Delaware |

001-40031 |

85-4164597 |

||||||

| (State or Other Jurisdiction of | (Commission | (IRS Employer | ||||||

| Incorporation or Organization) | File Number) | Identification Number) | ||||||

6811 Benjamin Franklin Drive, Suite 200 | ||||||||

Columbia, MD 21046 | ||||||||

(Address of principal executive offices, including Zip Code) | ||||||||

(410) 312-0885 | ||||||||

(Registrant's telephone number, including area code) | ||||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||

| Trading | Name of each exchange | |||||||||||||

Title of each class |

Symbols |

on which registered |

||||||||||||

| Common stock, $0.0001 par value | BBAI | New York Stock Exchange | ||||||||||||

| Redeemable warrants, each full warrant exercisable for one share of common stock at an exercise price of $11.50 per share | BBAI.WS | New York Stock Exchange | ||||||||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

99.2 |

||||||||

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|||||||

| Dated: | November 5, 2024 | |||||||

By: |

/s/ Sean Ricker | ||||

Name: |

Sean Ricker | ||||

Title: |

Chief Accounting Officer | ||||

| Three Months Ended September 30, | Nine Months Ended September 30, |

||||||||||||||||||||||

| $ thousands (expect per share amounts) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Revenues | $ | 41,505 | $ | 33,988 | $ | 114,409 | $ | 114,601 | |||||||||||||||

| Cost of revenues | 30,739 | 25,579 | 85,594 | 87,016 | |||||||||||||||||||

| Gross margin | 10,766 | 8,409 | 28,815 | 27,585 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Selling, general and administrative | 17,485 | 15,533 | 57,797 | 52,825 | |||||||||||||||||||

| Research and development | 3,820 | (349) | 8,529 | 3,004 | |||||||||||||||||||

| Restructuring charges | — | — | 1,317 | 780 | |||||||||||||||||||

| Transaction expenses | — | 1,437 | 1,450 | 1,437 | |||||||||||||||||||

| Goodwill impairment | — | — | 85,000 | — | |||||||||||||||||||

| Operating loss | (10,539) | (8,212) | (125,278) | (30,461) | |||||||||||||||||||

| Interest expense | 3,541 | 3,540 | 10,647 | 10,656 | |||||||||||||||||||

| Net (decrease) increase in fair value of derivatives | (1,278) | (15,659) | 14,832 | (1,971) | |||||||||||||||||||

| Other income | (647) | (87) | (1,719) | (87) | |||||||||||||||||||

| (Loss) income before income taxes | (12,155) | 3,994 | (149,038) | (39,059) | |||||||||||||||||||

| Income tax expense (benefit) | 21 | (5) | 22 | 51 | |||||||||||||||||||

| Net (loss) income | $ | (12,176) | $ | 3,999 | $ | (149,060) | $ | (39,110) | |||||||||||||||

Basic and diluted net (loss) income per share |

$ | (0.05) | $ | 0.03 | $ | (0.65) | $ | (0.27) | |||||||||||||||

Weighted-average shares outstanding: |

|||||||||||||||||||||||

Basic |

249,951,542 | 155,830,775 | 227,900,950 | 146,679,444 | |||||||||||||||||||

Diluted |

249,951,542 | 157,894,001 | 227,900,950 | 146,679,444 | |||||||||||||||||||

Other comprehensive loss |

|||||||||||||||||||||||

Foreign currency translation |

(8) | — | (8) | — | |||||||||||||||||||

Total other comprehensive loss |

(8) | — | (8) | — | |||||||||||||||||||

Total comprehensive (loss) income |

$ | (12,184) | $ | 3,999 | $ | (149,068) | $ | (39,110) | |||||||||||||||

| $ in thousands | September 30, 2024 |

December 31, 2023 | |||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 65,584 | $ | 32,557 | |||||||

Accounts receivable, less allowance for credit losses |

32,464 | 21,949 | |||||||||

| Contract assets | 1,914 | 4,822 | |||||||||

| Prepaid expenses and other current assets | 4,222 | 4,449 | |||||||||

| Total current assets | 104,184 | 63,777 | |||||||||

| Non-current assets: | |||||||||||

| Property and equipment, net | 1,519 | 997 | |||||||||

| Goodwill | 118,621 | 48,683 | |||||||||

| Intangible assets, net | 119,257 | 82,040 | |||||||||

| Right-of-use assets | 9,430 | 4,041 | |||||||||

| Other non-current assets | 1,072 | 372 | |||||||||

| Total assets | $ | 354,083 | $ | 199,910 | |||||||

| Liabilities and stockholders’ deficit | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 4,249 | $ | 11,038 | |||||||

| Short-term debt, including current portion of long-term debt | — | 1,229 | |||||||||

| Accrued liabilities | 26,356 | 16,233 | |||||||||

| Contract liabilities | 2,082 | 879 | |||||||||

| Current portion of long-term lease liability | 1,075 | 779 | |||||||||

| Derivative liabilities | 15,796 | 37,862 | |||||||||

| Other current liabilities | 1,027 | 602 | |||||||||

| Total current liabilities | 50,585 | 68,622 | |||||||||

| Non-current liabilities: | |||||||||||

| Long-term debt, net | 195,738 | 194,273 | |||||||||

| Long-term lease liability | 9,327 | 4,313 | |||||||||

| Deferred tax liabilities | — | 37 | |||||||||

| Total liabilities | 255,650 | 267,245 | |||||||||

| Stockholders’ equity (deficit): | |||||||||||

| Common stock, par value $0.0001; 500,000,000 shares authorized and 250,060,927 shares issued and outstanding at September 30, 2024 and 157,287,522 shares issued and outstanding at December 31, 2023 | 25 | 17 | |||||||||

| Additional paid-in capital | 618,256 | 303,428 | |||||||||

| Treasury stock, at cost 9,952,803 shares at September 30, 2024 and December 31, 2023 | (57,350) | (57,350) | |||||||||

| Accumulated deficit | (462,490) | (313,430) | |||||||||

| Accumulated other comprehensive loss | (8) | — | |||||||||

| Total stockholders’ equity (deficit) | 98,433 | (67,335) | |||||||||

| Total liabilities and stockholders’ equity (deficit) | $ | 354,083 | $ | 199,910 | |||||||

| Three Months Ended September 30, | Nine Months Ended September 30, |

||||||||||||||||||||||

| $ in thousands | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Cash flows from operating activities: | |||||||||||||||||||||||

Net (loss) income |

$ | (12,176) | $ | 3,999 | $ | (149,060) | $ | (39,110) | |||||||||||||||

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||||||||||||||||||

| Depreciation and amortization expense | 3,394 | 1,971 | 8,740 | 5,936 | |||||||||||||||||||

| Amortization of debt issuance costs | 505 | 506 | 1,517 | 1,512 | |||||||||||||||||||

| Equity-based compensation expense | 5,168 | 4,793 | 16,074 | 12,592 | |||||||||||||||||||

| Goodwill impairment | — | — | 85,000 | — | |||||||||||||||||||

| Non-cash lease expense | 190 | 153 | 553 | 450 | |||||||||||||||||||

| Provision for doubtful accounts | 44 | 50 | 220 | 1,607 | |||||||||||||||||||

| Deferred income tax (benefit) expense | — | — | (37) | 53 | |||||||||||||||||||

| Net increase in fair value of derivatives | (1,278) | (15,659) | 14,832 | (1,971) | |||||||||||||||||||

| Loss on sale of property and equipment | — | 2 | — | 10 | |||||||||||||||||||

| Changes in assets and liabilities: | |||||||||||||||||||||||

Decrease (increase) in accounts receivable |

836 | 7,189 | (5,396) | (546) | |||||||||||||||||||

(Increase) decrease in contract assets |

(703) | (106) | 3,078 | 860 | |||||||||||||||||||

| Decrease in prepaid expenses and other assets | 297 | 937 | 1,540 | 6,181 | |||||||||||||||||||

(Decrease) increase in accounts payable |

(3,177) | 1,778 | (8,224) | (6,346) | |||||||||||||||||||

| Increase in accrued liabilities | 5,958 | 1,375 | 7,610 | 2,035 | |||||||||||||||||||

(Decrease) increase in contract liabilities |

(983) | 320 | 486 | 298 | |||||||||||||||||||

(Decrease) increase in other liabilities |

29 | (728) | (246) | (1,794) | |||||||||||||||||||

| Net cash used in operating activities | (1,896) | 6,580 | (23,313) | (18,233) | |||||||||||||||||||

| Cash flows from investing activities: | |||||||||||||||||||||||

| Acquisition of business, net of cash acquired | — | — | 13,935 | — | |||||||||||||||||||

| Purchases of property and equipment | (137) | — | (304) | (2) | |||||||||||||||||||

| Capitalized software development costs | (4,171) | (2,744) | (7,396) | (2,744) | |||||||||||||||||||

| Net cash provided by (used in) investing activities | (4,308) | (2,744) | 6,235 | (2,746) | |||||||||||||||||||

| Cash flows from financing activities: | |||||||||||||||||||||||

| Proceeds from issuance of shares for exercised RDO and PIPE warrants | — | — | 53,809 | — | |||||||||||||||||||

| Proceeds from issuance of Private Placement and Registered Direct Offering shares | — | — | — | 50,000 | |||||||||||||||||||

| Payment of Private Placement and Registered Direct Offering transaction costs | — | (499) | — | (5,724) | |||||||||||||||||||

| Repayment of short-term borrowings | (417) | (522) | (1,229) | (2,059) | |||||||||||||||||||

| Proceeds from exercise of options | — | — | 119 | — | |||||||||||||||||||

| Issuance of common stock upon ESPP purchase | — | 531 | 607 | 531 | |||||||||||||||||||

| Payments of tax withholding from the issuance of common stock | (3) | (1,085) | (3,143) | (2,217) | |||||||||||||||||||

| Net cash provided by financing activities | (420) | (1,575) | 50,163 | 40,531 | |||||||||||||||||||

| Effect of foreign currency rate changes on cash and cash equivalents | (58) | — | (58) | — | |||||||||||||||||||

| Net increase in cash and cash equivalents | (6,682) | 2,261 | 33,027 | 19,552 | |||||||||||||||||||

| Cash and cash equivalents at the beginning of period | 72,266 | 29,923 | 32,557 | 12,632 | |||||||||||||||||||

| Cash and cash equivalents at the end of the period | $ | 65,584 | $ | 32,184 | $ | 65,584 | $ | 32,184 | |||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| $ thousands | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Net (loss) income | $ | (12,176) | $ | 3,999 | $ | (149,060) | $ | (39,110) | |||||||||||||||

| Interest expense | 3,541 | 3,540 | 10,647 | 10,656 | |||||||||||||||||||

| Interest income | (635) | (86) | (1,807) | (86) | |||||||||||||||||||

| Income tax expense (benefit) | 21 | (5) | 22 | 51 | |||||||||||||||||||

| Depreciation and amortization | 3,394 | 1,971 | 8,740 | 5,936 | |||||||||||||||||||

| EBITDA | (5,855) | 9,419 | (131,458) | (22,553) | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Equity-based compensation | 5,168 | 4,793 | 16,074 | 12,592 | |||||||||||||||||||

Employer payroll taxes related to equity-based compensation(1) |

29 | 8 | 741 | 365 | |||||||||||||||||||

Net (decrease) increase in fair value of derivatives(2) |

(1,278) | (15,659) | 14,832 | (1,971) | |||||||||||||||||||

Restructuring charges(3) |

— | — | 1,317 | 780 | |||||||||||||||||||

Non-recurring strategic initiatives(4) |

1,568 | 159 | 4,942 | 2,480 | |||||||||||||||||||

Non-recurring litigation(5) |

574 | — | 1,119 | — | |||||||||||||||||||

Transaction expenses(6) |

— | 1,437 | 1,450 | 1,437 | |||||||||||||||||||

Non-recurring integration costs(7) |

742 | — | 1,625 | — | |||||||||||||||||||

Goodwill impairment(8) |

— | — | 85,000 | — | |||||||||||||||||||

| Adjusted EBITDA | $ | 948 | $ | 157 | $ | (4,358) | $ | (6,870) | |||||||||||||||

| (1) | Includes employer payroll taxes due upon the vesting of equity awards granted to employees. | ||||

| (2) | The increase in fair value of derivatives during the nine months ended September 30, 2024, relates to the $42.3 million loss recorded upon the exercise of the 2023 RDO and 2023 PIPE Warrants (collectively, the “2023 Warrants”) and issuance of the warrants in 2024 (the “2024 Warrants”) in connection with the warrant exercise agreements entered into on February 27, 2024 and March 4, 2024. This loss is net of a $10.6 million gain related to the issuance of the 2024 Warrants and was further offset by a reduction of $27.4 million upon remeasurement of the 2024 Warrants and IPO Warrants’ fair value during the nine months ended September 30, 2024. The decrease in fair value of derivatives during the three months ended September 30, 2024 relates to remeasurement of the 2024 Warrants and IPO Warrants’ fair value. | ||||

| (3) | During the nine months ended September 30, 2024 and the nine months ended September 30, 2023, the Company incurred employee separation costs associated with a strategic review of the Company’s capacity and future projections to better align the organization and cost structure and improve the affordability of its products and services. | ||||

| (4) | Non-recurring professional fees related to the execution of certain strategic initiatives of the Company. | ||||

| (5) | Non-recurring litigation consists primarily of legal settlements and related fees for specific proceedings that we have determined arise outside of the ordinary course of business based on the following considerations which we assess regularly: (1) the frequency of similar cases that have been brought to date, or are expected to be brought within two years; (2) the complexity of the case; (3) the nature of the remedy(ies) sought, including the size of any monetary damages sought; (4) offensive versus defensive posture of us; (5) the counterparty involved; and (6) our overall litigation strategy. | ||||

| (6) | Transaction expenses consist primarily of diligence, legal and other related expenses incurred associated with the Pangiam Acquisition. | ||||

| (7) | Non-recurring internal integration costs related to the Pangiam Acquisition. | ||||

| (8) | During the nine months ended September 30, 2024, the Company recognized a non-cash goodwill impairment charge primarily driven by a decrease in share price during the quarter compared to the share price of the equity issued as consideration for the purchase of Pangiam. | ||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| $ in thousands | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Revenue | $ | 41,505 | $ | 33,988 | $ | 114,409 | $ | 114,601 | |||||||||||||||

| Net loss | (12,176) | 3,999 | (149,060) | (39,110) | |||||||||||||||||||

| Interest expense | 3,541 | 3,540 | 10,647 | 10,656 | |||||||||||||||||||

| Interest income | (635) | (86) | (1,807) | (86) | |||||||||||||||||||

Income tax expense (benefit) |

21 | (5) | 22 | 51 | |||||||||||||||||||

| Depreciation & amortization | 3,394 | 1,971 | 8,740 | 5,936 | |||||||||||||||||||

| EBITDA | $ | (5,855) | $ | 9,419 | $ | (131,458) | $ | (22,553) | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Equity-based compensation | 5,168 | 4,793 | 16,074 | 12,592 | |||||||||||||||||||

| Employer payroll taxes related to equity-based compensation | 29 | 8 | 741 | 365 | |||||||||||||||||||

Net (decrease) increase in fair value of derivatives |

(1,278) | (15,659) | 14,832 | (1,971) | |||||||||||||||||||

| Restructuring charges | — | — | 1,317 | 780 | |||||||||||||||||||

| Non-recurring integration costs and strategic initiatives | 2,310 | 159 | 6,567 | 2,480 | |||||||||||||||||||

| Non-recurring litigation | 574 | — | 1,119 | — | |||||||||||||||||||

| Transaction expenses | — | 1,437 | 1,450 | 1,437 | |||||||||||||||||||

| Goodwill impairment | — | — | 85,000 | — | |||||||||||||||||||

| Adjusted EBITDA | $ | 948 | $ | 157 | $ | (4,358) | $ | (6,870) | |||||||||||||||

Gross margin |

25.9 | % | 24.7 | % | 25.2 | % | 24.1 | % | |||||||||||||||

Net (loss) income margin |

(29.3) | % | 11.8 | % | (130.3) | % | (34.1) | % | |||||||||||||||

Adjusted EBITDA margin |

2.3 | % | 0.5 | % | (3.8) | % | (6.0) | % | |||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| $ in thousands | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Selling, general and administrative | $ | 17,485 | $ | 15,533 | $ | 57,797 | $ | 52,825 | |||||||||||||||

| Equity-based compensation allocated to selling, general and administrative expense | (3,029) | (3,071) | (9,180) | (8,193) | |||||||||||||||||||

| Non-recurring integration costs and strategic initiatives | (2,310) | (159) | (6,567) | (2,480) | |||||||||||||||||||

| Non-recurring litigation | (574) | — | (1,119) | — | |||||||||||||||||||

| Virgin Orbit AR Reserve | — | (50) | — | (1,475) | |||||||||||||||||||

Adjusted (recurring) selling, general and administrative expense |

$ | 11,572 | $ | 12,253 | $ | 40,931 | $ | 40,677 | |||||||||||||||

BigBear.ai Awarded Contract to Deliver the U.S. Army’s Global Force Information Management - Objective Environment (GFIM-OE) |

BigBear.ai and Concept Solutions Team Awarded Shared IDIQ contract with U.S. Federal Aviation Administration (FAA) |

|||||||

The U.S. Army awarded BigBear.ai a five-year $165.15 million sole source prime contract for GFIM production services. Since 2021, BigBear.ai has been working with the Army to transform 15 legacy systems into an enterprise-wide intelligent automation platform, supporting the Secretary of the Army’s vision for data-centric force management. Building on the contributions through Phase 1 and Phase 2, this contract will support the continued development and transition of GFIM-OE capabilities to production. |

BigBear.ai received an award as a subcontractor to Concept Solutions, LLC (CS). CS is one of fourteen companies awarded a FAA Information Technology Innovative Procurement Strategic Sourcing (ITIPSS) contract supporting the Office of Information Technology (AIT). This multiple-award IDIQ contract, with a $2.4 billion shared ceiling over ten years, will enable the FAA to acquire a full range of IT capabilities, solutions, and emerging technologies, offering state-of-the-art IT-related service solutions. |

|||||||

Read the PR: https://bit.ly/4feL8b7 |

Read the PR: https://bit.ly/3UkGpwG |

|||||||

BigBear.ai Implements Biometric Boarding Solutions for Denver International Airport (DEN) |

ConductorOS Excellence at RDER T-REX24-2 |

|||||||

BigBear.ai announced a successful installation of veriScan, BigBear.ai’s biometric verification solution, at DEN. veriScan is now deployed at 14 international departure gates at DEN, impacting the boarding process for over 46,600 international departing passengers. BigBear.ai’s veriScan offers a seamless experience for proper identification of individuals traveling internationally in settings with required security protocols. veriScan allows airlines at DEN to reduce boarding times. |

BigBear.ai demonstrated ConductorOS, the Company’s AI orchestration platform, at the DoD Office of the Under Secretary of Defense for the RDER T-REX24-2 event, highlighting its capabilities in edge AI orchestration. ConductorOS was recognized as a Tier 1 technology. |

|||||||

Read the PR: https://bit.ly/4hyzV7k |

Watch the Video: https://bit.ly/3YLPWiC |

|||||||

BigBear.ai, U.S. Navy to Exercise Mission Autonomy Proving Ground (MAPG) |

Carl Napoletano Appointed as BigBear.ai Chief Operating Officer |

|||||||

BigBear.ai announced its participation in previous and upcoming showcases with the U.S. Navy’s MAPG series of exercises, providing maritime domain awareness and AI orchestration. In collaboration with the U.S. Navy, BigBear.ai will continue to showcase ConductorOS, the company’s AI, data and sensor orchestration platform, to demonstrate multi-vendor interoperability and AI deployment for the maritime domain. |

Napoletano will continue to report directly to CEO Mandy Long. Napoletano has held a number of senior leadership positions at BigBear.ai, most recently serving as Vice President of Special Projects, where he oversaw the strategic integration of major acquisitions, including Pangiam. |

|||||||

| Read the PR: https://bit.ly/48uLFU4 | Read the PR: https://bit.ly/3Yfd6fT |

|||||||

BigBear.ai Receives Additional “Awardable” Status for DoD Work in the Chief Digital and Artificial Intelligence Office’s (CDAO) Tradewinds Solutions Marketplace |

||||||||

BigBear.ai announced additional “Awardable” status through the Chief Digital and Artificial Intelligence Office’s (CDAO) Tradewinds Solutions Marketplace. The Tradewinds Solutions Marketplace is the premier offering of Tradewinds, the DoD’s suite of tools and services designed to accelerate the procurement and adoption of Artificial Intelligence (AI)/Machine Learning (ML), data, and analytics capabilities. Available capabilities include Trueface, BigBear.ai's proprietary facial recognition software, and support for the DoD Joint Staff J3’s ORION, a technology-enabled decision-making platform. |

||||||||

| Adjusted EBITDA Calculation | ||

Key Metric: ($ thousands) |

3Q 22 | 4Q 22 | 1Q 23 | 2Q 23 | 3Q 23 | 4Q 23 | 1Q 24 | 2Q 24 | 3Q 24 |

||||||||||||||||||||

Revenue |

$ | 40,651 | $ | 40,357 | $ | 42,154 | $ | 38,459 | $ | 33,988 | $ | 40,563 | $ | 33,121 | $ | 39,783 | $ | 41,505 | |||||||||||

Net (loss) income |

(16,110) | (29,895) | (26,214) | (16,895) | 3,999 | (21,256) | (125,147) | (11,737) | (12,176) | ||||||||||||||||||||

Interest expense |

3,557 | 3,770 | 3,556 | 3,560 | 3,540 | 3,544 | 3,555 | 3,551 | 3,541 | ||||||||||||||||||||

Interest income |

— | — | — | — | (86) | (306) | (447) | (725) | (635) | ||||||||||||||||||||

Income tax expense (benefit) |

252 | (226) | 59 | (3) | (5) | 50 | (14) | 15 | 21 | ||||||||||||||||||||

Depreciation & amortization |

2,038 | 1,994 | 1,986 | 1,979 | 1,971 | 1,965 | 2,439 | 2,907 | 3,394 | ||||||||||||||||||||

EBITDA |

$ | (10,263) | $ | (24,357) | $ | (20,613) | $ | (11,359) | $ | 9,419 | $ | (16,003) | $ | (119,614) | $ | (5,989) | $ | (5,855) | |||||||||||

Adjustments: |

|||||||||||||||||||||||||||||

Equity-based compensation |

$ | 2,222 | $ | (295) | $ | 3,805 | $ | 3,994 | $ | 4,793 | $ | 6,079 | $ | 5,156 | $ | 5,749 | $ | 5,168 | |||||||||||

Employer payroll taxes related to equity-based compensation |

— | — | 183 | 174 | 8 | 75 | 664 | 48 | 29 | ||||||||||||||||||||

Net (decrease) increase in fair value of derivatives |

(102) | (27) | 10,567 | 3,121 | (15,659) | 9,395 | 23,992 | (7,882) | (1,278) | ||||||||||||||||||||

Restructuring charges |

1,562 | 2,641 | 755 | 25 | - | 42 | 860 | 457 | — | ||||||||||||||||||||

Non-recurring integration costs and strategic initiatives |

2,075 | 781 | 1,508 | 813 | 159 | 545 | 1,334 | 2,923 | 2,310 | ||||||||||||||||||||

Non-recurring litigation |

— | — | — | — | — | 2,250 | (121) | 666 | 574 | ||||||||||||||||||||

Transaction expenses |

566 | 454 | — | — | 1,437 | 1,284 | 1,103 | 347 | — | ||||||||||||||||||||

Goodwill impairment |

— | 18,292 |

— | — | — | — | 85,000 |

— | — | ||||||||||||||||||||

Adjusted EBITDA |

$ | (3,940) | $ | (2,511) | $ | (3,795) | $ | (3,232) | 157 |

$ | 3,667 | $ | (1,626) | $ | (3,681) | $ | 948 | ||||||||||||

Gross margin |

28.9% |

29.2% |

24.2% |

23.3% |

24.7% |

32.1% |

21.1% |

27.8 | % | 25.9 | % | ||||||||||||||||||

Net (loss) income margin |

(39.6%) |

(74.1%) |

(62.2%) |

(43.9%) |

11.8% |

(52.4%) |

(377.8%) |

(29.5) | % | (29.3) | % | ||||||||||||||||||

Adjusted EBITDA margin |

(9.7%) | (6.2%) | (9.0%) | (8.4%) | 0.5% | 9.0% | (4.9%) | (9.3) | % | 2.3 | % | ||||||||||||||||||

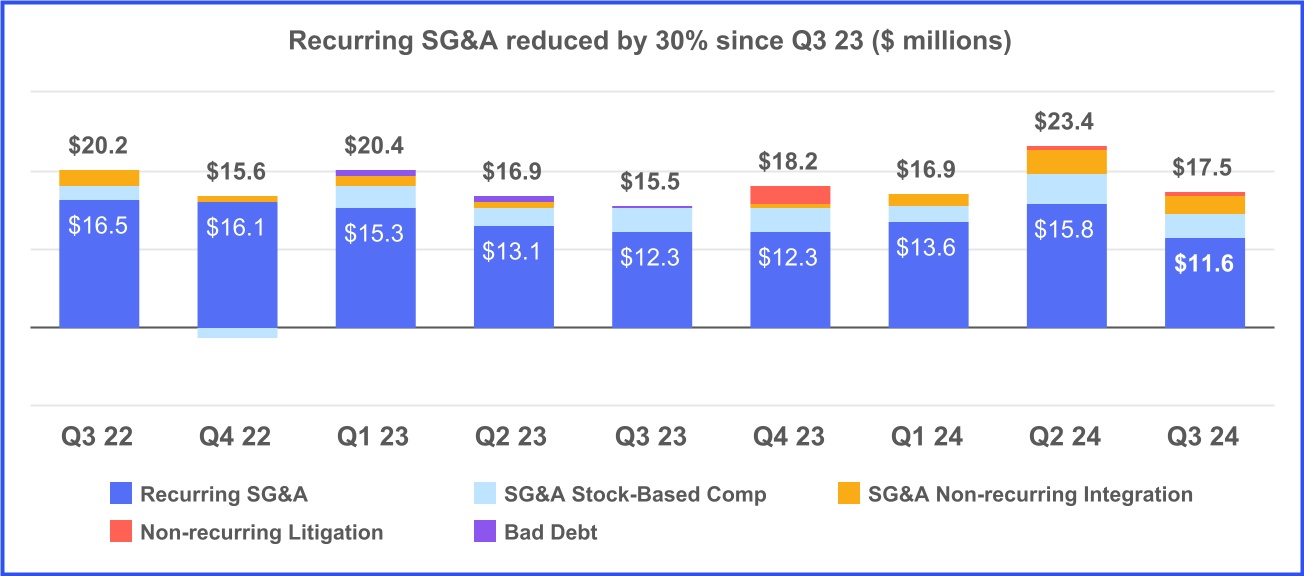

| Recurring SG&A Calculation | ||

Key Metric: ($ thousands) |

3Q 22 | 4Q 22 | 1Q 23 | 2Q 23 | 3Q 23 | 4Q 23 | 1Q 24 | 2Q 24 | 3Q 24 |

||||||||||||||||||||

Selling, general and administrative |

$ | 20,233 | $ | 15,570 | $ | 20,362 | $ | 16,930 | $ | 15,533 | $ | 18,232 | $ | 16,948 | $ | 23,364 | $ | 17,485 | |||||||||||

Equity-based compensation allocated to selling, general and administrative expense |

(1,635) | 1,279 | (2,803) | (2,319) | (3,071) | (3,156) | (2,171) | (3,980) | (3,029) | ||||||||||||||||||||

Non-recurring integration costs and strategic initiatives |

(2,075) |

(781) |

(1,508) |

(813) |

(159) |

(545) |

(1,334) |

(2,923) | (2,310) | ||||||||||||||||||||

Non-recurring litigation |

— | — | — | — | — | (2,250) |

121 |

(666) | (574) | ||||||||||||||||||||

Write-off of bad debt - Virgin Orbit bankruptcy |

— | — | (750) |

(675) |

(50) |

— | — | — | — | ||||||||||||||||||||

Adjusted (recurring) selling, general and administrative expenses |

$ | 16,523 | $ | 16,068 | $ | 15,301 | $ | 13,123 | $ | 12,253 | $ | 12,281 | $ | 13,564 | $ | 15,795 | $ | 11,572 | |||||||||||

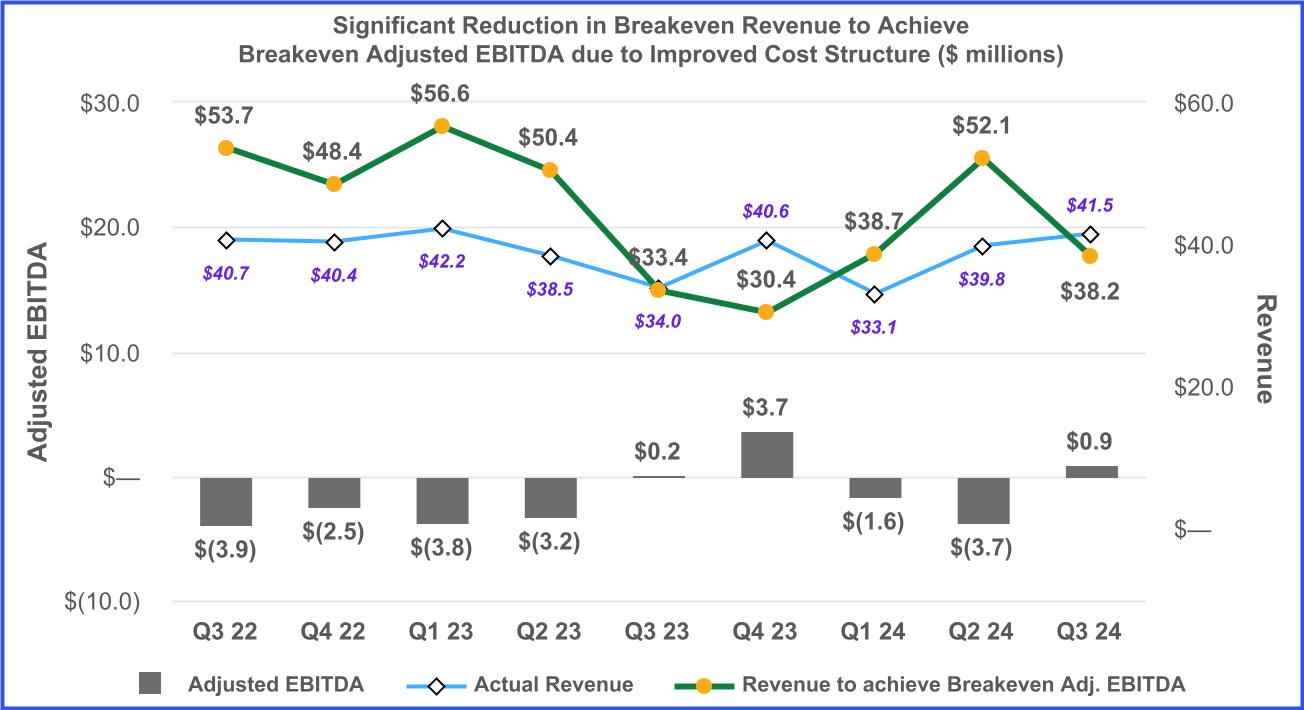

| Breakeven Revenue to Achieve Breakeven Adjusted EBITDA Calculation | ||

Key Metric: ($ thousands) |

3Q 22 | 4Q 22 | 1Q 23 | 2Q 23 | 3Q 23 | 4Q 23 | 1Q 24 | 2Q 24 | 3Q 24 |

||||||||||||||||||||

Revenues |

$ | 40,651 | $ | 40,357 | $ | 42,154 | $ | 38,459 | $ | 33,988 | $ | 40,563 | $ | 33,121 | $ | 39,783 | $ | 41,505 | |||||||||||

Gross margin ($) |

11,751 | 11,785 | 10,213 | 8,963 | 8,409 | 13,016 | 6,986 | 11,063 | 10,766 | ||||||||||||||||||||

Gross margin (%) |

28.9% |

29.2% |

24.2% |

23.3% |

24.7% |

32.1% |

21.1% |

27.8 | % | 25.9 | % | ||||||||||||||||||

Equity-based compensation allocated to cost of revenues |

571 |

892 |

874 |

1,442 |

1,498 |

1,632 |

2,653 |

799 | 1,318 | ||||||||||||||||||||

Adjusted gross margin ($) |

$ | 12,322 | $ | 12,677 | $ | 11,087 | $ | 10,405 | $ | 9,907 | $ | 14,648 | $ | 9,639 | $ | 11,862 | $ | 12,084 | |||||||||||

Adjusted gross margin (%) |

30.3% |

31.4% |

26.3% |

27.1% |

29.1% |

36.1% |

29.1% |

29.8 | % | 29.1 | % | ||||||||||||||||||

Adjusted EBITDA |

$ | (3,940) | $ | (2,511) | $ | (3,795) | $ | (3,232) | 157 |

$ | 3,667 | $ | (1,626) | $ | (3,681) | $ | 948 | ||||||||||||

/ Adjusted gross margin % |

30.3% |

31.4% |

26.3% |

27.1% |

29.1% |

36.1% |

29.1% |

29.8 | % | 29.1 | % | ||||||||||||||||||

Additional revenue required to achieve breakeven adjusted EBITDA |

$ | 12,998 | $ | 7,994 | $ | 14,440 | $ | 11,946 | $ | (539) | $ | (10,155) | $ | 5,587 | $ | 12,345 | $ | (3,256) | |||||||||||

Revenues |

$ | 40,651 | $ | 40,357 | $ | 42,154 | $ | 38,459 | $ | 33,988 | $ | 40,563 | $ | 33,121 | $ | 39,783 | $ | 41,505 | |||||||||||

Total revenue to achieve breakeven adjusted EBITDA |

$ | 53,649 | $ | 48,351 | $ | 56,594 | $ | 50,405 | $ | 33,449 | $ | 30,408 | $ | 38,708 | $ | 52,128 | $ | 38,249 | |||||||||||