Alabama |

001-40727 | 26-2518085 |

||||||

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number) |

(IRS Employer

Identification No.)

|

||||||

| 615 Quintard Ave. | ||||||||

Anniston, AL |

36201 | |||||||

| (Address of Principal Executive Offices) | (Zip Code) |

|||||||

| Title of each class |

Trading

Symbols(s)

|

Name of exchange

on which registered

|

||||||

| Common Stock, $5.00 par value | SSBK | The NASDAQ Stock Market LLC |

||||||

| Exhibit No. |

Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

Dated: July 23, 2024 |

SOUTHERN STATES BANCSHARES, INC. | |||||||

| By: | /s/ Lynn Joyce | |||||||

| Name: | Lynn Joyce | |||||||

| Title: | Senior Executive Vice President and Chief Financial Officer |

|||||||

|

SOUTHERN STATES

BANCSHARES, INC.

|

615 Quintard Avenue / Anniston, AL 36201 / (256) 241-1092 | ||||

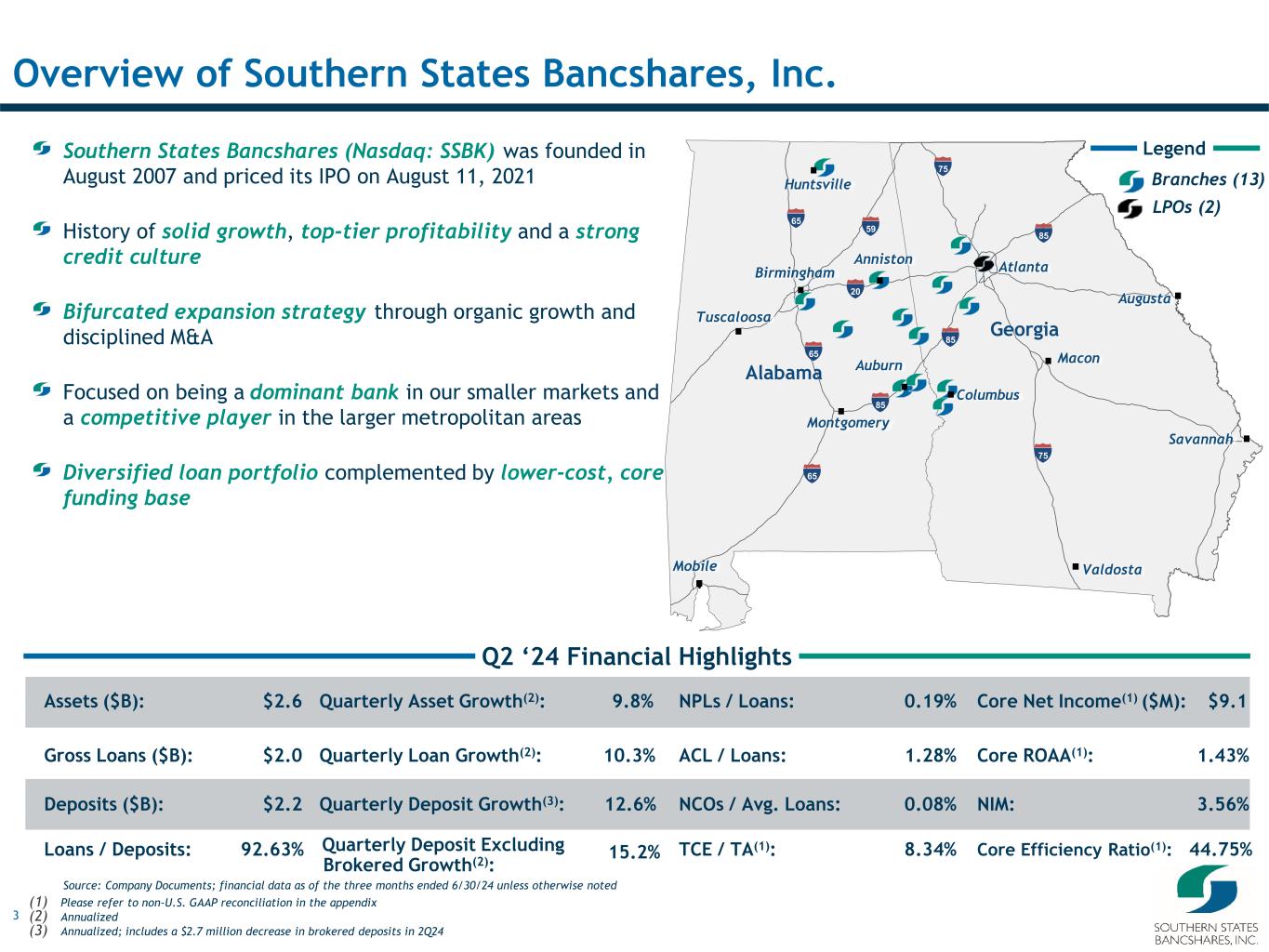

Southern States Bancshares, Inc. Announces Second Quarter 2024 Financial Results |

||||||||||||||

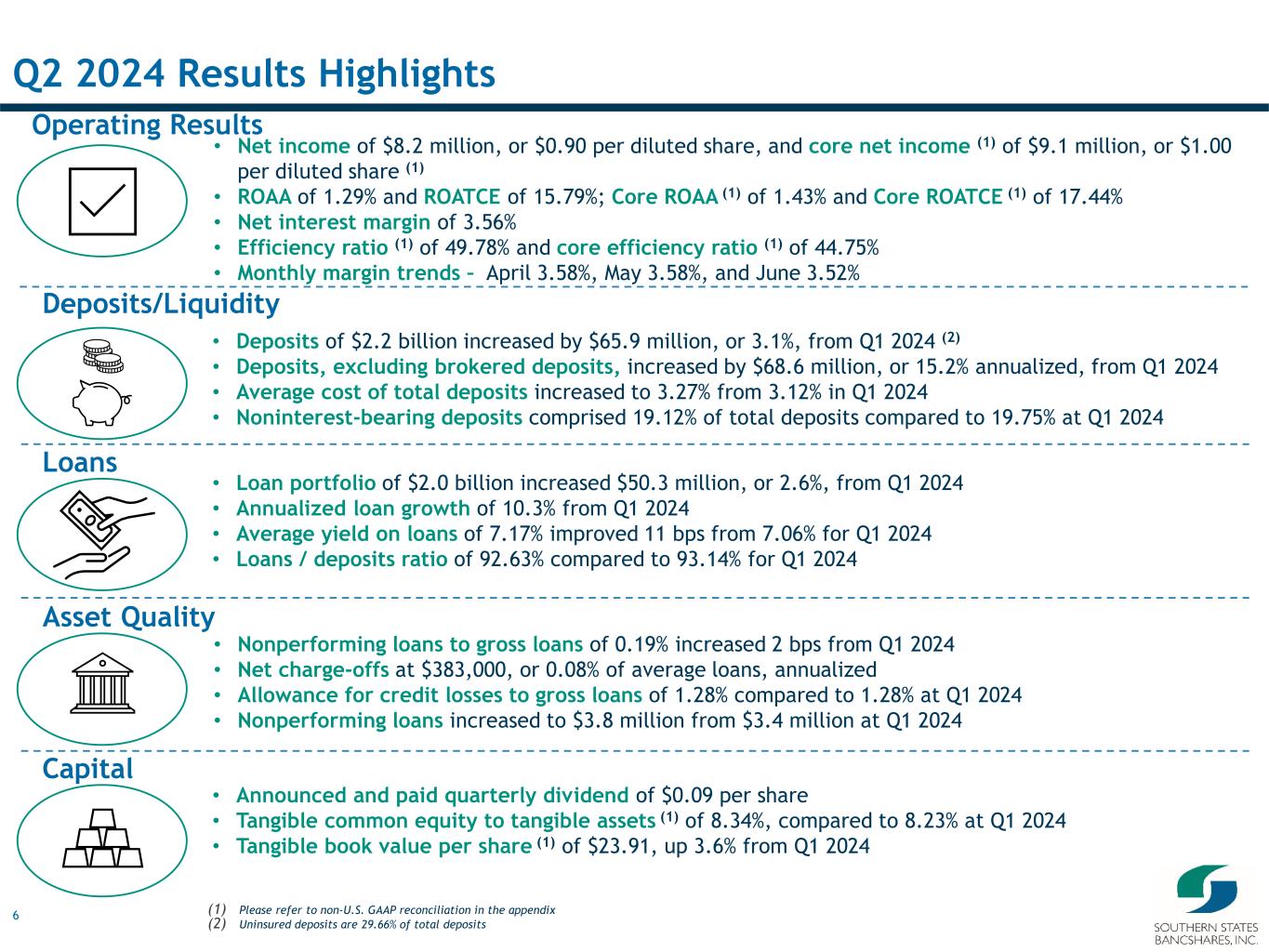

Second Quarter 2024 Performance and Operational Highlights | ||||||||||||||

•Net income of $8.2 million, or $0.90 per diluted share | ||||||||||||||

•Core net income(1) of $9.1 million, or $1.00 per diluted share(1) | ||||||||||||||

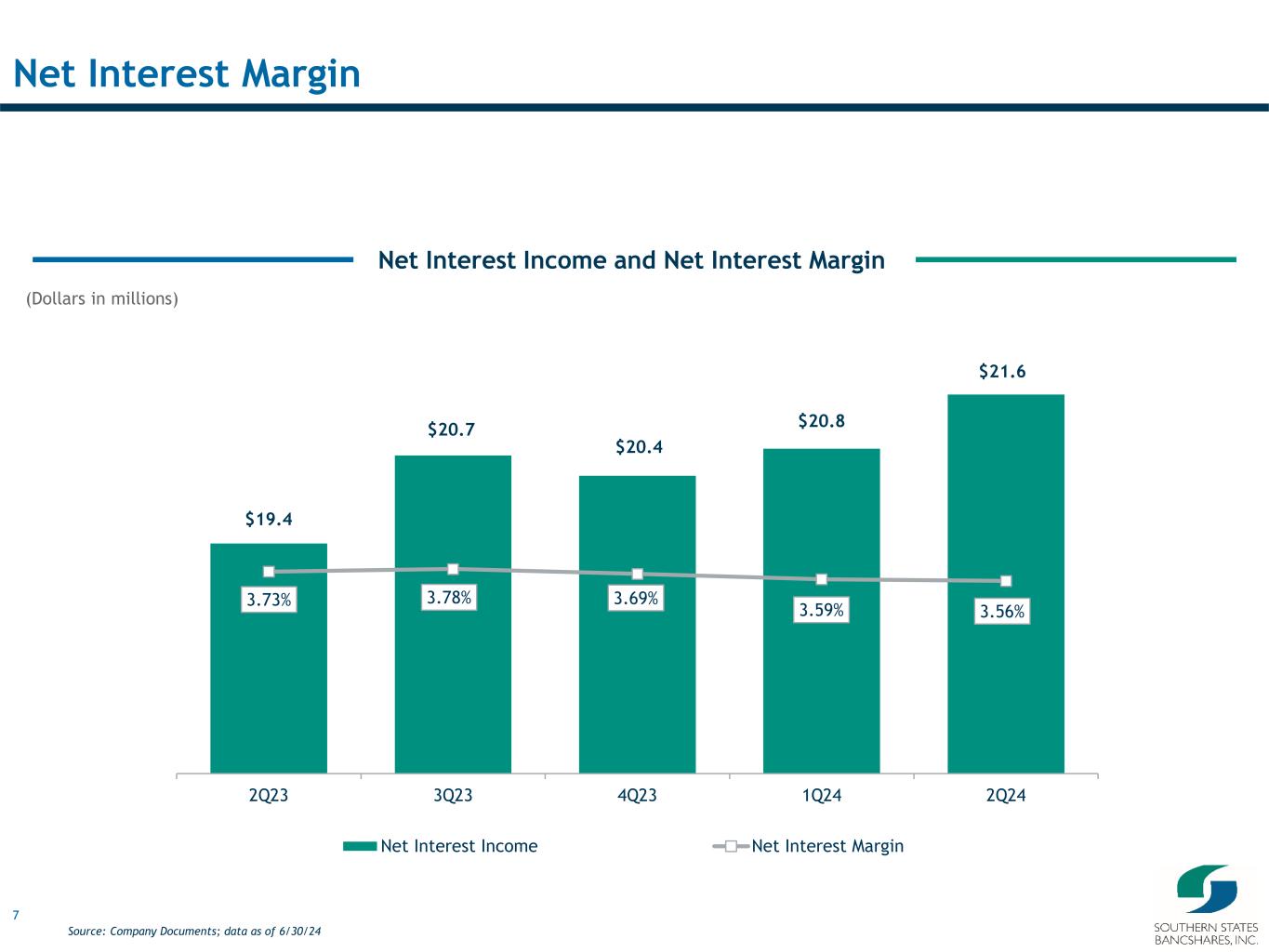

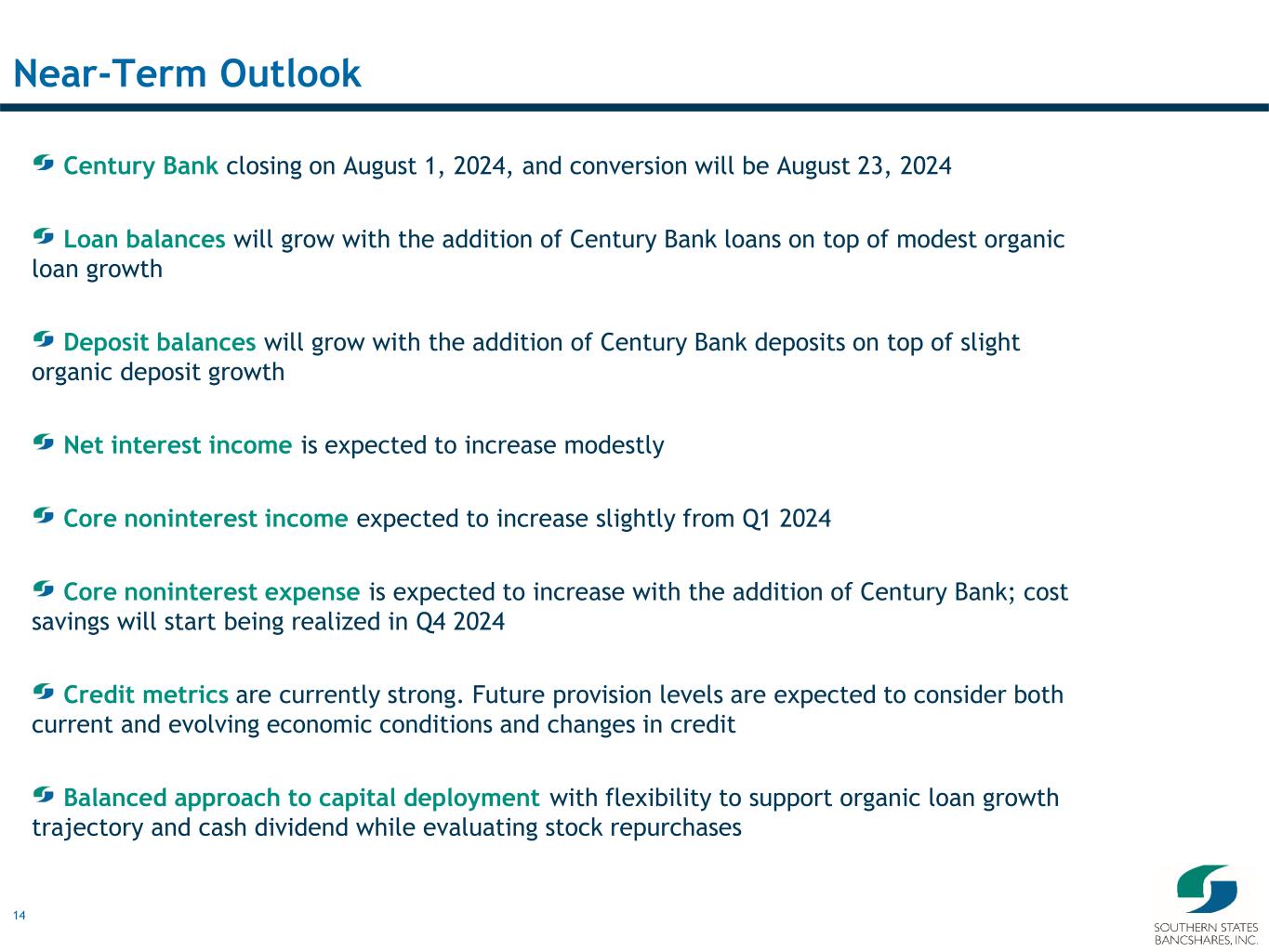

•Net interest income of $21.6 million, an increase of $740,000 from the prior quarter | ||||||||||||||

•Net interest margin (“NIM”) of 3.56%, down 3 basis points from the prior quarter | ||||||||||||||

•NIM of 3.57% on a fully-taxable equivalent basis (“NIM - FTE”)(1) | ||||||||||||||

•Return on average assets (“ROAA”) of 1.29%; return on average stockholders’ equity (“ROAE”) of 14.55%; and return on average tangible common equity (“ROATCE”)(1) of 15.79% | ||||||||||||||

•Core ROAA(1) of 1.43%; and core ROATCE(1) of 17.44% | ||||||||||||||

•Efficiency ratio of 49.78%; and core efficiency ratio of 44.75% | ||||||||||||||

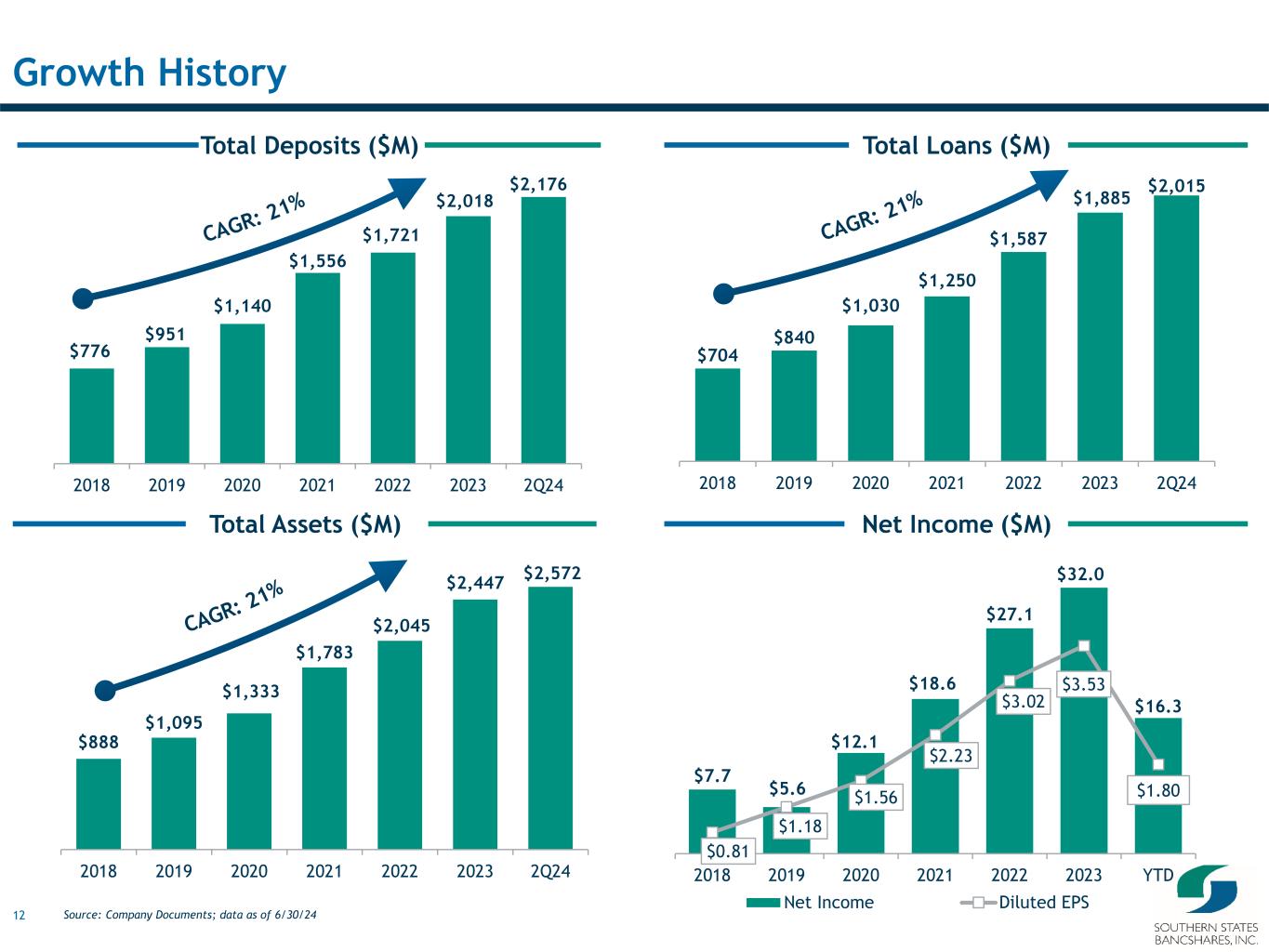

•Linked-quarter loans grew 10.3% annualized | ||||||||||||||

•Linked-quarter total deposits grew 12.6% annualized | ||||||||||||||

•Linked-quarter total deposits, excluding brokered deposits, grew 15.2% annualized | ||||||||||||||

| (1) See "Reconciliation of Non-GAAP Financial Measures" below for reconciliation of non-GAAP financial measures to their most closely comparable GAAP financial measures. | ||||||||||||||

| CEO Commentary | ||||||||||||||

| Mark Chambers, Chief Executive Officer and President of Southern States said, “We generated consistent growth in the second quarter with continued progress in business development adding high-quality loans and core deposits. We are seeing well-balanced loan growth across all our major areas of lending. Our total loan growth of 10.3% (annualized from the prior quarter) and total deposit growth of 12.6% reflected our ability to perform well through economic cycles.” | ||||||||||||||

| “We continue to be a high-performing bank with strong profitability metrics including ROATCE of 15.79%. Effective expense management resulted in our second highest core efficiency ratio of 44.75%.” | ||||||||||||||

| “Consistent with our prudent approach to risk management, we have a strong and durable foundation with high levels of capital reserves and strong credit quality. The addition of CBB Bancorp, which we expect to close on August 1, will strengthen our platform, drive loan and deposit growth, and expand our franchise in growing and attractive Georgia markets. Our two organizations are culturally aligned with a ‘Customer First’ mindset and we are excited to realize all the synergies that will benefit our customers, employees, shareholders, and the communities we serve.” | ||||||||||||||

| Net Interest Income and Net Interest Margin | ||||||||||||||

|

Three Months Ended | % Change June 30, 2024 vs. |

|||||||||||||||||||||||||||

| June 30, 2024 |

March 31, 2024 |

June 30, 2023 |

March 31, 2024 |

June 30, 2023 |

|||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Average interest-earning assets | $ | 2,440,425 | $ | 2,336,369 | $ | 2,091,998 | 4.5 | % | 16.7 | % | |||||||||||||||||||

| Net interest income | $ | 21,579 | $ | 20,839 | $ | 19,432 | 3.6 | % | 11.0 | % | |||||||||||||||||||

| Net interest margin | 3.56 | % | 3.59 | % | 3.73 | % | (3) | bps | (17) | bps | |||||||||||||||||||

| Noninterest Income | ||||||||||||||

|

Three Months Ended | % Change June 30, 2024 vs. |

|||||||||||||||||||||||||||

| June 30, 2024 |

March 31, 2024 |

June 30, 2023 |

March 31, 2024 |

June 30, 2023 |

|||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Service charges on deposit accounts | $ | 462 | $ | 463 | $ | 456 | (0.2) | % | 1.3 | % | |||||||||||||||||||

Swap fees |

4 | 15 | 173 | (73.3) | % | (97.7) | % | ||||||||||||||||||||||

| SBA/USDA fees | 58 | 64 | 66 | (9.4) | % | (12.1) | % | ||||||||||||||||||||||

| Mortgage origination fees | 92 | 96 | 188 | (4.2) | % | (51.1) | % | ||||||||||||||||||||||

Net gain (loss) on securities |

20 | (12) | (45) | (266.7) | % | (144.4) | % | ||||||||||||||||||||||

| Employee retention credit and related revenue (“ERC”) | — | — | 5,100 | N/A | N/A | ||||||||||||||||||||||||

| Other operating income | 732 | 642 | 924 | 14.0 | % | (20.8) | % | ||||||||||||||||||||||

| Total noninterest income | $ | 1,368 | $ | 1,268 | $ | 6,862 | 7.9 | % | (80.1) | % | |||||||||||||||||||

| Noninterest Expense | ||||||||||||||

|

Three Months Ended | % Change June 30, 2024 vs. |

|||||||||||||||||||||||||||

| June 30, 2024 |

March 31, 2024 |

June 30, 2023 |

March 31, 2024 |

June 30, 2023 |

|||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Salaries and employee benefits | $ | 6,112 | $ | 6,231 | $ | 7,863 | (1.9) | % | (22.3) | % | |||||||||||||||||||

| Equipment and occupancy expenses | 667 | 689 | 694 | (3.2) | % | (3.9) | % | ||||||||||||||||||||||

| Data processing fees | 686 | 643 | 646 | 6.7 | % | 6.2 | % | ||||||||||||||||||||||

| Regulatory assessments | 375 | 360 | 180 | 4.2 | % | 108.3 | % | ||||||||||||||||||||||

| Professional fees related to ERC | — | — | 1,243 | N/A | N/A | ||||||||||||||||||||||||

| Other operating expenses | 3,571 | 2,452 | 2,806 | 45.6 | % | 27.3 | % | ||||||||||||||||||||||

| Total noninterest expenses | $ | 11,411 | $ | 10,375 | $ | 13,432 | 10.0 | % | (15.0) | % | |||||||||||||||||||

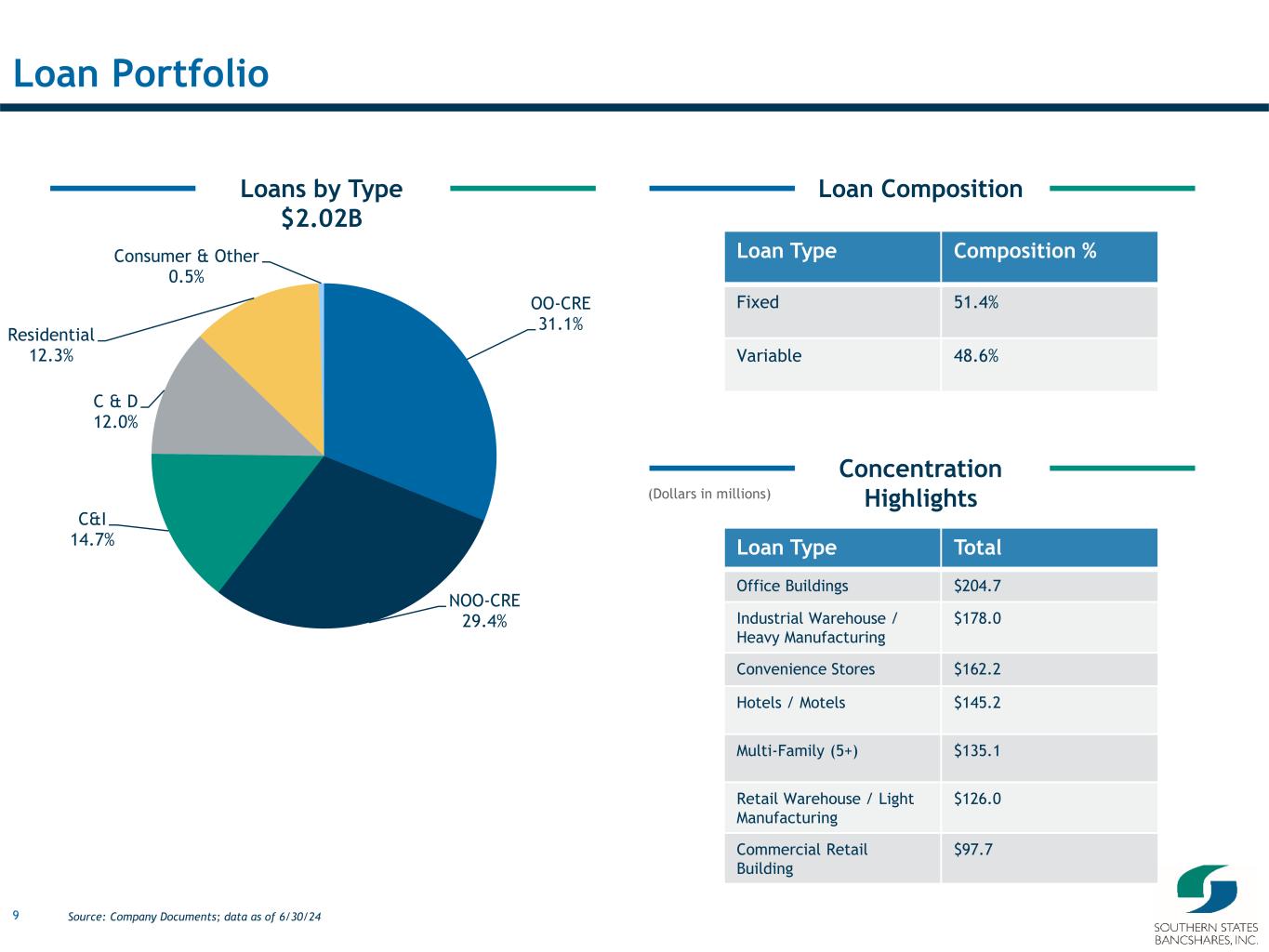

| Loans and Credit Quality | ||||||||||||||

|

Three Months Ended | % Change June 30, 2024 vs. |

|||||||||||||||||||||||||||

| June 30, 2024 |

March 31, 2024 |

June 30, 2023 |

March 31, 2024 |

June 30, 2023 |

|||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Gross loans | $ | 2,021,877 | $ | 1,971,396 | $ | 1,722,278 | 2.6 | % | 17.4 | % | |||||||||||||||||||

| Unearned income | (6,443) | (6,247) | (5,766) | 3.1 | % | 11.7 | % | ||||||||||||||||||||||

| Loans, net of unearned income (“Loans”) | 2,015,434 | 1,965,149 | 1,716,512 | 2.6 | % | 17.4 | % | ||||||||||||||||||||||

| Average loans, net of unearned (“Average loans”) | $ | 1,987,533 | $ | 1,916,288 | $ | 1,676,816 | 3.7 | % | 18.5 | % | |||||||||||||||||||

| Nonperforming loans (“NPL”) | $ | 3,784 | $ | 3,446 | $ | 1,010 | 9.8 | % | 274.7 | % | |||||||||||||||||||

| Provision for credit losses | $ | 1,067 | $ | 1,236 | $ | 1,557 | (13.7) | % | (31.5) | % | |||||||||||||||||||

| Allowance for credit losses (“ACL”) | $ | 25,828 | $ | 25,144 | $ | 21,385 | 2.7 | % | 20.8 | % | |||||||||||||||||||

| Net charge-offs | $ | 383 | $ | 470 | $ | 27 | (18.5) | % | 1318.5 | % | |||||||||||||||||||

| NPL to gross loans | 0.19 | % | 0.17 | % | 0.06 | % | |||||||||||||||||||||||

Net charge-offs to average loans(1) |

0.08 | % | 0.10 | % | 0.01 | % | |||||||||||||||||||||||

| ACL to loans | 1.28 | % | 1.28 | % | 1.25 | % | |||||||||||||||||||||||

| (1) Ratio is annualized. | |||||||||||||||||||||||||||||

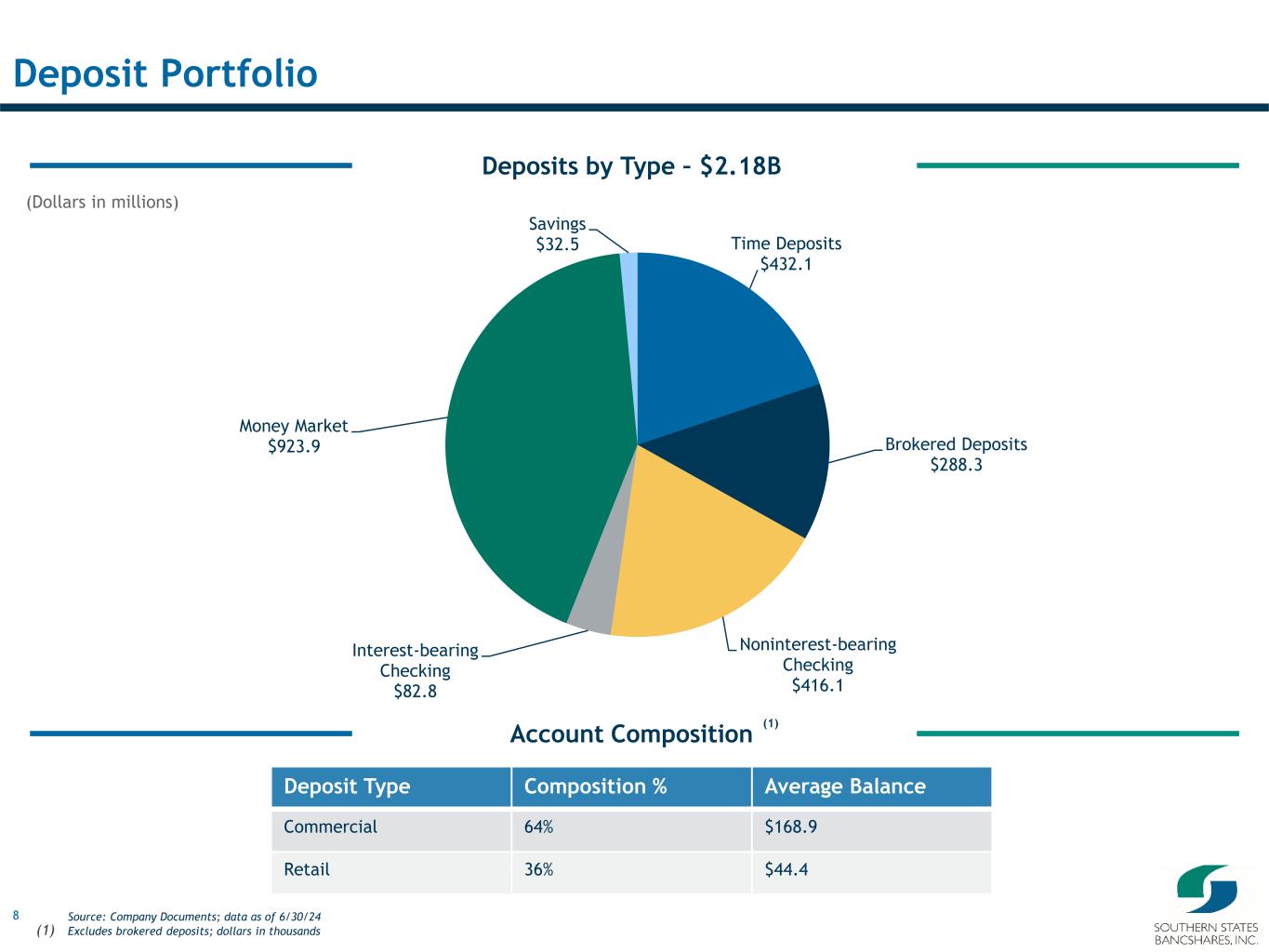

| Deposits | ||||||||||||||

|

Three Months Ended | % Change June 30, 2024 vs. |

|||||||||||||||||||||||||||

| June 30, 2024 |

March 31, 2024 |

June 30, 2023 |

March 31, 2024 |

June 30, 2023 |

|||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 416,068 | $ | 416,704 | $ | 449,433 | (0.2) | % | (7.4) | % | |||||||||||||||||||

| Interest-bearing deposits | 1,759,610 | 1,693,094 | 1,474,478 | 3.9 | % | 19.3 | % | ||||||||||||||||||||||

| Total deposits | $ | 2,175,678 | $ | 2,109,798 | $ | 1,923,911 | 3.1 | % | 13.1 | % | |||||||||||||||||||

| Uninsured deposits | $ | 645,283 | $ | 610,122 | $ | 553,084 | 5.8 | % | 16.7 | % | |||||||||||||||||||

| Uninsured deposits to total deposits | 29.66 | % | 28.92 | % | 28.75 | % | |||||||||||||||||||||||

| Noninterest deposits to total deposits | 19.12 | % | 19.75 | % | 23.36 | % | |||||||||||||||||||||||

| Capital | ||||||||||||||

|

June 30, 2024 |

March 31, 2024 |

June 30, 2023 |

||||||||||||||||||||||||||||||||

| Company | Bank | Company | Bank | Company | Bank | ||||||||||||||||||||||||||||||

| Tier 1 capital ratio to average assets | 8.72 | % | 11.52 | % | 8.79 | % | 11.67 | % | 8.70 | % | 11.82 | % | |||||||||||||||||||||||

| Risk-based capital ratios: | |||||||||||||||||||||||||||||||||||

| Common equity tier 1 (“CET1”) capital ratio | 9.54 | % | 12.61 | % | 9.39 | % | 12.47 | % | 9.11 | % | 12.37 | % | |||||||||||||||||||||||

| Tier 1 capital ratio | 9.54 | % | 12.61 | % | 9.39 | % | 12.47 | % | 9.11 | % | 12.37 | % | |||||||||||||||||||||||

| Total capital ratio | 14.50 | % | 13.77 | % | 14.42 | % | 13.63 | % | 14.42 | % | 13.47 | % | |||||||||||||||||||||||

| About Southern States Bancshares, Inc. | ||||||||||||||

| Forward-Looking Statements | ||||||||||||||

| Contact Information | ||||||||||||||

| Lynn Joyce | Margaret Boyce | |||||||||||||

| (205) 820-8065 | (310) 622-8247 | |||||||||||||

| ljoyce@ssbank.bank | ssbankir@finprofiles.com | |||||||||||||

| SELECT FINANCIAL DATA | |||||||||||||||||||||||||||||

| (Dollars in thousands, except share and per share amounts) | |||||||||||||||||||||||||||||

|

Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||

| June 30, 2024 |

March 31, 2024 |

June 30, 2023 |

June 30, 2024 |

June 30, 2023 |

|||||||||||||||||||||||||

| Results of Operations | |||||||||||||||||||||||||||||

| Interest income | $ | 41,007 | $ | 38,736 | $ | 32,185 | $ | 79,743 | $ | 60,884 | |||||||||||||||||||

| Interest expense | 19,428 | 17,897 | 12,753 | 37,325 | 21,906 | ||||||||||||||||||||||||

| Net interest income | 21,579 | 20,839 | 19,432 | 42,418 | 38,978 | ||||||||||||||||||||||||

| Provision for credit losses | 1,067 | 1,236 | 1,557 | 2,303 | 2,738 | ||||||||||||||||||||||||

| Net interest income after provision | 20,512 | 19,603 | 17,875 | 40,115 | 36,240 | ||||||||||||||||||||||||

| Noninterest income | 1,368 | 1,268 | 6,862 | 2,636 | 8,648 | ||||||||||||||||||||||||

| Noninterest expense | 11,411 | 10,375 | 13,432 | 21,786 | 23,590 | ||||||||||||||||||||||||

| Income tax expense | 2,271 | 2,377 | 2,549 | 4,648 | 4,871 | ||||||||||||||||||||||||

| Net income | $ | 8,198 | $ | 8,119 | $ | 8,756 | $ | 16,317 | $ | 16,427 | |||||||||||||||||||

Core net income(1) |

$ | 9,058 | $ | 8,128 | $ | 7,058 | $ | 17,186 | $ | 14,339 | |||||||||||||||||||

| Share and Per Share Data | |||||||||||||||||||||||||||||

| Shares issued and outstanding | 8,908,130 | 8,894,794 | 8,738,814 | 8,908,130 | 8,738,814 | ||||||||||||||||||||||||

| Weighted average shares outstanding: | |||||||||||||||||||||||||||||

| Basic | 8,957,608 | 8,913,477 | 8,763,635 | 8,935,542 | 8,763,046 | ||||||||||||||||||||||||

| Diluted | 9,070,568 | 9,043,122 | 8,950,847 | 9,062,548 | 9,001,600 | ||||||||||||||||||||||||

| Earnings per share: | |||||||||||||||||||||||||||||

| Basic | $ | 0.91 | $ | 0.91 | $ | 1.00 | $ | 1.82 | $ | 1.87 | |||||||||||||||||||

| Diluted | 0.90 | 0.90 | 0.98 | 1.80 | 1.82 | ||||||||||||||||||||||||

Core - diluted(1) |

1.00 | 0.90 | 0.79 | 1.90 | 1.59 | ||||||||||||||||||||||||

| Book value per share | 25.88 | 25.06 | 22.57 | 25.88 | 22.57 | ||||||||||||||||||||||||

Tangible book value per share(1) |

23.91 | 23.07 | 20.52 | 23.91 | 20.52 | ||||||||||||||||||||||||

| Cash dividends per common share | 0.09 | 0.09 | 0.09 | 0.18 | 0.18 | ||||||||||||||||||||||||

| Performance and Financial Ratios | |||||||||||||||||||||||||||||

| ROAA | 1.29 | % | 1.33 | % | 1.60 | % | 1.31 | % | 1.56 | % | |||||||||||||||||||

| ROAE | 14.55 | % | 14.87 | % | 18.15 | % | 14.71 | % | 17.43 | % | |||||||||||||||||||

Core ROAA(1) |

1.43 | % | 1.34 | % | 1.29 | % | 1.38 | % | 1.36 | % | |||||||||||||||||||

ROATCE(1) |

15.79 | % | 16.17 | % | 20.01 | % | 15.98 | % | 19.25 | % | |||||||||||||||||||

Core ROATCE(1) |

17.44 | % | 16.19 | % | 16.13 | % | 16.83 | % | 16.80 | % | |||||||||||||||||||

| NIM | 3.56 | % | 3.59 | % | 3.73 | % | 3.57 | % | 3.89 | % | |||||||||||||||||||

NIM - FTE(1) |

3.57 | % | 3.60 | % | 3.74 | % | 3.58 | % | 3.90 | % | |||||||||||||||||||

| Net interest spread | 2.59 | % | 2.63 | % | 2.86 | % | 2.60 | % | 3.08 | % | |||||||||||||||||||

| Yield on loans | 7.17 | % | 7.06 | % | 6.61 | % | 7.11 | % | 6.50 | % | |||||||||||||||||||

| Yield on interest-earning assets | 6.76 | % | 6.67 | % | 6.17 | % | 6.71 | % | 6.08 | % | |||||||||||||||||||

| Cost of interest-bearing liabilities | 4.17 | % | 4.04 | % | 3.31 | % | 4.11 | % | 3.00 | % | |||||||||||||||||||

Cost of funds(2) |

3.41 | % | 3.27 | % | 2.58 | % | 3.34 | % | 2.31 | % | |||||||||||||||||||

| Cost of interest-bearing deposits | 4.07 | % | 3.92 | % | 3.12 | % | 4.00 | % | 2.79 | % | |||||||||||||||||||

| Cost of total deposits | 3.27 | % | 3.12 | % | 2.38 | % | 3.20 | % | 2.11 | % | |||||||||||||||||||

| Noninterest deposits to total deposits | 19.12 | % | 19.75 | % | 23.36 | % | 19.12 | % | 23.36 | % | |||||||||||||||||||

| Core deposits to total deposits | 81.78 | % | 81.45 | % | 86.43 | % | 81.78 | % | 86.43 | % | |||||||||||||||||||

| Uninsured deposits to total deposits | 29.66 | % | 28.92 | % | 28.75 | % | 29.66 | % | 28.75 | % | |||||||||||||||||||

| Total loans to total deposits | 92.63 | % | 93.14 | % | 89.22 | % | 92.63 | % | 89.22 | % | |||||||||||||||||||

| Efficiency ratio | 49.78 | % | 46.90 | % | 51.00 | % | 48.36 | % | 50.02 | % | |||||||||||||||||||

Core efficiency ratio(1) |

44.75 | % | 46.90 | % | 49.96 | % | 45.81 | % | 49.38 | % | |||||||||||||||||||

| SELECT FINANCIAL DATA | |||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

|

Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||

| June 30, 2024 |

March 31, 2024 |

June 30, 2023 |

June 30, 2024 |

June 30, 2023 |

|||||||||||||||||||||||||

| Financial Condition (ending) | |||||||||||||||||||||||||||||

| Total loans | $ | 2,015,434 | $ | 1,965,149 | $ | 1,716,512 | $ | 2,015,434 | $ | 1,716,512 | |||||||||||||||||||

| Total securities | 204,131 | 197,006 | 182,717 | 204,131 | 182,717 | ||||||||||||||||||||||||

| Total assets | 2,572,011 | 2,510,975 | 2,277,803 | 2,572,011 | 2,277,803 | ||||||||||||||||||||||||

| Total noninterest-bearing deposits | 416,068 | 416,704 | 449,433 | 416,068 | 449,433 | ||||||||||||||||||||||||

Total core deposits(1) |

1,779,253 | 1,718,333 | 1,662,855 | 1,779,253 | 1,662,855 | ||||||||||||||||||||||||

| Total deposits | 2,175,678 | 2,109,798 | 1,923,911 | 2,175,678 | 1,923,911 | ||||||||||||||||||||||||

| Total borrowings | 136,873 | 146,773 | 131,472 | 136,873 | 131,472 | ||||||||||||||||||||||||

| Total liabilities | 2,341,430 | 2,288,094 | 2,080,553 | 2,341,430 | 2,080,553 | ||||||||||||||||||||||||

| Total shareholders’ equity | 230,581 | 222,881 | 197,250 | 230,581 | 197,250 | ||||||||||||||||||||||||

| Financial Condition (average) | |||||||||||||||||||||||||||||

| Total loans | $ | 1,987,533 | $ | 1,916,288 | $ | 1,676,816 | $ | 1,951,910 | $ | 1,643,376 | |||||||||||||||||||

| Total securities | 210,678 | 208,954 | 196,731 | 209,816 | 194,552 | ||||||||||||||||||||||||

| Total other interest-earning assets | 242,214 | 211,127 | 218,451 | 226,671 | 182,447 | ||||||||||||||||||||||||

| Total interest-earning assets | 2,440,425 | 2,336,369 | 2,091,998 | 2,388,397 | 2,020,375 | ||||||||||||||||||||||||

| Total assets | 2,553,010 | 2,447,278 | 2,200,843 | 2,500,144 | 2,129,328 | ||||||||||||||||||||||||

| Total noninterest-bearing deposits | 420,885 | 416,141 | 438,987 | 418,513 | 438,862 | ||||||||||||||||||||||||

| Total interest-bearing deposits | 1,729,682 | 1,633,307 | 1,412,047 | 1,681,494 | 1,356,648 | ||||||||||||||||||||||||

| Total deposits | 2,150,567 | 2,049,448 | 1,851,034 | 2,100,007 | 1,795,510 | ||||||||||||||||||||||||

| Total borrowings | 143,189 | 148,771 | 131,411 | 145,980 | 118,229 | ||||||||||||||||||||||||

| Total interest-bearing liabilities | 1,872,871 | 1,782,078 | 1,543,458 | 1,827,474 | 1,474,877 | ||||||||||||||||||||||||

| Total shareholders’ equity | 226,527 | 219,622 | 193,516 | 223,075 | 190,096 | ||||||||||||||||||||||||

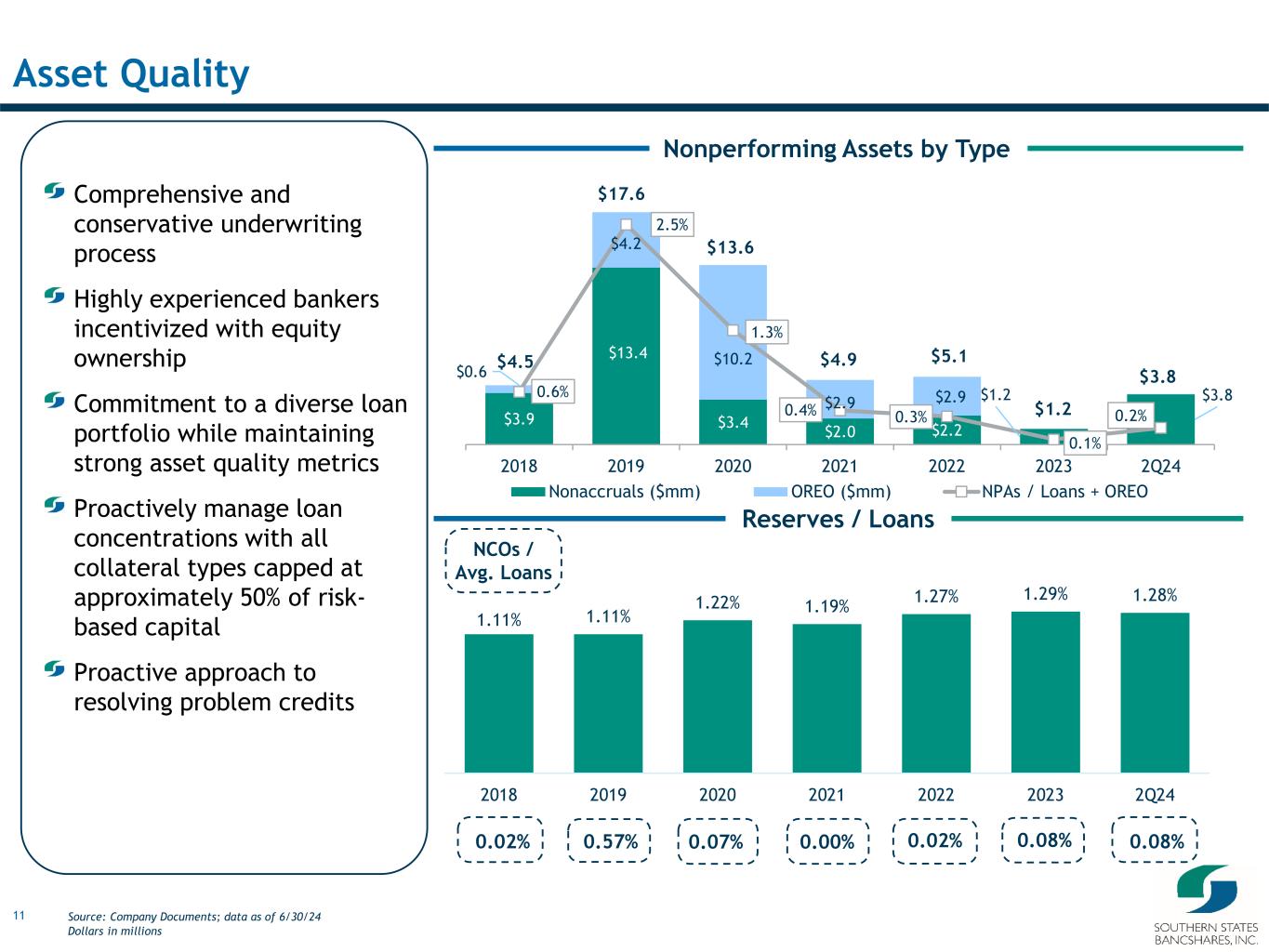

| Asset Quality | |||||||||||||||||||||||||||||

| Nonperforming loans | $ | 3,784 | $ | 3,446 | $ | 1,010 | $ | 3,784 | $ | 1,010 | |||||||||||||||||||

| Other real estate owned (“OREO”) | $ | 33 | $ | 33 | $ | 2,870 | $ | 33 | $ | 2,870 | |||||||||||||||||||

| Nonperforming assets (“NPA”) | $ | 3,817 | $ | 3,479 | $ | 3,880 | $ | 3,817 | $ | 3,880 | |||||||||||||||||||

Net charge-offs to average loans(2) |

0.08 | % | 0.10 | % | 0.01 | % | 0.09 | % | 0.03 | % | |||||||||||||||||||

Provision for credit losses to average loans(2) |

0.22 | % | 0.26 | % | 0.37 | % | 0.24 | % | 0.34 | % | |||||||||||||||||||

| ACL to loans | 1.28 | % | 1.28 | % | 1.25 | % | 1.28 | % | 1.25 | % | |||||||||||||||||||

| ACL to gross loans | 1.28 | % | 1.28 | % | 1.24 | % | 1.28 | % | 1.24 | % | |||||||||||||||||||

| ACL to NPL | 682.56 | % | 729.66 | % | 2117.33 | % | 682.56 | % | 2117.33 | % | |||||||||||||||||||

| NPL to loans | 0.19 | % | 0.18 | % | 0.06 | % | 0.19 | % | 0.06 | % | |||||||||||||||||||

| NPL to gross loans | 0.19 | % | 0.17 | % | 0.06 | % | 0.19 | % | 0.06 | % | |||||||||||||||||||

| NPA to gross loans and OREO | 0.19 | % | 0.18 | % | 0.22 | % | 0.19 | % | 0.22 | % | |||||||||||||||||||

| NPA to total assets | 0.15 | % | 0.14 | % | 0.17 | % | 0.15 | % | 0.17 | % | |||||||||||||||||||

| Regulatory and Other Capital Ratios | |||||||||||||||||||||||||||||

| Total shareholders’ equity to total assets | 8.97 | % | 8.88 | % | 8.66 | % | 8.97 | % | 8.66 | % | |||||||||||||||||||

Tangible common equity to tangible assets(3) |

8.34 | % | 8.23 | % | 7.94 | % | 8.34 | % | 7.94 | % | |||||||||||||||||||

| Tier 1 capital ratio to average assets | 8.72 | % | 8.79 | % | 8.70 | % | 8.72 | % | 8.70 | % | |||||||||||||||||||

Risk-based capital ratios: |

|||||||||||||||||||||||||||||

| CET1 capital ratio | 9.54 | % | 9.39 | % | 9.11 | % | 9.54 | % | 9.11 | % | |||||||||||||||||||

| Tier 1 capital ratio | 9.54 | % | 9.39 | % | 9.11 | % | 9.54 | % | 9.11 | % | |||||||||||||||||||

| Total capital ratio | 14.50 | % | 14.42 | % | 14.42 | % | 14.50 | % | 14.42 | % | |||||||||||||||||||

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION | |||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||

|

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

June 30, 2023 |

|||||||||||||||||||

| (Unaudited) | (Unaudited) | (Audited) | (Unaudited) | ||||||||||||||||||||

| Assets | |||||||||||||||||||||||

| Cash and due from banks | $ | 21,598 | $ | 20,470 | $ | 19,710 | $ | 21,299 | |||||||||||||||

| Interest-bearing deposits in banks | 140,440 | 129,917 | 134,846 | 159,818 | |||||||||||||||||||

| Federal funds sold | 76,334 | 86,736 | 96,095 | 84,812 | |||||||||||||||||||

| Total cash and cash equivalents | 238,372 | 237,123 | 250,651 | 265,929 | |||||||||||||||||||

| Securities available for sale, at fair value | 184,510 | 177,379 | 179,000 | 163,075 | |||||||||||||||||||

| Securities held to maturity, at amortized cost | 19,621 | 19,627 | 19,632 | 19,642 | |||||||||||||||||||

| Other equity securities, at fair value | 3,658 | 3,638 | 3,649 | 3,762 | |||||||||||||||||||

| Restricted equity securities, at cost | 4,633 | 5,108 | 5,684 | 3,862 | |||||||||||||||||||

| Loans held for sale | 1,716 | 425 | 450 | 1,589 | |||||||||||||||||||

| Loans, net of unearned income | 2,015,434 | 1,965,149 | 1,884,508 | 1,716,512 | |||||||||||||||||||

| Less allowance for credit losses | 25,828 | 25,144 | 24,378 | 21,385 | |||||||||||||||||||

| Loans, net | 1,989,606 | 1,940,005 | 1,860,130 | 1,695,127 | |||||||||||||||||||

| Premises and equipment, net | 26,192 | 26,262 | 26,426 | 26,957 | |||||||||||||||||||

| Accrued interest receivable | 9,654 | 9,561 | 8,711 | 7,372 | |||||||||||||||||||

| Bank owned life insurance | 33,000 | 30,075 | 29,884 | 29,521 | |||||||||||||||||||

| Annuities | 15,918 | 15,939 | 15,036 | 15,359 | |||||||||||||||||||

| Foreclosed assets | 33 | 33 | 33 | 2,870 | |||||||||||||||||||

| Goodwill | 16,862 | 16,862 | 16,862 | 16,862 | |||||||||||||||||||

| Core deposit intangible | 735 | 817 | 899 | 1,062 | |||||||||||||||||||

| Other assets | 27,501 | 28,121 | 29,616 | 24,814 | |||||||||||||||||||

| Total assets | $ | 2,572,011 | $ | 2,510,975 | $ | 2,446,663 | $ | 2,277,803 | |||||||||||||||

| Liabilities and Stockholders' Equity | |||||||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||

| Noninterest-bearing | $ | 416,068 | $ | 416,704 | $ | 437,959 | $ | 449,433 | |||||||||||||||

| Interest-bearing | 1,759,610 | 1,693,094 | 1,580,230 | 1,474,478 | |||||||||||||||||||

| Total deposits | 2,175,678 | 2,109,798 | 2,018,189 | 1,923,911 | |||||||||||||||||||

| Other borrowings | 8,000 | 7,997 | 26,994 | (13) | |||||||||||||||||||

| FHLB advances | 42,000 | 52,000 | 70,000 | 45,000 | |||||||||||||||||||

| Subordinated notes | 86,873 | 86,776 | 86,679 | 86,485 | |||||||||||||||||||

| Accrued interest payable | 2,024 | 1,805 | 1,519 | 1,063 | |||||||||||||||||||

| Other liabilities | 26,855 | 29,718 | 28,318 | 24,107 | |||||||||||||||||||

| Total liabilities | 2,341,430 | 2,288,094 | 2,231,699 | 2,080,553 | |||||||||||||||||||

| Stockholders' equity: | |||||||||||||||||||||||

| Common stock | 44,813 | 44,746 | 44,479 | 43,831 | |||||||||||||||||||

| Capital surplus | 79,248 | 79,282 | 78,361 | 77,101 | |||||||||||||||||||

| Retained earnings | 117,233 | 109,838 | 102,523 | 88,603 | |||||||||||||||||||

Accumulated other comprehensive loss |

(8,333) | (8,401) | (8,379) | (10,799) | |||||||||||||||||||

| Unvested restricted stock | (826) | (1,030) | (466) | (709) | |||||||||||||||||||

| Vested restricted stock units | (1,554) | (1,554) | (1,554) | (777) | |||||||||||||||||||

| Total stockholders' equity | 230,581 | 222,881 | 214,964 | 197,250 | |||||||||||||||||||

| Total liabilities and stockholders' equity | $ | 2,572,011 | $ | 2,510,975 | $ | 2,446,663 | $ | 2,277,803 | |||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME | |||||||||||||||||||||||||||||

| (Dollars in thousands, except per share amounts) | |||||||||||||||||||||||||||||

|

Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||

| June 30, 2024 |

March 31, 2024 |

June 30, 2023 |

June 30, 2024 |

June 30, 2023 |

|||||||||||||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||||||||||||||

| Interest income: | |||||||||||||||||||||||||||||

| Loans, including fees | $ | 35,421 | $ | 33,628 | $ | 27,630 | $ | 69,049 | $ | 52,965 | |||||||||||||||||||

| Taxable securities | 2,039 | 1,981 | 1,641 | 4,020 | 3,024 | ||||||||||||||||||||||||

| Nontaxable securities | 231 | 229 | 228 | 460 | 519 | ||||||||||||||||||||||||

| Other interest and dividends | 3,316 | 2,898 | 2,686 | 6,214 | 4,376 | ||||||||||||||||||||||||

| Total interest income | 41,007 | 38,736 | 32,185 | 79,743 | 60,884 | ||||||||||||||||||||||||

| Interest expense: | |||||||||||||||||||||||||||||

| Deposits | 17,511 | 15,906 | 10,998 | 33,417 | 18,766 | ||||||||||||||||||||||||

| Other borrowings | 1,917 | 1,991 | 1,755 | 3,908 | 3,140 | ||||||||||||||||||||||||

| Total interest expense | 19,428 | 17,897 | 12,753 | 37,325 | 21,906 | ||||||||||||||||||||||||

| Net interest income | 21,579 | 20,839 | 19,432 | 42,418 | 38,978 | ||||||||||||||||||||||||

| Provision for credit losses | 1,067 | 1,236 | 1,557 | 2,303 | 2,738 | ||||||||||||||||||||||||

| Net interest income after provision for credit losses | 20,512 | 19,603 | 17,875 | 40,115 | 36,240 | ||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||

| Service charges on deposit accounts | 462 | 463 | 456 | 925 | 906 | ||||||||||||||||||||||||

Swap fees |

4 | 15 | 173 | 19 | 169 | ||||||||||||||||||||||||

| SBA/USDA fees | 58 | 64 | 66 | 122 | 200 | ||||||||||||||||||||||||

| Mortgage origination fees | 92 | 96 | 188 | 188 | 288 | ||||||||||||||||||||||||

Net gain (loss) on securities |

20 | (12) | (45) | 8 | 469 | ||||||||||||||||||||||||

| Employee retention credit and related revenue | — | — | 5,100 | — | 5,100 | ||||||||||||||||||||||||

| Other operating income | 732 | 642 | 924 | 1,374 | 1,516 | ||||||||||||||||||||||||

| Total noninterest income | 1,368 | 1,268 | 6,862 | 2,636 | 8,648 | ||||||||||||||||||||||||

| Noninterest expenses: | |||||||||||||||||||||||||||||

| Salaries and employee benefits | 6,112 | 6,231 | 7,863 | 12,343 | 14,174 | ||||||||||||||||||||||||

| Equipment and occupancy expenses | 667 | 689 | 694 | 1,356 | 1,377 | ||||||||||||||||||||||||

| Data processing fees | 686 | 643 | 646 | 1,329 | 1,239 | ||||||||||||||||||||||||

| Regulatory assessments | 375 | 360 | 180 | 735 | 522 | ||||||||||||||||||||||||

| Professional fees related to ERC | — | — | 1,243 | — | 1,243 | ||||||||||||||||||||||||

| Other operating expenses | 3,571 | 2,452 | 2,806 | 6,023 | 5,035 | ||||||||||||||||||||||||

| Total noninterest expenses | 11,411 | 10,375 | 13,432 | 21,786 | 23,590 | ||||||||||||||||||||||||

| Income before income taxes | 10,469 | 10,496 | 11,305 | 20,965 | 21,298 | ||||||||||||||||||||||||

| Income tax expense | 2,271 | 2,377 | 2,549 | 4,648 | 4,871 | ||||||||||||||||||||||||

| Net income | $ | 8,198 | $ | 8,119 | $ | 8,756 | $ | 16,317 | $ | 16,427 | |||||||||||||||||||

| Basic earnings per share | $ | 0.91 | $ | 0.91 | $ | 1.00 | $ | 1.82 | $ | 1.87 | |||||||||||||||||||

| Diluted earnings per share | $ | 0.90 | $ | 0.90 | $ | 0.98 | $ | 1.80 | $ | 1.82 | |||||||||||||||||||

| AVERAGE BALANCE SHEET AND NET INTEREST MARGIN | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2024 |

March 31, 2024 |

June 30, 2023 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance |

Interest | Yield/Rate | Average Balance |

Interest | Yield/Rate | Average Balance |

Interest | Yield/Rate | |||||||||||||||||||||||||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Loans, net of unearned income(1) |

$ | 1,987,533 | $ | 35,421 | 7.17 | % | $ | 1,916,288 | $ | 33,628 | 7.06 | % | $ | 1,676,816 | $ | 27,630 | 6.61 | % | |||||||||||||||||||||||||||||||||||

| Taxable securities | 165,141 | 2,039 | 4.97 | % | 163,586 | 1,981 | 4.87 | % | 151,107 | 1,641 | 4.36 | % | |||||||||||||||||||||||||||||||||||||||||

| Nontaxable securities | 45,537 | 231 | 2.04 | % | 45,368 | 229 | 2.03 | % | 45,624 | 228 | 2.00 | % | |||||||||||||||||||||||||||||||||||||||||

| Other interest-earnings assets | 242,214 | 3,316 | 5.51 | % | 211,127 | 2,898 | 5.52 | % | 218,451 | 2,686 | 4.93 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 2,440,425 | $ | 41,007 | 6.76 | % | $ | 2,336,369 | $ | 38,736 | 6.67 | % | $ | 2,091,998 | $ | 32,185 | 6.17 | % | |||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (25,332) | (24,313) | (20,154) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 137,917 | 135,222 | 128,999 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $ | 2,553,010 | $ | 2,447,278 | $ | 2,200,843 | |||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Stockholders’ Equity: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing transaction accounts | 85,976 | 21 | 0.10 | % | 85,858 | 26 | 0.12 | % | 92,245 | 20 | 0.09 | % | |||||||||||||||||||||||||||||||||||||||||

| Savings and money market accounts | 929,930 | 9,229 | 3.99 | % | 902,361 | 8,804 | 3.92 | % | 845,742 | 6,872 | 3.26 | % | |||||||||||||||||||||||||||||||||||||||||

| Time deposits | 713,776 | 8,261 | 4.65 | % | 645,088 | 7,076 | 4.41 | % | 474,060 | 4,106 | 3.47 | % | |||||||||||||||||||||||||||||||||||||||||

| FHLB advances | 48,374 | 596 | 4.96 | % | 53,121 | 655 | 4.96 | % | 45,000 | 529 | 4.72 | % | |||||||||||||||||||||||||||||||||||||||||

| Other borrowings | 94,815 | 1,321 | 5.60 | % | 95,650 | 1,336 | 5.62 | % | 86,411 | 1,226 | 5.69 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 1,872,871 | $ | 19,428 | 4.17 | % | $ | 1,782,078 | $ | 17,897 | 4.04 | % | $ | 1,543,458 | $ | 12,753 | 3.31 | % | |||||||||||||||||||||||||||||||||||

| Noninterest-bearing liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 420,885 | $ | 416,141 | $ | 438,987 | |||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 32,727 | 29,437 | 24,882 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest-bearing liabilities | $ | 453,612 | $ | 445,578 | $ | 463,869 | |||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders’ Equity | 226,527 | 219,622 | 193,516 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities and Stockholders’ Equity | $ | 2,553,010 | $ | 2,447,278 | $ | 2,200,843 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 21,579 | $ | 20,839 | $ | 19,432 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest spread(2) |

2.59 | % | 2.63 | % | 2.86 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin(3) |

3.56 | % | 3.59 | % | 3.73 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin - FTE(4)(5) |

3.57 | % | 3.60 | % | 3.74 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Cost of funds(6) |

3.41 | % | 3.27 | % | 2.58 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Cost of interest-bearing deposits | 4.07 | % | 3.92 | % | 3.12 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Cost of total deposits | 3.27 | % | 3.12 | % | 2.38 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE BALANCE SHEET AND NET INTEREST MARGIN | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||

|

Six Months Ended | ||||||||||||||||||||||||||||||||||

| June 30, 2024 |

June 30, 2023 |

||||||||||||||||||||||||||||||||||

| Average Balance |

Interest | Yield/Rate | Average Balance |

Interest | Yield/Rate | ||||||||||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||

Loans, net of unearned income(1) |

$ | 1,951,910 | $ | 69,049 | 7.11 | % | $ | 1,643,376 | $ | 52,965 | 6.50 | % | |||||||||||||||||||||||

| Taxable securities | 164,363 | 4,020 | 4.92 | % | 145,344 | 3,024 | 4.20 | % | |||||||||||||||||||||||||||

| Nontaxable securities | 45,453 | 460 | 2.04 | % | 49,208 | 519 | 2.13 | % | |||||||||||||||||||||||||||

| Other interest-earnings assets | 226,671 | 6,214 | 5.51 | % | 182,447 | 4,376 | 4.84 | % | |||||||||||||||||||||||||||

| Total interest-earning assets | $ | 2,388,397 | $ | 79,743 | 6.71 | % | $ | 2,020,375 | $ | 60,884 | 6.08 | % | |||||||||||||||||||||||

| Allowance for credit losses | (24,822) | (20,315) | |||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 136,569 | 129,268 | |||||||||||||||||||||||||||||||||

| Total Assets | $ | 2,500,144 | $ | 2,129,328 | |||||||||||||||||||||||||||||||

| Liabilities and Stockholders’ Equity: | |||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||

| Interest-bearing transaction accounts | 85,917 | 48 | 0.11 | % | 93,093 | 40 | 0.09 | % | |||||||||||||||||||||||||||

| Savings and money market accounts | 916,145 | 18,032 | 3.96 | % | 825,982 | 11,911 | 2.91 | % | |||||||||||||||||||||||||||

| Time deposits | 679,432 | 15,337 | 4.54 | % | 437,573 | 6,815 | 3.14 | % | |||||||||||||||||||||||||||

| FHLB advances | 50,747 | 1,251 | 4.96 | % | 31,862 | 688 | 4.35 | % | |||||||||||||||||||||||||||

| Other borrowings | 95,233 | 2,657 | 5.61 | % | 86,367 | 2,452 | 5.73 | % | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 1,827,474 | $ | 37,325 | 4.11 | % | $ | 1,474,877 | $ | 21,906 | 3.00 | % | |||||||||||||||||||||||

| Noninterest-bearing liabilities: | |||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 418,513 | $ | 438,862 | |||||||||||||||||||||||||||||||

| Other liabilities | 31,082 | 25,493 | |||||||||||||||||||||||||||||||||

| Total noninterest-bearing liabilities | $ | 449,595 | $ | 464,355 | |||||||||||||||||||||||||||||||

| Stockholders’ Equity | 223,075 | 190,096 | |||||||||||||||||||||||||||||||||

| Total Liabilities and Stockholders’ Equity | $ | 2,500,144 | $ | 2,129,328 | |||||||||||||||||||||||||||||||

| Net interest income | $ | 42,418 | $ | 38,978 | |||||||||||||||||||||||||||||||

Net interest spread(2) |

2.60 | % | 3.08 | % | |||||||||||||||||||||||||||||||

Net interest margin(3) |

3.57 | % | 3.89 | % | |||||||||||||||||||||||||||||||

Net interest margin - FTE(4)(5) |

3.58 | % | 3.90 | % | |||||||||||||||||||||||||||||||

Cost of funds(6) |

3.34 | % | 2.31 | % | |||||||||||||||||||||||||||||||

| Cost of interest-bearing deposits | 4.00 | % | 2.79 | % | |||||||||||||||||||||||||||||||

| Cost of total deposits | 3.20 | % | 2.11 | % | |||||||||||||||||||||||||||||||

| LOAN COMPOSITION | |||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

|

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

June 30, 2023 |

|||||||||||||||||||||||||||||||||||||||||||

| Amount | % of gross | Amount | % of gross | Amount | % of gross | Amount | % of gross | ||||||||||||||||||||||||||||||||||||||||

| Real estate mortgages: | |||||||||||||||||||||||||||||||||||||||||||||||

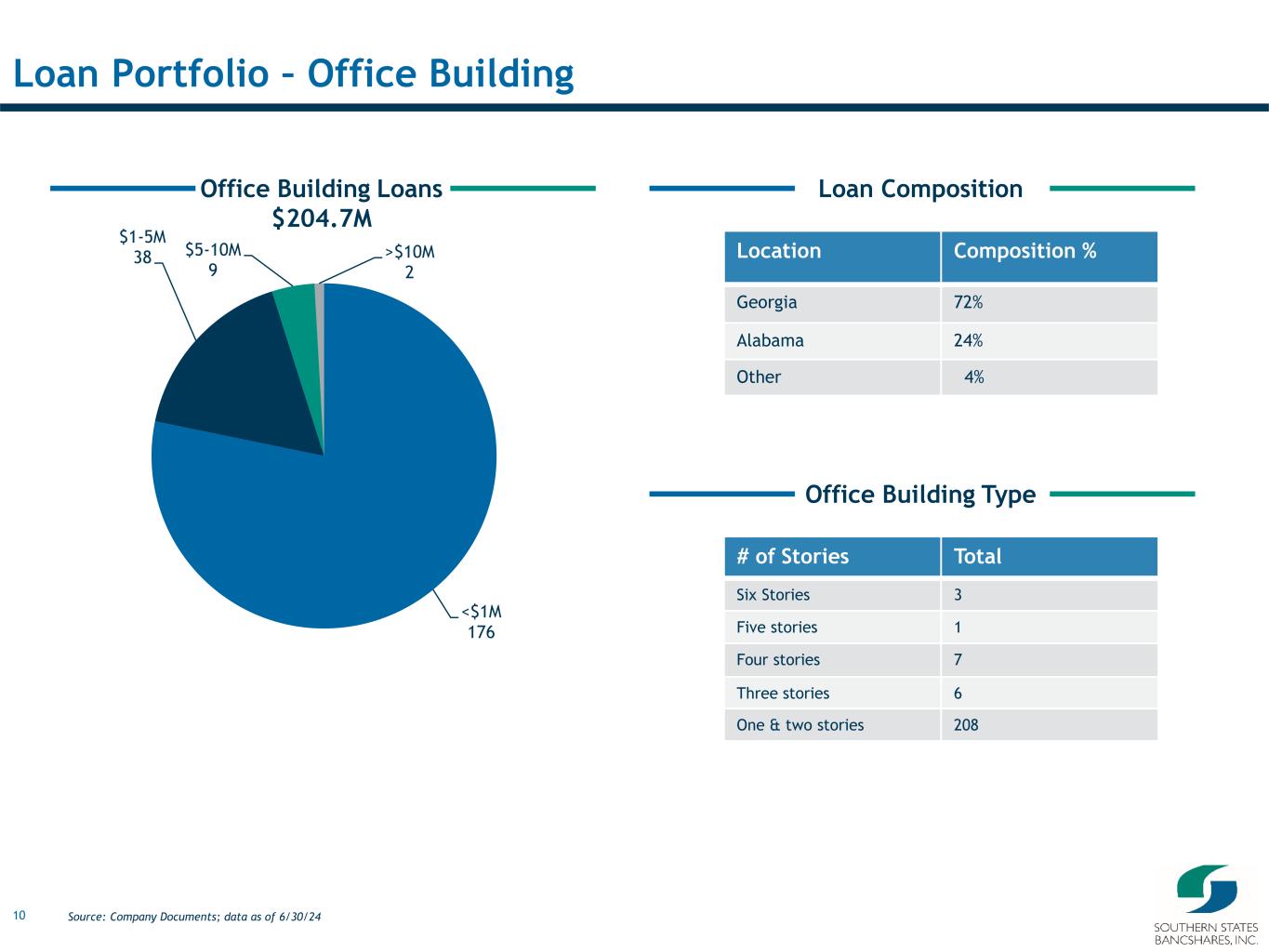

| Construction and development | $ | 242,573 | 12.0 | % | $ | 252,934 | 12.8 | % | $ | 242,960 | 12.9 | % | $ | 228,236 | 13.3 | % | |||||||||||||||||||||||||||||||

| Residential | 249,498 | 12.3 | % | 238,702 | 12.1 | % | 224,603 | 11.9 | % | 214,897 | 12.5 | % | |||||||||||||||||||||||||||||||||||

| Commercial | 1,222,739 | 60.5 | % | 1,182,634 | 60.0 | % | 1,144,867 | 60.5 | % | 1,011,815 | 58.7 | % | |||||||||||||||||||||||||||||||||||

| Commercial and industrial | 297,501 | 14.7 | % | 288,701 | 14.7 | % | 269,961 | 14.3 | % | 259,195 | 15.0 | % | |||||||||||||||||||||||||||||||||||

| Consumer and other | 9,566 | 0.5 | % | 8,425 | 0.4 | % | 8,286 | 0.4 | % | 8,135 | 0.5 | % | |||||||||||||||||||||||||||||||||||

| Gross loans | 2,021,877 | 100.0 | % | 1,971,396 | 100.0 | % | 1,890,677 | 100.0 | % | 1,722,278 | 100.0 | % | |||||||||||||||||||||||||||||||||||

| Unearned income | (6,443) | (6,247) | (6,169) | (5,766) | |||||||||||||||||||||||||||||||||||||||||||

| Loans, net of unearned income | 2,015,434 | 1,965,149 | 1,884,508 | 1,716,512 | |||||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (25,828) | (25,144) | (24,378) | (21,385) | |||||||||||||||||||||||||||||||||||||||||||

| Loans, net | $ | 1,989,606 | $ | 1,940,005 | $ | 1,860,130 | $ | 1,695,127 | |||||||||||||||||||||||||||||||||||||||

| DEPOSIT COMPOSITION | |||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

|

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

June 30, 2023 |

|||||||||||||||||||||||||||||||||||||||||||

| Amount | % of total | Amount | % of total | Amount | % of total | Amount | % of total | ||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing transaction | $ | 416,068 | 19.1 | % | $ | 416,704 | 19.7 | % | $ | 437,959 | 21.7 | % | $ | 449,433 | 23.3 | % | |||||||||||||||||||||||||||||||

| Interest-bearing transaction | 1,006,687 | 46.3 | % | 974,079 | 46.2 | % | 946,347 | 46.9 | % | 922,835 | 48.0 | % | |||||||||||||||||||||||||||||||||||

| Savings | 32,527 | 1.5 | % | 33,909 | 1.6 | % | 35,412 | 1.7 | % | 41,574 | 2.2 | % | |||||||||||||||||||||||||||||||||||

| Time deposits, $250,000 and under | 612,299 | 28.1 | % | 584,658 | 27.7 | % | 500,406 | 24.8 | % | 438,228 | 22.8 | % | |||||||||||||||||||||||||||||||||||

| Time deposits, over $250,000 | 108,097 | 5.0 | % | 100,448 | 4.8 | % | 98,065 | 4.9 | % | 71,841 | 3.7 | % | |||||||||||||||||||||||||||||||||||

| Total deposits | $ | 2,175,678 | 100.0 | % | $ | 2,109,798 | 100.0 | % | $ | 2,018,189 | 100.0 | % | $ | 1,923,911 | 100.0 | % | |||||||||||||||||||||||||||||||

| Nonperforming Assets | |||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||

|

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

June 30, 2023 |

|||||||||||||||||||

| Nonaccrual loans | $ | 3,784 | $ | 3,446 | $ | 1,017 | $ | 1,010 | |||||||||||||||

| Past due loans 90 days or more and still accruing interest | — | — | 160 | — | |||||||||||||||||||

| Total nonperforming loans | 3,784 | 3,446 | 1,177 | 1,010 | |||||||||||||||||||

| OREO | 33 | 33 | 33 | 2,870 | |||||||||||||||||||

| Total nonperforming assets | $ | 3,817 | $ | 3,479 | $ | 1,210 | $ | 3,880 | |||||||||||||||

Financial difficulty modification loans – nonaccrual(1) |

647 | 675 | 907 | 724 | |||||||||||||||||||

| Financial difficulty modification loans – accruing | 1,093 | 1,283 | 1,095 | 1,328 | |||||||||||||||||||

| Financial difficulty modification loans | $ | 1,740 | $ | 1,958 | $ | 2,002 | $ | 2,052 | |||||||||||||||

| Allowance for credit losses | $ | 25,828 | $ | 25,144 | $ | 24,378 | $ | 21,385 | |||||||||||||||

| Loans, net of unearned income at the end of the period | $ | 2,015,434 | $ | 1,965,149 | $ | 1,884,508 | $ | 1,716,512 | |||||||||||||||

| Gross loans outstanding at the end of period | $ | 2,021,877 | $ | 1,971,396 | $ | 1,890,677 | $ | 1,722,278 | |||||||||||||||

| Total assets | $ | 2,572,011 | $ | 2,510,975 | $ | 2,446,663 | $ | 2,277,803 | |||||||||||||||

| Allowance for credit losses to nonperforming loans | 682.56 | % | 729.66 | % | 2071.20 | % | 2117.33 | % | |||||||||||||||

| Nonperforming loans to loans, net of unearned income | 0.19 | % | 0.18 | % | 0.06 | % | 0.06 | % | |||||||||||||||

| Nonperforming loans to gross loans | 0.19 | % | 0.17 | % | 0.06 | % | 0.06 | % | |||||||||||||||

| Nonperforming assets to gross loans and OREO | 0.19 | % | 0.18 | % | 0.06 | % | 0.22 | % | |||||||||||||||

| Nonperforming assets to total assets | 0.15 | % | 0.14 | % | 0.05 | % | 0.17 | % | |||||||||||||||

| Nonaccrual loans by category: | |||||||||||||||||||||||

| Real estate mortgages: | |||||||||||||||||||||||

| Construction & Development | $ | — | $ | — | $ | — | $ | 33 | |||||||||||||||

| Residential Mortgages | 393 | 246 | 252 | 297 | |||||||||||||||||||

| Commercial Real Estate Mortgages | 2,182 | 2,422 | 765 | 671 | |||||||||||||||||||

| Commercial & Industrial | 1,209 | 778 | — | 9 | |||||||||||||||||||

| Consumer and other | — | — | — | — | |||||||||||||||||||

| Total | $ | 3,784 | $ | 3,446 | $ | 1,017 | $ | 1,010 | |||||||||||||||

| Allowance for Credit Losses | |||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

|

Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||

| June 30, 2024 |

March 31, 2024 |

June 30, 2023 |

June 30, 2024 |

June 30, 2023 | |||||||||||||||||||||||||

| Average loans, net of unearned income | $ | 1,987,533 | $ | 1,916,288 | $ | 1,676,816 | $ | 1,951,910 | $ | 1,643,376 | |||||||||||||||||||

| Loans, net of unearned income | 2,015,434 | 1,965,149 | 1,716,512 | 2,015,434 | 1,716,512 | ||||||||||||||||||||||||

| Gross loans | 2,021,877 | 1,971,396 | 1,722,278 | 2,021,877 | 1,722,278 | ||||||||||||||||||||||||

| Allowance for credit losses at beginning of the period | 25,144 | 24,378 | 19,855 | 24,378 | 20,156 | ||||||||||||||||||||||||

| Impact of adoption of ASC 326 | — | — | — | — | (1,285) | ||||||||||||||||||||||||

| Charge-offs: | |||||||||||||||||||||||||||||

| Construction and development | — | — | — | — | — | ||||||||||||||||||||||||

| Residential | — | 11 | — | 11 | — | ||||||||||||||||||||||||

| Commercial | 11 | 27 | — | 38 | — | ||||||||||||||||||||||||

| Commercial and industrial | 384 | 442 | 44 | 826 | 262 | ||||||||||||||||||||||||

| Consumer and other | 10 | 15 | — | 25 | 6 | ||||||||||||||||||||||||

| Total charge-offs | 405 | 495 | 44 | 900 | 268 | ||||||||||||||||||||||||

| Recoveries: | |||||||||||||||||||||||||||||

| Construction and development | — | — | — | — | — | ||||||||||||||||||||||||

| Residential | 6 | 8 | 17 | 14 | 28 | ||||||||||||||||||||||||

| Commercial | — | — | — | — | — | ||||||||||||||||||||||||

| Commercial and industrial | 15 | 16 | — | 31 | 14 | ||||||||||||||||||||||||

| Consumer and other | 1 | 1 | — | 2 | 2 | ||||||||||||||||||||||||

| Total recoveries | 22 | 25 | 17 | 47 | 44 | ||||||||||||||||||||||||

| Net charge-offs | $ | 383 | $ | 470 | $ | 27 | $ | 853 | $ | 224 | |||||||||||||||||||

| Provision for credit losses | $ | 1,067 | $ | 1,236 | $ | 1,557 | $ | 2,303 | $ | 2,738 | |||||||||||||||||||

| Balance at end of the period | $ | 25,828 | $ | 25,144 | $ | 21,385 | $ | 25,828 | $ | 21,385 | |||||||||||||||||||

| Allowance for credit losses on unfunded commitments at beginning of the period | $ | 1,288 | $ | 1,239 | $ | 1,285 | $ | 1,239 | $ | — | |||||||||||||||||||

| Impact of adoption of ASC 326 | — | — | — | — | 1,285 | ||||||||||||||||||||||||

(Credit) provision for credit losses on unfunded commitments |

(82) | 49 | 210 | (33) | 210 | ||||||||||||||||||||||||

| Balance at the end of the period | $ | 1,206 | $ | 1,288 | $ | 1,495 | $ | 1,206 | $ | 1,495 | |||||||||||||||||||

| Allowance to loans, net of unearned income | 1.28 | % | 1.28 | % | 1.25 | % | 1.28 | % | 1.25 | % | |||||||||||||||||||

| Allowance to gross loans | 1.28 | % | 1.28 | % | 1.24 | % | 1.28 | % | 1.24 | % | |||||||||||||||||||

Net charge-offs to average loans, net of unearned income(1) |

0.08 | % | 0.10 | % | 0.01 | % | 0.09 | % | 0.03 | % | |||||||||||||||||||

Provision for credit losses to average loans, net of unearned income(1) |

0.22 | % | 0.26 | % | 0.37 | % | 0.24 | % | 0.34 | % | |||||||||||||||||||

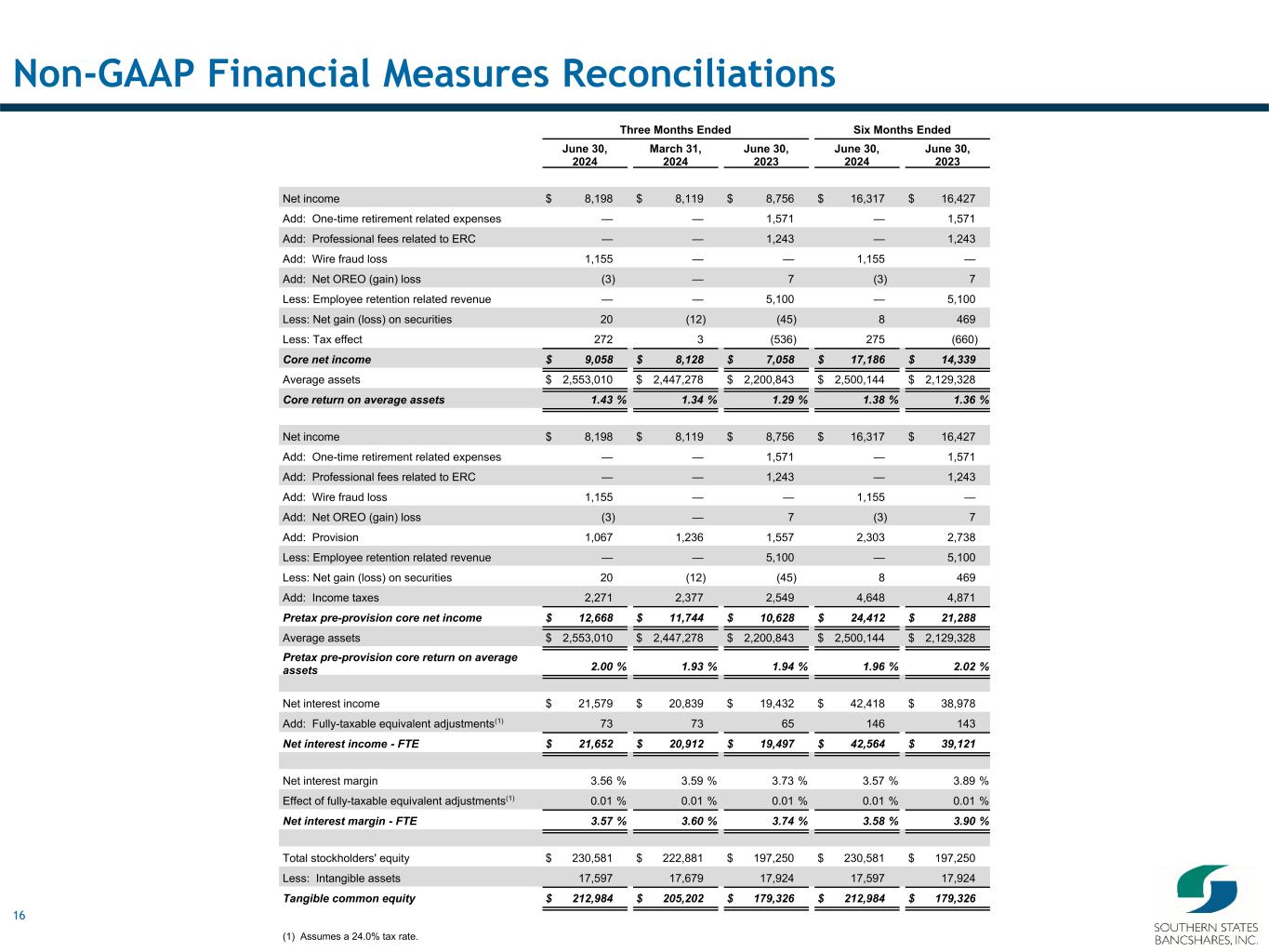

| Reconciliation of Non-GAAP Financial Measures | ||||||||||||||

| Reconciliation of Non-GAAP Financial Measures | |||||||||||||||||||||||||||||

| (Dollars in thousands, except share and per share amounts) | |||||||||||||||||||||||||||||

|

Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||

| June 30, 2024 |

March 31, 2024 |

June 30, 2023 |

June 30, 2024 |

June 30, 2023 |

|||||||||||||||||||||||||

| Net income | $ | 8,198 | $ | 8,119 | $ | 8,756 | $ | 16,317 | $ | 16,427 | |||||||||||||||||||

| Add: One-time retirement related expenses | — | — | 1,571 | — | 1,571 | ||||||||||||||||||||||||

| Add: Professional fees related to ERC | — | — | 1,243 | — | 1,243 | ||||||||||||||||||||||||

| Add: Wire fraud loss | 1,155 | — | — | 1,155 | — | ||||||||||||||||||||||||

Add: Net OREO (gain) loss |

(3) | — | 7 | (3) | 7 | ||||||||||||||||||||||||

| Less: Employee retention related revenue | — | — | 5,100 | — | 5,100 | ||||||||||||||||||||||||

Less: Net gain (loss) on securities |

20 | (12) | (45) | 8 | 469 | ||||||||||||||||||||||||

| Less: Tax effect | 272 | 3 | (536) | 275 | (660) | ||||||||||||||||||||||||

| Core net income | $ | 9,058 | $ | 8,128 | $ | 7,058 | $ | 17,186 | $ | 14,339 | |||||||||||||||||||

| Average assets | $ | 2,553,010 | $ | 2,447,278 | $ | 2,200,843 | $ | 2,500,144 | $ | 2,129,328 | |||||||||||||||||||

| Core return on average assets | 1.43 | % | 1.34 | % | 1.29 | % | 1.38 | % | 1.36 | % | |||||||||||||||||||

| Net income | $ | 8,198 | $ | 8,119 | $ | 8,756 | $ | 16,317 | $ | 16,427 | |||||||||||||||||||

| Add: One-time retirement related expenses | — | — | 1,571 | — | 1,571 | ||||||||||||||||||||||||

| Add: Professional fees related to ERC | — | — | 1,243 | — | 1,243 | ||||||||||||||||||||||||

| Add: Wire fraud loss | 1,155 | — | — | 1,155 | — | ||||||||||||||||||||||||

Add: Net OREO (gain) loss |

(3) | — | 7 | (3) | 7 | ||||||||||||||||||||||||

| Add: Provision | 1,067 | 1,236 | 1,557 | 2,303 | 2,738 | ||||||||||||||||||||||||

| Less: Employee retention related revenue | — | — | 5,100 | — | 5,100 | ||||||||||||||||||||||||

Less: Net gain (loss) on securities |

20 | (12) | (45) | 8 | 469 | ||||||||||||||||||||||||

| Add: Income taxes | 2,271 | 2,377 | 2,549 | 4,648 | 4,871 | ||||||||||||||||||||||||

| Pretax pre-provision core net income | $ | 12,668 | $ | 11,744 | $ | 10,628 | $ | 24,412 | $ | 21,288 | |||||||||||||||||||

| Average assets | $ | 2,553,010 | $ | 2,447,278 | $ | 2,200,843 | $ | 2,500,144 | $ | 2,129,328 | |||||||||||||||||||

| Pretax pre-provision core return on average assets | 2.00 | % | 1.93 | % | 1.94 | % | 1.96 | % | 2.02 | % | |||||||||||||||||||

| Net interest income | $ | 21,579 | $ | 20,839 | $ | 19,432 | $ | 42,418 | $ | 38,978 | |||||||||||||||||||

Add: Fully-taxable equivalent adjustments(1) |

73 | 73 | 65 | 146 | 143 | ||||||||||||||||||||||||

| Net interest income - FTE | $ | 21,652 | $ | 20,912 | $ | 19,497 | $ | 42,564 | $ | 39,121 | |||||||||||||||||||

| Net interest margin | 3.56 | % | 3.59 | % | 3.73 | % | 3.57 | % | 3.89 | % | |||||||||||||||||||

Effect of fully-taxable equivalent adjustments(1) |

0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | |||||||||||||||||||

| Net interest margin - FTE | 3.57 | % | 3.60 | % | 3.74 | % | 3.58 | % | 3.90 | % | |||||||||||||||||||

| Total stockholders' equity | $ | 230,581 | $ | 222,881 | $ | 197,250 | $ | 230,581 | $ | 197,250 | |||||||||||||||||||

| Less: Intangible assets | 17,597 | 17,679 | 17,924 | 17,597 | 17,924 | ||||||||||||||||||||||||

| Tangible common equity | $ | 212,984 | $ | 205,202 | $ | 179,326 | $ | 212,984 | $ | 179,326 | |||||||||||||||||||

| (1) Assumes a 24.0% tax rate. | |||||||||||||||||||||||||||||

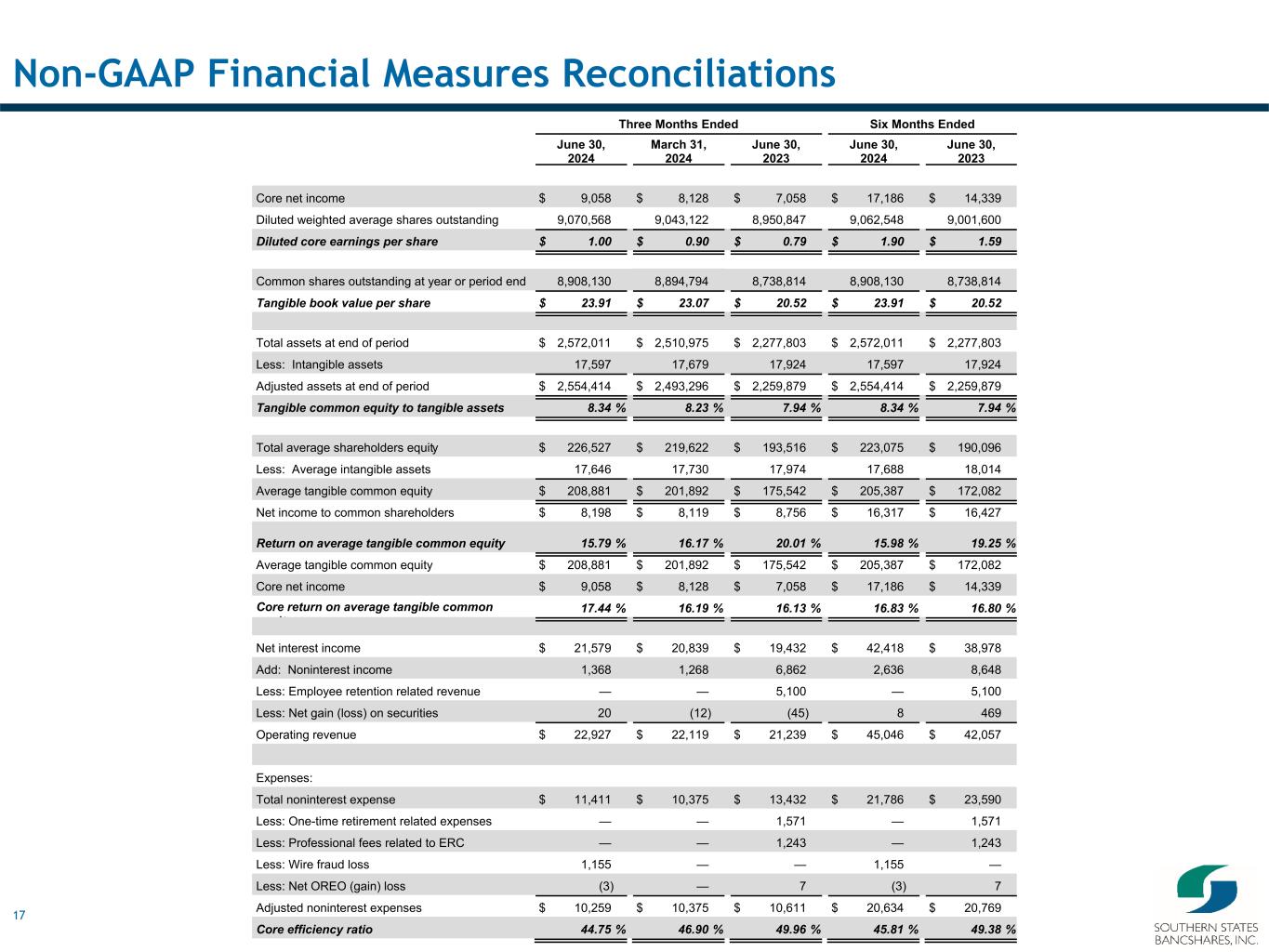

| Reconciliation of Non-GAAP Financial Measures | |||||||||||||||||||||||||||||

| (Dollars in thousands, except share and per share amounts) | |||||||||||||||||||||||||||||

|

Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||

| June 30, 2024 |

March 31, 2024 |

June 30, 2023 |

June 30, 2024 |

June 30, 2023 |

|||||||||||||||||||||||||

| Core net income | $ | 9,058 | $ | 8,128 | $ | 7,058 | $ | 17,186 | $ | 14,339 | |||||||||||||||||||

| Diluted weighted average shares outstanding | 9,070,568 | 9,043,122 | 8,950,847 | 9,062,548 | 9,001,600 | ||||||||||||||||||||||||

| Diluted core earnings per share | $ | 1.00 | $ | 0.90 | $ | 0.79 | $ | 1.90 | $ | 1.59 | |||||||||||||||||||

| Common shares outstanding at year or period end | 8,908,130 | 8,894,794 | 8,738,814 | 8,908,130 | 8,738,814 | ||||||||||||||||||||||||

| Tangible book value per share | $ | 23.91 | $ | 23.07 | $ | 20.52 | $ | 23.91 | $ | 20.52 | |||||||||||||||||||

| Total assets at end of period | $ | 2,572,011 | $ | 2,510,975 | $ | 2,277,803 | $ | 2,572,011 | $ | 2,277,803 | |||||||||||||||||||

| Less: Intangible assets | 17,597 | 17,679 | 17,924 | 17,597 | 17,924 | ||||||||||||||||||||||||

| Adjusted assets at end of period | $ | 2,554,414 | $ | 2,493,296 | $ | 2,259,879 | $ | 2,554,414 | $ | 2,259,879 | |||||||||||||||||||

| Tangible common equity to tangible assets | 8.34 | % | 8.23 | % | 7.94 | % | 8.34 | % | 7.94 | % | |||||||||||||||||||

| Total average shareholders equity | $ | 226,527 | $ | 219,622 | $ | 193,516 | $ | 223,075 | $ | 190,096 | |||||||||||||||||||

| Less: Average intangible assets | 17,646 | 17,730 | 17,974 | 17,688 | 18,014 | ||||||||||||||||||||||||

| Average tangible common equity | $ | 208,881 | $ | 201,892 | $ | 175,542 | $ | 205,387 | $ | 172,082 | |||||||||||||||||||

| Net income to common shareholders | $ | 8,198 | $ | 8,119 | $ | 8,756 | $ | 16,317 | $ | 16,427 | |||||||||||||||||||

| Return on average tangible common equity | 15.79 | % | 16.17 | % | 20.01 | % | 15.98 | % | 19.25 | % | |||||||||||||||||||

| Average tangible common equity | $ | 208,881 | $ | 201,892 | $ | 175,542 | $ | 205,387 | $ | 172,082 | |||||||||||||||||||

| Core net income | $ | 9,058 | $ | 8,128 | $ | 7,058 | $ | 17,186 | $ | 14,339 | |||||||||||||||||||

| Core return on average tangible common equity | 17.44 | % | 16.19 | % | 16.13 | % | 16.83 | % | 16.80 | % | |||||||||||||||||||

| Net interest income | $ | 21,579 | $ | 20,839 | $ | 19,432 | $ | 42,418 | $ | 38,978 | |||||||||||||||||||

| Add: Noninterest income | 1,368 | 1,268 | 6,862 | 2,636 | 8,648 | ||||||||||||||||||||||||

| Less: Employee retention related revenue | — | — | 5,100 | — | 5,100 | ||||||||||||||||||||||||

Less: Net gain (loss) on securities |

20 | (12) | (45) | 8 | 469 | ||||||||||||||||||||||||

| Operating revenue | $ | 22,927 | $ | 22,119 | $ | 21,239 | $ | 45,046 | $ | 42,057 | |||||||||||||||||||

| Expenses: | |||||||||||||||||||||||||||||

| Total noninterest expense | $ | 11,411 | $ | 10,375 | $ | 13,432 | $ | 21,786 | $ | 23,590 | |||||||||||||||||||

| Less: One-time retirement related expenses | — | — | 1,571 | — | 1,571 | ||||||||||||||||||||||||

| Less: Professional fees related to ERC | — | — | 1,243 | — | 1,243 | ||||||||||||||||||||||||

| Less: Wire fraud loss | 1,155 | — | — | 1,155 | — | ||||||||||||||||||||||||

| Less: Net OREO (gain) loss | (3) | — | 7 | (3) | 7 | ||||||||||||||||||||||||

| Adjusted noninterest expenses | $ | 10,259 | $ | 10,375 | $ | 10,611 | $ | 20,634 | $ | 20,769 | |||||||||||||||||||

| Core efficiency ratio | 44.75 | % | 46.90 | % | 49.96 | % | 45.81 | % | 49.38 | % | |||||||||||||||||||