Document

NEWS RELEASE

FORWARD AIR CORPORATION REPORTS FIRST QUARTER 2024 RESULTS

Industry veteran Shawn Stewart appointed as Chief Executive Officer

First quarter results impacted by elongated weak freight market and Omni Logistics deal closing

Cost synergy realization in line with initial diligence estimates

Preliminary April results providing early indication of improvement

GREENEVILLE, Tenn.- (BUSINESS WIRE) - May 8, 2024 - Forward Air Corporation (NASDAQ:FWRD) (the “Company”, “Forward”, “we”, “our”, or “us”) today reported financial results for the three months ended March 31, 2024 as presented in the tables below on a continuing operations basis (Final Mile is being reported as a discontinued operations).

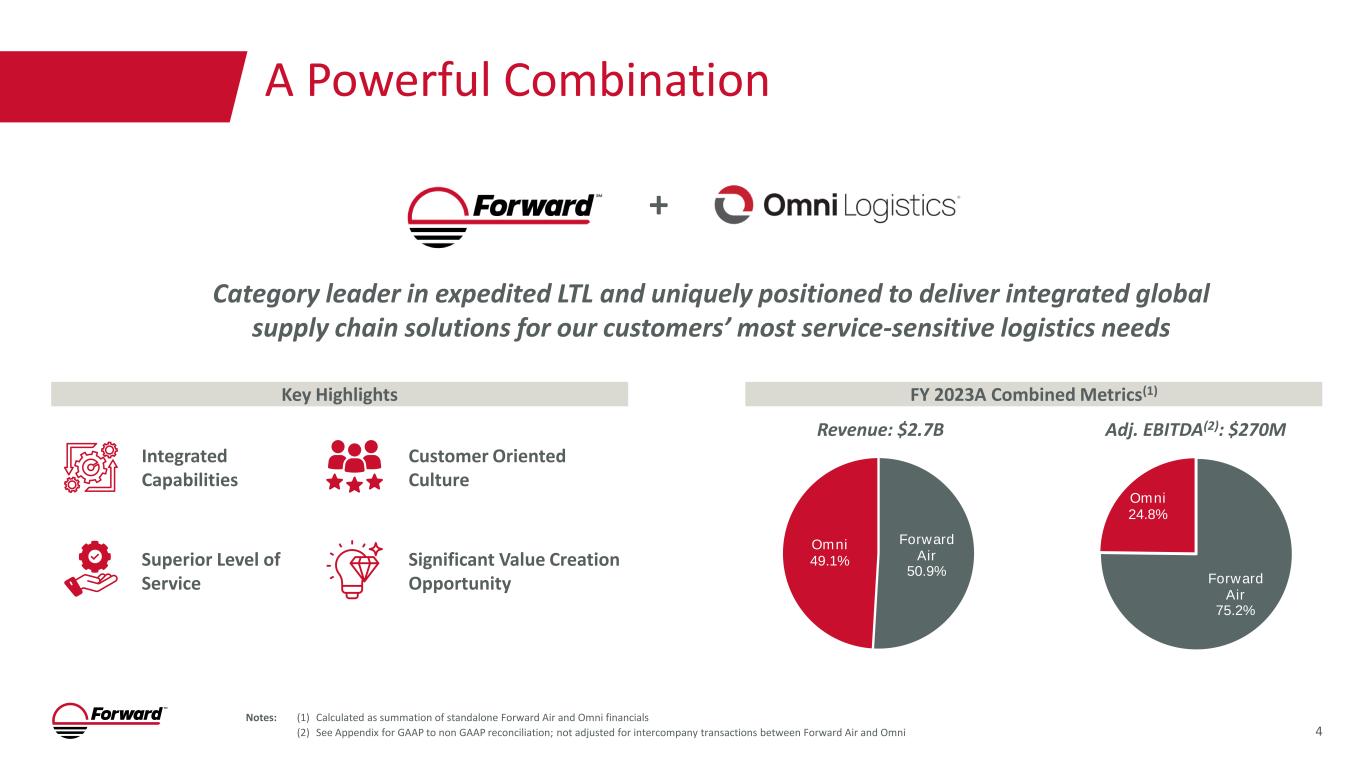

Recently appointed Chief Executive Officer Shawn Stewart, said, “It is a privilege to be leading Forward during this pivotal time. Together, Forward and Omni have created an industry leader dedicated to delivering world-class service to customers. Forward excels at providing best-in-class premium less-than-truckload service to an attractive and broad customer base, while Omni provides custom supply chain solutions across multiple service modes to domestic and international customers. Together, Forward and Omni, provide customers a seamless partnership and flawless execution for their time-sensitive and mission-critical freight.”

Mr. Stewart continued, “I see tremendous opportunity for the combined entity to maximize value for customers, employees and shareholders. I am committed to aggressively taking action to improve profitability, maximize synergy capture and drive our leadership in global supply chain and domestic transportation services. With the distractions of the deal closing behind us, our team is focused on execution. I look forward to sharing our progress along the next phase of our journey. To that end, we look forward to sharing our full year 2024 guidance and our path to achievement on our second quarter earnings call.”

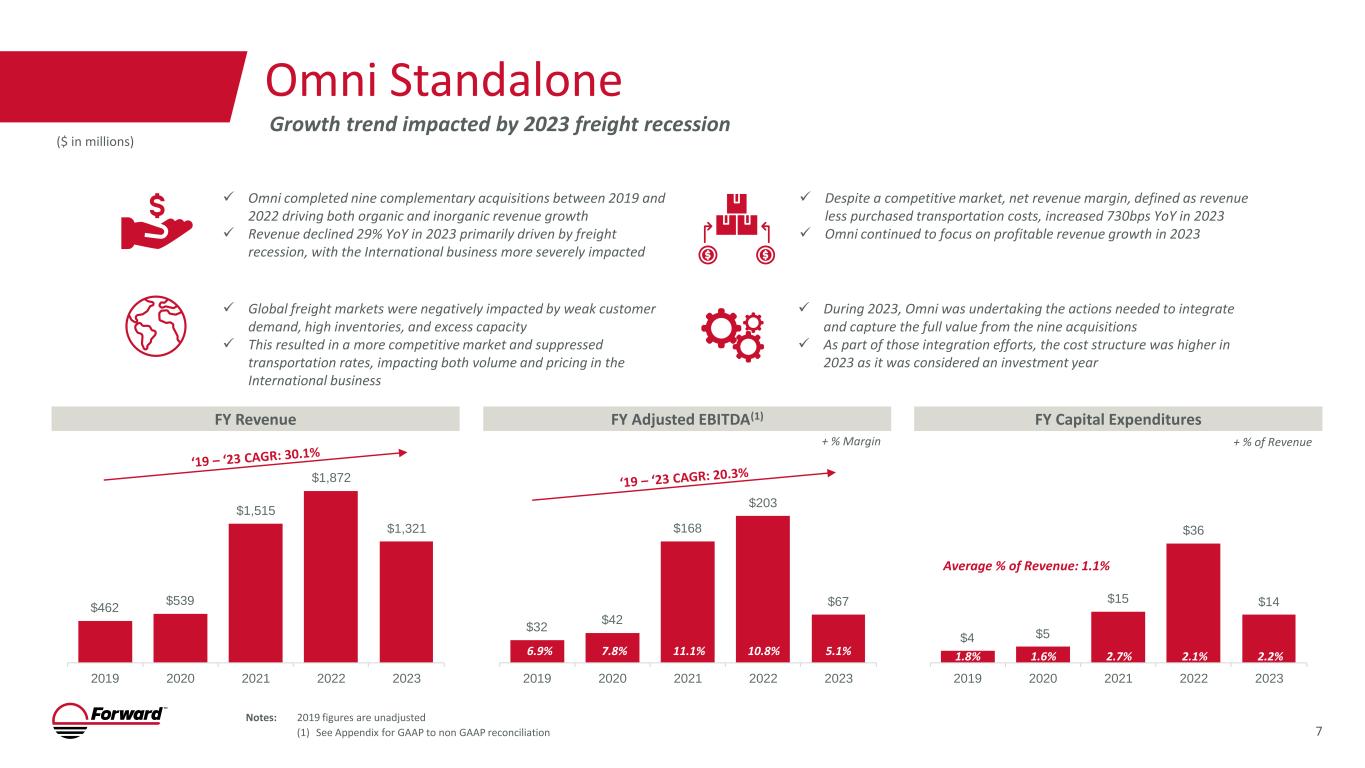

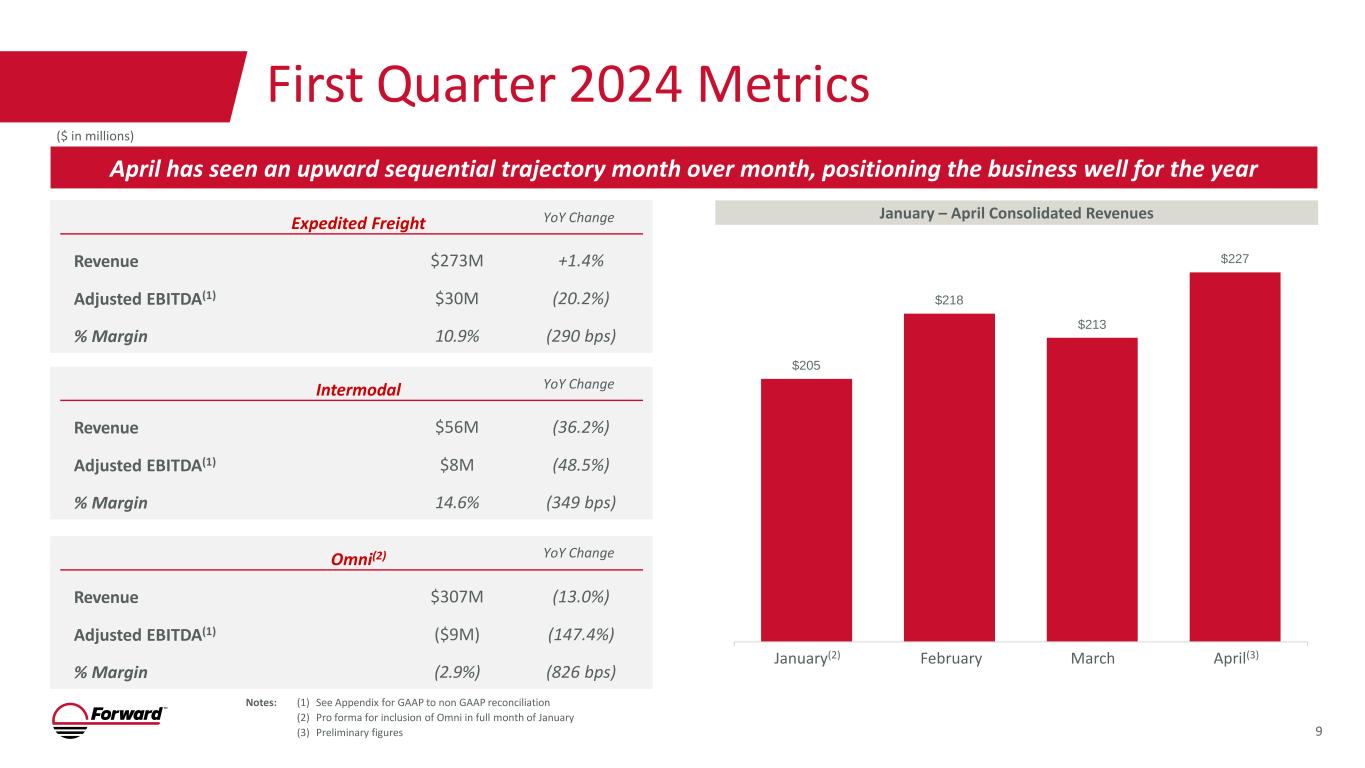

Rebecca J. Garbrick, Chief Financial Officer, said, “Our first quarter results did not meet our expectations. We continue to face challenging market conditions, characterized by weak freight demand, excess carrier capacity, and pressure on pricing. Omni's first quarter results were more adversely impacted as a result of its exposure to the international freight market. While these conditions led to decreased customer demand for our intermodal, truckload brokerage and Omni lines of business, we saw momentum in our less-than-truckload line of business where we experienced positive volume trends and improved freight quality metrics. In the first quarter, our shipments per day growth was +1.4%, weight per shipment was +7.4%, and revenue per shipment excluding fuel was +0.7% over the same period in the prior year. Unfortunately, this momentum did not offset softer demand for our intermodal and truckload brokerage services, resulting in an 8% decline in revenues and 41% decline in adjusted EBITDA on a continuing operations basis over the same period in the prior year, excluding the results of Omni. From the acquisition date, January 25, 2024, through the end of the quarter, Omni contributed $225 million in revenues and $(5.9) million in adjusted EBITDA.”

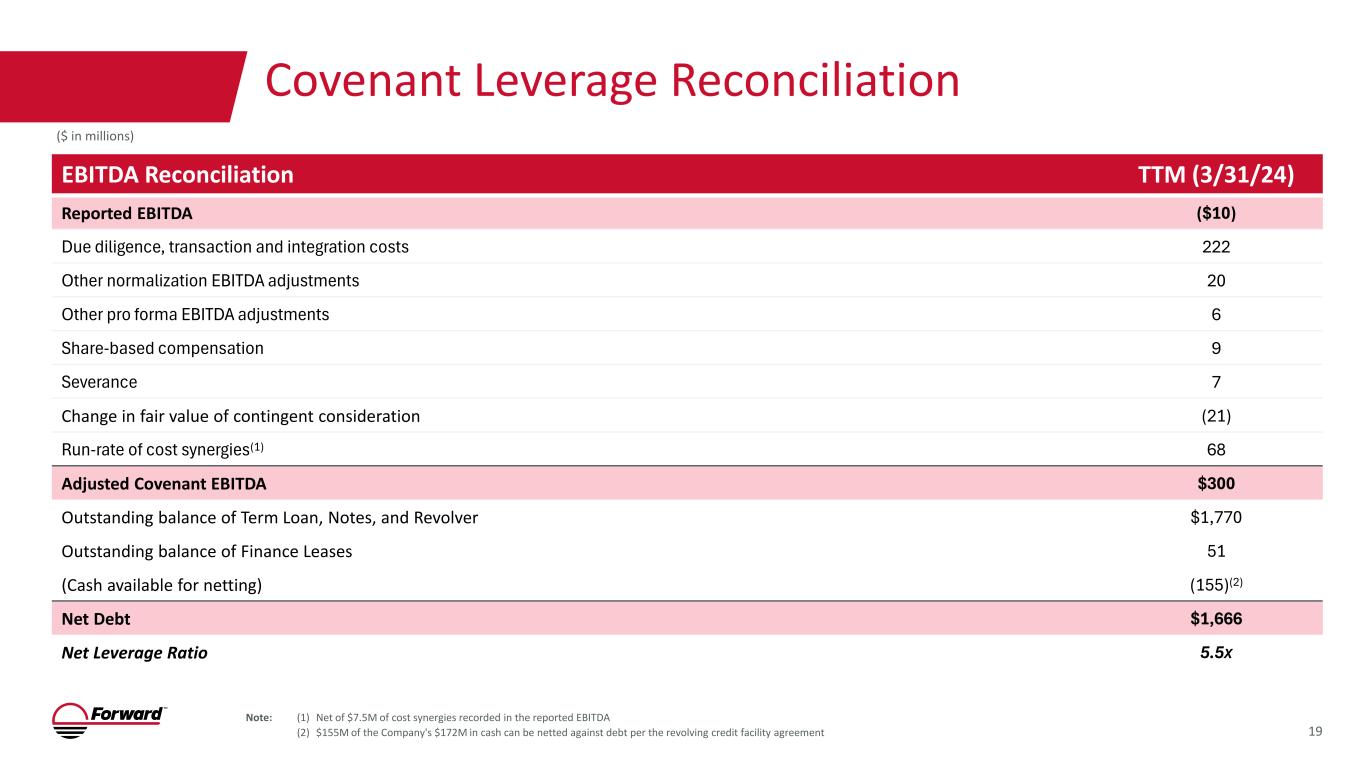

Ms. Garbrick continued, “Our first quarter results are not indicative of what we expect for 2024, and we are taking aggressive steps to improve profitability. One early positive indicator is the sequential growth in revenue as reflected in our preliminary April results. From the month of March 2024 to April 2024, we saw sequential revenue growth of 6% as compared to a sequential decline in revenue from March to April of (15%) over the same period in the prior year. We are also successfully executing on the cost synergies associated with the Omni transaction, which are in line with initial diligence estimates.

While our first quarter EBITDA was not reflective of run-rate synergies, we expect to see a steady increase in subsequent quarters until synergies are fully realized by the end of 2025.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

| (in thousands, except per share data) |

|

March 31, 2024 |

|

March 31, 2023 |

|

Change |

|

Percent Change |

| Operating revenue |

|

$ |

541,813 |

|

|

$ |

357,709 |

|

|

$ |

184,104 |

|

|

51.5 |

% |

| (Loss) income from operations |

|

$ |

(65,732) |

|

|

$ |

47,196 |

|

|

$ |

(112,928) |

|

|

(239.3) |

% |

| Operating margin |

|

(12.1) |

% |

|

13.2 |

% |

|

(2,530) bps |

| Net (loss) income |

|

$ |

(88,794) |

|

|

$ |

33,904 |

|

|

$ |

(122,698) |

|

|

(361.9) |

% |

| Net (loss) income per diluted share |

|

$ |

(2.35) |

|

|

$ |

1.27 |

|

|

$ |

(3.62) |

|

|

(285.0) |

% |

| Cash (used in) provided by operating activities |

|

$ |

(51,719) |

|

|

$ |

60,839 |

|

|

$ |

(112,558) |

|

|

(185.0) |

% |

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures: 1 |

|

|

|

|

|

|

|

|

| Adjusted income from operations |

|

$ |

12,534 |

|

|

$ |

47,196 |

|

|

$ |

(34,662) |

|

|

(73.4) |

% |

| Adjusted net (loss) income |

|

$ |

(24,172) |

|

|

$ |

33,904 |

|

|

$ |

(58,076) |

|

|

(171.3) |

% |

| Adjusted net (loss) income per diluted share |

|

$ |

(0.64) |

|

|

$ |

1.27 |

|

|

$ |

(1.91) |

|

|

(150.4) |

% |

| Adjusted EBITDA |

|

$ |

29,390 |

|

|

$ |

59,568 |

|

|

$ |

(30,178) |

|

|

(50.7) |

% |

| Free cash flow |

|

$ |

(55,840) |

|

|

$ |

56,135 |

|

|

$ |

(111,975) |

|

|

(199.5) |

% |

|

|

|

|

|

|

|

|

|

1 Reconciliation of these non-GAAP financial measures are provided below the financial tables. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Review of Financial Results

Forward Air will hold a conference call to discuss first quarter 2024 results on Thursday, May 9, 2024 at 10:00 a.m. ET. An Earnings Presentation has been posted online on the Investor Relations portion of the Company’s website at ir.forwardaircorp.com, and will be referenced during the conference call. The Company’s conference call will be available online on the Investor Relations portion of the Company’s website at ir.forwardaircorp.com, or by dialing (877) 876-9173, Access Code: FWRDQ124.

A replay of the conference call will be available on the Investor Relations portion of the Company’s website at www.forwardaircorp.com, which we use as a primary mechanism to communicate with our investors. Investors are urged to monitor the Investor Relations portion of the Company’s website to easily find or navigate to current and pertinent information about us.

About Forward Air Corporation

Forward Air is a leading asset-light provider of transportation services across the United States, Canada and Mexico. We provide expedited less-than-truckload (“LTL”) services, including local pick-up and delivery, shipment consolidation/deconsolidation, warehousing, and customs brokerage by utilizing a comprehensive national network of terminals. In addition, we offer truckload brokerage services, including dedicated fleet services; and intermodal, first-and last-mile, high-value drayage services, both to and from seaports and railheads, dedicated contract and Container Freight Station warehouse and handling services. Forward also operates a full portfolio of multimodal solutions, both domestically and internationally, via Omni Logistics. Omni Logistics is a global provider of air, ocean and ground services for mission-critical freight. We are more than a transportation company. Forward is a single resource for your shipping needs. For more information, visit our website at www.forwardaircorp.com.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Forward Air Corporation |

| Condensed Consolidated Statements of Comprehensive (Loss) Income |

| (Unaudited, in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

|

|

March 31, 2024 |

|

March 31, 2023 |

|

|

|

|

| Operating revenues: |

|

|

|

|

|

|

|

| Expedited Freight |

$ |

273,295 |

|

|

$ |

269,577 |

|

|

|

|

|

| Intermodal |

56,292 |

|

|

88,169 |

|

|

|

|

|

| Omni Logistics |

224,838 |

|

|

— |

|

|

|

|

|

| Eliminations and other operations |

(12,612) |

|

|

(37) |

|

|

|

|

|

| Operating revenues |

541,813 |

|

|

357,709 |

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

| Purchased transportation |

277,015 |

|

|

145,171 |

|

|

|

|

|

| Salaries, wages and employee benefits |

128,867 |

|

|

66,647 |

|

|

|

|

|

| Operating leases |

38,803 |

|

|

24,073 |

|

|

|

|

|

| Depreciation and amortization |

31,786 |

|

|

12,372 |

|

|

|

|

|

| Insurance and claims |

12,881 |

|

|

13,258 |

|

|

|

|

|

| Fuel expense |

5,246 |

|

|

5,686 |

|

|

|

|

|

| Other operating expenses |

112,947 |

|

|

43,306 |

|

|

|

|

|

| Impairment of goodwill, intangibles and other assets |

— |

|

|

— |

|

|

|

|

|

| Total operating expenses |

607,545 |

|

|

310,513 |

|

|

|

|

|

| Income (loss) from continuing operations: |

|

|

|

|

|

|

|

| Expedited Freight |

19,498 |

|

|

29,685 |

|

|

|

|

|

| Intermodal |

3,586 |

|

|

11,203 |

|

|

|

|

|

| Omni Logistics |

(28,585) |

|

|

— |

|

|

|

|

|

| Other Operations |

(60,231) |

|

|

6,308 |

|

|

|

|

|

| (Loss) income from continuing operations |

(65,732) |

|

|

47,196 |

|

|

|

|

|

| Other expense: |

|

|

|

|

|

|

|

| Interest expense, net |

(40,753) |

|

|

(2,355) |

|

|

|

|

|

| Foreign exchange loss |

(668) |

|

|

— |

|

|

|

|

|

| Other income, net |

9 |

|

|

— |

|

|

|

|

|

| Total other expense |

(41,412) |

|

|

(2,355) |

|

|

|

|

|

| (Loss) income before income taxes |

(107,144) |

|

|

44,841 |

|

|

|

|

|

| Income tax expense |

(18,350) |

|

|

10,937 |

|

|

|

|

|

| Net (loss) income from continuing operations |

(88,794) |

|

|

33,904 |

|

|

|

|

|

| Income from discontinued operation, net of tax |

— |

|

|

2,464 |

|

|

|

|

|

| Net (loss) income |

(88,794) |

|

|

36,368 |

|

|

|

|

|

| Net loss attributable to Non-controlling interest |

(27,082) |

|

|

— |

|

|

|

|

|

| Net (loss) income attributable to Forward Air |

$ |

(61,712) |

|

|

$ |

36,368 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share: |

|

|

|

|

|

|

|

| Basic net (loss) income per share |

|

|

|

|

|

|

|

| Continuing operations |

$ |

(2.35) |

|

|

$ |

1.28 |

|

|

|

|

|

| Discontinued operation |

— |

|

|

0.09 |

|

|

|

|

|

| Basic |

$ |

(2.35) |

|

|

$ |

1.37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net (loss) income per share |

|

|

|

|

|

|

|

| Continuing operations |

$ |

(2.35) |

|

|

$ |

1.27 |

|

|

|

|

|

| Discontinued operation |

— |

|

|

0.09 |

|

|

|

|

|

| Diluted |

$ |

(2.35) |

|

|

$ |

1.37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends per share: |

$ |

— |

|

|

$ |

0.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

$ |

(88,794) |

|

|

$ |

36,368 |

|

|

|

|

|

| Other comprehensive (loss) income: |

|

|

|

|

|

|

|

| Foreign currency translation adjustments |

(151) |

|

|

— |

|

|

|

|

|

| Comprehensive (loss) income |

$ |

(88,945) |

|

|

$ |

36,368 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expedited Freight Segment Information |

| (In thousands) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

| |

March 31, 2024 |

|

Percent of Revenue |

|

March 31, 2023 |

|

Percent of Revenue |

|

Change |

|

Percent Change |

| Operating revenues: |

|

|

|

|

|

|

|

|

|

|

|

Network 1 |

$ |

214,493 |

|

|

78.5 |

% |

|

$ |

205,931 |

|

|

76.4 |

% |

|

$ |

8,562 |

|

|

4.2 |

% |

| Truckload |

37,055 |

|

|

13.6 |

|

|

41,744 |

|

|

15.5 |

|

|

(4,689) |

|

|

(11.2) |

|

| Other |

21,747 |

|

|

8.0 |

|

|

21,902 |

|

|

8.1 |

|

|

(155) |

|

|

(0.7) |

|

| Total operating revenues |

273,295 |

|

|

100.0 |

|

|

269,577 |

|

|

100.0 |

|

|

3,718 |

|

|

1.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Purchased transportation |

127,760 |

|

|

46.7 |

|

|

125,194 |

|

|

46.4 |

|

|

2,566 |

|

|

2.0 |

|

| Salaries, wages and employee benefits |

62,553 |

|

|

22.9 |

|

|

55,918 |

|

|

20.7 |

|

|

6,635 |

|

|

11.9 |

|

| Operating leases |

14,982 |

|

|

5.5 |

|

|

15,738 |

|

|

5.8 |

|

|

(756) |

|

|

(4.8) |

|

| Depreciation and amortization |

10,290 |

|

|

3.8 |

|

|

7,626 |

|

|

2.8 |

|

|

2,664 |

|

|

34.9 |

|

| Insurance and claims |

10,652 |

|

|

3.9 |

|

|

9,219 |

|

|

3.4 |

|

|

1,433 |

|

|

15.5 |

|

| Fuel expense |

2,581 |

|

|

0.9 |

|

|

2,513 |

|

|

0.9 |

|

|

68 |

|

|

2.7 |

|

| Other operating expenses |

24,979 |

|

|

9.1 |

|

|

23,684 |

|

|

8.8 |

|

|

1,295 |

|

|

5.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

253,797 |

|

|

92.9 |

|

|

239,892 |

|

|

89.0 |

|

|

13,905 |

|

|

5.8 |

|

| Income from operations |

$ |

19,498 |

|

|

7.1 |

% |

|

$ |

29,685 |

|

|

11.0 |

% |

|

$ |

(10,187) |

|

|

(34.3) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Network revenue is comprised of all revenue, including linehaul, pickup and/or delivery, and fuel surcharge revenue, excluding accessorial and Truckload revenue. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expedited Freight Operating Statistics |

|

|

|

Three Months Ended |

|

March 31, 2024 |

|

March 31, 2023 |

|

Percent Change |

|

|

|

|

|

|

| Business days |

64 |

|

|

64 |

|

|

— |

% |

|

|

|

|

|

|

Tonnage 1,2 |

|

|

|

|

|

| Total pounds |

684,995 |

|

|

629,080 |

|

|

8.9 |

|

| Pounds per day |

10,703 |

|

|

9,829 |

|

|

8.9 |

|

|

|

|

|

|

|

Shipments 1,2 |

|

|

|

|

|

| Total shipments |

828 |

|

|

817 |

|

|

1.4 |

|

| Shipments per day |

12.9 |

|

|

12.8 |

|

|

1.4 |

|

|

|

|

|

|

|

| Weight per shipment |

827 |

|

|

770 |

|

|

7.4 |

|

|

|

|

|

|

|

Revenue per hundredweight 3 |

$ |

31.32 |

|

|

$ |

33.36 |

|

|

(6.1) |

|

Revenue per hundredweight, ex fuel 3 |

$ |

24.15 |

|

|

$ |

25.75 |

|

|

(6.2) |

|

|

|

|

|

|

|

Revenue per shipment 3 |

$ |

259.14 |

|

|

$ |

256.89 |

|

|

0.9 |

|

Revenue per shipment, ex fuel 3 |

$ |

199.78 |

|

|

$ |

198.30 |

|

|

0.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 In thousands |

2 Excludes accessorial and Truckload and products |

3 Includes intercompany revenue between the Network and Truckload revenue streams |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Intermodal Segment Information |

| (In thousands) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

| |

March 31, 2024 |

|

Percent of Revenue |

|

March 31, 2023 |

|

Percent of Revenue |

|

Change |

|

Percent Change |

| Operating revenue |

$ |

56,292 |

|

|

100.0 |

% |

|

$ |

88,169 |

|

|

100.0 |

% |

|

$ |

(31,877) |

|

|

(36.2) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Purchased transportation |

17,443 |

|

|

31.0 |

|

|

20,014 |

|

|

22.7 |

|

|

(2,571) |

|

|

(12.8) |

|

| Salaries, wages and employee benefits |

15,082 |

|

|

26.8 |

|

|

18,914 |

|

|

21.5 |

|

|

(3,832) |

|

|

(20.3) |

|

| Operating leases |

4,692 |

|

|

8.3 |

|

|

8,335 |

|

|

9.5 |

|

|

(3,643) |

|

|

(43.7) |

|

| Depreciation and amortization |

4,627 |

|

|

8.2 |

|

|

4,746 |

|

|

5.4 |

|

|

(119) |

|

|

(2.5) |

|

| Insurance and claims |

2,606 |

|

|

4.6 |

|

|

2,349 |

|

|

2.7 |

|

|

257 |

|

|

10.9 |

|

| Fuel expense |

2,361 |

|

|

4.2 |

|

|

3,173 |

|

|

3.6 |

|

|

(812) |

|

|

(25.6) |

|

| Other operating expenses |

5,895 |

|

|

10.5 |

|

|

19,435 |

|

|

22.0 |

|

|

(13,540) |

|

|

(69.7) |

|

| Total operating expenses |

52,706 |

|

|

93.6 |

|

|

76,966 |

|

|

87.3 |

|

|

(24,260) |

|

|

(31.5) |

|

| Income from operations |

$ |

3,586 |

|

|

6.4 |

% |

|

$ |

11,203 |

|

|

12.7 |

% |

|

$ |

(7,617) |

|

|

(68.0) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intermodal Operating Statistics |

|

|

|

Three Months Ended |

|

March 31, 2024 |

|

March 31, 2023 |

|

Percent Change |

| Drayage shipments |

62,659 |

|

|

72,465 |

|

|

(13.5) |

% |

| Drayage revenue per shipment |

$ |

822 |

|

|

$ |

1,136 |

|

|

(27.6) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Omni Logistics Segment Information |

|

|

|

|

|

|

|

|

| (In thousands) |

|

|

|

|

|

|

|

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

|

|

| |

March 31, 2024 |

|

Percent of Revenue |

|

|

|

|

|

|

|

|

| Operating revenue |

$ |

224,838 |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Purchased transportation |

144,424 |

|

|

64.2 |

|

|

|

|

|

|

|

|

|

| Salaries, wages and employee benefits |

48,775 |

|

|

21.7 |

|

|

|

|

|

|

|

|

|

| Operating leases |

19,127 |

|

|

8.5 |

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

16,869 |

|

|

7.5 |

|

|

|

|

|

|

|

|

|

| Insurance and claims |

2,053 |

|

|

0.9 |

|

|

|

|

|

|

|

|

|

| Fuel expense |

304 |

|

|

0.1 |

|

|

|

|

|

|

|

|

|

| Other operating expenses |

21,871 |

|

|

9.7 |

|

|

|

|

|

|

|

|

|

| Total operating expenses |

253,423 |

|

|

112.7 |

|

|

|

|

|

|

|

|

|

| Loss from operations |

$ |

(28,585) |

|

|

(12.7) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Forward Air Corporation |

|

| Condensed Consolidated Balance Sheets |

|

| (In thousands) |

|

| (Unaudited) |

|

| |

March 31, 2024 |

|

December 31, 2023 |

|

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and cash equivalents |

$ |

172,270 |

|

|

$ |

121,969 |

|

|

| Restricted cash equivalents |

— |

|

|

39,604 |

|

|

| Accounts receivable, net |

351,813 |

|

|

153,267 |

|

|

| Other receivables |

1,539 |

|

|

5,408 |

|

|

| Prepaid expenses |

39,512 |

|

|

25,682 |

|

|

| Other current assets |

4,299 |

|

|

1,098 |

|

|

|

|

|

|

|

| Total current assets |

569,433 |

|

|

347,028 |

|

|

|

|

|

|

|

| Noncurrent restricted cash equivalents |

— |

|

|

1,790,500 |

|

|

| Property and equipment |

591,562 |

|

|

508,280 |

|

|

| Less accumulated depreciation and amortization |

263,856 |

|

|

250,185 |

|

|

| Property and equipment, net |

327,706 |

|

|

258,095 |

|

|

| Operating lease right-of-use assets |

334,262 |

|

|

111,552 |

|

|

| Goodwill |

1,379,180 |

|

|

278,706 |

|

|

| Other acquired intangibles, net |

1,264,428 |

|

|

134,789 |

|

|

| Other assets |

84,251 |

|

|

58,863 |

|

|

|

|

|

|

|

| Total assets |

$ |

3,959,260 |

|

|

$ |

2,979,533 |

|

|

|

|

|

|

|

| Liabilities and Shareholders’ Equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

| Accounts payable |

$ |

130,646 |

|

|

$ |

45,430 |

|

|

| Accrued expenses |

118,955 |

|

|

62,948 |

|

|

| Other current liabilities |

73,461 |

|

|

71,727 |

|

|

| Current portion of debt and finance lease obligations |

28,134 |

|

|

12,645 |

|

|

| Current portion of operating lease liabilities |

93,645 |

|

|

44,344 |

|

|

|

|

|

|

|

| Total current liabilities |

444,841 |

|

|

237,094 |

|

|

|

|

|

|

|

| Finance lease obligations, less current portion |

34,306 |

|

|

26,736 |

|

|

| Long-term debt, less current portion |

1,664,107 |

|

|

— |

|

|

| Long-term debt held in escrow |

— |

|

|

1,790,500 |

|

|

| Operating lease liabilities, less current portion |

246,956 |

|

|

71,598 |

|

|

| Liabilities under tax receivable agreement |

13,270 |

|

|

— |

|

|

| Other long-term liabilities |

45,536 |

|

|

47,144 |

|

|

| Deferred income taxes |

177,806 |

|

|

42,200 |

|

|

|

|

|

|

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

| Preferred stock |

— |

|

|

— |

|

|

| Common stock |

265 |

|

|

257 |

|

|

| Additional paid-in capital |

508,675 |

|

|

283,684 |

|

|

| Retained earnings |

417,282 |

|

|

480,320 |

|

|

| Accumulated other comprehensive loss |

(151) |

|

|

— |

|

|

| Total shareholders’ equity attributable to Forward Air |

926,071 |

|

|

764,261 |

|

|

| Noncontrolling interest |

406,367 |

|

|

— |

|

|

| Total shareholders’ equity |

1,332,438 |

|

|

764,261 |

|

|

| Total liabilities and shareholders’ equity |

$ |

3,959,260 |

|

|

$ |

2,979,533 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Forward Air Corporation |

| Condensed Consolidated Statements of Cash Flows |

| (In thousands) |

| (Unaudited) |

|

Three Months Ended |

|

March 31, 2024 |

|

March 31, 2023 |

| Operating activities: |

|

|

|

| Net (loss) income from continuing operations |

$ |

(88,794) |

|

|

$ |

33,904 |

|

| Adjustments to reconcile net (loss) income of continuing operations to net cash (used in) provided by operating activities of continuing operations |

|

|

|

| Depreciation and amortization |

31,786 |

|

|

12,372 |

|

|

|

|

|

|

|

|

|

| Share-based compensation expense |

1,567 |

|

|

2,906 |

|

| Provision for revenue adjustments |

1,038 |

|

|

1,098 |

|

| Deferred income tax expense |

2,945 |

|

|

1,857 |

|

| Other |

4,169 |

|

|

(1,091) |

|

| Changes in operating assets and liabilities, net of effects from the purchase of acquired businesses: |

|

|

|

| Accounts receivable |

(20,495) |

|

|

16,397 |

|

| Other receivables |

5,367 |

|

|

— |

|

| Other current and noncurrent assets |

(7,104) |

|

|

10,910 |

|

| Accounts payable and accrued expenses |

17,802 |

|

|

(17,514) |

|

| Net cash (used in) provided by operating activities of continuing operations |

(51,719) |

|

|

60,839 |

|

|

|

|

|

| Investing activities: |

|

|

|

| Proceeds from sale of property and equipment |

849 |

|

|

1,815 |

|

| Purchases of property and equipment |

(4,970) |

|

|

(6,519) |

|

| Purchases of a business, net of cash acquired |

(1,565,242) |

|

|

(56,567) |

|

| Other |

(89) |

|

|

— |

|

| Net cash used in investing activities of continuing operations |

(1,569,452) |

|

|

(61,271) |

|

|

|

|

|

| Financing activities: |

|

|

|

| Repayments of finance lease obligations |

(4,560) |

|

|

(2,086) |

|

| Proceeds from credit facility |

— |

|

|

45,000 |

|

| Payments on credit facility |

(80,000) |

|

|

— |

|

| Payment of debt issuance costs |

(60,591) |

|

|

— |

|

| Payment of earn-out liability |

(12,247) |

|

|

— |

|

|

|

|

|

| Payments of dividends to shareholders |

— |

|

|

(6,345) |

|

| Repurchases and retirement of common stock |

— |

|

|

(54,783) |

|

|

|

|

|

| Payment of minimum tax withholdings on share-based awards |

(1,328) |

|

|

— |

|

| Contributions from subsidiary held for sale |

— |

|

|

4,852 |

|

| Net cash used in financing activities of continuing operations |

(158,726) |

|

|

(13,362) |

|

| Effect of exchange rate changes on cash |

94 |

|

|

— |

|

| Net decrease in cash and cash equivalents from continuing operations |

(1,779,803) |

|

|

(13,794) |

|

|

|

|

|

| Cash from discontinued operation: |

|

|

|

| Net cash provided by operating activities of discontinued operation |

— |

|

|

5,154 |

|

| Net cash used in investing activities of discontinued operation |

— |

|

|

(270) |

|

| Net cash used in financing activities of discontinued operation |

— |

|

|

(4,884) |

|

| Net decrease in cash and cash equivalents |

(1,779,803) |

|

|

(13,794) |

|

| Cash and cash equivalents at beginning of period of continuing operations |

1,952,073 |

|

|

45,822 |

|

| Cash at beginning of period of discontinued operation |

— |

|

|

— |

|

| Net decrease in cash and cash equivalents |

(1,779,803) |

|

|

(13,794) |

|

| Less: cash at end of period of discontinued operation |

— |

|

|

— |

|

| Cash and cash equivalents at end of period of continuing operations |

$ |

172,270 |

|

|

$ |

32,028 |

|

|

|

|

|

Forward Air Corporation Reconciliation of Non-GAAP Financial Measures

In this press release, the Company uses non-GAAP financial measures that are derived on the basis of methodologies other than in accordance with GAAP. The Company believes that meaningful analysis of its financial performance requires an understanding of the factors underlying that performance, including an understanding of items that are non-operational. Management uses these non-GAAP financial measures in making financial, operating, compensation and planning decisions as well as evaluating the Company’s performance.

For the three months ended March 31, 2024 and 2023, this press release contains the following non-GAAP financial measures: earnings before interest, taxes, depreciation and amortization (“EBITDA”), adjusted EBITDA, free cash flow, adjusted income from continuing operations, adjusted net income, and adjusted net income per diluted share. All non-GAAP financial measures are presented on a continuing operations basis.

The Company believes that EBITDA improves comparability from period to period by removing the impact of its capital structure (interest and financing expenses), asset base (depreciation and amortization) and tax impacts. The Company believes that free cash flow is an important measure of its ability to repay maturing debt or fund other uses of capital that it believes will enhance shareholder value. The Company believes providing adjusted EBITDA, adjusted income from operations, adjusted net income and adjusted net income per diluted share allows investors to compare Company performance consistently over various periods without regard to the impact of unusual, nonrecurring or nonoperational items.

Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s financial results prepared in accordance with GAAP. Non-GAAP financial information does not represent a comprehensive basis of accounting. As required by the Securities and Exchange Act of 1933 and the rules and regulations promulgated thereunder, the Company has included, for the periods indicated, a reconciliation of the non-GAAP financial measure to the most directly comparable GAAP financial measure.

The following is a reconciliation of net income to EBITDA for the three months ended March 31, 2024 and 2023 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

March 31, 2024 |

|

March 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(88,794) |

|

|

$ |

33,904 |

|

|

|

|

|

| Interest expense |

|

40,753 |

|

|

2,355 |

|

|

|

|

|

| Income tax (benefit) expense |

|

(18,350) |

|

|

10,937 |

|

|

|

|

|

| Depreciation and amortization |

|

31,786 |

|

|

12,372 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reported EBITDA |

|

(34,605) |

|

|

59,568 |

|

|

|

|

|

| Transaction and integration costs |

|

58,226 |

|

|

— |

|

|

|

|

|

| Severance costs |

|

5,769 |

|

|

— |

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

29,390 |

|

|

$ |

59,568 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following is a reconciliation of the change in operating revenues and adjusted EBITDA excluding the impact of Omni Logistics for the three months ended March 31, 2024 and 2023 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Forward Air Corporation (excluding Omni Logistics) |

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

March 31, 2024 |

|

March 31, 2023 |

|

Change |

|

Percent Change |

| Operating revenue |

$ |

329,565 |

|

|

$ |

357,709 |

|

|

$ |

(28,144) |

|

|

(8) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated EBITDA |

$ |

(34,605) |

|

|

$ |

59,568 |

|

|

|

|

|

| Omni Logistics - Income from Operations |

28,585 |

|

|

— |

|

|

|

|

|

| Omni Logistics - Depreciation and Amortization |

(16,869) |

|

|

— |

|

|

|

|

|

| Reported EBITDA |

(22,889) |

|

|

59,568 |

|

|

|

|

|

| Transaction and integration costs |

58,226 |

|

|

— |

|

|

|

|

|

| Adjusted EBITDA |

$ |

35,337 |

|

|

$ |

59,568 |

|

|

(24,231) |

|

|

(41) |

% |

|

|

|

|

|

|

|

|

The following is a reconciliation of net cash provided by operating activities to free cash flow for the three months ended March 31, 2024 and 2023 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

March 31, 2024 |

|

March 31, 2023 |

|

|

|

|

| Net cash (used in) provided by operating activities of continuing operations |

|

$ |

(51,719) |

|

|

$ |

60,839 |

|

|

|

|

|

| Proceeds from sale of property and equipment |

|

849 |

|

|

1,815 |

|

|

|

|

|

| Purchases of property and equipment |

|

(4,970) |

|

|

(6,519) |

|

|

|

|

|

| Free cash flow |

|

$ |

(55,840) |

|

|

$ |

56,135 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following is a reconciliation of reported income from operations, net income, and net income per diluted share to adjusted income from operations, net income, and net income per diluted share for the three months ended March 31, 2024 and 2023 (in thousands, except net income per diluted share):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2024 |

|

Three Months Ended March 31, 2023 |

|

|

Loss From Operations |

|

Net Loss1 |

|

Net Loss Per Diluted Share1 |

|

Income From Operations |

|

Net Income |

|

Net Income Per Diluted Share |

| As Reported |

|

$ |

(65,732) |

|

|

$ |

(88,794) |

|

|

$ |

(2.35) |

|

|

$ |

47,196 |

|

|

$ |

33,904 |

|

|

$ |

1.27 |

|

| Transaction and integration costs |

|

58,226 |

|

|

48,076 |

|

|

1.27 |

|

|

— |

|

|

— |

|

|

— |

|

| Severance |

|

5,769 |

|

|

4,763 |

|

|

0.13 |

|

|

— |

|

|

— |

|

|

— |

|

| Acquisition amortization |

|

14,271 |

|

|

11,783 |

|

|

0.31 |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As Adjusted |

|

$ |

12,534 |

|

|

$ |

(24,172) |

|

|

$ |

(0.64) |

|

|

$ |

47,196 |

|

|

$ |

33,904 |

|

|

$ |

1.27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Net loss and net loss per diluted share amounts are based on the after-tax effect of each item. The income tax effect is calculated by applying the effective tax rate to the pre-tax amount. The total tax benefit effect of the above item is $13,643. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Forward-looking statements included in this press release relate to the Company’s (i) ability to provide excellent service to its customers for their time-sensitive and mission-critical freight; (ii) ability to maximize value for customers, employees and shareholders and ability to be a leader in the global supply chain and domestic transportation services; (iii) ability and expectations regarding improved profitability; (iv) ability to achieve the intended benefits of the acquisition of Omni Logistics, including the timing of recognizing these potential revenue and cost synergies; (v) expectations regarding the Company’s ability to execute on its plan to integrate Omni Logistics in order to generate long-term value for shareholders and (vi) expectations regarding future market conditions as well as expectations regarding customer demand for the Company’s services.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. The following is a list of factors, among others, that could cause actual results to differ materially from those contemplated by the forward-looking statements: economic factors such as recessions, inflation, higher interest rates and downturns in customer business cycles, the Company’s ability to achieve the expected strategic, financial and other benefits of the acquisition of Omni Logistics, including the realization and timing of expected synergies and the achievement of deleveraging targets within the expected timeframes or at all, the risk that the businesses will not be integrated successfully or that integration may be more difficult, time-consuming or costly than expected, the risk that operating costs, customer loss, management and employee retention and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) as a result of the acquisition of Omni Logistics may be greater than expected, continued weakening of the freight environment, future debt and financing levels, our ability to deleverage, including, without limitation, through capital allocation or divestitures of non-core businesses, our ability to secure terminal facilities in desirable locations at reasonable rates, more limited liquidity than expected which limits our ability to make key investments, the creditworthiness of our customers and their ability to pay for services rendered, our inability to maintain our historical growth rate because of a decreased volume of freight or decreased average revenue per pound of freight moving through our network, the availability and compensation of qualified Leased Capacity Providers and freight handlers as well as contracted, third-party carriers needed to serve our customers’ transportation needs, our inability to manage our information systems and inability of our information systems to handle an increased volume of freight moving through our network, the occurrence of cybersecurity risks and events, market acceptance of our service offerings, claims for property damage, personal injuries or workers’ compensation, enforcement of and changes in governmental regulations, environmental, tax, insurance and accounting matters, the handling of hazardous materials, changes in fuel prices, loss of a major customer, increasing competition, and pricing pressure, our dependence on our senior management team and the potential effects of changes in employee status, seasonal trends, the occurrence of certain weather events, restrictions in our charter and bylaws and the risks described in our Annual Report on Form 10-K for the year ended December 31, 2023, and as may be identified in our subsequent Current Reports on Form 8-K.

We caution readers that any forward-looking statement made by us in this press release is based only on information currently available to us and they should not place undue reliance on these forward-looking statements, which reflect management’s opinion as of the date on which it is made. We undertake no obligation to publicly update any forward- looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise unless required by law.

SOURCE: Forward Air Corporation

Forward Air Corporation

Justin Moss, 404-362-8933

jmoss@forwardair.com