false2024FY00018302140.025http://fasb.org/us-gaap/2024#RestructuringCostsAndAssetImpairmentChargesP1YP1YP1Y0.025http://fasb.org/us-gaap/2024#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2024#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2024#OperatingLeaseLiabilityNoncurrenthttp://fasb.org/us-gaap/2024#OperatingLeaseLiabilityNoncurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2024#AccruedLiabilitiesAndOtherLiabilities0iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:puredna:acquisitiondna:employeeutr:sqftdna:leasedna:tranchedna:promissoryNotedna:facilitydna:milestonedna:votedna:installmentdna:founderdna:segmentdna:assetdna:materialRightdna:obligationdna:technicalDevelopmentPlan00018302142024-01-012024-12-3100018302142024-06-280001830214us-gaap:CommonClassAMember2025-02-170001830214us-gaap:CommonClassBMember2025-02-170001830214us-gaap:NonvotingCommonStockMember2025-02-1700018302142024-10-012024-12-3100018302142024-12-3100018302142023-12-310001830214us-gaap:RelatedPartyMember2024-12-310001830214us-gaap:RelatedPartyMember2023-12-310001830214dna:CellEngineeringRevenueMember2024-01-012024-12-310001830214dna:CellEngineeringRevenueMember2023-01-012023-12-310001830214dna:CellEngineeringRevenueMember2022-01-012022-12-310001830214us-gaap:ServiceMember2024-01-012024-12-310001830214us-gaap:ServiceMember2023-01-012023-12-310001830214us-gaap:ServiceMember2022-01-012022-12-310001830214us-gaap:ProductMember2024-01-012024-12-310001830214us-gaap:ProductMember2023-01-012023-12-310001830214us-gaap:ProductMember2022-01-012022-12-3100018302142023-01-012023-12-3100018302142022-01-012022-12-310001830214us-gaap:ProductAndServiceOtherMember2024-01-012024-12-310001830214us-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001830214us-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMember2024-01-012024-12-310001830214us-gaap:RelatedPartyMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMember2022-01-012022-12-310001830214us-gaap:CommonStockMember2021-12-310001830214us-gaap:AdditionalPaidInCapitalMember2021-12-310001830214us-gaap:RetainedEarningsMember2021-12-310001830214us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001830214us-gaap:NoncontrollingInterestMember2021-12-3100018302142021-12-310001830214us-gaap:CommonStockMember2022-01-012022-12-310001830214us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001830214us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001830214srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2021-12-310001830214srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-12-310001830214us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001830214us-gaap:RetainedEarningsMember2022-01-012022-12-310001830214us-gaap:CommonStockMember2022-12-310001830214us-gaap:AdditionalPaidInCapitalMember2022-12-310001830214us-gaap:RetainedEarningsMember2022-12-310001830214us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001830214us-gaap:NoncontrollingInterestMember2022-12-3100018302142022-12-310001830214us-gaap:CommonStockMember2023-01-012023-12-310001830214us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001830214us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001830214us-gaap:RetainedEarningsMember2023-01-012023-12-310001830214us-gaap:CommonStockMember2023-12-310001830214us-gaap:AdditionalPaidInCapitalMember2023-12-310001830214us-gaap:RetainedEarningsMember2023-12-310001830214us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001830214us-gaap:NoncontrollingInterestMember2023-12-310001830214us-gaap:CommonStockMember2024-01-012024-12-310001830214us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001830214us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001830214us-gaap:RetainedEarningsMember2024-01-012024-12-310001830214us-gaap:CommonStockMember2024-12-310001830214us-gaap:AdditionalPaidInCapitalMember2024-12-310001830214us-gaap:RetainedEarningsMember2024-12-310001830214us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001830214us-gaap:NoncontrollingInterestMember2024-12-310001830214srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2023-12-310001830214dna:RevisionOfPriorPeriodReclassificationAdjustment1Member2023-01-012023-12-310001830214srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2023-01-012023-12-310001830214srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2022-01-012022-12-310001830214us-gaap:CommonClassAMember2024-08-190001830214us-gaap:CommonClassBMember2024-08-190001830214us-gaap:CommonClassCMember2024-08-190001830214dna:TwoCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdna:CellEngineeringSegmentMember2024-01-012024-12-310001830214dna:TwoCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdna:BiosecuritySegmentMember2024-01-012024-12-310001830214dna:OneCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdna:BiosecuritySegmentMember2024-01-012024-12-310001830214dna:OneCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdna:CellEngineeringSegmentMember2023-01-012023-12-310001830214dna:OneCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdna:BiosecuritySegmentMember2023-01-012023-12-310001830214dna:TwoCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdna:BiosecuritySegmentMember2022-01-012022-12-310001830214srt:MinimumMemberdna:ComputerEquipmentAndSoftwareMember2024-12-310001830214srt:MaximumMemberdna:ComputerEquipmentAndSoftwareMember2024-12-310001830214us-gaap:FurnitureAndFixturesMember2024-12-310001830214srt:MinimumMemberdna:LabEquipmentMember2024-12-310001830214srt:MaximumMemberdna:LabEquipmentMember2024-12-310001830214srt:MinimumMemberus-gaap:ManufacturingFacilityMember2024-12-310001830214srt:MaximumMemberus-gaap:ManufacturingFacilityMember2024-12-310001830214us-gaap:VehiclesMember2024-12-310001830214dna:EquityMethodInvestmentFundingOfAdditionalLossesMember2024-12-310001830214dna:EquityMethodInvestmentFundingOfAdditionalLossesMember2022-12-310001830214dna:EquityMethodInvestmentFundingOfAdditionalLossesMember2023-12-3100018302142024-08-192024-08-1900018302142024-04-012024-06-300001830214srt:MinimumMember2024-12-310001830214srt:MaximumMember2023-12-310001830214us-gaap:EmployeeSeveranceMember2024-01-012024-12-310001830214us-gaap:EmployeeSeveranceMember2024-12-310001830214dna:AgBiomeInc.Member2024-04-102024-04-100001830214dna:AgBiomeInc.Memberus-gaap:CommonClassAMember2024-04-102024-04-100001830214dna:AgBiomeInc.Memberus-gaap:DevelopedTechnologyRightsMember2024-12-310001830214dna:OtherAssetAcquisitionsMember2024-01-012024-12-310001830214us-gaap:CommonClassAMemberdna:OtherAssetAcquisitionsMember2024-01-012024-12-310001830214dna:StridebioMember2023-04-052023-04-050001830214us-gaap:CommonClassAMemberdna:StridebioMember2023-04-052023-04-050001830214dna:StridebioMember2023-01-012023-12-310001830214us-gaap:CommonClassAMemberdna:StridebioMember2023-10-012023-10-310001830214dna:ZymergenMemberus-gaap:CommonClassAMember2022-10-190001830214dna:ZymergenMember2022-10-192022-10-190001830214dna:ZymergenMember2022-10-190001830214dna:ZymergenMemberus-gaap:DevelopedTechnologyRightsMember2022-10-192022-10-190001830214dna:ZymergenMemberus-gaap:DevelopedTechnologyRightsMember2022-10-190001830214dna:ZymergenMemberus-gaap:DatabasesMember2022-10-192022-10-190001830214dna:ZymergenMemberus-gaap:DatabasesMember2022-10-190001830214dna:ZymergenMember2022-01-012022-12-310001830214dna:NewGinkgoCommonStockMember2022-01-012022-12-310001830214dna:NewGinkgoCommonStockMember2022-12-310001830214dna:ZymergenMember2023-10-032023-10-030001830214dna:ZymergenBankruptcyMember2023-10-032023-10-030001830214dna:ZymergenBankruptcyMember2023-12-310001830214us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsMemberdna:ZymergenMember2023-10-020001830214us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsMember2023-10-020001830214us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsMemberdna:ZymergenMember2023-01-012023-10-020001830214us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsMemberdna:ZymergenMember2022-10-192022-12-310001830214dna:ZymergenMember2024-01-182024-01-180001830214dna:ZymergenMember2024-01-180001830214dna:ZymergenMember2024-01-012024-12-310001830214dna:BayerMember2022-10-170001830214dna:BayerAcquisitionAndJointVentureMember2022-10-172022-10-170001830214dna:BayerAcquisitionAndJointVentureMemberdna:JoynBioMember2022-10-170001830214dna:BayerAcquisitionAndJointVentureMember2022-10-170001830214dna:BayerAcquisitionAndJointVentureMember2022-01-012022-12-310001830214dna:BayerAcquisitionAndJointVentureMemberdna:JoynBioMember2022-10-172022-10-170001830214dna:BayerAcquisitionAndJointVentureMember2022-10-162022-10-160001830214dna:BayerAcquisitionAndJointVentureMember2022-12-310001830214dna:DevelopedTechnologyMemberdna:JoynBioMember2023-12-310001830214dna:BayerAcquisitionAndJointVentureMember2023-01-012023-12-310001830214dna:AltarSasMember2022-10-032022-10-030001830214us-gaap:RestrictedStockMemberdna:AltarSasMember2022-10-030001830214dna:AltarSasMemberus-gaap:CommonClassAMember2022-10-030001830214dna:AltarSasMember2022-10-0300018302142022-10-030001830214dna:AltarSasMember2024-01-012024-12-310001830214dna:FgenMemberus-gaap:CommonClassAMember2022-04-012022-04-010001830214dna:FgenMemberdna:ContingentConsiderationRestrictedStockMember2022-04-012022-04-010001830214dna:FgenMemberdna:MilestonesMember2022-04-012022-04-010001830214dna:FgenMember2022-04-012022-04-010001830214dna:FgenMemberus-gaap:CommonClassAMember2022-04-010001830214dna:UnrestrictedStockMemberdna:FgenMember2022-04-010001830214dna:UnrestrictedStockMemberdna:FgenMember2022-04-012022-04-010001830214us-gaap:RestrictedStockMemberdna:FgenMember2022-04-012022-04-010001830214us-gaap:RestrictedStockMemberdna:FgenMember2022-04-010001830214us-gaap:RestrictedStockMemberdna:FgenMember2022-04-042022-04-040001830214dna:FgenMember2022-04-010001830214dna:FgenMember2022-01-012022-12-310001830214dna:CircularisBiotechnologiesIncMember2022-10-032022-10-030001830214dna:CircularisBiotechnologiesIncMemberus-gaap:CommonClassAMember2022-10-030001830214dna:CircularisBiotechnologiesIncMember2022-10-030001830214dna:DevelopedTechnologyMember2022-10-030001830214dna:BaktusIncMember2022-08-172022-08-170001830214dna:BaktusIncMemberus-gaap:CommonClassAMember2022-08-170001830214dna:BaktusIncMember2022-08-170001830214us-gaap:MoneyMarketFundsMember2024-12-310001830214us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2024-12-310001830214us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2024-12-310001830214us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2024-12-310001830214dna:SynlogicIncWarrantsMember2024-12-310001830214us-gaap:FairValueInputsLevel1Memberdna:SynlogicIncWarrantsMember2024-12-310001830214us-gaap:FairValueInputsLevel2Memberdna:SynlogicIncWarrantsMember2024-12-310001830214us-gaap:FairValueInputsLevel3Memberdna:SynlogicIncWarrantsMember2024-12-310001830214dna:MarketableEquitySecuritiesMember2024-12-310001830214us-gaap:FairValueInputsLevel1Memberdna:MarketableEquitySecuritiesMember2024-12-310001830214us-gaap:FairValueInputsLevel2Memberdna:MarketableEquitySecuritiesMember2024-12-310001830214us-gaap:FairValueInputsLevel3Memberdna:MarketableEquitySecuritiesMember2024-12-310001830214us-gaap:OtherNoncurrentAssetsMemberus-gaap:NotesReceivableMember2024-12-310001830214us-gaap:FairValueInputsLevel1Memberus-gaap:NotesReceivableMemberus-gaap:OtherNoncurrentAssetsMember2024-12-310001830214us-gaap:FairValueInputsLevel2Memberus-gaap:NotesReceivableMemberus-gaap:OtherNoncurrentAssetsMember2024-12-310001830214us-gaap:FairValueInputsLevel3Memberus-gaap:NotesReceivableMemberus-gaap:OtherNoncurrentAssetsMember2024-12-310001830214us-gaap:FairValueInputsLevel1Member2024-12-310001830214us-gaap:FairValueInputsLevel2Member2024-12-310001830214us-gaap:FairValueInputsLevel3Member2024-12-310001830214us-gaap:MoneyMarketFundsMember2023-12-310001830214us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001830214us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2023-12-310001830214us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001830214dna:SynlogicIncWarrantsMember2023-12-310001830214us-gaap:FairValueInputsLevel1Memberdna:SynlogicIncWarrantsMember2023-12-310001830214us-gaap:FairValueInputsLevel2Memberdna:SynlogicIncWarrantsMember2023-12-310001830214us-gaap:FairValueInputsLevel3Memberdna:SynlogicIncWarrantsMember2023-12-310001830214dna:MarketableEquitySecuritiesMember2023-12-310001830214us-gaap:FairValueInputsLevel1Memberdna:MarketableEquitySecuritiesMember2023-12-310001830214us-gaap:FairValueInputsLevel2Memberdna:MarketableEquitySecuritiesMember2023-12-310001830214us-gaap:FairValueInputsLevel3Memberdna:MarketableEquitySecuritiesMember2023-12-310001830214us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NotesReceivableMember2023-12-310001830214us-gaap:FairValueInputsLevel1Memberus-gaap:NotesReceivableMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310001830214us-gaap:FairValueInputsLevel2Memberus-gaap:NotesReceivableMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310001830214us-gaap:FairValueInputsLevel3Memberus-gaap:NotesReceivableMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310001830214us-gaap:OtherNoncurrentAssetsMemberus-gaap:NotesReceivableMember2023-12-310001830214us-gaap:FairValueInputsLevel1Memberus-gaap:NotesReceivableMemberus-gaap:OtherNoncurrentAssetsMember2023-12-310001830214us-gaap:FairValueInputsLevel2Memberus-gaap:NotesReceivableMemberus-gaap:OtherNoncurrentAssetsMember2023-12-310001830214us-gaap:FairValueInputsLevel3Memberus-gaap:NotesReceivableMemberus-gaap:OtherNoncurrentAssetsMember2023-12-310001830214us-gaap:FairValueInputsLevel1Member2023-12-310001830214us-gaap:FairValueInputsLevel2Member2023-12-310001830214us-gaap:FairValueInputsLevel3Member2023-12-310001830214dna:PublicWarrantsMember2023-12-310001830214dna:PublicWarrantsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001830214dna:PublicWarrantsMemberus-gaap:FairValueInputsLevel2Member2023-12-310001830214dna:PublicWarrantsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001830214dna:PrivatePlacementWarrantsMember2023-12-310001830214dna:PrivatePlacementWarrantsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001830214dna:PrivatePlacementWarrantsMemberus-gaap:FairValueInputsLevel2Member2023-12-310001830214dna:PrivatePlacementWarrantsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001830214us-gaap:NotesReceivableMember2023-12-310001830214dna:ContingentConsiderationMember2023-12-310001830214us-gaap:NotesReceivableMember2024-01-012024-12-310001830214dna:PrivatePlacementWarrantsMember2024-01-012024-12-310001830214dna:ContingentConsiderationMember2024-01-012024-12-310001830214us-gaap:NotesReceivableMember2024-12-310001830214dna:PrivatePlacementWarrantsMember2024-12-310001830214dna:ContingentConsiderationMember2024-12-310001830214us-gaap:NotesReceivableMember2022-12-310001830214dna:PrivatePlacementWarrantsMember2022-12-310001830214dna:ContingentConsiderationMember2022-12-310001830214us-gaap:NotesReceivableMember2023-01-012023-12-310001830214dna:PrivatePlacementWarrantsMember2023-01-012023-12-310001830214dna:ContingentConsiderationMember2023-01-012023-12-310001830214dna:SeniorSecuredNoteMember2024-01-012024-12-310001830214dna:SeniorSecuredNoteMember2023-01-012023-12-310001830214dna:SeniorSecuredNoteMember2023-12-310001830214dna:SeniorSecuredNoteMember2024-12-310001830214dna:ConvertiblePromissoryNotesMember2024-01-012024-12-310001830214dna:ConvertiblePromissoryNotesMember2023-01-012023-12-310001830214dna:ConvertiblePromissoryNotesMember2024-12-310001830214dna:ConvertiblePromissoryNotesMember2023-12-310001830214dna:MeasurementInputScenarioProbabilitiesMembersrt:MinimumMemberdna:CellEngineeringSegmentMember2024-12-310001830214dna:MeasurementInputScenarioProbabilitiesMembersrt:MaximumMemberdna:CellEngineeringSegmentMember2024-12-310001830214us-gaap:MeasurementInputDiscountRateMemberdna:CellEngineeringSegmentMember2024-12-310001830214us-gaap:MeasurementInputExpectedTermMembersrt:MaximumMemberdna:CellEngineeringSegmentMember2024-01-012024-12-310001830214dna:MeasurementInputScenarioProbabilitiesMembersrt:MinimumMemberdna:CellEngineeringSegmentMember2023-12-310001830214dna:MeasurementInputScenarioProbabilitiesMembersrt:MaximumMemberdna:CellEngineeringSegmentMember2023-12-310001830214us-gaap:MeasurementInputDiscountRateMemberdna:CellEngineeringSegmentMember2023-12-310001830214us-gaap:MeasurementInputExpectedTermMembersrt:MinimumMemberdna:CellEngineeringSegmentMember2023-01-012023-12-310001830214us-gaap:MeasurementInputExpectedTermMembersrt:MaximumMemberdna:CellEngineeringSegmentMember2023-01-012023-12-310001830214dna:CellEngineeringSegmentMember2024-12-310001830214us-gaap:FairValueInputsLevel3Memberus-gaap:NotesReceivableMember2024-12-310001830214dna:CellEngineeringSegmentMember2023-12-310001830214us-gaap:FairValueInputsLevel3Memberdna:CellEngineeringSegmentMember2023-12-3100018302142023-12-012023-12-310001830214dna:MeasurementInputScenarioProbabilitiesMembersrt:MinimumMember2023-12-310001830214dna:MeasurementInputScenarioProbabilitiesMembersrt:MaximumMember2023-12-310001830214us-gaap:MeasurementInputDiscountRateMember2023-12-310001830214us-gaap:MeasurementInputExpectedTermMembersrt:MaximumMember2023-12-012023-12-310001830214dna:PublicWarrantsMember2021-02-260001830214dna:PrivatePlacementWarrantsMember2021-02-260001830214us-gaap:CommonClassAMembersrt:MinimumMember2021-02-260001830214us-gaap:RestrictedStockMemberdna:CircularisMember2024-12-310001830214us-gaap:RestrictedStockMemberdna:CircularisMember2024-01-012024-12-310001830214us-gaap:RestrictedStockMemberdna:CircularisMember2023-12-310001830214us-gaap:RestrictedStockMemberdna:CircularisMember2023-01-012023-12-310001830214us-gaap:RestrictedStockMember2023-12-310001830214us-gaap:FairValueMeasurementsRecurringMemberdna:ProbabilityWeightedPresentValueMembersrt:MinimumMember2024-12-310001830214us-gaap:FairValueMeasurementsRecurringMemberdna:ProbabilityWeightedPresentValueMembersrt:MaximumMember2024-12-310001830214us-gaap:FairValueMeasurementsRecurringMemberdna:ProbabilityWeightedPresentValueMembersrt:MinimumMember2023-12-310001830214us-gaap:FairValueMeasurementsRecurringMemberdna:ProbabilityWeightedPresentValueMembersrt:MaximumMember2023-12-310001830214us-gaap:FairValueMeasurementsRecurringMemberdna:ProbabilityWeightedPresentValueMember2024-12-310001830214us-gaap:FairValueMeasurementsRecurringMemberdna:ProbabilityWeightedPresentValueMember2023-12-310001830214us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMember2024-12-310001830214us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMember2023-12-310001830214dna:FGenAndAltarMember2021-07-310001830214dna:GenomaticaIncPreferredStockMember2024-01-012024-12-310001830214dna:GenomaticaIncPreferredStockMember2023-01-012023-12-310001830214dna:GenomaticaIncPreferredStockMember2022-01-012022-12-310001830214dna:NonMarketableEquitySecuritiesMember2024-01-012024-12-310001830214dna:NonMarketableEquitySecuritiesMember2023-01-012023-12-310001830214dna:SafeMember2023-01-012023-12-310001830214dna:SafeMember2022-01-012022-12-310001830214us-gaap:FairValueInputsLevel3Member2022-12-310001830214us-gaap:MeasurementInputExpectedTermMembersrt:MinimumMember2023-01-012023-12-310001830214us-gaap:MeasurementInputExpectedTermMembersrt:MaximumMember2023-01-012023-12-310001830214dna:MeasurementInputScenarioProbabilitiesMembersrt:MinimumMember2022-12-310001830214dna:MeasurementInputScenarioProbabilitiesMembersrt:MaximumMember2022-12-310001830214us-gaap:MeasurementInputDiscountRateMember2022-12-310001830214us-gaap:MeasurementInputExpectedTermMembersrt:MinimumMember2022-01-012022-12-310001830214us-gaap:MeasurementInputExpectedTermMembersrt:MaximumMember2022-01-012022-12-310001830214dna:SafesMember2024-01-012024-12-310001830214dna:SafesMember2023-01-012023-12-310001830214us-gaap:CommonClassAMember2021-02-260001830214dna:SafesMember2024-12-310001830214dna:SafesMember2023-12-310001830214dna:NonMarketableEquitySecuritiesMember2024-12-310001830214dna:NonMarketableEquitySecuritiesMember2023-12-310001830214dna:MarketableEquitySecuritiesMember2024-12-310001830214dna:MarketableEquitySecuritiesMember2023-12-310001830214dna:GenomaticaIncPreferredStockMember2024-12-310001830214dna:GenomaticaIncPreferredStockMember2023-12-310001830214dna:SynlogicIncWarrantMember2024-12-310001830214dna:SynlogicIncWarrantMember2023-12-310001830214dna:NonMarketableEquitySecuritiesMember2022-01-012022-12-310001830214dna:MarketableEquitySecuritiesMember2024-01-012024-12-310001830214dna:MarketableEquitySecuritiesMember2023-01-012023-12-310001830214dna:MarketableEquitySecuritiesMember2022-01-012022-12-310001830214dna:SafesMember2022-01-012022-12-310001830214dna:SynlogicIncWarrantMember2024-01-012024-12-310001830214dna:SynlogicIncWarrantMember2023-01-012023-12-310001830214dna:SynlogicIncWarrantMember2022-01-012022-12-310001830214dna:BiomeditLlcMember2024-01-012024-12-310001830214dna:BiomeditLlcMember2023-01-012023-12-310001830214dna:BiomeditLlcMember2022-01-012022-12-310001830214dna:JoynBioLlcMember2024-01-012024-12-310001830214dna:JoynBioLlcMember2023-01-012023-12-310001830214dna:JoynBioLlcMember2022-01-012022-12-310001830214dna:VerbBioticsLlcMember2024-01-012024-12-310001830214dna:VerbBioticsLlcMember2023-01-012023-12-310001830214dna:VerbBioticsLlcMember2022-01-012022-12-310001830214dna:AyanaLlcMember2024-01-012024-12-310001830214dna:AyanaLlcMember2023-01-012023-12-310001830214dna:AyanaLlcMember2022-01-012022-12-310001830214dna:OtherEquityInvestessMember2024-01-012024-12-310001830214dna:OtherEquityInvestessMember2023-01-012023-12-310001830214dna:OtherEquityInvestessMember2022-01-012022-12-310001830214dna:JoynBioMember2022-01-012022-12-310001830214dna:JoynBioMember2022-12-310001830214dna:AyanaBioLlcMemberus-gaap:LicenseMember2021-09-300001830214dna:VerbBioticsMemberus-gaap:LicenseMember2021-09-3000018302142021-09-012021-09-300001830214us-gaap:SeriesAPreferredStockMemberdna:VerbBioticsMember2021-09-012021-09-300001830214us-gaap:SeriesAPreferredStockMemberdna:AyanaBioLlcMember2021-09-012021-09-300001830214dna:VerbAndAyanaMember2022-01-012022-12-310001830214dna:VerbBioticsMember2022-12-310001830214dna:AyanaBioLlcMember2022-12-310001830214dna:VerbBioticsMembersrt:MaximumMember2022-12-310001830214us-gaap:MemberUnitsMemberdna:ConvertiblePromissoryNotesMember2022-01-012022-12-310001830214us-gaap:DevelopedTechnologyRightsMember2024-12-310001830214us-gaap:DevelopedTechnologyRightsMember2024-01-012024-12-310001830214us-gaap:DevelopedTechnologyRightsMember2023-12-310001830214us-gaap:DevelopedTechnologyRightsMember2023-01-012023-12-310001830214us-gaap:CustomerRelationshipsMember2023-12-310001830214us-gaap:CustomerRelationshipsMember2023-01-012023-12-310001830214dna:AssembledWorkforceMember2023-12-310001830214dna:AssembledWorkforceMember2023-01-012023-12-310001830214us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsMemberdna:AltarSasMember2024-04-100001830214srt:MaximumMember2024-12-310001830214dna:EquipmentLeasesMembersrt:MinimumMember2024-12-310001830214dna:EquipmentLeasesMembersrt:MaximumMember2024-12-3100018302142021-04-012021-04-3000018302142024-04-3000018302142023-09-012023-09-300001830214us-gaap:BuildingMember2023-09-012023-09-300001830214us-gaap:LeaseholdImprovementsMember2023-09-012023-09-3000018302142023-09-300001830214dna:LabEquipmentMember2024-12-310001830214dna:LabEquipmentMember2023-12-310001830214us-gaap:LeaseholdImprovementsMember2024-12-310001830214us-gaap:LeaseholdImprovementsMember2023-12-310001830214us-gaap:ManufacturingFacilityMember2024-12-310001830214us-gaap:ManufacturingFacilityMember2023-12-310001830214us-gaap:ConstructionInProgressMember2024-12-310001830214us-gaap:ConstructionInProgressMember2023-12-310001830214dna:ComputerEquipmentAndSoftwareMember2024-12-310001830214dna:ComputerEquipmentAndSoftwareMember2023-12-310001830214us-gaap:FurnitureAndFixturesMember2023-12-310001830214us-gaap:LandMember2024-12-310001830214us-gaap:LandMember2023-12-310001830214us-gaap:ConstructionInProgressMember2024-01-012024-12-310001830214dna:LabEquipmentMember2023-01-012023-12-310001830214us-gaap:AccountingStandardsUpdate201602Member2024-01-012024-12-310001830214us-gaap:AccountingStandardsUpdate201602Member2023-01-012023-12-310001830214us-gaap:AccountingStandardsUpdate201602Member2022-01-012022-12-3100018302142023-08-292023-08-290001830214dna:GoogleCloudMember2024-01-012024-12-310001830214dna:GoogleCloudMemberdna:CloudAndArtificialIntelligenceMember2024-12-310001830214dna:GoogleCloudMemberdna:CloudAndArtificialIntelligenceMember2024-01-012024-12-3100018302142022-03-312022-03-3100018302142022-03-310001830214dna:TwistBioscienceCorporationMember2024-01-012024-03-310001830214dna:StridebioMember2024-12-310001830214dna:StridebioMember2024-01-012024-12-310001830214us-gaap:CommonClassAMember2024-12-310001830214us-gaap:CommonClassBMember2024-12-310001830214us-gaap:CommonClassCMember2024-12-310001830214us-gaap:CommonClassAMember2023-12-310001830214us-gaap:CommonClassBMember2023-12-310001830214us-gaap:CommonClassCMember2023-12-310001830214dna:ShelfRegistrationStatementMember2022-10-042022-10-040001830214dna:ShelfRegistrationStatementMember2024-01-012024-12-310001830214dna:UnderwritingAgreementMember2022-11-152022-11-150001830214dna:UnderwritingAgreementMember2022-11-150001830214dna:NewGinkgoPreferredStockMember2024-12-310001830214us-gaap:CommonClassAMember2024-01-012024-12-310001830214us-gaap:CommonClassBMember2024-01-012024-12-310001830214dna:TwoThousandAndTwentyOneIncentiveAwardPlanMember2024-12-310001830214dna:WarrantsToPurchaseClassACommonStockMember2024-12-310001830214dna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMember2024-12-310001830214dna:InducementPlanMember2024-12-310001830214us-gaap:EmployeeStockOptionMember2024-12-310001830214us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-12-310001830214us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001830214us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001830214us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-12-310001830214us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001830214us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001830214us-gaap:CommonStockMemberdna:TwoThousandTwentyTwoInducementPlanMember2023-12-310001830214dna:TwoThousandTwentyTwoInducementPlanMember2024-12-310001830214dna:TwoThousandAndTwentyOneIncentiveAwardPlanMember2021-09-162021-09-160001830214dna:TwoThousandAndTwentyOneIncentiveAwardPlanMember2021-09-160001830214dna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMember2021-09-162021-09-160001830214dna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMember2021-09-160001830214us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001830214dna:FounderOptionsMember2024-04-300001830214dna:FounderOptionsMember2024-04-012024-04-300001830214dna:FounderOptionsMember2024-12-310001830214dna:FounderOptionsMember2024-01-012024-12-310001830214dna:FounderOptionsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-12-310001830214dna:FounderOptionsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-12-310001830214dna:FounderOptionsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-01-012024-12-310001830214dna:FounderOptionsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-12-310001830214dna:FounderOptionsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2024-01-012024-12-310001830214dna:FounderOptionsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2024-12-310001830214dna:FounderOptionsMemberdna:ShareBasedCompensationAwardTrancheFourMember2024-01-012024-12-310001830214dna:FounderOptionsMemberdna:ShareBasedCompensationAwardTrancheFourMember2024-12-310001830214us-gaap:RestrictedStockMember2024-01-012024-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2023-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2024-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001830214us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:CommonStockMemberdna:EarnOutSharesMember2021-09-160001830214us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:CommonStockMemberdna:EarnOutSharesMember2021-09-160001830214us-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:CommonStockMemberdna:EarnOutSharesMember2021-09-160001830214dna:ShareBasedCompensationAwardTrancheFourMemberus-gaap:CommonStockMemberdna:EarnOutSharesMember2021-09-160001830214dna:EarnOutSharesMembersrt:MinimumMember2021-09-162021-09-160001830214dna:EarnOutSharesMembersrt:MaximumMember2021-09-162021-09-160001830214us-gaap:ShareBasedCompensationAwardTrancheOneMember2021-11-150001830214dna:EarnoutRestrictedStockUnitsMember2023-12-310001830214dna:EarnoutRestrictedStockUnitsMember2024-01-012024-12-310001830214dna:EarnoutRestrictedStockUnitsMember2024-12-310001830214dna:EarnoutRestrictedStockUnitsMember2023-01-012023-12-310001830214dna:EarnoutRestrictedStockUnitsMember2022-01-012022-12-310001830214dna:EarnOutSharesMember2024-12-310001830214dna:EarnOutSharesMember2024-01-012024-12-310001830214dna:RestrictedStockAwardsMember2024-01-012024-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:FoodAndNutritionMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:FoodAndNutritionMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:FoodAndNutritionMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:PharmaceuticalAndBiotechnologyMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:PharmaceuticalAndBiotechnologyMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:PharmaceuticalAndBiotechnologyMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:AgricultureMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:AgricultureMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:AgricultureMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:GovernmentAndDefenseMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:GovernmentAndDefenseMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:GovernmentAndDefenseMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:IndustrialAndEnvironmentMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:IndustrialAndEnvironmentMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:IndustrialAndEnvironmentMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:CustomerAndTechnologyMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:CustomerAndTechnologyMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:CustomerAndTechnologyMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:CellEngineeringRevenueMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:CellEngineeringRevenueMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214us-gaap:ProductConcentrationRiskMemberdna:CellEngineeringRevenueMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214country:USus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-12-310001830214country:USus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001830214country:USus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001830214dna:CellEngineeringSegmentMember2024-01-012024-12-310001830214dna:CellEngineeringSegmentMember2023-01-012023-12-310001830214dna:CellEngineeringSegmentMember2022-01-012022-12-310001830214us-gaap:ServiceMemberdna:BiosecuritySegmentMember2024-01-012024-12-310001830214us-gaap:ServiceMemberdna:BiosecuritySegmentMember2023-01-012023-12-310001830214us-gaap:ServiceMemberdna:BiosecuritySegmentMember2022-01-012022-12-310001830214us-gaap:ProductMemberdna:BiosecuritySegmentMember2024-01-012024-12-310001830214us-gaap:ProductMemberdna:BiosecuritySegmentMember2023-01-012023-12-310001830214us-gaap:ProductMemberdna:BiosecuritySegmentMember2022-01-012022-12-310001830214dna:BiosecuritySegmentMember2024-01-012024-12-310001830214dna:BiosecuritySegmentMember2023-01-012023-12-310001830214dna:BiosecuritySegmentMember2022-01-012022-12-310001830214us-gaap:OperatingSegmentsMemberdna:CellEngineeringAndBiosecuritySegmentsMember2024-01-012024-12-310001830214us-gaap:OperatingSegmentsMemberdna:CellEngineeringAndBiosecuritySegmentsMember2023-01-012023-12-310001830214us-gaap:OperatingSegmentsMemberdna:CellEngineeringAndBiosecuritySegmentsMember2022-01-012022-12-310001830214us-gaap:CorporateNonSegmentMember2024-01-012024-12-310001830214us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001830214us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001830214dna:LabEquipmentMember2024-01-012024-12-310001830214dna:LeaseAssetsMember2023-01-012023-12-310001830214us-gaap:SeriesAPreferredStockMemberdna:BiomeditMember2022-04-012022-04-300001830214dna:BiomeditMember2022-04-012022-04-300001830214dna:BiomeditMember2023-12-310001830214dna:BiomeditMember2023-01-012023-12-310001830214dna:BiomeditMember2022-04-300001830214dna:BiomeditLlcMember2022-04-300001830214dna:BiomeditLlcMember2023-12-310001830214dna:BiomeditLlcMemberus-gaap:SeriesAPreferredStockMember2023-01-012023-12-310001830214dna:BiomeditLlcMember2023-12-310001830214dna:BiomeditLlcMember2023-01-012023-12-310001830214dna:BiomeditLlcMember2024-12-310001830214dna:BiomeditLlcMember2024-01-012024-12-310001830214dna:BiomeditLlcMember2022-01-012022-12-310001830214us-gaap:SeriesAPreferredStockMember2021-03-012021-03-310001830214dna:ArcaeaMemberus-gaap:SeriesAPreferredStockMember2022-01-012022-12-310001830214us-gaap:SeriesAPreferredStockMember2022-01-012022-12-310001830214dna:ArcaeaMember2022-01-012022-12-310001830214dna:ArcaeaMember2021-03-012021-03-310001830214dna:ArcaeaMemberus-gaap:LicenseMember2023-03-310001830214dna:ArcaeaLlcMember2021-03-310001830214dna:ArcaeaLlcMember2024-01-012024-12-310001830214dna:ArcaeaLlcMemberus-gaap:LicenseMember2021-01-012021-12-310001830214dna:ArcaeaLlcMember2021-12-310001830214dna:ArcaeaLlcMember2021-12-310001830214dna:ArcaeaLlcMember2021-01-012021-12-3100018302142021-01-012021-12-310001830214dna:ArcaeaLlcMember2024-12-310001830214dna:ArcaeaLlcMember2023-12-310001830214dna:ArcaeaLlcMember2024-01-012024-12-310001830214dna:ArcaeaLlcMember2023-01-012023-12-310001830214dna:ArcaeaLlcMember2022-01-012022-12-310001830214dna:AllonniaMemberus-gaap:SeriesAPreferredStockMember2019-12-012019-12-310001830214us-gaap:SeriesAPreferredStockMember2019-12-012019-12-310001830214dna:AllonniaMemberus-gaap:SeriesAPreferredStockMember2020-12-310001830214dna:AllonniaMemberus-gaap:SeriesAPreferredStockMember2020-01-012020-12-310001830214dna:AllonniaMember2020-01-012020-12-310001830214dna:AllonniaMemberus-gaap:SeriesAPreferredStockMember2021-01-012021-12-310001830214dna:AllonniaMemberus-gaap:SeriesAPreferredStockMember2023-01-012023-12-310001830214dna:AllonniaMember2021-01-012021-12-310001830214us-gaap:SeriesAPreferredStockMember2021-01-012021-12-310001830214dna:AllonniaMember2021-12-310001830214dna:AllonniaMemberus-gaap:SeriesAPreferredStockMember2021-12-310001830214dna:AllonniaMember2019-01-012019-12-310001830214dna:AllonniaMember2022-12-310001830214dna:AllonniaMember2024-01-012024-12-310001830214dna:AllonniaMember2023-01-012023-12-310001830214dna:AllonniaMember2024-12-310001830214dna:AllonniaMember2023-12-310001830214dna:AllonniaMember2022-01-012022-12-310001830214dna:TechnicalDevelopmentAgreementMemberdna:MotifFoodworksIncMember2018-09-300001830214us-gaap:SeriesAPreferredStockMemberdna:MotifFoodworksIncMember2018-09-012018-09-300001830214dna:MotifFoodworksIncMember2018-09-012018-09-300001830214dna:TechnicalDevelopmentAgreementMemberdna:MotifFoodworksIncMember2018-12-010001830214dna:TechnicalDevelopmentAgreementMemberdna:MotifFoodworksIncMember2018-01-012018-12-310001830214dna:TechnicalDevelopmentAgreementMemberdna:MotifFoodworksIncMember2024-12-310001830214dna:MotifFoodworksIncMember2023-01-012023-12-310001830214dna:MotifFoodworksIncMember2022-01-012022-12-310001830214dna:MotifFoodworksIncMember2024-01-012024-12-310001830214dna:MotifFoodworksIncMember2018-01-012018-12-310001830214dna:MotifFoodworksIncMember2018-12-310001830214dna:TechnicalDevelopmentAgreementMemberdna:MaterialRightsTrancheOneMemberdna:MotifFoodworksIncMember2018-12-310001830214dna:MotifFoodworksIncMember2023-12-310001830214dna:MotifFoodworksIncMember2023-01-012023-12-310001830214dna:MotifFoodworksIncMember2022-01-012022-12-310001830214dna:TwoThousandAndEighteenTechnicalDevelopmentAgreementMemberdna:GenomaticaMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2018-09-300001830214dna:TwoThousandAndEighteenTechnicalDevelopmentAgreementMemberdna:GenomaticaMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2018-12-310001830214dna:GenomaticaMember2018-12-310001830214dna:FoundryTermsOfServiceAgreementMemberdna:GenomaticaMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2021-12-310001830214dna:FoundryTermsOfServiceAgreementMemberdna:GenomaticaMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2020-12-310001830214dna:GenomaticaMember2024-12-310001830214dna:GenomaticaMember2023-12-310001830214dna:GenomaticaMember2024-01-012024-12-310001830214dna:GenomaticaMember2023-01-012023-12-310001830214dna:GenomaticaMember2022-01-012022-12-310001830214dna:CooksoniaMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:CapitalUnitClassAMember2017-09-012017-09-300001830214dna:CooksoniaMemberdna:RelatedPartyInvestorMemberus-gaap:CapitalUnitClassBMember2017-09-012017-09-300001830214dna:JoynBioLlcMemberdna:CooksoniaMemberdna:RelatedPartyInvestorMemberus-gaap:CapitalUnitClassBMember2017-09-300001830214dna:JoynBioLlcMemberdna:CooksoniaMemberdna:RelatedPartyInvestorMemberdna:CapitalUnitsClassCMember2017-09-300001830214us-gaap:CapitalUnitClassBMemberdna:CooksoniaMember2017-09-012017-09-300001830214dna:JoynBioLlcMemberdna:CapitalUnitsClassCMember2017-09-012017-09-300001830214dna:JoynBioLlcMemberdna:CooksoniaMemberdna:CapitalUnitsClassCMember2017-09-300001830214dna:JoynBioLlcMemberdna:BayerMemberdna:CapitalUnitsClassCMember2017-09-012017-09-300001830214dna:JoynBioLlcMemberdna:BayerMemberdna:CapitalUnitsClassCMember2017-09-300001830214dna:FoundryServicesAgreementMemberdna:JoynBioLlcMember2017-09-300001830214dna:FoundryServicesAgreementMemberdna:JoynBioLlcMember2019-12-310001830214dna:JoynBioLlcMemberdna:CooksoniaMember2017-09-300001830214us-gaap:ParentMemberdna:CooksoniaMember2017-09-300001830214us-gaap:ParentMemberdna:CooksoniaMember2017-09-012017-09-300001830214dna:CooksoniaMember2017-09-300001830214dna:CooksoniaMemberus-gaap:NoncontrollingInterestMember2017-09-300001830214dna:JoynBioLlcMember2017-09-300001830214us-gaap:DomesticCountryMember2024-12-310001830214dna:BeginToExpireInTwoThousandAndTwentyNineMemberus-gaap:DomesticCountryMember2024-12-310001830214dna:CarriedForwardIndefinitelyMemberus-gaap:DomesticCountryMember2024-12-310001830214us-gaap:StateAndLocalJurisdictionMember2024-12-310001830214dna:BeginToExpireInTwoThousandAndThirtyMemberus-gaap:StateAndLocalJurisdictionMember2024-12-310001830214dna:CarriedForwardIndefinitelyMemberus-gaap:StateAndLocalJurisdictionMember2024-12-310001830214us-gaap:ResearchMemberus-gaap:DomesticCountryMember2024-12-310001830214us-gaap:ResearchMemberus-gaap:StateAndLocalJurisdictionMember2024-12-310001830214us-gaap:WarrantMember2024-01-012024-12-310001830214us-gaap:WarrantMember2023-01-012023-12-310001830214us-gaap:WarrantMember2022-01-012022-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001830214us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001830214dna:EarnOutSharesMember2024-01-012024-12-310001830214dna:EarnOutSharesMember2023-01-012023-12-310001830214dna:EarnOutSharesMember2022-01-012022-12-310001830214us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001830214us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001830214us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001830214dna:EscrowSharesMember2024-01-012024-12-310001830214dna:EscrowSharesMember2023-01-012023-12-310001830214dna:EscrowSharesMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:AllonniaMember2024-12-310001830214us-gaap:RelatedPartyMemberdna:AllonniaMember2023-12-310001830214us-gaap:RelatedPartyMemberdna:ArcaeaMember2024-12-310001830214us-gaap:RelatedPartyMemberdna:ArcaeaMember2023-12-310001830214us-gaap:RelatedPartyMemberdna:BiomeditMember2024-12-310001830214us-gaap:RelatedPartyMemberdna:BiomeditMember2023-12-310001830214us-gaap:RelatedPartyMemberdna:GenomaticaMember2024-12-310001830214us-gaap:RelatedPartyMemberdna:GenomaticaMember2023-12-310001830214us-gaap:RelatedPartyMemberdna:MotifMember2024-12-310001830214us-gaap:RelatedPartyMemberdna:MotifMember2023-12-310001830214us-gaap:RelatedPartyMemberdna:AyanaMember2024-12-310001830214us-gaap:RelatedPartyMemberdna:AyanaMember2023-12-310001830214us-gaap:RelatedPartyMemberdna:OtherEquityInvesteesMember2024-12-310001830214us-gaap:RelatedPartyMemberdna:OtherEquityInvesteesMember2023-12-310001830214us-gaap:RelatedPartyMemberdna:MotifMember2024-01-012024-12-310001830214us-gaap:RelatedPartyMemberdna:MotifMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:MotifMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:ArcaeaMember2024-01-012024-12-310001830214us-gaap:RelatedPartyMemberdna:ArcaeaMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:ArcaeaMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:GenomaticaMember2024-01-012024-12-310001830214us-gaap:RelatedPartyMemberdna:GenomaticaMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:GenomaticaMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:AyanaMember2024-01-012024-12-310001830214us-gaap:RelatedPartyMemberdna:AyanaMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:AyanaMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:BiomeditMember2024-01-012024-12-310001830214us-gaap:RelatedPartyMemberdna:BiomeditMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:BiomeditMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:VerbBioticsMember2024-01-012024-12-310001830214us-gaap:RelatedPartyMemberdna:VerbBioticsMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:VerbBioticsMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:AllonniaMember2024-01-012024-12-310001830214us-gaap:RelatedPartyMemberdna:AllonniaMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:AllonniaMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:JoynBioMember2024-01-012024-12-310001830214us-gaap:RelatedPartyMemberdna:JoynBioMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:JoynBioMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMemberdna:OtherEquityInvesteesMember2024-01-012024-12-310001830214us-gaap:RelatedPartyMemberdna:OtherEquityInvesteesMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMemberdna:OtherEquityInvesteesMember2022-01-012022-12-310001830214us-gaap:RelatedPartyMember2022-04-300001830214dna:PromissoryNoteReceivableInterestRateMember2023-01-012023-12-310001830214dna:DiscountRateQualifyingEquityFinancingMember2023-01-012023-12-310001830214dna:DiscountRateNonQualifyingEquityFinancingMember2023-01-012023-12-310001830214us-gaap:RelatedPartyMember2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________

FORM 10-K

______________________________________________

(Mark One)

|

|

|

|

|

|

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

|

|

|

|

|

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-40097

______________________________________________

GINKGO BIOWORKS HOLDINGS, INC.

(Exact name of Registrant as specified in its Charter)

______________________________________________

|

|

|

|

|

|

Delaware |

87-2652913 |

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

27 Drydock Avenue

8th Floor

Boston, MA

|

02210 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (877) 422-5362

______________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered |

Class A common stock, par value $0.0001 per share |

|

DNA |

|

NYSE |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

x |

|

Accelerated filer |

o |

| Non-accelerated filer |

o |

|

Smaller reporting company |

o |

|

|

|

Emerging growth company |

o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of June 28, 2024, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity held by our non-affiliates was approximately $617 million based upon the closing price reported for such date on the New York Stock Exchange.

As of February 17, 2025, there were 45,808,499 shares of Class A common stock, 9,225,101 shares of Class B common stock, and 3,000,000 shares of non-voting Class C common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report is incorporated by reference from the registrant’s definitive proxy statement relating to its annual meeting of stockholders to be held in 2025, which definitive proxy statement will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

Table of Contents

Cautionary Note Regarding Forward Looking Statements

This annual report on Form 10-K and our annual report to shareholders (the “Annual Report”) include forward-looking statements regarding, among other things, the plans, strategies and prospects, both business and financial, of Ginkgo Bioworks Holdings, Inc. (“Ginkgo”). These statements are based on the beliefs and assumptions of the management of Ginkgo. Although Ginkgo believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, Ginkgo cannot assure you that it will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes”, “estimates”, “expects”, “projects”, “forecasts”, “may”, “will”, “should”, “seeks”, “plans”, “scheduled”, “anticipates” or “intends” or similar expressions. Forward-looking statements contained in the Annual Report include, but are not limited to, statements about:

•Ginkgo’s ability to raise additional capital in the future and to comply with restrictive covenants related to long-term indebtedness;

•Ginkgo’s ability to retain or recruit, or adapt to changes required in, its founders, senior executives, key personnel or directors;

•factors relating to the business, operations and financial performance of Ginkgo, including:

◦the performance and output of Ginkgo’s cell engineering and biosecurity offerings;

◦Ginkgo’s ability to effectively manage its organizational changes, including its restructuring actions commenced in 2024, and related impacts on Ginkgo’s financial performance;

◦Ginkgo’s exposure to the volatility and liquidity risks inherent in holding equity interests in certain of its customers;

◦rapidly changing technology and extensive competition in the synthetic biology industry that could make the products and processes Ginkgo is developing obsolete or non-competitive unless it continues to collaborate on the development of new and improved products and processes and pursue new market opportunities;

◦Ginkgo’s ability to convert potential customers from “on prem” research and development (“R&D”) to outsourced services, Ginkgo’s reliance on its customers to develop, produce and manufacture products using the engineered cells and/or biomanufacturing processes that Ginkgo develops and Ginkgo’s ability to accurately predict customer demand, including with respect to the data we access and hold;

◦the anticipated growth of Ginkgo’s biomonitoring and bioinformatics services and the relative value of the services on Ginkgo’s future Biosecurity revenue;

◦the scope and timing of Ginkgo's partnerships around the world;

◦Ginkgo’s ability to comply with laws and regulations applicable to its business; and

◦market conditions and global and economic factors beyond Ginkgo’s control, including initiatives undertaken by the U.S. government in the biotechnology sector, the frequency and scale of biological risks and threats, and the future potential and commercial applications of artificial intelligence (“AI”) and the biotechnology sector.

Each forward-looking statement is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Applicable risks and uncertainties include, among others:

•intense competition and competitive pressures from other companies worldwide in the industries in which Ginkgo operates;

•litigation, including securities or shareholder litigation, and the ability to adequately protect Ginkgo’s intellectual property rights;

•the success of Ginkgo’s programs, including the growing efficiency and cost-advantage of Foundry cell engineering services, and their potential to contribute revenue, and the relative contribution of Ginkgo’s programs to its future revenue, including the potential for future revenue related to downstream value to be in the form of potential future milestone payments, royalties, and/or equity consideration; and

•other factors detailed under the section entitled “Risk Factors.”

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this Annual Report are more fully described under the heading “Risk Factors” and elsewhere in this report. The risks described under the heading “Risk Factors” are not exhaustive. Other sections of this Annual Report describe additional factors that could adversely affect the business, financial condition or results of Ginkgo.

New risk factors emerge from time to time and it is not possible to predict all such risk factors, nor can Ginkgo assess the impact of all such risk factors on the business of Ginkgo, or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements, which speak only as of the date hereof. All forward-looking statements attributable to Ginkgo or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. Ginkgo undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Risk Factors Summary

Investing in our securities involves risks. You should carefully consider the risks described in “Risk Factors” beginning on page

22 before making a decision to invest in our Class A common stock. If any of these risks actually occur, our business, financial condition and results of operations would likely be materially adversely affected. Some of the risks related to Ginkgo’s business and industry are summarized below. References in the summary below to “we,” “us,” “our” and “the Company” generally refer to Ginkgo.

•We have a history of net losses. We expect to continue to incur losses for the foreseeable future, and we may never achieve or maintain profitability.

•Only our employees and directors are entitled to hold shares of Class B common stock (including shares of Class B common stock issued in the future), which have ten votes per share. This limits or precludes other stockholders’ ability to influence the outcome of matters submitted to stockholders for approval, including the election of directors, the approval of certain employee compensation plans, the adoption of certain amendments to our organizational documents and the approval of any merger, consolidation, sale of all or substantially all of our assets, or other major corporate transactions requiring stockholder approval.

•We may need substantial additional capital in the future in order to fund our business.

•We have experienced periods of significant organizational change, and if we fail to effectively manage these changes, then our business, results of operations, and financial condition could be adversely affected.

•Our limited operating history and evolving business makes it difficult to evaluate our current business and future prospects.

•We have exposure to the volatility and liquidity risks inherent in holding equity interests in other operating companies and other non-cash consideration.

•We have in the past, and in the future may continue to pursue strategic acquisitions and investments that are dilutive to our stockholders and that could have an adverse impact on our business if they are unsuccessful.

•We must continue to secure and maintain sufficient and stable supplies of laboratory reagents, consumables, equipment, and laboratory services. We depend on a limited number of suppliers, some of which are single-source suppliers, and contract manufacturers for critical supplies, equipment, and services for research, development, and manufacturing of our products and processes. Our reliance on these third parties exposes us to risks relating to costs, contractual terms, supply, and logistics, and the loss of any one or more of these suppliers or contract manufacturers or their failure to supply us with the necessary supplies, equipment, or services on a timely basis, could cause delays in our research, development, or production capacity and adversely affect our business.

•We use biological, hazardous, flammable and/or regulated materials that require considerable training, expertise and expense for handling, storage and disposal and may result in claims against us.

•Third parties may use our engineered cells, materials, and organisms and accompanying production processes in ways that could damage our reputation.

•Our investments in and use of AI may result in reputational harm, liabilities, or other adverse consequences to our business operations.

•Our recent restructuring actions in connection with our plans to reduce operational expenditures may not result in anticipated savings, could result in total costs and expenses that are greater than expected and could disrupt our business.

•If our customers discontinue their development, production and manufacturing efforts using our engineered cells and/or biomanufacturing processes, our future financial position may be adversely impacted.

•Further, because our revenue is concentrated in a limited number of customers, some of which are related parties, our revenue, results of operations, cash flows and reputation in the marketplace may suffer upon the loss of a significant customer.

•We are or could become involved in securities or shareholder litigation and other related matters, which could be expensive and time-consuming. Such litigation and related matters could harm our business.

•In certain cases, our business partners may have discretion in determining when and whether to make announcements about the status of our collaborations, including about developments and timelines for advancing programs, and the price of our common stock may decline as a result of announcements of unexpected results or developments.

•Uncertainty regarding the demand for passive monitoring programs and biosecurity services could materially adversely affect our business.

•Rapidly changing technology and emerging competition in the synthetic biology industry could make the platform, programs, and products we and our customers are developing obsolete or non-competitive unless we continue to develop our platform and pursue new market opportunities.

•Ethical, legal and social concerns about genetically modified organisms (“GMOs”) and genetically modified plant or animal cells and genetically modified proteins and biomaterials (collectively, “Genetically Modified Materials”) and their resulting products could limit or prevent the use of products or processes using our technologies, limit public acceptance of such products or processes and limit our revenues.

•If we are unable to obtain, maintain and defend patents protecting our intellectual property, our competitive position will be harmed. If we are unable to protect the confidentiality of our trade secrets, our business and competitive position will be harmed. We may become involved in lawsuits or other enforcement proceedings to protect or enforce our patents or other intellectual property, which could be expensive, time consuming and potentially unsuccessful.

•We rely on our customers, joint venturers, equity investees and other third parties to deliver timely and accurate information in order to accurately report our financial results in the time frame and manner required by law.

•We had in the past identified a material weakness in our internal controls over financial reporting, and we may identify additional material weaknesses in the future. A failure to maintain an effective system of internal control over financial reporting may result in a failure to accurately report our financial results or prevent fraud. As a result, stockholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our common stock.

•Failure to comply with federal, state, local and international laws and regulations could expose us to significant liabilities or penalties and adversely affect our business, our financial condition and results of operations and we may incur significant costs complying with such laws and regulations

•We and our laboratory partners are subject to a variety of laboratory testing standards, compliance with which is an expensive and time-consuming process, and any failure to comply could result in substantial penalties and disruptions to our business.

•Significant disruptions to our and our service providers’ information technology systems or data security incidents could result in significant financial, legal, regulatory, business and reputational harm to us.

PART I

Item 1. Business.

Unless the context otherwise requires, all references in this section to the “Company,” “Ginkgo,” “we,” “us,” or “our” refer to the business of Ginkgo Bioworks Holdings, Inc. and our subsidiaries.

Overview: Our Mission is to Make Biology Easier to Engineer

Our mission is to make biology easier to engineer. That has never changed. Every choice we’ve made with respect to our business model, our platform, our people, and our culture is grounded in whether it will advance our mission.

Why? Because:

1.Biology is programmable. All living things run on the same DNA code.

2.Biology matters. The ability to engineer biology has had and will have a profound impact on how we develop new medicines and vaccines, grow our food, and manufacture many of the things we use every day.

3.Biology is hard. Today, it is still too difficult and too costly to engineer biology, preventing critical innovations from reaching the market.

Ginkgo sells services in two business segments: cell engineering, where we provide biological R&D services for our customers across a range of industries, and biosecurity, where we provide services to government and commercial customers so they can work to identify, monitor, prevent, mitigate, and ultimately protect humanity from biological threats. An overview of these two business segments is provided below.

Cell engineering

Our cell engineering customers work with biology to discover and manufacture new products that have transformative potential across industries:

•in medicine, developing innovative new therapeutics and vaccines;

•in agriculture, advancing the sustainability and security of our food systems;

•in industrial biotechnology, advancing the way we manufacture a wide range of products for better performance and lower environmental impact; and

•in government, advancing new R&D priorities of strategic importance to the United States and its allies.

Because engineering biology is difficult and unpredictable, biotech R&D is traditionally performed by in-house labs filled with highly trained scientists running lab experiments by hand over several years in the hope of ultimately developing a working product. Many cell engineering projects fail in development due to scientific challenges, and many are terminated because they are taking too long or are over budget.

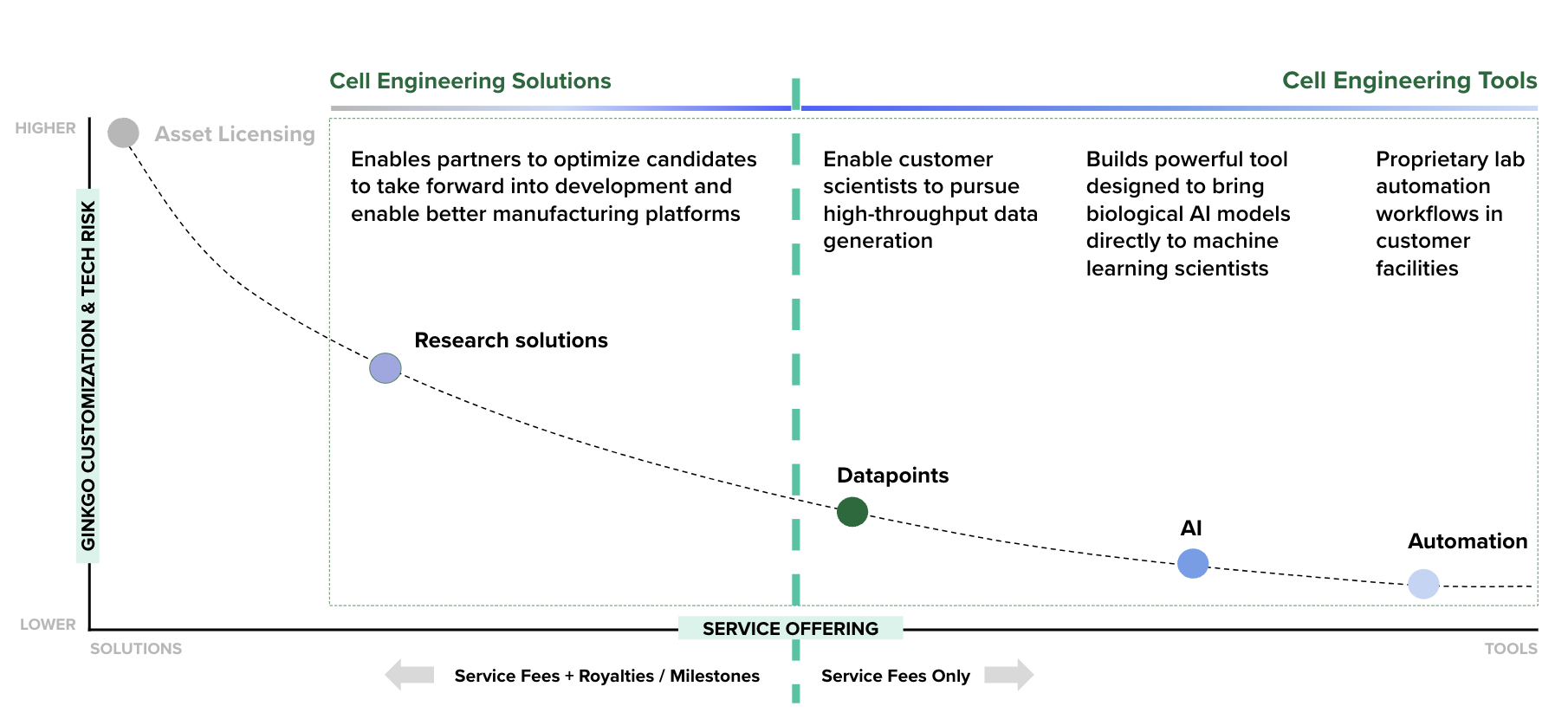

Ginkgo does not make end products; instead, we offer biological R&D services on our platform to enable our customers to bring their products to market. Historically, Ginkgo’s primary service offering has been end-to-end cell engineering R&D services (solutions). In 2024, Ginkgo expanded its service offering to include services that provide our customers cell engineering tools for biological R&D, which are intended to provide more targeted and bespoke resources to customers that continue to conduct in-house R&D. Our services are designed to offer customers better results on the dimensions of probability of success, speed, or cost – and ideally on all three.

The fundamental advantage of our cell engineering platform over traditional cell engineering done by hand at our customers’ labs is that our platform improves with scale while in-house cell engineering in our customers' labs largely does not. Compounding and mutually reinforcing improvements of our laboratory automation and software infrastructure—our Foundry—and our reusable data assets—our Codebase—enable us to improve our services with each successive project.

Our Foundry is a flexible capability for large scale data generation; it powers generative AI and machine learning (“ML”) tools that enable more successful biological R&D. We now offer services providing such data generation, AI and automation tools directly to Ginkgo customers. Our Codebase is a data asset comprising best practices for cell engineering, along with sequences and host cells that have been honed through dozens of programs and can be directly reusable for our end-to-end cell engineering solutions.

Cell engineering service offerings, depicted on a spectrum of customization and technical risk borne by Ginkgo on the vertical axis, and the mix of up-front service fees and downstream value we charge on the horizontal axis.

Biosecurity

In every technological revolution, reaping the benefits to the economy and society requires grappling with the corresponding risks. A critical part of making biology easier to engineer is creating robust biosecurity infrastructure to help manage the many accelerating and diversifying sources of biological risk, whether natural or engineered, accidental or malicious.

In the digital world, we’ve learned that we need to build comprehensive infrastructure to protect our digital systems —from financial markets to power grids—from harmful code. The modern cybersecurity industry offers tools to constantly identify, monitor, prevent, and mitigate cyber risk in near real-time. This is happening constantly, all around us. Our physical world demands the same type of widespread biosecurity infrastructure to detect, characterize, respond to, attribute, and prevent biological threats.

Building widespread biosecurity infrastructure is not easy, but the COVID-19 pandemic and subsequent biothreats (e.g., H5N1 and mpox) illustrate the growing risk and urgent need for a solution. During the COVID-19 pandemic, our healthcare infrastructure, the biomedical technology industry, and communities across the world mobilized in valiant and unprecedented ways, but millions of lives and trillions of dollars were still lost. Our current systems are overly reactive and remain insufficient to protect us from future biothreats, whether they come from Mother Nature, bioerror, or bioterror.

We need a fundamentally different approach to securing biology—one that starts with data. The genomic information that underlies the biological world is what allows us to program it like computers, and it’s what allows us to understand biology at a molecular level and learn to predict how it’s going to behave in the world. Our biosecurity platform is built on the premise that genetic information is a critical data asset that will form the foundation for next-generation biosecurity. By building services to help our customers monitor and analyze this data, we believe we are contributing to a step change in humanity's ability to rapidly and reliably identify, monitor, prevent, and mitigate biological threats.

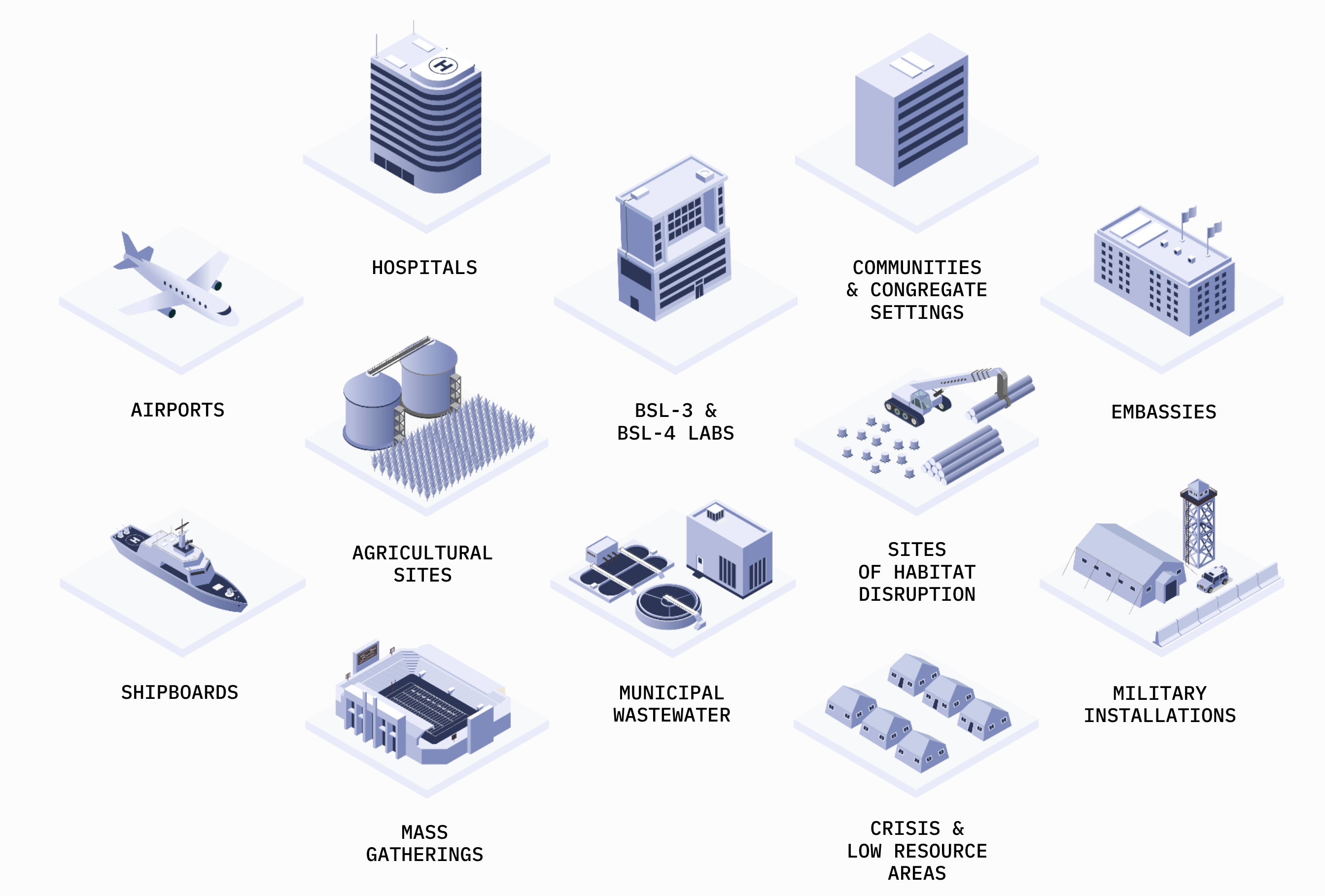

Because biosecurity is a matter of national and global security, our primary biosecurity customers are governments. Our biosecurity offering has evolved over the past several years. We currently provide biosecurity services via two core offerings as introduced in early 2024:

•Canopy, which helps our customers generate high value genomic data from strategically-positioned nodes (like airports and border checkpoints) via end-to-end biomonitoring programs; and

•Horizon, our digital surveillance, analytics and insights platform that detects and monitors biothreats worldwide.

Like our cell engineering platform, our biosecurity platform gets better with scale. As we deploy more detection nodes, we can achieve earlier detection and develop deeper insights about biothreats as they originate and travel across the globe. We invest in our platform to build out our operational (e.g., new node types), lab (e.g., new target detection), and digital (e.g., better prediction) capabilities. Increasing scale substantially strengthens the efficacy of our platform, as global data from multiple sources provides insights beyond what any single country’s data could yield alone.

Cell Engineering: enabling the discovery, functional optimization and efficient manufacturing of biotechnology products

Biology runs on a digital code. It’s just A’s, T’s, C’s, and G’s rather than 0’s and 1’s. There are sequences that code for programming logic—turning genes on when certain conditions are met—and there are sequences that encode functions and behaviors—the physical structures of proteins and enzymes that create biological structures and materials or catalyze chemical reactions. Synthetic biologists build cell programs by writing new sequences combining regulatory and functional elements into a synthesized strand of DNA and booting them up in cells to perform useful tasks, usually producing a particular bioproduct such as RNA, protein, enzyme, or chemical.

Biological code programs the world of atoms, not bits. This is what makes the potential impact of cell engineering so great, and inspires us to work to make biology easier to engineer and secure. But it also poses incredible challenges that make cell programming so hard today. Our code is a physical object with chemical properties. It folds and binds and interacts in many complex ways. It produces proteins that catalyze chemical reactions that interact in a complex web of connections. Even the simplest cell programs encounter incredible complexity, emerging from all of the interactions of chemicals, DNA, RNA, and proteins inside of a cell.

Because all organisms run on the same DNA code, general-purpose cell programming can be applied across many different markets to enable the design of new innovative products as well as improve manufacturing cost and sustainability of existing ones. Given the breadth of application areas and the potential of biology, we believe that the end markets for bioengineered products will be enormous. As we develop a greater ability to program biology and direct it towards novel and more challenging applications, the spectrum of possibilities will undoubtedly grow.

Today, our services span markets and modalities to enable a wide range of biotech products, including, but not limited to, systems for the discovery, optimization, and manufacturing of:

•DNA sequences delivered as vaccines and gene therapies,

•RNA sequences for vaccines and therapeutics including mRNA, circular RNA, and other approaches,

•Proteins used in biologic medicines and antibodies, adeno-associated virus (“AAV”) capsids and other delivery methods for gene therapies, vaccines, plant traits for crop protection, and food and alternative meat and dairy,

•Enzymes used in biocatalysis, diagnostics, therapeutics, and RNA vaccine production,

•Small molecules and natural products that can be produced via pathways of multiple enzymes in engineered cells for pharmaceutical ingredients and adjuvants, agricultural biochemicals, cosmetics and food ingredients, and specialty or commodity chemicals,

•Microbial cells that can provide crop nutrition or crop protection in agriculture, impact soil carbon sequestration to help address climate change, and microbiome therapeutics, and

•Mammalian cells for manufacturing of biologics, genomic medicines, and cell therapies.

Ginkgo provides these services using its platform for cell engineering. This platform brings together technology, data, biological assets and subject matter experts:

•proprietary automation technologies that enable flexibility and scale,

•in-house software, machine learning, and generative AI models for cell programming,

•massive databases of DNA sequences and labeled data on functional performance of engineered cells,

•reusable assets that enable faster and more predictable cell programming, and

•expert scientists that leverage platform tools and data to enable partners to achieve their desired results

Enabling customer success across markets

We sell end-to-end cell engineering solutions and cell engineering tools offerings to customers across markets. Our customers bring incredible depth and expertise in their unique technical domains and market areas. Whether it’s their understanding of underlying disease biology or plant physiology, their experience with the performance of regulatory trials in animal studies, in the clinic, or in the field, or their knowledge of product formulation and functional testing, they have specialized deeply to be able to develop, manufacture, distribute, and market a product. Our role is to enable: we provide our customers with R&D solutions and tools that help them access more biological design space in order to discover and optimize functionality and develop efficient manufacturing methods for their products.

Pharmaceutical and Biotechnology

There is an urgent and critical need for new, better, and more accessible therapeutics and vaccines worldwide. There is also widespread realization across the pharmaceutical industry that research productivity must be enhanced in order to meet this need. Yet, even with hundreds of billions of dollars spent annually on pharmaceutical R&D, the cost to bring a new drug to market is only increasing.

The pharmaceutical industry today relies heavily on outsourced R&D, both to specialized, innovative small biotech, as well as to contract research organizations (“CROs”) that can automate and scale specific common workflows at different stages of the R&D process for enhanced efficiency. These approaches enable access to both innovation and efficiency, but incur high switching costs both organizationally and technically.

At the same time, there is great promise in how AI tools may help uncover new disease biology and targets for therapeutics, as well as enable the programming of new medicines, in particular biologics and genomic medicines that are directly encoded in DNA and RNA sequences. Pharmaceutical R&D teams are looking for ways to generate and federate data to train better AI models, design and test more technical approaches, drive candidates at the preclinical stage to “fail fast” before costly clinical trials, and develop better leads by simultaneously optimizing along multiple dimensions important for therapeutic index as well as manufacturability and cost.

Our pharmaceutical and biotechnology customers use our services to develop new manufacturing methods for gene therapies, biologics, vaccines, and small molecule therapeutics and active pharmaceutical ingredients (“APIs”), and to discover new RNA therapeutics, natural products, and much more. They use our tools to generate high-quality data for training and validating AI models of cell and disease biology for use in target identification, target validation and drug discovery as well as for antibody developability.

Agriculture

Agriculture likewise faces an urgent need for innovation to address growing pressure on growers and food systems. Worldwide, agricultural innovation struggles due to long timelines, complex regulatory paths, and siloed data and capabilities.

Innovators in agricultural technology tap into biological diversity to develop new crop protection strategies, to combat resistance, and to provide safer, low residue options for growers that meet consumer expectations and regulatory guidelines.

These product developers need to understand mode of action and improve the performance and stability of innovative biologicals for crop nutrition and crop protection. And increasingly, they are also innovating in soil carbon sequestration and climate strategies.