false2024FYMARRIOTT INTERNATIONAL INC /MD/0001048286http://fasb.org/us-gaap/2024#CostOfRevenueP3YP5Yhttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligationsP2YP3Yhttp://www.marriott.com/20241231#RestructuringAndMergerRelatedCostshttp://fasb.org/us-gaap/2024#CostOfRevenueiso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:puremar:lawsuitmar:renewal_optionmar:segment00010482862024-01-012024-12-3100010482862024-06-3000010482862025-01-310001048286us-gaap:ManagementServiceBaseMember2024-01-012024-12-310001048286us-gaap:ManagementServiceBaseMember2023-01-012023-12-310001048286us-gaap:ManagementServiceBaseMember2022-01-012022-12-310001048286us-gaap:FranchiseMember2024-01-012024-12-310001048286us-gaap:FranchiseMember2023-01-012023-12-310001048286us-gaap:FranchiseMember2022-01-012022-12-310001048286us-gaap:ManagementServiceIncentiveMember2024-01-012024-12-310001048286us-gaap:ManagementServiceIncentiveMember2023-01-012023-12-310001048286us-gaap:ManagementServiceIncentiveMember2022-01-012022-12-310001048286mar:FeeServiceMember2024-01-012024-12-310001048286mar:FeeServiceMember2023-01-012023-12-310001048286mar:FeeServiceMember2022-01-012022-12-310001048286mar:OwnedLeasedandOtherMember2024-01-012024-12-310001048286mar:OwnedLeasedandOtherMember2023-01-012023-12-310001048286mar:OwnedLeasedandOtherMember2022-01-012022-12-310001048286mar:ReimbursementsMember2024-01-012024-12-310001048286mar:ReimbursementsMember2023-01-012023-12-310001048286mar:ReimbursementsMember2022-01-012022-12-3100010482862023-01-012023-12-3100010482862022-01-012022-12-3100010482862024-12-3100010482862023-12-310001048286us-gaap:TrademarksAndTradeNamesMember2024-12-310001048286us-gaap:TrademarksAndTradeNamesMember2023-12-310001048286mar:ContractAcquisitionCostsAndOtherMember2024-12-310001048286mar:ContractAcquisitionCostsAndOtherMember2023-12-310001048286mar:LoyaltyProgramMember2024-12-310001048286mar:LoyaltyProgramMember2023-12-310001048286mar:ContractServicesExcludingLoyaltyProgramMember2024-12-310001048286mar:ContractServicesExcludingLoyaltyProgramMember2023-12-310001048286mar:LoyaltyProgramMember2024-01-012024-12-310001048286mar:LoyaltyProgramMember2023-01-012023-12-310001048286mar:LoyaltyProgramMember2022-01-012022-12-3100010482862022-12-3100010482862021-12-310001048286us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310001048286us-gaap:AdditionalPaidInCapitalMember2021-12-310001048286us-gaap:RetainedEarningsMember2021-12-310001048286us-gaap:TreasuryStockCommonMember2021-12-310001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001048286us-gaap:RetainedEarningsMember2022-01-012022-12-310001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001048286us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-01-012022-12-310001048286us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001048286us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001048286us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001048286us-gaap:AdditionalPaidInCapitalMember2022-12-310001048286us-gaap:RetainedEarningsMember2022-12-310001048286us-gaap:TreasuryStockCommonMember2022-12-310001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001048286us-gaap:RetainedEarningsMember2023-01-012023-12-310001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001048286us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-12-310001048286us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001048286us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001048286us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001048286us-gaap:AdditionalPaidInCapitalMember2023-12-310001048286us-gaap:RetainedEarningsMember2023-12-310001048286us-gaap:TreasuryStockCommonMember2023-12-310001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001048286us-gaap:RetainedEarningsMember2024-01-012024-12-310001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001048286us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-12-310001048286us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001048286us-gaap:TreasuryStockCommonMember2024-01-012024-12-310001048286us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-12-310001048286us-gaap:AdditionalPaidInCapitalMember2024-12-310001048286us-gaap:RetainedEarningsMember2024-12-310001048286us-gaap:TreasuryStockCommonMember2024-12-310001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001048286us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembermar:AvendraLLCMember2017-01-012017-12-310001048286mar:AvendraLLCMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembermar:ReimbursementsMember2024-01-012024-12-310001048286mar:AvendraLLCMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembermar:ReimbursementsMember2023-01-012023-12-310001048286mar:AvendraLLCMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembermar:ReimbursementsMember2022-01-012022-12-310001048286mar:ContractServicesExcludingLoyaltyProgramMember2024-01-012024-12-310001048286mar:CostsIncurredtoFulfillContractsMember2024-12-310001048286mar:CostsIncurredtoFulfillContractsMember2023-12-310001048286us-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMember2024-12-310001048286mar:SheratonGrandChicagoHotelMember2024-10-012024-12-310001048286mar:SheratonGrandChicagoHotelMembermar:BuildingandLandLeaseholdMember2017-12-310001048286mar:SheratonGrandChicagoHotelMemberus-gaap:LandMember2024-01-310001048286mar:SheratonGrandChicagoHotelMember2024-12-310001048286us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001048286us-gaap:RestrictedStockUnitsRSUMember2024-12-310001048286us-gaap:RestrictedStockUnitsRSUMember2023-12-310001048286us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001048286us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001048286srt:MinimumMember2024-01-012024-12-310001048286srt:MaximumMember2024-01-012024-12-310001048286us-gaap:GuaranteeOfIndebtednessOfOthersMember2024-12-310001048286mar:GuaranteeOperatingProfitMember2024-12-310001048286us-gaap:GuaranteeTypeOtherMember2024-12-310001048286us-gaap:OtherCurrentLiabilitiesMember2024-12-310001048286us-gaap:OtherNoncurrentLiabilitiesMember2024-12-310001048286mar:NotYetInEffectConditionMembermar:GuaranteeOperatingProfitMember2024-12-310001048286mar:ClassActionLawsuitsRelatedToDataSecurityIncidentMember2018-11-302018-11-300001048286mar:ClassActionLawsuitsRelatedToDataSecurityIncidentMember2024-10-012024-12-310001048286srt:MinimumMember2024-12-310001048286mar:SeriesPSeniorNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesPSeniorNotesMember2024-12-310001048286mar:SeriesPSeniorNotesMember2023-12-310001048286mar:SeriesRNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesRNotesMember2024-12-310001048286mar:SeriesRNotesMember2023-12-310001048286mar:SeriesVNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesVNotesMember2024-12-310001048286mar:SeriesVNotesMember2023-12-310001048286mar:SeriesWNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesWNotesMember2024-12-310001048286mar:SeriesWNotesMember2023-12-310001048286mar:SeriesXNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesXNotesMember2024-12-310001048286mar:SeriesXNotesMember2023-12-310001048286mar:SeriesAANotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesAANotesMember2024-12-310001048286mar:SeriesAANotesMember2023-12-310001048286mar:SeriesCCNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesCCNotesMember2024-12-310001048286mar:SeriesCCNotesMember2023-12-310001048286mar:SeriesEENotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesEENotesMember2024-12-310001048286mar:SeriesEENotesMember2023-12-310001048286mar:SeriesFFNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesFFNotesMember2024-12-310001048286mar:SeriesFFNotesMember2023-12-310001048286mar:SeriesGGNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesGGNotesMember2024-12-310001048286mar:SeriesGGNotesMember2023-12-310001048286mar:SeriesHHNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesHHNotesMember2024-12-310001048286mar:SeriesHHNotesMember2023-12-310001048286mar:SeriesIINotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesIINotesMember2024-12-310001048286mar:SeriesIINotesMember2023-12-310001048286mar:SeriesJJNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesJJNotesMember2024-12-310001048286mar:SeriesJJNotesMember2023-12-310001048286mar:SeriesKKNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesKKNotesMember2024-12-310001048286mar:SeriesKKNotesMember2023-12-310001048286mar:SeriesLLNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesLLNotesMember2024-12-310001048286mar:SeriesLLNotesMember2023-12-310001048286mar:SeriesMMNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesMMNotesMember2024-12-310001048286mar:SeriesMMNotesMember2023-12-310001048286mar:SeriesNNNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesNNNotesMember2024-12-310001048286mar:SeriesNNNotesMember2023-12-310001048286mar:SeriesOONotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesOONotesMember2024-12-310001048286mar:SeriesOONotesMember2023-12-310001048286mar:SeriesPPNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesPPNotesMember2024-12-310001048286mar:SeriesPPNotesMember2023-12-310001048286mar:SeriesQQNotesMemberus-gaap:SeniorNotesMember2024-12-310001048286mar:SeriesQQNotesMember2024-12-310001048286mar:SeriesQQNotesMember2023-12-310001048286mar:SeriesPPNotesMemberus-gaap:SeniorNotesMember2024-08-310001048286mar:SeriesQQNotesMemberus-gaap:SeniorNotesMember2024-08-310001048286mar:SeriesPPAndQQNotesMemberus-gaap:SeniorNotesMember2024-08-012024-08-310001048286mar:SeriesNNNotesMemberus-gaap:SeniorNotesMember2024-02-290001048286mar:SeriesOONotesMemberus-gaap:SeniorNotesMember2024-02-290001048286mar:SeriesNNAndOONotesMemberus-gaap:SeniorNotesMember2024-02-012024-02-290001048286mar:CostsIncurredtoObtainContractsMember2024-12-310001048286mar:CostsIncurredtoObtainContractsMember2023-12-310001048286mar:AcquiredContractsAndOtherMember2024-12-310001048286mar:AcquiredContractsAndOtherMember2023-12-310001048286us-gaap:ComputerSoftwareIntangibleAssetMember2024-12-310001048286us-gaap:ComputerSoftwareIntangibleAssetMember2023-12-310001048286us-gaap:TrademarksAndTradeNamesMember2024-12-310001048286us-gaap:TrademarksAndTradeNamesMember2023-12-310001048286mar:CostsIncurredtoObtainContractsMembersrt:MinimumMember2024-12-310001048286mar:CostsIncurredtoObtainContractsMembersrt:MaximumMember2024-12-310001048286us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MinimumMember2024-12-310001048286us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MaximumMember2024-12-310001048286mar:ReimbursedExpensesMember2024-01-012024-12-310001048286mar:ReimbursedExpensesMember2023-01-012023-12-310001048286mar:ReimbursedExpensesMember2022-01-012022-12-310001048286mar:USAndCanadaSegmentMember2023-12-310001048286mar:EMEASegmentMember2023-12-310001048286mar:GreaterChinaMember2023-12-310001048286mar:APECMember2023-12-310001048286mar:CaribbeanAndLatinAmericaSegmentMember2023-12-310001048286mar:USAndCanadaSegmentMember2024-01-012024-12-310001048286mar:EMEASegmentMember2024-01-012024-12-310001048286mar:GreaterChinaMember2024-01-012024-12-310001048286mar:APECMember2024-01-012024-12-310001048286mar:CaribbeanAndLatinAmericaSegmentMember2024-01-012024-12-310001048286mar:USAndCanadaSegmentMember2024-12-310001048286mar:EMEASegmentMember2024-12-310001048286mar:GreaterChinaMember2024-12-310001048286mar:APECMember2024-12-310001048286mar:CaribbeanAndLatinAmericaSegmentMember2024-12-310001048286us-gaap:LandMember2024-12-310001048286us-gaap:LandMember2023-12-310001048286mar:BuildingAndLeaseholdImprovementsMember2024-12-310001048286mar:BuildingAndLeaseholdImprovementsMember2023-12-310001048286us-gaap:FurnitureAndFixturesMember2024-12-310001048286us-gaap:FurnitureAndFixturesMember2023-12-310001048286us-gaap:ConstructionInProgressMember2024-12-310001048286us-gaap:ConstructionInProgressMember2023-12-310001048286srt:MaximumMember2024-12-310001048286mar:ReimbursedCostsMember2024-01-012024-12-310001048286mar:ReimbursedCostsMember2023-01-012023-12-310001048286mar:ReimbursedCostsMember2022-01-012022-12-310001048286us-gaap:NonUsMember2024-12-310001048286us-gaap:NonUsMember2023-12-310001048286us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310001048286us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310001048286us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001048286us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001048286us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001048286mar:AccumulatedGainLossOtherAdjustmentsMember2021-12-310001048286us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310001048286mar:AccumulatedGainLossOtherAdjustmentsMember2022-01-012022-12-310001048286us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001048286mar:AccumulatedGainLossOtherAdjustmentsMember2022-12-310001048286us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310001048286mar:AccumulatedGainLossOtherAdjustmentsMember2023-01-012023-12-310001048286us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001048286mar:AccumulatedGainLossOtherAdjustmentsMember2023-12-310001048286us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-12-310001048286mar:AccumulatedGainLossOtherAdjustmentsMember2024-01-012024-12-310001048286us-gaap:AccumulatedTranslationAdjustmentMember2024-12-310001048286mar:AccumulatedGainLossOtherAdjustmentsMember2024-12-3100010482862024-01-012024-03-310001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:USAndCanadaSegmentMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:EMEASegmentMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:GreaterChinaMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:APECMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:USAndCanadaSegmentMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:EMEASegmentMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:GreaterChinaMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:APECMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:USAndCanadaSegmentMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:EMEASegmentMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:GreaterChinaMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:APECMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:USAndCanadaSegmentMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:EMEASegmentMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:GreaterChinaMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:APECMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:USAndCanadaSegmentMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:EMEASegmentMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:GreaterChinaMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:APECMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:USAndCanadaSegmentMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:EMEASegmentMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:GreaterChinaMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:APECMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:USAndCanadaSegmentMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:EMEASegmentMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:GreaterChinaMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:APECMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:USAndCanadaSegmentMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:EMEASegmentMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:GreaterChinaMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:APECMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:USAndCanadaSegmentMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:EMEASegmentMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:GreaterChinaMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:APECMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:USAndCanadaSegmentMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:EMEASegmentMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:GreaterChinaMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:APECMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:USAndCanadaSegmentMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:EMEASegmentMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:GreaterChinaMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:APECMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:USAndCanadaSegmentMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:EMEASegmentMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:GreaterChinaMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMembermar:APECMember2022-01-012022-12-310001048286us-gaap:OperatingSegmentsMember2024-01-012024-12-310001048286us-gaap:OperatingSegmentsMember2023-01-012023-12-310001048286us-gaap:OperatingSegmentsMember2022-01-012022-12-310001048286us-gaap:CorporateNonSegmentMember2024-01-012024-12-310001048286us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001048286us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001048286us-gaap:NonUsMemberus-gaap:OperatingSegmentsMember2024-01-012024-12-310001048286us-gaap:NonUsMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001048286us-gaap:NonUsMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001048286us-gaap:NonUsMemberus-gaap:OperatingSegmentsMembermar:ReimbursementsMember2024-01-012024-12-310001048286us-gaap:NonUsMemberus-gaap:OperatingSegmentsMembermar:ReimbursementsMember2023-01-012023-12-310001048286us-gaap:NonUsMemberus-gaap:OperatingSegmentsMembermar:ReimbursementsMember2022-01-012022-12-310001048286us-gaap:NonUsMembermar:ReimbursementsMember2024-01-012024-12-310001048286us-gaap:NonUsMembermar:ReimbursementsMember2023-01-012023-12-310001048286us-gaap:NonUsMembermar:ReimbursementsMember2022-01-012022-12-310001048286us-gaap:EquityMethodInvesteeMembermar:ReimbursementsMember2024-01-012024-12-310001048286us-gaap:EquityMethodInvesteeMembermar:ReimbursementsMember2023-01-012023-12-310001048286us-gaap:EquityMethodInvesteeMembermar:ReimbursementsMember2022-01-012022-12-310001048286us-gaap:EquityMethodInvesteeMember2024-01-012024-12-310001048286us-gaap:EquityMethodInvesteeMember2023-01-012023-12-310001048286us-gaap:EquityMethodInvesteeMember2022-01-012022-12-310001048286us-gaap:RelatedPartyMemberus-gaap:ManagementServiceMembermar:JWMFamilyEnterpriseL.P.Member2024-01-012024-12-310001048286us-gaap:RelatedPartyMemberus-gaap:ManagementServiceMembermar:JWMFamilyEnterpriseL.P.Member2023-01-012023-12-310001048286us-gaap:RelatedPartyMemberus-gaap:ManagementServiceMembermar:JWMFamilyEnterpriseL.P.Member2022-01-012022-12-310001048286us-gaap:RelatedPartyMembermar:FeeServiceMembermar:AffiliatedMembersOfTheMarriottFamilyMember2024-01-012024-12-310001048286us-gaap:RelatedPartyMembermar:FeeServiceMembermar:AffiliatedMembersOfTheMarriottFamilyMember2023-01-012023-12-310001048286us-gaap:RelatedPartyMembermar:FeeServiceMembermar:AffiliatedMembersOfTheMarriottFamilyMember2022-01-012022-12-310001048286mar:RestructuringAndMergerRelatedCostsMember2024-01-012024-12-310001048286us-gaap:CostOfSalesMember2024-01-012024-12-3100010482862024-10-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

|

|

|

|

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2024

or

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

Commission File No. 1-13881

MARRIOTT INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

52-2055918 |

(State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

|

|

| 7750 Wisconsin Avenue |

|

Bethesda |

|

Maryland |

|

20814 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(Registrant’s Telephone Number, Including Area Code) (301) 380-3000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Class A Common Stock, $0.01 par value |

|

MAR |

|

Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

|

Accelerated filer |

o |

|

Emerging growth company |

o |

| Non-accelerated filer |

o |

|

Smaller reporting company |

o |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of shares of common stock held by non-affiliates at June 30, 2024, was $56,461,271,207.

There were 275,695,298 shares of Class A Common Stock, par value $0.01 per share, outstanding at January 31, 2025.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement prepared for the 2025 Annual Meeting of Stockholders are incorporated by reference into Part III of this report.

MARRIOTT INTERNATIONAL, INC.

FORM 10-K TABLE OF CONTENTS

FISCAL YEAR ENDED DECEMBER 31, 2024

Throughout this report, we refer to Marriott International, Inc., together with its consolidated subsidiaries, as “we,” “us,” “Marriott,” or the “Company.” In order to make this report easier to read, we also refer throughout to (1) our Consolidated Financial Statements as our “Financial Statements,” (2) our Consolidated Statements of Income as our “Income Statements,” (3) our Consolidated Balance Sheets as our “Balance Sheets,” (4) our Consolidated Statements of Cash Flows as our “Statements of Cash Flows,” (5) our properties, brands, or markets in the United States and Canada as “U.S. & Canada,” and (6) our properties, brands, or markets in our Europe, Middle East & Africa, Greater China, Asia Pacific excluding China, and Caribbean & Latin America regions, as “International.” References throughout to numbered “Notes” refer to the Notes to our Financial Statements, unless otherwise stated. In addition, we use the term “hotel owners” throughout this report to refer, collectively, to owners of hotels and other lodging offerings operating in our system pursuant to management agreements, franchise agreements, license agreements or similar arrangements, and we use the term “hotels in our system” to refer to hotels and other lodging offerings operating in our system pursuant to such arrangements, as well as hotels that we own or lease. The terms “hotel owners” and “hotels in our system” exclude Homes & Villas by Marriott Bonvoy® (which we also exclude from our property and room count), timeshare, residential, and The Ritz-Carlton Yacht Collection®.

Cautionary Statement

All statements in this report are made as of the date this Form 10-K is filed with the U.S. Securities and Exchange Commission (the “SEC”). We undertake no obligation to publicly update or revise these statements, whether as a result of new information, future events or otherwise. We make forward-looking statements in Management’s Discussion and Analysis of Financial Condition and Results of Operations and elsewhere in this report based on the beliefs and assumptions of our management and on information available to us through the date this Form 10-K is filed with the SEC. Forward-looking statements include information related to our development pipeline; our expectations regarding rooms growth; our expectations related to new brands, offerings, and growth opportunities; our expectations regarding our ability to meet our liquidity requirements; our capital expenditures and other investment spending and reimbursement expectations; our expectations regarding future dividends and share repurchases; our expectations regarding certain claims, legal proceedings, settlements or resolutions; our comprehensive initiative to enhance our effectiveness and efficiency across the Company, including related goals, anticipated cost reductions, and other expected or potential benefits and outcomes; and other statements that are preceded by, followed by, or include the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “foresees,” or similar expressions; and similar statements concerning anticipated future events and expectations that are not historical facts.

We caution you that these statements are not guarantees of future performance and are subject to numerous evolving risks and uncertainties that we may not be able to accurately predict or assess, including the risks and uncertainties we describe in Part I, Item 1A, “Risk Factors,” of this report and other factors we describe from time to time in our periodic filings with the SEC.

PART I

Item 1. Business.

Overview

We are a worldwide operator, franchisor, and licensor of hotel, residential, timeshare, and other lodging properties under more than 30 brand names at different price and service points. Consistent with our focus on management, franchising, and licensing, we own or lease very few of our lodging properties (less than one percent of our system). As of year-end 2024, our system included 9,361 properties (1,706,331 rooms) in 144 countries and territories, and we also had nearly 3,800 hotels (over 577,000 rooms) in our development pipeline.

We discuss our operations in the following reportable business segments: (1) U.S. & Canada, (2) Europe, Middle East & Africa (“EMEA”), (3) Greater China, and (4) Asia Pacific excluding China (“APEC”). Our Caribbean & Latin America (“CALA”) operating segment does not meet the applicable accounting criteria for separate disclosure as a reportable business segment, and as such, we include its results in “Unallocated corporate and other.” See Note 14 for more information.

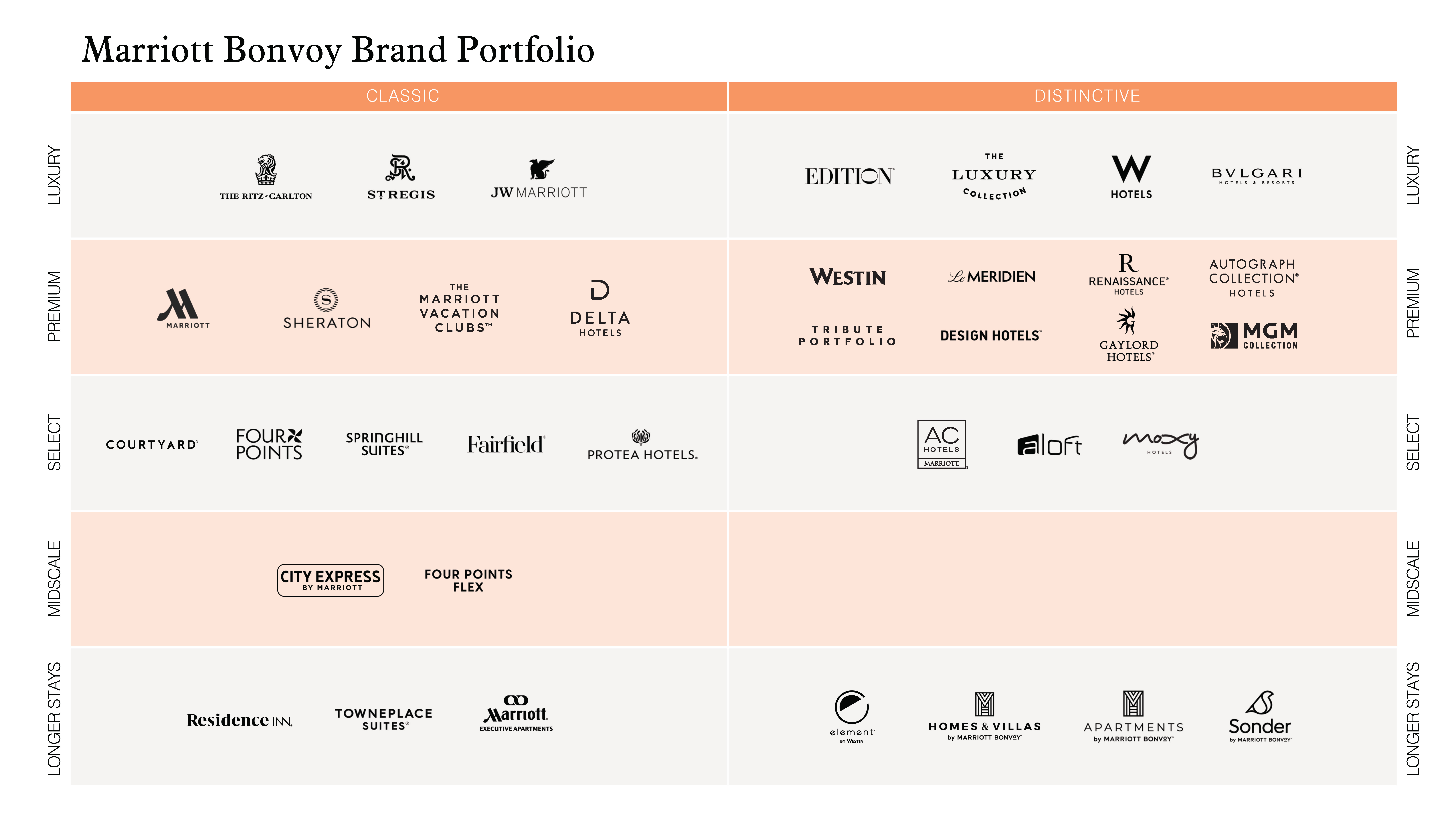

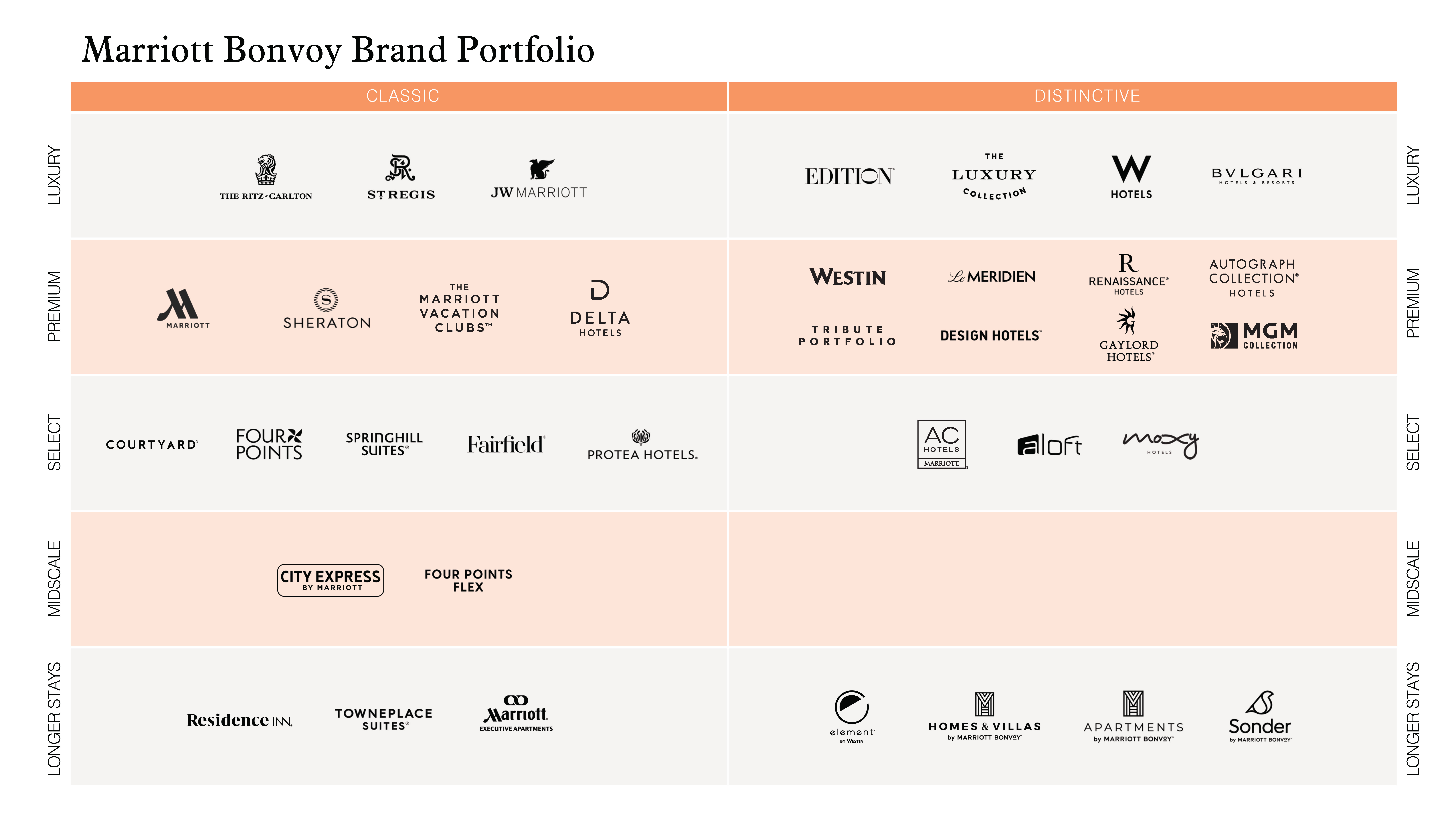

Brand Portfolio

We believe that our brand portfolio offers the most compelling range of brands and lodging offerings in hospitality. Our brands are categorized by style of offering - Classic and Distinctive. Our Classic brands offer time-honored hospitality for the modern traveler, and our Distinctive brands offer memorable experiences with a unique perspective - each of which we group into four quality tiers: Luxury, Premium, Select, and Midscale. Luxury offers bespoke and superb amenities and services. Premium offers sophisticated and thoughtful amenities and services. Select offers smart and easy amenities and services. Midscale offers limited services and essential amenities at a more affordable price point. Longer stay brands, which are classified under multiple quality tiers, offer amenities that mirror the comforts of home. The following table shows the portfolio of brands owned, operated, and/or licensed by Marriott for properties open at year-end 2024. In 2025, we expect properties to open under additional brand offerings, including our StudioResTM brand and our outdoor-focused lodging offerings.

The following table shows the geographic distribution of properties operating under the brands in our portfolio at year-end 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. & Canada |

Europe |

Middle East & Africa |

Asia Pacific excluding China |

Greater China |

Caribbean & Latin America |

Total |

| Luxury |

JW Marriott® |

Properties |

35 |

8 |

13 |

29 |

24 |

17 |

126 |

| Rooms |

19,269 |

2,525 |

4,734 |

9,399 |

9,556 |

4,496 |

49,979 |

The Ritz-Carlton® |

Properties |

43 |

13 |

16 |

24 |

18 |

9 |

123 |

| Rooms |

13,227 |

2,820 |

4,049 |

4,821 |

5,158 |

2,007 |

32,082 |

The Luxury Collection® |

Properties |

19 |

40 |

15 |

30 |

5 |

11 |

120 |

| Rooms |

9,903 |

5,801 |

2,691 |

7,125 |

1,488 |

1,570 |

28,578 |

W Hotels® |

Properties |

26 |

11 |

6 |

11 |

11 |

8 |

73 |

| Rooms |

8,417 |

2,271 |

2,175 |

2,754 |

3,905 |

1,931 |

21,453 |

St. Regis® |

Properties |

13 |

7 |

14 |

10 |

14 |

5 |

63 |

| Rooms |

2,669 |

887 |

3,511 |

2,066 |

3,659 |

675 |

13,467 |

EDITION® |

Properties |

5 |

5 |

4 |

3 |

2 |

1 |

20 |

| Rooms |

1,379 |

819 |

703 |

496 |

646 |

180 |

4,223 |

Bvlgari |

Properties |

— |

4 |

1 |

2 |

2 |

— |

9 |

| Rooms |

— |

332 |

121 |

157 |

201 |

— |

811 |

| Premium |

Marriott® Hotels |

Properties |

336 |

75 |

31 |

55 |

71 |

34 |

602 |

| Rooms |

131,983 |

21,341 |

9,976 |

16,512 |

24,852 |

9,174 |

213,838 |

Sheraton® |

Properties |

166 |

49 |

32 |

56 |

99 |

29 |

431 |

| Rooms |

64,254 |

13,469 |

9,513 |

16,914 |

38,399 |

8,091 |

150,640 |

Westin® |

Properties |

136 |

18 |

8 |

39 |

31 |

15 |

247 |

| Rooms |

55,323 |

6,074 |

2,147 |

11,026 |

10,370 |

4,347 |

89,287 |

Autograph Collection® |

Properties |

162 |

87 |

17 |

23 |

4 |

39 |

332 |

| Rooms |

37,404 |

12,024 |

2,753 |

4,969 |

571 |

12,777 |

70,498 |

Renaissance® Hotels |

Properties |

90 |

25 |

6 |

15 |

32 |

10 |

178 |

| Rooms |

28,315 |

5,834 |

1,728 |

3,806 |

11,307 |

2,959 |

53,949 |

Le Méridien® |

Properties |

24 |

16 |

20 |

33 |

21 |

3 |

117 |

| Rooms |

5,262 |

5,164 |

6,490 |

7,735 |

5,862 |

562 |

31,075 |

Delta Hotels by Marriott® (Delta Hotels®) |

Properties |

92 |

32 |

8 |

— |

4 |

3 |

139 |

| Rooms |

21,817 |

5,586 |

1,876 |

— |

1,529 |

561 |

31,369 |

MGM Collection with Marriott Bonvoy (2) |

Properties |

12 |

— |

— |

— |

— |

— |

12 |

| Rooms |

26,210 |

— |

— |

— |

— |

— |

26,210 |

Tribute Portfolio® |

Properties |

88 |

28 |

8 |

13 |

8 |

9 |

154 |

| Rooms |

16,578 |

3,794 |

1,173 |

1,444 |

1,735 |

1,011 |

25,735 |

Gaylord® Hotels |

Properties |

6 |

— |

— |

— |

— |

— |

6 |

| Rooms |

10,220 |

— |

— |

— |

— |

— |

10,220 |

Design Hotels® |

Properties |

20 |

93 |

9 |

13 |

4 |

22 |

161 |

| Rooms |

2,157 |

6,912 |

768 |

955 |

783 |

531 |

12,106 |

Marriott Executive Apartments® |

Properties |

— |

3 |

13 |

13 |

11 |

2 |

42 |

| Rooms |

— |

212 |

1,841 |

1,785 |

1,735 |

240 |

5,813 |

Apartments by Marriott BonvoyTM |

Properties |

— |

— |

— |

— |

— |

2 |

2 |

| Rooms |

— |

— |

— |

— |

— |

231 |

231 |

Sonder by Marriott Bonvoy |

Properties |

104 |

56 |

3 |

— |

— |

— |

163 |

| Rooms |

6,501 |

1,850 |

844 |

— |

— |

— |

9,195 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. & Canada |

Europe |

Middle East & Africa |

Asia Pacific excluding China |

Greater China |

Caribbean & Latin America |

Total |

| Select |

Courtyard by Marriott® (Courtyard®) |

Properties |

1,076 |

80 |

12 |

65 |

58 |

50 |

1,341 |

| Rooms |

148,671 |

14,639 |

2,635 |

13,184 |

14,951 |

8,100 |

202,180 |

Fairfield by Marriott® (Fairfield®) |

Properties |

1,174 |

1 |

— |

72 |

66 |

18 |

1,331 |

| Rooms |

111,495 |

222 |

— |

9,614 |

10,398 |

2,521 |

134,250 |

Residence Inn by Marriott® (Residence Inn®) |

Properties |

873 |

30 |

8 |

— |

— |

9 |

920 |

| Rooms |

107,249 |

3,446 |

1,205 |

— |

— |

1,328 |

113,228 |

SpringHill Suites by Marriott® (SpringHill Suites®) |

Properties |

563 |

— |

— |

— |

— |

— |

563 |

| Rooms |

66,666 |

— |

— |

— |

— |

— |

66,666 |

Four Points by Sheraton® (Four Points®) |

Properties |

148 |

24 |

23 |

50 |

67 |

20 |

332 |

| Rooms |

22,028 |

4,309 |

5,520 |

11,501 |

17,724 |

2,624 |

63,706 |

TownePlace Suites by Marriott® (TownePlace Suites®) |

Properties |

525 |

— |

— |

— |

— |

— |

525 |

| Rooms |

53,208 |

— |

— |

— |

— |

— |

53,208 |

Aloft® Hotels |

Properties |

166 |

11 |

12 |

17 |

14 |

17 |

237 |

| Rooms |

24,010 |

1,763 |

2,743 |

4,296 |

3,180 |

2,769 |

38,761 |

AC Hotels by Marriott® |

Properties |

126 |

88 |

2 |

7 |

2 |

19 |

244 |

| Rooms |

21,029 |

11,909 |

286 |

1,966 |

378 |

3,007 |

38,575 |

Moxy® Hotels |

Properties |

44 |

93 |

— |

13 |

11 |

— |

161 |

| Rooms |

7,805 |

17,587 |

— |

2,886 |

2,052 |

— |

30,330 |

Element® Hotels |

Properties |

90 |

2 |

7 |

3 |

8 |

— |

110 |

| Rooms |

12,428 |

275 |

1,189 |

572 |

1,647 |

— |

16,111 |

Protea Hotels® by Marriott |

Properties |

— |

— |

64 |

— |

— |

— |

64 |

| Rooms |

— |

— |

6,932 |

— |

— |

— |

6,932 |

Midscale |

City Express by MarriottSM |

Properties |

1 |

— |

— |

— |

— |

152 |

153 |

| Rooms |

83 |

— |

— |

— |

— |

17,694 |

17,777 |

Four Points FlexSM by Sheraton |

Properties |

— |

11 |

4 |

13 |

— |

— |

28 |

| Rooms |

— |

1,420 |

231 |

3,386 |

— |

— |

5,037 |

| Residences |

| Residences |

Properties |

72 |

12 |

17 |

20 |

2 |

14 |

137 |

| Rooms |

7,664 |

619 |

2,429 |

3,808 |

302 |

862 |

15,684 |

|

Subtotal Properties |

6,235 |

922 |

373 |

629 |

589 |

518 |

9,266 |

|

Subtotal Rooms |

1,043,224 |

153,904 |

80,263 |

143,177 |

172,388 |

90,248 |

1,683,204 |

|

|

|

|

|

|

|

|

|

Timeshare (1) |

Properties |

|

|

|

|

|

|

93 |

| Rooms |

|

|

|

|

|

|

22,750 |

Yacht (1) |

Properties |

|

|

|

|

|

|

2 |

| Rooms |

|

|

|

|

|

|

377 |

|

Total Properties |

|

|

|

|

|

|

9,361 |

| Total Rooms |

|

|

|

|

|

|

1,706,331 |

(1)We exclude geographical data for Timeshare and Yacht as these offerings are captured within “Unallocated corporate and other.”

(2)Excludes five MGM Collection with Marriott Bonvoy properties (two Autograph Collection, one Tribute Portfolio, one The Luxury Collection, and one W Hotels), which are presented within their respective brands.

Property and room counts presented by brand in the above table include certain hotels in our system that are not yet operating under such brand, but are expected to operate under such brand following the completion of planned renovations. In addition, Four Points Flex by Sheraton refers to properties previously referred to as Four Points Express by Sheraton.

Company-Operated Properties

At year-end 2024, we had 2,032 company-operated properties (586,201 rooms), which included properties under long-term management agreements with hotel owners and properties that we own and lease.

Terms of our management agreements vary, but we earn a management fee that is typically composed of a base management fee, which is a percentage of the revenues of the hotel, and an incentive management fee, which is based on the profits of the hotel. In many cases (particularly in our U.S. & Canada, Europe, and CALA regions), incentive management fees are subject to a specified owner return.

Our management agreements also typically include reimbursement of costs of operations (both direct and indirect). Such agreements are generally for initial periods of 20 to 30 years, with options for us to renew for up to 10 or more additional years. Our lease agreements also vary, but may include fixed annual rentals plus additional rentals based on a specified percentage of annual revenues that exceed a fixed amount. In many jurisdictions, our management agreements may be subordinated to mortgages or other liens securing indebtedness of the hotel owners. Many of our management agreements also permit the hotel owners to terminate the agreement if we do not meet certain performance metrics, financial returns fail to meet defined levels for a period of time, and we have not cured those deficiencies.

For the hotels we operate, we generally are responsible for hiring, training, and supervising the associates needed to operate the hotels and for incurring operational and administrative costs related to the operation of the hotels, and hotel owners are required to reimburse us for those costs. We provide centralized programs and services, such as our Loyalty Program (as defined below), reservations, and marketing, as well as various accounting and data processing services, and hotel owners are required to reimburse us for those costs as well.

Franchised, Licensed, and Other Properties

We have franchise, license, and other arrangements that permit hotel owners and certain other third parties to use many of our lodging brand names and systems.

Under our hotel franchising arrangements, we generally receive an initial application fee and continuing royalty fees, which typically range from four to seven percent of room revenues, plus for certain brands, up to four percent of food and beverage revenues, as well as reimbursement for centralized programs and services, such as our Loyalty Program, reservations, and marketing. Such agreements are generally for periods of 10 to 20 years.

We also have license and other agreements with third parties for certain offerings, such as for our timeshare properties, MGM Collection with Marriott Bonvoy, Design Hotels, and The Ritz-Carlton Yacht Collection, pursuant to which we receive royalty and certain other fees. For our timeshare properties, we receive royalty fees under license agreements with Marriott Vacations Worldwide Corporation and its affiliates (collectively, “MVW”) for certain brands. The royalty fees we receive from MVW consist of a fixed annual fee, adjusted for inflation, plus certain variable fees based on sales volumes. Certain licensees are also charged for certain systems and centralized programs and services, such as our Loyalty Program, reservations, and marketing.

At year-end 2024, we had 7,192 franchised, licensed, and other properties (1,104,446 rooms and timeshare units).

Residential

We use or license certain of our trademarks for the sale of residential real estate, often in conjunction with hotel development. We receive one-time branding fees upon the sale of each branded residential unit by the third-party developers who construct and sell the residences, with limited amounts, if any, of our capital at risk. We often also manage the related homeowners’ association and receive continuing management fees for that service. At year-end 2024, we had 137 branded residential properties (15,684 residential units).

Intellectual Property

We operate in a highly competitive industry and our brand names, trademarks, service marks, trade names, and logos are very important to our business, including the development, sales and marketing of our lodging offerings and services. We believe that our brand names and other intellectual property have come to represent outstanding quality, care, service, and value to our customers, guests, and the traveling public. Accordingly, we register and protect our intellectual property where we deem appropriate and otherwise protect against its unauthorized use.

Loyalty and Credit Card Programs

Marriott Bonvoy® is central to our business strategy. It encompasses our portfolio of over 30 brands and other travel offerings, our direct channels, and our award-winning travel loyalty program, which we refer to throughout this report as our “Loyalty Program.” Loyalty Program members can earn points for stays at participating properties and other travel offerings, such as Homes & Villas by Marriott Bonvoy, a global offering focusing on the premium and luxury tiers of rental homes, as well as through purchases with co-branded credit cards and our Loyalty Program partners. Members can redeem points for stays at participating properties, airline tickets, airline frequent flyer program miles, rental cars, products from Marriott Bonvoy Boutiques®, and a variety of other awards, including experiences from Marriott Bonvoy Moments®.

We believe that our Loyalty Program generates substantial repeat business that might otherwise go to competing properties. In 2024, 72 percent of our U.S. hotel room nights and 65 percent of our global hotel room nights were booked by Loyalty Program members. We strategically market to this large and growing guest base to generate revenue.

We have co-branded credit cards associated with Marriott Bonvoy in 11 countries. In the U.S., we have multi-year agreements with JPMorgan Chase and American Express. We also license credit card programs internationally, including in Japan, China, Canada, the United Arab Emirates, and other markets. We generally earn fixed amounts that are payable at contract inception and variable amounts that are paid to us monthly over the term of the agreements primarily based on card usage. We believe that our co-branded credit cards create a diverse revenue stream for the Company, reflect the quality and value of our portfolio of brands, and contribute to the strength of our Loyalty Program by creating value for our customers, hotel owners, and other parties with whom we have an affiliation. Payments received under our co-branded credit card agreements represent a significant funding source for the Loyalty Program.

See the “Loyalty Program” caption in Note 2 for more information about our Loyalty Program and co-branded credit cards.

Sales and Marketing and Reservation Systems

Marriott.com, the Marriott Bonvoy mobile app, and our other direct digital channels offer seamless digital experiences. We deliver customer-minded enhancements, including powerful in-stay capabilities through our mobile app, such as contactless check-in and check-out, Mobile Key, chat, service requests, mobile dining, and more. In addition, we are focused on strengthening Marriott Bonvoy by attracting more Loyalty Program members and localizing our experiences to reach new customers around the world. Our focus on creating frictionless experiences throughout our direct digital channels is foundational to our worldwide technology systems transformation. This multi-year transformation of our reservations, property management, and loyalty systems is focused on introducing new technology that delivers more choices for customers, new capabilities for associates, and new revenue opportunities for hotels in our system.

Our above-property sales deployment and revenue management strategies are designed around the way the customer wants to buy and the strategic priorities of hotels in our system. Our above-property sales strategy focuses on offering global business-to-business solutions, driving efficiencies, optimizing revenue, and enhancing customer loyalty while minimizing duplication of efforts at the hotel level. We also utilize innovative and sophisticated revenue management systems, many of which are proprietary, which are designed to facilitate pricing decisions, increase efficiency, and optimize property-level revenue. Most of the hotels in our portfolio utilize web-based programs to effectively manage the rate set-up and modification processes, which provides for greater pricing flexibility and increased efficiency.

Our marketing strategies focus on building awareness, increasing demand, promoting Marriott Bonvoy, and increasing customer loyalty. We do this through a variety of brand and marketing programs, offerings, and tools.

Competition

We compete for guests in many areas, including brand recognition and reputation, location, guest satisfaction, room rates, quality of service, amenities, quality of accommodations, safety and security, and the ability to earn and redeem loyalty program points. We encounter strong competition in the short-term lodging market from regional, national, and international chains that operate lodging properties or franchise their brands, lodging properties that are not affiliated with a chain, and online platforms, including Airbnb and Vrbo, that allow travelers to book short-term rentals of homes and apartments as an alternative to hotel rooms. Although we believe that our strong brand recognition assists us in attracting and retaining guests and hotel owners, we compete against many other companies with strong brands and guest appeal, including Hilton, IHG Hotels & Resorts, Hyatt, Wyndham Hotels & Resorts, Accor, Choice Hotels, Best Western Hotels & Resorts, and others. Our direct digital channels also compete for guests with online travel services platforms, such as Expedia.com, Priceline.com, Booking.com, Travelocity.com, Orbitz.com, and Trip.com, and search engines such as Google, Bing, Yahoo, and Baidu.

We believe that the location and quality of our lodging offerings, our Loyalty Program, our marketing programs, our reservation systems, and our emphasis on guest service and guest and associate satisfaction contribute to guest preference across all our brands.

Affiliation with a brand is common in the U.S. lodging industry. In 2024, approximately 73 percent of U.S. hotel rooms were brand-affiliated. Although lodging properties outside the U.S. also often affiliate with a brand, such brand affiliation is less prevalent than in the U.S. Based on lodging industry data, we have an approximately 17 percent share of the U.S. hotel market and a four percent share of the hotel market outside the U.S. (based on number of rooms).

We believe that our brands are attractive to hotel owners seeking a management company, franchise, or other licensing affiliation because of the benefits of our Loyalty Program, centralized reservation systems, marketing programs, and other offerings, and our emphasis on guest service.

Seasonality

In general, business at hotels in our system fluctuates moderately with the seasons. Business at some resort properties may be more seasonal depending on location.

Human Capital Management

Marriott’s long history of service, innovation, and growth is built on a culture of putting people first. We are committed to investing in our associates, with a focus on leadership development, competitive compensation, and creating a sense of well-being and belonging for all.

At year-end 2024, Marriott managed the employment of approximately 418,000 associates. This number includes approximately 155,000 associates employed by Marriott at properties, customer care centers, and above-property operations, as well as approximately 263,000 associates who are employed by our hotel owners but whose employment is managed by Marriott (which is common outside the U.S.). Approximately 118,000 of the associates employed by Marriott are located in the U.S., of which approximately 20,000 belong to labor unions. Outside the U.S., some of our associates are represented by trade unions, works councils, or employee associations. These numbers do not include hotel personnel employed by our independent franchisees and licensees or management companies hired by our franchisees and licensees. Marriott is committed to conducting its business in accordance with high ethical and legal standards, and our franchisees are expected to develop responsible human capital management practices.

We are focused on maintaining Marriott’s position as an employer of choice both for job seekers and our existing associates. To attract talent, we are targeting new labor pools, optimizing our recruiting practices, and sharing our story of long-term career potential. Our people brand, “Be™”, showcases associate stories to highlight the meaningful work and numerous opportunities at the Company. At our headquarters in Bethesda, Maryland, we utilize a hybrid work model to allow for flexibility and choice to meet the needs of our corporate workforce. For many hotel-based associates, we are innovating the way hotel jobs are structured, introducing more flexibility and choice through our integrated jobs program, which allows associates to have more cross-training and engaging roles.

We encourage continual feedback from our associates at all levels. We measure associate satisfaction through our Associate Engagement Survey, which gives all associates the opportunity to provide feedback about their work experience, providing valuable insights so we can drive improvements in our culture. In 2024, we changed our cadence from an annual survey to three times per year to allow for more frequent feedback. Our associate engagement scores exceeded the “Global Best Employer” external benchmark in 2024, and we were recognized as a top 10 company on the Fortune 100 Best Companies to Work For® in 2024, a list we have been on for 27 consecutive years.

In 2024, we launched a comprehensive initiative, with a focus on our headquarters and corporate offices, to enhance our effectiveness and efficiency across the Company and to advance our strategic objectives. As part of these efforts, we streamlined some roles, reshaped work to focus on our highest priorities, and de-layered the organization to speed up and simplify decision-making capabilities of our teams.

Our human capital strategy is based on three signature elements – Growing Great Leaders, Investing in Associates, and Providing Access to Opportunity.

Growing Great Leaders

We believe that associates at every level can inspire others through great leadership. Our Leadership Framework, designed to help us grow great leaders, starts with three Leadership Essentials that clearly define what great leadership means at Marriott at all levels of the organization. In 2024, we also revamped our leadership development offerings with tailored programming that targets successive managerial levels, creating a clear pathway for associates to progressively grow into leadership roles. Our leadership competencies are integrated into our performance management process and leadership development programs. Our talent development strategy is designed to provide opportunities for our associates to develop and grow their careers with Marriott for the long term while driving the performance of our business.

Investing in Associates

We are focused on providing our associates with the tools, resources, and support they need to thrive – both personally and professionally. We provide our eligible U.S. associates and their families with access to comprehensive compensation and benefits offerings, such as health care coverage, work/life support benefits, and other offerings, including retirement savings and employee stock purchase plans. Outside the U.S., we offer comprehensive compensation and benefit programs that vary based on the geographic market and we regularly evaluate these programs for competitiveness against the external talent market. Our TakeCare program provides associates with tools and resources to support their physical, mental, and financial well-being.

In addition, pay equity is foundational to our compensation structures and practices. Globally, pay equity best practices guide our determination of starting pay for our associates, including our policy of prohibiting compensation history inquiries. In the U.S., we conduct pay equity audits at least annually and make adjustments as needed.

Providing Access to Opportunity

Our focus on access to opportunity encompasses a range of initiatives and programs to support our goal to make all stakeholders (including associates, guests, hotel owners, and suppliers) feel welcome and valued. The Inclusion and Social Impact Committee of our Board of Directors (“Board”), established over 20 years ago, assists the Board in providing oversight of the Company’s strategy related to our people-first culture, associate well-being and inclusion, and corporate social responsibility and environmental matters.

Sustainability and Social Impact

We are focused on creating a positive and sustainable impact wherever we do business. Our sustainability and social impact platform, Serve 360: Doing Good in Every Direction, is built around four focus areas: Nurture Our World; Sustain Responsible Operations; Empower Through Opportunity; and Welcome All and Advance Human Rights. Our efforts are centered around (1) making the communities and environments where we operate better places to live, work, and visit, (2) embedding sustainability across our operations, (3) providing access to workplace readiness and opportunity for all to grow and succeed, and (4) encouraging cultural understanding and connecting people through the power of travel.

Our sustainability strategy and initiatives focus on a wide range of issues, including designing resource-efficient hotels, implementing technologies to track and reduce energy and water consumption, as well as waste and food waste, increasing the use of renewable energy, managing water-related risks, focusing on third-party sustainability certifications at the hotel-level, supporting ecosystem restoration initiatives, and focusing on responsible and local sourcing.

We have set near-term and long-term science-based emissions reduction targets, which were verified by the Science Based Targets initiative in 2024.

In response to humanitarian crises and natural disasters, hotels in our system often look to support their local communities in need by donating funds, hotel stays, food, supplies, and volunteer hours. We also deploy our Company relief funds to support affected associates and their families and charitable organizations providing relief in impacted areas. We also continue to focus on our efforts to advance human rights, including by continuing to train associates in human trafficking awareness and donating our training program to the broader lodging industry.

Government Regulations

As a company with global operations, we are subject to a wide variety of laws, regulations, and government policies around the world. Some of the regulations that most affect us and our business include those related to employment practices; marketing and advertising; consumer protection; trade and economic sanctions; anti-bribery, anti-corruption, and anti-money laundering; intellectual property; cybersecurity, data privacy, data localization, data transfers, and the handling of personally identifiable information; competition; climate and the environment; health, safety, and accessibility; liquor sales; the offer and sale of franchises; and credit card products.

Internet Address and Company SEC Filings

Our primary Internet address is Marriott.com. On the investor relations portion of our website, Marriott.com/investor, we provide a link to our electronic filings with the SEC, including our annual report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, and any amendments to these reports. We make all such filings available free of charge as soon as reasonably practicable after filing. The information found on our website is not part of this or any other report we file with or furnish to the SEC.

Item 1A. Risk Factors.

We are subject to various risks that make an investment in our securities risky. The events and consequences discussed in these risk factors could, in circumstances we may or may not be able to accurately predict, recognize, or control, have a material adverse effect on our business, liquidity, financial condition, and results of operations. In addition, these risks could cause results to differ materially from those we express in forward-looking statements contained in this report or in other Company communications. These risk factors do not identify all risks that we face, and our business could also be affected by factors, events, or uncertainties that are not presently known to us or that we currently do not consider to present significant risks to our operations.

Risks Relating to Our Industry

Our industry is highly competitive, which may impact our ability to compete successfully for guests. We operate in markets that contain many competitors. Our hotel brands and other lodging offerings generally compete with regional, national, and international chains that operate lodging properties or franchise their brands, lodging properties that are not affiliated with a chain, and online platforms that allow travelers to book short-term rentals of homes and apartments. Our ability to remain competitive and attract and retain business, group and leisure travelers depends on our success in distinguishing and driving preference for our lodging products and services, including our Loyalty Program, direct channels, consumer-facing technology platforms and services, our co-branded credit cards, and other offerings. If we cannot compete successfully in these areas, our business, liquidity, financial condition, and results of operations could be materially adversely affected. Further, new lodging supply in individual markets could have a negative impact on the hotel industry and hamper our ability to maintain or increase room rates or occupancy in those markets.

Economic and other global, national, and regional conditions and events have in the past impacted, and could in the future impact, our business, financial results and growth. Because we conduct our business on a global scale, we are affected by changes in global, national, or regional economies, governmental policies (including in areas such as trade, travel, immigration, labor, healthcare, and related issues), and geopolitical, public health, social and other conditions and events. Our business, financial results and growth are impacted by weak or volatile economic conditions; pandemics and other outbreaks of disease; natural and man-made disasters; changes in energy prices, interest rates and currency values; political instability, geopolitical disputes or conflict, actual or threatened war, terrorist activity, civil unrest and other acts of violence; heightened travel security measures, travel advisories, and disruptions in air and ground travel; and concerns over the foregoing. These conditions and events have in the past materially negatively impacted, and could in the future materially negatively impact, our business, operations, and financial results in many ways, including, but not limited to, as follows:

•reducing revenues at hotels in our system, impacting our fees and the ability of hotels to meet expenses, including payment of amounts owed to us;

•reducing revenues we receive from other programs and offerings;

•adversely affecting the value of our owned and leased properties or investments;

•affecting the ability or willingness of hotel owners to service, repay or refinance existing indebtedness or similar obligations, including loans or guaranty advances we have made to or for them;

•making it more difficult for hotel owners to obtain financing on commercially acceptable terms, or at all;

•causing hotel construction and opening delays;

•decreasing the rate at which new projects enter our pipeline;

•causing hotels to exit our system;

•increasing operating costs;

•requiring us to borrow or otherwise raise a significant amount of cash in order to preserve financial flexibility, repay maturing debt and manage debt maturities;

•causing the terms of our borrowing to be more expensive or more restrictive; and

•adversely affecting associate hiring and retention.

The conditions and events discussed in this risk factor could also give rise to, aggravate, and impact our ability to allocate resources to mitigate the other risks that we identify below, which in turn could materially adversely affect our business, liquidity, financial condition, and results of operations.

Risks Relating to Our Business

Operational Risks

Premature termination of our agreements with hotel owners could hurt our financial performance. Our agreements with hotel owners may be subject to premature termination in certain circumstances, such as the bankruptcy of a hotel owner, the failure of a hotel owner to comply with its payment or other obligations under the agreement, a failure under some agreements to meet specified financial or performance criteria which we do not cure, or in certain limited cases, other negotiated contractual termination rights.

Hotel owners may assert the right to terminate our agreements even where the agreements provide otherwise, and some courts have upheld such assertions about our agreements and may do so in the future. When terminations occur for certain of these or other reasons, we may need to enforce our right to damages for breach of contract and related claims, which may cause us to incur significant legal fees and expenses. We may have difficulty collecting damages from the hotel owner, and any damages we ultimately collect could be less than the projected future value of the fees and other amounts we would have otherwise collected under the agreement with the hotel owner. A significant loss of these agreements could hurt our financial performance or our ability to grow our business.

Disagreements with hotel owners and other counterparties may result in arbitration or litigation or delay implementation of product or service initiatives. Consistent with our focus on management, franchising, and licensing, we own very few of our lodging properties. The nature of our rights and responsibilities under our agreements with hotel owners and other counterparties may be subject to interpretation. This has from time to time given rise to disagreements with such parties, and may give rise to such disagreements in the future, including over new product, service, or systems initiatives and their associated costs, the timing and amount of capital investments, and reimbursement for operating costs, system costs, or other amounts. We have seen, and may in the future see, an increase in such disagreements during periods when hotel returns are weaker. We seek to resolve any disagreements and to develop and maintain positive relations with our hotel owners and other counterparties, but we cannot always do so. Failure to resolve such disagreements has resulted in arbitration or litigation, and could do so in the future. We could suffer significant losses, reduced profits, or constraints on our operations as the result of adverse dispute resolution outcomes.

An increase in the use of Internet travel intermediaries to book hotel reservations could adversely impact our business. Some of our hotel rooms are booked through Internet travel intermediaries such as Expedia.com, Priceline.com, Booking.com, Travelocity.com, Orbitz.com, and Trip.com. In addition to their focus on leisure travel, these intermediaries also provide offerings for corporate travel and group meetings. Internet search engines may also divert business away from our channels to intermediaries. Although our Best Rate Guarantee and Member Rate programs have helped limit guest preference shift to intermediaries and greatly reduced the ability of intermediaries to undercut the published rates at hotels in our system, intermediaries continue to use a variety of aggressive online marketing methods to attract guests, including the purchase by certain companies of trademarked online keywords such as “Marriott” from Internet search engines such as Google, Bing, Yahoo, and Baidu to steer guests toward their websites. Our business and profitability could be harmed to the extent that guest booking preference shifts from our direct digital channels to Internet travel intermediaries, diverting bookings away from our direct digital channels and increasing the overall cost of bookings for hotels in our system. At the same time, if we are not able to negotiate new agreements on satisfactory terms when our existing contracts with intermediaries (which generally have two- to three-year terms) come up for renewal, our business and prospects could be negatively impacted in a number of ways, including by reducing bookings or making our brands less attractive to hotel owners.

Our growth strategy depends upon attracting hotel owners to our platform, and future arrangements with these third parties may be less favorable to us, depending on the terms offered by our competitors. Adding properties to our system entails entering into and maintaining various arrangements with hotel owners. Our ability to attract and retain hotel owners and the terms of our agreements with hotel owners are influenced by the needs and preferences of hotel owners and the offerings otherwise available to hotel owners in the market, among other things. We cannot assure you that any of our current arrangements will continue or that we will be able to renew agreements or enter into new agreements in the future on terms that are as favorable to us as those that exist today.

The effects of, or our failure to comply with, applicable laws, regulations, and government policies may disrupt our business, lower our revenues, increase our costs, reduce our profits, limit our growth, or damage our reputation. We, the hotels in our system, our other lodging offerings, and the programs that we offer are subject to or affected by a variety of laws, regulations, and government policies around the globe, including, among others, those related to employment practices; marketing and advertising; consumer protection; trade and economic sanctions; anti-bribery, anti-corruption, and anti-money laundering; intellectual property; cybersecurity, data privacy, data localization, data transfers, and the handling of personally identifiable information; competition; climate and the environment; health, safety, and accessibility; liquor sales; the offer and sale of franchises; and credit card products. These laws, regulations, and government policies may be complex and change frequently and could have a range of adverse effects on our business. The compliance programs, internal controls, and policies we maintain and enforce need to be updated regularly to keep pace with changing laws, regulations, and government policies, may not cover all applicable risk areas, and, as we have seen in the past, may not prevent us, our associates, service providers, or agents from materially violating applicable laws, regulations, and government policies. The requirements of applicable laws, regulations, and government policies, our failure to meet such requirements (including investigations and publicity resulting from actual or alleged failures), or actions we take to comply with such requirements or investigations could have significant adverse effects on our results of operations, reputation, or ability to grow our business.

Third-party claims that we infringe the intellectual property rights of others or our failure to defend our own intellectual property rights could materially adversely affect our business. Third parties sometimes make claims against us for infringing their intellectual property rights (including as a result of the actions of our hotel owners, service providers, and other parties with whom we do business). We have been and are currently party to a number of such claims and may be subject to additional claims in the future. Such claims have in the past, and could in the future:

•be expensive and time consuming to defend;

•require or result in significant monetary payments to claimants;

•require or result in the limitation or cessation of our use of the intellectual property at issue;

•force us to redesign or rebrand our products or services; or

•result in other adverse effects on our business or reputation.

We may also be required to indemnify hotel owners, service providers, and other parties with whom we do business for losses they incur as a result of any infringement claims against them related to our intellectual property or as a result of our use of the intellectual property of third parties.

In addition, if third parties copy or use our intellectual property without authorization, the value of our brands, our competitive advantages, or our goodwill could be harmed. The steps we take to secure, protect, and defend our intellectual property rights may not succeed or be adequate to prevent others from infringing, copying, or using our intellectual property without proper authorization. Such steps, including enforcing our intellectual property rights, are costly and could force us to divert our resources, lead to counterclaims or other claims against us, or otherwise result in harm to our business.

If our brands, goodwill, or other intangible assets become impaired, we may be required to record significant non-cash charges to earnings. We hold a significant amount of goodwill and other intangible assets on our Balance Sheets. We review goodwill and indefinite-lived intangible assets for impairment annually or whenever events or circumstances indicate impairment may have occurred. Estimated fair values of our brands or reporting units could change if, for example, there are changes in the business climate, unanticipated changes in the competitive environment, adverse legal or regulatory claims, actions or developments, changes in guests’ perception and the reputation of our brands, or changes in interest rates, operating cash flows, or market capitalization. Because of the significance of our goodwill and other intangible assets, any future impairment of these assets could require material non-cash charges to our results of operations, which could have a material adverse effect on our reported financial condition and results of operations.