| TN | 62-1120025 | ||||||||||||||||

| (State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) | ||||||||||||||||

| 1915 Snapps Ferry Road | Building N | Greeneville | TN | 37745 | |||||||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||||||||

| 000-22490 | ||

| (Commission File Number) | ||

| Not Applicable | ||

| (Former name or former address, if changed since last report) | ||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, $0.01 par value | FWRD | NASDAQ | ||||||||||||

| No. | Exhibit | |||||||

| 104 | Cover Page Interactive File (the cover page tags are embedded within the Inline XBRL document) | |||||||

| FORWARD AIR CORPORATION | |||||||||||

Date: February 26, 2025 |

By: | /s/ Shawn Stewart |

|||||||||

|

Shawn Stewart

Chief Executive Officer

|

|||||||||||

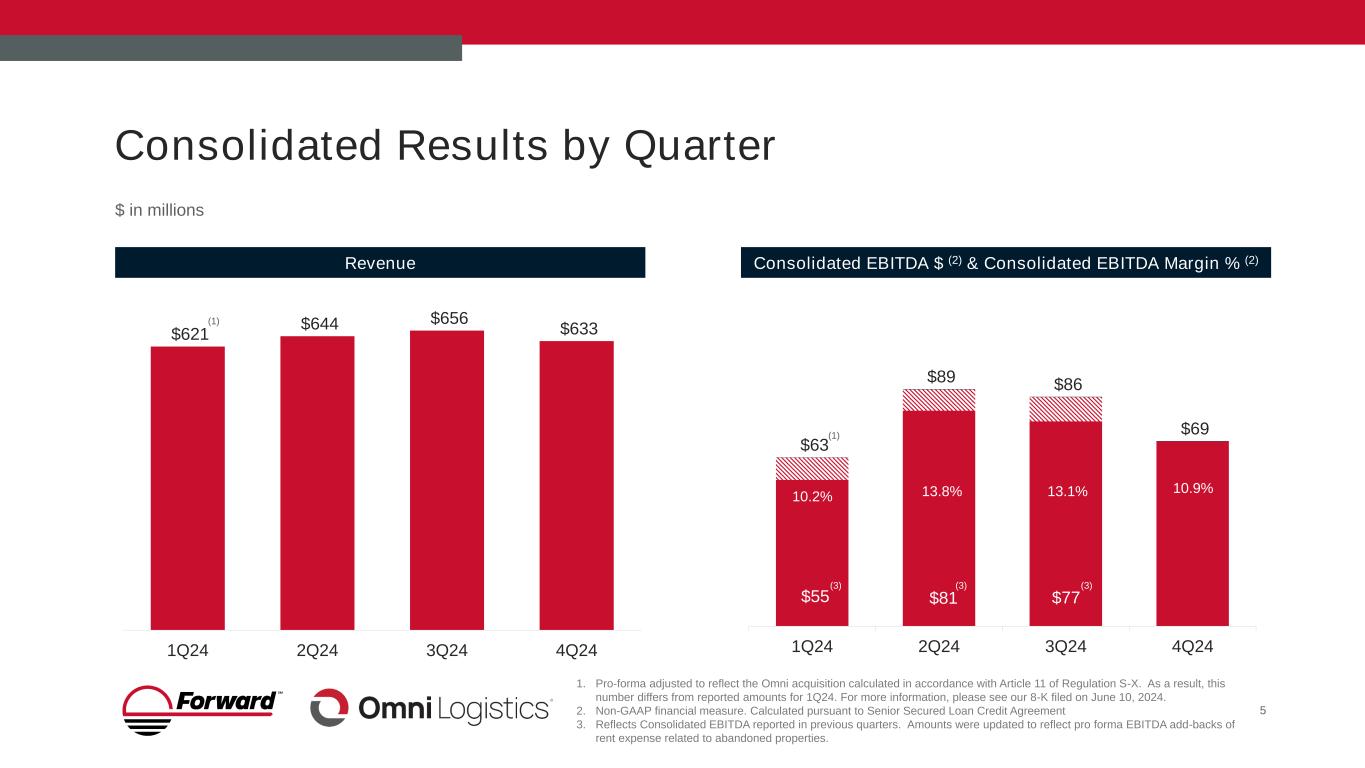

| Continuing Operations | Three Months Ended | |||||||||||||||||||||||||

| (in thousands, except per share data) | December 31, 2024 | December 31, 2023 | Change | Percent Change | ||||||||||||||||||||||

| Operating revenue | $ | 632,846 | $ | 338,428 | $ | 294,418 | 87.0 | % | ||||||||||||||||||

| Income from operations | 75,855 | $ | 3,000 | $ | 72,855 | 2,428.5 | % | |||||||||||||||||||

| Operating margin | 12.0 | % | 0.9 | % | 1,110 bps | |||||||||||||||||||||

| Net income | $ | (35,378) | $ | (14,721) | $ | (20,657) | 140.3 | % | ||||||||||||||||||

| Net income per diluted share | $ | (1.23) | $ | (0.58) | $ | (0.65) | 112.1 | % | ||||||||||||||||||

| Cash provided by operating activities | $ | (30,492) | $ | 57,092 | $ | (87,584) | (153.4) | % | ||||||||||||||||||

Non-GAAP Financial Measures: 1 |

||||||||||||||||||||||||||

| Consolidated EBITDA | $ | 69,259 | $ | 94,022 | $ | (24,763) | (26.3) | % | ||||||||||||||||||

| Free cash flow | $ | (35,098) | $ | 48,913 | $ | (84,011) | (171.8) | % | ||||||||||||||||||

1 Reconciliation of these non-GAAP financial measures are provided below the financial tables. | ||||||||||||||||||||||||||

| Continuing Operations | Twelve Months Ended | |||||||||||||||||||||||||

| (in thousands, except per share data) | December 31, 2024 | December 31, 2023 | Change | Percent Change | ||||||||||||||||||||||

| Operating revenue | $ | 2,474,262 | $ | 1,370,735 | $ | 1,103,527 | 80.5 | % | ||||||||||||||||||

| Income from operations | $ | (1,062,936) | $ | 88,210 | $ | (1,151,146) | (1,305.0) | % | ||||||||||||||||||

| Operating margin | (43.0) | % | 6.4 | % | (4,940) bps | |||||||||||||||||||||

| Net income | $ | (1,124,841) | $ | 42,803 | $ | (1,167,644) | (2,727.9) | % | ||||||||||||||||||

| Net income per diluted share | $ | (29.43) | $ | 1.64 | $ | (31.07) | (1,894.5) | % | ||||||||||||||||||

| Cash provided by operating activities | $ | (76,262) | $ | 199,212 | $ | (275,474) | (138.3) | % | ||||||||||||||||||

Non-GAAP Financial Measures: 1 |

||||||||||||||||||||||||||

| Consolidated EBITDA | $ | 307,711 | $ | 402,100 | $ | (94,389) | (23.5) | % | ||||||||||||||||||

| Free cash flow | $ | (108,185) | $ | 172,228 | $ | (280,413) | (162.8) | % | ||||||||||||||||||

1 Reconciliation of these non-GAAP financial measures are provided below the financial tables. | ||||||||||||||||||||||||||

| Forward Air Corporation | |||||||||||||||||||||||

| Condensed Consolidated Statements of Comprehensive Income | |||||||||||||||||||||||

| (Unaudited, in thousands, except per share data) | |||||||||||||||||||||||

| Three Months Ended | Twelve Months Ended | ||||||||||||||||||||||

| December 31, 2024 |

December 31, 2023 |

December 31, 2024 |

December 31, 2023 |

||||||||||||||||||||

| Operating revenue: | |||||||||||||||||||||||

| Expedited Freight | $ | 265,879 | $ | 279,070 | $ | 1,115,163 | $ | 1,096,958 | |||||||||||||||

| Omni | 325,609 | — | 1,196,841 | — | |||||||||||||||||||

| Intermodal | 59,829 | 59,440 | 232,832 | 274,043 | |||||||||||||||||||

| Corporate | 164 | — | 164 | — | |||||||||||||||||||

| Eliminations and other operations | (18,635) | (82) | (70,738) | (266) | |||||||||||||||||||

| Operating revenue | 632,846 | 338,428 | 2,474,262 | 1,370,735 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Purchased transportation | 319,498 | 150,351 | 1,250,570 | 586,195 | |||||||||||||||||||

| Salaries, wages, and employee benefits | 130,024 | 71,583 | 536,406 | 287,566 | |||||||||||||||||||

| Operating leases | 48,326 | 20,908 | 182,197 | 87,413 | |||||||||||||||||||

| Depreciation and amortization | 37,657 | 17,579 | 143,978 | 57,405 | |||||||||||||||||||

| Insurance and claims | 19,721 | 11,145 | 64,682 | 50,133 | |||||||||||||||||||

| Fuel expense | 5,500 | 5,271 | 21,460 | 22,004 | |||||||||||||||||||

| Other operating expenses | 75,333 | 58,591 | 309,508 | 191,809 | |||||||||||||||||||

| Impairment of goodwill | (79,068) | — | 1,028,397 | — | |||||||||||||||||||

| Total operating expenses | 556,991 | 335,428 | 3,537,198 | 1,282,525 | |||||||||||||||||||

| Income (loss) from continuing operations | |||||||||||||||||||||||

| Expedited Freight | 7,238 | 26,745 | 67,951 | 116,040 | |||||||||||||||||||

| Omni | 88,520 | — | (1,044,803) | — | |||||||||||||||||||

| Intermodal | 5,931 | 5,068 | 18,925 | 25,327 | |||||||||||||||||||

| Other operations | (25,834) | (28,813) | (105,009) | (53,157) | |||||||||||||||||||

| Income (loss) from continuing operations | 75,855 | 3,000 | (1,062,936) | 88,210 | |||||||||||||||||||

| Other expense: | |||||||||||||||||||||||

| Interest expense, net | (48,427) | (23,976) | (189,215) | (31,571) | |||||||||||||||||||

| Foreign exchange gain | 3,005 | — | 1,093 | — | |||||||||||||||||||

| Other income (expense), net | 1,188 | — | 1,226 | — | |||||||||||||||||||

| Total other expense | (44,234) | (23,976) | (186,896) | (31,571) | |||||||||||||||||||

| Income (loss) from continuing operations before income taxes | 31,621 | (20,976) | (1,249,832) | 56,639 | |||||||||||||||||||

| Income tax expense (benefit) | 67,000 | (6,255) | (124,990) | 13,836 | |||||||||||||||||||

| Net income (loss) from continuing operations | (35,378) | (14,721) | (1,124,841) | 42,803 | |||||||||||||||||||

| Income (loss) from discontinued operation, net of tax | (374) | 116,465 | (6,387) | 124,548 | |||||||||||||||||||

| Net (loss) income | $ | (35,752) | $ | 101,744 | $ | (1,131,228) | $ | 167,351 | |||||||||||||||

| Net (loss) attributable to noncontrolling interest | $ | 664 | $ | — | $ | (314,259) | $ | — | |||||||||||||||

| Net (loss) income attributable to Forward Air | $ | (36,416) | $ | 101,744 | $ | (816,969) | $ | 167,351 | |||||||||||||||

| Net income per share: | |||||||||||||||||||||||

| Basic net (loss) income per share: | |||||||||||||||||||||||

| Continuing operations | $ | (1.23) | $ | (0.58) | $ | (29.43) | $ | 1.64 | |||||||||||||||

| Discontinued operation | (0.01) | 4.51 | (0.23) | 4.78 | |||||||||||||||||||

Net income per basic share1 |

$ | (1.24) | $ | 3.94 | $ | (29.66) | $ | 6.42 | |||||||||||||||

| Diluted net (loss) income per share: | |||||||||||||||||||||||

| Continuing operations | $ | (1.23) | $ | (0.58) | $ | (29.43) | $ | 1.64 | |||||||||||||||

| Discontinued operation | (0.01) | 4.51 | (0.23) | 4.77 | |||||||||||||||||||

Net income per diluted share1 |

$ | (1.24) | $ | 3.93 | $ | (29.66) | $ | 6.40 | |||||||||||||||

| Dividends per share: | $ | — | $ | 0.24 | $ | — | $ | 0.96 | |||||||||||||||

| Expedited Freight Segment Information | |||||||||||||||||||||||||||||||||||

| (In thousands) | |||||||||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||

| December 31, 2024 | Percent of Revenue | December 31, 2023 | Percent of Revenue | Change | Percent Change | ||||||||||||||||||||||||||||||

| Operating revenue: | |||||||||||||||||||||||||||||||||||

Network 1 |

$ | 199,022 | 74.8 | % | $ | 217,279 | 77.9 | % | $ | (18,257) | (8.4) | % | |||||||||||||||||||||||

| Truckload | 45,087 | 17.0 | 38,538 | 13.8 | 6,549 | 17.0 | |||||||||||||||||||||||||||||

| Other | 21,770 | 8.2 | 23,253 | 8.3 | (1,483) | (6.4) | |||||||||||||||||||||||||||||

| Total operating revenue | 265,879 | 100.0 | 279,070 | 100.0 | (13,191) | (4.7) | |||||||||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||||||||||||||

| Purchased transportation | 136,151 | 51.2 | 132,359 | 47.4 | 3,792 | 2.9 | |||||||||||||||||||||||||||||

| Salaries, wages and employee benefits | 56,587 | 21.3 | 56,291 | 20.2 | 296 | 0.5 | |||||||||||||||||||||||||||||

| Operating leases | 18,130 | 6.8 | 15,396 | 5.5 | 2,734 | 17.8 | |||||||||||||||||||||||||||||

| Depreciation and amortization | 10,395 | 3.9 | 12,328 | 4.4 | (1,933) | (15.7) | |||||||||||||||||||||||||||||

| Insurance and claims | 10,423 | 3.9 | 9,438 | 3.4 | 985 | 10.4 | |||||||||||||||||||||||||||||

| Fuel expense | 2,605 | 1.0 | 2,906 | 1.0 | (301) | (10.4) | |||||||||||||||||||||||||||||

| Other operating expenses | 24,350 | 9.2 | 23,607 | 8.5 | 743 | 3.1 | |||||||||||||||||||||||||||||

| Total operating expenses | 258,641 | 97.3 | 252,325 | 90.4 | 6,316 | 2.5 | |||||||||||||||||||||||||||||

| Income from operations | $ | 7,238 | 2.7 | % | $ | 26,745 | 9.6 | % | $ | (19,507) | (72.9) | % | |||||||||||||||||||||||

1 Network revenue is comprised of all revenue, including linehaul, pickup and/or delivery, and fuel surcharge revenue, excluding accessorial and Truckload revenue. | |||||||||||||||||||||||||||||||||||

| Expedited Freight Operating Statistics | |||||||||||||||||

| Three Months Ended | |||||||||||||||||

| December 31, 2024 | December 31, 2023 | Percent Change | |||||||||||||||

| Business days | 64 | 63 | 1.6 | % | |||||||||||||

Tonnage 1,2 |

|||||||||||||||||

| Total pounds | 670,168 | 689,621 | (2.8) | ||||||||||||||

| Pounds per day | 10,471 | 10,946 | (4.3) | ||||||||||||||

Shipments 1,2 |

|||||||||||||||||

| Total shipments | 783 | 846 | (7.4) | ||||||||||||||

| Shipments per day | 12.2 | 13.4 | (9.0) | ||||||||||||||

| Weight per shipment | 856 | 815 | 5.0 | ||||||||||||||

Revenue per hundredweight 3 |

$ | 29.70 | $ | 31.52 | (5.8) | ||||||||||||

Revenue per hundredweight, ex fuel 3 |

$ | 23.74 | $ | 23.99 | (1.0) | ||||||||||||

Revenue per shipment 3 |

$ | 254.30 | $ | 256.90 | (1.0) | ||||||||||||

Revenue per shipment, ex fuel 3 |

$ | 203.26 | $ | 195.52 | 4.0 | ||||||||||||

1 In thousands. |

|||||||||||||||||

2 Excludes accessorial and Truckload products. | |||||||||||||||||

3 Includes intercompany revenue between the Network and Truckload revenue streams. | |||||||||||||||||

| Omni Logistics Segment Information | |||||||||||

| (In thousands) | |||||||||||

| (Unaudited) | |||||||||||

| Three Months Ended | |||||||||||

| December 31, 2024 |

Percent of Revenue | ||||||||||

| Operating revenue | $ | 325,609 | 100.0 | % | |||||||

| Operating expenses: | |||||||||||

| Purchased transportation | 183,084 | 56.2 | |||||||||

| Salaries, wages and employee benefits | 54,056 | 16.6 | |||||||||

| Operating leases | 23,036 | 7.1 | |||||||||

| Depreciation and amortization | 22,605 | 6.9 | |||||||||

| Insurance and claims | 3,911 | 1.2 | |||||||||

| Fuel expense | 863 | 0.3 | |||||||||

| Other operating expenses | 28,602 | 8.8 | |||||||||

| Impairment of goodwill | (79,068) | (24.3) | |||||||||

| Total operating expenses | 237,089 | 72.8 | |||||||||

| Income from operations | $ | 88,520 | 27.2 | % | |||||||

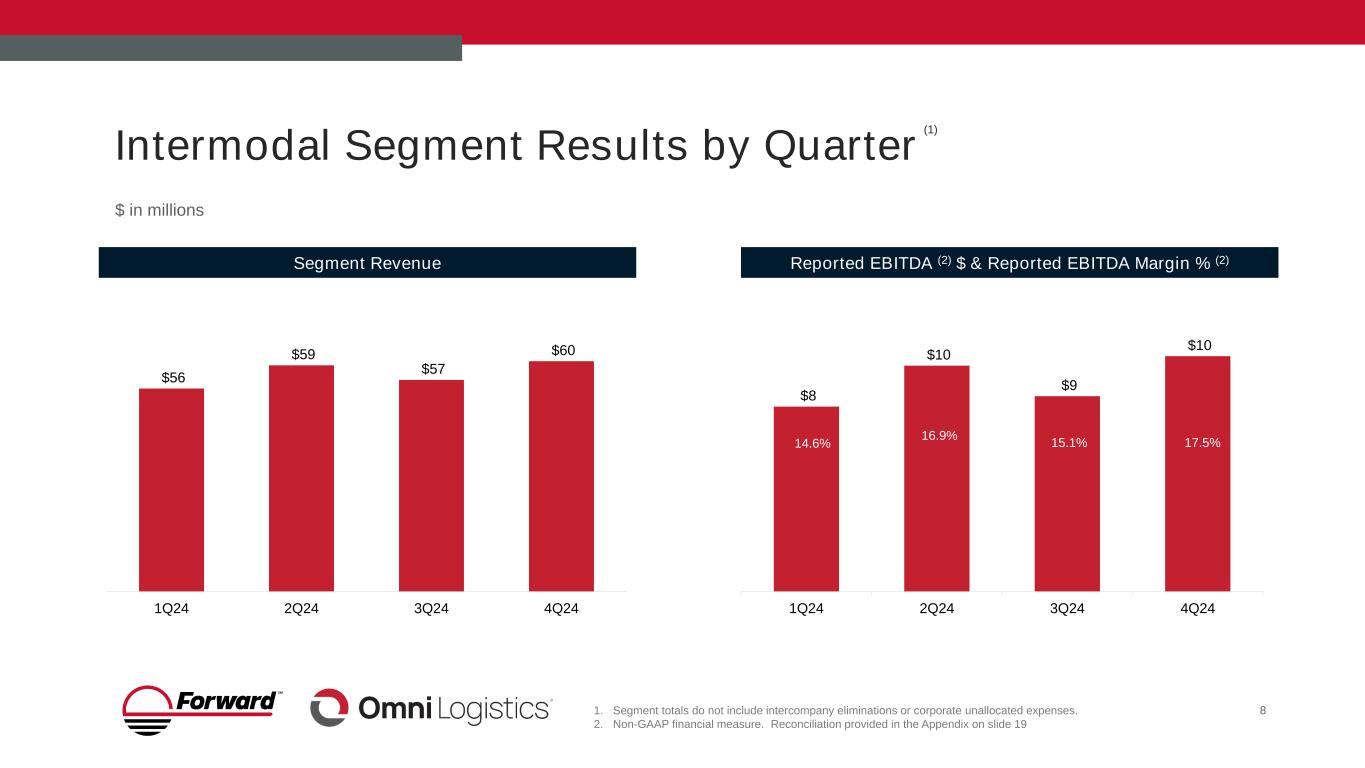

| Intermodal Segment Information | |||||||||||||||||||||||||||||||||||

| (In thousands) | |||||||||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||

| December 31, 2024 | Percent of Revenue | December 31, 2023 | Percent of Revenue | Change | Percent Change | ||||||||||||||||||||||||||||||

| Operating revenue | $ | 59,829 | 100.0 | % | $ | 59,440 | 100.0 | % | $ | 389 | 0.7 | % | |||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||||||||||||||

| Purchased transportation | 18,898 | 31.6 | 18,073 | 30.4 | 825 | 4.6 | |||||||||||||||||||||||||||||

| Salaries, wages and employee benefits | 14,227 | 23.8 | 15,243 | 25.6 | (1,016) | (6.7) | |||||||||||||||||||||||||||||

| Operating leases | 6,463 | 10.8 | 5,512 | 9.3 | 951 | 17.3 | |||||||||||||||||||||||||||||

| Depreciation and amortization | 4,519 | 7.6 | 5,251 | 8.8 | (732) | (13.9) | |||||||||||||||||||||||||||||

| Insurance and claims | 2,498 | 4.2 | 2,398 | 4.0 | 100 | 4.2 | |||||||||||||||||||||||||||||

| Fuel expense | 2,032 | 3.4 | 2,365 | 4.0 | (333) | (14.1) | |||||||||||||||||||||||||||||

| Other operating expenses | 5,261 | 8.8 | 5,530 | 9.3 | (269) | (4.9) | |||||||||||||||||||||||||||||

| Total operating expenses | 53,898 | 90.1 | 54,372 | 91.5 | (474) | (0.9) | |||||||||||||||||||||||||||||

| Income from operations | $ | 5,931 | 9.9 | % | $ | 5,068 | 8.5 | % | $ | 863 | 17.0 | % | |||||||||||||||||||||||

Intermodal Operating Statistics | |||||||||||||||||

| Three Months Ended | |||||||||||||||||

| December 31, 2024 | December 31, 2023 | Percent Change | |||||||||||||||

| Drayage shipments | 63,920 | 65,776 | (2.8) | % | |||||||||||||

| Drayage revenue per shipment | $ | 847 | $ | 821 | 3.2 | % | |||||||||||

| Forward Air Corporation | |||||||||||

| Condensed Consolidated Balance Sheets | |||||||||||

| (In thousands) (Unaudited) | |||||||||||

| December 31, 2024 | December 31, 2023 | ||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 104,903 | $ | 121,969 | |||||||

| Restricted cash equivalents | 363 | 39,604 | |||||||||

Accounts receivable, less allowance of $2,633 in 2024 and $2,206 in 2023 |

310,185 | 153,267 | |||||||||

| Other receivables | 205 | 5,408 | |||||||||

| Prepaid expenses | 29,053 | 25,682 | |||||||||

| Other current assets | 15,685 | 1,098 | |||||||||

| Total current assets | 460,394 | 347,028 | |||||||||

| Noncurrent restricted cash equivalents | — | 1,790,500 | |||||||||

Property and equipment, net of accumulated depreciation and amortization of $292,855 in 2024 and $250,185 in 2023 |

326,188 | 258,095 | |||||||||

| Operating lease right-of-use assets | 410,084 | 111,552 | |||||||||

| Goodwill | 564,948 | 278,706 | |||||||||

Other acquired intangibles, net of accumulated amortization of $144,845 in 2024 and $127,032 in 2023 |

999,216 | 134,789 | |||||||||

| Other assets | 71,940 | 58,863 | |||||||||

| Total assets | $ | 2,832,770 | $ | 2,979,533 | |||||||

| Liabilities and Shareholders’ Equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 96,059 | $ | 45,430 | |||||||

| Accrued expenses | 121,836 | 62,948 | |||||||||

| Other current liabilities | 43,147 | 71,727 | |||||||||

| Current portion of debt and finance lease obligations | 16,930 | 12,645 | |||||||||

| Current portion of operating lease liabilities | 96,440 | 44,344 | |||||||||

| Total current liabilities | 374,412 | 237,094 | |||||||||

| Finance lease obligations, less current portion | 30,858 | 26,736 | |||||||||

| Long-term debt, less current portion and debt issuance costs | 1,675,930 | — | |||||||||

| Long-term debt held in escrow | — | 1,790,500 | |||||||||

| Liability from tax receivable agreement | 13,295 | — | |||||||||

| Operating lease liabilities, less current portion | 325,640 | 71,598 | |||||||||

| Other long-term liabilities | 48,835 | 47,144 | |||||||||

| Deferred income taxes | 38,169 | 42,200 | |||||||||

| Shareholders’ equity: | |||||||||||

| Preferred stock, $0.01 par value: Authorized shares - 5,000,000; no shares issued or outstanding in 2024 and 2023 | — | — | |||||||||

| Preferred stock, Class B, $0.01 par value: Authorized shares - 15,000; issued and outstanding shares - 10,096 in 2024 and none in 2023 | — | — | |||||||||

| Common stock, $0.01 par value: Authorized shares - 50,000,000; issued and outstanding shares - 29,761,197 in 2024 and 25,670,663 in 2023 | 298 | 257 | |||||||||

| Additional paid-in capital | 582,153 | 283,684 | |||||||||

Retained (deficit) earnings |

(338,228) | 480,320 | |||||||||

| Accumulated other comprehensive loss | (2,732) | — | |||||||||

Total Forward Air shareholders equity |

241,491 | 764,261 | |||||||||

| Noncontrolling interest | 84,140 | — | |||||||||

| Total shareholders’ equity | 325,631 | 764,261 | |||||||||

| Total liabilities and shareholders’ equity | $ | 2,832,770 | $ | 2,979,533 | |||||||

| Forward Air Corporation | |||||||||||

| Condensed Consolidated Statements of Cash Flows | |||||||||||

| (In thousands) | |||||||||||

| (Unaudited) | |||||||||||

| Three Months Ended | |||||||||||

| December 31, 2024 | December 31, 2023 | ||||||||||

| Operating activities: | |||||||||||

| Net (loss) income from continuing operations | $ | (35,378) | $ | (14,721) | |||||||

| Adjustments to reconcile net income of continuing operations to net cash provided by operating activities of continuing operations: | |||||||||||

| Depreciation and amortization | 37,657 | 17,579 | |||||||||

| Impairment of goodwill | (79,068) | — | |||||||||

| Share-based compensation expense | 2,100 | 2,938 | |||||||||

| Provision for revenue adjustments | 874 | 1,065 | |||||||||

| Deferred income tax expense (benefit) | 108,276 | (11,092) | |||||||||

| Other | 3,014 | (135) | |||||||||

| Changes in operating assets and liabilities, net of effects from the purchase of acquired companies: | |||||||||||

| Accounts receivable | 36,050 | 9,588 | |||||||||

| Other receivables | 2,034 | (5,408) | |||||||||

| Other current and noncurrent assets | 2,004 | 27,061 | |||||||||

| Accounts payable and accrued expenses | (108,055) | 30,217 | |||||||||

| Net cash provided by operating activities of continuing operations | (30,492) | 57,092 | |||||||||

| Investing activities: | |||||||||||

| Proceeds from sale of property and equipment | 2,644 | 466 | |||||||||

| Purchases of property and equipment | (7,250) | (8,645) | |||||||||

| Purchase of businesses, net of cash acquired | 623 | — | |||||||||

| Other | (125) | — | |||||||||

| Net cash used in investing activities of continuing operations | (4,108) | (8,179) | |||||||||

| Financing activities: | |||||||||||

| Repayments of finance lease obligations | (3,086) | (2,660) | |||||||||

| Proceeds from credit facility | 75,000 | 25,000 | |||||||||

| Repayments on credit facility | (75,000) | (147,375) | |||||||||

| Proceeds from long-term debt held in escrow | — | 1,790,500 | |||||||||

| Payments of dividends to shareholders | — | (6,197) | |||||||||

| Proceeds from common stock issued under employee stock purchase plan | 398 | 379 | |||||||||

| Payment of minimum tax withholdings on share-based awards | — | (25) | |||||||||

| Contributions from subsidiary held for sale | — | 224,695 | |||||||||

| Net cash provided by (used in) financing activities of continuing operations | (2,688) | 1,884,317 | |||||||||

| Effect of exchange rate changes on cash | 874 | — | |||||||||

| Net increase (decrease) in cash of continuing operations | (36,414) | 1,933,230 | |||||||||

| Cash from discontinued operation: | |||||||||||

| Net cash used in operating activities of discontinued operations | (374) | (35,135) | |||||||||

| Net cash provided by investing activities of discontinued operations | — | 259,863 | |||||||||

| Net cash used in financing activities of discontinued operations | — | (224,728) | |||||||||

Net (decrease) increase in cash, cash equivalents |

(36,788) | 1,933,230 | |||||||||

| Cash, cash equivalents, and restricted cash equivalents at beginning of period of continuing operations | 138,156 | 18,843 | |||||||||

Net (decrease) increase in cash, cash equivalents, and restricted cash equivalents |

(32,890) | 1,933,230 | |||||||||

| Cash, cash equivalents, and restricted cash equivalents at end of period of continuing operations | $ | 105,266 | $ | 1,952,073 | |||||||

| Forward Air Corporation | |||||||||||

| Condensed Consolidated Statements of Cash Flows | |||||||||||

| (In thousands) | |||||||||||

| (Unaudited) | |||||||||||

| Year Ended | |||||||||||

| December 31, 2024 | December 31, 2023 | ||||||||||

| Operating activities: | |||||||||||

| Net income (loss) from continuing operations | $ | (1,124,841) | $ | 42,803 | |||||||

| Adjustments to reconcile net income (loss) of continuing operations to net cash provided by operating activities of continuing operations: | |||||||||||

| Depreciation and amortization | 143,978 | 57,405 | |||||||||

| Impairment of goodwill | 1,028,397 | — | |||||||||

| Share-based compensation expense | 10,188 | 11,495 | |||||||||

| Provision for revenue adjustments | 3,635 | 5,091 | |||||||||

| Deferred income tax expense (benefit) | (88,880) | (8,893) | |||||||||

| Other | 7,310 | (1,180) | |||||||||

| Changes in operating assets and liabilities, net of effects from the purchase of acquired companies: | |||||||||||

| Accounts receivable | 2,000 | 30,555 | |||||||||

| Other receivables | 8,193 | (5,408) | |||||||||

| Other current and noncurrent assets | (16,211) | 30,683 | |||||||||

| Accounts payable and accrued expenses | (50,031) | 36,661 | |||||||||

| Net cash (used in) provided by operating activities of continuing operations | (76,262) | 199,212 | |||||||||

| Investing activities: | |||||||||||

| Proceeds from sale of property and equipment | 5,137 | 3,741 | |||||||||

| Purchases of property and equipment | (37,060) | (30,725) | |||||||||

| Purchase of businesses, net of cash acquired | (1,564,619) | (56,703) | |||||||||

| Other | (444) | — | |||||||||

| Net cash used in investing activities of continuing operations | (1,596,986) | (83,687) | |||||||||

| Financing activities: | |||||||||||

| Repayments of finance lease obligations | (18,425) | (9,500) | |||||||||

| Proceeds from credit facility | 75,000 | 70,000 | |||||||||

| Payments on credit facility | (155,000) | (178,500) | |||||||||

| Proceeds from long-term debt held in escrow | — | 1,790,500 | |||||||||

| Payment of debt issuance costs | (60,591) | — | |||||||||

| Payment of earn-out liability | (12,247) | — | |||||||||

| Payments of dividends to shareholders | — | (24,995) | |||||||||

| Repurchases and retirement of common stock | — | (93,811) | |||||||||

| Proceeds from common stock issued under employee stock purchase plan | 753 | 800 | |||||||||

| Payment of minimum tax withholdings on share-based awards | (1,572) | (4,340) | |||||||||

| Contributions from subsidiary held for sale | — | 240,572 | |||||||||

| Net cash provided by (used in) financing activities of continuing operations | (172,082) | 1,790,726 | |||||||||

| Effect of exchange rate changes on cash | 1,012 | — | |||||||||

| Net (decrease) increase in cash, cash equivalents and restricted cash equivalents from continuing operations | (1,844,318) | 1,906,251 | |||||||||

| Cash from discontinued operation: | |||||||||||

| Net cash used in operating activities of discontinued operations | (6,387) | (17,824) | |||||||||

| Net cash provided by investing activities of discontinued operation | — | 258,525 | |||||||||

| Net cash used in financing activities of discontinued operation | — | (240,701) | |||||||||

Net (decrease) increase in cash and cash equivalents |

(1,850,705) | 1,906,251 | |||||||||

| Cash, cash equivalents, and restricted cash equivalents at beginning of period of continuing operations | 1,952,073 | 45,822 | |||||||||

Net (decrease) increase in cash, cash equivalents, and restricted cash equivalents |

(1,846,807) | 1,906,251 | |||||||||

| Cash, cash equivalents, and restricted cash equivalents at end of period of continuing operations | $ | 105,266 | $ | 1,952,073 | |||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||

| December 31, 2024 | December 31, 2023 | December 31, 2024 | December 31, 2023 | |||||||||||||||||||||||

| Income (loss) from continuing operations | $ | (35,378) | $ | (14,721) | $ | (1,124,841) | $ | 42,803 | ||||||||||||||||||

| Interest expense | 48,427 | 23,976 | 189,215 | 31,571 | ||||||||||||||||||||||

| Income tax (benefit) expense | 67,000 | (6,255) | (124,990) | 13,836 | ||||||||||||||||||||||

| Depreciation and amortization | 37,657 | 17,579 | 143,978 | 57,405 | ||||||||||||||||||||||

| Reported EBITDA | 117,706 | 20,579 | (916,638) | 145,615 | ||||||||||||||||||||||

| Impairment of goodwill | (79,068) | — | 1,028,397 | — | ||||||||||||||||||||||

| Transaction and integration costs | 10,074 | 29,619 | 81,467 | 57,490 | ||||||||||||||||||||||

| Severance costs | 1,923 | 198 | 16,337 | 517 | ||||||||||||||||||||||

| Optimization project costs | 9,873 | — | 9,873 | — | ||||||||||||||||||||||

| Pro forma synergies | 1,353 | — | 22,239 | — | ||||||||||||||||||||||

| Pro forma savings | 5,048 | 5,649 | 32,622 | 21,524 | ||||||||||||||||||||||

| Other | 2,351 | 1,485 | 33,414 | 7,085 | ||||||||||||||||||||||

| Pro forma -Omni adjusted EBITDA | — | 36,492 | — | 169,869 | ||||||||||||||||||||||

| Consolidated EBITDA | $ | 69,260 | $ | 94,022 | $ | 307,711 | $ | 402,100 | ||||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||||

| Continuing Operations | December 31, 2024 | December 31, 2023 | December 31, 2024 | December 31, 2023 | ||||||||||||||||||||||

Net cash provided by (used in) operating activities |

$ | (30,492) | $ | 57,092 | $ | (76,262) | $ | 199,212 | ||||||||||||||||||

| Proceeds from sale of property and equipment | 2,644 | 466 | 5,137 | 3,741 | ||||||||||||||||||||||

| Purchases of property and equipment | (7,250) | (8,645) | (37,060) | (30,725) | ||||||||||||||||||||||

| Free cash flow | $ | (35,098) | $ | 48,913 | $ | (108,185) | $ | 172,228 | ||||||||||||||||||