Document

ANNUAL INFORMATION FORM

for the year ended December 31, 2024

Dated: February 27, 2025

TABLE OF CONTENTS

|

|

|

|

|

|

|

1 |

|

3 |

|

3 |

|

5 |

|

13 |

|

46 |

|

46 |

|

48 |

|

49 |

|

51 |

|

59 |

|

59 |

|

59 |

|

59 |

|

59 |

|

60 |

|

60 |

|

A-1 |

ANNUAL INFORMATION FORM

Introduction

General

In this Annual Information Form, unless the context otherwise requires, “Docebo”, the “Company”, “we”, “us” or “our” refers to Docebo Inc., its subsidiaries and divisions and their respective predecessors. All references to “dollars”, “$” and “US$” are to United States dollars and all references to “C$” are to Canadian dollars. For an explanation of certain of the capitalized terms and expressions, please refer to the “Glossary of Terms” at the end of this Annual Information Form. Unless otherwise indicated, the information contained herein is given as at December 31, 2024.

Forward-Looking Information

All information other than statements of current and historical fact contained in this Annual Information Form is forward-looking information. In certain cases, forward-looking information can be identified by the use of words such as “plans”, “targets”, “expects”, “budget”, “scheduled”, “estimates”, “outlook”, “forecasts”, “intends”, “anticipates”, “projects”, “believes”, “pro forma” or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will”, “occur” or “be achieved” and similar words or the negative thereof. In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events or circumstances.

Forward-looking information in this Annual Information Form includes, but is not limited to, statements regarding the Company’s business; future financial position and business strategy; the learning management industry; our growth rates and growth strategies; addressable markets for our solutions; the achievement of advances in and expansion of our platform; expectations regarding our revenue and the revenue generation potential of our platform; our business plans and strategies; use of artificial intelligence (“AI”) in our platform and its impact on the Company’s business; and our competitive position in our industry. This forward-looking information is based on our opinions, estimates and assumptions in light of our experience and perception of historical trends, current conditions and expected future developments, as well as other factors that we currently believe are appropriate and reasonable in the circumstances. Despite a careful process to prepare and review the forward-looking information, there can be no assurance that the underlying opinions, estimates and assumptions will prove to be correct. Certain assumptions include: our ability to build our market share and enter new markets and industry verticals; our ability to retain key personnel; our ability to maintain and expand geographic scope; our ability to execute on our expansion plans, including the continued incorporation of AI into our platform; our ability to continue investing in infrastructure to support our growth; our ability to obtain and maintain existing financing on acceptable terms; our ability to execute on, and the impact of, our ESG (as defined herein) initiatives; our ability to execute on profitability initiatives; currency exchange and interest rates; the impact of competition; our ability to respond to the changes and trends in our industry or the global economy; and the changes in laws, rules, regulations, and global standards are material factors made in preparing forward-looking information and management’s expectations.

Forward-looking information is necessarily based on a number of opinions, estimates and assumptions that, while considered by the Company to be appropriate and reasonable as of the date of this Annual Information Form, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including but not limited to:

•the Company’s ability to execute its growth strategies;

•the impact of changing conditions in the global corporate e-learning market;

•increasing competition in the global corporate e-learning market in which the Company operates;

•fluctuations in currency exchange rates and volatility in financial markets;

•the Company’s ability to operate its business and effectively manage its growth under evolving macroeconomic conditions, such as high inflation and recessionary environments;

•fluctuations in the length and complexity of the sales cycle for our platform, especially for sales to larger enterprises;

•issues in the use of AI in our platform may result in reputational harm or liability;

•changes in the attitudes, financial condition and demand of our target market;

•developments and changes in applicable laws and regulations; and

•such other factors discussed in greater detail under “Risk Factors” in this Annual Information Form.

If any of these risks or uncertainties materialize, or if the opinions, estimates or assumptions underlying the forward-looking information prove incorrect, actual results or future events might vary materially from those anticipated in the forward-looking information. The opinions, estimates or assumptions referred to above and described in greater detail in “Risk Factors” should be considered carefully by readers of this Annual Information Form.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. Forward-looking information is provided for the purpose of presenting information about management’s current expectations and plans relating to the future and allowing investors and others to get a better understanding of our anticipated financial position, results of operations and operating environment. Readers are cautioned that such information may not be appropriate for other purposes.

Although we have attempted to identify important risk factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other risk factors not presently known to us or that we presently believe are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking information. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information, which speaks only as of the date made. The forward-looking information contained in this Annual Information Form represents our expectations as of the date of specified herein, and are subject to change after such date. However, we disclaim any intention or obligation or undertaking to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required under applicable securities laws.

All of the forward-looking information contained in this Annual Information Form is expressly qualified by the foregoing cautionary statements.

Corporate Structure

Name, Address and Incorporation

Docebo Inc. is an Ontario corporation existing under the Business Corporations Act (Ontario) (the “OBCA”).

The Company’s head and registered office is located at 366 Adelaide Street West, Suite 701, Toronto, Ontario M5V 1R9.

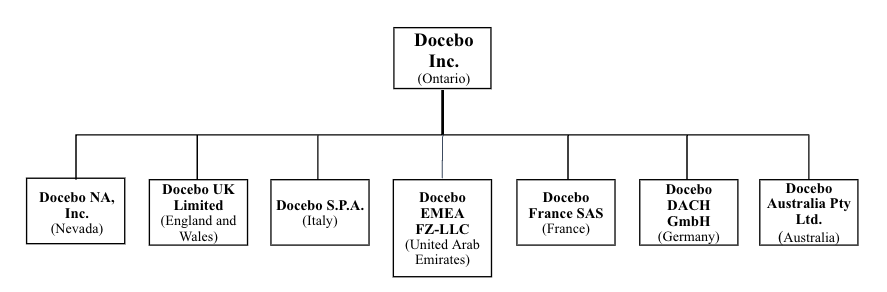

Intercorporate Relationships

The following diagram illustrates the inter-corporate relationships between the Company and its material subsidiaries (which are all wholly owned by the Company) as at the date of this Annual Information Form:

On October 1, 2019, the Company implemented a number of pre-closing reorganization steps. Specifically, the Company filed articles of amendment (“Articles”) to, among other things:

•change its name from “Docebo Canada Inc.” to “Docebo Inc.”;

•increase the number of issued and outstanding Common Shares of the Company on the basis of 100 Common Shares for each issued and outstanding Common Share; and

•set the voting, dividend and dissolution rights attaching to the Company’s Common Shares.

See “Description of Capital Structure” for more information about our current share capital.

General Development of the Business

The Docebo business was founded in 2005 as a learning management software company that develops and provides as a service to customers its learning management platform for training both internal and external workforces, partners and customers.

Docebo itself was incorporated in 2016 as Docebo Canada Inc. and all of the pre-existing operations of Docebo (primarily Docebo S.P.A. and Docebo NA, Inc.) were organized under the newly incorporated company. Since then, we have focused on developing our platform and growing our sales and marketing to expand our customer base. The Company completed its initial public offerings in Canada and the United States on October 8, 2019 and December 7, 2020, respectively.

On January 4, 2022, we announced the establishment of an at-the-market equity offering program that allows Intercap Equity Inc. (“Intercap Equity”) to sell up to US$200.0 million of outstanding Common Shares to the public, from time to time, at Intercap Equity’s discretion (the “ATM Program”). Docebo will not make any sales under, and will not receive any proceeds from, the ATM Program. No sales under the ATM Program will be made through a stock exchange or stock market in Canada.

On January 24, 2022, we announced the acquisition (the “Skillslive Acquisition”) of Skillslive Edu Pty Ltd., a consultancy and advisory organization specialized in providing elearning solutions and related professional services based in Melbourne, Australia.

On March 9, 2022, we announced the appointment of Sukaran Mehta as Chief Financial Officer of the Company. Mr. Mehta joined the Company in September 2019 as Vice President of Finance and was appointed interim Chief Financial Officer in September 2021.

On June 27, 2022, the Company announced the release of its inaugural Environmental, Social and Governance (“ESG”) report and a second report was issued in December 2023 (“ESG Report”) which highlights our ESG initiatives and best practices. In particular, the ESG Report outlines key areas of focus consistent among comparable companies in the software industry and alignment of the Company’s sustainability efforts with performance.

In September 2022 Alessio Artuffo became the Company’s President and Chief Operations Officer. Mr. Artuffo had served as the Company’s President since May 2021.

On April 4, 2023, we announced the acquisition (the “PeerBoard Acquisition”) of PeerBoard, a plug and play community-as-a-service platform owned and operated by Circles Collective Inc. (“PeerBoard”). The PeerBoard Acquisition enables Docebo to provide an integrated learning platform and community while enhancing the social learning experience for existing Docebo customers.

In May 2023, we announced a normal course issuer bid pursuant to which we have the ability to repurchase up to 1,650,672 of our Common Shares (the “NCIB”), representing approximately 5% of our issued and outstanding Common Shares as of May 1, 2023. In connection with the NCIB, we also entered into an automatic share purchase plan with our designated broker to facilitate the purchase of Common Shares under the NCIB at times when Docebo would ordinarily not be permitted to purchase Common Shares due to regulatory restrictions or self-imposed blackout periods. The NCIB commenced on May 18, 2023 and expired on May 17, 2024.

On June 12, 2023, we announced the acquisition (the “Edugo Acquisition”) of Edugo.AI (“Edugo”), a Generative AI-based Learning Technology that uses advanced Large Language Models (LLM) and algorithms to optimize learning paths and adapt to individual learner needs. The Edugo Acquisition was focused on two main objectives: enhancing its existing AI capabilities and adding new capabilities to the Docebo platform to better serve its customers.

In December 2023, the Company completed a substantial issuer bid (the “SIB”) under which the Company purchased for cancellation US$100,000,000 of its outstanding Common Shares at a price of US$55.00 per Common Share, representing approximately 5.7% of our issued and outstanding Common Shares as of expiry of the bid. The SIB commenced on November 23, 2023 and expired on December 28, 2023.

On November 22, 2023, the Company announced a CEO succession plan for Claudio Erba pursuant to which Mr. Erba will step away from his role as Chief Executive Officer and a member of the Board and will transition to the non-executive role of Chief Innovation Officer effective February 29, 2024. The Company also announced the appointment of Mr. Artuffo to the role of Interim Chief Executive Officer effective March 1, 2024.

In May 2024, we announced the renewal of our NCIB pursuant to which we have the ability to repurchase up to 1,764,037 of our Common Shares, representing approximately 10% of the Company’s public float as of May 6, 2024. In connection with the renewal of the NCIB, we also renewed our automatic share purchase plan with our designated broker to facilitate the purchase of Common Shares under the NCIB at times when Docebo would ordinarily not be permitted to purchase Common Shares due to regulatory restrictions or self-imposed blackout periods.

The renewed NCIB commenced on May 20, 2024 and will terminate on May 19, 2025 or such earlier time as Docebo completes its purchases pursuant to the bid or provides notice of termination.

In September 2024 Alessio Artuffo became the Company’s Chief Executive Officer and a member of the Board. Mr. Artuffo continues to serve as President of the Company.

On January 2, 2025, the Company announced that Sukaran Mehta will be stepping down from his role as Chief Financial Officer effective February 28, 2025. The Board intends to conduct a search to identify a successor that will include both internal and external candidates. Upon Mr. Mehta’s departure, Brandon Farber, Senior Vice President – Finance, will serve as Interim Chief Financial Officer.

Description of the Business

Mission and Overview

At Docebo, our mission is to redefine the way enterprises, including their internal and external workforce, partners and customers, learn by applying new technologies to the traditional corporate learning management system (“LMS”) market. We provide an easy-to-use, highly configurable and affordable learning platform with the end-to-end capabilities and critical functionality needed to train both internal and external workforces, partners and customers. Our solution allows our customers to take control of their desired training strategies and retain institutional knowledge, while providing efficient course delivery, advanced reporting tools and analytics. Our robust platform helps our customers centralize a broad range of learning materials from peer enterprises and learners into one LMS to expedite and enrich the learning process, increase productivity and grow teams uniformly.

Our solutions are sold on a subscription model and our subscriptions are typically structured with an initial fixed term of between one and three years, without the ability for customers to terminate for convenience. We charge our customers based upon a per-learner, per-module basis, varying depending on the size of the organization and complexity. For Fiscal 2024, 94% of our revenue was generated from our recurring subscription-based plans for our learning management platform.

With over 900 employees across eight global offices, Docebo sells its products in approximately 70 countries and empowers nearly 3,900 companies as at the end of Fiscal 2024. Of our US$216.9 million of revenue for Fiscal 2024, approximately 76% originates from customers in North America, with the remainder coming primarily from Europe and a small component coming from the rest of the world. Our customers are diversified across various industries including technology and media (Thomson Reuters Corporation, HP Inc. and Amazon Web Services, Inc.), consulting and professional services (Booking.com, Bupa, Newcross Healthcare Solutions, Experian PLC, Randstad NV and lastminute.com) and manufacturing and retail (Deliveroo, Advanced Auto Parts, Dine Brands Global, Bojangles Opco, LLC, L’Oréal S.A., Heineken NV, BMW AG, Enterprise Holdings and Milwaukee Electric Tool Corporation).

Our solutions have won numerous awards and industry recognitions, including being named a 2024 AWS Rising Star Technology Partner of the Year; winning Gold at the Canadian Marketing Awards for it’s thought leadership program, Leaders In Learning; placing as a Strategic Challenger in Fosway Group’s 2024 9-gridTM for Learning Systems, after being in their Core Leader category for six consecutive years from 2018 to 2023; Named powerhouse learning system on the Talented Learning Right-Fit grid 2024; 2024 Top 10 Enterprise LMS Award from Talented Learning; 80+ awards from Brandon Hall Group’s Excellence in Technology and HCM Excellence Awards from 2015 – 2024, including 2024 Seven Gold medals for Best Advance in Generative AI Learning Solutions, Best Advanced in Learning Management Measurement/Business Impact Tools, Best Advance in Learning Management Technology (LMT), Best Advance in Learning Management Technology for Compliance Training; Best Advance in Learning Management Technology in External Training; Best Advance in Social Learning Technology, Best Advance in Business Strategy and Technology Innovation and two Silver awards for Best Avance in Sales Enablement and Performance Tools (SEP), and Best Advance in Business Automation; 2024 Top 20 People’s Choice LMS Software from eLearning Industries plus numerous awards from eLearning Industry including Top Microlearning LMS for Corporate Training, Top Cloud-Based Learning Management Systems For Corporate Training, Top LMS for Mobile Learning, Top LMS Software for Compliance Training, Top LMS for User Experience, Top LMS for Customer Experience, Top LMS for Employee Onboarding, Top LMS for Employee Training, Top LMS Tools for Learning Accessibility, Top Gamification LMS, Top LMS for Learning Analytics Tools, and Best Learning Management System of the Year; Top 20 Learning Management Systems from Training Industry in 2024; 30+ awards across multiple categories from G2 Crowd in 2024 based on customer reviews, including Enterprise Leader Fall 2024; placed on the 2024 Capterra Short-List for Learning Management Systems; named 2024 Front-Runner for Best Employee Training by Software Advice; the Bronze award for 2022 Learning Provider of the Year from the Learning Performance Institute; named as a Fastest Growing Company in 2022 & 2023 by The Financial Times; 2021 & 2022 Tech Cares Award from Trust Radius; 2020 and 2021 winner of Deloitte’s Technology Fast 50TM in the category of Enterprise Fast 15 and Deloitte’s Technology Fast 500TM.

Industry Background

The corporate LMS market is a subset of the global corporate e-learning market. According to Reports Monitor, the LMS market is projected to reach approximately US$37.9 billion in revenue by the end of 2026, representing a compound annual growth rate of 19.1% between 2021 and 2026.

As companies worldwide continue to face tight labor markets and talent shortages, the need to upskill and reskill employees with learning has become critical to ensure a sustainable and scalable business. As a result of labor shortages and economic conditions impacting hiring and retention, enterprise organizations are increasingly seeing a correlation between providing effective ongoing learning opportunities to employees and improved productivity, higher retention rates and overall employee engagement and work satisfaction. As a result, both global and mid-market enterprises are starting to recognize that e-learning is an integral part of their overall business strategy, driven by changing business needs and technological advancements. We believe the positive impacts to productivity and employee retention within an enterprise following implementation of corporate e-learning solutions have now allowed for these solutions to be considered increasingly core to an enterprise’s operations and productivity, similar to the early stages of adoption for Customer Relationship Management (“CRM”), Business Intelligence (“BI”), Collaboration, Supply Chain Management and other Office Productivity software systems.

Re-Thinking the Traditional LMS

Learning technology has evolved from systems built for administrators, designed to host, deliver, track and manage learning content, to secure, cloud-based systems designed for learners, optimized to increase engagement, time spent learning and course completions. Organizations are now fighting to acquire skills, boost productivity, innovate faster, drive revenue, and grow. Docebo is built to meet these tangible business needs and is a powerful tool for administrators and engaging and intuitive for learners.

Learning technology demand and adoption is growing and organizations are recognizing the value learning has on business growth and success. In order to truly create a culture of learning that drives business outcomes, learning platforms are evolving to include features that improve the learner experience such as adaptive and hyper-personalized learning paths, learning in the flow of work and social and community-based learning. Learning platforms are also optimizing the administrator experience with capabilities such as generative AI co-pilot, AI-powered content creation and translation and powerful automations and integrations making it easier than ever to administer scaled learning programs to any audience. With the focus on business impact, it’s critical that learning platforms have the ability to track content and program performance, measure impact on learners and correlate learning to business outcomes.

Social Learning & Community

Social learning is the practice of people learning from one another, through sharing, observation, imitation and modeling. According to the 702010 Institute, 70% of workplace learning is informal, social learning from on-the-job experience; 20% is from coaching, mentoring and interaction with peers; and only 10% is from formal learning. By promoting natural social interactions and collaborative behaviors, social learning encourages higher learner engagement and productivity.

Social and community-based learning tools have become a top priority among enterprises globally, as they seek to facilitate employee engagement and collaboration. Enterprises support the sharing of internally produced, learner-generated knowledge through the use of in-house social sharing tools. When used externally, community tools provide an added space for peer-to-peer learning, helping to empower learners to self-serve.

Knowledge and Skills Management

In today’s rapidly changing business landscape, organizations must continuously manage and develop their knowledge and skills to remain competitive. Modern learning platforms, like Docebo, empower organizations to effectively capture, organize, and share institutional knowledge while aligning learning initiatives with strategic goals.

By providing tools to map skills to roles, identify gaps, and facilitate targeted development plans, Docebo ensures that employees are equipped to meet the demands of their roles and contribute to organizational success. Integrating knowledge sharing with structured skill development supports businesses in fostering innovation, improving productivity, and driving growth. This holistic approach ensures employees not only retain critical knowledge but also acquire the skills needed to adapt to evolving challenges and opportunities.

A Shift to AI-Powered Administrative and Learner Experiences

Docebo believes that AI provides one of the most powerful opportunities for innovation in learning and development. Docebo’s learning platform is powered by AI and includes several AI features throughout the system to enhance the way businesses and enterprises deploy, manage and scale their learning programs.

Docebo develops AI systems internally as well relies on third party LLMs. Currently, Docebo leverages AI to help administrators discover new content in our Content Marketplace, manage and map skills across content and learners, and automatically generate learning content and auto-graded assessments through our content creation tools. These components are the foundation for our ongoing work with AI, which looks to incorporate new capabilities through generative AI technologies in keeping with our guiding principles for effective and ethical use of AI.

Our guiding principles include:

•A pedagogy-first approach to product development and the use of AI.

•Continuous assessment of learner outcomes through AI, contributing to a comprehensive perspective on learning and content quality.

•Personalized learning in the flow of work as inevitable outcomes of AI in learning. Docebo is focused on bringing this to our customers through safe, responsible and effective AI.

•Inspectable, Explainable, Overridable. An effective AI for learning solution never removes humans from processes and outcomes. At Docebo, we design with these three core tenets at the heart of AI product development.

•Freeing users to focus on what matters by designing AI learning solutions that offload repetitive, time-consuming work so that learning designers and administrators can focus on strategically valuable tasks unique to their businesses.

Measuring the Impact of Learning

Docebo takes learning effectiveness seriously, recognizing that it goes beyond quantitative metrics like completion rates and test scores. The emphasis is on leveraging both qualitative and quantitative data to understand the true impact of learning initiatives on individuals and organizations. With ready-to-go questionnaires and built-in reporting, Docebo empowers customers to gather valuable insights that enable data-driven decisions to enhance the overall effectiveness of their training programs.

Docebo’s new insights capabilities further amplify this value by allowing organizations to build custom dashboards from scratch, tailored to their unique business needs and learning goals. This flexibility enables users to visualize data in ways that directly align with their strategic objectives, making it easier to identify trends, pinpoint areas for improvement, and communicate the tangible value of learning programs to stakeholders.

Moreover, Docebo addresses the challenge of breaking down organizational silos by providing a centralized hub for data. This ensures seamless integration of learning data into existing BI and data ecosystems, feeding data warehouses and other analytical tools. Through these capabilities, Docebo enables customers to measure, analyze, and improve learning value from a 360-degree perspective. Organizations can assess everything from learning engagement culture and knowledge retention to skills development, enablement, and business impact.

By demonstrating that learning is a strategic investment with measurable outcomes, Docebo empowers organizations to align their learning strategies with business objectives, driving sustainable growth and innovation.

Solutions

The Docebo Learning Platform currently includes the following capabilities: (i) “Learning Management and Delivery”, (ii) “Content Marketplace”, (iii) “Insights”, (iv) “Learning Evaluation”, (v) “Advanced Analytics”, (vi) “Communities”, (vii) “eCommerce”, (viii) “Integrations”, (ix) “Docebo Headless”, and (x) “AI Authoring”.

The Docebo Learning Platform is a cloud-based solution that allows learning administrators to deliver scalable and flexible personalized learning experiences, from formal training to social learning, to multiple internal, external and blended audiences.

Docebo’s Content Marketplace allows learning administrators to access the industry’s best off-the-shelf learning content and provide their learners with high-quality, predeveloped learning content. Learning administrators can partner with a Docebo Content specialist to help curate the right resources from our library of 40,000+ courses.

The Insights module allows organizations to understand the results of their learning programs with data visualizations that are straightforward and actionable. With features like modern interactive dashboards for Super Admins and Power Users, it offers a centralized source for all learning analytics needs. Customers can swiftly build, discover, and share meaningful insights, enabling quick and impactful decision-making on learning performance based on a single, reliable source of truth.

The Learning Evaluation module empowers learning administrators to incorporate the learner’s perspective into their analyses by facilitating the collection of feedback. This feedback enables organizations to demonstrate and enhance the effectiveness of their training programs while validating their investment in learning. Gain insights into how learning influences employee experience and performance through a combination of pre-built and custom questionnaires, tailored evaluation processes, and relevant learning benchmarks and metrics.

The Advanced Analytics pack combines two essential tools for organizations ready to elevate their learning data and analytics. It offers seamless integration of learning data into any data ecosystem and BI tool, allowing organizations to incorporate their learning and development data into a central repository. This integration helps them understand how learning impacts their business and contributes to their goals. Additionally, it unlocks a powerful BI tool within the Docebo platform, equipping Learning and Development teams with the resources they need to create customized metrics tailored to their specific needs. With advanced features at their fingertips, teams can confidently make data-driven decisions whenever necessary.

The Communities module seamlessly integrates a dynamic hub into the learning environment, enabling interactive learner communities to become a central part of the learning experience. With features like Q&A functionality, forums, spaces, personalized member profiles, rich moderation tools, and 1:1 messaging, the Communities module fosters a collaborative and engaging learning atmosphere.

Designed to enhance both knowledge sharing and community interaction, it enriches the overall learning journey by driving collaboration and creating a strong sense of belonging among users.

The eCommerce module allows administrators to monetize from digital training contents, seamlessly managing and selling training offerings—whether it is courses, subscriptions, or content licensing—all from a single platform. With centralized control over pricing, catalog management, and discounts, admins can create public landing pages to boost content visibility and customize learning by branch or group. Learners benefit from flexible purchasing options, including training credits, coupons, and discounts, ensuring a smooth, personalized buying experience through secure transactions across multiple payment gateways.

Docebo Integrations allow organizations to integrate Docebo with other business systems across their tech stack to improve the learner experience, drive efficiencies and scale learning programs. Connect with single sign-on, webinar tools, HR systems and more with off-the-shelf options or build and customize your own integrations and workflows for more unique requirements.

Docebo Headless allows businesses to build learning experiences outside of the Docebo learning environment in their own products or web environments so people can access learning where and when they need it, without having to switch between tools.

AI Authoring is an innovative package that empowers users to create tailored learning content effortlessly. Leveraging advanced AI capabilities, it allows users to generate content either from scratch or through an interactive chatbot experience. Whether crafting bespoke material or automating content creation, AI Authoring adapts to specific needs, ensuring relevance and personalization. This seamless and intuitive tool transforms content development, reducing time-to-market while maintaining high-quality outputs. Designed to enhance flexibility and creativity, AI Authoring is the ultimate solution for modern, dynamic learning experiences.

Additional modules can also be purchased for specific use cases and needs, including: “Docebo for Salesforce”, “Docebo Embed (OEM)”, “Docebo Mobile App Publisher”, and “Docebo for Microsoft Teams”. Docebo for Salesforce is a native integration that leverages Salesforce’s API and technology architecture to produce a learning experience that remains uniform no matter the use-case. Docebo Embed (OEM) eliminates disjointed learner experiences, long development cycles and ineffective partner models by allowing original equipment manufacturers (“OEMs”) to embed and re-sell the Docebo learning platform as a part of their software, including human capital management (“HCM”), risk management and retail/hospitality SaaS products. Docebo’s Mobile App Publisher product allows companies to create their own branded version of the award-winning “Docebo Go.Learn” mobile learning application and publish it as their own in Apple’s App Store, the Google Play Store or in their own Apple Store for Enterprise. Docebo Extended Enterprise breeds customer education, partner enablement, and retention by allowing customers to train multiple external audiences with a single LMS solution. Lastly, Docebo for Microsoft Teams is designed to remove barriers to learning, drive adoption and increase productivity by bringing learning directly into Microsoft Teams, where people at organizations who use this as their collaboration tool, already spend a large part of their time.

The modules and capabilities of our platform interconnect to deliver a holistic value proposition that has contributed to our success in the market, including the ability to:

•Offer hyper-personalized learning experiences to any audience/use case

•Monetize customer and partner learning programs with powerful e-commerce capabilities

•Enable social learning and unlock user-generated content via Docebo Communities

•Automate many repetitive tasks in the platform, from user provisioning to learner enrollments

•Provide access anywhere, anytime with a custom-branded mobile app, also available for offline learning

•Reach learners around the world with multi language and localization support available in over 40 languages

Docebo’s primary target market is comprised of (i) mid-market enterprises (“MMEs”) that use Docebo in individual divisions or as a global learning platform across their entire enterprise and (ii) larger enterprises for both internal and external use cases. The enterprises in our primary target market are broadly defined as having above 1,000 active users.

In December 2022 Docebo and aTalent, an Asia based leader in performance management, skills and competency, talent, succession and learning & development, expanded the current reseller relationship to an OEM partnership whereby aTalent will embed Docebo’s technology into their HCM suite.

In July 2023, Docebo announced a strategic partnership with OpenSesame, a leading provider of on-demand eLearning courses for enterprises. With more than 20,000 courses from the world’s leading publishers, OpenSesame boasts the broadest catalog of courses in the marketplace. The collaboration enables learning and development professionals to purchase OpenSesame eLearning courses directly from within their Docebo LMS.

In August 2023, Docebo announced a strategic partnership with Darwinbox, an end-to-end, mobile-first, and employee-first HCM platform built for enterprises. Darwinbox serves 850+ enterprises and 2.5 million+ employees across 116+ countries. Darwinbox has embedded the Docebo platform within their product and is marketing it as “Darwinbox LMS (Powered by Docebo)”.

In October 2024, Docebo and TEDAI Vienna, Europe’s inaugural TED conference dedicated entirely to artificial intelligence, announced their partnership for the highly anticipated TEDAI Vienna event. Docebo served as the official business learning partner for the conference, playing a pivotal role in shaping how enterprises and organizations leverage AI to transform workplace learning and development.

In November 2024, Docebo announced a strategic alliance with Deloitte, a leading provider of audit, consulting, tax and advisory services to many of the world’s most admired brands. We expect the alliance will guide companies as they evolve from transactional learning systems into agile and indispensable learning organizations, fully integrated with long-term business growth and operating efficiency.

In October 2024, Docebo expanded on their longstanding partnership with AWS by making the Docebo solutions available for purchase through the AWS Marketplace, allowing customers to get additional value in both their partnership with AWS and Docebo.

We believe our flexible platform is well-suited to support enterprises with particularly fragmented and complex use-cases, giving rise to multi-faceted training requirements such as employee certification, re-skilling, upskilling, knowledge retention, fast onboarding for high growth companies, customer training and partner training.

Growth Strategy

Our goal is to continue growing our business to become the leading provider of cloud-based subscription software applications to enterprises looking for innovative ways to train internal and external workforces, partners and customers as well as retain talent. By doing so, we enable our customers to efficiently and profitably develop and retain their workforces over time and provide them with a competitive advantage. We are focused on expanding our platform capabilities and features and intend to continue increasing our revenue by pursuing a growth strategy that includes the elements noted below.

Grow Enterprise Customer Base

We continue to build our direct sales force to take advantage of the growing demand for corporate learning solutions. We have significantly expanded our direct sales force to focus on MMEs and divisions of larger enterprises and have aligned our sales team’s compensation structure to fit this objective. In addition to expanding our sales force, we have also been able to drive substantial increases in the productivity and effectiveness of our sales personnel over time.

Land-and-Expand (Expansion Within Existing Customer Accounts)

We use a “land-and-expand” strategy to grow sales within businesses, beginning with either departmental deployments or individual learners. Currently, within any one customer account, individual employees, human resource and/or technical departments use our platform. Over the past two years we have increasingly concentrated on improving our efforts to up-sell our products within our existing customer base and we are beginning to yield positive results.

Artificial Intelligence

We believe the deployment of AI into our platform is critical to our ability to scale and differentiate our business over time. By expanding the use-cases of our key algorithms, we believe we can efficiently develop a platform and tools that can evolve to increasingly automate time-consuming administrative functions. One example would be automated course building using available public and private content, significantly reducing the cost and time associated with creating learning content. The Docebo platform currently uses AI in a variety of features, including virtual coach (which provides learners with a unique learning experience), AI-powered deep search (which enhances learning content discoverability), auto-tagging (which makes content easier to find), skill-tagging (which identifies relevant skills from the skills catalog) and personalized suggestions on training materials. Through the implementation of AI into our products, we believe that the nature and scope of learner interaction on our platform will expand considerably.

Build New Products

We have integrated several new features into our cloud-based technology learning platform, including social learning, training delivery and tracking, learning impact evaluation, and new analytics capabilities. We intend to continue to add features to our platform over time, including content catalogs and people analytics, which we believe will provide us the opportunity to generate more revenue from new and existing customers.

Opportunistic Acquisitions

While inorganic growth has not been part of our historical strategy, we selectively consider strategic acquisitions, investments and other relationships that we believe are consistent with our strategy and can significantly enhance the attractiveness of our technology platform or expand our end-markets. This may include acquisitions of teams and capabilities that will not immediately add to revenue, but serve to benefit the long-term growth of the Company.

Since the beginning of 2022, the Company has completed the Skillslive Acquisition, PeerBoard Acquisition and Edugo Acquisition. See “General Development of the Business”.

OEMs & Strategic Alliances

We continue to seek and develop relationships with third-party enterprises that offer differentiated and value-added channels to reach new customer accounts and existing customers. These may include independent referral or bidding relationships, co-selling arrangements, integrated service relationships, reciprocal sub-contracting, one-off projects or certain “white labelling” applications.

Geographic Expansion

For the fiscal year ended December 31, 2024, approximately 76% of our revenue came from customers based in North America. We see a significant opportunity to expand our reach into other regions, with a focus on Europe primarily, as well as the Asia-Pacific region, particularly in Australia and New Zealand. We have registered learners in approximately 70 countries globally as of December 31, 2024 and continue to expand our sales teams in both Europe and the Asia-Pacific region to further address these large markets.

Competitive Conditions

The learning and professional skill development market is rapidly evolving, fragmented and highly competitive. We expect to face continued competition in the future as competitors bundle new and more comprehensive offerings with their existing products and services, and as new products and product enhancements are introduced into the e-learning market. The Company faces direct and/or indirect competition from a variety of players, including:

•legacy corporate e-learning service providers such as Cornerstone On Demand and SAP SuccessFactors;

•corporate e-learning service providers such as SAP Litmos, Absorb LMS, MindTickle, Lessonly and SkillJar which offer solutions at comparable prices to our products;

•lower priced solutions such as 360Learning, Thrive, TalentLMS, Totara and LearnUpon;

•individual-focused e-learning services such as LinkedIn Learning, Udemy, Udacity and Pluralsight;

•Specialist providers focused on specific use cases such as Skilljar and Thought Industries (Customer Education), Seismic, Axonify and Schoox (Sales Enablement);

•local consulting firms that customize open source solutions such as Moodle; and

•free solutions such as YouTube and Google.

The competitive factors in Docebo’s principal market include flexibility and scalability across multiple use cases, platform features and functionality, reliability and uptime, scalability, learner experience, brand, service and support for learners and administrators, collaboration and engagement, software integration and third-party publisher partnerships, accessibility across several devices, operating systems and applications, powerful insights and data analytics, continued innovation and application of AI capabilities.

Docebo believes that it competes favourably across these factors and is not inhibited by legacy constraints given the relative nascency of the platform. However, many of Docebo’s competitors and potential competitors are larger and have greater brand name recognition, longer operating histories, access to larger customer bases, larger sales and marketing budgets and significantly greater resources. Moreover, because the Company’s principal market is changing rapidly, it is possible that additional new entrants, especially those with significant resources, more efficient operating models, more rapid technology development cycles and lower marketing costs, could introduce new products and services that disrupt the Company’s principal market and better address the needs of its customers and potential customers. For more information, see “Risk Factors – Risks Related to our Business and our Industry”.

Intellectual Property

Our intellectual property rights are important to our business. The Company has been issued trademark registrations in Canada, the United States, the European Union, and India covering the trademark “DOCEBO”. Docebo protects its intellectual property rights through a combination of trademarks and trade secret laws as well as contractual provisions.

The Company uses non-disclosure agreements with business partners, prospective customers, and other relationships where disclosure of proprietary information may be necessary. We also use such agreements with our employees and consultants which assign to us all intellectual property developed in the course of their employment or engagement. We also secure from such individuals obligations to execute such documentation as is reasonably required by the Company to evidence our ownership of such intellectual property.

We are subject to risks related to our intellectual property. For more information, see “Risk Factors – Risks Related to our Business and our Industry”.

Employees

As at December 31, 2024, the Company and its subsidiaries employed 991 employees, 253 of which are in Canada, 396 of which are in Italy, 187 of which are in the United States and 155 of which are located elsewhere.

Except for a limited group of employees located in Italy, none of our employees are represented by a labor organization or are party to a collective bargaining arrangement.

With offices in Toronto (Ontario), Biassono (Italy), Athens and Atlanta (Georgia), London (U.K.), Paris (France), Munich (Germany), Dubai (UAE) and Melbourne (Australia), we are truly a global organization with access to a large pool of talent, as these cities are home to excellent technical and business schools and universities. We recruit our employees in a variety of ways and look for talent that fits within the Company’s culture and is focused on growing with the Company over the long-term. We are also deeply committed to providing an inclusive environment valued on diversity and equality. As noted in the ESG Report, the Company currently has four resource groups to cultivate Diversity, Equity, and Inclusion throughout our employee team – Docebo Women’s Alliance, Docebo Pride, Docebo Green Ambassadors, and BIDOC – Black, Indigenous, Docebians of Color. We build industry-leading teams and highly encourage the development of women and other minorities in technology to bring our vision for e-learning to life. Docebo values curious minds, diverse backgrounds, fresh ideas, and those with a commitment to lifelong learning and continuous improvement.

We strive to combine the innovation and agility of a start-up with a history of deep sector expertise and operational proficiency. As a founder-led organization, we pride ourselves on helping pioneer the corporate LMS space, driven by the relentless pursuit of technological innovation and a highly engaged workforce.

Risk Factors

The following information is a summary only of certain risk factors and is qualified in its entirety by reference to, and must be read in conjunction with, the detailed information appearing elsewhere in this Annual Information Form. These risks and uncertainties are not the only ones facing the Company. Additional risks and uncertainties not currently known to the Company, or that the Company currently considers immaterial, may also impair the operations of the Company. If any such risks actually occur, the business, financial condition, or liquidity and results of operations of the Company, and the ability of the Company to pay dividends on the Common Shares, could be materially adversely affected.

Risks Related to our Business and our Industry

Market adoption of cloud-based learning solutions may not grow as we expect, which may harm our business and results of operations and even if market demand for such solutions increases, the demand for our platform may not increase.

We believe our future success will depend in part on the growth, if any, in the demand for cloud-based learning management solutions, particularly enterprise-grade solutions. The widespread adoption of our platform depends not only on strong demand for new forms of learning management, but also for solutions delivered via a SaaS business model in particular. The market for cloud-based learning solutions is less mature than the market for in-person learning solutions, which many businesses currently use, and these businesses may be slow or unwilling to migrate from these legacy approaches. As such, it is difficult to predict customer demand for our platform, customer adoption and renewal, the rate at which existing customers expand their engagement with our platform, the size and growth rate of the market for our platform, the entry of competitive products into the market, or the success of existing competitive products. Furthermore, even if businesses want to adopt a cloud-based technology learning solution, it may take them a long time to fully transition to this type of learning solution or they could be delayed due to budget constraints, weakening economic conditions, or other factors. A portion of our customer base is comprised of Small and Medium Sized Businesses (“SMBs”). We may experience customer turnover in respect of such SMBs, which are more susceptible than larger businesses to changes in general economic conditions and other risks affecting their businesses, such as uncertainty in the macroeconomic environment, including with respect to inflationary pressures, changes in consumer spending, exchange rate fluctuations, and increases of interest rates.

Many of these SMBs may be in the entrepreneurial stage of their development and there is no guarantee that their businesses will succeed. Some businesses may also have long-term contracts with existing vendors and cannot switch in the short term. Even if market demand for cloud-based technology learning solutions generally increases, we can make no assurance that adoption of our platform will also increase. If the market for cloud-based technology learning solutions does not grow as we expect or our platform does not achieve widespread adoption it could result in reduced customer spending, customer attrition, and decreased revenue, any of which would adversely affect our business and results of operations. We further believe that a significant portion of our market capitalization is based on our revenue growth rate. If we are unable to continue growing our revenues, or if new revenues are offset by the rate at which existing customers cancel, do not renew or downgrade their recurring subscriptions (known in the industry as “churn”), our market capitalization may be negatively impacted, which could limit our access to capital, deter potential new investors, and harm our overall business and operations.

If we are not able to develop new platform features that respond to the needs of our customers, our business and results of operations would be adversely affected.

We pride ourselves on the quality and functionality of our platform. However, we cannot make any assurance that any future features or enhancements that we develop will be successful. The success of any enhancement or new feature depends on several factors, including our understanding of market demand, timely execution, successful introduction, and market acceptance. We may not successfully develop new features or enhance our existing platform to meet customer needs or our new features and enhancements may not achieve adequate acceptance in the market. Additionally, we may not sufficiently increase our revenue to offset the upfront technology, sales and marketing, and other expenses we incur in connection with the development of platform features and enhancements. Any of the foregoing may adversely affect our business and results of operations.

Natural disasters, public health crises, political crises, or other catastrophic or adverse events, including adverse and uncertain macroeconomic conditions may adversely affect our business, operating results or financial position.

Natural disasters, such as earthquakes, hurricanes, tornadoes, floods, and other adverse weather and climate conditions; unforeseen public health crises, and other pandemics and epidemics; political crises, such as terrorist attacks, war, and other political instability; or other catastrophic events, have and could in the future disrupt our operations or the operations of one or more of our third-party providers and vendors.

Additionally, our business and results of operations have been, and may continue to be, impacted by recent adverse and uncertain macroeconomic conditions, including higher inflation, higher interest rates, and fluctuations or volatility in capital markets or foreign currency exchange rates, the collapse of financial institutions and related uncertainty regarding geopolitical events such as the ongoing conflict between Russia and Ukraine as well as Israel and the surrounding area. In particular, we have experienced in certain instances, and may continue to experience, longer sales cycles or generally increased scrutiny on spending from existing and potential customers due to macroeconomic uncertainty. We cannot be certain how long these uncertain macroeconomic conditions and the resulting effects on our industry, our business strategy, and customers will persist.

The market in which we participate is competitive, and if we do not compete effectively, our results of operations could be harmed.

The market for professional skill development is highly competitive, rapidly evolving, and fragmented, and we expect competition to continue to increase in the future. A significant number of companies have developed, or are developing, products and services that currently, or in the future may, compete with our offerings and be superior. This competition could result in decreased revenue, increased pricing pressure, increased sales and marketing expenses, and loss of market share, any of which could adversely affect our business, results of operations, and financial condition.

We face competition from traditional enterprise SaaS solutions, consumer-centric SaaS solutions, and free solutions. We compete directly or indirectly with:

•legacy corporate e-learning service providers such as Cornerstone On Demand, and SAP SuccessFactors;

•corporate e-learning service providers such as SAP Litmos, Absorb LMS, MindTickle, Lessonly and SkillJar which offer solutions at comparable prices to our products;

•lower priced solutions such as 360Learning, Thrive, TalentLMS, Totara and LearnUpon;

•individual-focused e-learning services such as LinkedIn Learning, Udemy, Udacity and Pluralsight;

•specialist providers focused on specific use cases such as Skilljar and Thought Industries (Customer Education), Seismic, Axonify and Schoox (Sales Enablement)

•local consulting firms that customize open source solutions such as Moodle; and

•free solutions such as YouTube and Google.

Many of our competitors and potential competitors are larger and have greater brand name recognition, longer operating histories, larger marketing budgets and established customer relationships, access to larger customer bases, and significantly greater resources for the development of their solutions. In addition, we face potential competition from participants in adjacent markets including human capital management solution providers that may enter our markets by leveraging related technologies and partnering with or acquiring other companies or providing alternative approaches to provide similar results. We may also face competition from companies entering our market, including large technology companies that could expand their offerings or acquire one of our competitors. While these companies may not currently focus on our market, they may have significantly greater financial resources and longer operating histories than we do. As a result, our competitors and potential competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, or customer requirements. Further, some potential customers, particularly large enterprises, may elect to develop their own internal solutions that address their learning management needs.

Our ability to compete is also subject to the risk of future disruptive technologies. If new technologies emerge that are able to deliver learning solutions at lower prices, with greater feature sets, more efficiently, or more conveniently, such technologies could adversely impact our ability to compete. With the introduction of new technologies and market entrants, we expect competition to intensify in the future.

Some of our principal competitors offer their solutions at a lower price or for free, which may result in pricing pressures on us. Many of our competitors that offer free solutions are also integrating features found previously only with paid solutions, which puts additional pressure on our pricing and feature development. If we are unable to maintain our pricing levels and competitive differentiation in the market, our results of operations would be negatively impacted.

If for any reason we are not able to develop enhanced and new features, keep pace with technological developments or respond to future disruptive technologies, our business will be harmed.

Our future success will depend on our ability to adapt and innovate. To attract new customers and increase revenue from existing customers, we will need to continually enhance and improve our platform and introduce new features. The success of any enhancement or new feature depends on several factors, including timely completion, introduction, and market acceptance. If we are unable to successfully develop or acquire new features or enhance our existing platform to meet customer needs, our business and operating results could be adversely affected. In addition, because our products are designed to operate on a variety of network, hardware and software platforms using Internet tools and protocols, we will need to continuously modify and enhance our products to keep pace with changes in internet-related hardware, software, communication, browser, and database technologies. If we are unable to respond in a timely and cost-effective manner to these rapid technological developments, our platform may become less marketable and less competitive or obsolete and our operating results may be negatively impacted.

Finally, our ability to grow is subject to the risk of future disruptive technologies. If new technologies emerge that are able to deliver LMS products and services at lower prices, more efficiently or more conveniently, such technologies could adversely impact our ability to compete.

If we fail to retain key employees or to recruit qualified technical and sales personnel, our business could be harmed.

We believe that our success depends on the continued employment of our senior management and other key employees. In addition, because our future success is dependent on our ability to continue to enhance and introduce new platform features, we are heavily dependent on our ability to attract and retain qualified personnel with the requisite education, background, and industry experience. As we expand our business, our continued success will also depend, in part, on our ability to attract and retain qualified sales, marketing, and operational personnel capable of supporting a larger and more diverse customer base. We and our competitors continue to face significant turnover in our employee base. Qualified individuals are in high demand in our industry, and we may incur significant costs to attract and retain them. The loss of the services of a significant number of our technology or sales personnel could be disruptive to our business development efforts or customer relationships. In addition, if any of our key employees join a competitor or decides to otherwise compete with us, we may experience a material disruption of our operations and business strategy, which may cause us to lose customers or increase operating expenses and may divert our attention as we seek to recruit replacements for the departed employees. Further, changes we make to our current and future work environments may not meet the needs or expectations of our employees or may be perceived as less favourable compared to other companies’ policies, which could negatively impact our ability to hire and retain qualified personnel. Our future work strategy and continued efforts related to employee onboarding, training and development and retention may not be successful. Further, our future work strategy is continuing to evolve and may not meet the needs of our existing and potential future employees and they may prefer work models offered by other companies.

If our customers do not expand their use of our platform beyond their current organizational engagements or renew their existing contracts with us, our ability to grow our business and improve our results of operations may be adversely affected.

Our future success depends, in part, on our ability to increase the adoption of our platform by our existing customers and future customers. Many of our customers initially use our platform in specific groups or departments within their organization. In addition, our customers may initially use our platform for a specific use case. Our ability to grow our business depends in part on our ability to persuade customers to expand their use of our platform to address additional use cases. Further, to continue to grow our business, it is important that our customers renew their subscriptions when existing contracts expire and that we expand our relationships with our existing customers. Our customers have no obligation to renew their subscriptions, and our customers may decide not to renew their subscriptions with a similar contract period, at the same prices and terms, with the same or a greater number of learners, or at all. In the past, some of our customers have elected not to renew their agreements with us, and it is difficult to accurately predict whether we will have future success in retaining customers or expanding our relationships with them. We offer our customers the flexibility to choose annual or multi-year contract terms. Although our contracts generally contain cancellation penalties, the difficulty and costs associated with switching to a competitor may not be significant for certain customers. New customers joining our platform may also decide not to continue or renew their subscription for reasons outside of our control. We have experienced significant growth in the number of learners of our platform, but we do not know whether we will continue to achieve similar learner growth in the future, or whether learner growth could be offset by increased churn. Our ability to retain our customers and expand our deployments with them may decline or fluctuate as a result of a number of factors, including our customers’ satisfaction with our platform, our customer support, our prices, the prices and features of competing solutions, reductions in our customers’ spending levels, insufficient learner adoption of our platform, and new feature releases. If our customers do not purchase additional subscriptions or renew their existing subscriptions, renew on less favorable terms, or fail to continue to expand their engagement with our platform, our revenue may decline or grow less quickly than anticipated, which would harm our results of operations.

If we are unable to increase sales of subscriptions to our platform to customers while mitigating the risks associated with serving such customers, our business, financial condition, and results of operations would suffer.

Our growth strategy is largely dependent upon increasing sales of subscriptions to our platform to our customers. As we seek to increase our sales to our customers, we face upfront sales costs and longer sales cycles, higher customer acquisition costs, more complex customer requirements and volume discount requirements.

We may enter into customized contractual arrangements with our customers in which we offer more favorable pricing terms in exchange for larger total contract values that accompany large deployments. As we drive a greater portion of our revenue through our deployments with customers, we expect that our revenue will continue to grow significantly but the price we charge customers per learner may decline. This may result in reduced margins in the future if our cost of revenue increases. For example, customers may request that we integrate our platform with their existing technologies, and these customization efforts could create additional costs and delays in utilization. In addition, customers often begin to use our platform on a limited basis, but nevertheless require education and interactions with our sales team, which increases our upfront investment in the sales effort with no guarantee that these customers will use our platform widely enough across their organization to justify our upfront investment. As we continue to expand our sales efforts to customers, we will need to continue to increase the investments we make in sales and marketing, and there is no guarantee that our investments will succeed and contribute to additional customer acquisition and revenue growth. If we are unable to increase sales to customers while mitigating the risks associated with serving such customers, our business, financial condition, and results of operations will suffer.

Failure to effectively expand our sales and marketing capabilities or to select appropriate marketing channels could harm our ability to increase our customer base and achieve broader market acceptance of our platform.

Our ability to broaden our customer base and achieve broader market acceptance of our platform will depend to a significant extent on the ability of our sales and marketing organizations to work together to drive our sales pipeline and cultivate customer and partner relationships to drive revenue growth. We have invested in and plan to continue expanding our sales and marketing organizations, both domestically and internationally. Identifying, recruiting, and training sales personnel will require significant time, expense, and attention. We also plan to dedicate significant resources to sales and marketing programs, including lead generation activities and brand awareness campaigns, such as search engine and email marketing, online banner and video advertising, learner events, and webinars. If we are unable to hire, develop, and retain talented sales or marketing personnel, if our new sales or marketing personnel are unable to achieve desired productivity levels in a reasonable period of time, or if we fail to select appropriate marketing channels and our sales and marketing programs are not effective, our ability to broaden our customer base and achieve broader market acceptance of our platform could be harmed. In addition, the investments we make in our sales and marketing organization will occur in advance of experiencing benefits from such investments, making it difficult to determine in a timely manner if we are efficiently allocating our resources in these areas.

If we fail to effectively manage our growth, our business and results of operations could be harmed.

We have experienced, and may continue to experience, rapid growth and organizational change, which has placed, and may continue to place, significant demands on our management and our administrative, operational, and financial resources. In addition, we operate globally, and have employees in Canada, the United States, Europe, the United Kingdom, Australia, and other regions. We plan to continue to expand our operations into other countries in the future, which will place additional demands on our resources and operations. Additionally, we continue to increase the breadth and scope of our platform and our operations. To support this growth, and to manage any future growth effectively, we must continue to improve our IT and financial infrastructures, our operating and administrative systems, and our ability to manage headcount, capital, and internal processes in an efficient manner. As we continue to grow, so does the size of our customers. The increased resources required to service these relatively large customers may cause us to divert resources away from our existing customers, which may have an adverse impact on our ability to maintain existing customers and our results of operations. Our organizational structure is also becoming more complex as we grow our operational, financial, and management infrastructure and we must continue to improve our internal controls as well as our reporting systems and procedures. We intend to continue to invest to expand our business, including investing in technology and sales and marketing operations, hiring additional personnel, improving our internal controls, reporting systems and procedures, and upgrading our infrastructure.

These investments will require significant capital expenditures and the allocation of management resources, and any investments we make will occur in advance of experiencing the benefits from such investments, making it difficult to determine in a timely manner if we are efficiently allocating our resources. If we do not achieve the benefits anticipated from these investments, or if the achievement of these benefits is delayed, our results of operations may be adversely affected.

Our recent rapid growth makes it difficult to evaluate our future prospects and may increase the risk that we will not continue to grow at or near historical rates.

We have grown rapidly over the last several years, and as a result, our ability to forecast our future results of operations is subject to a number of uncertainties, including our ability to effectively plan for and model future growth. Any predictions about our future revenue and expenses may not be as accurate as they would be if we had a longer history of high sales or operated in a more predictable market. We have encountered in the past, and will encounter in the future, risks and uncertainties frequently experienced by growing companies in rapidly changing industries. If our assumptions regarding these risks and uncertainties, which we use to plan and operate our business, are incorrect or change, or if we do not address these risks successfully, our results of operations could differ materially from our expectations, our growth rates may slow, and our business would suffer.

Our growth could be adversely affected if we fail to execute our “land and expand” strategy.

Our revenue and growth are dependent, in part, on our ability to retain customers and sell them additional products and services. While not a focus for us historically, we have invested considerably over the last three years in upselling efforts. Our ability to execute this aspect of our growth strategy will depend on a variety of factors, including:

•customer willingness to accept any price increases;

•the quality and perceived value of our product and service offerings by existing customers;

•effective sales and marketing efforts with respect to existing customers;

•our speed to market and avoidance of difficulties or delays in development of new products and services;

•the successful implementation of products and services; and

•the regulatory needs and requirements facing us and our existing customers.

Our inability to retain existing customers, sell those customers additional products and services, or successfully develop and implement new and enhanced products and services and, accordingly, increase our revenues, could adversely affect our future results of operations.

If we cannot maintain our Company’s culture as we grow, we could lose the innovation, teamwork, passion, and focus on execution that we believe contribute to our success and our business may be harmed.

We believe that a critical component to our success has been our Company’s culture. Our Company is aligned behind our culture and key values and we have invested substantial time and resources in building our team within this culture. Additionally, as we grow we may find it difficult to maintain these important aspects of our Company’s culture. If we fail to preserve our culture, our ability to retain and recruit personnel, our ability to effectively focus on and pursue our corporate objectives, and our business could be harmed.

Our quarterly and annual results of operations may vary significantly and may be difficult to predict. If we fail to meet the expectations of investors or securities analysts, our stock price and the value of your investment could decline.

Our quarterly and annual billings, revenue and results of operations have fluctuated significantly in the past and may vary significantly in the future due to a variety of factors, many of which are outside of our control. Our financial results in any one quarter should not be relied upon as indicative of future performance. We may not be able to accurately predict our future billings, revenue or results of operations. Factors that may cause fluctuations in our quarterly results of operations include, but are not limited to, those listed below:

•fluctuations in the demand for our platform, and the timing of sales, particularly larger subscriptions;

•our ability to attract new customers or retain existing customers;

•changes in customer renewal rates and our ability to increase sales to our existing customers;

•the seasonal buying patterns of our customers;

•the budgeting cycles and internal purchasing priorities of our customers;

•the payment terms and subscription term length associated with our platform sales and their effect on our billings and free cash flow;

•our ability to anticipate or respond to changes in the competitive landscape, including consolidation among competitors;

•the timing of expenses and recognition of revenue;

•the amount and timing of operating expenses related to the maintenance and expansion of our business, operations, and infrastructure;

•the timing and success of new product feature and service introductions by us or our competitors;

•network outages or actual or perceived security breaches;

•changes in laws and regulations that impact our business; and our ability to operate the Company’s business and effectively manage its growth under evolving macroeconomic conditions, such as high inflation and recessionary environments.

If our billings, revenue or results of operations fall below the expectations of investors or securities analysts in a particular quarter, or below any guidance that we may provide, the price of our Common Shares could decline.

If our security measures are breached or unauthorized access to customer data is otherwise obtained, our platform may be perceived as insecure, we may lose existing customers or fail to attract new customers, our reputation may be harmed, and we may incur significant liabilities.

Unauthorized access to, or other security breaches of (including malware attacks), our platform or the other systems or networks used in our business, including those of our vendors, contractors, or those with which we have strategic relationships, could result in the loss, compromise or corruption of data, loss of business, reputational damage adversely affecting customer or investor confidence, regulatory investigations and orders, litigation, indemnity obligations, damages for contract breach, penalties for violation of applicable laws or regulations, significant costs for remediation, and other liabilities. We have insurance coverage, but this coverage may be insufficient to compensate us for all liabilities that we may incur. Further, an actual or perceived security breach affecting one of our competitors or any other company that provides hosting services or delivers applications under a SaaS model, even if no confidential information of our customers is compromised, may adversely affect the market perception of our security measures and we could lose potential sales and existing customers.