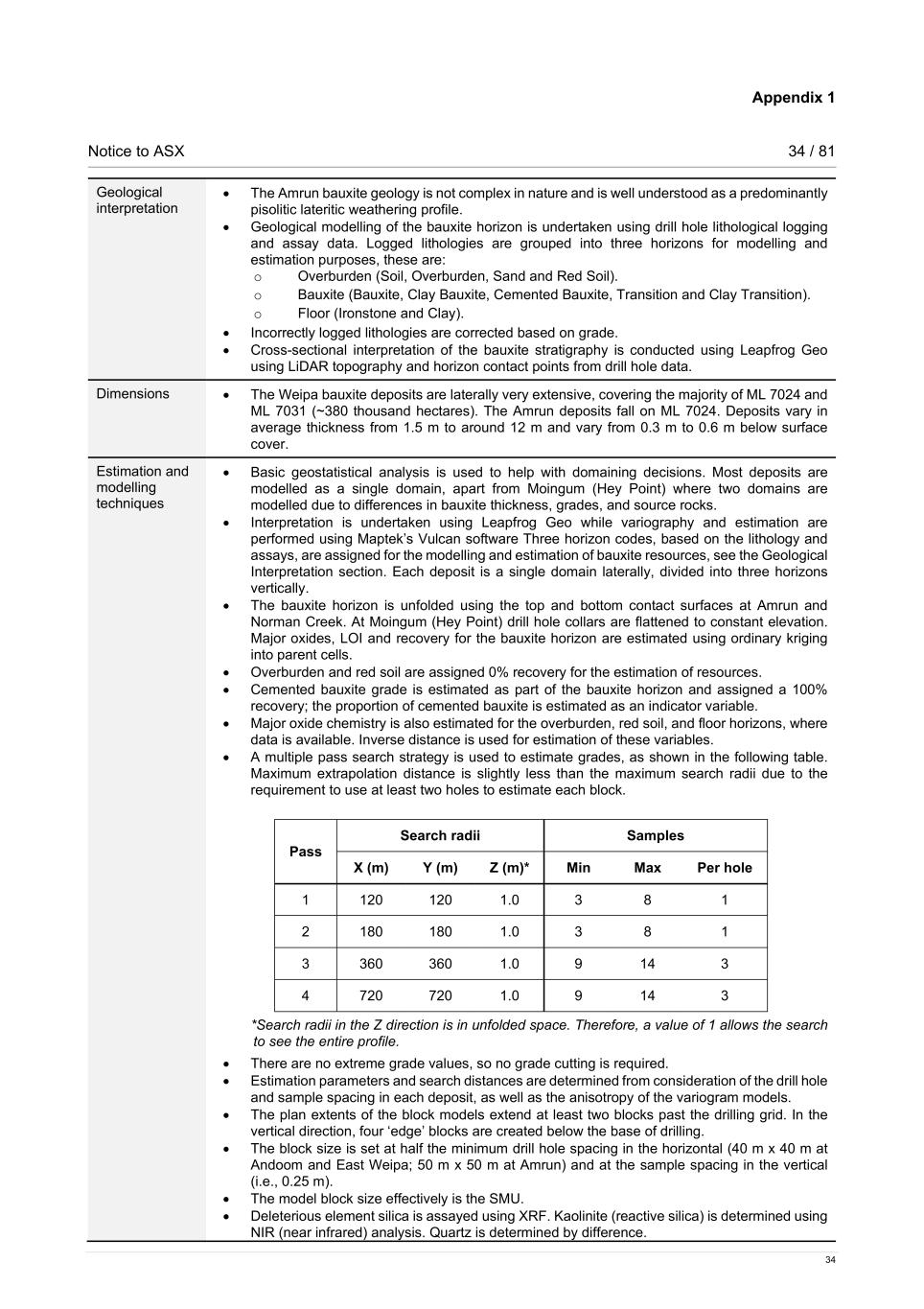

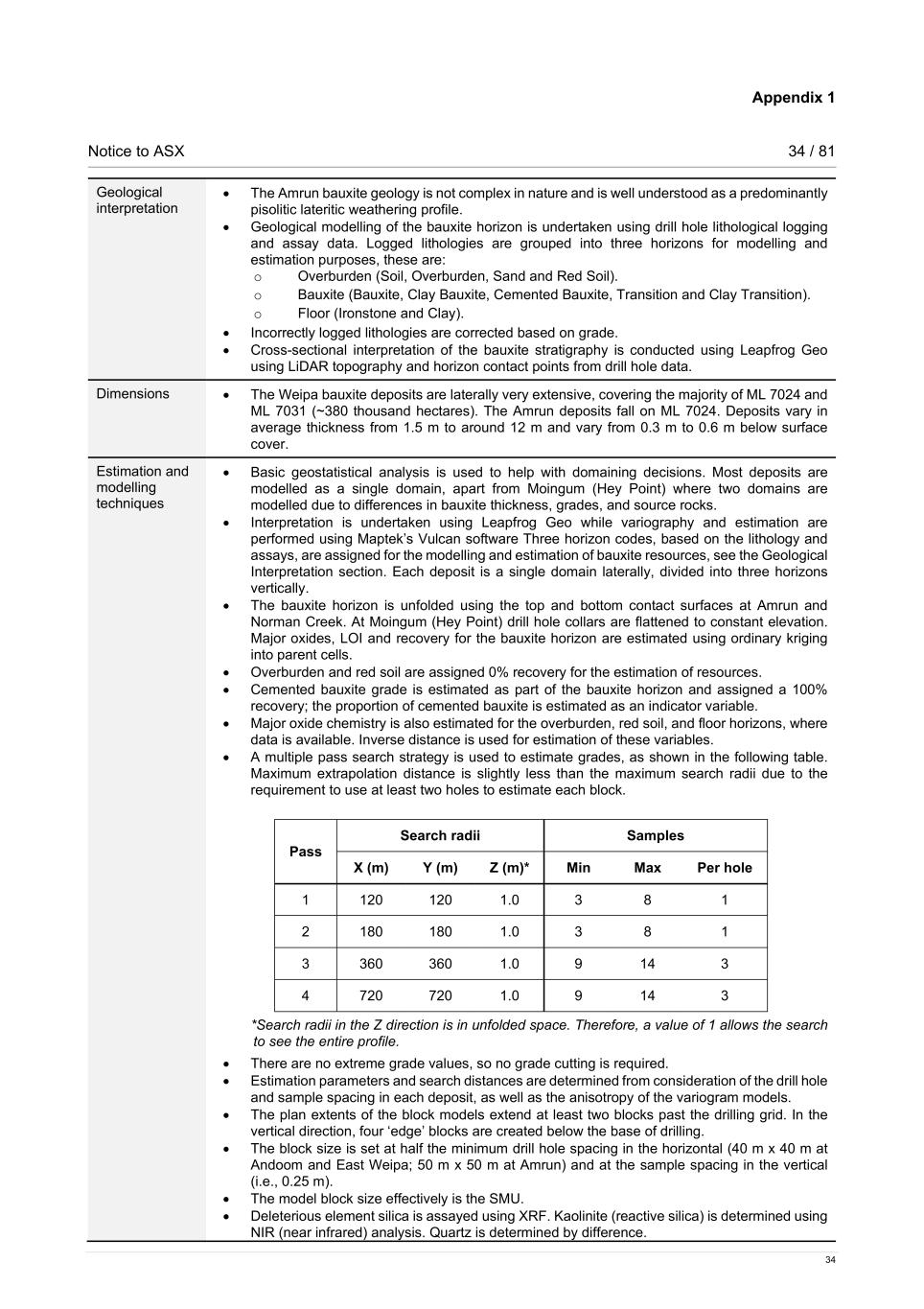

Notice to ASX 8 / 81 8 Pisolitic textures are dominant, with variable cementation. However, variably cemented coarser nodule horizons can occur. Modern day root channel structures and infill, in the upper part of the bauxite, are common. Gibbsite is the major mineralised mineral, with boehmite being of lesser significance. Bauxite occurs on laterally extensive plateaus. The bauxite orebodies are interpreted as flat-lying horizons with topography dictating the geometry. The orebodies are overlain by a thin (<1 m) overburden cover and occasional red soil. Beneath the bauxite mineralisation is often a transition zone defined by angular and lumpy textures and a geochemical signature of higher silica and lower alumina. The transition zone is often underlain by clay, with a distinct change in physical properties, particularly the colour. Drilling techniques; sampling, sub-sampling method and sample analysis method The current drilling method at Amrun utilises aircore drilling. The typical aircore rig is a Land Cruiser mounted rig with a small enough wheelbase to traverse drill lines cleared with one D-6 dozer blade width. Aircore drilling forces compressed air down a space inside the drill rods to the bit face, where the air is then used to return the sample up the inner tube of the drill rod and out via a cyclone. A three bladed HQ aircore bit is attached to 4 inch rods. The drilling system has been designed to reduce grinding of the sample. Logging is currently conducted on Panasonic Toughpads and data is captured in an offline acQuire™ logging package at the drill rig. This system allows for data validation to be applied during logging as well as a streamlined method of exporting the data for importing into the main RTA Geology database. Logging is qualitative in nature, i.e., based on lithology. Currently there are ~20 lithologies common to the deposits that get modelled into four horizons for the estimation of bauxite resources. All sample intervals (0.25 m) are logged. Logged lithologies are vetted against historical drill holes and assay parameters. Samples for geologic logging and analysis are collected on 0.25 m intervals (~2 to 3 kg) downhole. Whole samples are collected beneath a cyclone return system, i.e., no sample splitting is conducted, or sub samples taken. Multiscreen sampling is undertaken initially to determine optimum screen size for beneficiation at each deposit. Once determined, samples are then beneficiated at the appropriate screen size (1.7 mm for East Weipa, 0.3 mm for Andoom and 0.6 mm for the Amrun deposits). Samples are processed and X-ray florescence (XRF) analysed for the major oxides: Al2O3, SiO2, Fe2O3, TiO2 and LOI (loss on ignition), as well as minor elements and recovery. Estimation methodology Basic geostatistical analysis is used to help with domaining decisions. Most deposits are modelled as a single laterally extensive domain, apart from Moingum (Hey Point), where two laterally extensive domains have been modelled due to differences in source rocks affecting thickness and grade. Three horizon codes, based on the lithology and assays, are assigned for the modelling and estimation of bauxite resources at Weipa. Interpretation is undertaken using Leapfrog Geo while variography and estimation are performed using Maptek’s Vulcan software. The bauxite horizon is unfolded using the top and bottom contact surfaces at Amrun and Norman Creek. At Moingum (Hey Point) drill hole collars are flattened to constant elevation. The wireframes are filled with blocks on an in/out basis; there is no sub-blocking or block proportions used. For the bauxite horizon, major oxides; loss on ignition (LOI) and recovery are estimated into parent cells using ordinary kriging. Overburden is assigned 0% recovery for the estimation of resources. Cemented bauxite grade is estimated as part of the bauxite horizon and assigned a 100% recovery; the proportion of cemented bauxite is estimated as an indicator variable. Major oxide chemistry is also estimated for the overburden and floor horizons, where data is available. Ordinary kriging is used for interpolation, using the variogram models for the bauxite. Block sizes are determined by half the minimum drill hole spacing for each deposit. A multiple pass search strategy is used to estimate grades utilising different sized search ellipses that include a specified number of samples and drill holes. Maximum extrapolation distance is slightly less than the maximum search radii due to the requirement to use at least two holes to estimate each block.

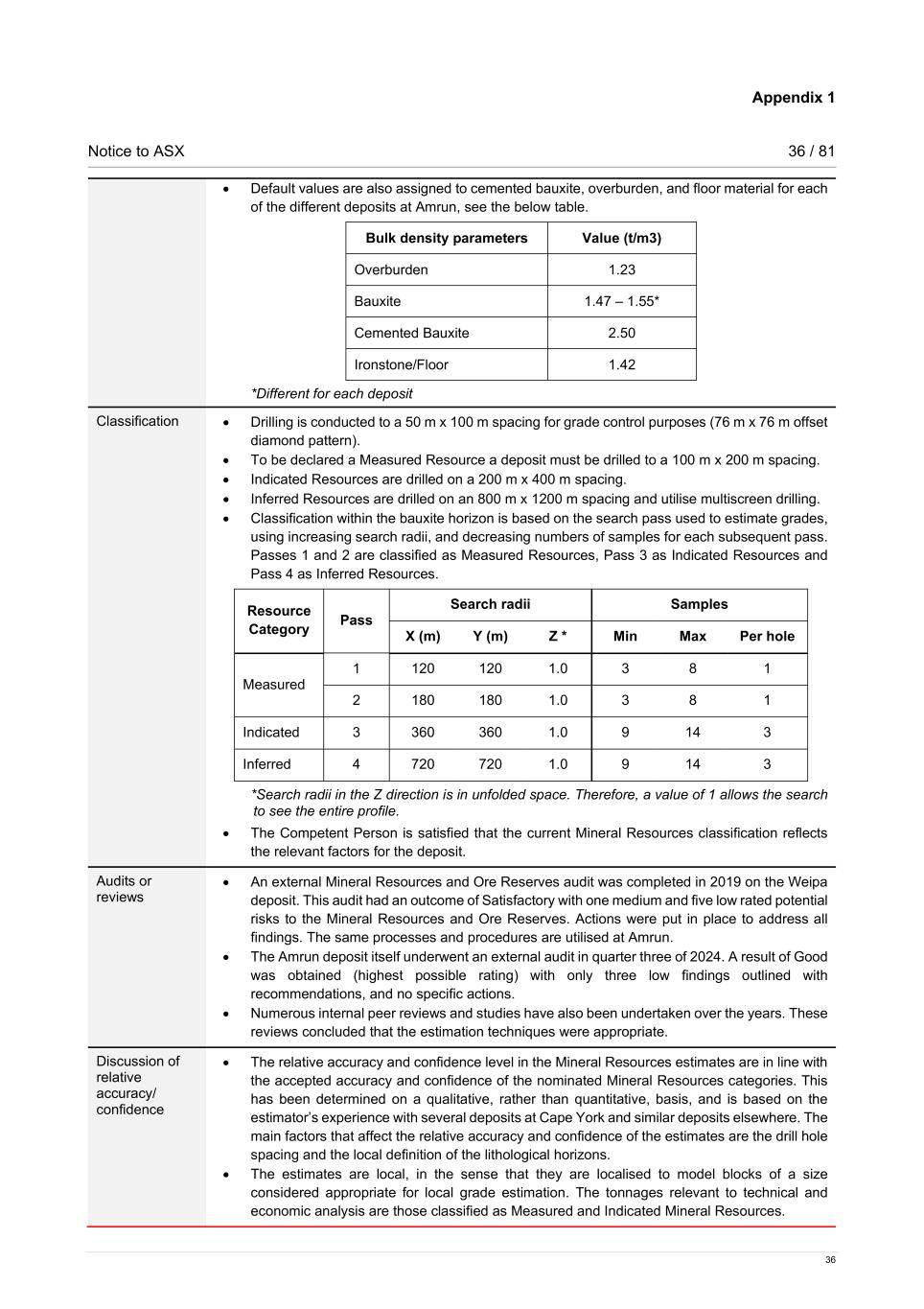

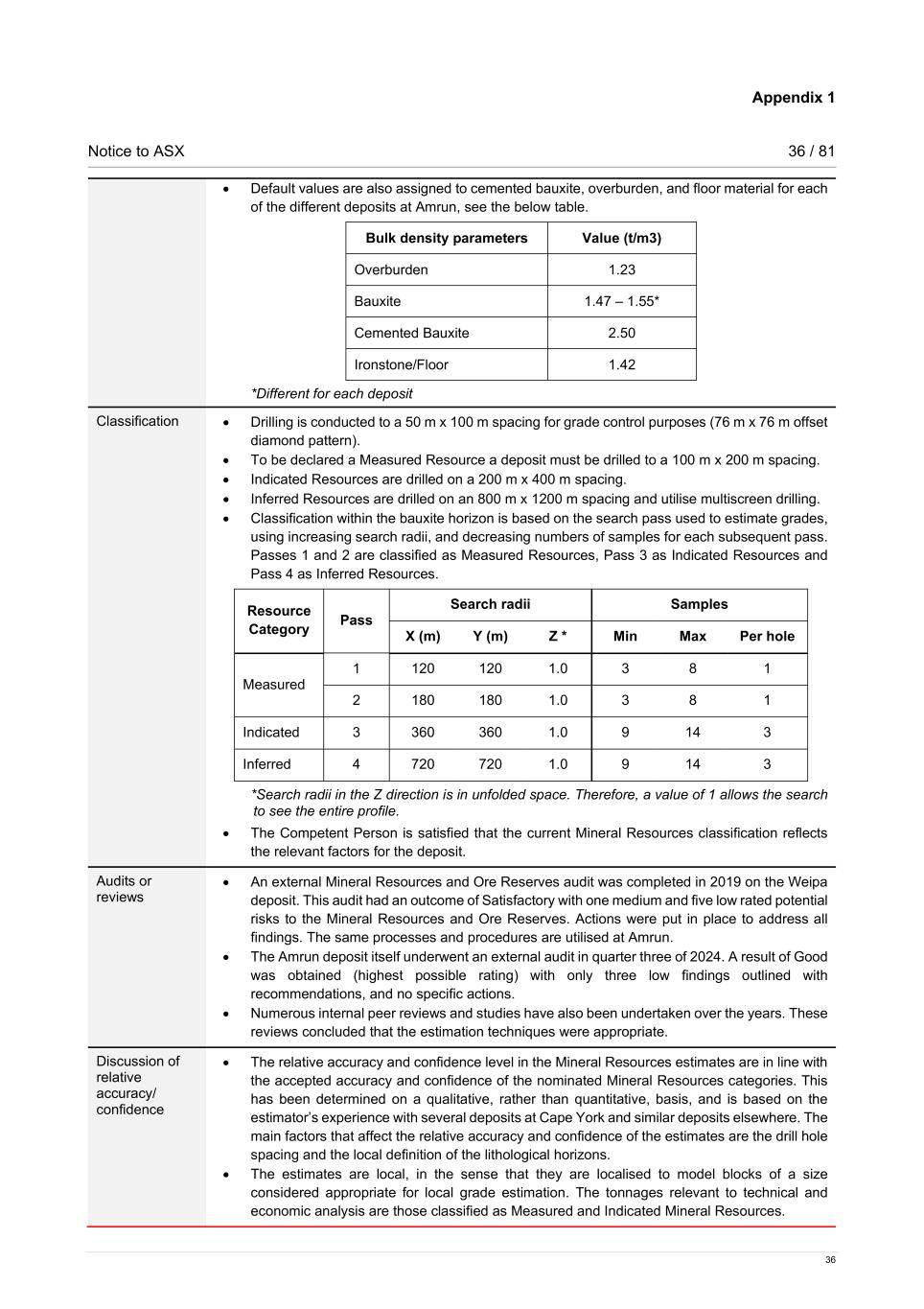

Notice to ASX 9 / 81 9 Cut-off grades and modifying factors RTA Pacific Operations employs a standard approach to identify Mineral Resources volumes with reasonable prospects for eventual economic extraction. Once the Ore Reserves are defined based on applied economic factors in the reserving process, the remaining blocks are evaluated based on economic and grade cut-offs (Al2O3 ≥ 40%; SiO2 ≤ 15%), thickness cut-offs and location (environmental, cultural heritage and infrastructure buffers) for each of the different deposits, and Mineral Resources defined. Criteria used for Mineral Resources classification Classification within the bauxite horizon is based on the search pass used to estimate grades, using increasing search radii, and decreasing numbers of samples for each subsequent pass. Passes 1 and 2 are classified as Measured Mineral Resources (120 m to 180 m), Pass 3 as Indicated (360 m) and Pass 4 as Inferred (720 m). Data of lesser quality (e.g., 2D historical data) is downgraded in classification and needs to be re-drilled to increase confidence. Summary of information to support Ore Reserves reporting – Amrun RTA Pacific Operations Ore Reserves are supported by the information set out in Appendix 1 and located at Resources & Reserves (riotinto.com) in accordance with the Table 1 checklist in the JORC Code. The following summary information is provided in accordance with Rule 5.9 of the ASX Listing Rules. Economic assumptions and study outcomes The Amrun operation has been operating continuously for over six years, and the Ore Reserves estimate, and life of mine plans are updated annually. This includes the reconciliation of operating parameters and review of input assumptions into the planning processes. The Amrun feasibility study was completed and approved by Rio Tinto in 2015. Rio Tinto applies a common process to the generation of commodity price assumptions across the group. This involves generation of long-term price forecasts based on current sales contracts, industry capacity analysis, global commodity consumption and economic growth trends (this includes the bonus / penalty adjustments for quality). Exchange rates are also based on internal Rio Tinto modelling of expected future country exchange rates. Capital and operating cost estimates are sourced from internal Rio Tinto financial modelling and / or project capital estimates. Third party payments are reflective of the current agreements in place. Due to the commercial sensitivity of these assumptions, an explanation of the methodology used to determine these assumptions has been provided, rather than the actual figures. Mining method and assumptions The Ore Reserves are mined through shallow, open cut techniques developed over several decades at the greater Weipa operations. Once the area is tree cleared and the topsoil / overburden removed, the bauxite is hauled to the processing facility for washing and / or sizing. Product bauxite is stockpiled for shipping to both internal and external customers. Several mining areas are active at any one time to enable blending and to mitigate against operational risk. Dilution and mining recovery parameters are applied during the Ore Reserves estimation process, based on reconciliation of past performance, and are reviewed annually. As the Ore Reserves are shallow, geotechnical risks are low. Stockpile heights and wet road conditions are managed in accordance with standard operating procedures. Completion of the Norman Creek Access Study has provided certainty regarding capital infrastructure and operating practices relating to extraction of the Ore Reserves south of Norman Creek. This includes haulage strategy, capital expenditure and operating cost profile.

Notice to ASX 10 / 81 10 There has been no material change to other Ore Reserves modifying factors, such as: governmental, tenure, environmental, cultural heritage, social or community. Appropriate agreements and approvals remain in place to enable continued operation. Processing methods and assumptions Amrun bauxite is beneficiated through established techniques to improve product quality and handleability. This is achieved through the removal of the finer fraction, leaving the coarser material as product. Expected bauxite recovery and quality from the beneficiation process is assessed through laboratory scale test work of samples generated from the resource drilling process. Cut-off grades, estimation methodology and modifying factors The Ore Reserves cut-off is based on an economic parameter, summarised as the margin realised upon sale of the bauxite. The economic cut-off approach considers revenue (bonus/penalty), fixed / operating / capital costs, royalties, and other third-party payments. Bauxite that satisfies this economic cut-off, is considered for inclusion in the Ore Reserves. There has been no material change to the economic cut-off methodology or process. Criteria used for Ore Reserves classification Given the level of confidence in the Ore Reserves modifying factors, Measured Resources are converted to both Proved and Probable Ore Reserves, and all Indicated Resources are converted to Probable Ore Reserves. Inferred Resources are not considered in the estimation of Ore Reserves. Completion of the Norman Creek Access Study has resulted in more of the Measured Resources being converted into Proved Ore Reserves.

Notice to ASX 11 / 81 11 Rio Tinto Copper – Winu project The Winu copper-gold project is located in the Paterson region of Western Australia, approximately 330 km east-southeast of the town of Port Hedland in the East Pilbara mineral field (Figure 2). The 2024 Mineral Resources include a substantially increased Indicated proportion, from 31% to 63% in tonnage, in comparison to the previously reported Mineral Resources. This change is supported mostly by the implementation of a different classification methodology which uses the relationship between drill hole spacing and orebody uncertainty as determined by conditional simulation of copper grades. The total Mineral Resources tonnage has increased by 2.7% in comparison to the previous reporting, reflecting changes in economic factors (metal price assumptions and economic pit shell optimisation). No resource drilling occurred at Winu in 2024 and the resource estimate used as the basis of Mineral Resources reporting has not been updated since the 31 December 2022 Rio Tinto Annual Report. Drilling at Winu completed in the last 12 months has been focused on sterilisation drilling in proposed infrastructure locations, hydrogeology and exploration. The presence of copper, gold and silver mineralisation of a similar geological style and setting at the margins indicates that the Winu deposit remains open in several directions. In December 2024, Rio Tinto signed a Term Sheet with Sumitomo Metal Mining for a Joint Venture to deliver the Winu project. Binding definitive agreements are expected to be completed in the first half of this year, with Rio Tinto to continue to develop and operate Winu as managing partner and SMM to acquire a 30% equity share of the project. The Rio Tinto Winu project team continues to work with the Nyangumarta and Martu Traditional Owners, as well as government regulators, to progress the agreements and approvals required for the future operation. Study activities also continue to strengthen the development pathway ahead of all Traditional Owner and regulatory approvals. Figure 2 Property location map – Winu

Notice to ASX 12 / 81 12 A comparison of the Indicated and Inferred Mineral Resources between 31 December 2024 and 31 December 2023 reporting periods at a 0.20% copper equivalent (CuEq) cut-off is shown in Table I. Table I Changes to Winu Mineral Resources Indicated Mineral Resources Inferred Mineral Resources Total Mineral Resources Mt % Cu g/t Au g/t Ag Mt % Cu g/t Au g/t Ag Mt % Cu g/t Au g/t Ag Mineral Resources as at 31 Dec 2023 222 0.45 0.35 2.73 499 0.38 0.33 1.98 721 0.40 0.34 2.21 Additions 242 0.34 0.29 1.80 - - - - 242 0.34 0.29 1.80 Depletions - - - - 223 0.34 0.29 1.81 223 0.34 0.29 1.81 Mineral Resources as at 31 Dec 2024 464 0.39 0.32 2.24 277 0.41 0.36 2.12 741 0.40 0.33 2.20 The total Mineral Resources is inclusive of a higher grade and shallower body of mineralisation that is the subject of detailed geological and geotechnical assessments, mine design and processing studies, supporting a starter pit design. At a 0.45% CuEq cut-off the Mineral Resources inside the starter pit includes 123 Mt @ 0.77% CuEq Indicated Resources and 28 Mt @ 0.88% CuEq Inferred Resources for a total of 150 Mt @ 0.79% CuEq, as shown in Table J. Table J Component of the Winu Mineral Resources within starter pit as at 31 December 2024, at 0.45% CuEq cut-off Indicated Mineral Resources within starter pit as at 31 December 2024 Inferred Mineral Resources within starter pit as at 31 December 2024 Total Mineral Resources within starter pit as at 31 December 2024 Tonnage Grade Tonnage Grade Tonnage Grade Mt % Cu g/t Au g/t Ag Mt % Cu g/t Au g/t Ag Mt % Cu g/t Au g/t Ag 123 0.61 0.46 3.88 28 0.82 0.68 4.19 150 0.65 0.50 3.94 Summary of information to support Mineral Resources reporting – Winu Mineral Resources are supported by the information set out in Appendix 2 to this release and located at Resources & Reserves (riotinto.com) in accordance with the Table 1 checklist in the JORC Code 2012. The following summary information is provided in accordance with rule 5.8 of the ASX Listing Rules. Geology and geological interpretation Winu is interpreted as a structurally controlled vein hosted Cu-Au-Ag (copper-gold-silver) deposit focused on the core of an anticline in Neoproterozoic metasedimentary rocks. There are multiple vein generations and orientations, but the veins are interpreted as being predominantly parallel to the fanned axial planes of the major and parasitic folds. Drilling techniques; sampling and sub-sampling techniques; and sample analysis method Drilling has been carried out using a combination of angled diamond and vertical and angled reverse circulation (RC) drilling methods, with sampling predominantly on a 1 m sample interval but honouring geological boundaries in the diamond drilled core. RC samples are split by cone splitter mounted on a cyclone at the rig. Core samples are cut by diamond saw with half dispatched for analysis. All sample preparation, involving crushing, pulverising and splitting, is conducted at commercial facilities in Perth, Western Australia. All analytical work is conducted at accredited commercial facilities in Perth. A combination of assaying methods is used including sequential leach, full acid digest with Inductively Coupled Plasma (ICP) with atomic emission

Notice to ASX 13 / 81 13 spectroscopy (AES) and mass spectroscopy (MS) finish and 30 g fire assay for gold with atomic absorption spectroscopy (AAS) finish. Estimation methodology Grade estimation utilises ordinary kriging at panel scale of 40 m x 40 m x 5 m with recoverable estimation by localised uniform conditioning (LUC) based on 10 m x 10 m x 5 m blocks to reflect the anticipated selective mining unit (SMU). The objective of the panel scale estimation is to establish a least biased global estimate, taking into account the drill hole spacing. The objective of the SMU scale estimation is to predict the likely grade/tonnage distribution at the time of mining. Dry bulk density has been estimated by ordinary kriging on 10 m x 10 m x 5 m blocks using approximately 6,000 measurements from drill core. Cut-off grades and modifying factors The Mineral Resources are reported at a cut-off grade of 0.2% CuEq, which is the marginal cut-off grade for the notional pit. The mineralisation within the starter pit is reported at a cut-off grade of 0.45% CuEq, representing a possible economic cut-off within this higher-grade area. Copper equivalents have been calculated using the formula: CuEq = ((Cu% * Cu price * Cu recovery) + (Au ppm * Au price * Au recovery) + (Ag ppm * Ag price * Ag recovery)) / (Cu price). Details of recoveries based on test work are shown in Appendix 2 (JORC Table 1). The reasonable prospects for economic extraction test is met on the basis of mining and processing studies that have been developed throughout 2024. These studies indicate conventional open pit mining and processing routes will be appropriate for the exploitation of the Winu deposit. Criteria used for Mineral Resource classification Mineral Resources classification is based initially on the level of confidence assigned to interpretations of geology and mineralisation controls, and an assessment of the quality of fundamental assay and geological data. The methodology supporting the previous 31 December 2023 Mineral Resources report was based on a quantitative assessment of copper grade uncertainty using the results of conditional simulation of copper grade, taking into account proposed mining rates and schedule. This approach reflected the precision of grade estimates at the scale of planned annual production but did not reflect the uncertainty at the scale of selective mining units. Moreover, the method did not directly capture geological and grade continuity at the block level. The new classification methodology adopted for 31 December 2024 Mineral Resources reporting uses geometric criteria linked to drill spacing. The approach uses geostatistical parameters (the conditional coefficient of variation) from a set of realisations determined by conditional simulation of copper to calibrate Mineral Resources class to drilling spacing. The classification process is based only on copper grades as copper is the primary contributor to project value. The method is independent of the mine schedule, provides a simple link to the assessment of geological and grade continuity and provides an expression of the local (block scale) geological and grade uncertainty. The adopted classification criteria are: • Indicated Resources: a threshold of grade estimate error determined by geostatistical means, converted to minimum drill spacing required to meet criteria for Indicated Resources (50 m for hypogene and 25 m for supergene domains).

Notice to ASX 14 / 81 14 • Inferred Resources: grade continuity implied by observations between drill holes. Minimum distance to drill hole (150 m for hypogene and 100 m for supergene domains) determined from variogram, representing the maximum range of correlation between distant samples. A smoothing step is included in the classification process to ensure isolated blocks are not included. The specific definition of Indicated and Inferred Resources is described in Table 1. A notional Mineral Resources pit shell has been defined to a maximum depth of 725 m with sufficient support provided by preliminary mining, processing and other studies. Mineralised material outside of the notional Mineral Resources pit shell is not included in the 31 December 2024 Mineral Resources statement. The notional Mineral Resources pit shell includes a higher grade and shallower body of mineralisation that is the subject of detailed geological and geotechnical assessments, mine design and processing studies, supporting a starter pit design. The Mineral Resources in the starter pit are classified predominantly as Indicated Resources (81% in tonnage), on the basis of data density supporting sufficient confidence in geological and grade continuity.

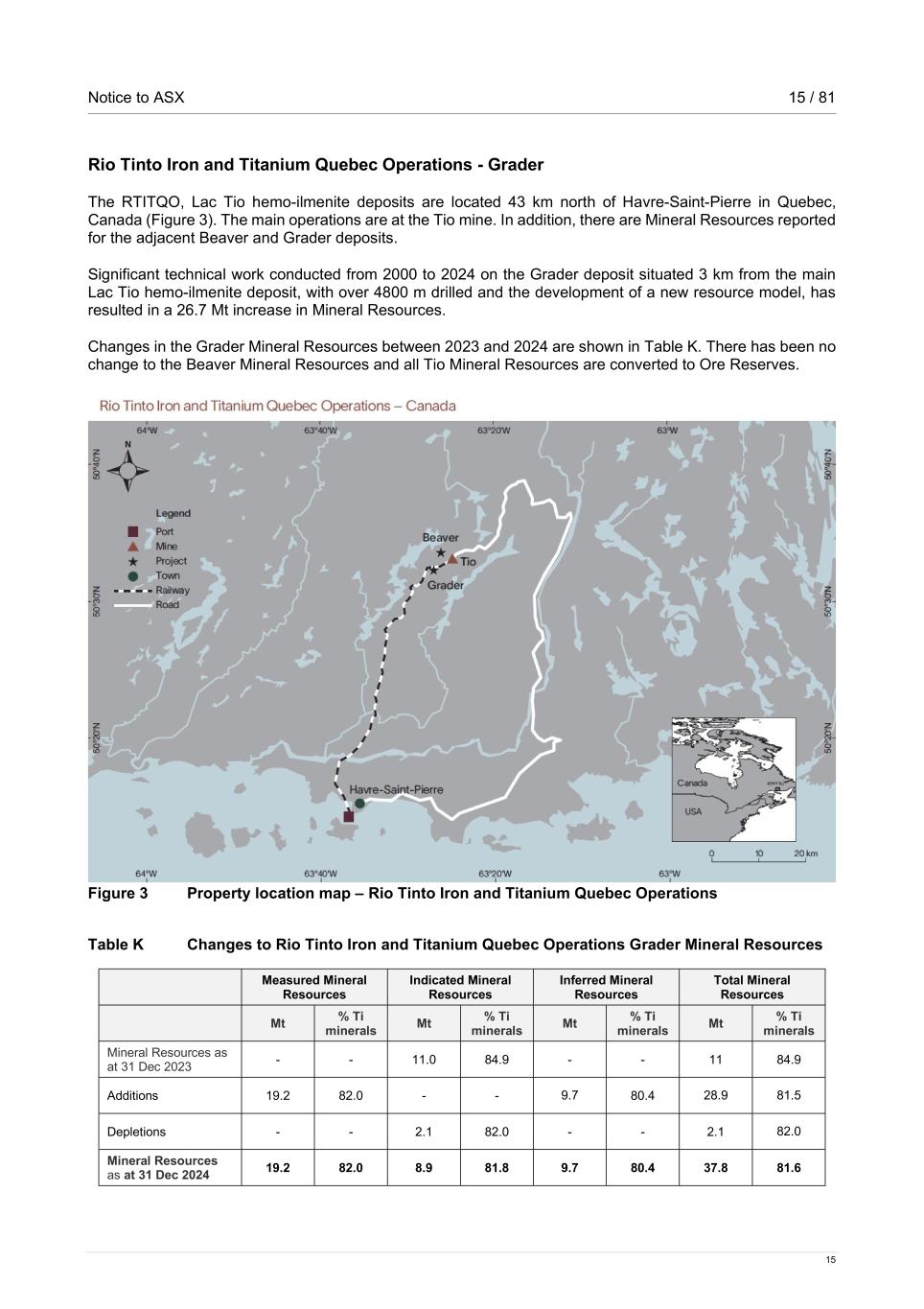

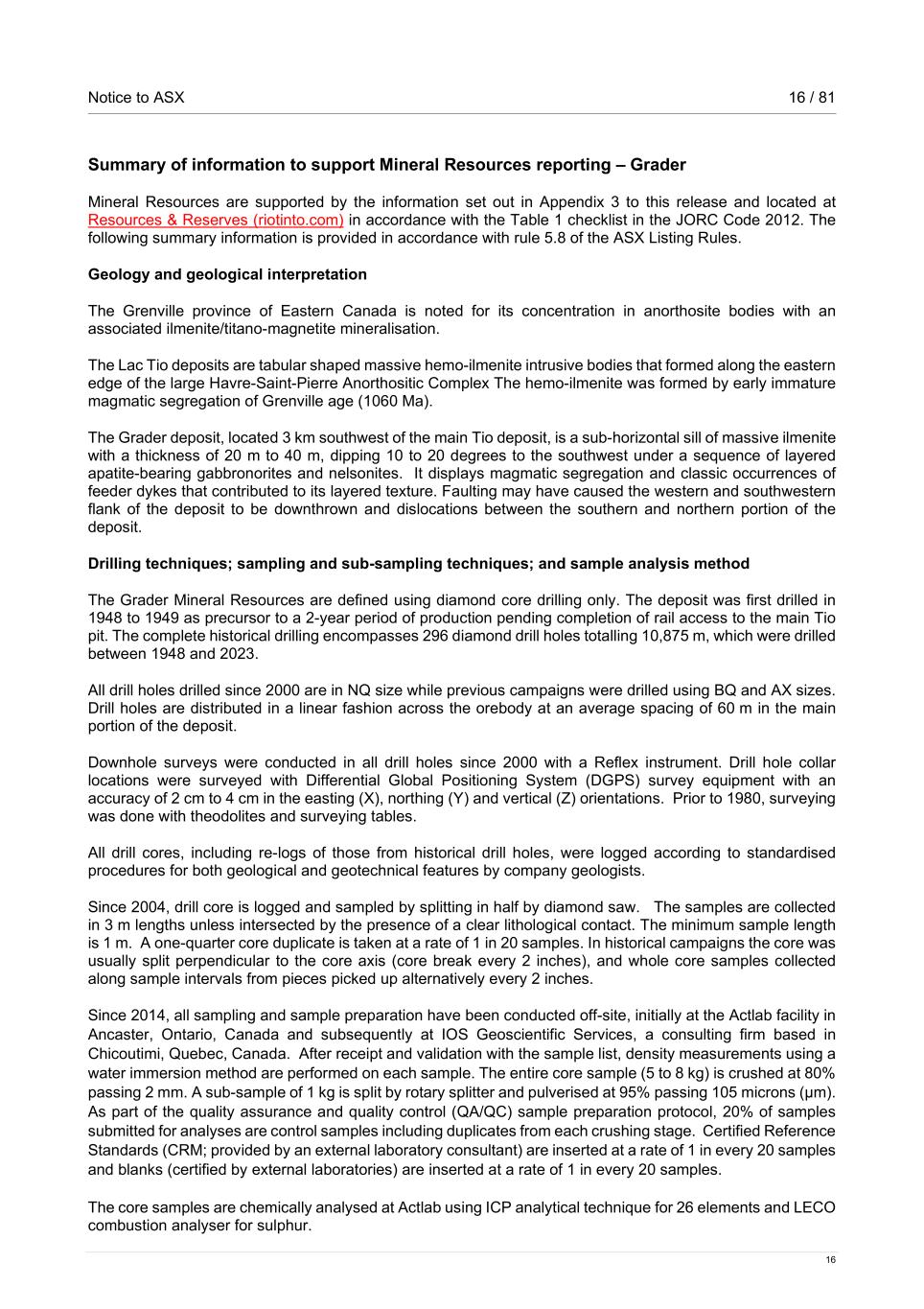

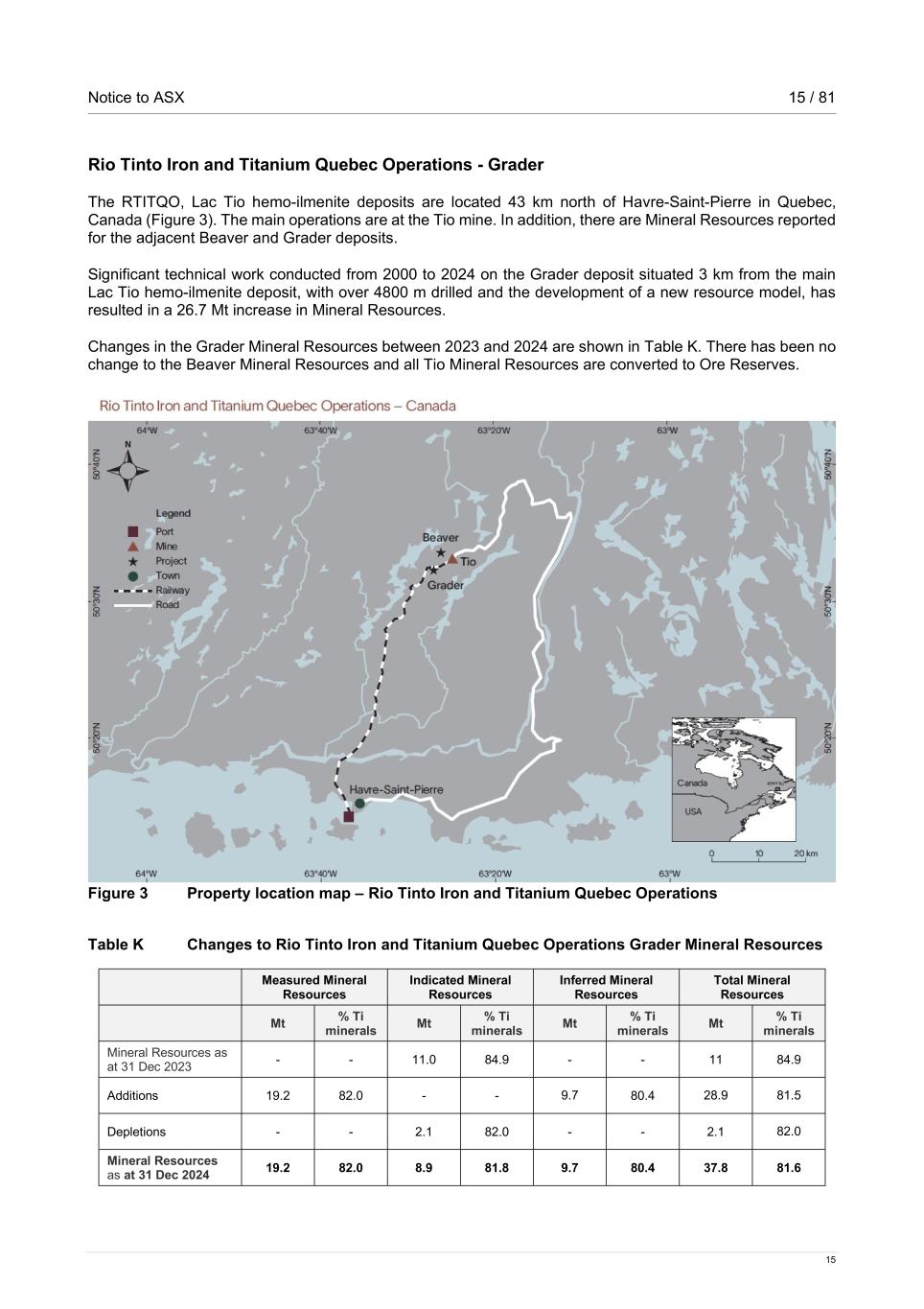

Notice to ASX 15 / 81 15 Rio Tinto Iron and Titanium Quebec Operations - Grader The RTITQO, Lac Tio hemo-ilmenite deposits are located 43 km north of Havre-Saint-Pierre in Quebec, Canada (Figure 3). The main operations are at the Tio mine. In addition, there are Mineral Resources reported for the adjacent Beaver and Grader deposits. Significant technical work conducted from 2000 to 2024 on the Grader deposit situated 3 km from the main Lac Tio hemo-ilmenite deposit, with over 4800 m drilled and the development of a new resource model, has resulted in a 26.7 Mt increase in Mineral Resources. Changes in the Grader Mineral Resources between 2023 and 2024 are shown in Table K. There has been no change to the Beaver Mineral Resources and all Tio Mineral Resources are converted to Ore Reserves. Figure 3 Property location map – Rio Tinto Iron and Titanium Quebec Operations Table K Changes to Rio Tinto Iron and Titanium Quebec Operations Grader Mineral Resources Measured Mineral Resources Indicated Mineral Resources Inferred Mineral Resources Total Mineral Resources Mt % Ti minerals Mt % Ti minerals Mt % Ti minerals Mt % Ti minerals Mineral Resources as at 31 Dec 2023 - - 11.0 84.9 - - 11 84.9 Additions 19.2 82.0 - - 9.7 80.4 28.9 81.5 Depletions - - 2.1 82.0 - - 2.1 82.0 Mineral Resources as at 31 Dec 2024 19.2 82.0 8.9 81.8 9.7 80.4 37.8 81.6

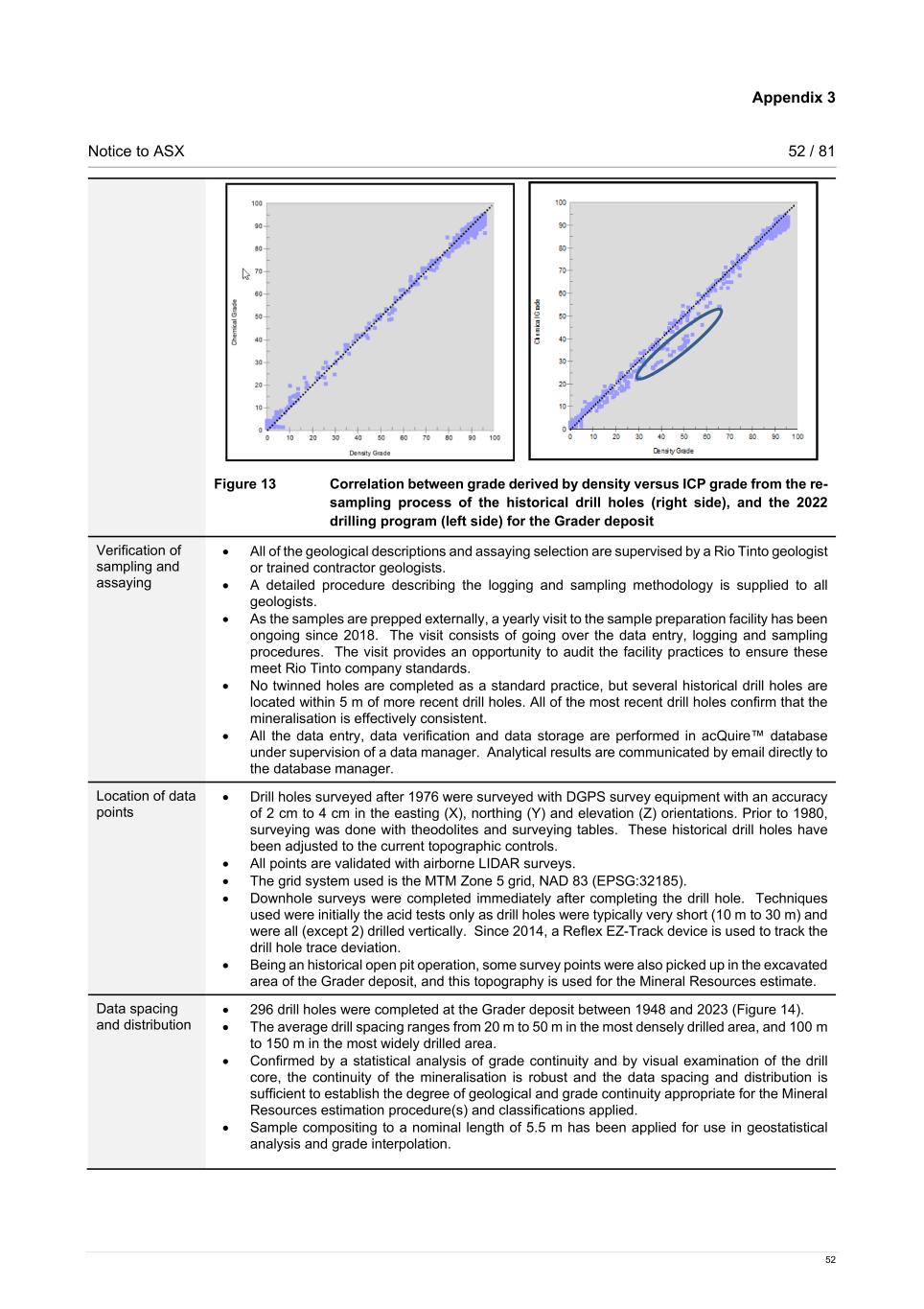

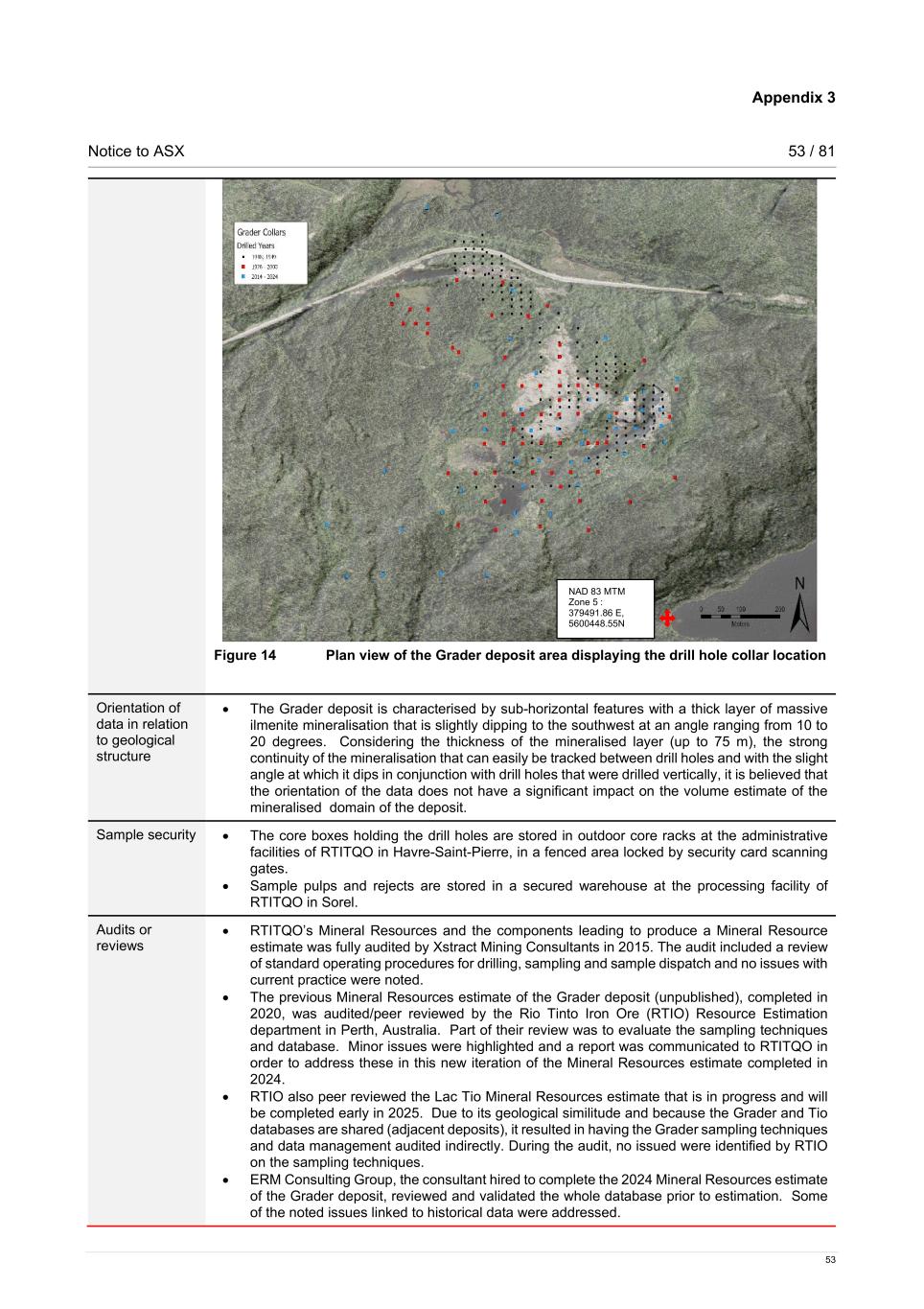

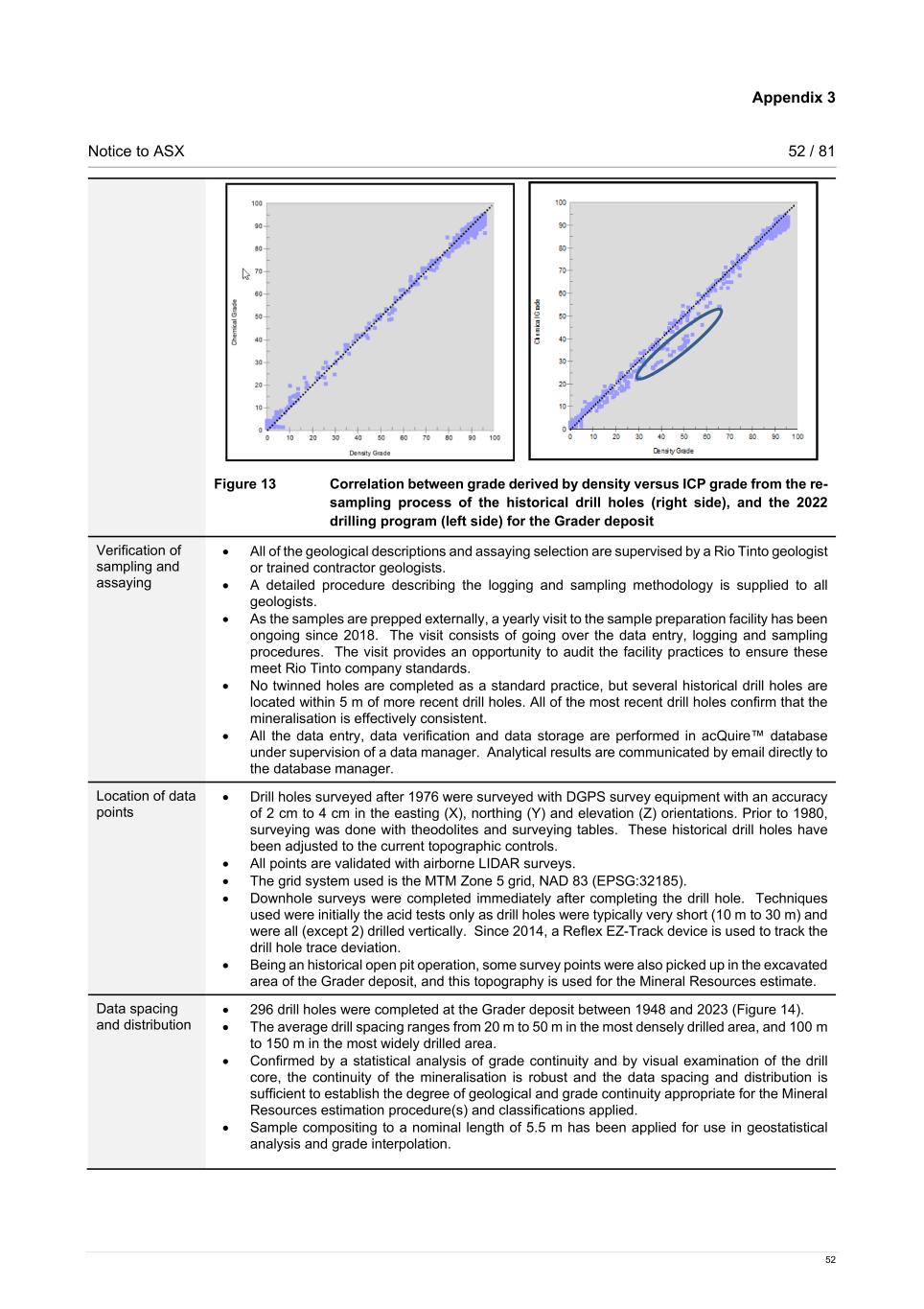

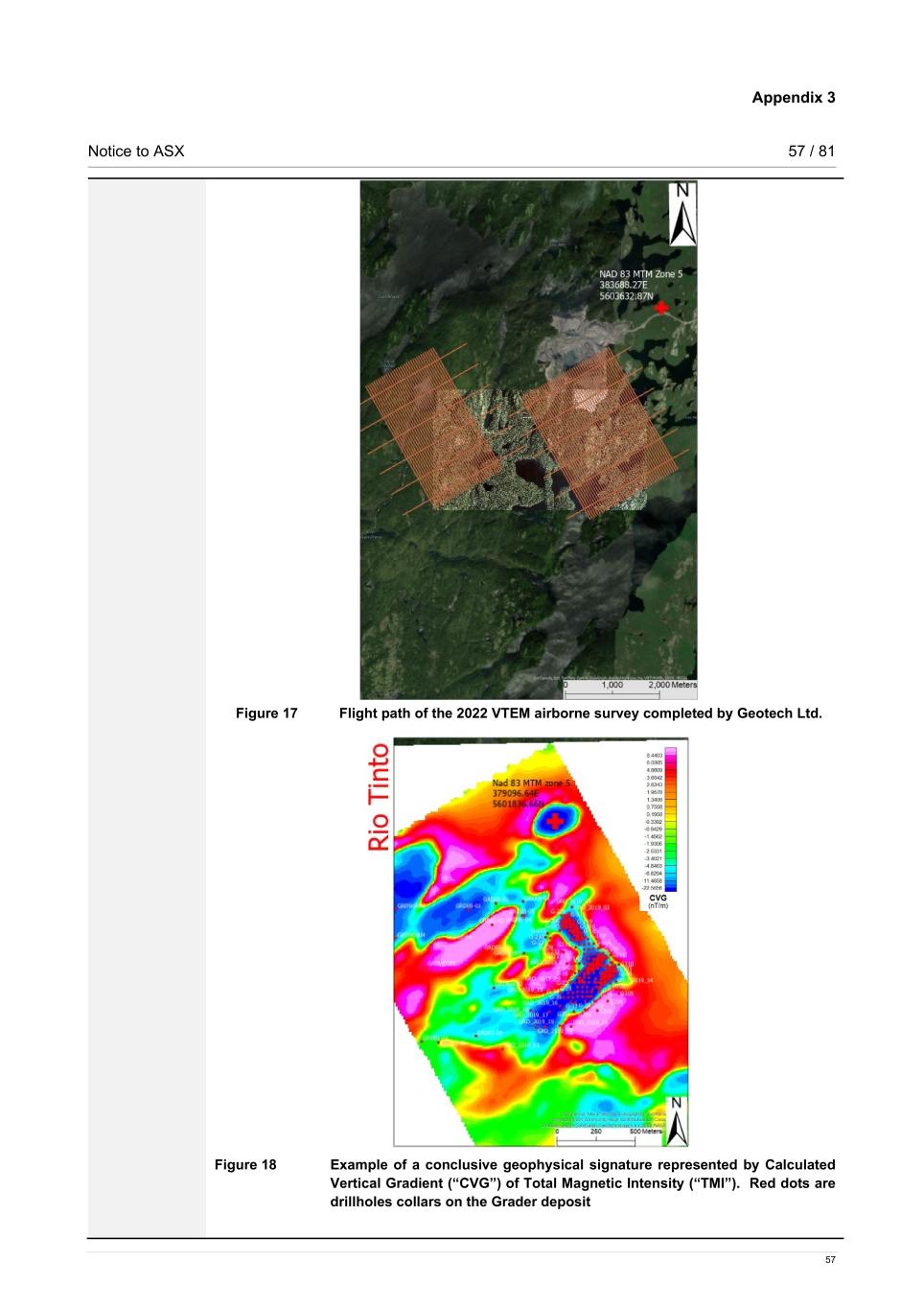

Notice to ASX 16 / 81 16 Summary of information to support Mineral Resources reporting – Grader Mineral Resources are supported by the information set out in Appendix 3 to this release and located at Resources & Reserves (riotinto.com) in accordance with the Table 1 checklist in the JORC Code 2012. The following summary information is provided in accordance with rule 5.8 of the ASX Listing Rules. Geology and geological interpretation The Grenville province of Eastern Canada is noted for its concentration in anorthosite bodies with an associated ilmenite/titano-magnetite mineralisation. The Lac Tio deposits are tabular shaped massive hemo-ilmenite intrusive bodies that formed along the eastern edge of the large Havre-Saint-Pierre Anorthositic Complex The hemo-ilmenite was formed by early immature magmatic segregation of Grenville age (1060 Ma). The Grader deposit, located 3 km southwest of the main Tio deposit, is a sub-horizontal sill of massive ilmenite with a thickness of 20 m to 40 m, dipping 10 to 20 degrees to the southwest under a sequence of layered apatite-bearing gabbronorites and nelsonites. It displays magmatic segregation and classic occurrences of feeder dykes that contributed to its layered texture. Faulting may have caused the western and southwestern flank of the deposit to be downthrown and dislocations between the southern and northern portion of the deposit. Drilling techniques; sampling and sub-sampling techniques; and sample analysis method The Grader Mineral Resources are defined using diamond core drilling only. The deposit was first drilled in 1948 to 1949 as precursor to a 2-year period of production pending completion of rail access to the main Tio pit. The complete historical drilling encompasses 296 diamond drill holes totalling 10,875 m, which were drilled between 1948 and 2023. All drill holes drilled since 2000 are in NQ size while previous campaigns were drilled using BQ and AX sizes. Drill holes are distributed in a linear fashion across the orebody at an average spacing of 60 m in the main portion of the deposit. Downhole surveys were conducted in all drill holes since 2000 with a Reflex instrument. Drill hole collar locations were surveyed with Differential Global Positioning System (DGPS) survey equipment with an accuracy of 2 cm to 4 cm in the easting (X), northing (Y) and vertical (Z) orientations. Prior to 1980, surveying was done with theodolites and surveying tables. All drill cores, including re-logs of those from historical drill holes, were logged according to standardised procedures for both geological and geotechnical features by company geologists. Since 2004, drill core is logged and sampled by splitting in half by diamond saw. The samples are collected in 3 m lengths unless intersected by the presence of a clear lithological contact. The minimum sample length is 1 m. A one-quarter core duplicate is taken at a rate of 1 in 20 samples. In historical campaigns the core was usually split perpendicular to the core axis (core break every 2 inches), and whole core samples collected along sample intervals from pieces picked up alternatively every 2 inches. Since 2014, all sampling and sample preparation have been conducted off-site, initially at the Actlab facility in Ancaster, Ontario, Canada and subsequently at IOS Geoscientific Services, a consulting firm based in Chicoutimi, Quebec, Canada. After receipt and validation with the sample list, density measurements using a water immersion method are performed on each sample. The entire core sample (5 to 8 kg) is crushed at 80% passing 2 mm. A sub-sample of 1 kg is split by rotary splitter and pulverised at 95% passing 105 microns (µm). As part of the quality assurance and quality control (QA/QC) sample preparation protocol, 20% of samples submitted for analyses are control samples including duplicates from each crushing stage. Certified Reference Standards (CRM; provided by an external laboratory consultant) are inserted at a rate of 1 in every 20 samples and blanks (certified by external laboratories) are inserted at a rate of 1 in every 20 samples. The core samples are chemically analysed at Actlab using ICP analytical technique for 26 elements and LECO combustion analyser for sulphur.

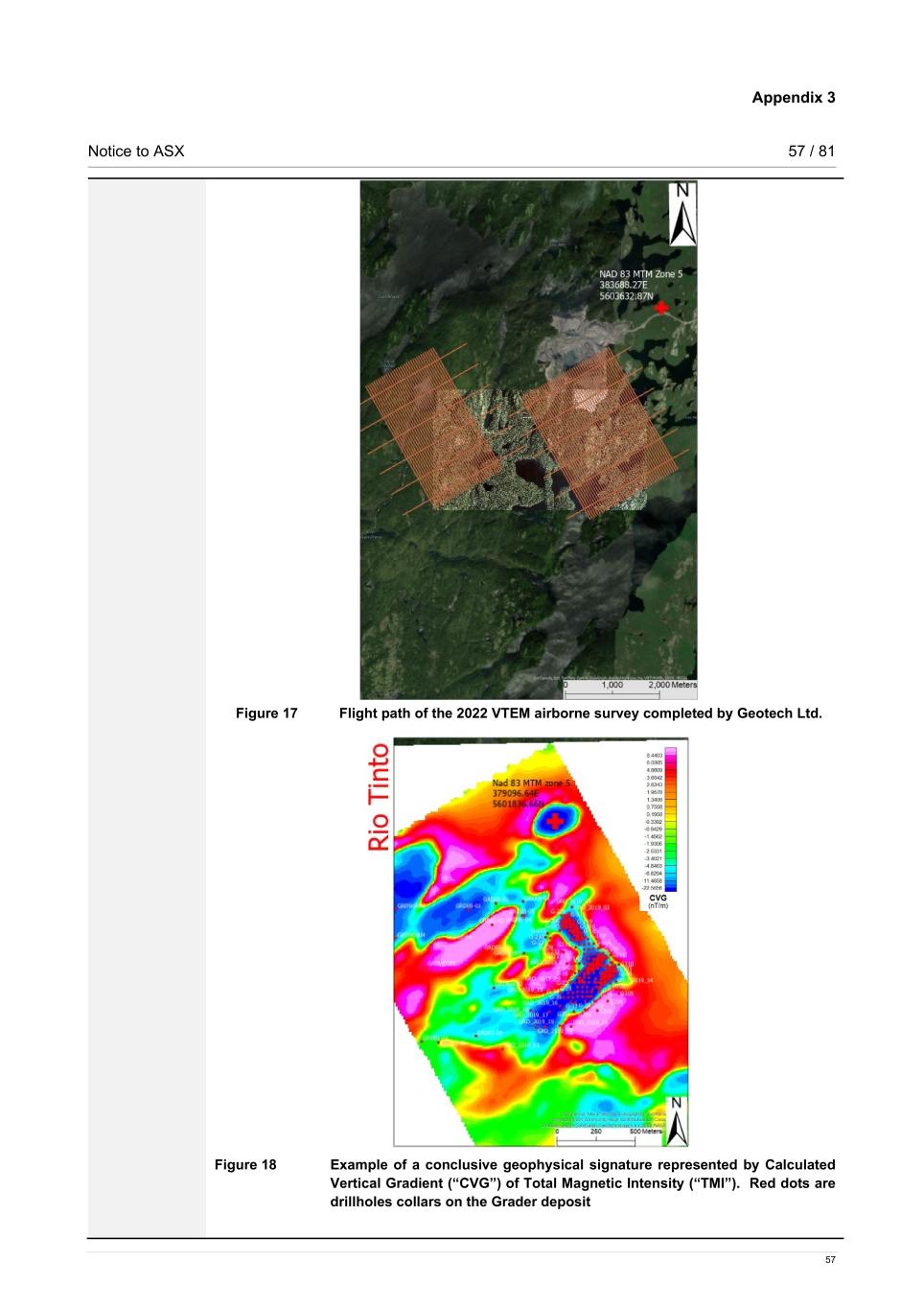

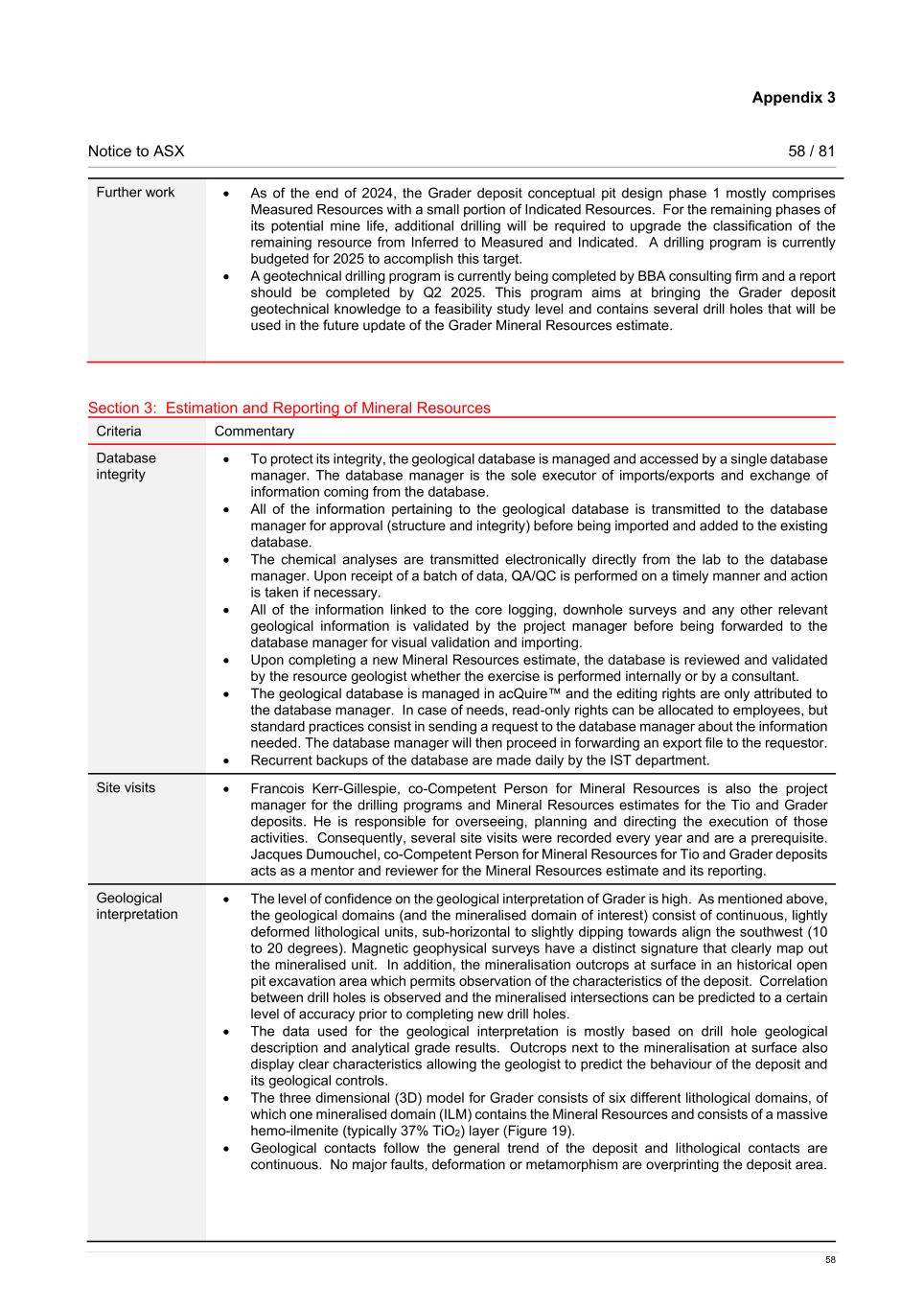

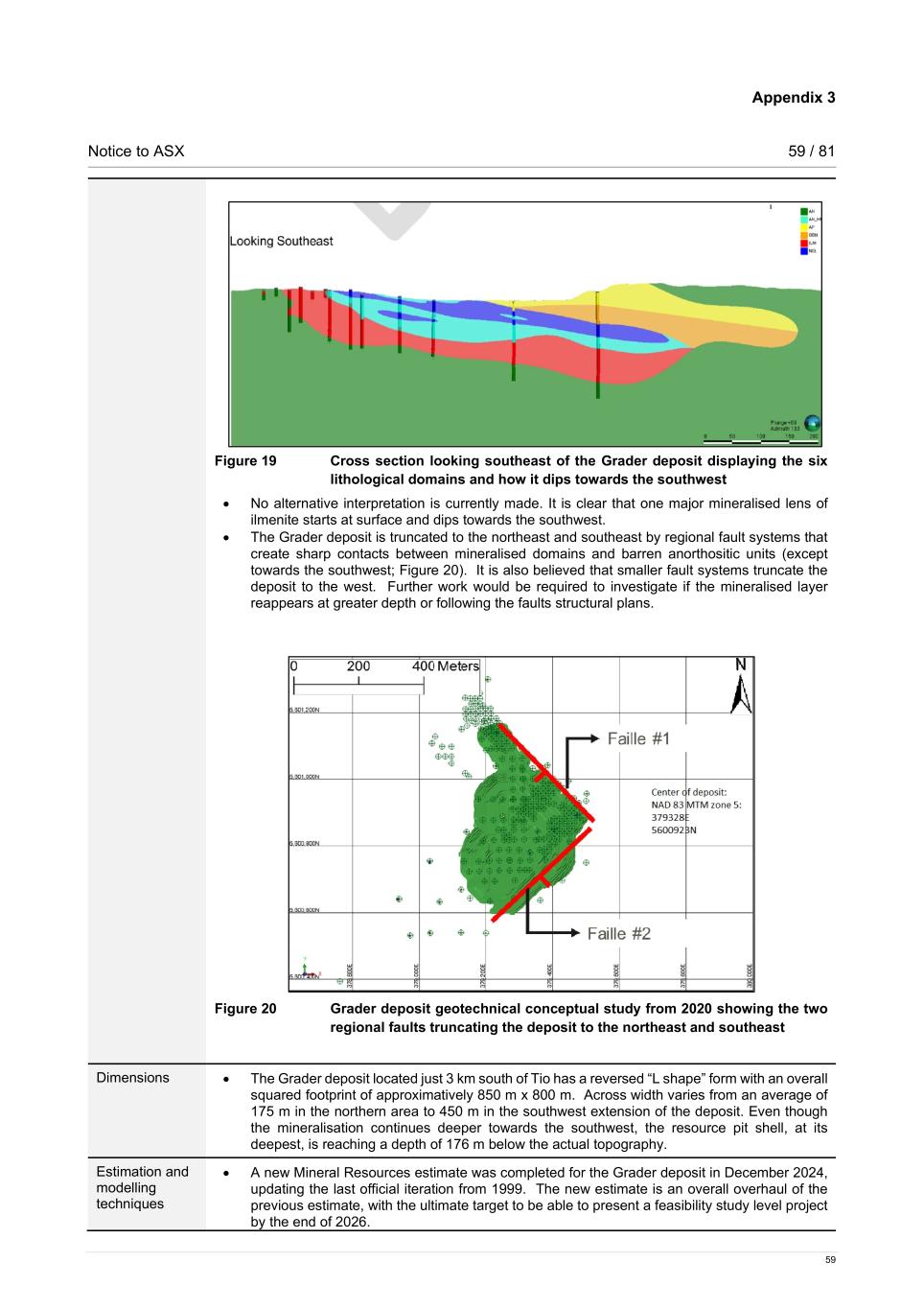

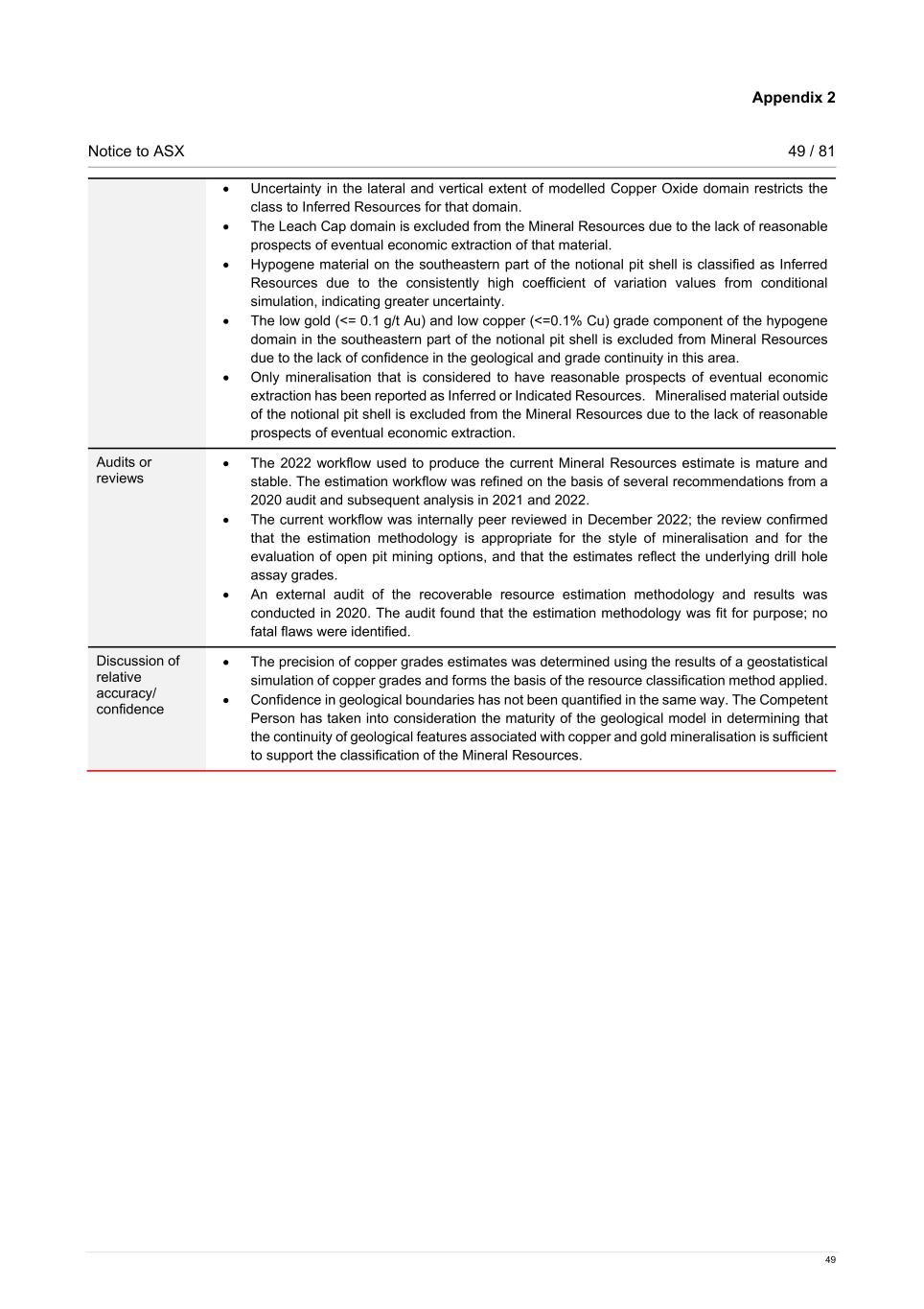

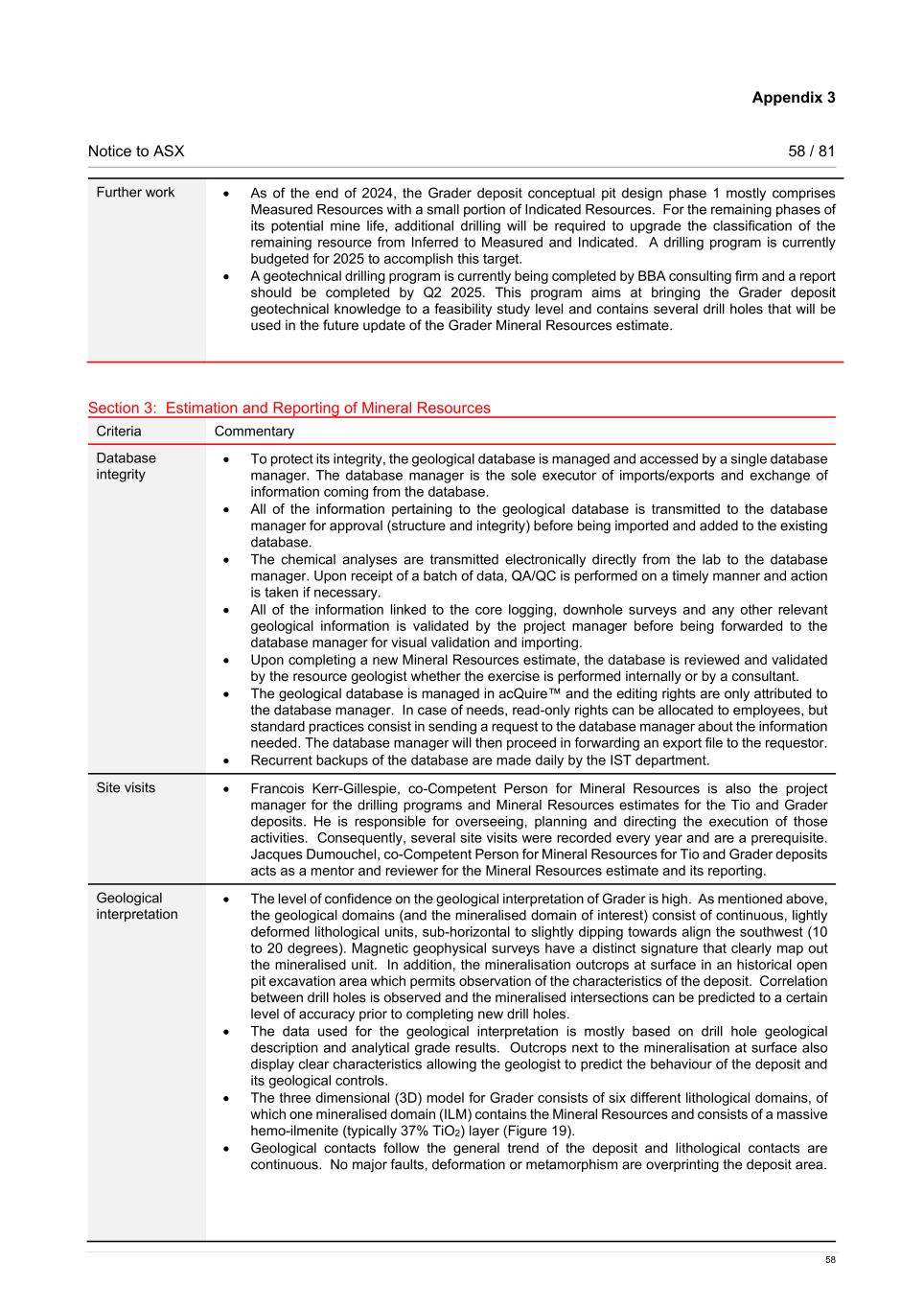

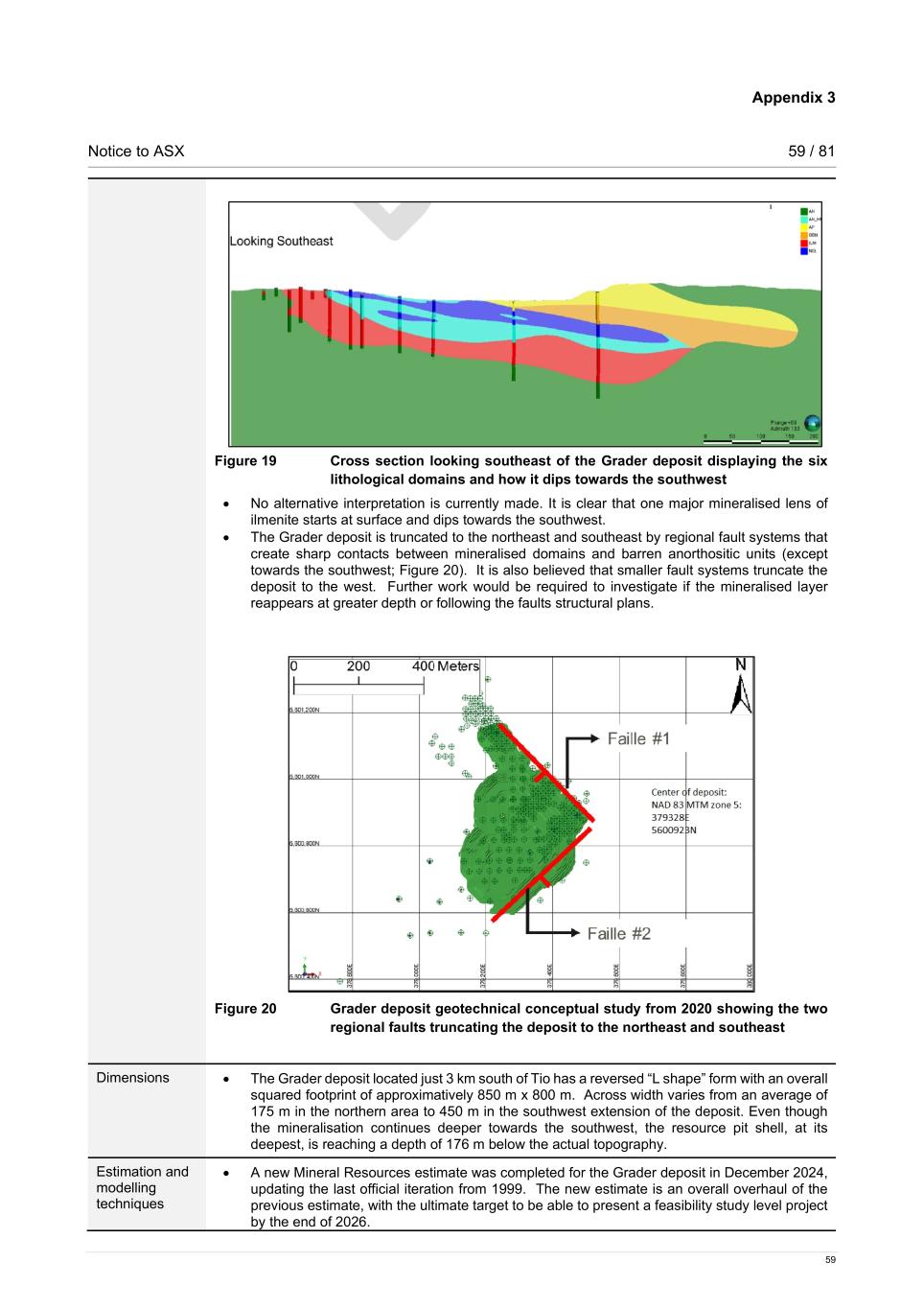

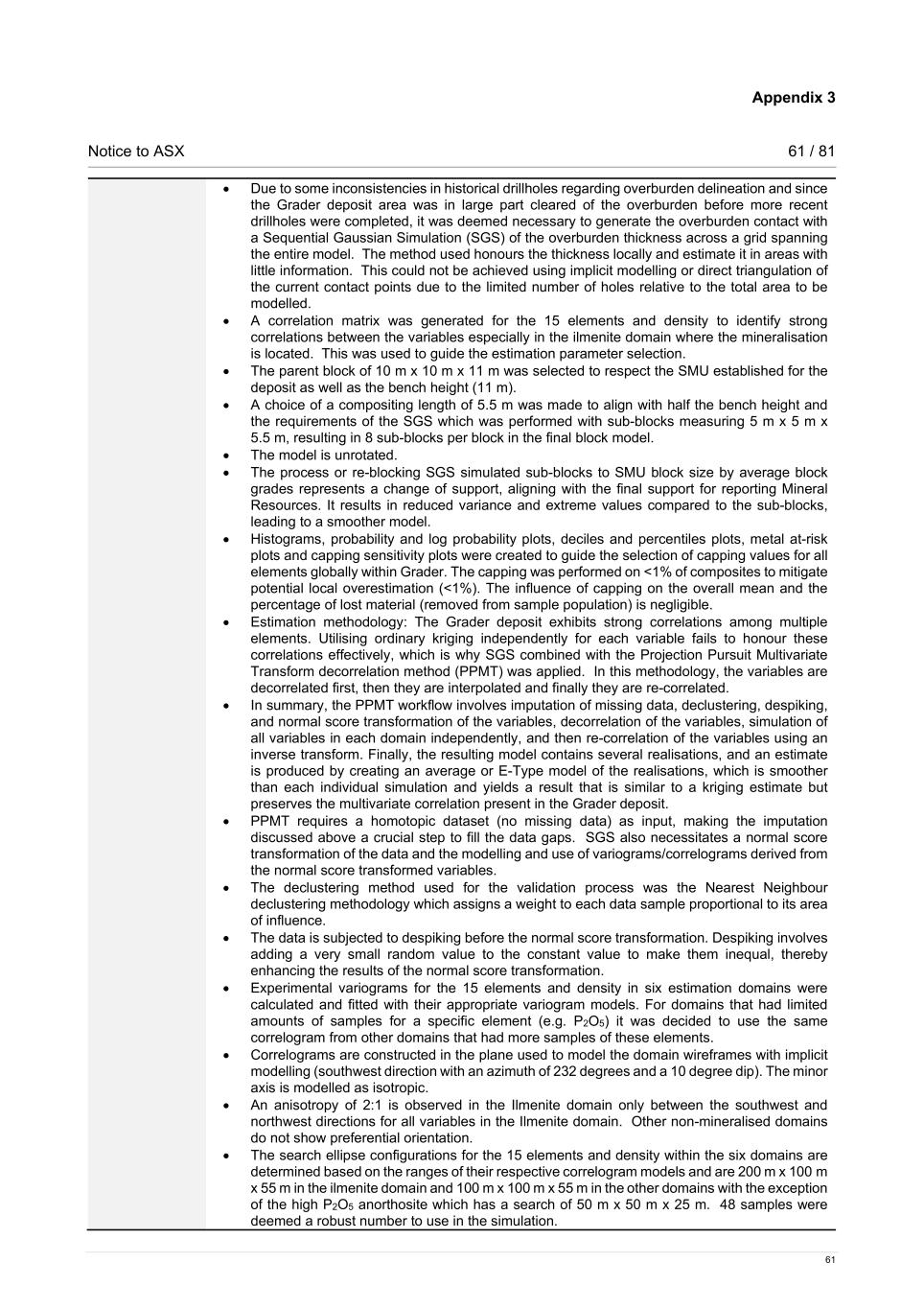

Notice to ASX 17 / 81 17 To validate the density derived ilmenite grade method used for historical drilling, a major re-sampling campaign of the 1976 to 2000 archived drill cores was conducted in 2019. 43% of the samples coming from the 1976 to 2000 drill cores were re-logged, analysed for density, and submitted to Actlab for ICP chemical analyses. The work, conducted under rigorous QA/QC protocols, confirmed the validity and accuracy of the original information, as the new ilmenite grades derived from chemical analyses confirmed that the original density analyses and grade values derived from density were adequate. Ilmenite grades for the initial 1948 to 1949 drilling campaign as well as the remaining 57% of the samples from the 1976 to 2000 drilling programs are still derived from density measurements only as the resampling program completed in 2019 proved that the grade derived from density methodology, which is based on a regression analysis of 3000 samples from the Tio and Grader deposits, is adequate. The analytical laboratory performs its own internal controls. Every 10th pulp sample is prepared and analysed in duplicate; and a blank is prepared every 30 samples and analysed. Samples are analysed using a Varian 735ES ICP and internal standards are used as part of the standard operating procedure. Estimation methodology Consultants ERM of Toronto, Ontario conducted the Mineral Resources estimate for the Grader deposit. The geological interpretation of the Grader deposit was completed using litho-geochemical analysis to define estimation domains. Consistent with the main lithologies recognised in drill cores, six domains were defined: massive ilmenite with intercalations of anorthosite lenses, anorthosite representing the anorthosite envelope, gabbronorite, and two domains of apatite-bearing lithologies: oxide-apatite-gabbronorite and nelsonite. An additional subdomain, within the anorthosite, was modelled to delineate anorthosites with a high content of P2O5 modelling was performed using Leapfrog Geo software. The Grader deposit exhibits strong correlations among multiple elements such as ilmenite, P2O5 and MgO, and preserving these correlations in the estimate is critical. Therefore, estimation was carried out using Sequential Gaussian Simulation (SGS) combined with the Projection Pursuit Multivariate Transform decorrelation method (PPMT) in Python using the Pygeostat library software. This approach allows for simulating the variables independently in each domain and subsequently re-correlating the variables using an inverse transform. A final estimate is produced by creating an average or E-Type model of several realisations. The use of simulation involves a normal score transformation of the data, first composited to a nominal length of 5.5 m, before performing the variography. Histograms, probability and log probability plots, deciles and percentiles plots, metal at-risk plots and capping sensitivity plots were created to guide the selection of capping values for all elements. The grade capping was performed on a domain basis. The results of outlier analysis resulted in a limited number of samples being globally capped for all elements to mitigate potential local overestimation. The influence of capping on the overall mean and the percentage of lost material is negligible. Correlograms were calculated and modelled for 15 elements and density in the six estimation domains. The block model is based on a SMU size of 10 m x 10 m x 11 m, first subdivided into sub-blocks of 5 m x 5 m x 5.5 m. The vertical dimension of the sub-blocks also matches the compositing size of samples, ensuring that the correlograms modelled are on the same support as the sub-blocks for the simulation. The search ellipse configurations for the 15 elements and density within the six domains was determined based on the full ranges of their respective correlogram models. The simulation was performed using a search of 48 composites. The 5 m x 5 m x 5.5 m sub-blocked model was re-blocked to the 10 m x 10 m x 11 m SMU by averaging the sub- blocks. This process represents a change of support, aligning with the final support for reporting resources. Nearest neighbour estimates using the same set of composites and estimation domains as the simulation were used to validate the estimate. Cut-off grades and modifying factors A cut-off grade of 74% ilmenite is applied in a pit optimisation process in order to yield a metallurgical target grade of 81.5% which meets Tio operation’s current production target. Ilmenite grade is calculated as sum of oxides (TiO2 + FeO + Fe2O3 + Cr2O3 + V2O5) in each sample to create the ilmenite variable. Achieving the target grade required adjusting the pit through the selection of cut-off grades. The pit optimisation process employed the Lerch-Grossmann algorithm to determine the optimal configuration of the open pit shell for Grader. This algorithm was applied using CAE Datamine’s Studio NPV Software.

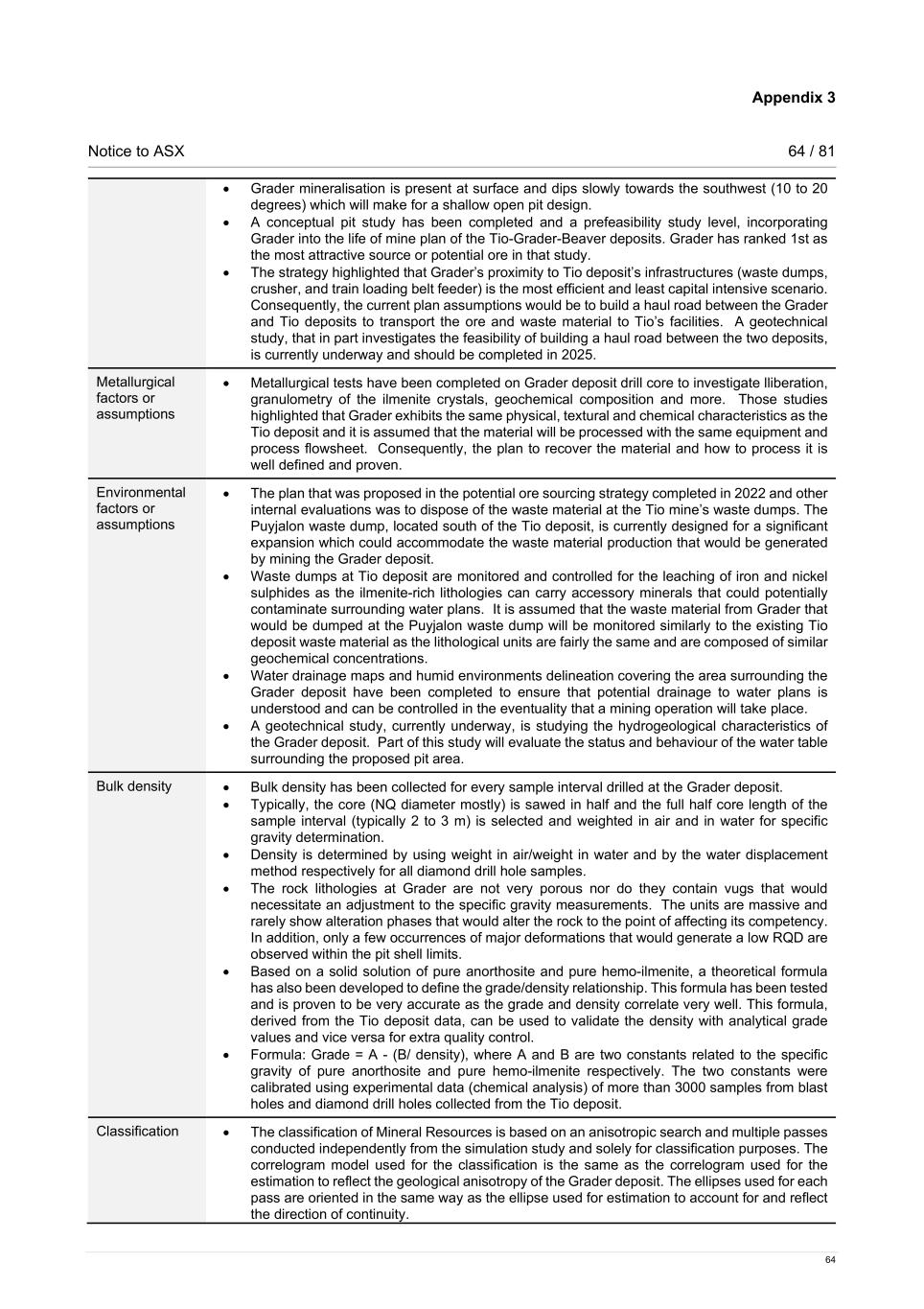

Notice to ASX 18 / 81 18 In addition to the cut-off grade, several other economic parameters are involved in the optimisation process including economic parameters such as commodity prices and operational costs, as well as operational considerations such as plant recovery, slope angles and the starting topography surface. The Engineering Consulting firm BBA of Montreal, Quebec was mandated to carry out a prefeasibility study (PFS) to evaluate the operating and capital costs associated with the development and operation of the Grader deposit to supplement feed from the Tio pit. A conceptual design of an initial 10-year pit developed within the envelop of Measured and Indicated Resources aims at producing approximately 600 thousand tonnes per annum (ktpa) ilmenite to be treated at the Tio mine crushing facilities. The pit would be expandable to access the remaining Mineral Resources. Mineral Resources above the 74% ilmenite cut-off are reported using the constraint of the pit shell generated from the optimisation process. As the Grader mineralisation retains the same physical, textural, and chemical characteristics to the Tio deposit it is destined to be processed at the RTITQO Sorel metallurgical complex to yield titanium slag and pig iron. Criteria used for Mineral Resource classification The resource classification is conducted utilising an omnidirectional search ellipse and multiple passes, conducted independently from the simulation study and solely for classification purposes. The search distances considered are based on the range of the omnidirectional correlogram (120 m) of the ilmenite grade, as it is the most economically significant variable and correlates well with other elements. Half the range of the correlogram (60 m) is used to classify Measured Resources, while a search radius of 1.5 times the range of the correlogram (180 m) is employed for classifying Indicated Resources. Blocks beyond 180 m are classified as Inferred Resources. The range of 60 m for Measured Resources is also supported by a drillhole spacing study carried out for the Lac Tio Mineral Resources estimation. Finally, a categorical smoothing of the resource classification is performed to account for isolated blocks of a given category surrounded by different categories. The result is supported by the Competent Persons’s interpretation of continuity across the Grader deposit.

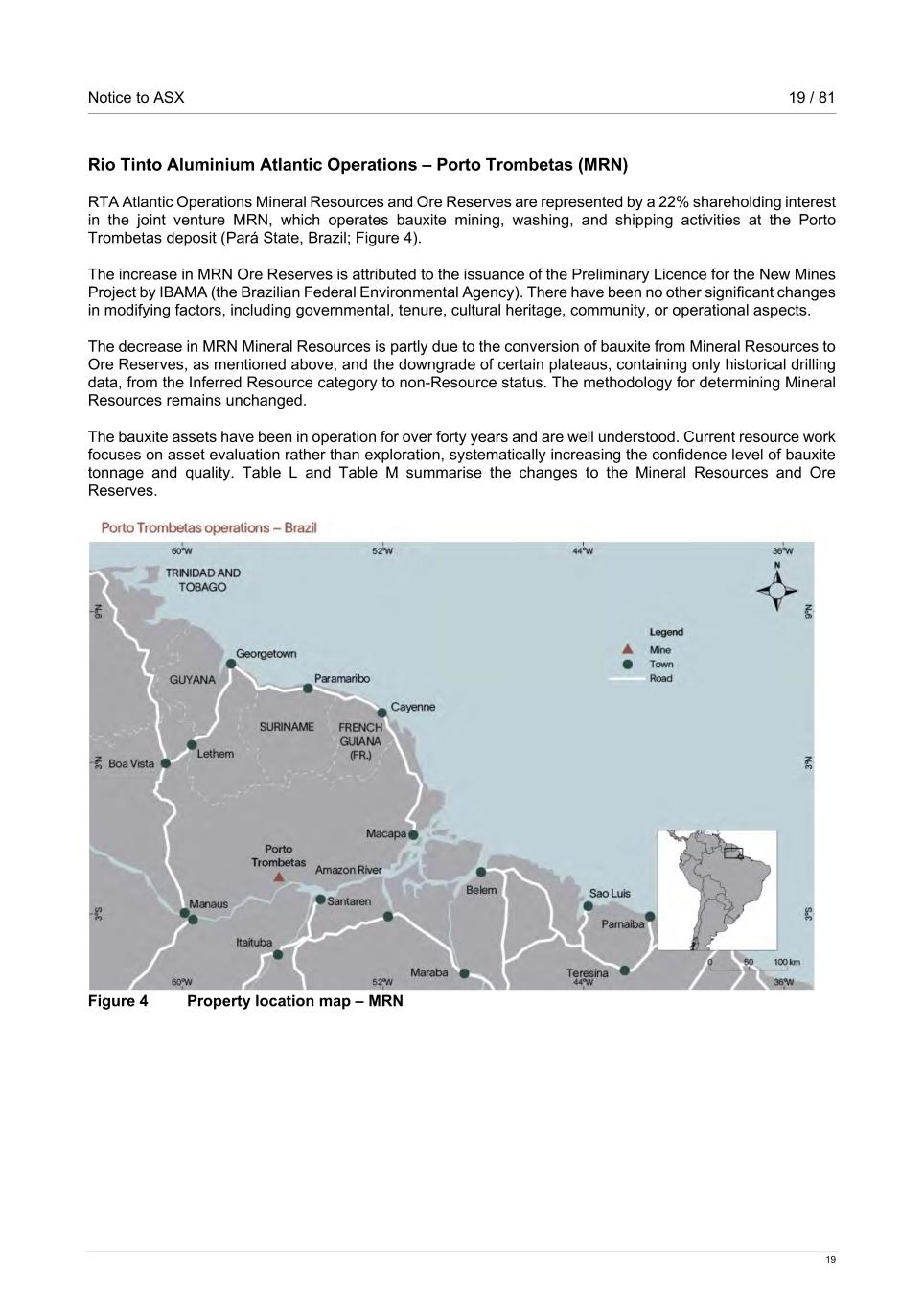

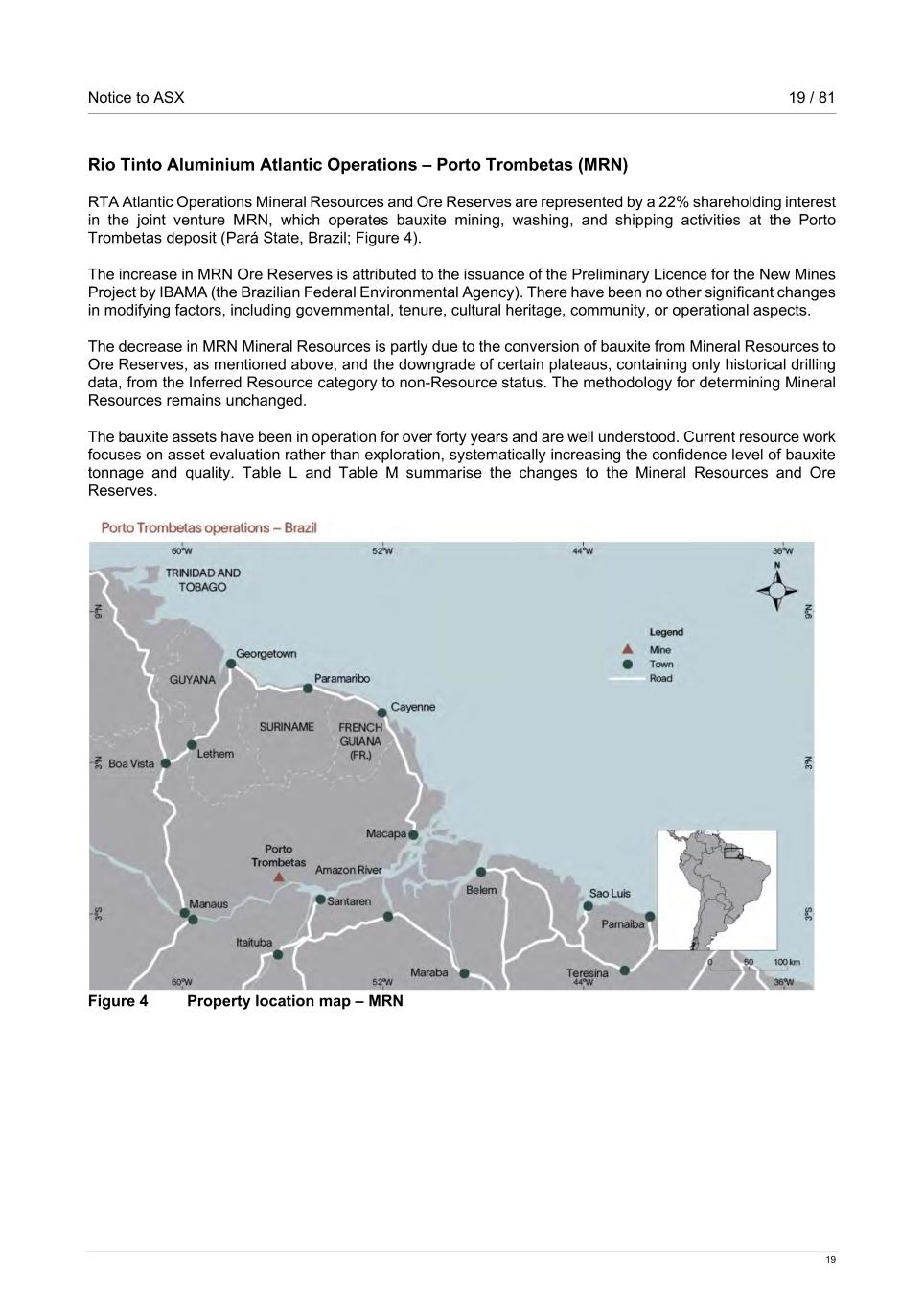

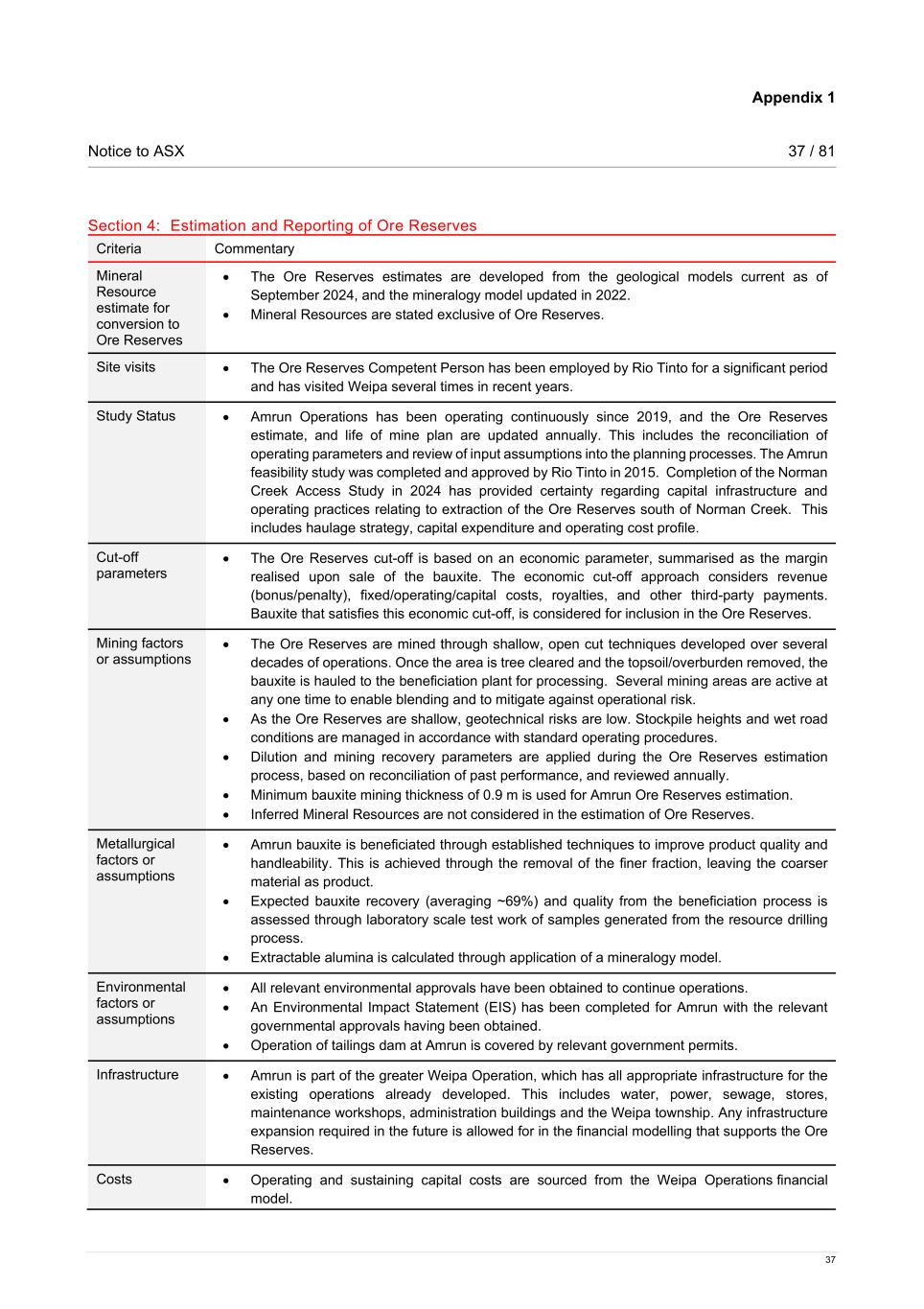

Notice to ASX 19 / 81 19 Rio Tinto Aluminium Atlantic Operations – Porto Trombetas (MRN) RTA Atlantic Operations Mineral Resources and Ore Reserves are represented by a 22% shareholding interest in the joint venture MRN, which operates bauxite mining, washing, and shipping activities at the Porto Trombetas deposit (Pará State, Brazil; Figure 4). The increase in MRN Ore Reserves is attributed to the issuance of the Preliminary Licence for the New Mines Project by IBAMA (the Brazilian Federal Environmental Agency). There have been no other significant changes in modifying factors, including governmental, tenure, cultural heritage, community, or operational aspects. The decrease in MRN Mineral Resources is partly due to the conversion of bauxite from Mineral Resources to Ore Reserves, as mentioned above, and the downgrade of certain plateaus, containing only historical drilling data, from the Inferred Resource category to non-Resource status. The methodology for determining Mineral Resources remains unchanged. The bauxite assets have been in operation for over forty years and are well understood. Current resource work focuses on asset evaluation rather than exploration, systematically increasing the confidence level of bauxite tonnage and quality. Table L and Table M summarise the changes to the Mineral Resources and Ore Reserves. Figure 4 Property location map – MRN

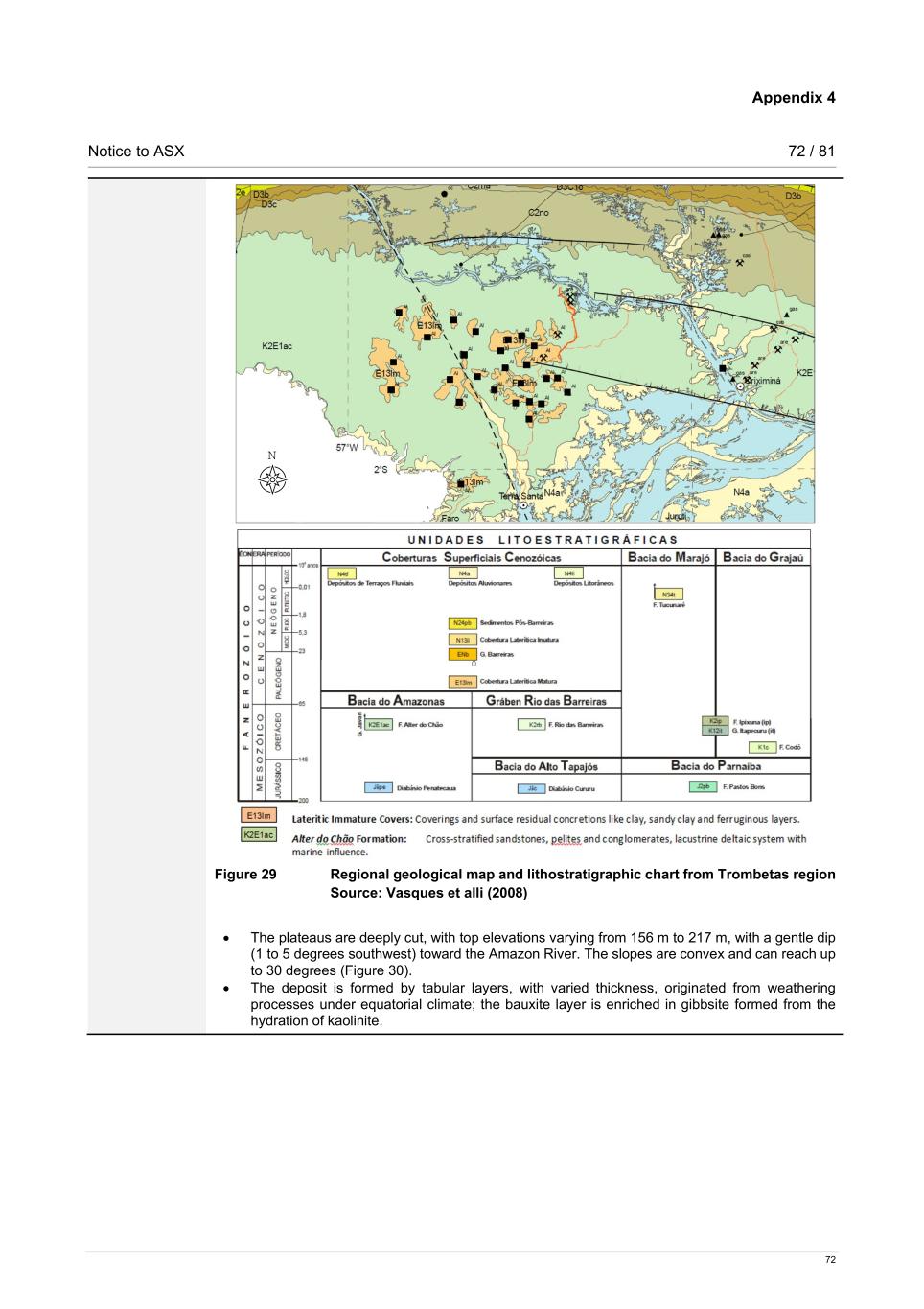

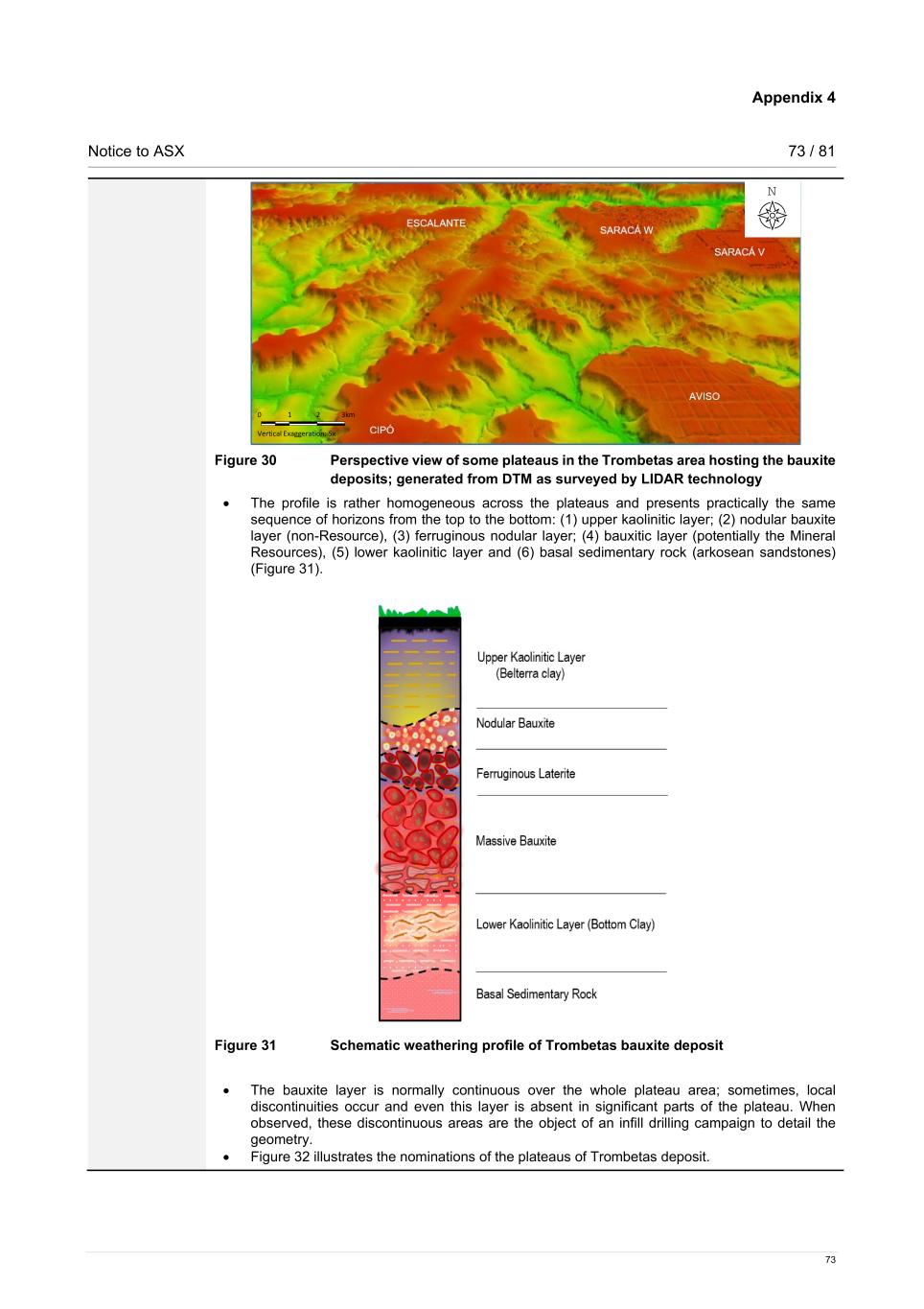

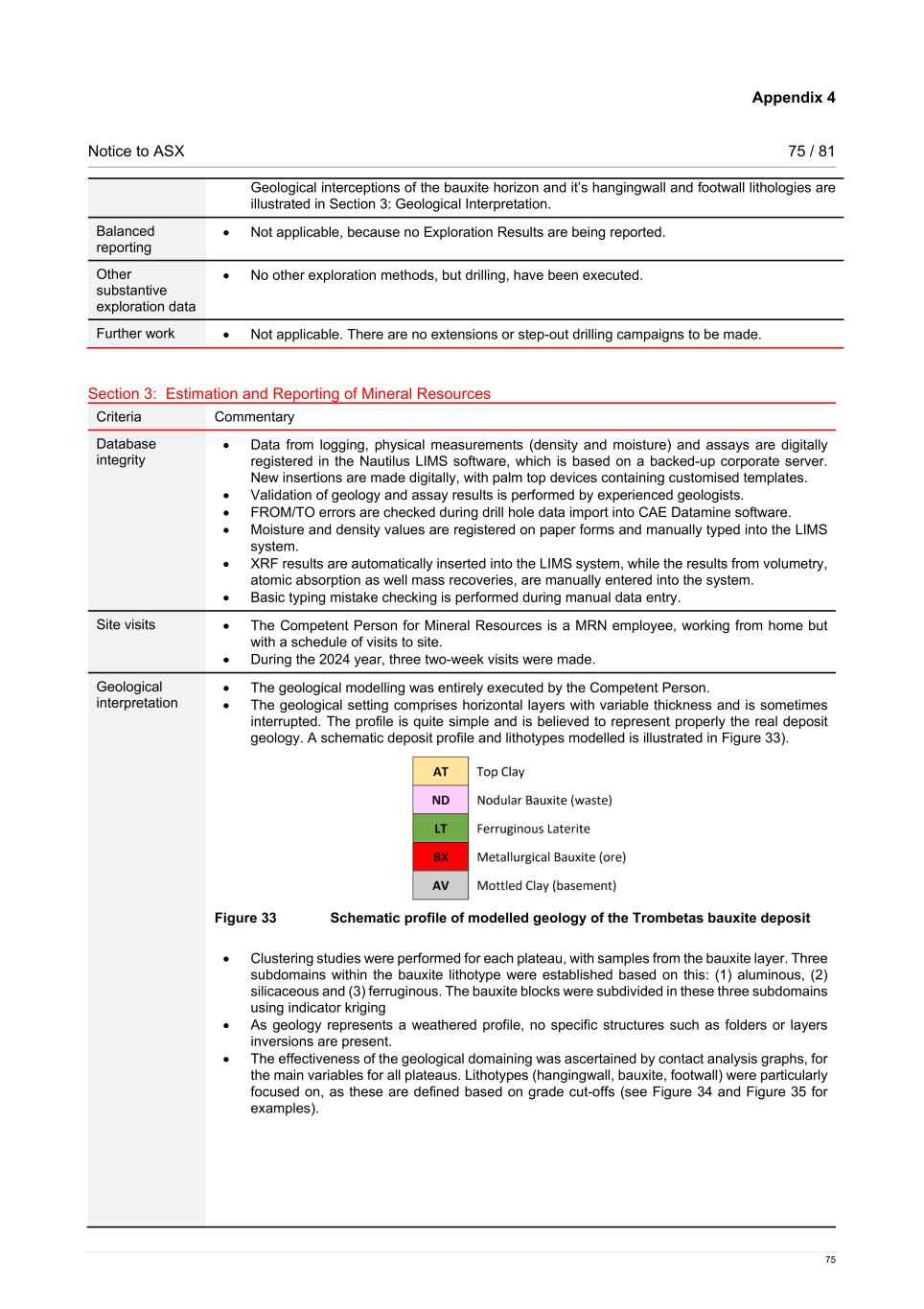

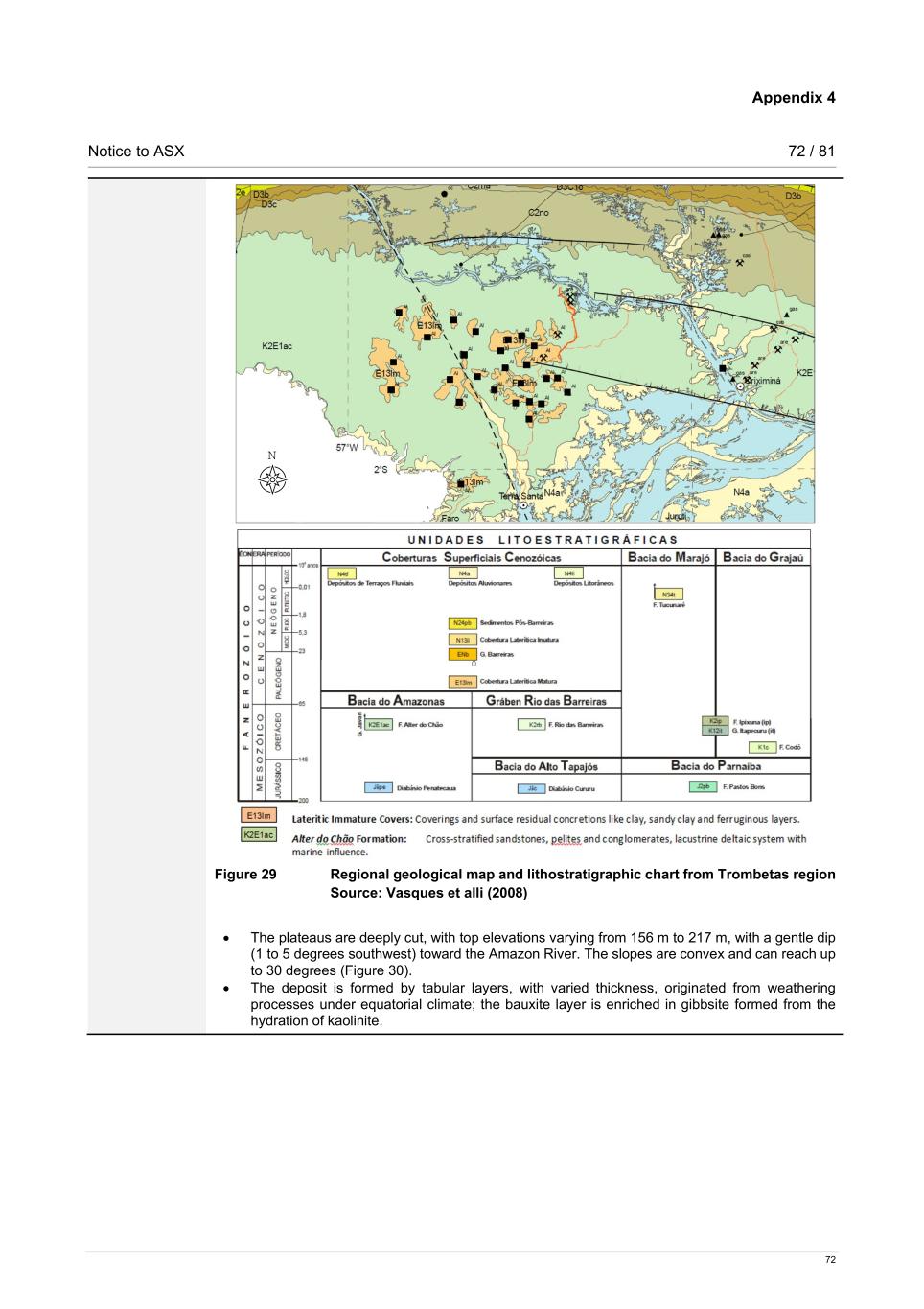

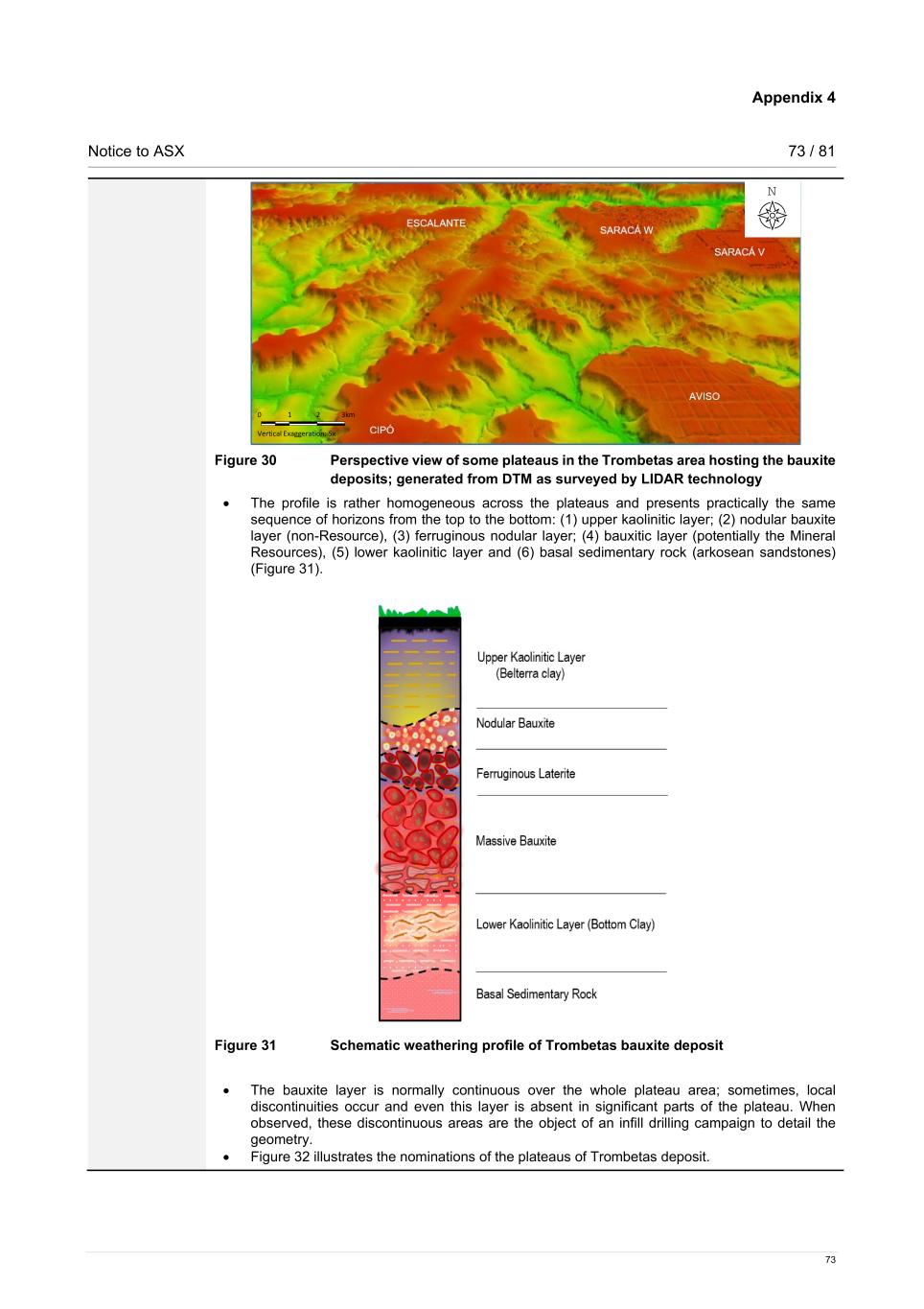

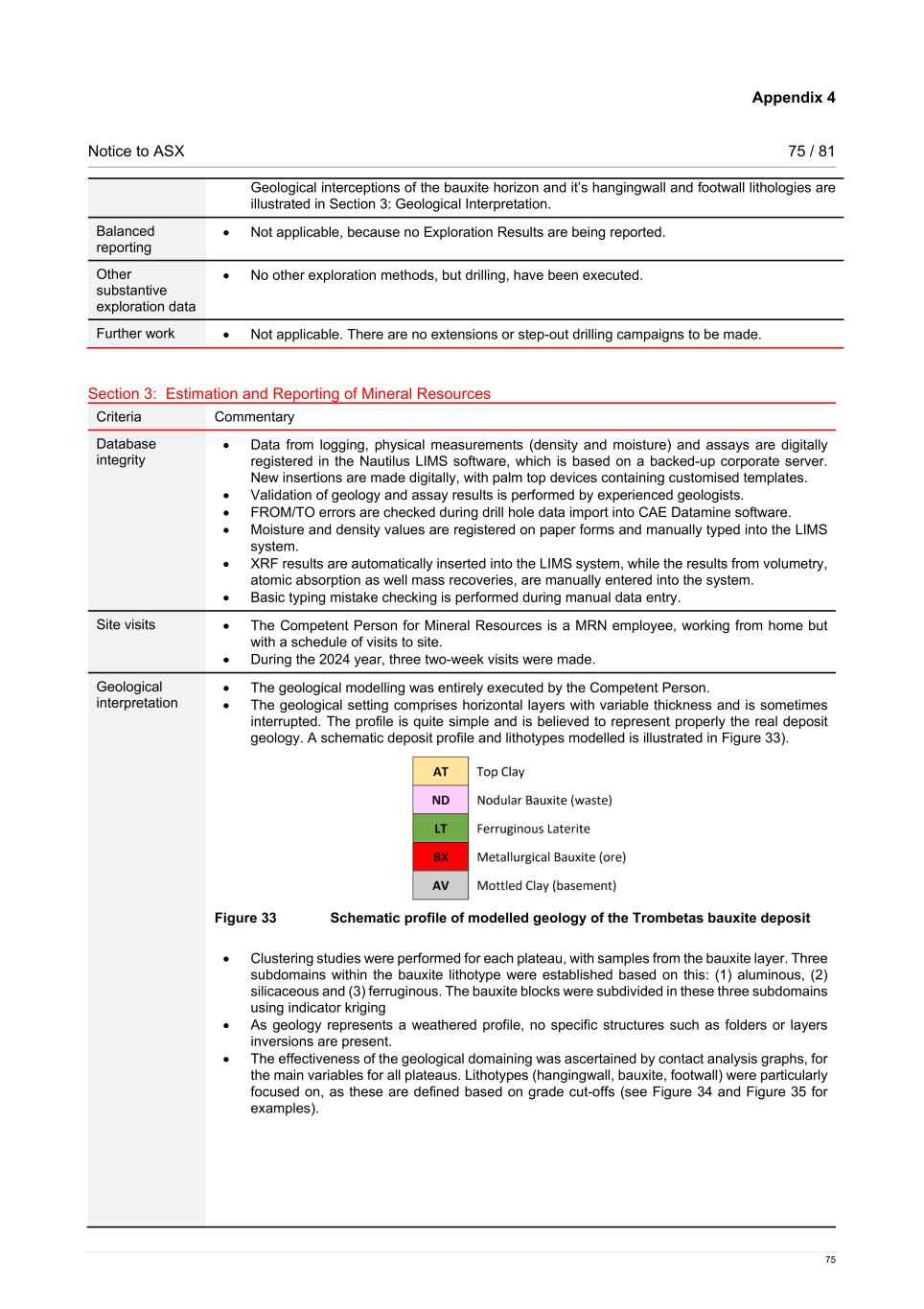

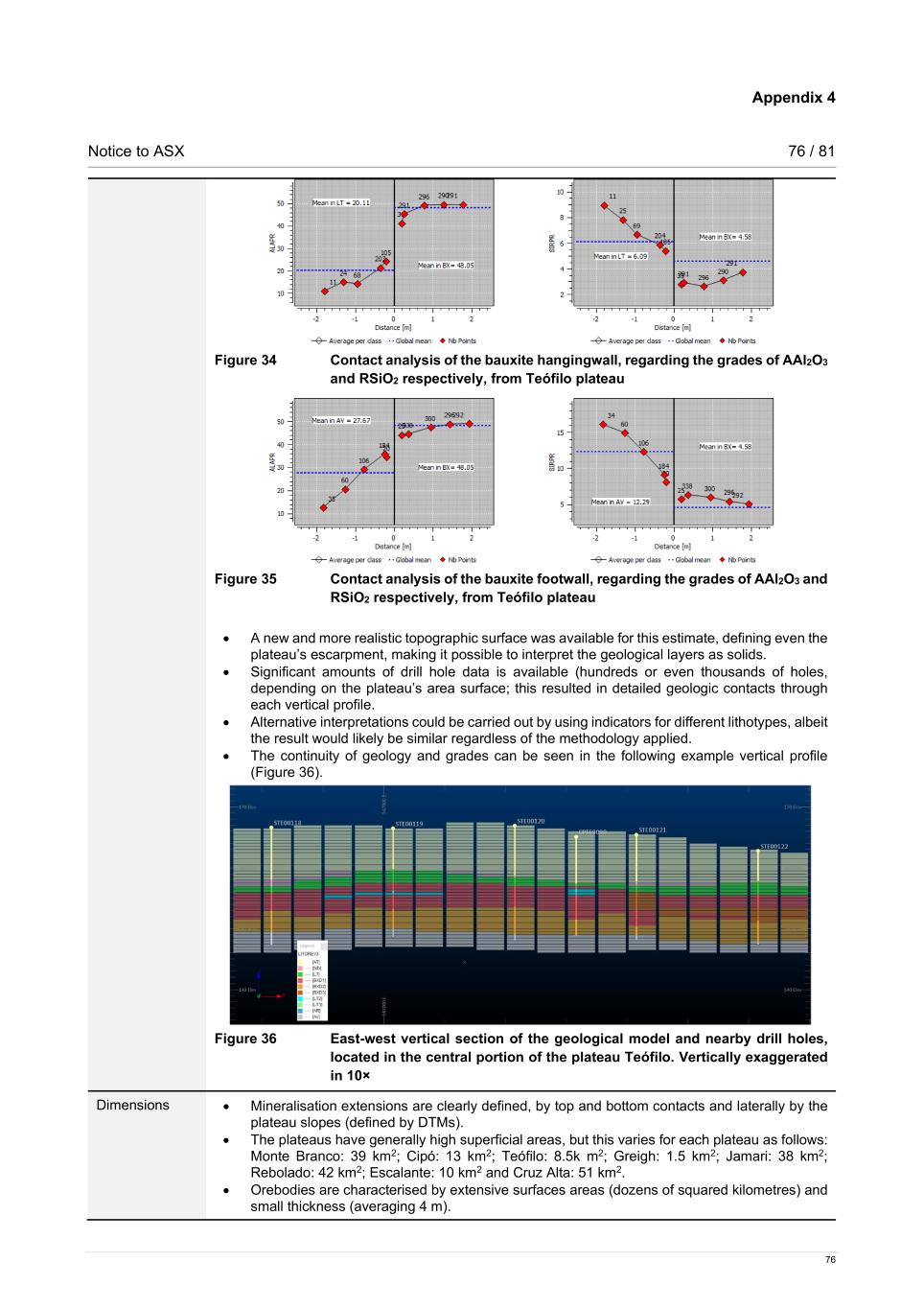

Notice to ASX 20 / 81 20 Table L Changes to MRN Mineral Resources Measured Mineral Resources Indicated Mineral Resources Inferred Mineral Resources Total Mineral Resources Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Mineral Resources as at 31 Dec 2023 422 47.3 5.3 3.5 48.9 2.5 146 49.5 4.0 571 47.9 5.0 Additions - - - - - - - - - - - - Depletions 178 48.0 4.5 0.1 42.4 3.4 112 50.1 3.6 290 48.8 4.2 Mineral Resources as at 31 Dec 2024 244 46.8 5.9 3.4 49.1 2.5 34 47.3 5.2 282 46.9 5.8 Table M Changes to MRN Ore Reserves Proved Ore Reserves Probable Ore Reserves Total Ore Reserves Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Mt % Al2O3 % SiO2 Ore Reserves as at 31 December 2023 43 48.9 4.9 3 49.0 4.9 46 48.9 4.9 Additions* 7 43.1 7.1 167 49.1 4.6 174 48.8 4.7 Depletions - Production 11 48.6 5.0 - - - 11 48.6 5.0 Ore Reserves as at 31 Dec 2024 39 48.0 5.2 170 49.1 4.6 209 48.9 4.7 * The additions in the ‘Proved’ category refer to the high silica project. In turn, the additions in the ‘Probable’ category refer to the new environmental licence. Summary of information to support Mineral Resources reporting – Porto Trombetas (MRN) RTA Atlantic Operations Mineral Resources are supported by the information set out in the Appendix 4 to this release and located at Resources & Reserves (riotinto.com) in accordance with the Table 1 checklist in the JORC Code. The following summary information is provided in accordance with Rule 5.8 of the ASX Listing Rules. Geology and geological interpretation The bauxite deposit is composed of a cluster of plateaus, geologically defined as mature lateritic covers formed during the Cenozoic-Paleogene period. These covers were weathered under an equatorial climate from clayey or arkosic sandstones of the Alter do Chão Formation in the Amazon Sedimentary Basin. The plateaus are deeply incised, with flattened tops at elevations ranging from 150 m to 200 m above sea level. They extend laterally for kilometres in length and width, covering up to thousands of hectares. The process of bauxitisation involves the conversion of kaolinite to the bauxite mineral gibbsite, driven by several weathering transformation fronts, including ferruginisation, silica and iron leaching, and alumina accumulation. In the deposit profile, the bauxite forms a continuous tabular layer with an average thickness of 4 m, covered by 6 m to 8 m of ferruginous laterite, nodular bauxite (not a Mineral Resource) and upper kaolinitic clay. Beneath this, it transitions to a mottled kaolinitic horizon. Although the dominant bauxite textures vary per plateau, they are primarily boxwork and concretionary, mixed with varying amounts of kaolinitic clay. Modern root channel structures and infill are common in the upper part of the layer. Gibbsite is the primary mineral, while boehmite is virtually absent.

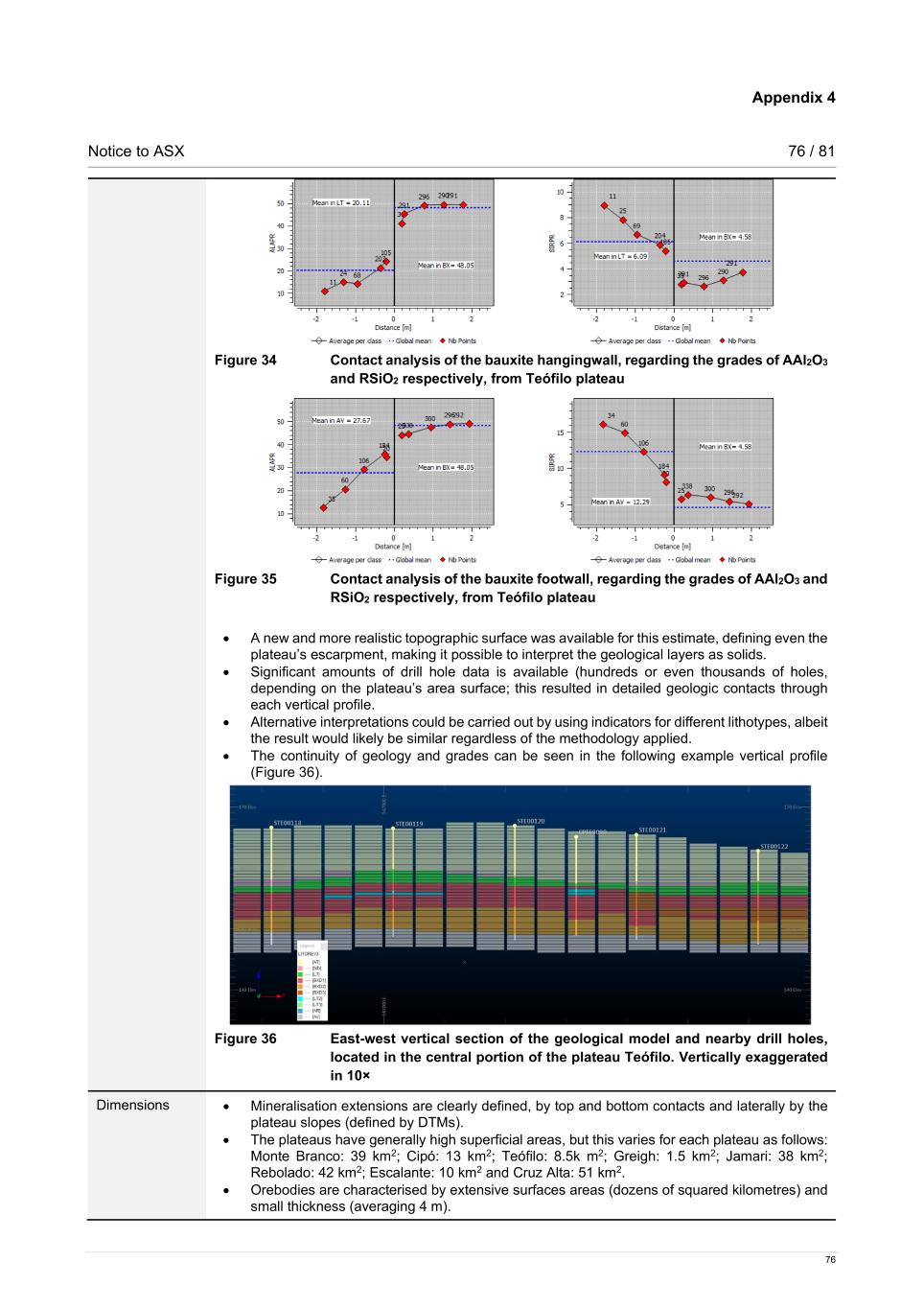

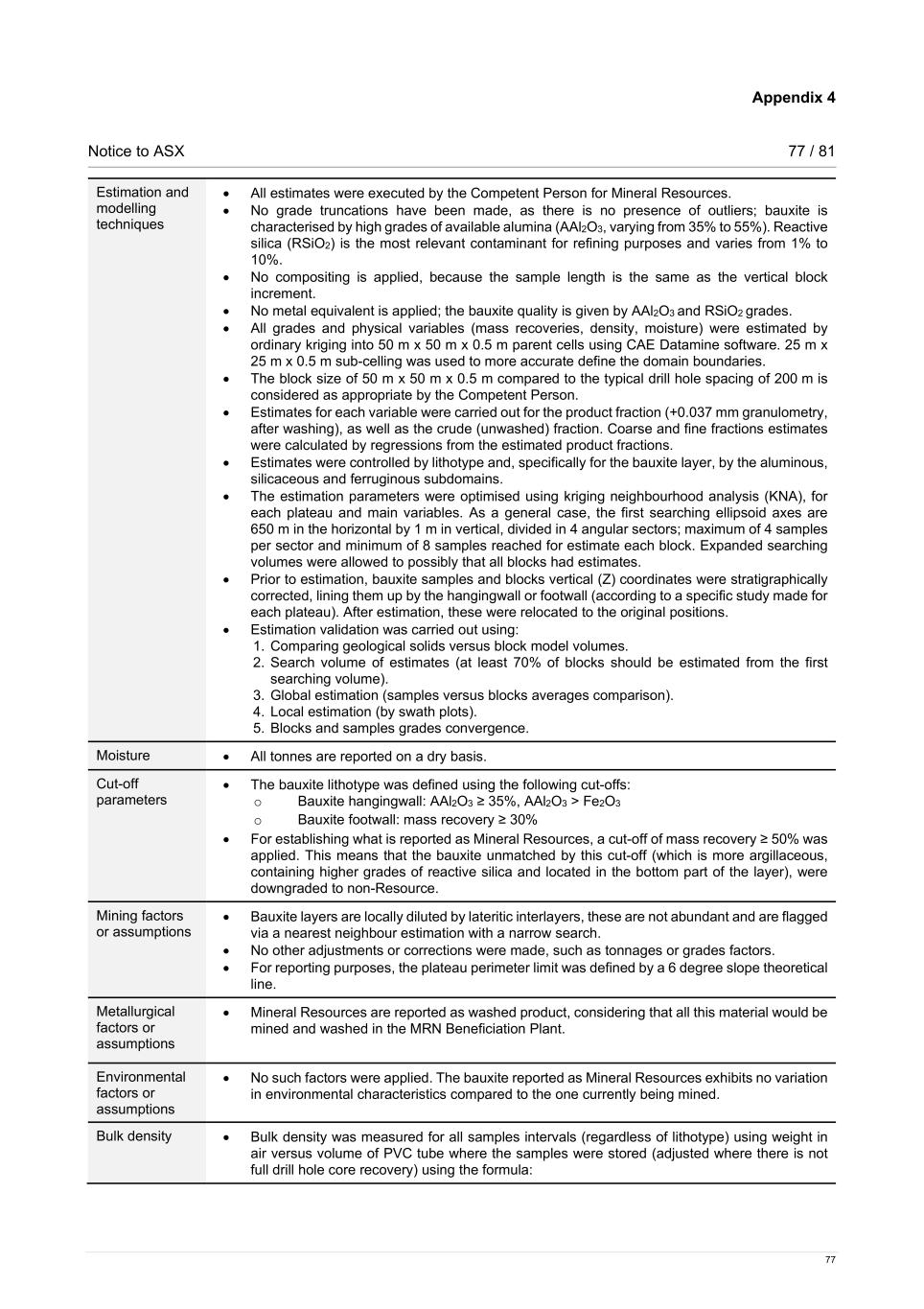

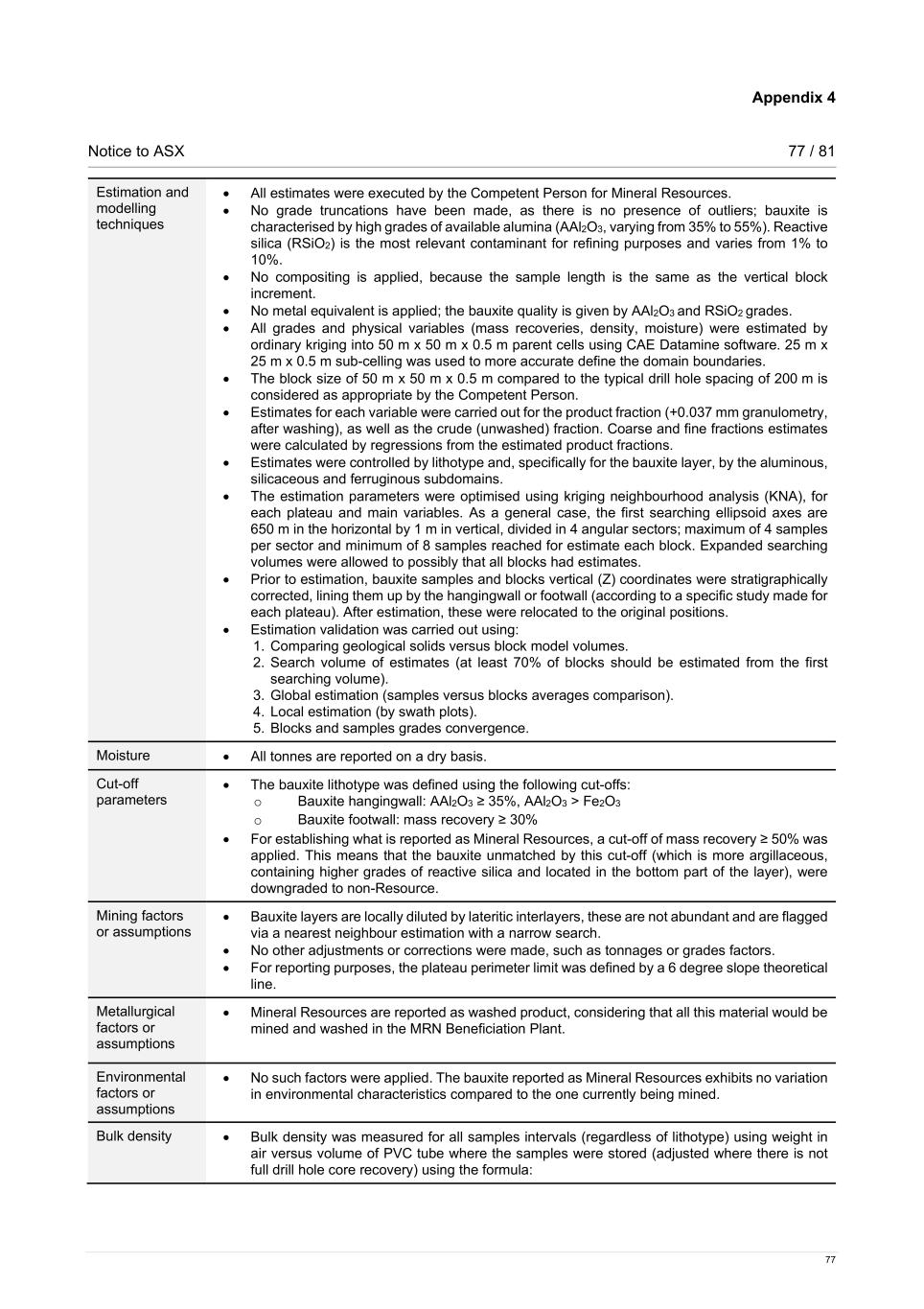

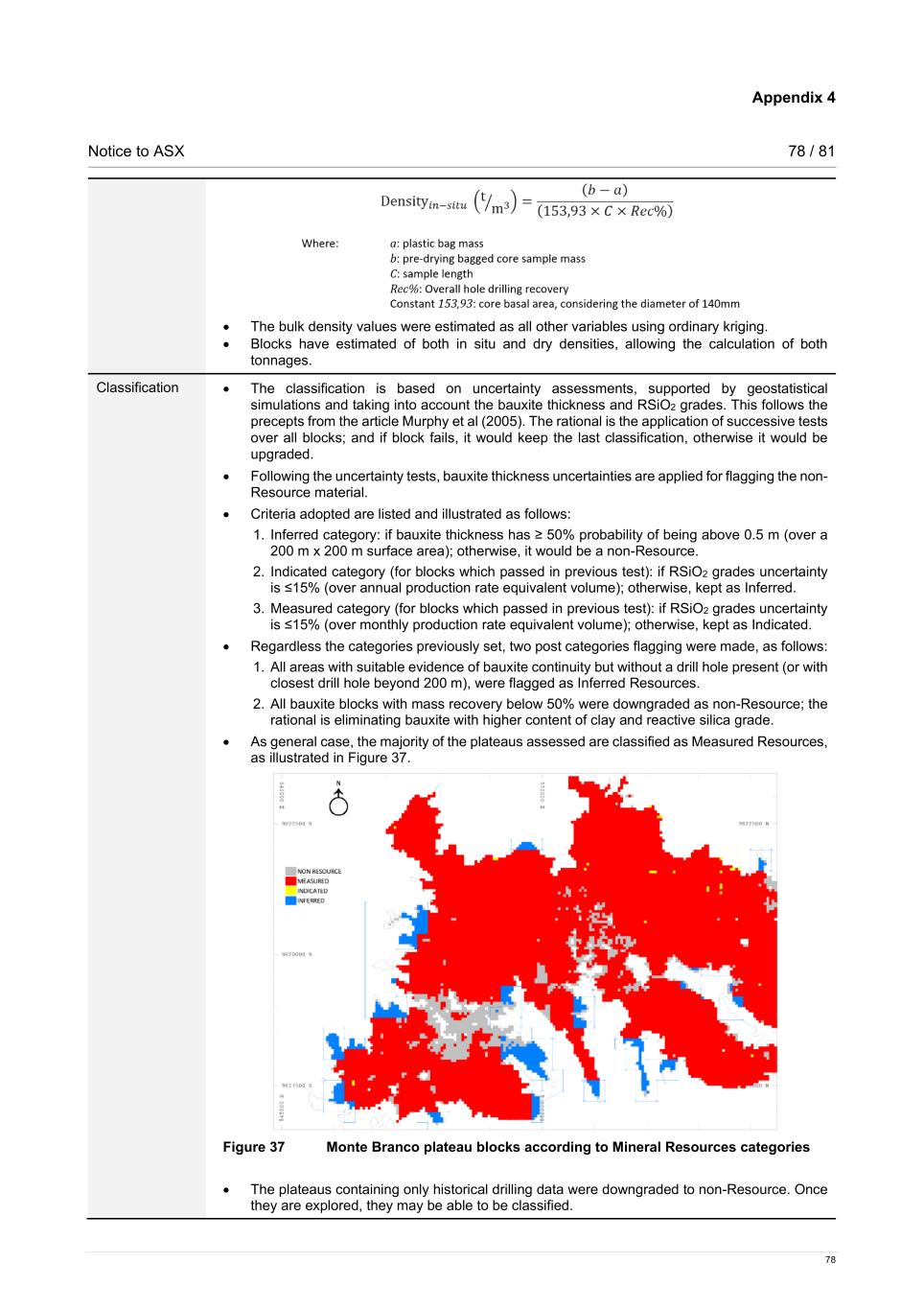

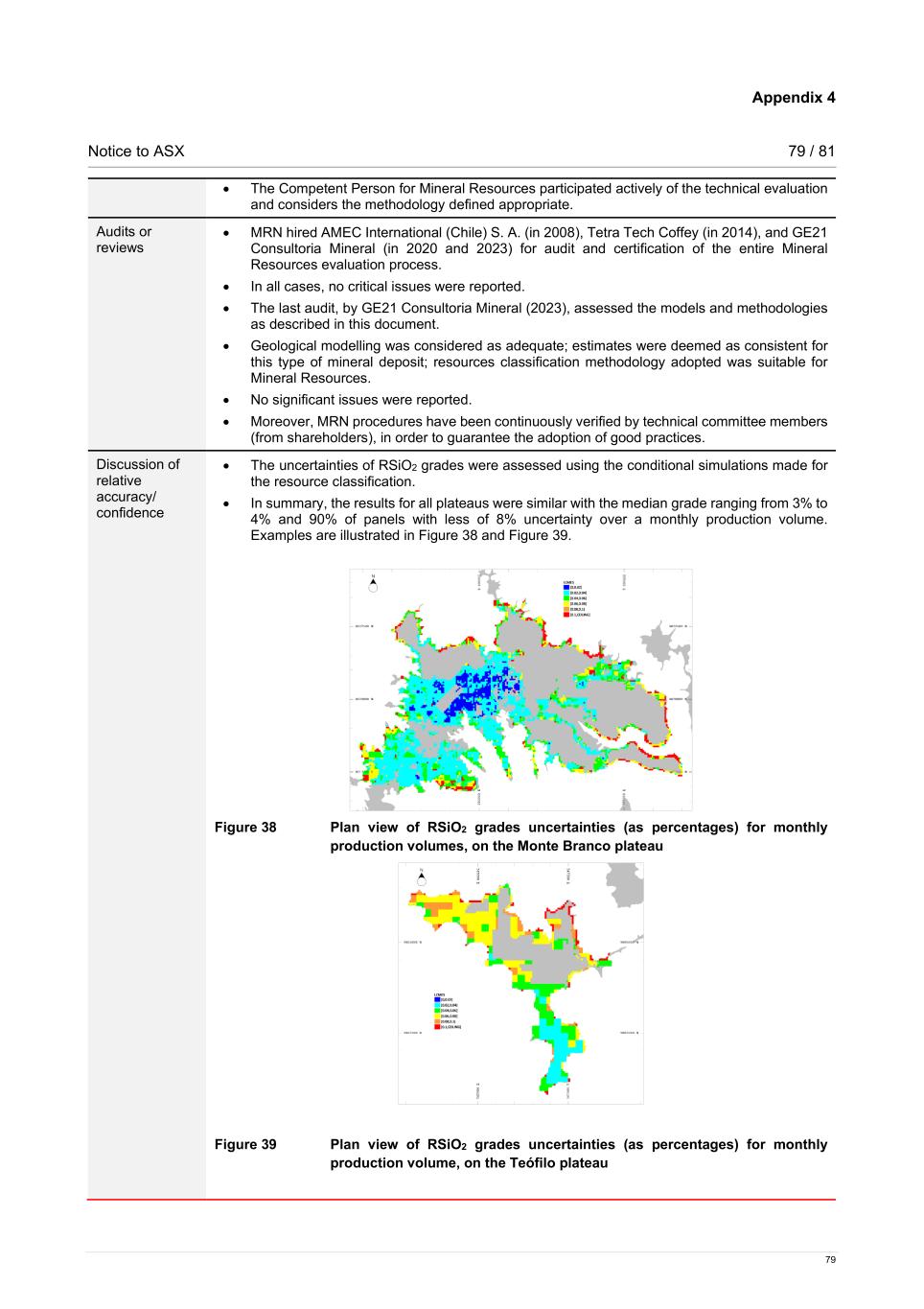

Notice to ASX 21 / 81 21 Drilling techniques; sampling, sub-sampling method and sample analysis method The current drilling method utilised at MRN is the aircore. The typical aircore rig is a roto-pneumatic Prominas R-1HB model mounted on a regular road truck, with a drilling set composed of a 6 inch crown bit, core barrel, and rods. All profiles except the upper kaolinitic layer are recovered, and drilling ends upon reaching the bottom kaolinitic layer. As drilling progresses, the core is inserted into a PVC tube within the core barrel. Once filled, the tube is removed from the hole, replaced, and drilling continues. The PVC tube containing the geological core is identified, sealed and transported for sampling. The adopted grid spacing is 200 meters squared (m2), covering the entire surface of the plateaus. Recently, an infill campaign with 100 m spacing has been executed in the plateaus being mined. Additionally, a 50 m spaced grid is being implemented in areas designated for grade control. Logging is currently conducted on tablets, with data captured into the Seequent MX Deposit application. In addition to geological classification, physical features are recorded. Typical samples are 0.5 m in length, varying from 0.3 m to 0.8 m to respect geological contacts. Sample processing includes weighing (for density calculation), drying (for moisture calculation) and wet screening for tailings removal, determination of mass recovery and partitioning into coarse and fine granulometries. Chemical analysis is performed by XRF for major oxides: Al2O3, SiO2, Fe2O3, TiO2 and LOI (calculated by difference). Additionally, available alumina and reactive silica grades are assayed by volumetry and atomic absorption, after alkaline digestion. Estimation methodology Basic geostatistical analysis is used to help with domaining decisions. The deposit is modelled as single layers. Five horizon codes, based on the lithology and assays, are assigned for the modelling and estimation of bauxite resources at MRN. Interpretation is undertaken using CAE Datamine RM implicit interpolation tool, while variography and estimation are performed using Geovariances Isatis.Neo software. 50 m x 50 m x 0.5 m sized blocks are filled between two modelled surfaces for flagging each lithotype, as well as under the topographic digital terrain model. For estimates, bauxite horizon samples and blocks were (temporarily) flattened by the hangingwall or footwall (depending on the plateau). Furthermore, clustering assessments were made, resulting in three geostatistical subdomains for filtering the estimates. All grades available as well as LOI and mass recoveries were estimated, for all lithotypes, into parent cells using ordinary kriging. Search strategy parameters were optimised by using the kriging neighbourhood analysis tool. Cut-off grades and modifying factors At MRN, the bauxite lithotype is defined by the following cutoffs: AAl2O3[1] ≥ 35%, AAl2O3 > Fe2O3, and mass recovery ≥ 30%. To identify Mineral Resources volumes with reasonable prospects for eventual economic extraction, an additional cut-off is applied: mass recovery ≥ 50%. Bauxites that do not meet this criterion are downgraded to non-Resource status. It is important to note that this downgraded bauxite is in the lower part of the layer and has higher silica grades and clay content. This approach has been validated through an economic extraction assessment. Additionally, material converted into Ore Reserves, as represented by the mining plan volumes, has been removed. The remaining amounts constitute the reported Mineral Resources exclusive of Ore Reserves. Criteria used for Mineral Resources classification Classification within the bauxite layer is based on conditional simulation assessments, considering bauxite thickness and reactive silica grades. The narrowly simulated points were aggregated into 200 m x 200 m x 1 m panels, and the coefficients of variation were calculated for annual (CVY) and monthly (CVM) production level volumes. Bauxite blocks within panels with a probability above 50% of having a thickness less than 0.5 m were flagged as non-Resource; otherwise, they were classified as Inferred Mineral Resources. Inferred Mineral Resources [1] Available alumina

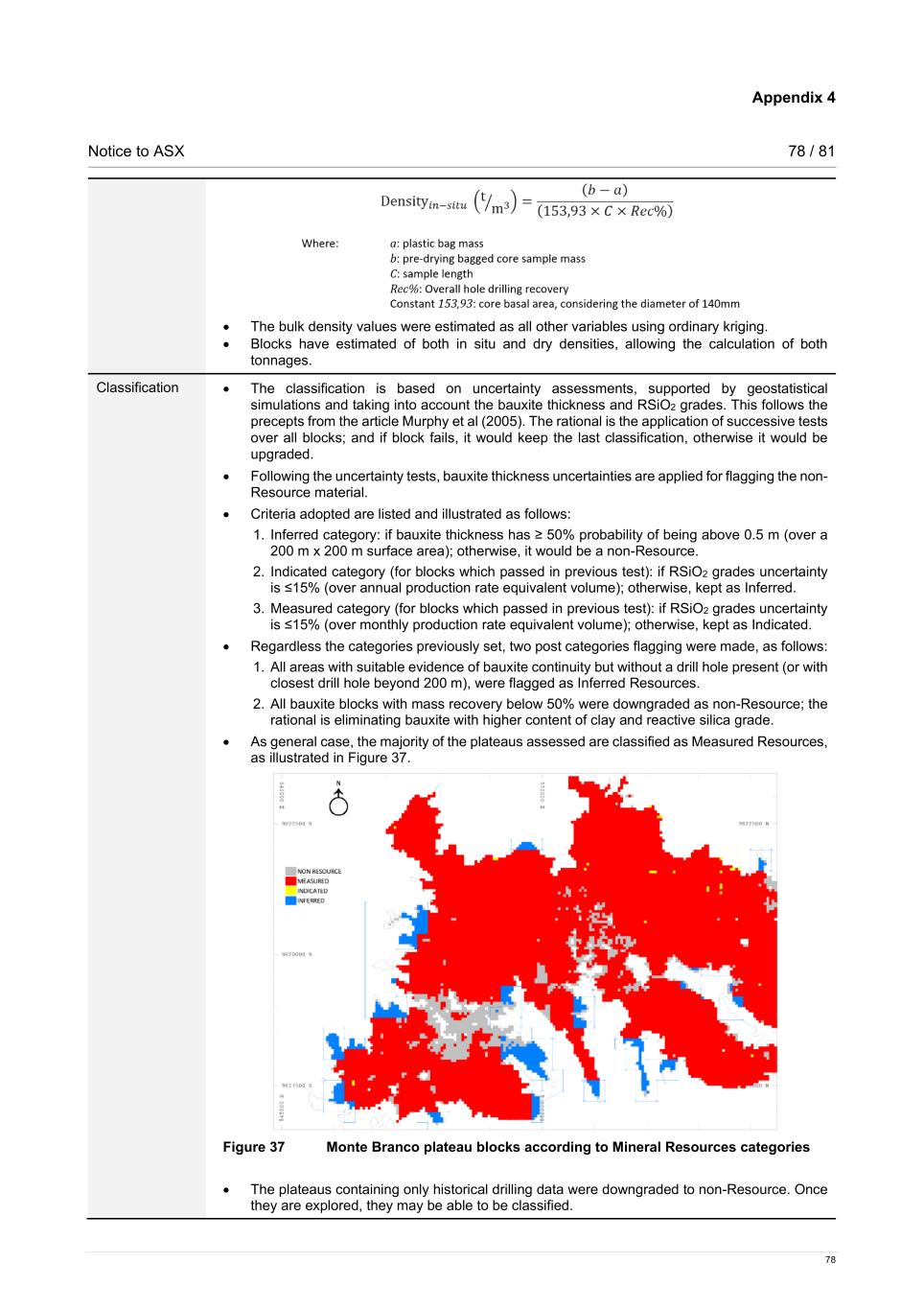

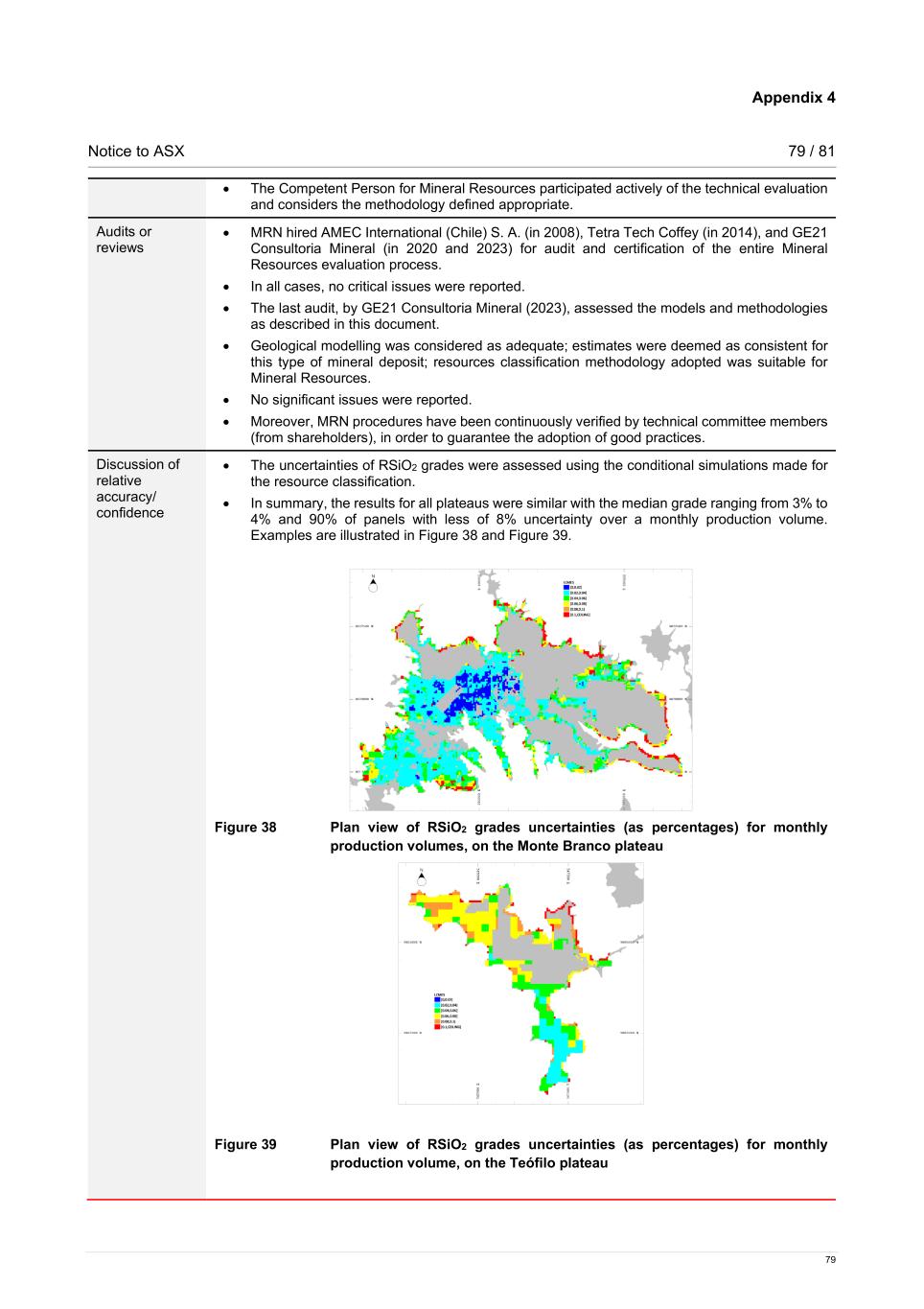

Notice to ASX 22 / 81 22 with CVY ≤ 15% were upgraded to the Indicated Resources category, and those with CVM ≤ 15% were upgraded to the Measured Resources category. Additional exception criteria adopted subsequently are: 1. Areas lacking drill holes (more than 200 m from the closest one), were automatically flagged as Inferred Resources. 2. Blocks with mass recovery under 50% were downgraded to non-Resource (as described previously). Plateaus with historical data (lower quality and transparency), located in the far west, have being downgraded to non-Resource status in this report and need to be re-drilled to increase confidence and potentially allow for future upgrades. Summary of information to support the Ore Reserves reporting – Porto Trombetas (MRN) RTA Atlantic Operations Ore Reserves are supported by the information set out in the Appendix 4 to this release and located at Resources & Reserves (riotinto.com) in accordance with the Table 1 checklist in the JORC Code. The following summary information is provided in accordance with rule 5.9 of the ASX Listing Rules. Economic assumptions and study outcomes MRN has been operating continuously for over forty years, and the Ore Reserves estimate, and life of mine plans are updated annually. This includes the reconciliation of operating parameters and review of input assumptions into the planning processes. MRN's Ore Reserves were audited in December 2023 by GE21 Consultoria Mineral Ltda. and are supported by a feasibility study. Rio Tinto applies a common process to the generation of bauxite price assumptions across the group and these assumptions are also applied to MRN. This involves generation of long-term price forecasts based on current sales contracts, industry capacity analysis, global commodity consumption and economic growth trends (this includes the bonus/penalty adjustments for quality). Exchange rates are also based on internal Rio Tinto modelling of expected future country exchange rates. Capital and operating cost estimates are sourced from internal MRN financial modelling and/or project capital estimates. Third party payments are reflective of the current agreements in place. Mining method and assumptions The mining method used at MRN is strip mining. The main operations are deforestation, stripping with dozers, scarification, excavation, and transportation with trucks. The mined bauxite is directed to two crushing systems and then passes through a washing plant. After washing, it is transported by rail to the port yards, and part of the bauxite goes through a drying process. The optimisation of the pits to support the Ore Reserves considers the following mining and processing costs: • Mining cost: Deforestation, reforestation, stripping, scarification, excavation, transportation, others, and crushing. • Process cost: Drying, wet process, final product process, and other process costs. The revenue includes the contractual sales values and the penalties and bonuses for quality and moisture. Mining dilution and recovery parameters are applied during the Ore Reserves estimation process, based on the last twelve months reconciliation, and are reviewed annually. As the mining method is strip mining and the pits are shallow, geotechnical risks are low. The increase in MRN Ore Reserves is attributed to the issuance of the Preliminary Licence for the New Mines Project by IBAMA (the Brazilian Federal Environmental Agency). There has been no material change to other Ore Reserves modifying factors, such as: governmental, tenure, environmental, cultural heritage, social or community. Appropriate agreements and approvals remain in place to enable continued operation.

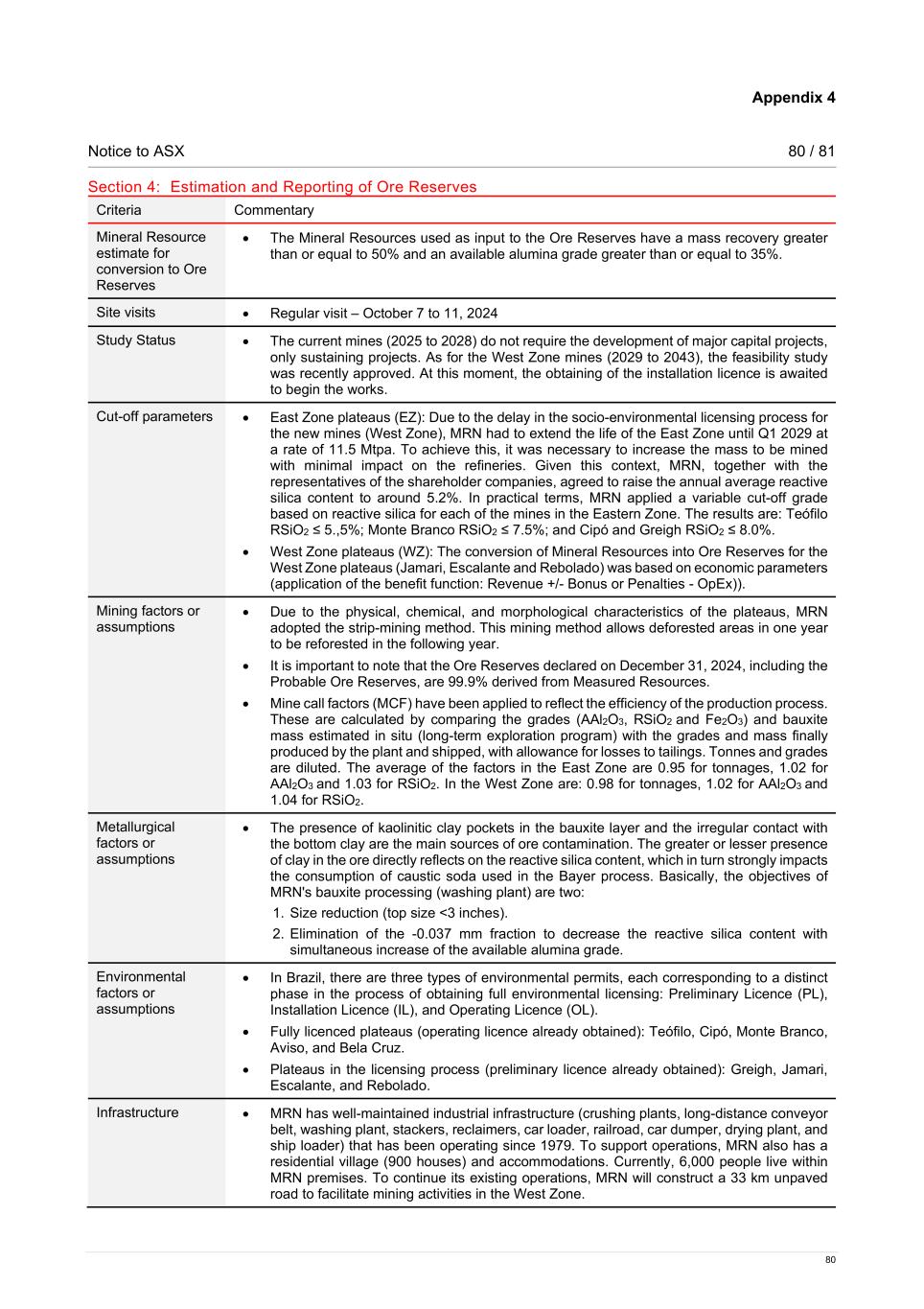

Notice to ASX 23 / 81 23 Processing methods and assumptions The MRN bauxite is beneficiated using established techniques to improve quality (reduce RSiO2[2]). This is achieved by removing the finer fraction, leaving the coarser material as the product. The expected recovery and quality of bauxite from the beneficiation process is controlled by sampling and analysis at various points in the process. Cut-off grades, estimation methodology and modifying factors The cut-off for Ore Reserves is based on economic parameters, net present value (NPV) or internal rate of return (IRR) or cross margin > 0. This criterion was updated in July 2023; until July 2023 only NPV > 0 was considered. The economic cut-off approach considers revenue (bonus/penalty), fixed/operating/capital costs, royalties and other third-party payments. Bauxite that meets this economic cut-off is considered for inclusion in Ore Reserves. The following table shows the evolution of the criterion. Table N Evolution of MRN Ore Reserves cut-off grades Criteria Up to June 2023 From July 2023 to April 2024 From April 2024 Probable Ore Reserves Proved Ore Reserves Probable Ore Reserves Proved Ore Reserves Probable Ore Reserves Proved Ore Reserves Mineral Resources Indicated Measured Indicated or Measured Measured Indicated or Measured Measured Economic Issues - - NPV > 0 NPV > 0 NPV or IRR or Gross Margin > 0 NPV or IRR or Gross Margin > 0 Technical Studies - - FEL2: Pre- Feasibility FEL3: Feasibility FEL2: Pre- Feasibility FEL3: Feasibility Permitting and Legal Requirements Operation Licence Operation Licence Preliminary Licence Operation Licence Preliminary Licence Operation Licence Mineral Rights - - Mining Concession Mining Concession Mining Concession Mining Concession Classification Given the level of confidence in the Ore Reserves modifying factors, Measured Resources are converted to both Proved and Probable Ore Reserves, and all Indicated Resources are converted to Probable Ore Reserves. Inferred Resources are not considered in the estimation of Ore Reserves. 2 Reactive silica

Notice to ASX 24 / 81 24 Competent Persons’ statements Rio Tinto Aluminium Pacific Operations The information in this report that relates to RTA Pacific Operations Mineral Resources is based on information compiled under the supervision of Mr Angus C. McIntyre, who is a Member of the Australasian Institute of Mining and Metallurgy (MAusIMM). Mr McIntyre has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity to which he is undertaking to qualify as a Competent Person as defined in the JORC Code. Mr McIntyre is a full-time employee of Rio Tinto and consents to the inclusion in this report of RTA Pacific Operations Bauxite Mineral Resources based on the information that he has prepared in the form and context in which it appears. The information in this report that relates to RTA Pacific Operations Ore Reserves is based on information compiled under the supervision of Mr William Saba who is a Member of the Australasian Institute of Mining and Metallurgy (MAusIMM). Mr Saba has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity to which he is undertaking to qualify as a Competent Person as defined in the JORC Code. Mr Saba is a full-time employee of Rio Tinto and consents to the inclusion in this report of RTA Pacific Operations Bauxite Ore Reserves based on the information that he has prepared in the form and context in which it appears. Rio Tinto Copper - Winu project The information in this report that relates to Winu Mineral Resources is based on information compiled under the supervision of Mr James Pocoe, who is a Member of the Australasian Institute of Mining and Metallurgy (MAuslMM). Mr Pocoe has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity to which he is undertaking to qualify as a Competent Person as defined in the JORC Code. Mr Pocoe is a full-time employee of Rio Tinto and consents to the inclusion in this report of Mineral Resources based on the information that he has prepared in the form and context in which it appears. Rio Tinto Iron and Titanium Quebec Operations The information in this report that relates to the data and geological models underpinning the Rio Tinto Iron and Titanium Quebec Operations Mineral Resources is based on information compiled under the supervision of Mr. Francois Kerr-Gillespie, who is a Member of the Ordre des geologues du Quebec. Mr Kerr-Gillespie has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity to which he is undertaking to qualify as a Competent Person as defined in the JORC Code. Mr Kerr-Gillespie is a full-time employee of Rio Tinto and consents to the inclusion in this report of Mineral Resources based on the information that he has prepared in the form and context in which it appears. The information in this report that relates to Rio Tinto Iron and Titanium Quebec Operations Mineral Resources is based on information compiled under the supervision of Mr Jacques Dumouchel, who is a Member of the Ordre des geologues du Quebec. Mr Dumouchel has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity to which he is undertaking to qualify as a Competent Person as defined in the JORC Code. Mr Dumouchel is a contract employee of Rio Tinto and consents to the inclusion in this report of Mineral Resources based on the information that he has prepared in the form and context in which it appears. Rio Tinto Aluminium Atlantic Operations – Porto Trombetas (MRN) The information in this report that relates to RTA Atlantic Operations - Porto Trombetas (MRN) Mineral Resources is based on information compiled under the supervision of Mr Robson Aglinskas, who is a Member of the Australasian Institute of Mining and Metallurgy (MAusIMM). Mr Aglinskas has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity to which he is undertaking to qualify as a Competent Person as defined in the JORC Code. Mr Aglinskas is a full-time employee of Mineração Rio do Norte and consents to the inclusion in this report of RTA Atlantic Operations - Porto Trombetas (MRN) Bauxite Mineral Resources based on the information that he has prepared in the form and context in which it appears. The information in this report that relates to RTA Atlantic Operations - Porto Trombetas (MRN) Ore Reserves is based on information compiled under the supervision of Mr Luiz Henrique Diniz Costa who is a Member of the Australasian Institute of Mining and Metallurgy (MAusIMM). Mr Costa has sufficient experience which is

Notice to ASX 25 / 81 25 relevant to the style of mineralisation and type of deposit under consideration and to the activity to which he is undertaking to qualify as a Competent Person as defined in the JORC Code. Mr Costa is a consultant to Mineração Rio do Norte and consents to the inclusion in this report of RTA Atlantic Operations - Porto Trombetas (MRN) Bauxite Ore Reserves based on the information that he has prepared in the form and context in which it appears.

Notice to ASX 26 / 81 26 Contacts Please direct all enquiries to media.enquiries@riotinto.com Media Relations, United Kingdom David Outhwaite M +44 7787 597 493 Media Relations, Australia Matt Chambers M +61 433 525 739 Michelle Lee M +61 458 609 322 Rachel Pupazzoni M +61 438 875 469 Media Relations, Canada Simon Letendre M +1 514 796 4973 Malika Cherry M +1 418 592 7293 Vanessa Damha M +1 514 715 2152 Media Relations, US Jesse Riseborough M +1 202 394 9480 Investor Relations, United Kingdom Rachel Arellano M +44 7584 609 644 David Ovington M +44 7920 010 978 Laura Brooks M +44 7826 942 797 Wei Wei Hu M +44 7825 907 230 Investor Relations, Australia Tom Gallop M +61 439 353 948 Amar Jambaa M +61 472 865 948 Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 Rio Tinto Limited Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 This announcement is authorised for release to the market by Andy Hodges, Rio Tinto’s Group Company Secretary. riotinto.com

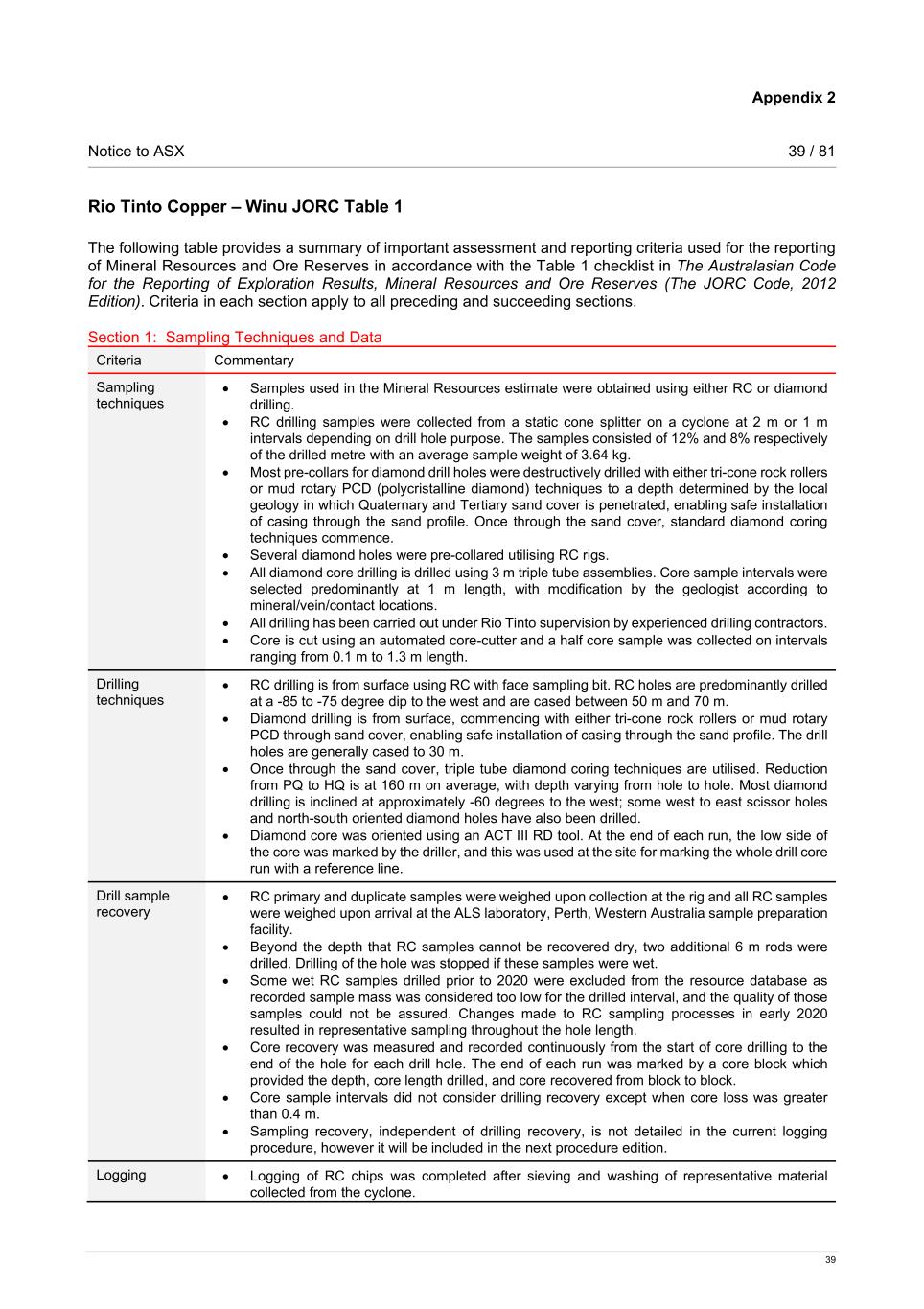

Appendix 1 Notice to ASX 27 / 81 27 Rio Tinto Aluminium Pacific Operations – Amrun JORC Table 1 The following table provides a summary of important assessment and reporting criteria used for the reporting of Mineral Resources and Ore Reserves in accordance with the Table 1 checklist in The Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves (The JORC Code, 2012 Edition). Criteria in each section apply to all preceding and succeeding sections. Section 1: Sampling Techniques and Data Criteria Commentary Sampling techniques • Samples for geologic logging and analysis are collected on 0.25 m intervals (~2 to 3 kg) downhole using aircore drilling methods. • Whole samples are collected beneath a cyclone return system (i.e., no sample splitting is conducted). • Multiscreen sampling is undertaken to determine optimum screen size for beneficiation at each deposit. • Once determined, samples are then beneficiated at the appropriate screen size (0.6 mm for the Amrun deposits). Drilling techniques • The current drilling method utilises aircore drilling. • The typical aircore rig used at Weipa is a Land Cruiser mounted rig with a small enough wheelbase to traverse drill lines cleared with one D-6 dozer blade width. Aircore drilling forces compressed air down a space inside the drill rods to the bit face, where the air is then used to return the sample up the inner tube of the drill rod and out via a cyclone. A three bladed HQ aircore bit is attached to 4 inch rods. The drilling system has been designed to reduce grinding of the sample. Drill sample recovery • No direct recovery measurements of aircore drilling samples are performed. • Whole sample is taken. • Holes are re-drilled if there is excessive sample loss (determined visually). • Sample weights are recorded before and after beneficiation in the laboratory. Logging • Standardised RTA bauxite logging systems are utilised for drilling. • Logging is currently conducted on Panasonic Toughpads and data is captured in an offline acQuire™ logging package at the drill rig. This system allows for data validation to be applied during logging as well as a streamlined method of exporting the data for importing into the main RTA Geology database. • Logging is qualitative in nature, i.e., based on lithology. Currently there are ~20 lithologies common to the deposits that get modelled into four horizons for the estimation of bauxite resources. • All sample intervals (0.25 m) are logged. • The holes are terminated four samples (1 m) into the floor lithologies as observed by the rig geologist. • Logged lithologies are vetted against historical drill holes and assay parameters. Sub-sampling techniques and sample preparation • No sub-sampling is undertaken. • Sample preparation of the 2 kg to 3 kg bauxite samples at Weipa is carried out at the purpose- built facility. The sample sizes are appropriate to the grain size of the material being sampled. The facility consists of two Kason washing screens, two drying ovens, a multiple screening facility, and grinding units. Beneficiated, un-beneficiated (crude) and multiscreen drill samples pass through this area prior to their being assayed for the major oxides and LOI. • Sample preparation at ALS (Australian Laboratory Services) laboratory, Brisbane is set up with the same specifications of equipment as Weipa, however, it has been expanded to six Kasons, multiple, larger drying ovens, more grinding capability, and room for multi-screen preparation. • Samples that have completed the appropriate Kason wash screen are crushed to <2.37 mm, split and then ground to 150 µm pulps for XRF, LOI and reactive silica analyses. • The majority of analyses are undertaken at ALS laboratory in Brisbane since 2015, prior to that the majority of the analyses were done at the Weipa onsite laboratory. • The sample size and preparation techniques are appropriate for the style of mineralisation.

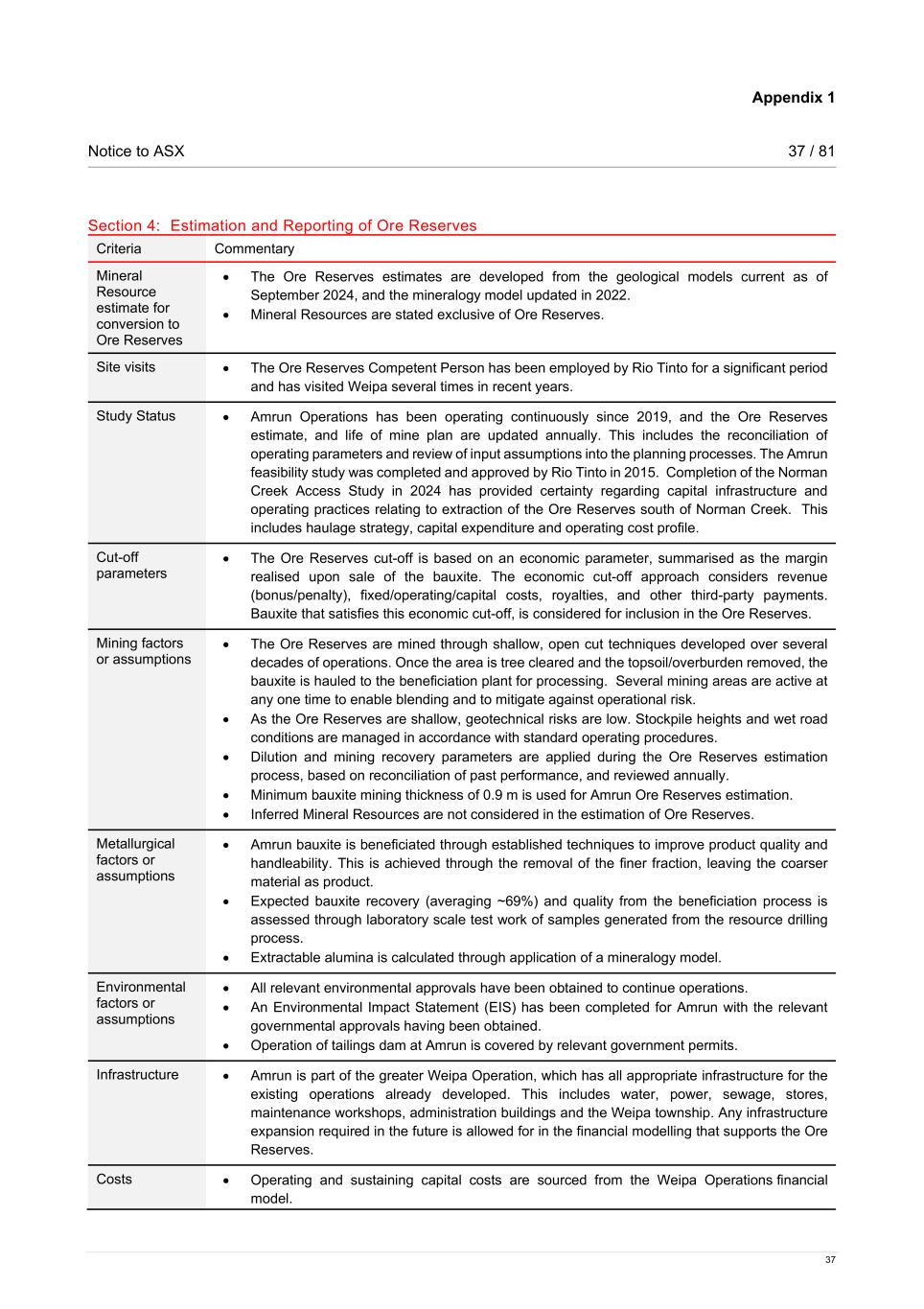

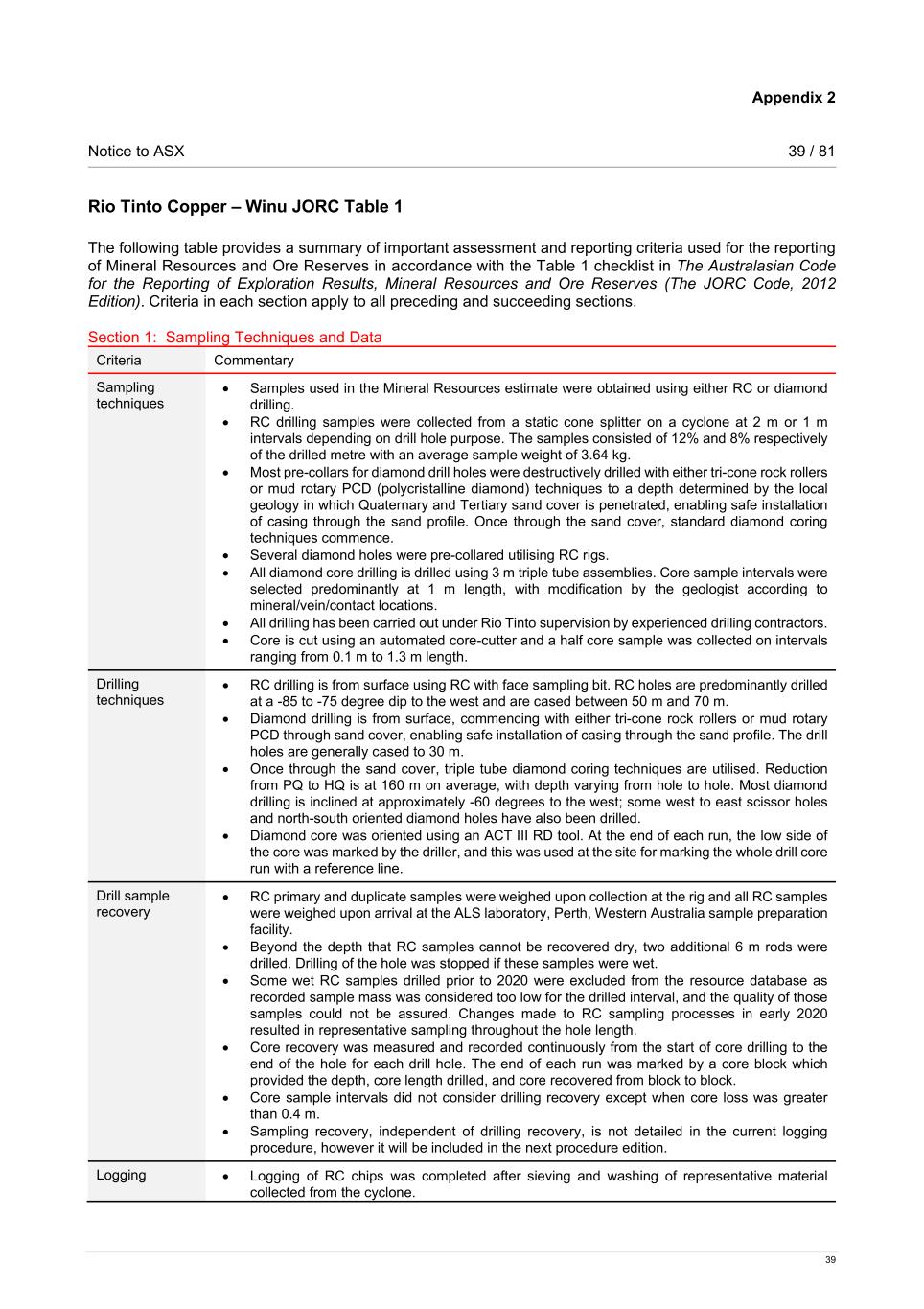

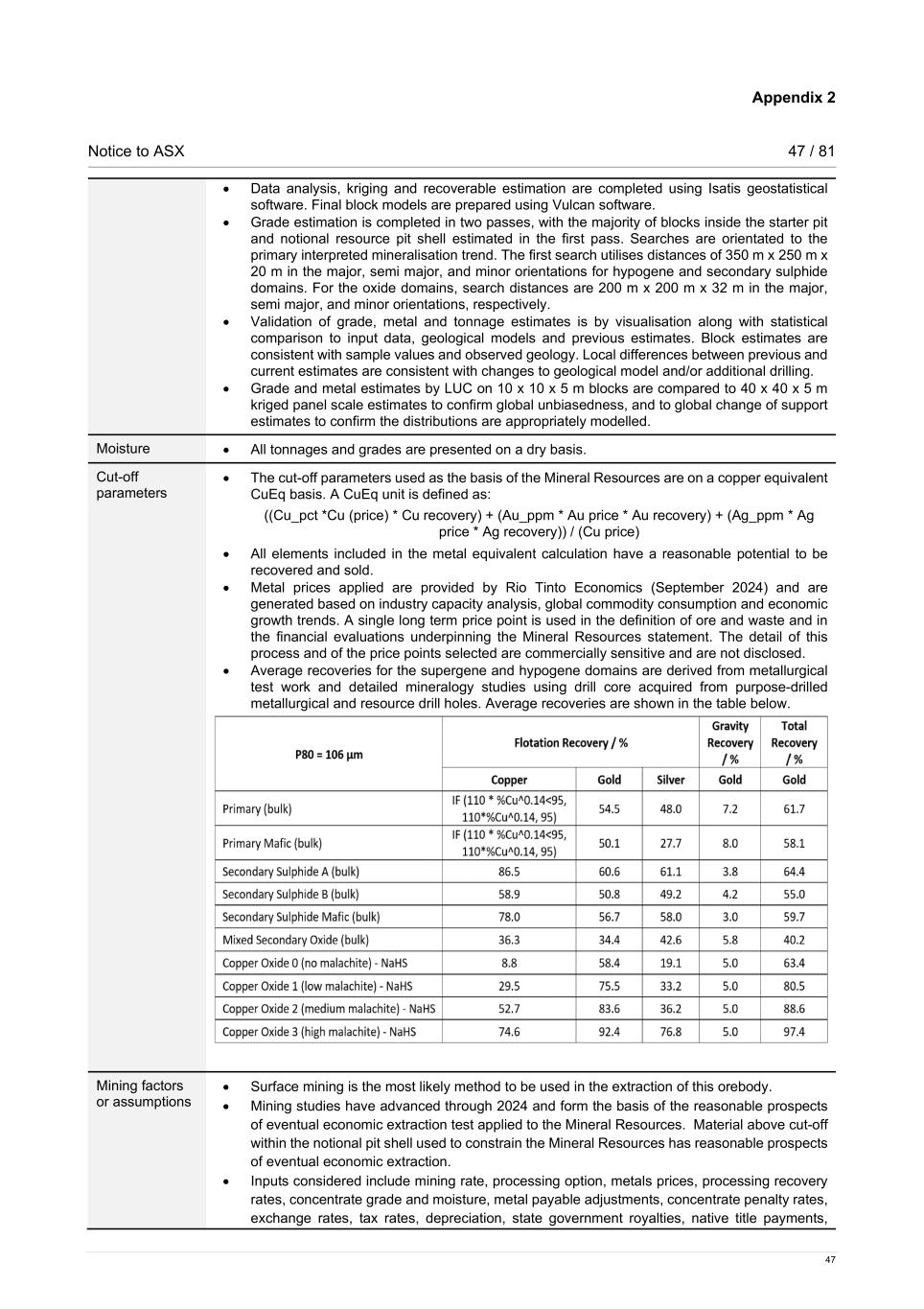

Appendix 1 Notice to ASX 28 / 81 28 Quality of assay data and laboratory tests • Bauxite industry standard XRF analysis of all major elements and a suite of trace elements are undertaken on all samples. • Matrix matched field standards are systematically used. The field team inserts field standards at a rate of 1 in every 50 samples. • Laboratory preparation blanks, duplicates and assay standards also form part of the QA/QC procedure. These are as follows: 2 blanks, 3 laboratory duplicates and 4 laboratory standards per batch (~100 samples). • Some of the historical data were processed at the Weipa Laboratory who participated in a “round robin” process managed through the RTA Process Improvement team. This process included all the RTA and affiliated laboratories and was reviewed on a quarterly basis to ensure that standards were maintained. The Weipa laboratory analysts also carried out internal checks on the assay data. Results not meeting certain criteria or outside a designated range were re-analysed. Field standards were also used by the Geology Department to monitor the performance of the laboratory via standard QA/QC routines. • The ALS Brisbane laboratory maintains its NATA accreditation through annual inspections and testing as required. RTA visit and audit both the preparation facility and analytical rooms regularly. • Every assay batch returned from the laboratories is checked through ioGAS QA/QC objects before being accepted to the database for use in resource estimation. Major oxides, LOI, and KSiO2 are checked routinely against performance of field standards, lab duplicates, and lab standards. • Analysis of the performance of certified standards, field duplicates, blanks and third-party check assaying has indicated an acceptable level of accuracy and precision with no significant bias or contamination. Verification of sampling and assaying • Infill drilling programs for resource definition return results in line with the wider spaced drilling. • Data validation occurs throughout the data collection process: during data capture, during importation into the database, following import into the database and during the modelling process (hole name, location checks, elevation checks, lithology order checks, missing data, and incorrect data). Location of data points • Pre-2016 drill hole peg locations were surveyed to Australian Height Datum (AHD) and the Geocentric Datum of Australia 1994 (GDA94) grid (and converted to local mine grids) by contract surveyors using DGPS survey equipment which was accurate to 10 cm in both horizontal and vertical directions. • Post 2016 surveys utilise GNSS GPS systems. Where a survey has not been completed, e.g., Amrun 2018 to 2019 drilling campaign, Light Detection and Ranging (LiDAR) positioning of drill collar elevations is utilised to provide the collar elevation. Data spacing and distribution • Drilling at Amrun is completed systematically according to the following spacing based on level of confidence: o Inferred Resources based on ~1200 m x 800 m. o Indicated Resources ~200 m x 400 m. o Measured Resources ~200 m x 100 m. o Assured (grade control) ~ 76 m x 76 m on an offset diamond pattern. • All downhole drill sampling is at 0.25 m intervals, and samples are taken of the cover and floor. • No sample compositing is done. • The data spacing and distribution is deemed sufficient by the Competent Person to establish geological and grade continuity appropriate for the Mineral Resources classification that has been applied. Orientation of data in relation to geological structure • Not applicable in lateritic bauxite deposits. All drill holes are vertical, which intersects the horizontal ore body perpendicularly. Sample security • Samples are collected, bagged, ticketed, and sealed at the drill sites. Samples are placed in bulk plastic containers, with a capacity of ~300 samples, for shipment to the laboratory. All samples are electronically logged into a system for tracking and validation. Samples are placed on a dispatch advice form and verified by the laboratory on arrival. All assay pulps are stored at Weipa or ALS Brisbane in purpose-built sample storage facilities. Audits or reviews • An external Mineral Resources and Ore Reserves audit was completed in 2019 on the Weipa deposit. This audit had an outcome of Satisfactory with one medium and five low rated potential