FOR IMMEDIATE RELEASE Financial Information Press Contact: Vincent C. Klinges Chief Financial Officer American Software, Inc. (404) 264-5477 American Software Reports First Quarter of Fiscal Year 2025 Results Subscription Fee Growth of 7% and Adjusted EBITDA Margin of 18% in Q1 ATLANTA (August 22, 2024) American Software, Inc. (NASDAQ: AMSWA) today reported preliminary financial results for the first quarter of fiscal year 2025. “Our Q1 performance was consistent with our internal expectations and reflected disciplined cost management in a skittish selling environment,” said Allan Dow, CEO and President of American Software. “As anticipated, sales cycles remained protracted due to continued economic uncertainty and the seasonality we typically experience at the start of our fiscal year. Regardless, the expansion of our late- stage pipeline coupled with indications that some of our clients and prospects are ready to move forward with projects leave us confident in achieving our original guidance for fiscal year 2025.” Fiscal Year 2025 Financial Outlook from Continuing Operations(a): • Total revenues of $104.0 million to $108.0 million, including total recurring revenues of $87.0 million to $89.0 million. • Adjusted EBITDA of $15.0 million to $16.4 million. Key First Quarter Financial Highlights from Continuing Operations: • Subscription fees were $14.8 million for the quarter ended July 31, 2024, a 7% increase compared to $13.8 million for the same period last year. • Total revenues for the quarter ended July 31, 2024 increased 1% to $26.2 million, compared to $25.9 million for the same period of the prior year, principally due to an increase in subscription and services revenue. • Recurring revenue streams for Maintenance and Subscriptions were $22.1 million or 84% of total revenues in the quarter ended July 31, 2024 compared to $21.9 million or 85% of total revenues in the same period of the prior year.

• Maintenance revenues for the quarter ended July 31, 2024 decreased 11% to $7.3 million compared to $8.2 million for the same period last year partially due to the divestiture of the Transportation group in November, 2023 and client conversions to the cloud. • Professional services and other revenues for the quarter ended July 31, 2024 increased 5% to $3.9 million for the quarter ended July 31, 2024 compared to $3.7 million for the same period last year. The increase was primarily driven by higher seasonal project work. • Software license revenues were $0.2 million for the quarter ended July 31, 2024 compared to $0.3 million in the same period last year, continuing the focus on cloud services sales. • Operating earnings for the quarter ended July 31, 2024 increased 32% to $1.8 million compared to $1.4 million for the same period last year. • GAAP net earnings from continuing operations for the quarter ended July 31, 2024 were $2.1 million or $0.06 per fully diluted share compared to $2.6 million or $0.08 per fully diluted share for the same period last year. • Adjusted net earnings from continuing operations for the quarter ended July 31, 2024, which excludes non-cash stock-based compensation expense and amortization of acquisition-related intangibles, were $4.1 million or $0.12 per fully diluted share compared to $4.0 million or $0.12 per fully diluted share for the same period last year. • EBITDA from continuing operations was $3.0 million for the quarter ended July 31, 2024 compared to $2.1 million for the same period last year. • Adjusted EBITDA from continuing operations increased 26% to $4.6 million for the quarter ended July 31, 2024 compared to $3.7 million for the same period last year. Adjusted EBITDA represents GAAP net earnings adjusted for amortization of intangibles, depreciation, interest income & other, net, income tax expense and non-cash stock-based compensation expense. The overall financial condition of the Company remains strong, with cash and investments of approximately $92.0 million. During the first quarter of fiscal year 2025, the Company paid shareholder dividends of approximately $3.7 million. Key First Quarter of Fiscal Year 2024 highlights: Clients & Channels • Notable new and existing customers placing orders with the Company in the first quarter include: Bob’s Discount Furniture, Inc., Carl Zeiss AG, Kingfisher Information Technology Services (UK) Ltd., NFI Interactive Logistics, LLC, Roland Foods LLC and Walter Surface Technologies, Inc. • During the quarter, SaaS subscription and software license agreements were signed with customers located in the following countries: Canada, Germany, Mexico and the United States. Company & Technology • In May, Logility, the operating subsidiary of American Software, Inc., launched additional cutting-edge generative AI capabilities continuing to expand its generative AI (GenAI) capabilities across the

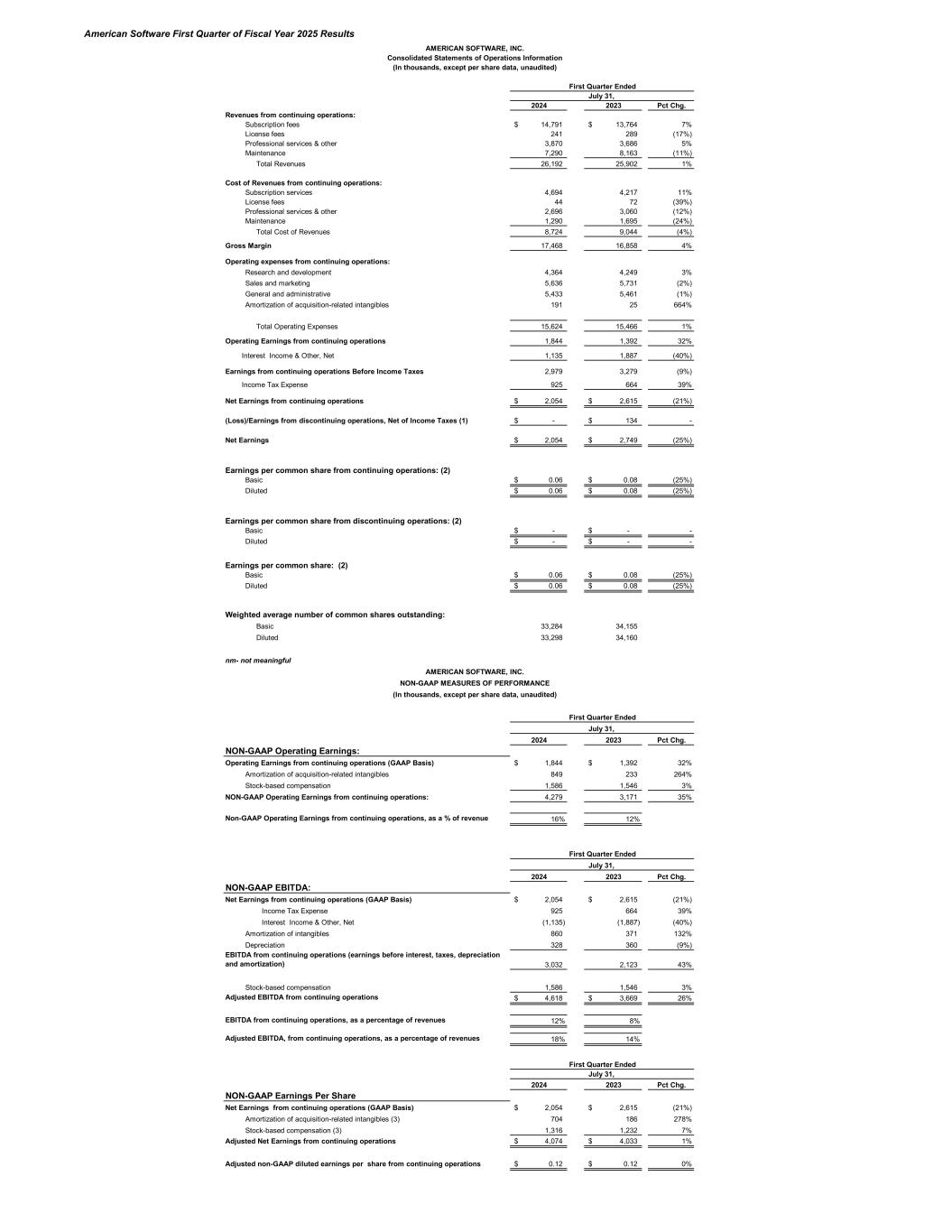

Logility® Digital Supply Chain Platform, to empower organizations with the tools they need to unlock their data and make their supply chains more efficient, resilient, and competitive. In collaboration with Deloitte Canada, Logility is addressing specific supply chain planning challenges in demand, supply, inventory, and order fulfillment to accelerate the expansion of these capabilities. Logility’s AI-first approach to supply chain planning with GenAI is tailor-made to help meet the demands and needs of the industry, empowering leaders to use technology designed to make timely, data-driven decisions in a highly competitive marketplace. • Reynolds Consumer Products, a Logility client, delivered a popular session at the Gartner Supply Chain Symposium in Orlando entitled “Beyond S&OP – The Journey to Integrated S&OE at Reynolds Consumer Products.” With Logility’s integrated solutions, Reynolds achieved remarkable outcomes such as a 20% improvement in forecast accuracy and drastically reduced inventory and freight costs. • Gartner recognized Logility as a Leader in the 2024 Gartner Magic Quadrant for Supply Chain Planning Solutions during Gartner’s premier supply chain management conference. This recognition was based on the company’s vision and execution capabilities highlighting the AI-driven approach to boosting agility and precision in supply chain management. • Worldly, a sustainability insights and data platform, and Logility announced their collaboration in June, to support compliant digital supply chains. Logility leverages Worldly’s comprehensive source of Environmental, Social, and Governance (ESG) data used by over 40,000 brands, retailers, and manufacturers to inform its innovative vendor management, traceability, and corporate responsibility applications. Driven by consumer demand, regulation, and corporate ESG initiatives, organizations increasingly require transparency across their global supply chains. Joint clients of Logility and Worldly manage over 3,500 tier one suppliers and over 10,000 tier two, tier three and tier four suppliers around the globe. • Logility was featured in a TechTalk entitled "Revolutionizing Supply Chains: Inside Logility’s AI Success Story,” also in June. In this episode, Scott Tillman, Senior Vice President of Innovation at Logility, explained the company’s groundbreaking approach to integrating artificial intelligence into supply chain operations. He further detailed how Logility's digital supply chain platform leverages AI to recognize patterns and improve forecast accuracy, helping clients reduce inventory by 20% and unlock significant working capital. • Logility announced LogiCon24. On September 24, 2024 this exclusive virtual event will bring together industry leaders, futurists, and peers to discuss the future of supply chains. It’s a great opportunity to gain insights, network, and stay ahead of the curve. Sign up at https://hubs.la/Q02KRJTC0 a) During the second quarter of fiscal year 2024, we divested our non-core information technology staffing firm, The Proven Method and its results are included in discontinuing operations. About American Software, Inc. Atlanta-based American Software, Inc. (NASDAQ: AMSWA), through its operating entity Logility, delivers optimized demand, inventory, manufacturing, and supply planning tools – helping give executives the confidence and control to increase margins and service levels, while delivering sustainable supply chains. Logility is a market-leading provider of AI-first supply chain management software engineered to help organizations build sustainable digital supply chains that improve people’s lives and the world we live in. The company’s approach is designed to reimagine supply chain planning by shifting away from traditional

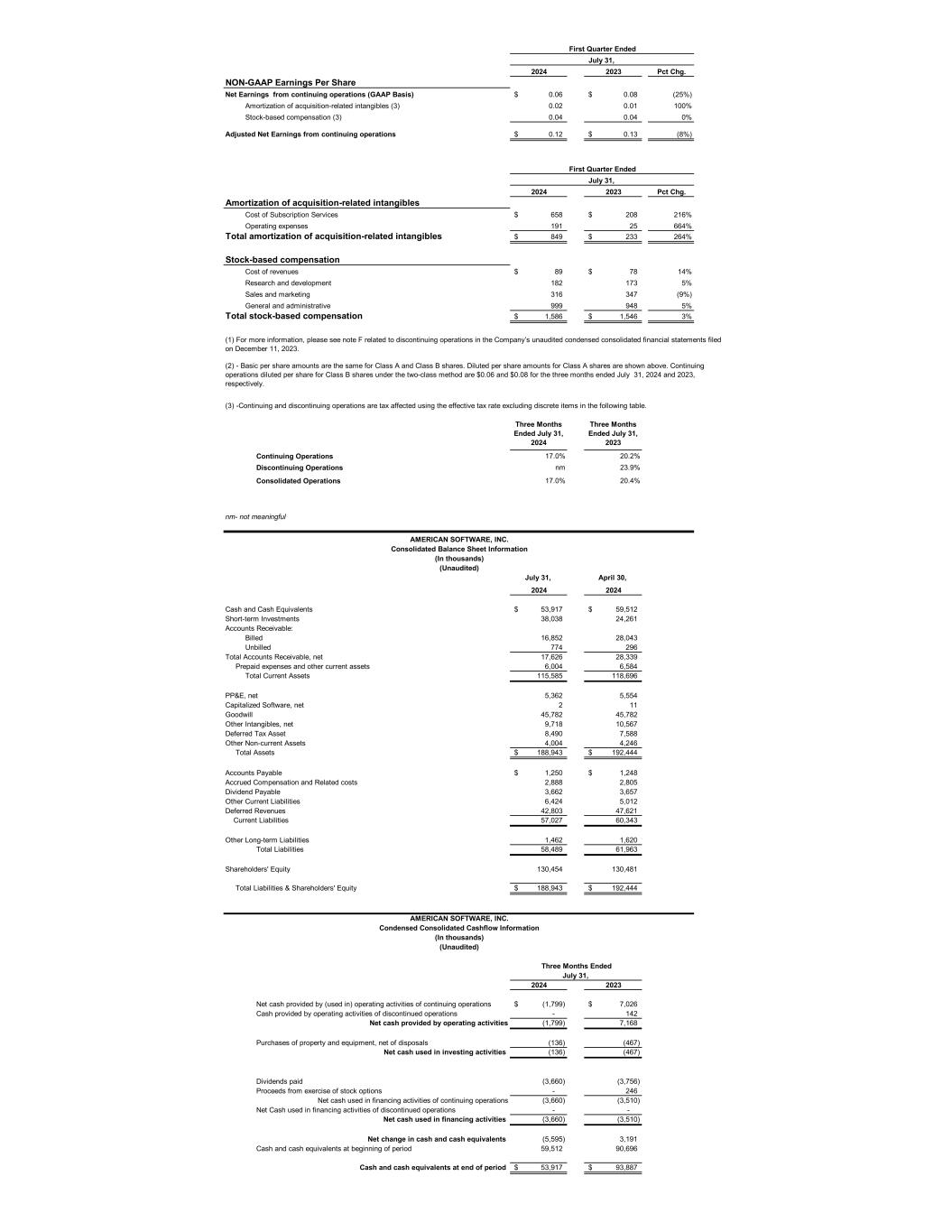

“what happened” processes to an AI-driven strategy that combines the power of humans and machines to predict and be ready for what’s coming. Logility’s fully integrated, end-to-end platform helps clients know faster, turn uncertainty into opportunity, and transform the supply chain from a cost center to an engine for growth. With over 550 clients in 80 countries, Logility is proud to work with some of the world’s leading brands, such as Reynolds Consumer Products, Denso, Sandvik, and Ansell. The company is headquartered in Atlanta, GA. Logility is a wholly-owned subsidiary of American Software, Inc. (NASDAQ: AMSWA). Learn more at www.logility.com. You can learn more about American Software at www.amsoftware.com. Operating and Non-GAAP Financial Measures American Software, Inc. (the “Company”) includes non-GAAP financial measures (EBITDA, adjusted EBITDA, adjusted net earnings and adjusted net earnings per share) in the summary financial information provided with this press release as supplemental information relating to its operating results. This financial information is not in accordance with, or an alternative for, GAAP-compliant financial information and may be different from the operating or non-GAAP financial information used by other companies. The Company believes that this presentation of EBITDA, adjusted EBITDA, adjusted net earnings and adjusted net earnings per share provides useful information to investors regarding certain additional financial and business trends relating to its financial condition and results of operations. EBITDA represents GAAP net earnings adjusted for amortization of intangibles, depreciation, interest income & other, net, and income tax expense. Adjusted EBITDA represents GAAP net earnings adjusted for amortization of intangibles, depreciation, interest income & other, net, income tax expense and non-cash stock-based compensation expense. Forward Looking Statements This press release contains forward-looking statements that are subject to substantial risks and uncertainties. There are a number of factors that could cause actual results or performance to differ materially from what is anticipated by statements made herein. These factors include, but are not limited to, continuing U.S. and global economic uncertainty and the timing and degree of business recovery; the irregular pattern of the Company’s revenues; dependence on particular market segments or customers; competitive pressures; market acceptance of the Company’s products and services; technological complexity; undetected software errors; potential product liability or warranty claims; risks associated with new product development; the challenges and risks associated with integration of acquired product lines, companies and services; uncertainty about the viability and effectiveness of strategic alliances; the Company’s ability to satisfy in a timely manner all Securities and Exchange Commission (SEC) required filings and the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and the rules and regulations adopted under that Section; as well as a number of other risk factors that could affect the Company’s future performance. For further information about risks the Company could experience as well as other information, please refer to the Company’s current Form 10-K and other reports and documents subsequently filed with the SEC. For more information, contact: Kevin Liu, American Software, Inc., (404) 364-7615 or email kliu@amsoftware.com. Logility® is a registered trademark of Logility, Inc. Other products mentioned in this document are registered, trademarked or service marked by their respective owners. ###

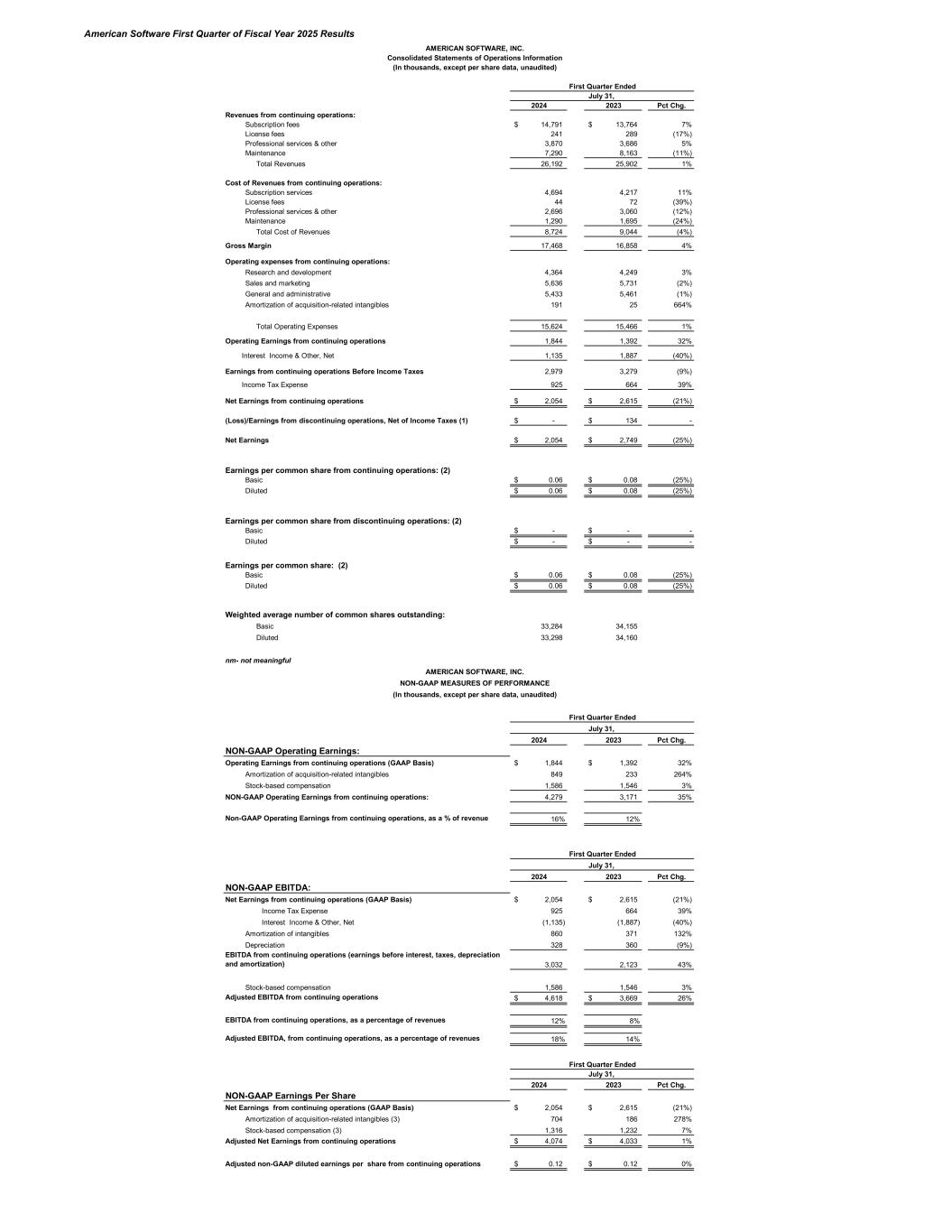

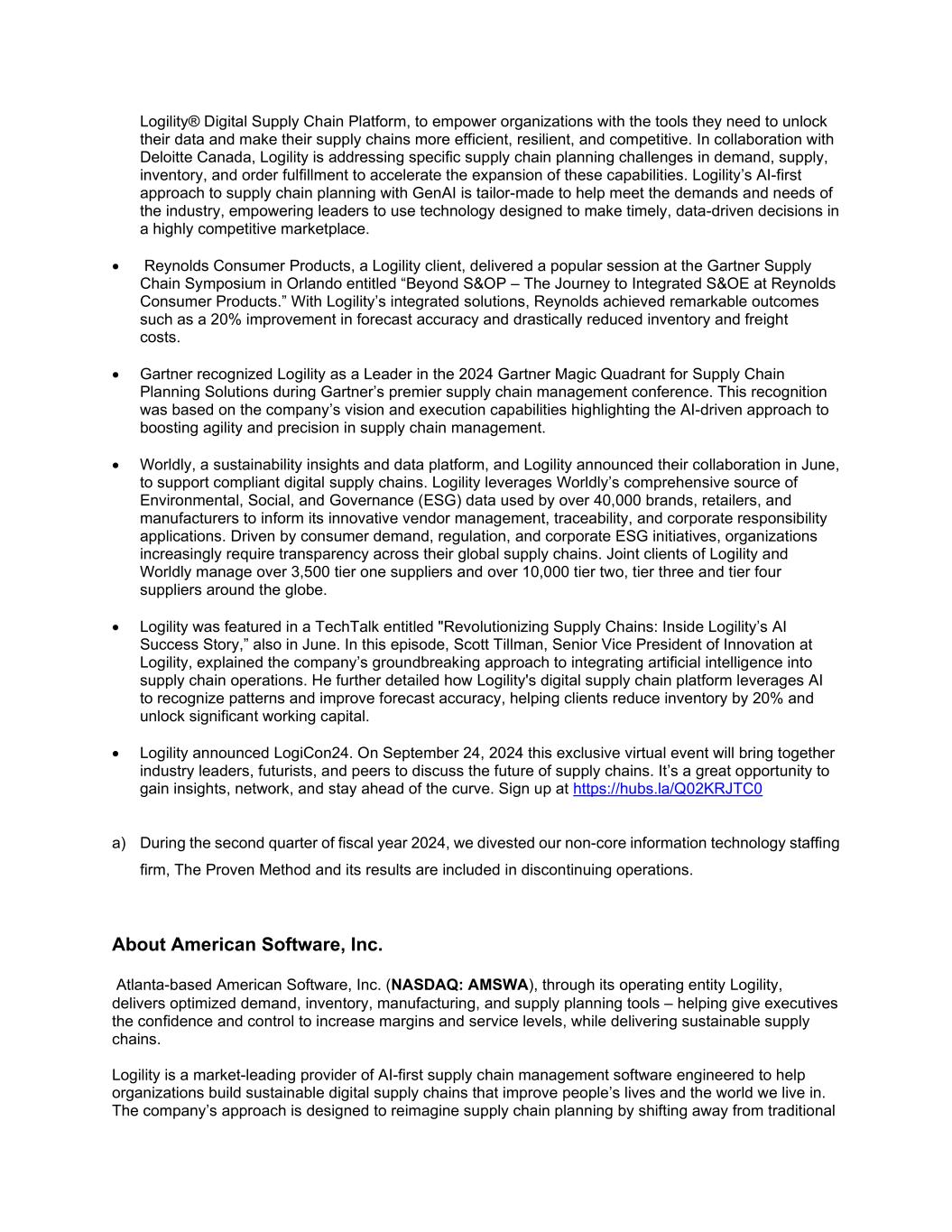

American Software First Quarter of Fiscal Year 2025 Results 2024 2023 Pct Chg. Revenues from continuing operations: Subscription fees 14,791$ 13,764$ 7% License fees 241 289 (17%) Professional services & other 3,870 3,686 5% Maintenance 7,290 8,163 (11%) Total Revenues 26,192 25,902 1% Cost of Revenues from continuing operations: Subscription services 4,694 4,217 11% License fees 44 72 (39%) Professional services & other 2,696 3,060 (12%) Maintenance 1,290 1,695 (24%) Total Cost of Revenues 8,724 9,044 (4%) Gross Margin 17,468 16,858 4% Operating expenses from continuing operations: Research and development 4,364 4,249 3% Sales and marketing 5,636 5,731 (2%) General and administrative 5,433 5,461 (1%) Amortization of acquisition-related intangibles 191 25 664% Total Operating Expenses 15,624 15,466 1% Operating Earnings from continuing operations 1,844 1,392 32% Interest Income & Other, Net 1,135 1,887 (40%) 2,979 3,279 (9%) Income Tax Expense 925 664 39% 2,054$ 2,615$ (21%) -$ 134$ - 2,054$ 2,749$ (25%) Earnings per common share from continuing operations: (2) Basic 0.06$ 0.08$ (25%) Diluted 0.06$ 0.08$ (25%) Earnings per common share from discontinuing operations: (2) Basic -$ -$ - Diluted -$ -$ - Earnings per common share: (2) Basic 0.06$ 0.08$ (25%) Diluted 0.06$ 0.08$ (25%) Weighted average number of common shares outstanding: Basic 33,284 34,155 Diluted 33,298 34,160 nm- not meaningful 2024 2023 Pct Chg. NON-GAAP Operating Earnings: 1,844$ 1,392$ 32% Amortization of acquisition-related intangibles 849 233 264% Stock-based compensation 1,586 1,546 3% 4,279 3,171 35% 16% 12% 2024 2023 Pct Chg. NON-GAAP EBITDA: 2,054$ 2,615$ (21%) Income Tax Expense 925 664 39% Interest Income & Other, Net (1,135) (1,887) (40%) Amortization of intangibles 860 371 132% Depreciation 328 360 (9%) 3,032 2,123 43% Stock-based compensation 1,586 1,546 3% 4,618$ 3,669$ 26% 12% 8% 18% 14% 2024 2023 Pct Chg. NON-GAAP Earnings Per Share 2,054$ 2,615$ (21%) Amortization of acquisition-related intangibles (3) 704 186 278% Stock-based compensation (3) 1,316 1,232 7% 4,074$ 4,033$ 1% Adjusted non-GAAP diluted earnings per share from continuing operations 0.12$ 0.12$ 0% First Quarter Ended July 31, Earnings from continuing operations Before Income Taxes (In thousands, except per share data, unaudited) Operating Earnings from continuing operations (GAAP Basis) July 31, AMERICAN SOFTWARE, INC. NON-GAAP Operating Earnings from continuing operations: Non-GAAP Operating Earnings from continuing operations, as a % of revenue Consolidated Statements of Operations Information (In thousands, except per share data, unaudited) AMERICAN SOFTWARE, INC. NON-GAAP MEASURES OF PERFORMANCE Net Earnings from continuing operations (Loss)/Earnings from discontinuing operations, Net of Income Taxes (1) Net Earnings First Quarter Ended July 31, First Quarter Ended First Quarter Ended July 31, Adjusted EBITDA, from continuing operations, as a percentage of revenues Net Earnings from continuing operations (GAAP Basis) EBITDA from continuing operations (earnings before interest, taxes, depreciation and amortization) Adjusted EBITDA from continuing operations EBITDA from continuing operations, as a percentage of revenues Adjusted Net Earnings from continuing operations Net Earnings from continuing operations (GAAP Basis)

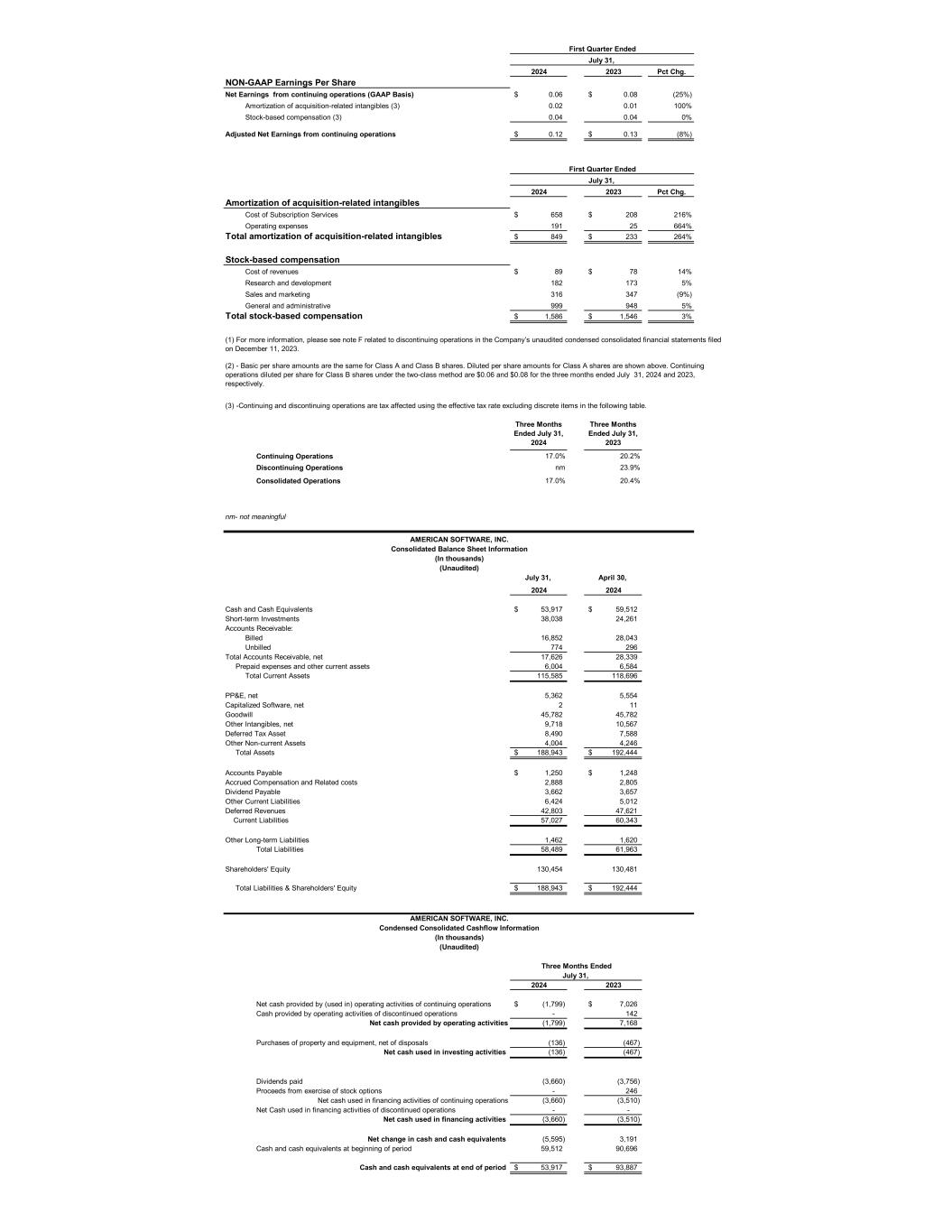

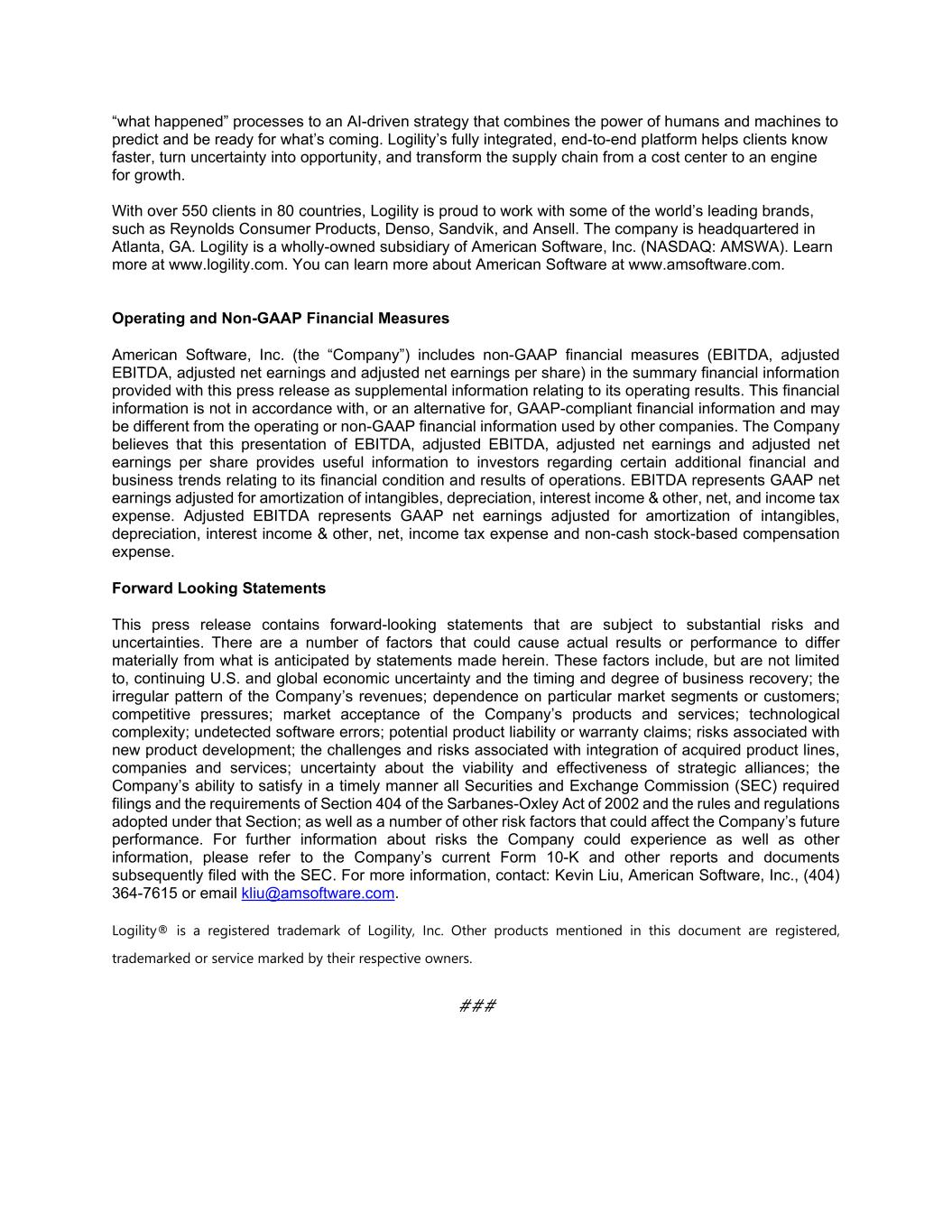

2024 2023 Pct Chg. NON-GAAP Earnings Per Share 0.06$ 0.08$ (25%) Amortization of acquisition-related intangibles (3) 0.02 0.01 100% Stock-based compensation (3) 0.04 0.04 0% 0.12$ 0.13$ (8%) 2024 2023 Pct Chg. Amortization of acquisition-related intangibles Cost of Subscription Services 658$ 208$ 216% Operating expenses 191 25 664% Total amortization of acquisition-related intangibles 849$ 233$ 264% Stock-based compensation Cost of revenues 89$ 78$ 14% Research and development 182 173 5% Sales and marketing 316 347 (9%) General and administrative 999 948 5% Total stock-based compensation 1,586$ 1,546$ 3% Three Months Ended July 31, 2024 Three Months Ended July 31, 2023 Continuing Operations 17.0% 20.2% Discontinuing Operations nm 23.9% Consolidated Operations 17.0% 20.4% nm- not meaningful July 31, April 30, 2024 2024 Cash and Cash Equivalents 53,917$ 59,512$ Short-term Investments 38,038 24,261 Accounts Receivable: Billed 16,852 28,043 Unbilled 774 296 Total Accounts Receivable, net 17,626 28,339 Prepaid expenses and other current assets 6,004 6,584 Total Current Assets 115,585 118,696 PP&E, net 5,362 5,554 Capitalized Software, net 2 11 Goodwill 45,782 45,782 Other Intangibles, net 9,718 10,567 Deferred Tax Asset 8,490 7,588 Other Non-current Assets 4,004 4,246 Total Assets 188,943$ 192,444$ Accounts Payable 1,250$ 1,248$ Accrued Compensation and Related costs 2,888 2,805 Dividend Payable 3,662 3,657 Other Current Liabilities 6,424 5,012 Deferred Revenues 42,803 47,621 Current Liabilities 57,027 60,343 Other Long-term Liabilities 1,462 1,620 Total Liabilities 58,489 61,963 Shareholders' Equity 130,454 130,481 Total Liabilities & Shareholders' Equity 188,943$ 192,444$ 2024 2023 Net cash provided by (used in) operating activities of continuing operations (1,799)$ 7,026$ Cash provided by operating activities of discontinued operations - 142 Net cash provided by operating activities (1,799) 7,168 Purchases of property and equipment, net of disposals (136) (467) Net cash used in investing activities (136) (467) Dividends paid (3,660) (3,756) Proceeds from exercise of stock options - 246 Net cash used in financing activities of continuing operations (3,660) (3,510) Net Cash used in financing activities of discontinued operations - - Net cash used in financing activities (3,660) (3,510) Net change in cash and cash equivalents (5,595) 3,191 Cash and cash equivalents at beginning of period 59,512 90,696 Cash and cash equivalents at end of period 53,917$ 93,887$ (3) -Continuing and discontinuing operations are tax affected using the effective tax rate excluding discrete items in the following table. (Unaudited) AMERICAN SOFTWARE, INC. (2) - Basic per share amounts are the same for Class A and Class B shares. Diluted per share amounts for Class A shares are shown above. Continuing operations diluted per share for Class B shares under the two-class method are $0.06 and $0.08 for the three months ended July 31, 2024 and 2023, respectively. (1) For more information, please see note F related to discontinuing operations in the Company’s unaudited condensed consolidated financial statements filed on December 11, 2023. July 31, Condensed Consolidated Cashflow Information Net Earnings from continuing operations (GAAP Basis) Adjusted Net Earnings from continuing operations First Quarter Ended July 31, First Quarter Ended July 31, Three Months Ended (In thousands) (Unaudited) AMERICAN SOFTWARE, INC. Consolidated Balance Sheet Information (In thousands)